UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22895

Capitol Series Trust

(Exact name of registrant as specified in charter)

Ultimus Asset Services, LLC

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246

(Address of principal executive offices) (Zip code)

Zachary P. Richmond

Ultimus Asset Services, LLC

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246

(Name and address of agent for service)

Registrant’s telephone number, including area code: 513-587-3400

Date of fiscal year end: September 30

Date of reporting period: September 30, 2016

| Item 1. | Reports to Stockholders. |

Fuller & Thaler

Behavioral Core Equity Fund

Annual Report

September 30, 2016

411 Borel Avenue, Suite 300

San Mateo, CA 94402

Fuller & Thaler Behavioral Core Equity Fund

Annual Report Commentary

September 30, 2016

For the period of October 1, 2015, through September 30, 2016, as provided by Raife Giovinazzo, CFA, PhD, Portfolio Manager.

For the 12-month period ended September 30, 2016, Class A Shares of the Fuller & Thaler Behavioral Core Equity Fund returned 15.74% (excluding sales charge), outperforming both the Russell 2000® Index (15.47% return) and the S&P 500® Index (15.43% return).

On average, our sector allocation detracted from performance, however, our behavioral process delivered superior stock selection which allowed the fund to outperform overall. In general, we aim to deliver a portfolio with similar sector composition and risk characteristics to that of our benchmark, but we will deviate when stock-specific opportunities arise.

Our investment process is based on decades of research into behavioral finance. Behavioral finance is the study of how investors actually behave, as opposed to how they should behave, when making investment decisions. Professional investors are human, and like all humans, they make mistakes. Investors make mistakes because they have emotions, use imperfect rules-of-thumb, and have priorities beyond risk and return. We look for those mistakes. We attempt to predict when other investors – the “market” – have likely made a behavioral mistake, and in turn, have created a buying opportunity.

There are two kinds of mistakes that produce buying opportunities: over-reaction and under-reaction. Other investors may over-react to bad news and losses (e.g., panic). Or they may under-react to good news (e.g., not pay attention). At the individual stock level, we search for events that suggest this type of investor misbehavior. If these behaviors are present, we then check fundamentals. In summary, if an investor mistake is likely and the company has solid fundamentals – we buy the stock.

While investors make mistakes in assets classes of all types and sizes, we believe they make even more mistakes in small-cap stocks. Why? Small-cap stocks receive less attention, making mistakes even more likely. Furthermore, there are four times more small-cap stocks than large-cap stocks – providing four times the opportunity set. Our fund invests in a portfolio of U.S. small-cap stocks and delivers similar risk characteristics to the Russell 2000. It is our behavioral edge that provides an opportunity to outperform.

Overall, our fund outperformed the major US stock indexes this past year, and has outperformed since inception. Looking forward, we see many opportunities. We believe our unique, behaviorally-driven investment process will continue to identify these opportunities and allow our fund to outperform both our peers and our benchmark.

1

Investment Results (Unaudited)

Average Annual Total Returns* as of September 30, 2016

| | | | | | | | | | | | | | | | |

| | | One

Year | | | Three

Year | | | Five

Year | | | Since

Inception

(9/8/11) | |

Fuller & Thaler Behavioral Core Equity Fund | | | | | | | | | | | | | |

Institutional Shares | | | 16.14% | | | | 11.22% | | | | 18.11% | | | | 16.57% | |

A Shares with Load (maximum sales load of 5.50%) | | | 9.36% | | | | 8.80% | | | | 16.40% | | | | 14.91% | |

A Shares without Load | | | 15.74% | | | | 10.87% | | | | 17.73% | | | | 16.20% | |

Select Shares | | | 15.86% | | | | 11.04% | | | | 17.94% | | | | 16.41% | |

Russell 2000® Index(a) | | | 15.47% | | | | 6.71% | | | | 15.82% | | | | 13.94% | |

S&P 500® Index(b) | | | 15.43% | | | | 11.16% | | | | 16.37% | | | | 15.12% | |

| | | | | | Expense Ratios(c) | |

| | | | | | Institutional

Shares | | | A Shares | | | Select

Shares | |

Gross | | | | | | | 1.60% | | | | 1.85% | | | | 1.70% | |

With Applicable Waivers | | | | | | | 0.65% | | | | 0.90% | | | | 0.75% | |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fuller & Thaler Behavioral Core Equity Fund (the “Fund”) distributions or the redemption of Fund shares. Current performance of the Fund may be lower or higher than the performance quoted. The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Performance data current to the most recent month end may be obtained by calling (888) 912-4562.

* Return figures reflect any change in price per share and assume the reinvestment of all distributions. The Fund’s returns reflect any fee reductions during the applicable periods. If such fee reductions had not occurred, the quoted performance would have been lower. Returns for periods greater than 1 year are annualized. Prior to October 26, 2015, the performance reflected represents that of the AllianzGI Behavioral Advantage Large Cap Fund (see Note 1).

(a) The Russell 2000® Index (“Russell 2000”) is a widely recognized unmanaged index of equity securities and is representative of a broader domestic equity market and range of securities than is found in the Fund’s portfolio. Effective 12/31/2015, the Fund’s benchmark was updated from the S&P 500 Index to the Russell 2000 as it was determined that the Russell 2000 more closely aligns with the investment strategy of the Fund. The Russell 2000 measures the performance of the small cap segment of the US equity universe. The Russell 2000 is a subset of the Russell 3000 Index and represents approximately 10% of total market capitalization of that index. Individuals cannot invest directly in an index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index.

(b) The S&P 500® Index is widely recognized unmanaged index of equity securities and is representative of a broader domestic equity market and range of securities than is found in the Fund’s portfolio. Individuals cannot invest directly in an index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index.

(c) The expense ratios are from the Fund’s prospectus dated January 28, 2016. Fuller & Thaler Asset Management, Inc. (the “Adviser”) has contractually agreed to waive its management fee and/or reimburse certain operating expenses so that total annual operating expenses, excluding interest, taxes, brokerage fees and commission, other extraordinary expense not incurred in the ordinary course of the Fund’s business and indirect expenses such as acquired fund fees and expenses, do not exceed 0.65%, 0.90% and 0.75% for Institutional Shares, A Shares and Select Shares, respectively, of the Fund’s average daily net assets through January 31, 2017, and 0.80%, 1.05% and 0.90% for Institutional Shares, A Shares and Select Shares, respectively, of the Fund’s average daily net assets through January 31, 2018. Additional information pertaining to the Fund’s expense ratios as of September 30, 2016 can be found on the financial highlights.

The Fund’s investment objectives, strategies, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Fund and may be obtained by calling the same number as above. Please read it carefully before investing.

The Fund is distributed by Unified Financial Securities, LLC, member FINRA/SIPC.

2

Investment Results – (Unaudited) (continued)

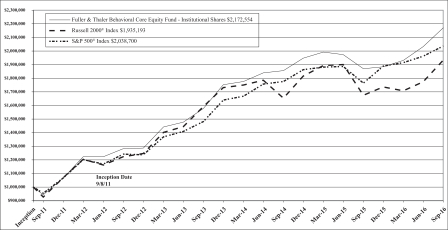

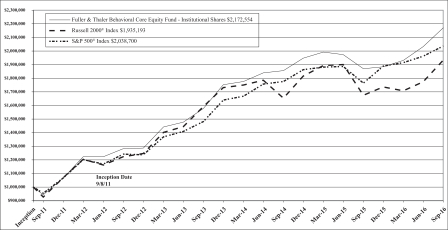

Comparison of the Growth of a $1,000,000 Investment in the Fuller & Thaler Behavioral Core Equity Fund - Institutional shares, Russell 2000® Index and S&P 500® Index

The chart above assumes an initial investment of $1,000,000 made on September 8, 2011 (commencement of operations) and held through September 30, 2016. THE FUND’S RETURNS REPRESENT PAST PERFORMANCE AND DO NOT GUARANTEE FUTURE RESULTS. The returns shown do not reflect deduction of taxes that a shareholder would pay on the Fund’s distributions or the redemption of the Fund’s shares. Investment returns and principal values will fluctuate so that your shares, when redeemed, may be worth more or less than their original purchase price.

Current performance may be lower or higher than the performance data quoted. For more information on the Fund, and to obtain performance data current to the most recent month-end, or to request a prospectus, please call (888) 912-4562. You should carefully consider the investment objectives, potential risks, management fees, and charges and expenses of the Fund before investing. The Fund’s prospectus contains this and other information about the Fund, and should be read carefully before investing.

The Fund is distributed by Unified Financial Securities, LLC, Member FINRA/SIPC.

3

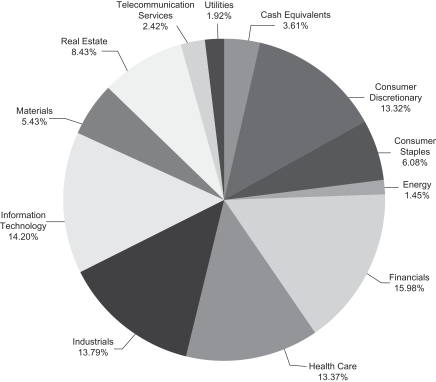

Portfolio Illustration (Unaudited)

September 30, 2016

The following chart gives a visual breakdown of the Fund by sector as a percentage of the fair value of portfolio investments.

Availability of Portfolio Schedule – (Unaudited)

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available at the SEC’s website at www.sec.gov. The Fund’s Forms N-Q may be reviewed and copied at the Public Reference Room in Washington DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

4

Schedule of Investments

September 30, 2016

| | | | | | | | |

| Shares | | | | | Fair Value | |

| | Common Stocks – 91.68% | | | | |

| |

| | | | Aerospace & Defense – 0.36% | |

| | 2,300 | | | Vectrus, Inc. * | | $ | 35,029 | |

| | | | | | | | |

| |

| | | | Auto Components – 0.60% | |

| | 800 | | | Visteon Corp. * | | | 57,328 | |

| | | | | | | | |

| |

| | | | Banks – 5.94% | |

| | 1,100 | | | Central Pacific Financial Corp. | | | 27,709 | |

| | 800 | | | CNB Financial Corp. | | | 16,928 | |

| | 2,800 | | | Farmers National Banc Corp. | | | 30,184 | |

| | 4,500 | | | Financial Institutions, Inc. | | | 121,995 | |

| | 4,500 | | | First Bancorp * | | | 23,400 | |

| | 600 | | | First Community Bancshares, Inc. | | | 14,880 | |

| | 1,400 | | | MBT Financial Corp. | | | 12,670 | |

| | 1,200 | | | Northrim Bancorp, Inc. | | | 30,900 | |

| | 4,700 | | | Old Line Bancshares, Inc. | | | 92,731 | |

| | 700 | | | Peapack-Gladstone Financial Corp. | | | 15,687 | |

| | 1,700 | | | Popular, Inc. | | | 64,974 | |

| | 900 | | | Renasant Corp. | | | 30,267 | |

| | 500 | | | Southern First Bancshares, Inc. * | | | 13,790 | |

| | 1,155 | | | Southside Bancshares, Inc. | | | 37,168 | |

| | 600 | | | United Community Banks, Inc. | | | 12,612 | |

| | 1,000 | | | WashingtonFirst Bankshares, Inc. | | | 24,610 | |

| | | | | | | | |

| | | | | | | 570,505 | |

| | | | | | | | |

| |

| | | | Beverages – 0.69% | |

| | 5,500 | | | Primo Water Corp. * | | | 66,715 | |

| | | | | | | | |

| |

| | | | Building Products – 1.34% | |

| | 2,200 | | | Trex Co., Inc. * | | | 129,184 | |

| | | | | | | | |

| |

| | | | Capital Markets – 1.99% | |

| | 1,700 | | | Evercore Partners, Inc. – Class A | | | 87,567 | |

| | 700 | | | Hennessy Advisors, Inc. | | | 24,829 | |

| | 1,100 | | | Houlihan Lokey, Inc. | | | 27,555 | |

| | 1,900 | | | Moelis & Co. - Class A | | | 51,091 | |

| | | | | | | | |

| | | | | | | 191,042 | |

| | | | | | | | |

| |

| | | | Chemicals – 4.26% | |

| | 2,500 | | | KMG Chemicals, Inc. | | | 70,825 | |

| | | | Chemicals – (continued) | |

| | 5,600 | | | Koppers Holdings, Inc. * | | | 180,208 | |

| | 2,800 | | | Trinseo S.A. | | | 158,368 | |

| | | | | | | | |

| | | | | | | 409,401 | |

| | | | | | | | |

| |

| | | | Commercial Services & Supplies – 1.91% | |

| | 2,700 | | | Quad Graphics, Inc. | | | 72,144 | |

| | 8,000 | | | Steelcase, Inc. – Class A | | | 111,120 | |

| | | | | | | | |

| | | | | | | 183,264 | |

| | | | | | | | |

| |

| | | | Communications Equipment – 1.08% | |

| | 13,900 | | | Extreme Networks, Inc. * | | | 62,411 | |

| | 800 | | | Plantronics, Inc. | | | 41,568 | |

| | | | | | | | |

| | | | | | | 103,979 | |

| | | | | | | | |

| |

| | | | Construction & Engineering – 4.45% | |

| | 5,200 | | | Comfort Systems USA, Inc. | | | 152,412 | |

| | 4,300 | | | IES Holdings, Inc. * | | | 76,497 | |

| | 7,100 | | | Quanta Services, Inc. * | | | 198,729 | |

| | | | | | | | |

| | | | | | | 427,638 | |

| | | | | | | | |

| |

| | | | Diversified Consumer Services – 0.74% | |

| | 6,000 | | | Cambium Learning Group, Inc. * | | | 32,580 | |

| | 2,100 | | | Collectors Universe, Inc. | | | 38,913 | |

| | | | | | | | |

| | | | | | | 71,493 | |

| | | | | | | | |

| |

| | | | Diversified Telecommunications Services – 2.31% | |

| | 33,600 | | | Cincinnati Bell, Inc. * | | | 137,088 | |

| | 4,900 | | | IDT Corp. | | | 84,476 | |

| | | | | | | | |

| | | | | | | 221,564 | |

| | | | | | | | |

| |

| | | | Electronic Equipment, Instruments & Components – 4.06% | |

| | 2,300 | | | Insight Enterprises, Inc. * | | | 74,865 | |

| | 4,100 | | | Kimball Electronics, Inc. * | | | 56,826 | |

| | 1,300 | | | PC Connection, Inc. | | | 34,346 | |

| | 4,000 | | | Sanmina Corp. * | | | 113,880 | |

| | 600 | | | SYNNEX Corp. | | | 68,466 | |

| | 2,600 | | | Vishay Precision Group, Inc. * | | | 41,678 | |

| | | | | | | | |

| | | | | | | 390,061 | |

| | | | | | | | |

See accompanying notes which are an integral part of these financial statements.

5

Schedule of Investments (continued)

September 30, 2016

| | | | | | | | |

| Shares | | | | | Fair Value | |

| | Common Stocks – (continued) | | | | |

| |

| | | | Energy Equipment & Services – 0.64% | |

| | 2,600 | | | PHI, Inc. * | | $ | 47,242 | |

| | 5,900 | | | Seadrill Ltd. * | | | 13,983 | |

| | | | | | | | |

| | | | | | | 61,225 | |

| | | | | | | | |

| |

| | | | Food & Staples Retailing – 2.68% | |

| | 3,000 | | | Ingles Markets, Inc. – Class A | | | 118,620 | |

| | 15,000 | | | SUPERVALU, Inc. * | | | 74,850 | |

| | 2,000 | | | Village Super Market, Inc. – Class A | | | 64,020 | |

| | | | | | | | |

| | | | | | | 257,490 | |

| | | | | | | | |

| | |

| | | | Food Products – 0.37% | | | | |

| | 700 | | | John B. Sanfilippo & Son, Inc. | | | 35,931 | |

| | | | | | | | |

| |

| | | | Health Care Equipment & Supplies – 0.93% | |

| | 3,500 | | | Cutera, Inc. * | | | 41,720 | |

| | 800 | | | Utah Medical Products, Inc. | | | 47,840 | |

| | | | | | | | |

| | | | | | | 89,560 | |

| | | | | | | | |

| |

| | | | Health Care Providers & Services – 5.31% | |

| | 600 | | | Amedisys, Inc. * | | | 28,464 | |

| | 1,800 | | | Civitas Solutions, Inc. * | | | 32,868 | |

| | 800 | | | CorVel Corp. * | | | 30,720 | |

| | 1,400 | | | Magellan Health, Inc. * | | | 75,222 | |

| | 1,700 | | | Owens & Minor, Inc. | | | 59,041 | |

| | 4,700 | | | Providence Service Corp./The * | | | 228,561 | |

| | 2,500 | | | Triple-S Management

Corp. – Class B * | | | 54,825 | |

| | | | | | | | |

| | | | | | | 509,701 | |

| | | | | | | | |

| |

| | | | Health Care Technology – 0.40% | |

| | 4,400 | | | Simulations Plus, Inc. | | | 38,808 | |

| | | | | | | | |

| |

| | | | Hotels, Restaurants & Leisure – 5.66% | |

| | 3,900 | | | Bob Evans Farms, Inc. | | | 149,370 | |

| | 6,200 | | | Century Casinos, Inc. * | | | 42,842 | |

| | 10,600 | | | Del Frisco’s Restaurant Group, Inc. * | | | 142,782 | |

| | | | Hotels, Restaurants & Leisure – (continued) | |

| | 2,500 | | | J Alexander’s Holdings, Inc. * | | | 25,325 | |

| | 2,200 | | | Marcus Corp./The | | | 55,088 | |

| | 9,100 | | | Ruth’s Hospitality Group, Inc. | | | 128,492 | |

| | | | | | | | |

| | | | | | | 543,899 | |

| | | | | | | | |

| |

| | | | Household Durables – 1.35% | |

| | 1,600 | | | CSS Industries, Inc. | | | 40,928 | |

| | 1,300 | | | NACCO Industries, Inc. | | | 88,348 | |

| | | | | | | | |

| | | | | | | 129,276 | |

| | | | | | | | |

| |

| | | | Household Products – 1.45% | |

| | 3,800 | | | Central Garden & Pet Co. – Class A * | | | 94,240 | |

| | 1,200 | | | Oil-Dri Corp of America | | | 45,168 | |

| | | | | | | | |

| | | | | | | 139,408 | |

| | | | | | | | |

| |

| | | | Independent Power and Renewable Electricity Producers – 1.11% | |

| | 43,300 | | | Atlantic Power Corp. | | | 106,951 | |

| | | | | | | | |

| | |

| | | | Insurance – 4.53% | | | | |

| | 3,200 | | | Allied World Assurance Co. Holdings AG | | | 129,344 | |

| | 2,500 | | | Ambac Financial Group, Inc. * | | | 45,975 | |

| | 2,800 | | | Genworth Financial, Inc. – Class A * | | | 13,888 | |

| | 4,200 | | | Hallmark Financial Services, Inc. * | | | 43,218 | |

| | 5,500 | | | Heritage Insurance Holdings, Inc. | | | 79,255 | |

| | 200 | | | Investors Title Co. | | | 19,900 | |

| | 3,300 | | | Maiden Holdings Ltd. | | | 41,877 | |

| | 4,300 | | | OneBeacon Insurance Group Ltd. – Class A | | | 61,404 | |

| | | | | | | | |

| | | | | | | 434,861 | |

| | | | | | | | |

| |

| | | | Internet Software & Services – 1.37% | |

| | 8,900 | | | Bankrate, Inc. * | | | 75,472 | |

| | 3,900 | | | DHI Group, Inc. * | | | 30,771 | |

| | 2,300 | | | Liquidity Services, Inc. * | | | 25,852 | |

| | | | | | | | |

| | | | | | | 132,095 | |

| | | | | | | | |

See accompanying notes which are an integral part of these financial statements.

6

Schedule of Investments (continued)

September 30, 2016

| | | | | | | | |

| Shares | | | | | Fair Value | |

| | Common Stocks – (continued) | | | | |

| | |

| | | | IT Services – 6.01% | | | | |

| | 700 | | | CSG Systems International, Inc. | | $ | 28,931 | |

| | 300 | | | DST Systems, Inc. | | | 35,376 | |

| | 10,600 | | | Hackett Group, Inc. | | | 175,112 | |

| | 12,900 | | | Lionbridge Technologies, Inc. * | | | 64,500 | |

| | 1,000 | | | ManTech International Corp. – Class A | | | 37,690 | |

| | 7,400 | | | Planet Payment, Inc. * | | | 27,454 | |

| | 3,000 | | | Science Applications International Corp. | | | 208,110 | |

| | | | | | | | |

| | | | | | | 577,173 | |

| | | | | | | | |

| |

| | | | Leisure Products – 0.53% | |

| | 1,400 | | | Johnson Outdoors, Inc. – Class A | | | 50,918 | |

| | | | | | | | |

| |

| | | | Life Sciences Tools & Services – 4.16% | |

| | 7,300 | | | Bruker Corp. | | | 165,345 | |

| | 9,300 | | | Enzo Biochem, Inc. * | | | 47,337 | |

| | 1,400 | | | INC Research Holdings, Inc. – Class A * | | | 62,412 | |

| | 2,200 | | | PRA Health Sciences, Inc. * | | | 124,322 | |

| | | | | | | | |

| | | | | | | 399,416 | |

| | | | | | | | |

| | |

| | | | Machinery – 3.05% | | | | |

| | 2,100 | | | Global Brass & Copper Holdings, Inc. | | | 60,669 | |

| | 1,900 | | | Miller Industries, Inc. | | | 43,301 | |

| | 400 | | | Omega Flex, Inc. | | | 15,424 | |

| | 8,600 | | | SPX Corp. * | | | 173,204 | |

| | | | | | | | |

| | | | | | | 292,598 | |

| | | | | | | | |

| | |

| | | | Media – 0.53% | | | | |

| | 3,800 | | | Reading International, Inc. – Class A * | | | 50,730 | |

| | | | | | | | |

| |

| | | | Metals & Mining – 0.90% | |

| | 1,800 | | | Worthington Industries, Inc. | | | 86,454 | |

| | | | | | | | |

| |

| | | | Mortgage Real Estate Investment Trusts (REITs) – 0.45% | |

| | 2,500 | | | Owens Realty Mortgage, Inc. | | | 43,300 | |

| | | | | | | | |

| | | | Multi-Utilities – 0.71% | | | | |

| | 1,600 | | | MDU Resources Group, Inc. | | | 40,704 | |

| | 700 | | | Unitil Corp. | | | 27,342 | |

| | | | | | | | |

| | | | | | | 68,046 | |

| | | | | | | | |

| |

| | | | Oil, Gas & Consumable Fuels – 0.74% | |

| | 3,200 | | | Evolution Petroleum Corp. | | | 20,096 | |

| | 1,100 | | | World Fuel Services Corp. | | | 50,886 | |

| | | | | | | | |

| | | | | | | 70,982 | |

| | | | | | | | |

| |

| | | | Personal Products – 0.59% | |

| | 1,800 | | | Nutraceutical International Corp. * | | | 56,232 | |

| | | | | | | | |

| |

| | | | Pharmaceuticals – 1.92% | |

| | 8,500 | | | Corcept Therapeutics, Inc. * | | | 55,250 | |

| | 1,500 | | | Heska Corp. * | | | 81,645 | |

| | 1,750 | | | Phibro Animal Health

Corp. – Class A | | | 47,565 | |

| | | | | | | | |

| | | | | | | 184,460 | |

| | | | | | | | |

| |

| | | | Professional Services – 1.19% | |

| | 2,200 | | | CRA International, Inc. * | | | 58,498 | |

| | 1,000 | | | Heidrick & Struggles International, Inc. | | | 18,550 | |

| | 1,800 | | | Kforce, Inc. | | | 36,882 | |

| | | | | | | | |

| | | | | | | 113,930 | |

| | | | | | | | |

| |

| | | | Real Estate Investment Trusts (REITs) – 5.93% | |

| | 9,200 | | | Armada Hoffler Properties, Inc. | | | 123,280 | |

| | 5,300 | | | CatchMark Timber Trust, Inc. – Class A | | | 61,957 | |

| | 5,880 | | | CorEnergy Infrastructure Trust, Inc. | | | 172,460 | |

| | 3,800 | | | OUTFRONT Media, Inc. | | | 89,870 | |

| | 4,300 | | | RLJ Lodging Trust | | | 90,429 | |

| | 2,100 | | | Xenia Hotels & Resorts, Inc. | | | 31,878 | |

| | | | | | | | |

| | | | | | | 569,874 | |

| | | | | | | | |

| |

| | | | Real Estate Management & Development – 2.09% | |

| | 2,700 | | | HFF, Inc. – Class A * | | | 74,763 | |

| | 2,200 | | | Marcus & Millichap, Inc. * | | | 57,530 | |

| | 1,800 | | | RMR Group, Inc./The – Class A | | | 68,292 | |

| | | | | | | | |

| | | | | | | 200,585 | |

| | | | | | | | |

See accompanying notes which are an integral part of these financial statements.

7

Schedule of Investments (continued)

September 30, 2016

| | | | | | | | |

| Shares | | | | | Fair Value | |

| | Common Stocks – (continued) | | | | |

| | |

| | | | Road & Rail – 0.46% | | | | |

| | 3,300 | | | Universal Truckload Services, Inc. | | $ | 44,286 | |

| | | | | | | | |

| |

| | | | Semiconductors & Semiconductor Equipment – 0.78% | |

| | 1,400 | | | Alpha & Omega SemiConductor Ltd. * | | | 30,408 | |

| | 3,700 | | | DSP Group, Inc. * | | | 44,437 | |

| | | | | | | | |

| | | | | | | 74,845 | |

| | | | | | | | |

| | |

| | | | Software – 0.47% | | | | |

| | (a) | | | Zedge, Inc. – Class B * | | | 1 | |

| | 11,100 | | | Zix Corp. * | | | 45,510 | |

| | | | | | | | |

| | | | | | | 45,511 | |

| | | | | | | | |

| | |

| | | | Specialty Retail – 1.79% | | | | |

| | 7,700 | | | Francesca’s Holdings Corp. * | | | 118,811 | |

| | 500 | | | Winmark Corp. | | | 52,760 | |

| | | | | | | | |

| | | | | | | 171,571 | |

| | | | | | | | |

| |

| | | | Textiles, Apparel & Luxury Goods – 1.21% | |

| | 1,700 | | | Culp, Inc. | | | 50,609 | |

| | 3,400 | | | Perry Ellis International, Inc. * | | | 65,552 | |

| | | | | | | | |

| | | | | | | 116,161 | |

| | | | | | | | |

| |

| | | | Thrifts & Mortgage Finance – 2.29% | |

| | 1,400 | | | Federal Agricultural Mortgage Corp. – Class C | | | 55,300 | |

| | 500 | | | Home Bancorp, Inc. | | | 14,000 | |

| | | | Thrifts & Mortgage Finance – (continued) | |

| | 3,600 | | | HomeStreet, Inc. * | | | 90,216 | |

| | 3,600 | | | NMI Holdings, Inc. – Class A * | | | 27,432 | |

| | 1,700 | | | Provident Financial Holdings, Inc. | | | 33,252 | |

| | | | | | | | |

| | | | | | | 220,200 | |

| | | | | | | | |

| |

| | | | Trading Companies & Distributors – 0.35% | |

| | 1,900 | | | Lawson Products, Inc. * | | | 33,687 | |

| | | | | | | | |

| | | | Total Common Stocks (Cost $8,067,399) | | | 8,807,367 | |

| | | | | | | | |

| |

| | | | Cash Equivalents – 3.43% | |

| | 329,680 | | | Federated U.S. Treasury Cash Reserves – Service Shares, 0.00%(b) | | | 329,680 | |

| | | | | | | | |

| | | | Total Cash Equivalents (Cost $329,680) | | | 329,680 | |

| | | | | | | | |

| | | | Total Investments – 95.11% (Cost $8,397,079) | | | 9,137,047 | |

| | | | | | | | |

| | | | Other Assets in Excess of Liabilities – 4.89% | | | 469,385 | |

| | | | | | | | |

| | | | NET ASSETS – 100.00% | | $ | 9,606,432 | |

| | | | | | | | |

| (a) | | Share amount is less than half a share. |

| (b) | | Rate disclosed is the seven day effective yield as of September 30, 2016. |

| * | | Non-income producing security. |

The industries shown on the schedule of investments are based on the Global Industry Classification Standard, or GICS® (“GICS”). The GICS was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS is a service mark of MSCI, Inc. and S&P and has been licensed for use by Ultimus Asset Services, LLC.

See accompanying notes which are an integral part of these financial statements.

8

Statement of Assets and Liabilities

September 30, 2016

| | | | |

Assets | | | | |

Investments in securities at fair value (cost $8,397,079) | | $ | 9,137,047 | |

Receivable for fund shares sold | | | 403,015 | |

Receivable for investments sold | | | 288,957 | |

Dividends receivable | | | 6,211 | |

Receivable from Adviser | | | 14,633 | |

Prepaid expenses | | | 35,820 | |

Total Assets | | | 9,885,683 | |

Liabilities | | | | |

Payable for investments purchased | | | 237,892 | |

Payable for fund shares redeemed | | | 27 | |

Accrued 12b-1 fees – A Shares | | | 1,717 | |

Accrued Administrative services fees – Select Shares(a) | | | 116 | |

Payable to administrator, fund accountant, and transfer agent | | | 6,677 | |

Payable to trustees | | | 140 | |

Other accrued expenses | | | 32,682 | |

Total Liabilities | | | 279,251 | |

Net Assets | | $ | 9,606,432 | |

Net Assets consist of: | | | | |

Paid-in capital | | $ | 10,313,680 | |

Accumulated undistributed net investment income | | | 93,225 | |

Accumulated undistributed net realized loss from investment transactions | | | (1,540,441 | ) |

Net unrealized appreciation on investments | | | 739,968 | |

Net Assets | | $ | 9,606,432 | |

Institutional Shares: | | | | |

Net Assets | | $ | 3,174,499 | |

Shares outstanding (unlimited number of shares authorized, no par value) | | | 167,313 | |

Net asset value, offering and redemption price per share | | $ | 18.97 | |

A Shares: | | | | |

Net Assets | | $ | 4,318,644 | |

Shares outstanding (unlimited number of shares authorized, no par value) | | | 230,316 | |

Net asset value and redemption price per share | | $ | 18.75 | |

Maximum offering price (100%/(100%-maximum sales charge) of net asset value adjusted to the nearest cent) per share | | $ | 19.84 | |

Maximum sales charge | | | 5.50 | % |

Select Shares(a): | | | | |

Net Assets | | $ | 2,113,289 | |

Shares outstanding (unlimited number of shares authorized, no par value) | | | 112,097 | |

Net asset value and redemption price per share | | $ | 18.85 | |

| (a) | | P Shares were renamed Select Shares on October 23, 2015. |

9

See accompanying notes which are an integral part of these financial statements.

Statement of Operations

For the year ended September 30, 2016

| | | | |

Investment Income: | | | | |

Dividend income (net of foreign taxes withheld of $197) | | $ | 229,766 | |

Total investment income | | | 229,766 | |

Expenses: | | | | |

Investment Adviser | | | 64,909 | |

12b-1 – A Shares | | | 6,086 | |

12b-1 – C Shares(a) | | | 380 | |

12b-1 – D Shares(a) | | | 358 | |

Administrative services – Select Shares(b) | | | 571 | |

Administration | | | 29,327 | |

Custodian | | | 7,463 | |

Fund accounting | | | 25,889 | |

Transfer agent | | | 18,945 | |

Legal | | | 5,729 | |

Registration | | | 53,413 | |

Audit | | | 31,375 | |

Trustee | | | 4,242 | |

Pricing | | | 5,854 | |

Printing | | | 16,684 | |

Overdraft fees | | | 310 | |

Miscellaneous | | | 33,198 | |

Total expenses | | | 304,733 | |

Fees contractually waived and reimbursed by Adviser | | | (225,366 | ) |

Net operating expenses | | | 79,367 | |

Net investment income | | | 150,399 | |

Net Realized and Unrealized Gain (Loss) on Investments | | | | |

Net realized loss on investment securities transactions | | | (1,039,692 | ) |

Net realized loss on foreign currency transactions | | | (39 | ) |

Net change in unrealized appreciation (depreciation) of investment securities | | | 1,066,736 | |

Net realized and unrealized gain (loss) on investments | | | 27,005 | |

Net increase in net assets resulting from operations | | $ | 177,404 | |

| (a) | | Effective October 23, 2015, C Shares and D Shares were converted to A Shares. |

| (b) | | P Shares were renamed Select Shares on October 23, 2015. |

10

See accompanying notes which are an integral part of these financial statements.

Statements of Changes in Net Assets

| | | | | | | | | | | | |

| | | For the

year ended

September 30, 2016 | | | Period from

December 1,

2014 through

September 30,

2015(a) | | | For the

year ended

November 30, 2014 | |

Increase (Decrease) in Net Assets due to: Operations: | |

Net investment income | | $ | 150,399 | | | $ | 578,743 | | | $ | 981,337 | |

Net realized (loss) on investment securities transactions | | | (1,039,731 | ) | | | 12,166,088 | | | | 6,048,044 | |

Net change in unrealized appreciation (depreciation) of investment securities | | | 1,066,736 | | | | (13,295,021 | ) | | | 3,453,370 | |

Net increase (decrease) in net assets resulting from operations | | | 177,404 | | | | (550,190 | ) | | | 10,482,751 | |

Distributions From: | | | | | | | | | | | | |

Net investment income: | | | | | | | | | | | | |

Institutional Shares | | | (227,200 | ) | | | (1,119,347 | ) | | | (412,898 | ) |

A Shares | | | (40,148 | ) | | | (151,343 | ) | | | (90,468 | ) |

C Shares(b) | | | – | | | | (7,028 | ) | | | (1,785 | ) |

D Shares(b) | | | – | | | | (33,727 | ) | | | (454 | ) |

Select Shares | | | (265 | ) | | | (2,311 | ) | | | (111 | ) |

Net realized gains: | | | | | | | | | | | | |

Institutional Shares | | | (1,854,228 | ) | | | (13,174,278 | ) | | | (1,759,764 | ) |

A Shares | | | (336,805 | ) | | | (2,518,110 | ) | | | (306,379 | ) |

C Shares(b) | | | – | | | | (208,608 | ) | | | (8,829 | ) |

D Shares(b) | | | – | | | | (588,302 | ) | | | (6,517 | ) |

Select Shares | | | (2,229 | ) | | | (27,964 | ) | | | (603 | ) |

| | | | (2,460,875 | ) | | | (17,831,018 | ) | | | (2,587,808 | ) |

Capital Transactions: | | | | | | | | | | | | |

Institutional Shares: | | | | | | | | | | | | |

Proceeds from shares sold | | | 901,044 | | | | 4,329,364 | | | | 44,216,425 | |

Reinvestment of distributions | | | 2,081,427 | | | | 14,293,625 | | | | 2,172,662 | |

Amount paid for shares redeemed | | | (13,082,906 | ) | | | (62,493,252 | ) | | | (27,583,735 | ) |

Total Capital Transactions – Institutional Shares | | | (10,100,435 | ) | | | (43,870,263 | ) | | | 18,805,352 | |

A Shares: | | | | | | | | | | | | |

Proceeds from shares sold | | | 2,166,579 | | | | 4,792,646 | | | | 3,827,973 | |

Shares issued in connection with Reorganization(b) | | | 2,552,871 | | | | – | | | | – | |

Reinvestment of distributions | | | 368,436 | | | | 236,093 | | | | 42,711 | |

Amount paid for shares redeemed | | | (1,478,847 | ) | | | (11,338,632 | ) | | | (3,281,256 | ) |

Total Capital Transactions – A Shares | | | 3,609,039 | | | | (6,309,893 | ) | | | 589,428 | |

C Shares(b): | | | | | | | | | | | | |

Proceeds from shares sold | | | 6,815 | | | | 595,452 | | | | 284,894 | |

Shares redeemed in connection with Reorganization | | | (429,826 | ) | | | – | | | | – | |

Reinvestment of distributions | | | – | | | | 215,605 | | | | 10,364 | |

Amount paid for shares redeemed | | | (310,842 | ) | | | (296,644 | ) | | | (89,007 | ) |

Total Capital Transactions – C Shares | | | (733,853 | ) | | | 514,413 | | | | 206,251 | |

11

See accompanying notes which are an integral part of these financial statements.

Statements of Changes in Net Assets (continued)

| | | | | | | | | | | | |

| | | For the

year ended

September 30, 2016 | | | Period from

December 1,

2014 through

September 30,

2015(a) | | | For the

year ended

November 30, 2014 | |

Capital Transactions (continued): | | | | | | | | | | | | |

D Shares(b): | | | | | | | | | | | | |

Proceeds from shares sold | | $ | 7,358 | | | $ | 2,761,053 | | | $ | 821,450 | |

Shares redeemed in connection with Reorganization | | | (2,123,045 | ) | | | – | | | | – | |

Reinvestment of distributions | | | – | | | | 621,362 | | | | 6,971 | |

Amount paid for shares redeemed | | | (26,679 | ) | | | (1,640,311 | ) | | | (49,299 | ) |

Total Capital Transactions – D Shares | | | (2,142,366 | ) | | | 1,742,104 | | | | 779,122 | |

Select Shares: | | | | | | | | | | | | |

Proceeds from shares sold | | | 1,968,894 | | | | – | | | | 92,492 | |

Reinvestment of distributions | | | 2,495 | | | | 30,275 | | | | 714 | |

Amount paid for shares redeemed | | | (86,707 | ) | | | (12,046 | ) | | | (684 | ) |

Total Capital Transactions – Select Shares | | | 1,884,682 | | | | 18,229 | | | | 92,522 | |

Net increase (decrease) in net assets resulting from capital transactions | | | (7,482,933 | ) | | | (47,905,410 | ) | | | 20,472,675 | |

Total Increase (Decrease) in Net Assets | | | (9,766,404 | ) | | | (66,286,618 | ) | | | 28,367,618 | |

Net Assets | | | | | | | | | | | | |

Beginning of period | | | 19,372,836 | | | | 85,659,454 | | | | 57,291,836 | |

End of period | | $ | 9,606,432 | | | $ | 19,372,836 | | | $ | 85,659,454 | |

Accumulated undistributed net investment income included in

net assets at end of period | | $ | 93,225 | | | $ | 215,914 | | | $ | 951,417 | |

Share Transactions – Institutional Shares: | | | | | | | | | |

Shares sold | | | 53,346 | | | | 192,084 | | | | 1,871,574 | |

Shares issued in reinvestment of distributions | | | 126,147 | | | | 664,256 | | | | 96,471 | |

Shares redeemed | | | (844,178 | ) | | | (2,891,123 | ) | | | (1,134,784 | ) |

Total Share Transactions – Institutional Shares | | | (664,685 | ) | | | (2,034,783 | ) | | | 833,261 | |

Share Transactions – A Shares: | | | | | | | | | | | | |

Shares sold | | | 117,652 | | | | 221,645 | | | | 162,296 | |

Shares issued in connection with Reorganization(b) | | | 129,981 | | | | – | | | | – | |

Shares issued in reinvestment of distributions | | | 22,521 | | | | 11,273 | | | | 1,899 | |

Shares redeemed | | | (85,474 | ) | | | (577,683 | ) | | | (136,703 | ) |

Total Share Transactions – A Shares | | | 184,680 | | | | (344,765 | ) | | | 27,492 | |

12

See accompanying notes which are an integral part of these financial statements.

Statements of Changes in Net Assets (continued)

| | | | | | | | | | | | |

| | | For the

year ended

September 30, 2016 | | | Period from

December 1,

2014 through

September 30,

2015(a) | | | For the

year ended

November 30, 2014 | |

Share Transactions – C Shares(b): | | | | | | | | | | | | |

Shares sold | | | 359 | | | | 25,819 | | | | 12,353 | |

Shares issued in reinvestment of distributions | | | – | | | | 10,623 | | | | 468 | |

Shares redeemed in connection with Reorganization | | | (22,500 | ) | | | – | | | | – | |

Shares redeemed | | | (16,472 | ) | | | (15,717 | ) | | | (3,656 | ) |

Total Share Transactions – C Shares | | | (38,613 | ) | | | 20,725 | | | | 9,165 | |

Share Transactions – D Shares(b): | | | | | | | | | | | | |

Shares sold | | | 382 | | | | 118,622 | | | | 33,945 | |

Shares issued in reinvestment of distributions | | | – | | | | 30,442 | | | | 313 | |

Shares redeemed in connection with Reorganization | | | (109,062 | ) | | | – | | | | – | |

Shares redeemed | | | (1,388 | ) | | | (78,989 | ) | | | (2,052 | ) |

Total Share Transactions – D Shares | | | (110,068 | ) | | | 70,075 | | | | 32,206 | |

Share Transactions – Select Shares: | | | | | | | | | | | | |

Shares sold | | | 110,957 | | | | – | | | | 3,788 | |

Shares issued in reinvestment of distributions | | | 152 | | | | 1,427 | | | | 32 | |

Shares redeemed | | | (4,363 | ) | | | (588 | ) | | | (28 | ) |

Total Share Transactions – Select Shares | | | 106,746 | | | | 839 | | | | 3,792 | |

| (a) | | Fiscal year end changed from November 30th to September 30th. |

| (b) | | Effective October 23, 2015, C Shares and D Shares were converted to A Shares. |

13

See accompanying notes which are an integral part of these financial statements.

Fuller & Thaler Behavioral Core Equity Fund – Institutional Shares

Financial Highlights

Selected data for a share outstanding throughout each period.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | For the

year ended

September 30,

2016 | | | Period

ended

September 30,

2015(a) | | | Years ended November 30, | | | Period

ended

November 30,

2011(b) | |

| | | | | 2014 | | | 2013 | | | 2012 | | |

Net asset value, at

beginning of period | | | $18.84 | | | | $25.83 | | | | $23.74 | | | | $19.10 | | | | $16.06 | | | | $15.00 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Income from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment income (loss)(c) | | | 0.25 | | | | 0.25 | | | | 0.31 | | | | 0.30 | | | | 0.34 | | | | 0.05 | |

| | | | | | |

Net realized and unrealized gain (loss) on investments | | | 2.42 | | | | (0.96 | ) | | | 2.81 | | | | 5.73 | | | | 2.77 | | | | 1.01 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Total from investment operations | | | 2.67 | | | | (0.71 | ) | | | 3.12 | | | | 6.03 | | | | 3.11 | | | | 1.06 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Distributions from: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment income | | | (0.28 | ) | | | (0.42 | ) | | | (0.19 | ) | | | (0.30 | ) | | | (0.07 | ) | | | – | |

| | | | | | |

Net realized gain | | | (2.26 | ) | | | (5.86 | ) | | | (0.84 | ) | | | (1.09 | ) | | | – | | | | – | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Total from distributions | | | (2.54 | ) | | | (6.28 | ) | | | (1.03 | ) | | | (1.39 | ) | | | (0.07 | ) | | | – | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, at

end of period | | | $18.97 | | | | $18.84 | | | | $25.83 | | | | $23.74 | | | | $19.10 | | | | $16.06 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Total Return(d) | | | 16.14 | % | | | (4.09 | )%(e) | | | 13.79 | % | | | 34.02 | % | | | 19.46 | % | | | 7.07 | %(e) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Ratios/Supplemental Data: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net assets at end of period (thousands) | | | $3,174 | | | | $15,677 | | | | $74,044 | | | | $48,281 | | | | $17,172 | | | | $10,705 | |

| | | | | | |

Before waiver: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Ratio of expenses to average net assets | | | 2.65 | % | | | 0.99 | %(f)(g) | | | 0.76 | % | | | 1.05 | % | | | 2.32 | % | | | 2.58 | %(f) |

| | | | | | |

After waiver: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Ratio of expenses to average net assets | | | 0.64 | % | | | 0.55 | %(f)(g) | | | 0.55 | % | | | 0.55 | % | | | 0.55 | % | | | 0.55 | %(f) |

| | | | | | |

Ratio of net investment income to average net assets | | | 1.33 | % | | | 1.33 | %(f)(g) | | | 1.29 | % | | | 1.44 | % | | | 1.88 | % | | | 1.48 | %(f) |

| | | | | | |

Portfolio turnover(h) | | | 194 | % | | | 108 | %(e) | | | 89 | % | | | 64 | % | | | 76 | % | | | 0 | %(e)(i) |

| (a) | | Fiscal year end changed from November 30th to September 30th. |

| (b) | | For the period September 8, 2011 (commencement of operations) through November 30, 2011. |

| (c) | | Per share net investment income has been calculated using the average shares method. |

| (d) | | Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions . |

| (g) | | Certain expenses incurred by the Fund were not annualized. |

| (h) | | Portfolio turnover is calculated on the basis on the Fund as a whole without distinguishing among the classes of shares. |

| (i) | | Amount rounds to less than 1%. |

14

See accompanying notes which are an integral part of these financial statements.

Fuller & Thaler Behavioral Core Equity Fund – A Shares

Financial Highlights

Selected data for a share outstanding throughout each period.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | For the

year ended

September 30,

2016 | | | Period

ended

September 30,

2015(a) | | | Years ended November 30, | | | Period

ended

November 30,

2011(b) | |

| | | | | 2014 | | | 2013 | | | 2012 | | |

Net asset value, at

beginning of period | | | $18.70 | | | | $25.67 | | | | $23.72 | | | | $19.04 | | | | $16.05 | | | | $15.00 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Income from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment income(c) | | | 0.20 | | | | 0.20 | | | | 0.24 | | | | 0.24 | | | | 0.29 | | | | 0.04 | |

| | | | | | |

Net realized and unrealized gain (loss) on investments | | | 2.38 | | | | (0.96 | ) | | | 2.79 | | | | 5.73 | | | | 2.76 | | | | 1.01 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Total from investment operations | | | 2.58 | | | | (0.76 | ) | | | 3.03 | | | | 5.97 | | | | 3.05 | | | | 1.05 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Distributions from: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment income | | | (0.27 | ) | | | (0.35 | ) | | | (0.24 | ) | | | (0.20 | ) | | | (0.06 | ) | | | – | |

| | | | | | |

Net realized gain | | | (2.26 | ) | | | (5.86 | ) | | | (0.84 | ) | | | (1.09 | ) | | | – | | | | – | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Total from distributions | | | (2.53 | ) | | | (6.21 | ) | | | (1.08 | ) | | | (1.29 | ) | | | (0.06 | ) | | | – | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, at

end of period | | | $18.75 | | | | $18.70 | | | | $25.67 | | | | $23.72 | | | | $19.04 | | | | $16.05 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Total Return(d) | | | 15.74 | % | | | (4.33 | )%(e) | | | 13.43 | % | | | 33.61 | % | | | 19.07 | % | | | 7.00 | %(e) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Ratios/Supplemental Data: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net assets at end of period (thousands) | | | $4,319 | | | | $853 | | | | $10,023 | | | | $8,607 | | | | $49 | | | | $11 | |

| | | | | | |

Before waiver: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Ratio of expenses to average net assets | | | 2.90 | % | | | 1.27 | %(f)(g) | | | 1.02 | % | | | 1.25 | % | | | 2.76 | % | | | 2.84 | %(f) |

| | | | | | |

After waiver: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Ratio of expenses to average net assets | | | 0.89 | % | | | 0.81 | %(f)(g) | | | 0.82 | % | | | 0.83 | % | | | 0.90 | % | | | 0.90 | %(f) |

| | | | | | |

Ratio of net investment income to average net assets | | | 1.32 | % | | | 1.11 | %(f)(g) | | | 1.02 | % | | | 1.09 | % | | | 1.59 | % | | | 1.14 | %(f) |

| | | | | | |

Portfolio turnover(h) | | | 194 | % | | | 108 | %(e) | | | 89 | % | | | 64 | % | | | 76 | % | | | 0 | %(e)(i) |

| (a) | | Fiscal year end changed from November 30th to September 30th. |

| (b) | | For the period September 8, 2011 (commencement of operations) through November 30, 2011. |

| (c) | | Per share net investment income has been calculated using the average shares method. |

| (d) | | Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions and excludes any sales charges. |

| (g) | | Certain expenses incurred by the Fund were not annualized. |

| (h) | | Portfolio turnover is calculated on the basis on the Fund as a whole without distinguishing among the classes of shares. |

| (i) | | Amount rounds to less than 1%. |

15

See accompanying notes which are an integral part of these financial statements.

Fuller & Thaler Behavioral Core Equity Fund – Select Shares

Financial Highlights

Selected data for a share outstanding throughout each period.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | For the

year ended

September 30,

2016 | | | Period

ended

September 30,

2015(a) | | | Years ended November 30, | | | Period

ended

November 30,

2011(b) | |

| | | | | 2014 | | | 2013 | | | 2012 | | |

Net asset value, at

beginning of period | | | $18.77 | | | | $25.84 | | | | $23.74 | | | | $19.09 | | | | $16.05 | | | | $15.00 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Income from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment income(c) | | | 0.23 | | | | 0.23 | | | | 0.31 | | | | 0.29 | | | | 0.32 | | | | 0.05 | |

| | | | | | |

Net realized and unrealized gain (loss) on investments | | | 2.38 | | | | (0.97 | ) | | | 2.78 | | | | 5.71 | | | | 2.79 | | | | 1.00 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Total from investment operations | | | 2.61 | | | | (0.74 | ) | | | 3.09 | | | | 6.00 | | | | 3.11 | | | | 1.05 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Distributions from: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment income | | | (0.27 | ) | | | (0.47 | ) | | | (0.15 | ) | | | (0.26 | ) | | | (0.07 | ) | | | – | |

| | | | | | |

Net realized gain | | | (2.26 | ) | | | (5.86 | ) | | | (0.84 | ) | | | (1.09 | ) | | | – | | | | – | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Total from distributions | | | (2.53 | ) | | | (6.33 | ) | | | (0.99 | ) | | | (1.35 | ) | | | (0.07 | ) | | | – | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, at

end of period | | | $18.85 | | | | $18.77 | | | | $25.84 | | | | $23.74 | | | | $19.09 | | | | $16.05 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Total Return(d) | | | 15.86 | % | | | (4.21 | )%(e) | | | 13.64 | % | | | 33.83 | % | | | 19.43 | % | | | 7.00 | %(e) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Ratios/Supplemental Data: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net assets at end of period (thousands) | | | $2,113 | | | | $100 | | | | $117 | | | | $17 | | | | $13 | | | | $11 | |

| | | | | | |

Before waiver: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Ratio of expenses to average net assets | | | 2.75 | % | | | 1.23 | %(f)(g) | | | 0.81 | % | | | 1.20 | % | | | 2.38 | % | | | 2.70 | %(f) |

| | | | | | |

After waiver: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Ratio of expenses to average net assets | | | 0.74 | % | | | 0.65 | %(f)(g) | | | 0.65 | % | | | 0.65 | % | | | 0.65 | % | | | 0.65 | %(f) |

| | | | | | |

Ratio of net investment income to average net assets | | | 1.70 | % | | | 1.25 | %(f)(g) | | | 1.29 | % | | | 1.42 | % | | | 1.76 | % | | | 1.39 | %(f) |

| | | | | | |

Portfolio turnover(h) | | | 194 | % | | | 108 | %(e) | | | 89 | % | | | 64 | % | | | 76 | % | | | 0 | %(e)(i) |

| (a) | | Fiscal year end changed from November 30th to September 30th. |

| (b) | | For the period September 8, 2011 (commencement of operations) through November 30, 2011. |

| (c) | | Per share net investment income has been calculated using the average shares method. |

| (d) | | Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions. |

| (g) | | Certain expenses incurred by the Fund were not annualized. |

| (h) | | Portfolio turnover is calculated on the basis on the Fund as a whole without distinguishing among the classes of shares. |

| (i) | | Amount rounds to less than 1%. |

16

See accompanying notes which are an integral part of these financial statements.

Notes to the Financial Statements

September 30, 2016

NOTE 1. ORGANIZATION

The Fuller & Thaler Behavioral Core Equity Fund (“the Fund”) was organized as a diversified series of Capitol Series Trust (the “Trust”) on March 18, 2015. The Trust is an open-end investment company established under the laws of Ohio by an Agreement and Declaration of Trust dated September 18, 2013 (the “Trust Agreement”). The Trust Agreement permits the Board of Trustees of the Trust (“the Board”) to issue an unlimited number of shares of beneficial interest of separate series without par value. The Fund is one of a series of funds currently authorized by the Board. The Fund’s investment adviser is Fuller & Thaler Asset Management, Inc. (the “Adviser” or “Fuller & Thaler”). The investment objective of the Fund is to seek long-term capital appreciation.

The Fund currently offers three share classes: Institutional Shares, A Shares and Select Shares. Each share represents an equal proportionate interest in the assets and liabilities belonging to the Fund and is entitled to such dividends and distributions out of income belonging to the Fund as are declared by the Board. A Shares currently has a maximum sales charge on purchases of 5.50% as a percentage of the original purchase price.

Reorganization – The Fuller & Thaler Behavioral Core Equity Fund is the legal successor to the AllianzGI Behavioral Advantage Large Cap Fund (the “Predecessor Fund”), a series of the Allianz Funds Multi-Strategy Trust, an unaffiliated registered investment company. On October 23, 2015, the Fund (which had no prior activity or net assets) acquired all the net assets of the Predecessor Fund pursuant to a plan of reorganization (the “Reorganization”).

The Reorganization was accomplished by a tax-free exchange of 171,108 shares of the Fund’s Class A Shares, valued at $3,360,777 for the 41,127, 22,500 and 109,062 shares, respectively, of the Class A Shares, Class C Shares and Class D Shares of the Predecessor Fund outstanding on October 23, 2015; 830,504 shares of the Fund’s Institutional Shares, valued at $16,440,186 for the 830,504 shares of the Institutional Shares of the Predecessor Fund outstanding on October 23, 2015; and 4,856 shares of the Fund’s Select Shares, valued at $95,761 for the 4,856 shares, of the Class P Shares of the Predecessor Fund outstanding on October 23, 2015.

For financial reporting purposes, assets received and shares issued by the Fund were recorded at fair value; however, the cost basis of the investments received from the Predecessor Fund was carried forward to align ongoing reporting of the Fund’s realized and unrealized gains and losses with amounts distributable to shareholders for tax purposes. Immediately prior to the merger, the net assets of the Predecessor Fund were $19,896,724, including $676,339 of unrealized appreciation, $230,311 of undistributed net investment income, and $1,642,910 of accumulated realized gain.

The accounting and performance history of the Class A, Class P and Institutional Class Shares of the Predecessor Fund were re-designated as that of the Class A, Select and Institutional Shares of the Fund, respectively.

The Reorganization shifted the investment advisory responsibility from Allianz Global Investors Fund Management LLC to Fuller & Thaler. Prior to the Reorganization, Fuller & Thaler served as the Predecessor Fund’s sub-adviser, thus maintaining the continuity of the portfolio management.

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES

The Fund is an investment company and follows accounting and reporting guidance under Financial Accounting Standards Board Accounting Standards Codification (“ASC”) Topic 946,

17

Notes to the Financial Statements (continued)

September 30, 2016

“Financial Services-Investment Companies”. The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of their financial statements. The policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”).

Securities Valuation – All investments in securities are recorded at their estimated fair value as described in Note 3.

Federal Income Taxes – The Fund makes no provision for federal income tax or excise tax. The Fund has qualified and intends to qualify each year as a regulated investment company (“RIC”) under subchapter M of the Internal Revenue Code of 1986, as amended, by complying with the requirements applicable to RICs and by distributing substantially all of its taxable income. The Fund also intends to distribute sufficient net investment income and net capital gains, if any, so that it will not be subject to excise tax on undistributed income and gains. If the required amount of net investment income or gains is not distributed, the Fund could incur a tax expense.

As of and during the fiscal year ended September 30, 2016, the Fund did not have a liability for any unrecognized tax benefits. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations. During the period, the Fund did not incur any interest or penalties.

Expenses – Expenses incurred by the Trust that do not relate to a specific fund of the Trust are allocated to the individual funds based on each fund’s relative net assets or another appropriate basis (as determined by the Board). Expenses attributable to any class are borne by that class. Income, realized gains and losses, unrealized appreciation and depreciation, and expenses are allocated to each class based on the net assets in relation to the relative net assets of the Fund.

Security Transactions and Related Income — The Fund follows industry practice and records security transactions on the trade date for financial reporting purposes. For all purposes other than financial reporting, security transactions are accounted for no later than one business day following trade date. The specific identification method is used for determining gains or losses for financial statements and income tax purposes. Dividend income is recorded on the ex-dividend date and interest income is recorded on an accrual basis. Discounts and premiums on securities purchased are accreted or amortized using the effective interest method. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates.

Dividends and Distributions – The Fund intends to distribute substantially all of its net investment income, net realized long term capital gains and its net realized short term capital gains, if any, at least once a year. Distributions to shareholders, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. The treatment for financial reporting purposes of distributions made to shareholders during the period from net investment income or net realized capital gains may differ from their ultimate treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of the recognition of certain components of income, expense or realized capital gains for federal income tax purposes. Where such differences are permanent in nature, they are reclassified in the components of net assets based on their ultimate characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations or net asset values per share of the Fund.

18

Notes to the Financial Statements (continued)

September 30, 2016

For the fiscal year ended September 30, 2016, the Fund made the following reclassifications to increase/ (decrease) the components of net assets:

| | | | | | | | |

Paid-in

Capital | | Accumulated

Undistributed Net

Investment Income | | | Accumulated Net

Realized Loss from

Investments | |

$ (1) | | $ | (5,475 | ) | | $ | 5,476 | |

NOTE 3. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS

Fair value is defined as the price that the Fund would receive upon selling an investment in an orderly transaction to an independent buyer in the principal or most advantageous market of the investment. GAAP established a three-tier hierarchy to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes.

Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk (the risk inherent in a particular valuation technique used to measure fair value such as pricing model and/or the risk inherent in the inputs to the valuation technique). Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances.

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below.

| | • | | Level 1 – unadjusted quoted prices in active markets for identical investments and/or registered investment companies where the value per share is determined and published and is the basis for current transactions for identical assets or liabilities at the valuation date. |

| | • | | Level 2 – other significant observable inputs (including, but not limited to, quoted prices for an identical security in an inactive market, quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| | • | | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining fair value of investments based on the best information available) |

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

In computing the net asset value (“NAV”) of the Fund, fair value is based on market valuations with respect to portfolio securities for which market quotations are readily available. Pursuant to Board-approved policies, the Fund relies on independent third-party pricing services to provide the current market value of securities. Those pricing services value equity securities traded on a securities exchange at the last reported sales price on the principal exchange. Equity securities quoted by NASDAQ are valued at the NASDAQ Official Closing Price. If there is no reported sale on the principal exchange, equity securities are valued at the mean between the most recent quoted bid and asked price. When using the market quotations or close prices provided by the pricing service and when the market is considered active, the security will be classified as a Level 1 security.

19

Notes to the Financial Statements (continued)

September 30, 2016

Sometimes, an equity security owned by the Fund will be valued by the pricing service with factors other than market quotations or when the market is considered inactive. When this happens, the security may be classified as a Level 2 security. When market quotations are not readily available, when the Fund determines that the market quotation or the price provided by the pricing service does not accurately reflect the current fair value, or when certain restricted or illiquid securities are being valued, such securities are valued as determined in good faith by the Adviser, in conformity with guidelines adopted by and subject to review by the Board. These securities are generally categorized as Level 3 securities.

Investments in open-end mutual funds, including money market mutual funds, are generally priced at the ending NAV provided by the service agent of the funds. These securities are categorized as Level 1 securities.

In accordance with the Trust’s valuation procedures, the Adviser is required to consider all appropriate factors relevant to the value of securities for which it has determined pricing sources are not available or reliable as described above. No single standard exists for determining fair value, because fair value depends upon the circumstances of each individual case. As a general principle, the current fair value of an issue of securities being valued by the Fund would be the amount which the Fund might reasonably expect to receive for them upon their current sale. Methods which are in accordance with this principle may, for example, be based on (i) a multiple of earnings; (ii) a discount from market of a similar freely traded security (including a derivative security or a basket of securities traded on other markets, exchanges or among dealers); or (iii) yield to maturity with respect to debt issues, or a combination of these and other methods. Good faith pricing is permitted if, in the Adviser’s opinion, the validity of market quotations appears to be questionable based on factors such as evidence of a thin market in the security based on a small number of quotations, a significant event occurs after the close of a market but before the Fund’s NAV calculation that may affect a security’s value, or the Adviser is aware of any other data that calls into question the reliability of market quotations. Fair value pricing may also be used in instances when the bonds the Fund invests in may default or otherwise cease to have market quotations readily available.

The following is a summary of the inputs used to value the Fund’s investments as of September 30, 2016:

| | | | | | | | | | | | | | | | |

| | | Valuation Inputs | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Common Stocks * | | $ | 8,807,367 | | | $ | – | | | $ | – | | | $ | 8,807,367 | |

Cash Equivalents | | | 329,680 | | | | – | | | | – | | | | 329,680 | |

Total | | $ | 9,137,047 | | | $ | – | | | $ | – | | | $ | 9,137,047 | |

| * | | Refer to Schedule of Investments for industry classifications. |

The Fund did not hold any investments during the reporting period in which other significant observable inputs (Level 2) were used in determining fair value. The Fund did not hold any investments during the reporting period in which significant unobservable inputs (Level 3) were used in determining fair value; therefore, no reconciliation of Level 3 securities is included for this reporting period.

The Trust recognizes transfers between fair value hierarchy levels at the end of the reporting period. There were no transfers between any levels for the fiscal year ended September 30, 2016.

20

Notes to the Financial Statements (continued)

September 30, 2016

NOTE 4. FEES AND OTHER TRANSACTIONS WITH AFFILIATES AND OTHER SERVICE PROVIDERS

Under the terms of the investment advisory agreement (the “Agreement”), the Adviser manages the Fund’s investments subject to approval of the Board. As compensation for its management services, the Fund is obligated to pay the Adviser a fee computed and accrued daily and paid monthly at an annual rate of 0.60% of the Fund’s average daily net assets. Prior to October 26, 2015, AGIFM was paid a fee at an annual rate of 0.40% and earned fees of $5,410. For the fiscal year ended September 30, 2016, the Adviser earned fees of $59,499 from the Fund. At September 30, 2016, the Adviser owed $14,633 to the Fund, including fee waivers and expense reimbursements.

The Adviser has contractually agreed to waive its management fee and/or reimburse expenses so that total annual operating expenses (excluding (i) interest; (ii) taxes; (iii) brokerage fees and commissions; nor the Fund’s (iv) other extraordinary expenses not incurred in the ordinary course of the Fund’s business; and (v) indirect expenses such as acquired fund fees and expenses) do not exceed 0.65%, 0.90% and 0.75% for Institutional Shares, A Shares and Select Shares, respectively, of the Fund’s average daily net assets through January 31, 2017, and 0.80%, 1.05% and 0.90% for Institutional Shares, A Shares and Select Shares, respectively, of the Fund’s average daily net assets through January 31, 2018 (“Expense Limitation”). Prior to October 26, 2015, the Adviser had contractually agreed to waive its management fee and/or reimburse expenses so that total annual operating expenses did not exceed 0.55%, 0.81% and 0.65% for Institutional Shares, A Shares and Select Shares, respectively, through March 31, 2016. During any fiscal year that the Agreement between the Adviser and Trust is in effect, the Adviser may recoup the sum of all fees previously waived or expenses reimbursed during any of the previous three years, less any reimbursement previously paid, if such recoupment can be achieved within the Expense Limitation as well as any expense limitation in effect at the time the reimbursement is made. This expense cap agreement may be terminated by the Board at any time.

The amounts subject to repayment by the Fund, pursuant to the aforementioned conditions, are as follows:

| | | | |

| Amount | | Recoverable

through | |

| $202,337 | | | September 30, 2019 | |

The Trust retains Ultimus Asset Services, LLC (“Ultimus”), formerly Huntington Asset Services, Inc. (“HASI”), to supply non-investment related administrative and compliance services for the Fund. Prior to October 26, 2015, the Fund was serviced by AGIFM. For the fiscal year ended September 30, 2016, Ultimus earned fees of $29,327 for administrative services provided to the Fund. At September 30, 2016, Ultimus was owed $2,625 by the Fund for administrative and compliance services.

The Trust also retains Ultimus to act as the Fund’s transfer agent and to provide fund accounting services. Prior to October 26, 2015, the Fund was serviced by Boston Financial Data Services, Inc. as transfer agent and State Street Bank & Trust Co. (“State Street”) as fund accounting agent. For the fiscal year ended September 30, 2016, Ultimus earned fees of $17,723 for transfer agent services provided to the Fund. For the fiscal year ended September 30, 2016, Ultimus earned fees of $17,764 from the Fund for fund accounting services. At September 30, 2016, Ultimus was owed $2,208 by the Fund for fund accounting services. At September 30, 2016, the Fund owed Ultimus $1,844 for transfer agent services.

Certain officers and one trustee of the Trust are employees of Ultimus. Unified Financial Securities, LLC (the “Distributor”) acts as the principal distributor of the Fund’s shares. Huntington National Bank is the custodian of the Fund’s investments (the “Custodian”). Effective at the close of business

21

Notes to the Financial Statements (continued)

September 30, 2016

on December 31, 2015, Ultimus Fund Solutions, LLC acquired HASI and the Distributor from Huntington Bancshares, Inc. (“HBI”). For the fiscal year ended September 30, 2016, the Custodian earned fees of $7,463 for custody services provided to the Fund. Prior to January 1, 2016, the HASI and the Distributor were under common control by HBI. Prior to October 26, 2015, the Fund’s distributor was Allianz Global Investors Distributors LLC and the custodian was State Street.

The Fund has adopted a Distribution Plan (the “Plan”) pursuant to Rule 12b-1 under the 1940 Act. The Plan provides that the Fund will pay the Distributor and/or any registered securities dealer, financial institution or any other person (the “Recipient”) a fee of 0.25% of the average daily net assets of the Fund’s A Shares in connection with the promotion and distribution of the Fund’s A Shares or the provision of personal services to shareholders, including, but not necessarily limited to, advertising, compensation to underwriters, dealers and selling personnel, the printing and mailing of prospectuses to other than current A Shares shareholders, the printing and mailing of sales literature and servicing shareholder accounts (“12b-1 Expenses”). The Fund or Distributor may pay all or a portion of these fees to any Recipient who renders assistance in distributing or promoting the sale of shares, or who provides certain shareholder services, pursuant to a written agreement. The Plan is a compensation plan, which means that compensation is provided regardless of whether 12b-1 Expenses are actually incurred. Accordingly, the 12b-1 Expenses of the A Shares of the Fund may be less than fees paid out by the class under the Plan. During the fiscal year ended September 30, 2016, the Distributor received $830 from commissions earned on sales of A Shares, of which $716 was re-allowed to intermediaries of the Fund.

The Fund has adopted an Administrative Services Plan (the “Services Plan”) for Select Shares of the Fund. The Services Plan allows the Fund to use Select Shares to pay financial intermediaries that provide services relating to Select Shares. The Services Plan permits payments for the provision of certain administrative, record keeping and other services to Select Share shareholders. The Services Plan permits the Fund to make service fee payments at an annual rate of up to 0.10% of the Fund’s average daily net assets attributable to its Select Shares.

NOTE 5. PURCHASES AND SALES OF SECURITIES

For the fiscal year ended September 30, 2016, purchases and sales of investment securities, other than short-term investments and short-term U.S. government obligations, were as follows:

| | | | |

Purchases | | | | |

U.S. Government Obligations | | $ | – | |

Other | | | 21,226,654 | |

Sales | | | | |

U.S. Government Obligations | | $ | – | |

Other | | | 31,697,460 | |

NOTE 6. ESTIMATES

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

22

Notes to the Financial Statements (continued)

September 30, 2016

NOTE 7. BENEFICIAL OWNERSHIP

The beneficial ownership, either directly or indirectly, of 25% or more of the voting securities of a fund creates a presumption of control of a fund, under Section 2(a) (9) of the Investment Company Act of 1940. At September 30, 2016, Charles Schwab & Co., Inc. (“Schwab”) owned 37% of the outstanding shares of the Fund. It is not known whether Schwab or any of the underlying beneficial owners owned or controlled 25% or more of the voting securities of the Fund.

NOTE 8. FEDERAL TAX INFORMATION

As of September 30, 2016, the net unrealized appreciation (depreciation) of investments for tax purposes was as follows:

| | | | |

Gross Unrealized Appreciation | | $ | 879,581 | |

Gross Unrealized Depreciation | | | (152,963 | ) |

Net Unrealized Appreciation (Depreciation) | | $ | 726,618 | |

At September 30, 2016, the aggregate cost of securities for federal income tax purposes was $8,410,429 for the Fund. The difference between book basis and tax basis unrealized appreciation is primarily attributable to the tax deferral of wash losses.

The tax character of distributions paid during the fiscal years ended September 30, 2016 and September 30, 2015, were as follows:

| | | | | | | | |

| | | 2016 | | | 2015 | |

Distributions paid from: | | | | | | | | |

Ordinary Income | | $ | 299,373 | | | $ | 5,284,997 | |

Net Long-Term Capital Gains | | | 2,161,502 | | | | 12,546,021 | |

Total Distributions Paid | | $ | 2,460,875 | | | $ | 17,831,018 | |

At September 30, 2016, the components of distributable earnings (accumulated losses) on a tax basis were as follows:

| | | | |

Undistributed Ordinary Income | | $ | 85,732 | |

Accumulated Capital and Other Losses | | | (1,519,598 | ) |

Unrealized Appreciation (Depreciation) | | | 726,618 | |

Total Accumulated Earnings (Deficit) | | $ | (707,248 | ) |

Certain capital losses incurred after October 31, and within the current taxable year, are deemed to arise on the first business day of the Fund’s following taxable year. For the tax year ended September 30, 2016, the Fund deferred post October capital losses in the amount of $1,519,598.

NOTE 9. COMMITMENTS AND CONTINGENCIES

The Fund indemnifies its officers and trustees for certain liabilities that may arise from the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred.

NOTE 10. SUBSEQUENT EVENTS

Management of the Fund has evaluated the need for disclosures and/or adjustments resulting from subsequent events through the date these financial statements were issued. Management has determined that there were no items requiring additional disclosure.

23

Report of Independent Registered Public Accounting Firm

The Board of Trustees and Shareholders

Capitol Series Trust: