UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22895

Capitol Series Trust

(Exact name of registrant as specified in charter)

Ultimus Asset Services, LLC

2960 North Meridian Street, Suite 300

Indianapolis, IN46208

(Address of principal executive offices) (Zip code)

Zachary P. Richmond

Ultimus Asset Services, LLC

2960 N. Meridian St. Suite 300

Indianapolis, IN 46208

(Name and address of agent for service)

Registrant’s telephone number, including area code: 513-587-3400

Date of fiscal year end: August 31

Date of reporting period: August 31, 2017

Item 1. Reports to Stockholders.

Where discipline meets common sense.

Annual Report

August 31, 2017

Meritage Growth Equity Fund MPGEX/MPGIX

Meritage Value Equity Fund MVEBX

Meritage Yield-Focus Equity Fund MPYEX/MPYIX

| | | | |

| 913.345.7000 | | www.meritageportfoliofunds.com | | 7500 College Blvd., Suite 1212, Overland Park, KS 66210 |

MESSAGE FROM THE CHIEF INVESTMENT OFFICER – (Unaudited)

At Meritage, we are value-driven investors. We buy stock in businesses when they i) score well in our comprehensive stock-ranking process (universe is global, all-cap and about 6,500 securities), and ii) are selling for less than we believe they are worth. Our value discipline is intended to provide a margin of safety and is one of our primary risk management tools, along with managing position sizes and diversification.

Dear Fellow Shareholders:

During the six months ended August 31, 2017, since our semi-annual report of February 28, 2017, the broad equity market as represented by the S&P 500 was up 5.7%. For the fiscal year ended August 31, 2017, the S&P was up 16.2%.

As mentioned in our semi-annual report, reaction to the prospect of significantly positive growth tax change, reduced regulatory pressure, along with higher spending for defense, safety and infrastructure are all factors helping the equity market environment. Despite major geopolitical risks, continued low interest rates plus gradually improving world GNP trends should produce a relatively stable market environment, in which our selection process can work effectively.

Notably, our Value strategy performed well in the past year as compared to its benchmark and our Growth strategy continued to perform well, in line with its respective market benchmark for the year and well ahead of the S&P 500. Our Yield-Focus strategy turned in a positive year, but trailed its most comparable benchmark, the Zacks Multi-Asset Income Index.

As always, the primary mechanism generating our strong long term returns was responsible for our results in fiscal 2017. Our robust bottom up value-centric security selection process continues to be refined and improved and rigorously searched for attractive mispriced securities, among all capitalization sizes and geographies throughout the world.

We explore this topic further in the following pages. A specific discussion of each Fund and its performance is included in Management’s Discussion of Fund Performance.

Thank you for your continued trust in us as stewards of your capital. As previously mentioned we have our own money invested alongside yours in each of our funds, and we remain committed to delivering attractive risk-adjusted returns over full market cycles.

Sincerely,

Mark Eveans, CFA

President and Chief Investment Officer

1

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE – (Unaudited)

Meritage Growth Equity Fund

For the fiscal year ended August 31, 2017, the Meritage Growth Equity Fund Institutional Class and Investor Class returned 20.3% and 20.0%, respectively. These returns were better than those provided by the broad equity market (as represented by the S&P 500) and closely tracked the Fund’s primary benchmark, the Russell 1000 Growth Index which returned 20.8% and the Lipper Large Cap Growth Index which returned 21.6% during the same time frame.

For the six months ended August 31, 2017, which is the period since our Semi-Annual Report, the Meritage Growth Equity Fund Institutional Class and Investor Class returned 8.5% and 8.4%, respectively. These returns lagged the Russell 1000 Growth Index benchmark which returned 10.7% during the same time frame, as well as the Lipper Large Cap Growth Index return of 12.9%.

From an attribution standpoint, the Fund’s strong performance over the course of the last 12 months, compared to the benchmark, was driven primarily by an over-weight for most of the period as compared to the benchmark in the Information Technology sector. Our stock selection in that sector was also superior. The interaction of these two factors was a significant positive. Sector underweights for Consumer Staples, Telecommunications, Real Estate, Energy and Materials were also positive factors for the Fund.

Regarding specific issues, the strongest gainers for the year were Nvidia Corp., up 181.6%, Coherent Inc., up 84.6% and II-VI Inc., up 68.0%.

The poorest performers for the year were Gibraltar Industries, down 27.3%, Acuity Brands Inc., down 23.7% and McKesson Corp., down 23.2%.

As a value-centric and process driven Growth manager, most sector differences as compared to the benchmark are a result of either an under or overweight of specific, bottom-up, attractively valued growth opportunities identified by our process, within that particular sector.

We expect a continuation of abnormally low interest rates and below average economic growth for the world’s leading economies. We believe many investors share our view and have correspondingly been willing to pay an excessive premium for well-known growth names. This is where we part company with the crowd, however, as we expect the value discipline embedded in our growth approach to yield better results over full market cycles.

Meritage Value Equity Fund

For the fiscal year ended August 31, 2017, the Meritage Value Equity Fund Institutional Class returned 13.4%. This return exceeded the Russell 1000 Value Index benchmark which returned 11.6% during the same time frame, and closely tracked the Lipper Large Cap Value Index return of 13.7%.

For the six months ended August 31, 2017, which is the period since our Semi-Annual Report, the Meritage Value Equity Fund Institutional Class returned 3.7%. This return significantly exceeded the Russell 1000 Value Index benchmark which returned 0.5% during the same time frame, as well as the Lipper Large Cap Value Index return of 1.9%.

From an attribution standpoint, the Fund’s overweight in the Health Care and Information Technology sectors, coupled with superior stock selection in both sectors were significant positive factors. An underweight in the Energy sector along with superior stock selection was also helpful to Fund performance. An underweight in the Consumer Discretionary and Consumer Staples sectors along with under-performing security selections in those sectors held back the Fund returns.

2

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE – (Unaudited) (continued)

Regarding individual issues, the strongest gainers for the year were Teradyne Inc., up 70.7%, Spirit AeroSystems Holdings, up 63.4%, and UnitedHealth Group Inc., up 48.6%.

The poorest performers for the year were Teva Pharmaceutical Industries, down 23.1%, World Fuel Services Corp., down 20.7% and Taro Pharmaceutical Industries, down 19.8%.

As a value-centric and process driven manager, most sector differences as compared to the benchmark are the result of either an under or overweight of specific bottom-up valuation opportunities identified by our process.

We expect a continuation of abnormally low interest rates and below average economic growth for the world’s leading economies. We believe many investors share our view and have correspondingly been willing to pay a premium for well-known stocks. This is where we part company with the crowd, however, as we expect the discipline embedded in our value approach will yield better results over full market cycles.

Meritage Yield-Focus Equity Fund

For the fiscal year ended August 31, 2017, the Meritage Yield-Focus Equity Fund Institutional Class and Investor Class returned 7.8% and 7.9%, respectively. These returns broadly trailed the 11.7% total return for the Russell 3000 Value Index, a general value market benchmark, and the Zacks Multi-Asset Income Index, a style-specific peer index, which returned 12.5% during the same time.

For the six months ended August 31, 2017, which is the period since our Semi-Annual Report, the Meritage Yield-Focus Equity Fund Institutional Class and Investor Class returned 1.4% and 1.3% respectively. These returns exceeded the Russell 3000 Value Index, which returned 0.3% during the time period, but trailed the Zacks Multi-Asset Index, which returned 3.7% during the same time frame.

A founding premise of the Yield-Focus Equity Fund is to earn 50–75% of the expected long-term equity return in the form of cash dividends and distributions. The strategy invests in six key types of equity asset classes – common stocks, master limited partnerships, other limited partnerships, real estate investment trusts, business development companies, convertible preferred stocks and, in rare situations, straight preferred stocks. The Meritage comprehensive security selection process searches globally for attractive yield franchises.

For fiscal year ended August 31, 2017, regarding equity asset class performance, convertible preferred stocks and MLPs were the strongest relative performers. REITs and straight preferred stocks had the lowest absolute returns. The best performing sectors were Energy, Consumer Staples, Industrials and Materials where strong stock selection helped relative performance. Performance was hurt by less favorable stock selection in the Utilities, Telecommunications, Consumer Discretionary and Financials sectors.

In terms of specific issues, the strongest performers for the year were Boeing Company, up 90.8%, HP Inc., up 37.1% and Reynolds American Inc., up 36.4%.

The poorest performers for the year were GameStop Corp, down 42.3%, Gannett Co., down 28.1% and CenturyLink, Inc., down 22.2%.

We use two benchmarks in assessing the performance of the Yield-Focus Equity Fund. The Russell 3000 Value Index is a long-term general purpose value-centric benchmark without specificity regarding the Fund’s distinct yield-focus style. The Zacks Multi-Asset Income Index has specific asset structure and distinguished dividend yield characteristics similar to the Fund.

3

INVESTMENT RESULTS – (Unaudited)

Average Annual Total Returns as of August 31, 2017 (a)

| | | | | | | | | | | | | | |

Fund/Index | | 1 Year | | | 3 Year | | | Since Inception

(12/23/13) | |

Meritage Growth Equity Fund – Institutional Class | | | 20.27 | % | | | 11.14 | % | | | 11.66 | % |

Meritage Growth Equity Fund – Investor Class | | | 20.02 | % | | | 10.89 | % | | | 11.38 | % |

Russell 1000 Growth Index (b) | | | 20.81 | % | | | 11.67 | % | | | 12.62 | % |

| | | | | | | | |

| | | Expense Ratios (c) | |

| | | Institutional Class | | | Investor Class | |

Gross | | | 1.63 | % | | | 1.88 | % |

With Applicable Waivers | | | 1.03 | % | | | 1.28 | % |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Current performance of a Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-855-261-0104.

The performance in the preceding table reflects any fee reductions during the applicable period. If such fee reductions had not occurred, the quoted performance would be lower.

| (a) | Return figures reflect any change in price per share and assume the reinvestment of all distributions. |

| (b) | The Russell 1000 Growth Index is a widely recognized unmanaged index of equity securities and is representative of a broader domestic equity market and range of securities than is found in the Fund’s portfolio. Individuals cannot invest directly in an index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index. |

| (c) | The expense ratios are from the Fund’s prospectus dated December 29, 2016. The Adviser has contractually agreed to waive or limit its fees and assume other expenses of the Fund through December 31, 2017, so that total annual fund operating expenses do not exceed 1.00% of the Fund’s average daily net assets. This operating expense limitation does not apply to brokerage fees and commissions, borrowing costs (such as interest and dividend expenses on securities sold short), taxes, 12b-1 fees, extraordinary expenses and indirect expenses (such as “acquired fund fees and expenses”). Additional information pertaining to the Fund’s expense ratios as of August 31, 2017 can be found in the financial highlights. |

The Fund’s investment objective, strategies, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the investment company and may be obtained by calling 1-855-261-0104. Please read it carefully before investing.

The Fund is distributed by Unified Financial Securities, LLC, Member FINRA/SIPC.

4

INVESTMENT RESULTS – (Unaudited) (continued)

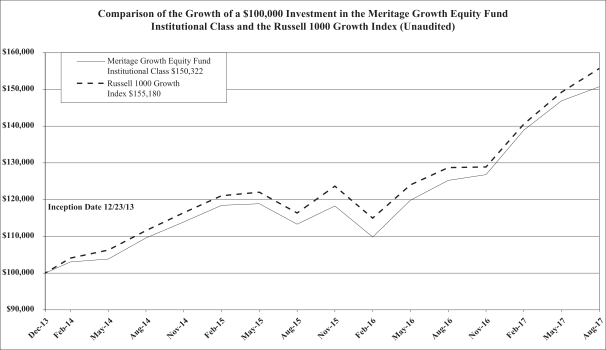

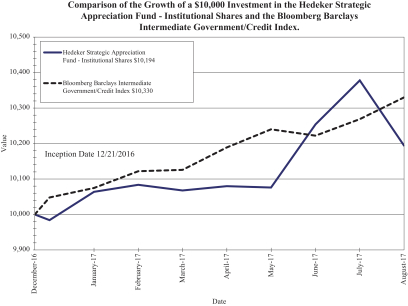

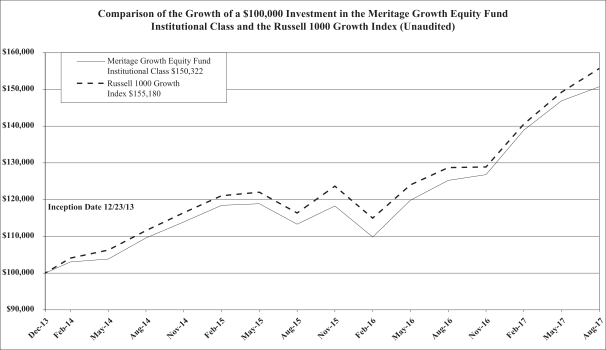

The chart above assumes an initial investment of $100,000 made on December 23, 2013 (commencement of operations) and held through August 31, 2017. THE FUND’S RETURNS REPRESENT PAST PERFORMANCE AND DO NOT GUARANTEE FUTURE RESULTS. The returns shown do not reflect deduction of taxes that a shareholder would pay on the Fund’s distributions or the redemption of the Fund’s shares. Investment returns and principal values will fluctuate so that your shares, when redeemed, may be worth more or less than their original purchase price.

The Russell 1000 Growth Index is a widely recognized unmanaged index of equity securities and is representative of a broader domestic equity market and range of securities than is found in the Fund’s portfolio. Individuals cannot invest directly in an Index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index. The Index returns do not include expenses, which have been deducted from the Fund’s return. These performance figures include the change in value of the stocks in the index plus the reinvestment of dividends and are not annualized. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Current performance may be lower or higher than the performance data quoted. For more information on the Fund, and to obtain performance data current to the most recent month-end, or to request a prospectus, please call 1-855-261-0104. You should carefully consider the investment objectives, potential risks, management fees, and charges and expenses of the Fund before investing. The Fund’s prospectus contains this and other information about the Fund, and should be read carefully before investing.

The Fund is distributed by Unified Financial Securities, LLC, member FINRA/SIPC..

5

INVESTMENT RESULTS – (Unaudited) (continued)

Average Annual Total Returns as of August 31, 2017 (a)

| | | | | | | | | | | | |

Fund/Index | | 1 Year | | | 3 Year | | | Since Inception

(12/23/13) | |

Meritage Value Equity Fund – Institutional Class | | | 13.41 | % | | | 5.25 | % | | | 6.96 | % |

Russell 1000 Value Index (b) | | | 11.58 | % | | | 6.74 | % | | | 8.77 | % |

| | | | |

| | | Expense Ratios (c) | |

| | | Institutional Class | |

Gross | | | 1.71 | % |

With Applicable Waivers | | | 1.04 | % |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Current performance of a Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-855-261-0104.

The performance in the preceding table reflects any fee reductions during the applicable period. If such fee reductions had not occurred, the quoted performance would be lower.

| (a) | Return figures reflect any change in price per share and assume the reinvestment of all distributions. |

| (b) | The Russell 1000 Value Index is a widely recognized unmanaged index of equity securities and is representative of a broader domestic equity market and range of securities than is found in the Fund’s portfolio. Individuals cannot invest directly in an index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index. |

| (c) | The expense ratios are from the Fund’s prospectus dated December 29, 2016. The Adviser has contractually agreed to waive or limit its fees and assume other expenses of the Fund through December 31, 2017, so that total annual fund operating expenses do not exceed 1.00% of the Fund’s average daily net assets. This operating expense limitation does not apply to brokerage fees and commissions, borrowing costs (such as interest and dividend expenses on securities sold short), taxes, 12b-1 fees, extraordinary expenses and indirect expenses (such as “acquired fund fees and expenses”). Additional information pertaining to the Fund’s expense ratios as of August 31, 2017 can be found in the financial highlights. |

The Fund’s investment objective, strategies, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the investment company and may be obtained by calling 1-855-261-0104. Please read it carefully before investing.

The Fund is distributed by Unified Financial Securities, LLC, Member FINRA/SIPC.

6

INVESTMENT RESULTS – (Unaudited) (continued)

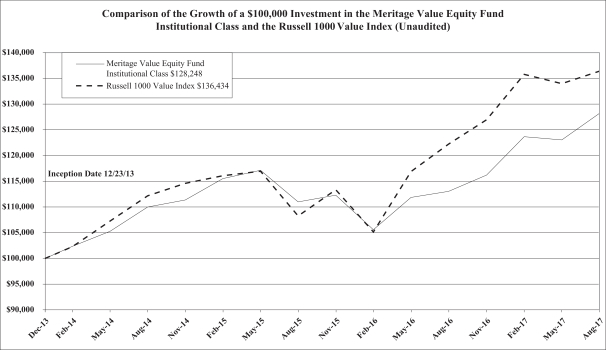

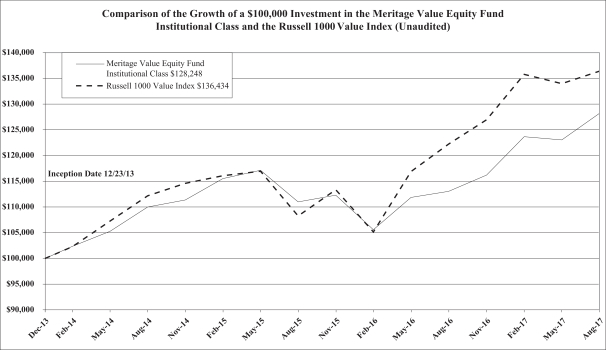

The chart above assumes an initial investment of $100,000 made on December 23, 2013 (commencement of operations) and held through August 31, 2017. THE FUND’S RETURNS REPRESENT PAST PERFORMANCE AND DO NOT GUARANTEE FUTURE RESULTS. The returns shown do not reflect deduction of taxes that a shareholder would pay on the Fund’s distributions or the redemption of the Fund’s shares. Investment returns and principal values will fluctuate so that your shares, when redeemed, may be worth more or less than their original purchase price.

The Russell 1000 Value Index is a widely recognized unmanaged index of equity securities and is representative of a broader domestic equity market and range of securities than is found in the Fund’s portfolio. Individuals cannot invest directly in an Index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index. The Index returns do not include expenses, which have been deducted from the Fund’s return. These performance figures include the change in value of the stocks in the index plus the reinvestment of dividends and are not annualized. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Current performance may be lower or higher than the performance data quoted. For more information on the Fund, and to obtain performance data current to the most recent month-end, or to request a prospectus, please call 1-855-261-0104. You should carefully consider the investment objectives, potential risks, management fees, and charges and expenses of the Fund before investing. The Fund’s prospectus contains this and other information about the Fund, and should be read carefully before investing.

The Fund is distributed by Unified Financial Securities, LLC, member FINRA/SIPC.

7

INVESTMENT RESULTS – (Unaudited) (continued)

Average Annual Total Returns as of August 31, 2017 (a)

| | | | | | | | | | | | |

Fund/Index | | 1 Year | | | 3 Year | | | Since Inception

(12/23/13) | |

Meritage Yield-Focus Equity Fund – Institutional Class | | | 7.79 | % | | | 1.08 | % | | | 4.19 | % |

Meritage Yield-Focus Equity Fund – Investor Class | | | 7.93 | % | | | 0.95 | % | | | 4.03 | % |

Russell 3000 Value Index (b) | | | 11.73 | % | | | 6.76 | % | | | 8.60 | % |

Zacks Multi-Asset Income Index TR (c) | | | 12.51 | % | | | -1.27 | % | | | 1.63 | % |

| | | | | | | | |

| | | Expense Ratios (d) | |

| | | Institutional Class | | | Investor Class | |

Gross | | | 1.64 | % | | | 1.89 | % |

With Applicable Waivers | | | 1.15 | % | | | 1.40 | % |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Current performance of a Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-855-261-0104.

The performance in the preceding table reflects any fee reductions during the applicable period. If such fee reductions had not occurred, the quoted performance would be lower.

| (a) | Return figures reflect any change in price per share and assume the reinvestment of all distributions. |

| (b) | The Russell 3000 Value Index is a widely recognized unmanaged index of equity securities and is representative of a broader domestic equity market and range of securities than is found in the Fund’s portfolio. Individuals cannot invest directly in an index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index. |

| (c) | The Zacks Multi-Asset Income Index is comprised of approximately 125 to 150 securities selected, based on investment and other criteria, from a universe of domestic and international companies. The universe of securities within the index includes U.S. listed common stocks and ADRs paying dividends, real estate investment trusts, MLPs, closed end funds, Canadian royalty trusts and traditional preferred stocks. Individuals cannot invest directly in an index. |

| (d) | The expense ratios are from the Fund’s prospectus dated December 29, 2016. The Adviser has contractually agreed to waive or limit its fees and assume other expenses of the Fund through December 31, 2017, so that total annual fund operating expenses do not exceed 1.00% of the Fund’s average daily net assets. This operating expense limitation does not apply to brokerage fees and commissions, borrowing costs (such as interest and dividend expenses on securities sold short), taxes, 12b-1 fees, extraordinary expenses and indirect expenses (such as “acquired fund fees and expenses”). Additional information pertaining to the Fund’s expense ratios as of August 31, 2017 can be found in the financial highlights. |

The Fund’s investment objective, strategies, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the investment company and may be obtained by calling 1-855-261-0104. Please read it carefully before investing.

The Fund is distributed by Unified Financial Securities, LLC, Member FINRA/SIPC.

8

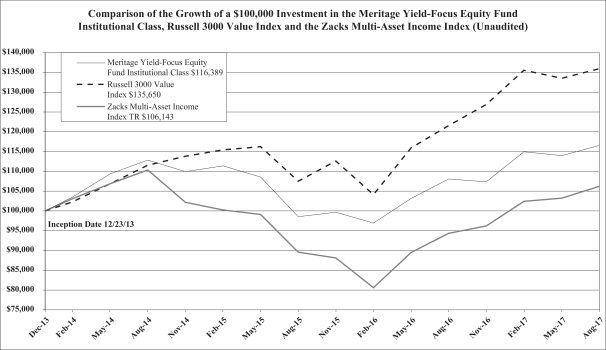

INVESTMENT RESULTS – (Unaudited) (continued)

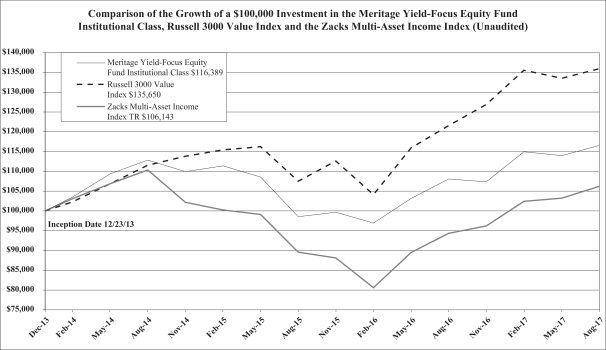

The chart above assumes an initial investment of $100,000 made on December 23, 2013 (commencement of operations) and held through August 31, 2017. THE FUND’S RETURNS REPRESENT PAST PERFORMANCE AND DO NOT GUARANTEE FUTURE RESULTS. The returns shown do not reflect deduction of taxes that a shareholder would pay on the Fund’s distributions or the redemption of the Fund’s shares. Investment returns and principal values will fluctuate so that your shares, when redeemed, may be worth more or less than their original purchase price.

The Russell 3000 Value Index is a widely recognized unmanaged index of equity securities and is representative of a broader domestic equity market and range of securities than is found in the Fund’s portfolio. Individuals cannot invest directly in an Index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index. The Index returns do not include expenses, which have been deducted from the Fund’s return. These performance figures include the change in value of the stocks in the index plus the reinvestment of dividends and are not annualized. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

The Zacks Multi-Asset Income Index is comprised of approximately 125 to 150 securities selected, based on investment and other criteria, from a universe of domestic and international companies. The universe of securities within the Index includes U.S. listed common stocks and ADRs paying dividends, real estate investment trusts, MLPs, closed end funds, Canadian royalty trusts and traditional preferred stocks. Individuals cannot invest directly in an Index.

Current performance may be lower or higher than the performance data quoted. For more information on the Fund, and to obtain performance data current to the most recent month-end, or to request a prospectus, please call 1-855-261-0104. You should carefully consider the investment objectives, potential risks, management fees, and charges and expenses of the Fund before investing. The Fund’s prospectus contains this and other information about the Fund, and should be read carefully before investing.

The Fund is distributed by Unified Financial Securities, LLC, member FINRA/SIPC.

9

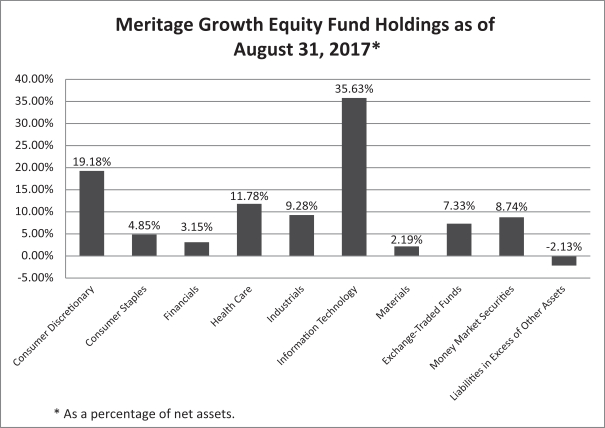

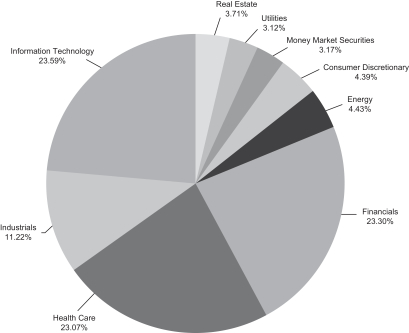

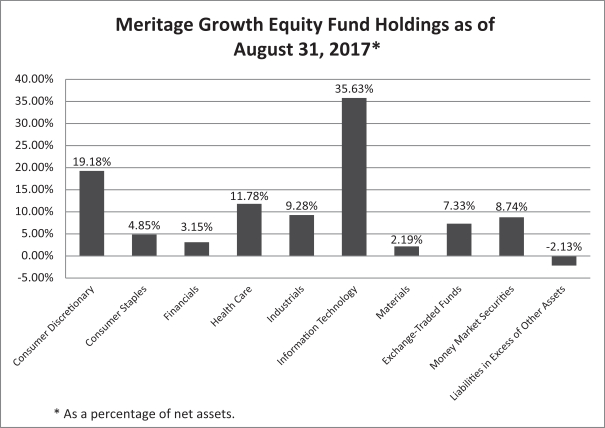

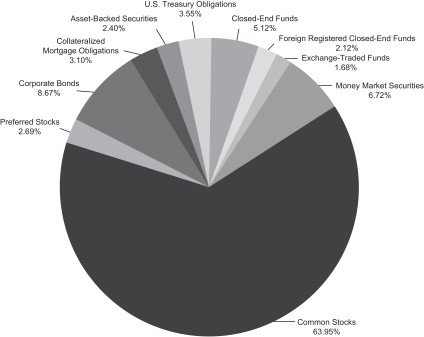

FUND HOLDINGS – (Unaudited)

The investment objective of the Meritage Growth Equity Fund is to seek growth of capital.

10

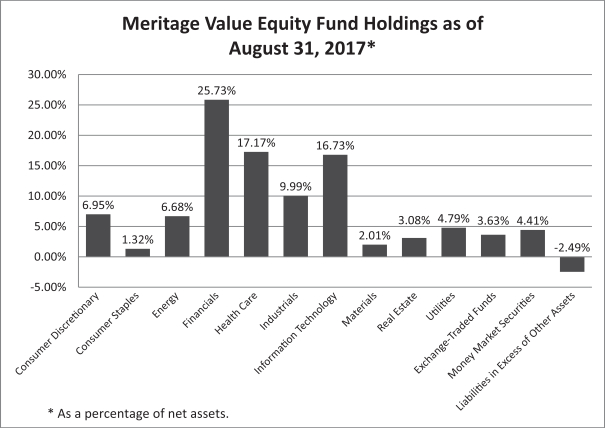

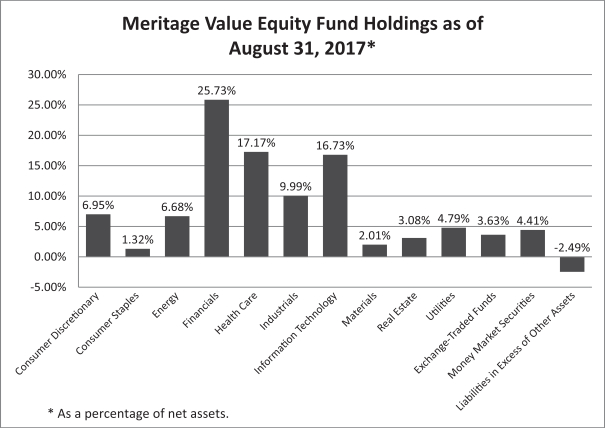

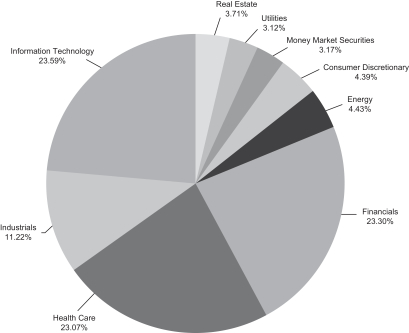

FUND HOLDINGS – (Unaudited) (continued)

The investment objective of the Meritage Value Equity Fund is to seek growth of capital. Income is a secondary objective.

11

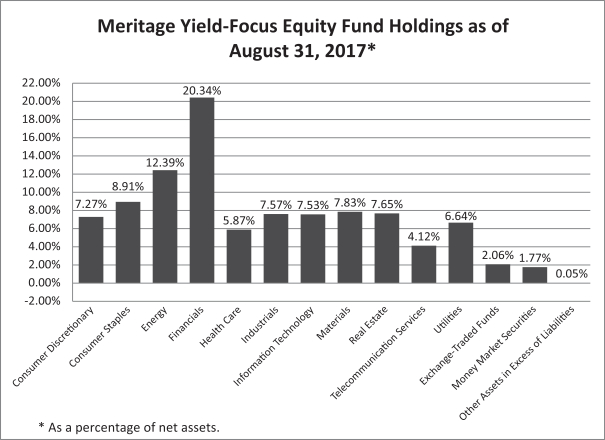

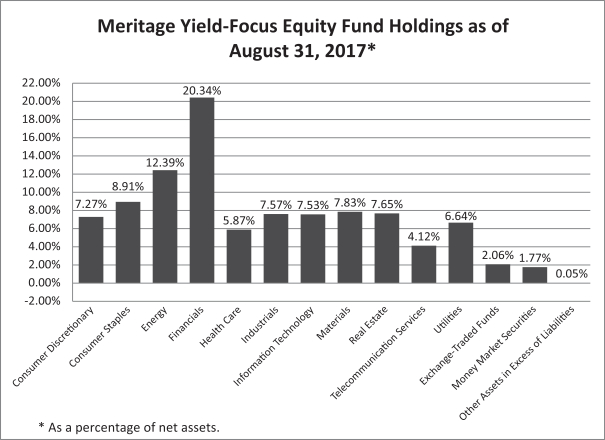

FUND HOLDINGS – (Unaudited) (continued)

The investment objective of the Meritage Yield-Focus Equity Fund is to seek long-term growth of capital with an emphasis on high current income.

AVAILABILITY OF PORTFOLIO SCHEDULE – (Unaudited)

The Funds will file their complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarter of each fiscal year on Form N-Q. The Funds’ Forms N-Q will be available at the SEC’s website at www.sec.gov. The Form N-Q may be reviewed and copied at the Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

12

MERITAGE GROWTH EQUITY FUND

SCHEDULE OF INVESTMENTS

August 31, 2017

| | | | | | | | |

| COMMON STOCKS – 86.06% | | Shares | | | Fair Value | |

Consumer Discretionary – 19.18% | |

Amazon.com, Inc. * | | | 850 | | | $ | 833,510 | |

Brunswick Corp. | | | 9,650 | | | | 506,432 | |

Delphi Automotive PLC | | | 4,290 | | | | 413,556 | |

Home Depot, Inc./The | | | 5,920 | | | | 887,230 | |

Priceline Group, Inc./The * | | | 405 | | | | 750,092 | |

Steven Madden Ltd. * | | | 7,030 | | | | 298,072 | |

Thor Industries, Inc. | | | 8,095 | | | | 879,441 | |

| | | | | | | | |

| | | | | | | 4,568,333 | |

| | | | | | | | |

Consumer Staples – 4.85% | |

Colgate-Palmolive Co. | | | 5,060 | | | | 362,498 | |

Monster Beverage Corp. * | | | 5,280 | | | | 294,730 | |

Reckitt Benckiser Group PLC | | | 25,800 | | | | 498,585 | |

| | | | | | | | |

| | | | | | | 1,155,813 | |

| | | | | | | | |

Financials – 3.15% | |

Aon PLC | | | 2,510 | | | | 349,292 | |

Everest Re Group Ltd. | | | 1,586 | | | | 400,433 | |

| | | | | | | | |

| | | | | | | 749,725 | |

| | | | | | | | |

Health Care – 11.78% | |

Amgen, Inc. | | | 2,421 | | | | 430,381 | |

Globus Medical, Inc., Class A * | | | 8,795 | | | | 265,873 | |

Intuitive Surgical, Inc. * | | | 361 | | | | 362,686 | |

Johnson & Johnson | | | 5,510 | | | | 729,359 | |

Masimo Corp. * | | | 2,915 | | | | 245,968 | |

Mettler-Toledo International, Inc. * | | | 706 | | | | 427,194 | |

Teleflex, Inc. | | | 1,617 | | | | 342,400 | |

| | | | | | | | |

| | | | | | | 2,803,861 | |

| | | | | | | | |

Industrials – 9.28% | |

AMETEK, Inc. | | | 5,245 | | | | 331,746 | |

Deluxe Corp. | | | 6,185 | | | | 428,930 | |

Ingersoll-Rand PLC | | | 3,370 | | | | 287,764 | |

Koninklijke Philips NV | | | 8,095 | | | | 307,529 | |

Nordson Corp. | | | 2,665 | | | | 291,285 | |

Snap-on, Inc. | | | 1,400 | | | | 206,598 | |

Trex Co., Inc. * | | | 4,690 | | | | 356,440 | |

| | | | | | | | |

| | | | | | | 2,210,292 | |

| | | | | | | | |

Information Technology – 35.63% | |

Alphabet, Inc., Class A * | | | 1,105 | | | | 1,055,540 | |

Apple, Inc. | | | 8,734 | | | | 1,432,376 | |

Applied Materials, Inc. | | | 8,330 | | | | 375,850 | |

See accompanying notes which are an integral part of these financial statements.

13

MERITAGE GROWTH EQUITY FUND

SCHEDULE OF INVESTMENTS – (continued)

August 31, 2017

| | | | | | | | |

| COMMON STOCKS – 86.06% – continued | | Shares | | | Fair Value | |

Information Technology – 35.63% – continued | | | | | | | | |

Autohome, Inc. ADR * | | | 5,995 | | | $ | 385,299 | |

Coherent, Inc. * | | | 1,382 | | | | 322,448 | |

Electronic Arts, Inc. * | | | 3,635 | | | | 441,652 | |

Facebook, Inc., Class A * | | | 1,610 | | | | 276,872 | |

Fiserv, Inc. * | | | 4,395 | | | | 543,705 | |

Flex Ltd. * | | | 18,065 | | | | 293,918 | |

MasterCard, Inc., Class A | | | 7,075 | | | | 943,097 | |

Microsoft Corp. | | | 13,720 | | | | 1,025,844 | |

Momo, Inc. * | | | 12,840 | | | | 494,725 | |

Tencent Holdings Ltd. ADR | | | 21,100 | | | | 893,163 | |

| | | | | | | | |

| | | | | | | 8,484,489 | |

| | | | | | | | |

Materials – 2.19% | |

Eagle Materials, Inc. | | | 5,355 | | | | 520,774 | |

| | | | | | | | |

TOTAL COMMON STOCKS (Cost $16,385,933) | | | | | | | 20,493,287 | |

| | | | | | | | |

EXCHANGE-TRADED FUNDS – 7.33% | |

Consumer Staples Select Sector SPDR Fund | | | 14,660 | | | | 802,049 | |

iShares Nasdaq Biotechnology ETF | | | 1,826 | | | | 608,697 | |

SPDR S&P Bank ETF | | | 8,015 | | | | 334,386 | |

| | | | | | | | |

TOTAL EXCHANGE-TRADED FUNDS (Cost $1,614,328) | | | | | | | 1,745,132 | |

| | | | | | | | |

MONEY MARKET SECURITIES – 8.74% | |

Morgan Stanley Institutional Liquidity Funds Treasury Securities Portfolio, Institutional Class, 0.85% (a) | | | 2,082,567 | | | | 2,082,567 | |

| | | | | | | | |

TOTAL MONEY MARKET SECURITIES (Cost $2,082,567) | | | | | | | 2,082,567 | |

| | | | | | | | |

TOTAL INVESTMENTS – 102.13% (Cost $20,082,828) | | | | | | | 24,320,986 | |

| | | | | | | | |

Liabilities in Excess of Other Assets – (2.13)% | | | | | | | (507,017 | ) |

| | | | | | | | |

NET ASSETS – 100.00% | | | | | | $ | 23,813,969 | |

| | | | | | | | |

| | (a) | Rate disclosed is the seven day effective yield as of August 31, 2017. |

| | * | Non-income producing security. |

ADR – American Depositary Receipt

ETF – Exchange-Traded Fund

SPDR – Standard & Poor’s Depository Receipts

The sectors shown on the schedule of investments are based on Global Industry Classification Standard, or GICS® (“GICS”). The GICS was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI, Inc. and S&P and has been licensed for use by Ultimus Asset Services, LLC.

See accompanying notes which are an integral part of these financial statements.

14

MERITAGE VALUE EQUITY FUND

SCHEDULE OF INVESTMENTS

August 31, 2017

| | | | | | | | |

| COMMON STOCKS – 94.45% | | Shares | | | Fair Value | |

Consumer Discretionary – 6.95% | | | | | | | | |

Adtalem Global Education, Inc. * | | | 8,305 | | | $ | 284,031 | |

Big Lots, Inc. | | | 5,900 | | | | 280,840 | |

Helen of Troy Ltd. * | | | 3,330 | | | | 300,699 | |

Ross Stores, Inc. | | | 4,230 | | | | 247,244 | |

| | | | | | | | |

| | | | | | | 1,112,814 | |

| | | | | | | | |

Consumer Staples – 1.32% | |

Ingredion, Inc. | | | 1,710 | | | | 211,732 | |

| | | | | | | | |

Energy – 6.68% | |

Chevron Corp. | | | 3,150 | | | | 339,003 | |

China Petroleum & Chemical Corp. ADR | | | 4,730 | | | | 362,507 | |

Royal Dutch Shell PLC ADR | | | 6,665 | | | | 367,775 | |

| | | | | | | | |

| | | | | | | 1,069,285 | |

| | | | | | | | |

Financials – 25.73% | |

Aspen Insurance Holdings Ltd. | | | 5,920 | | | | 267,584 | |

Berkshire Hathaway, Inc., Class B * | | | 2,369 | | | | 429,168 | |

Citigroup, Inc. | | | 5,180 | | | | 352,395 | |

Fidelity & Guaranty Life | | | 6,170 | | | | 192,813 | |

Horace Mann Educators Corp. | | | 7,290 | | | | 256,243 | |

Northern Trust Corp. | | | 3,580 | | | | 316,830 | |

Prudential Financial, Inc. | | | 3,575 | | | | 364,936 | |

Reinsurance Group of America, Inc. | | | 3,360 | | | | 451,752 | |

State Street Corp. | | | 4,905 | | | | 453,663 | |

Torchmark Corp. | | | 4,772 | | | | 367,301 | |

Unum Group | | | 6,105 | | | | 294,139 | |

Voya Financial, Inc. | | | 9,810 | | | | 375,036 | |

| | | | | | | | |

| | | | | | | 4,121,860 | |

| | | | | | | | |

Health Care – 17.17% | |

Aetna, Inc. | | | 2,570 | | | | 405,289 | |

Biogen, Inc. * | | | 1,560 | | | | 493,834 | |

Celgene Corp. * | | | 2,935 | | | | 407,760 | |

Cigna Corp. | | | 1,920 | | | | 349,555 | |

ICON PLC * | | | 3,465 | | | | 392,896 | |

PRA Health Sciences, Inc. * | | | 3,810 | | | | 294,894 | |

UnitedHealth Group, Inc. | | | 2,040 | | | | 405,756 | |

| | | | | | | | |

| | | | | | | 2,749,984 | |

| | | | | | | | |

Industrials – 9.99% | |

Herman Miller, Inc. | | | 4,940 | | | | 166,231 | |

Raytheon Co. | | | 2,030 | | | | 369,480 | |

Regal-Beloit Corp. | | | 4,020 | | | | 303,108 | |

See accompanying notes which are an integral part of these financial statements.

15

MERITAGE VALUE EQUITY FUND

SCHEDULE OF INVESTMENTS – (continued)

August 31, 2017

| | | | | | | | |

| COMMON STOCKS – 94.45% – continued | | Shares | | | Fair Value | |

Industrials – 9.99% – continued | |

Southwest Airlines Co. | | | 6,270 | | | $ | 326,918 | |

Spirit AeroSystems Holdings, Inc. | | | 5,835 | | | | 434,707 | |

| | | | | | | | |

| | | | | | | 1,600,444 | |

| | | | | | | | |

Information Technology – 16.73% | | | | | | | | |

Benchmark Electronics, Inc. * | | | 9,435 | | | | 306,637 | |

Check Point Software Technologies Ltd. * | | | 1,715 | | | | 191,857 | |

MAXIMUS, Inc. | | | 5,060 | | | | 307,547 | |

Sanmina Corp. * | | | 8,030 | | | | 300,723 | |

Skyworks Solutions, Inc. | | | 3,170 | | | | 333,991 | |

Synopsys, Inc. * | | | 3,535 | | | | 284,285 | |

Teradyne, Inc. | | | 6,880 | | | | 244,997 | |

Vishay Intertechnology, Inc. | | | 18,740 | | | | 331,698 | |

WNS Holdings Ltd. ADR * | | | 10,815 | | | | 378,525 | |

| | | | | | | | |

| | | | | | | 2,680,260 | |

| | | | | | | | |

Materials – 2.01% | | | | | | | | |

Cemex SAB de CV ADR * | | | 17,277 | | | | 160,849 | |

Louisiana-Pacific Corp. * | | | 6,320 | | | | 161,034 | |

| | | | | | | | |

| | | | | | | 321,883 | |

| | | | | | | | |

Real Estate – 3.08% | | | | | | | | |

Host Hotels & Resorts, Inc. | | | 8,890 | | | | 161,087 | |

Welltower, Inc. | | | 4,535 | | | | 332,053 | |

| | | | | | | | |

| | | | | | | 493,140 | |

| | | | | | | | |

Utilities – 4.79% | | | | | | | | |

Ameren Corp. | | | 6,520 | | | | 391,135 | |

Entergy Corp. | | | 4,745 | | | | 375,662 | |

| | | | | | | | |

| | | | | | | 766,797 | |

| | | | | | | | |

TOTAL COMMON STOCKS (Cost $12,191,384) | | | | | | | 15,128,199 | |

| | | | | | | | |

EXCHANGE-TRADED FUNDS – 3.63% | |

Energy Select Sector SPDR Fund | | | 4,845 | | | | 305,090 | |

Vanguard REIT ETF | | | 3,285 | | | | 276,071 | |

| | | | | | | | |

TOTAL EXCHANGE-TRADED FUNDS (Cost $612,627) | | | | | | | 581,161 | |

| | | | | | | | |

MONEY MARKET SECURITIES – 4.41% | | | | | | | | |

Morgan Stanley Institutional Liquidity Funds Treasury Securities Portfolio, Institutional Class, 0.85% (a) | | | 707,199 | | | | 707,199 | |

| | | | | | | | |

TOTAL MONEY MARKET SECURITIES (Cost $707,199) | | | | | | | 707,199 | |

| | | | | | | | |

TOTAL INVESTMENTS – 102.49% (Cost $13,511,210) | | | | | | | 16,416,559 | |

| | | | | | | | |

Liabilities in Excess of Other Assets – (2.49)% | | | | | | | (399,621 | ) |

| | | | | | | | |

NET ASSETS – 100.00% | | | | | | $ | 16,016,938 | |

| | | | | | | | |

See accompanying notes which are an integral part of these financial statements.

16

MERITAGE VALUE EQUITY FUND

SCHEDULE OF INVESTMENTS – (continued)

August 31, 2017

| | (a) | Rate disclosed is the seven day effective yield as of August 31, 2017. |

| | * | Non-income producing security. |

ADR – American Depositary Receipt

ETF – Exchange-Traded Fund

REIT – Real Estate Investment Trust

SPDR – Standard & Poor’s Depository Receipts

The sectors shown on the schedule of investments are based on Global Industry Classification Standard, or GICS® (“GICS”). The GICS was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI, Inc. and S&P and has been licensed for use by Ultimus Asset Services, LLC.

See accompanying notes which are an integral part of these financial statements.

17

MERITAGE YIELD-FOCUS EQUITY FUND

SCHEDULE OF INVESTMENTS

August 31, 2017

| | | | | | | | |

| COMMON STOCKS – 90.51% | | Shares | | | Fair Value | |

Consumer Discretionary – 7.27% | | | | | | | | |

GameStop Corp., Class A | | | 18,310 | | | $ | 338,735 | |

Garmin Ltd. | | | 11,765 | | | | 605,897 | |

Staples, Inc. | | | 44,130 | | | | 450,788 | |

Target Corp. | | | 10,085 | | | | 549,935 | |

| | | | | | | | |

| | | | | | | 1,945,355 | |

| | | | | | | | |

Consumer Staples – 8.91% | | | | | | | | |

Altria Group, Inc. | | | 9,765 | | | | 619,101 | |

British American Tobacco PLC | | | 4,795 | | | | 297,865 | |

Imperial Brands PLC ADR | | | 8,875 | | | | 371,419 | |

Philip Morris International, Inc. | | | 5,795 | | | | 677,609 | |

Unilever PLC ADR | | | 7,155 | | | | 416,493 | |

| | | | | | | | |

| | | | | | | 2,382,487 | |

| | | | | | | | |

Energy – 12.39% | | | | | | | | |

Alliance Holdings GP LP (a) | | | 10,870 | | | | 299,468 | |

Enterprise Products Partners LP (a) | | | 18,705 | | | | 487,639 | |

Phillips 66 Partners LP (a) | | | 8,805 | | | | 420,703 | |

Plains GP Holdings LP, Class A (a) | | | 21,845 | | | | 491,076 | |

Repsol SA ADR | | | 29,140 | | | | 501,208 | |

Shell Midstream Partners LP (a) | | | 10,092 | | | | 279,246 | |

Total SA ADR | | | 9,690 | | | | 504,268 | |

Valero Energy Corp. | | | 4,840 | | | | 329,604 | |

| | | | | | | | |

| | | | | | | 3,313,212 | |

| | | | | | | | |

Financials – 20.34% | | | | | | | | |

AllianceBernstein Holding LP (a) | | | 20,560 | | | | 482,132 | |

Ares Capital Corp. (b) | | | 26,140 | | | | 419,808 | |

AXA SA ADR | | | 14,700 | | | | 425,124 | |

Banco Latinoamericano de Comercio Exterior SA, Class E | | | 13,880 | | | | 374,205 | |

Bank of Montreal | | | 5,615 | | | | 403,101 | |

Federated Investors, Inc., Class B | | | 19,275 | | | | 526,400 | |

Invesco Ltd. | | | 18,060 | | | | 592,007 | |

Lazard Ltd., Class A (a) | | | 9,405 | | | | 403,380 | |

National Australia Bank Ltd. ADR | | | 21,120 | | | | 254,602 | |

Old Republic International Corp. | | | 25,210 | | | | 481,259 | |

Power Financial Corp. | | | 15,120 | | | | 407,786 | |

Solar Capital Ltd. (b) | | | 19,060 | | | | 407,312 | |

Valley National Bancorp | | | 23,650 | | | | 264,644 | |

| | | | | | | | |

| | | | | | | 5,441,760 | |

| | | | | | | | |

Health Care – 3.76% | | | | | | | | |

Merck & Co., Inc. | | | 8,330 | | | | 531,954 | |

Pfizer, Inc. | | | 13,945 | | | | 473,014 | |

| | | | | | | | |

| | | | | | | 1,004,968 | |

| | | | | | | | |

See accompanying notes which are an integral part of these financial statements.

18

MERITAGE YIELD-FOCUS EQUITY FUND

SCHEDULE OF INVESTMENTS – (continued)

August 31, 2017

| | | | | | | | |

| COMMON STOCKS – 90.51% – continued | | Shares | | | Fair Value | |

Industrials – 6.16% | | | | | | | | |

Boeing Co./The | | | 2,930 | | | $ | 702,204 | |

Eaton Corp. PLC | | | 6,260 | | | | 449,218 | |

Lockheed Martin Corp. | | | 1,625 | | | | 496,259 | |

| | | | | | | | |

| | | | | | | 1,647,681 | |

| | | | | | | | |

Information Technology – 5.44% | | | | | | | | |

HP, Inc. | | | 24,890 | | | | 474,901 | |

International Business Machines Corp. | | | 3,073 | | | | 439,531 | |

QUALCOMM, Inc. | | | 5,540 | | | | 289,576 | |

Western Union Co./The | | | 13,210 | | | | 249,933 | |

| | | | | | | | |

| | | | | | | 1,453,941 | |

| | | | | | | | |

Materials – 7.83% | | | | | | | | |

Domtar Corp. | | | 13,480 | | | | 545,131 | |

Innophos Holdings, Inc. | | | 6,025 | | | | 275,102 | |

Lyondellbasell Industries NV, Class A | | | 4,165 | | | | 377,307 | |

Norbord, Inc. | | | 8,140 | | | | 280,260 | |

Rio Tinto PLC ADR | | | 12,590 | | | | 617,917 | |

| | | | | | | | |

| | | | | | | 2,095,717 | |

| | | | | | | | |

Real Estate – 7.65% | | | | | | | | |

Brandywine Realty Trust | | | 23,960 | | | | 411,633 | |

CBL & Associates Properties, Inc. | | | 24,260 | | | | 194,080 | |

Medical Properties Trust, Inc. | | | 49,420 | | | | 650,367 | |

Uniti Group, Inc. | | | 13,750 | | | | 264,825 | |

VEREIT, Inc. | | | 62,090 | | | | 524,040 | |

| | | | | | | | |

| | | | | | | 2,044,945 | |

| | | | | | | | |

Telecommunication Services – 4.12% | | | | | | | | |

AT&T, Inc. | | | 12,265 | | | | 459,447 | |

CenturyLink, Inc. | | | 10,310 | | | | 203,313 | |

Verizon Communications, Inc. | | | 9,157 | | | | 439,261 | |

| | | | | | | | |

| | | | | | | 1,102,021 | |

| | | | | | | | |

Utilities – 6.64% | | | | | | | | |

Entergy Corp. | | | 7,115 | | | | 563,295 | |

Exelon Corp. | | | 15,425 | | | | 584,145 | |

Public Service Enterprise Group, Inc. | | | 13,445 | | | | 629,764 | |

| | | | | | | | |

| | | | | | | 1,777,204 | |

| | | | | | | | |

TOTAL COMMON STOCKS (Cost $21,279,716) | | | | | | | 24,209,291 | |

| | | | | | | | |

See accompanying notes which are an integral part of these financial statements.

19

MERITAGE YIELD-FOCUS EQUITY FUND

SCHEDULE OF INVESTMENTS – (continued)

August 31, 2017

| | | | | | | | |

| CONVERTIBLE PREFERRED STOCKS – 5.61% | | Shares | | | Fair Value | |

Health Care – 2.11% | | | | | | | | |

Anthem, Inc., 5.25% | | | 10,730 | | | $ | 563,110 | |

| | | | | | | | |

Industrials – 1.41% | | | | | | | | |

Stericycle, Inc., 5.25% | | | 6,365 | | | | 378,336 | |

| | | | | | | | |

Information Technology – 2.09% | | | | | | | | |

Belden, Inc., 6.75% | | | 5,295 | | | | 560,158 | |

| | | | | | | | |

TOTAL CONVERTIBLE PREFERRED STOCKS (Cost $1,387,821) | | | | | | | 1,501,604 | |

| | | | | | | | |

EXCHANGE-TRADED FUNDS – 2.06% | | | | | | | | |

SPDR S&P International Dividend ETF | | | 13,515 | | | | 550,736 | |

| | | | | | | | |

TOTAL EXCHANGE-TRADED FUNDS (Cost $525,056) | | | | | | | 550,736 | |

| | | | | | | | |

MONEY MARKET SECURITIES – 1.77% | | | | | | | | |

Morgan Stanley Institutional Liquidity Funds Treasury Securities Portfolio, Institutional Class, 0.85% (c) | | | 472,651 | | | | 472,651 | |

| | | | | | | | |

TOTAL MONEY MARKET SECURITIES (Cost $472,651) | | | | | | | 472,651 | |

| | | | | | | | |

TOTAL INVESTMENTS – 99.95% (Cost $23,665,244) | | | | | | | 26,734,282 | |

| | | | | | | | |

Other Assets in Excess of Liabilities – 0.05% | | | | | | | 13,347 | |

| | | | | | | | |

NET ASSETS – 100.00% | | | | | | $ | 26,747,629 | |

| | | | | | | | |

| | (a) | Master Limited Partnership |

| | (b) | Business Development Company |

| | (c) | Rate disclosed is the seven day effective yield as of August 31, 2017. |

| | ADR | – American Depositary Receipt |

| | ETF | – Exchange-Traded Fund |

| | SPDR – Standard | & Poor’s Depository Receipt |

The sectors shown on the schedule of investments are based on Global Industry Classification Standard, or GICS® (“GICS”). The GICS was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI, Inc. and S&P and has been licensed for use by Ultimus Asset Services, LLC.

See accompanying notes which are an integral part of these financial statements.

20

MERITAGE FUNDS

STATEMENTS OF ASSETS AND LIABILITIES

August 31, 2017

| | | | | | | | | | | | |

| | | Meritage Growth

Equity Fund | | | Meritage Value

Equity Fund | | | Meritage Yield-

Focus Equity Fund | |

Assets | | | | | | | | | | | | |

Investments in securities at value

(cost $20,082,828, $13,511,210 and $23,665,244) | | $ | 24,320,986 | | | $ | 16,416,559 | | | $ | 26,734,282 | |

Receivable for investments sold | | | 146,991 | | | | – | | | | 475,551 | |

Dividends receivable | | | 29,853 | | | | 18,999 | | | | 95,317 | |

Tax reclaims receivable | | | 952 | | | | – | | | | 12,889 | |

Receivable from Adviser | | | – | | | | 327 | | | | – | |

Prepaid expenses | | | 5,629 | | | | 5,134 | | | | 11,956 | |

| | | | | | | | | | | | |

Total Assets | | | 24,504,411 | | | | 16,441,019 | | | | 27,329,995 | |

| | | | | | | | | | | | |

| | | |

Liabilities | | | | | | | | | | | | |

Payable for fund shares redeemed | | | – | | | | – | | | | 7,000 | |

Payable for investments purchased | | | 653,672 | | | | 391,723 | | | | 531,844 | |

Payable to Adviser | | | 3,201 | | | | – | | | | 6,417 | |

Accrued 12b-1 fees – Investor class | | | 111 | | | | – | | | | 268 | |

Payable to Administrator | | | 6,772 | | | | 4,977 | | | | 8,395 | |

Payable to auditor | | | 20,500 | | | | 20,500 | | | | 20,500 | |

Other accrued expenses | | | 6,186 | | | | 6,881 | | | | 7,942 | |

| | | | | | | | | | | | |

Total Liabilities | | | 690,442 | | | | 424,081 | | | | 582,366 | |

| | | | | | | | | | | | |

| | | |

Net Assets | | $ | 23,813,969 | | | $ | 16,016,938 | | | $ | 26,747,629 | |

| | | | | | | | | | | | |

Net Assets consist of: | | | | | | | | | | | | |

Paid-in capital | | $ | 17,969,024 | | | $ | 13,514,756 | | | $ | 28,507,954 | |

Accumulated undistributed net investment income | | | 10,347 | | | | 90,491 | | | | 82,891 | |

Accumulated undistributed net realized gain (loss) from investment transactions and foreign currency translations | | | 1,596,440 | | | | (493,658 | ) | | | (4,912,254 | ) |

Net unrealized appreciation (depreciation) on investments | | | 4,238,158 | | | | 2,905,349 | | | | 3,069,038 | |

| | | | | | | | | | | | |

| | | |

Net Assets | | $ | 23,813,969 | | | $ | 16,016,938 | | | $ | 26,747,629 | |

| | | | | | | | | | | | |

| | | |

Net Assets: Institutional Class | | $ | 23,537,485 | | | $ | 16,016,938 | | | $ | 26,103,017 | |

| | | | | | | | | | | | |

Shares outstanding

(unlimited number of shares authorized, no par value) | | | 1,635,444 | | | | 1,286,807 | | | | 2,508,176 | |

| | | | | | | | | | | | |

Net asset value, offering and redemption price per share | | $ | 14.39 | | | $ | 12.45 | | | $ | 10.41 | |

| | | | | | | | | | | | |

| | | |

Net Assets: Investor Class | | $ | 276,484 | | | | | | | $ | 644,612 | |

| | | | | | | | | | | | |

Shares outstanding

(unlimited number of shares authorized, no par value) | | | 19,341 | | | | | | | | 61,360 | |

| | | | | | | | | | | | |

Net asset value, offering and redemption price per share | | $ | 14.30 | | | | | | | $ | 10.51 | |

| | | | | | | | | | | | |

See accompanying notes which are an integral part of these financial statements.

21

MERITAGE FUNDS

STATEMENTS OF OPERATIONS

For the year ended August 31, 2017

| | | | | | | | | | | | |

| | | Meritage Growth

Equity Fund | | | Meritage Value

Equity Fund | | | Meritage Yield-

Focus Equity Fund | |

Investment Income | | | | | | | | | | | | |

Dividend income

(net of foreign taxes withheld of $419, $6,188 and $15,342) | | $ | 225,156 | | | $ | 236,244 | | | $ | 1,449,736 | |

| | | | | | | | | | | | |

Total investment income | | | 225,156 | | | | 236,244 | | | | 1,449,736 | |

| | | | | | | | | | | | |

| | | |

Expenses | | | | | | | | | | | | |

Investment Adviser | | | 150,353 | | | | 108,026 | | | | 242,188 | |

Administration | | | 33,679 | | | | 24,175 | | | | 54,346 | |

Fund accounting | | | 22,454 | | | | 16,115 | | | | 36,431 | |

Audit | | | 22,785 | | | | 22,785 | | | | 22,785 | |

Registration | | | 15,447 | | | | 12,542 | | | | 34,049 | |

Transfer agent | | | 18,061 | | | | 12,968 | | | | 29,195 | |

Legal | | | 11,954 | | | | 11,357 | | | | 14,602 | |

Custodian | | | 5,188 | | | | 6,078 | | | | 6,709 | |

Insurance | | | 5,434 | | | | 5,188 | | | | 6,315 | |

Report printing | | | 5,873 | | | | 3,857 | | | | 6,881 | |

Trustee | | | 4,768 | | | | 4,755 | | | | 4,818 | |

12b-1 – Investor class | | | 447 | | | | 11 | (a) | | | 13,274 | |

Pricing | | | 2,104 | | | | 2,198 | | | | 2,474 | |

Other | | | 13,256 | | | | 12,949 | | | | 15,417 | |

| | | | | | | | | | | | |

Total expenses | | | 311,803 | | | | 243,004 | | | | 489,484 | |

Fees waived by Adviser | | | (110,633 | ) | | | (98,784 | ) | | | (152,868 | ) |

| | | | | | | | | | | | |

Net operating expenses | | | 201,170 | | | | 144,220 | | | | 336,616 | |

| | | | | | | | | | | | |

Net investment income | | | 23,986 | | | | 92,024 | | | | 1,113,120 | |

| | | | | | | | | | | | |

| |

Net Realized and Unrealized Gain (Loss) on Investments | | | | | |

Net realized gain on investment securities transactions | | | 1,852,658 | | | | 140,802 | | | | 1,746,269 | |

Net realized loss on foreign currency translations | | | – | | | | – | | | | (140 | ) |

Net change in unrealized appreciation (depreciation) of investment securities | | | 1,792,047 | | | | 1,534,876 | | | | (239,221 | ) |

| | | | | | | | | | | | |

Net realized and unrealized gain on investments | | | 3,644,705 | | | | 1,675,678 | | | | 1,506,908 | |

| | | | | | | | | | | | |

Net increase in net assets resulting from operations | | $ | 3,668,691 | | | $ | 1,767,702 | | | $ | 2,620,028 | |

| | | | | | | | | | | | |

| (a) | Meritage Value Equity Fund – Investor Class liquidated on February 3, 2017. |

See accompanying notes which are an integral part of these financial statements.

22

MERITAGE GROWTH EQUITY FUND

STATEMENTS OF CHANGES IN NET ASSETS

| | | | | | | | |

| | | For the Year

Ended

August 31, 2017 | | | For the Year

Ended

August 31, 2016 | |

Increase (Decrease) in Net Assets due to: | | | | | | | | |

Operations | | | | | | | | |

Net investment income | | $ | 23,986 | | | $ | 37,576 | |

Net realized gain (loss) on investment securities transactions | | | 1,852,658 | | | | (76,545 | ) |

Net change in unrealized appreciation (depreciation) of investment securities | | | 1,792,047 | | | | 1,687,088 | |

| | | | | | | | |

Net increase in net assets resulting from operations | | | 3,668,691 | | | | 1,648,119 | |

| | | | | | | | |

| | |

Distributions | | | | | | | | |

From net investment income – Institutional Class | | | (44,491 | ) | | | (8,254 | ) |

From net realized gains – Institutional Class | | | (171,541 | ) | | | (306,530 | ) |

From net realized gains – Investor Class | | | (1,047 | ) | | | (3,439 | ) |

| | | | | | | | |

Total distributions | | | (217,079 | ) | | | (318,223 | ) |

| | | | | | | | |

| | |

Capital Transactions – Institutional Class | | | | | | | | |

Proceeds from shares sold | | | 4,352,696 | | | | 3,937,403 | |

Reinvestment of distributions | | | 208,934 | | | | 306,740 | |

Amount paid for shares redeemed | | | (1,928,779 | ) | | | (1,405,523 | ) |

| | | | | | | | |

Total Institutional Class | | | 2,632,851 | | | | 2,838,620 | |

| | | | | | | | |

| | |

Capital Transactions – Investor Class | | | | | | | | |

Proceeds from shares sold | | | 211,276 | | | | 209,178 | |

Reinvestment of distributions | | | 1,047 | | | | 2,111 | |

Amount paid for shares redeemed | | | (328,967 | ) | | | (29,277 | ) |

| | | | | | | | |

Total Investor Class | | | (116,644 | ) | | | 182,012 | |

| | | | | | | | |

Net increase in net assets resulting from capital transactions | | | 2,516,207 | | | | 3,020,632 | |

| | | | | | | | |

Total Increase in Net Assets | | | 5,967,819 | | | | 4,350,528 | |

| | | | | | | | |

| | |

Net Assets | | | | | | | | |

Beginning of year | | | 17,846,150 | | | | 13,495,622 | |

| | | | | | | | |

End of year | | $ | 23,813,969 | | | $ | 17,846,150 | |

| | | | | | | | |

Accumulated undistributed net investment income included in net assets at end of year | | $ | 10,347 | | | $ | 38,921 | |

| | | | | | | | |

| | |

Share Transactions – Institutional Class | | | | | | | | |

Shares sold | | | 327,228 | | | | 347,376 | |

Shares issued in reinvestment of distributions | | | 16,822 | | | | 27,169 | |

Shares redeemed | | | (152,144 | ) | | | (121,465 | ) |

| | | | | | | | |

Total Institutional Class | | | 191,906 | | | | 253,080 | |

| | | | | | | | |

| | |

Share Transactions – Investor Class | | | | | | | | |

Shares sold | | | 15,392 | | | | 18,178 | |

Shares issued in reinvestment of distributions | | | 85 | | | | 188 | |

Shares redeemed | | | (26,638 | ) | | | (2,612 | ) |

| | | | | | | | |

Total Investor Class | | | (11,161 | ) | | | 15,754 | |

| | | | | | | | |

Net increase in shares outstanding | | | 180,745 | | | | 268,834 | |

| | | | | | | | |

See accompanying notes which are an integral part of these financial statements.

23

MERITAGE VALUE EQUITY FUND

STATEMENTS OF CHANGES IN NET ASSETS

| | | | | | | | |

| | | For the Year

Ended

August 31, 2017 | | | For the Year

Ended

August 31, 2016 | |

Increase (Decrease) in Net Assets due to: | | | | | | | | |

Operations | | | | | | | | |

Net investment income | | $ | 92,024 | | | $ | 117,793 | |

Net realized gain (loss) on investment securities transactions | | | 140,802 | | | | (615,738 | ) |

Net change in unrealized appreciation (depreciation) of investment securities | | | 1,534,876 | | | | 784,958 | |

| | | | | | | | |

Net increase in net assets resulting from operations | | | 1,767,702 | | | | 287,013 | |

| | | | | | | | |

Distributions | | | | | | | | |

From net investment income – Institutional Class | | | (115,272 | ) | | | (105,233 | ) |

From net investment income – Investor Class | | | (67 | )(a) | | | (66 | ) |

From net realized gains – Institutional Class | | | – | | | | (50,500 | ) |

From net realized gains – Investor Class | | | – | | | | (39 | ) |

| | | | | | | | |

Total distributions | | | (115,339 | ) | | | (155,838 | ) |

| | | | | | | | |

| | |

Capital Transactions – Institutional Class | | | | | | | | |

Proceeds from shares sold | | | 2,914,903 | | | | 3,408,257 | |

Reinvestment of distributions | | | 113,051 | | | | 153,110 | |

Amount paid for shares redeemed | | | (2,517,719 | ) | | | (1,159,673 | ) |

| | | | | | | | |

Total Institutional Class | | | 510,235 | | | | 2,401,694 | |

| | | | | | | | |

| | |

Capital Transactions – Investor Class(a) | | | | | | | | |

Proceeds from shares sold | | | 922 | | | | – | |

Reinvestment of distributions | | | 67 | | | | 105 | |

Amount paid for shares redeemed | | | (11,012 | ) | | | – | |

| | | | | | | | |

Total Investor Class | | | (10,023 | ) | | | 105 | |

| | | | | | | | |

Net increase in net assets resulting from capital transactions | | | 500,212 | | | | 2,401,799 | |

| | | | | | | | |

Total Increase in Net Assets | | | 2,152,575 | | | | 2,532,974 | |

| | | | | | | | |

| | |

Net Assets | | | | | | | | |

Beginning of year | | | 13,864,363 | | | | 11,331,389 | |

| | | | | | | | |

End of year | | $ | 16,016,938 | | | $ | 13,864,363 | |

| | | | | | | | |

Accumulated undistributed net investment income included in net assets at end of year | | $ | 90,491 | | | $ | 115,339 | |

| | | | | | | | |

| | |

Share Transactions – Institutional Class | | | | | | | | |

Shares sold | | | 247,653 | | | | 313,214 | |

Shares issued in reinvestment of distributions | | | 9,729 | | | | 14,164 | |

Shares redeemed | | | (222,567 | ) | | | (104,992 | ) |

| | | | | | | | |

Total Institutional Class | | | 34,815 | | | | 222,386 | |

| | | | | | | | |

| | |

Share Transactions – Investor Class(a) | | | | | | | | |

Shares sold | | | – | | | | | |

Shares issued in reinvestment of distributions | | | 6 | | | | 10 | |

Shares redeemed | | | (946 | ) | | | – | |

| | | | | | | | |

Total Investor Class | | | (940 | ) | | | 10 | |

| | | | | | | | |

Net increase in shares outstanding | | | 33,875 | | | | 222,396 | |

| | | | | | | | |

| (a) | Meritage Value Equity Fund – Investor Class liquidated on February 3, 2017. |

See accompanying notes which are an integral part of these financial statements.

24

MERITAGE YIELD-FOCUS EQUITY FUND

STATEMENTS OF CHANGES IN NET ASSETS

| | | | | | | | |

| | | For the Year

Ended

August 31, 2017 | | | For the Year

Ended

August 31, 2016 | |

Increase (Decrease) in Net Assets due to: | | | | | | | | |

Operations | | | | | | | | |

Net investment income | | $ | 1,113,120 | | | $ | 1,268,575 | |

Net realized gain (loss) on investment securities transactions | | | 1,746,129 | | | | (4,040,548 | ) |

Net change in unrealized appreciation (depreciation) of investment securities and foreign currency translations | | | (239,221 | ) | | | 6,318,403 | |

| | | | | | | | |

Net increase in net assets resulting from operations | | | 2,620,028 | | | | 3,546,430 | |

| | | | | | | | |

Distributions | | | | | | | | |

From net investment income – Institutional Class | | | (925,897 | ) | | | (982,202 | ) |

From net investment income – Investor Class | | | (141,974 | ) | | | (267,892 | ) |

| | | | | | | | |

Total distributions | | | (1,067,871 | ) | | | (1,250,094 | ) |

| | | | | | | | |

| | |

Capital Transactions – Institutional Class | | | | | | | | |

Proceeds from shares sold | | | 2,700,387 | | | | 11,584,316 | |

Reinvestment of distributions | | | 877,453 | | | | 949,085 | |

Amount paid for shares redeemed | | | (7,887,178 | ) | | | (13,279,431 | ) |

| | | | | | | | |

Total Institutional Class | | | (4,309,338 | ) | | | (746,030 | ) |

| | | | | | | | |

Capital Transactions – Investor Class | | | | | | | | |

Proceeds from shares sold | | | 565,477 | | | | 5,341,482 | |

Reinvestment of distributions | | | 136,022 | | | | 255,968 | |

Amount paid for shares redeemed | | | (11,250,540 | ) | | | (6,117,689 | ) |

| | | | | | | | |

Total Investor Class | | | (10,549,041 | ) | | | (520,239 | ) |

| | | | | | | | |

Net decrease in net assets resulting from capital transactions | | | (14,858,379 | ) | | | (1,266,269 | ) |

| | | | | | | | |

Total Increase (Decrease) in Net Assets | | | (13,306,222 | ) | | | 1,030,067 | |

| | | | | | | | |

| | |

Net Assets | | | | | | | | |

Beginning of year | | | 40,053,851 | | | | 39,023,784 | |

| | | | | | | | |

End of year | | $ | 26,747,629 | | | $ | 40,053,851 | |

| | | | | | | | |

Accumulated undistributed net investment income included in net assets at end of year | | $ | 82,891 | | | $ | 48,558 | |

| | | | | | | | |

| | |

Share Transactions – Institutional Class | | | | | | | | |

Shares sold | | | 264,568 | | | | 1,240,531 | |

Shares issued in reinvestment of distributions | | | 86,151 | | | | 101,101 | |

Shares redeemed | | | (775,089 | ) | | | (1,409,707 | ) |

| | | | | | | | |

Total Institutional Class | | | (424,370 | ) | | | (68,075 | ) |

| | | | | | | | |

| | |

Share Transactions – Investor Class | | | | | | | | |

Shares sold | | | 56,078 | | | | 560,884 | |

Shares issued in reinvestment of distributions | | | 13,555 | | | | 27,331 | |

Shares redeemed | | | (1,081,302 | ) | | | (651,855 | ) |

| | | | | | | | |

Total Investor Class | | | (1,011,669 | ) | | | (63,640 | ) |

| | | | | | | | |

Net decrease in shares outstanding | | | (1,436,039 | ) | | | (131,715 | ) |

| | | | | | | | |

See accompanying notes which are an integral part of these financial statements.

25

MERITAGE GROWTH EQUITY FUND – INSTITUTIONAL CLASS

FINANCIAL HIGHLIGHTS

(For a share outstanding during each period)

| | | | | | | | | | | | | | | | |

| | | For the

Year Ended

August 31, 2017 | | | For the

Year Ended

August 31, 2016 | | | For the

Year Ended

August 31, 2015 | | | For the

Period Ended

August 31, 2014 (a) | |

Selected Per Share Data: | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 12.11 | | | $ | 11.20 | | | $ | 10.95 | | | $ | 10.00 | |

| | | | | | | | | | | | | | | | |

Investment operations: | | | | | | | | | | | | | | | | |

Net investment income | | | 0.02 | | | | 0.03 | | | | 0.01 | | | | 0.01 | |

Net realized and unrealized gain on investments | | | 2.41 | | | | 1.12 | | | | 0.36 | | | | 0.94 | |

| | | | | | | | | | | | | | | | |

Total from investment operations | | | 2.43 | | | | 1.15 | | | | 0.37 | | | | 0.95 | |

| | | | | | | | | | | | | | | | |

Less distributions to shareholders: | | | | | | | | | | | | | | | | |

From net investment income | | | (0.03 | ) | | | (0.01 | ) | | | (0.01 | ) | | | – | |

From net realized gains | | | (0.12 | ) | | | (0.23 | ) | | | (0.11 | ) | | | – | |

| | | | | | | | | | | | | | | | |

Total distributions | | | (0.15 | ) | | | (0.24 | ) | | | (0.12 | ) | | | – | |

| | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 14.39 | | | $ | 12.11 | | | $ | 11.20 | | | $ | 10.95 | |

| | | | | | | | | | | | | | | | |

| | | | |

Total Return (b) | | | 20.27 | % | | | 10.41 | % | | | 3.38 | % | | | 9.50 | %(c) |

| | | | |

Ratios and Supplemental Data: | | | | | | | | | | | | | | | | |

Net assets, end of period (000 omitted) | | $ | 23,537 | | | $ | 17,479 | | | $ | 13,331 | | | $ | 10,642 | |

Ratio of net expenses to average net assets | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % | | | 1.00 | %(d) |

Ratio of expenses to average net assets before waiver | | | 1.55 | % | | | 1.60 | % | | | 1.66 | % | | | 3.49 | %(d) |

Ratio of net investment income to average net assets | | | 0.12 | % | | | 0.24 | % | | | 0.08 | % | | | 0.22 | %(d) |

Portfolio turnover rate (e) | | | 82 | % | | | 73 | % | | | 84 | % | | | 94 | %(c) |

| (a) | For the period December 23, 2013 (commencement of operations) to August 31, 2014. |

| (b) | Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends. |

| (e) | Portfolio turnover is calculated on the basis on the Fund as a whole without distinguishing among the classes of shares. |

See accompanying notes which are an integral part of these financial statements.

26

MERITAGE GROWTH EQUITY FUND – INVESTOR CLASS

FINANCIAL HIGHLIGHTS

(For a share outstanding during each period)

| | | | | | | | | | | | | | | | |

| | | For the

Year Ended

August 31, 2017 | | | For the

Year Ended

August 31, 2016 | | | For the

Year Ended

August 31, 2015 | | | For the

Period Ended

August 31, 2014 (a) | |

Selected Per Share Data: | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 12.03 | | | $ | 11.15 | | | $ | 10.92 | | | $ | 10.00 | |

| | | | | | | | | | | | | | | | |

Investment operations: | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | – | (b) | | | – | (b) | | | (0.02 | ) | | | – | (b) |

Net realized and unrealized gain on investments | | | 2.39 | | | | 1.11 | | | | 0.37 | | | | 0.92 | |

| | | | | | | | | | | | | | | | |

Total from investment operations | | | 2.39 | | | | 1.11 | | | | 0.35 | | | | 0.92 | |

| | | | | | | | | | | | | | | | |

Less distributions to shareholders: | | | | | | | | | | | | | | | | |

From net investment income | | | – | | | | – | | | | (0.01 | ) | | | – | |

From net realized gains | | | (0.12 | ) | | | (0.23 | ) | | | (0.11 | ) | | | – | |

| | | | | | | | | | | | | | | | |

Total distributions | | | (0.12 | ) | | | (0.23 | ) | | | (0.12 | ) | | | – | |

| | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 14.30 | | | $ | 12.03 | | | $ | 11.15 | | | $ | 10.92 | |

| | | | | | | | | | | | | | | | |

| | | | |

Total Return (c) | | | 20.02 | % | | | 10.13 | % | | | 3.17 | % | | | 9.20 | %(d) |

| | | | |

Ratios and Supplemental Data: | | | | | | | | | | | | | | | | |

Net assets, end of period (000 omitted) | | $ | 276 | | | $ | 367 | | | $ | 164 | | | $ | 136 | |

Ratio of net expenses to average net assets | | | 1.25 | % | | | 1.25 | % | | | 1.25 | % | | | 1.25 | %(e) |

Ratio of expenses to average net assets before waiver | | | 1.80 | % | | | 1.85 | % | | | 1.91 | % | | | 3.32 | %(e) |

Ratio of net investment income (loss) to average net assets | | | (0.10 | )% | | | (0.01 | )% | | | (0.17 | )% | | | 0.01 | %(e) |

Portfolio turnover rate (f) | | | 82 | % | | | 73 | % | | | 84 | % | | | 94 | %(d) |

| (a) | For the period December 23, 2013 (commencement of operations) to August 31, 2014. |

| (b) | Amount is less than $0.01. |

| (c) | Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends. |

| (f) | Portfolio turnover is calculated on the basis on the Fund as a whole without distinguishing among the classes of shares. |

See accompanying notes which are an integral part of these financial statements.

27

MERITAGE VALUE EQUITY FUND – INSTITUTIONAL CLASS

FINANCIAL HIGHLIGHTS

(For a share outstanding during each period)

| | | | | | | | | | | | | | | | |

| | | For the

Year Ended

August 31, 2017 | | | For the

Year Ended

August 31, 2016 | | | For the

Year Ended

August 31, 2015 | | | For the

Period Ended

August 31, 2014 (a) | |

Selected Per Share Data: | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 11.07 | | | $ | 11.00 | | | $ | 11.00 | | | $ | 10.00 | |

| | | | | | | | | | | | | | | | |

Investment operations: | | | | | | | | | | | | | | | | |

Net investment income | | | 0.07 | | | | 0.08 | | | | 0.10 | | | | 0.04 | |

Net realized and unrealized gain on investments | | | 1.41 | | | | 0.12 | | | | 0.01 | (b) | | | 0.96 | |

| | | | | | | | | | | | | | | | |

Total from investment operations | | | 1.48 | | | | 0.20 | | | | 0.11 | | | | 1.00 | |

| | | | | | | | | | | | | | | | |

Less distributions to shareholders: | | | | | | | | | | | | | | | | |

From net investment income | | | (0.10 | ) | | | (0.09 | ) | | | (0.04 | ) | | | – | |

From net realized gains | | | – | | | | (0.04 | ) | | | (0.07 | ) | | | – | |

| | | | | | | | | | | | | | | | |

Total distributions | | | (0.10 | ) | | | (0.13 | ) | | | (0.11 | ) | | | – | |

| | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 12.45 | | | $ | 11.07 | | | $ | 11.00 | | | $ | 11.00 | |

| | | | | | | | | | | | | | | | |

| | | | |

Total Return (c) | | | 13.41 | % | | | 1.85 | % | | | 0.94 | % | | | 10.00 | %(d) |

| | | | |

Ratios and Supplemental Data: | | | | | | | | | | | | | | | | |

Net assets, end of period (000 omitted) | | $ | 16,017 | | | $ | 13,854 | | | $ | 11,321 | | | $ | 9,673 | |

Ratio of net expenses to average net assets | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % | | | 1.00 | %(e) |

Ratio of expenses to average net assets before waiver | | | 1.69 | % | | | 1.67 | % | | | 1.66 | % | | | 3.58 | %(e) |

Ratio of net investment income to average net assets | | | 0.60 | % | | | 0.89 | % | | | 0.96 | % | | | 0.86 | %(e) |

Portfolio turnover rate (f) | | | 81 | % | | | 67 | % | | | 62 | % | | | 50 | %(d) |

| (a) | For the period December 23, 2013 (commencement of operations) to August 31, 2014. |

| (b) | The amount shown for a share outstanding throughout the period does not accord with the aggregate gains and losses in the portfolio securities during the period because of the timing of sales and purchases of fund shares in relation to fluctuating market values during the period. |

| (c) | Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends. |

| (f) | Portfolio turnover is calculated on the basis on the Fund as a whole without distinguishing among the classes of shares. |

See accompanying notes which are an integral part of these financial statements.

28

MERITAGE YIELD-FOCUS EQUITY FUND – INSTITUTIONAL CLASS

FINANCIAL HIGHLIGHTS

(For a share outstanding during each period)

| | | | | | | | | | | | | | | | |

| | | For the

Year Ended

August 31, 2017 | | | For the

Year Ended

August 31, 2016 | | | For the

Year Ended

August 31, 2015 | | | For the

Period Ended

August 31, 2014 (a) | |

Selected Per Share Data: | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 10.00 | | | $ | 9.44 | | | $ | 11.27 | | | $ | 10.00 | |

| | | | | | | | | | | | | | | | |

Investment operations: | | | | | | | | | | | | | | | | |

Net investment income | | | 0.37 | | | | 0.32 | | | | 0.33 | | | | 0.10 | |

Net realized and unrealized gain (loss) on investments | | | 0.40 | | | | 0.56 | | | | (1.71 | ) | | | 1.17 | |

| | | | | | | | | | | | | | | | |

Total from investment operations | | | 0.77 | | | | 0.88 | | | | (1.38 | ) | | | 1.27 | |

| | | | | | | | | | | | | | | | |

Less distributions to shareholders: | | | | | | | | | | | | | | | | |

From net investment income | | | (0.36 | ) | | | (0.32 | ) | | | (0.41 | ) | | | – | |

From net realized gains | | | – | | | | – | | | | (0.03 | ) | | | – | |

From return of capital | | | – | | | | – | | | | (0.01 | ) | | | – | |

| | | | | | | | | | | | | | | | |

Total distributions | | | (0.36 | ) | | | (0.32 | ) | | | (0.45 | ) | | | – | |

| | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 10.41 | | | $ | 10.00 | | | $ | 9.44 | | | $ | 11.27 | |

| | | | | | | | | | | | | | | | |

| | | | |

Total Return (b) | | | 7.79 | % | | | 9.58 | % | | | (12.56 | )% | | | 12.70 | %(c) |

| | | | |

Ratios and Supplemental Data: | | | | | | | | | | | | | | | | |

Net assets, end of period (000 omitted) | | $ | 26,103 | | | $ | 29,340 | | | $ | 28,316 | | | $ | 26,436 | |

Ratio of net expenses to average net assets | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % | | | 1.00 | %(d) |

Ratio of expenses to average net assets before waiver | | | 1.48 | % | | | 1.49 | % | | | 1.44 | % | | | 2.62 | %(d) |

Ratio of net investment income to average net assets | | | 3.49 | % | | | 3.41 | % | | | 3.17 | % | | | 2.70 | %(d) |

Portfolio turnover rate (e) | | | 60 | % | | | 99 | % | | | 86 | % | | | 63 | %(c) |

| (a) | For the period December 23, 2013 (commencement of operations) to August 31, 2014. |

| (b) | Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends. |

| (e) | Portfolio turnover is calculated on the basis on the Fund as a whole without distinguishing among the classes of shares. |

See accompanying notes which are an integral part of these financial statements.

29

MERITAGE YIELD-FOCUS EQUITY FUND – INVESTOR CLASS

FINANCIAL HIGHLIGHTS

(For a share outstanding during each period)

| | | | | | | | | | | | | | | | |

| | | For the

Year Ended

August 31, 2017 | | | For the

Year Ended

August 31, 2016 | | | For the

Year Ended

August 31, 2015 | | | For the

Period Ended

August 31, 2014 (a) | |

Selected Per Share Data: | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 9.98 | | | $ | 9.42 | | | $ | 11.25 | | | $ | 10.00 | |

| | | | | | | | | | | | | | | | |

Investment operations: | | | | | | | | | | | | | | | | |

Net investment income | | | 0.32 | (b) | | | 0.32 | | | | 0.29 | | | | 0.01 | |

Net realized and unrealized gain (loss) on investments | | | 0.46 | | | | 0.54 | | | | (1.70 | ) | | | 1.24 | |

| | | | | | | | | | | | | | | | |

Total from investment operations | | | 0.78 | | | | 0.86 | | | | (1.41 | ) | | | 1.25 | |

| | | | | | | | | | | | | | | | |

Less distributions to shareholders: | | | | | | | | | | | | | | | | |

From net investment income | | | (0.25 | ) | | | (0.30 | ) | | | (0.38 | ) | | | – | |

From net realized gains | | | – | | | | – | | | | (0.03 | ) | | | – | |

From return of capital | | | – | | | | – | | | | (0.01 | ) | | | – | |

| | | | | | | | | | | | | | | | |

Total distributions | | | (0.25 | ) | | | (0.30 | ) | | | (0.42 | ) | | | – | |

| | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 10.51 | | | $ | 9.98 | | | $ | 9.42 | | | $ | 11.25 | |

| | | | | | | | | | | | | | | | |

| | | | |

Total Return (c) | | | 7.93 | % | | | 9.35 | % | | | (12.85 | )% | | | 12.50 | %(d) |

| | | | |

Ratios and Supplemental Data: | | | | | | | | | | | | | | | | |

Net assets, end of period (000 omitted) | | $ | 644 | | | $ | 10,714 | | | $ | 10,708 | | | $ | 2,627 | |

Ratio of net expenses to average net assets | | | 1.25 | % | | | 1.25 | % | | | 1.25 | % | | | 1.25 | %(e) |

Ratio of expenses to average net assets before waiver | | | 1.73 | % | | | 1.74 | % | | | 1.69 | % | | | 2.46 | %(e) |

Ratio of net investment income to average net assets | | | 3.18 | % | | | 3.17 | % | | | 2.84 | % | | | 2.26 | %(e) |

Portfolio turnover rate (f) | | | 60 | % | | | 99 | % | | | 86 | % | | | 63 | %(d) |