UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22895

Capitol Series Trust

(Exact name of registrant as specified in charter)

Ultimus Asset Services, LLC

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246

(Address of principal executive offices) (Zip code)

Zachary P. Richmond

Ultimus Asset Services, LLC

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246

(Name and address of agent for service)

Registrant’s telephone number, including area code: 513-587-3400

Date of fiscal year end: August 31

Date of reporting period: February 28, 2017

Item 1. Reports to Stockholders.

Where discipline meets common sense.

Semi-Annual Report

February 28, 2017

Meritage Growth Equity Fund MPGEX/MPGIX

Meritage Value Equity Fund MVEBX

Meritage Yield-Focus Equity Fund MPYEX/MPYIX

| | | | |

| 913.345.7000 | | www.meritageportfoliofunds.com | | 7500 College Blvd., Suite 1212, Overland Park, KS 66210 |

MESSAGE FROM THE CHIEF INVESTMENT OFFICER – (Unaudited)

At Meritage, we are value-driven investors. We buy stock in businesses when i) they score well in our comprehensive stock-ranking process (universe is global, all-cap and about 6,500 securities), and ii) they are selling for less than we believe they are worth. Our value discipline is intended to provide a margin of safety and is one of our primary risk management tools, along with managing position sizes and diversification.

Dear Fellow Shareholders:

The past year has seen quite a change in the broad market. Specifically, we note how the S&P 500 marked its low for 2016 on February 11, 2016, closing at 1,829.08. At the conclusion of the first six months of fiscal year 2017, February 28, 2017, the S&P closed at 2,363.64. This period of slightly more than a year saw the S&P recover 32.19% from the low in 2016 and 10.01% from our last report six months ago on August 31, 2016.

Though not much has changed economically in these past six months, the market’s favorable reaction to the likelihood of change following a highly improbably election is logical. A policy agenda that includes the prospects of lower corporate and individual tax rates, a rollback in business regulation, massive infrastructure spending and the repatriation of foreign corporate earnings back to the U.S. are all potential developments that have been enthusiastically embraced by the stock market.

While we have seen interest rates begin to move higher off their historic lows, we expect a low interest rate environment to remain an important component to the investment backdrop. Economic activity, starting from a very low base around the world, should continue to see modest improvement. While many investors share our view, they have correspondingly been willing to pay a premium for well-known stocks. This is where we part company with the crowd, however, as we expect the discipline embedded in our value approach will yield better results over full market cycles.

Our Growth Fund continued to perform well for the past six months, ahead of its respective market benchmark. Our Value Fund turned in a solid six months, but trailed its primary benchmarks somewhat. The Yield-Focus Fund also performed well, but fell short of its most comparable benchmark, the Zacks Multi-Asset Income Index.

As always, we attribute our bottom-up value-centric security selection process for generating our strong long-term returns and our results so far in fiscal 2017. We continue to refine and improve this process of rigorously searching for attractive mispriced securities, among all capitalization sizes and geographies throughout the world.

We explore this topic further in the following pages. A specific discussion of each Fund and its performance is included in Management’s Discussion of Fund Performance.

Thank you for your continued trust in us as stewards of your capital. As previously mentioned we have our own money invested alongside yours in each of our funds, and we remain committed to delivering attractive risk-adjusted returns over full market cycles.

Sincerely,

Mark Eveans, CFA

President and Chief Investment Officer

1

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE – (Unaudited)

Meritage Growth Equity Fund

For the six-month period ended February 28, 2017, the Meritage Growth Equity Fund Institutional Class and Investors Class returned 10.82% and 10.70%, respectively. The Fund’s returns exceeded its primary benchmark, the Russell 1000 Growth Index, and the Lipper Large Cap Growth Index. They returned 9.15% and 7.66%, respectively, during the same time frame.

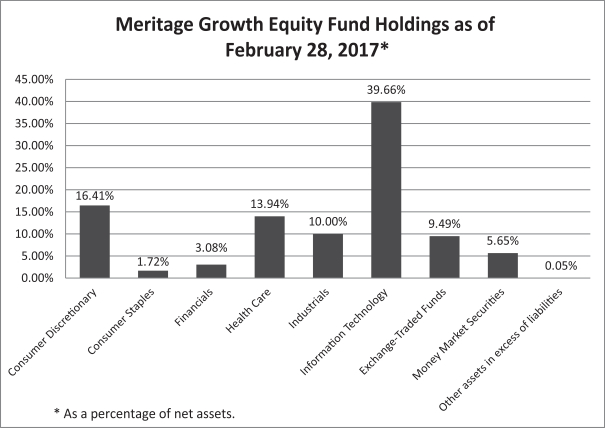

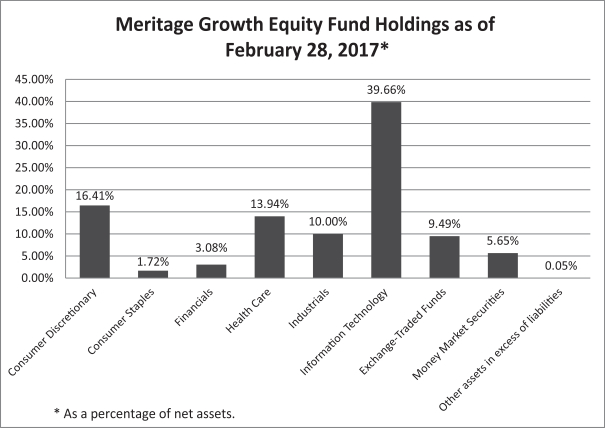

From an attribution standpoint the Fund’s strong performance over the course of the last six months, compared to the benchmark, was driven primarily by two key factors. The Fund was overweight in the Information Technology sector compared to the benchmark and our stock selection within that sector was superior. The interaction of these two factors was a significant positive.

Regarding specific issues, the strongest gainers for the six months were Coherent, Inc. up 73.6%, II-VI, Inc. up 68.0% and Nvidia up 65.9%.

The poorest performers for the six months were McKesson Corporation down 23.2%, Acuity Brands, Inc. down 23.1%, and AZZ Inc. down 15.7%.

As a value-centric and process driven Growth manager, most sector differences as compared to the benchmark are a result of either an under or overweight of specific, bottom-up, attractively valued growth opportunities identified by our process, within that particular sector.

While we have seen interest rates begin to move higher off their historic lows, we expect a low interest rate environment to remain an important component to the investment backdrop. Economic activity, starting from a very low base around the world, should continue to see some modest improvement. While many investors share our view, they have correspondingly been willing to pay an excessive premium for well-known growth stocks. This is where we part company with the crowd, however, as we expect the value discipline embedded in our growth approach will yield better results over full market cycles.

Meritage Value Equity Fund

For the six months ended February 28, 2017, the Meritage Value Equity Fund Institutional Class had a very nice return of 9.41%, but lagged the Russell 1000 Value Index benchmark which returned 11.07% during the same time frame, as well as the Lipper Large Cap Value Index return of 11.51%.

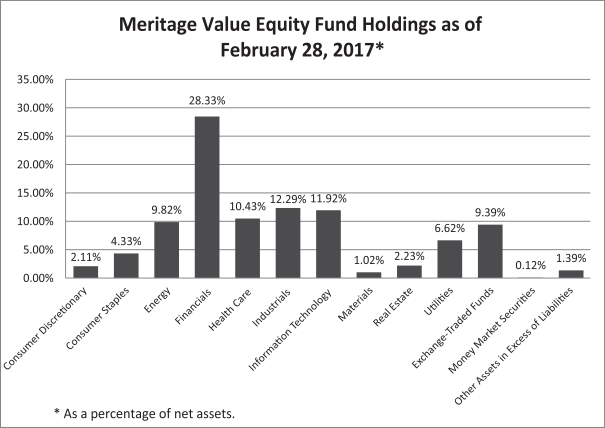

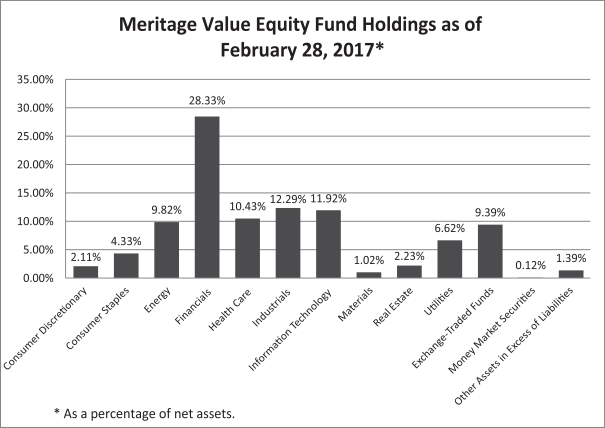

From an attribution standpoint, there were positive sector allocation influences from Real Estate and Telecommunications as well as superior stock selection within the Industrials, Health Care and Energy sectors. These were offset by subpar security selection in the Consumer Staples and Consumer Discretionary sectors.

Regarding individual issues, the strongest gainers for the six months were Southwest Airlines up 57.1%, Prudential Financial up 41.2%, and Voya Financial up 41.1%.

The poorest performers for the six months were Teva Pharmaceutical down 23.1%, World Fuel Services Corporation down 20.9% and Taro Pharmaceutical down 19.8%.

Because we are a value-centric and process driven manager, most sector differences as compared to the benchmark were the result of either an under or overweight of specific bottom-up valuation opportunities identified by our process.

2

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE – (Unaudited) (continued)

Meritage Yield-Focus Equity Fund

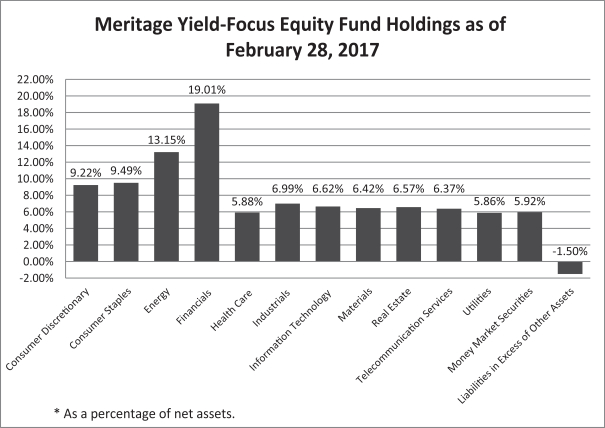

For the six months ended February 28, 2017, the Meritage Yield-Focus Equity Fund Institutional Class and Investors Class returned 6.34% and 6.53%, respectively. We use two benchmarks in assessing the performance of the Yield-Focus Equity Fund. The Russell 3000 Value Index is a long-term general purpose value-centric benchmark without specificity regarding the Fund’s distinct yield-focus style. The Zacks Multi-Asset Income Index has specific asset structure and distinguished dividend yield characteristics similar to the Fund. The Fund’s returns trailed the 11.42% total return for the Russell 3000 Value Index, as well as the Zacks Multi-Asset Income Index, which returned 8.52% during the same time. The Fund’s returns also trailed the Lipper Equity Income Index, which returned 9.20% during the period.

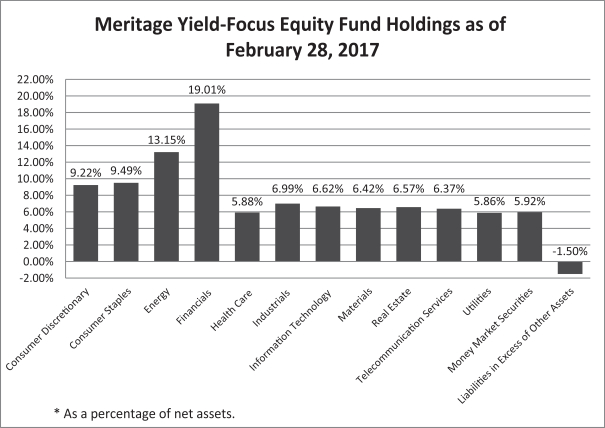

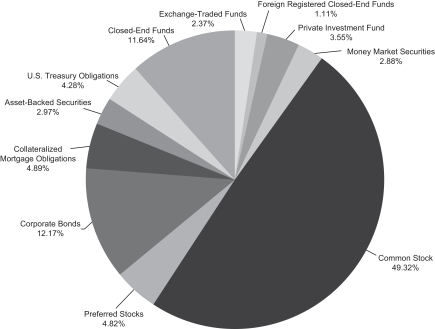

A founding premise of the Yield-Focus Equity Fund is to earn 50 – 75% of the expected long-term equity return in the form of cash dividends and distributions. The fund invests in six key types of equity asset classes – common stocks, master limited partnerships, other limited partnerships, real estate investment trusts, business development companies, convertible preferred stocks and, in rare situations, straight preferred stocks. The Meritage comprehensive security selection process searches globally for attractive yield franchises.

In terms of specific issues, the strongest performers for the period were Boeing Company up 41.5%, Universal Corp. up 26.9%, and Reynolds American up 26.4%.

The poorest performers for the year were GameStop Corp. down 26.2%, Gannett Co. down 24.6% and National Grid PLC ADR down 15.7%.

We use two benchmarks in assessing the performance of the Yield-Focus Equity Fund. The Russell 3000 Value Index is a long-term general purpose value-centric benchmark without specificity regarding the Fund’s distinct yield-focus style. The Zacks Multi-Asset Income Index has specific asset structure and distinguished dividend yield characteristics similar to the Fund.

3

Investment Results – (Unaudited)

Total Returns

For the Periods Ended February 28, 2017 (a)

| | | | | | |

Fund/Index | | Six Months | | 1 Year | | Since Inception

(12/23/13) |

Meritage Growth Equity Fund – Institutional Class | | 10.82% | | 26.25% | | 10.75% |

Meritage Growth Equity Fund – Investor Class | | 10.70% | | 25.99% | | 10.46% |

Russell 1000 Growth Index(b) | | 9.15% | | 22.15% | | 11.17% |

| | | | |

| | | Expense Ratios (c) |

| | | Institutional Class | | Investor Class |

Gross | | 1.63% | | 1.88% |

With Applicable Waivers | | 1.03% | | 1.28% |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Current performance of a Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-855-261-0104.

The performance in the preceding table reflects any fee reductions during the applicable period. If such fee reductions had not occurred, the quoted performance would be lower.

| (a) | Return figures reflect any change in price per share and assume the reinvestment of all distributions. Total returns for less than one year are not annualized. |

| (b) | The Russell 1000 Growth Index is a widely recognized unmanaged index of equity securities and is representative of a broader domestic equity market and range of securities than is found in the Fund’s portfolio. Individuals cannot invest directly in an Index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index. |

| (c) | The expense ratios are from the Fund’s prospectus dated December 29, 2016. The Adviser has contractually agreed to waive or limit its fees and assume other expenses of the Fund through December 31, 2017, so that total annual fund operating expenses do not exceed 1.00% of the Fund’s average daily net assets. This operating expense limitation does not apply to brokerage fees and commissions, borrowing costs (such as interest and dividend expenses on securities sold short), taxes, 12b-1 fees, extraordinary expenses and indirect expenses (such as “acquired fund fees and expenses”). Additional information pertaining to the Fund’s expense ratios as of February 28, 2017 can be found in the financial highlights. |

The Fund’s investment objective, strategies, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the investment company and may be obtained by calling 1-855-261-0104. Please read it carefully before investing.

The Fund is distributed by Unified Financial Securities, LLC, Member FINRA/SIPC.

4

Investment Results – (Unaudited) (continued)

Total Returns

For the Periods Ended February 28, 2017 (a)

| | | | | | |

Fund/Index | | Six Months | | 1 Year | | Since Inception

(12/23/13) |

Meritage Value Equity Fund – Institutional Class | | 9.41% | | 17.13% | | 6.89% |

Russell 1000 Value Index(b) | | 11.07% | | 29.13% | | 10.06% |

| | | | | | |

| | | Expense Ratios (c) | | | |

| | | Institutional Class | | | |

Gross | | 1.71% | | | | |

With Applicable Waivers | | 1.04% | | | | |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Current performance of a Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-855-261-0104.

The performance in the preceding table reflects any fee reductions during the applicable period. If such fee reductions had not occurred, the quoted performance would be lower.

| (a) | Return figures reflect any change in price per share and assume the reinvestment of all distributions. Total returns for less than one year are not annualized. |

| (b) | The Russell 1000 Value Index is a widely recognized unmanaged index of equity securities and is representative of a broader domestic equity market and range of securities than is found in the Fund’s portfolio. Individuals cannot invest directly in an Index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index. |

| (c) | The expense ratios are from the Fund’s prospectus dated December 29, 2016. The Adviser has contractually agreed to waive or limit its fees and assume other expenses of the Fund through December 31, 2017, so that total annual fund operating expenses do not exceed 1.00% of the Fund’s average daily net assets. This operating expense limitation does not apply to brokerage fees and commissions, borrowing costs (such as interest and dividend expenses on securities sold short), taxes, 12b-1 fees, extraordinary expenses and indirect expenses (such as “acquired fund fees and expenses”). Additional information pertaining to the Fund’s expense ratios as of February 28, 2017 can be found in the financial highlights. |

The Fund’s investment objective, strategies, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the investment company and may be obtained by calling 1-855-261-0104. Please read it carefully before investing.

The Fund is distributed by Unified Financial Securities, LLC, Member FINRA/SIPC.

5

Investment Results – (Unaudited) (continued)

Total Returns

For the Periods Ended February 28, 2017 (a)

| | | | | | |

Fund/Index | | Six Months | | 1 Year | | Since Inception

(12/23/13) |

Meritage Yield-Focus Equity Fund – Institutional Class | | 6.34% | | 18.48% | | 4.42% |

Meritage Yield-Focus Equity Fund – Investor Class | | 6.53% | | 18.57% | | 4.25% |

Russell 3000 Value Index(b) | | 11.42% | | 30.02% | | 9.93% |

Zacks Multi-Asset Income Index TR(c) | | 8.52% | | 26.82% | | 0.74% |

| | | | |

| | | Expense Ratios (d) |

| | | Institutional Class | | Investor Class |

Gross | | 1.64% | | 1.89% |

With Applicable Waivers | | 1.15% | | 1.40% |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Current performance of a Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-855-261-0104.

The performance in the preceding table reflects any fee reductions during the applicable period. If such fee reductions had not occurred, the quoted performance would be lower.

| (a) | Return figures reflect any change in price per share and assume the reinvestment of all distributions. Total returns for less than one year are not annualized. |

| (b) | The Russell 3000 Value Index is a widely recognized unmanaged index of equity securities and is representative of a broader domestic equity market and range of securities than is found in the Fund’s portfolio. Individuals cannot invest directly in an Index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index. |

| (c) | The Zacks Multi-Asset Income Index is comprised of approximately 125 to 150 securities selected, based on investment and other criteria, from a universe of domestic and international companies. The universe of securities within the Index includes U.S. listed common stocks and ADRs paying dividends, real estate investment trusts, MLPs, closed end funds, Canadian royalty trusts and traditional preferred stocks. Individuals cannot invest directly in an Index. |

| (d) | The expense ratios are from the Fund’s prospectus dated December 29, 2016. The Adviser has contractually agreed to waive or limit its fees and assume other expenses of the Fund through December 31, 2017, so that total annual fund operating expenses do not exceed 1.00% of the Fund’s average daily net assets. This operating expense limitation does not apply to brokerage fees and commissions, borrowing costs (such as interest and dividend expenses on securities sold short), taxes, 12b-1 fees, extraordinary expenses and indirect expenses (such as “acquired fund fees and expenses”). Additional information pertaining to the Fund’s expense ratios as of February 28, 2017 can be found in the financial highlights. |

The Fund’s investment objective, strategies, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the investment company and may be obtained by calling 1-855-261-0104. Please read it carefully before investing.

The Fund is distributed by Unified Financial Securities, LLC, Member FINRA/SIPC.

6

Fund Holdings – (Unaudited)

The investment objective of the Meritage Growth Equity Fund is to seek growth of capital.

7

Fund Holdings – (Unaudited) (continued)

The investment objective of the Meritage Value Equity Fund is to seek growth of capital. Income is a secondary objective.

8

Fund Holdings – (Unaudited) (continued)

The investment objective of the Meritage Yield-Focus Equity Fund is to seek long-term growth of capital with an emphasis on high current income.

Availability of Portfolio Schedule – (Unaudited)

The Funds will file their complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarter of each fiscal year on Form N-Q. The Funds’ Forms N-Q will be available at the SEC’s website at www.sec.gov. The Form N-Q may be reviewed and copied at the Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

9

MERITAGE GROWTH EQUITY FUND

SCHEDULE OF INVESTMENTS

February 28, 2017 (Unaudited)

| | | | | | | | |

| Common Stocks – 84.81% | | Shares | | | Fair Value | |

Consumer Discretionary – 16.41% | | | | | | | | |

Amazon.com, Inc. * | | | 961 | | | $ | 812,083 | |

Home Depot, Inc./The | | | 5,595 | | | | 810,772 | |

Omnicom Group, Inc. | | | 4,785 | | | | 407,204 | |

Priceline Group, Inc./The * | | | 390 | | | | 672,411 | |

Thor Industries, Inc. | | | 5,260 | | | | 582,913 | |

| | | | | | | | |

| | | | | | | 3,285,383 | |

| | | | | | | | |

Consumer Staples – 1.72% | |

Colgate-Palmolive Co. | | | 4,730 | | | | 345,195 | |

| | | | | | | | |

Financials – 3.08% | |

Aon PLC | | | 2,320 | | | | 268,308 | |

Everest Re Group Ltd. | | | 1,481 | | | | 348,242 | |

| | | | | | | | |

| | | | | | | 616,550 | |

| | | | | | | | |

Health Care – 13.94% | |

Amgen, Inc. | | | 2,261 | | | | 399,134 | |

Danaher Corp. | | | 4,572 | | | | 391,135 | |

Intuitive Surgical, Inc. * | | | 331 | | | | 243,947 | |

Johnson & Johnson | | | 5,205 | | | | 636,103 | |

Masimo Corp. * | | | 2,715 | | | | 245,327 | |

Mettler-Toledo International, Inc. * | | | 661 | | | | 314,781 | |

Teleflex, Inc. | | | 1,507 | | | | 288,108 | |

United Therapeutics Corp. * | | | 1,855 | | | | 274,021 | |

| | | | | | | | |

| | | | | | | 2,792,556 | |

| | | | | | | | |

Industrials – 10.00% | |

Acuity Brands, Inc. | | | 1,957 | | | | 413,514 | |

AMETEK, Inc. | | | 4,795 | | | | 258,786 | |

Deluxe Corp. | | | 5,790 | | | | 426,086 | |

Gibraltar Industries, Inc. * | | | 9,580 | | | | 397,091 | |

Snap-on, Inc. | | | 1,235 | | | | 209,543 | |

Trex Company, Inc. * | | | 4,375 | | | | 297,544 | |

| | | | | | | | |

| | | | | | | 2,002,564 | |

| | | | | | | | |

Information Technology – 39.66% | |

Alphabet, Inc., Class A * | | | 1,045 | | | | 882,952 | |

Apple, Inc. | | | 8,209 | | | | 1,124,551 | |

Applied Materials, Inc. | | | 7,790 | | | | 282,154 | |

Cisco Systems, Inc. | | | 13,770 | | | | 470,659 | |

Citrix Systems, Inc. * | | | 2,805 | | | | 221,455 | |

Coherent, Inc. * | | | 3,495 | | | | 638,117 | |

Fiserv, Inc. * | | | 4,105 | | | | 473,717 | |

Flex Ltd. * | | | 16,555 | | | | 272,992 | |

II-VI, Inc. * | | | 7,475 | | | | 266,110 | |

See accompanying notes which are an integral part of these financial statements.

10

MERITAGE GROWTH EQUITY FUND

SCHEDULE OF INVESTMENTS – (continued)

February 28, 2017 (Unaudited)

| | | | | | | | |

| Common Stocks – 84.81% – continued | | Shares | | | Fair Value | |

Information Technology – 39.66% – continued | |

Lam Research Corp. | | | 4,010 | | | $ | 475,345 | |

LogMeIn, Inc. | | | – | (a) | | | 25 | |

MasterCard, Inc., Class A | | | 4,740 | | | | 523,580 | |

MaxLinear, Inc., Class A * | | | 12,195 | | | | 317,558 | |

Microsoft Corp. | | | 12,965 | | | | 829,501 | |

NICE-Systems Ltd. ADR | | | 5,285 | | | | 360,701 | |

NVIDIA Corp. | | | 5,700 | | | | 578,436 | |

Xperi Corp. | | | 6,260 | | | | 224,421 | |

| | | | | | | | |

| | | | | | | 7,942,274 | |

| | | | | | | | |

TOTAL COMMON STOCKS (Cost $13,235,871) | | | | | | | 16,984,522 | |

| | | | | | | | |

Exchange-Traded Funds – 9.49% | |

Consumer Staples Select Sector SPDR Fund | | | 12,835 | | | | 707,209 | |

Financial Select Sector SPDR Fund | | | 12,065 | | | | 296,075 | |

iShares Nasdaq Biotechnology ETF | | | 1,596 | | | | 474,379 | |

iShares Russell 1000 Growth ETF | | | 1,230 | | | | 138,707 | |

iShares US Regional Banks ETF | | | 6,000 | | | | 285,060 | |

| | | | | | | | |

TOTAL EXCHANGE-TRADED FUNDS (Cost $1,761,632) | | | | | | | 1,901,430 | |

| | | | | | | | |

Money Market Securities – 5.65% | |

Morgan Stanley Institutional Liquidity Funds Treasury Securities Portfolio, Institutional Class, 0.40% (b) | | | 1,130,643 | | | | 1,130,643 | |

| | | | | | | | |

TOTAL MONEY MARKET SECURITIES (Cost $1,130,643) | | | | | | | 1,130,643 | |

| | | | | | | | |

TOTAL INVESTMENTS – 99.95% (Cost $16,128,146) | | | | | | | 20,016,595 | |

| | | | | | | | |

Other Assets in Excess of Liabilities – 0.05% | | | | | | | 10,769 | |

| | | | | | | | |

NET ASSETS – 100.00% | | | | | | $ | 20,027,364 | |

| | | | | | | | |

| | (a) | Rounds to less than 1 share. |

| | (b) | Rate disclosed is the seven day effective yield as of February 28, 2017. |

| | * | Non-income producing security. |

ADR – American Depositary Receipt

The sectors shown on the schedule of investments are based on Global Industry Classification Standard, or GICS® (“GICS”). The GICS was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS is a service mark of MSCI, Inc. and S&P and has been licensed for use by Ultimus Asset Services, LLC.

See accompanying notes which are an integral part of these financial statements.

11

MERITAGE VALUE EQUITY FUND

SCHEDULE OF INVESTMENTS

February 28, 2017 (Unaudited)

| | | | | | | | |

| Common Stocks – 89.10% | | Shares | | | Fair Value | |

Consumer Discretionary – 2.11% | |

Big Lots, Inc. | | | 3,060 | | | $ | 157,100 | |

DeVry Education Group, Inc. | | | 4,795 | | | | 154,159 | |

| | | | | | | | |

| | | | | | | 311,259 | |

| | | | | | | | |

Consumer Staples – 4.33% | |

CVS Health Corp. | | | 1,990 | | | | 160,354 | |

Ingredion, Inc. | | | 1,650 | | | | 199,469 | |

Pilgrim’s Pride Corp. | | | 13,665 | | | | 278,493 | |

| | | | | | | | |

| | | | | | | 638,316 | |

| | | | | | | | |

Energy – 9.82% | |

Chevron Corp. | | | 5,090 | | | | 572,625 | |

Royal Dutch Shell PLC ADR | | | 10,965 | | | | 568,974 | |

World Fuel Services Corp. | | | 8,485 | | | | 306,902 | |

| | | | | | | | |

| | | | | | | 1,448,501 | |

| | | | | | | | |

Financials – 28.33% | |

Aspen Insurance Holdings Ltd. | | | 6,080 | | | | 340,784 | |

Berkshire Hathaway, Inc., Class B * | | | 2,429 | | | | 416,379 | |

Citigroup, Inc. | | | 5,320 | | | | 318,189 | |

Fidelity & Guaranty Life | | | 6,105 | | | | 162,393 | |

Goldman Sachs Group, Inc./The | | | 1,107 | | | | 274,602 | |

Horace Mann Educators Corp. | | | 7,470 | | | | 312,993 | |

Prudential Financial, Inc. | | | 3,670 | | | | 405,682 | |

Reinsurance Group of America, Inc. | | | 3,450 | | | | 448,707 | |

State Street Corp. | | | 4,955 | | | | 394,963 | |

Torchmark Corp. | | | 4,902 | | | | 380,052 | |

Unum Group | | | 6,270 | | | | 306,164 | |

Voya Financial, Inc. | | | 10,090 | | | | 416,011 | |

| | | | | | | | |

| | | | | | | 4,176,919 | |

| | | | | | | | |

Health Care – 10.43% | |

Aetna, Inc. | | | 2,580 | | | | 332,201 | |

Biogen, Inc. * | | | 926 | | | | 267,244 | |

Cigna Corp. | | | 1,975 | | | | 294,077 | |

ICON PLC * | | | 3,560 | | | | 298,221 | |

UnitedHealth Group, Inc. | | | 2,095 | | | | 346,471 | |

| | | | | | | | |

| | | | | | | 1,538,214 | |

| | | | | | | | |

Industrials – 12.29% | |

Chicago Bridge & Iron Co. N.V. | | | 4,270 | | | | 143,344 | |

EnerSys | | | 3,930 | | | | 301,549 | |

Raytheon Co. | | | 2,080 | | | | 320,632 | |

Regal-Beloit Corp. | | | 4,120 | | | | 306,734 | |

See accompanying notes which are an integral part of these financial statements.

12

MERITAGE VALUE EQUITY FUND

SCHEDULE OF INVESTMENTS – (continued)

February 28, 2017 (Unaudited)

| | | | | | | | |

| Common Stocks – 89.10% – continued | | Shares | | | Fair Value | |

Industrials – 12.29% – continued | |

Southwest Airlines Co. | | | 6,430 | | | $ | 371,654 | |

Spirit AeroSystems Holdings, Inc. | | | 5,970 | | | | 367,812 | |

| | | | | | | | |

| | | | | | | 1,811,725 | |

| | | | | | | | |

Information Technology – 11.92% | |

Check Point Software Technologies Ltd. * | | | 3,230 | | | | 319,479 | |

Juniper Networks, Inc. | | | 6,015 | | | | 168,420 | |

MAXIMUS, Inc. | | | 2,665 | | | | 159,021 | |

Skyworks Solutions, Inc. | | | 1,985 | | | | 188,198 | |

Synopsys, Inc. * | | | 3,625 | | | | 258,970 | |

Teradyne, Inc. | | | 7,100 | | | | 201,924 | |

Vishay Intertechnology, Inc. | | | 9,540 | | | | 151,209 | |

WNS Holdings Ltd. ADR * | | | 10,965 | | | | 309,761 | |

| | | | | | | | |

| | | | | | | 1,756,982 | |

| | | | | | | | |

Materials – 1.02% | |

Innospec, Inc. | | | 2,300 | | | | 150,190 | |

| | | | | | | | |

Real Estate – 2.23% | |

Welltower, Inc. | | | 4,665 | | | | 328,323 | |

| | | | | | | | |

Utilities – 6.62% | |

Ameren Corp. | | | 6,595 | | | | 360,681 | |

Entergy Corp. | | | 4,875 | | | | 373,717 | |

Exelon Corp. | | | 6,565 | | | | 241,001 | |

| | | | | | | | |

| | | | | | | 975,399 | |

| | | | | | | | |

TOTAL COMMON STOCKS (Cost $10,757,745) | | | | | | | 13,135,828 | |

| | | | | | | | |

Exchange-Traded Funds – 9.39% | |

Materials Select Sector SPDR Fund | | | 5,270 | | | | 275,357 | |

SPDR S&P Oil & Gas Equipment & Services ETF | | | 12,450 | | | | 266,555 | |

SPDR S&P Regional Banking ETF | | | 5,480 | | | | 314,881 | |

Vanguard REIT ETF | | | 3,290 | | | | 280,505 | |

Vanguard Telecommunication Services ETF | | | 2,525 | | | | 246,794 | |

| | | | | | | | |

TOTAL EXCHANGE-TRADED FUNDS (Cost $1,323,928) | | | | | | | 1,384,092 | |

| | | | | | | | |

Money Market Securities – 0.12% | |

Morgan Stanley Institutional Liquidity Funds Treasury Securities Portfolio, Institutional Class, 0.40% (a) | | | 17,596 | | | | 17,596 | |

| | | | | | | | |

TOTAL MONEY MARKET SECURITIES (Cost $17,596) | | | | | | | 17,596 | |

| | | | | | | | |

TOTAL INVESTMENTS – 98.61% (Cost $12,099,269) | | | | | | | 14,537,516 | |

| | | | | | | | |

Other Assets in Excess of Liabilities – 1.39% | | | | | | | 205,313 | |

| | | | | | | | |

NET ASSETS – 100.00% | | | | | | $ | 14,742,829 | |

| | | | | | | | |

See accompanying notes which are an integral part of these financial statements.

13

MERITAGE VALUE EQUITY FUND

SCHEDULE OF INVESTMENTS – (continued)

February 28, 2017 (Unaudited)

| | (a) | Rate disclosed is the seven day effective yield as of February 28, 2017. |

| | * | Non-income producing security. |

ADR — American Depositary Receipt

The sectors shown on the schedule of investments are based on Global Industry Classification Standard, or GICS® (“GICS”). The GICS was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS is a service mark of MSCI, Inc. and S&P and has been licensed for use by Ultimus Asset Services, LLC.

See accompanying notes which are an integral part of these financial statements.

14

MERITAGE YIELD-FOCUS EQUITY FUND

SCHEDULE OF INVESTMENTS

February 28, 2017 (Unaudited)

| | | | | | | | |

| Common Stocks – 89.87% | | Shares | | | Fair Value | |

Consumer Discretionary – 9.22% | |

GameStop Corp., Class A | | | 11,390 | | | $ | 278,372 | |

Gannett Co., Inc. | | | 59,515 | | | | 518,971 | |

Garmin Ltd. | | | 12,320 | | | | 635,835 | |

Kohl’s Corp. | | | 11,055 | | | | 471,164 | |

Staples, Inc. | | | 45,955 | | | | 413,135 | |

Target Corp. | | | 4,185 | | | | 245,952 | |

| | | | | | | | |

| | | | | | | 2,563,429 | |

| | | | | | | | |

Consumer Staples – 9.49% | |

Altria Group, Inc. | | | 10,200 | | | | 764,184 | |

Philip Morris International, Inc. | | | 6,070 | | | | 663,754 | |

Reynolds American, Inc. | | | 9,477 | | | | 583,499 | |

Unilever PLC ADR | | | 13,215 | | | | 627,448 | |

| | | | | | | | |

| | | | | | | 2,638,885 | |

| | | | | | | | |

Energy – 13.15% | |

BP PLC ADR | | | 16,640 | | | | 564,429 | |

Enterprise Products Partners LP (a) | | | 19,580 | | | | 548,827 | |

Occidental Petroleum Corp. | | | 7,655 | | | | 501,785 | |

Phillips 66 Partners LP (a) | | | 5,400 | | | | 300,402 | |

Repsol SA ADR | | | 46,790 | | | | 692,258 | |

Total SA ADR | | | 10,055 | | | | 502,448 | |

Valero Energy Corp. | | | 8,040 | | | | 546,318 | |

| | | | | | | | |

| | | | | | | 3,656,467 | |

| | | | | | | | |

Financials – 19.01% | |

AllianceBernstein Holding LP (a) | | | 21,480 | | | | 509,076 | |

Ares Capital Corp. (b) | | | 27,175 | | | | 482,356 | |

Banco Latinoamericano de Comercio Exterior SA, Class E | | | 14,455 | | | | 406,619 | |

Bank of Montreal | | | 5,885 | | | | 445,083 | |

Federated Investors, Inc., Class B | | | 20,215 | | | | 549,242 | |

Invesco Ltd. | | | 18,910 | | | | 608,713 | |

Lazard Ltd., Class A (a) | | | 9,760 | | | | 420,266 | |

Maiden Holdings Ltd. | | | 30,245 | | | | 467,285 | |

Old Republic International Corp. | | | 26,390 | | | | 546,537 | |

Power Financial Corp. | | | 15,715 | | | | 410,932 | |

Solar Capital Ltd. (b) | | | 19,850 | | | | 442,059 | |

| | | | | | | | |

| | | | | | | 5,288,168 | |

| | | | | | | | |

Health Care – 3.85% | |

Merck & Co., Inc. | | | 8,710 | | | | 573,728 | |

Pfizer, Inc. | | | 14,595 | | | | 497,981 | |

| | | | | | | | |

| | | | | | | 1,071,709 | |

| | | | | | | | |

See accompanying notes which are an integral part of these financial statements.

15

MERITAGE YIELD-FOCUS EQUITY FUND

SCHEDULE OF INVESTMENTS – (continued)

February 28, 2017 (Unaudited)

| | | | | | | | |

| Common Stocks – 89.87% – continued | | Shares | | | Fair Value | |

Industrials – 5.31% | |

Boeing Co./The | | | 3,055 | | | $ | 550,603 | |

Eaton Corp. PLC | | | 6,510 | | | | 468,590 | |

Lockheed Martin Corp. | | | 1,715 | | | | 457,185 | |

| | | | | | | | |

| | | | | | | 1,476,378 | |

| | | | | | | | |

Information Technology – 6.62% | |

HP, Inc. | | | 38,445 | | | | 667,790 | |

International Business Machines Corp. | | | 3,203 | | | | 575,963 | |

QUALCOMM, Inc. | | | 5,770 | | | | 325,890 | |

Western Union Co./The | | | 13,830 | | | | 271,621 | |

| | | | | | | | |

| | | | | | | 1,841,264 | |

| | | | | | | | |

Materials – 6.42% | |

Domtar Corp. | | | 14,150 | | | | 538,973 | |

Lyondellbasell Industries NV, Class A | | | 7,670 | | | | 699,811 | |

Rio Tinto PLC ADR | | | 13,170 | | | | 546,818 | |

| | | | | | | | |

| | | | | | | 1,785,602 | |

| | | | | | | | |

Real Estate – 6.57% | |

Brandywine Realty Trust | | | 16,825 | | | | 280,305 | |

Medical Properties Trust, Inc. | | | 36,015 | | | | 483,321 | |

Omega Healthcare Investors, Inc. | | | 14,570 | | | | 475,565 | |

VEREIT, Inc. | | | 64,990 | | | | 589,459 | |

| | | | | | | | |

| | | | | | | 1,828,650 | |

| | | | | | | | |

Telecommunication Services – 6.37% | |

AT&T, Inc. | | | 12,845 | | | | 536,793 | |

CenturyLink, Inc. | | | 22,780 | | | | 552,643 | |

Verizon Communications, Inc. | | | 13,772 | | | | 683,504 | |

| | | | | | | | |

| | | | | | | 1,772,940 | |

| | | | | | | | |

Utilities – 3.86% | |

Entergy Corp. | | | 7,445 | | | | 570,734 | |

Public Service Enterprise Group, Inc. | | | 10,945 | | | | 503,251 | |

| | | | | | | | |

| | | | | | | 1,073,985 | |

| | | | | | | | |

TOTAL COMMON STOCKS (Cost $21,626,309) | | | | | | | 24,997,477 | |

| | | | | | | | |

Convertible Preferred Stocks – 5.71% | | | | | | | | |

Health Care – 2.03% | |

Anthem, Inc., 5.25% | | | 11,245 | | | | 564,049 | |

| | | | | | | | |

Industrials – 1.68% | |

Stericycle, Inc., 5.25% | | | 6,620 | | | | 468,696 | |

| | | | | | | | |

See accompanying notes which are an integral part of these financial statements.

16

MERITAGE YIELD-FOCUS EQUITY FUND

SCHEDULE OF INVESTMENTS – (continued)

February 28, 2017 (Unaudited)

| | | | | | | | |

| Convertible Preferred Stocks – 5.71% – continued | | Shares | | | Fair Value | |

Utilities – 2.00% | |

Exelon Corp., 6.50% | | | 11,210 | | | $ | 555,792 | |

| | | | | | | | |

TOTAL CONVERTIBLE PREFERRED STOCKS (Cost $1,435,729) | | | | | | | 1,588,537 | |

| | | | | | | | |

Money Market Securities – 5.92% | |

Morgan Stanley Institutional Liquidity Funds Treasury Securities Portfolio, Institutional Class, 0.40% (c) | | | 1,646,378 | | | | 1,646,378 | |

| | | | | | | | |

TOTAL MONEY MARKET SECURITIES (Cost $1,646,378) | | | | | | | 1,646,378 | |

| | | | | | | | |

TOTAL INVESTMENTS – 101.50% (Cost $24,708,416) | | | | | | | 28,232,392 | |

| | | | | | | | |

Liabilities in Excess of Other Assets – (1.50)% | | | | | | | (416,138 | ) |

| | | | | | | | |

NET ASSETS – 100.00% | | | | | | $ | 27,816,254 | |

| | | | | | | | |

| | (a) | Master Limited Partnership |

| | (b) | Business Development Company |

| | (c) | Rate disclosed is the seven day effective yield as of February 28, 2017. |

ADR – American Depositary Receipt

The sectors shown on the schedule of investments are based on Global Industry Classification Standard, or GICS® (“GICS”). The GICS was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS is a service mark of MSCI, Inc. and S&P and has been licensed for use by Ultimus Asset Services, LLC.

See accompanying notes which are an integral part of these financial statements.

17

MERITAGE FUNDS

STATEMENTS OF ASSETS AND LIABILITIES

February 28, 2017 (Unaudited)

| | | | | | | | | | | | |

| | | Meritage Growth

Equity Fund | | | Meritage Value

Equity Fund | | | Meritage Yield-

Focus Equity Fund | |

Assets | | | | | | | | | | | | |

Investments in securities at value (cost $16,128,146, $12,099,269 and $24,708,416) | | $ | 20,016,595 | | | $ | 14,537,516 | | | $ | 28,232,392 | |

Foreign currencies, at value (Cost $-, $- and $4,765) | | | – | | | | – | | | | 4,765 | |

Receivable for fund shares sold | | | – | | | | – | | | | 4,431 | |

Receivable for investments sold | | | – | | | | 274,128 | | | | 273,922 | |

Dividends receivable | | | 16,132 | | | | 30,952 | | | | 124,984 | |

Tax reclaims receivable | | | 926 | | | | – | | | | 9,360 | |

Prepaid expenses | | | 13,355 | | | | 12,425 | | | | 29,795 | |

| | | | | | | | | | | | |

Total Assets | | | 20,047,008 | | | | 14,855,021 | | | | 28,679,649 | |

| | | | | | | | | | | | |

| | | |

Liabilities | | | | | | | | | | | | |

Payable for fund shares redeemed | | | – | | | | – | | | | 5,500 | |

Payable for investments purchased | | | – | | | | 97,088 | | | | 812,372 | |

Payable to Adviser | | | 4,466 | | | | 2,605 | | | | 6,615 | |

Accrued 12b-1 fees – Investor class | | | 47 | | | | – | | | | 3,632 | |

Payable to administrator, fund accountant, and transfer agent | | | 4,955 | | | | 4,123 | | | | 10,724 | |

Payable to custodian | | | 640 | | | | 72 | | | | – | |

Other accrued expenses | | | 9,536 | | | | 8,304 | | | | 24,552 | |

| | | | | | | | | | | | |

Total Liabilities | | | 19,644 | | | | 112,192 | | | | 863,395 | |

| | | | | | | | | | | | |

| | | |

Net Assets | | $ | 20,027,364 | | | $ | 14,742,829 | | | $ | 27,816,254 | |

| | | | | | | | | | | | |

| | | |

Net Assets consist of: | | | | | | | | | | | | |

Paid-in capital | | $ | 15,952,691 | | | $ | 12,813,117 | | | $ | 29,391,072 | |

Accumulated undistributed net investment income | | | 1,088 | | | | 53,021 | | | | 204,428 | |

Accumulated undistributed net realized gain (loss) from investment transactions | | | 185,136 | | | | (561,556 | ) | | | (5,303,222 | ) |

Net unrealized appreciation on investments | | | 3,888,449 | | | | 2,438,247 | | | | 3,523,976 | |

| | | | | | | | | | | | |

| | | |

Net Assets | | $ | 20,027,364 | | | $ | 14,742,829 | | | $ | 27,816,254 | |

| | | | | | | | | | | | |

| | | |

Net Assets: Institutional Class | | $ | 19,894,459 | | | $ | 14,742,829 | | | $ | 27,261,829 | |

| | | | | | | | | | | | |

Shares outstanding

(unlimited number of shares authorized, no par value) | | | 1,500,027 | | | | 1,227,768 | | | | 2,599,885 | |

| | | | | | | | | | | | |

Net asset value, offering and redemption price per share | | $ | 13.26 | | | $ | 12.01 | | | $ | 10.49 | |

| | | | | | | | | | | | |

| | | |

Net Assets: Investor Class | | $ | 132,905 | | | | | | | $ | 554,425 | |

| | | | | | | | | | | | |

Shares outstanding

(unlimited number of shares authorized, no par value) | | | 10,076 | | | | | | | | 52,797 | |

| | | | | | | | | | | | |

Net asset value, offering and redemption price per share | | $ | 13.19 | | | | | | | $ | 10.50 | |

| | | | | | | | | | | | |

See accompanying notes which are an integral part of these financial statements.

18

MERITAGE FUNDS

STATEMENTS OF OPERATIONS

For the six months ended February 28, 2017 (Unaudited)

| | | | | | | | | | | | |

| | | Meritage Growth

Equity Fund | | | Meritage Value

Equity Fund | | | Meritage Yield-

Focus Equity Fund | |

Investment Income | | | | | | | | | | | | |

Dividend income

(net of foreign taxes withheld of $306, $2,937 and $8,465) | | $ | 96,918 | | | $ | 120,277 | | | $ | 871,171 | |

| | | | | | | | | | | | |

Total investment income | | | 96,918 | | | | 120,277 | | | | 871,171 | |

| | | | | | | | | | | | |

| | | |

Expenses | | | | | | | | | | | | |

Investment Adviser | | | 67,398 | | | | 50,311 | | | | 141,604 | |

Administration | | | 14,112 | | | | 10,594 | | | | 30,932 | |

Fund accounting | | | 9,434 | | | | 7,022 | | | | 20,736 | |

Audit | | | 10,232 | | | | 10,232 | | | | 10,232 | |

Registration | | | 7,538 | | | | 5,499 | | | | 17,108 | |

Transfer agent | | | 7,575 | | | | 5,644 | | | | 16,800 | |

Other | | | 5,885 | | | | 5,405 | | | | 10,742 | |

Legal | | | 4,359 | | | | 3,253 | | | | 9,496 | |

12b-1 – Investor class | | | 185 | | | | 11 | (a) | | | 12,569 | |

Report printing | | | 2,744 | | | | 1,750 | | | | 5,735 | |

Insurance | | | 3,297 | | | | 3,174 | | | | 3,597 | |

Custodian | | | 2,101 | | | | 1,831 | | | | 2,464 | |

Trustee | | | 1,971 | | | | 1,970 | | | | 1,970 | |

Pricing | | | 1,132 | | | | 1,119 | | | | 1,294 | |

| | | | | | | | | | | | |

Total expenses | | | 137,963 | | | | 107,815 | | | | 285,279 | |

Fees waived by Adviser | | | (47,703 | ) | | | (40,559 | ) | | | (83,468 | ) |

| | | | | | | | | | | | |

Net operating expenses | | | 90,260 | | | | 67,256 | | | | 201,811 | |

| | | | | | | | | | | | |

Net investment income | | | 6,658 | | | | 53,021 | | | | 669,360 | |

| | | | | | | | | | | | |

| |

Net Realized and Unrealized Gain (Loss) on Investments | | | | | |

Net realized gain on investment securities transactions | | | 449,426 | | | | 74,437 | | | | 1,374,693 | |

Net realized loss on foreign currency transactions | | | – | | | | – | | | | (161 | ) |

Net change in unrealized appreciation of investment securities | | | 1,442,338 | | | | 1,067,774 | | | | 215,717 | |

| | | | | | | | | | | | |

Net realized and unrealized gain on investments | | | 1,891,764 | | | | 1,142,211 | | | | 1,590,249 | |

| | | | | | | | | | | | |

Net increase in net assets resulting from operations | | $ | 1,898,422 | | | $ | 1,195,232 | | | $ | 2,259,609 | |

| | | | | | | | | | | | |

| (a) | Meritage Value Equity Fund – Investor Class liquidated on February 3, 2017. |

See accompanying notes which are an integral part of these financial statements.

19

MERITAGE GROWTH EQUITY FUND

STATEMENTS OF CHANGES IN NET ASSETS

| | | | | | | | |

| | | For the Six

Months Ended

February 28, 2017

(Unaudited) | | | For the

Year Ended

August 31, 2016 | |

Increase (Decrease) in Net Assets due to: | | | | | | | | |

Operations | | | | | | | | |

Net investment income | | $ | 6,658 | | | $ | 37,576 | |

Net realized gain (loss) on investment securities transactions | | | 449,426 | | | | (76,545 | ) |

Net change in unrealized appreciation of investment securities | | | 1,442,338 | | | | 1,687,088 | |

| | | | | | | | |

Net increase in net assets resulting from operations | | | 1,898,422 | | | | 1,648,119 | |

| | | | | | | | |

| | |

Distributions | | | | | | | | |

From net investment income – Institutional Class | | | (44,491 | ) | | | (8,254 | ) |

From net realized gains – Institutional Class | | | (171,541 | ) | | | (306,530 | ) |

From net realized gains – Investor Class | | | (1,047 | ) | | | (3,439 | ) |

| | | | | | | | |

Total distributions | | | (217,079 | ) | | | (318,223 | ) |

| | | | | | | | |

| | |

Capital Transactions – Institutional Class | | | | | | | | |

Proceeds from shares sold | | | 1,814,571 | | | | 3,937,403 | |

Reinvestment of distributions | | | 208,934 | | | | 306,740 | |

Amount paid for shares redeemed | | | (1,279,317 | ) | | | (1,405,523 | ) |

| | | | | | | | |

Total Institutional Class | | | 744,188 | | | | 2,838,620 | |

| | | | | | | | |

| | |

Capital Transactions – Investor Class | | | | | | | | |

Proceeds from shares sold | | | 29,490 | | | | 209,178 | |

Reinvestment of distributions | | | 1,047 | | | | 2,111 | |

Amount paid for shares redeemed | | | (274,854 | ) | | | (29,277 | ) |

| | | | | | | | |

Total Investor Class | | | (244,317 | ) | | | 182,012 | |

| | | | | | | | |

Net increase in net assets resulting from capital transactions | | | 499,871 | | | | 3,020,632 | |

| | | | | | | | |

Total Increase in Net Assets | | | 2,181,214 | | | | 4,350,528 | |

| | | | | | | | |

| | |

Net Assets | | | | | | | | |

Beginning of period | | | 17,846,150 | | | | 13,495,622 | |

| | | | | | | | |

End of period | | $ | 20,027,364 | | | $ | 17,846,150 | |

| | | | | | | | |

Accumulated undistributed net investment income included in net assets at end of period | | $ | 1,088 | | | $ | 38,921 | |

| | | | | | | | |

| | |

Share Transactions – Institutional Class | | | | | | | | |

Shares sold | | | 144,134 | | | | 347,376 | |

Shares issued in reinvestment of distributions | | | 16,822 | | | | 27,169 | |

Shares redeemed | | | (104,467 | ) | | | (121,465 | ) |

| | | | | | | | |

Total Institutional Class | | | 56,489 | | | | 253,080 | |

| | | | | | | | |

| | |

Share Transactions – Investor Class | | | | | | | | |

Shares sold | | | 2,265 | | | | 18,178 | |

Shares issued in reinvestment of distributions | | | 85 | | | | 188 | |

Shares redeemed | | | (22,776 | ) | | | (2,612 | ) |

| | | | | | | | |

Total Investor Class | | | (20,426 | ) | | | 15,754 | |

| | | | | | | | |

Net increase in shares outstanding | | | 36,063 | | | | 268,834 | |

| | | | | | | | |

See accompanying notes which are an integral part of these financial statements.

20

MERITAGE VALUE EQUITY FUND

STATEMENTS OF CHANGES IN NET ASSETS

| | | | | | | | |

| | | For the Six

Months Ended

February 28, 2017

(Unaudited) | | | For the

Year Ended

August 31, 2016 | |

Increase (Decrease) in Net Assets due to: | | | | | | | | |

Operations | | | | | | | | |

Net investment income | | $ | 53,021 | | | $ | 117,793 | |

Net realized gain (loss) on investment securities transactions | | | 74,437 | | | | (615,738 | ) |

Net change in unrealized appreciation of investment securities | | | 1,067,774 | | | | 784,958 | |

| | | | | | | | |

Net increase in net assets resulting from operations | | | 1,195,232 | | | | 287,013 | |

| | | | | | | | |

| | |

Distributions | | | | | | | | |

From net investment income – Institutional Class | | | (115,272 | ) | | | (105,233 | ) |

From net investment income – Investor Class | | | (67 | )(a) | | | (66 | ) |

From net realized gains – Institutional Class | | | – | | | | (50,500 | ) |

From net realized gains – Investor Class | | | – | | | | (39 | ) |

| | | | | | | | |

Total distributions | | | (115,339 | ) | | | (155,838 | ) |

| | | | | | | | |

| | |

Capital Transactions – Institutional Class | | | | | | | | |

Proceeds from shares sold | | | 1,788,063 | | | | 3,408,257 | |

Reinvestment of distributions | | | 113,051 | | | | 153,110 | |

Amount paid for shares redeemed | | | (2,091,596 | ) | | | (1,159,673 | ) |

| | | | | | | | |

Total Institutional Class | | | (190,482 | ) | | | 2,401,694 | |

| | | | | | | | |

| | |

Capital Transactions – Investor Class | | | | | | | | |

Reinvestment of distributions | | | 67 | (a) | | | 105 | |

Amount paid for shares redeemed | | | (11,012 | )(a) | | | – | |

| | | | | | | | |

Total Investor Class | | | (10,945 | ) | | | 105 | |

| | | | | | | | |

Net increase (decrease) in net assets resulting from capital transactions | | | (201,427 | ) | | | 2,401,799 | |

| | | | | | | | |

Total Increase in Net Assets | | | 878,466 | | | | 2,532,974 | |

| | | | | | | | |

| | |

Net Assets | | | | | | | | |

Beginning of period | | | 13,864,363 | | | | 11,331,389 | |

| | | | | | | | |

End of period | | $ | 14,742,829 | | | $ | 13,864,363 | |

| | | | | | | | |

Accumulated undistributed net investment income included in net assets at end of period | | $ | 53,021 | | | $ | 115,339 | |

| | | | | | | | |

| | |

Share Transactions – Institutional Class | | | | | | | | |

Shares sold | | | 153,443 | | | | 313,214 | |

Shares issued in reinvestment of distributions | | | 9,729 | | | | 14,164 | |

Shares redeemed | | | (187,396 | ) | | | (104,992 | ) |

| | | | | | | | |

Total Institutional Class | | | (24,224 | ) | | | 222,386 | |

| | | | | | | | |

| | |

Share Transactions – Investor Class | | | | | | | | |

Shares issued in reinvestment of distributions | | | 6 | (a) | | | 10 | |

Shares redeemed | | | (946 | )(a) | | | – | |

| | | | | | | | |

Total Investor Class | | | (940 | ) | | | 10 | |

| | | | | | | | |

Net increase (decrease) in shares outstanding | | | (25,164 | ) | | | 222,396 | |

| | | | | | | | |

| (a) | Meritage Value Equity Fund – Investor Class liquidated on February 3, 2017. |

See accompanying notes which are an integral part of these financial statements.

21

MERITAGE YIELD-FOCUS EQUITY FUND

STATEMENTS OF CHANGES IN NET ASSETS

| | | | | | | | |

| | | For the Six

Months Ended

February 28, 2017

(Unaudited) | | | For the

Year Ended

August 31, 2016 | |

Increase (Decrease) in Net Assets due to: | | | | | | | | |

Operations | | | | | | | | |

Net investment income | | $ | 669,360 | | | $ | 1,268,575 | |

Net realized gain (loss) on investment securities transactions | | | 1,374,532 | | | | (4,040,548 | ) |

Net change in unrealized appreciation of investment securities | | | 215,717 | | | | 6,318,403 | |

| | | | | | | | |

Net increase in net assets resulting from operations | | | 2,259,609 | | | | 3,546,430 | |

| | | | | | | | |

| | |

Distributions | | | | | | | | |

From net investment income – Institutional Class | | | (378,133 | ) | | | (982,202 | ) |

From net investment income – Investor Class | | | (135,357 | ) | | | (267,892 | ) |

| | | | | | | | |

Total distributions | | | (513,490 | ) | | | (1,250,094 | ) |

| | | | | | | | |

| | |

Capital Transactions – Institutional Class | | | | | | | | |

Proceeds from shares sold | | | 1,603,926 | | | | 11,584,316 | |

Reinvestment of distributions | | | 352,452 | | | | 949,085 | |

Amount paid for shares redeemed | | | (5,302,509 | ) | | | (13,279,431 | ) |

| | | | | | | | |

Total Institutional Class | | | (3,346,131 | ) | | | (746,030 | ) |

| | | | | | | | |

| | |

Capital Transactions – Investor Class | | | | | | | | |

Proceeds from shares sold | | | 433,652 | | | | 5,341,482 | |

Reinvestment of distributions | | | 129,553 | | | | 255,968 | |

Amount paid for shares redeemed | | | (11,200,790 | ) | | | (6,117,689 | ) |

| | | | | | | | |

Total Investor Class | | | (10,637,585 | ) | | | (520,239 | ) |

| | | | | | | | |

Net decrease in net assets resulting from capital transactions | | | (13,983,716 | ) | | | (1,266,269 | ) |

| | | | | | | | |

Total Increase (Decrease) in Net Assets | | | (12,237,597 | ) | | | 1,030,067 | |

| | | | | | | | |

| | |

Net Assets | | | | | | | | |

Beginning of period | | | 40,053,851 | | | | 39,023,784 | |

| | | | | | | | |

End of period | | $ | 27,816,254 | | | $ | 40,053,851 | |

| | | | | | | | |

Accumulated undistributed net investment income included in net assets at end of period | | $ | 204,428 | | | $ | 48,558 | |

| | | | | | | | |

| | |

Share Transactions – Institutional Class | | | | | | | | |

Shares sold | | | 158,185 | | | | 1,240,531 | |

Shares issued in reinvestment of distributions | | | 35,126 | | | | 101,101 | |

Shares redeemed | | | (525,972 | ) | | | (1,409,707 | ) |

| | | | | | | | |

Total Institutional Class | | | (332,661 | ) | | | (68,075 | ) |

| | | | | | | | |

| | |

Share Transactions – Investor Class | | | | | | | | |

Shares sold | | | 43,385 | | | | 560,884 | |

Shares issued in reinvestment of distributions | | | 12,933 | | | | 27,331 | |

Shares redeemed | | | (1,076,550 | ) | | | (651,855 | ) |

| | | | | | | | |

Total Investor Class | | | (1,020,232 | ) | | | (63,640 | ) |

| | | | | | | | |

Net decrease in shares outstanding | | | (1,352,893 | ) | | | (131,715 | ) |

| | | | | | | | |

See accompanying notes which are an integral part of these financial statements.

22

MERITAGE GROWTH EQUITY FUND – INSTITUTIONAL CLASS

FINANCIAL HIGHLIGHTS

(For a share outstanding during each period)

| | | | | | | | | | | | | | | | |

| | | For the Six

Months Ended

February 28, 2017

(Unaudited) | | | For the

Year Ended

August 31, 2016 | | | For the

Year Ended

August 31, 2015 | | | For the

Period Ended

August 31, 2014 (a) | |

Selected Per Share Data: | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 12.11 | | | $ | 11.20 | | | $ | 10.95 | | | $ | 10.00 | |

| | | | | | | | | | | | | | | | |

Investment operations: | | | | | | | | | | | | | | | | |

Net investment income | | | 0.01 | | | | 0.03 | | | | 0.01 | | | | 0.01 | |

Net realized and unrealized gain on investments | | | 1.29 | | | | 1.12 | | | | 0.36 | | | | 0.94 | |

| | | | | | | | | | | | | | | | |

Total from investment operations | | | 1.30 | | | | 1.15 | | | | 0.37 | | | | 0.95 | |

| | | | | | | | | | | | | | | | |

Less distributions to shareholders: | | | | | | | | | | | | | | | | |

From net investment income | | | (0.03 | ) | | | (0.01 | ) | | | (0.01 | ) | | | – | |

From net realized gains | | | (0.12 | ) | | | (0.23 | ) | | | (0.11 | ) | | | – | |

| | | | | | | | | | | | | | | | |

Total distributions | | | (0.15 | ) | | | (0.24 | ) | | | (0.12 | ) | | | – | |

| | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 13.26 | | | $ | 12.11 | | | $ | 11.20 | | | $ | 10.95 | |

| | | | | | | | | | | | | | | | |

| | | | |

Total Return (b) | | | 10.82 | %(c) | | | 10.41 | % | | | 3.38 | % | | | 9.50 | %(c) |

| | | | |

Ratios and Supplemental Data: | | | | | | | | | | | | | | | | |

Net assets, end of period (000 omitted) | | $ | 19,894 | | | $ | 17,479 | | | $ | 13,331 | | | $ | 10,642 | |

Ratio of net expenses to average net assets | | | 1.00 | %(d) | | | 1.00 | % | | | 1.00 | % | | | 1.00 | %(d) |

Ratio of expenses to average net assets before waiver | | | 1.53 | %(d) | | | 1.60 | % | | | 1.66 | % | | | 3.49 | %(d) |

Ratio of net investment income to average net assets | | | 0.08 | %(d) | | | 0.24 | % | | | 0.08 | % | | | 0.22 | %(d) |

Portfolio turnover rate (e) | | | 34 | %(c) | | | 73 | % | | | 84 | % | | | 94 | %(c) |

| (a) | For the period December 23, 2013 (commencement of operations) to August 31, 2014. |

| (b) | Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends. |

| (e) | Portfolio turnover is calculated on the basis on the Fund as a whole without distinguishing among the classes of shares. |

See accompanying notes which are an integral part of these financial statements.

23

MERITAGE GROWTH EQUITY FUND – INVESTOR CLASS

FINANCIAL HIGHLIGHTS

(For a share outstanding during each period)

| | | | | | | | | | | | | | | | |

| | | For the Six

Months Ended

February 28, 2017

(Unaudited) | | | For the

Year Ended

August 31, 2016 | | | For the

Year Ended

August 31, 2015 | | | For the

Period Ended

August 31, 2014 (a) | |

Selected Per Share Data: | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 12.03 | | | $ | 11.15 | | | $ | 10.92 | | | $ | 10.00 | |

| | | | | | | | | | | | | | | | |

Investment operations: | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | (0.02 | ) | | | – | (b) | | | (0.02 | ) | | | – | (b) |

Net realized and unrealized gain on investments | | | 1.30 | | | | 1.11 | | | | 0.37 | | | | 0.92 | |

| | | | | | | | | | | | | | | | |

Total from investment operations | | | 1.28 | | | | 1.11 | | | | 0.35 | | | | 0.92 | |

| | | | | | | | | | | | | | | | |

Less distributions to shareholders: | | | | | | | | | | | | | | | | |

From net investment income | | | – | | | | – | | | | (0.01 | ) | | | – | |

From net realized gains | | | (0.12 | ) | | | (0.23 | ) | | | (0.11 | ) | | | – | |

| | | | | | | | | | | | | | | | |

Total distributions | | | (0.12 | ) | | | (0.23 | ) | | | (0.12 | ) | | | – | |

| | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 13.19 | | | $ | 12.03 | | | $ | 11.15 | | | $ | 10.92 | |

| | | | | | | | | | | | | | | | |

| | | | |

Total Return (c) | | | 10.70 | %(d) | | | 10.13 | % | | | 3.17 | % | | | 9.20 | %(d) |

| | | | |

Ratios and Supplemental Data: | | | | | | | | | | | | | | | | |

Net assets, end of period (000 omitted) | | $ | 133 | | | $ | 367 | | | $ | 164 | | | $ | 136 | |

Ratio of net expenses to average net assets | | | 1.25 | %(e) | | | 1.25 | % | | | 1.25 | % | | | 1.25 | %(e) |

Ratio of expenses to average net assets before waiver | | | 1.78 | %(e) | | | 1.85 | % | | | 1.91 | % | | | 3.32 | %(e) |

Ratio of net investment income (loss) to average net assets | | | (0.14 | )%(e) | | | (0.01 | )% | | | (0.17 | )% | | | 0.01 | %(e) |

Portfolio turnover rate (f) | | | 34 | %(d) | | | 73 | % | | | 84 | % | | | 94 | %(d) |

| (a) | For the period December 23, 2013 (commencement of operations) to August 31, 2014. |

| (b) | Amount is less than $0.01. |

| (c) | Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends. |

| (f) | Portfolio turnover is calculated on the basis on the Fund as a whole without distinguishing among the classes of shares. |

See accompanying notes which are an integral part of these financial statements.

24

MERITAGE VALUE EQUITY FUND – INSTITUTIONAL CLASS

FINANCIAL HIGHLIGHTS

(For a share outstanding during each period)

| | | | | | | | | | | | | | | | |

| | | For the Six

Months Ended

February 28, 2017

(Unaudited) | | | For the

Year Ended

August 31, 2016 | | | For the

Year Ended

August 31, 2015 | | | For the

Period Ended

August 31, 2014 (a) | |

Selected Per Share Data: | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 11.07 | | | $ | 11.00 | | | $ | 11.00 | | | $ | 10.00 | |

| | | | | | | | | | | | | | | | |

Investment operations: | | | | | | | | | | | | | | | | |

Net investment income | | | 0.05 | | | | 0.08 | | | | 0.10 | | | | 0.04 | |

Net realized and unrealized gain on investments | | | 0.99 | | | | 0.12 | | | | 0.01 | (b) | | | 0.96 | |

| | | | | | | | | | | | | | | | |

Total from investment operations | | | 1.04 | | | | 0.20 | | | | 0.11 | | | | 1.00 | |

| | | | | | | | | | | | | | | | |

Less distributions to shareholders: | | | | | | | | | | | | | | | | |

From net investment income | | | (0.10 | ) | | | (0.09 | ) | | | (0.04 | ) | | | – | |

From net realized gains | | | – | | | | (0.04 | ) | | | (0.07 | ) | | | – | |

| | | | | | | | | | | | | | | | |

Total distributions | | | (0.10 | ) | | | (0.13 | ) | | | (0.11 | ) | | | – | |

| | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 12.01 | | | $ | 11.07 | | | $ | 11.00 | | | $ | 11.00 | |

| | | | | | | | | | | | | | | | |

| | | | |

Total Return (c) | | | 9.41 | %(d) | | | 1.85 | % | | | 0.94 | % | | | 10.00 | %(d) |

| | | | |

Ratios and Supplemental Data: | | | | | | | | | | | | | | | | |

Net assets, end of period (000 omitted) | | $ | 14,743 | | | $ | 13,854 | | | $ | 11,321 | | | $ | 9,673 | |

Ratio of net expenses to average net assets | | | 1.00 | %(e) | | | 1.00 | % | | | 1.00 | % | | | 1.00 | %(e) |

Ratio of expenses to average net assets before waiver | | | 1.60 | %(e) | | | 1.67 | % | | | 1.66 | % | | | 3.58 | %(e) |

Ratio of net investment income to average net assets | | | 0.79 | %(e) | | | 0.89 | % | | | 0.96 | % | | | 0.86 | %(e) |

Portfolio turnover rate (f) | | | 47 | %(d) | | | 67 | % | | | 62 | % | | | 50 | %(d) |

| (a) | For the period December 23, 2013 (commencement of operations) to August 31, 2014. |

| (b) | The amount shown for a share outstanding throughout the period does not accord with the aggregate gains and losses in the portfolio securities during the period because of the timing of sales and purchases of fund shares in relation to fluctuating market values during the period. |

| (c) | Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends. |

| (f) | Portfolio turnover is calculated on the basis on the Fund as a whole without distinguishing among the classes of shares. |

See accompanying notes which are an integral part of these financial statements.

25

MERITAGE YIELD-FOCUS EQUITY FUND – INSTITUTIONAL CLASS

FINANCIAL HIGHLIGHTS

(For a share outstanding during each period)

| | | | | | | | | | | | | | | | |

| | | For the Six

Months Ended

February 28, 2017

(Unaudited) | | | For the

Year Ended

August 31, 2016 | | | For the

Year Ended

August 31, 2015 | | | For the

Period Ended

August 31, 2014 (a) | |

Selected Per Share Data: | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 10.00 | | | $ | 9.44 | | | $ | 11.27 | | | $ | 10.00 | |

| | | | | | | | | | | | | | | | |

Investment operations: | | | | | | | | | | | | | | | | |

Net investment income | | | 0.19 | | | | 0.32 | | | | 0.33 | | | | 0.10 | |

Net realized and unrealized gain (loss) on investments | | | 0.44 | | | | 0.56 | | | | (1.71 | ) | | | 1.17 | |

| | | | | | | | | | | | | | | | |

Total from investment operations | | | 0.63 | | | | 0.88 | | | | (1.38 | ) | | | 1.27 | |

| | | | | | | | | | | | | | | | |

Less distributions to shareholders: | | | | | | | | | | | | | | | | |

From net investment income | | | (0.14 | ) | | | (0.32 | ) | | | (0.41 | ) | | | – | |

From net realized gains | | | – | | | | – | | | | (0.03 | ) | | | – | |

From return of capital | | | – | | | | – | | | | (0.01 | ) | | | – | |

| | | | | | | | | | | | | | | | |

Total distributions | | | (0.14 | ) | | | (0.32 | ) | | | (0.45 | ) | | | – | |

| | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 10.49 | | | $ | 10.00 | | | $ | 9.44 | | | $ | 11.27 | |

| | | | | | | | | | | | | | | | |

| | | | |

Total Return (b) | | | 6.34 | %(c) | | | 9.58 | % | | | (12.56 | )% | | | 12.70 | %(c) |

| | | | |

Ratios and Supplemental Data: | | | | | | | | | | | | | | | | |

Net assets, end of period (000 omitted) | | $ | 27,262 | | | $ | 29,340 | | | $ | 28,316 | | | $ | 26,436 | |

Ratio of net expenses to average net assets | | | 1.00 | %(d) | | | 1.00 | % | | | 1.00 | % | | | 1.00 | %(d) |

Ratio of expenses to average net assets before waiver | | | 1.44 | %(d) | | | 1.49 | % | | | 1.44 | % | | | 2.62 | %(d) |

Ratio of net investment income to average net assets | | | 3.61 | %(d) | | | 3.41 | % | | | 3.17 | % | | | 2.70 | %(d) |

Portfolio turnover rate (e) | | | 29 | %(c) | | | 99 | % | | | 86 | % | | | 63 | %(c) |

| (a) | For the period December 23, 2013 (commencement of operations) to August 31, 2014. |

| (b) | Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends. |

| (e) | Portfolio turnover is calculated on the basis on the Fund as a whole without distinguishing among the classes of shares. |

See accompanying notes which are an integral part of these financial statements.

26

MERITAGE YIELD-FOCUS EQUITY FUND – INVESTOR CLASS

FINANCIAL HIGHLIGHTS

(For a share outstanding during each period)

| | | | | | | | | | | | | | | | |

| | | For the Six

Months Ended

February 28, 2017

(Unaudited) | | | For the

Year Ended

August 31, 2016 | | | For the

Year Ended

August 31, 2015 | | | For the

Period Ended

August 31, 2014 (a) | |

Selected Per Share Data: | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 9.98 | | | $ | 9.42 | | | $ | 11.25 | | | $ | 10.00 | |

| | | | | | | | | | | | | | | | |

Investment operations: | | | | | | | | | | | | | | | | |

Net investment income | | | 0.17 | (b) | | | 0.32 | | | | 0.29 | | | | 0.01 | |

Net realized and unrealized gain (loss) on investments | | | 0.48 | | | | 0.54 | | | | (1.70 | ) | | | 1.24 | |

| | | | | | | | | | | | | | | | |

Total from investment operations | | | 0.65 | | | | 0.86 | | | | (1.41 | ) | | | 1.25 | |

| | | | | | | | | | | | | | | | |

Less distributions to shareholders: | | | | | | | | | | | | | | | | |

From net investment income | | | (0.13 | ) | | | (0.30 | ) | | | (0.38 | ) | | | – | |

From net realized gains | | | – | | | | – | | | | (0.03 | ) | | | – | |

From return of capital | | | – | | | | – | | | | (0.01 | ) | | | – | |

| | | | | | | | | | | | | | | | |

Total distributions | | | (0.13 | ) | | | (0.30 | ) | | | (0.42 | ) | | | – | |

| | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 10.50 | | | $ | 9.98 | | | $ | 9.42 | | | $ | 11.25 | |

| | | | | | | | | | | | | | | | |

| | | | |

Total Return (c) | | | 6.53 | %(d) | | | 9.35 | % | | | (12.85 | )% | | | 12.50 | %(d) |

| | | | |

Ratios and Supplemental Data: | | | | | | | | | | | | | | | | |

Net assets, end of period (000 omitted) | | $ | 554 | | | $ | 10,714 | | | $ | 10,708 | | | $ | 2,627 | |

Ratio of net expenses to average net assets | | | 1.25 | %(e) | | | 1.25 | % | | | 1.25 | % | | | 1.25 | %(e) |

Ratio of expenses to average net assets before waiver | | | 1.69 | %(e) | | | 1.74 | % | | | 1.69 | % | | | 2.46 | %(e) |

Ratio of net investment income to average net assets | | | 3.35 | %(e) | | | 3.17 | % | | | 2.84 | % | | | 2.26 | %(e) |

Portfolio turnover rate (f) | | | 29 | %(d) | | | 99 | % | | | 86 | % | | | 63 | %(d) |

| (a) | For the period December 23, 2013 (commencement of operations) to August 31, 2014. |

| (b) | Calculated using the average shares method. |

| (c) | Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends. |

| (f) | Portfolio turnover is calculated on the basis on the Fund as a whole without distinguishing among the classes of shares. |

See accompanying notes which are an integral part of these financial statements.

27

MERITAGE FUNDS

NOTES TO THE FINANCIAL STATEMENTS

February 28, 2017 (Unaudited)

NOTE 1. ORGANIZATION

The Meritage Growth Equity Fund (the “Growth Equity Fund”), the Meritage Value Equity Fund (the “Value Equity Fund”), and the Meritage Yield-Focus Equity Fund (the “Yield-Focus Equity Fund”) (each a “Fund” and, collectively the “Funds”) were each organized as a diversified series of the Capitol Series Trust (the “Trust”). The Trust is an open-end investment company established under the laws of Ohio by an Agreement and Declaration of Trust dated September 18, 2013 (the “Trust Agreement”). The Trust Agreement permits the Trust’s Board of Trustees (the “Board”) to issue an unlimited number of shares of beneficial interest of separate series without par value. The Growth Equity and Yield-Focus Equity Funds each offer two share classes, Institutional Class Shares and Investor Class Shares. As disclosed in a prospectus supplement dated February 15, 2017, the Value Equity Fund has discontinued the sale of its Investor Shares, and will continue to offer Institutional Shares. The Funds commenced operations on December 23, 2013. The Funds’ investment adviser is Meritage Portfolio Management, Inc. (the “Adviser”). The investment objective of the Growth Equity Fund is to seek growth of capital. The investment objective of the Value Equity Fund is to seek growth of capital, with income as a secondary objective. The investment objective of the Yield-Focus Equity Fund is to seek long-term growth of capital with an emphasis on high current income.

Each Fund’s prospectus provides a description of the investment objective, policies and strategies, along with information on the classes of shares currently being offered.

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES

The Funds are investment companies and follow accounting and reporting guidance under Financial Accounting Standards Board Accounting Standards Codification (“ASC”) Topic 946, “Financial Services-Investment Companies”. The following is a summary of significant accounting policies consistently followed by each Fund in the preparation of its financial statements. These policies are in conformity with generally accepted accounting principles in the United States of America (“GAAP”).

Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

Securities Valuation – All investments in securities are recorded at their estimated fair value as described in Note 3.

Foreign Currency Translation – The accounting records of the Funds are maintained in U.S. dollars. Foreign currency amounts are translated into U.S. dollars at the current rate of exchange each business day to determine the value of investments, and other assets and liabilities. Purchases and sales of foreign securities, and income and expenses, are translated at the prevailing rate of exchange on the respective date of these transactions. The Funds do not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from fluctuation arising from changes in market prices of securities held. These fluctuations are included with the net realized and unrealized gain or loss from investments.

Federal Income Taxes – The Funds make no provision for federal income or excise tax. Each Fund has qualified and intends to qualify each year as a regulated investment company (“RIC”) under subchapter M of the Internal Revenue Code of 1986, as amended, by complying with the requirements applicable to RICs and by distributing substantially all of its taxable income. Each Fund also intends to distribute sufficient net investment income and

28

MERITAGE FUNDS

NOTES TO THE FINANCIAL STATEMENTS – (continued)

February 28, 2017 (Unaudited)

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES – continued

net capital gains, if any, so that it will not be subject to excise tax on undistributed income and gains. If the required amount of net investment income or gains is not distributed, the Funds could incur a tax expense.

As of and during the six months ended February 28, 2017, the Funds did not have a liability for any unrecognized tax benefits. The Funds recognize interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations. During the period, the Funds did not incur any interest or penalties.

Expenses – Expenses incurred by the Trust that do not relate to a specific fund of the Trust are allocated to the individual funds based on each Fund’s relative net assets or another appropriate basis (as determined by the Board). Expenses specifically attributable to any class are borne by that class. Income, realized gains and losses, unrealized appreciation and depreciation, and expenses are allocated to each class based on the net assets in relation to the relative net assets of the Fund.

Security Transactions and Related Income – Throughout the reporting period, security transactions are accounted for no later than one business day following the trade date. For financial reporting purposes, security transactions are accounted for on trade date on the last business day of the reporting period. The specific identification method is used for determining gains or losses for financial statements and income tax purposes. Dividend income is recorded on the ex-dividend date. Interest income is recorded on an accrual basis and includes, where applicable, the amortization of premium or accretion of discount. Dividend income from real estate investment trusts (REITs) and distributions from limited partnerships are recognized on the ex-date and included in dividend income. The calendar year-end classification of distributions received from REITs during the fiscal year are reported subsequent to year end; accordingly, the Fund estimates the character of REIT distributions based on the most recent information available. Income or loss from limited partnerships is reclassified among the components of net assets upon receipt of K-1’s.

Dividends and Distributions – Each Fund intends to distribute substantially all of its net investment income, if any, as dividends to its shareholders on at least an annual basis, except for Yield-Focus Fund which will normally distribute dividends on a quarterly basis. Each Fund intends to distribute its net realized long term capital gains and its net realized short term capital gains, if any, at least once a year. Dividends to shareholders are recorded on the ex-dividend date. The amounts of dividends from net investment income and distributions from net realized gains are determined in accordance with federal income tax regulations, which may differ from GAAP. These differences are caused primarily by differences in the timing of the recognition of certain components of income, expense or realized capital gains for federal income tax purposes. Where such differences are permanent in nature, they are reclassified in the components of the net assets based on their ultimate characterization for federal income tax purposes. Any such reclassifications will have no effects on net assets, results of operations or net asset values per share of the Funds.

NOTE 3. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS