UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22894

INVESTMENT MANAGERS SERIES TRUST II

(Exact name of registrant as specified in charter)

235 W. Galena Street

Milwaukee, WI 53212

(Address of principal executive offices) (Zip code)

Diane J. Drake

Mutual Fund Administration, LLC

2220 E. Route 66, Suite 226

Glendora, CA 91740

(Name and address of agent for service)

(626) 385-5777

Registrant's telephone number, including area code

Date of fiscal year end: June 30

Date of reporting period: June 30, 2022

Item 1. Report to Stockholders.

| (a) | The registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Investment Company Act”), is as follows: |

ABRAHAM FORTRESS FUND

(Class I: FORTX)

(Class K: FORKX)

ANNUAL REPORT

JUNE 30, 2022

Abraham Fortress Fund

A series of Investment Managers Series Trust II

Table of Contents

| Letter to Shareholders (unaudited) | 1 |

| Fund Performance (unaudited) | 5 |

| Consolidated Schedule of Investments | 7 |

| Consolidated Statement of Assets and Liabilities | 18 |

| Consolidated Statement of Operations | 19 |

| Consolidated Statement of Changes in Net Assets | 20 |

| Consolidated Financial Highlights | 21 |

| Notes to Consolidated Financial Statements | 23 |

| Report of Independent Registered Public Accounting Firm | 39 |

| Supplemental Information (unaudited) | 40 |

| Expense Example (unaudited) | 45 |

This report and the financial statements contained herein are provided for the general information of the shareholders of the Abraham Fortress Fund (the “Fund”). This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

www.abrahamtrading.com

Salem Abraham, President Abraham Trading Company 2nd & Main St, Canadian, TX 79014 | July 1, 2022 |

Fellow Investors,

Our January letter to investors included the following: “Although interest rates and volatility present risks for equities, the diversifying strategies in the Fortress portfolio can benefit from market dislocation and may prove instrumental in navigating market turbulence. With our 30 plus years of experience in the alternatives space, we believe our team can provide insight and guidance to investors that want to diversify their investments beyond stocks and bonds. It’s always a good time to be diversified, and any battle is fought more successfully with veterans. We appreciate your investment with us. We look forward to navigating the market opportunities and perils ahead.” (Read the full letter here.)

In many ways, that tells the tale of the first six months of 2022. As of June 30, 2022, Abraham Fortress Fund Class K Shares were down -3.86% YTD. The key factors that helped us outperform the market were (1) Lighter exposure to stocks than the average portfolio, (2) The inclusion of the diversifying strategies in the Fortress portfolio, and (3) Opportunistic hedges and active risk management.

(Letter continued on next page…)

| | MTD (as of 06/30/22) | QTD (as of 06/30/22) | YTD (as of 06/30/22) | 1 Year (through 06/30/22) | 3 Year (through 06/30/22) | Since Start of Performance (7/1/18 to 06/30/22) |

| Fortress Class K Shares1 | -3.48% | -5.72% | -3.86% | -0.54% | 8.54% | 6.21% |

| 70/30 Blended Index² | -6.37% | -12.44% | -17.26% | -13.99% | 4.34% | 4.92% |

| MSCI ACWI Index³ | -8.43% | -15.66% | -20.18% | -15.75% | 6.21% | 6.09% |

| U.S. Bond Index⁴ | -1.57% | -4.69% | -10.35% | -10.29% | -0.93% | 1.20% |

Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate; therefore, you may have a gain or loss when you sell your shares. Current performance may be higher or lower than the performance data quoted. For the most recent month-end performance information, please visit our website at www.abrahamtrading.com.

Performance figures include the reinvestment of all dividends and any capital gains distributions. All returns are net of expenses. An investment of this nature is subject to a risk of loss. 1Performance between 07/01/2018 and 10/12/2021 is from the Abraham Fortress Fund, LP, a Delaware Limited Partnership (the “Predecessor Fund”). Performance beginning on 10/13/2021 is for the Abraham Fortress Fund, an SEC-registered open-end mutual fund (the “Fund”). The Fund’s objectives, policies, guidelines, and restrictions are materially equivalent to those of the Predecessor Fund. Fortress Class K performance reflects proprietary performance from 7/1/2018 through 4/30/2021, when Salem Abraham’s proprietary investments represented over half of the Predecessor Fund’s assets. ²70/30 Portfolio uses 70% MSCI ACWI Index and 30% Bloomberg US Aggregate Bond Index, and its statistics used in the tables above reflect no deductions for fees, expenses, or taxes. ³MSCI ACWI is MSCI’s global stock index, and its statistics used in the tables above reflect no deductions for fees, expenses, or taxes. ⁴US Aggregate Bond is the Bloomberg US Aggregate Bond Index, a broad-based flagship benchmark that measures the investment grade USD-denominated fixed-rate taxable bond market, and its statistics used in the tables above reflect no deductions for fees, expenses, or taxes. Gross expense ratio: 0.74%, Net expense ratio: 0.65%. Please review fees and expenses in the prospectus. Actual expenses may differ. You may pay fees, such as commissions, which are not reflected here. The Fund has contractually agreed to waive its fees and/or pay for operating expenses of the Fund to ensure that total annual fund operating expenses do not exceed 0.65% for K shares, effective until 10/13/23.

Factor #1: Anyone familiar with our investment philosophy knows that we believe portfolios with 70-80% stock exposure are risky and poorly diversified. The Fortress Fund will generally have 30-60% in equities, and its current exposure sits at 42.5%. Fixed income exposure is approximately 15%, and our diversifying strategies exposure is 20%, leaving 20.5% in short-term T bills. It’s important to remind everyone that the portfolio contains some leverage in the diversifying strategies bucket, and some of our equity exposure is achieved through treasuries combined with equity index futures¹, which also has leverage. When you read our semi-annual reports, you will see what appears to be high exposure to short-term T bills. However, those T-bills are often used to reduce leverage in other positions and can help fund stock index futures position¹. As ex hedge fund traders, we are familiar with the strategic use of derivatives, futures, and options.¹ The Fortress Fund benefits from that experience.

Given the discussion in the prior paragraph, I want to highlight the name of our firm. Abraham Trading Company is a peculiar name in the mutual fund space because of the word “trading.” Most groups use the term “investment management.” However, our team and investment philosophy grew out of trading skills and principles. We are proud of our company’s trading heritage, and we believe it is an asset for portfolio building and management. The first two quarters of this year have given us an opportunity to show why our background is well suited for the current market environment. During tumultuous markets, it’s important to have an experienced investment team who can be nimble when necessary.

This leads us to Key Factor #2. We could not be more pleased with the diversifying strategies portion of the Fortress portfolio. This third pillar of the Fortress portfolio is designed to behave independently from the stock and bond markets, especially during volatile market downturns. We were happy to see this group of investments produce profits and offset losses from our stock and bond allocations. The first six months of 2022 clearly demonstrated why we believe diversification should be the bedrock principle of every portfolio and why we feel traditional stock/bond portfolios with heavy stock weightings are particularly unwise in today’s markets.

Finally, we come to Key Factor #3. Risk management is in the DNA of our team and the Fortress Fund’s investment philosophy. The ocean floor is littered with the bodies of investors who did not respect risk, failing to trim their sails or change course in the face of a storm. You don’t drive the same speed when roads ice over. Why wouldn’t we make adjustments in dangerous markets? In late January, with Russia reassuring Ukraine that they were only conducting military exercises, we reduced the fund’s stock exposure from 50% down to 42.5%. Market volatility had picked up, and we felt it was prudent to have less equity exposure. In January, we also put on a small 5% long position in Brent Crude Oil futures. Our team has traded the crude oil market and almost every commodity market for over three decades. We liked the long position in crude oil. We also felt it could serve as an effective hedge that may profit if Russia invaded Ukraine, ideally offsetting some equity losses. Put options¹ on stock indexes were priced like flood insurance in New Orleans before a hurricane, so that was out of the question. We thought the crude oil position was a strategic and low cost partial hedge. That position was closed out and replaced with a long WTI Crude position in the December futures contract. We believe that this small position will continue to help counterbalance some equity exposure going forward. Also, longtime Fortress investors know that we typically have a long gold futures position of 0-10%. It has been at approximately 10% all year.

In short, this year has demanded trading agility and deep macro experience across all asset classes, particularly alternatives. Over the next 6 months, we believe investors will run the gauntlet in all asset classes amid sustained market volatility. Stock and bond portfolios were the golden goose for decades, but they are not always a recipe for steady profits, a smooth ride, or peaceful sleep. The answer to the puzzle before us is not in the rearview mirror. The market environment over the past three years shows how portfolios can potentially benefit from the broader diversification found in the Fortress Fund.

Past performance is no guarantee of future results, and diversification neither assures a profit nor guarantees against loss in a declining market. We have made missteps in the past, and our team knows we will make missteps again. However, the broad diversification of the Fortress Fund and the deep experience of our team means we can confidently embark on the journey ahead. We have not had any sleepless nights or upset stomachs thinking about our investments. In many ways, the team has enjoyed putting the portfolio to the test. Remember, our money is invested alongside yours. We appreciate your partnership and the confidence you have placed in us. Please call with any questions you may have.

Sincerely,

Salem Abraham, President

RISKS OF INVESTING

The Fund’s investment objectives, risks, charges, and expenses must be considered carefully before investing. The prospectus contains this and other important information about the investment company, and it may be obtained by calling (806) 323-8000, or visiting www.abrahamtrading.com. Read it carefully before investing.

There is no guarantee that any investment will achieve its goals and generate profits or avoid losses. Investors should carefully consider investment objectives, risks, charges, and expenses of the investment company and the Abraham Fortress Fund before investing. Diversification does not assure a profit nor protect against loss in a declining market.

Mutual fund investing involves risk; principal loss is possible. Investments in debt securities involve credit risk and typically decrease in value when interest rates rise. Investments in lower rated and non rated securities involve greater risk. Investments in foreign securities involve political, economic, and currency risks, greater volatility, and differences in accounting methods. Derivatives may involve certain costs and risks such as liquidity, interest rate, market, credit, management, and the risk that a position could not be closed when most advantageous. Investing in derivatives could lose more than the amount invested. The Fund may use leverage which may cause the effect of an increase or decrease in the value of the portfolio securities to be magnified and the Fund to be more volatile than if leverage was not used. The Fund invests in small and mid-cap companies, which involve additional risks such as limited liability and greater volatility than large-cap companies. Investments related to gold are considered speculative and are affected by a variety of worldwide economic, financial, and political factors. The price of gold may fluctuate sharply over short periods of time, even during periods of rising prices. Full descriptions of risk factors can be found in the fund’s prospectus at this link.

Shares of the Fund are only offered by current prospectus and are intended solely for persons to whom shares of the US registered funds may be sold. This document shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of shares of the Fund in any jurisdiction in which such offer, solicitation, or sale would be unlawful. The SEC and the Commodity Futures Trading Commission have not approved or disapproved these securities or passed upon the accuracy or adequacy of this information. Any representation to the contrary is a criminal offense. There can be no assurance that the Fund will achieve its investment objectives. Before you decide to invest in the Fund, carefully consider these risk factors (described in the prospectus at this link), which may cause investors to lose money:

| | ➢ | Government-sponsored entities risk | | |

| | ➢ | Foreign sovereign risk | ➢ | Cybersecurity risk |

| | ➢ | Interest rate risk | ➢ | Limited operating history |

| | ➢ | Market risk | ➢ | Asset segregation risk |

| | ➢ | Equity risk | ➢ | Subsidiary risk |

| | ➢ | Fixed income securities risk | ➢ | Recent market events |

| | ➢ | Indirect fees and expenses risk | ➢ | Currency risk |

| | ➢ | Tax risk | ➢ | ETF risk |

| | ➢ | Leveraging risk | ➢ | Gold risk |

| | ➢ | Derivatives risk | ➢ | Government-sponsored entities risk |

The Abraham Fortress Fund is distributed by IMST Distributors, LLC, a FINRA/SIPC member. Abraham Trading, LP, is not affiliated with IMST Distributors, LLC. The information presented in these materials is for general information purposes only and does not constitute an offer, subscription, recommendation, or solicitation to invest in either the Abraham Fortress Fund, LP (“Predecessor Fund”) or the Abraham Fortress Fund mutual fund (the “Fund”). The information in this document should not be relied upon independent of the Abraham Fortress Fund prospectus, which has important information regarding the Fund. While the information given is believed to be complete and accurate, we cannot guarantee their completeness or accuracy. As a term and condition of your use of this report, you expressly hold harmless and waive any claim you have or may have as a result of any of the information and statistics in this report provided by third parties being incomplete or inaccurate. The information may not in all cases be current, and it is subject to continuous change. Accordingly, you should not rely on any of the information contained in these materials as authoritative or a substitute for the exercise of your own skill and judgment in making any investment or other decision.

DEFINITIONS

Derivatives – Refers to a type of financial contract whose value is dependent on an underlying asset, group of assets, or benchmark.

Futures – Futures are derivative financial contracts that obligate parties to buy or sell an asset at a predetermined future date and price. The buyer must purchase or the seller must sell the underlying asset at the set price, regardless of the current market price at the expiration date. Underlying assets include physical commodities and financial instruments. Futures can be used for hedging or trade speculation.

Options – An option refers to a financial instrument that is based on the value of underlying securities such as stocks. An options contract offers the buyer the opportunity to buy or sell the underlying asset. Unlike futures, the holder is not required to buy or sell the asset if they decide against it. Options are used for hedging, income, or speculation.

Put Options – A put option is a contract giving the option buyer the right, but not the obligation, to sell a specified amount of an underlying security, at a predetermined price within a specified time frame.

| MAIN OFFICE | BRANCH OFFICE |

| 124 Main Street | 319 Main Suite |

| Moody Building, Suite 200 | Suite 300 |

| Canadian, Texas 79014 | Carbondale, Colorado 81623 |

| (806) 323-8000 | (970) 305-5000 |

Abraham Fortress Fund

FUND PERFORMANCE at June 30, 2022 (Unaudited)

The Fund’s current reporting period began on October 13, 2021. The Fund acquired the assets and liabilities of the Abraham Fortress Fund, LP (the “Predecessor Fund”), a Delaware limited partnership, on October 13, 2021.

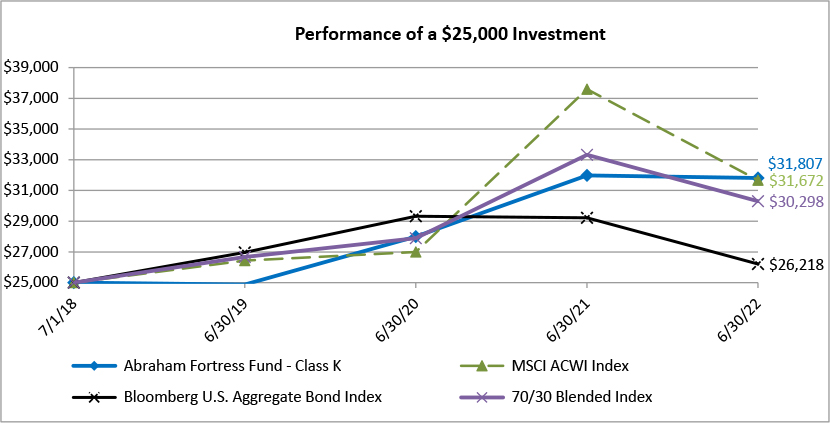

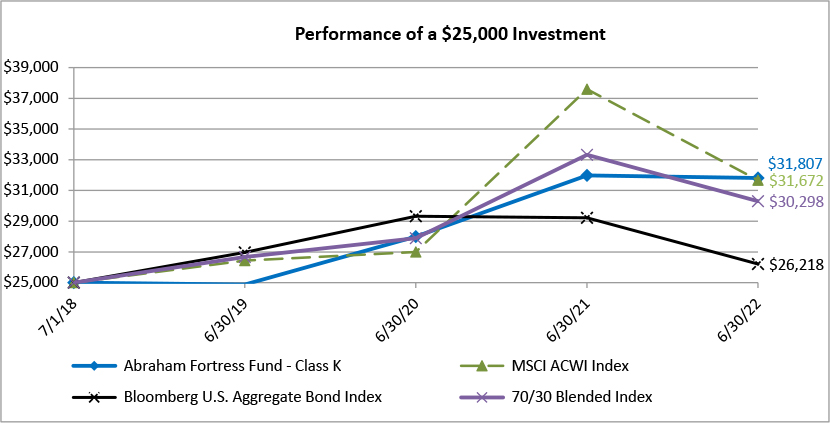

This graph compares a hypothetical $25,000 investment in the Fund’s Class K shares on July 1, 2018, the Predecessor Fund’s start of performance, with a similar investment in the MSCI ACWI Index, the Bloomberg U.S. Aggregate Bond Index and the 70/30 Blended Index. The performance graph above is shown for the Fund’s Class K shares; Class I shares performance may vary. Results include the reinvestment of all dividends and capital gains.

The MSCI ACWI Index captures large to mid-cap representation across 23 Developed Markets countries1 (as determined by MSCI) (including the United States) and 23 Emerging Markets countries1 (as determined by MSCI). The index covers approximately 85% of the global equity opportunity set. The Bloomberg U.S. Aggregate Bond Index is a measure of the performance of the U.S. dollar denominated investment grade bond market. The 70/30 Blended index is a blend of 70% MSCI ACWI Index and 30% Bloomberg U.S. Aggregate Bond Index. These indices do not reflect expenses, fees or sales charge, which would lower performance. The indices are unmanaged and it is not possible to invest in an index.

| Average Annual Total Returns as of June 30, 2022 | 1 Year* | 3 Years* | Since Start of Performance* | Start of Performance Date |

| Class I | -0.58% | 8.44% | 6.11% | 7/01/2018 |

| Class K | -0.54% | 8.54% | 6.21% | 7/01/2018 |

| MSCI ACWI Index | -15.75% | 6.21% | 6.09% | 7/01/2018 |

| Bloomberg U.S. Aggregate Bond Index | -10.29% | -0.93% | 1.20% | 7/01/2018 |

| 70/30 Blended Index | -13.99% | 4.34% | 4.92% | 7/01/2018 |

| * | The performance figures for Class I and Class K include the performance of the Predecessor Fund prior to October 13, 2021. For the performance from the beginning of the reporting period on October 13, 2021 through June 30, 2022, please refer to the Consolidated Financial Highlights section of this report. |

| 1 | Developed Market Countries include: Australia, Austria, Belguim, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the UK and the U.S. Emerging Market countries include: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Kuwait, Malaysia, Mexico, Peru, Philippines, Poland, Qatar, Saudi Arabia, South Africa, Taiwan, Thailand, Turkey and United Arab Emirates. |

Abraham Fortress Fund

FUND PERFORMANCE at June 30, 2022 (Unaudited)

The performance data quoted here represents past performance and past performance is not a guarantee of future results. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. The most recent month end performance may be obtained by calling (844) 323-8200.

Gross and net expense ratios for Class I shares were 0.84% and 0.75%, respectively, and for Class K shares were 0.74% and 0.65%, respectively, which were the amounts stated in the current prospectus dated October 13, 2021. The Fund’s Advisor has contractually agreed to waive its fees and/or pay for operating expenses of the Fund to ensure that total annual fund operating expenses (excluding, as applicable, taxes, leverage interest, brokerage commissions, acquired fund fees and expenses (as determined in accordance with Form N-1A), expenses incurred in connection with any merger or reorganization and extraordinary expenses such as litigation expenses) do not exceed 0.75%, and 0.65% of the average daily net assets of the Class I shares and Class K shares, respectively. This agreement is in effect until October 13, 2023, and it may be terminated before that date by the Trust’s Board of Trustees or it may be terminated by the Advisor, subject to consent of the Trust’s Board of Trustees. In the absence of such waivers, the Fund’s returns would be lower.

Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and the performance table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Abraham Fortress Fund

CONSOLIDATED SCHEDULE OF INVESTMENTS

As of June 30, 2022

| Number of Shares | | | | | Value | |

| | | | COMMON STOCKS — 27.2%1 | | |

| | | | COMMUNICATIONS — 2.5% | | | |

| | 318 | | | Activision Blizzard, Inc. | | $ | 24,759 | |

| | 272 | | | Alphabet, Inc. - Class A* | | | 592,759 | |

| | 2,912 | | | AT&T, Inc. | | | 61,036 | |

| | 17 | | | Booking Holdings, Inc.* | | | 29,733 | |

| | 83 | | | Charter Communications, Inc. - Class A* | | | 38,888 | |

| | 1,863 | | | Comcast Corp. - Class A | | | 73,104 | |

| | 1,134 | | | Meta Platforms, Inc. - Class A* | | | 182,858 | |

| | 181 | | | Netflix, Inc.* | | | 31,651 | |

| | 509 | | | T-Mobile US, Inc.* | | | 68,481 | |

| | 1,712 | | | Verizon Communications, Inc. | | | 86,884 | |

| | 741 | | | Walt Disney Co.* | | | 69,950 | |

| | 704 | | | Warner Bros Discovery, Inc.* | | | 9,448 | |

| | | | | | | | 1,269,551 | |

| | | | | CONSUMER DISCRETIONARY — 2.3% | | | | |

| | 4,140 | | | Amazon.com, Inc.* | | | 439,709 | |

| | 110 | | | Aptiv PLC*2 | | | 9,798 | |

| | 8 | | | AutoZone, Inc.* | | | 17,193 | |

| | 11 | | | Chipotle Mexican Grill, Inc.* | | | 14,380 | |

| | 255 | | | eBay, Inc. | | | 10,626 | |

| | 1,629 | | | Ford Motor Co. | | | 18,131 | |

| | 592 | | | General Motors Co.* | | | 18,802 | |

| | 426 | | | Home Depot, Inc. | | | 116,839 | |

| | 275 | | | Lowe's Cos., Inc. | | | 48,034 | |

| | 133 | | | Marriott International, Inc. - Class A | | | 18,089 | |

| | 305 | | | McDonald's Corp. | | | 75,298 | |

| | 645 | | | NIKE, Inc. - Class B | | | 65,919 | |

| | 27 | | | O'Reilly Automotive, Inc.* | | | 17,058 | |

| | 478 | | | Starbucks Corp. | | | 36,514 | |

| | 390 | | | Tesla, Inc.* | | | 262,634 | |

| | 486 | | | TJX Cos., Inc. | | | 27,143 | |

| | | | | | | | 1,196,167 | |

| | | | | CONSUMER STAPLES — 1.8% | | | | |

| | 749 | | | Altria Group, Inc. | | | 31,286 | |

| | 1,761 | | | Coca-Cola Co. | | | 110,784 | |

| | 344 | | | Colgate-Palmolive Co. | | | 27,568 | |

| | 77 | | | Constellation Brands, Inc. - Class A | | | 17,946 | |

| | 181 | | | Costco Wholesale Corp. | | | 86,750 | |

| | 94 | | | Dollar General Corp. | | | 23,071 | |

| | 147 | | | Estee Lauder Cos., Inc. - Class A | | | 37,436 | |

| | 137 | | | Kimberly-Clark Corp. | | | 18,516 | |

| | 499 | | | Kraft Heinz Co. | | | 19,032 | |

Abraham Fortress Fund

CONSOLIDATED SCHEDULE OF INVESTMENTS - Continued

As of June 30, 2022

| Number of Shares | | | | | Value | |

| | | | COMMON STOCKS 1 (Continued) | | | |

| | | | CONSUMER STAPLES (Continued) | | | |

| | 569 | | | Mondelez International, Inc. - Class A | | $ | 35,329 | |

| | 216 | | | Monster Beverage Corp.* | | | 20,023 | |

| | 564 | | | PepsiCo, Inc. | | | 93,996 | |

| | 635 | | | Philip Morris International, Inc. | | | 62,700 | |

| | 987 | | | Procter & Gamble Co. | | | 141,921 | |

| | 195 | | | Target Corp. | | | 27,540 | |

| | 352 | | | Walgreens Boots Alliance, Inc. | | | 13,341 | |

| | 1,131 | | | Walmart, Inc. | | | 137,507 | |

| | | | | | | | 904,746 | |

| | | | | ENERGY — 0.7% | | | | |

| | 786 | | | Chevron Corp. | | | 113,797 | |

| | 538 | | | ConocoPhillips | | | 48,318 | |

| | 239 | | | EOG Resources, Inc. | | | 26,395 | |

| | 1,726 | | | Exxon Mobil Corp. | | | 147,814 | |

| | 100 | | | Pioneer Natural Resources Co. | | | 22,308 | |

| | 572 | | | Schlumberger N.V.2 | | | 20,455 | |

| | | | | | | | 379,087 | |

| | | | | FINANCIALS — 2.2% | | | | |

| | 316 | | | American Express Co. | | | 43,804 | |

| | 339 | | | American International Group, Inc. | | | 17,333 | |

| | 90 | | | Aon PLC - Class A2 | | | 24,271 | |

| | 3,337 | | | Bank of America Corp. | | | 103,881 | |

| | 337 | | | Bank of New York Mellon Corp. | | | 14,056 | |

| | 913 | | | Berkshire Hathaway, Inc. - Class B* | | | 249,267 | |

| | 62 | | | BlackRock, Inc. | | | 37,761 | |

| | 174 | | | Capital One Financial Corp. | | | 18,129 | |

| | 771 | | | Charles Schwab Corp. | | | 48,712 | |

| | 176 | | | Chubb Ltd.2 | | | 34,598 | |

| | 809 | | | Citigroup, Inc. | | | 37,206 | |

| | 147 | | | CME Group, Inc. | | | 30,091 | |

| | 142 | | | Goldman Sachs Group, Inc. | | | 42,177 | |

| | 230 | | | Intercontinental Exchange, Inc. | | | 21,629 | |

| | 1,205 | | | JPMorgan Chase & Co. | | | 135,695 | |

| | 206 | | | Marsh & McLennan Cos., Inc. | | | 31,982 | |

| | 343 | | | MetLife, Inc. | | | 21,537 | |

| | 732 | | | Morgan Stanley | | | 55,676 | |

| | 172 | | | PNC Financial Services Group, Inc. | | | 27,137 | |

| | 238 | | | Progressive Corp. | | | 27,672 | |

| | 92 | | | T. Rowe Price Group, Inc. | | | 10,452 | |

| | 544 | | | Truist Financial Corp. | | | 25,802 | |

| | 605 | | | U.S. Bancorp | | | 27,842 | |

Abraham Fortress Fund

CONSOLIDATED SCHEDULE OF INVESTMENTS - Continued

As of June 30, 2022

| Number of Shares | | | | | Value | |

| | | | COMMON STOCKS 1 (Continued) | | | |

| | | | FINANCIALS (Continued) | | | |

| | 1,626 | | | Wells Fargo & Co. | | $ | 63,690 | |

| | | | | | | | 1,150,400 | |

| | | | | HEALTH CARE — 3.5% | | | | |

| | 721 | | | Abbott Laboratories | | | 78,337 | |

| | 721 | | | AbbVie, Inc. | | | 110,428 | |

| | 123 | | | Agilent Technologies, Inc. | | | 14,609 | |

| | 32 | | | Align Technology, Inc.* | | | 7,573 | |

| | 230 | | | Amgen, Inc. | | | 55,959 | |

| | 204 | | | Baxter International, Inc. | | | 13,103 | |

| | 116 | | | Becton, Dickinson and Co. | | | 28,597 | |

| | 581 | | | Boston Scientific Corp.* | | | 21,654 | |

| | 905 | | | Bristol-Myers Squibb Co. | | | 69,685 | |

| | 238 | | | Centene Corp.* | | | 20,137 | |

| | 135 | | | Cigna Corp. | | | 35,575 | |

| | 538 | | | CVS Health Corp. | | | 49,851 | |

| | 291 | | | Danaher Corp. | | | 73,774 | |

| | 160 | | | Dexcom, Inc.* | | | 11,925 | |

| | 255 | | | Edwards Lifesciences Corp.* | | | 24,248 | |

| | 99 | | | Elevance Health, Inc. | | | 47,775 | |

| | 390 | | | Eli Lilly & Co. | | | 126,450 | |

| | 23 | | | Embecta Corp.* | | | 582 | |

| | 511 | | | Gilead Sciences, Inc. | | | 31,585 | |

| | 127 | | | HCA Healthcare, Inc. | | | 21,344 | |

| | 52 | | | Humana, Inc. | | | 24,340 | |

| | 35 | | | IDEXX Laboratories, Inc.* | | | 12,276 | |

| | 64 | | | Illumina, Inc.* | | | 11,799 | |

| | 146 | | | Intuitive Surgical, Inc.* | | | 29,304 | |

| | 78 | | | IQVIA Holdings, Inc.* | | | 16,925 | |

| | 1,073 | | | Johnson & Johnson | | | 190,468 | |

| | 548 | | | Medtronic PLC2 | | | 49,183 | |

| | 1,030 | | | Merck & Co., Inc. | | | 93,905 | |

| | 165 | | | Moderna, Inc.* | | | 23,570 | |

| | 2,288 | | | Pfizer, Inc. | | | 119,960 | |

| | 44 | | | Regeneron Pharmaceuticals, Inc.* | | | 26,010 | |

| | 154 | | | Stryker Corp. | | | 30,635 | |

| | 161 | | | Thermo Fisher Scientific, Inc. | | | 87,468 | |

| | 384 | | | UnitedHealth Group, Inc. | | | 197,234 | |

| | 104 | | | Vertex Pharmaceuticals, Inc.* | | | 29,306 | |

| | 193 | | | Zoetis, Inc. | | | 33,175 | |

| | | | | | | | 1,818,749 | |

Abraham Fortress Fund

CONSOLIDATED SCHEDULE OF INVESTMENTS - Continued

As of June 30, 2022

| Number of Shares | | | | | Value | |

| | | | COMMON STOCKS 1 (Continued) | | | |

| | | | INDUSTRIALS — 1.5% | | | |

| | 235 | | | 3M Co. | | $ | 30,411 | |

| | 244 | | | Amphenol Corp. - Class A | | | 15,709 | |

| | 240 | | | Boeing Co.* | | | 32,813 | |

| | 353 | | | Carrier Global Corp. | | | 12,588 | |

| | 221 | | | Caterpillar, Inc. | | | 39,506 | |

| | 42 | | | Cintas Corp. | | | 15,688 | |

| | 904 | | | CSX Corp. | | | 26,270 | |

| | 125 | | | Deere & Co. | | | 37,434 | |

| | 163 | | | Eaton Corp. PLC2 | | | 20,536 | |

| | 243 | | | Emerson Electric Co. | | | 19,328 | |

| | 108 | | | FedEx Corp. | | | 24,485 | |

| | 114 | | | General Dynamics Corp. | | | 25,222 | |

| | 448 | | | General Electric Co. | | | 28,524 | |

| | 281 | | | Honeywell International, Inc. | | | 48,841 | |

| | 128 | | | Illinois Tool Works, Inc. | | | 23,328 | |

| | 287 | | | Johnson Controls International plc2 | | | 13,742 | |

| | 80 | | | L3Harris Technologies, Inc. | | | 19,336 | |

| | 112 | | | Lockheed Martin Corp. | | | 48,156 | |

| | 99 | | | Norfolk Southern Corp. | | | 22,502 | |

| | 65 | | | Northrop Grumman Corp. | | | 31,107 | |

| | 47 | | | Old Dominion Freight Line, Inc. | | | 12,045 | |

| | 610 | | | Raytheon Technologies Corp. | | | 58,627 | |

| | 129 | | | Republic Services, Inc. | | | 16,882 | |

| | 133 | | | TE Connectivity Ltd.2 | | | 15,049 | |

| | 97 | | | Trane Technologies PLC2 | | | 12,597 | |

| | 262 | | | Union Pacific Corp. | | | 55,879 | |

| | 354 | | | United Parcel Service, Inc. - Class B | | | 64,619 | |

| | 171 | | | Waste Management, Inc. | | | 26,160 | |

| | | | | | | | 797,384 | |

| | | | | MATERIALS — 0.3% | | | | |

| | 90 | | | Air Products and Chemicals, Inc. | | | 21,643 | |

| | 211 | | | DuPont de Nemours, Inc. | | | 11,728 | |

| | 117 | | | Ecolab, Inc. | | | 17,990 | |

| | 599 | | | Freeport-McMoRan, Inc. | | | 17,527 | |

| | 208 | | | Linde PLC2 | | | 59,806 | |

| | 325 | | | Newmont Corp. | | | 19,393 | |

| | 107 | | | Sherwin-Williams Co. | | | 23,958 | |

| | | | | | | | 172,045 | |

| | | | | REAL ESTATE — 0.4% | | | | |

| | 186 | | | American Tower Corp. - REIT | | | 47,540 | |

| | 176 | | | Crown Castle International Corp. - REIT | | | 29,635 | |

Abraham Fortress Fund

CONSOLIDATED SCHEDULE OF INVESTMENTS - Continued

As of June 30, 2022

| Number of Shares | | | | | Value | |

| | | | COMMON STOCKS 1 (Continued) | | | |

| | | | REAL ESTATE (Continued) | | | |

| | 119 | | | Digital Realty Trust, Inc. - REIT | | $ | 15,450 | |

| | 37 | | | Equinix, Inc. - REIT | | | 24,310 | |

| | 302 | | | Prologis, Inc. - REIT | | | 35,530 | |

| | 71 | | | Public Storage - REIT | | | 22,199 | |

| | 134 | | | Simon Property Group, Inc. - REIT | | | 12,719 | |

| | | | | | | | 187,383 | |

| | | | | TECHNOLOGY — 6.7% | | | | |

| | 269 | | | Accenture PLC - Class A2 | | | 74,688 | |

| | 194 | | | Adobe, Inc.* | | | 71,016 | |

| | 666 | | | Advanced Micro Devices, Inc.* | | | 50,929 | |

| | 214 | | | Analog Devices, Inc. | | | 31,263 | |

| | 6,689 | | | Apple, Inc. | | | 914,520 | |

| | 362 | | | Applied Materials, Inc. | | | 32,935 | |

| | 125 | | | Arista Networks, Inc.* | | | 11,718 | |

| | 90 | | | Autodesk, Inc.* | | | 15,476 | |

| | 172 | | | Automatic Data Processing, Inc. | | | 36,127 | |

| | 168 | | | Broadcom, Inc. | | | 81,616 | |

| | 113 | | | Cadence Design Systems, Inc.* | | | 16,953 | |

| | 1,720 | | | Cisco Systems, Inc. | | | 73,341 | |

| | 214 | | | Cognizant Technology Solutions Corp. - Class A | | | 14,443 | |

| | 248 | | | Fidelity National Information Services, Inc. | | | 22,734 | |

| | 269 | | | Fiserv, Inc.* | | | 23,933 | |

| | 335 | | | Fortinet, Inc.* | | | 18,954 | |

| | 1,658 | | | Intel Corp. | | | 62,026 | |

| | 366 | | | International Business Machines Corp. | | | 51,676 | |

| | 115 | | | Intuit, Inc. | | | 44,326 | |

| | 62 | | | KLA Corp. | | | 19,783 | |

| | 57 | | | Lam Research Corp. | | | 24,291 | |

| | 401 | | | Mastercard, Inc. - Class A | | | 126,507 | |

| | 226 | | | Microchip Technology, Inc. | | | 13,126 | |

| | 457 | | | Micron Technology, Inc. | | | 25,263 | |

| | 3,061 | | | Microsoft Corp. | | | 786,157 | |

| | 76 | | | Moody's Corp. | | | 20,670 | |

| | 69 | | | Motorola Solutions, Inc. | | | 14,462 | |

| | 34 | | | MSCI, Inc. | | | 14,013 | |

| | 1,019 | | | NVIDIA Corp. | | | 154,470 | |

| | 108 | | | NXP Semiconductors N.V.2 | | | 15,987 | |

| | 1,089 | | | Oracle Corp. | | | 76,088 | |

| | 147 | | | Paychex, Inc. | | | 16,739 | |

| | 479 | | | PayPal Holdings, Inc.* | | | 33,453 | |

| | 457 | | | QUALCOMM, Inc. | | | 58,377 | |

| | 43 | | | Roper Technologies, Inc. | | | 16,970 | |

Abraham Fortress Fund

CONSOLIDATED SCHEDULE OF INVESTMENTS - Continued

As of June 30, 2022

| Number of Shares | | | | | Value | |

| | | | COMMON STOCKS 1 (Continued) | | | |

| | | | TECHNOLOGY (Continued) | | | |

| | 144 | | | S&P Global, Inc. | | $ | 48,537 | |

| | 402 | | | Salesforce, Inc.* | | | 66,346 | |

| | 81 | | | ServiceNow, Inc.* | | | 38,517 | |

| | 63 | | | Synopsys, Inc.* | | | 19,133 | |

| | 377 | | | Texas Instruments, Inc. | | | 57,926 | |

| | 888 | | | Visa, Inc. - Class A | | | 174,838 | |

| | | | | | | | 3,470,327 | |

| | | | | UTILITIES — 5.3% | | | | |

| | 2,283 | | | Alliant Energy Corp. | | | 133,807 | |

| | 1,565 | | | Ameren Corp. | | | 141,413 | |

| | 1,775 | | | American Electric Power Co., Inc. | | | 170,293 | |

| | 745 | | | American Water Works Co., Inc. | | | 110,834 | |

| | 1,315 | | | Atmos Energy Corp. | | | 147,412 | |

| | 2,144 | | | CMS Energy Corp. | | | 144,720 | |

| | 1,628 | | | Consolidated Edison, Inc. | | | 154,823 | |

| | 962 | | | Constellation Energy Corp. | | | 55,084 | |

| | 330 | | | Dominion Energy, Inc. | | | 26,337 | |

| | 1,158 | | | DTE Energy Co. | | | 146,777 | |

| | 314 | | | Duke Energy Corp. | | | 33,664 | |

| | 1,236 | | | Entergy Corp. | | | 139,223 | |

| | 2,031 | | | Evergy, Inc. | | | 132,523 | |

| | 1,522 | | | Eversource Energy | | | 128,563 | |

| | 2,888 | | | Exelon Corp. | | | 130,884 | |

| | 3,369 | | | FirstEnergy Corp. | | | 129,336 | |

| | 800 | | | NextEra Energy, Inc. | | | 61,968 | |

| | 4,624 | | | PPL Corp. | | | 125,449 | |

| | 2,100 | | | Public Service Enterprise Group, Inc. | | | 132,888 | |

| | 2,471 | | | Southern Co. | | | 176,207 | |

| | 1,438 | | | WEC Energy Group, Inc. | | | 144,720 | |

| | 2,043 | | | Xcel Energy, Inc. | | | 144,563 | |

| | | | | | | | 2,711,488 | |

| | | | | TOTAL COMMON STOCKS | | | | |

| | | | | (Cost $16,834,391) | | | 14,057,327 | |

| Principal Amount | | | | | | |

| | | | U.S. TREASURY BILLS — 50.6% | | | |

| | | | United States Treasury Bill6 | | | |

| $ | 7,080,000 | | | 1.110%, 10/6/20223,5 | | | 7,046,908 | |

| | 850,000 | | | 1.270%, 10/20/20223 | | | 844,998 | |

| | 7,500,000 | | | 1.350%, 11/3/2022 | | | 7,448,565 | |

| | 5,750,000 | | | 1.450%, 11/17/20223,5 | | | 5,704,541 | |

Abraham Fortress Fund

CONSOLIDATED SCHEDULE OF INVESTMENTS - Continued

As of June 30, 2022

| Principal Amount | | | | | Value | |

| | | | U.S. TREASURY BILLS (Continued) | | | |

| $ | 5,100,000 | | | 1.620%, 12/1/20223 | | $ | 5,052,233 | |

| | | | | TOTAL U.S. TREASURY BILLS | | | | |

| | | | | (Cost $26,153,066) | | | 26,097,245 | |

| | | | | U.S. TREASURY NOTES — 15.6% | | | | |

| | | | | United States Treasury Note | | | | |

| | 2,250,000 | | | 0.625%, 12/31/2027 | | | 1,974,989 | |

| | 2,250,000 | | | 1.250%, 6/30/2028 | | | 2,027,637 | |

| | 2,250,000 | | | 1.375%, 12/31/2028 | | | 2,031,768 | |

| | 2,000,000 | | | 3.250%, 6/30/2029 | | | 2,027,500 | |

| | | | | TOTAL U.S. TREASURY NOTES | | | | |

| | | | | (Cost $8,504,369) | | | 8,061,894 | |

| Number of Contracts | | | | | | |

| | | | PURCHASED OPTIONS CONTRACTS — 0.1% | | | |

| | | | PUT OPTION — 0.1% | | | |

| | 375 | | | OTC GBP versus USD

Exercise Price: $115.00, Notional Amount: $26,953,125,

Expiration Date: August 5, 2022 | | | 49,219 | |

| | | | | TOTAL PUT OPTION | | | | |

| | | | | (Cost $21,514) | | | 49,219 | |

| | | | | TOTAL PURCHASED OPTIONS CONTRACTS | | | | |

| | | | | (Cost $21,514) | | | 49,219 | |

| Principal Amount | | | | | | |

| | | | SHORT-TERM INVESTMENTS — 0.0% | | | |

| $ | 10 | | | UMB Bank Demand Deposit, 0.01%3,4,5 | | | 10 | |

| | | | | TOTAL SHORT-TERM INVESTMENTS | | | | |

| | | | | (Cost $10) | | | 10 | |

| | | | | TOTAL INVESTMENTS — 93.5% | | | | |

| | | | | (Cost $51,513,350) | | | 48,265,695 | |

| | | | | Other Assets in Excess of Liabilities — 6.5% | | | 3,365,257 | |

| | | | | TOTAL NET ASSETS — 100.0% | | $ | 51,630,952 | |

PLC – Public Limited Company

REIT – Real Estate Investment Trusts

| * | Non-income producing security. |

| 1 | See additional notional stock exposure value via stock index futures on page 14. |

| 2 | Foreign security denominated in U.S. dollars. |

| 3 | All or a portion of this security is segregated as collateral for derivatives. The value of the securities pledged as collateral was $18,648,680, which represents 36.12% of total net assets of the Fund. |

| 4 | The rate is the annualized seven-day yield at period end. |

| 5 | All or a portion of this security is a holding of Abraham Fortress Fund, Ltd. |

| 6 | The rate is the effective yield as of June 30, 2022. |

See accompanying Notes to Consolidated Financial Statements.

Abraham Fortress Fund

CONSOLIDATED SCHEDULE OF INVESTMENTS -Continued

As of June 30, 2022

| Long Contracts | | Expiration Date | | Number of Contracts | | | Notional Value | | | Value at June 30, 2022 | | | Unrealized Appreciation (Depreciation) | |

| Commodity Futures | | | | | | | | | | | | | | |

| CMX Gold1 | | August 2022 | | | 27 | | | $ | 4,917,067 | | | $ | 4,879,710 | | | $ | (37,357 | ) |

| NY Mercantile Crude Oil1 | | December 2022 | | | 22 | | | | 1,993,257 | | | | 2,102,320 | | | | 109,063 | |

| | | | | | | | | | | | | | | | | | | |

| Index Futures | | | | | | | | | | | | | | | | | | |

| CME E-mini S&P 500 | | September 2022 | | | 24 | | | | 4,593,449 | | | | 4,547,400 | | | | (46,049 | ) |

| NYF MSCI EAFE Index | | September 2022 | | | 42 | | | | 3,925,680 | | | | 3,898,860 | | | | (26,820 | ) |

| Total Long Contracts | | | | | | | | $ | 15,429,453 | | | $ | 15,428,290 | | | $ | (1,163 | ) |

| 1 | All or a portion of this security is a holding of Abraham Fortress Fund, Ltd. |

See accompanying Notes to Consolidated Financial Statements.

Abraham Fortress Fund

CONSOLIDATED SCHEDULE OF INVESTMENTS -Continued

As of June 30, 2022

SWAP CONTRACTS

(OTC) TOTAL RETURN SWAP

| Counterparty | | Reference Entity | | Pay/Receive Total Return on Reference Entity | | Financing Rate1 | | | Pay/Receive Frequency | | Termination Date | | Notional Value | | | Unrealized Appreciation (Depreciation) | |

| Deutsche Bank | | Abraham Fortress

dbSelect Index Basket Swap2 | | Receive | | | 0.50% of Notional Value | | | Monthly | | June 13, 2024 | | $ | 33,408,787 | | | | 2,338,650 | |

| TOTAL SWAP CONTRACTS | | | | | | | | | | | | | | | | | | $ | 2,338,650 | |

| 1 | Financing rate is based upon notional trading amounts. |

| 2 | This investment is a holding of the Abraham Fortress Fund, Ltd. and is comprised of a proprietary basket of alternative programs investing in various futures contracts and forward foreign currency exchange contracts. |

Total Return Swap Top 50 Holdings^

| FUTURES CONTRACTS | | | | | | | | | | | | | | |

| Description | | Expiration Date | | Number of Long Contracts | | | Notional Value | | | Percentage Unrealized Appreciation (Depreciation) | | | of Custom Swap's Unrealized Appreciation (Depreciation) | |

| CMX Copper Future | | December 2022 | | | 13 | | | $ | 1,191,152 | | | $ | (78,150 | ) | | | -17.14 | % |

| CME E-Mini S&P 500 | | September 2022 | | | 4 | | | | 719,393 | | | | (16,617 | ) | | | -3.65 | % |

| NYM NY Harbour ULSD Future | | August 2022 | | | 2 | | | | 379,898 | | | | (35,786 | ) | | | -7.85 | % |

| CBT 30 year US Treasury Bonds | | September 2022 | | | 3 | | | | 359,746 | | | | 1,373 | | | | 0.30 | % |

| CBT Soybean Oil Future | | March 2023 | | | 9 | | | | 344,792 | | | | (47,495 | ) | | | -10.42 | % |

| CME MXN/USD | | September 2022 | | | 14 | | | | 343,233 | | | | (6,634 | ) | | | -1.46 | % |

| LIF FTSE 100 Index Future | | September 2022 | | | 4 | | | | 320,599 | | | | (3,586 | ) | | | -0.79 | % |

| CBT Corn Future | | December 2022 | | | 10 | | | | 315,181 | | | | (32,638 | ) | | | -7.16 | % |

| | | | | | | | | | 3,973,994 | | | | (219,533 | ) | | | | |

| Description | | Expiration Date | | Number of Short Contracts | | | Notional Value | | | Unrealized Appreciation (Depreciation) | | | Percentage of Custom Swap's Unrealized Appreciation (Depreciation) | |

| CME EUR/USD | | September 2022 | | | (64 | ) | | $ | (8,388,270 | ) | | $ | 175,120 | | | | 38.42 | % |

| CME AUD/USD | | September 2022 | | | (58 | ) | | | (3,963,902 | ) | | | 163,423 | | | | 35.85 | % |

| CMX Copper Future | | September 2022 | | | (20 | ) | | | (1,844,942 | ) | | | 173,081 | | | | 37.97 | % |

| CME JPY/USD | | September 2022 | | | (19 | ) | | | (1,730,411 | ) | | | 28,556 | | | | 6.26 | % |

| EUX Euro-BUND | | September 2022 | | | (6 | ) | | | (932,293 | ) | | | (188 | ) | | | -0.04 | % |

| CME Lean Hog Future | | August 2022 | | | (17 | ) | | | (708,703 | ) | | | 7,478 | | | | 1.64 | % |

| EUX 2 year Euro-Schatz | | September 2022 | | | (6 | ) | | | (708,685 | ) | | | (1,919 | ) | | | -0.42 | % |

| IFLL 3 Month SONIA Index Futures | | June 2023 | | | (2 | ) | | | (674,377 | ) | | | (2,071 | ) | | | -0.45 | % |

Abraham Fortress Fund

CONSOLIDATED SCHEDULE OF INVESTMENTS -Continued

As of June 30, 2022

| Description | | Expiration Date | | Number of Short Contracts | | | Notional Value | | | Unrealized Appreciation (Depreciation) | | | Percentage of Custom Swap's Unrealized Appreciation (Depreciation) | |

| CME SOFR 3month Futures | | June 2023 | | | (3 | ) | | | (646,234 | ) | | | (1,551 | ) | | | -0.34 | % |

| EUX Euro-BOBL | | September 2022 | | | (5 | ) | | | (629,473 | ) | | | (2,859 | ) | | | -0.63 | % |

| CME E-Mini Nasdaq-100 | | September 2022 | | | (3 | ) | | | (602,213 | ) | | | 10,663 | | | | 2.34 | % |

| CBT 2 year US Treasury Notes | | September 2022 | | | (3 | ) | | | (593,216 | ) | | | 216 | | | | 0.05 | % |

| CME SOFR 3month Futures | | June 2024 | | | (2 | ) | | | (587,149 | ) | | | (3,300 | ) | | | -0.72 | % |

| IFLL 3 Month SONIA Index Futures | | March 2025 | | | (2 | ) | | | (522,110 | ) | | | 596 | | | | 0.13 | % |

| IFLL 3 Month SONIA Index Futures | | June 2024 | | | (2 | ) | | | (490,319 | ) | | | 69 | | | | 0.02 | % |

| LIF 3 month Euro (EURIBOR) | | December 2023 | | | (2 | ) | | | (488,976 | ) | | | (1,716 | ) | | | -0.38 | % |

| EUX DAX Index Future | | September 2022 | | | (1 | ) | | | (488,306 | ) | | | 13,079 | | | | 2.87 | % |

| IFLL 3 Month SONIA Index Futures | | September 2024 | | | (2 | ) | | | (485,644 | ) | | | 1,348 | | | | 0.30 | % |

| IFLL 3 Month SONIA Index Futures | | September 2023 | | | (2 | ) | | | (477,261 | ) | | | (1,684 | ) | | | -0.37 | % |

| CME SOFR 3month Futures | | June 2025 | | | (2 | ) | | | (462,898 | ) | | | (2,670 | ) | | | -0.59 | % |

| SFE 3 year Australian Treasury Bond | | September 2022 | | | (6 | ) | | | (462,379 | ) | | | (1,592 | ) | | | -0.35 | % |

| IFLL 3 Month SONIA Index Futures | | March 2024 | | | (1 | ) | | | (442,231 | ) | | | (1,662 | ) | | | -0.36 | % |

| LIF 3 month Euro (EURIBOR) | | June 2023 | | | (2 | ) | | | (432,985 | ) | | | (1,566 | ) | | | -0.34 | % |

| IFLL 3 Month SONIA Index Futures | | June 2025 | | | (1 | ) | | | (407,387 | ) | | | (881 | ) | | | -0.19 | % |

| NYM Light Sweet Crude Oil (WTI) Future | | July 2022 | | | (4 | ) | | | (397,845 | ) | | | 13,903 | | | | 3.05 | % |

| MSE Three Month Canadian Bankers Acceptance Future | | March 2023 | | | (2 | ) | | | (397,075 | ) | | | (1,481 | ) | | | -0.32 | % |

| LIF Long Gilt Future | | September 2022 | | | (3 | ) | | | (395,483 | ) | | | 3,722 | | | | 0.82 | % |

| CME SOFR 3month Futures | | December 2023 | | | (2 | ) | | | (386,711 | ) | | | (1,979 | ) | | | -0.43 | % |

| CME SOFR 3month Futures | | September 2023 | | | (2 | ) | | | (385,998 | ) | | | (654 | ) | | | -0.14 | % |

| CME CAD/USD | | September 2022 | | | (5 | ) | | | (354,014 | ) | | | 3,673 | | | | 0.81 | % |

| CME Eurodollar | | March 2024 | | | (1 | ) | | | (350,403 | ) | | | 934 | | | | 0.20 | % |

| CME Eurodollar | | December 2023 | | | (1 | ) | | | (349,990 | ) | | | 1,331 | | | | 0.29 | % |

| MSE Three Month Canadian Bankers Acceptance Future | | December 2022 | | | (2 | ) | | | (347,350 | ) | | | 1,167 | | | | 0.26 | % |

| EUX Euro-OAT Future | | September 2022 | | | (2 | ) | | | (339,178 | ) | | | (769 | ) | | | -0.17 | % |

| CME SOFR 3month Futures | | December 2025 | | | (1 | ) | | | (323,578 | ) | | | (809 | ) | | | -0.18 | % |

| CME SOFR 3month Futures | | December 2024 | | | (1 | ) | | | (323,577 | ) | | | (1,745 | ) | | | -0.38 | % |

| CME Eurodollar | | June 2024 | | | (1 | ) | | | (315,656 | ) | | | 1,228 | | | | 0.27 | % |

| LIF 3 month Euro (EURIBOR) | | December 2024 | | | (1 | ) | | | (315,647 | ) | | | 254 | | | | 0.06 | % |

| SGX Mini Japanese Goverment Bond Future | | September 2022 | | | (3 | ) | | | (308,625 | ) | | | (751 | ) | | | -0.16 | % |

| | | | | | | | | | (32,461,494 | ) | | | 567,994 | | | | | |

| FORWARD FOREIGN CURRENCY CONTRACTS | | | | | | | | | | |

| Settlement Date | | Counterparty | | Currency Units to Receive/(Deliver) | | | In Exchange For | | | Unrealized Appreciation (Depreciation) | | | Percentage of Custom Swap's Unrealized Appreciation (Depreciation) | |

| 7/5/2022 | | Deutsche Bank | | | (100,038,422 | ) | | | JPY | | | | 605,234 | | | | GBP | | | | (551 | ) | | | -0.12 | % |

| 7/5/2022 | | Deutsche Bank | | | (441,482 | ) | | | USD | | | | 419,008 | | | | EUR | | | | (3,622 | ) | | | -0.79 | % |

| 7/5/2022 | | Deutsche Bank | | | (48,947,236 | ) | | | JPY | | | | 521,432 | | | | AUD | | | | (1,052 | ) | | | -0.23 | % |

| ^ | These investments are not direct holdings of the Fund. The holdings were determined based on the absolute notional values of the positions within the underlying swap basket. |

See accompanying Notes to Consolidated Financial Statements.

Abraham Fortress Fund

CONSOLIDATED SUMMARY OF INVESTMENTS (Unaudited)

As of June 30, 2022

| Security Type/Industry | | Percent of Total Net Assets | |

| Common Stocks | | | |

| Technology | | | 6.7 | % |

| Utilities | | | 5.3 | % |

| Health Care | | | 3.5 | % |

| Communications | | | 2.5 | % |

| Consumer Discretionary | | | 2.3 | % |

| Financials | | | 2.2 | % |

| Consumer Staples | | | 1.8 | % |

| Industrials | | | 1.5 | % |

| Energy | | | 0.7 | % |

| Real Estate | | | 0.4 | % |

| Materials | | | 0.3 | % |

| Total Common Stocks | | | 27.2 | % |

| Purchased Options Contracts | | | 0.1 | % |

| U.S. Treasury Bills | | | 50.6 | % |

| U.S. Treasury Notes | | | 15.6 | % |

| Short-Term Investments | | | 0.0 | % |

| Total Investments | | | 93.5 | % |

| Other Assets in Excess of Liabilities | | | 6.5 | % |

| Total Net Assets | | | 100.0 | % |

See accompanying Notes to Consolidated Financial Statements.

Abraham Fortress Fund

CONSOLIDATED STATEMENT OF ASSETS AND LIABILITIES

As of June 30, 2022

| Assets: | | | |

| Investments, at value (cost $51,491,836) | | $ | 48,216,476 | |

| Purchased options contracts, at value (cost $21,514) | | | 49,219 | |

| Unrealized appreciation on total return swap contract | | | 2,338,650 | |

| Cash | | | 659,452 | |

| Cash deposited with brokers for open futures contracts | | | 396,491 | |

| Cash held as collateral for open swap contract | | | 605 | |

| Receivables: | | | | |

| Fund shares sold | | | 384 | |

| Due from Advisor | | | 4,964 | |

| Dividends and interest | | | 10,971 | |

| Prepaid offering cost | | | 11,190 | |

| Other prepaid expenses | | | 55,592 | |

| Total Assets | | | 51,743,994 | |

| | | | | |

| Liabilities: | | | | |

| Payables: | | | | |

| Shareholder servicing fees (Note 6) | | | 1,182 | |

| Fund administration and accounting fees | | | 34,639 | |

| Transfer agent fees and expenses | | | 20,158 | |

| Custody fees | | | 4,485 | |

| Auditing fees | | | 27,499 | |

| Chief Compliance Officer fees | | | 3,179 | |

| Trustees' deferred compensation (Note 3) | | | 2,194 | |

| Printing and Postage | | | 2,034 | |

| Legal fees | | | 1,800 | |

| Director's Fees payable | | | 1,395 | |

| Net unrealized depreciation on futures contracts | | | 1,163 | |

| Accrued other expenses | | | 13,314 | |

| Total liabilities | | | 113,042 | |

| | | | | |

| Net Assets | | $ | 51,630,952 | |

| | | | | |

| Components of Net Assets: | | | | |

| Paid-in capital (par value of $0.01 per share with an unlimited number of shares authorized) | | $ | 53,241,692 | |

| Total accumulated earnings (deficit) | | | (1,610,740 | ) |

| Net Assets | | $ | 51,630,952 | |

| | | | | |

| Maximum Offering Price per Share: | | | | |

| Class I Shares: | | | | |

| Net assets applicable to shares outstanding | | $ | 15,328,272 | |

| Shares of beneficial interest issued and outstanding | | | 1,577,602 | |

| Redemption price per share | | $ | 9.72 | |

| | | | | |

| Class K Shares: | | | | |

| Net assets applicable to shares outstanding | | $ | 36,302,680 | |

| Shares of beneficial interest issued and outstanding | | | 3,734,104 | |

| Redemption price per share | | $ | 9.72 | |

See accompanying Notes to Consolidated Financial Statements.

Abraham Fortress Fund

CONSOLIDATED STATEMENT OF OPERATIONS

For the Period October 13, 2021* through June 30, 2022

| Investment Income: | | | |

| Dividends (net of withholding tax of $27) | | $ | 129,367 | |

| Interest | | | 177,676 | |

| Total investment income | | | 307,043 | |

| | | | | |

| Expenses: | | | | |

| Advisory fees | | | 182,696 | |

| Shareholder servicing fees- Class I (Note 6) | | | 10,322 | |

| Fund administration and accounting fees | | | 82,940 | |

| Transfer agent fees and expenses | | | 42,785 | |

| Custody fees | | | 11,750 | |

| Registration fees | | | 39,743 | |

| Auditing fees | | | 28,999 | |

| Offering cost expense | | | 28,639 | |

| Legal fees | | | 20,398 | |

| Miscellaneous | | | 17,482 | |

| Chief Compliance Officer fees | | | 11,112 | |

| Trustees' fees and expenses | | | 8,969 | |

| Shareholder reporting fees | | | 5,228 | |

| Insurance fees | | | 2,597 | |

| Total expenses | | | 493,660 | |

| Advisory fees waived | | | (182,696 | ) |

| Other expenses absorbed | | | (29,766 | ) |

| Fees paid indirectly | | | (33,350 | ) |

| Net expenses | | | 247,848 | |

| Net investment income (loss) | | | 59,195 | |

| | | | | |

| Realized and Unrealized Gain (Loss): | | | | |

| Net realized gain on: | | | | |

| Investments | | | (290,525 | ) |

| Futures contracts | | | 172,294 | |

| Swap contracts | | | 201,898 | |

| Net realized gain (loss) | | | 83,667 | |

| Net change in unrealized appreciation/depreciation on: | | | | |

| Investments | | | (3,275,360 | ) |

| Futures contracts | | | (1,163 | ) |

| Swap contracts | | | 2,338,650 | |

| Purchased options contracts | | | 27,705 | |

| Net change in unrealized appreciation/depreciation | | | (910,168 | ) |

| Net realized and unrealized gain (loss) | | | (826,501 | ) |

| Net Increase (Decrease) in Net Assets from Operations | | $ | (767,306 | ) |

| * | Beginning of reporting period (See Note 1). |

See accompanying Notes to Consolidated Financial Statements.

Abraham Fortress Fund

CONSOLIDATED STATEMENT OF CHANGES IN NET ASSETS

| | | For the Period October 13, 2021* through June 30, 2022 | |

| Increase (Decrease) in Net Assets from: | | | |

| Operations: | | | |

| Net investment income (loss) | | $ | 59,195 | |

| Net realized gain (loss) on investments, futures contracts, and swap contracts | | | 83,667 | |

| Net change in unrealized appreciation/depreciation on investments, futurescontracts, swap contracts and purchased options contracts | | | (910,168 | ) |

| Net increase (decrease) in net assets resulting from operations | | | (767,306 | ) |

| | | | | |

| Distributions to Shareholders: | | | | |

| Distributions from distributable earnings: | | | | |

| Class I | | | (202,068 | ) |

| Class K | | | (587,736 | ) |

| Total distributions to shareholders | | | (789,804 | ) |

| | | | | |

| Capital Transactions: | | | | |

| Net proceeds from shares sold: | | | | |

| Class I | | | 10,517,046 | |

| Class K | | | 2,716,251 | |

| Cost of Shares issued in connection with reorganization of Predecessor Fund (Note 1) | | | | |

| Class I | | | 11,339,731 | |

| Class K | | | 34,576,420 | |

| Reinvestment of distributions: | | | | |

| Class I | | | 202,052 | |

| Class K | | | 587,363 | |

| Cost of shares redeemed: | | | | |

| Class I | | | (6,246,175 | ) |

| Class K | | | (504,626 | ) |

| Net increase (decrease) in net assets from capital transactions | | | 53,188,062 | |

| | | | | |

| Total increase (decrease) in net assets | | | 51,630,952 | |

| | | | | |

| Net Assets: | | | | |

| Beginning of period | | | - | |

| End of period | | $ | 51,630,952 | |

| | | | | |

| Capital Share Transactions: | | | | |

| Shares sold: | | | | |

| Class I | | | 1,041,214 | |

| Class K | | | 267,739 | |

| Shares issued in connection with reorganization of Predecessor Fund (Note 1) | | | | |

| Class I | | | 1,133,973 | |

| Class K | | | 3,457,642 | |

| Shares reinvested: | | | | |

| Class I | | | 19,965 | |

| Class K | | | 58,040 | |

| Shares redeemed: | | | | |

| Class I | | | (617,550 | ) |

| Class K | | | (49,317 | ) |

| Net increase (decrease) in capital shares | | | 5,311,706 | |

| * | Beginning of reporting period (See Note 1). |

See accompanying Notes to Consolidated Financial Statements.

Abraham Fortress Fund

CONSOLIDATED FINANCIAL HIGHLIGHTS

Class I

Per share operating performance.

For a capital share outstanding throughout the period.

| | | For the Period October 13, 2021* through June 30, 2022 | |

| Net asset value, beginning of period | | $ | 10.00 | |

| Income from Investment Operations: | | | | |

| Net investment income (loss)1 | | | 0.01 | |

| Net realized and unrealized gain (loss) | | | (0.13 | ) |

| Total from investment operations | | | (0.12 | ) |

| | | | | |

| Less Distributions: | | | | |

| From net realized gain | | | (0.16 | ) |

| Total distributions | | | (0.16 | ) |

| | | | | |

| Net asset value, end of period | | $ | 9.72 | |

| | | | | |

| Total return2 | | | (1.23)% 3 | |

| | | | | |

| Ratios and Supplemental Data: | | | | |

| Net assets, end of period (in thousands) | | $ | 15,328 | |

| | | | | |

| Ratio of expenses to average net assets | | | | |

| Before fees waived and absorbed | | | 1.42% 4 | |

| After fees waived and absorbed | | | 0.75% 4 | |

| Ratio of net investment income (loss) to average net assets | | | | |

| Before fees waived and absorbed | | | (0.58%) 4 | |

| After fees waived and absorbed | | | 0.09% 4 | |

| | | | | |

| Portfolio turnover rate | | | 61% 3,5 | |

| * | Beginning of reporting period (See Note 1). |

| 1 | Based on average shares outstanding for the period. |

| 2 | Total returns would have been lower had expenses not been waived or absorbed by the Advisor. These returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| 5 | Calculated at the Fund level. |

See accompanying Notes to Consolidated Financial Statements.

Abraham Fortress Fund

CONSOLIDATED FINANCIAL HIGHLIGHTS

Class K

Per share operating performance.

For a capital share outstanding throughout the period.

| | | For the Period October 13, 2021* through June 30, 2022 | |

| Net asset value, beginning of period | | $ | 10.00 | |

| Income from Investment Operations: | | | | |

| Net investment income (loss)1 | | | 0.01 | |

| Net realized and unrealized gain (loss) | | | (0.13 | ) |

| Total from investment operations | | | (0.12 | ) |

| | | | | |

| Less Distributions: | | | | |

| From net realized gain | | | (0.16 | ) |

| Total distributions | | | (0.16 | ) |

| | | | | |

| Net asset value, end of period | | $ | 9.72 | |

| | | | | |

| Total return2 | | | (1.23)% 3 | |

| | | | | |

| Ratios and Supplemental Data: | | | | |

| Net assets, end of period (in thousands) | | $ | 36,303 | |

| | | | | |

| Ratio of expenses to average net assets | | | | |

| Before fees waived and absorbed | | | 1.32% 4 | |

| After fees waived and absorbed | | | 0.65% 4 | |

| Ratio of net investment income (loss) to average net assets | | | | |

| Before fees waived and absorbed | | | (0.48%) 4 | |

| After fees waived and absorbed | | | 0.19% 4 | |

| | | | | |

| Portfolio turnover rate | | | 61% 3,5 | |

| * | Beginning of reporting period (See Note 1). |

| 1 | Based on average shares outstanding for the period. |

| 2 | Total returns would have been lower had expenses not been waived or absorbed by the Advisor. These returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| 5 | Calculated at the Fund level. |

See accompanying Notes to Consolidated Financial Statements.

Abraham Fortress Fund

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2022

Note 1 – Organization

Abraham Fortress Fund (the “Fund”) is organized as a series of Investment Managers Series Trust II, a Delaware statutory trust (the “Trust”) which is registered as an open-end management investment company under the Investment Company Act of 1940, as amended (the “1940 Act”). The Fund is classified as a diversified Fund.

The Fund’s primary investment objective is to protect capital and achieve long-term capital appreciation. The Fund’s current reporting period began on October 13, 2021, following the reorganization of the Predecessor Fund. The Fund currently has two classes of shares, Class I and Class K. Class C shares have not yet commenced operations.

The Fund’s current reporting period begins on October 13, 2021 with a $45,916,151 transfer of shares of the Fund in exchange for the net assets of the Predecessor Fund, a Delaware statutory limited partnership. This exchange was nontaxable, whereby the Fund issued 1,133,973 Class I shares and 3,457,642 Class K shares for the net assets of the Predecessor Fund on October 13, 2021. Net assets with a fair market value of $45,916,151 (including net unrealized depreciation on securities and derivatives of $2,741,533) consisting of cash, interest receivable and securities and derivative instruments of the Predecessor Fund were the primary assets received by the Fund. For financial reporting purposes, assets received and shares issued by the Fund were recorded at fair value; however, the cost basis of the investments received from the Predecessor Fund was carried forward to align ongoing reporting of the Fund’s realized and unrealized gains and losses with amount distributable to shareholders for tax purposes.

From July 18, 2018 until October 12, 2021 the Predecessor Fund was registered with the CFTC and NFA as a Commodity Pool, and over that entire time period, Abraham Trading Co. was the registered Commodity Pool Operator of the Predecessor Fund. Abraham Trading Co. has been continuously registered with the CFTC and NFA as a Commodity Trading Advisor and Commodity Pool Operator since 1990. Cohen & Company, Ltd. served as the auditor of the Predecessor Fund from July 31, 2018 through October 12, 2021. After the conversion of the Predecessor Fund to a 40 Act open ended mutual fund on October 13, 2021, Cohen & Company Ltd. has continued to serve as the auditor of the Fund. As a hedge fund registered with the CFTC and NFA, the Predecessor Fund was required to have audited financial statements, including the reporting of investments, filed annually with both the CFTC and NFA. Over the entire life of the Predecessor Fund, a third-party administrator has performed the accounting for the Predecessor Fund, including compiling of its track records. UMB Fund Services was the administrator of the Predecessor Fund prior to its conversion to the Fund, and currently UMB Fund Services is the co-administrator of the Fund.

The shares of each class represent an interest in the same portfolio of investments of the Fund and have equal rights as to voting, redemptions, dividends and liquidation, subject to the approval of the Trustees. Income, expenses (other than expenses attributable to a specific class) and realized and unrealized gains and losses on investments are allocated to each class of shares in proportion to their relative net assets.

The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946, Financial Services—Investment Companies.

(a) Consolidation of Subsidiary

The Fund may invest up to 25% of its total assets in its subsidiary, Abraham Fortress Fund Ltd. a wholly-owned and controlled subsidiary (the “Subsidiary”) formed under the laws of the Cayman Islands. The Consolidated Schedule of Investments, Consolidated Statement of Assets and Liabilities, Consolidated Statement of Operations, Consolidated Statement of Changes in Net Assets and Consolidated Financial Highlights of the Fund include the accounts of the Subsidiary. All inter-company accounts and transactions have been eliminated in the consolidation for the Fund. The Subsidiary is advised by Abraham Trading Company and acts as an investment vehicle in order to effect certain investments consistent with the Fund’s investment objectives and policies specified in the Fund’s prospectus and statement of additional information. The Subsidiary will generally invest in derivatives, including swaps, commodity interests and other investments intended to serve as margin or collateral for derivative positions. The inception date of the Subsidiary was October 13, 2021. As of June 30, 2022, total assets of the Fund were $51,743,994, of which $10,552,200, or 20.39%, represented the Fund’s ownership of the shares of the Subsidiary.

Abraham Fortress Fund

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

June 30, 2022

Note 2 – Accounting Policies

The following is a summary of the significant accounting policies consistently followed by the Fund in the preparation of its financial statements. The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from these estimates and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operating during the reporting period. The preparation of the financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, and disclosure of contingent assets and liabilities at the date reported in the financial statements and the reported amounts of increases and decreases in net assets from operations during the period.

(a) Valuation of Investments

The Fund records investments at fair value. The Fund values equity securities at the last reported sale price on the principal exchange or in the principal over the counter (“OTC”) market in which such securities are traded, as of the close of regular trading on the NYSE on the day the securities are being valued or, if the last-quoted sales price is not readily available, the securities will be valued at the last bid or the mean between the last available bid and ask price. Securities traded on the NASDAQ are valued at the NASDAQ Official Closing Price (“NOCP”). Investments in open-end investment companies are valued at the daily closing net asset value of the respective investment company. Debt securities are valued by utilizing a price supplied by independent pricing service providers. The independent pricing service providers may use various valuation methodologies including matrix pricing and other analytical pricing models as well as market transactions and dealer quotations. These models generally consider such factors as yields or prices of bonds of comparable quality, type of issue, coupon, maturity, ratings and general market conditions. If a price is not readily available for a portfolio security, the security will be valued at fair value (the amount which the Fund might reasonably expect to receive for the security upon its current sale) as determined in good faith by the Fund’s advisor, subject to review and approval by the Valuation Committee, pursuant to procedures adopted by the Board of Trustees. The actions of the Valuation Committee are subsequently reviewed by the Board at its next regularly scheduled board meeting. The Valuation Committee meets as needed. The Valuation Committee is comprised of all the Trustees, but action may be taken by any one of the Trustees.

Financial derivative instruments, such as forward currency contracts, futures contracts, options contracts or swap agreements, derive their value from underlying asset prices, indices, reference rates and other inputs or a combination of these factors. These contracts are normally valued on the basis of broker- dealer quotations or a pricing service at the settlement price determined by the relevant exchange. Depending on the product and the terms of the transaction, the value of the derivative contracts can be estimated by a pricing service provider using a series of techniques, including simulation pricing models. The pricing models use inputs that are observed from actively quoted markets such as issuer details, indices, spreads, interest rates, curves, dividends and exchange rates. Forward currency contracts represent the purchase or sale of a specific quantity of a foreign currency at the current or spot price, with delivery and settlement at a specified future date. Forward currency contracts are presented at fair value using spot currency rates and are adjusted for the time value of money (forward points) and contractual prices of the underlying financial instruments.

Abraham Fortress Fund

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

June 30, 2022

Forward currency contracts are generally categorized in Level 2. Futures contracts are carried at fair value using the primary exchange’s closing (settlement) price and are generally categorized in Level 1.

Options contracts are carried at fair value using the primary exchange's closing (settlement) price and are generally categorized as Level 1. In the absence of a closing price, options contracts will be valued at the last bid or the mean between the last available bid and ask price, and categorized in Level 2.

The Fund’s total return swap contract tracks the performance of various underlying investment managers trading programs through a Deutsche Bank AG, London Branch proprietary index. The fair value of the total return swap contract is valued on each index business day as set out in the index description utilizing market data as of 4:15 pm London time and trade data as of 5:00 pm London time.

Please refer to Note 8 for more information on valuation.

(b) Foreign Currency Translation

The Fund’s records are maintained in U.S. dollars. The value of securities, currencies and other assets and liabilities denominated in currencies other than U.S. dollars are translated into U.S. dollars based upon foreign exchange rates prevailing at the end of the reporting period. The currencies are translated into U.S. dollars by using the exchange rates quoted at the close of the London Stock Exchange prior to when the Fund’s NAV is next determined. Purchases and sales of investment securities, income and expenses are translated on the respective dates of such transactions.

The Fund does not isolate that portion of its net realized and unrealized gains and losses on investments resulting from changes in foreign exchange rates from the impact arising from changes in market prices. Such fluctuations are included with net realized and unrealized gain or loss from investments.

Net realized foreign currency transaction gains and losses arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions, and the differences between the amounts of dividends, interest, and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign currency translation gains and losses arise from changes in the value of assets and liabilities, other than investments in securities, resulting from changes in the exchange rates.

(c) Forward Foreign Currency Exchange Contracts

The Fund may utilize forward foreign currency exchange contracts (“forward contracts”) under which they are obligated to exchange currencies on specified future dates at specified rates, and are subject to the translations of foreign exchange rates fluctuations. All contracts are “marked-to-market” daily and any resulting unrealized gains or losses are recorded as unrealized appreciation or depreciation on foreign currency translations. The Fund records realized gains or losses at the time the forward contract is settled. Counterparties to these forward contracts are major U.S. financial institutions.

(d) Futures Contracts

The Fund may use interest rate, foreign currency, index, commodity, and other futures contracts. The Fund may use options on futures contracts. A futures contract provides for the future sale by one party and purchase by another party of a specified quantity of the security or other financial instrument at a specified price and time. The Fund may invest in futures contracts and options on futures contracts through the Subsidiary. For example, a foreign currency futures contract provides for the future sale by one party and the purchase by the other party of a certain amount of a specified non-U.S. currency at a specified price, date, time and place. Similarly, an interest rate futures contract provides for the future sale by one party and the purchase by the other party of a certain amount of a specific interest rate sensitive financial instrument (e.g., a debt security) at a specified price, date, time and place. Securities, commodities and other financial indexes are capitalization weighted indexes that reflect the market value of the securities, commodities or other financial instruments respectively, represented in the indexes. A futures contract on an index is an agreement to be settled by delivery of an amount of cash equal to a specified multiplier times the difference between the value of the index at the close of the last trading day on the contract and the price at which the agreement is made. The clearing house of the exchange on which a futures contract is entered into becomes the counterparty to each purchaser and seller of the futures contract.

Abraham Fortress Fund

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

June 30, 2022

During the period the futures contracts are open, changes in the value of the contracts are recognized as unrealized gains or losses by “marking to market” on a daily basis to reflect the market value of the contracts at the end of each day’s trading. When the contracts are closed or expire, the Fund recognizes a realized gain or loss equal to the difference between the proceeds from, or cost of, the closing transactions and the Fund’s basis in the contract. Cash equal to the proceeds is settled in the broker account when the contracts are closed. In computing daily net asset value, the Fund will mark to market its open futures positions. The Fund also is required to deposit and to maintain margin with respect to put and call options on futures contracts written by it. Such margin deposits will vary depending on the nature of the underlying futures contract (and the related initial margin requirements), the current market value of the option and other futures positions held by the Fund. Although some futures contracts call for making or taking delivery of the underlying assets, generally these obligations are closed out prior to delivery by offsetting purchases or sales of matching futures contracts (involving the same exchange, underlying security or index and delivery month). If an offsetting purchase price is less than the original sale price, the Fund realizes a capital gain, or if it is more, the Fund realizes a capital loss. Conversely, if an offsetting sale price is more than the original purchase price, the Fund realizes a capital gain, or if it is less, the Fund realizes a capital loss. The transaction costs also must be included in these calculations. As discussed below, however, the Fund may not always be able to make an offsetting purchase or sale. In the case of a physically settled futures contract, this could result in the Fund being required to deliver, or receive, the underlying physical commodity, which could be adverse to the Fund. The Subsidiary may enter into agreements with certain parties which may lower margin deposits and mitigate some of the risks of being required to deliver, or receive, the physical commodity.