UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22894

INVESTMENT MANAGERS SERIES TRUST II

(Exact name of registrant as specified in charter)

235 W. Galena Street

Milwaukee, WI 53212

(Address of principal executive offices) (Zip code)

Diane J. Drake

Mutual Fund Administration, LLC

2220 E. Route 66, Suite 226

Glendora, CA 91740

(Name and address of agent for service)

(626) 385-5777

Registrant's telephone number, including area code

Date of fiscal year end: September 30

Date of reporting period: September 30, 2022

Item 1. Report to Stockholders.

The registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Investment Company Act”), is as follows:

The First Trust Capital Management Funds

Each a series of Investment Managers Series Trust II

| Table of Contents | |

| | |

| Shareholder Letter | 1 |

| Fund Performance | 8 |

| Schedule of Investments | 12 |

| Statements of Assets and Liabilities | 37 |

| Statements of Operations | 39 |

| Statements of Changes in Net Assets | 40 |

| Statements of Cash Flows | 42 |

| Financial Highlights | 44 |

| Notes to Financial Statements | 48 |

| Report of Independent Registered Public Accounting Firm | 64 |

| Supplemental Information | 65 |

| Expense Examples | 72 |

This report and the financial statements contained herein are provided for the general information of the shareholders of the First Trust Capital Management Funds. This report is not authorized for distribution to prospective investors in the Funds unless preceded or accompanied by an effective prospectus.

www.firsttrustcapital.com

FIRST TRUST CAPITAL MANAGEMENT FUNDS

ANNUAL SHAREHOLDER LETTER

Contents

| |

| Executive-Level Overview | Market Perspective |

| First Trust Merger Arbitrage Fund | VARAX | VARBX |

| First Trust Multi-Strategy Fund | OMOAX | OMOIX |

Executive-Level Overview

We like to preface our Annual Shareholder Letter with an Executive-level overview to reinforce our investment process and current mindset in present market conditions. As financial markets have faced rate hikes from the Federal Reserve (the “Fed”) and elevated volatility across both equity and credit markets, we continue to be cognizant of the current headline risks that have kept many investors cautious. The volatility across bond markets was in part due to the announcement of multiple rounds of rate hikes and a renewed Fed commitment to maintain an aggressive stance on fighting inflation. In periods of such significant volatility, both to the upside and downside, it becomes inherently more difficult for investors to position portfolios and adjust to new data. In our view, these market environments result in a host of investment implications which tend to manifest themselves in reduced deal volumes, investor base turnover, and pronounced shifts in investor biases. While we actively consider and monitor many of those macro-level risks and their effects on global capital markets, we remain steadfast in our effort to help investors build durable portfolios that provide a high probability of generating positive absolute performance regardless of the broader market environment and throughout various market cycles. While this approach can, at times, limit participation in attractive markets over the short-term, it also alleviates the responsibility of timing shifts in market sentiment that may unwind successful trades rapidly. Over the long term, we remain confident in our products’ ability to help investors construct portfolios that adhere to those investment guidelines. As is customary in our Annual Shareholder Letter, we will review what we believe to be the important drivers of performance and opportunity across each of our Funds for the past fiscal year period.

First Trust Merger Arbitrage Fund

The First Trust Merger Arbitrage Fund (the “Fund”) A and I share classes returned 0.91% and 1.27%, respectively, for the one-year fiscal period ending September 30, 2022. Comparatively, the Bloomberg Aggregate U.S. Bond Index1 (the “Aggregate”) suffered losses of -14.60% over that same lookback period. Downside volatility was not contained to the fixed income market as the S&P 500 Index lost -15.47% of its value in that same time frame. The team is pleased with our preservation of capital and relative performance given one of the worst time periods since the 1930’s for the traditional ”60/40” portfolio.

Amidst challenging market conditions, our merger arbitrage and SPAC portfolio continued to generate consistent returns despite a complicated macro landscape of inflation, rising rates and war. More specifically, the Fund generated positive returns in 8 of the last 12 months, having returned an average of +0.30% in each of those positive months. Comparatively, the Aggregate generated positive returns in only 3 of the last 12 months. In the nine months when the Aggregate saw a negative return, the Fund generated an average monthly return of +0.14% compared to the Aggregate’s average return over those same months of -2.09%. Additionally, the Fund continues to generate those returns with relatively muted risk levels despite macro risks, with realized volatility over the trailing one-year period of only 1.19%. Comparatively, the Aggregate demonstrated a realized volatility of 6.91% over that same timeframe. Additionally, correlation between the Fund and both the Aggregate and the S&P 500 index remains low at 0.06 and 0.44, respectively. As some modest spread widening was seen during market selloff periods, we remain confident in the Fund’s potential to generate a strong risk-adjusted and absolute return stream, largely isolated from broader market factors and developments over full market cycles. Although merger arbitrage strategies are not driven or anchored to market beta or risk, they are not completely agnostic to actions from market participants, and we are proud to have provided ballast to our shareholders’ portfolios during this difficult time period.

| 1 | The Aggregate broadly tracks $15 trillion of fixed income securities, nearly the entire U.S. investment-grade bond market, and includes government securities, mortgage-backed securities, asset-backed securities and corporate securities. |

First Trust Capital Management | 225 W. Wacker Drive | Suite 2100 | Chicago, IL 60606 | P: 773.386.6700 | F: 847.386.2910

The top five deals in the Fund as of September 30, 2022 were Avalara Inc. (AVLR) at a 5.2% position size, Zendesk (ZEN) at 4.2%, Flagstar Bancorp Inc. (FBC) at 3.4%, Switch Inc. (SWCH) at 2.5%, and Change Healthcare Inc. (CHNG) at 2.5%.

Periods of market volatility always bring both worry and opportunity to investors. During these times, we work to make sure our current portfolio risk profile is cognizant of the wider macro environment while keeping our focus on analyzing the opportunities the deal landscape presents us. As has been widely discussed, the market shock and knock-on effects across all assets are significant as we continue to adjust to a new Fed tightening regime and inflation.

The first half of 2022 was quite challenging for M&A in terms of opportunity set, and the expectation of merger activity to decline in softer economic periods is common. Despite this, M&A activity has been better than expected when compared to similar historic market periods, and even during the historically “quiet” summer months. Overall, the deal landscape presented fewer opportunities than typical, but more than enough for our risk-averse style of investing in the deals with the highest probability of closure.

On the SPAC side of the portfolio, we continue to increase our capital allocation into this unique asset class. As a group, SPAC yields to maturity have widened out to over 3%, providing us with significant opportunities to engage. Considering that you are guaranteed the return of your capital from the cash-in-trust and the attractive yield to maturity, SPACs have become a very attractive place to invest amidst the current market conditions. Over the course of the year, we have seen IPO volume contract, correlated to market conditions and the increased scrutiny on SPAC reporting coming from the SEC. When that picture becomes clearer, we are hopeful that the IPO volume could scale back up. In the meantime, the SPAC universe remains vast with many solid investment opportunities available given its material yield in short-dated positions.

We will adapt by remaining intellectually nimble to the current fact set and will be in a good position to take advantage of any market dislocations in high probability opportunities within the merger arb and SPAC universe. Over our 22-year history of merger arbitrage investing, this has worked out well for us with shallow drawdowns, quick recoveries, and no losing years in our entire operating history. We continue to approach the markets as we always have, with a great deal of humility and a risk-adjusted mindset. Thank you to our shareholders for their continued trust.

First Trust Multi-Strategy Fund

The First Trust Multi-Strategy Fund (the “Fund”) A and I Share Classes returned -5.82% and -5.54%, respectively, for the 1-year fiscal period ending September 30, 2022. The Fund’s benchmark, the ICE BofA 3-Month U.S. Treasury Bill Index, finished the fiscal year ending September 30, 2022 with a +0.62% return. The Fund’s negative performance, and underperformance relative to the benchmark, is attributable to the Fund’s put writing and structured credit strategies over the trailing one-year lookback period. These negative returns were largely driven by pressure and volatility seen in the structured credit book along with substantial equity sell-offs affecting our options strategy. Over a longer-term lookback, the overall correlation benefit across the three strategies remains robust, as the Fund’s volatility has remained very low at 4.13%. The diversification benefit within the portfolio is also evident in the fact that the strategies’ overall return-to-risk ratio was higher than each of the underlying strategies on a stand-alone basis.

First Trust Capital Management | 225 W. Wacker Drive | Suite 2100 | Chicago, IL 60606 | P: 773.386.6700 | F: 847.386.2910

Aside from the detractors in the portfolio, the merger arbitrage strategy continued its strong performance with its conservative approach to the merger and acquisition space contributing positive attribution to the portfolio over the year. Additionally, over the course of this year as equity markets sold off and created wider spreads, we were able to use dry powder within the Fund to take advantage of deeply discounted merger arbitrage investments that had been affected. While flows provide short-term volatility in merger spreads, they typically do not influence the fundamental outcomes of M&A deals.

Given the recent volatility in equity markets, we are likely to keep our Merger Arbitrage and Structured Credit allocations in the overweight position to mute aggregate portfolio volatility. We will look to incrementally scale into our Secured Put position if/when we see implied volatility grow to extreme levels, while also focusing on keeping the risk balanced between Merger Arbitrage and Structured Credit.

We continue to believe in the power of conviction-weighted portfolios and think that one of the main challenges to multi-alternative mutual funds historically has been overly diversified portfolios that largely net themselves out to minimal returns. In that vein, we currently allocate to three sub-strategies within the overall Fund. One of our key responsibilities is to remain constantly vigilant with respect to balancing the portfolio across the best mix of underlying strategies, attempting to provide the best chance to meet or exceed our absolute return mandate with a stable risk profile. The underlying strategies in the portfolio were largely selected for their attractive correlation benefits when viewed alongside one another, so the portfolio tends to run relatively balanced from a strategy exposure perspective. Importantly, shifts between strategy allocations have tended to be incremental in nature, in which one strategy may see a decrease in allocation across the course of a quarter while that harvested capital has been pushed to another underlying team with a more active opportunity set. As of the end of the fiscal year, the sub-strategy allocations were as follows: Asset Backed Fixed Income (35%), Arbitrage (42%), and Option Writing (22%).

As always, we thank you for your continued support and intend to work hard to maintain it.

Kind Regards,

|  |

| | |

Michael Peck, CFA Chief Executive Officer, Co-Chief Investment Officer mpeck@FirstTrustCapital.com | Brian R. Murphy Co-Chief Investment Officer bmurphy@FirstTrustCapital.com |

First Trust Capital Management | 225 W. Wacker Drive | Suite 2100 | Chicago, IL 60606 | P: 773.386.6700 | F: 847.386.2910

The views were those of the Portfolio Fund Managers as of September 30, 2022 and may not reflect their views on the date this material is first published or anytime thereafter. These views are intended to assist the shareholders of the Funds in understanding their investments and do not constitute investment advice. This material may contain discussions about investments that may or may not be held by the Funds as of the date of this material. All current and future holdings are subject to risk and to change.

VARBX Risk Considerations

You could lose money by investing in a fund. An investment in a fund is not a deposit of a bank and is not insured or guaranteed. There can be no assurance that a fund’s objective(s) will be achieved. Please refer to each fund’s prospectus and SAI for additional details on a fund’s risks. The order of the below risk factors does not indicate the significance of any particular risk factor.

Market risk is the risk that a particular security, or shares of a fund in general may fall in value. Securities are subject to market fluctuations caused by such factors as general economic conditions, political events, regulatory or market developments, changes in interest rates and perceived trends in securities prices. Shares of a fund could decline in value or underperform other investments as a result. In addition, local, regional or global events such as war, acts of terrorism, spread of infectious disease or other public health issues, recessions, or other events could have significant negative impact on a fund. In February 2022, Russia invaded Ukraine which has caused and could continue to cause significant market disruptions and volatility within the markets in Russia, Europe, and the United States. The hostilities and sanctions resulting from those hostilities could have a significant impact on certain fund investments as well as fund performance. The COVID-19 global pandemic and the ensuing policies enacted by governments and central banks have caused and may continue to cause significant volatility and uncertainty in global financial markets. While the U.S. has resumed “reasonably” normal business activity, many countries continue to impose lockdown measures. Additionally, there is no guarantee that vaccines will be effective against emerging variants of the disease.

In managing a fund’s investment portfolio, the portfolio managers will apply investment techniques and risk analyses that may not have the desired result.

Investments in companies that are the subject of a publicly announced transaction carry the risk the transaction is renegotiated, takes longer to complete than originally planned and that the transaction is never completed. Any such event could cause a fund to incur a loss. The risk/reward payout of merger arbitrage strategies typically is asymmetric, with the losses in failed transactions often far exceeding the gains in successful transactions.

An investment in SPACs, which are typically traded in the over-the-counter market, may also have little or no liquidity and may be subject to restrictions on resale.

Any decrease in negative correlation or increase in positive correlation between hedging positions the Advisor anticipated would be offsetting (such as short and long positions in securities or currencies held by the Fund) could result in significant losses for the Fund.

Leverage may result in losses that exceed the amount originally invested and may accelerate the rates of losses.

Short selling creates special risks which could result in increased gains or losses and volatility of returns. Because losses on short sales arise from increases in the value of the security sold short, such losses are theoretically unlimited.

The use of derivatives, including options, can lead to losses because of adverse movements in the price or value of the underlying asset, index or rate, which may be magnified by certain features of the derivatives.

The Fund must segregate liquid assets or engage in other measures to “cover” open positions with respect to certain kinds of derivatives and short sales.

Certain fund investments may be subject to restrictions on resale, trade over-the-counter or in limited volume, or lack an active trading market. Illiquid securities may trade at a discount and may be subject to wide fluctuations in market value.

High portfolio turnover may result in higher levels of transaction costs and may generate greater tax liabilities for shareholders.

A fund classified as “non-diversified” may invest a relatively high percentage of its assets in a limited number of issuers. As a result, a fund may be more susceptible to a single adverse economic or regulatory occurrence affecting one or more of these issuers, experience increased volatility and be highly concentrated in certain issuers.

The prices of fixed income securities respond to economic developments, particularly interest rate changes, changes to an issuer’s credit rating or market perceptions about the creditworthiness of an issuer.

There is no guarantee that a fund will provide a fixed or stable level of distributions at any time or over any period of time.

High yield securities, or “junk” bonds, are less liquid and are subject to greater market fluctuations and risk of loss than securities with higher ratings, and therefore, are considered to be highly speculative.

First Trust Capital Management | 225 W. Wacker Drive | Suite 2100 | Chicago, IL 60606 | P: 773.386.6700 | F: 847.386.2910

Preferred securities combine some of the characteristics of both common stocks and bonds. Preferred stocks are typically subordinated to other debt instruments in terms of priority to corporate income, and therefore will be subject to greater credit risk than those debt instruments.

Securities of micro-, small- and mid-capitalization companies may be more vulnerable to adverse general market or economic developments, may be less liquid, and may experience greater price volatility than larger, more established companies.

Securities of non-U.S. issuers are subject to additional risks, including currency fluctuations, political risks, withholding, the lack of adequate financial information, and exchange control restrictions impacting non-U.S. issuers.

As the use of Internet technology has become more prevalent in the course of business, funds have become more susceptible to potential operational risks through breaches in cyber security.

Changes in currency exchange rates and the relative value of non-US currencies may affect the value of a fund’s investments and the value of a fund’s shares.

First Trust Capital Management is the adviser to the Fund. The Fund’s distributor is First Trust Portfolios L.P.

The information presented is not intended to constitute an investment recommendation for, or advice to, any specific person. By providing this information, First Trust is not undertaking to give advice in any fiduciary capacity within the meaning of ERISA, the Internal Revenue Code or any other regulatory framework. Financial professionals are responsible for evaluating investment risks independently and for exercising independent judgment in determining whether investments are appropriate for their clients.

OMOIX Risk Considerations

You could lose money by investing in a fund. An investment in a fund is not a deposit of a bank and is not insured or guaranteed. There can be no assurance that a fund’s objective(s) will be achieved. Please refer to each fund’s prospectus and SAI for additional details on a fund’s risks. The order of the below risk factors does not indicate the significance of any particular risk factor.

Alternative Investments may employ complex strategies, have unique investment and risk characteristics and may not be appropriate for all investors.

Market risk is the risk that a particular security, or shares of a fund in general may fall in value. Securities are subject to market fluctuations caused by such factors as general economic conditions, political events, regulatory or market developments, changes in interest rates and perceived trends in securities prices. Shares of a fund could decline in value or underperform other investments as a result. In addition, local, regional or global events such as war, acts of terrorism, spread of infectious disease or other public health issues, recessions, or other events could have significant negative impact on a fund. In February 2022, Russia invaded Ukraine which has caused and could continue to cause significant market disruptions and volatility within the markets in Russia, Europe, and the United States. The hostilities and sanctions resulting from those hostilities could have a significant impact on certain fund investments as well as fund performance. The COVID-19 global pandemic and the ensuing policies enacted by governments and central banks have caused and may continue to cause significant volatility and uncertainty in global financial markets. While the U.S. has resumed “reasonably” normal business activity, many countries continue to impose lockdown measures. Additionally, there is no guarantee that vaccines will be effective against emerging variants of the disease.

In managing a fund’s investment portfolio, the portfolio managers will apply investment techniques and risk analyses that may not have the desired result.

Because the shares of CEFs cannot be redeemed upon demand, shares of many CEFs will trade on exchanges at market prices rather than net asset value, which may cause the shares to trade at a price greater than NAV (premium) or less than NAV (discount).

A fund may invest in the shares of CEFs, ETFs and ETNs which involves additional expenses that would not be present in a direct investment in the underlying funds. In addition, a fund’s investment performance and risks may be related to the investment performance and risks of the underlying funds.

Collateralized loan obligations (“CLOs”) carry additional risks, including, the possibility that distributions from collateral securities will not be adequate to make interest or other payments, the quality of the collateral may decline in value or default, the possibility that the investments in CLOs are subordinate to other classes or tranches, and the complex structure of the security may not be fully understood at the time of investment and may produce disputes with the issuer or unexpected investment results.

Certain structured products may be thinly traded or have a limited trading market and as a result may be characterized by the fund as illiquid securities.

Mortgage-related securities are more susceptible to adverse economic, political or regulatory events that affect the value of real estate. They are also subject to the risk that the rate of mortgage prepayments decreases, which extends the average life of a security and increases the interest rate exposure. Investments in companies that are the subject of a publicly announced transaction carry the risk the transaction is renegotiated, takes longer to complete than originally planned and that the transaction is never completed. Any such event could cause the fund to incur a loss. The risk/reward payout of merger arbitrage strategies typically is asymmetric, with the losses in failed transactions often far exceeding the gains in successful transactions.

First Trust Capital Management | 225 W. Wacker Drive | Suite 2100 | Chicago, IL 60606 | P: 773.386.6700 | F: 847.386.2910

The stocks of companies that have recently conducted an initial public offering are often subject to price volatility and speculative trading. These stocks may have exhibited above average price appreciation in connection with the initial public offering prior to inclusion in a fund. The price of stocks included in a fund may not continue to appreciate and their performance may not replicate the performance exhibited in the past.

The use of derivatives, including futures, options, swap agreements, and forward contracts, can lead to losses because of adverse movements in the price or value of the underlying asset, index or rate, which may be magnified by certain features of the derivatives.

Short selling creates special risks which could result in increased gains or losses and volatility of returns. Because losses on short sales arise from increases in the value of the security sold short, such losses are theoretically unlimited.

Leverage may result in losses that exceed the amount originally invested and may accelerate the rates of losses.

A fund may be subject to the risk that a counterparty will not fulfill its obligations which may result in significant financial loss to a fund.

Certain securities are subject to call, credit, interest rate, extension, and prepayment risks. These risks could result in a decline in a security’s value and/or income, increased volatility as interest rates rise or fall and have an adverse impact on a fund’s performance.

Subordinated securities are more likely to suffer a credit loss than non-subordinated securities of the same issuer and that loss is likely to be proportionately greater and take more time to recover interest or principal.

High yield securities, or “junk” bonds, are less liquid and are subject to greater market fluctuations and risk of loss than securities with higher ratings, and therefore, are considered to be highly speculative. Repurchase agreements typically involve the acquisition by a fund of fixed-income securities from a selling financial institution such as a bank or broker-dealer. A fund may incur a loss if the other party to a repurchase agreement is unwilling or unable to fulfill its contractual obligations to repurchase the underlying security. Reverse repurchase agreements involve the risk that the other party may fail to return the securities in a timely manner or at all. A fund could lose money if it is unable to recover the securities and/or if the value of collateral held by a fund, including the value of the investments made with cash collateral, is less than the value of securities.

To the extent a fund invests in floating or variable rate obligations that use the London Interbank Offered Rate (“LIBOR”) as a reference interest rate, it is subject to LIBOR Risk. The United Kingdom’s Financial Conduct Authority, which regulates LIBOR, has ceased making LIBOR available as a reference rate over a phase-out period that began December 31, 2021. There is no assurance that any alternative reference rate, including the Secured Overnight Financing Rate (“SOFR”) will be similar to or produce the same value or economic equivalence as LIBOR or that instruments using an alternative rate will have the same volume or liquidity. The unavailability or replacement of LIBOR may affect the value, liquidity or return on certain fund investments and may result in costs incurred in connection with closing out positions and entering into new trades. Any potential effects of the transition away from LIBOR on a fund or on certain instruments in which a fund invests can be difficult to ascertain, and they may vary depending on a variety of factors, and they could result in losses to a fund.

Securities of micro, small- and mid-capitalization companies may experience greater price volatility and be less liquid than larger, more established companies.

Securities of non-U.S. issuers are subject to additional risks, including currency fluctuations, political risks, withholding, the lack of adequate financial information, and exchange control restrictions impacting non-U.S. issuers. These risks may be heightened for securities of companies located in, or with significant operations in, emerging market countries.

Changes in currency exchange rates and the relative value of non-US currencies may affect the value of a fund’s investments and the value of a fund’s shares.

Stocks with growth characteristics tend to be more volatile than certain other stocks and their prices may fluctuate more dramatically than the overall stock market.

A fund with significant exposure to a single sector may be more affected by an adverse economic or political development than a broadly diversified fund.

High portfolio turnover may result in higher levels of transaction costs and may generate greater tax liabilities for shareholders.

Portfolio holdings that are valued using techniques other than market quotations may be subject to greater fluctuation in their valuations from one day to the next than if market quotations were used.

Value stocks are subject to the risk that valuations never improve or that the returns on value stocks are less than returns on other styles of investing or the overall stock market.

Securities issued or guaranteed by federal agencies and U.S. government sponsored instrumentalities may or may not be backed by the full faith and credit of the U.S. government.

As the use of Internet technology has become more prevalent in the course of business, funds have become more susceptible to potential operational risks through breaches in cyber security.

The prices of fixed income securities respond to economic developments, particularly interest rate changes, changes to an issuer’s credit rating or market perceptions about the creditworthiness of an issuer.

There is no guarantee that a fund will provide a fixed or stable level of distributions at any time or over any period of time.

First Trust Capital Management | 225 W. Wacker Drive | Suite 2100 | Chicago, IL 60606 | P: 773.386.6700 | F: 847.386.2910

First Trust Capital Management is the adviser to the Fund. The Fund’s distributor is First Trust Portfolios L.P.

The information presented is not intended to constitute an investment recommendation for, or advice to, any specific person. By providing this information, First Trust is not undertaking to give advice in any fiduciary capacity within the meaning of ERISA, the Internal Revenue Code or any other regulatory framework. Financial professionals are responsible for evaluating investment risks independently and for exercising independent judgment in determining whether investments are appropriate for their clients.

First Trust Capital Management | 225 W. Wacker Drive | Suite 2100 | Chicago, IL 60606 | P: 773.386.6700 | F: 847.386.2910

First Trust Merger Arbitrage Fund

FUND PERFORMANCE at September 30, 2022 (Unaudited)

This graph compares a hypothetical $500,000 investment in the Fund’s Class I shares with a similar investment in the Bloomberg Barclays US Aggregate Bond Index and the S&P 500 Index during the periods shown. The performance graph above is shown for the Fund’s Class I shares. Class A shares performance may vary. Results include the reinvestment of all dividends and capital gains.

| Average Annual Total Returns as of September 30, 2022 | 1 Year | 5 Years | 10 Years |

| Before deducting maximum sales charge | | | |

| Class A¹ | 0.91% | 3.18% | 3.47% |

| Class I² | 1.27% | 3.52% | 3.79% |

| After deducting maximum sales charge | | | |

| Class A¹ | -4.88% | 1.96% | 2.86% |

| Bloomberg Barclays US Aggregate Bond Index | -14.60% | -0.27% | 0.89% |

| S&P 500 Index | -15.47% | 9.24% | 11.70% |

| 1 | Maximum sales charge for Class A shares is 5.75%. No sales charge applies on investments of $1 million or more, but a contingent deferred sales charge of 1.00% will be imposed to the extent a finder’s fee was paid on certain redemptions of such shares within 12 months of the date of purchase. |

| 2 | Class I shares do not have any initial or deferred sales charge. |

The performance data quoted here represents past performance and past performance is not a guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. The most recent month end performance may be obtained by calling (877) 779-1999.

The expense ratios for Class A and Class I shares were 2.12% and 1.81%, respectively, which were the amounts stated in the current prospectus dated February 1, 2022. For the Fund’s current one year expense ratios, please refer to the Financial Highlights section of this report. The Fund’s advisor has contractually agreed to waive its fees and/or pay for operating expenses of the Fund to ensure that total annual fund operating expenses do not exceed 1.85% and 1.55% of the average daily net assets of the Fund’s Class A and Class I shares, respectively. This agreement is in effect until November 1, 2023, and it may be terminated before that date only by the Trust’s Board of Trustees.

First Trust Merger Arbitrage Fund

FUND PERFORMANCE at September 30, 2022 (Unaudited) – Continued

The Fund commenced investment operations on October 1, 2015, after the reorganization of Highland Capital Management Institutional Fund, LLC, a Delaware limited liability company which commenced operations on April 1, 2000 (the “Predecessor Fund”), into the Fund, pursuant to which the Predecessor Fund transferred substantially all of its assets into the Fund. As a result of the reorganization, the Fund is the accounting successor of the Predecessor Fund. The Predecessor Fund was not registered under the 1940 Act and, therefore, was not subject to certain restrictions imposed by the 1940 Act on registered investment companies and by the Internal Revenue Code of 1986, as amended, on regulated investment companies such as the Fund. Performance results shown in the graph and the performance table above for the period prior to October 1, 2015 reflect the performance of the Predecessor Fund.

Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and the performance table shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Shares redeemed within 30 days of purchase will be charged a redemption fee of 1.00%.

The Bloomberg Barclays US Aggregate Bond Index is market capitalization weighted and includes treasury securities, government agency bonds, mortgage backed bonds and corporate bonds. It excludes municipal bonds and treasury inflation-protected securities because of tax treatment. The S&P 500 Index includes a representative sample of 500 leading companies in leading industries of the U.S. economy and assumes any dividends are reinvested back into the index. These indices do not reflect expenses, fees or sales charge, which would lower performance. The indices are unmanaged and they are not available for investment.

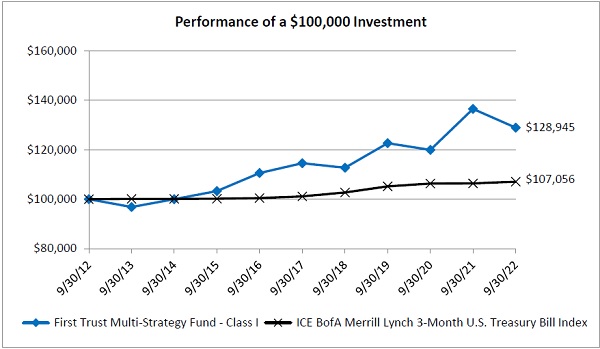

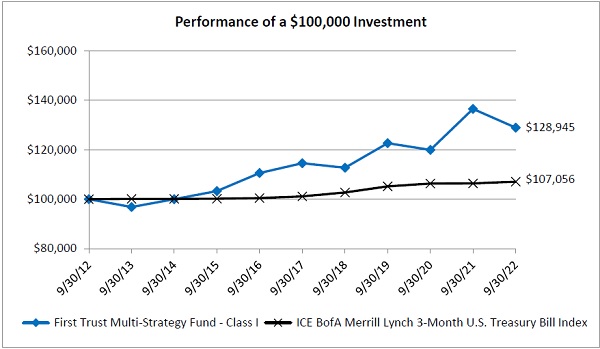

First Trust Multi-Strategy Fund

FUND PERFORMANCE at September 30, 2022 (Unaudited)

This graph compares a hypothetical $100,000 investment in the Fund’s Class I shares with a similar investment in the ICE BofA Merrill Lynch 3-Month U.S. Treasury Bill Index during the periods shown. The performance graph above is shown for the Fund’s Class I shares. Class A shares performance may vary. Results include the reinvestment of all dividends and capital gains.

| Average Annual Total Returns as of September 30, 2022 | 1 Year | 5 Years | 10 Years |

| Before deducting maximum sales charge | | | |

| Class A¹ | -5.82% | 2.11% | 2.27% |

| Class I² | -5.54% | 2.40% | 2.57% |

| After deducting maximum sales charge | | | |

| Class A¹ | -10.52% | 1.06% | 1.75% |

| ICE BofA Merrill Lynch 3-Month U.S. Treasury Bill Index | 0.62% | 1.15% | 0.68% |

| 1 | Effective August 22, 2022, maximum sales charge was lowered from 5.00% to 4.50%. No sales charge applies on investments of $250,000 or more, but a contingent deferred sales charge of 0.50% will be imposed to the extent a finder’s fee was paid on certain redemptions of such shares within 12 months of the date of purchase. Prior to August 22, 2022, the contingent deferred sales charge was 1.00%. |

| 2 | Class I shares do not have any initial or deferred sales charge. |

The performance data quoted here represents past performance and past performance is not a guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. The most recent month end performance may be obtained by calling (877) 779-1999.

The expense ratios for Class A and Class I shares were 2.60% and 2.37%, respectively, which were the amounts stated in the current prospectus dated February 1, 2022, as amended April 27, 2022. For the Fund’s current one year expense ratios, please refer to the Financial Highlights section of this report. The Fund’s advisor has contractually agreed to waive its fees and/or pay for operating expenses of the Fund to ensure that total annual fund operating expenses do not exceed 1.85% and 1.55% of the average daily net assets of the Fund’s Class A and Class I shares, respectively. This agreement is in effect until November 1, 2023, and it may be terminated before that date only by the Trust’s Board of Trustees.

First Trust Multi-Strategy Fund

FUND PERFORMANCE at September 30, 2022 (Unaudited) – Continued

The Fund commenced investment operations on December 16, 2016, after the reorganization of Vivaldi Orinda Macro Opportunities Fund, which commenced operations on April 30, 2012 (the “Predecessor Fund”), into the Fund, pursuant to which the Predecessor Fund transferred substantially all of its assets into the Fund. As a result of the reorganization, the Fund is the accounting successor of the Predecessor Fund. Performance results shown in the graph and the performance table above for the period prior to December 16, 2016 reflect the performance of the Predecessor Fund.

Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and the performance table shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

The ICE BofA Merrill Lynch 3-Month U.S. Treasury Bill Index tracks the performance of the U.S. Dollar denominated U.S. Treasury Bills publicly issued in the U.S. Domestic Market with a remaining term to final maturity of less than 3 months. This index does not reflect expenses, fees or sales charges, which would lower performance. The index is unmanaged and it is not available for investment.

First Trust Merger Arbitrage Fund

SCHEDULE OF INVESTMENTS

As of September 30, 2022

Number

of Shares | | | | | Value | |

| | | | | COMMON STOCKS — 95.3% | | | | |

| | | | | COMMERCIAL BANKS-CENTRAL US — 3.4% | | | | |

| | 2,212,106 | | | Flagstar Bancorp, Inc.1 | | $ | 73,884,340 | |

| | | | | | | | | |

| | | | | COMMERCIAL BANKS-SOUTHERN US — 0.0% | | | | |

| | 2,600 | | | First Horizon Corp.1 | | | 59,540 | |

| | | | | | | | | |

| | | | | COMPUTER DATA SECURITY — 0.6% | | | | |

| | 494,500 | | | Ping Identity Holding Corp.* | | | 13,880,615 | |

| | | | | | | | | |

| | | | | COMPUTER SERVICES — 1.9% | | | | |

| | 731,189 | | | Computer Services, Inc.1 | | | 40,763,787 | |

| | | | | | | | | |

| | | | | ELECTRONIC MEASURING INSTRUMENTS — 0.5% | | | | |

| | 193,068 | | | CyberOptics Corp.* | | | 10,383,197 | |

| | | | | | | | | |

| | | | | ENTERPRISE SOFTWARE/SERVICE — 5.5% | | | | |

| | 1,221,556 | | | Avalara, Inc.*,1 | | | 112,138,841 | |

| | 727,295 | | | BTRS Holdings, Inc.* | | | 6,734,752 | |

| | | | | | | | 118,873,593 | |

| | | | | INTERNET APPLICATION SOFTWARE — 4.2% | | | | |

| | 1,195,756 | | | Zendesk, Inc.* | | | 90,997,032 | |

| | | | | | | | | |

| | | | | MEDICAL INFORMATION SYSTEMS — 2.7% | | | | |

| | 549,850 | | | 1Life Healthcare, Inc.*,1 | | | 9,429,927 | |

| | 1,800,181 | | | Change Healthcare, Inc.* | | | 49,486,976 | |

| | | | | | | | 58,916,903 | |

| | | | | MEDICAL-BIOMEDICAL/GENERICS — 5.6% | | | | |

| | 276,667 | | | Biohaven Pharmaceutical Holding Co., Ltd.* | | | 41,823,750 | |

| | 715,842 | | | ChemoCentryx, Inc.*,1 | | | 36,980,398 | |

| | 1,017,722 | | | Forma Therapeutics Holdings, Inc.* | | | 20,303,554 | |

| | 345,341 | | | Global Blood Therapeutics, Inc.* | | | 23,517,722 | |

| | | | | | | | 122,625,424 | |

| | | | | OIL REFINING & MARKETING — 0.2% | | | | |

| | 218,718 | | | Sprague Resources LP1 | | | 4,339,365 | |

| | | | | | | | | |

| | | | | REITS-SINGLE TENANT — 1.3% | | | | |

| | 908,972 | | | STORE Capital Corp. | | | 28,478,093 | |

| | | | | | | | | |

| | | | | SPECIFIED PURPOSE ACQUISITIONS — 66.9% | | | | |

| | 195,867 | | | 10X Capital Venture Acquisition Corp. II - Class A* | | | 1,958,670 | |

| | 45,000 | | | 10X Capital Venture Acquisition Corp. III - Class A* | | | 454,500 | |

First Trust Merger Arbitrage Fund

SCHEDULE OF INVESTMENTS - Continued

As of September 30, 2022

Number

of Shares | | | | | Value | |

| | | | | COMMON STOCKS (Continued) | | | | |

| | | | | SPECIFIED PURPOSE ACQUISITIONS (Continued) | | | | |

| | 1,000,031 | | | 26 Capital Acquisition Corp.* | | $ | 9,870,306 | |

| | 35,042 | | | 5:01 Acquisition Corp. - Class A* | | | 350,070 | |

| | 3,200 | | | 7 Acquisition Corp. - Class A* | | | 32,288 | |

| | 288,514 | | | 7GC & Co. Holdings, Inc. - Class A* | | | 2,867,829 | |

| | 575,337 | | | ABG Acquisition Corp. I - Class A* | | | 5,713,096 | |

| | 146,522 | | | Accelerate Acquisition Corp. - Class A* | | | 1,438,846 | |

| | 421,934 | | | Accretion Acquisition Corp.* | | | 4,194,024 | |

| | 543,572 | | | Achari Ventures Holdings Corp. I* | | | 5,462,899 | |

| | 988,000 | | | Acropolis Infrastructure Acquisition Corp. - Class A* | | | 9,588,540 | |

| | 321,806 | | | Adara Acquisition Corp. - Class A* | | | 3,201,970 | |

| | 701,030 | | | Adit EdTech Acquisition Corp.* | | | 6,933,187 | |

| | 230,460 | | | Advanced Merger Partners, Inc. - Class A* | | | 2,267,726 | |

| | 511,254 | | | Aequi Acquisition Corp. - Class A* | | | 5,107,427 | |

| | 556,574 | | | Aesther Healthcare Acquisition Corp. - Class A*,2 | | | 5,671,489 | |

| | 651,500 | | | Aetherium Acquisition Corp. - Class A*,2 | | | 6,475,910 | |

| | 15,800 | | | AfterNext HealthTech Acquisition Corp. - Class A* | | | 154,366 | |

| | 122,956 | | | Agile Growth Corp. - Class A* | | | 1,220,953 | |

| | 5,730 | | | Ahren Acquisition Corp. - Class A* | | | 57,529 | |

| | 32,807 | | | Alpha Partners Technology Merger Corp.* | | | 322,165 | |

| | 20,633 | | | ALSP Orchid Acquisition Corp. I - Class A* | | | 206,949 | |

| | 97,276 | | | AltEnergy Acquisition Corp. - Class A* | | | 970,814 | |

| | 1,049,725 | | | Altimeter Growth Corp. II - Class A* | | | 10,402,775 | |

| | 100 | | | Andretti Acquisition Corp. - Class A* | | | 1,004 | |

| | 354,938 | | | Anzu Special Acquisition Corp. I - Class A* | | | 3,489,041 | |

| | 26,700 | | | Apeiron Capital Investment Corp. - Class A* | | | 268,335 | |

| | 256,028 | | | Apollo Strategic Growth Capital II - Class A* | | | 2,526,996 | |

| | 3,600 | | | APx Acquisition Corp. I - Class A* | | | 36,540 | |

| | 250,567 | | | Arbor Rapha Capital Bioholdings Corp. I - Class A* | | | 2,533,232 | |

| | 128,996 | | | Arctos NorthStar Acquisition Corp.* | | | 1,278,350 | |

| | 125,000 | | | Arena Fortify Acquisition Corp. - Class A* | | | 1,253,750 | |

| | 13,070 | | | Ares Acquisition Corp. - Class A* | | | 129,785 | |

| | 121,020 | | | Argus Capital Corp. - Class A* | | | 1,216,856 | |

| | 233,669 | | | Armada Acquisition Corp. I* | | | 2,317,996 | |

| | 109,925 | | | Arogo Capital Acquisition Corp. - Class A* | | | 1,092,654 | |

| | 502,283 | | | Arrowroot Acquisition Corp. - Class A* | | | 4,932,419 | |

| | 200,200 | | | ARYA Sciences Acquisition Corp. IV - Class A* | | | 1,983,982 | |

| | 159,629 | | | ARYA Sciences Acquisition Corp. V - Class A* | | | 1,564,364 | |

| | 192,109 | | | Ascendant Digital Acquisition Corp. III - Class A* | | | 1,947,985 | |

| | 20,658 | | | Astrea Acquisition Corp. - Class A* | | | 203,275 | |

| | 1,078,165 | | | Athena Consumer Acquisition Corp. - Class A* | | | 10,835,558 | |

| | 1,008,223 | | | Athlon Acquisition Corp. - Class A* | | | 9,961,243 | |

First Trust Merger Arbitrage Fund

SCHEDULE OF INVESTMENTS - Continued

As of September 30, 2022

Number

of Shares | | | | | Value | |

| | | | | COMMON STOCKS (Continued) | | | | |

| | | | | SPECIFIED PURPOSE ACQUISITIONS (Continued) | | | | |

| | 314,379 | | | Atlantic Avenue Acquisition Corp. - Class A* | | $ | 3,156,365 | |

| | 153,049 | | | Atlantic Coastal Acquisition Corp. - Class A* | | | 1,502,941 | |

| | 284,632 | | | Atlantic Coastal Acquisition Corp. II - Class A* | | | 2,852,013 | |

| | 59,674 | | | Ault Disruptive Technologies Corp.* | | | 601,514 | |

| | 1,100 | | | Aura FAT Projects Acquisition Corp. - Class A* | | | 11,077 | |

| | 970,391 | | | Aurora Acquisition Corp. - Class A* | | | 9,597,167 | |

| | 227,431 | | | Aurora Technology Acquisition Corp. - Class A* | | | 2,278,859 | |

| | 901,851 | | | Austerlitz Acquisition Corp. I - Class A* | | | 8,847,158 | |

| | 1,897,771 | | | Austerlitz Acquisition Corp. II - Class A* | | | 18,617,134 | |

| | 165,000 | | | Authentic Equity Acquisition Corp. - Class A* | | | 1,641,750 | |

| | 935,922 | | | Avalon Acquisition, Inc. - Class A* | | | 9,368,579 | |

| | 281,865 | | | Avanti Acquisition Corp.* | | | 2,824,287 | |

| | 35,419 | | | Avista Public Acquisition Corp. II - Class A* | | | 361,628 | |

| | 14,375 | | | AXIOS Sustainable Growth Acquisition Corp. - Class A* | | | 145,331 | |

| | 182,040 | | | B Riley Principal 250 Merger Corp. - Class A* | | | 1,782,172 | |

| | 343,174 | | | Banner Acquisition Corp. - Class A* | | | 3,397,423 | |

| | 1,143,700 | | | Banyan Acquisition Corp. - Class A* | | | 11,425,563 | |

| | 369,050 | | | Battery Future Acquisition Corp. - Class A* | | | 3,723,235 | |

| | 197,172 | | | BCLS Acquisition Corp. - Class A* | | | 1,975,663 | |

| | 4,400 | | | Belong Acquisition Corp. - Class A* | | | 43,384 | |

| | 441,803 | | | Benessere Capital Acquisition Corp. - Class A* | | | 4,581,497 | |

| | 249,829 | | | Berenson Acquisition Corp. I - Class A* | | | 2,458,317 | |

| | 1,038,690 | | | Better World Acquisition Corp.2 | | | 10,760,828 | |

| | 90,136 | | | Big Sky Growth Partners, Inc. - Class A* | | | 881,530 | |

| | 140,000 | | | BioPlus Acquisition Corp. - Class A* | | | 1,402,800 | |

| | 18,377 | | | Biotech Acquisition Co. - Class A* | | | 182,392 | |

| | 481 | | | Bite Acquisition Corp.* | | | 4,733 | |

| | 152,100 | | | Black Mountain Acquisition Corp. - Class A* | | | 1,525,563 | |

| | 11,903 | | | Black Spade Acquisition Co. - Class A* | | | 116,530 | |

| | 65,000 | | | Blockchain Coinvestors Acquisition Corp. I - Class A* | | | 655,850 | |

| | 385,890 | | | Blockchain Moon Acquisition Corp.* | | | 3,851,182 | |

| | 23,463 | | | Blue Ocean Acquisition Corp. - Class A* | | | 234,865 | |

| | 17,539 | | | Blue Safari Group Acquisition Corp. - Class A* | | | 180,476 | |

| | 774,530 | | | BlueRiver Acquisition Corp. - Class A* | | | 7,667,847 | |

| | 850,753 | | | BOA Acquisition Corp. - Class A* | | | 8,456,485 | |

| | 887,287 | | | Bridgetown Holdings Ltd. - Class A* | | | 8,899,489 | |

| | 139,523 | | | Bright Lights Acquisition Corp. - Class A* | | | 1,382,673 | |

| | 252 | | | Broad Capital Acquisition Corp.* | | | 2,520 | |

| | 104,300 | | | Broadscale Acquisition Corp. - Class A* | | | 1,027,355 | |

| | 29,902 | | | Build Acquisition Corp. - Class A* | | | 293,638 | |

| | 43,259 | | | BurTech Acquisition Corp. - Class A* | | | 432,590 | |

First Trust Merger Arbitrage Fund

SCHEDULE OF INVESTMENTS - Continued

As of September 30, 2022

Number

of Shares | | | | | Value | |

| | | | | COMMON STOCKS (Continued) | | | | |

| | | | | SPECIFIED PURPOSE ACQUISITIONS (Continued) | | | | |

| | 3,000 | | | BYTE Acquisition Corp. - Class A* | | $ | 29,700 | |

| | 75,195 | | | C5 Acquisition Corp. - Class A* | | | 754,206 | |

| | 102,786 | | | Cactus Acquisition Corp. I Ltd. - Class A* | | | 1,032,999 | |

| | 916,100 | | | Canna-Global Acquisition Corp. - Class A* | | | 9,280,093 | |

| | 4,340 | | | Capitalworks Emerging Markets Acquisition Corp. - Class A* | | | 43,877 | |

| | 744,270 | | | Carney Technology Acquisition Corp. II - Class A* | | | 7,405,486 | |

| | 941,469 | | | Cartesian Growth Corp. - Class A* | | | 9,329,958 | |

| | 199,998 | | | CARTESIAN GROWTH Corp. II* | | | 1,999,980 | |

| | 310,164 | | | Cartica Acquisition Corp. - Class A* | | | 3,129,555 | |

| | 130,854 | | | Cascadia Acquisition Corp. - Class A* | | | 1,286,295 | |

| | 1 | | | Catalyst Partners Acquisition Corp. - Class A* | | | 10 | |

| | 516,372 | | | Catcha Investment Corp. - Class A* | | | 5,112,083 | |

| | 187,642 | | | CF Acquisition Corp. IV - Class A* | | | 1,867,038 | |

| | 517,754 | | | CF Acquisition Corp. VII - Class A* | | | 5,177,540 | |

| | 159,542 | | | CF Acquisition Corp. VIII - Class A* | | | 1,627,328 | |

| | 31,347 | | | Chain Bridge I - Class A* | | | 316,605 | |

| | 16,847 | | | Chavant Capital Acquisition Corp.* | | | 169,649 | |

| | 28,750 | | | Chenghe Acquisition Co. - Class A* | | | 289,513 | |

| | 601,461 | | | Churchill Capital Corp. V - Class A* | | | 5,954,464 | |

| | 64,171 | | | Churchill Capital Corp. VI - Class A* | | | 630,865 | |

| | 1,082,110 | | | Churchill Capital Corp. VII - Class A* | | | 10,637,141 | |

| | 741,214 | | | Clarim Acquisition Corp. - Class A* | | | 7,330,606 | |

| | 1,182,547 | | | Class Acceleration Corp.* | | | 11,683,564 | |

| | 194,631 | | | Climate Real Impact Solutions II Acquisition Corp. - Class A* | | | 1,919,062 | |

| | 785,732 | | | Colicity, Inc. - Class A* | | | 7,731,603 | |

| | 3,000 | | | Coliseum Acquisition Corp. - Class A* | | | 29,460 | |

| | 6,639 | | | Colombier Acquisition Corp. - Class A* | | | 64,531 | |

| | 82,310 | | | Colonnade Acquisition Corp. II - Class A* | | | 816,515 | |

| | 30,900 | | | Compass Digital Acquisition Corp. - Class A* | | | 301,893 | |

| | 1,410,848 | | | Compute Health Acquisition Corp. - Class A* | | | 13,925,070 | |

| | 166,638 | | | Concord Acquisition Corp. - Class A* | | | 1,674,712 | |

| | 84,084 | | | Concord Acquisition Corp. II - Class A* | | | 814,774 | |

| | 704,614 | | | Concord Acquisition Corp. III - Class A* | | | 7,067,278 | |

| | 935,917 | | | Constellation Acquisition Corp. I - Class A* | | | 9,293,656 | |

| | 296,832 | | | Conx Corp. - Class A* | | | 2,968,320 | |

| | 334,744 | | | Corner Growth Acquisition Corp. - Class A* | | | 3,337,398 | |

| | 26,500 | | | Counter Press Acquisition Corp.* | | | 267,120 | |

| | 152,801 | | | COVA Acquisition Corp. - Class A* | | | 1,518,842 | |

| | 4,476 | | | Crescera Capital Acquisition Corp. - Class A* | | | 44,939 | |

| | 209,886 | | | Crixus BH3 Acquisition Co. - Class A* | | | 2,084,168 | |

| | 127,239 | | | Crown PropTech Acquisitions - Class A* | | | 1,262,211 | |

First Trust Merger Arbitrage Fund

SCHEDULE OF INVESTMENTS - Continued

As of September 30, 2022

Number

of Shares | | | | | Value | |

| | | | | COMMON STOCKS (Continued) | | | | |

| | | | | SPECIFIED PURPOSE ACQUISITIONS (Continued) | | | | |

| | 530,636 | | | Crucible Acquisition Corp. - Class A* | | $ | 5,285,135 | |

| | 313,339 | | | D & Z Media Acquisition Corp. - Class A* | | | 3,092,656 | |

| | 6,132 | | | Deep Lake Capital Acquisition Corp.* | | | 61,136 | |

| | 308,331 | | | Deep Medicine Acquisition Corp. - Class A* | | | 3,107,976 | |

| | 111,500 | | | Denali Capital Acquisition Corp. - Class A* | | | 1,122,805 | |

| | 231,585 | | | DHB Capital Corp. - Class A* | | | 2,278,796 | |

| | 633,658 | | | DHC Acquisition Corp. - Class A* | | | 6,266,878 | |

| | 150,000 | | | DiamondHead Holdings Corp. - Class A* | | | 1,480,500 | |

| | 740,577 | | | Digital Health Acquisition Corp.* | | | 7,502,045 | |

| | 4,293 | | | Digital Transformation Opportunities Corp. - Class A* | | | 42,157 | |

| | 200 | | | DILA Capital Acquisition Corp. - Class A* | | | 1,990 | |

| | 421,432 | | | Direct Selling Acquisition Corp. - Class A* | | | 4,269,106 | |

| | 267 | | | Disruptive Acquisition Corp. I - Class A* | | | 2,654 | |

| | 506,118 | | | dMY Technology Group, Inc. VI - Class A* | | | 5,040,935 | |

| | 29,600 | | | DP Cap Acquisition Corp. I - Class A* | | | 298,664 | |

| | 530,611 | | | Dragoneer Growth Opportunities Corp. III - Class A* | | | 5,194,682 | |

| | 811,457 | | | DTRT Health Acquisition Corp. - Class A* | | | 8,252,518 | |

| | 287,198 | | | East Resources Acquisition Co. - Class A* | | | 2,883,468 | |

| | 199,833 | | | Edify Acquisition Corp. - Class A* | | | 1,976,348 | |

| | 993,132 | | | EG Acquisition Corp. - Class A* | | | 9,712,732 | |

| | 439,580 | | | Emerging Markets Horizon Corp. - Class A* | | | 4,391,404 | |

| | 961,920 | | | Empowerment & Inclusion Capital I Corp. - Class A* | | | 9,503,770 | |

| | 793,340 | | | Enterprise 4.0 Technology Acquisition Corp. - Class A* | | | 8,012,734 | |

| | 627,604 | | | Epiphany Technology Acquisition Corp. - Class A* | | | 6,200,728 | |

| | 542,764 | | | EQ Health Acquisition Corp. - Class A* | | | 5,359,794 | |

| | 176,005 | | | ESGEN Acquisition Corp. - Class A* | | | 1,784,691 | |

| | 206,265 | | | Eucrates Biomedical Acquisition Corp.* | | | 2,068,838 | |

| | 218,600 | | | European Biotech Acquisition Corp. - Class A* | | | 2,168,512 | |

| | 300,000 | | | EVe Mobility Acquisition Corp. - Class A* | | | 3,027,000 | |

| | 23,365 | | | Everest Consolidator Acquisition Corp. - Class A* | | | 234,818 | |

| | 30,000 | | | Evergreen Corp. - Class A* | | | 302,400 | |

| | 252,212 | | | Evo Acquisition Corp. - Class A* | | | 2,479,244 | |

| | 300,000 | | | ExcelFin Acquisition Corp. - Class A* | | | 3,006,000 | |

| | 669,285 | | | Executive Network Partnering Corp. - Class A* | | | 6,679,464 | |

| | 1,036,619 | | | Far Peak Acquisition Corp. - Class A* | | | 10,252,162 | |

| | 805,288 | | | FAST Acquisition Corp. II - Class A* | | | 7,903,902 | |

| | 150,000 | | | Fat Projects Acquisition Corp. - Class A* | | | 1,492,500 | |

| | 155,060 | | | Feutune Light Acquisition Corp. - Class A* | | | 1,542,847 | |

| | 880 | | | FG Merger Corp.* | | | 8,818 | |

| | 387,000 | | | Fifth Wall Acquisition Corp. III - Class A* | | | 3,808,080 | |

| | 174,817 | | | Figure Acquisition Corp. I - Class A* | | | 1,721,947 | |

First Trust Merger Arbitrage Fund

SCHEDULE OF INVESTMENTS - Continued

As of September 30, 2022

Number

of Shares | | | | | Value | |

| | | | | COMMON STOCKS (Continued) | | | | |

| | | | | SPECIFIED PURPOSE ACQUISITIONS (Continued) | | | | |

| | 509,696 | | | Financial Strategies Acquisition Corp.* | | $ | 5,112,251 | |

| | 50,182 | | | Finnovate Acquisition Corp. - Class A* | | | 506,336 | |

| | 400,300 | | | FinServ Acquisition Corp. II - Class A* | | | 3,938,952 | |

| | 1,097,844 | | | Fintech Acquisition Corp. V - Class A* | | | 10,934,526 | |

| | 401,078 | | | FinTech Acquisition Corp. VI - Class A* | | | 3,990,726 | |

| | 1,000,001 | | | Fintech Ecosystem Development Corp. - Class A*,2 | | | 10,050,010 | |

| | 6,360 | | | Fintech Evolution Acquisition Group - Class A* | | | 63,091 | |

| | 385,000 | | | First Light Acquisition Group, Inc. - Class A*,2 | | | 3,792,250 | |

| | 391,809 | | | First Reserve Sustainable Growth Corp. - Class A* | | | 3,847,564 | |

| | 73,561 | | | Flame Acquisition Corp. - Class A* | | | 723,105 | |

| | 478,435 | | | Focus Impact Acquisition Corp. - Class A* | | | 4,793,919 | |

| | 449,251 | | | Forest Road Acquisition Corp. II - Class A* | | | 4,416,137 | |

| | 572,049 | | | Fortistar Sustainable Solutions Corp. - Class A* | | | 5,657,565 | |

| | 420,474 | | | Fortress Capital Acquisition Corp. - Class A* | | | 4,183,716 | |

| | 165,178 | | | Fortress Value Acquisition Corp. IV - Class A* | | | 1,625,352 | |

| | 1,137,226 | | | Forum Merger IV Corp. - Class A* | | | 11,167,559 | |

| | 123,844 | | | Frazier Lifesciences Acquisition Corp. - Class A* | | | 1,234,725 | |

| | 200 | | | Freedom Acquisition I Corp. - Class A* | | | 1,981 | |

| | 376,348 | | | Frontier Acquisition Corp. - Class A* | | | 3,729,609 | |

| | 343,426 | | | Frontier Investment Corp. - Class A* | | | 3,441,129 | |

| | 670,947 | | | FTAC Athena Acquisition Corp. - Class A* | | | 6,655,794 | |

| | 332,659 | | | FTAC Hera Acquisition Corp. - Class A* | | | 3,301,641 | |

| | 141,963 | | | FTAC Zeus Acquisition Corp. - Class A* | | | 1,426,728 | |

| | 752,424 | | | Fusion Acquisition Corp. II - Class A* | | | 7,403,852 | |

| | 350,401 | | | Future Health ESG Corp.* | | | 3,504,010 | |

| | 35,842 | | | FutureTech II Acquisition Corp. - Class A* | | | 360,212 | |

| | 272,635 | | | G&P Acquisition Corp. - Class A* | | | 2,723,624 | |

| | 249,400 | | | Galata Acquisition Corp. - Class A* | | | 2,491,506 | |

| | 189,624 | | | Games & Esports Experience Acquisition Corp. - Class A* | | | 1,924,684 | |

| | 18,804 | | | Gaming & Hospitality Acquisition Corp. - Class A* | | | 185,219 | |

| | 13,175 | | | Genesis Growth Tech Acquisition Corp. - Class A* | | | 133,331 | |

| | 1,000 | | | Genesis Unicorn Capital Corp. - Class A* | | | 9,970 | |

| | 66,666 | | | Gesher I Acquisition Corp. - Class A* | | | 667,327 | |

| | 90,424 | | | Gladstone Acquisition Corp. - Class A* | | | 918,708 | |

| | 42,027 | | | Glenfarne Merger Corp. - Class A* | | | 412,285 | |

| | 5,000 | | | Global Blockchain Acquisition Corp.* | | | 49,850 | |

| | 390,402 | | | Global Consumer Acquisition Corp.* | | | 3,974,292 | |

| | 145,600 | | | Global Partner Acquisition Corp. II - Class A* | | | 1,450,176 | |

| | 6,000 | | | Globalink Investment, Inc.* | | | 59,760 | |

| | 1,018,145 | | | Goal Acquisitions Corp.* | | | 10,018,547 | |

| | 1,375 | | | GoGreen Investments Corp. - Class A* | | | 13,929 | |

First Trust Merger Arbitrage Fund

SCHEDULE OF INVESTMENTS - Continued

As of September 30, 2022

Number

of Shares | | | | | Value | |

| | | | | COMMON STOCKS (Continued) | | | | |

| | | | | SPECIFIED PURPOSE ACQUISITIONS (Continued) | | | | |

| | 253,489 | | | Golden Arrow Merger Corp. - Class A* | | $ | 2,491,797 | |

| | 222,941 | | | Golden Falcon Acquisition Corp. - Class A* | | | 2,218,263 | |

| | 8,554 | | | Good Works II Acquisition Corp.* | | | 85,626 | |

| | 287,421 | | | Gores Holdings VII, Inc. - Class A* | | | 2,833,971 | |

| | 228,602 | | | Gores Technology Partners II, Inc. - Class A* | | | 2,244,872 | |

| | 2,800 | | | Gores Technology Partners, Inc. - Class A* | | | 27,510 | |

| | 200 | | | Graf Acquisition Corp. IV* | | | 1,950 | |

| | 350,937 | | | Group Nine Acquisition Corp. - Class A* | | | 3,470,767 | |

| | 560,574 | | | GX Acquisition Corp. II - Class A* | | | 5,502,034 | |

| | 196,916 | | | Hamilton Lane Alliance Holdings I, Inc. - Class A* | | | 1,947,499 | |

| | 2,253 | | | Hawks Acquisition Corp. - Class A* | | | 22,170 | |

| | 794,535 | | | Health Assurance Acquisition Corp. - Class A* | | | 7,929,459 | |

| | 36 | | | Healthcare AI Acquisition Corp. - Class A* | | | 363 | |

| | 489,698 | | | Healthcare Services Acquisition Corp. - Class A* | | | 4,867,598 | |

| | 200 | | | Heartland Media Acquisition Corp.* | | | 1,992 | |

| | 459,179 | | | Hennessy Capital Investment Corp. V - Class A* | | | 4,532,097 | |

| | 110,936 | | | HH&L Acquisition Co. - Class A* | | | 1,102,704 | |

| | 424,527 | | | HIG Acquisition Corp. - Class A* | | | 4,258,006 | |

| | 791,459 | | | Highland Transcend Partners I Corp. - Class A* | | | 7,882,932 | |

| | 18,200 | | | Home Plate Acquisition Corp. - Class A* | | | 179,088 | |

| | 493,871 | | | Horizon Acquisition Corp. II - Class A* | | | 4,938,710 | |

| | 27,691 | | | Hudson Executive Investment Corp. II - Class A* | | | 272,756 | |

| | 1,058,104 | | | Hudson Executive Investment Corp. III - Class A* | | | 10,401,162 | |

| | 253,893 | | | HumanCo Acquisition Corp. - Class A* | | | 2,528,774 | |

| | 100,200 | | | Hunt Cos. Acquisition Corp. I - Class A* | | | 1,017,030 | |

| | 542,852 | | | Ibere Pharmaceuticals - Class A* | | | 5,379,663 | |

| | 100,036 | | | Iconic Sports Acquisition Corp. - Class A* | | | 1,014,365 | |

| | 161,078 | | | Inception Growth Acquisition Ltd.* | | | 1,594,672 | |

| | 2,971 | | | Industrial Human Capital, Inc.* | | | 30,156 | |

| | 24,425 | | | Industrial Tech Acquisitions II, Inc. - Class A* | | | 244,250 | |

| | 825 | | | Infinite Acquisition Corp. - Class A* | | | 8,234 | |

| | 90,000 | | | InFinT Acquisition Corp.* | | | 912,600 | |

| | 100 | | | Inflection Point Acquisition Corp. - Class A* | | | 982 | |

| | 25,000 | | | Innovative International Acquisition Corp. - Class A* | | | 253,500 | |

| | 454,287 | | | INSU Acquisition Corp. III - Class A* | | | 4,524,699 | |

| | 5 | | | Integral Acquisition Corp. I - Class A* | | | 50 | |

| | 79,890 | | | Integrated Rail and Resources Acquisition Corp. - Class A* | | | 802,894 | |

| | 50,000 | | | Integrated Wellness Acquisition Corp. - Class A* | | | 505,500 | |

| | 417,652 | | | Intelligent Medicine Acquisition Corp. - Class A* | | | 4,205,756 | |

| | 350,000 | | | InterPrivate II Acquisition Corp. - Class A* | | | 3,444,245 | |

| | 760,205 | | | InterPrivate III Financial Partners, Inc. - Class A* | | | 7,450,009 | |

First Trust Merger Arbitrage Fund

SCHEDULE OF INVESTMENTS - Continued

As of September 30, 2022

Number

of Shares | | | | | Value | |

| | | | | COMMON STOCKS (Continued) | | | | |

| | | | | SPECIFIED PURPOSE ACQUISITIONS (Continued) | | | | |

| | 5,872 | | | InterPrivate IV InfraTech Partners, Inc. - Class A* | | $ | 57,839 | |

| | 81,920 | | | Investcorp Europe Acquisition Corp. I - Class A* | | | 830,669 | |

| | 86,788 | | | ION Acquisition Corp. III Ltd. - Class A* | | | 856,598 | |

| | 194,597 | | | Iris Acquisition Corp.* | | | 1,914,834 | |

| | 229,124 | | | Iron Spark I, Inc. - Class A | | | 2,268,328 | |

| | 2,859 | | | Itiquira Acquisition Corp. - Class A* | | | 28,418 | |

| | 8,481 | | | IX Acquisition Corp. - Class A* | | | 84,386 | |

| | 31,187 | | | Jack Creek Investment Corp. - Class A* | | | 310,311 | |

| | 250,100 | | | Jackson Acquisition Co. - Class A* | | | 2,490,996 | |

| | 118,750 | | | Jatt Acquisition Corp. - Class A* | | | 1,193,437 | |

| | 176,476 | | | Jaws Juggernaut Acquisition Corp. - Class A* | | | 1,732,994 | |

| | 698,266 | | | Jaws Mustang Acquisition Corp. - Class A* | | | 6,940,764 | |

| | 265,761 | | | Jiya Acquisition Corp. - Class A* | | | 2,652,295 | |

| | 164,168 | | | JOFF Fintech Acquisition Corp. - Class A* | | | 1,617,055 | |

| | 733,286 | | | Juniper II Corp. - Class A* | | | 7,303,529 | |

| | 72,200 | | | Jupiter Acquisition Corp. - Class A* | | | 698,896 | |

| | 2,900 | | | Jupiter Wellness Acquisition Corp. - Class A* | | | 29,087 | |

| | 202,782 | | | Kadem Sustainable Impact Corp. - Class A* | | | 1,993,347 | |

| | 74,998 | | | Kairos Acquisition Corp. - Class A* | | | 746,980 | |

| | 29,200 | | | Kernel Group Holdings, Inc. - Class A* | | | 289,956 | |

| | 268,228 | | | Khosla Ventures Acquisition Co. III - Class A* | | | 2,623,270 | |

| | 16,307 | | | Kimbell Tiger Acquisition Corp. - Class A* | | | 165,190 | |

| | 1,070,194 | | | Kismet Acquisition II Corp. - Class A* | | | 10,627,026 | |

| | 1,192,867 | | | Kismet Acquisition III Corp. - Class A* | | | 11,809,383 | |

| | 243,183 | | | KKR Acquisition Holdings I Corp. - Class A* | | | 2,392,921 | |

| | 896,520 | | | KL Acquisition Corp. - Class A* | | | 8,875,548 | |

| | 1,199 | | | KnightSwan Acquisition Corp. - Class A* | | | 11,954 | |

| | 275,000 | | | L Catterton Asia Acquisition Corp. - Class A* | | | 2,730,750 | |

| | 662,352 | | | Lakeshore Acquisition II Corp.*,2 | | | 6,656,638 | |

| | 260,100 | | | Landcadia Holdings IV, Inc. - Class A* | | | 2,554,182 | |

| | 15,733 | | | LAVA Medtech Acquisition Corp. - Class A* | | | 158,274 | |

| | 909,106 | | | Lazard Growth Acquisition Corp. I* | | | 9,018,332 | |

| | 201,034 | | | LDH Growth Corp. I - Class A* | | | 1,990,237 | |

| | 549,945 | | | Learn CW Investment Corp. - Class A* | | | 5,416,958 | |

| | 121,198 | | | Lefteris Acquisition Corp. - Class A* | | | 1,211,980 | |

| | 2,123,976 | | | Legato Merger Corp. II*,2 | | | 21,091,082 | |

| | 52,112 | | | Leo Holdings Corp. II - Class A* | | | 519,036 | |

| | 458,542 | | | Lerer Hippeau Acquisition Corp. - Class A* | | | 4,507,468 | |

| | 16,626 | | | Levere Holdings Corp. - Class A* | | | 164,265 | |

| | 801,082 | | | LF Capital Acquisition Corp. II - Class A* | | | 8,050,874 | |

| | 97,250 | | | Liberty Resources Acquisition Corp. - Class A* | | | 983,197 | |

First Trust Merger Arbitrage Fund

SCHEDULE OF INVESTMENTS - Continued

As of September 30, 2022

Number

of Shares | | | | | Value | |

| | | | | COMMON STOCKS (Continued) | | | | |

| | | | | SPECIFIED PURPOSE ACQUISITIONS (Continued) | | | | |

| | 68,430 | | | Lionheart III Corp. - Class A* | | $ | 690,459 | |

| | 143,047 | | | LIV Capital Acquisition Corp. II - Class A* | | | 1,437,622 | |

| | 50,000 | | | Live Oak Mobility Acquisition Corp. - Class A* | | | 491,000 | |

| | 45,419 | | | LMF Acquisition Opportunities, Inc. - Class A* | | | 466,453 | |

| | 237,400 | | | Logistics Innovation Technologies Corp. - Class A* | | | 2,319,398 | |

| | 1,132,902 | | | Longview Acquisition Corp. II - Class A* | | | 11,125,098 | |

| | 356,794 | | | Lux Health Tech Acquisition Corp. - Class A* | | | 3,571,508 | |

| | 743,809 | | | M3-Brigade Acquisition II Corp. - Class A* | | | 7,296,841 | |

| | 558,053 | | | M3-Brigade Acquisition III Corp. - Class A* | | | 5,619,594 | |

| | 27,119 | | | Macondray Capital Acquisition Corp. I - Class A* | | | 271,732 | |

| | 600,000 | | | Malacca Straits Acquisition Co., Ltd. - Class A*,2 | | | 6,156,000 | |

| | 3,010 | | | Marblegate Acquisition Corp. - Class A* | | | 29,980 | |

| | 283,139 | | | Marlin Technology Corp. - Class A* | | | 2,817,233 | |

| | 985,728 | | | Mason Industrial Technology, Inc. - Class A* | | | 9,660,134 | |

| | 116,076 | | | Maxpro Capital Acquisition Corp. - Class A* | | | 1,175,850 | |

| | 687,685 | | | McLaren Technology Acquisition Corp. - Class A* | | | 6,931,865 | |

| | 722,436 | | | MDH Acquisition Corp. - Class A* | | | 7,108,770 | |

| | 388,393 | | | Medicus Sciences Acquisition Corp.* | | | 3,845,091 | |

| | 706,793 | | | MedTech Acquisition Corp. - Class A* | | | 7,018,454 | |

| | 146,508 | | | Mercury Ecommerce Acquisition Corp. - Class A* | | | 1,460,685 | |

| | 24,055 | | | Metal Sky Star Acquisition Corp.* | | | 239,347 | |

| | 23,197 | | | Mission Advancement Corp. - Class A* | | | 227,795 | |

| | 65,165 | | | Monterey Bio Acquisition Corp.* | | | 658,167 | |

| | 596,962 | | | Monument Circle Acquisition Corp. - Class A* | | | 5,903,954 | |

| | 48,881 | | | Moringa Acquisition Corp. - Class A* | | | 485,388 | |

| | 176,863 | | | Motive Capital Corp II - Class A* | | | 1,766,861 | |

| | 30,500 | | | Mountain & Co. I Acquisition Corp. - Class A* | | | 312,320 | |

| | 4,583 | | | Murphy Canyon Acquisition Corp. - Class A* | | | 46,334 | |

| | 259,798 | | | Nabors Energy Transition Corp. - Class A* | | | 2,610,970 | |

| | 355,748 | | | Natural Order Acquisition Corp.* | | | 3,553,923 | |

| | 29,123 | | | New Vista Acquisition Corp. - Class A* | | | 289,483 | |

| | 68,198 | | | Newbury Street Acquisition Corp.* | | | 670,386 | |

| | 524,907 | | | Newcourt Acquisition Corp. - Class A* | | | 5,327,806 | |

| | 150,500 | | | NewHold Investment Corp. II - Class A* | | | 1,479,415 | |

| | 32,925 | | | NightDragon Acquisition Corp. - Class A* | | | 323,324 | |

| | 78,046 | | | Noble Rock Acquisition Corp. - Class A* | | | 775,777 | |

| | 1,124,964 | | | North Atlantic Acquisition Corp. - Class A* | | | 11,187,767 | |

| | 131,891 | | | North Mountain Merger Corp. - Class A* | | | 1,324,186 | |

| | 35,557 | | | Northern Genesis Acquisition Corp. III* | | | 348,814 | |

| | 640,563 | | | Northern Star Investment Corp. II - Class A* | | | 6,322,357 | |

| | 301,152 | | | Northern Star Investment Corp. III - Class A* | | | 2,964,841 | |

First Trust Merger Arbitrage Fund

SCHEDULE OF INVESTMENTS - Continued

As of September 30, 2022

Number

of Shares | | | | | Value | |

| | | | | COMMON STOCKS (Continued) | | | | |

| | | | | SPECIFIED PURPOSE ACQUISITIONS (Continued) | | | | |

| | 17,508 | | | Northern Star Investment Corp. IV - Class A* | | $ | 171,753 | |

| | 106 | | | NorthView Acquisition Corp.* | | | 1,054 | |

| | 496,505 | | | Nubia Brand International Corp. - Class A* | | | 4,960,085 | |

| | 22,140 | | | OceanTech Acquisitions I Corp. - Class A* | | | 225,607 | |

| | 52,823 | | | Omega Alpha SPAC - Class A* | | | 525,589 | |

| | 778,101 | | | OmniLit Acquisition Corp. - Class A*,2 | | | 7,843,258 | |

| | 864,991 | | | One Equity Partners Open Water I Corp. - Class A* | | | 8,537,461 | |

| | 219,004 | | | Onyx Acquisition Co. I - Class A* | | | 2,216,320 | |

| | 890 | | | OPY Acquisition Corp. I - Class A* | | | 8,838 | |

| | 424,015 | | | Orion Acquisition Corp. - Class A* | | | 4,172,308 | |

| | 175,006 | | | Orion Biotech Opportunities Corp. - Class A* | | | 1,725,559 | |

| | 2,400 | | | Osiris Acquisition Corp. - Class A* | | | 23,400 | |

| | 145,800 | | | Oxbridge Acquisition Corp. - Class A* | | | 1,466,748 | |

| | 18,564 | | | Oxus Acquisition Corp. - Class A* | | | 187,682 | |

| | 47,381 | | | Oyster Enterprises Acquisition Corp. - Class A* | | | 467,177 | |

| | 207 | | | Panacea Acquisition Corp. II - Class A* | | | 2,029 | |

| | 65,666 | | | Papaya Growth Opportunity Corp. I - Class A* | | | 658,630 | |

| | 661,472 | | | Parabellum Acquisition Corp. - Class A* | | | 6,541,958 | |

| | 75,551 | | | Pathfinder Acquisition Corp. - Class A* | | | 750,977 | |

| | 385,000 | | | Patria Latin American Opportunity Acquisition Corp. - Class A* | | | 3,919,300 | |

| | 28,063 | | | Pearl Holdings Acquisition Corp. - Class A* | | | 279,788 | |

| | 76,064 | | | Pegasus Digital Mobility Acquisition Corp. - Class A* | | | 763,683 | |

| | 4,000 | | | PepperLime Health Acquisition Corp. - Class A* | | | 39,960 | |

| | 457,670 | | | Perception Capital Corp. II - Class A* | | | 4,649,927 | |

| | 45,000 | | | Peridot Acquisition Corp. II - Class A* | | | 446,175 | |

| | 354,255 | | | Periphas Capital Partnering Corp. - Class A* | | | 8,767,811 | |

| | 387,600 | | | Phoenix Biotech Acquisition Corp. - Class A* | | | 3,914,760 | |

| | 583,112 | | | Pine Island Acquisition Corp. - Class A* | | | 5,819,458 | |

| | 332,134 | | | Pine Technology Acquisition Corp. - Class A* | | | 3,268,199 | |

| | 18,820 | | | Pioneer Merger Corp. - Class A* | | | 187,447 | |

| | 952,442 | | | Pivotal Investment Corp. III - Class A* | | | 9,386,316 | |

| | 128,884 | | | Plum Acquisition Corp. I - Class A* | | | 1,277,240 | |

| | 767,725 | | | Pontem Corp. - Class A* | | | 7,631,186 | |

| | 235,453 | | | Population Health Investment Co., Inc. - Class A* | | | 2,349,821 | |

| | 58,817 | | | Portage Fintech Acquisition Corp. - Class A* | | | 579,347 | |

| | 25,803 | | | Powered Brands - Class A* | | | 257,256 | |

| | 655,052 | | | PowerUp Acquisition Corp. - Class A* | | | 6,642,227 | |

| | 323,273 | | | Priveterra Acquisition Corp. - Class A* | | | 3,184,239 | |

| | 59,554 | | | Progress Acquisition Corp. - Class A* | | | 594,647 | |

| | 88,900 | | | PROOF Acquisition Corp. I - Class A* | | | 886,333 | |

| | 200,803 | | | Property Solutions Acquisition Corp. II - Class A* | | | 1,969,877 | |

First Trust Merger Arbitrage Fund

SCHEDULE OF INVESTMENTS - Continued

As of September 30, 2022

Number

of Shares | | | | | Value | |

| | | | | COMMON STOCKS (Continued) | | | | |

| | | | | SPECIFIED PURPOSE ACQUISITIONS (Continued) | | | | |

| | 548,826 | | | PropTech Investment Corp. II - Class A* | | $ | 5,460,819 | |

| | 173,014 | | | Prospector Capital Corp. - Class A* | | | 1,724,950 | |

| | 160,619 | | | PWP Forward Acquisition Corp. I - Class A* | | | 1,577,279 | |

| | 120,381 | | | Pyrophyte Acquisition Corp. - Class A* | | | 1,222,192 | |

| | 1,159,101 | | | Quantum FinTech Acquisition Corp.* | | | 11,428,736 | |

| | 5,299 | | | Recharge Acquisition Corp. - Class A* | | | 53,599 | |

| | 348,255 | | | Relativity Acquisition Corp. - Class A* | | | 3,492,998 | |

| | 739,140 | | | Research Alliance Corp. II - Class A* | | | 7,258,355 | |

| | 500,000 | | | Revelstone Capital Acquisition Corp. - Class A* | | | 4,960,000 | |

| | 1,098,594 | | | Revolution Healthcare Acquisition Corp. - Class A* | | | 10,799,179 | |

| | 638,049 | | | RF Acquisition Corp. - Class A*,2 | | | 6,297,544 | |

| | 31,250 | | | Rigel Resource Acquisition Corp. - Class A* | | | 315,313 | |

| | 344,636 | | | RMG Acquisition Corp. III - Class A* | | | 3,429,128 | |

| | 25,640 | | | ROC Energy Acquisition Corp.* | | | 257,426 | |

| | 50,000 | | | Rocket Internet Growth Opportunities Corp. - Class A* | | | 495,500 | |

| | 151,300 | | | Rose Hill Acquisition Corp. - Class A* | | | 1,537,208 | |

| | 830,924 | | | Rosecliff Acquisition Corp. I - Class A* | | | 8,176,292 | |

| | 200,000 | | | Ross Acquisition Corp. II - Class A* | | | 1,982,020 | |

| | 20,115 | | | Roth CH Acquisition IV Corp.* | | | 201,753 | |

| | 3,453 | | | Roth CH Acquisition V Corp.* | | | 34,426 | |

| | 93,690 | | | RXR Acquisition Corp. - Class A* | | | 921,910 | |

| | 600 | | | Sagaliam Acquisition Corp. - Class A* | | | 6,000 | |

| | 175,000 | | | Sanaby Health Acquisition Corp. I - Class A* | | | 1,771,000 | |

| | 946,157 | | | Sandbridge X2 Corp. - Class A* | | | 9,300,723 | |

| | 202,417 | | | Sarissa Capital Acquisition Corp. - Class A* | | | 2,024,170 | |

| | 234,927 | | | Science Strategic Acquisition Corp. Alpha - Class A* | | | 2,323,428 | |

| | 384,671 | | | ScION Tech Growth I - Class A* | | | 3,837,093 | |

| | 162,929 | | | ScION Tech Growth II - Class A* | | | 1,619,514 | |

| | 551,829 | | | SCP & CO Healthcare Acquisition Co. - Class A* | | | 5,446,552 | |

| | 229,721 | | | SDCL EDGE Acquisition Corp. - Class A* | | | 2,271,941 | |

| | 496,232 | | | Seaport Calibre Materials Acquisition Corp. - Class A* | | | 4,977,207 | |

| | 874,177 | | | Seaport Global Acquisition II Corp. - Class A*,2 | | | 8,741,770 | |

| | 100,000 | | | Semper Paratus Acquisition Corp.* | | | 1,016,000 | |

| | 362,652 | | | Senior Connect Acquisition Corp. I - Class A* | | | 3,608,387 | |

| | 140 | | | Shelter Acquisition Corp. I - Class A* | | | 1,386 | |

| | 419,016 | | | ShoulderUp Technology Acquisition Corp. - Class A* | | | 4,202,730 | |

| | 40 | | | SHUAA Partners Acquisition Corp. I - Class A* | | | 405 | |

| | 360 | | | Sierra Lake Acquisition Corp. - Class A* | | | 3,607 | |

| | 11,713 | | | Signal Hill Acquisition Corp. - Class A* | | | 116,544 | |

| | 300,404 | | | Silver Spike Acquisition Corp. II - Class A* | | | 2,980,008 | |

| | 800 | | | SILVERspac, Inc. - Class A* | | | 7,836 | |

First Trust Merger Arbitrage Fund

SCHEDULE OF INVESTMENTS - Continued

As of September 30, 2022

Number

of Shares | | | | | Value | |

| | | | | COMMON STOCKS (Continued) | | | | |

| | | | | SPECIFIED PURPOSE ACQUISITIONS (Continued) | | | | |