As filed with the Securities and Exchange Commission on September 4, 2015

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22917

Absolute Shares Trust

(Exact name of registrant as specified in charter)

Millington Securities, Inc.

331 Newman Springs Rd Suite 122

Red Bank, New Jersey 07701

(Address of principal executive offices) (Zip code)

Don Schreiber, Jr.

Millington Securities, Inc.

331 Newman Springs Rd Suite 122

Red Bank, New Jersey 07701

(Name and address of agent for service)

(732) 842-4920

Registrant's telephone number, including area code

Date of fiscal year end: June 30

Date of reporting period: June 30, 2015

Updated June 15, 2015

Item 1. Reports to Stockholders.

WBI SMID Tactical Growth Shares | WBIA

WBI SMID Tactical Value Shares | WBIB

WBI SMID Tactical Yield Shares | WBIC

WBI SMID Tactical Select Shares | WBID

WBI Large Cap Tactical Growth Shares | WBIE

WBI Large Cap Tactical Value Shares | WBIF

WBI Large Cap Tactical Yield Shares | WBIG

WBI Large Cap Tactical Select Shares | WBIL

WBI Tactical Income Shares | WBII

WBI Tactical High Income Shares | WBIH

| Absolute Shares Trust

Table of Contents |

| Absolute Shares Trust

Managers Discussion of Fund Performance

June 30, 2015 |

Dear Fellow Shareholder:

We would like to welcome our fellow shareholders who have invested in the WBI Shares ETFs during the inaugural year of their operations. We consider the launch of these ten funds to have been a resounding success. As of the close of their first full day of trading on August 27, 2014, the assets under management of the ten Funds amounted to more than $1 billion. The Funds have continued to attract assets since then, and as of the end of their fiscal reporting period have added approximately $475 million, bringing total assets across all of the Funds to more than $1.5 billion. We appreciate your confidence.

While the Funds are new, the investment philosophy and strategies used in their management have been developed over more than 20 years, and are based on those used for WBI’s separately managed accounts and mutual funds.

Investment Philosophy

The goal of the WBI Funds is to provide consistent, attractive returns with less volatility and risk to capital than traditional approaches. We believe capital preservation is essential to providing long-term portfolio growth and a consistent stream of income. Our focus on value, dividends, and risk management has become fundamental to our investment process.

Performance Overview

The Funds have not yet completed one full year of operation, however, from inception to the fiscal period ended June 30, 2015:

The WBI SMID Tactical Growth Shares (NYSE Arca: WBIA) returned 0.94% on a NAV basis, and 1.13% based on market value, versus the 4.15% return of the Russell Global SMID Growth Index, the Fund’s benchmark.

The WBI SMID Tactical Value Shares (NYSE Arca: WBIB) returned –0.84% on a NAV basis, and –0.60% based on market value, versus the –0.27% return of the Russell Global SMID Value Index, the Fund’s benchmark.

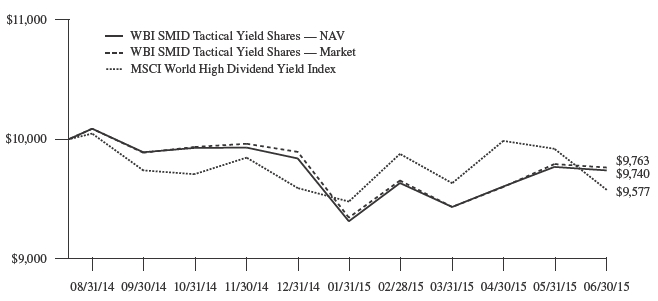

The WBI SMID Tactical Yield Shares (NYSE Arca: WBIC) returned –2.60% on a NAV basis, and –2.37% based on market value, versus the –4.23% return of the MSCI World High Dividend Yield Index, the Fund’s benchmark.

The WBI SMID Tactical Select Shares (NYSE Arca: WBID) returned –5.40% on a NAV basis, and –5.20% based on market value, versus the 1.87% return of the Russell Global SMID Defensive Index, the Fund’s benchmark.

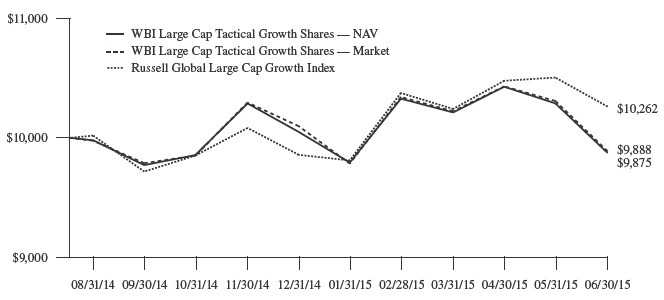

The WBI Large Cap Tactical Growth Shares (NYSE Arca: WBIE) returned –1.25% on a NAV basis, and –1.12% based on market value, versus the 2.62% return of the Russell Global Large Cap Growth Index, the Fund’s benchmark.

The WBI LARGE CAP Tactical Value Shares (NYSE Arca: WBIF) returned –3.29% on a NAV basis, and –3.07% based on market value, versus the –1.34% return of the Russell Global Large Cap Value Index, the Fund’s benchmark.

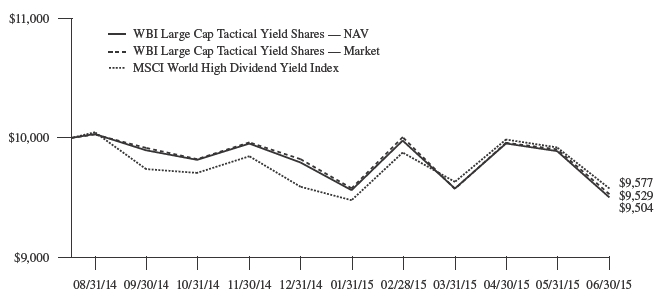

The WBI LARGE CAP Tactical Yield Shares (NYSE Arca: WBIG) returned –4.96% on a NAV basis, and –4.71% based on market value, versus the –4.23% return of the MSCI World High Dividend Yield Index, the Fund’s benchmark.

The WBI Large Cap Tactical Select Shares (NYSE Arca: WBIL) returned –4.41% on a NAV basis, and –4.20% based on market value, versus the –0.46% return of the Russell Global Large Cap Defensive Index, the Fund’s benchmark.

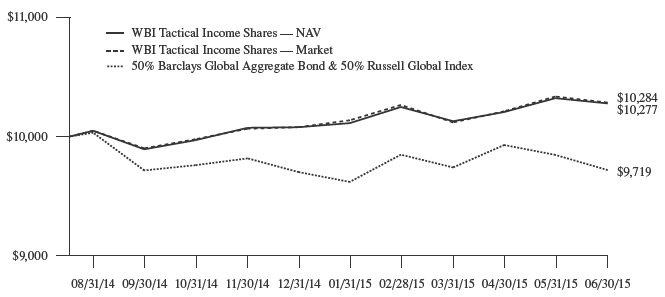

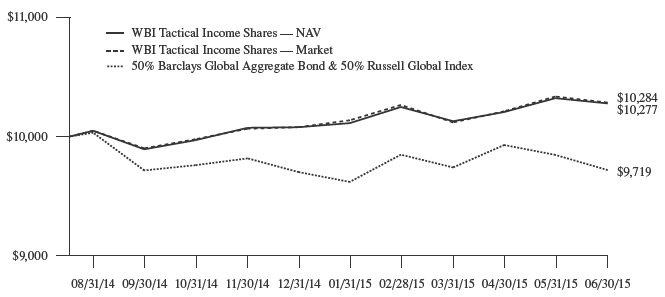

The WBI Tactical Income Shares (NYSE Arca: WBII) returned 2.77% on a NAV basis, and 2.84% based on market value, versus the –2.81% return of the 50% Barclays Global Aggregate Bond/50% Russell Global Index, the Fund’s custom benchmark.

The WBI Tactical High Income Shares (NYSE Arca: WBIH) returned –0.64% on a NAV basis, and –0.47% based on market value, versus the –2.81% return of the 50% Barclays Global Aggregate Bond/50% Russell Global Index, the Fund’s custom benchmark.

Net asset value total return is calculated assuming an initial investment made at the net asset value at the beginning of the period, reinvestment of all dividends and distributions at net asset value during the period, and the redemption on the last day of the period. Net asset value total return includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset value and returns for shareholder transactions. Market price total return is calculated assuming an initial investment made at the market price at the beginning of the period, reinvestment of all dividends and distributions at market price during the period, and sale at the market price on the last day of the period. Total investment returns calculated for a period of less than one year are not annualized.

The strategies used in the management of the Funds do not attempt to replicate or track the performance of any index, and differ significantly from the methods used to construct and maintain the indices that serve as their respective benchmarks. Each of the Funds uses active management processes to screen, rank, and purchase securities with particular attributes and sells securities when certain thresholds are reached, while benchmark indices are unmanaged and consist of a passive representation of all securities that meet the definition of the index constituents. In addition, each Fund uses strategies intended to mitigate volatility and protect capital, and as a result the Funds will often have

| Absolute Shares Trust

Managers Discussion of Fund Performance (continued)

June 30, 2015 |

a significant allocation to cash equivalents. Therefore, while each Fund’s performance includes the effect of an investment in cash equivalents from the proceeds of sales when certain thresholds are met, benchmark indices do not include an allocation to cash equivalents. A distinguishing characteristic of cash equivalents is that their prices are extremely stable and not subject to the levels of price volatility generally exhibited by other investments. Therefore, in periods during which the prices of the securities represented in benchmark indices are falling, an allocation to cash equivalents may contribute to Fund performance that is superior to their benchmarks. In periods during which the prices of the securities represented in benchmark indices are rising, an allocation to cash equivalents in a Fund may cause its performance to trail that of its benchmark. During the fiscal period since their inception, the Funds held material allocations to cash equivalents, which contributed to deviations in performance between each Fund and its respective benchmark. You cannot invest directly in an index, including a benchmark index, and benchmark performance does not include the deduction of transaction and operational expenses, or the deduction of an investment management fee, which would alter their indicated historical results.

Despite the limitations of benchmarks in assessing the performance of the Funds, indices can provide some context for understanding how market conditions and active management may have affected Fund performance. A benchmark for each of the Funds is shown because they provide a reference to investments that are similar to the types of investments that may appear from time to time in the Funds. However, none of the benchmarks are, or are likely to become, representative of past or expected Fund holdings or performance.

Review of Fund Trading Activity

The Funds attempt to provide consistent, attractive returns net of expenses with potentially less volatility and risk to capital than traditional approaches, whatever market conditions may be. This is the Funds’ definition of an absolute return approach to investment management. The investment process for each Fund includes a buy discipline and a sell discipline. Each Fund’s trading activity reflects this disciplined investment process as described in its prospectus, and summarized briefly below.

The Funds use quantitative computer screening of fundamental stock information to evaluate domestic and foreign equity securities in an attempt to find companies with attractive characteristics for the selected universe of securities. Dividend payments may be considered as part of the evaluation process. Once securities are identified, an overlay of technical analysis confirms timeliness of security purchases. The Funds then add qualifying securities using available cash within the parameters of each Fund’s investment objective and security selection criteria.

The Funds use a proprietary bond model to assess the appropriate duration of their exposure to debt securities. Duration is a measure of a fixed income security’s expected price sensitivity to changes in interest rates. Securities with longer durations are expected to experience greater price movements than securities with shorter duration for the same change in prevailing interest rates. A portion of a Fund’s bond exposure may also be invested to pursue perceived opportunities in varying segments of the debt market. This systematic process of identifying, evaluating, and purchasing securities constitutes the Sub-Advisor’s buy discipline for the Funds.

Once a security is purchased for a given Fund, a strict sell discipline with a dynamic stop loss and goal setting process attempts to control the effects of the volatility of each invested position on the Fund’s value. An initial stop percentage and goal price is established at the time a security is purchased. Once that security’s specified goal price has been achieved, a tightened goal stop replaces the initial stops set for each security. If a security stays within its acceptable price channel relative to either the initial stop or goal stop, it remains in the Fund’s portfolio. If the security moves below the acceptable price channel, a stop is triggered and the Fund will sell the security. This results in a responsive process that actively adjusts the Fund’s allocation by causing it to become more fully invested or by raising cash with the intention of protecting capital. This process is likely to result in a Fund holding meaningful allocations to cash equivalents during periods of market volatility.

The investment process has been built on the assumption that future events involve varying degrees of uncertainty. Therefore, the appearance of qualifying stock candidates in the screen results will be respected as a possible indication of the start of a durable price advance, and each stop loss trigger will result in a sale of the relevant security to help prevent losses to capital that could result if the security continued to be held and the price of the security continued to fall. As per this disciplined investment process, during the fiscal period securities identified by the screening and ranking process as attractive were purchased with available cash, and trailing stops were implemented for all securities purchased.

The security selection process has continued to uncover what we believe to be very attractive investment opportunities for each of the Funds. As would be expected, securities sold after hitting a goal stop were generally profitable, and those sold on an initial stop generally were not.

WBI SMID Tactical Growth Shares (WBIA)

As of June 30, 2015, WBIA held 31 securities in addition to a position in a money market fund which served as a cash equivalent. From the time of their purchase, 16 of these positions had unrealized gains of between 1.34% and 28.57%, while 15 had unrealized losses ranging from –1.26% to –18.50%. The aggregate unrealized gain amounted to 1.72% of the Fund’s period ending net asset value.

| Absolute Shares Trust

Managers Discussion of Fund Performance (continued)

June 30, 2015 |

Approximately 75% of the securities held by WBIA at any time during the fiscal period were sold. Approximately 27% of the Fund’s holdings were sold on goal stops for an average realized gain of 14.43%, and approximately 39% were sold after initial stops were hit for an average realized loss of –10.60%. Other dispositions (generally involving option activity and adjustments to short-term Treasury note positions) affected approximately 9% of the Fund’s positions, resulting in an average gain of 1.03%.

Examples of securities that made positive contributions to WBIA’s performance during the fiscal period include C&J Energy Services Inc., Community Health Systems Inc., Broadcom Corp., Zions Bancorporation, and GNC Holdings Inc. Examples of securities that detracted from the Fund’s performance during the fiscal period include Altisource Portfolio Solutions, Basic Energy Services Inc., Unit Corp., Century Aluminum Co., and Alcoa Inc.

Thirteen options hedges intended to reduce risk were implemented in WBIA during the fiscal period, resulting in an aggregate gain of approximately 0.31%. Examples of positions that were hedged with positive return contributions arising from the hedge itself include Informatica Corp., GNC Holdings, Inc., and Pilgrim’s Price Corp. There were no negative contributions to performance arising from the option hedges.

High turnover in WBIA’s holdings has the potential to result in the realization and distribution to shareholders of higher capital gains. If Fund shares are held in a taxable account, this may increase your tax liability. To the extent portfolio turnover increases transaction costs, it may also reduce Fund performance. Of course, selling a security in a timely fashion may also improve performance if a subsequent loss is avoided that exceeds the cost of executing the sale.

WBI SMID Tactical Value Shares (WBIB)

As of June 30, 2015, WBIB held 28 securities in addition to a position in a money market fund which served as a cash equivalent. From the time of their purchase, 15 of these positions had unrealized gains of between 0.87% and 30.01%, while 13 had unrealized losses ranging from –0.58% to –9.09%. The aggregate unrealized gain amounted to 3.00% of the Fund’s period ending net asset value.

Approximately 76% of the securities held by WBIB at any time during the fiscal period were sold. Approximately 24% of the Fund’s holdings were sold on goal stops for an average realized gain of 15.04%, and approximately 42% were sold after initial stops were hit for an average realized loss of –11.44%. Other dispositions (generally involving option activity and adjustments to short-term Treasury note positions) affected approximately 11% of the Fund’s positions, resulting in an average gain of 0.13%.

Examples of securities that made positive contributions to WBIB’s performance during the fiscal period include Centene Corp., Sina Corp., Manpowergroup Inc., World Fuel Services Corp., and Comerica Inc. Examples of securities that detracted from the Fund’s performance during the fiscal period include Basic Energy Services Inc., MRC Global Inc., Vista Outdoor, Superior Energy Services Inc., and C&J Energy Services Inc.

Eleven options hedges intended to reduce risk were implemented in WBIB during the fiscal period, resulting in an aggregate gain of approximately 0.11%. Examples of positions that were hedged with positive return contributions arising from the hedge itself include Centene Corp., Pilgrim’s Pride Corp., and Gannett Co Inc. Examples of positions that were hedged resulting in hedging costs include The Boeing Co. and a separate instance of hedging Centene Corp.

High turnover in the WBIB’s holdings has the potential to result in the realization and distribution to shareholders of higher capital gains. If Fund shares are held in a taxable account, this may increase your tax liability. To the extent portfolio turnover increases transaction costs, it may also reduce Fund performance. Of course, selling a security in a timely fashion may also improve performance if a subsequent loss is avoided that exceeds the cost of executing the sale.

WBI SMID Tactical Yield Shares (WBIC)

As of June 30, 2015, WBIC held 28 securities in addition to a position in a money market fund which served as a cash equivalent. From the time of their purchase, 11 of these positions had unrealized gains of between 0.72% and 20.41%, while 17 had unrealized losses ranging from –0.05% to –20.00%. The aggregate unrealized gain amounted to 0.14% of the Fund’s period ending net asset value.

Approximately 74% of the securities held by WBIC at any time during the fiscal period were sold. Approximately 21% of the Fund’s holdings were sold on goal stops for an average realized gain of 11.20%, and approximately 44% were sold after initial stops were hit for an average realized loss of –8.72%. Other dispositions (generally involving option activity and adjustments to short-term Treasury note positions) affected approximately 9% of the Fund’s positions, resulting in an average gain of 1.84%.

Examples of securities that made positive contributions to WBIC’s performance during the fiscal period include Cal-Maine Foods Inc., Gamestop Corp., Janus Capital Group Inc., Prosperity Bancshares Inc., and Cullen/Frost Bankers Inc. Examples of securities that detracted from the Fund’s performance during the fiscal period include International Game Technology PLC, Abercrombie & Fitch Class A Shares, Denbury Resources Inc., Mobile Telesystems PJSC Sponsored ADR, and Avon Products Inc.

| Absolute Shares Trust

Managers Discussion of Fund Performance (continued)

June 30, 2015 |

Seven options hedges intended to reduce risk were implemented in WBIC during the fiscal period, resulting in an aggregate gain of approximately 0.12%. Examples of positions that were hedged with positive return contributions arising from the hedge itself include Stifel Financial Corp., Pilgrim’s Pride Corp., and Xerox Corp. Only the hedge on The Boeing Co. resulted in hedging costs.

High turnover in the WBIC’s holdings has the potential to result in the realization and distribution to shareholders of higher capital gains. If Fund shares are held in a taxable account, this may increase your tax liability. To the extent portfolio turnover increases transaction costs, it may also reduce Fund performance. Of course, selling a security in a timely fashion may also improve performance if a subsequent loss is avoided that exceeds the cost of executing the sale.

WBI SMID Tactical Select Shares (WBID)

As of June 30, 2015, WBID held 31 securities in addition to a position in a money market fund which served as a cash equivalent. From the time of their purchase, 16 of these positions had unrealized gains of between 0.21% and 27.34%, while 15 had unrealized losses ranging from –0.03% to –14.31%. The aggregate unrealized loss amounted to –0.10% of the Fund’s period ending net asset value.

Approximately 76% of the securities held by WBID at any time during the fiscal period were sold. Approximately 22% of the Fund’s holdings were sold on goal stops for an average realized gain of 14.34%, and approximately 46% were sold after initial stops were hit for an average realized loss of –8.63%. Other dispositions (generally involving option activity and adjustments to short-term Treasury note positions) affected approximately 8% of the Fund’s positions, resulting in an average loss of –0.17%.

Examples of securities that made positive contributions to WBID’s performance during the fiscal period include Rite Aid Corp., Wabash National Corp., Freescale Semiconductor Ltd., Orbital ATK Inc., and GNC Holdings Inc. Examples of securities that detracted from the Fund’s performance during the fiscal period include International Game Technology PLC, Denbury Resources Inc., Vista Outdoor Inc., and SPX Corp., and Forum Energy Technologies Inc.

Ten options hedges intended to reduce risk were implemented in WBID during the fiscal period, resulting in an aggregate gain of approximately 0.31%. Examples of positions that were hedged with positive return contributions arising from the hedge itself include Freescale Semiconductor Ltd., Xerox Corp., and Gannett Co Inc. There were no negative contributions to performance arising from the option hedges.

High turnover in the WBID’s holdings has the potential to result in the realization and distribution to shareholders of higher capital gains. If Fund shares are held in a taxable account, this may increase your tax liability. To the extent portfolio turnover increases transaction costs, it may also reduce Fund performance. Of course, selling a security in a timely fashion may also improve performance if a subsequent loss is avoided that exceeds the cost of executing the sale.

WBI Large Cap Tactical Growth Shares (WBIE)

As of June 30, 2015, WBIE held 28 securities in addition to a position in a money market fund which served as a cash equivalent. From the time of their purchase, 13 of these positions had unrealized gains of between 0.21% and 11.65%, while 15 had unrealized losses ranging from –0.75% to –20.18%. The aggregate unrealized gain amounted to 1.99% of the Fund’s period ending net asset value.

Approximately 75% of the securities held by WBIE at any time during the fiscal period were sold. Approximately 26% of the Fund’s holdings were sold on goal stops for an average realized gain of 11.96%, and approximately 41% were sold after initial stops were hit for an average realized loss of –8.08%. Other dispositions (generally involving option activity and adjustments to short-term Treasury note positions) affected approximately 8% of the Fund’s positions, resulting in an average gain of 0.54%.

Examples of securities that made positive contributions to WBIE’s performance during the fiscal period include BHP Billiton Ltd Sponsored ADR, Valeant Pharmaceuticals International Inc., General Motors Co., The Boeing Co., and Walgreen Co. Examples of securities that detracted from the Fund’s performance during the fiscal period include South32 Ltd., Century Aluminum Co., World Acceptance Corp., Altisource Portfolio Solutions SA, and Bancolombia SA.

Twelve options hedges intended to reduce risk were implemented in WBIE during the fiscal period, resulting in an aggregate gain of approximately 0.32%. Examples of positions that were hedged with positive return contributions arising from the hedge itself include Marathon Petroleum Corp., Applied Materials Inc., and General Motors Co. There were two positions hedged that resulted in hedging costs, The Boeing Co. and salesforce.com inc.

High turnover in the WBIE’s holdings has the potential to result in the realization and distribution to shareholders of higher capital gains. If Fund shares are held in a taxable account, this may increase your tax liability. To the extent portfolio turnover increases transaction costs, it may also reduce Fund performance. Of course, selling a security in a timely fashion may also improve performance if a subsequent loss is avoided that exceeds the cost of executing the sale.

| Absolute Shares Trust

Managers Discussion of Fund Performance (continued)

June 30, 2015 |

WBI Large Cap Tactical Value Shares (WBIF)

As of June 30, 2015, WBIF held 30 securities in addition to a position in a money market fund which served as a cash equivalent. From the time of their purchase, 16 of these positions had unrealized gains of between 0.30% and 15.80%, while 14 had unrealized losses ranging from –0.39% to –14.20%. The aggregate unrealized gain amounted to 0.76% of the Fund’s period ending net asset value.

Approximately 76% of the securities held by WBIF at any time during the fiscal period were sold. Approximately 22% of the Fund’s holdings were sold on goal stops for an average realized gain of 13.30%, and approximately 60% were sold after initial stops were hit for an average realized loss of –7.80%. Other dispositions (generally involving option activity and adjustments to short-term Treasury note positions) affected approximately 6% of the Fund’s positions, resulting in an average loss of –1.33%.

Examples of securities that made positive contributions to WBIF’s performance during the fiscal period include Tencent Holdings Ltd., General Motors Co., The Boeing Co., Sumitomo Mitsui ADR, and Shire PLC ADR. Examples of securities that detracted from the Fund’s performance during the fiscal period include Copa Holdings SA Class A, Sasol Ltd. ADR, Bancolombia SA ADR, National Oilwell Varco Inc., and Tenaris SA ADR.

Thirteen options hedges intended to reduce risk were implemented in WBIF during the fiscal period, resulting in an aggregate gain of approximately 0.18%. Examples of positions that were hedged with positive return contributions arising from the hedge itself include Marathon Petroleum Corp., GNC Holdings Inc., and General Motors Co. Examples of positions that were hedged resulting in hedging costs include The Boeing Co., salesforce.com inc., and a separate instance of hedging GNC Holdings Inc.

High turnover in the WBIF’s holdings has the potential to result in the realization and distribution to shareholders of higher capital gains. If Fund shares are held in a taxable account, this may increase your tax liability. To the extent portfolio turnover increases transaction costs, it may also reduce Fund performance. Of course, selling a security in a timely fashion may also improve performance if a subsequent loss is avoided that exceeds the cost of executing the sale.

WBI Large Cap Tactical Yield Shares (WBIG)

As of June 30, 2015, WBIG held 28 securities in addition to a position in a money market fund which served as a cash equivalent. From the time of their purchase, 8 of these positions had unrealized gains of between 0.07% and 16.06%, while 20 had unrealized losses ranging from –0.59% to –14.55%. The aggregate unrealized loss amounted to –2.26% of the Fund’s period ending net asset value.

Approximately 75% of the securities held by WBIG at any time during the fiscal period were sold. Approximately 22% of the Fund’s holdings were sold on goal stops for an average realized gain of 12.74%, and approximately 45% were sold after initial stops were hit for an average realized loss of –9.26%. Other dispositions (generally involving option activity and adjustments to short-term Treasury note positions) affected approximately 8% of the Fund’s positions, resulting in an average loss of –0.25%.

Examples of securities that made positive contributions to WBIG’s performance during the fiscal period include Yum! Brands Inc., Prudential Financial Inc., General Motors Co., The Boeing Co., and Sumitomo Mitsui ASR. Examples of securities that detracted from the Fund’s performance during the fiscal period include Abercrombie & Fitch Co. Class A, Mobile Telesystems ADR, Tenaris SA ADR, Bancolombia SA ADR, and Sasol Ltd. ADR.

Twelve options hedges intended to reduce risk were implemented in WBIG during the fiscal period, resulting in an aggregate gain of approximately 0.23%. Examples of positions that were hedged with positive return contributions arising from the hedge itself include Marathon Petroleum Corp., General Motors Co., and Baxter International Inc. Examples of positions that were hedged resulting in hedging costs include The Hershey Co., Best Buy Company Inc., and The Boeing Co.

High turnover in the WBIG’s holdings has the potential to result in the realization and distribution to shareholders of higher capital gains. If Fund shares are held in a taxable account, this may increase your tax liability. To the extent portfolio turnover increases transaction costs, it may also reduce Fund performance. Of course, selling a security in a timely fashion may also improve performance if a subsequent loss is avoided that exceeds the cost of executing the sale.

WBI Large Cap Tactical Select Shares (WBIL)

As of June 30, 2015, WBIL held 25 securities in addition to a position in a money market fund which served as a cash equivalent. From the time of their purchase, 12 of these positions had unrealized gains of between 0.26% and 19.29%, while 13 had unrealized losses ranging from –0.24% to –11.58%. The aggregate unrealized gain amounted to 0.35% of the Fund’s period ending net asset value.

Approximately 74% of the securities held by WBIL at any time during the fiscal period were sold. Approximately 21% of the Fund’s holdings were sold on goal stops for an average realized gain of 9.46%, and approximately 40% were sold after initial stops were hit for an average realized loss of –8.64%. Other dispositions (generally involving option activity and adjustments to short-term Treasury note positions) affected approximately 13% of the Fund’s positions, resulting in an average gain of 0.86%.

| Absolute Shares Trust

Managers Discussion of Fund Performance (continued)

June 30, 2015 |

Examples of securities that made positive contributions to WBIL’s performance during the fiscal period include HCA Holdings Inc., The Boeing Co., Gilead Sciences Inc., iPath S&P 500 VIX Short-Term Futures ETN, and Baker Hughes Inc. Examples of securities that detracted from the Fund’s performance during the fiscal period include Altisource Portfolio Solutions SA, Southwest Airlines Co., Viacom Inc. Class B, Discovery Communications Class A, and Banco Bradesco ADR.

Fifteen options hedges intended to reduce risk were implemented in WBIL during the fiscal period, resulting in an aggregate gain of approximately 0.35%. Examples of positions that were hedged with positive return contributions arising from the hedge itself include Marathon Petroleum Corp., Applied Materials Inc., and Express Scripts Holding Co. Examples of positions that were hedged resulting in hedging costs include The Boeing Co., GNC Holdings Inc., and salesforce.com inc.

High turnover in the WBIL’s holdings has the potential to result in the realization and distribution to shareholders of higher capital gains. If Fund shares are held in a taxable account, this may increase your tax liability. To the extent portfolio turnover increases transaction costs, it may also reduce Fund performance. Of course, selling a security in a timely fashion may also improve performance if a subsequent loss is avoided that exceeds the cost of executing the sale.

WBI Tactical Income Shares (WBII)

As of June 30, 2015, WBII held 29 securities in addition to a position in a money market fund which served as a cash equivalent. From the time of their purchase, 15 of these positions had unrealized gains of between 0.01% and 9.95%, while 14 had unrealized losses ranging from –0.08% to –9.99%. The aggregate unrealized gain amounted to 0.003% of the Fund’s period ending net asset value.

Approximately 70% of the securities held by WBII at any time during the fiscal period were sold. Approximately 12% of the Fund’s holdings were sold on goal stops for an average realized gain of 18.06%, and approximately 22% were sold after initial stops were hit for an average realized loss of –8.05%. Other dispositions (generally involving option activity and adjustments to short-term Treasury note positions) affected approximately 36% of the Fund’s positions, resulting in an average gain of 2.16%.

Examples of securities that made positive contributions to WBII’s performance during the fiscal period include General Motors Co., Prudential Financial Inc., Cullen/Frost Bankers Inc., Orbital ATK Inc., and Vista Outdoor Inc. Examples of securities that detracted from the Fund’s performance during the fiscal period include Tenaris SA ADR, Vanguard Long-Term Corporate Bond ETF, Greenbrier Companies Inc., iShares iBoxx Investment Grade Corporate Bond ETF, and Valero Energy Corp.

Six options hedges intended to reduce risk were implemented in WBII during the fiscal period, resulting in an aggregate gain of approximately 0.13%. Examples of positions that were hedged with positive return contributions arising from the hedge itself include Marathon Petroleum Corp., General Motors Co., and Orbital ATK Inc. There were two positions hedged that resulted in hedging costs, The Hershey Co. and Best Buy Company Inc.

High turnover in the WBII’s holdings has the potential to result in the realization and distribution to shareholders of higher capital gains. If Fund shares are held in a taxable account, this may increase your tax liability. To the extent portfolio turnover increases transaction costs, it may also reduce Fund performance. Of course, selling a security in a timely fashion may also improve performance if a subsequent loss is avoided that exceeds the cost of executing the sale.

WBI Tactical High Income Shares (WBIH)

As of June 30, 2015, WBIH held 27 securities in addition to a position in a money market fund which served as a cash equivalent. From the time of their purchase, 11 of these positions had unrealized gains of between 0.01% and 13.59%, while 16 had unrealized losses ranging from –0.30% to –8.30%. The aggregate unrealized loss amounted to –0.18% of the Fund’s period ending net asset value.

Approximately 70% of the securities held by WBIH at any time during the fiscal period were sold. Approximately 12% of the Fund’s holdings were sold on goal stops for an average realized gain of 17.18%, and approximately 28% were sold after initial stops were hit for an average realized loss of –6.83%. Other dispositions (generally involving option activity and adjustments to short-term Treasury note positions) affected approximately 30% of the Fund’s positions, resulting in an average gain of 0.61%.

Examples of securities that made positive contributions to WBIH’s performance during the fiscal period include Comerica Inc., General Motors Co., Cullen/Frost Bankers Inc., Cyberonics Inc., and Abbvie Inc. Examples of securities that detracted from the Fund’s performance during the fiscal period include Avon Products Inc., Greenbrier Companies Inc., Entergy Corp., First Niagara Financial Group, and Valero Energy Corp.

Eight options hedges intended to reduce risk were implemented in WBIH during the fiscal period, resulting in an aggregate gain of approximately 0.15%. Examples of positions that were hedged with positive return contributions arising from the hedge itself include Marathon Petroleum Corp., General Motors Co., and Best Buy Company Inc. There were two positions hedged that resulted in hedging costs, The Hershey Co. and a separate instance of hedging Best Buy Company Inc.

| Absolute Shares Trust

Managers Discussion of Fund Performance (continued)

June 30, 2015 |

High turnover in the WBIH’s holdings has the potential to result in the realization and distribution to shareholders of higher capital gains. If Fund shares are held in a taxable account, this may increase your tax liability. To the extent portfolio turnover increases transaction costs, it may also reduce Fund performance. Of course, selling a security in a timely fashion may also improve performance if a subsequent loss is avoided that exceeds the cost of executing the sale.

Market Conditions

Quarter by quarter review of fiscal period market conditions 2014-2015

3rd Quarter 2014

The Funds were launched during the last week of August 2014, more than halfway through the year and nearly two-thirds through the third calendar quarter. Large company U.S. stocks had enjoyed solid gains in August. Unfortunately, those gains were sandwiched between negative returns in both July and September. Still, the Dow Jones Industrial Average (DJIA), S&P 500, and NASDAQ had enough gain left over to finish the third quarter of 2014 with slightly positive results.

The broader market didn’t fare nearly as well. The NYSE Composite, which measures the performance of all securities traded on the New York Stock Exchange, fell 2.52% for the quarter despite August’s gains. Small company stocks were especially hard hit. The Russell 2000 lost more than 6% in both July and September to end the quarter solidly in negative territory for both the quarter and year-to-date. The high closing value of the Russell 2000 came on July 1, and from there it fell 9.22% to end with a quarterly loss of 7.65%. From high to low it fell nearly the 10% commonly called a correction. Whatever anyone chooses to call it, the broad market’s summer weakness cast a pall over a huge swath of the investment landscape in the U.S.

Things weren’t much better in other equity markets around the world. With the exception of Japan, which continued its bounce-back from a more than 12% decline in the first four months of the year, most of the developed economies saw their stock markets end the quarter lower, with the EAFE down 6.39%.

Bonds on the other hand held up well during the quarter, although the prospect of higher rates in the not too distant future may have contributed to some weakness in September. As interest rates rise, existing bonds issued with lower rates become less attractive by comparison and their prices adjust accordingly. The Federal Reserve scheduled an end to its long-running bond buying program, or Quantitative Easing, for October. The imminent loss of a deep pocket buyer may also have had something to do with September’s softness in fixed income prices.

Commodities took a beating during the quarter. The U.S economy was showing signs of continuing recovery, but economies elsewhere in the world appeared to be faltering—or in outright contraction. Slower global growth translates into a reduced demand for a broad range of commodities, including oil, and reduced demand tends to take down prices. The comparative strength of the U.S. economy was accompanied by strength in the U.S. dollar, which surged 7.71%. What’s good for the dollar is often bad for gold, which fell 7.65% during the quarter—almost exactly as much as the dollar rose.

4th Quarter 2014

By the end of December, calendar year returns for 2014 looked pretty good. The Dow Jones Industrial Average (DJIA) gained 7.52%, the S&P 500 Index gained 11.39%, the NASDAQ Composite Index gained 13.40%, and the small company Russell 2000 Index gained 3.53%.

But that year-end snapshot doesn’t fully capture the way most of 2014 may have felt to stock investors. In mid-October, after about 80% of the year had already gone by, the S&P 500 and NASDAQ were only up 0.78% and 0.89% respectively, the Dow Jones Industrial Average was down –2.77% for the year, and the small company Russell 2000 was actually down –9.83%. A nice “Santa Claus” rally over eight trading days around Christmas tacked 6% onto the suddenly attractive year-end index results.

Many forecasters had predicted 2014 would be the year interest rates would finally rise, as the Federal Reserve phased out its Quantitative Easing bond buying program. Instead, the yield on the benchmark 10 year Treasury Note fell from 3.03% to as low as 2.06% before closing the year at 2.17%. Early in 2015, the Fed indicated that it expects to begin to “normalize” (that is—raise) interest rates sometime this year, but at a “patient” pace.

1st Quarter 2015

For the major U.S. equity indices, the first quarter of 2015 brought a lot of motion, but very little movement. The Dow Jones Industrial Average (DJIA) had daily moves of more than 100 points on 36 of the quarter’s 61 trading days; 18 up and 18 down. The average gain on the up days was 210 points while the average of the big down days was –195 points. There were four days with DJIA moves of more than 300 points; also evenly split with two up and two down. Still, by quarter’s end the DJIA had barely changed with a drop of –0.26%. The S&P 500 followed a similar pattern—down in January, up in February, down again in March—to end the quarter with a gain of just 0.44% (0.95% with dividends). The NASDAQ and small company Russell 2000 indices also had their ups and downs, but closed the quarter with gains of 3.48% and 3.99% respectively.

| Absolute Shares Trust

Managers Discussion of Fund Performance (continued)

June 30, 2015 |

Most of the early movement in stocks prices in 2015 took place in foreign markets. Equities seemed to celebrate the European Central Bank’s version of QE, or Quantitative Easing, with the DAX in Germany jumping 22.03%, and the CAC 40 in France gaining 17.81%. Monetary policy in the U.K. is determined by the Bank of England rather than the European Central Bank, and the FTSE’s gain was a relatively more modest 3.15%. Japan’s version of monetary easing was likely a contributing factor to the Nikkei’s quarterly gain of 10.06%.

While the gains in foreign markets were quite impressive in terms of their local currencies, for investors in the U.S. those gains were reduced in dollar terms by the dollar’s ongoing rally. The U.S. Dollar Index, which measures the dollar’s value against a basket of foreign currencies, jumped nearly 9% in the first three months of this year, adding to last year’s 12.79% gain. Converting foreign gains into increasingly expensive dollars means getting less bang for your Euro or Yen.

Since rising bond prices cause yields to fall, Central Banks perform Quantitative Easing by buying bonds, with the expectation that the added buying pressure will drive interest rates down, and the resulting cheap money will help to revive economic growth. Yields have not only fallen, but have fallen to levels that may have been unimaginable in the past. By the end of the first quarter, Swiss government bond yields fell below 0%. At that yield, investor must actually pay for the privilege of lending cash to the Swiss government for the next 10 years. The 10 year German government bond yield of 0.18% made the 1.92% yield U.S. 10 year Treasury was offering seem downright generous. It’s little wonder that U.S. bonds continued to attract buyers in the first quarter, adding to last year’s gains in Corporate and Treasury bond indices.

2nd Quarter 2015

After a lackluster first quarter, U.S. equity markets spent much of the second quarter of 2015 enjoying a respectable advance. That enjoyment came to an abrupt halt, however, as worries about possible contagion from the Greek debt crisis appeared to spread. As recently as one week before the end of the quarter the three major market indices were posting solid gains, with the S&P 500 ahead by 2.72%, the Dow Jones Industrial Average (DJIA) up by 2.07%, and the NASDAQ Composite up 5.29% for the quarter through June 23. The next four trading days saw those indices drop 3.13%, 3.02% and 3.91% respectively, with most of the damage coming in just one day. The DJIA lost 350 points, or 1.95% on the 29th, while the S&P 500 fell 2.09% and the NASDAQ lost 2.40% that day. When it was over, what had been a promising month and quarter for the U.S. stock indices had suddenly slipped away.

Stock markets around the world also slipped on the news from Greece. The heightened possibility of a Greek exit from the Eurozone took stocks down across Europe. For the quarter, the German DAX fell 8.53%, the CAC 40 in France dropped 4.84%, and the U.K.’s FTSE fell 3.72%.

On the other side of the globe, the Shanghai Composite began a dramatic slide that took it down more than 17% from its June 12th high, but nevertheless left it up 14.71% for the quarter and more than 30% higher for the year so far. According to data from The World Bank, in 2014 China’s economy was the second largest in the world, trailing only that of the U.S. It was also more than 43 times larger than the economy of Greece. It’s understandable that concerns about the Greek economy would ripple through global markets, but those concerns could be swamped by the waves of concern that could wash over global markets if Chinese stocks continue to sink.

The notion that interest rates would have to start rising someday has been drifting around bond markets for some time now. The drop in bond prices during the second quarter suggests investors are starting to believe that “someday” is someday soon. Comments from the Federal Reserve seemed to crystallize the loose idea of higher rates into the hard reality that rate hikes could be coming before the end of the year. While the Fed has yet to move on rates, some investors apparently decided not to wait before moving on from their bond holdings. Dow Jones Equal Weight U.S. Issued Corporate Bond Index slid throughout the second quarter, losing 3.35% for the period. Long term bonds were hit harder, with the Barclays Capital U.S. 20+ Year Treasury Bond Index falling 9.09% over that period.

Savers, who have been stuck with miniscule interest on their bank deposits, money market accounts and CDs for years, probably shouldn’t get too excited about the prospect of finally getting higher rates on their money. While the U.S. economy has been in recovery for a while now and employment here has improved, important economies around the world are still struggling. In fact, the global slowdown in economic activity is a prime suspect in the on-going dramatic slide in commodity prices (including oil). Falling prices can lead to a deflationary spiral that can stifle an economy. Japan is still fighting the deflation dragon it’s been battling for decades, and Europe is battling to keep from teetering toward deflation. With global conditions worrisome and no sign of inflation in the U.S., the Fed may be reluctant to risk making matters worse by raising interest rates too much. Demand from foreign investors for U.S. bonds may also help support bond prices and keep yields relatively low.

As for stocks, the bull market’s performance has already been running for more than 6 years now (since March 2009). For investors just joining the show, the good seats may already be taken. Market corrections of 20% are not all that rare, and this 6 year bull market started after a plunge in the S&P 500 of more than 50%. We believe diversification, value, careful stock selection, and a responsive risk management approach are always important, but are especially timely ideas after a lengthy bull market. The major U.S. stock indices may end up posting some positive numbers by the time we get to this time next year—but that doesn’t mean there won’t be some negative numbers between now and then.

| Absolute Shares Trust

Managers Discussion of Fund Performance (continued)

June 30, 2015 |

Investment Commentary

Caveat Emptor (“Let the buyer beware”)

Imagine a very nice family living in a very nice neighborhood in an especially beautiful and very nice home. They have lived there for a little over seven years now, and have been very happy. A few years ago they invested in finishing the basement, turning it into a beautiful family space with an entertainment center, exercise equipment, and separate room for the furnace and hot water heater. They even added a pair of sump pumps to protect their investment. Because their home made up a big part of their family wealth, they paid for homeowners’ insurance every month. It felt good to know that if something bad happened, they would be protected from a catastrophic financial loss.

Then the storm came. Wind and falling trees took down power lines, leaving their neighborhood very much in the dark for two weeks. Although they didn’t live near any lakes or rivers, the sudden deluge flooded the streets—and their once beautiful basement. Without electricity, the sump pumps sat quietly under four feet of water, with the ruined entertainment center, exercise equipment, furnace and hot water heater.

At least they had insurance. The insurance covered damage to all kinds of property from a great variety of causes, but unfortunately for the family, flooding from a backup of groundwater was not among them. The protection they thought they had been paying for all those years just wasn’t there. They were not alone. While some of their neighbors had been advised to add a groundwater rider to their policies, others had not and found themselves in the same sad situation. While they all understood the big picture benefits of homeowners’ insurance, some didn’t fully understand the details and limitations of the policies they owned. If only they had known…

One of the ways investors aim to protect themselves from unacceptable losses in their portfolios is through diversification. The big picture concept of the potential benefit of diversification is simple: owning a large number of stocks is intended to reduce the negative impact on a portfolio if something bad happens to one of them. An increasingly popular way to “buy” this kind of protection is through the use of index funds. According to the 2015 Investment Company Fact Book published by the Investment Company Institute (ICI):

| • | At the end of 2014 there were 382 index funds with $2.1 trillion in assets under management |

| • | In 2014 investors added $148 billion in new money to these funds |

| • | 31% of the households who owned mutual funds owned at least one equity index fund |

| • | One third of all index fund assets—approximately $693 billion—track the S&P 500 Index |

Just how much diversification protection does an index fund that holds around 500 stocks really offer? Let’s take a closer look at how the S&P 500 Index is put together to see if we can get a fuller understanding of the kind of equity exposure a fund designed to track this very popular index might offer.

The S&P 500 is a capitalization weighted index, which means each stock in the index is weighted based on the value of its stock price multiplied by its number of shares. The market capitalization is essentially the market value “footprint” of the company—the value the market has placed on the company.

Using data from our Bloomberg terminal to examine the details of the S&P 500 Index, we find that as of June 30:

| • | The five largest companies by market capitalization (Apple, Google, Microsoft, Exxon Mobil, and Berkshire Hathaway) accounted for 10.8% of the index weight |

| • | The 217 smallest companies by market capitalization (too many to list) also represented 10.8% of the index weight |

| • | Half the weight of the index was carried by just 54 companies; the other half was carried by the remaining 447 stocks in the index (there were 501 stocks in the index on 06/30) |

| • | More than 25% of the index weight was held by the biggest 18 stocks |

| • | The smallest 18 stocks had an average weight of 0.02% in the index |

| Absolute Shares Trust

Managers Discussion of Fund Performance (continued)

June 30, 2015 |

The notion that good news at a small company like QEP Resources will diversify away bad news at a big company like Apple that has 221 times its weight in the index just doesn’t add up.

Of course, worrying about how an index, and the hundreds of billions of dollars invested to track an index, might fare in a stormy market may seem out of step with what’s popular now. After all, the S&P 500 has been on the rise for years without a serious correction. Why prepare for a flooded basement on a sunny day?

Maybe the answer depends on how many disasters you’ve already lived through, and how much damage you’ve had to recover from. Investors who were tracking the S&P 500 on March 24, 2000 saw the index plummet 49% by October 9, 2002. Over the next five years the S&P clawed its way back to a 2.5% gain by October 9, 2007. It had been 71/2 years since it peaked in 2000.

And then it plunged again, this time losing 57% by March 9, 2009. If investors had been tracking the index throughout that decline, they would have watched each $100,000 invested reduced to $43,000 by the time it was over. If only they had known…

It’s hard to say whether the flood of cash into index investments today is a testament to investors’ confidence that markets will never have to weather another serious decline, or a belief that index funds will behave differently this time if conditions take a turn for the worse.

Maybe investors have simply forgotten what it feels like to have so much money washed away. After all, it’s been a little over 71/2 years since the last market peak.

| Absolute Shares Trust

Managers Discussion of Fund Performance (continued)

June 30, 2015 |

Of course, passively following an index is not the only way to invest, and mimicking the S&P 500—or any index—is not the approach we have taken with the client assets under our care. We don’t know when the next deluge of bad news will rain down on the market, or whether the account values of index-following investors will be left seriously under water when it does. But we do know that we will continue to follow the disciplined, responsive, risk-managed process we’ve used for our clients for more than 20 years, because trying our best to protect the value of our clients’ accounts under any conditions has always been our policy.

The Bottom Line

We believe that the appropriate approach to investing in a volatile world is one that’s responsive to continually changing conditions and opportunities. We think that process should be focused on managing risk as well as on pursuing return. It should be disciplined and have a track record that spans both good times and bad. In short, our opinion is that it should be just like the process we have used for our investment management clients for the last 23 years—and continue to use to manage the Funds today.

Sincerely,

|  |

| Gary E. Stroik | Don Schreiber, Jr. |

| Co-Portfolio Manager | Co-Portfolio Manager |

| Vice President & Chief Investment Officer | Founder & CEO |

Past performance is not a guarantee of future results.

Opinions expressed are those of WBI Investments, Inc. (“WBI”), the Funds’ investment adviser, are subject to change, are not guaranteed, and should not be construed as recommendations or investment advice.

| Absolute Shares Trust

Managers Discussion of Fund Performance (continued)

June 30, 2015 |

Exchange Traded Fund investing involves risk. Principal loss is possible. The Funds invest in emerging market and foreign securities which involve political, economic and currency risks, greater volatility and differences in accounting methods. These risks can be greater in emerging markets. The Funds invest in smaller and medium sized companies, which involve additional risks such as limited liquidity and greater volatility. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Investment by the Fund in lower-rated and non-rated securities presents a greater risk of loss to principal and interest than higher-rated securities. Investments in mortgage-backed securities may involve additional risks, such as credit risk, prepayment risk, possible illiquidity and default, and susceptibility to adverse economic developments. Because the Funds invest in other exchange-traded funds (“ETFs”), they are subject to additional risks that do not apply to conventional mutual funds, including the risks that the market price of an ETF’s shares may trade at a discount to its net asset value ("NAV"), an active secondary trading market may not develop or be maintained, or trading may be halted by the exchange in which they trade, which may impact a Fund’s ability to sell its shares. The Funds may invest in exchange-traded notes (“ETN”), which are subject to the credit risk of the issuer. Additional risks include volatility, lack of liquidity, and sensitivity to currencies, commodities markets, and interest rate changes. The Funds may invest in master limited partnerships (“MLP”), which are subject to certain risks inherent in the structure of MLPs, including complex tax structure risks, the limited ability for election or removal of management, limited voting rights, potential dependence on parent companies or sponsors for revenues to satisfy obligations, and potential conflicts of interest between partners, members and affiliates. The Funds may also use options and future contracts, which have the risks of unlimited losses of the underlying holdings due to unanticipated market movements and failure to correctly predict the direction of securities prices, interest rates and currency exchange rates. The investment in options is not suitable for all investors.

Investments in absolute return strategies are not intended to outperform stocks and bonds during strong market rallies. Diversification does not assure a profit or protect against a loss in a declining market.

Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any security. References to other funds should not be interpreted as an offer of these securities. For a complete list of Fund holdings, please refer to the Schedule of Investments in this report.

While the Funds are no-load, commission charges on the purchase of shares, management fees and other expenses will apply. Please refer to the prospectus for additional information.

A stop loss order directs a brokerage firm to sell the specified security at the prevailing market price should that security’s price fall to or below a stipulated price. A stop limit order directs a brokerage firm to sell the specified security should that security’s price fall to or below a stipulated price, but only if the transaction can be executed at or above the limit price given as part of the order. The Funds use WBI’s proprietary Dynamic Trailing Stop/Loss System (DTSTM), which is designed to help control the risk to invested capital when investing in volatile securities and markets. The DTSTM is not a stop loss order or stop limit order placed with a brokerage firm, but an internal process for monitoring price movements. While the DTSTM may be used to initiate the process for selling a security, it does not assure that a particular execution price will be received.

The source for index price and performance data used in the discussion of market conditions and market commentary is Bloomberg. The S&P 500® Index is a capitalization weighted index of 500 large capitalization stocks which is designed to measure broad domestic securities markets.

An investment in money market funds is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency. Although money market funds seek to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in these funds.

Any tax or legal information provided is merely a summary of our understanding and interpretation of some of the current income tax regulations and is not exhaustive. Investors must consult their tax advisor or legal counsel for advice and information concerning their particular situation. Neither the Funds nor any of their representatives may give legal or tax advice.

Must be preceded or accompanied by a prospectus.

WBI Shares Exchange Traded Funds are distributed by Foreside Fund Services, LLC.

| Absolute Shares Trust

Managers Discussion of Fund Performance (continued)

June 30, 2015 |

Benchmark Definitions

The Russell Global SMID Growth Index measures the growth segment for small and mid-size securities in the global equity universe.

The Russell Global SMID Value Index measures the value segment of the small to mid-cap global equity universe, which represents companies that are considered less expensive than the overall market.

The MSCI World High Dividend Yield Index is designed to reflect performance of equities in the parent index (excluding REITs) with higher dividend income and quality characteristics than average, and dividend yields that are sustainable and persistent.

The Russell Global SMID Defensive Index measures the performance of the investable securities in the Global SMID Defensive segment of the market.

The Russell Global Large Cap Growth Index measures the growth segment for the largest securities in the global equity universe.

The Russell Global Large Cap Value Index measures the value segment of the large cap global equity universe, which represents companies that are considered less expensive than the overall market.

The Russell Global Large Cap Defensive Index measures the performance of the investable securities in the Global Large Cap Defensive segment of the market.

The 50% Barclays Global Aggregate Bond & 50% Russell Global Index is a custom index combining the Barclays Global Aggregate High-Yield Bond Index and Russell Global Index. The Barclays Global Aggregate High-Yield Bond Index is an unmanaged index considered representative of fixed-rate, noninvestment-grade debt of companies in the U.S., developed markets and emerging markets. The Russell Global Index measures the performance of the global equity market based on all investable equity securities.

| Absolute Shares Trust

Portfolio Allocations |

As of June 30, 2015 (Unaudited)

| WBI SMID Tactical Growth Shares | | WBI Large Cap Tactical Growth Shares | | WBI Tactical Income Shares |

| | Percentage of | | | Percentage of | | | Percentage of |

| Sector | Net Assets | | Sector | Net Assets | | Sector | Net Assets |

| Consumer Discretionary | 28.8% | | Information Technology | 19.4% | | Exchange Traded Funds | 42.1% |

| Health Care | 15.8% | | Energy | 14.5% | | US Government Notes | 35.9% |

| Industrials | 10.5% | | Consumer Discretionary | 10.1% | | Health Care | 3.8% |

| Financials | 9.6% | | Health Care | 9.7% | | Financials | 3.6% |

| Information Technology | 9.1% | | Industrials | 9.4% | | Energy | 3.0% |

| Materials | 7.1% | | Financials | 6.7% | | Industrials | 1.1% |

| Energy | 4.9% | | Materials | 6.4% | | Short-Term Investments and | | |

| Utilities | 4.2% | | Consumer Staples | 4.5% | | Other Assets and Liabilities | 10.5% |

| Consumer Staples | 2.2% | | Utilities | 4.1% | | TOTAL | 100.0% |

| Short-Term Investments and | | | | Short-Term Investments and | | | | | |

| Other Assets and Liabilities | 7.8% | | Other Assets and Liabilities | 15.2% | | WBI Tactical High Income Shares | |

| TOTAL | 100.0% | | TOTAL | 100.0% | | | Percentage of |

| | | | | | | | | Sector | Net Assets |

| WBI SMID Tacal Value Shares | | | WBI Large Cap Tactical Value Shares | | | Exchange Traded Funds | 43.6% |

| | Percentage of | | | Percentage of | | US Government Notes | 20.5% |

| Sector | Net Assets | | Sector | Net Assets | | Health Care | 11.9% |

| Information Technology | 19.4% | | Consumer Discretionary | 16.4% | | Financials | 4.1% |

| Consumer Discretionary | 18.4% | | Information Technology | 15.1% | | Consumer Staples | 3.6% |

| Financials | 17.2% | | Health Care | 13.7% | | Energy | 3.1% |

| Industrials | 16.8% | | Industrials | 13.7% | | Information Technology | 0.6% |

| Health Care | 14.5% | | Energy | 12.4% | | Short-Term Investments and | | |

| Energy | 4.2% | | Consumer Staples | 7.5% | | Other Assets and Liabilities | 12.6% |

| Materials | 2.7% | | Materials | 5.9% | | TOTAL | 100.0% |

| Short-Term Investments and | | | | Financials | 5.4% | | | | |

| Other Assets and Liabilities | 6.8% | | Short-Term Investments and | | | | | | |

| TOTAL | 100.0% | | Other Assets and Liabilities | 9.9% | | | | |

| | | | | TOTAL | 100.0% | | | | |

| WBI SMID Tactical Yield Shares | | | | | | | | | |

| | Percentage of | | WBI Large Cap Tactical Yield Shares | | | | | |

| Sector | Net Assets | | | Percentage of | | | | |

| Consumer Discretionary | 29.9% | | Sector | Net Assets | | | | |

| Industrials | 18.9% | | Health Care | 13.4% | | | | |

| Financials | 14.4% | | Industrials | 12.6% | | | | |

| Materials | 10.6% | | Information Technology | 12.2% | | | | |

| Utilities | 7.4% | | Consumer Staples | 12.1% | | | | |

| Information Technology | 2.5% | | Consumer Discretionary | 10.6% | | | | |

| Energy | 2.0% | | Energy | 10.1% | | | | |

| Short-Term Investments and | | | | Financials | 5.7% | | | | |

| Other Assets and Liabilities | 14.3% | | Real Estate Investment Trusts | 3.8% | | | | |

| TOTAL | 100.0% | | Utilities | 3.7% | | | | |

| | | | | Materials | 3.5% | | | | |

| WBI SMID Tactical Select Shares | | | Short-Term Investments and | | | | | | |

| | Percentage of | | Other Assets and Liabilities | 12.3% | | | | |

| Sector | Net Assets | | TOTAL | 100% | | | | |

| Consumer Discretionary | 17.7% | | | | | | | | |

| Industrials | 15.2% | | WBI Large Cap Tactical Select Shares | | | | | |

| Financials | 12.8% | | | Percentage of | | | | |

| Information Technology | 8.8% | | Sector | Net Assets | | | | |

| Energy | 7.8% | | Health Care | 18.4% | | | | |

| Materials | 6.7% | | Information Technology | 18.2% | | | | |

| Health Care | 5.9% | | Consumer Discretionary | 12.4% | | | | |

| Utilities | 5.8% | | Energy | 10.1% | | | | |

| Short-Term Investments and | | | | Consumer Staples | 7.6% | | | | |

| Other Assets and Liabilities | 19.3% | | Real Estate Investment Trusts | 7.4% | | | | |

| TOTAL | 100.0% | | Industrials | 5.4% | | | | |

| | | | | Utilities | 4.8% | | | | |

| | | | | Materials | 3.3% | �� | | | |

| | | | | Short-Term Investments and | | | | | | |

| | | | | Other Assets and Liabilities | 12.4% | | | | |

| | | | | TOTAL | 100.0% | | | | |

| Absolute Shares Trust

WBI SMID Tactical Growth Shares

Performance Summary (Unaudited) |

Total Returns

Period Ended June 30, 2015 | Since

Inception (8/25/14) |

|

| WBI SMID Tactical Growth Shares — NAV | 0.94 | % |

| WBI SMID Tactical Growth Shares — Market | 1.13 | % |

| Russell Global SMID Growth Index | 4.15 | % |

This chart illustrates the performance of a hypothetical $10,000 investment made on August 25, 2014, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The performance data quoted represents past performance and is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For most recent month-end performance, please visit www.wbishares.com.

Per the Prospectus, the Fund’s annual operating expense (gross) is 1.00%. The Fund’s Sub-Advisor has contractually agreed to waive the fees and reimburse expenses of the Fund such that total annual operating expenses are limited to 1.25% of average net assets until at least September 30, 2016. (Actual expenses can be referenced in the Financial Highlights section later in this report.)

| Absolute Shares Trust

WBI SMID Tactical Value Shares

Performance Summary (Unaudited) |

| Total Returns | Since |

| Period Ended June 30, 2015 | Inception (8/25/14) |

| WBI SMID Tactical Value Shares — NAV | (0.84 | %) |

| WBI SMID Tactical Value Shares — Market | (0.60 | %) |

| Russell Global SMID Value Index | (0.27 | %) |

This chart illustrates the performance of a hypothetical $10,000 investment made on August 25, 2014, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The performance data quoted represents past performance and is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For most recent month-end performance, please visit www.wbishares.com.

Per the Prospectus, the Fund’s annual operating expense (gross) is 1.00%. The Fund’s Sub-Advisor has contractually agreed to waive the fees and reimburse expenses of the Fund such that total annual operating expenses are limited to 1.25% of average net assets until at least September 30, 2016. (Actual expenses can be referenced in the Financial Highlights section later in this report.)

| Absolute Shares Trust

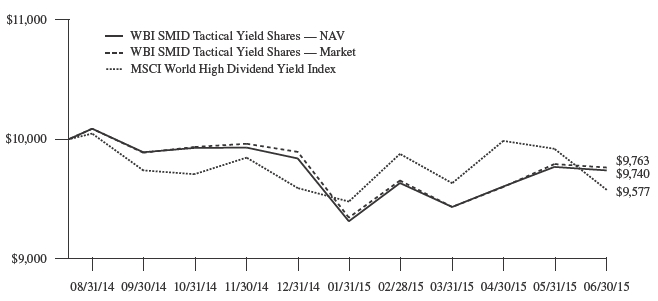

WBI SMID Tactical Yield Shares

Performance Summary (Unaudited) |

| Total Returns | Since |

| Period Ended June 30, 2015 | Inception (8/25/14) |

| WBI SMID Tactical Yield Shares — NAV | (2.60 | %) |

| WBI SMID Tactical Yield Shares — Market | (2.37 | %) |

| MSCI World High Dividend Yield Index | (4.23 | %) |

This chart illustrates the performance of a hypothetical $10,000 investment made on August 25, 2014, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The performance data quoted represents past performance and is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For most recent month-end performance, please visit www.wbishares.com.

Per the Prospectus, the Fund’s annual operating expense (gross) is 1.00%. The Fund’s Sub-Advisor has contractually agreed to waive the fees and reimburse expenses of the Fund such that total annual operating expenses are limited to 1.25% of average net assets until at least September 30, 2016. (Actual expenses can be referenced in the Financial Highlights section later in this report.)

| Absolute Shares Trust

WBI SMID Tactical Select Shares

Performance Summary (Unaudited) |

| Total Returns | Since |

| Period Ended June 30, 2015 | Inception (8/25/14) |

| WBI SMID Tactical Select Shares — NAV | (5.40 | %) |

| WBI SMID Tactical Select Shares — Market | (5.20 | %) |

| Russell Global SMID Defensive Index | 1.87 | % |

This chart illustrates the performance of a hypothetical $10,000 investment made on August 25, 2014, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The performance data quoted represents past performance and is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For most recent month-end performance, please visit www.wbishares.com.

Per the Prospectus, the Fund’s annual operating expense (gross) is 1.00%. The Fund’s Sub-Advisor has contractually agreed to waive the fees and reimburse expenses of the Fund such that total annual operating expenses are limited to 1.25% of average net assets until at least September 30, 2016. (Actual expenses can be referenced in the Financial Highlights section later in this report.)

| Absolute Shares Trust

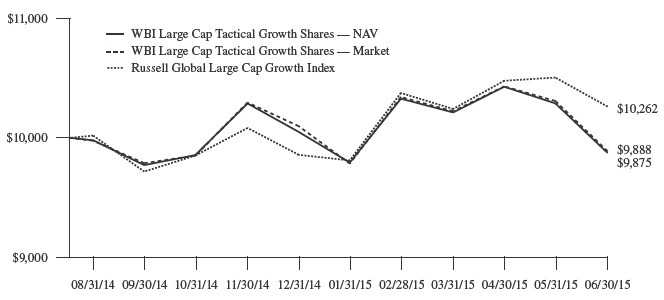

WBI Large Cap Tactical Growth Shares

Performance Summary (Unaudited) |

| Total Returns | Since |

| Period Ended June 30, 2015 | Inception (8/25/14) |

| WBI Large Cap Tactical Growth Shares — NAV | (1.25 | %) |

| WBI Large Cap Tactical Growth Shares — Market | (1.12 | %) |

| Russell Global Large Cap Growth Index | 2.62 | % |

This chart illustrates the performance of a hypothetical $10,000 investment made on August 25, 2014, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The performance data quoted represents past performance and is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For most recent month-end performance, please visit www.wbishares.com.

Per the Prospectus, the Fund’s annual operating expense (gross) is 1.00%. The Fund’s Sub-Advisor has contractually agreed to waive the fees and reimburse expenses of the Fund such that total annual operating expenses are limited to 1.25% of average net assets until at least September 30, 2016. (Actual expenses can be referenced in the Financial Highlights section later in this report.)

| Absolute Shares Trust

WBI Large Cap Tactical Value Shares

Performance Summary (Unaudited) |

| Total Returns | Since |

| Period Ended June 30, 2015 | Inception (8/25/14) |

| WBI Large Cap Tactical Value Shares — NAV | (3.29 | %) |

| WBI Large Cap Tactical Value Shares — Market | (3.07 | %) |

| Russell Global Large Cap Value Index | (1.34 | %) |

This chart illustrates the performance of a hypothetical $10,000 investment made on August 25, 2014, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The performance data quoted represents past performance and is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For most recent month-end performance, please visit www.wbishares.com.

Per the Prospectus, the Fund’s annual operating expense (gross) is 1.00%. The Fund’s Sub-Advisor has contractually agreed to waive the fees and reimburse expenses of the Fund such that total annual operating expenses are limited to 1.25% of average net assets until at least September 30, 2016. (Actual expenses can be referenced in the Financial Highlights section later in this report.)

| Absolute Shares Trust

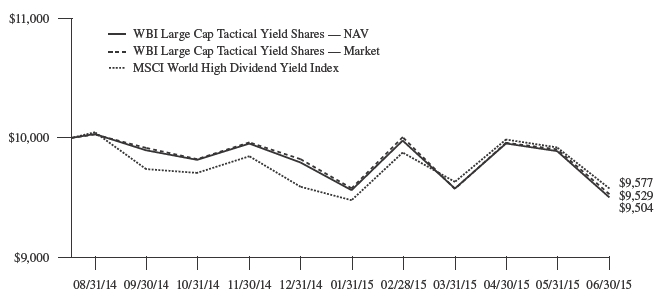

WBI Large Cap Tactical Yield Shares

Performance Summary (Unaudited) |

| Total Returns | Since |

| Period Ended June 30, 2015 | Inception (8/25/14) |

| WBI Large Cap Tactical Yield Shares — NAV | (4.96 | %) |

| WBI Large Cap Tactical Yield Shares — Market | (4.71 | %) |

| MSCI World High Dividend Yield Index | (4.23 | %) |

This chart illustrates the performance of a hypothetical $10,000 investment made on August 25, 2014, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The performance data quoted represents past performance and is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For most recent month-end performance, please visit www.wbishares.com.

Per the Prospectus, the Fund’s annual operating expense (gross) is 1.00%. The Fund’s Sub-Advisor has contractually agreed to waive the fees and reimburse expenses of the Fund such that total annual operating expenses are limited to 1.25% of average net assets until at least September 30, 2016. (Actual expenses can be referenced in the Financial Highlights section later in this report.)

| Absolute Shares Trust

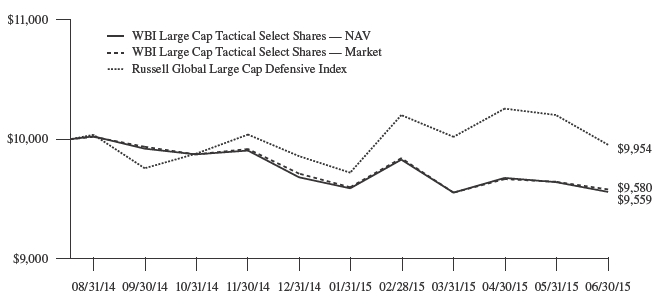

WBI Large Cap Tactical Select Shares

Performance Summary (Unaudited) |

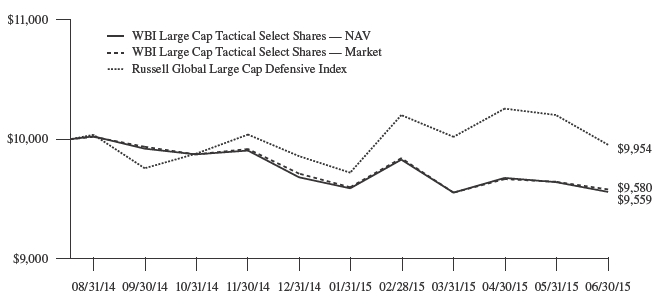

| Total Returns | Since |

| Period Ended June 30, 2015 | Inception (8/25/14) |

| WBI Large Cap Tactical Select Shares — NAV | (4.41 | %) |

| WBI Large Cap Tactical Select Shares — Market | (4.20 | %) |

| Russell Global Large Cap Defensive Index | (0.46 | %) |

This chart illustrates the performance of a hypothetical $10,000 investment made on August 25, 2014, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The performance data quoted represents past performance and is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For most recent month-end performance, please visit www.wbishares.com.