Millington Securities, Inc.

Don Schreiber, Jr.

Millington Securities, Inc.

ANNUAL REPORT

June 30, 2017

WBI Tactical SMG Shares | WBIA

WBI Tactical SMV Shares | WBIB

WBI Tactical SMY Shares | WBIC

WBI Tactical SMS Shares | WBID

WBI Tactical LCG Shares | WBIE

WBI Tactical LCV Shares | WBIF

WBI Tactical LCY Shares | WBIG

WBI Tactical LCS Shares | WBIL

WBI Tactical Income Shares | WBII

WBI Tactical High Income Shares | WBIH

WBI Tactical Rotation Shares | WBIR

WBI Power FactorTM High Dividend ETF | WBIY

| Absolute Shares Trust Table of Contents |

Management’s Discussion of Fund Performance | 1 |

Performance Summaries | 14 |

Portfolio Allocations | 26 |

Schedules of Investments | 27 |

Statements of Assets and Liabilities | 39 |

Statements of Operations | 42 |

Statements of Changes in Net Assets | 45 |

Financial Highlights | 51 |

Notes to Financial Statements | 57 |

Report of Independent Registered Public Accounting Firm | 71 |

Trustees and Officers | 72 |

Approval of Advisory Agreements and Board Considerations | 74 |

Expense Example | 76 |

Federal Tax Information | 79 |

Information About the Portfolio Holdings | 80 |

Information About Proxy Voting | 80 |

Frequency Distribution of Premiums and Discounts | 80 |

(This page intentionally left blank.)

| Absolute Shares Trust Management’s Discussion of Fund Performance (Unaudited) June 30, 2017 |

Dear Fellow Shareholder:

Two new funds joined the family of ten existing WBI Exchange Traded Funds (ETFs) during the fiscal year ended June 30, 2017. The WBI Tactical Rotation Shares launched on July 27, 2016, and the WBI Power Factor High Dividend ETF launched on December 22, 2016. The WBI Tactical Rotation Shares uses proprietary global asset rotation models covering a wide range of potential investment opportunities in an attempt to identify those with attractive prospects for risk-adjusted total return. The WBI Power Factor High Dividend ETF is designed to track the Solactive Power FactorTM High Dividend Index. The Solactive Power FactorTM High Dividend Index uses a rules-based methodology to select U.S. stocks ranked by certain fundamental value characteristics (Power FactorsTM) that have above average forecasted dividend yields.

Despite a few ups and downs, the twelve-month period ended June 30th was a generally favorable one for many investment markets. As discussed in more detail below, the underlying performance trends of the security types from which each fund’s selections are made varied, and the performance among the Funds reflected their participation in those trends. Favorable conditions may not continue indefinitely for every type of investment, but we believe the consistent application of the disciplined process used to manage the Funds will continue to prove to be extremely valuable and attractive to current and prospective shareholders.

We appreciate the continuing confidence of our existing shareholders, and welcome our new shareholders to the Funds.

Investment Philosophy

The goal of the WBI Funds is to provide consistent, attractive returns with less volatility and risk to capital than traditional approaches. We believe capital preservation is essential to providing long-term portfolio growth and a consistent stream of income. Our focus on value, dividends, and risk management has become fundamental to our investment process.

Performance Overview

The actively managed equity-focused Funds enjoyed double digit positive returns during the fiscal year ended June 30, 2017. The income Funds generated monthly distributions and gained during the period as well, although their significant allocation to fixed income investments moderated their appreciation.

The two new Funds have less than a full year of performance. The per share value of the WBI Tactical Rotation Shares slid during the first five months after its launch, but has made up much of that ground over the six months that followed. In its first six months of existence, the WBI Power Factor High Yield Dividend ETF has outperformed the index it is designed to track. This has nevertheless led to a slightly negative return, as a portion of the high-yielding dividend-paying stocks that comprise the index have fallen out of favor during the period.

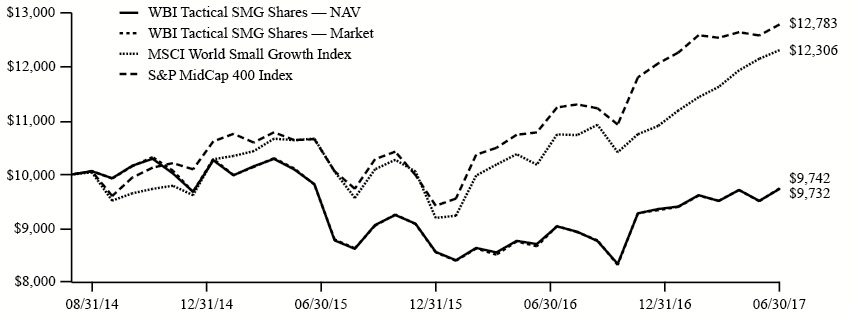

The WBI Tactical SMG Shares (NYSE Arca: WBIA) returned 11.74% on a NAV basis, and 12.38% based on market value, versus the 20.86% return of the MSCI World Small Growth GROSS USD Index, the Fund’s benchmark.

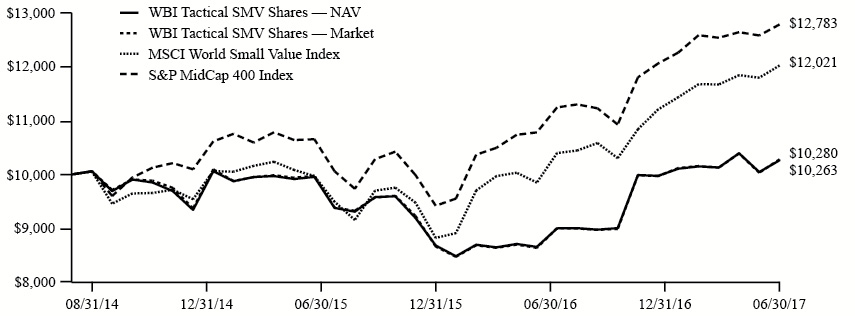

The WBI Tactical SMV Shares (NYSE Arca: WBIB) returned 18.55% on a NAV basis, and 19.01% based on market value, versus the 22.04% return of the MSCI World Small Value GROSS USD Index, the Fund’s benchmark.

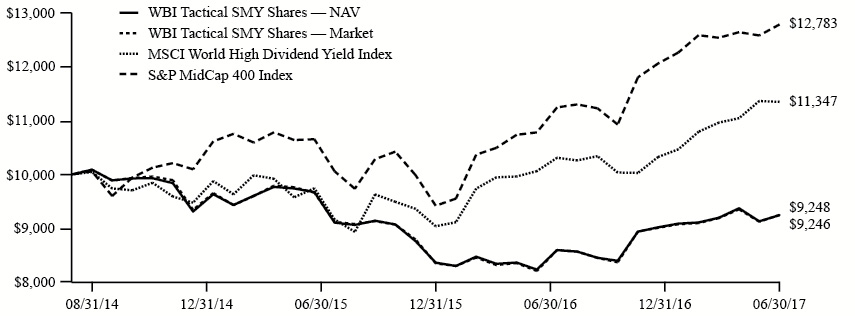

The WBI Tactical SMY Shares (NYSE Arca: WBIC) returned 12.26% on a NAV basis, and 12.65% based on market value, versus the 12.77% return of the MSCI World High Dividend Yield Gross TR Index, the Fund’s benchmark.

The WBI Tactical SMS Shares (NYSE Arca: WBID) returned 13.32% on a NAV basis, and 14.34% based on market value, versus the 17.08% return of the MSCI World Quality GROSS USD Index, the Fund’s benchmark.

The WBI Tactical LCG Shares (NYSE Arca: WBIE) returned 12.88% on a NAV basis, and 13.54% based on market value, versus the 18.68% return of the MSCI World Large Growth GROSS USD Index, the Fund’s benchmark.

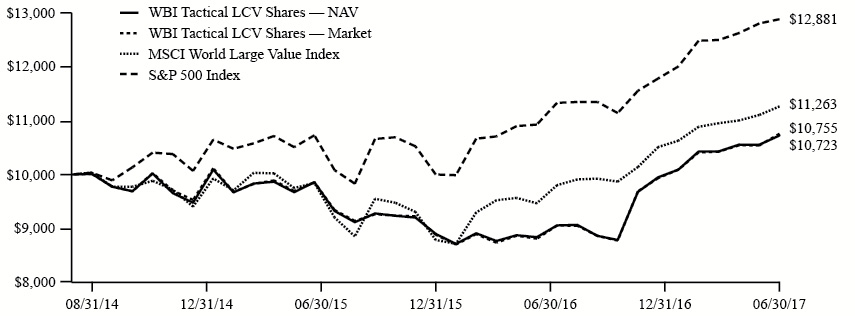

The WBI Tactical LCV Shares (NYSE Arca: WBIF) returned 21.34% on a NAV basis, and 22.10% based on market value, versus the 18.99% return of the MSCI World Large Value GROSS USD Index, the Fund’s benchmark.

The WBI Tactical LCY Shares (NYSE Arca: WBIG) returned 14.82% on a NAV basis, and 15.43% based on market value, versus the 12.77% return of the MSCI World High Dividend Yield Gross TR Index, the Fund’s benchmark.

The WBI Tactical LCS Shares (NYSE Arca: WBIL) returned 16.80% on a NAV basis, and 17.46% based on market value, versus the 17.08% return of the MSCI World Quality GROSS USD Index, the Fund’s benchmark.

The WBI Tactical Income Shares (NYSE Arca: WBII) returned 2.36% on a NAV basis, and 2.54% based on market value, versus the 3.29% return of the 20% MSCI World TR/80% Barclays Capital Aggregate Bond Index, the Fund’s custom benchmark.

1

| Absolute Shares Trust Management’s Discussion of Fund Performance (Unaudited) (continued) June 30, 2017 |

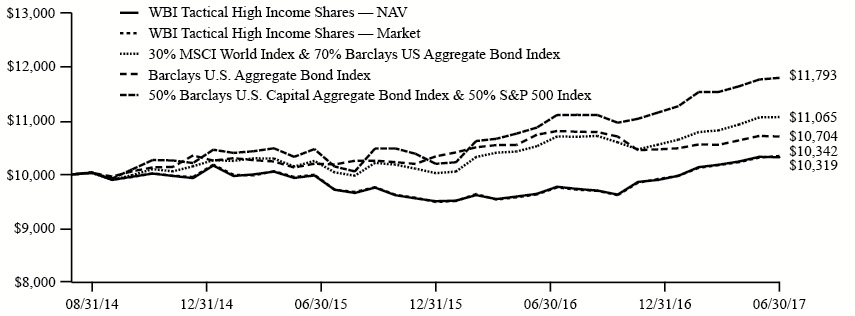

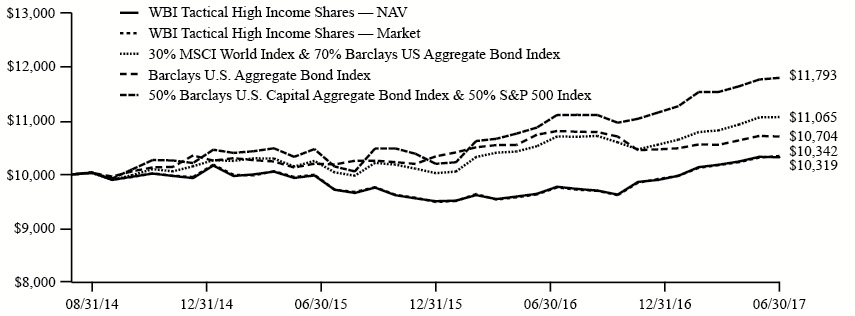

The WBI Tactical High Income Shares (NYSE Arca: WBIH) returned 7.04% on a NAV basis, and 7.40% based on market value, versus the 5.14% return of the 30% MSCI World TR/70% Barclays Capital Aggregate Bond Index and the -0.31% return of the Bloomberg Barclays Aggregate Bond Index, the Fund’s custom benchmarks.

The WBI Tactical Rotation Shares ETF (NYSE Arca: WBIR) returned -1.44% on a NAV basis, and -1.25% based on market value, versus the return of 7.16% of the 50% MSCI World TR/50% Barclays Capital Aggregate Bond Index, the Fund’s custom benchmark.

The WBI Power Factor High Yield Dividend ETF (NYSE Arca: WBIY) returned -1.64% on a NAV basis, and -1.16% based on market value, versus the return of 6.33% of the MSCI US Investable Market High Dividend Index, the Fund’s benchmark.

Net asset value total return is calculated assuming an initial investment made at the net asset value at the beginning of the period, reinvestment of all dividends and distributions at net asset value during the period, and the redemption on the last day of the period. Net asset value total return includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset value and returns for shareholder transactions. Market price total return is calculated assuming an initial investment made at the market price at the beginning of the period, reinvestment of all dividends and distributions at market price during the period, and sale at the market price on the last day of the period. Total investment returns calculated for a period of less than one year are not annualized.

With the exception of the index Fund, the WBI Power Factor High Yield Dividend ETF, the strategies used in the management of the Funds do not attempt to replicate or track the performance of any index, and differ significantly from the methods used to construct and maintain the indices that serve as their respective benchmarks. The eleven actively managed Funds (“Active Funds”) use proprietary processes to screen, rank, and purchase securities with particular attributes, and sell securities when certain thresholds are reached, while benchmark indices are unmanaged, and consist of a passive representation of all securities that meet the definition of the index constituents. In addition, each Active Fund uses strategies intended to mitigate volatility and protect capital, and as a result these Funds will often have a significant allocation to cash equivalents. Therefore, while each Active Fund’s performance includes the effect of an investment in cash equivalents from the proceeds of sales when certain thresholds are met, benchmark indices do not include an allocation to cash equivalents. A distinguishing characteristic of cash equivalents is that their prices are extremely stable and not subject to the levels of price volatility generally exhibited by other investments. Therefore, in periods during which the prices of the securities represented in benchmark indices are falling, an allocation to cash equivalents may contribute to Active Fund performance that outperforms their benchmarks. In periods during which the prices of the securities represented in benchmark indices are rising, an allocation to cash equivalents in an Active Fund may cause its performance to trail that of its benchmark. During the most recent fiscal period, the Funds generally did not hold persistently large allocations to cash equivalents, so deviations in performance between each Active Fund and its respective benchmark was primarily due to differences between the securities held by the Fund and those that make up the benchmark’s constituents. You cannot invest directly in an index, including a benchmark index, and benchmark performance does not include the deduction of transaction and operational expenses, or the deduction of an investment management fee, which would alter their indicated historical results.

The WBI Power Factor High Yield Dividend ETF is intended to track its benchmark index, the Solactive Power FactorTM High Dividend Index, and can reasonably be compared to its benchmark in evaluating its performance. Despite the limitations of using benchmarks to assess the performance of the Active Funds, indices can still provide some context for understanding how market conditions and active management may have affected Fund performance. A benchmark for each of the Active Funds is shown because they provide a reference to investments that are similar to the types of investments that may appear from time to time in the Funds. However, none of the benchmarks are, or are likely to become, representative of past or expected Active Fund holdings or performance.

Review of Active Fund Trading Activity

The Active Funds attempt to provide consistent, attractive returns net of expenses with potentially less volatility and risk to capital than traditional approaches, whatever market conditions may be. The investment process for each Fund includes a buy discipline and a sell discipline. Each Fund’s trading activity reflects this disciplined investment process as described in its prospectus, and summarized below.

The Active Funds that invest in individual equities use quantitative computer screening of fundamental stock information to evaluate domestic and foreign equity securities in an attempt to find companies with attractive characteristics for the selected universe of securities. Dividend payments may be considered as part of the evaluation process. Once securities are identified, an overlay of technical analysis confirms timeliness of security purchases. The Funds then add qualifying securities using available cash within the parameters of each Fund’s investment objective and security selection criteria.

The Active Funds that invest in fixed income securities and bond ETFs use a proprietary bond model to assess the appropriate duration of their exposure to debt securities. Duration is a measure of a fixed income security’s expected price sensitivity to changes in interest rates. Securities with longer durations are expected to experience greater price movements than securities with shorter duration for the same change in prevailing interest rates. A portion of a Fund’s bond exposure may also be invested to pursue perceived opportunities in varying segments

2

| Absolute Shares Trust Management’s Discussion of Fund Performance (Unaudited) (continued) June 30, 2017 |

of the debt market. This systematic process of identifying, evaluating, and purchasing securities constitutes the Sub-Advisor’s buy discipline for the Funds.

The WBI Tactical Rotation Shares uses proprietary global asset rotation models intended to identify investment opportunities with superior risk-adjusted return potential across a broad array of global asset classes, sectors, industries, geographic regions, indices, or security styles. The Fund’s allocation will change as the models’ assessments of the attractiveness of investment opportunities change with respect to the other opportunities being evaluated.

Once a security is purchased for a given Active Fund, a strict sell discipline with a dynamic stop loss and goal setting process attempts to control the effects of the volatility of each invested position on the Fund’s value. An initial stop percentage and goal price is established at the time a security is purchased. As that security’s specified goal price is approached, the initial stop tolerance set for each security is tightened. If a security stays within its acceptable price channel relative to its current stop, it remains in the Fund’s portfolio. If the security moves below the acceptable price channel, a stop is triggered and the Fund will sell the security. This results in a responsive process that actively adjusts the Fund’s allocation by causing it to become more fully invested or by raising cash with the intention of protecting capital. This process is likely to result in a Fund holding meaningful allocations to cash equivalents during periods of market volatility.

The investment process has been built on the assumption that future events involve varying degrees of uncertainty. Therefore, the appearance of qualifying candidates in the selection process will be respected as a possible indication of the start of a durable price advance, and each stop loss trigger will result in a sale of the relevant security to help prevent losses to capital that could result if the security continued to be held and the price of the security continued to fall. As per this disciplined investment process, during the fiscal period securities identified by the various ranking and selection processes as attractive were purchased with available cash, and trailing stops were implemented for all securities purchased.

The security selection process has continued to uncover what we believe to be very attractive investment opportunities for each of the Funds.

WBI Tactical SMG Shares (WBIA)

As of June 30, 2017, WBIA held 41 securities in addition to a position in a money market fund which served as a cash equivalent. From the time of their purchase, 29 of these positions had unrealized gains of between 0.19% and 20.96%, while 12 had unrealized losses ranging from -0.05% to -8.84%. The aggregate unrealized gain amounted to 3.86% of the Fund’s period ending net asset value.

Approximately 73% of the securities held by WBIA at any time during the fiscal period were sold. Approximately 48% of the Fund’s holdings were sold for gains, with an average realized gain of 14.4%, and approximately 51% were sold for an average realized loss of -7.1%. Other dispositions (generally involving option and other hedging activity) affected approximately 0.03% of the Fund’s positions, resulting in a loss of -0.29%.

Examples of securities that made positive contributions to WBIA’s performance during the fiscal period include Cognex Corporation, Group 1 Automotive Incorporated, Robert Half International Incorporated, Brown & Brown Incorporated, and Manpowergroup Incorporated. Examples of securities that detracted from the Fund’s performance during the fiscal period include Dollar General Corporation, Texas Roadhouse Incorporated, Apogee Enterprises Incorporated, Glacier Bancorp Incorporated, and Provident Financial Services.

Six option/volatility hedges intended to reduce risk were implemented in WBIA during the fiscal period, resulting in a loss of -0.29%. The only hedged position that resulted in a positive return was Broadcom Ltd. Examples of positions that were hedged with negative return contributions arising from the hedge itself include two separate instances of Russell 2000 Index, two separate instances of S&P 500 Index, and a separate instance of hedging Broadcom Ltd.

High turnover in WBIA’s holdings has the potential to result in the realization and distribution to shareholders of higher capital gains. If Fund shares are held in a taxable account, this may increase your tax liability. To the extent portfolio turnover increases transaction costs, it may also reduce Fund performance. Of course, selling a security in a timely fashion may also improve performance if a subsequent loss is avoided that exceeds the cost of executing the sale.

WBI Tactical SMV Shares (WBIB)

As of June 30, 2017, WBIB held 41 securities in addition to a position in a money market fund which served as a cash equivalent. From the time of their purchase, 28 of these positions had unrealized gains of between 0.07% and 24.44%, while 13 had unrealized losses ranging from -0.09% to -18.97%. The aggregate unrealized gain amounted to 4.21% of the Fund’s period ending net asset value.

Approximately 77% of the securities held by WBIB at any time during the fiscal period were sold. Approximately 47% of the Fund’s holdings were sold for gains, with an average realized gain of 16.3%, and approximately 53% were sold for an average realized loss of -8.8%. Other dispositions (generally involving option and other hedging activity) affected approximately 0.02% of the Fund’s positions, resulting in an average loss of -0.27%.

3

| Absolute Shares Trust Management’s Discussion of Fund Performance (Unaudited) (continued) June 30, 2017 |

Examples of securities that made positive contributions to WBIB’s performance during the fiscal period include Cosan Ltd. Class A Shares, Dana Incorporated, Kapstone Paper and Packaging, Citizens Financial Group, and Morgan Stanley. Examples of securities that detracted from the Fund’s performance during the fiscal period include The Geo Group Incorporated, Ingredion Incorporated, Pitney Bowes Incorporated, Targa Resources Corporation, and Kindred Healthcare Incorporated.

Four option/volatility hedges intended to reduce risk were implemented in WBIB during the fiscal period, resulting in an aggregate loss of approximately -0.27%. No hedged position resulted in a positive return contribution. Examples of positions that were hedged with negative return contributions arising from the hedge itself include two separate instances of Russell 2000 Index and two separate instances of S&P 500 Index.

High turnover in WBIB’s holdings has the potential to result in the realization and distribution to shareholders of higher capital gains. If Fund shares are held in a taxable account, this may increase your tax liability. To the extent portfolio turnover increases transaction costs, it may also reduce Fund performance. Of course, selling a security in a timely fashion may also improve performance if a subsequent loss is avoided that exceeds the cost of executing the sale.

WBI Tactical SMY Shares (WBIC)

As of June 30, 2017, WBIC held 34 securities in addition to a position in a money market fund which served as a cash equivalent. From the time of their purchase, 24 of these positions had unrealized gains of between 0.27% and 27.40%, while 10 had unrealized losses ranging from -0.08% to -3.55%. The aggregate unrealized gain amounted to 4.27% of the Fund’s period ending net asset value.

Approximately 80% of the securities held by WBIC at any time during the fiscal period were sold. Approximately 41% of the Fund’s holdings were sold for gains, with an average realized gain of 15.4%, and approximately 59% were sold for an average realized loss of -8.5%. Other dispositions (generally involving option and other hedging activity) affected approximately 0.03% of the Fund’s positions, resulting in an average loss of -0.28%.

Examples of securities that made positive contributions to WBIC’s performance during the fiscal period include DeVry Education Group Incorporated, ILG Incorporated, Webster Financial Corporation, Time Warner Incorporated, and The Boeing Company. Examples of securities that detracted from the Fund’s performance during the fiscal period include Quad Graphics Incorporated, Hollyfrontier Corporation, Pitney Bowes Incorporated, Cinemark Holdings Incorporated, and Time Incorporated.

Five option/volatility hedges intended to reduce risk were implemented in WBIC during the fiscal period, resulting in an aggregate loss of approximately -0.28%. The only hedged position that resulted in a positive return was Time Warner Incorporated. Examples of positions that were hedged with negative return contributions arising from the hedge itself two separate instances of Russell 2000 Index and two separate instances of S&P 500 Index.

High turnover in WBIC’s holdings has the potential to result in the realization and distribution to shareholders of higher capital gains. If Fund shares are held in a taxable account, this may increase your tax liability. To the extent portfolio turnover increases transaction costs, it may also reduce Fund performance. Of course, selling a security in a timely fashion may also improve performance if a subsequent loss is avoided that exceeds the cost of executing the sale.

WBI Tactical SMS Shares (WBID)

As of June 30, 2017, WBID held 39 securities in addition to a position in a money market fund which served as a cash equivalent. From the time of their purchase, 28 of these positions had unrealized gains of between 0.33% and 29.18%, while 11 had unrealized losses ranging from -0.39% to -10.51%. The aggregate unrealized gain amounted to 4.64% of the Fund’s period ending net asset value.

Approximately 77% of the securities held by WBID at any time during the fiscal period were sold. Approximately 43% of the Fund’s holdings were sold for gains, with an average realized gain of 14.1%, and approximately 57% were sold for an average realized loss of -8.4%. Other dispositions (generally involving option and other hedging activity) affected approximately 0.03% of the Fund’s positions, resulting in an average loss of -0.29%.

Examples of securities that made positive contributions to WBID’s performance during the fiscal period include Steel Dynamics Incorporated, Evercore Partners Incorporated – Class A Shares, Greif Incorporated – Class A Shares, Alaska Air Group Incorporated, and Vail Resorts Incorporated. Examples of securities that detracted from the Fund’s performance during the fiscal period include Essendant Incorporated, Ingredion Incorporated, LA-Z-BOY Incorporated, Nordstrom Incorporated, and Sturm Ruger & Co Incorporated.

Four option/volatility hedges intended to reduce risk were implemented in WBID during the fiscal period, resulting in an aggregate loss of approximately -0.29%. No hedged position resulted in a positive return contribution. Examples of positions that resulted in negative return contributions include two separate instances of Russell 2000 Index and two separate instances of S&P 500 Index.

High turnover in WBID’s holdings has the potential to result in the realization and distribution to shareholders of higher capital gains. If Fund shares are held in a taxable account, this may increase your tax liability. To the extent portfolio turnover increases transaction costs, it may

4

| Absolute Shares Trust Management’s Discussion of Fund Performance (Unaudited) (continued) June 30, 2017 |

also reduce Fund performance. Of course, selling a security in a timely fashion may also improve performance if a subsequent loss is avoided that exceeds the cost of executing the sale.

WBI Tactical LCG Shares (WBIE)

As of June 30, 2017, WBIE held 30 securities in addition to a position in a money market fund which served as a cash equivalent. From the time of their purchase, 26 of these positions had unrealized gains of between 0.58% and 36.51%, while 4 had unrealized losses ranging from -1.34% to -7.55%. The aggregate unrealized gain amounted to 4.89% of the Fund’s period ending net asset value.

Approximately 75% of the securities held by WBIE at any time during the fiscal period were sold. Approximately 45% of the Fund’s holdings were sold for gains, with an average realized gain of 14.5%, and approximately 55% were sold for an average realized loss of -7.2%. Other dispositions (generally involving option and other hedging activity) affected approximately 0.03% of the Fund’s positions, resulting in an average loss of -0.23%.

Examples of securities that made positive contributions to WBIE’s performance during the fiscal period include Applied Materials Incorporated, Regions Financial Corporation, Quest Diagnostics Incorporated, Apple Incorporated, and Republic Services Incorporated. Examples of securities that detracted from the Fund’s performance during the fiscal period include The Geo Group Incorporated, Dollar General Corporation, Mid-America Apartment Communities, Prologis Incorporated, and Nielsen Holdings Plc.

Six option/volatility hedges intended to reduce risk were implemented in WBIE during the fiscal period, resulting in an aggregate loss of approximately -0.23%. Examples of positions that were hedged with positive return contributions arising from the hedge itself include Time Warner Incorporated, CBS Corporation, and Conagra Brands. Examples of hedged positions that resulted in a negative return contribution were two separate instances of hedging the S&P 500 Index.

High turnover in WBIE’s holdings has the potential to result in the realization and distribution to shareholders of higher capital gains. If Fund shares are held in a taxable account, this may increase your tax liability. To the extent portfolio turnover increases transaction costs, it may also reduce Fund performance. Of course, selling a security in a timely fashion may also improve performance if a subsequent loss is avoided that exceeds the cost of executing the sale.

WBI Tactical LCV Shares (WBIF)

As of June 30, 2017, WBIF held 27 securities in addition to a position in a money market fund which served as a cash equivalent. From the time of their purchase, 24 of these positions had unrealized gains of between 0.14% and 13.49%, while 3 had unrealized losses ranging from -0.56% to -14.29%. The aggregate unrealized gain amounted to 4.31% of the Fund’s period ending net asset value.

Approximately 79% of the securities held by WBIF at any time during the fiscal period were sold. Approximately 51% of the Fund’s holdings were sold for gains, with an average realized gain of 14.1%, and approximately 49% were sold for an average realized loss of -6.2%. Other dispositions (generally involving option and other hedging activity) affected approximately 0.03% of the Fund’s positions, resulting in an average loss of -0.24%.

Examples of securities that made positive contributions to WBIF’s performance during the fiscal period include Copa Holdings SA – Class A Shares, Lincoln National Corporation, Best Buy Co Incorporated, Nucor Corporation, and Regions Financial Corporation. Examples of securities that detracted from the Fund’s performance during the fiscal period include Conagra Brands Incorporated, Bunge Ltd., Targa Resources Corporation, Digital Realty Trust Incorporated, and Bancolombia S.A. – Sponsored ADR.

Four option/volatility hedges intended to reduce risk were implemented in WBIF during the fiscal period, resulting in an aggregate loss of approximately -0.24%. The only hedged position that resulted in a positive return was Conagra Brands. Examples of hedged positions that resulted in a negative return contribution were two separate instances of hedging the S&P 500 Index.

High turnover in WBIF’s holdings has the potential to result in the realization and distribution to shareholders of higher capital gains. If Fund shares are held in a taxable account, this may increase your tax liability. To the extent portfolio turnover increases transaction costs, it may also reduce Fund performance. Of course, selling a security in a timely fashion may also improve performance if a subsequent loss is avoided that exceeds the cost of executing the sale.

WBI Tactical LCY Shares (WBIG)

As of June 30, 2017, WBIG held 28 securities in addition to a position in a money market fund which served as a cash equivalent. From the time of their purchase, 25 of these positions had unrealized gains of between 0.20% and 17.36%, while 3 had unrealized losses ranging from -0.55% to -4.54%. The aggregate unrealized gain amounted to 4.18% of the Fund’s period ending net asset value.

Approximately 77% of the securities held by WBIG at any time during the fiscal period were sold. Approximately 47% of the Fund’s holdings were sold for gains, with an average realized gain of 15.1%, and approximately 53% were sold for an average realized loss of -6.9%. Other

5

| Absolute Shares Trust Management’s Discussion of Fund Performance (Unaudited) (continued) June 30, 2017 |

dispositions (generally involving option and other hedging activity) affected approximately 0.03% of the Fund’s positions, resulting in an average loss of -0.26%.

Examples of securities that made positive contributions to WBIG’s performance during the fiscal period include Nucor Corporation, Regions Financial Corporation, Microchip Technology Incorporated, HP Incorporated, and ILG Incorporated. Examples of securities that detracted from the Fund’s performance during the fiscal period include Targa Resources Corporation, Nielsen Holdings Plc., SYSCO Corporation, LS Technologies Incorporated, and The Geo Group Incorporated.

Four option/volatility hedges intended to reduce risk were implemented in WBIF during the fiscal period, resulting in an aggregate loss of approximately -0.26%. The only hedged position that resulted in a positive return was Conagra Brands. Examples of hedged positions that resulted in a negative return contribution were two separate instances of hedging the S&P 500 Index.

High turnover in WBIG’s holdings has the potential to result in the realization and distribution to shareholders of higher capital gains. If Fund shares are held in a taxable account, this may increase your tax liability. To the extent portfolio turnover increases transaction costs, it may also reduce Fund performance. Of course, selling a security in a timely fashion may also improve performance if a subsequent loss is avoided that exceeds the cost of executing the sale.

WBI Tactical LCS Shares (WBIL)

As of June 30, 2017, WBIL held 30 securities in addition to a position in a money market fund which served as a cash equivalent. From the time of their purchase, 23 of these positions had unrealized gains of between 0.50% and 17.97%, while 7 had unrealized losses ranging from -0.57% to -5.34%. The aggregate unrealized gain amounted to 5.09% of the Fund’s period ending net asset value.

Approximately 75% of the securities held by WBIL at any time during the fiscal period were sold. Approximately 49% of the Fund’s holdings were sold for gains, with an average realized gain of 14.5%, and approximately 51% were sold for an average realized loss of -7.4%. Other dispositions (generally involving option and other hedging activity) affected approximately 0.03% of the Fund’s positions, resulting in an average loss of -0.25%.

Examples of securities that made positive contributions to WBIL’s performance during the fiscal period include Keycorp, Steel Dynamics Incorporated, Nucor Corporation, Regions Financial Corporation, and Lincoln National Corporation. Examples of securities that detracted from the Fund’s performance during the fiscal period include Conagra Brands Incorporated, Nielsen Holdings Plc., Cardinal Health Incorporated, Comcast Corporation – Class A Shares, and One Gas Incorporated.

Four option/volatility hedges intended to reduce risk were implemented in WBIL during the fiscal period, resulting in an aggregate loss of approximately -0.25%. The only hedged position that resulted in a positive return was Conagra Brands. Examples of hedged positions that resulted in a negative return contribution were two separate instances of hedging the S&P 500 Index.

High turnover in WBIL’s holdings has the potential to result in the realization and distribution to shareholders of higher capital gains. If Fund shares are held in a taxable account, this may increase your tax liability. To the extent portfolio turnover increases transaction costs, it may also reduce Fund performance. Of course, selling a security in a timely fashion may also improve performance if a subsequent loss is avoided that exceeds the cost of executing the sale.

WBI Tactical Income Shares (WBII)

As of June 30, 2017, WBII held 21 securities in addition to a position in a money market fund which served as a cash equivalent. From the time of their purchase, 19 of these positions had unrealized gains of between 0.08% and 7.36%, while 2 had unrealized losses ranging from -0.10% to -7.97%. The aggregate unrealized gain amounted to 1.46% of the Fund’s period ending net asset value.

Approximately 81% of the securities held by WBII at any time during the fiscal period were sold. Approximately 54% of the Fund’s holdings were sold for gains, with an average realized gain of 5.3%, and approximately 46% were sold for an average realized loss of -3.0%. Other dispositions (generally involving option and other hedging activity) affected approximately 15.31% of the Fund’s positions, resulting in an average loss of -0.05%.

Examples of securities that made positive contributions to WBII’s performance during the fiscal period include Lincoln National Corporation, Keycorp, Manpowergroup Incorporated, Morgan Stanley, and Regions Financial Corporation. Examples of securities that detracted from the Fund’s performance during the fiscal period include iShares 10-20 Year Treasury ETF, iShares 20+ Year Treasury Bond ETF, Invesco Ltd., SPDR Bloomberg Barclays International Treasury ETF, and Time Incorporated.

Two option/volatility hedges intended to reduce risk were implemented in WBII during the fiscal period, resulting in an aggregate loss of approximately -0.05%. No hedged position resulted in a positive return contribution. Examples of hedged positions that resulted in a negative return contribution were two separate instances of hedging the S&P 500 Index.

6

| Absolute Shares Trust Management’s Discussion of Fund Performance (Unaudited) (continued) June 30, 2017 |

High turnover in WBII’s holdings has the potential to result in the realization and distribution to shareholders of higher capital gains. If Fund shares are held in a taxable account, this may increase your tax liability. To the extent portfolio turnover increases transaction costs, it may also reduce Fund performance. Of course, selling a security in a timely fashion may also improve performance if a subsequent loss is avoided that exceeds the cost of executing the sale.

WBI Tactical High Income Shares (WBIH)

As of June 30, 2017, WBIH held 22 securities in addition to a position in a money market fund which served as a cash equivalent. From the time of their purchase, 14 of these positions had unrealized gains of between 0.68% and 14.60%, while 8 had unrealized losses ranging from -0.02% to -7.97%. The aggregate unrealized gain amounted to 2.02% of the Fund’s period ending net asset value.

Approximately 81% of the securities held by WBIH at any time during the fiscal period were sold. Approximately 51% of the Fund’s holdings were sold for gains, with an average realized gain of 8.0%, and approximately 49% were sold for an average realized loss of -4.5%. Other dispositions (generally involving option and other hedging activity) affected approximately 3.34% of the Fund’s positions, resulting in an average loss of -0.04%.

Examples of securities that made positive contributions to WBIH’s performance during the fiscal period include Regions Financial Corporation, Lincoln National Corporation, HP Incorporated, Morgan Stanley, and Keycorp. Examples of securities that detracted from the Fund’s performance during the fiscal period include Mid-America Apartment Communities, Targa Resources Corporation, Conagra Brands Incorporated, Extra Space Storage Incorporated, and Invesco Ltd.

Four option/volatility hedges intended to reduce risk were implemented in WBIH during the fiscal period, resulting in an aggregate loss of approximately -0.04%. The only hedged position that resulted in a positive return was Conagra Brands. Examples of hedged positions that resulted in a negative return contribution were two separate instances of hedging the S&P 500 Index.

High turnover in WBIH’s holdings has the potential to result in the realization and distribution to shareholders of higher capital gains. If Fund shares are held in a taxable account, this may increase your tax liability. To the extent portfolio turnover increases transaction costs, it may also reduce Fund performance. Of course, selling a security in a timely fashion may also improve performance if a subsequent loss is avoided that exceeds the cost of executing the sale.

WBI Tactical Rotation Shares (WBIR)

As of June 30, 2017, WBIR held 13 securities in addition to a position in a money market fund which served as a cash equivalent. From the time of their purchase, 12 of these positions had unrealized gains of between 0.30% and 4.92%, while 1 had unrealized losses of -0.43%. The aggregate unrealized gain amounted to 1.86% of the Fund’s period ending net asset value.

Approximately 87% of the securities held by WBIR at any time during the fiscal period were sold. Approximately 55% of the Fund’s holdings were sold for gains, with an average realized gain of 2.9%, and approximately 45% were sold for an average realized loss of -3.9%. The Fund had no holdings in other dispositions (generally involving option and other hedging activity).

Examples of securities that made positive contributions to WBIR’s performance during the fiscal period include iShares Latin America 40 ETF, iShares China Large-Cap ETF, Wisdomtree India Earnings ETF, iShares Russell 1000 Value ETF, and SPDR S&P 600 Small Cap Growth ETF. Examples of securities that detracted from the Fund’s performance during the fiscal period include First Trust Latin America ETF, iShares MSCI Global Silver Miners ETF, Etracs CMCI LNG Platinum TR ETN, Velocityshares VIX Short-Term ETN, and Vanguard Telecom Service ETF.

No option/volatility hedges were implemented in WBIR during the fiscal period.

High turnover in WBIR’s holdings has the potential to result in the realization and distribution to shareholders of higher capital gains. If Fund shares are held in a taxable account, this may increase your tax liability. To the extent portfolio turnover increases transaction costs, it may also reduce Fund performance. Of course, selling a security in a timely fashion may also improve performance if a subsequent loss is avoided that exceeds the cost of executing the sale.

Review of Index Fund Trading Activity

WBI Power Factor High Yield Dividend (WBIY)

WBIY is intended to track the Solactive Power FactorTM High Dividend Index, and its trading activity results from changes to the holdings of this underlying index. The composition of the underlying index is adjusted quarterly and screened monthly for dividend cuts or an overall negative outlook concerning the member companies’ dividend policy.

7

| Absolute Shares Trust Management’s Discussion of Fund Performance (Unaudited) (continued) June 30, 2017 |

As of June 30, 2017, WBIY held 50 securities in addition to a position in a money market fund which served as a cash equivalent. From the time of their purchase, 19 of these positions had unrealized gains of between 0.86% and 33.42%, while 31 had unrealized losses ranging from -0.29% to -46.95%. The aggregate unrealized loss amounted to -3.18% of the Fund’s period ending net asset value.

Approximately 41% of the securities held by WBIY at any time during the fiscal period were sold as a result of changes to the underlying index. Approximately 54% of the Fund’s holdings were sold for gains, with an average realized gain of 5.3%, and approximately 46% were sold for an average realized loss of -6.3%.

Examples of securities that made positive contributions to WBIY’s performance during the fiscal period include HP Incorporated, PPL Corporation, Emerson Electric Company, Great Plains Energy Incorporated, and Entergy Corporation. Examples of securities that detracted from the Fund’s performance during the fiscal period include Verizon Communications Incorporated, GNC Holdings Incorporated – Class A Shares, Seagate Technology, Western Refining Incorporated, and Cracker Barrel Old Country.

No option/volatility hedges were implemented in WBIY during the fiscal period.

High turnover in WBIY’s holdings has the potential to result in the realization and distribution to shareholders of higher capital gains. If Fund shares are held in a taxable account, this may increase your tax liability. To the extent portfolio turnover increases transaction costs, it may also reduce Fund performance. Of course, selling a security in a timely fashion may also improve performance if a subsequent loss is avoided that exceeds the cost of executing the sale.

Market Conditions

Quarter by quarter review of fiscal period market conditions 2016-2017

3rd Quarter 2016

U.S. equity returns trailed off a bit in August and September after a strong July, but still posted solidly positive numbers for the third quarter of 2016. For the Dow Jones Industrial Average (DJIA), its 2.80% July return slipped a bit to 2.11% by the end of the quarter, and the S&P 500 Index gave back a little of its 3.56% July gain to finish the quarter up by 3.31%. The NASDAQ Composite and small company Russell 2000 Index each cooled off from their torrid July pace as the summer wore on, but still added to their 6.60% and 5.90% starts for first quarter gains of 9.69% and 8.66% respectively.

International stock markets followed a similar pattern, with strong July returns leading to a good third quarter outcome. For the full three-month period, the EAFE gained 5.80%, the Nikkei in Japan was up 5.61%, German DAX rose 8.58%, and the Hang Seng Index in Hong Kong leapt 12.04%.

July was also the best month for bonds in the third quarter, but the returns were more modest. September was particularly harsh for long-term U.S. government bonds, as the August -0.94% slide in the Barclays U.S. Treasury 20+ Year Total Return Index picked up speed with a decline of -1.74%.

While stocks were enjoying a good July, commodities were heading the other way. The CRB Index sank -6.00% that month, then slid another -0.45% in August before bouncing back with a 3.39% September gain to end the quarter down by -3.25%

4th Quarter 2016

A weak October gave way to a strong November and December in U.S. equity markets. The Dow Jones Industrial Average (DJIA) and the S&P 500 Index each tacked on more in the fourth quarter than they had gained during the first three quarters of the year. The small company Russell 2000 Index added 8.43% in the quarter, almost as much as the 8.66% return it had achieved for the year up until then. The NASDAQ also enjoyed positive returns, but its 1.34% lagged the other major U.S. indices, and trailed its strong third quarter return.

International equity market results were mixed during the quarter, leaving the EAFE Index down by -1.88% for the calendar year. Japan’s Nikkei posted a 16.20% rise in the fourth quarter, but that was only just enough to recover losses earlier in the year, and eke out a small 0.42% positive return for all of 2016.

While stocks were enjoying a strong year-end, bonds were taking it on the chin. Bond prices fall as interest rates rise, and interest rates have been generally rising since summer. The yield on 10 year U.S. Treasuries has jumped from a low of 1.36% on July 8th to a high of 2.60% by December 15th, before settling to 2.44% by the end of the year. At the end of their two-day meeting on December 13-14, the Federal Reserve Board hiked the target for the federal funds rate by 0.25%, and suggested that it expected to raise rates three more times in 2017. Bond prices across the board were affected by rising rates, but the damage was especially pronounced in U.S. Treasuries with long maturities. The Bloomberg Barclays U.S. Treasury 20+ Year Total Return Index plummeted -12.16% for the quarter, and has lost -15.65% since its July high.

Gold started the fourth quarter up 24.01% for the year, but fell -12.80% over the last three months to end the year with a gain of 8.14%. Like gold, crude oil also started the year strong, up more than 30% at the end of September. Unlike gold, however, oil continued higher through year-end, gaining another 11.36% to finish the year with a gain of 45%.

8

| Absolute Shares Trust Management’s Discussion of Fund Performance (Unaudited) (continued) June 30, 2017 |

One year-long trend that was not reversed in the fourth quarter was the continuing reminder that forecasts and expectations often miss the mark. If fact, 2016 may be remembered mostly as the year when many expectations were overturned, from Britain’s decision to leave the European Union, to the U.S. election results. The forecasts about what would happen in the financial markets if these events were to occur proved to be almost a perfect inverse of the actual reactions. Rather than collapsing, equity prices sprinted higher. Of course, these newly unfolding events have spawned a new collection of forecasts and expectations about 2017 and beyond, and these new forecasts came with the same air of confidence as the old, stunningly wrong forecasts once enjoyed.

Rising stock prices, commodity prices, and interest rates were all indicative of expectations for robust economic growth in 2017.

1st Quarter 2017

The strong finish to 2016 for the major U.S. stock market indices carried over into the first two months of 2017 before cooling off in March, but still held on for solid first quarter gains. Large company stocks generally fared better than their smaller counterparts in the first quarter of the year, as the Dow Jones Industrial Average (DJIA) gained 4.56%, the S&P 500 Index was higher by 5.53% (6.07% including dividends), and the NASDAQ jumped 9.82%, The Russell 2000 index of smaller company stocks gained 2.12%.

International equities also generally enjoyed a solid first quarter, with the EAFE up by 6.47%, the German DAX ahead by 7.25%, and the Hang Seng in Hong Kong gaining 9.6%. Stocks in Japan, the world’s third largest economy, took a breather, posting a drop of -1.07%.

Despite the Federal Reserve’s decision to raise short-term interest rates in December and again in March, longer term government and corporate bonds generally held on for gains by quarter’s end.

Oil prices, as measured by the West Texas Intermediate Cushing Crude Oil Spot Price Index, dropped -12.51% from $53.72/barrel at the end of last year to as low as $47/barrel in March before bouncing back a bit to $50.60 for a decline of -5.81% by quarter’s end. Gold, on the other hand, enjoyed a solid 8.86% gain for the quarter, rising from $1,147.50/ounce to $1,249.20/ounce.

Much of the rally since last November in U.S. equity prices has been attributed to expectations that a pro-business agenda would be quickly forthcoming from the Republican controlled House of Representatives and Senate for prompt signature by the Republican President. The anticipation of swift enactment of laws to lower corporate taxes, reduce regulation, and increase military and infrastructure spending was widely expected to give a meaningful boost to corporate profits – and justify high and rising stock prices. Struggles with the process of enacting a Republican alternative to the Affordable Care Act appear to have raised doubts about those expectations. If there isn’t sufficient agreement among members of the majority party to address heath care, will there be enough consensus to reform the tax code, or pay for infrastructure plans? The first quarter of the year ended with many investors wondering if Congress will be able to enact enough of a pro-growth agenda to make a difference to the economy anytime soon.

2nd Quarter 2017

If businesses can grow their earnings without the benefit of legislative initiatives, stock prices can still reflect that growth. Continued optimism about the economy helped the U.S. equity markets follow up a strong first quarter with solid returns in the second quarter as well. The pace of gains slowed a bit, but the first half of 2017 ended with solid year-to-date results. The Dow Jones Industrial Average (DJIA) and S&P 500 Index posted gains in each of the last three months, resulting in quarterly gains of 3.32% and 2.57% respectively. The high-flying NASDAQ dipped a bit in June as technology stocks hit a pocket of weakness, but still landed a 3.87% gain for the quarter. For the first half of 2017, the DJIA is up 8.03%, the S&P 500 is ahead by 8.24%, and the NASDAQ stands 14.07% higher. Small companies also posted positive, but somewhat lower returns. The Russell 2000 Index of small companies gained 2.12% for the quarter, bringing its first half return to 4.29%.

Strength in international equity markets sputtered a bit in June, but held on to post positive returns for the quarter and for the first half of the year. The EAFE gained 5.03% over the last three months and is ahead by 11.83% for the year. Hong Kong’s Hang Seng index added 6.86% to its strong first quarter to bring its year-to-date return to 17.11%. Japan’s Nikkei turned around a negative first quarter to post a 5.95% second quarter return.

Falling oil prices contributed to commodities’ continued slump, with the CRB Index dropping -5.98% for the quarter, and -9.21% so far this year.

Rising interest rates can pressure the prices of existing bonds, as new bonds with higher rates become available. However, despite three hikes from the Federal Reserve since December and the suggestion of more to come, bonds have performed remarkably well. The Dow Jones Equal Weight Corporate Bond Index gained 2.63% for the quarter, and long-term Treasury bonds, which are typically very sensitive to changing rates, rose even more, with the Barclays U.S. Treasury 20+ Year Bond Index jumping 4.18%. How can these gains be consistent with the Fed’s moves? Here’s one way to connect the dots:

| | ● | a strong and growing economy can lead to an increase in inflation, |

| | ● | inflation erodes the purchasing power of the income and principal repayment from bonds, reducing their appeal, and |

| | ● | the Federal Reserve attacks inflation by hiking interest rates to slow the economy, hurting the value of existing bonds. |

9

| Absolute Shares Trust Management’s Discussion of Fund Performance (Unaudited) (continued) June 30, 2017 |

Therefore, if bond prices are holding relatively firm, it suggests bond investors believe:

| | ● | the economy is not going to grow quickly enough to spark inflation, |

| | ● | there’s virtually no inflation now for the Federal Reserve to fight, and |

| | ● | more rate hikes may hurt economic growth and corporate profits, driving investors from stocks to the perceived safety of bonds. |

It seems stock and bond investors have a difference of opinion about what’s coming next. The second half of the year may settle the question of which view is closer to the truth.

In the coming fiscal year, we expect companies to be tested against investment reality, whatever that reality turns out to be. How many pass that test could determine whether the recent rally in U.S. equity markets continues to make the grade.

Investment Commentary

Risk is for the birds!

Have you ever heard the expression “A canary in the coal mine”? Until remarkably recently, canaries were taken into coal mines as an early warning system. Canaries are more sensitive to poisonous gases than humans are, including colorless and odorless killers like carbon monoxide. Miners knew the air they were breathing was safe as long as the canaries were doing fine in their little cages. If the canary died, the miners knew trouble was in the air. While canary lovers may find this treatment of the little birds cruel, the miners preferred this “early warning system” to the alternative “too late warning system” of succumbing to the poisonous gases themselves. Fortunately for canaries, modern detection systems have relieved the birds of this responsibility, but the little yellow heroes undoubtedly saved many lives before winging their way into history.

Of course, warnings are only effective if you heed them. If, instead of heading for safety, the miners had called up to the surface “We’re gonna need more canaries down here!”, the world would have had far fewer canaries – and far fewer miners. Today, the expression “canary in the coal mine” has come to mean any early indication that trouble may be may seeping into our environment. As we continue to mine for investment opportunities, are there any early signs of a buildup of potentially toxic risks?

Valuation: One way investors assess the health of the stock market is by observing valuation. The notion is that if stocks become too expensive, investors with cash to invest will stop buying because they don’t want to overpay. Stock owners may decide to start taking profits at high prices before those prices get away from them. Less buying and more selling is not a healthy combination for prices. One popular measure of whether stocks are cheap or expensive is the P/E, or price earnings ratio. It measures how many years’ worth of earnings it would take to recoup the current price of a stock. In his book “Irrational Exuberance”, Yale Economics Professor and Nobel Prize winner Robert Shiller introduced the Cyclically Adjusted Price Earnings Ratio, or CAPE, which uses 10 years of earnings as a way of assessing value by smoothing out the short-term ups and downs in earnings. Since the year 1900, the CAPE of the S&P 500 has averaged 16.76. (Data Source: www.econ.yale.edu/~shiller/data.htm.) Since 1900 it’s only been above 29 three times. The first time was in July through September of 1929 at the end of the “Roaring Twenties” shortly before the stock market crash and Great Depression. It crossed 29 again in 1997, and then crossed 39 in 1999 on its way to topping out at 44.20 in December of that year, just before the “Dot Com” bubble burst and stocks tumbled. As of the end of this past quarter, the CAPE of the S&P 500 Index was 30.06.

Sentiment: Several sentiment polls suggest investors and consumers are as optimistic as they have been in years. What’s wrong with that? Historically, too much happiness has been a contrarian sign of trouble ahead. According to recent commentary from Ned Davis Research, the Conference Board’s Consumer Confidence Index is at its highest level since December 2000, the Bloomberg Consumer Comfort Index hit its highest level since August 2001, and the NDR Crowd Sentiment Poll hit a level in March that was above the average of peaks hit before other bear markets. Investors Intelligence Advisors Sentiment measure in March showed the most bulls since 1987, a year that included the infamous one-day -23% plunge in the Dow Jones Industrial Average.

Consumer Debt: There are signs that optimistic consumer sentiment may not continue to fuel robust consumer spending. The Federal Reserve’s most recent report on Consumer Debt shows consumers are carrying more than $3.8 trillion in outstanding debt, with more than $1 trillion each in student loans, car loans, and credit card balances. Consumer spending contributes significantly to U.S. economic growth, so consumers’ ability to borrow and service their debt is something to watch. The March data for the S&P/Experian Consumer Credit Default Indices show bank card default rates rising for five months in a row, with the national rate hitting a 45-month high. In what may be a related development, both Ford and General Motors recently reported disappointing sales.

Unless otherwise indicated, the source for all price and index data used in charts, tables and discussion is Bloomberg. You cannot invest directly in an index. |

10

| Absolute Shares Trust Management’s Discussion of Fund Performance (Unaudited) (continued) June 30, 2017 |

Interest Rates: The cost of borrowing money is the interest rate on the debt. Rising interest rates affect the affordability of mortgages, car loans, and credit card balances – all important contributors to the economy. The U.S. Federal Reserve Bank (the Fed) raised a key interest rate in June for the fourth time, with more rate hikes to come if recent comments from Fed decision makers is to be believed.

Quantitative Tightening or QT: In response to the financial crisis and Great Recession, The Fed began a process dubbed “Quantitative Easing” or QE. It involved month after month of buying billions of dollars worth of government and mortgage backed bonds in the open market. The goal was to drive down interest rates and stimulate economic growth by pumping billions in newly printed cash into the system. After three rounds of QE, the Federal Reserves’ balance sheet – the inventory of its assets including these bonds – has grown from under $900 billion before the crisis to approximately $4.5 trillion today. At their meeting in March, members of the Fed’s governing board began discussing reducing the size of its balance sheet – by beginning to reduce the supply of bonds it is holding in its inventory of assets. The Fed’s aggressive buying during each round of QE amounted to billions every month, and draining Fed’s inventory of these bonds will almost certainly be much more gradual and restrained. There is little doubt the Fed intends to make QT as painless as possible to avoid causing disruption in the financial markets as the cash they pumped into the economy is sucked back out. Still, the opposite of easing is tightening, and if easing delivered a tailwind to the economy, tightening could become a bit of a headwind.

Government Policy: Where are the tax cuts, infrastructure spending, and regulatory reforms investors appeared to be counting on? The kinds of changes that were widely expected to boost corporate profits seem to be mired in a dysfunctional congressional morass. What if the rancorous atmosphere in Washington doesn’t freshen? There’s even some uncertainty about whether Congress can cooperate enough to pass the legislation needed to prevent a government shutdown before the next deadline.

World events: As if domestic political issues weren’t problematic enough, geopolitical risks are also in the air. The threat from North Korea, the tragic civil war in Syria, and the specter of more terror attacks have the potential to drive investors from equities into investments they hope will be safe havens in a crisis.

The fluttering of all these canaries may be just a disquieting coincidence. After all, stocks have a history of being expensive for years before feeling the effects of overvaluation. Current levels of optimism may prompt consumers to dig down and spend more – despite current levels of debt. The Fed may be able to accurately gauge the right mix of interest rate hikes and Quantitative Tightening they can administer and yet keep the economy working. Some form of helpful legislative action may someday emerge from Washington, and the risks from world events may dissipate. Still, ignoring the warning signs may leave investors gasping should stocks someday succumb to these risks – or others that have yet to be detected.

11

| Absolute Shares Trust Management’s Discussion of Fund Performance (Unaudited) (continued) June 30, 2017 |

We believe that the disciplined process we have used for decades to closely monitor the portfolios under our care will help our clients achieve the returns they need at the level of risk they are willing to assume. To us, calling for more caution makes a lot more sense than calling for more canaries.

The Bottom Line

We believe that the appropriate approach to investing in a volatile world is one that’s responsive to continually changing conditions and opportunities. We think that process should be focused on managing risk as well as on pursuing return. It should be disciplined and have a track record that spans both good times and bad. In short, our opinion is that it should be just like the process we have used for our investment management clients for the last 24 years – and continue to use to manage the Funds today.

Sincerely,

|

|

Gary E. Stroik | Don Schreiber, Jr. |

Co-Portfolio Manager | Co-Portfolio Manager |

Vice President & Chief Investment Officer | Founder & CEO |

Past performance is not a guarantee of future results.

Opinions expressed are those of WBI Investments, Inc. (“WBI”), the Funds’ investment sub-adviser, are subject to change, are not guaranteed, and should not be construed as recommendations or investment advice or a solicitation to purchase or sell securities referenced in the Investment Commentary.

Exchange Traded Fund investing involves risk. Principal loss is possible. The Funds invest in emerging market and foreign securities which involve political, economic and currency risks, greater volatility and differences in accounting methods. These risks can be greater in emerging markets. The Funds invest in smaller and medium sized companies, which involve additional risks such as limited liquidity and greater volatility. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Investment by the Fund in lower-rated and non-rated securities presents a greater risk of loss to principal and interest than higher-rated securities. Investments in mortgage-backed securities may involve additional risks, such as credit risk, prepayment risk, possible illiquidity and default, and susceptibility to adverse economic developments. Because the Funds invest in other exchange-traded funds (“ETFs”), they are subject to additional risks that do not apply to conventional mutual funds, including the risks that the market price of an ETF's shares may trade at a discount to its net asset value ("NAV"), an active secondary trading market may not develop or be maintained, or trading may be halted by the exchange in which they trade, which may impact a Fund's ability to sell its shares. The Funds may invest in exchange-traded notes (“ETN”), which are subject to the credit risk of the issuer. Additional risks include volatility, lack of liquidity, and sensitivity to currencies, commodities markets, and interest rate changes. The Funds may invest in Real Estate Investment Trusts (REIT). Risks commonly associated with the direct ownership of real estate include fluctuations in the value of underlying properties, defaults by borrowers or tenants, changes in interest rates and risks related to general or local economic conditions. The Funds may invest in master limited partnerships (“MLP”), which are subject to certain risks inherent in the structure of

12

| Absolute Shares Trust Management’s Discussion of Fund Performance (Unaudited) (concluded) June 30, 2017 |

MLPs, including complex tax structure risks, the limited ability for election or removal of management, limited voting rights, potential dependence on parent companies or sponsors for revenues to satisfy obligations, and potential conflicts of interest between partners, members and affiliates. The Funds may also use options and future contracts, which have the risks of unlimited losses of the underlying holdings due to unanticipated market movements and failure to correctly predict the direction of securities prices, interest rates and currency exchange rates. The investment in options is not suitable for all investors.

Investments in absolute return strategies are not intended to outperform stocks and bonds during strong market rallies. Diversification does not assure a profit or protect against a loss in a declining market.

Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any security. References to other funds should not be interpreted as an offer of these securities. For a complete list of Fund holdings, please refer to the Schedule of Investments in this report.

While the Funds are no-load, commission charges on the purchase of shares, management fees and other expenses will apply. Please refer to the prospectus for additional information.

A stop loss order directs a brokerage firm to sell the specified security at the prevailing market price should that security’s price fall to or below a stipulated price. A stop limit order directs a brokerage firm to sell the specified security should that security’s price fall to or below a stipulated price, but only if the transaction can be executed at or above the limit price given as part of the order. The Funds use WBI’s proprietary Dynamic Trailing Stop/Loss System (DTSTM), which is designed to help control the risk to invested capital when investing in volatile securities and markets. The DTSTM is not a stop loss order or stop limit order placed with a brokerage firm, but an internal process for monitoring price movements. While the DTSTM may be used to initiate the process for selling a security, it does not assure that a particular execution price will be received.

Unless otherwise indicated, the source for index price and performance data used in the discussion of market conditions and market commentary is Bloomberg. The S&P 500® Index is a capitalization weighted index of 500 large capitalization stocks which is designed to measure broad domestic securities markets.

An investment in money market funds is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency. Although money market funds seek to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in these funds.

Any tax or legal information provided is merely a summary of our understanding and interpretation of some of the current income tax regulations and is not exhaustive. Investors must consult their tax advisor or legal counsel for advice and information concerning their particular situation. Neither the Funds nor any of their representatives may give legal or tax advice.

Must be preceded or accompanied by a prospectus.

WBI Shares Exchange Traded Funds are distributed by Foreside Fund Services, LLC.

Benchmark Definitions

The Russell Global SMID Growth Index measures the growth segment for small and mid-size securities in the global equity universe.

The Russell Global SMID Value Index measures the value segment of the small to mid-cap global equity universe, which represents companies that are considered less expensive than the overall market.

The MSCI World High Dividend Yield Index is designed to reflect performance of equities in the parent index (excluding REITs) with higher dividend income and quality characteristics than average, and dividend yields that are sustainable and persistent.

The Russell Global SMID Defensive Index measures the performance of the investable securities in the Global SMID Defensive segment of the market.

The Russell Global Large Cap Growth Index measures the growth segment for the largest securities in the global equity universe.

The Russell Global Large Cap Value Index measures the value segment of the large cap global equity universe, which represents companies that are considered less expensive than the overall market.

The Russell Global Large Cap Defensive Index measures the performance of the investable securities in the Global Large Cap Defensive segment of the market.

The 50% Barclays Global Aggregate Bond & 50% Russell Global Index is a custom index combining the Barclays Global Aggregate High-Yield Bond Index and Russell Global Index. The Barclays Global Aggregate High-Yield Bond Index is an unmanaged index considered representative of fixed-rate, noninvestment-grade debt of companies in the U.S., developed markets and emerging markets. The Russell Global Index measures the performance of the global equity market based on all investable equity securities.

The Financial Times Stock Exchange 100 Index (FTSE) is an index composed of the 100 largest companies listed on the London Stock Exchange.

13

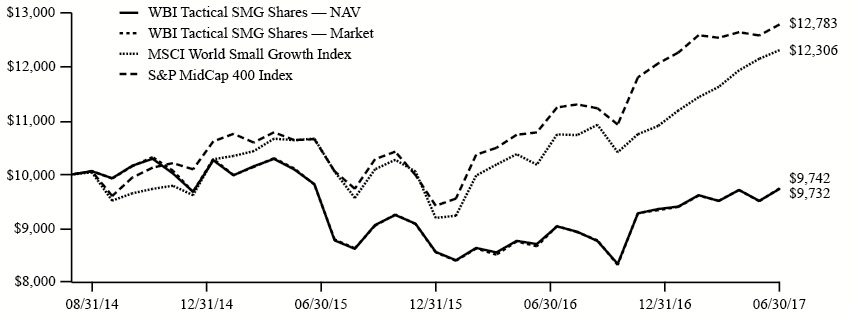

| Absolute Shares Trust WBI Tactical SMG Shares Performance Summary (Unaudited) |

Average Annual Returns Period Ended June 30, 2017 | 1 Year | Since Inception (8/25/14) |

WBI Tactical SMG Shares — NAV | 11.74% | (0.95)% |

WBI Tactical SMG Shares — Market | 12.38% | (0.91)% |

MSCI World Small Growth Index | 20.86% | 7.56% |

S&P MidCap 400 Index | 18.57% | 9.01% |

This chart illustrates the performance of a hypothetical $10,000 investment made on August 25, 2014, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

On October 31, 2016, the Fund changed its benchmark index from the S&P MidCap 400 Index to MSCI World Small Growth Index (the “New Index”). While the Fund’s strategy involves active management of a potentially wide range of assets, and no widely recognized benchmark is likely to be representative of the performance of the Fund, the Advisor believes that the New Index is more relevant to the Fund’s investment strategies and more commonly used by investors investing in similar funds.

The performance data quoted represents past performance and is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For most recent month-end performance, please visit www.wbishares.com.

Per the Prospectus, the Fund’s annual operating expense (gross) is 1.01%. The Fund’s Sub-Advisor has contractually agreed to waive the fees and reimburse expenses of the Fund such that total annual operating expenses are limited to 1.25% of average net assets until at least October 31, 2018. (Actual expenses can be referenced in the Financial Highlights section later in this report.)

14

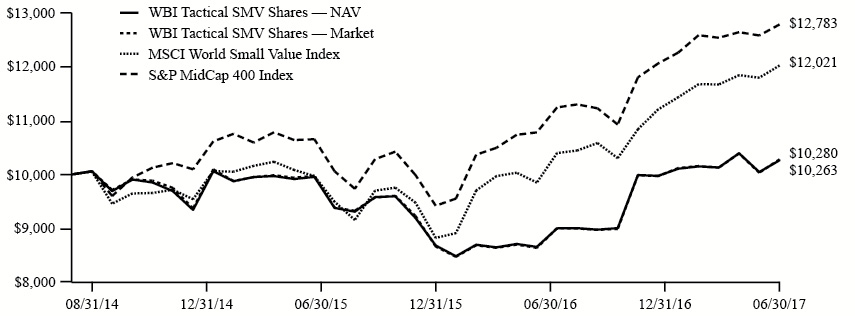

| Absolute Shares Trust WBI Tactical SMV Shares Performance Summary (Unaudited) |

Average Annual Returns Period Ended June 30, 2017 | 1 Year | Since Inception (8/25/14) |

WBI Tactical SMV Shares — NAV | 18.55% | 0.91% |

WBI Tactical SMV Shares — Market | 19.01% | 0.98% |

MSCI World Small Value Index | 22.04% | 6.68% |

S&P MidCap 400 Index | 18.57% | 9.01% |

This chart illustrates the performance of a hypothetical $10,000 investment made on August 25, 2014, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

On October 31, 2016, the Fund changed its benchmark index from the S&P MidCap 400 Index to MSCI World Small Value Index (the“New Index”). While the Fund’s strategy involves active management of a potentially wide range of assets, and no widely recognized benchmark is likely to be representative of the performance of the Fund, the Advisor believes that the New Index is more relevant to the Fund’s investment strategies and more commonly used by investors investing in similar funds.

The performance data quoted represents past performance and is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For most recent month-end performance, please visit www.wbishares.com.

Per the Prospectus, the Fund’s annual operating expense (gross) is 1.02%. The Fund’s Sub-Advisor has contractually agreed to waive the fees and reimburse expenses of the Fund such that total annual operating expenses are limited to 1.25% of average net assets until at least October 31, 2018. (Actual expenses can be referenced in the Financial Highlights section later in this report.)

15

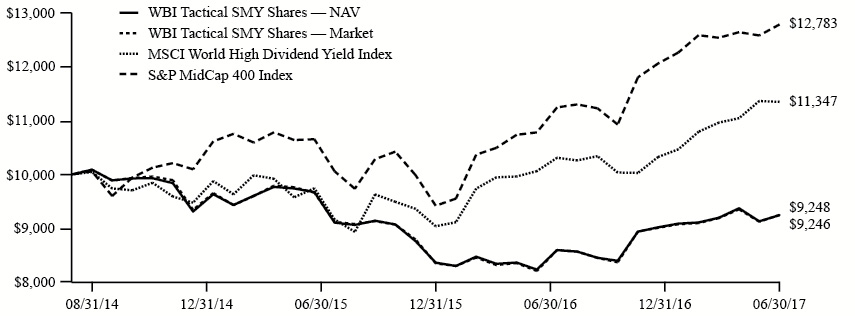

| Absolute Shares Trust WBI Tactical SMY Shares Performance Summary (Unaudited) |

Average Annual Returns Period Ended June 30, 2017 | 1 Year | Since Inception (8/25/14) |

WBI Tactical SMY Shares — NAV | 12.26% | (2.72)% |

WBI Tactical SMY Shares — Market | 12.65% | (2.71)% |

MSCI World High Dividend Yield Index | 12.77% | 4.54% |

S&P MidCap 400 Index | 18.57% | 9.01% |

This chart illustrates the performance of a hypothetical $10,000 investment made on August 25, 2014, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

On October 31, 2016, the Fund changed its benchmark index from the S&P MidCap 400 Index to MSCI World High Dividend Yield Index (the “New Index”). While the Fund’s strategy involves active management of a potentially wide range of assets, and no widely recognized benchmark is likely to be representative of the performance of the Fund, the Advisor believes that the New Index is more relevant to the Fund’s investment strategies and more commonly used by investors investing in similar funds.

The performance data quoted represents past performance and is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For most recent month-end performance, please visit www.wbishares.com.

Per the Prospectus, the Fund’s annual operating expense (gross) is 1.05%. The Fund’s Sub-Advisor has contractually agreed to waive the fees and reimburse expenses of the Fund such that total annual operating expenses are limited to 1.25% of average net assets until at least October 31, 2018. (Actual expenses can be referenced in the Financial Highlights section later in this report.)

16

| Absolute Shares Trust WBI Tactical SMS Shares Performance Summary (Unaudited) |

Average Annual Returns Period Ended June 30, 2017 | 1 Year | Since Inception (8/25/14) |

WBI Tactical SMS Shares — NAV | 13.32% | (2.03)% |

WBI Tactical SMS Shares — Market | 14.34% | (1.89)% |

MSCI World Quality Index | 17.08% | 8.13% |

S&P MidCap 400 Index | 18.57% | 9.01% |

This chart illustrates the performance of a hypothetical $10,000 investment made on August 25, 2014, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

On October 31, 2016, the Fund changed its benchmark index from the S&P MidCap 400 Index to MSCI World Quality Index (the “New Index”). While the Fund’s strategy involves active management of a potentially wide range of assets, and no widely recognized benchmark is likely to be representative of the performance of the Fund, the Advisor believes that the New Index is more relevant to the Fund’s investment strategies and more commonly used by investors investing in similar funds.

The performance data quoted represents past performance and is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For most recent month-end performance, please visit www.wbishares.com.

Per the Prospectus, the Fund’s annual operating expense (gross) is 1.03%. The Fund’s Sub-Advisor has contractually agreed to waive the fees and reimburse expenses of the Fund such that total annual operating expenses are limited to 1.25% of average net assets until at least October 31, 2018. (Actual expenses can be referenced in the Financial Highlights section later in this report.)

17

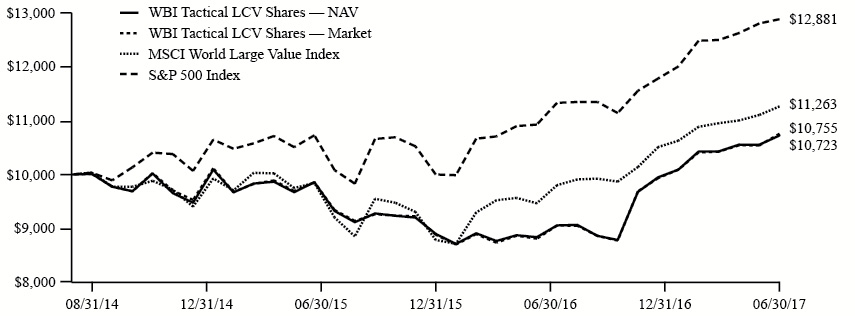

| Absolute Shares Trust WBI Tactical LCG Shares Performance Summary (Unaudited) |

Average Annual Returns Period Ended June 30, 2017 | 1 Year | Since Inception (8/25/14) |

WBI Tactical LCG Shares — NAV | 12.88% | 0.06% |

WBI Tactical LCG Shares — Market | 13.54% | 0.14% |

MSCI World Large Growth Index | 18.68% | 7.79% |

S&P 500 Index | 17.90% | 9.30% |

This chart illustrates the performance of a hypothetical $10,000 investment made on August 25, 2014, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.