ANNUAL REPORT

June 30, 2020

WBI BullBear Rising Income 3000 ETF | WBIE

WBI BullBear Value 3000 ETF | WBIF

WBI BullBear Yield 3000 ETF | WBIG

WBI BullBear Quality 3000 ETF | WBIL

WBI BullBear Global Income ETF | WBII

WBI Power Factor® High Dividend ETF | WBIY

WBI BullBear Trend Switch US 3000 Total Return ETF | WBIT

WBI BullBear Trend Switch US Total Return ETF | WBIN

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the Fund’s reports from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. Please contact your financial intermediary to elect to receive shareholder reports and other Fund communications electronically.

You may elect to receive all future reports in paper free of charge. Please contact your financial intermediary to inform them that you wish to continue receiving paper copies of shareholder reports and for details about whether your election to receive reports in paper will apply to all funds held with your financial intermediary.

| Absolute Shares Trust |

|

| |

| |

Management’s Discussion of Fund Performance | | | 1 |

Performance Summaries | | | 11 |

Portfolio Allocations | | | 19 |

Schedules of Investments | | | 20 |

Statements of Assets and Liabilities | | | 29 |

Statements of Operations | | | 31 |

Statements of Changes in Net Assets | | | 33 |

Financial Highlights | | | 35 |

Notes to Financial Statements | | | 39 |

Report of Independent Registered Public Accounting Firm | | | 50 |

Trustees and Officers | | | 51 |

Approval of Advisory Agreements and Board Considerations | | | 54 |

Expense Examples | | | 56 |

Federal Tax Information | | | 58 |

Information About the Portfolio Holdings | | | 59 |

Information About Proxy Voting | | | 59 |

Information About the Funds’ Trustees | | | 59 |

Frequency Distributions of Premiums and Discounts | | | 59 |

(This page intentionally left blank.)

| Absolute Shares Trust |

| |

| Management’s Discussion of Fund Performance |

| June 30, 2020 (Unaudited) |

|

Dear Fellow Shareholder:

In our experience, the conditions that affect investments are consistently subject to the possibility of uncertainty and change. We believe that the appropriate approach to investing in a volatile world is one that is responsive to continually changing conditions and opportunities. We think that process should be focused on managing risk as well as on pursuing return. It should be disciplined and have a track record that spans both good times and bad. In short, our opinion is that it should be just like the process we have used for our investment management clients for nearly 30 years and continue to use to manage the Funds today. We believe the consistent application of this disciplined approach will continue to be extremely valuable and attractive to current and prospective shareholders.

We appreciate the continuing confidence of our existing shareholders and welcome our new shareholders to the Funds.

Investment Philosophy

WBI’s general investment philosophy is primarily based on our belief that protecting capital is essential to providing long-term portfolio growth or a consistent stream of income. We believe it is important to offer a variety of alternatives that investors can choose from as they address changing circumstances. The ability to adapt and evolve as risks and opportunities appear is the key to pursuing a stable outcome in an uncertain world. The goal of the WBI Funds is to provide consistent, attractive returns with less volatility and risk to capital than traditional approaches.

WBI Funds include actively managed, passive (“smart-beta”) and trend-switch based portfolio strategies. Actively managed strategies include multifactor security selection models with our advanced dynamic trailing stop process to protect capital. The passively managed smart-beta strategy is designed to provide an investment alternative for clients seeking returns based on multifactor security selection models in a portfolio that is generally fully invested and rebalances quarterly. The trend-switch strategies utilize quantitative trend models to optimize risk and return for domestic stock and fixed income exposure.

Performance Overview

In response to market volatility during the most recent fiscal period, the actively managed equity-focused Funds periodically held significant allocations to cash equivalents, contributing to differences in performance between each Fund and its respective benchmark.

The WBI BullBear Rising Income 3000 ETF (NYSE Arca: WBIE) returned -1.89% on a NAV basis, and -1.73% based on market value, versus the 6.53% return of the Russell 3000 Total Return Index, the Fund’s benchmark.

The WBI BullBear Value 3000 ETF (NYSE Arca: WBIF) returned -5.40% on a NAV basis, and -5.30% based on market value, versus the -9.42% return of the Russell 3000 Value Total Return Index, the Fund’s benchmark.

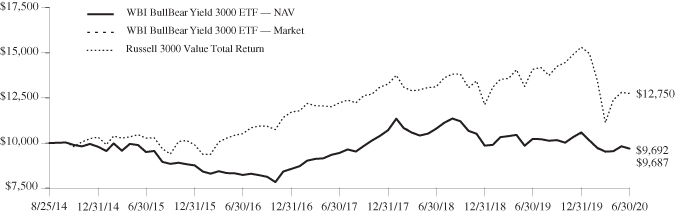

The WBI BullBear Yield 3000 ETF (NYSE Arca: WBIG) returned -5.22% on a NAV basis, and -5.07% based on market value, versus the -9.42% return of the Russell 3000 Value Total Return Index, the Fund’s benchmark.

The WBI BullBear Quality 3000 ETF (NYSE Arca: WBIL) returned -3.79% on a NAV basis, and -3.69% based on market value, versus the 6.53% return of the Russell 3000 Total Return Index, the Fund’s benchmark.

The WBI BullBear Global Income ETF (NYSE Arca: WBII) returned -2.97% on a NAV basis, and -2.87% based on market value, versus the 8.74% return of the Bloomberg Barclays US Aggregate Bond Total Return Index, the Fund’s benchmark.

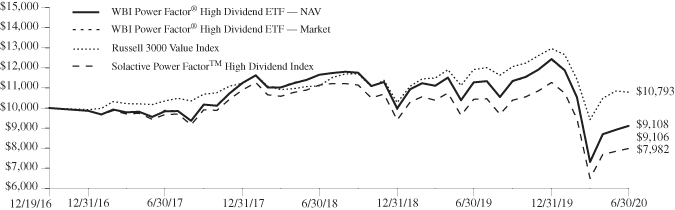

The WBI Power Factor® High Dividend ETF (NYSE Arca: WBIY) returned -19.24% on a NAV basis, and -19.08% based on market value, versus the -9.42% return of the Russell 3000 Value Total Return Index, the Fund’s benchmark, and versus the -18.98% return of the Solactive Power FactorTM High Dividend GTR Index, the Fund’s underlying index.

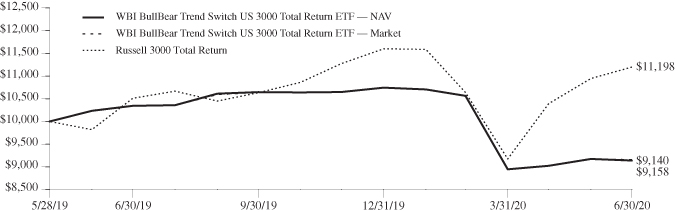

The WBI BullBear Trend Switch US 3000 Total Return ETF (NYSE Arca: WBIT) returned -11.65% on a NAV basis, and -11.55% based on market value, versus the 6.53% of the Russell 3000 Total Return Index, the Fund’s benchmark.

The WBI BullBear Trend Switch US Total Return ETF (NYSE Arca: WBIN) returned, since the Fund’s inception date of 7/18/2019, -11.49% on a NAV basis, and -11.64% based on market value, versus the 8.69% return of the Bloomberg Barclays US Aggregate Bond Total Return Index, the Fund’s benchmark.

Net asset value total return is calculated assuming an initial investment made at the net asset value at the beginning of the period, reinvestment of all dividends and distributions at net asset value during the period, and the redemption on the last day of the period. Net asset value total return includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset value and returns for shareholder transactions. Market price total return is calculated assuming an initial investment made at the market price at the beginning of the period, reinvestment of all dividends and distributions at market price during the period, and sale at the market price on the last day of the period. Total investment returns calculated for a period of less than one year are not annualized.

| Absolute Shares Trust |

| |

Management’s Discussion of Fund Performance (continued) |

| June 30, 2020 (Unaudited) |

|

With the exception of the passive index Fund, the WBI Power Factor® High Dividend ETF, the strategies used in the management of the Funds do not attempt to replicate or track the performance of any index and differ significantly from the methods used to construct and maintain the indices that serve as their respective benchmarks. The four actively managed equity-focused Funds (“Active Equity Funds”) use proprietary processes to screen, rank, and purchase securities with particular attributes, and sell securities when certain thresholds are reached, while benchmark indices are unmanaged, and consist of a passive representation of all securities that meet the definition of the index constituents. In addition, each Active Equity Fund uses strategies intended to mitigate volatility and protect capital, and as a result these Funds will often have a significant allocation to cash equivalents. Therefore, while each Active Equity Fund’s performance includes the effect of an investment in cash equivalents from the proceeds of sales when certain thresholds are met, benchmark indices do not include an allocation to cash equivalents.

A distinguishing characteristic of cash equivalents is that their prices are extremely stable and not subject to the levels of price volatility generally exhibited by other investments. Therefore, in periods during which the prices of the securities represented in benchmark indices are falling, an allocation to cash equivalents may contribute to Active Equity Fund performance that is superior to that of their benchmarks. In periods during which the prices of the securities represented in benchmark indices are rising, an allocation to cash equivalents in an Active Equity Fund may cause its performance to trail that of its benchmark. You cannot invest directly in an index, including a benchmark index, and benchmark performance does not include the deduction of transaction and operational expenses, or the deduction of an investment management fee, which would alter their indicated historical results.

Similarly, the WBI BullBear Global Income ETF (the “Active Income Fund”), as well as both the WBI BullBear Trend Switch US 3000 Total Return ETF and the WBI BullBear Trend Switch US Total Return ETF (the “Trend Switch Funds”) do not attempt to replicate or track the performance of any index and differ significantly from the methods used to construct and maintain the index that serves as their respective benchmarks. The Trend Switch Funds aim to optimize risk and return by utilizing either a quantitative equity model (the “Equity Model”) to evaluate when conditions are deemed favorable for equity market exposure, and/or a quantitative bond model (the “Bond Model”) which is used to identify the credit quality and duration exposure that will be implemented in a Fund. The WBI BullBear Global Income ETF strategy currently relies upon a combination of the Bond Model’s recommended exposure along with tactical investments in perceived lower risk and higher return opportunities in varying segments of the fixed income or equity markets.

The WBI Power Factor® High Dividend ETF (the “Passive Index Fund”) is intended to track its underlying index, the Solactive Power Factor™ High Dividend GTR Index, and can reasonably be compared to the index in evaluating its performance.

Review of Fund Trading Activity

The Active Funds attempt to provide consistent, attractive returns net of expenses with potentially less volatility and risk to capital than traditional approaches, whatever market conditions may be. The investment process for each Fund includes a buy discipline and a sell discipline. Each Fund’s trading activity reflects this disciplined investment process as described in its prospectus and summarized below.

The Active Equity Funds that invest in individual equities primarily use quantitative computer screening of fundamental stock information to evaluate domestic and foreign equity securities in an attempt to find companies with attractive characteristics for the selected universe of securities. Dividend payments may be considered as part of the evaluation process. Once securities are identified, an overlay of technical analysis confirms timeliness of security purchases. The Funds then add qualifying securities using available cash within the parameters of each Fund’s investment objective and security selection criteria.

Typically, once a security is purchased for a given Active Equity Fund, a strict sell discipline with a dynamic trailing stop loss and goal setting process attempts to control the effects of volatility for each invested position on the Fund’s value. An initial stop percentage and goal price is established at the time a security is purchased. As that security’s specified goal price is approached, the initial stop tolerance set for each security is tightened. If a security stays within its acceptable price channel relative to its current stop, it remains in the Fund’s portfolio. If the security moves below the acceptable price channel, a stop is triggered, and the Fund will sell the security. This results in a responsive process that actively adjusts the Fund’s allocation by causing it to become more fully invested or by raising cash with the intention of protecting capital. This process is likely to result in a Fund holding meaningful allocations to cash equivalents during periods of market volatility.

The WBI BullBear Global Income ETF uses proprietary quantitative models to assess the appropriate credit quality and duration of its exposure to debt securities. Credit quality is a measure of a borrower’s creditworthiness or risk of default. Duration is a measure of a fixed income security’s expected price sensitivity to changes in interest rates. Securities with longer durations are expected to experience greater price movements than securities with shorter duration for the same change in prevailing interest rates. A portion of the Fund’s exposure will also be invested to pursue perceived opportunities for high income and/or return in varying segments of the fixed income or equity market.

The WBI BullBear Trend Switch US 3000 Total Return ETF uses proprietary quantitative models to assess the perceived risk and return opportunities for both the equity and fixed income markets. The Equity Model is first used to determine whether conditions for risk are perceived to be low in which case the Fund will implement exposure to equity markets. However, if the Equity Model suggests that conditions for risk are high in the equity market, the Fund eliminates any equity exposure and relies upon the Bond Model to identify the appropriate credit quality and duration exposure to debt securities that it will implement.

The WBI BullBear Trend Switch US Total Return ETF uses the Bond Model to identify the appropriate credit quality and duration exposure to debt securities that it will implement.

| Absolute Shares Trust |

| |

Management’s Discussion of Fund Performance (continued)

|

| June 30, 2020 (Unaudited) |

|

The WBI Power Factor® High Dividend ETF seeks to achieve its investment objective by attempting to track the investment results of the Solactive Power Factor™ High Dividend GTR Index. The index is designed to select securities from the Solactive US Broad Market Index that exhibit certain yield and fundamental value characteristics. In particular, the Solactive Power Factor™ High Dividend GTR Index is designed to select equity securities with an above-average forecasted dividend yield, scored on the basis of three fundamental value characteristics (the “Power Factors®”). Quarterly rebalancing of the Passive Index Fund helps enforce a buy low – sell high discipline by locking in gains on stocks that have had outsized appreciation and seeks to confirm the strongest quality fundamentals for its constituents on a quarterly basis.

WBI BullBear Rising Income 3000 ETF (WBIE)

As of June 30, 2020, WBIE held 17 securities in addition to a position in a money market fund which served as a cash equivalent. Ebay Inc., Microsoft Corp, Amazon.com Inc. Clorox Company and NVIDIA Corp. were some of the largest positions in the Fund on this date.

Examples of securities that made positive contributions to WBIE’s performance during the fiscal period include Ebay Inc., AbbVie Inc., NVIDIA Corp, Microsoft Corp and Ross Stores Inc. Examples of securities that detracted from the Fund’s performance during the fiscal period include Hasbro Inc., Citizens Financial Group, Bank of America Corp and Synchrony Financial.

As the equity market began its rapid decline in February and March of 2020 due to COVID-19, the Fund’s sell discipline worked well and liquidated positions quickly to raise cash and protect investor capital.

High turnover in WBIE’s holdings has the potential to result in the realization and distribution to shareholders of higher capital gains. If Fund shares are held in a taxable account, this may increase your tax liability. To the extent portfolio turnover increases transaction costs, it may also reduce Fund performance. Of course, selling a security in a timely fashion may also improve performance if a subsequent loss is avoided that exceeds the cost of executing the sale.

WBI BullBear Value 3000 ETF (WBIF)

As of June 30, 2020, WBIF held 17 securities in addition to a position in a money market fund which served as a cash equivalent. Accenture, Ebay Inc., Illinois Tool Works, Amazon.com Inc. and Clorox Company were some of the largest positions in the Fund on this date.

Examples of securities that made positive contributions to WBIF’s performance during the fiscal period include NXP Semiconductors, NVIDIA Corp, Ebay Inc., Microsoft Corp, and Bristol-Myers Squibb Co. Examples of securities that detracted from the Fund’s performance during the fiscal period include Ameriprise Financial Inc., Cisco Systems Inc., Emerson Electric Co., Fifth Third Bancorp, and Qualcomm Inc.

As the equity market began its rapid decline in February and March of 2020 due to COVID-19, the Fund’s sell discipline worked well and liquidated positions quickly to raise cash and protect investor capital.

High turnover in WBIF’s holdings has the potential to result in the realization and distribution to shareholders of higher capital gains. If Fund shares are held in a taxable account, this may increase your tax liability. To the extent portfolio turnover increases transaction costs, it may also reduce Fund performance. Of course, selling a security in a timely fashion may also improve performance if a subsequent loss is avoided that exceeds the cost of executing the sale.

WBI BullBear Yield 3000 ETF (WBIG)

As of June 30, 2020, WBIG held 15 securities in addition to a position in a money market fund which served as a cash equivalent. Amazon.com Inc., Ebay Inc., Adobe Inc., Accenture, and Visa Inc. were some of the largest positions in the Fund on this date.

Examples of securities that made positive contributions to WBIG’s performance during the fiscal period include Ebay Inc., NVIDIA Corp, Target Corp, and Bristol-Myers Squibb Co. Examples of securities that detracted from the Fund’s performance during the fiscal period include Principal Financial Group, IBM Corp, Fifth Third Bancorp, and Emerson Electric Co.

As the equity market began its rapid decline in February and March of 2020 due to COVID-19, the Fund’s sell discipline worked well and liquidated positions quickly to raise cash and protect investor capital.

High turnover in WBIG’s holdings has the potential to result in the realization and distribution to shareholders of higher capital gains. If Fund shares are held in a taxable account, this may increase your tax liability. To the extent portfolio turnover increases transaction costs, it may also reduce Fund performance. Of course, selling a security in a timely fashion may also improve performance if a subsequent loss is avoided that exceeds the cost of executing the sale.

WBI BullBear Quality 3000 ETF (WBIL)

As of June 30, 2020, WBIL held 16 securities in addition to a position in a money market fund which served as a cash equivalent. Adobe Inc., Amazon.com Inc., Amgen Inc., Church & Dwight Co Inc., and Clorox Co. were some of the largest positions in the Fund on this date.

Examples of securities that made positive contributions to WBIL’s performance during the fiscal period include Ebay Inc., NVIDIA Corp, Microsoft Corp, AbbVie Inc., and Bristol-Myers Squibb Co. Examples of securities that detracted from the Fund’s performance during the fiscal period include Hasbro Inc., Northrop Grumman Corp, Darden Restaurants Inc., Navient Corp, and LPL Financial Holdings Inc.

As the equity market began its rapid decline in February and March of 2020 due to COVID-19, the Fund’s sell discipline worked well and liquidated positions quickly to raise cash and protect investor capital.

| Absolute Shares Trust |

| |

Management’s Discussion of Fund Performance (continued)

|

| June 30, 2020 (Unaudited) |

|

High turnover in WBIL’s holdings has the potential to result in the realization and distribution to shareholders of higher capital gains. If Fund shares are held in a taxable account, this may increase your tax liability. To the extent portfolio turnover increases transaction costs, it may also reduce Fund performance. Of course, selling a security in a timely fashion may also improve performance if a subsequent loss is avoided that exceeds the cost of executing the sale.

WBI BullBear Global Income ETF (WBII)

As of June 30, 2020, WBII held 5 securities in addition to a position in a money market fund which served as a cash equivalent. The SPDR Bloomberg Barclays High Yield Bond Fund and the iShares iBoxx High Yield Corporate Bond Fund were some of the largest positions in the Fund on this date.

Examples of securities that made positive contributions to WBII’s performance during the fiscal period include the Vanguard Long-Term Corporate Bond Fund, the SPDR Portfolio Long Term Treasury Fund, and the iShares iBoxx High Yield Corporate Bond Fund. Examples of securities that detracted from the Fund’s performance during the fiscal period include the Vanguard Long-Term Treasury Fund, the iShares 20+ Year Treasury Bond Fund and the Xtrackers USD High Yield Corporate Bond Fund.

A significant detraction from Fund performance during the fiscal period occurred over a two-day timespan as the equity market sold off rapidly and there was a significant rotation in fixed-income markets combined with a temporary liquidity crunch. The “perfect storm” occurred on the same day the Bond Model indicated that a switch from High Yield to Treasury exposure was required on March 9, 2020. Although the switch to a safer asset class was considered appropriate as the market would eventually decline rapidly until its March 23rd low, the fact that the switch occurred on the same day as record-breaking market volatility was an unfortunate coincidence. That day, global equity markets dropped the most since the Great Recession in 2008 as the COVID-19 pandemic response was exacerbated by an oil price war between Russia and Saudi Arabia. Before trading even started on March 9, equity and high yield bond markets were already down significantly in overnight activity (the S&P 500 Index was down more than -5%), and safe-haven assets like U.S. Treasuries were skyrocketing from a “flight to quality”. Fund management had to sell High Yield positions after they already had record breaking moves down in overnight activity, and, simultaneously buy Treasury positions after they already had record breaking moves up in overnight activity. Subsequently, on March 10, the government and Federal Reserve stepped in and a complete reversal in all markets occurred (so the Treasury positions now held in the Fund immediately dropped from their all-time highs). The Bond Model signal provided a good indicator; however, the timing of the market activity caused the Fund to drop by approximately -7% in just two days, which may have been avoided if the violent market moves occurred just one day later.

High turnover in WBII’s holdings has the potential to result in the realization and distribution to shareholders of higher capital gains. If Fund shares are held in a taxable account, this may increase your tax liability. To the extent portfolio turnover increases transaction costs, it may also reduce Fund performance. Of course, selling a security in a timely fashion may also improve performance if a subsequent loss is avoided that exceeds the cost of executing the sale.

WBI Power Factor® High Dividend (WBIY)

WBIY is intended to track the Solactive Power Factor™ High Dividend Index, and its trading activity results from changes to the holdings of this underlying index. The composition of the underlying index is adjusted quarterly and screened monthly for dividend cuts or an overall negative outlook concerning the member companies’ dividend policy.

As of June 30, 2020, WBIY held 50 securities in addition to a position in a money market fund which served as a cash equivalent. Santander Consumer USA, Marathon Petroleum Corp, AbbVie Inc., Lyondell Basell Industries, and Foot Locker Inc. were some of the largest positions in the Fund on that date.

Examples of securities that made positive contributions to WBIY’s performance during the fiscal period include Marathon Petroleum Corp, Big Lots Inc., AbbVie Inc., Foot Locker Inc., and Schlumberger Ltd. Examples of securities that detracted from the Fund’s performance during the fiscal period include Macy’s Inc., Ford Motor Co, Cadence Bancorp, Kohls Corp and The Gap Inc.

High turnover in WBIY’s holdings has the potential to result in the realization and distribution to shareholders of higher capital gains. If Fund shares are held in a taxable account, this may increase your tax liability. To the extent portfolio turnover increases transaction costs, it may also reduce Fund performance. Of course, selling a security in a timely fashion may also improve performance if a subsequent loss is avoided that exceeds the cost of executing the sale.

WBI BullBear Trend Switch 3000 Total Return ETF (WBIT)

As of June 30, 2020, WBIT held 3 securities in addition to a position in a money market fund which served as a cash equivalent. The iShares Russell 3000 Fund and the Vanguard Total Stock Market Fund were some of the largest positions in the Fund on this date.

Examples of securities that made positive contributions to WBIT’s performance during the fiscal period include the SPDR Bloomberg Barclays High Yield Bond Fund, the iShares iBoxx High Yield Corporate Bond Fund and the Vaneck Fallen Angels High Yield Bond Fund. Examples of securities that detracted from the Fund’s performance during the fiscal period include the SPDR Portfolio Long Term Treasury Fund, the Vanguard Long-Term Treasury Fund, and the iShares Russell 3000 Fund.

| Absolute Shares Trust |

| |

Management’s Discussion of Fund Performance (continued)

|

| June 30, 2020 (Unaudited) |

|

A significant detraction from Fund performance during the fiscal period occurred over a two-day timespan as the equity market sold off rapidly and there was a significant rotation in fixed-income markets combined with a temporary liquidity crunch. The “perfect storm” occurred on the same day the Bond Model indicated that a switch from High Yield to Treasury exposure was required on March 9, 2020. Although the switch to a safer asset class was considered appropriate as the market would eventually decline rapidly until its March 23rd low, the fact that the switch occurred on the same day as record-breaking market volatility was an unfortunate coincidence. That day, global equity markets dropped the most since the Great Recession in 2008 as the COVID-19 pandemic response was exacerbated by an oil price war between Russia and Saudi Arabia. Before trading even started on March 9, equity and high yield bond markets were already down significantly in overnight activity (the S&P 500 Index was down more than -5%), and safe-haven assets like U.S. Treasuries were skyrocketing from a “flight to quality”. Fund management had to sell High Yield positions after they already had record breaking moves down in overnight activity, and, simultaneously buy Treasury positions after they already had record breaking moves up in overnight activity. Subsequently, on March 10, the government and Federal Reserve stepped in and a complete reversal in all markets occurred (so the Treasury positions now held in the Fund immediately dropped from their all-time highs). The Bond Model signal provided a good indicator; however, the timing of the market activity caused the Fund to drop by approximately -12% in just two days, which may have been avoided if the violent market moves occurred just one day later.

High turnover in WBIT’s holdings has the potential to result in the realization and distribution to shareholders of higher capital gains. If Fund shares are held in a taxable account, this may increase your tax liability. To the extent portfolio turnover increases transaction costs, it may also reduce Fund performance. Of course, selling a security in a timely fashion may also improve performance if a subsequent loss is avoided that exceeds the cost of executing the sale.

WBI BullBear Trend Switch Total Return ETF (WBIN)

As of June 30, 2020, WBIN held 3 securities in addition to a position in a money market fund which served as a cash equivalent. The SPDR Bloomberg Barclays High Yield Bond Fund and the iShares iBoxx High Yield Corporate Bond Fund were some of the largest positions in the Fund on this date.

Examples of securities that made positive contributions to WBIN’s performance during the fiscal period include the SPDR Bloomberg Barclays High Yield Bond Fund, the iShares iBoxx High Yield Corporate Bond Fund and the Vanguard Long-Term Corporate Bond Fund. Examples of securities that detracted from the Fund’s performance during the fiscal period include the SPDR Portfolio Long Term Treasury Fund, the Vanguard Long-Term Treasury Fund, and the iShares 20+ Year Treasury Bond Fund.

A significant detraction from Fund performance during the fiscal period occurred over a two-day timespan as the equity market sold off rapidly and there was a significant rotation in fixed-income markets combined with a temporary liquidity crunch. The “perfect storm” occurred on the same day the Bond Model indicated that a switch from High Yield to Treasury exposure was required on March 9, 2020. Although the switch to a safer asset class was considered appropriate as the market would eventually decline rapidly until its March 23rd low, the fact that the switch occurred on the same day as record-breaking market volatility was an unfortunate coincidence. That day, global equity markets dropped the most since the Great Recession in 2008 as the COVID-19 pandemic response was exacerbated by an oil price war between Russia and Saudi Arabia. Before trading even started on March 9, equity and high yield bond markets were already down significantly in overnight activity (the S&P 500 Index was down more than -5%), and safe-haven assets like U.S. Treasuries were skyrocketing from a “flight to quality”. Fund management had to sell High Yield positions after they already had record breaking moves down in overnight activity, and, simultaneously buy Treasury positions after they already had record breaking moves up in overnight activity. Subsequently, on March 10, the government and Federal Reserve stepped in and a complete reversal in all markets occurred (so the Treasury positions now held in the Fund immediately dropped from their all-time highs). The Bond Model signal provided a good indicator; however, the timing of the market activity caused the Fund to drop by approximately -12% in just two days, which may have been avoided if the violent market moves occurred just one day later.

High turnover in WBIN’s holdings has the potential to result in the realization and distribution to shareholders of higher capital gains. If Fund shares are held in a taxable account, this may increase your tax liability. To the extent portfolio turnover increases transaction costs, it may also reduce Fund performance. Of course, selling a security in a timely fashion may also improve performance if a subsequent loss is avoided that exceeds the cost of executing the sale.

Quarter by Quarter Review of Market Conditions

3rd Quarter 2019

The third quarter of 2019 was eerily similar to the second quarter in many ways. Looking only at the S&P 500 Index for a moment, May produced a significant -6.58% decline followed by a June rebound of 6.89%. During the third quarter, an August decline was sandwiched between two slightly positive months. The result was a 1.19% return for the quarter and highlights once more that the year’s return at that point came almost entirely from the first quarter and especially the month of January. Volatility continued throughout the third quarter as new trade tariffs and Fed concerns set up a rapid 6% decline in the beginning of August followed by three failed attempts to rally back higher.

Although mainstream media continued to focus on relatively attractive year to date returns, one must remember that on a trailing 12-month basis, the S&P 500 was up only 2.15% since September of 2018. Pushing the point even further, the S&P 500 was up only 3.62% since a peak reached in January of 2018. Looking back over those previous 612 days, the S&P 500 was negative, or below that January 2018 watermark, almost 70% of the

| Absolute Shares Trust |

| |

Management’s Discussion of Fund Performance (continued)

|

| June 30, 2020 (Unaudited) |

|

time. Indices focused on stocks with strong value characteristics performed even worse. Large company value stocks, as represented by the Russell 1000 Value Total Return Index, were up only 1.98% since that January 2018 peak. Small and mid-sized company (“SMID”) value stocks, as represented by the Russell 2000 Value Total Return Index, were down -4.99%, and on a trailing 12-month basis, they were down -8.24%. In short, equity markets certainly had demonstrated periods of high volatility for almost two years already, but they really hadn’t moved higher to the degree that most people assumed.

In contrast, lower interest rates and a flight to quality helped fixed income assets perform well with the Bloomberg Barclays US Aggregate index returning 2.27% in Q3 and 10.30% over the prior 12 months.

An increase in volatility combined with the lack of a sustained trend continued to make this quarter quite challenging. The markets were constantly at the mercy of rapid fire “tweets” and other news fragments, many of which were later revealed as fake or at least questionable. But that didn’t stop the lemmings from running full speed ahead in one direction or another. The result was sudden spasms and market movements that diminished the efficacy of value-added money management.

Looking at the performance of the S&P 500 during the quarter, we can almost see the anxious herd making convictionless trades as markets were affected more by random psychological forces rather than fundamentals. The quarter started with the firm expectation that the Federal Reserve would lower interest rates for the first time since the Great Recession at its July meeting. They did cut the fed funds rate by 25 basis points (a basis point is 1/100th of one percent), but the market was very unhappy with the surrounding commentary. Fed Chairman Powell declared that this cut was a “midcycle adjustment to policy” rather than suggest this was the beginning of a new cycle of rate cutting. The market sold off significantly as it became concerned that getting what you want isn’t good enough.

Things only got worse from there. On August 1st, President Trump announced new 10% trade tariffs on the remaining $250 billion of Chinese goods that were not yet taxed to begin on September 1st. The week of July 29 through August 2nd became the worst week of 2019 as the S&P 500 lost almost 100 points or 3% of its value. On August 5th, another huge selloff occurred as China hit back with what many viewed as “currency manipulation” and threats that it would suspend imports of U.S. agricultural products. On the same day, the ISM Non-Manufacturing Index reported a decline to a three-year low of 53.7. This suggested the weakness already noted in the export-focused manufacturing sector might be spreading into the country’s much larger services sector.

The rest of August was a full-blown roller coaster ride. Markets were happy one day as some trade tariffs were delayed until December 1st but terrified the next day as protests in Hong Kong became more violent. More yield curve inversions startled many market participants who suddenly felt that the next recession was imminent. Weaker than forecast Chinese retail sales and industrial output, signs of German economic contraction and other gloomy global data sent investors running for cover worldwide. But then Fed officials or President Trump would say something that sent the market rocketing higher once again.

4th Quarter 2019

Although the third quarter of 2019 was filled with volatility and concern, most market indices produced solid returns in the fourth quarter to round out the year. Looking only at the S&P 500 Index for a moment, the third quarter’s 1.19% return was followed by an 8.53% return in the fourth quarter. New market highs were achieved, and investors celebrated a 29% return for the year while easily forgetting the -20% decline in Q4 of 2018.

Similar results were achieved in large capitalization companies, represented by the Russell 1000, as well as small and mid-sized capitalization companies represented by the Russell 2000. Volatility seemed to disappear as the markets pushed higher. The S&P 500 didn’t have more than a 1% up or down daily move since mid-October. As a result of lower volatility and bullish equity markets, U.S. fixed income assets didn’t perform quite as well in Q4 as they did in Q3 with the Bloomberg Barclays US Aggregate index returning just 0.18% in Q4 vs. its 2.27% return in Q3.

At the end of 2018, the Federal Reserve was raising rates, there was a government shutdown, and increasing tariffs on both Chinese and U.S. products were creating a great deal of uncertainty and investor pessimism. Once again, this resulted in significant volatility and close to a bear market as the S&P 500 sank almost 20% in the fourth quarter. In contrast, 2019 came to a close with a great deal of investor optimism demonstrated by a slow and steady grind upwards that was certainly due in large part to discussions surrounding an initial U.S. – China trade deal. The trade war was far from over and remains one of the core geo-political risks to this day. However, the “Phase One” trade deal that was officially signed on January 15 helped quell investor fears for the moment.

1st Quarter 2020

At the end of 2019, we were cautiously optimistic that markets would continue to grind higher for a while longer. However, we feared that downside risk potential was greater than it was throughout the previous year and noted that any signs of economic weakness or new uncertainty might cause a violent reaction to the downside. What an understatement!

Not since the Crash of 1929 have equities plunged so quickly into a bear market. During this quarter, the S&P 500 Index lost 34% of its value between the all time high reached on February 19th and the bottom reached on March 23rd. The Index did recover approximately 15% off that bottom by the end of the first quarter. However, it’s important to remember that a passive S&P 500 portfolio worth $100 on February 19 was worth only $66 one month later on March 23rd. At that point, an investor needed a 52% positive return before their portfolio breaks even at $100 again. This highlights the critical importance of capital preservation and is the reason WBI Investments remains so focused on risk mitigation and avoiding catastrophic losses like that which occurred in the first quarter.

| Absolute Shares Trust |

| |

Management’s Discussion of Fund Performance (continued)

|

| June 30, 2020 (Unaudited) |

|

Looking back in time while the record-breaking bull market continued to grind higher last year, most investors were keeping a close eye on the impact of trade wars, easy monetary policy, weaker corporate earnings, ballooning corporate debt, global economic slowdowns and inverted yield curves. Equities seemed to be priced for perfection, so many analysts looked for any indications that a market correction and economic recession might loom on the horizon. At the same time, there were still forecasters out there claiming “this time will be different” and “we will never again experience devastating recessions”. Of course, history did repeat itself and showed markets can still drop by 30% or more in just a few weeks, and devastating recessions are not a thing of the past.

However, history books will note the catalyst for this crisis was certainly different this time. We have never faced a global pandemic that caused so many economies to completely shut down or potentially face enormous loss of life. Furthermore, the devastating impact on global economies is just starting to reveal itself. Although COVID-19 was the catalyst for this crisis, the negative trends and indicators we were concerned about last year didn’t disappear. Unfortunately, the virus simply accelerated and exacerbated the market selloff and economic slow-down that many were already expecting.

The market’s 30%+ drop was only its seventh since 1928 and the quickest by more than two weeks. There were only two other instances where the speed of the decline was anywhere near as fast – 1929 and 1987. Furthermore, the S&P 500 lost 12.5% in March in its biggest monthly decline since the 16.9% slide of October 2008.

Due to a late quarter rebound, the year to date returns do not tell the whole story. Although the S&P 500 was down -20% year to date, the index lost -34% from its all-time high during the quarter. Similarly, although the Dow Jones Industrial Average was down -23% year to date, the index lost -37% from its all-time high during the quarter.

Value based investments demonstrated even worse results, on a relative basis, as the Russell 3000 Value Index lost -28% year to date including a -39% peak to trough decline during the quarter. Small and mid-sized capitalization companies also suffered worse than large-capitalization firms as the Russell 2000 dropped -31% year to date with a -42% peak to trough decline during the quarter.

U.S. fixed income assets benefitted from positive performance in January and February but enormous problems with liquidity and forced liquidations caused volatile gyrations even in the “safe haven” U.S Treasury market during March.

Certainly, this crisis is unique in so many ways. The speed with which it took hold and the fact that it impacted the entire world is mind numbing. The fear of sickness and death spread even faster than the illness itself. In February, we watched China build temporary hospitals in days and saw pictures of empty city streets as they brought their entire economy to a grinding halt. Social distancing became the only way to avoid catastrophic loss of life predictions, so China was forced to shut it all down and have people shelter-in-place. At the time, we realized that the hit to their economy would be massive, but it still seemed to be a relatively distant problem that was possibly already under control. Just a few weeks later, our country and so many others across the globe were forced to do the same thing. Shut down the economic engines, take the key out of the ignition, and bunker down.

2nd Quarter 2020

After the S&P 500 fell by -34% from the February 19th high to the March 23rd low, it then reversed course to post a 38.57% gain by the end of Q2, leaving the index down just -4.04% YTD. The Dow fared a bit worse, following the market roller coaster down and then up with a YTD decline of -9.55%. Growth and technology stocks, as measured by the NASDAQ, fared much better after falling slightly less than the S&P 500, -30.11% from the February high to March low, but rallying strong to a gain of 12.11% YTD through June 30. Value-based investments continued to underperform both growth and broader-based market indices. The Russell 1000 Value large-cap index ended the 2nd quarter down approximately -17% and the Russell 2000 Value small and mid-cap index held onto larger losses of -24.38%.

U.S. fixed-income assets as measured by the Bloomberg Barclays US Aggregate TR Index benefitted from the Fed’s easy monetary policy and stimulus, ending the second quarter up 6.14% for the year.

A massive tug of war is raging between the Federal Reserve and COVID-19 on a daily basis to influence markets and investor psyche. The economic recovery hinges on consumer spending, which is, in turn, dependent on a resumption of normal life for people all over the world. Flattening infection curves in the U.S. helped provide some optimism, allowing shelter-in-place and social distancing to be brushed aside by many who were cooped up for three months or more. However, in June, markets experienced a roller coaster decline of 5-10%, depending on the tracking index, caused by new increasing numbers of COVID-19 cases. Florida and Texas had cases surge a month after relaxing lockdown restrictions and cases began to rise again in other states as well.

For Fed and government stimulus efforts to take hold and give the economy a much needed boost in growth, people need to feel safe to resume normal activity. In the meantime, protecting capital from additional large potential losses should be an investor’s first priority. Before we get a clear indication that the danger from the virus has been contained, we would expect significant continued volatility. Markets will need to digest shutdown-induced economic and corporate profit declines not seen since The Great Depression.

With so much to worry about, we fully expect there to be significant risk to the downside, but markets could enter a new powerful bull market cycle by year end or early next year fueled by massive monetary and fiscal stimulus. This is probably the greatest “don’t fight the Fed” moment in history. With unprecedented stimulus that may exceed $10 trillion when all is said and done, you won’t want to miss the bull market that follows.

| Absolute Shares Trust |

| |

Management’s Discussion of Fund Performance (continued)

|

| June 30, 2020 (Unaudited) |

|

What Lies Ahead?

Nobody knows just how long this will last and how much damage will occur. Even acknowledging the enormous amount of monetary and fiscal stimulus that was injected into the market so far, John Williams (President of the New York Federal Reserve Bank) explained, “The coronavirus pandemic has created circumstances we have never experienced before in our lifetimes, and the reality is that the full scale of the economic consequences is still unknown.” He noted further “To put the current situation in context, we are running more open market operations, for greater sums, than at any time in our history.” So, although the markets have already bounced back quite a bit on news of drug trials, slowing infection rates, and prospects of returning the country back to “normal” again, the real economic impact is just starting to be revealed and it will be many months, if not years, before the full impact is truly understood.

The evolution of the pandemic, as well as the extent and duration of government measures to contain it, will largely determine the direction of markets in coming months, even considering the impact of central banks and fiscal emergency packages. COVID-19 still poses extensive challenges for professional virologists and the scientific community. However, politicians, economists and investors face their own significant questions and challenges. Everyone is still learning about the disease and the economic damage and so misjudgments are inevitable. Mistakes will be made in the markets, the economy and society. Hopefully they will be identified quickly and resolved.

Here at WBI, we continue to focus on risk mitigation and the protection of investor capital as we carefully monitor deteriorating economic data and the potential for additional market selloffs. Our strategies performed well as our active management system quickly moved out of equities and into cash and equivalents. However, our portfolio management system is also working to capture as much upside as possible even during these volatile times.

We appreciate your continued faith in our approach and wish you and your families both health and peace as we all navigate through these strange times together.

Sincerely,

|  |

| | |

Steven Van Solkema, CFA | Don Schreiber, Jr. |

Co-Portfolio Manager | Co-Portfolio Manager |

Chief Investment Officer | Founder & CEO |

| Absolute Shares Trust |

| |

Management’s Discussion of Fund Performance (continued)

|

| June 30, 2020 (Unaudited) |

|

Past performance is not a guarantee of future results.

Opinions expressed are those of WBI Investments, Inc. (“WBI”), the Funds’ investment sub-adviser, are subject to change, are not guaranteed, and should not be construed as recommendations or investment advice or a solicitation to purchase or sell securities referenced in the Investment Commentary.

Exchange Traded Fund investing involves risk. Principal loss is possible. The Funds invest in emerging market and foreign securities which involve political, economic and currency risks, greater volatility and differences in accounting methods. These risks can be greater in emerging markets. The Funds invest in smaller and medium sized companies, which involve additional risks such as limited liquidity and greater volatility. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Investments by the Funds in lower-rated and non-rated securities presents a greater risk of loss to principal and interest than higher-rated securities. Investments in mortgage-backed securities may involve additional risks, such as credit risk, prepayment risk, possible illiquidity and default, and susceptibility to adverse economic developments. Because the Funds invest in other exchange-traded funds (“ETFs”), they are subject to additional risks that do not apply to conventional funds, including the risks that the market price of an ETF’s shares may trade at a discount to its net asset value (“NAV”), an active secondary trading market may not develop or be maintained, or trading may be halted by the exchange in which they trade, which may impact a Fund’s ability to sell its shares. The Funds may invest in exchange-traded notes (“ETN”), which are subject to the credit risk of the issuer. Additional risks include volatility, lack of liquidity, and sensitivity to currencies, commodities markets, and interest rate changes. The Funds may invest in Real Estate Investment Trusts (REIT). Risks commonly associated with the direct ownership of real estate include fluctuations in the value of underlying properties, defaults by borrowers or tenants, changes in interest rates and risks related to general or local economic conditions. The Funds may invest in master limited partnerships (“MLP”), which are subject to certain risks inherent in the structure of MLPs, including complex tax structure risks, the limited ability for election or removal of management, limited voting rights, potential dependence on parent companies or sponsors for revenues to satisfy obligations, and potential conflicts of interest between partners, members and affiliates. The Funds may also use options and future contracts, which have the risks of unlimited losses of the underlying holdings due to unanticipated market movements and failure to correctly predict the direction of securities prices, interest rates and currency exchange rates. The investment in options is not suitable for all investors. Investments in absolute return strategies are not intended to outperform stocks and bonds during strong market rallies. Diversification does not assure a profit or protect against a loss in a declining market.

An investment in money market funds is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency. Although money market funds seek to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in these funds.

A stop loss order directs a brokerage firm to sell the specified security at the prevailing market price should that security’s price fall to or below a stipulated price. A stop limit order directs a brokerage firm to sell the specified security should that security’s price fall to or below a stipulated price, but only if the transaction can be executed at or above the limit price given as part of the order. The Funds use the Sub Advisor’s proprietary Dynamic Trailing Stop/Loss System (DTS™), which is designed to help control the risk to invested capital when investing in volatile securities and markets. The DTS™ is not a stop loss order or stop limit order placed with a brokerage firm, but an internal process for monitoring price movements. While the DTS™ may be used to initiate the process for selling a security, it does not assure that a particular execution price will be received.

Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any security. References to other funds should not be interpreted as an offer of these securities. For a complete list of Fund holdings, please refer to the Schedule of Investments in this report.

Any tax or legal information provided is merely a summary of our understanding and interpretation of some of the current income tax regulations and is not exhaustive. Investors must consult their tax advisor or legal counsel for advice and information concerning their particular situation. Neither the Funds nor any of their representatives may give legal or tax advice.

Must be preceded or accompanied by a prospectus.

WBI Shares Exchange Traded Funds are distributed by Foreside Fund Services, LLC.

| Absolute Shares Trust |

| |

Management’s Discussion of Fund Performance (concluded)

|

| June 30, 2020 (Unaudited) |

|

Benchmark Definitions

Unless otherwise indicated, the source for index price and performance data used in the discussion of market conditions and market commentary is Bloomberg.

The Russell 3000 Total Return Index is a float-adjusted market-cap weighted index that includes 3,000 stocks and covers 98% of the U.S. equity investable universe.

The Russell 3000 Value Total Return Index uses the value characteristic book-to-price ratio to create a style index based upon the Russell 3000 that contains companies with lower predicted and historical growth rates.

The Bloomberg Barclays US Aggregate Bond Total Return Index is calculated based on the U.S. dollar denominated, investment grade fixed-rate taxable bond market including treasury, government-related, corporate, MBS, ABS and CMBS debt, and includes the performance effect of income earned by securities in the index.

The Solactive Power FactorTM High Dividend GTR Index is constructed by scoring each ordinary dividend paying, common stock constituent from the 3,000 largest U.S. companies both directly and relative to industry peers using the three Power Factors and ranking those securities in descending order according to their dividend indicated yield. The 50 companies with the largest dividend indicated yield are chosen as Index components.

Other Index Definitions

The Dow Jones Industrial Average (DJIA or “The Dow”) is a price-weighted average of 30 of the largest blue-chip issues traded on the New York Stock Exchange.

The S&P 500 Index is a float-market-cap-weighted average of 500 large-cap U.S. companies in all major sectors.

The NASDAQ Composite Index is a market-value weighted index of all common stocks listed on NASDAQ.

The Russell 1000 Index is a float-adjusted market-cap weighted index that includes the largest 1,000 stocks by market-cap of the Russell 3000 Index.

The Russell 2000 Index is a float-adjusted market-cap weighted index that includes the smallest 2,000 stocks by market-cap of the Russell 3000 Index.

The Russell 1000 Value Index uses the value characteristic book-to-price ratio to create a style index based upon the Russell 1000 that contains companies with lower predicted and historical growth rates.

The Russell 2000 Value Index uses the value characteristic book-to-price ratio to create a style index based upon the Russell 2000 that contains companies with lower predicted and historical growth rates.

| Absolute Shares Trust |

| |

WBI BullBear Rising Income 3000 ETF |

Performance Summary (Unaudited) |

|

| | | | Since |

| Average Annual Returns | | | Inception |

| Period Ending June 30, 2020 | 1 Year | 5 Years | (8/25/14) |

WBI BullBear Rising Income 3000 ETF — NAV | (1.89)% | 2.01% | 1.50% |

WBI BullBear Rising Income 3000 ETF — Market | (1.73)% | 1.99% | 1.51% |

Russell 3000 Total Return | 6.53% | 10.03% | 9.51% |

This chart illustrates the performance of a hypothetical $10,000 investment made on August 25, 2014, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The performance data quoted represents past performance and is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For most recent month-end performance, please visit www.wbishares.com.

Per the Prospectus, the Fund’s annual operating expense (gross) is 1.24%. The Fund’s Sub-Advisor has contractually agreed to waive the fees and reimburse expenses of the Fund such that total annual operating expenses are limited to 1.25% of average net assets until at least October 31, 2021. (Actual expenses can be referenced in the Financial Highlights section later in this report.)

| Absolute Shares Trust |

| |

WBI BullBear Value 3000 ETF |

Performance Summary (Unaudited) |

|

| | | | Since |

| Average Annual Returns | | | Inception |

| Period Ending June 30, 2020 | 1 Year | 5 Years | (8/25/14) |

WBI BullBear Value 3000 ETF — NAV | (5.40)% | 2.08% | 1.19% |

WBI BullBear Value 3000 ETF — Market | (5.30)% | 2.03% | 1.20% |

Russell 3000 Value Total Return | (9.42)% | 4.41% | 4.24% |

This chart illustrates the performance of a hypothetical $10,000 investment made on August 25, 2014, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The performance data quoted represents past performance and is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For most recent month-end performance, please visit www.wbishares.com.

Per the Prospectus, the Fund’s annual operating expense (gross) is 1.25%. The Fund’s Sub-Advisor has contractually agreed to waive the fees and reimburse expenses of the Fund such that total annual operating expenses are limited to 1.25% of average net assets until at least October 31, 2021. (Actual expenses can be referenced in the Financial Highlights section later in this report.)

| Absolute Shares Trust |

| |

WBI BullBear Value 3000 ETF |

Performance Summary (Unaudited) |

|

| | | | Since |

| Average Annual Returns | | | Inception |

| Period Ending June 30, 2020 | 1 Year | 5 Years | (8/25/14) |

WBI BullBear Yield 3000 ETF — NAV | (5.22)% | 0.39% | (0.53)% |

WBI BullBear Yield 3000 ETF — Market | (5.07)% | 0.33% | (0.54)% |

Russell 3000 Value Total Return | (9.42)% | 4.41% | 4.24% |

This chart illustrates the performance of a hypothetical $10,000 investment made on August 25, 2014, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The performance data quoted represents past performance and is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For most recent month-end performance, please visit www.wbishares.com.

Per the Prospectus, the Fund’s annual operating expense (gross) is 1.14%. The Fund’s Sub-Advisor has contractually agreed to waive the fees and reimburse expenses of the Fund such that total annual operating expenses are limited to 1.25% of average net assets until at least October 31, 2021. (Actual expenses can be referenced in the Financial Highlights section later in this report.)

| Absolute Shares Trust |

| |

WBI BullBear Quality 3000 ETF |

Performance Summary (Unaudited) |

|

| | | | Since |

| Average Annual Returns | | | Inception |

| Period Ending June 30, 2020 | 1 Year | 5 Years | (8/25/14) |

WBI BullBear Quality 3000 ETF — NAV | (3.79)% | 2.45% | 1.30% |

WBI BullBear Quality 3000 ETF — Market | (3.69)% | 2.40% | 1.31% |

Russell 3000 Total Return | 6.53% | 10.03% | 9.51% |

This chart illustrates the performance of a hypothetical $10,000 investment made on August 25, 2014, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The performance data quoted represents past performance and is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For most recent month-end performance, please visit www.wbishares.com.

Per the Prospectus, the Fund’s annual operating expense (gross) is 1.23%. The Fund’s Sub-Advisor has contractually agreed to waive the fees and reimburse expenses of the Fund such that total annual operating expenses are limited to 1.25% of average net assets until at least October 31, 2021. (Actual expenses can be referenced in the Financial Highlights section later in this report.)

| Absolute Shares Trust |

| |

WBI BullBear Global Income ETF |

Performance Summary (Unaudited) |

|

| | | | Since |

| Average Annual Returns | | | Inception |

| Period Ending June 30, 2020 | 1 Year | 5 Years | (8/25/14) |

WBI BullBear Global Income ETF — NAV | (2.97)% | 1.17% | 1.47% |

WBI BullBear Global Income ETF — Market | (2.87)% | 1.15% | 1.47% |

Bloomberg Barclays US Aggregate Bond Index | 8.74% | 4.30% | 3.90% |

This chart illustrates the performance of a hypothetical $10,000 investment made on August 25, 2014, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The performance data quoted represents past performance and is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For most recent month-end performance, please visit www.wbishares.com.

Per the Prospectus, the Fund’s annual operating expense (gross) is 1.03%. The Fund’s Sub-Advisor has contractually agreed to waive the fees and reimburse expenses of the Fund such that total annual operating expenses are limited to 1.25% of average net assets until at least October 31, 2021. (Actual expenses can be referenced in the Financial Highlights section later in this report.)

| Absolute Shares Trust |

| |

WBI Power Factor® High Dividend ETF |

Performance Summary (Unaudited) |

|

| | | Since |

| Average Annual Returns | | Inception |

| Period Ending June 30, 2020 | 1 Year | (12/21/16) |

WBI Power Factor® High Dividend ETF — NAV | (19.24)% | (2.61)% |

WBI Power Factor® High Dividend ETF — Market | (19.08)% | (2.62)% |

Russell 3000 Value Index | (9.42)% | 2.19% |

Solactive Power FactorTM High Dividend Index | (23.51)% | (6.19)% |

This chart illustrates the performance of a hypothetical $10,000 investment made on December 21, 2016, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The performance data quoted represents past performance and is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For most recent month-end performance, please visit www.wbishares.com.

Per the Prospectus, the Fund’s annual operating expense (gross) is 0.77%. The Fund’s Sub-Advisor has contractually agreed to waive the fees and reimburse expenses of the Fund such that total annual operating expenses are limited to 0.70% of average net assets until at least October 31, 2021. (Actual expenses can be referenced in the Financial Highlights section later in this report.)

| Absolute Shares Trust |

| |

WBI BullBear Trend Switch US 3000 Total Return ETF |

Performance Summary (Unaudited) |

|

| | | Since |

| Average Annual Returns | | Inception |

| Period Ending June 30, 2020 | 1 Year | (5/28/2019) |

WBI BullBear Trend Switch US 3000 Total Return ETF — NAV | (11.65)% | (7.91)% |

WBI BullBear Trend Switch US 3000 Total Return ETF — Market | (11.55)% | (7.75)% |

Russell 3000 Total Return | 6.53% | 10.93% |

This chart illustrates the performance of a hypothetical $10,000 investment made on May 28, 2019, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The performance data quoted represents past performance and is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For most recent month-end performance, please visit www.wbishares.com.

Per the Prospectus, the Fund’s annual operating expense (gross) is 0.70%. (Actual expenses can be referenced in the Financial Highlights section later in this report.)

| Absolute Shares Trust |

| |

WBI BullBear Trend Switch US Total Return ETF |

Performance Summary (Unaudited) |

|

| | Since |

| Average Annual Returns | Inception |

| Period Ending June 30, 2020 | (7/18/2019) |

WBI BullBear Trend Switch US Total Return ETF — NAV | (11.49)% |

WBI BullBear Trend Switch US Total Return ETF — Market | (11.64)% |

Bloomberg Barclays US Aggregate Bond Index | 8.69% |

This chart illustrates the performance of a hypothetical $10,000 investment made on July 18, 2019, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The performance data quoted represents past performance and is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For most recent month-end performance, please visit www.wbishares.com.

Per the Prospectus, the Fund’s annual operating expense (gross) is 0.73%. (Actual expenses can be referenced in the Financial Highlights section later in this report.)

| Absolute Shares Trust |

|

|

|

As of June 30, 2020 (Unaudited)

| WBI BullBear Rising Income 3000 ETF | | | |

| | | Percentage of |

| Industry Group | | Net Assets |

Short-Term Investments and | | | |

Other Assets and Liabilities | | | 38.1 | % |

Retailing | | | 16.9 | % |

Software & Services | | | 15.8 | % |

Household & Personal Products | | | 9.2 | % |

Semiconductors & | | | | |

Semiconductor Equipment | | | 4.4 | % |

Capital Goods | | | 4.1 | % |

Pharmaceuticals, Biotechnology | | | | |

& Life Sciences | | | 3.7 | % |

Food, Beverage & Tobacco | | | 3.0 | % |

Transportation | | | 2.9 | % |

Food & Staples Retailing | | | 1.9 | % |

TOTAL | | | 100.0 | % |

| | | | | |

| WBI BullBear Value 3000 ETF | | | | |

| | | Percentage of |

| Industry Group | | Net Assets |

Short-Term Investments and | | | | |

Other Assets and Liabilities | | | 34.7 | % |

Software & Services | | | 20.7 | % |

Retailing | | | 17.4 | % |

Household & Personal Products | | | 8.4 | % |

Capital Goods | | | 4.6 | % |

Semiconductors & | | | | |

Semiconductor Equipment | | | 4.3 | % |

Pharmaceuticals, Biotechnology | | | | |

& Life Sciences | | | 3.2 | % |

Food, Beverage & Tobacco | | | 2.9 | % |

Food & Staples Retailing | | | 1.9 | % |

Transportation | | | 1.9 | % |

TOTAL | | | 100.0 | % |

| | | | | |

| WBI BullBear Yield 3000 ETF | | | | |

| | | Percentage of |

| Industry Group | | Net Assets |

Short-Term Investments and | | | | |

Other Assets and Liabilities | | | 35.0 | % |

Software & Services | | | 18.5 | % |

Retailing | | | 18.4 | % |

Household & Personal Products | | | 8.4 | % |

Capital Goods | | | 4.6 | % |

Semiconductors & | | | | |

Semiconductor Equipment | | | 4.6 | % |

Food, Beverage & Tobacco | | | 4.4 | % |

Pharmaceuticals, Biotechnology | | | | |

& Life Sciences | | | 4.2 | % |

Food & Staples Retailing | | | 1.9 | % |

TOTAL | | | 100.0 | % |

| | | | | |

| WBI BullBear Quality 3000 ETF | | | | |

| | | Percentage of |

| Industry Group | | Net Assets |

Short-Term Investments and | | | | |

Other Assets and Liabilities | | | 38.8 | % |

Retailing | | | 18.1 | % |

Software & Services | | | 17.2 | % |

Household & Personal Products | | | 8.7 | % |

Capital Goods | | | 4.6 | % |

Semiconductors & | | | | |

Semiconductor Equipment | | | 4.6 | % |

Pharmaceuticals, Biotechnology | | | | |

& Life Sciences | | | 4.2 | % |

Food, Beverage & Tobacco | | | 1.9 | % |

Food & Staples Retailing | | | 1.9 | % |

TOTAL | | | 100.0 | % |

| | | | | |

| WBI BullBear Global Income ETF | | | | |

| | | Percentage of |

| Industry Group | | Net Assets |

Exchange Traded Funds | | | 99.5 | % |

Short-Term Investments and | | | | |

Other Assets and Liabilities | | | 0.5 | % |

TOTAL | | | 100.0 | % |

| | | | | |

WBI Power Factor® High Dividend ETF | | | | |

| | | Percentage of |

| Industry Group | | Net Assets |

Banks | | | 18.1 | % |

Energy | | | 17.6 | % |

Materials | | | 8.6 | % |

Consumer Durables & Apparel | | | 8.0 | % |

Diversified Financials | | | 6.4 | % |

Media & Entertainment | | | 4.9 | % |

Pharmaceuticals, Biotechnology | | | | |

& Life Sciences | | | 4.7 | % |

Food, Beverage & Tobacco | | | 4.5 | % |

Insurance | | | 4.3 | % |

Media | | | 4.1 | % |

Telecommunication Services | | | 4.1 | % |

Consumer Services | | | 3.9 | % |

Retailing | | | 2.7 | % |

Software & Services | | | 2.2 | % |

Household & Personal Products | | | 1.5 | % |

Technology Hardware | | | | |

& Equipment | | | 1.3 | % |

Food & Staples Retailing | | | 1.1 | % |

Short-Term Investments and | | | | |

Other Assets and Liabilities | | | 0.8 | % |

Capital Goods | | | 0.6 | % |

Commercial & | | | | |

Professional Services | | | 0.6 | % |

TOTAL | | | 100.0 | % |

| | | | | |

| WBI BullBear Trend Switch | | | | |

| US 3000 Total Return ETF | | | | |

| | | Percentage of |

| Industry Group | | Net Assets |

Exchange Traded Funds | | | 99.5 | % |

Short-Term Investments and | | | | |

Other Assets and Liabilities | | | 0.5 | % |

TOTAL | | | 100.0 | % |

| | | | | |

| WBI BullBear Trend Switch | | | | |

| US Total Return ETF | | | | |

| | | Percentage of |

| Industry Group | | Net Assets |

Exchange Traded Funds | | | 99.4 | % |

Short-Term Investments and | | | | |

Other Assets and Liabilities | | | 0.6 | % |

TOTAL | | | 100.0 | % |

| Absolute Shares Trust |

|

WBI BullBear Rising Income 3000 ETF |

|

| | June 30, 2020 |

| Shares | | Security Description | | Value | |

| COMMON STOCKS — 61.9% | |

| | |

| Capital Goods — 4.1% | |

| | 9,998 | | Illinois Tool Works, Inc. | | $ | 1,748,150 | |

| | |

| Food & Staples Retailing — 1.9% | |

| | 2,730 | | Costco Wholesale Corp. | | | 827,763 | |

| | |

| Food, Beverage & Tobacco — 3.0% | |

| | 18,303 | | Monster Beverage Corp.* | | | 1,268,764 | |

| | |

| Household & Personal Products — 9.2% | |

| | 7,285 | | Church & Dwight Company, Inc. | | | 563,131 | |

| | 8,705 | | Clorox Company | | | 1,909,616 | |

| | 12,589 | | Procter & Gamble Company | | | 1,505,267 | |

| | | | | | | 3,978,014 | |

| | | | | |

| Pharmaceuticals, Biotechnology & Life Sciences — 3.7% | | | | |

| | 6,712 | | Amgen, Inc. | | | 1,583,092 | |

| | |

| Retailing — 16.9% | |

| | 706 | | Amazon.com, Inc.* | | | 1,947,727 | |

| | 37,685 | | eBay, Inc. + | | | 1,976,578 | |

| | 13,818 | | Lowe’s Companies, Inc. | | | 1,867,088 | |

| | 12,444 | | Target Corp. | | | 1,492,409 | |

| | | | | | | 7,283,802 | |

| | |

| Semiconductors & Semiconductor Equipment — 4.4% | |

| | 4,934 | | NVIDIA Corp. | | | 1,874,476 | |

| | |

| Software & Services — 15.8% | |

| | 4,158 | | Adobe Systems, Inc.* | | | 1,810,019 | |

| | 5,965 | | Intuit, Inc. | | | 1,766,773 | |

| | 9,700 | | Microsoft Corp. | | | 1,974,047 | |

| | 6,495 | | Visa, Inc. — Class A | | | 1,254,639 | |

| | | | | | | 6,805,478 | |

| | |

| Transportation — 2.9% | |

| | 7,467 | | Union Pacific Corp. | | | 1,262,446 | |

| | | | | |

| TOTAL COMMON STOCKS | | | | |

(Cost $25,462,749) | | | 26,631,985 | |

| | | | | | | | |

| Shares/ | | | | | | |

| Amount | |

| |

| |

| SHORT-TERM INVESTMENTS — 30.7% | | | | |

| | 13,215,965 | | U.S. Bank Money Market | | | | |

| | | | Deposit Account, 0.05% | |

| 13,215,965 | |

| TOTAL SHORT-TERM INVESTMENTS | |

(Cost $13,215,965) | | | 13,215,965 | |

| | | | | | | | |

| | |

| INVESTMENTS PURCHASED WITH PROCEEDS | |

| FROM SECURITIES LENDING — 0.9% | |

| | 367,290 | | Mount Vernon Liquid Assets | | | | |

| | | | Portfolio, LLC, 0.34% (a)(b) | | | 367,290 | |

| TOTAL INVESTMENTS PURCHASED WITH | |

| PROCEEDS FROM SECURITIES LENDING | |

(Cost $367,290) | | | 367,290 | |

| TOTAL INVESTMENTS — 93.4% | |

(Cost $39,046,004) | | | 40,215,240 | |

Other Assets in Excess of Liabilities — 6.6% | | | 2,804,600 | |

| NET ASSETS — 100.0% | | $ | 43,019,840 | |

_________

+ | All or portion of this security is on loan as of June 30, 2020. Total value of securities on loan is $366,940. |

* | Non-income producing security. |

(a) | The rate quoted is the annualized seven-day yield as of June 30, 2020. |

(b) | Privately offered liquidity fund. |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

The accompanying notes are an integral part of these financial statements.

| Absolute Shares Trust |

| |

WBI BullBear Value 3000 ETF |

|

|

| Shares | | Security Description | | Value | |

| COMMON STOCKS — 65.3% | |

| | |

| Capital Goods — 4.6% | |

| | 11,281 | | Illinois Tool Works, Inc. | | $ | 1,972,483 | |

| | |

| Food & Staples Retailing — 1.9% | |

| | 2,753 | | Costco Wholesale Corp. | | | 834,737 | |

| | | | | |

| Food, Beverage & Tobacco — 2.9% | | | | |