UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22961

EA Series Trust

(Exact name of registrant as specified in charter)

19 E. Eagle Road

Havertown, PA 19083

(Address of principal executive offices) (Zip code)

19 E. Eagle Road

Havertown, PA 19083

(Name and address of agent for service)

(215) 330-4476

Registrant’s telephone number, including area code

Date of fiscal year end: September 30, 2024

Date of reporting period: September 30, 2024

Item 1. Report to Stockholders.

(a)

| | | | | | | | |

| ARK 21Shares Active On-Chain Bitcoin Strategy ETF Ticker: ARKC Listed on: Cboe BZX Exchange, Inc. | September 30, 2024 Annual Shareholder Report 21shares-funds.com/product/arkc |

|

This annual shareholder report contains important information about the ARK 21Shares Active On-Chain Bitcoin Strategy ETF (the “Fund”) for the period of November 14, 2023 to September 30, 2024 (the “Period”). You can find additional information about the Fund at 21shares-funds.com/product/arkc. You can also request this information by contacting us at (215) 330-4476.

| | | | | | | | | | | |

WHAT WERE THE FUND COSTS FOR THE PERIOD?

(based on a hypothetical $10,000 investment) |

| COST OF $10,000 INVESTMENT | COST PAID AS A PERCENTAGE OF $10,000 INVESTMENT |

| $35 | 0.30% |

| | | | | | | | | | | |

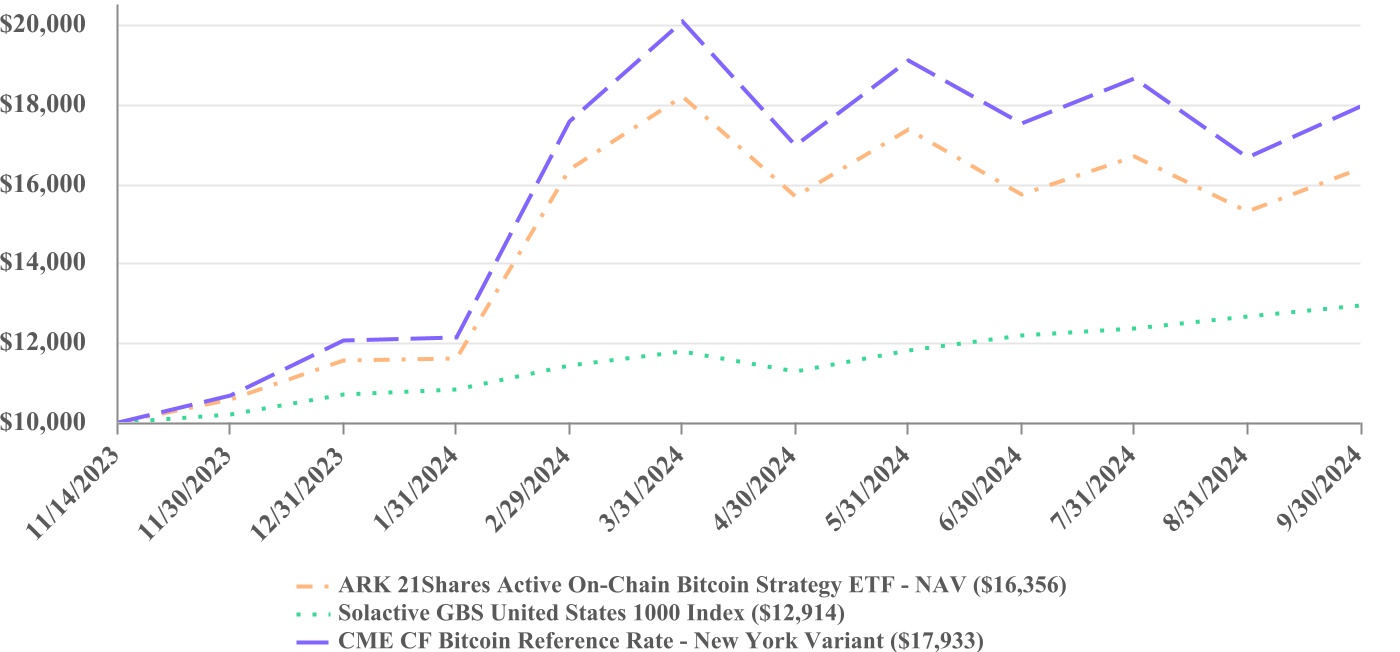

| PERFORMANCE OF A HYPOTHETICAL $10,000 INVESTMENT |

| | | | | | | | | | | | | | |

| CUMULATIVE TOTAL RETURNS |

| | | | Since Inception (11/14/2023) |

| ARK 21Shares Active On-Chain Bitcoin Strategy ETF - NAV | | | | 63.56% |

| Solactive GBS United States 1000 Index | | | | 29.14% |

| CME CF Bitcoin Reference Rate - New York Variant | | | | 79.33% |

| | | | |

The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Visit 21shares-funds.com/product/arkc for more recent performance information. |

Annual Shareholder Report: September 30, 2024

| | | | | | | | |

| ARK 21Shares Active On-Chain Bitcoin Strategy ETF Ticker: ARKC Listed on: Cboe BZX Exchange, Inc. | September 30, 2024 Annual Shareholder Report 21shares-funds.com/product/arkc |

|

| | | | | | | | | | | |

| WHAT FACTORS INFLUENCED PERFORMANCE FOR THE PERIOD? (TO BE UPDATED) |

The Fund seeks to achieve its investment objective by allocating its assets between exposure to bitcoin futures contracts (via an affiliated underlying ETF) and cash equivalents based on a proprietary model. For the Period, the Fund returned 63.56% vs. 29.14% for the Solactive GBS United States 1000 Index and 79.33% for the CME CF Bitcoin Reference Rate - New York Variant (the “CME Reference Rate”), a daily benchmark index price for spot Bitcoin in U.S. dollars published daily at 4 PM New York time.

During the Period, the Fund’s absolute performance was positively impacted by the SEC’s approval and subsequent launch of spot bitcoin ETFs in the United States in January 2024, expectations of price appreciation on the back of April’s Bitcoin network “halving,” and generally positive market risk sentiment driven by interest rate cuts in the United States and Europe. Additionally, the Fund’s proprietary signal generated timely rebalancing trades that capitalized on market opportunities, further enhancing overall performance. Conversely, news of bitcoin selling from Germany and creditors of now defunct crypto exchanges and lending products negatively impacted the Fund’s returns in June and July.

The Fund leverages on-chain data (i.e., information of all transactions carried out on a blockchain network that is recorded on a public ledger) to adjust its allocations between bitcoin futures and U.S. Treasury Bills. The Fund underperformed the CME Reference Rate due to a consistently upward-sloping CME Bitcoin futures curve (i.e., the spot price of bitcoin is lower than the futures contracts price).

| | | | | | | | | | | | | | | | | | | | |

| KEY FUND STATISTICS (as of Period End) |

| Net Assets | | $1,202,179 | | Portfolio Turnover Rate* | | 25% |

| # of Portfolio Holdings | | 2 | | Advisory Fees Paid | | $5,250 |

| *Excludes impact of in-kind transactions. |

| | | | | | |

| | | | | | | | | | | | | | |

| FUND HOLDINGS (as of % of net assets) |

| ARK 21Shares Active Bitcoin Futures Strategy ETF | 86.1% |

| Cash & Cash Equivalents | 13.9% |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy information, visit 21shares-funds.com/product/arkc. You can also request information by calling (215) 330-4476.

Householding

Householding is an option available to certain investors of the Fund. Householding is a method of delivery, based on the preference of the individual investor, in which a single copy of certain shareholder documents can be delivered to investors who share the same address, even if their accounts are registered under different names. Householding for the Fund is available through certain broker-dealers. If you are interested in enrolling in householding and receiving a single copy of prospectuses and other shareholder documents or you are currently enrolled in householding and wish to change your householding status, please contact your broker-dealer.

Annual Shareholder Report: September 30, 2024

| | | | | | | | |

| ARK 21Shares Blockchain and Digital Economy Innovation ETF Ticker: ARKD Listed on: Cboe BZX Exchange, Inc. | September 30, 2024 Annual Shareholder Report 21shares-funds.com/product/arkd |

|

| | | | | | | | | | | |

| This annual shareholder report contains important information about the ARK 21Shares Blockchain and Digital Economy Innovation ETF (the “Fund”) for the period of November 14, 2023 to September 30, 2024 (the “Period”). You can find additional information about the Fund at 21shares-funds.com/product/arkd. You can also request this information by contacting us at (215) 330-4476. This report describes changes to the Fund that occurred during the Period. |

| | | | | | | | | | | |

WHAT WERE THE FUND COSTS FOR THE PERIOD?

(based on a hypothetical $10,000 investment) |

| COST OF $10,000 INVESTMENT | COST PAID AS A PERCENTAGE OF $10,000 INVESTMENT |

| $64 | 0.55% |

| | | | | | | | | | | |

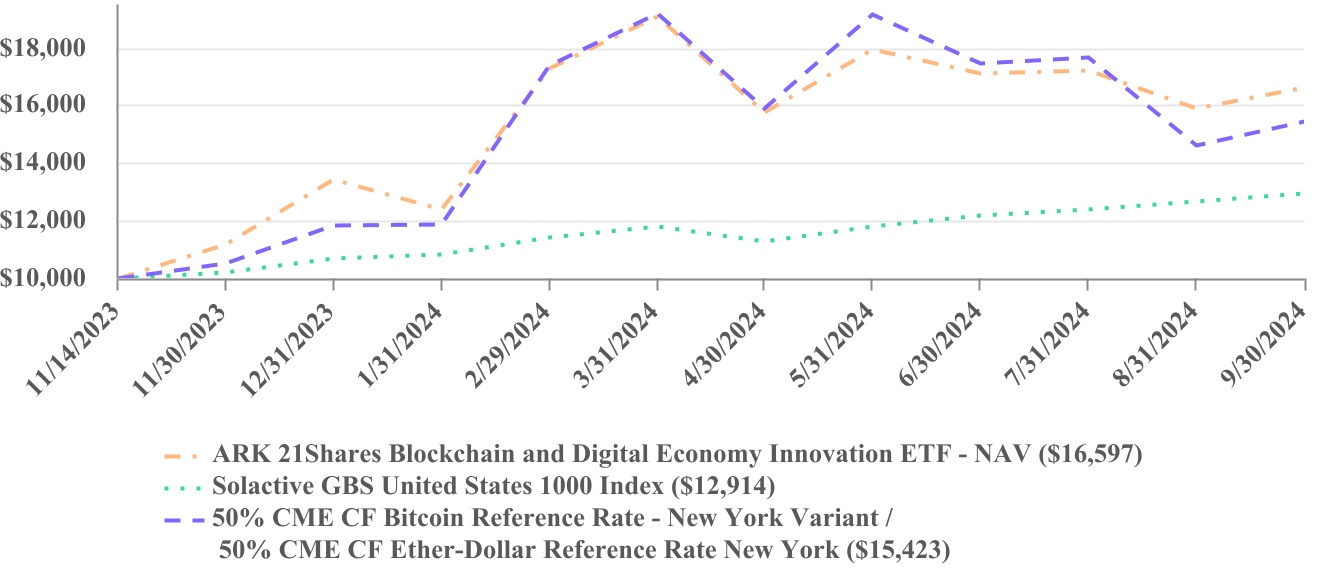

| PERFORMANCE OF A HYPOTHETICAL $10,000 INVESTMENT |

| | | | | | | | | | | | | | |

| CUMULATIVE TOTAL RETURNS |

| | | | Since Inception (11/14/2023) |

| ARK 21Shares Blockchain and Digital Economy Innovation ETF - NAV | | 65.97% |

| Solactive GBS United States 1000 Index | | 29.14% |

| 50% CME CF Bitcoin Reference Rate - New York Variant / 50% CME CF Ether-Dollar Reference Rate New York | | 54.23% |

| | | | |

The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Visit 21shares-funds.com/product/arkd for more recent performance information. |

Annual Shareholder Report: September 30, 2024

| | | | | | | | |

| ARK 21Shares Blockchain and Digital Economy Innovation ETF Ticker: ARKD Listed on: Cboe BZX Exchange, Inc. | September 30, 2024 Annual Shareholder Report 21shares-funds.com/product/arkd |

|

| | | | | | | | | | | |

| WHAT FACTORS INFLUENCED PERFORMANCE FOR THE PERIOD? |

The Fund seeks to achieve its investment objective by investing in a portfolio of assets that provide exposure to the blockchain and digital economy. For the Period, the Fund returned 65.97% vs. 29.14% for the Solactive GBS United States 1000 Index and 54.23% for an equally blended index consisting of 50% CME CF Bitcoin Reference Rate - New York Variant and 50% CME CF Ether-Dollar Reference Rate New York, daily benchmark indices for the price for spot bitcoin and ether, respectively, in U.S. dollars published daily at 4 PM New York time (the “Blended CME Reference Rate”).

During the Period, the Fund’s absolute performance was positively impacted by investor enthusiasm for the SEC’s approval and subsequent launch of spot bitcoin ETFs in the United States in January 2024 and generally positive market risk sentiment driven by interest rate cuts in the United States and Europe. Conversely, the Fund’s returns were negatively impacted by concerns over lackluster inflows into recently launched spot ether ETFs in the United States, growing traction among competing smart-contract platforms (decentralized systems that enable self-executing contracts on a blockchain), and falling Ethereum protocol revenue due to the recent growth of “Layer 2” platforms (off-chain technology built on top of a blockchain that strives to extend the capabilities of the underlying base layer network).

The Fund outperformed the Blended CME Reference Rate, primarily driven by its allocation to outperforming equities.

| | | | | | | | | | | | | | | | | | | | |

| KEY FUND STATISTICS (as of Period End) |

| Net Assets | | $3,024,374 | | Portfolio Turnover Rate* | | 29% |

| # of Portfolio Holdings | | 11 | | Advisory Fees Paid | | $14,476 |

| Excludes impact of in-kind transactions. |

| | | | | | |

| | | | | |

| FUND HOLDINGS (as a % of Net Assets) |

| Financials | 45.2% |

| ARK 21Shares Active Bitcoin Futures Strategy ETF | 24.6% |

| ARK 21Shares Active Ethereum Futures Strategy ETF | 17.2% |

| Information Technology | 8.5% |

| Consumer Discretionary | 4.3% |

| Cash & Cash Equivalents | 0.2% |

Material Fund Changes

This is a summary of certain changes to the Fund since November 14, 2023. For more complete information, you may review the Fund’s next prospectus, which we expect to be available by January 31, 2025, at 21shares-funds.com/product/arkd or by calling (215) 330-4476.

The Fund changed its principal investment strategies and related principal investment risks to invest in ether futures contracts (through an affiliated underlying ETF or through a subsidiary). Ether is a digital asset also referred to as a crypto asset. Ether, as a digital asset, is a unit of account on the “Ethereum network,” an open source, decentralized peer-to-peer computer network, which is also known as the “Ethereum Blockchain.” Through an affiliated underlying ETF or subsidiary, the Fund may invest in standardized, exchange-traded ether futures contracts that are cash settled in U.S. dollars and are traded on, or subject to the rules of, commodity exchanges registered with the Commodity Futures Trading Commission, such as the Chicago Mercantile Exchange.

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy information, visit 21shares-funds.com/product/arkd. You can also request information by calling (215) 330-4476.

Householding

Householding is an option available to certain investors of the Fund. Householding is a method of delivery, based on the preference of the individual investor, in which a single copy of certain shareholder documents can be delivered to investors who share the same address, even if their accounts are registered under different names. Householding for the Fund is available through certain broker-dealers. If you are interested in enrolling in householding and receiving a single copy of prospectuses and other shareholder documents or you are currently enrolled in householding and wish to change your householding status, please contact your broker-dealer.

Annual Shareholder Report: September 30, 2024

| | | | | | | | |

| ARK 21Shares Active Bitcoin Ethereum Strategy ETF Ticker: ARKY Listed on: Cboe BZX Exchange, Inc. | September 30, 2024 Annual Shareholder Report 21shares-funds.com/product/arky |

|

| | | | | | | | | | | |

| This annual shareholder report contains important information about the ARK 21Shares Active Bitcoin Ethereum Strategy ETF (the “Fund”) for the period of November 14, 2023 to September 30, 2024 (the “Period”). You can find additional information about the Fund at 21shares-funds.com/product/arky. You can also request this information by contacting us at (215) 330-4476. |

| | | | | | | | | | | |

WHAT WERE THE FUND COSTS FOR THE PERIOD?

(based on a hypothetical $10,000 investment) |

| COST OF $10,000 INVESTMENT | COST PAID AS A PERCENTAGE OF $10,000 INVESTMENT |

| $31 | 0.30% |

| | | | | | | | | | | |

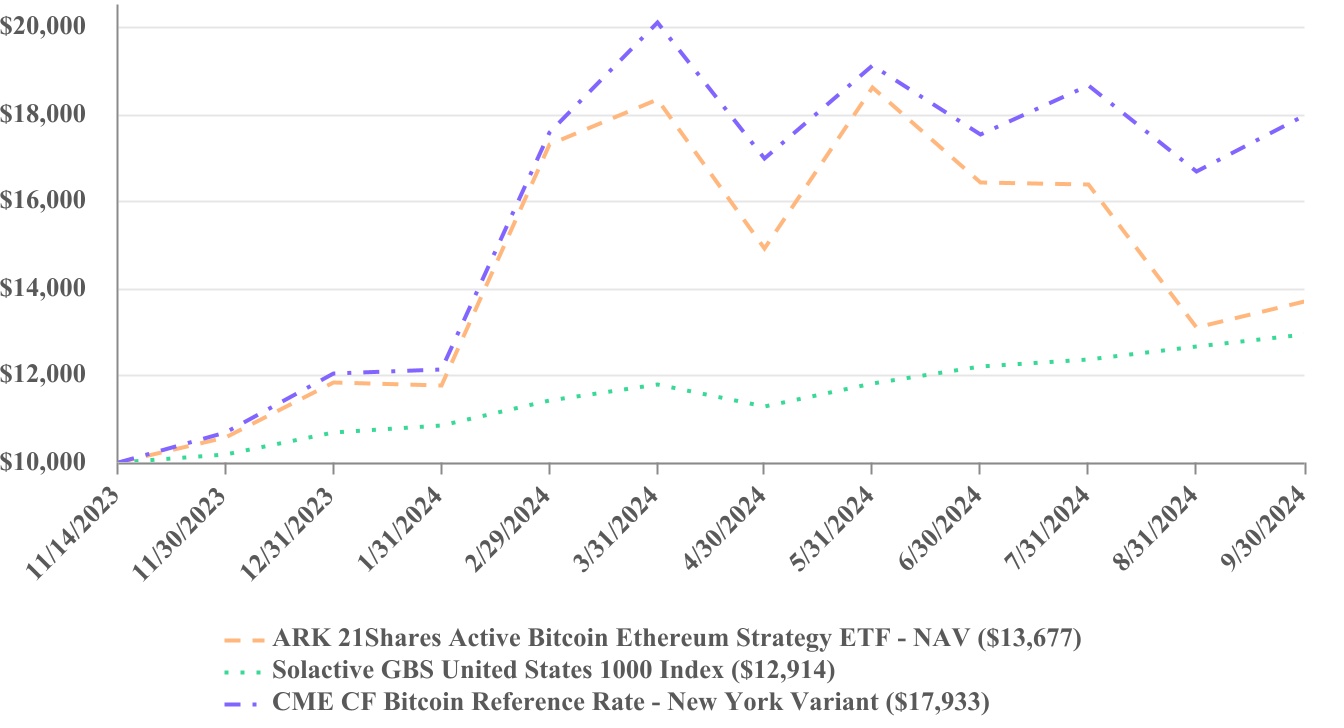

| PERFORMANCE OF A HYPOTHETICAL $10,000 INVESTMENT |

| | | | | | | | | | | | | | |

| CUMULATIVE TOTAL RETURNS |

| | | | Since Inception (11/14/2023) |

| ARK 21Shares Active Bitcoin Ethereum Strategy ETF - NAV | | | | 36.77% |

| Solactive GBS United States 1000 Index | | | | 29.14% |

| CME CF Bitcoin Reference Rate - New York Variant | | | | 79.33% |

| | | | |

The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Visit 21shares-funds.com/product/arky for more recent performance information. |

Annual Shareholder Report: September 30, 2024

| | | | | | | | |

| ARK 21Shares Active Bitcoin Ethereum Strategy ETF Ticker: ARKY Listed on: Cboe BZX Exchange, Inc. | September 30, 2024 Annual Shareholder Report 21shares-funds.com/product/arky |

|

| | | | | | | | | | | |

| WHAT FACTORS INFLUENCED PERFORMANCE FOR THE PERIOD? |

The Fund seeks to achieve its investment objective by investing in a portfolio of bitcoin and ether futures contracts primarily traded on the Chicago Mercantile Exchange (“CME”) (via affiliated underlying ETFs). For the Period, the Fund returned 36.77% vs. 29.14% for the Solactive GBS United States 1000 Index and 79.33% for the CME CF Bitcoin Reference Rate - New York Variant (the “CME Reference Rate”), a daily benchmark index price for spot Bitcoin in U.S. dollars published daily at 4 PM New York time.

During the Period, the Fund’s absolute performance was positively impacted by the SEC’s approval and subsequent launch of spot bitcoin ETFs in the United States in January 2024, expectations of price appreciation following April’s Bitcoin network “halving,” and generally positive market risk sentiment driven by interest rate cuts in the United States and Europe. However, news of bitcoin selling from Germany and creditors of now defunct crypto exchanges and lending products negatively impacted the Fund’s bitcoin futures holdings in June and July.

The Fund leverages on-chain data (i.e., information of all transactions carried out on a blockchain network that is recorded on a public ledger) to adjust its allocations between bitcoin futures and ether futures. The Fund underperformed the CME Reference Rate due to a consistently upward-sloping CME bitcoin and ether futures curve (i.e., the spot price of the bitcoin and ether is lower than the futures contracts price). In addition, ether futures underperformed bitcoin futures throughout the Period due to concerns over lackluster inflows into recently launched spot ether ETFs, growing traction among competing smart-contract platforms (decentralized systems that enable self-executing contracts on a blockchain), and declining Ethereum protocol revenue due to the rise of “Layer 2” platforms (off-chain technology built on top of a blockchain that strives to extend the capabilities of the underlying base layer network), thus negatively impacting the Fund’s performance. Additionally, the Fund’s proprietary model generated rebalancing trades that allocated weight to ether futures relative to bitcoin futures, further contributing to the underperformance.

| | | | | | | | | | | | | | | | | | | | |

| KEY FUND STATISTICS (as of Period End) |

| Net Assets | | $3,213,461 | | Portfolio Turnover Rate* | | 64% |

| # of Portfolio Holdings | | 3 | | Advisory Fees Paid | | $9,234 |

| *Excludes impact of in-kind transactions. |

| | | | | |

| FUND HOLDINGS (as a % of Net Assets) |

| ARK 21Shares Active Bitcoin Futures Strategy ETF | 79.8% |

| ARK 21Shares Active Ethereum Futures Strategy ETF | 20.0% |

| Cash & Cash Equivalents | 0.2% |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy information, visit 21shares-funds.com/product/arky. You can also request information by calling (215) 330-4476.

Householding

Householding is an option available to certain investors of the Fund. Householding is a method of delivery, based on the preference of the individual investor, in which a single copy of certain shareholder documents can be delivered to investors who share the same address, even if their accounts are registered under different names. Householding for the Fund is available through certain broker-dealers. If you are interested in enrolling in householding and receiving a single copy of prospectuses and other shareholder documents or you are currently enrolled in householding and wish to change your householding status, please contact your broker-dealer.

Annual Shareholder Report: September 30, 2024

| | | | | | | | |

| ARK 21Shares Active Bitcoin Futures Strategy ETF Ticker: ARKA Listed on: Cboe BZX Exchange, Inc. | September 30, 2024 Annual Shareholder Report 21shares-funds.com/product/arka |

|

| | | | | | | | | | | |

| This annual shareholder report contains important information about the ARK 21Shares Active Bitcoin Futures Strategy ETF (the “Fund”) for the period of November 13, 2023 to September 30, 2024 (the “Period”). You can find additional information about the Fund at 21shares-funds.com/product/arka. You can also request this information by contacting us at (215) 330-4476. This report describes changes to the Fund that occurred during the Period. |

| | | | | | | | | | | |

WHAT WERE THE FUND COSTS FOR THE PERIOD?

(based on a hypothetical $10,000 investment) |

| COST OF $10,000 INVESTMENT | COST PAID AS A PERCENTAGE OF $10,000 INVESTMENT |

| $79 | 0.70% |

| | | | | | | | | | | |

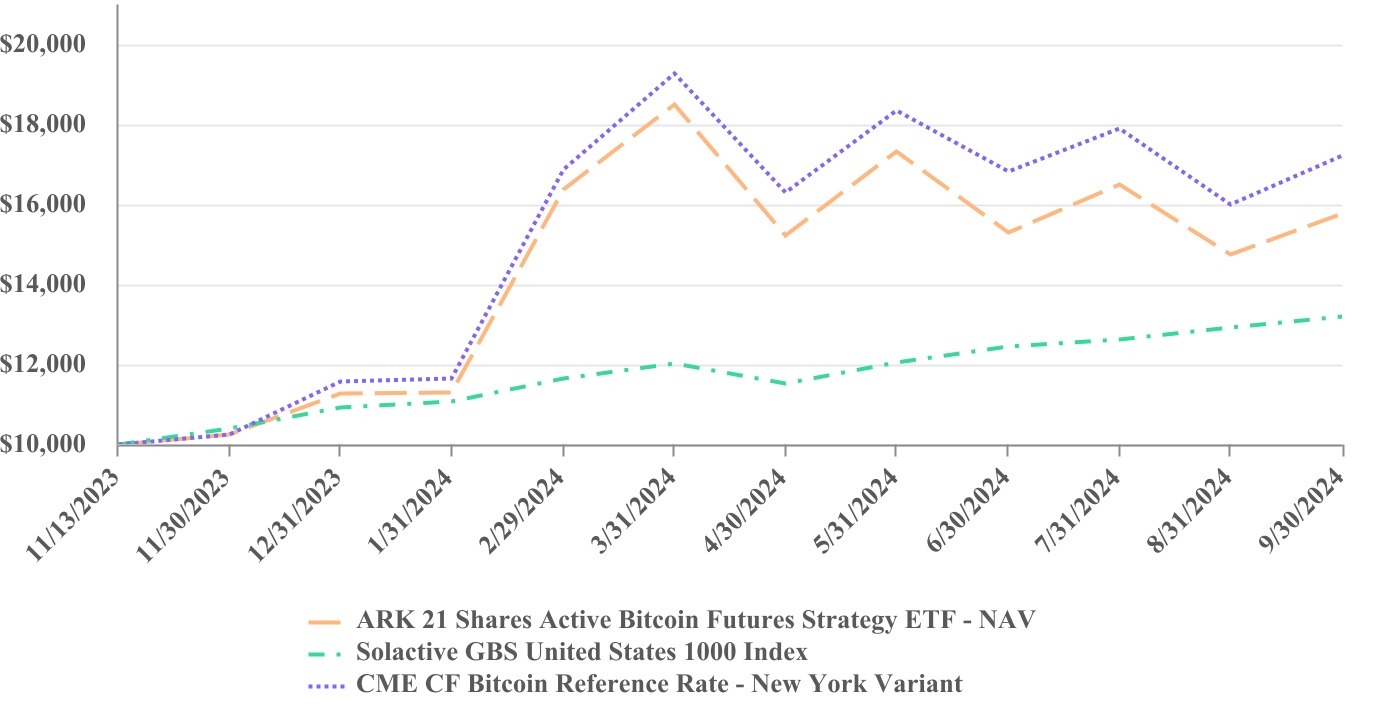

| PERFORMANCE OF A HYPOTHETICAL $10,000 INVESTMENT |

| | | | | | | | |

| CUMULATIVE TOTAL RETURNS |

| | Since Inception (11/13/2023) |

| ARK 21 Shares Active Bitcoin Futures Strategy ETF - NAV | | 57.62% |

| Solactive GBS United States 1000 Index | | 31.83% |

| CME CF Bitcoin Reference Rate - New York Variant | | 72.19% |

| | |

The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Visit 21shares-funds.com/product/arka for more recent performance information. |

Annual Shareholder Report: September 30, 2024

| | | | | | | | |

| ARK 21Shares Active Bitcoin Futures Strategy ETF Ticker: ARKA Listed on: Cboe BZX Exchange, Inc. | September 30, 2024 Annual Shareholder Report 21shares-funds.com/product/arka |

|

| | | | | | | | | | | |

| WHAT FACTORS INFLUENCED PERFORMANCE FOR THE PERIOD? |

The Fund seeks to achieve its investment objective by investing in a portfolio of bitcoin futures contracts primarily traded on the Chicago Mercantile Exchange (“CME”). For the Period, the Fund returned 57.62% vs. 31.83% for the Solactive GBS United States 1000 Index and 72.19% for the CME CF Bitcoin Reference Rate - New York Variant (the “CME Reference Rate”), a daily benchmark index price for spot bitcoin in U.S. dollars published daily at 4 PM New York time.

During the Period, the Fund’s absolute performance was positively impacted by the SEC’s approval and the subsequent launch of spot bitcoin ETFs in the United States in January 2024, expectations of price appreciation on the back of April’s Bitcoin network “halving,” and generally positive market risk sentiment driven by interest rate cuts in the United States and Europe. Conversely, news of bitcoin selling from Germany and creditors of now defunct crypto exchanges and lending products negatively impacted the Fund’s returns in June and July.

The Fund underperformed the CME Reference Rate index due to a consistently upward-sloping CME Bitcoin futures curve (i.e., the spot price of bitcoin is lower than the futures contracts price), which forced the Fund to buy higher-priced futures contracts and sell lower-priced ones when rolling contract exposure, resulting in a “negative roll yield.”

| | | | | | | | | | | | | | | | | | | | |

| KEY FUND STATISTICS (as of Period End) |

| Net Assets | | $10,877,751 | | Advisory Fees | | $79,520 |

| # of Portfolio Holdings | | 7 | | Fees Waived and/or Expenses Reimbursed | | (8,010) |

| Portfolio Turnover Rate* | | 0% | | Net Advisory Fees Paid | | $71,510 |

| *Excludes impact of in-kind transactions. |

| | | | | |

| FUND HOLDINGS (as a % of Net Assets) |

| Bitcoin Futures | 99.6% |

| Micro Bitcoin Futures | 0.3% |

| Cash & Cash Equivalents | 0.1% |

Material Fund Changes

This is a summary of certain changes to the Fund since November 14, 2023. For more complete information, you may review the Fund’s next prospectus, which we expect to be available by January 31, 2025, at 21shares-funds.com/product/arka or by calling (215) 330-4476.

Effective May 24, 2024, the Fund’s investment adviser has contractually agreed to waive receipt of its management fees and/or assume expenses of the Fund to the extent necessary to offset net interest expenses incurred in connection with investments in reverse repurchase agreements. This agreement shall remain in effect indefinitely and may only be terminated by the Board of Trustees.

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy information, visit 21shares-funds.com/product/arka. You can also request information by calling (215) 330-4476.

Householding

Householding is an option available to certain investors of the Fund. Householding is a method of delivery, based on the preference of the individual investor, in which a single copy of certain shareholder documents can be delivered to investors who share the same address, even if their accounts are registered under different names. Householding for the Fund is available through certain broker-dealers. If you are interested in enrolling in householding and receiving a single copy of prospectuses and other shareholder documents or you are currently enrolled in householding and wish to change your householding status, please contact your broker-dealer.

Annual Shareholder Report: September 30, 2024

| | | | | | | | |

| ARK 21Shares Active Ethereum Futures Strategy ETF Ticker: ARKZ Listed on: Cboe BZX Exchange, Inc. | September 30, 2024 Annual Shareholder Report 21shares-funds.com/product/arkz |

|

| | | | | | | | | | | |

| This annual shareholder report contains important information about the ARK 21Shares Active Ethereum Futures Strategy ETF (the “Fund”) for the period of November 13, 2023 to September 30, 2024 (the “Period”). You can find additional information about the Fund at 21shares-funds.com/product/arkz. You can also request this information by contacting us at (215) 330-4476. This report describes changes to the Fund that occurred during the Period. |

| | | | | | | | | | | |

WHAT WERE THE FUND COSTS FOR THE PERIOD?

(based on a hypothetical $10,000 investment) |

| COST OF $10,000 INVESTMENT | COST PAID AS A PERCENTAGE OF $10,000 INVESTMENT |

| $66 | 0.70% |

| | | | | | | | | | | |

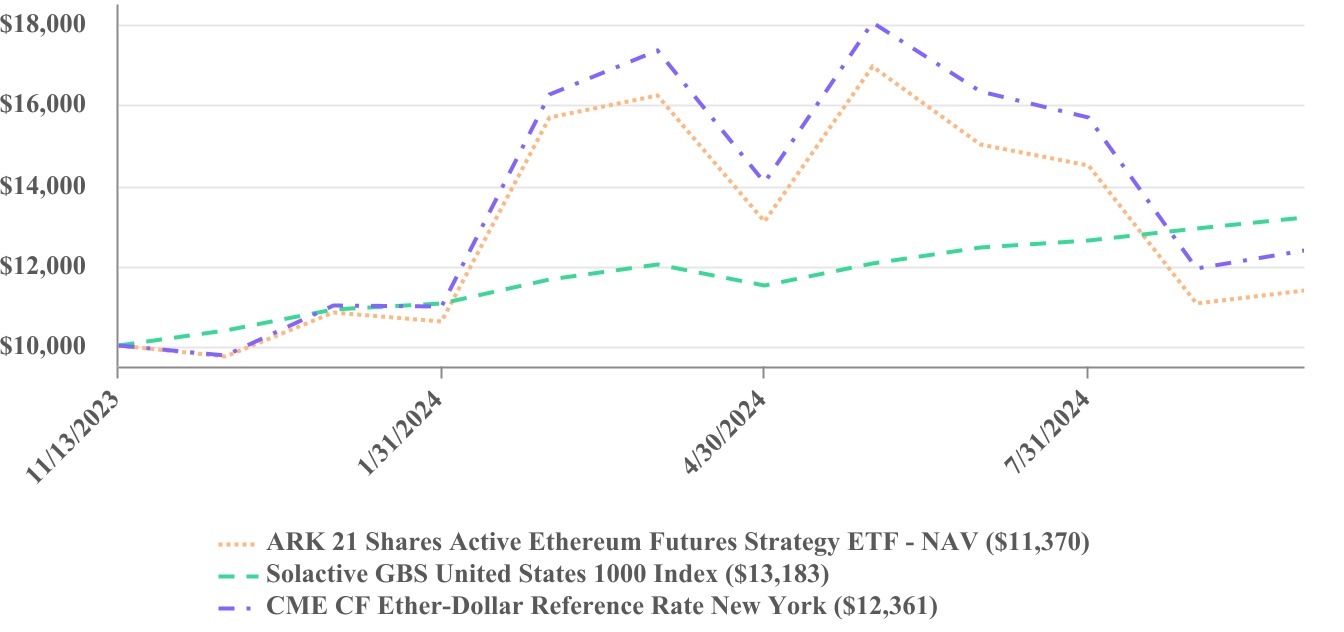

| PERFORMANCE OF A HYPOTHETICAL $10,000 INVESTMENT |

| | | | | | | | | | | | | | |

| CUMULATIVE TOTAL RETURNS |

| | | | Since Inception (11/13/2023) |

| ARK 21 Shares Active Ethereum Futures Strategy ETF - NAV | | | | 13.70% |

| Solactive GBS United States 1000 Index | | | | 31.83% |

| CME CF Ether-Dollar Reference Rate New York | | | | 23.61% |

| | | | |

The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Visit 21shares-funds.com/product/arkz for more recent performance information. |

Annual Shareholder Report: September 30, 2024

| | | | | | | | |

| ARK 21Shares Active Ethereum Futures Strategy ETF Ticker: ARKZ Listed on: Cboe BZX Exchange, Inc. | September 30, 2024 Annual Shareholder Report 21shares-funds.com/product/arkz |

|

| | | | | | | | | | | |

| WHAT FACTORS INFLUENCED PERFORMANCE FOR THE PERIOD? |

The Fund seeks to achieve its investment objective by investing in a portfolio of ether futures contracts primarily traded on the Chicago Mercantile Exchange (“CME”). For the Period, the Fund returned 13.70% vs. 31.83% for the Solactive GBS United States 1000 NTR Index and 23.61% for the CME CF ETH-USD 4 PM Reference Rate (the “CME Reference Rate”), a daily benchmark index price for spot ether in U.S. dollars published daily at 4 PM New York time.

During the Period, the Fund’s absolute performance was positively impacted by the SEC’s approval and subsequent launch of spot bitcoin ETFs in the United States in January 2024, which also bolstered Ethereum futures due to their high correlation with Bitcoin futures, alongside generally positive market risk sentiment driven by interest rate cuts in the United States and Europe. Conversely, the Fund’s returns were negatively impacted by concerns over lackluster inflows into recently launched spot ether ETFs, growing traction among competing smart-contract platforms (decentralized systems that enable self-executing contracts on a blockchain), and falling Ethereum protocol revenue due to the recent growth of “Layer 2” platforms (off-chain technology built on top of a blockchain that strives to extend the capabilities of the underlying base layer network).

The Fund underperformed the CME Reference Rate index due to a consistently upward-sloping CME ether futures curve (i.e., the spot price of ether is lower than the futures contracts price), which forced the Fund to buy higher-priced futures contracts and sell lower-priced ones when rolling contract exposure, resulting in a “negative roll yield.”

| | | | | | | | | | | | | | | | | | | | |

| KEY FUND STATISTICS (as of Period End) |

| Net Assets | | $7,098,030 | | Advisory Fees | | $53,159 |

| # of Portfolio Holdings | | 6 | | Fees Waived and/or Expenses Reimbursed | | (6,340) |

| Portfolio Turnover Rate* | | 0% | | Net Advisory Fees Paid | $46,819 |

| *Excludes impact of in-kind transactions. |

| | | | | |

| FUND HOLDINGS (as a % of Net Assets) |

| Ether Futures | 99.3% |

| Micro Ether Futures | 0.7% |

Material Fund Changes

This is a summary of certain changes to the Fund since November 14, 2023. For more complete information, you may review the Fund’s next prospectus, which we expect to be available by January 31, 2025, at 21shares-funds.com/product/arkz or by calling (215) 330-4476.

Effective May 24, 2024, the Fund’s investment adviser has contractually agreed to waive receipt of its management fees and/or assume expenses of the Fund to the extent necessary to offset net interest expenses incurred in connection with investments in reverse repurchase agreements. This agreement shall remain in effect indefinitely and may only be terminated by the Board of Trustees.

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy information, visit 21shares-funds.com/product/arkz. You can also request information by calling (215) 330-4476.

Householding

Householding is an option available to certain investors of the Fund. Householding is a method of delivery, based on the preference of the individual investor, in which a single copy of certain shareholder documents can be delivered to investors who share the same address, even if their accounts are registered under different names. Householding for the Fund is available through certain broker-dealers. If you are interested in enrolling in householding and receiving a single copy of prospectuses and other shareholder documents or you are currently enrolled in householding and wish to change your householding status, please contact your broker-dealer.

Annual Shareholder Report: September 30, 2024

(b) Not applicable

Item 2. Code of Ethics.

The registrant has adopted a code of ethics that applies to the registrant’s principal executive officer and principal financial officer. The registrant has not made any amendments to its code of ethics during the year covered by this report. The registrant has not granted any waivers from any provisions of the code of ethics during the year covered by this report.

A copy of the registrant’s Code of Ethics is incorporated by reference.

Item 3. Audit Committee Financial Expert.

The registrant’s Board of Trustees of the Trust has determined that there is at least one audit committee financial expert serving on its audit committee. Dr. Michael Pagano is an “audit committee financial expert” and is considered to be “independent” as each term is defined in Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

The registrant has engaged its principal accountant to perform audit services, audit-related services, tax services and other services during the past fiscal year. “Audit services” refer to performing an audit of the registrant’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years. “Audit-related services” refer to the assurance and related services by the principal accountant that are reasonably related to the performance of the audit. “Tax services” refer to professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning, including review of the registrant’s tax returns and calculations of required income, capital gain and excise distributions. There were no “Other services” provided by the principal accountant. The following table details the aggregate fees billed or expected to be billed for the last fiscal year for audit fees, audit-related fees, tax fees and other fees by the principal accountant.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | ARKC | | ARKD | | ARKY | | ARKA | | ARKZ | |

FYE 9/30/2024 | | | FYE 9/30/2024 | | | FYE 9/30/2024 | | | FYE 9/30/2024 | | FYE 9/30/2024 | |

| (a) Audit Fees | $7,250 | | | $7,250 | | | $7,250 | | | $7,750 | | $7,750 | |

| (b) Audit-Related Fees | N/A | | | N/A | | | N/A | | | N/A | | N/A | |

| (c) Tax Fees | $1,750 | | | $1,750 | | | $1,750 | | | $2,750 | | $2,750 | |

| (d) All Other Fees | N/A | | | N/A | | | N/A | | | N/A | | N/A | |

(e)(1) The audit committee has adopted pre-approval policies and procedures that require the audit committee to pre-approve all audit and non-audit services of the registrant, including services provided to any entity affiliated with the registrant.

(e)(2) None of the fees billed by any Fund's principal accountant were applicable to non-audit services pursuant to a waiver of the pre-approval requirement.

(f) All of the principal accountant’s hours spent on auditing the registrant’s financial statements were attributed to work performed by full-time permanent employees of the principal accountant.

(g)None of the fees billed by any Fund's principal accountant were applicable to non-audit services billed or expected to be billed to any Fund’s investment adviser.

(h) The audit committee of the board of trustees/directors has considered whether the provision of non-audit services that were rendered to the registrant's investment adviser is compatible with maintaining the principal accountant's independence

and has concluded that the provision of such non-audit services by the accountant has not compromised the accountant’s independence.

(i) The registrant has not been identified by the U.S. Securities and Exchange Commission as having filed an annual report issued by a registered public accounting firm branch or office that is located in a foreign jurisdiction where the Public Company Accounting Oversight Board is unable to inspect or completely investigate because of a position taken by an authority in that jurisdiction..

(j) The registrant is not a foreign issuer.

Item 5. Audit Committee of Listed Registrants.

(a) The registrant is an issuer as defined in Rule 10A-3 under the Securities Exchange Act of 1934, (the “Act”) and has a separately-designated standing audit committee established in accordance with Section 3(a)(58)(A) of the Act. The independent members of the committee are as follows: Daniel Dorn, Chukwuemeka (Emeka) Oguh, and Michael Pagano.

(b) Not applicable.

Item 6. Investments

(a)

| | |

| ARK 21SHARES ACTIVE ON CHAIN BITCOIN STRATEGY ETF |

| SCHEDULE OF INVESTMENTS |

| September 30, 2024 |

| | | | | | | | | | | | | | |

| EXCHANGE TRADED FUNDS - 86.1% |

| Shares |

| Value |

ARK 21Shares Active Bitcoin Futures Strategy ETF (a)(b) |

| 23,729 | |

| $ | 1,034,110 | |

TOTAL EXCHANGE TRADED FUNDS (Cost $1,334,283) | | |

| 1,034,110 | |

|

|

|

|

|

| SHORT-TERM INVESTMENTS - 57.0% | |

|

|

|

| Money Market Funds - 57.0% |

| |

| |

First American Government Obligations Fund - Class X, 4.82% (a)(c) |

| 685,632 | |

| 685,632 | |

TOTAL SHORT-TERM INVESTMENTS (Cost $685,632) | | |

| 685,632 | |

|

|

|

|

|

TOTAL INVESTMENTS - 143.1% (Cost $2,019,915) | | |

| $ | 1,719,742 | |

| Liabilities in Excess of Other Assets - (43.1)% | | |

| (517,563) | |

| TOTAL NET ASSETS - 100.0% |

| |

| $ | 1,202,179 | |

Percentages are stated as a percent of net assets.

| | | | | | | | |

| (a) |

| Fair value of this security exceeds 25% of the Fund’s net assets. Additional information for this security, including the financial statements, is available from the SEC’s EDGAR database at www.sec.gov. |

| (b) |

| Affiliated company as defined by the Investment Company Act of 1940. |

| (c) |

| The rate shown represents the 7-day effective yield as of September 30, 2024. |

The accompanying notes are an integral part of these financial statements.

1

| | |

| ARK 21SHARES BLOCKCHAIN AND DIGITAL ECONOMY INNOVATION ETF |

| SCHEDULE OF INVESTMENTS |

| September 30, 2024 |

| | | | | | | | | | | | | | |

| COMMON STOCKS - 58.0% |

| Shares |

| Value |

| Asset Management & Custody Banks - 6.1% | | | |

|

Galaxy Digital Holdings Ltd. (a) |

| 14,372 | |

| $ | 184,478 | |

|

|

|

|

|

| Broadline Retail - 4.3% | | | |

|

MercadoLibre, Inc. (a) |

| 63 |

| 129,274 | |

|

|

|

|

|

| Diversified Banks - 3.4% | | | |

|

NU Holdings Ltd./Cayman Islands - Class A (a) |

| 7,559 | |

| 103,180 | |

|

|

|

|

|

| Financial Exchanges & Data - 13.4% | | | |

|

Coinbase Global, Inc. - Class A (a) |

| 2,270 | |

| 404,446 | |

|

|

|

|

|

| Internet Services & Infrastructure - 8.5% | | | |

|

Shopify, Inc. - Class A (a) |

| 3,233 | |

| 259,093 | |

|

|

|

|

|

| Investment Banking & Brokerage - 5.9% | | | |

|

Robinhood Markets, Inc. - Class A (a) |

| 7,691 | |

| 180,123 | |

|

|

|

|

|

| Transaction & Payment Processing Services - 16.4% | | | |

|

Block, Inc. (a) |

| 5,373 | |

| 360,690 | |

PayPal Holdings, Inc. (a) |

| 1,734 | |

| 135,304 | |

|

|

|

| 495,994 | |

TOTAL COMMON STOCKS (Cost $1,463,677) | | |

| 1,756,588 | |

|

|

|

|

|

| EXCHANGE TRADED FUNDS - 41.8% |

| |

| |

ARK 21Shares Active Bitcoin Futures Strategy ETF (b) |

| 17,071 | |

| 743,954 | |

ARK 21Shares Active Ethereum Futures Strategy ETF (b) |

| 17,586 | |

| 520,194 | |

TOTAL EXCHANGE TRADED FUNDS (Cost $1,556,655) | | |

| 1,264,148 | |

|

|

|

|

|

| SHORT-TERM INVESTMENTS - 0.2% | |

|

|

|

| Money Market Funds - 0.2% |

| |

| |

First American Government Obligations Fund - Class X, 4.82% (c) |

| 5,034 | |

| 5,034 | |

TOTAL SHORT-TERM INVESTMENTS (Cost $5,034) | | |

| 5,034 | |

|

|

|

|

|

TOTAL INVESTMENTS - 100.0% (Cost $3,025,366) | | |

| $ | 3,025,770 | |

Liabilities in Excess of Other Assets - (0.0)% (d) | | |

| (1,396) | |

| TOTAL NET ASSETS - 100.0% |

| |

| $ | 3,024,374 | |

Percentages are stated as a percent of net assets.

(a) Non-income producing security.

(b) Affiliated company as defined by the Investment Company Act of 1940.

(c) The rate shown represents the 7-day effective yield as of September 30, 2024.

(d) Represents less than 0.05% of net assets.

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI, Inc. and S&P and has been licensed for use by U.S. Bank Global Fund Services.

The accompanying notes are an integral part of these financial statements.

2

| | |

| ARK 21SHARES ACTIVE BITCOIN ETHEREUM STRATEGY ETF |

| SCHEDULE OF INVESTMENTS |

| September 30, 2024 |

| | | | | | | | | | | | | | |

| EXCHANGE TRADED FUNDS - 99.8% |

| Shares |

| Value |

ARK 21Shares Active Bitcoin Futures Strategy ETF (a)(b) |

| 58,880 | |

| $ | 2,565,990 | |

ARK 21Shares Active Ethereum Futures Strategy ETF(b) |

| 21,696 | |

| 641,768 | |

TOTAL EXCHANGE TRADED FUNDS (Cost $3,990,421) | | |

| 3,207,758 | |

|

|

|

|

|

| SHORT-TERM INVESTMENTS - 0.6% | |

|

|

|

| Money Market Funds - 0.6% |

| |

| |

First American Government Obligations Fund - Class X, 4.82% (c) |

| 17,742 | |

| 17,742 | |

TOTAL SHORT-TERM INVESTMENTS (Cost $17,742) | | |

| 17,742 | |

|

|

|

|

|

TOTAL INVESTMENTS - 100.4% (Cost $4,008,163) | | |

| $ | 3,225,500 | |

| Liabilities in Excess of Other Assets - (0.4)% | | |

| (12,039) | |

| TOTAL NET ASSETS - 100.0% |

| |

| $ | 3,213,461 | |

Percentages are stated as a percent of net assets.

| | | | | | | | |

(a)

|

| Fair value of this security exceeds 25% of the Fund’s net assets. Additional information for this security, including the financial statements, is available from the SEC’s EDGAR database at www.sec.gov. |

| (b) | | Affiliated company as defined by the Investment Company Act of 1940. |

| (c) |

| The rate shown represents the 7-day effective yield as of September 30, 2024. |

The accompanying notes are an integral part of these financial statements.

3

| | |

| ARK 21SHARES ACTIVE BITCOIN FUTURES STRATEGY ETF |

| CONSOLIDATED SCHEDULE OF INVESTMENTS |

| September 30, 2024 |

| | | | | | | | | | | | | | |

| SHORT-TERM INVESTMENTS - 87.6% | | Shares | | Value |

Money Market Funds - 35.8%(a) | | | | |

First American Government Obligations Fund - Class X, 4.82%(b) | | 3,896,726 | | | $ | 3,896,726 | |

| | | | |

| U.S. Treasury Bills - 51.8% | | Par | | |

5.01%, 10/31/2024(c)(d) | | $ | 3,166,000 | | | 3,152,887 | |

4.54%, 11/29/2024(c)(d) | | 2,500,000 | | | 2,481,563 | |

| | | | 5,634,450 | |

TOTAL SHORT-TERM INVESTMENTS (Cost $9,531,176) | | | | 9,531,176 | |

| | | | |

TOTAL INVESTMENTS - 87.6% (Cost $9,531,176) | | | | $ | 9,531,176 | |

Money Market Deposit Account - 24.6%(e) | | | | 2,673,113 | |

Liabilities in Excess of Other Assets - (12.2)%(f) | | | | (1,326,538) | |

| TOTAL NET ASSETS - 100.0% | | | | $ | 10,877,751 | |

Percentages are stated as a percent of net assets.

| | | | | | | | |

| (a) | | Represents less than 0.05% of net assets. |

| (b) | | The rate shown represents the 7-day effective yield as of September 30, 2024. |

| (c) | | The rate shown is the effective yield. |

| (d) | | All or a portion of the security has been pledged as collateral in connection with open reverse repurchase agreements. At September 30, 2024, the value of securities pledged amounted to $3,980,200. |

| (e) | | The U.S. Bank Money Market Deposit Account (the “MMDA”) is a short-term vehicle in which the Fund holds cash balances. The MMDA will bear interest at a variable rate that is determined based on market conditions and is subject to change daily. The rate as of September 30, 2024 was 4.63%. |

| (f) | | Includes assets and deposits with broker pledged as collateral for derivative contracts. At September 30, 2024, the value of these assets total $3,094,098. |

| | |

|

| CONSOLIDATED SCHEDULE OF OPEN FUTURES CONTRACTS |

| September 30, 2024 |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Description | | Contracts Purchased | | Settlement Date | | Notional Amount | | Value / Unrealized Appreciation (Depreciation) |

| CME Bitcoin Futures | | 34 | | 10/25/2024 | | $ | 10,836,650 | | | $ | 7,738 | |

| CME Micro Bitcoin Futures | | 5 | | 10/25/2024 | | 31,873 | | | (570) | |

| Total Unrealized Appreciation (Depreciation) | | | | | | | | $ | 7,168 | |

| | |

|

| CONSOLIDATED SCHEDULE OF OPEN REVERSE REPURCHASE AGREEMENTS |

| September 30, 2024 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Counterparty | | Interest Rate | | Trade Date | | Maturity Date | | Net Closing Amount | | Face Value |

| StoneX Financial, Inc. | | 6.25% | | 9/27/2024 | | 10/31/2024 | | $ | 2,943,075 | | | $ | 2,925,300 | |

| StoneX Financial, Inc. | | 6.25% | | 9/27/2024 | | 11/29/2024 | | 982,218 | | | 971,425 | |

| | | | | | | | $ | 3,925,293 | | | $ | 3,896,725 | |

A reverse repurchase agreement, although structured as a sale and repurchase obligation, acts as a financing transaction under which the Fund will effectively pledge certain assets as collateral to secure a short-term loan. Generally, the other party to the agreement makes the loan in an amount less than the fair value of the pledged collateral. At the maturity of the reverse repurchase agreement, the Fund will be required to repay the loan and interest and correspondingly receive back its collateral. While used as collateral, the pledged assets continue to pay principal and interest which are for the benefit of the Fund.

The accompanying notes are an integral part of these financial statements.

4

| | |

| ARK 21SHARES ACTIVE ETHEREUM FUTURES STRATEGY ETF |

| CONSOLIDATED SCHEDULE OF INVESTMENTS |

| September 30, 2024 |

| | | | | | | | | | | | | | |

| SHORT-TERM INVESTMENTS - 113.1% | | Shares | | Value |

Money Market Funds - 49.3%(a) | | | | |

First American Government Obligations Fund - Class X, 4.82%(b) | | 3,505,504 | | | $ | 3,505,504 | |

| | | | |

| U.S. Treasury Bills - 63.8% | | Par | | |

5.01%, 10/31/2024(c)(d) | | $ | 2,250,000 | | | 2,240,681 | |

4.55%, 11/29/2024(c)(d) | | 2,300,000 | | | 2,283,000 | |

| | | | 4,523,681 | |

TOTAL SHORT-TERM INVESTMENTS (Cost $8,029,185) | | | | 8,029,185 | |

| | | | |

TOTAL INVESTMENTS - 113.1% (Cost $8,029,185) | | | | $ | 8,029,185 | |

Money Market Deposit Account - 9.7%(e) | | | | 689,543 | |

Liabilities in Excess of Other Assets - (22.8)%(f) | | | | (1,620,698) | |

| TOTAL NET ASSETS - 100.0% | | | | $ | 7,098,030 | |

Percentages are stated as a percent of net assets.

| | | | | | | | |

| (a) | | Represents less than 0.05% of net assets. |

| (b) | | The rate shown represents the 7-day effective yield as of September 30, 2024. |

| (c) | | The rate shown is the effective yield as of September 30, 2024. |

| (d) | | All or a portion of the security has been pledged as collateral in connection with open reverse repurchase agreements. At September 30, 2024, the value of securities pledged amounted to $3,580,703. |

| (e) | | The U.S. Bank Money Market Deposit Account (the “MMDA”) is a short-term vehicle in which the Fund holds cash balances. The MMDA will bear interest at a variable rate that is determined based on market conditions and is subject to change daily. The rate as of September 30, 2024 was 4.63%. |

| (f) | | Includes assets and deposits with broker pledged as collateral for derivative contracts. At September 30, 2024, the value of these assets total $2,200,491.

|

| | |

| CONSOLIDATED SCHEDULE OF OPEN FUTURES CONTRACTS |

| September 30, 2024 |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Description | | Contracts Purchased | | Settlement Date | | Notional Amount | | Value / Unrealized Appreciation (Depreciation) |

| CME Ether Futures | | 54 | | 10/25/2024 | | $ | 7,045,650 | | | $ | (174,902) | |

| CME Micro Ether Futures | | 195 | | 10/25/2024 | | 50,885 | | | 126 | |

| Total Unrealized Appreciation (Depreciation) | | | | | | | | $ | (174,776) | |

| | |

| CONSOLIDATED SCHEDULE OF OPEN REVERSE REPURCHASE AGREEMENTS |

| September 30, 2024 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Counterparty | | Interest Rate | | Trade Date | | Maturity Date | | Net Closing Amount | | Face Value |

| StoneX Financial, Inc. | | 6.25% | | 9/27/2024 | | 10/31/2024 | | $ | 2,207,306 | | | $ | 2,193,975 | |

| StoneX Financial, Inc. | | 6.25% | | 9/27/2024 | | 11/29/2024 | | 1,325,995 | | | 1,311,424 | |

| | | | | | | | $ | 3,533,301 | | | $ | 3,505,399 | |

A reverse repurchase agreement, although structured as a sale and repurchase obligation, acts as a financing transaction under which the Fund will effectively pledge certain assets as collateral to secure a short-term loan. Generally, the other party to the agreement makes the loan in an amount less than the fair value of the pledged collateral. At the maturity of the reverse repurchase agreement, the Fund will be required to repay the loan and interest and correspondingly receive back its collateral. While used as collateral, the pledged assets continue to pay principal and interest which are for the benefit of the Fund.

(b) Not applicable

The accompanying notes are an integral part of these financial statements.

5

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment

Companies.

STATEMENTS OF ASSETS AND LIABILITIES

September 30, 2024

| | | | | | | | | | | | | | | | | | | | |

| | ARK 21Shares Active On-Chain Bitcoin Strategy ETF | | ARK 21Shares Blockchain and Digital Economy Innovation ETF | | ARK 21Shares Active Bitcoin Ethereum Strategy ETF |

| Assets: | | | | | | |

| Affiliated investments, at value (See Note 2) | | $ | 1,034,110 | | | $ | 1,264,148 | | | $ | 3,207,758 | |

| Non-affiliated investments, at value (See Note 2) | | 685,632 | | | 1,761,622 | | | 17,742 | |

| Receivable for investment securities sold | | — | | | — | | | 522,635 | |

| Dividends and interest receivable | | 128 | | | 3 | | | 37 | |

| Total assets | | 1,719,870 | | | 3,025,773 | | | 3,748,172 | |

| | | | | | |

| Liabilities: | | | | | | |

| Payable for investment securities purchased | | 517,152 | | | — | | | 533,803 | |

| Accrued investment advisory fees (See Note 5) | | 539 | | | 1,399 | | | 908 | |

| Total liabilities | | 517,691 | | | 1,399 | | | 534,711 | |

| Net Assets | | $ | 1,202,179 | | | $ | 3,024,374 | | | $ | 3,213,461 | |

| | | | | | |

| Net Assets Consist of: | | | | | | |

| Paid-in capital | | $ | 1,372,857 | | | $ | 2,943,234 | | | $ | 4,871,396 | |

| Total distributable earnings (accumulated deficit) | | (170,678) | | | 81,140 | | | (1,657,935) | |

| Net Assets: | | $ | 1,202,179 | | | $ | 3,024,374 | | | $ | 3,213,461 | |

| | | | | | |

| Calculation of Net Asset Value Per Share: | | | | | | |

| Net Assets | | $ | 1,202,179 | | | $ | 3,024,374 | | | $ | 3,213,461 | |

| Shares Outstanding (unlimited shares of beneficial interest authorized, no par value) | | 40,000 | | | 80,000 | | | 120,000 | |

| Net Asset Value per Share | | $ | 30.05 | | | $ | 37.80 | | | $ | 26.78 | |

| | | | | | |

| Cost of investments in affiliates | | $ | 1,334,283 | | | $ | 1,556,655 | | | $ | 3,990,421 | |

| Cost of investments in non-affiliates | | $ | 685,632 | | | $ | 1,468,711 | | | $ | 17,742 | |

The accompanying notes are an integral part of these financial statements.

1

CONSOLIDATED STATEMENTS OF ASSETS AND LIABILITIES

September 30, 2024

| | | | | | | | | | | | | | |

| | ARK 21Shares Active Bitcoin Futures Strategy ETF | | ARK 21 Shares Active Ethereum Futures Strategy ETF |

| Assets: | | | | |

| Investments in securities, at value (See Note 2) | | $ | 9,531,176 | | | $ | 8,029,185 | |

| Cash equivalents | | 2,673,113 | | | 689,543 | |

| Deposits with broker for futures contracts | | 2,978,098 | | | 2,200,491 | |

| Receivable for fund shares sold | | 1,087,820 | | | — | |

| Dividends and interest receivable | | 10,134 | | | 1,804 | |

| Total assets | | 16,280,341 | | | 10,921,023 | |

| | | | |

| Liabilities: | | | | |

| Payable for reverse repurchase agreement | | 3,896,725 | | | 3,505,399 | |

| Payable for fund shares redeemed | | 1,087,820 | | | — | |

| Variation margin payable | | 408,348 | | | 311,383 | |

| Accrued investment advisory fees, net (See Note 5) | | 6,991 | | | 3,777 | |

| Interest payable for reverse repurchase agreement | | 2,706 | | | 2,434 | |

| Total liabilities | | 5,402,590 | | | 3,822,993 | |

| Net Assets | | $ | 10,877,751 | | | $ | 7,098,030 | |

| | | | |

| Net Assets Consist of: | | | | |

| Paid-in capital | | $ | 10,465,192 | | | $ | 7,263,477 | |

| Total distributable earnings (accumulated deficit) | | 412,559 | | | (165,447) | |

| Net Assets: | | $ | 10,877,751 | | | $ | 7,098,030 | |

| | | | |

| Calculation of Net Asset Value Per Share: | | | | |

| Net Assets | | $ | 10,877,751 | | | $ | 7,098,030 | |

Shares Outstanding (unlimited shares of beneficial interest authorized,

no par value) | | 250,000 | | | 240,000 | |

| Net Asset Value per Share | | $ | 43.51 | | | $ | 29.58 | |

| | | | |

| Cost of Investments in Securities | | $ | 9,531,176 | | | $ | 8,029,185 | |

The accompanying notes are an integral part of these financial statements.

2

STATEMENTS OF OPERATIONS

For the Period Ended September 30, 2024(1)

| | | | | | | | | | | | | | | | | | | | |

| | ARK 21Shares Active On-Chain Bitcoin Strategy ETF | | ARK 21Shares Blockchain and Digital Economy Innovation ETF | | ARK 21Shares Active Bitcoin Ethereum Strategy ETF |

| Investment Income: | | | | | | |

| Dividend income from affiliates | | $ | 551,947 | | | $ | 283,717 | | | $ | 756,694 | |

| Interest income | | 16,961 | | | 249 | | | 3,113 | |

| Total investment income | | 568,908 | | | 283,966 | | | 759,807 | |

| | | | | | |

| Expenses: | | | | | | |

| Investment advisory fees (See Note 5) | | 5,250 | | | 14,476 | | | 9,234 | |

| Net expenses | | 5,250 | | | 14,476 | | | 9,234 | |

| | | | | | |

| Net Investment Income (Loss) | | 563,658 | | | 269,490 | | | 750,573 | |

| | | | | | |

| Realized and Unrealized Gain (Loss) on Investments: | | | | | | |

| Net realized gain (loss) on: | | | | | | |

| Investments in affiliates | | 512,556 | | | 223,340 | | | 87,648 | |

| Investments in non-affiliates | | (150) | | | 208,072 | | | — | |

| Foreign currency | | — | | | 83 | | | — | |

| | 512,406 | | | 431,495 | | | 87,648 | |

| Net change in unrealized appreciation (depreciation) on: | | | | | | |

| Investments in affiliates | | (300,173) | | | (292,507) | | | (782,663) | |

| Investments in non-affiliates | | — | | | 292,490 | | | — | |

| Foreign currency | | — | | | 421 | | | — | |

| | (300,173) | | | 404 | | | (782,663) | |

| Net realized and unrealized gain (loss) on investments: | | 212,233 | | | 431,899 | | | (695,015) | |

| Net Increase (Decrease) in Net Assets Resulting from Operations | | $ | 775,891 | | | $ | 701,389 | | | $ | 55,558 | |

| | |

| (1) Each Fund commenced operations on November 14, 2023. |

The accompanying notes are an integral part of these financial statements.

3

CONSOLIDATED STATEMENTS OF OPERATIONS

For the Period Ended September 30, 2024(1)

| | | | | | | | | | | | | | |

| | ARK 21Shares Active Bitcoin Futures Strategy ETF | | ARK 21Shares Active Ethereum Futures Strategy ETF |

| Investment Income: | | | | |

| Interest income | | $ | 452,497 | | | $ | 286,260 | |

| Total investment income | | 452,497 | | | 286,260 | |

| | | | |

| Expenses: | | | | |

| Investment advisory fees (See Note 5) | | 79,520 | | | 53,159 | |

| Interest expense on reverse repurchase agreements | | 8,010 | | | 6,340 | |

| Total expenses | | 87,530 | | | 59,499 | |

| Less: Reimbursement of expenses from Advisor (See Note 5) | | (8,010) | | | (6,340) | |

| Net expenses | | 79,520 | | | 53,159 | |

| | | | |

| Net Investment Income (Loss) | | 372,977 | | | 233,101 | |

| | | | |

Realized and Unrealized Gain (Loss) on Investments

and Futures Contracts: | | | | |

| Net realized gain (loss) on: | | | | |

| Investments | | (703) | | | (239) | |

| Futures contracts | | 3,930,456 | | | (1,790,280) | |

| | 3,929,753 | | | (1,790,519) | |

| Net change in unrealized appreciation (depreciation) on: | | | | |

| | | | |

| Futures contracts | | 7,168 | | | (174,776) | |

| | 7,168 | | | (174,776) | |

Net realized and unrealized gain (loss) on investments

and futures contracts: | | 3,936,921 | | | (1,965,295) | |

| Net Increase (Decrease) in Net Assets Resulting from Operations | | $ | 4,309,898 | | | $ | (1,732,194) | |

| | |

| (1) Each Fund commenced operations on November 13, 2023. |

The accompanying notes are an integral part of these financial statements.

4

STATEMENTS OF CHANGES IN NET ASSETS

| | | | | | | | | | | | | | | | | | | | |

| | ARK 21Shares Active On-Chain Bitcoin Strategy ETF | | ARK 21Shares Blockchain and Digital Economy Innovation ETF | | ARK 21Shares Active Bitcoin Ethereum Strategy ETF |

| | For the Period Ended September 30, 2024(1) |

| Increase (Decrease) in Net Assets from: | | | | | | |

| Operations: | | | | | | |

| Net investment income (loss) | | $ | 563,658 | | | $ | 269,490 | | | $ | 750,573 | |

| Net realized gain (loss) on investments | | 512,406 | | | 431,495 | | | 87,648 | |

| Net change in unrealized appreciation (depreciation) on investments | | (300,173) | | | 404 | | | (782,663) | |

| Net increase (decrease) in net assets resulting from operations | | 775,891 | | | 701,389 | | | 55,558 | |

| | | | | | |

| Distributions to Shareholders: | | | | | | |

| Distributable earnings | | (563,526) | | | (269,683) | | | (750,750) | |

| Total distributions to shareholders | | (563,526) | | | (269,683) | | | (750,750) | |

| | | | | | |

| Capital Share Transactions: | | | | | | |

| Proceeds from shares sold | | 4,785,340 | | | 3,487,992 | | | 11,192,278 | |

| Payments for shares redeemed | | (3,795,526) | | | (895,324) | | | (7,286,902) | |

| Transaction fees (See Note 1) | | — | | | — | | | 3,277 | |

| Net increase (decrease) in net assets derived from net change in capital share transactions | | 989,814 | | | 2,592,668 | | | 3,908,653 | |

| Net Increase (Decrease) in Net Assets | | 1,202,179 | | | 3,024,374 | | | 3,213,461 | |

| | | | | | |

| Net Assets: | | | | | | |

| Beginning of period | | — | | | — | | | — | |

| End of period | | $ | 1,202,179 | | | $ | 3,024,374 | | | $ | 3,213,461 | |

| | | | | | |

| Changes in Shares Outstanding: | | | | | | |

| Shares outstanding, beginning of period | | — | | | — | | | — | |

| Shares sold | | 140,000 | | | 100,000 | | | 340,000 | |

| Shares repurchased | | (100,000) | | | (20,000) | | | (220,000) | |

| Shares outstanding, end of period | | 40,000 | | | 80,000 | | | 120,000 | |

| | |

| (1) Each Fund commenced operations on November 14, 2023. |

The accompanying notes are an integral part of these financial statements.

5

CONSOLIDATED STATEMENTS OF CHANGES IN NET ASSETS

| | | | | | | | | | | | | | |

| | ARK 21Shares Active Bitcoin Futures Strategy ETF | | ARK 21Shares Active Ethereum Futures Strategy ETF |

| | For the Period Ended September 30, 2024(1) |

| Increase (Decrease) in Net Assets from: | | | | |

| Operations: | | | | |

| Net investment income (loss) | | $ | 372,977 | | | $ | 233,101 | |

| Net realized gain (loss) on investments and futures contracts | | 3,929,753 | | | (1,790,519) | |

| Net change in unrealized appreciation (depreciation) on investments and futures contracts | | 7,168 | | | (174,776) | |

| Net increase (decrease) in net assets resulting from operations | | 4,309,898 | | | (1,732,194) | |

| | | | |

| Distributions to Shareholders: | | | | |

| Distributable earnings | | (3,904,502) | | | (222,748) | |

| Total distributions to shareholders | | (3,904,502) | | | (222,748) | |

| | | | |

| Capital Share Transactions: | | | | |

| Proceeds from shares sold | | 21,056,208 | | | 13,875,962 | |

| Payments for shares redeemed | | (10,590,033) | | | (4,842,518) | |

| Transaction fees (See Note 1) | | 6,180 | | | 19,528 | |

| Net increase (decrease) in net assets derived from net change in capital share transactions | | 10,472,355 | | | 9,052,972 | |

| Net Increase (Decrease) in Net Assets | | 10,877,751 | | | 7,098,030 | |

| | | | |

| Net Assets: | | | | |

| Beginning of period | | — | | | — | |

| End of period | | $ | 10,877,751 | | | $ | 7,098,030 | |

| | | | |

| Changes in Shares Outstanding: | | | | |

| Shares outstanding, beginning of period | | — | | | — | |

| Shares sold | | 450,000 | | | 400,000 | |

| Shares repurchased | | (200,000) | | | (160,000) | |

| Shares outstanding, end of period | | 250,000 | | | 240,000 | |

(1) Each Fund commenced operations on November 13, 2023.

The accompanying notes are an integral part of these financial statements.

6

FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning of Period | Net Investment Income (Loss)(1) | Net Realized and Unrealized Gain (Loss) on Investments | Net Increase (Decrease) in Net Asset Value Resulting from Operations | Distributions from Net Investment Income | Total Distributions | Transaction Fees (See Note 1) | Net Asset Value, End of Period | Total Return(2) | Net Assets, End of Period (000's) | Net Expenses(3)(4)(8) | Net Investment Income (Loss)(3) | Portfolio Turnover Rate(5) |

| ARK 21Shares Active On-Chain Bitcoin Strategy ETF | | | | | | | | | | | |

For the Period November 14, 2023⁽6⁾ to September 30, 2024(7) | $23.98 | 10.39 | 4.98 | 15.37 | (9.30) | (9.30) | — | $30.05 | 63.56% | $1,202 | 0.30% | 32.33% | 25% |

| | | | | | | | | | | | | |

| ARK 21Shares Blockchain and Digital Economy Innovation ETF | | | | | | | | | | |

For the Period November 14, 2023⁽6⁾ to September 30, 2024(7) | $24.73 | 3.58 | 12.84 | 16.42 | (3.35) | (3.35) | — | $37.80 | 65.97% | $3,024 | 0.55% | 10.27% | 29% |

| | | | | | | | | | | | | |

| ARK 21Shares Active Bitcoin Ethereum Strategy ETF | | | | | | | | | | | |

For the Period November 14, 2023⁽6⁾ to September 30, 2024(7) | $23.90 | 7.91 | 1.15 | 9.06 | (6.22) | (6.22) | 0.04 | $26.78 | 36.77% | $3,213 | 0.30% | 24.57% | 64% |

| | | | | |

| (1) | Net investment income per share represents net investment income divided by the daily average shares of beneficial interest outstanding throughout the period. |

| (2) | All returns reflect reinvested dividends, if any, but do not reflect the impact of taxes. Total return for a period of less than one year is not annualized. |

| (3) | For periods of less than one year, these ratios are annualized. |

| (4) | Net expenses include effects of any reimbursement or recoupment. |

| (5) | Portfolio turnover is not annualized and is calculated without regard to short-term securities having a maturity of less than one year. Excludes the impact of in-kind transactions. |

| (6) | Commencement of operations. |

| (7) | Includes adjustments in accordance with accounting principles generally accepted in the United States and, consequently, the net asset values for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder transactions. |

| (8) | Net expenses do not include expenses of the investment companies in which the Fund invests. |

The accompanying notes are an integral part of these financial statements.

7

CONSOLIDATED FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning of Period | Net Investment Income (Loss)(1) | Net Realized and Unrealized Gain (Loss) on Investments | Net Increase (Decrease) in Net Asset Value Resulting from Operations | Distributions from Net Investment Income | Total Distributions | Transaction Fees (See Note 1) | Net Asset Value, End of Period | Total Return(2) | Net Assets, End of Period (000's) | Net Expenses(3)(4) | Gross Expenses(3) | Net Investment Income (Loss)(3) | Portfolio Turnover Rate(5) |

| ARK 21Shares Active Bitcoin Futures Strategy ETF | | | | | | | | | | | | |

For the Period November 13, 2023⁽6⁾ to September 30, 2024(7) | $37.37 | 1.63 | 20.17 | 21.80 | (15.69) | (15.69) | 0.03 | $43.51 | 57.62% | $10,878 | 0.70% | 0.77% | 3.28% | 0% |

| | | | | | | | | | | | | | |

| ARK 21Shares Active Ethereum Futures Strategy ETF | | | | | | | | | | | | |

For the Period November 13, 2023⁽6⁾ to September 30, 2024(7) | $26.63 | 0.98 | 2.72 | 3.70 | (0.83) | (0.83) | 0.08 | $29.58 | 13.70% | $7,098 | 0.70% | 0.78% | 3.07% | 0% |

| | | | | |

| (1) | Net investment income per share represents net investment income divided by the daily average shares of beneficial interest outstanding throughout the period. |

| (2) | All returns reflect reinvested dividends, if any, but do not reflect the impact of taxes. Total return for a period of less than one year is not annualized. |

| (3) | For periods of less than one year, these ratios are annualized. |

| (4) | Net expenses include effects of any reimbursement or recoupment. |

| (5) | Portfolio turnover is not annualized and is calculated without regard to short-term securities having a maturity of less than one year. Excludes the impact of in-kind transactions. |

| (6) | Commencement of operations. |

| (7) | Includes adjustments in accordance with accounting principles generally accepted in the United States and, consequently, the net asset values for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder transactions. |

The accompanying notes are an integral part of these financial statements.

8

ARK 21SHARES ETFs

NOTES TO THE FINANCIAL STATEMENTS

September 30, 2024

NOTE 1 – ORGANIZATION

ARK 21Shares Active On-Chain Bitcoin Strategy ETF (“ARKC”), ARK 21Shares Blockchain and Digital Economy Innovation ETF (“ARKD”), ARK 21Shares Active Ethereum Futures Strategy ETF (“ARKY”), ARK 21Shares Active Bitcoin Futures Strategy ETF (“ARKA”), and ARK 21Shares Active Bitcoin Ethereum Strategy ETF (“ARKZ” and individually a “Fund” or collectively the “Funds”) are each a series of the EA Series Trust (the “Trust”), which was organized as a Delaware statutory trust on October 11, 2013. The Trust is registered with the Securities and Exchange Commission (“SEC”) under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company and the offering of the Funds’ shares (“Shares”) is registered under the Securities Act of 1933, as amended (the “Securities Act”). Each Fund is considered non-diversified under the 1940 Act. Each Fund qualifies as an investment company as defined in the Financial Accounting Standards Codification Topic 946-Financial Services - Investment Companies. The investment objective of each Fund is to seek capital appreciation.

| | | | | | | | | | | |

| Fund | Ticker | Commencement of Operations | Creation Unit Size |

| ARK 21Shares Active On-Chain Bitcoin Strategy ETF | ARKC | November 14, 2023 | 20,000 |

| ARK 21Shares Blockchain and Digital Economy Innovation ETF | ARKD | November 14, 2023 | 20,000 |

| ARK 21Shares Active Bitcoin Ethereum Strategy ETF | ARKY | November 14, 2023 | 20,000 |

| ARK 21Shares Active Bitcoin Futures Strategy ETF | ARKA | November 13, 2023 | 25,000 |

| ARK 21Shares Active Ethereum Futures Strategy ETF | ARKZ | November 13, 2023 | 20,000 |

Shares of the Funds are listed and traded on Cboe BZX Exchange, Inc. (“Cboe”). Market prices for the shares may be different from their net asset value (“NAV”). The Funds issue and redeem shares on a continuous basis at NAV only in blocks of shares, called “Creation Units.” Creation Units are issued and redeemed principally in-kind for securities included in a specified universe. Once created, shares generally trade in the secondary market at market prices that change throughout the day in share amounts less than a Creation Unit. Except when aggregated in Creation Units, shares are not redeemable securities of the Fund. Shares of the Fund may only be purchased or redeemed by certain financial institutions (“Authorized Participants”). An Authorized Participant is a participant of a clearing agency registered with the SEC, which has a written agreement with the Trust or one of its service providers that allows the authorized participant to place orders for the purchase and redemption of creation units. Most retail investors do not qualify as Authorized Participants nor have the resources to buy and sell whole Creation Units. Therefore, they are unable to purchase or redeem the shares directly from the Fund. Rather, most retail investors may purchase shares in the secondary market with the assistance of a broker and are subject to customary brokerage commissions or fees.

Authorized Participants may be required to pay a transaction fee to compensate the Trust or its custodian for costs incurred in connection with creation and redemption transactions. Certain transactions consisting all or partially of cash may also be subject to a variable charge, which is payable to the relevant Fund, of up to 2.00% of the value of the order in addition to the transaction fee. A Fund may determine to waive the variable charge on certain orders when such waiver is determined to be in the best interests of Fund shareholders. Transaction fees received by a Fund, if any, are displayed in the Capital Share Transactions sections of the Statements of Changes in Net Assets.

Wholly-owned and Controlled Subsidiaries

In order to achieve its investment objective, each of ARKA and ARKZ can invest up to 25% of its total assets (measured at each quarter end) in a wholly-owned subsidiary, ARK 21Shares Active Bitcoin Futures Cayman Ltd. (“Bitcoin CFC”) and ARK 21Shares Active Ethereum Futures Cayman Ltd. (“Ethereum CFC”), respectively, which acts as an investment vehicle in order to enter into certain investments for ARKA and ARKZ to each be consistent with its investment objective and policies specified in the Prospectus and Statement of Additional Information.

At September 30, 2024, investments in the Bitcoin CFC represented 15.8% of the total assets of ARKA and investments in the Ethereum CFC represented 17.3% of the total assets of ARKZ.

ARK 21SHARES ETFs

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

September 30, 2024

The consolidated financial statements of ARKA and ARKZ include the investment activity and financial statements of Bitcoin CFC and Ethereum CFC, respectively. All intercompany accounts and transactions have been eliminated in consolidation. Because each Fund may invest a substantial portion of its assets in the subsidiary, each Fund may be considered to be investing indirectly in some of those investments through its subsidiary. For that reason, references to each Fund may also encompass its subsidiary. The subsidiary is subject to the same investment restrictions and limitations, and follows the same compliance policies and procedures, as each Fund when viewed on a consolidated basis. Each Fund and its subsidiary are a “commodity pool” under the U.S. Commodity Exchange Act and Empowered Funds, LLC dba EA Advisers (the “Adviser”) and 21Shares US LLC are each a “commodity pool operator” registered with and regulated by the Commodity Futures Trading Commission (“CFTC”). As a result, additional CFTC-mandated disclosure, reporting and recordkeeping obligations apply with respect to each Fund and its respective subsidiary under CFTC and the SEC harmonized regulations.

NOTE 2 – SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Funds. These policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”).

A.Security Valuation. Equity securities that are traded on a national securities exchange, except those listed on the NASDAQ Global Market® (“NASDAQ”) are valued at the last reported sale price on the exchange on which the security is principally traded. Securities traded on NASDAQ will be valued at the NASDAQ Official Closing Price (“NOCP”). If, on a particular day, an exchange-traded or NASDAQ security does not trade, then the most recent quoted bid for exchange-traded or the mean between the most recent quoted bid and ask price for NASDAQ securities will be used. Equity securities that are not traded on a listed exchange are generally valued at the last sale price in the over-the-counter market. If a non-exchange traded security does not trade on a particular day, then the mean between the last quoted closing bid and asked price will be used. Prices denominated in foreign currencies are converted to U.S. dollar equivalents at the current exchange rate, which approximates fair value. Redeemable securities issued by open-end investment companies are valued at the investment company’s applicable net asset value, with the exception of exchange-traded open-end investment companies which are priced as equity securities. Fair values for long-term debt securities, including asset-backed securities (“ABS”), collateralized loan obligations (“CLO”), collateralized mortgage obligations (“CMO”), corporate obligations, whole loans, and mortgage-backed securities (“MBS”) are normally determined on the basis of valuations provided by independent pricing services. Vendors typically value such securities based on one or more inputs, including but not limited to, benchmark yields, transactions, bids, offers, quotations from dealers and trading systems, new issues, spreads and other relationships observed in the markets among comparable securities; and pricing models such as yield measurers calculated using factors such as cash flows, financial or collateral performance and other reference data. In addition to these inputs, MBS and ABS may utilize cash flows, prepayment information, default rates, delinquency and loss assumptions, collateral characteristics, credit enhancements and specific deal information. Reverse repurchase agreements are priced at their acquisition cost, and assessed for credit adjustments, which represents fair value. Futures contracts are carried at fair value using the primary exchange’s closing (settlement) price.

Subject to its oversight, the Trust’s Board of Trustees (the “Board”) has delegated primary responsibility for determining or causing to be determined the value of the Fund’s investments to Empowered Funds, LLC dba EA Advisers (the “Adviser”), pursuant to the Trust’s valuation policy and procedures, which have been adopted by the Trust and approved by the Board. In accordance with Rule 2a-5 under the 1940 Act, the Board designated the Adviser as the “valuation designee” of each Fund. If the Adviser, as valuation designee, determines that reliable market quotations are not readily available for an investment, the investment is valued at fair value as determined in good faith by the Adviser in accordance with the Trust’s fair valuation policy and procedures. The Adviser will provide the Board with periodic reports, no less frequently than quarterly, that discuss the functioning of the valuation process, if applicable, and that identify issues and valuation problems that have arisen, if any. As appropriate, the Adviser and the Board will review any securities valued by the Adviser in accordance with the Trust’s valuation policies during these periodic reports. The use of fair value pricing by the Fund may cause the net asset value of its shares to differ significantly from the net asset value that would be calculated without regard to

ARK 21SHARES ETFs

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)

September 30, 2024

such considerations. As of September 30, 2024, the Funds did not hold any securities that required fair valuation due to unobservable inputs.

As described above, the Fund may use various methods to measure the fair value of their investments on a recurring basis. GAAP establishes a hierarchy that prioritizes inputs to valuation methods. The three levels of inputs are:

Level 1 – Unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access.

Level 2 – Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

Level 3 – Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available; representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability and would be based on the best information available.

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

The following is a summary of the fair value classification of each Fund’s investments as of September 30, 2024:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| DESCRIPTION | | LEVEL 1 | | LEVEL 2 | | LEVEL 3 | | TOTAL |

| ARKC | | |

| Assets | | | | | | | | |

| Exchange Traded Funds | | $ | 1,034,110 | | | $ | — | | | $ | — | | | $ | 1,034,110 | |

| Money Market Funds | | 685,632 | | | — | | | — | | | 685,632 | |

| Total Investments in Securities | | $ | 1,719,742 | | | $ | — | | | $ | — | | | $ | 1,719,742 | |

| | | | | | | | |

| ARKD | | | | |

| Assets | | | | | | | | |

| Common Stocks | | $ | 1,756,588 | | | $ | — | | | $ | — | | | $ | 1,756,588 | |

| Exchange Traded Funds | | 1,264,148 | | | — | | | — | | | 1,264,148 | |

| Money Market Funds | | 5,034 | | | — | | | — | | | 5,034 | |

| Total Investments in Securities | | $ | 3,025,770 | | | $ | — | | | $ | — | | | $ | 3,025,770 | |

| | | | | | | | |

ARK 21SHARES ETFs

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)