Project Alinea TEAL SPECIAL COMMITTEE UPDATE FEBRUARY 2021 CONFIDENTIAL

The information herein has been prepared by Lazard Frères & Co . LLC (“Lazard”) based upon information supplied by you (“Teal” or the “Company”) or publicly available information, and portions of the information herein may be based upon certain statements, estimates and forecasts provided by the Company with respect to the anticipated future performance of the Company . Lazard has relied upon the accuracy and completeness of the foregoing information, and has not assumed any responsibility for any independent verification of such information or any independent valuation or appraisal of any of the assets or liabilities of the Company or any other entity, or concerning solvency or fair value of the Company or any other entity . With respect to financial forecasts, Lazard has assumed that they have been reasonably prepared on bases reflecting the best currently available estimates and judgments as to the future financial performance of the relevant entity ; we assume no responsibility for and express no view as to such forecasts . The information set forth herein is based upon economic, monetary, market and other conditions as in effect on, and the information made available to us as of, the date hereof, unless indicated otherwise . These materials and the information contained herein are confidential and may not be disclosed publicly or made available to third parties without the prior written consent of Lazard ; provided, however, that you may disclose to any and all persons the U . S . federal income tax treatment and tax structure of any transaction described herein and the portions of these materials that relate to such tax treatment or structure . Lazard is acting as investment banker to the Special Committee of the Board of Directors of the Company (the “Special Committee”), and will not be responsible for and will not provide any tax, accounting, actuarial, legal or other specialist advice . These materials are preliminary and summary in nature and do not include all of the information that the Special Committee should evaluate in considering a possible transaction . Lazard has been retained only by the Special Committee in connection with the transaction described herein and has no duties to any third party . Nothing herein shall constitute a commitment or undertaking on the part of Lazard or any related party to provide any service . Disclaimer PROJECT ALINEA CONFIDENTIAL 1

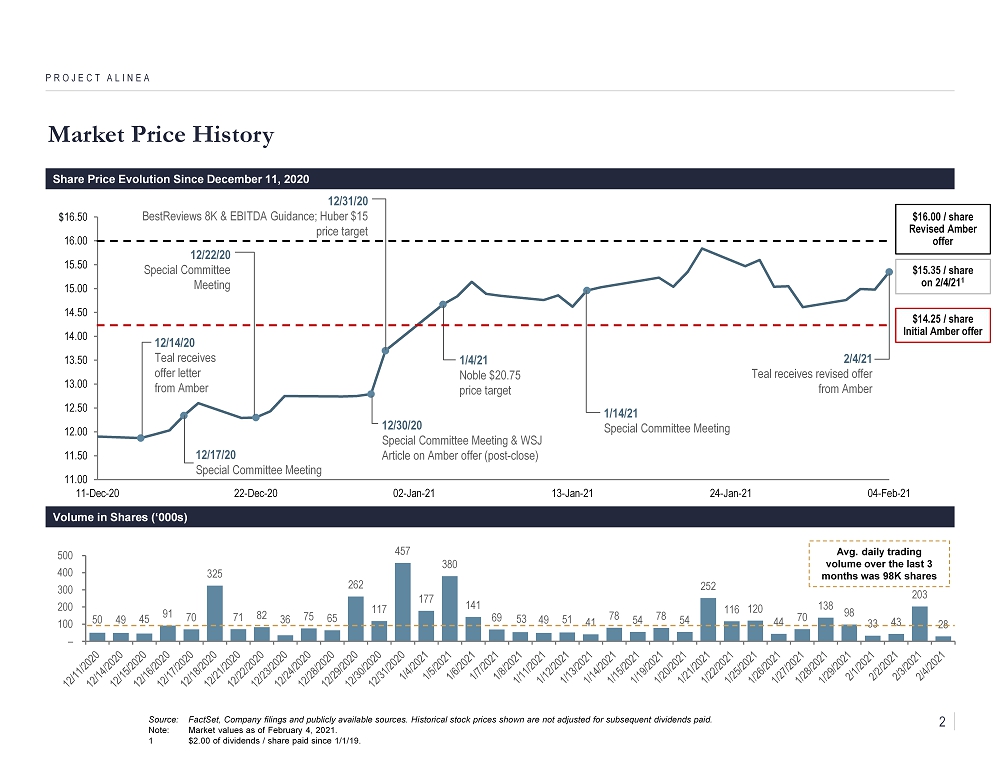

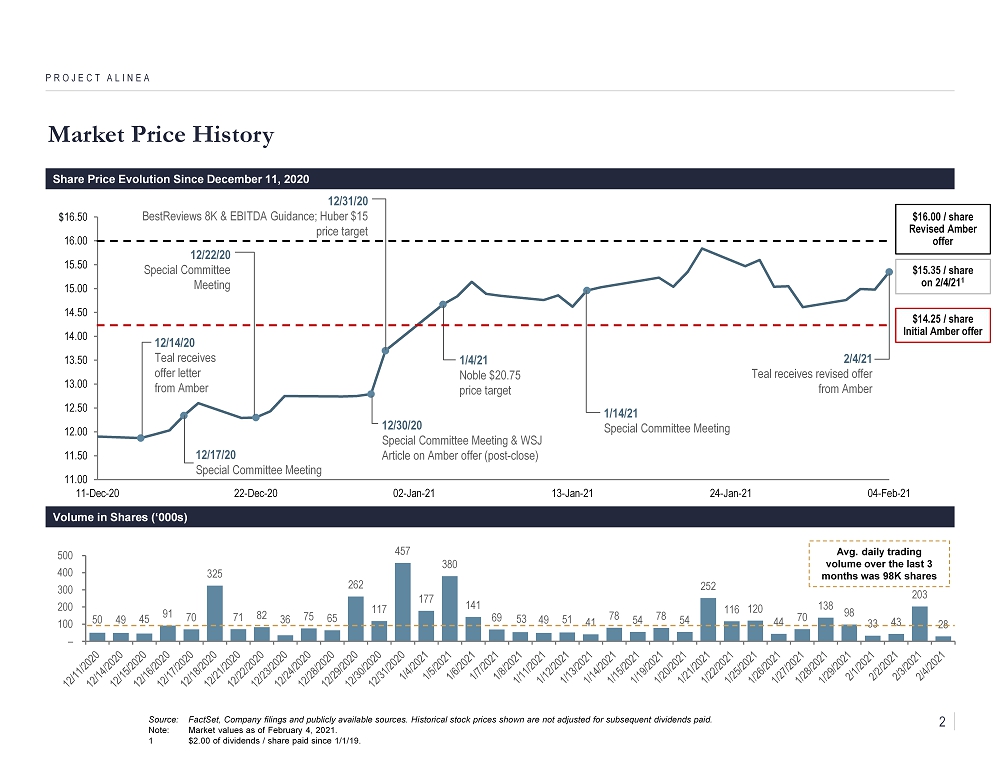

11.00 11.50 12.00 12.50 13.00 13.50 14.00 14.50 15.00 15.50 16.00 16.50 11-Dec-20 22-Dec-20 02-Jan-21 13-Jan-21 24-Jan-21 04-Feb-21 Market Price History PROJECT ALINEA Share Price Evolution Since December 11, 2020 $15.35 / share on 2/4/21 1 12/14/20 Teal receives offer letter from Amber Source: FactSet, Company filings and publicly available sources. Historical stock prices shown are not adjusted for subsequent d ividends paid. Note: Market values as of February 4, 2021. 1 $2.00 of dividends / share paid since 1/1/19. 1/14/21 Special Committee Meeting 12/31/20 BestReviews 8K & EBITDA Guidance; Huber $15 price target 1/4/21 Noble $20.75 price target Volume in Shares (‘000s) 50 49 45 91 70 325 71 82 36 75 65 262 117 457 177 380 141 69 53 49 51 41 78 54 78 54 252 116 120 44 70 138 98 33 43 203 28 – 100 200 300 400 500 Avg. daily trading volume over the last 3 months was 98K shares $ 12/22/20 Special Committee Meeting $14.25 / share Initial Amber offer 12/17/20 Special Committee Meeting $16.00 / share Revised Amber offer 2/4/21 Teal receives revised offer from Amber 12/30/20 Special Committee Meeting & WSJ Article on Amber offer (post - close) 2

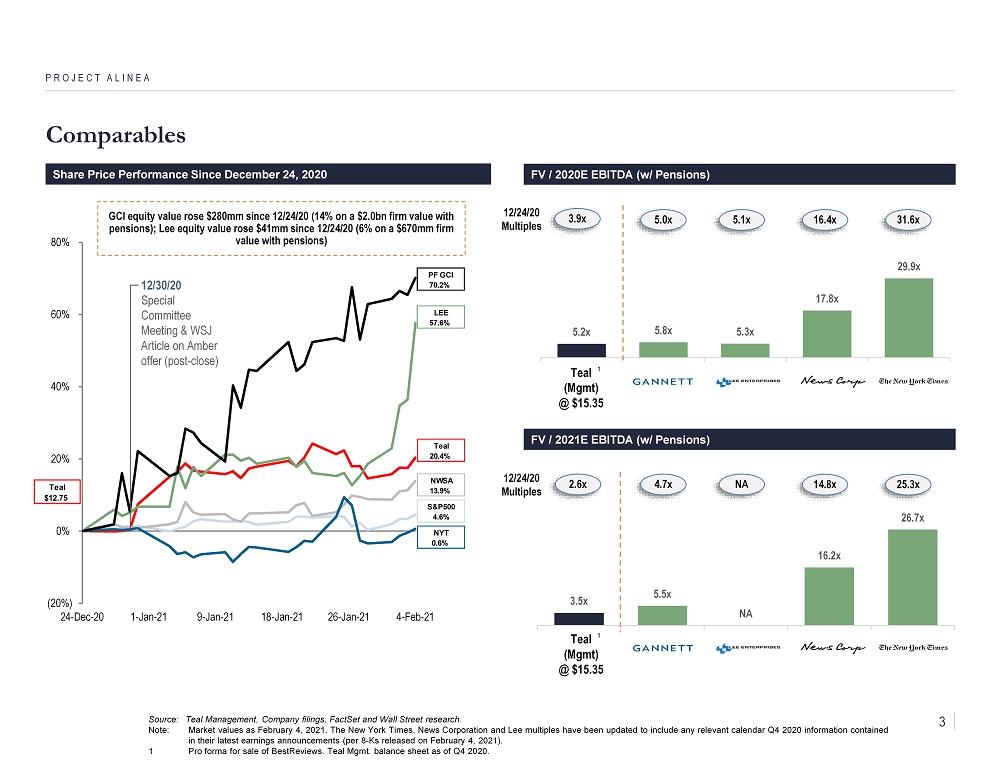

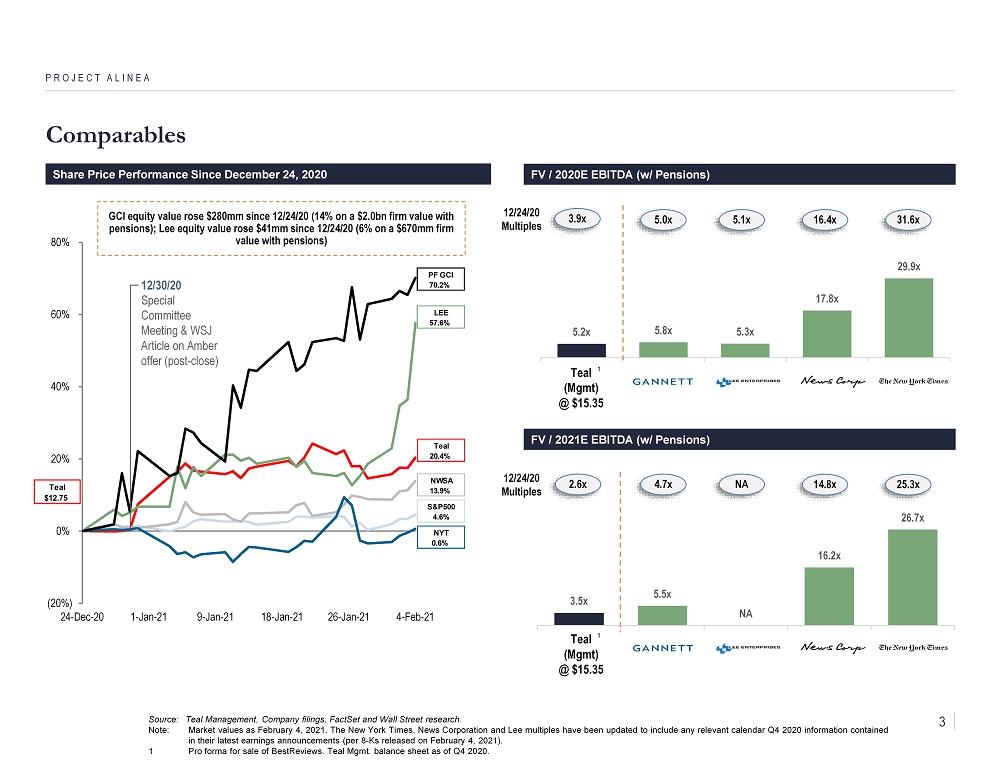

Comparables PROJECT ALINEA Source: Teal Management, Company filings, FactSet and Wall Street research. Note: Market values as February 4, 2021. The New York Times, News Corporation and Lee multiples have been updated to include any relevant calendar Q4 2020 information contained in their latest earnings announcements (per 8 - Ks released on February 4, 2021). 1 Pro forma for sale of BestReviews . Teal Mgmt. balance sheet as of Q4 2020. Share Price Performance Since December 24, 2020 (20%) 0% 20% 40% 60% 80% 24-Dec-20 1-Jan-21 9-Jan-21 18-Jan-21 26-Jan-21 4-Feb-21 NYT 0.6% S&P500 4.6% NWSA 13.9% LEE 57.6% PF GCI 70.2% Teal 20.4% Teal $12.75 FV / 2020E EBITDA (w/ Pensions) 5.2x 5.8x 5.3x 17.8x 29.9x FV / 2021E EBITDA (w/ Pensions) Teal ( Mgmt ) @ $15.35 3.5x 5.5x NA 16.2x 26.7x 31.6x 16.4x 5.1x 5.0x 12/24/20 Multiples 1 3.9x 25.3x 14.8x NA 4.7x 12/24/20 Multiples 2.6x 12/30/20 Special Committee Meeting & WSJ Article on Amber offer (post - close) Teal ( Mgmt ) @ $15.35 1 GCI equity value rose $280mm since 12/24/20 (14% on a $2.0bn firm value with pensions); Lee equity value rose $41mm since 12/24/20 (6% on a $670mm firm value with pensions) 3

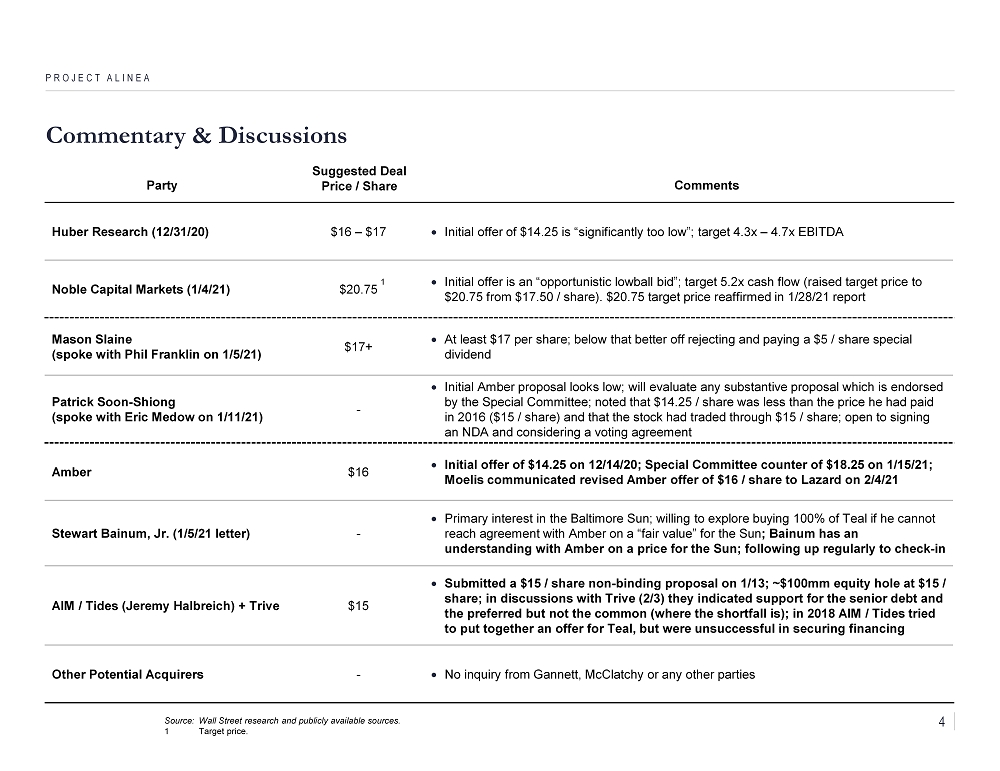

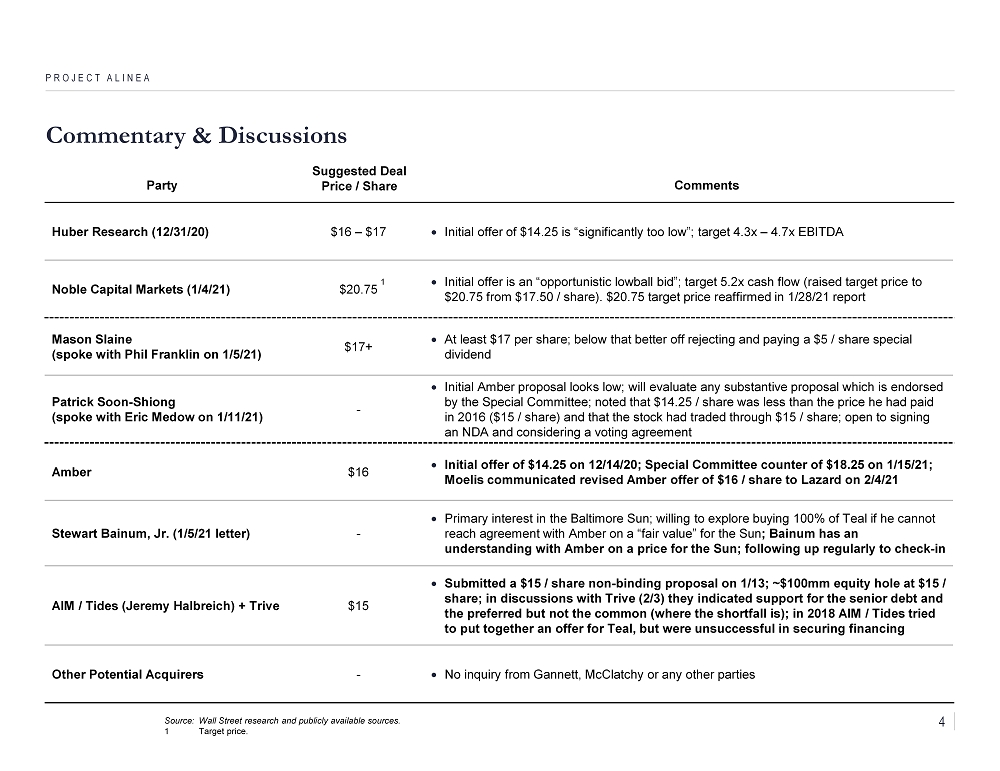

Commentary & Discussions PROJECT ALINEA Huber Research (12/31/20) $16 – $17 Initial offer of $14.25 is “significantly too low”; target 4.3x – 4.7x EBITDA Noble Capital Markets (1/4/21) $20.75 Initial offer is an “opportunistic lowball bid”; target 5.2x cash flow (raised target price to $20.75 from $17.50 / share). $20.75 target price reaffirmed in 1/28/21 report Mason Slaine (spoke with Phil Franklin on 1/5/21) $17+ At least $17 per share; below that better off rejecting and paying a $5 / share special dividend Patrick Soon - Shiong (spoke with Eric Medow on 1/11/21) - Initial Amber proposal looks low; will evaluate any substantive proposal which is endorsed by the Special Committee; noted that $14.25 / share was less than the price he had paid in 2016 ($15 / share) and that the stock had traded through $15 / share; open to signing an NDA and considering a voting agreement Amber $16 Initial offer of $14.25 on 12/14/20; Special Committee counter of $18.25 on 1/15/21; Moelis communicated revised Amber offer of $16 / share to Lazard on 2/4/21 Stewart Bainum , Jr. (1/5/21 letter) - Primary interest in the Baltimore Sun; willing to explore buying 100% of Teal if he cannot reach agreement with Amber on a “fair value” for the Sun ; Bainum has an understanding with Amber on a price for the Sun; following up regularly to check - in AIM / Tides (Jeremy Halbreich) + Trive $15 Submitted a $15 / share non - binding proposal on 1/13; ~$100mm equity hole at $15 / share; in discussions with Trive (2/3) they indicated support for the senior debt and the preferred but not the common (where the shortfall is); in 2018 AIM / Tides tried to put together an offer for Teal, but were unsuccessful in securing financing Other Potential Acquirers - No inquiry from Gannett, McClatchy or any other parties Party Suggested Deal Price / Share Comments Source: Wall Street research and publicly available sources. 1 Target price. 1 4

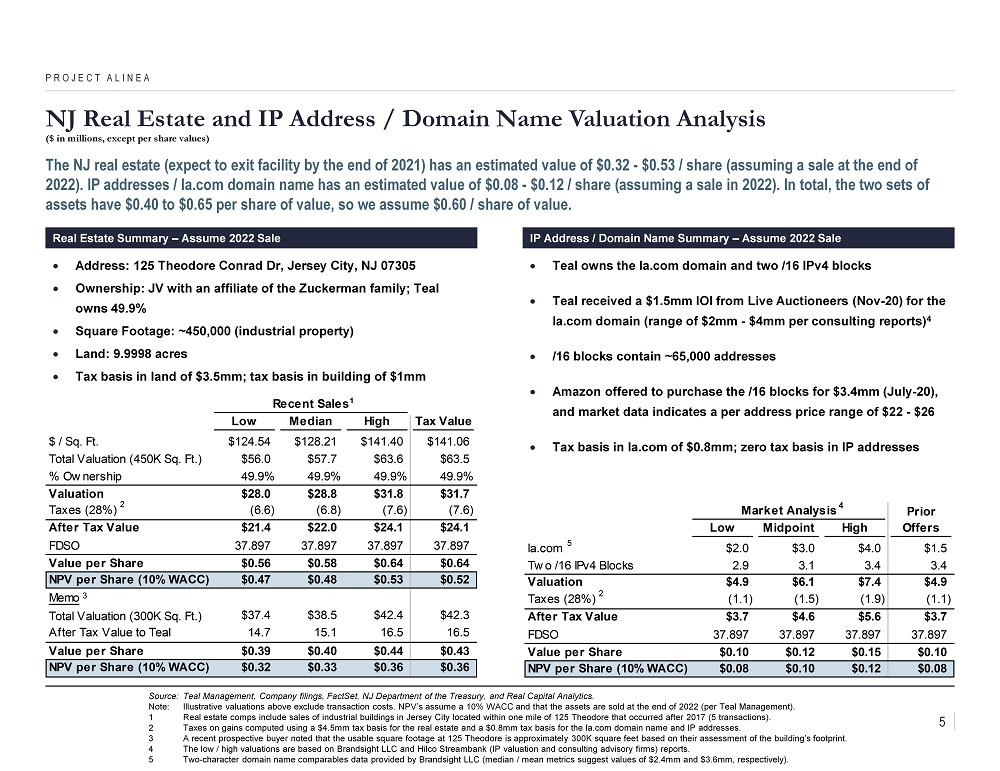

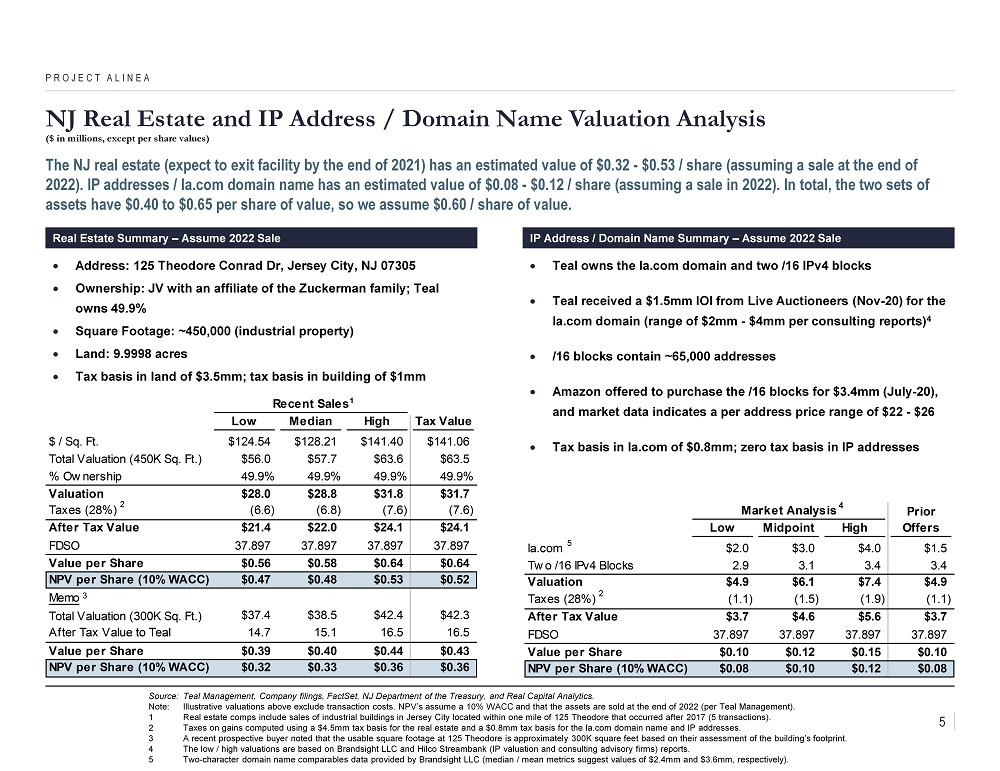

Address: 125 Theodore Conrad Dr, Jersey City, NJ 07305 Ownership: JV with an affiliate of the Zuckerman family; Teal owns 49.9% Square Footage: ~450,000 (industrial property) Land: 9.9998 acres Tax basis in land of $3.5mm; tax basis in building of $1mm The NJ real estate (expect to exit facility by the end of 2021) has an estimated value of $0.32 - $0.53 / share (assuming a sale at the end of 2022). IP addresses / la.com domain name has an estimated value of $0.08 - $0.12 / share (assuming a sale in 2022). In total, th e two sets of assets have $0.40 to $0.65 per share of value, so we assume $0.60 / share of value. NJ Real Estate and IP Address / Domain Name Valuation Analysis ($ in millions, except per share values) PROJECT ALINEA Real Estate Summary – Assume 2022 Sale IP Address / Domain Name Summary – Assume 2022 Sale Source: Teal Management, Company filings, FactSet, NJ Department of the Treasury, and Real Capital Analytics. Note: Illustrative valuations above exclude transaction costs. NPV’s assume a 10% WACC and that the assets are sold at the end o f 2022 (per Teal Management). 1 Real estate comps include sales of industrial buildings in Jersey City located within one mile of 125 Theodore that occurred aft er 2017 (5 transactions). 2 Taxes on gains computed using a $4.5mm tax basis for the real estate and a $0.8mm tax basis for the la.com domain name and IP ad dresses. 3 A recent prospective buyer noted that the usable square footage at 125 Theodore is approximately 300K square feet based on th eir assessment of the building’s footprint. 4 The low / high valuations are based on Brandsight LLC and Hilco Streambank (IP valuation and consulting advisory firms) reports. 5 Two - character domain name comparables data provided by Brandsight LLC (median / mean metrics suggest values of $2.4mm and $3.6mm, respectively). Teal owns the la.com domain and two /16 IPv4 blocks Teal received a $1.5mm IOI from Live Auctioneers (Nov - 20) for the la.com domain (range of $2mm - $4mm per consulting reports) 4 /16 blocks contain ~65,000 addresses Amazon offered to purchase the /16 blocks for $3.4mm (July - 20), and market data indicates a per address price range of $22 - $26 Tax basis in la.com of $0.8mm; zero tax basis in IP addresses Market Analysis Prior Low Midpoint High Offers la.com $2.0 $3.0 $4.0 $1.5 Two /16 IPv4 Blocks 2.9 3.1 3.4 3.4 Valuation $4.9 $6.1 $7.4 $4.9 Taxes (28%) (1.1) (1.5) (1.9) (1.1) After Tax Value $3.7 $4.6 $5.6 $3.7 FDSO 37.897 37.897 37.897 37.897 Value per Share $0.10 $0.12 $0.15 $0.10 NPV per Share (10% WACC) $0.08 $0.10 $0.12 $0.08 Recent SalesLow Median High Tax Value $ / Sq. Ft. $124.54 $128.21 $141.40 $141.06 Total Valuation (450K Sq. Ft.) $56.0 $57.7 $63.6 $63.5 % Ownership 49.9% 49.9% 49.9% 49.9% Valuation $28.0 $28.8 $31.8 $31.7 Taxes (28%) (6.6) (6.8) (7.6) (7.6) After Tax Value $21.4 $22.0 $24.1 $24.1 FDSO 37.897 37.897 37.897 37.897 Value per Share $0.56 $0.58 $0.64 $0.64 NPV per Share (10% WACC) $0.47 $0.48 $0.53 $0.52 Memo Total Valuation (300K Sq. Ft.) $37.4 $38.5 $42.4 $42.3 After Tax Value to Teal 14.7 15.1 16.5 16.5 Value per Share $0.39 $0.40 $0.44 $0.43 NPV per Share (10% WACC) $0.32 $0.33 $0.36 $0.36 1 2 2 3 5 4 5

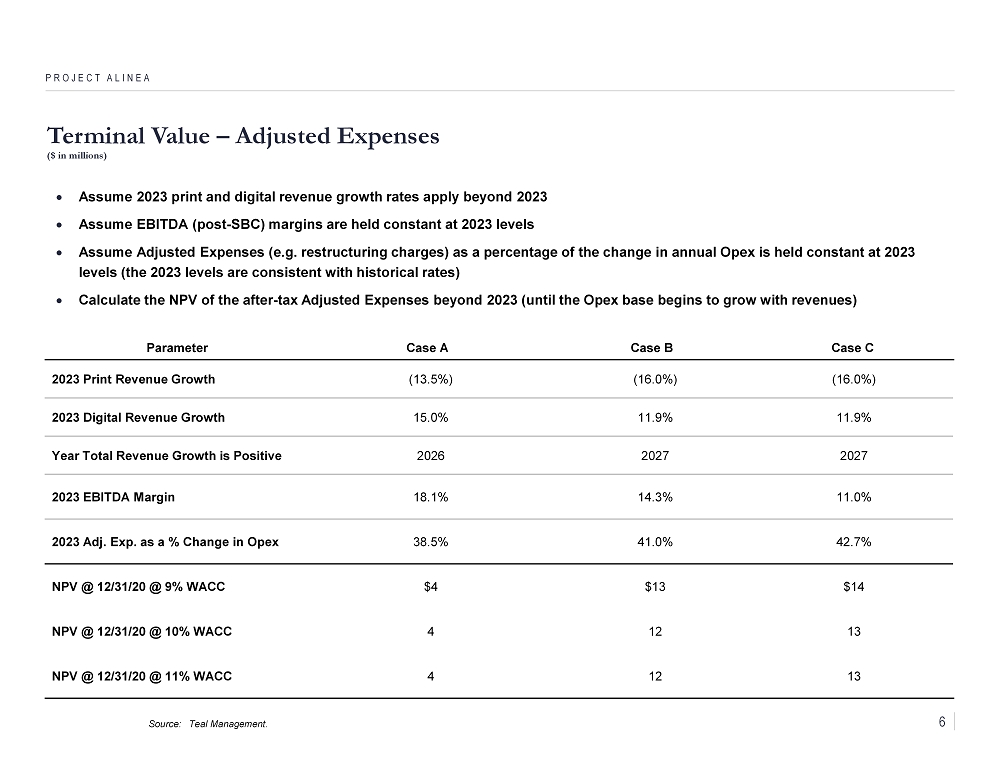

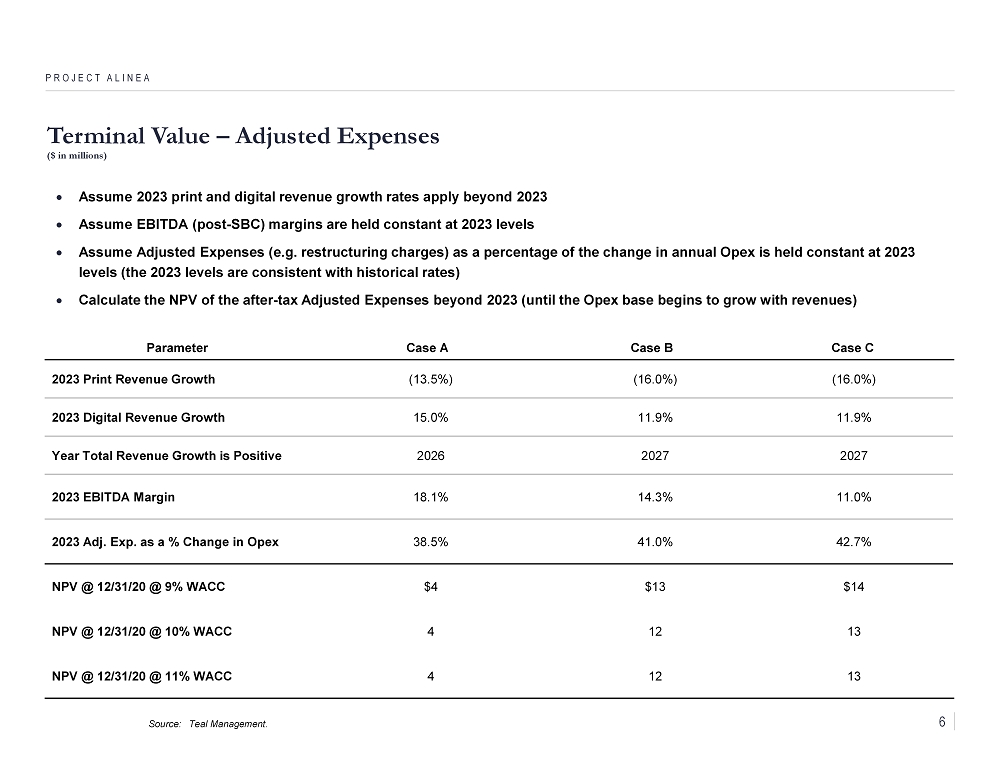

Terminal Value – Adjusted Expenses ($ in millions) PROJECT ALINEA Assume 2023 print and digital revenue growth rates apply beyond 2023 Assume EBITDA (post - SBC) margins are held constant at 2023 levels Assume Adjusted Expenses (e.g. restructuring charges) as a percentage of the change in annual Opex is held constant at 2023 levels (the 2023 levels are consistent with historical rates) Calculate the NPV of the after - tax Adjusted Expenses beyond 2023 (until the Opex base begins to grow with revenues) 2023 Print Revenue Growth (13.5%) (16.0%) (16.0%) 2023 Digital Revenue Growth 15.0% 11.9% 11.9% Year Total Revenue Growth is Positive 2026 2027 2027 2023 EBITDA Margin 18.1% 14.3% 11.0% 2023 Adj. Exp. as a % Change in Opex 38.5% 41.0% 42.7% NPV @ 12/31/20 @ 9% WACC $4 $13 $14 NPV @ 12/31/20 @ 10% WACC 4 12 13 NPV @ 12/31/20 @ 11% WACC 4 12 13 Parameter Case A Case B Case C Source: Teal Management. 6

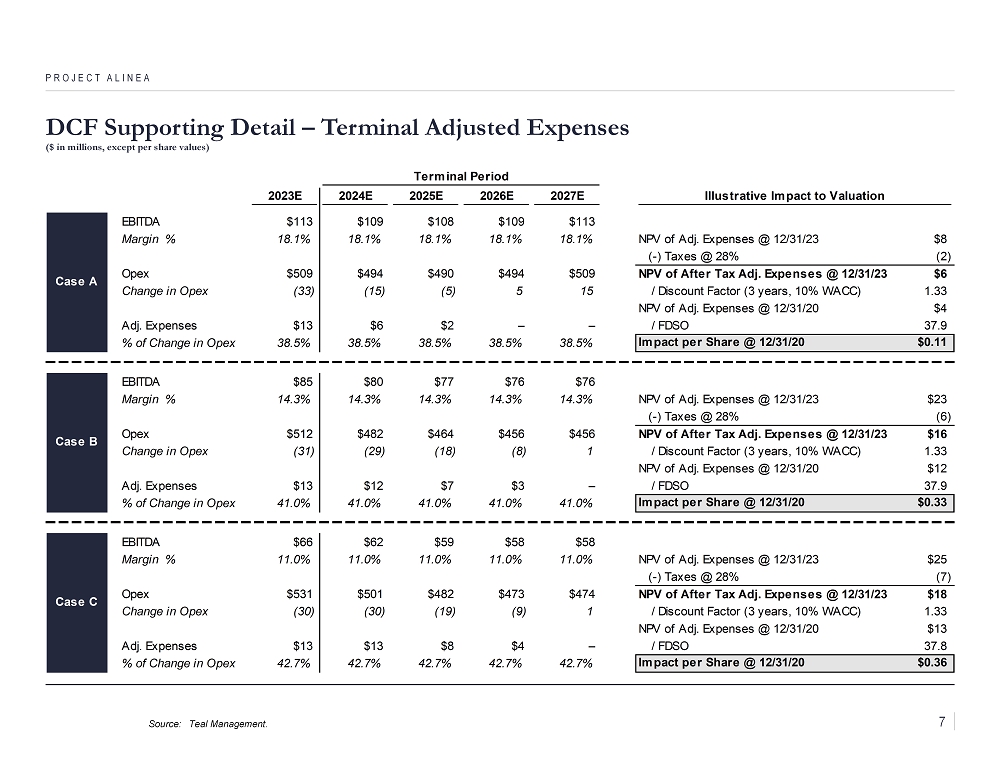

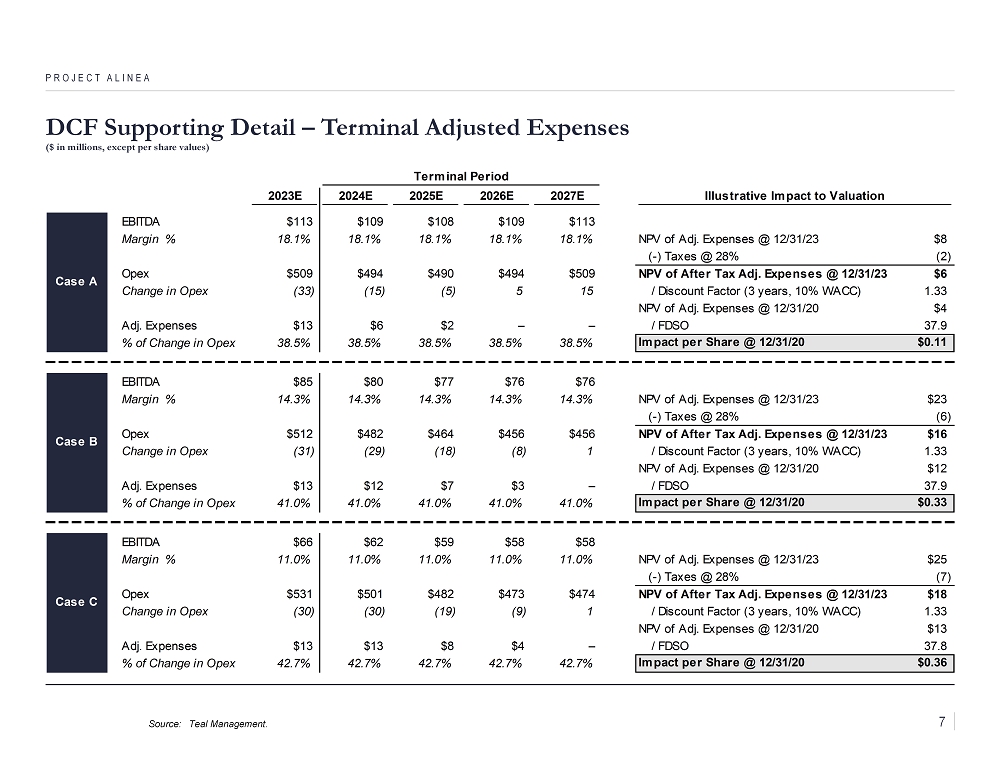

DCF Supporting Detail – Terminal Adjusted Expenses ($ in millions, except per share values) PROJECT ALINEA Source: Teal Management. Terminal Period 2023E 2024E 2025E 2026E 2027E Illustrative Impact to Valuation EBITDA $113 $109 $108 $109 $113 Margin % 18.1% 18.1% 18.1% 18.1% 18.1% NPV of Adj. Expenses @ 12/31/23 $8 (-) Taxes @ 28% (2) Opex $509 $494 $490 $494 $509 NPV of After Tax Adj. Expenses @ 12/31/23 $6 Change in Opex (33) (15) (5) 5 15 / Discount Factor (3 years, 10% WACC) 1.33 NPV of Adj. Expenses @ 12/31/20 $4 Adj. Expenses $13 $6 $2 – – / FDSO 37.9 % of Change in Opex 38.5% 38.5% 38.5% 38.5% 38.5% Impact per Share @ 12/31/20 $0.11 EBITDA $85 $80 $77 $76 $76 Margin % 14.3% 14.3% 14.3% 14.3% 14.3% NPV of Adj. Expenses @ 12/31/23 $23 (-) Taxes @ 28% (6) Opex $512 $482 $464 $456 $456 NPV of After Tax Adj. Expenses @ 12/31/23 $16 Change in Opex (31) (29) (18) (8) 1 / Discount Factor (3 years, 10% WACC) 1.33 NPV of Adj. Expenses @ 12/31/20 $12 Adj. Expenses $13 $12 $7 $3 – / FDSO 37.9 % of Change in Opex 41.0% 41.0% 41.0% 41.0% 41.0% Impact per Share @ 12/31/20 $0.33 EBITDA $66 $62 $59 $58 $58 Margin % 11.0% 11.0% 11.0% 11.0% 11.0% NPV of Adj. Expenses @ 12/31/23 $25 (-) Taxes @ 28% (7) Opex $531 $501 $482 $473 $474 NPV of After Tax Adj. Expenses @ 12/31/23 $18 Change in Opex (30) (30) (19) (9) 1 / Discount Factor (3 years, 10% WACC) 1.33 NPV of Adj. Expenses @ 12/31/20 $13 Adj. Expenses $13 $13 $8 $4 – / FDSO 37.8 % of Change in Opex 42.7% 42.7% 42.7% 42.7% 42.7% Impact per Share @ 12/31/20 $0.36 Case A Case B Case C 7

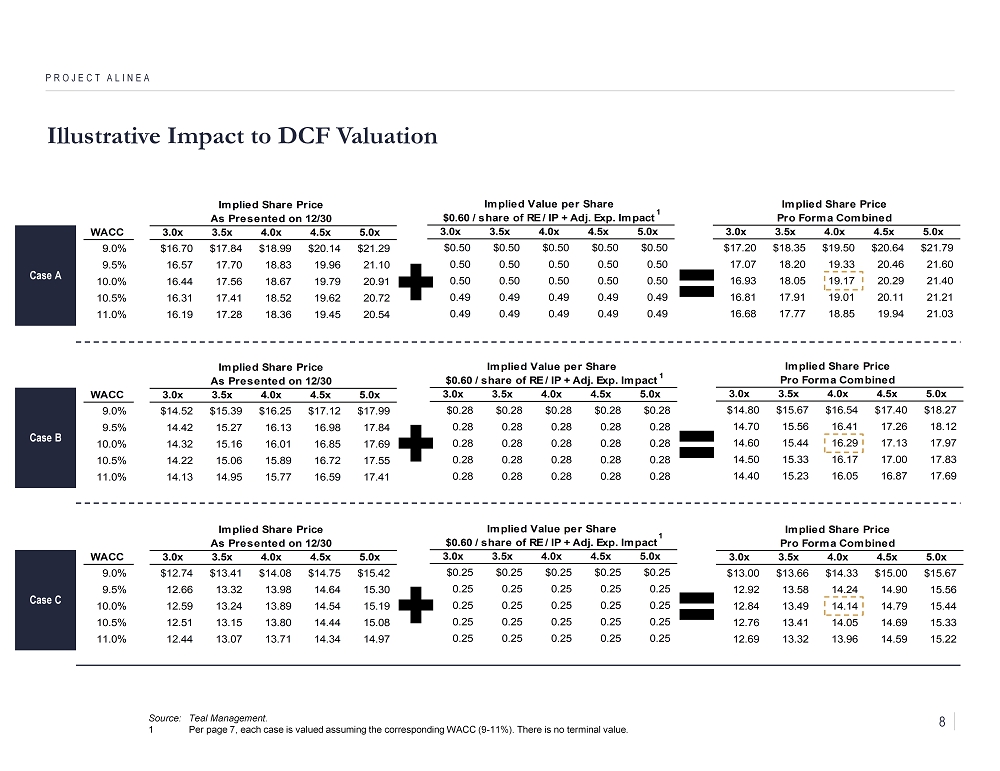

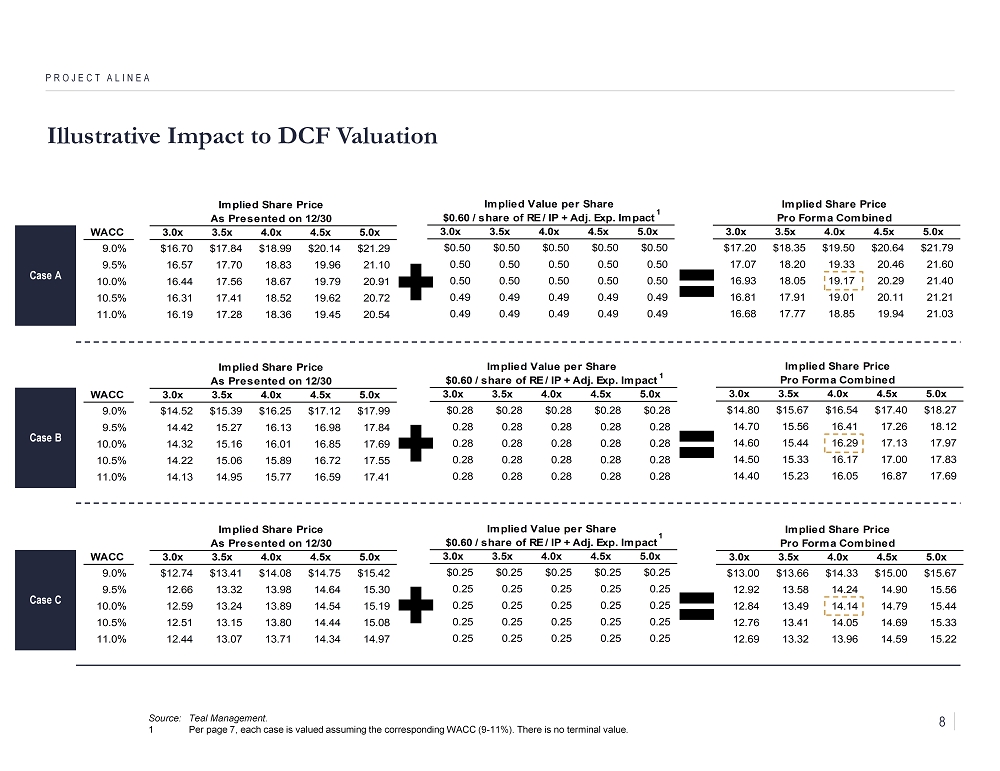

Illustrative Impact to DCF Valuation PROJECT ALINEA Source: Teal Management. 1 Per page 7, each case is valued assuming the corresponding WACC (9 - 11%). There is no terminal value. Implied Share Price Implied Share Price As Presented on 12/30 RE / IP + Adj. Expenses Impact WACC 3.0x 3.5x 4.0x 4.5x 5.0x 9.0% $12.74 $13.41 $14.08 $14.75 $15.42 9.5% 12.66 13.32 13.98 14.64 15.30 10.0% 12.59 13.24 13.89 14.54 15.19 10.5% 12.51 13.15 13.80 14.44 15.08 11.0% 12.44 13.07 13.71 14.34 14.97 Implied Value per Share Implied Share Price $0.60 / share of RE / IP + Adj. Exp. Impact Pro Forma Combined 3.0x 3.5x 4.0x 4.5x 5.0x $0.25 $0.25 $0.25 $0.25 $0.25 0.25 0.25 0.25 0.25 0.25 0.25 0.25 0.25 0.25 0.25 0.25 0.25 0.25 0.25 0.25 0.25 0.25 0.25 0.25 0.25 Implied Share Price Pro Forma Combined 3.0x 3.5x 4.0x 4.5x 5.0x $13.00 $13.66 $14.33 $15.00 $15.67 12.92 13.58 14.24 14.90 15.56 12.84 13.49 14.14 14.79 15.44 12.76 13.41 14.05 14.69 15.33 12.69 13.32 13.96 14.59 15.22 Case C Case B Implied Share Price Implied Share Price As Presented on 12/30 RE / IP + Adj. Expenses Impact WACC 3.0x 3.5x 4.0x 4.5x 5.0x 9.0% $14.52 $15.39 $16.25 $17.12 $17.99 9.5% 14.42 15.27 16.13 16.98 17.84 10.0% 14.32 15.16 16.01 16.85 17.69 10.5% 14.22 15.06 15.89 16.72 17.55 11.0% 14.13 14.95 15.77 16.59 17.41 Implied Value per Share Implied Share Price $0.60 / share of RE / IP + Adj. Exp. Impact Pro Forma Combined 3.0x 3.5x 4.0x 4.5x 5.0x $0.28 $0.28 $0.28 $0.28 $0.28 0.28 0.28 0.28 0.28 0.28 0.28 0.28 0.28 0.28 0.28 0.28 0.28 0.28 0.28 0.28 0.28 0.28 0.28 0.28 0.28 Implied Share Price Pro Forma Combined 3.0x 3.5x 4.0x 4.5x 5.0x $14.80 $15.67 $16.54 $17.40 $18.27 14.70 15.56 16.41 17.26 18.12 14.60 15.44 16.29 17.13 17.97 14.50 15.33 16.17 17.00 17.83 14.40 15.23 16.05 16.87 17.69 Case A Implied Share Price Implied Share Price As Presented on 12/30 RE / IP + Adj. Expenses Impact WACC 3.0x 3.5x 4.0x 4.5x 5.0x 9.0% $16.70 $17.84 $18.99 $20.14 $21.29 9.5% 16.57 17.70 18.83 19.96 21.10 10.0% 16.44 17.56 18.67 19.79 20.91 10.5% 16.31 17.41 18.52 19.62 20.72 11.0% 16.19 17.28 18.36 19.45 20.54 Implied Value per Share Implied Share Price $0.60 / share of RE / IP + Adj. Exp. Impact Pro Forma Combined 3.0x 3.5x 4.0x 4.5x 5.0x $0.50 $0.50 $0.50 $0.50 $0.50 0.50 0.50 0.50 0.50 0.50 0.50 0.50 0.50 0.50 0.50 0.49 0.49 0.49 0.49 0.49 0.49 0.49 0.49 0.49 0.49 Implied Share Price Pro Forma Combined 3.0x 3.5x 4.0x 4.5x 5.0x $17.20 $18.35 $19.50 $20.64 $21.79 17.07 18.20 19.33 20.46 21.60 16.93 18.05 19.17 20.29 21.40 16.81 17.91 19.01 20.11 21.21 16.68 17.77 18.85 19.94 21.03 1 1 1 8

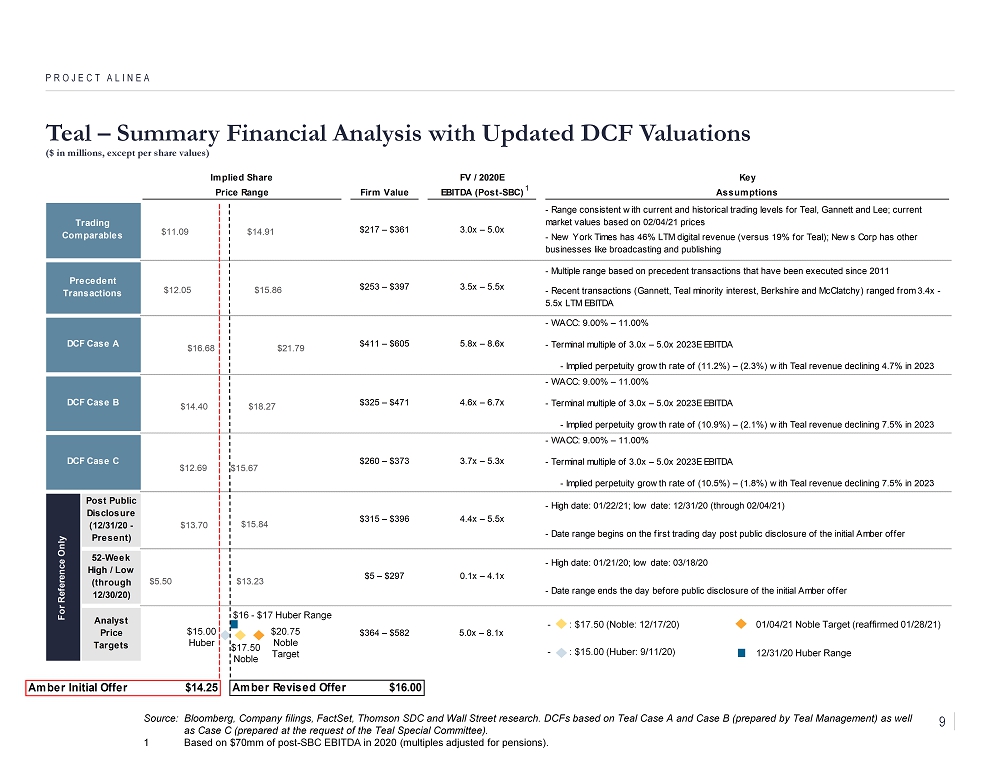

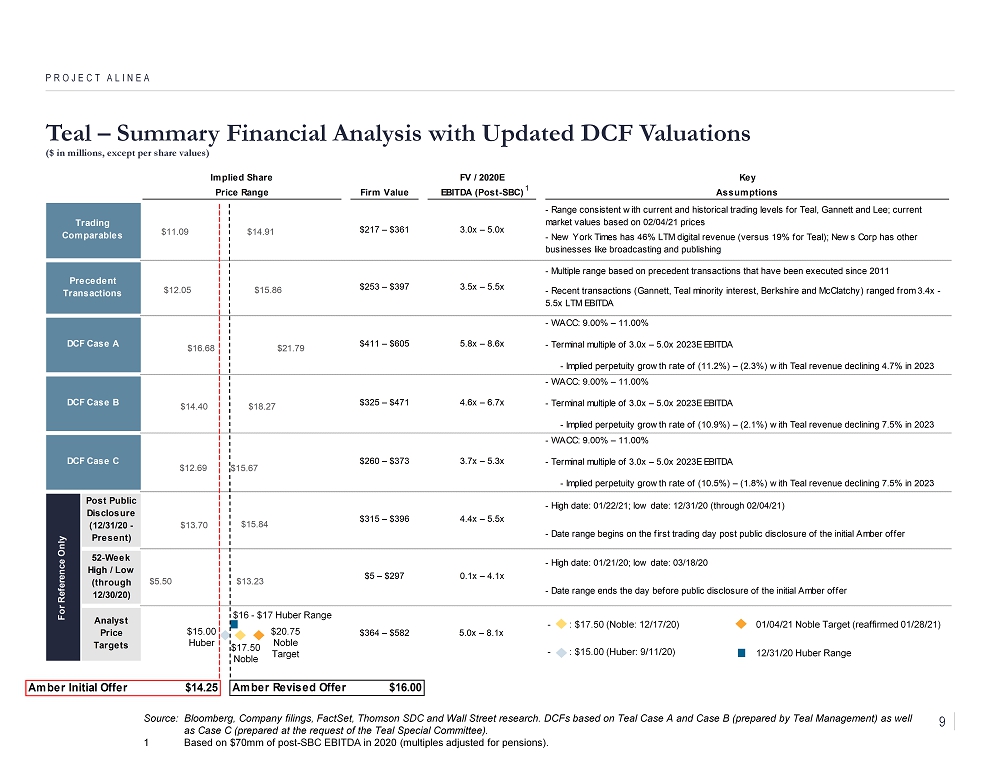

Implied Share FV / 2020E Key Price Range Firm Value EBITDA (Post-SBC) Assumptions - Range consistent with current and historical trading levels for Teal, Gannett and Lee; current market values based on 02/04/21 prices - New York Times has 46% LTM digital revenue (versus 19% for Teal); News Corp has other businesses like broadcasting and publishing - Multiple range based on precedent transactions that have been executed since 2011 - Recent transactions (Gannett, Teal minority interest, Berkshire and McClatchy) ranged from 3.4x - 5.5x LTM EBITDA - WACC: 9.00% – 11.00% - Terminal multiple of 3.0x – 5.0x 2023E EBITDA - Implied perpetuity growth rate of (11.2%) – (2.3%) with Teal revenue declining 4.7% in 2023 - WACC: 9.00% – 11.00% - Terminal multiple of 3.0x – 5.0x 2023E EBITDA - Implied perpetuity growth rate of (10.9%) – (2.1%) with Teal revenue declining 7.5% in 2023 - WACC: 9.00% – 11.00% - Terminal multiple of 3.0x – 5.0x 2023E EBITDA - Implied perpetuity growth rate of (10.5%) – (1.8%) with Teal revenue declining 7.5% in 2023 - High date: 01/22/21; low date: 12/31/20 (through 02/04/21) - Date range begins on the first trading day post public disclosure of the initial Amber offer - High date: 01/21/20; low date: 03/18/20 - Date range ends the day before public disclosure of the initial Amber offer $315 – $396 For Reference Only Post Public Disclosure (12/31/20 - Present) 52-Week High / Low (through 12/30/20) Analyst Price Targets $364 – $582 Trading Comparables $217 – $361 3.0x – 5.0x Precedent Transactions $253 – $397 3.5x – 5.5x DCF Case A $260 – $373 4.6x – 6.7x$325 – $471 $411 – $605 5.8x – 8.6x DCF Case C DCF Case B 3.7x – 5.3x 5.0x – 8.1x $5 – $297 0.1x – 4.1x 4.4x – 5.5x $5.50 $13.70 $12.69 $14.40 $16.68 $12.05 $11.09 $13.23 $15.84 $15.67 $18.27 $21.79 $15.86 $14.91 Teal – Summary Financial Analysis with Updated DCF Valuations ($ in millions, except per share values) PROJECT ALINEA Source: Bloomberg, Company filings, FactSet, Thomson SDC and Wall Street research. DCFs based on Teal Case A and Case B (prepare d by Teal Management) as well as Case C (prepared at the request of the Teal Special Committee). 1 Based on $70mm of post - SBC EBITDA in 2020 (multiples adjusted for pensions). $15.00 Huber $17.50 Noble 1 $16 - $17 Huber Range $20.75 Noble Target - : $17.50 (Noble: 12/17/20) - : $15.00 (Huber: 9/11/20) 01/04/21 Noble Target (reaffirmed 01/28/21) 12/31/20 Huber Range Amber Revised Offer $16.00 Amber Initial Offer $14.25 9

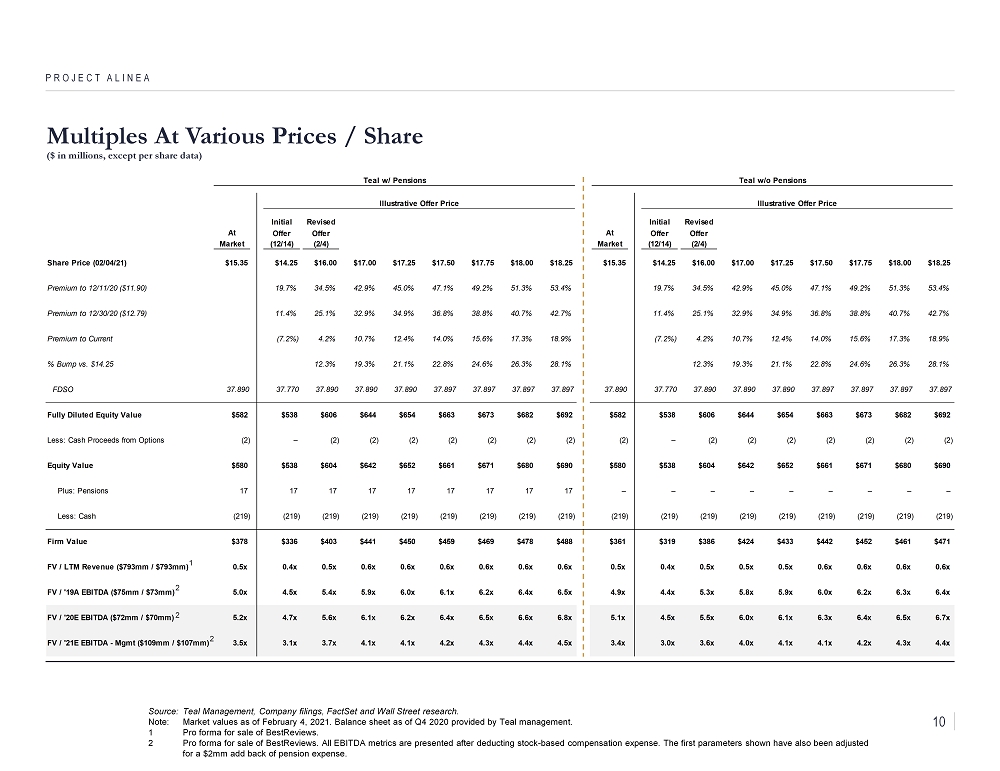

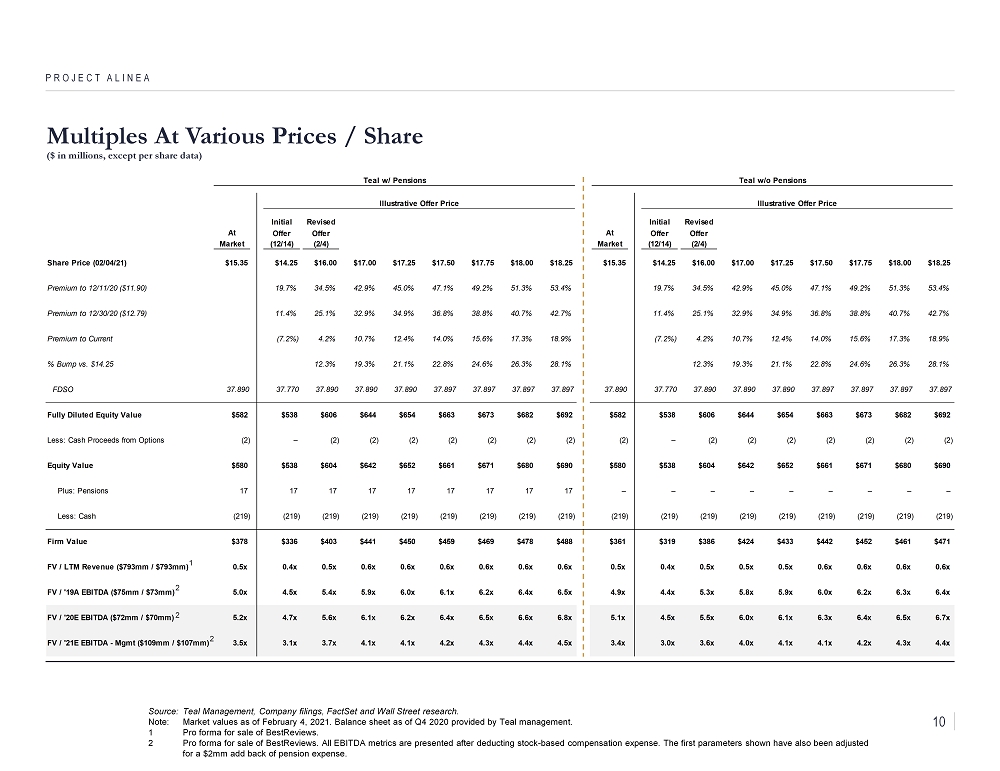

Teal w/ Pensions Teal w/o Pensions Illustrative Offer Price Illustrative Offer Price Initial Revised Initial Revised At Offer Offer At Offer Offer Market (12/14) (2/4) Market (12/14) (2/4) Share Price (02/04/21) $15.35 $14.25 $16.00 $17.00 $17.25 $17.50 $17.75 $18.00 $18.25 $15.35 $14.25 $16.00 $17.00 $17.25 $17.50 $17.75 $18.00 $18.25 Premium to 12/11/20 ($11.90) 19.7% 34.5% 42.9% 45.0% 47.1% 49.2% 51.3% 53.4% 19.7% 34.5% 42.9% 45.0% 47.1% 49.2% 51.3% 53.4% Premium to 12/30/20 ($12.79) 11.4% 25.1% 32.9% 34.9% 36.8% 38.8% 40.7% 42.7% 11.4% 25.1% 32.9% 34.9% 36.8% 38.8% 40.7% 42.7% Premium to Current (7.2%) 4.2% 10.7% 12.4% 14.0% 15.6% 17.3% 18.9% (7.2%) 4.2% 10.7% 12.4% 14.0% 15.6% 17.3% 18.9% % Bump vs. $14.25 12.3% 19.3% 21.1% 22.8% 24.6% 26.3% 28.1% 12.3% 19.3% 21.1% 22.8% 24.6% 26.3% 28.1% FDSO 37.890 37.770 37.890 37.890 37.890 37.897 37.897 37.897 37.897 37.890 37.770 37.890 37.890 37.890 37.897 37.897 37.897 37.897 Fully Diluted Equity Value $582 $538 $606 $644 $654 $663 $673 $682 $692 $582 $538 $606 $644 $654 $663 $673 $682 $692 Less: Cash Proceeds from Options (2) – (2) (2) (2) (2) (2) (2) (2) (2) – (2) (2) (2) (2) (2) (2) (2) Equity Value $580 $538 $604 $642 $652 $661 $671 $680 $690 $580 $538 $604 $642 $652 $661 $671 $680 $690 Plus: Pensions 17 17 17 17 17 17 17 17 17 – – – – – – – – – Less: Cash (219) (219) (219) (219) (219) (219) (219) (219) (219) (219) (219) (219) (219) (219) (219) (219) (219) (219) Firm Value $378 $336 $403 $441 $450 $459 $469 $478 $488 $361 $319 $386 $424 $433 $442 $452 $461 $471 FV / LTM Revenue ($793mm / $793mm) 0.5x 0.4x 0.5x 0.6x 0.6x 0.6x 0.6x 0.6x 0.6x 0.5x 0.4x 0.5x 0.5x 0.5x 0.6x 0.6x 0.6x 0.6x FV / '19A EBITDA ($75mm / $73mm) 5.0x 4.5x 5.4x 5.9x 6.0x 6.1x 6.2x 6.4x 6.5x 4.9x 4.4x 5.3x 5.8x 5.9x 6.0x 6.2x 6.3x 6.4x FV / '20E EBITDA ($72mm / $70mm) 5.2x 4.7x 5.6x 6.1x 6.2x 6.4x 6.5x 6.6x 6.8x 5.1x 4.5x 5.5x 6.0x 6.1x 6.3x 6.4x 6.5x 6.7x FV / '21E EBITDA - Mgmt ($109mm / $107mm) 3.5x 3.1x 3.7x 4.1x 4.1x 4.2x 4.3x 4.4x 4.5x 3.4x 3.0x 3.6x 4.0x 4.1x 4.1x 4.2x 4.3x 4.4x Multiples At Various Prices / Share ($ in millions, except per share data) PROJECT ALINEA Source: Teal Management, Company filings, FactSet and Wall Street research. Note: Market values as of February 4, 2021. Balance sheet as of Q4 2020 provided by Teal management. 1 Pro forma for sale of BestReviews . 2 Pro forma for sale of BestReviews . All EBITDA metrics are presented after deducting stock - based compensation expense. The first parameters shown have also been a djusted for a $2mm add back of pension expense. 1 2 2 2 10

CONFIDENTIAL Appendix PROJECT ALINEA

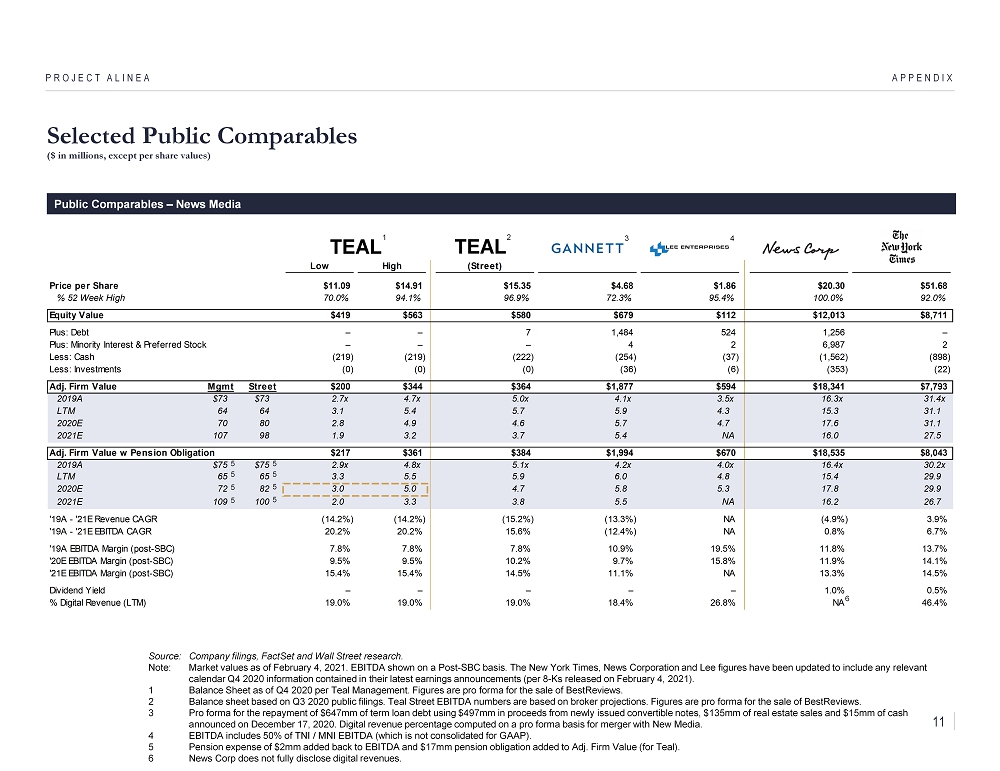

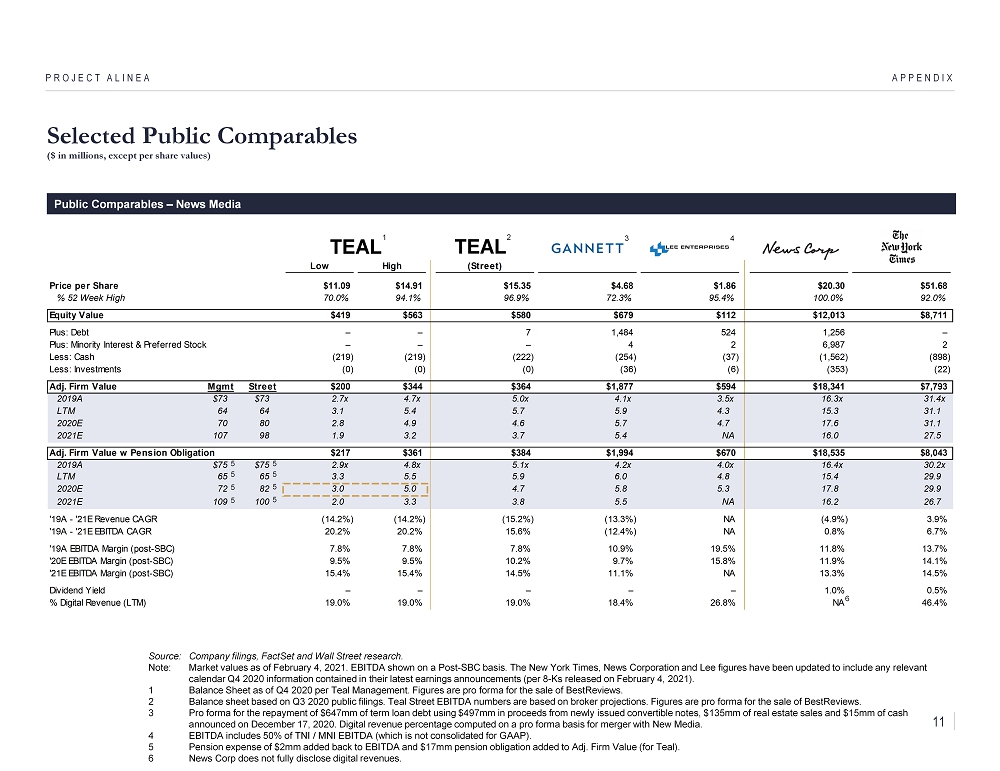

Low High (Street) Price per Share $11.09 $14.91 $15.35 $4.68 $1.86 $20.30 $51.68 % 52 Week High 70.0% 94.1% 96.9% 72.3% 95.4% 100.0% 92.0% Equity Value $419 $563 $580 $679 $112 $12,013 $8,711 Plus: Debt – – 7 1,484 524 1,256 – Plus: Minority Interest & Preferred Stock – – – 4 2 6,987 2 Less: Cash (219) (219) (222) (254) (37) (1,562) (898) Less: Investments (0) (0) (0) (36) (6) (353) (22) Adj. Firm Value Mgmt Street $200 $344 $364 $1,877 $594 $18,341 $7,793 2019A $73 $73 2.7x 4.7x 5.0x 4.1x 3.5x 16.3x 31.4x LTM 64 64 3.1 5.4 5.7 5.9 4.3 15.3 31.1 2020E 70 80 2.8 4.9 4.6 5.7 4.7 17.6 31.1 2021E 107 98 1.9 3.2 3.7 5.4 NA 16.0 27.5 Adj. Firm Value w Pension Obligation $217 $361 $384 $1,994 $670 $18,535 $8,043 2019A $75 $75 2.9x 4.8x 5.1x 4.2x 4.0x 16.4x 30.2x LTM 65 65 3.3 5.5 5.9 6.0 4.8 15.4 29.9 2020E 72 82 3.0 5.0 4.7 5.8 5.3 17.8 29.9 2021E 109 100 2.0 3.3 3.8 5.5 NA 16.2 26.7 '19A - '21E Revenue CAGR (14.2%) (14.2%) (15.2%) (13.3%) NA (4.9%) 3.9% '19A - '21E EBITDA CAGR 20.2% 20.2% 15.6% (12.4%) NA 0.8% 6.7% '19A EBITDA Margin (post-SBC) 7.8% 7.8% 7.8% 10.9% 19.5% 11.8% 13.7% '20E EBITDA Margin (post-SBC) 9.5% 9.5% 10.2% 9.7% 15.8% 11.9% 14.1% '21E EBITDA Margin (post-SBC) 15.4% 15.4% 14.5% 11.1% NA 13.3% 14.5% Dividend Yield – – – – – 1.0% 0.5% % Digital Revenue (LTM) 19.0% 19.0% 19.0% 18.4% 26.8% NA 46.4% TEAL TEAL Selected Public Comparables ($ in millions, except per share values) APPENDIX PROJECT ALINEA Public Comparables – News Media 4 3 5 2 Source: Company filings, FactSet and Wall Street research. Note: Market values as of February 4, 2021. EBITDA shown on a Post - SBC basis. The New York Times, News Corporation and Lee figur es have been updated to include any relevant calendar Q4 2020 information contained in their latest earnings announcements (per 8 - Ks released on February 4, 2021). 1 Balance Sheet as of Q4 2020 per Teal Management. Figures are pro forma for the sale of BestReviews . 2 Balance sheet based on Q3 2020 public filings. Teal Street EBITDA numbers are based on broker projections. Figures are pro fo rma for the sale of BestReviews . 3 Pro forma for the repayment of $647mm of term loan debt using $497mm in proceeds from newly issued convertible notes, $135mm of real estate sales and $15mm of cash announced on December 17, 2020. Digital revenue percentage computed on a pro forma basis for merger with New Media. 4 EBITDA includes 50% of TNI / MNI EBITDA (which is not consolidated for GAAP). 5 Pension expense of $2mm added back to EBITDA and $17mm pension obligation added to Adj. Firm Value (for Teal). 6 News Corp does not fully disclose digital revenues. 1 5 5 6 5 5 5 5 5 11

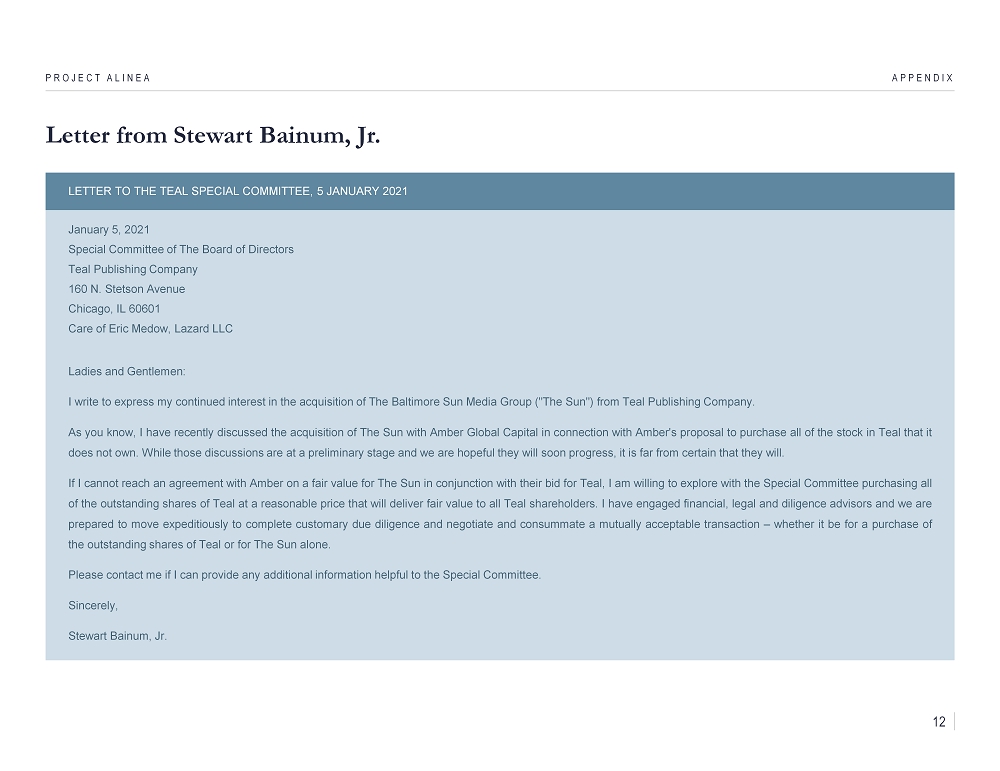

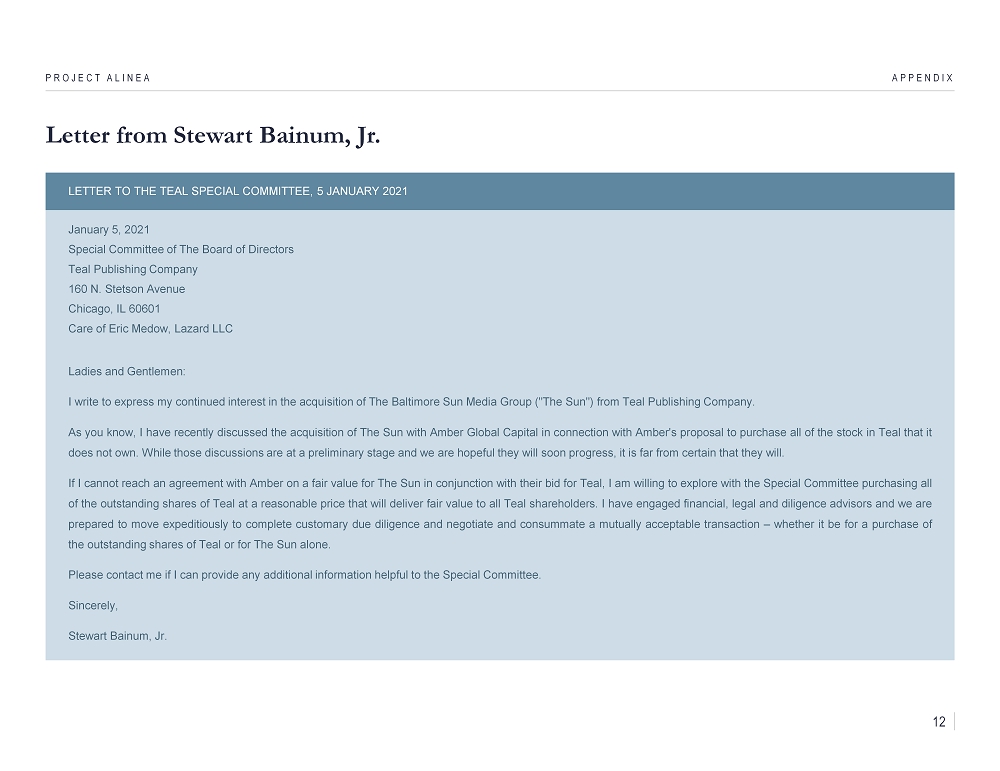

Letter from Stewart Bainum , Jr. APPENDIX PROJECT ALINEA January 5 , 2021 Special Committee of The Board of Directors Teal Publishing Company 160 N . Stetson Avenue Chicago, IL 60601 Care of Eric Medow, Lazard LLC Ladies and Gentlemen : I write to express my continued interest in the acquisition of The Baltimore Sun Media Group ("The Sun") from Teal Publishing Company . As you know, I have recently discussed the acquisition of The Sun with Amber Global Capital in connection with Amber's proposal to purchase all of the stock in Teal that it does not own . While those discussions are at a preliminary stage and we are hopeful they will soon progress, it is far from certain that they will . If I cannot reach an agreement with Amber on a fair value for The Sun in conjunction with their bid for Teal, I am willing to explore with the Special Committee purchasing all of the outstanding shares of Teal at a reasonable price that will deliver fair value to all Teal shareholders . I have engaged financial, legal and diligence advisors and we are prepared to move expeditiously to complete customary due diligence and negotiate and consummate a mutually acceptable transaction – whether it be for a purchase of the outstanding shares of Teal or for The Sun alone . Please contact me if I can provide any additional information helpful to the Special Committee . Sincerely, Stewart Bainum, Jr . LETTER TO THE TEAL SPECIAL COMMITTEE, 5 JANUARY 2021 12

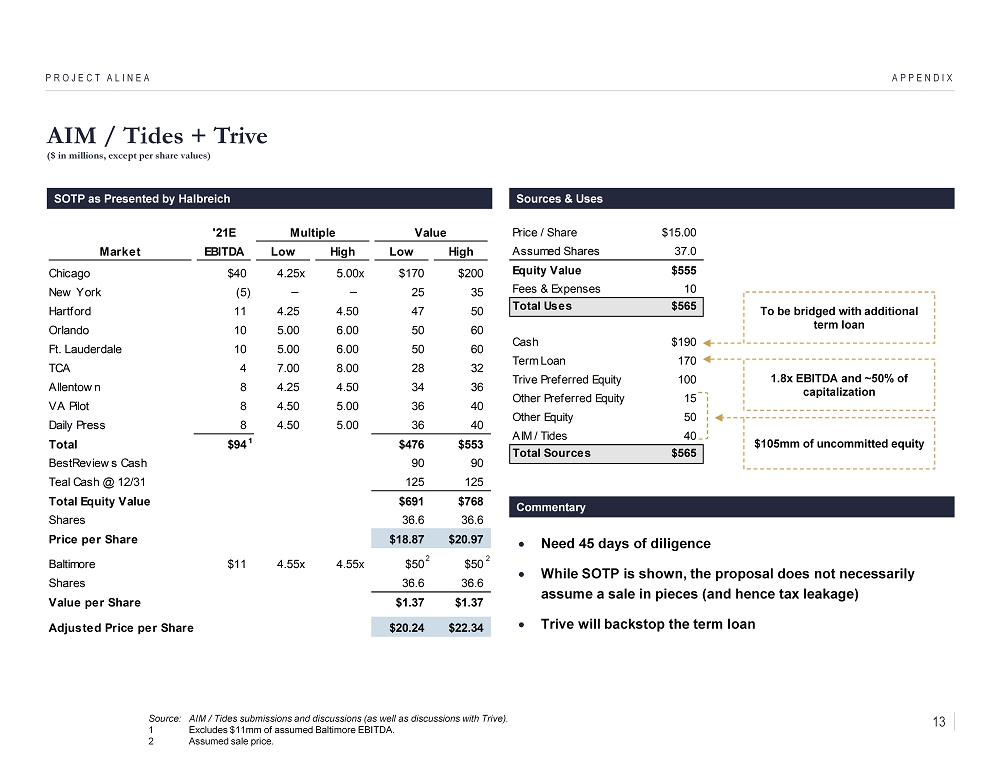

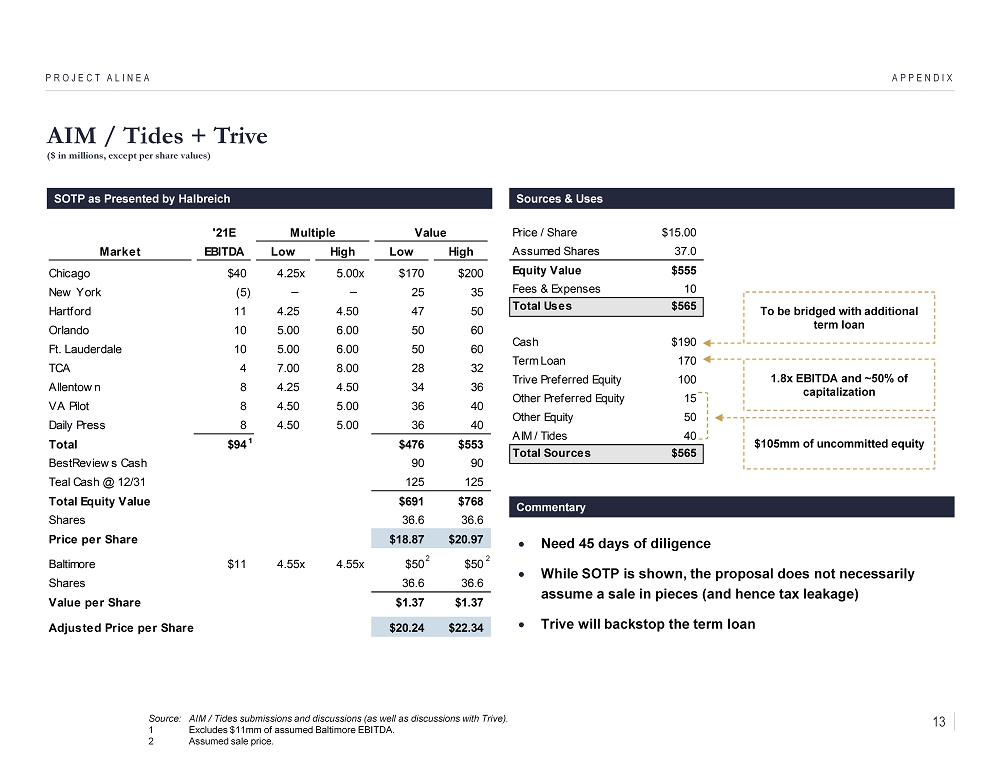

AIM / Tides + Trive ($ in millions, except per share values) APPENDIX PROJECT ALINEA SOTP as Presented by Halbreich Source: AIM / Tides submissions and discussions (as well as discussions with Trive ). 1 Excludes $11mm of assumed Baltimore EBITDA. 2 Assumed sale price. '21E Multiple Value Market EBITDA Low High Low High Chicago $40 4.25x 5.00x $170 $200 New York (5) 25 35 Hartford 11 4.25 4.50 47 50 Orlando 10 5.00 6.00 50 60 Ft. Lauderdale 10 5.00 6.00 50 60 TCA 4 7.00 8.00 28 32 Allentown 8 4.25 4.50 34 36 VA Pilot 8 4.50 5.00 36 40 Daily Press 8 4.50 5.00 36 40 Total $94 $476 $553 BestReviews Cash 90 90 Teal Cash @ 12/31 125 125 Total Equity Value $691 $768 Shares 36.6 36.6 Price per Share $18.87 $20.97 Baltimore $11 4.55x 4.55x $50 $50 Shares 36.6 36.6 Value per Share $1.37 $1.37 Adjusted Price per Share $20.24 $22.34 Sources & Uses Price / Share $15.00 Assumed Shares 37.0 Equity Value $555 Fees & Expenses 10 Total Uses $565 Cash $190 Term Loan 170 Trive Preferred Equity 100 Other Preferred Equity 15 Other Equity 50 AIM / Tides 40 Total Sources $565 Need 45 days of diligence While SOTP is shown, the proposal does not necessarily assume a sale in pieces (and hence tax leakage) Trive will backstop the term loan Commentary 1 2 2 1.8x EBITDA and ~50% of capitalization To be bridged with additional term loan – – $105mm of uncommitted equity 13