UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

811-22933

(Investment Company Act file number)

Apollo Diversified Real Estate Fund

(Exact name of Registrant as specified in charter)

Apollo Global Management, Inc.

9 West 57th Street, New York

New York 10019

(Address of principal executive offices)

(212) 515-3200

(Registrant's telephone number, including area code)

ALPS Fund Services, Inc.

1290 Broadway, Suite 1000

Denver, CO 80203

(Name and address of agent for service)

Copy to:

Terrence O. Davis, Esq.

Greenberg Traurig, LLP

Terminus 200

3333 Piedmont Road, NE, Suite 2500

Atlanta, GA 30305

Date of fiscal year end: September 30

Date of reporting period: October 1, 2021 – March 31, 2022

Item 1. Reports to Stockholders.

Apollo Diversified

Real Estate Fund

Semi-Annual Report

March 31, 2022

Effective May 2, 2022, Griffin Institutional Access® Real Estate Fund has been renamed Apollo Diversified Real Estate Fund.

Electronic Reports Disclosure

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary (such as a broker-dealer or bank). Instead, the reports will be made available on the Fund’s website (www.apollo.com), and you will be notified electronically or by mail, depending on your elections, each time a report is posted and provided with a website link to access the report.

You may elect to receive all future reports in paper, free of charge. If you invest directly with the Fund, you can call the Fund toll-free at 888.926.2688 or visit https://apollodiversifiedrealestatefund.apollo.com/investor-login/ to inform the Fund that you wish to continue receiving paper copies of your shareholder reports. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. Please note that not all financial intermediaries may offer this service. Your election to receive reports in paper will apply to all funds held in your account if you invest through your financial intermediary or all funds held with the fund sponsor if you invest directly with a fund.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive electronic delivery of shareholder reports and other communications by: (i) calling the Fund toll-free at 888.926.2688 or visiting https://apollodiversifiedrealestatefund.apollo.com/investor-login/, if you invest directly with the Fund, or (ii) contacting your financial intermediary, if you invest through a financial intermediary. Please note that not all financial intermediaries may offer this service.

Table of Contents

| Shareholder Letter | 2 |

| Portfolio Update | 15 |

| Schedule of Investments | 17 |

| Statement of Assets and Liabilities | 22 |

| Statement of Operations | 23 |

| Statements of Changes in Net Assets | 24 |

| Statement of Cash Flows | 26 |

| Financial Highlights | 27 |

| Notes to Financial Statements | 38 |

| Additional Information | 47 |

| Service Providers | 52 |

| Privacy Notice | 53 |

Dear Fellow Shareholders, We are pleased to present the Apollo Diversified Real Estate Fund (the “Fund”) semi-annual report. We greatly appreciate the support of our shareholders, and we will remain true to the Fund’s stated objective of delivering returns comprised of income and appreciation with moderate volatility and low correlation to the broader markets. During the one-year period ended March 31, 2022, the Fund’s load-waived Class A shares (NASDAQ: GIREX) delivered a total return of 24.28%, outperforming both stocks and bonds by 8.63% and 28.43%, respectively.1 This performance has fueled asset growth as the Fund recently surpassed $5.59 billion in assets under management as of March 31, 2022. From the Fund’s inception on June 30, 2014, through March 31, 2022, the Fund’s load-waived Class A shares (NASDAQ: GIREX) generated a(n):1 ● Total cumulative return of 81.69% and an 8.01% annualized return

● Sharpe ratio of 1.99

● Standard deviation of 3.63%, which is in line with the standard deviation for the Bloomberg U.S. Aggregate Bond Index (3.36%)

● Alpha of 5.23%

● Beta of 0.14 |  Randy I. Anderson, Ph.D., CRE Portfolio Manager, Apollo Diversified Real Estate Fund |

During the six-month period ended March 31, 2022, the United States economy continued to recover from the COVID-19 induced recession. As we move closer to pre-pandemic employment levels, consumption has also rebounded significantly. Unfortunately, supply chain bottlenecks have been slower to subside, leading to increased levels of inflation. Inflationary pressures, although appearing transitory during 2021, have become broad based which has necessitated monetary policy action. In an effort to calm inflation and tighten economic conditions, the Federal Open Market Committee (FOMC) has begun to both raise the Fed Funds target rate and taper its securities buying program.3 Moving forward, market participants will be focused on the pace and magnitude of future FOMC policy changes which will have varying impacts on risk assets. Further, the conflict in Ukraine adds additional complexity as the FOMC works to navigate towards a “soft landing” in which inflation moderates and economic growth persists. The consensus gross domestic product (GDP) forecast for 2022 of 2.8% remains well above the 20-year average growth rate of 1.9%, a reflection of the continued strength observed across the economy, despite increased geopolitical risks and FOMC action.4

In line with the broad economic recovery, the commercial real estate sector exhibited strong performance during the six months ended March 31, 2022. In fact, both public and private real estate markets exhibited record calendar year returns during 2021. The Fund, which actively allocates across all four quadrants of the commercial real estate investable universe, was positioned well to participate in this growth and ultimately delivered its best quarter of performance since inception during the fourth quarter of 2021. Moving forward, we maintain a constructive view on the real estate sector as fundamentals remain strong, particularly within our high-conviction investment themes including multifamily, industrial, and specialty (such as life sciences and student housing) property sectors. As of April 1, 2022, over 86% of the Fund’s private equity portfolio was allocated to these high-conviction themes.2

Multifamily fundamentals remained historically strong with national occupancy continuing to register record highs. CBRE Econometric Advisors reported an occupancy rate of 97.5% in Q1 2022, maintaining the highest level observed since 1994 and represented a 230-basis point increase year over year.5 Additionally, the national undersupply of housing coupled with elevated single-family home prices and increasing mortgage rates is making homeownership less affordable, but creating tailwinds for multifamily demand. These factors have contributed to robust rental rate growth with national asking rents increasing 14.8% year over year as of Q1 2022 according to data from Yardi Matrix.6 Further, strong job and wage growth have encouraged new household formation and put existing renters in better financial position to absorb future rent increases. We believe the secular growth trends that underpin the demand for multifamily housing should provide a supportive environment for this property type moving forward.

Past performance is not indicative of future results. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed. Investing involves risk, including loss of principal. Fund performance based on load-waived Class A shares and does not reflect any sales charge. The maximum sales charge for Class A shares is 5.75%. If the data reflected the deduction of such charges, the performance would be lower. Performance includes reinvestment of distributions and reflects management fees and other expenses. The Fund offers multiple different classes of shares. An investment in any share class of the Fund represents an investment in the same assets of the Fund. However, the purchase restrictions, ongoing fees, expenses, and performance for each share class are different. For more information on the differences in share classes, refer to the applicable prospectus, which can be found at: www.apollo.com.

Due to financial statement adjustments, performance information presented herein for the Fund differs from the Fund’s financial highlights which are prepared in accordance with U.S. GAAP. Such differences generally are attributable to valuation adjustments to certain of the Fund’s investments which are reflected in the financial statements.

The industrial sector continued to improve on already healthy fundamentals with vacancy rates remaining at historical lows at the end of the first quarter of 2022, falling 80 basis points year over year to 3.0%.5 Growth in e-commerce penetration as a percentage of total retail sales combined with more prevalent omnichannel retailing is driving demand for modern industrial assets. Additionally, many businesses are shoring up their logistics and supply chains by shifting to a “just-in-case” inventory management system by building a safety stock of inventory to handle surges in demand despite supply chain bottlenecks. Moving forward, we expect these factors to drive demand for industrial assets and provide a supportive dynamic for further rent growth.

Life sciences, the largest component of the specialty property type allocation within the Fund, is comprised primarily of laboratory facilities that are generally located in innovation clusters across the country. The life sciences industry has observed outsized growth over the past two years with private equity firms and the NIH (National Institutes of Health) pouring $70 billion into life sciences-related companies in 2020 and a record $78 billion in 2021.7 Moving forward, we believe the life sciences property subtype is poised to benefit from continued investment into the biotech industry where demand for modern lab space has significantly outpaced supply.

Within student housing, pre-leasing for the Fall 2022 term is off to a strong start with 63.7% pre-leased as of March 2022, which far exceeds the pre-pandemic level of 53.8% in March 2019.6 Preleasing activity is led by Class A properties that are located in close proximity to top universities. Attaining a higher education remains an attractive value proposition, bolstering demand for this property subtype moving forward.

The traditional office sector recovery slowed in the first quarter of 2022 due to lingering challenges related to new COVID-19 variants and headwinds from technology. While some companies are still contemplating a hybrid model for work-from-home arrangements, many have clear plans for a return to office in some form to capitalize on the culture, collaboration, and innovation that takes place when people are working in person. Leasing trends indicate a preference for Class A office properties in an apparent “flight to quality” as high-quality space is viewed as a prerequisite for attracting and maintaining top talent and creating desirable collaboration spaces.

The retail sector continues to benefit from the unwinding of pandemic-era restrictions and the elevated levels of demand from consumers for goods and services. Total retail employment has fully recovered and is approaching all-time highs. Additionally, availability continued to fall to 5.3% as of Q1 2022, representing a 120 basis point decrease year over year.5 While certain segments of the retail sector remain challenged, such as regional malls in secondary locations, grocery-anchored neighborhood centers have performed particularly well. A strong retail sales environment coupled with limited availability should place upward pressure on rent growth moving forward.

The Portfolio Management team has actively positioned the Fund with a preference for secular growth relative to cyclical growth by favoring its high-conviction themes of multifamily, industrial, and specialty property sectors. Through the Fund’s multi-manager structure, the Portfolio Management team is able to efficiently adjust portfolio allocations not only across property types but also across the four quadrants of the commercial real estate investable universe – private equity, private debt, public equity, and public debt. The team utilizes this structure to allocate capital to real estate securities that emphasize durable income, with properties within our high-conviction themes that are well located in supply constrained markets with an ability to grow rents. Additionally, the Fund has actively avoided exposure to ex-U.S. markets, which has provided a degree of insulation from the volatility associated with the ongoing conflict in Ukraine. Through this active management, the Fund’s private real estate portfolio has driven outsized returns relative the NCREIF-ODCE Index delivering a 3.41% excess return in the trailing one-year period ended December 31, 2021.8 As of April 1, 2022, the Fund provides diversification across 32 private managers that, in our view, are best in class, with over 3,000 investments representing more than $250 billion in gross real estate value.2

Apollo Diversified Real Estate Fund is a closed-end interval fund. Limited liquidity is provided to shareholders only through the Fund’s quarterly repurchase offers for no less than 5% and no more than 25% of the Fund’s shares outstanding at net asset value. The Fund is suitable only for investors who can bear the risks associated with the limited liquidity of the Fund and should be viewed as a long-term investment. There is no secondary market for the Fund’s shares, and none is expected to develop.

Diversification does not eliminate the risk of experiencing investment losses. Holdings and allocations are subject to change without notice. Represents the views of Apollo Real Estate Fund Adviser, LLC at the time of this letter and is subject to change.

Real estate has historically been a favored asset allocation tool by investors seeking durable, tax-efficient income with a degree of insulation from inflation. Historically, real estate has performed well in inflationary environments. The Fund continues to be an attractive alternative to traditional income-producing securities which may be challenged within a rising rate environment. We believe the Fund is well positioned to deliver on its stated investment objective by favoring secular growth trends within our high-conviction themes.

We thank you for your continued confidence and support.

Randy I. Anderson, Ph.D., CRE

Portfolio Manager, Apollo Diversified Real Estate Fund

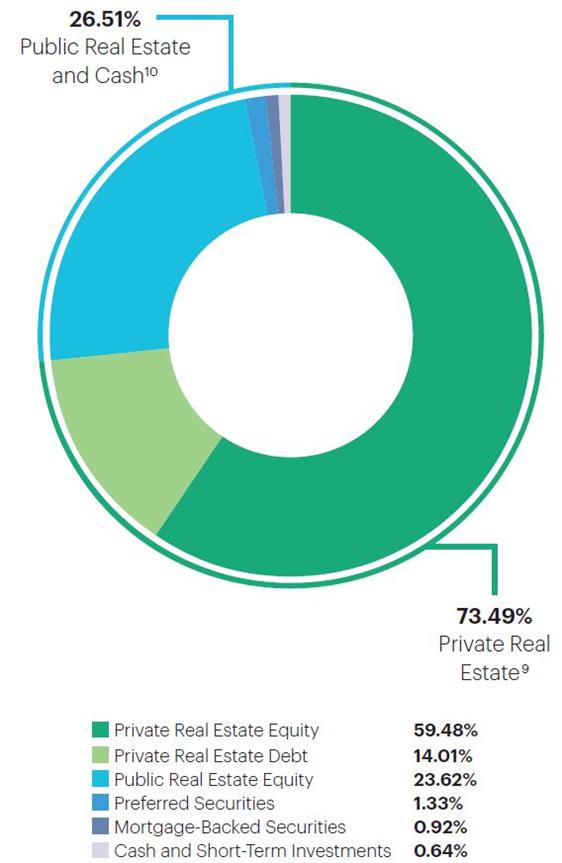

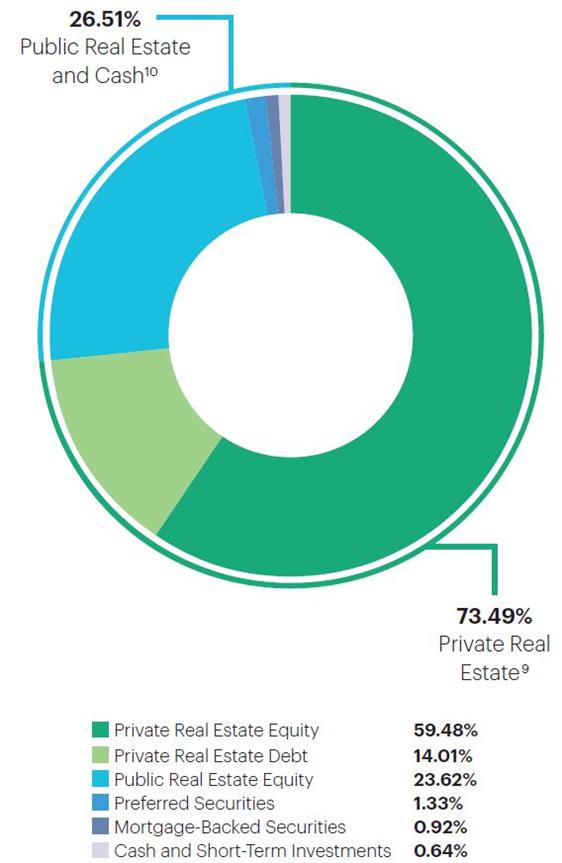

Portfolio Exposure as of April 1, 2022 (Unaudited)

Overall Portfolio Exposure

| Private Real Estate Exposure9 | 73% |

| Cortland Growth and Income Fund | 7.57% |

| Clarion Lion Properties Fund | 6.57% |

| Morgan Stanley Prime Property Fund | 4.62% |

| Clarion Lion Industrial Trust | 4.39% |

| Oaktree Real Estate Income Fund | 3.95% |

| CBRE U.S. Core Partners | 3.93% |

| CBRE U.S. Logistics Partners | 3.84% |

| Ventas Life Science and Healthcare Real Estate Fund | 3.61% |

| TA Realty Core Property Fund | 2.64% |

| Clarion Gables Multifamily Trust | 2.62% |

| TA Realty Logistics Fund | 2.50% |

| Dream U.S. Industrial Fund | 2.22% |

| CA Student Living Income and Growth Fund | 1.88% |

| Manulife U.S. Real Estate Fund | 1.81% |

| Prologis Targeted U.S. Logistics Fund | 1.81% |

| Sentinel Real Estate Fund | 1.45% |

| USAA U.S. Government Building Fund | 1.17% |

| GWL U.S. Property Fund | 0.76% |

| Prudential PRISA | 0.75% |

| Stockbridge Smart Markets Fund | 0.60% |

| Heitman America Real Estate Trust | 0.28% |

| BGO Diversified US Property Trust | 0.26% |

| UBS Trumbull Property Fund | 0.25% |

| Private Real Estate Equity | 59.48% |

| Heitman Core Real Estate Debt Income Trust | 2.29% |

| Brookfield Senior Mezzanine Real Estate Finance Fund | 2.22% |

| TCM CRE Credit Fund | 2.04% |

| JP Morgan U.S. Real Estate Core Mezzanine Debt Fund | 1.72% |

| PGIM Real Estate US Debt Fund | 1.29% |

| CBRE U.S. Credit Partners | 1.28% |

| ARES Real Estate Enhanced Income Fund | 1.12% |

| Voya Commercial Mortgage Lending Fund | 1.04% |

| CrossHarbor Strategic Debt Fund | 1.01% |

| Private Real Estate Debt | 14.01% |

| Public Real Estate Exposure and Cash10 | 27% |

| Public Real Estate Equity | 23.62% |

| Preferred Securities | 1.33% |

| Mortgage-Backed Securities | 0.92% |

| Cash and Short-Term Investments | 0.64% |

Past performance is not indicative of future results. Diversification does not eliminate the risk of experiencing investment losses. Holdings and allocations are subject to change without notice.

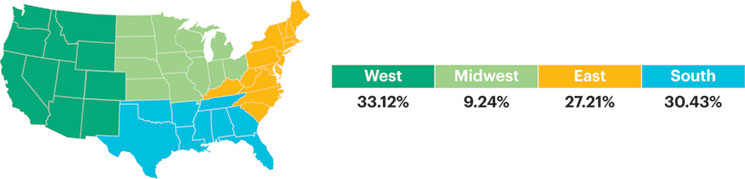

Private Fund Diversification as of April 1, 2022 (Unaudited)

Through its investment in private funds, Apollo Diversified Real Estate Fund offers immediate diversification by property sector, geography, and exposure to real estate equity and debt.

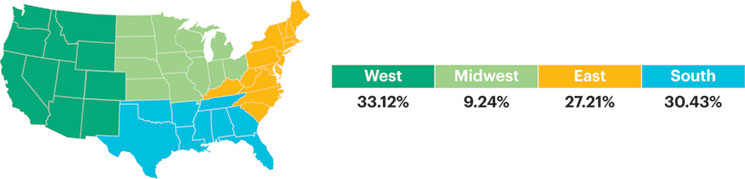

Private Real Estate Exposure: Geographic Diversification11

| Property Sector | Percentage of Total Fund Assets | Percentage of Private Fund Assets11 | Highlights11 |

Multifamily

Private Real Estate Equity

Private Real Estate Debt | 26.82%

20.43%

6.39% | 36.48%

27.79%

8.69% | 682 apartment investments comprised of over 261,000 units diversified across high-growth markets. |

Industrial

Private Real Estate Equity

Private Real Estate Debt | 23.38%

22.44%

0.94% | 31.82%

30.54%

1.28% | 2,049 investments boasting over 614 million square feet of industrial assets including facilities that support the fast-growing e-commerce logistics industries. |

Office

Private Real Estate Equity

Private Real Estate Debt | 9.33%

5.06%

4.27% | 12.69%

6.88%

5.81% | 238 high-quality office investments in diverse, high-demand metropolitan areas representing over 97 million square feet of space. |

Specialty

Private Real Estate Equity

Private Real Estate Debt | 8.67%

8.51%

0.16% | 11.80%

11.59%

0.21% | 176 investments spanning over 22 million square feet of life sciences facilities, healthcare assets, and government offices, together with more than 23,000 student housing beds across the country. |

Retail

Private Real Estate Equity

Private Real Estate Debt | 2.56%

1.76%

0.80% | 3.49%

2.40%

1.09% | 176 investments with more than 42 million square feet of retail space. |

Other

Private Real Estate Equity

Private Real Estate Debt | 1.99%

1.26%

0.73% | 2.71%

1.71%

1.00% | 300 investments comprised of self-storage facilities, parking garages, and land. |

Hospitality

Private Real Estate Equity

Private Real Estate Debt | 0.74%

0.02%

0.72% | 1.01%

0.03%

0.98% | 22 investments representing over 6,700 keys across the country. |

Past performance is not indicative of future results. Diversification does not eliminate the risk of experiencing investment losses. Holdings and allocations are subject to change without notice.

6

Private Fund Summaries (Unaudited)

| ARES Real Estate Enhanced Income Fund is an open-end real estate debt fund with a principal objective to generate current income with an emphasis on principal protection by creating a diversified portfolio of first mortgage loans secured by commercial real estate across major property types, which primarily includes multifamily, industrial, retail, office and hospitality properties. The ARES Real Estate Enhanced Income Fund will focus on the disciplined origination of first mortgage loans secured by commercial real estate assets with strong sponsorship and located in major markets within the United States. |

| BGO Diversified US Property Fund is an open-end core real estate private equity fund that invests in a portfolio of institutional-quality real estate assets in the U.S. BGO Diversified’s investment strategy is focused on maintaining stable income, building a diversified modern portfolio, using moderate leverage, and providing superior liquidity. BGO Diversified upholds a strong commitment to the principles of Responsible Property Investing. |

| Brookfield Senior Mezzanine Real Estate Finance Fund is an open-end senior real estate debt fund focused on providing primarily floating rate financing secured by commercial property primarily located in the U.S. and secured by generally well-leased/light transitional commercial real estate properties that generate significant cash flow. Brookfield Senior Mezzanine Real Estate Finance Fund will primarily focus on creating investment positions by originating floating rate whole loans, syndicating the first mortgage and retaining the mezzanine exposure. |

| CA Student Living Income and Growth Fund is an open-end private equity real estate fund that is focused exclusively on the student housing sector. The Fund aims to acquire institutional student housing properties at large public and private universities in the United States. |

| CBRE U.S. Core Partners is an open-end core fund that purchases and operates high-quality, income-producing office, industrial, retail, and multifamily assets in select major U.S. metropolitan markets that exhibit strong growth demographics. |

| CBRE U.S. Credit Partners is an open-end private debt fund focused on generating current income by constructing a portfolio of first mortgage loans and subordinated debt secured by high-quality income-producing commercial real estate diversified by product type and geography. |

| CBRE U.S. Logistics Partners is an open-end private equity real estate fund focused exclusively on the industrial sector. The Fund aims to acquire modern, highly-functional, stabilized logistics assets located in major population and consumption centers while simultaneously implementing a build-to-core strategy capitalizing on major metro markets with favorable supply and demand dynamics. |

| Clarion Gables Multifamily Trust provides investors access to a high-quality multifamily portfolio with a best-in-class operator and fund manager. Gables is a market-leading, vertically-integrated multifamily real estate company with a 34-year history in the management, construction, development, acquisition and disposition of multifamily communities in the United States. |

| Clarion Lion Industrial Trust is a private REIT focused on the industrial property sector in North America. Clarion Lion Industrial Trust invests primarily in big-box warehouse and distribution centers, with an emphasis on large, core industrial markets throughout the United States. |

| Clarion Lion Properties Fund is a core private REIT with interests in a diversified portfolio of primarily institutional quality real estate assets and related investments located throughout the U.S. The investment objective is to provide a strong income return with potential for long-term capital appreciation. |

| Cortland Growth and Income Fund, a leading Southern United States focused multifamily owner and operator, is a domestic multifamily open-end core-plus fund focused on acquiring best-in-class, income producing properties in U.S. growth markets. |

| CrossHarbor Strategic Debt Fund is an open-end debt fund that seeks to generate compelling risk-adjusted current and total returns for investors by originating and managing first mortgage loans secured by core, core-plus, and value-add commercial real estate located throughout the United States. |

| Dream US Industrial Fund is an open-end private equity real estate fund focused exclusively on the industrial sector. The Fund seeks to acquire and develop a portfolio of high-quality and functional industrial assets in strategic markets throughout the United States. The Fund will target core and core-plus assets including bulk distribution, last-mile warehousing, business parks, and light industrial assets in secondary interior distribution markets with a primary focus on markets experiencing strong economic and demographic fundamentals. |

| GWL U.S. Property Fund is an open-end real estate fund consisting of a diversified portfolio of institutional quality, income producing assets broadly allocated by property type and geographic location. GWL U.S. Property Fund employs a core plus strategy intertwined with a disciplined risk management process in seeking to achieve its performance objectives. |

| Heitman America Real Estate Trust is an open-end core commingled fund. Heitman America Real Estate Trust’s core strategy encompasses stabilized investments with low to moderate leverage and seeks to objectively minimize risk through diversification in property type, geographic location, and tenant composition. |

| Heitman Core Real Estate Debt Income Trust is an open-ended, commingled fund, that originates and services first mortgage loans secured by income-producing U.S. commercial real estate. Heitman Core Real Estate Debt Income Trust will seek to originate senior debt financing to high-quality real estate operators in both primary and specialty property sectors. |

Holdings are subject to change without notice.

7

| JP Morgan U.S. Real Estate Core Mezzanine Debt Fund pursues a disciplined, income-producing strategy achieved primarily by investing in a portfolio of real estate and real estate-related assets, consisting of mezzanine debt, B-notes, mortgages, and preferred equity investments. It focuses on the four primary property types including office, multifamily, industrial, and retail, owned and operated by experienced and financially capable sponsors with strong performance experience across investment cycles. |

| Manulife U.S. Real Estate Fund is a U.S. open-end core-plus fund that will target properties located in major U.S. markets, with the objective of preserving capital while delivering a combination of income and long-term capital appreciation. The Manulife U.S. Real Estate Fund will target an allocation of 60% core-plus assets and 40% core investments. |

| Morgan Stanley Prime Property Fund is an open-end core fund with a focus on office, retail, multifamily, industrial, self storage and hotel properties located in major real estate markets throughout the United States. |

| Oaktree Real Estate Income Fund is an open-ended fund that targets investments in commercial real estate, primarily office, multifamily and industrial assets. Oaktree Real Estate Income Fund intends to create value by investing in assets that require modest leasing and capital expenditures. |

| Prologis Targeted US Logistics Fund launched in 2004 as an open-ended, co-investment venture formed by Prologis to partner with institutional investors in acquiring, operating, and disposing of high-quality logistics facilities in key target markets across the U.S. The Fund seeks enhanced returns through actively managing, repositioning and renovating portfolio-owned assets. |

| PGIM Real Estate U.S. Debt Fund is an open-end debt fund that seeks to originate and service first mortgage and subordinate debt, fixed and floating rate loans, secured by stable income producing properties or properties exhibiting light transitional characteristics. PGIM Real Estate U.S. Debt Fund will focus on the four main property types in the top 30 MSAs and intends to provide secure income returns from investing in a low risk, low volatility portfolio of real estate debt, with a focus on capital preservation and stability of income. |

| Prudential PRISA is organized as a perpetual life, open-ended, commingled fund to invest primarily in core, well-leased, operating real estate assets located in the United States, with an emphasis on income. PRISA is Prudential Real Estate Investors (“PREI”) flagship fund, and represents one of the oldest and largest U.S. core real estate funds available in the marketplace. |

| Sentinel Real Estate Fund is a multifamily focused, core private REIT that emphasizes acquisitions of stabilized assets with in-place income with the goal of providing a substantial portion of investor returns in the form of distributed cash. |

| Stockbridge Smart Markets Fund is an open-end core fund that aims to capture performance in excess of the ODCE Index by acquiring assets in “smart markets” characterized by educated, stable and fast-growing employment bases. The Smart Market Fund’s target market strategy is based on the principle that real estate demand is dependent on jobs which are increasingly being created where there are educated work forces in the U.S. |

| TA Realty Core Property Fund invests and operates a diversified portfolio of commercial real estate assets across industrial, multifamily, office and retail property types. TA Realty Core Property Fund has three primary objectives: build and operate a first-class portfolio of institutional quality core real estate assets, generate consistent outperformance versus industry benchmarks and provide outstanding client service to investors. |

| TA Realty Logistics Fund is an open-end private equity real estate fund focused exclusively on the industrial sector. The Fund seeks to assemble a diversified portfolio of well-located logistics facilities in major distribution hubs and last-mile locations. The Fund targets mainly metropolitan areas of the United States that have population growth, economic growth, market economic diversity, supply constraints, liquidity, volatility, and relative yield necessary to create attractive long-term investment returns. |

| TCM CRE Credit Fund intends to focus primarily on investing in a diversified portfolio of primarily U.S. commercial real estate debt investments, generally within the mezzanine position of the capital stack. Trawler Capital Management Commercial Real Estate Credit Fund will focus on building and maintaining a portfolio of assets that are intended to provide strong risk adjusted returns in all cycles, with emphasis on stable cash flows. |

| UBS Trumbull Property Fund is an open-end, diversified Core fund focusing on the four main property types, with a small exposure to hotels. UBS Trumbull Property Fund focuses on top markets for high-quality Core, institutional real estate assets. |

| USAA U.S. Government Building Fund seeks to provide investors with attractive, risk-adjusted returns generated by the acquisition, build to suit development and operation of buildings located in the United States and leased or intended to be leased to U.S. federal, state and local governments and government agencies and departments. |

| Ventas Life Science and Healthcare Real Estate Fund is an open-ended investment vehicle formed by Ventas, Inc. to invest in high-quality healthcare properties, with a focus on the life science, medical office building, and seniors housing asset classes, in target markets primarily in the United States. The Fund’s primary objective is to generate attractive returns and cash flow with an emphasis on long-term capital growth through investment focused on the healthcare real estate sector. |

| Voya Commercial Mortgage Lending Fund is a perpetual life, open-ended, commercial mortgage debt fund. The Fund’s investment objective is to generate consistent current income with attractive risk-adjusted returns, while seeking to preserve capital through risk management of the portfolio of commercial mortgage loans and balance sheet management at the Fund level. The Fund will seek generally to achieve its investment objective by applying disciplined credit underwriting to identify and originate a diversified pool of commercial real estate loans located throughout the U.S., in primary, secondary and select tertiary markets. |

Holdings are subject to change without notice.

8

Fund Sub-Advisers (Unaudited)

Aon Investments USA Inc.

Aon Investments USA Inc. (“Aon”), an Aon Company, provides research and advisory services to the portion of the Fund’s investment portfolio that is allocated to private real estate funds. Partnering with Aon, a global leader ($4.1 trillion in assets under advisement as of June 30, 2021) within the institutional advisory services space, provides Apollo Real Estate Fund Adviser with the same level of research and due diligence as the nation’s top endowments, universities and pension funds.

CenterSquare Investment Management LLC

CenterSquare Investment Management LLC (“CenterSquare”) manages the portion of the Fund’s investment portfolio that is allocated to public real estate securities. CenterSquare has been managing real estate securities portfolios since 1995, across multiple strategies and market cycles and had approximately $15.5 billion in real estate assets under management as of December 31, 2021.

Apollo Real Estate Fund Adviser, LLC along with CenterSquare Investment Management have designed a public market strategy in line with the objectives of the Fund with a focus on identifying public real estate securities whose current prices are below their intrinsic values.

9

Glossary (Unaudited)

Alpha: A measure of risk-adjusted return implying how much a fund/manager outperformed its benchmark, given its risk profile.

Annualized Return: Calculated by annualizing cumulative return (i.e., adjusting it for a period of one year). Annualized return includes capital appreciation and assumes a reinvestment of dividends and distributions.

Basis Point: One basis point is equal to 1/100th of 1%, or 0.01%.

Beta: A measure of systematic risk (volatility), or the sensitivity of a fund to movements in a benchmark. A beta of 1 implies that you can expect the movement of a fund’s return series to match that of the benchmark used to measure beta. A value of less than 1 implies that the fund is less volatile than the index.

Bloomberg U.S. Aggregate Bond Index: An unmanaged index of domestic investment-grade bonds, including corporate, government and mortgage-backed securities.

Correlation: A statistical measure of how two securities move in relation to each other. A correlation ranges from -1 to 1. A positive correlation of 1 implies that as one security moves, either up or down, the other security will move in lockstep, in the same direction. A negative correlation of -1 indicates that the securities will move in the opposite direction. If the correlation is 0, the movements of the securities are said to have no correlation; they are completely random.

Coupon: The interest payment made on a debt security.

Cumulative Return: The compound return of an investment. It includes capital appreciation and assumes a reinvestment of dividends and distributions.

Debt Security: Any security that represents loaned money that must be repaid to the lender.

FTSE Nareit All Equity REITs Index: A free-float adjusted, market capitalization-weighted index of U.S. equity REITs. Constituents of the index include all tax-qualified REITs with more than 50% of total assets in qualifying real estate assets other than mortgages secured by real property.

NCREIF Fund Index – Open End Diversified Core Equity (NFI-ODCE): An index of investment returns reporting on both a historical and current basis the results of certain open-end commingled funds pursuing a core investment strategy. The NFI-ODCE Index is capitalization-weighted.

S&P 500 Index: An index based on market cap of the 500 largest companies having stock listed on the New York Stock Exchange (NYSE) or NASDAQ.

Sharpe Ratio: Measures risk-adjusted returns by calculating the excess return (above the risk-free rate) per unit of risk (standard deviation). The higher the ratio, the better the risk-adjusted returns. The average three-month U.S. Treasury T-bill auction was used as the risk-free rate in this material.

Standard Deviation: Measures the average deviations of a return series from its mean, and is often used as a measure of volatility/risk. A large standard deviation implies that there have been large swings in the return series of the manager.

10

Important Disclosures (Unaudited)

This material is neither an offer to sell nor a solicitation to purchase any security. Investors should carefully consider the investment objectives, risks, charges and expenses of Apollo Diversified Real Estate Fund (the “Fund”). This information and other important details about the Fund are contained in the prospectus, which can be obtained by visiting www.apollo.com. Please read the prospectus carefully before investing.

All Morningstar calculations and metrics are based on monthly data. CALCULATIONS AND METRICS REFLECT A LOAD-WAIVED, CLASS A SHARE (NASDAQ: GIREX). Investors of the load-waived class A share do not pay a front-end sales load/charge. The Fund offers multiple different classes of shares. An investment in any share class of the Fund represents an investment in the same assets of the Fund. However, the purchase restrictions, ongoing fees, expenses, and performance for each share class are different.

Past performance is not indicative of future results. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed. Investing involves risk, including loss of principal. Performance includes reinvestment of distributions and reflects management fees and other expenses. The Fund return does not reflect the deduction of all fees, including any applicable Fund share class sales load, third-party brokerage commissions or third-party investment advisory fees paid by investors to a financial intermediary for brokerage services. If the deduction of such fees was reflected, the performance would be lower. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investing in the Fund involves risks, including the risk that you may receive little or no return on your investment or that you may lose part or all of your investment. The ability of the Fund to achieve its investment objective depends, in part, on the ability of the Adviser to allocate effectively the assets of the Fund among the various securities and investments in which the Fund invests. There can be no assurance that the actual allocations will be effective in achieving the Fund’s investment objective or delivering positive returns. Current performance may be lower or higher than the performance quoted. The most recent performance is available at www.apollo.com or by calling 888.926.2688.

The Fund is a closed-end interval fund, the shares have no history of public trading, nor is it intended that the shares will be listed on a public exchange at this time. No secondary market is expected to develop for the Fund’s shares. Limited liquidity is provided to shareholders only through the Fund’s quarterly repurchase offers for no less than 5% and no more than 25% of the Fund’s shares outstanding at net asset value. There is no guarantee that an investor will be able to sell all the shares that the investor desires to sell in the repurchase offer. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Due to these restrictions, an investor should consider an investment in the Fund to be of limited liquidity. The Fund is suitable only for investors who can bear the risks associated with the limited liquidity of the Fund and should be viewed as a long-term investment. Investing in the Fund is speculative and involves a high degree of risk, including the risks associated with leverage and the risk of a substantial loss of investment. There is no guarantee that the investment strategies will work under all market conditions. You should carefully consider which class of shares to purchase.

The Fund’s inception date was June 30, 2014. Per the Fund’s prospectus dated May 2, 2022, the total annual expense ratio is 1.98% for Class A shares. The Adviser and Fund have entered into an expense limitation agreement until at least May 31, 2023 under which the Adviser has contractually agreed to waive its fees and to pay or absorb the ordinary annual operating expenses of the Fund (including offering expenses, but excluding taxes, interest, brokerage commissions, acquired fund fees and expenses and extraordinary expenses) to the extent that they exceed 1.91% for Class A shares.

Investors in the Fund should understand that the net asset value (“NAV”) of the Fund will fluctuate, which may result in a loss of the principal amount invested. The Fund’s investments may be negatively affected by the broad investment environment and capital markets in which the Fund invests, including the real estate market, the debt market and/or the equity securities market. The value of the Fund’s investments will increase or decrease based on changes in the prices of the investments it holds. This will cause the value of the Fund’s shares to increase or decrease. The Fund is “diversified” under the Investment Company Act of 1940. Diversification does not eliminate the risk of experiencing investment losses. Holdings are subject to change without notice. The Fund is not intended to be a complete investment program.

The Fund will not invest in real estate directly, but, because the Fund will concentrate its investments in securities of REITs and other real estate industry issuers, its portfolio will be significantly impacted by the performance of the real estate market and may experience more volatility and be exposed to greater risk than a more diversified portfolio. The value of companies engaged in the real estate industry is affected by: (i) changes in general economic and market conditions; (ii) changes in the value of real estate properties; (iii) risks related to local economic conditions, overbuilding and increased competition; (iv) increases in property taxes and operating expenses; (v) changes in zoning laws; (vi) casualty and condemnation losses; (vii) variations in rental income, neighborhood values or the appeal of property to tenants; (viii) the availability of financing and (ix) changes in interest rates and leverage. The value of securities of companies in the real estate industry may go through cycles of relative underperformance and outperformance in comparison to equity securities markets in general. By investing in the Fund, a shareholder will not be deemed to be an investor in any underlying fund and will not have the ability to exercise any rights attributable to an investor in any such underlying fund related to their investment. The Fund’s investment in Private Investment Funds will require it to bear a pro rata share of the vehicles’ expenses, including management and performance fees. Also, once an investment is made in a Private Investment Fund, neither the Adviser nor any Sub-Adviser will be able to exercise control over investment decisions made by the Private Investment Fund. The Fund may invest in securities of other investment companies, including ETFs. The Fund will indirectly bear its proportionate share of any management fees and other expenses paid by investment companies in which it invests, in addition to the management fees (and other expenses) paid by the Fund.

The Fund is advised by Apollo Real Estate Fund Adviser, LLC (“AREFA”). AREFA is registered as an investment adviser with the SEC pursuant to the provisions of the 1940 Act, as amended. AREFA is an indirect majority- owned subsidiary of Apollo Global Management, Inc. The Fund’s private real estate funds allocation is sub-advised by Aon Investments USA Inc. (“Aon”), an Aon Company. Aon is registered as an investment adviser with the SEC pursuant to the provisions of the 1940 Act. The Fund’s public real estate securities allocation is sub-advised by CenterSquare Investment Management LLC (“CenterSquare”). CenterSquare is an investment adviser registered with the SEC pursuant to the provisions of the 1940 Act. Registration with the SEC does not constitute an endorsement by the SEC nor does it imply a certain level of skill or training.

This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product or be relied upon for any other purpose. The views expressed represent an assessment of market conditions at a specific point in time, are opinions only and should not be relied upon as investment advice regarding a particular investment or markets in general. Such information does not constitute a recommendation to buy or sell specific securities or investment vehicles. It should not be assumed that any investment will be profitable or will equal the performance of the fund(s) or any securities or any sectors mentioned herein. The views expressed represent an assessment of market conditions at a specific point in time, are opinions only and should not be relied upon as investment advice regarding a particular investment or markets in general. Such information does not constitute a recommendation to buy or sell specific securities or investment vehicles. It should not be assumed that any investment will be profitable or will equal the performance of the fund(s) or any securities or any sectors mentioned herein. Information contained herein has been obtained from sources deemed to be reliable, but not guaranteed. Apollo Global Management and its affiliates do not provide tax, legal or accounting advice. This material is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction. This material represents views as of the date of this presentation and is subject to change without notice of any kind.

11

This semi-annual report may contain certain forward-looking statements. Such forward-looking statements can generally be identified by our use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “anticipate,” “estimate,” “believe,” “continue,” or other similar words. Because such statements include risks, uncertainties and contingencies, actual results may differ materially from the expectations, intentions, beliefs, plans or predictions of the future expressed or implied by such forward-looking statements. These risks, uncertainties and contingencies include, but are not limited to: uncertainties relating to changes in general economic and real estate conditions; uncertainties relating to the implementation of our investment strategy; uncertainties relating to capital proceeds; and other risk factors as outlined in the Fund’s prospectus, statement of additional information, annual report and semi-annual report filed with the U.S. Securities and Exchange Commission (the “SEC”).

During the six months ending March 31, 2022, the Fund paid distributions of $134,301,459 to its investors, consisting of distributions of $50,671,258 paid and $83,630,201 that was reinvested through the Fund’s distribution reinvestment program. During that period, the Fund recorded dividends and distributions from the Fund’s underlying investments totaling $91,021,078, and realized gains on its investments totaling $52,751,948, and fees and expenses of $50,806,126.

The Fund’s distribution policy is to make quarterly distributions to shareholders. Shareholders should not assume that the source of a distribution from the Fund is net profit. The Fund’s most recent annualized distribution rate as of March 31, 2022 was 5.22%. A portion of the Fund’s distributions includes return of capital. Please refer to the Fund’s most recent Section 19(a) notice for an estimate of the composition of the Fund’s most recent distribution, available at www.apollo.com, and the Fund’s semi-annual or annual reports filed with the U.S. Securities and Exchange Commission (the “SEC”) for additional information regarding the composition of distributions. The Fund’s distributions may be affected by numerous factors, including but not limited to changes in Fund expenses, investment performance, realized and projected market returns, fluctuations in market interest rates, and other factors. Distributions paid may exceed and, from time to time, have exceeded the Fund’s total return less fees and expenses of the Fund during some periods due to changes in market conditions affecting components of the Fund’s total return, including unrealized appreciation. Please reference the performance table below to view the Fund’s historical returns. Additionally, the Fund’s performance can always be found on the Apollo Global Management, Inc. website (www.apollo.com). The following chart presents the quarterly changes to the NAV, total return, and cumulative total return for load-waived Class A shares since inception.1 There is no assurance that the Fund’s distribution rate will be sustainable in the future nor are distributions guaranteed.

12

| Period Ending | NAV Return | Total Return | Cumulative Total Return |

| 6/30/14 | N/A | N/A | N/A |

| 9/30/14 | 0.44% | 1.65% | 1.65% |

| 12/31/14 | 2.11% | 3.40% | 5.10% |

| 3/31/15 | 0.98% | 2.28% | 7.50% |

| 6/30/15 | -1.24% | 0.06% | 7.56% |

| 9/30/15 | 1.13% | 2.47% | 10.21% |

| 12/31/15 | 1.01% | 2.34% | 12.79% |

| 3/31/16 | 1.00% | 2.33% | 15.42% |

| 6/30/16 | 0.95% | 2.28% | 18.05% |

| 9/30/16 | -0.04% | 1.28% | 19.57% |

| 12/31/16 | -0.26% | 1.05% | 20.83% |

| 3/31/17 | -0.15% | 1.17% | 22.24% |

| 6/30/17 | 0.26% | 1.59% | 24.18% |

| 9/30/17 | 0.00% | 1.32% | 25.83% |

| 12/31/17 | 0.90% | 2.23% | 28.64% |

| 3/31/18 | -0.97% | 0.34% | 29.08% |

| 6/30/18 | 1.24% | 2.58% | 32.41% |

| 9/30/18 | 0.11% | 1.43% | 34.31% |

| 12/31/18 | -1.04% | 0.27% | 34.67% |

| 3/31/19 | 2.10% | 3.45% | 39.33% |

| 6/30/19 | 0.15% | 1.47% | 41.38% |

| 9/30/19 | 0.40% | 1.73% | 43.82% |

| 12/31/19 | -0.11% | 1.21% | 45.56% |

| 3/31/20 | -6.70% | -5.46% | 37.61% |

| 6/30/20 | -2.63% | -1.34% | 35.77% |

| 9/30/20 | 0.00% | 1.33% | 37.57% |

| 12/31/20 | 1.41% | 2.76% | 41.37% |

| 3/31/21 | 2.07% | 3.42% | 46.20% |

| 6/30/21 | 3.66% | 5.04% | 53.56% |

| 9/30/21 | 3.15% | 4.52% | 60.51% |

| 12/31/21 | 7.21% | 8.62% | 74.35% |

| 3/31/22 | 2.85% | 4.21% | 81.69% |

13

Endnotes

| 1. | Past performance is not indicative of future results. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed. Investing involves risk, including loss of principal. Performance source: Morningstar Direct. Performance includes reinvestment of distributions and reflects management fees and other expenses. The Fund return does not reflect the deduction of all fees, including any applicable Fund share class sales load, third-party brokerage commissions or third-party investment advisory fees paid by investors to a financial intermediary for brokerage services. If the deduction of such fees was reflected, the performance would be lower. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance may be lower or higher than the performance quoted. The most recent performance is available at www.apollo.com or by calling 888.926.2688. As of 3/31/22, the Fund’s load-waived, Class A share had a one-year return of 24.28% and a five-year annualized return of 8.25%, the FTSE Nareit All Equity REITs Index had a one-year return of 23.58% and a five-year annualized return of 10.69%, the S&P 500 Index had a one-year return of 15.65% and a five-year annualized return of 15.99%, and the Bloomberg U.S. Aggregate Bond Index had a one-year return of -4.15% and a five-year annualized return of 2.14%. Alpha and beta calculation benchmark: S&P 500. Assets and securities contained within indices are different than the assets and securities contained in Apollo Diversified Real Estate Fund and will therefore have different risk and reward profiles. An investment cannot be made in an index, which is unmanaged and has returns that do not reflect any trading, management or other costs. There are limitations when comparing the Apollo Diversified Real Estate Fund to indices. Many open-end funds which track these indices offer daily liquidity, while closed-end interval funds offer liquidity on a periodic basis. Deteriorating general market conditions will reduce the value of stock securities. Fixed income risks include interest-rate and credit risk, bond values fluctuate in price so the value of your investment can go down depending on market conditions. Real estate securities and debt obligations may decline because of adverse developments affecting the real estate industry and real property values. |

| 2. | Fund holdings as of 4/1/22. Fund size based on Gross Asset Value (GAV). Fund holdings are subject to change without notice. Diversification does not eliminate the risk of experiencing investment losses. The Fund is not intended to be a complete investment program. |

| 3. | Federal Reserve, Board of Governors of the Federal Reserve System. |

| 5. | CBRE Econometric Advisors. |

| 8. | Apollo Real Estate Fund Adviser, LLC, NCREIF-ODCE Net Index as of 12/31/21. |

| 9. | Represents the Fund’s direct holdings in private funds in which the underlying holdings of each respective private fund generally consist of real estate-related interests that are not publicly traded. Holdings and allocations are subject to change without notice. |

| 10. | Represents (i) the Fund’s direct holdings in publicly traded, real estate-related securities; (ii) the Fund’s holdings in private funds and registered investment companies in which the underlying holdings are generally publicly traded; and (iii) cash and short-term investments. Holdings and allocations are subject to change without notice. |

| 11. | Metrics express the Fund’s portfolio allocated to private funds in which the underlying holdings of such private funds generally consist of real estate-related interests that are not publicly traded as of April 1, 2022. Underlying data and statistics of the Fund’s private real estate exposure generally as of December 31, 2021, however, in limited circumstances, data for certain private funds is as of the most recent quarter end. Holdings are subject to change without notice. Diversification does not eliminate the risk of experiencing investment losses. |

14

| Apollo Diversified Real Estate Fund | Portfolio Update |

| | March 31, 2022 (Unaudited) |

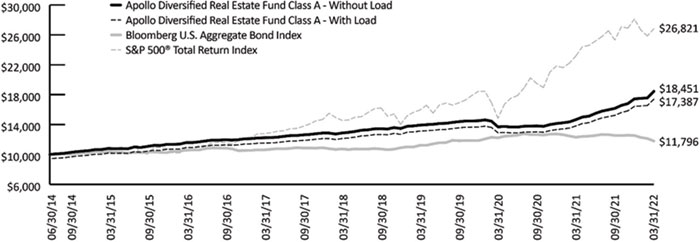

Performance (for the periods ended March 31, 2022)

| | 6 Month | 1 Year | 3 Year | 5 Year | Since Inception | Inception Date |

| Apollo Diversified Real Estate Fund – A – With Load* | 7.56% | 18.63% | 7.69% | 7.30% | 7.40% | 6/30/14 |

| Apollo Diversified Real Estate Fund – A – Without Load | 14.12% | 25.86% | 9.84% | 8.58% | 8.22% | 6/30/14 |

| Apollo Diversified Real Estate Fund – C – With Load** | 12.73% | 23.94% | 9.02% | 7.77% | 7.27% | 8/7/15 |

| Apollo Diversified Real Estate Fund – C – Without Load | 13.73% | 24.94% | 9.02% | 7.77% | 7.27% | 8/7/15 |

| Apollo Diversified Real Estate Fund – I – NAV | 14.31% | 26.17% | 10.12% | 8.86% | 8.34% | 8/7/15 |

| Apollo Diversified Real Estate Fund – M – NAV | 13.87% | 25.25% | 9.31% | 8.05% | 8.00% | 11/16/16 |

| Apollo Diversified Real Estate Fund – L – With Load*** | 9.15% | 20.22% | 8.01% | N/A | 7.42% | 4/24/17 |

| Apollo Diversified Real Estate Fund – L – Without Load | 14.01% | 25.53% | 9.58% | N/A | 8.37% | 4/24/17 |

| S&P 500® Total Return Index | 5.92% | 15.65% | 18.92% | 15.99% | 13.58% | 6/30/14 |

| Bloomberg U.S. Aggregate Bond Index | -5.92% | -4.15% | 1.69% | 2.14% | 2.15% | 6/30/14 |

| * | Adjusted for initial maximum sales charge of 5.75%. |

| ** | Adjusted for contingent deferred sales charge of 1.00%. |

| *** | Adjusted for initial maximum sales charge of 4.25%. |

The S&P 500® Total Return Index is an unmanaged index of 500 common stocks chosen for market size, liquidity and industry group representation. It is a market-value weighted index. The index is not actively managed and does not reflect any deduction for fees, expenses or taxes.

The Bloomberg U.S. Aggregate Bond Index measures the performance of the U.S. investment grade bond market.

Past performance is not indicative of future results. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed. Investing involves risk, including loss of principal. Fund performance includes reinvestment of distributions and reflects management fees and other expenses. The Fund return does not reflect the deduction of all fees, including third-party brokerage commissions or third-party investment advisory fees paid by investors to a financial intermediary for brokerage services. If the deduction of such fees was reflected, the performance would be lower. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance may be lower or higher than the performance quoted. The most recent performance is available at www.apollodiversifiedrealestatefund.com or by calling 888.926.2688. An investment cannot be made in an index, which is unmanaged and has returns that do not reflect any trading, management or other costs. Index performance does not represent actual Fund or portfolio performance, nor does it represent actual performance of the Fund’s Adviser or sub-advisers.

Class A shares are offered subject to a maximum sales charge of 5.75% of the offering price. Class L shares are offered subject to a maximum sales charge of 4.25% of the offering price. Class C, Class I and Class M shares are offered at net asset value. Class C shares may be subject to a 1.00% contingent deferred sales charge on shares redeemed during the first 365 days after their purchase. The Fund’s investment adviser has contractually agreed to waive its fees and to pay or absorb the ordinary annual operating expenses of the Fund (including offering expenses, but excluding taxes, interest, brokerage commissions, acquired fund fees and expenses and extraordinary expenses), to the extent that they exceed 1.91%, 2.66%, 1.66%, 2.41% and 2.16% per annum of the Fund’s average daily net assets attributable to Class A, Class C, Class I, Class M and Class L shares, respectively. The Expense Limitation Agreement will remain in effect for Class A, Class C, Class I, Class L and Class M shares, unless and until the Board approves its modification or termination. Per the Fund's most recent prospectus, the total expense ratio after recoupment, if applicable, is 1.98%, 2.73%, 1.73%, 2.47%, and 2.21% for Class A, Class C, Class I, Class M and Class L, respectively. Please review the Fund’s Prospectus for more details regarding the Fund’s fees and expenses. No assurances can be given that the Fund will pay a distribution in the future; or, if any such distribution is paid, the amount or rate of the distribution.

| Semi-Annual Report | March 31, 2022 | 15 |

| Apollo Diversified Real Estate Fund | Portfolio Update |

| | March 31, 2022 (Unaudited) |

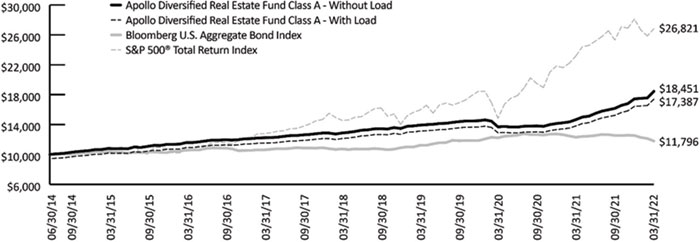

Performance of $10,000 Initial Investment (as of March 31, 2022)

The graph shown above represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Past performance is not indicative of future results. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed. Investing involves risk, including loss of principal. Fund performance includes reinvestment of distributions and reflects management fees and other expenses. The Fund return does not reflect the deduction of all fees, including third-party brokerage commissions or third-party investment advisory fees paid by investors to a financial intermediary for brokerage services. If the deduction of such fees was reflected, the performance would be lower. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The most recent performance is available at www.apollodiversifiedrealestatefund.com or by calling 888.926.2688. An investment cannot be made in an index, which is unmanaged and has returns that do not reflect any trading, management or other costs. Index performance does not represent actual Fund or portfolio performance, nor does it represent actual performance of the Fund’s Adviser or sub-advisers.

| Sector Allocation (as a % of Net Assets) | | |

| | | |

| Private Investment Funds | | 76.92% |

| Publicly Traded Securities | | 23.83% |

| Preferred Stocks | | 1.37% |

| Cash, Cash Equivalents, & Other Net Assets | | -2.12% |

| Total | | 100.00% |

| 16 | 1.888.926.2688 | www.apollo.com |

| Apollo Diversified Real Estate Fund | Schedule of Investments |

March 31, 2022 (Unaudited)

| Description | | Shares | | | Value (Note 2) | |

| REAL ESTATE INVESTMENT TRUSTS (100.75%)(a) | | | | | | | | |

| | | | | | | | | |

| Private Investment Funds (76.92%)* | | | | | | | | |

| AEW Core Property Trust (U.S.), Inc. | | | 1,855 | | | $ | 2,361,283 | |

| Ares Real Estate Enhanced Income Fund, L.P. | | | N/A | | | | 65,496,300 | |

| Barings Core Property Fund, L.P. | | | 51,340 | | | | 8,249,781 | |

| BGO Diversified US Property Fund, L.P. | | | 5,252 | | | | 15,265,996 | |

| Brookfield Senior Mezzanine Real Estate Finance Fund | | | 121,318 | | | | 125,144,600 | |

| CA Student Living Income and Growth Fund | | | 85,518 | | | | 106,305,361 | |

| CBRE U.S. Core Partners, L.P. | | | 118,589,710 | | | | 237,708,977 | |

| CBRE U.S. Credit Partners, L.P. | | | 51,880 | | | | 54,479,798 | |

| CBRE U.S. Logistics Partners, L.P. | | | 184,547,680 | | | | 234,068,477 | |

| Clarion Gables Multifamily Trust, L.P. | | | 88,035 | | | | 161,557,173 | |

| Clarion Lion Industrial Trust, L.P. | | | 70,777 | | | | 264,954,710 | |

| Clarion Lion Properties Fund, L.P. | | | 200,008 | | | | 386,126,948 | |

| Cortland Growth and Income Fund, L.P. | | | 271,670 | | | | 448,556,527 | |

| CrossHarbor Strategic Debt Fund, L.P. | | | N/A | | | | 66,353,954 | |

| Dream U.S. Industrial Fund, L.P. | | | 86,480 | | | | 134,914,054 | |

| GWL U.S. Property Fund, L.P. | | | N/A | | | | 45,565,625 | |

| Heitman America Real Estate Trust, L.P. | | | 11,138 | | | | 16,907,903 | |

| Heitman Core Real Estate Debt Income Trust | | | 133,249 | | | | 133,969,584 | |

| JPM U.S. Real Estate Mezzanine Debt Fund, L.P. | | | 978,563 | | | | 101,376,416 | |

| Manulife U.S. Real Estate Fund, L.P. | | | 54,385 | | | | 107,558,288 | |

| Morgan Stanley Prime Property Fund | | | 11,677 | | | | 271,342,532 | |

| Oaktree Real Estate Income Fund, L.P. | | | N/A | | | | 213,728,612 | |

| PGIM Real Estate US Debt Fund, L.P. | | | 57,353 | | | | 75,630,365 | |

| Principal Real Estate Liquid Debt Fund, L.P. | | | 2,479,801 | | | | 61,342,075 | |

| PRISA, L.P. | | | 19,071 | | | | 43,990,009 | |

| Prologis Targeted U.S. Logistics Fund, L.P. | | | 34,887 | | | | 111,331,909 | |

| Sentinel Real Estate Fund, L.P. | | | 705 | | | | 84,915,092 | |

| Stockbridge Smart Markets Fund, L.P. | | | 17,690 | | | | 36,703,012 | |

| TA Realty Core Property Fund, L.P. | | | 101,640 | | | | 157,144,240 | |

| TA Realty Logistics Fund, L.P. | | | 110,164 | | | | 130,196,353 | |

| TCM CRE Credit Fund, L.P. | | | 118,586 | | | | 119,506,709 | |

| UBS Trumbull Property Fund | | | 1,343 | | | | 15,641,111 | |

| USAA US Government Building Fund, LLC | | | N/A | | | | 67,391,888 | |

| Ventas Life Science and Healthcare Real Estate Fund | | | 155,111 | | | | 207,897,468 | |

| Voya Commercial Mortgage Lending Fund, L.P. | | | N/A | | | | 60,537,190 | |

| | | | | | | | 4,374,220,320 | |

| Publicly Traded Securities (23.83%) | | | | | | | | |

| Acadia Realty Trust | | | 723,258 | | | | 15,673,001 | |

| Agree Realty Corp. | | | 491,200 | | | | 32,596,032 | |

| Alexandria Real Estate Equities, Inc. | | | 173,560 | | | | 34,928,950 | |

| American Campus Communities, Inc. | | | 298,783 | | | | 16,722,885 | |

| American Homes 4 Rent, Class A | | | 668,719 | | | | 26,768,822 | |

| American Tower Corp. | | | 31,880 | | | | 8,008,894 | |

| Americold Realty Trust | | | 556,576 | | | | 15,517,339 | |

| Apple Hospitality REIT, Inc. | | | 395,580 | | | | 7,108,573 | |

| AvalonBay Communities, Inc. | | | 223,600 | | | | 55,535,532 | |

| Brixmor Property Group, Inc. | | | 1,170,650 | | | | 30,214,476 | |

| Cousins Properties, Inc. | | | 478,701 | | | | 19,286,863 | |

| Digital Realty Trust, Inc. | | | 333,820 | | | | 47,335,676 | |

| Diversified Healthcare Trust | | | 421,722 | | | | 1,349,510 | |

| Semi-Annual Report | March 31, 2022 | 17 |

| Apollo Diversified Real Estate Fund | Schedule of Investments |

March 31, 2022 (Unaudited)

| Description | | Shares | | | Value (Note 2) | |

| Publicly Traded Securities (continued) | | | | | | | | |

| Duke Realty Corp. | | | 740,460 | | | $ | 42,991,108 | |

| Empire State Realty Trust, Inc., Class A | | | 465,480 | | | | 4,571,014 | |

| Equinix, Inc. | | | 110,970 | | | | 82,297,571 | |

| Equity Residential | | | 601,710 | | | | 54,105,763 | |

| Extra Space Storage, Inc. | | | 99,950 | | | | 20,549,720 | |

| First Industrial Realty Trust, Inc. | | | 335,314 | | | | 20,759,290 | |

| Four Corners Property Trust, Inc. | | | 290,710 | | | | 7,860,798 | |

| Host Hotels & Resorts, Inc. | | | 870,650 | | | | 16,916,729 | |

| Hudson Pacific Properties, Inc. | | | 521,350 | | | | 14,467,462 | |

| Invitation Homes, Inc. | | | 1,140,070 | | | | 45,808,013 | |

| JBG SMITH Properties | | | 541,510 | | | | 15,822,922 | |

| Kilroy Realty Corp. | | | 401,830 | | | | 30,707,849 | |

| Life Storage, Inc. | | | 299,480 | | | | 42,055,976 | |

| Medical Properties Trust, Inc. | | | 938,780 | | | | 19,845,809 | |

| MGM Growth Properties LLC, Class A | | | 519,600 | | | | 20,108,520 | |

| Mid-America Apartment Communities, Inc. | | | 186,648 | | | | 39,093,424 | |

| Omega Healthcare Investors, Inc. | | | 296,290 | | | | 9,232,396 | |

| Outfront Media, Inc. | | | 513,470 | | | | 14,597,952 | |

| Park Hotels & Resorts, Inc. | | | 478,270 | | | | 9,340,613 | |

| Phillips Edison & Co., Inc. | | | 338,756 | | | | 11,649,819 | |

| Prologis, Inc. | | | 703,450 | | | | 113,593,106 | |

| Public Storage | | | 163,430 | | | | 63,783,460 | |

| Realty Income Corp. | | | 334,340 | | | | 23,169,762 | |

| Rexford Industrial Realty, Inc. | | | 363,780 | | | | 27,134,350 | |

| RPT Realty | | | 730,136 | | | | 10,053,973 | |

| Sabra Health Care REIT, Inc. | | | 845,800 | | | | 12,593,962 | |

| SBA Communications Corp. | | | 25,690 | | | | 8,839,929 | |

| Simon Property Group, Inc. | | | 297,710 | | | | 39,166,728 | |

| Spirit Realty Capital, Inc. | | | 101,290 | | | | 4,661,366 | |

| Sun Communities, Inc. | | | 224,310 | | | | 39,319,300 | |

| Sunstone Hotel Investors, Inc. | | | 286,650 | | | | 3,376,737 | |

| UDR, Inc. | | | 653,320 | | | | 37,480,968 | |

| Ventas, Inc. | | | 825,850 | | | | 51,004,496 | |

| Veris Residential, Inc. | | | 702,540 | | | | 12,217,171 | |

| VICI Properties, Inc. | | | 750,870 | | | | 21,369,760 | |

| Welltower, Inc. | | | 378,370 | | | | 36,376,492 | |

| WeWork, Inc. | | | 319,080 | | | | 2,176,126 | |

| Xenia Hotels & Resorts, Inc. | | | 765,260 | | | | 14,761,865 | |

| | | | | | | | 1,354,908,852 | |

| TOTAL REAL ESTATE INVESTMENT TRUSTS | | | | | | | | |

| (Cost $4,503,913,792) | | | | | | | 5,729,129,172 | |

| Description | | Coupon Rate | | | Shares | | | Value (Note 2) | |

| PREFERRED STOCKS (1.37%)(b) | | | | | | | | | | | | |

| Agree Realty Corp., Series A | | | 4.25 | % | | | 62,000 | | | | 1,232,560 | |

| American Homes 4 Rent, Series G | | | 5.88 | % | | | 15,000 | | | | 376,200 | |

| American Homes 4 Rent, Series H | | | 6.25 | % | | | 179,000 | | | | 4,619,990 | |

| Chatham Lodging Trust, Series A | | | 6.63 | % | | | 19,800 | | | | 482,526 | |

| DiamondRock Hospitality Co., Series A | | | 8.25 | % | | | 47,139 | | | | 1,270,396 | |

| Digital Realty Trust, Inc., Series K | | | 5.85 | % | | | 145,000 | | | | 3,774,350 | |

| Digital Realty Trust, Inc., Series L | | | 5.20 | % | | | 46,000 | | | | 1,145,400 | |

| 18 | 1.888.926.2688 | www.apollo.com |

| Apollo Diversified Real Estate Fund | Schedule of Investments |

March 31, 2022 (Unaudited)

| Description | | Coupon Rate | | | Shares | | | Value (Note 2) | |

| PREFERRED STOCKS (continued) | | | | | | | | | | | | |

| DigitalBridge Group, Inc., Series I | | | 7.15 | % | | | 89,500 | | | $ | 2,227,655 | |

| DigitalBridge Group, Inc., Series J | | | 7.13 | % | | | 20,000 | | | | 494,400 | |

| EPR Properties, Series G | | | 5.75 | % | | | 54,000 | | | | 1,296,000 | |

| Federal Realty Investment Trust, Series C | | | 5.00 | % | | | 84,143 | | | | 2,125,452 | |

| Hersha Hospitality Trust, Series C | | | 6.88 | % | | | 81,500 | | | | 1,902,210 | |

| Hersha Hospitality Trust, Series D | | | 6.50 | % | | | 30,000 | | | | 664,500 | |

| Hudson Pacific Properties, Inc., Series C | | | 4.75 | % | | | 46,000 | | | | 990,380 | |

| Kimco Realty Corp., Series L | | | 5.13 | % | | | 18,703 | | | | 469,445 | |

| Kimco Realty Corp., Series M | | | 5.25 | % | | | 80,600 | | | | 2,009,358 | |

| National Storage Affiliates Trust, Series A | | | 6.00 | % | | | 130,828 | | | | 3,330,881 | |

| Pebblebrook Hotel Trust, Series E | | | 6.38 | % | | | 121,301 | | | | 2,937,146 | |

| Pebblebrook Hotel Trust, Series G | | | 6.38 | % | | | 42,500 | | | | 1,049,750 | |

| Pebblebrook Hotel Trust, Series H | | | 5.70 | % | | | 89,000 | | | | 2,018,520 | |

| PS Business Parks, Inc., Series Z | | | 4.88 | % | | | 145,000 | | | | 3,406,050 | |

| Public Storage, Series G | | | 5.05 | % | | | 7,000 | | | | 175,490 | |

| Public Storage, Series H | | | 5.60 | % | | | 44,500 | | | | 1,163,675 | |

| Public Storage, Series J | | | 4.70 | % | | | 25,000 | | | | 582,750 | |

| Public Storage, Series L | | | 4.63 | % | | | 165,000 | | | | 3,841,200 | |

| Rexford Industrial Realty, Inc., Series B | | | 5.88 | % | | | 80,000 | | | | 2,012,000 | |

| Rexford Industrial Realty, Inc., Series C | | | 5.63 | % | | | 57,260 | | | | 1,433,791 | |

| Saul Centers, Inc., Series D | | | 6.13 | % | | | 107,000 | | | | 2,673,930 | |

| Saul Centers, Inc., Series E | | | 6.00 | % | | | 57,000 | | | | 1,433,470 | |

| Seritage Growth Properties, Series A | | | 7.00 | % | | | 168,025 | | | | 3,654,544 | |

| SITE Centers Corp., Series A | | | 6.38 | % | | | 154,700 | | | | 3,869,047 | |

| SL Green Realty Corp., Series I | | | 6.50 | % | | | 23,000 | | | | 580,290 | |

| Spirit Realty Capital, Inc., Series A | | | 6.00 | % | | | 178,900 | | | | 4,501,124 | |

| Summit Hotel Properties, Inc., Series E | | | 6.25 | % | | | 98,000 | | | | 2,408,840 | |

| Summit Hotel Properties, Inc., Series F | | | 5.88 | % | | | 33,476 | | | | 784,008 | |

| Sunstone Hotel Investors, Inc., Series H | | | 6.13 | % | | | 87,500 | | | | 2,109,625 | |

| Sunstone Hotel Investors, Inc., Series I | | | 5.70 | % | | | 110,431 | | | | 2,521,140 | |

| Urstadt Biddle Properties, Inc., Series H | | | 6.25 | % | | | 94,000 | | | | 2,355,640 | |

| Urstadt Biddle Properties, Inc., Series K | | | 5.88 | % | | | 8,000 | | | | 200,880 | |

| Vornado Realty Trust, Series L | | | 5.40 | % | | | 8,500 | | | | 199,920 | |

| Vornado Realty Trust, Series M | | | 5.25 | % | | | 22,000 | | | | 509,080 | |

| Vornado Realty Trust, Series N | | | 5.25 | % | | | 33,118 | | | | 769,331 | |

| Vornado Realty Trust, Series O | | | 4.45 | % | | | 120,000 | | | | 2,403,600 | |

| | | | | | | | | | | | | |

| TOTAL PREFERRED STOCKS | | | | | | | | | | | | |

| (Cost $77,847,144) | | | | | | | | | | | 78,006,544 | |

| | | 7-Day Yield | | | Shares | | | Value (Note 2) | |

| SHORT TERM INVESTMENT (0.18%) | | | | | | | | | | | | |

| MSILF Treasury Portfolio | | | 0.18 | % | | | 10,239,832 | | | | 10,239,832 | |

| | | | | | | | | | | | | |

| TOTAL SHORT TERM INVESTMENT | | | | | | | | | | | | |

| (Cost $10,239,832) | | | | | | | | | | | 10,239,832 | |

| | | | | | | | | | | | | |

| TOTAL INVESTMENTS (102.30%) | | | | | | | | | | | | |

| (Cost $4,592,000,768) | | | | | | | | | | $ | 5,817,375,548 | |

| | | | | | | | | | | | | |

| Liabilities in Excess of Other Assets (-2.30%) | | | | | | | | | | | (130,799,279 | ) |

| NET ASSETS (100.00%) | | | | | | | | | | $ | 5,686,576,269 | |

| Semi-Annual Report | March 31, 2022 | 19 |

| Apollo Diversified Real Estate Fund | Schedule of Investments |

March 31, 2022 (Unaudited)

| (a) | A portion of these securities is held as collateral for the outstanding Lines of Credit. At March 31, 2022 outstanding collateral amounted to $5,729,129,172. |

| (b) | These securities have no contractual maturity date, are not redeemable and contractually pay an indefinite stream of dividends. |

Common Abbreviations:

LLC - Limited Liability Company

L.P. - Limited Partnership

REIT - Real Estate Investment Trust

| 20 | 1.888.926.2688 | www.apollo.com |

| Apollo Diversified Real Estate Fund | Schedule of Investments |

March 31, 2022 (Unaudited)

| * | Additional Information on Investments in Private Investment Funds: |

| Value | | | Fund Name | | Redemption Frequency | | Redemption Notice (Days) | | | Unfunded Commitment as of March 31, 2022 | |

| $ | 2,361,283 | | | AEW Core Property Trust (U.S.), Inc. | | Quarterly | | 45 | | | $ | 0 | |

| | 65,496,300 | | | Ares Real Estate Enhanced Income Fund, L.P. | | Quarterly | | 90 | | | | 0 | |

| | 8,249,781 | | | Barings Core Property Fund, L.P. | | Quarterly | | 30 | | | | 0 | |

| | 15,265,996 | | | BGO Diversified US Property Fund, L.P. | | Quarterly | | N/A** | | | | 0 | |

| | 125,144,600 | | | Brookfield Senior Mezzanine Real Estate Finance Fund | | Quarterly | | 90 | | | | 4,194,142 | |

| | 106,305,361 | | | CA Student Living Income and Growth Fund | | Quarterly | | 90 | | | | 0 | |

| | 237,708,977 | | | CBRE U.S. Core Partners, L.P. | | Quarterly | | 60 | | | | 0 | |

| | 54,479,798 | | | CBRE U.S. Credit Partners, L.P. | | Quarterly | | 60 | | | | 70,000,000 | |

| | 234,068,477 | | | CBRE U.S. Logistics Partners, L.P. | | Quarterly | | 90 | | | | 0 | |

| | 161,557,173 | | | Clarion Gables Multifamily Trust, L.P. | | Quarterly | | 90 | | | | 0 | |

| | 264,954,710 | | | Clarion Lion Industrial Trust, L.P. | | Quarterly | | 90 | | | | 0 | |

| | 386,126,948 | | | Clarion Lion Properties Fund, L.P. | | Quarterly | | 90 | | | | 0 | |

| | 448,556,527 | | | Cortland Growth and Income Fund, L.P. | | Quarterly | | 90 | | | | 0 | |

| | 66,353,954 | | | CrossHarbor Strategic Debt Fund, L.P. | | Quarterly | | 90 | | | | 0 | |

| | 134,914,054 | | | Dream U.S. Industrial Fund, L.P. | | Quarterly | | 60 | | | | 0 | |

| | 45,565,625 | | | GWL U.S. Property Fund, L.P. | | Quarterly | | 90 | | | | 0 | |

| | 16,907,903 | | | Heitman America Real Estate Trust, L.P. | | Quarterly | | 90 | | | | 0 | |

| | 133,969,584 | | | Heitman Core Real Estate Debt Income Trust | | Quarterly | | 90 | | | | 0 | |

| | 101,376,416 | | | JPM U.S. Real Estate Mezzanine Debt Fund, L.P. | | Quarterly | | 60 | | | | 0 | |

| | 107,558,288 | | | Manulife U.S. Real Estate Fund, L.P. | | Quarterly | | 60 | | | | 0 | |

| | 271,342,532 | | | Morgan Stanley Prime Property Fund | | Quarterly | | 90 | | | | 0 | |

| | 213,728,612 | | | Oaktree Real Estate Income Fund, L.P. | | Quarterly | | 90 | | | | 0 | |

| | 75,630,365 | | | PGIM Real Estate US Debt Fund, L.P. | | Quarterly | | 90 | | | | 0 | |

| | 61,342,075 | | | Principal Real Estate Liquid Debt Fund, L.P. | | Monthly | | 10 | | | | 0 | |

| | 43,990,009 | | | PRISA, L.P. | | Quarterly | | 90 | | | | 0 | |

| | 111,331,909 | | | Prologis Targeted U.S. Logistics Fund, L.P. | | Quarterly | | 90 | | | | 0 | |

| | 84,915,092 | | | Sentinel Real Estate Fund, L.P. | | Quarterly | | N/A** | | | | 0 | |

| | 36,703,012 | | | Stockbridge Smart Markets Fund, L.P. | | Quarterly | | 45 | | | | 40,000,000 | |

| | 157,144,240 | | | TA Realty Core Property Fund, L.P. | | Quarterly | | 45 | | | | 35,000,000 | |

| | 130,196,353 | | | TA Realty Logistics Fund, L.P. | | Quarterly | | 45 | | | | 38,829,375 | |

| | 119,506,709 | | | TCM CRE Credit Fund, L.P. | | Quarterly | | 90 | | | | 10,100,000 | |

| | 15,641,111 | | | UBS Trumbull Property Fund | | Quarterly | | 60 | | | | 0 | |

| | 67,391,888 | | | USAA US Government Building Fund, LLC | | Quarterly | | 60 | | | | 0 | |

| | 207,897,468 | | | Ventas Life Science and Healthcare Real Estate Fund | | Quarterly | | 90 | | | | 50,000,000 | |

| | 60,537,190 | | | Voya Commercial Mortgage Lending Fund, L.P. | | Quarterly | | 90 | | | | 0 | |

| $ | 4,374,220,320 | | | | | | | | | | $ | 248,123,517 | |