| OMB APPROVAL |

OMB Number: 3235-0570

Expires: July 31, 2022

Estimated average burden hours per response: 20.6 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-22960 | |

| Eubel Brady & Suttman Mutual Fund Trust |

| (Exact name of registrant as specified in charter) |

| 225 Pictoria Drive, Suite 450 | Cincinnati, Ohio 45246 |

| (Address of principal executive offices) | (Zip code) |

Carol J. Highsmith, Esq.

| 225 Pictoria Drive, Suite 450 Cincinnati, Ohio 45246 |

| (Name and address of agent for service) |

| Registrant's telephone number, including area code: | (513) 587-3400 | |

| Date of fiscal year end: | July 31 | |

| | | |

| Date of reporting period: | January 31, 2021 | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to the Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| |

| |

| |

| |

| |

| Eubel Brady & Suttman |

| Income and Appreciation Fund |

| Ticker Symbol: EBSZX |

| |

| |

| |

| Eubel Brady & Suttman |

| Income Fund |

| Ticker Symbol: EBSFX |

| |

| |

| |

| Each a series of the |

| Eubel Brady & Suttman Mutual Fund Trust |

| |

| |

| |

| |

| |

| SEMI-ANNUAL REPORT |

| January 31, 2021 |

| (Unaudited) |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| EUBEL BRADY & SUTTMAN MUTUAL FUND TRUST |

| LETTER TO OUR SHAREHOLDERS | January 31, 2021 |

Dear Shareholders:

The fixed-income environment remained challenging during the six months ended January 31, 2021. Yields of shorter-term investment grade corporate bonds declined and credit spreads narrowed across the credit and maturity spectrum. Bond issuance was high during the period with companies refinancing higher yielding debt into longer maturities sporting lower yields and swapping variable rate debt for fixed to better quantify future interest rate expense. Markets easily absorbed the new issuance in spite of investors receiving less yield and fewer protections than in more rational times. It is an issuer’s (or sellers) market.

In light of the current environment, we continue to maintain a defensive bias keeping maturities reasonably short and selectively taking credit risk rather than extending maturities to increase yield. Securities with shorter maturities are generally more liquid than longer ones, which should position us well to capitalize on market dislocations and navigate the current yield environment.

We discuss the current environment, review our investment philosophy and results, and share our perspective below. Feel free to give us a call with questions, comments or both.

Current Environment – The Federal Reserve (the “Fed”) maintained its spot on centerstage during the period, flanked by the prospects of a COVID vaccine rollout, and the possibility of another sizeable stimulus program.

The Fed’s commitment to keep short-term rates low for the foreseeable future and its willingness to continue supporting main street and Wall Street, has distorted the cost of capital, in our view. Maintaining investment discipline is always important, but crucial in the unusual environment in which we find ourselves currently.

The Fed’s influence not only impacts yields but credit spreads too. The credit spread is the number of basis points a corporate bond trades over a Treasury of equal maturity. Essentially, it is an investor’s compensation for taking on the default risk of a corporate bond. Credit spreads narrow and widen over time, based on investor demand and the perceived creditworthiness of the

underlying company, and the ebb and flow of Treasury yields. With credit spreads so narrow, compensation for default risk is less than long-term averages. We believe prudence is warranted.

Although corporate bond yields trended lower during the period, the 10-Year Treasury’s yield consistently rose, seemingly on the prospects of a stronger economy supported by wide-spread COVID vaccinations and another round of economic stimulus.

As we drafted this letter, COVID vaccinations seem poised for acceleration as the current administration has pledged 100 million vaccinations in the first 100 days. A tall order for sure, but directionally correct. Achieving wide- spread vaccinations domestically and globally is key to reopening many businesses and borders which in turn is key to the domestic and global economy being weaned off life support.

When taken together, another round of economic stimulus and increased economic activity, due to greater freedom of movement afforded by vaccinations, could stoke inflationary concerns. A higher-than-average rate of inflation in the near-term would not be surprising given the Fed’s 2020 decision to focus on a 2% average rate of inflation.

Regarding convertible securities, finding investments that meet our criteria remains difficult due to lofty underlying equity valuations and low (or non-existent) yields. By way of example, the majority of recent new convertible issues had 0% coupons and the average convertible was trading around 150% of par at the end of 2020. Additionally, an estimated 60% of the convertible market was comprised of growth type issues (generally expensive), and the convertible bonds of a well-known electric vehicle company represented an estimated 9% of the entire U.S. convertible market at year-end. The valuation of its underlying stock is in the stratosphere.

Although there was a high level of convertible issuance in 2020, it was, in part, due to opportunistic and rescue borrowing (think airlines, travel, leisure and retail). Deal pricing was aggressive with deals being upsized, average coupons declining and initial conversion premiums widening. Like with non-convertible bonds, issuers were generally in the driver’s seat.

When attractively priced convertibles are not available for purchase, we generally hold non-convertible corporate bonds. If equity markets weaken in the future, those convertibles issued on rich initial terms may become more interesting. We would enjoy an opportunity to check a few items off our shopping list.

Investment Philosophy – Managing risks so that investors are adequately compensated for them is an important element of our bottom-up investment philosophy. Interest rates are extremely difficult to accurately forecast over time, so we refrain from doing so. We are, however, cognizant of interest rate levels.

In our view, flexibility in portfolio management can support long-term success. Therefore, each Fund has latitude with respect to maturity, duration (price sensitivity to a change in interest rates) and credit quality (among other factors). This flexibility allows us to invest where we find the most value, rather than being confined to specific maturity, duration and credit rating targets (boxes, if you will). Being largely unconstrained allows us to hold bonds to maturity, and we often do so. We believe this flexibility provides the Funds an advantage over those confined to specific mandates. Only EBS clients are permitted to invest in the Funds. This provides a more stable asset base as compared to funds open to the general public.

Each Fund held fewer than 50 securities at period-end, yet maintained good diversification in our view. While many funds hold hundreds of securities, we believe a narrower focus is more advantageous. The composition of the EBS Funds will often be materially different than their benchmarks. As such, you should expect the Funds’ returns to diverge from their benchmarks, often significantly. Neither Fund uses leverage (borrows money) to make investments.

Results For Various Periods Ended January 31, 2021 – Since inception (September 30, 2014) through January 31, 2021, the Eubel Brady & Suttman Income and Appreciation Fund (“EBSZX”) posted an average annual total return of 3.37%, while its primary benchmark, the ICE BofA U.S.

Yield Alternatives Index (the “Index”), returned 5.72% (annualized) over the same period. During the five-year period ended January 31, 2021, the Fund returned 5.45% per year and the Index 10.56%. During the three-year period ended January 31, 2021, the Fund returned 3.50% per year and the Index 9.41%. Over the year ended January 31, 2021, the Fund returned 7.11% and the Index returned 12.76%. Over the six-month period ended January 31, 2021, the Fund increased 5.39% and the Index 13.68%.

The primary factors contributing to EBSZX’s underperformance in the aforementioned periods ended January 31, 2021 are described below:

| ● | EBSZX’s investment in short-duration non-convertible securities and underweight allocation to convertibles contributed to its underperformance relative to its primary benchmark. |

| ● | The Fund’s minimal equity sensitivity benefited it commensurately as equity markets lifted, but not enough to keep pace with the more equity sensitive benchmark. Given current equity valuations, the Fund is positioned more defensively. |

We believe EBSZX is positioned well to capitalize on additional convertible investments should they become available at prices we find compelling. We remain very selective at present.

Since inception (September 30, 2014) through January 31, 2021, the Eubel Brady & Suttman Income Fund (“EBSFX”) logged an average annual total return of 2.68%, while its primary benchmark, the ICE BofA U.S. Corporate & Government Master Index (the “ICE Index”) was up 4.07% (annualized) over the same period. During the five-year period ended January 31, 2021, the

Fund returned 3.73% per annum and the ICE Index 4.42% (annualized). During the three-year period ended January 31, 2021, the Fund returned 3.32% (annualized) and the ICE Index 5.99% (annualized). Over the year ended January 31, 2021, the Fund increased 4.39% and the ICE Index 5.00%. Over the six-month period ended January 31, 2021, the Fund increased 2.28% and the ICE Index declined 1.57%.

The primary factors contributing to EBSFX’s outperformance during the six-month period and underperformance in other periods ended January 31, 2021 are described below:

| ● | EBSFX’s primary reason for outperforming on a six-month basis was its void in Treasuries. As Treasury yields rose, their prices declined negatively impacting the primary benchmark. |

| ● | EBSFX’s primary reasons for underperforming during the other periods were, in part, due to its weighted average maturity and duration (price sensitivity to a change in interest rates) being shorter than its primary benchmark and it had less exposure to Government & Agency debt. Due to its greater exposure to Government & Agency debt and longer average duration, the primary benchmark benefited more from declining yields than did the Fund. |

Our Perspective – With COVID-19 vaccine production and vaccinations accelerating, society has started its long journey down the road toward normalcy. However, there will likely be continued fallout in those industries requiring face-to-face interactions and/or international travel to conduct business. Debt markets have been generous with capital and terms, yet

eventually those debts must be repaid. While there is certainly pent-up demand for travel, dining, and sports activities, it is unknown whether there will be enough demand soon enough to propel distressed companies to a better financial state.

Given the uneven economic recovery and its dependency on monetary and fiscal support, coupled with minimal compensation for extending maturities – we expect to keep average maturities focused on the shorter end of the yield curve until conditions warrant otherwise.

With a reasonably short duration portfolio, we should be in a good position to capitalize on fixed-income market dislocations which can result in higher yields and wider credit spreads.

If yields simply rise at a measured pace, we can methodically roll maturing instruments into higher yielding ones and extend

maturities if the additional compensation is adequate. Given the low level of yields, there is not much give up on the downside should yields decline further from present levels.

Regarding EBSZX, our exposure to convertible securities is less than we would prefer, and we stand ready to capitalize on opportunities as they arise.

We welcome your questions, comments or both and may be reached at 1-800-391-1223. As always, we appreciate your trust and confidence in our firm.

Sincerely,

The EBS Research Group

Important Disclosures – Performance data quoted in this letter or the report itself represents past performance. Past performance does not guarantee future results. The value of an investor’s shares will fluctuate and may be worth more or less than the original cost when redeemed. Current performance may be higher or lower than performance quoted herein. Performance data, current to the most recent month end, is available by calling 1-800-391-1223.

The information in this “Letter To Our Shareholders” represents the opinion of the author and is not intended to be a forecast or investment advice. This publication does not constitute an offer or solicitation of any transaction in any securities. Information contained in this publication has been obtained from sources believed to be reliable but has not been independently verified by EBS. Please note that any discussion of fund holdings, fund performance and views expressed are as of January 31, 2021 (except if otherwise stated) and are subject to change without notice.

EUBEL BRADY & SUTTMAN MUTUAL FUND TRUST

PORTFOLIO INFORMATION

January 31, 2021 (Unaudited) |

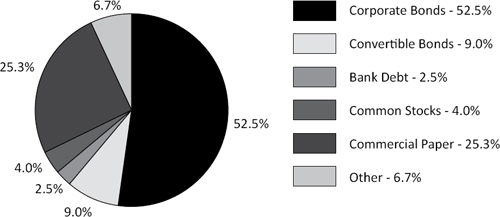

Eubel Brady & Suttman Income and Appreciation Fund

Asset Allocation (% of Net Assets)

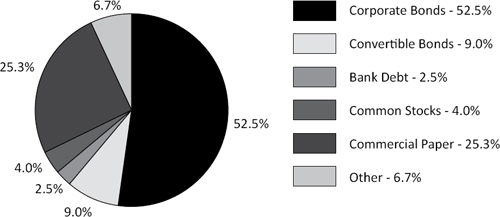

Eubel Brady & Suttman Income Fund

Asset Allocation (% of Net Assets)

| EUBEL BRADY & SUTTMAN INCOME AND APPRECIATION FUND |

| SCHEDULE OF INVESTMENTS |

| January 31, 2021 (Unaudited) |

| CORPORATE BONDS — 52.5% | | Coupon | | | Maturity | | | Par Value | | | Value | |

| Communications — 5.0% | | | | | | | | | | | | |

| Discovery Communications, LLC | | | 2.950 | % | | | 03/20/23 | | | $ | 900,000 | | | $ | 945,635 | |

| Discovery Communications, LLC | | | 3.800 | % | | | 03/13/24 | | | | 2,085,000 | | | | 2,270,744 | |

| Verizon Communications, Inc. (3MO LIBOR + 100) (a) | | | 1.219 | % | | | 03/16/22 | | | | 2,100,000 | | | | 2,122,813 | |

| | | | | | | | | | | | | | | | 5,339,192 | |

| Consumer Discretionary — 3.8% | | | | | | | | | | | | | | | | |

| AutoZone, Inc. | | | 3.700 | % | | | 04/15/22 | | | | 2,250,000 | | | | 2,323,775 | |

| Silversea Cruise Finance Ltd., 144A | | | 7.250 | % | | | 02/01/25 | | | | 1,600,000 | | | | 1,652,000 | |

| | | | | | | | | | | | | | | | 3,975,775 | |

| Consumer Staples — 4.3% | | | | | | | | | | | | | | | | |

| Honeywell International, Inc. | | | 0.483 | % | | | 08/19/22 | | | | 1,125,000 | | | | 1,126,471 | |

| Kroger Company (The) | | | 3.850 | % | | | 08/01/23 | | | | 1,000,000 | | | | 1,076,982 | |

| Mondelēz International, Inc., 144A | | | 2.000 | % | | | 10/28/21 | | | | 2,290,000 | | | | 2,315,435 | |

| | | | | | | | | | | | | | | | 4,518,888 | |

| Energy — 1.7% | | | | | | | | | | | | | | | | |

| CONSOL Energy, Inc., 144A | | | 11.000 | % | | | 11/15/25 | | | | 2,000,000 | | | | 1,750,000 | |

| | | | | | | | | | | | | | | | | |

| Financials — 16.8% | | | | | | | | | | | | | | | | |

| American International Group, Inc. | | | 3.300 | % | | | 03/01/21 | | | | 2,900,000 | | | | 2,900,000 | |

| Bank of America Corporation (3MO LIBOR + 370.5, effective 09/05/24) (a)(b) | | | 6.250 | % | | | 03/05/65 | | | | 2,000,000 | | | | 2,213,564 | |

| CNG Holdings, Inc., 144A | | | 12.500 | % | | | 06/15/24 | | | | 2,700,000 | | | | 2,470,500 | |

| Goldman Sachs Group, Inc. (The) (3MO LIBOR + 75) (a) | | | 0.963 | % | | | 02/23/23 | | | | 500,000 | | | | 505,201 | |

| Goldman Sachs Group, Inc. (The) (3MO LIBOR + 100) (a) | | | 1.218 | % | | | 07/24/23 | | | | 2,500,000 | | | | 2,525,046 | |

| Pershing Square Holdings Ltd., 144A | | | 5.500 | % | | | 07/15/22 | | | | 2,500,000 | | | | 2,636,394 | |

| Round Up Ventures, L.P. (c)(d)(e) | | | 15.000 | % | | | 03/06/25 | | | | 2,272,755 | | | | 2,425,641 | |

| Wells Fargo & Company | | | 3.750 | % | | | 01/24/24 | | | | 1,895,000 | | | | 2,060,866 | |

| | | | | | | | | | | | | | | | 17,737,212 | |

| Health Care — 6.1% | | | | | | | | | | | | | | | | |

| AbbVie, Inc. | | | 2.900 | % | | | 11/06/22 | | | | 3,000,000 | | | | 3,129,420 | |

| Becton, Dickinson and Company (3MO LIBOR + 103) (a) | | | 1.255 | % | | | 06/06/22 | | | | 2,615,000 | | | | 2,641,903 | |

| Becton, Dickinson and Company | | | 2.894 | % | | | 06/06/22 | | | | 661,000 | | | | 681,568 | |

| | | | | | | | | | | | | | | | 6,452,891 | |

See accompanying notes to financial statements.

EUBEL BRADY & SUTTMAN INCOME AND APPRECIATION FUND

SCHEDULE OF INVESTMENTS (Continued) |

CORPORATE BONDS — 52.5%

(Continued) | | Coupon | | | Maturity | | | Par Value | | | Value | |

| Industrials — 4.7% | | | | | | | | | | | | |

| General Electric Company (3MO LIBOR + 100) (a) | | | 1.217 | % | | | 03/15/23 | | | $ | 1,000,000 | | | $ | 1,008,699 | |

| Penske Truck Leasing Company, L.P., 144A | | | 4.125 | % | | | 08/01/23 | | | | 1,130,000 | | | | 1,223,597 | |

| Roper Technologies, Inc. | | | 2.800 | % | | | 12/15/21 | | | | 2,700,000 | | | | 2,752,031 | |

| | | | | | | | | | | | | | | | 4,984,327 | |

| Materials — 7.7% | | | | | | | | | | | | | | | | |

| Avnet, Inc. | | | 3.750 | % | | | 12/01/21 | | | | 2,600,000 | | | | 2,663,958 | |

| Ball Corporation | | | 5.000 | % | | | 03/15/22 | | | | 1,672,000 | | | | 1,745,902 | |

| DowDuPont, Inc. | | | 4.493 | % | | | 11/15/25 | | | | 1,345,000 | | | | 1,561,393 | |

| Steel Dynamics, Inc. | | | 2.800 | % | | | 12/15/24 | | | | 2,000,000 | | | | 2,147,036 | |

| | | | | | | | | | | | | | | | 8,118,289 | |

| Utilities — 2.4% | | | | | | | | | | | | | | | | |

| Southern Company (The) | | | 2.350 | % | | | 07/01/21 | | | | 2,495,000 | | | | 2,512,865 | |

| | | | | | | | | | | | | | | | | |

| Total Corporate Bonds (Cost $54,124,155) | | | | | | | | | | | | | | $ | 55,389,439 | |

| CONVERTIBLE BONDS — 9.0% | | Coupon | | | Maturity | | | Par Value | | | Value | |

| Consumer Discretionary — 2.0% | | | | | | | | | | | | | | | | |

| Patrick Industries, Inc. | | | 1.000 | % | | | 02/01/23 | | | $ | 2,000,000 | | | $ | 2,113,413 | |

| | | | | | | | | | | | | | | | | |

| Financials — 4.3% | | | | | | | | | | | | | | | | |

| Ares Capital Corporation | | | 3.750 | % | | | 02/01/22 | | | | 2,000,000 | | | | 2,012,000 | |

| Redwood Trust, Inc. | | | 4.750 | % | | | 08/15/23 | | | | 2,700,000 | | | | 2,572,170 | |

| | | | | | | | | | | | | | | | 4,584,170 | |

| Technology — 2.7% | | | | | | | | | | | | | | | | |

| Palo Alto Networks, Inc. | | | 0.750 | % | | | 07/01/23 | | | | 2,000,000 | | | | 2,835,709 | |

| | | | | | | | | | | | | | | | | |

| Total Convertible Bonds (Cost $8,357,252) | | | | | | | | | | | | | | $ | 9,533,292 | |

See accompanying notes to financial statements.

EUBEL BRADY & SUTTMAN INCOME AND APPRECIATION FUND

SCHEDULE OF INVESTMENTS (Continued) |

| BANK DEBT — 2.5% | | Coupon | | | Maturity | | | Par Value | | | Value | |

| Financials — 2.1% | | | | | | | | | | | | | | | | |

| NCP SPV Texas, L.P. Revolving Loan (Prime + 275) (a)(c)(e) | | | 6.000 | % | | | 11/30/22 | | | $ | 2,179,459 | | | $ | 2,193,750 | |

| | | | | | | | | | | | | | | | | |

| Materials — 0.4% | | | | | | | | | | | | | | | | |

| Ball Metalpack, LLC (3MO LIBOR + 450) (a) | | | 4.733 | % | | | 07/26/25 | | | | 487,500 | | | | 483,234 | |

| | | | | | | | | | | | | | | | | |

| Total Bank Debt (Cost $2,664,521) | | | | | | | | | | | | | | $ | 2,676,984 | |

| COMMON STOCKS — 4.0% | | Shares | | | Value | |

| Financials — 3.5% | | | | | | | | |

| Capital One Financial Corporation | | | 9,904 | | | $ | 1,032,591 | |

| Hartford Financial Services Group, Inc. (The) | | | 41,269 | | | | 1,981,737 | |

| Lincoln National Corporation | | | 15,673 | | | | 712,965 | |

| | | | | | | | 3,727,293 | |

| Industrials — 0.5% | | | | | | | | |

| Air Industries Group (f) | | | 327,171 | | | | 454,768 | |

| | | | | | | | | |

| Total Common Stocks (Cost $1,788,524) | | | | | | $ | 4,182,061 | |

| WARRANTS — 0.0% (g) | | Shares | | | Value | |

| Materials — 0.0% (g) | | | | | | | | |

| American Zinc Recycling, LLC $630.227, expires 09/30/22 (c)(e)(f) (Cost $1,211,719) | | | 965 | | | $ | 10 | |

See accompanying notes to financial statements.

EUBEL BRADY & SUTTMAN INCOME AND APPRECIATION FUND

SCHEDULE OF INVESTMENTS (Continued) |

| COMMERCIAL PAPER — 25.3% (h) | | Par Value | | | Value | |

| BASF SE, 0.15%, due 02/05/21 | | $ | 3,000,000 | | | $ | 2,999,837 | |

| Consolidated Edison, Inc., 0.09%, due 02/08/21 | | | 3,000,000 | | | | 2,999,948 | |

| Duke Energy Corporation, 0.12%, due 02/19/21 | | | 3,000,000 | | | | 2,999,820 | |

| FMC Technologies, Inc., 0.18%, due 02/02/21 | | | 3,000,000 | | | | 2,999,985 | |

| Harley Davidson Financial Services, Inc., 0.25%, due 02/18/21 | | | 3,000,000 | | | | 2,999,646 | |

| McCormick & Company, Inc., 0.12%, due 02/02/21 | | | 3,000,000 | | | | 2,999,990 | |

| Mitsubishi International Corporation, 0.12%, due 02/04/21 | | | 3,000,000 | | | | 2,999,802 | |

| Societe Generale S.A., 0.14%, due 02/04/21 | | | 3,000,000 | | | | 2,999,851 | |

| Unilever Capital Corporation, 0.11%, due 03/03/21 | | | 2,675,000 | | | | 2,674,702 | |

| Total Commercial Paper (Cost $26,673,581) | | | | | | $ | 26,673,581 | |

| MONEY MARKET FUNDS — 6.2% | | Shares | | | Value | |

| Invesco Short-Term Investments Trust - Treasury Portfolio -Institutional Class, 0.01% (i) (Cost $6,584,546) | | | 6,584,546 | | | $ | 6,584,546 | |

| | | | | | | | | |

| Total Investments at Value — 99.5% (Cost $101,404,298) | | | | | | $ | 105,039,913 | |

| | | | | | | | | |

| Other Assets in Excess of Liabilities — 0.5% | | | | | | | 561,205 | |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 105,601,118 | |

| 144A - | Security was purchased in a transaction exempt from registration in compliance with Rule 144A of the Securities Act of 1933. This security may be resold in transactions exempt from registration, normally to qualified institutional buyers. The total value of such securities is $12,047,926 as of January 31, 2021, representing 11.4% of net assets. |

LIBOR - London Interbank Offered Rate.

| (a) | Variable rate security. Interest rate resets periodically. The rate shown is the effective interest rate as of January 31, 2021. For securities based on a published reference rate and spread, the reference rate and spread (in basis points) are indicated parenthetically. |

| (b) | Security has a perpetual maturity date. |

| (c) | Illiquid security. The total fair value of these securities as of January 31, 2021 was $4,619,401, representing 4.4% of net assets. |

| (d) | Payment-in-kind bond. The rate shown is the coupon rate of 11.0% and the payment in kind rate of 4.0%. |

| (e) | Security has been fair valued using significant unobservable inputs in good faith by the Adviser in conformity with guidelines adopted by and subject to review by the Board of Trustees. The total value of these securities is $4,619,401 as of January 31, 2021, representing 4.4% of net assets. |

| (f) | Non-income producing security. |

| (g) | Percentage rounds to less than 0.1%. |

| (h) | The rate shown is the annualized yield at the time of purchase, not a coupon rate. |

| (i) | The rate shown is the 7-day effective yield as of January 31, 2021. |

See accompanying notes to financial statements.

EUBEL BRADY & SUTTMAN INCOME FUND

SCHEDULE OF INVESTMENTS

January 31, 2021 (Unaudited) |

| CORPORATE BONDS — 49.6% | | Coupon | | | Maturity | | | Par Value | | | Value | |

| Communications — 2.6% | | | | | | | | | | | | | | | | |

| Discovery Communications, LLC | | | 4.375 | % | | | 06/15/21 | | | $ | 600,000 | | | $ | 608,769 | |

| Discovery Communications, LLC | | | 3.300 | % | | | 05/15/22 | | | | 1,161,000 | | | | 1,196,612 | |

| Verizon Communications, Inc. (3MO LIBOR + 100) (a) | | | 1.219 | % | | | 03/16/22 | | | | 5,000,000 | | | | 5,054,317 | |

| | | | | | | | | | | | | | | | 6,859,698 | |

| Consumer Discretionary — 3.1% | | | | | | | | | | | | | | | | |

| AutoZone, Inc. | | | 2.500 | % | | | 04/15/21 | | | | 1,609,000 | | | | 1,613,307 | |

| Marriott International, Inc. | | | 2.300 | % | | | 01/15/22 | | | | 2,000,000 | | | | 2,026,458 | |

| Silversea Cruise Finance Ltd., 144A | | | 7.250 | % | | | 02/01/25 | | | | 4,500,000 | | | | 4,646,250 | |

| | | | | | | | | | | | | | | | 8,286,015 | |

| Consumer Staples — 6.2% | | | | | | | | | | | | | | | | |

| Keurig Dr Pepper, Inc. | | | 3.551 | % | | | 05/25/21 | | | | 5,000,000 | | | | 5,051,448 | |

| Kroger Company (The) | | | 2.950 | % | | | 11/01/21 | | | | 5,206,000 | | | | 5,300,098 | |

| Mondelēz International, Inc.,144A | | | 2.000 | % | | | 10/28/21 | | | | 5,995,000 | | | | 6,061,586 | |

| | | | | | | | | | | | | | | | 16,413,132 | |

| Energy — 1.2% | | | | | | | | | | | | | | | | |

| CONSOL Energy, Inc., 144A | | | 11.000 | % | | | 11/15/25 | | | | 3,700,000 | | | | 3,237,500 | |

| | | | | | | | | | | | | | | | | |

| Financials — 17.3% | | | | | | | | | | | | | | | | |

| American International Group, Inc. | | | 3.300 | % | | | 03/01/21 | | | | 2,557,000 | | | | 2,557,000 | |

| Bank of America Corporation (3MO LIBOR + 370.5, effective 09/05/24) (a)(b) | | | 6.250 | % | | | 03/05/65 | | | | 4,000,000 | | | | 4,427,128 | |

| Bank of the Ozarks, Inc. (3MO LIBOR + 442.5, effective 07/01/21) (a) | | | 5.500 | % | | | 07/01/26 | | | | 4,792,000 | | | | 4,860,767 | |

| Barclays Bank plc (3MO LIBOR + 211) (a) | | | 2.316 | % | | | 08/10/21 | | | | 2,684,000 | | | | 2,711,180 | |

| Citigroup, Inc. | | | 2.900 | % | | | 12/08/21 | | | | 2,220,000 | | | | 2,264,636 | |

| CNG Holdings, Inc., 144A | | | 12.500 | % | | | 06/15/24 | | | | 6,300,000 | | | | 5,764,500 | |

| Goldman Sachs Group, Inc. (The) (3MO LIBOR + 75) (a) | | | 0.963 | % | | | 02/23/23 | | | | 500,000 | | | | 505,201 | |

| Goldman Sachs Group, Inc. (The) (3MO LIBOR + 100) (a) | | | 1.218 | % | | | 07/24/23 | | | | 5,500,000 | | | | 5,555,101 | |

| JPMorgan Chase & Company | | | 2.700 | % | | | 05/18/23 | | | | 3,000,000 | | | | 3,146,627 | |

| Morgan Stanley | | | 4.875 | % | | | 11/01/22 | | | | 3,100,000 | | | | 3,332,530 | |

| Pershing Square Holdings Ltd., 144A | | | 5.500 | % | | | 07/15/22 | | | | 5,000,000 | | | | 5,272,787 | |

| Round Up Ventures, L.P. (c)(d)(e) | | | 15.000 | % | | | 03/06/25 | | | | 4,958,739 | | | | 5,292,308 | |

| | | | | | | | | | | | | | | | 45,689,765 | |

See accompanying notes to financial statements.

EUBEL BRADY & SUTTMAN INCOME FUND

SCHEDULE OF INVESTMENTS (Continued) |

CORPORATE BONDS — 49.6%

(Continued) | | Coupon | | | Maturity | | | Par Value | | | Value | |

| Health Care — 4.6% | | | | | | | | | | | | | | | | |

| AbbVie, Inc. | | | 2.900 | % | | | 11/06/22 | | | $ | 6,000,000 | | | $ | 6,258,840 | |

| Becton, Dickinson and Company (3MO LIBOR + 103) (a) | | | 1.255 | % | | | 06/06/22 | | | | 5,825,000 | | | | 5,884,927 | |

| | | | | | | | | | | | | | | | 12,143,767 | |

| Industrials — 7.3% | | | | | | | | | | | | | | | | |

| Caterpillar, Inc. | | | 2.600 | % | | | 06/26/22 | | | | 2,691,000 | | | | 2,760,952 | |

| General Electric Company (3MO LIBOR + 100) (a) | | | 1.217 | % | | | 03/15/23 | | | | 5,000,000 | | | | 5,043,493 | |

| Penske Truck Leasing Company, L.P., 144A | | | 2.700 | % | | | 03/14/23 | | | | 5,000,000 | | | | 5,212,825 | |

| Penske Truck Leasing Company, L.P., 144A | | | 4.125 | % | | | 08/01/23 | | | | 1,000,000 | | | | 1,082,829 | |

| Roper Technologies, Inc. | | | 2.800 | % | | | 12/15/21 | | | | 4,903,000 | | | | 4,997,485 | |

| | | | | | | | | | | | | | | | 19,097,584 | |

| Materials — 5.4% | | | | | | | | | | | | | | | | |

| Ball Corporation | | | 5.000 | % | | | 03/15/22 | | | | 2,772,000 | | | | 2,894,522 | |

| Cabot Corporation | | | 3.700 | % | | | 07/15/22 | | | | 3,980,000 | | | | 4,134,347 | |

| Sherwin-Williams Company (The) | | | 4.200 | % | | | 01/15/22 | | | | 5,250,000 | | | | 5,392,252 | |

| Steel Dynamics, Inc. | | | 2.800 | % | | | 12/15/24 | | | | 1,575,000 | | | | 1,690,791 | |

| | | | | | | | | | | | | | | | 14,111,912 | |

| Utilities — 1.9% | | | | | | | | | | | | | | | | |

| Duke Energy Corporation (3MO LIBOR + 25) (a) | | | 0.482 | % | | | 11/26/21 | | | | 3,000,000 | | | | 3,004,590 | |

| Southern Company (The) | | | 2.350 | % | | | 07/01/21 | | | | 2,000,000 | | | | 2,014,321 | |

| | | | | | | | | | | | | | | | 5,018,911 | |

| Total Corporate Bonds (Cost $128,904,801) | | | | | | | | | | | | | | $ | 130,858,284 | |

| BANK DEBT — 1.4% | | Coupon | | | Maturity | | | Par Value | | | Value | |

| Financials — 1.4% | | | | | | | | | | | | | | | | |

| NCP SPV Texas, L.P. Revolving Loan (Prime + 275) (a)(c)(e) (Cost $3,632,432) | | | 6.000 | % | | | 11/30/22 | | | $ | 3,632,432 | | | $ | 3,656,250 | |

See accompanying notes to financial statements.

EUBEL BRADY & SUTTMAN INCOME FUND

SCHEDULE OF INVESTMENTS (Continued) |

| COMMERCIAL PAPER — 24.9% (f) | | Par Value | | | Value | |

| BASF SE, 0.15%, due 02/05/21 | | $ | 6,000,000 | | | $ | 5,999,674 | |

| Consolidated Edison, Inc., 0.09%, due 02/08/21 | | | 7,000,000 | | | | 6,999,877 | |

| Duke Energy Corporation, 0.12%, due 02/19/21 | | | 3,000,000 | | | | 2,999,820 | |

| Fidelity National Information Services, Inc., 0.25%, due 02/25/21 | | | 6,300,000 | | | | 6,298,950 | |

| FMC Technologies, Inc., | | | | | | | | |

| 0.18%, due 02/02/2021 | | | 6,000,000 | | | | 5,999,970 | |

| 0.30%, due 02/24/2021 | | | 1,200,000 | | | | 1,199,770 | |

| Harley Davidson Financial Services, Inc., 0.25%, due 02/18/21 | | | 6,000,000 | | | | 5,999,292 | |

| McCormick & Company, Inc., 0.12%, due 02/02/21 | | | 6,000,000 | | | | 5,999,980 | |

| Mitsubishi International Corporation, 0.12%, due 02/04/21 | | | 6,000,000 | | | | 5,999,605 | |

| Societe Generale S.A., 0.14%, due 02/04/21 | | | 6,000,000 | | | | 5,999,702 | |

| Suncor Energy, Inc., 0.26%, due 02/01/21 | | | 6,000,000 | | | | 6,000,000 | |

| Walgreens Boots Alliance, Inc., 0.28%, due 02/03/21 | | | 6,000,000 | | | | 5,999,907 | |

| Total Commercial Paper (Cost $65,496,547) | | | | | | $ | 65,496,547 | |

See accompanying notes to financial statements.

EUBEL BRADY & SUTTMAN INCOME FUND

SCHEDULE OF INVESTMENTS (Continued) |

| MONEY MARKET FUNDS — 23.7% | | Shares | | | Value | |

| Invesco Short-Term Investments Trust - Treasury Portfolio -Institutional Class, 0.01% (g) (Cost $62,559,959) | | | 62,559,959 | | | $ | 62,559,959 | |

| | | | | | | | | |

| Total Investments at Value — 99.6% (Cost $260,593,739) | | | | | | $ | 262,571,040 | |

| | | | | | | | | |

| Other Assets in Excess of Liabilities — 0.4% | | | | | | | 1,035,130 | |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 263,606,170 | |

| 144A - | Security was purchased in a transaction exempt from registration in compliance with Rule 144A of the Securities Act of 1933. This security may be resold in transactions exempt from registration, normally to qualified institutional buyers. The total value of such securities is $31,278,277 as of January 31, 2021, representing 11.9% of net assets. |

LIBOR - London Interbank Offered Rate.

| (a) | Variable rate security. Interest rate resets periodically. The rate shown is the effective interest rate as of January 31, 2021. For securities based on a published reference rate and spread, the reference rate and spread (in basis points) are indicated parenthetically. |

| (b) | Security has a perpetual maturity date. |

| (c) | Illiquid security. The total fair value of these securities as of January 31, 2021 was $8,948,558, representing 3.4% of net assets. |

| (d) | Payment-in-kind bond. The rate shown is the coupon rate of 11.0% and the payment in kind rate of 4.0%. |

| (e) | Security has been fair valued using significant unobservable inputs in good faith by the Adviser in conformity with guidelines adopted by and subject to review by the Board of Trustees. The total value of these securities is $8,948,558 as of January 31, 2021, representing 3.4% of net assets. |

| (f) | The rate shown is the annualized yield at the time of purchase, not a coupon rate. |

| (g) | The rate shown is the 7-day effective yield as of January 31, 2021. |

See accompanying notes to financial statements.

| EUBEL BRADY & SUTTMAN MUTUAL FUND TRUST |

| STATEMENTS OF ASSETS AND LIABILITIES |

| January 31, 2021 (Unaudited) |

| | | Eubel Brady | | | | |

| | | & Suttman | | | | |

| | | Income and | | | Eubel Brady | |

| | | Appreciation | | | & Suttman | |

| | | Fund | | | Income Fund | |

| ASSETS | | | | | | | | |

| Investments in securities: | | | | | | | | |

| At cost | | $ | 101,404,298 | | | $ | 260,593,739 | |

| At value (Note 2) | | $ | 105,039,913 | | | $ | 262,571,040 | |

| Capital shares receivable | | | 3,491 | | | | 13,899 | |

| Dividends and interest receivable | | | 643,792 | | | | 1,061,864 | |

| Other assets | | | 20,177 | | | | 23,852 | |

| Total assets | | | 105,707,373 | | | | 263,670,655 | |

| | | | | | | | | |

| LIABILITIES | | | | | | | | |

| Payable for capital shares redeemed | | | 77,644 | | | | 4,820 | |

| Payable to administrator (Note 4) | | | 17,305 | | | | 38,210 | |

| Other accrued expenses | | | 11,306 | | | | 21,455 | |

| Total liabilities | | | 106,255 | | | | 64,485 | |

| | | | | | | | | |

| NET ASSETS | | $ | 105,601,118 | | | $ | 263,606,170 | |

| | | | | | | | | |

| NET ASSETS CONSIST OF: | | | | | | | | |

| Paid-in capital | | $ | 102,224,538 | | | $ | 264,255,704 | |

| Accumulated earnings (deficit) | | | 3,376,580 | | | | (649,534 | ) |

| NET ASSETS | | $ | 105,601,118 | | | $ | 263,606,170 | |

| | | | | | | | | |

| Shares of beneficial interest outstanding (unlimited number of shares authorized, no par value) | | | 10,481,474 | | | | 26,492,392 | |

| | | | | | | | | |

| Net asset value, offering price and redemption price per share (Note 2) | | $ | 10.08 | | | $ | 9.95 | |

See accompanying notes to financial statements.

| EUBEL BRADY & SUTTMAN MUTUAL FUND TRUST |

| STATEMENTS OF OPERATIONS |

| For the Six Months Ended January 31, 2021 (Unaudited) |

| | | Eubel Brady | | | | |

| | | & Suttman | | | | |

| | | Income and | | | Eubel Brady | |

| | | Appreciation | | | & Suttman | |

| | | Fund | | | Income Fund | |

| INVESTMENT INCOME | | | | | | | | |

| Dividends | | $ | 43,471 | | | $ | 4,814 | |

| Interest | | | 1,552,463 | | | | 3,053,235 | |

| Total investment income | | | 1,595,934 | | | | 3,058,049 | |

| | | | | | | | | |

| EXPENSES | | | | | | | | |

| Administration fees (Note 4) | | | 49,535 | | | | 107,041 | |

| Shareholder servicing fees (Note 6) | | | 20,882 | | | | 45,101 | |

| Registration and filing fees | | | 14,100 | | | | 20,910 | |

| Legal fees | | | 16,607 | | | | 16,607 | |

| Custody and bank service fees | | | 8,193 | | | | 12,958 | |

| Audit and tax services fees | | | 8,933 | | | | 8,933 | |

| Trustees’ fees and expenses (Note 4) | | | 8,313 | | | | 8,313 | |

| Insurance expense | | | 3,708 | | | | 7,316 | |

| Printing of shareholder reports | | | 2,028 | | | | 2,028 | |

| Postage and supplies | | | 2,100 | | | | 1,938 | |

| Pricing fees | | | 1,538 | | | | 1,549 | |

| Other expenses | | | 2,228 | | | | 2,494 | |

| Total expenses | | | 138,165 | | | | 235,188 | |

| | | | | | | | | |

| NET INVESTMENT INCOME | | | 1,457,769 | | | | 2,822,861 | |

| | | | | | | | | |

| REALIZED AND UNREALIZED GAINS ON INVESTMENTS | | | | | | | | |

| Net realized gains from investment transactions | | | 1,911,208 | | | | 617,880 | |

| Net change in unrealized appreciation (depreciation) on investments | | | 1,988,851 | | | | 1,712,262 | |

| NET REALIZED AND UNREALIZED GAINS ON INVESTMENTS | | | 3,900,059 | | | | 2,330,142 | |

| | | | | | | | | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 5,357,828 | | | $ | 5,153,003 | |

See accompanying notes to financial statements.

| EUBEL BRADY & SUTTMAN INCOME AND APPRECIATION FUND |

| STATEMENTS OF CHANGES IN NET ASSETS |

| | | Six Months | | | | |

| | | Ended | | | | |

| | | January 31, | | | Year Ended | |

| | | 2021 | | | July 31, | |

| | | (Unaudited) | | | 2020 | |

| FROM OPERATIONS | | | | | | | | |

| Net investment income | | $ | 1,457,769 | | | $ | 3,278,120 | |

| Net realized gains from investment transactions | | | 1,911,208 | | | | 101,915 | |

| Net change in unrealized appreciation (depreciation) on investments | | | 1,988,851 | | | | (303,607 | ) |

| Net increase in net assets resulting from operations | | | 5,357,828 | | | | 3,076,428 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS (Note 2) | | | (2,100,041 | ) | | | (3,315,245 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS | | | | | | | | |

| Proceeds from shares sold | | | 5,020,141 | | | | 18,544,836 | |

| Net asset value of shares issued in reinvestment of distributions to shareholders | | | 2,098,900 | | | | 3,313,598 | |

| Payments for shares redeemed | | | (6,410,116 | ) | | | (8,781,072 | ) |

| Net increase in net assets from capital share transactions | | | 708,925 | | | | 13,077,362 | |

| | | | | | | | | |

| TOTAL INCREASE IN NET ASSETS | | | 3,966,712 | | | | 12,838,545 | |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of period | | | 101,634,406 | | | | 88,795,861 | |

| End of period | | $ | 105,601,118 | | | $ | 101,634,406 | |

| | | | | | | | | |

| CAPITAL SHARES ACTIVITY | | | | | | | | |

| Shares sold | | | 503,824 | | | | 1,918,266 | |

| Shares reinvested | | | 210,791 | | | | 343,372 | |

| Shares redeemed | | | (641,744 | ) | | | (905,005 | ) |

| Net increase in shares outstanding | | | 72,871 | | | | 1,356,633 | |

| Shares outstanding at beginning of period | | | 10,408,603 | | | | 9,051,970 | |

| Shares outstanding at end of period | | | 10,481,474 | | | | 10,408,603 | |

See accompanying notes to financial statements.

| EUBEL BRADY & SUTTMAN INCOME FUND |

| STATEMENTS OF CHANGES IN NET ASSETS |

| | | Six Months | | | | |

| | | Ended | | | | |

| | | January 31, | | | Year Ended | |

| | | 2021 | | | July 31, | |

| | | (Unaudited) | | | 2020 | |

| FROM OPERATIONS | | | | | | | | |

| Net investment income | | $ | 2,822,861 | | | $ | 7,004,041 | |

| Net realized gains (losses) from investment transactions | | | 617,880 | | | | (2,507,765 | ) |

| Net change in unrealized appreciation (depreciation) on investments | | | 1,712,262 | | | | 1,334,621 | |

| Net increase in net assets resulting from operations | | | 5,153,003 | | | | 5,830,897 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS (Note 2) | | | (2,834,287 | ) | | | (7,003,977 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS | | | | | | | | |

| Proceeds from shares sold | | | 72,856,450 | | | | 56,707,791 | |

| Net asset value of shares issued in reinvestment of distributions to shareholders | | | 2,830,303 | | | | 6,994,245 | |

| Payments for shares redeemed | | | (17,894,790 | ) | | | (59,749,154 | ) |

| Net increase in net assets from capital share transactions | | | 57,791,963 | | | | 3,952,882 | |

| | | | | | | | | |

| TOTAL INCREASE IN NET ASSETS | | | 60,110,679 | | | | 2,779,802 | |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of period | | | 203,495,491 | | | | 200,715,689 | |

| End of period | | $ | 263,606,170 | | | $ | 203,495,491 | |

| | | | | | | | | |

| CAPITAL SHARES ACTIVITY | | | | | | | | |

| Shares sold | | | 7,343,525 | | | | 5,791,136 | |

| Shares reinvested | | | 285,939 | | | | 715,082 | |

| Shares redeemed | | | (1,806,043 | ) | | | (6,201,262 | ) |

| Net increase in shares outstanding | | | 5,823,421 | | | | 304,956 | |

| Shares outstanding at beginning of period | | | 20,668,972 | | | | 20,364,016 | |

| Shares outstanding at end of period | | | 26,492,393 | | | | 20,668,972 | |

See accompanying notes to financial statements.

| EUBEL BRADY & SUTTMAN INCOME AND APPRECIATION FUND |

| FINANCIAL HIGHLIGHTS |

Per Share Data for a Share Outstanding Throughout Each Period

| | | Six Months | | | | | | | | | | | | | | | | |

| | | Ended | | | | | | | | | | | | | | | | |

| | | January 31, | | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | |

| | | 2021 | | | July 31, | | | July 31, | | | July 31, | | | July 31, | | | July 31, | |

| | | (Unaudited) | | | 2020 | | | 2019 | | | 2018 | | | 2017 | | | 2016 | |

| Net asset value at beginning of period | | $ | 9.76 | | | $ | 9.81 | | | $ | 9.86 | | | $ | 9.97 | | | $ | 9.71 | | | $ | 9.85 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.14 | | | | 0.34 | | | | 0.32 | | | | 0.27 | | | | 0.27 | | | | 0.28 | |

| Net realized and unrealized gains (losses) on investments | | | 0.38 | | | | (0.05 | ) | | | (0.05 | ) | | | (0.11 | ) | | | 0.27 | | | | (0.05 | ) |

| Total from investment operations | | | 0.52 | | | | 0.29 | | | | 0.27 | | | | 0.16 | | | | 0.54 | | | | 0.23 | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.14 | ) | | | (0.34 | ) | | | (0.32 | ) | | | (0.27 | ) | | | (0.28 | ) | | | (0.28 | ) |

| Net realized gains on investments | | | (0.06 | ) | | | — | | | | — | | | | — | | | | — | | | | (0.09 | ) |

| Total distributions | | | (0.20 | ) | | | (0.34 | ) | | | (0.32 | ) | | | (0.27 | ) | | | (0.28 | ) | | | (0.37 | ) |

| Net asset value at end of period .. | | $ | 10.08 | | | $ | 9.76 | | | $ | 9.81 | | | $ | 9.86 | | | $ | 9.97 | | | $ | 9.71 | |

| Total return (a) | | | 5.39 | % (b) | | | 3.04 | % | | | 2.82 | % | | | 1.61 | % | | | 5.65 | % | | | 2.55 | % |

| Net assets at end of period (000’s) | | $ | 105,601 | | | $ | 101,634 | | | $ | 88,796 | | | $ | 88,318 | | | $ | 84,969 | | | $ | 79,253 | |

| Ratios/supplementary data: | | | | | | | | | | | | | | | | | | | | | | | | |

| Ratio of total expenses to average net assets | | | 0.26 | % (c) | | | 0.27 | % | | | 0.27 | % | | | 0.25 | % | | | 0.26 | % | | | 0.25 | % |

| Ratio of net investment income to average net assets | | | 2.78 | % (c) | | | 3.48 | % | | | 3.24 | % | | | 2.71 | % | | | 2.72 | % | | | 2.94 | % |

| Portfolio turnover rate | | | 12 | % (b) | | | 45 | % | | | 16 | % | | | 60 | % | | | 42 | % | | | 33 | % |

| (a) | Total return is a measure of the change in value of an investment in the Fund over the periods covered, which assumes any dividends or capital gains distributions are reinvested in shares of the Fund. The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

See accompanying notes to financial statements.

| EUBEL BRADY & SUTTMAN INCOME FUND |

| FINANCIAL HIGHLIGHTS |

Per Share Data for a Share Outstanding Throughout Each Period

| | | Six Months | | | | | | | | | | | | | | | | |

| | | Ended | | | | | | | | | | | | | | | | |

| | | January 31, | | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | |

| | | 2021 | | | July 31, | | | July 31, | | | July 31, | | | July 31, | | | July 31, | |

| | | (Unaudited) | | | 2020 | | | 2019 | | | 2018 | | | 2017 | | | 2016 | |

| Net asset value at beginning of period | | $ | 9.85 | | | $ | 9.86 | | | $ | 9.82 | | | $ | 10.00 | | | $ | 9.97 | | | $ | 9.89 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.12 | | | | 0.35 | | | | 0.33 | | | | 0.27 | | | | 0.24 | | | | 0.25 | |

| Net realized and unrealized gains (losses) on investments | | | 0.10 | | | | (0.01 | ) | | | 0.04 | | | | (0.19 | ) | | | 0.04 | | | | 0.10 | |

| Total from investment operations | | | 0.22 | | | | 0.34 | | | | 0.37 | | | | 0.08 | | | | 0.28 | | | | 0.35 | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.12 | ) | | | (0.35 | ) | | | (0.33 | ) | | | (0.26 | ) | | | (0.24 | ) | | | (0.25 | ) |

| Net realized gains on investments | | | — | | | | — | | | | — | | | | — | | | | (0.01 | ) | | | (0.02 | ) |

| Total distributions | | | (0.12 | ) | | | (0.35 | ) | | | (0.33 | ) | | | (0.26 | ) | | | (0.25 | ) | | | (0.27 | ) |

| Net asset value at end of period .. | | $ | 9.95 | | | $ | 9.85 | | | $ | 9.86 | | | $ | 9.82 | | | $ | 10.00 | | | $ | 9.97 | |

| Total return (a) | | | 2.28 | % (b) | | | 3.49 | % | | | 3.86 | % | | | 0.86 | % | | | 2.75 | % | | | 3.58 | % |

| Net assets at end of period (000’s) | | $ | 263,606 | | | $ | 203,495 | | | $ | 200,716 | | | $ | 198,903 | | | $ | 185,957 | | | $ | 160,540 | |

| Ratios/supplementary data: | | | | | | | | | | | | | | | | | | | | | | | | |

| Ratio of total expenses to average net assets | | | 0.21 | % (c) | | | 0.21 | % | | | 0.20 | % | | | 0.20 | % | | | 0.20 | % | | | 0.20 | % |

| Ratio of net investment income to average net assets | | | 2.49 | % (c) | | | 3.51 | % | | | 3.37 | % | | | 2.69 | % | | | 2.36 | % | | | 2.54 | % |

| Portfolio turnover rate | | | 13 | % (b) | | | 27 | % | | | 19 | % | | | 65 | % | | | 40 | % | | | 35 | % |

| (a) | Total return is a measure of the change in value of an investment in the Fund over the periods covered, which assumes any dividends or capital gains distributions are reinvested in shares of the Fund. The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

See accompanying notes to financial statements.

| EUBEL BRADY & SUTTMAN MUTUAL FUND |

| TRUST NOTES TO FINANCIAL STATEMENTS |

| January 31, 2021 (Unaudited) |

Eubel Brady & Suttman Income and Appreciation Fund (“EBS Income and Appreciation Fund”) and Eubel Brady & Suttman Income Fund (“EBS Income Fund”) (individually, a “Fund” and collectively, the “Funds”) are each a no-load diversified series of Eubel Brady & Suttman Mutual Fund Trust (the “Trust”), an open-end management investment company organized as an Ohio business trust on April 22, 2014.

The investment objective of EBS Income and Appreciation Fund is to provide total return through a combination of current income and capital appreciation.

The investment objective of EBS Income Fund is to preserve capital, produce income and maximize total return.

| 2. | Significant Accounting Policies |

The Funds follow accounting and reporting guidance under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946, “Financial Services – Investment Companies,” including Accounting Standards Update 2013-08. The following is a summary of significant accounting policies followed by the Funds. These policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”).

Securities Valuation — Securities that are traded on any stock exchange are generally valued at the last quoted sale price. Lacking a last sale price, an exchange traded security is generally valued at its last bid price. Securities traded on NASDAQ are generally valued at the NASDAQ Official Closing Price. Investments representing shares of other open-end investment companies, including money market funds, are valued at their net asset value (“NAV”) as reported by such companies. The Funds typically use an independent pricing service to determine the value of their fixed income securities. The pricing service utilizes electronic data processing techniques based on yield spreads relating to securities with similar characteristics to determine prices for normal institutional-size trading units of fixed income securities without regard to sale or bid prices. Commercial paper may be valued at amortized cost, which under normal circumstances approximates market value.

If Eubel Brady & Suttman Asset Management, Inc. (the “Adviser”), the investment adviser to the Funds, determines that a price provided by the pricing service does not accurately reflect the market value of the securities or, when prices are not readily available from the pricing service, securities are valued at fair value as determined in good faith by the Adviser in conformity with guidelines adopted by and subject to review by the Board of Trustees of the Trust (the “Board”).

| EUBEL BRADY & SUTTMAN MUTUAL FUND TRUST |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

GAAP establishes a single authoritative definition of fair value, sets out a framework for measuring fair value and requires additional disclosures about fair value measurements.

Various inputs are used in determining the value of each Fund’s investments. These inputs are summarized in the three broad levels listed below:

| ● | Level 1 – quoted prices in active markets for identical securities |

| ● | Level 2 – other significant observable inputs |

| ● | Level 3 – significant unobservable inputs |

Certain fixed income securities held by the Funds are classified as Level 2 since the values are typically provided by an independent pricing service that utilizes various “other significant observable inputs” as discussed above. Other fixed income securities (including certain corporate bonds and bank debt) and warrants held by the Funds, are classified as Level 3 since the values for these securities are based on prices derived from one or more significant inputs that are unobservable. The inputs or methodology used are not necessarily an indication of the risks associated with investing in those securities. The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety is based on the lowest level input that is significant to the fair value measurement.

The following is a summary of each Fund’s investments and the inputs used to value the investments as of January 31, 2021 by security type:

| EBS Income and Appreciation Fund: | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Corporate Bonds | | $ | — | | | $ | 52,963,798 | | | $ | 2,425,641 | | | $ | 55,389,439 | |

| Convertible Bonds | | | — | | | | 9,533,292 | | | | — | | | | 9,533,292 | |

| Bank Debt | | | — | | | | 483,234 | | | | 2,193,750 | | | | 2,676,984 | |

| Common Stocks | | | 4,182,061 | | | | — | | | | — | | | | 4,182,061 | |

| Warrants | | | — | | | | — | | | | 10 | | | | 10 | |

| Commercial Paper | | | — | | | | 26,673,581 | | | | — | | | | 26,673,581 | |

| Money Market Funds | | | 6,584,546 | | | | — | | | | — | | | | 6,584,546 | |

| Total | | $ | 10,766,607 | | | $ | 89,653,905 | | | $ | 4,619,401 | | | $ | 105,039,913 | |

| | | | | | | | | | | | | | | | | |

| EUBEL BRADY & SUTTMAN MUTUAL FUND TRUST |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| EBS Income Fund: | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Corporate Bonds | | $ | — | | | $ | 125,565,976 | | | $ | 5,292,308 | | | $ | 130,858,284 | |

| Bank Debt | | | — | | | | — | | | | 3,656,250 | | | | 3,656,250 | |

| Commercial Paper | | | — | | | | 65,496,547 | | | | — | | | | 65,496,547 | |

| Money Market Funds | | | 62,559,959 | | | | — | | | | — | | | | 62,559,959 | |

| Total | | $ | 62,559,959 | | | $ | 191,062,523 | | | $ | 8,948,558 | | | $ | 262,571,040 | |

| | | | | | | | | | | | | | | | | |

The following is a reconciliation of Level 3 investments of the Funds for which significant unobservable inputs were used to determine fair value for the six months ended January 31, 2021:

| EBS Income and Appreciation Fund | |

| | | Value | | | | | | | | | | | | Net change | | | Value | |

| | | as of | | | | | | | | | | | | in unrealized | | | as of | |

| Investments | | July 31, | | | | | | Sales/ | | | Realized | | | appreciation | | | January 31, | |

| in Securities | | 2020 | | | Purchases | | | maturities | | | gain (loss) | | | (depreciation) | | | 2021 | |

| Corporate Bonds | | $ | 2,311,310 | | | $ | 44,782 | | | $ | — | | | $ | — | | | $ | 69,549 | | | $ | 2,425,641 | |

| Bank Debt | | | 833,528 | | | | 2,361,407 | | | | (1,012,717 | ) | | | — | | | | 11,532 | | | | 2,193,750 | |

| Warrants | | | 10 | | | | — | | | | — | | | | — | | | | — | | | | 10 | |

| Total | | $ | 3,144,848 | | | $ | 2,406,189 | | | $ | (1,012,717 | ) | | $ | — | | | $ | 81,081 | | | $ | 4,619,401 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| EBS Income Fund | |

| | | Value | | | | | | | | | | | | Net change | | | Value | |

| | | as of | | | | | | | | | | | | in unrealized | | | as of | |

| Investments | | July 31, | | | | | | Sales/ | | | Realized | | | appreciation | | | January 31, | |

| in Securities | | 2020 | | | Purchases | | | maturities | | | gain (loss) | | | (depreciation) | | | 2021 | |

| Corporate Bonds | | $ | 5,042,859 | | | $ | 97,707 | | | $ | — | | | $ | — | | | $ | 151,742 | | | $ | 5,292,308 | |

| Bank Debt | | | 1,389,214 | | | | 3,935,679 | | | | (1,687,862 | ) | | | — | | | | 19,219 | | | | 3,656,250 | |

| Total | | $ | 6,432,073 | | | $ | 4,033,386 | | | $ | (1,687,862 | ) | | $ | — | | | $ | 170,961 | | | $ | 8,948,558 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

The total change in unrealized appreciation (depreciation) included on the Statements of Operations attributable to Level 3 investments still held at January 31, 2021 is $81,081 and $170,961 for EBS Income and Appreciation Fund and EBS Income Fund, respectively.

| EUBEL BRADY & SUTTMAN MUTUAL FUND TRUST |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

The following table summarizes the valuation techniques used and unobservable inputs developed by the Adviser in conformity with guidelines adopted by and subject to review by the Board to determine the fair value of the Level 3 investments.

| EBS Income and Appreciation Fund |

| | | | | | | | | | | | Weighted |

| | | Fair Value at | | | | | | | | | Average of |

| | | January 31, | | | Valuation | | Unobservable | | Value/ | | Unobservable |

| | | 2021 | | | Technique | | Input1 | | Range | | Inputs |

| Corporate Bonds | | $ | 2,425,641 | | | Management’s Estimate of Future Cash Flows | | Discount Rate2 | | 13.21% | | N/A |

| Bank Debt | | $ | 2,193,750 | | | DCF Model | | Discount Rate2 | | 5.62% | | N/A |

| Warrants | | $ | 10 | | | Management’s Estimate of Future Cash Flows | | N/A | | N/A | | N/A |

| | | | | | | | | | | | | |

| EBS Income Fund |

| | | | | | | | | | | | Weighted |

| | | Fair Value at | | | | | | | | | Average of |

| | | January 31, | | | Valuation | | Unobservable | | Value/ | | Unobservable |

| | | 2021 | | | Technique | | Input1 | | Range | | Inputs |

| Corporate Bonds | | $ | 5,292,308 | | | Management’s Estimate of Future Cash Flows | | Discount Rate2 | | 13.21% | | N/A |

| Bank Debt | | $ | 3,656,250 | | | DCF Model | | Discount Rate2 | | 5.62% | | N/A |

DCF - Discounted Cash Flow

| 1 | Significant increases and decreases in the unobservable inputs used to determine fair value of Level 3 assets could result in significantly higher or lower fair value measurements. An increase to the unobservable input would result in a decrease to the fair value. A decrease to the unobservable input would have the opposite effect. |

| 2 | The Discount Rate used is determined by the Adviser by employing a reference benchmark, adjusted by a credit spread. |

There were no derivative instruments held by the Funds as of or during the six months ended January 31, 2021.

Share Valuation — The NAV per share of each Fund is calculated daily by dividing the total value of its assets, less liabilities, by the number of shares outstanding. The offering price and redemption price per share of each Fund is equal to its NAV per share.

| EUBEL BRADY & SUTTMAN MUTUAL FUND TRUST |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

Estimates — The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

Investment Income, Investment Transactions and Realized Capital Gains and Losses — Dividend income is recorded on the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the security received. Interest income is recorded as earned. Discounts and premiums on fixed income securities are amortized using the effective interest method. Investment transactions are accounted for on trade date. Realized capital gains and losses on investments sold are determined on a specific identification basis.

Expenses — Expenses of the Trust that are directly identifiable to a specific Fund are charged to that Fund. Expenses which are not readily identifiable to a specific Fund are allocated in such a manner as deemed equitable.

Distributions to Shareholders — Distributions to shareholders of net investment income, if any, are paid monthly. Capital gain distributions, if any, are distributed to shareholders annually. Distributions are based on amounts calculated in accordance with applicable federal income tax regulations, which may differ from GAAP. These differences are due primarily to differing treatments of income and realized capital gains on various investment securities held by the Funds, timing differences and differing characterizations of distributions made by the Funds. Dividends and distributions are recorded on the ex-dividend date. The tax character of distributions paid by each Fund during the periods ended January 31, 2021 and July 31, 2020 was ordinary income.

Federal Income Tax — Each Fund has qualified and intends to continue to qualify each year as a “regulated investment company” under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”). Qualification generally will relieve the Funds of liability for federal income taxes to the extent 100% of their net investment income and net realized capital gains are distributed in accordance with the Code.

In order to avoid imposition of the excise tax applicable to regulated investment companies, it is also each Fund’s intention to declare as dividends in each calendar year at least 98% of its net investment income (earned during the calendar year) and 98.2% of its net realized capital gains (earned during the twelve months ended October 31) plus undistributed amounts from prior years.

| EUBEL BRADY & SUTTMAN MUTUAL FUND TRUST |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

The following information is computed on a tax basis for each item as of January 31, 2021:

| | | EBS Income and | | | | |

| | | Appreciation | | | EBS Income | |

| | | Fund | | | Fund | |

| Tax cost of portfolio investments | | $ | 101,535,029 | | | $ | 260,600,153 | |

| Gross unrealized appreciation | | $ | 5,352,037 | | | $ | 2,936,144 | |

| Gross unrealized depreciation | | | (1,847,153 | ) | | | (965,257 | ) |

| Net unrealized appreciation on investments | | | 3,504,884 | | | | 1,970,887 | |

| Capital loss carryforwards | | | (1,428,485 | ) | | | (3,237,036 | ) |

| Other gains | | | 1,300,181 | | | | 616,615 | |

| Accumulated earnings (deficit) | | $ | 3,376,580 | | | $ | (649,534 | ) |

| | | | | | | | | |

The difference between the federal income tax cost of portfolio investments and the Schedule of Investments cost for the Funds is due to certain timing differences in the recognition of capital gains or losses under income tax regulations and GAAP. These “book/tax” differences are temporary in nature and are primarily due to basis adjustments related to each Fund’s holdings in convertible bonds and/or warrants and the differing methods in the authorization of premiums on fixed income securities.

As of July 31, 2020, the Funds had the following capital loss carryforwards (“CLCFs”) for federal income tax purposes:

| | | EBS Income and | | | | |

| | | Appreciation | | | EBS Income | |

| | | Fund | | | Fund | |

| Short-term | | $ | 443,806 | | | $ | 395,444 | |

| Long-term | | | 984,679 | | | | 2,841,592 | |

| | | $ | 1,428,485 | | | $ | 3,237,036 | |

| | | | | | | | | |

These CLCFs, which do not expire, may be utilized in the current and future years to offset net realized capital gains, if any, prior to distributing such gains to shareholders.

The Funds recognize the tax benefits or expenses of uncertain tax positions only when the position is “more likely than not” to be sustained assuming examination by tax authorities. Management has reviewed each Fund’s tax positions for the current and all open tax years (generally, three years) and has concluded that no provision for unrecognized tax benefits or expenses is required in these financial statements. Each Fund identifies its major tax jurisdiction as U.S. Federal.

| EUBEL BRADY & SUTTMAN MUTUAL FUND TRUST |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| 3. | Unfunded Loan Commitment |

At January 31, 2021, unfunded loan commitments for the Funds were as follows:

| | | | | Unfunded | |

| Fund | | Borrower | | Commitment | |

| EBS Income and Appreciation Fund | | NCP SVP Texas, L.P. | | $ | 664,867 | |

| EBS Income Fund | | NCP SVP Texas, L.P. | | $ | 1,108,108 | |

Pursuant to an Asset-Based Lending Credit Agreement between the Funds and NCP SVP Texas, L.P. (the “Borrower”), the Borrower has agreed to pay the Funds a commitment fee equal to 0.25% of the average daily unfunded commitment balance, which is included within interest income on the Statements of Operations.

| 4. | Transactions with Related Parties |

Certain officers of the Trust are also officers of the Adviser, of Ultimus Fund Solutions, LLC (“Ultimus”), the administrative services agent, shareholder servicing and transfer agent, and accounting services agent for the Funds, or of Ultimus Fund Distributors, LLC (the “Distributor”), the principal underwriter and exclusive agent for the distribution of shares of the Funds.

Investment Adviser — Under the terms of the Management Agreement between the Trust and the Adviser, the Adviser manages each Fund’s investments subject to oversight by the Board. The Funds do not pay the Adviser investment advisory fees under the Management Agreement. However, prior to investing in a Fund, a prospective shareholder must enter into an investment advisory agreement with the Adviser that calls for the payment of an advisory fee based upon a percentage of all assets (including shares of the Funds) managed by the Adviser on behalf of the prospective shareholder. The fee schedule may be negotiable at the time the account is opened and is generally based upon the value of assets held in the client’s account and the style of management.

The Adviser has entered into an agreement with the Funds under which it has agreed to reimburse Fund expenses to the extent necessary to limit total annual operating expenses (excluding brokerage costs, taxes, interest, acquired fund fees and expenses, expenses incurred pursuant to the Funds’ Shareholder Servicing Plan and extraordinary expenses) to an amount not exceeding 0.35% of each Fund’s average daily net assets. Any payments by the Adviser of expenses which are a Fund’s obligation are subject to repayment by the Fund for a period of three years following the date on which such expenses were paid, provided that the repayment does not cause the Fund’s total annual operating expenses to exceed the lesser of: (i) the expense limitation in effect at the time such expenses were reimbursed; and (ii) the expense limitation in effect at the time the Adviser seeks reimbursement

| EUBEL BRADY & SUTTMAN MUTUAL FUND TRUST |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

of such expenses. This agreement is currently in effect until December 1, 2021. No expense reimbursements were required during the six months ended January 31, 2021.

Administrator — Ultimus provides administration, fund accounting and transfer agency services to each Fund. The Funds pay Ultimus fees in accordance with the agreements for such services. In addition, the Funds pay out-of-pocket expenses including, but not limited to, postage, supplies and certain costs related to the pricing of the Funds’ portfolio securities.

Compensation of Trustees — Trustees and officers affiliated with the Adviser or Ultimus are not compensated by the Funds for their services. Each Trustee who is not an interested person of the Trust receives from the Funds a fee of $2,625 for attendance at each meeting of the Board, in addition to reimbursement of travel and other expenses incurred in attending the meetings. The Chairman of the Audit and Governance Committee receives an additional annual fee of $1,000, paid quarterly.

| 5. | Securities Transactions |

During the six months ended January 31, 2021, cost of purchases and proceeds from sales and maturities of investment securities, other than short-term investments and U.S. government securities, were as follows:

| | | EBS Income and | | | | |

| | | Appreciation | | | EBS Income | |

| | | Fund | | | Fund | |

| Purchases of investment securities | | $ | 8,838,634 | | | $ | 17,757,691 | |

| Proceeds from sales and maturities of investment securities | | $ | 23,283,823 | | | $ | 27,661,737 | |

| | | | | | | | | |

During the six months ended January 31, 2021, there were no purchases or sales and maturities from U.S. government long-term securities for the Funds.

| 6. | Shareholder Servicing Plan |

The Funds have adopted a Shareholder Servicing Plan (the “Plan”) which allows each Fund to make payments to financial organizations (including payments directly to the Adviser and the Distributor) for providing account administration and account maintenance services to Fund shareholders. The annual fees paid under the Plan may not exceed an amount equal to 0.25% of each Fund’s average daily net assets. During the six months ended January 31, 2021, EBS Income and Appreciation Fund and EBS Income Fund incurred $20,882 and $45,101, respectively, of shareholder servicing fees pursuant to the Plan. No payments were made to the Adviser or the Distributor during the six months ended January 31, 2021.

| EUBEL BRADY & SUTTMAN MUTUAL FUND TRUST |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| 7. | Contingencies and Commitments |

The Funds indemnify the Trust’s officers and Trustees for certain liabilities that might arise from the performance of their duties to the Funds. Additionally, in the normal course of business the Funds enter into contracts that contain a variety of representations and warranties and which provide general indemnifications. The Funds’ maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Funds that have not yet occurred. However, based on experience, the Funds expect the risk of loss to be remote.

The Funds are required to recognize in the financial statements the effects of all subsequent events that provide additional evidence about conditions that existed as of the date of the Statements of Assets and Liabilities. For non-recognized subsequent events that must be disclosed to keep the financial statements from being misleading, the Funds are required to disclose the nature of the event as well as an estimate of its financial effect, or a statement that such an estimate cannot be made. Management has evaluated subsequent events through the issuance of these financial statements and has noted no such events.

| EUBEL BRADY & SUTTMAN MUTUAL FUND TRUST |

| ABOUT YOUR FUNDS’ EXPENSES (Unaudited) |

We believe it is important for you to understand the impact of costs on your investment. All mutual funds have operating expenses. As a shareholder of the Funds, you incur ongoing costs, including shareholder servicing fees and other operating expenses. These ongoing costs, which are deducted from each Fund’s gross income, directly reduce the investment return of the Funds.

A mutual fund’s ongoing costs are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. The examples below are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period (August 1, 2020 through January 31, 2021).

The table below illustrates each Fund’s ongoing costs in two ways:

Actual fund return – This section helps you to estimate the actual expenses that you paid over the period. The “Ending Account Value” shown is based on each Fund’s actual return, and the fourth column shows the dollar amount of operating expenses that would have been paid by an investor who started with $1,000 in each Fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for the Funds under the heading “Expenses Paid During Period.”

Hypothetical 5% return – This section is intended to help you compare the Funds’ ongoing costs with those of other mutual funds. It assumes that each Fund had an annual return of 5% before expenses during the period shown, but that the expense ratio is unchanged. In this case, because the returns used are not the Funds’ actual returns, the results do not apply to your investment. The example is useful in making comparisons because the U.S. Securities and Exchange Commission (the “SEC”) requires all mutual funds to calculate expenses based on a 5% return. You can assess each Fund’s ongoing costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Note that expenses shown in the table are meant to highlight and help you compare ongoing costs only. They will not help you determine the relative total costs of owning different funds. The Funds do not charge transaction fees, such as purchase or redemption fees, nor do they impose any sales loads.

The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

| EUBEL BRADY & SUTTMAN MUTUAL FUND TRUST |

| ABOUT YOUR FUNDS’ EXPENSES (Unaudited) (Continued) |

More information about the Funds’ expenses can be found in this report. For additional information on operating expenses and other shareholder costs, please refer to the Funds’ prospectus.

| | | Beginning | | Ending | | | | Expenses |

| | | Account Value | | Account Value | | Expense | | Paid During |

| | | August 1, 2020 | | January 31, 2021 | | Ratio(a) | | Period(b) |

| EBS Income and Appreciation Fund | | | | | | | | |

| Based on Actual Fund Return | | $1,000.00 | | $1,053.90 | | 0.26% | | $1.35 |

| Based on Hypothetical 5% Fund Return (before expenses) | | $1,000.00 | | $1,023.89 | | 0.26% | | $1.33 |

| EBS Income Fund | | | | | | | | |

| Based on Actual Fund Return | | $1,000.00 | | $1,022.80 | | 0.21% | | $1.07 |

| Based on Hypothetical 5% Fund Return (before expenses) | | $1,000.00 | | $1,024.15 | | 0.21% | | $1.07 |

| (a) | Annualized, based on each Fund’s most recent one-half year expenses. |

| (b) | Expenses are equal to each Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

| EUBEL BRADY & SUTTMAN MUTUAL FUND TRUST |

| LIQUIDITY RISK MANAGEMENT PROGRAM (Unaudited) |

The Funds have adopted and implemented a written liquidity risk management program as required by Rule 22e-4 (the “Liquidity Rule”) under the Investment Company Act of 1940. The program is reasonably designed to assess, manage, and periodically review each Fund’s liquidity risk, taking into consideration, among other factors, the Funds’ investment strategies and the liquidity of their portfolio investments during normal and reasonably foreseeable stressed conditions; their short and long-term cash flow projections; and their cash holdings and access to other funding sources. The Board of Trustees approved the appointment of a Liquidity Risk Management Program Administrator (the “Liquidity Administrator”), which includes representatives from Eubel, Brady & Suttman Asset Management, Inc., the Funds’ investment adviser. The Liquidity Administrator is responsible for the administration of the program and its policies and procedures and for reporting to the Board on at least an annual basis regarding the program’s operation, adequacy and effectiveness, as well as any material changes to the program. The Liquidity Administrator assessed each Fund’s liquidity risk profile and the adequacy and effectiveness of the liquidity risk management program’s operations during the period from June 1, 2019 through May 31, 2020 (the “Review Period”) in order to prepare a written report for the Board of Trustees (the “Report”) for consideration at its meeting held on September 23, 2020. During the Review Period, none of the Funds experienced unusual stress or disruption to its operations from any purchase and redemption activity. Also, during the Review Period the Funds held adequate levels of cash and highly liquid investments to meet shareholder redemption activities in accordance with applicable requirements. The Report concluded that the Funds’ liquidity risk management program is reasonably designed to prevent violations of the Liquidity Rule and has been effectively implemented during the Review Period.

| OTHER INFORMATION (Unaudited) |

The Trust files a complete listing of portfolio holdings for the Funds with the SEC as of the end of the first and third quarters of each fiscal year as an exhibit on Form N-PORT. These filings are available upon request by calling 1-800-391-1223. Furthermore, you may obtain a copy of the filings on the SEC’s website at www.sec.gov.

A description of the policies and procedures that the Funds use to vote proxies relating to portfolio securities is available without charge upon request by calling toll-free 1-800-391-1223, or on the SEC’s website at www.sec.gov. Information regarding how the Funds voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is also available without charge upon request by calling toll-free 1-800-391-1223, or on the SEC’s website at www.sec.gov.

This page intentionally left blank.

This page intentionally left blank.