May 2024 Semi-Annual Letter: Smead International Value Fund

As we close the first half of the 2024 fiscal year for the Smead International Value Fund (the Fund; SVXLX), we feel fortunate to be side-by-side with our investors and pleased with our portfolio's position.

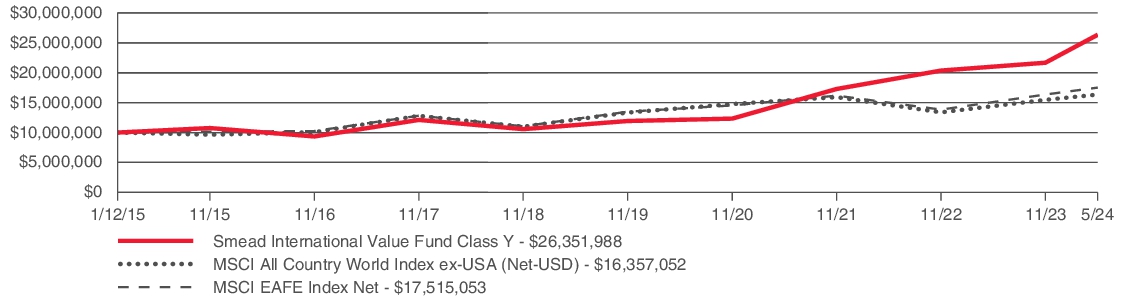

The Fund's Investor Class gained 21.42% during the first half of the fiscal year versus a gain of 12.76% for the MSCI EAFE Net Return Index and a gain of 11.11% for the MSCI ACWI ex-US Net Return Index.

Our largest contributors for the first half were Unicredit (UCG IM), Frontline (FRO NO), and Bawag Group AG (BG AV).

The largest detractors in the portfolio were Interfor (IFP CN), WH Smith (SMWH LN), and Dr Ing Porsche AG (P911 GR).

Lumpy, Rather Than Smooth

Gyrations in Berkshire's earnings don't bother us in the least: Charlie and I would much rather earn a lumpy 15% over time than a smooth 12%. (After all, our earnings swing wildly on a daily and weekly basis - why should we demand that smoothness accompany each orbit that the earth makes of the sun?) We are most comfortable with that thinking, however, when we have shareholder/partners who can also accept volatility, and that's why we regularly repeat our cautions.

- Warren Buffet, Berkshire Hathaway Shareholder Letter 1996

As we look back at the first six months of the 2024 fiscal year for the Smead International Fund, the words of Mr. Buffett ring loudly in our ears and minds. Warren was talking about the returns on capital in his insurance business (super-cat operation) to explain to the Berkshire shareholders how they should face earnings volatility.

This is important for fellow fund shareholders as we watch the price of oil swing around, the price of interest rates swing around, and the economy to and fro day to day. Most investors despise volatility. The investment management industry tries to build products to manage volatility, very unsuccessfully from a historic standpoint. We do not agree with this approach.

As investors in the Fund, we don’t believe we have any ability to predict stock price volatility. In our discipline, we focus on things that you can price and value over time via our eight criteria. Things that are more valuable are the capital structure of the business, the cash generation of the cash flow statement and the consistency of those cash flows.

Consistency can be used reflexively with volatility, but these may be the most paramount issues when analyzing stocks today. To harken back to Buffett’s quote, it looks like most investors would rather have a smooth 12% return on equity (ROE).

A good picture of this is L’Oreal (OR FP). L’Oreal is a very successful cosmetic operator owned partially by Nestle and the Bettencourt family. The people who are very excited about their future like that they produce over 70% gross margins as they believe that is a great indicator of their control of their customers. However, L’Oreal historically produced a mid-teens return on equity that was over 20% in 2023. The return on invested capital (ROIC) has historically been a low-teen percent and has crept up to the mid-teens. Again, it looks like a historically smooth 12% ROIC. At that level, you’d double your capital every six years.