UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number:811-22985

SMEAD FUNDS TRUST

(Exact name of registrant as specified in charter)

1001 Fourth Avenue, Suite 4305

Seattle, WA 98154

(Address of principal executive offices) (Zip code)

Cole W. Smead

Smead Capital Management, Inc.

1001 Fourth Avenue, Suite 4305

Seattle, WA 98154

Copy to:

Pamela M. Krill, Esq

Godfrey & Kahn, S.C.

833 East Michigan Street, Suite 1800

Milwaukee, WI 53202

(Name and address of agent for service)

Registrant’s telephone number, including area code: (877)701-2883

Date of fiscal year end: November 30

Date of reporting period: November 30, 2018

Item 1. Report to Shareholders.

2

Annual Report

November 30, 2018

Investment Adviser

Smead Capital Management, Inc.

1001 4th Avenue

Suite 4305

Seattle, Washington 98154

Phone:877-807-4122

www.smeadfunds.com

Table of Contents

Dear Shareholders:

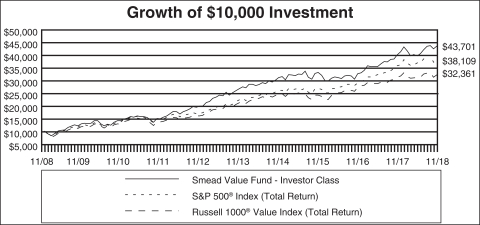

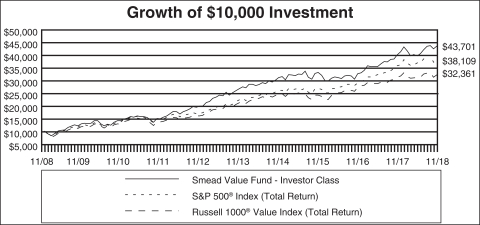

This has been a very trying and rewarding year for the Smead Value Fund (SMVLX). We say ‘trying’ because we had to fight through two 10% stock market corrections and some historically ludicrous and hare-like success for the most popular and large tech darlings (the FAANG stocks1). The Fund earned 0.25% in the fiscal fourth quarter versus-4.40% for the S&P 500 Index and-2.15% for the Russell 1000 Value Index. For the fiscal year 2018, the Fund earned 8.65% versus returns of 6.27% for the S&P 500 and 2.96% for the Russell 1000 Value.

We never doubted what we were doing when the rabbits ran way out in front of us in the last 12 months. We have great confidence in our eight criteria for stock selection and our view that Mr. Market is never anything other than a short-term barometer of enthusiasm. This defends us when the going gets tough. We’ve had 10 full fiscal years as a fund and we feel blessed to report that our returns have beaten both indexes and rewarded our long-time shareholders for trusting that the tortoise can create wealth.

Where should the tortoise look for opportunities today?

The biggest winners this year were Discovery Communications (DISCA), Merck & Co (MRK) and Amgen (AMGN). Discovery benefited from solid and early execution of its Scripps Networks acquisition. This deal was doubted by the market from the outset, giving us a very attractive valuation profile during our early involvement. Merck has developed itself into a formidable immuno-oncology contender with great success from Keytruda. Amgen has had similar success with its cholesterol drug Repatha, which has added fuel to the Amgen cash-flow machine, allowing the Board of Directors to accelerate share buybacks.

Our poorest performers for the year included our two homebuilders, NVR Inc (NVR) and Lennar Corp (LEN), as well as eBay (EBAY). The stock prices of our homebuilders have been severely pressured all year long due to the fevered pitch of new home buying hitting the pause button. Our secular positive thesis for these names is unchanged, and we view this as a price you pay for longer term compounding while the voting-machine of the marketweighs-in. eBay has spent too long trying to get its user experience and interface perfected, and they have paid for it by a slowdown in revenues versus market expectations. At less than 12-times next year’s estimated earnings, we think it offers attractive value for a (still!) high moat business.

As the market did its voting during the fiscal year, we spent a good amount of time sitting on our hands. We brought no new securities into our roster, and only had a single name fully deleted due to our exit out of Alaska Airlines (ALK) in early April 2018.

The easiest way to think about our trims and adds during the year were based on valuation opportunities. Early in the year we trimmed NVR based on valuation which seemed fully subscribed, only to add three times later in the year as enthusiasm on the name was lost. We also picked up more Home Depot (HD), Kroger (KR), Target (TGT), Tegna (TGNA), Walgreens (WBA), Disney (DIS), Comcast (CMCSA) and Amgen (AMGN) on valuation discounts. Shelf-space was made for these purchases by trimming back on

| 1 | FAANG companies include Facebook, Amazon, Apple, Netflix and Google parent Alphabet. |

1

JPMorgan Chase (JPM) and Bank of America (BAC), largely due to weighting restrictions we have in those names. Lastly, PayPal (PYPL) and eBay (EBAY) were trimmed on valuation.

Warmest regards,

| | | | |

| |  | |  |

William Smead Lead Portfolio Manager | | Tony Scherrer, CFA Co-Portfolio Manager | | Cole Smead, CFA Co-Portfolio Manager |

The information contained herein represents the opinion of Smead Capital Management and is not intended to be a forecast of future events, a guarantee of future results, nor investment advice.

The Smead Value Fund’s investment objective, risks, charges and expenses must be considered carefully before investing. The statutory and summary prospectuses contain this and other important information about the Fund, and it may be obtained by calling877-807-4122, or visiting www.smeadfunds.com. Read it carefully before investing.

Past performance is not a guarantee of future results.

The information provided herein represents the opinion of Smead Capital Management, Inc. and is not intended to be a forecast of future events, a guarantee of future results, nor investment advice.

Must be preceded or accompanied by a prospectus.

Mutual fund investing involves risk. Principal loss is possible.

Fund holdings are subject to change at any time and should not be considered recommendations to buy or sell any security. Please refer to the Schedule of Investments in this report for a complete list of Fund holdings as of the date of this report.

The S&P 500® Index is a broad based unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general. Standard & Poor’s®, S&P®, S&P 500® and Standard & Poor’s 500® are trade names or trademarks of Standard & Poor’s Financial Services, LLC. The Russell 1000® Value Index measures the performance of those Russell 1000® companies with lowerprice-to book ratios and lower forecasted growth values. Frank Russell Company is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of Russell Investment Group. You cannot invest directly in an index.

2

SMEAD VALUE FUND

Expense Example

(Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and (2) ongoing costs, including management fees, distribution(12b-1) fees, shareholder servicing fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund, and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period as indicated below.

Actual Expenses

The second line of the following table provides information about actual account values and actual expenses. If you purchase Class A shares and Class S shares of the Fund you will pay a maximum initial sales charge of 5.75% and 5% when you invest. Class A shares and Class S shares are also subject to a contingent deferred sales charge of 1.00% for purchases of $1,000,000 or more that are redeemed within eighteen months of purchase. In addition, you will be assessed fees for outgoing wire transfers, returned checks and stop payment orders at prevailing rates charged byUMB Fund Services, Inc., the Fund’s transfer agent. To the extent the Fund invests in shares of exchange traded funds (“ETFs”) or other investment companies as part of its investment strategy, you will indirectly bear your proportionate share of any fees and expenses charged by the underlying funds in which the Fund invests in addition to the expenses of the Fund. Actual expenses of the underlying funds are expected to vary among the various underlying funds. These expenses are not included in the Example. The Example includes, but is not limited to, advisory fees, fund administration and accounting, custody and transfer agent fees. You may use the information in the first line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The third line of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

3

SMEAD VALUE FUND

Expense Example (Continued)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Beginning

Account

Value

6/1/18 | | Actual

Ending

Account

Value

11/30/18 | | Hypothetical

Ending

Account

Value | | Actual

Expenses

Paid

During

Period(1) | | Hypothetical

Expenses

Paid During

Period(1) | | Net

Expense

Ratio

During

Period(2) |

Investor Class | | | $ | 1,000.00 | | | | $ | 1,098.60 | | | | $ | 1,019.15 | | | | $ | 6.21 | | | | $ | 5.97 | | | | | 1.18 | % |

Class A | | | | 1,000.00 | | | | | 1,098.80 | | | | | 1,019.10 | | | | | 6.26 | | | | | 6.02 | | | | | 1.19 | |

Class I1 | | | | 1,000.00 | | | | | 1,099.70 | | | | | 1,020.16 | | | | | 5.16 | | | | | 4.96 | | | | | 0.98 | |

Class I3(3) | | | | 1,000.00 | | | | | 1,100.30 | | | | | 1,020.61 | | | | | 4.69 | | | | | 4.51 | | �� | | | 0.89 | |

Class R1 | | | | 1,000.00 | | | | | 1,097.00 | | | | | 1,017.60 | | | | | 7.83 | | | | | 7.54 | | | | | 1.49 | |

Class R2 | | | | 1,000.00 | | | | | 1,135.80 | | | | | 1,019.35 | | | | | 6.10 | | | | | 5.77 | | | | | 1.14 | |

Class S(3) | | | | 1,000.00 | | | | | 1,099.00 | | | | | 1,019.40 | | | | | 5.95 | | | | | 5.72 | | | | | 1.13 | |

Class Y | | | | 1,000.00 | | | | | 1,100.40 | | | | | 1,020.86 | | | | | 4.42 | | | | | 4.26 | | | | | 0.84 | |

| (1) | Investor Class, Class A, Class I1, Class I3, Class R1, Class R2, Class S and Class Y expenses are calculated using each Class’ annualized net expense ratio (as disclosed), multiplied by the average account value over the period, and multiplied by 183/365 (to reflect the most recentone-half year period). |

| (3) | Class I3 and Class S shares commenced operations on February 28, 2018. |

4

SMEAD VALUE FUND

Investment Highlights

(Unaudited)

The Fund seekslong-term capital appreciation through concentrated positions. Therefore, the Fund maintains approximately 25-30 companies in its portfolio. The Fund invests in U.S. large capitalization companies through ownership of common stock.

Sector Breakdown

(% of Investments as of November 30, 2018)

Continued

5

SMEAD VALUE FUND

Investment Highlights (Continued)

(Unaudited)

Average Annual Total Returns for the period ended November 30, 2018

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Inception

Date | | 1 Year | | 5 Years | | 10 Years | | Since

Inception |

Smead Value Fund – Investor Class | | | | 1/2/2008 | | | | | 8.65% | | | | | 10.19% | | | | | 15.89% | | | | | 8.59% | |

Smead Value Fund – Class A | | | | 1/27/2014 | | | | | 8.80% | | | | | 10.21% | | | | | N/A | | | | | 10.39% | |

Smead Value Fund – Class I1 | | | | 12/18/2009 | | | | | 8.93% | | | | | 10.49% | | | | | N/A | | | | | 14.54% | |

Smead Value Fund – Class I3 | | | | 2/28/2018 | | | | | 6.02% | | | | | N/A | | | | | N/A | | | | | 6.69% | |

Smead Value Fund – Class R1 | | | | 11/25/2014 | | | | | 8.47% | | | | | 9.95% | | | | | N/A | | | | | 8.56% | |

Smead Value Fund – Class R2 | | | | 11/25/2014 | | | | | 11.88% | | | | | N/A | | | | | N/A | | | | | 9.51% | |

Smead Value Fund – Class S | | | | 2/28/2018 | | | | | 5.83% | | | | | N/A | | | | | N/A | | | | | 6.43% | |

Smead Value Fund – Class Y | | | | 11/25/2014 | | | | | 9.11% | | | | | 10.61% | | | | | N/A | | | | | 9.31% | |

S&P 500® Index (Total Return) | | | | | | | | | 6.27% | | | | | 11.12% | | | | | 14.32% | | | | | 8.25% | |

Russell 1000® Value Index (Total Return) | | | | | | | | | 2.96% | | | | | 8.65% | | | | | 12.46% | | | | | 6.63% | |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling877-807-4122.

Investment performance reflects fee waivers in effect. In the absence of such waivers, total returns would be reduced.

The returns shown assume reinvestment of Fund distributions and do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The following graph illustrates performance of a hypothetical investment made in the Fund and broad-based securities indices on the Fund’s inception date. The graph does not reflect any future performance.

The S&P 500® Index is a broad based unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general.

Standard & Poor’s®, S&P®, S&P 500® and Standard & Poor’s 500® are trade names or trademarks of Standard & Poor’s Financial Services, LLC.

The Russell 1000® Value Index measures the performance of those Russell 1000® Value Index companies with lowerprice-to-book ratios and lower forecasted growth values.

Frank Russell Company is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of Russell Investment Group.

One cannot invest directly in an index.

Continued

6

SMEAD VALUE FUND

Investment Highlights (Continued)

(Unaudited)

Continued

7

SMEAD VALUE FUND

|

| Schedule of Investments |

|

| November 30, 2018 |

| | | | | | | | | | |

| | | Shares | | Value |

COMMON STOCKS 97.83% | | | | | | | | | | |

| | |

Banks 11.91% | | | | | | | | | | |

Bank of America Corp. | | | | 1,826,704 | | | | $ | 51,878,394 | |

JPMorgan Chase & Co. | | | | 502,037 | | | | | 55,821,494 | |

Wells Fargo & Co. | | | | 731,472 | | | | | 39,704,300 | |

| | | | | | | | | | |

| | | | | | | | | 147,404,188 | |

| | | | | | | | | | |

| | |

Consumer Durables & Apparel 8.56% | | | | | | | | | | |

Lennar Corp. – Class A | | | | 915,201 | | | | | 39,106,539 | |

NVR, Inc. (a) | | | | 27,290 | | | | | 66,860,500 | |

| | | | | | | | | | |

| | | | | | | | | 105,967,039 | |

| | | | | | | | | | |

| | |

Consumer Services 0.99% | | | | | | | | | | |

Starbucks Corp. | | | | 183,746 | | | | | 12,259,533 | |

| | | | | | | | | | |

| | |

Diversified Financials 11.90% | | | | | | | | | | |

American Express Co. | | | | 655,717 | | | | | 73,617,348 | |

Berkshire Hathaway, Inc. – Class B (a) | | | | 337,752 | | | | | 73,710,996 | |

| | | | | | | | | | |

| | | | | | | | | 147,328,344 | |

| | | | | | | | | | |

| | |

Food & Staples Retailing 9.04% | | | | | | | | | | |

Kroger Co. | | | | 1,227,491 | | | | | 36,407,383 | |

Walgreens Boots Alliance, Inc. | | | | 891,181 | | | | | 75,456,295 | |

| | | | | | | | | | |

| | | | | | | | | 111,863,678 | |

| | | | | | | | | | |

| | |

Health Care Equipment & Services 1.69% | | | | | | | | | | |

AmerisourceBergen Corp. | | | | 234,592 | | | | | 20,855,229 | |

| | | | | | | | | | |

| | |

Insurance 4.81% | | | | | | | | | | |

Aflac, Inc. | | | | 1,300,496 | | | | | 59,484,687 | |

| | | | | | | | | | |

| | |

Media 16.18% | | | | | | | | | | |

Comcast Corp. – Class A | | | | 976,742 | | | | | 38,102,705 | |

Discovery, Inc. – Class A (a) | | | | 2,792,850 | | | | | 85,796,352 | |

Tegna, Inc. | | | | 2,274,619 | | | | | 30,229,687 | |

Walt Disney Co. | | | | 399,305 | | | | | 46,115,734 | |

| | | | | | | | | | |

| | | | | | | | | 200,244,478 | |

| | | | | | | | | | |

| | |

Pharmaceuticals, Biotechnology & Life Sciences 15.51% | | | | | | | | | | |

Amgen, Inc. | | | | 387,096 | | | | | 80,612,742 | |

Johnson & Johnson | | | | 156,628 | | | | | 23,008,653 | |

Merck & Co., Inc. | | | | 560,356 | | | | | 44,458,645 | |

Pfizer, Inc. | | | | 948,859 | | | | | 43,865,752 | |

| | | | | | | | | | |

| | | | | | | | | 191,945,792 | |

| | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

8

SMEAD VALUE FUND

|

| Schedule of Investments (Continued) |

|

| November 30, 2018 |

| | | | | | | | | | |

| | | Shares | | Value |

| | |

Retailing 10.50% | | | | | | | | | | |

Home Depot, Inc. | | | | 260,322 | | | | $ | 46,941,263 | |

Nordstrom, Inc. | | | | 461,247 | | | | | 24,386,129 | |

Target Corp. | | | | 825,547 | | | | | 58,580,815 | |

| | | | | | | | | | |

| | | | | | | | | 129,908,207 | |

| | | | | | | | | | |

| | |

Software & Services 6.74% | | | | | | | | | | |

Accenture PLC – Class A (b) | | | | 235,671 | | | | | 38,772,593 | |

eBay, Inc. (a) | | | | 932,770 | | | | | 27,843,185 | |

PayPal Holdings, Inc. (a) | | | | 195,882 | | | | | 16,808,634 | |

| | | | | | | | | | |

| | | | | | | | | 83,424,412 | |

| | | | | | | | | | |

TOTAL COMMON STOCKS (Cost $890,193,084) | | | | | | | | | 1,210,685,587 | |

| | | | | | | | | | |

| | |

SHORT-TERM INVESTMENTS 2.40% | | | | | | | | | | |

| | |

Money Market Fund 2.40% | | | | | | | | | | |

State Street Institutional U.S. Government Money Market 0.17% (c) | | | | 29,713,808 | | | | | 29,713,808 | |

| | | | | | | | | | |

TOTAL SHORT-TERM INVESTMENTS (Cost $29,713,808) | | | | | | | | | 29,713,808 | |

| | | | | | | | | | |

TOTAL INVESTMENTS (Cost $919,906,892) 100.23% | | | | | | | | | 1,240,399,395 | |

Liabilities in Excess of Other Assets (0.23%) | | | | | | | | | (2,895,312 | ) |

| | | | | | | | | | |

TOTAL NET ASSETS 100.00% | | | | | | | | $ | 1,237,504,083 | |

| | | | | | | | | | |

| (a) | Non-income producing security. |

| (b) | Foreign issued security. |

| (c) | The rate shown is the1-month performance for the month ended November 30, 2018. |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by Smead Capital Management, Inc.

The accompanying notes are an integral part of these financial statements.

9

SMEAD VALUE FUND

|

| Statement of Assets and Liabilities |

|

| November 30, 2018 |

| | | | | |

Assets | | | | | |

Investments, at value (cost $919,906,892) | | | $ | 1,240,399,395 | |

Receivable for Fund shares sold | | | | 777,125 | |

Dividends and interest receivable | | | | 3,280,969 | |

Due from Adviser | | | | 293 | |

| | | | | |

Total Assets | | | | 1,244,457,782 | |

| | | | | |

| |

Liabilities | | | | | |

Payable for Fund shares redeemed | | | | 299,489 | |

Payable to Adviser | | | | 603,429 | |

Payable to Administrator | | | | 46,528 | |

Payable for investments purchased | | | | 5,775,246 | |

Payable for distribution fees | | | | 52,007 | |

Payable for shareholder servicing fees | | | | 20,937 | |

Accrued expenses and other liabilities | | | | 156,063 | |

| | | | | |

Total Liabilities | | | | 6,953,699 | |

| | | | | |

Net Assets | | | $ | 1,237,504,083 | |

| | | | | |

| |

Net Assets Consist Of: | | | | | |

Paid-in capital | | | $ | 841,380,086 | |

Total distributable earnings (loss) | | | | 396,123,997 | |

| | | | | |

Net Assets | | | $ | 1,237,504,083 | |

| | | | | |

| |

Investor Class Shares | | | | | |

Net assets | | | | 136,278,386 | |

Shares of beneficial interest outstanding (unlimited number of shares authorized, $0.001 par value) | | | | 2,774,072 | |

Net asset value, offering price and redemption price per share | | | $ | 49.13 | |

| | | | | |

| |

Class A Shares | | | | | |

Net assets | | | | 122,653,402 | |

Shares of beneficial interest outstanding (unlimited number of shares authorized, $0.001 par value) | | | | 2,512,473 | |

Net asset value, offering price and redemption price per share(1) | | | $ | 48.82 | |

| | | | | |

Maximum offering price per share (48.82/0.9425)(2) | | | $ | 51.80 | |

| | | | | |

| |

Class I1 Shares | | | | | |

Net assets | | | | 963,977,803 | |

Shares of beneficial interest outstanding (unlimited number of shares authorized, $0.001 par value) | | | | 19,630,984 | |

Net asset value, offering price and redemption price per share | | | $ | 49.10 | |

| | | | | |

The accompanying notes are an integral part of these financial statements.

10

SMEAD VALUE FUND

|

| Statement of Assets and Liabilities (Continued) |

|

| November 30, 2018 |

| | | | | |

Class I3 Shares | | | | | |

Net assets | | | | 3,150 | |

Shares of beneficial interest outstanding (unlimited number of shares authorized, $0.001 par value) | | | | 64 | |

Net asset value, offering price and redemption price per share | | | $ | 49.14 | |

| | | | | |

| |

Class R1 Shares | | | | | |

Net assets | | | | 791,500 | |

Shares of beneficial interest outstanding (unlimited number of shares authorized, $0.001 par value) | | | | 16,386 | |

Net asset value, offering price and redemption price per share | | | $ | 48.30 | |

| | | | | |

| |

Class R2 Shares | | | | | |

Net assets | | | | 9,697 | |

Shares of beneficial interest outstanding (unlimited number of shares authorized, $0.001 par value) | | | | 194 | |

Net asset value, offering price and redemption price per share | | | $ | 50.01 | |

| | | | | |

| |

Class S Shares | | | | | |

Net assets | | | | 3,144 | |

Shares of beneficial interest outstanding (unlimited number of shares authorized, $0.001 par value) | | | | 64 | |

Net asset value, offering price and redemption price per share | | | $ | 48.83 | |

| | | | | |

Maximum offering price per share (48.83/0.95)(3) | | | $ | 51.40 | |

| | | | | |

| |

Class Y Shares | | | | | |

Net assets | | | | 13,787,001 | |

Shares of beneficial interest outstanding (unlimited number of shares authorized, $0.001 par value) | | | | 280,273 | |

Net asset value, offering price and redemption price per share | | | $ | 49.19 | |

| | | | | |

| (1) | A contingent deferred sales charge (“CDSC”) of 1.00% may be charged on shares redeemed within eighteen months of purchase. Redemption price per share is equal to net asset value less any redemption or CDSC fees. |

| (2) | Reflects a maximum sales charge of 5.75%. |

| (3) | Reflects a maximum sales charge of 5%. |

The accompanying notes are an integral part of these financial statements.

11

SMEAD VALUE FUND

|

| Statement of Operations |

|

| November 30, 2018 |

| | | | | |

Investment Income | | | | | |

Dividend income | | | $ | 20,243,178 | |

Interest income | | | | 606,146 | |

| | | | | |

Total Investment Income | | | | 20,849,324 | |

| | | | | |

| |

Expenses | | | | | |

Management fees | | | | 9,286,144 | |

Distribution fees – Investor Class | | | | 355,811 | |

Distribution fees – Class A | | | | 371,643 | |

Distribution fees – Class I3 | | | | 3 | |

Distribution fees – Class R1 | | | | 5,221 | |

Distribution fees – Class R2 | | | | 1,463 | |

Distribution fees – Class S | | | | 8 | |

Shareholder servicing fees – Investor Class | | | | 188,264 | |

Shareholder servicing fees – Class A | | | | 126,350 | |

Shareholder servicing fees – Class I1 | | | | 1,057,507 | |

Shareholder servicing fees – Class R1 | | | | 1,577 | |

Shareholder servicing fees – Class R2 | | | | 193 | |

Administration fees | | | | 241,677 | |

Transfer agent fees and expenses | | | | 320,950 | |

Fund accounting fees | | | | 210,723 | |

Federal and state registration fees | | | | 120,440 | |

Custody fees | | | | 63,218 | |

Reports to shareholders | | | | 70,184 | |

Legal fees | | | | 107,841 | |

Audit and tax fees | | | | 18,000 | |

Trustees’ fees | | | | 130,000 | |

Recoupment of previously reimbursed expenses (Note 3) | | | | 168,981 | |

Other expenses | | | | 33,621 | |

| | | | | |

Total Expenses | | | | 12,879,819 | |

Expense Waiver by Adviser (Note 3) | | | | (2,235 | ) |

| | | | | |

Net Expenses | | | | 12,877,584 | |

| | | | | |

| |

Net Investment Income | | | | 7,971,740 | |

| | | | | |

| |

Realized and Unrealized Gain on Investments | | | | | |

Net realized gain from investments | | | | 79,980,515 | |

Change in net unrealized appreciation on investments | | | | 18,121,698 | |

| | | | | |

Net Realized and Unrealized Gain on Investments | | | | 98,102,213 | |

| | | | | |

Net Increase in Net Assets from Operations | | | $ | 106,073,953 | |

| | | | | |

The accompanying notes are an integral part of these financial statements.

12

SMEAD VALUE FUND

|

| Statements of Changes in Net Assets |

|

| |

| | | | | | | | | | |

| | | Year Ended

November 30, 2018 | | Year Ended

November 30, 2017 |

From Operations | | | | | | |

Net investment income | | | $ | 7,971,740 | | | | $ | 6,865,876 | |

Net realized gain from investments | | | | 79,980,515 | | | | | 59,621,177 | |

Change in net unrealized appreciation

on investments | | | | 18,121,698 | | | | | 172,496,173 | |

| | | | | | | | | | |

Net increase in net assets from operations | | | | 106,073,953 | | | | | 238,983,226 | |

| | | | | | | | | | |

| | |

From Distributions | | | | | | | | | | |

Investor Class | | | | (6,844,729 | ) | | | | (6,582,119 | )* |

Class A | | | | (7,098,232 | ) | | | | (4,861,906 | )* |

Class I1 | | | | (43,681,051 | ) | | | | (25,534,529 | )* |

Class R1 | | | | (77,076 | ) | | | | (46,361 | )* |

Class R2 | | | | (55,652 | ) | | | | (55,290 | )* |

Class Y | | | | (636,744 | ) | | | | (394,731 | )* |

| | | | | | | | | | |

Net decrease in net assets resulting from

distributions paid | | | | (58,393,484 | ) | | | | (37,474,936 | ) |

| | | | | | | | | | |

| | |

From Capital Share Transactions | | | | | | | | | | |

Proceeds from shares sold | | | | 242,573,761 | | | | | 251,088,199 | |

Issued in reinvestment of dividends

and distributions | | | | 27,708,127 | | | | | 19,235,046 | |

Payments for shares redeemed | | | | (313,572,364 | ) | | | | (359,051,139 | ) |

| | | | | | | | | | |

Net decrease in net assets from

capital share transactions | | | | (43,290,476 | ) | | | | (88,727,894 | ) |

| | | | | | | | | | |

Total Increase in Net Assets | | | | 4,389,993 | | | | | 112,780,396 | |

| | |

Net Assets | | | | | | | | | | |

Beginning of year | | | | 1,233,114,090 | | | | | 1,120,333,694 | |

| | | | | | | | | | |

End of year | | | $ | 1,237,504,083 | | | | $ | 1,233,114,090 | † |

| | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

13

SMEAD VALUE FUND

|

| Statements of Changes in Net Assets (Continued) |

The following information was previously reported in the November 30, 2017 financial statements. The distribution information for the year ended November 30, 2017 presented on the Statements of Changes in Net Assets is presented for comparative purposes to the November 30, 2017 financial statements, which conform to the SEC Final Rule on Disclosure Update and Simplification which was effective November 5, 2018.

| * | Dividends and Distributions to Shareholders for the year ended November 30, 2017 were as follows: |

| | | | | |

Investor Class: | | | | | |

Net investment income | | | $ | (1,039,276 | ) |

Net realized gain on investments | | | $ | (5,542,843 | ) |

Class A: | | | | | |

Net investment income | | | $ | (982,379 | ) |

Net realized gain on investments | | | $ | (3,879,527 | ) |

Class I1: | | | | | |

Net investment income | | | $ | (6,529,290 | ) |

Net realized gain on investments | | | $ | (19,005,239 | ) |

Class R1: | | | | | |

Net investment income | | | $ | (8,770 | ) |

Net realized gain on investments | | | $ | (37,591 | ) |

Class R2: | | | | | |

Net investment income | | | $ | (8,557 | ) |

Net realized gain on investments | | | $ | (46,733 | ) |

Class Y: | | | | | |

Net investment income | | | $ | (111,841 | ) |

Net realized gain on investments | | | $ | (282,890 | ) |

| † | Accumulated undistributed net investment income for year ended November 30, 2017 was 6,538,739 |

The accompanying notes are an integral part of these financial statements.

14

(This Page Intentionally Left Blank.)

15

SMEAD VALUE FUND

| | | | |

| Financial Highlights |

|

| November 30, 2018 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | |

Income from investment operations | | Less distributions paid |

| | | Net Asset

Value,

Beginning

of Period | | Net

investment

income | | Net realized

and

unrealized

gain/(loss) on

investments | | Total from

investment

operations | | Distributions

from net

investment

income | | Distributions

from net

realized gain

on

investments | | Total

distributions

paid |

Investor Class | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

November 30, 2018 | | | $ | 47.29 | | | | $ | 0.19 | (4) | | | $ | 3.75 | | | | $ | 3.94 | | | | $ | (0.10 | ) | | | $ | (2.00 | ) | | | $ | (2.10 | ) |

November 30, 2017 | | | | 39.79 | | | | | 0.15 | (4) | | | | 8.57 | | | | | 8.72 | | | | | (0.19 | ) | | | | (1.03 | ) | | | | (1.22 | ) |

November 30, 2016 | | | | 41.57 | | | | | 0.23 | (4) | | | | (0.81 | ) | | | | (0.58 | ) | | | | (0.20 | ) | | | | (1.00 | ) | | | | (1.20 | ) |

November 30, 2015 | | | | 40.98 | | | | | 0.27 | (4) | | | | 2.11 | | | | | 2.38 | | | | | (0.16 | ) | | | | (1.63 | ) | | | | (1.79 | ) |

November 30, 2014 | | | | 36.35 | | | | | 0.18 | (4) | | | | 5.62 | | | | | 5.80 | | | | | (0.12 | ) | | | | (1.05 | ) | | | | (1.17 | ) |

| | | | | | | |

Class A | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

November 30, 2018 | | | | 47.03 | | | | | 0.22 | (4) | | | | 3.72 | | | | | 3.94 | | | | | (0.15 | ) | | | | (2.00 | ) | | | | (2.15 | ) |

November 30, 2017 | | | | 39.62 | | | | | 0.20 | (4) | | | | 8.50 | | | | | 8.70 | | | | | (0.26 | ) | | | | (1.03 | ) | | | | (1.29 | ) |

November 30, 2016 | | | | 41.47 | | | | | 0.24 | (4) | | | | (0.79 | ) | | | | (0.55 | ) | | | | (0.30 | ) | | | | (1.00 | ) | | | | (1.30 | ) |

November 30, 2015 | | | | 40.95 | | | | | 0.30 | (4) | | | | 2.07 | | | | | 2.37 | | | | | (0.22 | ) | | | | (1.63 | ) | | | | (1.85 | ) |

November 30, 2014(7) | | | | 35.45 | | | | | 0.07 | (4) | | | | 5.43 | | | | | 5.50 | | | | | — | | | | | — | | | | | — | |

| | | | | | | |

Class I1 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

November 30, 2018 | | | | 47.33 | | | | | 0.33 | (4) | | | | 3.72 | | | | | 4.05 | | | | | (0.28 | ) | | | | (2.00 | ) | | | | (2.28 | ) |

November 30, 2017 | | | | 39.87 | | | | | 0.28 | (4) | | | | 8.56 | | | | | 8.84 | | | | | (0.35 | ) | | | | (1.03 | ) | | | | (1.38 | ) |

November 30, 2016 | | | | 41.66 | | | | | 0.33 | (4) | | | | (0.79 | ) | | | | (0.46 | ) | | | | (0.33 | ) | | | | (1.00 | ) | | | | (1.33 | ) |

November 30, 2015 | | | | 41.07 | | | | | 0.39 | (4) | | | | 2.09 | | | | | 2.48 | | | | | (0.26 | ) | | | | (1.63 | ) | | | | (1.89 | ) |

November 30, 2014 | | | | 36.40 | | | | | 0.27 | (4) | | | | 5.63 | | | | | 5.90 | | | | | (0.18 | ) | | | | (1.05 | ) | | | | (1.23 | ) |

| | | | | | | |

Class I3 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

November 30, 2018(10) | | | | 46.35 | | | | | 0.31 | (4) | | | | 2.48 | | | | | 2.79 | | | | | — | | | | | — | | | | | — | |

| | | | | | | |

Class R1 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

November 30, 2018 | | | | 46.57 | | | | | 0.06 | (4) | | | | 3.69 | | | | | 3.75 | | | | | (0.02 | ) | | | | (2.00 | ) | | | | (2.02 | ) |

November 30, 2017 | | | | 39.33 | | | | | 0.06 | (4) | | | | 8.45 | | | | | 8.51 | | | | | (0.24 | ) | | | | (1.03 | ) | | | | (1.27 | ) |

November 30, 2016 | | | | 41.31 | | | | | 0.12 | (4) | | | | (0.81 | ) | | | | (0.69 | ) | | | | (0.29 | ) | | | | (1.00 | ) | | | | (1.29 | ) |

November 30, 2015 | | | | 40.95 | | | | | 0.35 | (4) | | | | 1.89 | | | | | 2.24 | | | | | (0.25 | ) | | | | (1.63 | ) | | | | (1.88 | ) |

November 30, 2014(8) | | | | 40.63 | | | | | 0.00 | (4)(9) | | | | 0.32 | | | | | 0.32 | | | | | — | | | | | — | | | | | — | |

| | | | | | | |

Class R2 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

November 30, 2018 | | | | 46.73 | | | | | (0.16 | )(4) | | | | 5.49 | | | | | 5.33 | | | | | (0.05 | ) | | | | (2.00 | ) | | | | (2.05 | ) |

November 30, 2017 | | | | 39.40 | | | | | 0.08 | (4) | | | | 8.47 | | | | | 8.55 | | | | | (0.19 | ) | | | | (1.03 | ) | | | | (1.22 | ) |

November 30, 2016 | | | | 41.36 | | | | | 0.16 | (4) | | | | (0.80 | ) | | | | (0.64 | ) | | | | (0.32 | ) | | | | (1.00 | ) | | | | (1.32 | ) |

November 30, 2015 | | | | 40.95 | | | | | 0.17 | (4) | | | | 2.13 | | | | | 2.30 | | | | | (0.26 | ) | | | | (1.63 | ) | | | | (1.89 | ) |

November 30, 2014(8) | | | | 40.63 | | | | | 0.00 | (4)(9) | | | | 0.32 | | | | | 0.32 | | | | | — | | | | | — | | | | | — | |

| | | | | | | |

Class S | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

November 30, 2018(10) | | | | 46.14 | | | | | 0.23 | (4) | | | | 2.46 | | | | | 2.69 | | | | | — | | | | | — | | | | | — | |

| | | | | | | |

Class Y | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

November 30, 2018 | | | | 47.40 | | | | | 0.40 | (4) | | | | 3.73 | | | | | 4.13 | | | | | (0.34 | ) | | | | (2.00 | ) | | | | (2.34 | ) |

November 30, 2017 | | | | 39.92 | | | | | 0.35 | (4) | | | | 8.57 | | | | | 8.92 | | | | | (0.41 | ) | | | | (1.03 | ) | | | | (1.44 | ) |

November 30, 2016 | | | | 41.70 | | | | | 0.37 | (4) | | | | (0.78 | ) | | | | (0.41 | ) | | | | (0.37 | ) | | | | (1.00 | ) | | | | (1.37 | ) |

November 30, 2015 | | | | 41.06 | | | | | 0.42 | (4) | | | | 2.13 | | | | | 2.55 | | | | | (0.28 | ) | | | | (1.63 | ) | | | | (1.91 | ) |

November 30, 2014(8) | | | | 40.74 | | | | | 0.01 | (4) | | | | 0.31 | | | | | 0.32 | | | | | — | | | | | — | | | | | — | |

The accompanying notes are an integral part of these financial statements.

16

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | Ratio of expenses

to average net assets | | Ratio of net investment income

(loss) to average net assets | | |

Net Asset

Value,

End of

Period | | Total

Return(1)(2) | |

Net assets

at end of

period

(000’s) | | Before

waivers and

recoupment

of expenses(3) | | After

waivers and

recoupment

of expenses(3) | | Before

waivers and

recoupment

of expenses(3) | | After

waivers and

recoupments

of expenses(3) | | Portfolio

turnover

rate(2) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | $49.13 | | | | | 8.65 | % | | | $ | 136,278 | | | | | 1.24 | % | | | | 1.26 | % | | | | 0.43 | % | | | | 0.41 | % | | | | 10.98 | % |

| | | 47.29 | | | | | 22.51 | % | | | | 155,602 | | | | | 1.25 | % | | | | 1.23 | %(5) | | | | 0.34 | % | | | | 0.36 | %(6) | | | | 20.04 | % |

| | | 39.79 | | | | | (1.34 | )% | | | | 216,244 | | | | | 1.26 | % | | | | 1.26 | % | | | | 0.60 | % | | | | 0.60 | % | | | | 23.67 | % |

| | | 41.57 | | | | | 6.25 | % | | | | 385,928 | | | | | 1.34 | % | | | | 1.26 | % | | | | 0.61 | % | | | | 0.67 | % | | | | 20.26 | % |

| | | 40.98 | | | | | 16.45 | % | | | | 366,067 | | | | | 1.26 | % | | | | 1.25 | % | | | | 0.46 | % | | | | 0.47 | % | | | | 12.70 | % |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 48.82 | | | | | 8.80 | % | | | | 122,653 | | | | | 1.19 | % | | | | 1.19 | % | | | | 0.47 | % | | | | 0.47 | % | | | | 10.98 | % |

| | | 47.03 | | | | | 22.51 | % | | | | 163,989 | | | | | 1.18 | % | | | | 1.16 | %(5) | | | | 0.45 | % | | | | 0.46 | %(6) | | | | 20.04 | % |

| | | 39.62 | | | | | (1.28 | )% | | | | 152,921 | | | | | 1.22 | % | | | | 1.22 | % | | | | 0.64 | % | | | | 0.64 | % | | | | 23.67 | % |

| | | 41.47 | | | | | 6.23 | % | | | | 148,500 | | | | | 1.30 | % | | | | 1.26 | % | | | | 0.74 | % | | | | 0.76 | % | | | | 20.26 | % |

| | | 40.95 | | | | | 15.51 | % | | | | 27,378 | | | | | 1.45 | % | | | | 1.44 | % | | | | 0.20 | % | | | | 0.21 | % | | | | 12.70 | % |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 49.10 | | | | | 8.93 | % | | | | 963,978 | | | | | 0.97 | % | | | | 0.98 | % | | | | 0.72 | % | | | | 0.70 | % | | | | 10.98 | % |

| | | 47.33 | | | | | 22.86 | % | | | | 897,547 | | | | | 0.98 | % | | | | 0.96 | %(5) | | | | 0.65 | % | | | | 0.67 | %(6) | | | | 20.04 | % |

| | | 39.87 | | | | | (1.05 | )% | | | | 736,903 | | | | | 1.00 | % | | | | 0.99 | % | | | | 0.86 | % | | | | 0.87 | % | | | | 23.67 | % |

| | | 41.66 | | | | | 6.51 | % | | | | 781,146 | | | | | 1.07 | % | | | | 0.99 | % | | | | 0.90 | % | | | | 0.96 | % | | | | 20.26 | % |

| | | 41.07 | | | | | 16.75 | % | | | | 544,490 | | | | | 1.01 | % | | | | 1.00 | % | | | | 0.71 | % | | | | 0.72 | % | | | | 12.70 | % |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 49.14 | | | | | 6.02 | % | | | | 3 | | | | | 0.89 | % | | | | 0.89 | % | | | | 0.88 | % | | | | 0.88 | % | | | | 10.98 | % |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 48.30 | | | | | 8.47 | % | | | | 792 | | | | | 1.50 | % | | | | 1.50 | % | | | | 0.12 | % | | | | 0.12 | % | | | | 10.98 | % |

| | | 46.57 | | | | | 22.14 | % | | | | 1,779 | | | | | 1.49 | % | | | | 1.48 | %(5) | | | | 0.13 | % | | | | 0.15 | %(6) | | | | 20.04 | % |

| | | 39.33 | | | | | (1.62 | )% | | | | 1,447 | | | | | 1.54 | % | | | | 1.54 | % | | | | 0.33 | % | | | | 0.33 | % | | | | 23.67 | % |

| | | 41.31 | | | | | 5.91 | % | | | | 553 | | | | | 1.64 | % | | | | 1.59 | % | | | | 0.85 | % | | | | 0.88 | % | | | | 20.26 | % |

| | | 40.95 | | | | | 0.79 | % | | | | 5 | | | | | 1.57 | % | | | | 1.57 | % | | | | 0.23 | % | | | | 0.23 | % | | | | 12.70 | % |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 50.01 | | | | | 11.88 | % | | | | 10 | | | | | 1.44 | % | | | | 1.49 | % | | | | (0.28 | )% | | | | (0.33 | )% | | | | 10.98 | % |

| | | 46.73 | | | | | 22.28 | % | | | | 1,263 | | | | | 1.43 | % | | | | 1.41 | %(5) | | | | 0.18 | % | | | | 0.20 | %(6) | | | | 20.04 | % |

| | | 39.40 | | | | | (1.51 | )% | | | | 1,841 | | | | | 1.49 | % | | | | 1.44 | % | | | | 0.37 | % | | | | 0.42 | % | | | | 23.67 | % |

| | | 41.36 | | | | | 6.07 | % | | | | 1,579 | | | | | 1.55 | % | | | | 1.44 | % | | | | 0.35 | % | | | | 0.44 | % | | | | 20.26 | % |

| | | 40.95 | | | | | 0.79 | % | | | | 5 | | | | | 1.62 | % | | | | 1.44 | % | | | | 0.18 | % | | | | 0.36 | % | | | | 12.70 | % |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 48.83 | | | | | 5.83 | % | | | | 3 | | | | | 1.14 | % | | | | 1.14 | % | | | | 0.64 | % | | | | 0.64 | % | | | | 10.98 | % |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 49.19 | | | | | 9.11 | % | | | | 13,787 | | | | | 0.86 | % | | | | 0.84 | % | | | | 0.84 | % | | | | 0.86 | % | | | | 10.98 | % |

| | | 47.40 | | | | | 23.04 | % | | | | 12,934 | | | | | 0.83 | % | | | | 0.81 | %(5) | | | | 0.80 | % | | | | 0.82 | %(6) | | | | 20.04 | % |

| | | 39.92 | | | | | (0.93 | )% | | | | 10,978 | | | | | 0.88 | % | | | | 0.84 | % | | | | 0.93 | % | | | | 0.97 | % | | | | 23.67 | % |

| | | 41.70 | | | | | 6.69 | % | | | | 1,192 | | | | | 0.95 | % | | | | 0.84 | % | | | | 0.94 | % | | | | 1.04 | % | | | | 20.26 | % |

| | | 41.06 | | | | | 0.79 | % | | | | 5 | | | | | 0.85 | % | | | | 0.82 | % | | | | 0.95 | % | | | | 0.98 | % | | | | 12.70 | % |

17

SMEAD VALUE FUND

| | | | |

| Financial Highlights (Continued) |

|

| November 30, 2018 |

| (1) | Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends. |

| (2) | Not annualized for periods of less than one year. |

| (3) | Annualized for periods of less than one year. |

| (4) | Based on average shares outstanding. |

| (5) | Includes anon-recurring reimbursement from service provider. Excluding thisnon-recurring reimbursement, the Ratio of expenses to average net assets after waivers and recoupment of expenses would have been 1.25%, 1.18%, 0.98%, 1.49%, 1.43% and 0.83%, respectively. |

| (6) | Includes anon-recurring reimbursement from service provider. Excluding thisnon-recurring reimbursement, the Ratio of net investment income to average net assets after waivers and recoupment of expenses would have been 0.34%, 0.45%, 0.65%, 0.13%, 0.18% and 0.80%, respectively. |

| (7) | Class A shares commenced operations on January 27, 2014. |

| (8) | Class R1 shares, Class R2 shares and Class Y shares commenced operations on November 25, 2014. |

| (9) | Amount is less than $0.005. |

| (10) | Class I3 shares and Class S shares commenced operations on February 28, 2018. |

The accompanying notes are an integral part of these financial statements.

18

SMEAD VALUE FUND

Notes to Financial Statements

November 30, 2018

The Smead Value Fund (the “Fund”) is anon-diversified series of Smead Funds Trust, a Delaware statutory trust (the “Trust”) organized on July 17, 2014. Pursuant to a reorganization that took place on November 21, 2014, the Fund is the successor to the Smead Value Fund, a series of Trust for Professional Managers (the “Predecessor Fund”). As a result of the reorganization, the Fund assumed the performance and accounting history of the Predecessor Fund prior to the date of the reorganization. The Trust is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as anopen-end management investment company. The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standard Codification Topic 946 Financial Services-Investment Companies. The Fund’s investment objective is long-term capital appreciation. The Trust may issue an unlimited number of interests (or shares) of beneficial interest, each with a par value of $0.001. The Fund currently offers eight classes of shares: Investor Class, Class A, Class I1, Class I3, Class R1, Class R2, Class S and Class Y shares. Class C, Class I2, Class R3 and Class R4 shares are not yet in operation. Each class of shares of the Fund has identical rights and privileges except with respect to the distribution and shareholder servicing fees, and voting rights on matters affecting a single class of shares. The classes differ principally in their respective distribution and shareholder servicing expenses. Costs incurred by the Fund in connection with the organization, registration and the initial public offering of shares were paid by Smead Capital Management, Inc. (the “Adviser”).

| (2) | Significant Accounting Policies |

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of the financial statements. These policies are in conformity with generally accepted accounting principles in the United States of America (“GAAP”).

Each security owned by the Fund that is listed on a securities exchange is valued at its last sale price on that exchange on the date as of which assets are valued. When the security is listed on more than one exchange, the Fund will use the price of the exchange that the Fund generally considers to be the principal exchange on which the security is traded.

Fund securities listed on The NASDAQ Stock Market, Inc. (“NASDAQ”) will be valued at the NASDAQ Official Closing Price (“NOCP”), which may not necessarily represent the last sale price. If the NOCP is not available, such securities shall be valued at the last sale price on the day of valuation. If there has been no sale on such exchange or on NASDAQ on such day, the security is valued at the mean between the most recent bid and asked prices on such day.Over-the-counter securities that are not traded on NASDAQ shall be valued at the most recent trade price.

Debt securities other than short-term instruments are valued at the mean between the closing bid and asked prices provided by a pricing service (“Pricing Service”). If the

19

SMEAD VALUE FUND

Notes to Financial Statements (Continued)

November 30, 2018

closing bid and ask prices are not readily available, the Pricing Service may provide a price determined by a matrix pricing method or other analytical pricing models. Short-term debt securities, such as commercial paper, bankers acceptances and U.S. Treasury Bills having a maturity of less than 60 days, are valued at amortized cost which approximates fair value. If a short-term debt security has a maturity of greater than 60 days, it is valued at market price.

Redeemable securities issued byopen-end, registered investment companies, including money market funds, are valued at the net asset value (“NAV”) of such companies for purchase and/or redemption orders placed on that day.

When market quotations are not readily available, any security or other asset is valued at its fair value as determined under fair value pricing procedures approved by the Trust’s Board of Trustees (the “Board of Trustees”). These fair value pricing procedures will also be used to price a security when corporate events, events in the securities market and/or world events cause the Adviser to believe that a security’s last sale price may not reflect its actual fair market value. The intended effect of using fair value pricing procedures is to ensure that the Fund is accurately priced.

The Fund’s Valuation Procedures include fair valuation accounting standards that establish an authoritative definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs used to develop the measurements of fair value. These inputs are summarized in the three broad levels listed below:

| | Level 1— | unadjusted quoted prices in active markets for identical securities. |

| | Level 2— | other significant observable inputs (including unadjusted quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.). |

| | Level 3— | significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments). |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The following table summarizes the valuations inputs of the Fund’s investments by each fair value hierarchy level as of November 30, 2018:

| | | | | | | | | | | | | | | | | | | | |

| | | Level 1 | | Level 2 | | Level 3 | | Total |

Equity | | | | | | | | | | | | | | | | | | | | |

Common Stocks(1) | | | $ | 1,210,685,587 | | | | $ | — | | | | $ | — | | | | $ | 1,210,685,587 | |

| | | | | | | | | | | | | | | | | | | | |

Total Equity | | | | 1,210,685,587 | | | | | — | | | | | — | | | | | 1,210,685,587 | |

Short-Term Investments | | | | — | | | | | 29,713,808 | | | | | — | | | | | 29,713,808 | |

| | | | | | | | | | | | | | | | | | | | |

Total Investments

in Securities | | | $ | 1,210,685,587 | | | | $ | 29,713,808 | | | | $ | — | | | | $ | 1,240,399,395 | |

| | | | | | | | | | | | | | | | | | | | |

| | (1) | See the Schedule of Investments for industry classification. |

No Level 3 securities were held in the Fund at November 30, 2018. For the year ended November 30, 2018, there were no transfers between levels for the Fund. It is the

20

SMEAD VALUE FUND

Notes to Financial Statements (Continued)

November 30, 2018

Fund’s policy to record transfers between levels as of the end of the reporting period. The Fund did not hold financial derivative instruments during the reporting period.

The NAV per share of the Fund is calculated by dividing the sum of the value of the securities held by the Fund, plus cash or other assets, minus all liabilities (including estimated accrued expenses) by the total number of shares outstanding for the Fund, rounded to the nearest cent. The Fund’s shares will not be priced on the days on which the New York Stock Exchange is closed for trading.

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

| | (d) | Allocation of Income, Expenses and Gains/Losses |

Income, expenses (other than those deemed attributable to a specific share class – distribution and shareholder servicing fees), and gains and losses of the Fund are allocated daily to each class of shares based upon the ratio of net assets represented by each class as a percentage of the net assets of the Fund. Expenses deemed directly attributable to a class of shares are recorded by the specific class. Most Fund expenses are allocated by class based on relative net assets. Rule 12b-1 fees are expensed at 0.16% of the average daily net assets of Class I3 shares, 0.25% of average daily net assets of the Investor Class and Class A shares, 0.41% of the average daily net assets of Class S shares and 0.50% of the average daily net assets of the Class R1 and Class R2 shares. Shareholder servicing fees are authorized up to 0.25% of the average daily net assets attributable to each respective share class. The Fund implemented 0.14% for the Investor Class shares, 0.09% for Class A shares, 0.12% for Class I1 shares, 0.16% for Class R1 shares, and 0.07% for Class R2 shares.

The Fund complies with the requirements of Subchapter M of the Internal Revenue Code of 1986, as amended, necessary to qualify as a regulated investment company and makes the requisite distributions of income and capital gains to its shareholders sufficient to relieve it from all or substantially all federal income taxes. Therefore, no federal income tax provision has been provided.

As of and during the year ended November 30, 2018, the Fund did not have a liability for any unrecognized tax benefits. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the statement of operations. During the year ended November 30, 2018, the Fund did not incur any interest or penalties.

21

SMEAD VALUE FUND

Notes to Financial Statements (Continued)

November 30, 2018

As of November 30, 2018, the components of accumulated earnings on a tax basis were as follows:

| | | | | |

Cost basis of investments for federal income tax purposes | | | $ | 921,754,960 | |

| | | | | |

Gross tax unrealized appreciation | | | | 324,762,679 | |

Gross tax unrealized depreciation | | | | (6,118,244 | ) |

| | | | | |

Net tax unrealized appreciation | | | $ | 318,644,435 | |

| | | | | |

Undistributed ordinary income | | | $ | — | |

Undistributed long-term capital gain | | | | 77,479,562 | |

| | | | | |

Total distributable earnings | | | $ | 77,479,562 | |

| | | | | |

Other accumulated losses | | | | — | |

| | | | | |

Total accumulated gains | | | $ | 396,123,997 | |

| | | | | |

The tax basis of investments for tax and financial reporting purposes differs principally due to the deferral of losses on wash sales.

| | (f) | Distributions to Shareholders |

The Fund will distribute any net investment income and any net realized long or short- term capital gains at least annually. Distributions from net realized gains for book purposes may includeshort-term capital gains. All short-term capital gains are included in ordinary income for tax purposes. Distributions to shareholders are recorded on theex-dividend date. The Fund may also pay a special distribution at the end of the calendar year to comply with federal tax requirements. Income and capital gains distributions may differ from GAAP, primarily due to timing differences in the recognition of income, gains and losses by the Fund. GAAP requires that certain components of net assets relating to permanent differences be reclassified between the components of net assets. These reclassifications have no effect on net assets or net asset value per share. For the year ended November 30, 2018, the following permanent adjustments were recorded. Such adjustments were attributed to the usage of equalization for tax purposes.

| | | | | | |

Total Distributable

Earnings (Loss) | | | Paid-in Capital | |

| $ | (10,963,879 | ) | | $ | 10,963,879 | |

The tax character of distributions paid during the years ended November 30, 2018 and November 30, 2017 was as follows:

| | | | | | | | | | |

| | | November 30, 2018 | | November 30, 2017 |

Ordinary Income | | | $ | 6,231,400 | | | | $ | 8,680,113 | |

Long-Term Capital Gain | | | $ | 52,162,084 | | | | $ | 28,794,823 | |

22

SMEAD VALUE FUND

Notes to Financial Statements (Continued)

November 30, 2018

On December 13, 2018, the Fund declared and paid distributions from ordinary income and long-term capital gains to shareholders of record on December 12, 2018.

| | | | | | | | | | | | | | | |

| | | Distributions Paid from | | Total

Distributions

Paid |

Class | | Ordinary

Income | | Realized

Gain/Loss |

Investor Class | | | $ | — | | | | $ | 8,575,781 | | | | $ | 8,575,781 | |

Class A | | | | — | | | | | 7,780,661 | | | | | 7,780,661 | |

Class I1 | | | | 202,494 | | | | | 60,201,518 | | | | | 60,404,012 | |

Class I3 | | | | 1 | | | | | 199 | | | | | 200 | |

Class R1 | | | | — | | | | | 50,814 | | | | | 50,814 | |

Class R2 | | | | — | | | | | 600 | | | | | 600 | |

Class S | | | | — | | | | | 199 | | | | | 199 | |

Class Y | | | | 22,821 | | | | | 869,806 | | | | | 892,627 | |

Investment transactions are recorded on the trade date. The Fund determines the gain or loss from investment transactions based on specified identification using the first in, first out method. Dividend income, less foreign withholding tax, is recognized on theex-dividend date and interest income is recognized on an accrual basis.

The Fund has an Investment Advisory Agreement (the “Agreement”) with the Adviser to furnish investment advisory services to the Fund. Under the terms of the Agreement, the Fund compensates the Adviser for its management services at the annual rate of 0.75% of the Fund’s average daily net assets.

The Adviser has contractually agreed to waive its management fee and/or reimburse the Fund’s other expenses at least through March 31, 2019 to the extent necessary to ensure that the Fund’s operating expenses do not exceed 1.26%, 1.26%, 0.99%, 1.00%, 1.59%, 1.44%, 1.25% and 0.84% (the “Expense Limitation Cap”) of the Fund’s average daily net assets for the Investor Class, Class A, Class I1, Class I3, Class R1, Class R2, Class S and Class Y shares, respectively. Any such waiver or reimbursement is subject to later adjustment to allow the Adviser to recoup amounts waived or reimbursed to the extent actual fees and expenses for a fiscal period are less than the Expense Limitation Cap in place at the time of waiver; provided, however, that the Adviser shall only be entitled to recoup such amounts over the following three fiscal years. For the year ended November 30, 2018, the Adviser waived expenses of $2,235. The following table shows the waived or reimbursed expenses subject to potential recovery expiring on November 30:

| | | | | | | | |

Year incurred | | Expiration Year | | | Smead Value Fund | |

| 2016 | | | 2019 | | | $ | 3,384 | |

| 2017 | | | 2020 | | | | 524 | |

| 2018 | | | 2021 | | | | 2,235 | |

For the year ended November 30, 2018, the Fund made repayments to the Adviser for previously waived and reimbursed fees in the amount of $168,981.

23

SMEAD VALUE FUND

Notes to Financial Statements (Continued)

November 30, 2018

| (4) | Distribution Plan and Shareholder Servicing Plan |

The Fund has adopted a plan pursuant to Rule12b-1 (the“12b-1 Plan”), which authorizes it to pay ALPS Distributors, Inc. (the “Distributor”) a distribution fee at an annual rate of 0.16% of the Fund’s average daily net assets of Class I3 shares, 0.25% of the Fund’s average daily net assets of Investor Class and Class A shares, 0.41% of the Fund’s average daily net assets of Class S shares, and 0.50% of the Fund’s average daily net assets of Class R1 and Class R2 shares for services to prospective Fund shareholders and distribution of Fund shares. During the year ended November 30, 2018, the Fund accrued expenses of $734,148 pursuant to the 12b-1 Plan. As of November 30, 2018, the Fund owed the Distributor fees of $52,007.

The Fund has also adopted a shareholder servicing plan (the “Shareholder Servicing Plan”). The Shareholder Servicing Plan authorizes payment of a shareholder servicing fee to the Distributor up to 0.25% of the average daily net assets attributable to the respective class. The Fund implemented 0.14% for the shareholder servicing fee for the Investor Class shares of the Fund, 0.09% for the shareholder servicing fee for the Class A shares of the Fund, 0.12% for the shareholder servicing fee for the Class I1 shares of the Fund, 0.16% for the shareholder servicing fee for the Class R1 shares of the Fund, and 0.07% for the shareholder servicing fee for the Class R2 shares of the Fund. There is no shareholder servicing fee for the Class I3 shares, Class S shares and Class Y shares. For those share classes that currently charge less than the maximum shareholder servicing fee, the Fund may increase such fee, but not beyond the maximum of 0.25%, only after providing affected shareholders with 30 days prior written notice. The following table details the Shareholder Servicing Plan fees paid for the year ended November 30, 2018.

| | | | | |

Investor Class | | | $ | 188,264 | |

Class A | | | | 126,350 | |

Class I1 | | | | 1,057,507 | |

Class R1 | | | | 1,577 | |

Class R2 | | | | 193 | |

| (5) | Accounting, Custody, Administration and Transfer Agent Fees |

State Street Bank and Trust Company (“State Street”) serves as the Fund’s accounting agent, custodian of the Fund’s investments and administrator of the Fund. For its services, the Fund pays State Street a fee that is calculated daily and paid monthly at an annual rate based on the aggregate average daily net assets of the Fund, along with transactional andout-of-pocket fees.

DST Asset Manager Solutions, Inc. (“DST”) was the Fund’s transfer and dividend disbursing agent through November 8, 2018. DST receives a monthly fee and is reimbursed for certain out-of-pocket expenses.

UMB Fund Services, Inc. (“UMB”) is the Fund’s transfer and dividend disbursing agent from November 9, 2018 to November 30, 2018. UMB receives a fee that is calculated daily and paid monthly at an annual rate based on the average daily net assets of the Fund, and is reimbursed for certainout-of-pocket expenses.

24

SMEAD VALUE FUND

Notes to Financial Statements (Continued)

November 30, 2018

| (6) | Capital Share Transactions |

Transactions in shares of the Fund were as follows:

| | | | | | | | | | | | | | | | | | | | |

| | | For The Year Ended

November 30, 2018 | | For The Year Ended

November 30, 2017 |

| | | Shares | | Amount | | Shares | | Amount |

Proceeds from shares sold | | | | | | | | | | | | | | | | | | | | |

Investor Class | | | | 106,984 | | | | $ | 5,077,191 | | | | | 203,267 | | | | $ | 8,513,978 | |

Class A | | | | 562,806 | | | | | 26,476,921 | | | | | 861,515 | | | | | 36,845,880 | |

Class I1 | | | | 4,410,241 | | | | | 208,827,304 | | | | | 4,805,669 | | | | | 202,510,233 | |

Class I3* | | | | 64 | | | | | 3,000 | | | | | — | | | | | — | |

Class R1 | | | | 3,731 | | | | | 170,597 | | | | | 6,937 | | | | | 285,087 | |

Class R2 | | | | 1,578 | | | | | 71,706 | | | | | 5,622 | | | | | 232,090 | |

Class S* | | | | 64 | | | | | 3,000 | | | | | — | | | | | — | |

Class Y | | | | 41,990 | | | | | 1,944,042 | | | | | 61,556 | | | | | 2,700,931 | |

| | | | |

Issued in reinvestment of dividends and distributions | | | | | | | | | | | | | | | | | | | | |

Investor Class | | | | 140,453 | | | | | 6,422,894 | | | | | 155,029 | | | | | 6,159,309 | |

Class A | | | | 101,321 | | | | | 4,597,959 | | | | | 81,513 | | | | | 3,218,126 | |

Class I1 | | | | 352,063 | | | | | 16,050,530 | | | | | 238,610 | | | | | 9,460,873 | |

Class R2 | | | | — | | | | | — | | | | | 51 | | | | | 2,007 | |

Class Y | | | | 13,960 | | | | | 636,744 | | | | | 9,953 | | | | | 394,731 | |

| | | | |

Payments for shares redeemed | | | | | | | | | | | | | | | | | | | | |

Investor Class | | | | (763,450 | ) | | | | (36,023,479 | ) | | | | (2,502,959 | ) | | | | (106,162,995 | ) |

Class A | | | | (1,638,291 | ) | | | | (78,673,189 | ) | | | | (1,316,499 | ) | | | | (54,915,051 | ) |

Class I1 | | | | (4,096,184 | ) | | | | (194,058,569 | ) | | | | (4,563,649 | ) | | | | (193,509,288 | ) |

Class R1 | | | | (25,555 | ) | | | | (1,182,551 | ) | | | | (5,503 | ) | | | | (231,952 | ) |

Class R2 | | | | (28,400 | ) | | | | (1,375,880 | ) | | | | (25,397 | ) | | | | (1,032,938 | ) |

Class Y | | | | (48,532 | ) | | | | (2,258,696 | ) | | | | (73,620 | ) | | | | (3,198,915 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total decrease in net

assets from capital

share transactions | | | | (865,157 | ) | | | $ | (43,290,476 | ) | | | | (2,057,905 | ) | | | $ | (88,727,894 | ) |

| | | | | | | | | | | | | | | | | | | | |

| * | Class I3 and Class S shares commenced operations on February 28, 2018. |

| (7) | Investment Transactions |

The aggregate purchases and sales of securities, excluding short-term investments, for the Fund for the year ended November 30, 2018 were $131,208,229 and $209,864,476, respectively. There were no purchases or sales of U.S. government securities for the Fund.

25

SMEAD VALUE FUND

Notes to Financial Statements (Continued)

November 30, 2018

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a fund creates a presumption of control of the fund, under Section 2(a)(9) of the 1940 Act. At November 30, 2018, Merrill Lynch Pierce Fenner & Smith, for the benefit of its customers, held 48.77%, 100.00% and 100.00% of outstanding shares of Class I1, Class R1 and Class R2, respectively. At November 30, 2018, National Financial Services LLC, for the benefit of its customers, held 64.47% of outstanding shares of Class Y. At November 30, 2018, National Financial Services LLC, for the benefit of its customers, held 41.25% of outstanding shares of the Investor Class. At November 30, 2018, Shamokawa Living Trust, for the benefit of its customers, held 100.00% and 100.00% of outstanding shares of Class I3 and Class S. At November 30, 2018, there was no beneficial ownership of Class A shares.

General Investment Risks

An investment in the Fund represents an indirect investment in the assets owned by the Fund. As with any mutual fund, the value of the assets owned by the Fund may move up or down, and as a result, an investment in the Fund at any point in time may be worth more or less than the original amount invested.

The Fund’s transactions in listed securities are settled/paid for upon delivery to or from their counterparties; therefore, the risk of counterparty default for listed securities is considered minimal, as delivery of securities sold is only made once the Fund has received payment. Payment is made on a purchase once the securities have been delivered by the counterparty. The trade will fail if either party fails to meet its obligations.

Market and Regulatory Risks

Events in the financial markets and economy may cause volatility and uncertainty and affect Fund performance. Market events may affect a single issuer, industry, sector, or the market as a whole. In addition, because of interdependencies between markets, events in one market may adversely impact other markets or issuers in which the Fund invests in unforeseen ways. Traditionally liquid investments may experience periods of diminished liquidity. During a general downturn in the financial markets, multiple asset classes may decline in value and the Fund may lose value, regardless of the individual results of the securities and other instruments in which the Fund invests. Governmental and regulatory actions, including tax law changes, may also impair Fund management and have unexpected or adverse consequences on particular markets, strategies, or investments. Future market or regulatory events may impact the Fund in unforeseen ways, such as causing the Fund to alter its existing strategies or potentially, to liquidate and close.

Equity Investments Risks

Stock markets are volatile. Equity investments tend to go up or down in value, sometimes rapidly and unpredictably, in response to many factors, including a company’s historical and prospective earnings, the value of its assets, general

26

SMEAD VALUE FUND

Notes to Financial Statements (Continued)

November 30, 2018

economic conditions, interest rates, investor perceptions, and market liquidity. Due to the complexities of markets, events in one market or sector may adversely impact other markets or sectors.

In August 2018, FASB issued Accounting Standards Update 2018-13 Fair Value Measurement (Topic 820) Disclosure Framework – Changes to the Disclosure Requirements, which sets forth a methodology for disclosing the fair value hierarchy. Compliance is effective for interim and annual reporting periods in fiscal years that begin after December 15, 2019.

Management has evaluated the possibility of subsequent events through the date of issuance and determined that there are no additional material events that would require adjustment to or disclosure in the Fund’s financial statements.

27

SMEAD VALUE FUND

Report of Independent Registered Public Accounting Firm

To the Shareholders of Smead Value Fund and

Board of Trustees of Smead Funds Trust

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Smead Funds Trust, comprising Smead Value Fund (the “Fund”) as of November 30, 2018, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, including the related notes, and the financial highlights for each of the five years in the period then ended (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of November 30, 2018, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits include performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of November 30, 2018, by correspondence with the custodian and brokers or by other appropriate auditing procedures where replies from brokers were not received. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the Fund’s auditor since 2007.

COHEN & COMPANY, LTD.

Cleveland, Ohio

January 28, 2019

28

SMEAD VALUE FUND

Basis for Trustees’ Approval of Investment Advisory Agreement

(Unaudited)

The Board of Trustees (the “Trustees”) of Smead Funds Trust (the “Trust”) met on July 25, 2018 to consider the renewal of the Investment Advisory Agreement (the “Agreement”) between the Trust, on behalf of the Smead Value Fund (the “Fund”), a series of the Trust, and Smead Capital Management, Inc., the Fund’s investment adviser (the “Adviser”). Prior to this meeting, the Trustees requested and received materials to assist them in considering the renewal of the Agreement. The materials provided contained information with respect to the factors enumerated below, including a copy of the Agreement, a memorandum prepared by the Trust’s outside legal counsel discussing in detail the Trustees’ fiduciary obligations and the factors they should assess in considering the renewal of the Agreement, detailed comparative performance information provided by the Adviser, as well as the management fees and other expenses of the Fund, due diligence materials relating to the Adviser (including the Adviser’s response to the Independent Trustees’ request for information, the Adviser’s Form ADV and select financial statements of the Adviser) and other pertinent information. Based on their evaluation of the information provided by the Adviser, in conjunction with the Fund’s other service providers, the Trustees, by a unanimous vote (including a separate vote of the Trustees who are not “interested persons,” as that term is defined in the Investment Company Act of 1940, as amended (the “Independent Trustees”)), approved the renewal of the Agreement for an additionalone-year term.

DISCUSSION OF FACTORS CONSIDERED

In considering the renewal of the Agreement and reaching their conclusions, the Trustees reviewed and analyzed various factors that they determined were relevant, including the factors enumerated below.

| 1. | NATURE, EXTENT AND QUALITY OF SERVICES |

The Independent Trustees reviewed and considered the nature, extent and quality of the services provided by the Adviser and expected that they would continue to be of high quality. They noted that the Adviser’s history, experience and reputation were exceptional. The Independent Trustees considered the experience and qualifications of the personnel at the Adviser who were responsible for providing services to the Fund, and the compensation structure of the Adviser. The Independent Trustees also considered the resources, policies, procedures and infrastructure of the Adviser devoted to ensuring compliance with applicable laws and regulations, as well as the Adviser’s commitment to those programs, including upgrades to the Adviser’s systems and revisions to the compliance program made over the course of the past year. The Independent Trustees noted that there were currently no known pending regulatory inquiries by the SEC or other regulatory agencies involving the Adviser, and that the Adviser recently underwent a mock audit conducted by a third party consulting firm (ACA) with extensive experience in this space. The Independent Trustees concluded that the Adviser’s key personnel had sufficient expertise necessary to continue to serve as investment adviser to the Fund and that the nature, overall quality and extent of the management services were satisfactory and reliable.

29

SMEAD VALUE FUND

Basis for Trustees’ Approval of Investment Advisory Agreement (Continued)

(Unaudited)