UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-23024

Pacer Funds Trust

(Exact name of registrant as specified in charter)

500 Chesterfield Parkway

Malvern, PA 19355

(Address of principal executive offices) (Zip code)

Joe M. Thomson, President

500 Chesterfield Parkway

Malvern, PA 19355

(Name and address of agent for service)

610-644-8100

Registrant's telephone number, including area code

Date of fiscal year end: October 31

Date of reporting period: October 31, 2021

Item 1. Reports to Stockholders.

(a)

Pacer Funds

TABLE OF CONTENTS

| | Page |

Letter to Shareholders | 1 |

Portfolio Allocation | 9 |

Performance Summary | 13 |

Expense Example | 29 |

Schedules of Investments | 31 |

Statements of Assets & Liabilities | 50 |

Statements of Operations | 54 |

Statements of Changes in Net Assets | 59 |

Financial Highlights | 66 |

Notes to Financial Statements | 82 |

Report of Independent Registered Accounting Firm | 102 |

Additional Information | 104 |

Pacer Funds

Dear Shareholder,

As I look back on the last year, I am filled with an overwhelming sense of gratitude and pride for our accomplishments as a company. The stresses of the pandemic combined with an unpredictable market made for an interesting few quarters. However, I feel that this last year has been about perseverance and growth. Our Pacer team was able to almost double our assets under management despite rocky market conditions and the ongoing pandemic, growing from $5.7 billion in AUM at the end of 2020 to nearing $10 billion at the end of 2021.

With the addition of fourteen new funds this past year, we were nothing short of busy. The year began in the midst of our partnership with Swan Global Management as we worked together to launch thirteen buffer strategy ETFs which would launch quarterly in groups of three throughout 2021. Our partnership with Metaurus Advisors came to culmination in the summer as we launched two dividend-focused ETFs – the Pacer Metaurus US Large Cap Dividend Multiplier 400 ETF (QDPL) and the Pacer Metaurus US Large Cap Dividend Multiplier 300 ETF (TRPL). This series of passive ETFs are designed to provide exposure to approximately 400% or 300%, respectively, of the ordinary dividend yield of the S&P 500 Index. And finally, as we crossed our $9 billion in assets under management, we acquired the Pacer Pacific Asset Floating Rate High Income ETF (FLRT). Each of these funds were launched with investors and financial advisors in mind. Since our inception, we have dedicated ourselves to creating innovative products and unique investment strategies to help investors and financial advisors reach their goals.

We thank our investors, financial advisors, and partners for continuing to entrust your assets with us. As we move into the new year, we look forward to growing with you.

Joe M. Thomson Chairman, Pacer Funds Trust

Market Environment Overview

2021 was a year of stellar earnings growth, record consumer spending, constrained supply chains, accommodative monetary policy, increased inflation, and rapid vaccination rates. Most major indices saw new all-time highs with the S&P 500 alone up 42.91% from 10/30/20 to 10/29/21.

As economies reopened the demand for oil skyrocketed, sending energy prices with it. Subsequently, the energy sector saw the greatest returns, outperforming the second best, financials, by 28.35%. Financial Services benefited as interest rates increased, with the ten-year yield going from 0.87% in late October 2020 to 1.74% in March of 2021. However, during the Summer the ten-year yield began to lose its steam and fell back down to 1.18%. During this time investors rotated into treasuries as the covid-delta variant began making headlines.

Government stimulus and a tight labor market put upward pressure on U.S. household assets. The combination of strong household balance sheets and pent-up consumer demand led to personal expenditures increasing 11.99% from October 2020 to October 2021. This number represented the 96th percentile of all values seen since 1959.

Global supply chains, impacted by severe bottlenecks, continued to face shortages even after economies began reopening. Many believe the lingering effects of Covid-19 mitigation strategies have dramatically reduced production while demand for these goods is returning to pre-pandemic levels. A mass shortage of both truck drivers and warehouse workers is now being referred to as the “Great Resignation” by economist and has also put pressure on supply chains.

The staggering levels of quantitative easing seen in 2020 continued into 2021, as the Fed expanded their balance sheet from approximately $7.1 trillion to $8.6 trillion. Purchasing $120 billion of treasury and mortgage-backed securities every month. This helped push year-over-year inflation to 6.2%, the greatest level in over thirty years.

Between early November of 2020 and late May of 2021, approximately 295 million vaccine doses were administered in the United States. By October 2021, that number had grown to 422 million and accounted for half of all the vaccines administered worldwide. Three companies, Pfizer, Moderna, and Johnson & Johnson are to thank for the rapid deployment. Their work was instrumental to the reopening of economies and return to normal that we began to see in 2021.

Pacer American Energy Independence ETF

The Pacer American Energy Independence ETF (the “Fund”) is an exchange traded fund (“ETF”) that seeks to track the performance, before fees and expenses, of the American Energy Independence Index (the “Index”).

The Index is based on a proprietary methodology developed by SL Advisors, LLC, the Fund’s Index Provider (the “Index Provider”) and the investment adviser to the Predecessor Fund (as defined below), which is not affiliated with the Fund, its distributor, or Pacer Advisors, Inc., the Fund’s investment adviser (the “Adviser”).

1

Pacer Funds

The Index uses a proprietary, rules-based methodology to measure the performance of a portfolio of U.S. and Canadian exchange-listed equity securities of companies that generate a majority of their cash flow from certain qualifying “midstream” energy infrastructure activities. The companies in the Index are expected to benefit from regulatory policies favoring and industry trends toward American energy independence (i.e., a reduced or eliminated need for the United States to import fuels, such as coal, crude oil, or natural gas). Midstream energy infrastructure refers to the processing, storage, transportation, and distribution of crude oil, natural gas, refined products, and their related products, as well as the transmission or storage of renewable energy. The following activity segments are considered qualifying midstream energy infrastructure activities: gathering & processing, compression, fractionation, logistics, midstream services, pipeline transportation, storage and terminaling of oil, gas, natural gas liquids, and refined products, as well as operating liquid natural gas facilities. The following activity segments are not qualifying activities: refining, shipping, exploration, production, retail distribution, or oil services. The Index may include small-, mid-, and large-capitalization companies.

The Index includes securities across the following categories of midstream companies. Such categories and the “weight” (defined as the percentage of the total Index) assigned to each category at the time of each rebalance of the Index are as follows:

U.S. & Canadian Midstream Companies (80%) U.S.- or Canadian-listed companies that (i) have their principal place of business in the United States or Canada, (ii) elect to be treated as a corporation for U.S. or Canadian federal income tax purposes, and (iii) generate a majority of their cash flow or revenue from midstream energy infrastructure related activities. U.S. Midstream MLPs* (20%) U.S.-listed Midstream MLPs that (i) have their principal place of business in the United States, (ii) elect to be treated as a partnership for U.S. federal income tax purposes, (iii) do not pay incentive distribution rights (“IDRs”), and (iv) are not affiliates of MLP GPs that are owned in the Index.

* | If an MLP that would be included in the Index has a tracking stock that is a corporation or elects to be taxed as a corporation, then such tracking stock will be included in the Index in place of the MLP and will use the MLP’s adjusted market capitalization for calculating its weight. |

MLPs are publicly traded partnerships that receive at least 90% of their income from certain qualifying sources, such as natural resource-based midstream energy infrastructure activities. The equity interests, or units, of an MLP trade on public securities exchanges exactly like the shares of a corporation, without entity level taxation. An MLP typically consists of a general partner and limited partners. The operations and management of the MLP are controlled by the general partner, and the general partner typically has an ownership stake in the MLP and may have certain preferential rights to income from the MLP, such as IDRs. IDRs provide their owner with a larger share of the aggregate cash distributions made by a company once such distributions increase to certain specified levels and are designed to provide the holder of the IDRs with a strong incentive to increase the MLP’s aggregate cash distributions.

At the time of each quarterly rebalance of the Index, each company meeting the Index’s criteria for the above categories is included in the Index, provided that the company has a minimum market capitalization of $500 million.

The Index is rebalanced quarterly, effective on the last trading day of each calendar quarter. Within each of the above categories, Index constituents are weighted based on their free-float market capitalization (i.e., market capitalization based on the number of shares available to the public), subject to the following constraints as of the time of each rebalance. Each individual Index constituent is limited to a weight of 7.25%, and any excess weight is 2 redistributed equally among the other companies in the same category first and then to the remaining companies as needed.

Additionally, the aggregate weight of companies with individual weights greater than 5% (“5% Companies”) may not exceed 45% as of the time of each rebalance. If the aggregate weight of the 5% Companies would exceed 45%, the excess weight will be redistributed proportionally to companies with a weight of less than 4.25%. If at the time of a rebalance a company’s weight would be between 4.25% and 5%, the company’s weight will be reduced to 4.25% and the excess redistributed to companies in the same category with a weight of less than 4.25%.

The Fund had a NAV total return of 80.71%. The Index had a total return of 83.80%. The S&P 500 had a total return of 42.91%.

The Funds top three contributors to its return were Tanga Resources Corp at 244.27%, EnLink Midstream LLC at 211.01%, and Cheniere Energy, Inc. at 178.74%. The Funds bottom three contributors to return were New Fortress Energy Inc. Class A at -16.12%, Altus Midstream Co. Class A at 43.44%, and TC Energy Corporation at 43.59%. Performance numbers reflect their total return during the period.

Pacer Salt High truBeta US Market ETF

The Pacer Salt High truBeta US Market ETF (the “Fund”) is an exchange traded fund (“ETF”) that seeks to track the total return performance, before fees and expenses, of the Salt High truBeta US Market Index (the “Index”).

The Index uses an objective, rules-based methodology to measure the performance of an equal-weighted portfolio of approximately 100 large- and mid-capitalization U.S.-listed stocks with the highest forecasted systematic risk relative to the market (known as “beta”). Construction of the Index begins with the constituents of the Solactive US Large & Mid Cap Index (the “Equity Universe”), generally the 1,000 largest U.S.-listed common stocks and real estate investment trusts (“REITs”). Companies in the Equity Universe are then screened to keep only the

2

Pacer Funds

500 stocks with the highest average daily traded value over the past 30 days. Those 500 stocks are then analyzed using a proprietary algorithm developed by the Index Provider to calculate each stock’s truBeta forecast, i.e., its projected beta for the subsequent quarter, and to eliminate stocks whose performance is weakly correlated with the broader U.S. equity market (the remaining securities are referred to as the “Index Universe”).

A stock’s truBeta forecast is calculated using a machine learning process (i.e., a quantitative model that is automatically adjusted based on past results to improve accuracy) that compares the stock’s historical long-, medium-, and short-term risk and returns to those of the broader U.S. equity market (using the SPDR S&P 500 ETF (SPY) as a market proxy). A stock with a truBeta of 1.00 would be expected to demonstrate a risk and return profile identical to that of the broader U.S. equity market. A stock with a truBeta of more than 1.00 would be expected to be more volatile than the broader U.S. equity market and consequently, exhibit outsized reactions to market events (i.e., outperform the market in a rising market and underperform the market in a declining market). As of October 31, 2020, the Index had an average truBeta of approximately 1.14. Consequently, the Index is expected to be more volatile than the broader U.S. equity market.

At the time of each rebalance of the Index, the Index is constructed of the 100 stocks in the Index Universe with the highest truBeta, equally weighted and subject to a maximum 30% of the number of constituents in the Index being from a single sector. If more than 30% of the constituents would be from a single sector, the stock with the lowest truBeta score in such sector will be removed from the Index and replaced with the stock with the next highest truBeta forecast not already included in the Index. This process is repeated until each sector complies with the sector concentration constraint.

The Index is rebalanced quarterly on the third Friday of March, June, September, and December (each, an “Effective Date”) based on truBeta forecasts utilizing data as of five business days prior to the Effective Date of the applicable rebalance month. Each rebalance of the Index utilizes constituent prices at the close of trading five business days prior to the Effective Date for weighting purposes.

The Fund had a NAV total return of 52.53%. The Index had a total return of 53.94%. The S&P 500 Index had a total return of 42.91%.

During the fiscal year, the top three sectors for contribution to performance were Energy at 164.68%, Materials at 108.93%, and Financials at 89.57%. The three sectors with the lowest contribution to performance were Health Care at -11.19%, Industrials at 6.47%, and Real Estate at 7.65%. Sector performance numbers reflect their total return during the period.

Pacer Salt Low truBeta Market ETF

The Pacer Salt Low truBeta US Market ETF (the “Fund”) is an exchange traded fund (“ETF”) that seeks to track the total return performance, before fees and expenses, of the Salt Low truBeta US Market Index (the “Index”).

The Index uses an objective, rules-based methodology to measure the performance of an equal-weighted portfolio of approximately 100 large and mid-capitalization U.S.-listed stocks with the lowest levels of variability in their historical beta calculations (“Beta Variability”) and forecasted beta of less than 1.00. “Beta” is a calculation of an investment’s systematic risk relative to the market.

Construction of the Index begins with the constituents of the Solactive US Large & Mid Cap Index (the “Equity Universe”), generally the 1,000 largest U.S.-listed common stocks and real estate investment trusts (“REITs”). Companies in the Equity Universe are then screened to keep only the 500 stocks with the highest average daily traded value over the past 30 days. The remaining stocks (the “Index Universe”) are analyzed using a proprietary algorithm developed by the Index Provider to calculate each stock’s truBeta forecast, i.e., its projected beta for the subsequent quarter.

A stock’s truBeta forecast is calculated based on a stock’s historical long-, medium-, and short-term performance, combined with machine learning (i.e., a quantitative modeling process that is automatically adjusted based on past results in an attempt to improve accuracy), to evaluate and compare its risk and return to those of the broader U.S. equity market. A stock with a truBeta of 1.00 would be expected to demonstrate a risk and return profile equivalent with the broader U.S. equity market (i.e., the stock’s price will move proportionately with levels of the broader market). A stock with a truBeta of less than 1.00 would be expected to be less volatile than the broader U.S. equity market and consequently, outperform the market in a declining market and underperform the market in a rising market.

The Index Universe is then further screened to keep only stocks with a truBeta score of less than 1.00. A Beta Variability score is calculated for the remaining stocks (the “Eligible Components”) based on the absolute difference between the short-term and medium-term data points used to generate the truBeta estimate. A lower score indicates less variability in beta over time.

The Index is initially constructed of the 100 Eligible Components with the lowest Beta Variability score, equally weighted, and subject to a maximum 30% of the number of constituents in the Index being from a single sector. If more than 30% of the constituents would be from a single sector, the Eligible Component with the next lowest Beta Variability score not from the sector is selected instead of the Eligible Component that would have caused the Index to exceed the 30% limit.

3

Pacer Funds

The Index is rebalanced quarterly on the third Friday of March, June, September, and December (each, an “Effective Date”) based on truBeta forecasts and Beta Variability scores utilizing data as of five business days prior to the Effective Date of the applicable rebalance month (each, a “Selection Date”). Each rebalance of the Index utilizes constituent prices at the close of trading on the Selection Date for weighting purposes.

To minimize turnover at each quarterly rebalance, stocks remain in the Index unless their truBeta score on the Selection Date is 1.00 or higher, regardless of their Beta Variability score. Additions to the Index at each rebalance are selected using the same process as the initial selection, ranking the Eligible Components not already in the Index by their Beta Variability score and selecting Eligible Components starting with the lowest Beta Variability score to arrive at a total of 100 components.

The Fund had a NAV total return of 23.01%. The Index had a total return of 23.79%. The S&P 500 Index had a total return of 42.91%.

During the fiscal year, the top three sectors for contribution to performance were Real Estate at 45.99%, Financials at 42.05%, and Industrials at 41.06%. The three sectors with the lowest contribution to performance were Utilities at 7.33%, Communication Services at 13.96%, and Consumer Staples at 14.89%. Sector performance numbers reflect their total return during the period.

Pacer Swan SOS Conservative (December) ETF

The Pacer Swan SOS Conservative (December) ETF (the “Fund”) seeks to provide investors with returns that, before fees and expenses of the Fund, match those of the SPDR® S&P 500® ETF Trust (the “Underlying ETF”) up to a predetermined upside cap of 9.92% (before fees and expenses of the Fund) and 9.17% (after fees and expenses of the Fund), while providing a buffer against Underlying ETF losses between 5% and 30% over the period from December 22, 2020 to December 17, 2021.

The Fund uses FLEX Options to employ a “structured outcome strategy.” Structured outcome strategies seek to produce pre-determined target investment outcomes based upon the performance of an underlying security or index. The predetermined outcomes sought by the Fund are intended to reflect the performance of the Underlying ETF over an approximate one-year period (the “Investment Period”), subject to a buffer (the “Buffer”) against certain Underlying ETF losses and a cap (the “Cap”) as set forth in the following table:

Investment Period Start: December 22, 2020

Investment Period End: December 17, 2021

Buffer: 5% to 30%

Cap (after Fund fees and expenses): 9.92%

Cap (after Fund fees and expenses): 9.17%

Year-To-Date, the Fund had a NAV total return of 7.94%. The S&P 500 Index had a price return of 26.40%.

Pacer Swan SOS Moderate (December) ETF

The Pacer Swan SOS Moderate (December) ETF (the “Fund”) seeks to provide investors with returns that, before fees and expenses of the Fund, match those of the SPDR® S&P 500® ETF Trust (“the Underlying ETF”) up to a predetermined upside cap of 12.25% (before fees and expenses of the Fund) and 11.50% (after fees and expenses of the Fund), while providing a buffer against the first 15% of Underlying ETF losses, over the period from December 22, 2020 to December 17, 2021.

The Fund uses FLEX Options to employ a “structured outcome strategy.” Structured outcome strategies seek to produce pre-determined target investment outcomes based upon the performance of an underlying security or index. The predetermined outcomes sought by the Fund are intended to reflect the performance of the Underlying ETF over an approximate one-year period (the “Investment Period”), subject to a buffer (the “Buffer”) against certain Underlying ETF losses and a cap (the “Cap”) as set forth in the following table:

Investment Period Start: December 22, 2020

Investment Period End: December 17, 2021

Buffer: 15%

Cap (before Fund fees and expenses): 12.25%

Cap (after Fund fees and expenses): 11.50%

Year-To-Date, the Fund had a NAV total return of 10.20%. The S&P 500 Index had a price return of 26.40%.

4

Pacer Funds

Pacer Swan SOS Flex (December) ETF

The Pacer Swan SOS Flex (December) ETF (the “Fund”) seeks to provide investors with returns that match those of the SPDR® S&P 500® ETF Trust (the “Underlying ETF”) up to a predetermined upside cap of 18.52% (before fees and expenses of the Fund) and 17.17% (after fees and expenses of the Fund), while providing a buffer against the first 20% of Underlying ETF losses with the benefits of such buffer declining from 20% to 0% for Underlying ETF losses between 20% and 40%, over the period from December 22, 2020 to December 17, 2021.

The Fund uses FLEX Options to employ a “structured outcome strategy.” Structured outcome strategies seek to produce pre-determined target investment outcomes based upon the performance of an underlying security or index. The predetermined outcomes sought by the Fund are intended to reflect the performance of the Underlying ETF over an approximate one-year period (the “Investment Period”), subject to a buffer (the “Buffer”) against certain Underlying ETF losses and a cap (the “Cap”) as set forth in the following table:

Investment Period Start: December 22, 2020

Investment Period End: December 17, 2021

Full Buffer: 20%

Fading Buffer: 20% to 40%

Cap (before Fund fees and expenses): 18.52%

Cap (after Fund fees and expenses): 17.17%

Year-To-Date, the Fund had a NAV total return of 15.85%. The S&P 500 Index had a price return of 26.40%.

Pacer Swan SOS Fund of Funds ETF

The Pacer Swan SOS Fund of Funds ETF (the “Fund”) seeks capital appreciation with downside protection

The Fund is an actively-managed exchange-traded fund (“ETF”) that seeks to achieve its investment objective by investing in a portfolio of other ETFs also managed by the Fund’s investment adviser, Pacer Advisors, Inc. (the “Adviser”), that seek exposure to U.S. equity securities, while limiting downside risk (the “Underlying ETFs”). Certain Underlying ETFs may also be sub-advised by the Fund’s investment sub-adviser, Swan Global Management, LLC (“Swan” or the “Sub-Adviser”).

Underlying ETFs that use a structured outcome strategy generally seek to produce pre-determined target investment outcomes for a specific period of time based upon the performance of an underlying security (such as an ETF) or index (a “reference asset”) through the use of a combination of call and put options on such reference asset. The pre-determined outcomes sought by such Underlying ETFs may include a buffer against certain reference asset losses and a cap based on the performance of the reference asset over a fixed period of time (e.g., one year). Investments in such strategies reflect an investment in a portfolio of options linked to a reference asset that, when bought at inception of the strategy and held to the expiration of the options (an “Investment Period”), seeks to target returns that buffer against downside losses due to a decline in the reference asset, while providing participation up to a maximum capped gain in the reference asset.

Year-To-Date, the Fund had a NAV total return of 11.01%. The S&P 500 Index had a price return of 25.03%.

Pacer Swan SOS Conservative (April) ETF

The Pacer Swan SOS Conservative (April) ETF (the “Fund”) seeks to provide investors with returns that, before fees and expenses of the Fund, match those of the SPDR® S&P 500® ETF Trust (the “Underlying ETF”) up to a predetermined upside cap of 9.10% (before fees and expenses of the Fund) and 8.35% (after fees and expenses of the Fund), while providing a buffer against Underlying ETF losses between 5% and 30% over the period from April 1, 2021 to March 31, 2022.

The Fund uses FLEX Options to employ a “structured outcome strategy.” Structured outcome strategies seek to produce pre-determined target investment outcomes based upon the performance of an underlying security or index. The predetermined outcomes sought by the Fund are intended to reflect the performance of the Underlying ETF over an approximate one-year period (the “Investment Period”), subject to a buffer (the “Buffer”) against certain Underlying ETF losses and a cap (the “Cap”) as set forth in the following table:

Investment Period Start: April 1, 2021

Investment Period End: March 31, 2022

Buffer: 5% to 30%

Cap (before Fund fees and expenses): 9.10%

Cap (after Fund fees and expenses): 8.35%

Year-To-Date, the Fund had a NAV total return of 5.45%. The S&P 500 Index had a price return of 16.83%.

5

Pacer Funds

Pacer Swan SOS Moderate (April) ETF

The Pacer Swan SOS Moderate (April) ETF (the “Fund”) seeks to provide investors with returns that, before fees and expenses of the Fund, match those of the SPDR® S&P 500® ETF Trust (“the Underlying ETF”) up to a predetermined upside cap of 10.48% (before fees and expenses of the Fund) and 9.73% (after fees and expenses of the Fund), while providing a buffer against the first 15% of Underlying ETF losses, over the period from April 1, 2021 to March 31, 2022.

The Fund uses FLEX Options to employ a “structured outcome strategy.” Structured outcome strategies seek to produce pre-determined target investment outcomes based upon the performance of an underlying security or index. The predetermined outcomes sought by the Fund are intended to reflect the performance of the Underlying ETF over an approximate one-year period (the “Investment Period”), subject to a buffer (the “Buffer”) against certain Underlying ETF losses and a cap (the “Cap”) as set forth in the following table:

Investment Period Start: April 1, 2021

Investment Period End: March 31, 2022

Buffer: 15%

Cap (before Fund fees and expenses): 10.48%

Cap (after Fund fees and expenses): 9.73%

Year-To-Date, the Fund had a NAV total return of 6.67%. The S&P 500 Index had a price return of 16.83%.

Pacer Swan SOS Flex (April) ETF

The Pacer Swan SOS Flex (April) ETF (the “Fund”) seeks to provide investors with returns that match those of the SPDR® S&P 500® ETF Trust (the “Underlying ETF”) up to a predetermined upside cap of 16.04% (before fees and expenses of the Fund) and 15.29% (after fees and expenses of the Fund), while providing a buffer against the first 20% of Underlying ETF losses with the benefits of such buffer declining from 20% to 0% for Underlying ETF losses between 20% and 40%, over the period from April 1, 2021 to March 31, 2022.

The Fund uses FLEX Options to employ a “structured outcome strategy.” Structured outcome strategies seek to produce pre-determined target investment outcomes based upon the performance of an underlying security or index. The predetermined outcomes sought by the Fund are intended to reflect the performance of the Underlying ETF over an approximate one-year period (the “Investment Period”), subject to a buffer (the “Buffer”) against certain Underlying ETF losses and a cap (the “Cap”) as set forth in the following table:

Investment Period Start: April 1, 2021

Investment Period End: March 31, 2022

Full Buffer: 20%

Fading Buffer: 20% to 40%

Cap (before Fund fees and expenses): 16.04%

Cap (after Fund fees and expenses): 15.29%

Year-To-Date, the Fund had a NAV total return of 10.37%. The S&P 500 Index had a price return of 16.83%.

Pacer Swan SOS Conservative (July) ETF

The Pacer Swan SOS Conservative (July) ETF (the “Fund”) seeks to provide investors with returns that, before fees and expenses of the Fund, match those of the SPDR® S&P 500® ETF Trust (the “Underlying ETF”) up to a predetermined upside cap of 7.15% (before fees and expenses of the Fund) and 6.40% (after fees and expenses of the Fund), while providing a buffer against Underlying ETF losses between 5% and 30% over the period from July 1, 2021 to June 30, 2022.

The Fund uses FLEX Options to employ a “structured outcome strategy.” Structured outcome strategies seek to produce predetermined target investment outcomes based upon the performance of an underlying security or index. The pre-determined outcomes sought by the Fund are intended to reflect the performance of the Underlying ETF over an approximate one-year period (the “Investment Period”), subject to a buffer (the “Buffer”) against certain Underlying ETF losses and a cap (the “Cap”) as set forth in the following table:

Investment Period Start: July 1, 2021

Investment Period End: June 30, 2022

Buffer: 5% to 30%

Cap (before Fund fees and expenses): 7.15%

Cap (after Fund fees and expenses): 6.40%

Year-To-Date, the Fund had a NAV total return of 2.22%. The S&P 500 Index had a price return of 7.63%.

6

Pacer Funds

Pacer Swan SOS Moderate (July) ETF

The Pacer Swan SOS Moderate (July) ETF (the “Fund”) seeks to provide investors with returns that, before fees and expenses of the Fund, match those of the SPDR® S&P 500® ETF Trust (“the Underlying ETF”) up to a predetermined upside cap of 7.95% (before fees and expenses of the Fund) and 7.20% (after fees and expenses of the Fund), while providing a buffer against the first 15% of Underlying ETF losses, over the period from July 1, 2021 to June 30, 2022.

The Fund uses FLEX Options to employ a “structured outcome strategy.” Structured outcome strategies seek to produce pre-determined target investment outcomes based upon the performance of an underlying security or index. The predetermined outcomes sought by the Fund are intended to reflect the performance of the Underlying ETF over an approximate one-year period (the “Investment Period”), subject to a buffer (the “Buffer”) against certain Underlying ETF losses and a cap (the “Cap”) as set forth in the following table:

Investment Period Start: July 1, 2021

Investment Period End: June 30, 2022

Buffer: 15%

Cap (before Fund fees and expenses): 7.95%

Cap (after Fund fees and expenses): 7.20%

Year-To-Date, the Fund had a NAV total return of 2.63%. The S&P 500 Index had a price return of 7.63%.

Pacer Swan SOS Flex (July) ETF

The Pacer Swan SOS Flex (July) ETF (the “Fund”) seeks to provide investors with returns that match those of the SPDR® S&P 500® ETF Trust (the “Underlying ETF”) up to a predetermined upside cap of 11.30% (before fees and expenses of the Fund) and 10.55% (after fees and expenses of the Fund), while providing a buffer against the first 20% of Underlying ETF losses with the benefits of such buffer declining from 20% to 0% for Underlying ETF losses between 20% and 40%, over the period from July 1, 2021 to June 30, 2022.

The Fund uses FLEX Options to employ a “structured outcome strategy.” Structured outcome strategies seek to produce pre-determined target investment outcomes based upon the performance of an underlying security or index. The predetermined outcomes sought by the Fund are intended to reflect the performance of the Underlying ETF over an approximate one-year period (the “Investment Period”), subject to a buffer (the “Buffer”) against certain Underlying ETF losses and a cap (the “Cap”) as set forth in the following table:

Investment Period Start: July 1, 2021

Investment Period End: June 30, 2022

Full Buffer: 20%

Fading Buffer: 20% to 40%

Cap (before Fund fees and expenses): 11.30%

Cap (after Fund fees and expenses): 10.55%

Year-To-Date, the Fund had a NAV total return of 4.05%. The S&P 500 Index had a price return of 7.63%.

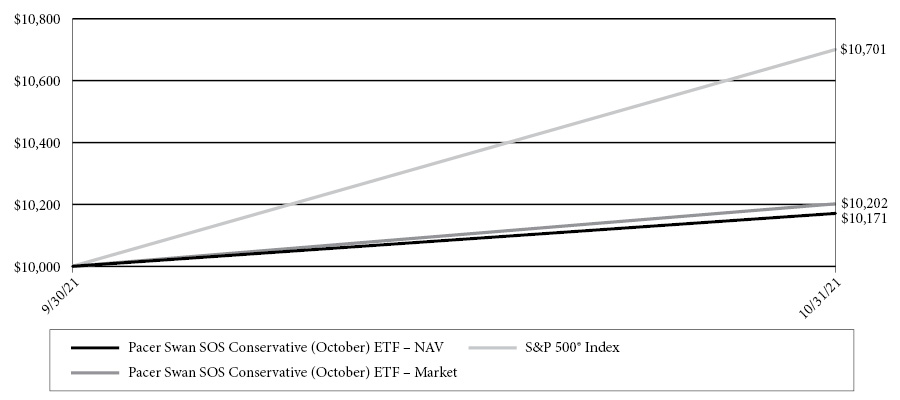

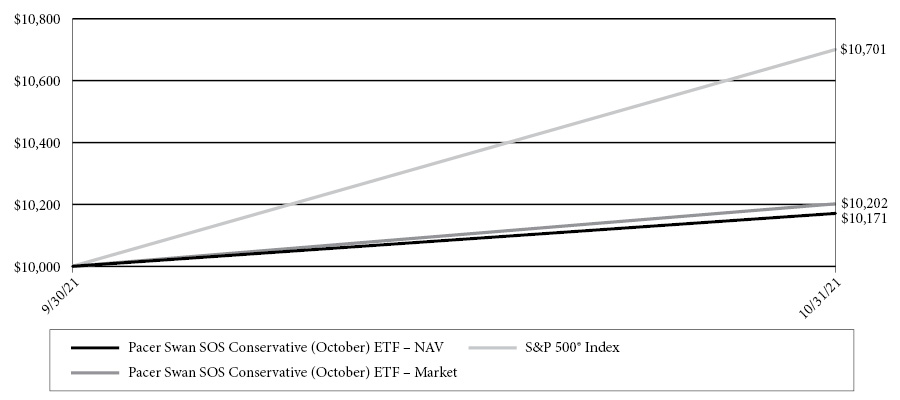

Pacer Swan SOS Conservative (October) ETF

The Pacer Swan SOS Conservative (October) ETF (the “Fund”) seeks to provide investors with returns that, before fees and expenses of the Fund, match those of the SPDR® S&P 500® ETF Trust (the “Underlying ETF”) up to a predetermined upside cap of 7.56% (before fees and expenses of the Fund) and 6.81% (after fees and expenses of the Fund), while providing a buffer against Underlying ETF losses between 5% and 30% over the period from October 1, 2021 to September 30, 2022.

The Fund uses FLEX Options to employ a “structured outcome strategy.” Structured outcome strategies seek to produce predetermined target investment outcomes based upon the performance of an underlying security or index. The pre-determined outcomes sought by the Fund are intended to reflect the performance of the Underlying ETF over an approximate one-year period (the “Investment Period”), subject to a buffer (the “Buffer”) against certain Underlying ETF losses and a cap (the “Cap”) as set forth in the following table:

Investment Period Start: October 1, 2021

Investment Period End: September 30, 2022

Buffer: 5% to 30%

Cap (before Fund fees and expenses): 7.56%

Cap (after Fund fees and expenses): 6.81%

Year-To-Date, the Fund had a NAV total return of 1.71%. The S&P 500 Index had a price return of 7.01%.

7

Pacer Funds

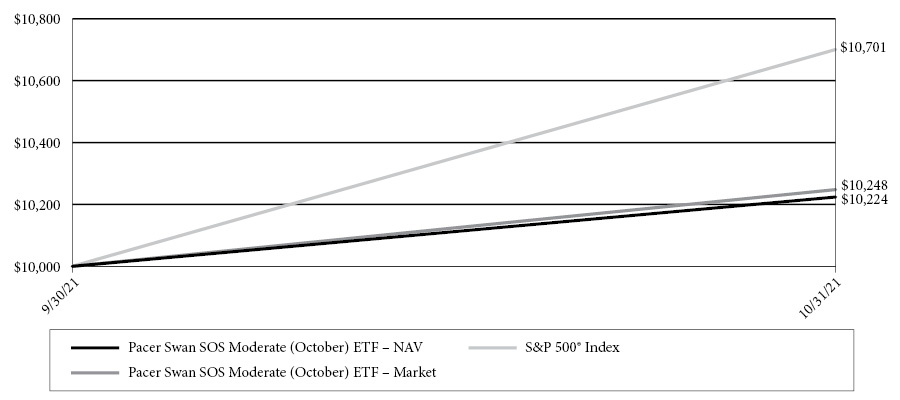

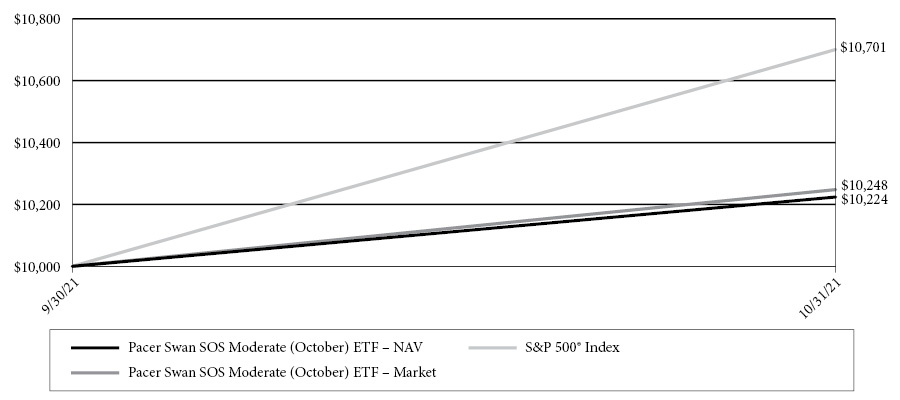

Pacer Swan SOS Moderate (October) ETF

The Pacer Swan SOS Moderate (October) ETF (the “Fund”) seeks to provide investors with returns that, before fees and expenses of the Fund, match those of the SPDR® S&P 500® ETF Trust (“the Underlying ETF”) up to a predetermined upside cap of 9.07% (before fees and expenses of the Fund) and 8.32% (after fees and expenses of the Fund), while providing a buffer against the first 15% of Underlying ETF losses, over the period from October 1, 2021 to September 30, 2022.

The Fund uses FLEX Options to employ a “structured outcome strategy.” Structured outcome strategies seek to produce predetermined target investment outcomes based upon the performance of an underlying security or index. The pre-determined outcomes sought by the Fund are intended to reflect the performance of the Underlying ETF over an approximate one-year period (the “Investment Period”), subject to a buffer (the “Buffer”) against certain Underlying ETF losses and a cap (the “Cap”) as set forth in the following table:

Investment Period Start: October 1, 2021

Investment Period End: September 30, 2022

Buffer: 15%

Cap (before Fund fees and expenses): 9.07%

Cap (after Fund fees and expenses): 8.32%

Year-To-Date, the Fund had a NAV total return of 2.24%. The S&P 500 Index had a price return of 7.01%.

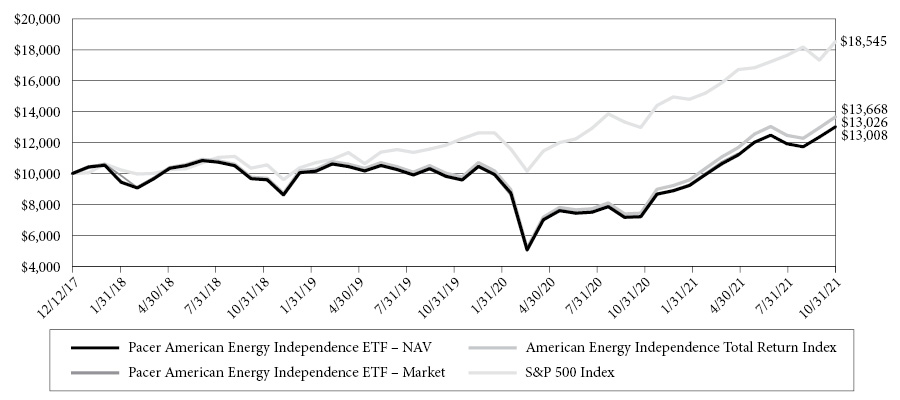

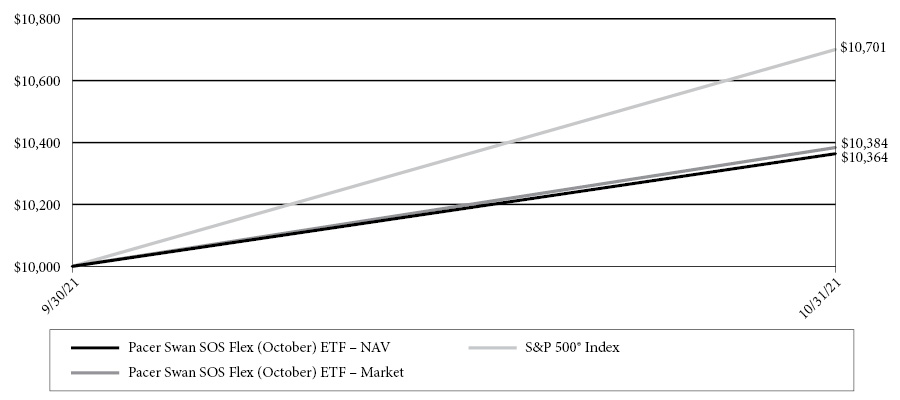

Pacer Swan SOS Flex (October) ETF

The Pacer Swan SOS Flex (October) ETF (the “Fund”) seeks to provide investors with returns that match those of the SPDR® S&P 500® ETF Trust (the “Underlying ETF”) up to a predetermined upside cap of 12.98% (before fees and expenses of the Fund) and 12.23% (after fees and expenses of the Fund), while providing a buffer against the first 20% of Underlying ETF losses with the benefits of such buffer declining from 20% to 0% for Underlying ETF losses between 20% and 40%, over the period from October 1, 2021 to September 30, 2022.

The Fund uses FLEX Options to employ a “structured outcome strategy.” Structured outcome strategies seek to produce predetermined target investment outcomes based upon the performance of an underlying security or index. The pre-determined outcomes sought by the Fund are intended to reflect the performance of the Underlying ETF over an approximate one-year period (the “Investment Period”), subject to a buffer (the “Buffer”) against certain Underlying ETF losses and a cap (the “Cap”) as set forth in the following table:

Investment Period Start: October 1, 2021

Investment Period End: September 30, 2022

Full Buffer: 20%

Fading Buffer: 20% to 40%

Cap (before Fund fees and expenses): 12.98%

Cap (after Fund fees and expenses): 12.23%

Year-To-Date, the Fund had a NAV total return of 3.64%. The S&P 500 Index had a price return of 7.01%.

8

Pacer Funds

PORTFOLIO ALLOCATION (Unaudited)

As of October 31, 2021

Pacer American Energy Independence ETF

Sector(a) | | Percentage of

Net Assets | |

Transportation and Warehousing | | | 59.8 | % |

Utilities | | | 21.4 | % |

Mining, Quarrying, and Oil and Gas Extraction | | | 9.8 | % |

Professional Scientific and Technical Services | | | 5.0 | % |

Real Estate and Rental and Leasing | | | 2.2 | % |

Wholesale Trade | | | 0.6 | % |

Retail Trade | | | 0.4 | % |

Short-Term Investments | | | 0.2 | % |

Investments Purchased With Proceeds From Securities Lending | | | 4.2 | % |

Other Assets in Excess of Liabilities | | | -3.6 | % |

Total | | | 100.0 | % |

(a) | The Fund may classify a company in a different category than the American Energy Independence Index. |

Pacer Salt High truBetaTM US Market ETF

Sector(a) | | Percentage of

Net Assets | |

Financial | | | 28.1 | % |

Consumer Cyclical | | | 25.7 | % |

Energy | | | 14.9 | % |

Technology | | | 9.9 | % |

Basic Materials | | | 6.9 | % |

Industrial | | | 5.7 | % |

Consumer, Non-cyclical | | | 4.8 | % |

Communications | | | 3.8 | % |

Short-Term Investments | | | 0.2 | % |

Investments Purchased With Proceeds From Securities Lending | | | 23.7 | % |

Liabilities in Excess of Other Assets | | | -23.7 | % |

| | | | 100.0 | % |

(a) | The Fund may classify a company in a different category than the Salt High truBetaTM US Market Index. |

Pacer Salt Low truBetaTM US Market ETF

Sector(a) | | Percentage of

Net Assets | |

Consumer, Non-cyclical | | | 37.6 | % |

Utilities | | | 17.5 | % |

Financials | | | 16.5 | % |

Consumer Cyclical | | | 8.4 | % |

Communications | | | 6.7 | % |

Technology | | | 5.7 | % |

Industrials | | | 5.2 | % |

Basic Materials | | | 2.1 | % |

Short-Term Investments | | | 0.2 | % |

Investments Purchased With Proceeds From Securities Lending | | | 15.6 | % |

Liabilities in Excess of Other Assets | | | -15.5 | % |

| | | | 100.0 | % |

(a) | The Fund may classify a company in a different category than the Salt Low truBetaTM US Market Index. |

9

Pacer Funds

PORTFOLIO ALLOCATION (Unaudited)

As of October 31, 2021 (Continued)

Pacer Swan SOS Conservative (December) ETF

Sector | | Percentage of

Net Assets | |

Purchased Options | | | 114.2 | % |

Short-Term Investments | | | 0.1 | % |

Liabilities in Excess of Other Assets | | | -14.3 | % |

| | | | 100.0 | % |

Pacer Swan SOS Moderate (December) ETF

Sector | | Percentage of

Net Assets | |

Purchased Options | | | 111.9 | % |

Short-Term Investments | | | 0.3 | % |

Liabilities in Excess of Other Assets | | | -12.2 | % |

| | | | 100.0 | % |

Pacer Swan SOS Flex (December) ETF

Sector | | Percentage of

Net Assets | |

Purchased Options | | | 106.5 | % |

Short-Term Investments | | | 0.2 | % |

Liabilities in Excess of Other Assets | | | -6.7 | % |

| | | | 100.0 | % |

Pacer Swan SOS Fund of Funds ETF

Sector | | Percentage of

Net Assets | |

Affiliated Exchange-Traded Funds | | | 99.0 | % |

Short-Term Investments | | | 2.5 | % |

Liabilities in Excess of Other Assets | | | -1.5 | % |

| | | | 100.0 | % |

Pacer Swan SOS Conservative (April) ETF

Sector | | Percentage of

Net Assets | |

Purchased Options | | | 109.0 | % |

Short-Term Investments | | | 0.5 | % |

Liabilities in Excess of Other Assets | | | -9.5 | % |

| | | | 100.0 | % |

Pacer Swan SOS Moderate (April) ETF

Sector | | Percentage of

Net Assets | |

Purchased Options | | | 108.2 | % |

Short-Term Investments | | | 0.6 | % |

Liabilities in Excess of Other Assets | | | -8.8 | % |

| | | | 100.0 | % |

10

Pacer Funds

PORTFOLIO ALLOCATION (Unaudited)

As of October 31, 2021 (Continued)

Pacer Swan SOS Flex (April) ETF

Sector | | Percentage of

Net Assets | |

Purchased Options | | | 104.7 | % |

Short-Term Investments | | | 0.5 | % |

Liabilities in Excess of Other Assets | | | -5.2 | % |

| | | | 100.0 | % |

Pacer Swan SOS Conservative (July) ETF

Sector | | Percentage of

Net Assets | |

Purchased Options | | | 106.0 | % |

Short-Term Investments | | | 0.6 | % |

Liabilities in Excess of Other Assets | | | -6.6 | % |

| | | | 100.0 | % |

Pacer Swan SOS Moderate (July) ETF

Sector | | Percentage of

Net Assets | |

Purchased Options | | | 106.5 | % |

Short-Term Investments | | | 0.8 | % |

Liabilities in Excess of Other Assets | | | -7.3 | % |

| | | | 100.0 | % |

Pacer Swan SOS Flex (July) ETF

Sector | | Percentage of

Net Assets | |

Purchased Options | | | 105.5 | % |

Short-Term Investments | | | 0.8 | % |

Liabilities in Excess of Other Assets | | | -6.3 | % |

| | | | 100.0 | % |

Pacer Swan SOS Conservative (October) ETF

Sector | | Percentage of

Net Assets | |

Purchased Options | | | 107.2 | % |

Short-Term Investments | | | 0.8 | % |

Liabilities in Excess of Other Assets | | | -8.0 | % |

| | | | 100.0 | % |

Pacer Swan SOS Moderate (October) ETF

Sector | | Percentage of

Net Assets | |

Purchased Options | | | 107.8 | % |

Short-Term Investments | | | 0.7 | % |

Liabilities in Excess of Other Assets | | | -8.5 | % |

| | | | 100.0 | % |

11

Pacer Funds

PORTFOLIO ALLOCATION (Unaudited)

As of October 31, 2021 (Continued)

Pacer Swan SOS Flex (October) ETF

Sector | | Percentage of

Net Assets | |

Purchased Options | | | 106.9 | % |

Short-Term Investments | | | 0.9 | % |

Liabilities in Excess of Other Assets | | | -7.8 | % |

| | | | 100.0 | % |

12

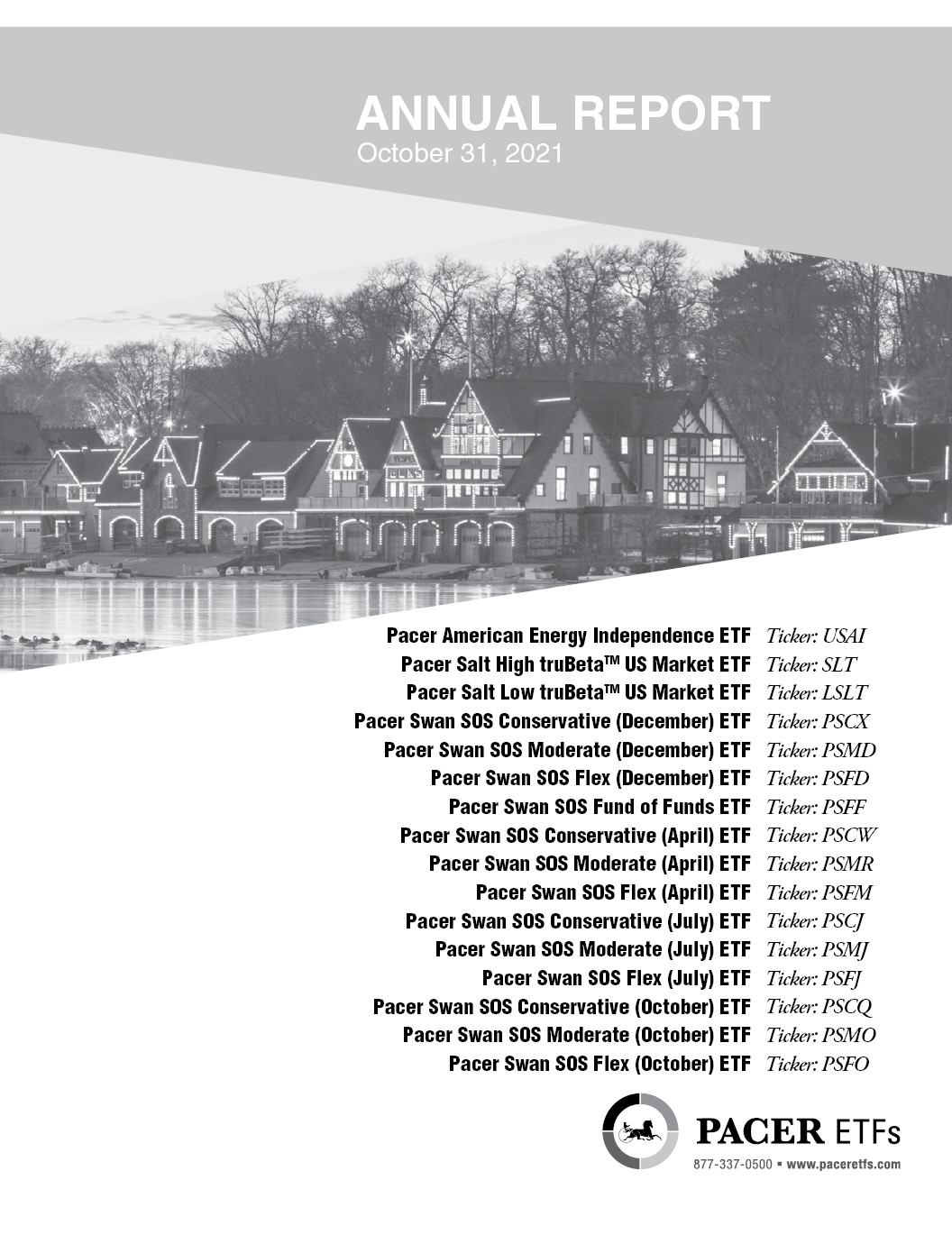

Pacer American Energy Independence ETF

PERFORMANCE SUMMARY

(Unaudited)

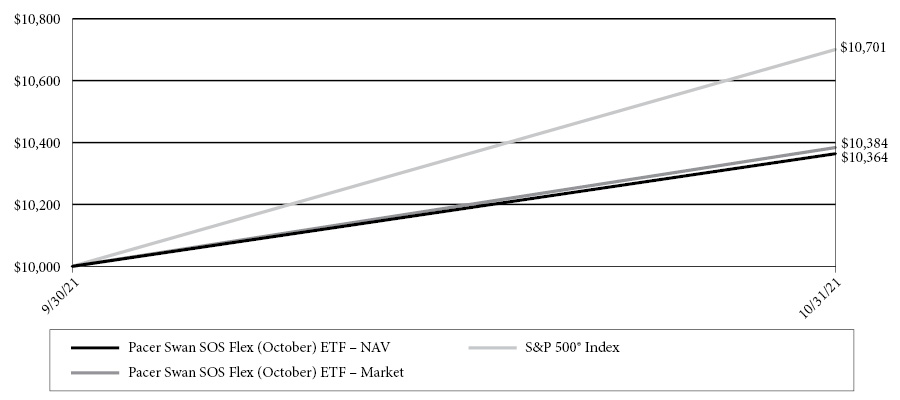

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made on December 12, 2017, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The American Energy Independence Total Return Index uses a proprietary, rules based methodology to measure the performance of a portfolio of U.S. and Canadian exchange-listed equity securities of companies that generate a majority of their cash flow from certain qualifying “midstream” energy infrastructure activities. The companies in the Index are expected to benefit from regulatory policies favoring and industry trends toward American energy independence (i.e., a reduced or eliminated need for the United States to import fuels, such as coal, crude oil, or natural gas). Midstream energy infrastructure refers to the processing, storage, transportation, and distribution of crude oil, natural gas, refined products, and their related products as well as the transmission or storage of renewable energy. The following activity segments are considered qualifying midstream energy infrastructure activities: gathering & processing, compression, fractionation, logistics, midstream services, pipeline transportation, storage and terminaling of oil, gas, natural gas liquids, and refined products, as well as liquid natural gas facilities. The following activity segments are not qualifying activities: refining, shipping, exploration, production, retail, distribution, power generation or oil services. The Index may include small-, mid-, and large-capitalization companies.

The S&P 500 Index consists of approximately 500 leasing U.S.-listed companies representing approximately 8% of the U.S. equity market capitalization.

Annualized Returns(1)

(For the period ended October 31, 2021)

| | One Year | Three Year | Since Inception(2) |

Pacer American Energy Independence ETF - NAV | 80.71% | 10.46% | 7.04% |

Pacer American Energy Independence ETF - Market | 80.57% | 10.34% | 7.00% |

American Energy Independence Total Return Index (3) | 83.80% | 11.88% | 8.38% |

S&P 500 Index (3) | 42.91% | 21.48% | 17.23% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated February 28, 2021, is 0.75%. For performance information current to the most recent month-end, please call 1-877-337-0500. |

(2) | Inception date is December 12, 2017. The Fund is the sucessor to the investment performance of the American Energy Independence ETF (the “Predecessor USAI”) as a result of the reorganization of the Predecessor USAI Fund into the Fund on December 16, 2019. Accordingly, the performance information shown in the chart and table above for periods prior to December 16, 2019 is that of the Predecessor USAI Fund’s Shares for the Fund. The Predecessor USAI Fund was advised by SL Advisors, LLC and sub-advised by Penserra Capital Management LLC and had substantially the same investment objectives, policies, and strategies as the Fund. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

13

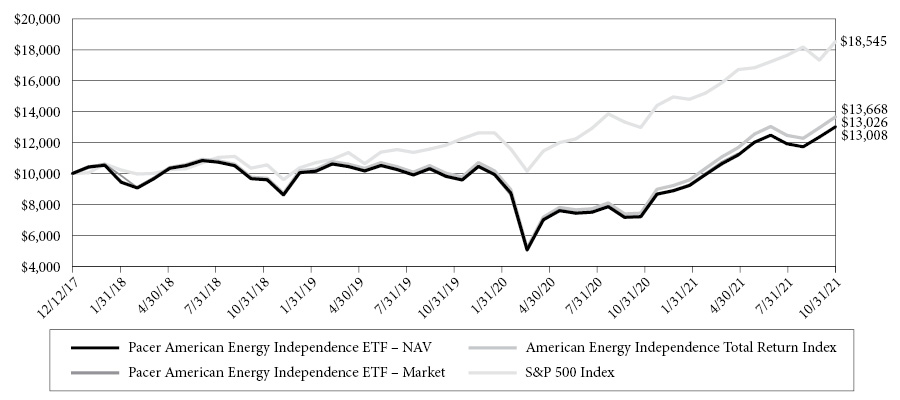

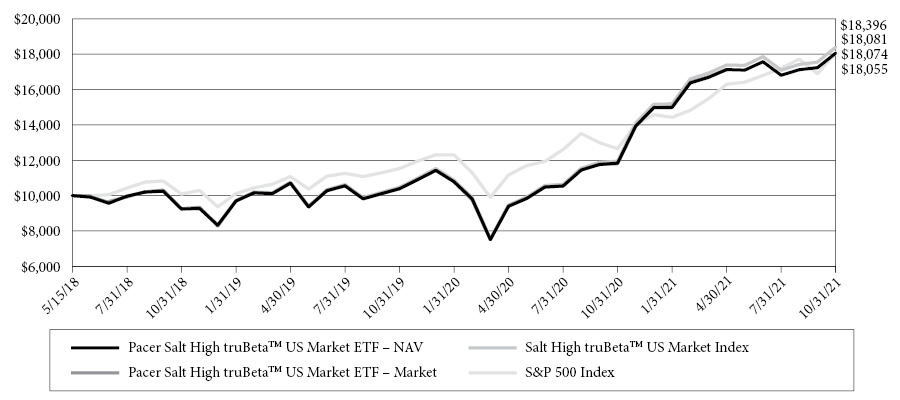

Pacer Salt High truBetaTM US Market ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made on May 15, 2018, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The Salt High truBetaTM US Market Index uses an objective, rules-based methodology to measure the performance of an equal-weighted portfolio of approximately 100 large- and mid-capitalization U.S.-listed stocks with the highest forecasted systematic risk relative to the market (known as “beta”). Construction of the Index begins with the constituents of the Solactive US Large & Mid Cap Index (the “Equity Universe”), generally the 1,000 largest U.S.-listed common stocks and real estate investment trusts (“REITs”). Companies in the Equity Universe are then screened to keep only the 500 stocks with the highest average daily traded value over the past 30 days. Those 500 stocks are then analyzed using a proprietary algorithm developed by the Index Provider to calculate each stock’s truBetaTM forecast, i.e., its projected beta for the subsequent quarter, and to eliminate stocks whose performance is weakly correlated with the broader U.S. equity market (the remaining securities are referred to as the “Index Universe”).

The S&P 500 Index consists of approximately 500 leasing U.S.-listed companies representing approximately 8% of the U.S. equity market capitalization.

Annualized Returns(1)

(For the period ended October 31, 2021)

| | One Year | Three Year | Since Inception(2) |

Pacer Salt High truBetaTM US Market ETF - NAV | 52.53% | 25.01% | 18.60% |

Pacer Salt High truBetaTM US Market ETF - Market | 53.14% | 25.03% | 18.64% |

Salt High truBetaTM US Market Index(3) | 53.94% | 25.69% | 19.25% |

S&P 500 Index® (3) | 42.91% | 21.48% | 18.65% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated February 28, 2021, is 0.60%. For performance information current to the most recent month-end, please call 1-877-337-0500. |

(2) | Inception date is May 15, 2018. The Fund is the successor to the investment performance of the Salt Low truBetaTM US Market ETF, as a result of the reorganization of the Salt Low truBetaTM US Market ETF into the Fund on October 5, 2020. In addition, the Salt Low truBetaTM US Market ETF was the successor to the investment performance of Salt Low truBetaTM US Market ETF, a series of Salt Funds Trust, as a result of the reorganization of the series of Salt Funds Trust into a series of ETF Series Solutions that occurred on December 16, 2019 (together, the “Predecessor SLT”). Accordingly, any performance information for periods prior to October 5, 2020 is that of the series of ETF Series Solutions; any performance for periods prior to December 16, 2019 is that of the series of Salt Funds Trust. The Predecessor SLT Fund was advised by Salt Financial, LLC and sub-advised by Penserra Capital Management LLC and had substantially the same investment objectives, policies, and strategies as the Fund. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

14

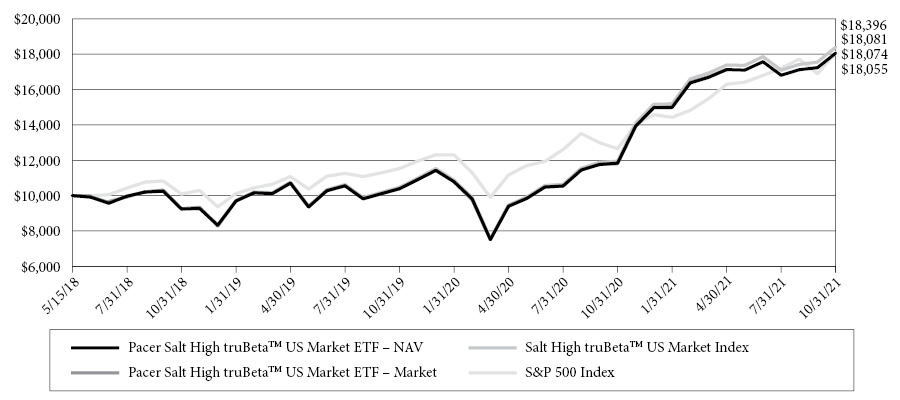

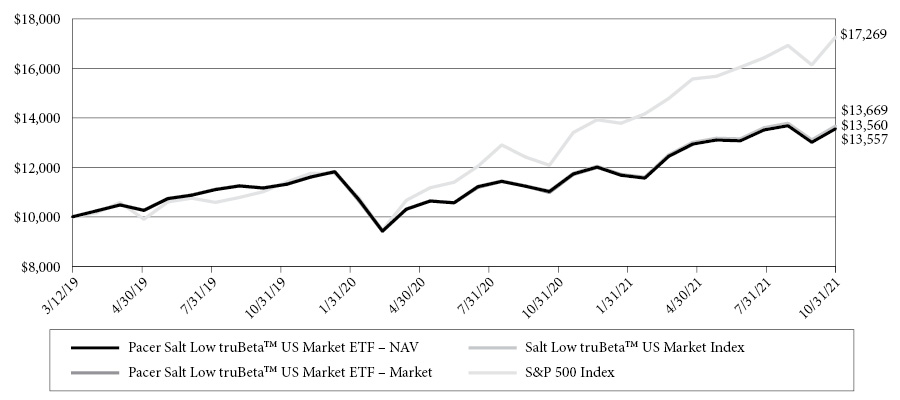

Pacer Salt Low truBetaTM US Market ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made on March 12, 2019, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The Salt Low truBetaTM US Market Index uses a an objective, rules-based methodology to to measure the performance of an equal-weighted portfolio of approximately 100 large and mid-capitalization U.S.-listed stocks with the lowest levels of variability in their historical beta calculations (“Beta Variability”) and forecasted beta of less than 1.00. “Beta” is a calculation of an investment’s systematic risk relative to the market. Construction of the Index begins with the constituents of the Solactive US Large & Mid Cap Index (the “Equity Universe”), generally the 1,000 largest U.S.-listed common stocks and real estate investment trusts (“REITs”). Companies in the Equity Universe are then screened to keep only the 500 stocks with the highest average daily traded value over the past 30 days. The remaining stocks (the “Index Universe”) are analyzed using a proprietary algorithm developed by the Index Provider to calculate each stock’s truBeta forecast, i.e., its projected beta for the subsequent quarter.

The S&P 500 Index consists of approximately 500 leasing U.S.-listed companies representing approximately 8% of the U.S. equity market capitalization.

Annualized Returns(1)

(For the period ended October 31, 2021)

| | One Year | Since Inception(2) |

Pacer Salt Low truBetaTM US Market ETF - NAV | 23.01% | 12.24% |

Pacer Salt Low truBetaTM US Market ETF - Market | 23.42% | 12.23% |

Salt Low truBetaTM US Market Index TR(3) | 23.79% | 12.58% |

S&P 500® Index (3) | 42.91% | 23.01% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated February 28, 2021, is 0.60%. For performance information current to the most recent month-end, please call 1-877-337-0500. |

(2) | Inception date is March 12, 2019. The Fund is the successor to the Salt Low truBetaTM US Market ETF, a series of ETF Series Solutions, as a result of the reorganization of the Salt Low truBetaTM US Market ETF into the Fund on October 2, 2020. In addition, the Salt Low truBetaTM US Market ETF was the successor to the investment performance of Salt Low truBetaTM US Market ETF, a series of Salt Funds Trust, as a result of the reorganization of the series of Salt Funds Trust into a series of ETF Series Solutions that occurred on December 16, 2019 (together, the “Predecessor LSLT”). The Predecessor LSLT Fund commenced operations on March 12, 2019. Accordingly, any performance information for periods prior to October 2, 2020 is that of the series of ETF Series Solutions; any performance for periods prior to December 16, 2019 is that of the series of Salt Funds Trust. The Predecessor SLT Fund was advised by Salt Financial, LLC and sub-advised by Penserra Capital Management, LLC and had substantially the same investment objectives, policies, and strategies as the Fund. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

15

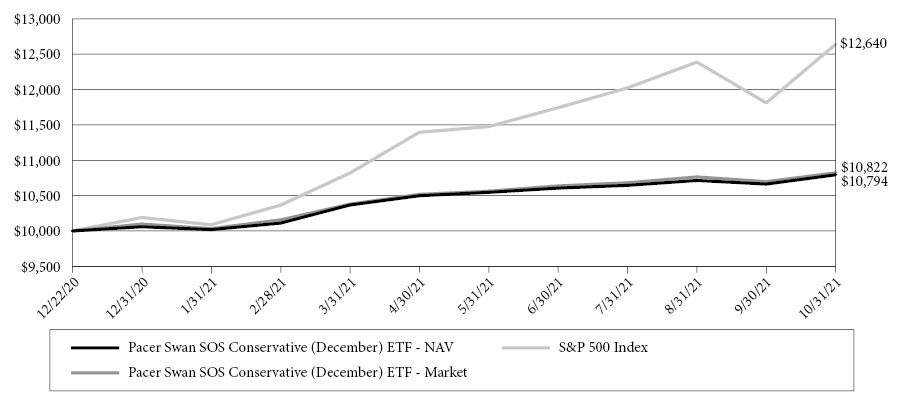

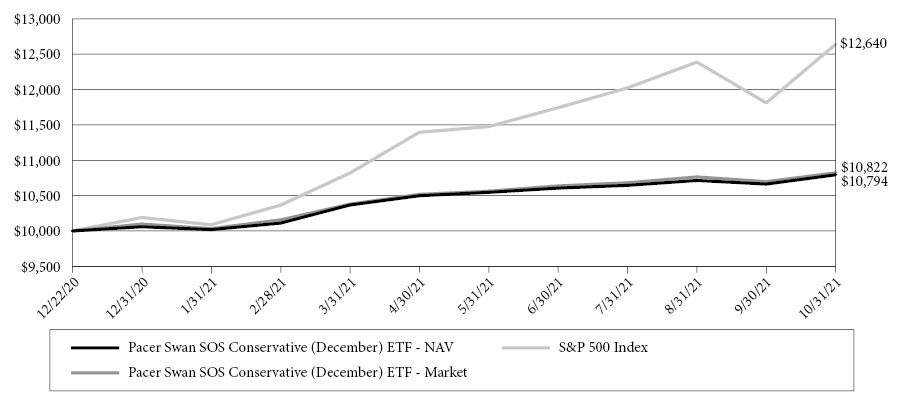

Pacer Swan SOS Conservative (December) ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made on December 22, 2020, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The Pacer Swan SOS Conservative (December) ETF (the “Fund”) seeks to provide investors with returns that, before fees and expenses of the Fund, match those of the SPDR® S&P 500 ETF Trust (the “Underlying ETF”) up to a predetermined upside cap of 9.92% (before fees and expenses of the Fund) and 9.17% (after fees and expenses of the Fund), while providing a buffer against Underlying ETF losses between 5% and 30% over the period from December 22, 2020 to December 17, 2021.

The S&P 500 Index consists of approximately 500 leading U.S.-listed companies representing approximately 8% of the U.S. equity market capitalization.

Cumulative Returns (1)

(For the period ended October 31, 2021)

| | Since Inception(2) |

Pacer Swan SOS Conservative (December) ETF - NAV | 7.94% |

Pacer Swan SOS Conservative (December) ETF - Market | 8.22% |

S&P 500 Index (3) | 26.40% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated December 23, 2020 as supplemented March 17, 2021, is 0.75%. For performance information current to the most recent month-end, please call 1-877-337-0500. |

(2) | Inception date is December 22, 2020. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

16

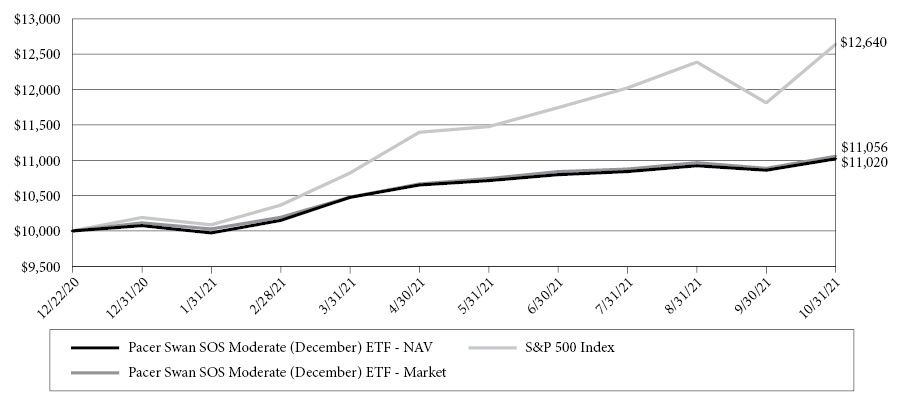

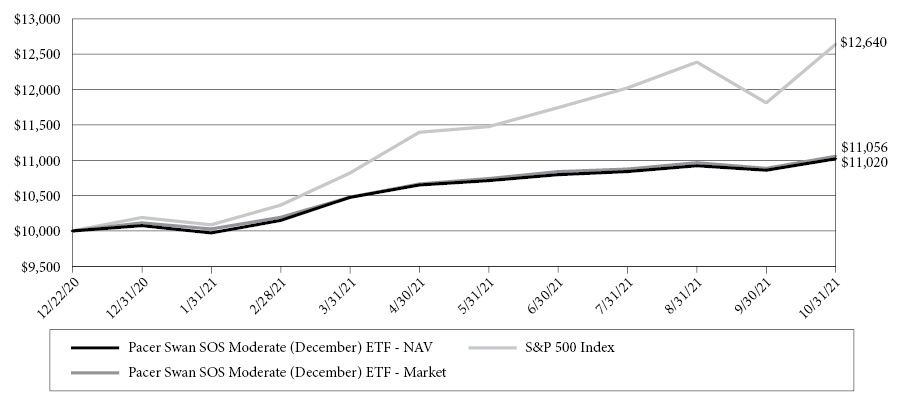

Pacer Swan SOS Moderate (December) ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made on December 22, 2020, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The Pacer Swan SOS Moderate (December) ETF (the “Fund”) seeks to provide investors with returns that, before fees and expenses of the Fund, match those of the SPDR® S&P 500® ETF Trust (“the Underlying ETF”) up to a predetermined upside cap of 12.25% (before fees and expenses of the Fund) and 11.50% (after fees and expenses of the Fund), while providing a buffer against the first 15% of Underlying ETF losses, over the period from December 22, 2020 to December 17, 2021.

The S&P 500 Index consists of approximately 500 leading U.S.-listed companies representing approximately 8% of the U.S. equity market capitalization.

Cumulative Returns (1)

(For the period ended October 31, 2021)

| | Since Inception(2) |

Pacer Swan SOS Moderate (December) ETF - NAV | 10.20% |

Pacer Swan SOS Moderate (December) ETF - Market | 10.56% |

S&P 500 Index (3) | 26.40% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated December 23, 2020 as supplemented March 17, 2021, is 0.75%. For performance information current to the most recent month-end, please call 1-877-337-0500. |

(2) | Inception date is December 22, 2020. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

17

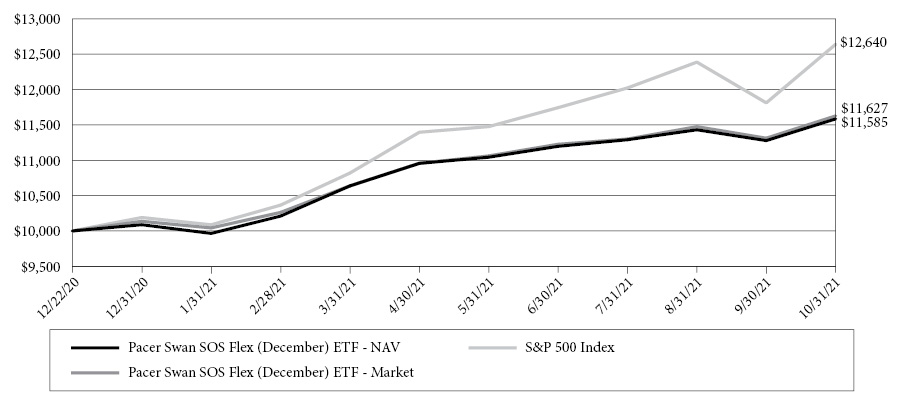

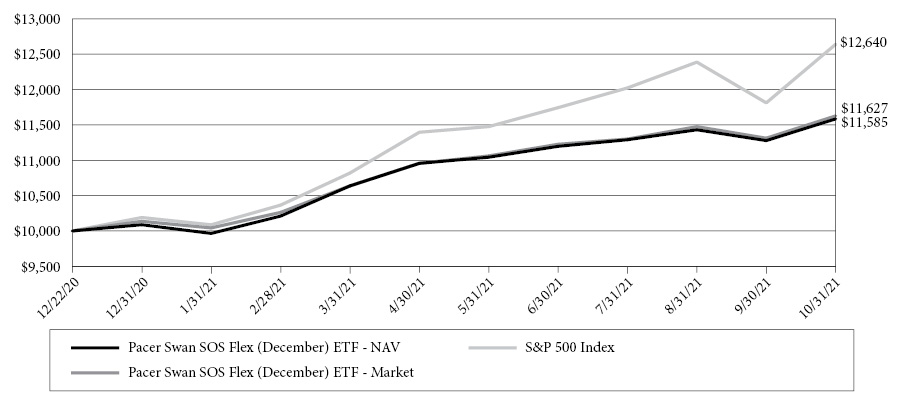

Pacer Swan SOS Flex (December) ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made on December 22, 2020, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The Pacer Swan SOS Flex (December) ETF (the “Fund”) seeks to provide investors with returns that match those of the SPDR® S&P 500® ETF Trust (the “Underlying ETF”) up to a predetermined upside cap of 18.52% (before fees and expenses of the Fund) and 17.17% (after fees and expenses of the Fund), while providing a buffer against the first 20% of Underlying ETF losses with the benefits of such buffer declining from 20% to 0% for Underlying ETF losses between 20% and 40%, over the period from December 22, 2020 to December 17, 2021.

The S&P 500 Index consists of approximately 500 leading U.S.-listed companies representing approximately 8% of the U.S. equity market capitalization.

Cumulative Returns (1)

(For the period ended October 31, 2021)

| | Since Inception(2) |

Pacer Swan SOS Flex (December) ETF - NAV | 15.85% |

Pacer Swan SOS Flex (December) ETF - Market | 16.72% |

S&P 500 Index (3) | 26.40% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated December 23, 2020 as supplemented March 17, 2021, is 0.75%. For performance information current to the most recent month-end, please call 1-877-337-0500. |

(2) | Inception date is December 22, 2020. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

18

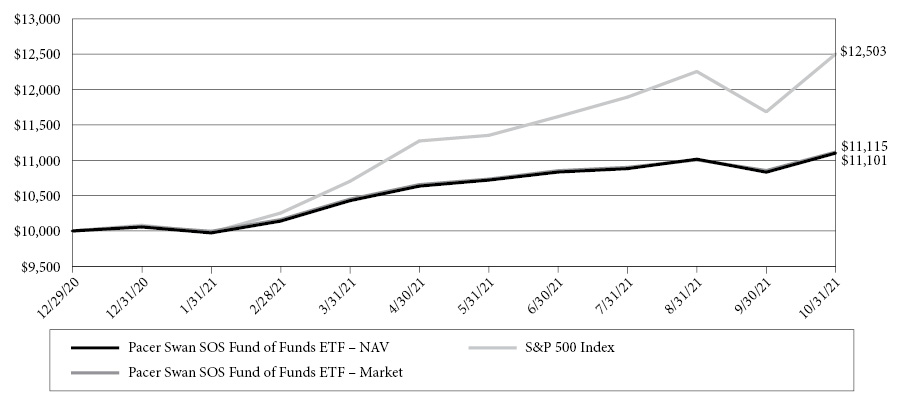

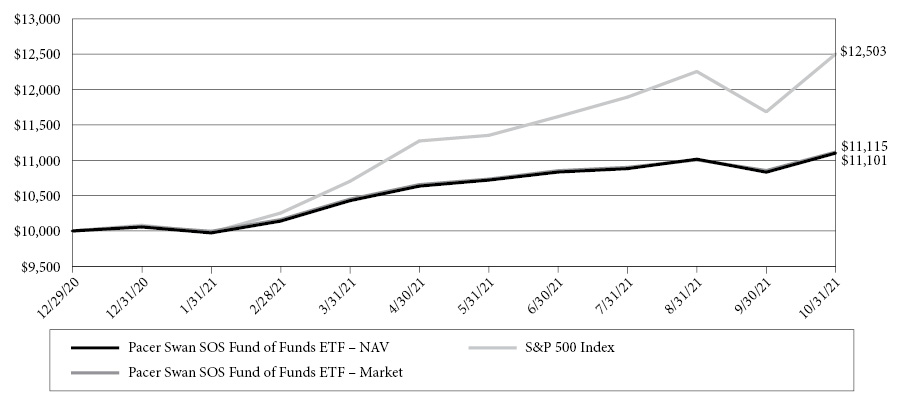

Pacer Swan SOS Fund of Funds ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made on December 29, 2020, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The Pacer Swan SOS Fund of Funds ETF (the “Fund”) seeks capital appreciation with downside protection.

The S&P 500 Index consists of approximately 500 leading U.S.-listed companies representing approximately 8% of the U.S. equity market capitalization.

Cumulative Returns (1)

(For the period ended October 31, 2021)

| | Since Inception(2) |

Pacer Swan SOS Fund of Funds ETF - NAV | 11.01% |

Pacer Swan SOS Fund of Funds ETF - Market | 11.15% |

S&P 500 Index (3) | 25.03% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated December 23, 2020 as supplemented March 17, 2021, is 0.93%. For performance information current to the most recent month-end, please call 1-877-337-0500. |

(2) | Inception date is December 29, 2020. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

19

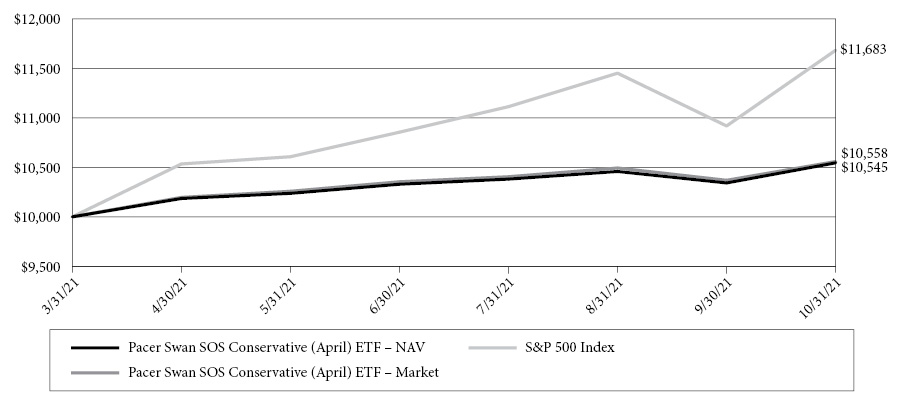

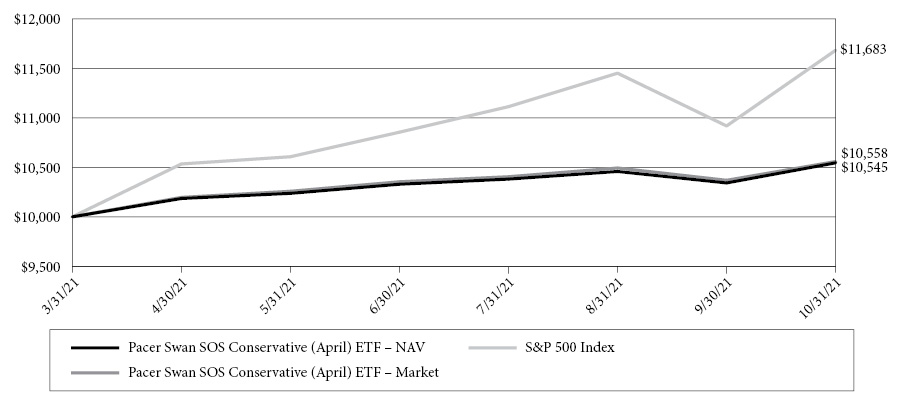

Pacer Swan SOS Conservative (April) ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made on March 31, 2021, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The Pacer Swan SOS Conservative (April) ETF (the “Fund”) seeks to provide investors with returns that, before fees and expenses of the Fund, match those of the SPDR® S&P 500® ETF Trust (the “Underlying ETF”) up to a predetermined upside cap of 9.10% (before fees and expenses of the Fund) and 8.35% (after fees and expenses of the Fund), while providing a buffer against Underlying ETF losses between 5% and 30% over the period from April 1, 2021 to March 31, 2022.

The S&P 500 Index consists of approximately 500 leading U.S.-listed companies representing approximately 8% of the U.S. equity market capitalization.

Cumulative Returns (1)

(For the period ended October 31, 2021)

| | Since Inception(2) |

Pacer Swan SOS Conservative (April) ETF - NAV | 5.45% |

Pacer Swan SOS Conservative (April) ETF - Market | 5.58% |

S&P 500 Index (3) | 16.83% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated December 23, 2020 as supplemented April 1, 2021, is 0.75%. For performance information current to the most recent month-end, please call 1-877-337-0500. |

(2) | Inception date is March 31, 2021. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

20

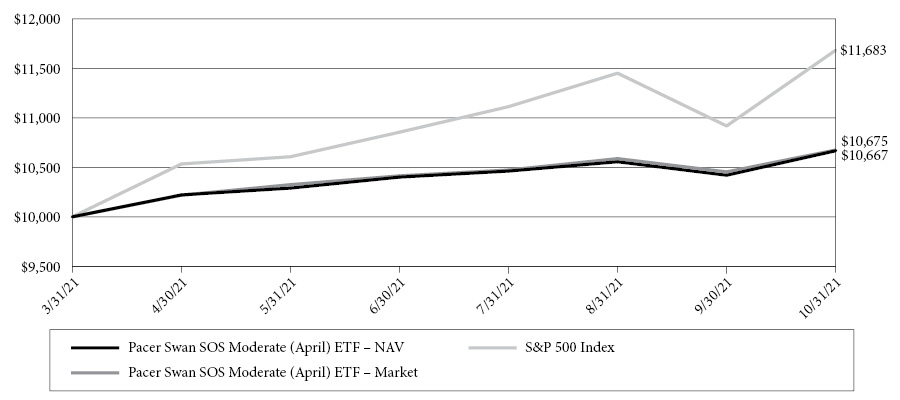

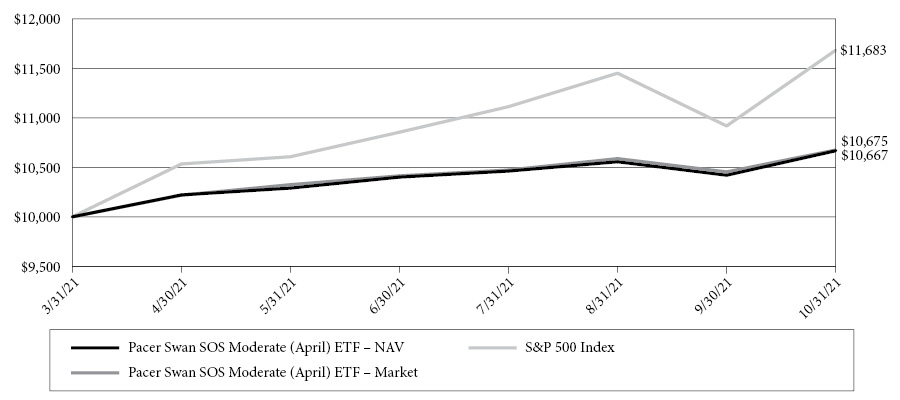

Pacer Swan SOS Moderate (April) ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made on March 31, 2021, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The Pacer Swan SOS Moderate (April) ETF (the “Fund”) seeks to provide investors with returns that, before fees and expenses of the Fund, match those of the SPDR® S&P 500® ETF Trust (“the Underlying ETF”) up to a predetermined upside cap of 10.48% (before fees and expenses of the Fund) and 9.73% (after fees and expenses of the Fund), while providing a buffer against the first 15% of Underlying ETF losses, over the period from April 1, 2021 to March 31, 2022.

The S&P 500 Index consists of approximately 500 leading U.S.-listed companies representing approximately 8% of the U.S. equity market capitalization.

Cumulative Returns (1)

(For the period ended October 31, 2021)

| | Since Inception(2) |

Pacer Swan SOS Moderate (April) ETF - NAV | 6.67% |

Pacer Swan SOS Moderate (April) ETF - Market | 6.75% |

S&P 500 Index (3) | 16.83% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated December 23, 2020 as supplemented April 1, 2021, is 0.75%. For performance information current to the most recent month-end, please call 1-877-337-0500. |

(2) | Inception date is March 31, 2021. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

21

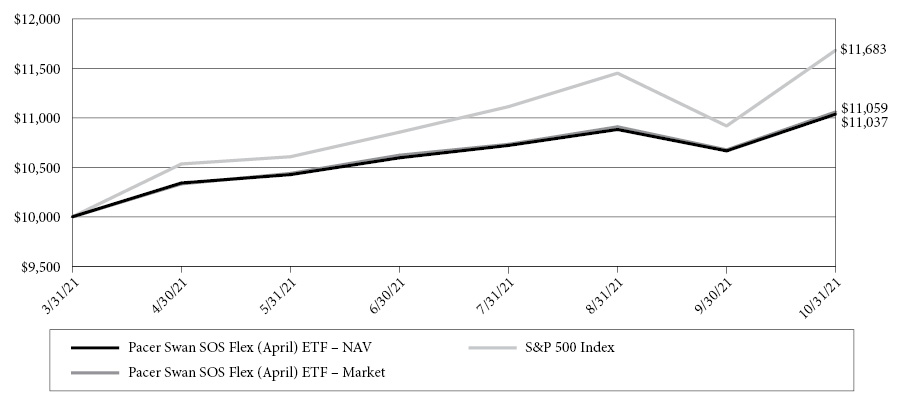

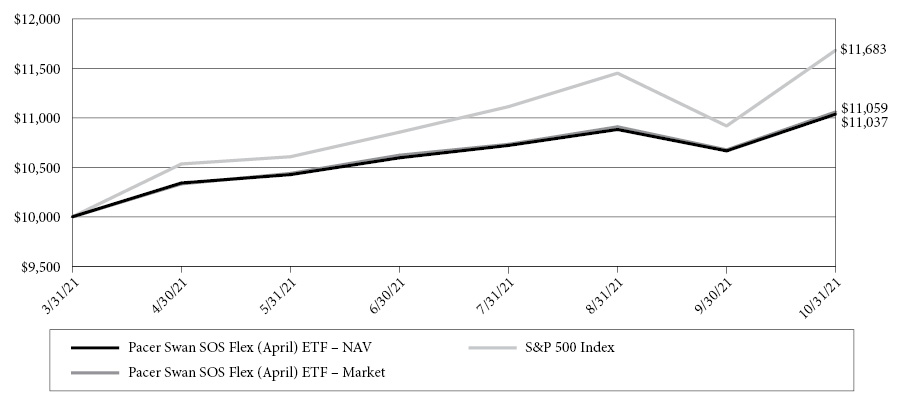

Pacer Swan SOS Flex (April) ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made on March 31, 2021, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The Pacer Swan SOS Flex (April) ETF (the “Fund”) seeks to provide investors with returns that match those of the SPDR® S&P 500® ETF Trust (the “Underlying ETF”) up to a predetermined upside cap of 16.04% (before fees and expenses of the Fund) and 15.29% (after fees and expenses of the Fund), while providing a buffer against the first 20% of Underlying ETF losses with the benefits of such buffer declining from 20% to 0% for Underlying ETF losses between 20% and 40%, over the period from April 1, 2021 to March 31, 2022.

The S&P 500 Index consists of approximately 500 leading U.S.-listed companies representing approximately 8% of the U.S. equity market capitalization.

Cumulative Returns (1)

(For the period ended October 31, 2021)

| | Since Inception(2) |

Pacer Swan SOS Flex (April) ETF - NAV | 10.37% |

Pacer Swan SOS Flex (April) ETF - Market | 10.59% |

S&P 500 Index (3) | 16.83% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated December 23, 2020 as supplemented April 1, 2021, is 0.75%. For performance information current to the most recent month-end, please call 1-877-337-0500. |

(2) | Inception date is March 31, 2021. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

22

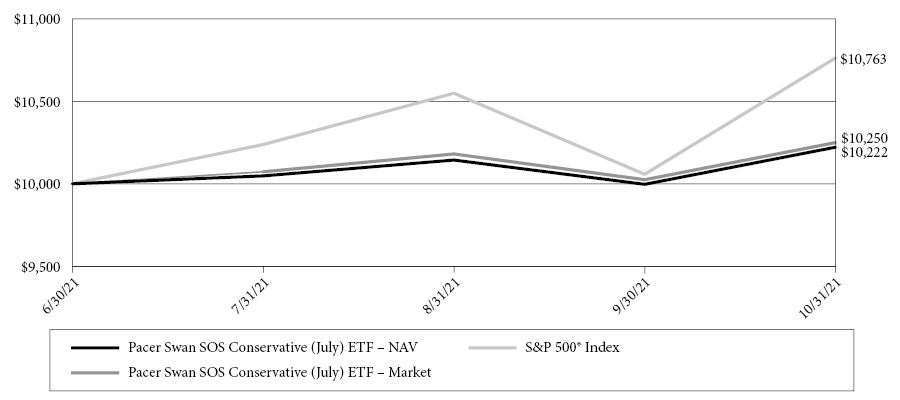

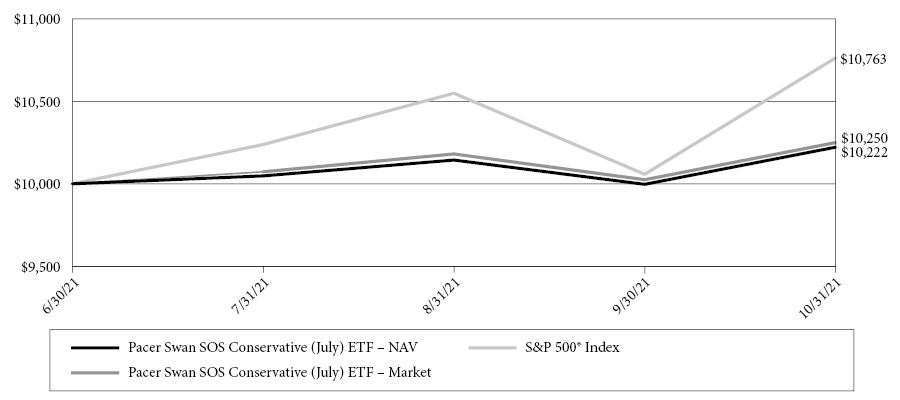

Pacer Swan SOS Conservative (July) ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000, investment made on June 30, 2021, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The Pacer Swan SOS Conservative (July) ETF seeks to provide investors with returns that match those of the SPDR® S&P 500® ETF Trust (the “Underlying ETF”) up to a predetermined upside cap of 7.15% (before fees and expenses of the Fund) and 6.40% (after fees and expenses of the Fund), while providing a buffer against Underlying ETF losses between 5% and 30%, over the period from July 1, 2021 to June 30, 2022.

The S&P 500 Index consists of approximately 500 leading U.S.-listed companies representing approximately 8% of the U.S. equity market capitalization.

Cumulative Returns (1)

(For the period ended October 31, 2021)

| | Since Inception(2) |

Pacer Swan SOS Conservative (July) ETF - NAV | 2.22% |

Pacer Swan SOS Conservative (July) ETF - Market | 2.50% |

S&P 500 Index (3) | 7.63% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated July 1, 2021, is 0.75% For performance information current to the most recent month-end, please call 1-877-337-0500. |

(2) | Inception date is June 30, 2021. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

23

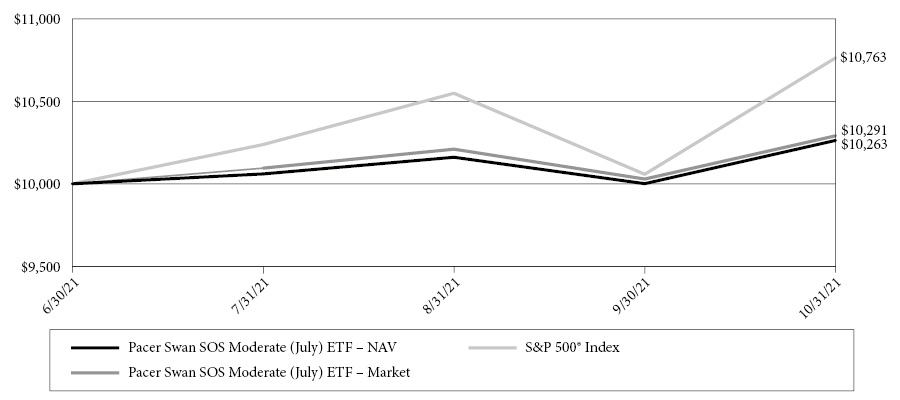

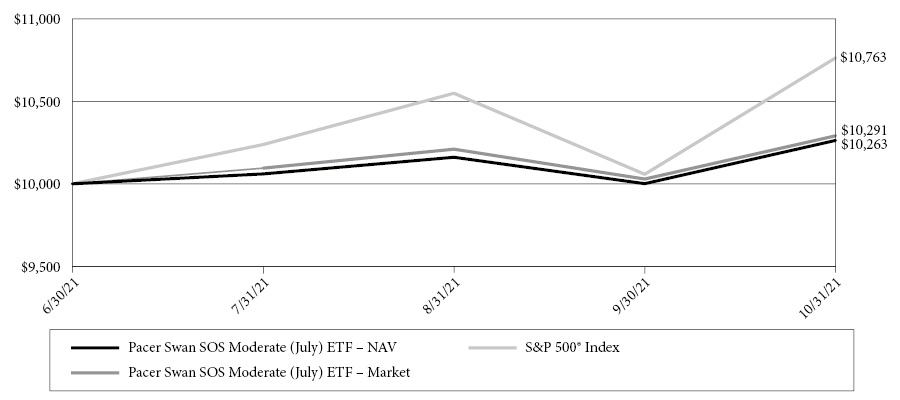

Pacer Swan SOS Moderate (July) ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000, investment made on June 30, 2021, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The Pacer Swan SOS Moderate (July) ETF seeks to provide investors with returns that match those of the SPDR® S&P 500® ETF Trust (the “Underlying ETF”) up to a predetermined upside cap of 7.95% (before fees and expenses of the Fund) and 7.20% (after fees and expenses of the Fund), while providing a buffer against the first 15% of Underlying ETF losses, over the period from July 1, 2021 to June 30, 2022.

The S&P 500 Index consists of approximately 500 leading U.S.-listed companies representing approximately 8% of the U.S. equity market capitalization.

Cumulative Returns (1)

(For the period ended October 31, 2021)

| | Since Inception(2) |

Pacer Swan SOS Moderate (July) ETF - NAV | 2.63% |

Pacer Swan SOS Moderate (July) ETF - Market | 2.91% |

S&P 500 Index (3) | 7.63% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated July1, 2021, is 0.75% For performance information current to the most recent month-end, please call 1-877-337-0500. |

(2) | Inception date is June 30, 2021. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

24

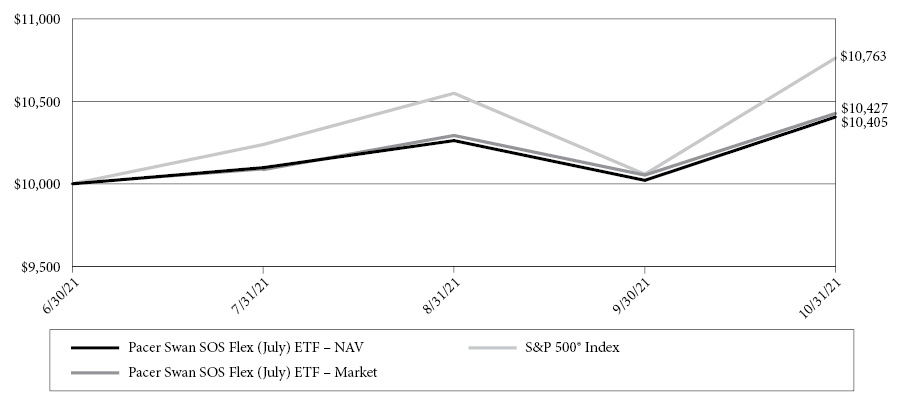

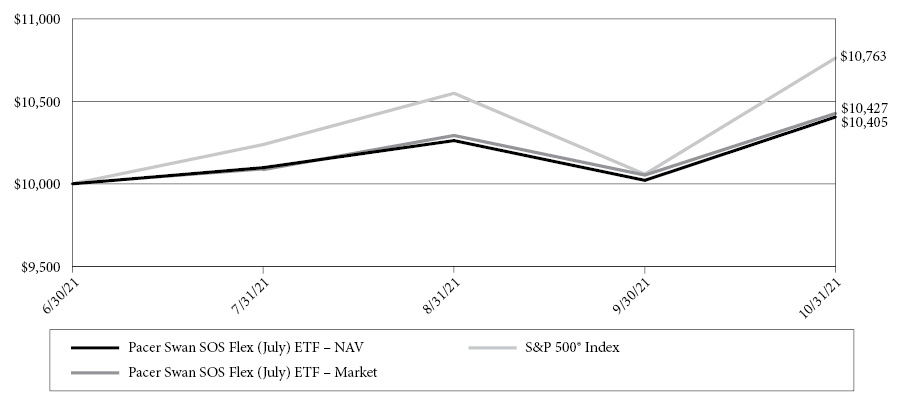

Pacer Swan SOS Flex (July) ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000, investment made on June 30, 2021, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The Pacer Swan SOS Flex (July) ETF seeks to provide investors with returns that match those of the SPDR® S&P 500® ETF Trust (the “Underlying ETF”) up to a predetermined upside cap of 11.30% (before fees and expenses of the Fund) and 10.55% (after fees and expenses of the Fund), while providing a buffer against the first 20% of Underlying ETF losses with the benefits of such buffer declining form 20% to 0% for Underlying ETF losses between 20% and 40%, over the period from July 1, 2021 to June 30, 2022.

The S&P 500 Index consists of approximately 500 leading U.S.-listed companies representing approximately 8% of the U.S. equity market capitalization.

Cumulative Returns (1)

(For the period ended October 31, 2021)

| | Since Inception(2) |

Pacer Swan SOS Flex (July) ETF - NAV | 4.05% |

Pacer Swan SOS Flex (July) ETF - Market | 4.27% |

S&P 500 Index (3) | 7.63% |