As filed with the U.S. Securities and Exchange Commission on 07/08/2020

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-23024

Pacer Funds Trust

(Exact name of registrant as specified in charter)

500 Chesterfield Parkway

Malvern, PA 19355

(Address of principal executive offices) (Zip code)

Joe M. Thomson, President

500 Chesterfield Parkway

Malvern, PA 19355

(Name and address of agent for service)

610-644-8100

Registrant's telephone number, including area code

Date of fiscal year end: April 30

Date of reporting period: May 1, 2019 through April 30, 2020

Item 1. Reports to Stockholders.

Pacer Funds

TABLE OF CONTENTS

| | Page |

Letter to Shareholders | 1 |

Portfolio Allocation | 14 |

Performance Summary | 21 |

Expense Example | 45 |

Schedules of Investments | 47 |

Statements of Assets & Liabilities | 86 |

Statements of Operations | 91 |

Statements of Changes in Net Assets | 96 |

Financial Highlights | 107 |

Notes to Financial Statements | 129 |

Report of Independent Registered Public Accounting Firm | 149 |

Additional Information | 151 |

Pacer Funds

Dear Shareholder,

Looking back on this past fiscal year, I am filled with gratitude and pride. As a company, we have surpassed milestones such as growing our assets under management to over $6 billion and building our team to serve more financial advisors and their clients across the country. Our unique model, which centers around the distribution of our exchange traded funds (ETFs) through the financial advisor community, continues to be our focus.

Our goal, from our inception nearly five years ago, has been to design innovative products to help investors and financial advisors meet their objectives. This year, we expanded our fund offerings by adding six exchange traded funds to our flagship Trendpilot and Cash Cows Series’. These include our first fixed income ETF, the Pacer Trendpilot US Bond ETF (PTBD), as well as the Pacer Trendpilot International ETF (PTIN), Pacer Trendpilot Fund of Funds ETF (TRND), Pacer Emerging Markets Cash Cows 100 ETF (ECOW), Pacer US Cash Cows Growth ETF (BUL) and Pacer Cash Cows Fund of Funds ETF (HERD). In addition, we acquired the Pacer American Energy Independence ETF (USAI) and the Pacer CSOP FTSE China A50 ETF (AFTY). These additions allow us to offer a more comprehensive range of products.

We thank the investors, financial advisors and our partners for entrusting your assets with us as we look forward to growing with you.

Joe M. Thomson

Chairman, Pacer Funds Trust

1

Pacer Funds

Market Environment Overview

2019 was another strong year for equity market performance as the 10-year long bull market continued to make all-time highs. 2020 started off with a sharp January advance before peaking in February as news of the escalating Coronavirus pandemic began to surface. The selloff intensified in early March as reports of the increasing spread of the virus roiled markets and resulted in government-imposed shutdowns. The market bottomed in late March after recording one of the largest and fastest declines in history. The market ultimately found a bottom in late March as the number of reported new cases flatted and market participants began to price in a v-shaped recovery in economic activity. As of April 30, the market has nearly retraced 2/3 of the decline.

2020 has been one of the narrowest markets in history with a small subset of large cap technology stocks driving a large proportion of the advance in major market averages. Technology, Consumer, and Healthcare stocks have led the way, while Energy and Financials have lagged. Growth stocks have continued to outperform value stocks and US stocks have outperformed International stocks.

The outlook for the rest of the year looks likely to be driven by news regarding the containment of the virus and the loosing of restrictions driving a recovery in economic activity. The key risks facing this market are signs of a worsening spread of the virus, slower than expected economic recovery, and narrow market participation.

The Pacer Trendpilot™ Series

The Pacer Trendpilot series is based on a trend following strategy that alternates exposure between a Benchmark Index and 3-Month US T-Bills using three indicators. It is designed to participate in the market when it is trending up, maintain some exposure during short term market declines and exit the market when it is trending down. The period referenced in this section for all Trendpilot Funds is for the fiscal year end of April 30, 2020.

Pacer Trendpilot® US Large Cap ETF

The Pacer Trendpilot® US Large Cap ETF (the “Fund”) is an exchange traded fund that seeks to track the total return performance, before fees and expenses, of the Pacer Trendpilot® US Large Cap Index (the “Index”).

The Index uses an objective, rules-based methodology to implement a systematic trend-following strategy that directs exposure (i) 100% to the S&P 500 Index, (ii) 50% to the S&P 500 Index and 50% to 3-Month US Treasury bills, or (iii) 100% to 3-Month US Treasury bills, depending on the relative performance of the S&P 500 Total Return Index and its 200-business day historical simple moving average.

The S&P 500 Total Return Index is a total return version of the S&P 500 Index and reflects the reinvestment of dividends paid by the securities in the S&P 500 Index. The S&P 500 Index consists of approximately 500 leading U.S.-listed companies representing approximately 80% of the U.S. equity market capitalization.

The Fund

The Fund had a total return of -10.71%. The Index had a total return of -10.25%. The S&P 500 Index had a total return of 0.86%.

The Fund had two exposure changes during the fiscal year. Summary details of these changes are presented in the following table.

PTLC EXPOSURE CHANGES |

Dates | Resulting Exposure | U.S. Treasury 3-Month Yield |

March 12, 2020 | 50% T-Bills / 50% Equities | 0.30% |

March 13, 2020 | 100% T-Bills | 0.24% |

Pacer Trendpilot® US Mid Cap ETF

The Pacer Trendpilot® US Mid Cap ETF (the “Fund”) is an exchange traded fund that seeks to track the total return performance, before fees and expenses, of the Pacer Trendpilot US Mid Cap Trendpilot Index (the “Index”).

The Index uses an objective, rules-based methodology to implement a systematic trend-following strategy that directs exposure (i) 100% to the S&P MidCap 400 Index, (ii) 50% to the S&P MidCap 400 Index and 50% to 3-Month US Treasury bills, or (iii) 100% to 3-Month US Treasury bills, depending on the relative performance of the S&P MidCap 400 Total Return Index and its 200-business day historical simple moving average.

2

Pacer Funds

The S&P MidCap 400 Total Return Index is a total return version of the S&P MidCap 400 Index and reflects the reinvestment of dividends paid by the securities in the S&P MidCap 400 Index. The S&P Midcap 400 measures the performance of mid-capitalization stocks in the United States.

The Fund

The Fund had a total return of -7.11%. The Index had a total return of -6.72%. The S&P MidCap 400 Index had a total return of -14.94%.

The Fund had three exposure changes during the fiscal year. Summary details of these changes are presented in the following table.

PTMC EXPOSURE CHANGES |

Dates | Resulting Exposure | U.S. Treasury 3-Month Yield |

May 31, 2019 | 100% T-Bills | 2.34% |

June 12, 2019 | 100% Equities | 2.21% |

March 4, 2020 | 100% T-Bills | 0.71% |

Pacer Trendpilot® 100 ETF

The Pacer Trendpilot® 100 ETF (the “Fund”) seeks to track the total return performance, before fees and expenses, of the Pacer NASDAQ-100 Trendpilot™ Index (the “Index”).

The Index uses an objective, rules-based methodology to implement a systematic trend-following strategy that directs exposure (i) 100% to the Nasdaq-100 Index, (ii) 50% to the Nasdaq-100 Index and 50% to 3-Month US Treasury bills, or (iii) 100% to 3-Month US Treasury bills, depending on the relative performance of the Nasdaq-100 Total Return Index and its 200-business day historical simple moving average.

The Nasdaq-100 Total Return Index is a total return version of the Nasdaq-100 Index and reflects the reinvestment of dividends paid by the securities in the Nasdaq-100 Index. The Nasdaq-100 Index includes approximately 100 of the largest non-financial securities listed on The Nasdaq Stock Market based on market capitalization. The Nasdaq-100 Index comprises securities of companies across major industry groups, including computer, biotechnology, healthcare, telecommunications and transportation. However, it does not contain securities of financial companies, including investment companies. The Nasdaq-100 Index was developed by Nasdaq OMX. There is no minimum market capitalization requirement for inclusion in the Nasdaq-100 Index. Inclusion is determined based on the top 100 largest issuers based on market capitalization meeting all other eligibility requirements.

The Fund

The Fund had a total return of 5.78%. The Index had a total return of 6.09%. The NASDAQ-100 Index had a total return of 16.90%.

The Fund had two exposure changes during the fiscal year. Summary details of these changes are presented in the following table.

PTNQ EXPOSURE CHANGES |

Dates | Resulting Exposure | U.S. Treasury 3-Month Yield |

March 18, 2020 | 50% T-Bills / 50% Equities | -0.01% |

April 16, 2020 | 100% Equities | 0.11% |

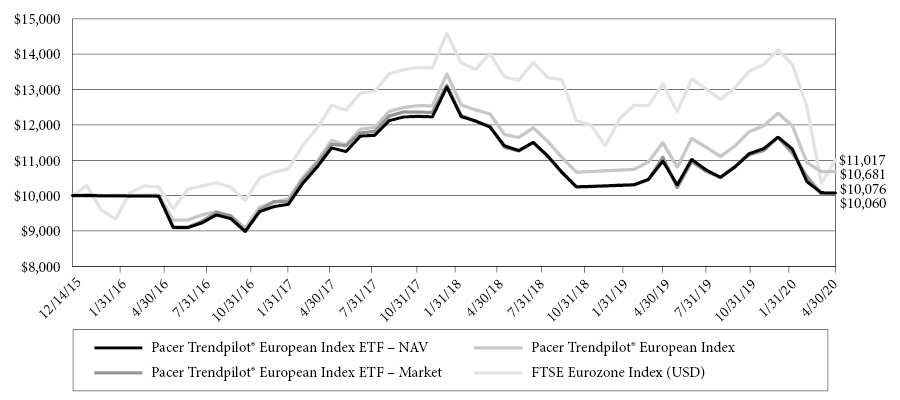

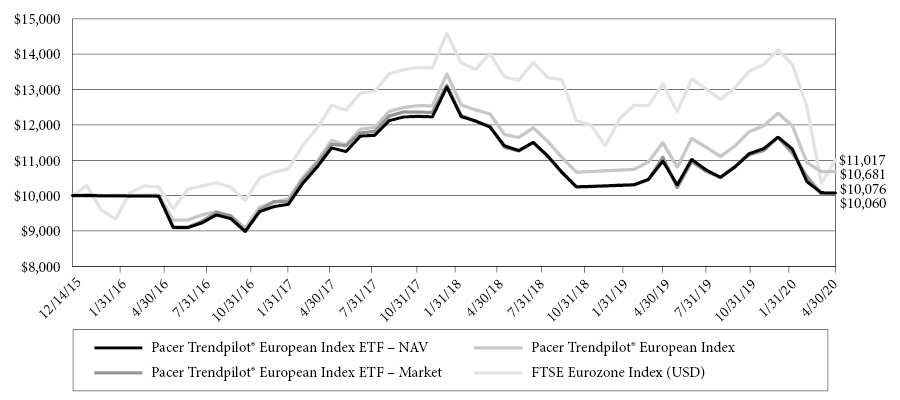

Pacer Trendpilot® European Index ETF

The Pacer Trendpilot® European Index ETF (the “Fund”) seeks to track the total return performance, before fees and expenses, of the Pacer Trendpilot European Index (the “Index”).

The Index uses an objective, rules-based methodology to implement a systematic trend-following strategy that directs exposure (i) 100% to the FTSE Eurozone Index, (ii) 50% to the FTSE Eurozone Index and 50% to 3-Month US Treasury bills, or (iii) 100% to 3-Month US Treasury bills, depending on the relative performance of the FTSE Eurozone Total Return Index and its 200-business day historical simple moving average.

3

Pacer Funds

The FTSE Eurozone Index is a rules-based, float-adjusted, market capitalization weighted index comprised of large- and mid-capitalization stocks providing coverage of the developed markets in the euro zone, including primarily France, Germany, Spain, the Netherlands and Italy. The FTSE Eurozone Index is a subset of the FTSE Global Equity Index Series, which covers 98% of the world’s investable market capitalization. The FTSE Eurozone Total Return Index is a total return version of the FTSE Eurozone Index and reflects the reinvestment of dividend paid by the securities in the FTSE Eurozone Index.

The Fund

The Fund had a total return of -8.18%. The Index had a total return of -7.11%. The FTSE Eurozone Index (USD) had a total return of -16.31%.

The Fund had two exposure changes during the fiscal year. Summary details of these changes are presented in the following table.

PTEU EXPOSURE CHANGES |

Dates | Resulting Exposure | U.S. Treasury 3-Month Yield |

March 5, 2020 | 50% T-Bills / 50% Equities | 0.61% |

March 9, 2020 | 100% T-Billss | 0.34% |

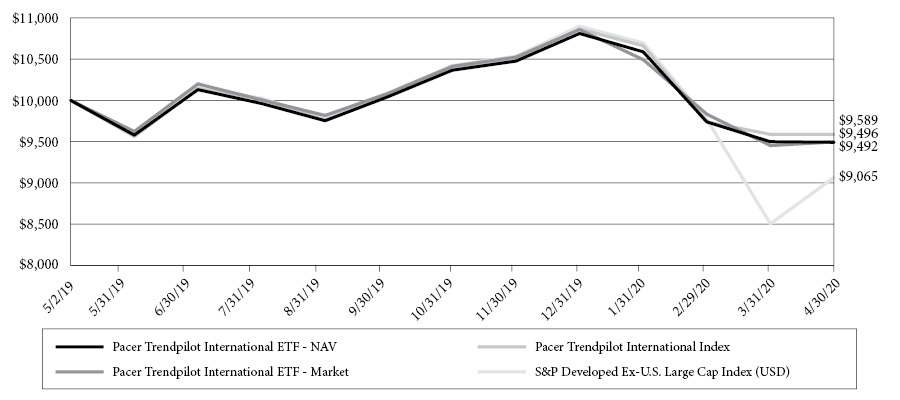

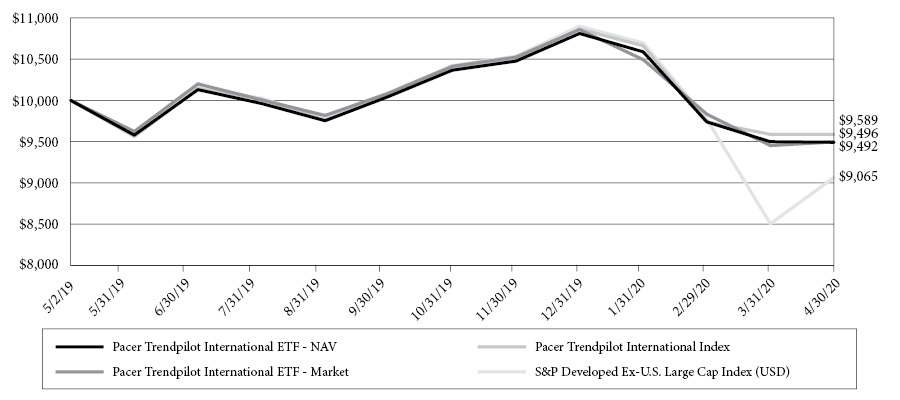

Pacer Trendpilot® International ETF

The Pacer Trendpilot® International ETF is an exchange traded fund (“ETF”) that seeks to track the total return performance, before fees and expenses, of the Pacer Trendpilot International Index (the “Index”).

The Index uses an objective, rules-based methodology to implement a systematic trend-following strategy that directs exposure (i) 100% to the S&P Developed Ex-U.S. LargeCap Index, (ii) 50% to the S&P Developed Ex-U.S. LargeCap Index and 50% to 3-Month US Treasury bills, or (iii) 100% to 3-Month US Treasury bills, depending on the relative performance of the S&P Developed Ex-U.S. LargeCap Index and its 200-business day historical simple moving average (the “200-day moving average”). The calculation of the 200-day moving average for the S&P Developed Ex-U.S. LargeCap Index is based on the total return version of the S&P Developed Ex-U.S. LargeCap Local Currency Index and reflects the reinvestment of dividends paid by the securities in the S&P Developed Ex-U.S. LargeCap Index. The Index is expected to be predominantly invested in the components of the S&P Developed Ex-U.S. LargeCap Index over most short- and long-term periods and is only expected to invest in 3-Month US Treasury bills from time to time in response to adverse market conditions as defined by the “50/50 Indicator” and “T-Bill Indicator” below.

The S&P Developed Ex-U.S. LargeCap Index is a rules-based, float-adjusted, market capitalization-weighted index comprised of large-capitalization stocks providing coverage of the developed markets excluding the United States. The S&P Developed Ex-U.S. LargeCap Index is a subset of the S&P Global BMI, a comprehensive, rules-based index measuring global stock market performance.

The Fund

The Fund’s inception date was May 2, 2019. The Fund had a since inception return of -5.08%. The Index had a total return of -4.11%. The S&P Developed Ex-US Large Cap Index had a total return of -9.35%.

The Fund had two exposure changes during the fiscal year. Summary details of these changes are presented in the following table.

PTIN EXPOSURE CHANGES |

Dates | Resulting Exposure | U.S. Treasury 3-Month Yield |

March 5, 2020 | 50% T-Bills / 50% Equities | 0.61% |

March 10, 2020 | 100% T-Bills | 0.43% |

Pacer Trendpilot® US Bond ETF

The Pacer Trendpilot US Bond ETF (the “Fund”) is an exchange traded fund (“ETF”) that seeks to track the total return performance, before fees and expenses, of the Pacer Trendpilot US Bond Index (the “Index”).

4

Pacer Funds

The Index uses an objective, rules-based methodology to implement a systematic trend-following strategy that directs exposure to one of the following positions: (i) 100% to the S&P U.S. High Yield Corporate Bond Index, (ii) 50% to the S&P U.S. High Yield Corporate Bond Index and 50% to the S&P U.S. Treasury Bond 7-10 Year Index or (iii) 100% to S&P U.S. Treasury Bond 7-10 Year Index, depending on the Risk Ratio.

The S&P U.S. High Yield Corporate Bond Index is designed to track the performance of U.S. dollar-denominated, high-yield corporate bonds issued in the U.S. The S&P U.S. Treasury Bond 7-10 Year Index is designed to measure the performance of U.S. Treasury bonds maturing in 7 to 10 years. The Index uses a “Risk Ratio” to signal a change in the position of the Index. The Risk Ratio is calculated by dividing the value of the S&P U.S. High Yield Corporate Bond Index by the value of the S&P U.S. Treasury Bond 7-10 Year Index.

The Index, and consequently the Fund, may stay in any of its three possible positions for an extended period of time. As described below, the Index will change its position based on the following indicators, and each change will become effective by the close of business on the sixth business day after the indicator for the change is triggered. The Index will be in a new position effective on the seventh business day.

The Fund

The Fund had an inception date of October 22, 2019. The fund had a since inception return of 4.24%. The Index had a return of 4.34%. The S&P US High Yield Corporate Bond Index had a total return of -6.85%. The S&P US Treasury Bond 7-10 Year Index had a total return of 9.87%.

The Fund had two exposure changes during the fiscal year. Summary details of these changes are presented in the following table.

PTBD EXPOSURE CHANGES |

Dates | Resulting Exposure | U.S. Treasuriy 10-Year Yield |

October 23, 2019 | 100% High Yield Bonds | 1.76% |

March 2, 2020 | 100% U.S. Treasury Bonds | 1.16% |

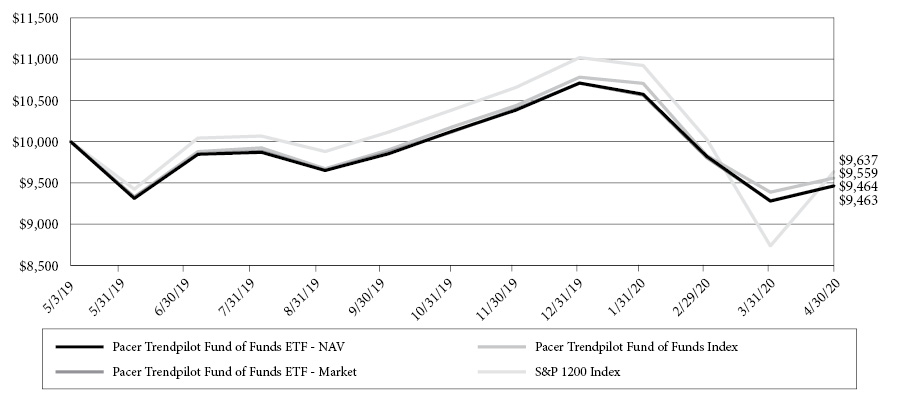

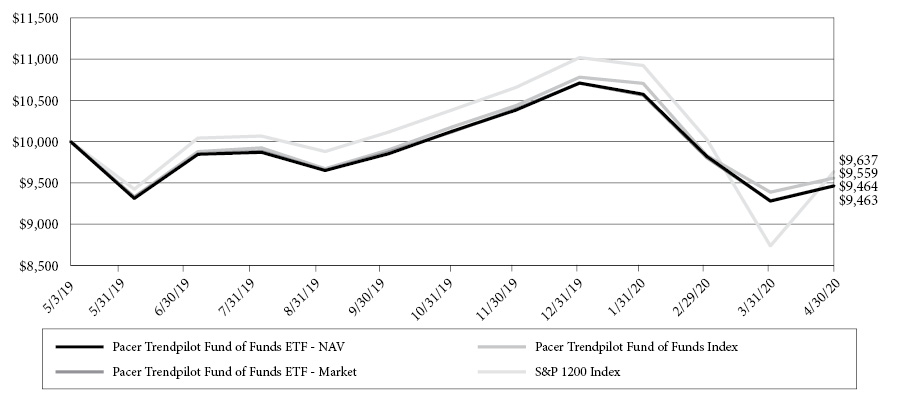

Pacer Trendpilot® Fund of Funds ETF

The Pacer Trendpilot Fund of Funds ETF is an exchange traded fund (“ETF”) that seeks to track the total return performance, before fees and expenses, of the Pacer Trendpilot Fund of Funds Index (the “Index” or the “Fund of Funds Index”).

The Fund of Funds Index uses an objective, rules-based approach to construct a portfolio that, as of each quarterly rebalance, is composed of the ETFs listed in the following table, each advised by the Adviser (collectively, the “Trendpilot ETFs”). Each of the Trendpilot ETFs is an index-based ETF that seeks to track the total return performance, before fees and expenses, of the underlying index listed in the following table (collectively, the “Trendpilot Indexes”). Each Trendpilot Index uses an objective, rules-based methodology to implement a systematic trend-following strategy that directs exposure (i) 100% to the “Equity Component” specified in the table below, (ii) 50% to the applicable Equity Component and 50% to 3-Month US Treasury bills, or (iii) 100% to 3-Month US Treasury bills, depending on the relative performance of the Equity Component and its 200- business day historical simple moving average (the “200-day moving average”). The calculation of the 200-day moving average for each Equity Component is based on the total return version of such Equity Component and reflects the reinvestment of dividends paid by the securities in such Equity Component.

Weight | Trendpilot ETF | Trendpilot Index | Equity Universe |

20% | Pacer Trendpilot® US Large Cap ETF | Pacer Trendpilot US Large Cap Index S | S&P 500® Index |

20% | Pacer Trendpilot® US Mid Cap ETF | Pacer Trendpilot US Mid Cap Index | S&P MidCap 400® Index |

20% | Pacer Trendpilot® 100 ETF | Pacer NASDAQ-100 Trendpilot Index | NASDAQ-100® Index |

40% | Pacer Trendpilot® International ETF | Pacer Trendpilot International Index | S&P Developed Ex-U.S. LargeCap Index |

The Fund

The Fund had an inception date of May 3, 2019. The Fund had a since inception return of -5.37%. The Index had a return of -4.41%. The S&P Global 1200 Index had a total return of -3.63%.

The Pacer Cash Cows Index® ETF Series

The Pacer Cash Cows ETFs aim to provide capital appreciation over time by screening broad based indexes to identify quality companies with high free cash flow yield. The period referenced in this section for all Cash Cows Funds is for the fiscal year end of April 30, 2020.

5

Pacer Funds

Pacer Global Cash Cows Dividend ETF

The Pacer Global Cash Cows Dividend ETF (the “Fund”) seeks to track the total return performance, before fees and expenses, of the Pacer Global Cash Cows Dividend Index (the “Index”).

The Index uses an objective, rules-based methodology to provide exposure to global companies with high dividend yield backed by a high free cash flow yield. The initial index universe is derived from the component companies of the FTSE Developed Large Cap Index. The initial universe of companies is screened based on their average projected free cash flows and earnings over each of the next two fiscal years. Companies with negative average projected free cash flows or earnings are removed from the Index universe. Additionally, financial companies, other than real estate investment trusts, are excluded from the Index universe. The remaining companies are ranked by their free cash flow yield for the trailing twelve-month period. The 300 companies with the highest free cash flow yield are then ranked by their dividend yield. The equity securities of the 100 companies with the highest dividend yield are included in the Index.

The FTSE Developed Large-Cap Index is a market-capitalization weighted index representing the performance of large-cap stocks in developed markets. The FTSE Developed Large-Cap Total Return Index is a total return version of the FTSE Developed Large-Cap Index and reflects the reinvestment of dividends paid by the securities in the FTSE Developed Large-Cap Index.

The Fund

The Fund had a total return of -17.32%. The Index had a total return of -16.46%. The FTSE Developed Large-Cap Index had a total return of -1.78%.

During the fiscal year, the top three sectors for contribution to performance were Healthcare at 21.94%, Industrials at -8.92%, and Utilities at -12.92%. The three sectors with the lowest contribution to performance were Consumer Discretionary at -29.64%, Real Estate at -39.05%, and Energy at -38.09%. Sector performance numbers reflect their total return during the period.

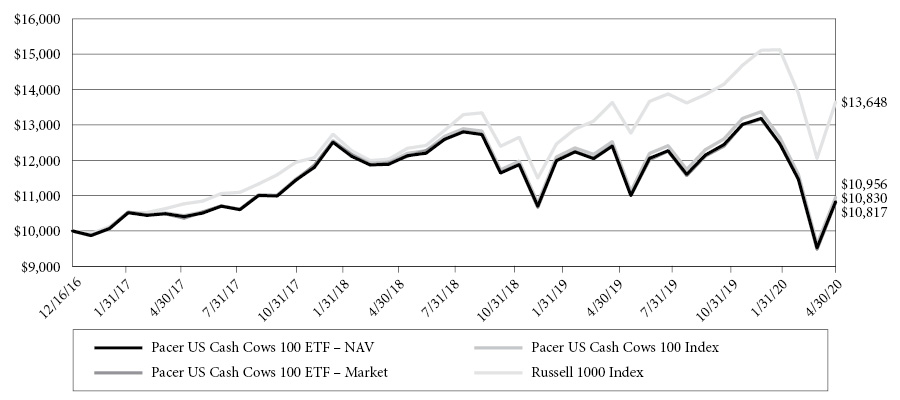

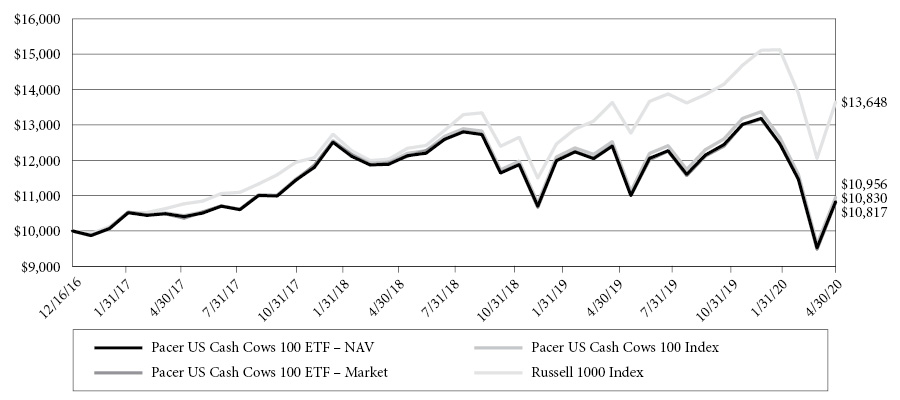

Pacer US Cash Cows 100 ETF

The Pacer US Cash Cows 100 ETF (the “Fund”) seeks to track the total return performance, before fees and expenses, of the Pacer US Cash Cows 100 Index (the “Index”).

The Index uses an objective, rules-based methodology to provide exposure to large and mid-capitalization U.S. companies with high free cash flow yields. The initial index universe is derived from the component companies of the Russell 1000 Index. The initial universe of companies is screened based on their average projected free cash flows and earnings over each of the next two fiscal years. Companies with no forward year estimates available for free cash flows or earnings will remain in the Index universe. Companies with negative average projected free cash flows or earnings are removed from the Index universe. Additionally, financial companies, other than real estate investment trusts, are excluded from the Index universe. The remaining companies are ranked by their free cash flow yield for the trailing twelve-month period. The equity securities of the 100 companies with the highest free cash flow yield are included in the Index.

The Russell 1000 Index is a market-capitalization weighted index representing the top 1,000 large-cap stocks in the Russell 3000 Index. The Russell 1000 Total Return Index is a total return version of the Russell 1000 Index that reflects the reinvestment of dividends paid by the securities in the Russell 1000 Index.

The Fund

The Fund had a total return of -12.63%. The Index had a total return of -12.54%. The Russell 1000 Index had a total return of 0.09%.

During the fiscal year, the top three sectors for contribution to performance were Healthcare at 24.33%, Consumer Staples at 9.95%, and Real Estate at -19.74%. The three sectors with the lowest contribution to performance were Consumer Discretionary at -25.31%, Communication Services at -12.91%, and Industrials at -27.18%. Sector performance numbers reflect their total return during the period.

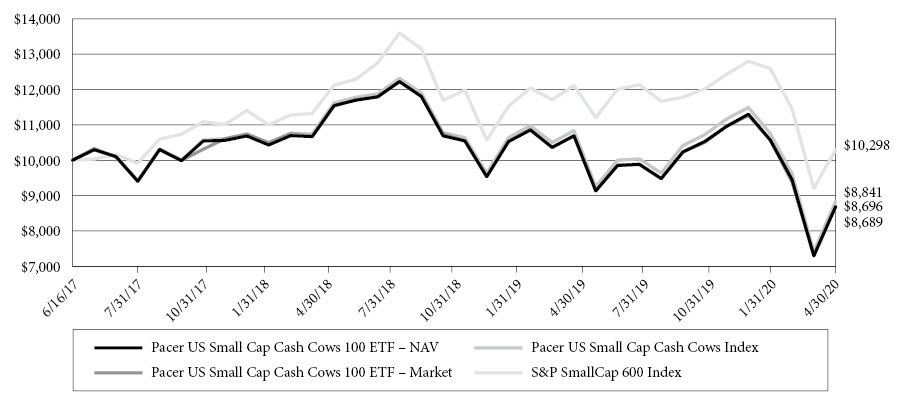

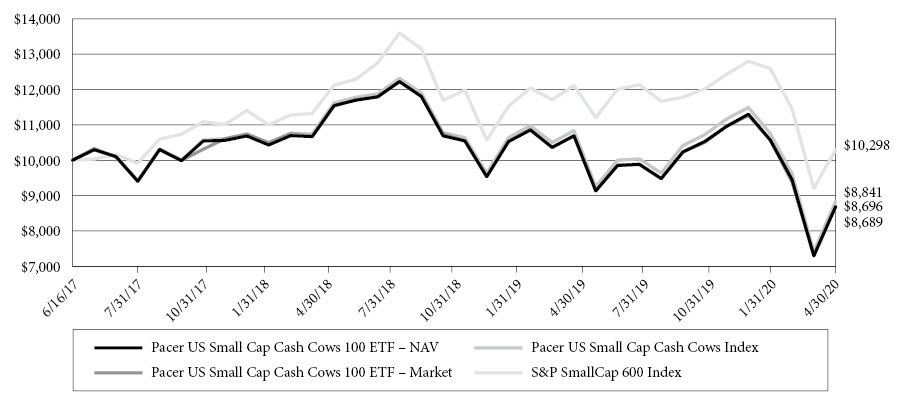

Pacer US Small Cap Cash Cows 100 ETF

The Pacer US Small Cap Cash Cows 100 ETF (the “Fund”) seeks to track the total performance, before fees and expenses, of the Pacer US Small Cap Cash Cows 100 Index (the “Index”).

The Index uses an objective, rules-based methodology to provide exposure to small-capitalization U.S. companies with high free cash flow yields. The initial index universe is derived from the component companies of the S&P Small Cap 600 Index. The initial universe of companies is screened based on their average projected free cash flows and earnings over each of the next two fiscal years. Companies with no forward year estimates available for free cash flows or earnings will remain in the Index universe. Companies with negative average projected

6

Pacer Funds

free cash flows or earnings are removed from the Index universe. Additionally, financial companies, other than real estate investment trusts, are excluded from the Index universe. The remaining companies are ranked by their free cash flow yield for the trailing twelve-month period. The equity securities of the 100 companies with the highest free cash flow yield are included in the Index.

The S&P SmallCap 600 Index measures the performance of 600 small sized companies in the US equity market, with market capitalization ranging from $450 million to $2.1 billion USD. The Index does not overlap holdings with the S&P 500 or S&P MidCap 400.

The Fund

The Fund had a total return of -18.72%. The Index had a total return of -18.83%. The S&P 600 Index had a total return of -19.60%.

During the fiscal year, the top three sectors for contribution to performance were Healthcare at 12.15%, Real Estate at 67.43%, and Consumer Staples at 5.55%. The three sectors with the lowest contribution to performance were Materials at -39.80%, Energy at –77.63%, and Consumer Discretionary at -30.68%. Sector performance numbers reflect their total return during the period.

Pacer Developed Markets International Cash Cows 100 ETF

The Pacer Developed Markets International Cash Cows 100 ETF (the “Fund”) seeks to track the total performance, before fees and expenses, of the Pacer Developed Markets International Cash Cows 100 Index (the “Index”).

The Index uses an objective, rules-based methodology to provide exposure to large and mid-capitalization non-U.S. companies in developed markets with high free cash flow yields. The initial index universe is derived from the component companies of the FTSE Developed ex US Index. The initial universe of companies is screened based on their average projected free cash flows and earnings over each of the next two fiscal years. Companies with no forward year estimates available for free cash flows or earnings will remain in the Index universe. Companies with negative average projected free cash flows or earnings are removed from the Index universe. Additionally, financial companies, other than real estate investment trusts and companies with a market capitalization of less than $3 billion are excluded from the Index universe. The remaining companies are ranked by their average daily trading value (“ADTV”) for the prior three months. The 500 companies with the highest ADTV are then ranked by their free cash flow yield for the trailing twelve-month period. The equity securities of the 100 companies with the highest free cash flow yield are included in the Index.

The FTSE Developed ex-US Index is comprised of Large (85%) and Mid (15%) cap stocks providing coverage of Developed markets (24 countries) excluding the US. The index is derived from the FTSE Global Equity Index Series, which covers over 99% of the world’s investable market capitalization.

The Fund

The Fund had a total return of -20.04%. The Index had a total return of -18.97%. The FTSE Developed ex US Index had a total return of -11.18%.

During the fiscal year, the top three sectors for contribution to performance were Healthcare at 24.21%, Information Technology at 4.14%, and Real Estate at -34.42%. The three sectors with the lowest contribution to performance were Consumer Discretionary at -24.94%, Materials at -22.70%, and Energy at -40.29%. Sector performance numbers reflect their total return during the period.

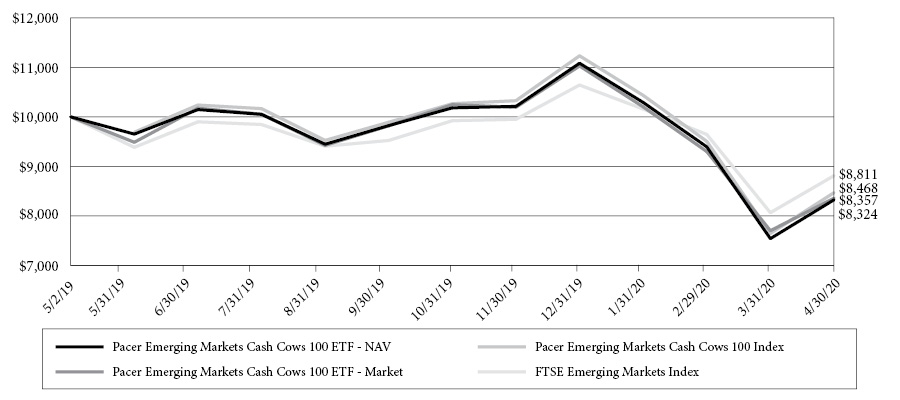

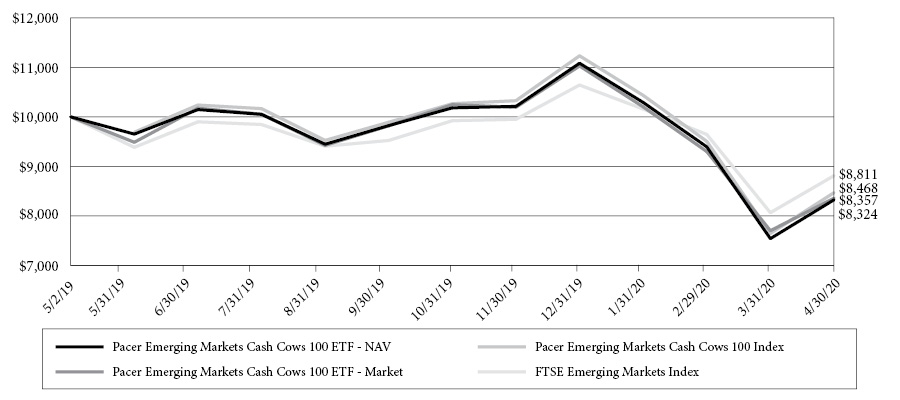

Pacer Emerging Markets Cash Cows 100 ETF

The Pacer Emerging Markets Cash Cows 100 ETF is an exchange traded fund (“ETF”) that seeks to track the total return performance, before fees and expenses, of the Pacer Emerging Markets Cash Cows 100 Index (the “Index”).

The Index uses an objective, rules-based methodology to provide exposure to large and mid-capitalization companies in emerging markets with high free cash flow yields. Companies with high free cash flow yields are commonly referred to as “cash cows”. The initial index universe is derived from the component companies of the FTSE Emerging Markets Index. The Fund defines emerging markets countries as those countries included in the FTSE Emerging Markets Index. As of April 2020, the Index had significant exposure to companies in Hong Kong, Taiwan, Russia, and Brazil. The initial universe of companies is screened based on their average projected free cash flows and earnings (if available) over each of the next two fiscal years. Companies with no forward year estimates available for free cash flows or earnings will remain in the Index universe. Companies with negative average projected free cash flows or earnings are removed from the Index universe. Additionally, financial companies, other than real estate investment trusts (“REITs”), companies with a market capitalization of less than $2 billion, and companies whose average daily trading value (“ADTV”) for the prior 90 days does not exceed $5 million are excluded from the Index universe. The remaining companies are ranked by their free cash flow yield for the trailing twelve-month period. The equity securities of the 100 companies with the highest free cash flow yield (the “Top 100 Companies”) are included in the Index, subject to the exceptions

7

Pacer Funds

described below. At the time of each rebalance of the Index, the companies included in the Index are weighted in proportion to their trailing twelve-month free cash flow, and weightings are capped at 2% of the weight of the Index for any individual company. Additionally, the Index is limited to a maximum of twenty companies from any individual country and any sector. As of April 2020, the Index had significant exposure to companies in the materials, energy and information technology sectors. If the Top 100 Companies include more than 20 companies from an individual country or sector (the “Exposure Limit”), the Index will exclude the companies with the lowest free cash flow yield from each country and/or sector needed to meet the Exposure Limit and will include companies outside the Top 100 Companies based on their free cash flow yield until the Index includes 100 companies and satisfies the Exposure Limit. As of April 30, 2020, the companies included in the Index had a market capitalization of $671 million to $50.6 billion. The Index is reconstituted and rebalanced semi-annually as of the close of business on the 3rd Friday of June and December based on data as of the 1st Friday of the applicable rebalance month.

The Fund

The Fund had an inception date of May 2, 2019. The Fund had a since inception return of -16.76%. The Index had a total return of -15.32%. The FTSE Emerging Market Index had a total return of -11.89%.

During the fiscal year, the top three sectors for contribution to performance were Information Technology at 16.85%, Health Care at 1.51%, and Telecommunication Services at 11.33%. The three sectors with the lowest contribution to performance were Consumer Staples at -25.38%, Communication Services at -20.49%, and Energy at -24.25%. Sector performance numbers reflect their total return during the period.

Pacer Cash Cows Growth ETF

The Pacer US Cash Cows Growth ETF is an exchange traded fund (“ETF”) that seeks to track the total return performance, before fees and expenses, of the Pacer US Cash Cows Growth Index (the “Index”).

The Fund employs a “passive management” (or indexing) investment approach designed to track the total return performance, before fees and expenses, of the Index. The Index is based on a proprietary methodology developed and maintained by Index Design Group, an affiliate of Pacer Advisors, Inc., the Fund’s investment adviser (the “Adviser”). The Index uses an objective, rules-based methodology to provide exposure to mid- and large-capitalization U.S. companies with high free cash flow yields. Companies with high free cash flow yields are commonly referred to as “cash cows”. The initial Index universe is derived from the component companies of the S&P 900® Pure Growth Index. The initial universe of companies is screened based on their average projected free cash flows and earnings (if available) over each of the next two fiscal years. Companies for which information on their projected free cash flows or earnings is not available will remain in the Index universe. Companies with negative average projected free cash flows or earnings are removed from the Index universe. Additionally, financial companies, other than real estate investment trusts (“REITs”), are excluded from the Index universe. The remaining companies are ranked by their free cash flow yield for the trailing twelve month period. The equity securities of the 50 companies with the highest free cash flow yield are included in the Index. As of April 2020, the Index had significant exposure to companies in the information technology, consumer discretionary and industrials. At the time of each rebalance of the Index, the companies included in the Index are weighted in proportion to their current market capitalization, and weightings are capped at 5% of the weight of the Index for any individual company. Weight above the 5% limitation is redistributed among the other Index constituents in proportion to their weights. As of April 23, 2020, the Index had a market capitalization range of $1.3 billion to $1.3 trillion. The Index is reconstituted and rebalanced quarterly as of the close of business on the 3nd Friday of March, June, September, and December based on data as of the 2nd Friday of the applicable rebalance month.

The Fund

The Fund had an inception date of May 2, 2019. The Fund had a since inception return of -6.52%. The Index had a total return of -6.49%. The S&P 900 Pure Growth Index had a total return of -5.48%.

During the fiscal year, the top three sectors for contribution to performance were Healthcare at 67.44%, Communication Services at 10.41%, and Real Estate at 21.56%. The three sectors with the lowest contribution to performance were Energy at -41.33%, Materials at -64.72%, and Information Technology at -10.61%. Sector performance numbers reflect their total return during the period.

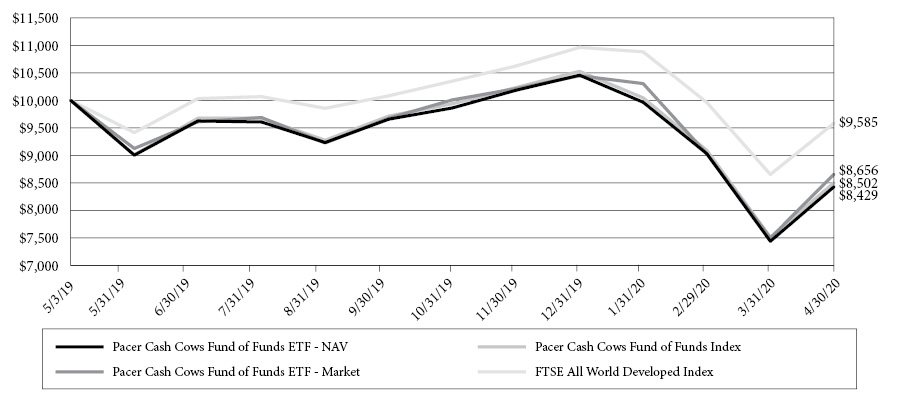

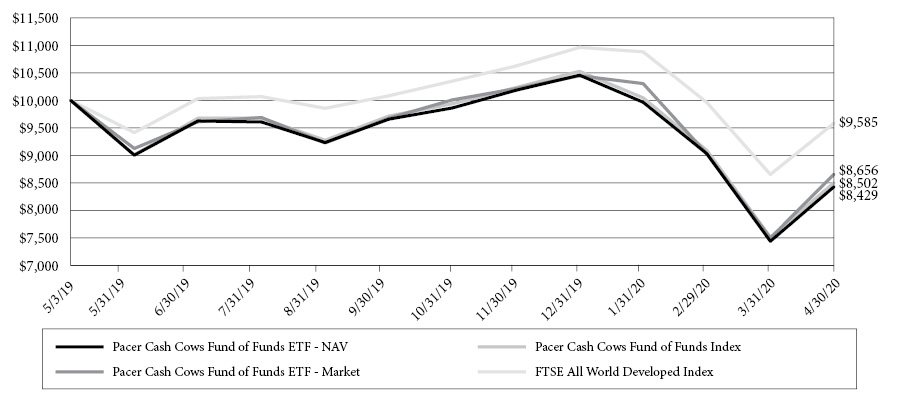

Pacer Cash Cows Fund of Funds ETF

The Pacer Cash Cows Fund of Funds ETF is an exchange traded fund (“ETF”) that seeks to track the total return performance, before fees and expenses, of the Pacer Cash Cows Fund of Funds Index (the “Index” or the “Fund of Funds Index”).

8

Pacer Funds

The Fund employs a “passive management” (or indexing) investment approach designed to track the total return performance, before fees and expenses, of the Index. The Index is based on a proprietary methodology developed and maintained by Index Design Group, an affiliate of Pacer Advisors, Inc., the Fund’s investment adviser (the “Adviser”). The Fund of Funds Index uses an objective, rules-based approach to construct a portfolio that, as of each quarterly rebalance, is composed of the ETFs listed in the following table, each advised by the Adviser (collectively, the “Cash Cows ETFs”). Each of the Cash Cows ETFs is an index-based ETF that seeks to track the total return performance, before fees and expenses, of the applicable underlying index listed in the following table (collectively, the “Cash Cows Indexes”). Each Cash Cows Index uses an objective, rules-based methodology to provide exposure to companies with high free cash flow yields (commonly referred to as “cash cows”) selected from the applicable “Equity Universe” as indicated in the following table.

Weight | Cash Cows ETF | Cash Cows Index | Equity Universe |

20% | Pacer US Cash Cows 100 ETF | Pacer US Cash Cows 100 Index | Russell 1000 Index |

20% | Pacer Global Cash Cows Dividend ETF | Pacer Global Cash Cows Dividend Index | FTSE Developed Large Cap Index |

20% | Pacer US Small Cap Cash Cows 100 ETF | Pacer US Small Cap Cash Cows Index | S&P Small Cap 600® Index |

20% | Pacer US Cash Cows Growth ETF | Pacer US Cash Cows Growth Index | S&P 900® Pure Growth Index |

20% | Pacer Developed Markets

International Cash Cows 100 ETF | Pacer Developed Markets

International Cash Cows 100 Index | FTSE Developed ex US Index |

The Fund

The Fund had an inception date of May 3, 2019. The Fund had a since inception return of -15.71%. The Index had a total return of -14.98%. The FTSE All-World Developed Index had a total return of -4.15%.

The Pacer Custom ETF Series

The Pacer Custom ETFs are strategy-driven, rules-based and are each designed to offer a specific investment focus. The period referenced in this section for all custom funds is for the fiscal year end of April 30, 2020.

Pacer WealthShield ETF

The Pacer WealthShield ETF (the “Fund”) seeks to track the total performance, before fees and expenses, of the Pacer WealthShield Index (the “Index”).

The Index uses an objective, rules-based methodology to implement a trend-following strategy that directs some or all of the Index’s exposure to (i) U.S. equity securities or (ii) U.S. Treasury securities depending on the strength of the high yield corporate (“junk”) bond market relative to U.S. Treasury bonds and the momentum of certain U.S. equity sectors or industries and of long-term U.S. Treasury bonds.

The Fund

The Fund had a total return of -3.04%. The Index had a total return of -3.59%. The S&P 500 Index had a total return of 0.86%.

Throughout the fiscal year, the Fund spent most of the time with “risk on” and went “risk off”, in June and September 2019, and March to April in 2020.

Pacer Military Times Best Employers ETF

The Pacer Military Times Best Employers ETF (the “Fund”) seeks to track the total performance, before fees and expenses, of the Military Times Best for VetsSM Index (the “Index”).

The Index is owned and developed by VETS Indexes, LLC (the “Index Provider”) and based on The Military Times Best for VetsSM: Employers list (the “Best for Vets List”) published annually by Sightline Media Group. The Best for Vets List is published each year based on detailed surveys (the “Best for Vets Survey”) completed by companies doing business in the United States that address the recruiting of U.S. armed forces veterans and service members, company culture, policies and reservist accommodations. Responses to each such category of questions are weighted to create a composite score and companies with composite scores in the top 60% of all participating companies are included on The Best for Vets List. Companies on the Best for Vets List are expected to come from a variety of sectors and industries, such as banking, information technology, energy and telecommunications, among others. Although all the companies in the Index have their stock listed on a U.S. exchange, such companies may have significant (or a majority of their) business operations outside of the United States.

9

Pacer Funds

The Index is composed of the U.S.-listed stocks of companies that have been included in the Best for Vets List for the last three consecutive years, have a minimum market capitalization of $200 million and meet the Index’s liquidity threshold. Index components are equally weighted at the time of each annual reconstitution of the Index, which is effective at the close of business on the third Friday of each September. As of April 30, 2020, the Index was made up of 48 companies and included significant allocations to companies in the financial, industrial and information technology sectors. Companies previously included in the Index for two consecutive years that are no longer on the Best for Vets List may continue to be included in the Index if the reason that they are no longer on the Best for Vets List is because they did not complete the most recent Best for Vets Survey.

The Fund

The Fund had a total return of -1.59%. The Index had a total return of -1.76%. The S&P 500 Index had a total return of 0.86%.

During the fiscal year, the top three sectors for contribution to performance were Information Technology at 13.16%, Healthcare at 25.61%, and Consumer Staples at 17.73%. The three sectors with the lowest contribution to performance were Utilities at 0.78%, Industrials at -7.24%, and Financials at -20.21%. Sector performance numbers reflect their total return during the period.

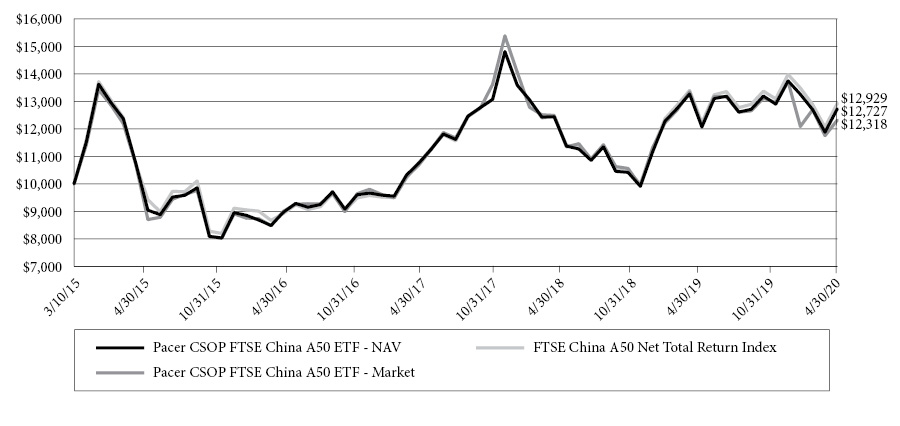

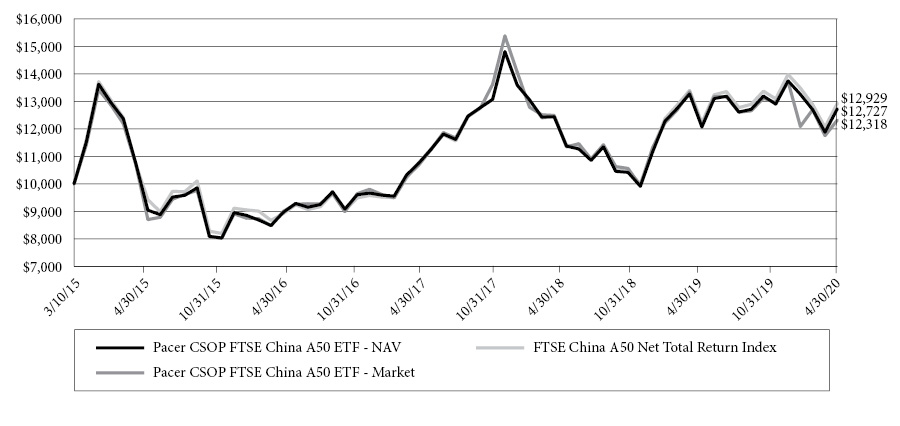

Pacer CSOP FTSE China A50 ETF

The Pacer CSOP FTSE China A50 ETF (the “Fund”) is an exchange traded fund (“ETF”) that seeks to provide investment results that, before fees and expenses, track the performance for the FTSE China A50 Net Total Return Index (the “Index.”)

The Fund employs a “passive management” (or indexing) investment approach designed to track the total return performance, before fees and expenses, of the Index. The Index The Index is comprised of A-Shares issued by the 50 largest companies in the China A-Shares market. The Index is a net total return index, which means that the performance of the Index assumes that dividends paid by the Index constituents, net of any withholding taxes, are reinvested in additional shares of such Index constituents. The Index is a free float-adjusted market capitalization-weighted index compiled and published by FTSE International Limited (“FTSE” or the “Index Provider”), which is not affiliated with the Fund, Pacer Advisors, Inc. (the “Adviser”), CSOP Asset Management Limited (the “Sub-Adviser”), or the Fund’s distributor. The Index is a real-time, tradable index comprising the largest 50 China A-Share companies by full market capitalization of the FTSE China AAll Cap Free Index. The Index is a subset of the FTSE China AAll Cap Free Index, FTSE’s most comprehensive benchmark for the Chinese A-Share market. It is denominated and quoted in Chinese Yuan (“CNY”) and comprised of stocks listed on the Shanghai Stock and Shenzhen Stock Exchange main markets, the Shenzhen SME Board and/or the Shenzhen ChiNext Board. The Index Provider determines the composition of the Index and relative weightings of the Index constituents based on the Index’s methodology, and publishes information regarding the market value of the Index.

The Fund

The Fund’s last fiscal year ended September 30, 2019. Since last fiscal year end, the Fund had a total return of 0.14%. The FTSE China A50 Index had a total return of 0.30% during this same timeframe.

Pacer Benchmark Data & Infrastructure Real Estate SCTR ETF

The Pacer Benchmark Data & Infrastructure Real Estate SCTRSM ETF (the “Fund”) is an exchange traded fund that seeks to track the total return performance, before fees and expenses, of the Benchmark Data & Infrastructure Real Estate SCTRSM Index (the “Index”).

The Index is generally composed of the U.S.-listed equity securities of companies that derive at least 85% of their earnings or revenues from real estate operations in the data and infrastructure real estate sectors (“Eligible Companies”). At the time of each reconstitution of the Index, Eligible Companies with a market capitalization of more than $200 million and average daily traded volume of at least 10,000 shares are included in the Index (the “Index Constituents”). A significant portion of the Index is expected to be composed of real estate investment trusts (“REITs”). The real estate companies included in the Index may utilize leverage, and some may be highly leveraged. Additionally, such companies may include significant business operations outside of the United States.

The Index is reconstituted and rebalanced quarterly as of the close of business on the third Friday of each March, June, September, and December based on data as of the end of the previous month (each, a “Reference Date”). Index Constituents 39 are weighted based on their free-float market capitalization (i.e., market capitalization based on the number of shares available to the public), subject to the following constraints as of the time of each reconstitution of the Index. Each Index Constituent’s weight is capped at 15% and the sum of Index Constituents with weights greater than 4.5% cannot exceed 45% of the total Index weight. If the foregoing limits would be exceeded at the time of a reconstitution of the Index, the excess weight is proportionally redistributed to all Index Constituents with weights below such limits.

10

Pacer Funds

The Fund

The Fund had a total return of 19.50%. The Index had a total return of 20.30%. The FTSE NAREIT All Equity REITS Index had a total return of -8.30%.

The Fund’s top three contributors to its return were Equinix, Inc., Crown Castle International Corp, and American Tower Corporation. These stocks realized total returns of 51.21%, 31.13%, and 23.99%, respectively.

The Fund’s bottom three contributors to its return were Uniti Group Inc., Lamar Advertising Company, and OUTFRONT Media Inc. These stocks realized total returns of -31.54%, -26.66%, and -30.32%.

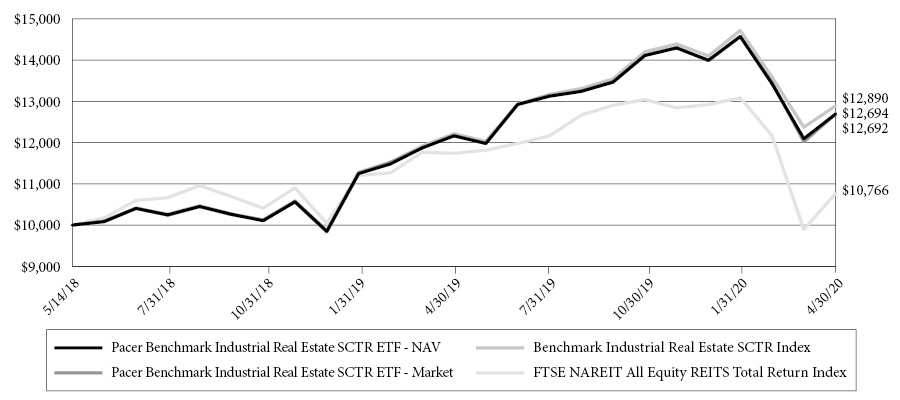

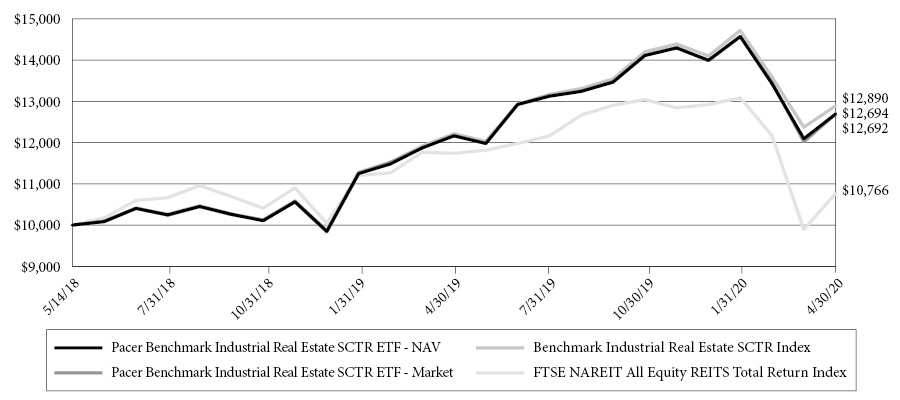

Pacer Benchmark Industrial Real Estate SCTR ETF

The Pacer Benchmark Industrial Real Estate SCTRSM ETF (the “Fund”) is an exchange traded fund that seeks to track the total return performance, before fees and expenses, of the Benchmark Industrial Real Estate SCTRSM Index (the “Index”).

The Index is generally composed of the U.S.-listed equity securities of companies that derive at least 85% of their earnings or revenues from real estate operations in the industrial real estate sector (“Industrial Companies”), including companies that derivate at least 85% of their earnings or revenues from self-storage real estate operations (“Self-Storage Companies”). At the time of each reconstitution of the Index, Industrial Companies with a market capitalization of more than $200 million and average daily traded volume of at least 10,000 shares are included in the Index (the “Index Constituents”). A significant portion of the Index is expected to be composed of real estate investment trusts (“REITs”). The real estate companies included in the Index may utilize leverage, and some may be highly leveraged. Additionally, such companies may include significant business operations outside of the United States.

The Index is reconstituted and rebalanced quarterly as of the close of business on the third Friday of each March, June, September, and December based on data as of the end of the previous month (each, a “Reference Date”). Index Constituents are weighted based on their free-float market capitalization (i.e., market capitalization based on the number of shares available to the public), subject to the following constraints as of the time of each reconstitution of the Index. The sum of all Industrial Companies that are not Self-Storage Companies cannot exceed 80% of the total Index weight, and the remaining weight will be composed of Self-Storage Companies. Additionally, each Index Constituent’s weight is capped at 15% and the sum of Index Constituents with weights greater than 4.5% cannot exceed 45% of the total Index weight. If the foregoing limits would be exceeded at the time of a reconstitution of the Index, the excess weight is proportionally redistributed to all Index Constituents with weights below such limits.

The Fund

Fund had a total return of 4.38%. The Index had a total return of 5.55%. The FTSE NAREIT All Equity REITS Index had a total return of -8.30%.

The Fund’s top three contributors to its return were Prologis, Inc., Liberty Property Trust, and Duke Realty Corporation. These stocks realized total returns of 19.49%, 27.69%, and 14.50%, respectively.

The Fund’s bottom three contributors to its return were One Liberty Properties, Inc., Life Storage, Inc., and PS Business Parks, Inc. These stocks realized total returns of -39.51%, -4.33%, and -13.76%, respectively.

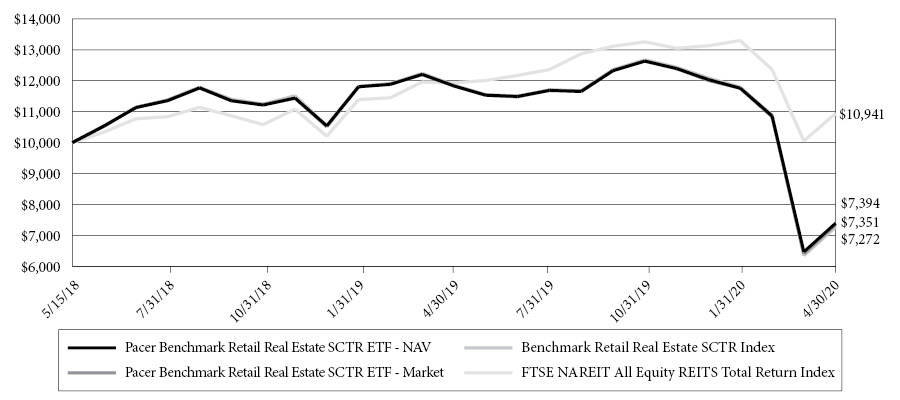

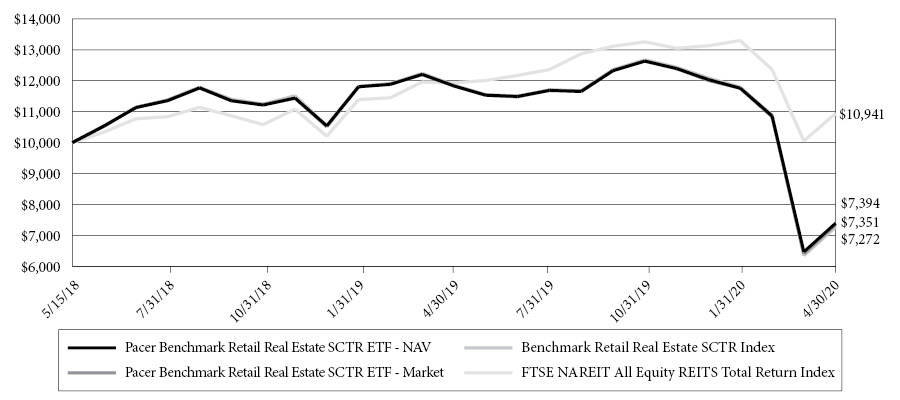

Pacer Benchmark Retail Real Estate SCTR ETF

The Pacer Benchmark Retail Real Estate SCTRSM ETF (the “Fund”) is an exchange traded fund that seeks to track the total return performance, before fees and expenses, of the Benchmark Retail Real Estate SCTRSM Index (the “Index”).

The Index is generally composed of the U.S.-listed equity securities of companies that derive at least 85% of their earnings or revenues from real estate operations in the retail real estate sector (“Eligible Companies”). At the time of each reconstitution of the Index, Eligible Companies with a market capitalization of more than $200 million and average daily traded volume of at least 10,000 shares are included in the Index (the “Index Constituents”). A significant portion of the Index is expected to be composed of real estate investment trusts (“REITs”). The real estate companies included in the Index may utilize leverage, and some may be highly leveraged. Additionally, such companies may include significant business operations outside of the United States.

The Index is reconstituted and rebalanced quarterly as of the close of business on the third Friday of each March, June, September, and December based on data as of the end of the previous month (each, a “Reference Date”). Index Constituents are weighted based on their free-float market capitalization (i.e., market capitalization based on the number of shares available to the public), subject to the following constraints as of the time of each reconstitution of the Index. Each Index Constituent’s weight is capped at 15% and the sum of Index Constituents with weights greater than 4.5% cannot exceed 19 45% of the total Index weight. If the foregoing limits would be exceeded at the time of a reconstitution of the Index, the excess weight is proportionally redistributed to all Index Constituents with weights below such limits.

11

Pacer Funds

The Fund

The Fund had a total return of -37.49%. The Index had a total return of -38.66%. The FTSE NAREIT All Equity REITS Index had a total return of -8.30%.

The Fund’s top three contributors to its return were Agree Realty Corporation, Alexander’s, Inc., and Getty Realty Corp. These stocks realized total returns of 2.93%, -12.69%, and -11.95%, respectively.

The Fund’s bottom three contributors to its return were Simon Property Group, Inc., Realty Income Corporation, and National Retail Properties, Inc. These stocks realized total returns of -59.41%, -18.38%, and -35.22%, respectively.

Pacer CFRA-Stovall Equal Weight Seasonal Rotation ETF

The Pacer CFRA-Stovall Equal Weight Seasonal Rotation ETF (the “Fund”) is an exchange traded fund (“ETF”) that seeks to track the total return performance, before fees and expenses, of the Pacer CFRA-Stovall Equal Weight Seasonal Rotation Index (the “Index”).

The Index uses an objective, rules-based methodology to track the performance of a semi-annual rotation of certain sectors within the S&P 500 Equal Weight Index (“EWI”). The S&P 500 EWI is an equal-weighted version of the S&P 500®, which measures the performance of the large-cap segment of the U.S. equity market. The S&P 500 EWI includes stocks covering all 11 Global Industry Classification Standard (“GICS®”) sectors, six of which are eligible for inclusion in the Index.

On the last business day of each April, the Index is equally weighted in the S&P 500 EWI Consumer Staples and Healthcare sectors. The Index holdings then float until the last business day of the following October, when the Index is reconstituted and rebalanced to an equal weighting in the S&P 500 EWI Consumer Discretionary, Industrials, Information Technology, and Materials sectors. The Index holdings then float until the last business day of the following April (the next calendar year), when the Index is reconstituted and rebalanced back to an equal weighting in the S&P 500 EWI Consumer Staples and Healthcare sectors.

The Fund

The Fund had a total return of -8.80%. The Index had a total return of -7.16%. The S&P 500 Index had a total return of 0.86%.

During the fiscal year, the top three sectors for contribution to performance were Healthcare at 7.87%, Consumer Staples at 5.72%, and Information Technology at -1.72%. The three sectors with the lowest contribution to performance were Materials at -16.11%, Industrials at -17.59% and Consumer Discretionary at -24.95%. Sector performance numbers reflect their total return during the period.

The Pacer Leaders ETF Series

The Pacer Leaders ETFs are strategy-driven, rules-based and are each designed to offer exposure to leaders in specific themes. The period referenced in this section for all custom funds is for the fiscal year end of April 30, 2020.

Pacer US Export Leaders ETF

The Pacer US Export Leaders ETF (the “Fund”) is an exchange traded fund that seeks to track the total return performance, before fees and expenses, of the Pacer US Export Leaders Index (the “Index”).

The Index uses an objective, rules-based methodology to measure the performance of an equal weight portfolio of approximately 100 large- and mid-capitalization U.S. companies with a high percentage of foreign sales and high free cash flow growth. Free cash flow is a company’s cash flow from operations minus its capital expenditures. Construction of the Index begins with an initial universe of the 200 companies across the S&P 900® Index (which is comprised of the S&P 500® Index (“S&P 500”) and S&P MidCap 400® Index (“S&P MidCap 400”)) that have the highest annual foreign sales as a percentage of total sales. The 200 companies are then narrowed to the 100 companies with the highest change in free cash flow growth over the past five years, and those 100 companies are equally weighted to create the Index. The Index is reconstituted and rebalanced to equal-weight quarterly. From time to time, the Index may include more or less than 100 companies as a result of events such as acquisitions, spin-offs and other corporate actions. The S&P 500 consists of approximately 500 leading U.S.-listed companies representing approximately 80% of the U.S. equity market capitalization. The S&P MidCap 400 measures the performance of mid-capitalization stocks in the United States.

The Fund

The Fund had a total return of -2.53%. The Index had a total return of -1.96%. The S&P 900 Index had a total return of -0.19%.

12

Pacer Funds

During the fiscal year, the top three sectors for contribution to performance were Healthcare at 22.77%, Information Technology at 5.54%, and Materials at -1.13%. The three sectors with the lowest contribution to performance were Energy at -53.58%, Industrials at -14.52%, and Consumer Discretionary at -26.75%. Sector performance numbers reflect their total return during the period.

The performance data quoted is historical. Past performance is no guarantee of future results. You cannot invest directly in an index.

Before investing you should carefully consider the Fund’s investment objectives, risks, charges and expenses. This and other information is in the prospectus. A copy may be obtained by visiting www.paceretfs.com or calling 1-877-337-0500. Please read the prospectus carefully before investing.

An investment in the Funds is subject to investment risk, including the possible loss of principal. Pacer ETF shares may be bought and sold on an exchange through a brokerage account. Brokerage commissions and ETF expenses will reduce investment returns. There can be no assurance that an active trading market for ETF shares will be developed or maintained. The risks associated with these funds are detailed in the prospectus and could include factors such as concentration risk, currency exchange rate risk, equity market risk, European investments risk, fixed income risk, foreign securities risk, geographic concentration risk, government obligations risk, high portfolio turnover risk, index criteria risk, large and mid-capitalization investing risk, monthly exposure risk, new fund risk, non-diversification risk, other investment companies risk, passive investment risk, sector risk, smaller-capitalization companies risk, style risk, tracking risk, trend lag risk and/or special risks of exchange traded funds.

The Pacer Trendpilot® US Large Cap Index, Pacer Trendpilot® US Mid Cap Index, Pacer US Small Cap Cash Cows Index and Pacer WealthShield Index (the “Indices”) are the property of Index Design Group, LLC which has contracted with S&P Opco, LLC (a subsidiary of S&P Dow Jones Indices LLC) to calculate and maintain the Indices. The Indices are not sponsored by S&P Dow Jones Indices or its affiliates or its third party licensors (collectively, “S&P Dow Jones Indices”). S&P Dow Jones Indices will not be liable for any errors or omissions in calculating the Indices. “Calculated by S&P Dow Jones Indices” and the related stylized mark(s) are service marks of S&P Dow Jones Indices and have been licensed for use by Index Design Group, LLC. S&P® is a registered trademark of Standard & Poor’s Financial Services LLC (“SPFS”) and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”).

The Pacer NASDAQ-100 Trendpilot® Index is co-owned by Index Design Group, LLC. and Nasdaq, Inc. (which with its affiliates is referred to as the “Corporations”). The NASDAQ-100 is a registered trademark of the Corporations and is licensed for use by Index Design Group, LLC. The Product(s) are not issued, endorsed, sold, or promoted by the Corporations. The Corporations make no warranties and bear no liability with respect to the product(s).

Source: FTSE International Limited (“FTSE”) © FTSE 2017. “FTSE®” is a trade mark of the London Stock Exchange Group companies and is used by FTSE International Limited under license. All rights in the FTSE indices and / or FTSE ratings vest in FTSE and/or its licensors. Neither FTSE nor its licensors accept any liability for any errors or omissions in the FTSE indices and / or FTSE ratings or underlying data and no party may rely on any FTSE indices, ratings and / or data underlying data contained in this communication. No further distribution of FTSE Data is permitted without FTSE’s express written consent. FTSE does not promote, sponsor or endorse the content of this communication.

The Russell 1000 Index (the “Index”) is a trademark of Frank Russell Company (“Russell”) and has been licensed for use by Index Design Group, LLC (“IDG”). The Pacer US Cash Cows 100 Index is not in any way sponsored, endorsed, sold or promoted by Russell or the London Stock Exchange Group companies (“LSEG”) (together the “Licensor Parties”) and none of the Licensor Parties make any claim, prediction, warranty or representation whatsoever, expressly or impliedly, either as to (i) the results to be obtained from the use of the Index (upon which the Pacer US Cash Cows 100 Index is based), (ii) the figure at which the Index is said to stand at any particular time on any particular day or otherwise, or (iii) the suitability of the Index for the purpose to which it is being put in connection with the Pacer US Cash Cows 100 Index. None of the Licensor Parties have provided or will provide any financial or investment advice or recommendation in relation to the Index to IDG or to its clients. The Index is calculated by Russell or its agent. None of the Licensor Parties shall be (a) liable (whether in negligence or otherwise) to any person for any error in the Index or (b) under any obligation to advise any person of any error therein.

“VETS INDEXES(SM)” and “MILITARY TIMES BEST FOR VETS INDEX(SM)” are service marks of VETS Indexes LLC and have been licensed for use by Pacer Advisors, LLC. The Product is not sponsored, endorsed, sold or promoted by VETS Indexes LLC and VETS Indexes LLC makes no representation regarding the advisability of investing in the Product or such similar language as may be approved in advance by VETS.

Investment products offered are: Not FDIC Insured ● No Bank Guarantee ● May Lose Value

Trendpilot®, Cash Cows Index® and Strategy Driven ETFs™ are trademarks of Index Design Group, LLC.

Distributor: Pacer Financial, Inc, member FINRA, SIPC, an affiliate of Pacer Advisors, Inc.

13

Pacer Funds

PORTFOLIO ALLOCATION (Unaudited)

As of April 30, 2020

Pacer Trendpilot ® US Large Cap ETF

Sector(a) | Percentage of

Net Assets |

Short-Term Investments | 100.8% |

Investments Purchased with Proceeds from Securities Lending | 31.1% |

Liabilities in excess of other assets | -31.9% |

Total | 100.0% |

(a) | The Fund may classify a company in a different category than the The Pacer Trendpilot ® US Large Cap Index. |

Pacer Trendpilot ® US Mid Cap ETF

Sector(a) | Percentage of

Net Assets |

Consumer, Non-Cyclical | 0.0%(b) |

Short-Term Investments | 100.1% |

Investments Purchased with Proceeds from Securities Lending | 30.1% |

Liabilities in excess of other assets | -30.2% |

Total | 100.0% |

(a) | The Fund may classify a company in a different category than the The Pacer Trendpilot ® US Mid Cap Index. |

Pacer Trendpilot ® 100 ETF

Sector(a) | Percentage of

Net Assets |

Technology | 43.5% |

Communications | 33.9% |

Consumer, Non-Cyclical | 13.9% |

Consumer, Cyclical | 7.1% |

Utilities | 0.8% |

Industrial | 0.6% |

Financial | 0.3% |

Short-Term Investments | 0.0%(b) |

Investments Purchased with Proceeds from Securities Lending | 13.4% |

Liabilities in Excess of Other Assets | -13.5% |

Total | 100.0% |

(a) | The Fund may classify a company in a different category than the Pacer Nasdaq-100 Trendpilot ® Index. |

Pacer Trendpilot ® European Index ETF

Country(a) | Percentage of

Net Assets |

Spain | 0.0%(b) |

Greece | 0.0%(b) |

Short-Term Investments | 99.5% |

Investments Purchased with Proceeds from Securities Lending | 29.4% |

Liabilities in excess of other assets | -28.9% |

Total | 100.0% |

(a) | The Fund generally classifies a company based on its country of incorporation, but may designate a different country in certain circumstances. |

14

Pacer Funds

PORTFOLIO ALLOCATION (Unaudited) (Continued)

As of April 30, 2020

Pacer Global Cash Cows Dividend ETF

Sector(a) | Percentage of

Net Assets |

Consumer, Non-Cyclical | 25.8% |

Communications | 22.3% |

Energy | 15.0% |

Basic Materials | 12.7% |

Consumer, Cyclical | 8.9% |

Industrial | 4.1% |

Technology | 3.6% |

Financial | 3.5% |

Utilities | 2.5% |

Diversified | 0.4% |

Short-Term Investments | 0.1% |

Investments Purchased with Proceeds from Securities Lending | 26.4% |

Liabilities in excess of other assets | -25.3% |

Total | 100.0% |

(a) | The Fund may classify a company in a different category than the Pacer Global Cash Cows Dividend 100 Index. |

Pacer US Cash Cows 100 ETF

Sector(a) | Percentage of

Net Assets |

Consumer, Non-Cyclical | 23.8% |

Technology | 16.8% |

Communications | 14.3% |

Consumer, Cyclical | 13.2% |

Basic Materials | 10.1% |

Industrial | 9.9% |

Energy | 8.5% |

Utilities | 2.7% |

Financial | 0.6% |

Short-Term Investments | 0.1% |

Investments Purchased with Proceeds from Securities Lending | 29.3% |

Liabilities in excess of other assets | -29.3% |

Total | 100.0% |

(a) | The Fund may classify a company in a different category than the Pacer US Cash Cows 100 Index. |

Pacer US Small Cap Cash Cows 100 ETF

Sector(a) | Percentage of

Net Assets |

Industrial | 33.2% |

Consumer, Cyclical | 29.4% |

Consumer, Non-Cyclical | 19.6% |

Technology | 8.0% |

Basic Materials | 5.7% |

Energy | 2.3% |

Financial | 1.5% |

Short-Term Investments | 0.2% |

Investments Purchased with Proceeds from Securities Lending | 25.4% |

Liabilities in excess of other assets | -25.3% |

Total | 100.0% |

(a) | The Fund may classify a company in a different category than the Pacer US Small Cap Cash Cows 100 Index. |

15

Pacer Funds

PORTFOLIO ALLOCATION (Unaudited) (Continued)

As of April 30, 2020

Pacer Developed Markets International Cash Cows 100 ETF

Sector(a) | Percentage of

Net Assets |

Consumer, Non-Cyclical | 21.7% |

Consumer, Cyclical | 19.4% |

Basic Materials | 19.2% |

Energy | 13.2% |

Communications | 11.8% |

Technology | 7.0% |

Industrial | 4.5% |

Utilities | 1.9% |

Financial | 0.4% |

Investments Purchased with Proceeds from Securities Lending | 20.3% |

Liabilities in excess of other assets | -19.4% |

Total | 100.0% |

(a) | The Fund may classify a company in a different category than the Pacer Developed Markets International Cash Cows 100 Index. |

Pacer WealthShield ETF

Sector(a) | Percentage of

Net Assets |

U.S. Treasury Notes/Bonds | 94.6% |

Exchange Traded Funds | 4.7% |

Short-Term Investments | 0.0%(b) |

Investments Purchased with Proceeds from Securities Lending | 28.9% |

Liabilities in excess of other assets | -28.2% |

Total | 100.0% |

(a) | The Fund may classify a company in a different category than the Pacer WealthShield Index. |

Pacer Military Times Best Employers ETF

Sector(a) | Percentage of

Net Assets |

Consumer, Non-Cyclical | 23.4% |

Financial | 19.4% |

Industrial | 15.6% |

Technology | 11.7% |

Communications | 11.5% |

Consumer, Cyclical | 9.3% |

Utilities | 8.8% |

Exchange Traded Funds | 0.0%(b) |

Short-Term Investments | 0.2% |

Other assets in excess of liabilities | 0.1% |

Total | 100.0% |

(a) | The Fund may classify a company in a different category than the Military Times Best for VETS Total Return Index. |

16

Pacer Funds

PORTFOLIO ALLOCATION (Unaudited) (Continued)

As of April 30, 2020

Pacer Benchmark Retail Real Estate SCTRSM ETF

Sector(a) | Percentage of

Net Assets |

Financial | 99.5% |

Short-Term Investments | 0.1% |

Investments Purchased with Proceeds from Securities Lending | 20.7% |

Liabilities in excess of other assets | -20.3% |

Total | 100.0% |

(a) | The Fund may classify a company in a different category than the Benchmark Retail Real Estate SCTRSM Index. |

Pacer Benchmark Industrial Real Estate SCTRSM ETF

Sector(a) | Percentage of

Net Assets |

Financial | 99.2% |

Short-Term Investments | 0.7% |

Investments Purchased with Proceeds from Securities Lending | 4.7% |

Liabilities in excess of other assets | -4.6% |

Total | 100.0% |

(a) | The Fund may classify a company in a different category than the Benchmark Industrial Real Estate SCTRSM Index. |

Pacer Benchmark Data & Infrastructure Real Estate SCTRSM ETF

Sector(a) | Percentage of

Net Assets |

Financial | 84.2% |

Communications | 14.1% |

Short-Term Investments | 1.7% |

Exchange Traded Funds | 1.6% |

Investments Purchased with Proceeds from Securities Lending | 19.0% |

Liabilities in excess of other assets | -20.6% |

Total | 100.0% |

(a) | The Fund may classify a company in a different category than the Benchmark Data & Infrastructure Real Estate SCTRSM Index. |

Pacer US Export Leaders ETF

Sector(a) | Percentage of

Net Assets |

Technology | 27.7% |

Industrial | 27.0% |

Consumer, Non-Cyclical | 16.3% |

Consumer, Cyclical | 10.4% |

Basic Materials | 9.5% |

Communications | 4.1% |

Energy | 2.1% |

Exchange Traded Funds | 1.0% |

Financial | 0.9% |

Utilities | 0.9% |

Short-Term Investments | 0.1% |

Other assets in excess of liabilities | 0.0%(b) |

Total | 100.0% |

(a) | The Fund may classify a company in a different category than the Pacer US Export Leaders Index. |

17

Pacer Funds

PORTFOLIO ALLOCATION (Unaudited) (Continued)

As of April 30, 2020

Pacer CFRA-Stovall Equal Weight Seasonal Rotation ETF

Sector(a) | Percentage of

Net Assets |

Consumer, Non-Cyclical | 91.4% |

Consumer, Cyclical | 4.4% |

Industrial | 3.4% |

Technology | 0.8% |

Short-Term Investments | 0.2% |

Liabilities in excess of other assets | -0.2% |

Total | 100.0% |

(a) | The Fund may classify a company in a different category than the Pacer CFRA-Stovall Equal Weight Seasonal Rotation Index. |

Pacer US Cash Cows Growth ETF

Sector(a) | Percentage of

Net Assets |

Technology | 42.7% |

Industrial | 16.3% |

Communications | 15.0% |

Consumer, Cyclical | 10.6% |

Basic Materials | 6.1% |

Energy | 6.1% |

Consumer, Non-Cyclical | 1.8% |

Utilities | 1.2% |

Short-Term Investments | 0.2% |

Liabilities in excess of other assets | 0.0%(b) |

Total | 100.0% |

(a) | The Fund may classify a company in a different category than the Pacer US Cash Cows Growth Index. |

Pacer Trendpilot ® International ETF

Sector(a) | Percentage of

Net Assets |

Consumer, Non-Cyclical | 0.0%(b) |

Financial | 0.0%(b) |

Consumer, Cyclical | 0.0%(b) |

Energy | 0.0%(b) |

Basic Materials | 0.0%(b) |

Communications | 0.0%(b) |

Utilities | 0.0%(b) |

Short-Term Investments | 100.0% |

Liabilities in excess of other assets | 0.0%(b) |

Total | 100.0% |

(a) | The Fund may classify a company in a different category than the Pacer Trendpilot ® International Index. |

18

Pacer Funds

PORTFOLIO ALLOCATION (Unaudited) (Continued)

As of April 30, 2020

Pacer Emerging Markets Cash Cows 100 ETF

Sector(a) | Percentage of

Net Assets |

Basic Materials | 19.6% |

Energy | 18.0% |

Industrial | 15.5% |

Communications | 12.6% |

Consumer, Non-Cyclical | 9.4% |

Technology | 9.1% |

Consumer, Cyclical | 7.0% |

Utilities | 4.6% |

Financial | 2.5% |

Diversified | 1.3% |

Short-Term Investments | 0.5% |

Liabilities in excess of other assets | -0.1% |

Total | 100.0% |

(a) | The Fund may classify a company in a different category than the Pacer Emerging Markets Cash Cows 100 Index. |

Pacer Cash Cows Fund of Funds ETF

Sector(a) | Percentage of

Net Assets |

Exchange Traded Funds | 100.0% |

Short-Term Investments | 0.0%(b) |

Liabilities in excess of other assets | 0.0%(b) |

Total | 100.0% |

(a) | The Fund may classify a company in a different category than the Pacer Cash Cows Fund of Funds Index. |

Pacer Trendpilot ® Fund of Funds ETF

Sector(a) | Percentage of

Net Assets |

Exchange Traded Funds | 100.0% |

Short-Term Investments | 0.0%(b) |

Liabilities in excess of other assets | 0.0%(b) |

Total | 100.0% |

(a) | The Fund may classify a company in a different category than the Pacer Trendpilot ® Fund of Funds Index. |

19

Pacer Funds

PORTFOLIO ALLOCATION (Unaudited) (Continued)

As of April 30, 2020

Pacer Trendpilot ® US Bond ETF

Sector(a) | Percentage of

Net Assets |

U.S. Treasury Notes/Bonds | 99.2% |

Short-Term Investments | 0.1% |

Other assets in excess of liabilities | 0.7% |

Total | 100.0% |

(a) | The Fund may classify a company in a different category than the Pacer Trendpilot ® US Bond Index. |

Pacer CSOP FTSE China A50 ETF

Sector(a) | Percentage of

Net Assets |

Financial | 51.0% |

Consumer, Non-Cyclical | 24.5% |

Industrial | 8.5% |

Consumer, Cyclical | 8.2% |

Communications | 2.7% |

Technology | 1.9% |

Energy | 1.6% |

Utilities | 1.2% |

Short-Term Investments | 0.4% |

Other assets in excess of liabilities | 0.0%(b) |

Total | 100.0% |

(a) | The Fund may classify a company in a different category than the FTSE China A50 Net Total Return Index. |

20

Pacer Trendpilot ® US Large Cap ETF

PERFORMANCE SUMMARY

(Unaudited)

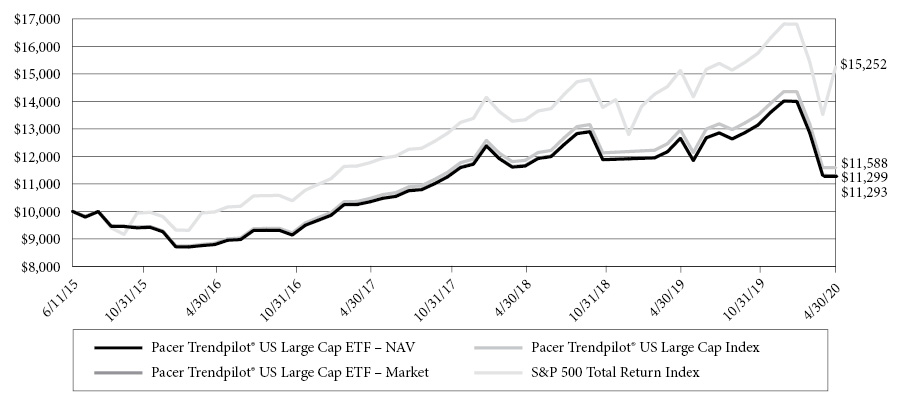

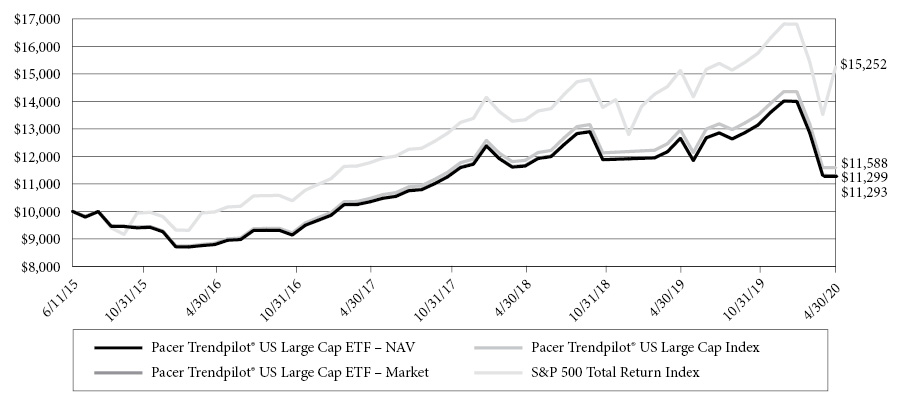

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made on June 11, 2015, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The Pacer Trendpilot ® US Large Cap Index uses an objective, rules-based methodology to implement a systematic trend-following strategy that directs exposure (i) 100% to the S&P 500 Index, (ii) 50% to the S&P 500 Total Return Index and 50% to 3-Month US Treasury bills, or (iii) 100% to 3-Month US Treasury bills, depending on the relative performance of the S&P 500 Total Return Index and its 200-business day historical simple moving average.

The S&P 500 Total Return Index consists of approximately 500 leading U.S.-listed companies representing approximately 8% of the U.S. equity market capitalization.

Annualized Returns(1)

(For the year ended April 30, 2020)

| | One Year | Three Year | Since Inception(2) |

Pacer Trendpilot ® US Large Cap ETF - NAV | -10.71% | 2.98% | 2.53% |

Pacer Trendpilot ® US Large Cap ETF - Market | -10.78% | 2.95% | 2.52% |

Pacer Trendpilot ® US Large Cap Index(3) | -10.25% | 3.58% | 3.14% |

S&P 500 ® Total Return Index(3) | 0.86% | 9.04% | 9.02% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated August 31, 2019, is 0.60%. For performance information current to the most recent month-end, please call 1-877-337-0500. |

(2) | Inception date is June 11, 2015. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

21

Pacer Trendpilot ® US Mid Cap ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made on June 11, 2015, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The Pacer Trendpilot ® US Mid Cap Index uses an objective, rules-based methodology to implement a systematic trend-following strategy that directs exposure (i) 100% to the S&P MidCap 400 Index, (ii) 50% to the S&P MidCap 400 Index and 50% to 3-Month US Treasury bills, or (iii) 100% to 3-Month US Treasury bills, depending on the relative performance of the S&P MidCap 400 Total Return Index and its 200-business day historical simple moving average.

The S&P MidCap 400 Index is a total return version of the S&P MidCap 400 Index and reflects the reinvestment of dividends paid by the securities in the S&P MidCap 400 Index. The S&P Midcap 400 measures the performance of mid-capitalization stocks in the United States.

Annualized Returns(1)

(For the year ended April 30, 2020)

| | One Year | Three Year | Since Inception(2) |

Pacer Trendpilot ® US Mid Cap ETF - NAV | -7.11% | 1.40% | 3.38% |

Pacer Trendpilot ® US Mid Cap ETF - Market | -7.18% | 1.33% | 3.37% |

Pacer Trendpilot ® US Mid Cap Index(3) | -6.72% | 1.90% | 3.97% |

S&P MidCap 400 Index(3) | -14.94% | -0.03% | 3.09% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated August 31, 2019, is 0.60%. For performance information current to the most recent month-end, please call 1-877-337-0500. |

(2) | Inception date is June 11, 2015. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

22

Pacer Trendpilot ® 100 ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made on June 11, 2015, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

Pacer NASDAQ-100 Trendpilot ® Index uses an objective, rules-based methodology to implement a systematic trend-following strategy that directs exposure (i) 100% to the NASDAQ-100 Index, (ii) 50% to the NASDAQ-100 Index and 50% to 3-Month US Treasury bills, or (iii) 100% to 3-Month US Treasury bills, depending on the relative performance of the NASDAQ-100 Index and its 200-business day historical simple moving average.

The NASDAQ-100 Index includes approximately 100 of the largest non-financial securities listed on The NASDAQ Stock Market based on market capitalization. The NASDAQ-100 Index comprises securities of companies across major industry groups, including computer, biotechnology, healthcare, telecommunications and transportation. However, it does not contain securities of financial companies, including investment companies. The NASDAQ-100 Index was developed by NASDAQ OMX. There is no minimum market capitalization requirement for inclusion in the NASDAQ-100 Index. Inclusion is determined based on the top 100 largest issuers based on market capitalization meeting all other eligibility requirements.

Annualized Returns(1)

(For the year ended April 30, 2020)

| | One Year | Three Year | Since Inception(2) |

Pacer Trendpilot ® 100 ETF - NAV | 5.78% | 13.39% | 9.28% |

Pacer Trendpilot ® 100 ETF - Market | 5.82% | 13.46% | 9.30% |

Pacer NASDAQ-100 Trendpilot ® Index(3) | 6.09% | 13.93% | 9.89% |

NASDAQ-100 Index(3) | 16.90% | 18.52% | 16.61% |