As filed with the U.S. Securities and Exchange Commission on 1/8/2021.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-23024

Pacer Funds Trust

(Exact name of registrant as specified in charter)

500 Chesterfield Parkway

Malvern, PA 19355

(Address of principal executive offices) (Zip code)

Joe M. Thomson, President

500 Chesterfield Parkway

Malvern, PA 19355

(Name and address of agent for service)

610-644-8100

Registrant's telephone number, including area code

Date of fiscal year end: October 31

Date of reporting period: October 31, 2020

Item 1. Reports to Stockholders.

Pacer Funds

TABLE OF CONTENTS

| | Page |

Letter to Shareholders | 1 |

Portfolio Allocation | 2 |

Performance Summary | 3 |

Expense Example | 6 |

Schedules of Investments | 7 |

Statements of Assets & Liabilities | 12 |

Statements of Operations | 13 |

Statements of Changes in Net Assets | 14 |

Financial Highlights | 16 |

Notes to Financial Statements | 19 |

Report of Independent Registered Public Accounting Firm | 27 |

Review of Liquidity Risk Management Program | 28 |

Additional Information | 29 |

Pacer Funds

Dear Shareholder,

Looking back on this difficult and taxing year, I am still filled with an overwhelming sense of gratitude and pride for our accomplishments as a company. Despite rocky market conditions and a global pandemic, our team has persisted. We maintained our assets under management and continued to launch products and bring new people onto our team aiming to serve more financial advisors and their clients across the country. Our unique model, which centers around the distribution of our exchange traded funds (ETFs) through the financial advisor community, continues to be our focus, albeit with an adaptive model in these challenging times.

Since our inception more than five years ago, our goal has been to design innovative products to help investors and financial advisors reach their own objectives. Since our launch, we have expanded our product offerings beyond our seven-fund flagship family, the Trendpilot ETF Series, to include seven funds in the Cash Cows ETF Series, nine within our Custom ETF Series, and one Pacer Leaders ETF. This year, we partnered with SL Advisors to add a new fund to the Pacer Custom ETF Series, the Pacer American Energy Independence ETF (USAI), to provide investors with exposure to midstream energy infrastructure activities. Additionally, we launched a new fund family: the Pacer Factor ETF Series. As we expand this exciting new investment series, we also teamed up with Salt Financial to create the Pacer Salt High truBeta US Market ETF (SLT) and Pacer Salt Low truBeta US Market ETF (LSLT). These three fund additions allow us to offer a more comprehensive range of products.

We thank the investors, financial advisors and our partners for entrusting your assets with us as we look forward to growing with you.

Joe M. Thomson Chairman, Pacer Funds Trust

Market Environment Overview

2019 was another strong year for equity market performance as the 10-year long bull market continued to make all-time highs.2020 started off with a sharp January advance before peaking in February as news of the escalating Coronavirus pandemic began to surface. The selloff intensified in early March as reports of the increasing spread of the virus roiled markets and resulted in government-imposed shutdowns. The market bottomed in late March after recording one of the largest and fastest declines in history. The market ultimately found a bottom in late March as the number of reported new cases flatted and market participants began to price in a v-shaped recovery in economic activity. The market continued to move higher before making a new all-time high in August. Since August, the market has churned sideways as investors weigh the uncertainty of the November election.

2020 has been one of the narrowest markets in history with a small subset of large cap technology stocks driving a large proportion of the advance in major market averages. Technology, Consumer, and Healthcare stocks have led the way, while Energy and Financials have lagged. Growth stocks have continued to outperform value stocks and US stocks have outperformed International stocks.

The outlook for the rest of the year looks likely to be driven by news regarding the containment of the virus and the threat of increased shutdowns weighing on the recent recovery in economic activity. In addition, uncertainty about the election will likely continue into January as investors learn what the policy outlook in Washington will look like. The key risks facing this market are signs of a worsening spread of the virus, slower than expected economic recovery, narrow market participation, and partisan divisions undermining fiscal policy support from Washington. With the Federal Reserve directive that interest rates will remain low for the near future, thus making higher yielding investments hard to find, the equity market rally may continue into 2021 as investors search for a total return solution.

USAI: The top 3 contributors to return for the fund were New Fortress Energy Inc., Antero Midstream Corp, and Hess Midstream LP, which contributed 4.46%, 1.76%, and 1.49% to the Fund’s overall performance, respectively. The bottom 3 contributors to return were ONEOK, Inc., Kinder Morgan Inc., and Energy Transfer, LP. These contributed -4.37%, -3.99%, and -2.71% respectively to the Fund’s overall return.

SLT: The top 3 contributors to return for the fund were Immunomedics, Inc., Cloudflare, Inc., and Enphase Energy, Inc., which contributed 2.41%, 1.48%, and 1.43% to the Fund’s overall performance, respectively. The bottom 3 contributors to return were Expedia Group, Inc., Wynn Resorts, Limited, and Athene Holding Limited. These contributed -1.08%, -0.89% and -0.87% respectively to the Fund’s overall return.

LSLT: The top 3 contributors to return for the fund were Danaher Corporation, Conagra Brancds, Inc., and Rollins, Inc., which contributed 0.49%, 0.34%, and 0.34% to the Fund’s overall performance, respectively. The bottom 3 contributors to return were Equity Residential, FirstEnergy Corp, and Molson Coors Beverage Company. These contributed -0.84%, -0.59% and -0.47% respectively to the Fund’s overall return.

1

Pacer Funds

PORTFOLIO ALLOCATION (Unaudited)

As of October 31, 2020

Pacer American Energy Independence ETF

Sector(a) | | Percentage of

Net Assets | |

Transportation and Warehousing | | | 43.5 | % |

Utilities | | | 31.7 | % |

Mining, Quarrying, and Oil and Gas Extraction | | | 17.8 | % |

Real Estate and Rental and Leasing | | | 2.8 | % |

Wholesale Trade | | | 2.6 | % |

Retail Trade | | | 0.4 | % |

Short-Term Investments | | | 0.6 | % |

Other Assets in Excess of Liabilities | | | 0.6 | % |

Total | | | 100.0 | % |

(a) | The Fund may classify a company in a different category than the American Energy Independence Index. |

Pacer Salt High truBetaTM US Market ETF

Sector(a) | | Percentage of

Net Assets | |

Technology | | | 28.1 | % |

Communications | | | 19.6 | % |

Consumer Cyclical | | | 16.8 | % |

Financial | | | 14.5 | % |

Consumer, Non-cyclical | | | 12.4 | % |

Energy | | | 3.4 | % |

Industrial | | | 1.9 | % |

Basic Materials | | | 1.0 | % |

Short-Term Investments | | | 2.3 | % |

Liabilities in Excess of Other Assets | | | 0.0 | %(b) |

| | | | 100.0 | % |

(a) | The Fund may classify a company in a different category than the Salt High truBetaTM US Market Index. |

Pacer Salt Low truBetaTM US Market ETF

Sector(a) | | Percentage of

Net Assets | |

Consumer, Non-cyclical | | | 38.2 | % |

Utilities | | | 19.6 | % |

Financials | | | 15.7 | % |

Consumer Cyclical | | | 7.3 | % |

Communications | | | 6.8 | % |

Industrials | | | 5.5 | % |

Technology | | | 4.7 | % |

Basic Materials | | | 1.8 | % |

Short-Term Investments | | | 0.3 | % |

Other Assets in Excess of Liabilities | | | 0.1 | % |

| | | | 100.0 | % |

(a) | The Fund may classify a company in a different category than the Salt Low truBetaTM US Market Index. |

2

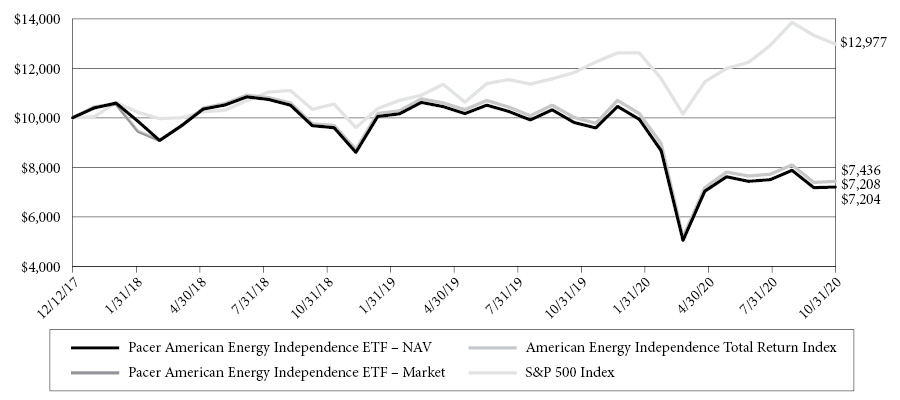

Pacer American Energy Independence ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made on December 12, 2017, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The American Energy Independence Total Return Index uses a proprietary, rules based methodology to measure the performance of a portfolio of U.S. and Canadian exchange-listed equity securities of companies that generate a majority of their cash flow from certain qualifying “midstream” energy infrastructure activities. The companies in the Index are expected to benefit from regulatory policies favoring and industry trends toward American energy independence (i.e., a reduced or eliminated need for the United States to import fuels, such as coal, crude oil, or natural gas). Midstream energy infrastructure refers to the processing, storage, transportation, and distribution of crude oil, natural gas, refined products, and their related products as well as the transmission or storage of renewable energy. The following activity segments are considered qualifying midstream energy infrastructure activities: gathering & processing, compression, fractionation, logistics, midstream services, pipeline transportation, storage and terminaling of oil, gas, natural gas liquids, and refined products, as well as liquid natural gas facilities, renewable energy transmission and storage infrastructure. The following activity segments are not qualifying activities: refining, shipping, exploration, production, retail, distribution, coal related activities, power generation or oil services. The Index may include small-, mid-, and large-capitalization companies.

The S&P 500 Total Return Index consists of approximately 500 leading U.S.-listed companies representing approximately 8% of the U.S. equity market capitalization.

Annualized Returns(1)

(For the period ended October 31, 2020)

| | 11 Months | One Year | Since Inception(2) |

Pacer American Energy Independence ETF - NAV | -24.76% | -26.61% | -10.73% |

Pacer American Energy Independence ETF - Market | -24.90% | -26.60% | -10.75% |

American Energy Independence Total Return Index (3) | -23.95% | -25.78% | -9.76% |

S&P 500 Index (3) | 5.87% | 9.71% | 9.45% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated March 31, 2020, is 0.75%. For performance information current to the most recent month-end, please call 1-877-337-0500. |

(2) | Inception date is December 12, 2017. The Fund is the sucessor to the investment performance of the American Energy Independence ETF (the “Predecessor USAI”) as a result of the reorganization of the Predecessor USAI Fund into the Fund on December 16, 2019. Accordingly, the performance information shown in the chart and table above for periods prior to December 16, 2019 is that of the Predecessor USAI Fund’s Shares for the Fund. The Predecessor USAI Fund was advised by SL Advisors, LLC and sub-advised by Penserra Capital Management LLC and had substantially the same investment objectives, policies, and strategies as the Fund. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

3

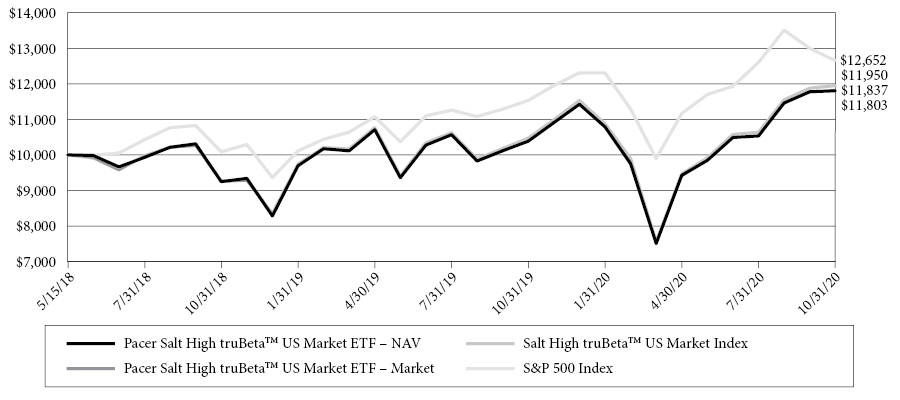

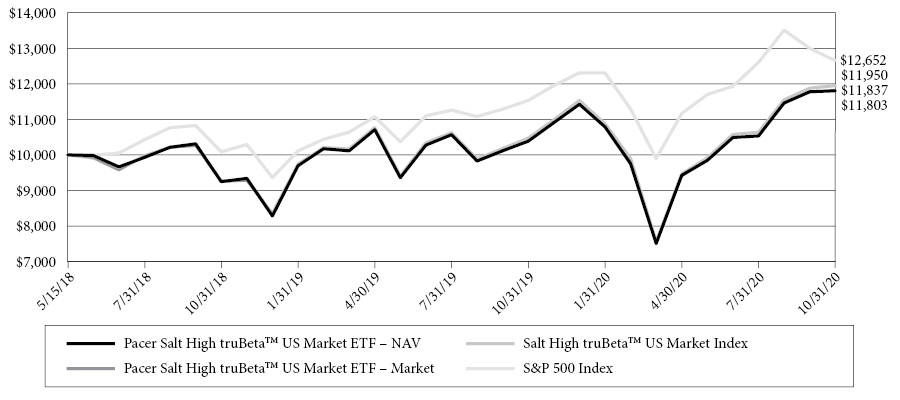

Pacer Salt High truBetaTM US Market ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made on May 15, 2018, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The Salt High truBetaTM US Market Index uses an objective, rules-based methodology to measure the performance of an equal-weighted portfolio of approximately 100 large- and mid-capitalization U.S.-listed stocks with the highest forecasted systematic risk relative to the market (known as “beta”). Construction of the Index begins with the constituents of the Solactive US Large & Mid Cap Index (the “Equity Universe”), generally the 1,000 largest U.S.-listed common stocks and real estate investment trusts (“REITs”). Companies in the Equity Universe are then screened to keep only the 500 stocks with the highest average daily traded value over the past 30 days. Those 500 stocks are then analyzed using a proprietary algorithm developed by the Index Provider to calculate each stock’s truBetaTM forecast, i.e., its projected beta for the subsequent quarter, and to eliminate stocks whose performance is weakly correlated with the broader U.S. equity market (the remaining securities are referred to as the “Index Universe”).

The S&P 500 Index consists of approximately 500 leading U.S.-listed companies representing approximately 8% of the U.S. equity market capitalization.

Annualized Returns(1)

(For the period ended October 31, 2020)

| | Ten Months | One Year | Since Inception(2) |

Pacer Salt High truBetaTM US Market ETF - NAV | 3.55% | 13.91% | 7.09% |

Pacer Salt High truBetaTM US Market ETF - Market | 3.32% | 13.65% | 6.96% |

Salt High truBetaTM US Market Index (3) | 3.64% | 14.13% | 7.50% |

S&P 500® Index (3) | 2.77% | 9.71% | 10.02% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated September 27, 2020, is 0.60%. For performance information current to the most recent month-end, please call 1-877-337-0500. |

(2) | Inception date is May 15, 2018. The Fund is the successor to the investment performance of the Salt Low truBetaTM US Market ETF, as a result of the reorganization of the Salt Low truBetaTM US Market ETF into the Fund on October 5, 2020. In addition, the Salt Low truBetaTM US Market ETF was the successor to the investment performance of Salt Low truBetaTM US Market ETF, a series of Salt Funds Trust, as a result of the reorganization of the series of Salt Funds Trust into a series of ETF Series Solutions that occurred on December 16, 2019 (together, the “Predecessor SLT”). Accordingly, any performance information for periods prior to October 5, 2020 is that of the series of ETF Series Solutions; any performance for periods prior to December 16, 2019 is that of the series of Salt Funds Trust. The Predecessor SLT Fund was advised by Salt Financial LLC and sub-advised by Penserra Capital Management LLC and had substantially the same investment objectives, policies, and strategies as the Fund. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

4

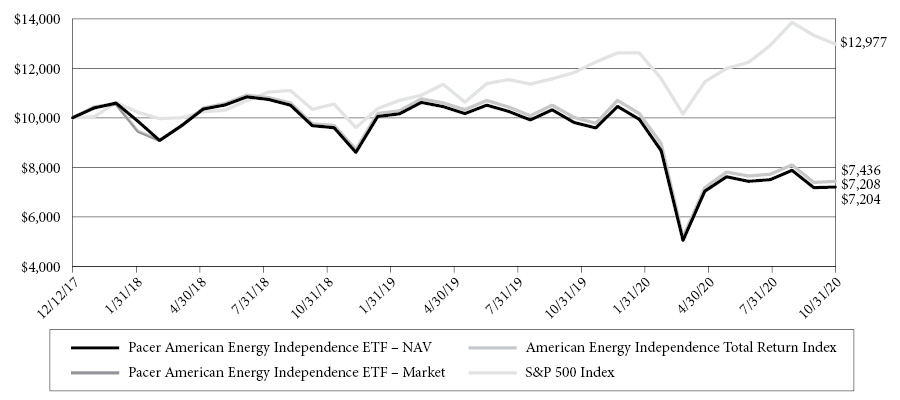

Pacer Salt Low truBetaTM US Market ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made on March 12, 2019, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The Salt High truBetaTM US Market Total Return Index uses a an objective, rules-based methodology to to measure the performance of an equal-weighted portfolio of approximately 100 large and mid-capitalization U.S.-listed stocks with the lowest levels of variability in their historical beta calculations (“Beta Variability”) and forecasted beta of less than 1.00. “Beta” is a calculation of an investment’s systematic risk relative to the market.

The S&P 500 Index consists of approximately 500 leading U.S.-listed companies representing approximately 8% of the U.S. equity market capitalization.

Annualized Returns(1)

(For the period ended October 31, 2020)

| | Ten Months | One Year | Since Inception(2) |

Pacer Salt Low truBetaTM US Market ETF - NAV | -5.04% | -1.27% | 6.13% |

Pacer Salt Low truBetaTM US Market ETF - Market | -5.37% | -1.59% | 5.90% |

Salt Low truBetaTM US Market Market Index(3) | -4.98% | -1.18% | 6.24% |

S&P 500® Index(3) | 2.77% | 9.71% | 12.25% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated September 27, 2020, is 0.60%. For performance information current to the most recent month-end, please call 1-877-337-0500. |

(2) | Inception date is March 12, 2019. The Fund is the successor to the Salt Low truBetaTM US Market ETF, a series of ETF Series Solutions, as a result of the reorganization of the Salt Low truBetaTM US Market ETF into the Fund on October 2, 2020. In addition, the Salt Low truBetaTM US Market ETF was the successor to the investment performance of Salt Low truBetaTM US Market ETF, a series of Salt Funds Trust, as a result of the reorganization of the series of Salt Funds Trust into a series of ETF Series Solutions that occurred on December 16, 2019 (together, the “Predecessor LSLT”). The Predecessor LSLT Fund commenced operations on March 12, 2019. Accordingly, any performance information for periods prior to October 2, 2020 is that of the series of ETF Series Solutions; any performance for periods prior to December 16, 2019 is that of the series of Salt Funds Trust. The Predecessor SLT Fund was advised by Salt Financial LLC and sub-advised by Penserra Capital Management LLC and had substantially the same investment objectives, policies, and strategies as the Fund. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

5

Pacer Funds

EXPENSE EXAMPLE

For the Six-Months Ended October 31, 2020 (Unaudited)

As a shareholder of a Fund, you pay ongoing expenses, such as advisory fees, and other fund expenses. The following examples are intended to help you understand the ongoing cost (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other funds. Please note, the expenses shown in the tables are meant to highlight ongoing costs only and do not reflect any transactional costs. You may pay brokerage commissions on your purchase and sale of Fund shares, which are not reflected in the following examples. Each example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period as indicated below.

Actual Expenses

The columns under the heading entitled “Actual” help you estimate the actual expenses you paid over the period. The “Actual Ending Account Value” shown is derived from a Fund’s actual return and the “Actual Expenses Paid During Period” show the dollar amount that would have been paid by an investor who started with $1,000 in the Fund. To estimate the expenses you paid on your account during this period, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000=8.6), then multiply the result by the number in the column under the heading untitled “Actual Expenses Paid During Period”.

Hypothetical Example for Comparison Purposes

The columns under the heading entitled “Hypothetical” provide information about hypothetical account value and hypothetical expenses based on a Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s return. The hypothetical account value and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in a Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs which may be applicable to your account. Therefore, the last column of the table (Hypothetical Expenses Paid During Period) is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | Fund’s Annual

Expense Ratio | Beginning

Account Value

05/01/20 | Ending

Account Value

10/31/20 | Expenses Paid

During Period(a) |

Pacer American Energy Independence ETF | | | | |

Actual | 0.75% | $ 1,000.00 | $ 1,029.40 | $ 3.83 |

Hypothetical(b) | 0.75% | $ 1,000.00 | $ 1,021.37 | $ 3.81 |

Pacer Salt High truBetaTM US Market ETF | | | | |

Actual | 0.33% | $ 1,000.00 | $ 1,259.90 | $ 1.87 |

Hypothetical(b) | 0.33% | $ 1,000.00 | $ 1,023.48 | $ 1.68 |

Pacer Salt Low truBetaTM US Market ETF | | | | |

Actual | 0.34% | $ 1,000.00 | $ 1,069.60 | $ 1.77 |

Hypothetical(b) | 0.34% | $ 1,000.00 | $ 1,023.43 | $ 1.73 |

(a) | The dollar amounts shown as expenses paid during the period are equal to the annualized six-month expense ratio multiplied by the average account value during the period, multiplied by the number of days (184) in the most recent six-month period and divided by the number of days in the most recent twelve-month period (366). |

(b) | Assumes 5% return before expenses. |

6

Pacer American Energy Independence ETF

SCHEDULES OF INVESTMENTS

October 31, 2020

| | | Shares | | | Value | |

COMMON STOCKS — 73.5% | | | | |

| | | | | | | | | |

Energy — 25.8% (a) | | | | |

Enbridge, Inc. | | | 29,448 | | | $ | 811,406 | |

Gibson Energy, Inc. | | | 22,992 | | | | 338,590 | |

Keyera Corp. | | | 28,539 | | | | 405,068 | |

Pembina Pipeline Corp. | | | 36,306 | | | | 760,020 | |

TC Energy Corp. | | | 19,534 | | | | 768,868 | |

| | | | | | | | 3,083,952 | |

Mining, Quarrying, and Oil and Gas Extraction — 5.4% |

Archrock, Inc. | | | 56,758 | | | | 336,575 | |

Hess Midstream LP - Class A | | | 18,368 | | | | 313,725 | |

| | | | | | | | 650,300 | |

Pipelines — 42.3% (a) | | | | |

Antero Midstream Corp. | | | 67,017 | | | | 384,007 | |

Cheniere Energy, Inc. (b) | | | 10,454 | | | | 500,433 | |

Equitrans Midstream Corp. | | | 50,950 | | | | 369,897 | |

Inter Pipeline Ltd. | | | 47,850 | | | | 425,956 | |

Kinder Morgan, Inc. | | | 69,713 | | | | 829,585 | |

New Fortress Energy, Inc. | | | 8,420 | | | | 304,215 | |

ONEOK, Inc. | | | 20,515 | | | | 594,935 | |

Plains GP Holdings LP - Class A | | | 52,938 | | | | 338,274 | |

Targa Resources Corp. | | | 30,238 | | | | 485,320 | |

Williams Cos., Inc. | | | 43,178 | | | | 828,586 | |

| | | | | | | | 5,061,208 | |

TOTAL COMMON STOCKS (Cost $10,407,295 | | | | | | | 8,795,460 | |

| | | | | |

MASTER LIMITED PARTNERSHIPS AND RELATED COMPANIES — 25.3% |

| | | | | | | | | |

Gas — 0.7% | | | | |

Western Midstream Partners LP | | | 10,072 | | | | 82,086 | |

| | | | | | | | | |

Pipelines — 24.6% | | | | |

Crestwood Equity Partners LP | | | 3,004 | | | | 45,000 | |

Energy Transfer LP | | | 89,407 | | | | 460,446 | |

EnLink Midstream LLC | | | 124,918 | | | | 338,528 | |

Enterprise Products Partners LP | | | 55,775 | | | | 924,192 | |

Genesis Energy LP | | | 7,173 | | | | 30,126 | |

Holly Energy Partners LP | | | 2,765 | | | | 31,687 | |

Magellan Midstream Partners LP | | | 10,013 | | | | 355,862 | |

MPLX LP | | | 16,200 | | | | 278,802 | |

Noble Midstream Partners LP | | | 2,939 | | | | 23,424 | |

NuStar Energy LP | | | 5,208 | | | | 51,507 | |

PBF Logistics LP | | | 2,310 | | | | 16,955 | |

| | | Shares | | | Value | |

Pipelines — 24.6% (Continued) | | | | |

Phillips 66 Partners LP | | | 3,050 | | | $ | 71,583 | |

Rattler Midstream LP | | | 43,900 | | | | 257,693 | |

Shell Midstream Partners LP | | | 6,445 | | | | 56,394 | |

| | | | | | | | 2,942,199 | |

TOTAL MASTER LIMITED PARTNERSHIPS AND RELATED COMPANIES (Cost $3,788,825) | | | | | | | 3,024,285 | |

| | | | | |

| | | Principal

Amount | | | | | |

SHORT-TERM INVESTMENTS — 0.6% | | | | |

| | | | | | | | | |

Money Market Deposit Accounts, — 0.6% | | | | |

U.S. Bank Money Market Deposit Account, 0.025% (c) | | $ | 71,062 | | | | 71,062 | |

TOTAL SHORT-TERM INVESTMENTS (Cost $71,062) | | | | | | | 71,062 | |

| | | | | |

Total Investments (Cost $14,267,182) — 99.4% | | | | | | | 11,890,807 | |

Other Assets in Excess of Liabilities — 0.6% | | | | | | | 75,235 | |

TOTAL NET ASSETS — 100.0% | | | | | | $ | 11,966,042 | |

| | (a) | To the extent that the Fund invests more heavily in particular industry groups of the economy, its performance will be especially sensitive to developments that significantly affect those industry groups or strategies. |

| | (b) | Non-income producing security. |

| | (c) | The rate shown is as of October 31, 2020. |

For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or they may be defined by Fund management. This definition does not apply for all purposes of this report, which may combine sub-classifications for reporting ease. Categories are shown as a percentage of net assets.

The accompanying notes are an integral part of the financial statements.

7

Pacer Salt High truBetaTM US Market ETF

SCHEDULES OF INVESTMENTS

October 31, 2020

| | | Shares | | | Value | |

COMMON STOCKS — 95.9% | | | | |

| | | | | | | | | |

Agriculture — 1.2% | | | | |

Darling Ingredients, Inc. (a) | | | 2,167 | | | $ | 93,181 | |

| | | | | | | | | |

Auto Manufacturers — 1.0% | | | | |

Tesla Motors, Inc. (a) | | | 209 | | | | 81,100 | |

| | | | | | | | | |

Banks — 2.7% | | | | |

Goldman Sachs Group, Inc. | | | 374 | | | | 70,701 | |

Morgan Stanley | | | 2,999 | | | | 144,402 | |

| | | | | | | | 215,103 | |

Biotechnology — 1.3% | | | | |

Amicus Therapeutics, Inc. (a) | | | 5,830 | | | | 103,949 | |

| | | | | | | | | |

Commercial Services — 6.0% | | | | |

Chegg, Inc. (a) | | | 1,144 | | | | 84,016 | |

Global Payments, Inc. | | | 462 | | | | 72,876 | |

PayPal Holdings, Inc. (a) | | | 418 | | | | 77,802 | |

Quanta Services, Inc. | | | 1,463 | | | | 91,335 | |

Square, Inc. - Class A (a) | | | 550 | | | | 85,184 | |

TransUnion | | | 891 | | | | 70,977 | |

| | | | | | | | 482,190 | |

Computers — 3.7% | | | | |

Apple, Inc. | | | 671 | | | | 73,045 | |

Crowdstrike Holdings, Inc. - Class A (a) | | | 594 | | | | 73,561 | |

DXC Technology Co. | | | 3,839 | | | | 70,715 | |

Zscaler, Inc. (a) | | | 583 | | | | 79,142 | |

| | | | | | | | 296,463 | |

Distribution/Wholesale — 0.9% | | | | |

LKQ Corp. (a) | | | 2,343 | | | | 74,953 | |

| | | | | | | | | |

Diversified Financial Services — 2.7% | | | | |

Jefferies Financial Group, Inc. | | | 4,334 | | | | 84,556 | |

MasterCard, Inc. - Class A | | | 220 | | | | 63,501 | |

Visa, Inc. - Class A | | | 385 | | | | 69,958 | |

| | | | | | | | 218,015 | |

Energy-Alternate Sources — 2.6% | | | | |

Enphase Energy, Inc. (a) | | | 1,155 | | | | 113,294 | |

First Solar, Inc. (a) | | | 1,067 | | | | 92,877 | |

| | | | | | | | 206,171 | |

Engineering & Construction — 0.9% | | | | |

KBR, Inc. | | | 3,058 | | | | 68,163 | |

| | | | | | | | | |

Food — 1.0% | | | | |

Beyond Meat, Inc. (a) | | | 561 | | | | 79,903 | |

| | | | | | | | | |

| | | Shares | | | Value | |

Healthcare-Services — 2.0% | | | | |

Catalent, Inc. (a) | | | 913 | | | $ | 80,134 | |

Teladoc Health, Inc. (a) | | | 396 | | | | 77,798 | |

| | | | | | | | 157,932 | |

Home Builders — 3.5% | | | | |

DR Horton, Inc. | | | 1,056 | | | | 70,552 | |

Lennar Corp. - Class A | | | 968 | | | | 67,983 | |

PulteGroup, Inc. | | | 1,661 | | | | 67,702 | |

Toll Brothers, Inc. | | | 1,683 | | | | 71,157 | |

| | | | | | | | 277,394 | |

Insurance — 3.6% | | | | |

Athene Holding Ltd. - Class A (a) | | | 2,090 | | | | 67,047 | |

Equitable Holdings, Inc. | | | 3,817 | | | | 82,028 | |

Principal Financial Group, Inc. | | | 1,815 | | | | 71,184 | |

Prudential Financial, Inc. | | | 1,111 | | | | 71,126 | |

| | | | | | | | 291,385 | |

Internet — 18.9% | | | | |

Alphabet, Inc. - Class A (a) | | | 44 | | | | 71,109 | |

Alphabet, Inc. - Class C (a) | | | 55 | | | | 89,155 | |

Amazon.com, Inc. (a) | | | 22 | | | | 66,795 | |

Chewy, Inc. - Class A (a) | | | 1,397 | | | | 86,055 | |

eBay, Inc. | | | 1,441 | | | | 68,635 | |

Etsy, Inc. (a) | | | 682 | | | | 82,924 | |

Expedia Group, Inc. | | | 792 | | | | 74,567 | |

Facebook, Inc. - Class A (a) | | | 286 | | | | 75,249 | |

IAC/InterActiveCorp (a) | | | 616 | | | | 74,363 | |

Netflix, Inc. (a) | | | 154 | | | | 73,264 | |

Okta, Inc. (a) | | | 385 | | | | 80,785 | |

Pinterest, Inc. - Class A (a) | | | 2,200 | | | | 129,690 | |

Roku, Inc. (a) | | | 484 | | | | 97,962 | |

Snap, Inc. - Class A (a) | | | 3,113 | | | | 122,621 | |

Twitter, Inc. (a) | | | 1,925 | | | | 79,618 | |

Wayfair, Inc. - Class A (a) | | | 297 | | | | 73,665 | |

Zendesk, Inc. (a) | | | 803 | | | | 89,085 | |

Zillow Group, Inc. - Class C (a) | | | 880 | | | | 77,986 | |

| | | | | | | | 1,513,528 | |

Leisure Time — 2.1% | | | | |

Harley-Davidson, Inc. | | | 2,706 | | | | 88,973 | |

Planet Fitness, Inc. - Class A (a) | | | 1,331 | | | | 78,889 | |

| | | | | | | | 167,862 | |

Lodging — 2.5% | | | | |

Marriott International, Inc. - Class A | | | 748 | | | | 69,474 | |

MGM Resorts International | | | 3,300 | | | | 67,881 | |

Wynn Resorts Ltd. | | | 913 | | | | 66,129 | |

| | | | | | | | 203,484 | |

Media — 0.7% | | | | |

DISH Network Corp. - Class A (a) | | | 2,343 | | | | 59,723 | |

| | | | | | | | | |

The accompanying notes are an integral part of the financial statements.

8

Pacer Salt High truBetaTM US Market ETF

SCHEDULES OF INVESTMENTS

October 31, 2020 (Continued)

| | | Shares | | | Value | |

COMMON STOCKS — 95.9% (Continued) | | | | |

| | | | | | | | | |

Mining — 1.0% | | | | |

Freeport-McMoRan, Inc. | | | 4,609 | | | $ | 79,920 | |

| | | | | | | | | |

Oil & Gas Services — 0.8% | | | | |

Halliburton Co. | | | 5,258 | | | | 63,411 | |

| | | | | | | | | |

Pharmaceuticals — 1.0% | | | | |

Horizon Therapeutics PLC (a) | | | 1,056 | | | | 79,126 | |

| | | | | | | | | |

Private Equity — 2.6% | | | | |

Apollo Global Management, Inc. | | | 1,683 | | | | 62,035 | |

The Blackstone Group Inc. - Class A | | | 1,463 | | | | 73,765 | |

KKR & Co, Inc. | | | 2,178 | | | | 74,379 | |

| | | | | | | | 210,179 | |

Real Estate — 1.0% | | | | |

CBRE Group, Inc. - Class A (a) | | | 1,606 | | | | 80,942 | |

| | | | | |

Retail — 6.8% | | | | |

Best Buy Co., Inc. | | | 704 | | | | 78,531 | |

Carvana Co. (a) | | | 440 | | | | 81,554 | |

Darden Restaurants, Inc. | | | 858 | | | | 78,868 | |

Floor & Decor Holdings, Inc. - Class A (a) | | | 1,056 | | | | 77,088 | |

Lowe’s Cos., Inc. | | | 462 | | | | 73,042 | |

The Wendy’s Co. | | | 3,498 | | | | 76,431 | |

Williams-Sonoma, Inc. | | | 825 | | | | 75,248 | |

| | | | | | | | 540,762 | |

Semiconductors — 6.1% | | | | |

Advanced Micro Devices, Inc. (a) | | | 979 | | | | 73,709 | |

CREE, Inc. (a) | | | 1,254 | | | | 79,754 | |

KLA Corp. | | | 440 | | | | 86,759 | |

Lam Research Corp. | | | 253 | | | | 86,546 | |

NVIDIA Corp. | | | 154 | | | | 77,210 | |

Teradyne, Inc. | | | 1,001 | | | | 87,938 | |

| | | | | | | | 491,916 | |

Software — 18.3% | | | | |

Adobe Systems, Inc. (a) | | | 154 | | | | 68,853 | |

Alteryx, Inc. - Class A (a) | | | 704 | | | | 88,246 | |

Autodesk, Inc. (a) | | | 330 | | | | 77,728 | |

Ceridian HCM Holding, Inc. (a) | | | 1,023 | | | | 88,203 | |

Cloudflare, Inc. - Class A (a) | | | 2,200 | | | | 114,334 | |

Coupa Software, Inc. (a) | | | 308 | | | | 82,452 | |

DocuSign, Inc. (a) | | | 374 | | | | 75,642 | |

Dynatrace, Inc. (a) | | | 1,914 | | | | 67,583 | |

Microsoft Corp. | | | 363 | | | | 73,497 | |

Nutanix, Inc. - Class A (a) | | | 3,135 | | | | 76,306 | |

Salesforce.com, Inc. (a) | | | 308 | | | | 71,539 | |

ServiceNow, Inc. (a) | | | 165 | | | | 82,099 | |

| | | Shares | | | Value | |

Software — 18.3% (Continued) | | | | |

Slack Technologies, Inc. - Class A (a) | | | 2,926 | | | $ | 74,847 | |

Smartsheet, Inc. - Class A (a) | | | 1,617 | | | | 80,607 | |

Twilio, Inc. - Class A (a) | | | 330 | | | | 92,060 | |

Workday, Inc. - Class A (a) | | | 363 | | | | 76,274 | |

Zoom Video Communications, Inc. - Class A (a) | | | 198 | | | | 91,260 | |

Zynga, Inc. - Class A (a) | | | 9,031 | | | | 81,189 | |

| | | | | | | | 1,462,719 | |

Transportation — 1.0% | | | | |

FedEx Corp. | | | 319 | | | | 82,771 | |

TOTAL COMMON STOCKS (Cost $7,166,070) | | | | | | | 7,682,245 | |

| | | | | |

REAL ESTATE INVESTMENT TRUSTS — 1.8% | | | | |

| | | | | | | | | |

VICI Properties, Inc. | | | 3,113 | | | | 71,443 | |

Weyerhaeuser Co. | | | 2,651 | | | | 72,346 | |

TOTAL REAL ESTATE INVESTMENT TRUSTS (Cost $134,249) | | | | | | | 143,789 | |

| | | | | | | | | |

| | | Principal

Amount | | | | | |

SHORT-TERM INVESTMENTS — 2.3% | | | | |

| | | | | | | | | |

Money Market Deposit Accounts, — 2.3% | | | | |

U.S. Bank Money Market Deposit Account, 0.025% (c) | | $ | 181,658 | | | | 181,658 | |

TOTAL SHORT-TERM INVESTMENTS (Cost $181,658) | | | | | | | 181,658 | |

| | | | | |

Total Investments (Cost $7,481,977) — 100.0% | | | | | | | 8,007,692 | |

Liabilities in Excess of Other Assets — 0.0% (b) | | | | | | | (1,629 | ) |

TOTAL NET ASSETS — 100.0% | | | | | | $ | 8,006,063 | |

| | (a) | Non-income producing security. |

| | (c) | The rate shown is as of October 31, 2020. |

For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or they may be defined by Fund management. This definition does not apply for all purposes of this report, which may combine sub-classifications for reporting ease. Categories are shown as a percentage of net assets.

The accompanying notes are an integral part of the financial statements.

9

Pacer Salt Low truBetaTM US Market ETF

SCHEDULES OF INVESTMENTS

October 31, 2020

| | | Shares | | | Value | |

COMMON STOCKS — 90.6% | | | | |

| | | | | | | | | |

Aerospace/Defense — 0.9% | | | | |

General Dynamics Corp. | | | 564 | | | $ | 74,070 | |

| | | | | | | | | |

Agriculture — 2.7% | | | | |

Altria Group, Inc. | | | 1,848 | | | | 66,676 | |

Archer-Daniels-Midland Co. | | | 1,740 | | | | 80,457 | |

Philip Morris International, Inc. | | | 984 | | | | 69,884 | |

| | | | | | | | 217,017 | |

Apparel — 1.0% | | | | |

NIKE, Inc. - Class B | | | 684 | | | | 82,135 | |

| | | | | | | | | |

Auto Parts & Equipment — 1.1% | | | | |

Gentex Corp. | | | 3,060 | | | | 84,670 | |

| | | | | | | | | |

Beverages — 4.8% | | | | |

Brown-Forman Corp. - Class B | | | 1,032 | | | | 71,941 | |

Coca-Cola Co. | | | 1,596 | | | | 76,704 | |

Keurig Dr Pepper, Inc. | | | 2,796 | | | | 75,212 | |

Molson Coors Brewing Co. - Class B | | | 2,328 | | | | 82,085 | |

PepsiCo, Inc. | | | 588 | | | | 78,375 | |

| | | | | | | | 384,317 | |

Biotechnology — 0.9% | | | | |

Amgen, Inc. | | | 324 | | | | 70,289 | |

| | | | | | | | | |

Chemicals — 1.8% | | | | |

Air Products & Chemicals, Inc. | | | 264 | | | | 72,927 | |

Ecolab, Inc. | | | 396 | | | | 72,702 | |

| | | | | | | | 145,629 | |

Commercial Services — 2.2% | | | | |

Rollins, Inc. | | | 1,512 | | | | 87,469 | |

Service Corp. International | | | 1,896 | | | | 87,804 | |

| | | | | | | | 175,273 | |

Cosmetics/Personal Care — 3.1% | | | | |

Colgate-Palmolive Co. | | | 1,044 | | | | 82,361 | |

Estee Lauder Cos., Inc. - Class A | | | 384 | | | | 84,349 | |

Procter & Gamble Co. | | | 576 | | | | 78,970 | |

| | | | | | | | 245,680 | |

Distribution/Wholesale — 1.1% | | | | |

Copart, Inc. (a) | | | 804 | | | | 88,729 | |

| | | | | | | | | |

Diversified Financial Services — 2.8% | | | | |

CME Group, Inc. | | | 504 | | | | 75,963 | |

Intercontinental Exchange, Inc. | | | 816 | | | | 77,030 | |

Western Union Co. | | | 3,672 | | | | 71,384 | |

| | | | | | | | 224,377 | |

| | | Shares | | | Value | |

Electric — 19.6% | | | | |

Alliant Energy Corp. | | | 1,560 | | | $ | 86,237 | |

Ameren Corp. | | | 1,056 | | | | 85,663 | |

American Electric Power Co., Inc. | | | 1,032 | | | | 92,808 | |

CMS Energy Corp. | | | 1,332 | | | | 84,355 | |

Consolidated Edison, Inc. | | | 1,104 | | | | 86,653 | |

Dominion Energy, Inc. | | | 1,008 | | | | 80,983 | |

Duke Energy Corp. | | | 984 | | | | 90,636 | |

Edison International | | | 1,608 | | | | 90,112 | |

Evergy, Inc. | | | 1,536 | | | | 84,787 | |

Eversource Energy | | | 996 | | | | 86,921 | |

Exelon Corp. | | | 2,232 | | | | 89,034 | |

FirstEnergy Corp. | | | 2,712 | | | | 80,601 | |

Pinnacle West Capital Corp. | | | 1,152 | | | | 93,969 | |

PPL Corp. | | | 2,940 | | | | 80,850 | |

Public Service Enterprise Group, Inc. | | | 1,548 | | | | 90,016 | |

Southern Co. | | | 1,572 | | | | 90,311 | |

WEC Energy Group, Inc. | | | 852 | | | | 85,669 | |

Xcel Energy, Inc. | | | 1,164 | | | | 81,515 | |

| | | | | | | | 1,561,120 | |

Environmental Control — 1.9% | | | | |

Republic Services, Inc. | | | 828 | | | | 73,005 | |

Waste Management, Inc. | | | 720 | | | | 77,695 | |

| | | | | | | | 150,700 | |

Food — 7.9% | | | | |

Campbell Soup Co. | | | 1,788 | | | | 83,446 | |

ConAgra Foods, Inc. | | | 2,340 | | | | 82,111 | |

General Mills, Inc. | | | 1,380 | | | | 81,586 | |

Hershey Co. | | | 552 | | | | 75,878 | |

Hormel Foods Corp. | | | 1,632 | | | | 79,462 | |

Kellogg Co. | | | 1,224 | | | | 76,977 | |

Kroger Co. | | | 2,340 | | | | 75,371 | |

Mondelez International, Inc. - Class A | | | 1,416 | | | | 75,218 | |

| | | | | | | | 630,049 | |

Healthcare-Products — 5.1% | | | | |

Baxter International, Inc. | | | 960 | | | | 74,467 | |

Danaher Corp. | | | 396 | | | | 90,898 | |

Edwards Lifesciences Corp. (a) | | | 972 | | | | 69,683 | |

Medtronic PLC | | | 780 | | | | 78,444 | |

ResMed, Inc. | | | 468 | | | | 89,828 | |

| | | | | | | | 403,320 | |

Healthcare-Services — 1.0% | | | | |

UnitedHealth Group, Inc. | | | 264 | | | | 80,557 | |

| | | | | | | | | |

Household Products/Wares — 2.8% | | | | |

Church & Dwight Co., Inc. | | | 852 | | | | 75,308 | |

Clorox Co. | | | 372 | | | | 77,097 | |

Kimberly-Clark Corp. | | | 540 | | | | 71,599 | |

| | | | | | | | 224,004 | |

The accompanying notes are an integral part of the financial statements.

10

Pacer Salt Low truBetaTM US Market ETF

SCHEDULES OF INVESTMENTS

October 31, 2020 (Continued)

| | | Shares | | | Value | |

COMMON STOCKS — 90.6% (Continued) | | | | |

| | | | | | | | | |

Insurance — 3.9% | | | | |

Allstate Corp. | | | 864 | | | $ | 76,680 | |

Brown & Brown, Inc. | | | 1,800 | | | | 78,318 | |

Marsh & McLennan Cos., Inc. | | | 708 | | | | 73,250 | |

Progressive Corp. | | | 864 | | | | 79,401 | |

| | | | | | | | 307,649 | |

Media — 1.9% | | | | |

Comcast Corp. - Class A | | | 1,824 | | | | 77,046 | |

The New York Times Co. - Class A | | | 1,872 | | | | 74,243 | |

| | | | | | | | 151,289 | |

Pharmaceuticals — 7.7% | | | | |

Alkermes PLC (a) | | | 4,668 | | | | 75,855 | |

Bristol-Myers Squibb Co. | | | 1,380 | | | | 80,661 | |

CVS Health Corp. | | | 1,428 | | | | 80,097 | |

Eli Lilly & Co. | | | 540 | | | | 70,448 | |

Johnson & Johnson | | | 540 | | | | 74,039 | |

Merck & Co., Inc. | | | 960 | | | | 72,202 | |

Pfizer, Inc. | | | 2,232 | | | | 79,191 | |

Zoetis, Inc. | | | 516 | | | | 81,812 | |

| | | | | | | | 614,305 | |

Retail — 4.1% | | | | |

Costco Wholesale Corp. | | | 240 | | | | 85,829 | |

Dollar General Corp. | | | 396 | | | | 82,649 | |

McDonald’s Corp. | | | 360 | | | | 76,680 | |

Yum! Brands, Inc. | | | 876 | | | | 81,757 | |

| | | | | | | | 326,915 | |

Software — 4.7% | | | | |

Akamai Technologies, Inc. (a) | | | 768 | | | | 73,052 | |

Black Knight, Inc. (a) | | | 996 | | | | 87,598 | |

Citrix Systems, Inc. | | | 600 | | | | 67,962 | |

Fidelity National Information Services, Inc. | | | 564 | | | | 70,269 | |

Oracle Corp. | | | 1,404 | | | | 78,779 | |

| | | | | | | | 377,660 | |

Telecommunications — 4.9% | | | | |

AT&T, Inc. | | | 2,772 | | | | 74,899 | |

Cisco Systems, Inc. | | | 2,004 | | | | 71,944 | |

Motorola Solutions, Inc. | | | 528 | | | | 83,456 | |

T-Mobile US, Inc. (a) | | | 733 | | | | 80,315 | |

Verizon Communications, Inc. | | | 1,356 | | | | 77,278 | |

| | | | | | | | 387,892 | |

Transportation — 2.7% | | | | |

Expeditors International of Washington, Inc. | | | 876 | | | | 77,412 | |

Knight-Swift Transportation Holdings, Inc. | | | 1,788 | | | | 67,926 | |

Union Pacific Corp. | | | 408 | | | | 72,294 | |

| | | | | | | | 217,632 | |

TOTAL COMMON STOCKS (Cost $7,035,082) | | | | | | | 7,225,278 | |

| | | | | |

| | | Shares | | | Value | |

REAL ESTATE INVESTMENT TRUSTS — 9.0% | | | | |

AGNC Investment Corp. | | | 5,736 | | | $ | 80,132 | |

American Campus Communities, Inc. | | | 2,352 | | | | 88,106 | |

American Homes 4 Rent - Class A | | | 2,808 | | | | 79,382 | |

Crown Castle International Corp. | | | 516 | | | | 80,599 | |

CubeSmart | | | 2,520 | | | | 85,504 | |

Digital Realty Trust, Inc. | | | 552 | | | | 79,654 | |

Duke Realty Corp. | | | 2,172 | | | | 82,514 | |

Equity Residential | | | 1,488 | | | | 69,906 | |

Lexington Realty Trust | | | 7,344 | | | | 72,926 | |

TOTAL REAL ESTATE INVESTMENT TRUSTS (Cost $706,040) | | | | | | | 718,723 | |

| | | | | | | | | |

| | | Principal

Amount | | | | | |

SHORT-TERM INVESTMENTS — 0.3% | | | | |

| | | | | | | | | |

Money Market Deposit Accounts, — 0.3% | | | | |

U.S. Bank Money Market Deposit Account, 0.025% (b) | | $ | 24,042 | | | | 24,042 | |

TOTAL SHORT-TERM INVESTMENTS (Cost $24,042) | | | | | | | 24,042 | |

| | | | | |

Total Investments (Cost $7,765,164 — 99.9% | | | | | | | 7,968,043 | |

Other Assets in Excess of Liabilities — 0.1% | | | | | | | 8,050 | |

TOTAL NET ASSETS — 100.0% | | | | | | $ | 7,976,093 | |

| | (a) | Non-income producing security. |

| | (b) | The rate shown is as of October 31, 2020. |

For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or they may be defined by Fund management. This definition does not apply for all purposes of this report, which may combine sub-classifications for reporting ease. Categories are shown as a percentage of net assets.

The accompanying notes are an integral part of the financial statements.

11

Pacer Funds

Statements of Assets & Liabilities

October 31, 2020

| | | Pacer

American Energy

Independence

ETF | | | Pacer

Salt High

truBetaTM US

Market ETF | | | Pacer

Salt Low

truBetaTM US

Market ETF | |

ASSETS | | | | | | | | | | | | |

Investments in Securities, at Value* | | $ | 11,890,807 | | | $ | 8,007,692 | | | $ | 7,968,043 | |

Foreign Currency at Value* | | | 834 | | | | — | | | | — | |

Interest and Dividends Receivable | | | 134,097 | | | | 2,110 | | | | 11,734 | |

Total Assets | | | 12,025,738 | | | | 8,009,802 | | | | 7,979,777 | |

| | | | | | | | | | | | | |

LIABILITIES | | | | | | | | | | | | |

Management Fees Payable | | | 7,946 | | | | 3,739 | | | | 3,684 | |

Payable for Distributions to Shareholders | | | 51,750 | | | | — | | | | — | |

Total Liabilities | | | 59,696 | | | | 3,739 | | | | 3,684 | |

| | | | | | | | | | | | | |

NET ASSETS | | $ | 11,966,042 | | | $ | 8,006,063 | | | $ | 7,976,093 | |

| | | | | | | | | | | | | |

NET ASSETS CONSIST OF: | | | | | | | | | | | | |

Paid-in Capital | | $ | 17,623,677 | | | $ | 11,052,238 | | | $ | 8,596,892 | |

Total Distributable Earnings (Accumulated Deficit) | | | (5,657,635 | ) | | | (3,046,175 | ) | | | (620,799 | ) |

Net Assets | | $ | 11,966,042 | | | $ | 8,006,063 | | | $ | 7,976,093 | |

* Identified Cost: | | | | | | | | | | | | |

Investments in Securities | | $ | 14,267,182 | | | $ | 7,481,977 | | | $ | 7,765,164 | |

Foreign Currencies | | | 861 | | | | — | | | | — | |

| | | | | | | | | | | | | |

Net Asset Value: | | | | | | | | | | | | |

Net Assets | | $ | 11,966,042 | | | $ | 8,006,063 | | | $ | 7,976,093 | |

Shares Outstanding (No Par Value) | | | 800,000 | | | | 275,000 | | | | 300,000 | |

Net Asset Value, Offering and Redemption Price per Share | | $ | 14.96 | | | $ | 29.11 | | | $ | 26.59 | |

The accompanying notes are an integral part of the financial statements.

12

Pacer Funds

STATEMENTS OF OPERATIONS

For the Period Ended October 31, 2020

| | Pacer American Energy

Independence ETF (a) | | | Pacer Salt High truBetaTM

US Market ETF (c) | | | Pacer Salt Low truBetaTM

US Market ETF (e) | |

| | | For the

Period Ended

October 31,

2020 (b) | | | For the

Year Ended

November 30,

2019 | | | For the

Period Ended

October 31,

2020 (d) | | | For the

Year Ended

December 31,

2019 | | | For the

Period Ended

October 31,

2020 (d) | | | For the

Period Ended

December 31,

2019 (f) | |

INVESTMENT INCOME | | | | | | | | | | | | | | | | | | | | | | | | |

Income: | | | | | | | | | | | | | | | | | | | | | | | | |

Dividends* | | $ | 270,348 | | | $ | 266,863 | | | $ | 198,704 | | | $ | 190,020 | | | $ | 194,407 | | | $ | 135,270 | |

Interest | | | 433 | | | | 1,119 | | | | 223 | | | | 950 | | | | 174 | | | | 410 | |

Adviser contributions | | | — | | | | — | | | | — | | | | — | | | | — | | | | 2,167 | |

Total Investment Income | | | 270,781 | | | | 267,982 | | | | 198,927 | | | | 190,970 | | | | 194,581 | | | | 137,847 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

EXPENSES | | | | | | | | | | | | | | | | | | | | | | | | |

Management fees | | | 79,334 | | | | 86,164 | | | | 29,438 | | | | 35,882 | | | | 24,204 | | | | 14,101 | |

Total Expenses | | | 79,334 | | | | 86,164 | | | | 29,438 | | | | 35,882 | | | | 24,204 | | | | 14,101 | |

Less: fees waived | | | — | | | | — | | | | — | | | | — | | | | (13,970 | ) | | | (12,572 | ) |

Net Expenses | | | 79,334 | | | | 86,164 | | | | 29,438 | | | | 35,882 | | | | 10,234 | | | | 1,529 | |

Net Investment Income | | | 191,447 | | | | 181,818 | | | | 169,489 | | | | 155,088 | | | | 184,347 | | | | 136,318 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

REALIZED & UNREALIZED GAIN (LOSS) ON INVESTMENTS | | | | | | | | | | | | | | | | | | | | | | | | |

Net Realized Gain (Loss) on(g): | | | | | | | | | | | | | | | | | | | | | | | | |

Net Realized Gain (Loss) on Investments | | | (3,105,529 | ) | | | (378,745 | ) | | | (3,226,845 | ) | | | 156,397 | | | | (851,123 | ) | | | 21,452 | |

Net Realized Gain (Loss) on In-Kind Redemptions | | | 1,208,719 | | | | 995,446 | | | | 4,019,141 | | | | 1,839,406 | | | | 400,084 | | | | — | |

Net realized Gain (Loss) on Foreign Currency | | | 264 | | | | (554 | ) | | | — | | | | — | | | | — | | | | — | |

Total | | | (1,896,546 | ) | | | 616,147 | | | | 792,296 | | | | 1,995,803 | | | | (451,039 | ) | | | 21,452 | |

Net Change in Unrealized Appreciation (Depreciation) of: | | | | | | | | | | | | | | | | | | | | | | | | |

Change in Unrealized Appreciation (Depreciation) on Investments | | | (1,114,930 | ) | | | (500,471 | ) | | | (552,103 | ) | | | 1,458,045 | | | | (460,175 | ) | | | 663,054 | |

Change in Unrealized Appreciation (Depreciation) on Foreign Currency | | | (134 | ) | | | 18 | | | | — | | | | — | | | | — | | | | — | |

Total | | | (1,115,064 | ) | | | (500,453 | ) | | | (552,103 | ) | | | 1,458,045 | | | | (460,175 | ) | | | 663,054 | |

Net Realized and Unrealized Gain (Loss) on Investments | | | (3,011,610 | ) | | | 115,694 | | | | 240,193 | | | | 3,453,848 | | | | (911,214 | ) | | | 684,506 | |

NET INCREASE (DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS | | $ | (2,820,163 | ) | | $ | 297,512 | | | $ | 409,682 | | | $ | 3,608,936 | | | $ | (726,867 | ) | | $ | 820,824 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

* Net of fees and foreign withholding tax of | | $ | 28,954 | | | $ | 28,485 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

(a) | Shares of the Predecessor USAI Fund converted Shares at the close of business on December 13, 2019. See Note 1 to the Financial Statements. |

(b) | For the period ended December 1, 2019 to October 31, 2020. |

(c) | Shares of the Predecessor SLT Fund converted Shares at the close of business on October 2, 2020. See Note 1 to the Financial Statements. |

(d) | For the period ended January 1, 2020 to October 31, 2020. |

(e) | Shares of the Predecessor LSLT Fund converted Shares at the close of business on October 2, 2020. See Note 1 to the Financial Statements. |

(f) | The Fund commenced operations on March 12, 2019. The information presented is for the period from March 12, 2019 to December 31, 2019. |

(g) | Certain amounts in the prior period’s Statement of Operations were reclassified for comparability to the current period’s presentation. See Note 1 to the Financial Statements. |

The accompanying notes are an integral part of the financial statements.

13

Pacer Funds

STATEMENTS OF CHANGES IN NET ASSETS

| | Pacer American Energy Independence ETF (a) | |

| | | For the

Period Ended

October 31,

2020 (b) | | | For the

Year Ended

November 30,

2019 | | | For the

Period Ended

November 30,

2018 (c) | |

OPERATIONS | | | | | | | | | | | | |

Net Investment Income (Loss) | | $ | 191,447 | | | $ | 181,818 | | | $ | 135,122 | |

Net Realized Gain (Loss) on Investments and Foreign Currency Transactions | | | (1,896,546 | ) | | | 616,147 | | | | (142,992 | ) |

Change in Unrealized Appreciation (Depreciation) of Investments and Foreign Currency Transactions | | | (1,115,064 | ) | | | (500,453 | ) | | | (761,014 | ) |

Net Increase (Decrease) in Net Assets Resulting from Operations | | | (2,820,163 | ) | | | 297,512 | | | | (768,884 | ) |

| | | | | | | | | | | | | |

DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | | | | | |

Net Investment Income | | | (245,568 | ) | | | (112,296 | ) | | | (133,840 | ) |

Return of Capital | | | (709,985 | ) | | | (626,154 | ) | | | (88,652 | ) |

Total Distributions to Shareholders | | | (955,553 | ) | | | (738,450 | ) | | | (222,492 | ) |

| | | | | | | | | | | | | |

CAPITAL SHARE TRANSACTIONS | | | | | | | | | | | | |

Proceeds from Shares Sold | | | 9,066,280 | | | | 17,042,250 | | | | 10,275,020 | |

Payments for Shares Redeemed | | | (4,221,315 | ) | | | (14,988,310 | ) | | | — | |

Transaction Fees (See Note 1) | | | — | | | | 147 | | | | — | |

Net Increase (Decrease) in Net Assets Derived from Capital Share Transactions (d) | | | 4,844,965 | | | | 2,054,087 | | | | 10,275,020 | |

Net Increase (Decrease) in Net Assets | | $ | 1,069,249 | | | $ | 1,613,149 | | | $ | 9,283,644 | |

| | | | | | | | | | | | | |

NET ASSETS | | | | | | | | | | | | |

Beginning of Period/Year | | $ | 10,896,793 | | | $ | 9,283,644 | | | $ | — | |

End of Period/Year | | $ | 11,966,042 | | | $ | 10,896,793 | | | $ | 9,283,644 | |

(a) | Shares of the Predecessor USAI Fund converted Shares at the close of business on December 13, 2019. See Note 1 to the Financial Statements. |

(b) | For the period ended December 1, 2019 to October 31, 2020. |

(c) | Fund inception date of December 12, 2017. The information presented is from December 12, 2017 to November 30, 2018. |

(d) | A summary of capital share transactions is as follows: |

| | | Shares (e) | | | Shares (e) | | | Shares | |

Subscriptions | | | 550,000 | | | | 700,000 | | | | 400,000 | |

Redemptions | | | (250,000 | ) | | | (600,000 | ) | | | — | |

Net Increase (Decrease) | | | 300,000 | | | | 100,000 | | | | 400,000 | |

(e) | Shares of Predecessor Fund converted into Fund Shares at the close of business on December 13, 2019. See Note 1 to the Financial Statements. |

The accompanying notes are an integral part of the financial statements.

14

Pacer Funds

STATEMENTS OF CHANGES IN NET ASSETS

| | | Pacer Salt High truBetaTM US Market ETF (a) | | | Pacer Salt Low truBetaTM

US Market ETF (a) | |

| | | For the

Period Ended

October 31,

2020 (b) | | | For the

Year Ended

December 31,

2019 | | | For the

Period Ended

December 31,

2018 (c) | | | For the

Period Ended

October 31,

2020 (b) | | | For the

Period Ended

December 31,

2019 (d) | |

OPERATIONS | | | | | | | | | | | | | | | | | | | | |

Net Investment Income (Loss) | | $ | 169,489 | | | $ | 155,088 | | | $ | 26,398 | | | $ | 184,347 | | | $ | 136,318 | |

Net Realized Gain (Loss) on Investments | | | 792,296 | | | | 1,995,803 | | | | (769,325 | ) | | | (451,039 | ) | | | 21,452 | |

Change in Unrealized Appreciation (Depreciation) of Investments | | | (552,103 | ) | | | 1,458,045 | | | | (380,227 | ) | | | (460,175 | ) | | | 663,054 | |

Net Increase (Decrease) in Net Assets Resulting from Operations | | | 409,682 | | | | 3,608,936 | | | | (1,123,154 | ) | | | (726,867 | ) | | | 820,824 | |

| | | | | | | | | | | | | | | | | | | | | |

DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | | | | | | | | | | | | | |

Dividends and Distributions | | | — | | | | (155,507 | ) | | | (49,240 | ) | | | (179,737 | ) | | | (138,282 | ) |

Total Distributions to Shareholders | | | — | | | | (155,507 | ) | | | (49,240 | ) | | | (179,737 | ) | | | (138,282 | ) |

| | | | | | | | | | | | | | | | | | | | | |

CAPITAL SHARE TRANSACTIONS | | | | | | | | | | | | | | | | | | | | |

Proceeds from Shares Sold | | | 4,923,967 | | | | 11,643,208 | | | | 10,077,645 | | | | 2,801,520 | | | | 8,610,788 | |

Payments for Shares Redeemed | | | (12,790,613 | ) | | | (7,909,050 | ) | | | (629,817 | ) | | | (3,212,153 | ) | | | — | |

Transaction Fees (See Note 1) | | | — | | | | — | | | | 6 | | | | — | | | | — | |

Net Increase (Decrease) in Net Assets Derived from Capital Share Transactions (a) | | | (7,866,646 | ) | | | 3,734,158 | | | | 9,447,834 | | | | (410,633 | ) | | | 8,610,788 | |

Net Increase (Decrease) in Net Assets | | $ | (7,456,964 | ) | | $ | 7,187,587 | | | $ | 8,275,440 | | | $ | (1,317,237 | ) | | $ | 9,293,330 | |

| | | | | | | | | | | | | | | | | | | | | |

NET ASSETS | | | | | | | | | | | | | | | | | | | | |

Beginning of Period/Year | | $ | 15,463,027 | | | $ | 8,275,440 | | | $ | — | | | $ | 9,293,330 | | | $ | — | |

End of Period/Year | | $ | 8,006,063 | | | $ | 15,463,027 | | | $ | 8,275,440 | | | $ | 7,976,093 | | | $ | 9,293,330 | |

(a) | Shares of the Predecessor SLT Fund and the Predecessor LSLT Fund each converted Shares at the close of business on October 2, 2020. See Note 1 to the Financial Statements. |

(b) | For the period ended January 1, 2020 to October 31, 2020. |

(c) | Fund commenced operations on May 15, 2018 . The information presented is from May 15, 2018 to December 31, 2018. |

(d) | The Fund commenced operations on March 12, 2019. The information presented is for the period from March 12, 2019 to December 31, 2019. Shares of the Predecessor Fund converted to shares of the Fund at the close of business December 13, 2019. |

(e) | Summary of capital share transactions is as follows: |

| | | Shares (f) | | | Shares (f) | | | Shares | | | Shares (f) | | | Shares (d) | |

Subscriptions | | | 200,000 | | | | 450,000 | | | | 425,000 | | | | 100,000 | | | | 325,000 | |

Redemptions | | | (475,000 | ) | | | (300,000 | ) | | | (25,000 | ) | | | (125,000 | ) | | | — | |

Net Increase (Decrease) | | | (275,000 | ) | | | 150,000 | | | | 400,000 | | | | (25,000 | ) | | | 325,000 | |

(f) | Shares of each Predecessor Fund converted into separate Fund Shares at the close of business on October 2, 2020. See Note 1 to the Financial Statements. |

The accompanying notes are an integral part of the financial statements.

15

Pacer American Energy Independence ETF

FINANCIAL HIGHLIGHTS

For a capital share outstanding throughout the year/period

| | For the

Period Ended

October 31,

2020(a) | | | For the

Year Ended

November 30,

2019 | | | For the

Period Ended

November 30,

2018(b) | |

Net Asset Value, Beginning of Period | | $ | 21.79 | | | $ | 23.21 | | | $ | 25.00 | |

| | | | | | | | | | | | | |

INCOME (LOSS) FROM INVESTMENT OPERATIONS: | | | | | | | | | | | | |

Net Investment Income (c) | | | 0.28 | | | | 0.37 | | | | 0.55 | |

Net Realized and Unrealized Gain (Loss) on Investments (d) | | | (5.55 | ) | | | (0.34 | ) | | | (1.51 | ) |

Total from Investment Operations | | | (5.27 | ) | | | 0.03 | | | | (0.96 | ) |

| | | | | | | | | | | | | |

LESS DISTRIBUTIONS: | | | | | | | | | | | | |

Distributions From: | | | | | | | | | | | | |

Net Investment Income | | | (0.52 | ) | | | (0.22 | ) | | | (0.50 | ) |

Return of Capital | | | (1.04 | ) | | | (1.23 | ) | | | (0.33 | ) |

Total Distributions | | | (1.56 | ) | | | (1.45 | ) | | | (0.83 | ) |

| | | | | | | | | | | | | |

CAPITAL SHARE TRANSACTIONS: | | | | | | | | | | | | |

Transaction Fees (See Note 1) | | | — | | | | 0.00 | (e) | | | — | |

| | | | | | | | | | | | | |

Net Asset Value, End of Period | | $ | 14.96 | | | $ | 21.79 | | | $ | 23.21 | |

Total return | | | -24.76 | %(f) | | | -0.13 | % | | | -4.06 | %(f) |

| | | | | | | | | | | | | |

SUPPLEMENTAL DATA: | | | | | | | | | | | | |

Net Assets at End of Period (000’s) | | $ | 11,966 | | | $ | 10,897 | | | $ | 9,284 | |

| | | | | | | | | | | | | |

RATIOS TO AVERAGE NET ASSETS: | | | | | | | | | | | | |

Expenses to Average Net Assets | | | 0.75 | %(g) | | | 0.75 | % | | | 0.75 | %(g) |

Net Investment Income (Loss) to Average Net Assets | | | 1.81 | %(g) | | | 1.58 | % | | | 2.25 | %(g) |

Portfolio Turnover Rate (h) | | | 41 | %(f) | | | 26 | % | | | 61 | %(f) |

(a) | Shares of the Predecessor USAI Fund converted Shares at the close of business on December 13, 2019. See Note 1 in the Financial Statements. For the period ended December 1, 2019 to October 31, 2020. |

(b) | Commencement of operations on December 12, 2017. |

(c) | Calculated based on average shares outstanding during the period. |

(d) | Realized and unrealized gains and losses per share are balancing amounts necessary to reconcile to the change in net asset value for the period and may reconcile with aggregate gains and losses in the statement of operations due to share transactions for the period. |

(e) | Represents less than $0.005. |

(h) | Excludes the impact of in-kind transactions. |

The accompanying notes are an integral part of the financial statements.

16

Pacer Salt High truBetaTM US Market ETF

FINANCIAL HIGHLIGHTS

For a capital share outstanding throughout the year/period

| | | For the

Period Ended

October 31,

2020(a) | | | For the

Year Ended

December 31,

2019 | | | For the

Period Ended

December 31,

2018(b) | |

Net Asset Value, Beginning of Period | | $ | 28.11 | | | $ | 20.69 | | | $ | 25.00 | |

| | | | | | | | | | | | | |

INCOME (LOSS) FROM INVESTMENT OPERATIONS: | | | | | | | | | | | | |

Net Investment Income (Loss) (c) | | | 0.37 | | | | 0.32 | | | | 0.14 | |

Net Realized and Unrealized Gain (Loss) on Investments (g) | | | 0.63 | | | | 7.40 | | | | (4.32 | ) |

Total from Investment Operations | | | 1.00 | | | | 7.72 | | | | (4.18 | ) |

| | | | | | | | | | | | | |

LESS DISTRIBUTIONS: | | | | | | | | | | | | |

Distributions from: | | | | | | | | | | | | |

Net Investment Income | | | — | | | | (0.30 | ) | | | (0.07 | ) |

Realized Gains | | | — | | | | — | | | | (0.06 | ) |

Total Distributions | | | — | | | | (0.30 | ) | | | (0.13 | ) |

| | | | | | | | | | | | | |

CAPITAL SHARE TRANSACTIONS: | | | | | | | | | | | | |

Transaction fees (See Note 1) | | | — | | | | — | | | | (0.00 | )(h) |

Net Asset Value, End of Period | | $ | 29.11 | | | $ | 28.11 | | | $ | 20.69 | |

Total Return | | | 3.55% | | | | 37.32 | % | | | -16.76 | %(d) |

| | | | | | | | | | | | | |

SUPPLEMENTAL DATA: | | | | | | | | | | | | |

Net Assets at End of Period (000’s) | | $ | 8,006 | | | $ | 15,463 | | | $ | 8,275 | |

| | | | | | | | | | | | | |

RATIOS TO AVERAGE NET ASSETS: | | | | | | | | | | | | |

Expenses to Average Net Assets | | | 0.31 | %(e) | | | 0.30 | %(i) | | | 0.50 | %(e) |

Net Investment Income (Loss) to Average Net Assets | | | 1.79 | %(e) | | | 1.28 | % | | | 0.97 | %(e) |

Portfolio Turnover Rate (f) | | | 157 | %(d) | | | 202 | % | | | 145 | %(d) |

(a) | Shares of the Predecessor SLT Fund converted Shares at the close of business on October 2, 2020. See Note 1 in the Financial Statements. For the period ended January 1, 2020 to October 31, 2020. |

(b) | The Fund commenced operations on May 15, 2018. The information presented is for the period from May 15, 2018 to December 31, 2018. |

(c) | Calculated based on average shares outstanding during the period. |

(f) | Excludes the impact of in-kind transactions. |

(g) | Realized and unrealized gains and losses per share in this caption are balancing amounts necessary to reconcile to the change in net asset value for the period and may reconcile with the aggregate gains and losses in the statement of operations due to share transactions for the period. |

(h) | Represents less than $0.005. |

(i) | Effective January 14, 2019, the Predessor SLT Fund’s adviser reduced its management fee from 0.50% to 0.29%. See Note 3 to the Financial Statements. |

The accompanying notes are an integral part of the financial statements.

17

Pacer Salt Low truBetaTM US Market ETF

FINANCIAL HIGHLIGHTS

For a capital share outstanding throughout the period

| | | For the

Period Ended

October 31,

2020(a) | | | For the

Period Ended

December 31,

2019(b) | |

Net Asset Value, Beginning of Period | | $ | 28.59 | | | $ | 25.00 | |

| | | | | | | | | |

INCOME (LOSS) FROM INVESTMENT OPERATIONS: | | | | | | | | |

Net Investment Income (Loss) (c) | | | 0.53 | | | | 0.62 | |

Net Realized and Unrealized Gain (Loss) on Investments (g) | | | (2.01 | ) | | | 3.40 | |

Total from Investment Operations | | | (1.48 | ) | | | 4.02 | |

| | | | | | | | | |

LESS DISTRIBUTIONS: | | | | | | | | |

Distributions from: | | | | | | | | |

Net Investment Income | | | (0.45 | ) | | | (0.43 | ) |

Realized Gains | | | (0.07 | ) | | | — | |

Total Distributions | | | (0.52 | ) | | | (0.43 | ) |

| | | | | | | | | |

Net Asset Value, End of Period | | $ | 26.59 | | | $ | 28.59 | |

Total Return | | | -5.04 | %(d) | | | 16.09 | %(d)(i) |

| | | | | | | | | |

SUPPLEMENTAL DATA: | | | | | | | | |

Net Assets at End of Period (000’s) | | $ | 7,976 | | | $ | 9,293 | |

| | | | | | | | | |

RATIOS TO AVERAGE NET ASSETS: | | | | | | | | |

Expenses to Average Net Assets before Fees Waived | | | 0.31 | %(e) | | | 0.29 | %(e) |

Expenses to Average Net Assets after Fees Waived | | | 0.13 | %(e) | | | 0.03 | %(h)(e) |

Net Investment Income (Loss) to Average Net Assets before Fees Waived | | | 2.21 | %(e) | | | 2.54 | %(e) |

Net Investment Income (Loss) to Average Net Assets after Fees Waived | | | 2.39 | %(e) | | | 2.79 | %(e) |

Portfolio Turnover Rate (f) | | | 39 | %(d) | | | 31 | %(d) |

(a) | Shares of the Predecessor LSLT Fund converted Shares at the close of business on October 2, 2020. See Note 1 in the Financial Statements. For the period ended January 1, 2020 to October 31, 2020. |

(b) | The Fund commenced operations on March 12, 2019. The information presented is for the period from March 12, 2019 to December 31, 2019. Shares of the Predecessor Fund converted to shares of the Fund at the close of business December 13, 2019. |

(c) | Calculated based on average shares outstanding during the period. |

(f) | Excludes the impact of in-kind transactions. |

(g) | Realized and unrealized gains and losses per share in this caption are balancing amounts necessary to reconcile to the change in net asset value for the period and may reconcile with the aggregate gains and losses in the statement of operations due to share transactions for the period. |

(h) | Effective May 13, 2019, the Predecessor Fund’s adviser agreed to waive the Fund’s full unitary management fee of 0.29% on the first $100 million in net assets. See Note 3 to the Financial Statements. |

(i) | Net increase from contributions contributed 0.04% to this return. See Note 3 to the Financial Statements. |

The accompanying notes are an integral part of the financial statements.

18

Pacer Funds

NOTES TO FINANCIAL STATEMENTS

October 31, 2020

NOTE 1 – ORGANIZATION

Pacer American Energy Independence ETF (“USAI”), Pacer Salt High truBetaTM US Market ETF (“SLT”) and Pacer Salt Low truBetaTM US Market ETF (“LSLT”), (individually the “Fund” or collectively the “Funds”) are series of Pacer Funds Trust (the “Trust”), a Delaware statutory trust organized on August 12, 2014. All Funds in the Trust, except USAI, SLT and LSLT, fiscal year ends are April 30th and as such are not included in these financial statements. The Trust is registered with the Securities and Exchange Commission (the “SEC”) under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company and the offering of the Funds’ shares (“Shares”) is registered under the Securities Act of 1933, as amended (the “Securities Act”). The investment objective of the Funds is to track the performance, before fees and expenses, of the American Energy Independence Index, the Pacer Salt High truBetaTM US Market Index and the Salt Low truBetaTM US Market Index. USAI commenced operations on December 12, 2017. SLT commenced operations on May 15, 2018, and LSLT commenced operations on March 12, 2019. Each of the Funds are non-diversified series of the Trust.

USAI is the successor in interest to American Energy Independence ETF (the “USAI Predecessor Fund”) having the same investment objective that was included as a series of another investment company, ETF Series Solutions that was advised by SL Advisors, LLC and sub-advised by Penserra Capital Management LLC. On December 10, 2019, the shareholders of the USAI Predecessor Fund approved the reorganization of the USAI Predecessor Fund with and into USAI and effective as of the close of business on December 13, 2019, the assets and liabilities of the USAI Predecessor Fund were transferred to USAI in exchange for shares of USAI. For financial reporting purposes, assets received and shares issued by USAI were recorded at fair value; however, the cost basis of the investments received from the USAI Predecessor Fund was carried forward to align ongoing reporting of USAI’s realized and unrealized gains and losses with amounts distributable to shareholders for tax purposes. Costs incurred by USAI in connection with the reorganization were paid by the Pacer Advisors, Inc. (the “Adviser”). The fiscal year end of the USAI Predecessor Fund was November 30. The reporting period covered by this annual report for USAI is December 1, 2019 through October 31, 2020. Operations prior to December 16, 2019 were for the USAI Predecessor Fund. The net assets were $11,300,062, including ($873,236) of net unrealized depreciation, ($556,632) of undistributed (accumulated) net investment income, and $479,349 of undistributed (accumulated) net realized gain and shares outstanding were 500,000, all of which were transferred into the Trust at NAV at the close of business on December 13, 2019.

SLT is the successor in interest to Salt High truBetaTM US Market ETF (the “SLT Predecessor Fund”) having the same investment objective that was included as a series of another investment company, ETF Series Solutions that was advised by Salt Financial LLC and sub-advised by Penserra Capital Management LLC. On September 29, 2020, the shareholders of the SLT Predecessor Fund approved the reorganization of the SLT Predecessor Fund with and into SLT, and effective as of the close of business on October 2, 2020, the assets and liabilities of the SLT Predecessor Fund were transferred to SLT in exchange for shares of SLT. For financial reporting purposes, assets received and shares issued bySLT were recorded at fair value; however, the cost basis of the investments received from the SLT Predecessor Fund was carried forward to align ongoing reporting of SLT’s realized and unrealized gains and losses with amounts distributable to shareholders for tax purposes. Costs incurred by SLT in connection with the reorganization were paid by the Pacer Advisors, Inc. (the “Adviser”). The fiscal year end of the SLT Predecessor Fund was December 31. The reporting period covered by this annual report for SLT is January 1, 2020 through October 31, 2020. Operations prior to October 5, 2020 were for the SLT Predecessor Fund. The net assets were $8,245,397, including $768,257 of net unrealized appreciation, ($425) of undistributed (accumulated) net investment income, and ($1,203,643) of undistributed (accumulated) net realized loss and shares outstanding were 275,000, all of which were transferred into the Trust at NAV at the close of business on October 2, 2020.

LSLT is the successor in interest to Salt Low truBetaTM US Market ETF (the “LSLT Predecessor Fund”) having the same investment objective that was included as a series of another investment company, ETF Series Solutions that was advised by Salt Financial LLC and sub-advised by Penserra Capital Management LLC. On September 29, 2020, the shareholders of the LSLT Predecessor Fund approved the reorganization of the LSLT Predecessor Fund with and into LSLT, and effective as of the close of business on October 2, 2020, the assets and liabilities of the LSLT Predecessor Fund were transferred to LSLT in exchange for shares of LSLT. For financial reporting purposes, assets received and shares issued by LSLT were recorded at fair value; however, the cost basis of the investments received from the LSLT Predecessor Fund was carried forward to align ongoing reporting of LSLT’s realized and unrealized gains and losses with amounts distributable to shareholders for tax purposes. Costs incurred by LSLT in connection with the reorganization were paid by the Pacer Advisors, Inc. (the “Adviser”). The fiscal year end of the LSLT Predecessor Fund was December 31. The reporting period covered by this annual report for LSLT is January 1, 2020 through October 31, 2020. Operations prior to October 5, 2020 were for the LSLT Predecessor Fund. The net assets were $8,269,463, including $497,549 of net unrealized appreciation, $9,209 of undistributed (accumulated) net investment income, and $14,478 of undistributed (accumulated) net realized gain and shares outstanding were 300,000, all of which were transferred into the Trust at NAV at the close of business on October 2, 2020.

The primary purpose of each of the reorganizations was to move the existing Funds from its existing trusts to another trust, which Pacer Advisors, Inc. (the “Adviser”) believed would allow each Fund to become part of a series of a stable fund family with a consistent Adviser across all funds in the Trust. Shareholders are expected to benefit accordingly and to enjoy an improvement in the level and quality of services provided to them and each Fund.

19

Pacer Funds

NOTES TO FINANCIAL STATEMENTS

October 31, 2020 (Continued)

Shares of the USAI are listed and traded on the NYSE Arca, Inc., (“NYSE”) and shares of SLT and LSLT are listed and traded on the Cboe BZX Exchange, Inc., (“Cboe”). Market prices for the shares may be different from their net asset value (“NAV”). The Funds issue and redeem shares on a continuous basis at NAV only in large blocks of shares, called “Creation Units,” which generally consist of 50,000 shares except SLT and LSLT which generally consist of 25,000 shares. Creation Units are issued and redeemed principally in-kind for securities included in a specified universe. Once created, Shares generally trade in the secondary market at market prices that change throughout the day in amounts less than a Creation Unit. Except when aggregated in Creation Units, Shares are not redeemable securities of a Fund. Shares of a Fund may only be purchased directly from or redeemed directly to a Fund by certain financial institutions (“Authorized Participants”). An Authorized Participant is either (i) a broker-dealer or other participant in the clearing process through the Continuous Net Settlement System of the National Securities Clearing Corporation or (ii) a DTC participant and, in each case, must have executed a Participant Agreement with Pacer Financial, Inc. (the “Distributor”). Prior to December 16, 2019, Quasar Distributors, LLC acted as the principal underwriter for USAI. Prior to October 5, 2020, Compass Distributors, LLC acted as the principal underwriter for SLT and LSLT. Most retail investors do not qualify as Authorized Participants nor have the resources to buy and sell whole Creation Units. Therefore, they are unable to purchase or redeem the shares directly from a Fund. Rather, most retail investors may purchase Shares in the secondary market with the assistance of a broker and are subject to customary brokerage commissions or fees.