UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number811-23015

SEI Catholic Values Trust

(Exact name of registrant as specified in charter)

SEI Investments

One Freedom Valley Drive

Oaks, Pennsylvania 19456

(Address of principal executive offices) (Zip code)

Timothy D. Barto, Esq.

SEI Investments

One Freedom Valley Drive

Oaks, PA 19456

(Name and address of agent for service)

Registrant’s telephone number, including area code:1-610-676-1000

Date of fiscal year end: February 29, 2020

Date of reporting period: February 29, 2020

| Item 1. | Reports to Stockholders. |

February 29, 2020

ANNUAL REPORT

SEI Catholic Values Trust

| › | Catholic Values Equity Fund |

| › | Catholic Values Fixed Income Fund |

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Funds’ shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the Funds or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds electronically by contacting your financial intermediary.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can follow the instructions included with this disclosure, if applicable, or you can contact your financial intermediary to inform it that you wish to continue receiving paper copies of your shareholder reports. If you invest directly with the Funds, you can inform the Funds that you wish to continue receiving paper copies of your shareholder reports by calling1-800-DIAL-SEI. Your election to receive reports in paper will apply to all funds held with the SEI Funds or your financial intermediary.

TABLE OF CONTENTS

The Trust files its complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarter of each fiscal year on FormN-PORT. The Trust’s FormsN-PORT are available on the Commission’s website at http://www.sec.gov.

A description of the policies and procedures that the Trust uses to determine how to vote proxies relating to portfolio securities, as well as information relating to how a Fund voted proxies relating to portfolio securities during the most recent12-month period ended June 30, is available (i) without charge, upon request, by calling1-800-DIAL-SEI; and (ii) on the Commission’s website at http://www.sec.gov.

LETTER TO SHAREHOLDERS

February 29, 2020 (Unaudited)

To our Shareholders:

Equity markets remained generally strong for much of the fiscal year ending February 29, 2020; the S&P 500 Index hit itsall-time high in February before concerns about the international spread of a novel coronavirus(COVID-19) began to dominate financial markets, sending the index into correction territory before the end of the reporting period. Trade war fears, Brexit uncertainty and central-bank easing also weighed on investor expectations at different points through the 12 months ending February 29, 2020.

The Federal Reserve (Fed) cut interest rates three times during the fiscal year; the Fed’s accommodative turn in monetary policy midway through the reporting period included an early conclusion in August to its balance-sheet reduction program, which was initially scheduled to end in September. These actions came amid below-target inflation and uncertainty about trade developments. An emergency rate cut just after the period ended was designed to bolster the economy in response to the economic threat posed by the coronavirus outbreak; it was the first emergency move by the Fed since the global financial crisis.

The European Central Bank (ECB) sought to provide fresh stimulus following itsmid-September meeting by reducing its deposit rate from-0.40% to a record low of-0.50%—and adopting a new system to offset possible consequent bank-reserve losses. Christine Lagarde succeeded Mario Draghi as ECB President in November and seemed to maintain her predecessor’s dovish views at her first policy meetings in December and January.

The Japanese yen, typically viewed as a safe-haven asset in“risk-off” environments, finished the period 2.5% higher against the U.S. dollar, while the Bank of Japan (BOJ) held monetary policy stable. The Chinese yuan finished the year down 4.4% against the U.S. dollar as trade-related tensions initially drove the exchange rate to an11-year low in September. The currency rebounded some after confidence grew that a limited U.S.-China trade agreement would be reached; however, it faltered again asCOVID-19 worries grew over the final month of the period.

Crude-oil prices gained more than 15% at the start of the fiscal year. From May onward, the commodity became a victim of the U.S.-China tariff war and general sluggishness in global economic growth, although it remained 6% higher at the start of 2020. Over the final two months of the period, the impact of the coronavirus on travel restrictions sapped demand; oil finished the 12 months down almost 22% and off over 30% from its period highs.

Geopolitical Events

Market volatility accelerated over the final two months of the period following concerns aboutCOVID-19 and its eventual economic effect: A deadly strain originated in Wuhan, China, and began spreading at a faster pace as the months progressed. The outbreak spread to other countries, prompting Mongolia and Russia to close their borders with China and other countries to erect transportation and quarantine barriers to Chinese trade and travel. Beyond the threat to public health, the outbreak and resulting containment measures evoked concerns about the potential dampening of economic activity at the same time that China has struggled to navigate an economic soft patch.

The United States-Mexico-Canada trade agreement was approved by the Congress and signed by President Donald Trump near the end of the fiscal year, officially replacing the North American Free Trade Agreement. President Trump and France’s President Emmanuel Macron successfully walked back threats of tariffs that originated with French plans for a digital tax that would have targetedUS-based multi-national technology companies. The prospect of a digital taxre-surfaced in other countries—including the U.K., Italy, Austria and Turkey—which prompted more threats of retailiatory tariffs by Treasury Secretary Steven Mnuchin. Sajid Javid, the UK’s former Chancellor of the Exchequer, disappointed Secretary Mnuchin by explaining during a joint interview in late January at the World Economic Forum that the U.K. would prioritize trade negotiations with the EU over a deal with the U.S.

China and the U.S. formalized a “phase one” trade deal inmid-January that offered tariff relief to China (via the reduction of existing tariffs and the delay of additional scheduled tariffs). In exchange, China committed to purchasing $200 billion in U.S. products over atwo-year period; addressing its long-standing practice of forcing the transfer of intellectual property and technology to Chinese counterparts in exchange for access to the Chinese market; and promising to continue opening its financial-services industry to foreign investors.

President Trump’s impeachment trial ended with an acquittal by the U.S. Senate toward the end of the reporting period—even as the U.S. media surfaced corroborating first-hand accounts of President Trump directing underlying events central to the articles of impeachment.

| | |

| SEI Catholic Values Trust / Annual Report / February 29, 2020 | | 1 |

LETTER TO SHAREHOLDERS (Continued)

February 29, 2020 (Unaudited)

U.K. Prime Minister Theresa May announced on May 24 her intention to resign following a poor showing for Conservatives in European Parliamentary elections. May’s inability to establish sufficient support for her Brexit deal or a viable alternative had become an impasse, and her recent overtures for a second referendum alienated a large subset of her party’s leadership. Boris Johnson, her successor as prime minister, faced sharp resistance from the outset of his tenure; however, the UK’s Conservative Party consolidated its power in amid-December election—winning a majority of seats in the House of Commons and gaining approval for Prime Minister Boris Johnson’s EU departure deal. The country officially left the EU at the end of January 2020, giving way to an11-month transition period to negotiate terms of the futureU.K.-EU relationship.

Elsewhere, after months of demonstrations, protesters in Hong Kong saw some success when a proposed law that would have allowed for extradition to mainland China was withdrawn. Protests continued, however, amid a reported increase in China’s police presence and undercover activity, although coronavirus concerns eventually put an end to most large-scale demonstrations.

Economic Performance

The U.S. economy grew by a seasonally-adjusted annualized 3.1% in the first quarter of 2019, driven by increases in inventories and trade; however, GDP expanded just 2.0% in the second quarter as a decline in exports and inventory builds countered robust consumer spending. The third quarter saw a slight increase in annualized growth at 2.1%, as the robust U.S. labor market helped to support the moderate pace of activity, allowing the10-year expansion to continue despite decelerating global trends. Economic growth again registered 2.1% in the fourth quarter, driven by an increase in net trade but weakened by a sharp slowdown in consumer spending.

The U.S. labor market remained robust throughout the fiscal year: the unemployment rate fell, finishing the period at a50-year low of 3.5%; the labor-force participation rate ended at 63.4%, slightly higher from a year earlier. Average hourly earnings gained 3.0% over the year, although a modest increase in price pressures weighed on real (inflation-adjusted) personal income growth. The historically strong labor market and improving wage growth helped boost the debt profile of the U.S. consumer.

Broad economic growth in the eurozone slowed to its weakest pace in seven years at the end of the fourth quarter of 2019, as slumping exports in Germany and declining industrial production in France and Italy hampered expansion; the slowdown strengthened the case for continued accommodative policy by the ECB for some time.

The Bank of England (BoE) held its official bank rate unchanged during the reporting period. Committee guidance in July noted a bias toward higher rates, in contrast to the looser monetary policy shifts of the Fed and ECB; however, toward the end of the period, the BoE indicated a willingness to cut if global growth remained slow or Brexit uncertainties continued. The U.K. economy grew just 1.1% seasonally-adjusted at annual rates through the fourth quarter of 2019, its weakest level since 2010.

Japanese GDP contracted 7.1% in seasonally-adjusted annualized terms in the fourth quarter of 2019 as the country’s sales tax hike weakened consumer and business spending; the Bank of Japan maintained monetary stimulus in an attempt to counter slowing growth and weak productivity gains. Meanwhile, GDP in China expanded by just 6.0%year-on-year and seasonally-adjusted in the fourth quarter of 2019, matching the third quarter for its weakest pace in 28 years, as a lack of consumer confidence due to the U.S. trade war pressured economic growth.

Market Developments

The S&P 500 Index returned 8.19%, as the modest U.S. economic expansion continued, corporate profitability was reasonably strong and the Fed eased monetary policy;mega-large-cap stocks, a narrow group of companies with unusually large weights in the broad equity index, outperformed, and growth companies in the information technology sector generally led. Although many value stocks underperformed, the utilities sector was an area of strength among traditional value industries. Commodity-sensitive stocks, particularly those within the materials and energy sectors, lagged.

U.S.large-cap stocks (Russell 1000 Index) finished the reporting period up 7.82%;small-cap stocks (Russell 2000 Index) were hit harder in the coronavirus-driven selloff toward the end of the year, as investors tended to avoid smaller companies with lesser financial strength, and finished the period off 4.92%.

| | |

| 2 | | SEI Catholic Values Trust / Annual Report / February 29, 2020 |

Despite continued accommodative monetary policy from the ECB, European equities lagged, as fears over trade wars andCOVID-19 grew. The MSCI Europe Index (Net) finished off 0.64% in U.S. dollar terms but 3.00% higher in euros; the euro finished down 3.62% versus the U.S. dollar for the period. The MSCI ACWI Index (Net), a proxy for global equities in both developed and emerging markets, rose 3.89% in U.S. dollar terms.

The FTSE UK SeriesAll-Share Index gave up itsfiscal-year-to-date gains over the final two months; the index lost 5.18% in U.S. dollar terms over the full reporting period, while it fell 1.43% in sterling.

Emerging-market equities were lower. The MSCI Emerging Markets Index (Net) also gave up all of itsfiscal-year-to-date gains over the final two months to finish the reporting period down 1.88% in U.S. dollar terms. U.S.-China trade news generally drove performance for most of the year; however, amid-period rally after the U.S. and China agreed to a“phase-one” trade deal was wiped out afterCOVID-19 concerns accelerated before the end of the fiscal year.

Led by the dovish tone of global central banks and lukewarm economic data in the U.S. and Europe, global high-yield bonds outperformed global government bonds. A continuing theme for U.S.fixed-income markets was the inverted yield curve. In August, the spread between2-year and5-year Treasurys inverted, as did the spread between3-year and5-year Treasurys. Notably, the spread between3-month and10-year rates inverted for the first time in about 12 years during March, a signal of impending recession to some market watchers. After this differential first inverted early in 2019, it reverted again for a short time in May and then again in October, before turning negative again in February.

In July, the Federal Open Market Committee cut rates for the first time in 11 years and did so again in September and October. Yields for10-year U.S. government bonds ended the period down 160 basis points at an all–time low of 1.13%, as investors rushed to safe-have securities in February;2-year yields declined during the fiscal year to finish down 166 basis points at 0.86%.

Inflation-sensitive assets, such as commodities and Treasury inflation-protected securities, were mixed. The Bloomberg Commodity Total Return Index (which represents the broad commodity market) gave up all itsfiscal-year-to-date gains in the final two months to finish down 11.05% over the fullone-year period, primarily due to coronavirus-related concerns that travel restrictions would destroy demand in China; the Bloomberg Barclays1-10 Year US TIPS Index (USD) moved 7.86% higher during the reporting period.

The high-yield market, as measured by the ICE BofA US High Yield Constrained Index, was up 5.91% during the reporting period, while global fixed income, as measured by the Bloomberg Barclays Global Aggregate Index, did better and climbed 7.92%.

U.S. investment-grade corporate debt performed well, as the Bloomberg Barclays US Corporate Investment Grade Index returned 15.81%, as investors remained eager to buy higher-yielding securities. U.S. asset- and mortgage-backed securities also managed gains during the fiscal year, benefiting from favorablesupply-and-demand dynamics and continued improvement in collateral.

Emerging-market debt (EMD) delivered strong performance due to the improving growth outlook in the region relative to developed markets. The J.P. Morgan Global Bond Index-Emerging Markets(GBI-EM) Global Diversified Index, which tracks local-currency-denominated EM bonds, gained 3.73% in U.S. dollar terms. The J.P. Morgan Emerging Markets Bond Index (EMBI) Global Diversified Index, which tracks EMD denominated in external currencies (such as the U.S. dollar), was up 9.68%.

Our View

At the beginning of 2019, many investors were licking their wounds following a sharp global stock-market correction. Today we are confronted with a notably different market backdrop as share prices generally ended 2019 near their highs of the year. The spread ofCOVID-19—first within China’s mainland borders and then to the rest of the world—has introduced a significant headwind to the global economy, which financial markets have acknowledged in the rapid downward repricing of assets through late January and February.

With regard to the U.S. economy, our expectations turned out to be mildly optimistic. But we think it’s worth pointing out thatquarter-to-quarter fluctuations in the country’s seasonally-adjusted gross domestic product (GDP) growth have remained on a relatively narrow path compared to their far more volatile historical range. One reason for the lower volatility was steady growth in U.S. household spending. By contrast, the contribution to real U.S. GDP growth

| | |

| SEI Catholic Values Trust / Annual Report / February 29, 2020 | | 3 |

LETTER TO SHAREHOLDERS (Concluded)

February 29, 2020 (Unaudited)

from investment, both residential andnon-residential, has been in a slowing trend; the pace of business spending in the country has eased dramatically since early 2018. On the positive side, the absence of an investment boom means there should be little to no side effect; even if a recession were to develop in the next year or so, we believe it almost certainly will not be especially painful.

On the other side of the pond, Prime Minister Boris Johnson’s decision to hold a snap election in the fourth quarter paid off. He now enjoys the largest Tory majority in Parliament since 1987, when Margaret Thatcher wasre-elected Prime Minister for a third term. The victory eliminated the possibility of a dramatic remaking of the British economy as envisioned by the Labour party—and decreased the likelihood of a hung Parliament, which could have prolonged the uncertainty surrounding Brexit.

Of course, uncertainty still remains. While the U.K. formally left the EU in January, the two parties still must negotiate their future trading relationship by the end of 2020. Ano-deal Brexit would provide a substantial negative shock to merchandise trade because dealings with the EU would revert to the most-favored-nation rules of the World Trade Organization. Trade in financial services, a category critical to the U.K.’s economic well-being, would be saddled with increased regulations, paperwork and costs.

It continues to be our working assumption that ano-deal Brexit will be avoided, although it may take an extension of the transition period to effect a deal that minimizes the disruption. With that said, Boris Johnson already announced his intention to exit the transition period at the December 31, 2020 deadline.

For Europe, we accurately anticipated a further slowdown in economic growth over 2019. We think it may now make sense to look past the current gloom when it comes to Europe. The lessening of trade tensions should provide export-dependent Europe with a moderate boost in 2020.

Government policy also is geared toward encouraging growth. There are signs that ECB policy is having some positive impact. The banking system is slowly recuperating. Lending to households and businesses has been in a modestly accelerating trend over the past few years. There also is more serious discussion nowadays about easing fiscal policy. Even Jens Weidman, President of the Deutsche Bundesbank, member of the Governing Council of the ECB, and a long-time hawk, has recently felt comfortable backing calls for government spending. Perhaps there’s hope that fiscal policy will turn into a tailwind for eurozone growth instead of a steady headwind.

Our expectation that emerging-market economies would enjoy a decent 2019 didn’t pan out. First, we thought an economic turnaround in China was just around the corner. The country had been pushing through various monetary, fiscal and structural reform measures aimed at jumpstarting economic growth, and we assumed that the Chinese government would go back to the debt well if needed. This happened only to a limited extent.

We have frequently made the argument that anall-encompassing trade war between China and the U.S. would be in neither countries’ interest. The economic and political reverberations would simply be too painful. And so, the agreement on a“phase-one” deal at least helps lower the temperature and halts thetit-for-tat tariff escalations. We expect the truce will hold through the 2020 U.S. presidential election.

Looking at the big picture for the year ahead, we anticipate continued growth for the U.S. and global economies, but at a sluggish pace. This should keep inflation under control and encourage central banks to remain accommodative. Quantitative easing also should help keepfixed-income yields relatively steady even as government deficit spending picks up. Altogether, this scenario should be positive for risk assets.

We’ve summarized the major themes and outstanding questions that could cause markets to behave in ways that run counter to our positioning in 2020:

• The U.S. is converging with the rest of the world as U.S. economic and profits growth decline. Given the disparity in stock-market valuations, international markets are expected to outperform U.S. equities.

• The partial U.S./Chinatrade-war truce and a steady progression of fiscal and monetary stimulus measures over the past two years should pay off in 2020. Early signs of improvement are already apparent, which should boost the prospects of trade-dependent economies, notwithstanding the pressures created by efforts to contain theCOVID-19 outbreak.

| | |

| 4 | | SEI Catholic Values Trust / Annual Report / February 29, 2020 |

• The U.S. dollar should reverse convincingly by losing value relative to other currencies. The Fed’s pivot toward an aggressive approach to supporting the overnight lending market has the potential to significantly increase the global supply of dollars, and its emergency rate cut in early March should also put downward pressure on the dollar’s value relative to other currencies. Since we believe the dollar is overvalued on a fundamental basis, its depreciation is a high-conviction call. This would be a tailwind fornon-U.S. economies and financial markets.

• The value style should prevail. Modest improvement in global economic growth, a tendency for inflation and interest rates to move higher and the record disparity in valuation between the most- and least-expensive stocks should lead to a stronger result for value-oriented active managers.

• We foresee less Brexit uncertainty, assuming a trade deal can be reached between the EU and U.K. We expect rationality to prevail, but ano-deal Brexit remains a residual risk. As theyear-end 2020 transition deadline nears, U.K. and European markets could experience renewed volatility if the negotiations appear to be foundering on irreconcilable differences.

• Presidential politics could roil equity markets in the U.S. and elsewhere. A sense of which Democratic nominee will face Donald Trump in the coming U.S. presidential election should get clearer in March, when 25 states and Puerto Rico go to the polls; California and Texas, plus 12 other states, will have held their primary elections on Super Tuesday, March 3.

In our view, another stellar year for U.S. equities in 2020 would be a source of concern rather than celebration. Equities and other risky assets are not well-correlated with the fundamentals in the short run. Investor expectations can change much more quickly and far more dramatically than the fundamentals. Indeed, as seen in the past two years, changes in investor expectations can sometimes completely negate the change in the fundamentals.

With that in mind, we will retain our emphasis on strategic investing over tactical moves. We will also continue to take stock of the economic and financial developments around the globe and provide our thoughts on where global growth and interest rates are headed. That’s actually the easy part, as the experience of the last few years illustrates. Figuring out how investors might react to the shifts in macroeconomic conditions is almost always the much harder exercise.

On behalf of SEI, I want to thank you for your continued confidence. We are working every day to maintain that trust, and we look forward to serving your investment needs in the future.

Sincerely,

Bill Lawrence, CFA

Head and Chief Investment Officer of Traditional Asset Management

| | |

| SEI Catholic Values Trust / Annual Report / February 29, 2020 | | 5 |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

February 29, 2020 (Unaudited)

Catholic Values Equity Fund

I. Objective

The Catholic Values Equity Fund (the “Fund”) seeks long-term capital appreciation.

II. Investment Approach

The Fund uses a multi-manager approach, relying on a number ofsub-advisors with differing investment approaches to manage portions of the Fund’s portfolio, under the general supervision of SEI Investments Management Corporation (SIMC). The Fund utilized the followingsub-advisors as of February 29, 2020: Brandywine Global Investment Management, LLC; Coho Partners, Ltd.; Copeland Capital Management, LLC; EARNEST Partners, LLC; Fred Alger Management, Inc.; Parametric Portfolio Associates LLC; and Snow Capital Management L.P. During the fiscal year, EAM Investors, LLC, was terminated from the Fund, while Copeland Capital Management, LLC, was added to the Fund.

III. Returns

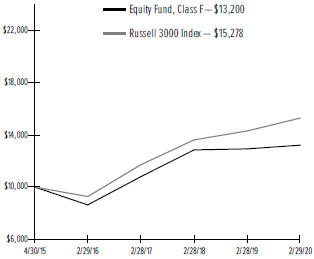

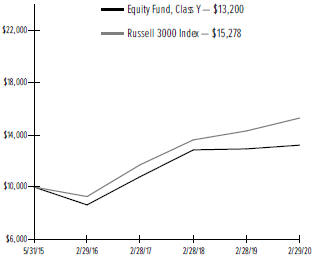

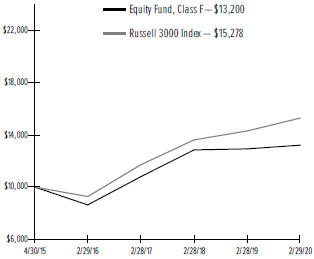

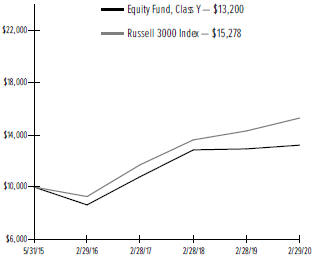

For the period from March 1, 2019, through February 29, 2020, the Fund’s F class shares returned 2.09%. The Fund’s primary benchmark—the Russell 3000 Index (USD)—returned 6.90%.

IV. Performance Discussion

For the full fiscal year, U.S.large-cap equities finished positive. As noted in the shareholder letter, strong corporate earnings, an accommodative monetary policy by the Federal Reserve and the eventual cooling of trade tensions between the U.S. and China propelled markets higher for most of the reporting period. This trend reversed during the final month of the fiscal year, as markets declined sharply due to concerns around the potential effects of the coronavirus on the global economy.

Growth sectors—notably information technology and communication services—were the best performers, as also mentioned in the shareholder letter. Utilities and consumer staples stocks also performed well due to an increase in demand for bond proxies as interest rates declined. Traditional value sectors such as energy, materials and industrials were the worst performers as investors continued to favor their growth counterparts.

Fund performance was hurt most by its exposure tonon-U.S. stocks, which significantly underperformed U.S. equities. Within the U.S., the Fund was hurt by its tilt toward the less-expensive portions of the market and itsmid-cap exposure, both of which underperformed the broad U.S. market during the period.

EAM Investors was terminated from the Fund in September and was replaced by Copeland Capital Management, a small- and medium-capitalization stability manager. This change reduced the beta of thesmaller-cap portion of the Fund.

EARNEST Partners was the largest detractor due to the manager’s exposure tonon-U.S. stocks, which underperformed. Among the other managers, Snow Capital Management and Brandywine Global Investment Management both detracted due to their value exposure, while Coho Partners and Copeland Capital Management detracted due to their lower-beta exposure and underweights tolarge-cap growth stocks. Prior to its termination, EAM Investors detracted due to itssmall-cap exposure.

Fred Alger Management was the only manager that contributed to relative Fund performance during the fiscal year due to its exposure to U.S.large-cap growth stocks, the best-performing category during the reporting period.

| | | | | | |

| AVERAGE ANNUAL TOTAL RETURN1 |

| | | One-Year Return | | Three-Year Return | | Annualized Inception to Date |

Class F | | 2.09% | | 6.90% | | 5.89% |

Class Y | | 2.28% | | 7.04% | | 6.02% |

Russell 3000 Index | | 6.90% | | 9.28% | | 9.15% |

| | |

| 6 | | SEI Catholic Values Trust / Annual Report / February 29, 2020 |

Comparison of Change in the Value of a $10,000 Investment in the Catholic Values Equity Fund, Class F, versus the Russell 3000 Index

| 1 | For the year ended 2/29/2020. Past performance is no indication of future performance. Class F shares were offered beginning on 4/30/2015 and Class Y share were offered beginning 5/31/2015. The graph is based on only the Class F; performance for Class Y would be different due to differences in fee structures. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The returns for certain periods reflect fee waivers and/or reimbursements in effect for that period; absent fee waivers and reimbursements, performance would have been lower. |

Comparison of Change in the Value of a $10,000 Investment in the Catholic Values Equity Fund, Class Y, versus the Russell 3000 Index

| 1 | For the year ended 2/29/2020. Past performance is no indication of future performance. Class Y shares were offered beginning on 5/31/2015 and Class F share were offered beginning 4/30/2015. The graph is based on only the Class Y; performance for Class F would be different due to differences in fee structures. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The returns for certain periods reflect fee waivers and/or reimbursements in effect for that period; absent fee waivers and reimbursements, performance would have been lower. |

| | |

| SEI Catholic Values Trust / Annual Report / February 29, 2020 | | 7 |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

February 29, 2020 (Unaudited)

Catholic Values Fixed Income Fund

I. Objective

The Catholic Values Fixed Income Fund (the Fund) seeks a high level of current income with preservation of capital.

II. Investment Approach

The Fund uses a multi-manager approach, relying on a number ofsub-advisors with differing investment approaches to manage portions of the Fund’s portfolio, under the general supervision of SEI Investments Management Corporation (SIMC). The Fund utilized the followingsub-advisors as of February 29, 2020: Income Research & Management; Western Asset Management Company; and Western Asset Management Company Limited. There were no manager changes during the period.

III. Returns

For the period from March 1, 2019, through February 29, 2020, the Fund’s F class shares returned 11.28%. The Fund’s benchmark—the Bloomberg Barclays US Aggregate Bond Index (USD)—returned 11.68%.

IV. Performance Discussion

The fiscal year began with U.S.-China trade war concerns, Brexit uncertainty and heightened geopolitical tensions; however, accommodative policy responses by the Federal Reserve—which lowered rates three times during the12-month period—helped assuage those fears until late in the reporting period. As noted in the shareholder letter, concerns about the spread of the coronavirus beyond China late in the fiscal year caused market participants to adjust their outlook for a possible U.S. recession. As also addressed in the shareholder letter, yields moved lower on global growth concerns, especially in January and February, when coronavirus fears resulted in a flight to safety. Risk assets and spread sectors enjoyed outperformance until the end of the period.

2-year Treasury yields declined 160 basis points to yield 0.91%, while10-year Treasury yields declined 157 basis points to yield 1.15%, anall-time low.30-year Treasury yields declined 141 basis points to yield 1.68%, also anall-time low, with the majority of the decline occurring over the final two months of the fiscal year. Corporate bonds and the securitized sectors generated positive absolute and excess returns against comparable Treasury bonds.

A slightly long duration posture enhanced Fund performance and an overweight to the30-year segment of the yield curve was also beneficial. While

corporate spreads ended the year close to unchanged, they narrowed for a majority of the fiscal year, before widening in the first two months of 2020. Demand for corporate credit was robust during the year as low global yields attracted investors to the additional yield provided by corporate credit. An overweight to corporates enhanced returns and selection within financials was also additive. Declining yields and continued house price appreciation, as well as improving wages, resulted in strong fundamentals for housing and housing-related sectors; combined with limited new issuance that provided support fornon-agency mortgages, the Fund’s overweight was additive. The Fund’s overweight in the securitized sectors of asset-backed securities (ABS) and commercial mortgage-backed securities (CMBS) also benefited, as both U.S. consumer and commercial properties were supported by improving wages and an expanding economy. The Fund moved to an overweight in agency mortgage-backed securities (MBS) during the year, which slightly detracted given the area’s underperformance.

Both managers contributed during the fiscal year. Income Research benefited from overweights to CMBS and ABS, as well as an underweight to agency MBS. Western’s longer duration posture, as well as its overweight to the30-year segment of the curve, enhanced returns. An overweight to investment-grade corporate credit was positive, as was security selection within the financials sector. A small allocation to high-yield and emerging-markets debt generated positive returns, but both allocations underperformed the investment-grade market.

The Fund used Treasury futures, eurodollar futures andto-be-announced (TBA) forward contracts to efficiently manage duration, yield-curve and market exposures. (TBA contracts confer the obligation to buy or sell future debt obligations of the three U.S. government-sponsored agencies that issue or guarantee MBS—Fannie Mae, Freddie Mac and Ginnie Mae.) None of these had a meaningful impact on performance.

| | | | | | |

| AVERAGE ANNUAL TOTAL RETURN1 |

| | | One-Year Return | | Three-Year Return | | Annualized Inception to Date |

Class F | | 11.28% | | 5.06% | | 3.88% |

Class Y | | 11.28% | | 5.12% | | 4.13% |

Bloomberg Barclays U.S. Aggregate Bond Index | | 11.68% | | 5.01% | | 3.68% |

| | |

| 8 | | SEI Catholic Values Trust / Annual Report / February 29, 2020 |

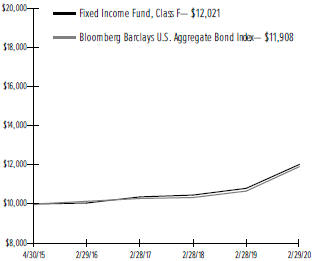

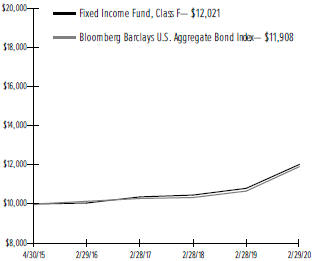

Comparison of Change in the Value of a $10,000 Investment in the Fixed Income Fund, Class F, versus the Bloomberg Barclays U.S. Aggregate Bond Index

| 1 | For the year ended 2/29/2020. Past performance is no indication of future performance. Class F shares were offered beginning on 4/30/2015 and Class Y share were offered beginning 5/31/2015. The graph is based on only the Class F; performance for Class Y would be different due to differences in fee structures. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The returns for certain periods reflect fee waivers and/or reimbursements in effect for that period; absent fee waivers and reimbursements, performance would have been lower. |

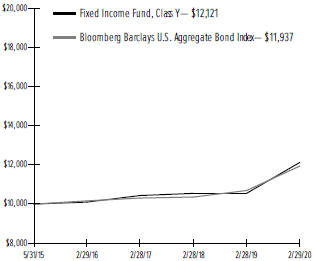

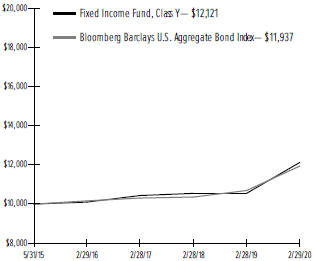

Comparison of Change in the Value of a $10,000 Investment in the Fixed Income Fund, Class Y, versus the Bloomberg Barclays U.S. Aggregate Bond Index

| 1 | For the year ended 2/29/2020. Past performance is no indication of future performance. Class Y shares were offered beginning on 5/31/2015 and Class F share were offered beginning 4/30/2015. The graph is based on only the Class Y; performance for Class F would be different due to differences in fee structures. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The returns for certain periods reflect fee waivers and/or reimbursements in effect for that period; absent fee waivers and reimbursements, performance would have been lower. |

| | |

| SEI Catholic Values Trust / Annual Report / February 29, 2020 | | 9 |

SCHEDULE OF INVESTMENTS

February 29, 2020

Catholic Values Equity Fund

| | | | | | | | |

†Percentages based on total investments. | |

| | | |

| Description | | Shares | | Market Value

($ Thousands) |

| | |

COMMON STOCK — 75.1% | | | | | | | | |

|

Communication Services — 6.5% | |

Activision Blizzard Inc | | | 1,536 | | | $ | 89 | |

Alphabet Inc, Cl A * | | | 1,737 | | | | 2,326 | |

Alphabet Inc, Cl C * | | | 600 | | | | 804 | |

AT&T Inc | | | 71,309 | | | | 2,511 | |

Cable One Inc | | | 159 | | | | 250 | |

Charter Communications Inc, Cl A * | | | 128 | | | | 63 | |

Cogent Communications Holdings Inc | | | 825 | | | | 60 | |

Comcast Corp, Cl A | | | 14,311 | | | | 579 | |

Electronic Arts Inc * | | | 1,255 | | | | 127 | |

Facebook Inc, Cl A * | | | 14,219 | | | | 2,737 | |

Fox Corp | | | 2,882 | | | | 88 | |

Interpublic Group of Cos Inc/The | | | 2,450 | | | | 52 | |

John Wiley & Sons Inc, Cl A | | | 1,163 | | | | 43 | |

Live Nation Entertainment Inc * | | | 9,784 | | | | 595 | |

Madison Square Garden Co/The * | | | 191 | | | | 51 | |

Netflix Inc * | | | 639 | | | | 236 | |

Omnicom Group Inc | | | 21,567 | | | | 1,494 | |

Pinterest Inc, Cl A * | | | 13,499 | | | | 263 | |

Spotify Technology SA * | | | 360 | | | | 49 | |

Sprint Corp * | | | 8,319 | | | | 77 | |

Take-Two Interactive Software Inc * | | | 734 | | | | 79 | |

T-Mobile US Inc * | | | 1,965 | | | | 177 | |

Twitter Inc * | | | 1,626 | | | | 54 | |

Verizon Communications Inc | | | 38,472 | | | | 2,084 | |

ViacomCBS Inc, Cl B | | | 2,018 | | | | 50 | |

Walt Disney Co/The | | | 6,703 | | | | 789 | |

| | |

| | | | | | | 15,727 | |

Consumer Discretionary — 9.5% | | | | | |

Aaron’s Inc | | | 1,952 | | | | 77 | |

Amazon.com Inc * | | | 2,127 | | | | 4,007 | |

American Eagle Outfitters Inc | | | 3,622 | | | | 47 | |

Aptiv PLC | | | 6,678 | | | | 522 | |

AutoZone Inc * | | | 44 | | | | 45 | |

Best Buy Co Inc | | | 2,027 | | | | 153 | |

Bloomin’ Brands Inc | | | 12,279 | | | | 221 | |

Booking Holdings Inc * | | | 27 | | | | 46 | |

| | | | | | | | |

| | | |

| Description | | Shares | | Market Value

($ Thousands) |

COMMON STOCK (continued) | | | | | | | | |

BorgWarner Inc | | | 537 | | | $ | 17 | |

Carnival Corp | | | 25,197 | | | | 843 | |

Cheesecake Factory Inc/The | | | 4,938 | | | | 176 | |

Cinemark Holdings Inc | | | 7,063 | | | | 183 | |

Columbia Sportswear Co | | | 602 | | | | 49 | |

Cooper Tire & Rubber Co | | | 1,766 | | | | 45 | |

Core-Mark Holding Co Inc | | | 1,662 | | | | 38 | |

Darden Restaurants Inc | | | 434 | | | | 42 | |

Dave & Buster’s Entertainment Inc | | | 6,395 | | | | 211 | |

Designer Brands Inc, Cl A | | | 6,986 | | | | 94 | |

Dollar General Corp | | | 12,945 | | | | 1,946 | |

Dollar Tree Inc * | | | 565 | | | | 47 | |

Domino’s Pizza Inc | | | 494 | | | | 168 | |

DR Horton Inc | | | 1,823 | | | | 97 | |

Dunkin’ Brands Group Inc | | | 777 | | | | 52 | |

eBay Inc | | | 16,090 | | | | 557 | |

Ford Motor Co | | | 6,427 | | | | 45 | |

frontdoor Inc * | | | 1,095 | | | | 46 | |

Gap Inc/The | | | 2,620 | | | | 37 | |

Garmin Ltd | | | 814 | | | | 72 | |

General Motors Co | | | 23,895 | | | | 729 | |

Goodyear Tire & Rubber Co/The | | | 3,742 | | | | 36 | |

Hanesbrands Inc | | | 1,600 | | | | 21 | |

Hasbro Inc | | | 526 | | | | 41 | |

Hilton Worldwide Holdings Inc | | | 1,519 | | | | 148 | |

Home Depot Inc/The | | | 4,929 | | | | 1,074 | |

Hyatt Hotels Corp, Cl A | | | 774 | | | | 59 | |

International Game Technology PLC | | | 3,712 | | | | 40 | |

Kohl’s Corp | | | 839 | | | | 33 | |

L Brands Inc | | | 1,140 | | | | 25 | |

Las Vegas Sands Corp | | | 4,137 | | | | 241 | |

Lear Corp | | | 411 | | | | 46 | |

Lowe’s Cos Inc | | | 20,401 | | | | 2,174 | |

Macy’s Inc | | | 1,472 | | | | 19 | |

Magna International Inc | | | 15,024 | | | | 688 | |

Marriott International Inc/MD, Cl A | | | 679 | | | | 84 | |

McDonald’s Corp | | | 4,615 | | | | 896 | |

Modine Manufacturing Co * | | | 56,146 | | | | 419 | |

Mohawk Industries Inc * | | | 3,343 | | | | 405 | |

Monro Inc | | | 1,767 | | | | 99 | |

NIKE Inc, Cl B | | | 7,479 | | | | 669 | |

Nordstrom Inc | | | 1,516 | | | | 53 | |

Norwegian Cruise Line Holdings Ltd * | | | 1,053 | | | | 39 | |

O’Reilly Automotive Inc * | | | 141 | | | | 52 | |

Polaris Inc | | | 549 | | | | 45 | |

PulteGroup Inc | | | 17,585 | | | | 707 | |

Ross Stores Inc | | | 16,509 | | | | 1,796 | |

Royal Caribbean Cruises Ltd | | | 2,285 | | | | 184 | |

Service Corp International/US | | | 1,137 | | | | 54 | |

Starbucks Corp | | | 5,909 | | | | 464 | |

Target Corp | | | 585 | | | | 60 | |

Tesla Inc * | | | 308 | | | | 206 | |

| | |

| 10 | | SEI Catholic Values Trust / Annual Report / February 29, 2020 |

| | | | | | | | |

| | | |

| Description | | Shares | | Market Value

($ Thousands) |

| | |

COMMON STOCK (continued) | | | | | | | | |

TJX Cos Inc/The | | | 6,986 | | | $ | 418 | |

Tractor Supply Co | | | 1,428 | | | | 126 | |

Ulta Beauty Inc * | | | 235 | | | | 60 | |

Urban Outfitters Inc * | | | 10,226 | | | | 240 | |

Vail Resorts Inc | | | 213 | | | | 45 | |

VF Corp | | | 1,652 | | | | 119 | |

Wendy’s Co/The | | | 2,626 | | | | 50 | |

Williams-Sonoma Inc | | | 723 | | | | 45 | |

Wyndham Destinations Inc | | | 1,185 | | | | 47 | |

Wyndham Hotels & Resorts Inc | | | 874 | | | | 45 | |

Yum China Holdings Inc | | | 3,981 | | | | 174 | |

Yum! Brands Inc | | | 560 | | | | 50 | |

| | |

| | | | | | | 22,908 | |

| | |

Consumer Staples — 6.5% | | | | | | | | |

Altria Group Inc | | | 30,349 | | | | 1,225 | |

Andersons Inc/The | | | 2,352 | | | | 43 | |

Archer-Daniels-Midland Co | | | 1,290 | | | | 49 | |

Brown-Forman Corp, Cl B | | | 1,103 | | | | 68 | |

Bunge Ltd | | | 963 | | | | 45 | |

Calavo Growers Inc | | | 598 | | | | 43 | |

Campbell Soup Co | | | 3,192 | | | | 144 | |

Casey’s General Stores Inc | | | 338 | | | | 55 | |

Clorox Co/The | | | 1,567 | | | | 250 | |

Coca-Cola Co/The | | | 17,527 | | | | 938 | |

Colgate-Palmolive Co | | | 7,862 | | | | 531 | |

Conagra Brands Inc | | | 42,655 | | | | 1,139 | |

Constellation Brands Inc, Cl A | | | 832 | | | | 144 | |

Costco Wholesale Corp | | | 1,758 | | | | 494 | |

Flowers Foods Inc | | | 2,694 | | | | 58 | |

General Mills Inc | | | 1,001 | | | | 49 | |

Hain Celestial Group Inc/The * | | | 2,713 | | | | 64 | |

Hershey Co/The | | | 1,957 | | | | 282 | |

Hormel Foods Corp | | | 1,199 | | | | 50 | |

Ingredion Inc | | | 2,018 | | | | 168 | |

J&J Snack Foods Corp | | | 282 | | | | 45 | |

JM Smucker Co/The | | | 14,572 | | | | 1,501 | |

Kellogg Co | | | 3,231 | | | | 195 | |

Keurig Dr Pepper Inc | | | 1,806 | | | | 50 | |

Kimberly-Clark Corp | | | 3,984 | | | | 523 | |

Kraft Heinz Co/The | | | 1,549 | | | | 38 | |

Kroger Co/The | | | 53,078 | | | | 1,493 | |

McCormick & Co Inc/MD | | | 941 | | | | 138 | |

Medifast Inc | | | 1,600 | | | | 133 | |

Molson Coors Beverage Co, Cl B | | | 16,232 | | | | 805 | |

Mondelez International Inc, Cl A | | | 3,900 | | | | 206 | |

Monster Beverage Corp * | | | 884 | | | | 55 | |

PepsiCo Inc | | | 7,058 | | | | 932 | |

Philip Morris International Inc | | | 15,125 | | | | 1,238 | |

Pilgrim’s Pride Corp * | | | 1,903 | | | | 40 | |

Sprouts Farmers Market Inc * | | | 6,447 | | | | 103 | |

Sysco Corp | | | 5,470 | | | | 365 | |

Tyson Foods Inc, Cl A | | | 7,722 | | | | 524 | |

| | | | | | | | |

| | | |

| Description | | Shares | | Market Value ($ Thousands) |

| | |

COMMON STOCK (continued) | | | | | | | | |

Unilever NV | | | 24,134 | | | $ | 1,273 | |

US Foods Holding Corp * | | | 1,326 | | | | 45 | |

Walgreens Boots Alliance Inc | | | 4,725 | | | | 216 | |

| | |

| | | | | | | 15,757 | |

| | |

Energy — 2.4% | | | | | | | | |

Antero Resources Corp * | | | 14,903 | | | | 24 | |

Apache Corp | | | 1,840 | | | | 46 | |

Baker Hughes Co, Cl A | | | 1,514 | | | | 24 | |

Cabot Oil & Gas Corp | | | 3,226 | | | | 45 | |

Chevron Corp | | | 17,769 | | | | 1,659 | |

ConocoPhillips | | | 14,292 | | | | 692 | |

Core Laboratories NV | | | 9,374 | | | | 252 | |

Delek US Holdings Inc | | | 3,314 | | | | 71 | |

Devon Energy Corp | | | 1,691 | | | | 27 | |

EOG Resources Inc | | | 556 | | | | 35 | |

EQT Corp | | | 4,686 | | | | 28 | |

Exxon Mobil Corp | | | 5,995 | | | | 308 | |

Gulfport Energy Corp * | | | 22,131 | | | | 18 | |

Halliburton Co | | | 15,463 | | | | 262 | |

Helmerich & Payne Inc | | | 1,311 | | | | 48 | |

Hess Corp | | | 853 | | | | 48 | |

Kinder Morgan Inc/DE | | | 20,643 | | | | 396 | |

Kosmos Energy Ltd | | | 8,047 | | | | 25 | |

Marathon Petroleum Corp | | | 850 | | | | 40 | |

Occidental Petroleum Corp | | | 24,687 | | | | 808 | |

ONEOK Inc | | | 921 | | | | 61 | |

Phillips 66 | | | 555 | | | | 42 | |

Phillips 66 Partners LP (A) | | | 994 | | | | 54 | |

Range Resources Corp | | | 5,600 | | | | 16 | |

Schlumberger Ltd | | | 26,212 | | | | 710 | |

| | |

| | | | | | | 5,739 | |

| | |

Financials — 10.9% | | | | | | | | |

Affiliated Managers Group Inc | | | 631 | | | | 48 | |

Aflac Inc | | | 31,869 | | | | 1,366 | |

AGNC Investment Corp ‡ | | | 2,829 | | | | 48 | |

Allstate Corp/The | | | 1,314 | | | | 138 | |

Ally Financial Inc | | | 1,718 | | | | 43 | |

American Equity Investment Life Holding Co | | | 7,458 | | | | 189 | |

American Express Co | | | 2,157 | | | | 237 | |

American International Group Inc | | | 1,158 | | | | 49 | |

Annaly Capital Management Inc ‡ | | | 44,804 | | | | 397 | |

Aon PLC | | | 352 | | | | 73 | |

Bancorp Inc/The * | | | 5,099 | | | | 62 | |

Bank of America Corp | | | 61,307 | | | | 1,747 | |

Bank of Hawaii Corp | | | 618 | | | | 46 | |

Bank of New York Mellon Corp/The | | | 7,482 | | | | 299 | |

Bank OZK | | | 3,712 | | | | 94 | |

BankUnited Inc | | | 11,232 | | | | 334 | |

BlackRock Inc, Cl A | | | 522 | | | | 242 | |

Capital One Financial Corp | | | 657 | | | | 58 | |

Cboe Global Markets Inc | | | 459 | | | | 52 | |

| | |

| SEI Catholic Values Trust / Annual Report / February 29, 2020 | | 11 |

SCHEDULE OF INVESTMENTS

February 29, 2020

Catholic Values Equity Fund(Continued)

| | | | | | | | |

| | | |

| Description | | Shares | | Market Value

($ Thousands) |

| |

COMMON STOCK (continued) | | | | | |

Charles Schwab Corp/The | | | 1,647 | | | $ | 67 | |

Chimera Investment Corp ‡ | | | 2,685 | | | | 53 | |

Chubb Ltd | | | 1,561 | | | | 226 | |

Citigroup Inc | | | 36,340 | | | | 2,306 | |

CME Group Inc, Cl A | | | 2,621 | | | | 521 | |

CNA Financial Corp | | | 1,170 | | | | 49 | |

CNO Financial Group Inc | | | 3,333 | | | | 53 | |

Cohen & Steers Inc | | | 2,433 | | | | 152 | |

Cowen Inc, Cl A | | | 9,917 | | | | 148 | |

Credit Acceptance Corp * | | | 122 | | | | 49 | |

Cullen/Frost Bankers Inc | | | 599 | | | | 47 | |

Discover Financial Services | | | 857 | | | | 56 | |

E*TRADE Financial Corp | | | 6,681 | | | | 306 | |

Equitable Holdings Inc | | | 2,436 | | | | 52 | |

Essent Group Ltd | | | 2,911 | | | | 127 | |

Evercore Inc, Cl A | | | 1,057 | | | | 70 | |

Everest Re Group Ltd | | | 2,339 | | | | 580 | |

FactSet Research Systems Inc | | | 513 | | | | 136 | |

Fifth Third Bancorp | | | 1,877 | | | | 46 | |

First Commonwealth Financial Corp | | | 17,417 | | | | 206 | |

First Hawaiian Inc | | | 1,924 | | | | 46 | |

First Republic Bank/CA | | | 491 | | | | 49 | |

FNB Corp/PA | | | 24,890 | | | | 251 | |

Franklin Resources Inc | | | 1,707 | | | | 37 | |

Great Western Bancorp Inc | | | 7,760 | | | | 209 | |

Green Dot Corp, Cl A * | | | 2,003 | | | | 68 | |

Hartford Financial Services Group Inc/The | | | 4,339 | | | | 217 | |

Home BancShares Inc/AR | | | 4,338 | | | | 73 | |

Huntington Bancshares Inc/OH | | | 3,797 | | | | 47 | |

Intercontinental Exchange Inc | | | 9,530 | | | | 850 | |

Invesco Ltd | | | 3,179 | | | | 46 | |

Janus Henderson Group PLC | | | 2,462 | | | | 52 | |

JPMorgan Chase & Co | | | 13,583 | | | | 1,577 | |

KeyCorp | | | 3,317 | | | | 54 | |

Legg Mason Inc | | | 1,747 | | | | 87 | |

Lincoln National Corp | | | 881 | | | | 40 | |

MarketAxess Holdings Inc | | | 419 | | | | 136 | |

Marsh & McLennan Cos Inc | | | 24,009 | | | | 2,510 | |

MetLife Inc | | | 4,026 | | | | 172 | |

MFA Financial Inc ‡ | | | 7,145 | | | | 52 | |

Moody’s Corp | | | 599 | | | | 144 | |

Morgan Stanley | | | 21,240 | | | | 956 | |

Morningstar Inc | | | 695 | | | | 102 | |

MSCI Inc, Cl A | | | 753 | | | | 223 | |

Nasdaq Inc | | | 587 | | | | 60 | |

National General Holdings Corp | | | 2,508 | | | | 49 | |

Navient Corp | | | 3,923 | | | | 44 | |

Northern Trust Corp | | | 2,684 | | | | 236 | |

PNC Financial Services Group Inc/The | | | 2,121 | | | | 268 | |

Principal Financial Group Inc | | | 1,152 | | | | 51 | |

Progressive Corp/The | | | 15,046 | | | | 1,101 | |

Prosperity Bancshares Inc | | | 1,900 | | | | 123 | |

| | | | | | | | |

| | | |

| Description | | Shares | | Market Value

($ Thousands) |

| |

COMMON STOCK (continued) | | | | | |

Prudential Financial Inc | | | 5,745 | | | $ | 434 | |

Regions Financial Corp | | | 5,506 | | | | 74 | |

S&P Global Inc | | | 5,433 | | | | 1,445 | |

Santander Consumer USA Holdings Inc | | | 2,144 | | | | 52 | |

SLM Corp | | | 33,402 | | | | 346 | |

State Street Corp | | | 28,794 | | | | 1,961 | |

Synchrony Financial | | | 2,528 | | | | 74 | |

T Rowe Price Group Inc | | | 1,349 | | | | 159 | |

TD Ameritrade Holding Corp | | | 1,020 | | | | 43 | |

Travelers Cos Inc/The | | | 433 | | | | 52 | |

Truist Financial Corp | | | 2,659 | | | | 123 | |

Two Harbors Investment Corp ‡ | | | 12,558 | | | | 170 | |

Umpqua Holdings Corp | | | 19,773 | | | | 304 | |

US Bancorp | | | 2,210 | | | | 103 | |

Virtu Financial Inc, Cl A | | | 2,754 | | | | 52 | |

Voya Financial Inc | | | 1,992 | | | | 105 | |

Willis Towers Watson PLC | | | 290 | | | | 55 | |

Zions Bancorp NA | | | 1,209 | | | | 48 | |

| | |

| | | | | | | 26,302 | |

| | |

Health Care — 12.4% | | | | | | | | |

Abbott Laboratories | | | 27,179 | | | | 2,094 | |

ABIOMED Inc * | | | 297 | | | | 45 | |

Acadia Healthcare Co Inc * | | | 1,743 | | | | 52 | |

Adaptive Biotechnologies Corp * | | | 21,754 | | | | 611 | |

Agios Pharmaceuticals Inc * | | | 5,241 | | | | 249 | |

Alcon Inc * | | | 10,489 | | | | 643 | |

Alexion Pharmaceuticals Inc * | | | 6,483 | | | | 610 | |

Align Technology Inc * | | | 178 | | | | 39 | |

Alkermes PLC * | | | 8,748 | | | | 182 | |

Alnylam Pharmaceuticals Inc * | | | 2,438 | | | | 287 | |

AmerisourceBergen Corp, Cl A | | | 14,468 | | | | 1,220 | |

Anthem Inc | | | 969 | | | | 249 | |

Avantor Inc * | | | 39,503 | | | | 622 | |

Baxter International Inc | | | 8,300 | | | | 693 | |

BioMarin Pharmaceutical Inc * | | | 5,384 | | | | 487 | |

Boston Scientific Corp * | | | 31,408 | | | | 1,174 | |

Bruker Corp | | | 13,975 | | | | 609 | |

Cantel Medical Corp | | | 1,430 | | | | 90 | |

Cardinal Health Inc | | | 3,870 | | | | 202 | |

Centene Corp * | | | 812 | | | | 43 | |

Cerner Corp | | | 4,557 | | | | 316 | |

Change Healthcare Inc * | | | 2,000 | | | | 27 | |

Chemed Corp | | | 330 | | | | 138 | |

Cigna Corp | | | 2,288 | | | | 419 | |

Covetrus Inc * | | | 987 | | | | 11 | |

CVS Health Corp | | | 50,541 | | | | 2,991 | |

DaVita Inc * | | | 1,288 | | | | 100 | |

DENTSPLY SIRONA Inc | | | 1,719 | | | | 85 | |

DexCom Inc * | | | 914 | | | | 252 | |

Edwards Lifesciences Corp * | | | 2,783 | | | | 570 | |

Elanco Animal Health Inc * | | | 22,354 | | | | 612 | |

Encompass Health Corp | | | 1,566 | | | | 117 | |

| | |

| 12 | | SEI Catholic Values Trust / Annual Report / February 29, 2020 |

| | | | | | | | |

| | | |

| Description | | Shares | | Market Value

($ Thousands) |

| | |

COMMON STOCK (continued) | | | | | | | | |

Ensign Group Inc/The | | | 3,095 | | | $ | 138 | |

Exact Sciences Corp * | | | 2,022 | | | | 164 | |

Exelixis Inc * | | | 15,274 | | | | 284 | |

Guardant Health Inc * | | | 1,334 | | | | 116 | |

Healthpeak Properties Inc ‡ | | | 7,017 | | | | 222 | |

Henry Schein Inc * | | | 2,467 | | | | 150 | |

Hill-Rom Holdings Inc | | | 495 | | | | 48 | |

Hologic Inc * | | | 1,306 | | | | 62 | |

Horizon Therapeutics Plc * | | | 31,836 | | | | 1,089 | |

Humana Inc * | | | 1,123 | | | | 359 | |

ICU Medical Inc * | | | 171 | | | | 33 | |

IDEXX Laboratories Inc * | | | 489 | | | | 124 | |

Incyte Corp * | | | 8,026 | | | | 605 | |

Integra LifeSciences Holdings Corp * | | | 1,163 | | | | 61 | |

Intuitive Surgical Inc * | | | 693 | | | | 370 | |

Ionis Pharmaceuticals Inc * | | | 2,668 | | | | 135 | |

IQVIA Holdings Inc * | | | 4,622 | | | | 645 | |

Laboratory Corp of America Holdings * | | | 513 | | | | 90 | |

Magellan Health Inc * | | | 3,153 | | | | 189 | |

Masimo Corp * | | | 357 | | | | 58 | |

McKesson Corp | | | 370 | | | | 52 | |

Mettler-Toledo International Inc * | | | 959 | | | | 673 | |

Moderna Inc * | | | 6,336 | | | | 164 | |

Nektar Therapeutics, Cl A * | | | 30,410 | | | | 633 | |

Neurocrine Biosciences Inc * | | | 1,794 | | | | 170 | |

Penumbra Inc * | | | 330 | | | | 55 | |

PRA Health Sciences Inc * | | | 6,960 | | | | 656 | |

Premier Inc, Cl A * | | | 1,272 | | | | 37 | |

Quest Diagnostics Inc | | | 2,735 | | | | 290 | |

ResMed Inc | | | 2,570 | | | | 408 | |

Sage Therapeutics Inc * | | | 1,048 | | | | 49 | |

Sarepta Therapeutics Inc * | | | 2,080 | | | | 238 | |

Seattle Genetics Inc * | | | 1,982 | | | | 226 | |

STERIS PLC | | | 1,076 | | | | 171 | |

Stryker Corp | | | 2,405 | | | | 458 | |

Teleflex Inc | | | 473 | | | | 158 | |

Tivity Health Inc * | | | 14,847 | | | | 188 | |

United Therapeutics Corp * | | | 4,865 | | | | 501 | |

Varian Medical Systems Inc * | | | 2,254 | | | | 277 | |

Veeva Systems Inc, Cl A * | | | 378 | | | | 54 | |

Vertex Pharmaceuticals Inc * | | | 6,085 | | | | 1,363 | |

Waters Corp * | | | 3,288 | | | | 641 | |

West Pharmaceutical Services Inc | | | 999 | | | | 150 | |

Zimmer Biomet Holdings Inc | | | 5,327 | | | | 725 | |

Zoetis Inc, Cl A | | | 5,540 | | | | 738 | |

| | |

| | | | | | | 29,856 | |

| | |

Industrials — 6.4% | | | | | | | | |

3M Co | | | 8,358 | | | | 1,247 | |

ACCO Brands Corp | | | 6,870 | | | | 55 | |

ADT Inc | | | 6,874 | | | | 44 | |

AGCO Corp | | | 675 | | | | 41 | |

Alaska Air Group Inc | | | 775 | | | | 39 | |

| | | | | | | | |

| | | |

| Description | | Shares | | Market Value ($ Thousands) |

| | |

COMMON STOCK (continued) | | | | | | | | |

Allegion plc | | | 536 | | | $ | 62 | |

Allison Transmission Holdings Inc | | | 400 | | | | 16 | |

AMERCO | | | 140 | | | | 45 | |

American Airlines Group Inc | | | 21,513 | | | | 410 | |

AMETEK Inc | | | 605 | | | | 52 | |

AO Smith Corp | | | 943 | | | | 37 | |

Apogee Enterprises Inc | | | 11,422 | | | | 345 | |

Armstrong World Industries Inc | | | 200 | | | | 20 | |

ASGN Inc * | | | 744 | | | | 38 | |

Astec Industries Inc | | | 2,843 | | | | 107 | |

Atlas Air Worldwide Holdings Inc * | | | 2,238 | | | | 60 | |

Caterpillar Inc | | | 357 | | | | 44 | |

Chart Industries Inc * | | | 2,499 | | | | 142 | |

Cintas Corp | | | 3,204 | | | | 855 | |

Clean Harbors Inc * | | | 646 | | | | 45 | |

Colfax Corp * | | | 1,869 | | | | 63 | |

CoStar Group Inc * | | | 101 | | | | 67 | |

CSX Corp | | | 1,508 | | | | 106 | |

Cummins Inc | | | 1,667 | | | | 252 | |

Deere & Co | | | 1,422 | | | | 223 | |

Delta Air Lines Inc | | | 6,659 | | | | 307 | |

Donaldson Co Inc | | | 397 | | | | 18 | |

Dover Corp | | | 1,366 | | | | 140 | |

Eaton Corp PLC | | | 7,424 | | | | 674 | |

Emerson Electric Co | | | 1,607 | | | | 103 | |

Equifax Inc | | | 375 | | | | 53 | |

Fastenal Co | | | 1,480 | | | | 51 | |

FedEx Corp | | | 1,376 | | | | 194 | |

Flowserve Corp | | | 1,306 | | | | 52 | |

Fortive Corp | | | 627 | | | | 43 | |

Gates Industrial Corp PLC * | | | 5,238 | | | | 55 | |

Graco Inc | | | 401 | | | | 20 | |

GrafTech International Ltd | | | 3,996 | | | | 33 | |

HD Supply Holdings Inc * | | | 1,156 | | | | 44 | |

HEICO Corp | | | 674 | | | | 73 | |

Hexcel Corp | | | 889 | | | | 57 | |

Hubbell Inc, Cl B | | | 100 | | | | 13 | |

IAA Inc * | | | 500 | | | | 21 | |

IHS Markit Ltd | | | 1,072 | | | | 76 | |

Illinois Tool Works Inc | | | 9,041 | | | | 1,517 | |

Ingersoll-Rand PLC | | | 3,308 | | | | 427 | |

JB Hunt Transport Services Inc | | | 477 | | | | 46 | |

JetBlue Airways Corp * | | | 2,913 | | | | 46 | |

Johnson Controls International plc | | | 8,766 | | | | 321 | |

Kansas City Southern | | | 423 | | | | 64 | |

KAR Auction Services Inc | | | 3,646 | | | | 70 | |

Landstar System Inc | | | 477 | | | | 48 | |

LB Foster Co, Cl A * | | | 2,646 | | | | 42 | |

Lennox International Inc | | | 194 | | | | 44 | |

Macquarie Infrastructure Corp | | | 1,159 | | | | 45 | |

ManpowerGroup Inc | | | 944 | | | | 72 | |

Masco Corp | | | 1,719 | | | | 71 | |

| | |

| SEI Catholic Values Trust / Annual Report / February 29, 2020 | | 13 |

SCHEDULE OF INVESTMENTS

February 29, 2020

Catholic Values Equity Fund(Continued)

| | | | | | | | |

| | | |

| Description | | Shares | | Market Value

($ Thousands) |

| | |

COMMON STOCK (continued) | | | | | | | | |

MSC Industrial Direct Co Inc, Cl A | | | 923 | | | $ | 57 | |

Nielsen Holdings PLC | | | 2,443 | | | | 44 | |

Nordson Corp | | | 843 | | | | 122 | |

nVent Electric PLC | | | 2,436 | | | | 58 | |

Oshkosh Corp | | | 837 | | | | 60 | |

Owens Corning | | | 2,456 | | | | 139 | |

PACCAR Inc | | | 771 | | | | 52 | |

Parker-Hannifin Corp | | | 356 | | | | 66 | |

Pentair PLC | | | 1,364 | | | | 54 | |

Regal Beloit Corp | | | 733 | | | | 57 | |

Republic Services Inc, Cl A | | | 700 | | | | 63 | |

Resideo Technologies Inc * | | | 2,553 | | | | 27 | |

Robert Half International Inc | | | 846 | | | | 43 | |

Rockwell Automation Inc | | | 1,053 | | | | 193 | |

Rollins Inc | | | 1,349 | | | | 51 | |

Roper Technologies Inc | | | 173 | | | | 61 | |

Ryder System Inc | | | 1,027 | | | | 39 | |

Schneider National Inc, Cl B | | | 2,470 | | | | 44 | |

Sensata Technologies Holding PLC * | | | 1,149 | | | | 47 | |

Snap-on Inc | | | 657 | | | | 95 | |

Southwest Airlines Co | | | 1,122 | | | | 52 | |

Spirit AeroSystems Holdings Inc, Cl A | | | 1,276 | | | | 67 | |

Stanley Black & Decker Inc | | | 4,507 | | | | 648 | |

Tetra Tech Inc | | | 604 | | | | 49 | |

Timken Co/The | | | 1,209 | | | | 54 | |

Toro Co/The | | | 721 | | | | 52 | |

TransDigm Group Inc | | | 1,140 | | | | 636 | |

Trinity Industries Inc | | | 2,541 | | | | 52 | |

Uber Technologies Inc * | | | 1,225 | | | | 42 | |

United Airlines Holdings Inc * | | | 1,139 | | | | 70 | |

United Parcel Service Inc, Cl B | | | 2,273 | | | | 206 | |

United Rentals Inc * | | | 402 | | | | 53 | |

Univar Solutions Inc * | | | 2,330 | | | | 40 | |

Valmont Industries Inc | | | 383 | | | | 45 | |

Verisk Analytics Inc, Cl A | | | 474 | | | | 74 | |

WABCO Holdings Inc * | | | 401 | | | | 54 | |

Waste Management Inc | | | 3,911 | | | | 433 | |

Watsco Inc | | | 331 | | | | 52 | |

WESCO International Inc * | | | 1,999 | | | | 81 | |

Westinghouse Air Brake Technologies Corp | | | 720 | | | | 49 | |

Woodward Inc | | | 485 | | | | 50 | |

WW Grainger Inc | | | 5,535 | | | | 1,536 | |

Xylem Inc/NY | | | 6,247 | | | | 483 | |

| | |

| | | | | | | 15,505 | |

|

Information Technology — 14.4% | |

Accenture PLC, Cl A | | | 3,770 | | | | 681 | |

Adobe Inc * | | | 6,489 | | | | 2,239 | |

Advanced Micro Devices Inc * | | | 1,592 | | | | 72 | |

Akamai Technologies Inc * | | | 623 | | | | 54 | |

Alliance Data Systems Corp | | | 550 | | | | 47 | |

Amdocs Ltd | | | 2,854 | | | | 182 | |

Analog Devices Inc | | | 1,648 | | | | 180 | |

| | | | | | | | |

| | | |

| Description | | Shares | | Market Value

($ Thousands) |

| |

COMMON STOCK (continued) | | | | | |

ANSYS Inc * | | | 247 | | | $ | 60 | |

Apple Inc | | | 16,799 | | | | 4,592 | |

Applied Materials Inc | | | 8,190 | | | | 476 | |

Arista Networks Inc * | | | 1,035 | | | | 200 | |

Atlassian Corp PLC, Cl A * | | | 391 | | | | 57 | |

Autodesk Inc * | | | 816 | | | | 156 | |

Automatic Data Processing Inc | | | 3,388 | | | | 524 | |

Avalara Inc * | | | 580 | | | | 49 | |

Badger Meter Inc | | | 1,861 | | | | 112 | |

Broadcom Inc | | | 1,407 | | | | 384 | |

Broadridge Financial Solutions Inc | | | 422 | | | | 44 | |

Cabot Microelectronics Corp | | | 872 | | | | 121 | |

Cadence Design Systems Inc * | | | 832 | | | | 55 | |

Cerence Inc * | | | 2,304 | | | | 50 | |

Cisco Systems Inc | | | 17,608 | | | | 703 | |

Cognex Corp | | | 1,339 | | | | 60 | |

Cognizant Technology Solutions Corp, Cl A | | | 621 | | | | 38 | |

CommScope Holding Co Inc * | | | 4,486 | | | | 49 | |

Cree Inc * | | | 500 | | | | 22 | |

Crowdstrike Holdings Inc, Cl A * | | | 3,869 | | | | 231 | |

Dell Technologies Inc, Cl C * | | | 1,116 | | | | 45 | |

DXC Technology Co | | | 691 | | | | 17 | |

EPAM Systems Inc * | | | 306 | | | | 68 | |

Fidelity National Information Services Inc | | | 10,000 | | | | 1,397 | |

First Solar Inc * | | | 343 | | | | 16 | |

Fiserv Inc * | | | 509 | | | | 56 | |

Genpact Ltd | | | 1,364 | | | | 52 | |

Global Payments Inc | | | 2,827 | | | | 520 | |

GoDaddy Inc, Cl A * | | | 834 | | | | 58 | |

Hewlett Packard Enterprise Co | | | 12,502 | | | | 160 | |

HP Inc | | | 15,698 | | | | 326 | |

II-VI Inc * | | | 3,451 | | | | 102 | |

Intuit Inc | | | 1,427 | | | | 379 | |

IPG Photonics Corp * | | | 399 | | | | 51 | |

Jabil Inc | | | 1,463 | | | | 47 | |

Jack Henry & Associates Inc | | | 558 | | | | 85 | |

Juniper Networks Inc | | | 2,222 | | | | 47 | |

Keysight Technologies Inc * | | | 2,242 | | | | 212 | |

KLA Corp | | | 445 | | | | 68 | |

Lam Research Corp | | | 1,246 | | | | 366 | |

Littelfuse Inc | | | 331 | | | | 53 | |

LogMeIn Inc | | | 1,178 | | | | 100 | |

Mastercard Inc, Cl A | | | 3,434 | | | | 997 | |

Maxim Integrated Products Inc | | | 912 | | | | 51 | |

Microchip Technology Inc | | | 11,543 | | | | 1,047 | |

Micron Technology Inc * | | | 3,474 | | | | 183 | |

Microsoft Corp | | | 40,199 | | | | 6,513 | |

Motorola Solutions Inc | | | 302 | | | | 50 | |

National Instruments Corp | | | 400 | | | | 16 | |

NCR Corp * | | | 4,554 | | | | 115 | |

NetApp Inc | | | 980 | | | | 46 | |

NortonLifeLock Inc | | | 1,997 | | | | 38 | |

| | |

| 14 | | SEI Catholic Values Trust / Annual Report / February 29, 2020 |

| | | | | | | | |

| | | |

| Description | | Shares | | Market Value ($ Thousands) |

| | |

COMMON STOCK (continued) | | | | | | | | |

NVIDIA Corp | | | 4,762 | | | $ | 1,286 | |

Okta Inc, Cl A * | | | 490 | | | | 63 | |

ON Semiconductor Corp * | | | 2,294 | | | | 43 | |

PayPal Holdings Inc * | | | 10,264 | | | | 1,108 | |

QUALCOMM Inc | | | 4,917 | | | | 385 | |

salesforce.com Inc * | | | 14,309 | | | | 2,438 | |

Skyworks Solutions Inc | | | 606 | | | | 61 | |

Super Micro Computer Inc * | | | 23,511 | | | | 597 | |

SYNNEX Corp | | | 404 | | | | 51 | |

Teradata Corp * | | | 1,351 | | | | 27 | |

Texas Instruments Inc | | | 4,800 | | | | 548 | |

Universal Display Corp | | | 324 | | | | 51 | |

VeriSign Inc * | | | 270 | | | | 51 | |

Visa Inc, Cl A | | | 16,706 | | | | 3,036 | |

VMware Inc, Cl A * | | | 382 | | | | 46 | |

Workday Inc, Cl A * | | | 251 | | | | 44 | |

Xerox Holdings Corp | | | 737 | | | | 24 | |

Xilinx Inc | | | 598 | | | | 50 | |

| | |

| | | | | | | 34,628 | |

| | |

Materials — 3.1% | | | | | | | | |

Air Products & Chemicals Inc | | | 3,688 | | | | 810 | |

Alcoa Corp * | | | 2,528 | | | | 35 | |

AptarGroup Inc | | | 1,090 | | | | 110 | |

Avery Dennison Corp | | | 400 | | | | 46 | |

Axalta Coating Systems Ltd * | | | 700 | | | | 17 | |

B2Gold Corp | | | 22,920 | | | | 91 | |

Ball Corp | | | 5,045 | | | | 356 | |

Berry Global Group Inc * | | | 1,067 | | | | 41 | |

Cabot Corp | | | 1,164 | | | | 44 | |

Century Aluminum Co * | | | 9,125 | | | | 53 | |

Commercial Metals Co | | | 13,873 | | | | 253 | |

Corteva Inc | | | 14,578 | | | | 397 | |

Crown Holdings Inc * | | | 11,818 | | | | 833 | |

Domtar Corp | | | 1,435 | | | | 41 | |

Dow Inc | | | 975 | | | | 39 | |

DuPont de Nemours Inc | | | 4,840 | | | | 208 | |

Eastman Chemical Co | | | 5,513 | | | | 339 | |

Ecolab Inc | | | 466 | | | | 84 | |

FMC Corp | | | 524 | | | | 49 | |

Freeport-McMoRan Inc | | | 28,122 | | | | 280 | |

Huntsman Corp | | | 7,027 | | | | 133 | |

International Flavors & Fragrances Inc | | | 737 | | | | 88 | |

International Paper Co | | | 1,238 | | | | 46 | |

Linde PLC | | | 2,709 | | | | 517 | |

Livent Corp * | | | 9,157 | | | | 82 | |

LyondellBasell Industries NV, Cl A | | | 607 | | | | 43 | |

Newmont Corp | | | 28,149 | | | | 1,256 | |

Nucor Corp | | | 870 | | | | 36 | |

O-I Glass Inc, Cl I | | | 5,327 | | | | 58 | |

PPG Industries Inc | | | 510 | | | | 53 | |

Quaker Chemical Corp | | | 350 | | | | 55 | |

Royal Gold Inc | | | 466 | | | | 45 | |

| | | | | | | | |

| | | |

| Description | | Shares | | Market Value ($ Thousands) |

| | |

COMMON STOCK (continued) | | | | | | | | |

Sherwin-Williams Co/The | | | 1,291 | | | $ | 667 | |

Sonoco Products Co | | | 903 | | | | 44 | |

Steel Dynamics Inc | | | 1,777 | | | | 47 | |

United States Steel Corp | | | 3,984 | | | | 32 | |

Valvoline Inc | | | 2,446 | | | | 48 | |

Vulcan Materials Co | | | 363 | | | | 44 | |

Westrock Co | | | 1,448 | | | | 48 | |

| | |

| | | | | | | 7,468 | |

| | |

Real Estate — 1.6% | | | | | | | | |

Alexandria Real Estate Equities Inc ‡ | | | 885 | | | | 134 | |

American Campus Communities Inc ‡ | | | 1,095 | | | | 48 | |

American Tower Corp ‡ | | | 1,117 | | | | 253 | |

AvalonBay Communities Inc ‡ | | | 909 | | | | 182 | |

Brandywine Realty Trust ‡ | | | 3,873 | | | | 53 | |

CBRE Group Inc, Cl A *‡ | | | 6,783 | | | | 381 | |

Colony Capital Inc ‡ | | | 9,970 | | | | 39 | |

CoreSite Realty Corp ‡ | | | 699 | | | | 73 | |

Corporate Office Properties Trust ‡ | | | 2,505 | | | | 63 | |

Crown Castle International Corp ‡ | | | 1,420 | | | | 203 | |

CubeSmart ‡ | | | 1,472 | | | | 45 | |

Digital Realty Trust Inc ‡ | | | 437 | | | | 52 | |

Equinix Inc ‡ | | | 145 | | | | 83 | |

Equity Residential ‡ | | | 780 | | | | 59 | |

Essex Property Trust Inc ‡ | | | 187 | | | | 53 | |

Extra Space Storage Inc ‡ | | | 438 | | | | 44 | |

Federal Realty Investment Trust ‡ | | | 402 | | | | 47 | |

Gaming and Leisure Properties Inc ‡ | | | 1,375 | | | | 61 | |

Host Hotels & Resorts Inc ‡ | | | 7,990 | | | | 116 | |

Howard Hughes Corp/The *‡ | | | 411 | | | | 44 | |

Iron Mountain Inc ‡ | | | 1,533 | | | | 47 | |

Jones Lang LaSalle Inc ‡ | | | 410 | | | | 61 | |

Kennedy-Wilson Holdings Inc ‡ | | | 2,346 | | | | 47 | |

Kilroy Realty Corp ‡ | | | 811 | | | | 59 | |

Kimco Realty Corp ‡ | | | 2,506 | | | | 43 | |

Life Storage Inc ‡ | | | 520 | | | | 56 | |

National Retail Properties Inc ‡ | | | 993 | | | | 51 | |

Prologis Inc ‡ | | | 7,761 | | | | 654 | |

Public Storage ‡ | | | 298 | | | | 62 | |

Realty Income Corp ‡ | | | 747 | | | | 54 | |

Regency Centers Corp ‡ | | | 826 | | | | 47 | |

Ryman Hospitality Properties Inc ‡ | | | 610 | | | | 42 | |

Simon Property Group Inc ‡ | | | 566 | | | | 70 | |

SL Green Realty Corp ‡ | | | 586 | | | | 46 | |

STORE Capital Corp ‡ | | | 1,477 | | | | 49 | |

Ventas Inc ‡ | | | 1,890 | | | | 102 | |

VEREIT Inc ‡ | | | 6,295 | | | | 55 | |

Vornado Realty Trust ‡ | | | 765 | | | | 41 | |

Welltower Inc ‡ | | | 1,829 | | | | 137 | |

Weyerhaeuser Co ‡ | | | 5,915 | | | | 154 | |

| | | | | | | 3,910 | |

| | |

| SEI Catholic Values Trust / Annual Report / February 29, 2020 | | 15 |

SCHEDULE OF INVESTMENTS

February 29, 2020

Catholic Values Equity Fund(Continued)

| | | | | | | | |

| | | |

| Description | | Shares | | Market Value ($ Thousands) |

| | |

COMMON STOCK (continued) | | | | | | | | |

| | |

Utilities — 1.4% | | | | | | | | |

Algonquin Power & Utilities Corp | | | 10,124 | | | $ | 151 | |

Ameren Corp | | | 786 | | | | 62 | |

American Electric Power Co Inc | | | 675 | | | | 60 | |

American States Water Co | | | 596 | | | | 46 | |

American Water Works Co Inc | | | 1,550 | | | | 192 | |

Avangrid Inc | | | 1,034 | | | | 51 | |

CMS Energy Corp | | | 6,772 | | | | 409 | |

Consolidated Edison Inc | | | 664 | | | | 52 | |

Dominion Energy Inc | | | 694 | | | | 54 | |

DTE Energy Co | | | 416 | | | | 46 | |

Duke Energy Corp | | | 1,264 | | | | 116 | |

Edison International | | | 839 | | | | 56 | |

Entergy Corp | | | 595 | | | | 70 | |

Eversource Energy | | | 3,118 | | | | 270 | |

Exelon Corp | | | 6,186 | | | | 267 | |

FirstEnergy Corp | | | 1,272 | | | | 57 | |

NextEra Energy Inc | | | 1,489 | | | | 376 | |

NiSource Inc | | | 1,898 | | | | 51 | |

Pinnacle West Capital Corp | | | 566 | | | | 51 | |

PPL Corp | | | 1,714 | | | | 51 | |

Public Service Enterprise Group Inc | | | 1,789 | | | | 92 | |

Sempra Energy | | | 466 | | | | 65 | |

Southern Co/The | | | 1,127 | | | | 68 | |

UGI Corp | | | 1,182 | | | | 43 | |

WEC Energy Group Inc | | | 737 | | | | 68 | |

Xcel Energy Inc | | | 6,735 | | | | 420 | |

| | |

| | | | | | | 3,244 | |

Total Common Stock

(Cost $150,085) ($ Thousands) | | | | | | | 181,044 | |

| |

FOREIGN COMMON STOCK — 22.9% | | | | | |

| | |

Australia — 0.4% | | | | | | | | |

BHP Group Ltd ADR | | | 22,006 | | | | 953 | |

South32 Ltd ADR | | | 5,251 | | | | 37 | |

| | | | | | | 990 | |

| | |

Austria — 0.7% | | | | | | | | |

Erste Group Bank AG | | | 28,543 | | | | 973 | |

Schoeller-Bleckmann Oilfield Equipment AG | | | 4,496 | | | | 183 | |

voestalpine AG | | | 21,904 | | | | 476 | |

| | | | | | | 1,632 | |

| | |

Bermuda — 0.2% | | | | | | | | |

Marvell Technology Group Ltd | | | 20,966 | | | | 447 | |

| | |

Brazil — 0.3% | | | | | | | | |

Banco Bradesco SA ADR | | | 83,269 | | | | 565 | |

Banco Santander SA ADR | | | 18,970 | | | | 69 | |

| | | | | | | 634 | |

| | | | | | | | |

| | | |

| Description | | Shares | | Market Value ($ Thousands) |

| |

FOREIGN COMMON STOCK (continued) | | | | | |

| | |

Canada — 1.1% | | | | | | | | |

Canadian Natural Resources Ltd | | | 54,520 | | | $ | 1,407 | |

Magna International Inc | | | 17,257 | | | | 785 | |

Rogers Communications Inc, Cl B | | | 9,788 | | | | 449 | |

| | | | | | | 2,641 | |

| | |

Chile — 0.1% | | | | | | | | |

Sociedad Quimica y Minera de Chile SA ADR | | | 5,090 | | | | 139 | |

| | |

China — 1.7% | | | | | | | | |

Alibaba Group Holding Ltd ADR * | | | 9,602 | | | | 1,997 | |

Anhui Conch Cement Co Ltd, Cl H | | | 176,500 | | | | 1,294 | |

Baidu Inc ADR * | | | 2,280 | | | | 274 | |

BYD Co Ltd, Cl H | | | 102,000 | | | | 624 | |

| | | | | | | 4,189 | |

| | |

Colombia — 0.4% | | | | | | | | |

Bancolombia SA ADR | | | 21,447 | | | | 1,018 | |

| | |

Czech Republic — 0.2% | | | | | | | | |

Komercni banka as | | | 18,993 | | | | 579 | |

| | |

France — 1.4% | | | | | | | | |

Capgemini SE | | | 11,367 | | | | 1,239 | |

Societe Generale SA | | | 29,345 | | | | 825 | |

Sodexo SA | | | 13,340 | | | | 1,271 | |

| | | | | | | 3,335 | |

| | |

Germany — 1.0% | | | | | | | | |

BASF SE | | | 10,767 | | | | 628 | |

Continental AG | | | 8,173 | | | | 912 | |

Vonovia SE ‡ | | | 18,319 | | | | 978 | |

| | | | | | | 2,518 | |

| | |

Hong Kong — 1.0% | | | | | | | | |

ANTA Sports Products Ltd | | | 60,000 | | | | 482 | |

China Life Insurance Co Ltd, Cl H | | | 544,000 | | | | 1,275 | |

Sinopharm Group Co Ltd, Cl H | | | 206,000 | | | | 636 | |

| | | | | | | 2,393 | |

| | |

India — 0.8% | | | | | | | | |

HDFC Bank Ltd ADR | | | 16,647 | | | | 913 | |

ICICI Bank Ltd ADR | | | 72,838 | | | | 1,010 | |

| | | | | | | 1,923 | |

| | |

Ireland — 1.9% | | | | | | | | |

ICON PLC * | | | 15,594 | | | | 2,433 | |

Jazz Pharmaceuticals PLC * | | | 8,971 | | | | 1,028 | |

Medtronic PLC | | | 11,729 | | | | 1,181 | |

| | | | | | | 4,642 | |

| | |

Israel — 0.4% | | | | | | | | |

Check Point Software Technologies Ltd * | | | 8,209 | | | | 852 | |

| | |

Italy — 0.4% | | | | | | | | |

Prysmian SpA | | | 36,774 | | | | 864 | |

| | |

| 16 | | SEI Catholic Values Trust / Annual Report / February 29, 2020 |

| | | | | | | | |

| | | |

| Description | | Shares | | Market Value ($ Thousands) |

| |

FOREIGN COMMON STOCK (continued) | | | | | |

| | |

Japan — 1.3% | | | | | | | | |

Denso Corp | | | 35,200 | | | $ | 1,377 | |

Hitachi Ltd | | | 29,500 | | | | 995 | |

Toray Industries Inc | | | 129,300 | | | | 749 | |

| | | | | | | 3,121 | |

| | |

Mexico — 0.3% | | | | | | | | |

Grupo Financiero Banorte SAB de CV, Cl O | | | 132,600 | | | | 721 | |

| | |

Netherlands — 2.3% | | | | | | | | |

Heineken NV | | | 13,435 | | | | 1,332 | |

NXP Semiconductors NV | | | 7,872 | | | | 895 | |

RELX PLC | | | 51,732 | | | | 1,231 | |

Royal Dutch Shell PLC, Cl A | | | 28,974 | | | | 618 | |

Royal Dutch Shell PLC ADR, Cl A | | | 31,237 | | | | 1,375 | |

Royal Dutch Shell PLC ADR, Cl B | | | 3,500 | | | | 156 | |

| | | | | | | 5,607 | |

| | |

Norway — 1.2% | | | | | | | | |

DNB ASA | | | 87,206 | | | | 1,435 | |

Equinor ASA ADR | | | 71,816 | | | | 1,117 | |

Norsk Hydro ASA | | | 100,136 | | | | 282 | |

| | | | | | | 2,834 | |

| | |

Puerto Rico — 0.0% | | | | | | | | |

OFG Bancorp | | | 2,668 | | | | 45 | |

Popular Inc | | | 1,000 | | | | 48 | |

| | | | | | | 93 | |

| | |

Singapore — 0.6% | | | | | | | | |

DBS Group Holdings Ltd | | | 81,100 | | | | 1,401 | |

| | |

South Korea — 0.5% | | | | | | | | |

Samsung Electronics Co Ltd | | | 25,496 | | | | 1,138 | |

| | | | | | | | |

| | | |

| Description | | Shares | | Market Value ($ Thousands) |

| |

FOREIGN COMMON STOCK (continued) | | | | | |

| | |