UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

(Investment Company Act file number)

Resource Credit Income Fund |

(Exact name of registrant as specified in charter)

One Crescent Drive, Suite 203

Philadelphia, PA 19103

(Address of principal executive offices) (Zip code)

Shelle Weisbaum

Resource Real Estate, Inc.

1845 Walnut Street, 18th Floor

Philadelphia, PA 19103

(Name and address of agent for service)

Copy to:

ALPS Fund Services, Inc.

1290 Broadway, Suite 1100

Denver, CO 80203

Registrant's telephone number, including area code: (212) 506-3899

Date of fiscal year end: September 30

Date of reporting period: April 20, 2015 – September 30, 2015

Item 1. Reports to Stockholders.

TABLE OF CONTENTS

| Shareholder Letter | | 1 |

| Portfolio Update | | 2 |

| Portfolio of Investments | | 4 |

| Statement of Assets and Liabilities | | 5 |

| Statement of Operations | | 7 |

| Statement of Changes in Net Assets | | 8 |

| Financial Highlights | | |

| Class A | | 10 |

| Class C | | 11 |

| Class W | | 12 |

| Class I | | 13 |

| Class U | | 14 |

| Class T | | 15 |

| Class D | | 16 |

| Notes to Financial Statements | | 17 |

| Report of Independent Registered Public Accounting Firm | | 23 |

| Additional Information | | 24 |

| Trustees & Officers | | 25 |

| Privacy Notice | | 27 |

| Resource Credit Income Fund | Shareholder Letter |

September 30, 2015 (Unaudited)

Dear Shareholders:

The Resource Credit Income Fund is a newly organized, continuously offered, non-diversified, closed-end management investment company. The Fund is an interval fund that will offer to make quarterly repurchases of each class of shares at the NAV of that class of shares.

The Fund's investment objectives are to produce current income and achieve capital preservation with moderate volatility and low to moderate correlation to the broader equity markets. The Fund did not actively invest during the 2015 fiscal year (it held all its assets in a money market fund), but is anticipating making its first active investments in fixed-income and fixed-income related securities in the first quarter of the 2016 fiscal year.

Sincerely,

Michael Terwilliger

Portfolio Manager

Resource Credit Income Fund

| Annual Report | September 30, 2015 | 1 |

| Resource Credit Income Fund | Portfolio Update |

September 30, 2015 (Unaudited)

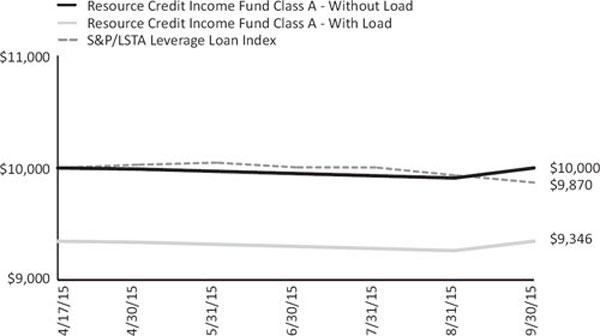

The Fund's performance figures for the period ended September 30, 2015, compared to its benchmark:

| | Since Inception | Inception |

| Resource Credit Income Fund - A - Without Load | 0.00%* | 4/17/2015 |

| Resource Credit Income Fund - A - With Load | -6.54%* | 4/17/2015 |

| Resource Credit Income Fund - C - Without Load | 0.00%* | 4/17/2015 |

| Resource Credit Income Fund - C - With Load | -1.48%* | 4/17/2015 |

| Resource Credit Income Fund - W - Without Load | 0.00%* | 4/17/2015 |

| Resource Credit Income Fund - I - Without Load | 0.00%* | 4/17/2015 |

| Resource Credit Income Fund - U - Without Load | 0.00%* | 4/17/2015 |

| Resource Credit Income Fund - U - With Load | -6.54%* | 4/17/2015 |

| Resource Credit Income Fund - T - Without Load | 0.00%* | 4/17/2015 |

| Resource Credit Income Fund - T - With Load | -1.48%* | 4/17/2015 |

| Resource Credit Income Fund - D - Without Load | 0.00%* | 4/17/2015 |

| S&P/LSTA Leverage Loan Index | -1.30%* | 4/17/2015 |

The S&P/LSTA Leveraged Loan Index (LLI) covers the U.S. market back to 1997 and currently calculates on a daily basis. This index is run in partnership between S&P and the Loan Syndications & Trading Association, the loan market's trade group.

Past performance is not predictive of future results. The investment return and principal value of an investment will fluctuate. An investor's shares when redeemed, may be worth more or less than the original cost. Total return is calculated assuming reinvestment of all dividends and distributions. Performance figures for periods less than one year are not annualized. The Fund's total annual operating expense, including underlying funds before fee waivers is 3.62% for Class A, 4.37% for Class C, 4.12% for Class W, 3.37% for Class I , 3.62% for Class U, 4.37% for Class T and 4.12% for Class D shares per the most recent Class specific prospectus filings. After fee waivers, the Fund's total annual operating expense is 3.62% for Class A, 4.37% for Class C, 4.12% for Class W, 3.37% for Class I , 3.62% for Class U, 4.37% for Class T and 4.12% for Class D shares. Class A and Class U shares are subject to a maximum sales load of 6.50% imposed on purchases. Class C and Class T shares are subject to a maximum sales load of 1.50% imposed on purchases. For performance information current to the most recent month-end, please call toll-free 1-855-747-9559.

| 2 | www.resourcecreditincome.com |

| Resource Credit Income Fund | Portfolio Update |

September 30, 2015 (Unaudited)

Comparison of the Change in Value of a $10,000 Investment

Portfolio Composition as of September 30, 2015

| Asset Type | | Percent of Net Assets | |

| Short Term Investments | | | 51.99% | |

| Total Investments | | | 51.99% | |

| Other Assets in Excess of Liabilities | | | 48.01% | |

| Net Assets | | | 100.00% | |

| Annual Report | September 30, 2015 | 3 |

| Resource Credit Income Fund | Portfolio of Investments |

| Shares | | | | Value | |

| | SHORT TERM INVESTMENTS (51.99%) | | | |

| | 111,779 | | Dreyfus Treasury Cash Management, Institutional Class, 0.01% (a) (Cost $111,779) | | $ | 111,779 | |

| | | | | | | | |

| | | | TOTAL SHORT TERM INVESTMENTS (Cost $111,779) | | | 111,779 | |

| | | | | | | | |

| | | | TOTAL INVESTMENTS (51.99%) (Cost $111,779) | | $ | 111,779 | |

| | | | | | | | |

| | | | OTHER ASSETS IN EXCESS OF LIABILITIES (48.01%) | | | 103,221 | |

| | | | | | | | |

| | | | NET ASSETS (100.00%) | | $ | 215,000 | |

(a) | Money market fund; interest rate reflects seven-day effective yield on September 30, 2015. |

| See Notes to Financial Statements. | |

| 4 | www.resourcecreditincome.com |

| Resource Credit Income Fund | Statement of Assets and Liabilities |

| ASSETS | | | |

| Investments, at value (Cost $111,779) | | $ | 111,779 | |

| Deferred offering cost | | | 289,760 | |

| Prepaid expenses and other assets | | | 10,741 | |

| Total assets | | | 412,280 | |

| | | | | |

| LIABILITIES | | | | |

| Payable due to adviser | | | 117,867 | |

| Administration fees payable | | | 15,820 | |

| Custody fees payable | | | 1,250 | |

| Payable for trustee fees and expenses | | | 300 | |

| Distribution fees payable | | | 3 | |

| Shareholder servicing fees payable | | | 14 | |

| Dealer manager fees payable | | | 10 | |

| Payable for transfer agency fees | | | 31,691 | |

| Accrued expenses and other liabilities | | | 30,325 | |

| Total liabilities | | | 197,280 | |

| NET ASSETS | | $ | 215,000 | |

| | | | | |

| NET ASSETS CONSISTS OF | | | | |

| Paid‐in capital | | $ | 214,982 | |

| Accumulated net investment income | | | 18 | |

| NET ASSETS | | $ | 215,000 | |

| See Notes to Financial Statements. | |

| Annual Report | September 30, 2015 | 5 |

| Resource Credit Income Fund | Statement of Assets and Liabilities |

| PRICING OF SHARES | | | |

| Class A | | | |

| Net Assets | | $ | 2,500 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 250 | |

Net Asset Value and redemption price per share(a) | | $ | 10.00 | |

| Maximum Offering Price Per Share (Maximum Sales Charge of 6.50%) | | $ | 10.70 | |

| Class C | | | | |

| Net Assets | | $ | 2,500 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 250 | |

Net Asset Value and redemption price per share(a) | | $ | 10.00 | |

| Maximum Offering Price Per Share (Maximum Sales Charge of 1.50%) | | $ | 10.15 | |

| Class W | | | | |

| Net Assets | | $ | 2,500 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 250 | |

| Net Asset Value, offering and redemption price per share | | $ | 10.00 | |

| Class I | | | | |

| Net Assets | | $ | 200,000 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 20,000 | |

| Net Asset Value, offering and redemption price per share | | $ | 10.00 | |

| Class U | | | | |

| Net Assets | | $ | 2,500 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 250 | |

Net Asset Value and redemption price per share(a) | | $ | 10.00 | |

| Maximum Offering Price Per Share (Maximum Sales Charge of 6.50%) | | $ | 10.70 | |

| Class T | | | | |

| Net Assets | | $ | 2,500 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 250 | |

Net Asset Value and redemption price per share(a) | | $ | 10.00 | |

| Maximum Offering Price Per Share (Maximum Sales Charge of 1.50%) | | $ | 10.15 | |

| Class D | | | | |

| Net Assets | | $ | 2,500 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 250 | |

| Net Asset Value, offering and redemption price per share | | $ | 10.00 | |

(a) | Redemption price varies based on length of time held (Note 1). |

| See Notes to Financial Statements. | |

| 6 | www.resourcecreditincome.com |

| Resource Credit Income Fund | Statement of Operations |

| | For the Period Ended September 30, 2015(a) |

| INVESTMENT INCOME | | | |

| Dividends | | $ | 28 | |

| Total investment income | | | 28 | |

| | | | | |

| EXPENSES | | | | |

| Investment advisory fees (Note 3) | | | 1,773 | |

| Administrative fees (Note 3) | | | 59,816 | |

| Distribution fees (Note 3): | | | | |

| Class C | | | 8 | |

| Class T | | | 8 | |

| Shareholder servicing fees (Note 3): | | | | |

| Class A | | | 3 | |

| Class C | | | 3 | |

| Class W | | | 3 | |

| Class U | | | 3 | |

| Class T | | | 3 | |

| Class D | | | 3 | |

| Dealer manager fees (Note3): | | | | |

| Class W | | | 5 | |

| Class D | | | 5 | |

| Transfer agent fees (Note 3) | | | 37,866 | |

| Audit fees | | | 10,000 | |

| Legal fees | | | 9,490 | |

| Printing expense | | | 24,082 | |

| Registration fees | | | 160 | |

| Custody fees | | | 2,500 | |

| Trustee fees and expenses (Note 3) | | | 9,300 | |

| Offering costs | | | 235,250 | |

| Other expenses | | | 26,273 | |

| Total expenses | | | 416,554 | |

| Less fees waived/expenses reimbursed by investment adviser (Note 3) | | | (398,666 | ) |

| Less fees waived by administrator (Note 3) | | | (17,860 | ) |

| Total net expenses | | | 28 | |

| NET INVESTMENT INCOME | | | – | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | – | |

(a) | The Fund commenced operations on April 20, 2015. |

| See Notes to Financial Statements. | |

| Annual Report | September 30, 2015 | 7 |

| Resource Credit Income Fund | Statement of Changes in Net Assets |

| | | Period Ended | |

| | | September 30, 2015(a) | |

| OPERATIONS | | | |

| Net increase in net assets resulting from operations | | $ | – | |

| | | | | |

| CAPITAL SHARE TRANSACTIONS | | | | |

| Class A | | | | |

| Proceeds from sales of shares | | | 2,500 | |

| Net increase from capital shares transactions | | | 2,500 | |

| | | | | |

| Class C | | | | |

| Proceeds from sales of shares | | | 2,500 | |

| Net increase from capital shares transactions | | | 2,500 | |

| | | | | |

| Class W | | | | |

| Proceeds from sales of shares | | | 2,500 | |

| Net increase from capital shares transactions | | | 2,500 | |

| | | | | |

| Class I | | | | |

| Net increase from capital shares transactions | | | – | |

| | | | | |

| Class U | | | | |

| Proceeds from sales of shares | | | 2,500 | |

| Net increase from capital shares transactions | | | 2,500 | |

| | | | | |

| Class T | | | | |

| Proceeds from sales of shares | | | 2,500 | |

| Net increase from capital shares transactions | | | 2,500 | |

| | | | | |

| Class D | | | | |

| Proceeds from sales of shares | | | 2,500 | |

| Net increase from capital shares transactions | | | 2,500 | |

| | | | | |

| Net increase in net assets | | | 15,000 | |

| | | | | |

| NET ASSETS | | | | |

| Beginning of period | | | 200,000 | |

| End of period* | | $ | 215,000 | |

| | | | | |

| *Including accumulated net investment income of: | | $ | 18 | |

| See Notes to Financial Statements. | |

| 8 | www.resourcecreditincome.com |

| Resource Credit Income Fund | Statement of Changes in Net Assets |

| | | Period Ended September 30, 2015(a) | |

| OTHER INFORMATION | | | |

| Capital Shares Transactions | | | |

| Class A | | | |

| Issued | | | 250 | |

| Net increase in capital shares | | | 250 | |

| | | | | |

| Class C | | | | |

| Issued | | | 250 | |

| Net increase in capital shares | | | 250 | |

| | | | | |

| Class W | | | | |

| Issued | | | 250 | |

| Net increase in capital shares | | | 250 | |

| | | | | |

| Class I | | | | |

| Net increase in capital shares | | | – | |

| | | | | |

| Class U | | | | |

| Issued | | | 250 | |

| Net increase in capital shares | | | 250 | |

| | | | | |

| Class T | | | | |

| Issued | | | 250 | |

| Net increase in capital shares | | | 250 | |

| | | | | |

| Class D | | | | |

| Issued | | | 250 | |

| Net increase in capital shares | | | 250 | |

(a) | The Fund commenced operations on April 20, 2015. |

| See Notes to Financial Statements. | |

| Annual Report | September 30, 2015 | 9 |

| Resource Credit Income Fund – Class A | Financial Highlights |

For a Share Outstanding Throughout the Period Presented

| | | For the Period Ended September 30, 2015(a) | |

| NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 10.00 | |

| | | | | |

| INCOME FROM INVESTMENT OPERATIONS | | | | |

Net investment income(b) | | | – | |

| Total income from investment operations | | | – | |

| INCREASE IN NET ASSET VALUE | | | – | |

| NET ASSET VALUE, END OF PERIOD | | $ | 10.00 | |

| | | | | |

TOTAL RETURN(c) | | | – | % |

| | | | | |

| RATIOS AND SUPPLEMENTAL DATA | | | | |

| Net assets, end of period (in 000s) | | $ | 3 | |

| | | | | |

| RATIOS TO AVERAGE NET ASSETS | | | | |

| Expenses, gross | | | 472.13 | %(d) |

| Expenses, net of fees waived/expenses reimbursed by investment adviser and administrator | | | 0.02 | %(d) |

| Net investment income | | | 0.00 | %(d) |

| | | | | |

| PORTFOLIO TURNOVER RATE | | | 0 | %(e) |

| (a) | The Fund's Class A commenced operations on April 20, 2015. |

| (b) | Per share numbers have been calculated using the average shares method. |

| (c) | Total returns shown are historical in nature and assume changes in share price, reinvestment of dividends and capital gains distribution, if any. Had the Adviser not absorbed a portion of Fund expenses, total returns would have been lower. Total returns for periods less than one year are not annualized and does not reflect the impact of sales charges. |

See Notes to Financial Statements.

| 10 | www.resourcecreditincome.com |

| Resource Credit Income Fund – Class C | Financial Highlights |

For a Share Outstanding Throughout the Period Presented

| | | For the Period Ended September 30, 2015(a) | |

| NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 10.00 | |

| | | | | |

| INCOME FROM INVESTMENT OPERATIONS | | | | |

Net investment income(b) | | | – | |

| Total income from investment operations | | | – | |

| INCREASE IN NET ASSET VALUE | | | – | |

| NET ASSET VALUE, END OF PERIOD | | $ | 10.00 | |

| | | | | |

TOTAL RETURN(c) | | | – | % |

| | | | | |

| RATIOS AND SUPPLEMENTAL DATA | | | | |

| Net assets, end of period (in 000s) | | $ | 3 | |

| | | | | |

| RATIOS TO AVERAGE NET ASSETS | | | | |

| Expenses, gross | | | 473.06 | %(d) |

| Expenses, net of fees waived/expenses reimbursed by investment adviser and administrator | | | 0.02 | %(d) |

| Net investment income | | | 0.00 | %(d) |

| | | | | |

| PORTFOLIO TURNOVER RATE | | | 0 | %(e) |

| (a) | The Fund's Class C commenced operations on April 20, 2015. |

| (b) | Per share numbers have been calculated using the average shares method. |

| (c) | Total returns shown are historical in nature and assume changes in share price, reinvestment of dividends and capital gains distribution, if any. Had the Adviser not absorbed a portion of Fund expenses, total returns would have been lower. Total returns for periods less than one year are not annualized and does not reflect the impact of sales charges. |

See Notes to Financial Statements.

| Annual Report | September 30, 2015 | 11 |

| Resource Credit Income Fund – Class W | Financial Highlights |

For a Share Outstanding Throughout the Period Presented

| | | For the Period Ended September 30, 2015(a) | |

| NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 10.00 | |

| | | | | |

| INCOME FROM INVESTMENT OPERATIONS | | | | |

Net investment income(b) | | | – | |

| Total income from investment operations | | | – | |

| INCREASE IN NET ASSET VALUE | | | – | |

| NET ASSET VALUE, END OF PERIOD | | $ | 10.00 | |

| | | | | |

TOTAL RETURN(c) | | | – | % |

| | | | | |

| RATIOS AND SUPPLEMENTAL DATA | | | | |

| Net assets, end of period (in 000s) | | $ | 3 | |

| | | | | |

| RATIOS TO AVERAGE NET ASSETS | | | | |

| Expenses, gross | | | 472.69 | %(d) |

| Expenses, net of fees waived/expenses reimbursed by investment adviser and administrator | | | 0.04 | %(d) |

| Net investment income | | | 0.00 | %(d) |

| | | | | |

| PORTFOLIO TURNOVER RATE | | | 0 | %(e) |

| (a) | The Fund's Class W commenced operations on April 20, 2015. |

| (b) | Per share numbers have been calculated using the average shares method. |

| (c) | Total returns shown are historical in nature and assume changes in share price, reinvestment of dividends and capital gains distribution, if any. Had the Adviser not absorbed a portion of Fund expenses, total returns would have been lower. Total returns for periods less than one year are not annualized. |

See Notes to Financial Statements.

| 12 | www.resourcecreditincome.com |

| Resource Credit Income Fund – Class I | Financial Highlights |

For a Share Outstanding Throughout the Period Presented

| | | For the Period Ended September 30, 2015(a) | |

| NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 10.00 | |

| | | | | |

| INCOME FROM INVESTMENT OPERATIONS | | | | |

Net investment income(b) | | | – | |

| Total income from investment operations | | | – | |

| INCREASE IN NET ASSET VALUE | | | – | |

| NET ASSET VALUE, END OF PERIOD | | $ | 10.00 | |

| | | | | |

TOTAL RETURN(c) | | | – | % |

| | | | | |

| RATIOS AND SUPPLEMENTAL DATA | | | | |

| Net assets, end of period (in 000s) | | $ | 200 | |

| | | | | |

| RATIOS TO AVERAGE NET ASSETS | | | | |

| Expenses, gross | | | 430.52 | %(d) |

| Expenses, net of fees waived/expenses reimbursed by investment adviser and administrator | | | 0.03 | %(d) |

| Net investment income | | | 0.00 | %(d) |

| | | | | |

| PORTFOLIO TURNOVER RATE | | | 0 | %(e) |

| (a) | The Fund's Class I commenced operations on April 20, 2015. |

| (b) | Per share numbers have been calculated using the average shares method. |

| (c) | Total returns shown are historical in nature and assume changes in share price, reinvestment of dividends and capital gains distribution, if any. Had the Adviser not absorbed a portion of Fund expenses, total returns would have been lower. Total returns for periods less than one year are not annualized. |

See Notes to Financial Statements.

| Annual Report | September 30, 2015 | 13 |

| Resource Credit Income Fund – Class U | Financial Highlights |

For a Share Outstanding Throughout the Period Presented

| | | For the Period Ended September 30, 2015(a) | |

| NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 10.00 | |

| | | | | |

| INCOME FROM INVESTMENT OPERATIONS | | | | |

Net investment income(b) | | | – | |

| Total income from investment operations | | | – | |

| INCREASE IN NET ASSET VALUE | | | – | |

| NET ASSET VALUE, END OF PERIOD | | $ | 10.00 | |

| | | | | |

TOTAL RETURN(c) | | | – | % |

| | | | | |

| RATIOS AND SUPPLEMENTAL DATA | | | | |

| Net assets, end of period (in 000s) | | $ | 3 | |

| | | | | |

| RATIOS TO AVERAGE NET ASSETS | | | | |

| Expenses, gross | | | 472.13 | %(d) |

| Expenses, net of fees waived/expenses reimbursed by investment adviser and administrator | | | 0.02 | %(d) |

| Net investment income | | | 0.00 | %(d) |

| | | | | |

| PORTFOLIO TURNOVER RATE | | | 0 | %(e) |

| (a) | The Fund's Class U commenced operations on April 20, 2015. |

| (b) | Per share numbers have been calculated using the average shares method. |

| (c) | Total returns shown are historical in nature and assume changes in share price, reinvestment of dividends and capital gains distribution, if any. Had the Adviser not absorbed a portion of Fund expenses, total returns would have been lower. Total returns for periods less than one year are not annualized and does not reflect the impact of sales charges. |

See Notes to Financial Statements.

| 14 | www.resourcecreditincome.com |

| Resource Credit Income Fund – Class T | Financial Highlights |

For a Share Outstanding Throughout the Period Presented

| | | For the Period Ended September 30, 2015(a) | |

| NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 10.00 | |

| | | | | |

| INCOME FROM INVESTMENT OPERATIONS | | | | |

Net investment income(b) | | | – | |

| Total income from investment operations | | | – | |

| INCREASE IN NET ASSET VALUE | | | – | |

| NET ASSET VALUE, END OF PERIOD | | $ | 10.00 | |

| | | | | |

TOTAL RETURN(c) | | | – | % |

| | | | | |

| RATIOS AND SUPPLEMENTAL DATA | | | | |

| Net assets, end of period (in 000s) | | $ | 3 | |

| | | | | |

| RATIOS TO AVERAGE NET ASSETS | | | | |

| Expenses, gross | | | 473.06 | %(d) |

| Expenses, net of fees waived/expenses reimbursed by investment adviser and administrator | | | 0.02 | %(d) |

| Net investment income | | | 0.00 | %(d) |

| | | | | |

| PORTFOLIO TURNOVER RATE | | | 0 | %(e) |

| (a) | The Fund's Class T commenced operations on April 20, 2015. |

| (b) | Per share numbers have been calculated using the average shares method. |

| (c) | Total returns shown are historical in nature and assume changes in share price, reinvestment of dividends and capital gains distribution, if any. Had the Adviser not absorbed a portion of Fund expenses, total returns would have been lower. Total returns for periods less than one year are not annualized and does not reflect the impact of sales charges. |

See Notes to Financial Statements.

| Annual Report | September 30, 2015 | 15 |

| Resource Credit Income Fund – Class D | Financial Highlights |

For a Share Outstanding Throughout the Period Presented

| | | For the Period Ended September 30, 2015(a) | |

| NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 10.00 | |

| | | | | |

| INCOME FROM INVESTMENT OPERATIONS | | | | |

Net investment income(b) | | | – | |

| Total income from investment operations | | | – | |

| INCREASE IN NET ASSET VALUE | | | – | |

| NET ASSET VALUE, END OF PERIOD | | $ | 10.00 | |

| | | | | |

TOTAL RETURN(c) | | | – | % |

| | | | | |

| RATIOS AND SUPPLEMENTAL DATA | | | | |

| Net assets, end of period (in 000s) | | $ | 3 | |

| | | | | |

| RATIOS TO AVERAGE NET ASSETS | | | | |

| Expenses, gross | | | 472.70 | %(d) |

| Expenses, net of fees waived/expenses reimbursed by investment adviser and administrator | | | 0.02 | %(d) |

| Net investment income | | | 0.00 | %(d) |

| | | | | |

| PORTFOLIO TURNOVER RATE | | | 0 | %(e) |

| (a) | The Fund's Class D commenced operations on April 20, 2015. |

| (b) | Per share numbers have been calculated using the average shares method. |

| (c) | Total returns shown are historical in nature and assume changes in share price, reinvestment of dividends and capital gains distribution, if any. Had the Adviser not absorbed a portion of Fund expenses, total returns would have been lower. Total returns for periods less than one year are not annualized. |

See Notes to Financial Statements.

| 16 | www.resourcecreditincome.com |

| Resource Credit Income Fund | Notes to Financial Statements |

September 30, 2015

1. ORGANIZATION

Resource Credit Income Fund (the "Trust" or the "Fund") was organized as a Delaware statutory trust on December 11, 2014 and is registered under the Investment Company Act of 1940, as amended, (the "1940 Act"), as a non-diversified, closed-end management investment company that operates as an interval fund with a continuous offering of Fund shares. The Fund's investment adviser is Resource Financial Fund Management, Inc. (the "Adviser"). The investment objective is to produce current income with a secondary objective to achieve capital preservation with moderate volatility and low to moderate correlation to the broader equity markets. The Fund pursues its investment objectives by investing, under normal circumstances, at least 80% of its assets (defined as net assets plus the amount of any borrowing for investment purposes) in fixed-income and fixed-income related securities.

The Fund currently offers Class A, Class C, Class W, Class I, Class U, Class T and Class D shares; all classes of shares commenced operations on April 20, 2015. With the approval of the Board, effective September 30, 2015, the Fund's fiscal year end was changed from February 28 to September 30. Class W, Class I and Class D shares are offered at net asset value. Class A and Class U shares are offered at net asset value plus a maximum sales charge of 6.50% and may also be subject to a 0.50% early withdrawal charge, which will be deducted from repurchase proceeds, for shareholders tendering shares fewer than 365 days after the original purchase date, if (i) the original purchase was for amounts of $1 million or more and (ii) the selling broker received the reallowance of the dealer-manager fee. Class C and Class T shares are offered at net asset value plus a maximum sales charge of 1.50% and may also be subject to a 1.00% early withdrawal charge, which will be deducted from repurchase proceeds, for shareholders tendering shares fewer than 365 days after the original purchase date. Each class represents an interest in the same assets of the Fund and classes are identical except for differences in their sales charge structures and ongoing service and distribution charges. All classes of shares have equal voting privileges except that each class has exclusive voting rights with respect to its service and/or distribution plans. The Fund's income, expenses (other than class specific distribution fees) and realized and unrealized gains and losses are allocated proportionately each day based upon the relative net assets of each class.

2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies followed by the Fund in preparation of its financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America ("GAAP"). The Fund is considered an investment company for financial reporting purposes under GAAP. The preparation of financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses for the period. Actual results could differ from those estimates.

Security Valuation – Securities listed on an exchange are valued at the last reported sale price at the close of the regular trading session of the exchange on the business day the value is being determined, or in the case of securities listed on NASDAQ, at the NASDAQ Official Closing Price ("NOCP"). Short-term investments that mature in 60 days or less may be valued at amortized cost, provided such valuations represent fair value.

When price quotations for certain securities are not readily available, or if the available quotations are not believed to be reflective of market value by the Adviser, those securities will be valued at "fair value" as determined in good faith by the Valuation Committee using procedures adopted by and under the supervision of the Fund's Board of Trustees (the "Board"). There can be no assurance that the Fund could purchase or sell a portfolio security at the price used to calculate the Fund's net asset value ("NAV").

Fair valuation procedures may be used to value a substantial portion of the assets of the Fund. The Fund may use the fair value of a security to calculate its NAV when, for example, (1) a portfolio security is not traded in a public market or the principal market in which the security trades is closed, (2) trading in a portfolio security is suspended and not resumed prior to the normal market close, (3) a portfolio security is not traded in significant volume for a substantial period, or (4) the Adviser determines that the quotation or price for a portfolio security provided by a broker-dealer or independent pricing service is inaccurate.

The "fair value" of securities may be difficult to determine and thus judgment plays a greater role in the valuation process. The fair valuation methodology may include or consider the following guidelines, as appropriate: (1) evaluation of all relevant factors, including but not limited to, pricing history, current market level, supply and demand of the respective security; (2) comparison to the values and current pricing of securities that have comparable characteristics; (3) knowledge of historical market information with respect to the security; (4) other factors relevant to the security which would include, but not be limited to, duration, yield, fundamental analytical data, the Treasury yield curve and credit quality.

| Annual Report | September 30, 2015 | 17 |

| Resource Credit Income Fund | Notes to Financial Statements |

September 30, 2015

Fair Value Measurements – A three-tier hierarchy has been established to classify fair value measurements for disclosure purposes. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk. Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability that are developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity's own assumptions about the assumptions market participants would use in pricing the asset or liability that are developed based on the best information available. In accordance with the authoritative guidance on fair value measurements and disclosure under GAAP, the Fund discloses the fair value of its investments in a hierarchy that prioritizes the inputs to valuation techniques used to measure the fair value.

Various inputs are used in determining the value of the Fund's investments as of the reporting period end. These inputs are categorized in the following hierarchy under applicable financial accounting standards:

| Level 1 – | Unadjusted quoted prices in active markets for identical, unrestricted assets or liabilities that the Fund has the ability to access at the measurement date; |

| | |

| Level 2 – | Quoted prices which are not active, quoted prices for similar assets or liabilities in active markets or inputs other than quoted prices that are observable (either directly or indirectly) for substantially the full term of the asset or liability at the measurement date; and |

| | |

| Level 3 – | Significant unobservable prices or inputs (including the Fund's own assumptions in determining the fair value of investments) where there is little or no market activity for the asset or liability at the measurement date. |

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

An investment level within the fair value hierarchy is based on the lowest level input, individually or in the aggregate, that is significant to fair value measurement. The valuation techniques used by the Fund to measure fair value during the period ended September 30, 2015 maximized the use of observable inputs and minimized the use of unobservable inputs.

The inputs or methodologies used for valuing securities are not necessarily an indication of the risk or liquidity associated with investing in those securities. The following is a summary of the inputs used in valuing the Fund's investments as of September 30, 2015:

| Investments in Securities at Value | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Short Term Investments | | $ | 111,779 | | | $ | – | | | $ | – | | | $ | 111,779 | |

| TOTAL | | $ | 111,779 | | | $ | – | | | $ | – | | | $ | 111,779 | |

There were no transfers between Levels 1, 2 and 3 during the period ended September 30, 2015. It is the Fund's policy to recognize transfers between levels at the end of the reporting period.

Security Transactions and Investment Income – Investment security transactions are accounted for on a trade date basis. Cost is determined and gains and losses are based upon the specific identification method for both financial statement and federal income tax purposes. Dividend income is recorded on the ex-dividend date and interest income is recorded on the accrual basis. Purchase discounts and premiums on securities are accreted and amortized over the life of the respective securities.

Federal and Other Taxes – The Fund has qualified, except as described below, and intends to continue to qualify as a regulated investment company ("RIC") and to comply with the applicable provisions of the Internal Revenue Code of 1986, as amended (the "Code"), and to distribute substantially all of its taxable income to its shareholders. Therefore, no federal income or excise tax provisions are required.

As of September 30, 2015, the Fund did not qualify as a RIC under Subchapter M of the Code because it did not meet certain quarterly diversification tests. Accordingly, the Fund will file as a "C" corporation for the period ended September 30, 2015. As a "C" corporation, the Fund was subject to federal income taxes on any taxable income for that period. However, as there are currently no investments held, the Fund had no net investment income for the period and consequently did not incur any tax liability. The Fund expects to meet qualifications and plans to be taxed as a RIC in future periods. Therefore, no provision was made for federal income or excise taxes related to the period ended September 30, 2015.

| 18 | www.resourcecreditincome.com |

| Resource Credit Income Fund | Notes to Financial Statements |

September 30, 2015

The Fund evaluates tax positions taken (or expected to be taken) in the course of preparing the Fund's tax provisions to determine whether these positions meet a "more-likely-than-not" standard that, based on the technical merits, have a more than fifty percent likelihood of being sustained by a taxing authority upon examination. A tax position that meets the "more-likely-than-not" recognition threshold is measured to determine the amount of benefit to recognize in the financial statements.

As of and during the period ended September 30, 2015, the Fund did not have a liability for any unrecognized tax benefits. The Fund files U.S. federal, state and local tax returns as required. The Fund's tax returns are subject to examination by the relevant tax authorities until expiration of the applicable statute of limitations which is generally three years after the filing of the tax return for federal purposes and four years for most state returns. Tax returns for open years have incorporated no uncertain tax positions that require a provision for income taxes.

Foreign Currency – The accounting records of the Fund are maintained in U.S. dollars. Investment securities and other assets and liabilities denominated in a foreign currency and income receipts and expense payments are translated into U.S. dollars using the prevailing exchange rate at the London market close. Purchases and sales of securities are translated into U.S. dollars at the contractual currency rates established at the approximate time of the trade. Net realized gains and losses on foreign currency transactions represent net gains and losses from currency realized between the trade and settlement dates on securities transactions and the difference between income accrued versus income received. The effects of changes in foreign currency exchange rates on investments in securities are included with the net realized and unrealized gain or loss on investment securities.

Distributions to Shareholders – Distributions from investment income are declared and paid quarterly. Distributions from net realized capital gains, if any, are declared and paid annually and are recorded on the ex-dividend date. The character of income and gains to be distributed is determined in accordance with income tax regulations, which may differ from GAAP.

Offering Costs – Offering costs incurred by the Fund of $525,010 were treated as deferred charges until operations commenced and are being amortized over a 12-month period using the straight line method. Unamortized amounts are included in deferred offering costs in the Statement of Assets and Liabilities.

Indemnification – The Trust indemnifies its officers and Trustees for certain liabilities that may arise from the performance of their duties to the Trust. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties and which provide general indemnities. The Fund's maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on industry experience, the Trust expects the risk of loss due to these warranties and indemnities to be remote.

3. ADVISORY FEES AND OTHER RELATED PARTY TRANSACTIONS

Advisory Fees – Pursuant to an investment advisory agreement (the "Advisory Agreement"), investment advisory services are provided to the Fund by the Adviser. Under the terms of the Advisory Agreement, the Adviser receives a monthly base management fee calculated at an annual rate of 1.85% of the average daily net assets of the Fund. For the period ended September 30, 2015, the Fund incurred $1,773 in base management fees, all of which were waived.

The Adviser has contractually agreed to waive all or part of its management fees (excluding any incentive fee) and/or make payments to limit Fund expenses, (including all organization and offering expenses, but excluding interest, brokerage commissions, acquired fund fees and expenses and extraordinary expenses) at least until May 19, 2016, so that the total annual operating expenses of the Fund do not exceed 2.59% per annum of Class A average daily net assets, 3.34% per annum of Class C average daily net assets, 3.09% per annum of Class W average daily net assets, 2.34% per annum of Class I average daily net assets, 2.59% per annum of Class U and average daily net assets, 3.34% per annum of Class T average daily net assets and 3.09% per annum of Class D average daily net assets. Fee waivers and expense payments may be recouped by the Adviser from the Fund, to the extent that overall expenses fall below the expense limitation, within three years of when the amounts were waived or reimbursed. Effective September 30, 2015, in addition to the contractual expense limitation agreement that is in place, the Adviser also voluntarily agreed to waive/reimburse all net operating expenses of the Fund as of the September 30, 2015 fiscal year end.

| Annual Report | September 30, 2015 | 19 |

| Resource Credit Income Fund | Notes to Financial Statements |

September 30, 2015

As of September 30, 2015, the balance of recoupable expenses for the Fund was as follows:

| Fund | Expires February 20, 2018 | Expires September 30, 2018 |

| Resource Credit Income Fund | $36,870* | $398,666 |

| * | Organizational Expenses were reduced from $37,338 to $36,870 subsequent to the February 20, 2015 Seed Audit Financial Statements. |

The Adviser is also paid an incentive fee. The incentive fee is calculated and payable quarterly in arrears based upon the Fund's "pre-incentive fee net investment income" for the immediately preceding quarter and is subject to a hurdle rate, expressed as a rate of return on the Fund's "adjusted capital," equal to 2.25% per quarter (or an annualized hurdle rate of 9.0%), subject to a "catch-up" feature. For this purpose, "pre-incentive fee net investment income" means interest income, dividend income and any other income accrued during the calendar quarter, minus the Fund's operating expenses for the quarter (including the management fee, expenses reimbursed to the Adviser and any interest expenses and distributions paid on any issued and outstanding preferred shares, but excluding the incentive fee). "Adjusted capital" means the cumulative gross proceeds received by the Fund from the sale of shares (including pursuant to the Fund's distribution reinvestment plan), reduced by amounts paid in connection with purchases of shares pursuant to the Fund's share repurchase program.

No incentive fee is payable in any calendar quarter in which the Fund's pre-incentive fee net investment income does not exceed the quarterly hurdle rate of 2.25%. For any calendar quarter in which the Fund's pre-incentive fee net investment income is greater than the hurdle rate, but less than or equal to 2.8125%, the incentive fee will equal the amount of the Fund's pre-incentive fee net investment income in excess of the hurdle rate. This portion of the Fund's pre-incentive fee net investment income which exceeds the hurdle rate but is less than or equal to 2.8125% is referred to as the "catch-up." The "catch-up" provision is intended to provide the Adviser with an incentive fee of 20.0% on all of the Fund's pre-incentive fee net investment income when the Fund's pre-incentive fee net investment income reaches 2.8125% in any calendar quarter. For any calendar quarter in which the Fund's pre-incentive fee net investment income exceeds 2.8125% of adjusted capital, the incentive fee will equal 20.0% of pre-incentive fee net investment income. For the period ended September 30, 2015, there was no incentive fee incurred.

Fund Accounting Fees and Expenses – ALPS Fund Services, Inc. ("ALPS") serves as the Fund's administrator and accounting agent (the "Administrator") and receives customary fees from the Fund for such services. ALPS agreed to voluntarily waive a portion of its fee for the period ended September 30, 2015.

Transfer Agent – DST Systems Inc., an affiliate of ALPS, serves as transfer, dividend paying and shareholder servicing agent for the Fund ("Transfer Agent").

Distributor – The Fund has entered into a Distribution Agreement with ALPS Distributors, Inc. (the "Distributor") to provide distribution services to the Fund. There are no fees paid to the Distributor pursuant to the Distribution Agreement. The Board has adopted, on behalf of the Fund, a Shareholder Servicing Plan under which the Fund may compensate financial industry professionals for providing ongoing services in respect of clients with whom they have distributed shares of the Fund. Under the Shareholder Servicing Plan, the Fund's Class A, Class C, Class W, Class U, Class T and Class D shares are subject to a shareholder servicing fee at an annual rate of 0.25% of the average daily net assets attributable to that share class. For the period ended September 30, 2015, the Fund incurred shareholder servicing fees of $18. The Class C and Class T shares also pay to the Distributor a distribution fee, pursuant to a distribution plan adopted by the board, that accrues at an annual rate equal to 0.75% of the Fund's average daily net assets attributable to Class C and Class T shares and is payable on a quarterly basis. In addition Class W and Class D shares pay to Resource Securities, Inc. (the "Dealer Manager"), an affiliate of the Adviser, a dealer manager fee, pursuant to a distribution plan adopted by the board, that accrues at an annual rate equal to 0.50% of the Fund's average daily net assets attributable to Class W and Class D shares and is payable on a quarterly basis. Class A, Class I, and Class U shares are not currently subject to a distribution fee. For the period ended September 30, 2015, the Fund accrued $16 in distribution fees and $10 in dealer manager fees.

The Distributor acts as the Fund's principal underwriter in a continuous public offering of the Fund's shares. The Distributor is an affiliate of ALPS. During the period ended September 30, 2015, no fees were retained by the Distributor.

Trustees – Each Trustee who is not affiliated with the Trust or the Adviser will receive an annual fee of $10,000, plus $2,000 for attending the annual in-person meeting of the Board of Trustees, plus $500 for attending each of the remaining telephonic meetings, as well as reimbursement for any reasonable expenses incurred attending the meetings. None of the executive officers receives compensation from the Trust.

| 20 | www.resourcecreditincome.com |

| Resource Credit Income Fund | Notes to Financial Statements |

September 30, 2015

4. INVESTMENT TRANSACTIONS

The cost of purchases and proceeds from the sale of securities, other than short-term securities, for the period ended September 30, 2015 amounted to $0 and $0, respectively.

5. TAX BASIS INFORMATION

For the year ended September 30, 2015, the following reclassifications, which had no impact on results of operations or net assets, were recorded to reflect tax character.

| | | | | | | | | | |

| | | Paid-in Capital | | | Accumulated Net Investment Income | | | Accumulated Net Realized Loss on Investments | |

| Resource Credit Income Fund | | $ | (18 | ) | | $ | 18 | | | $ | – | |

The following information is computed on a tax basis for each item as of September 30, 2015:

| | | | | | | | | | | | | |

| | | Gross Appreciation (excess of value over tax cost) | | | Gross Depreciation (excess of tax cost over value) | | | Net Unrealized Appreciation | | | Cost of Investments for Income Tax Purposes | |

| Resource Credit Income Fund | | $ | – | | | $ | – | | | $ | – | | | $ | 111,779 | |

As of September 30, 2015, the components of accumulated earnings on a tax basis were as follows:

| Undistributed ordinary income | | $ | 18 | |

| Accumulated capital gains | | | – | |

| Net unrealized appreciation on investments | | | – | |

| Total distributable earnings | | $ | 18 | |

The Fund had no capital losses recognized during the period April 20, 2015 to September 30, 2015.

There were no distributions paid during the period ended September 30, 2015.

6. REPURCHASE OFFERS

Pursuant to Rule 23c-3 under the 1940 Act, the Fund offers shareholders on a quarterly basis the option of redeeming shares, at net asset value, of up to 5% of its issued and outstanding shares as of the close of regular business hours on the New York Stock Exchange on the Repurchase Pricing Date. If shareholders tender for repurchase more than 5% of the outstanding shares of the Fund, the Fund may, but is not required to, repurchase up to an additional 2%. If the Fund determines not to repurchase an additional 2%, or if more than 7% of the shares are tendered, then the Fund will repurchase shares on a pro rata basis based upon the number of shares tendered by each shareholder. There can be no assurance that the Fund will be able to repurchase all shares that each shareholder has tendered, even if all the shares in a shareholder's account are tendered. In the event of an oversubscribed offer, you may not be able to tender all shares that you wish to tender and may have to wait until the next quarterly repurchase offer to tender the remaining shares. Subsequent repurchase requests will not be given priority over other shareholder requests. During the period ended September 30, 2015, the Fund completed no quarterly repurchase offers because during that time, the Adviser was the sole shareholder of the Fund.

7. BENEFICIAL OWNERSHIP

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a fund creates a presumption of control of the fund, under Section 2(a)(9) of the 1940 Act. As of September 30, 2015, the Adviser was the sole shareholder of the Fund.

| Annual Report | September 30, 2015 | 21 |

| Resource Credit Income Fund | Notes to Financial Statements |

September 30, 2015

8. UNDERLYING INVESTMENT IN OTHER INVESTMENT COMPANIES

The Fund currently seeks to achieve its investment objectives by investing a portion of its assets in Dreyfus Treasury Cash Management, Institutional Class (the "Dreyfus Fund"), an open-end management investment company registered under the Investment Company Act of 1940, as amended. The Fund may redeem its investments from the Dreyfus Fund at any time if the Adviser determines that it is in the best interest of the Fund and its shareholders to do so. The latest financial statements for the Dreyfus Fund can be found at www.sec.gov.

The performance of the Fund may be directly affected by the performance of the Dreyfus Fund. As of September 30, 2015, the percentage of the Fund's net assets invested in the Dreyfus Fund was 51.99%.

9. SUBSEQUENT EVENTS

Subsequent events after the date of the Statement of Assets and Liabilities have been evaluated through the date the financial statements were issued.

Management has determined that there were no subsequent events to report through the issuance of these financial statements.

| 22 | www.resourcecreditincome.com |

| | Report of Independent Registered |

| Resource Credit Income Fund | Public Accounting Firm |

To the Board of Trustees and the Shareholders of

Resource Credit Income Fund

We have audited the accompanying statement of assets and liabilities of Resource Credit Income Fund (the "Fund"), including the portfolio of investments, as of September 30, 2015, and the related statements of operations and changes in net assets and the financial highlights for the period April 20, 2015 (commencement of operations) through September 30, 2015. These financial statements and financial highlights are the responsibility of the Fund's management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of September 30, 2015 by correspondence with the custodian. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Resource Credit Income Fund as of September 30, 2015, and the results of its operations, the changes in its net assets and its financial highlights the period April 20, 2015 through September 30, 2015, in conformity with accounting principles generally accepted in the United States of America.

BBD, LLP

Philadelphia, Pennsylvania

November 24, 2015

| Annual Report | September 30, 2015 | 23 |

| Resource Credit Income Fund | Additional Information |

September 30, 2015 (Unaudited)

1. PROXY VOTING POLICIES AND VOTING RECORD

A description of the policies and procedures that the Fund uses to vote proxies relating to portfolio securities is available without charge upon request by calling toll-free 855-747-9559, or on the Securities and Exchange Commission's ("SEC") website at http://www.sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30th is available without charge upon request by calling toll-free 855-747-9559, or on the SEC's website at http://www.sec.gov.

2. QUARTERLY PORTFOLIO HOLDINGS

The Fund files a complete listing of portfolio holdings for the Fund with the SEC as of the first and third quarters of each fiscal year on Form N-Q. The filings are available upon request by calling 855-747-9559. Furthermore, you may obtain a copy of the filing on the SEC's website at http://www.sec.gov. The Fund's Form N-Q may also be reviewed and copied at the SEC's Public Reference Room in Washington, D.C., and information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

| 24 | www.resourcecreditincome.com |

| Resource Credit Income Fund | Trustees & Officers |

September 30, 2015 (Unaudited)

The business and affairs of the Fund are managed under the direction of the Trustees. Information concerning the Trustees and officers of the Fund is set forth below. Generally, each Trustee and officer serves an indefinite term or until certain circumstances such as resignation, death or otherwise as specified in the Fund's organizational documents. Any Trustee may be removed at a meeting of shareholders by a vote meeting the requirements of the Fund's organization documents. The Statement of Additional Information of the Fund includes additional information about the Trustees and officers and is available, without charge, upon request by calling the Fund's toll‐free at 1‐855‐747‐9559. Refer to footnote 3 of the financial statements for additional information on Independent Trustee Compensation. The Interested Trustees and officers do not receive compensation from the Fund for their services to the Fund.

INDEPENDENT TRUSTEES

Name, Address

and Age* | | Position(s) Held

with the Fund** | | Principal Occupation

During the Past Five Years | | Number of

Portfolios

in Fund

Complex***

Overseen

by Trustee | | Other Directorships held

by Trustee During Last 5 Years |

Fred Berlinsky

Born in 1959 | | Trustee, Chairman of the Board | | Markeim‐Chalmers, Inc., President (since March 1986) | | 2 | | Resource Real Estate Diversified Income Fund (since November 13, 2012) |

Enrique Casanova

Born in 1973 | | Trustee | | Team Epic, Marketing Consultant (December 2003 to Present) | | 2 | | Independent Director, RCP Reserves Holdings Manager, Inc. (August 2006 to October 2012) Resource Real Estate Diversified Income Fund (since November 13, 2012) |

David Burns

Born in 1974 | | Trustee | | Ampure Capital, LLC, President (since June 2004) GT Securities, Registered Representative (since June 2010) Anthrotect, Acting CFO (since December 2012); Doorways, LTD (since January 2001) | | 2 | | Doorways, LTD (since January 2001) RCP Regents Center (since June 2006) Resource Real Estate Diversified Income Fund (since January 27, 2015) |

| Annual Report | September 30, 2015 | 25 |

| Resource Credit Income Fund | Trustees & Officers |

September 30, 2015 (Unaudited)

INTERESTED TRUSTEES AND OFFICERS

Name, Address

and Age* | | Position(s) Held

with the Fund** | | Principal Occupation

During the Past Five Years | | Number of

Portfolios

in Fund

Complex***

Overseen by Trustee | | Other Directorships held

by Trustee During Last 5 Years |

Jeffrey F. Brotman

Born in 1963 | | Trustee | | Resource America, Inc., Executive Vice President (since June 2007) Resource Capital Corp, Executive Vice President (since 2009) | | 2 | | Chairman of the Board of Directors of TRM Corporation (September 2006 to September 2008) Resource Real Estate, Inc. (since 2008) Resource Real Estate Diversified Income Fund (since November 13, 2012) |

Alan Feldman

Born in 1963 | | Trustee | | Resource Real Estate, Inc., Chief Executive Officer and director (since May 2004) Resource America, Inc., Senior Vice President (since August 2002) | | 2 | | Resource Real Estate, Inc. (since 2004) Resource Real Estate Diversified Income Fund (since November 13, 2012) |

Justin Milberg Born in 1966 | | President | | Resource Liquid Alternatives, Chief Operating Officer (since November 2014) Resource Financial Fund Management, Managing Director (since May 2012) Bank of America Merrill Lynch, Managing Director, (2005 to 2011) | | N/A | | N/A |

Steven Saltzman Born in 1963 | | Treasurer, Chief Financial and Accounting Officer and Senior Vice President | | Resource Real Estate, Inc., Chief Financial Officer (since January 2012) Resource Real Estate Diversified Income Fund, Treasurer and Senior Vice President (since November 13, 2012) | | N/A | | N/A |

Darshan Patel Born in 1970 | | Chief Compliance Officer, Secretary and Senior Vice President | | Resource Real Estate, Inc. (since October 2014) Chief Compliance Officer and Chief Legal Officer of Resource Financial Fund Management, Inc., an affiliate of Resource Real Estate, Inc. (since 2002) Chief Compliance Officer and President of Resource Securities, Inc., an affiliate of Resource Real Estate, Inc. (since 2004) Resource Real Estate Diversified Income Fund, Secretary and Senior Vice President (since October 14, 2014) | | N/A | | N/A |

| * | Unless otherwise noted, the address of each Trustee and Officer is c/o Resource Financial Fund Management, Inc., One Crescent Drive, Suite 203, Philadelphia, PA 19112. |

| ** | The term of office for each Trustee and officer listed above will continue indefinitely. |

| *** | The term "Fund Complex" refers to the Resource Credit Income Fund and the Resource Real Estate Diversified Income Fund. |

| 26 | www.resourcecreditincome.com |

| Resource Credit Income Fund | Privacy Notice |

(Unaudited)

| | | | | | | | Rev. 5/2015 |

| | | | |

| FACTS | | WHAT DOES RESOURCE CREDIT INCOME FUND DO WITH YOUR PERSONAL INFORMATION? |

| | | | | | | | |

| Why? | | Financial companies choose how they share your personal information. Federal law gives consumers the right to limit some but not all sharing. Federal law also requires us to tell you how we collect, share, and protect your personal information. Please read this notice carefully to understand what we do. |

| | | | | | | | |

| What? | | The types of personal information we collect and share depend on the product or service you have with us. This information can include: |

| | | | ▪ | Social Security number | ▪ | Purchase History | |

| | | | ▪ | Assets | ▪ | Account Balances | |

| | | | ▪ | Retirement Assets | ▪ | Account Transactions | |

| | | | ▪ | Transaction History | ▪ | Wire Transfer Instructions | |

| | | | ▪ | Checking Account Information | | | |

| | | When you are no longer our customer, we continue to share your information as described in this notice. |

| | | | | | | | |

| How? | | All financial companies need to share customers' personal information to run their everyday business. In the section below, we list the reasons financial companies can share their customers' personal information; the reasons Resource Credit Income Fund chooses to share; and whether you can limit this sharing. |

| Reasons we can share your personal information | | Does Resource Credit

Income Fund share? | | Can you limit this sharing? |

| | | | | |

| For our everyday business purposes – | | | | |

| such as to process your transactions, maintain your account(s), respond to court orders and legal investigations, or report to credit bureaus | | Yes | | No |

| | | | | |

| For our marketing purposes – | | | | |

| to offer our products and services to you | | No | | We don't share |

| | | | | |

| For joint marketing with other financial companies | | No | | We don't share |

| | | | | |

| For our affiliates' everyday business purposes – | | No | | We don't share |

| information about your transactions and experiences | | | | |

| | | | | |

| For our affiliates' everyday business purposes – | | No | | We don't share |

| information about your creditworthiness | | | | |

| | | | | |

| For nonaffiliates to market to you | | No | | We don't share |

| Questions? | | Call 1‐855‐747‐9559 |

| Annual Report | September 30, 2015 | 27 |

| Resource Credit Income Fund | Privacy Notice |

(Unaudited)

| Who we are | | | | |

| | | | | |

| Who is providing this notice? | | Resource Credit Income Fund |

| | | | | |

| What we do | | | | |

| | | | | |

| How does Resource Credit Income Fund protect my personal information? | | To protect your personal information from unauthorized access and use, we use security measures that comply with federal law. These measures include computer safeguards and secured files and buildings. |

| | | | |

| | | Our service providers are held accountable for adhering to strict policies and procedures to prevent any misuse of your nonpublic personal information. |

| | | | | |

| How does Resource Credit Income Fund collect my personal information? | | We collect your personal information, for example, when you |

| | | ▪ | Open an account |

| | | ▪ | Provide account information |

| | | ▪ | Give us your contact information |

| | | | ▪ | Make deposits or withdrawals from your account |

| | | | ▪ | Make a wire transfer |

| | | | ▪ | Tell us where to send the money |

| | | | ▪ | Tells us who receives the money |

| | | | ▪ | Show your government‐issued ID |

| | | | ▪ | Show your driver's license |

| | | We also collect your personal information from other companies. |

| | | | | |

| Why can't I limit all sharing? | | Federal law gives you the right to limit only |

| | | | ▪ | Sharing for affiliates' everyday business purposes – information about your creditworthiness |

| | | | ▪ | Affiliates from using your information to market to you |

| | | | ▪ | Sharing for nonaffiliates to market to you |

| | | | | |

| | | State laws and individual companies may give you additional rights to limit sharing. |

| Definitions | | | | |

| | | | | |

| Affiliates | | Companies related by common ownership or control. They can be financial and nonfinancial companies. |

| | | | ▪ | Resource Credit Income Fund does not share with our affiliates. |

| | | | | |

| Nonaffiliates | | Companies not related by common ownership or control. They can be financial and nonfinancial companies |

| | | | ▪ | Resource Credit Income Fund does not share with nonaffiliates so they can market to you. |

| | | | | |

| Joint marketing | | A formal agreement between nonaffiliated financial companies that together market financial products or services to you. |

| | | | ▪ | Resource Credit Income Fund doesn't jointly market. |

| 28 | www.resourcecreditincome.com |

| | |

| | INVESTMENT ADVISER |

| | Resource Financial Fund Management, Inc. |

| | One Crescent Drive, Suite 203 |

| | Philadelphia, Pennsylvania 19112 |

| | |

| | DISTRIBUTOR |

| | ALPS Distributors, Inc. |

| | 1290 Broadway, Suite 1100 |

| | Denver, Colorado 80203 |

| | |

| | LEGAL COUNSEL |

| | Thompson Hine LLP |

| | 41 South High Street, Suite 1700 |

| | Columbus, Ohio 43215 |

| | |

| | INDEPENDENT REGISTERED |

| | PUBLIC ACCOUNTING FIRM |

| | BBD, LLP |

| | 1835 Market Street, 26th Floor |

| | Philadelphia, Pennsylvania 19103 |

| | |

| | Must be accompanied or preceded by a Prospectus. |

| | ALPS Distributors, Inc. is the Distributor for Resource Credit Income Fund. |

Item 2. Code of Ethics.

| (a) | As of the end of the period covered by this report, the registrant has adopted a code of ethics that applies to the registrant's principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party. |

| (c) | During the period covered by this report, there have not been any amendments to the provisions of the code of ethics adopted in Item 2(a) of this report. |

| (d) | During the period covered by this report, the registrant had not granted any express or implicit waivers from the provisions of the code of ethics adopted in Item 2(a) of this report. |

| (f) | The registrant's Code of Ethics is attached as an Exhibit hereto. |

Item 3. Audit Committee Financial Expert.

(a)(1)(ii) The Board of Trustees of the registrant has determined that the registrant has at least one Audit Committee Financial Expert serving on its audit committee.

(a)(2) The Board of Trustees of the registrant has designated Mr. David M. Burns as the registrant's Audit Committee Financial Expert. Mr. Burns is "independent" as defined in paragraph (a)(2) of Item 3 to Form N-CSR.

Item 4. Principal Accountant Fees and Services.

| (a) | Audit Fees: For the registrant's fiscal period ended September 30, 2015, the aggregate fees billed for professional services rendered by the principal accountant for the audit of the registrant's annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements were $7,000. |

| (b) | Audit-Related Fees: For the registrant's fiscal period ended September 30, 2015, the aggregate fees billed for assurance and related services by the principal accountant that are reasonably related to the performance of the audit of the registrant's financial statements and are not otherwise reported under paragraph (a) of this Item 4, were $0. |

| (c) | Tax Fees: For the registrant's fiscal period ended September 30, 2015, the aggregate fees billed for professional services rendered by the principal accountant for tax compliance, tax advice and tax planning, which were comprised of the preparation of Federal and state income tax returns, assistance with calculation of required income, capital gain and excise distributions and preparation of Federal excise tax returns, were $3,000. |

| (d) | All Other Fees: For the registrant's fiscal period ended September 30, 2015, the aggregate fees billed for products and services provided by the principal accountant, other than the services reported in paragraphs (a) through (c) of this Item 4, were $0. |

| (e) (1) | The registrant's audit committee is required to pre-approve all audit services and, when appropriate, any non-audit services (including audit-related, tax and all other services) to the registrant. The registrant's audit committee also is required to pre-approve, when appropriate, any non-audit services (including audit-related, tax and all other services) to its adviser, or any entity controlling, controlled by or under common control with the adviser that provides ongoing services to the registrant, to the extent that the services may be determined to have an impact on the operations or financial reporting of the registrant. Services are reviewed on an engagement by engagement basis by the Audit Committee. |

| (2) | No services described in paragraphs (b) through (d) of this Item 4 were approved by the registrant's audit committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X. |

| (f) | During the audit of registrant's financial statements for the most recent fiscal year, less than 50 percent of the hours expended on the principal accountant's engagement were attributed to work performed by persons other than the principal accountant's full-time, permanent employees. |

| (g) | For the registrant's fiscal period ended September 30, 2015, the aggregate non-audit fees for services billed by the registrant's accountant for services rendered to the registrant and rendered to the registrant's investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser) and any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the registrant were $3,000. |

| (h) | The registrant's audit committee has considered whether the provision of non-audit services to the registrant's investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant, that were not pre-approved pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X, is compatible with maintaining the principal accountant's independence. |

Item 5. Audit Committee of Listed Registrants.

Not applicable to the registrant.

Item 6. Investments.

| (a) | The schedule of investments is included as part of the Reports to Shareholders filed under Item 1 of this report. |

| (b) | Not applicable to the registrant. |

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Pursuant to Rule 206(4)-6 and Rule 204-2 under the Advisers Act, it is a fraudulent, deceptive, or manipulative act, practice or course of business, within the meaning of Section 206(4) of the Advisers Act, for an investment adviser to exercise voting authority with respect to client securities, unless (i) the adviser has adopted and implemented written policies and procedures that are reasonably designed to ensure that the adviser votes proxies in the best interests of its clients, (ii) the adviser describes its proxy voting procedures to its clients and provides copies on request, and (iii) the adviser discloses to clients how they may obtain information on how the adviser voted their proxies.

The Adviser will vote proxies on behalf of its individual clients. In order to fulfill its responsibilities under the Advisers Act, the Adviser has adopted the following policies and procedures for proxy voting with regard to companies in the investment portfolio of the Fund(s).

Voting Proxies

| 1. | All proxies sent to clients that are actually received by the Adviser (to vote on behalf of the client) will be provided to the Operations Unit. |

| 2. | The Operations Unit will generally adhere to the following procedures (subject to limited exception): |

| (a) | A written record of each proxy received by the Adviser (on behalf of its clients) will be kept in the Adviser's files; |

| (b) | The Operations Unit will determine which client of the Adviser holds the security to which the proxy relates; |

(c) Prior to voting any proxies, the Operations Unit will determine if there are any conflicts of interest related to the proxy in question in accordance with the general guidelines set forth below. If a conflict is identified, the Operations Unit will then make a determination (which may be in consultation with outside legal counsel) as to whether the conflict is material;

(d) If no material conflict is identified pursuant to these procedures, the Operations Unit will vote the proxy in accordance with the guidelines set forth below. The Operations Unit will deliver the proxy in accordance with instructions related to such proxy in a timely and appropriate manner.

Conflicts of Interest

1. As stated above, in evaluating how to vote a proxy, the Operations Unit will first determine whether there is a conflict of interest related to the proxy in question between Adviser and its clients. This examination will include (but will not be limited to) an evaluation of whether the Adviser (or any affiliate of the Adviser) has any relationship with the company (or an affiliate of the company) to which the proxy relates outside of an investment in such company by a client of the Adviser.

2. If a conflict is identified and deemed "material" by the Operations Unit, the Adviser will determine whether voting in accordance with the proxy voting guidelines outlined below is in the best interests of the client (which may include utilizing an independent third party to vote such proxies).

3. With respect to material conflicts, the Adviser will determine whether it is appropriate to disclose the conflict to affected clients and give such clients the opportunity to vote the proxies in question themselves. However, with respect to ERISA clients whose advisory contract reserves the right to vote proxies when the Adviser has determined that a material conflict exists that affects its best judgment as a fiduciary to the ERISA client, the Adviser will:

| (a) | Give the ERISA client the opportunity to vote the proxies in question themselves; or |

(b) Follow designated special proxy voting procedures related to voting proxies pursuant to the terms of the investment management agreement with such ERISA clients (if any).

Proxy Voting Guidelines

To be determined by the Adviser.

Disclosure of Procedures

A summary of the above proxy voting procedures will be included in Part II of the Adviser's Form ADV and will be updated whenever these policies and procedures are updated. Clients will be provided with contact information as to how they can obtain information about: (a) the Adviser's proxy voting procedures (i.e., a copy of these procedures); and (b) how the Adviser voted proxies that are relevant to the affected client.

Record-keeping Requirements

The Operations Unit will be responsible for maintaining files relating to the Adviser's proxy voting procedures. Records will be maintained and preserved for five years from the end of the fiscal year during which the last entry was made on record, with records for the first two years kept in the offices of the Adviser. Records of the following will be included in the files:

1. Copies of these proxy voting policies and procedures, and any amendments thereto;

2. A copy of each proxy statement that the Adviser actually received; provided, however, that the Adviser may rely on obtaining a copy of proxy statements from the SEC's EDGAR system for those proxy statements that are so available;

3. A record of each vote that the Adviser casts;

4. A copy of any document that the Adviser created that was material to making a decision how to vote the proxies, or memorializes that decision (if any); and

5. A copy of each written request for information on how the Adviser voted such client's proxies and a copy of any written response to any request for information on how the Adviser voted proxies on behalf of clients.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.