UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

811-23016

(Investment Company Act file number)

Resource Credit Income Fund

(Exact name of Registrant as specified in charter)

717 Fifth Avenue, 14th Floor

New York, NY 10022

(Address of principal executive offices) (Zip code)

The Corporation Trust Company

Corporation Trust Center, 1209 Orange Street

Wilmington, DE 19801

(Name and address of agent for service)

Registrant's telephone number, including area code: (212) 506-3899

Date of fiscal year end: September 30

Date of reporting period: October 1, 2017– September 30, 2018

Item 1. Reports to Stockholders.

| Shareholder Letter | 1 |

| Portfolio Update | 3 |

| Portfolio of Investments | 5 |

| Statement of Assets and Liabilities | 9 |

| Statement of Operations | 10 |

| Statements of Changes in Net Assets | 11 |

| Financial Highlights | |

| Class A | 14 |

| Class C | 15 |

| Class W | 16 |

| Class I | 17 |

| Class L | 18 |

| Notes to Financial Statements | 19 |

| Report of Independent Registered Public Accounting Firm | 27 |

| Additional Information | 28 |

| Trustees & Officers | 29 |

| Privacy Notice | 32 |

| Resource Credit Income Fund | Shareholder Letter |

| | September 30, 2018 (Unaudited) |

Dear Shareholders:

It is our pleasure to present the Resource Credit Income Fund (the “Fund”) Annual Report for the fiscal year ended September 30, 2018. Our track record shows that we continue to deliver on our core objectives of producing current income and achieving capital preservation, with moderate volatility and low to moderate correlation to the broader equity markets.

In pursuing a wide array of investments, we aim to provide our investors with diverse exposure to the credit markets as we seek attractive investments across a broad universe. The Fund’s core assets include Public Credit (primarily business development companies, commonly known as “BDCs”); Private Credit (institutional-access private credit funds); and Direct Credit (comprised of loans, bonds and CLO debt).

The Fund’s current target allocations within these strategies are as follows:

We made a tactical shift in the portfolio since our semi-annual report shareholder letter dated March 31, 2018. At the end of 2017, we had reduced our target allocation to Public Credit from 20% to 15% due to BDCs’ negative contribution to the Fund’s volatility. However, in order to capitalize on anticipated regulatory changes, we are currently overweight Public Credit at approximately 20%.

In early 2018, Congress passed legislation that permits BDCs to increase their statutory leverage from 1.0x Debt-to-Equity to 2.0x Debt-to-Equity. This modest increase in leverage should, in our view, boost the Return on Equity achieved by BDCs and ultimately benefit shareholders.

There are also indications that the U.S. Securities and Exchange Commission may reverse the treatment of Acquired Fund Fees and Expenses (“AFFE”) for BDCs in the coming months. Doing so may prompt influential market indices (such as the Russell 2000) to start including BDCs amongst their constituents, which we believe would attract new buyers and enhance valuations.

Separately, we continue to assemble a group of world-class managers within our Private Credit portfolio. With our recent allocation to an opportunistic strategy managed by GSO (Blackstone), the Fund now has Private Credit investments managed by five different investment managers and one unfunded commitment to a sixth investment manager. We continue to place a high strategic value on the diversification, total return potential and idiosyncratic credit exposure these Private Credit investments provide to our investors.

Informing each of the investments in the portfolio, the Fund continues to adhere to, and refine, its proprietary investment process - the Resource America Liquid Alternatives Score (“RALAS”). The disciplined and regimented approach embodied by RALAS helps inform each of our investment decisions and limits systematic biases in our decision-making.

Fund Performance

Over the twelve-month period ended September 30, 2018, the Fund’s class A shares continued to outpace fixed income benchmarks, posting a gain of 6.19%. By way of comparison, the S&P/LSTA Leveraged Loan Total Return Index1 and the ICE of BAML US High Yield Index2 posted total returns of 5.19% and 2.90%, respectively, over that same period. The Barclay’s U.S. Aggregate Bond Index,3 perhaps the most widely cited fixed income benchmark, declined 1.22% over that same period. Direct Credit contributed most meaningfully to the Fund’s performance during the period.

Positioning

On the domestic front, with the economy continuing to expand and unemployment plummeting to new lows, we see little in the data that would divert the Federal Reserve’s (the “Fed”) rate hike trajectory. We anticipate several additional increases in the Fed rate through the end of 2019. While a disorderly market event may prompt the Fed to pause, we do not believe that modest increases in market volatility would derail this path to normalization.

On the international front, the European Central Bank announced that it would finally conclude its Quantitative Easing program at the end of 2018. Japan has also reduced its buying activities in recent months. We believe this pullback in liquidity will add incremental pressure on global interest rates.

Although we believe our overweight orientation towards floating rate credit remains appropriate, we would emphasize that the Fund is not expressly a floating rate fund. By mandate, the Fund will look to deploy its capital appropriately throughout the ever-changing interest rate

| Annual Report | September 30, 2018 | 1 |

| Resource Credit Income Fund | Shareholder Letter |

| September 30, 2018 (Unaudited) |

environment. As such, the Fund will tilt the portfolio back toward fixed rate investments when we believe we have reached the height of the current rate hike cycle.

Regardless of the macro backdrop, the Fund’s strategy nevertheless remains unchanged: seek to deliver high income and diverse fixed income exposure within the corporate loan and bond market to our investors. The interval fund structure and proprietary analytical process enables the Resource Credit Income Fund to function as a value buyer within the credit markets. We feel that the Fund’s track record demonstrates our ability to deliver on this principle.

Thank you for being a shareholder of Resource Credit Income Fund.

Sincerely,

Michael Terwilliger, CFA

Portfolio Manager

Resource Credit Income Fund

| 1 | S&P/LSTA Leveraged Loan Total Return Index - The S&P/LSTA Leveraged Loan Index (the Index) is a market value-weighted index designed to measure the performance of the U.S. leveraged loan market based upon market weightings, spreads and interest payments. |

| 2 | ICE BofAML US High Yield Index - The BofAML US High Yield Index tracks the performance of US dollar denominated below investment grade corporate debt publicly issued in the US domestic market. |

| 3 | Barclays U.S. Aggregate Total Return Value Index - The Barclays U.S. Aggregate Total Return Value Index is a broad-based flagship benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS and CMBS (agency and non-agency). |

| Resource Credit Income Fund | Portfolio Update |

| September 30, 2018 (Unaudited) |

The Fund’s performance figures for the period ended September 30, 2018, compared to its benchmark:

| Resource Credit Income Fund | 1 Month | Quarter | 6 Month | YTD | 1 Year | 3 Year | Since Inception* | Inception |

| Class A Shares | 0.22% | 1.94% | 3.93% | 4.91% | 6.09% | 9.28% | 8.01% | 4/17/2015 |

| Class A Shares w/ Sales Charge | -5.58% | -3.88% | -2.03% | -1.15% | -0.01% | 6.84% | 5.91% | 4/17/2015 |

| Class C Shares | 0.22% | 1.75% | 3.62% | 4.41% | 5.39% | 9.01% | 7.78% | 4/17/2015 |

| Class C Shares w/ Sales Charge(a) | -2.23% | -0.76% | 1.08% | 1.86% | 2.84% | 8.47% | 7.31% | 4/17/2015 |

| Class I Shares | 0.38% | 2.01% | 4.16% | 5.21% | 6.46% | 9.56% | 8.25% | 4/17/2015 |

| Class L Shares | 0.25% | 1.88% | 3.89% | 4.81% | 5.92% | – | 5.80% | 7/28/2017 |

| Class L Shares w/ Sales Charge | -4.03% | -2.45% | -0.54% | 0.37% | 1.45% | – | 1.94% | 7/28/2017 |

| Class W Shares | 0.31% | 1.94% | 4.02% | 4.91% | 6.19% | 9.14% | 7.89% | 4/17/2015 |

| S&P/LSTA Leverage Loan Index | 0.69% | 1.84% | 2.55% | 4.03% | 5.19% | 5.32% | 4.21% | 4/17/2015 |

| (a) | Effective as of December 23, 2016, Class C shares no longer have a sales charge. |

The S&P/LSTA Leveraged Loan Index is a market value-weighted index designed to measure the performance of the U.S. leveraged loan market based upon market weightings, spreads and interest payments.

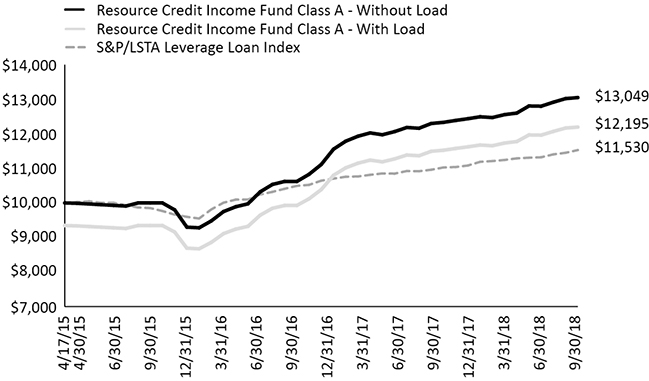

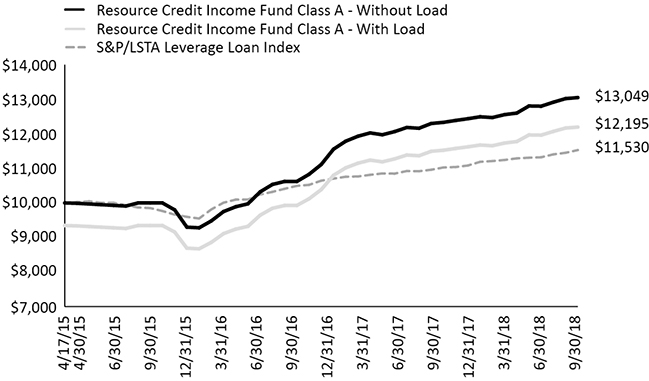

Past performance is not indicative of future results. The investment return and principal value of an investment will fluctuate. An investor’s shares when redeemed, may be worth more or less than the original cost. Total return is calculated assuming reinvestment of all dividends and distributions. Performance figures for periods less than one year are not annualized. The Fund’s total annual operating expenses, including acquired fund fees and expenses, before fee waivers is 6.25% for Class A, 6.63% for Class C, 5.70% for Class W, 5.80% for Class I and 5.74% for Class L shares per the most recent Class specific prospectus filings. After fee waivers, the Fund’s total annual operating expense is 3.94% for Class A, 4.69% for Class C, 3.94% for Class W, 3.69% for Class I and 4.19% for Class L shares. Class A shares are subject to maximum sales loads of 5.75% imposed on purchases. Class L shares are subject to a maximum sales load of 4.25% imposed on purchases. Share repurchases within 365 days may be subject to an early withdrawal charge of 0.50% for Class A and 1.00% for Class C shares. For performance information current to the most recent month-end, please call toll-free 1-855-747-9559.

| Annual Report | September 30, 2018 | 3 |

| Resource Credit Income Fund | Portfolio Update |

| September 30, 2018 (Unaudited) |

Comparison of the Change in Value of a $10,000 Investment

Portfolio Composition as of September 30, 2018

| Asset Type | Percent of Net Assets |

| Bonds & Notes | 28.87% |

| Bank Loans | 25.64% |

| Private Investment Funds | 21.59% |

| Common Equity | 17.22% |

| Preferred Stocks | 2.63% |

| Real Estate Investment Trusts – Common Stocks | 0.81% |

| Short Term Investment | 0.16% |

| Total Investments | 96.92% |

| Other Assets in Excess of Liabilities | 3.08% |

| Net Assets | 100.00% |

| Resource Credit Income Fund | Portfolio of Investments |

| September 30, 2018 |

| | | Interest/Dividend Rate | | Maturity | | Principal | | | Value | |

| BANK LOANS (25.64%) | | | | | | | | | | | | |

| 8th Avenue Food & Provisions, Inc., Second Lien Term Loan(a)(b) | | L + 7.75% | | 09/21/2026 | | $ | 500,000 | | | $ | 505,000 | |

| ABG Intermediate Holdings 2 LLC, Second Lien Initial Term Loan(a) | | 1M US L + 7.75%, 1% Floor | | 09/29/2025 | | | 2,130,000 | | | | 2,148,638 | |

| Advantage Sales & Marketing, Inc., Second Lien Term Loan(a) | | 1M US L + 6.50%, 1% Floor | | 07/25/2022 | | | 2,425,000 | | | | 2,052,156 | |

| Asurion LLC, Second Lien Replacement B-2 Term Loan(a) | | 1M US L + 6.50% | | 08/04/2025 | | | 5,000,000 | | | | 5,148,450 | |

| Ball Metalpack Finco LLC, Second Lien Initial Term Loan(a) | | 1M US L + 8.75%, 1% Floor | | 07/31/2026 | | | 3,000,000 | | | | 2,966,250 | |

| BBB Industries US Holdings, Inc., Second Lien Term Loan(a) | | 3M US L + 8.50% | | 06/29/2026 | | | 3,000,000 | | | | 2,999,999 | |

| CIBT Global, Inc., Second Lien Initial Term Loan(a) | | 3M US L + 7.75%, 1% Floor | | 06/01/2025 | | | 1,000,000 | | | | 1,000,000 | |

| Equinox Holdings, Inc., Second Lien Initial Term Loan(a) | | 1M US L + 7.00%, 1% Floor | | 09/06/2024 | | | 1,250,000 | | | | 1,283,206 | |

| Institutional Shareholder Services, Inc., Second Lien Initial Term Loan(a) | | 3M US L + 7.75%, 1% Floor | | 10/16/2025 | | | 2,000,000 | | | | 2,020,000 | |

| Jo-Ann Stores LLC, Second Lien Initial Term Loan(a) | | 1M US L + 9.25%, 1% Floor | | 05/21/2024 | | | 2,000,000 | | | | 1,981,250 | |

| KeyW Corp., Second Lien Initial Term Loan(a) | | 1M US L + 8.75%, 1% Floor | | 05/08/2025 | | | 3,000,000 | | | | 2,990,625 | |

| MedPlast Holdings, Inc., Second Lien Initial Term Loan(a) | | 3M US L + 7.75% | | 07/02/2026 | | | 2,000,000 | | | | 2,035,000 | |

| OEConnection LLC, Second Lien Term Loan(a) | | 1M US L + 8.00%, 1% Floor | | 11/22/2025 | | | 1,492,574 | | | | 1,492,574 | |

| Paradigm Acquisition Corp., Second Lien Initial Term Loan(a) | | 3M US L + 8.50%, 1% Floor | | 10/10/2025 | | | 2,000,000 | | | | 2,030,000 | |

| Paradigm Acquisition Corp., First Lien Initial Term Loan(a) | | 3M US L + 4.25%, 1% Floor | | 10/11/2024 | | | 992,500 | | | | 994,981 | |

| Restaurant Technologies, Inc., Second Lien Term Loan(a)(b) | | L + 6.50% | | 09/24/2026 | | | 1,000,000 | | | | 1,011,875 | |

| Sound Inpatient Physicians, Inc., Second Lien Initial Term Loan(a) | | 1M US L + 6.75% | | 06/26/2026 | | | 1,000,000 | | | | 1,006,250 | |

| UFC Holdings LLC, Second Lien Term Loan(a) | | 1M US L + 7.50%, 1% Floor | | 08/18/2024 | | | 250,000 | | | | 253,360 | |

| USS Ultimate Holdings, Inc., Second Lien Initial Term Loan(a) | | 1M US L + 7.75%, 1% Floor | | 08/25/2025 | | | 4,750,000 | | | | 4,773,750 | |

| VIP Cinema Holdings, Inc., First Lien Initial Term Loan(a) | | 3M US L + 6.00%, 1% Floor | | 03/01/2023 | | | 693,750 | | | | 698,520 | |

| WASH Multifamily Laundry Systems LLC, Second Lien Initial US Term Loan(a) | | 1M US L + 7.00%, 1% Floor | | 05/15/2023 | | | 1,123,389 | | | | 1,106,538 | |

| WASH Multifamily Laundry Systems LLC, Second Lien Initial Canadian Term Loan(a) | | 1M US L + 7.00%, 1% Floor | | 05/12/2023 | | | 196,756 | | | | 193,805 | |

| Winebow Group LLC, Second Lien Term Loan(a) | | 1M US L + 7.50%, 1% Floor | | 01/02/2022 | | | 4,275,000 | | | | 3,184,875 | |

| | | | | | | | | | | | | |

| TOTAL BANK LOANS | | | | | | | | | | |

| (Cost $44,231,202) | | | | | | | | | | | 43,877,102 | |

| | | | | | | | | | | | | |

| BONDS & NOTES (28.87%) | | | | | | | | | | | | |

| ASSET BACKED SECURITIES (9.96%) | | | | | | | | | | | | |

| Apidos CLO XXII, Class E(a)(c) | | 3M US L + 7.25% | | 10/20/2027 | | | 1,000,000 | | | | 1,000,221 | |

| Bowman Park CLO, Ltd., Class F(a)(c)(d) | | 3M US L + 7.00% | | 11/23/2025 | | | 1,000,000 | | | | 1,002,823 | |

| Canyon Capital CLO 2014-1, Ltd., Class ER(a)(c) | | 3M US L + 7.70% | | 01/30/2031 | | | 1,000,000 | | | | 962,104 | |

| Dryden 37 Senior Loan Fund, Class FR(a)(c) | | 3M US L + 7.48% | | 01/15/2031 | | | 2,312,500 | | | | 2,236,483 | |

| Jamestown CLO V, Ltd., Class F(a)(c)(d) | | 3M US L + 5.85% | | 01/17/2027 | | | 1,400,000 | | | | 1,260,634 | |

| OCP CLO 2013-4, Ltd., Class DR(a)(c)(d) | | 3M US L + 6.77% | | 04/24/2029 | | | 1,000,000 | | | | 1,009,823 | |

| Octagon Investment Partners 36, Ltd., Class F(a)(c) | | 3M US L + 7.75% | | 04/15/2031 | | | 1,000,000 | | | | 987,500 | |

| Octagon Investment Partners XIV, Ltd., Class ER(a)(c)(d) | | 3M US L + 8.35% | | 07/15/2029 | | | 2,132,000 | | | | 2,135,189 | |

| Saranac Clo VII, Ltd., Class ER(a)(c) | | 3M US L + 6.72% | | 11/20/2029 | | | 500,000 | | | | 504,086 | |

| Tralee CLO II, Ltd., Class ER(a)(c)(d) | | 3M US L + 7.85% | | 07/20/2029 | | | 1,000,000 | | | | 1,014,155 | |

| Tralee CLO II, Ltd., Class FR(a)(c)(d) | | 3M US L + 8.85% | | 07/20/2029 | | | 1,000,000 | | | | 968,130 | |

| Trinitas CLO III, Ltd., Class F(a)(c)(d) | | 3M US L + 6.50% | | 07/15/2027 | | | 550,000 | | | | 530,427 | |

| Venture XV CLO, Ltd., Class ER(a)(c)(d) | | 3M US L + 7.11% | | 07/15/2028 | | | 1,500,000 | | | | 1,501,198 | |

| Voya CLO 2014-2, Ltd., Class ER(a)(c) | | 3M US L + 7.70% | | 04/17/2030 | | | 1,000,000 | | | | 981,123 | |

| York CLO-2, Ltd., Class F(a)(c) | | 3M US L + 7.25% | | 01/22/2031 | | | 1,000,000 | | | | 952,885 | |

| | | | | | | | | | | | 17,046,781 | |

| COMMERCIAL MORTGAGE-BACKED SECURITIES (0.07%) | | | | | | | | | | | | |

| Hypo Real Estate Bank International AG, Class A2(a)(e)(f) | | 3M GBP L + 0.22% | | 03/20/2022 | | | 200,000 | | | | 117,306 | |

| See Notes to Financial Statements. |

| Annual Report | September 30, 2018 | | 5 |

| Resource Credit Income Fund | Portfolio of Investments |

| September 30, 2018 |

| | | Interest/Dividend Rate | | | Maturity | | Principal | | | Value | |

| CONVERTIBLE CORPORATE BOND (2.21%) | | | | | | | | | | | | | | |

| GSV Capital Corp.(d) | | | 4.750% | | | 03/28/2023 | | $ | 3,915,000 | | | $ | 3,773,414 | |

| KeyW Holding Corp. | | | 2.500% | | | 07/15/2019 | | | 5,000 | | | | 5,002 | |

| | | | | | | | | | | | | | 3,778,416 | |

| CORPORATE BONDS (16.63%) | | | | | | | | | | | | | | |

| APX Group, Inc.(d) | | | 8.750% | | | 12/01/2020 | | | 300,000 | | | | 300,750 | |

| Artesyn Embedded Technologies, Inc.(c)(d) | | | 9.750% | | | 10/15/2020 | | | 4,500,000 | | | | 4,297,500 | |

| Blueline Rental Corp.(c)(d) | | | 9.250% | | | 03/15/2024 | | | 2,000,000 | | | | 2,103,750 | |

| CEC Entertainment, Inc. | | | 8.000% | | | 02/15/2022 | | | 5,174,000 | | | | 4,708,340 | |

| Dole Food Co., Inc.(c)(d) | | | 7.250% | | | 06/15/2025 | | | 4,000,000 | | | | 3,920,000 | |

| Eldorado Gold Corp.(c)(d) | | | 6.125% | | | 12/15/2020 | | | 2,000,000 | | | | 1,905,000 | |

| Monitronics International, Inc.(d) | | | 9.125% | | | 04/01/2020 | | | 2,650,000 | | | | 2,014,000 | |

| New Enterprise Stone & Lime Co., Inc.(c)(d) | | | 10.125% | | | 04/01/2022 | | | 500,000 | | | | 537,813 | |

| New Enterprise Stone & Lime Co., Inc.(c)(d) | | | 6.250% | | | 03/15/2026 | | | 1,475,000 | | | | 1,489,750 | |

| Pioneer Holdings LLC / Pioneer Finance Corp.(c)(d) | | | 9.000% | | | 11/01/2022 | | | 5,250,000 | | | | 5,433,750 | |

| Titan Acquisition, Ltd. / Titan Co.-Borrower LLC(c) | | | 7.750% | | | 04/15/2026 | | | 2,000,000 | | | | 1,740,000 | |

| | | | | | | | | | | | | | 28,450,653 | |

| TOTAL BONDS & NOTES | | | | | | | | | | | | | | |

| (Cost $49,586,228) | | | | | | | | | | | | | 49,393,156 | |

| | | | | | | | Shares | | | Value | |

| COMMON EQUITY (17.22%) | | | | | | | | | | | | | | |

| BUSINESS DEVELOPMENT COMPANIES (15.55%) | | | | | | | | | | | | | | |

| Ares Capital Corp.(d) | | | | | | | | | 405,825 | | | | 6,976,132 | |

| BlackRock Capital Investment Corp.(d) | | | | | | | | | 510,071 | | | | 3,009,419 | |

| Monroe Capital Corp.(d) | | | | | | | | | 80,000 | | | | 1,085,600 | |

| OFS Capital Corp.(d) | | | | | | | | | 84,510 | | | | 1,005,669 | |

| PennantPark Floating Rate Capital Ltd.(d) | | | | | | | | | 164,748 | | | | 2,166,436 | |

| PennantPark Investment Corp.(d) | | | | | | | | | 324,149 | | | | 2,418,152 | |

| Solar Capital Ltd.(d) | | | | | | | | | 180,197 | | | | 3,852,612 | |

| Solar Senior Capital Ltd.(d) | | | | | | | | | 113,034 | | | | 1,888,798 | |

| WhiteHorse Finance, Inc.(d) | | | | | | | | | 301,636 | | | | 4,192,740 | |

| | | | | | | | | | | | | | 26,595,558 | |

| INVESTMENT COMPANIES (1.67%) | | | | | | | | | | | | | | |

| Apollo Investment Corp.(d) | | | | | | | | | 270,000 | | | | 1,468,800 | |

| Corporate Capital Trust, Inc.(d) | | | | | | | | | 36,171 | | | | 551,969 | |

| TriplePoint Venture Growth BDC Corp. | | | | | | | | | 62,000 | | | | 842,580 | |

| | | | | | | | | | | | | | 2,863,349 | |

| TOTAL COMMON EQUITY | | | | | | | | | | | | | | |

| (Cost $29,094,951) | | | | | | | | | | | | | 29,458,907 | |

| | | | | | | | | | | | | | | |

| PREFERRED STOCKS (2.63%) | | | | | | | | | | | | | | |

| DIVERSIFIED FINANCIAL SERVICES (2.63%) | | | | | | | | | | | | | | |

| RoundPoint Mortgage Servicing Corp.(c)(e)(g) | | | 8.000% | | | | | | 45,000 | | | | 4,500,000 | |

| | | | | | | | | | | | | | | |

| TOTAL PREFERRED STOCKS | | | | | | | | | | | | | | |

| (Cost $4,500,000) | | | | | | | | | | | | | 4,500,000 | |

| | | | | | | | | | | | | | | |

| PRIVATE INVESTMENT FUNDS (21.59%) | | | | | | | | | | | | | | |

| BlackRock Global Credit Opportunities Fund, LP(e)(f) | | | | | | | | | | | | | 3,979,996 | |

| CVC European Midmarket Solutions Fund(e)(f) | | | | | | | | | | | | | 9,200,893 | |

| GoldenTree Credit Opportunities Fund(e)(f) | | | | | | | | | | | | | 9,842,526 | |

| GSO Credit Alpha Fund II LP(e)(f) | | | | | | | | | | | | | 546,509 | |

| See Notes to Financial Statements. | |

| 6 | www.resourcealts.com |

| Resource Credit Income Fund | Portfolio of Investments |

| September 30, 2018 |

| | | Shares | | | Value | |

| PRIVATE INVESTMENT FUNDS (21.59%) | | | | | | |

| (continued) | | | | | | |

| Tree Line Credit Strategies LP(e)(f) | | | | | | $ | 13,364,162 | |

| | | | | | | | | |

| TOTAL PRIVATE INVESTMENT FUNDS | | | | | | | | |

| (Cost $37,021,206) | | | | | | | 36,934,086 | |

| | | | | | | |

| COMMON EQUITY (0.81%) | | | | | | |

| TRADED REAL ESTATE INVESTMENT TRUSTS (0.81%) | | | | | | |

| Great Ajax Corp.(d) | | | 101,573 | | | | 1,382,409 | |

| | | | | | | | | |

| TOTAL COMMON EQUITY | | | | | | | | |

| (Cost $1,362,979) | | | | | | | 1,382,409 | |

| | | | | | | | | |

| SHORT TERM INVESTMENTS (0.16%) | | | | | | | | |

| Dreyfus Treasury Cash Management, | | | | | | | | |

| Institutional Class, 1.93%(h) | | | 267,007 | | | | 267,007 | |

| | | | | | | | | |

| TOTAL SHORT TERM INVESTMENTS | | | | | | | | |

| (Cost $267,007) | | | | | | | 267,007 | |

| | | | | | | | | |

| INVESTMENTS, AT VALUE (96.92%) | | | | | | | | |

| (Cost $166,063,573) | | | | | | $ | 165,812,667 | |

| | | | | | | | | |

| Other Assets In Excess Of Liabilities (3.08%) | | | | | | | 5,265,075 | |

| | | | | | | | | |

| NET ASSETS (100.00%) | | | | | | $ | 171,077,742 | |

Investment Abbreviations:

LIBOR - London Interbank Offered Rate

Libor Rates:

1M US L - 1 Month LIBOR as of September 30, 2018 was 2.26%

3M US L - 3 Month LIBOR as of September 30, 2018 was 2.40%

3M GBP L - 3 Month POUND LIBOR as of September 30, 2018 was 0.80%.

| (a) | Variable rate investment. Interest rates reset periodically. Interest rate shown reflects the rate in effect at September 30, 2018. For securities based on a published reference rate and spread, the reference rate and spread are indicated in the description above. Certain variable rate securities are not based on a published reference rate and spread but are determined by the issuer or agent and are based on current market conditions. These securities do not indicate a reference rate and spread in their description above. |

| (b) | All or a portion of this position has not settled as of September 30, 2018. The interest rate shown represents the stated spread over the London Interbank Offered Rate ("LIBOR" or "L"); the Fund will not accrue interest until the settlement date, at which point LIBOR will be established. |

| (c) | Securities exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be sold in the ordinary course of business in transactions exempt from registration, normally to qualified institutional buyers. As of September 30, 2018, the aggregate market value of those securities was $42,974,344, representing 25.12% of net assets. |

| (d) | All or a portion of each of these securities may be segregated as collateral for the Fund's line of credit. The aggregate market value of those securities was $61,484,125. |

| (e) | Fair value estimated using fair valuation procedures adopted by the Board of Trustees. Total value of such securities is $41,551,392, representing 24.29% of net assets. |

| (f) | Illiquid security. See chart below. |

| (g) | Non-income producing security. |

| (h) | Money market fund; interest rate reflects seven-day effective yield on September 30, 2018. |

See Notes to Financial Statements.

| Annual Report | September 30, 2018 | 7 |

| Resource Credit Income Fund | Portfolio of Investments |

| September 30, 2018 |

Securities determined to be illiquid under the procedures approved by the Fund's Board of Trustees are as follows.

| Date(s) of Purchase | | Security | | Cost | | | Value | | | % of Net Assets | |

| 3/31/2018 - 9/30/2018 | | BlackRock Global Credit Opportunities Fund, LP | | $ | 3,927,902 | | | $ | 3,979,996 | | | | 2.33 | % |

| 09/30/2017- 9/30/2018 | | CVC European Midmarket Solutions Fund | | | 9,054,167 | | | | 9,200,893 | | | | 5.38 | % |

| 10/30/2015- 09/30/2018 | | GoldenTree Credit Opportunities Fund | | | 10,000,000 | | | | 9,842,526 | | | | 5.75 | % |

| 06/30/2018 - 09/30/2018 | | GSO Credit Alpha Fund II LP | | | 539,137 | | | | 546,509 | | | | 0.32 | % |

| 10/30/2015 | | Hypo Real Estate Bank International AG, Class A2 | | | 139,587 | | | | 117,306 | | | | 0.07 | % |

| 12/31/2017- 09/30/2018 | | Tree Line Credit Strategies LP | | | 13,500,000 | | | | 13,364,162 | | | | 7.81 | % |

| | | Total | | $ | 37,160,793 | | | $ | 37,051,392 | | | | 21.66 | % |

Additional information on investments in private investment trusts:

| Value | | | Security | | Redemption Frequency | | Redemption Notice (Days) | | Unfunded Commitments as of September 30, 2018 | |

| $ | 3,979,996 | | | BlackRock Global Credit Opportunities Fund, LP | | N/A | | N/A | | $ | 16,072,098 | |

| | 9,200,893 | | | CVC European Midmarket Solutions Fund | | N/A | | N/A | | | 6,027,959 | |

| | 9,842,526 | | | GoldenTree Credit Opportunities Fund(a) | | Semi-Annual | | 90 | | | – | |

| | 546,509 | | | GSO Credit Alpha Fund II LP | | N/A | | N/A | | | 14,460,863 | |

| | 13,364,162 | | | Tree Line Credit Strategies LP | | Quarterly | | 90 | | | – | |

| (a) | Redemptions are subject to a two-year holding period, and may be limited to 10% per redemption date, or 20% during any 12 month period, past which redemptions would be processed on a pro rata basis. |

See Notes to Financial Statements.

| Resource Credit Income Fund | Statement of Assets and Liabilities |

| September 30, 2018 |

| ASSETS | | | |

| Investments, at value (Cost $166,063,573) | | $ | 165,812,667 | |

| Cash | | | 82,591 | |

| Dividends and interest receivable | | | 2,697,301 | |

| Receivable for securities sold | | | 500,000 | |

| Receivable for Fund shares sold | | | 1,392,169 | |

| Capital contributed in advance | | | 2,500,000 | |

| Prepaid expenses and other assets | | | 28,981 | |

| Total assets | | | 173,013,709 | |

| | | | | |

| LIABILITIES | | | | |

| Interest on line of credit payable | | | 165 | |

| Payable for investments purchased | | | 1,495,411 | |

| Payable due to adviser | | | 149,149 | |

| Administration fees payable | | | 43,677 | |

| Custody fees payable | | | 12,622 | |

| Payable for compliance services fees | | | 13,851 | |

| Distribution fees payable | | | 17,963 | |

| Shareholder servicing fees payable | | | 71,612 | |

| Payable for transfer agency fees | | | 36,884 | |

| Accrued expenses and other liabilities | | | 94,633 | |

| Total liabilities | | | 1,935,967 | |

| NET ASSETS | | $ | 171,077,742 | |

| | | | | |

| NET ASSETS CONSISTS OF | | | | |

| Paid-in capital | | $ | 169,646,525 | |

| Total distributable earnings | | | 1,431,217 | |

| NET ASSETS | | $ | 171,077,742 | |

| Commitments (Note 8) | | | | |

| | | | | |

| PRICING OF SHARES | | | | |

| Class A | | | | |

| Net Assets | | $ | 29,711,776 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 2,678,448 | |

| Net Asset Value and redemption price per share(a) | | $ | 11.09 | |

| Maximum Offering Price Per Share (Maximum Sales Charge of 5.75%) | | $ | 11.77 | |

| Class C | | | | |

| Net Assets | | $ | 26,719,939 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 2,381,908 | |

| Net Asset Value, offering and redemption price per share(a) | | $ | 11.22 | |

| Class W | | | | |

| Net Assets | | $ | 75,275,005 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 6,788,338 | |

| Net Asset Value, offering and redemption price per share | | $ | 11.09 | |

| Class I | | | | |

| Net Assets | | $ | 29,273,424 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 2,633,223 | |

| Net Asset Value, offering and redemption price per share | | $ | 11.12 | |

| Class L | | | | |

| Net Assets | | $ | 10,097,598 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 910,711 | |

| Net Asset Value and redemption price per share | | $ | 11.09 | |

| Maximum Offering Price Per Share (Maximum Sales Charge of 4.25%) | | $ | 11.58 | |

| (a) | Redemption price varies based on length of time held (Note 1). |

See Notes to Financial Statements.

| Annual Report | September 30, 2018 | 9 |

| Resource Credit Income Fund | Statement of Operations |

| For the Year Ended September 30, 2018 |

| INVESTMENT INCOME | | | |

| Dividends | | $ | 3,920,023 | |

| Interest | | | 6,603,648 | |

| Total investment income | | | 10,523,671 | |

| | | | | |

| EXPENSES | | | | |

| Investment advisory fees (Note 3) | | | 1,993,017 | |

| Administrative fees (Note 3) | | | 212,694 | |

| Distribution fees (Note 3): | | | | |

| Class C | | | 121,117 | |

| Class L | | | 15,170 | |

| Shareholder servicing fees (Note 3): | | | | |

| Class A | | | 44,136 | |

| Class C | | | 40,372 | |

| Class W | | | 123,995 | |

| Class L | | | 15,170 | |

| Interest expense (Note 7) | | | 30,026 | |

| Transfer agent fees (Note 3) | | | 188,421 | |

| Audit fees | | | 20,459 | |

| Legal fees | | | 76,689 | |

| Printing expense | | | 129,453 | |

| Registration fees | | | 98,200 | |

| Custody fees | | | 36,597 | |

| Trustee fees and expenses (Note 3) | | | 47,417 | |

| Compliance services fees (Note 3) | | | 77,263 | |

| Networking Fees: | | | | |

| Class A | | | 3,348 | |

| Class C | | | 3,675 | |

| Class W | | | 7,123 | |

| Class I | | | 4,522 | |

| Class L | | | 599 | |

| Other expenses | | | 31,413 | |

| Total expenses | | | 3,320,876 | |

| Less fees waived by investment adviser (Note 3) | | | (389,990 | ) |

| Total net expenses | | | 2,930,886 | |

| NET INVESTMENT INCOME | | | 7,592,785 | |

| Net realized gain on investments | | | 346,966 | |

| Long-term capital gains distributions from other investment companies | | | 55,134 | |

| Net change in unrealized depreciation on investments | | | (1,273,653 | ) |

| NET REALIZED AND UNREALIZED LOSS ON INVESTMENTS | | | (871,553 | ) |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 6,721,232 | |

See Notes to Financial Statements.

| Resource Credit Income Fund | Statements of Changes in Net Assets |

| | | For the Year Ended September 30, 2018 | | | For the Year Ended September 30, 2017 | |

| OPERATIONS | | | | | | | | |

| Net investment income | | $ | 7,592,785 | | | $ | 1,218,166 | |

| Net realized gain | | | 346,966 | | | | 422,275 | |

| Long-term capital gains distributions from other investment companies | | | 55,134 | | | | – | |

| Net change in unrealized appreciation/(depreciation) | | | (1,273,653 | ) | | | 927,548 | |

| Net increase in net assets resulting from operations | | | 6,721,232 | | | | 2,567,989 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

| Total Distributable Earnings | | | | | | | | |

| Class A | | | (1,285,527 | ) | | | (578,853 | )(a) |

| Class C | | | (855,635 | ) | | | (231,332 | )(a) |

| Class W | | | (2,974,317 | ) | | | (698,164 | )(a) |

| Class I | | | (940,703 | ) | | | (56,506 | )(a) |

| Class U(b) | | | – | | | | (121 | )(a) |

| Class T(b) | | | – | | | | (107 | )(a) |

| Class D(b) | | | – | | | | (112 | )(a) |

| Class L(c) | | | (362,054 | ) | | | (23,590 | )(a) |

| From return of capital: | | | | | | | | |

| Class A | | | (201,747 | ) | | | (102,433 | ) |

| Class C | | | (140,920 | ) | | | (40,936 | ) |

| Class W | | | (485,745 | ) | | | (123,546 | ) |

| Class I | | | (166,346 | ) | | | (9,999 | ) |

| Class U(b) | | | – | | | | (22 | ) |

| Class T(b) | | | – | | | | (19 | ) |

| Class D(b) | | | – | | | | (20 | ) |

| Class L(c) | | | (59,569 | ) | | | (4,175 | ) |

| Net decrease in net assets from distributions | | | (7,472,563 | ) | | | (1,869,935 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS | | | | | | | | |

| Class A | | | | | | | | |

| Proceeds from sales of shares | | | 14,588,691 | | | | 11,200,870 | |

| Distributions reinvested | | | 811,960 | | | | 402,321 | |

| Cost of shares redeemed | | | (1,630,897 | ) | | | (68,781 | ) |

| Net increase from capital shares transactions | | | 13,769,754 | | | | 11,534,410 | |

| | | | | | | | | |

| Class C | | | | | | | | |

| Proceeds from sales of shares | | | 18,238,698 | | | | 8,328,902 | |

| Distributions reinvested | | | 661,140 | | | | 166,087 | |

| Cost of shares redeemed | | | (1,048,083 | ) | | | (63,743 | ) |

| Net increase from capital shares transactions | | | 17,851,755 | | | | 8,431,246 | |

| | | | | | | | | |

| Class W | | | | | | | | |

| Proceeds from sales of shares | | | 50,950,259 | | | | 26,610,726 | |

| Distributions reinvested | | | 1,634,354 | | | | 303,286 | |

| Cost of shares redeemed | | | (3,752,387 | ) | | | (765,910 | ) |

| Net increase from capital shares transactions | | | 48,832,226 | | | | 26,148,102 | |

| | | | | | | | | |

| Class I | | | | | | | | |

| Proceeds from sales of shares | | | 26,698,003 | | | | 2,710,332 | |

| Distributions reinvested | | | 583,677 | | | | 41,972 | |

| Cost of shares redeemed | | | (813,196 | ) | | | – | |

| Net increase from capital shares transactions | | | 26,468,484 | | | | 2,752,304 | |

| | | | | | | | | |

| Class U(b) | | | | | | | | |

| Distributions reinvested | | | – | | | | 143 | |

| Cost of shares redeemed | | | – | | | | (3,017 | ) |

| Net decrease from capital shares transactions | | | – | | | | (2,874 | ) |

| See Notes to Financial Statements. |

| Annual Report | September 30, 2018 | 11 | |

| Resource Credit Income Fund | Statements of Changes in Net Assets (continued) |

| | | For the Year Ended September 30, 2018 | | | For the Year Ended September 30, 2017 | |

| Class T(b) | | | | | | | | |

| Distributions reinvested | | $ | – | | | $ | 126 | |

| Cost of shares redeemed | | | – | | | | (2,980 | ) |

| Net decrease from capital shares transactions | | | – | | | | (2,854 | ) |

| | | | | | | | | |

| Class D(b) | | | | | | | | |

| Distributions reinvested | | | – | | | | 132 | |

| Cost of shares redeemed | | | – | | | | (2,992 | ) |

| Net decrease from capital shares transactions | | | – | | | | (2,860 | ) |

| | | | | | | | | |

| Class L(c) | | | | | | | | |

| Proceeds from sales of shares | | | 7,941,082 | | | | 2,441,155 | |

| Distributions reinvested | | | 209,121 | | | | 9,026 | |

| Cost of shares redeemed | | | (441,477 | ) | | | – | |

| Net increase from capital shares transactions | | | 7,708,726 | | | | 2,450,181 | |

| | | | | | | | | |

| Net increase in net assets | | | 113,879,614 | | | | 52,005,709 | |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of year | | | 57,198,128 | | | | 5,192,419 | |

| End of year | | $ | 171,077,742 | | | $ | 57,198,128 | (d) |

| | | | | | | | | |

| OTHER INFORMATION | | | | | | | | |

| Capital Shares Transactions | | | | | | | | |

| Class A | | | | | | | | |

| Issued | | | 1,309,446 | | | | 1,017,674 | |

| Distributions reinvested | | | 73,338 | | | | 36,600 | |

| Redeemed | | | (146,683 | ) | | | (6,155 | ) |

| Net increase in capital shares | | | 1,236,101 | | | | 1,048,119 | |

| | | | | | | | | |

| Class C | | | | | | | | |

| Issued | | | 1,619,485 | | | | 746,104 | |

| Distributions reinvested | | | 59,026 | | | | 14,896 | |

| Redeemed | | | (93,467 | ) | | | (6,057 | ) |

| Net increase in capital shares | | | 1,585,044 | | | | 754,943 | |

| | | | | | | | | |

| Class W | | | | | | | | |

| Issued | | | 4,572,518 | | | | 2,399,426 | |

| Distributions reinvested | | | 147,634 | | | | 27,427 | |

| Redeemed | | | (337,423 | ) | | | (69,494 | ) |

| Net increase in capital shares | | | 4,382,729 | | | | 2,357,359 | |

| | | | | | | | | |

| Class I | | | | | | | | |

| Issued | | | 2,386,225 | | | | 243,024 | |

| Distributions reinvested | | | 52,619 | | | | 3,801 | |

| Redeemed | | | (73,151 | ) | | | – | |

| Net increase in capital shares | | | 2,365,693 | | | | 246,825 | |

| | | | | | | | | |

| Class U(b) | | | | | | | | |

| Distributions reinvested | | | – | | | | 13 | |

| Redeemed | | | – | | | | (272 | ) |

| Net decrease in capital shares | | | – | | | | (259 | ) |

| See Notes to Financial Statements. | |

| 12 | www.resourcealts.com |

| Resource Credit Income Fund | Statements of Changes in Net Assets (continued) |

| | | For the Year Ended September 30, 2018 | | | For the Year Ended September 30, 2017 | |

| OTHER INFORMATION | | | | | | | | |

| Capital Shares Transactions | | | | | | | | |

| Class T(b) | | | | | | | | |

| Distributions reinvested | | | – | | | | 12 | |

| Redeemed | | | – | | | | (270 | ) |

| Net decrease in capital shares | | | – | | | | (258 | ) |

| | | | | | | | | |

| Class D(b) | | | | | | | | |

| Distributions reinvested | | | – | | | | 12 | |

| Redeemed | | | – | | | | (270 | ) |

| Net decrease in capital shares | | | – | | | | (258 | ) |

| | | | | | | | | |

| Class L(c) | | | | | | | | |

| Issued | | | 711,812 | | | | 219,042 | |

| Distributions reinvested | | | 18,887 | | | | 817 | |

| Redeemed | | | (39,847 | ) | | | – | |

| Net increase in capital shares | | | 690,852 | | | | 219,859 | |

| (a) | For the prior year ended September 30, 2017, Resource Credit Income Fund had total distributions consisted of Net Investment Income of $411,703 for Class A, $164,532 for Class C, $496,562 for Class W, $ 40,189 for Class I, $86 for Class U, $76 for Class T,$80 for Class D, and $16,778 for Class L and Net Realized Gains of $167,150 for Class A, $66,800 for Class C, $201,602 for Class W, $16,317 for Class I, $35 for Class U, $31 for Class T,$32 for Class D, and $6,812 for Class L |

| (b) | Effective as of July 7, 2017, the Fund has suspended the offering of its Class U, Class T and Class D shares. |

| (c) | The Fund's Class L commenced operations on July 28, 2017. |

| (d) | For the year ended September 30, 2017, Net Assets included accumulated net investment income of $798. |

| See Notes to Financial Statements. | |

| Annual Report | September 30, 2018 | 13 |

| Resource Credit Income Fund – Class A | Financial Highlights |

| For a Share Outstanding Throughout the Periods Presented |

| | | Year Ended September 30, 2018 | | | Year Ended September 30, 2017 | | | Year Ended September 30, 2016 | | | For the Period Ended September 30, 2015(a) | |

| NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 11.13 | | | $ | 10.26 | | | $ | 10.00 | | | $ | 10.00 | |

| | | | | | | | | | | | | | | | | |

| INCOME FROM INVESTMENT OPERATIONS | | | | | | | | | | | | | | | | |

| Net investment income(b) | | | 0.79 | | | | 0.57 | | | | 0.43 | | | | – | |

| Net realized and unrealized gain/(loss) on investments | | | (0.13 | ) | | | 1.02 | | | | 0.18 | | | | – | |

| Total income from investment operations | | | 0.66 | | | | 1.59 | | | | 0.61 | | | | – | |

| | | | | | | | | | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | | | | | | | | | |

| From net investment income | | | (0.57 | ) | | | (0.47 | ) | | | (0.27 | ) | | | – | |

| From net realized gain on investments | | | (0.04 | ) | | | (0.16 | ) | | | – | | | | – | |

| From return of capital | | | (0.09 | ) | | | (0.09 | ) | | | (0.08 | ) | | | – | |

| Total distributions | | | (0.70 | ) | | | (0.72 | ) | | | (0.35 | ) | | | – | |

| INCREASE/(DECREASE) IN NET ASSET VALUE | | | (0.04 | ) | | | 0.87 | | | | 0.26 | | | | – | |

| NET ASSET VALUE, END OF PERIOD | | $ | 11.09 | | | $ | 11.13 | | | $ | 10.26 | | | $ | 10.00 | |

| | | | | | | | | | | | | | | | | |

| TOTAL RETURN(c) | | | 6.09 | % | | | 15.79 | %(d) | | | 6.22 | %(d) | | | – | % |

| | | | | | | | | | | | | | | | | |

| RATIOS AND SUPPLEMENTAL DATA | | | | | | | | | | | | | | | | |

| Net assets, end of period (in 000s) | | $ | 29,712 | | | $ | 16,049 | | | $ | 4,043 | | | $ | 3 | |

| | | | | | | | | | | | | | | | | |

| RATIOS TO AVERAGE NET ASSETS | | | | | | | | | | | | | | | | |

| Including interest expense:(e) | | | | | | | | | | | | | | | | |

| Expenses, gross | | | 2.93 | % | | | 4.90 | % | | | 31.46 | % | | | 472.13 | %(f) |

| Expenses, net of fees waived/expenses reimbursed by investment adviser | | | 2.61 | % | | | 2.59 | % | | | 2.59 | % | | | 0.02 | %(f) |

| Excluding interest expense:(e) | | | | | | | | | | | | | | | | |

| Expenses, gross | | | 2.91 | % | | | 4.90 | % | | | 34.54 | % | | | N/A | (f) |

| Expenses, net of fees waived/expenses reimbursed by investment adviser | | | 2.59 | % | | | 2.59 | % | | | 2.59 | % | | | N/A | (f) |

| Net investment income(e) | | | 7.06 | % | | | 5.20 | % | | | 4.43 | % | | | 0.00 | %(f) |

| | | | | | | | | | | | | | | | | |

| PORTFOLIO TURNOVER RATE | | | 43 | % | | | 39 | % | | | 22 | % | | | 0 | %(g) |

| | | | | | | | | | | | | | | | | |

| BORROWINGS AT END OF PERIOD | | | | | | | | | | | | | | | | |

| Aggregate amount outstanding (000s) | | $ | – | | | $ | – | | | $ | 5 | | | $ | – | |

| Asset coverage per $1,000 (000s) | | $ | – | | | $ | – | | | $ | 1,032,060 | | | $ | – | |

| (a) | The Fund's Class A commenced operations on April 20, 2015. |

| (b) | Per share numbers have been calculated using the average shares method. |

| (c) | Total returns shown are historical in nature and assume changes in share price, reinvestment of dividends and capital gains distribution, if any. Had the Fund's investment adviser not absorbed a portion of Fund expenses, total returns would have been lower. Total returns for periods less than one year are not annualized. Returns shown exclude applicable sales charges. |

| (d) | Includes adjustments in accordance with accounting principles generally accepted in the United States of America and, as such, the net asset values for financial reporting purposes and the returns based upon those net asset values may differ from net asset values and returns for shareholder transactions. |

| (e) | Ratios do not include expenses of underlying Investment Companies and Private Investment Funds in which the Fund invests. |

| See Notes to Financial Statements. | |

| 14 | www.resourcealts.com |

| Resource Credit Income Fund – Class C | Financial Highlights |

| For a Share Outstanding Throughout the Periods Presented |

| | | Year Ended September 30, 2018 | | | Year Ended September 30, 2017 | | | Year Ended September 30, 2016 | | | For the Period Ended September 30, 2015(a) | |

| NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 11.25 | | | $ | 10.36 | | | $ | 10.00 | | | $ | 10.00 | |

| | | | | | | | | | | | | | | | | |

| INCOME FROM INVESTMENT OPERATIONS | | | | | | | | | | | | | | | | |

| Net investment income(b) | | | 0.72 | | | | 0.50 | | | | 0.59 | | | | – | |

| Net realized and unrealized gain/(loss) on investments | | | (0.13 | ) | | | 1.03 | | | | 0.08 | | | | – | |

| Total income from investment operations | | | 0.59 | | | | 1.53 | | | | 0.67 | | | | – | |

| | | | | | | | | | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | | | | | | | | | |

| From net investment income | | | (0.50 | ) | | | (0.40 | ) | | | (0.24 | ) | | | – | |

| From net realized gain on investments | | | (0.04 | ) | | | (0.16 | ) | | | – | | | | – | |

| From return of capital | | | (0.08 | ) | | | (0.08 | ) | | | (0.07 | ) | | | – | |

| Total distributions | | | (0.62 | ) | | | (0.64 | ) | | | (0.31 | ) | | | – | |

| INCREASE/(DECREASE) IN NET ASSET VALUE | | | (0.03 | ) | | | 0.89 | | | | 0.36 | | | | – | |

| NET ASSET VALUE, END OF PERIOD | | $ | 11.22 | | | $ | 11.25 | | | $ | 10.36 | | | $ | 10.00 | |

| | | | | | | | | | | | | | | | | |

| TOTAL RETURN(c) | | | 5.39 | % | | | 15.03 | %(d) | | | 6.85 | %(d) | | | – | % |

| | | | | | | | | | | | | | | | | |

| RATIOS AND SUPPLEMENTAL DATA | | | | | | | | | | | | | | | | |

| Net assets, end of period (in 000s) | | $ | 26,720 | | | $ | 8,965 | | | $ | 434 | | | $ | 3 | |

| | | | | | | | | | | | | | | | | |

| RATIOS TO AVERAGE NET ASSETS | | | | | | | | | | | | | | | | |

| Including interest expense:(e) | | | | | | | | | | | | | | | | |

| Expenses, gross | | | 3.75 | % | | | 5.28 | % | | | 18.42 | % | | | 473.06 | %(f) |

| Expenses, net of fees waived/expenses reimbursed by investment adviser | | | 3.37 | % | | | 3.34 | % | | | 3.34 | % | | | 0.02 | %(f) |

| Excluding interest expense:(e) | | | | | | | | | | | | | | | | |

| Expenses, gross | | | 3.72 | % | | | 5.28 | % | | | 18.42 | % | | | N/A | (f) |

| Expenses, net of fees waived/expenses reimbursed by investment adviser | | | 3.34 | % | | | 3.34 | % | | | 3.34 | % | | | N/A | (f) |

| Net investment income(e) | | | 6.38 | % | | | 4.46 | % | | | 5.85 | % | | | 0.00 | %(f) |

| | | | | | | | | | | | | | | | | |

| PORTFOLIO TURNOVER RATE | | | 43 | % | | | 39 | % | | | 22 | % | | | 0 | %(g) |

| | | | | | | | | | | | | | | | | |

| BORROWINGS AT END OF PERIOD | | | | | | | | | | | | | | | | |

| Aggregate amount outstanding (000s) | | $ | – | | | $ | – | | | $ | 5 | | | $ | – | |

| Asset coverage per $1,000 (000s) | | $ | – | | | $ | – | | | $ | 1,032,060 | | | $ | – | |

| (a) | The Fund's Class C commenced operations on April 20, 2015. |

| (b) | Per share numbers have been calculated using the average shares method. |

| (c) | Total returns shown are historical in nature and assume changes in share price, reinvestment of dividends and capital gains distribution, if any. Had the Fund's investment adviser not absorbed a portion of Fund expenses, total returns would have been lower. Total returns for periods less than one year are not annualized. |

| (d) | Includes adjustments in accordance with accounting principles generally accepted in the United States of America and, as such, the net asset values for financial reporting purposes and the returns based upon those net asset values may differ from net asset values and returns for shareholder transactions. |

| (e) | Ratios do not include expenses of underlying Investment Companies and Private Investment Funds in which the Fund invests. |

| See Notes to Financial Statements. | |

| Annual Report | September 30, 2018 | 15 |

| Resource Credit Income Fund – Class W | Financial Highlights |

| For a Share Outstanding Throughout the Periods Presented |

| | | Year Ended September 30, 2018 | | | Year Ended September 30, 2017 | | | Year Ended September 30, 2016 | | | For the Period Ended September 30, 2015(a) | |

| NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 11.12 | | | $ | 10.24 | | | $ | 10.00 | | | $ | 10.00 | |

| | | | | | | | | | | | | | | | | |

| INCOME FROM INVESTMENT OPERATIONS | | | | | | | | | | | | | | | | |

| Net investment income(b) | | | 0.79 | | | | 0.58 | | | | 0.63 | | | | – | |

| Net realized and unrealized gain/(loss) on investments | | | (0.12 | ) | | | 1.01 | | | | (0.07 | )(c) | | | – | |

| Total income from investment operations | | | 0.67 | | | | 1.59 | | | | 0.56 | | | | – | |

| | | | | | | | | | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | | | | | | | | | |

| From net investment income | | | (0.57 | ) | | | (0.46 | ) | | | (0.25 | ) | | | – | |

| From net realized gain on investments | | | (0.04 | ) | | | (0.16 | ) | | | – | | | | – | |

| From return of capital | | | (0.09 | ) | | | (0.09 | ) | | | (0.07 | ) | | | – | |

| Total distributions | | | (0.70 | ) | | | (0.71 | ) | | | (0.32 | ) | | | – | |

| INCREASE/(DECREASE) IN NET ASSET VALUE | | | (0.03 | ) | | | 0.88 | | | | 0.24 | | | | – | |

| NET ASSET VALUE, END OF PERIOD | | $ | 11.09 | | | $ | 11.12 | | | $ | 10.24 | | | $ | 10.00 | |

| | | | | | | | | | | | | | | | | |

| TOTAL RETURN(d) | | | 6.19 | % | | | 15.77 | %(e) | | | 5.74 | %(e) | | | – | % |

| | | | | | | | | | | | | | | | | |

| RATIOS AND SUPPLEMENTAL DATA | | | | | | | | | | | | | | | | |

| Net assets, end of period (in 000s) | | $ | 75,275 | | | $ | 26,757 | | | $ | 494 | | | $ | 3 | |

| | | | | | | | | | | | | | | | | |

| RATIOS TO AVERAGE NET ASSETS | | | | | | | | | | | | | | | | |

| Including interest expense:(f) | | | | | | | | | | | | | | | | |

| Expenses, gross | | | 2.98 | % | | | 4.35 | % | | | 17.52 | % | | | 472.69 | %(g) |

| Expenses, net of fees waived/expenses reimbursed by investment adviser | | | 2.62 | % | | | 2.61 | %(h) | | | 3.09 | % | | | 0.04 | %(g) |

| Excluding interest expense:(f) | | | | | | | | | | | | | | | | |

| Expenses, gross | | | 2.95 | % | | | 4.35 | % | | | 17.52 | % | | | N/A | (g) |

| Expenses, net of fees waived/expenses reimbursed by investment adviser | | | 2.59 | % | | | 2.61 | %(h) | | | 3.09 | % | | | N/A | (g) |

| Net investment income(f) | | | 7.10 | % | | | 5.22 | %(h) | | | 6.24 | % | | | 0.00 | %(g) |

| | | | | | | | | | | | | | | | | |

| PORTFOLIO TURNOVER RATE | | | 43 | % | | | 39 | % | | | 22 | % | | | 0 | %(i) |

| | | | | | | | | | | | | | | | | |

| BORROWINGS AT END OF PERIOD | | | | | | | | | | | | | | | | |

| Aggregate amount outstanding (000s) | | $ | – | | | $ | – | | | $ | 5 | | | $ | – | |

| Asset coverage per $1,000 (000s) | | $ | – | | | $ | – | | | $ | 1,032,060 | | | $ | – | |

| (a) | The Fund's Class W commenced operations on April 20, 2015. |

| (b) | Per share numbers have been calculated using the average shares method. |

| (c) | Realized and unrealized losses per share do not correlate to the aggregate of the net realized and unrealized gains on the Statement of Operations for the year ended September 30, 2016, primarily due to the timing of sales and repurchases of the Fund's shares in relation to fluctuating market values for the Fund's portfolio. |

| (d) | Total returns shown are historical in nature and assume changes in share price, reinvestment of dividends and capital gains distribution, if any. Had the Fund's investment adviser not absorbed a portion of Fund expenses, total returns would have been lower. Total returns for periods less than one year are not annualized. |

| (e) | Includes adjustments in accordance with accounting principles generally accepted in the United States of America and, as such, the net asset values for financial reporting purposes and the returns based upon those net asset values may differ from net asset values and returns for shareholder transactions. |

| (f) | Ratios do not include expenses of underlying Investment Companies and Private Investment Funds in which the Fund invests. |

| (h) | Effective January 5, 2017, the annual expense limitation changed from 3.09% to 2.59%. |

| See Notes to Financial Statements. | |

| 16 | www.resourcealts.com |

| Resource Credit Income Fund – Class I | Financial Highlights |

| For a Share Outstanding Throughout the Periods Presented |

| | | Year Ended September 30, 2018 | | | Year Ended September 30, 2017 | | | Year Ended September 30, 2016 | | | For the Period Ended September 30, 2015(a) | |

| NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 11.15 | | | $ | 10.28 | | | $ | 10.00 | | | $ | 10.00 | |

| | | | | | | | | | | | | | | | | |

| INCOME FROM INVESTMENT OPERATIONS | | | | | | | | | | | | | | | | |

| Net investment income(b) | | | 0.84 | | | | 0.63 | | | | 0.35 | | | | – | |

| Net realized and unrealized gain/(loss) on investments | | | (0.14 | ) | | | 0.99 | | | | 0.28 | | | | – | |

| Total income from investment operations | | | 0.70 | | | | 1.62 | | | | 0.63 | | | | – | |

| | | | | | | | | | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | | | | | | | | | |

| From net investment income | | | (0.60 | ) | | | (0.50 | ) | | | (0.27 | ) | | | – | |

| From net realized gain on investments | | | (0.04 | ) | | | (0.16 | ) | | | – | | | | – | |

| From return of capital | | | (0.09 | ) | | | (0.09 | ) | | | (0.08 | ) | | | – | |

| Total distributions | | | (0.73 | ) | | | (0.75 | ) | | | (0.35 | ) | | | – | |

| INCREASE/(DECREASE) IN NET ASSET VALUE | | | (0.03 | ) | | | 0.87 | | | | 0.28 | | | | – | |

| NET ASSET VALUE, END OF PERIOD | | $ | 11.12 | | | $ | 11.15 | | | $ | 10.28 | | | $ | 10.00 | |

| | | | | | | | | | | | | | | | | |

| TOTAL RETURN(c) | | | 6.46 | % | | | 16.07 | %(d) | | | 6.42 | %(d) | | | – | % |

| | | | | | | | | | | | | | | | | |

| RATIOS AND SUPPLEMENTAL DATA | | | | | | | | | | | | | | | | |

| Net assets, end of period (in 000s) | | $ | 29,273 | | | $ | 2,982 | | | $ | 213 | | | $ | 200 | |

| | | | | | | | | | | | | | | | | |

| RATIOS TO AVERAGE NET ASSETS | | | | | | | | | | | | | | | | |

| Including interest expense:(e) | | | | | | | | | | | | | | | | |

| Expenses, gross | | | 2.78 | % | | | 4.45 | % | | | 72.33 | % | | | 430.52 | %(f) |

| Expenses, net of fees waived/expenses reimbursed by investment adviser | | | 2.37 | % | | | 2.34 | % | | | 2.34 | % | | | 0.03 | %(f) |

| Excluding interest expense:(e) | | | | | | | | | | | | | | | | |

| Expenses, gross | | | 2.75 | % | | | 4.45 | % | | | 72.33 | % | | | N/A | (f) |

| Expenses, net of fees waived/expenses reimbursed by investment adviser | | | 2.34 | % | | | 2.34 | % | | | 2.34 | % | | | N/A | (f) |

| Net investment income(e) | | | 7.51 | % | | | 5.71 | % | | | 3.53 | % | | | 0.00 | %(f) |

| | | | | | | | | | | | | | | | | |

| PORTFOLIO TURNOVER RATE | | | 43 | % | | | 39 | % | | | 22 | % | | | 0 | %(g) |

| | | | | | | | | | | | | | | | | |

| BORROWINGS AT END OF PERIOD | | | | | | | | | | | | | | | | |

| Aggregate amount outstanding (000s) | | $ | – | | | $ | – | | | $ | 5 | | | $ | – | |

| Asset coverage per $1,000 (000s) | | $ | – | | | $ | – | | | $ | 1,032,060 | | | $ | – | |

| (a) | The Fund's Class I commenced operations on April 20, 2015. |

| (b) | Per share numbers have been calculated using the average shares method. |

| (c) | Total returns shown are historical in nature and assume changes in share price, reinvestment of dividends and capital gains distribution, if any. Had the Fund's investment adviser not absorbed a portion of Fund expenses, total returns would have been lower. Total returns for periods less than one year are not annualized. |

| (d) | Includes adjustments in accordance with accounting principles generally accepted in the United States of America and, as such, the net asset values for financial reporting purposes and the returns based upon those net asset values may differ from net asset values and returns for shareholder transactions. |

| (e) | Ratios do not include expenses of underlying Investment Companies and Private Investment Funds in which the Fund invests. |

| See Notes to Financial Statements. | |

| Annual Report | September 30, 2018 | 17 |

| Resource Credit Income Fund – Class L | Financial Highlights |

| For a Share Outstanding Throughout the Periods Presented |

| | | For theYear Ended September 30, 2018 | | | For the Period Ended September 30, 2017(a) | |

| NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 11.12 | | | $ | 11.19 | |

| | | | | | | | | |

| INCOME/(LOSS) FROM INVESTMENT OPERATIONS | | | | | | | | |

| Net investment income(b) | | | 0.77 | | | | 0.13 | |

| Net realized and unrealized loss on investments | | | (0.13 | ) | | | (0.03 | )(c) |

| Total income from investment operations | | | 0.64 | | | | 0.10 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

| From net investment income | | | (0.55 | ) | | | (0.10 | ) |

| From net realized gain on investments | | | (0.04 | ) | | | (0.04 | ) |

| From return of capital | | | (0.08 | ) | | | (0.03 | ) |

| Total distributions | | | (0.67 | ) | | | (0.17 | ) |

| INCREASE/(DECREASE) IN NET ASSET VALUE | | | (0.03 | ) | | | (0.07 | ) |

| NET ASSET VALUE, END OF PERIOD | | $ | 11.09 | | | $ | 11.12 | |

| | | | | | | | | |

| TOTAL RETURN(d) | | | 5.92 | % | | | 0.88 | % |

| | | | | | | | | |

| RATIOS AND SUPPLEMENTAL DATA | | | | | | | | |

| Net assets, end of period (in 000s) | | $ | 10,098 | | | $ | 2,445 | |

| | | | | | | | | |

| RATIOS TO AVERAGE NET ASSETS | | | | | | | | |

| Including interest expense:(e) | | | | | | | | |

| Expenses, gross | | | 3.24 | % | | | 4.39 | %(f) |

| Expenses, net of fees waived/expenses reimbursed by investment advisor | | | 2.87 | % | | | 2.84 | %(f) |

| Excluding interest expense:(e) | | | | | | | | |

| Expenses, gross | | | 3.21 | % | | | 4.39 | %(f) |

| Expenses, net of fees waived/expenses reimbursed by investment advisor | | | 2.84 | % | | | 2.84 | %(f) |

| Net investment income (e) | | | 6.92 | % | | | 6.67 | %(f) |

| PORTFOLIO TURNOVER RATE | | | 43 | % | | | 39 | %(g)(h) |

| | | | | | | | | |

| BORROWINGS AT END OF PERIOD | | | | | | | | |

| Aggregate amount outstanding (000s) | | $ | – | | | $ | – | |

| Asset coverage per $1,000 (000s) | | $ | – | | | $ | – | |

| (a) | The Fund's Class L commenced operations on July 28, 2017. |

| (b) | Per share numbers have been calculated using the average shares method. |

| (c) | Realized and unrealized losses per share do not correlate to the aggregate of the net realized and unrealized gains on the Statement of Operations for the year ended September 30, 2017, primarily due to the timing of sales and repurchases of the Fund's shares in relation to fluctuating market values for the Fund's portfolio. |

| (d) | Total returns shown are historical in nature and assume changes in share price, reinvestment of dividends and capital gains distribution, if any. Had the Fund's investment adviser not absorbed a portion of Fund expenses, total returns would have been lower. Total returns for periods less than one year are not annualized. Returns shown exclude applicable sales charges. |

| (e) | Ratios do not include expenses of underlying Investment Companies and Private Investment Funds in which the Fund invests. |

| (h) | Portfolio turnover rate is calculated at the Fund level and represents the year ended September 30, 2017. |

| See Notes to Financial Statements. | |

| 18 | www.resourcealts.com |

| Resource Credit Income Fund | Notes to Financial Statements |

| | September 30, 2018 |

Resource Credit Income Fund (the “Trust” or the “Fund”) was organized as a Delaware statutory trust on December 11, 2014 and is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a closed-end management investment company that operates as an interval fund with a continuous offering of Fund shares. Effective April 11, 2017 the Fund’s investment advisory agreement was transferred from Resource Financial Fund Management, Inc. to an affiliate, Resource Alternative Advisor, LLC (the “Adviser”). The investment objectives are to produce current income and to achieve capital preservation with moderate volatility and low to moderate correlation to the broader equity markets. The Fund is non- diversified and pursues its investment objectives by investing, under normal circumstances, at least 80% of its assets (defined as net assets plus the amount of any borrowing for investment purposes) in fixed-income and fixed-income related securities.

The Fund currently offers Class A, Class C, Class W, Class I and Class L shares; all classes of shares except Class L commenced operations on April 20, 2015. Class L shares commenced operations on July 28, 2017. Effective as of July 7, 2017, the Fund suspended the offering and operation of its Class U, Class T and Class D shares. Class C, Class W and Class I shares are offered at net asset value. Class A shares are offered at net asset value plus a maximum sales charge of 5.75% and may also be subject to a 0.50% early withdrawal charge, which will be deducted from repurchase proceeds, for shareholders tendering shares fewer than 365 days after the original purchase date, if (i) the original purchase was for amounts of $1 million or more and (ii) the selling broker received the reallowance of the dealer-manager fee. Class C shares are subject to a 1.00% early withdrawal charge. Class L shares are offered at net asset value plus a maximum sales charge of 4.25%. Each class represents an interest in the same assets of the Fund and classes are identical except for differences in their sales charge structures, ongoing service and distribution charges and early withdrawal charges. All classes of shares have equal voting privileges except that each class has exclusive voting rights with respect to its service and/or distribution plans. The Fund’s income, expenses (other than class-specific distribution fees) and realized and unrealized gains and losses are allocated proportionately each day based upon the relative net assets of each class.

| 2. SIGNIFICANT ACCOUNTING POLICIES |

The following is a summary of significant accounting policies followed by the Fund in preparation of its financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The Fund is considered an investment company for financial reporting purposes under GAAP. The Fund follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Codification (“ASC”) Topic 946 “Financial Services – Investment Companies” including FASB Accounting Standard Update (“ASU”) 2013-08. The preparation of financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses for the period. Actual results could differ from those estimates.

Securities Valuation – Securities listed on an exchange are valued at the last reported sale price at the close of the regular trading session of the exchange on the business day the value is being determined, or in the case of securities listed on NASDAQ, at the NASDAQ Official Closing Price. In the absence of a sale, such securities shall be valued at the last bid price. Futures are valued based on their daily settlement value. Short-term investments that mature in 60 days or less may be valued at amortized cost, provided such valuations represent fair value.

Structured credit and other similar debt securities including, but not limited to, CDO (“Collateralized Debt Obligation”) debt and equity securities, ABS (“Asset-Backed Security”) securities, CMBS (“Commercial Mortgage Backed Security”) securities and other securitized investments backed by certain debt or other receivables (collectively, “Structured Credit Securities”), are valued on the basis of valuations provided by dealers in those instruments and/or independent pricing services recommended by the Adviser and approved by the Fund’s Board of Trustees (the “Board”). In determining fair value, dealers and pricing services will generally use information with respect to transactions in the securities being valued, quotations from other dealers, market transactions in comparable securities, analyses and evaluations of various relationships between securities and yield to maturity information. The Adviser will, based on its reasonable judgment, select the dealer or pricing service quotation that most accurately reflects the fair market value of the Structured Credit Security while taking into account the information utilized by the dealer or pricing service to formulate the quotation in addition to any other relevant factors. In the event that there is a material discrepancy between quotations received from third-party dealers or the pricing services, the Adviser may (i) use an average of the quotations received or (ii) select an individual quotation that the Adviser, based upon its reasonable judgment, determines to be reasonable. In any instance in which the Adviser selects an individual quotation, the Adviser will provide to the Fund’s Valuation Committee an analysis of the factors relied upon in the selection of the relevant quotation.

When price quotations for certain securities are not readily available, or if the available quotations are not believed to be reflective of market value by the Adviser, those securities will be valued at “fair value” as determined in good faith by the Fund’s Fair Value Committee using procedures adopted by and under the supervision of the Board. There can be no assurance that the Fund could purchase or sell a portfolio security at the price used to calculate the Fund’s net asset value (“NAV”).

| | |

| Annual Report | September 30, 2018 | 19 |

| Resource Credit Income Fund | Notes to Financial Statements |

| | September 30, 2018 |

Fair valuation procedures may be used to value a substantial portion of the assets of the Fund. The Fund may use the fair value of a security to calculate its NAV when, for example, (1) a portfolio security is not traded in a public market or the principal market in which the security trades is closed, (2) trading in a portfolio security is suspended and not resumed prior to the normal market close, (3) a portfolio security is not traded in significant volume for a substantial period, or (4) the Adviser determines that the quotation or price for a portfolio security provided by a broker- dealer or independent pricing service is inaccurate.

The “fair value” of securities may be difficult to determine and thus judgment plays a greater role in the valuation process. The fair valuation methodology may include or consider the following guidelines, as appropriate: (1) evaluation of all relevant factors, including but not limited to, pricing history, current market level, supply and demand of the respective security; (2) comparison to the values and current pricing of securities that have comparable characteristics; (3) knowledge of historical market information with respect to the security; and (4) other factors relevant to the security which would include, but not be limited to, duration, yield, fundamental analytical data, the Treasury yield curve and credit quality.

Valuation of Private Investment Funds – The Fund invests a portion of its assets in Private Investment Funds. Private Investment Funds measure their investment assets at fair value and generally report a NAV on a calendar quarter basis. In accordance with ASC 820, the Fund has elected to apply the practical expedient and to value its investments in Private Investment Funds at their respective NAVs at each quarter. For non- calendar quarter days, the Valuation Committee estimates the fair value of each Private Investment Fund by adjusting the most recent NAV for such Private Investment Fund, as necessary, by the change in a relevant benchmark that the Valuation Committee has deemed to be representative of the market.

Loan Participation and Assignments – The Fund may invest in direct debt instruments which are interests in amounts owed to lenders or lending syndicates by corporate, governmental or other borrowers. The Fund’s investments in loans may be in the form of participations in loans or assignments of all or a portion of the loans from third parties. A loan is often administered by a bank or other financial institution (the “Lender”) that acts as agent for all holders. The Lender administers the terms of the loan, as specified in the loan agreement. The Fund may invest in multiple series or tranches of a loan, which may have varying terms and carry different associated risks. The Fund generally has no right to enforce compliance with the terms of the loan agreement with the borrower. As a result, the Fund may be subject to the credit risk of both the borrower and the Lender that is selling the loan agreement. When the Fund purchases assignments from Lenders, the Fund typically acquires all of the direct rights and obligations against the borrower of the loan. The Fund may enter into unfunded loan commitments, which are contractual obligations for future funding. Unfunded loan commitments represent a future obligation in full, even though a percentage of the notional loan amounts may not be utilized by the borrower. When investing in a loan participation, the Fund has the right to receive payments of principal, interest and any fees to which it is entitled only from the Lender selling the loan agreement and only upon receipt of payments by the Lender from the borrower. The Fund may receive a commitment fee based on the undrawn portion of the underlying line of credit portion of a floating rate loan. In certain circumstances, the Fund may receive a penalty fee upon the prepayment of a floating rate loan by a borrower. For the year ended September 30, 2018, no penalty fees were received by the Fund. Fees earned or paid are recorded as a component of interest income or interest expense, respectively. Fees earned or paid are recorded as a component of interest income or interest expense, respectively, on the Statement of Operations.

Fair Value Measurements – A three-tier hierarchy has been established to classify fair value measurements for disclosure purposes. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk. Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability that are developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability that are developed based on the best information available. In accordance with the authoritative guidance on fair value measurements and disclosure under GAAP, the Fund discloses the fair value of its investments in a hierarchy that prioritizes the inputs to valuation techniques used to measure the fair value.

Various inputs are used in determining the value of the Fund’s investments as of the reporting period end. These inputs are categorized in the following hierarchy under applicable financial accounting standards:

| Level 1 – | Unadjusted quoted prices in active markets for identical, unrestricted assets or liabilities that the Fund has the ability to access at the measurement date; |

| | |

| Level 2 – | Quoted prices which are not active, quoted prices for similar assets or liabilities in active markets or inputs other than quoted prices that are observable (either directly or indirectly) for substantially the full term of the asset or liability at the measurement date; and |

| | |

| Level 3 – | Significant unobservable prices or inputs (including the Fund’s own assumptions in determining the fair value of investments) where there is little or no market activity for the asset or liability at the measurement date. |

| Resource Credit Income Fund | Notes to Financial Statements |

| | September 30, 2018 |

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

An investment level within the fair value hierarchy is based on the lowest level input, individually or in the aggregate, that is significant to fair value measurement. The valuation techniques used by the Fund to measure fair value during the year ended September 30, 2018 maximized the use of observable inputs and minimized the use of unobservable inputs.

The inputs or methodologies used for valuing securities are not necessarily an indication of the risk or liquidity associated with investing in those securities. The following is a summary of the fair values according to the inputs used in valuing the Fund’s investments as of September 30, 2018:

Resource Credit Income Fund

| Investments in Securities at Value | | Level 1 | | | Level 2 | | | Level 3 | | | Other | | | Total | |

| Bank Loans | | $ | – | | | $ | 43,877,102 | | | $ | – | | | $ | – | | | $ | 43,877,102 | |

| Bonds & Notes(a) | | | | | | | | | | | | | | | | | | | | |

| Asset Backed Securities | | | – | | | | 17,046,781 | | | | – | | | | – | | | | 17,046,781 | |

| Commercial Mortgage-Backed Securities | | | – | | | | – | | | | 117,306 | | | | – | | | | 117,306 | |

| Convertible Corporate Bond | | | – | | | | 3,778,416 | | | | – | | | | – | | | | 3,778,416 | |

| Corporate Bonds | | | – | | | | 28,450,653 | | | | – | | | | – | | | | 28,450,653 | |

| Common Equity(a) | | | 29,458,907 | | | | – | | | | – | | | | – | | | | 29,458,907 | |

| Preferred Stocks(a) | | | – | | | | – | | | | 4,500,000 | | | | – | | | | 4,500,000 | |

| Private Investment Funds | | | | | | | | | | | | | | | | | | | | |

| (Measured at net asset value)(b) | | | – | | | | – | | | | – | | | | 36,934,086 | | | | 36,934,086 | |

| Real Estate Investment Trusts- Common Equity(a) | | | 1,382,409 | | | | – | | | | – | | | | – | | | | 1,382,409 | |

| Short Term Investments | | | 267,007 | | | | – | | | | – | | | | – | | | | 267,007 | |

| TOTAL | | $ | 31,108,323 | | | $ | 93,152,952 | | | $ | 4,617,306 | | | $ | 36,934,086 | | | $ | 165,812,667 | |

| (a) | For detailed descriptions, see the accompanying Portfolio of Investments. |

| (b) | In accordance with ASC 820-10, certain investments that are measured at fair value using the net asset value per share (or its equivalent) practical expedient have not been classified in the fair value hierarchy. The fair value amounts presented in this table are intended to permit reconciliation of the fair value hierarchy to the amounts presented in the Statement of Assets and Liabilities. |

| Asset Type | | Balance as of September 30, 2017 | | | Accrued Discount/ premium | | | Return of Capital | | | Realized Gain/(Loss) | | | Change in Unrealized Appreciation/ Depreciation | | | Purchases | | | Sales Proceeds | | | Transfer into Level 3 | | | Transfer Out of Level 3 | | | Balance as of September 30, 2018 | | | Net change in unrealized appreciation/(depreciation) included in the Statements of Operations attributable to Level 3 investments held at September 30, 2018 | |

| Commercial Mortgage Backed Securities | | | 77,720 | | | | – | | | | – | | | | – | | | | 39,586 | | | | – | | | | – | | | | – | | | | – | | | $ | 117,306 | | | $ | 39,586 | |

| Preferred Stocks | | | – | | | | – | | | | – | | | | – | | | | – | | | | 4,500,000 | | | | – | | | | – | | | | – | | | $ | 4,500,000 | | | $ | – | |

| | | $ | 77,720 | | | $ | – | | | $ | – | | | $ | – | | | $ | 39,586 | | | $ | 4,500,000 | | | $ | – | | | $ | – | | | $ | – | | | $ | 4,617,306 | | | $ | 39,586 | |

Significant unobservable valuation inputs for material Level 3 investments as of September 30, 2018 are as follows:

| | | Fair Value at 9/30/2018 | | | Valuation Technique | | Unobservable Input | | Range |

| Commercial Mortgage Backed Securities | | $ | 117,306 | | | Broker Quote | | Broker Quote | | N/A |

| Preferred Stocks | | $ | 4,500,000 | | | Purchase Price | | Purchase Price | | N/A |

| | |