UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

811-23016

(Investment Company Act file number)

Resource Credit Income Fund

(Exact name of registrant as specified in charter)

One Crescent Drive, Suite 203

Philadelphia, PA 19103

(Address of principal executive offices) (Zip code)

Shelle Weisbaum

Resource Real Estate, Inc.

1845 Walnut Street, 18th Floor

Philadelphia, PA 19103

(Name and address of agent for service)

Copy to:

ALPS Fund Services, Inc.

1290 Broadway, Suite 1100

Denver, CO 80203

Registrant's telephone number, including area code: (212) 506-3899

Date of fiscal year end: September 30

Date of reporting period: October 1, 2015 – September 30, 2016

Item 1. Reports to Stockholders.

| Shareholder Letter | 1 |

| Portfolio Update | 3 |

| Portfolio of Investments | 5 |

| Statement of Assets and Liabilities | 7 |

| Statement of Operations | 9 |

| Statements of Changes in Net Assets | 10 |

| Financial Highlights | |

| Class A | 12 |

| Class C | 13 |

| Class W | 14 |

| Class I | 15 |

| Class U | 16 |

| Class T | 17 |

| Class D | 18 |

| Notes to Financial Statements | 19 |

| Report of Independent Registered Public Accounting Firm | 26 |

| Additional Information | 27 |

| Trustees & Officers | 29 |

| Privacy Notice | 31 |

| Resource Credit Income Fund | Shareholder Letter |

September 30, 2016 (Unaudited)

Dear Shareholders:

We are pleased to present the Annual Report for the Resource Credit Income Fund (the “Fund”), for the period ending September 30, 2016. We are also proud of the Fund’s early success in deploying capital and fundraising, as well as meeting our key investment goals:

| • | Delivering Current Income. The Fund paid a dividend of 17.5 cents per share for A shares for the quarters ended June 30, 2016 and September 30, 2016. Such amounts are consistent with an annualized dividend rate of 70 cents per share. |

| • | Preserving Principal. The Fund has continued to invest in corporate loans—both directly as well as in assets backed by corporate loans—which represent senior and collateralized positions we believe will help protect capital. |

| • | Diversifying Investment Portfolio. The Fund invests across four credit strategies and held 27 distinct investments as of 9/30/2016. The portfolio provides investors with broad‐based credit exposure with diversification across issuer, industry and geography. |

Investment Philosophy and Process

The Fund’s investments remain focused on four broad strategies within the fixed‐income universe: publicly traded credit‐linked equities (e.g. primarily public Business Development Companies commonly known as BDCs); structured credit instruments, with a focus on Collateralized Loan Obligations (CLOs); private credit funds; and traded loans and bonds. Our target allocations within these strategies are as follows:

| • | 20% Publicly traded BDCs and other credit‐linked securities |

| • | 20% Private credit funds |

The Fund intends to broadly follow these guidelines, but will adjust allocations depending on market conditions to maximize risk‐adjusted returns.

We have implemented a proprietary investment process, rooted in thorough due diligence and credit analysis, to identify opportunities in our investment universe. More specifically, we have developed the Resource America Liquid Alternatives Score (RALAS) to identify business, capital structure and industry risks as well as quantify return potential for each investment opportunity. We believe our scoring system will help drive yield for investors while mitigating principal losses by reducing credit risk.

Investment Environment and Fund Performance

The Fund began investing in late 2015 and early 2016, which represented a period of historical volatility in the credit markets. The U.S. High Yield1 market fell by 5.0% in 2015—with most of the loss realized in the last quarter—and then lost another 5.0% in January and February of 2016.

Through careful security selection, the Fund capitalized on this historical volatility to generate a total return of 14.2% during the second half of the fiscal year. While all four strategies generated positive returns, publicly traded BDCs and loans were the largest contributors during the period.

This performance underscores an important structural advantage of the Fund, which we believe can help deliver long‐term gains for investors. Specifically, the interval fund structure limits the Fund’s redemption obligation to 5% per quarter. This cap can help the fund manage liquidity during periods of market turmoil to take advantage of buying opportunities. Therefore, we believe the Fund’s structure can help provide a sustainable competitive advantage relative to mutual funds that do not similarly restrict redemptions.

Specific to the third quarter, the Fund posted a total return of 6.38%. Although the S&P 500 does not represent a benchmark for the Fund—and our Fund’s diversified portfolio belies benchmarking in general—it is nevertheless instructive to note this broader equity market index gained 3.9% over that same timeframe.

Investment Positioning

The Fund began the year with the overarching view that investors needed to prepare for a rising rate environment. The Fund therefore has been weighted towards floating rate assets, which can potentially generate higher interest income when rates rise (thereby helping to preserve principal). We believe our investors are beginning to see the early benefits of our strategy.

The vast majority of the loans owned by the Fund pay interest linked to a base‐rate of 3 Month LIBOR2, with a floor set at 1.0%. When this base‐rate moves above this 1.0% floor, the Fund can generate incremental income. As of 9/30, the market price of 3 Month LIBOR had risen to 0.85% (from roughly 0.62% at the beginning of the year). With the U.S. Federal Reserve strongly signaling a rate hike in December, as well as additional moves in 2017, the Fund believes it is within striking distance of generating additional income from its existing loan positions.

| Annual Report | September 30, 2016 | 1 |

| Resource Credit Income Fund | Shareholder Letter |

September 30, 2016 (Unaudited)

From a sector standpoint, the Fund continues to avoid direct exposure to the Oil & Gas industry as we believe risk / reward remains negatively skewed to the downside. We believe the U.S. economy remains fundamentally sound and therefore continue to weight towards domestic exposure.

Thank you for being a shareholder of the Resource Credit Income Fund and we look forward to a long‐term partnership.

Sincerely,

Michael Terwilliger, CFA

Global Portfolio Manager

Resource Credit Income Fund

| 1 | Bank of America Merrill Lynch U.S. High Yield Index (H0A0). One cannot directly invest in an index. |

| 2 | London Interbank Offered Rate (LIBOR) is the average of interest rates, estimated by each of the leading banks in London, that would be charged on interbank borrowings. |

Senior loans hold the most senior position in the capital structure of a borrower. Substantial increases in interest rates may cause an increase in loan defaults as borrowers may lack resources to meet higher debt service requirements.

BDCs may carry risks similar to those of a private equity or venture capital fund. BDC company securities are not redeemable at the option of the shareholder and they may trade in the market at a discount to their net asset value.

Non-traded BDCs are subject to commissions, expenses, and offering and organizational costs that reduce the value of an investor’s (including the Fund’s) investment. Non-traded BDCs are not liquid.

CDOs and other structured products, consisting of CBOs, CLOs and credit- linked notes may bear risks of the underlying investments, index or reference obligation and are subject to counterparty risk. Certain structured products may be thinly traded or have a limited trading market.

| 2 | www.resourcecreditincome.com |

| Resource Credit Income Fund | Portfolio Update |

September 30, 2016 (Unaudited)

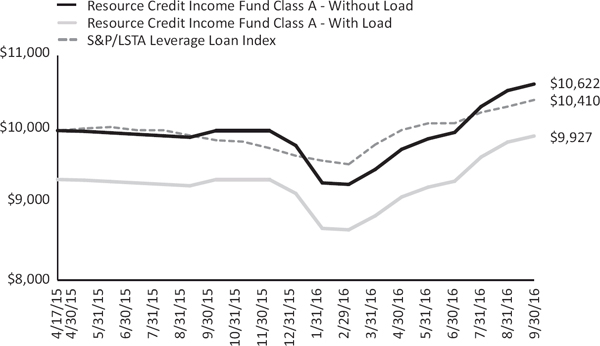

The Fund’s performance figures for the period ended September 30, 2016, compared to its benchmark:

| Resource Credit Income Fund | 1 Month | Quarter | 6 Month | YTD | 1 Year | Since Inception* | Inception |

| Class A Shares | 0.82% | 6.48% | 12.05% | 8.39% | 6.22% | 4.23% | 4/17/2015 |

| Class A Shares w/ Sales Charge | ‐5.73% | ‐0.43% | 4.75% | 1.35% | ‐0.73% | ‐0.50% | 4/17/2015 |

| Class C Shares | 0.64% | 6.23% | 13.07% | 9.14% | 6.85% | 4.66% | 4/17/2015 |

| Class C Shares w/ CDSC | ‐0.88% | 4.65% | 11.42% | 7.49% | 5.27% | 3.59% | 4/17/2015 |

| Class D Shares | 0.78% | 6.35% | 11.77% | 8.00% | 5.73% | 3.91% | 4/17/2015 |

| Class I Shares | 0.73% | 6.47% | 12.14% | 8.60% | 6.42% | 4.37% | 4/17/2015 |

| Class T Shares | 0.63% | 6.19% | 11.54% | 7.67% | 5.40% | 3.68% | 4/17/2015 |

| Class T Shares w/ Sales Charge | ‐0.91% | 4.59% | 9.91% | 6.04% | 3.85% | 2.63% | 4/17/2015 |

| Class U Shares | 0.82% | 6.48% | 12.05% | 8.39% | 6.22% | 4.23% | 4/17/2015 |

| Class U Shares w/ Sales Charge | ‐5.73% | ‐0.43% | 4.75% | 1.35% | ‐0.73% | ‐0.50% | 4/17/2015 |

| Class W Shares | 0.69% | 6.25% | 11.78% | 8.01% | 5.74% | 3.91% | 4/17/2015 |

| S&P/LSTA Leverage Loan Index | 0.86% | 3.08% | 6.08% | 7.72% | 5.46% | 2.80% | 4/17/2015 |

The S&P/LSTA Leveraged Loan Index (LLI) covers the U.S. market back to 1997 and currently calculates on a daily basis. This index is run in partnership between S&P and the Loan Syndications & Trading Association, the loan market’s trade group.

Diversification does not prevent losses or guarantee returns.

Past performance is not predictive of future results. The investment return and principal value of an investment will fluctuate. An investor’s shares when redeemed, may be worth more or less than the original cost. Total return is calculated assuming reinvestment of all dividends and distributions. Performance figures for periods less than one year are not annualized. The Fund’s total annual operating expense, including underlying funds before fee waivers is 430.77% for Class A, 431.52% for Class C, 431.27% for Class W, 430.52% for Class I, 430.77% for Class U, 431.52% for Class T and 431.27% for Class D shares per the most recent Class specific prospectus filings. After fee waivers, the Fund’s total annual operating expense is 2.63% for Class A, 3.38% for Class C, 3.13% for Class W, 2.38% for Class I, 2.63% for Class U, 3.38% for Class T and 3.13% for Class D shares. Class A and Class U shares are subject to a maximum sales load of 6.50% imposed on purchases. Class C and Class T shares are subject to a maximum sales load of 1.50% imposed on purchases. For performance information current to the most recent month-end, please call toll-free 1-855-747-9559.

| Annual Report | September 30, 2016 | 3 |

| Resource Credit Income Fund | Portfolio Update |

September 30, 2016 (Unaudited)

Comparison of the Change in Value of a $10,000 Investment

Portfolio Composition as of September 30, 2016

| Asset Type | Percent of Net Assets |

| Bonds & Notes | 34.83% |

| Bank Loans | 26.67% |

| Common Stock | 18.11% |

| Private Investment Funds | 9.75% |

| Short Term Investments | 6.28% |

| Real Estate Investment Trusts ‐ Common Stocks | 2.50% |

| Total Investments | 98.14% |

| Other Assets in Excess of Liabilities | 1.86% |

| Net Assets | 100.00% |

| 4 | www.resourcecreditincome.com |

| Resource Credit Income Fund | Portfolio of Investments |

September 30, 2016

| Principal ($) | | | Value | |

| | | BANK LOANS (26.67%)(a) | | | |

| 125,000 | | Advantage Sales & Marketing, Inc., Second Lien Term Loan, 7.500% 07/25/2022 | $ | 119,258 | |

| 425,000 | | Asurion Hold Co., Term Loan, 10.000% 08/31/2021 | | 423,140 | |

| 100,000 | | Asurion Opco, Second Lien Term Loan, 8.500% 03/03/2021 | | 99,708 | |

| 124,405 | | BJ's Wholesale Club, Inc., Second Lien Term Loan, 8.500% 03/26/2020 | | 125,369 | |

| 18,630 | | Coinamatic Canada, Inc. (Canada Ltd.), Second Lien Term Loan, 8.000% 05/12/2023 | | 18,490 | |

| 125,000 | | Renaissance Learning, Inc., Second Lien Term Loan, 8.000% 04/11/2022 | | 123,228 | |

| 250,000 | | UFC Holdings LLC, Second Lien Term Loan, 8.500% 08/18/2024 | | 254,688 | |

| 106,370 | | Wash Multifamily Acquisition, Inc., Second Lien Term Loan, 8.000% 05/15/2023 | | 105,572 | |

| 125,000 | | Winebow Holdings, Inc. (The Vintner Group, Inc.), Second Lien Term Loan, 8.500% 01/02/2022 | | 115,313 | |

| | | | | 1,384,766 | |

| | | TOTAL BANK LOANS (Cost $1,328,676) | | 1,384,766 | |

| | | | | | |

| | | BONDS & NOTES (34.83%) | | | |

| | | ASSET BACKED SECURITIES (12.82%) | | | |

| 250,000 | | MidOcean Credit CLO, 7.580% 10/19/2018(a)(b) | | 232,200 | |

| 250,000 | | Tralee CLO III Ltd., 7.696% 07/20/2026(a)(b) | | 237,106 | |

| 300,000 | | Trinitas CLO III Ltd., 7.180% 07/15/2027(a)(b) | | 196,266 | |

| | | | | 665,572 | |

| | | COMMERCIAL MORTGAGE BACKED SECURITIES (0.47%) | | | |

| 200,000 | | Hypo Real Estate Bank International AG, 0.596% 03/20/2022(a) | | 24,627 | |

| | | | | | |

| | | CORPORATE BONDS (21.54%) | | | |

| 175,000 | | Cliffs Natural Resources, 8.000% 09/30/2020(b)(c) | | 172,375 | |

| 125,000 | | Cliffs Natural Resources, 4.800% 10/01/2020(c) | | 103,750 | |

| 280,000 | | JBS USA, 5.750% 06/15/2025(c)(d) | | 276,500 | |

| 350,000 | | Jo‐Ann Stores Holdings, 9.750% 10/15/2019(b) | | 342,124 | |

| 225,000 | | New Enterprise Stone & Lime Co., 11.000% 09/01/2018(c) | | 223,875 | |

| | | | | 1,118,624 | |

| | | TOTAL BONDS & NOTES (Cost $1,834,143) | | 1,808,823 | |

| Shares | | | | | |

| | | COMMON STOCKS (18.11%) | | | |

| | | BUSINESS DEVELOPMENT COMPANIES (18.11%) | | | |

| 19,732 | | Ares Capital Corp.(c) | | 305,846 | |

| 9,050 | | OFS Capital Corp.(c) | | 117,922 | |

| 6,438 | | PennantPark Floating Rate Capital, Ltd.(c) | | 85,175 | |

| 14,984 | | PennantPark Investment Corp.(c) | | 112,680 | |

| 2,000 | | Solar Capital, Ltd.(c) | | 41,040 | |

| 5,503 | | Solar Senior Capital Ltd. | | 89,204 | |

| 17,240 | | WhiteHorse Finance, Inc.(c) | | 188,433 | |

| | | | | 940,300 | |

| | | TOTAL COMMON STOCKS (Cost $906,684) | | 940,300 | |

| | | | | | |

| | | REAL ESTATE INVESTMENT TRUSTS ‐ COMMON STOCKS (2.50%) | | | |

| | | TRADED REAL ESTATE INVESTMENT TRUSTS (2.50%) | | | |

| 9,500 | | Great Ajax Corp.(c) | | 129,675 | |

| | | | | | |

| | | TOTAL REAL ESTATE INVESTMENT TRUSTS ‐ COMMON STOCKS (Cost $105,177) | | 129,675 | |

See Notes to Financial Statements.

| Annual Report | September 30, 2016 | 5 |

| Resource Credit Income Fund | Portfolio of Investments |

September 30, 2016

| Shares | | | Value | |

| | | PRIVATE INVESTMENT FUNDS (9.75%) | | | |

| 1 | | GoldenTree Credit Opportunities Fund(e) | $ | 506,315 | |

| | | | | | |

| | | TOTAL PRIVATE INVESTMENT FUNDS (Cost $500,000) | | 506,315 | |

| | | | | | |

| | | SHORT TERM INVESTMENTS (6.28%) | | | |

| 325,914 | | Dreyfus Treasury Cash Management, Institutional Class, 0.21%(f) | | 325,914 | |

| | | | | | |

| | | TOTAL SHORT TERM INVESTMENTS (Cost $325,914) | | 325,914 | |

| | | | | | |

| | | TOTAL INVESTMENTS (98.14%) (Cost $5,000,594) | $ | 5,095,793 | |

| | | | | | |

| | | OTHER ASSETS IN EXCESS OF LIABILITIES (1.86%) | | 96,626 | (g) |

| | | | | | |

| | | NET ASSETS (100.00%) | $ | 5,192,419 | |

(a) | Floating or variable rate security. The rate shown is the effective interest rate as of September 30, 2016. |

(b) | Securities exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be sold in the ordinary course of business in transactions exempt from registration, normally to qualified institutional buyers. As of September 30, 2016, the aggregate market value of those securities was $1,180,071, representing 22.73% of net assets. |

(c) | All or a portion of each of these securities may be segregated as collateral for the Fund's line of credit. |

(d) | Securities were purchased pursuant to Regulation S under the Securities Act of 1933, which exempts from registration securities offered and sold outside of the United States. Such securities cannot be sold by the issuer in the United States without either an effective registration statement filed pursuant to the Securities Act of 1933, or pursuant to an exemption from registration. These securities have been deemed liquid under guidelines approved by the Fund’s Board of Trustees, unless otherwise noted below. At period end, the aggregate value of those securities was $276,500, representing 5.33% of net assets. |

(e) | Illiquid security. See below. |

(f) | Money market fund; interest rate reflects seven-day effective yield on September 30, 2016. |

(g) | Includes cash which is being held as collateral for the Fund's line of credit. |

Security determined to be illiquid under the procedures approved by the Fund's Board of Trustees.

Information related to the illiquid security is as follows:

| Date(s) of Purchase | Security | Cost | Value | % of Net Assets | |

| 10/30/15 | GoldenTree Credit Opportunities Fund | $ | 500,000 | $ | 506,315 | 9.75 | % |

See Notes to Financial Statements.

| 6 | www.resourcecreditincome.com |

Resource Credit Income Fund | Statement of Assets and Liabilities |

September 30, 2016

| | | | |

| ASSETS | | | |

| Investments, at value (Cost $5,000,594) | | $ | 5,095,793 | |

| Cash | | | 5,419 | |

| Cash collateral pledged for line of credit | | | 15,933 | |

| Dividends and interest receivable | | | 64,863 | |

| Receivable for fund shares sold | | | 16,585 | |

| Receivable due from adviser | | | 114,796 | |

| Prepaid expenses and other assets | | | 53,572 | |

| Total assets | | | 5,366,961 | |

| | | | | |

| LIABILITIES | | | | |

| Line of credit payable | | | 5,036 | |

| Administration fees payable | | | 39,216 | |

| Custody fees payable | | | 3,750 | |

| Distribution fees payable | | | 425 | |

| Distribution due to shareholders | | | 32,296 | |

| Shareholder servicing fees payable | | | 5,466 | |

| Dealer manager fees payable | | | 377 | |

| Payable for transfer agency fees | | | 46,298 | |

| Accrued expenses and other liabilities | | | 41,678 | |

| Total liabilities | | | 174,542 | |

| NET ASSETS | | $ | 5,192,419 | |

| | | | | |

| NET ASSETS CONSISTS OF | | | | |

| Paid‐in capital | | $ | 5,043,864 | |

| Accumulated net realized gain | | | 53,356 | |

| Net unrealized appreciation | | | 95,199 | |

| NET ASSETS | | $ | 5,192,419 | |

See Notes to Financial Statements.

Annual Report | September 30, 2016 | 7 |

Resource Credit Income Fund | Statement of Assets and Liabilities |

| PRICING OF SHARES | | | |

| Class A | | | |

| Net Assets | | $ | 4,042,891 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 394,228 | |

Net Asset Value and redemption price per share(a) | | $ | 10.26 | |

| Maximum Offering Price Per Share (Maximum Sales Charge of 6.50%) | | $ | 10.97 | |

| Class C | | | | |

| Net Assets | | $ | 434,408 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 41,921 | |

Net Asset Value and redemption price per share(a) | | $ | 10.36 | |

| Maximum Offering Price Per Share (Maximum Sales Charge of 1.50%) | | $ | 10.52 | |

| Class W | | | | |

| Net Assets | | $ | 494,303 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 48,250 | |

| Net Asset Value, offering and redemption price per share | | $ | 10.24 | |

| Class I | | | | |

| Net Assets | | $ | 212,882 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 20,705 | |

| Net Asset Value, offering and redemption price per share | | $ | 10.28 | |

| Class U | | | | |

| Net Assets | | $ | 2,655 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 259 | |

Net Asset Value and redemption price per share(a) | | $ | 10.26 | (b) |

| Maximum Offering Price Per Share (Maximum Sales Charge of 6.50%) | | $ | 10.97 | |

| Class T | | | | |

| Net Assets | | $ | 2,637 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 258 | |

Net Asset Value and redemption price per share(a) | | $ | 10.23 | (b) |

| Maximum Offering Price Per Share (Maximum Sales Charge of 1.50%) | | $ | 10.39 | |

| Class D | | | | |

| Net Assets | | $ | 2,643 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 258 | |

| Net Asset Value, offering and redemption price per share | | $ | 10.24 | |

(a) | Redemption price varies based on length of time held (Note 1). |

(b) | Net asset value per share does not recalculate due to fractional shares not presented and rounding. |

See Notes to Financial Statements.

8 | www.resourcecreditincome.com |

| Resource Credit Income Fund | Statement of Operations |

For the Year Ended September 30, 2016

| INVESTMENT INCOME | | | |

| Dividends | | $ | 82,960 | |

| Interest | | | 87,553 | |

| Total investment income | | | 170,513 | |

| EXPENSES | | | | |

| Investment advisory fees (Note 3) | | | 44,810 | |

| Administrative fees (Note 3) | | | 139,356 | |

| Distribution fees (Note 3): | | | | |

| Class C | | | 428 | |

| Class T | | | 19 | |

| Shareholder servicing fees (Note 3): | | | | |

| Class A | | | 5,222 | |

| Class C | | | 143 | |

| Class W | | | 179 | |

| Class U | | | 7 | |

| Class T | | | 7 | |

| Class D | | | 7 | |

| Dealer manager fees (Note3): | | | | |

| Class W | | | 356 | |

| Class D | | | 12 | |

| Interest expense | | | 36 | |

| Transfer agent fees (Note 3) | | | 73,595 | |

| Audit fees | | | 28,001 | |

| Legal fees | | | 34,421 | |

| Printing expense | | | 24,867 | |

| Registration fees | | | 35,964 | |

| Custody fees | | | 6,250 | |

| Trustee fees and expenses (Note 3) | | | 44,948 | |

| Offering costs | | | 417,860 | |

| Other expenses | | | 36,394 | |

| Total expenses | | | 892,882 | |

| Less fees waived/expenses reimbursed by investment adviser (Note 3) | | | (829,791 | ) |

| Total net expenses | | | 63,091 | |

| NET INVESTMENT INCOME | | | 107,422 | |

| Net realized gain on investments | | | 32,696 | |

| Net realized gain on foreign currency transactions | | | 1,754 | |

| Long-term capital gains distributions from other investment companies | | | 3,349 | |

| Net change in unrealized appreciation on investments | | | 95,199 | |

| NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS, FUTURES CONTRACTS AND FOREIGN CURRENCY TRANSACTIONS | | | 132,998 | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 240,420 | |

See Notes to Financial Statements.

| Annual Report | September 30, 2016 | 9 |

| Resource Credit Income Fund | Statements of Changes in Net Assets |

| | | For the Year Ended September 30, 2016 | | | For the Period Ended September 30, 2015(a) | |

| OPERATIONS | | | | | | |

| Net investment income | | $ | 107,422 | | | $ | – | |

| Net realized gain | | | 34,450 | | | | – | |

| Long-term capital gains distributions from other investment companies | | | 3,349 | | | | – | |

| Net change in unrealized appreciation | | | 95,199 | | | | – | |

| Net increase in net assets resulting from operations | | $ | 240,420 | | | $ | – | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

| From investment income: | | | | | | | | |

| Class A | | | (88,663 | ) | | | – | |

| Class C | | | (5,740 | ) | | | – | |

| Class W | | | (6,522 | ) | | | – | |

| Class I | | | (5,641 | ) | | | – | |

| Class U | | | (70 | ) | | | – | |

| Class T | | | (62 | ) | | | – | |

| Class D | | | (65 | ) | | | – | |

| From return of capital: | | | | | | | | |

| Class A | | | (22,593 | ) | | | – | |

| Class C | | | (1,463 | ) | | | – | |

| Class W | | | (1,662 | ) | | | – | |

| Class I | | | (1,437 | ) | | | – | |

| Class U | | | (18 | ) | | | – | |

| Class T | | | (16 | ) | | | – | |

| Class D | | | (17 | ) | | | – | |

| Net decrease in net assets from distributions | | | (133,969 | ) | | | – | |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS | | | | | | | | |

| Class A | | | | | | | | |

| Proceeds from sales of shares | | | 3,865,775 | | | | 2,500 | |

| Distributions reinvested | | | 78,298 | | | | – | |

| Net increase from capital shares transactions | | | 3,944,073 | | | | 2,500 | |

| | | | | | | | | |

| Class C | | | | | | | | |

| Proceeds from sales of shares | | | 425,022 | | | | 2,500 | |

| Distributions reinvested | | | 5,594 | | | | – | |

| Net increase from capital shares transactions | | | 430,616 | | | | 2,500 | |

| | | | | | | | | |

| Class W | | | | | | | | |

| Proceeds from sales of shares | | | 488,715 | | | | 2,500 | |

| Distributions reinvested | | | 238 | | | | – | |

| Net increase from capital shares transactions | | | 488,953 | | | | 2,500 | |

| | | | | | | | | |

| Class I | | | | | | | | |

| Distributions reinvested | | | 7,078 | | | | – | |

| Net increase from capital shares transactions | | | 7,078 | | | | – | |

| | | | | | | | | |

| Class U | | | | | | | | |

| Proceeds from sales of shares | | | – | | | | 2,500 | |

| Distributions reinvested | | | 88 | | | | – | |

| Net increase from capital shares transactions | | | 88 | | | | 2,500 | |

| | | | | | | | | |

| Class T | | | | | | | | |

| Proceeds from sales of shares | | | – | | | | 2,500 | |

| Distributions reinvested | | | 78 | | | | – | |

| Net increase from capital shares transactions | | | 78 | | | | 2,500 | |

See Notes to Financial Statements.

| 10 | www.resourcecreditincome.com |

| Resource Credit Income Fund | Statements of Changes in Net Assets |

| | | For the Year Ended September 30, 2016 | | | For the Period Ended September 30, 2015(a) | |

| Class D | | | | | | |

| Proceeds from sales of shares | | | – | | | | 2,500 | |

| Distributions reinvested | | | 82 | | | | – | |

| Net increase from capital shares transactions | | | 82 | | | | 2,500 | |

| | | | | | | | | |

| Net increase in net assets | | | 4,977,419 | | | | 15,000 | |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of period | | | 215,000 | | | | 200,000 | |

| End of period* | | $ | 5,192,419 | | | $ | 215,000 | |

| | | | | | | | | |

| *Including accumulated net investment income of: | | $ | – | | | $ | 18 | |

| | | | | | | | | |

| OTHER INFORMATION | | | | | | | | |

| Capital Shares Transactions | | | | | | | | |

| Class A | | | | | | | | |

| Issued | | | 386,182 | | | | 250 | |

| Distributions reinvested | | | 7,796 | | | | – | |

| Net increase in capital shares | | | 393,978 | | | | 250 | |

| | | | | | | | | |

| Class C | | | | | | | | |

| Issued | | | 41,127 | | | | 250 | |

| Distributions reinvested | | | 544 | | | | – | |

| Net increase in capital shares | | | 41,671 | | | | 250 | |

| | | | | | | | | |

| Class W | | | | | | | | |

| Issued | | | 47,977 | | | | 250 | |

| Distributions reinvested | | | 23 | | | | – | |

| Net increase in capital shares | | | 48,000 | | | | 250 | |

| | | | | | | | | |

| Class I | | | | | | | | |

| Distributions reinvested | | | 705 | | | | – | |

| Net increase in capital shares | | | 705 | | | | – | |

| | | | | | | | | |

| Class U | | | | | | | | |

| Issued | | | – | | | | 250 | |

| Distributions reinvested | | | 9 | | | | – | |

| Net increase in capital shares | | | 9 | | | | 250 | |

| | | | | | | | | |

| Class T | | | | | | | | |

| Issued | | | – | | | | 250 | |

| Distributions reinvested | | | 8 | | | | – | |

| Net increase in capital shares | | | 8 | | | | 250 | |

| | | | | | | | | |

| Class D | | | | | | | | |

| Issued | | | – | | | | 250 | |

| Distributions reinvested | | | 8 | | | | – | |

| Net increase in capital shares | | | 8 | | | | 250 | |

| (a) | The Fund commenced operations on April 20, 2015. |

See Notes to Financial Statements.

| Annual Report | September 30, 2016 | 11 |

| Resource Credit Income Fund – Class A | Financial Highlights |

For a Share Outstanding Throughout the Periods Presented

| | | Year Ended September 30, 2016 | | | For the Period Ended September 30, 2015(a) | |

| NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 10.00 | | | $ | 10.00 | |

| | | | | | | | | |

| INCOME FROM INVESTMENT OPERATIONS | | | | | | | | |

Net investment income(b) | | | 0.43 | | | | – | |

| Net realized and unrealized gain on investments | | | 0.18 | | | | – | |

| Total income from investment operations | | | 0.61 | | | | – | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

| From net investment income | | | (0.27 | ) | | | – | |

| From return of capital | | | (0.08 | ) | | | – | |

| Total distributions | | | (0.35 | ) | | | – | |

| INCREASE IN NET ASSET VALUE | | | 0.26 | | | | – | |

| NET ASSET VALUE, END OF PERIOD | | $ | 10.26 | | | $ | 10.00 | |

| | | | | | | | | |

TOTAL RETURN(c) | | | 6.22 | % | | | – | % |

| | | | | | | | | |

| RATIOS AND SUPPLEMENTAL DATA | | | | | | | | |

| Net assets, end of period (in 000s) | | $ | 4,043 | | | $ | 3 | |

| | | | | | | | | |

| RATIOS TO AVERAGE NET ASSETS | | | | | | | | |

Including interest expense:(d) | | | | | | | | |

| Expenses, gross | | | 34.54 | % | | | 472.13 | %(e) |

| Expenses, net of fees waived/expenses reimbursed by investment adviser | | | 2.59 | % | | | 0.02 | %(e) |

Excluding interest expense:(d) | | | | | | | | |

| Expenses, gross | | | 34.54 | % | | | N/A | |

| Expenses, net of fees waived/expenses reimbursed by investment adviser | | | 2.59 | % | | | N/A | |

| Net investment income | | | 4.43 | % | | | 0.00 | %(e) |

| | | | | | | | | |

| PORTFOLIO TURNOVER RATE | | | 22 | % | | | 0 | %(f) |

| (a) | The Fund's Class A commenced operations on April 20, 2015. |

| (b) | Per share numbers have been calculated using the average shares method. |

| (c) | Total returns shown are historical in nature and assume changes in share price, reinvestment of dividends and capital gains distribution, if any. Had the Adviser not absorbed a portion of Fund expenses, total returns would have been lower. Total returns for periods less than one year are not annualized. Returns shown exclude applicable sales charges. |

| (d) | Ratios do not include expenses of underlying investment companies in which the Fund invests. |

See Notes to Financial Statements.

| 12 | www.resourcecreditincome.com |

| Resource Credit Income Fund – Class C | Financial Highlights |

For a Share Outstanding Throughout the Periods Presented

| | | Year Ended September 30, 2016 | | | For the Period Ended September 30, 2015(a) | |

| NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 10.00 | | | $ | 10.00 | |

| | | | | | | | | |

| INCOME FROM INVESTMENT OPERATIONS | | | | | | | | |

Net investment income(b) | | | 0.59 | | | | – | |

| Net realized and unrealized gain on investments | | | 0.08 | | | | – | |

| Total income from investment operations | | | 0.67 | | | | – | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

| From net investment income | | | (0.24 | ) | | | – | |

| From return of capital | | | (0.07 | ) | | | – | |

| Total distributions | | | (0.31 | ) | | | – | |

| INCREASE IN NET ASSET VALUE | | | 0.36 | | | | – | |

| NET ASSET VALUE, END OF PERIOD | | $ | 10.36 | | | $ | 10.00 | |

| | | | | | | | | |

TOTAL RETURN(c) | | | 6.85 | % | | | – | % |

| | | | | | | | | |

| RATIOS AND SUPPLEMENTAL DATA | | | | | | | | |

| Net assets, end of period (in 000s) | | $ | 434 | | | $ | 3 | |

| | | | | | | | | |

| RATIOS TO AVERAGE NET ASSETS | | | | | | | | |

Including interest expense:(d) | | | | | | | | |

| Expenses, gross | | | 18.42 | % | | | 473.06 | %(e) |

| Expenses, net of fees waived/expenses reimbursed by investment adviser | | | 3.34 | % | | | 0.02 | %(e) |

Excluding interest expense:(d) | | | | | | | | |

| Expenses, gross | | | 18.42 | % | | | N/A | |

| Expenses, net of fees waived/expenses reimbursed by investment adviser | | | 3.34 | % | | | N/A | |

| Net investment income | | | 5.85 | % | | | 0.00 | %(e) |

| | | | | | | | | |

| PORTFOLIO TURNOVER RATE | | | 22 | % | | | 0 | %(f) |

| (a) | The Fund's Class C commenced operations on April 20, 2015. |

| (b) | Per share numbers have been calculated using the average shares method. |

| (c) | Total returns shown are historical in nature and assume changes in share price, reinvestment of dividends and capital gains distribution, if any. Had the Adviser not absorbed a portion of Fund expenses, total returns would have been lower. Total returns for periods less than one year are not annualized. Returns shown exclude applicable sales charges. |

| (d) | Ratios do not include expenses of underlying investment companies in which the Fund invests. |

See Notes to Financial Statements.

| Annual Report | September 30, 2016 | 13 |

| Resource Credit Income Fund – Class W | Financial Highlights |

For a Share Outstanding Throughout the Periods Presented

| | | Year Ended September 30, 2016 | | | For the Period Ended September 30, 2015(a) | |

| NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 10.00 | | | $ | 10.00 | |

| | | | | | | | | |

| INCOME FROM INVESTMENT OPERATIONS | | | | | | | | |

Net investment income(b) | | | 0.63 | | | | – | |

| Net realized and unrealized loss on investments | | | (0.07 | )(c) | | | – | |

| Total income from investment operations | | | 0.56 | | | | – | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

| From net investment income | | | (0.25 | ) | | | – | |

| From return of capital | | | (0.07 | ) | | | – | |

| Total distributions | | | (0.32 | ) | | | – | |

| INCREASE IN NET ASSET VALUE | | | 0.24 | | | | – | |

| NET ASSET VALUE, END OF PERIOD | | $ | 10.24 | | | $ | 10.00 | |

| | | | | | | | | |

TOTAL RETURN(d) | | | 5.74 | % | | | – | % |

| | | | | | | | | |

| RATIOS AND SUPPLEMENTAL DATA | | | | | | | | |

| Net assets, end of period (in 000s) | | $ | 494 | | | $ | 3 | |

| | | | | | | | | |

| RATIOS TO AVERAGE NET ASSETS | | | | | | | | |

Including interest expense:(e) | | | | | | | | |

| Expenses, gross | | | 17.52 | % | | | 472.69 | %(f) |

| Expenses, net of fees waived/expenses reimbursed by investment adviser | | | 3.09 | % | | | 0.04 | %(f) |

Excluding interest expense:(e) | | | | | | | | |

| Expenses, gross | | | 17.52 | % | | | N/A | |

| Expenses, net of fees waived/expenses reimbursed by investment adviser | | | 3.09 | % | | | N/A | |

| Net investment income | | | 6.24 | % | | | 0.00 | %(f) |

| | | | | | | | | |

| PORTFOLIO TURNOVER RATE | | | 22 | % | | | 0 | %(g) |

| (a) | The Fund's Class W commenced operations on April 20, 2015. |

| (b) | Per share numbers have been calculated using the average shares method. |

| (c) | Realized and unrealized losses per share do not correlate to the aggregate of the net realized and unrealized gains on the Statement of Operations for the period ended September 30, 2016, primarily due to the timing of sales and repurchases of the Fund's shares in relation to fluctuating market values for the Fund's portfolio. |

| (d) | Total returns shown are historical in nature and assume changes in share price, reinvestment of dividends and capital gains distribution, if any. Had the Adviser not absorbed a portion of Fund expenses, total returns would have been lower. Total returns for periods less than one year are not annualized. |

| (e) | Ratios do not include expenses of underlying investment companies in which the Fund invests. |

See Notes to Financial Statements.

| 14 | www.resourcecreditincome.com |

| Resource Credit Income Fund – Class I | Financial Highlights |

For a Share Outstanding Throughout the Periods Presented

| | | Year Ended September 30, 2016 | | | For the Period Ended September 30, 2015(a) | |

| NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 10.00 | | | $ | 10.00 | |

| | | | | | | | | |

| INCOME FROM INVESTMENT OPERATIONS | | | | | | | | |

Net investment income(b) | | | 0.35 | | | | – | |

| Net realized and unrealized gain on investments | | | 0.28 | | | | – | |

| Total income from investment operations | | | 0.63 | | | | – | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

| From net investment income | | | (0.27 | ) | | | – | |

| From return of capital | | | (0.08 | ) | | | – | |

| Total distributions | | | (0.35 | ) | | | – | |

| INCREASE IN NET ASSET VALUE | | | 0.28 | | | | – | |

| NET ASSET VALUE, END OF PERIOD | | $ | 10.28 | | | $ | 10.00 | |

| | | | | | | | | |

TOTAL RETURN(c) | | | 6.42 | % | | | – | % |

| | | | | | | | | |

| RATIOS AND SUPPLEMENTAL DATA | | | | | | | | |

| Net assets, end of period (in 000s) | | $ | 213 | | | $ | 200 | |

| | | | | | | | | |

| RATIOS TO AVERAGE NET ASSETS | | | | | | | | |

Including interest expense:(d) | | | | | | | | |

| Expenses, gross | | | 72.33 | % | | | 430.52 | %(e) |

| Expenses, net of fees waived/expenses reimbursed by investment adviser | | | 2.34 | % | | | 0.03 | %(e) |

Excluding interest expense:(d) | | | | | | | | |

| Expenses, gross | | | 72.33 | % | | | N/A | |

| Expenses, net of fees waived/expenses reimbursed by investment adviser | | | 2.34 | % | | | N/A | |

| Net investment income | | | 3.53 | % | | | 0.00 | %(e) |

| | | | | | | | | |

| PORTFOLIO TURNOVER RATE | | | 22 | % | | | 0 | %(f) |

| (a) | The Fund's Class I commenced operations on April 20, 2015. |

| (b) | Per share numbers have been calculated using the average shares method. |

| (c) | Total returns shown are historical in nature and assume changes in share price, reinvestment of dividends and capital gains distribution, if any. Had the Adviser not absorbed a portion of Fund expenses, total returns would have been lower. Total returns for periods less than one year are not annualized. |

| (d) | Ratios do not include expenses of underlying investment companies in which the Fund invests. |

See Notes to Financial Statements.

| Annual Report | September 30, 2016 | 15 |

| Resource Credit Income Fund – Class U | Financial Highlights |

For a Share Outstanding Throughout the Periods Presented

| | | Year Ended September 30, 2016 | | | For the Period Ended September 30, 2015(a) | |

| NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 10.00 | | | $ | 10.00 | |

| | | | | | | | | |

| INCOME FROM INVESTMENT OPERATIONS | | | | | | | | |

Net investment income(b) | | | 0.32 | | | | – | |

| Net realized and unrealized gain on investments | | | 0.29 | | | | – | |

| Total income from investment operations | | | 0.61 | | | | – | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

| From net investment income | | | (0.27 | ) | | | – | |

| From return of capital | | | (0.08 | ) | | | – | |

| Total distributions | | | (0.35 | ) | | | – | |

| INCREASE IN NET ASSET VALUE | | | 0.26 | | | | – | |

| NET ASSET VALUE, END OF PERIOD | | $ | 10.26 | | | $ | 10.00 | |

| | | | | | | | | |

TOTAL RETURN(c) | | | 6.22 | % | | | – | % |

| | | | | | | | | |

| RATIOS AND SUPPLEMENTAL DATA | | | | | | | | |

| Net assets, end of period (in 000s) | | $ | 3 | | | $ | 3 | |

| | | | | | | | | |

| RATIOS TO AVERAGE NET ASSETS | | | | | | | | |

Including interest expense:(d) | | | | | | | | |

| Expenses, gross | | | 72.67 | % | | | 472.13 | %(e) |

| Expenses, net of fees waived/expenses reimbursed by investment adviser | | | 2.59 | % | | | 0.02 | %(e) |

Excluding interest expense:(d) | | | | | | | | |

| Expenses, gross | | | 72.67 | % | | | N/A | |

| Expenses, net of fees waived/expenses reimbursed by investment adviser | | | 2.59 | % | | | N/A | |

| Net investment income | | | 3.28 | % | | | 0.00 | %(e) |

| | | | | | | | | |

| PORTFOLIO TURNOVER RATE | | | 22 | % | | | 0 | %(f) |

| (a) | The Fund's Class U commenced operations on April 20, 2015. |

| (b) | Per share numbers have been calculated using the average shares method. |

| (c) | Total returns shown are historical in nature and assume changes in share price, reinvestment of dividends and capital gains distribution, if any. Had the Adviser not absorbed a portion of Fund expenses, total returns would have been lower. Total returns for periods less than one year are not annualized. Returns shown exclude applicable sales charges. |

| (d) | Ratios do not include expenses of underlying investment companies in which the Fund invests. |

See Notes to Financial Statements.

| 16 | www.resourcecreditincome.com |

| Resource Credit Income Fund – Class T | Financial Highlights |

For a Share Outstanding Throughout the Periods Presented

| | | Year Ended September 30, 2016 | | | For the Period Ended September 30, 2015(a) | |

| NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 10.00 | | | $ | 10.00 | |

| | | | | | | | | |

| INCOME FROM INVESTMENT OPERATIONS | | | | | | | | |

Net investment income(b) | | | 0.25 | | | | – | |

| Net realized and unrealized gain on investments | | | 0.29 | | | | – | |

| Total income from investment operations | | | 0.54 | | | | – | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

| From net investment income | | | (0.24 | ) | | | – | |

| From return of capital | | | (0.07 | ) | | | – | |

| Total distributions | | | (0.31 | ) | | | – | |

| INCREASE IN NET ASSET VALUE | | | 0.23 | | | | – | |

| NET ASSET VALUE, END OF PERIOD | | $ | 10.23 | | | $ | 10.00 | |

| | | | | | | | | |

TOTAL RETURN(c) | | | 5.40 | % | | | – | % |

| | | | | | | | | |

| RATIOS AND SUPPLEMENTAL DATA | | | | | | | | |

| Net assets, end of period (in 000s) | | $ | 3 | | | $ | 3 | |

| | | | | | | | | |

| RATIOS TO AVERAGE NET ASSETS | | | | | | | | |

Including interest expense:(d) | | | | | | | | |

| Expenses, gross | | | 73.55 | % | | | 473.06 | %(e) |

| Expenses, net of fees waived/expenses reimbursed by investment adviser | | | 3.34 | % | | | 0.02 | %(e) |

Excluding interest expense:(d) | | | | | | | | |

| Expenses, gross | | | 73.55 | % | | | N/A | |

| Expenses, net of fees waived/expenses reimbursed by investment adviser | | | 3.34 | % | | | N/A | |

| Net investment income | | | 2.53 | % | | | 0.00 | %(e) |

| | | | | | | | | |

| PORTFOLIO TURNOVER RATE | | | 22 | % | | | 0 | %(f) |

| (a) | The Fund's Class T commenced operations on April 20, 2015. |

| (b) | Per share numbers have been calculated using the average shares method. |

| (c) | Total returns shown are historical in nature and assume changes in share price, reinvestment of dividends and capital gains distribution, if any. Had the Adviser not absorbed a portion of Fund expenses, total returns would have been lower. Total returns for periods less than one year are not annualized. Returns shown exclude applicable sales charges. |

| (d) | Ratios do not include expenses of underlying investment companies in which the Fund invests. |

See Notes to Financial Statements.

| Annual Report | September 30, 2016 | 17 |

| Resource Credit Income Fund – Class D | Financial Highlights |

For a Share Outstanding Throughout the Periods Presented

| | | Year Ended September 30, 2016 | | | For the Period Ended September 30, 2015(a) | |

| NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 10.00 | | | $ | 10.00 | |

| | | | | | | | | |

| INCOME FROM INVESTMENT OPERATIONS | | | | | | | | |

Net investment income(b) | | | 0.27 | | | | – | |

| Net realized and unrealized gain on investments | | | 0.29 | | | | – | |

| Total income from investment operations | | | 0.56 | | | | – | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

| From net investment income | | | (0.25 | ) | | | – | |

| From return of capital | | | (0.07 | ) | | | – | |

| Total distributions | | | (0.32 | ) | | | – | |

| INCREASE IN NET ASSET VALUE | | | 0.24 | | | | – | |

| NET ASSET VALUE, END OF PERIOD | | $ | 10.24 | | | $ | 10.00 | |

| | | | | | | | | |

TOTAL RETURN(c) | | | 5.73 | % | | | – | % |

| | | | | | | | | |

| RATIOS AND SUPPLEMENTAL DATA | | | | | | | | |

| Net assets, end of period (in 000s) | | $ | 3 | | | $ | 3 | |

| | | | | | | | | |

| RATIOS TO AVERAGE NET ASSETS | | | | | | | | |

Including interest expense:(d) | | | | | | | | |

| Expenses, gross | | | 73.23 | % | | | 472.70 | %(e) |

| Expenses, net of fees waived/expenses reimbursed by investment adviser | | | 3.09 | % | | | 0.02 | %(e) |

Excluding interest expense:(d) | | | | | | | | |

| Expenses, gross | | | 73.23 | % | | | N/A | |

| Expenses, net of fees waived/expenses reimbursed by investment adviser | | | 3.09 | % | | | N/A | |

| Net investment income | | | 2.78 | % | | | 0.00 | %(e) |

| | | | | | | | | |

| PORTFOLIO TURNOVER RATE | | | 22 | % | | | 0 | %(f) |

| (a) | The Fund's Class D commenced operations on April 20, 2015. |

| (b) | Per share numbers have been calculated using the average shares method. |

| (c) | Total returns shown are historical in nature and assume changes in share price, reinvestment of dividends and capital gains distribution, if any. Had the Adviser not absorbed a portion of Fund expenses, total returns would have been lower. Total returns for periods less than one year are not annualized. |

| (d) | Ratios do not include expenses of underlying investment companies in which the Fund invests. |

See Notes to Financial Statements.

| 18 | www.resourcecreditincome.com |

| Resource Credit Income Fund | Notes to Financial Statements |

September 30, 2016

1. ORGANIZATION

Resource Credit Income Fund (the “Trust” or the “Fund”) was organized as a Delaware statutory trust on December 11, 2014 and is registered under the Investment Company Act of 1940, as amended, (the “1940 Act”), as a non‐diversified, closed‐end management investment company that operates as an interval fund with a continuous offering of Fund shares. The Fund’s investment adviser is Resource Financial Fund Management, Inc. (the “Adviser”). The investment objectives are to produce current income and to achieve capital preservation with moderate volatility and low to moderate correlation to the broader equity markets. The Fund pursues its investment objectives by investing, under normal circumstances, at least 80% of its assets (defined as net assets plus the amount of any borrowing for investment purposes) in fixed‐income and fixed‐income related securities.

The Fund currently offers Class A, Class C, Class W, Class I, Class U, Class T and Class D shares; all classes of shares commenced operations on April 20, 2015. With the approval of the Board, effective September 30, 2015, the Fund’s fiscal year end was changed from February 28 to September 30. Class W, Class I and Class D shares are offered at net asset value. Class A and Class U shares are offered at net asset value plus a maximum sales charge of 6.50% and may also be subject to a 0.50% early withdrawal charge, which will be deducted from repurchase proceeds, for shareholders tendering shares fewer than 365 days after the original purchase date, if (i) the original purchase was for amounts of $1 million or more and (ii) the selling broker received the reallowance of the dealer‐manager fee. Class C and Class T shares are offered at net asset value plus a maximum sales charge of 1.50% and may also be subject to a 1.00% early withdrawal charge, which will be deducted from repurchase proceeds, for shareholders tendering shares fewer than 365 days after the original purchase date. Each class represents an interest in the same assets of the Fund and classes are identical except for differences in their sales charge structures and ongoing service and distribution charges. All classes of shares have equal voting privileges except that each class has exclusive voting rights with respect to its service and/or distribution plans. The Fund’s income, expenses (other than class specific distribution fees) and realized and unrealized gains and losses are allocated proportionately each day based upon the relative net assets of each class.

2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies followed by the Fund in preparation of its financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The Fund is considered an investment company for financial reporting purposes under GAAP. The preparation of financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses for the period. Actual results could differ from those estimates.

Security Valuation – Securities listed on an exchange are valued at the last reported sale price at the close of the regular trading session of the exchange on the business day the value is being determined, or in the case of securities listed on NASDAQ, at the NASDAQ Official Closing Price (“NOCP”). Short‐term investments that mature in 60 days or less may be valued at amortized cost, provided such valuations represent fair value.

Structured credit and other similar debt securities including, but not limited to CDO (“Collateralized Debt Obligation”) debt and equity securities, ABS (“Asset‐Backed Security”) securities, CMBS (“Commercial Mortgage Backed Security”) securities, and other securitized investments backed by certain debt or other receivables (collectively “Structured Credit Securities”) are valued on the basis of valuations provided by dealers in those instruments and/or independent pricing services recommended by the Adviser and approved by the Trust’s Board of Trustees (the “Board”). In determining value, dealers and pricing services will generally use information with respect to transactions in the securities being valued; quotations from other dealers; market transactions in comparable securities; analyses and evaluations of various relationships between securities; and yield to maturity information. The Adviser will, based on its reasonable judgment, select the dealer or pricing service quotation that most accurately reflects the fair market value of the Structured Credit Security while taking into account the information utilized by the dealer or pricing service to formulate the quotation in addition to any other relevant factors. In the event that there is a material discrepancies between quotations received from third party dealers or the pricing services the Adviser may (i) use an average of the quotations received or (ii) select an individual quotation that the Adviser, based up its reasonable judgment, determines to be accurate. In any instance in which the Adviser selects a single bid pursuant to section (e)(ii), the Adviser will provide to the Fair Value Committee an analysis of the factors relied upon in the selection of the relevant quotation.

When price quotations for certain securities are not readily available, or if the available quotations are not believed to be reflective of market value by the Adviser, those securities will be valued at “fair value” as determined in good faith by the Fair Value Committee using procedures adopted by and under the supervision of the Board. There can be no assurance that the Fund could purchase or sell a portfolio security at the price used to calculate the Fund’s net asset value (“NAV”).

| Annual Report | September 30, 2016 | 19 |

| Resource Credit Income Fund | Notes to Financial Statements |

September 30, 2016

Fair valuation procedures may be used to value a substantial portion of the assets of the Fund. The Fund may use the fair value of a security to calculate its NAV when, for example, (1) a portfolio security is not traded in a public market or the principal market in which the security trades is closed, (2) trading in a portfolio security is suspended and not resumed prior to the normal market close, (3) a portfolio security is not traded in significant volume for a substantial period, or (4) the Adviser determines that the quotation or price for a portfolio security provided by a broker‐dealer or independent pricing service is inaccurate.

The “fair value” of securities may be difficult to determine and thus judgment plays a greater role in the valuation process. The fair valuation methodology may include or consider the following guidelines, as appropriate: (1) evaluation of all relevant factors, including but not limited to, pricing history, current market level, supply and demand of the respective security; (2) comparison to the values and current pricing of securities that have comparable characteristics; (3) knowledge of historical market information with respect to the security; (4) other factors relevant to the security which would include, but not be limited to, duration, yield, fundamental analytical data, the Treasury yield curve and credit quality.

Valuation of Private Investment Funds – The Fund invests a portion of its assets in Private Investment Funds. Private Investment Funds measure their investment assets at fair value, and report a NAV per share on a calendar quarter basis. In accordance with Accounting Standards Codification (“ASC”) 820, the Fund has elected to apply the practical expedient and to value its investments in Private Investment Funds at their respective NAVs at each quarter. For non‐calendar quarter days, the Fair Value Committee estimates the fair value of each Investment Fund by adjusting the most recent NAV for each Private Investment Fund, as necessary, by the change in a relevant benchmark that the Fair Value Committee has deemed to be representative of the market.

Loan Participation and Assignments – The Fund may invest in direct debt instruments which are interests in amounts owed to lenders or lending syndicates by corporate, governmental, or other borrowers. The Fund’s investments in loans may be in the form of participations in loans or assignments of all or a portion of the loans from third parties. A loan is often administered by a bank or other financial institution (the “lender”) that acts as agent for all holders. The agent administers the terms of the loan, as specified in the loan agreement. The Fund may invest in multiple series or tranches of a loan, which may have varying terms and carry different associated risks. The Fund generally has no right to enforce compliance with the terms of the loan agreement with the borrower. As a result, the Fund may be subject to the credit risk of both the borrower and the lender that is selling the loan agreement. When the Fund purchases assignments from lenders they acquire direct rights against the borrower of the loan. The Fund may enter into unfunded loan commitments, which are contractual obligations for future funding. Unfunded loan commitments represent a future obligation in full, even though a percentage of the notional loan amounts may not be utilized by the borrower. When investing in a loan participation, the Fund has the right to receive payments of principal, interest and any fees to which it is entitled only from the lender selling the loan agreement and only upon receipt of payments by the lender from the borrower. The Fund may receive a commitment fee based on the undrawn portion of the underlying line of credit portion of a floating rate loan. In certain circumstances, the Fund may receive a penalty fee upon the prepayment of a floating rate loan by a borrower. For the year ended September 30, 2016, no penalty fees were received by the Fund. Fees earned or paid are recorded as a component of interest income or interest expense, respectively, on the Statement of Operations.

Fair Value Measurements – A three‐tier hierarchy has been established to classify fair value measurements for disclosure purposes. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk. Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability that are developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability that are developed based on the best information available. In accordance with the authoritative guidance on fair value measurements and disclosure under GAAP, the Fund discloses the fair value of its investments in a hierarchy that prioritizes the inputs to valuation techniques used to measure the fair value.

Various inputs are used in determining the value of the Fund’s investments as of the reporting period end. These inputs are categorized in the following hierarchy under applicable financial accounting standards:

| Level 1 – | Unadjusted quoted prices in active markets for identical, unrestricted assets or liabilities that the Fund has the ability to access at the measurement date; |

| Level 2 – | Quoted prices which are not active, quoted prices for similar assets or liabilities in active markets or inputs other than quoted prices that are observable (either directly or indirectly) for substantially the full term of the asset or liability at the measurement date; and |

| Level 3 – | Significant unobservable prices or inputs (including the Fund’s own assumptions in determining the fair value of investments) where there is little or no market activity for the asset or liability at the measurement date. |

| 20 | www.resourcecreditincome.com |

| Resource Credit Income Fund | Notes to Financial Statements |

September 30, 2016

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

An investment level within the fair value hierarchy is based on the lowest level input, individually or in the aggregate, that is significant to fair value measurement. The valuation techniques used by the Fund to measure fair value during the period ended September 30, 2016 maximized the use of observable inputs and minimized the use of unobservable inputs.

The inputs or methodologies used for valuing securities are not necessarily an indication of the risk or liquidity associated with investing in those securities. The following is a summary of the inputs used in valuing the Fund’s investments as of September 30, 2016:

| Investments in Securities at Value | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Bank Loans | | $ | – | | | $ | 1,384,766 | | | $ | – | | | $ | 1,384,766 | |

Bonds & Notes(a) | | | – | | | | 1,808,823 | | | | – | | | | 1,808,823 | |

Common Stocks(a) | | | 940,300 | | | | – | | | | – | | | | 940,300 | |

| Real Estate Investment Trusts ‐ Common Stocks | | | 129,675 | | | | – | | | | – | | | | 129,675 | |

Private Investment Funds (Measured at net asset value)(b) | | | – | | | | – | | | | – | | | | 506,315 | |

| Short Term Investments | | | 325,914 | | | | – | | | | – | | | | 325,914 | |

| TOTAL | | $ | 1,395,889 | | | $ | 3,193,589 | | | $ | – | | | $ | 5,095,793 | |

(a) | For detailed descriptions, see the accompanying Portfolio of Investments. |

(b) | In accordance with Subtopic 820-10, certain investments that are measured at fair value using the net asset value per share (or its equivalent) practical expedient have not been classified in the fair value hierarchy. The fair value amounts presented in this table are intended to permit reconciliation of the fair value hierarchy to the amounts presented in the Statement of Assets and Liabilities. |

There were no transfers between Levels 1, 2 and 3 during the period ended September 30, 2016. It is the Fund’s policy to recognize transfers between levels at the end of the reporting period.

Security Transactions and Investment Income – Investment security transactions are accounted for on a trade date basis. Cost is determined and gains and losses are based upon the specific identification method for both financial statement and federal income tax purposes. Dividend income is recorded on the ex‐dividend date and interest income is recorded on the accrual basis. Purchase discounts and premiums on securities are accreted and amortized over the life of the respective securities.

Federal and Other Taxes – The Fund has qualified, except as described below, and intends to continue to qualify as a regulated investment company ("RIC") and to comply with the applicable provisions of the Internal Revenue Code of 1986, as amended (the "Code"), and to distribute substantially all of its taxable income to its shareholders. Therefore, no federal income or excise tax provisions are required.

As of September 30, 2015, the Fund did not qualify as a RIC under Subchapter M of the Code because it did not meet certain quarterly diversification tests. Accordingly, the Fund filed as a "C" corporation for the period ended September 30, 2015. As a "C" corporation, the Fund was subject to federal income taxes on any taxable income for that period. However, as there were no investments held, the Fund had no net investment income for the period and consequently did not incur any tax liability. The Fund has met qualifications as of September 30, 2016 and expects to be taxed as a RIC in future periods. Therefore, no provision was made for federal income or excise taxes related to the period ended September 30, 2016.

The Fund evaluates tax positions taken (or expected to be taken) in the course of preparing the Fund’s tax provisions to determine whether these positions meet a “more‐likely‐than‐not” standard that, based on the technical merits, have a more than fifty percent likelihood of being sustained by a taxing authority upon examination. A tax position that meets the “more‐likely‐than‐not” recognition threshold is measured to determine the amount of benefit to recognize in the financial statements.

As of and during the period ended September 30, 2016, the Fund did not have a liability for any unrecognized tax benefits. The Fund files U.S. federal, state and local tax returns as required. The Fund’s tax returns are subject to examination by the relevant tax authorities until expiration of the applicable statute of limitations which is generally three years after the filing of the tax return for federal purposes and four years for most state returns. Tax returns for open years have incorporated no uncertain tax positions that require a provision for income taxes.

| Annual Report | September 30, 2016 | 21 |

| Resource Credit Income Fund | Notes to Financial Statements |

September 30, 2016

Foreign Currency – The accounting records of the Fund are maintained in U.S. dollars. Investment securities and other assets and liabilities denominated in a foreign currency and income receipts and expense payments are translated into U.S. dollars using the prevailing exchange rate at the London market close. Purchases and sales of securities are translated into U.S. dollars at the contractual currency rates established at the approximate time of the trade. Net realized gains and losses on foreign currency transactions represent net gains and losses from currency realized between the trade and settlement dates on securities transactions and the difference between income accrued versus income received. The effects of changes in foreign currency exchange rates on investments in securities are included with the net realized and unrealized gain or loss on investment securities.

Distributions to Shareholders – Distributions from investment income are declared and paid quarterly. Distributions from net realized capital gains, if any, are declared and paid annually and are recorded on the ex‐dividend date. The character of income and gains to be distributed is determined in accordance with income tax regulations, which may differ from GAAP.

Offering Costs – Offering costs incurred by the Fund of $653,110 were treated as deferred charges until operations commenced and were amortized over a 12‐month period using the straight line method. All amounts have been amortized as of September 30, 2016.

Concentration of Credit Risk – The Fund places its cash with one banking institution, which is insured by Federal Deposit Insurance Corporation (FDIC). The FDIC limit is $250,000. At various times throughout the year, the amount on deposit may exceed the FDIC limit and subject the Fund to a credit risk. The Fund does not believe that such deposits are subject to any unusual risk associated with investment activities.

Indemnification – The Trust indemnifies its officers and Trustees for certain liabilities that may arise from the performance of their duties to the Trust. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties and which provide general indemnities. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on industry experience, the Trust expects the risk of loss due to these warranties and indemnities to be remote.

3. ADVISORY FEES AND OTHER RELATED PARTY TRANSACTIONS

Advisory Fees – Pursuant to an investment advisory agreement (the “Advisory Agreement”), investment advisory services are provided to the Fund by the Adviser. Under the terms of the Advisory Agreement, the Adviser receives a monthly base management fee calculated at an annual rate of 1.85% of the average daily net assets of the Fund. For the year ended September 30, 2016, the Fund incurred $44,810 in base management fees, all of which were waived.

The Adviser has contractually agreed to waive all or part of its management fees (excluding any incentive fee) and/or make payments to limit Fund expenses, (including all organization and offering expenses, but excluding interest, brokerage commissions, acquired fund fees and expenses and extraordinary expenses) at least until September 9, 2018, so that the total annual operating expenses of the Fund do not exceed 2.59% per annum of Class A average daily net assets, 3.34% per annum of Class C average daily net assets, 3.09% per annum of Class W average daily net assets, 2.34% per annum of Class I average daily net assets, 2.59% per annum of Class U average daily net assets, 3.34% per annum of Class T average daily net assets and 3.09% per annum of Class D average daily net assets. Fee waivers and expense payments may be recouped by the Adviser from the Fund, to the extent that overall expenses fall below the expense limitation, within three years of when the amounts were waived or reimbursed. As of September 30, 2015, in addition to the contractual expense limitation agreement that is in place, the Adviser also voluntarily agreed to waive/reimburse all net operating expenses of the Fund as of the September 30, 2015 fiscal year end. During the period ended September 30, 2016, the Adviser waived fees and reimbursed expenses of $829,791.

As of September 30, 2016, the balance of recoupable expenses for the Fund was as follows:

| Fund | Expires February 20, 2018 | Expires September 30, 2018 | Expires September 30, 2019 |

| Resource Credit Income Fund | $36,870* | $398,666 | $829,791 |

| * | Organizational Expenses were reduced from $37,338 to $36,870 subsequent to the February 20, 2015 Seed Audit Financial Statements. |

The Adviser is also paid an incentive fee. The incentive fee is calculated and payable quarterly in arrears based upon the Fund’s “pre‐incentive fee net investment income” for the immediately preceding quarter and is subject to a hurdle rate, expressed as a rate of return on the Fund’s “adjusted capital,” equal to 2.25% per quarter (or an annualized hurdle rate of 9.0%), subject to a “catch‐up” feature. For this purpose, “pre‐incentive fee net investment income” means interest income, dividend income and any other income accrued during the calendar quarter, minus the Fund’s operating expenses for the quarter (including the management fee, expenses reimbursed to the Adviser and any interest expenses and distributions paid on any issued and outstanding preferred shares, but excluding the incentive fee). “Adjusted capital” means the cumulative gross proceeds received by the Fund from the sale of shares (including pursuant to the Fund’s distribution reinvestment plan), reduced by amounts paid in connection with purchases of shares pursuant to the Fund’s share repurchase program.

| 22 | www.resourcecreditincome.com |

| Resource Credit Income Fund | Notes to Financial Statements |

September 30, 2016

No incentive fee is payable in any calendar quarter in which the Fund’s pre‐incentive fee net investment income does not exceed the quarterly hurdle rate of 2.25%. For any calendar quarter in which the Fund’s pre‐incentive fee net investment income is greater than the hurdle rate, but less than or equal to 2.8125%, the incentive fee will equal the amount of the Fund’s pre‐incentive fee net investment income in excess of the hurdle rate. This portion of the Fund’s pre‐incentive fee net investment income which exceeds the hurdle rate but is less than or equal to 2.8125% is referred to as the “catch‐up.” The “catch‐up” provision is intended to provide the Adviser with an incentive fee of 20.0% on all of the Fund’s pre‐incentive fee net investment income when the Fund’s pre‐incentive fee net investment income reaches 2.8125% in any calendar quarter. For any calendar quarter in which the Fund’s pre‐incentive fee net investment income exceeds 2.8125% of adjusted capital, the incentive fee will equal 20.0% of pre‐incentive fee net investment income. For the period ended September 30, 2016, there was no incentive fee incurred.

Fund Accounting Fees and Expenses – ALPS Fund Services, Inc. (“ALPS”) serves as the Fund’s Administrator and Accounting Agent�� (the “Administrator”) and receives customary fees from the Fund for such services.

Transfer Agent – DST Systems Inc., an affiliate of ALPS, serves as transfer, dividend paying and shareholder servicing agent for the Fund (“Transfer Agent”).

Distributor – The Fund has entered into a Distribution Agreement with ALPS Distributors, Inc. (the “Distributor”) to provide distribution services to the Fund. There are no fees paid to the Distributor pursuant to the Distribution Agreement. The Board has adopted, on behalf of the Fund, a Shareholder Servicing Plan under which the Fund may compensate financial industry professionals for providing ongoing services in respect of clients with whom they have distributed shares of the Fund. Under the Shareholder Servicing Plan, the Fund’s Class A, Class C, Class W, Class U, Class T and Class D shares are subject to a shareholder servicing fee at an annual rate of 0.25% of the average daily net assets attributable to that share class. For the period ended September 30, 2016, the Fund incurred shareholder servicing fees of $5,565. The Class C and Class T shares also pay to the Distributor a distribution fee, pursuant to a distribution plan adopted by the Board, that accrues at an annual rate equal to 0.75% of the Fund’s average daily net assets attributable to Class C and Class T shares and is payable on a quarterly basis. In addition Class W and Class D shares pay to Resource Securities, Inc. (the “Dealer Manager”), an affiliate of the Adviser, a dealer manager fee, pursuant to a distribution plan adopted by the Board, that accrues at an annual rate equal to 0.50% of the Fund’s average daily net assets attributable to Class W and Class D shares and is payable on a quarterly basis. Class A, Class I, and Class U shares are not currently subject to a distribution fee. For the period ended September 30, 2016, the Fund accrued $447 in distribution fees and $368 in dealer manager fees.

The Distributor acts as the Fund’s principal underwriter in a continuous public offering of the Fund’s shares. The Distributor is an affiliate of ALPS. During the period ended September 30, 2016, no fees were retained by the Distributor.

Trustees – Each Trustee who is not affiliated with the Trust or the Adviser will receive an annual fee of $10,000, plus $2,000 for attending the annual in‐person meeting of the Board of Trustees, plus $500 for attending each of the remaining telephonic meetings, as well as reimbursement for any reasonable expenses incurred attending the meetings. None of the executive officers receives compensation from the Trust.

4. INVESTMENT TRANSACTIONS

The cost of purchases and proceeds from the sale of securities, other than short‐term securities, for the period ended September 30, 2016 amounted to $5,018,363 and $387,187, respectively.

5. TAX BASIS INFORMATION

For the year ended September 30, 2016, the following reclassifications, which had no impact on results of operations or net assets, were recorded to reflect tax character.

| | | Paid-in Capital | | | Accumulated Net Investment Income | | | Accumulated Net Realized Loss on Investments | |

| Resource Credit Income Fund | | $ | (14,880 | ) | | $ | (677 | ) | | $ | 15,557 | |

| Annual Report | September 30, 2016 | 23 |

| Resource Credit Income Fund | Notes to Financial Statements |

September 30, 2016

The following information is computed on a tax basis for each item as of September 30, 2016:

| | | Gross Appreciation (excess of value over tax cost) | | | Gross Depreciation (excess of tax cost over value) | | | Net Unrealized Appreciation | | | Cost of Investments for Income Tax Purposes | |

| Resource Credit Income Fund | | $ | 291,291 | | | $ | (142,736 | ) | | $ | 148,555 | | | $ | 4,947,238 | |

As of September 30, 2016, the components of accumulated earnings on a tax basis were as follows:

| Undistributed ordinary income | | $ | – | |

| Accumulated capital gains | | | – | |

| Net unrealized appreciation on investments | | | 148,555 | |

| Total distributable earnings | | $ | 148,555 | |

The tax characteristics of distributions paid for the year ended September 30, 2016 were as follows:

| September 30, 2016 | | Ordinary Income | | Long-Term Capital Gain | | | Return of Capital | |

| Resource Credit Income Fund | | $ | 106,763 | | | $ | – | | | $ | 27,206 | |

There were no distributions paid during the period ended September 30, 2015.