We are pleased to present the semi‐annual report for the Resource Credit Income Fund for the period ending March 31, 2016. We are actively deploying our seed capital and have begun marketing the Fund to external investors. Despite being early in its lifecycle, the Fund has delivered value to shareholders by:

Our investment universe includes four broad categories of fixed‐income: publicly traded credit‐linked equities (e.g. primarily public business development companies (BDCs)); structured credit instruments, with a focus on structured credit; private credit funds; and traded loans and bonds. Our target allocations within these categories are as follows:

The CIF intends to broadly follow these guidelines, but will adjust allocations depending on market conditions to maximize risk adjusted returns.

We have implemented our proprietary investment process, rooted in thorough due diligence and credit analysis to identify attractive opportunities within our investment universe. More specifically, we have developed the Resource America Liquid Alternatives Score (RALAS) to identify business, capital structure and industry risk as well as quantify return potential within each potential investment. We believe our scoring system will help drive yield for investors while helping protect principal by screening‐out credit risk.

The CIF began investing in late 2015 and early 2016—a period of near historic volatility for the credit markets. As a proxy for the broader credit markets, the U.S. High Yield1 market ended 2015 down approximately 5.0% (with much of this decline coming in the fourth quarter) and declined an additional approximately 5.0% in early 2016. The credit markets snapped‐back in early February and U.S. High Yield is now up nearly 6.0% for the year.

The Fund capitalized on the market’s dislocation to drive returns for our investors. As an example, the CIF began investing in public BDCs in early January and generated a total return of 8.35% in the first quarter. Importantly, the CIF’s BDC portfolio nearly doubled the return of the S&P 500 BDC Index2, which returned 4.37% in that period. As a further comparison, the S&P 500 Index returned roughly 1.35% in the first quarter of 2016.

Outside of the BDC portfolio, the Fund continued to rebound from market driven declines at the start of the year. We believe we will continue to see opportunities for the CIF to generate income for investors while maintaining our focus on preservation of capital.

Interest rate risk has retreated in recent weeks on the back of dovish commentary from the Federal Reserve. Nevertheless, the CIF remains conscious of being late in the credit cycle and of the Fed’s aspiration to “normalize” interest rates. The Fund will therefore continue to weight toward loan‐based instruments, which can mitigate interest‐rate risk. Investors will recall that loans are generally floating rate obligations, paying greater income in a rising rate environment.

From a sector standpoint, the Fund has limited its exposure to cyclical industries. We have no direct exposure to Energy or Metals & Mining, as we view risk as outweighing reward in those industries currently. We view the macro picture in the U.S. as generally sound and therefore have allocated toward companies primarily exposed to the domestic economy.

Thank you for being a shareholder of the Resource Credit Income Fund and we look forward to long‐term partnership.

Senior loans hold the most senior position in the capital structure of a borrower. Substantial increases in interest rates may cause an increase in loan defaults as borrowers may lack resources to meet higher debt service requirements.

BDCs may carry risks similar to those of a private equity or venture capital fund. BDC company securities are not redeemable at the option of the shareholder and they may trade in the market at a discount to their net asset value.

Non-traded BDCs are subject to commissions, expenses, and offering and organizational costs that reduce the value of an investor’s (including the Fund’s) investment. Non-traded BDCs are not liquid.

CDOs and other structured products, consisting of CBOs, CLOs and credit- linked notes may bear risks of the underlying investments, index or reference obligation and are subject to counterparty risk. Certain structured products may be thinly traded or have a limited trading market.

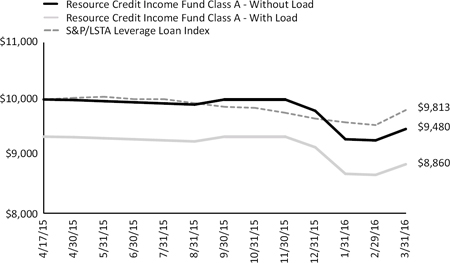

The Fund’s performance figures for the period ended March 31, 2016, compared to its benchmark:

The S&P/LSTA Leveraged Loan Index (LLI) covers the U.S. market back to 1997 and currently calculates on a daily basis. This index is run in partnership between S&P and the Loan Syndications & Trading Association, the loan market’s trade group.

Diversification does not prevent losses or guarantee returns.

Past performance is not predictive of future results. The investment return and principal value of an investment will fluctuate. An investor’s shares when redeemed, may be worth more or less than the original cost. Total return is calculated assuming reinvestment of all dividends and distributions. Performance figures for periods less than one year are not annualized. The Fund’s total annual operating expense, including underlying funds before fee waivers is 430.77% for Class A, 431.52% for Class C, 431.27% for Class W, 430.52% for Class I, 430.77% for Class U, 431.52% for Class T and 431.27% for Class D shares per the most recent Class specific prospectus filings. After fee waivers, the Fund’s total annual operating expense is 2.63% for Class A, 3.38% for Class C, 3.13% for Class W, 2.38% for Class I, 2.63% for Class U, 3.38% for Class T and 3.13% for Class D shares. Class A and Class U shares are subject to a maximum sales load of 6.50% imposed on purchases. Class C and Class T shares are subject to a maximum sales load of 1.50% imposed on purchases. For performance information current to the most recent month-end, please call toll-free 1-855-747-9559.

Security determined to be illiquid under the procedures approved by the Fund's Board of Trustees.

| Resource Credit Income Fund | Notes to Financial Statements |

March 31, 2016 (Unaudited)

1. ORGANIZATION

Resource Credit Income Fund (the “Trust” or the “Fund”) was organized as a Delaware statutory trust on December 11, 2014 and is registered under the Investment Company Act of 1940, as amended, (the “1940 Act”), as a non-diversified, closed-end management investment company that operates as an interval fund with a continuous offering of Fund shares. The Fund’s investment adviser is Resource Financial Fund Management, Inc. (the “Adviser”). The investment objective is to produce current income with a secondary objective to achieve capital preservation with moderate volatility and low to moderate correlation to the broader equity markets. The Fund pursues its investment objectives by investing, under normal circumstances, at least 80% of its assets (defined as net assets plus the amount of any borrowing for investment purposes) in fixed-income and fixed-income related securities.

The Fund currently offers Class A, Class C, Class W, Class I, Class U, Class T and Class D shares; all classes of shares commenced operations on April 20, 2015. With the approval of the Board, effective September 30, 2015, the Fund’s fiscal year end was changed from February 28 to September 30. Class W, Class I and Class D shares are offered at net asset value. Class A and Class U shares are offered at net asset value plus a maximum sales charge of 6.50% and may also be subject to a 0.50% early withdrawal charge, which will be deducted from repurchase proceeds, for shareholders tendering shares fewer than 365 days after the original purchase date, if (i) the original purchase was for amounts of $1 million or more and (ii) the selling broker received the reallowance of the dealer-manager fee. Class C and Class T shares are offered at net asset value plus a maximum sales charge of 1.50% and may also be subject to a 1.00% early withdrawal charge, which will be deducted from repurchase proceeds, for shareholders tendering shares fewer than 365 days after the original purchase date. Each class represents an interest in the same assets of the Fund and classes are identical except for differences in their sales charge structures and ongoing service and distribution charges. All classes of shares have equal voting privileges except that each class has exclusive voting rights with respect to its service and/or distribution plans. The Fund’s income, expenses (other than class specific distribution fees) and realized and unrealized gains and losses are allocated proportionately each day based upon the relative net assets of each class.

2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies followed by the Fund in preparation of its financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The Fund is considered an investment company for financial reporting purposes under GAAP. The preparation of financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses for the period. Actual results could differ from those estimates.

Security Valuation – Securities listed on an exchange are valued at the last reported sale price at the close of the regular trading session of the exchange on the business day the value is being determined, or in the case of securities listed on NASDAQ, at the NASDAQ Official Closing Price (“NOCP”). Short-term investments that mature in 60 days or less may be valued at amortized cost, provided such valuations represent fair value.

Structured credit and other similar debt securities including, but not limited to CDO (“Collateralized Debt Obligation”) debt and equity securities, ABS (“Asset-Backed Security”) securities, CMBS (“Commercial Mortgage Backed Security”) securities, and other securitized investments backed by certain debt or other receivables (collectively “Structured Credit Securities”) are valued on the basis of valuations provided by dealers in those instruments and/or independent pricing services recommended by the Adviser and approved by the Trust’s Board of Trustees (the “Board”). In determining value, dealers and pricing services will generally use information with respect to transactions in the securities being valued; quotations from other dealers; market transactions in comparable securities; analyses and evaluations of various relationships between securities; and yield to maturity information. The Adviser will, based on its reasonable judgment, select the dealer or pricing service quotation that most accurately reflects the fair market value of the Structured Credit Security while taking into account the information utilized by the dealer or pricing service to formulate the quotation in addition to any other relevant factors. In the event that there is a material discrepancies between quotations received from third party dealers or the pricing services the Adviser may (i) use an average of the quotations received or (ii) select an individual quotation that the Adviser, based up its reasonable judgment, determines to be accurate. In any instance in which the Adviser selects a single bid pursuant to section (e)(ii), the Adviser will provide to the Fair Value Committee an analysis of the factors relied upon in the selection of the relevant quotation.

When price quotations for certain securities are not readily available, or if the available quotations are not believed to be reflective of market value by the Adviser, those securities will be valued at “fair value” as determined in good faith by the Valuation Committee using procedures adopted by and under the supervision of the Board. There can be no assurance that the Fund could purchase or sell a portfolio security at the price used to calculate the Fund’s net asset value (“NAV”).

Fair valuation procedures may be used to value a substantial portion of the assets of the Fund. The Fund may use the fair value of a security to calculate its NAV when, for example, (1) a portfolio security is not traded in a public market or the principal market in which the security trades is closed, (2) trading in a portfolio security is suspended and not resumed prior to the normal market close, (3) a portfolio security is not traded in significant volume for a substantial period, or (4) the Adviser determines that the quotation or price for a portfolio security provided by a broker-dealer or independent pricing service is inaccurate.

| Semi-Annual Report | March 31, 2016 | 19 |

| Resource Credit Income Fund | Notes to Financial Statements |

March 31, 2016 (Unaudited)

The “fair value” of securities may be difficult to determine and thus judgment plays a greater role in the valuation process. The fair valuation methodology may include or consider the following guidelines, as appropriate: (1) evaluation of all relevant factors, including but not limited to, pricing history, current market level, supply and demand of the respective security; (2) comparison to the values and current pricing of securities that have comparable characteristics; (3) knowledge of historical market information with respect to the security; (4) other factors relevant to the security which would include, but not be limited to, duration, yield, fundamental analytical data, the Treasury yield curve and credit quality.

Valuation of Private Investment Funds – The Fund invests a portion of its assets in Private Investment Funds. Private Investment Funds measure their investment assets at fair value, and report a NAV per share on a calendar quarter basis. In accordance with Accounting Standards Codification (“ASC”) 820, the Fund has elected to apply the practical expedient and to value its investments in Private Investment Funds at their respective NAVs at each quarter. For non-calendar quarter days, the Valuation Committee estimates the fair value of each Investment Fund by adjusting the most recent NAV for each Private Investment Fund, as necessary, by the change in a relevant benchmark that the Valuation Committee has deemed to be representative of the market.

Loan Participation and Assignments – The Fund may invest in direct debt instruments which are interests in amounts owed to lenders or lending syndicates by corporate, governmental, or other borrowers. The Fund’s investments in loans may be in the form of participations in loans or assignments of all or a portion of the loans from third parties. A loan is often administered by a bank or other financial institution (the “lender”) that acts as agent for all holders. The agent administers the terms of the loan, as specified in the loan agreement. The Fund may invest in multiple series or tranches of a loan, which may have varying terms and carry different associated risks. The Fund generally has no right to enforce compliance with the terms of the loan agreement with the borrower. As a result, the Fund may be subject to the credit risk of both the borrower and the lender that is selling the loan agreement. When the Fund purchases assignments from lenders they acquire direct rights against the borrower of the loan. The Fund may enter into unfunded loan commitments, which are contractual obligations for future funding. Unfunded loan commitments represent a future obligation in full, even though a percentage of the notional loan amounts may not be utilized by the borrower. When investing in a loan participation, the Fund has the right to receive payments of principal, interest and any fees to which it is entitled only from the lender selling the loan agreement and only upon receipt of payments by the lender from the borrower. The Fund may receive a commitment fee based on the undrawn portion of the underlying line of credit portion of a floating rate loan. In certain circumstances, the Fund may receive a penalty fee upon the prepayment of a floating rate loan by a borrower. For the six months ended March 31, 2016, no penalty fees were received by the Fund. Fees earned or paid are recorded as a component of interest income or interest expense, respectively, on the Statement of Operations.

Fair Value Measurements – A three-tier hierarchy has been established to classify fair value measurements for disclosure purposes. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk. Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability that are developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability that are developed based on the best information available. In accordance with the authoritative guidance on fair value measurements and disclosure under GAAP, the Fund discloses the fair value of its investments in a hierarchy that prioritizes the inputs to valuation techniques used to measure the fair value.

Various inputs are used in determining the value of the Fund’s investments as of the reporting period end. These inputs are categorized in the following hierarchy under applicable financial accounting standards:

| Level 1 – | Unadjusted quoted prices in active markets for identical, unrestricted assets or liabilities that the Fund has the ability to access at the measurement date; |

| Level 2 – | Quoted prices which are not active, quoted prices for similar assets or liabilities in active markets or inputs other than quoted prices that are observable (either directly or indirectly) for substantially the full term of the asset or liability at the measurement date; and |

| Level 3 – | Significant unobservable prices or inputs (including the Fund’s own assumptions in determining the fair value of investments) where there is little or no market activity for the asset or liability at the measurement date. |

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

| 20 | www.resourcecreditincome.com |

| Resource Credit Income Fund | Notes to Financial Statements |

March 31, 2016 (Unaudited)

An investment level within the fair value hierarchy is based on the lowest level input, individually or in the aggregate, that is significant to fair value measurement. The valuation techniques used by the Fund to measure fair value during the six months ended March 31, 2016 maximized the use of observable inputs and minimized the use of unobservable inputs.

The inputs or methodologies used for valuing securities are not necessarily an indication of the risk or liquidity associated with investing in those securities. The following is a summary of the inputs used in valuing the Fund’s investments as of March 31, 2016:

| Investments in Securities at Value | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Bank Loans | | $ | – | | | $ | 554,173 | | | $ | – | | | $ | 554,173 | |

Bonds & Notes(a) | | | – | | | | 116,788 | | | | – | | | | 116,788 | |

Common Stocks(a) | | | 321,717 | | | | – | | | | – | | | | 321,717 | |

| Real Estate Investment Trusts ‐ Common Stocks | | | 85,044 | | | | – | | | | – | | | | 85,044 | |

Private Investment Funds (Measured at net asset value)(b) | | | – | | | | – | | | | – | | | | 471,741 | |

| Short Term Investments | | | 742,673 | | | | – | | | | – | | | | 742,673 | |

| TOTAL | | $ | 1,149,434 | | | $ | 670,961 | | | $ | – | | | $ | 2,292,136 | |

| (a) | For detailed descriptions, see the accompanying Portfolio of Investments. |

| (b) | In accordance with Subtopic 820-10, certain investments that are measured at fair value using the net asset value per share (or its equivalent) practical expedient have not been classified in the fair value hierarchy. The fair value amounts presented in this table are intended to permit reconciliation of the fair value hierarchy to the amounts presented in the Statement of Assets and Liabilities. |

There were no transfers between Levels 1, 2 and 3 during the six months ended March 31, 2016. It is the Fund's policy to recognize transfers between levels at the end of the reporting period.

Security Transactions and Investment Income – Investment security transactions are accounted for on a trade date basis. Cost is determined and gains and losses are based upon the specific identification method for both financial statement and federal income tax purposes. Dividend income is recorded on the ex-dividend date and interest income is recorded on the accrual basis. Purchase discounts and premiums on securities are accreted and amortized over the life of the respective securities.

Federal and Other Taxes – The Fund has qualified, except as described below, and intends to continue to qualify as a regulated investment company ("RIC") and to comply with the applicable provisions of the Internal Revenue Code of 1986, as amended (the "Code"), and to distribute substantially all of its taxable income to its shareholders. Therefore, no federal income or excise tax provisions are required.

As of September 30, 2015, the Fund did not qualify as a RIC under Subchapter M of the Code because it did not meet certain quarterly diversification tests. Accordingly, the Fund will file as a "C" corporation for the period ended September 30, 2015. As a "C" corporation, the Fund was subject to federal income taxes on any taxable income for that period. However, as there were currently no investments held, the Fund had no net investment income for the period and consequently did not incur any tax liability. The Fund has met subsequent diversification tests and expects to meet qualifications and to be taxed as a RIC in the current fiscal year and all future periods. Therefore, no provision was made for federal income or excise taxes related to the period ended March 31, 2016.

The Fund evaluates tax positions taken (or expected to be taken) in the course of preparing the Fund’s tax provisions to determine whether these positions meet a “more-likely-than-not” standard that, based on the technical merits, have a more than fifty percent likelihood of being sustained by a taxing authority upon examination. A tax position that meets the “more-likely-than-not” recognition threshold is measured to determine the amount of benefit to recognize in the financial statements.

As of and during the six months ended March 31, 2016, the Fund did not have a liability for any unrecognized tax benefits. The Fund files U.S. federal, state and local tax returns as required. The Fund’s tax returns are subject to examination by the relevant tax authorities until expiration of the applicable statute of limitations which is generally three years after the filing of the tax return for federal purposes and four years for most state returns. Tax returns for open years have incorporated no uncertain tax positions that require a provision for income taxes.

Foreign Currency – The accounting records of the Fund are maintained in U.S. dollars. Investment securities and other assets and liabilities denominated in a foreign currency and income receipts and expense payments are translated into U.S. dollars using the prevailing exchange rate at the London market close. Purchases and sales of securities are translated into U.S. dollars at the contractual currency rates established at the approximate time of the trade. Net realized gains and losses on foreign currency transactions represent net gains and losses from currency realized between the trade and settlement dates on securities transactions and the difference between income accrued versus income received. The effects of changes in foreign currency exchange rates on investments in securities are included with the net realized and unrealized gain or loss on investment securities.

| Semi-Annual Report | March 31, 2016 | 21 |

| Resource Credit Income Fund | Notes to Financial Statements |

March 31, 2016 (Unaudited)

Distributions to Shareholders – Distributions from investment income are declared and paid quarterly. Distributions from net realized capital gains, if any, are declared and paid annually and are recorded on the ex-dividend date. The character of income and gains to be distributed is determined in accordance with income tax regulations, which may differ from GAAP.

Offering Costs – Offering costs incurred by the Fund of $588,810 were treated as deferred charges until operations commenced and are being amortized over a 12-month period using the straight line method. Unamortized amounts are included in deferred offering costs in the Statement of Assets and Liabilities.

Concentration of Credit Risk – The Fund places its cash with one banking institution, which is insured by Federal Deposit Insurance Corporation (FDIC). The FDIC limit is $250,000. At various times throughout the year, the amount on deposit may exceed the FDIC limit and subject the Fund to a credit risk. The Fund does not believe that such deposits are subject to any unusual risk associated with investment activities.

Indemnification – The Trust indemnifies its officers and Trustees for certain liabilities that may arise from the performance of their duties to the Trust. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties and which provide general indemnities. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on industry experience, the Trust expects the risk of loss due to these warranties and indemnities to be remote.

3. ADVISORY FEES AND OTHER RELATED PARTY TRANSACTIONS

Advisory Fees – Pursuant to an investment advisory agreement (the “Advisory Agreement”), investment advisory services are provided to the Fund by the Adviser. Under the terms of the Advisory Agreement, the Adviser receives a monthly base management fee calculated at an annual rate of 1.85% of the average daily net assets of the Fund. For the six months ended March 31, 2016, the Fund incurred $14,933 in base management fees, all of which were waived.

The Adviser has contractually agreed to waive all or part of its management fees (excluding any incentive fee) and/or make payments to limit Fund expenses, (including all organization and offering expenses, but excluding interest, brokerage commissions, acquired fund fees and expenses and extraordinary expenses) at least until January 31, 2017, so that the total annual operating expenses of the Fund do not exceed 2.59% per annum of Class A average daily net assets, 3.34% per annum of Class C average daily net assets, 3.09% per annum of Class W average daily net assets, 2.34% per annum of Class I average daily net assets, 2.59% per annum of Class U and average daily net assets, 3.34% per annum of Class T average daily net assets and 3.09% per annum of Class D average daily net assets. Fee waivers and expense payments may be recouped by the Adviser from the Fund, to the extent that overall expenses fall below the expense limitation, within three years of when the amounts were waived or reimbursed. As of September 30, 2015, in addition to the contractual expense limitation agreement that is in place, the Adviser also voluntarily agreed to waive/reimburse all net operating expenses of the Fund as of the September 30, 2015 fiscal year end. During the six months ended March 31, 2016, the Adviser waived fees and reimbursed expenses of $509,500.

As of September 30, 2015, the balance of recoupable expenses for the Fund was as follows:

| Fund | | Expires February 20, 2018 | | | Expires September 30, 2018 | |

| Resource Credit Income Fund | | $ | 36,870 | * | | $ | 398,666 | |

| * | Organizational Expenses were reduced from $37,338 to $36,870 subsequent to the February 20, 2015 Seed Audit Financial Statements. |

The Adviser is also paid an incentive fee. The incentive fee is calculated and payable quarterly in arrears based upon the Fund’s “pre-incentive fee net investment income” for the immediately preceding quarter and is subject to a hurdle rate, expressed as a rate of return on the Fund’s “adjusted capital,” equal to 2.25% per quarter (or an annualized hurdle rate of 9.0%), subject to a “catch-up” feature. For this purpose, “pre-incentive fee net investment income” means interest income, dividend income and any other income accrued during the calendar quarter, minus the Fund’s operating expenses for the quarter (including the management fee, expenses reimbursed to the Adviser and any interest expenses and distributions paid on any issued and outstanding preferred shares, but excluding the incentive fee). “Adjusted capital” means the cumulative gross proceeds received by the Fund from the sale of shares (including pursuant to the Fund’s distribution reinvestment plan), reduced by amounts paid in connection with purchases of shares pursuant to the Fund’s share repurchase program.

| 22 | www.resourcecreditincome.com |

| Resource Credit Income Fund | Notes to Financial Statements |

March 31, 2016 (Unaudited)

No incentive fee is payable in any calendar quarter in which the Fund’s pre-incentive fee net investment income does not exceed the quarterly hurdle rate of 2.25%. For any calendar quarter in which the Fund’s pre-incentive fee net investment income is greater than the hurdle rate, but less than or equal to 2.8125%, the incentive fee will equal the amount of the Fund’s pre-incentive fee net investment income in excess of the hurdle rate. This portion of the Fund’s pre-incentive fee net investment income which exceeds the hurdle rate but is less than or equal to 2.8125% is referred to as the “catch-up.” The “catch-up” provision is intended to provide the Adviser with an incentive fee of 20.0% on all of the Fund’s pre-incentive fee net investment income when the Fund’s pre-incentive fee net investment income reaches 2.8125% in any calendar quarter. For any calendar quarter in which the Fund’s pre-incentive fee net investment income exceeds 2.8125% of adjusted capital, the incentive fee will equal 20.0% of pre-incentive fee net investment income. For the six months ended March 31, 2016, there was no incentive fee incurred.

Fund Accounting Fees and Expenses – ALPS Fund Services, Inc. (“ALPS”) serves as the Fund’s administrator and accounting agent and receives customary fees from the Fund for such services. ALPS agreed to voluntarily waive a portion of its fee for the period from commencement through November 1, 2016.

Transfer Agent – DST Systems Inc., an affiliate of ALPS, serves as transfer, dividend paying and shareholder servicing agent for the Fund (“Transfer Agent”).

Distributor – The Fund has entered into a Distribution Agreement with ALPS Distributors, Inc. (the “Distributor”) to provide distribution services to the Fund. There are no fees paid to the Distributor pursuant to the Distribution Agreement. The Board has adopted, on behalf of the Fund, a Shareholder Servicing Plan under which the Fund may compensate financial industry professionals for providing ongoing services in respect of clients with whom they have distributed shares of the Fund. Under the Shareholder Servicing Plan, the Fund’s Class A, Class C, Class W, Class U, Class T and Class D shares are subject to a shareholder servicing fee at an annual rate of 0.25% of the average daily net assets attributable to that share class. For the six months ended March 31, 2016, the Fund incurred shareholder servicing fees of $1,781. The Class C and Class T shares also pay to the Distributor a distribution fee, pursuant to a distribution plan adopted by the board, that accrues at an annual rate equal to 0.75% of the Fund’s average daily net assets attributable to Class C and Class T shares and is payable on a quarterly basis. In addition Class W and Class D shares pay to Resource Securities, Inc. (the “Dealer Manager”), an affiliate of the Adviser, a dealer manager fee, pursuant to a distribution plan adopted by the board, that accrues at an annual rate equal to 0.50% of the Fund’s average daily net assets attributable to Class W and Class D shares and is payable on a quarterly basis. Class A, Class I, and Class U shares are not currently subject to a distribution fee. For the six months ended March 31, 2016, the Fund accrued $18 in distribution fees and $10 in dealer manager fees.

The Distributor acts as the Fund’s principal underwriter in a continuous public offering of the Fund’s shares. The Distributor is an affiliate of ALPS. During the six months ended March 31, 2016, no fees were retained by the Distributor.

Trustees – Each Trustee who is not affiliated with the Trust or the Adviser will receive an annual fee of $10,000, plus $2,000 for attending the annual in‐person meeting of the Board of Trustees, plus $500 for attending each of the remaining telephonic meetings, as well as reimbursement for any reasonable expenses incurred attending the meetings. None of the executive officers receives compensation from the Trust.

4. INVESTMENT TRANSACTIONS

The cost of purchases and proceeds from the sale of securities, other than short-term securities, for the six months ended March 31, 2016 amounted to $1,836,023 and $166,250, respectively.

5. TAX BASIS INFORMATION

The following information is computed on a tax basis for each item as of March 31, 2016:

| | | Gross Appreciation (excess of value over tax cost) | | | Gross Depreciation (excess of tax cost over value) | | | Net Unrealized Depreciation | | | Cost of Investments for Income Tax Purposes | |

| Resource Credit Income Fund | | $ | 62,637 | | | $ | (158,516 | ) | | $ | (95,879 | ) | | $ | 2,388,015 | |

The Fund had no capital losses recognized during the period April 20, 2015 to September 30, 2015.

There were no distributions paid during the period ended September 30, 2015.

| Semi-Annual Report | March 31, 2016 | 23 |

| Resource Credit Income Fund | Notes to Financial Statements |

March 31, 2016 (Unaudited)

6. REPURCHASE OFFERS

Pursuant to Rule 23c-3 under the 1940 Act, the Fund offers shareholders on a quarterly basis the option of redeeming shares, at net asset value, of up to 5% of its issued and outstanding shares as of the close of regular business hours on the New York Stock Exchange on the Repurchase Pricing Date. If shareholders tender for repurchase more than 5% of the outstanding shares of the Fund, the Fund may, but is not required to, repurchase up to an additional 2%. If the Fund determines not to repurchase an additional 2%, or if more than 7% of the shares are tendered, then the Fund will repurchase shares on a pro rata basis based upon the number of shares tendered by each shareholder. There can be no assurance that the Fund will be able to repurchase all shares that each shareholder has tendered, even if all the shares in a shareholder's account are tendered. In the event of an oversubscribed offer, you may not be able to tender all shares that you wish to tender and may have to wait until the next quarterly repurchase offer to tender the remaining shares. Subsequent repurchase requests will not be given priority over other shareholder requests.

During the six months ended March 31, 2016, the Fund completed no quarterly repurchase offers.

7. BENEFICIAL OWNERSHIP

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a fund creates a presumption of control of the fund, under Section 2(a)(9) of the 1940 Act. As of March 31, 2016, the name, address and percentage of ownership of each entity or person that owned of record or beneficially 25% or more outstanding shares of the Fund were as follows:

| Class A Shares |

| Name | Percentage of Fund |

| Resource Financial Management, Inc. | 60.63% |

8. UNDERLYING INVESTMENT IN OTHER INVESTMENT COMPANIES

The Fund currently seeks to achieve its investment objectives by investing a portion of its assets in Dreyfus Treasury Cash Management, Institutional Class (the “Dreyfus Fund”), an open-end management investment company registered under the Investment Company Act of 1940, as amended. The Fund may redeem its investments from the Dreyfus Fund at any time if the Adviser determines that it is in the best interest of the Fund and its shareholders to do so. The latest financial statements for the Dreyfus Fund can be found at www.sec.gov.

The performance of the Fund may be directly affected by the performance of the Dreyfus Fund. As of March 31, 2016, the percentage of the Fund’s net assets invested in the Dreyfus Fund was 31.24%.

9. SUBSEQUENT EVENTS

Subsequent events after the date of the Statement of Assets and Liabilities have been evaluated through the date the financial statements were issued.

The Fund completed a quarterly repurchase offer on April 13, 2016 which resulted in no Fund shares being repurchased.

Management has determined that there were no other subsequent events to report through the issuance of these financial statements.

| 24 | www.resourcecreditincome.com |

| Resource Credit Income Fund | Additional Information |

March 31, 2016 (Unaudited)

1. PROXY VOTING POLICIES AND VOTING RECORD

A description of the policies and procedures that the Fund uses to vote proxies relating to portfolio securities is available without charge upon request by calling toll-free 855-747-9559, or on the Securities and Exchange Commission’s (“SEC”) website at http://www.sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30th is available without charge upon request by calling toll-free 855-747-9559, or on the SEC’s website at http://www.sec.gov.

2. QUARTERLY PORTFOLIO HOLDINGS

The Fund files a complete listing of portfolio holdings for the Fund with the SEC as of the first and third quarters of each fiscal year on Form N-Q. The filings are available upon request by calling 855-747-9559. Furthermore, you may obtain a copy of the filing on the SEC’s website at http://www.sec.gov. The Fund’s Form N-Q may also be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C., and information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

| Semi-Annual Report | March 31, 2016 | 25 |

INVESTMENT ADVISER

Resource Financial Fund Management, Inc.

One Crescent Drive, Suite 203

Philadelphia, Pennsylvania 19112

DISTRIBUTOR

ALPS Distributors, Inc.

1290 Broadway, Suite 1100

Denver, Colorado 80203

LEGAL COUNSEL

Thompson Hine LLP

41 South High Street, Suite 1700

Columbus, Ohio 43215

INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

BBD, LLP

1835 Market Street, 26th Floor

Philadelphia, Pennsylvania 19103

Must be accompanied or preceded by a Prospectus.

ALPS Distributors, Inc. is the Distributor for Resource Credit Income Fund.