UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

811-23016

(Investment Company Act file number)

Resource Credit Income Fund

(Exact name of registrant as specified in charter)

712 Fifth Avenue, 12th Floor

New York, NY 10019

(Address of principal executive offices) (Zip code)

The Corporation Trust Company

Corporation Trust Center, 1209 Orange Street

Wilmington, DE 19801

(Name and address of agent for service)

Copy to:

JoAnn M. Strasser Thompson Hine LLP 41 South High Street, 17th Floor Columbus, OH 43215 (614) 469-3265 | Lawrence S. Block Resource Credit Income Fund 717 Fifth Avenue, 18th Floor New York, NY 10022 (212) 705-5090 |

Registrant's telephone number, including area code: (212) 506-3899

Date of fiscal year end: September 30

Date of reporting period: October 1, 2017 - March 31, 2018

Item 1. Reports to Stockholders.

| Shareholder Letter | 1 |

| Portfolio Update | 3 |

| Portfolio of Investments | 5 |

| Statement of Assets and Liabilities | 8 |

| Statement of Operations | 9 |

| Statements of Changes in Net Assets | 10 |

| Financial Highlights | |

| Class A | 13 |

| Class C | 14 |

| Class W | 15 |

| Class I | 16 |

| Class L | 17 |

| Notes to Financial Statements | 18 |

| Additional Information | 25 |

| Resource Credit Income Fund | Shareholder Letter |

March 31, 2018 (Unaudited)

Dear Shareholders:

We are pleased to present you with the Resource Credit Income Fund (the “Fund” or “CIF”) Semi-Annual Report for the six months ended March 31, 2018. As evidenced by its track record, the Fund again delivered on its core objectives of protecting investors’ principal and limiting market volatility while generating current income through investing in a range of credit assets.

The Fund seeks investments within the following segments of the fixed income universe: publicly traded credit-linked equities (e.g. primarily public business development companies, commonly known as BDCs); private credit funds; and direct investment in traded loans and bonds (which encompasses structured credit).

The Fund’s current target allocations within these strategies are as follows:

| ● | 15% Publicly traded BDCs and other credit-linked securities |

| ● | 25% Private credit funds |

| ● | 60% Direct loans and bonds |

We would highlight two developments in the portfolio since our last shareholder letter.

First, the Fund has lowered its target allocation to publicly traded BDCs from 20% to 15%. We continue to believe BDCs represent an attractively priced yield-based asset class, but we are mindful of their contribution to the Fund’s overall volatility. A modest reduction in target exposure should lower the Fund’s volatility without sacrificing the attractive yield and liquidity provided by the strategy.

Second, we are pleased to announce our fourth private credit investment, BlackRock Global Credit Opportunities Fund, LP. This investment furthers the Fund’s objective of providing investors with access to what we believe are the world’s preeminent credit managers, as well as a range of differentiated credit strategies. With four funded private credit investments and three unfunded commitments, we are pleased by the increased diversification within our portfolio.

Amid a backdrop that we believe is signaling additional interest rate pressures, the Fund remains roughly 75% invested in floating-rate instruments. We would again emphasize that the Fund does not rely upon interest rates to drive returns and the Fund does not “bet” on the direction of rates. Furthermore, we continue to rely upon our proprietary investment process, the Resource America Liquid Alternatives Score, to assist in the Fund’s investment process. By taking a disciplined and regimented approach to credit analysis - attempting to quantify key fundamental, industry and capital structure factors - we attempt to identify attractive risk-adjusted return opportunities for the Fund while seeking to minimize subjective investment biases.

Fund Performance

In a period punctuated by a dramatic increase in market volatility, the Fund posted a gain of 2.08% during the semi-annual period. By way of comparison, the S&P/LSTA Leveraged Loan Total Return Index1 and the ICE of BAML US High Yield Index2 posted total returns of 2.58% and -0.51%, respectively, over that same period.

Investment Positioning

In late 2015, the Fund began investing with the perspective that investors needed to adjust their portfolios to guard against the looming threat of rising interest rates - a decision that has proven prescient as U.S. 10-Year Treasury yields troughed at 1.37% in July 2016 and have migrated to just below 3.00% at the end of March 2018.

Although interest rates have increased dramatically, we believe a confluence of global macro and U.S. fiscal policy factors will continue to push rates higher. In our view, the U.S. Federal Reserve (the “Fed”) is rapidly attempting to “normalize” interest rates before the next downturn, particularly given the firm economic environment. Barring a notable slowdown, we believe the Fed’s default position for the coming quarter will be to increase rates even further. The Fed has signaled three interest rate increases in 2018 (two following the 25bps increase at the March meeting), but we see increasing risks for a fourth interest rate increase.

On the fiscal policy front, the recent tax cut will contribute roughly $1.3 trillion of deficit spending over the next ten years3. The price for ending the government shutdown in early 2018 included more than $300 billion of additional unfunded outlays. Deficit spending will further pressure interest rates as the Fed must attract buyers of this paper with higher yields.

| Semi-Annual Report | March 31, 2018 | 1 |

| Resource Credit Income Fund | Shareholder Letter |

March 31, 2018 (Unaudited)

The Fund’s strategy is designed to provide investors with a fixed income strategy that minimizes interest rate risk through active management and “value-based” security selection within the corporate loan and bond universe. We feel that the Fund’s track-record demonstrates our ability to deliver on this principle.

Thank you for being a shareholder of Resource Credit Income Fund.

Sincerely,

Michael Terwilliger, CFA

Portfolio Manager

Resource Credit Income Fund

| 1 | S&P/LSTA Leveraged Loan Total Return Index - The S&P/LSTA Leveraged Loan Index (the Index) is a market value-weighted index designed to measure the performance of the U.S. leveraged loan market based upon market weightings, spreads and interest payments. |

| 2 | ICE BofAML US High Yield Index - The BofAML US High Yield Index tracks the performance of US dollar denominated below investment grade corporate debt publicly issued in the US domestic market. |

| 3 | “Tax Cuts Spending Raise Deficit 1 Trillion”, NBC News 4/09/2018. |

| 2 | www.resourcecreditincome.com |

| Resource Credit Income Fund | Portfolio Update |

March 31, 2018 (Unaudited)

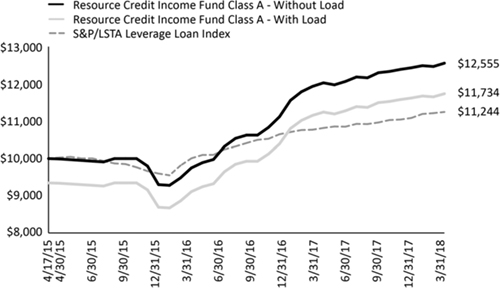

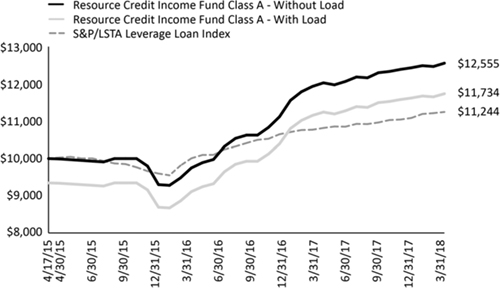

The Fund’s performance figures for the period ended March 31, 2018, compared to its benchmark:

| Resource Credit Income Fund | 1 Month | Quarter | 6 Month | YTD | 1 Year | Since Inception* | Inception |

| Class A Shares | 0.67% | 0.95% | 2.08% | 0.95% | 5.24% | 8.00% | 4/17/2015 |

| Class A Shares w/ Sales Charge | -5.13% | -4.89% | -3.80% | -4.89% | -0.81% | 5.56% | 4/17/2015 |

| Class C Shares | 0.58% | 0.76% | 1.71% | 0.76% | 4.36% | 7.84% | 4/17/2015 |

| Class C Shares w/ Sales Charge(a) | -1.90% | -1.72% | -0.78% | -1.72% | 1.84% | 7.30% | 4/17/2015 |

| Class I Shares | 0.65% | 1.01% | 2.21% | 1.01% | 5.41% | 8.21% | 4/17/2015 |

| Class L Shares | 0.61% | 0.88% | 1.95% | 0.88% | 0.00% | 2.85% | 7/28/2017 |

| Class L Shares w/ Sales Charge | -3.64% | -3.39% | -2.35% | -3.39% | 0.00% | -1.55% | 7/28/2017 |

| Class W Shares | 0.67% | 0.86% | 2.08% | 0.86% | 5.24% | 7.83% | 4/17/2015 |

| S&P/LSTA Leverage Loan Index | 0.28% | 1.45% | 2.58% | 1.45% | 4.43% | 4.05% | 4/17/2015 |

| (a) | Effective as of December 23, 2016, Class C shares no longer have a sales charge. |

The S&P/LSTA Leveraged Loan Index is a market value-weighted index designed to measure the performance of the U.S. leveraged loan market based upon market weightings, spreads and interest payments.

Past performance is not predictive of future results. The investment return and principal value of an investment will fluctuate. An investor’s shares when redeemed, may be worth more or less than the original cost. Total return is calculated assuming reinvestment of all dividends and distributions. Performance figures for periods less than one year are not annualized. The Fund’s total annual operating expenses, including acquired fund fees and expenses, before fee waivers is 6.25% for Class A, 6.63% for Class C, 5.70% for Class W, 5.80% for Class I and 5.74% for Class L shares per the most recent Class specific prospectus filings. After fee waivers, the Fund’s total annual operating expense is 3.94% for Class A, 4.69% for Class C, 3.94% for Class W, 3.69% for Class I and 4.19% for Class L shares. Class A shares are subject to maximum sales loads of 5.75% imposed on purchases. Class L shares are subject to a maximum sales load of 4.25% imposed on purchases. Share repurchases within 365 days may be subject to an early withdrawal charge of 0.50% for Class A and 1.00% for Class C shares. For performance information current to the most recent month- end, please call toll-free 1-855-747-9559.

| Semi-Annual Report | March 31, 2018 | 3 |

| Resource Credit Income Fund | Portfolio Update |

March 31, 2018 (Unaudited)

Comparison of the Change in Value of a $10,000 Investment

Portfolio Composition as of March 31, 2018

| Asset Type | Percent of Net Assets |

| Bonds & Notes | 32.93% |

| Bank Loan | 23.79% |

| Common Stock | 21.33% |

| Private Investment Funds | 16.65% |

| Real Estate Investment Trusts - Common Stocks | 1.34% |

| Short Term Security | 0.40% |

| Total Investments | 96.44% |

| Other Assets in Excess of Liabilities | 3.56% |

| Net Assets | 100.00% |

| 4 | www.resourcecreditincome.com |

| Resource Credit Income Fund | Portfolio of Investments |

March 31, 2018 (Unaudited)

| | | Interest | | Maturity | | Principal | | Value |

| BANK LOANS (23.79%) | | | | | | | | | | | | |

| ABG Intermediate Holdings 2 LLC, Second Lien Initial Term Loan(a) | | 3M US L + 7.75% | | 09/29/2025 | | $ | 1,000,000 | | | $ | 1,016,250 | |

| Advantage Sales & Marketing, Inc., Second Lien Term Loan(a) | | 3M US L + 6.50%, 1% Floor | | 07/25/2022 | | | 2,425,000 | | | | 2,335,796 | |

| BJ's Wholesale Club, Inc., Second Lien Initial Term Loan(a) | | 1M US L + 7.50%, 1% Floor | | 02/03/2025 | | | 1,300,000 | | | | 1,307,514 | |

| CIBT Global, Inc., Second Lien Initial Term Loan(a) | | 3M US L + 7.75% | | 06/01/2025 | | | 1,000,000 | | | | 1,010,000 | |

| Coinamatic Canada, Inc., Second Lien Initial Canadian Term Loan(a) | | 1M US L + 7.00%, 1% Floor | | 05/12/2023 | | | 18,630 | | | | 18,537 | |

| Equinox Holdings, Inc., Second Lien Initial Term Loan(a) | | 1M US L + 7.00%, 1% Floor | | 09/06/2024 | | | 1,250,000 | | | | 1,284,375 | |

| Genoa, a QoL Healthcare Co. LLC, Second Lien Initial Term Loan(a) | | 1M US L + 8.00%, 1% Floor | | 10/28/2024 | | | 400,000 | | | | 406,000 | |

| Institutional Shareholder Services, Inc., Second Lien Initial Term Loan(a) | | 3M US L + 7.75% | | 10/16/2025 | | | 2,000,000 | | | | 2,020,001 | |

| OEConnection LLC, Second Lien Term Loan(a) | | 3M US L + 8.00% | | 11/22/2025 | | | 1,500,000 | | | | 1,500,000 | |

| Paradigm Acquisition Corp., First Lien Initial Term Loan(a) | | 3M US L + 4.25% | | 10/11/2024 | | | 997,500 | | | | 1,007,475 | |

| Paradigm Acquisition Corp., Second Lien Initial Term Loan(a) | | 3M US L + 8.50% | | 10/10/2025 | | | 2,000,000 | | | | 2,010,000 | |

| Renaissance Learning, Inc., Second Lien Initial Term Loan(a) | | 3M US L + 7.00%, 1% Floor | | 04/11/2022 | | | 4,803,208 | | | | 4,833,228 | |

| UFC Holdings LLC, Second Lien Term Loan(a) | | 1M US L + 7.50%, 1% Floor | | 08/18/2024 | | | 250,000 | | | | 255,375 | |

| USS Ultimate Holdings, Inc., Second Lien Initial Term Loan(a) | | 1M US L + 7.75%, 1% Floor | | 08/25/2025 | | | 2,000,000 | | | | 2,027,910 | |

| VIP Cinema Holdings, Inc., First Lien Initial Term Loan(a) | | 3M US L + 6.00% | | 03/01/2023 | | | 712,500 | | | | 720,740 | |

| Wash MultiFamily Acquisition, Inc., Second Lien Initial Term Loan(a) | | 1M US L + 7.00%, 1% Floor | | 05/15/2023 | | | 106,370 | | | | 105,838 | |

| Winebow Holdings, Inc. (Vinter Group, Inc.), Second Lien Term Loan(a) | | 1M US L + 7.50%, 1% Floor | | 01/02/2022 | | | 2,775,000 | | | | 2,594,625 | |

| | | | | | | | | | | | | |

| TOTAL BANK LOANS | | | | | | | | | | | | |

| (Cost $24,152,303) | | | | | | | | | | | 24,453,664 | |

| | | | | | | | | | | | | |

| BONDS & NOTES (32.93%) | | | | | | | | | | | | |

| ASSET BACKED SECURITIES (18.59%) | | | | | | | | | | | | |

| Apex Credit CLO 2015-II, Ltd., Class E(a)(b)(c) | | 3M US L + 7.00% | | 10/19/2026 | | | 500,000 | | | | 500,528 | |

| Apidos CLO XXII, Class E(a)(b) | | 3M US L + 7.25% | | 10/20/2027 | | | 1,000,000 | | | | 1,004,909 | |

| Battalion CLO VI, Ltd., Class E(a)(b)(c) | | 3M US L + 5.20% | | 10/17/2026 | | | 1,131,000 | | | | 997,159 | |

| Bowman Park CLO, Ltd., Class F(a)(b)(c) | | 3M US L + 7.00% | | 11/23/2025 | | | 1,000,000 | | | | 1,003,283 | |

| Canyon Capital CLO 2014-1, Ltd., Class ER(a)(b) | | 3M US L + 7.70% | | 01/30/2031 | | | 1,000,000 | | | | 939,799 | |

| Dryden 37 Senior Loan Fund, Class FR(a)(b) | | 3M US L + 7.48% | | 01/15/2031 | | | 2,312,500 | | | | 2,226,016 | |

| Jamestown CLO V, Ltd., Class F(a)(b)(c) | | 3M US L + 5.85% | | 01/17/2027 | | | 1,400,000 | | | | 1,173,435 | |

| Marathon CLO VI, Ltd., Class E(a)(b)(c) | | 3M US L + 5.80% | | 05/13/2025 | | | 1,100,000 | | | | 1,007,972 | |

| Midocean Credit CLO V, Class E(a)(b)(c) | | 3M US L + 6.95% | | 10/19/2028 | | | 750,000 | | | | 755,246 | |

| OCP CLO 2013-4, Ltd., Class DR(a)(b)(c) | | 3M US L + 6.77% | | 04/24/2029 | | | 1,000,000 | | | | 1,007,462 | |

| Octagon Investment Partners XIV, Ltd., Class ER(a)(b)(c) | | 3M US L + 8.35% | | 07/15/2029 | | | 2,132,000 | | | | 2,103,902 | |

| Saranac CLO II, Ltd., Class ER(a)(b) | | 3M US L + 6.72% | | 11/20/2029 | | | 500,000 | | | | 489,175 | |

| Tralee CLO II, Ltd., Class FR(a)(b)(c) | | 3M US L + 8.85% | | 07/20/2029 | | | 1,000,000 | | | | 950,698 | |

| Tralee CLO II, Ltd., Class ER(a)(b)(c) | | 3M US L + 7.85% | | 07/20/2029 | | | 1,000,000 | | | | 1,023,299 | |

| Trinitas CLO III, Ltd., Class F(a)(b)(c) | | 3M US L + 6.50% | | 07/15/2027 | | | 550,000 | | | | 523,252 | |

| Venture XV CLO, Ltd., Class ER(a)(b)(c) | | 3M US L + 7.11% | | 07/15/2028 | | | 1,500,000 | | | | 1,511,865 | |

| Voya CLO 2014-2, Ltd., Class ER(a)(b) | | 3M US L + 7.70% | | 04/17/2030 | | | 1,000,000 | | | | 955,141 | |

| York CLO-2, Ltd., Class F(a)(b) | | 3M US L + 7.25% | | 01/22/2031 | | | 1,000,000 | | | | 939,041 | |

| | | | | | | | | | | | 19,112,182 | |

| COMMERCIAL MORTGAGE BACKED SECURITIES (0.07%) | | | | | | | | | |

| Hypo Real Estate Bank International AG, Class A2(a)(d)(e) | | 3M GBP L + 0.22% | | 03/20/2022 | | | 200,000 | | | | 73,658 | |

| | | | | | | | | | | | | |

| CORPORATE BONDS (14.27%) | | | | | | | | | | | | |

| Artesyn Embedded Technologies, Inc.(b)(c) | | 9.750% | | 10/15/2020 | | | 3,500,000 | | | | 3,430,000 | |

| Blueline Rental Corp.(b)(c) | | 9.250% | | 03/15/2024 | | | 2,000,000 | | | | 2,149,360 | |

| Jo-Ann Stores Holdings, Inc.(b)(c) | | 9.750% (or 10.500% PIK)% | | 10/15/2019 | | | 4,755,000 | | | | 4,766,887 | |

| Monitronics International, Inc. | | 9.125% | | 04/01/2020 | | | 2,650,000 | | | | 2,045,005 | |

| New Enterprise Stone & Lime Co., Inc.(b) | | 6.250% | | 03/15/2026 | | | 1,475,000 | | | | 1,480,531 | |

| New Enterprise Stone & Lime Co., Inc.(b) | | 10.125% | | 04/01/2022 | | | 500,000 | | | | 538,750 | |

See Notes to Financial Statements.

| Semi-Annual Report | March 31, 2018 | 5 |

| Resource Credit Income Fund | Portfolio of Investments |

March 31, 2018 (Unaudited)

| | Interest | | Maturity | | Principal | | Value |

| CORPORATE BONDS (continued) | | | | | | | | | | |

| | | | | | | | | | | |

| Pioneer Holdings LLC / Pioneer Finance Corp.(b)(c) | 9.000 | % | | 11/01/2022 | $ | 250,000 | | $ | 261,250 | |

| | | | | | | | | | 14,671,783 | |

| TOTAL BONDS & NOTES | | | | | | | | | | |

| (Cost $33,627,308) | | | | | | | | | 33,857,623 | |

| | | Shares | | Value |

| COMMON STOCKS (21.33%) | | | | | | | | |

| BUSINESS DEVELOPMENT COMPANIES (19.95%) | | | | | | | | |

| Ares Capital Corp.(c) | | | 346,793 | | | | 5,503,605 | |

| BlackRock Capital Investment Corp.(c) | | | 344,738 | | | | 2,078,770 | |

| Monroe Capital Corp. | | | 80,000 | | | | 984,000 | |

| OFS Capital Corp.(c) | | | 84,510 | | | | 948,202 | |

| PennantPark Floating Rate Capital Ltd.(c) | | | 164,748 | | | | 2,156,551 | |

| PennantPark Investment Corp.(c) | | | 256,764 | | | | 1,715,184 | |

| Solar Capital Ltd.(c) | | | 132,051 | | | | 2,681,956 | |

| Solar Senior Capital Ltd.(c) | | | 83,094 | | | | 1,395,979 | |

| WhiteHorse Finance, Inc.(c) | | | 246,213 | | | | 3,057,965 | |

| | | | | | | | | |

| INVESTMENT COMPANIES (1.38%) | | | | | | | | |

| Corporate Capital Trust, Inc. | | | 36,171 | | | | 611,290 | |

| TPG Specialty Lending, Inc. | | | 45,000 | | | | 803,700 | |

| | | | | | | | | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Cost $22,724,990) | | | | | | | 21,937,202 | |

| | | | | | | | | |

| REAL ESTATE INVESTMENT TRUSTS - COMMON STOCKS (1.34%) | | | | | | | | |

| TRADED REAL ESTATE INVESTMENT TRUSTS (1.34%) | | | 101,573 | | | | 1,376,314 | |

| Great Ajax Corp.(c) | | | | | | | | |

| | | | | | | | | |

| TOTAL REAL ESTATE INVESTMENT TRUSTS - | | | | | | | | |

| COMMON STOCKS | | | | | | | | |

| (Cost $1,381,952) | | | | | | | 1,376,314 | |

| | | | | | | | | |

| PRIVATE INVESTMENT FUNDS (16.65%) | | | | | | | | |

| BlackRock Global Credit Opportunities Fund, LP(d) | | | | | | | 254,053 | |

| CVC European Midmarket Solutions Fund(d) | | | | | | | 4,831,720 | |

| GoldenTree Credit Opportunities Fund(d) | | | | | | | 6,129,580 | |

| Tree Line Credit Strategies LP(d) | | | | | | | 5,910,714 | |

| | | | | | | | | |

| TOTAL PRIVATE INVESTMENT FUNDS | | | | | | | | |

| (Cost $17,061,309) | | | | | | | 17,126,067 | |

| | | | | | | | | |

| SHORT TERM INVESTMENTS (0.40%) | | | | | | | | |

| Dreyfus Treasury Cash Management, Institutional Class, 1.48%(f) | | | 413,707 | | | | 413,707 | |

| | | | | | | | | |

| TOTAL SHORT TERM INVESTMENTS | | | | | | | | |

| (Cost $413,707) | | | | | | | 413,707 | |

See Notes to Financial Statements.

| 6 | www.resourcecreditincome.com |

| Resource Credit Income Fund | Portfolio of Investments |

| | March 31, 2018 (Unaudited) |

| TOTAL INVESTMENTS (96.44%) | | Value | |

| (Cost $99,361,569) | | $ | 99,164,577 | |

| | | | | |

| Other Assets In Excess Of Liabilities (3.56%) | | | 3,664,778 | |

| | | | | |

| NET ASSETS (100.00%) | | $ | 102,829,355 | |

Investment Abbreviations:

LIBOR - London Interbank Offered Rate

Libor Rates:

1M US L - 1 Month LIBOR as of March 31, 2018 was 1.88%

3M US L - 3 Month LIBOR as of March 31, 2018 was 2.31%

3M GBP L - 3 Month POUND LIBOR as of March 31, 2018 was 0.71%

| (a) | Variable rate investment. Interest rates reset periodically. Interest rate shown reflects the rate in effect at March 31, 2018. For securities based on a published reference rate and spread, the reference rate and spread are indicated in the description above. Certain variable rate securities are not based on a published reference rate and spread but are determined by the issuer or agent and are based on current market conditions. These securities do not indicate a reference rate and spread in their description above. |

| (b) | Securities exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be sold in the ordinary course of business in transactions exempt from registration, normally to qualified institutional buyers. As of March 31, 2018, the aggregate market value of those securities was $31,738,960, representing 30.87% of net assets. |

| (c) | All or a portion of each of these securities may be segregated as collateral for the Fund's line of credit. The aggregate market value of those securities was $27,153,677. |

| (d) | Illiquid security. See below. |

| (e) | Fair value estimated using fair valuation procedures adopted by the Board of Trustees. Total value of such securities is $73,658, representing 0.07% of net assets. |

| (f) | Money market fund; interest rate reflects seven-day effective yield on March 31, 2018. |

Securities determined to be illiquid under the procedures approved by the Fund's Board of Trustees is as follows:

| Date(s) of Purchase | | | Security | | Cost | | | Value | | | % of Net Assets | |

| | 3/31/2018 | | | BlackRock Global Credit Opportunities Fund, LP | | $ | 254,009 | | | $ | 254,053 | | | | 0.25 | % |

| | 09/30/2017- 12/31/2018 | | | CVC European Midmarket Solutions Fund | | | 4,807,300 | | | | 4,831,720 | | | | 4.70 | % |

| | 10/30/2015- 03/31/2018 | | | GoldenTree Credit Opportunities Fund | | | 6,000,000 | | | | 6,129,580 | | | | 5.95 | % |

| | 10/30/2015 | | | Hypo Real Estate Bank International AG, Class A2 | | | 139,587 | | | | 73,658 | | | | 0.07 | % |

| | 12/31/2017- 03/31/2018 | | | Tree Line Credit Strategies LP | | | 6,000,000 | | | | 5,910,714 | | | | 5.75 | % |

| | | | | Total | | $ | 17,200,896 | | | $ | 17,199,725 | | | | 16.72 | % |

Additional information on investments in private investment trusts:

| Value | | | Security | | Redemption Frequency | | | Redemption

Notice (Days) | | | Unfunded Commitments as of March 31, 2018 | |

| $ | 254,053 | | | BlackRock Global Credit Opportunities Fund, LP | | | N/A | | | | N/A | | | $ | 14,745,991 | |

| | 4,831,720 | | | CVC European Midmarket Solutions Fund | | | N/A | | | | N/A | | | | 5,221,342 | |

| | 6,129,580 | | | GoldenTree Credit Opportunities Fund(a) | | | Semi-Annual | | | | 90 | | | | – | |

| | 5,910,714 | | | Tree Line Credit Strategies LP | | | Quarterly | | | | 90 | | | | – | |

| (a) | Redemptions are subject to a two-year holding period, and may be limited to 10% per redemption date, or 20% during any 12 month period, past which redemptions would be processed on a pro rata basis. |

| See Notes to Financial Statements. | |

| Semi-Annual Report | March 31, 2018 | 7 |

| Resource Credit Income Fund | Statement of Assets and Liabilities |

March 31, 2018 (Unaudited)

| ASSETS | | | |

| Investments, at value (Cost $99,361,569) | | $ | 99,164,577 | |

| Cash | | | 99,726 | |

| Dividends and interest receivable | | | 1,724,597 | |

| Receivable for securities sold | | | 972,433 | |

| Receivable for Fund shares sold | | | 812,451 | |

| Capital contributed in advance | | | 5,000,000 | |

| Prepaid expenses and other assets | | | 68,220 | |

| Total assets | | | 107,842,004 | |

| | | | | |

| LIABILITIES | | | | |

| Payable for investments purchased | | | 4,815,216 | |

| Payable due to adviser | | | 124,290 | |

| Administration fees payable | | | 19,152 | |

| Custody fees payable | | | 798 | |

| Payable for compliance services fees | | | 7,304 | |

| Distribution fees payable | | | 10,270 | |

| Shareholder servicing fees payable | | | 28,889 | |

| Payable for transfer agency fees | | | 1,308 | |

| Accrued expenses and other liabilities | | | 5,422 | |

| Total liabilities | | | 5,012,649 | |

| NET ASSETS | | $ | 102,829,355 | |

| | | | | |

| NET ASSETS CONSISTS OF | | | | |

| Paid-in capital | | $ | 102,889,245 | |

| Accumulated net investment loss | | | (57,628 | ) |

| Accumulated net realized gain | | | 194,730 | |

| Net unrealized depreciation | | | (196,992 | ) |

| NET ASSETS | | $ | 102,829,355 | |

| Commitments (Note 8) | | | | |

| PRICING OF SHARES | | | | |

| Class A | | | | |

| Net Assets | | $ | 20,913,982 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 1,900,243 | |

| Net Asset Value and redemption price per share(a) | | $ | 11.01 | |

| Maximum Offering Price Per Share (Maximum Sales Charge of 5.75%) | | $ | 11.68 | |

| Class C | | | | |

| Net Assets | | $ | 14,850,683 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 1,334,351 | |

| Net Asset Value, offering and redemption price per share(a) | | $ | 11.13 | |

| Class W | | | | |

| Net Assets | | $ | 48,177,658 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 4,379,033 | |

| Net Asset Value, offering and redemption price per share | | $ | 11.00 | |

| Class I | | | | |

| Net Assets | | $ | 13,505,412 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 1,224,382 | |

| Net Asset Value, offering and redemption price per share | | $ | 11.03 | |

| Class L | | | | |

| Net Assets | | $ | 5,381,620 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 489,265 | |

| Net Asset Value and redemption price per share | | $ | 11.00 | |

| Maximum Offering Price Per Share (Maximum Sales Charge of 4.25%) | | $ | 11.49 | |

| (a) | Redemption price varies based on length of time held (Note 1). |

| See Notes to Financial Statements. | |

| 8 | www.resourcecreditincome.com |

| Resource Credit Income Fund | Statement of Operations |

| | | | |

| | For the Six Months Ended March 31, 2018 (Unaudited) |

| INVESTMENT INCOME | | | | |

| Dividends | | $ | 1,305,067 | |

| Interest | | | 2,423,975 | |

| Total investment income | | | 3,729,042 | |

| | | | | |

| EXPENSES | | | | |

| Investment advisory fees (Note 3) | | | 713,086 | |

| Administrative fees (Note 3) | | | 90,269 | |

| Distribution fees (Note 3): | | | | |

| Class C | | | 43,004 | |

| Class L | | | 5,136 | |

| Shareholder servicing fees (Note 3): | | | | |

| Class A | | | 16,002 | |

| Class C | | | 14,335 | |

| Class W | | | 44,809 | |

| Class L | | | 5,136 | |

| Interest expense | | | 350 | |

| Transfer agent fees (Note 3) | | | 59,318 | |

| Audit fees | | | 9,995 | |

| Legal fees | | | 29,532 | |

| Printing expense | | | 33,748 | |

| Registration fees | | | 43,083 | |

| Custody fees | | | 7,647 | |

| Trustee fees and expenses (Note 3) | | | 22,196 | |

| Compliance services fees (Note 3) | | | 7,304 | |

| Networking Fees: | | | | |

| Class A | | | 1,104 | |

| Class C | | | 1,151 | |

| Class W | | | 2,164 | |

| Class I | | | 654 | |

| Class L | | | 12 | |

| Other expenses | | | 14,773 | |

| Total expenses | | | 1,164,808 | |

| Less fees waived/expenses reimbursed by investment adviser (Note 3) | | | (123,797 | ) |

| Total net expenses | | | 1,041,011 | |

| NET INVESTMENT INCOME | | | 2,688,031 | |

| Net realized gain on investments | | | 90,057 | |

| Net change in unrealized depreciation on investments | | | (1,219,739 | ) |

| NET REALIZED AND UNREALIZED LOSS ON INVESTMENTS | | | (1,129,682 | ) |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 1,558,349 | |

| See Notes to Financial Statements. | |

| Semi-Annual Report | March 31, 2018 | 9 |

| Resource Credit Income Fund | Statements of Changes in Net Assets |

| | | For the Six

Months Ended

March 31, 2018 (Unaudited) | | | For the

Year Ended

September 30, 2017 | |

| OPERATIONS | | | | | | |

| Net investment income | | $ | 2,688,031 | | | $ | 1,218,166 | |

| Net realized gain | | | 90,057 | | | | 422,275 | |

| Net change in unrealized appreciation | | | (1,219,739 | ) | | | 927,548 | |

| Net increase in net assets resulting from operations | | | 1,558,349 | | | | 2,567,989 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

| From investment income: | | | | | | | | |

| Class A | | | (607,883 | ) | | | (411,703 | ) |

| Class C | | | (353,352 | ) | | | (164,532 | ) |

| Class W | | | (1,314,721 | ) | | | (496,562 | ) |

| Class I | | | (325,665 | ) | | | (40,189 | ) |

| Class U(a) | | | – | | | | (86 | ) |

| Class T(a) | | | – | | | | (76 | ) |

| Class D(a) | | | – | | | | (80 | ) |

| Class L(b) | | | (144,836 | ) | | | (16,778 | ) |

| From realized gains on investments: | | | | | | | | |

| Class A | | | – | | | | (167,150 | ) |

| Class C | | | – | | | | (66,800 | ) |

| Class W | | | – | | | | (201,602 | ) |

| Class I | | | – | | | | (16,317 | ) |

| Class U(a) | | | – | | | | (35 | ) |

| Class T(a) | | | – | | | | (31 | ) |

| Class D(a) | | | – | | | | (32 | ) |

| Class L(b) | | | – | | | | (6,812 | ) |

| From return of capital: | | | | | | | | |

| Class A | | | – | | | | (102,433 | ) |

| Class C | | | – | | | | (40,936 | ) |

| Class W | | | – | | | | (123,546 | ) |

| Class I | | | – | | | | (9,999 | ) |

| Class U(a) | | | – | | | | (22 | ) |

| Class T(a) | | | – | | | | (19 | ) |

| Class D(a) | | | – | | | | (20 | ) |

| Class L(b) | | | – | | | | (4,175 | ) |

| Net decrease in net assets from distributions | | | (2,746,457 | ) | | | (1,869,935 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS | | | | | | | | |

| Class A | | | | | | | | |

| Proceeds from sales of shares | | | 5,332,670 | | | | 11,200,870 | |

| Distributions reinvested | | | 327,281 | | | | 402,321 | |

| Cost of shares redeemed | | | (568,382 | ) | | | (68,781 | ) |

| Net increase from capital shares transactions | | | 5,091,569 | | | | 11,534,410 | |

| | | | | | | | | |

| Class C | | | | | | | | |

| Proceeds from sales of shares | | | 5,994,314 | | | | 8,328,902 | |

| Distributions reinvested | | | 240,847 | | | | 166,087 | |

| Cost of shares redeemed | | | (192,353 | ) | | | (63,743 | ) |

| Net increase from capital shares transactions | | | 6,042,808 | | | | 8,431,246 | |

| | | | | | | | | |

| Class W | | | | | | | | |

| Proceeds from sales of shares | | | 21,843,034 | | | | 26,610,726 | |

| Distributions reinvested | | | 608,682 | | | | 303,286 | |

| Cost of shares redeemed | | | (453,379 | ) | | | (765,910 | ) |

| Net increase from capital shares transactions | | | 21,998,337 | | | | 26,148,102 | |

| See Notes to Financial Statements. | |

| 10 | www.resourcecreditincome.com |

| Resource Credit Income Fund | Statements of Changes in Net Assets |

| | | For the Six

Months Ended

March 31, 2018 (Unaudited) | | | For the

Year Ended

September 30, 2017 | |

| Class I | | | | | | | | |

| Proceeds from sales of shares | | $ | 10,592,268 | | | $ | 2,710,332 | |

| Distributions reinvested | | | 193,074 | | | | 41,972 | |

| Cost of shares redeemed | | | (101,596 | ) | | | – | |

| Net increase from capital shares transactions | | | 10,683,746 | | | | 2,752,304 | |

| | | | | | | | | |

| Class U(a) | | | | | | | | |

| Distributions reinvested | | | – | | | | 143 | |

| Cost of shares redeemed | | | – | | | | (3,017 | ) |

| Net decrease from capital shares transactions | | | – | | | | (2,874 | ) |

| | | | | | | | | |

| Class T(a) | | | | | | | | |

| Distributions reinvested | | | – | | | | 126 | |

| Cost of shares redeemed | | | – | | | | (2,980 | ) |

| Net decrease from capital shares transactions | | | – | | | | (2,854 | ) |

| | | | | | | | | |

| Class D(a) | | | | | | | | |

| Distributions reinvested | | | – | | | | 132 | |

| Cost of shares redeemed | | | – | | | | (2,992 | ) |

| Net decrease from capital shares transactions | | | – | | | | (2,860 | ) |

| | | | | | | | | |

| Class L(b) | | | | | | | | |

| Proceeds from sales of shares | | | 2,936,002 | | | | 2,441,155 | |

| Distributions reinvested | | | 71,935 | | | | 9,026 | |

| Cost of shares redeemed | | | (5,062 | ) | | | – | |

| Net increase from capital shares transactions | | | 3,002,875 | | | | 2,450,181 | |

| | | | | | | | | |

| Net increase in net assets | | | 45,631,227 | | | | 52,005,709 | |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of period | | | 57,198,128 | | | | 5,192,419 | |

| End of period* | | $ | 102,829,355 | | | $ | 57,198,128 | |

| | | | | | | | | |

| *Including accumulated net investment income/(loss) of: | | $ | (57,628 | ) | | $ | 798 | |

| See Notes to Financial Statements. | |

| Semi-Annual Report | March 31, 2018 | 11 |

| Resource Credit Income Fund | Statements of Changes in Net Assets |

| | | For the Six

Months Ended

March 31, 2018 (Unaudited) | | | For the

Year Ended

September 30, 2017 | |

| OTHER INFORMATION | | | | | | | | |

| Capital Shares Transactions | | | | | | | | |

| Class A | | | | | | | | |

| Issued | | | 479,506 | | | | 1,017,674 | |

| Distributions reinvested | | | 29,635 | | | | 36,600 | |

| Redeemed | | | (51,245 | ) | | | (6,155 | ) |

| Net increase in capital shares | | | 457,896 | | | | 1,048,119 | |

| | | | | | | | | |

| Class C | | | | | | | | |

| Issued | | | 533,060 | | | | 746,104 | |

| Distributions reinvested | | | 21,570 | | | | 14,896 | |

| Redeemed | | | (17,143 | ) | | | (6,057 | ) |

| Net increase in capital shares | | | 537,487 | | | | 754,943 | |

| | | | | | | | | |

| Class W | | | | | | | | |

| Issued | | | 1,959,087 | | | | 2,399,426 | |

| Distributions reinvested | | | 55,155 | | | | 27,427 | |

| Redeemed | | | (40,818 | ) | | | (69,494 | ) |

| Net increase in capital shares | | | 1,973,424 | | | | 2,357,359 | |

| | | | | | | | | |

| Class I | | | | | | | | |

| Issued | | | 948,519 | | | | 243,024 | |

| Distributions reinvested | | | 17,465 | | | | 3,801 | |

| Redeemed | | | (9,132 | ) | | | – | |

| Net increase in capital shares | | | 956,852 | | | | 246,825 | |

| | | | | | | | | |

| Class U(a) | | | | | | | | |

| Distributions reinvested | | | – | | | | 13 | |

| Redeemed | | | – | | | | (272 | ) |

| Net decrease in capital shares | | | – | | | | (259 | ) |

| | | | | | | | | |

| Class T(a) | | | | | | | | |

| Distributions reinvested | | | – | | | | 12 | |

| Redeemed | | | – | | | | (270 | ) |

| Net decrease in capital shares | | | – | | | | (258 | ) |

| | | | | | | | | |

| Class D(a) | | | | | | | | |

| Distributions reinvested | | | – | | | | 12 | |

| Redeemed | | | – | | | | (270 | ) |

| Net decrease in capital shares | | | – | | | | (258 | ) |

| | | | | | | | | |

| Class L(b) | | | | | | | | |

| Issued | | | 263,347 | | | | 219,042 | |

| Distributions reinvested | | | 6,516 | | | | 817 | |

| Redeemed | | | (457 | ) | | | – | |

| Net increase in capital shares | | | 269,406 | | | | 219,859 | |

| (a) | Effective as of July 7, 2017, the Fund has suspended the offering of its Class U, Class T, and Class D shares. |

| (b) | The Fund's Class L commenced operations on July 28, 2017. |

| See Notes to Financial Statements. | |

| 12 | www.resourcecreditincome.com |

| Resource Credit Income Fund – Class A | Financial Highlights |

For a Share Outstanding Throughout the Periods Presented

| | | For the Six

Months Ended

March 31, 2018 (Unaudited) | | | Year Ended

September 30, 2017 | | | Year Ended

September 30, 2016 | | | For the

Period Ended

September 30, 2015(a) | |

| NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 11.13 | | | $ | 10.26 | | | $ | 10.00 | | | $ | 10.00 | |

| | | | | | | | | | | | | | | | | |

| INCOME FROM INVESTMENT OPERATIONS | | | | | | | | | | | | | | | | |

| Net investment income(b) | | | 0.38 | | | | 0.57 | | | | 0.43 | | | | – | |

| Net realized and unrealized gain/(loss) on investments | | | (0.15 | ) | | | 1.02 | | | | 0.18 | | | | – | |

| Total income from investment operations | | | 0.23 | | | | 1.59 | | | | 0.61 | | | | – | |

| | | | | | | | | | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | | | | | | | | | |

| From net investment income | | | (0.34 | ) | | | (0.47 | ) | | | (0.27 | ) | | | – | |

| From net realized gain on investments | | | (0.01 | ) | | | (0.16 | ) | | | – | | | | – | |

| From return of capital | | | – | | | | (0.09 | ) | | | (0.08 | ) | | | – | |

| Total distributions | | | (0.35 | ) | | | (0.72 | ) | | | (0.35 | ) | | | – | |

| INCREASE/DECREASE IN NET ASSET VALUE | | | (0.12 | ) | | | 0.87 | | | | 0.26 | | | | – | |

| NET ASSET VALUE, END OF PERIOD | | $ | 11.01 | | | $ | 11.13 | | | $ | 10.26 | | | $ | 10.00 | |

| | | | | | | | | | | | | | | | | |

| TOTAL RETURN(c) | | | 2.08 | % | | | 15.79 | % | | | 6.22 | % | | | – | % |

| | | | | | | | | | | | | | | | | |

| RATIOS AND SUPPLEMENTAL DATA | | | | | | | | | | | | | | | | |

| Net assets, end of period (in 000s) | | $ | 20,914 | | | $ | 16,049 | | | $ | 4,043 | | | $ | 3 | |

| | | | | | | | | | | | | | | | | |

| RATIOS TO AVERAGE NET ASSETS | | | | | | | | | | | | | | | | |

| Including interest expense:(d) | | | | | | | | | | | | | | | | |

| Expenses, gross | | | 2.85 | %(e) | | | 4.90 | % | | | 31.46 | % | | | 472.13 | %(e) |

| Expenses, net of fees waived/expenses reimbursed by investment adviser | | | 2.59 | %(e) | | | 2.59 | % | | | 2.59 | % | | | 0.02 | %(e) |

| Excluding interest expense:(d) | | | | | | | | | | | | | | | | |

| Expenses, gross | | | 2.85 | %(e) | | | 4.90 | % | | | 34.54 | % | | | N/A | |

| Expenses, net of fees waived/expenses reimbursed by investment adviser | | | 2.59 | %(e) | | | 2.59 | % | | | 2.59 | % | | | N/A | |

| Net investment income | | | 6.91 | %(e) | | | 5.20 | % | | | 4.43 | % | | | 0.00 | %(e) |

| | | | | | | | | | | | | | | | | |

| PORTFOLIO TURNOVER RATE | | | 36 | %(f) | | | 39 | % | | | 22 | % | | | 0 | %(f) |

| | | | | | | | | | | | | | | | | |

| BORROWINGS AT END OF PERIOD | | | | | | | | | | | | | | | | |

| Aggregate amount outstanding (000s) | | $ | – | | | $ | – | | | $ | 5 | | | $ | – | |

| Asset coverage per $1,000 (000s) | | $ | – | | | $ | – | | | $ | 1,032,060 | | | $ | – | |

| (a) | The Fund's Class A commenced operations on April 20, 2015. |

| (b) | Per share numbers have been calculated using the average shares method. |

| (c) | Total returns shown are historical in nature and assume changes in share price, reinvestment of dividends and capital gains distribution, if any. Had the adviser not absorbed a portion of Fund expenses, total returns would have been lower. Total returns for periods less than one year are not annualized. Returns shown exclude applicable sales charges. |

| (d) | Ratios do not include expenses of underlying investment companies in which the Fund invests. |

| (e) | Annualized. |

| (f) | Not annualized. |

See Notes to Financial Statements.

| Semi-Annual Report | March 31, 2018 | 13 |

| Resource Credit Income Fund – Class C | Financial Highlights |

For a Share Outstanding Throughout the Periods Presented

| | | For the Six

Months Ended

March 31, 2018 (Unaudited) | | | Year Ended

September 30, 2017 | | | Year Ended

September 30, 2016 | | | For the

Period Ended

September 30, 2015(a) | |

| NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 11.25 | | | $ | 10.36 | | | $ | 10.00 | | | $ | 10.00 | |

| | | | | | | | | | | | | | | | | |

| INCOME FROM INVESTMENT OPERATIONS | | | | | | | | | | | | | | | | |

| Net investment income(b) | | | 0.35 | | | | 0.50 | | | | 0.59 | | | | – | |

| Net realized and unrealized gain/(loss) on investments | | | (0.16 | ) | | | 1.03 | | | | 0.08 | | | | – | |

| Total income from investment operations | | | 0.19 | | | | 1.53 | | | | 0.67 | | | | – | |

| | | | | | | | | | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | | | | | | | | | |

| From net investment income | | | (0.30 | ) | | | (0.40 | ) | | | (0.24 | ) | | | – | |

| From net realized gain on investments | | | (0.01 | ) | | | (0.16 | ) | | | – | | | | – | |

| From return of capital | | | – | | | | (0.08 | ) | | | (0.07 | ) | | | – | |

| Total distributions | | | (0.31 | ) | | | (0.64 | ) | | | (0.31 | ) | | | – | |

| INCREASE/DECREASE IN NET ASSET VALUE | | | (0.12 | ) | | | 0.89 | | | | 0.36 | | | | – | |

| NET ASSET VALUE, END OF PERIOD | | $ | 11.13 | | | $ | 11.25 | | | $ | 10.36 | | | $ | 10.00 | |

| | | | | | | | | | | | | | | | | |

| TOTAL RETURN(c) | | | 1.71 | % | | | 15.03 | % | | | 6.85 | % | | | –% | |

| | | | | | | | | | | | | | | | | |

| RATIOS AND SUPPLEMENTAL DATA | | | | | | | | | | | | | | | | |

| Net assets, end of period (in 000s) | | $ | 14,851 | | | $ | 8,965 | | | $ | 434 | | | $ | 3 | |

| | | | | | | | | | | | | | | | | |

| RATIOS TO AVERAGE NET ASSETS | | | | | | | | | | | | | | | | |

| Including interest expense:(d) | | | | | | | | | | | | | | | | |

| Expenses, gross | | | 3.68 | %(e) | | | 5.28 | % | | | 18.42 | % | | | 473.06 | %(e) |

| Expenses, net of fees waived/expenses reimbursed by investment adviser | | | 3.34 | %(e) | | | 3.34 | % | | | 3.34 | % | | | 0.02 | %(e) |

| Excluding interest expense:(d) | | | | | | | | | | | | | | | | |

| Expenses, gross | | | 3.68 | %(e) | | | 5.28 | % | | | 18.42 | % | | | N/A | |

| Expenses, net of fees waived/expenses reimbursed by investment adviser | | | 3.34 | %(e) | | | 3.34 | % | | | 3.34 | % | | | N/A | |

| Net investment income | | | 6.28 | %(e) | | | 4.46 | % | | | 5.85 | % | | | 0.00 | %(e) |

| | | | | | | | | | | | | | | | | |

| PORTFOLIO TURNOVER RATE | | | 36 | %(f) | | | 39 | % | | | 22 | % | | | 0 | %(f) |

| | | | | | | | | | | | | | | | | |

| BORROWINGS AT END OF PERIOD | | | | | | | | | | | | | | | | |

| Aggregate amount outstanding (000s) | | $ | – | | | $ | – | | | $ | 5 | | | $ | – | |

| Asset coverage per $1,000 (000s) | | $ | – | | | $ | – | | | $ | 1,032,060 | | | $ | – | |

| (a) | The Fund's Class C commenced operations on April 20, 2015. |

| (b) | Per share numbers have been calculated using the average shares method. |

| (c) | Total returns shown are historical in nature and assume changes in share price, reinvestment of dividends and capital gains distribution, if any. Had the adviser not absorbed a portion of Fund expenses, total returns would have been lower. Total returns for periods less than one year are not annualized. |

| (d) | Ratios do not include expenses of underlying investment companies in which the Fund invests. |

| (e) | Annualized. |

| (f) | Not annualized. |

See Notes to Financial Statements.

| 14 | www.resourcecreditincome.com |

| Resource Credit Income Fund – Class W | Financial Highlights |

For a Share Outstanding Throughout the Periods Presented

| | | For the Six

Months Ended

March 31, 2018 (Unaudited) | | | Year Ended

September 30, 2017 | | | Year Ended

September 30, 2016 | | | For the

Period Ended

September 30, 2015(a) | |

| NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 11.12 | | | $ | 10.24 | | | $ | 10.00 | | | $ | 10.00 | |

| | | | | | | | | | | | | | | | | |

| INCOME FROM INVESTMENT OPERATIONS | | | | | | | | | | | | | | | | |

| Net investment income(b) | | | 0.39 | | | | 0.58 | | | | 0.63 | | | | – | |

| Net realized and unrealized gain/(loss) on investments | | | (0.16 | ) | | | 1.01 | | | | (0.07 | )(c) | | | – | |

| Total income from investment operations | | | 0.23 | | | | 1.59 | | | | 0.56 | | | | – | |

| | | | | | | | | | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | | | | | | | | | |

| From net investment income | | | (0.34 | ) | | | (0.46 | ) | | | (0.25 | ) | | | – | |

| From net realized gain on investments | | | (0.01 | ) | | | (0.16 | ) | | | – | | | | – | |

| From return of capital | | | – | | | | (0.09 | ) | | | (0.07 | ) | | | – | |

| Total distributions | | | (0.35 | ) | | | (0.71 | ) | | | (0.32 | ) | | | – | |

| INCREASE/DECREASE IN NET ASSET VALUE | | | (0.12 | ) | | | 0.88 | | | | 0.24 | | | | – | |

| NET ASSET VALUE, END OF PERIOD | | $ | 11.00 | | | $ | 11.12 | | | $ | 10.24 | | | $ | 10.00 | |

| | | | | | | | | | | | | | | | | |

| TOTAL RETURN(d) | | | 2.08 | % | | | 15.77 | % | | | 5.74 | % | | | –% | |

| | | | | | | | | | | | | | | | | |

| RATIOS AND SUPPLEMENTAL DATA | | | | | | | | | | | | | | | | |

| Net assets, end of period (in 000s) | | $ | 48,178 | | | $ | 26,757 | | | $ | 494 | | | $ | 3 | |

| | | | | | | | | | | | | | | | | |

| RATIOS TO AVERAGE NET ASSETS | | | | | | | | | | | | | | | | |

| Including interest expense:(e) | | | | | | | | | | | | | | | | |

| Expenses, gross | | | 2.93 | %(f) | | | 4.35 | % | | | 17.52 | % | | | 472.69 | %(f) |

| Expenses, net of fees waived/expenses reimbursed by investment adviser | | | 2.59 | %(f) | | | 2.61 | %(g) | | | 3.09 | % | | | 0.04 | %(f) |

| Excluding interest expense:(e) | | | | | | | | | | | | | | | | |

| Expenses, gross | | | 2.93 | %(f) | | | 4.35 | % | | | 17.52 | % | | | N/A | |

| Expenses, net of fees waived/expenses reimbursed by investment adviser | | | 2.59 | %(f) | | | 2.61 | %(g) | | | 3.09 | % | | | N/A | |

| Net investment income | | | 7.05 | %(f) | | | 5.22 | %(g) | | | 6.24 | % | | | 0.00 | %(f) |

| PORTFOLIO TURNOVER RATE | | | 36 | %(h) | | | 39 | % | | | 22 | % | | | 0 | %(h) |

| BORROWINGS AT END OF PERIOD | | | | | | | | | | | | | | | | |

| Aggregate amount outstanding (000s) | | $ | – | | | $ | – | | | $ | 5 | | | $ | – | |

| Asset coverage per $1,000 (000s) | | $ | – | | | $ | – | | | $ | 1,032,060 | | | $ | – | |

| (a) | The Fund's Class W commenced operations on April 20, 2015. |

| (b) | Per share numbers have been calculated using the average shares method. |

| (c) | Realized and unrealized losses per share do not correlate to the aggregate of the net realized and unrealized gains on the Statement of Operations for the period ended September 30, 2016, primarily due to the timing of sales and repurchases of the Fund's shares in relation to fluctuating market values for the Fund's portfolio. |

| (d) | Total returns shown are historical in nature and assume changes in share price, reinvestment of dividends and capital gains distribution, if any. Had the adviser not absorbed a portion of Fund expenses, total returns would have been lower. Total returns for periods less than one year are not annualized. |

| (e) | Ratios do not include expenses of underlying investment companies in which the Fund invests. |

| (f) | Annualized. |

| (g) | Effective January 5, 2017, the annual expense limitation changed from 2.49% to 1.99%. |

| (h) | Not annualized. |

| See Notes to Financial Statements. | |

| Semi-Annual Report | March 31, 2018 | 15 |

| Resource Credit Income Fund – Class I | Financial Highlights |

For a Share Outstanding Throughout the Periods Presented

| | | For the Six

Months Ended

March 31, 2018 (Unaudited) | | |

Year Ended September 30, 2017 | | | Year Ended

September 30, 2016 | | | For the

Period Ended

September 30, 2015(a) | |

| NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 11.15 | | | $ | 10.28 | | | $ | 10.00 | | | $ | 10.00 | |

| | | | | | | | | | | | | | | | | |

| INCOME FROM INVESTMENT OPERATIONS | | | | | | | | | | | | | | | | |

| Net investment income(b) | | | 0.43 | | | | 0.63 | | | | 0.35 | | | | – | |

| Net realized and unrealized gain/(loss) on investments | | | (0.19 | ) | | | 0.99 | | | | 0.28 | | | | – | |

| Total income from investment operations | | | 0.24 | | | | 1.62 | | | | 0.63 | | | | – | |

| | | | | | | | | | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | | | | | | | | | |

| From net investment income | | | (0.35 | ) | | | (0.50 | ) | | | (0.27 | ) | | | – | |

| From net realized gain on investments | | | (0.01 | ) | | | (0.16 | ) | | | – | | | | – | |

| From return of capital | | | – | | | | (0.09 | ) | | | (0.08 | ) | | | – | |

| Total distributions | | | (0.36 | ) | | | (0.75 | ) | | | (0.35 | ) | | | – | |

| INCREASE/DECREASE IN NET ASSET VALUE | | | (0.12 | ) | | | 0.87 | | | | 0.28 | | | | – | |

| NET ASSET VALUE, END OF PERIOD | | $ | 11.03 | | | $ | 11.15 | | | $ | 10.28 | | | $ | 10.00 | |

| | | | | | | | | | | | | | | | | |

| TOTAL RETURN(c) | | | 2.21 | % | | | 16.07 | % | | | 6.42 | % | | | –% | |

| | | | | | | | | | | | | | | | | |

| RATIOS AND SUPPLEMENTAL DATA | | | | | | | | | | | | | | | | |

| Net assets, end of period (in 000s) | | $ | 13,505 | | | $ | 2,982 | | | $ | 213 | | | $ | 200 | |

| | | | | | | | | | | | | | | | | |

| RATIOS TO AVERAGE NET ASSETS | | | | | | | | | | | | | | | | |

| Including interest expense:(d) | | | | | | | | | | | | | | | | |

| Expenses, gross | | | 2.68 | %(e) | | | 4.45 | % | | | 72.33 | % | | | 430.52 | %(e) |

| Expenses, net of fees waived/expenses reimbursed by investment adviser | | | 2.34 | %(e) | | | 2.34 | % | | | 2.34 | % | | | 0.03 | %(e) |

| Excluding interest expense:(d) | | | | | | | | | | | | | | | | |

| Expenses, gross | | | 2.68 | %(e) | | | 4.45 | % | | | 72.33 | % | | | N/A | |

| Expenses, net of fees waived/expenses reimbursed by investment adviser | | | 2.34 | %(e) | | | 2.34 | % | | | 2.34 | % | | | N/A | |

| Net investment income | | | 7.67 | %(e) | | | 5.71 | % | | | 3.53 | % | | | 0.00 | %(e) |

| PORTFOLIO TURNOVER RATE | | | 36 | %(f) | | | 39 | % | | | 22 | % | | | 0 | %(f) |

| | | | | | | | | | | | | | | | | |

| BORROWINGS AT END OF PERIOD | | | | | | | | | | | | | | | | |

| Aggregate amount outstanding (000s) | | $ | – | | | $ | – | | | $ | 5 | | | $ | – | |

| Asset coverage per $1,000 (000s) | | $ | – | | | $ | – | | | $ | 1,032,060 | | | $ | – | |

| (a) | The Fund's Class I commenced operations on April 20, 2015. |

| (b) | Per share numbers have been calculated using the average shares method. |

| (c) | Total returns shown are historical in nature and assume changes in share price, reinvestment of dividends and capital gains distribution, if any. Had the adviser not absorbed a portion of Fund expenses, total returns would have been lower. Total returns for periods less than one year are not annualized. |

| (d) | Ratios do not include expenses of underlying investment companies in which the Fund invests. |

| (e) | Annualized. |

| (f) | Not annualized. |

See Notes to Financial Statements.

| 16 | www.resourcecreditincome.com |

| Resource Credit Income Fund – Class L | Financial Highlights |

For a Share Outstanding Throughout the Periods Presented

| | | For the Six

Months Ended

March 31, 2018 (Unaudited) | | | For the

Period Ended

September 30, 2017(a) | |

| NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 11.12 | | | $ | 11.19 | |

| | | | | | | | | |

| INCOME/(LOSS) FROM INVESTMENT OPERATIONS | | | | | | | | |

| Net investment income(b) | | | 0.38 | | | | 0.13 | |

| Net realized and unrealized loss on investments | | | (0.17 | ) | | | (0.03 | )(c) |

| Total income from investment operations | | | 0.21 | | | | 0.10 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

| From net investment income | | | (0.32 | ) | | | (0.10 | ) |

| From net realized gain on investments | | | (0.01 | ) | | | (0.04 | ) |

| From return of capital | | | 0.00 | | | | (0.03 | ) |

| Total distributions | | | (0.33 | ) | | | (0.17 | ) |

| INCREASE/(DECREASE) IN NET ASSET VALUE | | | (0.12 | ) | | | (0.07 | ) |

| NET ASSET VALUE, END OF PERIOD | | $ | 11.00 | | | $ | 11.12 | |

| | | | | | | | | |

| TOTAL RETURN(d) | | | 1.95 | % | | | 0.88 | % |

| RATIOS AND SUPPLEMENTAL DATA | | | | | | | | |

| Net assets, end of period (in 000s) | | $ | 5,382 | | | $ | 2,445 | |

| | | | | | | | | |

| RATIOS TO AVERAGE NET ASSETS | | | | | | | | |

| Including interest expense:(e) | | | | | | | | |

| Expenses, gross | | | 3.16 | %(f) | | | 4.39 | %(f) |

| Expenses, net of fees waived/expenses reimbursed by investment advisor and administrator | | | 2.84 | %(f) | | | 2.84 | %(f) |

| Excluding interest expense:(e) | | | | | | | | |

| Expenses, gross | | | 3.16 | %(f) | | | 4.39 | %(f) |

| Expenses, net of fees waived/expenses reimbursed by investment advisor | | | 2.84 | %(f) | | | 2.84 | %(f) |

| Net investment income (e) | | | 6.84 | %(f) | | | 6.67 | %(f) |

| PORTFOLIO TURNOVER RATE | | | 36 | %(g) | | | 39 | %(g)(h) |

| (a) | The Fund's Class L commenced operations on July 28, 2017. |

| (b) | Per share numbers have been calculated using the average shares method. |

| (c) | Realized and unrealized losses per share do not correlate to the aggregate of the net realized and unrealized gains on the Statement of Operations for the period ended September 30, 2017, primarily due to the timing of sales and repurchases of the Fund's shares in relation to fluctuating market values for the Fund's portfolio. |

| (d) | Total returns shown are historical in nature and assume changes in share price, reinvestment of dividends and capital gains distribution, if any. Had the adviser not absorbed a portion of Fund expenses, total returns would have been lower. Total returns for periods less than one year are not annualized. Returns shown exclude applicable sales charges. |

| (e) | Ratios do not include expenses of underlying investment companies in which the Fund invests. |

| (f) | Annualized. |

| (g) | Not annualized. |

| (h) | Portfolio turnover rate is calculated at the Fund level and represents the year ended September 30, 2017. |

See Notes to Financial Statements.

| Semi-Annual Report | March 31, 2018 | 17 |

| Resource Credit Income Fund | Notes to Financial Statements |

March 31, 2018 (Unaudited)

1. ORGANIZATION

Resource Credit Income Fund (the “Trust” or the “Fund”) was organized as a Delaware statutory trust on December 11, 2014 and is registered under the Investment Company Act of 1940, as amended, (the “1940 Act”), as a closed-end management investment company that operates as an interval fund with a continuous offering of Fund shares. Effective April 11, 2017 the Fund’s investment advisory agreement was transferred from Resource Financial Fund Management, Inc. to Resource Alternative Advisor, LLC (the “Adviser”). The investment objectives are to produce current income and to achieve capital preservation with moderate volatility and low to moderate correlation to the broader equity markets. The Fund is non-diversified and pursues its investment objectives by investing, under normal circumstances, at least 80% of its assets (defined as net assets plus the amount of any borrowing for investment purposes) in fixed-income and fixed-income related securities.

The Fund currently offers Class A, Class C, Class W, Class I, and Class L shares; all classes of shares except Class L commenced operations on April 20, 2015. Class L shares commenced operations on July 28, 2017. Effective as of July 7, 2017, the Fund suspended the offering and operation of its Class U, Class T, and Class D shares. Class C, Class W, and Class I shares are offered at net asset value. Class A shares are offered at net asset value plus a maximum sales charge of 5.75% and may also be subject to a 0.50% early withdrawal charge, which will be deducted from repurchase proceeds, for shareholders tendering shares fewer than 365 days after the original purchase date, if (i) the original purchase was for amounts of $1 million or more and (ii) the selling broker received the reallowance of the dealer-manager fee. Class C shares are subject to a 1.00% early withdrawal charge. Class L shares are offered at net asset value plus a maximum sales charge of 4.25%. Each class represents an interest in the same assets of the Fund and classes are identical except for differences in their sales charge structures and ongoing service and distribution charges. All classes of shares have equal voting privileges except that each class has exclusive voting rights with respect to its service and/or distribution plans. The Fund’s income, expenses (other than class specific distribution fees) and realized and unrealized gains and losses are allocated proportionately each day based upon the relative net assets of each class.

2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies followed by the Fund in preparation of its financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The Fund is considered an investment company for financial reporting purposes under GAAP. The preparation of financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses for the period. Actual results could differ from those estimates. The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standard Codification (“ASC”) Topic 946 “Financial Services – Investment Companies” including FASB Accounting Standard Update ASU 2013-08.

Securities Valuation – Securities listed on an exchange are valued at the last reported sale price at the close of the regular trading session of the exchange on the business day the value is being determined, or in the case of securities listed on NASDAQ, at the NASDAQ Official Closing Price. Short-term investments that mature in 60 days or less may be valued at amortized cost, provided such valuations represent fair value.

Structured credit and other similar debt securities including, but not limited to collateralized debt obligation debt and equity securities, asset- backed securities, commercial mortgage-backed securities, and other securitized investments backed by certain debt other receivables (collectively “Structured Credit Securities”) are valued on the basis of valuations provided by dealers in those instruments and/or independent pricing services recommended by the Adviser and approved by the Trust’s Board of Trustees (the “Board”). In determining value, dealers and pricing services will generally use information with respect to transactions in the securities being valued; quotations from other dealers; market transactions in comparable securities; analyses and evaluations of various relationships between securities; and yield to maturity information. The Adviser will, based on its reasonable judgment, select the dealer or pricing service quotation that most accurately reflects the fair market value of the Structured Credit Security while taking into account the information utilized by the dealer or pricing service to formulate the quotation in addition to any other relevant factors. In the event that there is a material discrepancies between quotations received from third party dealers or the pricing services the Adviser may (i) use an average of the quotations received or (ii) select an individual quotation that the Adviser, based upon its reasonable judgment, determines to be accurate. In any instance in which the Adviser selects a single bid pursuant to section (e)(ii), the Adviser will provide to the fair value committee an analysis of the factors relied upon in the selection of the relevant quotation.

When price quotations for certain securities are not readily available, or if the available quotations are not believed to be reflective of market value by the Adviser, those securities will be valued at “fair value” as determined in good faith by the fair value committee using procedures adopted by and under the supervision of the Board. There can be no assurance that the Fund could purchase or sell a portfolio security at the price used to calculate the Fund’s net asset value (“NAV”).

| 18 | www.resourcecreditincome.com |

| Resource Credit Income Fund | Notes to Financial Statements |

March 31, 2018 (Unaudited)

Fair valuation procedures may be used to value a substantial portion of the assets of the Fund. The Fund may use the fair value of a security to calculate its NAV when, for example, (1) a portfolio security is not traded in a public market or the principal market in which the security trades is closed, (2) trading in a portfolio security is suspended and not resumed prior to the normal market close, (3) a portfolio security is not traded in significant volume for a substantial period, or (4) the Adviser determines that the quotation or price for a portfolio security provided by a broker-dealer or independent pricing service is inaccurate.

The “fair value” of securities may be difficult to determine and thus judgment plays a greater role in the valuation process. The fair valuation methodology may include or consider the following guidelines, as appropriate: (1) evaluation of all relevant factors, including but not limited to, pricing history, current market level, supply and demand of the respective security; (2) comparison to the values and current pricing of securities that have comparable characteristics; (3) knowledge of historical market information with respect to the security; (4) other factors relevant to the security which would include, but not be limited to, duration, yield, fundamental analytical data, the Treasury yield curve and credit quality.

Valuation of Private Investment Funds – The Fund invests a portion of its assets in private investment funds. Private investment funds measure their investment assets at fair value, and report a NAV per share when a NAV is not provided. In accordance with ASC 820, the Fund has elected to apply the practical expedient and to value its investments in private investment funds at their respective NAVs at each date a NAV is provided. For days when a NAV is not provided, the fair value committee estimates the fair value of each investment fund by adjusting the most recent NAV for each private investment fund, as necessary, by the change in a relevant benchmark that the fair value committee has deemed to be representative of the market.

Loan Participation and Assignments – The Fund may invest in direct debt instruments which are interests in amounts owed to lenders or lending syndicates by corporate, governmental, or other borrowers. The Fund’s investments in loans may be in the form of participations in loans or assignments of all or a portion of the loans from third parties. A loan is often administered by a bank or other financial institution (the “lender”) that acts as agent for all holders. The agent administers the terms of the loan, as specified in the loan agreement. The Fund may invest in multiple series or tranches of a loan, which may have varying terms and carry different associated risks. The Fund generally has no right to enforce compliance with the terms of the loan agreement with the borrower. As a result, the Fund may be subject to the credit risk of both the borrower and the lender that is selling the loan agreement. When the Fund purchases assignments from lenders, they acquire direct rights against the borrower of the loan. The Fund may enter into unfunded loan commitments, which are contractual obligations for future funding. Unfunded loan commitments represent a future obligation in full, even though a percentage of the notional loan amounts may not be utilized by the borrower. When investing in a loan participation, the Fund has the right to receive payments of principal, interest and any fees to which it is entitled only from the lender selling the loan agreement and only upon receipt of payments by the lender from the borrower. The Fund may receive a commitment fee based on the undrawn portion of the underlying line of credit portion of a floating rate loan. In certain circumstances, the Fund may receive a penalty fee upon the prepayment of a floating rate loan by a borrower. Fees earned or paid are recorded as a component of interest income or interest expense, respectively, on the Statement of Operations.

Fair Value Measurements – A three-tier hierarchy has been established to classify fair value measurements for disclosure purposes. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk. Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability that are developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability that are developed based on the best information available. In accordance with the authoritative guidance on fair value measurements and disclosure under GAAP, the Fund discloses the fair value of its investments in a hierarchy that prioritizes the inputs to valuation techniques used to measure the fair value.

Various inputs are used in determining the value of the Fund’s investments as of the reporting period end. These inputs are categorized in the following hierarchy under applicable financial accounting standards:

| Level 1 – | Unadjusted quoted prices in active markets for identical, unrestricted assets or liabilities that the Fund has the ability to access at the measurement date; |

| Level 2 – | Quoted prices which are not active, quoted prices for similar assets or liabilities in active markets or inputs other than quoted prices that are observable (either directly or indirectly) for substantially the full term of the asset or liability at the measurement date; and |

| Level 3 – | Significant unobservable prices or inputs (including the Fund’s own assumptions in determining the fair value of investments) where there is little or no market activity for the asset or liability at the measurement date. |

| Semi-Annual Report | March 31, 2018 | 19 |

| Resource Credit Income Fund | Notes to Financial Statements |

March 31, 2018 (Unaudited)

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

An investment level within the fair value hierarchy is based on the lowest level input, individually or in the aggregate, that is significant to fair value measurement. The valuation techniques used by the Fund to measure fair value during the six months ended March 31, 2018 maximized the use of observable inputs and minimized the use of unobservable inputs.

The inputs or methodologies used for valuing securities are not necessarily an indication of the risk or liquidity associated with investing in those securities. The following is a summary of the inputs used in valuing the Fund’s investments as of March 31, 2018:

Resource Credit Income Fund

| Investments in Securities at Value | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Bank Loan | | $ | – | | | $ | 24,453,664 | | | $ | – | | | $ | 24,453,664 | |

| Bonds & Notes(a) | | | – | | | | 33,857,623 | | | | – | | | | 33,857,623 | |

| Common Stocks(a) | | | 21,937,202 | | | | – | | | | – | | | | 21,937,202 | |

| Real Estate Investment Trusts - Common Stocks | | | 1,376,314 | | | | – | | | | – | | | | 1,376,314 | |

| Private Investment Funds | | | | | | | | | | | | | | | | |

| (Measured at net asset value)(b) | | | – | | | | – | | | | – | | | | 17,126,067 | |

| Short Term Investments | | | 413,707 | | | | – | | | | – | | | | 413,707 | |

| TOTAL | | $ | 23,727,223 | | | $ | 58,311,287 | | | $ | – | | | $ | 99,164,577 | |

| (a) | For detailed descriptions, see the accompanying Portfolio of Investments. |

| (b) | In accordance with ASC 820-10, certain investments that are measured at fair value using the net asset value per share (or its equivalent) practical expedient have not been classified in the fair value hierarchy. The fair value amounts presented in this table are intended to permit reconciliation of the fair value hierarchy to the amounts presented in the Statement of Assets and Liabilities. |

There were no transfers between Levels 1, 2 and 3 during the six months ended March 31, 2018. It is the Fund’s policy to recognize transfers between levels at the end of the reporting period.

Securities Transactions and Investment Income – Investment security transactions are accounted for on a trade date basis. Cost is determined and gains and losses are based upon the specific identification method for both financial statement and federal income tax purposes. Dividend income is recorded on the ex-dividend date and interest income is recorded on the accrual basis. Purchase discounts and premiums on securities are accreted and amortized over the life of the respective securities.

Federal and Other Taxes – No provision for income taxes is included in the accompanying financial statements, as the Fund intends to distribute to shareholders all taxable investment income and realized gains and otherwise comply with Subchapter M of the Internal Revenue Code of 1986, as amended, applicable to regulated investment companies.

The Fund evaluates tax positions taken (or expected to be taken) in the course of preparing the Fund’s tax provisions to determine whether these positions meet a “more-likely-than-not” standard that, based on the technical merits, have a more than fifty percent likelihood of being sustained by a taxing authority upon examination. A tax position that meets the “more-likely-than-not” recognition threshold is measured to determine the amount of benefit to recognize in the financial statements.

As of and during the six months ended March 31, 2018, the Fund did not have a liability for any unrecognized tax benefits. The Fund files U.S. federal, state and local tax returns as required. The Fund’s tax returns are subject to examination by the relevant tax authorities until expiration of the applicable statute of limitations which is generally three years after the filing of the tax return for federal purposes and four years for most state returns. Tax returns for open years have incorporated no uncertain tax positions that require a provision for income taxes.

Foreign Currency – The accounting records of the Fund are maintained in U.S. dollars. Investment securities and other assets and liabilities denominated in a foreign currency and income receipts and expense payments are translated into U.S. dollars using the prevailing exchange rate at the London market close. Purchases and sales of securities are translated into U.S. dollars at the contractual currency rates established at the approximate time of the trade. Net realized gains and losses on foreign currency transactions represent net gains and losses from currency realized between the trade and settlement dates on securities transactions and the difference between income accrued versus income received. The effects of changes in foreign currency exchange rates on investments in securities are included with the net realized and unrealized gain or loss on investment securities.

| 20 | www.resourcecreditincome.com |

| Resource Credit Income Fund | Notes to Financial Statements |

March 31, 2018 (Unaudited)

Distributions to Shareholders – Distributions from investment income are declared and paid quarterly. Distributions from net realized capital gains, if any, are declared and paid annually and are recorded on the ex-dividend date. The character of income and gains to be distributed is determined in accordance with income tax regulations, which may differ from GAAP.

Concentration of Credit Risk – The Fund places its cash with one banking institution, which is insured by Federal Deposit Insurance Corporation (“FDIC”). The FDIC limit is $250,000. At various times throughout the year, the amount on deposit may exceed the FDIC limit and subject the Fund to a credit risk. The Fund does not believe that such deposits are subject to any unusual risk associated with investment activities.

Early Withdrawal Charge – Selling brokers, or other financial intermediaries that have entered into distribution agreements with the Distributor, may receive a commission of up to 1.00% of the purchase price of Class C shares and up to 0.50% on the purchase of Class A shares of $1 million or more. Shareholders who tender for repurchase of such shareholder's Class C shares within 365 days of purchase will be subject to an early withdrawal charge of 1.00% of the original purchase price. Shareholders tendering Class A shares fewer than 365 days after the original purchase date may be subject to an early withdrawal charge of 0.50%, which will be deducted from repurchase proceeds, if (i) the original purchase was for amounts of $1 million or more and (ii) the selling broker received the reallowance of the dealer-manager fee. The Distributor may waive the imposition of the early withdrawal charge in the following situations: (1) shareholder death or (2) shareholder disability. Any such waiver does not imply that the early withdrawal charge will be waived at any time in the future or that such early withdrawal charge will be waived for any other shareholder. Class A (with respect to purchases of under $1 million) shares will not be subject to an early withdrawal charge. For the six months ended March 31, 2018, the Fund did not have any early withdrawal charges.

Indemnification – The Trust indemnifies its officers and Trustees for certain liabilities that may arise from the performance of their duties to the Trust. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties and which provide general indemnities. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on industry experience, the Trust expects the risk of loss due to these warranties and indemnities to be remote.

3. ADVISORY FEES AND OTHER TRANSACTIONS WITH SERVICE PROVIDERS

Advisory Fees – Pursuant to an investment advisory agreement (the “Advisory Agreement”), investment advisory services are provided to the Fund by the Adviser. Under the terms of the Advisory Agreement, the Adviser receives a monthly base management fee calculated at an annual rate of 1.85% of the average daily net assets of the Fund. For the six months ended March 31, 2018, the Fund incurred $713,086 in base management fees.

The Adviser has contractually agreed to waive all or part of its management fees (excluding any incentive fee) and/or make payments to limit Fund expenses, (including all organization and offering expenses, but excluding interest, brokerage commissions, acquired fund fees and expenses and extraordinary expenses) at least until September 9, 2018, so that the total annual operating expenses of the Fund do not exceed 2.59% per annum of Class A average daily net assets, 3.34% per annum of Class C average daily net assets, 2.59% per annum of Class W average daily net assets, 2.34% per annum of Class I average daily net assets, and 2.84% per annum of Class L average daily net assets. Fee waivers and expense payments may be recouped by the Adviser from the Fund, to the extent that overall expenses fall below the expense limitation, within three years of when the amounts were waived or reimbursed. During the six months ended March 31, 2018, the Adviser waived fees and reimbursed expenses of $123,797.

As of March 31, 2018 the following amounts were available for recoupment by the advisor based upon their potential expiration dates: