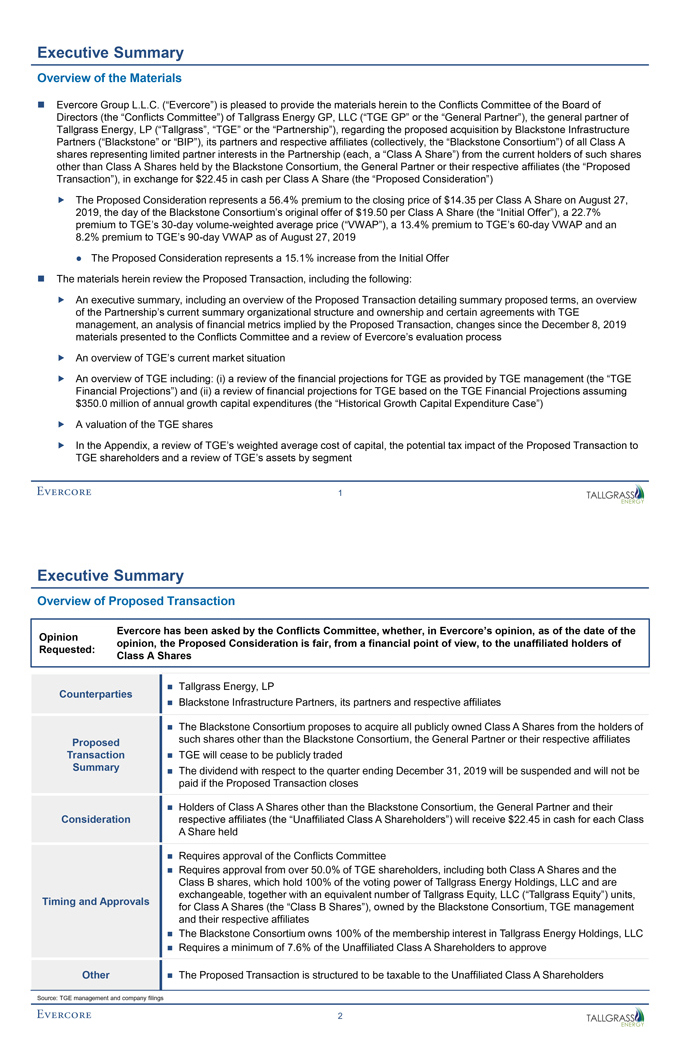

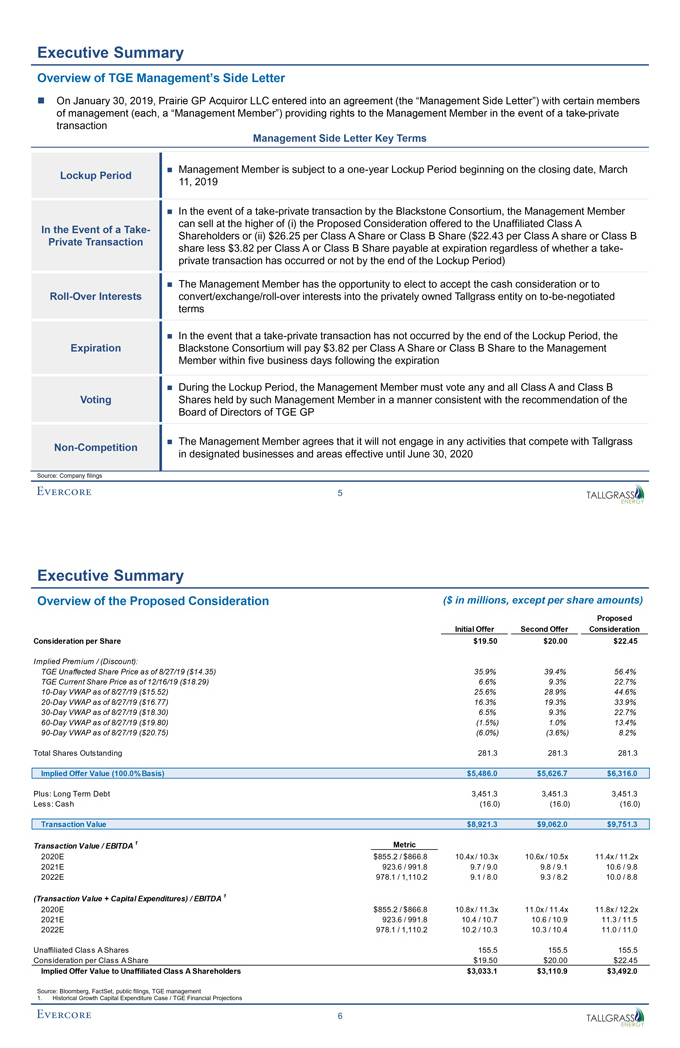

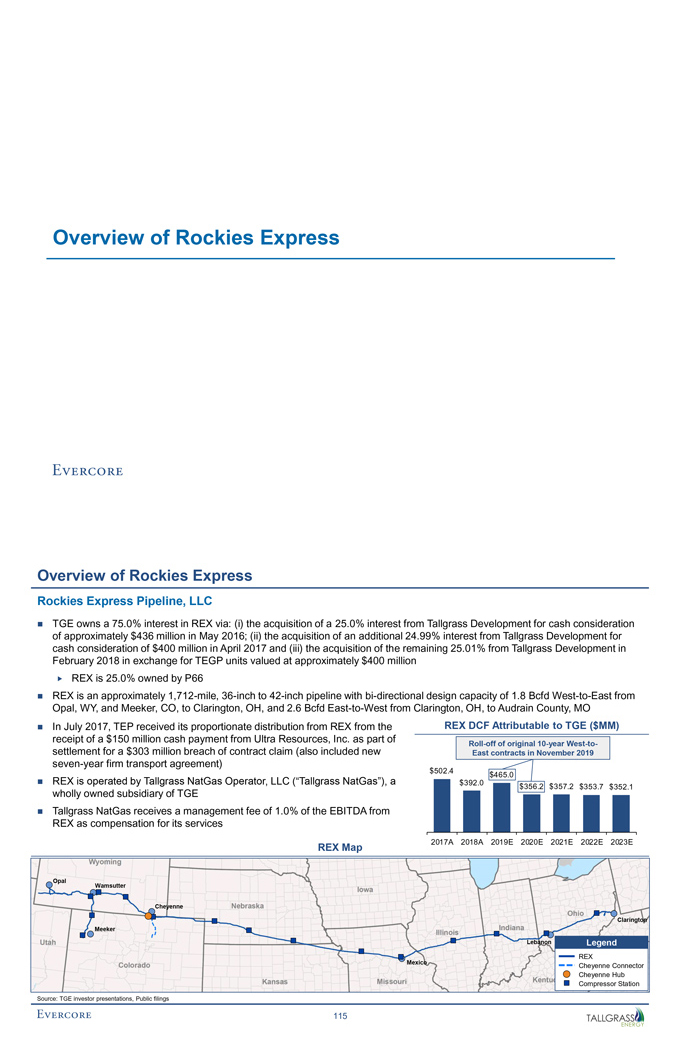

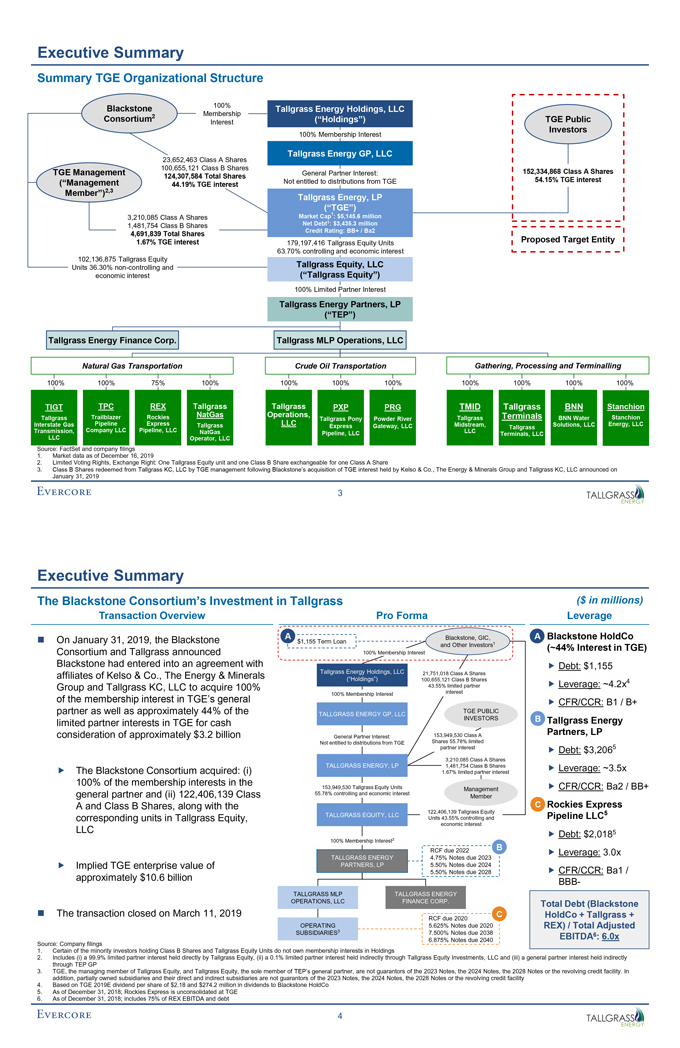

Executive Summary Summary TGE Organizational Structure Blackstone 100% Tallgrass Energy Holdings, LLC 2 Membership Consortium Interest (“Holdings”) TGE Public Investors 100% Membership Interest Tallgrass Energy GP, LLC 23,652,463 Class A Shares 100,655,121 Class B Shares TGE Management General Partner Interest: 152,334,868 Class A Shares 124,307,584 Total Shares (“Management Not entitled to distributions from TGE 54.15% TGE interest 44.19% TGE interest Member”)2,3 Tallgrass Energy, LP (“TGE”) Market Cap1: $5,145.6 million 3,210,085 Class A Shares 1 1,481,754 Class B Shares Net Debt : $3,435.3 million Credit Rating: BB+ / Ba2 4,691,839 Total Shares 1.67% TGE interest 179,197,416 Tallgrass Equity Units Proposed Target Entity 63.70% controlling and economic interest 102,136,875 Tallgrass Equity Units 36.30%non-controlling and Tallgrass Equity, LLC economic interest (“Tallgrass Equity”) 100% Limited Partner Interest Tallgrass Energy Partners, LP (“TEP”) Tallgrass Energy Finance Corp. Tallgrass MLP Operations, LLC Natural Gas Transportation Crude Oil Transportation Gathering, Processing and Terminalling 100% 100% 75% 100% 100% 100% 100% 100% 100% 100% 100% TIGT TPC REX Tallgrass Tallgrass PXP PRG TMID Tallgrass BNN Stanchion Trailblazer Rockies NatGas Operations, Terminals Stanchion Tallgrass Tallgrass Pony Powder River Tallgrass BNN Water Interstate Gas Pipeline Express Tallgrass LLC Express Gateway, LLC Midstream, Solutions, LLC Energy, LLC Tallgrass Transmission, Company LLC Pipeline, LLC NatGas LLC Pipeline, LLC Terminals, LLC LLC Operator, LLC Source: FactSet and company filings 1. Market data as of December 16, 2019 2. Limited Voting Rights, Exchange Right: One Tallgrass Equity unit and one Class B Share exchangeable for one Class A Share 3. Class B Shares redeemed from Tallgrass KC, LLC by TGE management following Blackstone’s acquisition of TGE interest held by Kelso & Co., The Energy & Minerals Group and Tallgrass KC, LLC announced on January 31, 2019 3

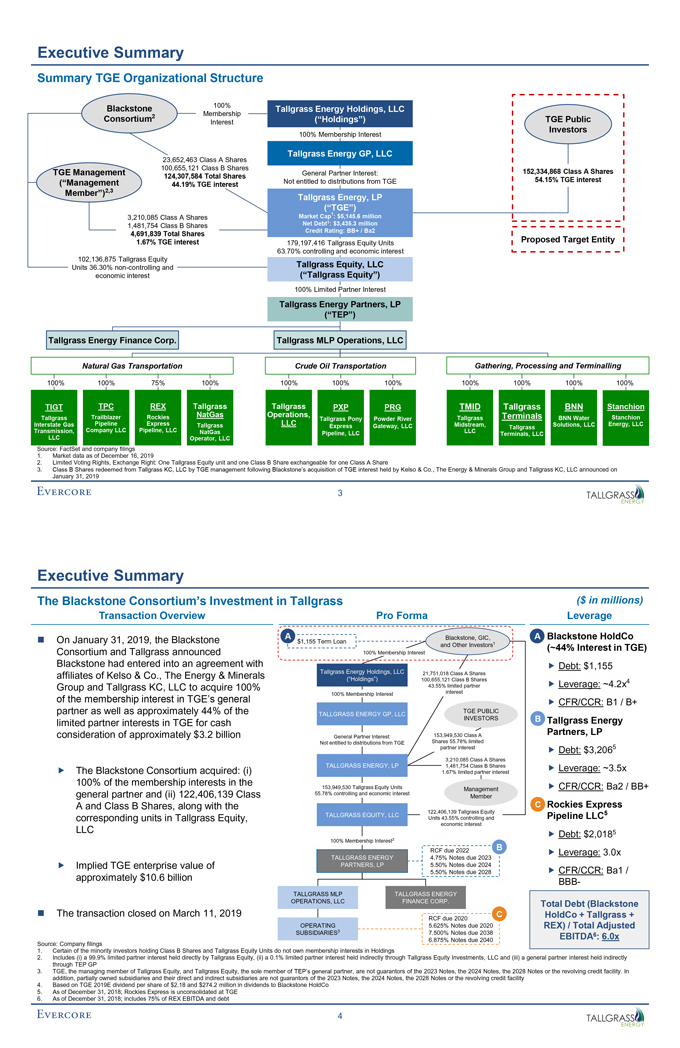

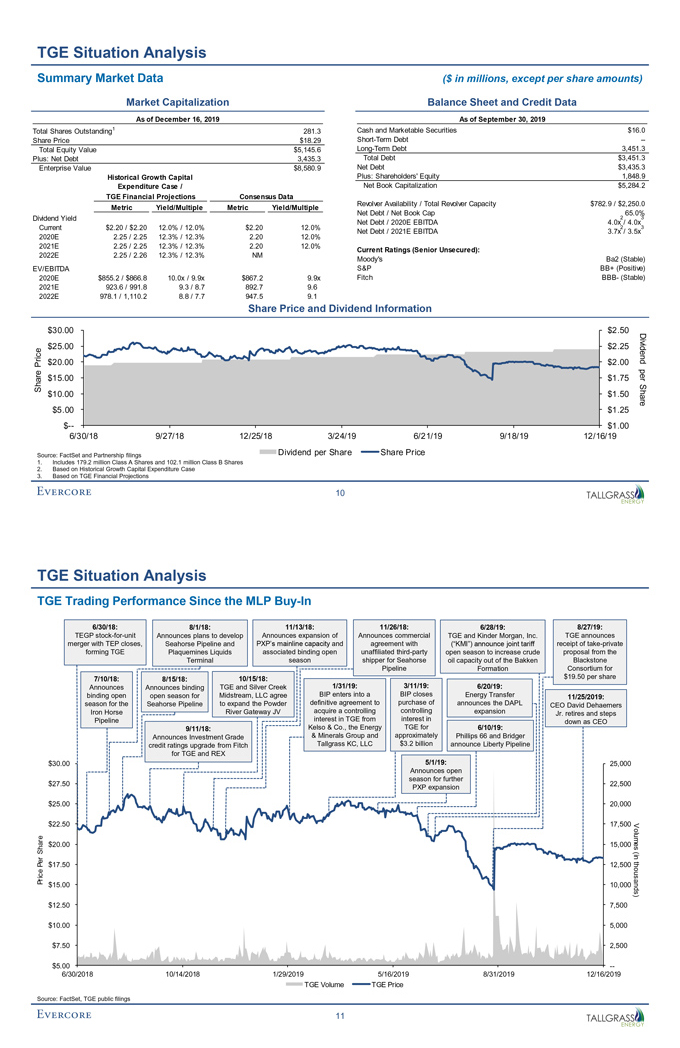

Executive Summary The Blackstone Consortium’s Investment in Tallgrass ($ in millions) Transaction Overview Pro Forma Leverage ï® On January 31, 2019, the Blackstone A Blackstone, GIC, Aï® Blackstone HoldCo $1,155 Term Loan 1 and Other Investors (~44% Interest in TGE) Consortium and Tallgrass announced 100% Membership Interest Blackstone had entered into an agreement with ï,„ Debt: $1,155 affiliates of Kelso & Co., The Energy & Minerals Tallgrass Energy Holdings, LLC 21,751,018 Class A Shares (“Holdings”) 100,655,121 Class B Shares 4 Group and Tallgrass KC, LLC to acquire 100% 43.55% limited partner ï,„ Leverage: ~4.2x of the membership interest in TGE’s general 100% Membership Interest interest ï,„ CFR/CCR: B1 / B+ partner as well as approximately 44% of the TGE PUBLIC TALLGRASS ENERGY GP, LLC limited partner interests in TGE for cash INVESTORS Bï® Tallgrass Energy consideration of approximately $3.2 billion 153,949,530 Class A Partners, LP General Partner Interest: Shares 55.78% limited Not entitled to distributions from TGE partner interestï,„ Debt: $3,2065 3,210,085 Class A Shares ï,„ The Blackstone Consortium acquired: (i) TALLGRASS ENERGY, LP 1,481,754 Class B Sharesï,„ Leverage: ~3.5x 1.67% limited partner interest 100% of the membership interests in the 153,949,530 Tallgrass Equity Units Managementï,„ CFR/CCR: Ba2 / BB+ general partner and (ii) 122,406,139 Class 55.78% controlling and economic interest Member A and Class B Shares, along with the Cï® Rockies Express 122,406,139 Tallgrass Equity 5 TALLGRASS EQUITY, LLC Pipeline LLC corresponding units in Tallgrass Equity, Units 43.55% controlling and economic interest LLC 5 2ï,„ Debt: $2,018 100% Membership Interest B RCF due 2022ï,„ Leverage: 3.0x TALLGRASS ENERGY 4.75% Notes due 2023ï,„ Implied TGE enterprise value of PARTNERS, LP 5.50% Notes due 2024 5.50% Notes due 2028ï,„ CFR/CCR: Ba1 / approximately $10.6 billionBBB- TALLGRASS MLP TALLGRASS ENERGY OPERATIONS, LLC FINANCE CORP. Total Debt (Blackstone ï® The transaction closed on March 11, 2019 C HoldCo + Tallgrass + RCF due 2020 OPERATING 5.625% Notes due 2020 REX) / Total Adjusted SUBSIDIARIES3 7.500% Notes due 2038 6.875% Notes due 2040 EBITDA6: 6.0x Source: Company filings 1. Certain of the minority investors holding Class B Shares and Tallgrass Equity Units do not own membership interests in Holdings 2. Includes (i) a 99.9% limited partner interest held directly by Tallgrass Equity, (ii) a 0.1% limited partner interest held indirectly through Tallgrass Equity Investments, LLC and (iii) a general partner interest held indirectly through TEP GP 3. TGE, the managing member of Tallgrass Equity, and Tallgrass Equity, the sole member of TEP’s general partner, are not guarantors of the 2023 Notes, the 2024 Notes, the 2028 Notes or the revolving credit facility. In addition, partially owned subsidiaries and their direct and indirect subsidiaries are not guarantors of the 2023 Notes, the 2024 Notes, the 2028 Notes or the revolving credit facility 4. Based on TGE 2019E dividend per share of $2.18 and $274.2 million in dividends to Blackstone HoldCo 5. As of December 31, 2018; Rockies Express is unconsolidated at TGE 6. As of December 31, 2018; includes 75% of REX EBITDA and debt 4