UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-23161

NuShares ETF Trust

(Exact name of registrant as specified in charter)

Nuveen Investments

333 West Wacker Drive, Chicago, IL 60606

(Address of principal executive offices) (Zip code)

Christopher M. Rohrbacher

Nuveen Investments

333 West Wacker Drive

Chicago, IL 60606

(Name and address of agent for service)

Registrant’s telephone number, including area code: (312) 917-7700

Date of fiscal year end: October 31

Date of reporting period: October 31, 2017

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policy making roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss.3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

| | | | | | | | | | |

| | | | | | | Listing Exchange | | Ticker Symbol |

| | | Fund Name | | | | | | | | |

|

| | Nushares ESG Emerging Markets Equity ETF | | | | Cboe BZX Exchange, Inc. | | NUEM | | |

| | Nushares ESG International Developed Markets Equity ETF | | | | Cboe BZX Exchange, Inc. | | NUDM | | |

| | Nushares ESG Large-Cap Growth ETF | | | | Cboe BZX Exchange, Inc. | | NULG | | |

| | Nushares ESG Large-Cap Value ETF | | | | Cboe BZX Exchange, Inc. | | NULV | | |

| | Nushares ESG Mid-Cap Growth ETF | | | | Cboe BZX Exchange, Inc. | | NUMG | | |

| | Nushares ESG Mid-Cap Value ETF | | | | Cboe BZX Exchange, Inc. | | NUMV | | |

| | Nushares ESG Small-Cap ETF | | | | Cboe BZX Exchange, Inc. | | NUSC | | |

| | | | | | | | | | | | |

| | | | | | |

| | | | |

| | | | | | | | |

| | |

| | Life is Complex. | | |

| | |

| | Nuveen makes things e-simple. | | |

| | |

| | It only takes a minute to sign up for e-Reports. Once enrolled, you’ll receive an e-mail as soon as your Nuveen Fund information is ready—no more waiting for delivery by regular mail. Just click on the link within the e-mail to see the report and save it on your computer if you wish. | | |

| | | | |

| | | | | | Free e-Reports right to your e-mail! | | |

| | | |

| | | | | | www.investordelivery.com If you receive your Nuveen Fund distributions and statements from your

financial advisor or brokerage account. |

| | | | |

| | | | or | | www.nuveen.com/accountaccess If you receive your Nuveen Fund distributions and statements directly from Nuveen. Must be preceded by or accompanied by a prospectus. NOT FDIC INSURED MAY LOSE VALUE

NO BANK GUARANTEE | | |

| | | | | | | | | | |

| | | | | | | | | | | | | |

Table

of Contents

Chairman’s Letter

to Shareholders

Dear Shareholders,

Asset prices have steadily climbed this year, propelled by a “Goldilocks” economic scenario that enabled markets to sidestep geopolitical tensions, natural disasters, terrorism events and political noise. The U.S. economy continued to run not too hot, not too cold, with steady growth and low levels of unemployment, inflation and interest rates. Corporate earnings have been healthy and recession risk appeared low. At the same time, growth across the rest of the world has improved as well, leading to upward revisions in global growth projections.

Yet, a global synchronized recovery also brings the prospect of higher inflation. Central banks have to manage the delicate balance between too-loose financial conditions, which risks economies overheating, and too-tight conditions, which could trigger recession. The nomination of Jerome Powell for Chairman of the U.S. Federal Reserve (Fed) is largely expected to maintain the course set by Chair Janet Yellen after her term expires in February 2018, and the much anticipated tax overhaul, passed at the end of December, may likely boost economic growth but could complicate the Fed’s job of managing interest rates in the years ahead.

Meanwhile, politics will remain in the forefront. A budget showdown is expected in 2018, as Congress sets to debate the U.S. debt ceiling limit and spending related to the military, disaster relief, the Children’s Health Insurance Program and immigration policy. In addition, the ongoing “Brexit” negotiations and the North American Free Trade Agreement (NAFTA) talks may impact key trade and political partnerships. Tensions with North Korea may continue to flare.

The magnitude of the market’s bullishness this year has been somewhat surprising, but gains may not be so easy in the coming years. Nobody can predict market shifts, and that is why Nuveen encourages you to talk to your financial advisor to ensure your investment portfolio is appropriately diversified for your objectives, time horizon and risk tolerance. On behalf of the other members of the Nuveen Fund Board, we look forward to continuing to earn your trust in the months and years ahead.

Sincerely,

William J. Schneider

Chairman of the Board

December 22, 2017

Portfolio Managers’

Comments

Nushares ESG Emerging Markets Equity ETF (NUEM)

Nushares ESG International Developed Markets Equity ETF (NUDM)

Nushares ESG Large-Cap Growth ETF (NULG)

Nushares ESG Large-Cap Value ETF (NULV)

Nushares ESG Mid-Cap Growth ETF (NUMG)

Nushares ESG Mid-Cap Value ETF (NUMV)

Nushares ESG Small-Cap ETF (NUSC)

These Funds features portfolio management by Teachers Advisors, LLC, an affiliate of Nuveen, LLC. Portfolio managers Philip James (Jim) Campagna, CFA, and Lei Liao, CFA, discuss U.S. economic and market conditions, key investment strategies and the performance of the Funds during the abbreviated annual reporting period. Jim and Lei have managed the Funds since their commencement of operations on December 13, 2016. For the Nushares ESG International Developed Markets Equity ETF (NUDM) and Nushares ESG Emerging Markets Equity ETF (NUEM), portfolio managers Philip James (Jim) Campagna, CFA, and Lei Liao, CFA, have managed these Funds during the abbreviated reporting period from the Funds’ commencement of operations on June 6, 2017 through October 31, 2017. Please refer to the Funds’ prospectuses for more information, available at https://www.nuveen.com/ETF/Default.aspx.

What factors affected the U.S. economy and the U.S. stock market during the abbreviated annual reporting period ended October 31, 2017?

The U.S. economy continued to expand at a below-trend pace in the reporting period overall but did mark two consecutive quarters of above 3% growth in the second and third quarters of 2017. The Bureau of Economic Analysis reported its “second” estimate of third-quarter gross domestic product (GDP) at an annualized rate of 3.3%, an increase from 3.1% in the second quarter, alleviating concerns that Hurricanes Harvey, Irma and Maria depressed the nation’s output. GDP is the value of goods and services produced by the nation’s economy less the value of the goods and services used up in production, adjusted for price changes. Despite some softening in shopping and dining out activity due to the hurricanes, consumer spending remained the main driver of demand in the economy. Business investment had been muted for most of the recovery but has accelerated in 2017, with the “hard” data now falling more in line with the highly optimistic business sentiment levels, or “soft” data, seen after President Trump won the election.

Elsewhere in the economy, the labor market continued to tighten, with unemployment staying below 5% over the course of the reporting period. As reported by the Bureau of Labor Statistics, the unemployment rate fell to 4.1% in October 2017 from 4.8% in October 2016 and job gains averaged around 167,000 per month for the past twelve months. Higher energy prices, especially gasoline, helped drive a steady increase in inflation over this reporting period. The Consumer Price Index (CPI) increased 2.0% over the twelve-month reporting period ended October 31, 2017 on a seasonally adjusted basis, as reported by the Bureau of Labor Statistics. The core CPI (which excludes food and energy) increased 1.8% during the same period, slightly below the Federal Reserve’s (Fed) unofficial longer term inflation objective of 2.0%. The housing market also continued to improve, with historically low mortgage rates and low inventory driving home prices higher. The S&P CoreLogic Case-Shiller U.S. National Home Price Index, which covers all

This material is not intended to be a recommendation or investment advice, does not constitute a solicitation to buy or sell securities, and is not provided in a fiduciary capacity. The information provided does not take into account the specific objectives or circumstances of any particular investor, or suggest any specific course of action. Investment decisions should be made based on an investor’s objectives and circumstances and in consultation with his or her advisors.

Certain statements in this report are forward-looking statements. Discussions of specific investments are for illustration only and are not intended as recommendations of individual investments. The forward-looking statements and other views expressed herein are those of the portfolio managers as of the date of this report. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements and the views expressed herein are subject to change at any time, due to numerous market and other factors. Each Fund disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

Refer to the Glossary of Terms Used in this report for further definition of the terms used within this section.

Portfolio Managers’ Comments (continued)

nine U.S. census divisions, recorded a 6.2% annual gain in September 2017 (most recent data available at the time this report was prepared). The 10-City and 20-City Composites reported year-over-year increases of 5.7% and 6.2%, respectively.

With the U.S. economy delivering a sustainable, albeit muted, growth rate, the Fed’s policy making committee raised its main benchmark interest rate in December 2016, March 2017 and June 2017. These moves were widely expected by the markets, as were the Fed’s decisions to leave rates unchanged at the July, September and October/November 2017 meetings. (There was no August meeting.) The Fed also announced it would begin reducing its balance sheet in October 2017 by allowing a small amount of maturing Treasury and mortgage securities to roll off without reinvestment. The market expects the pace to remain moderate and predictable, with minimal market disruption. The Fed also signaled its intention to raise its target interest rate one more time in 2017.

While the markets remained comfortable with the course of monetary policy during this reporting period, the political environment was frequently a source of uncertainty. Markets were initially highly optimistic about pricing in the new administration’s “pro-growth” fiscal agenda after Donald Trump won the election. However, several attempts at health care reform were unable to pass in Congress, which weakened the outlook for the remainder of President Trump’s agenda. The hurricanes caused enormous devastation in Texas, Florida and Puerto Rico, which will require federal aid. The debt ceiling vote, expected to be a protracted showdown in Congress, turned out to be a non-event after the Republican president and Congressional Democrats reached a compromise in early September (although the debate will resume when the current extension expires in December 2017). As the reporting period ended, legislators were refocusing their efforts on tax reform and President Trump nominated Jerome Powell to replace Fed Chair Janet Yellen when her term ends in February 2018. Although both events were initially considered market friendly, the specifics of a tax reform bill, its implications for the economic and corporate landscapes and whether it passes remain to be seen and could pose challenges to the Fed’s ability to manage interest rates in the future (subsequent to the close of the reporting period, the tax bill was signed into law). Geopolitical risks also remained prominent throughout the reporting period, with the ongoing renegotiation of the North American Free Trade Agreement (NAFTA); the start of “Brexit” talks between the U.K. and European Union; closely watched elections in the Netherlands, France and Germany; and escalating tensions between the U.S. and North Korea.

The environment was strongly supportive to U.S. stock prices in the abbreviated reporting period. Stocks extended their gains on decent economic growth data and strong corporate profitability, especially in the information technology sector. Additionally, for the first time since the global financial crisis, economic growth outside the U.S. was showing evidence of improvement, particularly in Europe and Japan, or stabilization, in the case of emerging markets. Upgraded global growth forecasts further helped stocks shrug off geopolitical flare-ups, terrorist attacks, concerns about low global inflation and political uncertainties both at home and abroad.

What key strategies were used to manage the Funds during the abbreviated reporting period and how did these strategies influence performance?

These Funds employ a passive management (or “indexing”) approach, seeking to track the investment results, before fees and expenses, of their respective indexes that meet certain environment, social and governance (“ESG”) criteria. You cannot invest directly in an index. Each Fund seeks to track its index by investing all, or substantially all, of its assets in the securities represented in its index in approximately the same proportions as the index. Each Fund rebalances its holdings quarterly in response to the quarterly rebalance of its index, which occurs in February, May, August and November.

NUEM seeks to track the investment results, before fees and expenses, of the TIAA ESG Emerging Markets Equity Index (the “NUEM Index”), which is comprised solely of listed equity securities issued by companies (and depositary receipts representing such securities) located in countries with emerging markets that meet certain ESG criteria. The NUEM Index selects from the securities included in the MSCI Emerging Markets Index (the “NUEM Base Index”), which currently consists of large- and mid-capitalization companies located in one of the following 24 emerging market countries: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Pakistan, Peru, Philippines, Poland, Qatar, Russia, South Africa, Taiwan, Thailand, Turkey and the United Arab Emirates.

NUDM seeks to track the investment results, before fees and expenses, of the TIAA ESG International Developed Markets Equity Index (the “NUDM Index”), which is comprised solely of listed equity securities issued by companies (and depositary receipts representing such securities) located in countries with developed markets, excluding the United States and Canada, that meet certain ESG criteria. The NUDM Index selects from the securities included in the MSCI EAFE Index (the “NUDM Base Index”), which currently

consists of large- and mid-capitalization companies located in one of the following 21 developed market countries: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland and the United Kingdom.

NULG seeks to track the investment results, before fees and expenses, of the TIAA ESG USA Large-Cap Growth Index (the “NULG Index”), which is comprised of equity securities issued by large-capitalization companies listed on U.S. exchanges that meet certain ESG criteria. The NULG Index selects from the securities included in the MSCI USA Growth Index (the “NULG Base Index”), which generally consists of large- and mid-capitalization U.S. equity securities that exhibit overall growth style characteristics based on five variables: long-term forward earnings per share (“EPS”) growth rate, short-term forward EPS growth rate, current internal growth rate, long-term historical EPS growth trend, and long-term historical sales per share growth trend.

NULV seeks to track the investment results, before fees and expenses, of the TIAA ESG USA Large-Cap Value Index (the “NULV Index”), which is comprised of equity securities issued by large-capitalization companies listed on U.S. exchanges that meet certain ESG criteria. The NULV Index selects from the securities included in the MSCI USA Value Index (the “NULV Base Index”), which generally consists of large- and mid-capitalization U.S. equity securities that exhibit overall value style characteristics based on three variables: book value to price, 12-month forward earnings to price and dividend yield.

NUMG seeks to track the investment results, before fees and expenses, of the TIAA ESG USA Mid-Cap Growth Index (the “NUMG Index”), which is comprised of equity securities issued by mid-capitalization companies listed on U.S. exchanges that meet certain ESG criteria. The NUMG Index selects from the securities included in the MSCI USA Mid-Cap Growth Index (the “NUMG Base Index”), which generally consists of mid-capitalization U.S. equity securities that exhibit overall growth style characteristics based on five variables: long-term forward EPS growth rate, short-term forward EPS growth rate, current internal growth rate, long-term historical EPS growth trend and long-term historical sales per share growth trend.

NUMV seeks to track the investment results, before fees and expenses, of the TIAA ESG USA Mid-Cap Value Index (the “NUMV Index”), which is comprised of equity securities issued by mid-capitalization companies listed on U.S. exchanges that meet certain ESG criteria. The NUMV Index selects from the securities included in the MSCI USA Mid-Cap Value Index (the “NUMV Base Index”), which generally consists of mid-capitalization U.S. equity securities that exhibit overall value style characteristics based on three variables: book value to price, 12-month forward earnings to price and dividend yield.

NUSC seeks to track the investment results, before fees and expenses, of the TIAA ESG USA Small-Cap Index (the “NUSC Index”), which is comprised of equity securities issued by small-capitalization companies listed on U.S. exchanges that meet certain ESG criteria. The NUSC Index selects from the securities included in the MSCI USA Small Cap Index (the “NUSC Base Index”), which generally consists of equity securities that comprise the small-cap segment of the U.S. market.

MSCI Inc. (“MSCI”) is the index provider for each Index and Base Index. Each Index and Base Index are owned, calculated and controlled by MSCI, in its sole discretion. Neither the sub-adviser nor its affiliates has any discretion to select Index components or change the Index methodology. Each Index identifies equity securities from its Base Index that satisfy certain ESG criteria, based on ESG performance data collected by MSCI ESG Research, Inc. ESG performance is measured on an industry-specific basis, with assessment categories varying by industry.

For the five U.S. Funds, performance was driven by style and market cap trends. For the period from the Funds’ inception on December 13, 2016 through October 31, 2017, growth-style stocks decisively outperformed value-style stocks. On a market capitalization basis, large-cap growth stocks led, followed by mid-cap growth stocks and small-cap stocks. The gains of large-cap value and mid-cap value stocks trailed those of their growth-stock counterparts. Accordingly, among the five Funds, NULG was the top performing Fund and NUMV posted the smallest gain in this abbreviated reporting period. The outperformance of the information technology sector helped drive the strong returns in NULG, NUMG and NUSC, as it was the largest sector weighting in the three Funds. In contrast, the largest sector exposure in the value-style funds, NULV and NUMV, was financials. The financials sector performed well in the abbreviated reporting period but lagged the rally in information technology shares.

The two international Funds, NUDM and NUEM, were measured over a shorter timeframe than the five U.S. Funds. From NUDM and NUEM’s inception on June 6, 2017 to October 31, 2017, international stocks delivered positive returns overall, with NUEM leading

Portfolio Managers’ Comments (continued)

performance over NUDM due to the outperformance of emerging market stocks over developed market stocks. The two Funds benefited from the strong performance of economically sensitive sectors, such as information technology, financials, consumer discretionary and industrials, where the Funds held larger exposures.

How did the Funds perform in the abbreviated reporting period ended October 31, 2017?

The tables in each Fund’s Performance Overview and Expense Ratios section of this report provides the Funds’ total return performance for the abbreviated reporting period from the Funds’ commencement of operation on December 13, 2016 through October 31, 2017 or June 6, 2017 through October 31, 2017. Each Fund’s total returns at net asset value (NAV) are compared with the performance of the Index, which each Fund is designed to track.

The total return for each Fund slightly trailed that of its respective Index over this abbreviated reporting period. The trailing performance is primarily attributable to fees and expenses. The Indexes are unmanaged and therefore their returns do not reflect any fees or expenses, which would detract from their performance. You cannot invest directly in an index.

Risk Considerations

Nushares ESG Emerging Markets Equity ETF (NUEM)

Investing involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. This ETF seeks to generally track the investment results of an index; however the Fund may underperform, outperform or be more volatile than the referenced index. Non-U.S. investments involve risks such as currency fluctuation, political and economic instability, lack of liquidity and differing legal and accounting standards. These risks are magnified in emerging markets. In addition, because the Index selects securities for inclusion based on environmental, social, and governance (ESG) criteria, the Fund may forgo some market opportunities available to funds that don’t use these criteria. A portfolio concentrated in a single industry sector or country may present more risk than a portfolio broadly diversified over several industries or countries. These and other risks, such as mid-cap stock risk, are described in the Fund’s prospectus.

Nushares ESG International Developed Markets Equity ETF (NUDM)

Investing involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. An exchange-traded fund seeks to generally track the investment results of an index; however the Fund may underperform, outperform or be more volatile than the referenced index. Non-U.S. investments involve risks such as currency fluctuation, political and economic instability, lack of liquidity and differing legal and accounting standards. In addition, because the Index selects securities for inclusion based on environmental, social, and governance (ESG) criteria, the Fund may forgo some market opportunities available to funds that don’t use these criteria. A portfolio concentrated in a single industry sector or country may present more risk than a portfolio broadly diversified over several industries or countries. These and other risks, such as mid-cap stock risk, are described in the Fund’s prospectus.

Nushares ESG Large-Cap Growth ETF (NULG)

Investing involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. This ETF seeks to generally track the investment results of an index; however the Fund may underperform, outperform or be more volatile than the referenced index. In addition, because the Index selects securities for inclusion based on environmental, social, and governance (ESG) criteria, the Fund may forgo some market opportunities available to funds that don’t use these criteria. The value of equity securities may decline significantly over short or extended periods of time. Growth stocks tend to be more volatile and can experience sharp price declines. Because it invests primarily in large-capitalization stocks, the Fund may underperform funds that invest primarily in stocks of smaller capitalization companies during periods when the stocks of such companies are in favor. These and other risk considerations are described in detail in the Fund’s prospectus.

Nushares ESG Large-Cap Value ETF (NULV)

Investing involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. This ETF seeks to generally track the investment results of an index; however the Fund may underperform, outperform or be more volatile than the referenced index. In addition, because the Index selects securities for inclusion based on environmental, social, and governance (ESG) criteria, the Fund may forgo some market opportunities available to funds that don’t use these criteria. The value of equity securities may decline significantly over short or extended periods of time. Value stocks may not be fully recognized by the market and be undervalued. Because it invests primarily in large-capitalization stocks, the Fund may underperform funds that invest primarily in stocks of smaller capitalization companies during periods when the stocks of such companies are in favor. These and other risk considerations are described in detail in the Fund’s prospectus.

Risk Considerations (continued)

Nushares ESG Mid-Cap Growth ETF (NUMG)

Investing involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. This ETF seeks to generally track the investment results of an index; however the Fund may underperform, outperform or be more volatile than the referenced index. In addition, because the Index selects securities for inclusion based on environmental, social, and governance (ESG) criteria, the Fund may forgo some market opportunities available to funds that don’t use these criteria. The value of equity securities may decline significantly over short or extended periods of time. Because it invests primarily in mid-capitalization stocks, the Fund may be subject to greater volatility than those that invest in larger companies, but may be less volatile than investments in smaller companies. Growth stocks tend to be more volatile and can experience sharp price declines. These and other risk considerations are described in detail in the Fund’s prospectus.

Nushares ESG Mid-Cap Value ETF (NUMV)

Investing involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. This ETF seeks to generally track the investment results of an index; however the Fund may underperform, outperform or be more volatile than the referenced index. In addition, because the Index selects securities for inclusion based on environmental, social, and governance (ESG) criteria, the Fund may forgo some market opportunities available to funds that don’t use these criteria. The value of equity securities may decline significantly over short or extended periods of time. Value stocks may not be fully recognized by the market and be undervalued. Because it invests primarily in mid-capitalization stocks, the Fund may be subject to greater volatility than those that invest in larger companies, but may be less volatile than investments in smaller companies. These and other risk considerations are described in detail in the Fund’s prospectus.

Nushares ESG Small-Cap ETF (NUSC)

Investing involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. This ETF seeks to generally track the investment results of an index; however the Fund may underperform, outperform or be more volatile than the referenced index. In addition, because the Index selects securities for inclusion based on environmental, social, and governance (ESG) criteria, the Fund may forgo some market opportunities available to funds that don’t use these criteria. The value of equity securities may decline significantly over short or extended periods of time. Investments in smaller companies are subject to greater volatility than those of larger companies. These and other risk considerations are described in detail in the Fund’s prospectus.

Fund Performance

and Expense Ratios

The Fund Performance and Expense Ratio for each Fund are shown within this section of the report.

Returns quoted represent past performance, which is no guarantee of future results. Investment returns and principal value will fluctuate so that when shares are sold, they may be worth more or less than their original cost. Current performance may be higher or lower than the performance shown. Total returns for a period of less than one year are not annualized. Returns assume reinvestment of dividends and capital gains. Market price returns are based on the closing market price as of the end of the reporting period. For performance current to the most recent month-end visit nuveen.com or call (800) 257-8787.

Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares.

The expense ratios represents each Fund’s total operating expenses as reflected in the most recent prospectus. The expense ratios shown include management fees and other applicable fees and expenses paid by the Fund.

Fund Performance and Expense Ratios (continued)

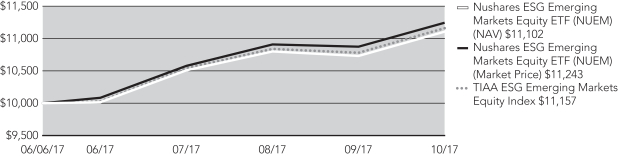

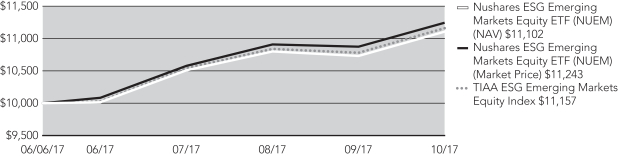

Nushares ESG Emerging Markets Equity ETF (NUEM)

Refer to the first page of this Fund Performance and Expense Ratios section for further explanation of the information included within this section. Refer to the Glossary of Terms Used in this Report for definitions of terms used within this section.

Fund Performance

Total Returns as of October 31, 2017

| | | | |

| | | Cumulative | |

| | | Since

Inception | |

NUEM at NAV | | | 11.03% | |

NUEM at Market Price | | | 12.42% | |

TIAA ESG Emerging Markets Equity Index | | | 11.57% | |

MSCI Emerging Markets Index | | | 11.56% | |

Total Returns as of September 30, 2017 (Most Recent Calendar Quarter)

| | | | |

| | | Cumulative | |

| | | Since

Inception | |

NUEM at NAV | | | 7.28% | |

NUEM at Market Price | | | 8.69% | |

Since inception returns are from 6/6/17. Indexes are not available for direct investment.

Expense Ratio as of Most Recent Prospectus

Growth of an Assumed $10,000 Investment as of October 31, 2017

The graph does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares.

Fund Performance and Expense Ratios (continued)

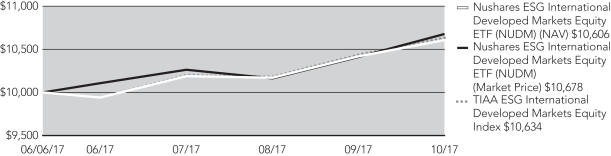

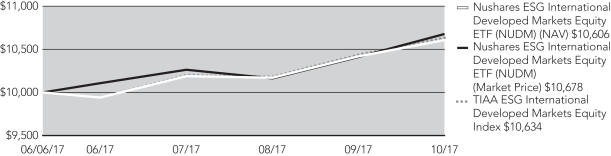

Nushares ESG International Developed Markets Equity ETF (NUDM)

Refer to the first page of this Fund Performance and Expense Ratios section for further explanation of the information included within this section. Refer to the Glossary of Terms Used in this Report for definitions of terms used within this section.

Fund Performance

Total Returns as of October 31, 2017

| | | | |

| | | Cumulative | |

| | | Since

Inception | |

NUDM at NAV | | | 6.07% | |

NUDM at Market Price | | | 6.78% | |

TIAA ESG International Developed Markets Equity Index | | | 6.34% | |

MSCI EAFE Index | | | 5.95% | |

Total Returns as of September 30, 2017 (Most Recent Calendar Quarter)

| | | | |

| | | Cumulative | |

| | | Since

Inception | |

NUDM at NAV | | | 4.16% | |

NUDM at Market Price | | | 4.13% | |

Since inception returns are from 6/6/17. Indexes are not available for direct investment.

Expense Ratio as of Most Recent Prospectus

Growth of an Assumed $10,000 Investment as of October 31, 2017

The graph does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares.

Fund Performance and Expense Ratios (continued)

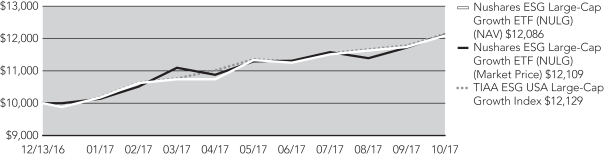

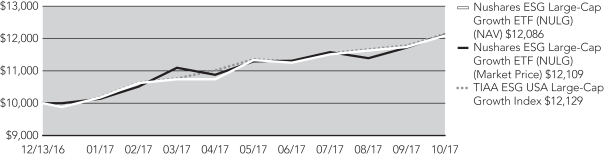

Nushares ESG Large-Cap Growth ETF (NULG)

Refer to the first page of this Fund Performance and Expense Ratios section for further explanation of the information included within this section. Refer to the Glossary of Terms Used in this Report for definitions of terms used within this section.

Fund Performance

Total Returns as of October 31, 2017

| | | | |

| | | Cumulative | |

| | | Since

Inception | |

NULG at NAV | | | 20.88% | |

NULG at Market Price | | | 21.10% | |

TIAA ESG USA Large-Cap Growth Index | | | 21.29% | |

MSCI USA Growth Index | | | 21.83% | |

Total Returns as of September 30, 2017 (Most Recent Calendar Quarter)

| | | | |

| | | Cumulative | |

| | | Since

Inception | |

NULG at NAV | | | 17.33% | |

NULG at Market Price | | | 17.17% | |

Since inception returns are from 12/13/16. Indexes are not available for direct investment.

Expense Ratio as of Most Recent Prospectus

Growth of an Assumed $10,000 Investment as of October 31, 2017

The graph does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares.

Fund Performance and Expense Ratios (continued)

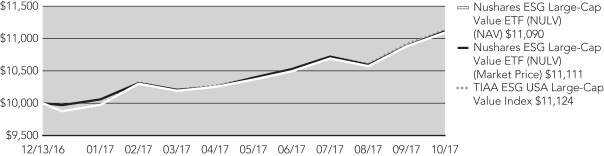

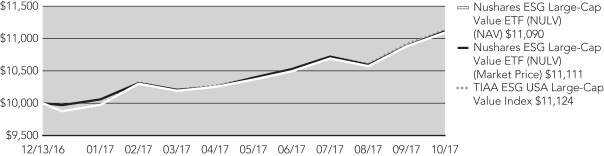

Nushares ESG Large-Cap Value ETF (NULV)

Refer to the first page of this Fund Performance and Expense Ratios section for further explanation of the information included within this section. Refer to the Glossary of Terms Used in this Report for definitions of terms used within this section.

Fund Performance

Total Returns as of October 31, 2017

| | | | |

| | | Cumulative | |

| | | Since

Inception | |

NULV at NAV | | | 10.90% | |

NULV at Market Price | | | 11.11% | |

TIAA ESG USA Large-Cap Value Index | | | 11.24% | |

MSCI USA Value Index | | | 9.31% | |

Total Returns as of September 30, 2017 (Most Recent Calendar Quarter)

| | | | |

| | | Cumulative | |

| | | Since

Inception | |

NULV at NAV | | | 8.75% | |

NULV at Market Price | | | 8.80% | |

Since inception returns are from 12/13/16. Indexes are not available for direct investment.

Expense Ratio as of Most Recent Prospectus

Growth of an Assumed $10,000 Investment as of October 31, 2017

The graph does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares.

Fund Performance and Expense Ratios (continued)

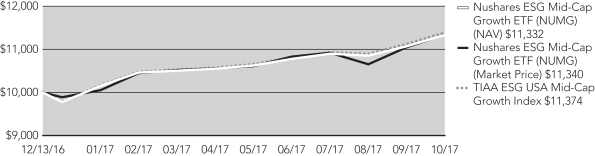

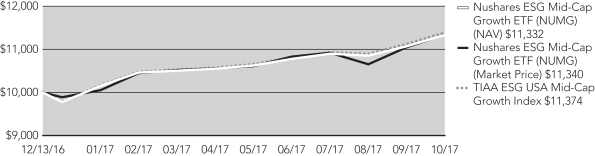

Nushares ESG Mid-Cap Growth ETF (NUMG)

Refer to the first page of this Fund Performance and Expense Ratios section for further explanation of the information included within this section. Refer to the Glossary of Terms Used in this Report for definitions of terms used within this section.

Fund Performance

Total Returns as of October 31, 2017

| | | | |

| | | Cumulative | |

| | | Since

Inception | |

NUMG at NAV | | | 13.30% | |

NUMG at Market Price | | | 13.38% | |

TIAA ESG USA Mid-Cap Growth Index | | | 13.74% | |

MSCI USA Mid-Cap Growth Index | | | 13.75% | |

Total Returns as of September 30, 2017 (Most Recent Calendar Quarter)

| | | | |

| | | Cumulative | |

| | | Since

Inception | |

NUMG at NAV | | | 10.68% | |

NUMG at Market Price | | | 10.39% | |

Since inception returns are from 12/13/16. Indexes are not available for direct investment.

Expense Ratio as of Most Recent Prospectus

Growth of an Assumed $10,000 Investment as of October 31, 2017

The graph does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares.

Fund Performance and Expense Ratios (continued)

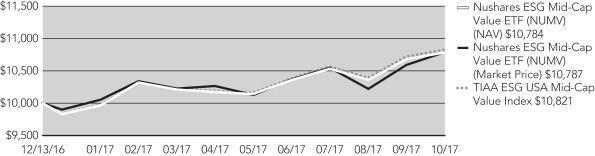

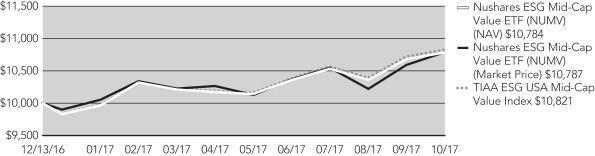

Nushares ESG Mid-Cap Value ETF (NUMV)

Refer to the first page of this Fund Performance and Expense Ratios section for further explanation of the information included within this section. Refer to the Glossary of Terms Used in this Report for definitions of terms used within this section.

Fund Performance

Total Returns as of October 31, 2017

| | | | |

| | | Cumulative | |

| | | Since

Inception | |

NUMV at NAV | | | 7.82% | |

NUMV at Market Price | | | 7.86% | |

TIAA ESG USA Mid-Cap Value Index | | | 8.21% | |

MSCI USA Mid-Cap Value Index | | | 9.25% | |

Total Returns as of September 30, 2017 (Most Recent Calendar Quarter)

| | | | |

| | | Cumulative | |

| | | Since

Inception | |

NUMV at NAV | | | 6.80% | |

NUMV at Market Price | | | 5.90% | |

Since inception returns are from 12/13/16. Indexes are not available for direct investment.

Expense Ratio as of Most Recent Prospectus

Growth of an Assumed $10,000 Investment as of October 31, 2017

The graph does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares.

Fund Performance and Expense Ratios (continued)

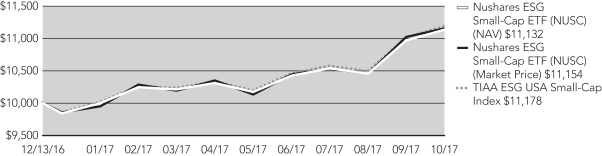

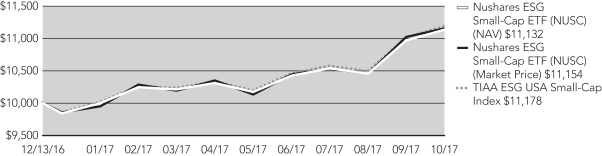

Nushares ESG Small-Cap ETF (NUSC)

Refer to the first page of this Fund Performance and Expense Ratios section for further explanation of the information included within this section. Refer to the Glossary of Terms Used in this Report for definitions of terms used within this section.

Fund Performance

Total Returns as of October 31, 2017

| | | | |

| | | Cumulative | |

| | | Since

Inception | |

NUSC at NAV | | | 11.34% | |

NUSC at Market Price | | | 11.54% | |

TIAA ESG USA Small-Cap Index | | | 11.78% | |

MSCI USA Small-Cap Index | | | 12.12% | |

Total Returns as of September 30, 2017 (Most Recent Calendar Quarter)

| | | | |

| | | Cumulative | |

| | | Since

Inception | |

NUSC at NAV | | | 9.68% | |

NUSC at Market Price | | | 10.20% | |

Since inception returns are from 12/13/16. Indexes are not available for direct investment.

Expense Ratio as of Most Recent Prospectus

Growth of an Assumed $10,000 Investment as of October 31, 2017

The graph does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares.

Holding

Summaries as of October 31, 2017

This data relates to the securities held in each Fund’s portfolio of investments as of the end of this reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change.

Nushares ESG Emerging Markets Equity ETF (NUEM)

Fund Allocation

(% of net assets)

| | | | |

Common Stocks | | | 100.1% | |

Common Stock Rights | | | 0.0% | |

Other Assets Less Liabilities | | | (0.1)% | |

Net Assets | | | 100% | |

Top Five Common Stock Holdings

(% of net assets)

| | | | |

Tencent Holdings Limited | | | 6.2% | |

Taiwan Semiconductor Manufacturing Company Limited | | | 4.7% | |

Naspers Limited | | | 2.4% | |

Geely Automobile Holdings Limited | | | 1.8% | |

NHN Corporation | | | 1.8% | |

Portfolio Composition

(% of net assets)

| | | | |

Financials | | | 24.6% | |

Information Technology | | | 24.3% | |

Consumer Discretionary | | | 13.2% | |

Materials | | | 7.9% | |

Industrials | | | 7.2% | |

Consumer Staples | | | 5.6% | |

Other | | | 17.3% | |

Other Assets Less Liabilities | | | (0.1)% | |

Net Assets | | | 100% | |

Country Allocation

(% of net assets)

| | | | |

China | | | 28.9% | |

Korea, Republic Of | | | 14.9% | |

Taiwan | | | 12.2% | |

India | | | 8.5% | |

Brazil | | | 7.4% | |

South Africa | | | 6.9% | |

Mexico | | | 3.1% | |

Malaysia | | | 2.6% | |

Thailand | | | 2.2% | |

Chile | | | 1.9% | |

Other | | | 11.5% | |

Other Assets Less Liabilities | | | (0.1)% | |

Net Assets | | | 100% | |

Nushares ESG International Developed Markets Equity ETF (NUDM)

Fund Allocation

(% of net assets)

| | | | |

Common Stocks | | | 98.6% | |

Common Stock Rights | | | 0.0% | |

Other Assets Less Liabilities | | | 1.4% | |

Net Assets | | | 100% | |

Top Five Common Stocks Holdings

(% of net assets)

| | | | |

Nestle SA | | | 3.0% | |

Roche Holdings AG, Sponsored ADR | | | 2.1% | |

Siemens AG, Sponsored ADR | | | 2.0% | |

Banco Santander S.A. | | | 1.9% | |

Astrazeneca PLC | | | 1.7% | |

Portfolio Composition

(% of net assets)

| | | | |

Financials | | | 20.2% | |

Industrials | | | 15.9% | |

Consumer Discretionary | | | 11.8% | |

Consumer Staples | | | 11.2% | |

Health Care | | | 10.6% | |

Materials | | | 8.2% | |

Information Technology | | | 6.2% | |

Other | | | 14.5% | |

Other Assets Less Liabilities | | | 1.4% | |

Net Assets | | | 100% | |

Country Allocation

(% of net assets)

| | | | |

Japan | | | 23.9% | |

United Kingdom | | | 16.9% | |

France | | | 10.6% | |

Germany | | | 9.8% | |

Switzerland | | | 7.9% | |

Australia | | | 6.6% | |

Netherlands | | | 3.5% | |

Spain | | | 3.5% | |

Sweden | | | 3.0% | |

Italy | | | 2.4% | |

Other | | | 10.5% | |

Other Assets Less Liabilities | | | 1.4% | |

Net Assets | | | 100% | |

Holding Summaries as of October 31, 2017 (continued)

Nushares ESG Large-Cap Growth ETF (NULG)

Fund Allocation

(% of net assets)

| | | | |

Common Stocks | | | 99.7% | |

Other Assets Less Liabilities | | | 0.3% | |

Net Assets | | | 100% | |

Portfolio Composition

(% of net assets)

| | | | |

Information Technology | | | 36.6% | |

Consumer Discretionary | | | 19.7% | |

Health Care | | | 13.5% | |

Industrials | | | 11.6% | |

Consumer Staples | | | 5.5% | |

Financials | | | 5.5% | |

Other | | | 7.3% | |

Other Assets Less Liabilities | | | 0.3% | |

Net Assets | | | 100% | |

Top Five Common Stock Holdings

(% of net assets)

| | | | |

Apple, Inc. | | | 8.4% | |

Microsoft Corporation | | | 3.9% | |

Alphabet Inc., Class C Shares | | | 3.4% | |

Alphabet Inc., Class A Shares | | | 3.2% | |

Oracle Corporation | | | 2.5% | |

Nushares ESG Large-Cap Value ETF (NULV)

Fund Allocation

(% of net assets)

| | | | |

Common Stocks | | | 99.8% | |

Other Assets Less Liabilities | | | 0.2% | |

Net Assets | | | 100% | |

Portfolio Composition

(% of net assets)

| | | | |

Financials | | | 26.2% | |

Health Care | | | 12.7% | |

Information Technology | | | 12.3% | |

Consumer Staples | | | 10.2% | |

Industrials | | | 9.5% | |

Utilities | | | 6.6% | |

Energy | | | 6.5% | |

Other | | | 15.8% | |

Other Assets Less Liabilities | | | 0.2% | |

Net Assets | | | 100% | |

Top Five Common Stocks Holdings

(% of net assets)

| | | | |

Johnson & Johnson | | | 4.6% | |

Microsoft Corporation | | | 4.1% | |

Bank of America Corporation | | | 3.8% | |

Intel Corporation | | | 3.5% | |

Proctor & Gamble Company | | | 3.1% | |

Holding Summaries as of October 31, 2017 (continued)

Nushares ESG Mid-Cap Growth ETF (NUMG)

Fund Allocation

(% of net assets)

| | | | |

Common Stocks | | | 99.9% | |

Other Assets Less Liabilities | | | 0.1% | |

Net Assets | | | 100% | |

Portfolio Composition

(% of net assets)

| | | | |

Information Technology | | | 25.5% | |

Industrials | | | 22.0% | |

Consumer Discretionary | | | 15.0% | |

Health Care | | | 14.7% | |

Real Estate | | | 6.1% | |

Financials | | | 5.9% | |

Other | | | 10.7% | |

Other Assets Less Liabilities | | | 0.1% | |

Net Assets | | | 100% | |

Top Five Common Stock Holdings

(% of net assets)

| | | | |

ServiceNow Inc. | | | 2.5% | |

SBA Communications Corporation | | | 2.3% | |

Workday Inc., Class A | | | 2.1% | |

CarMax, Inc. | | | 2.0% | |

Idexx Labs Inc. | | | 2.0% | |

Nushares ESG Mid-Cap Value ETF (NUMV)

Fund Allocation

(% of net assets)

| | | | |

Common Stocks | | | 99.8% | |

Other Assets Less Liabilities | | | 0.2% | |

Net Assets | | | 100% | |

Portfolio Composition

(% of net assets)

| | | | |

Financials | | | 26.1% | |

Consumer Discretionary | | | 15.5% | |

Real Estate | | | 13.3% | |

Materials | | | 13.3% | |

Industrials | | | 7.9% | |

Information Technology | | | 7.3% | |

Health Care | | | 5.1% | |

Other | | | 11.3% | |

Other Assets Less Liabilities | | | 0.2% | |

Net Assets | | | 100% | |

Top Five Common Stock Holdings

(% of net assets)

| | | | |

Microchip Technology Incorporated | | | 2.9% | |

Principal Financial Group, Inc. | | | 2.5% | |

Citizens Financial Group Inc. | | | 2.5% | |

Eversource Energy | | | 2.5% | |

WestRock Company | | | 2.4% | |

Holding Summaries as of October 31, 2017 (continued)

Nushares ESG Small-Cap ETF (NUSC)

Fund Allocation

(% of net assets)

| | | | |

Common Stocks | | | 99.9% | |

Other Assets Less Liabilities | | | 0.1% | |

Net Assets | | | 100% | |

Portfolio Composition

(% of net assets)

| | | | |

Information Technology | | | 17.2% | |

Industrials | | | 16.1% | |

Financials | | | 15.8% | |

Health Care | | | 12.0% | |

Consumer Discretionary | | | 11.2% | |

Real Estate | | | 9.8% | |

Materials | | | 5.9% | |

Other | | | 11.9% | |

Other Assets Less Liabilities | | | 0.1% | |

Net Assets | | | 100% | |

Top Five Common Stock Holdings

(% of net assets)

| | | | |

First American Corporation | | | 0.9% | |

Take-Two Interactive Software, Inc. | | | 0.8% | |

Aqua America Inc. | | | 0.7% | |

ON Semiconductor Corporation | | | 0.6% | |

White Mountain Insurance Group | | | 0.6% | |

Expense

Examples

As a shareholder of one or more of the Funds, you incur two types of costs: (1) transaction costs, including brokerage commissions on purchases and sales of Fund shares, and (2) ongoing costs, including management fees and other applicable Fund expenses. The Examples below are intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other funds. Since NUEM’s and NUDM’s expense examples below reflect only the first 148 days of the Fund’s operations, they may not provide a meaningful understanding of each Fund’s ongoing expenses.

The Examples below are based on an investment of $1,000 invested at the beginning of the period and held through October 31, 2017.

The beginning of the period of NUEM and NUDM is June 6, 2017 (commencement of operations). The beginning of the period for NULG, NULV, NUMG, NUMV and NUSC is May 1, 2017.

The information under “Actual Performance,” together with the amount you invested, allows you to estimate actual expenses incurred over the reporting period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.60) and multiply the result by the cost shown for your Fund in the row entitled “Expenses Incurred During Period” to estimate the expenses incurred on your account during this period.

The information under “Hypothetical Performance” provides information about hypothetical account values and hypothetical expenses based on each Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expense you incurred for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the hypothetical information is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

Nushares ESG Emerging Markets Equity ETF (NUEM)

| | | | |

Actual Performance | | | | |

Beginning Account Value | | $ | 1,000.00 | |

Ending Account Value | | $ | 1,110.30 | |

Expenses Incurred During Period | | $ | 1.93 | |

Hypothetical Performance (5% annualized return before expenses) | | | | |

Beginning Account Value | | $ | 1,000.00 | |

Ending Account Value | | $ | 1,018.45 | |

Expenses Incurred During Period | | $ | 1.84 | |

Expenses are equal to the Fund’s annualized net expense ratio of 0.45% multiplied by the average account value over the period, multiplied by 148/365 (to reflect the 148 days in the period since commencement of operations).

Expense Examples (continued)

Nushares ESG International Developed Markets Equity ETF (NUDM)

| | | | |

Actual Performance | | | | |

Beginning Account Value | | $ | 1,000.00 | |

Ending Account Value | | $ | 1,060.70 | |

Expenses Incurred During Period | | $ | 1.67 | |

Hypothetical Performance (5% annualized return before expenses) | | | | |

Beginning Account Value | | $ | 1,000.00 | |

Ending Account Value | | $ | 1,018.65 | |

Expenses Incurred During Period | | $ | 1.64 | |

Expenses are equal to the Fund’s annualized net expense ratio of 0.40% multiplied by the average account value over the period, multiplied by 148/365 (to reflect the 148 days in the period since commencement of operations).

Nushares ESG Large-Cap Growth ETF (NULG)

| | | | |

Actual Performance | | | | |

Beginning Account Value | | $ | 1,000.00 | |

Ending Account Value | | $ | 1,100.40 | |

Expenses Incurred During Period | | $ | 1.85 | |

Hypothetical Performance (5% annualized return before expenses) | | | | |

Beginning Account Value | | $ | 1,000.00 | |

Ending Account Value | | $ | 1,023.44 | |

Expenses Incurred During Period | | $ | 1.79 | |

Expenses are equal to the Fund’s annualized net expense ratio of 0.35% multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

Nushares ESG Large-Cap Value ETF (NULV)

| | | | |

Actual Performance | | | | |

Beginning Account Value | | $ | 1,000.00 | |

Ending Account Value | | $ | 1,081.90 | |

Expenses Incurred During Period | | $ | 1.84 | |

Hypothetical Performance (5% annualized return before expenses) | | | | |

Beginning Account Value | | $ | 1,000.00 | |

Ending Account Value | | $ | 1,023.44 | |

Expenses Incurred During Period | | $ | 1.79 | |

Expenses are equal to the Fund’s annualized net expense ratio of 0.35% multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

Nushares ESG Mid-Cap Growth ETF (NUMG)

| | | | |

Actual Performance | | | | |

Beginning Account Value | | $ | 1,000.00 | |

Ending Account Value | | $ | 1,074.50 | |

Expenses Incurred During Period | | $ | 2.09 | |

Hypothetical Performance (5% annualized return before expenses) | | | | |

Beginning Account Value | | $ | 1,000.00 | |

Ending Account Value | | $ | 1,023.19 | |

Expenses Incurred During Period | | $ | 2.04 | |

Expenses are equal to the Fund’s annualized net expense ratio of 0.40% multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

Nushares ESG Mid-Cap Value ETF (NUMV)

| | | | |

Actual Performance | | | | |

Beginning Account Value | | $ | 1,000.00 | |

Ending Account Value | | $ | 1,060.50 | |

Expenses Incurred During Period | | $ | 2.08 | |

Hypothetical Performance (5% annualized return before expenses) | | | | |

Beginning Account Value | | $ | 1,000.00 | |

Ending Account Value | | $ | 1,023.19 | |

Expenses Incurred During Period | | $ | 2.04 | |

Expenses are equal to the Fund’s annualized net expense ratio of 0.40% multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

Nushares ESG Small-Cap ETF (NUSC)

| | | | |

Actual Performance | | | | |

Beginning Account Value | | $ | 1,000.00 | |

Ending Account Value | | $ | 1,079.90 | |

Expenses Incurred During Period | | $ | 2.10 | |

Hypothetical Performance (5% annualized return before expenses) | | | | |

Beginning Account Value | | $ | 1,000.00 | |

Ending Account Value | | $ | 1,023.19 | |

Expenses Incurred During Period | | $ | 2.04 | |

Expenses are equal to the Fund’s annualized net expense ratio of 0.40% multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

Report of

Independent Registered Public Accounting Firm

To the Board of Trustees and Shareholders of

Nushares ETF Trust:

We have audited the accompanying statements of assets and liabilities, including the portfolios of investments, of Nushares ESG Emerging Markets Equity ETF, Nushares ESG International Developed Markets Equity ETF, Nushares ESG Large-Cap Growth ETF, Nushares ESG Large-Cap Value ETF, Nushares ESG Mid-Cap Growth ETF, Nushares ESG Mid-Cap Value ETF, and Nushares ESG Small-Cap ETF (seven of the funds comprising Nushares ETF Trust) (the “Funds”) as of October 31, 2017, and the related statements of operations and changes in net assets and the financial highlights for the periods June 6, 2017 (commencement of operations) through October 31, 2017 for Nushares ESG Emerging Markets Equity ETF and Nushares ESG International Developed Markets Equity ETF and December 13, 2016 (commencement of operations) through October 31, 2017 for Nushares ESG Large-Cap Growth ETF, Nushares ESG Large-Cap Value ETF, Nushares ESG Mid-Cap Growth ETF, Nushares ESG Mid-Cap Value ETF, and Nushares ESG Small-Cap ETF. These financial statements and financial highlights are the responsibility of the Funds’ management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of October 31, 2017, by correspondence with the custodian and brokers or other appropriate auditing procedures. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of the Funds as of October 31, 2017, the results of their operations, the changes in their net assets, and the financial highlights for the periods specified in the first paragraph, in conformity with U.S. generally accepted accounting principles.

/s/ KPMG LLP

Chicago, Illinois

December 27, 2017

Nushares ESG Emerging Markets Equity ETF (NUEM)

| | |

| Portfolio of Investments | | October 31, 2017 |

| | | | | | | | |

| Shares | | | Description (1) | | Value | |

| | |

| | | | LONG-TERM INVESTMENTS – 100.1% | | | | |

| | |

| | | | COMMON STOCKS – 100.1% | | | | |

| | |

| | | | Consumer Discretionary – 13.2% | | | |

| | |

| | 609,609 | | | Alibaba Pictures Group Ltd, (2) | | $ | 99,234 | |

| | |

| | 51,599 | | | Anta Sports Products Ltd | | | 230,819 | |

| | |

| | 345 | | | Arcelik A.S | | | 1,883 | |

| | |

| | 3,946 | | | Astro Malaysia Holdings Bhd | | | 2,619 | |

| | |

| | 63 | | | Bajaj Auto Limited | | | 3,171 | |

| | |

| | 5,787 | | | BEC World PLC, (2) | | | 3,031 | |

| | |

| | 216 | | | Bharat Forge Ltd | | | 2,355 | |

| | |

| | 4 | | | Bosch Ltd | | | 1,297 | |

| | |

| | 130,743 | | | Brilliance China Automotive Holdings Limited | | | 330,469 | |

| | |

| | 30,844 | | | BYD Co Ltd | | | 270,218 | |

| | |

| | 30 | | | CCC SA | | | 2,250 | |

| | |

| | 135 | | | Cheil Worldwide Inc. | | | 2,506 | |

| | |

| | 40,968 | | | Chongqing Changan Automobile Co Ltd, (2) | | | 53,614 | |

| | |

| | 243 | | | Cyfrowy Polsat SA | | | 1,694 | |

| | |

| | 131,069 | | | Dongfeng Motor Group Co Ltd | | | 179,758 | |

| | |

| | 10,782 | | | DXB Entertainments PJSC, (2) | | | 2,172 | |

| | |

| | 193 | | | Eclat Textile Company Limited | | | 2,307 | |

| | |

| | 462 | | | Feng Tay Enterprise Co Ltd | | | 2,083 | |

| | |

| | 552 | | | FF Group, (2) | | | 11,562 | |

| | |

| | 154 | | | Ford Otomotiv Sanayi AS | | | 2,172 | |

| | |

| | 2,647 | | | Formosa Taffeta Co Ltd | | | 2,716 | |

| | |

| | 148,141 | | | Geely Automobile Holdings Limited | | | 458,562 | |

| | |

| | 438,732 | | | Gome Retail Holdings Ltd, (2) | | | 56,235 | |

| | |

| | 101,569 | | | Guangzhou Automobile Group Company Limited | | | 252,562 | |

| | |

| | 60,726 | | | Haier Electronics Group Co., Ltd | | | 159,953 | |

| | |

| | 39 | | | Hankook Tire Company Limited | | | 1,880 | |

| | |

| | 216 | | | Hanon Systems | | | 2,506 | |

| | |

| | 28 | | | Hero MotoCorp Limited | | | 1,666 | |

| | |

| | 6,804 | | | Home Product Center PCL | | | 2,622 | |

| | |

| | 220 | | | Hotai Motor Co Ltd | | | 2,553 | |

| | |

| | 39 | | | Hotel Shilla Company Limited | | | 2,726 | |

| | |

| | 163 | | | Imperial Holdings Limited | | | 2,336 | |

| | |

| | 27 | | | LG Electronics Inc. | | | 2,193 | |

| | |

| | 181 | | | Lojas Renner S.A, (WI/DD) | | | 1,908 | |

| | |

| | 1 | | | LPP SA | | | 2,356 | |

Nushares ESG Emerging Markets Equity ETF (NUEM) (continued)

| | |

| Portfolio of Investments | | October 31, 2017 |

| | | | | | | | |

| Shares | | | Description (1) | | Value | |

| | |

| | | | Consumer Discretionary (continued) | | | |

| | |

| | 81 | | | Mahindra & Mahindra Ltd | | $ | 1,683 | |

| | |

| | 23,060 | | | Media Nusantara Citra TBK PT | | | 2,652 | |

| | |

| | 1,919 | | | Minor International PCL, (2) | | | 2,498 | |

| | |

| | 173 | | | Mr Price Group Ltd | | | 2,144 | |

| | |

| | 2,414 | | | Naspers Limited | | | 588,083 | |

| | |

| | 180 | | | Nien Made Enterprise Co Ltd | | | 1,874 | |

| | |

| | 1,782 | | | PT Matahari Department Store Tbk | | | 1,130 | |

| | |

| | 1,144 | | | Robinson PCL, (2) | | | 2,557 | |

| | |

| | 28,820 | | | SACI Falabella | | | 276,481 | |

| | |

| | 27,684 | | | Shenzhou International Group Holdings Ltd | | | 236,324 | |

| | |

| | 15,339 | | | Surya Citra Media Pt Tbk | | | 2,432 | |

| | |

| | 180 | | | The Foschini Group Ltd | | | 1,725 | |

| | |

| | 244 | | | Titan Co Ltd | | | 2,409 | |

| | |

| | 396 | | | Truworths International Limited | | | 2,110 | |

| | |

| | 1,605 | | | UMW Holdings BHD, (2) | | | 1,987 | |

| | |

| | 334 | | | Woolworths Holdings Limited | | | 1,331 | |

| | |

| | 3,054 | | | Yulon Motor Company | | | 2,552 | |

| | | | Total Consumer Discretionary | | | 3,287,960 | |

| | |

| | | | Consumer Staples – 5.6% | | | |

| | |

| | 11 | | | Amorepacific Corporation | | | 3,083 | |

| | |

| | 18 | | | Amorepacific Corporation | | | 2,868 | |

| | |

| | 27 | | | Amorepacific Group | | | 3,458 | |

| | |

| | 199 | | | Arca Continental SAB de CV | | | 1,269 | |

| | |

| | 90 | | | Bid Corporation Limited | | | 1,979 | |

| | |

| | 109 | | | BIM Birlesik Magazalar AS | | | 2,221 | |

| | |

| | 2,892 | | | Cia Brasileira de Distribuicao, (2), (WI/DD) | | | 67,364 | |

| | |

| | 3 | | | CJ CheilJedang Corporation | | | 980 | |

| | |

| | 14,967 | | | Coca-Cola Femsa SAB de CV | | | 101,396 | |

| | |

| | 200 | | | Coca-Cola Icecek AS | | | 2,033 | |

| | |

| | 97,445 | | | CP ALL PCL | | | 205,333 | |

| | |

| | 389 | | | Dabur India Ltd | | | 2,002 | |

| | |

| | 171 | | | Dongsuh Companies Inc. | | | 4,197 | |

| | |

| | 441 | | | Embotelladora Andina SA | | | 2,230 | |

| | |

| | 477 | | | Eurocash SA | | | 4,825 | |

| | |

| | 38,028 | | | Fomento Economico Mexicano S.A | | | 331,990 | |

| | |

| | 175 | | | Godrej Consumer Products Ltd | | | 2,522 | |

| | |

| | 166 | | | Gruma S.A.B de C.V | | | 2,183 | |

| | |

| | 79,273 | | | Grupo Bimbo SAB de CV | | | 183,946 | |

| | |

| | 117 | | | Hindustan Unilever Ltd | | | 2,238 | |

| | | | | | | | |

| Shares | | | Description (1) | | Value | |

| | |

| | | | Consumer Staples (continued) | | | |

| | |

| | 4,378 | | | Indfood CBP Sukses Makmur Tbk PT | | $ | 2,841 | |

| | |

| | 777 | | | Kimberly-Clark de Mexico SAB de CV, Class A Shares | | | 1,340 | |

| | |

| | 2 | | | LG Household & Health Care | | | 2,101 | |

| | |

| | 2 | | | LG Household & Health Care | | | 1,169 | |

| | |

| | 25 | | | Lotte Confectionery Co Ltd | | | 1,662 | |

| | |

| | 3 | | | Lotte Confectionery Co Ltd, (2) | | | 498 | |

| | |

| | 155 | | | M Dias Branco SA, (2), (WI/DD) | | | 2,281 | |

| | |

| | 372 | | | Marico Limited | | | 1,811 | |

| | |

| | 208 | | | Massmart Holdings Limited | | | 1,575 | |

| | |

| | 261 | | | Natura Cosmeticos SA, (WI/DD) | | | 2,471 | |

| | |

| | 18 | | | Nestle India Ltd | | | 2,003 | |

| | |

| | 2 | | | Ottogi Corporation | | | 1,355 | |

| | |

| | 488 | | | Pick n Pay Stores Ltd | | | 2,046 | |

| | |

| | 146 | | | Pioneer Foods Group Ltd | | | 1,229 | |

| | |

| | 713 | | | PPB Group Berhad Bhd | | | 2,826 | |

| | |

| | 300 | | | President Chain Store Corp. | | | 2,696 | |

| | |

| | 118 | | | ShopRite Holdings Limited | | | 1,689 | |

| | |

| | 570 | | | Standard Foods Corporation | | | 1,412 | |

| | |

| | 115,183 | | | Sun Art Retail Group Ltd | | | 116,338 | |

| | |

| | 126 | | | The Spar Group Limited | | | 1,482 | |

| | |

| | 54 | | | Tiger Brands Limited | | | 1,474 | |

| | |

| | 379 | | | Ulker Biskuvi Sanayi AS | | | 2,021 | |

| | |

| | 471 | | | Unilever Indonesia Tbk PT | | | 1,723 | |

| | |

| | 147,692 | | | Uni-President Enterprises Corporation | | | 308,513 | |

| | | | Total Consumer Staples | | | 1,392,673 | |

| | |

| | | | Energy – 4.9% | | | |

| | |

| | 7,879 | | | Cosan SA Industria e Comercio, (WI/DD) | | | 90,077 | |

| | |

| | 52,975 | | | Energy Absolute PCL, (2) | | | 68,970 | |

| | |

| | 483,418 | | | IRPC PCL, (2) | | | 93,861 | |

| | |

| | 13,006 | | | Qatar Gas Transport Co Ltd, (WI/DD) | | | 54,121 | |

| | |

| | 2,173 | | | S-Oil Corporation | | | 249,235 | |

| | |

| | 39,350 | | | Thai Oil PCL, (2) | | | 120,822 | |

| | |

| | 6,030 | | | Tupras Turkiye Petrol Rafinerileri IS | | | 216,801 | |

| | |

| | 13,288 | | | Ultrapar Participacoes S.A, (WI/DD) | | | 317,237 | |

| | | | Total Energy | | | 1,211,124 | |

| | |

| | | | Financials – 24.6% | | | |

| | |

| | 804 | | | Abu Dhabi Commercial Bank | | | 1,618 | |

| | |

| | 45,857 | | | Axis Bank Limited | | | 371,869 | |

| | |

| | 90 | | | Bajaj Finance Limited | | | 2,501 | |

Nushares ESG Emerging Markets Equity ETF (NUEM) (continued)

| | |

| Portfolio of Investments | | October 31, 2017 |

| | | | | | | | |

| Shares | | | Description (1) | | Value | |

| | |

| | | | Financials (continued) | | | |

| | |

| | 7,816 | | | Banco Bradesco SA, (2), (WI/DD) | | $ | 78,319 | |

| | |

| | 35,646 | | | Banco Bradesco SA, (2), (WI/DD) | | | 377,888 | |

| | |

| | 47 | | | Banco De Credito E Inversion | | | 3,164 | |

| | |

| | 29,639 | | | Banco do Brasil S.A, (2), (WI/DD) | | | 312,032 | |

| | |

| | 6,052 | | | Banco Santander Brasil SA, (WI/DD) | | | 52,929 | |

| | |

| | 44,560 | | | Banco Santander Chile | | | 3,504 | |

| | |

| | 271 | | | Bancolombia SA, (2) | | | 2,511 | |

| | |

| | 1,314 | | | Bancolombia SA, (2) | | | 12,522 | |

| | |

| | 2,604 | | | Bank Central Asia TBK PT | | | 4,013 | |

| | |

| | 6,337 | | | Bank Danamon Indonesia TBK PT | | | 2,383 | |

| | |

| | 100 | | | Bank Handlowy w Warszawie SA | | | 2,045 | |

| | |

| | 28,946 | | | Bank Millennium SA, (2) | | | 63,479 | |

| | |

| | 3,628 | | | Bank Negara Indonesia Persero TBK PT | | | 2,033 | |

| | |

| | 1,332 | | | Bank of the Philippine Islands | | | 2,529 | |

| | |

| | 21 | | | Bank Zachodni WBK SA | | | 2,108 | |

| | |

| | 5,979 | | | Barclays Africa Group Limited | | | 59,252 | |

| | |

| | 335 | | | BM&FBovespa SA, (WI/DD) | | | 2,447 | |

| | |

| | 227 | | | BNK Financial Group Inc. | | | 2,014 | |

| | |

| | 1,650 | | | Cathay Financial Holding Company Limited | | | 2,725 | |

| | |

| | 597 | | | Chailease Holding Co Ltd | | | 1,540 | |

| | |

| | 133,148 | | | China Everbright Bank Co Limited | | | 62,804 | |

| | |

| | 171,022 | | | CIMB Group Holdings BHD | | | 248,039 | |

| | |

| | 570 | | | Commercial International Bank Egypt SAE | | | 2,553 | |

| | |

| | 891 | | | Coronation Fund Managers Limited | | | 4,496 | |

| | |

| | 1,090 | | | CrediCorp Limited | | | 228,290 | |

| | |

| | 279 | | | DGB Financial Group Inc. | | | 2,602 | |

| | |

| | 1,568 | | | Dubai Islamic Bank PJSC | | | 2,613 | |

| | |

| | 5,197 | | | E.Sun Financial Holding Co Ltd | | | 3,162 | |

| | |

| | 86,851 | | | Firstrand Limited | | | 314,761 | |

| | |

| | 189,877 | | | Fubon Financial Holding Co Ltd | | | 302,511 | |

| | |

| | 47,406 | | | Gentera SAB de CV | | | 48,074 | |

| | |

| | 11,171 | | | Grupo de Inversiones Suramericana SA, (2) | | | 141,776 | |

| | |

| | 3,737 | | | Grupo de Inversiones Suramericana SA, (2) | | | 46,126 | |

| | |

| | 353 | | | Grupo Financiero Banorte SAB de CV | | | 2,096 | |

| | |

| | 13,149 | | | Grupo Financiero Santander Mexico SAB de CV | | | 22,146 | |

| | |

| | 8,199 | | | Hana Financial Group Inc. | | | 350,910 | |

| | |

| | 81 | | | Hyundai Marine & Fire Insurance Co Ltd | | | 3,279 | |

| | |

| | 57,996 | | | ICICI Bank Limited | | | 268,619 | |

| | |

| | 2,008 | | | IDFC Bank Ltd | | | 1,755 | |

| | | | | | | | |

| Shares | | | Description (1) | | Value | |

| | |

| | | | Financials (continued) | | | |

| | |

| | 111 | | | Indiabulls Housing Finance Ltd | | $ | 2,131 | |

| | |

| | 155 | | | Industrial Bank of Korea | | | 2,124 | |

| | |

| | 308 | | | Investec PLC | | | 2,100 | |

| | |

| | 34,143 | | | Itau Unibanco Holding SA, (WI/DD) | | | 438,875 | |

| | |

| | 711 | | | Itausa-Investimentos Itau S.A, (WI/DD) | | | 2,278 | |

| | |

| | 426 | | | Kasikornbank PCL | | | 2,924 | |

| | |

| | 549 | | | Kasikornbank PCL | | | 3,636 | |

| | |

| | 7,713 | | | KB Financial Group Inc. | | | 402,052 | |

| | |

| | 5,115 | | | Krung Thai Bank Public Company Limited | | | 2,802 | |

| | |

| | 1,125 | | | Malayan Banking BHD | | | 2,458 | |

| | |

| | 712 | | | mBank SA, (2) | | | 90,095 | |

| | |

| | 1,125 | | | MCB Bank Ltd, (2) | | | 2,136 | |

| | |

| | 11,934 | | | Mega Financial Holding Co Ltd | | | 9,378 | |

| | |

| | 1,189 | | | National Bank of Abu Dhabi PJSC | | | 3,351 | |

| | |

| | 101 | | | Nedbank Group Limited | | | 1,481 | |

| | |

| | 5,626 | | | OTP Bank PLC | | | 226,838 | |

| | |

| | 153 | | | PSG Group Limited | | | 2,840 | |

| | |

| | 3,862 | | | PT Bank Mandiri | | | 2,008 | |

| | |

| | 95,691 | | | PT Bank Rakyat Indonesia | | | 110,067 | |

| | |

| | 32,401 | | | Public Bank Bhd | | | 156,590 | |

| | |

| | 3,672 | | | Qatar National Bank, (WI/DD) | | | 122,543 | |

| | |

| | 34,355 | | | RHB Bank BHD | | | 41,224 | |

| | |

| | 334 | | | RMB Holdings Limited | | | 1,476 | |

| | |

| | 48 | | | Samsung Card Co | | | 1,570 | |

| | |

| | 1,107 | | | Samsung Fire & Marine Insurance Co Ltd | | | 269,747 | |

| | |

| | 59,346 | | | Sanlam Limited | | | 296,704 | |

| | |

| | 1,306 | | | Shinhan Financial Group Company Limited | | | 58,518 | |

| | |

| | 522 | | | Siam Commercial Bank PCL, (2) | | | 2,302 | |

| | |

| | 30,143 | | | Standard Bank Group Limited | | | 349,577 | |

| | |

| | 7,084 | | | Taishin Financial Holding Co Ltd | | | 3,100 | |

| | |

| | 2,955 | | | Taiwan Business Bank | | | 816 | |

| | |

| | 209 | | | The Commercial Bank QSC, (2), (WI/DD) | | | 1,516 | |

| | |

| | 42,618 | | | TMB Bank PCL, (2) | | | 3,310 | |

| | |

| | 829 | | | Turkiye Garanti Bankasi A.S | | | 2,277 | |

| | |

| | 18,432 | | | Yes Bank Ltd | | | 89,526 | |

| | |

| | 5,940 | | | Yuanta Financial Holding Co Ltd | | | 2,639 | |

| | | | Total Financials | | | 6,135,046 | |

| | |

| | | | Health Care – 4.1% | | | |

| | |

| | 1,813 | | | 3SBio, Inc., (2) | | | 3,244 | |

Nushares ESG Emerging Markets Equity ETF (NUEM) (continued)

| | |

| Portfolio of Investments | | October 31, 2017 |

| | | | | | | | |

| Shares | | | Description (1) | | Value | |

| | |

| | | | Health Care (continued) | | | |

| | |

| | 148 | | | Apollo Hospitals Enterprise Limited | | $ | 2,367 | |

| | |

| | 4,140 | | | Bangkok Dusit Medical Services PCL, (2) | | | 2,642 | |

| | |

| | 299 | | | Bumrungrad Hospital PCL, (2) | | | 1,980 | |

| | |

| | 59,824 | | | China Medical Systems Holdings, Limited | | | 110,572 | |

| | |

| | 202,442 | | | CSPC Pharmaceuticals Group Limited | | | 351,856 | |

| | |

| | 76 | | | Dr Reddys Laboratories Limited | | | 2,849 | |

| | |

| | 254 | | | Glenmark Pharmaceuticals Ltd | | | 2,427 | |

| | |

| | 4 | | | Hanmi Pharm Co Ltd, (2) | | | 1,655 | |

| | |

| | 1,398 | | | Hartalega Holdings Bhd | | | 2,516 | |

| | |

| | 1,180 | | | Life Healthcare Group Holdings Ltd | | | 2,186 | |

| | |

| | 165 | | | Lupin Ltd | | | 2,614 | |

| | |

| | 891 | | | Netcare Limited | | | 1,568 | |

| | |

| | 498 | | | Odontoprev SA, (WI/DD) | | | 2,396 | |

| | |

| | 57 | | | Piramal Enterprises Ltd | | | 2,410 | |

| | |

| | 20,181 | | | PT Kalbe Farma Tbl | | | 2,381 | |

| | |

| | 93 | | | Richter Gedoen NYRT | | | 2,313 | |

| | |

| | 93,294 | | | Shandong Weigao Group Medical Polymer Company Limited | | | 66,965 | |

| | |

| | 23,349 | | | Shanghai Fosun Pharmaceutical Group Company Limited | | | 116,568 | |

| | |

| | 33,219 | | | Shanghai Pharmaceuticals Holding Company, Limited | | | 85,796 | |

| | |

| | 57,620 | | | Sinopharm Group Co Ltd | | | 257,753 | |

| | |

| | 10 | | | Yuhan Corporation | | | 1,821 | |

| | | | Total Health Care | | | 1,026,879 | |

| | |

| | | | Industrials – 7.2% | | | |

| | |

| | 2,203 | | | Aboitiz Equity Ventures Equity, Inc. | | | 3,196 | |

| | |

| | 1,476 | | | Airports of Thailand PCL, (2) | | | 2,633 | |

| | |

| | 310 | | | Aselsan Elektronik Sanayi Ve Ticaret AS | | | 2,771 | |

| | |

| | 1,611 | | | Ashok Leyland Ltd | | | 3,263 | |

| | |

| | 2,197 | | | Berli Jucker Public Co, (2) | | | 3,538 | |

| | |

| | 184 | | | Bidvest Group Limited | | | 2,231 | |

| | |

| | 6,688 | | | BTS Group Holdings PCL, (2) | | | 1,711 | |

| | |

| | 10,307 | | | CCR SA, (WI/DD) | | | 57,342 | |

| | |

| | 78,402 | | | China Conch Venture Holdings Ltd | | | 159,783 | |

| | |

| | 200,693 | | | China South Locomotive and Rolling Stock Corporation Limited | | | 197,817 | |

| | |

| | 10 | | | CJ Corp. | | | 1,665 | |

| | |

| | 27 | | | Daelim Industrial Co Ltd | | | 2,010 | |

| | |

| | 144 | | | Doosan Heavy Industries & Construction Co Ltd | | | 2,249 | |

| | |

| | 6,815 | | | DP World Ltd, (2) | | | 161,856 | |

| | |

| | 5,067 | | | Eva Airways | | | 2,495 | |

| | |

| | 3,493 | | | Evergreen Marine Corp Taiwan Ltd, (2) | | | 2,091 | |

| | | | | | | | |

| Shares | | | Description (1) | | Value | |

| | |

| | | | Industrials (continued) | | | |

| | |

| | 142,479 | | | Far Eastern New Century Corp. | | $ | 122,120 | |

| | |

| | 180 | | | Grupo Aeroportuario del Pacifico S.A.B. de CV | | | 1,715 | |

| | |

| | 93 | | | Grupo Aeroportuario del Sureste SA de CV | | | 1,666 | |

| | |

| | 82 | | | GS Engineering & Construction Corp., (2) | | | 1,903 | |

| | |

| | 1,271 | | | HAP Seng Consolidated BHD | | | 2,786 | |

| | |

| | 355 | | | Havells India Limited | | | 2,658 | |

| | |

| | 282 | | | Hiwin Technologies Corporation | | | 2,824 | |

| | |

| | 2,359 | | | Hyundai Engineering & Construction Co Ltd | | | 79,697 | |

| | |

| | 1,498 | | | Hyundai Heavy Industries | | | 209,253 | |

| | |

| | 5,259 | | | Jasa Marga Persero Tbk PT | | | 2,520 | |

| | |

| | 168,776 | | | JG Summit Holdings, Inc. | | | 251,407 | |

| | |

| | 54 | | | KEPCO Plant Service & Engineering Co Ltd | | | 1,991 | |

| | |

| | 81 | | | Korean Air Lines Co Ltd, (2) | | | 2,288 | |

| | |

| | 207 | | | Latam Airlines Group S.A | | | 2,862 | |

| | |

| | 38 | | | LG Corp. | | | 2,917 | |

| | |

| | 120 | | | Localize Rent A Car SA, (WI/DD) | | | 2,123 | |

| | |

| | 1,172 | | | Malaysia Airport Holdings BHD | | | 2,292 | |

| | |

| | 2,863 | | | Samsung C&T Corporation | | | 378,207 | |

| | |

| | 135 | | | Siemens AG, Sponsored ADR | | | 2,647 | |

| | |

| | 672 | | | SM Investments Corporation | | | 12,431 | |

| | |

| | 398 | | | TAV Havalimanlari Holding AS | | | 1,978 | |

| | |

| | 900 | | | Turk Hava Yollari AO, (2) | | | 2,461 | |

| | |

| | 1,866 | | | Turk Sise ve Cam Fabrikalari SA | | | 2,187 | |

| | |

| | 291 | | | WEG SA, (WI/DD) | | | 1,893 | |

| | |

| | 69,321 | | | Zhejiang Expressway Company Limited | | | 85,743 | |

| | | | Total Industrials | | | 1,787,220 | |

| | |

| | | | Information Technology – 24.3% | | | |

| | |

| | 22,981 | | | AAC Technologies Holdings Inc. | | | 420,632 | |

| | |

| | 5,112 | | | Acer Inc. | | | 2,644 | |

| | |

| | 2,281 | | | Advanced Semiconductor Engineering | | | 2,749 | |

| | |

| | 308 | | | Advantech Co Ltd | | | 2,104 | |

| | |