| | | OMB APPROVAL |

| | | OMB Number: | 3235-0570 |

| | | Expires: | July 31, 2022 |

| | UNITED STATES | Estimated average burden hours per response. . . . . . . . . . . . . . .20.6 |

| | SECURITIES AND EXCHANGE COMMISSION | |

| | Washington, D.C. 20549 | |

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-23037 |

| |

| Tekla World Healthcare Fund |

| (Exact name of registrant as specified in charter) |

| |

| 100 Federal Street, 19th Floor, Boston, MA | | 02110 |

| (Address of principal executive offices) | | (Zip code) |

| |

| |

| (Name and address of agent for service) |

| |

| Registrant’s telephone number, including area code: | 617-772-8500 | |

| |

| Date of fiscal year end: | September 30 | |

| |

| Date of reporting period: | October 1, 2020 to March 31, 2021 | |

| | | | | | | | | | |

ITEM 1. REPORTS TO STOCKHOLDERS.

TEKLA WORLD HEALTHCARE FUND

Semiannual Report

March 31, 2021

TEKLA WORLD HEALTHCARE FUND

Distribution policy: The Fund has implemented a managed distribution policy (the Policy) that provides for monthly distributions at a rate set by the Board of Trustees. Under the current Policy, the Fund intends to make monthly distributions at a rate of $0.1167 per share to shareholders of record. The Policy would result in a return of capital to shareholders, if the amount of the distribution exceeds the Fund's net investment income and realized capital gains. A return of capital may occur, for example, when some or all of the money that you invested in the Fund is paid back to you. A return of capital distribution does not necessarily reflect the Fund's investment performance and should not be confused with "yield" or "income."

The amounts and sources of distributions reported in the Fund's notices pursuant to Section 19(a) of the Investment Company Act of 1940 are only estimates and are not being provided for tax reporting purposes. The actual amounts and sources of the amounts for tax reporting purposes will depend upon the Fund's investment experience during its fiscal year and may be subject to changes based on tax regulations. The Fund will send you a Form 1099-DIV for the calendar year that tells you how to report distributions for federal income tax purposes.

You should not draw any conclusions about the Fund's investment performance from the amount of distributions pursuant to the Policy or from the terms of the Policy. The Policy has been established by the Trustees and may be changed or terminated by them without shareholder approval. The Trustees regularly review the Policy and the frequency and rate of distributions considering the purpose and effect of the Policy, the financial market environment, and the Fund's income, capital gains and capital available to pay distributions. The suspension or termination of the Policy could have the effect of creating a trading discount or widening an existing trading discount. At this time there are no reasonably foreseeable circumstances that might cause the Trustees to terminate the Policy.

Consider these risks before investing: As with any investment company that invests in equity securities, the Fund is subject to market risk—the possibility that the prices of equity securities will decline over short or extended periods of time. As a result, the value of an investment in the Fund's shares will fluctuate with the market generally and market sectors in particular. You could lose money over short or long periods of time. Political and economic news can influence marketwide trends and can cause disruptions in the U.S. or world financial markets. Other factors may be ignored by the market as a whole but may cause movements in the price of one company's stock or the stock of companies in one or more industries. All of these factors may have a greater impact on initial public offerings and emerging company shares. Different types of equity securities tend to shift into and out of favor with investors, depending on market and economic conditions. The performance of funds that invest in equity securities of healthcare companies may at times be better or worse than the performance of funds that focus on other types of securities or that have a broader investment style.

TEKLA WORLD HEALTHCARE FUND

Dear Shareholders,

I think it is obvious in the United States and around the world that, over the last year, the COVID-19 epidemic has been the dominating factor in nearly everyone's lives, family and job, as well as in all aspects of the economy and markets. We have not been surprised by the volatility of these things but admit to not expecting what felt like an inexorable upward move in the market during the worst months of the pandemic. We report herein on the period September 30, 2020 to March 31, 2021. Fund performance for that period is described elsewhere in this report. But given the dynamics of the last year, we feel that we should speak to the bigger, Covid-related picture in our commentary.

As you may well be aware, in the first part of 2020 nearly all equity markets we see as related to the Fund declined—some as much as 30%—in response to the infections, quarantines and deaths reported. However, those same markets rebounded impressively through the rest of the calendar year producing very positive results for calendar year 2020. For example, the S&P 500® Index* ("SPX") net advanced 18% in 2020. The broad S&P Composite 1500® Health Care Index* ("S15HLTH") trailed the SPX but still advanced approximately 14%. Interestingly, the NASDAQ Biotechtechnology Index®* ("NBI") advanced approximately 26%. The SPDR® S&P® Biotech ETF* ("XBI"), which tracks an index dominated by small-and mid-cap biotech companies, advanced approximately 48%, quite a dramatic result.

Much has been made of the markets' 2020 advance. Others have opined in great detail on this subject. In short, we think it is generally accepted that financial stimulus provided by the government and the promise of low interest rates promulgated by the Federal Reserve allowed and/or encouraged investment in the stock market (and in risk assets in particular) in preference to other asset classes.

1

The first quarter of 2021 has been quite a different story. Things have been a bit more complicated. The broad SPX and S15HLTH advanced 6% and 3%, respectively with only moderate volatility in the first quarter of calendar year 2021. By contrast, the NBI and XBI have been much more volatile. The NBI was up almost 14% by early February but retraced this entire gain ending the quarter down fractionally. The small- and mid-cap focused XBI was up almost 24% by early February and retreated even more dramatically, declining by 22% in less than two months to end the quarter down by a few percent.

The question of course is what happened to cause this situation and, more importantly, where are we going. From a personal point of view, we have all had a horrific year. More than thirty-two million Americans have contracted COVID-19 and well more than 500,000 individuals have died. Millions of children have had access to education reduced or eliminated. Millions of people have lost their jobs and we expect that hundreds of thousands of businesses have closed forever. Much of this loss cannot be recovered.

Having said this, we also need to evaluate where we are and where we expect to be as shareholders of the Fund. From a healthcare fund point of view, the view is a little more nuanced. From our perspective, COVID-19 arrived out of the blue. As described above, markets declined precipitously. Almost immediately, 200 companies started working on covid vaccines and therapeutics. Miraculously, biopharma partnered with the U.S. and other governments to approve multiple vaccines in a year (compared to a typical ten year development cycle).

In parallel, we witnessed a vitriolic election cycle that changed a good deal of how government governs. We saw civil unrest that rivaled what we observed in the 1960's. A work from home world was created largely out of whole cloth. Simplistically, the economy unwound and then apparently rewound.

A year later we find ourselves with still high unemployment, Covid case rates still dramatically higher than when we all went home, approaching 50% of the adult population vaccinated with herd immunity anticipated by some experts within the next few months, a push to get back to school

2

and to work, a separate and opposing push to continue working from home, a Federal Reserve committed to low interest rate for the foreseeable future, a government committed to continued stimulus and to increasing the safety net, the stock market higher than it was a year ago and what seems like generally positive sentiment. Whew!!

With respect to healthcare, what has all this produced? It was a banner, if volatile (particularly in the first quarter of 2021) year, for healthcare stock performance, a year of record investment in the sector, approximately 100 new biotech IPOs, an apparently less cooperative FDA, a hint (or more) of drug pricing pressure, first quarter company reporting results that look promising, healthcare trading at the biggest discount to the SPX in many years and, perhaps not surprisingly, quite a bit of uncertainty about where healthcare goes from here.

Having said all this, our view is pretty simple. We are fundamental analysts. We see attractive valuations, lots of innovation and a favorable macro environment (with low cost of capital and many companies well-funded). We think a fair analysis of all this is that it may well be a bumpy ride, but over any reasonable timeframe we see way more possibility for upside opportunity for the sector than for any extended downside pain.

We note that during the report period, THW completed a Rights Offering. Tekla directed the undertaking and provided legal and other out of pocket costs which would otherwise have been borne by the Fund. As a result, this offering was done at what we believe was a relatively low cost and modest dilution to the Fund. The offering provided shareholders the opportunity to acquire additional shares of THW at a discount and raised approximately $100 Million in additional capital for the Fund to utilize at a time when the Advisor sees a number of attractive investment opportunities.

Be well,

Daniel R. Omstead

President and Portfolio Manager

3

TEKLA WORLD HEALTHCARE FUND

Fund Essentials

Objective of the Fund

The Fund's investment objective is to seek current income and long-term capital appreciation.

Description of the Fund

Tekla World Healthcare Fund ("THW") is a non-diversified closed-end fund traded on the New York Stock Exchange under the ticker THW. THW employs a versatile growth and income investment strategy investing across all healthcare subsectors and across a company's full capital structure. THW invests at least 40% of AUM in ex-U.S. companies or those with substantial ex-U.S. revenues.

Investment Philosophy

Tekla Capital Management LLC, the Investment Adviser to the Fund, believes that:

• Aging demographics and adoption of new medical products and services may provide long-term tailwinds for healthcare companies

• Opportunities outside the United States may be underappreciated and timely

• Investment opportunity spans the globe including biotechnology, healthcare technology, life sciences and medical devices

• The potential for value creation may exist in companies both inside and outside the United States that are commercializing novel technologies

Fund Overview and Characteristics as of 3/31/21

Market Price1 | | $15.07 | |

NAV2 | | $15.01 | |

Premium/(Discount) | | 0.40% | |

Average 30 Day Volume | | 271,400 | |

Net Assets | | $453,987,263 | |

Managed Assets | | $573,987,263 | |

Leverage Outstanding | | $120,000,000 | |

Total Leverage Ratio3 | | 20.91% | |

Ticker | | THW | |

NAV Ticker | | XTHWX | |

Commencement of

Operations Date | | 6/30/15 | |

Fiscal Year to Date

Distributions

per Share | | $0.70 | |

1 The closing price at which the Fund's shares were traded on the exchange.

2 Per-share dollar value of the Fund, calculated by dividing the total value of all the securities in its portfolio, plus any other assets and less liabilities, by the number of Fund shares outstanding.

3 As a percentage of managed assets.

Holdings of the Fund (Data is based on net assets)

Asset Allocation as of 3/31/21

Sector Diversification as of 3/31/21

This data is subject to change on a daily basis.

4

TEKLA WORLD HEALTHCARE FUND

Largest Holdings by Issuer

(Excludes Short-Term Investments)

As of March 31, 2021

(Unaudited)

| Issuer – Sector | | % of Net

Assets | |

| Johnson & Johnson – Pharmaceuticals | | | 6.4 | % | |

| AbbVie, Inc. – Biotechnology | | | 5.5 | % | |

| AstraZeneca plc – Pharmaceuticals | | | 5.0 | % | |

| UnitedHealth Group, Inc. – Health Care Providers & Services | | | 4.7 | % | |

| Abbott Laboratories – Health Care Equipment & Supplies | | | 4.2 | % | |

| Roche Holding AG – Pharmaceuticals | | | 4.0 | % | |

| Anthem, Inc. – Health Care Providers & Services | | | 3.3 | % | |

| Medtronic plc – Health Care Equipment & Supplies | | | 3.2 | % | |

| Merck & Co., Inc. – Pharmaceuticals | | | 3.2 | % | |

| Cigna Corp. – Health Care Providers & Services | | | 3.1 | % | |

| Novartis AG – Pharmaceuticals | | | 3.1 | % | |

| Pfizer, Inc. – Pharmaceuticals | | | 2.8 | % | |

| Eli Lilly & Co. – Pharmaceuticals | | | 2.7 | % | |

| Thermo Fisher Scientific, Inc. – Life Sciences Tools & Services | | | 2.7 | % | |

| Zimmer Biomet Holdings, Inc. – Health Care Equipment & Supplies | | | 2.6 | % | |

| Bristol-Myers Squibb Co. – Pharmaceuticals | | | 2.5 | % | |

| HCA, Inc. – Health Care Providers & Services | | | 2.2 | % | |

| Amgen, Inc. – Biotechnology | | | 2.0 | % | |

| Danaher Corp. – Medical Devices and Diagnostics | | | 2.0 | % | |

| Bayer AG – Pharmaceuticals | | | 1.8 | % | |

COUNTRY DIVERSIFICATION

As of March 31, 2021 (Unaudited) | | % of Net

Assets | | % of Managed

Assets | |

United States | | | 70.0 | % | | | 55.4 | % | |

United States (with substantial ex-U.S. revenue) | | | 22.4 | % | | | 17.7 | % | |

Switzerland | | | 7.6 | % | | | 6.0 | % | |

United Kingdom | | | 6.6 | % | | | 5.2 | % | |

Ireland | | | 5.9 | % | | | 4.7 | % | |

Japan | | | 4.3 | % | | | 3.4 | % | |

France | | | 2.3 | % | | | 1.8 | % | |

Germany | | | 1.8 | % | | | 1.5 | % | |

Australia | | | 1.7 | % | | | 1.4 | % | |

Denmark | | | 1.1 | % | | | 0.9 | % | |

Netherlands | | | 1.0 | % | | | 0.8 | % | |

China | | | 0.7 | % | | | 0.6 | % | |

Israel | | | 0.3 | % | | | 0.2 | % | |

Spain | | | 0.2 | % | | | 0.1 | % | |

5

Portfolio Highlights as of March 31, 2021

Among other investments, Tekla World Healthcare Fund's performance benefitted in the past six months by the following:

DENTSPLY Sirona, Inc. (XRAY) is a multinational company that manufactures and distributes dental supplies, dental equipment and dental software. The COVID-19 pandemic pressured dental patient volumes, but the Company did a good job navigating these volume headwinds. In our view, recent acquisitions and divestitures and a renewed focus on operating efficiencies position the Company for stronger top and bottom line growth. The stock appreciated significantly following better than expected Q4 earnings and 2021 guidance that was ahead of investor expectations. The Fund had an overweight position during this period.

Waters Corp. (WAT) is a leading global supplier of analytical instruments, consumables and services to life science, industrial and academic organizations conducting research. The Company's stock rose in the period with renewed growth in its liquid chromatography business due to a successful replacement initiative as well as strong early customer adoption of its new e-commerce platform. The Fund held an overweight position.

Alexion Pharmaceuticals, Inc. (ALXN) a company marketing therapeutics for rare autoimmune and cardiological diseases received a takeout offer from AstraZeneca plc late last year. The stock outperformed while we held an overweight position.

Among other examples, Tekla World Healthcare Fund's performance was negatively impacted by the following investments:

UnitedHealth Group, Inc. (UNH) is a large diversified managed care company with exposure in the commercial, Medicare and Medicaid markets. The vertically integrated company also operates a large PBM (Pharmacy Benefit Manager), has expansive care delivery capabilities and offers a broad suite of healthcare IT solutions. The Fund was underweight UNH, which had a strong positive return during this reporting period.

AstraZeneca plc (AZN) is a large multinational pharmaceutical company with geographic sales exposure across developed and emerging markets in cancer and autoimmune therapeutics and also distributes a COVID-19 vaccine at cost. During this period, the company announced its intention to acquire Alexion Pharmaceuticals, Inc. (ALXN), which received mixed reactions from investors, and faced negative headlines surrounding the

6

rollout of its COVID-19 vaccine. The company's stock underperformed in the period while the Fund was overweight.

Abbott Laboratories (ABT) is a large multinational healthcare company that markets a variety of products including medical devices and clinical diagnostics. The company posted strong results in this period largely driven by COVID-related testing volumes and robust growth in its diabetes product segment. We were net underweight the stock during this period.

Fund Performance

THW is a closed-end fund which invests predominantly in healthcare companies. Subject to regular consideration, the Trustees of THW have instituted a policy of making monthly distributions to shareholders.

The Fund invests in equity and debt of healthcare companies. The Fund seeks to benefit from the earnings growth of the healthcare industry while capturing income. Income is derived from multiple sources including equity dividends, fixed income coupons, real estate investment trust distributions, convertible securities coupons and selective equity covered call writing premiums. In order to accomplish its objectives, THW often holds a majority of its assets in equities. Allocation of assets to various healthcare sectors can vary significantly as can the percentage of the portfolio which is overwritten. Under normal market conditions, the Fund expects to invest at least 40 percent of its managed assets in companies organized or located outside of the U.S. or companies that do a substantial amount of business outside the U.S. ("Foreign Issuers").

The Fund may invest up to 20 percent of managed assets, measured at the time of investment, in non-convertible debt of healthcare companies. It may also invest up to 20 percent of managed assets in healthcare REITs. The Fund may also hold up to 30 percent of managed assets in convertible securities and may invest a portion of its assets in restricted securities. In order to generate additional "current" income THW often sells (or writes) calls against a material portion of its equity assets. The portion of equity assets overwritten can vary, but usually represents less than 20 percent of managed assets. At times, the overwritten portion of assets is materially less than 20 percent of managed assets. The use of covered calls is intended to produce "current" income, but may limit upside in bullish markets. The Fund may also use leverage to enhance yield. The Fund may incur leverage up to 20 percent of managed assets at the time of borrowing. "Managed Assets" means the total assets of the Fund (including any assets attributable to borrowings for investment purposes) minus the sum of the Fund's accrued liabilities (other than liabilities representing borrowings for investment purposes).

The Fund considers investments in companies of all sizes and in all healthcare subsectors, including but not limited to, biotechnology,

7

pharmaceuticals, healthcare equipment, healthcare supplies, life science tools and services, healthcare distributors, managed healthcare, healthcare technology, and healthcare facilities. The Fund expects to invest at least 40 percent of managed assets in companies organized or located outside the United States or companies that do a substantial amount of business outside the United States. The Fund also emphasizes innovation, investing both in public and pre-public venture companies. The Fund considers its pre-public and other restricted investments to be a differentiating characteristic. Among the various healthcare subsectors, THW has considered the biotechnology subsector, including both pre-public and public companies, to be a key contributor to the healthcare sector. The Fund holds biotech assets, including both public and pre-public, often representing 10-25% of net assets.

There is no commonly published index which matches the investment strategy of THW. With respect to the Fund's equity investments, THW often holds 10-25% of its assets in biotechnology. By contrast, the S&P Global 1200 Healthcare Index®* ("SGH") consists of approximately 100 global companies representing most or all of the healthcare subsectors in which THW typically invests; biotechnology often represents up to 20% of this index. By contrast, the NBI which contains over 270 constituents, is much more narrowly constructed. The vast majority of this index is comprised of biotechnology, pharmaceutical and life science tools companies. In recent years, biotechnology has often represented 72-82% of the NBI. Neither the SGH nor NBI indices contain any material amount of pre-public company assets.

The S&P 500® Health Care Corporate Bond Index* ("SP5HCBIT") measures the performance of U.S. corporate debt issued by constituents in the healthcare sector of the SPX. This index is generally reflective of the debt assets in which THW invests though the Fund invests in the SPX debt components as well as those of smaller capitalization companies.

The S&P Composite 1500® Health Care REITs Index* ("S15HCRT") is comprised of U.S. publicly traded REITs in the healthcare sector. This index is generally reflective of the REITs in which THW invests.

Given the circumstances, we present both NAV and stock returns for the Fund in comparison to several commonly published indices. We note that THW is a dynamically configured multi-asset class global healthcare growth and income fund. There is no readily available index comprised of similar characteristics to THW and to which THW can directly be compared. Therefore, we provide returns for a number of indices representing the major components of THW's assets. Having said this, we note that there are no readily available indices representing the covered call strategy employed by THW or the restricted security components of THW.

8

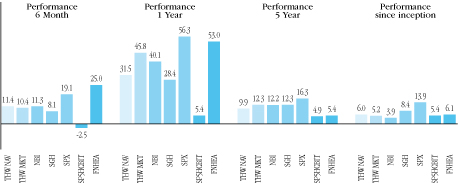

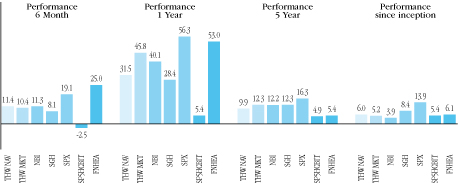

6 Month Index Performance Ending March 31, 2021

Fund Performance for the Period Ended March 31, 2021

Period | | THW NAV | | THW MKT | | NBI | | SGH | | SPX | | SP5HCBIT | | S15HCRT | |

| 6 month | | | 11.40 | | | | 10.36 | | | | 11.34 | | | | 8.08 | | | | 19.06 | | | | -2.48 | | | | 24.96 | | |

| 1 year | | | 31.49 | | | | 45.80 | | | | 40.12 | | | | 28.44 | | | | 56.33 | | | | 5.44 | | | | 53.04 | | |

| 5 year | | | 9.94 | | | | 12.33 | | | | 12.21 | | | | 12.30 | | | | 16.28 | | | | 4.87 | | | | 5.41 | | |

inception | | | 5.97 | | | | 5.15 | | | | 3.91 | | | | 8.36 | | | | 13.90 | | | | 5.41 | | | | 6.07 | | |

Inception date June 26, 2015

All performance over one-year has been annualized.

Performance data quoted represents past performance, which is no guarantee of future results, and current performance may be lower or higher than the figures shown. The NAV total return takes into account the Fund's total annual expenses and does not reflect transaction charges. If transaction charges were reflected, NAV total return would be reduced. All distributions are assumed to be reinvested either in accordance with the dividend reinvestment plan (DRIP) for market price returns or NAV for NAV returns. Until the DRIP price is available from the Plan Agent, the market price returns reflect the reinvestment at the closing market price on the last business day of the month. Once the DRIP is available around mid-month, the market price returns are updated to reflect reinvestment at the DRIP price.

*The trademarks NASDAQ Biotechnology Index®, S&P Composite 1500® Health Care Index, S&P Global 1200 Health Care Index®, S&P Composite 1500® Health Care REITs Index, S&P 500® Health Care Corporate Bond Index, SPDR® S&P® Biotech ETF and S&P 500® Index referenced in this report are the property of their respective owners. These trademarks are not owned by or associated with the Fund or its service providers, including Tekla Capital Management LLC.

9

TEKLA WORLD HEALTHCARE FUND

SCHEDULE OF INVESTMENTS

MARCH 31, 2021

(Unaudited)

PRINCIPAL

AMOUNT | | NON-CONVERTIBLE NOTES - 17.1% of

Net Assets | | VALUE | |

| | | France - 0.6% | |

$ | 2,600,000 | | | Sanofi, 3.63% due 06/19/28 | | $ | 2,895,645 | | |

| | | Ireland - 0.6% | |

| | 516,000 | | | Endo Dac/Endo Finance LLC/Endo Finco,

Inc., 9.50% due 07/31/27 (a) | | | 560,505 | | |

| | 789,000 | | | Endo Dac/Endo Finance LLC/Endo Finco,

Inc., 6.00% due 06/30/28 (a) | | | 639,090 | | |

| | 1,500,000 | | | Shire Acquisitions Investments Ireland DAC,

3.20% due 09/23/26 | | | 1,615,283 | | |

| | | | 2,814,878 | | |

| | | United Kingdom - 1.2% | |

| | 5,000,000 | | | AstraZeneca plc, 3.38% due 11/16/25 | | | 5,441,690 | | |

| | | United States - 14.7% | |

| | 3,200,000 | | | AbbVie, Inc., 4.50% due 05/14/35 | | | 3,737,901 | | |

| | 1,400,000 | | | Allergan Sales LLC, 5.00% due 12/15/21 (a) | | | 1,428,291 | | |

| | 2,000,000 | | | Amgen, Inc., 3.63% due 05/22/24 | | | 2,158,885 | | |

| | 831,000 | | | Baxalta, Inc., 4.00% due 06/23/25 | | | 920,855 | | |

| | 1,200,000 | | | Becton, Dickinson and Co., 3.73%

due 12/15/24 | | | 1,310,816 | | |

| | 560,000 | | | Biogen, Inc., 3.63% due 09/15/22 | | | 585,279 | | |

| | 1,400,000 | | | Bristol-Myers Squibb Co., 3.40%

due 07/26/29 | | | 1,528,611 | | |

| | 2,785,000 | | | Cigna Corp., 3.50% due 06/15/24 | | | 3,000,800 | | |

| | 191,000 | | | CVS Health Corp., 3.70% due 03/09/23 | | | 202,695 | | |

| | 4,000,000 | | | EMD Finance LLC, 3.25% due 03/19/25 (a) | | | 4,288,824 | | |

| | 2,000,000 | | | GlaxoSmithKline Capital, Inc., 2.80%

due 03/18/23 | | | 2,092,753 | | |

| | 1,400,000 | | | GlaxoSmithKline Capital plc, 3.00%

due 06/01/24 | | | 1,495,854 | | |

| | 1,000,000 | | | GlaxoSmithKline Capital plc, 3.38%

due 06/01/29 | | | 1,086,048 | | |

| | 1,000,000 | | | HCA, Inc., 5.88% due 05/01/23 | | | 1,088,825 | | |

| | 1,250,000 | | | HCA, Inc., 5.38% due 02/01/25 | | | 1,394,394 | | |

| | 600,000 | | | HCA, Inc., 5.25% due 04/15/25 | | | 684,787 | | |

| | 4,300,000 | | | Johnson & Johnson, 2.45% due 03/01/26 | | | 4,573,588 | | |

| | 1,400,000 | | | Johnson & Johnson, 2.90% due 01/15/28 | | | 1,512,971 | | |

| | 1,400,000 | | | Laboratory Corporation of America

Holdings, 3.60% due 02/01/25 | | | 1,514,700 | | |

| | 4,000,000 | | | Mallinckrodt International Finance

S.A./Mallinckrodt CB LLC, 5.50%

due 04/15/25 (a) | | | 2,810,000 | | |

The accompanying notes are an integral part of these financial statements.

10

TEKLA WORLD HEALTHCARE FUND

SCHEDULE OF INVESTMENTS

MARCH 31, 2021

(Unaudited, continued)

PRINCIPAL

AMOUNT | |

United States - continued | |

VALUE | |

$ | 1,200,000 | | | McKesson Corp., 3.80% due 03/15/24 | | $ | 1,301,675 | | |

| | 1,675,000 | | | Medtronic plc, 4.38% due 03/15/35 | | | 2,012,564 | | |

| | 1,400,000 | | | Merck & Co., Inc., 2.80% due 05/18/23 | | | 1,473,663 | | |

| | 1,463,000 | | | Merck & Co., Inc., 2.75% due 02/10/25 | | | 1,557,082 | | |

| | 2,115,000 | | | Novartis Capital Corp., 3.40% due 05/06/24 | | | 2,291,526 | | |

| | 193,000 | | | Par Pharmaceutical, Inc., 7.50%

due 04/01/27 (a) | | | 205,198 | | |

| | 5,300,000 | | | Pfizer, Inc., 3.45% due 03/15/29 | | | 5,813,343 | | |

| | 1,750,000 | | | Senior Housing Properties Trust, 4.75%

due 05/01/24 | | | 1,798,125 | | |

| | 1,500,000 | | | Tenet Healthcare Corp., 6.75%

due 06/15/23 | | | 1,621,875 | | |

| | 1,400,000 | | | Thermo Fisher Scientific, Inc., 3.20%

due 08/15/27 | | | 1,516,006 | | |

| | 1,400,000 | | | UnitedHealth Group, Inc., 2.88%

due 12/15/21 | | | 1,425,719 | | |

| | 2,560,000 | | | UnitedHealth Group, Inc., 3.88%

due 12/15/28 | | | 2,883,839 | | |

| | 5,000,000 | | | Zimmer Biomet Holdings, Inc., 4.25%

due 08/15/35 | | | 5,196,063 | | |

| | | | 66,513,555 | | |

| | | | | TOTAL NON-CONVERTIBLE NOTES

(Cost $73,539,451) | | | 77,665,768 | | |

SHARES | | CONVERTIBLE PREFERRED

(Restricted) (b) (c) - 1.3% of Net Assets | | | |

| | | France - 0.7% | |

| | 131,952 | | | Dynacure Series C | | | 3,283,585 | | |

| | | Ireland - 0.2% | |

| | 52,267 | | | Priothera Ltd., Series A, 6.00% | | | 612,935 | | |

| | | Switzerland - 0.3% | |

| | 151,333 | | | Oculis SA, Series B2, 6.00% | | | 1,333,120 | | |

| | | United States - 0.1% | |

| | 87,650 | | | IO Light Holdings, Inc. Series A2 | | | 337,514 | | |

| | 1,307,690 | | | Rainier Therapeutics, Inc. Series A, 6.00% | | | 131 | | |

| | 757,575 | | | Rainier Therapeutics, Inc. Series B, 6.00% | | | 140,909 | | |

| | | | 478,554 | | |

| | | | | TOTAL CONVERTIBLE PREFERRED

(Cost $6,785,620) | | | 5,708,194 | | |

The accompanying notes are an integral part of these financial statements.

11

TEKLA WORLD HEALTHCARE FUND

SCHEDULE OF INVESTMENTS

MARCH 31, 2021

(Unaudited, continued)

SHARES | | COMMON STOCKS AND WARRANTS - 104.3%

of Net Assets | | VALUE | |

| | | Australia - 1.7% | |

| | 38,719 | | | CSL Ltd. | | $ | 7,783,096 | | |

| | | China - 0.7% | |

| | 127,000 | | | Everest Medicines Ltd. (a) (c) | | | 1,201,534 | | |

| | 43,164 | | | I-Mab (c) (d) | | | 2,092,159 | | |

| | | | 3,293,693 | | |

| | | Denmark - 1.1% | |

| | 81,867 | | | MorphoSys AG (c) (d) | | | 1,784,701 | | |

| | 48,406 | | | Novo Nordisk A/S (d) | | | 3,263,532 | | |

| | | | 5,048,233 | | |

| | | France - 1.0% | |

| | 11,955 | | | Cellectis S.A. (c) (d) | | | 241,610 | | |

| | 81,554 | | | Sanofi (d) | | | 4,033,661 | | |

| | | | 4,275,271 | | |

| | | Germany - 1.8% | |

| | 131,684 | | | Bayer AG | | | 8,332,818 | | |

| | | Ireland - 5.1% | |

| | 36,963 | | | Endo International plc (c) | | | 273,896 | | |

| | 23,592 | | | ICON plc (c) | | | 4,632,761 | | |

| | 32,980 | | | Mallinckrodt plc (c) | | | 12,428 | | |

| | 107,108 | | | Medtronic plc (e) | | | 12,652,668 | | |

| | 15,882 | | | Perrigo Co. plc | | | 642,745 | | |

| | 26,505 | | | STERIS plc | | | 5,048,672 | | |

| | | | 23,263,170 | | |

| | | Israel - 0.3% | |

| | 105,381 | | | Teva Pharmaceutical Industries Ltd. (c) (d) (e) | | | 1,216,097 | | |

| | | Japan - 4.3% | |

| | 88,837 | | | Astellas Pharma, Inc. | | | 1,365,551 | | |

| | 108,150 | | | Daiichi Sankyo Co., Ltd. | | | 3,150,000 | | |

| | 13,660 | | | Eisai Co., Ltd. | | | 915,272 | | |

| | 19,364 | | | Hoya Corp. | | | 2,274,363 | | |

| | 14,872 | | | M3, Inc. | | | 1,016,897 | | |

| | 57,880 | | | Olympus Corp. | | | 1,197,589 | | |

| | 22,660 | | | Ono Pharmaceutical Co., Ltd. | | | 591,442 | | |

| | 41,616 | | | Otsuka Holdings Co., Ltd. | | | 1,761,609 | | |

| | 15,413 | | | Shionogi & Co., Ltd | | | 828,523 | | |

| | 7,430 | | | Sysmex Corp. | | | 800,206 | | |

| | 210,146 | | | Takeda Pharmaceutic (c) (d) | | | 3,837,266 | | |

The accompanying notes are an integral part of these financial statements.

12

TEKLA WORLD HEALTHCARE FUND

SCHEDULE OF INVESTMENTS

MARCH 31, 2021

(Unaudited, continued)

SHARES | | Japan - continued | | VALUE | |

| | 19,200 | | | Takeda Pharmaceuticals Co., Ltd. | | $ | 691,009 | | |

| | 34,576 | | | Terumo Corp. | | | 1,248,764 | | |

| | | | 19,678,491 | | |

| | | Netherlands - 1.0% | |

| | 4,333 | | | Argenx SE (c) (d) | | | 1,193,265 | | |

| | 56,927 | | | Koninklijke Philips N.V. | | | 3,246,547 | | |

| | | | 4,439,812 | | |

| | | Spain - 0.2% | |

| | 47,373 | | | Grifols, S.A. (d) | | | 819,079 | | |

| | | Switzerland - 7.3% | |

| | 5,773 | | | Lonza Group AG | | | 3,227,481 | | |

| | 136,225 | | | Novartis AG (d) | | | 11,644,513 | | |

| | 453,086 | | | Roche Holding AG (d) | | | 18,377,168 | | |

| | | | 33,249,162 | | |

| | | United Kingdom - 5.4% | |

| | 344,333 | | | AstraZeneca plc (d) (e) | | | 17,120,237 | | |

| | 99,560 | | | Smith & Nephew plc (d) | | | 3,773,324 | | |

| | 436,105 | | | Verona Pharma plc (c) (d) | | | 3,645,838 | | |

| | 513,192 | | | Verona Pharma plc Warrants (expiration

04/27/22, exercise price $2.85) (b) (c) | | | 10,612 | | |

| | | | 24,550,011 | | |

| | | United States - 74.4% | |

| | 10,451 | | | 1Life Healthcare, Inc. (c) | | | 408,425 | | |

| | 160,793 | | | Abbott Laboratories (e) | | | 19,269,433 | | |

| | 195,988 | | | AbbVie, Inc. (e) | | | 21,209,821 | | |

| | 12,900 | | | Agilent Technologies, Inc. | | | 1,640,106 | | |

| | 15,870 | | | Alexion Pharmaceuticals, Inc. (c) | | | 2,426,682 | | |

| | 3,039 | | | Align Technology, Inc. (c) | | | 1,645,710 | | |

| | 28,276 | | | Amgen, Inc. | | | 7,035,352 | | |

| | 41,648 | | | Anthem, Inc. (e) | | | 14,949,550 | | |

| | 318,362 | | | Ardelyx, Inc. (c) | | | 2,107,556 | | |

| | 62,815 | | | Atreca, Inc. (c) | | | 962,954 | | |

| | 5,100 | | | Becton, Dickinson and Co. | | | 1,240,065 | | |

| | 15,476 | | | Biogen, Inc. (c) | | | 4,329,411 | | |

| | 42,319 | | | Boston Scientific Corp. (c) | | | 1,635,629 | | |

| | 154,148 | | | Bristol-Myers Squibb Co. (e) | | | 9,731,363 | | |

| | 7,053 | | | Celldex Therapeutics, Inc. (c) | | | 145,292 | | |

| | 45,900 | | | Cigna Corp. (e) | | | 11,095,866 | | |

| | 8,700 | | | Community Health Systems, Inc. (c) | | | 117,624 | | |

| | 14,900 | | | Community Healthcare Trust, Inc. | | | 687,188 | | |

| | 48,874 | | | CVS Health Corp. | | | 3,676,791 | | |

The accompanying notes are an integral part of these financial statements.

13

TEKLA WORLD HEALTHCARE FUND

SCHEDULE OF INVESTMENTS

MARCH 31, 2021

(Unaudited, continued)

SHARES | | United States - continued | | VALUE | |

| | 39,368 | | | Danaher Corp. | | $ | 8,860,949 | | |

| | 92,162 | | | DENTSPLY Sirona, Inc. (e) | | | 5,880,857 | | |

| | 14,569 | | | DexCom, Inc. (c) (e) | | | 5,235,953 | | |

| | 63,841 | | | Diversified Healthcare Trust REIT | | | 305,160 | | |

| | 37,128 | | | Edwards Lifesciences Corp. (c) | | | 3,105,386 | | |

| | 65,754 | | | Eli Lilly & Co. (e) | | | 12,284,162 | | |

| | 11,230 | | | Exact Sciences Corp. (c) (e) | | | 1,479,889 | | |

| | 4,325 | | | Five Star Senior Living, Inc. (c) | | | 26,469 | | |

| | 187,532 | | | Galera Therapeutics, Inc. (c) | | | 1,654,032 | | |

| | 82,508 | | | Gilead Sciences, Inc. (e) | | | 5,332,492 | | |

| | 143,229 | | | Global Medical REIT, Inc. | | | 1,877,732 | | |

| | 35,785 | | | HCA Healthcare, Inc. (e) | | | 6,739,747 | | |

| | 92,654 | | | Healthcare Realty Trust, Inc. | | | 2,809,269 | | |

| | 56,913 | | | Healthcare Trust of America, Inc. | | | 1,569,661 | | |

| | 83,601 | | | Healthpeak Properties, Inc. | | | 2,653,496 | | |

| | 4,217 | | | Hologic, Inc. (c) | | | 313,660 | | |

| | 32,458 | | | Horizon Therapeutics plc | | | 2,987,434 | | |

| | 8,082 | | | Humana, Inc. (e) | | | 3,388,379 | | |

| | 5,643 | | | IDEXX Laboratories, Inc. (c) | | | 2,761,176 | | |

| | 8,908 | | | Illumina, Inc. (c) (e) | | | 3,421,207 | | |

| | 11,108 | | | Incyte Corp. (c) | | | 902,747 | | |

| | 6,885 | | | Intuitive Surgical, Inc. (c) | | | 5,087,602 | | |

| | 42,629 | | | Iovance Biotherapeutics, Inc. (c) | | | 1,349,634 | | |

| | 16,579 | | | IQVIA Holdings, Inc. (c) (e) | | | 3,202,068 | | |

| | 139,292 | | | Johnson & Johnson | | | 22,892,640 | | |

| | 17,766 | | | Laboratory Corporation of America

Holdings (c) (e) | | | 4,530,863 | | |

| | 46,903 | | | LTC Properties, Inc. | | | 1,956,793 | | |

| | 29,287 | | | McKesson Corp. (e) | | | 5,712,137 | | |

| | 145,186 | | | Medical Properties Trust, Inc. | | | 3,089,558 | | |

| | 147,710 | | | Merck & Co., Inc. (e) | | | 11,386,964 | | |

| | 3,150 | | | Mettler-Toledo International, Inc. (c) | | | 3,640,424 | | |

| | 9,338 | | | Molina Healthcare, Inc. (c) | | | 2,182,851 | | |

| | 4,442 | | | National Health Investors, Inc. | | | 321,068 | | |

| | 1,002 | | | Nektar Therapeutics (c) | | | 20,040 | | |

| | 96,025 | | | New Senior Investment Group, Inc. | | | 598,236 | | |

| | 71,075 | | | Omega Healthcare Investors, Inc. | | | 2,603,477 | | |

| | 40,906 | | | Owens & Minor, Inc. (e) | | | 1,537,657 | | |

| | 8,245 | | | PerkinElmer, Inc. | | | 1,057,751 | | |

| | 194,296 | | | Pfizer, Inc. | | | 7,039,344 | | |

| | 168,741 | | | Physicians Realty Trust | | | 2,981,654 | | |

| | 41,267 | | | R1 RCM, Inc. (c) | | | 1,018,470 | | |

| | 9,360 | | | Regeneron Pharmaceuticals, Inc. (c) (e) | | | 4,428,590 | | |

The accompanying notes are an integral part of these financial statements.

14

TEKLA WORLD HEALTHCARE FUND

SCHEDULE OF INVESTMENTS

MARCH 31, 2021

(Unaudited, continued)

SHARES | | United States - continued | | VALUE | |

| | 36,611 | | | ResMed, Inc. (e) | | $ | 7,103,266 | | |

| | 90,781 | | | Sabra Health Care REIT, Inc. | | | 1,575,958 | | |

| | 30,895 | | | Stryker Corp. (e) | | | 7,525,404 | | |

| | 5,648 | | | Teladoc Health, Inc. (c) (e) | | | 1,026,524 | | |

| | 600 | | | Teleflex, Inc. | | | 249,276 | | |

| | 23,127 | | | Thermo Fisher Scientific, Inc. | | | 10,554,700 | | |

| | 45,731 | | | UnitedHealth Group, Inc. | | | 17,015,133 | | |

| | 8,183 | | | Universal Health Realty Income Trust | | | 554,644 | | |

| | 22,357 | | | Universal Health Services, Inc. (e) | | | 2,982,200 | | |

| | 51,692 | | | Ventas, Inc. | | | 2,757,251 | | |

| | 18,786 | | | Vertex Pharmaceuticals, Inc. (c) | | | 4,036,924 | | |

| | 17,645 | | | Waters Corp. (c) (e) | | | 5,014,180 | | |

| | 41,484 | | | Welltower, Inc. | | | 2,971,499 | | |

| | 42,493 | | | Zimmer Biomet Holdings, Inc. (e) | | | 6,802,279 | | |

| | 18,783 | | | Zoetis, Inc. | | | 2,957,947 | | |

| | | | 337,669,681 | | |

| | | | | TOTAL COMMON STOCKS AND

WARRANTS

(Cost $428,073,836) | | | 473,618,614 | | |

PRINCIPAL

AMOUNT | | SHORT-TERM INVESTMENT - 3.4%

of Net Assets | | | |

$ | 15,382,000 | | | Repurchase Agreement, Fixed Income Clearing

Corp., repurchase value $15,382,000, 0.00%,

dated 03/31/21, due 04/01/21 (collateralized

by U.S. Treasury Note 0.50%, due 04/15/24,

market value $13,141,981 and U.S. Treasury

Bond 4.75% due 02/15/37, market value

$2,547,766) | | | 15,382,000 | | |

| | | | | TOTAL SHORT-TERM INVESTMENT

(Cost $15,382,000) | | | 15,382,000 | | |

The accompanying notes are an integral part of these financial statements.

15

TEKLA WORLD HEALTHCARE FUND

SCHEDULE OF INVESTMENTS

MARCH 31, 2021

(Unaudited, continued)

NUMBER OF

CONTRACTS

(100 SHARES

EACH)/

NOTIONAL

AMOUNT ($) | |

OPTION CONTRACTS WRITTEN - (0.2)%

of Net Assets

| | VALUE | |

| | | Call Option Contracts Written - (0.2)% | |

316/(3,792,000) | | Abbott Laboratories Apr21 120 Call | | ( | $60,988 | ) | |

193/(2,026,500) | | AbbVie, Inc. Apr21 105 Call | | | (76,235 | ) | |

191/(2,101,000) | | AbbVie, Inc. Apr21 110 Call | | | (18,718 | ) | |

18/(630,000) | | Anthem, Inc. Apr21 350 Call | | | (26,010 | ) | |

19/(684,000) | | Anthem, Inc. Apr21 360 Call | | | (22,040 | ) | |

1,009/(5,045,000) | | AstraZeneca plc Apr21 50 Call | | | (80,720 | ) | |

294/(1,837,500) | | Bristol-Myers Squibb Co. Apr21 62.5 Call | | | (44,688 | ) | |

93/(2,325,000) | | Cigna Corp. Apr21 250 Call | | | (17,670 | ) | |

46/(299,000) | | DENTSPLY Sirona, Inc. Apr21 65 Call | | | (3,680 | ) | |

14/(504,000) | | DexCom, Inc. Apr21 360 Call | | | (16,772 | ) | |

14/(532,000) | | DexCom, Inc. Apr21 380 Call | | | (4,900 | ) | |

65/(1,235,000) | | Eli Lilly & Co. Apr21 190 Call | | | (17,550 | ) | |

10/(140,000) | | Exact Sciences Corp. Apr21 140 Call | | | (2,000 | ) | |

108/(702,000) | | Gilead Sciences, Inc. Apr21 65 Call | | | (9,720 | ) | |

39/(760,500) | | HCA Healthcare, Inc. Apr21 195 Call | | | (8,307 | ) | |

35/(700,000) | | HCA Healthcare, Inc. Apr21 200 Call | | | (2,730 | ) | |

13/(539,500) | | Humana, Inc. Apr21 415 Call | | | (14,560 | ) | |

9/(378,000) | | Humana, Inc. Apr21 420 Call | | | (9,270 | ) | |

3/(129,000) | | Illumina, Inc. Apr21 430 Call | | | (240 | ) | |

48/(936,000) | | IQVIA Holdings, Inc. Apr21 195 Call | | | (19,200 | ) | |

29/(696,000) | | Laboratory Corporation of America

Holdings Apr21 240 Call | | | (53,650 | ) | |

29/(725,000) | | Laboratory Corporation of America

Holdings Apr21 250 Call | | | (31,900 | ) | |

14/(266,000) | | McKesson Corp. Apr21 190 Call | | | (11,725 | ) | |

15/(292,500) | | McKesson Corp. Apr21 195 Call | | | (8,175 | ) | |

106/(1,272,000) | | Medtronic plc Apr21 120 Call | | | (16,960 | ) | |

106/(1,325,000) | | Medtronic plc Apr21 125 Call | | | (2,862 | ) | |

104/(806,000) | | Merck & Co., Inc. Apr21 77.5 Call | | | (10,608 | ) | |

41/(164,000) | | Owens & Minor, Inc. Apr21 40 Call | | | (4,510 | ) | |

9/(427,500) | | Regeneron Pharmaceuticals, Inc.

Apr21 475 Call | | | (10,530 | ) | |

9/(445,500) | | Regeneron Pharmaceuticals, Inc.

Apr21 495 Call | | | (3,690 | ) | |

18/(342,000) | | ResMed, Inc. Apr21 190 Call | | | (7,920 | ) | |

17/(331,500) | | ResMed, Inc. Apr21 195 Call | | | (7,055 | ) | |

29/(696,000) | | Stryker Corp. Apr21 240 Call | | | (19,720 | ) | |

The accompanying notes are an integral part of these financial statements.

16

TEKLA WORLD HEALTHCARE FUND

SCHEDULE OF INVESTMENTS

MARCH 31, 2021

(Unaudited, continued)

NUMBER OF

CONTRACTS

(100 SHARES

EACH)/

NOTIONAL

AMOUNT ($) | |

Call Option Contracts Written - continued | | VALUE | |

29/(725,000) | | Stryker Corp. Apr21 250 Call | | ( | $6,380 | ) | |

10/(200,000) | | Teladoc Health, Inc. Apr21 200 Call | | | (2,100 | ) | |

153/(168,300) | | Teva Pharmaceutical Industries Ltd.

Apr21 11 Call | | | (11,934 | ) | |

151/(181,200) | | Teva Pharmaceutical Industries Ltd.

Apr21 12 Call | | | (2,718 | ) | |

15/(210,000) | | Universal Health Services, Inc.

Apr21 140 Call | | | (1,875 | ) | |

16/(448,000) | | Waters Corp. Apr21 280 Call | | | (13,680 | ) | |

42/(693,000) | | Zimmer Biomet Holdings, Inc.

Apr21 165 Call | | | (10,500 | ) | |

42/(714,000) | | Zimmer Biomet Holdings, Inc.

Apr21 170 Call | | | (2,730 | ) | |

| | | TOTAL OPTION CONTRACTS WRITTEN

(Premiums received ($666,739)) | | | (697,220 | ) | |

| | | TOTAL INVESTMENTS - 125.9%

(Cost $523,114,168) | | | 571,677,356 | | |

| | | OTHER LIABILITIES IN EXCESS OF

ASSETS - (25.9)% | | | (117,690,093 | ) | |

| | | NET ASSETS - 100% | | $ | 453,987,263 | | |

(a) Security exempt from registration under Rule 144A of the Securities Act of 1933, as amended. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers.

(b) Security fair valued using significant unobservable inputs. See Investment Valuation and Fair Value Measurements.

(c) Non-income producing security.

(d) American Depository Receipt

(e) A portion of security is pledged as collateral for call options written.

The accompanying notes are an integral part of these financial statements.

17

TEKLA WORLD HEALTHCARE FUND

SCHEDULE OF INVESTMENTS

MARCH 31, 2021

(Unaudited, continued)

The following forward contracts were held as of March 31, 2021

Description | | Counterparty | | Settlement

Date | | Currency | | Settlement

Value

(in USD) | | Current

Value | | Unrealized

Gain/(Loss) | |

Contracts Sold: | |

Australian

Dollar | | Goldman Sachs Bank | | 04/30/21 | | 4,572,304 AUD | | $ | 3,486,409 | | | $ | 3,473,381 | | | $ | 13,028 | | |

British Pound | | Goldman Sachs Bank | | 04/30/21 | | 9,626,100 GBP | | | 13,279,832 | | | | 13,271,605 | | | | 8,227 | | |

Danish Krone | | Goldman Sachs Bank | | 04/29/21 | | 10,661,183 DKK | | | 1,691,073 | | | | 1,681,324 | | | | 9,749 | | |

Euro | | Goldman Sachs Bank | | 04/30/21 | | 11,686,116 EUR | | | 13,787,152 | | | | 13,711,132 | | | | 76,020 | | |

Israeli Sheqel | | Goldman Sachs Bank | | 04/30/21 | | 4,457,647 ILS | | | 1,338,513 | | | | 1,333,680 | | | | 4,833 | | |

Japanese Yen | | Goldman Sachs Bank | | 04/30/21 | | 1,203,463,586 JPY | | | 10,975,863 | | | | 10,871,877 | | | | 103,986 | | |

Swiss Franc | | Goldman Sachs Bank | | 04/30/21 | | 16,552,450 CHF | | | 17,633,301 | | | | 17,524,463 | | | | 108,838 | | |

| | | | | | | | | | | $ | 61,867,462 | | | $ | 324,681 | | |

The accompanying notes are an integral part of these financial statements.

18

TEKLA WORLD HEALTHCARE FUND

STATEMENT OF ASSETS AND LIABILITIES

MARCH 31, 2021

(Unaudited)

ASSETS: | |

Investments, at value (cost $523,780,907) | | $ | 572,374,576 | | |

Cash | | | 824 | | |

Foreign currency, at value (Cost $16,974) | | | 16,914 | | |

Dividends and interest receivable | | | 2,552,326 | | |

Prepaid expenses | | | 96,880 | | |

Unrealized appreciation on forward currency contracts | | | 324,681 | | |

Other assets (see Note 1) | | | 113,889 | | |

Total assets | | | 575,480,090 | | |

LIABILITIES: | |

Accrued advisory fee | | | 455,091 | | |

Accrued investor support service fees | | | 22,754 | | |

Accrued shareholder reporting fees | | | 46,588 | | |

Loan Payable | | | 120,000,000 | | |

Options written, at value (premium received $666,739) | | | 697,220 | | |

Interest payable | | | 193,476 | | |

Accrued other | | | 77,698 | | |

Total liabilities | | | 121,492,827 | | |

Commitments and Contingencies (see Notes 1 and 4) | | | |

NET ASSETS | | $ | 453,987,263 | | |

SOURCES OF NET ASSETS: | |

Shares of beneficial interest, par value $.01 per share,

unlimited number of shares authorized, amount

paid in on 30,245,754 shares issued and outstanding | | $ | 302,457 | | |

Additional paid-in-capital | | | 477,896,309 | | |

Total distributable earnings (loss) | | | (24,211,503 | ) | |

Total net assets (equivalent to $15.01 per share

based on 30,245,754 shares outstanding) | | $ | 453,987,263 | | |

The accompanying notes are an integral part of these financial statements.

19

TEKLA WORLD HEALTHCARE FUND

STATEMENT OF OPERATIONS

SIX MONTHS ENDED MARCH 31, 2021

(Unaudited)

INVESTMENT INCOME: | |

Dividend income (net of foreign tax of $175,621) | | $ | 4,731,022 | | |

Interest and other income | | | 1,090,822 | | |

Total investment income | | | 5,821,844 | | |

EXPENSES: | |

Advisory fees | | | 2,759,401 | | |

Interest expense | | | 572,025 | | |

Investor support service fees | | | 137,970 | | |

Custodian fees | | | 83,674 | | |

Trustees' fees and expenses | | | 71,119 | | |

Shareholder reporting | | | 53,818 | | |

Administration fees | | | 52,051 | | |

Auditing fees | | | 36,984 | | |

Legal fees | | | 36,745 | | |

Transfer agent fees | | | 14,872 | | |

Other (see Note 2) | | | 148,369 | | |

Total expenses | | | 3,967,028 | | |

Net investment income | | | 1,854,816 | | |

REALIZED AND UNREALIZED GAIN (LOSS): | |

Net realized gain (loss) on: | |

Investments | | | 2,397,136 | | |

Closed or expired option contracts written | | | 1,357,683 | | |

Foreign currency transactions | | | (41,358 | ) | |

Forward contracts | | | (850,822 | ) | |

Net realized gain | | | 2,862,639 | | |

Change in unrealized appreciation (depreciation) on: | |

Investments | | | 41,992,494 | | |

Option contracts written | | | (165,211 | ) | |

Foreign currency | | | (1,340 | ) | |

Forward contracts | | | 914,186 | | |

Change in unrealized appreciation (depreciation) | | | 42,740,129 | | |

Net realized and unrealized gain (loss) | | | 45,602,768 | | |

Net increase in net assets resulting from

operations | | $ | 47,457,584 | | |

The accompanying notes are an integral part of these financial statements.

20

TEKLA WORLD HEALTHCARE FUND

STATEMENTS OF CHANGES IN NET ASSETS

| | | Six months ended

March 31, 2021

(Unaudited) | | Year ended

September 30,

2020 | |

NET INCREASE (DECREASE) IN NET

ASSETS RESULTING FROM OPERATIONS: | |

Net investment income | | $ | 1,854,816 | | | $ | 2,921,662 | | |

Net realized gain | | | 2,862,639 | | | | 2,030,127 | | |

Change in net unrealized appreciation | | | 42,740,129 | | | | 55,951,095 | | |

Net increase in net assets resulting

from operations | | | 47,457,584 | | | | 60,902,884 | | |

DISTRIBUTIONS TO SHAREHOLDERS

(See Note 1): | |

Distributions | | | (21,147,364 | )* | | | (1,410,869 | ) | |

Return of capital | | | — | | | | (40,791,001 | ) | |

Total distributions | | | (21,147,364 | ) | | | (42,201,870 | ) | |

CAPITAL SHARE TRANSACTIONS: | |

Reinvestment of distributions

(77,102 and 66,217 shares,

respectively) | | | 1,151,519 | | | | 948,619 | | |

Fund shares repurchased

(0 and 53,513 shares,

respectively) (see Note 1) | | | — | | | | (598,698 | ) | |

Total capital share transactions | | | 1,151,519 | | | | 349,921 | | |

Net increase in net assets | | | 27,461,739 | | | | 19,050,935 | | |

NET ASSETS: | |

Beginning of period | | | 426,525,524 | | | | 407,474,589 | | |

End of period | | $ | 453,987,263 | | | $ | 426,525,524 | | |

* A portion of the distributions may be deemed a tax return of capital at year end.

The accompanying notes are an integral part of these financial statements.

21

TEKLA WORLD HEALTHCARE FUND

STATEMENT OF CASH FLOWS

SIX MONTHS ENDED MARCH 31, 2021

(Unaudited)

CASH FLOWS FROM OPERATING ACTIVITIES: | |

Purchases of portfolio securities | | ($ | 152,303,802 | ) | |

Net maturities of short-term investments | | | (4,799,000 | ) | |

Sales of portfolio securities | | | 171,830,728 | | |

Proceeds from option contracts written | | | 2,281,174 | | |

Interest income received | | | 1,384,531 | | |

Dividend income received | | | 4,432,693 | | |

Other operating receipts (expenses paid) | | | (4,173,766 | ) | |

Net cash provided from operating activities | | | 18,652,558 | | |

CASH FLOWS FROM FINANCING ACTIVITIES: | |

Cash distributions paid | | | (19,995,845 | ) | |

Decrease in payable due to custodian | | | (13,975 | ) | |

Net cash used for financing activities | | | (20,009,820 | ) | |

NET INCREASE/DECREASE IN CASH | | | (1,357,262 | ) | |

CASH AT BEGINNING OF THE PERIOD | | | 1,375,000 | | |

CASH AT END OF SIX MONTHS | | $ | 17,738 | | |

RECONCILIATION OF NET INCREASE IN NET ASSETS

RESULTING FROM OPERATIONS TO NET CASH

PROVIDED FROM OPERATING ACTIVITIES: | |

Net increase in net assets resulting from operations | | $ | 47,457,584 | | |

Purchases of portfolio securities | | | (152,303,802 | ) | |

Purchases to close option contracts written | | | — | | |

Net maturities of short-term investments | | | (4,799,000 | ) | |

Sales of portfolio securities | | | 171,830,728 | | |

Proceeds from option contracts written | | | 2,281,174 | | |

Accretion of discount | | | 71,365 | | |

Net realized gain on investments, options and

foreign currencies | | | (2,862,639 | ) | |

Increase in net unrealized (appreciation) depreciation

on investments, options and foreign currencies | | | (42,740,129 | ) | |

Increase in dividends and interest receivable | | | (75,985 | ) | |

Decrease in accrued expenses | | | (25,963 | ) | |

Decrease in prepaid expenses and interest payable | | | (180,775 | ) | |

Net cash provided from operating activities | | $ | 18,652,558 | | |

Cash paid for interest | | $ | 378,549 | | |

The accompanying notes are an integral part of these financial statements.

22

TEKLA WORLD HEALTHCARE FUND

| | | Six months

ended

March 31, 2021 | | Years ended September 30, | |

| | | (Unaudited) | | 2020 | | 2019 | | 2018 | | 2017 | | 2016 | |

OPERATING PERFORMANCE FOR A SHARE

OUTSTANDING THROUGHOUT EACH PERIOD | |

Net asset value per share,

beginning of period | | $ | 14.14 | | | $ | 13.51 | | | $ | 15.24 | | | $ | 15.55 | | | $ | 16.08 | | | $ | 17.38 | | |

Net investment income (1) | | | 0.06 | | | | 0.10 | | | | 0.06 | | | | 0.11 | | | | 0.12 | | | | 0.09 | | |

Net realized and unrealized

gain (loss) | | | 1.51 | | | | 1.93 | | | | (0.40 | ) | | | 0.96 | | | | 0.74 | | | | (0.06 | ) | |

Total increase (decrease)

from investment operations | | | 1.57 | | | | 2.03 | | | | (0.34 | ) | | | 1.07 | | | | 0.86 | | | | 0.03 | | |

Distributions to shareholders from: | |

Net investment income | | | (0.70 | ) | | | (0.05 | ) | | | (0.19 | ) | | | (0.60 | ) | | | (1.30 | ) | | | (1.38 | )(2) | |

Net realized capital gains | | | — | | | | — | | | | — | | | | — | | | | (0.03 | ) | | | (0.02 | )(2) | |

Return of capital (tax basis) | | | — | | | | (1.35 | ) | | | (1.21 | ) | | | (0.80 | ) | | | (0.07 | ) | | | — | | |

Total distributions | | | (0.70 | ) | | | (1.40 | ) | | | (1.40 | ) | | | (1.40 | ) | | | (1.40 | ) | | | (1.40 | ) | |

Increase resulting from

shares repurchased | | | — | | | | — | (3) | | | 0.01 | | | | 0.02 | | | | 0.01 | | | | 0.07 | | |

Net asset value per share,

end of period | | $ | 15.01 | | | $ | 14.14 | | | $ | 13.51 | | | $ | 15.24 | | | $ | 15.55 | | | $ | 16.08 | | |

Per share market value,

end of period | | $ | 15.07 | | | $ | 14.33 | | | $ | 13.44 | | | $ | 14.03 | | | $ | 14.56 | | | $ | 14.68 | | |

Total investment return

at market value | | | 10.36 | %* | | | 18.14 | % | | | 6.80 | % | | | 6.91 | % | | | 9.47 | % | | | 12.34 | % | |

Total investment return

at net asset value | | | 11.40 | %* | | | 15.97 | % | | | (1.10 | %) | | | 8.66 | % | | | 6.74 | % | | | 1.81 | % | |

RATIOS | |

Net investment income

to average net assets | | | 0.84 | %** | | | 0.68 | % | | | 0.45 | % | | | 0.78 | % | | | 0.77 | % | | | 0.53 | % | |

Expenses to average net assets | | | 1.80 | %** | | | 2.16 | % | | | 2.53 | % | | | 2.28 | % | | | 2.05 | % | | | 1.70 | % | |

Expenses, excluding interest

expense, to average

net assets | | | 1.54 | %** | | | 1.57 | % | | | 1.59 | % | | | 1.57 | % | | | 1.55 | % | | | 1.47 | % | |

SUPPLEMENTAL DATA | |

Net assets at end of period

(in millions) | | $ | 454 | | | $ | 427 | | | $ | 407 | | | $ | 463 | | | $ | 480 | | | $ | 499 | | |

Portfolio turnover rate | | | 27.29 | %* | | | 48.11 | % | | | 55.17 | % | | | 54.60 | % | | | 58.05 | % | | | 67.00 | % | |

Senior securities (loan facility)

outstanding (in millions) | | $ | 120 | | | $ | 120 | | | $ | 120 | | | $ | 120 | | | $ | 120 | | | $ | 120 | | |

Asset coverage ratio on

revolving credit facility at

period end | | | 478 | % | | | 455 | % | | | 440 | % | | | 486 | % | | | 500 | % | | | 516 | % | |

Asset coverage per $1,000 on

revolving credit facility at

period end | | $ | 4,783 | | | $ | 4,554 | | | $ | 4,396 | | | $ | 4,861 | | | $ | 4,999 | | | $ | 5,160 | | |

* Not annualized.

** Annualized.

(1) Computed using average shares outstanding.

(2) Amount previously presented incorrectly as solely distributions from income has been revised to reflect the proper classification.

(3) Amount represents less than $0.005 per share.

The accompanying notes are an integral part of these financial statements.

23

TEKLA WORLD HEALTHCARE FUND

NOTES TO FINANCIAL STATEMENTS

MARCH 31, 2021

(Unaudited)

(1) Organization and Significant Accounting Policies

Tekla World Healthcare Fund (the Fund) is a Massachusetts business trust formed on March 5, 2015 and registered under the Investment Company Act of 1940 as a non-diversified closed-end management investment company. The Fund commenced operations on June 30, 2015. The investment objective is to seek current income and long-term capital appreciation through investments in U.S. and non-U.S. companies engaged in the healthcare industry (including equity securities and debt securities). The Fund invests primarily in securities of public and private companies believed by the Fund's Investment Adviser, Tekla Capital Management LLC (the Adviser), to have significant potential for above-average growth.

The preparation of these financial statements requires the use of certain estimates by management in determining the Fund's assets, liabilities, revenues and expenses. Actual results could differ from these estimates and such differences could be material. The following is a summary of significant accounting policies followed by the Fund, which are in conformity with accounting principles generally accepted in the United States of America (GAAP). The Fund is an investment company and follows accounting and reporting guidance in the Financial Accounting Standards Board Accounting Standards Codification 946. Events or transactions occurring after March 31, 2021, through the date that the financial statements were issued, have been evaluated in the preparation of these financial statements.

The impact of the COVID-19 outbreak on the financial performance of the Fund's investments will depend on future developments, including the duration and spread of the outbreak and related advisories and restrictions. These developments and the impact of COVID-19 on the financial markets and the overall economy are highly uncertain and cannot be predicted. If the financial markets and/or the overall economy are impacted for an extended period, the Fund's future investment results may be materially adversely affected.

Investment Valuation

Shares of publicly traded companies listed on national securities exchanges or trading in the over-the-counter market are typically valued at the last sale price, as of the close of trading, generally 4 p.m., Eastern Time. The Fund holds securities, currencies and other assets that are denominated in a foreign currency. The Fund will normally use the currency exchange rates as of 4:00 p.m. (Eastern Time) when valuing such assets. The Board of Trustees of the Fund (the Trustees) has established and approved fair valuation policies and procedures

24

TEKLA WORLD HEALTHCARE FUND

NOTES TO FINANCIAL STATEMENTS

MARCH 31, 2021

(continued)

with respect to securities for which quoted prices may not be available or which do not reflect fair value. Convertible, corporate and government bonds are valued using a third-party pricing service. Convertible bonds are valued using this pricing service only on days when there is no sale reported. Puts and calls generally are valued at the close of regular trading on the securities or commodities exchange on which they are primarily traded. Options on securities generally are valued at their last sale price in the case of exchange traded options or, in the case of OTC-traded options, the average of the last sale price as obtained from two or more dealers unless there is only one dealer, in which case that dealer's price is used. Forward foreign currency contracts are valued on the basis of the value of the underlying currencies at the prevailing forward exchange rates. Restricted securities of companies that are publicly traded are typically valued based on the closing market quote on the valuation date adjusted for the impact of the restriction as determined in good faith by the Adviser also using fair valuation policies and procedures approved by the Trustees described below. Short-term investments with a maturity of 60 days or less are generally valued at amortized cost, which approximates fair value.

Convertible preferred shares, warrants or convertible note interests in private companies, and other restricted securities, as well as shares of publicly traded companies for which market quotations are not readily available, such as stocks for which trading has been halted or for which there are no current day sales, or which do not reflect fair value, are typically valued in good faith, based upon the recommendations made by the Adviser pursuant to fair valuation policies and procedures approved by the Trustees.

The Adviser has a Valuation Sub-Committee comprised of senior management which reports to the Valuation Committee of the Board at least quarterly. Each fair value determination is based on a consideration of relevant factors, including both observable and unobservable inputs. Observable and unobservable inputs the Adviser considers may include (i) the existence of any contractual restrictions on the disposition of securities; (ii) information obtained from the company, which may include an analysis of the company's financial statements, products, intended markets or technologies; (iii) the price of the same or similar security negotiated at arm's length in an issuer's completed subsequent round of financing; (iv) the price and extent of public trading in similar securities of the issuer or of comparable companies; or (v) a probability and time value adjusted analysis of contractual terms. Where available and appropriate, multiple valuation methodologies are applied to confirm fair value. Significant unobservable inputs

25

TEKLA WORLD HEALTHCARE FUND

NOTES TO FINANCIAL STATEMENTS

MARCH 31, 2021

(continued)

identified by the Adviser are often used in the fair value determination. A significant change in any of these inputs may result in a significant change in the fair value measurement. Due to the uncertainty inherent in the valuation process, such estimates of fair value may differ significantly from the values that would have been used had a ready market for the investments existed, and differences could be material. Additionally, changes in the market environment and other events that may occur over the life of the investments may cause the gains or losses ultimately realized on these investments to be different from the valuations used at the date of these financial statements.

Options on Securities

An option contract is a contract in which the writer (seller) of the option grants the buyer of the option, upon payment of a premium, the right to purchase from (call option) or sell to (put option) the writer a designated instrument at a specified price within a specified period of time. Certain options, including options on indices, will require cash settlement by the Fund if the option is exercised. The Fund enters into option contracts in order to hedge against potential adverse price movements in the value of portfolio assets, as a temporary substitute for selling selected investments, to lock in the purchase price of a security or currency which it expects to purchase in the near future, as a temporary substitute for purchasing selected investments, or to enhance potential gain or to gain or hedge exposure to financial market risk.

The Fund's obligation under an exchange traded written option or investment in an exchange traded purchased option is valued at the last sale price or in the absence of a sale, the mean between the closing bid and asked prices. Gain or loss is recognized when the option contract expires, is exercised or is closed.

If the Fund writes a covered call option, the Fund foregoes, in exchange for the premium, the opportunity to profit during the option period from an increase in the market value of the underlying security above the exercise price. If the Fund writes a put option it accepts the risk of a decline in the market value of the underlying security below the exercise price. Over-the-counter options have the risk of the potential inability of counterparties to meet the terms of their contracts. The Fund's maximum exposure to purchased options is limited to the premium initially paid. In addition, certain risks may arise upon entering into option contracts including the risk that an illiquid secondary market will limit the Fund's ability to close out an option contract prior to the expiration date and that a change in the value of the option contract may not

26

TEKLA WORLD HEALTHCARE FUND

NOTES TO FINANCIAL STATEMENTS

MARCH 31, 2021

(continued)

correlate exactly with changes in the value of the securities or currencies hedged.

All options on securities and securities indices written by the Fund are required to be covered. When the Fund writes a call option, this means that during the life of the option the Fund may own or have the contractual right to acquire the securities subject to the option or may maintain with the Fund's custodian in a segregated account appropriate liquid securities in an amount at least equal to the market value of the securities underlying the option. The prices provided by a pricing service take into account broker dealer market price quotations for institutional size trading in similar groups of securities, yields or securities with similar characteristics, security quantity, maturity, coupon and other security characteristics as well as any developments related to the specific securities. The pricing service may use a matrix approach, regarding securities with similar characteristics to determine the valuation for a security. When the Fund writes a put option, this means that the Fund will maintain with the Fund's custodian in a segregated account appropriate liquid securities in an amount at least equal to the exercise price of the option.

The average number of outstanding call options written for the six months ended March 31, 2021 was 2,212.

Derivatives not accounted

for as hedging instruments

under ASC 815 | | Statement of Assets and

Liabilities Location | | Statement of Operations Location | |

Equity contracts

| | | | | | Liabilities, Options

written, at value

| | $ | 697,220

| | | Net realized gain on

closed or expired option

contracts written | | $ | 1,357,683 | | |

| | | | | |

| | | | | | Change in unrealized

appreciation (depreciation)

on option contracts written | | ($ | 165,211 | ) | |

Forward Currency

contracts

| | | | | | Assets: Forward

currency, unrealized

appreciation | | $ | 324,681 | | | Net realized gain (loss)

on forward contracts

| | ($ | 850,822 | ) | |

| | | | | |

| | | | | | Change in unrealized

appreciation (depreciation)

on forward contracts | | $ | 914,186 | | |

Forward Contracts

Forward contracts involve the purchase or sale of a specific quantity of a commodity, government security, foreign currency, or other asset at a specified price, with delivery and settlement at a specified future date. Because it is a completed contract, a purchase forward contract can be a cover for the sale of

27

TEKLA WORLD HEALTHCARE FUND

NOTES TO FINANCIAL STATEMENTS

MARCH 31, 2021

(continued)

a futures contract. The Fund may enter into forward contracts for hedging purposes and non-hedging purposes (i.e., to increase returns). Forward contracts may be used by the Fund for hedging purposes to protect against uncertainty in the level of future foreign currency exchange rates, such as when the Fund anticipates purchasing or selling a foreign security. Forward contracts may also be used to attempt to protect the value of the Fund's existing holdings of foreign securities. Forward contracts may also be used for non-hedging purposes to pursue the Fund's investment objective. There is no requirement that the Fund hedge all or any portion of its exposure to foreign currency risks.

Average notional amount of forward contracts for the six months ended March 31, 2021 was $66,904,608.

Other Assets

Other assets in the Statement of Assets and Liabilities consists of amounts due to the Fund at various times in the future in connection with the sale of the investment in one private company.

Investment Transactions and Income

Investment transactions are recorded on a trade date basis. Gains and losses from sales of investments are recorded using the "identified cost" method. Interest income is recorded on the accrual basis, adjusted for amortization of premiums and accretion of discounts. Dividend income is recorded on the ex-dividend date, less any foreign taxes withheld. Upon notification from issuers, some of the dividend income received may be redesignated as a reduction of cost of the related investment if it represents a return of capital.

The aggregate cost of purchases and proceeds from sales of investment securities (other than short-term investments) for the six months ended March 31, 2021 totaled $148,831,442 and $169,275,383, respectively.

Repurchase Agreements

In managing short-term investments the Fund may from time to time enter into transactions in repurchase agreements. In a repurchase agreement, the Fund's custodian takes possession of the underlying collateral securities from the counterparty, the market value of which is at least equal to the principal, including accrued interest, of the repurchase transaction at all times. In the event of default or bankruptcy by the other party to the agreement, realization and/or retention of the collateral by the Fund may be delayed. The Fund may enter into repurchase transactions with any broker, dealer, registered clearing agency or

28

TEKLA WORLD HEALTHCARE FUND

NOTES TO FINANCIAL STATEMENTS

MARCH 31, 2021

(continued)

bank. Repurchase agreement transactions are not counted for purposes of the limitations imposed on the Fund's investment in debt securities.

Distribution Policy

Pursuant to a Securities and Exchange Commission exemptive order the Fund may make periodic distributions that include capital gains as frequently as 12 times in any one taxable year in respect of its common shares, and the Fund has implemented a managed distribution policy (the Policy) providing for monthly distributions at a rate set by the Trustees. Under the current Policy, the Fund intends to make monthly distributions at a rate of $0.1167 per share to shareholders of record. If taxable income and net long-term realized gains exceed the amount required to be distributed under the Policy, the Fund will at a minimum make distributions necessary to comply with the requirements of the Internal Revenue Code. The Policy has been established by the Trustees and may be changed by them without shareholder approval. The Trustees regularly review the Policy and the frequency and distribution rate considering the purpose and effect of the Policy, the financial market environment, and the Fund's income, capital gains and capital available to pay distributions.

Share Repurchase Program

In March 2021, the Trustees approved the renewal of the repurchase program to allow the Fund to repurchase up to 12% of its outstanding shares in the open market for a one-year period ending July 14, 2022. Prior to this renewal, in March 2020, the Trustees approved the renewal of the share repurchase program to allow the Fund to repurchase up to 12% of its outstanding shares for a one-year period ending July 14, 2021. The share repurchase program is intended to enhance shareholder value and potentially reduce the discount between the market price of the Fund's shares and the Fund's net asset value.

During the six months ended March 31, 2021, the Fund did not repurchase any shares through the repurchase program.

During the year ended September 30, 2020, the Fund repurchased 53,513 shares at a total cost of $598,698. The weighted average discount per share between the cost of repurchase and the net asset value applicable to such shares at the date of repurchase was 12.27%.

Federal Taxes

It is the Fund's policy to comply with the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute to its

29

TEKLA WORLD HEALTHCARE FUND

NOTES TO FINANCIAL STATEMENTS

MARCH 31, 2021

(continued)

shareholders substantially all of its taxable income and its net realized capital gains, if any. Therefore, no Federal income or excise tax provision is required.

As of March 31, 2021, the Fund had no uncertain tax positions that would require financial statement recognition or disclosure. The Fund's federal tax returns are subject to examination by the Internal Revenue Service for a period of three years.

Distributions

The Fund records all distributions to shareholders on the ex-dividend date. Such distributions are determined in conformity with income tax regulations, which may differ from GAAP. These differences include temporary and permanent differences from losses on wash sale transactions, deferral of post October losses, distributions from real estate investment trusts, premium amortization accruals, book to tax difference due to merger, losses disallowed on straddles and foreign currency gains and losses. Reclassifications are made to the Fund's capital accounts to reflect income and gains available for distribution under income tax regulations.

The cumulative distributions paid this fiscal year-to-date are currently estimated to be from the following sources: net investment income, net realized short-term capital gains, and return of capital or other capital source. The amounts and sources of distributions are only estimates and not being provided for tax reporting purposes. The actual amounts and sources of the amounts for tax reporting purposes will depend upon the Fund's investment experience during the remainder of its fiscal year and may be subject to changes based on tax regulations.

Statement of Cash Flows

The cash and restricted cash amount shown in the Statement of Cash Flows is the amount included in the Fund's Statement of Assets and Liabilities and represents cash and restricted cash on hand at March 31, 2021.

Commitments and Contingencies

Under the Fund's organizational documents, its officers and Trustees may be indemnified against certain liabilities and expenses arising out of the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into agreements with service providers that may contain indemnification clauses. The Fund's maximum exposure under these agreements is unknown as this would involve future claims that may be made against

30

TEKLA WORLD HEALTHCARE FUND

NOTES TO FINANCIAL STATEMENTS

MARCH 31, 2021

(continued)

the Fund that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

Loan Payable

The Fund maintains a $125,000,000 line of credit with the Bank of Nova Scotia (the Line of Credit) which expires on January 28, 2022. As of March 31, 2021, the Fund had drawn down $120,000,000 from the Line of Credit, which was the maximum borrowing outstanding during the period. The Fund is charged interest at the rate of 0.75% above the relevant LIBOR rate adjusted by the Statutory Reserve Rate for borrowing (per annum). The Fund is also charged a commitment fee on the daily unused balance of the line of credit at the rate of 0.10% (per annum). Per the Line of Credit agreement, the Fund paid an upfront fee of 0.05% on the total line of credit balance, which is being amortized through January 29, 2022. The Fund pledges its investment securities as the collateral for the line of credit per the terms of the agreement. The weighted average interest rate and the average outstanding loan payable for the period from October 1, 2020 to March 31, 2021 were 0.9378% and $120,000,000, respectively. The stated carrying amount of the line of credit approximates its fair value based upon the short term nature of the borrowings and the interest rates being based upon the market terms. The borrowings under the line of credit would be considered as Level 2 in the fair value hierarchy (See Note 3) at March 31, 2021.

Investor Support Services