united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered

management investment companies

| Investment Company Act file number | 811-23066 | |

Northern Lights Fund Trust IV

(Exact name of registrant as specified in charter)

| 225 Pictoria Drive, Suite 450, Cincinnati, OH | | 45246 |

| (Address of principal executive offices) | | (Zip code) |

Wendy Wang, Ultimus Fund Solutions, LLC

4221 North 203rd Street, Suite 100, Elkhorn, NE 68022

(Name and address of agent for service)

| Registrant’s telephone number, including area code: | 631-470-2612 | |

| Date of fiscal year end: | 6/30 | |

| | | |

| Date of reporting period: | 6/30/24 | |

Item 1. Reports to Stockholders.

| (a) | Insert Tailored Shareholder Report |

Fulcrum Diversified Absolute Return Fund

Institutional Class (FARIX)

Annual Shareholder Report - June 30, 2024

This annual shareholder report contains important information about Fulcrum Diversified Absolute Return Fund for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at https://www.fulcrumassetfunds.com/. You can also request this information by contacting us at 855-538-5278.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional | $113 | 1.13% |

How did the Fund perform during the reporting period?

Asset markets begun the period under pressure from talk of more restrictive monetary policy but this receded later in Q4-23 as an economic soft landing scenario and an improving environment for risk assets became the central theme. U.S. mega cap growth stocks were the main driver of equity market gains. Fixed income markets failed to benefit from the improved sentiment with inflation lingering above central bank targets. The Fund returned +9.35% for the period ended June 30, 2024, meeting its investment objective. Dynamic Asset Allocation strategies were the largest contributor to returns, capturing the broad upward move in equity markets, whilst remaining underweight fixed income. Discretionary Macro strategies also added to returns, from a broad array of sub-strategies and most notably thematic equities. Diversifying Strategies were flat over the period.

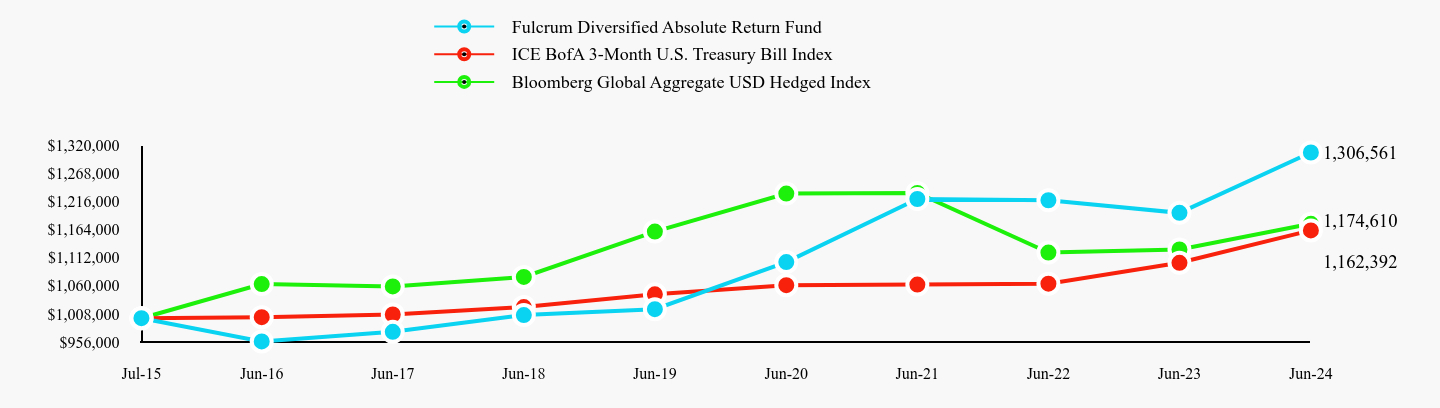

How has the Fund performed since inception?

The Fund has performed consistently against its benchmark. The market in the year ended 2024 proved to be more volatile than previous years. To counter the volatile, a long-term view has been taken when considering performance.

Total Return Based on $1,000,000 Investment

| Fulcrum Diversified Absolute Return Fund | ICE BofA 3-Month U.S. Treasury Bill Index | Bloomberg Global Aggregate USD Hedged Index |

|---|

| Jul-15 | $1,000,000 | $1,000,000 | $1,000,000 |

| Jun-16 | 957,000 | 1,001,957 | 1,063,172 |

| Jun-17 | 974,868 | 1,006,829 | 1,058,782 |

| Jun-18 | 1,005,761 | 1,020,545 | 1,076,299 |

| Jun-19 | 1,016,707 | 1,044,150 | 1,160,207 |

| Jun-20 | 1,103,789 | 1,061,158 | 1,230,612 |

| Jun-21 | 1,220,551 | 1,062,158 | 1,231,552 |

| Jun-22 | 1,218,137 | 1,063,942 | 1,121,452 |

| Jun-23 | 1,194,858 | 1,102,495 | 1,127,263 |

| Jun-24 | 1,306,561 | 1,162,392 | 1,174,610 |

Average Annual Total Returns

| 1 Year | 5 Years | Since Inception (July 31, 2015) |

|---|

| Fulcrum Diversified Absolute Return Fund | 9.35% | 5.14% | 3.04% |

| ICE BofA 3-Month U.S. Treasury Bill Index | 5.43% | 2.17% | 1.70% |

| Bloomberg Global Aggregate USD Hedged Index | 4.20% | 0.25% | 1.82% |

- Net Assets$200,114,475

- Number of Portfolio Holdings884

- Advisory Fee (net of waivers)$1,630,102

- Portfolio Turnover239%

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

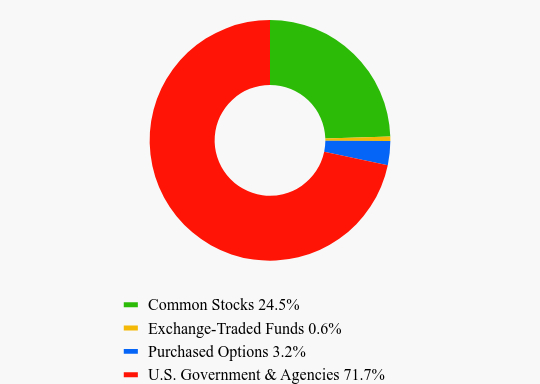

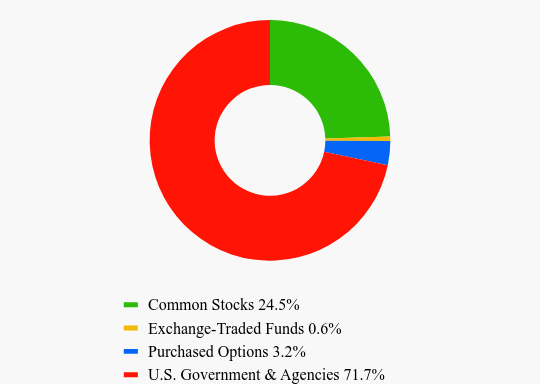

What did the Fund invest in?

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Common Stocks | 24.5% |

| Exchange-Traded Funds | 0.6% |

| Purchased Options | 3.2% |

| U.S. Government & Agencies | 71.7% |

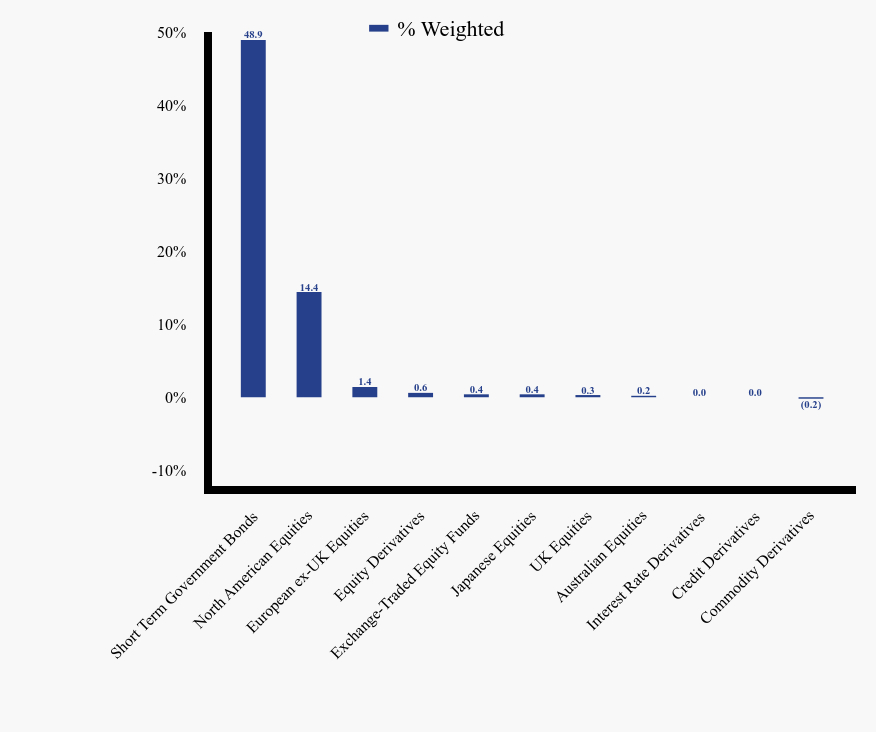

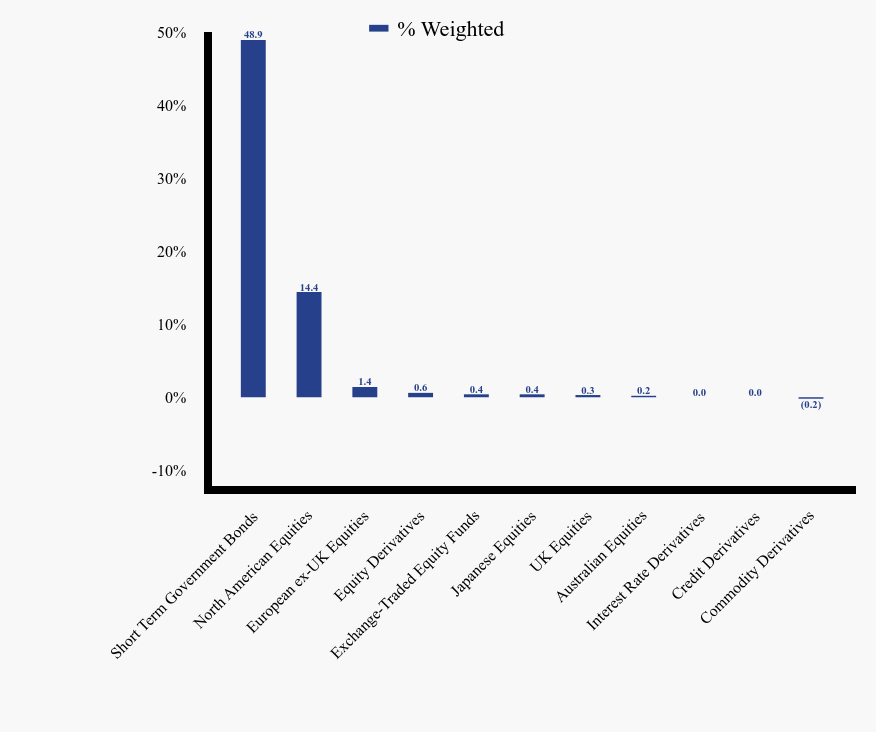

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Short Term Government Bonds | 48.9 |

| North American Equities | 14.4 |

| European ex-UK Equities | 1.4 |

| Equity Derivatives | 0.6 |

| Exchange-Traded Equity Funds | 0.4 |

| Japanese Equities | 0.4 |

| UK Equities | 0.3 |

| Australian Equities | 0.2 |

| Interest Rate Derivatives | 0.0 |

| Credit Derivatives | 0.0 |

| Commodity Derivatives | (0.2) |

No material changes occurred during the year ended June 30, 2024.

If you wish to receive a copy of this document at a new address, contact 855-538-5278.

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://www.fulcrumassetfunds.com/ ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Fulcrum Diversified Absolute Return Fund (FARIX)

Annual Shareholder Report - June 30, 2024

Fulcrum Diversified Absolute Return Fund

Super Institutional Class (FARYX)

Annual Shareholder Report - June 30, 2024

This annual shareholder report contains important information about Fulcrum Diversified Absolute Return Fund for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at https://www.fulcrumassetfunds.com/. You can also request this information by contacting us at 855-538-5278.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Super Institutional | $105 | 1.05% |

How did the Fund perform during the reporting period?

Asset markets begun the period under pressure from talk of more restrictive monetary policy but this receded later in Q4-23 as an economic soft landing scenario and an improving environment for risk assets became the central theme. U.S. mega cap growth stocks were the main driver of equity market gains. Fixed income markets failed to benefit from the improved sentiment with inflation lingering above central bank targets. The Fund returned +9.35% for the period ended June 30, 2024, meeting its investment objective. Dynamic Asset Allocation strategies were the largest contributor to returns, capturing the broad upward move in equity markets, whilst remaining underweight fixed income. Discretionary Macro strategies also added to returns, from a broad array of sub-strategies and most notably thematic equities. Diversifying Strategies were flat over the period.

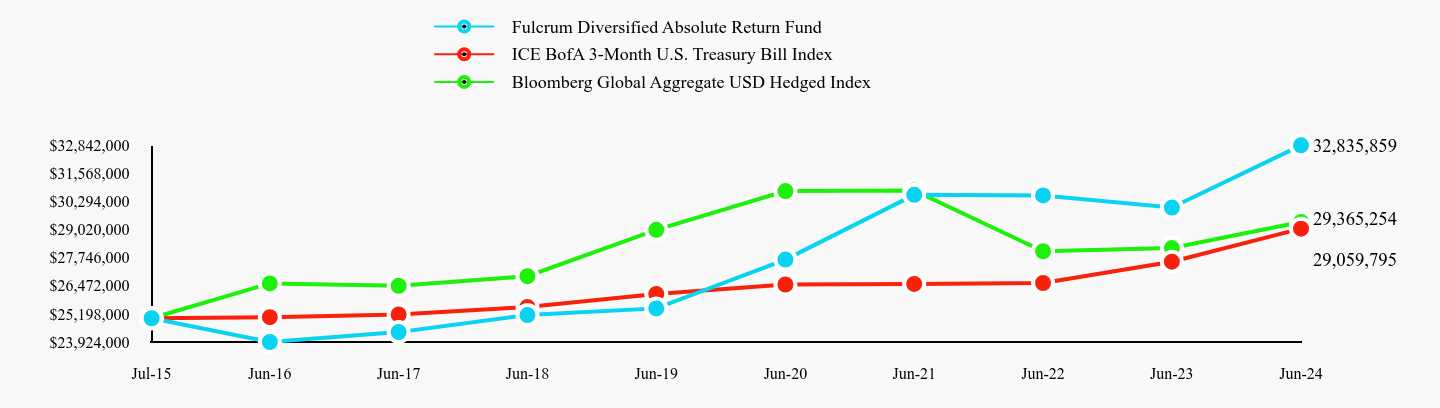

How has the Fund performed since inception?

The Fund has performed consistently against its benchmark. The market in the year ended 2024 proved to be more volatile than previous years. To counter the volatile, a long-term view has been taken when considering performance.

Total Return Based on $25,000,000 Investment

| Fulcrum Diversified Absolute Return Fund | ICE BofA 3-Month U.S. Treasury Bill Index | Bloomberg Global Aggregate USD Hedged Index |

|---|

| Jul-15 | $25,000,000 | $25,000,000 | $25,000,000 |

| Jun-16 | 23,925,000 | 25,048,935 | 26,579,288 |

| Jun-17 | 24,371,817 | 25,170,729 | 26,469,543 |

| Jun-18 | 25,143,299 | 25,513,637 | 26,907,479 |

| Jun-19 | 25,447,539 | 26,103,757 | 29,005,184 |

| Jun-20 | 27,659,280 | 26,528,948 | 30,765,291 |

| Jun-21 | 30,592,425 | 26,553,959 | 30,788,808 |

| Jun-22 | 30,565,144 | 26,598,544 | 28,036,289 |

| Jun-23 | 30,016,211 | 27,562,383 | 28,181,571 |

| Jun-24 | 32,835,859 | 29,059,795 | 29,365,254 |

Average Annual Total Returns

| 1 Year | 5 Years | Since Inception (July 31, 2015) |

|---|

| Fulcrum Diversified Absolute Return Fund | 9.39% | 5.23% | 3.10% |

| ICE BofA 3-Month U.S. Treasury Bill Index | 5.43% | 2.17% | 1.70% |

| Bloomberg Global Aggregate USD Hedged Index | 4.20% | 0.25% | 1.82% |

- Net Assets$200,114,475

- Number of Portfolio Holdings884

- Advisory Fee (net of waivers)$1,630,102

- Portfolio Turnover239%

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

What did the Fund invest in?

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Common Stocks | 24.5% |

| Exchange-Traded Funds | 0.6% |

| Purchased Options | 3.2% |

| U.S. Government & Agencies | 71.7% |

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Short Term Government Bonds | 48.9 |

| North American Equities | 14.4 |

| European ex-UK Equities | 1.4 |

| Equity Derivatives | 0.6 |

| Exchange-Traded Equity Funds | 0.4 |

| Japanese Equities | 0.4 |

| UK Equities | 0.3 |

| Australian Equities | 0.2 |

| Interest Rate Derivatives | 0.0 |

| Credit Derivatives | 0.0 |

| Commodity Derivatives | (0.2) |

No material changes occurred during the year ended June 30, 2024.

If you wish to receive a copy of this document at a new address, contact 855-538-5278.

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://www.fulcrumassetfunds.com/ ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Fulcrum Diversified Absolute Return Fund (FARYX)

Annual Shareholder Report - June 30, 2024

Item 2. Code of Ethics.

| (a) | The registrant has, as of the end of the period covered by this report, adopted a code of ethics that applies to the registrant's principal executive officer, principal financial officer, and principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party. |

| | |

| (b) | Not applicable |

| | |

| (c) | During the period covered by this report, there were no amendments to any provision of the code of ethics. |

| | |

| (d) | During the period covered by this report, there were no waivers or implicit waivers of a provision of the code of ethics. |

| | |

| (e) | Not applicable |

| | |

| (f) | See Item 19(a)(1) |

Item 3. Audit Committee Financial Expert.

| (a)(1) | The Registrant’s board of trustees has determined that Joseph Breslin is an audit committee financial expert, as defined in Item 3 of Form N-CSR. Mr. Breslin is independent for purposes of this Item 3. |

Item 4. Principal Accountant Fees and Services.

| (a) | Audit Fees. The aggregate fees billed for each of the last two fiscal years for professional services rendered by the registrant's principal accountant for the audit of the registrant's annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years are as follows: |

2024 – $60,000

2023 – $75,000

| (b) | Audit-Related Fees. There were no fees billed in each of the last two fiscal years for assurances and related services by the principal accountant that are reasonably related to the performance of the audit of the registrant’s financial statements and are not reported under paragraph (a) of this item. |

| (c) | Tax Fees. The aggregate fees billed in each of the last two fiscal years for professional services rendered by the principal accountant for tax compliance are as follows: |

2024 – $10,000

2023 – $10,000

Preparation of Federal & State income tax returns, assistance with calculation of required income, capital gain and excise distributions and preparation of Federal excise tax returns.

| (d) | All Other Fees. The aggregate fees billed in each of the last two fiscal years for products and services provided by the registrant’s principal accountant, other than the services reported in paragraphs (a) through (c) of this item were $0 and $0 for the fiscal years ended June 30, 2023 and 2024, respectively. |

| (e)(1) | The audit committee does not have pre-approval policies and procedures. Instead, the audit committee or audit committee chairman approves on a case-by-case basis each audit or non-audit service before the principal accountant is engaged by the registrant. |

| | |

| (e)(2) | There were no services described in each of paragraphs (b) through (d) of this Item that were approved by the audit committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X. |

| | |

| (f) | Not applicable. The percentage of hours expended on the principal accountant's engagement to audit the registrant's financial statements for the most recent fiscal year that were attributed to work performed by persons other than the principal accountant's full-time, permanent employees was zero percent (0%). |

| (g) | All non-audit fees billed by the registrant's principal accountant for services rendered to the registrant for the fiscal years ended June 30, 2023 and 2024, respectively are disclosed in (b)-(d) above. There were no audit or non-audit services performed by the registrant's principal accountant for the registrant's adviser. |

| | |

| (h) | Not applicable. |

| | |

| (i) | Not applicable. |

| | |

| (j) | Not applicable. |

Item 5. Audit Committee of Listed Companies.

Not applicable to open-end investment companies.

Item 6. Investments.

Schedule of investments in securities of unaffiliated issuers is included under Item 7.

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

Fulcrum Diversified Absolute Return Fund

| Super Institutional Class | FARYX |

| Institutional Class | FARIX |

a series of Northern Lights Fund Trust IV

Annual Financial Statements

June 30, 2024

855-538-5278

www.fulcrumassetfunds.com

fulcrumfunds@ultimusfundsolutions.com

FULCRUM DIVERSIFIED ABSOLUTE RETURN FUND

CONSOLIDATED SCHEDULE OF INVESTMENTS

June 30, 2024

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 16.7% | | | | |

| | | | | ADVERTISING & MARKETING - 0.0%(a) | | | | |

| | 42 | | | Omnicom Group, Inc. | | $ | 3,767 | |

| | | | | | | | | |

| | | | | AEROSPACE & DEFENSE - 0.1% | | | | |

| | 29 | | | AeroVironment, Inc.(b) | | | 5,283 | |

| | 18 | | | Dassault Aviation S/A(c) | | | 3,270 | |

| | 5,508 | | | Saab A.B.(c) | | | 132,542 | |

| | 22 | | | Teledyne Technologies, Inc.(b) | | | 8,536 | |

| | | | | | | | 149,631 | |

| | | | | APPAREL & TEXTILE PRODUCTS - 0.1% | | | | |

| | 20 | | | adidas A.G.(c) | | | 4,778 | |

| | 112 | | | Gildan Activewear, Inc.(c) | | | 4,248 | |

| | 35 | | | Hermes International SCA(c) | | | 80,236 | |

| | 86 | | | LVMH Moet Hennessy Louis Vuitton S.E.(c) | | | 65,741 | |

| | 252 | | | NIKE, Inc., Class B | | | 18,993 | |

| | | | | | | | 173,996 | |

| | | | | ASSET MANAGEMENT - 0.1% | | | | |

| | 1,269 | | | Apollo Global Management, Inc. | | | 149,831 | |

| | 110 | | | BlackRock, Inc. | | | 86,605 | |

| | 1,482 | | | EQT A.B.(c) | | | 43,802 | |

| | 46 | | | Groupe Bruxelles Lambert N.V.(c) | | | 3,284 | |

| | 171 | | | Intermediate Capital Group PLC(c) | | | 4,717 | |

| | | | | | | | 288,239 | |

| | | | | AUTOMOTIVE - 0.2% | | | | |

| | 1,084 | | | Niterra Company Ltd.(c) | | | 31,469 | |

| | 251 | | | Rheinmetall A.G.(c) | | | 127,906 | |

| | 702 | | | Tesla, Inc.(b) | | | 138,912 | |

| | | | | | | | 298,287 | |

| | | | | BANKING - 0.5% | | | | |

| | 32,383 | | | Banco Santander S/A(c) | | | 150,225 | |

| | 2,216 | | | Bank of America Corporation | | | 88,130 | |

| | 398 | | | Bank of Ireland Group PLC(c) | | | 4,165 | |

| | 99 | | | BNP Paribas S/A(c) | | | 6,313 | |

| | 891 | | | CaixaBank S/A(c) | | | 4,718 | |

| | 544 | | | Commonwealth Bank of Australia(c) | | | 46,221 | |

See accompanying notes to consolidated financial statements.

FULCRUM DIVERSIFIED ABSOLUTE RETURN FUND

CONSOLIDATED SCHEDULE OF INVESTMENTS (Continued)

June 30, 2024

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 16.7% (Continued) | | | | |

| | | | | BANKING - 0.5% (Continued) | | | | |

| | 8,608 | | | HSBC Holdings PLC(c) | | $ | 74,418 | |

| | 3,226 | | | Intesa Sanpaolo SpA(c) | | | 11,995 | |

| | 1,586 | | | JPMorgan Chase & Company | | | 320,785 | |

| | 56 | | | KBC Group N.V.(c) | | | 3,953 | |

| | 43 | | | Macquarie Group Ltd.(c) | | | 5,871 | |

| | 6,552 | | | Mitsubishi UFJ Financial Group, Inc.(c) | | | 70,421 | |

| | 374 | | | Nordea Bank Abp(c) | | | 4,450 | |

| | 657 | | | Royal Bank of Canada(c) | | | 69,940 | |

| | 378 | | | Toronto-Dominion Bank (The)(c) | | | 20,776 | |

| | 1,151 | | | Wells Fargo & Company | | | 68,358 | |

| | | | | | | | 950,739 | |

| | | | | BEVERAGES - 0.1% | | | | |

| | 2,049 | | | Celsius Holdings, Inc.(b) | | | 116,977 | |

| | 1,269 | | | Monster Beverage Corporation(b) | | | 63,387 | |

| | | | | | | | 180,364 | |

| | | | | BIOTECHNOLOGY & PHARMACEUTICALS - 0.8% | | | | |

| | 540 | | | AbbVie, Inc. | | | 92,621 | |

| | 244 | | | Amgen, Inc. | | | 76,238 | |

| | 789 | | | AstraZeneca PLC(c) | | | 123,237 | |

| | 119 | | | Bayer A.G.(c) | | | 3,363 | |

| | 960 | | | Bristol-Myers Squibb Company | | | 39,869 | |

| | 625 | | | CSL Ltd.(c) | | | 123,070 | |

| | 429 | | | Eli Lilly & Company | | | 388,407 | |

| | 4 | | | GRAIL, Inc.(b) | | | 67 | |

| | 845 | | | Johnson & Johnson | | | 123,505 | |

| | 772 | | | Merck & Company, Inc. | | | 95,574 | |

| | 2,028 | | | Novo Nordisk A/S(c) | | | 292,883 | |

| | 1,258 | | | Rhythm Pharmaceuticals, Inc.(b) | | | 51,653 | |

| | 340 | | | Sanofi S/A(c) | | | 32,758 | |

| | 2,147 | | | Structure Therapeutics, Inc. - ADR(b) | | | 84,313 | |

| | 1,461 | | | Viking Therapeutics, Inc.(b) | | | 77,448 | |

| | | | | | | | 1,605,006 | |

See accompanying notes to consolidated financial statements.

FULCRUM DIVERSIFIED ABSOLUTE RETURN FUND

CONSOLIDATED SCHEDULE OF INVESTMENTS (Continued)

June 30, 2024

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 16.7% (Continued) | | | | |

| | | | | CABLE & SATELLITE - 0.0%(a) | | | | |

| | 1,234 | | | Comcast Corporation, Class A | | $ | 48,323 | |

| | | | | | | | | |

| | | | | CHEMICALS - 0.1% | | | | |

| | 32 | | | Arkema S/A(c) | | | 2,782 | |

| | 210 | | | Dow, Inc. | | | 11,141 | |

| | 518 | | | Sherwin-Williams Company (The) | | | 154,586 | |

| | 26 | | | Yara International ASA(c) | | | 749 | |

| | | | | | | | 169,258 | |

| | | | | COMMERCIAL SUPPORT SERVICES - 0.2% | | | | |

| | 3,896 | | | Castellum A.B.(b)(c) | | | 47,575 | |

| | 210 | | | Compass Group PLC(c) | | | 5,734 | |

| | 1,897 | | | Daiseki Company Ltd.(c) | | | 44,104 | |

| | 68 | | | Intertek Group PLC(c) | | | 4,121 | |

| | 1,670 | | | Recruit Holdings Company Ltd.(c) | | | 89,351 | |

| | 334 | | | Republic Services, Inc. | | | 64,910 | |

| | 601 | | | Waste Connections, Inc.(c) | | | 105,435 | |

| | 373 | | | Waste Management, Inc. | | | 79,576 | |

| | | | | | | | 440,806 | |

| | | | | CONSTRUCTION MATERIALS - 0.1% | | | | |

| | 1,199 | | | Holcim A.G.(c) | | | 106,269 | |

| | 994 | | | Kingspan Group PLC(c) | | | 84,652 | |

| | 129 | | | Owens Corning | | | 22,410 | |

| | | | | | | | 213,331 | |

| | | | | CONTAINERS & PACKAGING - 0.1% | | | | |

| | 664 | | | AptarGroup, Inc. | | | 93,497 | |

| | 4,314 | | | Billerud Aktiebolag(c) | | | 39,937 | |

| | | | | | | | 133,434 | |

| | | | | DATA CENTER REIT - 0.1% | | | | |

| | 161 | | | Equinix, Inc. | | | 121,812 | |

| | | | | | | | | |

| | | | | DIVERSIFIED INDUSTRIALS - 0.3% | | | | |

| | 979 | | | Eaton Corporation PLC(c) | | | 306,965 | |

| | 2,037 | | | Emerson Electric Company | | | 224,396 | |

| | | | | | | | 531,361 | |

See accompanying notes to consolidated financial statements.

FULCRUM DIVERSIFIED ABSOLUTE RETURN FUND

CONSOLIDATED SCHEDULE OF INVESTMENTS (Continued)

June 30, 2024

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 16.7% (Continued) | | | | |

| | | | | E-COMMERCE DISCRETIONARY - 0.3% | | | | |

| | 3,088 | | | Amazon.com, Inc.(b) | | $ | 596,756 | |

| | | | | | | | | |

| | | | | ELECTRIC UTILITIES - 1.6% | | | | |

| | 8,040 | | | AES Corporation (The) | | | 141,263 | |

| | 3,213 | | | Alliant Energy Corporation | | | 163,542 | |

| | 1,886 | | | Ameren Corporation | | | 134,113 | |

| | 2,509 | | | American Electric Power Company, Inc. | | | 220,141 | |

| | 1,721 | | | Boralex, Inc.(c) | | | 42,150 | |

| | 2,024 | | | Consolidated Edison, Inc. | | | 180,986 | |

| | 1,078 | | | Constellation Energy Corporation | | | 215,891 | |

| | 1,113 | | | Duke Energy Corporation | | | 111,556 | |

| | 4,014 | | | Edison International | | | 288,246 | |

| | 472 | | | EDP Renovaveis S/A(c) | | | 6,598 | |

| | 9,611 | | | Enel SpA(c) | | | 66,860 | |

| | 1,086 | | | Engie S/A(c) | | | 15,513 | |

| | 2,722 | | | Evergy, Inc. | | | 144,184 | |

| | 2,574 | | | Eversource Energy | | | 145,972 | |

| | 318 | | | Hydro One Ltd.(c) | | | 9,262 | |

| | 6,400 | | | Iberdrola S/A(c) | | | 83,059 | |

| | 4,518 | | | National Grid PLC(c) | | | 50,408 | |

| | 4,014 | | | NextEra Energy, Inc. | | | 284,232 | |

| | 1,501 | | | Pinnacle West Capital Corporation | | | 114,646 | |

| | 802 | | | PNM Resources, Inc. | | | 29,642 | |

| | 1,340 | | | Public Service Enterprise Group, Inc. | | | 98,758 | |

| | 515 | | | RWE A.G.(c) | | | 17,626 | |

| | 2,697 | | | SEMPRA | | | 205,134 | |

| | 2,302 | | | Southern Company (The) | | | 178,566 | |

| | 2,233 | | | WEC Energy Group, Inc. | | | 175,201 | |

| | | | | | | | 3,123,549 | |

| | | | | ELECTRICAL EQUIPMENT - 0.7% | | | | |

| | 1,357 | | | AMETEK, Inc. | | | 226,226 | |

| | 3,264 | | | Amphenol Corporation, Class A | | | 219,896 | |

| | 755 | | | Assa Abloy A.B., Class B(c) | | | 21,346 | |

| | 815 | | | Daikin Industries Ltd.(c) | | | 113,334 | |

See accompanying notes to consolidated financial statements.

FULCRUM DIVERSIFIED ABSOLUTE RETURN FUND

CONSOLIDATED SCHEDULE OF INVESTMENTS (Continued)

June 30, 2024

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 16.7% (Continued) | | | | |

| | | | | ELECTRICAL EQUIPMENT - 0.7% (Continued) | | | | |

| | 615 | | | Hubbell, Inc. | | $ | 224,770 | |

| | 46 | | | Lennox International, Inc. | | | 24,609 | |

| | 514 | | | Nibe Industrier A.B.(c) | | | 2,180 | |

| | 21 | | | Novanta, Inc.(b) | | | 3,425 | |

| | 2,670 | | | nVent Electric PLC(c) | | | 204,549 | |

| | 15 | | | Schindler Holding A.G.(c) | | | 3,770 | |

| | 753 | | | Schneider Electric S.E.(c) | | | 180,930 | |

| | 512 | | | Trane Technologies PLC(c) | | | 168,412 | |

| | | | | | | | 1,393,447 | |

| | | | | ENGINEERING & CONSTRUCTION - 0.3% | | | | |

| | 328 | | | AECOM | | | 28,910 | |

| | 404 | | | Arcosa, Inc. | | | 33,698 | |

| | 3,150 | | | Cellnex Telecom S/A(c) | | | 102,479 | |

| | 149 | | | Comfort Systems USA, Inc. | | | 45,314 | |

| | 571 | | | Construction Partners, Inc., Class A(b) | | | 31,525 | |

| | 961 | | | Fluor Corporation(b) | | | 41,852 | |

| | 542 | | | Granite Construction, Inc. | | | 33,588 | |

| | 110 | | | Installed Building Products, Inc. | | | 22,625 | |

| | 260 | | | Jacobs Solutions, Inc. | | | 36,325 | |

| | 588 | | | KBR, Inc. | | | 37,714 | |

| | 384 | | | Primoris Services Corporation | | | 19,158 | |

| | 171 | | | Quanta Services, Inc. | | | 43,449 | |

| | 466 | | | Sterling Infrastructure, Inc.(b) | | | 55,146 | |

| | 206 | | | Tetra Tech, Inc. | | | 42,123 | |

| | 60 | | | TopBuild Corporation(b) | | | 23,116 | |

| | | | | | | | 597,022 | |

| | | | | ENTERTAINMENT CONTENT - 0.1% | | | | |

| | 234 | | | Capcom Company Ltd.(c) | | | 4,412 | |

| | 148 | | | Konami Group Corporation(c) | | | 10,654 | |

| | 104 | | | Square Enix Holdings Company Ltd.(c) | | | 3,124 | |

| | 546 | | | Take-Two Interactive Software, Inc.(b) | | | 84,897 | |

| | | | | | | | 103,087 | |

| | | | | FOOD - 0.5% | | | | |

| | 707 | | | Bakkafrost P/F(c) | | | 35,893 | |

See accompanying notes to consolidated financial statements.

FULCRUM DIVERSIFIED ABSOLUTE RETURN FUND

CONSOLIDATED SCHEDULE OF INVESTMENTS (Continued)

June 30, 2024

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 16.7% (Continued) | | | | |

| | | | | FOOD - 0.5% (Continued) | | | | |

| | 5,381 | | | BellRing Brands, Inc.(b) | | $ | 307,470 | |

| | 4,813 | | | Mowi ASA(c) | | | 80,111 | |

| | 1,995 | | | Nestle S/A(c) | | | 203,691 | |

| | 128 | | | Salmar ASA(c) | | | 6,738 | |

| | 1,806 | | | Simply Good Foods Company (The)(b) | | | 65,251 | |

| | 6,708 | | | Vital Farms, Inc.(b) | | | 313,733 | |

| | | | | | | | 1,012,887 | |

| | | | | FORESTRY, PAPER & WOOD PRODUCTS - 0.0%(a) | | | | |

| | 970 | | | West Fraser Timber Company Ltd.(c) | | | 74,490 | |

| | | | | | | | | |

| | | | | GAS & WATER UTILITIES - 0.1% | | | | |

| | 1,822 | | | American Water Works Company, Inc. | | | 235,329 | |

| | 1,078 | | | Veolia Environnement S/A(c) | | | 32,242 | |

| | | | | | | | 267,571 | |

| | | | | HEALTH CARE FACILITIES & SERVICES - 1.5% | | | | |

| | 4,889 | | | Cardinal Health, Inc. | | | 480,686 | |

| | 2,412 | | | Cencora, Inc. | | | 543,424 | |

| | 2,612 | | | Centene Corporation(b) | | | 173,176 | |

| | 710 | | | Cigna Group (The) | | | 234,705 | |

| | 831 | | | CVS Health Corporation | | | 49,079 | |

| | 591 | | | Elevance Health, Inc. | | | 320,239 | |

| | 177 | | | Humana, Inc. | | | 66,136 | |

| | 14 | | | Lonza Group A.G.(c) | | | 7,643 | |

| | 1,242 | | | McKesson Corporation | | | 725,377 | |

| | 388 | | | Molina Healthcare, Inc.(b) | | | 115,352 | |

| | 616 | | | UnitedHealth Group, Inc. | | | 313,704 | |

| | | | | | | | 3,029,521 | |

| | | | | HOME CONSTRUCTION - 0.5% | | | | |

| | 244 | | | Armstrong World Industries, Inc. | | | 27,631 | |

| | 525 | | | AZEK Company, Inc. (The)(b) | | | 22,118 | |

| | 1,185 | | | DR Horton, Inc. | | | 167,002 | |

| | 263 | | | Fortune Brands Innovations, Inc. | | | 17,079 | |

| | 1,944 | | | KB Home | | | 136,430 | |

| | 599 | | | Lennar Corporation, Class A | | | 89,772 | |

See accompanying notes to consolidated financial statements.

FULCRUM DIVERSIFIED ABSOLUTE RETURN FUND

CONSOLIDATED SCHEDULE OF INVESTMENTS (Continued)

June 30, 2024

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 16.7% (Continued) | | | | |

| | | | | HOME CONSTRUCTION - 0.5% (Continued) | | | | |

| | 404 | | | LGI Homes, Inc.(b) | | $ | 36,154 | |

| | 275 | | | Masco Corporation | | | 18,334 | |

| | 239 | | | Meritage Homes Corporation | | | 38,682 | |

| | 19 | | | NVR, Inc.(b) | | | 144,183 | |

| | 1,220 | | | PulteGroup, Inc. | | | 134,322 | |

| | 1,541 | | | Taylor Morrison Home Corporation(b) | | | 85,433 | |

| | 749 | | | Toll Brothers, Inc. | | | 86,270 | |

| | 2,009 | | | Tri Pointe Homes, Inc.(b) | | | 74,835 | |

| | | | | | | | 1,078,245 | |

| | | | | HOUSEHOLD PRODUCTS - 0.3% | | | | |

| | 1,351 | | | Church & Dwight Company, Inc. | | | 140,072 | |

| | 156 | | | Colgate-Palmolive Company | | | 15,138 | |

| | 45 | | | Estee Lauder Companies, Inc. (The), Class A | | | 4,788 | |

| | 1,545 | | | Procter & Gamble Company (The) | | | 254,801 | |

| | 287 | | | Reckitt Benckiser Group PLC(c) | | | 15,535 | |

| | 3,432 | | | Unicharm Corporation(c) | | | 110,236 | |

| | | | | | | | 540,570 | |

| | | | | INDUSTRIAL REIT - 0.1% | | | | |

| | 783 | | | Prologis, Inc. | | | 87,939 | |

| | 130 | | | Warehouses De Pauw CVA(c) | | | 3,523 | |

| | | | | | | | 91,462 | |

| | | | | INDUSTRIAL SUPPORT SERVICES - 0.0%(a) | | | | |

| | 53 | | | Ashtead Group PLC(c) | | | 3,539 | |

| | 81 | | | Ferguson PLC(c) | | | 15,686 | |

| | 95 | | | SiteOne Landscape Supply, Inc.(b) | | | 11,534 | |

| | 42 | | | United Rentals, Inc. | | | 27,162 | |

| | | | | | | | 57,921 | |

| | | | | INFRASTRUCTURE REIT - 0.0%(a) | | | | |

| | 94 | | | American Tower Corporation, Class A | | | 18,272 | |

| | | | | | | | | |

| | | | | INSTITUTIONAL FINANCIAL SERVICES - 0.1% | | | | |

| | 191 | | | CME Group, Inc. | | | 37,551 | |

| | 135 | | | Deutsche Boerse A.G.(c) | | | 27,636 | |

| | 689 | | | Interactive Brokers Group, Inc., Class A | | | 84,471 | |

See accompanying notes to consolidated financial statements.

FULCRUM DIVERSIFIED ABSOLUTE RETURN FUND

CONSOLIDATED SCHEDULE OF INVESTMENTS (Continued)

June 30, 2024

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 16.7% (Continued) | | | | |

| | | | | INSTITUTIONAL FINANCIAL SERVICES - 0.1% (Continued) | | | | |

| | 299 | | | London Stock Exchange Group PLC(c) | | $ | 35,529 | |

| | 881 | | | Morgan Stanley | | | 85,625 | |

| | | | | | | | 270,812 | |

| | | | | INSURANCE - 0.5% | | | | |

| | 27 | | | Allstate Corporation (The) | | | 4,311 | |

| | 41 | | | Aon PLC, Class A(c) | | | 12,037 | |

| | 114 | | | Arch Capital Group Ltd.(b)(c) | | | 11,501 | |

| | 395 | | | Arthur J Gallagher & Company | | | 102,427 | |

| | 501 | | | Berkshire Hathaway, Inc., Class B(b) | | | 203,806 | |

| | 486 | | | Chubb Ltd. (c) | | | 123,969 | |

| | 276 | | | Coface S/A(c) | | | 3,847 | |

| | 129 | | | Fairfax Financial Holdings Ltd.(c) | | | 146,736 | |

| | 1,109 | | | Hartford Financial Services Group, Inc. (The) | | | 111,499 | |

| | 149 | | | Marsh & McLennan Companies, Inc. | | | 31,397 | |

| | 876 | | | MS&AD Insurance Group Holdings, Inc.(c) | | | 19,468 | |

| | 178 | | | Progressive Corporation (The) | | | 36,972 | |

| | 126 | | | SCOR S.E.(c) | | | 3,194 | |

| | 5 | | | Swiss Life Holding A.G.(c) | | | 3,677 | |

| | 817 | | | Tokio Marine Holdings, Inc.(c) | | | 30,498 | |

| | 501 | | | Travelers Companies, Inc. (The) | | | 101,873 | |

| | 877 | | | Voya Financial, Inc. | | | 62,399 | |

| | | | | | | | 1,009,611 | |

| | | | | INTERNET MEDIA & SERVICES - 0.7% | | | | |

| | 484 | | | Airbnb, Inc., Class A(b) | | | 73,389 | |

| | 1,789 | | | Alphabet, Inc., Class A | | | 325,867 | |

| | 1,560 | | | Alphabet, Inc., Class C | | | 286,136 | |

| | 401 | | | Auto Trader Group PLC(c) | | | 4,061 | |

| | 744 | | | Meta Platforms, Inc., Class A | | | 375,140 | |

| | 172 | | | Netflix, Inc.(b) | | | 116,079 | |

| | 30 | | | REA Group Ltd.(c) | | | 3,935 | |

| | 500 | | | Rightmove PLC(c) | | | 3,394 | |

| | 379 | | | Shopify, Inc., Class A(b)(c) | | | 25,044 | |

| | 49 | | | Spotify Technology S/A(b)(c) | | | 15,376 | |

See accompanying notes to consolidated financial statements.

FULCRUM DIVERSIFIED ABSOLUTE RETURN FUND

CONSOLIDATED SCHEDULE OF INVESTMENTS (Continued)

June 30, 2024

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 16.7% (Continued) | | | | |

| | | | | INTERNET MEDIA & SERVICES - 0.7% (Continued) | | | | |

| | 1,885 | | | Uber Technologies, Inc.(b) | | $ | 137,002 | |

| | | | | | | | 1,365,423 | |

| | | | | LEISURE FACILITIES & SERVICES - 0.3% | | | | |

| | 4,108 | | | Chipotle Mexican Grill, Inc.(b) | | | 257,366 | |

| | 219 | | | McDonald’s Corporation | | | 55,810 | |

| | 1,094 | | | Starbucks Corporation | | | 85,168 | |

| | 1,026 | | | TKO Group Holdings, Inc. | | | 110,798 | |

| | | | | | | | 509,142 | |

| | | | | MACHINERY - 0.1% | | | | |

| | 1,580 | | | Atlas Copco A.B., Class A(c) | | | 29,701 | |

| | 303 | | | Atlas Copco A.B., Class B(c) | | | 4,894 | |

| | 702 | | | Crane Company | | | 101,776 | |

| | 1,186 | | | Ingersoll Rand, Inc. | | | 107,736 | |

| | 301 | | | TOMRA Systems ASA(c) | | | 3,592 | |

| | | | | | | | 247,699 | |

| | | | | MEDICAL EQUIPMENT & DEVICES - 0.2% | | | | |

| | 1,099 | | | Boston Scientific Corporation(b) | | | 84,634 | |

| | 324 | | | Cochlear Ltd.(c) | | | 71,783 | |

| | 930 | | | Edwards Lifesciences Corporation(b) | | | 85,904 | |

| | 1,051 | | | Hoya Corporation(c) | | | 122,207 | |

| | 26 | | | Illumina, Inc.(b) | | | 2,714 | |

| | 224 | | | Insulet Corporation(b) | | | 45,203 | |

| | 31 | | | Mettler-Toledo International, Inc.(b) | | | 43,325 | |

| | | | | | | | 455,770 | |

| | | | | METALS & MINING - 0.2% | | | | |

| | 20,985 | | | Denison Mines Corporation(b)(c) | | | 42,025 | |

| | 4,755 | | | Energy Fuels, Inc.(b)(c) | | | 28,811 | |

| | 645 | | | Franco-Nevada Corporation(c) | | | 76,446 | |

| | 170 | | | Glencore PLC(c) | | | 969 | |

| | 724 | | | Hecla Mining Company | | | 3,511 | |

| | 1,115 | | | Newmont Corporation | | | 46,685 | |

| | 217 | | | Pan American Silver Corporation(c) | | | 4,314 | |

| | 607 | | | Rio Tinto Ltd.(c) | | | 48,181 | |

| | 933 | | | Rio Tinto PLC(c) | | | 61,341 | |

See accompanying notes to consolidated financial statements.

FULCRUM DIVERSIFIED ABSOLUTE RETURN FUND

CONSOLIDATED SCHEDULE OF INVESTMENTS (Continued)

June 30, 2024

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 16.7% (Continued) | | | | |

| | | | | METALS & MINING - 0.2% (Continued) | | | | |

| | 30 | | | Royal Gold, Inc. | | $ | 3,755 | |

| | | | | | | | 316,038 | |

| | | | | MULTI ASSET CLASS REIT - 0.0%(a) | | | | |

| | 5,218 | | | Segro PLC(c) | | | 59,246 | |

| | | | | | | | | |

| | | | | OIL & GAS PRODUCERS - 0.3% | | | | |

| | 3,607 | | | Antero Resources Corporation(b) | | | 117,697 | |

| | 1,415 | | | BP PLC(c) | | | 8,500 | |

| | 1,797 | | | CNX Resources Corporation(b) | | | 43,667 | |

| | 4,598 | | | Eni SpA(c) | | | 70,701 | |

| | 3,374 | | | Itochu Enex Company Ltd.(c) | | | 31,901 | |

| | 245 | | | Murphy USA, Inc. | | | 115,018 | |

| | 1,896 | | | Ovintiv, Inc. | | | 88,866 | |

| | 1,299 | | | Parkland Corporation(c) | | | 36,410 | |

| | | | | | | | 512,760 | |

| | | | | OIL & GAS SERVICES & EQUIPMENT - 0.2% | | | | |

| | 8,879 | | | Aker Solutions ASA(c) | | | 36,760 | |

| | 3,729 | | | Baker Hughes Company | | | 131,149 | |

| | 2,220 | | | Expro Group Holdings N.V.(b) | | | 50,882 | |

| | 1,872 | | | Schlumberger N.V.(c) | | | 88,321 | |

| | | | | | | | 307,112 | |

| | | | | PUBLISHING & BROADCASTING - 0.0%(a) | | | | |

| | 3,700 | | | Future PLC(c) | | | 49,064 | |

| | 128 | | | Schibsted ASA(c) | | | 3,779 | |

| | | | | | | | 52,843 | |

| | | | | RESIDENTIAL REIT - 0.0%(a) | | | | |

| | 19 | | | AvalonBay Communities, Inc. | | | 3,931 | |

| | 278 | | | UNITE Group PLC (The)(c) | | | 3,135 | |

| | | | | | | | 7,066 | |

| | | | | RETAIL - CONSUMER STAPLES - 1.3% | | | | |

| | 871 | | | Costco Wholesale Corporation | | | 740,341 | |

| | 8,712 | | | Hims & Hers Health, Inc.(b) | | | 175,895 | |

| | 1,442 | | | Kroger Company (The) | | | 71,999 | |

| | 2,595 | | | Sprouts Farmers Market, Inc.(b) | | | 217,098 | |

See accompanying notes to consolidated financial statements.

FULCRUM DIVERSIFIED ABSOLUTE RETURN FUND

CONSOLIDATED SCHEDULE OF INVESTMENTS (Continued)

June 30, 2024

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 16.7% (Continued) | | | | |

| | | | | RETAIL - CONSUMER STAPLES - 1.3% (Continued) | | | | |

| | 17,708 | | | Tesco PLC(c) | | $ | 68,498 | |

| | 18,285 | | | Walmart, Inc. | | | 1,238,077 | |

| | | | | | | | 2,511,908 | |

| | | | | RETAIL - DISCRETIONARY - 0.3% | | | | |

| | 449 | | | Brunello Cucinelli SpA(c) | | | 44,972 | |

| | 119 | | | Builders FirstSource, Inc.(b) | | | 16,471 | |

| | 506 | | | Home Depot, Inc. (The) | | | 174,185 | |

| | 39,617 | | | JD Sports Fashion PLC(c) | | | 59,846 | |

| | 410 | | | Lowe’s Companies, Inc. | | | 90,389 | |

| | 210 | | | Lululemon Athletica, Inc.(b) | | | 62,727 | |

| | 903 | | | Pets at Home Group PLC(c) | | | 3,372 | |

| | 1,122 | | | TJX Companies, Inc. (The) | | | 123,532 | |

| | | | | | | | 575,494 | |

| | | | | RETAIL REIT - 0.0%(a) | | | | |

| | 63 | | | Realty Income Corporation | | | 3,328 | |

| | | | | | | | | |

| | | | | SELF-STORAGE REIT - 0.0%(a) | | | | |

| | 235 | | | Big Yellow Group PLC(c) | | | 3,488 | |

| | 31 | | | Public Storage | | | 8,917 | |

| | | | | | | | 12,405 | |

| | | | | SEMICONDUCTORS - 1.1% | | | | |

| | 559 | | | Applied Materials, Inc. | | | 131,918 | |

| | 262 | | | BE Semiconductor Industries N.V.(c) | | | 43,826 | |

| | 186 | | | Broadcom, Inc. | | | 298,629 | |

| | 258 | | | Infineon Technologies A.G.(c) | | | 9,481 | |

| | 104 | | | KLA Corporation | | | 85,749 | |

| | 121 | | | Lam Research Corporation | | | 128,847 | |

| | 285 | | | Microchip Technology, Inc. | | | 26,078 | |

| | 1,078 | | | Micron Technology, Inc. | | | 141,789 | |

| | 8,141 | | | NVIDIA Corporation | | | 1,005,739 | |

| | 359 | | | NXP Semiconductors N.V.(c) | | | 96,603 | |

| | 357 | | | QUALCOMM, Inc. | | | 71,107 | |

| | 565 | | | Taiwan Semiconductor Manufacturing Company Ltd. - ADR | | | 98,202 | |

| | | | | | | | 2,137,968 | |

See accompanying notes to consolidated financial statements.

FULCRUM DIVERSIFIED ABSOLUTE RETURN FUND

CONSOLIDATED SCHEDULE OF INVESTMENTS (Continued)

June 30, 2024

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 16.7% (Continued) | | | | |

| | | | | SOFTWARE - 1.2% | | | | |

| | 150 | | | Adobe, Inc.(b) | | $ | 83,331 | |

| | 525 | | | Akamai Technologies, Inc.(b) | | | 47,292 | |

| | 202 | | | ANSYS, Inc.(b) | | | 64,943 | |

| | 82 | | | Autodesk, Inc.(b) | | | 20,291 | |

| | 338 | | | Cadence Design Systems, Inc.(b) | | | 104,020 | |

| | 19 | | | Cloudflare, Inc., Class A(b) | | | 1,574 | |

| | 66 | | | Crowdstrike Holdings, Inc., Class A(b) | | | 25,291 | |

| | 141 | | | Dassault Systemes S.E.(c) | | | 5,332 | |

| | 129 | | | Elastic N.V.(b) | | | 14,694 | |

| | 406 | | | Fortinet, Inc.(b) | | | 24,470 | |

| | 45 | | | HubSpot, Inc.(b) | | | 26,541 | |

| | 115 | | | Intuit, Inc. | | | 75,579 | |

| | 339 | | | JFrog Ltd.(b) | | | 12,729 | |

| | 2,470 | | | Microsoft Corporation | | | 1,103,966 | |

| | 59 | | | nCino, Inc.(b) | | | 1,856 | |

| | 40 | | | Okta, Inc.(b) | | | 3,744 | |

| | 1,049 | | | Oracle Corporation | | | 148,118 | |

| | 278 | | | Palo Alto Networks, Inc.(b) | | | 94,245 | |

| | 138 | | | Pegasystems, Inc. | | | 8,353 | |

| | 21 | | | PTC, Inc.(b) | | | 3,815 | |

| | 173 | | | Qualys, Inc.(b) | | | 24,670 | |

| | 208 | | | Rapid7, Inc.(b) | | | 8,992 | |

| | 83 | | | Roper Technologies, Inc. | | | 46,784 | |

| | 434 | | | Salesforce, Inc. | | | 111,581 | |

| | 323 | | | SAP S.E.(c) | | | 65,576 | |

| | 180 | | | ServiceNow, Inc.(b) | | | 141,601 | |

| | 199 | | | Smartsheet, Inc., Class A(b) | | | 8,772 | |

| | 33 | | | Synopsys, Inc.(b) | | | 19,637 | |

| | 385 | | | Tenable Holdings, Inc.(b) | | | 16,778 | |

| | 9 | | | Tyler Technologies, Inc.(b) | | | 4,525 | |

| | 159 | | | Varonis Systems, Inc.(b) | | | 7,627 | |

| | 37 | | | Veeva Systems, Inc., Class A(b) | | | 6,771 | |

| | 228 | | | Workday, Inc., Class A(b) | | | 50,972 | |

| | | | | | | | 2,384,470 | |

See accompanying notes to consolidated financial statements.

FULCRUM DIVERSIFIED ABSOLUTE RETURN FUND

CONSOLIDATED SCHEDULE OF INVESTMENTS (Continued)

June 30, 2024

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 16.7% (Continued) | | | | |

| | | | | SPECIALTY FINANCE - 0.0%(a) | | | | |

| | 121 | | | American Express Company | | $ | 28,018 | |

| | | | | | | | | |

| | | | | STEEL - 0.0%(a) | | | | |

| | 36 | | | ArcelorMittal S/A(c) | | | 824 | |

| | 1,146 | | | Mitsui & Company Ltd.(c) | | | 26,010 | |

| | | | | | | | 26,834 | |

| | | | | TECHNOLOGY HARDWARE - 0.5% | | | | |

| | 4,462 | | | Apple, Inc. | | | 939,787 | |

| | 450 | | | Nintendo Company Ltd.(c) | | | 23,934 | |

| | 520 | | | Panasonic Holdings Corporation(c) | | | 4,257 | |

| | 800 | | | Sony Group Corporation(c) | | | 67,833 | |

| | 15 | | | Super Micro Computer, Inc.(b) | | | 12,290 | |

| | | | | | | | 1,048,101 | |

| | | | | TECHNOLOGY SERVICES - 0.6% | | | | |

| | 210 | | | Accenture PLC, Class A(c) | | | 63,716 | |

| | 3 | | | Adyen N.V.(b)(c) | | | 3,578 | |

| | 1,499 | | | Amadeus IT Group S/A(c) | | | 99,783 | |

| | 42 | | | Amdocs Ltd. | | | 3,315 | |

| | 83 | | | Automatic Data Processing, Inc. | | | 19,811 | |

| | 29 | | | Booz Allen Hamilton Holding Corporation | | | 4,463 | |

| | 386 | | | Broadridge Financial Solutions, Inc. | | | 76,042 | |

| | 103 | | | Computacenter PLC(c) | | | 3,739 | |

| | 147 | | | Corpay, Inc.(b) | | | 39,162 | |

| | 15 | | | Equifax, Inc. | | | 3,637 | |

| | 114 | | | Experian PLC(c) | | | 5,312 | |

| | 8 | | | FactSet Research Systems, Inc. | | | 3,266 | |

| | 25 | | | Fair Isaac Corporation(b) | | | 37,217 | |

| | 877 | | | Fiserv, Inc.(b) | | | 130,708 | |

| | 305 | | | International Business Machines Corporation | | | 52,750 | |

| | 57 | | | Jack Henry & Associates, Inc. | | | 9,463 | |

| | 439 | | | Mastercard, Inc., Class A | | | 193,669 | |

| | 53 | | | MSCI, Inc. | | | 25,533 | |

| | 1,079 | | | Netcompany Group A/S(b)(c) | | | 46,302 | |

| | 39 | | | Paychex, Inc. | | | 4,624 | |

See accompanying notes to consolidated financial statements.

FULCRUM DIVERSIFIED ABSOLUTE RETURN FUND

CONSOLIDATED SCHEDULE OF INVESTMENTS (Continued)

June 30, 2024

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 16.7% (Continued) | | | | |

| | | | | TECHNOLOGY SERVICES - 0.6% (Continued) | | | | |

| | 329 | | | PayPal Holdings, Inc.(b) | | $ | 19,092 | |

| | 926 | | | QinetiQ Group PLC(c) | | | 5,188 | |

| | 376 | | | RELX PLC(c) | | | 17,296 | |

| | 220 | | | S&P Global, Inc. | | | 98,120 | |

| | 211 | | | Softcat PLC(c) | | | 4,846 | |

| | 17 | | | Verisk Analytics, Inc. | | | 4,582 | |

| | 828 | | | Visa, Inc., Class A | | | 217,326 | |

| | 311 | | | WEX, Inc.(b) | | | 55,091 | |

| | 134 | | | Wolters Kluwer N.V.(c) | | | 22,221 | |

| | | | | | | | 1,269,852 | |

| | | | | TELECOMMUNICATIONS - 0.0%(a) | | | | |

| | 214 | | | TELUS Corporation(c) | | | 3,239 | |

| | 107 | | | T-Mobile US, Inc. | | | 18,851 | |

| | 1,333 | | | Verizon Communications, Inc. | | | 54,973 | |

| | | | | | | | 77,063 | |

| | | | | TRANSPORTATION & LOGISTICS - 0.4% | | | | |

| | 1 | | | AP Moller - Maersk A/S - Series A(c) | | | 1,698 | |

| | 2,845 | | | Ardmore Shipping Corporation(c) | | | 64,098 | |

| | 1,733 | | | Canadian Pacific Kansas City Ltd.(c) | | | 136,464 | |

| | 632 | | | CH Robinson Worldwide, Inc. | | | 55,692 | |

| | 6,657 | | | DHT Holdings, Inc.(c) | | | 77,021 | |

| | 486 | | | DSV A/S(c) | | | 74,474 | |

| | 691 | | | Expeditors International of Washington, Inc. | | | 86,230 | |

| | 3,317 | | | Frontline PLC(c) | | | 85,446 | |

| | 1,445 | | | International Seaways, Inc. | | | 85,443 | |

| | 11 | | | Kuehne + Nagel International A.G.(c) | | | 3,164 | |

| | 952 | | | Scorpio Tankers, Inc.(c) | | | 77,388 | |

| | 2 | | | Svitzer A/S(b)(c) | | | 75 | |

| | 1,232 | | | Teekay Tankers Ltd., Class A(c) | | | 84,774 | |

| | | | | | | | 831,967 | |

| | | | | WHOLESALE - CONSUMER STAPLES - 0.0%(a) | | | | |

| | 536 | | | ITOCHU Corporation(c) | | | 26,169 | |

See accompanying notes to consolidated financial statements.

FULCRUM DIVERSIFIED ABSOLUTE RETURN FUND

CONSOLIDATED SCHEDULE OF INVESTMENTS (Continued)

June 30, 2024

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 16.7% (Continued) | | | | |

| | | | | WHOLESALE - DISCRETIONARY - 0.0%(a) | | | | |

| | 2,133 | | | Toyota Tsusho Corporation(c) | | $ | 41,529 | |

| | | | | | | | | |

| | | | | TOTAL COMMON STOCKS (Cost $29,358,319) | | | 33,381,782 | |

| | | | | | | | | |

| | | | | EXCHANGE-TRADED FUNDS — 0.4% | | | | |

| | | | | EQUITY - 0.4% | | | | |

| | 3,748 | | | Global X MSCI Argentina ETF | | | 212,924 | |

| | 11,882 | | | iShares MSCI Taiwan ETF | | | 643,885 | |

| | | | | TOTAL EXCHANGE-TRADED FUNDS (Cost $770,665) | | | 856,809 | |

| | Contracts | | | | | Broker/

Counterparty | | | Expiration Date | | | Exercise Price | | | Notional Value | | | Fair Value | |

| | | | | CURRENCY OPTIONS PURCHASED - 0.8% | | | | | | | | | | | | | | | | | | |

| | | | | CALL OPTIONS PURCHASED - 0.3% | | | | | | | | | | | | | | | | | | |

| | | | | AUD/USD | | JPM | | | 07/08/2024 | | | $ | 0.7000 | | | $ | 207,000 | | | $ | 22 | |

| | | | | AUD/USD | | JPM | | | 09/17/2024 | | | | 0.7950 | | | | 3,129,000 | | | | 279 | |

| | | | | EUR/CHF | | JPM | | | 07/19/2024 | | | | 0.9750 | | | | 3,659,000 | | | | 5,200 | |

| | | | | EUR/GBP | | JPM | | | 07/11/2024 | | | | 0.8640 | | | | 598,000 | | | | 18,135 | |

| | | | | EUR/HUF | | JPM | | | 09/11/2024 | | | | 420.0000 | | | | 148,000 | | | | 10,043 | |

| | | | | EUR/NOK | | JPM | | | 07/26/2024 | | | | 11.4000 | | | | 3,924,000 | | | | 9,161 | |

| | | | | MXN/JPY | | JPM | | | 09/25/2024 | | | | 9.3000 | | | | 3,623,000 | | | | 25,608 | |

| | | | | USD/CNH | | JPM | | | 07/11/2024 | | | | 7.2600 | | | | 4,652,000 | | | | 5 | |

| | | | | USD/CNH | | JPM | | | 07/25/2024 | | | | 7.5000 | | | | 4,703,000 | | | | 50 | |

| | | | | USD/CNH | | JPM | | | 08/29/2024 | | | | 7.3000 | | | | 4,063,000 | | | | 2,757 | |

| | | | | USD/CNH | | JPM | | | 09/27/2024 | | | | 7.3700 | | | | 6,228,000 | | | | 14,532 | |

| | | | | USD/CNH | | JPM | | | 10/18/2024 | | | | 7.7000 | | | | 216,000 | | | | 3,337 | |

| | | | | USD/CNH | | JPM | | | 10/30/2024 | | | | 7.5000 | | | | 214,000 | | | | 15,749 | |

| | | | | USD/CNH | | JPM | | | 11/28/2024 | | | | 7.4500 | | | | 19,334,000 | | | | 59,010 | |

| | | | | USD/CNH | | JPM | | | 12/18/2024 | | | | 7.6250 | | | | 2,250,000 | | | | 134,276 | |

| | | | | USD/CNH | | JPM | | | 12/20/2024 | | | | 7.7750 | | | | 45,000 | | | | 1,289 | |

| | | | | USD/JPY | | JPM | | | 07/15/2024 | | | | 162.0000 | | | | 4,077,000 | | | | 14,285 | |

| | | | | USD/JPY | | JPM | | | 07/16/2024 | | | | 161.0000 | | | | 6,071,000 | | | | 5,052 | |

| | | | | USD/JPY | | JPM | | | 02/17/2025 | | | | 171.0000 | | | | 872,000 | | | | 93,214 | |

| | | | | USD/JPY | | JPM | | | 02/25/2025 | | | | 175.0000 | | | | 30,683,000 | | | | 118,909 | |

| | | | | USD/JPY | | JPM | | | 06/30/2025 | | | | 182.5000 | | | | 207,000 | | | | 9,608 | |

| | | | | USD/KRW | | JPM | | | 07/22/2024 | | | | 1,406.0000 | | | | 3,249,000 | | | | 5,574 | |

| | | | | USD/MXN | | JPM | | | 07/12/2024 | | | | 19.5000 | | | | 2,148,000 | | | | 421 | |

| | | | | USD/MXN | | JPM | | | 07/16/2024 | | | | 19.5000 | | | | 3,194,000 | | | | 357 | |

| | | | | USD/MXN | | JPM | | | 09/10/2024 | | | | 19.2000 | | | | 860,000 | | | | 12,288 | |

| | | | | USD/TWD | | JPM | | | 03/31/2025 | | | | 33.5000 | | | | 11,123,000 | | | | 86,817 | |

| | | | | TOTAL CALL OPTIONS PURCHASED (Cost - $755,924) | | | | | | | | | | | | | | | | | 645,978 | |

See accompanying notes to consolidated financial statements.

FULCRUM DIVERSIFIED ABSOLUTE RETURN FUND

CONSOLIDATED SCHEDULE OF INVESTMENTS (Continued)

June 30, 2024

| Contracts | | | | | Broker/

Counterparty | | | Expiration Date | | | Exercise Price | | | Notional Value | | | Fair Value | |

| | | | | CURRENCY OPTIONS PURCHASED - 0.8% (Continued) | | | | | | | | | | | | | | | | | | |

| | | | | PUT OPTIONS PURCHASED - 0.5% | | | | | | | | | | | | | | | | | | |

| | | | | EUR/AUD | | JPM | | | 07/11/2024 | | | $ | 1.6250 | | | $ | 6,254,000 | | | $ | 7 | |

| | | | | EUR/CHF | | JPM | | | 08/12/2024 | | | | 0.9250 | | | | 299,000 | | | | 19,244 | |

| | | | | EUR/GBP | | JPM | | | 07/11/2024 | | | | 0.8210 | | | | 149,000 | | | | 1,513 | |

| | | | | EUR/GBP | | JPM | | | 07/11/2024 | | | | 0.8350 | | | | 3,022,000 | | | | 759 | |

| | | | | EUR/USD | | JPM | | | 07/11/2024 | | | | 1.0700 | | | | 4,686,000 | | | | 6,614 | |

| | | | | EUR/USD | | JPM | | | 07/19/2024 | | | | 1.0110 | | | | 593,000 | | | | 6,003 | |

| | | | | EURUSD | | JPM | | | 07/19/2024 | | | | 1.0400 | | | | 3,983,000 | | | | 4,022 | |

| | | | | EUR/USD | | JPM | | | 07/23/2024 | | | | 1.0500 | | | | 201,000 | | | | 26,046 | |

| | | | | EUR/USD | | JPM | | | 08/09/2024 | | | | 1.0500 | | | | 1,236,000 | | | | 187,953 | |

| | | | | EUR/USD | | JPM | | | 08/13/2024 | | | | 1.0550 | | | | 1,238,000 | | | | 251,232 | |

| | | | | EUR/USD | | JPM | | | 09/11/2024 | | | | 1.0500 | | | | 967,000 | | | | 179,482 | |

| | | | | EUR/USD | | JPM | | | 09/27/2024 | | | | 1.0100 | | | | 256,000 | | | | 11,362 | |

| | | | | GBP/USD | | JPM | | | 07/12/2024 | | | | 1.2600 | | | | 2,798,000 | | | | 4,869 | |

| | | | | GBP/USD | | JPM | | | 07/17/2024 | | | | 1.1800 | | | | 60,000 | | | | 47 | |

| | | | | NOK/SEK | | JPM | | | 08/27/2024 | | | | 0.9600 | | | | 5,179,000 | | | | 43,724 | |

| | | | | USD/CHF | | JPM | | | 08/05/2024 | | | | 0.8500 | | | | 216,000 | | | | 1,864 | |

| | | | | USD/JPY | | JPM | | | 07/17/2024 | | | | 152.5000 | | | | 3,738,000 | | | | 1,968 | |

| | | | | USD/JPY | | JPM | | | 07/17/2024 | | | | 155.0000 | | | | 3,203,000 | | | | 3,707 | |

| | | | | USD/JPY | | JPM | | | 12/03/2026 | | | | 110.0000 | | | | 633,000 | | | | 43,218 | |

| | | | | USD/JPY | | JPM | | | 12/03/2026 | | | | 110.0000 | | | | 730,000 | | | | 38,623 | |

| | | | | USD/KRW | | JPM | | | 07/22/2024 | | | | 1,365.0000 | | | | 3,249,000 | | | | 10,522 | |

| | | | | USD/MXN | | JPM | | | 07/03/2024 | | | | 16.5000 | | | | 1,554,000 | | | | 2 | |

| | | | | USD/MXN | | JPM | | | 07/03/2024 | | | | 17.1000 | | | | 3,196,000 | | | | 3 | |

| | | | | USD/MXN | | JPM | | | 07/03/2024 | | | | 17.1000 | | | | 3,108,000 | | | | 3 | |

| | | | | USD/MXN | | JPM | | | 08/06/2024 | | | | 17.0000 | | | | 3,197,000 | | | | 191 | |

| | | | | USD/MXN | | JPM | | | 08/06/2024 | | | | 17.1500 | | | | 4,673,000 | | | | 398 | |

| | | | | USD/TRY | | JPM | | | 11/11/2024 | | | | 30.0000 | | | | 129,000 | | | | 619 | |

| | | | | USD/TRY | | JPM | | | 01/10/2025 | | | | 32.0000 | | | | 116,000 | | | | 3,463 | |

| | | | | USD/TRY | | JPM | | | 02/24/2025 | | | | 34.5000 | | | | 4,341,000 | | | | 25,920 | |

| | | | | USD/TRY | | JPM | | | 03/05/2025 | | | | 35.0000 | | | | 4,320,000 | | | | 33,240 | |

| | | | | USD/ZAR | | JPM | | | 07/12/2024 | | | | 18.3000 | | | | 3,208,000 | | | | 3 | |

| | | | | USD/ZAR | | JPM | | | 08/13/2024 | | | | 17.5000 | | | | 9,568,000 | | | | 44,993 | |

| | | | | XAU/USD | | JPM | | | 10/02/2024 | | | | 1,250.0000 | | | | 1,213,000 | | | | 21 | |

| | | | | TOTAL PUT OPTIONS PURCHASED (Cost - $1,207,259) | | | | | | | | | | | | | | | | | 951,635 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | TOTAL CURRENCY OPTIONS PURCHASED (Cost - $1,963,183) | | | | | | | | | | | | | | | | | 1,597,613 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | INDEX OPTIONS PURCHASED - 0.2%(d) | | | | | | | | | | | | | | | | | | |

| | | | | CALL OPTIONS PURCHASED - 0.2%(d) | | | | | | | | | | | | | | | | | | |

| | 700 | | | Chicago Board Options Exchange VIX US | | MS | | | 10/17/2024 | | | | 45.0000 | | | | 870,800 | | | | 26,600 | |

| | 700 | | | Chicago Board Options Exchange VIX US | | MS | | | 10/17/2024 | | | | 47.5000 | | | | 870,800 | | | | 23,100 | |

See accompanying notes to consolidated financial statements.

FULCRUM DIVERSIFIED ABSOLUTE RETURN FUND

CONSOLIDATED SCHEDULE OF INVESTMENTS (Continued)

June 30, 2024

| Contracts | | | | | Broker/

Counterparty | | | Expiration Date | | | Exercise Price | | | Notional Value | | | Fair Value | |

| | | | | INDEX OPTIONS PURCHASED - 0.2%(d) (Continued) | | | | | | | | | | | | | | | | | | |

| | | | | CALL OPTIONS PURCHASED - 0.2%(d) (Continued) | | | | | | | | | | | | | | | | | | |

| | 700 | | | Chicago Board Options Exchange VIX US | | MS | | | 10/17/2024 | | | $ | 50.0000 | | | $ | 870,800 | | | $ | 21,700 | |

| | 700 | | | Chicago Board Options Exchange VIX US | | MS | | | 10/17/2024 | | | | 55.0000 | | | | 870,800 | | | | 18,200 | |

| | 700 | | | Chicago Board Options Exchange VIX US | | MS | | | 10/17/2024 | | | | 60.0000 | | | | 870,800 | | | | 14,700 | |

| | 700 | | | Chicago Board Options Exchange VIX US | | MS | | | 10/17/2024 | | | | 65.0000 | | | | 870,800 | | | | 13,300 | |

| | 206 | | | FTSE 100 Index UKX(e) | | MS | | | 09/23/2024 | | | | 8,750.0000 | | | | 16,818,087 | | | | 42,967 | |

| | 6 | | | Nikkei 225 NKY(e) | | MS | | | 07/15/2024 | | | | 39,000.0000 | | | | 1,476,720 | | | | 30,025 | |

| | 6 | | | Nikkei 225 NKY(e) | | MS | | | 07/15/2024 | | | | 39,375.0000 | | | | 1,476,720 | | | | 20,887 | |

| | 6 | | | Nikkei 225 NKY(e) | | MS | | | 07/15/2024 | | | | 39,750.0000 | | | | 1,476,720 | | | | 13,241 | |

| | 6 | | | Nikkei 225 NKY(e) | | MS | | | 07/15/2024 | | | | 40,250.0000 | | | | 1,476,720 | | | | 6,714 | |

| | 6 | | | Tokyo Stock Exchange Tokyo Stock Price Index TPX(e) | | MS | | | 07/15/2024 | | | | 2,750.0000 | | | | 1,048,200 | | | | 26,109 | |

| | 6 | | | Tokyo Stock Exchange Tokyo Stock Price Index TPX(e) | | MS | | | 07/15/2024 | | | | 2,775.0000 | | | | 1,048,200 | | | | 19,022 | |

| | 6 | | | Tokyo Stock Exchange Tokyo Stock Price Index TPX(e) | | MS | | | 07/15/2024 | | | | 2,800.0000 | | | | 1,048,200 | | | | 13,054 | |

| | 6 | | | Tokyo Stock Exchange Tokyo Stock Price Index TPX(e) | | MS | | | 07/15/2024 | | | | 2,850.0000 | | | | 1,048,200 | | | | 4,849 | |

| | | | | TOTAL CALL OPTIONS PURCHASED (Cost - $287,514) | | | | | | | | | | | | | | | | | 294,468 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | PUT OPTIONS PURCHASED - 0.0%(a)(d) | | | | | | | | | | | | | | | | | | |

| | 6 | | | Nikkei 225 NKY(e) | | MS | | | 07/15/2024 | | | | 37,375.0000 | | | | 1,476,720 | | | | 1,082 | |

| | 6 | | | Nikkei 225 NKY(e) | | MS | | | 07/15/2024 | | | | 37,875.0000 | | | | 1,476,720 | | | | 2,126 | |

| | 6 | | | Nikkei 225 NKY(e) | | MS | | | 07/15/2024 | | | | 38,375.0000 | | | | 1,476,720 | | | | 3,916 | |

| | 6 | | | Nikkei 225 NKY(e) | | MS | | | 07/15/2024 | | | | 38,625.0000 | | | | 1,476,720 | | | | 5,222 | |

| | 6 | | | Tokyo Stock Exchange Tokyo Stock Price Index TPX(e) | | MS | | | 07/15/2024 | | | | 2,625.0000 | | | | 1,048,200 | | | | 410 | |

| | 6 | | | Tokyo Stock Exchange Tokyo Stock Price Index TPX(e) | | MS | | | 07/15/2024 | | | | 2,675.0000 | | | | 1,048,200 | | | | 895 | |

| | 6 | | | Tokyo Stock Exchange Tokyo Stock Price Index TPX(e) | | MS | | | 07/15/2024 | | | | 2,700.0000 | | | | 1,048,200 | | | | 1,455 | |

| | 6 | | | Tokyo Stock Exchange Tokyo Stock Price Index TPX(e) | | MS | | | 07/15/2024 | | | | 2,725.0000 | | | | 1,048,200 | | | | 2,312 | |

| | | | | TOTAL PUT OPTIONS PURCHASED (Cost - $86,254) | | | | | | | | | | | | | | | | | 17,418 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | TOTAL INDEX OPTIONS PURCHASED (Cost - $373,768) | | | | | | | | | | | | | | | | | 311,886 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | OTC DUAL AND TRIPLE BINARY OPTIONS PURCHASED - 0.9%(h) | | | | | | | | | | | | | | | | | | |

| | | | | PUT OPTIONS PURCHASED - 0.9% | | | | | | | | | | | | | | | | | | |

| | 294,000 | | | DEDZ4 ≥ 152 and SX5E ≤ 5375 | | MS | | | 12/23/2024 | | | | | | | | 59,332 | | | | 250,060 | |

| | 210,000 | | | EURUSD ≤ 1.0628 and US2YRSOFR ≤ 3.749% | | MS | | | 07/09/2024 | | | | | | | | 15,330 | | | | - | |

| | 156,000 | | | EURUSD ≤ 1.0644 and AUDUSD ≥ 0.6657 | | MS | | | 08/09/2024 | | | | | | | | 4,886 | | | | 11,286 | |

| | 247,000 | | | GBPUSD ≤ 1.2136 and SPX ≥ 5067.25 | | MS | | | 09/23/2024 | | | | | | | | 15,981 | | | | 19,139 | |

| | 588,000 | | | GLD US ≥ 194.3 and USO US ≤ 64.254 | | MS | | | 08/19/2024 | | | | | | | | 52,626 | | | | 12,612 | |

| | 1,032,000 | | | GLD US ≥ 198.93 and USO US ≤ 60.651 | | MS | | | 08/19/2024 | | | | | | | | 51,084 | | | | 8,504 | |

| | 780,000 | | | NKY ≥ 41013.50 and USDJPY ≤ 146.67 | | GS | | | 12/16/2024 | | | | | | | | 41,340 | | | | 18,613 | |

| | 779,000 | | | NKY ≥ 41386.35 and USDJPY ≤ 146.67 | | GS | | | 01/13/2025 | | | | | | | | 42,845 | | | | 21,017 | |

| | 748,000 | | | SPX ≤ 4652.75 and USDJPY ≤ 145.42 | | CIT | | | 03/24/2025 | | | | | | | | 60,588 | | | | 12,717 | |

| | 748,000 | | | SPX ≤ 4652.75 and USDJPY ≤ 145.42 | | CIT | | | 04/18/2025 | | | | | | | | 60,588 | | | | 15,257 | |

| | 766,000 | | | SPX ≤ 4675.28 and USDJPY ≤ 146.78 | | GS | | | 11/24/2025 | | | | | | | | 91,154 | | | | 41,911 | |

| | 766,000 | | | SPX ≤ 4675.28 and USDJPY ≤ 146.78 | | GS | | | 12/22/2025 | | | | | | | | 93,835 | | | | 41,316 | |

| | 748,000 | | | SPX ≤ 4757.30 and USDJPY ≤ 142.39 | | CIT | | | 03/24/2025 | | | | | | | | 60,588 | | | | 10,375 | |

| | 748,000 | | | SPX ≤ 4757.30 and USDJPY ≤ 142.39 | | CIT | | | 04/18/2025 | | | | | | | | 60,588 | | | | 12,134 | |

| | 763,000 | | | SPX ≤ 4760.29 and US5YRSOFR < 3.329% | | CIT | | | 07/22/2024 | | | | | | | | 62,566 | | | | 38 | |

See accompanying notes to consolidated financial statements.

FULCRUM DIVERSIFIED ABSOLUTE RETURN FUND

CONSOLIDATED SCHEDULE OF INVESTMENTS (Continued)

June 30, 2024

| Contracts | | | | | Broker/

Counterparty | | | Expiration Date | | | Exercise Price | | | Notional Value | | | Fair Value | |

| | | | | OTC DUAL AND TRIPLE BINARY OPTIONS PURCHASED - 0.9% (Continued)(h) | | | | | | | | | | | | | | | | | | |

| | | | | PUT OPTIONS PURCHASED - 0.9% (Continued) | | | | | | | | | | | | | | | | | | |

| | 775,000 | | | SPX < 4881.34 and US10YRSOFR ≥ 4.04% | | CIT | | | 12/23/2024 | | | | | | | $ | 37,588 | | | $ | 26,304 | |

| | 775,000 | | | SPX < 4881.34 and US10YRSOFR ≥ 4.120% | | CIT | | | 12/23/2024 | | | | | | | | 28,675 | | | | 22,829 | |

| | 782,000 | | | SPX < 5088.85 and US5YRSOFR ≥ 4.060% | | MS | | | 12/23/2024 | | | | | | | | 61,387 | | | | 38,993 | |

| | 783,000 | | | SPX ≤ 5088.85 and US5YRSOFR ≥ 4.066% | | MS | | | 12/16/2024 | | | | | | | | 61,466 | | | | 38,588 | |

| | 782,000 | | | SPX ≤ 5088.85 and US5YRSOFR ≥ 4.072% | | MS | | | 12/09/2024 | | | | | | | | 61,387 | | | | 37,663 | |

| | 783,000 | | | SPX ≤ 5088.85 and US5YRSOFR ≥ 4.078% | | MS | | | 12/02/2024 | | | | | | | | 61,466 | | | | 36,565 | |

| | 775,000 | | | SPX ≤ 5152.52 and US10YRSOFR ≥ 4.080% | | CIT | | | 12/23/2024 | | | | | | | | 47,663 | | | | 39,887 | |

| | 775,000 | | | SPX ≤ 5152.52 and US10YRSOFR ≥ 4.16% | | CIT | | | 12/23/2024 | | | | | | | | 75,950 | | | | 34,826 | |

| | 537,000 | | | SPX ≥ 5167.45 and USDCNH ≥ 7.25 | | CIT | | | 01/20/2025 | | | | | | | | 51,391 | | | | 158,588 | |

| | 781,000 | | | SPX ≥ 5488.88 and EURUSD ≤ 1.0445 | | CIT | | | 12/09/2024 | | | | | | | | 48,422 | | | | 77,672 | |

| | 781,000 | | | SPX ≥ 5488.88 and EURUSD ≤ 1.0445 | | CIT | | | 12/23/2024 | | | | | | | | 48,422 | | | | 82,432 | |

| | 771,000 | | | SPX ≥ 5510 and EURUSD ≤ 1.04 | | CIT | | | 11/25/2024 | | | | | | | | 37,548 | | | | 61,923 | |

| | 771,000 | | | SPX ≥ 5510 and EURUSD ≤ 1.04 | | CIT | | | 12/23/2024 | | | | | | | | 37,548 | | | | 68,898 | |

| | 771,000 | | | SPX ≥ 5599 and EURUSD ≤ 1.05 | | CIT | | | 11/25/2024 | | | | | | | | 37,548 | | | | 67,734 | |

| | 771,000 | | | SPX ≥ 5599 and EURUSD ≤ 1.05 | | CIT | | | 12/23/2024 | | | | | | | | 37,548 | | | | 76,265 | |

| | 78,000 | | | SPX ≥ 5908.50 and USDCNH ≥ 7.2680 | | JPM | | | 12/23/2024 | | | | | | | | 4,875 | | | | 5,567 | |

| | 786,000 | | | SPX ≥ 5937 and EURUSD ≤ 1.0594 | | GS | | | 12/02/2024 | | | | | | | | 42,051 | | | | 21,291 | |

| | 786,000 | | | SPX ≥ 5937 and EURUSD ≤ 1.0594 | | GS | | | 12/09/2024 | | | | | | | | 42,051 | | | | 22,268 | |

| | 786,000 | | | SPX ≥ 5937 and EURUSD ≤ 1.0594 | | GS | | | 12/16/2024 | | | | | | | | 42,051 | | | | 25,929 | |

| | 786,000 | | | SPX ≥ 5937 and EURUSD ≤ 1.0594 | | GS | | | 12/23/2024 | | | | | | | | 42,051 | | | | 27,666 | |

| | 1,660,000 | | | SPX≤4874.45 and USDJPY≤144.452 and CLV4≤67.473 | | CIT | | | 09/18/2024 | | | | | | | | 79,680 | | | | 738 | |

| | 2,168,000 | | | SPX≤4996.53 and USDJPY≤148.45 and CLV4≤69.82 | | CIT | | | 09/18/2024 | | | | | | | | 101,896 | | | | 3,105 | |

| | 209,000 | | | SX5E ≤ 5000.00 and DEDZ ≥ 160.00 | | MS | | | 12/23/2024 | | | | | | | | 55,852 | | | | 38,562 | |

| | 622,000 | | | US10YRSOFR ≥ 3.862% and USDJPY ≤ 153.8061 | | CIT | | | 08/16/2024 | | | | | | | | 58,468 | | | | 29,581 | |

| | 781,000 | | | US10YRSOFR ≥ 3.981% and USDJPY ≤ 156.18 | | CIT | | | 08/16/2024 | | | | | | | | 64,784 | | | | 51,134 | |

| | 783,000 | | | US10YRSOFR ≥ 3.981% and USDJPY ≤ 156.18 | | CIT | | | 08/30/2024 | | | | | | | | 64,950 | | | | 59,493 | |

| | 73,000 | | | USDCNH ≥ 7.3058 and USDMXN ≤ 16.7606 | | MS | | | 08/26/2024 | | | | | | | | 5,694 | | | | 576 | |

| | 200,000 | | | USDJPY ≥ 163.71 and USDMXN ≤ 17.9741 | | MS | | | 12/23/2024 | | | | | | | | 13,600 | | | | 15,971 | |

| | 766,000 | | | USDKRW ≥ 1420.64 and KOSPI ≥ 403.23 | | GS | | | 12/12/2025 | | | | | | | | 28,725 | | | | 35,675 | |

| | 516,667 | | | USO US ≤ 72.3995 and US10YSOFR ≥ 4.187% | | CIT | | | 07/18/2024 | | | | | | | | 47,792 | | | | 1,803 | |

| | 516,667 | | | USO US ≤ 72.3995 and US10YSOFR ≥ 4.187% | | CIT | | | 08/16/2024 | | | | | | | | 47,792 | | | | 12,225 | |

| | 516,667 | | | USO US ≤ 72.3995 and US10YSOFR ≥ 4.187% | | CIT | | | 09/18/2024 | | | | | | | | 47,792 | | | | 21,195 | |

| | 895,000 | | | XAUUSD ≥ 2485.10 and USDCNH ≥ 7.3417 | | MS | | | 04/18/2025 | | | | | | | | 48,330 | | | | 44,693 | |

| | 895,000 | | | XAUUSD ≥ 2485.10 and USDCNH ≥ 7.3417 | | MS | | | 05/19/2025 | | | | | | | | 48,330 | | | | 49,194 | |

| | | | | TOTAL PUT OPTIONS PURCHASED (Cost - $2,394,099) | | | | | | | | | | | | | | | | | 1,810,812 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | TOTAL BINARY OPTIONS PURCHASED (Cost - $2,394,099) | | | | | | | | | | | | | | | | | 1,810,812 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | FUTURE OPTIONS PURCHASED - 0.3%(f) | | | | | | | | | | | | | | | | | | |

| | | | | CALL OPTIONS PURCHASED - 0.2%(f) | | | | | | | | | | | | | | | | | | |

| | 137 | | | 3 Month SOFR | | MS | | | 09/16/2024 | | | | 95.0000 | | | | 32,486,125 | | | | 10,275 | |

| | 214 | | | 3 Month SOFR | | MS | | | 12/16/2024 | | | | 96.0000 | | | | 50,902,575 | | | | 25,412 | |

| | 16 | | | AUD/USD Euro | | MS | | | 07/08/2024 | | | | 67.0000 | | | | 1,069,280 | | | | 3,520 | |

| | 16 | | | AUD/USD Euro | | MS | | | 07/08/2024 | | | | 67.5000 | | | | 1,069,280 | | | | 1,280 | |

| | 16 | | | AUD/USD Euro | | MS | | | 07/08/2024 | | | | 68.0000 | | | | 1,069,280 | | | | 320 | |

See accompanying notes to consolidated financial statements.

FULCRUM DIVERSIFIED ABSOLUTE RETURN FUND

CONSOLIDATED SCHEDULE OF INVESTMENTS (Continued)

June 30, 2024

| Contracts | | | | | Broker/

Counterparty | | | Expiration Date | | | Exercise Price | | | Notional Value | | | Fair Value | |

| | | | | FUTURE OPTIONS PURCHASED - 0.3%(f) (Continued) | | | | | | | | | | | | | | | | | | |

| | | | | CALL OPTIONS PURCHASED - 0.2%(f) (Continued) | | | | | | | | | | | | | | | | | | |

| | 13 | | | Canadian Dollar | | MS | | | 07/08/2024 | | | $ | 73.2500 | | | $ | 951,600 | | | $ | 2,340 | |

| | 13 | | | Canadian Dollar | | MS | | | 07/08/2024 | | | | 73.5000 | | | | 951,600 | | | | 1,170 | |

| | 13 | | | Canadian Dollar | | MS | | | 07/08/2024 | | | | 73.7500 | | | | 951,600 | | | | 520 | |

| | 14 | | | Crude Oil(e) | | MS | | | 07/18/2024 | | | | 82.0000 | | | | 1,141,560 | | | | 21,280 | |

| | 14 | | | Crude Oil(e) | | MS | | | 07/18/2024 | | | | 83.0000 | | | | 1,141,560 | | | | 15,820 | |

| | 14 | | | Crude Oil(e) | | MS | | | 07/18/2024 | | | | 84.5000 | | | | 1,141,560 | | | | 9,940 | |

| | 14 | | | Crude Oil(e) | | MS | | | 07/18/2024 | | | | 86.5000 | | | | 1,141,560 | | | | 5,460 | |

| | 131 | | | EURIBOR 3M | | MS | | | 12/17/2024 | | | | 97.7500 | | | | 29,563,425 | | | | 6,140 | |

| | 132 | | | Stoxx50 1Y | | MS | | | 09/23/2024 | | | | 160.0000 | | | | 17,236,472 | | | | 59,672 | |

| | 44 | | | Stoxx50 1Y | | MS | | | 12/23/2024 | | | | 160.0000 | | | | 51,709,416 | | | | 28,234 | |

| | 130 | | | Stoxx50 2Y | | MS | | | 09/23/2024 | | | | 158.0000 | | | | 50,925,940 | | | | 26,599 | |

| | 49 | | | SX5E Dividend | | MS | | | 12/23/2024 | | | | 135.0000 | | | | 598,045 | | | | 134,691 | |

| | | | | TOTAL CALL OPTIONS PURCHASED (Cost - $566,066) | | | | | | | | | | | | | | | | | 352,673 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | PUT OPTIONS PURCHASED - 0.1%(f) | | | | | | | | | | | | | | | | | | |

| | 137 | | | 3 Month SOFR | | MS | | | 09/16/2024 | | | | 94.6875 | | | | 32,486,125 | | | | 4,281 | |

| | 16 | | | AUD/USD Euro | | MS | | | 07/08/2024 | | | | 65.5000 | | | | 1,069,280 | | | | 320 | |

| | 16 | | | AUD/USD Euro | | MS | | | 07/08/2024 | | | | 66.0000 | | | | 1,069,280 | | | | 960 | |

| | 16 | | | AUD/USD Euro | | MS | | | 07/08/2024 | | | | 66.5000 | | | | 1,069,280 | | | | 2,720 | |

| | 13 | | | Canadian Dollar | | MS | | | 07/08/2024 | | | | 72.5000 | | | | 951,600 | | | | 325 | |

| | 13 | | | Canadian Dollar | | MS | | | 07/08/2024 | | | | 72.7500 | | | | 951,600 | | | | 650 | |

| | 13 | | | Canadian Dollar | | MS | | | 07/08/2024 | | | | 73.0000 | | | | 951,600 | | | | 1,560 | |

| | 14 | | | Crude Oil(e) | | MS | | | 07/18/2024 | | | | 76.0000 | | | | 1,141,560 | | | | 3,780 | |

| | 14 | | | Crude Oil(e) | | MS | | | 07/18/2024 | | | | 78.0000 | | | | 1,141,560 | | | | 7,560 | |

| | 14 | | | Crude Oil(e) | | MS | | | 07/18/2024 | | | | 79.5000 | | | | 1,141,560 | | | | 12,600 | |

| | 14 | | | Crude Oil(e) | | MS | | | 07/18/2024 | | | | 81.0000 | | | | 1,141,560 | | | | 20,580 | |

| | 115 | | | S&P Emini | | MS | | | 09/23/2024 | | | | 5,300.0000 | | | | 31,748,625 | | | | 265,937 | |

| | 9 | | | U.S. Treasury Bond | | MS | | | 07/29/2024 | | | | 114.0000 | | | | 1,064,813 | | | | 2,391 | |

| | 19 | | | U.S. Treasury Bond | | MS | | | 07/29/2024 | | | | 115.0000 | | | | 2,247,938 | | | | 8,016 | |

| | | | | TOTAL PUT OPTIONS PURCHASED (Cost - $449,289) | | | | | | | | | | | | | | | | | 331,680 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | TOTAL FUTURE OPTIONS PURCHASED (Cost - $1,015,355) | | | | | | | | | | | | | | | | | 684,353 | |

Principal

Amount ($) | | | | | Yield (%) | | | Maturity | | | | |

| | | | | SHORT-TERM INVESTMENTS — 48.9% | | | | | | | | | | |

| | | | | U.S. TREASURY BILLS — 48.9% | | | | | | | | | | |

| | 10,500,000 | | | United States Treasury Bill | | 5.34 | | | 07/02/24 | | | | 10,498,472 | |

| | 12,000,000 | | | United States Treasury Bill | | 5.01 | | | 07/16/24 | | | | 11,973,725 | |

| | 12,000,000 | | | United States Treasury Bill | | 5.16 | | | 08/01/24 | | | | 11,945,957 | |

| | 8,650,000 | | | United States Treasury Bill | | 5.29 | | | 08/29/24 | | | | 8,575,468 | |

| | 9,150,000 | | | United States Treasury Bill | | 5.26 | | | 09/05/24 | | | | 9,062,560 | |

See accompanying notes to consolidated financial statements.

FULCRUM DIVERSIFIED ABSOLUTE RETURN FUND

CONSOLIDATED SCHEDULE OF INVESTMENTS (Continued)

June 30, 2024

Principal

Amount ($) | | | | | Yield (%) | | | Maturity | | | Fair Value | |

| | | | | SHORT-TERM INVESTMENTS — 48.9% (Continued) | | | | | | | | | | |

| | | | | U.S. TREASURY BILLS — 48.9% (Continued) | | | | | | | | | | |

| | 10,200,000 | | | United States Treasury Bill | | 5.28 | | | 09/19/24 | | | $ | 10,081,839 | |

| | 12,200,000 | | | United States Treasury Bill | | 5.26 | | | 10/31/24 | | | | 12,035,402 | |

| | 13,150,000 | | | United States Treasury Bill | | 5.29 | | | 10/31/24 | | | | 12,919,604 | |

| | 10,000,000 | | | United States Treasury Bill | | 5.29 | | | 12/05/24 | | | | 9,776,057 | |

| | 1,020,000 | | | United States Treasury Bill | | 5.28 | | | 12/19/24 | | | | 995,220 | |

| | | | | TOTAL SHORT-TERM INVESTMENTS (Cost $97,865,957) | | | | | | | | | 97,864,049 | |

| | | | | | | | | | | | | | | |

| | | | | TOTAL INVESTMENTS - 68.2% (Cost $133,741,346) | | | | | | | | $ | 136,507,304 | |

| | | | | CALL OPTIONS WRITTEN - (0.1)% (Premiums received - $443,450) | | | | | | | | | (325,165 | ) |

| | | | | PUT OPTIONS WRITTEN - (0.3)% (Premiums received - $361,818) | | | | | | | | | (536,250 | ) |

| | | | | OTHER ASSETS IN EXCESS OF LIABILITIES - 32.2% | | | | | | | | | 64,468,586 | |

| | | | | NET ASSETS - 100.0% | | | | | | | | $ | 200,114,475 | |

| Contracts | | | | | Broker/

Counterparty | | | Expiration Date | | | Exercise Price | | | Notional Value | | | | |

| | | | | WRITTEN FUTURE OPTIONS - (0.4)%(f) | | | | | | | | | | | | | | | | | | |

| | | | | CALL OPTIONS WRITTEN - (0.1)%(f) | | | | | | | | | | | | | | | | | | |

| | 16 | | | Cocoa(e) | | MS | | | 08/05/2024 | | | $ | 10,750.0000 | | | $ | 1,236,960 | | | $ | 18,880 | |

| | 169 | | | Euro STOXX 50 Volatility Index | | MS | | | 07/18/2024 | | | | 17.0000 | | | | 288,652 | | | | 19,914 | |

| | 105 | | | Euro STOXX 50 Volatility Index | | MS | | | 07/18/2024 | | | | 18.0000 | | | | 179,340 | | | | 9,842 | |

| | 158 | | | Euro STOXX 50 Volatility Index | | MS | | | 07/18/2024 | | | | 19.0000 | | | | 269,864 | | | | 11,848 | |

| | 58 | | | Euro STOXX 50 Volatility Index | | MS | | | 07/18/2024 | | | | 20.0000 | | | | 99,064 | | | | 3,417 | |

| | 111 | | | Euro STOXX 50 Volatility Index | | MS | | | 07/18/2024 | | | | 21.0000 | | | | 189,588 | | | | 5,351 | |

| | 58 | | | Euro STOXX 50 Volatility Index | | MS | | | 07/18/2024 | | | | 22.0000 | | | | 99,064 | | | | 2,330 | |

| | 47 | | | Euro STOXX 50 Volatility Index | | MS | | | 07/18/2024 | | | | 23.0000 | | | | 80,276 | | | | 1,636 | |

| | 47 | | | Euro STOXX 50 Volatility Index | | MS | | | 07/18/2024 | | | | 25.0000 | | | | 80,276 | | | | 1,133 | |

| | 111 | | | Euro STOXX 50 Volatility Index | | MS | | | 07/18/2024 | | | | 26.0000 | | | | 189,588 | | | | 2,378 | |

| | 6 | | | EURO-BUND | | MS | | | 07/29/2024 | | | | 131.5000 | | | | 789,720 | | | | 6,813 | |

| | 14 | | | EURO-BUND | | MS | | | 07/29/2024 | | | | 132.0000 | | | | 1,842,680 | | | | 12,598 | |

| | 14 | | | EURO-BUND | | MS | | | 07/29/2024 | | | | 133.0000 | | | | 1,842,680 | | | | 7,649 | |

| | 14 | | | EURO-BUND | | MS | | | 07/29/2024 | | | | 134.0000 | | | | 1,842,680 | | | | 4,649 | |

| | 8 | | | EURO-BUND | | MS | | | 07/29/2024 | | | | 135.0000 | | | | 1,052,960 | | | | 1,628 | |

| | 265 | | | Stoxx50 1Y | | MS | | | 09/23/2024 | | | | 164.0000 | | | | 103,810,570 | | | | 52,233 | |

| | 88 | | | Stoxx50 1Y | | MS | | | 12/23/2024 | | | | 166.0000 | | | | 34,472,944 | | | | 22,436 | |

| | 261 | | | Stoxx50 2Y | | MS | | | 09/23/2024 | | | | 162.0000 | | | | 102,243,618 | | | | 18,174 | |

| | 17 | | | U.S. 10 Year Treasury Note | | MS | | | 07/29/2024 | | | | 110.5000 | | | | 1,869,469 | | | | 8,766 | |

| | 9 | | | U.S. 10 Year Treasury Note | | MS | | | 07/29/2024 | | | | 110.7500 | | | | 989,719 | | | | 3,797 | |

| | 9 | | | U.S. 10 Year Treasury Note | | MS | | | 07/29/2024 | | | | 111.0000 | | | | 989,719 | | | | 3,094 | |

| | 9 | | | U.S. 10 Year Treasury Note | | MS | | | 07/29/2024 | | | | 111.2500 | | | | 989,719 | | | | 2,531 | |

| | 8 | | | U.S. 10 Year Treasury Note | | MS | | | 07/29/2024 | | | | 111.5000 | | | | 879,750 | | | | 1,875 | |

| | 27 | | | U.S. 10 Year Treasury Note | | MS | | | 07/29/2024 | | | | 112.0000 | | | | 2,969,156 | | | | 4,219 | |

| | 9 | | | U.S. 10 Year Treasury Note | | MS | | | 07/29/2024 | | | | 112.5000 | | | | 989,719 | | | | 844 | |

See accompanying notes to consolidated financial statements.

FULCRUM DIVERSIFIED ABSOLUTE RETURN FUND

CONSOLIDATED SCHEDULE OF INVESTMENTS (Continued)

June 30, 2024

| Contracts | | | | | Broker/

Counterparty | | | Expiration Date | | | Exercise Price | | | Notional Value | | | Fair Value | |

| | | | | WRITTEN FUTURE OPTIONS - (0.4)%(f) (Continued) | | | | | | | | | | | | | | | | | | |

| | | | | CALL OPTIONS WRITTEN - (0.1)%(f) (Continued) | | | | | | | | | | | | | | | | | | |

| | 9 | | | U.S. 10 Year Treasury Note | | MS | | | 07/29/2024 | | | $ | 112.7500 | | | $ | 989,719 | | | $ | 703 | |

| | 8 | | | U.S. 10 Year Treasury Note | | MS | | | 07/29/2024 | | | | 113.0000 | | | | 879,750 | | | | 500 | |

| | | | | TOTAL CALL OPTIONS WRITTEN (Proceeds - $391,188) | | | | | | | | | | | | | | | | | 229,238 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | PUT OPTIONS WRITTEN - (0.3)%(f) | | | | | | | | | | | | | | | | | | |

| | 16 | | | Cocoa(e) | | MS | | | 08/05/2024 | | | | 10,000.0000 | | | | 1,236,960 | | | | 391,040 | |

| | 169 | | | Euro STOXX 50 Volatility Index | | MS | | | 07/18/2024 | | | | 13.5000 | | | | 288,652 | | | | 3,168 | |

| | 105 | | | Euro STOXX 50 Volatility Index | | MS | | | 07/18/2024 | | | | 14.0000 | | | | 179,340 | | | | 3,093 | |

| | 158 | | | Euro STOXX 50 Volatility Index | | MS | | | 07/18/2024 | | | | 14.5000 | | | | 269,864 | | | | 7,615 | |

| | 169 | | | Euro STOXX 50 Volatility Index | | MS | | | 07/18/2024 | | | | 15.0000 | | | | 288,652 | | | | 12,220 | |

| | 216 | | | Euro STOXX 50 Volatility Index | | MS | | | 07/18/2024 | | | | 16.0000 | | | | 368,928 | | | | 28,345 | |

| | 47 | | | Euro STOXX 50 Volatility Index | | MS | | | 07/18/2024 | | | | 17.0000 | | | | 80,276 | | | | 9,566 | |

| | 14 | | | EURO-BUND | | MS | | | 07/29/2024 | | | | 128.0000 | | | | 1,842,680 | | | | 1,350 | |

| | 6 | | | EURO-BUND | | MS | | | 07/29/2024 | | | | 129.0000 | | | | 789,720 | | | | 1,221 | |

| | 14 | | | EURO-BUND | | MS | | | 07/29/2024 | | | | 130.0000 | | | | 1,842,680 | | | | 5,699 | |

| | 6 | | | EURO-BUND | | MS | | | 07/29/2024 | | | | 130.5000 | | | | 789,720 | | | | 3,342 | |

| | 8 | | | EURO-BUND | | MS | | | 07/29/2024 | | | | 131.0000 | | | | 1,052,960 | | | | 6,085 | |

| | 8 | | | EURO-BUND | | MS | | | 07/29/2024 | | | | 131.5000 | | | | 1,052,960 | | | | 8,056 | |

| | 49 | | | SX5E Dividend | | MS | | | 12/23/2024 | | | | 90.0000 | | | | 598,045 | | | | 52 | |

| | 17 | | | U.S. 10 Year Treasury Note | | MS | | | 07/29/2024 | | | | 108.0000 | | | | 1,869,469 | | | | 2,391 | |

| | 9 | | | U.S. 10 Year Treasury Note | | MS | | | 07/29/2024 | | | | 108.5000 | | | | 989,719 | | | | 1,969 | |

| | 17 | | | U.S. 10 Year Treasury Note | | MS | | | 07/29/2024 | | | | 109.0000 | | | | 1,869,469 | | | | 5,844 | |

| | 9 | | | U.S. 10 Year Treasury Note | | MS | | | 07/29/2024 | | | | 109.2500 | | | | 989,719 | | | | 3,797 | |

| | 17 | | | U.S. 10 Year Treasury Note | | MS | | | 07/29/2024 | | | | 109.5000 | | | | 1,869,469 | | | | 8,766 | |

| | 9 | | | U.S. 10 Year Treasury Note | | MS | | | 07/29/2024 | | | | 109.7500 | | | | 989,719 | | | | 5,625 | |

| | 17 | | | U.S. 10 Year Treasury Note | | MS | | | 07/29/2024 | | | | 110.0000 | | | | 1,869,469 | | | | 12,750 | |