UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-23096

Legg Mason ETF Investment Trust

(Exact name of registrant as specified in charter)

620 Eighth Avenue, 47th Floor, New York, NY 10018

(Address of principal executive offices) (Zip code)

Harris Goldblat

Franklin Templeton

100 First Stamford Place

Stamford, CT 06902

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-877-721-1926

Date of fiscal year end: March 31

Date of reporting period: March 31, 2023

| ITEM 1. | REPORT TO STOCKHOLDERS. |

The Annual Report to Stockholders is filed herewith.

| | |

| Annual Report | | March 31, 2023 |

Franklin Low Volatility High Dividend Index ETFs

Franklin International Low Volatility High Dividend Index ETF

Franklin U.S. Low Volatility High Dividend Index ETF

|

| INVESTMENT PRODUCTS: NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE |

| | |

| II | | Franklin Low Volatility High Dividend Index ETFs |

Letter from the president

Dear Shareholder,

We are pleased to provide the annual report of Franklin International Low Volatility High Dividend Index ETF and Franklin U.S. Low Volatility High Dividend Index ETF for the twelve-month reporting period ended March 31, 2023. Please read on for a detailed look at prevailing economic and market conditions during the Funds’ reporting period and to learn how those conditions have affected each Fund’s performance.

As always, we remain committed to providing you with excellent service and a full spectrum of investment choices. We also remain committed to supplementing the support you receive from your financial advisor. One way we accomplish this is through our website, www.franklintempleton.com. Here you can gain immediate access to market and investment information, including:

| • | | Fund net asset value and market price, |

| • | | Market insights and commentaries from our portfolio managers, and |

| • | | A host of educational resources. |

We look forward to helping you meet your financial goals.

Sincerely,

|

| Patrick O’Connor |

| President and Chief Executive Officer - Investment Management President |

April 28, 2023 |

| | |

| Franklin Low Volatility High Dividend Index ETFs | | III |

Funds overview

Franklin International Low Volatility High Dividend Index ETF

Q. What is the Fund’s investment strategy?

A. The Fund seeks to track the investment results of the QS International Low Volatility High Dividend Hedged Index (the “Underlying Index”). The Underlying Index seeks to provide more stable income through investments in stocks of profitable companies in developed markets outside of the United States with relatively high dividend yields or anticipated dividend yields and lower price and earnings volatility, while mitigating exposure to exchange-rate fluctuations between the U.S. dollar and other international currencies. The Underlying Index is designed to have higher returns than an equivalent unhedged investment when the currencies in which its component securities are denominated are weakening relative to the U.S. dollar. Conversely, the Underlying Index is designed to have lower returns than an equivalent unhedged investment when the currencies in which its component securities are denominated are rising relative to the U.S. dollar. The Underlying Index is based on a proprietary methodology created and sponsored by Franklin Advisers, Inc. (“Franklin Advisers”), the Fund’s subadviser. Franklin Advisers is affiliated with both LMPFA and the Fund. The Fund will invest at least 80% of its net assets, plus borrowings for investment purposes, if any, in securities that compose its Underlying Index. Securities that compose the Underlying Index include depositary receipts representing securities in the Underlying Index.

The Underlying Index is composed of equity securities in developed markets outside of the United States across a range of market capitalizations that are included in the MSCI World ex-US IMI Local Indexi. Stocks in the Underlying Index must have demonstrated profitability over the last four fiscal quarters as a whole. Only stocks that have paid or are anticipated to pay a dividend are included in the Underlying Index. The methodology calculates a composite “stable yield” score, with the yield of stocks with relatively high price volatility (as measured over the past 12 months based on the standard deviation of daily returns) and earnings volatility (as measured by the variation of past earnings and projected earnings) and from countries with relatively high interest rates adjusted downward and the yield of stocks with relatively low price volatility and earnings volatility and from countries with relatively low interest rates adjusted upward. The Underlying Index will also take into account foreign withholding taxes on dividend payments to minimize their impact on distribution yield. Underlying Index weights are calculated to maximize its stable yield score subject to concentration limits, liquidity requirements and turnover restraints. Franklin Advisers anticipates that the number of component securities in the Underlying Index will range from 50 to 200 but this number may vary due to market conditions. At the time of each reconstitution, no individual component of the Underlying Index will exceed 2.5% of the Underlying Index, no individual sector will exceed 25% of the Underlying Index, no country will exceed 15% of the Underlying Index, no region will exceed 50% of the Underlying Index and real estate investment trust (“REIT”) components as a whole will not exceed 15% of the Underlying Index. The Underlying Index’s components are reconstituted annually and rebalanced quarterly. The fund’s securities portfolio is rebalanced when the Underlying Index is rebalanced or reconstituted. The composition of the Underlying Index and the fund after reconstitution and rebalancing may fluctuate and exceed the above Underlying Index limitations due to market movements. As of June 30, 2022, the Underlying Index consisted of securities from the following 18 countries: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Italy, Japan, Netherlands, Norway, Singapore, Spain, Sweden, Switzerland and the United Kingdom. The Underlying Index may include large-, mid- or small-capitalization companies.

The Fund may invest up to 20% of its net assets in foreign currency forward contracts and other currency hedging instruments, certain index futures, options, options on index futures, swap contracts or other derivatives (“Financial Instruments”) related to its Underlying Index and its component securities; cash and cash equivalents; other investment companies, including ETFs; and in securities and other instruments not included in its Underlying Index, but which Franklin Advisers believes will help the fund track its Underlying Index. As noted below, the Fund invests in currency hedging instruments to offset the Fund’s exposure to the currencies in which the Fund’s holdings are denominated. The Fund may also invest in equity index futures and currency derivatives to gain exposure to local markets or segments of local markets for cash flow management purposes and as a portfolio management technique.

Q. What were the overall market conditions during the Fund’s reporting period?

A. International equity returns were volatile and modestly positive across major regions for the one-year period from April 1, 2022, through March 31, 2023, with sector level results mixed. Throughout the period, markets were influenced by concerns about inflation, monetary policy tightening by many central banks, the Russia-Ukraine war, China’s COVID-19 policy and slowing corporate profits. The MSCI World ex US Indexii had positive returns in US-dollar terms, led at the country level by Denmark, Spain and Italy. Israel was the laggard. At the sector level, Energy, Consumer Discretionary and Consumer Staples led the way, while the Real Estate sector saw the steepest decline.

The period began with record-high inflation in multiple countries — driven by consumer demand and continued supply-chain disruptions — which prompted many central banks to raise interest rates in the second quarter of 2022. Additionally, the ongoing Russia-Ukraine war and resulting sanctions continued to disrupt trade and pushed crude oil and natural gas prices to record highs, though natural gas prices ended

| | | | | | |

| Franklin Low Volatility High Dividend Index ETFs 2023 Annual Report | | | | | 1 | |

Funds overview (cont’d)

the quarter lower. Recession fears increased along with high inflation, rising interest rates and surging government bond yields, dampening consumer sentiment in many countries. In this environment, during 2022’s second quarter, the MSCI World ex US Index generated negative returns in US-dollar terms, the worst quarterly decline since the beginning of the COVID-19 pandemic in early 2020. All major regions posted double-digit percentage losses.

Following a strong rally during the first half of the third quarter 2022, global equities fell sharply during the remainder of the period, marking a third consecutive quarterly decline. Investors worried that the global economy would weaken further or enter a recession as many central banks tighten monetary policy. Global manufacturing activity contracted in September 2022 for the first time since June 2020 as output fell, new orders decreased, and international trade contracted. Although inflationary pressures began to ease as the price of many commodities declined, annual inflation rates remained near or at record highs in multiple regions, prompting many central banks to continue raising interest rates. The release of the U.S. Federal Reserve’s (Fed) July meeting minutes included hawkish comments by Fed officials and other central bankers at the Jackson Hole Economic Symposium in late August prompted an equity market selloff which intensified in September as the Fed raised rates for the fifth time in 2022. In this environment, the MSCI World ex US Index generated negative net returns in US-dollar terms for 2022’s third quarter.

Global equities collectively advanced in the fourth quarter of 2022 as gains in October and November more than offset losses in December, and the MSCI World ex US Index generated positive returns. However, as the quarter wound down, a return of investor concerns about slower global economic growth driven by the aggressive rate-hiking actions of many central banks during the year led global equities to retreat; they closed 2022 with their worst annual loss since the 2008 global financial crisis. The ongoing Russia-Ukraine war and a COVID-19 surge in China after the country’s easing of its zero-COVID policy also weighed on investor sentiment. On the economic front, global manufacturing activity continued to contract in December as output declined in four of the largest industrial economies — the U.S., China, the eurozone and Japan — and international trade volumes fell.

Global equities collectively rose during the first quarter of 2023 amid signs of economic resilience and investor optimism about an approaching end to the worldwide rate-hiking cycle. After a strong rally in January, global stocks declined in February as strong employment reports and high inflation in certain regions prompted hawkish comments from many central banks. Financial markets experienced heightened volatility in March due to banking turmoil in the United States and Switzerland. However, quick action by authorities in both countries to stem potential contagion reassured many investors, driving global stocks higher. In economic data, global manufacturing activity contracted in March after stabilizing in February, although output rose for the second consecutive month.

Q. How did we respond to these changing market conditions?

A. The Fund uses a passive investment approach to achieve its investment objective, and therefore made no change in investment approach in response to market conditions.

Performance review

For the twelve months ended March 31, 2023, Franklin International Low Volatility High Dividend Index ETF generated a +6.90% return on a net asset value (“NAV”)iii basis and +7.89% based on its market priceiv per share.

The performance table shows the Fund’s total return for the twelve months ended March 31, 2023, based on its NAV and market price as of March 31, 2023. The Fund seeks to track the investment results of the QS International Low Volatility High Dividend Hedged Index (NR), which returned +7.44% for the same period. The Fund’s secondary benchmark, the MSCI World ex-US IMI local Index (NR), returned +1.75% over the same time frame. The Lipper International Large-Cap Value Funds Category Averagev returned +1.36% for the period. Please note that Lipper performance returns are based on each fund’s NAV.

| | | | | | | | |

Performance Snapshot as of March 31, 2023

(unaudited) | |

| | | 6 months | | | 12 months | |

| Franklin International Low Volatility High Dividend Index ETF: | | | | | | | | |

$26.81 (NAV) | | | 16.33 | % | | | 6.90 | %*† |

$26.96 (Market Price) | | | 16.81 | % | | | 7.89 | %*‡ |

| QS International Low Volatility High Dividend Hedged Index (NR) | | | 16.48 | % | | | 7.44 | % |

| MSCI World ex-US IMI Local Index (NR) | | | 15.59 | % | | | 1.75 | % |

| Lipper International Large-Cap Value Funds Category Average | | | 28.93 | % | | | 1.36 | % |

The performance shown represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above. Principal value and investment returns will fluctuate so shares, when sold, may be worth more or less than their original cost. Performance data current to the most recent month-end is available at www.franklintempleton.com.

| | | | |

| 2 | | | | Franklin Low Volatility High Dividend Index ETFs 2023 Annual Report |

Investors buy and sell shares of an exchange-traded fund (“ETF”) at market price (not NAV) in the secondary market throughout the trading day. These shares are not individually available for direct purchase from or direct redemption to the ETF. Market price returns are typically based upon the official closing price of the Fund’s shares. These returns do not represent investors’ returns had they traded shares at other times. Performance figures for periods shorter than one year represent cumulative figures and are not annualized.

Information showing the Fund’s net asset value, market price, premiums and discounts, and bid-ask spreads for various time periods is available by visiting the Fund’s website at www.franklintempleton.com.

As of the Fund’s current prospectus dated July 29, 2022, the gross total annual fund operating expense ratio for the Fund was 0.40%.

* Total returns are based on changes in NAV or market price, respectively. Returns reflect the deduction of all Fund expenses. Returns do not reflect the deduction of brokerage commissions or taxes that investors pay on distributions or the sale of shares.

† Total return assumes the reinvestment of all distributions at NAV.

‡ Total return assumes the reinvestment of all distributions at market price, which typically is based upon the official closing price of the Fund’s shares.

Q. What were the leading contributors to performance?

A. Looking at the performance of the Underlying Index by country for the reporting period and considering both returns and weights in the Underlying Index, the leading contributors were Switzerland, Germany and Japan. From a sector perspective, Utilities, Consumer Staples and Materials fared best, with positive returns in the Underlying Index.

Q. What were the leading detractors from performance?

A. By virtue of negative returns for the period and their weight in the Underlying Index, the leading detractors at the country level were Canada, Australia and the U.K. The leading detractors at the sector level, again by virtue of return and weight, were the Financials, Real Estate and Industrials sectors.

Looking for additional information?

The Fund’s daily NAV is available online at www.franklintempleton.com. The Fund is traded under the symbol “LVHI” and its closing market price is available on most financial websites. In a continuing effort to provide information concerning the Fund, shareholders may call 1-877-721-1926 (toll free), Monday through Friday from 8:00 a.m. to 5:30 p.m. Eastern time, for the Fund’s current NAV, market price and other information.

Thank you for your investment in Franklin International Low Volatility High Dividend Index ETF. As always, we appreciate that you have chosen us to manage your assets and we remain focused on achieving the Fund’s investment goals.

Sincerely,

Michael LaBella, CFA

Portfolio Manager

Franklin Advisers, Inc.

Vaneet Chadha, CFA

Portfolio Manager

Franklin Advisers, Inc.

Christopher W. Floyd, CFA

Portfolio Manager

Franklin Advisers, Inc.

| | | | | | |

| Franklin Low Volatility High Dividend Index ETFs 2023 Annual Report | | | | | 3 | |

Funds overview (cont’d)

Jose Maldonado, CFA

Portfolio Manager

Franklin Advisers, Inc.

April 13, 2023

RISKS: The market values of securities or other assets will fluctuate, sometimes sharply and unpredictably, due to changes in general market conditions, overall economic trends or events, governmental actions or intervention, actions taken by the U.S. Federal Reserve or foreign central banks, market disruptions caused by trade disputes or other factors, political developments, armed conflicts, economic sanctions and countermeasures in response to sanctions, major cybersecurity events, investor sentiment, the global and domestic effects of a pandemic, and other factors that may or may not be related to the issuer of the security or other asset.

Equity securities are subject to market and price fluctuations. Dividends are not guaranteed, and a company may reduce or eliminate its dividend at any time. In rising markets, the value of large-cap stocks may not rise as much as smaller-cap stocks. Small- and mid-cap stocks involve greater risks and volatility than large-cap stocks. The Fund may focus its investments in certain industries, increasing its vulnerability to market volatility. There is no guarantee that the Fund will achieve a high degree of correlation to the index it seeks to track. The Fund does not seek to outperform the index it tracks and does not seek temporary defensive positions when markets decline or appear overvalued. Derivatives, such as options and futures, can be illiquid, may disproportionately increase losses and have a potentially large impact on Fund performance. Please see the Fund’s prospectus for a more complete discussion of these and other risks and the Fund’s investment strategies.

The mention of sector breakdowns is for informational purposes only and should not be construed as a recommendation to purchase or sell any securities. The information provided regarding such sectors is not a sufficient basis upon which to make an investment decision. Investors seeking financial advice regarding the appropriateness of investing in any securities or investment strategies discussed should consult their financial professional. The Fund’s top five sector holdings (as a percentage of net assets) as of March 31, 2023, were: financials (19.1%), utilities (15.2%), materials (12.5%), consumer discretionary (12.1%) and consumer staples (10.4%). The Fund’s composition may differ over time.

All investments are subject to risk including the possible loss of principal. Past performance is no guarantee of future results. An index is a statistical composite that tracks a specified financial market, sector or rules-based investment process. Unlike a fund, an index does not actually hold a portfolio of securities and therefore does not incur the expenses incurred by a fund. These expenses negatively impact fund performance. All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index.

The information provided is not intended to be a forecast of future events, a guarantee of future results or investment advice. Views expressed may differ from those of the firm as a whole.

| i | MSCI World ex-US IMI Local Index (NR) captures large-, mid- and small-cap representation across 22 of 23 Developed Markets (DM) countries — excluding the United States. With 3,491 constituents, the index covers approximately 99% of the free float-adjusted market capitalization in each country. The index calculates performance utilizing local currencies taking out the effect of the converting to the U.S. dollar. Net Returns (NR) include income net of tax withholding when dividends are paid. |

| ii | The MSCI World ex USA Index captures large and mid-cap representation across 22 of 23 Developed Markets countries — excluding the United States. With 913 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country. |

| iii | Net Asset Value (NAV) is calculated by subtracting total liabilities from total assets and dividing the results by the number of shares outstanding. |

| iv | Market price is determined by supply and demand. It is the price at which an investor purchases or sells shares of the Fund. The market price may differ from the Fund’s NAV. |

| v | Lipper, Inc., a wholly-owned subsidiary of Refinitiv, provides independent insight on global collective investments. Returns are based on the twelve-month period ended March 31, 2023, including the reinvestment of all distributions, including returns of capital, if any, calculated among the 75 funds in the Fund’s Lipper category. |

| | | | |

| 4 | | | | Franklin Low Volatility High Dividend Index ETFs 2023 Annual Report |

Franklin U.S. Low Volatility High Dividend Index ETF

Q. What is the Fund’s investment strategy?

A. The Fund seeks to track the investment results of the QS Low Volatility High Dividend Index (the “Underlying Index”). The Underlying Index seeks to provide more stable income through investments in stocks of profitable U.S. companies with relatively high dividend yields and lower price and earnings volatility. The Underlying Index is based on a proprietary methodology created and sponsored by Franklin Advisers, Inc. (“Franklin Advisers”), the Fund’s subadviser. Franklin Advisers is affiliated with both LMPFA and the fund. The Underlying Index is composed of stocks of U.S. companies across a wide range of market capitalizations, including the largest 3,000 U.S. stocks as determined by the Solactive US Broad Market Index. Stocks in the Underlying Index must have demonstrated profitability over the last four fiscal quarters as a whole. Stocks whose yields are not supported by earnings are excluded from the Underlying Index. The methodology calculates a composite “stable yield” score, with the yield of stocks with relatively higher price volatility and earnings volatility adjusted downward and the yield of stocks with relatively lower price volatility and earnings volatility adjusted upward. Franklin Advisers anticipates that the number of component securities in the Underlying Index will range from 50 to 100. At the time of each reconstitution, no individual component of the Underlying Index will exceed 2.5% of the Underlying Index, no individual sector will exceed 25% of the Underlying Index, and real estate investment trust (“REIT”) components as a whole will not exceed 15% of the Underlying Index. The Underlying Index’s components are reconstituted annually and rebalanced quarterly. The composition of the Underlying Index and the fund after reconstitution and rebalancing may fluctuate and exceed the above Underlying Index limitations due to market movements. The Underlying Index may include large-, mid- or small-capitalization companies.

The Fund’s portfolio is rebalanced when the Underlying Index is rebalanced or reconstituted. The Fund may trade at times other than when the Underlying Index is rebalanced or reconstituted for a variety of reasons, including when adjustments may be made to its representative sampling process from time to time or when investing cash.

The Fund will invest at least 80% of its net assets, plus borrowings for investment purposes, if any, in securities that compose the Underlying Index.

The Fund may invest up to 20% of its net assets in certain index futures, options, options on index futures, swap contracts or other derivatives (“Financial Instruments”) related to its Underlying Index and its component securities; cash and cash equivalents; other investment companies, including exchange-traded funds; and in securities and other instruments not included in its Underlying Index but which Franklin Advisers believes will help the Fund track its Underlying Index. The Fund may invest in exchange-traded equity index futures to manage sector exposure and for cash management purposes.

Q. What were the overall market conditions during the Fund’s reporting period?

A. U.S. equities as measured by the Russell 3000® Indexi were volatile but negative for the twelve-month period ended March 31, 2023, returning -8.58%. The Real Estate, Communication Services and Consumer Discretionary sectors were especially hard hit, each with a negative return significantly worse than the Russell 3000® Index overall. Only the Energy and Consumer Staples sectors were in positive territory.

U.S. equities suffered broad-based losses during the second quarter of 2022. Investors unloaded riskier assets amid persistently elevated inflation and interest-rate hikes by the U.S. Federal Reserve (Fed) that grew in size with each meeting. The market reflected a growing fear that the Fed might push the country into a recession before price stability is restored. A comparatively minor stock market rally in late June occurred despite the release of worsening economic data. The quarter capped a volatile first half of the year that saw U.S. and non-U.S. stocks, bonds and currencies jolted by surging inflation, central bank moves and the Russia-Ukraine war. Consumer expectations sank amid the worst inflation shock since the early 1970s and drew market attention toward the possibility that corporate profit margins may come under pressure in the coming quarters.

The U.S. equity market rose during the first half of the 2022’s third quarter but ended down as investors feared that the Fed’s aggressive rate hikes to combat persistently high inflation could lead to a recession. Standard & Poor’s® 500 (S&P 500®)ii stocks fell for a third consecutive quarter to 22-month lows, capped by the worst September (-9.21%) in two decades. To cool stubbornly high inflation, the Fed lifted the federal funds target rate range by 75 basis points (bps) in both July and September, and the Fed indicated the latest increase would not be the last. Stocks sold off further in September as Fed Chair Jerome Powell reiterated the main points he made in his hawkish speech at Jackson Hole in late August 2022. He stressed that monetary policy may have to be restrictive for a while to bring inflation down and that the process may be painful. He also warned of a housing market correction and said a soft landing for the economy may be less likely.

| | | | | | |

Franklin Low Volatility High Dividend Index ETFs 2023 Annual Report | | | | | 5 | |

Funds overview (cont’d)

Following a solid rebound in October and November as inflation data improved, the U.S. equity market pulled back broadly in December, leaving major indexes with their strongest quarter of 2022 but their worst calendar-year performance since 2008. Even as the U.S. economy returned to growth in the third quarter and supply chains continued improving through December 2022, investor sentiment oscillated between expectations of a soft and a hard economic landing, driven by what was the fastest pace of interest-rate hikes since the early 1980s. And although markets initially cheered as China began rapidly phasing out pandemic lockdowns tied to its zero-COVID policies, by mid-December U.S. investors grew at least equally worried about the global implications of a dramatic surge in COVID-19 cases across China.

Key U.S. equity indexes ended the first quarter of 2023 with gains despite a bout of heightened financial market volatility in March due to turmoil in the banking industry. Two mid-sized U.S. banks collapsed, and a Swiss bank was forced into a merger. However, quick intervention by the authorities helped to calm these fears, while better-than-feared corporate earnings reports and smaller interest-rate increases from the US Federal Reserve also supported investor sentiment.

Against this backdrop, the Fed raised interest rates eight times during the reporting period in its fight against inflation (four of those raises by 75bp) which fell from a June 2022 high of 9.1% to 6% by the end of the period. While the most recent 25bp increase in March 2023 brought the target rate to the highest level since 2007, the pace of the increases has been slowing, and signs of gathering headwinds including the bank crisis may impact the likelihood of future increases.

Q. How did we respond to these changing market conditions?

A. The Fund uses a passive investment approach to achieve its investment objective, and therefore made no change in investment approach in response to market conditions.

Performance review

For the twelve months ended March 31, 2023, Franklin U.S. Low Volatility High Dividend Index ETF generated a -2.85% return on a net asset value (“NAV”)iii basis and -3.01% based on its market priceiv per share.

The performance table shows the Fund’s total return for the twelve months ended March 31, 2023, based on its NAV and market price as of March 31, 2023. The Fund seeks to track the investment results of the QS Low Volatility High Dividend Index (NR), which returned -2.61% for the same period. The Fund’s broad-based market index, the Russell 3000® Index returned -8.58% over the same time frame. The Lipper Multi-Cap Value Funds Category Averagev returned -5.30% for the period. Please note that Lipper performance returns are based on each fund’s NAV.

| | | | | | | | |

Performance Snapshot as of March 31, 2023

(unaudited) | |

| | | 6 months | | | 12 months | |

| Franklin U.S. Low Volatility High Dividend Index ETF: | | | | | | | | |

$37.30 (NAV) | | | 11.26 | % | | | -2.85 | %*† |

$37.28 (Market Price) | | | 11.07 | % | | | -3.01 | %*‡ |

| QS Low Volatility High Dividend Index (NR) | | | 16.78 | % | | | -2.61 | % |

| Russell 3000® Index | | | 14.88 | % | | | -8.58 | % |

| Lipper Multi-Cap Value Funds Category Average | | | 13.85 | % | | | -5.30 | % |

The performance shown represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above. Principal value and investment returns will fluctuate so shares, when sold, may be worth more or less than their original cost. Performance data current to the most recent month-end is available at www.franklintempleton.com.

Investors buy and sell shares of an exchange-traded fund (“ETF”) at market price (not NAV) in the secondary market throughout the trading day. These shares are not individually available for direct purchase from or direct redemption to the ETF. Market price returns are typically based upon the official closing price of the Fund’s shares. These returns do not represent investors’ returns had they traded shares at other times. Performance figures for periods shorter than one year represent cumulative figures and are not annualized.

Information showing the Fund’s net asset value, market price, premiums and discounts, and bid-ask spreads for various time periods is available by visiting the Fund’s website at www.franklintempleton.com.

As of the Fund’s current prospectus dated July 29, 2022, the gross total annual fund operating expense ratio for the Fund was 0.27%.

* Total returns are based on changes in NAV or market price, respectively. Returns reflect the deduction of all Fund expenses. Returns do not reflect the deduction of brokerage commissions or taxes that investors pay on distributions or the sale of shares.

† Total return assumes the reinvestment of all distributions at NAV.

‡ Total return assumes the reinvestment of all distributions at market price, which typically is based upon the official closing price of the Fund’s shares.

| | | | |

| 6 | | | | Franklin Low Volatility High Dividend Index ETFs 2023 Annual Report |

Q. What were the leading contributors to performance?

A. The leading contributors to performance in the Underlying Index (the “Index”) for the reporting period were the Consumer Staples, Health Care and Consumer Discretionary sectors, by virtue of their weight in the Index and positive returns.

Q. What were the leading detractors from performance?

A. The leading detractors from performance were the Utilities, Real Estate and Financials sectors, all with returns more negative than the portfolio average.

Looking for additional information?

The Fund’s daily NAV is available online at www.franklintempleton.com. The Fund is traded under the symbol “LVHD” and its closing market price is available on most financial websites. In a continuing effort to provide information concerning the Fund, shareholders may call 1-877-721-1926 (toll free), Monday through Friday from 8:00 a.m. to 5:30 p.m. Eastern time, for the Fund’s current NAV, market price and other information.

Thank you for your investment in Franklin U.S Low Volatility High Dividend Index ETF. As always, we appreciate that you have chosen us to manage your assets and we remain focused on achieving the Fund’s investment goals.

Sincerely,

Michael LaBella, CFA

Portfolio Manager

Franklin Advisers, Inc.

Vaneet Chadha, CFA

Portfolio Manager

Franklin Advisers, Inc.

Christopher W. Floyd, CFA

Portfolio Manager

Franklin Advisers, Inc.

Jose Maldonado, CFA

Portfolio Manager

Franklin Advisers, Inc.

April 13, 2023

RISKS: The market values of securities or other assets will fluctuate, sometimes sharply and unpredictably, due to changes in general market conditions, overall economic trends or events, governmental actions or intervention, actions taken by the U.S. Federal Reserve or foreign central banks, market disruptions caused by trade disputes or other factors, political developments, armed conflicts, economic sanctions and countermeasures in response to sanctions, major cybersecurity events, investor sentiment, the global and domestic effects of a pandemic, and other factors that may or may not be related to the issuer of the security or other asset.

Equity securities are subject to market and price fluctuations. Dividends are not guaranteed, and a company may reduce or eliminate its dividend at any time. International investments are subject to special risks including currency fluctuations, social, economic, and political uncertainties, which could increase volatility. Currency investing contains heightened risks that include market, political, regulatory, and national conditions, and may not

| | | | | | |

| Franklin Low Volatility High Dividend Index ETFs 2023 Annual Report | | | | | 7 | |

Funds overview (cont’d)

be suitable for all investors. In rising markets, the value of large-cap stocks may not rise as much as smaller-cap stocks. Small- and mid-cap stocks involve greater risks and volatility than large-cap stocks. The Fund may focus its investments in certain industries, increasing its vulnerability to market volatility. There is no guarantee that the Fund will achieve a high degree of correlation to the index it seeks to track. The Fund does not seek to outperform the index it tracks and does not seek temporary defensive positions when markets decline or appear overvalued. Derivatives, such as options and futures, can be illiquid, may disproportionately increase losses and have a potentially large impact on Fund performance. Distributions are not guaranteed and are subject to change. Please see the Fund’s prospectus for a more complete discussion of these and other risks and the Fund’s investment strategies.

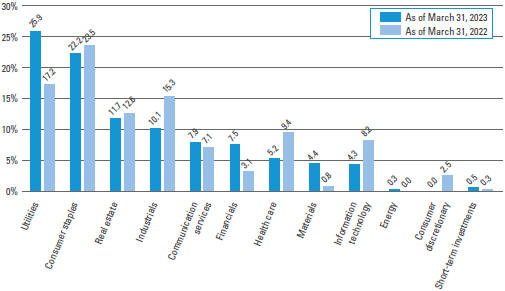

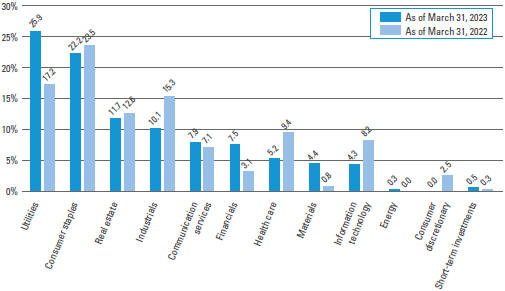

The mention of sector breakdowns is for informational purposes only and should not be construed as a recommendation to purchase or sell any securities. The information provided regarding such sectors is not a sufficient basis upon which to make an investment decision. Investors seeking financial advice regarding the appropriateness of investing in any securities or investment strategies discussed should consult their financial professional. The Fund’s top five sector holdings (as a percentage of net assets) as of March 31, 2023, were: utilities (25.9%), consumer staples (22.2%), real estate (11.6%), industrials (10.1%) and communication services (7.8%). The Fund’s composition may differ over time.

All investments are subject to risk including the possible loss of principal. Past performance is no guarantee of future results. An index is a statistical composite that tracks a specified financial market, sector or rules-based investment process. Unlike a fund, an index does not actually hold a portfolio of securities and therefore does not incur the expenses incurred by a fund. These expenses negatively impact fund performance. All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index.

The information provided is not intended to be a forecast of future events, a guarantee of future results or investment advice. Views expressed may differ from those of the firm as a whole.

| i | The Russell 3000® Index is market capitalization weighted and measures the performance of the largest 3,000 U.S. companies representing the majority of the U.S. market’s total capitalization. Frank Russell Company is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of Frank Russell Company. |

| ii | Standard & Poor’s® 500 Index (S&P 500®) is a market capitalization-weighted index of 500 stocks designed to measure total U.S. equity market performance. |

| iii | Net Asset Value (NAV) is calculated by subtracting total liabilities from total assets and dividing the results by the number of shares outstanding. |

| iv | Market price is determined by supply and demand. It is the price at which an investor purchases or sells shares of the Fund. The market price may differ from the Fund’s NAV. |

| v | Lipper, Inc., a wholly-owned subsidiary of Refinitiv, provides independent insight on global collective investments. Returns are based on the five-month period ended March 31, 2023, including the reinvestment of all distributions, including returns of capital, if any, calculated among the 660 funds in the Fund’s Lipper category. |

| | | | |

| 8 | | | | Franklin Low Volatility High Dividend Index ETFs 2023 Annual Report |

Funds at a glance (unaudited)

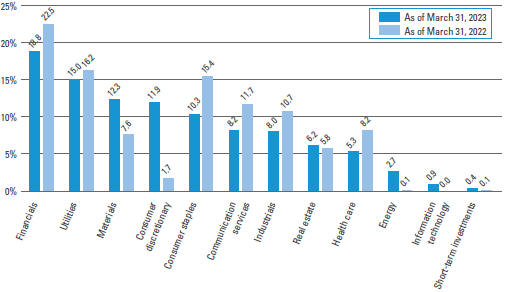

Franklin International Low Volatility High Dividend Index ETF Investment Breakdown† (%) as a percent of total investments

| † | The bar graph above represents the composition of the Fund’s investments as of March 31, 2023 and March 31, 2022 and does not include derivatives, such as futures contracts and forward foreign currency contracts. The composition of the Fund’s investments is subject to change at any time. |

| | | | |

| Franklin Low Volatility High Dividend Index ETFs 2023 Annual Report | | | | 9 |

Funds at a glance (unaudited) (cont’d)

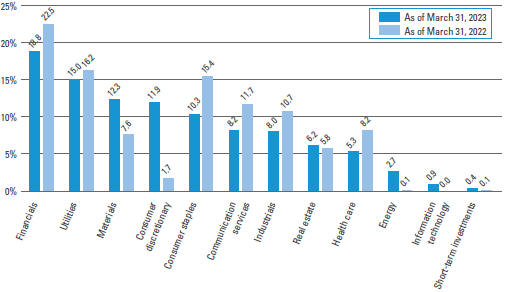

Franklin U.S. Low Volatility High Dividend Index ETF Investment Breakdown† (%) as a percent of total investments

| † | The bar graph above represents the composition of the Fund’s investments as of March 31, 2023 and March 31, 2022 and does not include derivatives, such as futures contracts. The composition of the Fund’s investments is subject to change at any time. |

| | | | |

| 10 | | | | Franklin Low Volatility High Dividend Index ETFs 2023 Annual Report |

Funds expenses (unaudited)

Franklin International Low Volatility High Dividend Index ETF

Example

As a shareholder of the Fund, you may incur two types of costs: (1) transaction costs, such as brokerage commissions paid on purchases and sales of Fund shares; and (2) ongoing costs, including management fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other funds.

This example is based on an investment of $1,000 invested on October 1, 2022 and held for the six months ended March 31, 2023.

Actual expenses

The table below titled “Based on actual total return” provides information about actual account values and actual expenses. You may use the information provided in this table, together with the amount you invested, to estimate the expenses that you paid over the period. To estimate the expenses you paid on your account, divide your ending account value by $1,000 (for example, an $8,600 ending account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During the Period”.

Hypothetical example for comparison purposes

The table below titled “Based on hypothetical total return” providesinformationabouthypotheticalaccountvaluesandhypothetical expenses based on the actual expense ratio and an assumed rate of return of 5.00% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use the information provided in this table to compare the ongoing costs of investing in the Fund and other funds. To do so, compare the 5.00% hypothetical example relating to the Fund with the 5.00% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table below are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as brokerage commissions paid on purchases and sales of Fund shares. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| Based on actual total return1 | | | | Based on hypothetical total return1 |

Actual

Total

Return2 | | Beginning

Account Value | | Ending Account Value | | Annualized

Expense

Ratio3 | | Expenses

Paid During

the Period3,4 | | | | Hypothetical

Annualized

Total Return | | Beginning

Account Value | | Ending Account Value | | Annualized

Expense

Ratio3 | | Expenses

Paid During

the Period3,4 |

| | | 16.33% | | | | $ | 1,000.00 | | | | $ | 1,163.30 | | | | | 0.41 | % | | | $ | 2.21 | | | | | | | 5.00 | % | | | | $1,000.00 | | | | $ | 1,022.89 | | | | | 0.41 | % | | | $ | 2.07 | |

| 1 | For the six months ended March 31, 2023. |

| 2 | Assumes the reinvestment of all distributions, including returns of capital, if any, at net asset value. Total return is not annualized, as it may not be representative of the total return for the year. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. |

| 3 | Included in the expense ratio are “Other fees” described in Note 1 under Federal and other taxes which are not annualized. Without these expenses, the expense ratio would have been 0.40% and the actual and hypothetical expenses paid during the period would have been $2.16 and $2.02, respectively. |

| 4 | Expenses (net of fee waivers and/or expense reimbursements) are equal to the Fund’s annualized expense ratio (except for non-recurring expenses, if any) multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (182), then divided by 365. |

| | | | | | |

| Franklin Low Volatility High Dividend Index ETFs 2023 Annual Report | | | | | 11 | |

Funds expenses (unaudited) (cont’d)

Franklin U.S. Low Volatility High Dividend Index ETF

Example

As a shareholder of the Fund, you may incur two types of costs: (1) transaction costs, such as brokerage commissions paid on purchases and sales of Fund shares; and (2) ongoing costs, including management fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other funds.

This example is based on an investment of $1,000 invested on October 1, 2022 and held for the six months ended March 31, 2023.

Actual expenses

The table below titled “Based on actual total return” provides information about actual account values and actual expenses. You may use the information provided in this table, together with the amount you invested, to estimate the expenses that you paid over the period. To estimate the expenses you paid on your account, divide your ending account value by $1,000 (for example, an $8,600 ending account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During the Period”.

Hypothetical example for comparison purposes

The table below titled “Based on hypothetical total return” providesinformationabouthypotheticalaccountvaluesandhypothetical expenses based on the actual expense ratio and an assumed rate of return of 5.00% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use the information provided in this table to compare the ongoing costs of investing in the Fund and other funds. To do so, compare the 5.00% hypothetical example relating to the Fund with the 5.00% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table below are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as brokerage commissions paid on purchases and sales of Fund shares. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| Based on actual total return1 | | | | Based on hypothetical total return1 |

Actual

Total Return2 | | Beginning Account Value | | Ending Account Value | | Annualized Expense Ratio | | Expenses Paid During

the Period3 | | | | Hypothetical Annualized Total Return | | Beginning Account Value | | Ending Account Value | | Annualized Expense Ratio | | Expenses Paid During

the Period3 |

| | | 11.26% | | | | $ | 1,000.00 | | | | $ | 1,112.60 | | | | | 0.27 | % | | | $ | 1.42 | | | | | | | 5.00 | % | | | | $1,000.00 | | | | $ | 1,023.59 | | | | | 0.27 | % | | | $ | 1.36 | |

| 1 | For the six months ended March 31, 2023. |

| 2 | Assumes the reinvestment of all distributions, including returns of capital, if any, at net asset value. Total return is not annualized, as it may not be representative of the total return for the year. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. |

| 3 | Expenses (net of fee waivers and/or expense reimbursements) are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (182), then divided by 365. |

| | | | |

| 12 | | | | Franklin Low Volatility High Dividend Index ETFs 2023 Annual Report |

Funds performance (unaudited)

Franklin International Low Volatility High Dividend Index ETF

| | | | |

| Net Asset Value | | | |

| Average annual total returns1 | | | |

| Twelve Months Ended 3/31/23 | | | 6.90 | % |

| Five Years Ended 3/31/23 | | | 6.65 | |

| Inception date of 7/27/16 through 3/31/23 | | | 6.94 | |

| |

| Cumulative total returns1 | | | |

| Inception date of 7/27/16 through 3/31/23 | | | 56.52 | % |

| | | | |

| Market Price | | | |

| Average annual total returns2 | | | |

| Twelve Months Ended 3/31/23 | | | 7.89 | % |

| Five Years Ended 3/31/23 | | | 6.60 | |

| Inception date of 7/27/16 through 3/31/23 | | | 6.97 | |

| |

| Cumulative total returns2 | | | |

| Inception date of 7/27/16 through 3/31/23 | | | 56.84 | % |

All figures represent past performance and are not a guarantee of future results. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV. The returns shown do not reflect the deduction of brokerage commissions or taxes that investors would pay on distributions or the sale of shares. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower.

Investors buy and sell shares of the Fund at market price, not NAV, in the secondary market throughout the trading day. These shares are not individually available for direct purchase from or direct redemption to the Fund. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and effective July 1, 2020, market price returns typically are based upon the official closing price of the Fund’s shares. Prior to July 1, 2020, market price returns generally were based upon the mid-point between the bid and ask on the Fund’s principal trading market when the Fund’s NAV was determined, which was typically 4:00 p.m. Eastern time (U.S.). Market price performance reported for periods prior to July 1, 2020 continue to reflect market prices calculated based upon the mid-point between the bid and ask on the Fund’s principal trading market typically as of 4:00 p.m. Eastern time (U.S.). These returns do not represent investors’ returns had they traded shares at other times. NAV and market price returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other exchange-traded funds, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors’ assessment of the underlying value of the Fund’s portfolio securities.

| 1 | Assumes the reinvestment of all distributions, including returns of capital, if any, at net asset value. |

| 2 | Assumes the reinvestment of all distributions, including returns of capital, if any, at market price. |

| | | | | | |

| Franklin Low Volatility High Dividend Index ETFs 2023 Annual Report | | | | | 13 | |

Funds performance (unaudited) (cont’d)

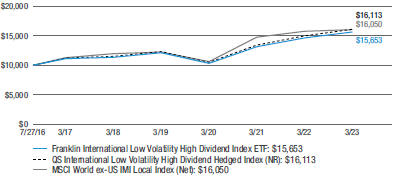

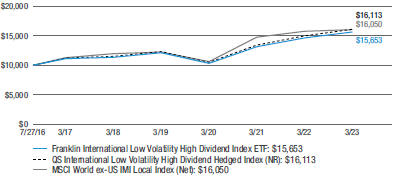

Franklin International Low Volatility High Dividend Index ETF

Historical performance

Value of $10,000 invested in

Franklin International Low Volatility High Dividend Index ETF vs. QS International Low Volatility High Dividend Hedged Index (NR) and MSCI World ex-US IMI Local Index (Net)† — July 27, 2016 - March 31, 2023

All figures represent past performance and are not a guarantee of future results. Investment returns and principal value of an Investment will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV. The returns shown do not reflect the deduction of brokerage commissions or taxes that investors would pay on distributions or the sale of shares. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower.

| † | Hypothetical illustration of $10,000 invested in Franklin International Low Volatility High Dividend Index ETF on July 27, 2016 (inception date), assuming the reinvestment of all distributions, including returns of capital, if any, at net asset value through March 31, 2023. The hypothetical illustration also assumes a $10,000 investment in the QS International Low Volatility High Dividend Hedged Index (NR) and MSCI World ex-US IMI Local Index (Net). The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund. The QS International Low Volatility High Dividend Hedged Index (NR) (the “Underlying Index”) is an index composed of publicly traded equity securities of developed markets outside of the United States with relatively high yield and low price and earnings volatility. The Underlying Index is based on a proprietary methodology created and sponsored by Franklin Advisers, Inc., the Fund’s subadviser. The MSCI World ex-US IMI Local Index (Net) captures large-, mid- and small-cap representation across 22 of 23 developed markets. The local version of the index calculates performance utilizing local currencies taking out the effect of converting to the U.S. dollar. The indices are not subject to the same management and trading expenses as a fund. An index is a statistical composite that tracks a specified financial market, sector, or rules-based investment process. Unlike a fund, an index does not actually hold a portfolio of securities and therefore does not incur the expenses incurred by a fund. These expenses negatively impact fund performance. All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index. |

| | | | |

| 14 | | | | Franklin Low Volatility High Dividend Index ETFs 2023 Annual Report |

Franklin U.S. Low Volatility High Dividend Index ETF

| | | | |

| Net Asset Value | | | |

| Average annual total returns1 | | | |

| Twelve Months Ended 3/31/23 | | | -2.85 | % |

| Five Years Ended 3/31/23 | | | 8.20 | |

| Inception date of 12/28/15 through 3/31/23 | | | 9.07 | |

| |

| Cumulative total returns1 | | | |

| Inception date of 12/28/15 through 3/31/23 | | | 87.80 | % |

| | | | |

| Market Price | | | |

| Average annual total returns2 | | | |

| Twelve Months Ended 3/31/23 | | | -3.01 | % |

| Five Years Ended 3/31/23 | | | 8.18 | |

| Inception date of 12/28/15 through 3/31/23 | | | 9.06 | |

| |

| Cumulative total returns2 | | | |

| Inception date of 12/28/15 through 3/31/23 | | | 87.68 | % |

All figures represent past performance and are not a guarantee of future results. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV. The returns shown do not reflect the deduction of brokerage commissions or taxes that investors would pay on distributions or the sale of shares. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower.

Investors buy and sell shares of the Fund at market price, not NAV, in the secondary market throughout the trading day. These shares are not individually available for direct purchase from or direct redemption to the Fund. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and effective July 1, 2020, market price returns typically are based upon the official closing price of the Fund’s shares. Prior to July 1, 2020, market price returns generally were based upon the mid-point between the bid and ask on the Fund’s principal trading market when the Fund’s NAV was determined, which was typically 4:00 p.m. Eastern time (U.S.). Market price performance reported for periods prior to July 1, 2020 continue to reflect market prices calculated based upon the mid-point between the bid and ask on the Fund’s principal trading market typically as of 4:00 p.m. Eastern time (U.S.). These returns do not represent investors’ returns had they traded shares at other times. NAV and market price returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other exchange-traded funds, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors’ assessment of the underlying value of the Fund’s portfolio securities.

| 1 | Assumes the reinvestment of all distributions, including returns of capital, if any, at net asset value. |

| 2 | Assumes the reinvestment of all distributions, including returns of capital, if any, at market price. |

| | | | |

| Franklin Low Volatility High Dividend Index ETFs 2023 Annual Report | | | | 15 |

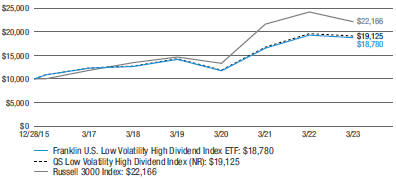

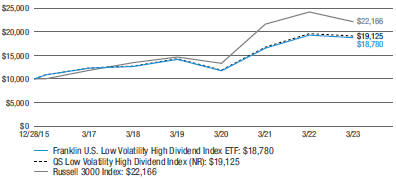

Funds performance (unaudited) (cont’d)

Franklin U.S. Low Volatility High Dividend Index ETF

Historical performance

Value of $10,000 invested in

Franklin U.S. Low Volatility High Dividend Index ETF vs. QS Low Volatility High Dividend Index (NR) and Russell 3000 Index† — December 28, 2015 - March 31, 2023

All figures represent past performance and are not a guarantee of future results. Investment returns and principal value of an Investment will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV. The returns shown do not reflect the deduction of brokerage commissions or taxes that investors would pay on distributions or the sale of shares. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower.

| † | Hypothetical illustration of $10,000 invested in Franklin U.S. Low Volatility High Dividend Index ETF on December 28, 2015 (inception date), assuming the reinvestment of all distributions, including returns of capital, if any, at net asset value through March 31, 2023. The hypothetical illustration also assumes a $10,000 investment in the QS Low Volatility High Dividend Index (NR) and the Russell 3000 Index (the “Index”). The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund. QS Low Volatility High Dividend Index (NR) (the “Underlying Index”) is an index composed of equity securities of U.S. companies with relatively high yield and low price and earnings volatility. The Underlying Index is based on a proprietary methodology created and sponsored by Franklin Advisers, Inc., the Fund’s subadviser. The Underlying Index is composed of stocks of U.S. companies across a wide range of market capitalizations, including the largest 3,000 U.S. stocks as determined by the Solactive US Broad Market Index. The Index measures the performance of the 3,000 largest U.S. companies based on total market capitalization, which represents approximately 98% of the U.S. equity market. The indices are not subject to the same management and trading expenses as a fund. An index is a statistical composite that tracks a specified financial market, sector, or rules-based investment process. Unlike a fund, an index does not actually hold a portfolio of securities and therefore does not incur the expenses incurred by a fund. These expenses negatively impact fund performance. All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index. |

| | | | |

| 16 | | | | Franklin Low Volatility High Dividend Index ETFs 2023 Annual Report |

Schedules of investments

March 31, 2023

Franklin International Low Volatility High Dividend Index ETF

(Percentages shown based on Fund net assets)

| | | | | | | | |

| Security | | Shares | | | Value | |

| Common Stocks — 98.4% | | | | | | | | |

| Communication Services — 8.3% | | | | | | | | |

Diversified Telecommunication Services — 5.6% | | | | | | | | |

Koninklijke KPN NV | | | 1,152,203 | | | $ | 4,075,898 | |

Orange SA | | | 794,739 | | | | 9,456,445 | |

Proximus SADP | | | 167,616 | | | | 1,619,655 | |

Singapore Telecommunications Ltd. | | | 2,878,800 | | | | 5,326,500 | |

Total Diversified Telecommunication Services | | | | | | | 20,478,498 | |

Media — 0.2% | | | | | | | | |

Metropole Television SA | | | 20,074 | | | | 326,051 | |

Telenet Group Holding NV | | | 13,386 | | | | 304,535 | |

Total Media | | | | | | | 630,586 | |

Wireless Telecommunication Services — 2.5% | | | | | | | | |

SoftBank Corp. | | | 799,900 | | | | 9,189,624 | |

Total Communication Services | | | | | | | 30,298,708 | |

| Consumer Discretionary — 9.6% | | | | | | | | |

Automobiles — 5.2% | | | | | | | | |

Bayerische Motoren Werke AG | | | 88,331 | | | | 9,686,935 | |

Mercedes-Benz Group AG | | | 120,783 | | | | 9,288,088 | |

Total Automobiles | | | | | | | 18,975,023 | |

Broadline Retail — 0.4% | | | | | | | | |

Harvey Norman Holdings Ltd. | | | 615,976 | | | | 1,476,929 | |

Household Durables — 2.9% | | | | | | | | |

Barratt Developments PLC | | | 616,718 | | | | 3,557,256 | |

Haseko Corp. | | | 188,700 | | | | 2,182,052 | |

Taylor Wimpey PLC | | | 2,194,369 | | | | 3,227,387 | |

Vistry Group PLC | | | 157,969 | | | | 1,525,456 | |

Total Household Durables | | | | | | | 10,492,151 | |

Specialty Retail — 1.1% | | | | | | | | |

JB Hi-Fi Ltd. | | | 139,718 | | | | 3,974,179 | |

T-Gaia Corp. | | | 20,600 | | | | 258,487 | |

Total Specialty Retail | | | | | | | 4,232,666 | |

Total Consumer Discretionary | | | | | | | 35,176,769 | |

| Consumer Staples — 10.4% | | | | | | | | |

Consumer Staples Distribution & Retail — 2.2% | | | | | | | | |

Tesco PLC | | | 2,439,235 | | | | 8,013,497 | |

Food Products — 0.9% | | | | | | | | |

Golden Agri-Resources Ltd. | | | 2,861,200 | | | | 613,322 | |

Orkla ASA | | | 155,930 | | | | 1,105,629 | |

Wilmar International Ltd. | | | 548,600 | | | | 1,737,133 | |

Total Food Products | | | | | | | 3,456,084 | |

Tobacco — 7.3% | | | | | | | | |

British American Tobacco PLC | | | 244,673 | | | | 8,593,255 | |

Imperial Brands PLC | | | 376,455 | | | | 8,676,325 | |

Japan Tobacco Inc. | | | 452,200 | | | | 9,506,767 | |

Total Tobacco | | | | | | | 26,776,347 | |

Total Consumer Staples | | | | | | | 38,245,928 | |

See Notes to Financial Statements.

| | | | | | |

| Franklin Low Volatility High Dividend Index ETFs 2023 Annual Report | | | | | 17 | |

Schedules of investments (cont’d)

March 31, 2023

Franklin International Low Volatility High Dividend Index ETF

(Percentages shown based on Fund net assets)

| | | | | | | | |

| Security | | Shares | | | Value | |

| Energy — 2.7% | | | | | | | | |

Oil, Gas & Consumable Fuels — 2.7% | | | | | | | | |

Itochu Enex Co. Ltd. | | | 24,900 | | | $ | 211,226 | |

Pembina Pipeline Corp. | | | 262,444 | | | | 8,489,894 | |

Viva Energy Group Ltd. | | | 653,396 | | | | 1,325,965 | |

Total Energy | | | | | | | 10,027,085 | |

| Financials — 19.1% | | | | | | | | |

Banks — 10.2% | | | | | | | | |

Bank of Nova Scotia | | | 135,379 | | | | 6,809,213 | |

BOC Hong Kong Holdings Ltd. | | | 1,266,781 | | | | 3,945,604 | |

Canadian Imperial Bank of Commerce | | | 154,554 | | | | 6,544,862 | |

DBS Group Holdings Ltd. | | | 350,400 | | | | 8,697,078 | |

Oversea-Chinese Banking Corp. Ltd. | | | 503,600 | | | | 4,685,444 | |

United Overseas Bank Ltd. | | | 288,900 | | | | 6,466,597 | |

Total Banks | | | | | | | 37,148,798 | |

Insurance — 8.9% | | | | | | | | |

Assicurazioni Generali SpA | | | 239,998 | | | | 4,792,510 | |

Great-West Lifeco Inc. | | | 253,468 | | | | 6,708,703 | |

Japan Post Holdings Co. Ltd. | | | 1,059,000 | | | | 8,565,734 | |

Legal & General Group PLC | | | 394,750 | | | | 1,166,045 | |

Poste Italiane SpA | | | 208,404 | | | | 2,131,071 | |

Zurich Insurance Group AG | | | 19,477 | | | | 9,331,819 | |

Total Insurance | | | | | | | 32,695,882 | |

Total Financials | | | | | | | 69,844,680 | |

| Health Care — 5.3% | | | | | | | | |

Pharmaceuticals — 5.3% | | | | | | | | |

Novartis AG, Registered Shares | | | 103,475 | | | | 9,487,238 | |

Sanofi | | | 92,606 | | | | 10,085,330 | |

Total Health Care | | | | | | | 19,572,568 | |

| Industrials — 8.1% | | | | | | | | |

Construction & Engineering — 2.9% | | | | | | | | |

ACS Actividades de Construccion y Servicios SA | | | 64,228 | | | | 2,048,059 | |

Bouygues SA | | | 121,697 | | | | 4,110,650 | |

Chudenko Corp. | | | 14,500 | | | | 232,497 | |

Kumagai Gumi Co. Ltd. | | | 36,700 | | | | 733,228 | |

NCC AB, Class B Shares | | | 26,410 | | | | 234,058 | |

Nishimatsu Construction Co. Ltd. | | | 85,500 | | | | 2,200,297 | |

Okumura Corp. | | | 27,100 | | | | 637,336 | |

Peab AB, Class B Shares | | | 69,719 | | | | 348,610 | |

Total Construction & Engineering | | | | | | | 10,544,735 | |

Electrical Equipment — 0.1% | | | | | | | | |

Nippon Carbon Co. Ltd. | | | 13,900 | | | | 428,206 | |

Ground Transportation — 0.2% | | | | | | | | |

ComfortDelGro Corp. Ltd. | | | 1,035,700 | | | | 919,203 | |

See Notes to Financial Statements.

| | | | |

| 18 | | | | Franklin Low Volatility High Dividend Index ETFs 2023 Annual Report |

Franklin International Low Volatility High Dividend Index ETF

(Percentages shown based on Fund net assets)

| | | | | | | | |

| Security | | Shares | | | Value | |

Industrial Conglomerates — 1.3% | | | | | | | | |

CK Hutchison Holdings Ltd. | | | 495,106 | | | $ | 3,071,569 | |

Keppel Corp. Ltd. | | | 376,600 | | | | 1,594,718 | |

Total Industrial Conglomerates | | | | | | | 4,666,287 | |

Machinery — 0.2% | | | | | | | | |

Sembcorp Marine Ltd. | | | 7,188,506 | | | | 643,400 | * |

Professional Services — 0.7% | | | | | | | | |

Adecco Group AG, Registered Shares | | | 50,299 | | | | 1,825,201 | |

SmartGroup Corp. Ltd. | | | 163,622 | | | | 702,445 | |

Total Professional Services | | | | | | | 2,527,646 | |

Trading Companies & Distributors — 2.7% | | | | | | | | |

Kanematsu Corp. | | | 46,300 | | | | 571,227 | |

Mitsubishi Corp. | | | 264,900 | | | | 9,456,307 | |

Total Trading Companies & Distributors | | | | | | | 10,027,534 | |

Total Industrials | | | | | | | 29,757,011 | |

| Information Technology — 0.9% | | | | | | | | |

Communications Equipment — 0.1% | | | | | | | | |

VTech Holdings Ltd. | | | 34,167 | | | | 204,350 | |

Electronic Equipment, Instruments & Components — 0.8% | | | | | | | | |

Nippon Electric Glass Co. Ltd. | | | 161,600 | | | | 3,095,037 | |

Total Information Technology | | | | | | | 3,299,387 | |

| Materials — 12.5% | | | | | | | | |

Chemicals — 3.2% | | | | | | | | |

Evonik Industries AG | | | 182,613 | | | | 3,841,024 | |

Incitec Pivot Ltd. | | | 2,539,464 | | | | 5,323,524 | |

Toyo Ink SC Holdings Co. Ltd. | | | 28,600 | | | | 441,818 | |

Yara International ASA | | | 47,329 | | | | 2,051,220 | |

Total Chemicals | | | | | | | 11,657,586 | |

Construction Materials — 3.1% | | | | | | | | |

CSR Ltd. | | | 433,399 | | | | 1,378,778 | |

Holcim AG | | | 153,059 | | | | 9,868,289 | |

Total Construction Materials | | | | | | | 11,247,067 | |

Containers & Packaging — 0.2% | | | | | | | | |

Transcontinental Inc., Class A Shares | | | 61,313 | | | | 635,624 | |

Metals & Mining — 4.8% | | | | | | | | |

BHP Group Ltd. | | | 278,252 | | | | 8,801,751 | |

Labrador Iron Ore Royalty Corp. | | | 15,101 | | | | 357,064 | |

Rio Tinto PLC | | | 126,486 | | | | 8,567,248 | |

Total Metals & Mining | | | | | | | 17,726,063 | |

Paper & Forest Products — 1.2% | | | | | | | | |

Navigator Co. SA | | | 144,268 | | | | 516,615 | |

UPM-Kymmene oyj | | | 122,287 | | | | 4,111,979 | |

Total Paper & Forest Products | | | | | | | 4,628,594 | |

Total Materials | | | | | | | 45,894,934 | |

See Notes to Financial Statements.

| | | | | | |

| Franklin Low Volatility High Dividend Index ETFs 2023 Annual Report | | | | | 19 | |

Schedules of investments (cont’d)

March 31, 2023

Franklin International Low Volatility High Dividend Index ETF

(Percentages shown based on Fund net assets)

| | | | | | | | |

| Security | | Shares | | | Value | |

| Real Estate — 6.3% | | | | | | | | |

Diversified REITs — 0.3% | | | | | | | | |

Charter Hall Long Wale REIT | | | 185,812 | | | | $ 521,436 | |

Takara Leben Real Estate Investment Corp. | | | 802 | | | | 539,929 | |

Total Diversified REITs | | | | | | | 1,061,365 | |

Health Care REITs — 0.3% | | | | | | | | |

Cofinimmo SA | | | 4,348 | | | | 385,233 | |

NorthWest Healthcare Properties Real Estate Investment Trust | | | 107,938 | | | | 675,535 | |

Total Health Care REITs | | | | | | | 1,060,768 | |

Industrial REITs — 0.9% | | | | | | | | |

CapitaLand Ascendas REIT | | | 1,094,800 | | | | 2,355,029 | |

Mapletree Industrial Trust | | | 533,300 | | | | 950,638 | |

Total Industrial REITs | | | | | | | 3,305,667 | |

Office REITs — 0.3% | | | | | | | | |

Cromwell Property Group | | | 738,020 | | | | 274,330 | |

Ichigo Office REIT Investment Corp. | | | 1,139 | | | | 828,426 | |

Total Office REITs | | | | | | | 1,102,756 | |

Real Estate Management & Development — 3.0% | | | | | | | | |

Cibus Nordic Real Estate AB | | | 15,991 | | | | 167,011 | |

Daiwa House Industry Co. Ltd. | | | 191,000 | | | | 4,468,961 | |

Henderson Land Development Co. Ltd. | | | 245,256 | | | | 848,247 | |

Kerry Properties Ltd. | | | 100,276 | | | | 256,121 | |

Sun Hung Kai Properties Ltd. | | | 377,945 | | | | 5,296,078 | |

Total Real Estate Management & Development | | | | | | | 11,036,418 | |

Retail REITs — 1.5% | | | | | | | | |

AEON REIT Investment Corp. | | | 1,062 | | | | 1,156,238 | |

CT Real Estate Investment Trust | | | 43,176 | | | | 511,406 | |

Frasers Centrepoint Trust | | | 279,800 | | | | 481,924 | |

Frontier Real Estate Investment Corp. | | | 217 | | | | 774,476 | |

SmartCentres Real Estate Investment Trust | | | 95,072 | | | | 1,866,526 | |

Waypoint REIT Ltd. | | | 469,981 | | | | 815,254 | |

Total Retail REITs | | | | | | | 5,605,824 | |

Total Real Estate | | | | | | | 23,172,798 | |

| Utilities — 15.2% | | | | | | | | |

Electric Utilities — 7.8% | | | | | | | | |

CK Infrastructure Holdings Ltd. | | | 172,981 | | | | 940,934 | |

Emera Inc. | | | 225,602 | | | | 9,255,125 | |

Iberdrola SA | | | 803,198 | | | | 10,022,211 | |

Power Assets Holdings Ltd. | | | 298,324 | | | | 1,599,939 | |

Red Electrica Corp. SA | | | 116,928 | | | | 2,057,991 | |

SSE PLC | | | 90,483 | | | | 2,017,156 | |

Terna — Rete Elettrica Nazionale SpA | | | 343,072 | | | | 2,820,081 | |

Total Electric Utilities | | | | | | | 28,713,437 | |

Gas Utilities — 1.2% | | | | | | | | |

Italgas SpA | | | 115,211 | | | | 704,087 | |

See Notes to Financial Statements.

| | | | |

| 20 | | | | Franklin Low Volatility High Dividend Index ETFs 2023 Annual Report |

Franklin International Low Volatility High Dividend Index ETF

(Percentages shown based on Fund net assets)

| | | | | | | | | | | | |

| Security | | | | | Shares | | | Value | |

Gas Utilities — continued | | | | | | | | | | | | |

Rubis SCA | | | | | | | 18,010 | | | $ | 482,717 | |

Snam SpA | | | | | | | 602,960 | | | | 3,202,717 | |

Total Gas Utilities | | | | | | | | | | | 4,389,521 | |

Multi-Utilities — 6.2% | | | | | | | | | | | | |

A2A SpA | | | | | | | 1,047,069 | | | | 1,672,255 | |

E.ON SE | | | | | | | 860,362 | | | | 10,749,519 | |

Iren SpA | | | | | | | 179,528 | | | | 344,260 | |

National Grid PLC | | | | | | | 721,856 | | | | 9,786,695 | |

Total Multi-Utilities | | | | | | | | | | | 22,552,729 | |

Total Utilities | | | | | | | | | | | 55,655,687 | |

Total Common Stocks (Cost — $341,228,439) | | | | | | | | | | | 360,945,555 | |

| | | |

| | | Rate | | | | | | | |

| Preferred Stocks — 2.5% | | | | | | | | | | | | |

| Consumer Discretionary — 2.5% | | | | | | | | | | | | |

Automobiles — 2.5% | | | | | | | | | | | | |

Volkswagen AG (Cost — $9,113,994) | | | 6.972 | % | | | 66,310 | | | | 9,051,424 | (a) |

Total Investments before Short-Term Investments (Cost — $350,342,433) | | | | | | | | | | | 369,996,979 | |

| Short-Term Investments — 0.4% | | | | | | | | | | | | |

Invesco Treasury Portfolio, Institutional Class (Cost — $1,608,465) | | | 4.716 | % | | | 1,608,465 | | | | 1,608,465 | (b) |

Total Investments — 101.3% (Cost — $351,950,898) | | | | | | | | | | | 371,605,444 | |

Liabilities in Excess of Other Assets — (1.3)% | | | | | | | | | | | (4,810,801) | |

Total Net Assets — 100.0% | | | | | | | | | | $ | 366,794,643 | |

| * | Non-income producing security. |

| (a) | The rate shown represents the yield as of March 31, 2023. |

| (b) | Rate shown is one-day yield as of the end of the reporting period. |

| | |

Abbreviation(s) used in this schedule: |

| |

| REIT | | — Real Estate Investment Trust |

At March 31, 2023, the Fund had the following open futures contracts:

| | | | | | | | | | | | | | | | | | | | |

| | | Number of

Contracts | | | Expiration

Date | | | Notional

Amount | | | Market

Value | | | Unrealized

Appreciation | |

| Contracts to Buy: | | | | | | �� | | | | | | | | | | | | | | |

| MSCI EAFE Index | | | 15 | | | | 6/23 | | | $ | 1,470,581 | | | $ | 1,572,375 | | | $ | 101,794 | |

At March 31, 2023, the Fund had the following open forward foreign currency contracts:

| | | | | | | | | | | | | | | | | | | | |

Currency

Purchased | | | Currency

Sold | | | Counterparty | | Settlement

Date | | | Unrealized

Appreciation

(Depreciation) | |

| USD | | | 127,983 | | | CHF | | | 117,957 | | | Bank of New York | | | 4/11/23 | | | $ | (1,289) | |

| USD | | | 131,120 | | | CHF | | | 122,892 | | | Bank of New York | | | 4/11/23 | | | | (3,561) | |

| USD | | | 132,805 | | | CHF | | | 120,733 | | | Bank of New York | | | 4/11/23 | | | | 490 | |

| USD | | | 256,457 | | | CHF | | | 235,516 | | | Bank of New York | | | 4/11/23 | | | | (1,651) | |

| USD | | | 257,986 | | | CHF | | | 235,516 | | | Bank of New York | | | 4/11/23 | | | | (123) | |

| USD | | | 510,315 | | | CHF | | | 472,148 | | | Bank of New York | | | 4/11/23 | | | | (7,124) | |

| USD | | | 27,915,583 | | | CHF | | | 26,178,843 | | | Bank of New York | | | 4/11/23 | | | | (774,492) | |

See Notes to Financial Statements.

| | | | | | |

| Franklin Low Volatility High Dividend Index ETFs 2023 Annual Report | | | | | 21 | |

Schedules of investments (cont’d)

March 31, 2023

Franklin International Low Volatility High Dividend Index ETF

| | | | | | | | | | | | | | | | | | | | |

Currency

Purchased | | | Currency

Sold | | | Counterparty | | Settlement

Date | | | Unrealized

Appreciation

(Depreciation) | |

| USD | | | 448,976 | | | EUR | | | 415,648 | | | Bank of New York | | | 4/11/23 | | | $ | (2,883) | |

| USD | | | 457,479 | | | EUR | | | 425,508 | | | Bank of New York | | | 4/11/23 | | | | (5,099) | |

| USD | | | 459,353 | | | EUR | | | 433,118 | | | Bank of New York | | | 4/11/23 | | | | (11,498) | |

| USD | | | 899,593 | | | EUR | | | 830,048 | | | Bank of New York | | | 4/11/23 | | | | (2,770) | |

| USD | | | 902,124 | | | EUR | | | 830,048 | | | Bank of New York | | | 4/11/23 | | | | (238) | |

| USD | | | 1,772,340 | | | EUR | | | 1,664,027 | | | Bank of New York | | | 4/11/23 | | | | (36,658) | |

| USD | | | 98,469,357 | | | EUR | | | 92,614,805 | | | Bank of New York | | | 4/11/23 | | | | (2,214,138) | |