UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | |

| Investment Company Act file number | | 811-23075 |

Nuveen High Income November 2021 Target Term Fund

(Exact name of registrant as specified in charter)

Nuveen Investments

333 West Wacker Drive, Chicago, IL 60606

(Address of principal executive offices) (Zip code)

Gifford R. Zimmerman

Nuveen Investments

333 West Wacker Drive, Chicago, IL 60606

(Name and address of agent for service)

Registrant’s telephone number, including area code: (312) 917-7700

Date of fiscal year end: December 31

Date of reporting period: June 30, 2017

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policy making roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss.3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

| | |

| | |  |

| Closed-End Funds | |

| | | | | | |

| | | | | | | Semi-Annual Report June 30, 2017 |

| | | |

| | | | | | |

| | | | | | | |

| JHY | | | | | | |

| Nuveen High Income 2020 Target Term Fund | | |

| | | | | | | |

| JHD | | | | | | |

| Nuveen High Income December 2019 Target Term Fund | | |

| | | | | | | |

| JHA | | | | | | |

| Nuveen High Income December 2018 Target Term Fund | | |

| | | | | | | |

| JHB | | | | | | |

| Nuveen High Income November 2021 Target Term Fund | | |

| | | | | | | | | | | | |

| | | | |

| | | | |

| | | | | | | | |

| |

| | Life is Complex |

| |

| | Nuveen makes things e-simple. It only takes a minute to sign up for e-Reports. Once enrolled, you’ll receive an e-mail as soon as your Nuveen Fund information is ready – no more waiting for delivery by regular mail. Just click on the link within the e-mail to see the report and save it on your computer if you wish. |

| | |

| | Free e-Reports right to your e-mail! |

| |

| | www.investordelivery.com If you receive your Nuveen Fund distributions and statements from your financial advisor or brokerage account. |

| |

| or | | www.nuveen.com/accountaccess If you receive your Nuveen Fund distributions and statements directly from Nuveen. |

Table

of Contents

Chairman’s Letter

to Shareholders

Dear Shareholders,

Some of the key assumptions driving the markets higher at the beginning of 2017 have recently come into question. Following the collapse of the health care reform bill in the Senate, progress on the rest of the White House’s pro-growth fiscal agenda, including tax reform and large infrastructure projects, is expected to be delayed. Economic growth projections, in turn, have been lowered, and with inflation recently waning, the markets are expecting fewer rate hikes from the Federal Reserve (Fed) than the Fed itself had predicted. Yet, asset prices continued to rise.

Investors have largely looked beyond policy disappointments and focused instead on the healthy profits reported by U.S. companies during the first two quarters of 2017. U.S. growth has remained slow and steady, European growth has surprised to the upside and concern that China would decelerate too rapidly has eased, further contributing to an optimistic tone in the markets. Additionally, political risk in Europe has moderated, with the election of mainstream candidates in the Dutch and French elections earlier this year.

The remainder of the year could bring challenges to this benign macro environment. The debt ceiling looms, with a vote needed from Congress to raise or suspend the nation’s borrowing limit before the Treasury is unable to pay its bills in full or on time (likely in early October). The mechanics of the U.K.’s separation from the European Union remain to be seen, as “Brexit” negotiations develop. A tightening of financial conditions in China or a more aggressive-than-expected policy action from the Fed, European Central Bank or Bank of Japan could also turn into headwinds.

Market volatility readings have been remarkably low lately, but conditions can change quickly. As market conditions evolve, Nuveen remains committed to rigorously assessing opportunities and risks. If you’re concerned about how resilient your investment portfolio might be, we encourage you to talk to your financial advisor. On behalf of the other members of the Nuveen Fund Board, we look forward to continuing to earn your trust in the months and years ahead.

Sincerely,

William J. Schneider

Chairman of the Board

August 23, 2017

Portfolio Managers’

Comments

Nuveen High Income 2020 Target Term Fund (JHY)

Nuveen High Income December 2019 Target Term Fund (JHD)

Nuveen High Income December 2018 Target Term Fund (JHA)

Nuveen High Income November 2021 Target Term Fund (JHB)

Nuveen High Income 2020 Target Term Fund (JHY), Nuveen High Income December 2019 Target Term Fund (JHD), Nuveen High Income December 2018 Target Term Fund (JHA), and Nuveen High Income November 2021 Target Term Fund (JHB) are closed-end funds that are advised by Nuveen Fund Advisors, LLC (NFAL) and feature portfolio management by Nuveen Asset Management, LLC (NAM). The Funds’ portfolio managers are John T. Fruit, CFA, and Jeffrey T. Schmitz, CFA.

Here the Fund’s portfolio management team discusses key investment strategies and the Fund’s performance for the six-month reporting period ended June 30, 2017.

Nuveen High Income 2020 Target Term Fund (JHY)

What key strategies were used to manage the Fund during this six-month reporting period ended June 30, 2017?

The Fund has an objective to provide a high level of current income and to return the original $9.85 net asset value (NAV) per common share on or about November 1, 2020. The Fund will seek to achieve its investment objectives by investing primarily in shorter maturity, high yield (below investment grade) corporate debt securities. High yield bonds typically offer higher yields than investment grade bonds, in exchange for greater credit risk. Bonds with shorter maturities have lower duration (or interest rate sensitivity) than longer maturity bonds, which may help mitigate price declines if rates rise.

The Fund may invest in other types of securities including senior loans, convertible securities and other types of debt instruments and derivatives that provide comparable economic exposure to the corporate debt market. At least 80% of its managed assets will be in corporate debt securities and separately, at least 80% in securities that, at the time of investment, are rated below investment grade or are unrated but judged by the portfolio managers to be of comparable quality. No more than 15% will be in securities rated CCC+/Caa1 or lower at the time of investment. Up to 30%

This material is not intended to be a recommendation or investment advice, does not constitute a solicitation to buy or sell securities, and is not provided in a fiduciary. The information provided does not take into account the specific objectives or circumstances of any particular investor, or suggest any specific course of action. Investment decisions should be made based on an investor’s objectives or circumstances and in consultation with his or her advisors.

Certain statements in this report are forward-looking statements. Discussions of specific investments are for illustration only and are not intended as recommendations of individual investments. The forward-looking statements and other views expressed herein are those of the portfolio managers as of the date of this report. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements and the views expressed herein are subject to change at any time, due to numerous market and other factors. The Funds disclaim any obligation to update publicly or revise any forward-looking statements or views expressed herein.

For financial reporting purposes, the ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s (S&P), Moody’s Investors Service, Inc. (Moody’s) or Fitch, Inc. (Fitch). This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below investment grade ratings. Certain bonds backed by U.S. Government or agency securities are regarded as having an implied rating equal to the rating of such securities. Holdings designated N/R are not rated by these national rating agencies.

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

Portfolio Managers’ Comments (continued)

may be in securities of non-U.S. issuers, including up to 20% in emerging market issuers and up to 10% may be in non-U.S. dollar denominated securities.

The Fund seeks to identify securities across diverse sectors and industries that the managers believe are undervalued or mispriced. In seeking to return the original NAV on or about November 1, 2020, the Fund intends to utilize various portfolio and cash flow management techniques, including setting aside a portion of its net investment income, possibly retaining gains and limiting the longest maturity of any holding to no later than May 1, 2021. The Fund also uses leverage.

How did the Fund perform during this six-month reporting period ended June 30, 2017?

The table in the Performance Overview and Holding Summaries section of this report provides total return performance for the Fund for the six-month, one-year and since inception periods ended June 30, 2017. For the six-month reporting period ended June 30, 2017, the Fund outperformed the Bloomberg Barclays U.S. High Yield 1-5 Year Cash Pay 2% Issuer Capped Index based on the Fund’s total return at NAV.

High yield spreads continued to tighten throughout the reporting period despite a brief correction in March when a temporary spike in interest rates, coupled with a slide in oil prices, caused high yield spreads to briefly widen. By the end of the reporting period, however, credit spreads were once again supported by steady investor interest in the Treasury market combined with low financial market volatility and strengthening equity markets. During the reporting period, high yield spreads in the broader market tightened by roughly 50 basis points to levels not seen since mid-2014, ending the reporting period at 390 basis points over Treasuries. Tightening spreads helped the segment achieve solid gains as demonstrated by a 4.27% return for the benchmark Bloomberg Barclays U.S. High Yield 1-5 Year Cash Pay 2% Issuer Capped Index and a 4.93% return for the broader Bloomberg Barclays U.S. Corporate High Yield Bond Index. Several other factors continued to positively affect the market including a pickup in economic activity around the world, solid corporate earnings, ongoing support from central banks across the globe and an underwhelming supply of bonds in the market. All of these positive factors aside, the high yield market did not experience strong inflows during the reporting period. Investors appeared wary about policy risk surrounding the Trump administration, geopolitical tensions, the decline in oil prices, lofty valuations and heightened risks as we head toward the September meetings for the European Central Bank and Federal Reserve.

The Fund seeks to protect against credit losses to help ensure the goal of returning its original NAV. While the Fund is designed to own more or less a static portfolio of high yield bonds, at times we have to add new securities to replace ones that have been called away or tendered. As we replace these bonds, we seek to maximize the Fund’s yield within the maturity, diversification and credit quality constraints described at the outset of the strategy. We may also look to maximize the Fund’s yield through opportunistic sales of securities that we believe have reached their upside potential, investing the proceeds in other securities that have a more attractive yield or credit profile. Our goal is to monetize some holdings at a gain, which should help to offset any realized or mark-to-market losses that may occur elsewhere in the portfolio. We believe the Fund’s focus on shorter-dated maturities, coupled with limitations to CCC rated securities, should result in lower volatility and help buffer its NAV performance during periods of weakness for the high yield market.

During the reporting period, credit performance within the Fund continued to be strong and generally in line with the overall market, which showed little in the way of weakening credit conditions or increases in default expectations. In select cases, we harvested some price gains in the portfolio to offset some modest realized losses. This helped us to increase the overall quality of the portfolio by reducing its weight in underperforming credits or credits that we deemed were no longer suitable for the risk profile of the Fund. Again though, given the strong credit environment, we saw little in the way of credit deterioration among portfolio credits and the Fund had no defaults across its whole portfolio. The Fund was able to outperform the benchmark mainly by avoiding some of the weaker index performers, particularly in the energy industry.

The uptick in global default rates that resulted from the spike in defaults among energy and commodity companies over the past two years has run its course. By June 2017, Moody’s global speculative grade default rate had fallen to 3.2%, down from its August 2016 high of 4.8%, and the rating agency is forecasting the global default rate will decline further to 2.5% by December 2017. Tightening high yield spreads and low levels of unemployment are just two factors signaling that the default rate will trend lower over the next twelve months. Other leading indicators of future default pressures have also improved, including strong performance from financial and bank equities and lower overall equity volatility.

The Fund continued to carry below-market exposures to energy and CCC rated debt as set forth at its inception, which helped to mitigate volatility in its NAV during the reporting period. While we continue to attempt to maximize portfolio yield where achievable, we do so within the context of protecting the Fund’s credit quality and positioning the portfolio to alleviate the effects of early calls or redemptions. We expect to see some degree of call activity given the most recent downward trend in rates and the propensity for issuers to refinance their short-term debt and replace it with longer maturities. However, as a result of tightening credit spreads in the high yield market, the Fund’s NAV moved higher over the course of the reporting period. As of the end of the reporting period, the Fund was on track to return its original NAV as described in its prospectus.

Nuveen High Income December 2019 Target Term Fund (JHD)

What key strategies were used to manage the Fund during this six-month reporting period ended June 30, 2017?

The Fund has an objective to provide a high level of current income and to return the original $9.86 net asset value (NAV) per common share on or about December 1, 2019. The Fund will seek to achieve its investment objectives by investing primarily in shorter maturity, high yield (below investment grade) corporate debt securities. High yield bonds typically offer higher yields than investment grade bonds, in exchange for greater credit risk. Bonds with shorter maturities have lower duration (or interest rate sensitivity) than longer maturity bonds, which may help mitigate price declines if rates rise.

The Fund may invest in other types of securities including senior loans, convertible securities and other types of debt instruments and derivatives that provide comparable economic exposure to the corporate debt market. At least 80% of its managed assets will be in corporate debt securities and separately, at least 80% in securities that, at the time of investment, are rated below investment grade or are unrated but judged by the portfolio managers to be of comparable quality. No more than 15% will be in securities rated CCC+/Caa1 or lower at the time of investment. Up to 30% may be in securities of non-U.S. issuers, including up to 20% in emerging market issuers and up to 10% may be in non-U.S. dollar denominated securities.

The Fund seeks to identify securities across diverse sectors and industries that the managers believe are undervalued or mispriced. In seeking to return the original NAV on or about December 1, 2019, the Fund intends to utilize various portfolio and cash flow management techniques, including setting aside a portion of its net investment income, possibly retaining gains and limiting the longest maturity of any holding to no later than June 1, 2020. The Fund also uses leverage.

How did the Fund perform during this six-month reporting period ended June 30, 2017?

The table in the Performance Overview and Holding Summaries section of this report provides total return performance for the Fund for the six-month, one-year and since inception periods ended June 30, 2017. For the six-month reporting period ended June 30, 2017, the Fund outperformed the Bloomberg Barclays U.S. High Yield 1-5 Year Cash Pay 2% Issuer Capped Index based on the Fund’s total return at NAV.

Portfolio Managers’ Comments (continued)

High yield spreads continued to tighten throughout the first half of 2017 despite a brief correction in March when a temporary spike in interest rates, coupled with a slide in oil prices, caused high yield spreads to briefly widen. By the end of the reporting period, however, credit spreads were once again supported by steady investor interest in the Treasury market combined with low financial market volatility and strengthening equity markets. During the reporting period, high yield spreads in the broader market tightened by roughly 50 basis points to levels not seen since mid-2014, ending the reporting period at 390 basis points over Treasuries. Tightening spreads helped the segment achieve solid gains as demonstrated by a 4.27% return for the benchmark Bloomberg Barclays U.S. High Yield 1-5 Year Cash Pay 2% Issuer Capped Index and a 4.93% return for the broader Bloomberg Barclays U.S. Corporate High Yield Bond Index. Several other factors continued to positively affect the market including a pickup in economic activity around the world, solid corporate earnings, ongoing support from central banks across the globe and an underwhelming supply of bonds in the market. All of these positive factors aside, the high yield market did not experience strong inflows during the reporting period. Investors appeared wary about policy risk surrounding the Trump administration, geopolitical tensions, the decline in oil prices, lofty valuations and heightened risks as we head toward the September meetings for the European Central Bank and Federal Reserve.

The Fund seeks to protect against credit losses to help ensure the goal of returning its original NAV. While the Fund is designed to own more or less a static portfolio of high yield bonds, at times we have to add new securities to replace ones that have been called away or tendered. As we replace these bonds, we seek to maximize the Fund’s yield within the maturity, diversification and credit quality constraints described at the outset of the strategy. We may also look to maximize the Fund’s yield through opportunistic sales of securities that we believe have reached their upside potential, investing the proceeds in other securities that have a more attractive yield or credit profile. Our goal is to monetize some holdings at a gain, which should help to offset any realized or mark-to-market losses that may occur elsewhere in the portfolio. We believe the Fund’s focus on shorter-dated maturities, coupled with limitations to CCC rated securities, should result in lower volatility and help buffer its NAV performance during periods of weakness for the high yield market.

During the reporting period, credit performance within the Fund continued to be strong and generally in line with the overall market, which showed little in the way of weakening credit conditions or increases in default expectations. In select cases, we harvested some price gains in the portfolio to offset some modest realized losses. This helped us to increase the overall quality of the portfolio by reducing its weight in underperforming credits or credits that we deemed were no longer suitable for the risk profile of the Fund. Again though, given the strong credit environment, we saw little in the way of credit deterioration among portfolio credits and the Fund had no defaults across its whole portfolio. The Fund was able to outperform the benchmark mainly by avoiding some of the weaker index performers, particularly in the energy industry.

The uptick in global default rates that resulted from the spike in defaults among energy and commodity companies over the past two years has run its course. By June 2017, Moody’s global speculative grade default rate had fallen to 3.2%, down from its August 2016 high of 4.8% for this cycle, and the rating agency is forecasting the global default rate will decline further to 2.5% by December 2017. Tightening high yield spreads and low levels of unemployment are just two factors signaling that the default rate will trend lower over the next twelve months. Other leading indicators of future default pressures have also improved, including strong performance from financial and bank equities and lower overall equity volatility.

The Fund continued to carry below market exposures to energy and CCC rated debt as set forth at its inception, which helped to mitigate volatility in its NAV during the reporting period. While we continue to attempt to maximize portfolio yield where achievable, we do so within the context of protecting the Fund’s credit quality and positioning the portfolio to alleviate the effects of early calls or redemptions. We expect to see some degree of call activity given the most recent downward trend in rates and the propensity for issuers to refinance their short-term debt and replace it with

longer maturities. However, as a result of tightening credit spreads in the high yield market, the Fund’s NAV moved higher over the course of the reporting period. As of the end of the reporting period, the Fund was on track to return its original NAV as described in its prospectus.

Nuveen High Income December 2018 Target Term Fund (JHA)

What key strategies were used to manage the Fund during this six-month reporting period ended June 30, 2017?

The Fund has an objective to provide a high level of current income and to return the original $9.86 net asset value (NAV) per common share on or about December 1, 2018. The Fund will seek to achieve its investment objectives by investing primarily in shorter maturity, high yield (below investment grade) corporate debt securities. High yield bonds typically offer higher yields than investment grade bonds, in exchange for greater credit risk. Bonds with shorter maturities have lower duration (or interest rate sensitivity) than longer maturity bonds, which may help mitigate price declines if rates rise.

The Fund may invest in other types of securities including senior loans, convertible securities and other types of debt instruments and derivatives that provide comparable economic exposure to the corporate debt market. At least 80% of its managed assets will be in corporate debt securities and separately, at least 80% in securities that, at the time of investment, are rated below investment grade or are unrated but judged by the portfolio managers to be of comparable quality. No more than 15% will be in securities rated CCC+/Caa1 or lower at the time of investment. Up to 30% may be in securities of non-U.S. issuers, including up to 20% in emerging market issuers and up to 10% may be in non-U.S. dollar denominated securities.

The Fund seeks to identify securities across diverse sectors and industries that the managers believe are undervalued or mispriced. In seeking to return the original NAV on or about December 1, 2018, the Fund intends to utilize various portfolio and cash flow management techniques, including setting aside a portion of its net investment income, possibly retaining gains and limiting the longest maturity of any holding to no later than June 1, 2019. The Fund also uses leverage.

How did the Fund perform during this six-month reporting period ended June 30, 2017?

The table in the Performance Overview and Holding Summaries section of this report provides total return performance for the Fund for the six-month, one-year and since inception periods ended June 30, 2017. For the six-month reporting period ended June 30, 2017, the Fund underperformed the Bloomberg Barclays U.S. High Yield 1-5 Year Cash Pay 2% Issuer Capped Index based on the Fund’s total return at NAV.

High yield spreads continued to tighten throughout the reporting period despite a brief correction in March when a temporary spike in interest rates, coupled with a slide in oil prices, caused high yield spreads to briefly widen. By the end of the reporting period, however, credit spreads were once again supported by steady investor interest in the Treasury market combined with low financial market volatility and strengthening equity markets. During the reporting period, high yield spreads in the broader market tightened by roughly 50 basis points to levels not seen since mid-2014, ending the reporting period at 390 basis points over Treasuries. Tightening spreads helped the segment achieve solid gains as demonstrated by a 4.27% return for the benchmark Bloomberg Barclays U.S. High Yield 1-5 Year Cash Pay 2% Issuer Capped Index and a 4.93% return for the broader Bloomberg Barclays U.S. Corporate High Yield Bond Index. Several other factors continued to positively affect the market including a pickup in economic activity around the world, solid corporate earnings, ongoing support from central banks across the globe and an underwhelming supply of bonds in the market. All of these positive factors aside, the high yield market did not experience strong inflows during the reporting period. Investors appeared wary about policy risk surrounding the Trump administration, geopolitical tensions, the decline in oil prices, lofty valuations and heightened risks as we head toward the September meetings for the European Central Bank and Federal Reserve.

Portfolio Managers’ Comments (continued)

The Fund seeks to protect against credit losses to help ensure the goal of returning its original NAV. While the Fund is designed to own more or less a static portfolio of high yield bonds, at times we have to add new securities to replace ones that have been called away or tendered. As we replace these bonds, we seek to maximize the Fund’s yield within the maturity, diversification and credit quality constraints described at the outset of the strategy. We may also look to maximize the Fund’s yield through opportunistic sales of securities that we believe have reached their upside potential, investing the proceeds in other securities that have a more attractive yield or credit profile. Our goal is to monetize some holdings at a gain, which should help to offset any realized or mark-to-market losses that may occur elsewhere in the portfolio. We believe the Fund’s focus on shorter-dated maturities, coupled with limitations to CCC rated securities, should result in lower volatility and help buffer its NAV performance during periods of weakness for the high yield market.

During the reporting period, credit performance within the Fund continued to be strong and generally in line with the overall market, which showed little in the way of weakening credit conditions or increases in default expectations. In select cases, we harvested some price gains in the portfolio to offset some modest realized losses. This helped us to increase the overall quality of the portfolio by reducing its weight in underperforming credits or credits that we deemed were no longer suitable for the risk profile of the Fund. While the Fund marginally underperformed the benchmark due to its modest overweight exposure to some underperforming credits, by and large the Fund continued to see little in the way of credit deterioration among portfolio credits and the Fund had no defaults across its whole portfolio.

The uptick in global default rates that resulted from the spike in defaults among energy and commodity companies over the past two years has run its course. By June 2017, Moody’s global speculative grade default rate had fallen to 3.2%, down from its August 2016 high of 4.8% for this cycle, and the rating agency is forecasting the global default rate will decline further to 2.5% by December 2017. Tightening high yield spreads and low levels of unemployment are just two factors signaling that the default rate will trend lower over the next twelve months. Other leading indicators of future default pressures have also improved, including strong performance from financial and bank equities and lower overall equity volatility.

The Fund continued to carry below-market exposures to energy and CCC rated debt as set forth at its inception, which helped to mitigate volatility in its NAV during the reporting period. While we continue to attempt to maximize portfolio yield where achievable, we do so within the context of protecting the Fund’s credit quality and positioning the portfolio to alleviate the effects of early calls or redemptions. Of course, we expect to see some degree of call activity given the most recent downward trend in rates and the propensity for issuers to refinance their short-term debt and replace it with longer maturities. However, as a result of tightening credit spreads in the high yield market, the Fund’s NAV moved higher over the course of the reporting period. As of the end of the reporting period, the Fund was on track to return its original NAV as described in its prospectus.

Nuveen High Income November 2021 Target Term Fund (JHB)

What key strategies were used to manage the Fund during this six-month reporting period ended June 30, 2017?

The Fund has an objective to provide a high level of current income and to return the original $9.85 net asset value (NAV) per common share on or about November 1, 2021. The Fund will seek to achieve its investment objectives by investing primarily in shorter maturity, high yield (below investment grade) corporate debt securities. High yield bonds typically offer higher yields than investment grade bonds, in exchange for greater credit risk. Bonds with shorter maturities have lower duration (or interest rate sensitivity) than longer maturity bonds, which may help mitigate price declines if rates rise.

The Fund may invest in other types of securities including senior loans, convertible securities and other types of debt instruments and derivatives that provide comparable economic exposure to the corporate debt market. At least 80% of

its managed assets will be in corporate debt securities and separately, at least 80% in securities that, at the time of investment, are rated below investment grade or are unrated but judged by the portfolio managers to be of comparable quality. No more than 15% will be in securities rated CCC+/Caa1 or lower at the time of investment. Up to 30% may be in securities of non-U.S. issuers, including up to 20% in emerging market issuers, and up to 10% may be in non-U.S. dollar denominated securities.

The Fund seeks to identify securities across diverse sectors and industries that the managers believe are undervalued or mispriced. In seeking to return the original NAV on or about November 1, 2021, the Fund intends to utilize various portfolio and cash flow management techniques, including setting aside a portion of its net investment income, possibly retaining gains and limiting the longest maturity of any holding to no later than May 1, 2022. The Fund also uses leverage.

How did the Fund perform during this six-month reporting period ended June 30, 2017?

The table in the Performance Overview and Holding Summaries section of this report provides total return performance for the Fund for the six-month and since inception periods ended June 30, 2017. For the six-month reporting period ended June 30, 2017, the Fund outperformed the Bloomberg Barclays U.S. High Yield 1-5 Year Cash Pay 2% Issuer Capped Index based on the Fund’s total return at NAV.

High yield spreads continued to tighten throughout the reporting period despite a brief correction in March when a temporary spike in interest rates, coupled with a slide in oil prices, caused high yield spreads to briefly widen. By the end of the reporting period, however, credit spreads were once again supported by steady investor interest in the Treasury market combined with low financial market volatility and strengthening equity markets. During the reporting period, high yield spreads in the broader market tightened by roughly 50 basis points to levels not seen since mid-2014, ending the reporting period at 390 basis points over Treasuries. Tightening spreads helped the segment achieve solid gains as demonstrated by a 4.27% return for the benchmark Bloomberg Barclays U.S. High Yield 1-5 Year Cash Pay 2% Issuer Capped Index and a 4.93% return for the broader Bloomberg Barclays U.S. Corporate High Yield Bond Index. Several other factors continued to positively affect the market including a pickup in economic activity around the world, solid corporate earnings, ongoing support from central banks across the globe and an underwhelming supply of bonds in the market. All of these positive factors aside, the high yield market did not experience strong inflows during the reporting period. Investors appeared wary about policy risk surrounding the Trump administration, geopolitical tensions, the decline in oil prices, lofty valuations and heightened risks as we head toward the September meetings for the European Central Bank and Federal Reserve.

The Fund seeks to protect against credit losses to help ensure the goal of returning its original NAV. While the Fund is designed to own more or less a static portfolio of high yield bonds, at times we have to add new securities to replace ones that have been called away or tendered. As we replace these bonds, we seek to maximize the Fund’s yield within the maturity, diversification and credit quality constraints described at the outset of the strategy. We may also look to maximize the Fund’s yield through opportunistic sales of securities that we believe have reached their upside potential, investing the proceeds in other securities that have a more attractive yield or credit profile. Our goal is to monetize some holdings at a gain, which should help to offset any realized or mark-to-market losses that may occur elsewhere in the portfolio. We believe the Fund’s focus on shorter-dated maturities, coupled with limitations to CCC rated securities, should result in lower volatility and help buffer its NAV performance during periods of weakness for the high yield market.

During the reporting period, credit performance within the Fund continued to be strong and generally in line with the overall market, which showed little in the way of weakening credit conditions or increases in default expectations. In select cases, we harvested some price gains in the portfolio to offset some modest realized losses. This helped us to increase the overall quality of the portfolio by reducing its weight in underperforming credits or credits that we deemed

Portfolio Managers’ Comments (continued)

were no longer suitable for the risk profile of the Fund. Again though, given the strong credit environment, we saw little in the way of credit deterioration among portfolio credits and the Fund had no defaults across its whole portfolio. The Fund was able to outperform the benchmark mainly by avoiding some of the weaker index performers, particularly in the energy industry.

The uptick in global default rates that resulted from the spike in defaults among energy and commodity companies over the past two years has run its course. By June 2017, Moody’s global speculative grade default rate had fallen to 3.2%, down from its August 2016 high of 4.8% for this cycle, and the rating agency is forecasting the global default rate will decline further to 2.5% by December 2017. Tightening high yield spreads and low levels of unemployment are just two factors signaling that the default rate will trend lower over the next twelve months. Other leading indicators of future default pressures have also improved, including strong performance from financial and bank equities and lower overall equity volatility.

The Fund continued to carry below market exposures to energy and CCC rated debt as set forth at its inception, which helped to mitigate volatility in its NAV during the reporting period. While we continue to attempt to maximize portfolio yield where achievable, we do so within the context of protecting the Fund’s credit quality and positioning the portfolio to alleviate the effects of early calls or redemptions. Of course, we expect to see some degree of call activity given the most recent downward trend in rates and the propensity for issuers to refinance their short-term debt and replace it with longer maturities. However, as a result of tightening credit spreads in the high yield market, the Fund’s NAV moved higher over the course of the reporting period. As of the end of the reporting period, the Fund was on track to return its original NAV as described in its prospectus.

Fund

Leverage

IMPACT OF THE FUNDS’ LEVERAGE STRATEGIES ON PERFORMANCE

One important factor impacting the returns of the Funds relative to their comparative benchmarks was the Funds’ use of leverage through the use of bank borrowings. The Funds use leverage because our research has shown that, over time, leveraging provides opportunities for additional income and total return for shareholders. However, use of leverage also can expose shareholders to additional volatility. For example, as the prices of securities held by a Fund decline, the negative impact of these valuation changes on NAV and shareholder total return is magnified by the use of leverage. Conversely, leverage may enhance returns during periods when the prices of securities held by a Fund generally are rising. The Funds’ use of leverage had a positive impact on the performance in each Fund during this reporting period.

As of June 30, 2017, the Funds’ percentages of leverage are shown in the accompanying table.

| | | | | | | | | | | | | | | | |

| | | JHY | | | JHD | | | JHA | | | JHB | |

Effective Leverage* | | | 23.08 | % | | | 24.41 | % | | | 23.63 | % | | | 25.07 | % |

Regulatory Leverage* | | | 23.08 | % | | | 24.41 | % | | | 23.63 | % | | | 25.07 | % |

| * | Effective Leverage is a Fund’s effective economic leverage, and includes both regulatory leverage and the leverage effects of certain derivative and other investments in a Fund’s portfolio that increase the Fund’s investment exposure. Regulatory leverage consists of preferred shares issued or borrowings of a Fund. Both of these are part of a Fund’s capital structure. A Fund, however, may from time to time borrow on a typically transient basis in connection with its day-to-day operations, primarily in connection with the need to settle portfolio trades. Such incidental borrowings are excluded from the calculation of a Fund’s effective leverage ratio. Regulatory leverage is subject to asset coverage limits set forth in the Investment Company Act of 1940. |

THE FUNDS’ REGULATORY LEVERAGE

Bank Borrowings

As noted above, the Funds employ leverage through the use of bank borrowings. The Funds’ bank borrowing activities are as shown in the accompanying table.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Current Reporting Period | | | | | | Subsequent to the Close of

the Reporting Period | |

| Fund | | January 1, 2017 | | | Draws | | | Paydowns | | | June 30, 2017 | | | Average Balance

Outstanding | | | | | | Draws | | | Paydowns | | | August 25,

2017 | |

JHY | | $ | 44,000,000 | | | $ | — | | | $ | — | | | $ | 44,000,000 | | | $ | 44,000,000 | | | | | | | $ | — | | | $ | — | | | $ | 44,000,000 | |

JHD | | $ | 90,000,000 | | | $ | — | | | $ | — | | | $ | 90,000,000 | | | $ | 90,000,000 | | | | | | | $ | — | | | $ | — | | | $ | 90,000,000 | |

JHA | | $ | 92,000,000 | | | $ | — | | | $ | — | | | $ | 92,000,000 | | | $ | 92,000,000 | | | | | | | $ | — | | | $ | 40,500,000 | | | $ | 51,500,000 | |

JHB | | $ | 190,000,000 | | | $ | — | | | $ | — | | | $ | 190,000,000 | | | $ | 190,000,000 | | | | | | | $ | — | | | $ | — | | | $ | 190,000,000 | |

Refer to Notes to Financial Statements, Note 8 – Borrowing Arrangements for further details.

Share

Information

DISTRIBUTION INFORMATION

The following information regarding the Funds’ distributions is current as of June 30, 2017. Each Fund’s distribution levels may vary over time based on each Fund’s investment activity and portfolio investment value changes.

During the current reporting period, the Funds’ distributions to shareholders were as shown in the accompanying table.

| | | | | | | | | | | | | | | | |

| | | Per Share Amounts | |

| Monthly Distributions (Ex-Dividend Date) | | JHY | | | JHD | | | JHA | | | JHB | |

January 2017 | | $ | 0.0555 | | | $ | 0.0505 | | | $ | 0.0505 | | | $ | 0.0500 | |

February | | | 0.0555 | | | | 0.0505 | | | | 0.0450 | | | | 0.0500 | |

March | | | 0.0555 | | | | 0.0505 | | | | 0.0450 | | | | 0.0500 | |

April | | | 0.0555 | | | | 0.0505 | | | | 0.0450 | | | | 0.0500 | |

May | | | 0.0555 | | | | 0.0505 | | | | 0.0450 | | | | 0.0500 | |

June 2017 | | | 0.0490 | | | | 0.0505 | | | | 0.0400 | | | | 0.0500 | |

Total Distributions from Net Investment Income | | $ | 0.3265 | | | $ | 0.3030 | | | $ | 0.2705 | | | $ | 0.3000 | |

| | | | |

Current Distribution Rate* | | | 5.83 | % | | | 5.93 | % | | | 4.77 | % | | | 5.93 | % |

| * | Current distribution rate is based on the Fund’s current annualized monthly distribution divided by the Fund’s current market price. The Fund’s monthly distributions to its shareholders may be comprised of ordinary income, net realized capital gains and, if at the end of the fiscal year the Fund’s cumulative net ordinary income and net realized gains are less than the amount of the Fund’s distributions, a return of capital for tax purposes. |

Each Fund seeks to pay regular monthly dividends out of its net investment income at a rate that reflects its past and projected net income performance. To permit each Fund to maintain a more stable monthly dividend, the Fund may pay dividends at a rate that may be more or less than the amount of net income actually earned by the Fund during the period. If a Fund has cumulatively earned more than it has paid in dividends, it will hold the excess in reserve as undistributed net investment income (UNII) as part of the Fund’s net asset value. Conversely, if a Fund has cumulatively paid in dividends more than it has earned, the excess will constitute a negative UNII that will likewise be reflected in the Fund’s net asset value. Each Fund will, over time, pay all its net investment income as dividends to shareholders.

As of June 30, 2017, all the Funds had positive UNII balances, based upon our best estimate, for tax purposes and positive UNII balances for financial reporting purposes.

All monthly dividends paid by the Funds during the current reporting period, were paid from net investment income. If a portion of the Funds’ monthly distributions were sourced from or comprised of elements other than net investment income, including capital gains and/or a return of capital, shareholders would have received a notice to that effect. For financial reporting purposes, the composition and per share amounts of each Fund’s dividends for the reporting period are presented in this report’s Statement of Changes in Net Assets and Financial Highlights, respectively. For income tax purposes, distribution information for each Fund as of its most recent tax year end is presented in Note 6 – Income Tax Information within the Notes to Financial Statements of this report.

EQUITY SHELF PROGRAM

During the previous reporting period, JHY filed a registration statement with the Securities and Exchange Commission to issue additional shares through an equity shelf program (“Shelf Offering”), which became effective during the current reporting period. Under this program JHY, subject to market conditions, may raise additional capital from time to time in varying amounts and offering methods at a net price at or above the Fund’s NAV per share. Under the Shelf Offering, the Fund was authorized to issue additional shares as shown in the accompanying table.

| | | | |

| | | JHY | |

Additional authorized shares | | | 3,400,000 | |

During the current reporting period, JHY sold shares through its Shelf Offering at a weighted average premium to its NAV per share as shown in the accompanying table.

| | | | |

| | | JHY | |

Shares sold through Shelf Offering | | | 1,054,058 | |

Weighted average premium to NAV per share sold | | | 2.55 | % |

Refer to the Notes to Financial Statements, Note 4 – Fund Shares, Equity Shelf Programs and Offering Costs for further details of Shelf Offerings and the Fund’s transactions.

SHARE REPURCHASES

During August 2017 (subsequent to the close of the reporting period), the Funds’ Board of Trustees reauthorized JHY, JHD and JHA and authorized JHB to participate in Nuveen’s closed-end fund complex-wide share repurchase program, allowing each Fund to repurchase an aggregate of up to approximately 10% of its outstanding shares.

As of June 30, 2017, and since the inception of the Funds’ repurchase programs, the following Funds have cumulatively repurchased and retired their outstanding shares as shown in the accompanying table.

| | | | | | | | | | | | |

| | | JHY | | | JHD | | | JHA | |

Shares cumulatively repurchased and retired | | | — | | | | — | | | | — | |

Shares authorized for repurchase | | | 1,370,000 | | | | 2,705,000 | | | | 2,930,000 | |

OTHER SHARE INFORMATION

As of June 30, 2017, and during the current reporting period, the Funds’ share prices were trading at premium/(discount) to their share NAVs as shown in the accompanying table.

| | | | | | | | | | | | | | | | |

| | | JHY | | | JHD | | | JHA | | | JHB | |

NAV | | $ | 9.93 | | | $ | 10.30 | | | $ | 10.13 | | | $ | 10.16 | |

Share price | | $ | 10.09 | | | $ | 10.22 | | | $ | 10.06 | | | $ | 10.11 | |

Premium/(Discount) to NAV | | | 1.61 | % | | | (0.78 | )% | | | (0.69 | )% | | | (0.49 | )% |

6-month average premium/(discount) to NAV | | | 2.95 | % | | | (0.41 | )% | | | 0.15 | % | | | (0.16 | )% |

JHY, JHD, JHA and JHB each have an investment objective to return $9.85, $9.86, $9.86 and $9.85, respectively (the original net asset value following each Fund’s initial public offering (the “Original NAV”)) to shareholders on or about the end of the Fund’s term. There can be no assurance that the Funds will be able to return the Original NAV to shareholders, and such return is not backed or otherwise guaranteed by the Funds’ investment adviser, Nuveen Fund Advisors, LLC (the “Adviser”), or any other entity.

Each Fund’s ability to return Original NAV to common shareholders on or about the Termination Date will depend on market conditions and the success of various portfolio and cash flow management techniques. Each Fund currently intends to set aside and retain in its net assets a portion of its net investment income and possibly all or a portion of its gains. This will reduce the amounts otherwise available for distribution prior to the liquidation of each Fund, and the Fund may incur taxes on such retained amount, which will reduce the overall amounts that the Fund would have otherwise been able to distribute. Such retained income or gains, net of any taxes, would constitute a portion of the liquidating distribution returned to investors at the end of each Fund’s term. In addition, each Fund’s investment in shorter term and lower yielding securities, especially as the Fund nears the end of its term, may reduce investment income and, therefore, the monthly dividends during the period prior to termination. Investors that purchase shares in the secondary market (particularly if their purchase price differs meaningfully from the Original NAV) may receive more or less than their original investment.

Risk

Considerations

Fund shares are not guaranteed or endorsed by any bank or other insured depository institution, and are not federally insured by the Federal Deposit Insurance Corporation.

Nuveen High Income 2020 Target Term Fund (JHY)

Investing in closed-end funds involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. Closed-end fund shares may frequently trade at a discount or premium to their net asset value. Debt or fixed income securities such as those held by the Fund, are subject to market risk, credit risk, interest rate risk, derivatives risk, liquidity risk, and income risk. As interest rates rise, bond prices fall. Lower credit debt securities may be more likely to fail to make timely interest or principal payments and may be subject to higher liquidity risk. Leverage increases return volatility and magnifies the Fund’s potential return and its risks; there is no guarantee a fund’s leverage strategy will be successful. Foreign investments involve additional risks, including currency fluctuation, political and economic instability, lack of liquidity and differing legal and accounting standards. The risks of foreign investments are magnified in emerging markets. These and other risk considerations including the Fund’s limited term and call risk are described in more detail on the Fund’s web page at www.nuveen.com/JHY.

Nuveen High Income December 2019 Target Term Fund (JHD)

Investing in closed-end funds involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. Closed-end fund shares may frequently trade at a discount or premium to their net asset value. Debt or fixed income securities such as those held by the Fund, are subject to market risk, credit risk, interest rate risk, derivatives risk, liquidity risk, and income risk. As interest rates rise, bond prices fall. Lower credit debt securities may be more likely to fail to make timely interest or principal payments and may be subject to higher liquidity risk. Leverage increases return volatility and magnifies the Fund’s potential return and its risks; there is no guarantee a fund’s leverage strategy will be successful. Foreign investments involve additional risks, including currency fluctuation, political and economic instability, lack of liquidity and differing legal and accounting standards. The risks of foreign investments are magnified in emerging markets. These and other risk considerations including the Fund’s limited term and call risk are described in more detail on the Fund’s web page at www.nuveen.com/JHD.

Nuveen High Income December 2018 Target Term Fund (JHA)

Investing in closed-end funds involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. Closed-end fund shares may frequently trade at a discount or premium to their net asset value. Debt or fixed income securities such as those held by the Fund, are subject to market risk, credit risk, interest rate risk, derivatives risk, liquidity risk, and income risk. As interest rates rise, bond prices fall. Lower credit debt securities may be more likely to fail to make timely interest or principal payments and may be subject to higher liquidity risk. Leverage increases return volatility and magnifies the Fund’s potential return and its risks; there is no guarantee a fund’s leverage strategy will be successful. Foreign investments involve additional risks, including currency fluctuation, political and economic instability, lack of liquidity and differing legal and accounting standards. The risks of foreign investments are magnified in emerging markets. These and other risk considerations including the Fund’s limited term and call risk are described in more detail on the Fund’s web page at nuveen.com/JHA.

Nuveen High Income November 2021 Target Term Fund (JHB)

Investing in closed-end funds involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. Closed-end fund shares may frequently trade at a discount or premium to their net asset value. Debt or fixed income securities such as those held by the Fund, are subject to market risk, credit risk, interest rate risk, derivatives risk, liquidity risk, and income risk. As interest rates rise, bond prices fall. Lower credit debt

Risk Considerations (continued)

securities may be more likely to fail to make timely interest or principal payments and may be subject to higher liquidity risk. Leverage increases return volatility and magnifies the Fund’s potential return and its risks; there is no guarantee a fund’s leverage strategy will be successful. Foreign investments involve additional risks, including currency fluctuation, political and economic instability, lack of liquidity and differing legal and accounting standards. The risks of foreign investments are magnified in emerging markets. These and other risk considerations including the Fund’s limited term and call risk are described in more detail on the Fund’s web page at www.nuveen.com/JHB.

JHY

Nuveen High Income 2020 Target Term Fund

Performance Overview and Holding Summaries as of June 30, 2017

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

Average Annual Total Returns as of June 30, 2017

| | | | | | | | | | | | |

| | | Cumulative | | | Average Annual | |

| | | 6-Month | | | 1-Year | | | Since

Inception | |

| JHY at NAV | | | 5.24% | | | | 14.37% | | | | 7.81% | |

| JHY at Share Price | | | 2.11% | | | | (0.19)% | | | | 7.55% | |

| Bloomberg Barclays U.S. High Yield 1-5 Year Cash Pay 2% Issuer Capped Index | | | 4.27% | | | | 11.96% | | | | 7.12% | |

Since inception returns are from 7/28/15. Past performance is not predictive of future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses, and assume reinvestment of distributions. Comparative index return information is provided for the Fund’s shares at NAV only. Indexes are not available for direct investment.

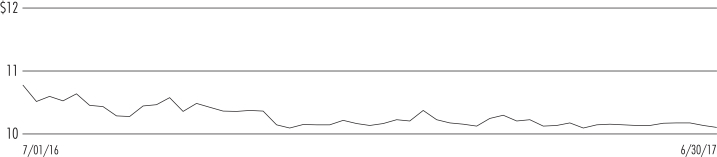

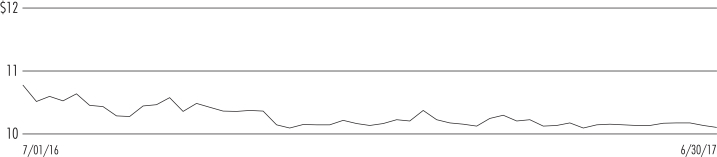

Share Price Performance — Weekly Closing Price

This data relates to the securities held in the Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change.

For financial reporting purposes, the ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Certain bonds backed by U.S. Government or agency securities are regarded as having an implied rating equal to the rating of such securities. Holdings designated N/R are not rated by these national rating agencies.

Fund Allocation

(% of net assets)

| | | | |

| Corporate Bonds | | | 121.1% | |

| Convertible Bonds | | | 2.3% | |

| Sovereign Debt | | | 1.3% | |

| Repurchase Agreements | | | 2.1% | |

| Other Assets Less Liabilities | | | 3.2% | |

Net Assets Plus Borrowings | | | 130.0% | |

| Borrowings | | | (30.0)% | |

Net Assets | | | 100% | |

Country Allocation

(% of total investments)1

| | | | |

| United States | | | 73.9% | |

| Canada | | | 7.6% | |

| Japan | | | 2.6% | |

| Bermuda | | | 2.3% | |

| United Kingdom | | | 2.3% | |

| Luxembourg | | | 2.0% | |

| Brazil | | | 1.7% | |

| Argentina | | | 1.5% | |

| Hong Kong | | | 1.4% | |

| Netherlands | | | 1.1% | |

| Other | | | 3.6% | |

Total | | | 100% | |

Portfolio Composition

(% of total investments)

| | | | |

| Oil, Gas & Consumable Fuels | | | 11.3% | |

| Diversified Financial Services | | | 6.3% | |

| Metals & Mining | | | 5.6% | |

| Wireless Telecommunication Services | | | 5.3% | |

| Household Durables | | | 4.9% | |

| Independent Power & Renewable Electricity Producers | | | 4.9% | |

| Consumer Finance | | | 4.0% | |

| Media | | | 3.7% | |

| Specialty Retail | | | 3.7% | |

| Machinery | | | 3.7% | |

| Commercial Services & Supplies | | | 3.4% | |

| Diversified Telecommunication Services | | | 3.1% | |

| Health Care Providers & Services | | | 2.9% | |

| Hotels, Restaurants & Leisure | | | 2.9% | |

| Airlines | | | 2.5% | |

| Aerospace & Defense | | | 2.2% | |

| Real Estate Management & Development | | | 2.0% | |

| Road & Rail | | | 1.7% | |

| Building Products | | | 1.6% | |

| Industrial Conglomerates | | | 1.4% | |

| Construction & Engineering | | | 1.2% | |

| Other | | | 19.1% | |

| Sovereign Debt | | | 1.0% | |

| Repurchase Agreements | | | 1.6% | |

Total | | | 100% | |

Credit Quality

(% of total long-term investments)

| | | | |

| BBB | | | 3.6% | |

| BB or Lower | | | 92.9% | |

| N/R (not rated) | | | 3.5% | |

Total | | | 100% | |

Top Five Issuers

(% of total investments)

| | | | |

| The Hertz Corporation | | | 1.7% | |

| Jefferies Finance LLC Corporation | | | 1.7% | |

| DPL, Inc. | | | 1.5% | |

| Titan International Inc. | | | 1.5% | |

| Clear Channel Worldwide | | | 1.5% | |

| 1 | Includes 8.9% (as a percentage of total investments) in emerging markets countries. |

JHD

Nuveen High Income December 2019 Target Term Fund

Performance Overview and Holding Summaries as of June 30, 2017

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

Average Annual Total Returns as of June 30, 2017

| | | | | | | | | | | | |

| | | Cumulative | | | Average Annual | |

| | | 6-Month | | | 1-Year | | | Since

Inception | |

| JHD at NAV | | | 4.50% | | | | 11.07% | | | | 9.43% | |

| JHD at Share Price | | | 4.22% | | | | 4.98% | | | | 7.36% | |

| Bloomberg Barclays U.S. High Yield 1-5 Year Cash Pay 2% Issuer Capped Index | | | 4.27% | | | | 11.96% | | | | 12.92% | |

Since inception returns are from 5/10/16. Past performance is not predictive of future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses, and assume reinvestment of distributions. Comparative index return information is provided for the Fund’s shares at NAV only. Indexes are not available for direct investment.

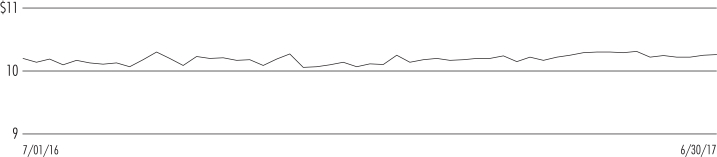

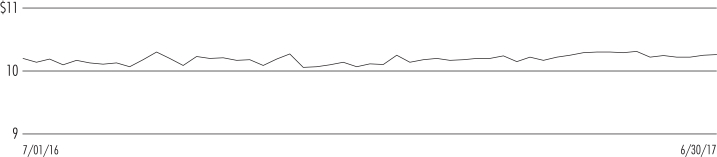

Share Price Performance — Weekly Closing Price

This data relates to the securities held in the Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change.

For financial reporting purposes, the ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Certain bonds backed by U.S. Government or agency securities are regarded as having an implied rating equal to the rating of such securities. Holdings designated N/R are not rated by these national rating agencies.

Fund Allocation

(% of net assets)

| | | | |

| Corporate Bonds | | | 125.7% | |

| Convertible Bonds | | | 2.7% | |

| Sovereign Debt | | | 1.8% | |

| Repurchase Agreements | | | 0.1% | |

| Other Assets Less Liabilities | | | 2.0% | |

Net Assets Plus Borrowings | | | 132.3% | |

| Borrowings | | | (32.3)% | |

Net Assets | | | 100% | |

Country Allocation

(% of total investments)1

| | | | |

| United States | | | 73.5% | |

| Canada | | | 4.6% | |

| United Kingdom | | | 3.9% | |

| Luxembourg | | | 3.7% | |

| Brazil | | | 3.3% | |

| Japan | | | 1.9% | |

| Germany | | | 1.3% | |

| Hong Kong | | | 1.2% | |

| Ireland | | | 1.1% | |

| Australia | | | 1.1% | |

| Other | | | 4.4% | |

Total | | | 100% | |

Portfolio Composition

(% of total investments)

| | | | |

| Oil, Gas & Consumable Fuels | | | 8.5% | |

| Household Durables | | | 6.9% | |

| Independent Power & Renewable Electricity Producers | | | 5.9% | |

| Health Care Providers & Services | | | 5.4% | |

| Metals & Mining | | | 4.7% | |

| Technology Hardware, Storage & Peripherals | | | 4.2% | |

| Diversified Financial Services | | | 4.1% | |

| Wireless Telecommunication Services | | | 3.9% | |

| Media | | | 3.7% | |

| Airlines | | | 3.5% | |

| Equity Real Estate Investment Trusts | | | 3.3% | |

| Hotels, Restaurants & Leisure | | | 3.1% | |

| Consumer Finance | | | 3.0% | |

| Diversified Telecommunication Services | | | 2.8% | |

| Banks | | | 2.7% | |

| Chemicals | | | 2.2% | |

| Commercial Services & Supplies | | | 2.1% | |

| Energy Equipment & Services | | | 1.8% | |

| Health Care Equipment & Supplies | | | 1.8% | |

| Electronic Equipment, Instruments & Components | | | 1.8% | |

| Food Products | | | 1.7% | |

| Specialty Retail | | | 1.7% | |

| | | | |

| Other | | | 19.7% | |

| Sovereign Debt | | | 1.4% | |

| Repurchase Agreements | | | 0.1% | |

Total | | | 100% | |

Credit Quality

(% of total long-term investments)

| | | | |

| A | | | 0.1% | |

| BBB | | | 15.2% | |

| BB or Lower | | | 82.4% | |

| N/R (not rated) | | | 2.3% | |

Total | | | 100% | |

Top Five Issuers

(% of total investments)

| | | | |

Tenet Healthcare Corporation | | | 1.8% | |

American Airlines Group Inc. | | | 1.6% | |

CenturyLink Inc. | | | 1.6% | |

Kindred Healthcare Inc. | | | 1.5% | |

DPL, Inc. | | | 1.5% | |

| 1 | Includes 10.0% (as a percentage of total investments) in emerging markets countries. |

JHA

Nuveen High Income December 2018 Target Term Fund

Performance Overview and Holding Summaries as of June 30, 2017

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

Average Annual Total Returns as of June 30, 2017

| | | | | | | | | | | | |

| | | Cumulative | | | Average Annual | |

| | | 6-Month | | | 1-Year | | | Since

Inception | |

| JHA at NAV | | | 3.21% | | | | 7.52% | | | | 7.27% | |

| JHA at Share Price | | | 2.70% | | | | 2.66% | | | | 5.89% | |

| Bloomberg Barclays U.S. High Yield 1-5 Year Cash Pay 2% Issuer Capped Index | | | 4.27% | | | | 11.96% | | | | 9.90% | |

Since inception returns are from 11/12/15. Past performance is not predictive of future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses, and assume reinvestment of distributions. Comparative index return information is provided for the Fund’s shares at NAV only. Indexes are not available for direct investment.

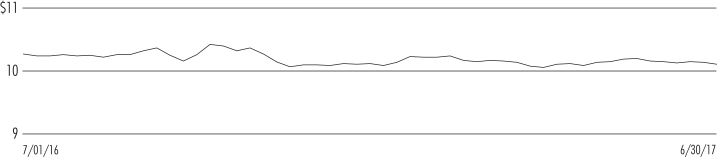

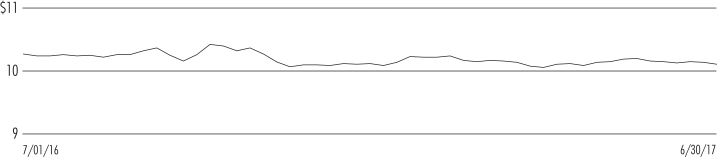

Share Price Performance — Weekly Closing Price

This data relates to the securities held in the Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change.

For financial reporting purposes, the ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Certain bonds backed by U.S. Government or agency securities are regarded as having an implied rating equal to the rating of such securities. Holdings designated N/R are not rated by these national rating agencies.

Fund Allocation

(% of net assets)

| | | | |

| Corporate Bonds | | | 117.4% | |

| Convertible Bonds | | | 6.2% | |

| Sovereign Debt | | | 3.0% | |

| Repurchase Agreements | | | 2.2% | |

| Other Assets Less Liabilities | | | 2.1% | |

Net Assets Plus Borrowings | | | 130.9% | |

| Borrowings | | | (30.9)% | |

Net Assets | | | 100% | |

Country Allocation

(% of total investments)1

| | | | |

| United States | | | 76.9% | |

| Canada | | | 4.5% | |

| United Kingdom | | | 2.6% | |

| Brazil | | | 2.6% | |

| Japan | | | 2.0% | |

| Luxembourg | | | 2.0% | |

| Ireland | | | 1.9% | |

| India | | | 1.7% | |

| Netherlands | | | 1.3% | |

| Germany | | | 1.2% | |

| Other | | | 3.3% | |

Total | | | 100% | |

Portfolio Composition

(% of total investments)

| | | | |

| Oil, Gas & Consumable Fuels | | | 9.9% | |

| Household Durables | | | 6.2% | |

| Metals & Mining | | | 5.6% | |

| Airlines | | | 4.6% | |

| Equity Real Estate Investment Trusts | | | 4.4% | |

| Consumer Finance | | | 4.3% | |

| Health Care Providers & Services | | | 4.2% | |

| Media | | | 3.6% | |

| Diversified Telecommunication Services | | | 3.6% | |

| Technology Hardware, Storage & Peripherals | | | 3.5% | |

| Automobiles | | | 3.3% | |

| Electronic Equipment, Instruments & Components | | | 3.0% | |

| Independent Power & Renewable Electricity Producers | | | 2.9% | |

| Machinery | | | 2.7% | |

| Health Care Equipment & Supplies | | | 2.6% | |

| Banks | | | 2.0% | |

| Capital Markets | | | 2.0% | |

| Wireless Telecommunication Services | | | 2.0% | |

| Commercial Services & Supplies | | | 1.9% | |

| Energy Equipment & Services | | | 1.9% | |

| Food Products | | | 1.7% | |

| Other | | | 20.0% | |

| | | | |

| Sovereign Debt | | | 2.4% | |

| Repurchase Agreements | | | 1.7% | |

Total | | | 100% | |

Credit Quality

(% of total long-term investments)

| | | | |

| A | | | 0.4% | |

| BBB | | | 24.5% | |

| BB or Lower | | | 72.0% | |

| N/R (not rated) | | | 3.1% | |

Total | | | 100% | |

Top Five Issuers

(% of total investments)

| | | | |

| Tenet Healthcare Corporation | | | 2.6% | |

| HCA Inc. | | | 2.0% | |

| Sprint Communications Inc. | | | 2.0% | |

| iStar Inc. | | | 1.9% | |

| Qwest Capital Funding Inc. | | | 1.8% | |

| 1 | Includes 9.3% (as a percentage of total investments) in emerging markets countries. |

JHB

Nuveen High Income November 2021 Target Term Fund

Performance Overview and Holding Summaries as of June 30, 2017

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

Cumulative Total Returns as of June 30, 2017

| | | | | | | | |

| | | Cumulative | |

| | | 6-Month | | | Since

Inception | |

| JHB at NAV | | | 5.49% | | | | 7.87% | |

| JHB at Share Price | | | 5.41% | | | | 5.75% | |

| Bloomberg Barclays U.S. High Yield 1-5 Year Cash Pay 2% Issuer Capped Index | | | 4.27% | | | | 7.96% | |

Since inception returns are from 8/23/16. Past performance is not predictive of future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses, and assume reinvestment of distributions. Comparative index return information is provided for the Fund’s shares at NAV only. Indexes are not available for direct investment.

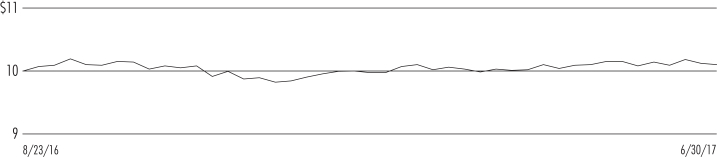

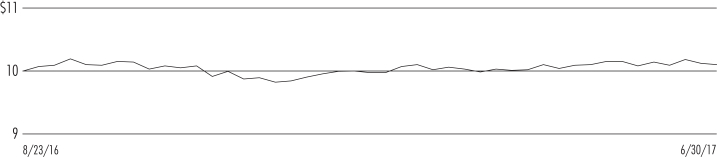

Share Price Performance — Weekly Closing Price

This data relates to the securities held in the Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change.

For financial reporting purposes, the ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Certain bonds backed by U.S. Government or agency securities are regarded as having an implied rating equal to the rating of such securities. Holdings designated N/R are not rated by these national rating agencies.

Fund Allocation

(% of net assets)

| | | | |

| Corporate Bonds | | | 129.1% | |

| Convertible Bonds | | | 0.7% | |

| Sovereign Debt | | | 0.6% | |

| Other Assets Less Liabilities | | | 3.0% | |

Net Assets Plus Borrowings | | | 133.4% | |

| Borrowings | | | (33.4)% | |

Net Assets | | | 100% | |

Country Allocation

(% of total investments)1

| | | | |

| United States | | | 74.7% | |

| Canada | | | 5.3% | |

| Luxembourg | | | 5.0% | |

| United Kingdom | | | 3.0% | |

| Netherlands | | | 1.5% | |

| Japan | | | 1.4% | |

| Australia | | | 1.2% | |

| Brazil | | | 1.1% | |

| Mexico | | | 1.0% | |

| Ireland | | | 0.9% | |

| Other | | | 4.9% | |

Total | | | 100% | |

Portfolio Composition

(% of total investments)

| | | | |

| Metals & Mining | | | 9.7% | |

| Oil, Gas & Consumable Fuels | | | 8.8% | |

| Media | | | 8.3% | |

| Wireless Telecommunication Services | | | 5.1% | |

| Household Durables | | | 4.7% | |

| Health Care Providers & Services | | | 4.5% | |

| Hotels, Restaurants & Leisure | | | 4.3% | |

| Diversified Financial Services | | | 4.0% | |

| Consumer Finance | | | 4.0% | |

| Independent Power & Renewable Electricity Producers | | | 3.4% | |

| Diversified Telecommunication Services | | | 2.9% | |

| Equity Real Estate Investment Trusts | | | 2.6% | |

| Chemicals | | | 2.6% | |

| Commercial Services & Supplies | | | 2.5% | |

| Real Estate Management & Development | | | 2.4% | |

| Aerospace & Defense | | | 2.0% | |

| Airlines | | | 1.7% | |

| Machinery | | | 1.7% | |

| Containers & Packaging | | | 1.6% | |

| Specialty Retail | | | 1.5% | |

| Pharmaceuticals | | | 1.5% | |

| Other | | | 19.8% | |

| Sovereign Debt | | | 0.4% | |

Total | | | 100% | |

Credit Quality

(% of total long-term investments)

| | | | |

| A | | | 0.1% | |

| BBB | | | 2.9% | |

| BB or Lower | | | 94.5% | |

| N/R (not rated) | | | 2.5% | |

Total | | | 100% | |

Top Five Issuers

(% of total investments)

| | | | |

| CenturyLink Inc. | | | 1.3% | |

| Icahn Enterprises Finance | | | 1.2% | |

| OneMain Financial Holdings, Inc. | | | 1.2% | |

| Wind Acquisition Finance SA | | | 1.2% | |

| United States Steel Corporation | | | 1.2% | |

| 1 | Includes 10.2% (as a percentage of total investments) in emerging markets countries. |

Shareholder

Meeting Report

The annual meeting of shareholders was held in the offices of Nuveen on April 6, 2017 for JHY, JHD, JHA and JHB; at this meeting the shareholders were asked to elect Board Members.

| | | | | | | | | | | | | | | | |

| | | JHY | | | JHD | | | JHA | | | JHB | |

| | | Common

Shares | | | Common

Shares | | | Common

Shares | | | Common

Shares | |

Approval of the Board Members was reached as follows: | | | | | | | | | |

William Adams IV | | | | | | | | | | | | | | | | |

For | | | 11,261,545 | | | | 21,912,145 | | | | 24,082,730 | | | | 45,982,790 | |

Withhold | | | 85,735 | | | | 263,727 | | | | 293,462 | | | | 511,377 | |

Total | | | 11,347,280 | | | | 22,175,872 | | | | 24,376,192 | | | | 46,494,167 | |

David J. Kundert | | | | | | | | | | | | | | | | |

For | | | 11,263,945 | | | | 21,907,645 | | | | 24,023,621 | | | | 45,966,826 | |

Withhold | | | 83,335 | | | | 268,227 | | | | 352,571 | | | | 527,341 | |

Total | | | 11,347,280 | | | | 22,175,872 | | | | 24,376,192 | | | | 46,494,167 | |

John K. Nelson | | | | | | | | | | | | | | | | |

For | | | 11,264,945 | | | | 21,912,645 | | | | 24,086,630 | | | | 46,002,697 | |

Withhold | | | 82,335 | | | | 263,227 | | | | 289,562 | | | | 491,470 | |

Total | | | 11,347,280 | | | | 22,175,872 | | | | 24,376,192 | | | | 46,494,167 | |

Terence J. Toth | | | | | | | | | | | | | | | | |

For | | | 11,264,445 | | | | 21,912,145 | | | | 24,040,724 | | | | 46,002,197 | |

Withhold | | | 82,835 | | | | 263,727 | | | | 335,468 | | | | 491,970 | |

Total | | | 11,347,280 | | | | 22,175,872 | | | | 24,376,192 | | | | 46,494,167 | |

JHY

| | |

Nuveen High Income 2020 Target Term Fund |

Portfolio of Investments | | June 30, 2017 (Unaudited) |

| | | | | | | | | | | | | | | | | | | | |

Principal

Amount (000) | | | Description (1) | | Coupon | | | Maturity | | | Ratings (2) | | | Value | |

| |

| | | | LONG-TERM INVESTMENTS – 124.7% (98.4% of Total Investments) | |

| | | | | |

| | | | CORPORATE BONDS – 121.1% (95.5% of Total Investments) | | | | | | | | | | | | | | | | |

| | | | | |

| | | | Aerospace & Defense – 2.7% | | | | | | | | | | | | |

| | | | | |

| $ | 1,250 | | | Bombardier Inc., 144A | | | 7.750% | | | | 3/15/20 | | | | B | | | $ | 1,343,750 | |

| | 2,700 | | | Triumph Group Inc. | | | 4.875% | | | | 4/01/21 | | | | B1 | | | | 2,683,125 | |

| | 3,950 | | | Total Aerospace & Defense | | | | | | | | | | | | | | | 4,026,875 | |

| | | | | |

| | | | Airlines – 3.2% | | | | | | | | | | | | |

| | | | | |

| | 1,524 | | | Air Canada, 144A | | | 7.750% | | | | 4/15/21 | | | | BB– | | | | 1,744,980 | |

| | 825 | | | American Airlines Group Inc., 144A | | | 4.625% | | | | 3/01/20 | | | | BB– | | | | 853,273 | |

| | 2,000 | | | Virgin Australia Holdings Limited, 144A | | | 8.500% | | | | 11/15/19 | | | | B– | | | | 2,105,000 | |

| | 4,349 | | | Total Airlines | | | | | | | | | | | | | | | 4,703,253 | |

| | | | | |

| | | | Auto Components – 1.1% | | | | | | | | | | | | |

| | | | | |

| | 1,500 | | | American & Axle Manufacturing Inc. | | | 6.250% | | | | 3/15/21 | | | | BB– | | | | 1,541,250 | |

| | | | | |

| | | | Banks – 1.4% | | | | | | | | | | | | |

| | | | | |

| | 2,000 | | | Popular Inc. | | | 7.000% | | | | 7/01/19 | | | | BB– | | | | 2,100,000 | |

| | | | | |

| | | | Building Products – 2.0% | | | | | | | | | | | | |

| | | | | |

| | 1,000 | | | Euramax International Inc., 144A | | | 12.000% | | | | 8/15/20 | | | | B– | | | | 1,090,000 | |

| | 1,750 | | | Taylor Morrison Monarch Communities, 144A | | | 5.250% | | | | 4/15/21 | | | | BB– | | | | 1,793,750 | |

| | 2,750 | | | Total Building Products | | | | | | | | | | | | | | | 2,883,750 | |

| | | | | |

| | | | Chemicals – 1.2% | | | | | | | | | | | | |

| | | | | |

| | 750 | | | CF Industries Inc. | | | 7.125% | | | | 5/01/20 | | | | BB+ | | | | 828,750 | |

| | 1,000 | | | Hexion Inc. | | | 10.000% | | | | 4/15/20 | | | | CCC+ | | | | 992,500 | |

| | 1,750 | | | Total Chemicals | | | | | | | | | | | | | | | 1,821,250 | |

| | | | | |