SHAREHOLDER LETTER

Dear Shareholder,

We are pleased to provide the Gallery Trust annual report for the Mondrian Funds for the fiscal year ending October 31, 2019. Following an extended period of comparatively calm markets, the past 12 months have brought greater volatility driven by swings in geopolitical uncertainty and economic outlook. Following a sharply negative environment over the last two months of 2018, most equity and fixed income markets have been strongly positive YTD 2019 supported by dovish central banks around the globe. Mondrian’s commitment to our defensive value philosophy and process produced positive absolute returns for our Funds and we believe it continues to be the best approach for long-term success. Please see our portfolio managers’ discussions of the Funds’ performance in the pages that follow.

We would also like to highlight that this past December, the Gallery Trust Fund Family expanded through the launch of three Funds: Mondrian U.S. Small Cap Equity Fund (MPUSX), Mondrian Global Listed Infrastructure Fund (MGIFX), and the Rothko Emerging Markets Equity Fund (RKEMX). Mondrian has a long history of managing U.S. equity assets and small cap strategies. We also believe that listed infrastructure investments match well with our discounted cash flow analysis process. Rothko Investment Strategies is a separate investment division operating within Mondrian Investment Partners which uses fundamentally grounded rules in an actively managed systematic process. By expanding our mutual fund offerings to include U.S. Small Cap, Global Listed Infrastructure, and a systematic emerging market strategy, we continue to position ourselves to meet the growing needs of our clients.

For more information about the Mondrian Funds, please continue reading this report or visit http://www.mondrian.com/mutualfunds/. For the Rothko Emerging Markets Equity Fund, please refer to the Rothko Annual Report and www.rothko.com/mutualfunds. We would also be happy to speak with you at 888-832-4386.

Thank you,

Mondrian Investment Partners

PORTFOLIO PERFORMANCE REVIEW

Mondrian International Value Equity Fund

(all returns in U.S. dollars)

Twelve months ended October 31, 2019

Despite geopolitical and economic uncertainty, international equities generated positive returns over twelve months, supported by dovish central banks. Asia Pacific markets led European markets as political uncertainty weighed on the UK. Defensive sectors led returns as investors favoured safe havens amid increased economic uncertainty. Growth outperformed value as central banks committed to further monetary easing, which favours growth-oriented investments by potentially suppressing investors’ discount rates.

In a challenging period for value investors, the Mondrian International Value Equity Fund (the “Fund”) saw a return of 7.93% and exceeded the returns of the value sub-index whilst lagging the broader benchmark. The Fund was defensive in the very weak fourth quarter of 2018 and year-to-date has captured most but not all of the upside in very strong markets led by growth stocks.

Country allocation added to relative returns

Country allocation effects added to relative returns in Asia Pacific markets, led by the underweight position in Japan. The Japanese equity market lagged as economically-sensitive sectors were held back by increased global trade tensions, slowing growth and yen appreciation, while investors began to worry about October’s planned consumption tax hike. The Fund’s underweight position in Japan added to relative returns. The Australian equity market posted strong returns, supported by the unexpected re-election of the centre-right Liberal-National coalition, a spike in the iron ore price on supply concerns, and a cut in interest rates. The Fund’s underweight position in the market slightly weighed on relative returns. However, with household balance sheets stretched, house prices elevated and wage growth stagnant; we still have concerns over the medium-term outlook for the Australian economy.

European markets were held back by political uncertainty in the UK and Spain, while the German market lagged on stalling industrial production and the implementation of a new autos emissions testing regime. The Swiss equity market rose strongly, bolstered by gains from index heavyweights Nestlé and Roche. The UK equity market was held back by declines from stocks in the weak energy sector, as demand concerns led the oil price lower. The Fund’s overweight position in the UK market was broadly offset by the overweight position in the Italian market.

Stock selection held back relative returns, driven by holdings in the UK

Strong stock selection in Italy and Spain was more than offset by stock selection in the UK, where holdings of domestically-exposed stocks weighed on relative returns. Despite the ongoing political uncertainty, we continue to believe that the

PORTFOLIO PERFORMANCE REVIEW (continued)

skew of outcomes looks attractive for a basket of undervalued domestically-oriented UK stocks.

Fund relative returns were supported by the strong returns of Spanish utility Iberdrola, which was boosted by solid operational performance and a robust growth outlook, particularly in renewables and networks. Gains from Italian integrated utility Enel also supported relative returns, as the company published an updated strategic plan which anticipated sustained attractive dividend growth.

However, Fund relative returns were held back by the position in Wood Group, the UK engineering services company which was held back by weakness in the oil price and the broader oil and gas sector’s constrained state of capital investment. CK Hutchison, the Hong Kong listed conglomerate, was held back by a number of factors, including its exposure to the weak euro and British pound, and weak sentiment towards Hong Kong despite the group’s very limited exposure to Hong Kong itself. In Denmark, weak returns for ISS, the facilities services company, were driven by the loss of a contract with health care conglomerate Novartis and ongoing restructuring costs.

Sector allocation held back relative returns

The defensive utilities sector led returns as investors sought stocks with stable earnings profiles amid global growth concerns and geopolitical tensions. The sector also benefitted from the ongoing need for network investments and from monetization of renewable assets at attractive valuations. The energy sector was the weakest over twelve months as demand concerns more than offset supply tightening and drove oil price volatility. The Fund’s overweight position in the utilities sector was more than offset by the overweight position in the energy sector.

Stock selection within sectors held back relative returns, driven by stock selection in the consumer discretionary sector, which saw a divergence in returns between the outperforming luxury brands and the autos, which struggled following the new autos emissions testing regime, weak global sales data and China’s reintroduction of tariffs on US autos. The Fund’s exposure to autos held back relative returns. We continue to believe that selected auto-related stocks look cheap even with conservative assumptions which reflect the challenges faced by companies in the sector. This was partly offset by strong stock selection in the utilities sector, with positive returns from Iberdrola, Enel and SSE.

International currencies strengthened against the US dollar; currency allocation slightly added to relative investment returns

In a turbulent period for equity markets, the Japanese yen appreciated against the US dollar, and the Fund’s underweight position held back relative returns. This was more than offset, however, by the benefit from the underweight position in the weak Australian dollar.

PORTFOLIO PERFORMANCE REVIEW (continued)

Definition of Comparative Index

The MSCI EAFE (Europe, Australasia, Far East) Index is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. & Canada.

PORTFOLIO PERFORMANCE REVIEW (continued)

Mondrian Emerging Markets Value Equity Fund

(all returns in U.S. dollars)

Twelve months ended October 31, 2019

Despite a volatile market environment, the MSCI Emerging Markets Index (“the Index”) recovered sharply from the weakness during 2018 to post a positive return of 11.9% in USD terms over the last twelve months ended October 31, 2019. Markets remained resilient during this period despite a clear escalation in global geo-political tensions. The US-China trade dispute continues to remain unresolved, and has resulted in the introduction of wide ranging tariffs and retaliatory counter measures from both governments. Given this backdrop, market volatility was also impacted by concerns over the outlook for global economic growth. The sustainability of tighter monetary policy was questioned and indeed the US Federal Reserve did reverse course and announced three separate interest rate cuts from July 2019 onwards. The last twelve months witnessed a pronounced divergence between the performance of value and growth stocks; as the value sub-index gained only 6.0% in comparison to an 18.0% return for the growth sub-index.

Although China remained the focal point for the majority of trade headlines, the Chinese market actually outperformed the index return posting a return of 12.9% demonstrating the domestic resilience of the market during this period. The majority of the other major Asian markets also outperformed, with the exception being Korea which only gained 5.2%. Both EMEA (Europe, the Middle East, and Africa) and Latin America underperformed the index return on a relative basis. EMEA was held back by the performance of South Africa, Turkey and the Middle East, despite Russia (+34.3%) being the best performing market in the Index. Mexico lagged within Latin America, and both Argentina and Chile suffered from political crises.

From a sector perspective, interest-rate sensitive utilities and real estate sectors outperformed, while materials and industrials reacted negatively to a weaker economic outlook. Health care was also weak, underperforming on drug pricing pressure and concerns over the regulatory outlook across several countries.

The Mondrian Emerging Markets Value Equity Fund (“the Fund”) narrowly underperformed the strong positive return of the MSCI Emerging Markets Index over the last twelve months. The Fund underperformed the broad index by 74 basis points but outperformed the value sub-index by approximately 480 basis points.

Top-down allocation contributed positively to investment returns

The Fund benefitted from positioning in EMEA and Latin America. Within EMEA relative returns were aided by zero exposure to the Middle Eastern markets of Qatar and Saudi Arabia, the latter of which was officially included in the Index for the first time during the course of the year. Equally in Latin America no exposure

PORTFOLIO PERFORMANCE REVIEW (continued)

to Argentina and Chile was a positive factor, and although overweight allocation to the outperforming Brazilian market supported relative returns, this impact was largely offset by the corresponding exposure to the depreciating Brazilian real. Top-down attribution in Asia was largely neutral, with the positive contribution from an overweight to allocation to India offset by overweight positioning in the weak Malaysian market.

Sector allocation detracted from relative returns

The Fund’s overweight to the materials sector was the primary detractor from relative sector returns. A further small negative contribution stemmed from the Fund’s overweight allocation to the weak health care sector however this was more than offset by very positive stock selection within the sector, led by the Fund’s Chinese health care names. Investment performance was supported by the underweight allocation to the communication services sector, which now contains a number of the Chinese internet related companies, as well as narrow overweight positioning in the consumer discretionary and information technology sectors which both strongly outperformed over the period.

Stock selection negative overall; held back significantly by Indiabulls Housing Finance

Stock selection in India was the key factor that weighed on the Fund’s investment performance, primarily due to the sharp decline in the share price of Indiabulls Housing Finance which fell heavily during the year and detracted approximately 270bps from relative returns by itself. The stock has endured allegations of misappropriation of public funds which were promptly withdrawn. Despite this, and the continued complete denial of wrongdoing by the company, these allegations resurfaced and the share price reacted very negatively after the Delhi High Court agreed to set a date to hear the claims later this year. Indiabulls aside, stock selection across the rest of the Fund was mostly positive, particularly in China and Taiwan. Chinese stock selection was driven by the outperformance of holdings in food group WH Group, white goods manufacturer Midea Group, life insurance provider Ping An Insurance, and health care name CSPC Pharmaceutical. In Taiwan, positive stock selection was driven by semiconductor names TSMC and ASE Technology given signs of improving semiconductor demand from 5G related activities. Elsewhere, REIT Fibra Uno recovered in anticipation of lower interest rates, and the share price of Russian energy producer Gazprom rose sharply following the declaration of an improved capital allocation policy for shareholders. Stock selection in Brazil was negative as aircraft manufacturer Embraer lagged following the announcement of the final terms of its upcoming merger with Boeing that disappointed market expectations. In South Africa, chemical producer Sasol underperformed following cost overruns at their US based ethane cracker project.

PORTFOLIO PERFORMANCE REVIEW (continued)

Investment Strategy

The Fund’s investment strategy focuses on stocks we believe are fundamentally undervalued with overweight positions to the attractively valued markets of China, India and Korea; as well as an overweight position in the financials, materials and health care sectors. The Fund holds an underweight allocation to the communication services sector, primarily driven by an underweight exposure to Chinese internet related companies, where valuations mostly remained challenged. The Fund also holds an underweight allocation to the energy sector, and underweight positioning in EMEA given unattractive risk adjusted valuations.

Definition of Comparative Index

The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets.

PORTFOLIO PERFORMANCE REVIEW (continued)

Mondrian International Government Fixed Income Fund

(all returns in U.S. dollars)

Twelve months ended October 31, 2019

The FTSE Non-U.S. Dollar World Government Bond Index was up 9.3% in U.S. dollar unhedged terms over the 12 months to October 31, 2019. The strongest performing markets were Mexico (up 26.9%) and the UK (up 13.0%). Mexico was strong over the period, as investors became more comfortable about the policies of the relatively new administration, following a period of heightened concern in late 2018. The weakest performing markets were Norway (down 5.2%) and Sweden (down 0.9%). The Swedish krona was weak over the year, as currency traders focused on relatively weak inflation out-turns over the period.

The Mondrian International Government Fixed Income Fund outperformed the benchmark by 1.5% in NAV terms, leaving it up 10.8% in absolute terms. Overweight positions to Mexico, to the British pound and to the Japanese yen benefitted performance. An overweight to Australia fully hedged also added to relative performance over the 12 month period. These positions were partially offset by the underweight positon to the relatively strong UK market.

The Fund maintains exposure to those countries where Prospective Real Yields are highest, such as Australia, New Zealand and Mexico. We continue to believe that selected currencies are extremely undervalued versus the U.S. dollar – the British pound and Swedish krona in particular, so maintain overweight positions to these currencies. We also deem international currencies to be undervalued versus the U.S. dollar on average, based on our Purchasing Power Parity analysis. The Fund continues to maintain a zero weight to corporate credit, as we deem corporate credit (and many other forms of credit) to be very overvalued versus treasuries, and are concerned about a number of potential catalysts that could lead to wider credit spreads going forward.

Definition of Comparative Index

The FTSE Non-U.S. Dollar World Government Bond Index (WGBI) measures the performance of fixed-rate, local currency, investment-grade sovereign bonds. The WGBI is a widely used benchmark that currently includes sovereign debt from over 20 countries, denominated in a variety of currencies, and has more than 30 years of history available. The WGBI provides a broad benchmark for the global sovereign fixed income market.

PORTFOLIO PERFORMANCE REVIEW (continued)

Mondrian U.S. Small Cap Equity Fund

(all returns in U.S. dollars)

Since Inception (December 17, 2018) ended October 31, 2019

The Russell 2000 Index gained 14.8% in the period December 17, 2018 to October 31, 2019. After rebounding strongly through January and February from the mid-December 2018 market weakness the benchmark trended sideways, although it exhibited volatility. Competing forces underlay the latter. On the upside was continued strength in the domestic economy. While friction within the global economy, due to the ongoing Sino-US trade tensions, weighed on the downside.

In December, slowing global economic growth suppressed yields of longer-dated treasuries. Concurrently the Federal Reserve raised its main policy tool – the Federal Funds rate. As a result the treasury yield curve approached an inversion, which was seen by some as an indication of a looming recession. Investors cut their exposure to equities as they adopted a risk-off stance, precipitating a marked decline. That position that was quickly reversed – the index gained 25.8% from trough to peak – after the Chinese government enacted stimulus measures and the Federal Reserve held interest rates flat at its January and March meetings. Growing expectations of trade resolution also positively influenced the market.

Prospects of a trade deal ebbed and flowed after and the yield curve inverted and then corrected. In October, tentative signs of a trade deal and improving leading economic indicators helped the market to once again return to the level it had reached in February.

From a sector perspective, the information technology sector delivered a stand-out return of 31.3%. Leading the sector was the semiconductors industry group, which was a particular beneficiary of the improved trade outlook given these companies often feature Sino-US cross-border supply chains. Rising 22.5%, Industrials was another sector that gained from the potential removal of tariffs. The energy sector was the notable underperformer, falling 23.9%. Aside from episodic strength arising due to supply disruptions, the oil price has reflected a supply demand misalignment, as evidenced by burgeoning US oil inventories.

The Mondrian U.S. Small Cap Equity Fund outperformed the benchmark index by 4.02%. Robust stock selection drove returns and was broad-based. Positive selector allocation bolstered performance. Contributions to stock selection from materials, energy, information technology and communication services were noteworthy. With the exception of materials, the Fund’s positioning relative to each of these sectors was positive. Holding back returns was stock selection within the health care, consumer discretionary and consumer staples sectors.

Definition of Comparative Index

The Russell 2000 Index is an unmanaged market index that measures the performance of the 2,000 smallest companies in the Russell 3000® Index.

PORTFOLIO PERFORMANCE REVIEW (continued)

Mondrian Global Listed Infrastructure Fund

(all returns in U.S. dollars)

Since Inception (December 17, 2018) ended October 31, 2019

After suffering sharp declines in the fourth quarter of 2018 due to macro-economic concerns, global equity markets rebounded strongly in the first half of 2019 and continued to edge higher through October. This can largely be attributed to more dovish central banks, optimism over a potential US-China trade settlement, and increased confidence that the US was not entering a recession.

Since inception in mid-December 2018 through to the end of October 2019 the Mondrian Global Listed Infrastructure Fund has achieved both a high absolute return and significant outperformance of the MSCI ACWI Core Infrastructure Index. This outperformance stems mainly from stock selection.

Mexican airport operator Grupo Aeroportuario del Centro Norte was the fund’s top performing investment during this period. Shares in the company had been hit hard in the market sell-off in the final quarter of 2018 and rebounded from low levels, helped by continued strong passenger growth. Also in Latin America, CCR, the Brazilian toll road operator, contributed strongly to the fund’s return, helped by a decline in Brazilian government bond yields and growing appreciation of opportunities for the company from the new government’s infrastructure policies. Although listed in the US, Kansas City Southern is a railroad operator with significant operations in Mexico where reform of energy markets is supporting volume growth. Furthermore, it has shown good progress in improving efficiency, leading to margin expansion and helping the shares rally.

BBA Aviation, the UK-listed business and general aviation fixed-base operator, announced that they would sell their Ontic business, which manufactures aircraft aftermarket parts and provides maintenance services, and return the proceeds to shareholders. This decision to focus on their core business and the price achieved were taken positively by the market, making the company a strong contributor to performance. Also in the UK, Pennon Group, a water utility, outperformed thanks to the diminished probability of a Labour government. The Labour party would like to nationalize water companies with uncertain compensation for existing shareholders.

Detracting from the Fund’s return was Jiangsu Expressway, the Chinese toll road operator. Moves by the government to accelerate electronic toll collection via increased discounts combined with more general fears over the strength of the Chinese economy to drive down its share price. These fears also weighed on the share price of Beijing Capital International Airport, but of greater negative impact was the Chinese government’s release of its slot allocation plan for the new Daxing Airport. This was more favourable to the new airport than expected. Subsequent to this announcement we sold the investment.

PORTFOLIO PERFORMANCE REVIEW (concluded)

Outside China, Naturgy, the Portuguese gas utility, saw its share price suffer when the regulator published proposals for lower-than-expected remuneration of gas networks. However, our recent meeting with the company confirmed that new management is focused on disciplined capital allocation, which should help unlock the value we see.

In the US, certain electric utility investments were a drag on performance. Investors in Edison International became spooked by news of wildfires in southern California. Despite a step-up in readiness and prevention efforts and new legislation that helps to reduce risks to shareholders, investors remain fearful of a repeat of the freak 2017 and 2018 fire seasons. Eversource Energy performed poorly in early 2019 as they announced an unexpected equity raise to fund their investment plans. We divested shortly after, investing the proceeds in Kansas City Southern (see above).

The Fund is positioned to take advantage of the particularly attractive risk-adjusted returns we find in infrastructure stocks in the UK and Europe and the electric utilities sector.

Definition of Comparative Index

The MSCI ACWI Core Infrastructure Index captures large and mid-cap securities across the 23 Developed Markets (DM) countries*. The Index is designed to represent the performance of listed companies within the developed markets that are engaged in core industrial infrastructure activities.

Growth of a $1,000,000 Investment

| | AVERAGE ANNUAL TOTAL RETURN

FOR THE YEAR ENDED OCTOBER 31, 2019* | |

| | 1 Year | 3 Years | 5 Years | 10 Years | |

| Mondrian International Value Equity Fund | 7.93% | 6.97% | 3.24% | 5.04% | |

| MSCI EAFE Index (Net) | 11.04% | 8.48% | 4.31% | 5.41% | |

| * | On March 14, 2016, The International Equity Portfolio, a series of Delaware Pooled Trust (the “International Equity Predecessor Fund”) was reorganized into the Mondrian International Equity Fund. Inception date of the Predecessor Fund was February 4, 1992. Information presented from February 4, 1992 to March 14, 2016 is that of the International Equity Predecessor Fund. |

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, it may be worth less than its original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund’s performance assumes the reinvestment of dividends and capital gains. Index returns assume reinvestment of dividends and, unlike a fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives. The Fund’s holdings and allocations are subject to change because it is actively managed and should not be considered recommendations to buy individual securities.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. If the Adviser had not limited certain expenses, the Fund’s total return would have been lower.

See definition of the comparative index on page 4.

Growth of a $1,000,000 Investment

| | AVERAGE ANNUAL TOTAL RETURN

FOR THE YEAR ENDED OCTOBER 31, 2019* | |

| | 1 Year | 3 Years | 5 Years | 10 Years | |

| Mondrian Emerging Markets Value Equity Fund | 11.12% | 4.92% | -0.47% | 1.74% | |

| MSCI Emerging Markets Index (Net) | 11.86% | 7.36% | 2.93% | 3.78% | |

| * | On September 24, 2018, the Laudus Mondrian Emerging Markets Fund (the “Emerging Markets Predecessor Fund”) was reorganized into the Mondrian Emerging Markets Equity Fund. Inception date of the Emerging Markets Predecessor Fund was November 2, 2007. Information presented from November 2, 2007 to September 24, 2018 is that of the Emerging Markets Predecessor Fund. |

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, it may be worth less than its original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund’s performance assumes the reinvestment of dividends and capital gains. Index returns assume reinvestment of dividends and, unlike a fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives. The Fund’s holdings and allocations are subject to change because it is actively managed and should not be considered recommendations to buy individual securities.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. If the Adviser had not limited certain expenses, the Fund’s total return would have been lower.

See definition of the comparative index on page 7.

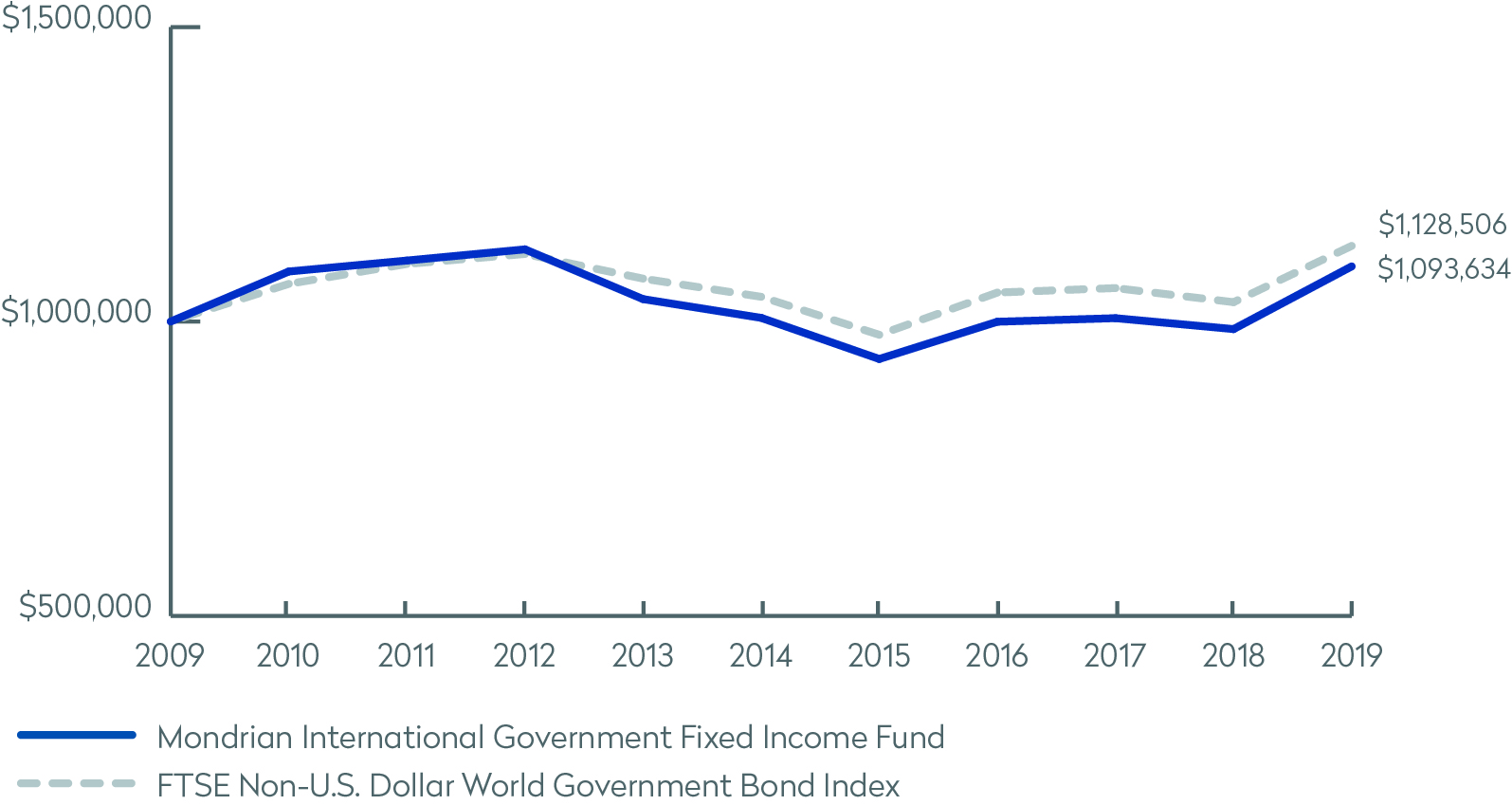

Growth of a $1,000,000 Investment

| | AVERAGE ANNUAL TOTAL RETURN

FOR THE YEAR ENDED OCTOBER 31, 2019* | |

| | 1 Year | 3 Years | 5 Years | 10 Years | |

| Mondrian International Government Fixed Income Fund | 10.79% | 3.04% | 1.68% | 0.90% | |

| FTSE Non-U.S. Dollar World Government Bond Index | 9.25% | 2.46% | 1.61% | 1.22% | |

| * | On September 24, 2018, the Laudus Mondrian International Government Fixed Income Fund (the “Fixed Income Predecessor Fund”) was reorganized into the Mondrian International Government Fixed Income Fund. Inception date of the Fixed Income Predecessor Fund was November 2, 2007. Information presented from November 2, 2007 to September 24, 2018 is that of the Fixed Income Predecessor Fund. |

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, it may be worth less than its original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund’s performance assumes the reinvestment of dividends and capital gains. Index returns assume reinvestment of dividends and, unlike a fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives. The Fund’s holdings and allocations are subject to change because it is actively managed and should not be considered recommendations to buy individual securities.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. If the Adviser had not limited certain expenses, the Fund’s total return would have been lower.

See definition of the comparative index on page 8.

Growth of a $1,000,000 Investment

| | TOTAL RETURN

FOR THE PERIOD ENDED OCTOBER 31, 2019 | |

| | Cumulative Inception to Date* | |

| Mondrian U.S. Small Cap Equity Fund | 18.80% | |

| Russell 2000 Index | 14.78% | |

| * | The fund commenced operations on December 17, 2018. |

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, it may be worth less than its original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund’s performance assumes the reinvestment of dividends and capital gains. Index returns assume reinvestment of dividends and, unlike a fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives. The Fund’s holdings and allocations are subject to change because it is actively managed and should not be considered recommendations to buy individual securities.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. If the Adviser had not limited certain expenses, the Fund’s total return would have been lower.

See definition of the comparative index on page 9.

Growth of a $1,000,000 Investment

| | TOTAL RETURN

FOR THE PERIOD ENDED OCTOBER 31, 2019 | |

| | Cumulative Inception to Date* | |

| Mondrian Global Listed Infrastructure Fund | 21.49% | |

| MSCI ACWI Core Infrastructure Index | 17.79% | |

| * | The fund commenced operations on December 17, 2018. |

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, it may be worth less than its original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund’s performance assumes the reinvestment of dividends and capital gains. Index returns assume reinvestment of dividends and, unlike a fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives. The Fund’s holdings and allocations are subject to change because it is actively managed and should not be considered recommendations to buy individual securities.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. If the Adviser had not limited certain expenses, the Fund’s total return would have been lower.

See definition of the comparative index on page 11.

| SCHEDULE OF INVESTMENTS |

Sector Weightings† (unaudited): |

† Percentages based on total investments. |

| COMMON STOCK — 98.7% | | | | | | |

| | | | | | | |

| AUSTRALIA — 1.2% | | | | | | |

QBE Insurance Group Ltd | | | 846,170 | | | | | |

| Total Australia | | | | | | | | |

| | | | | | | | | |

| CHINA — 1.7% | | | | | | | | |

China Mobile Ltd | | | 1,236,500 | | | | | |

| Total China | | | | | | | | |

| | | | | | | | | |

| DENMARK — 1.7% | | | | | | | | |

ISS A/S | | | 401,919 | | | | | |

| Total Denmark | | | | | | | | |

| | | | | | | | | |

| FRANCE — 7.0% | | | | | | | | |

Cie de Saint-Gobain SA | | | 423,009 | | | | 17,205,882 | |

Sanofi SA | | | 172,264 | | | | 15,873,449 | |

Societe Generale SA | | | 329,681 | | | | | |

| Total France | | | | | | | | |

| | | | | | | | | |

The accompanying notes are an integral part of the financial statements.

| COMMON STOCK — continued | | | | | | | | |

| | | | | | | |

| GERMANY — 10.6% | | | | | | | | |

Allianz SE | | | 64,356 | | | $ | 15,718,994 | |

Continental AG | | | 99,118 | | | | 13,252,287 | |

Daimler AG | | | 244,555 | | | | 14,294,938 | |

Deutsche Telekom AG | | | 641,588 | | | | 11,282,996 | |

Evonik Industries AG | | | 373,088 | | | | | |

| Total Germany | | | | | | | | |

| | | | | | | | | |

| HONG KONG — 5.9% | | | | | | | | |

CK Hutchison Holdings Ltd | | | 1,904,500 | | | | 17,620,869 | |

Jardine Matheson Holdings Ltd | | | 85,015 | | | | 4,856,057 | |

WH Group Ltd | | | 12,758,000 | | | | | |

| Total Hong Kong | | | | | | | | |

| | | | | | | | | |

| ITALY — 4.7% | | | | | | | | |

Enel SpA | | | 1,739,963 | | | | 13,467,626 | |

Eni SpA | | | 988,108 | | | | | |

| Total Italy | | | | | | | | |

| | | | | | | | | |

| JAPAN — 24.8% | | | | | | | | |

| Coca-Cola Bottlers Japan Holdings Inc | | | 496,000 | | | | 11,330,975 | |

FUJIFILM Holdings Corp | | | 345,700 | | | | 15,301,843 | |

Fujitsu Ltd | | | 115,300 | | | | 10,272,260 | |

Honda Motor Co Ltd | | | 561,300 | | | | 15,291,644 | |

Isuzu Motors Ltd | | | 452,200 | | | | 5,307,561 | |

Kyocera Corp | | | 191,200 | | | | 12,645,156 | |

Mitsubishi Electric Corp | | | 752,200 | | | | 10,841,738 | |

| Nippon Telegraph & Telephone Corp | | | 157,000 | | | | 7,815,835 | |

Otsuka Holdings Co Ltd | | | 252,400 | | | | 10,606,456 | |

Secom Co Ltd | | | 37,000 | | | | 3,448,514 | |

Sekisui Chemical Co Ltd | | | 509,600 | | | | 8,961,296 | |

| Sumitomo Electric Industries Ltd | | | 605,100 | | | | 8,385,333 | |

Takeda Pharmaceutical Co Ltd | | | 464,100 | | | | 16,881,052 | |

Tokio Marine Holdings Inc | | | 245,352 | | | | | |

| Total Japan | | | | | | | | |

The accompanying notes are an integral part of the financial statements.

| COMMON STOCK — continued | | | | | | | | |

| | | | | | | |

| NETHERLANDS — 3.5% | | | | | | | | |

Ahold Delhaize NV | | | 164,445 | | | $ | 4,094,527 | |

Royal Dutch Shell PLC Class B^ | | | 597,720 | | | | | |

| Total Netherlands | | | | | | | | |

| | | | | | | | | |

| SINGAPORE — 4.4% | | | | | | | | |

| Singapore Telecommunications Ltd | | | 3,235,002 | | | | 7,847,041 | |

United Overseas Bank Ltd | | | 945,040 | | | | | |

| Total Singapore | | | | | | | | |

| | | | | | | | | |

| SPAIN — 2.8% | | | | | | | | |

Banco Santander SA | | | 3,820,426 | | | | 15,313,746 | |

Iberdrola SA | | | 137,256 | | | | | |

| Total Spain | | | | | | | | |

| | | | | | | | | |

| SWEDEN — 2.6% | | | | | | | | |

Telia Co AB | | | 3,659,421 | | | | | |

| Total Sweden | | | | | | | | |

| | | | | | | | | |

| SWITZERLAND — 5.5% | | | | | | | | |

ABB Ltd | | | 670,157 | | | | 14,055,295 | |

Novartis AG | | | 129,780 | | | | 11,325,657 | |

Zurich Insurance Group AG | | | 21,131 | | | | | |

| Total Switzerland | | | | | | | | |

| | | | | | | | | |

| TAIWAN — 1.6% | | | | | | | | |

| Taiwan Semiconductor Manufacturing Co Ltd | | | 764,000 | | | | 7,491,795 | |

| Taiwan Semiconductor Manufacturing Co Ltd ADR | | | 48,317 | | | | | |

| Total Taiwan | | | | | | | | |

| | | | | | | | | |

| UNITED KINGDOM — 20.7% | | | | | | | | |

BP PLC | | | 1,870,567 | | | | 11,855,962 | |

G4S PLC | | | 3,443,450 | | | | 9,224,284 | |

GlaxoSmithKline PLC | | | 723,169 | | | | 16,567,529 | |

John Wood Group PLC | | | 1,325,561 | | | | 5,808,848 | |

Kingfisher PLC | | | 4,007,521 | | | | 10,756,077 | |

The accompanying notes are an integral part of the financial statements.

| COMMON STOCK — continued | | | | | | | | |

| | | | | | | |

| UNITED KINGDOM — continued | | | | | | | | |

Lloyds Banking Group PLC | | | 23,401,663 | | | $ | 17,218,027 | |

National Grid PLC | | | 471,397 | | | | 5,503,570 | |

SSE PLC | | | 1,072,330 | | | | 17,828,412 | |

Tesco PLC | | | 4,763,737 | | | | 14,513,542 | |

Travis Perkins PLC | | | 254,416 | | | | 4,722,576 | |

WPP PLC | | | 938,642 | | | | | |

| Total United Kingdom | | | | | | | | |

| | | | | | | | | |

| Total Common Stock | | | | | | | | |

(Cost $596,022,962) | | | | | | | | |

| | | | | | | | | |

| PREFERRED STOCK — 0.2% | | | | | | | | |

| | | | | | | | | |

| GERMANY — 0.2% | | | | | | | | |

| Bayerische Motoren Werke AG, 4.66% | | | 13,304 | | | | | |

| | | | | | | | | |

| Total Preferred Stock | | | | | | | | |

(Cost $963,310) | | | | | | | | |

| Total Value of Securities — 98.9% | | | | | | | | |

(Cost $596,986,272) | | | | | | | | |

Percentages are based on Net Assets of $607,301,863.

| ^ | Security traded on the London Stock Exchange. |

ADR — American Depositary Receipt

Ltd. — Limited

PLC — Public Limited Company

As of October 31, 2019, all of the Fund’s investments were considered Level 1, in accordance with the authoritative guidance on fair value measurements and disclosure under U.S. GAAP.

For the year ended October 31, 2019, there were no transfers in or out of Level 3.

For more information on valuation inputs, see Note 2 in Notes to Financial Statements.

The accompanying notes are an integral part of the financial statements.

| SCHEDULE OF INVESTMENTS |

Sector Weightings (unaudited)†: |

† Percentages based on total investments. |

| COMMON STOCK — 98.6% | | | | | | |

| | | | | | | |

| BRAZIL — 8.5% | | | | | | |

Embraer SA ADR | | | 60,222 | | | $ | 1,046,056 | |

Hypera SA * | | | 138,300 | | | | 1,186,956 | |

Itau Unibanco Holding SA ADR | | | 127,172 | | | | 1,148,363 | |

Suzano Papel e Celulose SA | | | 83,000 | | | | | |

| Total Brazil | | | | | | | | |

| | | | | | | | | |

| CHINA — 29.3% | | | | | | | | |

| Alibaba Group Holding Ltd ADR * | | | 9,223 | | | | 1,629,427 | |

| Brilliance China Automotive Holdings Ltd | | | 254,000 | | | | 281,360 | |

| China Medical System Holdings Ltd | | | 609,000 | | | | 828,481 | |

China Merchants Bank Class H | | | 363,000 | | | | 1,737,186 | |

China Mobile Ltd | | | 134,000 | | | | 1,091,023 | |

CSPC Pharmaceutical Group | | | 600,000 | | | | 1,542,889 | |

| Hengan International Group Co Ltd | | | 91,500 | | | | 639,897 | |

Midea Group Co Ltd Class A | | | 152,203 | | | | 1,200,680 | |

NetEase ADR | | | 3,385 | | | | 967,636 | |

| Ping An Insurance Group Co of China Ltd Class H | | | 233,500 | | | | 2,704,219 | |

The accompanying notes are an integral part of the financial statements.

| COMMON STOCK — continued | | | | | | | | |

| | | | | | | |

| CHINA — continued | | | | | | | | |

SAIC Motor Corp Ltd Class A | | | 131,610 | | | $ | 439,610 | |

| Tingyi Cayman Islands Holding Corp Class H | | | 650,000 | | | | | |

| Total China | | | | | | | | |

| | | | | | | | | |

| HONG KONG — 5.7% | | | | | | | | |

Sands China Ltd | | | 250,800 | | | | 1,240,245 | |

WH Group Ltd | | | 1,390,500 | | | | | |

| Total Hong Kong | | | | | | | | |

| | | | | | | | | |

| INDIA — 11.5% | | | | | | | | |

Bajaj Auto Ltd | | | 13,979 | | | | 640,004 | |

HCL Technologies Ltd | | | 64,199 | | | | 1,052,428 | |

| Housing Development Finance Corp Ltd | | | 17,988 | | | | 540,664 | |

Indiabulls Housing Finance Ltd | | | 149,300 | | | | 434,984 | |

Infosys Ltd Sponsored ADR | | | 74,435 | | | | 713,831 | |

Larsen & Toubro Ltd GDR | | | 21,866 | | | | 454,113 | |

Lupin Ltd | | | 58,388 | | | | 613,361 | |

Vedanta Ltd | | | 492,701 | | | | | |

| Total India | | | | | | | | |

| | | | | | | | | |

| INDONESIA — 1.5% | | | | | | | | |

| Bank Rakyat Indonesia Persero Tbk PT | | | 2,297,900 | | | | | |

| Total Indonesia | | | | | | | | |

| | | | | | | | | |

| MALAYSIA — 2.7% | | | | | | | | |

Genting Malaysia Bhd | | | 606,000 | | | | 465,540 | |

Malayan Banking Bhd | | | 385,045 | | | | | |

| Total Malaysia | | | | | | | | |

| | | | | | | | | |

| MEXICO — 3.3% | | | | | | | | |

| Fibra Uno Administracion SA de CV REIT | | | 693,444 | | | | 1,054,054 | |

| Grupo Financiero Banorte SAB de CV Class O | | | 90,967 | | | | | |

| Total Mexico | | | | | | | | |

| | | | | | | | | |

The accompanying notes are an integral part of the financial statements.

| COMMON STOCK — continued | | | | | | | | |

| | | | | | | |

| PERU — 0.9% | | | | | | | | |

Credicorp Ltd | | | 1,980 | | | | | |

| Total Peru | | | | | | | | |

| | | | | | | | | |

| RUSSIA — 5.0% | | | | | | | | |

Gazprom PJSC ADR | | | 180,124 | | | | 1,443,244 | |

LUKOIL PJSC ADR | | | 10,240 | | | | | |

| Total Russia | | | | | | | | |

| | | | | | | | | |

| SOUTH AFRICA — 3.5% | | | | | | | | |

Mondi | | | 54,082 | | | | 1,119,134 | |

Sasol Ltd | | | 28,745 | | | | | |

| Total South Africa | | | | | | | | |

| | | | | | | | | |

| SOUTH KOREA — 12.8% | | | | | | | | |

Korea Zinc Co Ltd | | | 730 | | | | 272,624 | |

LG Chem Ltd | | | 6,270 | | | | 1,657,162 | |

Samsung Electronics Co Ltd | | | 17,587 | | | | 761,859 | |

| Samsung Electronics Co Ltd GDR | | | 1,578 | | | | 1,708,952 | |

| Samsung Fire & Marine Insurance Co Ltd | | | 3,050 | | | | 567,558 | |

Shinhan Financial Group Co Ltd | | | 30,944 | | | | | |

| Total South Korea | | | | | | | | |

| | | | | | | | | |

| TAIWAN — 11.0% | | | | | | | | |

| ASE Technology Holding Co Ltd | | | 390,000 | | | | 1,018,544 | |

CTBC Financial Holding | | | 1,014,000 | | | | 706,191 | |

Mega Financial Holding Co Ltd | | | 469,000 | | | | 460,672 | |

| Taiwan Semiconductor Manufacturing Co Ltd ADR | | | 59,046 | | | | | |

| Total Taiwan | | | | | | | | |

| | | | | | | | | |

| THAILAND — 1.3% | | | | | | | | |

Kasikornbank PCL NVDR | | | 131,400 | | | | | |

| Total Thailand | | | | | | | | |

The accompanying notes are an integral part of the financial statements.

| COMMON STOCK — continued | | | | | | | | |

| | | | | | | |

| UNITED ARAB EMIRATES — 1.2% | | | | | | | | |

First Abu Dhabi Bank PJSC | | | 138,118 | | | | | |

| Total United Arab Emirates | | | | | | | | |

| | | | | | | | | |

| UNITED KINGDOM — 0.4% | | | | | | | | |

Anglo American PLC | | | 7,468 | | | | | |

| Total United Kingdom | | | | | | | | |

| | | | | | | | | |

| Total Common Stock | | | | | | | | |

(Cost $45,230,466) | | | | | | | | |

| | | | | | | | | |

| PREFERRED STOCK — 1.0% | | | | | | | | |

| | | | | | | | | |

| SOUTH KOREA — 1.0% | | | | | | | | |

Samsung Electronics Co Ltd** | | | 12,779 | | | | | |

| | | | | | | | | |

| Total Preferred Stock | | | | | | | | |

(Cost $398,164) | | | | | | | | |

| Total Value of Securities — 99.6% | | | | | | | | |

(Cost $45,628,630) | | | | | | | | |

Percentages are based on Net Assets of $47,496,389.

| * | Non-income producing security. |

| ** | There is currently no rate available. |

ADR — American Depositary Receipt

GDR — Global Depositary Receipt

Ltd. — Limited

NVDR — Non-Voting Depositary Receipt

PJSC — Public Joint Stock Company

PLC — Public Limited Company

REIT — Real Estate Investment Trust

As of October 31, 2019, all of the Fund’s investments were considered Level 1, in accordance with the authoritative guidance on fair value measurements and disclosure under U.S. GAAP.

For the year ended October 31, 2019, there were no transfers in or out of Level 3.

For more information on valuation inputs, see Note 2 in Notes to Financial Statements.

The accompanying notes are an integral part of the financial statements.

| SCHEDULE OF INVESTMENTS |

Sector Weightings† (unaudited): |

† Percentages based on total investments. |

| GLOBAL BONDS — 91.7% | | | | | | | |

| Face Amount (Local Currency) | | | | |

| AUSTRALIA — 4.0% | | | | | | | |

| Australia Government Bond | | | | | | | |

5.750%, 05/15/21 | AUD | | | 155,000 | | | $ | 114,790 | |

4.750%, 04/21/27 | AUD | | | 480,000 | | | | 418,695 | |

3.250%, 04/21/25 | AUD | | | 325,000 | | | | 251,816 | |

3.000%, 03/21/47 | AUD | | | 385,000 | | | | | |

| Total Australia | | | | | | | | | |

| | | | | | | | | | |

| AUSTRIA — 4.7% | | | | | | | | | |

| Republic of Austria Government Bond | | | | | | | | | |

6.250%, 07/15/27 | EUR | | | 785,000 | | | | | |

| Total Austria | | | | | | | | | |

| | | | | | | | | | |

| BELGIUM — 4.1% | | | | | | | | | |

| Kingdom of Belgium Government Bond | | | | | | | | | |

1.000%, 06/22/26 (A) | EUR | | | 950,000 | | | | | |

| Total Belgium | | | | | | | | | |

| | | | | | | | | | |

| CANADA — 2.1% | | | | | | | | | |

| Canadian Government Bond | | | | | | | | | |

5.000%, 06/01/37 | CAD | | | 224,000 | | | | 259,208 | |

1.500%, 06/01/26 | CAD | | | 200,000 | | | | 152,651 | |

0.750%, 09/01/21 | CAD | | | 224,000 | | | | | |

| Total Canada | | | | | | | | | |

| | | | | | | | | | |

| FINLAND — 4.6% | | | | | | | | | |

| Finland Government Bond | | | | | | | | | |

0.500%, 09/15/27 (A) | EUR | | | 1,099,000 | | | | | |

| Total Finland | | | | | | | | | |

The accompanying notes are an integral part of the financial statements.

| GLOBAL BONDS — continued | | | | | | | | | |

| Face Amount (Local Currency) | | | | |

| FRANCE — 2.7% | | | | | | | | | |

| French Republic Government Bond OAT | | | | | | | | | |

1.500%, 05/25/31 | EUR | | | 300,000 | | | $ | 393,319 | |

0.500%, 05/25/25 | EUR | | | 315,000 | | | | | |

| Total France | | | | | | | | | |

| | | | | | | | | | |

| GERMANY — 4.9% | | | | | | | | | |

| Bundesrepublik Deutschland Bundesanleihe | | | | | | | | | |

2.500%, 07/04/44 | EUR | | | 100,000 | | | | 180,167 | |

| Kreditanstalt fuer Wiederaufbau | | | | | | | | | |

2.050%, 02/16/26 | JPY | | | 112,000,000 | | | | | |

| Total Germany | | | | | | | | | |

| | | | | | | | | | |

| ITALY — 10.7% | | | | | | | | | |

| Italy Buoni Poliennali Del Tesoro | | | | | | | | | |

4.750%, 09/01/44 (A) | EUR | | | 100,000 | | | | 173,988 | |

2.950%, 09/01/38 (A) | EUR | | | 500,000 | | | | 673,710 | |

2.000%, 02/01/28 | EUR | | | 850,000 | | | | 1,043,185 | |

1.450%, 05/15/25 | EUR | | | 308,000 | | | | 362,165 | |

0.050%, 04/15/21 | EUR | | | 685,000 | | | | | |

| Total Italy | | | | | | | | | |

| | | | | | | | | | |

| JAPAN — 18.7% | | | | | | | | | |

| Japan Government Thirty Year Bond | | | | | | | | | |

2.400%, 12/20/34 | JPY | | | 110,000,000 | | | | 1,373,436 | |

0.300%, 06/20/46 | JPY | | | 80,000,000 | | | | 731,609 | |

| Japan Government Twenty Year Bond | | | | | | | | | |

1.600%, 06/20/30 | JPY | | | 175,000,000 | | | | 1,914,775 | |

0.200%, 06/20/36 | JPY | | | 131,400,000 | | | | | |

| Total Japan | | | | | | | | | |

| | | | | | | | | | |

| MALAYSIA — 2.0% | | | | | | | | | |

| Malaysia Government Bond | | | | | | | | | |

4.254%, 05/31/35 | MYR | | | 900,000 | | | | 227,379 | |

4.181%, 07/15/24 | MYR | | | 1,350,000 | | | | | |

| Total Malaysia | | | | | | | | | |

The accompanying notes are an integral part of the financial statements.

| GLOBAL BONDS — continued | | | | | | | | | |

| Face Amount (Local Currency) | | | | |

| MEXICO — 3.1% | | | | | | | | | |

| Mexican Bonos | | | | | | | | | |

8.500%, 11/18/38 | MXN | | | 1,263,000 | | | $ | 75,303 | |

8.000%, 11/07/47 | MXN | | | 12,000,000 | | | | 686,900 | |

7.750%, 11/23/34 | MXN | | | 1,750,000 | | | | | |

| Total Mexico | | | | | | | | | |

| | | | | | | | | | |

| NETHERLANDS — 4.6% | | | | | | | | | |

| Netherlands Government Bond | | | | | | | | | |

5.500%, 01/15/28 | EUR | | | 250,000 | | | | 415,339 | |

2.750%, 01/15/47 (A) | EUR | | | 250,000 | | | | 474,946 | |

0.500%, 01/15/40 (A) | EUR | | | 250,000 | | | | 302,074 | |

0.250%, 07/15/29 (A) | EUR | | | 100,000 | | | | | |

| Total Netherlands | | | | | | | | | |

| | | | | | | | | | |

| NEW ZEALAND — 8.0% | | | | | | | | | |

| New Zealand Government Bond | | | | | | | | | |

5.500%, 04/15/23 | NZD | | | 975,000 | | | | 722,126 | |

4.500%, 04/15/27 | NZD | | | 1,000,000 | | | | 792,268 | |

2.750%, 04/15/37 | NZD | | | 986,000 | | | | | |

| Total New Zealand | | | | | | | | | |

| | | | | | | | | | |

| SUPRANATIONAL — 13.4% | | | | | | | | | |

| Asian Development Bank | | | | | | | | | |

2.350%, 06/21/27 | JPY | | | 110,000,000 | | | | 1,231,090 | |

| European Financial Stability Facility | | | | | | | | | |

0.950%, 02/14/28 | EUR | | | 1,100,000 | | | | 1,341,121 | |

| European Investment Bank | | | | | | | | | |

2.150%, 01/18/27 | JPY | | | 109,000,000 | | | | | |

| Total Supranational | | | | | | | | | |

| | | | | | | | | | |

| UNITED KINGDOM — 4.1% | | | | | | | | | |

| United Kingdom Gilt | | | | | | | | | |

4.500%, 09/07/34 | GBP | | | 200,000 | | | | 390,273 | |

The accompanying notes are an integral part of the financial statements.

| GLOBAL BONDS — continued | | | | | | | | | |

| Face Amount (Local Currency) | | | | |

| UNITED KINGDOM — continued | | | | | | | | | |

4.250%, 09/07/39 | GBP | | | 370,000 | | | | | |

| Total United Kingdom | | | | | | | | | |

| | | | | | | | | | |

| Total Global Bonds | | | | | | | | | |

(Cost $24,172,887) | | | | | | | | | |

| | | | | | | | | | |

| U.S. TREASURY OBLIGATIONS — 6.7% | | | | | | | | | |

| | | | | | | | | | |

| United States Treasury Bond | | | | | | | | | |

2.750%, 08/15/42 | $ | |

| 575,000 | | | $ | 637,846 | |

| United States Treasury Notes | | | | | | | | | |

1.625%, 02/15/26 | | | | 1,125,000 | | | | 1,126,933 | |

1.250%, 03/31/21 | | | | 119,800 | | | | | |

| | | | | | | | | | |

| Total U.S. Treasury Obligations | | | | | | | | | |

(Cost $1,682,855) | | | | | | | | | |

| Total Value of Securities — 98.4% | | | | | | | | | |

(Cost $25,855,742) | | | | | | | | | |

A list of the open forward foreign currency exchange contracts held by the Fund at October 31, 2019 is as follows:

| Counterparty | Maturity Date | Currency to Deliver | | Currency to Receive | | | Unrealized

Appreciation

(Depreciation) | |

| Brown Brothers Harriman | 01/31/20 | EUR | | | 113,000 | | USD | | | 126,897 | | | $ | 50 | |

| Brown Brothers Harriman | 01/31/20 | USD | | | 1,817,250 | | EUR | | | 1,627,500 | | | | 9,691 | |

| Brown Brothers Harriman | 01/31/20 | USD | | | 2,513,526 | | GBP | | | 1,948,500 | | | | 18,096 | |

| Brown Brothers Harriman | 01/31/20 | USD | | | 382,490 | | JPY | | | 41,382,000 | | | | 3,124 | |

| Brown Brothers Harriman | 01/31/20 | USD | | | 840,404 | | SEK | | | 8,135,500 | | | | 6,628 | |

| Brown Brothers Harriman | 01/31/20 | NZD | | | 3,506,000 | | USD | | | 2,229,308 | | | | (22,310 | ) |

| Brown Brothers Harriman | 01/31/20 | AUD | | | 1,629,500 | | USD | | | 1,119,972 | | | | | |

| Net Unrealized Appreciation on Forward Foreign Currency Exchange Contracts | | | | | |

The accompanying notes are an integral part of the financial statements.

Percentages are based on Net Assets of $28,117,086.

| (A) | Securities sold within terms of a private placement memorandum, exempt from registration under Section 144A of the Securities Act of 1933, as amended, and may be sold only to dealers in that program or other “accredited investors.” The total value of securities as of October 31, 2019 was $4,197,832 and represents 14.9% of Net Assets. |

AUD — Australian Dollar

CAD — Canadian Dollar

EUR — Euro

GBP — Pound Sterling

JPY — Japanese Yen

MXN — Mexican Peso

MYR — Malaysian Ringgit

NZD — New Zealand Dollar

SEK — Swedish Krona

USD — United States Dollar

The following is a list of the inputs used as of October 31, 2019, in valuing the Fund’s investments carried at market value:

| Investments in Securities | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Global Bonds | | $ | — | | | $ | 25,791,479 | | | $ | — | | | $ | 25,791,479 | |

| U.S. Treasury Obligations | | | | | | | | | | | | | | | | |

| Total Investments in Securities | | | | | | | | | | | | | | | | |

| Other Financial Instruments | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Forward Contracts* | | | | | | | | | | | | |

| Unrealized Appreciation | | $ | — | | | $ | 37,589 | | | $ | — | | | $ | 37,589 | |

| Unrealized Depreciation | | | | | | | | | | | | | | | | |

| Total Other Financial Instruments | | | | | | | | | | | | | | | | |

| * | Forward foreign currency exchange contracts are valued at the unrealized appreciation (depreciation) on the instrument. |

For the year ended October 31, 2019, there were no transfers in or out of Level 3.

Amounts designated as “—” are $0 or have been rounded to $0.

For more information on valuation inputs, see Note 2 in Notes to Financial Statements.

The accompanying notes are an integral part of the financial statements.

| SCHEDULE OF INVESTMENTS |

Sector Weightings† (unaudited): |

† Percentages based on total investments. |

| COMMON STOCK — 100.8% | | | | | | |

| | | | | | | |

| UNITED STATES — 100.8% | | | | | | |

| Communication Services — 2.9% | | | | | | |

National CineMedia Inc | | | 5,076 | | | | | |

| | | | | | | | | |

| Consumer Discretionary — 3.1% | | | | | | | | |

Cedar Fair LP | | | 824 | | | | | |

| | | | | | | | | |

| Consumer Staples — 1.7% | | | | | | | | |

Cal-Maine Foods Inc * | | | 654 | | | | | |

| | | | | | | | | |

| Energy — 2.3% | | | | | | | | |

Green Plains Partners LP | | | 2,538 | | | | | |

| | | | | | | | | |

| Financials — 3.3% | | | | | | | | |

Moelis Class A | | | 1,389 | | | | | |

| | | | | | | | | |

| Health Care — 13.3% | | | | | | | | |

Acadia Healthcare Co Inc * | | | 1,281 | | | | 38,417 | |

AMN Healthcare Services Inc * | | | 798 | | | | 46,890 | |

| Computer Programs & Systems Inc | | | 1,058 | | | | 24,408 | |

iRadimed Corp * | | | 1,402 | | | | 35,401 | |

Meridian Bioscience Inc * | | | 1,509 | | | | 14,773 | |

Tivity Health Inc * | | | 2,361 | | | | | |

| | | | | | | | | |

The accompanying notes are an integral part of the financial statements.

| COMMON STOCK — continued | | | | | | | | |

| | | | | | | |

| UNITED STATES — continued | | | | | | | | |

| Industrials — 35.9% | | | | | | | | |

AAR Corp | | | 1,117 | | | $ | 46,635 | |

Astronics Corp * | | | 1,303 | | | | 37,709 | |

Barnes Group Inc | | | 855 | | | | 49,975 | |

Donaldson Co Inc | | | 744 | | | | 39,239 | |

Douglas Dynamics Inc | | | 770 | | | | 36,059 | |

EnerSys | | | 607 | | | | 40,584 | |

Graco Inc | | | 296 | | | | 13,379 | |

Luxfer Holdings PLC | | | 2,693 | | | | 45,404 | |

McGrath RentCorp | | | 149 | | | | 11,370 | |

Regal Beloit | | | 520 | | | | 38,506 | |

SP Plus Corp * | | | 814 | | | | 35,954 | |

Tetra Tech Inc | | | 444 | | | | 38,837 | |

Timken Company | | | 722 | | | | 35,378 | |

Triumph Group Inc | | | 947 | | | | 19,669 | |

US Ecology Inc | | | 711 | | | | | |

| | | | | | | | | |

| Information Technology — 16.5% | | | | | | | | |

Cabot Microelectronics Corp | | | 289 | | | | 43,674 | |

| Comtech Telecommunications Corp | | | 1,070 | | | | 37,396 | |

FLIR Systems Inc | | | 786 | | | | 40,526 | |

MAXIMUS Inc | | | 513 | | | | 39,368 | |

NIC Inc | | | 1,818 | | | | 42,759 | |

Vishay Intertechnology Inc | | | 2,065 | | | | | |

| | | | | | | | | |

| Materials — 12.9% | | | | | | | | |

AptarGroup Inc | | | 213 | | | | 25,166 | |

Greif Inc Class A | | | 983 | | | | 38,504 | |

Innospec Inc | | | 533 | | | | 48,695 | |

PH Glatfelter Co | | | 2,306 | | | | 41,508 | |

PolyOne Corp | | | 1,163 | | | | | |

| | | | | | | | | |

The accompanying notes are an integral part of the financial statements.

| COMMON STOCK — continued | | | | | | | | |

| | | | | | | |

| UNITED STATES — continued | | | | | | | | |

| Real Estate — 8.9% | | | | | | | | |

| American Campus Communities Inc REIT | | | 831 | | | $ | 41,533 | |

| Landmark Infrastructure Partners LP | | | 2,450 | | | | 44,639 | |

Outfront Media Inc REIT | | | 1,726 | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Total Common Stock | | | | | | | | |

(Cost $1,320,994) | | | | | | | | |

| Total Value of Securities — 100.8% | | | | | | | | |

(Cost $1,320,994) | | | | | | | | |

Percentages are based on Net Assets of $1,485,312.

| * | Non-income producing security. |

L.P. — Limited Partnership

PLC — Public Limited Company

REIT — Real Estate Investment Trust

As of October 31, 2019, all of the Fund’s investments were considered Level 1, in accordance with the authoritative guidance on fair value measurements and disclosure under U.S. GAAP.

For the period ended October 31, 2019, there were no transfers in or out of Level 3.

For more information on valuation inputs, see Note 2 in Notes to Financial Statements.

The accompanying notes are an integral part of the financial statements.

| SCHEDULE OF INVESTMENTS |

Sector Weightings† (unaudited): |

† Percentages based on total investments. |

| COMMON STOCK — 101.5% | | | | | | |

| | | | | | | |

| BRAZIL — 3.0% | | | | | | |

CCR SA | | | 10,800 | | | | | |

| Total Brazil | | | | | | | | |

| | | | | | | | | |

| CANADA — 8.7% | | | | | | | | |

Emera Inc | | | 1,499 | | | | 62,061 | |

Enbridge Inc | | | 1,921 | | | | | |

| Total Canada | | | | | | | | |

| | | | | | | | | |

| CHINA — 2.8% | | | | | | | | |

| Jiangsu Expressway Co Ltd Class H | | | 32,000 | | | | | |

| Total China | | | | | | | | |

| | | | | | | | | |

| FRANCE — 4.6% | | | | | | | | |

Veolia Environnement SA | | | 2,676 | | | | | |

| Total France | | | | | | | | |

| | | | | | | | | |

| GERMANY — 3.9% | | | | | | | | |

| Fraport AG Frankfurt Airport Services Worldwide | | | 712 | | | | | |

| Total Germany | | | | | | | | |

| | | | | | | | | |

| INDIA — 3.3% | | | | | | | | |

Power Grid Corp of India Ltd | | | 18,022 | | | | | |

| Total India | | | | | | | | |

The accompanying notes are an integral part of the financial statements.

| COMMON STOCK — continued | | | | | | | | |

| | | | | | | |

| ITALY — 8.7% | | | | | | | | |

Atlantia SpA | | | 2,754 | | | $ | 68,004 | |

Snam SpA | | | 12,416 | | | | | |

| Total Italy | | | | | | | | |

| | | | | | | | | |

| JAPAN — 4.6% | | | | | | | | |

West Japan Railway Co | | | 800 | | | | | |

| Total Japan | | | | | | | | |

| | | | | | | | | |

| MEXICO — 3.2% | | | | | | | | |

| Grupo Aeroportuario del Centro Norte SAB de CV Class B | | | 7,065 | | | | | |

| Total Mexico | | | | | | | | |

| | | | | | | | | |

| PORTUGAL — 3.9% | | | | | | | | |

EDP - Energias de Portugal SA | | | 14,191 | | | | | |

| Total Portugal | | | | | | | | |

| | | | | | | | | |

| SPAIN — 4.7% | | | | | | | | |

Naturgy Energy Group SA | | | 2,643 | | | | | |

| Total Spain | | | | | | | | |

| | | | | | | | | |

| UNITED ARAB EMIRATES — 3.1% | | | | | | | | |

DP World PLC | | | 3,591 | | | | | |

| Total United Arab Emirates | | | | | | | | |

| | | | | | | | | |

| UNITED KINGDOM — 15.7% | | | | | | | | |

BBA Aviation PLC | | | 16,012 | | | | 62,970 | |

National Grid PLC | | | 5,017 | | | | 58,573 | |

Pennon Group PLC | | | 5,180 | | | | 60,269 | |

SSE PLC | | | 3,425 | | | | | |

| Total United Kingdom | | | | | | | | |

The accompanying notes are an integral part of the financial statements.

| COMMON STOCK — continued | | | | | | | | |

| | | | | | | |

| UNITED STATES — 31.3% | | | | | | | | |

| Industrials — 4.0% | | | | | | | | |

Kansas City Southern | | | 430 | | | | | |

| | | | | | | | | |

| Utilities — 27.3% | | | | | | | | |

Dominion Energy | | | 756 | | | | 62,408 | |

Duke Energy Corp | | | 738 | | | | 69,564 | |

Edison International | | | 867 | | | | 54,534 | |

Evergy Inc | | | 829 | | | | 52,981 | |

PPL Corp | | | 1,932 | | | | 64,703 | |

Southern Co/The | | | 920 | | | | 57,647 | |

Xcel Energy Inc | | | 831 | | | | | |

| | | | | | | | | |

| Total United States | | | | | | | | |

| | | | | | | | | |

| Total Common Stock | | | | | | | | |

(Cost $1,357,347) | | | | | | | | |

| | | | | | | | | |

| Total Value of Securities — 101.5% | | | | | | | | |

(Cost $1,357,347) | | | | | | | | |

Percentages are based on Net Assets of $1,518,889.

Ltd. — Limited

PLC — Public Limited Company

As of October 31, 2019, all of the Fund’s investments were considered Level 1, in accordance with the authoritative guidance on fair value measurements and disclosure under U.S. GAAP

For the period ended October 31, 2019, there were no transfers in or out of Level 3.

For more information on valuation inputs, see Note 2 in Notes to Financial Statements.

The accompanying notes are an integral part of the financial statements.

| STATEMENTS OF ASSETS AND LIABILITIES | |

| | | Mondrian International Value Equity Fund | | | Mondrian Emerging Markets Value Equity Fund | | | Mondrian International Government Fixed Income Fund | |

| Assets: | | | | | | | | | |

| Investments (Cost $596,986,272, $45,628,630 and $25,855,742) | | $ | 600,347,551 | | | $ | 47,286,499 | | | $ | 27,675,487 | |

Foreign currency (Cost $210,082, $127,336 and $631) | | | 213,636 | | | | 127,364 | | | | 638 | |

Cash | | | 1,870,952 | | | | 484,347 | | | | 305,522 | |

Reclaims receivable | | | 2,690,816 | | | | 917 | | | | — | |

| Dividends and interest receivable | | | 2,436,847 | | | | 57,233 | | | | 159,425 | |

| Receivable for capital shares sold | | | 361,405 | | | | 19 | | | | 263 | |

| Unrealized appreciation on forward foreign currency contracts | | | — | | | | — | | | | 37,589 | |

| Receivable for investment securities sold | | | — | | | | 299,792 | | | | — | |

Prepaid expenses | | | | | | | | | | | | |

Total assets | | | | | | | | | | | | |

| Liabilities: | | | | | | | | | | | | |

| Payable due to Investment Adviser | | | 286,629 | | | | 45,673 | | | | 5,769 | |

| Payable for capital shares redeemed | | | 260,730 | | | | — | | | | 1,361 | |

| Payable due to Administrator | | | 51,275 | | | | 3,994 | | | | 2,442 | |

Audit fees payable | | | 12,200 | | | | 12,200 | | | | 13,300 | |

| Chief Compliance Officer fees payable | | | 5,234 | | | | 411 | | | | 259 | |

Payable due to Trustees | | | 95 | | | | 7 | | | | 5 | |

| Payable for investment securities purchased | | | — | | | | 650,031 | | | | — | |

| Unrealized depreciation on forward foreign currency contracts | | | — | | | | — | | | | 28,231 | |

| Unrealized depreciation on spot foreign currency contracts | | | — | | | | 549 | | | | — | |

| Accrued foreign capital gains tax | | | — | | | | 6,754 | | | | — | |

Other accrued expenses | | | | | | | | | | | | |

Total liabilities | | | | | | | | | | | | |

Net assets | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Net assets consist of: | | | | | | | | | | | | |

Paid-in capital | | $ | 576,989,568 | | | $ | 153,755,543 | | | $ | 27,803,915 | |

| Total distributable earnings/(loss) | | | | | | | | | | | | |

Net assets | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Outstanding Shares of Beneficial Interest

(unlimited authorization - no par value) | | | | | | | | | | | | |

Net Asset Value, Offering and Redemption Price Per Share | | | | | | | | | | | | |

The accompanying notes are an integral part of the financial statements.

| STATEMENTS OF ASSETS AND LIABILITIES | | | | | | |

| | | Mondrian

U.S. Small Cap Equity Fund | | | Mondrian Global Listed Infrastructure Fund | |

| Assets: | | | | | | |

| Investments (Cost $1,320,994 and $1,357,347) | | $ | 1,497,798 | | | $ | 1,542,012 | |

| Foreign currency (Cost $ — and $6,779) | | | — | | | | 7,026 | |

Cash | | | 29,637 | | | | 10,289 | |

| Receivable for investment securities sold | | | 14,844 | | | | 48,357 | |

| Receivable from Investment Adviser | | | 5,752 | | | | 9,276 | |

Deferred offering costs | | | 4,375 | | | | 4,375 | |

Dividends receivable | | | 2,073 | | | | 1,901 | |

Reclaims receivable | | | — | | | | 481 | |

Prepaid expenses | | | | | | | | |

Total assets | | | | | | | | |

| Liabilities: | | | | | | | | |

Offering costs payable to Adviser | | | 37,627 | | | | 37,627 | |

| Payable for investment securities purchased | | | 15,514 | | | | 48,578 | |

Audit fees payable | | | 12,300 | | | | 13,450 | |

Accrued foreign capital gains tax | | | — | | | | 702 | |

Payable due to Administrator | | | 130 | | | | 130 | |

| Chief Compliance Officer fees payable | | | 13 | | | | 13 | |

Other accrued expenses | | | | | | | | |

Total liabilities | | | | | | | | |

Net assets | | | | | | | | |

| | | | | | | | | |

| Net assets consist of: | | | | | | | | |

Paid-in capital | | $ | 1,249,980 | | | $ | 1,250,925 | |

Total distributable earnings | | | | | | | | |

Net assets | | | | | | | | |

| | | | | | | | | |

Outstanding Shares of Beneficial Interest

(unlimited authorization - no par value) | | | | | | | | |

Net Asset Value, Offering and Redemption Price Per Share | | | | | | | | |

The accompanying notes are an integral part of the financial statements.

| STATEMENTS OF OPERATIONS | | | |

| | | Mondrian International Value Equity Fund | |

| Investment income | | | |

Dividends | | $ | 26,328,319 | |

Less: foreign taxes withheld | | | | |

Total investment income | | | | |

| | | | | |

| Expenses | | | | |

Investment advisory fees | | | 4,012,068 | |

Accounting and administration fees | | | 586,195 | |

Legal fees | | | 143,448 | |

Custodian fees | | | 70,711 | |

Printing fees | | | 69,277 | |

Registration fees | | | 59,620 | |

| Dividend disbursing and transfer agent fees and expenses | | | 58,748 | |

Other | | | 46,989 | |

Trustees’ fees and expenses | | | 33,597 | |

Audit and tax | | | 32,957 | |

Chief Compliance Officer fees | | | | |

Total expenses | | | | |

| Less: | | | | |

Investment advisory fees waived | | | | |

Net expenses | | | | |

| | | | | |

Net investment income | | | | |

| | | | | |

| Net realized gain on: | | | | |

Investments | | | 15,309,662 | |

Foreign currency transactions | | | | |

Net realized gain | | | | |

| Net change in unrealized appreciation/(depreciation) on: | | | | |

Investments | | | 8,330,654 | |

| Foreign currency transactions and translation of other assets and liabilities denominated in foreign currency | | | | |

| Net change in unrealized appreciation/(depreciation) | | | | |

Net realized and unrealized gain | | | | |

| | | | | |

| Net increase in net assets resulting from operations | | | | |

The accompanying notes are an integral part of the financial statements.

| STATEMENTS OF OPERATIONS | | | |

| | | Mondrian Emerging Markets Value Equity Fund | |

| Investment income | | | |

Dividends | | $ | 2,115,540 | |

Less: foreign taxes withheld | | | | |

Total investment income | | | | |

| | | | | |

| Expenses | | | | |

Investment advisory fees | | | 470,088 | |

Accounting and administration fees | | | 64,124 | |

Audit and tax | | | 32,956 | |

Custodian fees | | | 32,324 | |

Registration fees | | | 30,798 | |

| Dividend disbursing and transfer agent fees and expenses | | | 26,275 | |

Legal fees | | | 17,321 | |

Printing fees | | | 13,146 | |

Other | | | 12,729 | |

Trustees’ fees and expenses | | | 4,012 | |

Chief Compliance Officer fees | | | | |

Total expenses | | | | |

| Less: | | | | |

Investment advisory fees waived | | | | |

Net expenses | | | | |

| | | | | |

Net investment income | | | | |

| | | | | |

| Net realized gain(loss) on: | | | | |

Investments | | | 251,224 | |

Foreign currency transactions | | | | |

Net realized gain | | | | |

| Net change in unrealized appreciation/(depreciation) on: | | | | |

Investments | | | 7,194,495 | |

| Accrued foreign capital gains tax on appreciated securities | | | (6,754 | ) |

| Foreign currency transactions and translation of other assets and liabilities denominated in foreign currency | | | | |

| Net change in unrealized appreciation/(depreciation) | | | | |

Net realized and unrealized gain | | | | |

| | | | | |

| Net increase in net assets resulting from operations | | | | |

The accompanying notes are an integral part of the financial statements.

STATEMENTS OF OPERATIONS | | | |

| | | Mondrian International Government Fixed Income Fund | |

| Investment income | | | |

Interest | | $ | 540,181 | |

Less: foreign taxes withheld | | | | |

Total investment income | | | | |

| | | | | |

| Expenses | | | | |

Investment advisory fees | | | 150,399 | |

Audit and tax | | | 35,157 | |

Accounting and administration fees | | | 30,786 | |

Registration fees | | | 28,420 | |

| Dividend disbursing and transfer agent fees and expenses | | | 22,945 | |

Custodian fees | | | 16,244 | |

Legal fees | | | 8,051 | |

Printing fees | | | 6,451 | |

Other | | | 6,360 | |

Trustees’ fees and expenses | | | 1,773 | |

Chief Compliance Officer fees | | | | |

Total expenses | | | | |

| Less: | | | | |

Investment advisory fees waived | | | | |

Net expenses | | | | |

| | | | | |

Net investment income | | | | |

| | | | | |

| Net realized gain(loss) on: | | | | |

Investments | | | 697,203 | |

Foreign currency transactions | | | 166,319 | |

Foreign currency exchange contracts | | | | |

Net realized gain | | | | |

| Net change in unrealized appreciation/(depreciation) on: | | | | |

Investments | | | 2,251,577 | |

| Foreign currency transactions and translation of other assets and liabilities denominated in foreign currency | | | 8,481 | |

Foreign currency exchange contracts | | | | |

| Net change in unrealized appreciation/(depreciation) | | | | |

Net realized and unrealized gain | | | | |

| | | | | |

| Net increase in net assets resulting from operations | | | | |

The accompanying notes are an integral part of the financial statements.

| STATEMENTS OF OPERATIONS | | | |

| | | Mondrian

U.S. Small Cap Equity Fund(1) | |

| Investment income | | | |

Dividends | | | | |

Total investment income | | | | |

| | | | | |

| Expenses | | | | |

Offering costs | | | 33,252 | |

Audit and tax | | | 24,600 | |

| Dividend disbursing and transfer agent fees and expenses | | | 20,293 | |

Investment advisory fees | | | 9,457 | |

Registration fees | | | 1,365 | |

Accounting and administration fees | | | 1,278 | |

Custodian fees | | | 609 | |

Other | | | 389 | |

Legal fees | | | 275 | |

Printing fees | | | 199 | |

Trustees’ fees and expenses | | | 66 | |

Chief compliance officer fees | | | | |

Total expenses | | | | |

| Less: | | | | |

Investment advisory fees waived | | | (9,457 | ) |

Reimbursement from Investment Adviser | | | | |

Net expenses | | | | |

| | | | | |

Net investment income | | | | |

| | | | | |

| Net realized gain on: | | | | |

Investments | | | | |

Net realized gain | | | | |

| Net change in unrealized appreciation/(depreciation) on: | | | | |

Investments | | | | |

| Net change in unrealized appreciation/(depreciation) | | | | |

Net realized and unrealized gain | | | | |

| | | | | |

| Net increase in net assets resulting from operations | | | | |

| (1) | The fund commenced operations on December 17, 2018. |

The accompanying notes are an integral part of the financial statements.

| STATEMENTS OF OPERATIONS | | | |

| | | Mondrian Global Listed Infrastructure Fund(1) | |

| Investment income | | | |

Dividends | | $ | 54,360 | |

Less: foreign taxes withheld | | | | |

Total investment income | | | | |

| | | | | |

| Expenses | | | | |

Offering costs | | | 33,252 | |

Audit and tax | | | 26,900 | |

| Dividend disbursing and transfer agent fees and expenses | | | 20,291 | |

Investment advisory fees | | | 10,171 | |

Other | | | 5,341 | |

Custodian fees | | | 4,887 | |

Registration fees | | | 1,361 | |

Accounting and administration fees | | | 1,277 | |

Legal fees | | | 280 | |

Printing fees | | | 203 | |

Trustees’ fees and expenses | | | 66 | |

Chief compliance officer fees | | | | |

Total expenses | | | | |

| Less: | | | | |

Investment advisory fees waived | | | (10,171 | ) |

Reimbursement from Investment Adviser | | | | |

Net expenses | | | | |

| | | | | |

Net investment income | | | | |

| | | | | |

| Net realized gain (loss) on: | | | | |

Investments | | | 48,787 | |

Foreign currency transactions | | | | |

Net realized gain | | | | |

| Net change in unrealized appreciation/(depreciation) on: | | | | |

Investments | | | 184,665 | |

| Accrued foreign capital gains tax on appreciated securities | | | (702 | ) |

| Foreign currency transactions and translation of other assets and liabilities denominated in foreign currency | | | | |

| Net change in unrealized appreciation/(depreciation) | | | | |

Net realized and unrealized gain | | | | |

| | | | | |

| Net increase in net assets resulting from operations | | | | |

| (1) | The fund commenced operations on December 17, 2018. |

The accompanying notes are an integral part of the financial statements.

| STATEMENTS OF CHANGES IN NET ASSETS | | | | | | |

| | | Year ended October 31, 2019 | | | Year ended October 31, 2018 | |

| Operations: | | | | | | |

Net investment income | | $ | 19,461,922 | | | $ | 15,426,689 | |