UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________

FORM N-CSR

________

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811-23091

Gallery Trust

(Exact name of registrant as specified in charter)

________

SEI Investments

One Freedom Valley Drive

Oaks, PA 19456

(Address of principal executive offices) (Zip code)

Michael Beattie

C/O SEI Investments

One Freedom Valley Drive

Oaks, PA 19456

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-888-832-4386

Date of fiscal year end: October 31, 2024

Date of reporting period: October 31, 2024

Item 1. Reports to Stockholders.

| (a) | A copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Act”) (17 CFR § 270.30e-1), is attached hereto. |

Mondrian Emerging Markets Value Equity Fund

Institutional Shares - MPEMX

Annual Shareholder Report: October 31, 2024

This annual shareholder report contains important information about Institutional Shares of the Mondrian Emerging Markets Value Equity Fund (the "Fund") for the period from November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.mondrian.com/mutualfunds/emerging-markets-value-equity-fund/. You can also request this information by contacting us at 888-832-4386.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Mondrian Emerging Markets Value Equity Fund, Institutional Shares | $102 | 0.92% |

|---|

How did the Fund perform in the last year?

The Emerging Markets (EM) Asset Class delivered strong returns over the twelve-month period, as the MSCI EM Index gained 25.3%. The key theme that has dominated global equity market moves has been the increasing expectations for the current and future monetisation of Artificial Intelligence (AI). The most notable beneficiary in US markets has been Nvidia, gaining over 150% during 2024 alone. Although the largest EM stocks exposed to the AI theme haven’t risen as much, several have produced excellent returns, particularly in Taiwan. The likes of TSMC, Hon Hai, and MediaTek led MSCI Taiwan to rise 61.0%, which in turn was the primary driver for the outperformance of Asia (+28.9%) over EMEA (+18.8%) and Latin America (+2.4%). Despite China’s headline return of +21.7%, the market had been a clear laggard for most of the year, with ongoing stresses in the property sector and weak domestic consumption dragging on economic growth. This prompted the Chinese authorities to unveil a co-ordinated set of stimulus measures in late September ’24 that sparked an immediate 35%+ rally in Chinese equities. Market returns across Europe, Middle East, and Africa (EMEA) were broadly positive, despite lagging the returns of the likes of Taiwan and India. South Africa (+35.7%) was the best performing market in the region. Latin America’s underperformance was led by Brazil (+0.8%), and Mexico (-2.1%). In both cases investor concern over the outlook under left-wing governments led to relative underperformance and currency depreciation. The Mondrian Emerging Markets Equity Fund (“the Fund”) returned +21.2%. The Fund’s relative returns lagged the Index return over the period, driven by a combination of negative top-down allocation and a smaller negative impact from stock selection. From a top-down perspective, the overweight allocation to Latin America as well as the underperformance of South Korea and Indonesia hindered investment performance. An important offsetting factor was the Fund’s overweight positioning in China leading into the sharp rally experienced in September ’24. The overall contribution from stock selection to investment returns was balanced. Positioning in Taiwan was a significant positive, with Fund holdings in TSMC, Hon Hai, MediaTek, and CTBC Financial contributing the majority of the 315bps gained from the market. This was offset by headwinds from stock selection in China, India, Indonesia and Brazil. Within Latin America, the Fund benefitted from the holdings in Peruvian financial services provider Credicorp and a recovery in Mexican airport operator GAP following the favourable renewal of its operating agreement for the next 5 years. At the sector level, relative underperformance stemmed primarily from negative stock selection within the health care and consumer discretionary sectors. At the beginning of the reporting period the Fund held an overweight allocation to IT, however due to the material outperformance of several IT holdings throughout the course of the year and the subsequent realization of profits by reducing these positions, the Fund now holds an underweight to IT. Across the remaining sectors, stock selection in energy and positioning in the utilities sector added value.

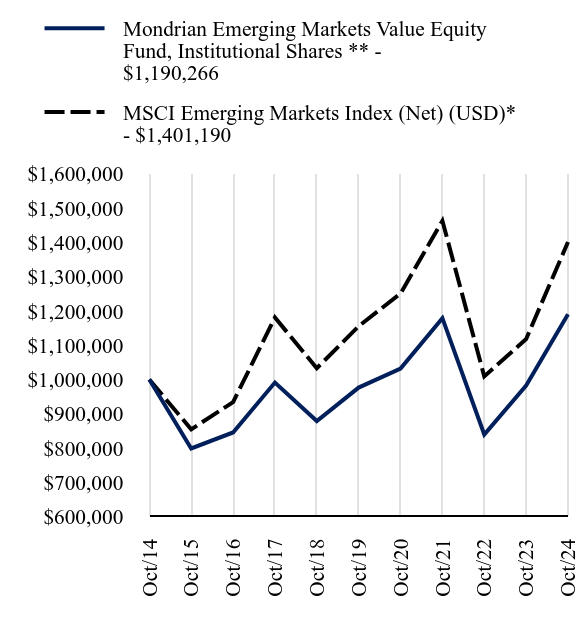

How did the Fund perform during the last 10 years?

Total Return Based on $1,000,000 Investment

| Mondrian Emerging Markets Value Equity Fund, Institutional Shares ** - $1190266 | MSCI Emerging Markets Index (Net) (USD)* - $1401190 |

|---|

| Oct/14 | $1000000 | $1000000 |

|---|

| Oct/15 | $798887 | $854675 |

|---|

| Oct/16 | $845448 | $933881 |

|---|

| Oct/17 | $991112 | $1180900 |

|---|

| Oct/18 | $878775 | $1033096 |

|---|

| Oct/19 | $976539 | $1155579 |

|---|

| Oct/20 | $1031923 | $1250933 |

|---|

| Oct/21 | $1179173 | $1463095 |

|---|

| Oct/22 | $839534 | $1009149 |

|---|

| Oct/23 | $982362 | $1118131 |

|---|

| Oct/24 | $1190266 | $1401190 |

|---|

Since its inception on September 24, 2018. The line graph represents historical performance of a hypothetical investment of $1,000,000 in the Fund since inception. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is not indicative of future performance.Call 888-832-4386 or visit https://www.mondrian.com/mutualfunds/emerging-markets-value-equity-fund/ for current month-end performance.

*As of October 2024, pursuant to the new regulatory requirements, this index has been added to represent the broad-based securities market index.

** The financial statements include the financial information of the Predecessor Fund through September 24, 2018 (See Note 1 in Notes to Financial Statements).

Average Annual Total Returns as of October 31, 2024

| Fund/Index Name | 1 Year | 5 Years | 10 Years |

|---|

| Mondrian Emerging Markets Value Equity Fund, Institutional Shares ** | 21.16% | 4.04% | 1.76% |

|---|

| MSCI Emerging Markets Index (Net) (USD)* | 25.32% | 3.93% | 3.43% |

|---|

On September 24, 2018, the Laudus Mondrian Emerging Markets Fund (the “Emerging Markets Predecessor Fund”) was reorganized into the Mondrian Emerging Markets Equity Fund. Inception date of the Emerging Markets Predecessor Fund was November 2, 2007. Information presented from November 2, 2007 to September 24, 2018 is that of the Emerging Markets Predecessor Fund.

Key Fund Statistics as of October 31, 2024

| Total Net Assets | Number of Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $20,623,182 | 60 | $32,916 | 40% |

|---|

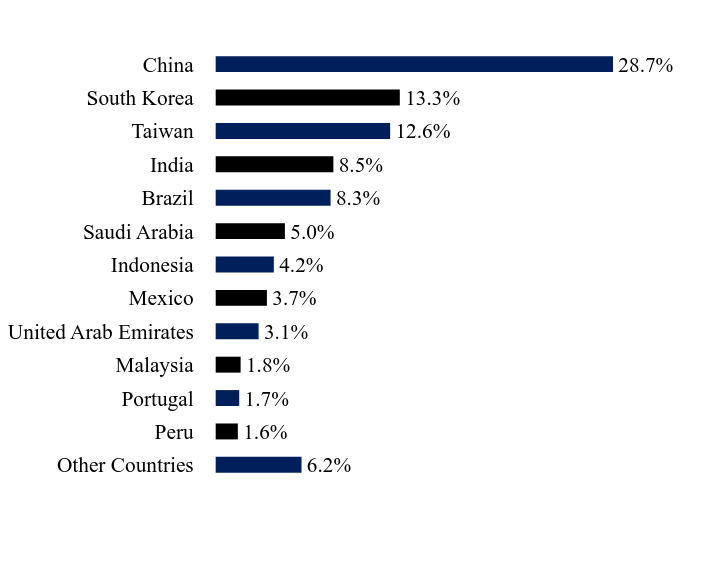

What did the Fund invest in?

| Value | Value |

|---|

| Other Countries | 6.2% |

| Peru | 1.6% |

| Portugal | 1.7% |

| Malaysia | 1.8% |

| United Arab Emirates | 3.1% |

| Mexico | 3.7% |

| Indonesia | 4.2% |

| Saudi Arabia | 5.0% |

| Brazil | 8.3% |

| India | 8.5% |

| Taiwan | 12.6% |

| South Korea | 13.3% |

| China | 28.7% |

| Holding Name | | | Percentage of Total Net Assets |

|---|

| Taiwan Semiconductor Manufacturing Co Ltd | | | 9.4% |

| Alibaba Group Holding Ltd | | | 5.2% |

| Samsung Electronics Co Ltd, Preference | | | 3.5% |

| Tencent Holdings Ltd | | | 3.4% |

| HDFC Bank Ltd | | | 3.4% |

| Axis Bank Ltd | | | 3.0% |

| Shinhan Financial Group Co Ltd | | | 2.8% |

| Bank Rakyat Indonesia Persero Tbk PT | | | 2.6% |

| Yum China Holdings Inc | | | 2.3% |

| Petroleo Brasileiro ADR | | | 2.3% |

* Percentages are calculated based on total net assets.

There were no material changes during the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, call or visit:

Rule 30e-1 of the Investment Company Act of 1940 permits funds to transmit only one copy of a proxy statement, annual report or semi-annual report to shareholders (who need not be related) with the same residential, commercial or electronic address, provided that the shareholders have consented in writing and the reports are addressed either to each shareholder individually or to the shareholders as a group. This process is known as “householding” and is designed to reduce the duplicate copies of materials that shareholders receive and to lower printing and mailing costs for funds. Once implemented, if you would like to discontinue householding for your accounts, please call toll-free at 888-832-4386 to request individual copies of these documents. Once the Fund receives notice to stop householding, we will begin sending individual copies 30 days after receiving your request.

Mondrian Emerging Markets Value Equity Fund / Institutional Shares - MPEMX

Annual Shareholder Report - October 31, 2024

MON-AR-TSR-2024-1

Mondrian Global Equity Value Fund

Institutional Shares - MPGVX

Annual Shareholder Report: October 31, 2024

This annual shareholder report contains important information about Institutional Shares of the Mondrian Global Equity Value Fund (the "Fund") for the period from November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.mondrian.com/mutualfunds/global-equity-value-fund/. You can also request this information by contacting us at 888-832-4386.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Mondrian Global Equity Value Fund, Institutional Shares | $83 | 0.74% |

|---|

How did the Fund perform in the last year?

Global markets got off to a strong start in the period after data released in November 2023 showed US inflation had fallen by more than expected; bond yields fell, and equities recorded one of their best months since the arrival of COVID-19 vaccines. Global markets continued their strong performance through the end of the year after the Federal Reserve adopted a more dovish stance. Markets continued to rise in the first half of 2024 as macroeconomic data surprised to the upside and as excitement continued to grow over the potential for artificial intelligence. Markets fell at the beginning of August 2024 as the Bank of Japan unexpectedly raised interest rates, triggering a sharp appreciation in the Japanese yen as market participants unwound some of the ‘yen carry trade’. This coupled with the renewed fears of a US recession led to a sharp selloff in equity markets. However, markets rebounded strongly from this later in the third quarter as more encouraging macro data was reported in the US and softening inflation led the Fed to cut interest rates by 50bps in September. Sectoral performance saw a partial reversal of the trends seen through the first half of the year with IT underperforming and defensive sectors outperforming. Global markets fell in October 2024, after a strong run through the first nine months of the year, in part because of the gyrations in the US bond market. The Fund gained 24.8% over the twelve months, a challenging period for a defensive value manager, underperforming the strongly rising MSCI AC World Index which gained 32.8%, while providing a very solid absolute return. Negative stock selection, in particular in the US, drove the majority of relative returns while overweight exposure to the weaker Japanese market and underweight exposure to the stronger US market also held back returns. Country allocation was a headwind for performance: Overweight exposure to the Japanese, UK, and South Korean markets, as well as underweight exposure to the stronger US market, held back returns in the period. These negative effects were only slightly offset by underweight exposure to the relatively weaker Swiss market. Sector allocation also held back returns: The Fund’s sector allocation held back returns as defensive sectors like consumer staples and health care lagged while growth-oriented sectors like information technology and communication services outperformed strongly. This was only partly offset by underweight exposure to the relatively weaker energy sector. Stock selection at the country level was the main detractor from relative performance in the period: Stock selection was strong in the UK and the Netherlands. However, this was more than offset by weaker selections in the US: Dollar Tree lagged, after the company announced it was contemplating strategic alternatives for its struggling Family Dollar stores. Currency allocation was a small positive contributor: The Fund’s overweight exposure to the Japanese yen held back returns, as did the overweight to the relatively weaker Brazilian real. However, these effects were more than offset by overweight exposure to UK sterling and underweight exposure to the US dollar.

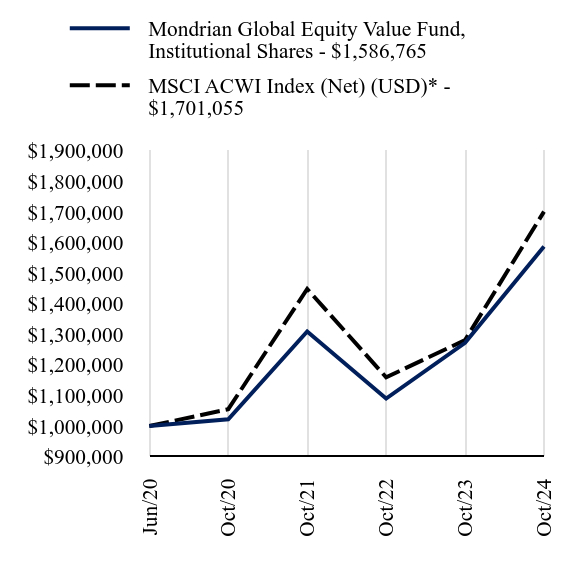

How did the Fund perform since inception?

Total Return Based on $1,000,000 Investment

| Mondrian Global Equity Value Fund, Institutional Shares - $1586765 | MSCI ACWI Index (Net) (USD)* - $1701055 |

|---|

| Jun/20 | $1000000 | $1000000 |

|---|

| Oct/20 | $1022000 | $1055018 |

|---|

| Oct/21 | $1309106 | $1448301 |

|---|

| Oct/22 | $1089856 | $1159259 |

|---|

| Oct/23 | $1271982 | $1281003 |

|---|

| Oct/24 | $1586765 | $1701055 |

|---|

Since its inception on June 30, 2020. The line graph represents historical performance of a hypothetical investment of $1,000,000 in the Fund since inception. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is not indicative of future performance.Call 888-832-4386 or visit https://www.mondrian.com/mutualfunds/global-equity-value-fund/ for current month-end performance.

*As of October 2024, pursuant to the new regulatory requirements, this index has been added to represent the broad-based securities market index.

Average Annual Total Returns as of October 31, 2024

| Fund/Index Name | 1 Year | Annualized Since Inception |

|---|

| Mondrian Global Equity Value Fund, Institutional Shares | 24.75% | 11.23% |

|---|

| MSCI ACWI Index (Net) (USD)* | 32.79% | 13.02% |

|---|

Key Fund Statistics as of October 31, 2024

| Total Net Assets | Number of Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $231,258,212 | 55 | $1,085,825 | 48% |

|---|

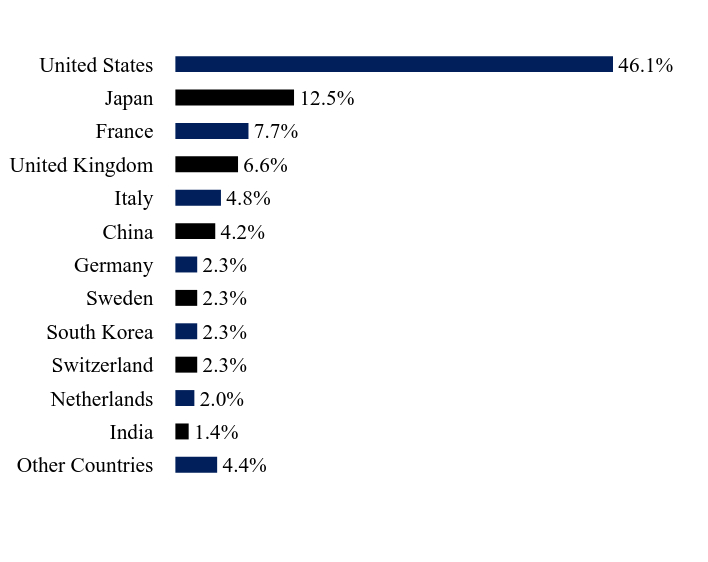

What did the Fund invest in?

| Value | Value |

|---|

| Other Countries | 4.4% |

| India | 1.4% |

| Netherlands | 2.0% |

| Switzerland | 2.3% |

| South Korea | 2.3% |

| Sweden | 2.3% |

| Germany | 2.3% |

| China | 4.2% |

| Italy | 4.8% |

| United Kingdom | 6.6% |

| France | 7.7% |

| Japan | 12.5% |

| United States | 46.1% |

| Holding Name | | | Percentage of Total Net Assets |

|---|

| Enel SpA | | | 3.0% |

| L3Harris Technologies Inc | | | 2.8% |

| UnitedHealth Group Inc | | | 2.8% |

| Wells Fargo & Co | | | 2.8% |

| Kenvue Inc | | | 2.8% |

| Sony Corp Group | | | 2.7% |

| British American Tobacco PLC | | | 2.6% |

| Meta Platforms Inc, Cl A | | | 2.6% |

| Charles Schwab Corp | | | 2.6% |

| DuPont de Nemours | | | 2.6% |

* Percentages are calculated based on total net assets.

There were no material changes during the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, call or visit:

Rule 30e-1 of the Investment Company Act of 1940 permits funds to transmit only one copy of a proxy statement, annual report or semi-annual report to shareholders (who need not be related) with the same residential, commercial or electronic address, provided that the shareholders have consented in writing and the reports are addressed either to each shareholder individually or to the shareholders as a group. This process is known as “householding” and is designed to reduce the duplicate copies of materials that shareholders receive and to lower printing and mailing costs for funds. Once implemented, if you would like to discontinue householding for your accounts, please call toll-free at 888-832-4386 to request individual copies of these documents. Once the Fund receives notice to stop householding, we will begin sending individual copies 30 days after receiving your request.

Mondrian Global Equity Value Fund / Institutional Shares - MPGVX

Annual Shareholder Report - October 31, 2024

MON-AR-TSR-2024-2

Mondrian Global Listed Infrastructure Fund

Institutional Shares - MGIFX

Annual Shareholder Report: October 31, 2024

This annual shareholder report contains important information about Institutional Shares of the Mondrian Global Listed Infrastructure Fund (the "Fund") for the period from November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.mondrian.com/mutualfunds/global-listed-infrastructure-fund/. You can also request this information by contacting us at 888-832-4386.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Mondrian Global Listed Infrastructure Fund, Institutional Shares | $106 | 0.95% |

|---|

How did the Fund perform in the last year?

Global equity markets rallied strongly over the year on the back of promising macroeconomic data that continued to show a healthy US economy with inflation slowing, as well as growing excitement over the potential for artificial intelligence (AI). The MSCI ACW index rose 32.8%. The MSCI ACW Core Infrastructure index underperformed this index due to a lack of exposure to AI-related sectors like Information Technology and relatively lower returns from infrastructure stocks, such as railroads and airports, within the industrials sector. The fund’s performance was broadly in line with this index. HCA, the US hospital operator, was the largest contributor to the fund’s return, with the company showing steady growth in patient admissions and strong pricing, as well as margin expansion as a result of improving labor availability. Medical procedures had been slow to recover post-COVID and labor shortages had pushed up costs for hospital operators, but these issues have now normalized. Rubis, the French energy infrastructure company, saw its share price rise after posting strong financial results. In addition, an activist investor disclosed a significant position and wrote a letter to the company’s board pushing for strategy and governance changes. As the shares approached our assessment of fair value we divested from the company. Shares in TC Energy, the natural-gas focused pipeline company, rose as investors became increasingly confident of a successful outcome of the spin-off of its oil pipelines business. There is also growing expectation of significant electricity demand from data centers, with gas better able to deliver the steady, uninterrupted power required than renewable alternatives. Enel Americas, the Chilean-listed electric utility, saw it shares decline as adverse weather patterns impacted hydroelectric generation operations in the company’s main markets. In Colombia, very dry conditions caused by the El Niño weather phenomenon has contributed to low reservoir levels and low output from Enel Americas’ hydro assets. As a result, the company had to purchase electricity on the sport market at elevated prices to deliver contracted volumes. Meanwhile in Brazil, heavy rainfall led to unusually-high reservoir levels, bringing down power prices and squeezing power generation margins. Guangdong Investment, the Chinese water utility, was one of the weaker investments over the period as confidence in China’s troubled property sector remained depressed. Although the company’s real estate development operations have grown significantly in recent years, we believe that the challenges there are overshadowing the stable cash flows of its core water utility business, resulting in material undervaluation of the company by the market. Another weak performer during the year was Prologis, the US industrial real estate company. The company lowered their full year guidance due to soft demand in key markets, particularly Southern California. A significant proportion of Prologis’ portfolio is earning rents below market rates and as these contracts expire and roll onto market rates, the company will see strong revenue growth in the coming years.

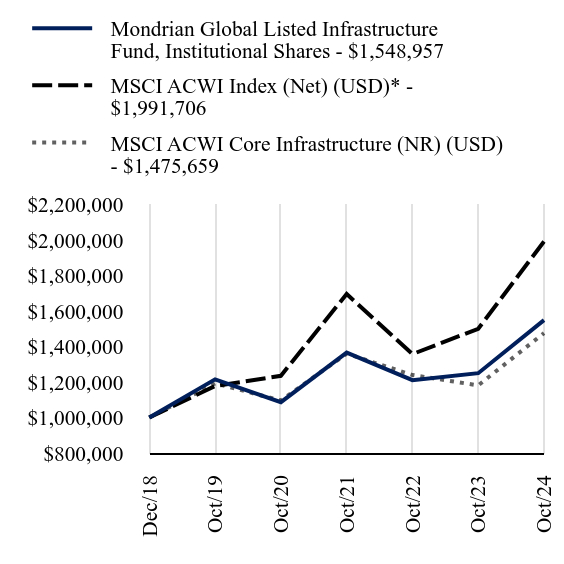

How did the Fund perform since inception?

Total Return Based on $1,000,000 Investment

| Mondrian Global Listed Infrastructure Fund, Institutional Shares - $1548957 | MSCI ACWI Index (Net) (USD)* - $1991706 | MSCI ACWI Core Infrastructure (NR) (USD) - $1475659 |

|---|

| Dec/18 | $1000000 | $1000000 | $1000000 |

|---|

| Oct/19 | $1214932 | $1177720 | $1192352 |

|---|

| Oct/20 | $1086633 | $1235284 | $1095897 |

|---|

| Oct/21 | $1365905 | $1695766 | $1359639 |

|---|

| Oct/22 | $1210436 | $1357337 | $1239464 |

|---|

| Oct/23 | $1249867 | $1499883 | $1181160 |

|---|

| Oct/24 | $1548957 | $1991706 | $1475659 |

|---|

Since its inception on December 17, 2018. The line graph represents historical performance of a hypothetical investment of $1,000,000 in the Fund since inception. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is not indicative of future performance.Call 888-832-4386 or visit https://www.mondrian.com/mutualfunds/global-listed-infrastructure-fund/ for current month-end performance.

*As of October 2024, pursuant to the new regulatory requirements, this index has been added to represent the broad-based securities market index.

Average Annual Total Returns as of October 31, 2024

| Fund/Index Name | 1 Year | 5 Years | Annualized Since Inception |

|---|

| Mondrian Global Listed Infrastructure Fund, Institutional Shares | 23.93% | 4.98% | 7.73% |

|---|

| MSCI ACWI Index (Net) (USD)* | 32.79% | 11.08% | 12.44% |

|---|

| MSCI ACWI Core Infrastructure (NR) (USD) | 24.93% | 4.36% | 6.85% |

|---|

Key Fund Statistics as of October 31, 2024

| Total Net Assets | Number of Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $1,936,395 | 26 | $- | 18% |

|---|

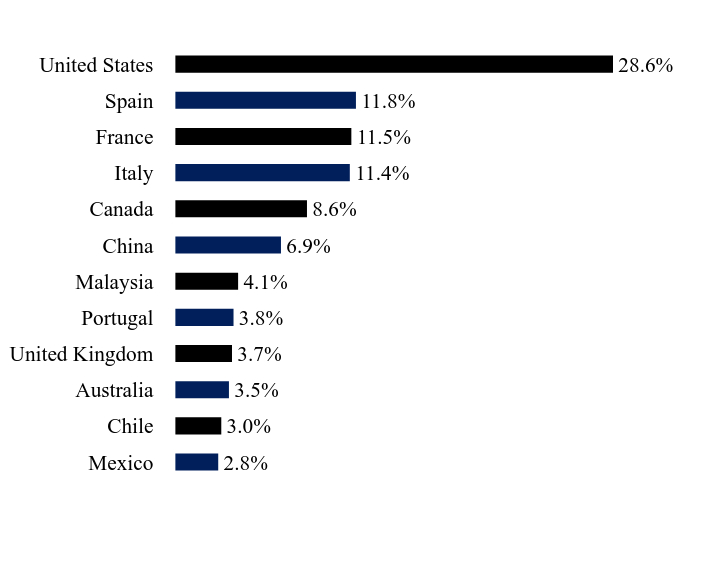

What did the Fund invest in?

| Value | Value |

|---|

| Mexico | 2.8% |

| Chile | 3.0% |

| Australia | 3.5% |

| United Kingdom | 3.7% |

| Portugal | 3.8% |

| Malaysia | 4.1% |

| China | 6.9% |

| Canada | 8.6% |

| Italy | 11.4% |

| France | 11.5% |

| Spain | 11.8% |

| United States | 28.6% |

| Holding Name | | | Percentage of Total Net Assets |

|---|

| Edison International | | | 4.7% |

| Prologis Inc | | | 4.4% |

| Enav SpA | | | 4.4% |

| Enbridge Inc | | | 4.3% |

| Enel SpA | | | 4.3% |

| South Bow, Cl W | | | 4.2% |

| Cellnex Telecom | | | 4.2% |

| Eversource Energy | | | 4.2% |

| Westports Holdings | | | 4.1% |

| Iberdrola SA | | | 4.0% |

* Percentages are calculated based on total net assets.

There were no material changes during the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, call or visit:

Rule 30e-1 of the Investment Company Act of 1940 permits funds to transmit only one copy of a proxy statement, annual report or semi-annual report to shareholders (who need not be related) with the same residential, commercial or electronic address, provided that the shareholders have consented in writing and the reports are addressed either to each shareholder individually or to the shareholders as a group. This process is known as “householding” and is designed to reduce the duplicate copies of materials that shareholders receive and to lower printing and mailing costs for funds. Once implemented, if you would like to discontinue householding for your accounts, please call toll-free at 888-832-4386 to request individual copies of these documents. Once the Fund receives notice to stop householding, we will begin sending individual copies 30 days after receiving your request.

Mondrian Global Listed Infrastructure Fund / Institutional Shares - MGIFX

Annual Shareholder Report - October 31, 2024

MON-AR-TSR-2024-3

Mondrian International Value Equity Fund

Institutional Shares - MPIEX

Annual Shareholder Report: October 31, 2024

This annual shareholder report contains important information about Institutional Shares of the Mondrian International Value Equity Fund (the "Fund") for the period from November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.mondrian.com/mutualfunds/international-value-equity-fund/. You can also request this information by contacting us at 888-832-4386.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Mondrian International Value Equity Fund, Institutional Shares | $82 | 0.74% |

|---|

How did the Fund perform in the last year?

International equity markets rose strongly over the last twelve months. Equity markets were supported by slowing inflation and better-than-expected economic and employment data. The Hong Kong equity market was a notable laggard as the Chinese economy slowed and slid into deflation and was further weighed down by a growing property crisis. The financials sector led returns on more robust economic data. The IT sector outperformed as global technology companies were buoyed by AI optimism. Most major international currencies appreciated against the US dollar as the Fed delivered a larger-than-expected interest rate cut of 50bps. The Fund generated strong absolute returns in the past twelve months, but slightly lagged index returns. Country allocation to Taiwan and Singapore added to relative returns: The overweight position in the strong Singaporean equity market and the exposure to Taiwan added to relative returns. Strong returns in Singapore were driven by the banks. Stock selection in France held back relative returns: Strong stock selection in the Netherlands was driven by Philips, the Dutch health care technology company, which was buoyed by the settlement of litigation concerning their sleep apnea devices. The costs were lower, and the settlement came sooner than expected. Philips’ order intake and margins also continued to improve from the COVID-related supply chain disruptions. This was more than offset by stock selection in France where Kering, the French luxury goods company, is undergoing a brand transformation at its largest design house, Gucci. The broader luxury goods segment underperformed on Chinese consumer weakness. Relative returns were held back by the underweight position in the financials sector: The positive impact of the overweight position in the strong industrials sector was more than offset by the underweight position in the strong financials sector and the overweight position in the weak energy sector. Stock selection within the consumer staples and IT sectors added to relative returns. Currency allocation held back relative returns: The positive impact of the overweight position in the strong British pound was more than offset by the underweight position in the strong Swiss franc and the overweight position in the weak Japanese yen. The Japanese yen lagged other international currencies as the Bank of Japan’s new governor, Kazuo Ueda, maintained Japan’s ultra-loose monetary policy throughout 2023. The Bank of Japan did eventually raise its policy rate for the first time in 17 years in March 2024, and then again in July 2024, which led to a sharp rally in the yen in the third quarter of 2024.

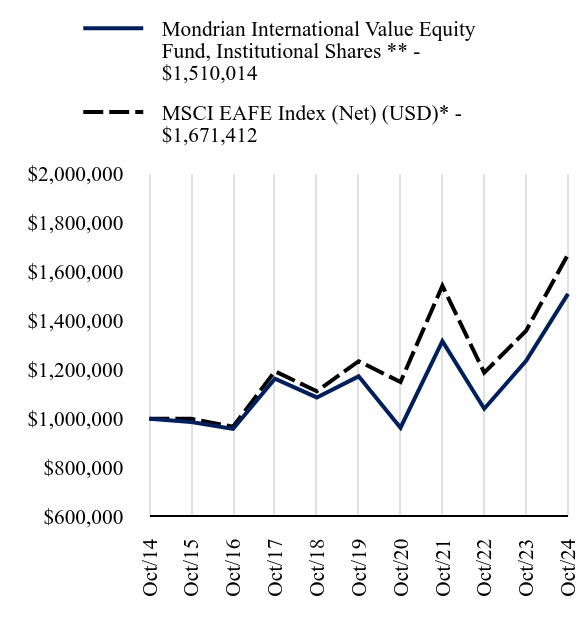

How did the Fund perform during the last 10 years?

Total Return Based on $1,000,000 Investment

| Mondrian International Value Equity Fund, Institutional Shares ** - $1510014 | MSCI EAFE Index (Net) (USD)* - $1671412 |

|---|

| Oct/14 | $1000000 | $1000000 |

|---|

| Oct/15 | $986114 | $999325 |

|---|

| Oct/16 | $958230 | $967080 |

|---|

| Oct/17 | $1163148 | $1193741 |

|---|

| Oct/18 | $1086816 | $1111917 |

|---|

| Oct/19 | $1172980 | $1234715 |

|---|

| Oct/20 | $963267 | $1149960 |

|---|

| Oct/21 | $1317020 | $1543021 |

|---|

| Oct/22 | $1040737 | $1188144 |

|---|

| Oct/23 | $1236598 | $1359247 |

|---|

| Oct/24 | $1510014 | $1671412 |

|---|

Since its inception on March 14, 2016. The line graph represents historical performance of a hypothetical investment of $1,000,000 in the Fund since inception. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is not indicative of future performance.Call 888-832-4386 or visit https://www.mondrian.com/mutualfunds/international-value-equity-fund/ for current month-end performance.

*As of October 2024, pursuant to the new regulatory requirements, this index has been added to represent the broad-based securities market index.

** The financial statements include the financial information of the Predecessor Fund through March 14, 2016 (See Note 1 in Notes to Financial Statements).

Average Annual Total Returns as of October 31, 2024

| Fund/Index Name | 1 Year | 5 Years | 10 Years |

|---|

| Mondrian International Value Equity Fund, Institutional Shares ** | 22.11% | 5.18% | 4.21% |

|---|

| MSCI EAFE Index (Net) (USD)* | 22.97% | 6.24% | 5.27% |

|---|

On March 14, 2016, The International Equity Portfolio, a series of Delaware Pooled Trust (the “International Equity Predecessor Fund”) was reorganized into the Mondrian International Equity Fund. Inception date of the Predecessor Fund was February 4, 1992. Information presented from February 4, 1992 to March 14, 2016 is that of the International Equity Predecessor Fund.

Key Fund Statistics as of October 31, 2024

| Total Net Assets | Number of Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $883,324,004 | 53 | $5,084,122 | 34% |

|---|

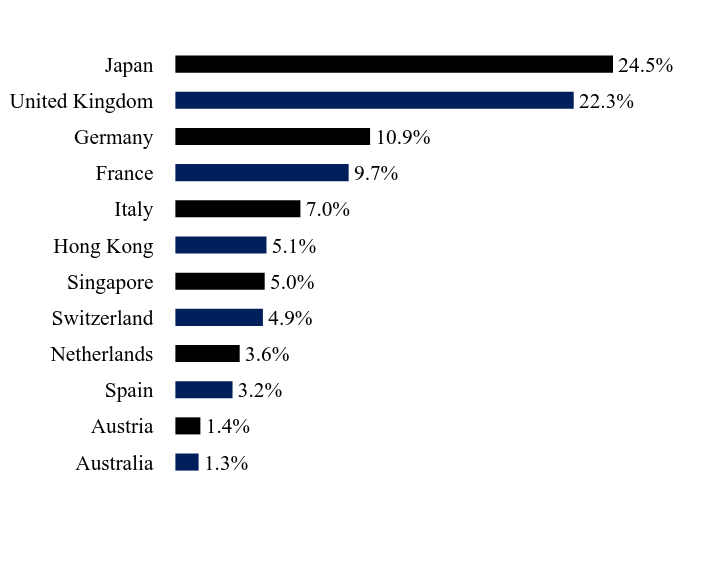

What did the Fund invest in?

| Value | Value |

|---|

| Australia | 1.3% |

| Austria | 1.4% |

| Spain | 3.2% |

| Netherlands | 3.6% |

| Switzerland | 4.9% |

| Singapore | 5.0% |

| Hong Kong | 5.1% |

| Italy | 7.0% |

| France | 9.7% |

| Germany | 10.9% |

| United Kingdom | 22.3% |

| Japan | 24.5% |

| Holding Name | | | Percentage of Total Net Assets |

|---|

| Lloyds Banking Group PLC | | | 3.3% |

| Enel SpA | | | 3.3% |

| Allianz SE | | | 3.2% |

| Banco Santander SA | | | 3.2% |

| United Overseas Bank Ltd | | | 3.1% |

| Fujitsu Ltd | | | 3.1% |

| SSE PLC | | | 3.0% |

| Imperial Brands PLC | | | 3.0% |

| Sony Corp Group | | | 2.9% |

| FUJIFILM Holdings Corp | | | 2.9% |

* Percentages are calculated based on total net assets.

There were no material changes during the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, call or visit:

Rule 30e-1 of the Investment Company Act of 1940 permits funds to transmit only one copy of a proxy statement, annual report or semi-annual report to shareholders (who need not be related) with the same residential, commercial or electronic address, provided that the shareholders have consented in writing and the reports are addressed either to each shareholder individually or to the shareholders as a group. This process is known as “householding” and is designed to reduce the duplicate copies of materials that shareholders receive and to lower printing and mailing costs for funds. Once implemented, if you would like to discontinue householding for your accounts, please call toll-free at 888-832-4386 to request individual copies of these documents. Once the Fund receives notice to stop householding, we will begin sending individual copies 30 days after receiving your request.

Mondrian International Value Equity Fund / Institutional Shares - MPIEX

Annual Shareholder Report - October 31, 2024

MON-AR-TSR-2024-4

Item 2. Code of Ethics.

The Registrant (also referred to as the “Trust”) has adopted a code of ethics that applies to the Registrant’s principal executive officer, principal financial officer, controller or principal accounting officer, and any person who performs a similar function. There have been no amendments to or waivers granted to this code of ethics during the period covered by this report.

Item 3. Audit Committee Financial Expert.

(a)(1) The Registrant’s board of trustees has determined that the Registrant has at least one audit committee financial expert serving on the audit committee.

(a) (2) The Registrant’s audit committee financial experts are Thomas P. Lemke and Jay Nadel, and each of Mr. Lemke and Mr. Nadel is “independent” as that term is defined in Form N-CSR Item 3 (a)(2).

Item 4. Principal Accountant Fees and Services.

Fees billed by PricewaterhouseCoopers LLP (“PwC”) related to the Trust.

PwC billed the Trust aggregate fees for services rendered to the Trust for the last two fiscal years as follows:

| | 2024 | 2023 |

| | | All fees and services to the Trust that were pre-approved | All fees and services to service affiliates that were pre-approved | All other fees and services to service affiliates that did not require pre-approval | All fees and services to the Trust that were pre-approved | All fees and services to service affiliates that were pre-approved | All other fees and services to service affiliates that did not require pre-approval |

| (a) | Audit Fees(1) | $109,059 | None | None | $103,760 | None | None |

| (b) | Audit-Related Fees | None | None | None | None | None | None |

| (c) | Tax Fees | None | None | $65,000(3) | $17,583(2) | None | $125,000(3) |

| (d) | All Other Fees | None | None | $146,757(4) | None | None | $149,452(4) |

Notes:

| (1) | Audit fees include amounts related to the audit of the Trust’s annual financial statements and services normally provided by the accountant in connection with statutory and regulatory filings. |

| (2) | Contains tax compliance services for Mondrian International Value Equity Fund. |

| (3) | Contains tax compliance services provided to service affiliates of the Funds. |

| (4) | Non-audit assurance engagements for service affiliates of the Funds. |

(e)(1) The Trust’s Audit Committee has adopted and the Board of Trustees has ratified an Audit and Non-Audit Services Pre-Approval Policy (the “Policy”), which sets forth the procedures and the conditions pursuant to which services proposed to be performed by the independent auditor of the Funds may be pre-approved.

The Policy provides that all requests or applications for proposed services to be provided by the independent auditor must be submitted to the Registrant’s Chief Financial Officer (“CFO”) and must include a detailed description of the services proposed to be rendered. The CFO will determine whether such services:

| (1) | require specific pre-approval; |

| (2) | are included within the list of services that have received the general pre-approval of the Audit Committee pursuant to the Policy; or |

| (3) | have been previously pre-approved in connection with the independent auditor’s annual engagement letter for the applicable year or otherwise. In any instance where services require pre-approval, the Audit Committee will consider whether such services are consistent with SEC’s rules and whether the provision of such services would impair the auditor’s independence |

Requests or applications to provide services that require specific pre-approval by the Audit Committee will be submitted to the Audit Committee by the CFO. The Audit Committee will be informed by the CFO on a quarterly basis of all services rendered by the independent auditor. The Audit Committee has delegated specific pre-approval authority to either the Audit Committee Chair or financial expert, provided that the estimated fee for any said proposed pre-approved service does not exceed $100,000 and any pre-approval decisions are reported to the Audit Committee at the Audit Committee’s next regularly-scheduled meeting.

Services that have received the general pre-approval of the Audit Committee are identified and described in the Policy. In addition, the Policy sets forth a maximum fee per engagement with respect to each identified service that has received general pre-approval.

All services to be provided by the independent auditor shall be provided pursuant to a signed written engagement letter with the Registrant, the investment adviser or applicable control affiliate (except that matters as to which an engagement letter would be impractical because of timing issues or because the matter is small may not be the subject of an engagement letter) that sets forth both the services to be provided by the independent auditor and the total fees to be paid to the independent auditor for those services.

In addition, the Audit Committee has determined to take additional measures on an annual basis to meet the Audit Committee’s responsibility to oversee the work of the independent auditor and to assure the auditor's independence from the Registrant, such as (a) reviewing a formal written statement from the independent auditor delineating all relationships between the independent auditor and the Registrant, and (b) discussing with the independent auditor the independent auditor’s methods and procedures for ensuring independence.

| (e)(2) | Percentage of fees billed applicable to non-audit services pursuant to waiver of pre-approval requirement were as follows (PwC): |

| | 2024 | 2023 |

Audit-Related Fees | None | None |

| Tax Fees | None | None |

All Other Fees | None | None |

(f) Not applicable.

(g) The aggregate non-audit fees and services billed by PwC for services rendered to the Registrant, and rendered to the Registrant’s investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the Registrant for the last fiscal-years-ended October 31st were $211,757 and $274,452 for 2024 and 2023, respectively.

(h) During the past fiscal year, all non-audit services provided by Registrant’s principal accountant to either Registrant’s investment adviser or to any entity controlling, controlled by, or under common control with Registrant’s investment adviser that provides ongoing services to Registrant were pre-approved by the Audit Committee of Registrant’s Board of Trustees. Included in the Audit Committee’s pre-approval of these non-audit services was the review and consideration as to whether the provision of these non-audit services is compatible with maintaining the principal accountant’s independence.

(i) Not Applicable. The Registrant has not retained, for the preparation of the audit report on the financial statements included in the Form N-CSR, a registered public accounting firm that has a branch or office that is located in a foreign jurisdiction and that the Public Company Accounting Oversight Board (the “PCAOB”) has determined that the PCAOB is unable to inspect or investigate completely because of a position taken by an authority in the foreign jurisdiction.

(j) Not Applicable. The Registrant is not a “foreign issuer,” as defined in 17 CFR § 240.3b-4.

Item 5. Audit Committee of Listed Registrants.

Not applicable to open-end management investment companies.

Item 6. Schedule of Investments.

| (a) | The Schedule of Investments is included as part of the Financial Statements and Other Information filed under Item 7 of this form. |

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

Financial statements and financial highlights are filed herein.

Gallery Trust

TABLE OF CONTENTS

| Financial Statements (Form N-CSR Item 7) | |

| Schedules of Investments | 1 |

| Statements of Assets and Liabilities | 16 |

| Statements of Operations | 18 |

| Statements of Changes in Net Assets | 22 |

| Financial Highlights | 26 |

| Notes to Financial Statements | 30 |

| Report of Independent Registered Public Accounting Firm | 53 |

| Notice to Shareholders (Unaudited) | 55 |

| Fund Information | 57 |

This report has been prepared for shareholders and may be distributed to others only if preceded or accompanied by an effective prospectus.

| Gallery Trust | Mondrian International Value Equity Fund October 31, 2024 |

| | |

| SCHEDULE OF INVESTMENTS | | | | | | |

| | | | | | | |

| COMMON STOCK — 98.9% | | | | | | |

| | | | | | | |

| | | Number of

Shares | | | Value

(U.S. $) | |

| AUSTRALIA — 1.3% | | | | | | | | |

| Aurizon Holdings Ltd | | | 5,052,062 | | | $ | 11,201,741 | |

| Total Australia | | | | | | | 11,201,741 | |

| | | | | | | | | |

| AUSTRIA — 1.4% | | | | | | | | |

| ANDRITZ | | | 207,480 | | | | 12,526,190 | |

| Total Austria | | | | | | | 12,526,190 | |

| | | | | | | | | |

| FRANCE — 9.7% | | | | | | | | |

| Bouygues SA | | | 650,946 | | | | 20,922,382 | |

| Kering SA | | | 52,222 | | | | 13,043,508 | |

| Pernod Ricard SA | | | 66,820 | | | | 8,337,032 | |

| Sanofi SA | | | 225,337 | | | | 23,813,545 | |

| Vinci SA | | | 173,036 | | | | 19,383,594 | |

| Total France | | | | | | | 85,500,061 | |

| | | | | | | | | |

| GERMANY — 10.9% | | | | | | | | |

| Allianz SE | | | 91,169 | | | | 28,700,455 | |

| Continental AG | | | 160,857 | | | | 10,039,131 | |

| Deutsche Post | | | 549,120 | | | | 22,057,866 | |

| Evonik Industries AG | | | 1,052,781 | | | | 23,202,407 | |

| HeidelbergMaterials AG | | | 111,637 | | | | 12,295,592 | |

| Total Germany | | | | | | | 96,295,451 | |

| | | | | | | | | |

| HONG KONG — 5.1% | | | | | | | | |

| CK Hutchison Holdings Ltd | | | 3,391,500 | | | | 17,836,334 | |

| Jardine Matheson Holdings Ltd | | | 337,215 | | | | 12,957,171 | |

| WH Group Ltd | | | 18,710,639 | | | | 14,562,798 | |

| Total Hong Kong | | | | | | | 45,356,303 | |

| | | | | | | | | |

| ITALY — 7.0% | | | | | | | | |

| Enel SpA | | | 3,785,767 | | | | 28,711,513 | |

| Eni SpA | | | 504,913 | | | | 7,691,426 | |

| Snam SpA | | | 5,194,466 | | | | 24,953,710 | |

| Total Italy | | | | | | | 61,356,649 | |

The accompanying notes are an integral part of the financial statements.

| Gallery Trust | Mondrian International Value Equity Fund October 31, 2024 |

| | |

| COMMON STOCK — continued | | | | | | |

| | | Number of

Shares | | | Value

(U.S. $) | |

| JAPAN — 24.5% | | | | | | | | |

| FUJIFILM Holdings Corp | | | 1,076,400 | | | $ | 25,605,749 | |

| Fujitsu Ltd | | | 1,407,800 | | | | 27,066,139 | |

| Hitachi Ltd | | | 478,100 | | | | 12,012,196 | |

| Honda Motor Co Ltd | | | 1,354,100 | | | | 13,618,337 | |

| Kao Corp | | | 122,900 | | | | 5,416,865 | |

| KDDI Corp | | | 325,400 | | | | 10,145,776 | |

| Kyocera Corp | | | 842,600 | | | | 8,545,404 | |

| MINEBEA MITSUMI | | | 698,900 | | | | 12,303,770 | |

| Mitsubishi Electric Corp | | | 637,900 | | | | 11,222,276 | |

| Nippon Telegraph & Telephone Corp | | | 13,554,000 | | | | 13,077,381 | |

| Panasonic Holdings | | | 1,347,900 | | | | 11,093,270 | |

| Secom Co Ltd | | | 452,100 | | | | 16,077,991 | |

| Sony Corp Group | | | 1,476,300 | | | | 25,979,214 | |

| Sumitomo Metal Mining | | | 362,500 | | | | 10,022,614 | |

| Toyota Industries Corp | | | 198,300 | | | | 13,746,563 | |

| Total Japan | | | | | | | 215,933,545 | |

| | | | | | | | | |

| NETHERLANDS — 3.6% | | | | | | | | |

| Koninklijke Ahold Delhaize NV | | | 401,019 | | | | 13,232,944 | |

| Koninklijke Philips NV * | | | 710,670 | | | | 18,696,866 | |

| Total Netherlands | | | | | | | 31,929,810 | |

| | | | | | | | |

| SINGAPORE — 5.0% | | | | | | | | |

| Singapore Telecommunications Ltd | | | 7,180,802 | | | | 16,941,184 | |

| United Overseas Bank Ltd | | | 1,131,340 | | | | 27,501,802 | |

| Total Singapore | | | | | | | 44,442,986 | |

| | | | | | | | | |

| SPAIN — 3.2% | | | | | | | | |

| Banco Santander SA | | | 5,817,379 | | | | 28,420,155 | |

| Total Spain | | | | | | | 28,420,155 | |

| | | | | | | | | |

| SWITZERLAND — 4.9% | | | | | | | | |

| Nestle SA | | | 91,729 | | | | 8,667,716 | |

| Novartis AG | | | 123,410 | | | | 13,390,760 | |

| Roche Holding AG | | | 34,590 | | | | 10,719,563 | |

| Sandoz Group AG | | | 232,400 | | | | 10,594,715 | |

| Total Switzerland | | | | | | | 43,372,754 | |

The accompanying notes are an integral part of the financial statements.

| Gallery Trust | Mondrian International Value Equity Fund October 31, 2024 |

| | |

| COMMON STOCK — continued | | | | | | |

| | | Number of

Shares | | | Value

(U.S. $) | |

| UNITED KINGDOM — 22.3% | | | | | | | | |

| Associated British Foods PLC | | | 421,322 | | | $ | 12,109,588 | |

| BP PLC | | | 2,892,750 | | | | 14,147,999 | |

| British American Tobacco PLC | | | 272,347 | | | | 9,523,787 | |

| GSK PLC | | | 1,246,856 | | | | 22,516,573 | |

| Imperial Brands PLC | | | 865,344 | | | | 26,114,525 | |

| Kingfisher PLC | | | 3,403,011 | | | | 12,869,588 | |

| Lloyds Banking Group PLC | | | 42,788,275 | | | | 29,370,041 | |

| Shell PLC | | | 530,627 | | | | 17,716,315 | |

| SSE PLC | | | 1,183,055 | | | | 26,883,171 | |

| Tesco PLC | | | 781,261 | | | | 3,449,811 | |

| WPP PLC | | | 2,123,535 | | | | 22,320,444 | |

| Total United Kingdom | | | | | | | 197,021,842 | |

| | | | | | | | | |

| Total Common Stock | | | | | | | | |

| (Cost $813,187,374) | | | | | | | 873,357,487 | |

| | | | | | | | | |

| Total Value of Securities — 98.9% | | | | | | | | |

| (Cost $813,187,374) | | | | | | $ | 873,357,487 | |

Percentages are based on Net Assets of $883,324,004.

| * | Non-income producing security. |

Ltd — Limited

PLC — Public Limited Company

As of October 31, 2024, all of the Fund's investments were considered Level 2, in accordance the authoritative guidance on fair value measurements and disclosure under U.S. GAAP.

For more information on valuation inputs, see Note 2 in Notes to Financial Statements.

The accompanying notes are an integral part of the financial statements.

| Gallery Trust | Mondrian Emerging Markets Value Equity Fund October 31, 2024 |

| | |

| SCHEDULE OF INVESTMENTS | | | | | | |

| | | | | | | |

| COMMON STOCK — 92.3% | | | | | | |

| | | Number of

Shares | | | Value

(U.S. $) | |

| BRAZIL — 6.6% | | | | | | | | |

| Ambev SA | | | 117,900 | | | $ | 256,974 | |

| Hypera SA | | | 67,500 | | | | 258,982 | |

| Petroleo Brasileiro ADR | | | 34,706 | | | | 466,796 | |

| Vale Sponsored ADR Class B | | | 35,406 | | | | 378,844 | |

| Total Brazil | | | | | | | 1,361,596 | |

| | | | | | | | | |

| CANADA — 1.3% | | | | | | | | |

| Barrick Gold Corp US | | | 14,309 | | | | 276,450 | |

| Total Canada | | | | | | | 276,450 | |

| | | | | | | | | |

| CHILE — 0.7% | | | | | | | | |

| Sociedad Quimica y Minera de Chile Sponsored ADR | | | 3,777 | | | | 144,999 | |

| Total Chile | | | | | | | 144,999 | |

| | | | | | | | | |

| CHINA — 28.7% | | | | | | | | |

| Alibaba Group Holding Ltd | | | 87,384 | | | | 1,068,909 | |

| Autohome Inc Sponsored ADR | | | 10,742 | | | | 301,850 | |

| Baidu Inc Sponsored ADR * | | | 1,995 | | | | 182,004 | |

| China Medical System Holdings Ltd | | | 108,000 | | | | 108,027 | |

| China Merchants Bank Class A | | | 58,800 | | | | 309,062 | |

| China Tower Class H | | | 2,828,000 | | | | 381,585 | |

| CSPC Pharmaceutical Group Ltd | | | 525,520 | | | | 389,060 | |

| Gree Electric Appliances Inc Class A | | | 31,596 | | | | 193,311 | |

| Midea Group Co Ltd Class A | | | 22,003 | | | | 220,566 | |

| PetroChina Class H | | | 476,000 | | | | 357,435 | |

| Ping An Insurance Group Co of China Ltd Class H | | | 67,000 | | | | 415,118 | |

| Sinotruk Hong Kong Ltd | | | 100,500 | | | | 271,257 | |

| Tencent Holdings Ltd | | | 13,600 | | | | 709,133 | |

| Tingyi Cayman Islands Holding Corp Class H | | | 158,000 | | | | 230,505 | |

| Wuliangye Yibin Class A | | | 10,200 | | | | 210,603 | |

| Xinyi Solar Holdings Ltd | | | 178,000 | | | | 91,290 | |

| Yum China Holdings Inc | | | 10,680 | | | | 471,095 | |

| Total China | | | | | | | 5,910,810 | |

The accompanying notes are an integral part of the financial statements.

| Gallery Trust | Mondrian Emerging Markets Value Equity Fund October 31, 2024 |

| | |

| COMMON STOCK — continued | | | | | | |

| | | Number of

Shares | | | Value

(U.S. $) | |

| FINLAND — 1.3% | | | | | | | | |

| Metso Corp | | | 28,276 | | | $ | 269,107 | |

| Total Finland | | | | | | | 269,107 | |

| | | | | | | | | |

| HONG KONG — 1.4% | | | | | | | | |

| WH Group Ltd | | | 370,728 | | | | 288,544 | |

| Total Hong Kong | | | | | | | 288,544 | |

| | | | | | | | | |

| INDIA — 8.5% | | | | | | | | |

| Axis Bank Ltd | | | 45,076 | | | | 619,216 | |

| HDFC Bank | | | 33,767 | | | | 694,071 | |

| HDFC Bank Ltd Sponsored ADR | | | 2,304 | | | | 145,221 | |

| Indus Towers Ltd * | | | 71,916 | | | | 290,177 | |

| Total India | | | | | | | 1,748,685 | |

| | | | | | | | | |

| INDONESIA — 4.2% | | | | | | | | |

| Bank Rakyat Indonesia Persero Tbk PT | | | 1,781,539 | | | | 543,109 | |

| Telkom Indonesia Persero Tbk PT | | | 1,846,400 | | | | 330,031 | |

| Total Indonesia | | | | | | | 873,140 | |

| | | | | | | | | |

| KAZAKHSTAN — 0.6% | | | | | | | | |

| Kaspi.KZ JSC ADR | | | 1,174 | | | | 129,304 | |

| Total Kazakhstan | | | | | | | 129,304 | |

| | | | | | | | | |

| MALAYSIA — 1.8% | | | | | | | | |

| Malayan Banking Bhd | | | 152,000 | | | | 364,012 | |

| Total Malaysia | | | | | | | 364,012 | |

| | | | | | | | | |

| MEXICO — 3.7% | | | | | | | | |

| Grupo Aeroportuario Pacifico Class B | | | 22,634 | | | | 394,267 | |

| Grupo Financiero Banorte SAB de CV Sponsored Class O | | | 44,944 | | | | 313,672 | |

| Wal-Mart de Mexico SAB de CV | | | 16,716 | | | | 46,156 | |

| Total Mexico | | | | | | | 754,095 | |

The accompanying notes are an integral part of the financial statements.

| Gallery Trust | Mondrian Emerging Markets Value Equity Fund October 31, 2024 |

| | |

| COMMON STOCK — continued | | | | | | |

| | | Number of

Shares | | | Value

(U.S. $) | |

| PERU — 1.6% | | | | | | | | |

| Credicorp Ltd | | | 1,813 | | | $ | 333,828 | |

| Total Peru | | | | | | | 333,828 | |

| | | | | | | | | |

| PORTUGAL — 1.7% | | | | | | | | |

| Jeronimo Martins SGPS | | | 18,175 | | | | 353,287 | |

| Total Portugal | | | | | | | 353,287 | |

| | | | | | | | | |

| SAUDI ARABIA — 5.0% | | | | | | | | |

| Saudi Arabian Oil Co | | | 52,753 | | | | 378,928 | |

| Saudi National Bank | | | 40,934 | | | | 359,848 | |

| Saudi Telecom Co | | | 25,827 | | | | 289,863 | |

| Total Saudi Arabia | | | | | | | 1,028,639 | |

| | | | | | | | | |

| SOUTH KOREA — 8.6% | | | | | | | | |

| Kia Corp | | | 3,591 | | | | 237,469 | |

| KT Corp | | | 1,223 | | | | 38,996 | |

| KT Corp ADR * | | | 10,429 | | | | 164,048 | |

| LG Chem Ltd | | | 468 | | | | 105,227 | |

| Samsung Electronics Co Ltd | | | 9,066 | | | | 384,951 | |

| Samsung Fire & Marine Insurance Co Ltd | | | 1,135 | | | | 275,170 | |

| Shinhan Financial Group Co Ltd | | | 15,335 | | | | 571,232 | |

| Total South Korea | | | | | | | 1,777,093 | |

| | | | | | | | | |

| TAIWAN — 12.6% | | | | | | | | |

| Hon Hai Precision Industry Co Ltd | | | 26,000 | | | | 166,653 | |

| Lite-On Technology Corp | | | 118,000 | | | | 369,906 | |

| MediaTek Inc | | | 3,000 | | | | 116,785 | |

| Taiwan Semiconductor Manufacturing Co Ltd | | | 62,000 | | | | 1,944,288 | |

| Total Taiwan | | | | | | | 2,597,632 | |

| | | | | | | | | |

| UNITED ARAB EMIRATES — 3.1% | | | | | | | | |

| Adnoc Gas Plc | | | 348,506 | | | | 313,679 | |

The accompanying notes are an integral part of the financial statements.

| Gallery Trust | Mondrian Emerging Markets Value Equity Fund October 31, 2024 |

| | |

| COMMON STOCK — continued | | | | | | |

| | | Number of

Shares | | | Value

(U.S. $) | |

| UNITED ARAB EMIRATES (continued) | | | | | | | | |

| First Abu Dhabi Bank PJSC | | | 88,699 | | | $ | 316,981 | |

| Total United Arab Emirates | | | | | | | 630,660 | |

| | | | | | | | | |

| UNITED KINGDOM — 0.9% | | | | | | | | |

| Mondi PLC | | | 11,385 | | | $ | 184,361 | |

| Total United Kingdom | | | | | | | 184,361 | |

| | | | | | | | | |

| Total Common Stock | | | | | | | | |

| (Cost $17,680,722) | | | | | | | 19,026,242 | |

| | | | | | | | | |

| PREFERRED STOCK — 6.4% | | | | | | | | |

| | | | | | | | | |

| BRAZIL — 1.7% | | | | | | | | |

| Itau Unibanco Holding SA Sponsored ADR^ | | | 13,827 | | | | 83,653 | |

| Itausa SA^ | | | 145,289 | | | | 266,406 | |

| | | | | | | | 350,059 | |

| SOUTH KOREA — 4.7% | | | | | | | | |

| Hyundai Motor^ | | | 1,284 | | | | 148,348 | |

| LG Chem Ltd^ | | | 646 | | | | 97,259 | |

| Samsung Electronics Co Ltd^ | | | 21,088 | | | | 725,433 | |

| | | | | | | | 971,040 | |

| Total Preferred Stock | | | | | | | | |

| (Cost $1,430,064) | | | | | | | 1,321,099 | |

| | | | | | | | | |

| Total Value of Securities — 98.7% | | | | | | | | |

| (Cost $19,110,786) | | | | | | $ | 20,347,341 | |

Percentages are based on Net Assets of $20,623,182.

| * | Non-income producing security. |

| ^ | There is currently no rate available. |

ADR — American Depositary Receipt

Ltd — Limited

The accompanying notes are an integral part of the financial statements.

| Gallery Trust | Mondrian Emerging Markets Value Equity Fund October 31, 2024 |

| | |

PJSC — Public Joint Stock Company

PLC — Public Limited Company

SGPS — Sociedade Gestora de Participações Sociais

The following is a summary of the level of the inputs used as of October 31, 2024, in valuing the Fund’s investments carried at value:

| Investments in Securities | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stock | | $ | 4,617,777 | | | $ | 14,408,465 | | | $ | — | | | $ | 19,026,242 | |

| Preferred Stock | | | 350,059 | | | | 971,040 | | | | — | | | | 1,321,099 | |

| Total Investments in Securities | | $ | 4,967,836 | | | $ | 15,379,505 | | | $ | — | | | $ | 20,347,341 | |

For more information on valuation inputs, see Note 2 in Notes to Financial Statements.

The accompanying notes are an integral part of the financial statements.

| Gallery Trust | Mondrian Global Listed |

| | Infrastructure Fund |

| | October 31, 2024 |

SCHEDULE OF INVESTMENTS

COMMON STOCK — 99.7%

| | | Number of | | | Value | |

| | | Shares | | | (U.S. $) | |

| AUSTRALIA — 3.5% | | | | | | | | |

| Aurizon Holdings Ltd | | | 30,734 | | | $ | 68,145 | |

| Total Australia | | | | | | | 68,145 | |

| | | | | | | | | |

| CANADA — 8.6% | | | | | | | | |

| Enbridge Inc | | | 2,074 | | | | 83,773 | |

| South Bow Class W * | | | 3,279 | | | | 81,884 | |

| Total Canada | | | | | | | 165,657 | |

| | | | | | | | | |

| CHILE — 3.0% | | | | | | | | |

| Enel Americas SA | | | 625,163 | | | | 58,555 | |

| Total Chile | | | | | | | 58,555 | |

| | | | | | | | | |

| CHINA — 6.9% | | | | | | | | |

| Guangdong Investment Ltd | | | 104,000 | | | | 66,204 | |

| Jiangsu Expressway Co Ltd Class H | | | 68,000 | | | | 68,426 | |

| Total China | | | | | | | 134,630 | |

| | | | | | | | | |

| FRANCE — 11.5% | | | | | | | | |

| Eiffage SA | | | 834 | | | | 77,624 | |

| Veolia Environnement SA | | | 2,124 | | | | 67,436 | |

| Vinci SA | | | 686 | | | | 76,846 | |

| Total France | | | | | | | 221,906 | |

| | | | | | | | | |

| ITALY — 11.4% | | | | | | | | |

| Enav SpA | | | 20,221 | | | | 85,671 | |

| Enel SpA | | | 11,002 | | | | 83,440 | |

| Snam SpA | | | 10,742 | | | | 51,603 | |

| Total Italy | | | | | | | 220,714 | |

| | | | | | | | | |

| MALAYSIA — 4.1% | | | | | | | | |

| Westports Holdings | | | 82,400 | | | | 79,220 | |

| Total Malaysia | | | | | | | 79,220 | |

The accompanying notes are an integral part of the financial statements.

| Gallery Trust | Mondrian Global Listed |

| | Infrastructure Fund |

| | October 31, 2024 |

| COMMON STOCK — continued | | | | | | |

| | | Number of | | | Value | |

| | | Shares | | | (U.S. $) | |

| MEXICO — 2.8% | | | | | | | | |

| Promotora y Operadora de Infraestructura | | | 6,119 | | | $ | 53,314 | |

| Total Mexico | | | | | | | 53,314 | |

| | | | | | | | | |

| PORTUGAL — 3.8% | | | | | | | | |

| EDP Energias de Portugal SA | | | 18,568 | | | | 73,100 | |

| Total Portugal | | | | | | | 73,100 | |

| | | | | | | | | |

| SPAIN — 11.8% | | | | | | | | |

| Cellnex Telecom | | | 2,220 | | | | 81,531 | |

| Iberdrola SA | | | 5,236 | | | | 77,778 | |

| Redeia Corp SA | | | 3,763 | | | | 69,675 | |

| Total Spain | | | | | | | 228,984 | |

| | | | | | | | | |

| UNITED KINGDOM — 3.7% | | | | | | | | |

| SSE PLC | | | 3,194 | | | | 72,579 | |

| Total United Kingdom | | | | | | | 72,579 | |

| | | | | | | | | |

| UNITED STATES — 28.6% | | | | | | | | |

| American Tower REIT | | | 361 | | | | 77,088 | |

| CSX Corp | | | 2,312 | | | | 77,776 | |

| Edison International | | | 1,095 | | | | 90,228 | |

| Eversource Energy | | | 1,238 | | | | 81,522 | |

| HCA Healthcare Inc | | | 197 | | | | 70,672 | |

| Norfolk Southern Corp | | | 283 | | | | 70,872 | |

| Prologis Inc | | | 760 | | | | 85,834 | |

| Total United States | | | | | | | 553,992 | |

| | | | | | | | | |

| Total Common Stock | | | | | | | | |

| (Cost $1,860,116) | | | | | | | 1,930,796 | |

| | | | | | | | | |

| Total Value of Securities — 99.7% | | | | | | | | |

| (Cost $1,860,116) | | | | | | $ | 1,930,796 | |

Percentages are based on Net Assets of $1,936,395.

| * | Non-income producing security. |

The accompanying notes are an integral part of the financial statements.

| Gallery Trust | Mondrian Global Listed |

| | Infrastructure Fund |

| | October 31, 2024 |

Ltd — Limited

PLC — Public Limited Company

REIT — Real Estate Investment Trust

The following is a summary of the level of the inputs used as of October 31, 2024, in valuing the Fund’s investments carried at value:

| Investments in Securities | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stock | | $ | 910,738 | | | $ | 1,020,058 | | | $ | — | | | $ | 1,930,796 | |

| Total Investments in Securities | | $ | 910,738 | | | $ | 1,020,058 | | | $ | — | | | $ | 1,930,796 | |

For more information on valuation inputs, see Note 2 in Notes to Financial Statements.

The accompanying notes are an integral part of the financial statements.

| Gallery Trust | Mondrian Global Equity |

| | Value Fund |

| | October 31, 2024 |

SCHEDULE OF INVESTMENTS

COMMON STOCK — 97.0%

| | | Number of | | | Value | |

| | | Shares | | | (U.S. $) | |

| AUSTRALIA — 1.2% | | | | | | | | |

| Aurizon Holdings Ltd | | | 1,206,220 | | | $ | 2,674,505 | |

| Total Australia | | | | | | | 2,674,505 | |

| | | | | | | | | |

| BRAZIL — 0.9% | | | | | | | | |

| Hypera SA | | | 528,900 | | | | 2,029,269 | |

| Total Brazil | | | | | | | 2,029,269 | |

| | | | | | | | | |

| CHINA — 4.2% | | | | | | | | |

| Alibaba Group Holding Ltd | | | 357,700 | | | | 4,375,499 | |

| Midea Group Co Ltd Class A | | | 228,055 | | | | 2,286,104 | |

| Ping An Insurance Group Co of China Ltd Class H | | | 225,000 | | | | 1,394,052 | |

| Yum China Holdings Inc | | | 39,265 | | | | 1,731,979 | |

| Total China | | | | | | | 9,787,634 | |

| | | | | | | | | |

| FRANCE — 7.7% | | | | | | | | |

| Kering SA | | | 16,549 | | | | 4,133,450 | |

| Pernod Ricard SA | | | 24,056 | | | | 3,001,431 | |

| Sanofi SA | | | 51,604 | | | | 5,453,495 | |

| Vinci SA | | | 46,109 | | | | 5,165,157 | |

| Total France | | | | | | | 17,753,533 | |

| | | | | | | | | |

| GERMANY — 2.3% | | | | | | | | |

| Deutsche Post | | | 134,707 | | | | 5,411,111 | |

| Total Germany | | | | | | | 5,411,111 | |

| | | | | | | | | |

| INDIA — 1.4% | | | | | | | | |

| HDFC Bank Ltd | | | 163,766 | | | | 3,366,163 | |

| Total India | | | | | | | 3,366,163 | |

| | | | | | | | | |

| INDONESIA — 1.3% | | | | | | | | |

| Bank Rakyat Indonesia Persero Tbk PT | | | 9,656,300 | | | | 2,943,763 | |

| Total Indonesia | | | | | | | 2,943,763 | |

| | | | | | | | | |

| ITALY — 4.8% | | | | | | | | |

| Enel SpA | | | 908,368 | | | | 6,889,124 | |

The accompanying notes are an integral part of the financial statements.

| Gallery Trust | Mondrian Global Equity |

| | Value Fund |

| | October 31, 2024 |

COMMON STOCK — continued

| | | Number of | | | Value | |

| | | Shares | | | (U.S. $) | |

| ITALY (continued) | | | | | | | | |

| Snam SpA | | | 889,208 | | | $ | 4,271,669 | |

| Total Italy | | | | | | | 11,160,793 | |

| | | | | | | | | |

| JAPAN — 12.5% | | | | | | | | |

| Fujitsu Ltd | | | 290,300 | | | | 5,581,262 | |

| Hitachi Ltd | | | 94,600 | | | | 2,376,812 | |

| MatsukiyoCocokara & Co | | | 299,200 | | | | 4,073,514 | |

| SCSK Corp | | | 161,400 | | | | 3,011,674 | |

| Sony Corp Group | | | 355,600 | | | | 6,257,677 | |

| Sundrug Co Ltd | | | 171,000 | | | | 4,229,489 | |

| Toyota Industries Corp | | | 49,800 | | | | 3,452,238 | |

| Total Japan | | | | | | | 28,982,666 | |

| | | | | | | | | |

| NETHERLANDS — 2.0% | | | | | | | | |

| Koninklijke Philips NV * | | | 174,192 | | | | 4,582,780 | |

| Total Netherlands | | | | | | | 4,582,780 | |

| | | | | | | | | |

| SOUTH KOREA — 0.4% | | | | | | | | |

| Samsung Electronics Co Ltd | | | 20,767 | | | | 881,788 | |

| Total South Korea | | | | | | | 881,788 | |

| | | | | | | | | |

| SWEDEN — 2.3% | | | | | | | | |

| Autoliv | | | 57,725 | | | | 5,361,498 | |

| Total Sweden | | | | | | | 5,361,498 | |

| | | | | | | | | |

| SWITZERLAND — 2.3% | | | | | | | | |

| Roche Holding | | | 16,870 | | | | 5,228,072 | |

| Total Switzerland | | | | | | | 5,228,072 | |

| | | | | | | | | |

| TAIWAN — 1.0% | | | | | | | | |

| Taiwan Semiconductor Manufacturing Co Ltd | | | 74,000 | | | | 2,320,602 | |

| Total Taiwan | | | | | | | 2,320,602 | |

| | | | | | | | | |

| UNITED KINGDOM — 6.6% | | | | | | | | |

| Associated British Foods PLC | | | 145,826 | | | | 4,191,314 | |

| British American Tobacco PLC | | | 173,266 | | | | 6,058,992 | |

The accompanying notes are an integral part of the financial statements.

| Gallery Trust | Mondrian Global Equity |

| | Value Fund |

| | October 31, 2024 |

COMMON STOCK — continued

| | | Number of | | | Value | |

| | | Shares | | | (U.S. $) | |

| UNITED KINGDOM (continued) | | | | | | | | |

| Lloyds Banking Group PLC | | | 7,373,212 | | | $ | 5,061,002 | |

| Total United Kingdom | | | | | | | 15,311,308 | |

| | | | | | | | | |

| UNITED STATES — 46.1% | | | | | | | | |

| AbbVie Inc | | | 8,994 | | | | 1,833,607 | |

| Amazon.com Inc * | | | 21,068 | | | | 3,927,075 | |

| American Tower REIT | | | 4,859 | | | | 1,037,591 | |

| CDW Corp | | | 23,067 | | | | 4,341,902 | |

| Centene Corp * | | | 34,714 | | | | 2,161,294 | |

| Charles Schwab Corp | | | 84,306 | | | | 5,971,394 | |

| CNH Industrial | | | 316,153 | | | | 3,550,398 | |

| Dollar Tree Inc * | | | 43,939 | | | | 2,840,217 | |

| DuPont de Nemours | | | 71,463 | | | | 5,930,714 | |

| Exxon Mobil Corp | | | 29,932 | | | | 3,495,459 | |

| HCA Healthcare Inc | | | 15,291 | | | | 5,485,493 | |

| Kenvue Inc | | | 278,184 | | | | 6,378,759 | |

| L3Harris Technologies Inc | | | 26,604 | | | | 6,583,692 | |

| Labcorp Holdings | | | 23,293 | | | | 5,317,093 | |

| McDonald's | | | 17,239 | | | | 5,035,684 | |

| Meta Platforms Inc Class A | | | 10,604 | | | | 6,018,618 | |

| Micron Technology Inc | | | 10,812 | | | | 1,077,416 | |

| Microsoft Corp | | | 12,435 | | | | 5,052,962 | |

| NNN REIT Class REIT | | | 70,420 | | | | 3,059,045 | |

| Prologis Inc | | | 28,950 | | | | 3,269,613 | |

| Sysco | | | 72,584 | | | | 5,440,171 | |

| Texas Instruments Inc | | | 28,812 | | | | 5,853,446 | |

| UnitedHealth Group Inc | | | 11,589 | | | | 6,541,991 | |

| Wells Fargo & Co | | | 98,861 | | | | 6,418,056 | |

| Total United States | | | | | | | 106,621,690 | |

| | | | | | | | | |

| Total Common Stock | | | | | | | | |

| (Cost $198,090,593) | | | | | | | 224,417,175 | |

The accompanying notes are an integral part of the financial statements.

| Gallery Trust | Mondrian Global Equity |

| | Value Fund |

| | October 31, 2024 |

PREFERRED STOCK — 1.9%

| | | Number of | | | Value | |

| | | Shares | | | (U.S. $) | |

| SOUTH KOREA — 1.9% | | | | | | | | |

| Samsung Electronics Co Ltd^ | | | 128,007 | | | | 4,403,477 | |

| | | | | | | | | |

| Total Preferred Stock | | | | | | | | |

| (Cost $5,834,128) | | | | | | | 4,403,477 | |

| | | | | | | | | |

| Total Value of Securities — 98.9% | | | | | | | | |

| (Cost $203,924,721) | | | | | | $ | 228,820,652 | |

Percentages are based on Net Assets of $231,258,212.

| * | Non-income producing security. |

| ^ | There is currently no rate available. |

Ltd — Limited

PLC — Public Limited Company

REIT — Real Estate Investment Trust

The following is a summary of the level of the inputs used as of October 31, 2024, in valuing the Fund’s investments carried at value:

| Investments in Securities | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stock | | $ | 115,744,436 | | | $ | 108,672,739 | | | $ | — | | | $ | 224,417,175 | |

| Preferred Stock | | | — | | | | 4,403,477 | | | | — | | | | 4,403,477 | |

| Total Investments in Securities | | $ | 115,744,436 | | | $ | 113,076,216 | | | $ | — | | | $ | 228,820,652 | |

For more information on valuation inputs, see Note 2 in Notes to Financial Statements.

The accompanying notes are an integral part of the financial statements.

| Gallery Trust | October 31, 2024 |

STATEMENTS OF ASSETS AND LIABILITIES

| | | Mondrian | | | Mondrian | |

| | | International | | | Emerging | |

| | | Value Equity | | | Markets Value | |

| | | Fund | | | Equity Fund | |

| Assets: | | | | | | | | |

| Investments (Cost $813,187,374 and $19,110,786) | | $ | 873,357,487 | | | $ | 20,347,341 | |

| Foreign currency (Cost $61 and $771) | | | 61 | | | | 763 | |

| Cash | | | 2,661,537 | | | | 313,194 | |

| Receivable for investment securities sold | | | 7,925,588 | | | | 32,028 | |

| Reclaims receivable | | | 3,420,541 | | | | 2,081 | |

| Dividends receivable | | | 3,222,543 | | | | 63,454 | |

| Receivable for capital shares sold | | | 839,623 | | | | 2,540 | |

| Unrealized appreciation on spot foreign currency contracts | | | 21,309 | | | | — | |

| Receivable from Investment Adviser | | | — | | | | 2,556 | |

| Prepaid expenses | | | 43,558 | | | | 13,350 | |

| Total assets | | | 891,492,247 | | | | 20,777,307 | |

| | | | | | | | | |

| Liabilities: | | | | | | | | |

| Payable for investment securities purchased | | | 7,467,228 | | | | 46,069 | |

| Payable due to Investment Adviser | | | 447,913 | | | | — | |

| Payable due to Administrator | | | 69,734 | | | | 1,647 | |

| Payable for capital shares redeemed | | | 48,719 | | | | — | |

| Audit fees payable | | | 26,389 | | | | 26,389 | |

| Chief Compliance Officer fees payable | | | 9,203 | | | | 220 | |

| Transfer Agent Fees Payable | | | 8,258 | | | | 5,564 | |

| Payable due to Trustees | | | 645 | | | | 15 | |

| Accrued foreign capital gains tax | | | — | | | | 61,961 | |

| Other accrued expenses | | | 90,154 | | | | 12,260 | |

| Total liabilities | | | 8,168,243 | | | | 154,125 | |

| | | | | | | | | |

| Commitments and Contingencies† | | | | | | | | |

| Net assets | | $ | 883,324,004 | | | $ | 20,623,182 | |

| | | | | | | | | |

| Net assets consist of: | | | | | | | | |

| Paid-in capital | | $ | 786,022,968 | | | $ | 126,602,792 | |

| Total distributable earnings/(accumulated loss) | | | 97,301,036 | | | | (105,979,610 | ) |

| Net assets | | $ | 883,324,004 | | | $ | 20,623,182 | |

| | | | | | | | | |

| Outstanding Shares of Beneficial Interest | | | | | | | | |

| (unlimited authorization - no par value) | | | 55,944,902 | | | | 2,594,365 | |

| Net Asset Value, Offering and Redemption Price Per Share | | $ | 15.79 | | | $ | 7.95 | |

| † | See Note 5 in the Notes to Financial Statements. |

The accompanying notes are an integral part of the financial statements.

| Gallery Trust | October 31, 2024 |

STATEMENTS OF ASSETS AND LIABILITIES

| | | Mondrian | | | | |

| | | Global Listed | | | Mondrian | |

| | | Infrastructure | | | Global Equity | |

| | | Fund | | | Value Fund | |

| Assets: | | | | | | | | |

| Investments (Cost $1,860,116 and $203,924,721) | | $ | 1,930,796 | | | $ | 228,820,652 | |

| Foreign currency (Cost $6,320 and $12,544) | | | 6,268 | | | | 12,440 | |

| Cash | | | 15,591 | | | | 1,880,180 | |

| Receivable from Investment Adviser | | | 9,579 | | | | — | |

| Receivable for investment securities sold | | | 9,568 | | | | 562,649 | |

| Reclaims receivable | | | 8,259 | | | | 235,964 | |

| Receivable for capital shares sold | | | — | | | | 27,200 | |

| Dividends receivable | | | — | | | | 561,108 | |

| Prepaid expenses | | | 3,276 | | | | 15,519 | |

| Total assets | | | 1,983,337 | | | | 232,115,712 | |

| | | | | | | | | |

| Liabilities: | | | | | | | | |

| Audit fees payable | | | 27,707 | | | | 26,389 | |

| Payable for investment securities purchased | | | 10,399 | | | | 569,325 | |

| Transfer Agent Fees Payable | | | 5,412 | | | | 5,958 | |

| Payable due to Administrator | | | 151 | | | | 18,017 | |

| Chief Compliance Officer fees payable | | | 20 | | | | 2,377 | |

| Unrealized depreciation on spot foreign currency contracts | | | 4 | | | | 2,744 | |

| Payable due to Trustees | | | 1 | | | | 167 | |

| Payable for capital shares redeemed | | | — | | | | 3 | |

| Payable due to Investment Adviser | | | — | | | | 102,027 | |

| Accrued foreign capital gains tax | | | — | | | | 104,286 | |

| Other accrued expenses | | | 3,248 | | | | 26,207 | |

| Total liabilities | | | 46,942 | | | | 857,500 | |

| | | | | | | | | |

| Commitments and Contingencies† | | | | | | | | |

| Net assets | | $ | 1,936,395 | | | $ | 231,258,212 | |

| | | | | | | | | |

| Net assets consist of: | | | | | | | | |

| Paid-in capital | | $ | 1,795,981 | | | $ | 201,268,458 | |

| Total distributable earnings | | | 140,414 | | | | 29,989,754 | |

| Net assets | | $ | 1,936,395 | | | $ | 231,258,212 | |

| | | | | | | | | |

| Outstanding Shares of Beneficial Interest | | | | | | | | |

| (unlimited authorization - no par value) | | | 174,275 | | | | 15,699,450 | |

| Net Asset Value, Offering and Redemption Price Per Share | | $ | 11.11 | | | $ | 14.73 | |

| † | See Note 5 in the Notes to Financial Statements. |

The accompanying notes are an integral part of the financial statements.

| Gallery Trust | For the Year Ended

October 31, 2024 |

STATEMENTS OF OPERATIONS

| | | Mondrian | |

| | | International | |

| | | Value Equity | |

| | | Fund | |

| Investment income | | | | |

| Dividends | | $ | 35,239,463 | |

| Less: foreign taxes withheld | | | (2,706,540 | ) |

| Total investment income | | | 32,532,923 | |

| | | | | |

| Expenses | | | | |

| Investment advisory fees | | | 5,580,213 | |

| Accounting and administration fees – Note 4 | | | 793,453 | |

| Custodian fees | | | 91,103 | |

| Registration fees | | | 86,821 | |

| Dividend disbursing and transfer agent fees and expenses | | | 50,165 | |

| Trustees' fees and expenses | | | 47,922 | |

| Printing fees | | | 46,820 | |

| Legal fees | | | 43,670 | |

| Audit fees | | | 28,502 | |

| Chief Compliance Officer fees | | | 15,057 | |

| Other | | | 65,223 | |

| Total expenses | | | 6,848,949 | |

| | | | | |

| Less: | | | | |

| Investment advisory fees waived – Note 5 | | | (496,091 | ) |

| Net expenses | | | 6,352,858 | |

| | | | | |

| Net investment income | | | 26,180,065 | |

| | | | | |

| Net realized gain/(loss) on: | | | | |

| Investments | | | 40,338,193 | |

| Foreign currency transactions | | | 309,041 | |

| Net realized gain | | | 40,647,234 | |

| | | | | |

| Net change in unrealized appreciation/(depreciation) on: | | | | |

| Investments | | | 98,555,786 | |

| Foreign currency transactions and translation of other assets and liabilities denominated in foreign currency | | | 970 | |

| Net change in unrealized appreciation/(depreciation) | | | 98,556,756 | |

| Net realized and unrealized gain | | | 139,203,990 | |

| | | | | |

| Net increase in net assets resulting from operations | | $ | 165,384,055 | |

The accompanying notes are an integral part of the financial statements.

| Gallery Trust | For the Year Ended October 31, 2024 |

STATEMENTS OF OPERATIONS

| | | Mondrian Emerging Markets Value Equity Fund | |