UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-23100

BERNSTEIN FUND, INC.

(Exact name of registrant as specified in charter)

1345 Avenue of the Americas, New York, New York 10105

(Address of principal executive offices) (Zip code)

Joseph J. Mantineo

AllianceBernstein L.P.

1345 Avenue of the Americas

New York, New York 10105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 221-5672

Date of fiscal year end: September 30, 2017

Date of reporting period: September 30, 2017

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

BERNSTEIN FUND, INC.

Small Cap Core Portfolio

International Small Cap Portfolio

International Strategic Equities Portfolio

ANNUAL REPORT

SEPTEMBER 30, 2017

Table of Contents

Before investing in any portfolio of the Bernstein Fund, Inc., a prospective investor should consider carefully the portfolio’s investment objectives and policies, charges, expenses and risks. These and other matters of importance to prospective investors are contained in the portfolios’ prospectus, an additional copy of which may be obtained by visiting our website at www.bernstein.com and clicking on “Investments”, then “Mutual Fund Information—Prospectuses, SAIs and Shareholder Reports” or by calling your financial advisor or by calling Bernstein’s mutual fund shareholder help line at 212.756.4097. Please read the prospectus carefully before investing.

For performance information current to the most recent month-end, please call (collect) 212.486.5800.

This shareholder report must be preceded or accompanied by the Bernstein Fund, Inc. prospectus for individuals who are not shareholders of the Fund.

You may obtain a description of the Fund’s proxy voting policies and procedures, and information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, without charge. Simply visit www.AllianceBernstein.com, or go to the Securities and Exchange Commission’s website at www.sec.gov, or call AllianceBernstein at 800.227.4618.

The Fund will file its complete schedule of portfolio holdings with the Commission for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Form N-Q is available on the Commission’s website at www.sec.gov. The Fund’s Form N-Q may also be reviewed and copied at the Commission’s Public Reference Room in Washington, D.C.; information on the operation of the Public Reference Room may be obtained by calling 800.SEC.0330.

Investment Products Offered: · Are Not FDIC Insured · May Lose Value · Are Not Bank Guaranteed

Portfolio Manager Commentary (Unaudited)

To Our Shareholders—November 15, 2017

On the following pages, you will find the 2017 annual report for the Portfolios (collectively, the “Portfolios”; and individually, a “Portfolio”) of the Bernstein Fund, Inc. (the “Fund”). The annual report covers the six- and 12-month periods ended September 30, 2017, and includes financial statements as well as notes to the financial statements, information about the recent performance of the Portfolios and a listing of each Portfolio’s holdings as of the period end.

Equity markets generally delivered exceptionally strong returns around the world during the 12-month period ended September 30, 2017. In a change from the pattern of recent years, broad index returns were stronger for non-US than US stock markets, and emerging markets did better than developed markets. US taxable and tax-exempt bond returns were positive but very low.

The stock-market rally reflected improved earnings growth after a two-year period of flat growth in the US and an extended period of weak earnings in Europe and emerging markets. Nine years after the financial crisis of 2008, markets are currently benefiting from modest economic growth around the world.

While volatility has fallen to low levels after a brief spike late last year, we expect to see volatility rise to more normal levels. Given high valuations and the likely deceleration of earnings growth going forward, we expect lower future returns from stocks in all geographies. We also expect slowly rising interest rates to result in muted bond returns.

If you have any questions about your investments in the Portfolios, please contact your Bernstein Advisor by calling 212.756.4097, or visit www.bernstein.com. As always, we are firmly dedicated to your investment success. Thank you for your continued interest in the Portfolios.

Sincerely,

Kathleen M. Fisher

President

Bernstein Fund, Inc.

Small Cap Core Portfolio

Investment Objectives and Strategy

The Portfolio seeks to provide long-term growth of capital. The Portfolio invests, under normal circumstances, at least 80% of its net assets (plus any borrowings for investment purposes) in equity securities of small-capitalization companies or other securities or instruments with similar economic characteristics, including derivatives related to equity securities. Equity securities are primarily common stocks, although, for purposes of the 80% policy, equity securities may also include preferred stocks, warrants, convertible securities, sponsored or unsponsored American Depositary Receipts (“ADRs”) and Global Depositary Receipts (“GDRs”) and equity real estate investment trusts (“REITs”). You will be notified at least 60 days prior to any change to the Portfolio’s 80% investment policy.

AllianceBernstein L.P. serves as the Portfolio’s investment manager (the “Adviser”). The Adviser invests the assets of the Portfolio primarily in a diversified portfolio of equity securities of small-capitalization companies located in the US. The Portfolio defines small-capitalization companies as those that, at the time of investment, fall within the capitalization range between the smallest company in the Russell 2000 Index (“Russell 2000”) and the largest company in the Russell 2000. The market capitalization of the companies included in the Portfolio’s definition of “small-capitalization” companies changes over time as the capitalization of the securities included in the Russell 2000 changes.

The Adviser utilizes both quantitative analysis and fundamental research to determine which securities will be held by the Portfolio and to manage risk. The Adviser applies quantitative analysis to all of the securities in the Portfolio’s research universe, which is composed primarily of securities in the Portfolio’s benchmark. Those securities that score highly on this quantitative analysis are then screened to eliminate those securities that the Adviser is recommending against purchasing based on its fundamental research, and a portfolio is constructed from the remaining highly ranked securities based on diversification and risk considerations. In its quantitative analysis, the Adviser considers a number of metrics that have historically provided some indication of favorable future returns, including metrics relating to valuation,

(Portfolio Manager Commentary continued on next page)

Portfolio Manager Commentary (continued)

quality, investor behavior and corporate behavior. In general, stocks are purchased when, in the view of the Adviser, they provide the highest expected returns, considering their contribution to the estimated risk of the Portfolio’s existing investments. Typically, growth in the size of a company’s market capitalization relative to other domestically traded companies does not cause the Adviser to dispose of the security. The Adviser expects to seek to manage the overall portfolio volatility of the Portfolio relative to the Russell 2000 by favoring securities that offer the best balance between return and targeted risk.

The Portfolio may also invest in exchange-traded funds (“ETFs”) and other investment companies from time to time.

The Portfolio expects to utilize derivatives, such as options, futures contracts, forwards and swaps. For example, the Portfolio may use stock index futures contracts to equitize cash. Derivatives may provide a more efficient and economical exposure to market segments than direct investments, and may also be a more efficient way to alter the Portfolio’s exposure.

Investment Results

The table on page 8 shows the Portfolio’s performance compared to its benchmark, the Russell 2000 Index, for the six- and 12-month periods ended September 30, 2017. Also included in the table is the Portfolio’s peer group, as represented by the Lipper Small-Cap Core Funds Average (the “Lipper Average”). Funds in the Lipper Average have generally similar investment objectives to the Portfolio, although some of the funds may have different investment policies and sales and management fees and fund expenses.

All share classes of the Portfolio underperformed the benchmark and the Lipper Average over both periods.

In early 2017, investor expectations for economic growth and inflation fell, interest rates and oil prices declined and the US dollar started to depreciate. Investors turned to a narrow set of stocks with strong secular growth potential, which led markets higher. Both high-profitability companies and attractively valued companies severely underperformed in the first three quarters of 2017. The Portfolio is heavily invested in high profitability and attractive valuation stocks, which tend to outperform in the long run. These exposures, relative to the benchmark, detracted during both periods.

The Portfolio utilized derivatives in the form of futures for investment purposes, which added to absolute performance for both periods.

International Small Cap Portfolio

Investment Objective and Strategy

The Portfolio seeks to provide long-term growth of capital. The Portfolio invests, under normal circumstances, at least 80% of its net assets (plus any borrowings for investment purposes) in equity securities of small-capitalization companies or other securities or instruments with similar economic characteristics, including derivatives related to equity securities. Equity securities are primarily common stocks, although, for purposes of the 80% policy, equity securities may also include preferred stocks, warrants, convertible securities, sponsored or unsponsored ADRs and GDRs and equity REITs. You will be notified at least 60 days prior to any change to the Portfolio’s 80% investment policy.

AllianceBernstein L.P. serves as the Portfolio’s investment manager. The Adviser invests the assets of the Portfolio primarily in a diversified portfolio of equity securities of small-capitalization companies located outside of the United States. Under normal circumstances, at least 65% of the Portfolio’s net assets are invested in companies located outside of the United States. The Portfolio defines small-capitalization companies as those that, at the time of investment, have market capitalizations within the market capitalization range of the Portfolio’s benchmark, the Morgan Stanley Capital International (“MSCI”) All Country World Index (“ACWI”) ex-US Small Cap. The market capitalization of the companies included in the Portfolio’s definition of “small-capitalization” companies changes over time as the capitalization of the securities included in the MSCI ACWI ex-US Small Cap changes.

The Portfolio’s exposure to non-US companies may change over time based on the Adviser’s assessment of market conditions and the investment merit of non-US issuers. Under normal circumstances, the Adviser invests in companies located in at least three countries other than the United States and, at times, may have exposure to issuers in several different countries. In determining a company’s location for purposes of the Portfolio’s investment policies and restrictions, the Adviser may consider: (1) the place of domicile, (2) where the company has an established presence and conducts its business and (3) where the company conducts a significant part of its economic activities. The Portfolio may invest in both developed and emerging-market countries and, at times, may invest significantly in emerging markets.

The Adviser seeks to identify attractive investment opportunities primarily through its fundamental investment

(Portfolio Manager Commentary continued on next page)

Portfolio Manager Commentary (continued)

research or quantitative analysis. In applying its fundamental research, the Adviser generally seeks to identify companies that possess both attractive valuation and compelling company- and/or industry-level investment catalysts. In applying its quantitative analysis, the Adviser typically considers a number of metrics that historically have provided some indication of favorable future returns, including metrics related to valuation, quality, investor behavior and corporate behavior. Utilizing these resources, the Adviser expects to allocate the Portfolio’s assets among issuers, industries and geographic locations to attempt to create a diversified portfolio of investments.

The Portfolio may invest in established companies and also in new and less-seasoned issuers. The Portfolio may also invest in ETFs and other investment companies from time to time.

The Portfolio expects to utilize derivatives, such as options, futures contracts, forwards and swaps. For example, the Portfolio may invest in currency derivatives as discussed below and in futures contracts to gain exposure to certain markets. Derivatives may provide a more efficient and economical exposure to market segments than direct investments, and may also be a more efficient way to alter the Portfolio’s exposure.

Fluctuations in currency exchange rates can have a dramatic impact on the returns of foreign equity securities. The Adviser may employ currency hedging strategies, including the use of currency-related derivatives, to seek to reduce currency risk in the Portfolio, but it is not required to do so. The Adviser may also take long and short positions in currencies or related derivatives for investment purposes, independent of any security positions. The Adviser may use stock index futures contracts to gain access to certain markets.

Investment Results

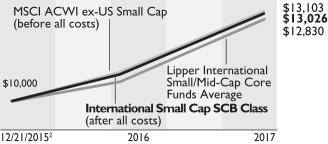

The table on page 8 shows the Portfolio’s performance compared to its benchmark, the MSCI ACWI ex-US Small Cap (net), for the six- and 12-month periods ended September 30, 2017. Also included in the table is the Portfolio’s peer group, as represented by the Lipper International Small/Mid-Cap Core Funds Average. Funds in the Lipper Average have generally similar investment objectives to the Portfolio, although some of the funds may have different investment policies and sales and management fees and fund expenses.

All share classes of the Portfolio outperformed the benchmark for both periods, and outperformed the Lipper Average for the six-month period, and underperformed for the 12-month period. International equity markets rallied strongly for both periods as slow but steady global economic and robust corporate earnings growth drove gains. For the 12-month period, strong stock selection in technology and industrials was partially offset by weak stock selection in health care, utilities, and financials, relative to the benchmark. Over the six-month period, strong stock selection in industrials and technology helped performance.

The Portfolio utilized derivatives in the form of currency forwards for hedging purposes, which added to absolute performance in both periods.

International Strategic Equities Portfolio

Investment Objective and Strategy

The Portfolio seeks to provide long-term growth of capital. The Portfolio invests, under normal circumstances, at least 80% of its net assets (plus any borrowings for investment purposes) in equity securities or other securities or instruments with similar economic characteristics, including derivatives related to equity securities. Equity securities are primarily common stocks, although, for purposes of the 80% policy, equity securities may also include preferred stocks, warrants, convertible securities, sponsored or unsponsored ADRs and GDRs and equity REITs. You will be notified at least 60 days prior to any change to the Portfolio’s 80% investment policy.

AllianceBernstein L.P. serves as the Portfolio’s investment manager. The Adviser invests the assets of the Portfolio primarily (under normal circumstances, at least 65% of net assets) in equity securities of issuers in countries that make up the MSCI ACWI ex-US, which includes both developed and emerging-market countries. The Portfolio focuses on securities of large-cap and mid-cap companies. The Adviser expects to allocate fund assets among issuers in many foreign countries, but not necessarily in the same proportion that the countries are represented in the MSCI ACWI ex-US and may invest in issuers in countries outside of the MSCI ACWI ex-US. The Portfolio’s exposure among non-US countries may change over time based on the Adviser’s assessment of market conditions and the investment merit of particular non-US issuers. Under normal circumstances, the Adviser invests in companies located in at least three countries other than the United States and expects to have exposure to issuers in several different countries. In determining a company’s location for purposes of the Portfolio’s investment policies and restrictions, the Adviser may consider: (1) the place of domicile, (2) where the company has an established presence and conducts its

(Portfolio Manager Commentary continued on next page)

Portfolio Manager Commentary (continued)

business and (3) where the company conducts a significant part of its economic activities. The Portfolio may, at times, invest significantly in emerging markets.

The Adviser utilizes both fundamental and quantitative research to both determine which securities will be held by the Portfolio and to manage risk. Specifically, the Portfolio’s management team uses the universe of securities selected by the Adviser’s various fundamental investment teams focusing on international equity securities, and applies its quantitative analysis to these securities. In applying its quantitative analysis, the Adviser considers a number of metrics that have historically provided some indication of favorable future returns, including metrics relating to valuation, quality, investor behavior and corporate behavior. Utilizing these resources, the Adviser expects to allocate the Portfolio’s assets among issuers, industries and geographic locations to attempt to create a diversified portfolio of investments.

The Portfolio may also invest in ETFs and other investment companies from time to time.

The Portfolio expects to utilize derivatives, such as options, futures contracts, forwards and swaps. For example, the Portfolio may invest in currency derivatives as discussed below and in futures contracts to gain exposure to certain markets. Derivatives may provide a more efficient and economical exposure to market segments than direct investments, and may also be a more efficient way to alter the Portfolio’s exposure.

Fluctuations in currency exchange rates can have a dramatic impact on the returns of foreign equity securities. The Adviser may employ currency hedging strategies, including the use of currency-related derivatives, to seek to reduce currency risk in the Portfolio, but it is not required to do so. The Adviser may also take long and short positions in currencies or related derivatives for investment purposes, independent of any security positions. The Adviser may use stock index futures contracts to gain access to certain markets.

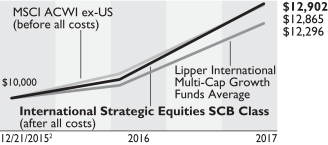

Investment Results

The table on page 8 shows the Portfolio’s performance compared to its benchmark, the MSCI ACWI ex-US (net), for the six- and 12-month periods ended September 30, 2017. Also included in the table is the Portfolio’s peer group, as represented by the Lipper International Multi-Cap Growth Funds Average. Funds in the Lipper Average have generally similar investment objectives to the Portfolio, although some of the funds may have different investment policies and sales and management fees and fund expenses.

All share classes of the Portfolio outperformed the benchmark for both the six- and 12-month periods, and outperformed the Lipper Average for the 12-month period, and underperformed for the six-month period.

International equity markets delivered strong returns during the first nine months of 2017. The stock-market rally reflected improved economic and earnings growth in Europe and emerging markets after an extended period of weak earnings. Over the 12-month period, stock selection was the largest driver of returns versus the benchmark, with health care, consumer discretionary and financial holdings contributing most; technology, consumer staples and utilities holdings detracted modestly. Sector positioning also helped, but active currency positioning detracted.

Over the six-month period, stock selection also contributed most to relative returns; it was particularly strong within the financial, health care and consumer discretionary sectors, but detracted within technology, utilities, and energy. Sector selection also added to returns, while active currency hedges offset the drag caused by the currency positioning implicit in the stocks held.

The Portfolio utilized derivatives in the form of futures for hedging purposes, and currency forwards for hedging and investment purposes, which added to absolute performance for both periods. Currency forwards are used to reduce the level of currency risk, which was achieved.

Disclosures and Risks (Unaudited)

Benchmark Disclosures

None of the following indices or averages reflects fees and expenses associated with the active management of a mutual fund portfolio. The Russell 2000 Index measures the performance of the small-cap segment of the US equity universe. The MSCI ACWI ex-US Small Cap measures the performance of the small-cap market segment across 22 developed markets (excluding the US) and 23 emerging-market countries. The MSCI ACWI ex-US measures the performance of the large- and mid-cap market segment across 22 developed markets (excluding the US) and 23 emerging-market countries. MSCI makes no express or implied warranties or representations, and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices, any securities or financial products. This report is not approved, reviewed or produced by MSCI. Net returns include the reinvestment of dividends after deduction of non-US withholding tax. Investors cannot invest directly in an index, and their results are not indicative of the performance for any specific investment, including the Portfolios.

A Word About Risk

All Portfolios:

The share price of the Portfolios will fluctuate and you may lose money. There is no guarantee that the Portfolios will achieve their investment objectives.

Market Risk: The Portfolios are subject to market risk, which is the risk that stock prices in general may decline over short or extended periods. In the past decade, financial markets in the United States, Europe and elsewhere have experienced increased volatility, decreased liquidity and heightened uncertainty. These market conditions may recur from time to time and have an adverse impact on various securities markets. The US government and the Federal Reserve, as well as certain foreign governments and central banks, have taken steps to support financial markets. Other governments have tried to support markets by buying stocks and through other market interventions. Government intervention may not work as intended, particularly if the efforts are perceived by investors as being unlikely to achieve the desired results. The Federal Reserve has reduced its market support activities and has begun raising interest rates. Further Federal Reserve or other US or non-US governmental or central bank actions, including interest rate increases or decreases, could negatively affect financial markets generally, increase market volatility and reduce the value and liquidity of securities in which the Portfolios invest.

Current political uncertainty surrounding the European Union (“EU”) and its membership may increase market volatility. The United Kingdom has voted to withdraw from the EU, and one or more other countries may withdraw from the EU and/or abandon the Euro, the common currency of the EU. The financial instability of some countries in the EU, together with the risk of that financial instability impacting other more stable countries, may increase the risk of investing in companies in Europe and worldwide. In addition, policy and legislative changes in the United States and in other countries are affecting many aspects of financial regulation, and may in some instances contribute to decreased liquidity and increased volatility in the financial markets. The impact of these changes, and the practical implications for market participants, may not be fully known for some time.

Economies and financial markets throughout the world are becoming increasingly interconnected. Economic, financial or political events, trading and tariff arrangements, terrorism, natural disasters and other circumstances in one country or region could have profound impacts on global economies or markets. As a result, whether or not the Portfolios invest in securities of issuers located in or with significant exposure to countries experiencing economic and financial difficulties, the value and liquidity of the Portfolios’ investments may be negatively affected.

Liquidity Risk: Liquidity risk exists when particular investments are difficult to purchase or sell, possibly preventing the Portfolios from selling out of these illiquid securities at an advantageous price. Illiquid securities may also be difficult to value. Derivatives and securities involving substantial market and credit risk tend to involve greater liquidity risk.

Redemption Risk: The Portfolios may experience heavy redemptions that could cause the Portfolios to liquidate their assets at inopportune times or at a loss or depressed value, which could cause the value of your investment to decline.

Capitalization Risk: Investments in small- and mid-capitalization companies may be more volatile than investments in large-capitalization companies. Investments in small- and mid-capitalization companies may have additional risks because these companies may have limited product lines, markets or financial resources.

(Disclosures & Risks continued on next page)

Disclosures and Risks (continued)

Allocation Risk: The Portfolios may seek to focus on different investment disciplines or factors at different times as means to achieve their investment objectives. In the event that the investment disciplines or factors to which the Portfolios have greater exposure perform worse than the investment disciplines or factors with less exposure, the Portfolios’ returns may be negatively affected.

Derivatives Risk: The Portfolios may use derivatives in currency hedging strategies as well as for direct investments to gain access to certain markets, earn income, enhance return and broaden portfolio diversification, which entail greater risk than if used solely for hedging purposes. In addition to other risks such as the credit risk of the counterparty, derivatives involve the risk that changes in the value of the derivative may not correlate with relevant assets, rates or indices. Derivatives may be illiquid and difficult to price or unwind, and small changes may produce disproportionate losses for the Portfolios. Certain derivatives have the potential for unlimited loss, regardless of the size of the initial investment. Assets required to be set aside or posted to cover or secure derivatives positions may themselves go down in value, and these collateral and other requirements may limit investment flexibility. Some derivatives involve leverage, which can make the Portfolios more volatile and can compound other risks. The US government and foreign governments are in the process of adopting and implementing regulations governing derivatives markets, including mandatory clearing of certain derivatives, margin, reporting and registration requirements. The ultimate impact of the regulations remains unclear. Additional regulation may make derivatives more costly, limit their availability or utility, otherwise adversely affect their performance, or disrupt markets.

Management Risk: The Portfolios are subject to management risk because they are actively managed investment portfolios. The Adviser will apply its investment techniques and risk analyses in making investment decisions for the Portfolios, but its decisions may not produce the desired results. In some cases, derivative and other investment techniques may be unavailable or the Adviser may determine not to use them, possibly even under market conditions where their use could benefit the Portfolios. In addition, the Adviser may change the Portfolios’ investment strategies or policies from time to time. Those changes may not lead to the results intended by the Adviser and could have an adverse effect on the Adviser and could have an adverse effect on the value or performance of the Portfolios.

REIT Risk: Investing in REITs involves certain unique risks in addition to those risks associated with investing in the real estate industry in general. Equity REITs may be affected by changes in the value of the underlying property owned by the REITs, while mortgage REITs may be affected by the quality of any credit extended. REITs are dependent upon management skills, are not diversified, and are subject to heavy cash flow dependency, default by borrowers and self-liquidation. Investing in REITs also involves risks similar to those associated with investing in small-capitalization companies. REITs may have limited financial resources, may trade less frequently and in a limited volume and may be subject to more abrupt or erratic price movements than larger company securities.

Investment in Other Investment Companies Risk: As with other investments, investments in other investment companies, including other AB Mutual Funds and ETFs, are subject to market and selection risk. In addition, if the Portfolios acquire shares of investment companies, shareholders bear both their proportionate share of expenses in the Portfolios (including management and advisory fees) and, indirectly, the expenses of the investment companies.

International Strategic Equities and International Small Cap Portfolios

Foreign (Non-US) Securities Risk: Investments in foreign securities entail significant risks in addition to those customarily associated with investing in US securities. These risks include risks related to adverse market, economic, political and regulatory factors and social instability, all of which could disrupt the financial markets in which the Portfolios invest and adversely affect the value of the Portfolios’ assets.

Country Concentration Risk: The Portfolios may not always be diversified among countries or regions and the effect on the share price of the Portfolios of specific risks identified above such as political, regulatory and currency may be magnified due to concentration of the Portfolios’ investments in a particular country or region.

Emerging Markets Securities Risk: The risks of investing in foreign (non-US) securities are heightened with respect to issuers in emerging-market countries because the markets are less developed and less liquid and there may be a greater amount of economic, political and social uncertainty. In addition, the value of the Portfolios’ investments may decline

(Disclosures & Risks continued on next page)

Disclosures and Risks (continued)

because of factors such as unfavorable or unsuccessful government actions and reduction of government or central bank support.

Foreign Currency Risk: This is the risk that changes in foreign (non-US) currency exchange rates may negatively affect the value of the Portfolios’ investments or reduce the returns of the Portfolios. For example, the value of the Portfolios’ investments in foreign securities and foreign currency positions may decrease if the US dollar is strong (i.e., gaining value relative to other currencies) and other currencies are weak (i.e., losing value relative to the US dollar).

Actions by a Few Major Investors: In certain countries, volatility may be heightened by actions of a few major investors. For example, substantial increases or decreases in cash flows of mutual funds investing in these markets could significantly affect local stock prices and, therefore, share prices of the Portfolios.

These risks are discussed in further detail in the Portfolios’ prospectus.

An Important Note About Historical Performance

The performance shown on the following pages represents past performance and does not guarantee future results. Performance information is as of the dates shown. Current performance may be lower or higher than the performance information shown. You may obtain performance information current to the most recent month-end by calling 212.756.4097. The investment return and principal value of an investment in the Portfolios will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost.

Investors should consider the investment objectives, risks, charges and expenses of the Fund/Portfolios carefully before investing. For copies of our prospectus or summary prospectus, which contain this and other information, visit www.bernstein.com, click on “Investments”, then “Mutual Fund Information—Prospectuses, SAIs and Shareholder Reports”, or call Bernstein’s mutual fund shareholder help line at 212.756.4097 or contact your Bernstein Advisor. Please read the prospectus and/or summary prospectus carefully before investing.

Historical Performance (Unaudited)

Bernstein Fund Portfolios vs. Their Benchmarks and Lipper Averages

| | | | | | | | | | | | | | |

| | | TOTAL RETURNS | | | AVERAGE ANNUAL TOTAL RETURNS | | | |

| THROUGH SEPTEMBER 30, 2017 | | PAST SIX

MONTHS | | | PAST 12

MONTHS | | | SINCE

INCEPTION | | | INCEPTION DATE |

Small Cap Core Portfolio1 | | | | | | | | | | | | | | 12/29/2015 |

SCB Class Shares | | | 4.99 | % | | | 15.98 | % | | | 12.15 | % | | |

Advisor Class Shares | | | 5.15 | | | | 16.29 | | | | 12.44 | | | |

Class Z Shares | | | 5.06 | | | | 16.22 | | | | 12.40 | | | |

Russell 2000 Index | | | 8.27 | | | | 20.74 | | | | 16.99 | | | |

Lipper Small-Cap Core Funds Average | | | 6.46 | | | | 18.57 | | | | 15.25 | | | |

| | | | | | | | | | | | | | | |

International Small Cap Portfolio2 | | | | | | | | | | | | | | 12/21/2015 |

SCB Class Shares | | | 14.52 | | | | 19.28 | | | | 16.03 | | | |

Advisor Class Shares | | | 14.59 | | | | 19.51 | | | | 16.21 | | | |

Class Z Shares | | | 14.59 | | | | 19.52 | | | | 16.22 | | | |

MSCI ACWI ex-US Small Cap—(net) | | | 13.57 | | | | 19.19 | | | | 16.41 | | | |

Lipper International Small/Mid-Cap Core Funds Average | | | 14.23 | | | | 20.27 | | | | 15.29 | | | |

| | | | | | | | | | | | | | | |

International Strategic Equities Portfolio3 | | | | | | | | | | | | | | 12/21/2015 |

SCB Class Shares | | | 13.91 | | | | 22.01 | | | | 15.41 | | | |

Advisor Class Shares | | | 14.08 | | | | 22.38 | | | | 15.61 | | | |

Class Z Shares | | | 14.07 | | | | 22.35 | | | | 15.65 | | | |

MSCI ACWI ex-US—(net) | | | 12.30 | | | | 19.61 | | | | 15.22 | | | |

Lipper International Multi-Cap Growth Funds Average | | | 14.34 | | | | 18.25 | | | | 13.00 | | | |

| 1 | | The current prospectus table shows the total annual operating expense ratios for the Portfolio as 1.40%, 1.15% and 1.21% for SCB Class, Advisor Class and Class Z shares, respectively, gross of any fee waivers or expense reimbursements. Contractual fee waivers and/or expense reimbursements limit the Portfolio’s annual operating expense ratios exclusive of acquired fund fees and expenses other than the advisory fees of any registered funds advised by the Adviser in which the Portfolio may invest, interest expense, taxes, extraordinary expenses, and brokerage commissions and other transaction costs to 1.30%, 1.05% and 1.05% for SCB Class, Advisor Class and Class Z shares, respectively. These waivers may not be terminated prior to January 27, 2018. Any fees waived and expenses borne by the Adviser may be reimbursed by the Portfolio until the end of the third fiscal year after the fiscal period in which the fee was waived or the expense was borne, provided that no reimbursement payment will be made that would cause the Portfolio’s total annual operating expenses to exceed the expense limitations. Absent reimbursements or waivers, performance would have been lower. The Financial Highlights section of this report sets forth expense ratio data for the current reporting period; the expense ratios shown above may differ from the expense ratios in the Financial Highlights section since they are based on different time periods. |

| 2 | | The current prospectus table shows the total annual operating expense ratios for the Portfolio as 1.53%, 1.22% and 1.23% for SCB Class, Advisor Class and Class Z shares, respectively, gross of any fee waivers or expense reimbursements. Contractual fee waivers and/or expense reimbursements limit the Portfolio’s annual operating expense ratios exclusive of acquired fund fees and expenses other than the advisory fees of any registered funds advised by the Adviser in which the Portfolio may invest, interest expense, taxes, extraordinary expenses, and brokerage commissions and other transaction costs to 1.35%, 1.10% and 1.10% for SCB Class, Advisor Class and Class Z shares, respectively. These waivers may not be terminated prior to January 27, 2018. Any fees waived and expenses borne by the Adviser may be reimbursed by the Portfolio until the end of the third fiscal year after the fiscal period in which the fee was waived or the expense was borne, provided that no reimbursement payment will be made that would cause the Portfolio’s total annual operating expenses to exceed the expense limitations. Absent reimbursements or waivers, performance would have been lower. The Financial Highlights section of this report sets forth expense ratio data for the current reporting period; the expense ratios shown above may differ from the expense ratios in the Financial Highlights section since they are based on different time periods. |

| 3 | | The current prospectus table shows the total annual operating expense ratios for the Portfolio as 1.34%, 1.06% and 1.08% for SCB Class, Advisor Class and Class Z shares, respectively, gross of any fee waivers or expense reimbursements. Contractual fee waivers and/or expense reimbursements limit the Portfolio’s annual operating expense ratios exclusive of acquired fund fees and expenses other than the advisory fees of any registered funds advised by the Adviser in which the Portfolio may invest, interest expense, taxes, extraordinary expenses, and brokerage commissions and other transaction costs, on an annualized basis, from exceeding 1.20%, 0.95% and 0.95% for SCB Class, Advisor Class and Class Z shares, respectively. These waivers may not be terminated prior to January 27, 2018. Any fees waived and expenses borne by the Adviser may be reimbursed by the Portfolio until the end of the third fiscal year after the fiscal period in which the fee was waived or the expense was borne, provided that no reimbursement payment will be made that would cause the Portfolio’s total annual operating expenses to exceed the expense limitations. This contractual agreement may be terminated by the Board of Directors of Bernstein Fund, Inc. at its discretion prior to the expiration date. The Adviser has contractually agreed to waive 0.05% of the management fee through January 27, 2018. |

See Disclosures, Risks and Note about Historical Performance on pages 5-7.

(Historical Performance continued on next page)

Historical Performance (continued from previous page)

|

| Small Cap Core-SCB Class Shares |

Growth of a $10,000 Investment in the Portfolio |

12/29/20151 to 9/30/2017 |

|

|

|

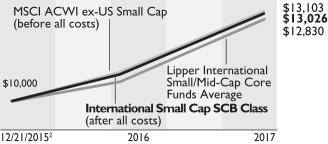

| International Small Cap-SCB Class Shares |

Growth of a $10,000 Investment in the Portfolio |

12/21/20152 to 9/30/2017 |

|

|

|

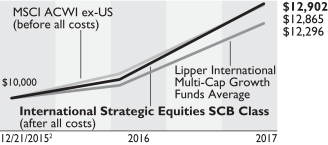

| International Strategic Equities-SCB Class Shares |

Growth of a $10,000 Investment in the Portfolio |

12/21/20152 to 9/30/2017 |

|

| | | Past performance is no guarantee of future results and an investment in the Portfolios could lose value. Each chart illustrates the total value of an assumed $10,000 investment as compared to the performance of each Portfolio’s respective benchmark and Lipper Average for the period since inception through September 30, 2017. |

| 1 | | Inception date: 12/29/2015. |

| 2 | | Inception date: 12/21/2015. |

See Disclosures, Risks and Note about Historical Performance on pages 5-7.

Expense Example—September 30, 2017 (Unaudited)

As a shareholder of a Portfolio, you incur various ongoing costs, including management fees and other Portfolio expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Portfolio and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period as indicated below.

Actual Expenses—The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes—The second line of the table below provides information about hypothetical account values and hypothetical expenses based on a Portfolio’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Portfolio and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), or contingent deferred sales charges on redemptions. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | |

| SMALL CAP CORE PORTFOLIO | | BEGINNING

ACCOUNT VALUE

APRIL 1, 2017 | | | ENDING

ACCOUNT VALUE

SEPTEMBER 30, 2017 | | | EXPENSES

PAID DURING

PERIOD* | | | ANNUALIZED

EXPENSE

RATIO* | |

SCB Class | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 1,049.90 | | | $ | 6.06 | | | | 1.18 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,019.15 | | | $ | 5.97 | | | | 1.18 | % |

Advisor Class | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 1,051.50 | | | $ | 4.78 | | | | 0.93 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,020.41 | | | $ | 4.71 | | | | 0.93 | % |

Class Z | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 1,050.60 | | | $ | 4.99 | | | | 0.97 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,020.21 | | | $ | 4.91 | | | | 0.97 | % |

| |

| | | | |

| INTERNATIONAL SMALL CAP PORTFOLIO | | BEGINNING

ACCOUNT VALUE

APRIL 1, 2017 | | | ENDING

ACCOUNT VALUE

SEPTEMBER 30, 2017 | | | EXPENSES

PAID DURING

PERIOD* | | | ANNUALIZED

EXPENSE

RATIO* | |

SCB Class | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 1,145.20 | | | $ | 7.26 | | | | 1.35 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,018.30 | | | $ | 6.83 | | | | 1.35 | % |

Advisor Class | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 1,145.90 | | | $ | 5.92 | | | | 1.10 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,019.55 | | | $ | 5.57 | | | | 1.10 | % |

Class Z | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 1,145.90 | | | $ | 5.92 | | | | 1.10 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,019.55 | | | $ | 5.57 | | | | 1.10 | % |

| |

| | | | |

| INTERNATIONAL STRATEGIC EQUITIES PORTFOLIO | | BEGINNING

ACCOUNT VALUE

APRIL 1, 2017 | | | ENDING

ACCOUNT VALUE

SEPTEMBER 30, 2017 | | | EXPENSES

PAID DURING

PERIOD* | | | ANNUALIZED

EXPENSE

RATIO* | |

SCB Class | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 1,139.10 | | | $ | 6.27 | | | | 1.17 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,019.20 | | | $ | 5.92 | | | | 1.17 | % |

Advisor Class | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 1,140.80 | | | $ | 4.94 | | | | 0.92 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,020.46 | | | $ | 4.66 | | | | 0.92 | % |

Class Z | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 1,140.70 | | | $ | 5.10 | | | | 0.95 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,020.31 | | | $ | 4.81 | | | | 0.95 | % |

| |

| * | | Expenses are equal to the classes’ annualized expense ratios multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period). |

| ** | | Assumes 5% annual return before expenses. |

Portfolio Summary—September 30, 2017 (Unaudited)

| | | | | | |

| Small Cap Core Portfolio |

| Sector Breakdown1 | | | |

Financials | | | 18.6 | % | | |

Information Technology | | | 17.2 | | | |

Industrials | | | 15.9 | | | |

Health Care | | | 13.8 | | | |

Consumer Discretionary | | | 13.4 | | | |

Real Estate | | | 6.2 | | | |

Energy | | | 4.6 | | | |

Materials | | | 4.1 | | | |

Utilities | | | 3.4 | | | |

Consumer Staples | | | 2.4 | | | |

Telecommunication Services | | | 0.4 | | | |

| | | | | | |

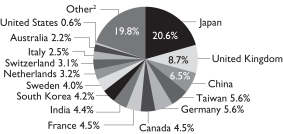

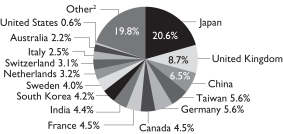

| International Small Cap Portfolio |

| Sector Breakdown1 | | | Country Breakdown1 |

Industrials | | | 20.1 | % | |  |

Consumer Discretionary | | | 19.4 | | |

Information Technology | | | 15.8 | | |

Materials | | | 10.2 | | |

Consumer Staples | | | 9.6 | | |

Financials | | | 9.5 | | |

Real Estate | | | 4.4 | | |

Health Care | | | 4.4 | | |

Energy | | | 2.7 | | |

Utilities | | | 1.7 | | |

Telecommunication Services | | | 1.7 | | |

Funds and Investment Trusts | | | 0.5 | | |

| | | | | | |

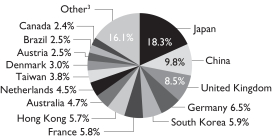

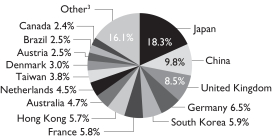

| International Strategic Equities Portfolio |

| Sector Breakdown1 | | | Country Breakdown1 |

Financials | | | 20.9 | % | |  |

Information Technology | | | 19.3 | | |

Industrials | | | 18.5 | | |

Consumer Discretionary | | | 11.9 | | |

Health Care | | | 7.2 | | |

Consumer Staples | | | 7.2 | | |

Telecommunication Services | | | 4.6 | | |

Energy | | | 3.3 | | |

Materials | | | 2.8 | | |

Real Estate | | | 2.8 | | |

Utilities | | | 1.5 | | |

| 1 | | All data are as of September 30, 2017. The Portfolio’s country and sector breakdowns are expressed as a percentage of each Portfolio’s long-term investments and may vary over time. Each Portfolio may also invest in other financial instruments, including derivative instruments, which provide investment exposure to a variety of asset classes (see “Schedule of Investments” section of the Small Cap Core, International Small Cap and International Strategic Equities Portfolios). |

| 2 | | “Other” represents 6.3% in MSCI EM Index countries and 12.5% in MSCI EAFE Index countries and 1.0% in other emerging market countries. |

| 3 | | “Other” represents 1.4% in MSCI EM Index countries and 14.7% in MSCI EAFE Index countries. |

| | | Please note: The sector classifications presented herein are based on the Global Industry Classification Standard (GICS) which was developed by Morgan Stanley Capital International and Standard & Poor’s. The components are divided into sector, industry group, and industry sub-indices as classified by the GICS for each of the market capitalization indices in the broad market. These sector classifications are broadly defined. The “Schedule of Investments” section of the report reflects more specific industry information and is consistent with the investment restrictions discussed in the Portfolios’ prospectus. |

Schedule of Investments

Bernstein Fund, Inc.

Schedule of Investments

Small Cap Core Portfolio

September 30, 2017

| | | | | | | | |

| Company | | Shares | | | U.S. $ Value | |

| | | | | | | | |

| COMMON STOCKS–99.5% | |

| Financials–18.5% | |

| Banks–10.3% | |

1st Source Corp. | | | 30,300 | | | $ | 1,539,240 | |

Associated Banc-Corp. | | | 34,000 | | | | 824,500 | |

Bank of NT Butterfield & Son Ltd. (The) | | | 48,680 | | | | 1,783,635 | |

Banner Corp. | | | 28,960 | | | | 1,774,669 | |

Cathay General Bancorp | | | 126,410 | | | | 5,081,682 | |

City Holding Co. | | | 45,490 | | | | 3,271,186 | |

Community Trust Bancorp, Inc. | | | 55,330 | | | | 2,572,845 | |

Customers Bancorp, Inc.(a) | | | 97,780 | | | | 3,189,584 | |

Eagle Bancorp, Inc.(a) | | | 20,470 | | | | 1,372,513 | |

Enterprise Financial Services Corp. | | | 19,650 | | | | 832,178 | |

Farmers Capital Bank Corp. | | | 27,840 | | | | 1,170,672 | |

FCB Financial Holdings, Inc.–Class A(a) | | | 69,120 | | | | 3,338,496 | |

Fidelity Southern Corp. | | | 28,980 | | | | 685,087 | |

First Citizens BancShares, Inc./NC–Class A | | | 8,310 | | | | 3,107,026 | |

First Commonwealth Financial Corp. | | | 103,560 | | | | 1,463,303 | |

First Financial Corp./IN | | | 59,830 | | | | 2,847,908 | |

First Interstate BancSystem, Inc. | | | 35,950 | | | | 1,375,087 | |

Flushing Financial Corp. | | | 64,930 | | | | 1,929,720 | |

Great Southern Bancorp, Inc. | | | 34,950 | | | | 1,944,967 | |

Great Western Bancorp, Inc. | | | 94,150 | | | | 3,886,512 | |

Hanmi Financial Corp. | | | 99,610 | | | | 3,082,929 | |

Heritage Financial Corp./WA | | | 82,340 | | | | 2,429,030 | |

Hilltop Holdings, Inc. | | | 172,730 | | | | 4,490,980 | |

Home BancShares, Inc./AR | | | 33,670 | | | | 849,157 | |

Hope Bancorp, Inc. | | | 84,690 | | | | 1,499,860 | |

International Bancshares Corp. | | | 114,340 | | | | 4,585,034 | |

LegacyTexas Financial Group, Inc. | | | 42,580 | | | | 1,699,794 | |

MBT Financial Corp. | | | 103,620 | | | | 1,134,639 | |

Preferred Bank/Los Angeles CA | | | 16,390 | | | | 989,137 | |

Republic Bancorp, Inc./KY–Class A | | | 66,840 | | | | 2,599,408 | |

ServisFirst Bancshares, Inc. | | | 31,100 | | | | 1,208,235 | |

State Bank Financial Corp. | | | 63,720 | | | | 1,825,578 | |

Sterling Bancorp/DE | | | 94,420 | | | | 2,327,453 | |

TCF Financial Corp. | | | 106,260 | | | | 1,810,670 | |

Texas Capital Bancshares, Inc.(a) | | | 54,620 | | | | 4,686,396 | |

Umpqua Holdings Corp. | | | 235,820 | | | | 4,600,848 | |

Western Alliance Bancorp(a) | | | 68,770 | | | | 3,650,312 | |

Wintrust Financial Corp. | | | 36,040 | | | | 2,822,292 | |

Xenith Bankshares, Inc.(a) | | | 33,620 | | | | 1,092,650 | |

| | | | | | | | |

| | | | | | | 91,375,212 | |

| | | | | | | | |

| Capital Markets–0.8% | |

BGC Partners, Inc.–Class A | | | 64,350 | | | | 931,145 | |

Evercore, Inc.–Class A | | | 22,330 | | | | 1,791,982 | |

Houlihan Lokey, Inc. | | | 34,360 | | | | 1,344,507 | |

Lazard Ltd.–Class A | | | 17,920 | | | | 810,342 | |

Stifel Financial Corp. | | | 44,400 | | | | 2,373,624 | |

| | | | | | | | |

| | | | | | | 7,251,600 | |

| | | | | | | | |

| | | | | | | | |

| Consumer Finance–0.5% | |

Nelnet, Inc.–Class A | | | 58,550 | | | $ | 2,956,775 | |

OneMain Holdings, Inc.(a) | | | 61,460 | | | | 1,732,558 | |

| | | | | | | | |

| | | | | | | 4,689,333 | |

| | | | | | | | |

| Insurance–3.0% | |

American Equity Investment Life Holding Co. | | | 28,984 | | | | 842,855 | |

Assured Guaranty Ltd. | | | 80,320 | | | | 3,032,080 | |

CNO Financial Group, Inc. | | | 198,840 | | | | 4,640,926 | |

Employers Holdings, Inc. | | | 53,680 | | | | 2,439,756 | |

Fidelity & Guaranty Life | | | 31,990 | | | | 993,289 | |

First American Financial Corp. | | | 25,470 | | | | 1,272,736 | |

HCI Group, Inc. | | | 31,620 | | | | 1,209,465 | |

National Western Life Group, Inc.–Class A | | | 5,200 | | | | 1,814,800 | |

Primerica, Inc. | | | 41,970 | | | | 3,422,653 | |

Third Point Reinsurance Ltd.(a) | | | 254,200 | | | | 3,965,520 | |

Universal Insurance Holdings, Inc. | | | 109,810 | | | | 2,525,630 | |

| | | | | | | | |

| | | | | | | 26,159,710 | |

| | | | | | | | |

| Mortgage Real Estate Investment Trusts (REITs)–0.8% | |

AG Mortgage Investment Trust, Inc. | | | 96,120 | | | | 1,849,349 | |

ARMOUR Residential REIT, Inc. | | | 73,540 | | | | 1,978,226 | |

MTGE Investment Corp. | | | 108,540 | | | | 2,105,676 | |

PennyMac Mortgage Investment Trust | | | 72,260 | | | | 1,256,601 | |

| | | | | | | | |

| | | | | | | 7,189,852 | |

| | | | | | | | |

| Thrifts & Mortgage Finance–3.1% | |

BofI Holding, Inc.(a) | | | 89,110 | | | | 2,536,962 | |

Essent Group Ltd.(a) | | | 75,680 | | | | 3,065,040 | |

Federal Agricultural Mortgage Corp.–Class C | | | 23,060 | | | | 1,677,384 | |

HomeStreet, Inc.(a) | | | 26,220 | | | | 707,940 | |

LendingTree, Inc.(a) | | | 4,510 | | | | 1,102,469 | |

MGIC Investment Corp.(a) | | | 454,300 | | | | 5,692,379 | |

NMI Holdings, Inc.–Class A(a) | | | 217,990 | | | | 2,703,076 | |

Radian Group, Inc. | | | 287,290 | | | | 5,369,450 | |

Walker & Dunlop, Inc.(a) | | | 81,920 | | | | 4,286,874 | |

| | | | | | | | |

| | | | | | | 27,141,574 | |

| | | | | | | | |

| | | | | | | 163,807,281 | |

| | | | | | | | |

| | | | | | | | |

| |

| Information Technology–17.1% | |

| Communications Equipment–1.7% | |

Comtech Telecommunications Corp. | | | 32,970 | | | | 676,874 | |

Extreme Networks, Inc.(a) | | | 265,980 | | | | 3,162,502 | |

Finisar Corp.(a) | | | 35,460 | | | | 786,148 | |

InterDigital, Inc./PA | | | 37,710 | | | | 2,781,113 | |

Lumentum Holdings, Inc.(a) | | | 31,490 | | | | 1,711,482 | |

NETGEAR, Inc.(a) | | | 72,010 | | | | 3,427,676 | |

Oclaro, Inc.(a) | | | 249,070 | | | | 2,149,474 | |

| | | | | | | | |

| | | | | | | 14,695,269 | |

| | | | | | | | |

| Electronic Equipment, Instruments & Components–5.4% | |

Anixter International, Inc.(a) | | | 58,700 | | | | 4,989,500 | |

Belden, Inc. | | | 22,470 | | | | 1,809,509 | |

Benchmark Electronics, Inc.(a) | | | 123,850 | | | | 4,229,477 | |

Celestica, Inc. (Toronto)(a) | | | 284,530 | | | | 3,522,481 | |

Control4 Corp.(a) | | | 39,640 | | | | 1,167,794 | |

ePlus, Inc.(a) | | | 15,380 | | | | 1,421,881 | |

| | | | | | | | |

| | | |

| Company | | Shares | | | U.S. $ Value | |

| | | | | | | | |

Fitbit, Inc.(a) | | | 315,990 | | | $ | 2,199,290 | |

II-VI, Inc.(a) | | | 49,980 | | | | 2,056,677 | |

Insight Enterprises, Inc.(a) | | | 54,530 | | | | 2,504,018 | |

Jabil, Inc. | | | 123,330 | | | | 3,521,072 | |

KEMET Corp.(a) | | | 64,250 | | | | 1,357,603 | |

Littelfuse, Inc. | | | 18,460 | | | | 3,615,945 | |

Methode Electronics, Inc. | | | 59,480 | | | | 2,518,978 | |

Rogers Corp.(a) | | | 11,464 | | | | 1,527,922 | |

Sanmina Corp.(a) | | | 133,120 | | | | 4,945,408 | |

SYNNEX Corp. | | | 23,200 | | | | 2,935,032 | |

Tech Data Corp.(a) | | | 15,380 | | | | 1,366,513 | |

TTM Technologies, Inc.(a) | | | 156,580 | | | | 2,406,635 | |

| | | | | | | | |

| | | | | | | 48,095,735 | |

| | | | | | | | |

| Internet Software & Services–1.8% | |

Bankrate, Inc.(a) | | | 83,560 | | | | 1,165,662 | |

Blucora, Inc.(a) | | | 97,540 | | | | 2,467,762 | |

LogMeIn, Inc. | | | 15,640 | | | | 1,721,182 | |

Stamps.com, Inc.(a) | | | 15,590 | | | | 3,159,313 | |

Trade Desk, Inc. (The)–Class A(a) | | | 56,470 | | | | 3,473,470 | |

Web.com Group, Inc.(a) | | | 154,140 | | | | 3,853,500 | |

| | | | | | | | |

| | | | | | | 15,840,889 | |

| | | | | | | | |

| IT Services–2.8% | |

Booz Allen Hamilton Holding Corp. | | | 94,680 | | | | 3,540,085 | |

CACI International, Inc.–Class A(a) | | | 35,950 | | | | 5,009,633 | |

Convergys Corp. | | | 110,100 | | | | 2,850,489 | |

EVERTEC, Inc. | | | 112,560 | | | | 1,784,076 | |

Hackett Group, Inc. (The) | | | 40,970 | | | | 622,334 | |

MAXIMUS, Inc. | | | 55,360 | | | | 3,570,720 | |

Perficient, Inc.(a) | | | 106,530 | | | | 2,095,445 | |

Science Applications International Corp. | | | 36,703 | | | | 2,453,596 | |

WNS Holdings Ltd. (ADR)(a) | | | 69,700 | | | | 2,544,050 | |

| | | | | | | | |

| | | | | | | 24,470,428 | |

| | | | | | | | |

| Semiconductors & Semiconductor Equipment–3.3% | |

Advanced Energy Industries, Inc.(a) | | | 64,120 | | | | 5,178,331 | |

Ambarella, Inc.(a) | | | 21,820 | | | | 1,069,398 | |

Amkor Technology, Inc.(a) | | | 45,830 | | | | 483,507 | |

Brooks Automation, Inc. | | | 60,300 | | | | 1,830,708 | |

Cabot Microelectronics Corp. | | | 22,110 | | | | 1,767,252 | |

Cirrus Logic, Inc.(a) | | | 14,160 | | | | 755,011 | |

Kulicke & Soffa Industries, Inc.(a) | | | 86,830 | | | | 1,872,923 | |

Microsemi Corp.(a) | | | 25,690 | | | | 1,322,521 | |

MKS Instruments, Inc. | | | 56,380 | | | | 5,325,091 | |

Rudolph Technologies, Inc.(a) | | | 46,990 | | | | 1,235,837 | |

Semtech Corp.(a) | | | 53,310 | | | | 2,001,790 | |

Silicon Laboratories, Inc.(a) | | | 23,320 | | | | 1,863,268 | |

Synaptics, Inc.(a) | | | 14,520 | | | | 568,894 | |

Ultra Clean Holdings, Inc.(a) | | | 49,350 | | | | 1,511,097 | |

Versum Materials, Inc. | | | 70,090 | | | | 2,720,894 | |

| | | | | | | | |

| | | | | | | 29,506,522 | |

| | | | | | | | |

| Software–1.7% | |

Aspen Technology, Inc.(a) | | | 78,120 | | | | 4,906,717 | |

Blackbaud, Inc. | | | 5,380 | | | | 472,364 | |

Fair Isaac Corp. | | | 37,290 | | | | 5,239,245 | |

Progress Software Corp. | | | 111,950 | | | | 4,273,132 | |

| | | | | | | | |

Zix Corp.(a) | | | 114,880 | | | $ | 561,763 | |

| | | | | | | | |

| | | | | | | 15,453,221 | |

| | | | | | | | |

| Technology Hardware, Storage & Peripherals–0.4% | |

Travelport Worldwide Ltd. | | | 218,250 | | | | 3,426,525 | |

| | | | | | | | |

| | | | | | | 151,488,589 | |

| | | | | | | | |

| | | | | | | | |

| | |

| Industrials–15.8% | | | | | |

| Aerospace & Defense–0.7% | | | | | |

Curtiss-Wright Corp. | | | 28,490 | | | | 2,978,345 | |

National Presto Industries, Inc. | | | 16,560 | | | | 1,762,812 | |

Vectrus, Inc.(a) | | | 60,980 | | | | 1,880,623 | |

| | | | | | | | |

| | | | | | | 6,621,780 | |

| | | | | | | | |

| Air Freight & Logistics–0.4% | |

Forward Air Corp. | | | 40,070 | | | | 2,293,206 | |

XPO Logistics, Inc.(a) | | | 20,360 | | | | 1,380,001 | |

| | | | | | | | |

| | | | | | | 3,673,207 | |

| | | | | | | | |

| Airlines–0.1% | |

Hawaiian Holdings, Inc.(a) | | | 14,660 | | | | 550,483 | |

| | | | | | | | |

| Building Products–1.9% | |

Apogee Enterprises, Inc. | | | 49,860 | | | | 2,406,244 | |

Builders FirstSource, Inc.(a) | | | 239,900 | | | | 4,315,801 | |

Continental Building Products, Inc.(a) | | | 105,970 | | | | 2,755,220 | |

Gibraltar Industries, Inc.(a) | | | 23,640 | | | | 736,386 | |

PGT Innovations, Inc.(a) | | | 140,850 | | | | 2,105,708 | |

Ply Gem Holdings, Inc.(a) | | | 146,990 | | | | 2,506,179 | |

Trex Co., Inc.(a) | | | 17,760 | | | | 1,599,643 | |

| | | | | | | | |

| | | | | | | 16,425,181 | |

| | | | | | | | |

| Commercial Services & Supplies–2.0% | |

ACCO Brands Corp.(a) | | | 87,930 | | | | 1,046,367 | |

Casella Waste Systems, Inc.–Class A(a) | | | 65,060 | | | | 1,223,128 | |

Deluxe Corp. | | | 72,290 | | | | 5,274,278 | |

Ennis, Inc. | | | 91,810 | | | | 1,804,066 | |

Kimball International, Inc.–Class B | | | 160,660 | | | | 3,176,248 | |

Quad/Graphics, Inc. | | | 73,250 | | | | 1,656,183 | |

Steelcase, Inc.–Class A | | | 68,860 | | | | 1,060,444 | |

Tetra Tech, Inc. | | | 34,010 | | | | 1,583,166 | |

Viad Corp. | | | 15,900 | | | | 968,310 | |

| | | | | | | | |

| | | | | | | 17,792,190 | |

| | | | | | | | |

| Construction & Engineering–2.6% | |

AECOM(a) | | | 75,850 | | | | 2,792,039 | |

Argan, Inc. | | | 46,040 | | | | 3,096,190 | |

Comfort Systems USA, Inc. | | | 42,270 | | | | 1,509,039 | |

EMCOR Group, Inc. | | | 75,720 | | | | 5,253,454 | |

Jacobs Engineering Group, Inc. | | | 68,950 | | | | 4,017,716 | |

MasTec, Inc.(a) | | | 67,650 | | | | 3,138,960 | |

Primoris Services Corp. | | | 32,248 | | | | 948,736 | |

Tutor Perini Corp.(a) | | | 74,370 | | | | 2,112,108 | |

| | | | | | | | |

| | | | | | | 22,868,242 | |

| | | | | | | | |

| Electrical Equipment–0.8% | |

Generac Holdings, Inc.(a) | | | 102,730 | | | | 4,718,389 | |

General Cable Corp. | | | 66,970 | | | | 1,262,384 | |

Schedule of Investments (continued)

| | | | | | | | |

| | | |

| Company | | Shares | | | U.S. $ Value | |

| | | | | | | | |

Regal Beloit Corp. | | | 16,480 | | | $ | 1,301,920 | |

| | | | | | | | |

| | | | | | | 7,282,693 | |

| | | | | | | | |

| Machinery–2.7% | |

Alamo Group, Inc. | | | 12,710 | | | | 1,364,672 | |

Donaldson Co., Inc. | | | 47,240 | | | | 2,170,205 | |

Global Brass & Copper Holdings, Inc. | | | 81,910 | | | | 2,768,558 | |

Greenbrier Cos., Inc. (The) | | | 20,800 | | | | 1,001,520 | |

Kadant, Inc. | | | 31,200 | | | | 3,074,760 | |

Lincoln Electric Holdings, Inc. | | | 27,260 | | | | 2,499,197 | |

Meritor, Inc.(a) | | | 183,290 | | | | 4,767,373 | |

Oshkosh Corp. | | | 32,420 | | | | 2,675,947 | |

Wabash National Corp. | | | 142,040 | | | | 3,241,353 | |

| | | | | | | | |

| | | | | | | 23,563,585 | |

| | | | | | | | |

| Professional Services–1.4% | |

ICF International, Inc.(a) | | | 40,890 | | | | 2,206,016 | |

Insperity, Inc. | | | 25,610 | | | | 2,253,680 | |

On Assignment, Inc.(a) | | | 36,750 | | | | 1,972,740 | |

RPX Corp.(a) | | | 83,280 | | | | 1,105,958 | |

TriNet Group, Inc.(a) | | | 60,240 | | | | 2,025,269 | |

TrueBlue, Inc.(a) | | | 138,460 | | | | 3,108,427 | |

| | | | | | | | |

| | | | | | | 12,672,090 | |

| | | | | | | | |

| Road & Rail –1.0% | |

ArcBest Corp. | | | 28,620 | | | | 957,339 | |

Knight-Swift Transportation Holdings, Inc.(a) | | | 54,167 | | | | 2,250,639 | |

Ryder System, Inc. | | | 37,440 | | | | 3,165,552 | |

Saia, Inc.(a) | | | 40,060 | | | | 2,509,759 | |

| | | | | | | | |

| | | | | | | 8,883,289 | |

| | | | | | | | |

| Trading Companies & Distributors–2.2% | |

Applied Industrial Technologies, Inc. | | | 53,440 | | | | 3,516,352 | |

Beacon Roofing Supply, Inc.(a) | | | 52,340 | | | | 2,682,425 | |

GATX Corp. | | | 30,290 | | | | 1,864,652 | |

H&E Equipment Services, Inc. | | | 113,730 | | | | 3,320,916 | |

MRC Global, Inc.(a) | | | 132,280 | | | | 2,313,577 | |

Neff Corp.(a) | | | 36,070 | | | | 901,750 | |

Rush Enterprises, Inc.–Class A(a) | | | 75,060 | | | | 3,474,528 | |

Titan Machinery, Inc.(a) | | | 95,870 | | | | 1,488,861 | |

| | | | | | | | |

| | | | | | | 19,563,061 | |

| | | | | | | | |

| | | | | | | 139,895,801 | |

| | | | | | | | |

| | | | | | | | |

| |

| Health Care–13.7% | |

| Biotechnology–5.6% | |

Aimmune Therapeutics, Inc.(a) | | | 32,510 | | | | 805,923 | |

Amicus Therapeutics, Inc.(a) | | | 131,990 | | | | 1,990,409 | |

Arena Pharmaceuticals, Inc.(a) | | | 33,311 | | | | 849,431 | |

Audentes Therapeutics, Inc.(a) | | | 35,230 | | | | 986,792 | |

Avexis, Inc.(a) | | | 15,530 | | | | 1,502,217 | |

BeiGene Ltd. (ADR)(a) | | | 9,840 | | | | 1,018,046 | |

Biohaven Pharmaceutical Holding Co., Ltd.(a) | | | 22,800 | | | | 852,264 | |

BioSpecifics Technologies Corp.(a) | | | 12,970 | | | | 603,364 | |

Bluebird Bio, Inc.(a) | | | 13,180 | | | | 1,810,273 | |

Blueprint Medicines Corp.(a) | | | 32,060 | | | | 2,233,620 | |

Clovis Oncology, Inc.(a) | | | 29,750 | | | | 2,451,400 | |

| | | | | | | | |

Cytokinetics, Inc.(a) | | | 77,970 | | | $ | 1,130,565 | |

CytomX Therapeutics, Inc.(a) | | | 54,690 | | | | 993,717 | |

Dynavax Technologies Corp.(a) | | | 64,570 | | | | 1,388,255 | |

Eagle Pharmaceuticals, Inc./DE(a) | | | 17,710 | | | | 1,056,224 | |

Emergent BioSolutions, Inc.(a) | | | 37,660 | | | | 1,523,347 | |

Enanta Pharmaceuticals, Inc.(a) | | | 28,480 | | | | 1,332,864 | |

Exact Sciences Corp.(a) | | | 68,870 | | | | 3,245,155 | |

FibroGen, Inc.(a) | | | 45,660 | | | | 2,456,508 | |

Genomic Health, Inc.(a) | | | 33,970 | | | | 1,090,097 | |

Ligand Pharmaceuticals, Inc.(a) | | | 15,450 | | | | 2,103,518 | |

Loxo Oncology, Inc.(a) | | | 19,263 | | | | 1,774,508 | |

Myriad Genetics, Inc.(a) | | | 63,820 | | | | 2,309,008 | |

Neurocrine Biosciences, Inc.(a) | | | 15,230 | | | | 933,294 | |

Portola Pharmaceuticals, Inc.(a) | | | 28,810 | | | | 1,556,604 | |

Prothena Corp. PLC(a) | | | 29,700 | | | | 1,923,669 | |

Puma Biotechnology, Inc.(a) | | | 16,650 | | | | 1,993,838 | |

Radius Health, Inc.(a) | | | 15,660 | | | | 603,693 | |

Retrophin, Inc.(a) | | | 52,450 | | | | 1,305,481 | |

Sage Therapeutics, Inc.(a) | | | 14,910 | | | | 928,893 | |

Sangamo Therapeutics, Inc.(a) | | | 95,942 | | | | 1,439,130 | |

Sarepta Therapeutics, Inc.(a) | | | 34,690 | | | | 1,573,538 | |

Spark Therapeutics, Inc.(a) | | | 6,110 | | | | 544,768 | |

Vanda Pharmaceuticals, Inc.(a) | | | 47,060 | | | | 842,374 | |

| | | | | | | | |

| | | | | | | 49,152,787 | |

| | | | | | | | |

| Health Care Equipment & Supplies–2.9% | |

AngioDynamics, Inc.(a) | | | 110,250 | | | | 1,884,173 | |

Cardiovascular Systems, Inc.(a) | | | 26,740 | | | | 752,731 | |

CONMED Corp. | | | 43,960 | | | | 2,306,581 | |

Cutera, Inc.(a) | | | 15,700 | | | | 649,195 | |

Globus Medical, Inc.–Class A(a) | | | 55,810 | | | | 1,658,673 | |

Halyard Health, Inc.(a) | | | 75,660 | | | | 3,406,970 | |

Heska Corp.(a) | | | 8,590 | | | | 756,693 | |

Inogen, Inc.(a) | | | 9,720 | | | | 924,372 | |

Integer Holdings Corp.(a) | | | 66,680 | | | | 3,410,682 | |

Lantheus Holdings, Inc.(a) | | | 60,370 | | | | 1,074,586 | |

LeMaitre Vascular, Inc. | | | 17,680 | | | | 661,586 | |

Masimo Corp.(a) | | | 29,390 | | | | 2,543,998 | |

Merit Medical Systems, Inc.(a) | | | 40,820 | | | | 1,728,727 | |

OraSure Technologies, Inc.(a) | | | 63,590 | | | | 1,430,775 | |

Orthofix International NV(a) | | | 59,920 | | | | 2,831,220 | |

| | | | | | | | |

| | | | | | | 26,020,962 | |

| | | | | | | | |

| Health Care Providers & Services–2.7% | |

Amedisys, Inc.(a) | | | 63,420 | | | | 3,548,983 | |

Chemed Corp. | | | 24,240 | | | | 4,897,692 | |

HealthSouth Corp. | | | 38,530 | | | | 1,785,865 | |

LHC Group, Inc.(a) | | | 40,970 | | | | 2,905,592 | |

Molina Healthcare, Inc.(a) | | | 60,060 | | | | 4,129,726 | |

Owens & Minor, Inc. | | | 19,700 | | | | 575,240 | |

PharMerica Corp.(a) | | | 43,150 | | | | 1,264,295 | |

WellCare Health Plans, Inc.(a) | | | 25,720 | | | | 4,417,153 | |

| | | | | | | | |

| | | | | | | 23,524,546 | |

| | | | | | | | |

| Health Care Technology–0.3% | |

Quality Systems, Inc.(a) | | | 183,550 | | | | 2,887,242 | |

| | | | | | | | |

| | | | | | | | |

| | | |

| Company | | Shares | | | U.S. $ Value | |

| | | | | | | | |

| Life Sciences Tools & Services–0.5% | |

Enzo Biochem, Inc.(a) | | | 85,950 | | | $ | 899,896 | |

INC Research Holdings, Inc.–Class A(a) | | | 22,310 | | | | 1,166,813 | |

PRA Health Sciences, Inc.(a) | | | 31,370 | | | | 2,389,453 | |

| | | | | | | | |

| | | | | | | 4,456,162 | |

| | | | | | | | |

| Pharmaceuticals–1.7% | |

Aerie Pharmaceuticals, Inc.(a) | | | 28,210 | | | | 1,371,006 | |

Catalent, Inc.(a) | | | 72,810 | | | | 2,906,575 | |

Corcept Therapeutics, Inc.(a) | | | 126,060 | | | | 2,432,958 | |

Impax Laboratories, Inc.(a) | | | 90,520 | | | | 1,837,556 | |

Innoviva, Inc.(a) | | | 149,790 | | | | 2,115,035 | |

Intersect ENT, Inc.(a) | | | 38,170 | | | | 1,188,995 | |

Phibro Animal Health Corp.–Class A | | | 48,720 | | | | 1,805,076 | |

Supernus Pharmaceuticals, Inc.(a) | | | 44,770 | | | | 1,790,800 | |

| | | | | | | | |

| | | | | | | 15,448,001 | |

| | | | | | | | |

| | | | | | | 121,489,700 | |

| | | | | | | | |

| | | | | | | | |

| |

| Consumer Discretionary–13.4% | |

| Auto Components–2.4% | |

American Axle & Manufacturing Holdings, Inc.(a) | | | 142,270 | | | | 2,501,107 | |

Cooper Tire & Rubber Co. | | | 45,300 | | | | 1,694,220 | |

Cooper-Standard Holdings, Inc.(a) | | | 40,020 | | | | 4,641,119 | |

Dana, Inc. | | | 119,370 | | | | 3,337,585 | |

Dorman Products, Inc.(a) | | | 20,660 | | | | 1,479,669 | |

LCI Industries | | | 14,610 | | | | 1,692,569 | |

Stoneridge, Inc.(a) | | | 82,530 | | | | 1,634,919 | |

Superior Industries International, Inc. | | | 33,650 | | | | 560,273 | |

Tenneco, Inc. | | | 67,900 | | | | 4,119,493 | |

| | | | | | | | |

| | | | | | | 21,660,954 | |

| | | | | | | | |

| Automobiles–0.3% | | | | | |

Thor Industries, Inc. | | | 22,590 | | | | 2,844,307 | |

| | | | | | | | |

| Diversified Consumer Services–1.7% | | | | | |

Adtalem Global Education, Inc. | | | 74,940 | | | | 2,686,599 | |

Grand Canyon Education, Inc.(a) | | | 31,500 | | | | 2,860,830 | |

Houghton Mifflin Harcourt Co.(a) | | | 76,110 | | | | 917,126 | |

K12, Inc.(a) | | | 145,510 | | | | 2,595,898 | |

Sotheby’s(a) | | | 51,040 | | | | 2,353,454 | |

Strayer Education, Inc. | | | 36,820 | | | | 3,213,281 | |

Weight Watchers International, Inc.(a) | | | 8,450 | | | | 367,998 | |

| | | | | | | | |

| | | | | | | 14,995,186 | |

| | | | | | | | |

| Hotels, Restaurants & Leisure–2.5% | | | | | |

Brinker International, Inc. | | | 35,600 | | | | 1,134,216 | |

Churchill Downs, Inc. | | | 10,300 | | | | 2,123,860 | |

Cracker Barrel Old Country Store, Inc. | | | 9,450 | | | | 1,432,809 | |

Denny’s Corp.(a) | | | 230,290 | | | | 2,867,110 | |

Papa John’s International, Inc. | | | 22,770 | | | | 1,663,804 | |

Pinnacle Entertainment, Inc.(a) | | | 145,900 | | | | 3,109,129 | |

Red Robin Gourmet Burgers, Inc.(a) | | | 48,340 | | | | 3,238,780 | |

Ruth’s Hospitality Group, Inc. | | | 124,710 | | | | 2,612,675 | |

Scientific Games Corp.–Class A(a) | | | 36,810 | | | | 1,687,739 | |

Texas Roadhouse, Inc.–Class A | | | 44,910 | | | | 2,206,877 | |

| | | | | | | | |

| | | | | | | 22,076,999 | |

| | | | | | | | |

| | | | | | | | |

| Household Durables–1.6% | | | | | |

Beazer Homes USA, Inc.(a) | | | 92,900 | | | $ | 1,740,946 | |

CalAtlantic Group, Inc. | | | 25,400 | | | | 930,402 | |

Ethan Allen Interiors, Inc. | | | 94,480 | | | | 3,061,152 | |

Flexsteel Industries, Inc. | | | 29,810 | | | | 1,511,367 | |

Hooker Furniture Corp. | | | 21,690 | | | | 1,035,697 | |

KB Home | | | 78,930 | | | | 1,903,792 | |

MDC Holdings, Inc. | | | 72,280 | | | | 2,400,419 | |

NACCO Industries, Inc.–Class A | | | 13,310 | | | | 1,141,998 | |

| | | | | | | | |

| | | | | | | 13,725,773 | |

| | | | | | | | |

| Internet & Direct Marketing Retail–0.4% | | | | | |

HSN, Inc. | | | 35,390 | | | | 1,381,979 | |

Nutrisystem, Inc. | | | 35,910 | | | | 2,007,369 | |

| | | | | | | | |

| | | | | | | 3,389,348 | |

| | | | | | | | |

| Media–0.4% | | | | | |

AMC Entertainment Holdings, Inc.–Class A | | | 78,940 | | | | 1,160,418 | |

Gray Television, Inc.(a) | | | 59,340 | | | | 931,638 | |

Regal Entertainment Group–Class A | | | 104,150 | | | | 1,666,400 | |

| | | | | | | | |

| | | | | | | 3,758,456 | |

| | | | | | | | |

| Multiline Retail–0.4% | | | | | |

Big Lots, Inc. | | | 54,510 | | | | 2,920,101 | |

Ollie’s Bargain Outlet Holdings, Inc.(a) | | | 20,470 | | | | 949,808 | |

| | | | | | | | |

| | | | | | | 3,869,909 | |

| | | | | | | | |

| Specialty Retail–2.9% | | | | | | | | |

Aaron’s, Inc. | | | 89,520 | | | | 3,905,758 | |

Caleres, Inc. | | | 105,970 | | | | 3,234,204 | |

Children’s Place, Inc. (The) | | | 15,230 | | | | 1,799,424 | |

Citi Trends, Inc. | | | 27,150 | | | | 539,470 | |

Five Below, Inc.(a) | | | 56,920 | | | | 3,123,770 | |

Group 1 Automotive, Inc. | | | 21,420 | | | | 1,552,093 | |

Michaels Cos., Inc. (The)(a) | | | 136,380 | | | | 2,928,079 | |

Pier 1 Imports, Inc. | | | 231,050 | | | | 968,099 | |

RH(a) | | | 21,260 | | | | 1,495,003 | |

Sally Beauty Holdings, Inc.(a) | | | 81,970 | | | | 1,604,973 | |

Select Comfort Corp.(a) | | | 92,380 | | | | 2,868,399 | |

Williams-Sonoma, Inc. | | | 27,730 | | | | 1,382,618 | |

| | | | | | | | |

| | | | | | | 25,401,890 | |

| | | | | | | | |

| Textiles, Apparel & Luxury Goods–0.8% | | | | | |

Deckers Outdoor Corp.(a) | | | 26,930 | | | | 1,842,281 | |

Vera Bradley, Inc.(a) | | | 65,890 | | | | 580,491 | |

Wolverine World Wide, Inc. | | | 148,440 | | | | 4,282,494 | |

| | | | | | | | |

| | | | | | | 6,705,266 | |

| | | | | | | | |

| | | | | | | 118,428,088 | |

| | | | | | | | |

| | | | | | | | |

| |

| Real Estate–6.2% | |

| Equity Real Estate Investment Trusts (REITs)–5.6% | |

Ashford Hospitality Prime, Inc. | | | 52,800 | | | | 501,600 | |

CareTrust REIT, Inc. | | | 54,340 | | | | 1,034,634 | |

CBL & Associates Properties, Inc. | | | 171,940 | | | | 1,442,577 | |

Chesapeake Lodging Trust | | | 49,360 | | | | 1,331,239 | |

CoreCivic, Inc. | | | 64,360 | | | | 1,722,917 | |

CorEnergy Infrastructure Trust, Inc. | | | 45,690 | | | | 1,615,142 | |

Schedule of Investments (continued)

| | | | | | | | |

| | | |

| Company | | Shares | | | U.S. $ Value | |

| | | | | | | | |

Cousins Properties, Inc. | | | 229,010 | | | $ | 2,138,953 | |

Education Realty Trust, Inc. | | | 27,840 | | | | 1,000,291 | |

First Industrial Realty Trust, Inc. | | | 107,130 | | | | 3,223,542 | |

Gramercy Property Trust | | | 83,673 | | | | 2,531,108 | |

Independence Realty Trust, Inc. | | | 127,670 | | | | 1,298,404 | |

InfraREIT, Inc. | | | 126,550 | | | | 2,830,923 | |

iStar, Inc.(a) | | | 235,370 | | | | 2,777,366 | |

MedEquities Realty Trust, Inc. | | | 158,782 | | | | 1,865,689 | |

Medical Properties Trust, Inc. | | | 124,010 | | | | 1,628,251 | |

Monmouth Real Estate Investment Corp.–Class A | | | 83,465 | | | | 1,351,298 | |

National Health Investors, Inc. | | | 21,800 | | | | 1,684,922 | |

One Liberty Properties, Inc. | | | 39,930 | | | | 972,695 | |

Potlatch Corp. | | | 36,000 | | | | 1,836,000 | |

Preferred Apartment Communities, Inc.–Class A | | | 98,250 | | | | 1,854,960 | |

Ryman Hospitality Properties, Inc. | | | 45,660 | | | | 2,853,293 | |

Select Income REIT | | | 36,130 | | | | 846,165 | |

STAG Industrial, Inc. | | | 68,900 | | | | 1,892,683 | |

Summit Hotel Properties, Inc. | | | 129,550 | | | | 2,071,505 | |

Sunstone Hotel Investors, Inc. | | | 186,840 | | | | 3,002,519 | |

UMH Properties, Inc. | | | 107,040 | | | | 1,664,472 | |

Xenia Hotels & Resorts, Inc. | | | 131,680 | | | | 2,771,864 | |

| | | | | | | | |

| | | | | | | 49,745,012 | |

| | | | | | | | |

| Real Estate Management & Development–0.6% | |

HFF, Inc.–Class A | | | 50,030 | | | | 1,979,187 | |

RE/MAX Holdings, Inc.–Class A | | | 22,300 | | | | 1,417,165 | |

RMR Group, Inc. (The)–Class A | | | 32,570 | | | | 1,672,469 | |

| | | | | | | | |

| | | | | | | 5,068,821 | |

| | | | | | | | |

| | | | | | | 54,813,833 | |

| | | | | | | | |

| | | | | | | | |

| | | |

| Energy–4.5% | | | | | | | | |

| Energy Equipment & Services–1.1% | | | | | | | | |