UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-23100

BERNSTEIN FUND, INC.

(Exact name of registrant as specified in charter)

1345 Avenue of the Americas, New York, New York 10105

(Address of principal executive offices) (Zip code)

Joseph J. Mantineo

AllianceBernstein L.P.

1345 Avenue of the Americas

New York, New York 10105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 221-5672

Date of fiscal year end: September 30, 2018

Date of reporting period: September 30, 2018

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

BERNSTEIN FUND, INC.

Small Cap Core Portfolio

International Small Cap Portfolio

International Strategic Equities Portfolio

ANNUAL REPORT

SEPTEMBER 30, 2018

Table of Contents

Before investing in any portfolio of the Bernstein Fund, Inc., a prospective investor should consider carefully the portfolio’s investment objectives and policies, charges, expenses and risks. These and other matters of importance to prospective investors are contained in the portfolios’ prospectus, an additional copy of which may be obtained by visiting our website at www.Bernstein.com and clicking on “Investments”, then “Mutual Fund Information—Prospectuses, SAIs and Shareholder Reports” or by calling your financial advisor or by calling Bernstein’s mutual fund shareholder help line at 212.756.4097. Please read the prospectus carefully before investing.

For performance information current to the most recent month-end, please call (collect) 212.486.5800.

This shareholder report must be preceded or accompanied by the Bernstein Fund, Inc. prospectus for individuals who are not shareholders of the Fund.

You may obtain a description of the Fund’s proxy voting policies and procedures, and information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, without charge. Simply visit www.AllianceBernstein.com, or go to the Securities and Exchange Commission’s website at www.sec.gov, or call AllianceBernstein at 800.227.4618.

The Fund will file its complete schedule of portfolio holdings with the Commission for the first and third quarters of each fiscal year. The Fund’s portfolio holdings reports are available on the Commission’s website at www.sec.gov. The Fund’s portfolio holdings reports may also be reviewed and copied at the Commission’s Public Reference Room in Washington, D.C.; information on the operation of the Public Reference Room may be obtained by calling 800.SEC.0330.

Investment Products Offered: · Are Not FDIC Insured · May Lose Value · Are Not Bank Guaranteed

Portfolio Manager Commentary (Unaudited)

To Our Shareholders—November 15, 2018

On the following pages, you will find the 2018 annual report for the Portfolios (collectively, the “Portfolios”, and individually, a “Portfolio”) of the Bernstein Fund, Inc. (the “Fund”). The annual report covers the six- and 12-month periods ended September 30, 2018, and includes financial statements as well as notes to the financial statements, information about the recent performance of the Portfolios and a listing of each Portfolio’s holdings as of the period end.

Equity returns diverged during the 12 months ended September 30, 2018, with US stocks standing out relative to their non-US counterparts. The disparity in equity returns—which emerged mid-way through the period—was partly spurred by intensifying tariff issues. It also mirrored broader economic activity, as the US economy accelerated while non-US countries slowed, following a period when global growth had been unusually synchronized. Interest rates rose, exerting downward pressure on US taxable bond returns, though tax-exempt bond returns were slightly positive.

Several factors buoyed sentiment around US stocks: extremely strong corporate earnings growth, corporate tax cuts, deregulation and a benign inflation backdrop. In contrast, non-US equities were hampered by diverse regional concerns, such as: Italian budget deficits in Europe and significant, though idiosyncratic, economic strains in select markets like Turkey and Argentina. A rising US dollar, higher US interest rates, and heightened vulnerability to trade tensions further depressed non-US markets, especially emerging markets.

Despite this year’s patterns, we continue to expect global equity allocations to provide better risk-adjusted returns than US-only strategies, over the long run. With US equity valuations high, and potential pressures on earnings coming from higher wage and input costs, valuations in non-US markets look more attractive. Overall, we expect that slower economic growth in the years ahead will likely contribute to lower returns on global stocks than have been experienced in the past. In addition, we are likely to see a gradual increase in global interest rates, constraining bond returns.

If you have any questions about your investments in the Portfolios, please contact your Bernstein Advisor by calling 212.756.4097, or visit www.Bernstein.com. As always, we are firmly dedicated to your investment success. Thank you for your continued interest in the Portfolios.

Sincerely,

Kathleen M. Fisher

President

Bernstein Fund, Inc.

Small Cap Core Portfolio

Investment Objectives and Strategy

The Portfolio seeks to provide long-term growth of capital. The Portfolio invests, under normal circumstances, at least 80% of its net assets (plus any borrowings for investment purposes) in equity securities of small-capitalization companies or other securities or instruments with similar economic characteristics, including derivatives related to equity securities. Equity securities are primarily common stocks, although, for purposes of the 80% policy, equity securities may also include preferred stocks, warrants, convertible securities, sponsored or unsponsored American Depositary Receipts (“ADRs”) and Global Depositary Receipts (“GDRs”) and equity real estate investment trusts (“REITs”). You will be notified at least 60 days prior to any change to the Portfolio’s 80% investment policy.

AllianceBernstein L.P. serves as the Portfolio’s investment manager (the “Adviser”). The Adviser invests the assets of the Portfolio primarily in a diversified portfolio of equity securities of small-capitalization companies located in the US. The Portfolio defines small-capitalization companies as those that, at the time of investment, fall within the capitalization range between the smallest company in the Russell 2000 Index (“Russell 2000”) and the largest company in the Russell 2000. The market capitalization of the companies included in the Portfolio’s definition of “small-capitalization” companies changes over time as the capitalization of the securities included in the Russell 2000 changes.

The Adviser utilizes both quantitative analysis and fundamental research to determine which securities will be held by the Portfolio and to manage risk. The Adviser applies

(Portfolio Manager Commentary continued on next page)

Portfolio Manager Commentary (continued)

quantitative analysis to all of the securities in the Portfolio’s research universe, which is composed primarily of securities in the Portfolio’s benchmark. Those securities that score highly on this quantitative analysis are then screened to eliminate those securities that the Adviser is recommending against purchasing based on its fundamental research, and a portfolio is constructed from the remaining highly ranked securities based on diversification and risk considerations. In its quantitative analysis, the Adviser considers a number of metrics that have historically provided some indication of favorable future returns, including metrics relating to valuation, quality, investor behavior and corporate behavior. In general, stocks are purchased when, in the view of the Adviser, they provide the highest expected returns, considering their contribution to the estimated risk of the Portfolio’s existing investments. Typically, growth in the size of a company’s market capitalization relative to other domestically traded companies does not cause the Adviser to dispose of the security. The Adviser expects to seek to manage the overall portfolio volatility of the Portfolio relative to the Russell 2000 by favoring securities that offer the best balance between return and targeted risk.

The Portfolio may also invest in exchange-traded funds (“ETFs”) and other investment companies from time to time.

The Portfolio expects to utilize derivatives, such as options, futures contracts, forwards and swaps. For example, the Portfolio may use stock index futures contracts to equitize cash. Derivatives may provide a more efficient and economical exposure to market segments than direct investments, and may also be a more efficient way to alter the Portfolio’s exposure.

Investment Results

The table on page 9 shows the Portfolio’s performance compared to its benchmark, the Russell 2000 Index, for the six- and 12-month periods ended September 30, 2018. The table also includes the Portfolio’s peer group, as represented by the Lipper Small-Cap Core Funds Average (the “Lipper Average”). Funds in the Lipper Average have generally similar investment objectives to the Portfolio, although some of the funds may have different investment policies and sales and management fees and fund expenses.

The Portfolio underperformed the benchmark and outperformed the Lipper Average during both periods. Corporate earnings growth has been strong over the 12-month period, as the US economy continued to grow and benefit from tax cuts. Small-cap stocks delivered strong returns despite investor anxiety caused by the recent escalation in trade conflicts and the Portfolio participated in this rally.

The Portfolio maintains a long-term exposure to attractive valuation, high profitability and positive-sentiment stocks, which we believe should outperform over the long term. As the 12-month period progressed, growth stocks meaningfully outperformed their value peers. During both periods, the Portfolio’s exposure to value stocks was a significant detractor in this environment, whereas exposure to factors related to market sentiment contributed. An overweight in the materials sector, as well as value choices in automobiles and industrials detracted from performance, relative to the benchmark. An underweight to the real estate sector, in addition to stock selection in biotechnology, and the oil and gas space contributed.

The Portfolio utilized futures for investment purposes, which added to absolute performance for both periods.

International Small Cap Portfolio

Investment Objective and Strategy

The Portfolio seeks to provide long-term growth of capital. The Portfolio invests, under normal circumstances, at least 80% of its net assets (plus any borrowings for investment purposes) in equity securities of small-capitalization companies or other securities or instruments with similar economic characteristics, including derivatives related to equity securities. Equity securities are primarily common stocks, although, for purposes of the 80% policy, equity securities may also include preferred stocks, warrants, convertible securities, sponsored or unsponsored ADRs and GDRs and equity REITs. You will be notified at least 60 days prior to any change to the Portfolio’s 80% investment policy.

AllianceBernstein L.P. serves as the Portfolio’s Adviser. The Adviser invests the assets of the Portfolio primarily in a diversified portfolio of equity securities of small-capitalization companies located outside of the United States. Under normal circumstances, at least 65% of the Portfolio’s net assets are invested in companies located outside of the United States. The Portfolio defines small-capitalization companies as those that, at the time of investment, have market capitalizations within the market capitalization range of the Portfolio’s benchmark, the Morgan Stanley Capital International (“MSCI”) All Country World Index (“ACWI”) ex-USA Small Cap. The market capitalization of the companies included in the Portfolio’s definition of “small-capitalization” companies changes over time as the capitalization of the securities included in the MSCI ACWI ex-USA Small Cap changes.

The Portfolio’s exposure to non-US companies may change over time based on the Adviser’s assessment of market conditions and the investment merit of non-US issuers. Under

(Portfolio Manager Commentary continued on next page)

Portfolio Manager Commentary (continued)

normal circumstances, the Adviser invests in companies located in at least three countries other than the United States and, at times, may have exposure to issuers in several different countries. In determining a company’s location for purposes of the Portfolio’s investment policies and restrictions, the Adviser may consider: (1) the place of domicile, (2) where the company has an established presence and conducts its business and (3) where the company conducts a significant part of its economic activities. The Portfolio may invest in both developed and emerging-market countries and, at times, may invest significantly in emerging markets.

The Adviser seeks to identify attractive investment opportunities primarily through its fundamental investment research or quantitative analysis. In applying its fundamental research, the Adviser generally seeks to identify companies that possess both attractive valuation and compelling company- and/or industry-level investment catalysts. In applying its quantitative analysis, the Adviser typically considers a number of metrics that historically have provided some indication of favorable future returns, including metrics related to valuation, quality, investor behavior and corporate behavior. Utilizing these resources, the Adviser expects to allocate the Portfolio’s assets among issuers, industries and geographic locations to attempt to create a diversified portfolio of investments.

The Portfolio may invest in established companies and also in new and less-seasoned issuers. The Portfolio may also invest in ETFs and other investment companies from time to time.

The Portfolio expects to utilize derivatives, such as options, futures contracts, forwards and swaps. For example, the Portfolio may invest in currency derivatives as discussed below and in futures contracts to gain exposure to certain markets. Derivatives may provide a more efficient and economical exposure to market segments than direct investments, and may also be a more efficient way to alter the Portfolio’s exposure.

Fluctuations in currency exchange rates can have a dramatic impact on the returns of foreign equity securities. The Adviser may employ currency hedging strategies, including the use of currency-related derivatives, to seek to reduce currency risk in the Portfolio, but it is not required to do so. The Adviser may also take long and short positions in currencies or related derivatives for investment purposes, independent of any security positions. The Adviser may use stock index futures contracts to gain access to certain markets.

Investment Results

The table on page 9 shows the Portfolio’s performance compared to its benchmark, the MSCI ACWI ex-US Small Cap (net), for the six- and 12-month periods ended September 30, 2018. The table also includes the Portfolio’s peer group, as represented by the Lipper International Small/Mid-Cap Growth Funds Average. Funds in the Lipper Average have generally similar investment objectives to the Portfolio, although some of the funds may have different investment policies and sales and management fees and fund expenses.

For both periods, the Portfolio underperformed the benchmark and the Lipper Average. Relative performance was largely driven by stock selection in both periods, while country selection was positive and sector selection was largely neutral. For the 12-month period, positive stock selection in consumer staples, energy and financials was partially offset by weak stock selection in health care, information technology and industrials. An underweight in the strong-performing health care sector detracted from returns, as did an overweight position in China. The Chinese market was negatively affected by worries around the ongoing trade war between the US and China and a domestic slowdown; however, the Portfolio’s stock selection within China contributed strongly to returns.

For the six-month period, weak stock selection in the information technology, health care and materials sectors detracted from performance, while energy, financials and staples holdings again contributed. An underweight position in the strong-performing health care sector was a detractor, while an overweight to energy contributed as oil prices rose. An overweight in China detracted from returns, but stock selection within China contributed, while stock selection within Germany and Australia negatively affected performance.

The Portfolio utilized currency forwards for hedging purposes, which detracted from absolute performance for both periods.

International Strategic Equities Portfolio

Investment Objective and Strategy

The Portfolio seeks to provide long-term growth of capital. The Portfolio invests, under normal circumstances, at least 80% of its net assets (plus any borrowings for investment purposes) in equity securities or other securities or instruments with similar economic characteristics, including derivatives related to equity securities. Equity securities are primarily common stocks, although, for

(Portfolio Manager Commentary continued on next page)

Portfolio Manager Commentary (continued)

purposes of the 80% policy, equity securities may also include preferred stocks, warrants, convertible securities, sponsored or unsponsored ADRs and GDRs and equity REITs. You will be notified at least 60 days prior to any change to the Portfolio’s 80% investment policy.

AllianceBernstein L.P. serves as the Portfolio’s Adviser. The Adviser invests the assets of the Portfolio primarily (under normal circumstances, at least 65% of net assets) in equity securities of issuers in countries that make up the MSCI ACWI ex-US, which includes both developed and emerging-market countries. The Portfolio focuses on securities of large-cap and mid-cap companies. The Adviser expects to allocate fund assets among issuers in many foreign countries, but not necessarily in the same proportion that the countries are represented in the MSCI ACWI ex-US and may invest in issuers in countries outside of the MSCI ACWI ex-US. The Portfolio’s exposure among non-US countries may change over time based on the Adviser’s assessment of market conditions and the investment merit of particular non-US issuers. Under normal circumstances, the Adviser invests in companies located in at least three countries other than the United States and expects to have exposure to issuers in several different countries. In determining a company’s location for purposes of the Portfolio’s investment policies and restrictions, the Adviser may consider: (1) the place of domicile, (2) where the company has an established presence and conducts its business and (3) where the company conducts a significant part of its economic activities. The Portfolio may, at times, invest significantly in emerging markets.

The Adviser utilizes both fundamental and quantitative research to both determine which securities will be held by the Portfolio and to manage risk. Specifically, the Portfolio’s management team uses the universe of securities selected by the Adviser’s various fundamental investment teams focusing on international equity securities, and applies its quantitative analysis to these securities. In applying its quantitative analysis, the Adviser considers a number of metrics that have historically provided some indication of favorable future returns, including metrics relating to valuation, quality, investor behavior and corporate behavior. Utilizing these resources, the Adviser expects to allocate the Portfolio’s assets among issuers, industries and geographic locations to attempt to create a diversified portfolio of investments.

The Portfolio may also invest in ETFs and other investment companies from time to time.

The Portfolio expects to utilize derivatives, such as options, futures contracts, forwards and swaps. For example, the Portfolio may invest in currency derivatives as discussed below and in futures contracts to gain exposure to certain markets. Derivatives may provide a more efficient and economical exposure to market segments than direct investments, and may also be a more efficient way to alter the Portfolio’s exposure.

Fluctuations in currency exchange rates can have a dramatic impact on the returns of foreign equity securities. The Adviser may employ currency hedging strategies, including the use of currency-related derivatives, to seek to reduce currency risk in the Portfolio, but it is not required to do so. The Adviser may also take long and short positions in currencies or related derivatives for investment purposes, independent of any security positions. The Adviser may use stock index futures contracts to gain access to certain markets.

Investment Results

The table on page 9 shows the Portfolio’s performance compared to its benchmark, the MSCI ACWI ex-US (net), for the six- and 12-month periods ended September 30, 2018. The table also includes the Portfolio’s peer group, as represented by the Lipper International Multi-Cap Growth Funds Average. Funds in the Lipper Average have generally similar investment objectives to the Portfolio, although some of the funds may have different investment policies and sales and management fees and fund expenses.

The Portfolio underperformed the benchmark and the Lipper Average for both periods. International equity markets delivered low single-digit returns over the 12-month period; for the one-year period ended September 30, 2018, the MSCI ACWI (net) returned 1.76%, but over the six-month period, it fell 1.93%. The decline was seen across many developed and emerging countries, but several emerging markets—namely Turkey, Argentina and South Africa—were particularly weak.

For the 12-month period, security selection contributed to relative returns, while country selection was neutral. An overweight to Brazil, and underweights to Turkey and Peru detracted the most, while an overweight in Norway, and underweights in South Africa and Germany contributed. Stock selection in consumer staples, financials and information technology added to performance; selection in materials, real estate and industrials detracted. Currency contributions from the US dollar were more than offset by the negative impact from a currency overweight to Russia and Brazil.

(Portfolio Manager Commentary continued on next page)

Portfolio Manager Commentary (continued)

Over the six-month period, stock selection detracted from performance, particularly in real estate, industrials and financials, while consumer discretionary holdings contributed. Country selection also detracted, led by Brazil, the UK and China. Underweights in South Korea and South Africa positively impacted performance. Contributions from the US dollar were offset by currencies in China, Brazil and Russia.

During both periods, the Portfolio utilized futures and currency forwards for hedging purposes; futures had no material impact on absolute returns, and currency forwards detracted. Currency forwards are used to reduce the level of currency risk, which was achieved.

Disclosures and Risks (Unaudited)

Benchmark Disclosures

None of the following indices or averages reflects fees and expenses associated with the active management of a mutual fund portfolio. The Russell 2000® Index measures the performance of the small-cap segment of the US equity universe. The MSCI ACWI ex-USA Small Cap (net) measures the performance of the small-cap market segment across 22 of 23 developed markets (excluding the US) and 24 emerging-market countries. The MSCI ACWI ex-US (net, free float-adjusted, market capitalization weighted) represents the equity market performance of developed and emerging markets, excluding the United States. MSCI makes no express or implied warranties or representations, and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices, any securities or financial products. This report is not approved, reviewed or produced by MSCI. Net returns include the reinvestment of dividends after deduction of non-US withholding tax. Investors cannot invest directly in an index, and their results are not indicative of the performance for any specific investment, including the Portfolios.

A Word About Risk

All Portfolios:

The share price of the Portfolios will fluctuate and you may lose money. There is no guarantee that the Portfolios will achieve their investment objectives.

Market Risk: The Portfolios are subject to market risk, which is the risk that stock prices in general may decline over short or extended periods. Stock prices may decline in response to adverse changes in the economy or the economic outlook; deterioration in investor sentiment; interest-rate, currency and commodity price fluctuations; adverse geopolitical, social or environmental developments; issuer- and sector-specific considerations; and other factors. In the past decade, financial markets in the United States, Europe and elsewhere have experienced increased volatility, decreased liquidity and heightened uncertainty. These market conditions may recur from time to time and have an adverse impact on various securities markets. The US government and the Federal Reserve, as well as certain foreign governments and central banks, have taken steps to support financial markets. Other governments have tried to support markets by buying stocks and through other market interventions. Government intervention may not work as intended, particularly if the efforts are perceived by investors as being unlikely to achieve the desired results. The Federal Reserve has reduced its market support activities and has begun raising interest rates. Further Federal Reserve or other US or non-US governmental or central bank actions, including interest-rate increases or decreases, could negatively affect financial markets generally, increase market volatility and reduce the value and liquidity of securities in which the Portfolios invest.

Current political uncertainty surrounding the European Union (“EU”) and its membership may increase market volatility. The United Kingdom has voted to withdraw from the EU, and one or more other countries may withdraw from the EU and/or abandon the Euro, the common currency of the EU. The financial instability of some countries in the EU, together with the risk of that financial instability impacting other more stable countries, may increase the risk of investing in companies in Europe and worldwide. In addition, policy and legislative changes in the United States and in other countries are affecting many aspects of financial regulation, and may in some instances contribute to decreased liquidity and increased volatility in the financial markets. The impact of these changes, and the practical implications for market participants, may not be fully known for some time.

Economies and financial markets throughout the world are becoming increasingly interconnected. Economic, financial or political events, trading and tariff arrangements, terrorism, natural disasters and other circumstances in one country or region could have profound impacts on global economies or markets. As a result, whether or not the Portfolios invest in securities of issuers located in or with significant exposure to countries experiencing economic and financial difficulties, the value and liquidity of the Portfolios’ investments may be negatively affected.

Liquidity Risk: Liquidity risk exists when particular investments are difficult to purchase or sell, possibly preventing the Portfolios from selling out of these illiquid securities at an advantageous price. Illiquid securities may also be difficult to value. Derivatives and securities involving substantial market and credit risk tend to involve greater liquidity risk.

Redemption Risk: The Portfolios may experience heavy redemptions that could cause the Portfolios to liquidate their assets at inopportune times or at a loss or depressed value, which could cause the value of your investment to decline. Redemption risk is heightened during periods of overall market turmoil.

(Disclosures and Risks continued on next page)

Disclosures and Risks (continued)

Sector Risk: The Portfolios may have more risk because of concentrated investments in a particular market sector, such as the technology or financial services sector. Market or economic factors affecting that sector could have a major effect on the value of the Portfolios’ investments.

Capitalization Risk: Investments in small- and mid-capitalization companies may be more volatile than investments in large-capitalization companies. Investments in small- and mid-capitalization companies may have additional risks because these companies may have limited product lines, markets or financial resources.

Allocation Risk: The Portfolios may seek to focus on different investment disciplines or factors at different times as a means to achieve their investment objectives. In the event that the investment disciplines or factors to which the Portfolios have greater exposure perform worse than the investment disciplines or factors with less exposure, the Portfolios’ returns may be negatively affected.

Derivatives Risk: The Portfolios may use derivatives in currency hedging as well as for direct investments to gain access to certain markets, earn income, enhance return and broaden portfolio diversification, which entail greater risk than if used solely for hedging purposes. In addition to other risks such as the credit risk of the counterparty, derivatives involve the risk that changes in the value of the derivative may not correlate with relevant assets, rates or indices. Derivatives may be illiquid and difficult to price or unwind, and small changes may produce disproportionate losses for the Portfolios. Certain derivatives have the potential for unlimited loss, regardless of the size of the initial investment. Assets required to be set aside or posted to cover or secure derivatives positions may themselves go down in value, and these collateral and other requirements may limit investment flexibility. Some derivatives involve leverage, which can make the Portfolios more volatile and can compound other risks. The US government and foreign governments have been adopting and implementing regulations governing derivatives markets, including mandatory clearing of certain derivatives, margin, reporting and registration requirements. The ultimate impact of the regulations remains unclear. Additional regulation may make derivatives more costly, limit their availability or utility, otherwise adversely affect their performance, or disrupt markets.

Management Risk: The Portfolios are subject to management risk because they are actively managed investment portfolios. The Adviser will apply its investment techniques and risk analyses in making investment decisions for the Portfolios, but these techniques, analyses and decisions may not work as intended or may not produce the desired results. In some cases, derivatives and other investment techniques may be unavailable or the Adviser may determine not to use them, possibly even under market conditions where their use could benefit the Portfolios. In addition, the Adviser may change the Portfolios’ investment strategies or policies from time to time. Those changes may not lead to the results intended by the Adviser and could have an adverse effect on the Adviser and could have an adverse effect on the value or performance of the Portfolios.

REIT Risk: Investing in REITs involves certain unique risks in addition to those risks associated with investing in the real estate industry in general. Equity REITs may be affected by changes in the value of the underlying property owned by the REITs, while mortgage REITs may be affected by the quality of any credit extended. REITs are dependent upon management skills, are not diversified, and are subject to heavy cash flow dependency, default by borrowers and self-liquidation. Investing in REITs also involves risks similar to those associated with investing in small-capitalization companies. REITs may have limited financial resources, may trade less frequently and in a limited volume and may be subject to more abrupt or erratic price movements than larger company securities.

Investment in Other Investment Companies Risk: As with other investments, investments in other investment companies, including other registered funds advised by the Adviser and ETFs, are subject to market and selection risk. In addition, if the Portfolios acquire shares of investment companies, shareholders bear both their proportionate share of expenses in the Portfolios (including management and advisory fees) and, indirectly, the expenses of the investment companies.

International Strategic Equities and International Small Cap Portfolios

Foreign (Non-US) Securities Risk: Investments in foreign securities entail significant risks in addition to those customarily associated with investing in US securities. These risks include risks related to adverse market, economic, political and regulatory factors and social instability, all of which could disrupt the financial markets in which the Portfolios invest and adversely affect the value of the Portfolios’ assets.

(Disclosures and Risks continued on next page)

Disclosures and Risks (continued)

Country Concentration Risk: The Portfolios may not always be diversified among countries or regions and the effect on the share price of the Portfolios of specific risks such as political, regulatory and currency may be magnified due to concentration of the Portfolios’ investments in a particular country or region.

Emerging-Markets Securities Risk: The risks of investing in foreign (non-US) securities are heightened with respect to issuers in emerging-market countries because the markets are less developed and less liquid and there may be a greater amount of economic, political and social uncertainty, and these risks are even more pronounced in “frontier” markets, which are investable markets with lower total market capitalization and liquidity than the more developed emerging markets. In addition, the value of the Portfolios’ investments may decline because of factors such as unfavorable or unsuccessful government actions and reduction of government or central bank support.

Foreign Currency Risk: This is the risk that changes in foreign (non-US) currency exchange rates may negatively affect the value of the Portfolios’ investments or reduce the returns of the Portfolios. For example, the value of the Portfolios’ investments in foreign securities and foreign currency positions may decrease if the US dollar is strong (i.e., gaining value relative to other currencies) and other currencies are weak (i.e., losing value relative to the US dollar).

Actions by a Few Major Investors: In certain countries, volatility may be heightened by actions of a few major investors. For example, substantial increases or decreases in cash flows of mutual funds investing in these markets could significantly affect local stock prices and, therefore, share prices of the Portfolios.

These risks are discussed in further detail in the Portfolios’ prospectus.

An Important Note About Historical Performance

The performance shown on the following pages represents past performance and does not guarantee future results. Performance information is as of the dates shown. Current performance may be lower or higher than the performance information shown. You may obtain performance information current to the most recent month-end by calling 212.756.4097. The investment return and principal value of an investment in the Portfolios will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost.

Investors should consider the investment objectives, risks, charges and expenses of the Portfolios carefully before investing. For copies of our prospectus or summary prospectus, which contain this and other information, visit www.Bernstein.com, click on “Investments”, then “Mutual Fund Information—Prospectuses, SAIs and Shareholder Reports”, or call Bernstein’s mutual fund shareholder help line at 212.756.4097 or contact your Bernstein Advisor. Please read the prospectus and/or summary prospectus carefully before investing.

Historical Performance (Unaudited)

Bernstein Fund Portfolios vs. Their Benchmarks and Lipper Averages

| | | | | | | | | | | | | | | | |

| | | TOTAL RETURNS | | | AVERAGE ANNUAL TOTAL RETURNS | | | | |

| THROUGH SEPTEMBER 30, 2018 | | PAST SIX

MONTHS | | | PAST 12

MONTHS | | | SINCE

INCEPTION | | | INCEPTION DATE | |

Small Cap Core Portfolio1 | | | | | | | | | | | | 12/29/2015 | |

SCB Class Shares | | | 9.30 | % | | | 12.44 | % | | | 12.25 | % | | | | |

Advisor Class Shares | | | 9.45 | | | | 12.64 | | | | 12.51 | | | | | |

Class Z Shares | | | 9.46 | | | | 12.69 | | | | 12.51 | | | | | |

Russell 2000 Index | | | 11.61 | | | | 15.24 | | | | 16.35 | | | | | |

Lipper Small-Cap Core Funds Average | | | 9.16 | | | | 11.97 | | | | 14.13 | | | | | |

| | | | | | | | | | | | | | | | | |

International Small Cap Portfolio2 | | | | | | | | | | | | 12/21/2015 | |

SCB Class Shares | | | -5.13 | | | | 1.29 | | | | 10.49 | | | | | |

Advisor Class Shares | | | -5.04 | | | | 1.53 | | | | 10.70 | | | | | |

Class Z Shares | | | -5.04 | | | | 1.54 | | | | 10.70 | | | | | |

MSCI ACWI ex-USA Small Cap (net) | | | -4.07 | | | | 1.86 | | | | 10.95 | | | | | |

Lipper International Small/Mid-Cap Growth Funds Average | | | -3.41 | | | | 3.15 | | | | 10.53 | | | | | |

| | | | | | | | | | | | | | | | | |

International Strategic Equities Portfolio3 | | | | | | | | | | | | 12/21/2015 | |

SCB Class Shares | | | -5.32 | | | | 0.86 | | | | 9.94 | | | | | |

Advisor Class Shares | | | -5.16 | | | | 1.18 | | | | 10.19 | | | | | |

Class Z Shares | | | -5.16 | | | | 1.18 | | | | 10.22 | | | | | |

MSCI ACWI ex-US (net) | | | -1.93 | | | | 1.76 | | | | 10.18 | | | | | |

Lipper International Multi-Cap Growth Funds Average | | | -1.49 | | | | 2.90 | | | | 9.24 | | | | | |

| 1 | | The current prospectus table shows the total annual operating expense ratios for the Portfolio as 1.18%, 0.92% and 0.93% for SCB Class, Advisor Class and Class Z shares, respectively, gross of any fee waivers or expense reimbursements. The Financial Highlights section of this report sets forth expense ratio data for the current reporting period; the expense ratios shown above may differ from the expense ratios in the Financial Highlights section since they are based on different time periods. |

| 2 | | The current prospectus table shows the total annual operating expense ratios for the Portfolio as 1.36%, 1.11% and 1.11% for SCB Class, Advisor Class and Class Z shares, respectively, gross of any fee waivers or expense reimbursements. Contractual fee waivers and/or expense reimbursements limit the Portfolio’s annual operating expense ratios exclusive of acquired fund fees and expenses other than the advisory fees of any registered funds advised by the Adviser in which the Portfolio may invest, interest expense, taxes, extraordinary expenses, and brokerage commissions and other transaction costs to 1.35%, 1.10% and 1.10% for SCB Class, Advisor Class and Class Z shares, respectively. These waivers may not be terminated prior to January 26, 2019. Any fees waived and expenses borne by the Adviser may be reimbursed by the Portfolio until the end of the third fiscal year after the fiscal period in which the fee was waived or the expense was borne, provided that no reimbursement payment will be made that would cause the Portfolio’s total annual operating expenses to exceed the expense limitations. Absent reimbursements or waivers, performance would have been lower. The Financial Highlights section of this report sets forth expense ratio data for the current reporting period; the expense ratios shown above may differ from the expense ratios in the Financial Highlights section since they are based on different time periods. |

| 3 | | The current prospectus table shows the total annual operating expense ratios for the Portfolio as 1.09%, 0.84% and 0.86% for SCB Class, Advisor Class and Class Z shares, respectively, gross of any fee waivers or expense reimbursements. The Financial Highlights section of this report sets forth expense ratio data for the current reporting period; the expense ratios shown above may differ from the expense ratios in the Financial Highlights section since they are based on different time periods. |

See Disclosures, Risks and Note about Historical Performance on pages 6–8.

(Historical Performance continued on next page)

Historical Performance (continued from previous page)

|

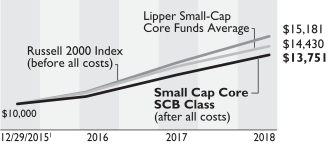

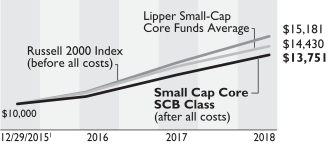

| Small Cap Core—SCB Class Shares |

Growth of a $10,000 Investment in the Portfolio |

|

|

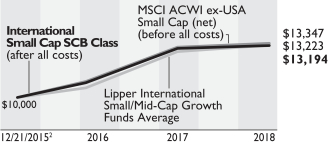

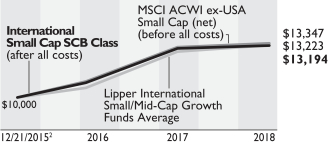

| International Small Cap—SCB Class Shares |

Growth of a $10,000 Investment in the Portfolio |

|

|

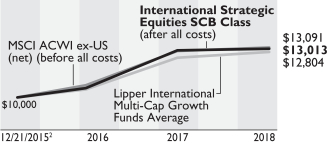

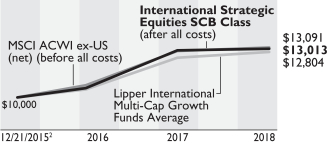

| International Strategic Equities—SCB Class Shares |

Growth of a $10,000 Investment in the Portfolio |

|

| | | Past performance is no guarantee of future results and an investment in the Portfolios could lose value. Each chart illustrates the total value of an assumed $10,000 investment as compared to the performance of each Portfolio’s respective benchmark and Lipper Average for the period since inception through September 30, 2018. |

| 1 | | Inception date: 12/29/2015. |

| 2 | | Inception date: 12/21/2015. |

See Disclosures, Risks and Note about Historical Performance on pages 6–8.

Expense Example—September 30, 2018 (Unaudited)

As a shareholder of a Portfolio, you incur various ongoing costs, including management fees and other Portfolio expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Portfolio and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period as indicated below.

Actual Expenses—The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes—The second line of the table below provides information about hypothetical account values and hypothetical expenses based on a Portfolio’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Portfolio and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), or contingent deferred sales charges on redemptions. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | | | | | | | |

| SMALL CAP CORE PORTFOLIO | | BEGINNING

ACCOUNT VALUE

APRIL 1, 2018 | | | ENDING

ACCOUNT VALUE

SEPTEMBER 30, 2018 | | | EXPENSES

PAID DURING

PERIOD* | | | ANNUALIZED

EXPENSE

RATIO* | | | | | | | |

SCB Class | | | | | | | | | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 1,093.00 | | | $ | 5.98 | | | | 1.14 | % | | | | | | | | |

Hypothetical** | | $ | 1,000 | | | $ | 1,019.35 | | | $ | 5.77 | | | | 1.14 | % | | | | | | | | |

Advisor Class | | | | | | | | | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 1,094.50 | | | $ | 4.67 | | | | 0.89 | % | | | | | | | | |

Hypothetical** | | $ | 1,000 | | | $ | 1,020.61 | | | $ | 4.51 | | | | 0.89 | % | | | | | | | | |

Class Z | | | | | | | | | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 1,094.60 | | | $ | 4.57 | | | | 0.87 | % | | | | | | | | |

Hypothetical** | | $ | 1,000 | | | $ | 1,020.71 | | | $ | 4.41 | | | | 0.87 | % | | | | | | | | |

| | | | | | | | | |

| | | | | | |

| INTERNATIONAL SMALL CAP PORTFOLIO | | BEGINNING

ACCOUNT VALUE

APRIL 1, 2018 | | | ENDING

ACCOUNT VALUE

SEPTEMBER 30, 2018 | | | EXPENSES

PAID DURING

PERIOD* | | | ANNUALIZED

EXPENSE

RATIO* | | | TOTAL

EXPENSES PAID

DURING PERIOD+ | | | TOTAL

ANNUALIZED

EXPENSE RATIO+ | |

SCB Class | | | | | | | | | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 948.70 | | | $ | 6.55 | | | | 1.34 | % | | $ | 6.59 | | | | 1.35 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,018.35 | | | $ | 6.78 | | | | 1.34 | % | | $ | 6.83 | | | | 1.35 | % |

Advisor Class | | | | | | | | | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 949.60 | | | $ | 5.33 | | | | 1.09 | % | | $ | 5.38 | | | | 1.10 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,019.60 | | | $ | 5.52 | | | | 1.09 | % | | $ | 5.57 | | | | 1.10 | % |

Class Z | | | | | | | | | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 949.60 | | | $ | 5.33 | | | | 1.09 | % | | $ | 5.38 | | | | 1.10 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,019.60 | | | $ | 5.52 | | | | 1.09 | % | | $ | 5.57 | | | | 1.10 | % |

| |

| | | | | | |

| INTERNATIONAL STRATEGIC EQUITIES PORTFOLIO | | BEGINNING

ACCOUNT VALUE

APRIL 1, 2018 | | | ENDING

ACCOUNT VALUE

SEPTEMBER 30, 2018 | | | EXPENSES

PAID DURING

PERIOD* | | | ANNUALIZED

EXPENSE

RATIO* | | | | | | | |

SCB Class | | | | | | | | | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 946.80 | | | $ | 4.88 | | | | 1.00 | % | | | | | | | | |

Hypothetical** | | $ | 1,000 | | | $ | 1,020.05 | | | $ | 5.06 | | | | 1.00 | % | | | | | | | | |

Advisor Class | | | | | | | | | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 948.40 | | | $ | 3.66 | | | | 0.75 | % | | | | | | | | |

Hypothetical** | | $ | 1,000 | | | $ | 1,021.31 | | | $ | 3.80 | | | | 0.75 | % | | | | | | | | |

Class Z | | | | | | | | | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 948.40 | | | $ | 3.71 | | | | 0.76 | % | | | | | | | | |

Hypothetical** | | $ | 1,000 | | | $ | 1,021.26 | | | $ | 3.85 | | | | 0.76 | % | | | | | | | | |

| | | | | | | | | |

| * | | Expenses are equal to the classes’ annualized expense ratios, multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period). |

| ** | | Assumes 5% annual return before expenses. |

| + | | In connection with the Portfolios’ investments in affiliated/unaffiliated underlying portfolios, the Portfolios incur no direct expenses, but bear proportionate shares of the fees and expenses (i.e., operating, administrative and investment advisory fees) of the affiliated/unaffiliated underlying portfolios. The Adviser has contractually agreed to waive its fees from the Portfolios in an amount equal to the Portfolios’ pro rata share of certain acquired fund fees and expenses of the affiliated underlying portfolios. The Portfolios’ total expenses are equal to the classes’ annualized expense ratio plus the Portfolio’s pro rata share of the weighted average expense ratio of the affiliated/unaffiliated underlying portfolios in which it invests, multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period). |

Portfolio Summary—September 30, 2018 (Unaudited)

| | | | | | |

| Small Cap Core Portfolio | | | |

| Sector Breakdown1 | | | |

Financials | | | 17.5% | | | |

Health Care | | | 16.7% | | | |

Consumer Discretionary | | | 14.7% | | | |

Industrials | | | 14.0% | | | |

Information Technology | | | 13.4% | | | |

Real Estate | | | 6.6% | | | |

Energy | | | 5.5% | | | |

Materials | | | 4.8% | | | |

Consumer Staples | | | 3.0% | | | |

Utilities | | | 2.6% | | | |

Communication Services | | | 1.2% | | | |

| | | | | | |

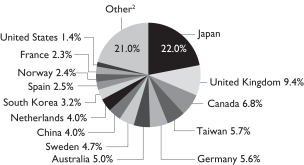

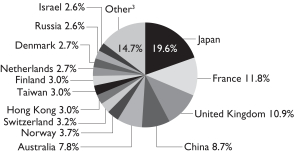

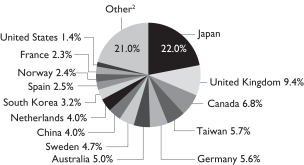

| International Small Cap Portfolio |

| Sector Breakdown1 | | | Country Breakdown1 |

Industrials | | | 22.6 | % | |

|

Consumer Discretionary | | | 12.2 | % |

Information Technology | | | 11.5 | % |

Financials | | | 10.4 | % |

Consumer Staples | | | 9.9 | % |

Materials | | | 7.6 | % |

Energy | | | 6.8 | % |

Health Care | | | 6.6 | % |

Real Estate | | | 6.2 | % |

Communication Services | | | 4.2 | % |

Utilities | | | 1.9 | % |

Funds and Investment Trusts | | | 0.1 | % |

| | | | | | |

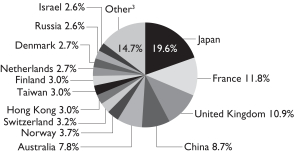

| International Strategic Equities Portfolio |

| Sector Breakdown1 | | | Country Breakdown1 |

Financials | | | 17.7 | % | |

|

Consumer Discretionary | | | 16.9 | % |

Information Technology | | | 10.7 | % |

Energy | | | 10.6 | % |

Health Care | | | 10.5 | % |

Industrials | | | 9.1 | % |

Consumer Staples | | | 8.5 | % |

Communication Services | | | 7.1 | % |

Materials | | | 4.1 | % |

Real Estate | | | 3.1 | % |

Utilities | | | 1.7 | % |

| 1 | | All data are as of September 30, 2018. The Portfolio’s country and sector breakdowns are expressed as a percentage of each Portfolio’s long-term investments and may vary over time. Each Portfolio may also invest in other financial instruments, including derivative instruments, which provide investment exposure to a variety of asset classes (see “Schedule of Investments” section of the Small Cap Core, International Small Cap and International Strategic Equities Portfolios). |

| 2 | | “Other” represents 10.3% in MSCI EM Index countries, 10.4% in MSCI EAFE Index countries and 0.3% in other emerging-market countries. |

| 3 | | “Other” represents 4.2% in MSCI EM Index countries, 6.9% in MSCI EAFE Index countries and 3.6% in other emerging-market countries. |

| | | Please note: The sector classifications presented herein are based on the Global Industry Classification Standard (GICS) which was developed by Morgan Stanley Capital International and Standard & Poor’s. The components are divided into sector, industry group, and industry sub-indices as classified by the GICS for each of the market capitalization indices in the broad market. These sector classifications are broadly defined. The “Schedule of Investments” section of the report reflects more specific industry information and is consistent with the investment restrictions discussed in the Portfolio’s prospectus. |

Schedule of Investments

Bernstein Fund, Inc.

Schedule of Investments

Small Cap Core Portfolio

September 30, 2018

| | | | | | | | |

| Company | | Shares | | | U.S. $ Value | |

| COMMON STOCKS–99.1% | | | | | |

| Financials–17.3% | |

| Banks–8.3% | | | | | | | | |

1st Source Corp. | | | 28,510 | | | $ | 1,500,196 | |

Bank of NT Butterfield & Son Ltd. (The) | | | 121,330 | | | | 6,292,174 | |

Cathay General Bancorp | | | 135,400 | | | | 5,610,976 | |

Community Trust Bancorp, Inc. | | | 49,860 | | | | 2,311,011 | |

Eagle Bancorp, Inc.(a) | | | 78,320 | | | | 3,962,992 | |

Enterprise Financial Services Corp. | | | 19,650 | | | | 1,042,433 | |

FCB Financial Holdings, Inc.–Class A(a) | | | 65,850 | | | | 3,121,290 | |

Fidelity Southern Corp. | | | 28,980 | | | | 718,124 | |

First Citizens BancShares, Inc./NC–Class A | | | 9,180 | | | | 4,151,930 | |

First Financial Corp./IN | | | 49,810 | | | | 2,500,462 | |

Great Southern Bancorp, Inc. | | | 41,730 | | | | 2,309,755 | |

Great Western Bancorp, Inc. | | | 125,570 | | | | 5,297,798 | |

Guaranty Bancorp | | | 34,300 | | | | 1,018,710 | |

Hancock Whitney Corp. | | | 106,620 | | | | 5,069,781 | |

Hanmi Financial Corp. | | | 99,610 | | | | 2,480,289 | |

Hope Bancorp, Inc. | | | 83,770 | | | | 1,354,561 | |

International Bancshares Corp. | | | 105,680 | | | | 4,755,600 | |

Republic Bancorp, Inc./KY–Class A | | | 62,300 | | | | 2,872,030 | |

S&T Bancorp, Inc. | | | 50,160 | | | | 2,174,938 | |

State Bank Financial Corp. | | | 63,170 | | | | 1,906,471 | |

Synovus Financial Corp. | | | 70,930 | | | | 3,247,885 | |

TCF Financial Corp. | | | 127,000 | | | | 3,023,870 | |

Texas Capital Bancshares, Inc.(a) | | | 39,530 | | | | 3,267,154 | |

Umpqua Holdings Corp. | | | 159,300 | | | | 3,313,440 | |

Western Alliance Bancorp(a) | | | 73,140 | | | | 4,160,935 | |

Wintrust Financial Corp. | | | 41,720 | | | | 3,543,697 | |

| | | | | | | | |

| | | | | | | 81,008,502 | |

| | | | | | | | |

| Capital Markets–1.1% | | | | | | | | |

Blucora, Inc.(a) | | | 39,210 | | | | 1,578,203 | |

Evercore, Inc.–Class A | | | 24,710 | | | | 2,484,591 | |

Houlihan Lokey, Inc. | | | 62,540 | | | | 2,809,922 | |

Stifel Financial Corp. | | | 30,140 | | | | 1,544,976 | |

Waddell & Reed Financial, Inc.–Class A | | | 95,900 | | | | 2,031,162 | |

| | | | | | | | |

| | | | | | | 10,448,854 | |

| | | | | | | | |

| Consumer Finance–1.1% | | | | | | | | |

Encore Capital Group, Inc.(a) | | | 48,980 | | | | 1,755,933 | |

Green Dot Corp.–Class A(a) | | | 58,290 | | | | 5,177,318 | |

Nelnet, Inc.–Class A | | | 56,790 | | | | 3,246,684 | |

| | | | | | | | |

| | | | | | | 10,179,935 | |

| | | | | | | | |

| Diversified Financial Services–0.3% | | | | | | | | |

FGL Holdings(a) | | | 225,790 | | | | 2,020,820 | |

Texas Pacific Land Trust | | | 1,380 | | | | 1,190,333 | |

| | | | | | | | |

| | | | | | | 3,211,153 | |

| | | | | | | | |

| Insurance–3.6% | | | | | | | | |

Ambac Financial Group, Inc.(a) | | | 102,920 | | | | 2,101,626 | |

American Equity Investment Life Holding Co. | | | 121,884 | | | | 4,309,818 | |

Assured Guaranty Ltd. | | | 121,590 | | | $ | 5,134,746 | |

CNO Financial Group, Inc. | | | 218,870 | | | | 4,644,421 | |

Employers Holdings, Inc. | | | 34,140 | | | | 1,546,542 | |

First American Financial Corp. | | | 60,090 | | | | 3,100,043 | |

Genworth Financial, Inc.–Class A(a) | | | 499,650 | | | | 2,083,541 | |

Heritage Insurance Holdings, Inc. | | | 84,400 | | | | 1,250,808 | |

National Western Life Group, Inc.–Class A | | | 8,070 | | | | 2,575,944 | |

Primerica, Inc. | | | 24,270 | | | | 2,925,749 | |

Third Point Reinsurance Ltd.(a) | | | 105,660 | | | | 1,373,580 | |

Universal Insurance Holdings, Inc. | | | 89,220 | | | | 4,331,631 | |

| | | | | | | | |

| | | | | | | 35,378,449 | |

| | | | | | | | |

| Mortgage Real Estate Investment Trusts (REITs)–0.3% | |

AG Mortgage Investment Trust, Inc. | | | 100,900 | | | | 1,834,362 | |

PennyMac Mortgage Investment Trust | | | 55,170 | | | | 1,116,641 | |

| | | | | | | | |

| | | | | | | 2,951,003 | |

| | | | | | | | |

| Thrifts & Mortgage Finance–2.6% | | | | | | | | |

Axos Financial, Inc.(a) | | | 63,440 | | | | 2,181,702 | |

BankUnited, Inc. | | | 76,150 | | | | 2,695,710 | |

Essent Group Ltd.(a) | | | 129,780 | | | | 5,742,765 | |

Federal Agricultural Mortgage Corp.–Class C | | | 11,530 | | | | 832,235 | |

MGIC Investment Corp.(a) | | | 600,600 | | | | 7,993,986 | |

NMI Holdings, Inc.–Class A(a) | | | 93,310 | | | | 2,113,471 | |

Walker & Dunlop, Inc. | | | 75,450 | | | | 3,989,796 | |

| | | | | | | | |

| | | | | | | 25,549,665 | |

| | | | | | | | |

| | | | | | | 168,727,561 | |

| | | | | | | | |

| | | | | | | | |

| | | |

| Health Care–16.5% | | | | | | | | |

| Biotechnology–5.4% | | | | | | | | |

Adamas Pharmaceuticals, Inc.(a) | | | 30,490 | | | | 610,410 | |

Aimmune Therapeutics, Inc.(a) | | | 51,080 | | | | 1,393,462 | |

Array BioPharma, Inc.(a) | | | 148,120 | | | | 2,251,424 | |

Ascendis Pharma A/S (Sponsored ADR)(a) | | | 14,200 | | | | 1,006,212 | |

Audentes Therapeutics, Inc.(a) | | | 45,140 | | | | 1,787,093 | |

BeiGene Ltd. (Sponsored ADR)(a) | | | 4,980 | | | | 857,656 | |

Biohaven Pharmaceutical Holding Co., Ltd.(a) | | | 27,110 | | | | 1,017,981 | |

Blueprint Medicines Corp.(a) | | | 33,500 | | | | 2,615,010 | |

Clovis Oncology, Inc.(a) | | | 12,260 | | | | 360,076 | |

CytomX Therapeutics, Inc.(a) | | | 44,670 | | | | 826,395 | |

Deciphera Pharmaceuticals, Inc.(a) | | | 43,470 | | | | 1,683,158 | |

Eagle Pharmaceuticals, Inc./DE(a) | | | 23,160 | | | | 1,605,683 | |

Emergent BioSolutions, Inc.(a) | | | 55,130 | | | | 3,629,208 | |

Enanta Pharmaceuticals, Inc.(a) | | | 17,890 | | | | 1,528,879 | |

Exact Sciences Corp.(a) | | | 27,720 | | | | 2,187,662 | |

Halozyme Therapeutics, Inc.(a) | | | 100,390 | | | | 1,824,086 | |

Ligand Pharmaceuticals, Inc.(a) | | | 16,200 | | | | 4,446,738 | |

Loxo Oncology, Inc.(a) | | | 19,963 | | | | 3,410,279 | |

Madrigal Pharmaceuticals, Inc.(a) | | | 8,900 | | | | 1,905,757 | |

Myriad Genetics, Inc.(a) | | | 69,210 | | | | 3,183,660 | |

Neurocrine Biosciences, Inc.(a) | | | 14,340 | | | | 1,763,103 | |

Pieris Pharmaceuticals, Inc.(a) | | | 112,280 | | | | 628,768 | |

REGENXBIO, Inc.(a) | | | 31,620 | | | | 2,387,310 | |

Retrophin, Inc.(a) | | | 59,190 | | | | 1,700,529 | |

Sarepta Therapeutics, Inc.(a) | | | 7,090 | | | | 1,145,106 | |

Spark Therapeutics, Inc.(a) | | | 28,220 | | | | 1,539,401 | |

Schedule of Investments (continued)

| | | | | | | | |

| Company | | Shares | | | U.S. $ Value | |

Ultragenyx Pharmaceutical, Inc.(a) | | | 35,380 | | | $ | 2,700,909 | |

Vanda Pharmaceuticals, Inc.(a) | | | 96,050 | | | | 2,204,348 | |

| | | | | | | | |

| | | | | | | 52,200,303 | |

| | | | | | | | |

| Health Care Equipment & Supplies–4.7% | | | | | | | | |

AngioDynamics, Inc.(a) | | | 36,070 | | | | 784,162 | |

Atrion Corp. | | | 5,010 | | | | 3,480,948 | |

Avanos Medical, Inc.(a) | | | 31,310 | | | | 2,144,735 | |

AxoGen, Inc.(a) | | | 17,240 | | | | 635,294 | |

Cantel Medical Corp. | | | 10,420 | | | | 959,265 | |

CONMED Corp. | | | 23,490 | | | | 1,860,878 | |

Globus Medical, Inc.–Class A(a) | | | 91,500 | | | | 5,193,540 | |

Haemonetics Corp.(a) | | | 44,150 | | | | 5,058,707 | |

ICU Medical, Inc.(a) | | | 6,310 | | | | 1,784,153 | |

Inogen, Inc.(a) | | | 5,750 | | | | 1,403,690 | |

Integer Holdings Corp.(a) | | | 38,250 | | | | 3,172,837 | |

iRhythm Technologies, Inc.(a) | | | 15,870 | | | | 1,502,254 | |

LivaNova PLC(a) | | | 25,440 | | | | 3,153,797 | |

Masimo Corp.(a) | | | 23,170 | | | | 2,885,592 | |

Merit Medical Systems, Inc.(a) | | | 36,550 | | | | 2,245,997 | |

Neogen Corp.(a) | | | 34,230 | | | | 2,448,472 | |

OraSure Technologies, Inc.(a) | | | 42,920 | | | | 663,114 | |

Orthofix Medical, Inc.(a) | | | 56,850 | | | | 3,286,498 | |

Penumbra, Inc.(a) | | | 11,980 | | | | 1,793,406 | |

Tactile Systems Technology, Inc.(a) | | | 24,990 | | | | 1,775,540 | |

| | | | | | | | |

| | | | | | | 46,232,879 | |

| | | | | | | | |

| Health Care Providers & Services–2.8% | | | | | | | | |

Addus HomeCare Corp.(a) | | | 37,790 | | | | 2,650,968 | |

Amedisys, Inc.(a) | | | 33,310 | | | | 4,162,418 | |

AMN Healthcare Services, Inc.(a) | | | 62,110 | | | | 3,397,417 | |

Chemed Corp. | | | 9,310 | | | | 2,975,290 | |

Diplomat Pharmacy, Inc.(a) | | | 51,350 | | | | 996,704 | |

LHC Group, Inc.(a) | | | 24,710 | | | | 2,544,883 | |

Molina Healthcare, Inc.(a) | | | 21,190 | | | | 3,150,953 | |

RadNet, Inc.(a) | | | 85,130 | | | | 1,281,206 | |

Tivity Health, Inc.(a) | | | 27,960 | | | | 898,914 | |

WellCare Health Plans, Inc.(a) | | | 14,980 | | | | 4,800,940 | |

| | | | | | | | |

| | | | | | | 26,859,693 | |

| | | | | | | | |

| Health Care Technology–0.3% | | | | | | | | |

HealthStream, Inc. | | | 62,500 | | | | 1,938,125 | |

Medidata Solutions, Inc.(a) | | | 17,540 | | | | 1,285,857 | |

| | | | | | | | |

| | | | | | | 3,223,982 | |

| | | | | | | | |

| Life Sciences Tools & Services–0.5% | | | | | | | | |

Cambrex Corp.(a) | | | 8,320 | | | | 569,088 | |

ICON PLC(a) | | | 16,830 | | | | 2,587,612 | |

PRA Health Sciences, Inc.(a) | | | 19,650 | | | | 2,165,234 | |

| | | | | | | | |

| | | | | | | 5,321,934 | |

| | | | | | | | |

| Pharmaceuticals–2.8% | | | | | | | | |

Aerie Pharmaceuticals, Inc.(a) | | | 30,140 | | | | 1,855,117 | |

Amphastar Pharmaceuticals, Inc.(a) | | | 78,500 | | | | 1,510,340 | |

Catalent, Inc.(a) | | | 46,330 | | | | 2,110,331 | |

Corcept Therapeutics, Inc.(a) | | | 93,870 | | | | 1,316,057 | |

Endo International PLC(a) | | | 168,900 | | | | 2,842,587 | |

GW Pharmaceuticals PLC (Sponsored ADR)(a) | | | 6,800 | | | | 1,174,632 | |

Horizon Pharma PLC(a) | | | 154,510 | | | $ | 3,025,306 | |

Innoviva, Inc.(a) | | | 120,540 | | | | 1,837,030 | |

Intersect ENT, Inc.(a) | | | 21,640 | | | | 622,150 | |

Lannett Co., Inc.(a) | | | 42,250 | | | | 200,688 | |

Mallinckrodt PLC(a) | | | 99,910 | | | | 2,928,362 | |

MyoKardia, Inc.(a) | | | 27,060 | | | | 1,764,312 | |

Phibro Animal Health Corp.–Class A | | | 40,670 | | | | 1,744,743 | |

Revance Therapeutics, Inc.(a) | | | 63,360 | | | | 1,574,496 | |

Supernus Pharmaceuticals, Inc.(a) | | | 57,920 | | | | 2,916,272 | |

| | | | | | | | |

| | | | | | | 27,422,423 | |

| | | | | | | | |

| | | | | | | 161,261,214 | |

| | | | | | | | |

| | | | | | | | |

| | | |

| Consumer Discretionary–14.5% | | | | | | | | |

| Auto Components–0.7% | | | | | | | | |

Cooper-Standard Holdings, Inc.(a) | | | 21,440 | | | | 2,572,371 | |

Stoneridge, Inc.(a) | | | 57,930 | | | | 1,721,680 | |

Tower International, Inc. | | | 102,240 | | | | 3,092,760 | |

| | | | | | | | |

| | | | | | | 7,386,811 | |

| | | | | | | | |

| Automobiles–0.5% | | | | | | | | |

Thor Industries, Inc. | | | 32,790 | | | | 2,744,523 | |

Winnebago Industries, Inc. | | | 62,370 | | | | 2,067,565 | |

| | | | | | | | |

| | | | | | | 4,812,088 | |

| | | | | | | | |

| Diversified Consumer Services–2.1% | | | | | | | | |

Adtalem Global Education, Inc.(a) | | | 85,960 | | | | 4,143,272 | |

Grand Canyon Education, Inc.(a) | | | 16,780 | | | | 1,892,784 | |

Hillenbrand, Inc. | | | 111,770 | | | | 5,845,571 | |

K12, Inc.(a) | | | 138,510 | | | | 2,451,627 | |

Sotheby’s(a) | | | 17,460 | | | | 858,857 | |

Strategic Education, Inc. | | | 29,627 | | | | 4,059,788 | |

Weight Watchers International, Inc.(a) | | | 22,230 | | | | 1,600,338 | |

| | | | | | | | |

| | | | | | | 20,852,237 | |

| | | | | | | | |

| Hotels, Restaurants & Leisure–3.1% | | | | | | | | |

Bloomin’ Brands, Inc. | | | 159,570 | | | | 3,157,890 | |

Brinker International, Inc. | | | 60,540 | | | | 2,829,034 | |

Churchill Downs, Inc. | | | 6,500 | | | | 1,805,050 | |

Denny’s Corp.(a) | | | 197,090 | | | | 2,901,165 | |

Hilton Grand Vacations, Inc.(a) | | | 79,490 | | | | 2,631,119 | |

Penn National Gaming, Inc.(a) | | | 159,610 | | | | 5,254,361 | |

Pinnacle Entertainment, Inc.(a) | | | 62,880 | | | | 2,118,427 | |

Ruth’s Hospitality Group, Inc. | | | 110,700 | | | | 3,492,585 | |

Texas Roadhouse, Inc.–Class A | | | 41,740 | | | | 2,892,165 | |

Wingstop, Inc. | | | 49,180 | | | | 3,357,519 | |

| | | | | | | | |

| | | | | | | 30,439,315 | |

| | | | | | | | |

| Household Durables–0.8% | | | | | | | | |

Beazer Homes USA, Inc.(a) | | | 105,030 | | | | 1,102,815 | |

Helen of Troy Ltd.(a) | | | 28,560 | | | | 3,738,504 | |

TopBuild Corp.(a) | | | 46,280 | | | | 2,629,630 | |

| | | | | | | | |

| | | | | | | 7,470,949 | |

| | | | | | | | |

| Internet & Direct Marketing Retail–1.8% | | | | | | | | |

Etsy, Inc.(a) | | | 84,030 | | | | 4,317,461 | |

GrubHub, Inc.(a) | | | 17,030 | | | | 2,360,699 | |

Nutrisystem, Inc. | | | 113,530 | | | | 4,206,287 | |

| | | | | | | | |

| Company | | Shares | | | U.S. $ Value | |

Shutterstock, Inc. | | | 19,130 | | | $ | 1,044,115 | |

Stamps.com, Inc.(a) | | | 25,420 | | | | 5,750,004 | |

| | | | | | | | |

| | | | | | | 17,678,566 | |

| | | | | | | | |

| Leisure Products–0.4% | | | | | | | | |

MCBC Holdings, Inc.(a) | | | 47,250 | | | | 1,695,330 | |

Sturm Ruger & Co., Inc. | | | 39,270 | | | | 2,711,593 | |

| | | | | | | | |

| | | | | | | 4,406,923 | |

| | | | | | | | |

| Multiline Retail–1.0% | | | | | | | | |

Big Lots, Inc. | | | 66,350 | | | | 2,772,767 | |

Dillard’s, Inc.–Class A | | | 24,960 | | | | 1,905,446 | |

Ollie’s Bargain Outlet Holdings, Inc.(a) | | | 49,400 | | | | 4,747,340 | |

| | | | | | | | |

| | | | | | | 9,425,553 | |

| | | | | | | | |

| Specialty Retail–2.7% | | | | | | | | |

Abercrombie & Fitch Co.–Class A | | | 74,690 | | | | 1,577,453 | |

American Eagle Outfitters, Inc. | | | 70,380 | | | | 1,747,535 | |

Chico’s FAS, Inc. | | | 162,240 | | | | 1,406,621 | |

Children’s Place, Inc. (The) | | | 21,470 | | | | 2,743,866 | |

Citi Trends, Inc. | | | 54,500 | | | | 1,567,965 | |

Five Below, Inc.(a) | | | 35,470 | | | | 4,613,228 | |

RH(a) | | | 18,930 | | | | 2,480,019 | |

Signet Jewelers Ltd. | | | 71,640 | | | | 4,723,225 | |

Sleep Number Corp.(a) | | | 78,630 | | | | 2,892,012 | |

Tailored Brands, Inc. | | | 87,440 | | | | 2,202,614 | |

| | | | | | | | |

| | | | | | | 25,954,538 | |

| | | | | | | | |

| Textiles, Apparel & Luxury Goods–1.4% | | | | | | | | |

Deckers Outdoor Corp.(a) | | | 41,500 | | | | 4,921,070 | |

Fossil Group, Inc.(a) | | | 33,400 | | | | 777,552 | |

G-III Apparel Group Ltd.(a) | | | 72,410 | | | | 3,489,438 | |

Vera Bradley, Inc.(a) | | | 102,460 | | | | 1,563,540 | |

Wolverine World Wide, Inc. | | | 64,970 | | | | 2,537,078 | |

| | | | | | | | |

| | | | | | | 13,288,678 | |

| | | | | | | | |

| | | | | | | 141,715,658 | |

| | | | | | | | |

| | | | | | | | |

| | | |

| Industrials–13.8% | | | | | | | | |

| Aerospace & Defense–0.5% | | | | | | | | |

Curtiss-Wright Corp. | | | 24,290 | | | | 3,337,932 | |

Vectrus, Inc.(a) | | | 39,260 | | | | 1,224,519 | |

| | | | | | | | |

| | | | | | | 4,562,451 | |

| | | | | | | | |

| Air Freight & Logistics–0.4% | | | | | | | | |

Echo Global Logistics, Inc.(a) | | | 56,130 | | | | 1,737,224 | |

Forward Air Corp. | | | 20,910 | | | | 1,499,247 | |

XPO Logistics, Inc.(a) | | | 9,630 | | | | 1,099,457 | |

| | | | | | | | |

| | | | | | | 4,335,928 | |

| | | | | | | | |

| Airlines–0.5% | | | | | | | | |

Hawaiian Holdings, Inc. | | | 85,870 | | | | 3,443,387 | |

SkyWest, Inc. | | | 22,280 | | | | 1,312,292 | |

| | | | | | | | |

| | | | | | | 4,755,679 | |

| | | | | | | | |

| Building Products–1.6% | | | | | | | | |

Builders FirstSource, Inc.(a) | | | 275,030 | | | | 4,037,440 | |

Continental Building Products, Inc.(a) | | | 105,580 | | | | 3,964,529 | |

NCI Building Systems, Inc.(a) | | | 170,670 | | | $ | 2,585,651 | |

Patrick Industries, Inc.(a) | | | 30,130 | | | | 1,783,696 | |

Trex Co., Inc.(a) | | | 49,090 | | | | 3,778,948 | |

| | | | | | | | |

| | | | | | | 16,150,264 | |

| | | | | | | | |

| Commercial Services & Supplies–1.6% | | | | | | | | |

ACCO Brands Corp. | | | 330,650 | | | | 3,736,345 | |

Brady Corp.–Class A | | | 24,190 | | | | 1,058,313 | |

Casella Waste Systems, Inc.–Class A(a) | | | 54,490 | | | | 1,692,459 | |

Deluxe Corp. | | | 32,510 | | | | 1,851,120 | |

Ennis, Inc. | | | 55,600 | | | | 1,137,020 | |

Kimball International, Inc.–Class B | | | 72,300 | | | | 1,211,025 | |

Quad/Graphics, Inc. | | | 73,810 | | | | 1,538,200 | |

SP Plus Corp.(a) | | | 46,320 | | | | 1,690,680 | |

Steelcase, Inc.–Class A | | | 68,860 | | | | 1,273,910 | |

| | | | | | | | |

| | | | | | | 15,189,072 | |

| | | | | | | | |

| Construction & Engineering–1.9% | | | | | | | | |

Comfort Systems USA, Inc. | | | 48,130 | | | | 2,714,532 | |

EMCOR Group, Inc. | | | 64,880 | | | | 4,873,137 | |

MasTec, Inc.(a) | | | 26,120 | | | | 1,166,258 | |

Primoris Services Corp. | | | 175,078 | | | | 4,345,436 | |

Quanta Services, Inc.(a) | | | 74,990 | | | | 2,503,166 | |

Tutor Perini Corp.(a) | | | 162,310 | | | | 3,051,428 | |

| | | | | | | | |

| | | | | | | 18,653,957 | |

| | | | | | | | |

| Electrical Equipment–1.1% | | | | | | | | |

Atkore International Group, Inc.(a) | | | 164,930 | | | | 4,375,593 | |

EnerSys | | | 25,000 | | | | 2,178,250 | |

Generac Holdings, Inc.(a) | | | 69,010 | | | | 3,892,854 | |

| | | | | | | | |

| | | | | | | 10,446,697 | |

| | | | | | | | |

| Machinery–2.1% | | | | | | | | |

Alamo Group, Inc. | | | 12,480 | | | | 1,143,293 | |

Barnes Group, Inc. | | | 27,900 | | | | 1,981,737 | |

Global Brass & Copper Holdings, Inc. | | | 78,290 | | | | 2,888,901 | |

Greenbrier Cos., Inc. (The) | | | 43,470 | | | | 2,612,547 | |

Harsco Corp.(a) | | | 65,460 | | | | 1,868,883 | |

Hyster-Yale Materials Handling, Inc. | | | 26,040 | | | | 1,602,241 | |

Kadant, Inc. | | | 15,670 | | | | 1,690,009 | |

Meritor, Inc.(a) | | | 213,170 | | | | 4,126,971 | |

Wabash National Corp. | | | 160,090 | | | | 2,918,441 | |

| | | | | | | | |

| | | | | | | 20,833,023 | |

| | | | | | | | |

| Professional Services–2.3% | | | | | | | | |

ASGN, Inc.(a) | | | 48,860 | | | | 3,856,520 | |

Barrett Business Services, Inc. | | | 39,120 | | | | 2,612,434 | |

FTI Consulting, Inc.(a) | | | 46,580 | | | | 3,409,190 | |

ICF International, Inc. | | | 36,420 | | | | 2,747,889 | |

Insperity, Inc. | | | 38,500 | | | | 4,541,075 | |

Kforce, Inc. | | | 36,740 | | | | 1,381,424 | |

TriNet Group, Inc.(a) | | | 24,360 | | | | 1,371,955 | |

TrueBlue, Inc.(a) | | | 91,970 | | | | 2,395,818 | |

| | | | | | | | |

| | | | | | | 22,316,305 | |

| | | | | | | | |

| Road & Rail–0.5% | | | | | | | | |

ArcBest Corp. | | | 40,470 | | | | 1,964,819 | |

Knight-Swift Transportation Holdings, Inc. | | | 23,457 | | | | 808,797 | |

Saia, Inc.(a) | | | 24,240 | | | | 1,853,148 | |

| | | | | | | | |

| | | | | | | 4,626,764 | |

| | | | | | | | |

Schedule of Investments (continued)

| | | | | | | | |

| Company | | Shares | | | U.S. $ Value | |

| Trading Companies & Distributors–1.3% | | | | | | | | |

Applied Industrial Technologies, Inc. | | | 42,590 | | | $ | 3,332,667 | |

BMC Stock Holdings, Inc.(a) | | | 161,850 | | | | 3,018,503 | |

GMS, Inc.(a) | | | 110,750 | | | | 2,569,400 | |

Rush Enterprises, Inc.–Class A | | | 57,130 | | | | 2,245,780 | |

Titan Machinery, Inc.(a) | | | 117,280 | | | | 1,816,081 | |

| | | | | | | | |

| | | | | | | 12,982,431 | |

| | | | | | | | |

| | | | | | | 134,852,571 | |

| | | | | | | | |

| | | | | | | | |

| | | |

| Information Technology–13.3% | | | | | | | | |

| Communications Equipment–1.6% | | | | | | | | |

Ciena Corp.(a) | | | 158,560 | | | | 4,953,415 | |

Comtech Telecommunications Corp. | | | 64,130 | | | | 2,325,995 | |

Finisar Corp.(a) | | | 108,500 | | | | 2,066,925 | |

InterDigital, Inc./PA | | | 50,630 | | | | 4,050,400 | |

Ubiquiti Networks, Inc. | | | 25,690 | | | | 2,539,713 | |

| | | | | | | | |

| | | | | | | 15,936,448 | |

| | | | | | | | |

| Electronic Equipment, Instruments & Components–2.9% | |

Anixter International, Inc.(a) | | | 35,630 | | | | 2,504,789 | |

ePlus, Inc.(a) | | | 38,230 | | | | 3,543,921 | |

II-VI, Inc.(a) | | | 13,820 | | | | 653,686 | |

Insight Enterprises, Inc.(a) | | | 32,760 | | | | 1,771,988 | |

Jabil, Inc. | | | 117,260 | | | | 3,175,401 | |

Littelfuse, Inc. | | | 13,240 | | | | 2,620,063 | |

Novanta, Inc.(a) | | | 15,470 | | | | 1,058,148 | |

PC Connection, Inc. | | | 30,380 | | | | 1,181,478 | |

Sanmina Corp.(a) | | | 110,400 | | | | 3,047,040 | |

SYNNEX Corp. | | | 37,990 | | | | 3,217,753 | |

Tech Data Corp.(a) | | | 39,510 | | | | 2,827,731 | |

TTM Technologies, Inc.(a) | | | 135,160 | | | | 2,150,396 | |

| | | | | | | | |

| | | | | | | 27,752,394 | |

| | | | | | | | |

| IT Services–2.9% | | | | | | | | |

Booz Allen Hamilton Holding Corp. | | | 64,020 | | | | 3,177,313 | |

CACI International, Inc.–Class A(a) | | | 29,200 | | | | 5,377,180 | |

Convergys Corp. | | | 127,640 | | | | 3,030,174 | |

Genpact Ltd. | | | 41,160 | | | | 1,259,908 | |

ManTech International Corp./VA–Class A | | | 47,690 | | | | 3,018,777 | |

MAXIMUS, Inc. | | | 69,390 | | | | 4,514,513 | |

Perficient, Inc.(a) | | | 127,920 | | | | 3,409,068 | |

Science Applications International Corp. | | | 26,943 | | | | 2,171,606 | |

WNS Holdings Ltd. (ADR)(a) | | | 40,990 | | | | 2,080,242 | |

| | | | | | | | |

| | | | | | | 28,038,781 | |

| | | | | | | | |

| Semiconductors & Semiconductor Equipment–1.9% | |

Cabot Microelectronics Corp. | | | 16,000 | | | | 1,650,720 | |

Cirrus Logic, Inc.(a) | | | 108,590 | | | | 4,191,574 | |

Cypress Semiconductor Corp. | | | 125,670 | | | | 1,820,958 | |

Kulicke & Soffa Industries, Inc. | | | 126,070 | | | | 3,005,509 | |

MKS Instruments, Inc. | | | 14,870 | | | | 1,191,830 | |

Monolithic Power Systems, Inc. | | | 14,670 | | | | 1,841,525 | |

Semtech Corp.(a) | | | 41,800 | | | | 2,324,080 | |

Silicon Laboratories, Inc.(a) | | | 22,280 | | | | 2,045,304 | |

SMART Global Holdings, Inc.(a) | | | 29,740 | | | | 854,728 | |

| | | | | | | | |

| | | | | | | 18,926,228 | |

| | | | | | | | |

| Software–3.9% | | | | | | | | |

Appfolio, Inc.–Class A(a) | | | 31,080 | | | $ | 2,436,672 | |

Aspen Technology, Inc.(a) | | | 26,920 | | | | 3,066,457 | |

Blackbaud, Inc. | | | 10,680 | | | | 1,083,806 | |

Bottomline Technologies DE, Inc.(a) | | | 45,180 | | | | 3,285,038 | |

Envestnet, Inc.(a) | | | 20,570 | | | | 1,253,742 | |

Fair Isaac Corp.(a) | | | 13,010 | | | | 2,973,436 | |

j2 Global, Inc. | | | 58,990 | | | | 4,887,321 | |

New Relic, Inc.(a) | | | 43,750 | | | | 4,122,562 | |

Nutanix, Inc.–Class A(a) | | | 28,220 | | | | 1,205,558 | |

Paycom Software, Inc.(a) | | | 7,520 | | | | 1,168,683 | |

Pegasystems, Inc. | | | 39,350 | | | | 2,463,310 | |

Progress Software Corp. | | | 69,540 | | | | 2,454,067 | |

Trade Desk, Inc. (The)–Class A(a) | | | 31,580 | | | | 4,765,738 | |

Verint Systems, Inc.(a) | | | 62,740 | | | | 3,143,274 | |

| | | | | | | | |

| | | | | | | 38,309,664 | |

| | | | | | | | |

| Technology Hardware, Storage & Peripherals–0.1% | |

NCR Corp.(a) | | | 29,150 | | | | 828,152 | |

| | | | | | | | |

| | | | | | | 129,791,667 | |

| | | | | | | | |

| | | | | | | | |

| | | |

| Real Estate–6.6% | | | | | | | | |

| Equity Real Estate Investment Trusts (REITs)–5.7% | |

CareTrust REIT, Inc. | | | 92,740 | | | | 1,642,425 | |

Chesapeake Lodging Trust | | | 55,160 | | | | 1,768,981 | |

CoreCivic, Inc. | | | 56,930 | | | | 1,385,107 | |

CorEnergy Infrastructure Trust, Inc. | | | 63,460 | | | | 2,384,827 | |

CoreSite Realty Corp. | | | 26,520 | | | | 2,947,433 | |

Cousins Properties, Inc. | | | 229,010 | | | | 2,035,899 | |

CubeSmart | | | 88,920 | | | | 2,536,888 | |

First Industrial Realty Trust, Inc. | | | 77,170 | | | | 2,423,138 | |

InfraREIT, Inc. | | | 122,480 | | | | 2,590,452 | |

iStar, Inc. | | | 235,370 | | | | 2,629,083 | |

MedEquities Realty Trust, Inc. | | | 106,952 | | | | 1,039,573 | |

Monmouth Real Estate Investment Corp.–Class A | | | 94,465 | | | | 1,579,455 | |

National Health Investors, Inc. | | | 27,060 | | | | 2,045,465 | |

National Storage Affiliates Trust | | | 91,000 | | | | 2,315,040 | |