UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-23117

JPMorgan Trust IV

(Exact name of registrant as specified in charter)

270 Park Avenue

New York, NY 10017

(Address of principal executive offices) (Zip code)

Frank J. Nasta

270 Park Avenue

New York, NY 10017

(Name and Address of Agent for Service)

Registrant’s telephone number, including area code: (800) 480-4111

Date of fiscal year end: Last day of February

Date of reporting period: May 31, 2016 through February 28, 2017

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. Section 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

Annual Report

J.P. Morgan Municipal Bond Funds

February 28, 2017

JPMorgan Municipal Income Fund

JPMorgan Ohio Municipal Bond Fund

JPMorgan Short-Intermediate Municipal Bond Fund

JPMorgan Tax Free Bond Fund

JPMorgan Ultra-Short Municipal Fund

CONTENTS

Investments in a Fund are not deposits or obligations of, or guaranteed or endorsed by, any bank and are not insured or guaranteed by the FDIC, the Federal Reserve Board or any other government agency. You could lose money if you sell when a Fund’s share price is lower than when you invested.

Past performance is no guarantee of future performance. The general market views expressed in this report are opinions based on market and other conditions through the end of the reporting period and are subject to change without notice. These views are not intended to predict the future performance of a Fund or the securities markets. References to specific securities and their issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Such views are not meant as investment advice and may not be relied on as an indication of trading intent on behalf of any Fund.

Prospective investors should refer to the Funds’ prospectus for a discussion of the Funds’ investment objectives, strategies and risks. Call J.P. Morgan Funds Service Center at 1-800-480-4111 for a prospectus containing more complete information about a Fund, including management fees and other expenses. Please read it carefully before investing.

CEO’S LETTER

March 22, 2017 (Unaudited)

Dear Shareholders,

For most of the past twelve months, the U.S. economy was one of the few bright spots among developed nations as most of Europe and Japan struggled with low or negative economic growth. However, by the end of February 2017 there emerged clear signals that the world’s 20 largest economies were moving in a more synchronized fashion that could lead to an accelerating global economy.

| | |

| | “While the global economy appeared to grow more synchronized during the twelve months ended February 28, 2017, there also emerged political uncertainties in the U.S. and Europe.” |

Indeed, the World Bank has estimated that global economic growth in 2017 will rise by 2.7% compared with 2.3% in 2016 and economists generally expect each of the world’s 20 largest economies will see an increase in gross domestic product in 2017.

In the 19-nation euro zone, manufacturing activity rose in February 2017 for the sixth consecutive month and reached levels not seen in nearly six years. Economic confidence surveys have been the strongest since 2011. While unemployment across the euro zone remained nearly twice that of the U.S., the jobless rate fell faster than expected in early 2017 to its lowest level since 2009. Importantly, euro zone inflation reached the European Central Bank’s target of 2.0% in February 2017, which provided further evidence that the risk of a painful deflationary spiral had receded.

Meanwhile, Chinese factory activity was stronger than economists expected in February 2017 and more broadly, Chinese economic stimulus measures initiated in 2016 appeared to bolster trade throughout Asia. In Japan, corporate profits were estimated at record highs even in the face of a stronger yen. South Korean exports grew in February 2017 for the fourth consecutive month. Economic data from Australia and India showed signs of stronger growth.

To a certain extent, the healthier global economy was supported by a rebound in global oil prices, which reached 15-month highs in October 2016. Prices for other commodities also rose during 2016, helping growth in those emerging market nations reliant on natural resource exports.

In the U.S., the pace of economic expansion was sufficient to persuade the Federal Reserve Bank to raise interest rates in December 2016 and again in March 2017. Meanwhile, leading

stock market indexes hit record highs in late 2016 and early 2017 amid strength in corporate profits and the broader U.S. economy. Investor expectations that the Republican Party’s newly-won control of the U.S. presidency along with its majorities in both houses of the U.S. Congress would bolster economic growth while lowering certain taxes further supported U.S. financial assets.

While the global economy appeared to grow more synchronized during the twelve months ended February 28, 2017, there also emerged political uncertainties in the U.S. and Europe. In the U.K., a populist drive to exit the European Union won a surprise victory in mid-2016. While global financial markets generally rebounded from the sharp sell-off that followed the June 23rd referendum, the ultimate impact of the so-called Brexit remained uncertain and was seen as a drag on the U.K. economy. In November, Donald Trump, who campaigned on a platform that included tighter restrictions on immigration and protective trade policies, won the U.S. presidency. While voters in the Netherlands declined to give the anti-immigrant Party for Freedom a majority in the lower house of Parliament, populist parties were vying for power in France, Germany and elsewhere.

Each of these parties and their leaders — both in the U.S. and elsewhere — share broad policy goals that prioritize restricting immigration and shunning supranational trade agreements. Given that immigration and free trade are key drivers of economic growth in advanced, post-industrial nations, it remains to be seen how much electoral support these shared agendas would earn.

In the face of all this, U.S. and foreign financial markets generally rewarded investors with positive returns for the twelve months through February 28, 2017. Over time, we believe financial markets will continue to reward those investors who maintain patience and discipline in the context of a properly diversified portfolio.

We look forward to managing your investment needs for years to come. Should you have any questions, please visit www.jpmorganfunds.com or contact the J.P. Morgan Funds Service Center at 1-800-480-4111.

Sincerely yours,

George C.W. Gatch

CEO, Investment Funds Management,

J.P. Morgan Asset Management

| | | | | | | | |

| | | |

| FEBRUARY 28, 2017 | | J.P. MORGAN MUNICIPAL BOND FUNDS | | | | | 1 | |

J.P. Morgan Municipal Bond Funds

MARKET OVERVIEW

TWELVE MONTHS ENDED FEBRUARY 28, 2017 (Unaudited)

U.S. financial markets generally provided positive returns for the twelve month reporting period amid continued growth in the U.S. economy and rising domestic interest rates. While U.S. equity outperformed most other asset classes, commodities and corporate bonds also had positive returns. At the end of June 2016, the U.K.’s vote to exit from the European Union led to a global sell-off in financial markets. However, U.S. markets rebounded within a month.

Commodities prices stabilized during the reporting period and global oil prices reached 15-month highs in October. Oil prices were further bolstered by the Organization of Petroleum Exporting Countries’ decision to curb production.

Following the November 8, 2016, elections, the Republican Party assumed control of the presidency and retained its majority in both houses of the U.S. Congress. In the following months, key U.S. equity benchmarks reached multiple record closing highs. While U.S. Treasury bonds underperformed other bond market sectors, corporate bonds and high-yield bonds (also known as “junk bonds”) posted positive returns as investors sought higher yields on fixed-income assets.

However, investor expectation of changes to tax rates for corporate and municipal bonds hurt returns on municipal bonds. The rally in U.S. equity markets also drew investment away from the municipal bond market. For the twelve months ended February 28, 2017, the Bloomberg Barclays Municipal Bond Index returned 0.25%.

| | | | | | |

| | | |

| 2 | | | | J.P. MORGAN MUNICIPAL BOND FUNDS | | FEBRUARY 28, 2017 |

JPMorgan Municipal Income Fund

FUND COMMENTARY

TWELVE MONTHS ENDED FEBRUARY 28, 2017 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | |

| Fund (Class I Shares)1* | | | (0.16)% | |

| Bloomberg Barclays U.S. 1-15 Year Blend (1-17) Municipal Bond Index (formerly Barclays U.S. 1-15 Year Blend (1-17) Municipal Bond Index) | | | 0.02% | |

| |

| Net Assets as of 2/28/2017 (In Thousands) | | $ | 270,811 | |

| Duration as of 2/28/2017 | | | 4.9 years | |

INVESTMENT OBJECTIVE**

The JPMorgan Municipal Income Fund (the “Fund”) seeks current income exempt from federal income taxes.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

For the twelve months ended February 28, 2017, the Fund’s Class I Shares underperformed the Bloomberg Barclays U.S. 1-15 Year Blend (1-17) Municipal Bond Index (the “Benchmark”).

The Fund’s overweight position in the education and water & sewer bond sectors were leading detractors from relative performance. The Fund’s underweight position to short duration pre-refunded bonds also detracted from relative performance.

Relative to the Benchmark, the Fund’s overweight position in the housing sector and industrial development revenue/pollution control revenue bond sector, as well as its underweight position in state and local general obligation bonds were leading contributors to performance. The Fund’s relative underweight position in the five-to-nine year duration range also contributed to relative performance. Duration measures the price sensitivity of a bond or a portfolio of bonds to relative changes in interest rates. Generally, bonds with longer duration will experience a larger increase or decrease in price as interest rates fall or rise, respectively, versus bonds with shorter duration.

HOW WAS THE FUND POSITIONED?

The Fund’s portfolio managers continued to emphasize higher yielding sectors, particularly the housing sector. At the end of the twelve month period, the Fund’s overall duration was roughly in line with that of the Benchmark.

| | | | |

CREDIT QUALITY ALLOCATIONS*** | |

| AAA | | | 22.6 | % |

| AA | | | 49.8 | |

| A | | | 17.9 | |

| BBB | | | 5.2 | |

| BB | | | 0.6 | |

| NR | | | 3.9 | |

J.P. Morgan Investment Management receives credit ratings on underlying securities of the portfolio from three major rating agencies — Standard & Poor’s (“S&P”), Moody’s and Fitch. When calculating credit quality breakdown, S&P is used as the primary independent rating agency source. Where an S&P rating is not available for a particular security, the Moody’s rating will be used, if available, and Fitch, if available, is used for securities not rated by Moody’s or S&P. Securities not rated by any of the three agencies are reflected as not rated (NR).

Although the Credit Quality Allocations table reflects the ratings of the bonds detailed in the Schedule of Investments, 0.8% of the investments in the table is held in prerefunded municipal bonds or escrowed to maturity securities. Prerefunded municipal bonds and escrowed to maturity securities are bonds the principal and interest of which are to be paid by Treasuries, Agencies and other government securities that have been placed in escrow accounts. For both prerefunded and escrowed to maturity securities, the credit status is considered the same, the only difference is prerefundeds are paid off at a call date while escrowed to maturity are retired at maturity.

| 1 | | Effective April 3, 2017, the Fund’s Select Class Shares were renamed Class I Shares. |

| * | | The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| ** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | | Percentages indicated are based on total investments as of February 28, 2017. The Fund’s portfolio composition is subject to change. |

| | | | | | | | |

| | | |

| FEBRUARY 28, 2017 | | J.P. MORGAN MUNICIPAL BOND FUNDS | | | | | 3 | |

JPMorgan Municipal Income Fund

FUND COMMENTARY

TWELVE MONTHS ENDED FEBRUARY 28, 2017 (Unaudited) (continued)

| | | | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS AS OF FEBRUARY 28, 2017 | |

| | | | |

| | | INCEPTION DATE OF

CLASS | | 1 YEAR | | | 5 YEAR | | | 10 YEAR | |

CLASS A SHARES | | February 23, 1993 | | | | | | | | | | | | |

With Sales Charge* | | | | | (4.10 | )% | | | 1.37 | % | | | 2.89 | % |

Without Sales Charge | | | | | (0.40 | ) | | | 2.14 | | | | 3.28 | |

CLASS C SHARES | | November 4, 1997 | | | | | | | | | | | | |

With CDSC** | | | | | (1.87 | ) | | | 1.56 | | | | 2.70 | |

Without CDSC | | | | | (0.87 | ) | | | 1.56 | | | | 2.70 | |

CLASS I SHARES (FORMERLY SELECT CLASS SHARES) | | February 9, 1993 | | | (0.16 | ) | | | 2.39 | | | | 3.53 | |

| * | | Sales Charge for Class A Shares is 3.75%. |

| ** | | Assumes a 1% CDSC (contingent deferred sales charge) for the one year period and 0% CDSC thereafter. |

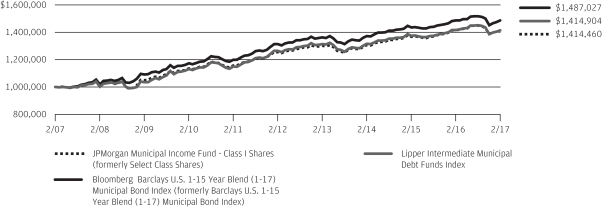

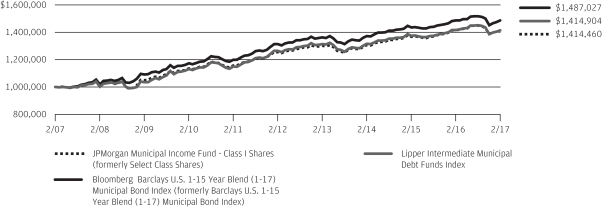

TEN YEAR PERFORMANCE (2/28/07 TO 2/28/17)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date, month-end performance information please call 1-800-480-4111.

The graph illustrates comparative performance for $1,000,000 invested in Class I Shares of the JPMorgan Municipal Income Fund, the Bloomberg Barclays U.S. 1-15 Year Blend (1-17) Municipal Bond Index and the Lipper Intermediate Municipal Debt Funds Index from February 28, 2007 to February 28, 2017. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the Bloomberg Barclays U.S. 1-15 Year Blend (1-17) Municipal Bond Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the benchmark, if applicable. The performance of the Lipper Intermediate Municipal Debt Funds Index includes expenses associated with a mutual fund, such as investment management fees. These expenses are not identical to the expenses incurred

by the Fund. The Bloomberg Barclays U.S. 1-15 Year Blend (1-17) Municipal Bond Index represents the performance of municipal bonds with maturities from 1 to 17 years. The Lipper Intermediate Municipal Debt Funds Index is an index based on the total returns of certain mutual funds within the Fund’s designated category as determined by Lipper, Inc. Investors cannot invest directly in an index.

Capital gain distributions are subject to federal income tax; a portion of the Fund’s income distributions may be subject to the alternative minimum tax and some investors may be subject to certain state and local taxes.

Class I Shares have a $1,000,000 minimum initial investment.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | |

| | | |

| 4 | | | | J.P. MORGAN MUNICIPAL BOND FUNDS | | FEBRUARY 28, 2017 |

JPMorgan Ohio Municipal Bond Fund

FUND COMMENTARY

TWELVE MONTHS ENDED FEBRUARY 28, 2017 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | |

| Fund (Class I Shares)1* | | | (0.36)% | |

| Bloomberg Barclays U.S. 1-15 Year Blend (1-17) Municipal Bond Index (formerly Barclays U.S. 1-15 Year Blend (1-17) Municipal Bond Index) | | | 0.02% | |

| |

| Net Assets as of 2/28/2017 (In Thousands) | | | $121,426 | |

| Duration as of 2/28/2017 | | | 4.8 years | |

INVESTMENT OBJECTIVE**

The JPMorgan Ohio Municipal Bond Fund (the “Fund”) seeks current income exempt from federal income tax and Ohio personal income tax, consistent with the preservation of principal.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

For the twelve months ended February 28, 2017, the Fund’s Class I Shares underperformed the Bloomberg Barclays U.S. 1-15 Year Blend (1-17) Municipal Bond Index (the “Benchmark”).

Relative to the Benchmark, the Fund’s overweight position and longer duration in local general obligation bonds was a leading detractor from performance during the reporting period.

Duration measures the price sensitivity of a bond or a portfolio of bonds to relative changes in interest rates. Generally, bonds with longer duration will experience a larger increase or decrease in price as interest rates fall or rise, respectively, versus bonds with shorter duration. The Fund’s overweight position in the leasing sector also detracted from relative performance.

The Fund’s overweight positions and shorter relative duration in pre-refunded bonds and housing bonds were leading contributors to performance relative to the Benchmark. The Fund’s shorter duration in bonds rated AAA also helped relative performance.

HOW WAS THE FUND POSITIONED?

During the reporting period, the Fund’s average duration contracted relative to the Benchmark as interest rates moved upward during the latter part of the reporting period. The Fund’s portfolio managers preferred to invest in issuances from large, highly rated state and local municipalities. Among revenue bond sectors, the Fund managers preferred essential service sectors. However, Fund positioning is generally a result of security structure, duration, credit quality and the unique characteristics of the Ohio municipal bond market.

| | | | |

CREDIT QUALITY ALLOCATIONS*** | |

| AAA | | | 16.6 | % |

| AA | | | 70.5 | |

| A | | | 9.5 | |

| BBB | | | 2.0 | |

| NR | | | 1.4 | |

J.P. Morgan Investment Management receives credit ratings on underlying securities of the portfolio from three major rating agencies — Standard & Poor’s (“S&P”), Moody’s and Fitch. When calculating credit quality breakdown, S&P is used as the primary independent rating agency source. Where an S&P rating is not available for a particular security, the Moody’s rating will be used, if available, and Fitch, if available, is used for securities not rated by Moody’s or S&P. Securities not rated by any of the three agencies are reflected as not rated (NR).

Although the Credit Quality Allocations table reflects the ratings of the bonds detailed in the Schedule of Investments, 22.1% of the investments in the table is held in prerefunded municipal bonds or escrowed to maturity securities. Prerefunded municipal bonds and escrowed to maturity securities are bonds the principal and interest of which are to be paid by Treasuries, Agencies and other government securities that have been placed in escrow accounts. For both prerefunded and escrowed to maturity securities, the credit status is considered the same, the only difference is prerefundeds are paid off at a call date while escrowed to maturity are retired at maturity.

| 1 | | Effective April 3, 2017, the Fund’s Select Class Shares were renamed Class I Shares. |

| * | | The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| ** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | | Percentages indicated are based on total investments as of February 28, 2017. The Fund’s portfolio composition is subject to change. |

| | | | | | | | |

| | | |

| FEBRUARY 28, 2017 | | J.P. MORGAN MUNICIPAL BOND FUNDS | | | | | 5 | |

JPMorgan Ohio Municipal Bond Fund

FUND COMMENTARY

TWELVE MONTHS ENDED FEBRUARY 28, 2017 (Unaudited) (continued)

| | | | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS AS OF FEBRUARY 28, 2017 | |

| | | | |

| | | INCEPTION DATE OF

CLASS | | 1 YEAR | | | 5 YEAR | | | 10 YEAR | |

CLASS A SHARES | | February 18, 1992 | | | | | | | | | | | | |

With Sales Charge* | | | | | (4.33 | )% | | | 0.89 | % | | | 2.76 | % |

Without Sales Charge | | | | | (0.59 | ) | | | 1.66 | | | | 3.16 | |

CLASS C SHARES | | February 19, 2005 | | | | | | | | | | | | |

With CDSC** | | | | | (2.19 | ) | | | 1.05 | | | | 2.54 | |

Without CDSC | | | | | (1.19 | ) | | | 1.05 | | | | 2.54 | |

CLASS I SHARES (FORMERLY SELECT CLASS SHARES) | | July 2, 1991 | | | (0.36 | ) | | | 1.92 | | | | 3.42 | |

| * | | Sales Charge for Class A Shares is 3.75%. |

| ** | | Assumes a 1% CDSC (contingent deferred sales charge) for the one year period and 0% CDSC thereafter. |

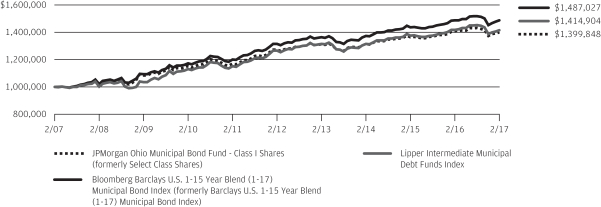

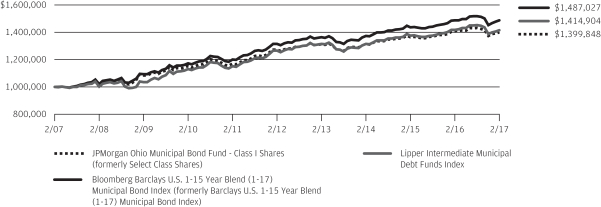

TEN YEAR PERFORMANCE (2/28/07 TO 2/28/17)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

The graph illustrates comparative performance for $1,000,000 invested in Class I Shares of the JPMorgan Ohio Municipal Bond Fund, the Bloomberg Barclays U.S. 1-15 Year Blend (1-17) Municipal Bond Index and the Lipper Intermediate Municipal Debt Funds Index from February 28, 2007 to February 28, 2017. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the Bloomberg Barclays U.S. 1-15 Year Blend (1-17) Municipal Bond Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the benchmark, if applicable. The performance of the Lipper Intermediate Municipal Debt Funds Index includes expenses associated with a mutual fund, such as investment management fees. These expenses are not identical to the expenses incurred by

the Fund. The Bloomberg Barclays U.S. 1-15 Year Blend (1-17) Municipal Bond Index represents the performance of municipal bonds with maturities from 1 to 17 years. The Lipper Intermediate Municipal Debt Funds Index is an index based on the total returns of certain mutual funds within the Fund’s designated category as determined by Lipper, Inc. Investors cannot invest directly in an index.

Capital gain distributions are subject to federal income tax; a portion of the Fund’s income distributions may be subject to the alternative minimum tax and some investors may be subject to certain state and local taxes.

Class I Shares have a $1,000,000 minimum initial investment.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | |

| | | |

| 6 | | | | J.P. MORGAN MUNICIPAL BOND FUNDS | | FEBRUARY 28, 2017 |

JPMorgan Short-Intermediate Municipal Bond Fund

FUND COMMENTARY

TWELVE MONTHS ENDED FEBRUARY 28, 2017 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | |

| Fund (Select Class Shares) 1* | | | (0.37)% | |

| Bloomberg Barclays U.S. 1-5 Year Blend (1-6) Municipal Bond Index (formerly Barclays U.S. 1-5 Year Blend (1-6) Municipal Bond Index) | | | 0.29% | |

| |

| Net Assets as of 2/28/2017 (In Thousands) | | $ | 2,076,038 | |

| Duration as of 2/28/2017 | | | 3.2 years | |

INVESTMENT OBJECTIVE**

The JPMorgan Short-Intermediate Municipal Bond Fund (the “Fund”) seeks as high a level of current income exempt from federal income tax as is consistent with relative stability of principal.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

For the twelve months ended February 28, 2017, the Fund’s Select Class Shares underperformed the Bloomberg Barclays U.S. 1-5 Year Blend (1-6) Municipal Bond Index (the “Benchmark”).

Relative to the Benchmark, the Fund’s longer duration profile detracted from performance as interest rates rose. Generally, bond yields in the three-to-five year portion of the yield curve rose more than the shorter and longer portions during the reporting period and the Fund’s overweight positions in the short and long portions of the curve also detracted from relative performance. The yield curve shows the relationship between yields and maturity dates for a set of similar bonds at a given point in time. The Fund’s relative longer duration in the local general obligation and the hospital sectors also detracted from relative performance, as did the Fund’s underweight position in short duration pre-refunded bonds.

The Fund’s relative shorter duration in the electric sector and the industrial redevelopment revenue/pollution control revenue sector were leading positive contributors to performance relative to the Benchmark. The Fund’s underweight positions in bonds issued by the states of Florida and Massachusetts also contributed to relative performance.

HOW WAS THE FUND POSITIONED?

During the reporting period, the Fund employed a bottom-up, security selection-based investment approach. The Fund’s portfolio managers sought to take advantage of opportunities stemming from increased volatility, supply pressures and headline credit risk, while maintaining the Fund’s bias toward higher quality issuances.

| | | | |

CREDIT QUALITY ALLOCATIONS*** | |

| AAA | | | 29.1 | % |

| AA | | | 49.0 | |

| A | | | 19.8 | |

| BBB | | | 1.3 | |

| NR | | | 0.8 | |

J.P. Morgan Investment Management receives credit ratings on underlying securities of the portfolio from three major rating agencies — Standard & Poor’s (“S&P”), Moody’s and Fitch. When calculating credit quality breakdown, S&P is used as the primary independent rating agency source. Where an S&P rating is not available for a particular security, the Moody’s rating will be used, if available, and Fitch, if available, is used for securities not rated by Moody’s or S&P. Securities not rated by any of the three agencies are reflected as not rated (NR).

Although the Credit Quality Allocations table reflects the ratings of the bonds detailed in the Schedule of Investments, 4.7% of the investments in the table is held in prerefunded municipal bonds or escrowed to maturity securities. Prerefunded municipal bonds and escrowed to maturity securities are bonds the principal and interest of which are to be paid by Treasuries, Agencies and other government securities that have been placed in escrow accounts. For both prerefunded and escrowed to maturity securities, the credit status is considered the same, the only difference is prerefundeds are paid off at a call date while escrowed to maturity are retired at maturity.

| 1 | | Effective April 3, 2017, the Fund’s Select Class Shares were no longer offered. |

| * | | The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| ** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | | Percentages indicated are based on total investments as of February 28, 2017. The Fund’s portfolio composition is subject to change. |

| | | | | | | | |

| | | |

| FEBRUARY 28, 2017 | | J.P. MORGAN MUNICIPAL BOND FUNDS | | | | | 7 | |

JPMorgan Short-Intermediate Municipal Bond Fund

FUND COMMENTARY

TWELVE MONTHS ENDED FEBRUARY 28, 2017 (Unaudited) (continued)

| | | | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS AS OF FEBRUARY 28, 2017 | |

| | | | |

| | | INCEPTION DATE OF

CLASS | | 1 YEAR | | | 5 YEAR | | | 10 YEAR | |

CLASS A SHARES | | May 4, 1998 | | | | | | | | | | | | |

With Sales Charge* | | | | | (2.96 | )% | | | 0.03 | % | | | 1.47 | % |

Without Sales Charge | | | | | (0.69 | ) | | | 0.49 | | | | 1.70 | |

CLASS C SHARES | | November 1, 2001 | | | | | | | | | | | | |

With CDSC** | | | | | (2.27 | ) | | | (0.03 | ) | | | 1.18 | |

Without CDSC | | | | | (1.27 | ) | | | (0.03 | ) | | | 1.18 | |

CLASS I SHARES (FORMERLY INSTITUTIONAL CLASS SHARES) | | June 19, 2009 | | | (0.20 | ) | | | 0.97 | | | | 2.15 | |

SELECT CLASS SHARES | | May 4, 1998 | | | (0.37 | ) | | | 0.75 | | | | 1.96 | |

| * | | Sales Charge for Class A Shares is 2.25%. |

| ** | | Assumes a 1% CDSC (contingent deferred sales charge) for the one year period and 0% CDSC thereafter. |

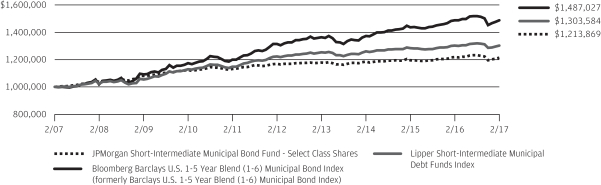

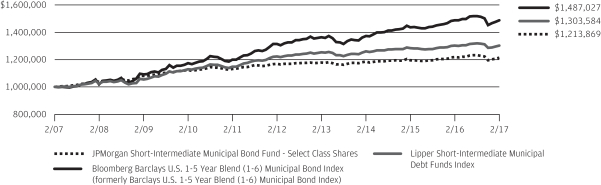

TEN YEAR PERFORMANCE (2/28/07 TO 2/28/17)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date, month-end performance information please call 1-800-480-4111.

Returns for Class I Shares prior to its inception are based on the performance of Select Class Shares. The actual returns of Class I Shares would have been different than those shown because Class I Shares had different expenses than Select Class Shares.

The graph illustrates comparative performance for $1,000,000 invested in Select Class Shares of the JPMorgan Short-Intermediate Municipal Bond Fund, the Bloomberg Barclays U.S. 1-5 Year Blend (1-6) Municipal Bond Index and the Lipper Short-Intermediate Municipal Debt Funds Index from February 28, 2007 to February 28, 2017. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the Bloomberg Barclays U.S. 1-5 Year Blend (1-6) Municipal Bond Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the benchmark, if applicable. The performance of the Lipper Short-Intermediate

Municipal Debt Funds Index includes expenses associated with a mutual fund, such as investment management fees. These expenses are not identical to the expenses incurred by the Fund. The Bloomberg Barclays U.S. 1-5 Year Blend (1-6) Municipal Bond Index is an unmanaged index of investment grade tax-exempt municipal bonds with maturities of 1–5.999 years. The Lipper Short-Intermediate Municipal Debt Funds Index represents the total returns of certain mutual funds within the Fund’s designated category as determined by Lipper, Inc. Investors cannot invest directly in an index.

Capital gain distributions are subject to federal income tax; a portion of the Fund’s income distributions may be subject to the alternative minimum tax and some investors may be subject to certain state and local taxes.

Select Class Shares have a $1,000,000 minimum initial investment.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | |

| | | |

| 8 | | | | J.P. MORGAN MUNICIPAL BOND FUNDS | | FEBRUARY 28, 2017 |

JPMorgan Tax Free Bond Fund

FUND COMMENTARY

TWELVE MONTHS ENDED FEBRUARY 28, 2017 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | |

Fund (Class A Shares, without a sales charge)* | | | (0.03)% | |

Bloomberg Barclays Municipal Bond Index (formerly Barclays Municipal Bond Index) | | | 0.25% | |

| |

Net Assets as of 2/28/2017 (In Thousands) | | | $322,395 | |

Duration as of 2/28/2017 | | | 6.3 years | |

INVESTMENT OBJECTIVE**

The JPMorgan Tax Free Bond Fund (the “Fund”) seeks as high a level of current income exempt from federal income tax as is consistent with relative stability of principal.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

For the twelve months ended February 28, 2017, the Fund’s Class A Shares underperformed the Bloomberg Barclays Municipal Bond Index (the “Benchmark”).

Relative to the Benchmark, the Fund’s longer duration profile and its underweight position in A-rated bonds detracted from performance during the reporting period. Duration measures the price sensitivity of a bond or a portfolio of bonds to relative changes in interest rates. Generally, bonds with longer duration will experience a larger increase or decrease in price as interest rates fall or rise, respectively, versus bonds with shorter duration. The Fund’s longer duration profile in the special tax sector and its underweight position in industrial development revenue/pollution control revenue bond sector also detracted from relative performance.

During the reporting period, the Fund’s overall duration profile moved from being longer relative to the Benchmark to being shorter than the Benchmark, which helped relative performance as U.S. interest rates rose. Bonds with five-year maturities generally had negative returns during the reporting period and the Fund’s underweight position in the five-year portion of the yield curve also helped relative performance. The yield curve shows the relationship between yields and maturity dates for a set of similar bonds at a given point in time. The Fund’s overweight position in pre-refunded bonds also helped relative performance.

HOW WAS THE FUND POSITIONED?

The Fund continued to employ a bottom-up, security selection-based investment approach and sought to take advantage of opportunities stemming from increased volatility, supply pressures and headline credit risk. For liquidity, and to enhance the Fund’s overall credit quality, the Fund maintained its overweight position versus the Benchmark in pre-refunded bonds.

| | | | |

CREDIT QUALITY ALLOCATIONS*** | |

| AAA | | | 18.7 | % |

| AA | | | 59.4 | |

| A | | | 13.0 | |

| BBB | | | 6.0 | |

| NR | | | 2.9 | |

J.P. Morgan Investment Management receives credit ratings on underlying securities of the portfolio from three major rating agencies — Standard & Poor’s (“S&P”), Moody’s and Fitch. When calculating credit quality breakdown, S&P, is used as the primary independent rating agency source. Where an S&P rating is not available for a particular security, the Moody’s rating will be used, if available, and Fitch, if available, is used for securities not rated by Moody’s or S&P. Securities not rated by any of the three agencies are reflected as not rated (NR).

Although the Credit Quality Allocations table reflects the ratings of the bonds detailed in the Schedule of Investments, 22.1% of the investments in the table is held in prerefunded municipal bonds or escrowed to maturity securities. Prerefunded municipal bonds and escrowed to maturity securities are bonds the principal and interest of which are to be paid by Treasuries, Agencies and other government securities that have been placed in escrow accounts. For both prerefunded and escrowed to maturity securities, the credit status is considered the same, the only difference is prerefundeds are paid off at a call date while escrowed to maturity are retired at maturity.

| * | | The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| ** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | | Percentages indicated are based on total investments as of February 28, 2017. The Fund’s portfolio composition is subject to change. |

| | | | | | | | |

| | | |

| FEBRUARY 28, 2017 | | J.P. MORGAN MUNICIPAL BOND FUNDS | | | | | 9 | |

JPMorgan Tax Free Bond Fund

FUND COMMENTARY

TWELVE MONTHS ENDED FEBRUARY 28, 2017 (Unaudited) (continued)

| | | | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS AS OF FEBRUARY 28, 2017 | |

| | | | |

| | | INCEPTION DATE OF

CLASS | | 1 YEAR | | | 5 YEAR | | | 10 YEAR | |

CLASS A SHARES | | March 1, 1988 | | | | | | | | | | | | |

With Sales Charge* | | | | | (3.78 | )% | | | 2.20 | % | | | 3.28 | % |

Without Sales Charge | | | | | (0.03 | ) | | | 2.99 | | | | 3.68 | |

CLASS C SHARES | | July 1, 2008 | | | | | | | | | | | | |

With CDSC** | | | | | (1.66 | ) | | | 2.30 | | | | 2.99 | |

Without CDSC | | | | | (0.66 | ) | | | 2.30 | | | | 2.99 | |

CLASS I SHARES (FORMERLY SELECT CLASS SHARES) | | February 1, 1995 | | | 0.09 | | | | 3.16 | | | | 3.86 | |

| * | | Sales Charge for Class A Shares is 3.75%. |

| ** | | Assumes a 1% CDSC (contingent deferred sales charge) for the one year period and 0% CDSC thereafter. |

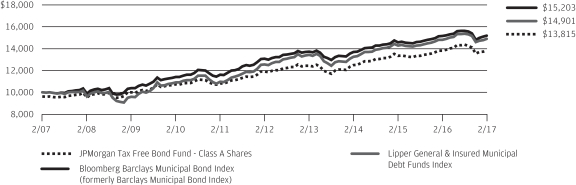

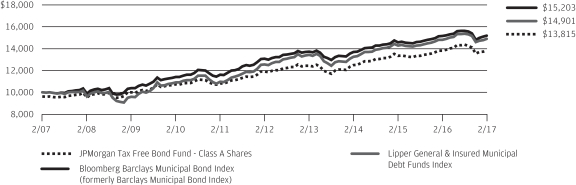

TEN YEAR PERFORMANCE (2/28/07 TO 2/28/17)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date, month-end performance information please call 1-800-480-4111.

Returns for Class C Shares prior to its inception are based on the performance of Class B Shares, all of which converted to Class A Shares on June 19, 2015. The actual returns of Class C Shares would have been similar to those shown because Class C Shares had similar expenses to Class B Shares.

The graph illustrates comparative performance for $10,000 invested in Class A Shares of the JPMorgan Tax Free Bond Fund, the Bloomberg Barclays Municipal Bond Index and the Lipper General & Insured Municipal Debt Funds Index from February 28, 2007 to February 28, 2017. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and includes a sales charge. The performance of the Bloomberg Barclays Municipal Bond Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the benchmark, if applicable. The performance of the Lipper General & Insured Municipal Debt Funds Index includes expenses associated with a mutual fund, such as investment management fees. These expenses are not identical to the expenses

incurred by the Fund. The Bloomberg Barclays Municipal Bond Index is a total return performance benchmark for the long-term, investment-grade tax-exempt bond market. The Lipper General & Insured Municipal Debt Funds Index represents the total returns of certain mutual funds within the Fund’s designated category as defined by Lipper, Inc. Investors cannot invest directly in an index.

Capital gain distributions are subject to federal income tax; a portion of the Fund’s income distributions may be subject to the alternative minimum tax and some investors may be subject to certain state and local taxes.

Class A Shares have a $1,000 minimum initial investment and carry a 3.75% sales charge.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | |

| | | |

| 10 | | | | J.P. MORGAN MUNICIPAL BOND FUNDS | | FEBRUARY 28, 2017 |

JPMorgan Ultra-Short Municipal Fund

FUND SUMMARY

FOR THE PERIOD MAY 31, 2016 (FUND INCEPTION DATE) THROUGH FEBRUARY 28, 2017 (Unaudited)

| | | | |

REPORTING PERIOD RETURN: | |

Fund (Class I Shares)1* | | | 0.65% | |

Bloomberg Barclays 1 Year Municipal Bond Index (formerly Barclays 1 Year Municipal Bond Index) | | | 0.51% | |

| |

Net Assets as of 2/28/2017 (In Thousands) | | | $32,175 | |

Duration as of 2/28/2017 | | | 0.7 years | |

INVESTMENT OBJECTIVE**

The JPMorgan Ultra-Short Municipal Fund (the “Fund”) seeks as high a level of current income exempt from federal income tax as is consistent with relative stability of principal.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

For the period ended February 28, 2017, the Fund’s Class I Shares outperformed the Bloomberg Barclays 1 Year Municipal Bond Index (the “Benchmark”). Relative to the Benchmark, the Fund’s shorter duration profile was a leading contributor to performance amid rising interest rates. Duration measures the price sensitivity of a bond or a portfolio of bonds to relative changes in interest rates. Generally, bonds with longer duration will experience a larger increase or decrease in price as interest rates fall or rise, respectively, versus bonds with shorter duration. Overall, lower quality bonds generally outperformed higher quality bonds and the Fund’s overweight position in bonds rated A and BBB, as well as its underweight position in bonds rated AAA also contributed to relative performance. The Fund’s overweight position in education bonds was the leading detractor from relative performance.

HOW WAS THE FUND POSITIONED?

During the reporting period, the Fund’s managers sought to maintain an average weighted maturity of two years or less and used a risk/reward analysis to identify investments that they believed would perform well over market cycles.

| | | | |

CREDIT QUALITY ALLOCATIONS*** | |

| AAA | | | 13.8 | % |

| AA | | | 48.7 | |

| A | | | 20.5 | |

| BBB | | | 9.7 | |

| BB | | | 1.5 | |

| NR | | | 5.8 | |

J.P. Morgan Investment Management receives credit ratings on underlying securities of the portfolio from three major rating agencies — Standard and Poor’s (“S&P”), Moody’s and Fitch. When calculating credit quality breakdown, S&P is used as the primary independent rating agency source. Where an S&P rating is not available for a particular security, the Moody’s rating will be used, if available, and Fitch, if available, is used for securities not rated by Moody’s or S&P. Securities not rated by any of the three agencies are reflected as not rated (NR).

Although the Credit Quality Allocations table reflects the ratings of the bonds detailed in the Schedule of Investments, 4.8% of the investments in the table is held in prerefunded municipal bonds or escrowed to maturity securities. Prerefunded municipal bonds and escrowed to maturity securities are bonds the principal and interest of which are to be paid by Treasuries, Agencies and other government securities that have been placed in escrow accounts. For both prerefunded and escrowed to maturity securities, the credit status is considered the same, the only difference is prerefundeds are paid off at a call date while escrowed to maturity are retired at maturity.

| 1 | | Effective April 3, 2017, the Fund’s Select Class Shares were renamed Class I Shares. |

| * | | The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| ** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | | Percentages indicated are based on total investments as of February 28, 2017. The Fund’s portfolio composition is subject to change. |

| | | | | | | | |

| | | |

| FEBRUARY 28, 2017 | | J.P. MORGAN MUNICIPAL BOND FUNDS | | | | | 11 | |

JPMorgan Ultra-Short Municipal Fund

FUND SUMMARY

FOR THE PERIOD MAY 31, 2016 (FUND INCEPTION DATE) THROUGH FEBRUARY 28, 2017 (Unaudited) (continued)

| | | | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS AS OF FEBRUARY 28, 2017 | |

| | | | |

| | | | | | | | | INCEPTION DATE OF

CLASS | | SINCE

INCEPTION* | |

CLASS A SHARES | | | | | | | | | | May 31, 2016 | | | | |

With Sales Charge** | | | | | | | | | | | | | (1.74 | )% |

Without Sales Charge | | | | | | | | | | | | | 0.52 | |

CLASS I SHARES (FORMERLY SELECT CLASS SHARES) | | | | | | | | | | May 31, 2016 | | | 0.65 | |

| ** | | Sales Charge for Class A Shares is 2.25%. |

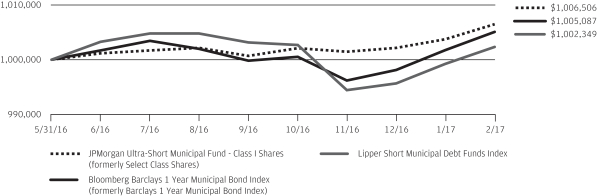

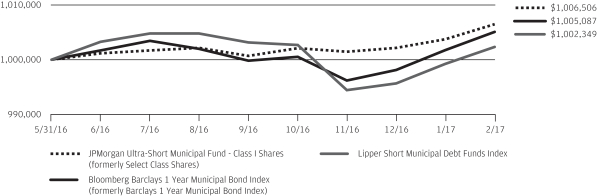

LIFE OF FUND PERFORMANCE (5/31/16 TO 2/28/17)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date, month-end performance information please call 1-800-480-4111.

The Fund commenced operations on May 31, 2016.

The graph illustrates comparative performance for $1,000,000 invested in Class I Shares of the JPMorgan Ultra-Short Municipal Fund, the Bloomberg Barclays 1 Year Municipal Bond Index and the Lipper Short Municipal Debt Funds Index from May 31, 2016 to February 28, 2017. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the Bloomberg Barclays 1 Year Municipal Bond Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of securities included in the benchmark, if applicable. The performance of the Lipper Short Municipal Debt Funds Index includes expenses associated with a mutual fund, such as investment management fees. These expenses are not identical to the expenses incurred by the Fund. The Bloomberg Barclays 1 Year Municipal Bond Index is an unmanaged index that includes bonds with a minimum credit rating of BAA3, are issued as part of a deal of at least $50 million, have an amount outstanding of at least $5 million, and have maturities of 1 to 2 years.

The Lipper Short Municipal Debt Funds Index is an index based on the total returns of certain mutual funds within the Fund’s designated category as determined by Lipper, Inc. Investors cannot invest directly in an index.

Capital gain distributions are subject to federal income tax; a portion of the Fund’s income distributions may be subject to the alternative minimum tax and some investors may be subject to certain state and local taxes.

Class I Shares have a $1,000,000 minimum initial investment.

Subsequent to the inception of the Fund on May 31, 2016 until August 31, 2016, the Fund did not experience any shareholder activity. If such shareholder activity had occurred, the Fund’s performance may have been impacted.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | |

| | | |

| 12 | | | | J.P. MORGAN MUNICIPAL BOND FUNDS | | FEBRUARY 28, 2017 |

JPMorgan Municipal Income Fund

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF FEBRUARY 28, 2017

(Amounts in thousands)

| | | | | | | | |

PRINCIPAL

AMOUNT($) | | | SECURITY DESCRIPTION | | VALUE($) | |

| | Municipal Bonds — 93.9% (t) | |

| | | | Alabama — 0.8% | |

| | | | Utility — 0.8% | |

| | 2,000 | | | The Lower Alabama Gas District, Gas Project, Series A, Rev., 5.000%, 09/01/31 | | | 2,268 | |

| | | | | | | | |

| | | | Alaska — 0.8% | |

| | | | Housing — 0.4% | |

| | 1,000 | | | Alaska Housing Finance Corp., General Mortgage, Series A, Rev., 3.500%, 06/01/46 | | | 1,053 | |

| | | | | | | | |

| | | | Other Revenue — 0.4% | |

| | 1,195 | | | Northern Tobacco Securitization Corp., Series A, Rev., 4.625%, 06/01/23 | | | 1,201 | |

| | | | | | | | |

| | | | Total Alaska | | | 2,254 | |

| | | | | | | | |

| | | | Arizona — 2.1% | |

| | | | Water & Sewer — 2.1% | |

| | 2,645 | | | City of Scottsdale, Water & Sewer System, Rev., 5.250%, 07/01/22 | | | 3,140 | |

| | 2,150 | | | City of Tucson, Water System, Rev., 5.000%, 07/01/24 | | | 2,558 | |

| | | | | | | | |

| | | | Total Arizona | | | 5,698 | |

| | | | | | | | |

| | | | California — 1.7% | |

| | | | General Obligation — 0.3% | |

| | 1,000 | | | Salinas Union High School District, GO, BAN, Zero Coupon, 08/01/20 | | | 939 | |

| | | | | | | | |

| | | | Housing — 0.1% | |

| | 205 | | | California Rural Home Mortgage Finance Authority, Single Family Mortgage, Mortgage-Backed Security Program, Series A, Rev., GNMA/FNMA/FHLMC, 5.400%, 12/01/36 | | | 209 | |

| | | | | | | | |

| | | | Industrial Development Revenue/Pollution Control Revenue — 0.6% | |

| | 1,750 | | | California Pollution Control Financing Authority, Solid Waste Disposal, Waste Management, Inc. Project, Series B-2, Rev., VAR, AMT, 3.125%, 11/03/25 | | | 1,750 | |

| | | | | | | | |

| | | | Other Revenue — 0.3% | |

| | 750 | | | State of California, Department of Veterans Affairs, Series B, Rev., 3.500%, 12/01/45 | | | 792 | |

| | | | | | | | |

| | | | Transportation — 0.4% | |

| | 1,000 | | | Bay Area Toll Authority, Toll Bridge, San Francisco Bay Area, Series C, Rev., VAR, 1.875%, 04/01/19 | | | 1,011 | |

| | | | | | | | |

| | | | Total California | | | 4,701 | |

| | | | | | | | |

| | | | Colorado — 2.4% | |

| | | | Certificate of Participation/Lease — 0.2% | |

| | 625 | | | Pueblo County Judicial Complex Project, COP, AGM, 5.000%, 09/15/21 | | | 705 | |

| | | | | | | | |

| | | | | | | | |

PRINCIPAL

AMOUNT($) | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | | |

| | | | Education — 0.4% | |

| | | | Colorado Educational & Cultural Facilities Authority, University Corp. for Atmospheric Research Project, | | | | |

| | 450 | | | Rev., 4.000%, 09/01/20 | | | 485 | |

| | 470 | | | Rev., 5.000%, 09/01/22 | | | 536 | |

| | | | | | | | |

| | | | | | | 1,021 | |

| | | | | | | | |

| | | | General Obligation — 0.4% | |

| | 1,000 | | | Douglas County School District No. Re-1, Douglas & Elbert Counties, GO, 5.250%, 12/15/20 | | | 1,147 | |

| | | | | | | | |

| | | | Hospital — 1.3% | |

| | 2,415 | | | Colorado Health Facilities Authority, Parkview Medical Center, Inc., Project, Series B, Rev., 5.000%, 09/01/22 | | | 2,457 | |

| | 1,000 | | | University of Colorado Hospital Authority, Series C-1, Rev., VAR, 4.000%, 03/01/20 | | | 1,063 | |

| | | | | | | | |

| | | | | | | 3,520 | |

| | | | | | | | |

| | | | Housing — 0.1% | |

| | | | Denver City & County, Single Family Home Mortgage, Metropolitan Mayors Caucus Program, | | | | |

| | 70 | | | Rev., GNMA COLL, 6.150%, 11/01/34 | | | 71 | |

| | 25 | | | Series A, Rev., GNMA/FNMA/FHLMC, 7.300%, 11/01/31 | | | 25 | |

| | 115 | | | El Paso County, Single Family Mortgage, Southern Front Range Region Program, Series E, Rev., AMT, GNMA/FNMA/FHLMC, 5.850%, 04/01/41 | | | 117 | |

| | | | | | | | |

| | | | | | | 213 | |

| | | | | | | | |

| | | | Total Colorado | | | 6,606 | |

| | | | | | | | |

| | | | Connecticut — 2.4% | |

| | | | Education — 1.6% | |

| | | | Connecticut State Higher Education Supplemental Loan Authority, CHESLA Loan Program, | | | | |

| | 760 | | | Series A, Rev., 4.000%, 11/15/19 | | | 794 | |

| | 1,560 | | | Series A, Rev., 5.250%, 11/15/23 | | | 1,740 | |

| | 1,500 | | | Series A, Rev., 5.250%, 11/15/24 | | | 1,672 | |

| | | | | | | | |

| | | | | | | 4,206 | |

| | | | | | | | |

| | | | Housing — 0.8% | |

| | | | Connecticut Housing Finance Authority, Housing Mortgage Finance Program, | | | | |

| | 585 | | | Subseries A-1, Rev., 4.000%, 11/15/45 | | | 627 | |

| | 500 | | | Subseries A-1, Rev., 4.000%, 11/15/47 | | | 540 | |

| | 990 | | | Subseries E-1, Rev., 3.500%, 11/15/46 | | | 1,044 | |

| | | | | | | | |

| | | | | | | 2,211 | |

| | | | | | | | |

| | | | Total Connecticut | | | 6,417 | |

| | | | | | | | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | | | |

| | | |

| FEBRUARY 28, 2017 | | J.P. MORGAN MUNICIPAL BOND FUNDS | | | | | 13 | |

JPMorgan Municipal Income Fund

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF FEBRUARY 28, 2017 (continued)

(Amounts in thousands)

| | | | | | | | |

PRINCIPAL

AMOUNT($) | | | SECURITY DESCRIPTION | | VALUE($) | |

| | Municipal Bonds — continued | |

| | | | Delaware — 0.2% | |

| | | | Housing — 0.2% | |

| | | | Delaware State Housing Authority, Senior Single Family Mortgage, | | | | |

| | 375 | | | Series A-1, Rev., AMT, 4.900%, 07/01/29 | | | 394 | |

| | 205 | | | Series D-1, Rev., AMT, GNMA/FNMA/FHLMC, 4.625%, 01/01/23 | | | 206 | |

| | | | | | | | |

| | | | Total Delaware | | | 600 | |

| | | | | | | | |

| | | | District of Columbia — 1.3% | |

| | | | Water & Sewer — 1.3% | |

| | 3,000 | | | District of Columbia Water & Sewer Authority Public Utility, Subordinate Lien, Green Bonds, Series A, Rev., 5.000%, 10/01/45 | | | 3,388 | |

| | | | | | | | |

| | | | Florida — 12.9% | |

| | | | Certificate of Participation/Lease — 3.9% | |

| | 4,000 | | | Collier County School Board, Master Lease Program, Series A, COP, AGM, 5.250%, 02/15/21 | | | 4,564 | |

| | 2,250 | | | South Florida Water Management District, COP, 5.000%, 10/01/32 | | | 2,554 | |

| | 3,000 | | | The School Board of Miami-Dade County, Series D, COP, 5.000%, 02/01/27 | | | 3,488 | |

| | | | | | | | |

| | | | | | | 10,606 | |

| | | | | | | | |

| | | | Hospital — 0.5% | |

| | 1,100 | | | Palm Beach County Health Facilities Authority, Hospital, BRRH Corp. Obligated Group, Rev., 5.000%, 12/01/21 | | | 1,240 | |

| | | | | | | | |

| | | | Housing — 1.0% | |

| | 345 | | | Broward County Housing Finance Authority, Series B, Rev., AMT, GNMA/FNMA/FHLMC, 4.500%, 04/01/27 | | | 345 | |

| | | | Florida Housing Finance Corp., Homeowner Mortgage, Special Program, | | | | |

| | 510 | | | Series A, Rev., GNMA/FNMA/FHLMC, 5.000%, 07/01/28 | | | 530 | |

| | 570 | | | Series B, Rev., GNMA COLL, 4.500%, 01/01/29 | | | 600 | |

| | 525 | | | Series B, Rev., GNMA/FNMA/FHLMC, 4.500%, 01/01/29 | | | 553 | |

| | 415 | | | Orange County Housing Finance Authority, Multi-County Program, Series A, Rev., AMT, GNMA/FNMA/FHLMC, 5.125%, 09/01/38 | | | 425 | |

| | 310 | | | Pinellas County Housing Finance Authority, Multi-County Program, Series A-2, Rev., AMT, GNMA/FNMA/FHLMC, 4.900%, 09/01/27 | | | 310 | |

| | | | | | | | |

| | | | | | | 2,763 | |

| | | | | | | | |

| | | | | | | | |

PRINCIPAL

AMOUNT($) | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | | |

| | | | Industrial Development Revenue/Pollution Control Revenue — 1.8% | |

| | 835 | | | Broward County Fuel System, Fort Lauderdale Fuel Facilities LLC Project, Series A, Rev., AMT, AGM, 5.000%, 04/01/24 | | | 938 | |

| | 500 | | | County of Escambia, Pollution Control, Gulf Power Company Project, Rev., VAR, 2.100%, 04/11/19 | | | 507 | |

| | 1,600 | | | County of Lee, Florida Solid Waste System, Rev., AMT, NATL-RE, 5.000%, 10/01/22 | | | 1,817 | |

| | 1,545 | | | Palm Beach County, Solid Waste Authority, Rev., BHAC, 5.500%, 10/01/22 | | | 1,719 | |

| | | | | | | | |

| | | | | | | 4,981 | |

| | | | | | | | |

| | | | Other Revenue — 0.9% | |

| | 2,000 | | | Miami Beach Redevelopment Agency, Historic Convention Village, Series A, Rev., 5.000%, 02/01/27 | | | 2,307 | |

| | | | | | | | |

| | | | Prerefunded — 0.2% | |

| | 455 | | | Palm Beach County, Solid Waste Authority, Rev., BHAC, 5.500%, 10/01/19 (p) | | | 506 | |

| | | | | | | | |

| | | | Transportation — 1.7% | |

| | 2,635 | | | City of Orlando, Greater Orlando Aviation Authority, Airport Facilities, Series B, Rev., AMT, 5.000%, 10/01/26 | | | 2,916 | |

| | 1,500 | | | Tampa-Hillsborough County Expressway Authority, Series A, Rev., 5.000%, 07/01/27 | | | 1,692 | |

| | | | | | | | |

| | | | | | | 4,608 | |

| | | | | | | | |

| | | | Utility — 2.9% | |

| | 5,000 | | | City of Port St. Lucie, Utility Systems, Rev., NATL-RE, 5.250%, 09/01/24 | | | 5,902 | |

| | 800 | | | Florida Municipal Power Agency, All Requirements Power Supply Project, Series A, Rev., 5.000%, 10/01/30 | | | 928 | |

| | 1,000 | | | Pasco County, Solid Waste Disposal & Resource Recovery System, Rev., AMT, 5.000%, 10/01/20 | | | 1,119 | |

| | | | | | | | |

| | | | | | | 7,949 | |

| | | | | | | | |

| | | | Total Florida | | | 34,960 | |

| | | | | | | | |

| | | | Georgia — 0.9% | |

| | | | Hospital — 0.4% | |

| | 860 | | | Gainesville & Hall County Hospital Authority, Northeast Georgia Health System, Inc. Project, Series A, Rev., RAN, 5.000%, 02/15/26 | | | 997 | |

| | | | | | | | |

| | | | Housing — 0.5% | |

| | 540 | | | Atlanta Urban Residential Finance Authority, Single Family Mortgage, Mortgage-Backed Securities Program, Series B, Rev., GNMA/FNMA/FHLMC, 5.500%, 03/01/41 | | | 567 | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | |

| | | |

| 14 | | | | J.P. MORGAN MUNICIPAL BOND FUNDS | | FEBRUARY 28, 2017 |

| | | | | | | | |

PRINCIPAL

AMOUNT($) | | | SECURITY DESCRIPTION | | VALUE($) | |

| | Municipal Bonds — continued | |

| | | | Housing — continued | | | | |

| | 750 | | | Georgia Housing & Finance Authority, Single Family Mortgage, Series A, Rev., 4.000%, 12/01/47 | | | 811 | |

| | | | | | | | |

| | | | | | | 1,378 | |

| | | | | | | | |

| | | | Total Georgia | | | 2,375 | |

| | | | | | | | |

| | | | Illinois — 1.4% | |

| | | | General Obligation — 0.8% | |

| | 2,000 | | | Chicago Board of Education, Series C, GO, AGC-ICC, 5.250%, 12/01/26 | | | 2,088 | |

| | | | | | | | |

| | | | Housing — 0.6% | |

| | | | City of Aurora, Single Family Mortgage, | | | | |

| | 193 | | | Series A, Rev., AMT, GNMA/FNMA/FHLMC, 5.500%, 12/01/39 | | | 199 | |

| | 179 | | | Series B, Rev., GNMA/FNMA/FHLMC, 5.450%, 12/01/39 | | | 183 | |

| | 20 | | | City of Peoria, City of Moline & City of Freeport, Collateralized Single Family Mortgage, Series A, Rev., GNMA COLL, 7.600%, 04/01/27 | | | 20 | |

| | 1,300 | | | Illinois Housing Development Authority, Homeowner Mortgage, Series C, Rev., 3.500%, 08/01/46 | | | 1,363 | |

| | | | | | | | |

| | | | | | | 1,765 | |

| | | | | | | | |

| | | | Total Illinois | | | 3,853 | |

| | | | | | | | |

| | | | Indiana — 3.1% | |

| | | | Hospital — 0.7% | |

| | 1,670 | | | Indiana Health Facility Financing Authority, Ascension Health Credit Group, Series A-1, Rev., 5.000%, 11/15/34 | | | 1,874 | |

| | | | | | | | |

| | | | Housing — 0.3% | |

| | 625 | | | Indiana Housing & Community Development Authority, Home First Mortgage, Series A, Rev., GNMA/FNMA/FHLMC, 4.500%, 06/01/28 | | | 657 | |

| | | | | | | | |

| | | | Industrial Development Revenue/Pollution Control Revenue — 1.6% | |

| | 2,000 | | | City of Whiting, Environmental Facilities, BP Products North America, Inc. Project, Rev., VAR, AMT, 5.000%, 11/01/22 | | | 2,260 | |

| | 1,880 | | | County of St. Joseph, Economic Development, St. Mary’s College Project, Series A, Rev., 5.000%, 04/01/26 | | | 2,181 | |

| | | | | | | | |

| | | | | | | 4,441 | |

| | | | | | | | |

| | | | Water & Sewer — 0.5% | |

| | 1,250 | | | Indiana State Finance Authority, First Lien Wastewater Utility, CWA Authority Project, Series A, Rev., 5.000%, 10/01/30 | | | 1,405 | |

| | | | | | | | |

| | | | Total Indiana | | | 8,377 | |

| | | | | | | | |

| | | | | | | | |

PRINCIPAL

AMOUNT($) | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | | |

| | | | Iowa — 0.9% | |

| | | | Education — 0.6% | |

| | | | Iowa Student Loan Liquidity Corp., Student Loan, | | | | |

| | 500 | | | Series A, Rev., AMT, 5.000%, 12/01/18 | | | 531 | |

| | 1,000 | | | Series A, Rev., AMT, 5.000%, 12/01/25 | | | 1,133 | |

| | | | | | | | |

| | | | | | | 1,664 | |

| | | | | | | | |

| | | | Housing — 0.3% | |

| | | | Iowa Finance Authority, Single Family Mortgage, Mortgage-Backed Securities Program, | | | | |

| | 135 | | | Series 1, Rev., GNMA/FNMA/FHLMC, 5.000%, 07/01/28 | | | 141 | |

| | 685 | | | Series A, Rev., GNMA/FNMA/FHLMC, 4.000%, 07/01/46 | | | 735 | |

| | | | | | | | |

| | | | | | | 876 | |

| | | | | | | | |

| | | | Total Iowa | | | 2,540 | |

| | | | | | | | |

| | | | Kentucky — 0.2% | |

| | | | Industrial Development Revenue/Pollution Control Revenue — 0.2% | |

| | 500 | | | County of Carroll, Pollution Control, Kentucky Utilities Company Project, Series A, Rev., VAR, 1.050%, 09/01/19 | | | 494 | |

| | | | | | | | |

| | | | Louisiana — 0.3% | |

| | | | Housing — 0.3% | |

| | 148 | | | East Baton Rouge Mortgage Finance Authority, Single Family Mortgage, Mortgage-Backed Securities Program, Series A-2, Rev., GNMA/FNMA/FHLMC, 5.250%, 10/01/39 | | | 152 | |

| | 350 | | | Louisiana Housing Finance Agency, Single Family Mortgage, Home Ownership Program, Series A, Rev., GNMA/FNMA/FHLMC, 5.500%, 06/01/40 | | | 359 | |

| | 140 | | | Louisiana Housing Finance Agency, Single Family Mortgage, Mortgage-Backed Securities Program, Series A, Rev., GNMA/FNMA/FHLMC, 4.600%, 12/01/28 | | | 144 | |

| | | | | | | | |

| | | | Total Louisiana | | | 655 | |

| | | | | | | | |

| | | | Maine — 0.6% | |

| | | | Housing — 0.6% | |

| | | | Maine State Housing Authority, | | | | |

| | 1,010 | | | Series A, Rev., 4.000%, 11/15/45 | | | 1,079 | |

| | 325 | | | Series A-1, Rev., AMT, 4.500%, 11/15/28 | | | 342 | |

| | 265 | | | Series B, Rev., 4.000%, 11/15/43 | | | 278 | |

| | | | | | | | |

| | | | Total Maine | | | 1,699 | |

| | | | | | | | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | | | |

| | | |

| FEBRUARY 28, 2017 | | J.P. MORGAN MUNICIPAL BOND FUNDS | | | | | 15 | |

JPMorgan Municipal Income Fund

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF FEBRUARY 28, 2017 (continued)

(Amounts in thousands)

| | | | | | | | |

PRINCIPAL

AMOUNT($) | | | SECURITY DESCRIPTION | | VALUE($) | |

| | Municipal Bonds — continued | |

| | | | Massachusetts — 9.1% | |

| | | | Education — 0.8% | |

| | 1,000 | | | Massachusetts Educational Financing Authority, Education Loan, Rev., AMT, 5.000%, 07/01/21 | | | 1,103 | |

| | 820 | | | Massachusetts Health & Educational Facilities Authority, Massachusetts Institute of Technology, Series L, Rev., 5.250%, 07/01/33 | | | 1,050 | |

| | | | | | | | |

| | | | | | | 2,153 | |

| | | | | | | | |

| | | | General Obligation — 1.1% | |

| | 2,500 | | | Commonwealth of Massachusetts, Series B, GO, AGM, 5.250%, 09/01/21 | | | 2,920 | |

| | | | | | | | |

| | | | Housing — 0.3% | |

| | | | Massachusetts Housing Finance Agency, Single Family Housing, | | | | |

| | 405 | | | Series 169, Rev., 4.000%, 12/01/44 | | | 424 | |

| | 500 | | | Series 183, Rev., 3.500%, 12/01/46 | | | 524 | |

| | | | | | | | |

| | | | | | | 948 | |

| | | | | | | | |

| | | | Water & Sewer — 6.9% | |

| | 5,000 | | | Massachusetts Water Pollution Abatement Trust, Pool Program, Rev., 5.250%, 08/01/24 | | | 6,134 | |

| | | | Massachusetts Water Resources Authority, | | | | |

| | 7,925 | | | Series B, Rev., AGM, 5.250%, 08/01/28 | | | 9,904 | |

| | 2,000 | | | Series B, Rev., AGM, 5.250%, 08/01/29 | | | 2,515 | |

| | | | | | | | |

| | | | | | | 18,553 | |

| | | | | | | | �� |

| | | | Total Massachusetts | | | 24,574 | |

| | | | | | | | |

| | | | Michigan — 1.3% | |

| | | | Housing — 0.5% | |

| | 1,330 | | | Michigan State Housing Development Authority, Single-Family Mortgage, Series B, Rev., 3.500%, 06/01/47 | | | 1,391 | |

| | | | | | | | |

| | | | Industrial Development Revenue/Pollution Control Revenue — 0.8% | |

| | 570 | | | Michigan Strategic Fund, The Detroit Edison Company Pollution Control Bonds Project, Series CC, Rev., VAR, 1.450%, 09/01/21 | | | 556 | |

| | 1,395 | | | Saginaw County Economic Development Corp., BGI South LLC-Recovery Zone, Rev., 5.000%, 12/01/20 | | | 1,526 | |

| | | | | | | | |

| | | | | | | 2,082 | |

| | | | | | | | |

| | | | Total Michigan | | | 3,473 | |

| | | | | | | | |

| | | | Minnesota — 2.5% | |

| | | | General Obligation — 0.0% (g) | |

| | 35 | | | State of Minnesota, Series A, GO, 5.000%, 10/01/21 (p) | | | 40 | |

| | | | | | | | |

| | | | | | | | |

PRINCIPAL

AMOUNT($) | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | | |

| | | | Housing — 2.5% | |

| | | | Dakota County Community Development Agency, Single Family Mortgage, Mortgage-Backed Securities Program, | | | | |

| | 415 | | | Series A, Rev., GNMA/FNMA/FHLMC, 4.500%, 06/01/35 | | | 437 | |

| | 382 | | | Series A, Rev., GNMA/FNMA/FHLMC, 5.125%, 12/01/40 | | | 384 | |

| | 17 | | | Series B, Rev., GNMA/FNMA/FHLMC, 5.150%, 12/01/38 | | | 17 | |

| | 590 | | | Minneapolis Community Development Agency, Multi-Family Housing, Riverside Homes Project, Rev., 6.100%, 09/01/19 | | | 592 | |

| | | | Minneapolis/St. Paul Housing Finance Board, Single Family Mortgage, Mortgage-Backed Securities Program, City Living Home Programs, | | | | |

| | 172 | | | Series A-1, Rev., GNMA/FNMA/FHLMC, 5.250%, 12/01/40 | | | 173 | |

| | 535 | | | Series A-2, Rev., GNMA/FNMA/FHLMC, 5.520%, 03/01/41 | | | 563 | |

| | | | Minnesota Housing Finance Agency, Homeownership Finance, Mortgage-Backed Securities Program, | | | | |

| | 520 | | | Series A, Rev., GNMA/FNMA/FHLMC, 4.250%, 07/01/28 | | | 540 | |

| | 285 | | | Series D, Rev., GNMA/FNMA/FHLMC, 4.500%, 07/01/34 | | | 297 | |

| | | | Minnesota Housing Finance Agency, Non Profit Housing, State Appropriation, | | | | |

| | 1,015 | | | Rev., 5.250%, 08/01/24 | | | 1,147 | |

| | 1,070 | | | Rev., 5.250%, 08/01/25 | | | 1,208 | |

| | 825 | | | Rev., 5.250%, 08/01/26 | | | 930 | |

| | 390 | | | Minnesota Housing Finance Agency, Residential Housing Finance, Series D, Rev., GNMA/FNMA/FHLMC, 4.000%, 07/01/40 | | | 404 | |

| | | | | | | | |

| | | | | | | 6,692 | |

| | | | | | | | |

| | | | Total Minnesota | | | 6,732 | |

| | | | | | | | |

| | | | Mississippi — 0.7% | |

| | | | Housing — 0.7% | |

| | 590 | | | Mississippi Home Corp., Home Ownership Mortgage, Series A, Rev., GNMA COLL, 4.500%, 12/01/31 | | | 617 | |

| | 1,165 | | | Mississippi Home Corp., Single Family Mortgage, Series B-1, Rev., GNMA/FNMA/FHLMC, 5.375%, 12/01/38 | | | 1,206 | |

| | | | | | | | |

| | | | Total Mississippi | | | 1,823 | |

| | | | | | | | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | |

| | | |

| 16 | | | | J.P. MORGAN MUNICIPAL BOND FUNDS | | FEBRUARY 28, 2017 |

| | | | | | | | |

PRINCIPAL

AMOUNT($) | | �� | SECURITY DESCRIPTION | | VALUE($) | |

| | Municipal Bonds — continued | |

| | | | Missouri — 1.6% | |

| | | | Housing — 0.8% | |

| | 1,865 | | | Missouri Housing Development Commission, Single Family Mortgage, First Place Homeownership Loan Program, Series B, Rev., GNMA/FNMA/FHLMC COLL, 3.500%, 05/01/41 | | | 1,964 | |

| | 280 | | | Missouri Housing Development Commission, Single Family Mortgage, Special Homeownership Loan Program, Series E-1, Rev., GNMA/FNMA/FHLMC, 5.000%, 11/01/27 | | | 295 | |

| | | | | | | | |

| | | | | | | 2,259 | |

| | | | | | | | |

| | | | Transportation — 0.8% | |

| | 2,105 | | | City of St. Louis, Lambert-St. Louis International Airport, Series B, Rev., AMT, AGM, 5.000%, 07/01/19 | | | 2,134 | |

| | | | | | | | |

| | | | Total Missouri | | | 4,393 | |

| | | | | | | | |

| | | | Nevada — 0.0% (g) | |

| | | | Housing — 0.0% (g) | |

| | 73 | | | Nevada Rural Housing Authority, Single Family Mortgage, Series A, Rev., AMT, GNMA/FNMA/FHLMC, 5.200%, 11/01/40 | | | 75 | |

| | | | | | | | |

| | | | New Hampshire — 2.1% | |

| | | | Education — 2.0% | |

| | | | City of Manchester, School Facilities, | | | | |

| | 3,545 | | | Rev., NATL-RE, 5.500%, 06/01/24 | | | 4,302 | |

| | 900 | | | Rev., NATL-RE, 5.500%, 06/01/27 | | | 1,125 | |

| | | | | | | | |

| | | | | | | 5,427 | |

| | | | | | | | |

| | | | Housing — 0.1% | |

| | 245 | | | New Hampshire Housing Finance Authority, Single Family Mortgage, Series E, Rev., 6.625%, 07/01/38 | | | 259 | |

| | | | | | | | |

| | | | Total New Hampshire | | | 5,686 | |

| | | | | | | | |

| | | | New Jersey — 3.3% | |

| | | | Education — 1.0% | |

| | 250 | | | New Jersey Educational Facilities Authority, College of New Jersey Issue, Series A, Rev., 5.000%, 07/01/18 | | | 263 | |

| | | | New Jersey Higher Education Student Assistance Authority, Senior Student Loan, | | | | |

| | 500 | | | Series 1A, Rev., AMT, 5.000%, 12/01/19 | | | 537 | |

| | 1,750 | | | Series 1A, Rev., AMT, 5.000%, 12/01/24 | | | 1,943 | |

| | | | | | | | |

| | | | | | | 2,743 | |

| | | | | | | | |

| | | | | | | | |

PRINCIPAL

AMOUNT($) | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | | |

| | | | General Obligation — 0.5% | |

| | 1,215 | | | Egg Harbor Township Board of Education, GO, AGM, 5.750%, 07/15/24 | | | 1,494 | |

| | | | | | | | |

| | | | Hospital — 0.8% | |

| | | | New Jersey Health Care Facilities Financing Authority, University Hospital Issue, | | | | |

| | 1,000 | | | Series A, Rev., AGM, 5.000%, 07/01/22 | | | 1,128 | |

| | 820 | | | Series A, Rev., AGM, 5.000%, 07/01/23 | | | 932 | |

| | | | | | | | |

| | | | | | | 2,060 | |

| | | | | | | | |

| | | | Industrial Development Revenue/Pollution Control Revenue — 0.2% | |

| | 500 | | | Gloucester County Improvement Authority, Solid Waste Resource Recovery, Waste Management, Inc. Project, Series A, Rev., VAR, 2.125%, 12/01/17 | | | 503 | |

| | | | | | | | |

| | | | Transportation — 0.8% | |

| | 2,000 | | | New Jersey Transportation Trust Fund Authority, Transportation System, Series A, Rev., 5.500%, 12/15/21 | | | 2,191 | |

| | | | | | | | |

| | | | Total New Jersey | | | 8,991 | |

| | | | | | | | |

| | | | New York — 10.8% | |

| | | | Housing — 1.5% | |

| | | | New York Mortgage Agency, Homeowner Mortgage, | | | | |

| | 1,745 | | | Series 195, Rev., 4.000%, 10/01/46 | | | 1,878 | |

| | 1,665 | | | Series 197, Rev., 3.500%, 10/01/44 | | | 1,755 | |

| | 345 | | | New York State Mortgage Agency, 39th Series, Rev., 5.000%, 04/01/28 | | | 362 | |

| | | | | | | | |

| | | | | | | 3,995 | |

| | | | | | | | |

| | | | Other Revenue — 2.8% | |

| | 4,000 | | | New York State Dormitory Authority, State Sales Tax, Series B, Rev., 5.000%, 03/15/30 | | | 4,713 | |

| | | | Niagara Tobacco Asset Securitization Corp., Tobacco Settlement Asset-Backed Bonds, | | | | |

| | 400 | | | Rev., 5.000%, 05/15/22 | | | 452 | |

| | 1,660 | | | Rev., 5.000%, 05/15/23 | | | 1,896 | |

| | 500 | | | TSASC, Inc., Tobacco Settlement, Series B, Rev., 5.000%, 06/01/20 | | | 537 | |

| | | | | | | | |

| | | | | | | 7,598 | |

| | | | | | | | |

| | | | Prerefunded — 0.0% (g) | |

| | 5 | | | New York State Dormitory Authority, Series A, Rev., 5.250%, 02/15/19 (p) | | | 5 | |

| | | | | | | | |

| | | | Special Tax — 0.8% | |

| | 1,995 | | | New York State Dormitory Authority, Series A, Rev., 5.250%, 02/15/24 | | | 2,154 | |

| | | | | | | | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | | | |

| | | |

| FEBRUARY 28, 2017 | | J.P. MORGAN MUNICIPAL BOND FUNDS | | | | | 17 | |

JPMorgan Municipal Income Fund

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF FEBRUARY 28, 2017 (continued)

(Amounts in thousands)

| | | | | | | | |

PRINCIPAL