UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-23117

JPMorgan Trust IV

(Exact name of registrant as specified in charter)

270 Park Avenue

New York, NY 10017

(Address of principal executive offices) (Zip code)

Frank J. Nasta

270 Park Avenue

New York, NY 10017

(Name and Address of Agent for Service)

Registrant’s telephone number, including area code: (800) 480-4111

Date of fiscal year end: June 30

Date of reporting period: July 1, 2017 through December 31, 2017

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. Section 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

J.P. Morgan Funds

Semi-Annual Report

December 31, 2017 (Unaudited)

JPMorgan SmartSpendingSM 2050 Fund

Contents

Investments in the Fund are not deposits or obligations of, or guaranteed or endorsed by, any bank and are not insured or guaranteed by the FDIC, the Federal Reserve Board or any other government agency. You could lose money if you sell when the Fund’s share price is lower than when you invested.

Past performance is no guarantee of future performance. The general market views expressed in this report are opinions based on market and other conditions through the end of the reporting period and are subject to change without notice. These views are not intended to predict the future performance of the Fund or the securities markets. References to specific securities and their issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Such views are not meant as investment advice and may not be relied on as an indication of trading intent on behalf of the Fund.

Prospective investors should refer to the Fund’s prospectus for a discussion of the Fund’s investment objective, strategies and risks. Call J.P. Morgan Funds Service Center at 1-800-480-4111 for a prospectus containing more complete information about the Fund including management fees and other expenses. Please read it carefully before investing.

CEO’S LETTER

February 1, 2018 (Unaudited)

Dear Shareholder,

The U.S. economy continued to grow in the second half of 2017, supported by a synchronized global economy and central bank policies that also helped lift equity prices in the U.S. and elsewhere.

The U.S. economy entered its third longest expansion on record in 2017, and gross domestic product (GDP) rose by 3.2% in the third quarter and an estimated 2.6% in the fourth quarter. During the second half of 2017, unemployment fell to 4.1% in December from 4.3% in June, and U.S. consumer confidence reached a 17-year high in November. Corporate profits rose during the second half of the year amid stable energy prices and a decline in the value of the U.S. dollar.

Notably, the second half of 2017 included three large hurricanes, wildfires and other assorted natural disasters that combined to cause an estimated $306 billion in damage in the U.S. While companies in some specific sectors of the economy reported that Hurricanes Harvey, Irma and Maria affected revenue or earnings, any impact on the larger economy appeared to be limited.

The U.S. Federal Reserve raised interest rates in December 2017 and indicated it would raise rates three more times in the year ahead. However, interest rates overall remained relatively low during the reporting period and provided support for both the domestic economy and financial markets.

Most developed market and emerging market economies also continued to grow in the second half of 2017. Growth in Europe was strong enough that the European Central Bank committed to reducing its monthly asset purchases by half and the Bank of England raised its benchmark interest rate for the first time in ten years. Japan registered its longest economic expansion in a decade and China’s GDP grew by an estimated 6.8% in the second half of 2017, supported by personal consumption and growth in foreign trade.

Roughly 120 countries, comprising three-fourths of global GDP, had experienced increased economic growth by the end of 2017, according to the International Monetary Fund (IMF).

Meanwhile, global financial markets provided investors with positive returns for the six months ended December 31, 2017. Overall, equity markets outperformed bond markets, with emerging market equities largely outperforming developed market equities.

In the wake of stronger-than-expected growth in the U.S. and other leading economies, the IMF revised its forecast for 2018 U.S. GDP growth to 2.7% from 2.3%. The IMF cited growth from external demand and a reduction in U.S. corporate tax rates from the 2017 Tax Cuts and Jobs Act. Historically high consumer confidence, increased business investment and growth in corporate earnings all indicate that the U.S. economy should continue to expand. We believe investors who maintain a properly diversified portfolio and a long-term outlook will be able to benefit from the current global economic expansion.

We look forward to managing your investment needs for years to come. Should you have any questions, please visit www.jpmorganfunds.com or contact the J.P. Morgan Funds Service Center at 1-800-480-4111.

Sincerely yours,

George C.W. Gatch

CEO, Global Funds Management & Institutional, J.P. Morgan Asset Management

1

JPMorgan SmartSpendingSM 2050 Fund

FUND SUMMARY

Six Months Ended December 31, 2017 (Unaudited)

| | | | |

Reporting Period Return: | | | |

Fund (Class I Shares)* | | | 5.47 | % |

MSCI World Index (net of foreign withholding taxes) | | | 10.61 | % |

Bloomberg Barclays U.S. Aggregate Index (formerly Barclays U.S. Aggregate Index) | | | 1.24 | % |

Net Assets as of 12/31/2017 | | $ | 31,631,961 | |

Investment objective** and strategies.…. The JPMorgan SmartSpendingSM 2050 Fund (the “Fund”) seeks to provide total return consisting of current income and capital appreciation. The Fund will invest in J.P. Morgan funds and directly in securities and other financial instruments according to an investment strategy that seeks to achieve a level of total return that supports shareholders systematically redeeming, or spending down, a portion of their investment in the Fund each year until December 31, 2050 (the Fund’s maturity date).

| | | | |

PORTFOLIO COMPOSITION BY ASSET CLASS*** | | | |

Fixed Income | | | 61.5 | % |

U.S. Equity | | | 19.2 | |

International Equity | | | 12.8 | |

Short-Term Investment | | | 3.8 | |

Alternative Assets | | | 1.6 | |

U.S. Treasury Obligation | | | 1.1 | |

| * | The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| ** | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | Percentages indicated are based on total investments as of December 31, 2017. The Fund’s portfolio composition is subject to change. |

2

JPMorgan SmartSpendingSM 2050 Fund

FUND SUMMARY

Six Months Ended December 31, 2017 (Unaudited) (continued)

AVERAGE ANNUAL TOTAL RETURNS AS OF DECEMBER 31, 2017

| | | | | | | | | | | | | | |

| | | INCEPTION DATE OF CLASS | | 6 MONTH* | | | 1 YEAR | | | SINCE

INCEPTION | |

CLASS A SHARES | | December 30, 2016 | | | | | | | | | | | | |

With Sales Charge** | | | | | 0.58 | % | | | 5.84 | % | | | 5.82 | % |

Without Sales Charge | | | | | 5.34 | | | | 10.84 | | | | 10.81 | |

CLASS C SHARES | | December 30, 2016 | | | | | | | | | | | | |

With CDSC*** | | | | | 4.07 | | | | 9.30 | | | | 10.27 | |

Without CDSC | | | | | 5.07 | | | | 10.30 | | | | 10.27 | |

CLASS I SHARES | | December 30, 2016 | | | 5.47 | | | | 11.12 | | | | 11.09 | |

CLASS R2 SHARES | | December 30, 2016 | | | 5.12 | | | | 10.39 | | | | 10.36 | |

CLASS R3 SHARES | | December 30, 2016 | | | 5.25 | | | | 10.67 | | | | 10.64 | |

CLASS R4 SHARES | | December 30, 2016 | | | 5.38 | | | | 10.94 | | | | 10.91 | |

CLASS R5 SHARES | | December 30, 2016 | | | 5.45 | | | | 11.10 | | | | 11.07 | |

CLASS R6 SHARES | | December 30, 2016 | | | 5.52 | | | | 11.22 | | | | 11.19 | |

| ** | Sales Charge for Class A Shares is 4.50%. |

| *** | Assumes a 1% CDSC (contingent deferred sales charge) for the 6 month and one year periods and 0% CDSC thereafter. |

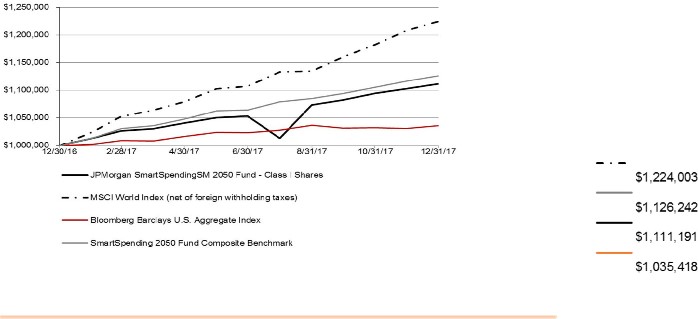

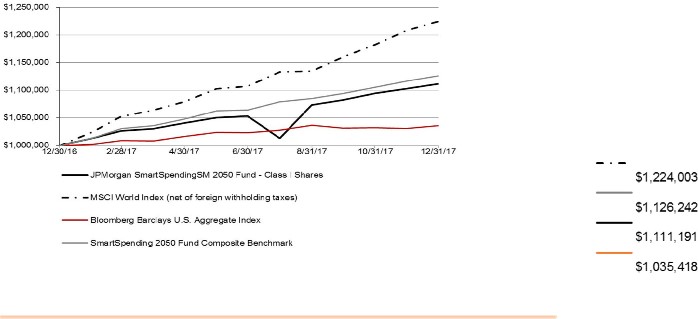

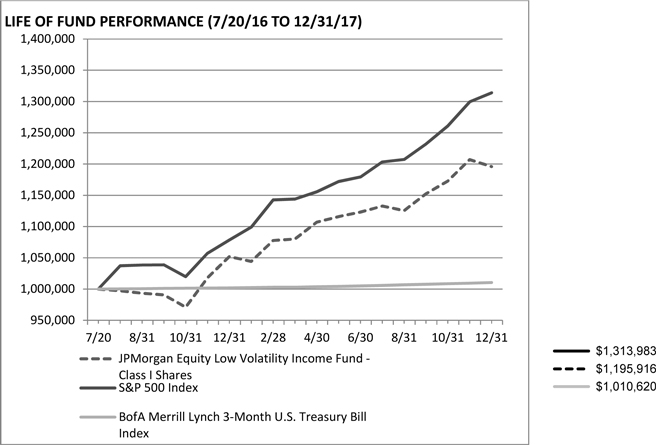

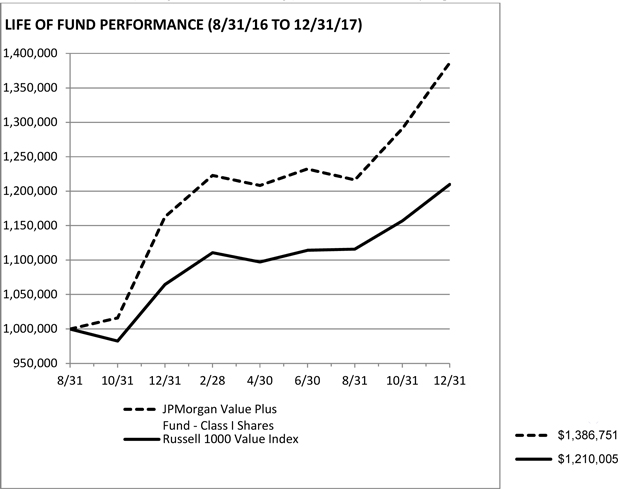

LIFE OF FUND PERFORMANCE (12/30/16 TO 13/31/17)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date, month-end performance information please call 1-800-480-4111.

3

JPMorgan SmartSpendingSM 2050 Fund

FUND SUMMARY

Six Months Ended December 31, 2017 (Unaudited) (continued)

The Fund commenced operations on December 30, 2016.

The graph illustrates comparative performance for $1,000,000 invested in Class I Shares of the JPMorgan SmartSpendingSM 2050 Fund, the MSCI World Index (net of foreign withholding taxes), the Bloomberg Barclays U.S. Aggregate Index and the JPMorgan SmartSpending 2050 Composite Benchmark from December 30, 2016 to December 31, 2017. The performance of the Fund may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares. The Bloomberg Barclays U.S. Aggregate Index is an unmanaged index representing SEC-registered taxable and dollar denominated securities. It covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through, and asset-backed securities. The MSCI World Index (net of foreign withholding taxes) is a broad measure of the performance of developed countries’ equity markets. The JPMorgan SmartSpending 2050 Composite Benchmark is a composite benchmark of unmanaged indexes that includes 50% MSCI World Index (net of foreign withholding taxes) and 50% Bloomberg Barclays U.S. Aggregate Index. Investors cannot invest directly in an index.

Class I Shares have a $1,000,000 minimum initial investment.

Since the Fund’s inception, it has not experienced any shareholder activity. If shareholder activity had occurred, the Fund’s performance may have been impacted.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

4

JPMorgan SmartSpendingSM 2050 Fund

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF DECEMBER 31, 2017 (Unaudited)

| | | | | | | | |

SHARES | | | SECURITY DESCRIPTION | | VALUE($) | |

| | Exchange Traded Funds — 28.1% | | | | |

| | | | Fixed Income — 15.5% | | | | |

| | 23,185 | | | iShares Core U.S. Aggregate Bond Fund | | | 2,534,815 | |

| | 20,829 | | | iShares TIPS Bond Fund | | | 2,376,173 | |

| | | | | | | | |

| | | | Total Fixed Income | | | 4,910,988 | |

| | | | | | | | |

| | | | International Equity — 8.1% | | | | |

| | 22,867 | | | iShares Core MSCI EAFE Fund | | | 1,511,280 | |

| | 18,321 | | | iShares Core MSCI Emerging Markets Fund | | | 1,042,465 | |

| | | | | | | | |

| | | | Total International Equity | | | 2,553,745 | |

| | | | | | | | |

| | | | U.S. Equity — 4.5% | | | | |

| | 1,973 | | | iShares Russell 2000 Fund | | | 300,804 | |

| | 2,326 | | | iShares Russell Mid-Cap Fund | | | 484,110 | |

| | 7,634 | | | Vanguard REIT Fund | | | 633,469 | |

| | | | | | | | |

| | | | Total U.S. Equity | | | 1,418,383 | |

| | | | | | | | |

| | | | Total Exchange Traded Funds (Cost $8,194,602) | | | 8,883,116 | |

| | | | | | | | |

|

SHARES | |

| | Investment Companies — 67.1% (b) | | | | |

| | | | Alternative Assets — 1.6% | | | | |

| | 54,319 | | | JPMorgan Commodities Strategy Fund, Class R6 Shares | | | 504,085 | |

| | | | | | | | |

| | | | Fixed Income — 46.0% | | | | |

| | 526,179 | | | JPMorgan Core Bond Fund, Class R6 Shares | | | 6,098,413 | |

| | 391,847 | | | JPMorgan Core Plus Bond Fund, Class R6 Shares | | | 3,244,495 | |

| | 30,153 | | | JPMorgan Corporate Bond Fund, Class R6 Shares | | | 298,514 | |

| | 93,577 | | | JPMorgan Emerging Markets Debt Fund, Class R6 Shares | | | 783,236 | |

| | 57,899 | | | JPMorgan Emerging Markets Strategic Debt Fund, Class R6 Shares | | | 490,407 | |

| | 82,481 | | | JPMorgan Floating Rate Income Fund, Class R6 Shares | | | 773,674 | |

| | 386,653 | | | JPMorgan High Yield Fund, Class R6 Shares | | | 2,865,098 | |

| | | | | | | | |

| | | | Total Fixed Income | | | 14,553,837 | |

| | | | | | | | |

| | | | International Equity — 4.7% | | | | |

| | 79,209 | | | JPMorgan International Research Enhanced Equity Fund, Class R6 Shares | | | 1,496,257 | |

| | | | | | | | |

| | | | | | |

SHARES | | SECURITY DESCRIPTION | | VALUE($) | |

Investment Companies — continued | | | | |

| | U.S. Equity — 14.8% | | | | |

| 56,533 | | JPMorgan Equity Index Fund, Class R6 Shares | | | 2,316,142 | |

| 30,389 | | JPMorgan Growth Advantage Fund, Class R6 Shares (a) | | | 627,536 | |

| 67,491 | | JPMorgan U.S. Equity Fund, Class R6 Shares | | | 1,102,134 | |

| 17,464 | | JPMorgan Value Advantage Fund, Class R6 Shares | | | 628,352 | |

| | | | | | |

| | Total U.S. Equity | | | 4,674,164 | |

| | | | | | |

| | Total Investment Companies (Cost $20,259,147) | | | 21,228,343 | |

| | | | | | |

| | |

PRINCIPAL AMOUNT($) | | | | | |

U.S. Treasury Obligation — 1.1% | | | | |

| 360,000 | | U.S. Treasury Notes, 0.75%, 01/31/2018 (k)

(Cost $359,956) | | | 359,863 | |

| | | | | | |

SHARES | | | | | |

Short-Term Investment — 3.8% | | | | |

| | Investment Company — 3.8% | | | | |

| 1,195,454 | | JPMorgan U.S. Government Money Market Fund, Institutional Class Shares, 1.14% (b) (l)

(Cost $1,195,454) | | | 1,195,454 | |

| | | | | | |

| | Total Investments — 100.1% (Cost $30,009,159) | | | 31,666,776 | |

| | Liabilities in Excess of Other Assets — (0.1)% | | | (34,815 | ) |

| | | | | | |

| | NET ASSETS — 100.0% | | $ | 31,631,961 | |

| | | | | | |

Percentages indicated are based on net assets.

SEE NOTES TO FINANCIAL STATEMENTS.

5

JPMorgan SmartSpendingSM 2050 Fund

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF DECEMBER 31, 2017 (Unaudited) (continued)

Futures contracts outstanding as of December 31, 2017:

| | | | | | | | | | | | | | | | | | | | |

Description | | Number of

Contracts | | | Expiration

Date | | | Trading Currency | | | Notional Amount

($) | | | Value and

Unrealized

Appreciation

(Depreciation) ($) | |

Long Contracts | | | | | | | | | | | | | | | | | | | | |

Australia 10 Year Bond | | | 6 | | | | 03/2018 | | | | AUD | | | | 604,653 | | | | (4,647 | ) |

EURO STOXX 50 Index | | | 15 | | | | 03/2018 | | | | EUR | | | | 627,055 | | | | (17,376 | ) |

MSCI Emerging Markets E- | | | | | | | | | | | | | | | | | | | | |

Mini Index | | | 11 | | | | 03/2018 | | | | USD | | | | 640,035 | | | | 26,157 | |

S&P 500 E-Mini Index | | | 3 | | | | 03/2018 | | | | USD | | | | 401,400 | | | | 5,064 | |

TOPIX Index | | | 5 | | | | 03/2018 | | | | JPY | | | | 804,132 | | | | 17,810 | |

U.S. Treasury 10 Year Note | | | 11 | | | | 03/2018 | | | | USD | | | | 1,364,172 | | | | (4,063 | ) |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | 22,945 | |

| | | | | | | | | | | | | | | | | | | | |

Short Contracts | | | | | | | | | | | | | | | | | | | | |

Euro-Bund | | | (5 | ) | | | 03/2018 | | | | EUR | | | | (969,959 | ) | | | 11,104 | |

FTSE 100 Index | | | (3 | ) | | | 03/2018 | | | | GBP | | | | (308,196 | ) | | | (11,199 | ) |

U.S. Treasury 2 Year Note | | | (7 | ) | | | 03/2018 | | | | USD | | | | (1,498,656 | ) | | | 2,283 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | 2,188 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | 25,133 | |

| | | | | | | | | | | | | | | | | | | | |

NOTES TO SCHEDULE OF PORTFOLIO INVESTMENTS

| | | | |

AUD | | — | | Australian Dollar |

EAFE | | — | | Europe, Australasia and Far East |

EUR | | — | | Euro |

FTSE | | — | | Financial Times and the London Stock Exchange |

GBP | | — | | British Pound |

JPY | | — | | Japanese Yen |

MSCI | | — | | Morgan Stanley Capital International |

REIT | | — | | Real Estate Investment Trust. |

TIPS | | — | | Treasury Inflation Protected Security |

TOPIX | | — | | Tokyo Stock Price Index |

USD | | — | | United States Dollar |

(a) | | — | | Non-income producing security. |

(b) | | — | | Investment in affiliate. Fund is registered under the Investment Company Act of 1940, as amended, and advised by J.P. Morgan Investment Management Inc. |

(k) | | — | | All or a portion of this security is deposited with the broker as initial margin for futures contracts. |

(l) | | — | | The rate shown is the current yield as of December 31, 2017. |

Detailed information about investment portfolios of the underlying funds can be found in shareholder reports filed with the Securities and Exchange Commission (SEC) by each such underlying fund semi-annually on Form N-CSR and in certified portfolio holdings filed quarterly on Form N-Q, and are available for download from both the SEC’s as well as each respective underlying fund’s website. Detailed information about underlying J.P. Morgan Funds can also be found at www.jpmorganfunds.com or by calling 1-800-480-4111.

SEE NOTES TO FINANCIAL STATEMENTS.

6

STATEMENT OF ASSETS AND LIABILITIES

AS OF DECEMBER 31, 2017 (Unaudited)

| | | | |

| | | JPMorgan

SmartSpendingSM

2050 Fund | |

ASSETS: | | | | |

Investments in non-affiliates, at value | | $ | 9,242,979 | |

Investments in affiliates, at value | | | 22,423,797 | |

Receivables: | | | | |

Investment securities sold | | | 3,899,399 | |

Interest from non-affiliates | | | 1,130 | |

Dividends from affiliates | | | 990 | |

Variation margin on futures contracts | | | 132,949 | |

Due from Adviser | | | 23,615 | |

| | | | |

Total Assets | | | 35,724,859 | |

| | | | |

LIABILITIES: | | | | |

Payables: | | | | |

Investment securities purchased | | | 3,930,882 | |

Fund shares redeemed | | | 132,442 | |

Accrued liabilities: | | | | |

Distribution fees | | | 37 | |

Service fees | | | 2,415 | |

Custodian and accounting fees | | | 9,582 | |

Other | | | 17,540 | |

| | | | |

Total Liabilities | | | 4,092,898 | |

| | | | |

Net Assets | | $ | 31,631,961 | |

| | | | |

NET ASSETS: | | | | |

Paid-in-Capital | | $ | 29,473,566 | |

Accumulated undistributed (distributions in excess of) net investment income | | | (44,282 | ) |

Accumulated net realized gains (losses) | | | 521,788 | |

Net unrealized appreciation (depreciation) | | | 1,680,889 | |

| | | | |

Total Net Assets | | $ | 31,631,961 | |

| | | | |

Net Assets: | | | | |

Class A | | $ | 22,168 | |

Class C | | | 22,054 | |

Class I | | | 31,476,901 | |

Class R2 | | | 22,073 | |

Class R3 | | | 22,128 | |

Class R4 | | | 22,183 | |

Class R5 | | | 22,215 | |

Class R6 | | | 22,239 | |

| | | | |

Total | | $ | 31,631,961 | |

| | | | |

Outstanding units of beneficial interest (shares) ($0.0001 par value; unlimited number of shares authorized): | | | | |

Class A | | | 1,378 | |

Class C | | | 1,371 | |

Class I | | | 1,956,714 | |

Class R2 | | | 1,372 | |

Class R3 | | | 1,376 | |

Class R4 | | | 1,379 | |

Class R5 | | | 1,381 | |

Class R6 | | | 1,382 | |

| |

Net Asset Value (a): | | | | |

Class A - Redemption price per share | | $ | 16.09 | |

Class C - Offering price per share (b) | | | 16.09 | |

Class I - Offering and redemption price per share | | | 16.09 | |

Class R2 - Offering and redemption price per share | | | 16.09 | |

Class R3 - Offering and redemption price per share | | | 16.09 | |

Class R4 - Offering and redemption price per share | | | 16.09 | |

Class R5 - Offering and redemption price per share | | | 16.09 | |

Class R6 - Offering and redemption price per share | | | 16.09 | |

Class A maximum sales charge | | | 4.50 | % |

Class A maximum public offering price per share [net asset value per share/(100% – maximum sales charge)] | | $ | 16.85 | |

| | | | |

Cost of investments in non-affiliates | | $ | 8,554,558 | |

Cost of investments in affiliates | | | 21,454,601 | |

| (a) | Per share amounts may not recalculate due to rounding of net assets and/or shares outstanding. |

| (b) | Redemption price for Class C Shares varies based upon length of time the shares are held. |

SEE NOTES TO FINANCIAL STATEMENTS.

7

STATEMENT OF OPERATIONS

FOR THE SIX MONTHS ENDED DECEMBER 31, 2017 (Unaudited)

| | | | |

| | | JPMorgan

SmartSpendingSM

2050 Fund | |

INVESTMENT INCOME: | | | | |

Dividend income from non-affiliates | | $ | 155,771 | |

Dividend income from affiliates | | | 280,743 | |

Interest income from non-affiliates | | | 1,595 | |

| | | | |

Total investment income | | | 438,109 | |

| | | | |

EXPENSES: | | | | |

Investment advisory fees | | | 55,340 | |

Administration fees | | | 12,875 | |

Distribution fees: | | | | |

Class A | | | 28 | |

Class C | | | 82 | |

Class R2 | | | 54 | |

Class R3 | | | 27 | |

Service fees: | | | | |

Class A | | | 28 | |

Class C | | | 27 | |

Class I | | | 39,338 | |

Class R2 | | | 27 | |

Class R3 | | | 27 | |

Class R4 | | | 28 | |

Class R5 | | | 13 | |

Custodian and accounting fees | | | 13,631 | |

Professional fees | | | 13,928 | |

Trustees’ and Chief Compliance Officer’s fees | | | 12,899 | |

Printing and mailing costs | | | 9,517 | |

Registration and filing fees | | | 672 | |

Transfer agency fees (See Note 2.H) | | | 231 | |

Offering costs | | | 47,104 | |

Other | | | 4,956 | |

| | | | |

Total expenses | | | 210,832 | |

| | | | |

Less fees waived | | | (85,026 | ) |

Less expense reimbursements | | | (94,315 | ) |

| | | | |

Net expenses | | | 31,491 | |

| | | | |

Net investment income (loss) | | | 406,618 | |

| | | | |

REALIZED/UNREALIZED GAINS (LOSSES): | | | | |

Net realized gain (loss) on transactions from: | | | | |

Investments in non-affiliates | | | 99,079 | |

Investments in affiliates | | | 296,762 | |

Futures contracts | | | 189,993 | |

Foreign currency transactions | | | 161 | |

| | | | |

Net realized gain (loss) | | | 585,995 | |

| | | | |

Distributions of capital gains received from investment company affiliates | | | 189,825 | |

| | | | |

Change in net unrealized appreciation/depreciation on: | | | | |

Investments in non-affiliates | | | 235,654 | |

Investments in affiliates | | | 238,676 | |

Futures contracts | | | (619 | ) |

Foreign currency translations | | | 9 | |

| | | | |

Change in net unrealized appreciation/depreciation | | | 473,720 | |

| | | | |

Net realized/unrealized gains (losses) | | | 1,249,540 | |

| | | | |

Change in net assets resulting from operations | | $ | 1,656,158 | |

| | | | |

SEE NOTES TO FINANCIAL STATEMENTS.

8

STATEMENTS OF CHANGES IN NET ASSETS

FOR THE PERIODS INDICATED

| | | | | | | | |

| | | JPMorgan

SmartSpendingSM 2050

Fund | |

| | | Six Months Ended

December 31, 2017

(Unaudited) | | | Period Ended June 30,

2017 (a) | |

CHANGE IN NET ASSETS RESULTING FROM OPERATIONS: | | | | | | | | |

Net investment income (loss) | | $ | 406,618 | | | $ | 320,465 | |

Net realized gain (loss) | | | 585,995 | | | | 80,612 | |

Distributions of capital gains received from investment company affiliates | | | 189,825 | | | | — | |

Change in net unrealized appreciation/depreciation | | | 473,720 | | | | 1,207,169 | |

| | | | | | | | |

Change in net assets resulting from operations | | | 1,656,158 | | | | 1,608,246 | |

| | | | | | | | |

DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

Class A | | | | | | | | |

From net investment income | | | (309 | ) | | | (164 | ) |

From net realized gains | | | (237 | ) | | | — | |

Class C | | | | | | | | |

From net investment income | | | (253 | ) | | | (114 | ) |

From net realized gains | | | (235 | ) | | | — | |

Class I | | | | | | | | |

From net investment income | | | (482,765 | ) | | | (281,132 | ) |

From net realized gains | | | (337,297 | ) | | | — | |

Class R2 | | | | | | | | |

From net investment income | | | (263 | ) | | | (122 | ) |

From net realized gains | | | (236 | ) | | | — | |

Class R3 | | | | | | | | |

From net investment income | | | (290 | ) | | | (148 | ) |

From net realized gains | | | (236 | ) | | | — | |

Class R4 | | | | | | | | |

From net investment income | | | (318 | ) | | | (173 | ) |

From net realized gains | | | (237 | ) | | | — | |

Class R5 | | | | | | | | |

From net investment income | | | (333 | ) | | | (189 | ) |

From net realized gains | | | (237 | ) | | | — | |

Class R6 | | | | | | | | |

From net investment income | | | (346 | ) | | | (199 | ) |

From net realized gains | | | (237 | ) | | | — | |

| | | | | | | | |

Total distributions to shareholders | | | (823,829 | ) | | | (282,241 | ) |

| | | | | | | | |

CAPITAL TRANSACTIONS: | | | | | | | | |

Change in net assets resulting from capital transactions | | | (141,947 | ) | | | 29,615,574 | |

| | | | | | | | |

NET ASSETS: | | | | | | | | |

Change in net assets | | | 690,382 | | | | 30,941,579 | |

Beginning of period | | | 30,941,579 | | | | — | |

| | | | | | | | |

End of period | | $ | 31,631,961 | | | $ | 30,941,579 | |

| | | | | | | | |

Accumulated undistributed (distributions in excess of) net investment income | | $ | (44,282 | ) | | $ | 33,977 | |

| | | | | | | | |

| (a) | Commencement of operations was December 30, 2016. |

SEE NOTES TO FINANCIAL STATEMENTS.

9

STATEMENTS OF CHANGES IN NET ASSETS

FOR THE PERIODS INDICATED (continued)

| | | | | | | | |

| | | JPMorgan

SmartSpendingSM 2050

Fund | |

| | | Six Months Ended

December 31, 2017

(Unaudited) | | | Period Ended June 30,

2017 (a) | |

CAPITAL TRANSACTIONS: | | | | | | | | |

Class A | | | | | | | | |

Proceeds from shares issued | | $ | — | | | $ | 20,000 | |

Distributions reinvested | | | 546 | | | | 164 | |

| | | | | | | | |

Change in net assets resulting from Class A capital transactions | | $ | 546 | | | $ | 20,164 | |

| | | | | | | | |

Class C | | | | | | | | |

Proceeds from shares issued | | $ | — | | | $ | 20,000 | |

Distributions reinvested | | | 488 | | | | 114 | |

| | | | | | | | |

Change in net assets resulting from Class C capital transactions | | $ | 488 | | | $ | 20,114 | |

| | | | | | | | |

Class I | | | | | | | | |

Proceeds from shares issued | | $ | — | | | $ | 29,860,000 | |

Distributions reinvested | | | 820,062 | | | | 281,132 | |

Cost of shares redeemed | | | (965,776 | ) | | | (666,667 | ) |

| | | | | | | | |

Change in net assets resulting from Class I capital transactions | | $ | (145,714 | ) | | $ | 29,474,465 | |

| | | | | | | | |

Class R2 | | | | | | | | |

Proceeds from shares issued | | $ | — | | | $ | 20,000 | |

Distributions reinvested | | | 499 | | | | 122 | |

| | | | | | | | |

Change in net assets resulting from Class R2 capital transactions | | $ | 499 | | | $ | 20,122 | |

| | | | | | | | |

Class R3 | | | | | | | | |

Proceeds from shares issued | | $ | — | | | $ | 20,000 | |

Distributions reinvested | | | 526 | | | | 148 | |

| | | | | | | | |

Change in net assets resulting from Class R3 capital transactions | | $ | 526 | | | $ | 20,148 | |

| | | | | | | | |

Class R4 | | | | | | | | |

Proceeds from shares issued | | $ | — | | | $ | 20,000 | |

Distributions reinvested | | | 555 | | | | 173 | |

| | | | | | | | |

Change in net assets resulting from Class R4 capital transactions | | $ | 555 | | | $ | 20,173 | |

| | | | | | | | |

Class R5 | | | | | | | | |

Proceeds from shares issued | | $ | — | | | $ | 20,000 | |

Distributions reinvested | | | 570 | | | | 189 | |

| | | | | | | | |

Change in net assets resulting from Class R5 capital transactions | | $ | 570 | | | $ | 20,189 | |

| | | | | | | | |

Class R6 | | | | | | | | |

Proceeds from shares issued | | $ | — | | | $ | 20,000 | |

Distributions reinvested | | | 583 | | | | 199 | |

| | | | | | | | |

Change in net assets resulting from Class R6 capital transactions | | $ | 583 | | | $ | 20,199 | |

| | | | | | | | |

Total change in net assets resulting from capital transactions | | $ | (141,947 | ) | | $ | 29,615,574 | |

| | | | | | | | |

| (a) | Commencement of operations was December 30, 2016. |

SEE NOTES TO FINANCIAL STATEMENTS.

10

STATEMENTS OF CHANGES IN NET ASSETS

FOR THE PERIODS INDICATED (continued)

| | | | | | | | |

| | | JPMorgan

SmartSpendingSM 2050

Fund | |

| | | Six Months Ended

December 31, 2017

(Unaudited) | | | Period Ended June 30,

2017 (a) | |

SHARE TRANSACTIONS: | | | | | | | | |

Class A | | | | | | | | |

Issued | | | — | | | | 1,333 | |

Reinvested | | | 34 | | | | 11 | |

| | | | | | | | |

Change in Class A Shares | | | 34 | | | | 1,344 | |

| | | | | | | | |

Class C | | | | | | | | |

Issued | | | — | | | | 1,334 | |

Reinvested | | | 30 | | | | 7 | |

| | | | | | | | |

Change in Class C Shares | | | 30 | | | | 1,341 | |

| | | | | | | | |

Class I | | | | | | | | |

Issued | | | — | | | | 1,990,667 | |

Reinvested | | | 51,020 | | | | 18,135 | |

Redeemed | | | (60,240 | ) | | | (42,868 | ) |

| | | | | | | | |

Change in Class I Shares | | | (9,220 | ) | | | 1,965,934 | |

| | | | | | | | |

Class R2 | | | | | | | | |

Issued | | | — | | | | 1,333 | |

Reinvested | | | 31 | | | | 8 | |

| | | | | | | | |

Change in Class R2 Shares | | | 31 | | | | 1,341 | |

| | | | | | | | |

Class R3 | | | | | | | | |

Issued | | | — | | | | 1,333 | |

Reinvested | | | 33 | | | | 10 | |

| | | | | | | | |

Change in Class R3 Shares | | | 33 | | | | 1,343 | |

| | | | | | | | |

Class R4 | | | | | | | | |

Issued | | | — | | | | 1,333 | |

Reinvested | | | 35 | | | | 11 | |

| | | | | | | | |

Change in Class R4 Shares | | | 35 | | | | 1,344 | |

| | | | | | | | |

Class R5 | | | | | | | | |

Issued | | | — | | | | 1,334 | |

Reinvested | | | 35 | | | | 12 | |

| | | | | | | | |

Change in Class R5 Shares | | | 35 | | | | 1,346 | |

| | | | | | | | |

Class R6 | | | | | | | | |

Issued | | | — | | | | 1,333 | |

Reinvested | | | 36 | | | | 13 | |

| | | | | | | | |

Change in Class R6 Shares | | | 36 | | | | 1,346 | |

| | | | | | | | |

| (a) | Commencement of operations was December 30, 2016. |

SEE NOTES TO FINANCIAL STATEMENTS.

11

FINANCIAL HIGHLIGHTS

FOR THE PERIODS INDICATED

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Per share operating performance | | | Ratios/Supplemental data | |

| | | | | | Investment operations | | | Distributions | | | | | | | | | Ratios to average net assets (a) | | | | |

| | | Net asset

value,

beginning of

period | | | Net investment

income (loss)

(b)(c) | | | Net realized and

unrealized gains

(losses) on

investments | | | Total from

investment

operations | | | Net

investment

income | | | Net

realized

gain | | | Total

distributions | | | Net asset

value, end

of period | | | Total return

(excludes

sales

charge)

(d)(e) | | | Net assets,

end of period | | | Net expenses

(f)(g) | | | Net

investment income

(loss) (c)(g) | | | Expenses without

waivers and

reimbursements

(f)(g) | | | Portfolio

turnover

rate (d) | |

SmartSpending 2050 Fund | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Class A | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Six Months Ended December 31, 2017 (Unaudited) | | $ | 15.66 | | | $ | 0.19 | | | $ | 0.64 | | | $ | 0.83 | | | $ | (0.23 | ) | | $ | (0.17 | ) | | $ | (0.40 | ) | | $ | 16.09 | | | | 5.34 | % | | $ | 22,168 | | | | 0.44 | % | | | 2.37 | % | | | 1.63 | % | | | 23 | % |

December 30, 2016 (h) through June 30, 2017 | | | 15.00 | | | | 0.14 | | | | 0.64 | | | | 0.78 | | | | (0.12 | ) | | | — | | | | (0.12 | ) | | | 15.66 | | | | 5.23 | | | | 21,050 | | | | 0.45 | | | | 1.85 | | | | 3.76 | | | | 8 | |

Class C | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Six Months Ended December 31, 2017 (Unaudited) | | | 15.66 | | | | 0.15 | | | | 0.64 | | | | 0.79 | | | | (0.19 | ) | | | (0.17 | ) | | | (0.36 | ) | | | 16.09 | | | | 5.07 | | | | 22,054 | | | | 0.95 | | | | 1.82 | | | | 2.20 | | | | 23 | |

December 30, 2016 (h) through June 30, 2017 | | | 15.00 | | | | 0.10 | | | | 0.64 | | | | 0.74 | | | | (0.08 | ) | | | — | | | | (0.08 | ) | | | 15.66 | | | | 4.97 | | | | 21,000 | | | | 0.93 | | | | 1.36 | | | | 4.32 | | | | 8 | |

Class I | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Six Months Ended December 31, 2017 (Unaudited) | | | 15.66 | | | | 0.21 | | | | 0.64 | | | | 0.85 | | | | (0.25 | ) | | | (0.17 | ) | | | (0.42 | ) | | | 16.09 | | | | 5.47 | | | | 31,476,901 | | | | 0.20 | | | | 2.57 | | | | 1.19 | | | | 23 | |

December 30, 2016 (h) through June 30, 2017 | | | 15.00 | | | | 0.16 | | | | 0.64 | | | | 0.80 | | | | (0.14 | ) | | | — | | | | (0.14 | ) | | | 15.66 | | | | 5.36 | | | | 30,794,263 | | | | 0.19 | | | | 2.09 | | | | 1.26 | | | | 8 | |

Class R2 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Six Months Ended December 31, 2017 (Unaudited) | | | 15.66 | | | | 0.15 | | | | 0.64 | | | | 0.79 | | | | (0.19 | ) | | | (0.17 | ) | | | (0.36 | ) | | | 16.09 | | | | 5.12 | | | | 22,073 | | | | 0.86 | | | | 1.91 | | | | 1.95 | | | | 23 | |

December 30, 2016 (h) through June 30, 2017 | | | 15.00 | | | | 0.11 | | | | 0.64 | | | | 0.75 | | | | (0.09 | ) | | | — | | | | (0.09 | ) | | | 15.66 | | | | 5.02 | | | | 21,009 | | | | 0.84 | | | | 1.44 | | | | 4.09 | | | | 8 | |

Class R3 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Six Months Ended December 31, 2017 (Unaudited) | | | 15.66 | | | | 0.17 | | | | 0.64 | | | | 0.81 | | | | (0.21 | ) | | | (0.17 | ) | | | (0.38 | ) | | | 16.09 | | | | 5.25 | | | | 22,128 | | | | 0.61 | | | | 2.16 | | | | 1.70 | | | | 23 | |

December 30, 2016 (h) through June 30, 2017 | | | 15.00 | | | | 0.13 | | | | 0.64 | | | | 0.77 | | | | (0.11 | ) | | | — | | | | (0.11 | ) | | | 15.66 | | | | 5.15 | | | | 21,035 | | | | 0.59 | | | | 1.69 | | | | 3.82 | | | | 8 | |

Class R4 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Six Months Ended December 31, 2017 (Unaudited) | | | 15.66 | | | | 0.19 | | | | 0.64 | | | | 0.83 | | | | (0.23 | ) | | | (0.17 | ) | | | (0.40 | ) | | | 16.09 | | | | 5.38 | | | | 22,183 | | | | 0.36 | | | | 2.41 | | | | 1.45 | | | | 23 | |

December 30, 2016 (h) through June 30, 2017 | | | 15.00 | | | | 0.15 | | | | 0.64 | | | | 0.79 | | | | (0.13 | ) | | | — | | | | (0.13 | ) | | | 15.66 | | | | 5.27 | | | | 21,060 | | | | 0.35 | | | | 1.94 | | | | 3.57 | | | | 8 | |

Class R5 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Six Months Ended December 31, 2017 (Unaudited) | | | 15.66 | | | | 0.21 | | | | 0.63 | | | | 0.84 | | | | (0.24 | ) | | | (0.17 | ) | | | (0.41 | ) | | | 16.09 | | | | 5.45 | | | | 22,215 | | | | 0.23 | | | | 2.55 | | | | 1.31 | | | | 23 | |

December 30, 2016 (h) through June 30, 2017 | | | 15.00 | | | | 0.16 | | | | 0.64 | | | | 0.80 | | | | (0.14 | ) | | | — | | | | (0.14 | ) | | | 15.66 | | | | 5.35 | | | | 21,076 | | | | 0.20 | | | | 2.09 | | | | 3.43 | | | | 8 | |

Class R6 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Six Months Ended December 31, 2017 (Unaudited) | | | 15.66 | | | | 0.22 | | | | 0.63 | | | | 0.85 | | | | (0.25 | ) | | | (0.17 | ) | | | (0.42 | ) | | | 16.09 | | | | 5.52 | | | | 22,239 | | | | 0.11 | | | | 2.67 | | | | 1.19 | | | | 23 | |

December 30, 2016 (h) through June 30, 2017 | | | 15.00 | | | | 0.17 | | | | 0.64 | | | | 0.81 | | | | (0.15 | ) | | | — | | | | (0.15 | ) | | | 15.66 | | | | 5.40 | | | | 21,086 | | | | 0.10 | | | | 2.19 | | | | 3.33 | | | | 8 | |

| (a) | Annualized for periods less than one year, unless otherwise noted. |

| (b) | Calculated based upon average shares outstanding. |

| (c) | Net investment income (loss) is affected by timing of distributions from underlying Funds. |

| (d) | Not annualized for periods less than one year. |

| (e) | Includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset values for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder transactions. |

| (f) | Does not include expenses of underlying Funds. |

| (g) | Certain non-recurring expenses incurred by the Fund were not annualized for the six months ended December 31, 2017 and the period ended June 30, 2017. |

| (h) | Commencement of operations. |

SEE NOTES TO FINANCIAL STATEMENTS.

12

NOTES TO FINANCIAL STATEMENTS

AS OF DECEMBER 31, 2017 (Unaudited)

1. Organization

JPMorgan Trust IV (the “Trust”) was formed on November 11, 2015, as a Delaware statutory trust, pursuant to a Declaration of Trust dated November 11, 2015 and is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company.

The following is a separate fund of the Trust (the “Fund”) covered by this report:

| | | | |

Classes Offered | | Diversified/ Non-Diversified |

SmartSpendingSM 2050 Fund Class A, Class C, Class I, Class R2, Class R3, Class R4, Class R5 and Class R6 | | Diversified |

The investment objective of the Fund is to seek to provide total return consisting of current income and capital appreciation.

The Fund commenced operations on December 30, 2016. Currently, the Fund is not publicly offered for investment.

Class A Shares generally provide for a front-end sales charge while Class C Shares provide for a contingent deferred sales charge (“CDSC”). No sales charges are assessed with respect to Class I, Class R2, Class R3, Class R4, Class R5 and Class R6 Shares. Certain Class A Shares, for which front-end sales charges have been waived, may be subject to a CDSC as described in the Fund’s prospectus. Beginning on November 14, 2017, Class C Shares automatically convert to Class A Shares after ten years. All classes of shares have equal rights as to earnings, assets and voting privileges, except that each class may bear different transfer agency, distribution and service fees and each class has exclusive voting rights with respect to its distribution plan and shareholder servicing agreements.

J.P. Morgan Investment Management Inc. (“JPMIM”), an indirect, wholly-owned subsidiary of JPMorgan Chase & Co. (“JPMorgan”), acts as Adviser (the “Adviser”) and Administrator (the “Administrator”) to the Fund.

2. Significant Accounting Policies

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. The Fund is an investment company and, accordingly, follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board Accounting Standards Codification Topic 946 — Investment Companies, which is part of U.S. generally accepted accounting principles (“GAAP”). The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

A. Valuation of Investments — The valuation of investments is in accordance with GAAP and the Fund’s valuation policies set forth by and under the supervision and responsibility of the Board of Trustees (the “Board”), which established the following approach to valuation, as described more fully below: (i) investments for which market quotations are readily available shall be valued at such unadjusted quoted prices and (ii) all other investments for which market quotations are not readily available shall be valued at their fair value as determined in good faith by the Board.

The Administrator has established the J.P. Morgan Asset Management Americas Valuation Committee (“AVC”) to assist the Board with the oversight and monitoring of the valuation of the Fund’s investments. The Administrator implements the valuation policies of the Fund’s investments, as directed by the Board. The AVC oversees and carries out the policies for the valuation of investments held in the Fund. This includes monitoring the appropriateness of fair values based on results of ongoing valuation oversight, including but not limited to consideration of macro or security specific events, market events and pricing vendor and broker due diligence. The Administrator is responsible for discussing and assessing the potential impacts to the fair values on an ongoing basis, and at least on a quarterly basis with the AVC and the Board.

Equities and other exchange-traded instruments are valued at the last sale price or official market closing price on the primary exchange on which the instrument is traded before the net asset values (“NAV”) of the Fund are calculated on a valuation date. Certain foreign equity instruments, as well as certain derivatives with equity reference obligations, are valued by applying international fair value factors provided by approved affiliated and unaffiliated pricing vendors or third party broker-dealers (collectively referred to as “Pricing Services”). The factors seek to adjust the local closing price for movements of local markets post closing, but prior to the time the NAVs are calculated. Investments in open-end investment companies, excluding exchange-traded funds (“ETFs”) (the “Underlying Funds”), are valued at each Underlying Fund’s NAV per share as of the report date.

Fixed income instruments are valued based on prices received from Pricing Services. The Pricing Services use multiple valuation techniques to determine the valuation of fixed income instruments. In instances where sufficient market activity exists, the Pricing Services may utilize a market-based approach through which trades or quotes from market makers are used to determine the valuation of these instruments. In instances where sufficient market activity may not exist, the Pricing Services also utilize proprietary valuation models which may consider market transactions in comparable securities and the various relationships between securities in determining fair value and/or market characteristics in order to estimate the relevant cash flows, which are then discounted to calculate the fair values.

Futures are generally valued on the basis of available market quotations.

Valuations reflected in this report are as of the report date. As a result, changes in valuation due to market events and/or issuer related events after the report date and prior to issuance of the report are not reflected herein.

The various inputs that are used in determining the valuation of the Fund’s investments are summarized into the three broad levels listed below.

| • | | Level 1 — Unadjusted inputs using quoted prices in active markets for identical investments. |

13

| • | | Level 2 — Other significant observable inputs including, but not limited to, quoted prices for similar investments, inputs other than quoted prices that are observable for investments (such as interest rates, prepayment speeds, credit risk, etc.) or other market corroborated inputs. |

| • | | Level 3 — Significant inputs based on the best information available in the circumstances, to the extent observable inputs are not available (including the Fund’s assumptions in determining the fair value of investments). |

A financial instrument’s level within the fair value hierarchy is based on the lowest level of any input, both individually and in the aggregate, that is significant to the fair value measurement. The inputs or methodology used for valuing instruments are not necessarily an indication of the risk associated with investing in those instruments.

The following table represents each valuation input as presented on the Schedule of Portfolio Investments (“SOI”):

| | | | | | | | | | | | | | | | |

| | | Level 1

Quoted prices | | | Level 2

Other significant

observable

inputs | | | Level 3

Significant

unobservable

inputs | | | Total | |

Total Investments in Securities (a) | | $ | 31,306,913 | | | $ | 359,863 | | | $ | — | | | $ | 31,666,776 | |

| | | | | | | | | | | | | | | | |

Appreciation in Other Financial Instruments | | | | | | | | | | | | |

Futures Contracts (a) | | $ | 44,608 | | | $ | 17,810 | | | $ | — | | | $ | 62,418 | |

| | | | | | | | | | | | | | | | |

Depreciation in Other Financial Instruments | | | | | | | | | | | | |

Futures Contracts (a) | | $ | (8,710 | ) | | $ | (28,575 | ) | | $ | — | | | $ | (37,285 | ) |

| | | | | | | | | | | | | | | | |

| (a) | All portfolio holdings designated in level 1 and level 2 are disclosed individually on the SOI. Level 2 consists of foreign futures with equity reference obligations and a U.S. Treasury Note held as initial margin for futures contracts. Please refer to the SOI for asset class specifics of portfolio holdings. |

There were no transfers among any levels during the six months December 31, 2017.

B. Futures Contracts — The Fund used treasury and index futures contracts to gain exposure to or to overweight or underweight allocations among various sectors or markets, maintain liquidity or minimize transaction costs. The Fund also buys futures contracts to invest incoming cash in the market or sells futures in response to cash outflows, thereby simulating an invested position in the underlying index while maintaining a cash balance for liquidity.

Futures contracts provide for the delayed delivery of the underlying instrument at a fixed price or are settled for a cash amount based on the change in the value of the underlying instrument at a specific date in the future. Upon entering into a futures contract, the Fund is required to deposit with the broker, cash or securities in an amount equal to a certain percentage of the contract amount, which is referred to as the initial margin deposit. Subsequent payments, referred to as variation margin, are made or received by the Fund periodically and are based on changes in the market value of open futures contracts. Changes in the market value of open futures contracts are recorded as Change in net unrealized appreciation/ depreciation on the Statements of Operations. Realized gains or losses, representing the difference between the value of the contract at the time it was opened and the value at the time it was closed, are reported on the Statements of Operations at the closing or expiration of the futures contract. Securities deposited as initial margin are designated in the SOIs and cash deposited is recorded on the Statements of Assets and Liabilities. A receivable from and/or a payable to brokers for the daily variation margin is also recorded on the Statements of Assets and Liabilities.

The use of futures contracts exposes the Fund to equity price and interest rate risks. The Fund may be subject to the risk that the change in the value of the futures contract may not correlate perfectly with the underlying instrument. Use of long futures contracts subjects the Fund to risk of loss in excess of the amounts shown on the Statements of Assets and Liabilities, up to the notional amount of the futures contracts. Use of short futures contracts subjects the Fund to unlimited risk of loss. The Fund may enter into futures contracts only on exchanges or boards of trade. The exchange or board of trade acts as the counterparty to each futures transaction; therefore, the Fund’s credit risk is limited to failure of the exchange or board of trade. Under some circumstances, futures exchanges may establish daily limits on the amount that the price of a futures contract can vary from the previous day’s settlement price, which could effectively prevent liquidation of positions.

The tables below disclose the volume of the Fund’s futures contracts activity during the six months ended December 31, 2017:

| | | | | | | | |

| | | Average

Notional

Balance | | | Ending

Notional

Balance | |

Long Futures Contracts: | | | | | | | | |

Equity | | $ | 2,496,817 | | | $ | 2,472,622 | |

Interest Rate | | | 1,710,452 | | | | 1,968,825 | |

| | |

Short Futures Contracts: | | | | | | | | |

Equity | | | 294,189 | | | | 308,196 | |

Interest Rate | | | 3,166,553 | | | | 2,468,615 | |

14

The Fund’s futures contracts are not subject to master netting arrangements (the right to close out all transactions traded with a counterparty and net amounts owed or due across transactions).

C. Summary of Derivatives Information — The following table presents the value of derivatives held as of December 31, 2017, by their primary underlying risk exposure and respective location on the Statements of Assets and Liabilities:

| | | | | | |

Derivative Contracts | | Statements of Assets and Liabilities Location | | | |

Gross Assets: | | | | Futures Contracts (a) | |

Equity contracts | | Receivables, Net Assets — Unrealized Appreciation | | $ | 49,031 | |

Interest rate contracts | | Receivables, Net Assets — Unrealized Appreciation | | | 13,387 | |

| | | | | | |

Total | | | | $ | 62,418 | |

| | | | | | |

| | |

Gross Liabilities: | | | | | | |

Equity contracts | | Payables, Net Assets — Unrealized Depreciation | | $ | (28,575 | ) |

Interest rate contracts | | Payables, Net Assets — Unrealized Depreciation | | | (8,710 | ) |

| | | | | | |

Total | | | | $ | (37,285 | ) |

| | | | | | |

| (a) | This amount reflects the cumulative appreciation (depreciation) of futures contracts as reported on the SOIs. The Statements of Assets and Liabilities only reflect the current day variation margin receivable/payable to brokers. |

The following tables present the effect of derivatives on the Statements of Operations for the six months ended December 31, 2017, by primary underlying risk exposure:

| | | | |

Amount of Realized Gain (Loss) on Derivatives Recognized on the Statement of Operations | |

Derivative Contracts | | Futures Contracts | |

Equity contracts | | $ | 192,647 | |

Interest rate contracts | | | (2,654 | ) |

| | | | |

Total | | $ | 189,993 | |

| | | | |

|

Amount of Change in Unrealized Appreciation (Depreciation) on Derivatives Recognized on the Statement of Operations | |

Derivative Contracts | | Futures Contracts | |

Equity contracts | | $ | 24,114 | |

Interest rate contracts | | | (24,733 | ) |

| | | | |

Total | | $ | (619 | ) |

| | | | |

The Fund’s derivatives contracts held at December 31, 2017 are not accounted for as hedging instruments under GAAP.

D. Investment Transactions with Affiliates — The Fund invested in Underlying Funds which are advised by the Adviser or its affiliates. An issuer which is under common control with the Fund may be considered an affiliate. For the purposes of the financial statements, the Fund assumes the issuers listed in the table below to be affiliated issuers. Underlying Funds’ distributions may be reinvested into the Underlying Funds. Reinvestment amounts are included in the purchase cost amounts in the table below. Included in the purchases and sales amounts in the table below are exchanges between certain share classes of the affiliated Underlying Funds. Such exchanges are not treated as purchases and sales for the purpose of recognizing realized gains (losses) or portfolio turnover.

15

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the six months ended December 31, 2017 | |

| | | | | | | | | |

Security Description | | Shares at

December

31, 2017 | | | Market Value

June 30, 2017

($) | | | Purchases at

Cost ($) | | | Proceeds from

Sales ($) | | | Net Realized

Gain (Loss) ($) | | | Change

in Unrealized

Appreciation/

(Depreciation) ($) | | | Market Value

December 31,

2017 ($) | | | Dividend/Interest

Income ($) | | | Capital Gain

Distributions

($) | |

JPMorgan Commodities Strategy Fund, Class R6 Shares | | | 54,319 | | | | 470,571 | | | | 951 | | | | — | | | | — | | | | 32,563 | | | | 504,085 | | | | 951 | | | | — | |

JPMorgan Core Bond Fund, Class R6 Shares | | | 526,179 | | | | 5,870,543 | | | | 377,096 | | | | 129,132 | | | | 1,782 | | | | (21,876 | ) | | | 6,098,413 | | | | 82,148 | | | | 13,514 | |

JPMorgan Core Plus Bond Fund, Class R6 Shares | | | 391,847 | | | | — | | | | 3,244,495 | | | | — | | | | — | | | | — | | | | 3,244,495 | | | | — | | | | — | |

JPMorgan Corporate Bond Fund, Class R6 Shares | | | 30,153 | | | | 859,025 | | | | 20,467 | | | | 578,567 | | | | 18,513 | | | | (20,924 | ) | | | 298,514 | | | | 10,932 | | | | 9,535 | |

JPMorgan Emerging Markets Debt Fund, Class R6 Shares | | | 93,577 | | | | 426,255 | | | | 353,126 | | | | — | | | | — | | | | 3,855 | | | | 783,236 | | | | 15,292 | | | | — | |

JPMorgan Emerging Markets Strategic Debt Fund, Class R6 Shares | | | 57,899 | | | | 426,202 | | | | 57,533 | | | | — | | | | — | | | | 6,672 | | | | 490,407 | | | | 10,149 | | | | — | |

JPMorgan Equity Index Fund, Class R6 Shares | | | 56,533 | | | | 3,085,665 | | | | 58,024 | | | | 1,112,210 | | | | 164,900 | | | | 119,763 | | | | 2,316,142 | | | | 28,036 | | | | 29,988 | |

JPMorgan Floating Rate Income Fund, Class R6 Shares | | | 82,481 | | | | 761,104 | | | | 15,041 | | | | — | | | | — | | | | (2,471 | ) | | | 773,674 | | | | 15,041 | | | | — | |

JPMorgan Growth Advantage Fund, Class R6 Shares | | | 30,389 | | | | 770,920 | | | | 31,711 | | | | 250,954 | | | | 55,526 | | | | 20,333 | | | | 627,536 | | | | — | | | | 31,712 | |

JPMorgan High Yield Fund, Class R6 Shares | | | 386,653 | | | | 3,028,327 | | | | 326,181 | | | | 481,380 | | | | 7,219 | | | | (15,249 | ) | | | 2,865,098 | | �� | | 79,279 | | | | — | |

JPMorgan International Research Enhanced Equity Fund, Class I Shares | | | — | | | | 1,409,887 | | | | — | | | | 1,237,699 | | | | — | | | | (172,188 | ) | | | — | | | | — | | | | — | |

JPMorgan International Research Enhanced Equity Fund, Class R6 Shares | | | 79,209 | | | | — | | | | 1,300,687 | | | | 56,680 | | | | 20,168 | | | | 232,082 | | | | 1,496,257 | | | | 16,359 | | | | 13,953 | |

JPMorgan U.S. Equity Fund, Class R6 Shares | | | 67,491 | | | | 1,050,019 | | | | 90,801 | | | | 69,562 | | | | 6,557 | | | | 24,319 | | | | 1,102,134 | | | | 7,292 | | | | 83,509 | |

JPMorgan U.S. Government Money Market Fund, Class Institutional Shares | | | 1,195,454 | | | | 853,949 | | | | 1,161,145 | | | | 819,640 | | | | — | | | | — | | | | 1,195,454 | | | | 5,061 | | | | — | |

JPMorgan Value Advantage Fund, Class R6 Shares | | | 17,464 | | | | 782,599 | | | | 17,816 | | | | 225,957 | | | | 22,097 | | | | 31,797 | | | | 628,352 | | | | 10,203 | | | | 7,614 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total | | | | | | | 19,795,066 | | | | 7,055,074 | | | | 4,961,781 | | | | 296,762 | | | | 238,676 | | | | 22,423,797 | | | | 280,743 | | | | 189,825 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

E. Offering and Organizational Costs — Total offering costs of $93,787 incurred in connection with the offering of shares of the Fund are amortized on a straight line basis over 12 months from the date the Fund commenced operations. Costs paid in connection with the organization of the Fund, if any, were recorded as an expense at the time the Fund commenced operations and are included as part of Professional fees on the Statement of Operations. For the six months December 31, 2017, total offering costs amortized were $47,104.

F. Foreign Currency Translation — The books and records of the Fund are maintained in U.S. dollars. Foreign currency amounts are translated into U.S. dollars at the prevailing exchange rates of such currencies against the U.S. dollar. The market value of investment securities and other assets and liabilities are translated at the exchange rate as of the valuation date. Purchases and sales of investment securities, income and expenses are translated at the exchange rate prevailing on the respective dates of such transactions.

The Fund does not isolate the effect of changes in foreign exchange rates from changes in market prices on securities held. Accordingly, such changes are included within Change in net unrealized appreciation/depreciation on investments on the Statement of Operations.

Reported realized foreign currency gains and losses arise from the disposition of foreign currency, currency gains or losses realized between the trade and settlement dates on securities transactions, and the difference between the amounts of dividends, interest and foreign withholding taxes recorded on the Fund’s books on the transaction date and the U.S. dollar equivalent of the amounts actually received or paid. These reported realized foreign currency gains and losses are included in Net realized gain (loss) on foreign currency transactions on the Statement of Operations. Unrealized foreign currency gains and losses arise from changes (due to changes in exchange rates) in the value of foreign currency and other assets and liabilities denominated in foreign currencies, which are held at year end are included in Change in net unrealized appreciation/depreciation on foreign currency translations on the Statement of Operations.

G. Security Transactions and Investment Income — Investment transactions are accounted for on the trade date (the date the order to buy or sell is executed). Securities gains and losses are calculated on a specifically identified cost basis. Interest income is determined on the basis of coupon interest accrued using the effective interest method which adjusts for amortization of premiums and accretion of discounts. Distributions of net investment income and realized capital gains from the Underlying Funds and ETFs, if any, are recorded on the ex-dividend date.

H. Allocation of Income and Expenses — Expenses directly attributable to a fund are charged directly to that fund, while the expenses attributable to more than one fund of the Trust are allocated among the respective funds. In calculating the NAV of each class, investment income, realized and unrealized gains and losses and expenses, other than class-specific expenses, are allocated daily to each class of shares based upon the proportion of net assets of each class at the beginning of each day.

16

Transfer agency fees are class-specific expenses. The amount of the transfer agency fees charged to each class of the Fund for the six months ended December 31, 2017 are as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Class A | | | Class C | | | Class I | | | Class R2 | | | Class R3 | | | Class R4 | | | Class R5 | | | Class R6 | | | Total | |

Transfer agency fees | | $ | 27 | | | $ | 27 | | | $ | 42 | | | $ | 27 | | | $ | 27 | | | $ | 27 | | | $ | 27 | | | $ | 27 | | | $ | 231 | |

The Fund invests in Underlying Funds and ETFs and, as a result, bears a portion of the expenses incurred by these Underlying Funds and ETFs. These expenses are not reflected in the expenses shown on the Statement of Operations and are not included in the ratios to average net assets shown in the Financial Highlights. Certain expenses of affiliated Underlying Funds and ETFs are waived as described in Note 3.F.

I. Federal Income Taxes — The Fund is treated as a separate taxable entity for Federal income tax purposes. The Fund’s policy is to comply with the provisions of the Internal Revenue Code of 1986, as amended (the “Code”), applicable to regulated investment companies and to distribute to shareholders all of its distributable net investment income and net realized capital gains on investments. Accordingly, no provision for Federal income tax is necessary. Management has reviewed the Fund’s tax positions for all open tax years and has determined that as of December 31, 2017, no liability for income tax is required in the Fund’s financial statements for net unrecognized tax benefits. However, management’s conclusions may be subject to future review based on changes in, or the interpretation of, the accounting standards or tax laws and regulations. The Fund’s Federal tax returns for the prior three fiscal years remains, or since inception if shorter, subject to examination by the Internal Revenue Service.

J. Distributions to Shareholders — Distributions from net investment income are generally declared and paid monthly and are declared separately for each class. No class has preferential dividend rights; differences in per share rates are due to differences in separate class expenses. Net realized capital gains, if any, are distributed at least annually. The amount of distributions from net investment income and net realized capital gains is determined in accordance with Federal income tax regulations, which may differ from GAAP. To the extent these “book/tax” differences are permanent in nature (i.e., that they result from other than timing of recognition — “temporary differences”), such amounts are reclassified within the capital accounts based on their Federal tax-basis treatment.

3. Fees and Other Transactions with Affiliates

A. Investment Advisory Fee — Pursuant to an Investment Advisory Agreement, the Adviser supervises the investments of the Fund and for such services is paid a fee. The fee is accrued daily and paid monthly at an annual rate of 0.35% of the Fund’s average daily net assets.

The Adviser waived Investment Advisory fees and/or reimbursed expenses as outlined in Note 3.F.

B. Administration Fee — Pursuant to an Administration Agreement, the Administrator provides certain administration services to the Fund. In consideration of these services, the Administrator receives a fee accrued daily and paid monthly at an annual rate of 0.15% of the first $25 billion of the average daily net assets of all funds in the J.P. Morgan Funds Complex covered by the Administration Agreement (excluding certain funds of funds and money market funds) and 0.075% of the average daily net assets in excess of $25 billion of all such funds. For the six months ended December 31, 2017, the effective annualized rate was 0.08% of the Fund’s average daily net assets, notwithstanding any fee waivers and/or expense reimbursements.

JPMorgan Chase Bank, N.A. (“JPMCB”), a wholly-owned subsidiary of JPMorgan, serves as the Fund’s sub-administrator (the “Sub-administrator”). For its services as Sub-administrator, JPMCB receives a portion of the fees payable to the Administrator.

C. Distribution Fees — Pursuant to a Distribution Agreement, JPMorgan Distribution Services, Inc. (“JPMDS”), an indirect, wholly-owned subsidiary of JPMorgan, serves as the Trust’s principal underwriter and promotes and arranges for the sale of the Fund’s shares.

The Board has adopted a Distribution Plan (the “Distribution Plan”) for Class A, Class C, Class R2 and Class R3 Shares of the Fund in accordance with Rule 12b-1 under the 1940 Act. Class I, Class R4, Class R5 and Class R6 do not charge a distribution fee. The Distribution Plan provides that the Fund shall pay distribution fees, including payments to JPMDS, at annual rates of 0.25%, 0.75%, 0.50% and 0.25% of the average daily net assets of Class A, Class C, Class R2 and Class R3 Shares, respectively.

D. Service Fees — The Trust, on behalf of the Fund, has entered into a Shareholder Servicing Agreement with JPMDS under which JPMDS provides certain support services to the shareholders. For performing these services, JPMDS receives a fee, except for Class R6 Shares which do not charge a service fee, that is accrued daily and paid monthly equal to a percentage of the average daily net assets as shown in the table below:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Class A | | | Class C | | | Class I | | | R2 Class | | | R3 Class | | | R4 Class | | | R5 Class | |

| | 0.25 | % | | | 0.25 | % | | | 0.25 | % | | | 0.25 | % | | | 0.25 | % | | | 0.25 | % | | | 0.10 | % |

JPMDS has entered into shareholder services contracts with affiliated and unaffiliated financial intermediaries who provide shareholder services and other related services to their clients or customers who invest in the Fund under which JPMDS will pay all or a portion of such fees earned to financial intermediaries for performing such services.

E. Custodian and Accounting Fees — JPMCB provides portfolio custody and accounting services to the Fund. For performing these services, the Fund pays JPMCB transaction and asset-based fees that vary according to the number of transactions and positions, plus out-of-pocket expenses.

17

The amounts paid directly to JPMCB by the Fund for custody and accounting services are included in Custodian and accounting fees on the Statement of Operations. Payments to the custodian may be reduced by credits earned by the Fund, based on uninvested cash balances held by the custodian. Such earnings credits, if any, are presented separately on the Statement of Operations.

Interest expense paid to the custodian related to cash overdrafts, if any, is included in Interest expense to affiliates on the Statement of Operations.

F. Waivers and Reimbursements — The Adviser, Administrator and JPMDS have contractually agreed to waive fees and/or reimburse expenses to the extent that total annual operating expenses of the Fund, Underlying Funds and ETFs (excluding dividend and interest expenses related to short sales, interest, taxes, expenses related to litigation and potential litigation, extraordinary expenses incurred by the Fund and any Underlying Fund and ETFs and acquired fund fees incurred by an Underlying Fund and ETFs) exceed the percentages of the Fund’s average daily net assets as shown in the table below:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Class A | | | Class C | | | Class I | | | R2 Class | | | R3 Class | | | R4 Class | | | R5 Class | | | R6 Class | |

| | 0.74 | % | | | 1.24 | % | | | 0.49 | % | | | 1.15 | % | | | 0.90 | % | | | 0.65 | % | | | 0.50 | % | | | 0.40 | % |

The expense limitation agreement was in effect for the six months ended December 31, 2017 and is in place until at least October 31, 2018.

For the six months ended December 31, 2017, the Fund’s service providers waived fees and/or reimbursed expenses for the Fund as follows. None of these parties expect the Fund to repay any such waived fees and reimbursed expenses in future years.

| | | | | | | | | | | | | | | | | | |

| Contractual Waivers | | | | |

Investment Advisory

Fees | | | Administration

Fees | | | Service

Fees | | | Total | | | Contractual

Reimbursement | |

| $ | 55,329 | | | $ | 12,875 | | | $ | 16,822 | | | $ | 85,026 | | | $ | 94,315 | |

The Underlying Funds may impose separate advisory and servicing fees. To avoid charging a servicing fee at an effective rate above 0.25% for Class A, Class C, Class I, Class R2, Class R3 and Class R4 Shares and above 0.10% for Class R5 Shares, JPMDS may waive servicing fees with respect to the Fund in an amount equal to the weighted average pro-rata amount of servicing fees charged by the affiliated Underlying Funds. These waivers may be in addition to any waivers required to meet the Fund’s contractual expense limitations, but will not exceed the Fund’s servicing fees.

G. Other — Certain officers of the Trust are affiliated with the Adviser, the Administrator and JPMDS. Such officers, with the exception of the Chief Compliance Officer, receive no compensation from the Fund for serving in their respective roles.

The Board appointed a Chief Compliance Officer to the Fund in accordance with Federal securities regulations. The Fund, along with other affiliated funds, makes reimbursement payments, on a pro-rata basis, to the Administrator for a portion of the fees associated with the Office of the Chief Compliance Officer. Such fees are included in Trustees’ and Chief Compliance Officer’s fees on the Statement of Operations.

The Trust adopted a Trustee Deferred Compensation Plan (the “Plan”) which allows the Independent Trustees to defer the receipt of all or a portion of compensation related to performance of their duties as Trustees. The deferred fees are invested in various J.P. Morgan Funds until distribution in accordance with the Plan.

The Fund may use related party broker-dealers. For the six months ended December 31, 2017, the Fund did not incur any brokerage commissions with broker-dealers affiliated with the Adviser.

The SEC has granted an exemptive order permitting the Fund to invest in certain financial instruments in addition to Underlying Funds and securities.

4. Investment Transactions

During the six months ended December 31, 2017, purchases and sales of investments (excluding short-term investments) were as follows:

| | | | | | |

Purchases

(excluding

U.S. Government) | | | Sales (excluding

U.S. Government) | |

| $ | 6,816,431 | | | $ | 7,447,542 | |

During the six months ended June 30, 2017, there were no purchases or sales of U.S. Government securities.

5. Federal Income Tax Matters

For Federal income tax purposes, the estimated cost and unrealized appreciation (depreciation) in value of investments held at December 31, 2017 were as follows:

| | | | | | | | | | | | | | |

Aggregate

Cost | | | Gross

Unrealized

Appreciation | | | Gross

Unrealized

Depreciation | | | Net Unrealized

Appreciation

(Depreciation) | |

| $ | 30,009,159 | | | $ | 1,725,825 | | | $ | 43,075 | | | $ | 1,682,750 | |

18

At June 30, 2017, the Fund did not have any net capital loss carryforwards.

6. Borrowings

The Fund relies upon an exemptive order granted by the SEC (the “Order”) permitting the establishment and operation of an Interfund Lending Facility (the “Facility”). The Facility allows the Fund to directly lend and borrow money to or from any other fund relying upon the Order at rates beneficial to both the borrowing and lending funds. Advances under the Facility are taken primarily for temporary or emergency purposes, including the meeting of redemption requests that otherwise might require the untimely disposition of securities, and are subject to the Fund’s borrowing restrictions. The Interfund loan rate is determined, as specified in the Order, by averaging the current repurchase agreement rate and the current bank loan rate. The Order was granted to JPMorgan Trust II and may be relied upon by the Fund because the Fund and the series of JPMorgan Trust II are both investment companies in the same “group of investment companies” (as defined in Section 12(d)(1)(G) of the 1940 Act).

The Trust and JPMCB have entered into a financing arrangement. Under this arrangement, JPMCB provides an unsecured, uncommitted credit facility in the aggregate amount of $100 million to certain of the J.P. Morgan Funds, including the Fund. Advances under the arrangement are taken primarily for temporary or emergency purposes, including the meeting of redemption requests that otherwise might require the untimely disposition of securities, and are subject to the Fund’s borrowing restrictions. Interest on borrowings is payable at a rate determined by JPMCB at the time of borrowing. This agreement has been extended until November 5, 2018.

The Fund had no borrowings outstanding from another fund or from the unsecured, uncommitted credit facility during the six months ended December 31, 2017.

7. Risks, Concentrations and Indemnifications

In the normal course of business, the Fund enters into contracts that contain a variety of representations which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown. The amount of exposure would depend on future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

As of December 31, 2017, all of the Fund’s shares were held by the Adviser.

Because of the Fund’s investments in the Underlying Funds and ETFs, the Fund indirectly pays a portion of the expenses incurred by the Underlying Funds and ETFs. As a result, the cost of investing in the Fund may be higher than the cost of investing in a mutual fund that invests directly in Individual securities and financial instruments. The Fund is also subject to certain risks related to the Underlying Funds’ and ETFs’ investments in securities and financial instruments such as equity securities, foreign and emerging markets securities and real estate securities. These securities are subject to risks specific to their structure, sector or market.