UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-23117

JPMorgan Trust IV

(Exact name of registrant as specified in charter)

277 Park Avenue

New York, NY 10172

(Address of principal executive offices) (Zip code)

Gregory S. Samuels

277 Park Avenue

New York, NY 10172

(Name and Address of Agent for Service)

Registrant’s telephone number, including area code: (800) 480-4111

Date of fiscal year end: June 30

Date of reporting period: July 1, 2020 through June 30, 2021

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. Section 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

a.) The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

b.) A copy of the notice transmitted to shareholders in reliance on Rule 30e-3 under the 1940 Act that contains disclosures specified by paragraph (c)(3) of that rule is included in the Annual Reports. Not Applicable. Notices do not incorporate disclosures from the shareholder reports.

Annual Report

J.P. Morgan Large Cap Funds

June 30, 2021

JPMorgan Equity Focus Fund

JPMorgan Equity Income Fund

JPMorgan Equity Premium Income Fund

JPMorgan Hedged Equity Fund

JPMorgan Hedged Equity 2 Fund

JPMorgan Hedged Equity 3 Fund

JPMorgan Large Cap Growth Fund

JPMorgan Large Cap Value Fund

JPMorgan U.S. Applied Data Science Value Fund

(formerly known as JPMorgan Intrepid Value Fund)

JPMorgan U.S. Equity Fund

JPMorgan U.S. GARP Equity Fund

(formerly known as JPMorgan Intrepid Growth Fund)

JPMorgan U.S. Large Cap Core Plus Fund

JPMorgan U.S. Research Enhanced Equity Fund

JPMorgan U.S. Sustainable Leaders Fund

(formerly known as JPMorgan Intrepid Sustainable Equity Fund)

JPMorgan U.S. Value Fund

(formerly known as JPMorgan Growth and Income Fund)

CONTENTS

Investments in a Fund are not deposits or obligations of, or guaranteed or endorsed by, any bank and are not insured or guaranteed by the FDIC, the Federal Reserve Board or any other government agency. You could lose money if you sell when a Fund’s share price is lower than when you invested.

Past performance is no guarantee of future performance. The general market views expressed in this report are opinions based on market and other conditions through the end of the reporting period and are subject to change without notice. These views are not intended to predict the future performance of a Fund or the securities markets. References to specific securities and their issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Such views are not meant as investment advice and may not be relied on as an indication of trading intent on behalf of any Fund.

Prospective investors should refer to the Funds’ prospectuses for a discussion of the Funds’ investment objectives, strategies and risks. Call J.P. Morgan Funds Service Center at 1-800-480-4111 for a prospectus containing more complete information about a Fund, including management fees and other expenses. Please read it carefully before investing.

LETTER TO SHAREHOLDERS

August 4, 2021 (Unaudited)

Dear Shareholders,

The rally in equity markets that began in the second half of last year accelerated in 2021 on the back of mass vaccinations against COVID-19, federal relief and recovery efforts and a surge in both corporate profits and consumer spending. As a result, we find ourselves in a different environment than we inhabited a year ago.

| | |

| | “Amid opportunities and challenges both new and old, J.P. Morgan Asset Management will seek to continue to provide investors with innovative strategies and solutions to build durable portfolios that are bolstered by our extensive experience in risk management.” — Andrea L. Lisher |

U.S. equity markets turned in a particularly remarkable performance over the twelve months ended June 30, 2021. The S&P 500 posted a total return of 40.79%; the Russell 1000 returned 43.07%; the Russell Mid Cap Index returned 49.80% and the Russell Small Cap Index returned 62.03%. The lesson for investors, we believe, is clear: Those who were consistently and fully invested in the second half of 2020 through the first half of 2021 stood to benefit greatly from the superlative performance in global equity markets.

The rollout of mass vaccinations and the partial reopening of economies at all scales have fueled job growth, consumer spending and rising corporate profits. However, the pandemic

remains a global threat and the Delta variant of COVID-19 has driven a resurgence in infections across the U.S. and elsewhere. At the same time, a rush of economic activity has driven prices higher for a range of products and commodities and raised investor concerns about the timing of any potential response to rising inflation by the U.S. Federal Reserve. While the central bank has acknowledged stronger-than-expected inflationary data, it has also maintained its stance that upward pressure on consumer prices is likely to be a temporary effect of the economic recovery.

Amid opportunities and challenges both new and old, J.P. Morgan Asset Management will seek to continue to provide investors with innovative strategies and solutions to build durable portfolios that are bolstered by our extensive experience in risk management. We seek to maintain our focus on the needs of our clients and shareholders with the same fundamental practices and principles that have driven our success for more than a century.

On behalf of J.P. Morgan Asset Management, thank you for entrusting us to manage your investment. Should you have any questions, please visit www.jpmorganfunds.com or contact the J.P. Morgan Funds Service Center at 1-800-480-4111.

Sincerely yours,

Andrea L. Lisher

Head of Americas, Client

J.P. Morgan Asset Management

| | | | | | | | | | |

| | | | | |

| JUNE 30, 2021 | | J.P. MORGAN LARGE CAP FUNDS | | | | | | | | 1 |

J.P. Morgan Large Cap Funds

MARKET OVERVIEW

TWELVE MONTHS ENDED JUNE 30, 2021 (Unaudited)

Overall, U.S. and emerging markets equity led a remarkable global rally in stocks on the back of massive central bank interventions, unprecedented fiscal spending and the rollout of multiple vaccines against COVID-19 and its variants. The initial reopening of the U.S. economy in 2021 fueled a surge in corporate profits, consumer spending and business investment.

Leading U.S. equity indexes rose in July and August 2020, punctuated by five consecutive record high closings for the S&P 500 Index in late August – a stretch not seen since 2017. While the spread of COVID-19 accelerated in the U.S., multiple candidate vaccines were being developed around the world and the number of hospitalizations at the end of the summer was relatively small compared with what was to come at the end of the year.

Equity prices across the globe largely declined over September and October 2020. Re-closings across Asia and Europe in response to the pandemic dented investor optimism. The inability of the U.S. Congress to adopt further spending for pandemic relief put acute pressure on the S&P 500 Index in the final week of October.

U.S. equity prices began to rebound in November and by mid-month the S&P 500 Index reached a closing high and crossed 3,600 points for the first time amid the U.S. Food and Drug Administration’s approval of the first COVID-19 vaccines. November and December saw broad gains in global equity, partly driven by continued investor demand for U.S. large cap stocks, particularly in the technology sector. Notably, emerging markets equity surged ahead of developed markets in December as China, Taiwan and other emerging market nations appeared to have greater success in containing the pandemic.

While the global rally in equity markets appeared to take a pause in January 2021, equity prices surged higher from February through June 2021. In the U.S., the successful if uneven distribution of vaccines combined with a $1.9 trillion U.S. fiscal relief and recovery package -- and the prospect of additional federal government spending – helped push leading equity indexes higher in the first half of 2021. Corporate earnings and cash flows reached record highs in the first quarter of 2021. Robust growth in consumer spending, business investments and manufacturing data added further fuel to the rally in U.S. equity markets.

In May, historically high valuations for U.S. equity fueled investor demand for higher returns elsewhere in both developed and emerging markets. However, the uneven distribution of vaccines, continued spread of COVID-19 and its variants, and disparities in the re-openings of national economies weighed on select equity markets in June.

Within U.S. equity markets, the S&P 500 Index returned 40.79%; the Russell 1000 Index returned 43.07%; the Russell Mid Cap Index returned 49.80% and the Russell 2000 Index returned 62.03% for the twelve months ended June 30, 2021.

| | | | | | | | | | |

| | | | | |

| 2 | | | | | | | | J.P. MORGAN LARGE CAP FUNDS | | JUNE 30, 2021 |

JPMorgan Equity Focus Fund

FUND COMMENTARY

TWELVE MONTHS ENDED JUNE 30, 2021 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | | | |

| Fund (Class I Shares)* | | | 47.46% | |

| S&P 500 Index | | | 40.79% | |

| |

| Net Assets as of 6/30/2021 (In Thousands) | | | $131,894 | |

INVESTMENT OBJECTIVE**

The JPMorgan Equity Focus Fund (the “Fund”) seeks long term capital appreciation.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund’s Class I Shares outperformed the S&P 500 Index (the “Benchmark”) for the twelve months ended June 30, 2021. The Fund’s security selection and overweight position in the financials sector and its security selection in the consumer discretionary sector were leading contributors to performance relative to the Benchmark, while the Fund’s security selection in the health care sector and its underweight position in the communication services sector were leading detractors from relative performance.

Leading individual contributors to relative performance included the Fund’s overweight positions in Tesla Inc., Capital One Financial Corp. and Charles Schwab Corp. Shares of Tesla, a producer of electric vehicles and energy storage systems, rose after the company was added to the S&P 500 Index. Shares of Capital One Financial, a banking and financial services company, rose amid improvement in its credit card business during the reporting period and general investor demand for financial sector stocks. Shares of Charles Schwab, a financial services provider, rose following the company’s $26 billion acquisition of TD Ameritrade in October 2020 and amid general investor demand for financials sector stocks.

Leading individual detractors from relative performance included the Fund’s overweight positions in Xcel Energy Inc., Home Depot Inc. and Discovery Inc. Shares of Xcel, an electricity and natural gas utility, fell late in the period following a run-up in the share price in early 2021. Shares of Home Depot, a home improvement retail chain, fell after a significant run-up in the share price in 2020. Shares of Discovery, an entertainment and media company, fell sharply in March 2021 following the collapse of Archegos Capital Management, which held large leveraged positions in Discovery shares.

HOW WAS THE FUND POSITIONED?

The Fund’s portfolio managers employed a bottom-up fundamental approach to stock selection. As a result of this approach to stock selection, the Fund’s largest positions were

in the information technology and financials sectors and the Fund’s smallest positions were in the consumer staples and utilities sectors.

| | | | | | | | |

TOP TEN EQUITY HOLDINGS OF THE

PORTFOLIO AS OF JUNE 30, 2021 | | PERCENT OF

TOTAL

INVESTMENTS | |

| | 1. | | | Microsoft Corp. | | | 5.5 | % |

| | 2. | | | Apple, Inc. | | | 4.8 | |

| | 3. | | | Alphabet, Inc., Class C | | | 4.7 | |

| | 4. | | | AutoZone, Inc. | | | 3.8 | |

| | 5. | | | Amazon.com, Inc. | | | 3.8 | |

| | 6. | | | Berkshire Hathaway, Inc., Class B | | | 3.5 | |

| | 7. | | | Loews Corp. | | | 3.4 | |

| | 8. | | | Capital One Financial Corp. | | | 3.1 | |

| | 9. | | | Bank of America Corp. | | | 3.0 | |

| | 10. | | | AbbVie, Inc. | | | 2.9 | |

| | | | |

PORTFOLIO COMPOSITION BY SECTOR

AS OF JUNE 30, 2021 | | PERCENT OF

TOTAL

INVESTMENTS | |

| |

Information Technology | | | 23.4 | % |

Financials | | | 15.0 | |

Communication Services | | | 13.1 | |

Health Care | | | 12.7 | |

Consumer Discretionary | | | 10.8 | |

Materials | | | 5.0 | |

Real Estate | | | 4.6 | |

Industrials | | | 3.6 | |

Energy | | | 3.5 | |

Utilities | | | 2.8 | |

Consumer Staples | | | 2.8 | |

Short-Term Investments | | | 2.7 | |

| * | | The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| ** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| | | | | | | | | | |

| | | | | |

| JUNE 30, 2021 | | J.P. MORGAN LARGE CAP FUNDS | | | | | | | | 3 |

JPMorgan Equity Focus Fund

FUND COMMENTARY

TWELVE MONTHS ENDED JUNE 30, 2021 (Unaudited) (continued)

| | | | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS AS OF JUNE 30, 2021 | |

| | | | |

| | | INCEPTION DATE OF

CLASS | | 1 YEAR | | | 5 YEAR | | | SINCE

INCEPTION | |

CLASS A SHARES | | July 29, 2011 | | | | | | | | | | | | |

With Sales Charge* | | | | | 39.35 | % | | | 18.13 | % | | | 14.55 | % |

Without Sales Charge | | | | | 47.07 | | | | 19.40 | | | | 15.18 | |

CLASS C SHARES | | July 29, 2011 | | | | | | | | | | | | |

With CDSC** | | | | | 45.37 | | | | 18.81 | | | | 14.71 | |

Without CDSC | | | | | 46.37 | | | | 18.81 | | | | 14.71 | |

CLASS I SHARES | | July 29, 2011 | | | 47.46 | | | | 19.71 | | | | 15.47 | |

CLASS R6 SHARES | | October 1, 2018 | | | 47.82 | | | | 19.88 | | | | 15.55 | |

| * | | Sales Charge for Class A Shares is 5.25%. |

| ** | | Assumes a 1% CDSC (contingent deferred sales charge) for the one year period and 0% CDSC thereafter. |

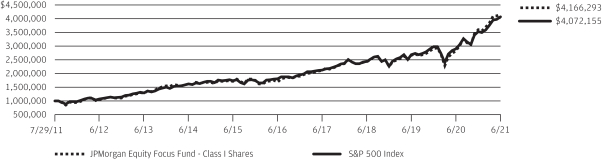

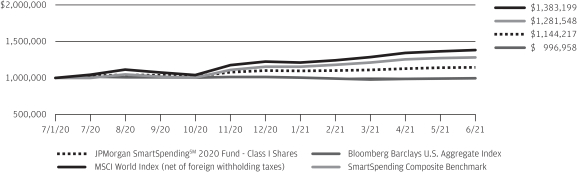

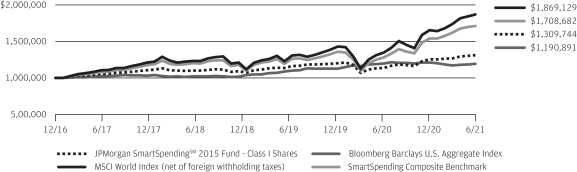

LIFE OF FUND PERFORMANCE (7/29/11 TO 6/30/21)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

The Fund commenced operations on July 29, 2011.

Returns for Class R6 Shares prior to their inception date are based on the performance of Class I Shares. The actual returns of Class R6 Shares would have been different than those shown because Class R6 Shares have different expenses than Class I Shares.

The graph illustrates comparative performance for $1,000,000 invested in Class I Shares of the JPMorgan Equity Focus Fund and the S&P 500 Index from July 29, 2011 to June 30, 2021. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the S&P 500 Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of securities included in the benchmark, if applicable. The S&P 500 Index is an unmanaged index generally representative of the performance of

large companies in the U.S. stock market. Investors cannot invest directly in an index.

Class I Shares have a $1,000,000 minimum initial investment.

Subsequent to the inception date of the Fund and through July 31, 2013, the Fund did not experience any shareholder activity. If such shareholder activity had occurred, the Fund’s performance may have been impacted.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the applicable inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on gains resulting from redemptions of Fund shares.

Because Class C Shares automatically convert to Class A Shares after 8 years, the 10 year average annual total return shown above for Class C reflects Class A performance for the period after conversion.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | | | | | |

| | | | | |

| 4 | | | | | | | | J.P. MORGAN LARGE CAP FUNDS | | JUNE 30, 2021 |

JPMorgan Equity Income Fund

FUND COMMENTARY

TWELVE MONTHS ENDED JUNE 30, 2021 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | | | |

| Fund (Class I Shares)* | | | 40.16% | |

| Russell 1000 Value Index | | | 43.68% | |

| |

| Net Assets as of 6/30/2021 (In Thousands) | | | $46,405,657 | |

INVESTMENT OBJECTIVE**

The JPMorgan Equity Income Fund (the “Fund”) seeks capital appreciation and current income.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund’s Class I Shares underperformed the Russell 1000 Value Index (the “Benchmark”) for the twelve months ended June 30, 2021. The Fund’s security selection in the consumer discretionary and health care sectors was a leading detractor from performance relative to the Benchmark, while the Fund’s security selection in the information technology and industrials sectors was a leading contributor to relative performance.

Leading individual detractors from relative performance included the Fund’s overweight positions in CME Group Inc. and General Dynamics Corp., and its underweight position in Alphabet Inc. Shares of CME Group, a financial derivatives market operator, underperformed after the company reported lower-than-expected earnings and revenue for the third quarter of 2020. Shares of General Dynamics, an aerospace and defense manufacturer, underperformed after the company reported lower-than-expected earnings and revenue for the fourth quarter of 2020. Shares of Alphabet, parent company of Google Inc., which were not held in the Fund, rose on continued growth in earnings and revenue throughout the period.

Leading individual contributors to relative performance included the Fund’s underweight positions in AT&T Corp. and Intel Corp. and its out-of-Benchmark position in Deere Inc. Shares of AT&T, a telecommunications and entertainment provider not held in the Fund, fell amid investor concerns that the company’s sale of its WarnerMedia unit would reduce AT&T’s quarterly dividends. Shares of Intel, a semiconductor manufacturer, fell as competitive pressure reduced sales in the data center business and the company issued a lower-than-expected forecast for the second quarter of 2021. Shares of Deere, a maker of agriculture and construction equipment, rose after the company reported better-than-expected earnings for its fiscal second quarter and raised its earnings forecast for the fiscal year 2021.

HOW WAS THE FUND POSITIONED?

The Fund’s portfolio managers’ focus remained on stock selection, as they believed that quality companies trading at

attractive valuations had the greatest potential to outperform in the long term. As the Fund aimed to purchase stocks with above average dividend yields, the research process was designed to identify companies with predictable and durable business models deemed capable of generating sustainable free cash flow.

| | | | | | | | |

TOP TEN EQUITY HOLDINGS OF THE

PORTFOLIO AS OF JUNE 30, 2021 | | PERCENT OF

TOTAL

INVESTMENTS | |

| | | | | | | | |

| | 1. | | | Comcast Corp., Class A | | | 2 .6 | % |

| | 2. | | | BlackRock, Inc. | | | 2 .5 | |

| | 3. | | | Bank of America Corp. | | | 2 .4 | |

| | 4. | | | UnitedHealth Group, Inc. | | | 2 .4 | |

| | 5. | | | ConocoPhillips | | | 2 .4 | |

| | 6. | | | Bristol-Myers Squibb Co. | | | 2 .2 | |

| | 7. | | | Analog Devices, Inc. | | | 2 .2 | |

| | 8. | | | PNC Financial Services Group, Inc. (The) | | | 2 .2 | |

| | 9. | | | Medtronic plc | | | 2 .0 | |

| | 10. | | | Philip Morris International, Inc. | | | 2 .0 | |

| | | | |

PORTFOLIO COMPOSITION BY SECTOR

AS OF JUNE 30, 2021 | | PERCENT OF

TOTAL

INVESTMENTS | |

| |

Financials | | | 23.7 | % |

Industrials | | | 14.8 | |

Health Care | | | 14.4 | |

Information Technology | | | 9.5 | |

Consumer Staples | | | 8.6 | |

Consumer Discretionary | | | 8.1 | |

Energy | | | 5.6 | |

Utilities | | | 3.9 | |

Communication Services | | | 3.6 | |

Materials | | | 3.2 | |

Real Estate | | | 2.2 | |

| Short-Term Investments | | | 2.4 | |

| * | | The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| ** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| | | | | | | | | | |

| | | | | |

| JUNE 30, 2021 | | J.P. MORGAN LARGE CAP FUNDS | | | | | | | | 5 |

JPMorgan Equity Income Fund

FUND COMMENTARY

TWELVE MONTHS ENDED JUNE 30, 2021 (Unaudited) (continued)

| | | | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS AS OF JUNE 30, 2021 | |

| | | | |

| | | INCEPTION DATE OF

CLASS | | 1 YEAR | | | 5 YEAR | | | 10 YEAR | |

CLASS A SHARES | | February 18, 1992 | | | | | | | | | | | | |

With Sales Charge* | | | | | 32.46 | % | | | 11.63 | % | | | 11.64 | % |

Without Sales Charge | | | | | 39.81 | | | | 12.84 | | | | 12.24 | |

CLASS C SHARES | | November 4, 1997 | | | | | | | | | | | | |

With CDSC** | | | | | 38.19 | | | | 12.29 | | | | 11.79 | |

Without CDSC | | | | | 39.19 | | | | 12.29 | | | | 11.79 | |

CLASS I SHARES | | July 2, 1987 | | | 40.16 | | | | 13.13 | | | | 12.52 | |

CLASS R2 SHARES | | February 28, 2011 | | | 39.47 | | | | 12.56 | | | | 11.96 | |

CLASS R3 SHARES | | September 9, 2016 | | | 39.79 | | | | 12.85 | | | | 12.24 | |

CLASS R4 SHARES | | September 9, 2016 | | | 40.19 | | | | 13.13 | | | | 12.52 | |

CLASS R5 SHARES | | February 28, 2011 | | | 40.41 | | | | 13.32 | | | | 12.73 | |

CLASS R6 SHARES | | January 31, 2012 | | | 40.51 | | | | 13.43 | | | | 12.81 | |

| * | | Sales Charge for Class A Shares is 5.25%. |

| ** | | Assumes a 1% CDSC (contingent deferred sales charge) for the one year period and 0% CDSC thereafter. |

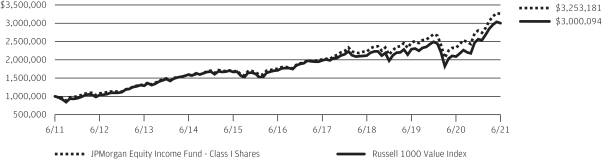

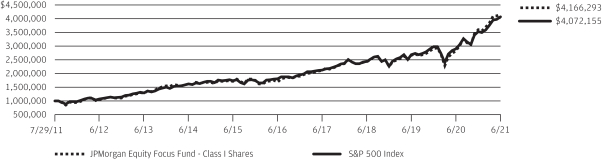

TEN YEAR PERFORMANCE (6/30/11 TO 6/30/21)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

Returns for Class R4 Shares prior to their inception dates are based on the performance of Class I Shares. The actual returns for Class R4 Shares would have been similar to those shown because Class R4 Shares had similar expenses to Class I Shares.

Returns for Class R3 Shares prior to their inception date are based on the performance of Class A Shares. The actual returns for Class R3 Shares would have been similar than those shown because Class R3 Shares currently have the same expenses as Class A Shares.

Returns for Class R6 Shares prior to their inception date are based on the performance of Class R5 Shares and, prior to February 28, 2011, Class I Shares. The actual returns for Class R6 Shares would have been different than those shown because Class R6 Shares have different expenses than Class R5 and Class I Shares.

The graph illustrates comparative performance for $1,000,000 invested in Class I Shares of the JPMorgan Equity Income Fund and the Russell 1000 Value

Index from June 30, 2011 to June 30, 2021. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the Russell 1000 Value Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the benchmark, if applicable. The Russell 1000 Value Index is an unmanaged index which measures the performance of those Russell 1000 companies with lower price-to-book ratios and lower forecasted growth values. Investors cannot invest directly in an index.

Class I Shares have a $1,000,000 minimum initial investment.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on gains resulting from redemptions of Fund shares.

Because Class C Shares automatically convert to Class A Shares after 8 years, the 10 year average annual total return shown above for Class C reflects Class A Performance for the period after conversion.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | | | | | |

| | | | | |

| 6 | | | | | | | | J.P. MORGAN LARGE CAP FUNDS | | JUNE 30, 2021 |

JPMorgan Equity Premium Income Fund

FUND COMMENTARY

TWELVE MONTHS ENDED JUNE 30, 2021 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | | | |

| Fund (Class I Shares)* | | | 29.87% | |

| S&P 500 Index | | | 40.79% | |

| ICE BofAML 3-Month US Treasury Bill Index | | | 0.09% | |

| |

| Net Assets as of 6/30/2021 (In Thousands) | | | $900,804 | |

INVESTMENT OBJECTIVE**

The JPMorgan Equity Premium Income Fund (the “Fund”) seeks current income while maintaining prospects for capital appreciation.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund’s Class I Shares underperformed the S&P 500 Index (the “Benchmark”) and outperformed the ICE BofAML 3-Month US Treasury Bill Index for the twelve months ended June 30, 2021. The Fund’s security selection in the financials sector and its underweight position in the utilities sector were leading detractors from performance relative to the Benchmark, while the Fund’s security selection and overweight position in the industrials sector and its security selection in the consumer discretionary sector were leading contributors to relative performance.

Leading individual detractors from performance relative to the Benchmark included the Fund’s underweight position in Nvidia Corp. and its overweight positions in Jack Henry & Associates Inc. and Progressive Corp. Shares of Nvidia, a semiconductor maker not held in the Fund, rose amid consecutive quarters of better-than-expected earnings and revenue. Shares of Jack Henry & Associates, a payment processing provider mainly serving the financial services sector, fell after the company reported several quarters of lower-than-expected revenue. Shares of Progressive, a property and casualty insurer, fell amid lower-than-expected earnings and revenue for the first quarter of 2021 as well as a decline in monthly revenue.

Leading individual contributors to relative performance included the Fund’s overweight positions in Target Corp. and Trane Technologies PLC, and its underweight position in Intel Corp. Shares of Target, a discount department store chain, rose following consecutive quarters of better-than-expected growth in earnings and revenue amid a strong rebound in consumer spending during the period. Shares of Trane Technologies, an air conditioning, heating and ventilation company, rose after the company reported better-than-expected earnings and revenue amid strong consumer and commercial demand. Shares of Intel, a semiconductor manufacturer not held in the Fund, fell as competitive pressure reduced sales in the data center business and the company issued a lower-than-expected forecast for the second quarter of 2021.

HOW WAS THE FUND POSITIONED?

The Fund seeks to generate income through a combination of selling options and investing in large cap stocks and delivering monthly income from associated option premiums and stock dividends. The Fund’s portfolio managers employed a proprietary research process designed to identify what they believed were overvalued and undervalued stocks with attractive risk/return characteristics.

| | | | | | | | | | |

| | | | | |

| JUNE 30, 2021 | | J.P. MORGAN LARGE CAP FUNDS | | | | | | | | 7 |

JPMorgan Equity Premium Income Fund

FUND COMMENTARY

TWELVE MONTHS ENDED JUNE 30, 2021 (Unaudited) (continued)

| | | | | | | | |

TOP TEN EQUITY HOLDINGS OF THE

PORTFOLIO AS OF JUNE 30, 2021 | | PERCENT OF

TOTAL

INVESTMENTS | |

| | 1. | | | Toronto-Dominion Bank (The), ELN, 35.60%, 8/6/2021, (linked to S&P 500 Index) | | | 3.6 | % |

| | 2. | | | Royal Bank of Canada, ELN, 36.35%, 7/16/2021, (linked to S&P 500 Index) | | | 3.1 | |

| | 3. | | | BNP Paribas, ELN, 37.87%, 7/23/2021, (linked to S&P 500 Index) | | | 3.0 | |

| | 4. | | | UBS AG, ELN, 36.40%, 7/30/2021, (linked to S&P 500 Index) | | | 3.0 | |

| | 5. | | | Citigroup Global Markets Holdings, Inc., ELN, 38.70%, 7/9/2021, (linked to S&P 500 Index) | | | 2.6 | |

| | 6. | | | Microsoft Corp. | | | 1.6 | |

| | 7. | | | Intuit, Inc. | | | 1.6 | |

| | 8. | | | Accenture plc, Class A | | | 1.5 | |

| | 9. | | | Target Corp. | | | 1.5 | |

| | 10. | | | Eli Lilly & Co. | | | 1.4 | |

| | | | |

PORTFOLIO COMPOSITION BY SECTOR

AS OF JUNE 30, 2021 | | PERCENT OF

TOTAL

INVESTMENTS | |

| |

Health Care | | | 11.3 | % |

Information Technology | | | 11.2 | |

Industrials | | | 10.6 | |

Consumer Staples | | | 9.9 | |

Financials | | | 9.1 | |

Communication Services | | | 7.5 | |

Consumer Discretionary | | | 7.4 | |

Utilities | | | 6.3 | |

Materials | | | 3.3 | |

Real Estate | | | 2.6 | |

Energy | | | 0.8 | |

| Other*** | | | 15.3 | |

Short-Term Investments | | | 4.7 | |

| * | | The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| ** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | | Equity-Linked Notes that are linked to the S&P 500 Index. |

| | | | | | | | | | |

| | | | | |

| 8 | | | | | | | | J.P. MORGAN LARGE CAP FUNDS | | JUNE 30, 2021 |

| | | | |

AVERAGE ANNUAL TOTAL RETURNS AS OF JUNE 30, 2021 |

| | | | | | | | | | | | |

| | | |

| | | INCEPTION DATE OF

CLASS | | | 1 YEAR | | | SINCE

INCEPTION | |

CLASS A SHARES | | | August 31, 2018 | | | | | | | | | |

With Sales Charge* | | | | | | | 22.76 | % | | | 8.28 | % |

Without Sales Charge | | | | | | | 29.57 | | | | 10.36 | |

CLASS C SHARES | | | August 31, 2018 | | | | | | | | | |

With CDSC** | | | | | | | 28.03 | | | | 9.81 | |

Without CDSC | | | | | | | 29.03 | | | | 9.81 | |

CLASS I SHARES | | | August 31, 2018 | | | | 29.87 | | | | 10.61 | |

CLASS R5 SHARES | | | August 31, 2018 | | | | 30.06 | | | | 10.78 | |

CLASS R6 SHARES | | | August 31, 2018 | | | | 30.29 | | | | 10.89 | |

| * | | Sales Charge for Class A Shares is 5.25%. |

| ** | | Assumes a 1% CDSC (contingent deferred sales charge) for the one year period and 0% CDSC thereafter. |

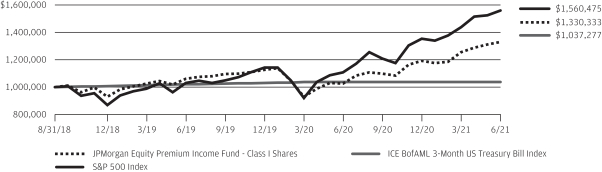

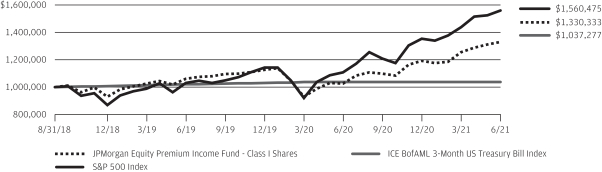

LIFE OF FUND PERFORMANCE (8/31/18 to 6/30/21)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

The Fund commenced operations on August 31, 2018.

The graph illustrates comparative performance for $1,000,000 invested in Class I Shares of the JPMorgan Equity Premium Income Fund, the S&P 500 Index and the ICE BofAML 3-Month US Treasury Bill Index from August 31, 2018 to June 30, 2021. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the S&P 500 Index and the ICE BofAML 3-Month US Treasury Bill Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and approximates the minimum possible dividend reinvestment of the securities included in the benchmarks, if applicable. These expenses are not identical to the expenses incurred by the Fund. The S&P 500 Index is an unmanaged index generally representative of the performance of large companies in the U.S. stock market. The ICE BofAML 3-Month US Treasury Bill Index is comprised of a single issue purchased at the

beginning of the month and held for a full month. Each month the ICE BofAML 3-Month US Treasury Bill Index is rebalanced and the issue selected is the outstanding Treasury Bill that matures closest to, but not beyond, 3 months from the rebalancing date. Investors cannot invest directly in an index.

Class I Shares have a $1,000,000 minimum initial investment.

Subsequent to the inception date of the Fund and through April 7, 2019, the Fund did not experience any shareholder activity. If such shareholder activity had occurred, the Fund’s performance may have been impacted.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on gains resulting from redemptions of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | | | | | |

| | | | | |

| JUNE 30, 2021 | | J.P. MORGAN LARGE CAP FUNDS | | | | | | | | 9 |

JPMorgan Hedged Equity Fund

FUND COMMENTARY

TWELVE MONTHS ENDED JUNE 30, 2021 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | | | |

| Fund (Class I Shares)* | | | 19.66% | |

| S&P 500 Index | | | 40.79% | |

| |

| Net Assets as of 6/30/2021 (In Thousands) | | | $18,294,923 | |

INVESTMENT OBJECTIVE**

The JPMorgan Hedged Equity Fund (the “Fund”) seeks to provide capital appreciation.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund’s Class I Shares underperformed the S&P 500 Index (the “Benchmark”) for the twelve months ended June 30, 2021. The Fund’s security selection in the pharmaceutical/medical technology and real estate investment trust sectors was a leading detractor from performance relative to the Benchmark, while the Fund’s security selection in the technology and telecommunications sectors was a leading contributor to relative performance.

Leading individual detractors from relative performance included the Fund’s overweight position in FedEx Corp. and its underweight positions in Walt Disney Co. and J.P. Morgan Chase & Co. Shares of FedEx, a parcel and freight delivery company, underperformed amid investor concerns about global supply chain problems. Shares of Walt Disney, an entertainment and media company, rose amid increased consumer demand for its online streaming service. Shares of J.P. Morgan Chase, a banking and financial services company that the Fund is prohibited from holding, rose amid better-than-expected earnings and general investor demand for financial sector stocks.

Leading individual contributors to relative performance included the Fund’s overweight positions in Applied Materials Inc. and Capital One Financial Corp. and its underweight position in Intel Inc. Shares of Applied Materials, a semiconductor manufacturing equipment provider, rose amid a surge in global demand for semiconductors in 2021. Shares of Capital One Financial, a banking and financial services company, rose amid improvement in its credit card business during the reporting period and general investor demand for financial sector stocks. Shares of Intel, a semiconductor manufacturer, fell as competitive pressure reduced sales in the data center business and the company issued a lower-than-expected forecast for the second quarter of 2021.

HOW WAS THE FUND POSITIONED?

The Fund used an enhanced index strategy that invests primarily in common stocks of large capitalization U.S. companies, while systematically purchasing and selling exchange-traded index put options and selling exchange-traded index call options. The option overlay is known as a Put/Spread Collar

strategy. The combination of the diversified portfolio of equity securities, downside protection from index put options and income from index call options provided the Fund with a portion of the returns associated with equity market investments while exposing the Fund to less risk than traditional long-only equity strategies.

| | | | | | | | |

TOP TEN EQUITY HOLDINGS OF THE

PORTFOLIO AS OF JUNE 30, 2021 | | PERCENT OF

TOTAL

INVESTMENTS | |

| | | | | | | | |

| | 1. | | | Microsoft Corp. | | | 6.5 | % |

| | 2. | | | Apple, Inc. | | | 5.8 | |

| | 3. | | | Amazon.com, Inc. | | | 4.4 | |

| | 4. | | | Alphabet, Inc., Class A | | | 2.5 | |

| | 5. | | | Facebook, Inc., Class A | | | 2.2 | |

| | 6. | | | Alphabet, Inc., Class C | | | 2.0 | |

| | 7. | | | Berkshire Hathaway, Inc., Class B | | | 1.6 | |

| | 8. | | | S&P 500 Index 9/30/2021 at USD 4,065.00, European Style | | | 1.5 | |

| | 9. | | | Tesla, Inc. | | | 1.4 | |

| | 10. | | | Mastercard, Inc., Class A | | | 1.4 | |

| | | | |

PORTFOLIO COMPOSITION BY SECTOR

AS OF JUNE 30, 2021 | | PERCENT OF

TOTAL

INVESTMENTS | |

| |

Information Technology | | | 26.4 | % |

Consumer Discretionary | | | 12.6 | |

Health Care | | | 12.6 | |

Financials | | | 11.4 | |

Communication Services | | | 11.0 | |

Industrials | | | 8.5 | |

Consumer Staples | | | 4.9 | |

Energy | | | 2.8 | |

Utilities | | | 2.4 | |

Materials | | | 2.3 | |

Real Estate | | | 1.8 | |

Put Options Purchased | | | 1.6 | |

Short-Term Investments | | | 1.7 | |

| * | | The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| ** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| | | | | | | | | | |

| | | | | |

| 10 | | | | | | | | J.P. MORGAN LARGE CAP FUNDS | | JUNE 30, 2021 |

| | | | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS AS OF JUNE 30, 2021 | |

| | | | |

| | | INCEPTION DATE OF

CLASS | | 1 YEAR | | | 5 YEAR | | | SINCE

INCEPTION | |

CLASS A SHARES | | December 13, 2013 | | | | | | | | | | | | |

With Sales Charge* | | | | | 13.06 | % | | | 9.56 | % | | | 7.79 | % |

Without Sales Charge | | | | | 19.31 | | | | 10.75 | | | | 8.56 | |

CLASS C SHARES | | December 13, 2013 | | | | | | | | | | | | |

With CDSC** | | | | | 17.76 | | | | 10.21 | | | | 8.02 | |

Without CDSC | | | | | 18.76 | | | | 10.21 | | | | 8.02 | |

CLASS I SHARES | | December 13, 2013 | | | 19.66 | | | | 11.04 | | | | 8.84 | |

CLASS R5 SHARES | | December 13, 2013 | | | 19.79 | | | | 11.21 | | | | 9.03 | |

CLASS R6 SHARES | | December 13, 2013 | | | 19.90 | | | | 11.30 | | | | 9.10 | |

| * | | Sales Charge for Class A Shares is 5.25%. |

| ** | | Assumes a 1% CDSC (contingent deferred sales charge) for the one year period and 0% CDSC thereafter. |

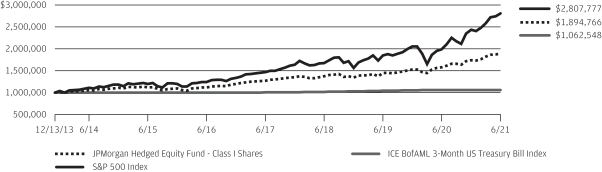

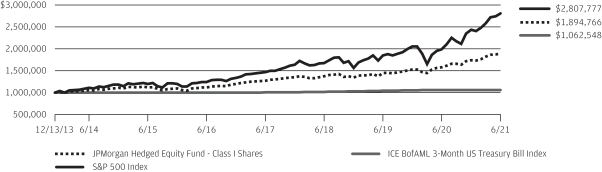

LIFE OF FUND PERFORMANCE (12/13/13 TO 6/30/21)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

The Fund commenced operations on December 13, 2013.

The graph illustrates comparative performance for $1,000,000 invested in Class I Shares of the JPMorgan Hedged Equity Fund, the S&P 500 Index and the ICE BofAML 3-Month US Treasury Bill Index from December 13, 2013 to June 30, 2021. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the S&P 500 Index and the ICE BofAML 3-Month US Treasury Bill Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and approximates the minimum possible dividend reinvestment of the securities included in the benchmarks, if applicable. The S&P 500 Index is an unmanaged index generally representative of the performance of large companies in the U.S. stock market. The ICE BofAML 3-Month US Treasury Bill Index is comprised of a single issue purchased at the

beginning of the month and held for a full month. Each month the ICE BofAML 3-Month US Treasury Bill Index is rebalanced and the issue selected is the outstanding Treasury Bill that matures closest to, but not beyond, 3 months from the rebalancing date. Investors cannot invest directly in an index.

Class I Shares have a $1,000,000 minimum initial investment.

Subsequent to the inception date of the Fund and through May 30, 2014, the Fund did not experience any shareholder activity. If such shareholder activity had occurred, the Fund’s performance may have been impacted.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on gains resulting from redemptions of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | | | | | |

| | | | | |

| JUNE 30, 2021 | | J.P. MORGAN LARGE CAP FUNDS | | | | | | | | 11 |

JPMorgan Hedged Equity 2 Fund

FUND COMMENTARY

FOR THE PERIOD FEBRUARY 26, 2021 (INCEPTION DATE) THROUGH JUNE 30, 2021 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | | | |

| Fund (Class I Shares)* | | | 6.63% | |

| S&P 500 Index | | | 13.30% | |

| |

Net Assets as of 6/30/2021 (In Thousands) | | | $1,391,868 | |

INVESTMENT OBJECTIVE**

The JPMorgan Hedged Equity 2 Fund (the “Fund”) seeks to provide capital appreciation.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund’s Class I Shares underperformed the S&P 500 Index (the “Benchmark”) for the period from inception on February 26, 2021 to June 30, 2021. The Fund’s security selection in the pharmaceutical/medical technology and utilities sectors was a leading detractor from performance relative to the Benchmark, while the Fund’s security selection in the technology and media sectors was a leading contributor to relative performance.

Leading individual detractors from relative performance included the Fund’s underweight position in Adobe Inc. and its overweight positions in Deere & Co. and Netflix Inc. Shares of Adobe, a software company not held in the Fund, rose after the company reported better-than-expected earnings and revenue for its fiscal second quarter. Shares of Deere, a maker of agricultural and construction equipment, underperformed late in the period after the company warned of pandemic-related constraints on its supply chain. Shares of Netflix, an online entertainment provider, fell amid investor concerns about slowing growth in new subscribers.

Leading individual contributors to relative performance included the Fund’s overweight position in Walt Disney Co. and its underweight positions in J.P. Morgan Chase & Co. and Intel Inc. Shares of Walt Disney, an entertainment and media company, rose amid increased consumer demand for its online streaming service. Shares of J.P. Morgan Chase, a banking and financial services company that the Fund is prohibited from holding, underperformed amid declining interest rates during the period. Shares of Intel, a semiconductor manufacturer, fell as competitive pressure reduced sales in the data center business and the company issued a lower-than-expected forecast for the second quarter of 2021.

HOW WAS THE FUND POSITIONED?

The Fund used an enhanced index strategy that invests primarily in common stocks of large capitalization U.S. companies, while systematically purchasing and selling exchange-traded index put options and selling exchange-traded index call

options. The option overlay is known as a Put/Spread Collar strategy. The combination of the diversified portfolio of equity

securities, downside protection from index put options and income from index call options provided the Fund with a portion of the returns associated with equity market investments while exposing the Fund to less risk than traditional long-only equity strategies.

| | | | | | | | |

TOP TEN EQUITY HOLDINGS OF THE

PORTFOLIO AS OF JUNE 30, 2021 | | PERCENT OF

TOTAL

INVESTMENTS | |

| | | | | | | | |

| | 1. | | | Microsoft Corp. | | | 6.3 | % |

| | 2. | | | Apple, Inc. | | | 5.7 | |

| | 3. | | | Amazon.com, Inc. | | | 4.3 | |

| | 4. | | | Alphabet, Inc., Class A | | | 2.4 | |

| | 5. | | | Facebook, Inc., Class A | | | 2.2 | |

| | 6. | | | Alphabet, Inc., Class C | | | 2.0 | |

| | 7. | | | Berkshire Hathaway, Inc., Class B | | | 1.5 | |

| | 8. | | | Tesla, Inc. | | | 1.4 | |

| | 9. | | | Mastercard, Inc., Class A | | | 1.3 | |

| | 10. | | | NVIDIA Corp. | | | 1.3 | |

| | | | |

PORTFOLIO COMPOSITION BY SECTOR

AS OF JUNE 30, 2021 | | PERCENT OF

TOTAL

INVESTMENTS | |

| |

| Information Technology | | | 25.7 | % |

| Consumer Discretionary | | | 12.3 | |

| Health Care | | | 12.2 | |

| Financials | | | 11.0 | |

| Communication Services | | | 10.7 | |

| Industrials | | | 8.3 | |

| Consumer Staples | | | 4.8 | |

| Energy | | | 2.7 | |

| Utilities | | | 2.3 | |

| Materials | | | 2.3 | |

| Real Estate | | | 1.7 | |

| Put Options Purchased | | | 0.3 | |

| Short-Term Investments | | | 5.7 | |

| * | | The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| ** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| | | | | | | | | | |

| | | | | |

| 12 | | | | | | | | J.P. MORGAN LARGE CAP FUNDS | | JUNE 30, 2021 |

| | | | | | |

TOTAL RETURNS AS OF JUNE 30, 2021 | |

| | |

| | | INCEPTION DATE OF

CLASS | | SINCE

INCEPTION | |

CLASS A SHARES | | February 26, 2021 | | | | |

With Sales Charge* | | | | | 6.54 | % |

Without Sales Charge | | | | | 6.54 | |

CLASS C SHARES | | February 26, 2021 | | | | |

With CDSC** | | | | | 5.36 | |

Without CDSC | | | | | 6.36 | |

CLASS I SHARES | | February 26, 2021 | | | 6.63 | |

CLASS R5 SHARES | | February 26, 2021 | | | 6.66 | |

CLASS R6 SHARES | | February 26, 2021 | | | 6.75 | |

| * | | Sales Charge for Class A Shares is 5.25%. |

| ** | | Assumes a 1% CDSC (contingent deferred sales charge) for the period. |

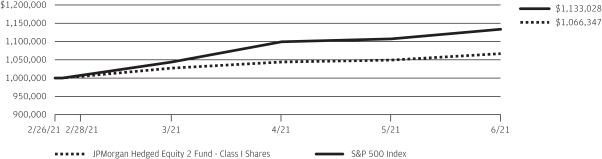

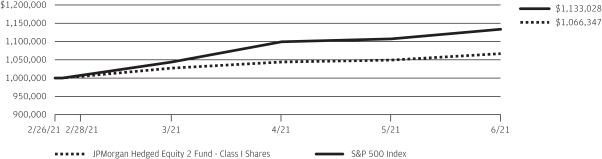

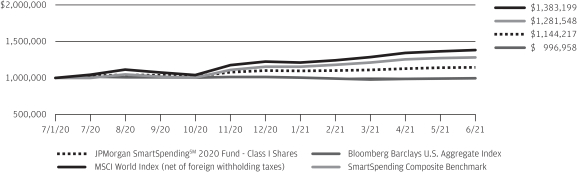

LIFE OF FUND PERFORMANCE (2/26/21 TO 6/30/21)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

The Fund commenced operations on February 26, 2021.

The graph illustrates comparative performance for $1,000,000 invested in Class I Shares of the JPMorgan Hedged Equity 2 Fund and the S&P 500 Index from February 26, 2021 to June 30, 2021. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the S&P 500 Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and approximates the minimum possible dividend reinvestment of

the securities included in the benchmarks, if applicable. The S&P 500 Index is an unmanaged index generally representative of the performance of large companies in the U.S. stock market. Investors cannot invest directly in an index.

Class I Shares have a $1,000,000 minimum initial investment.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on gains resulting from redemptions of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | | | | | |

| | | | | |

| JUNE 30, 2021 | | J.P. MORGAN LARGE CAP FUNDS | | | | | | | | 13 |

JPMorgan Hedged Equity 3 Fund

FUND COMMENTARY

FOR THE PERIOD FEBRUARY 26, 2021 (INCEPTION DATE) THROUGH JUNE 30, 2021 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | | | |

| Fund (Class I Shares)* | | | 6.64% | |

| S&P 500 Index | | | 13.30% | |

| |

| Net Assets as of 6/30/2021 (In Thousands) | | | $566,566 | |

INVESTMENT OBJECTIVE**

The JPMorgan Hedged Equity 3 Fund (the “Fund”) seeks to provide capital appreciation.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund’s Class I Shares underperformed the S&P 500 Index (the “Benchmark”) for the period from inception on February 26, 2021 to June 30, 2021. The Fund’s security selection in the pharmaceutical/medical technology and utilities sectors was a leading detractor from performance relative to the Benchmark, while the Fund’s security selection in the technology and media sectors was a leading contributor to relative performance.

Leading individual detractors from relative performance included the Fund’s underweight position in Adobe Inc. and its overweight positions in Deere & Co. and Netflix Inc. Shares of Adobe, a software company not held in the Fund, rose after the company reported better-than-expected earnings and revenue for its fiscal second quarter. Shares of Deere, a maker of agricultural and construction equipment, underperformed late in the period after the company warned of pandemic-related constraints on its supply chain. Shares of Netflix, an online entertainment provider, fell amid investor concerns about slowing growth in new subscribers.

Leading individual contributors to relative performance included the Fund’s overweight position in Walt Disney Co. and its underweight positions in J.P. Morgan Chase & Co. and Intel Inc. Shares of Walt Disney, an entertainment and media company, rose amid increased consumer demand for its online streaming service. Shares of J.P. Morgan Chase, a banking and financial services company that the Fund is prohibited from holding, underperformed amid declining interest rates during the period. Shares of Intel, a semiconductor manufacturer, fell as competitive pressure reduced sales in the data center business and the company issued a lower-than-expected forecast for the second quarter of 2021.

HOW WAS THE FUND POSITIONED?

The Fund used an enhanced index strategy that invests primarily in common stocks of large capitalization U.S. companies, while systematically purchasing and selling exchange-traded index put options and selling exchange-traded index call options. The option overlay is known as a Put/Spread Collar

strategy. The combination of the diversified portfolio of equity securities, downside protection from index put options and income from index call options provided the Fund with a portion of the returns associated with equity market investments while exposing the Fund to less risk than traditional long-only equity strategies.

| | | | | | | | |

TOP TEN EQUITY HOLDINGS OF THE

PORTFOLIO AS OF JUNE 30, 2021 | | PERCENT OF

TOTAL

INVESTMENTS | |

| | |

| | 1. | | | Microsoft Corp. | | | 6.4 | % |

| | 2. | | | Apple, Inc. | | | 5.8 | |

| | 3. | | | Amazon.com, Inc. | | | 4.4 | |

| | 4. | | | Alphabet, Inc., Class A | | | 2.5 | |

| | 5. | | | Facebook, Inc., Class A | | | 2.2 | |

| | 6. | | | Alphabet, Inc., Class C | | | 2.0 | |

| | 7. | | | Berkshire Hathaway, Inc., Class B | | | 1.6 | |

| | 8. | | | Tesla, Inc. | | | 1.4 | |

| | 9. | | | Mastercard, Inc., Class A | | | 1.4 | |

| | 10. | | | NVIDIA Corp. | | | 1.3 | |

| | | | |

PORTFOLIO COMPOSITION BY SECTOR

AS OF JUNE 30, 2021 | | PERCENT OF

TOTAL

INVESTMENTS | |

| |

Information Technology | | | 26.3 | % |

Consumer Discretionary | | | 12.6 | |

Health Care | | | 12.5 | |

Financials | | | 11.3 | |

Communication Services | | | 10.9 | |

Industrials | | | 8.5 | |

Consumer Staples | | | 4.9 | |

Energy | | | 2.8 | |

Utilities | | | 2.3 | |

Materials | | | 2.3 | |

Real Estate | | | 1.8 | |

Put Options Purchased | | | 0.8 | |

Short-Term Investments | | | 3.0 | |

| * | | The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| ** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| | | | | | | | | | |

| | | | | |

| 14 | | | | | | | | J.P. MORGAN LARGE CAP FUNDS | | JUNE 30, 2021 |

| | | | | | |

TOTAL RETURNS AS OF JUNE 30, 2021 | |

| | |

| | | INCEPTION DATE OF

CLASS | | SINCE

INCEPTION | |

CLASS A SHARES | | February 26, 2021 | | | | |

With Sales Charge* | | | | | 6.50 | % |

Without Sales Charge | | | | | 6.50 | |

CLASS C SHARES | | February 26, 2021 | | | | |

With CDSC** | | | | | 5.37 | |

Without CDSC | | | | | 6.37 | |

CLASS I SHARES | | February 26, 2021 | | | 6.64 | |

CLASS R5 SHARES | | February 26, 2021 | | | 6.64 | |

CLASS R6 SHARES | | February 26, 2021 | | | 6.68 | |

| * | | Sales Charge for Class A Shares is 5.25%. |

| ** | | Assumes a 1% CDSC (contingent deferred sales charge) for the period. |

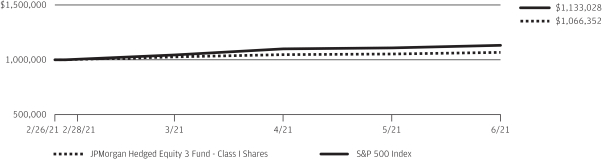

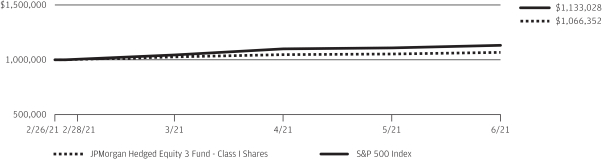

LIFE OF FUND PERFORMANCE (2/26/21 TO 6/30/21)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

The Fund commenced operations on February 26, 2021.

The graph illustrates comparative performance for $1,000,000 invested in Class I Shares of the JPMorgan Hedged Equity 3 Fund and the S&P 500 Index from February 26, 2021 to June 30, 2021. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the S&P 500 Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and approximates the minimum possible dividend reinvestment of

the securities included in the benchmarks, if applicable. The S&P 500 Index is an unmanaged index generally representative of the performance of large companies in the U.S. stock market. Investors cannot invest directly in an index.

Class I Shares have a $1,000,000 minimum initial investment.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on gains resulting from redemptions of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | | | | | |

| | | | | |

| JUNE 30, 2021 | | J.P. MORGAN LARGE CAP FUNDS | | | | | | | | 15 |

JPMorgan Large Cap Growth Fund

FUND COMMENTARY

TWELVE MONTHS ENDED JUNE 30, 2021 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | | | |

| Fund (Class I Shares)* | | | 41.37% | |

| Russell 1000 Growth Index | | | 42.50% | |

| |

| Net Assets as of 6/30/2021 (In Thousands) | | | $37,416,380 | |

INVESTMENT OBJECTIVE**

The JPMorgan Large Cap Growth Fund (the “Fund”) seeks long-term capital appreciation.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund’s Class I Shares underperformed the Russell 1000 Growth Index (the “Benchmark”) for the twelve months ended June 30, 2021. The Fund’s security selection in the health care and industrials sectors was a leading detractor from performance relative to the Benchmark, while the Fund’s security selection and overweight position in the consumer discretionary sector and its security selection in the information technology sector were leading contributors to relative performance.

Leading individual detractors from relative performance included the Fund’s overweight positions in Seagen Inc., Regeneron Pharmaceuticals Inc. and DexCom Inc. Shares of Seagen, a drug development company, fell after the company reported lower-than-expected earnings for the first quarter of 2021. Shares of Regeneron Pharmaceuticals, a drug development company, fell as the U.S. approval of multiple vaccines against COVID-19 reduced demand for alternative therapies for the virus. Shares of DexCom, a medical device manufacturer, fell during the period following a run-up in the stock price in 2020.

Leading individual contributors to relative performance included the Fund’s overweight positions in Tesla Inc., Snap Inc. and ASML Holdings NV. Shares of Tesla, a producer of electric vehicles and energy storage systems, rose after the company was added to the S&P 500 Index. Shares of Snap, an online camera platform and social media provider, rose after the company reported consecutive quarters of better-than-expected earnings and revenue during the period. Shares of ASML Holdings, a semiconductor manufacturing equipment maker, rose on growth in demand amid a global supply shortage of semiconductors.

HOW WAS THE FUND POSITIONED?

The Fund’s portfolio managers utilized a bottom-up approach to stock selection, rigorously researching individual companies in an effort to construct portfolios of stocks that have strong fundamentals and positive price momentum. The Fund’s portfolio managers sought to invest in companies with attractive

fundamentals that, in their view, possessed the potential to significantly exceed expectations for a prolonged period of time.

| | | | | | | | |

TOP TEN EQUITY HOLDINGS OF THE

PORTFOLIO AS OF JUNE 30, 2021 | | PERCENT OF

TOTAL

INVESTMENTS | |

| | |

| | 1. | | | Alphabet, Inc., Class C | | | 6.0 | % |

| | 2. | | | Apple, Inc. | | | 5.8 | |

| | 3. | | | Microsoft Corp. | | | 4.7 | |

| | 4. | | | Facebook, Inc., Class A | | | 4.5 | |

| | 5. | | | PayPal Holdings, Inc. | | | 3.4 | |

| | 6. | | | Amazon.com, Inc. | | | 3.2 | |

| | 7. | | | Deere & Co. | | | 3.1 | |

| | 8. | | | Snap, Inc., Class A | | | 2.5 | |

| | 9. | | | Charles Schwab Corp. (The) | | | 2.1 | |

| | 10. | | | Morgan Stanley | | | 2.0 | |

| | | | |

PORTFOLIO COMPOSITION BY SECTOR

AS OF JUNE 30, 2021 | | PERCENT OF

TOTAL

INVESTMENTS | |

| |

Information Technology | | | 28.9 | % |

Communication Services | | | 17.3 | |

Consumer Discretionary | | | 13.7 | |

Health Care | | | 10.8 | |

Industrials | | | 9.6 | |

Financials | | | 8.6 | |

Consumer Staples | | | 3.7 | |

Materials | | | 2.3 | |

Short-Term Investments | | | 5.1 | |

| * | | The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| ** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| | | | | | | | | | |

| | | | | |

| 16 | | | | | | | | J.P. MORGAN LARGE CAP FUNDS | | JUNE 30, 2021 |

| | | | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS AS OF JUNE 30, 2021 | |

| | | | |

| | | INCEPTION DATE OF

CLASS | | 1 YEAR | | | 5 YEAR | | | 10 YEAR | |

CLASS A SHARES | | February 22, 1994 | | | | | | | | | | | | |

With Sales Charge* | | | | | 33.60 | % | | | 26.47 | % | | | 17.67 | % |

Without Sales Charge | | | | | 41.00 | | | | 27.84 | | | | 18.30 | |

CLASS C SHARES | | November 4, 1997 | | | | | | | | | | | | |

With CDSC** | | | | | 39.32 | | | | 27.20 | | | | 17.83 | |

Without CDSC | | | | | 40.32 | | | | 27.20 | | | | 17.83 | |

CLASS I SHARES | | February 28, 1992 | | | 41.37 | | | | 28.13 | | | | 18.54 | |

CLASS R2 SHARES | | November 3, 2008 | | | 40.65 | | | | 27.51 | | | | 18.01 | |

CLASS R3 SHARES | | September 9, 2016 | | | 41.01 | | | | 27.81 | | | | 18.28 | |

CLASS R4 SHARES | | September 9, 2016 | | | 41.37 | | | | 28.12 | | | | 18.54 | |

CLASS R5 SHARES | | April 14, 2009 | | | 41.57 | | | | 28.33 | | | | 18.75 | |

CLASS R6 SHARES | | November 30, 2010 | | | 41.70 | | | | 28.46 | | | | 18.85 | |

| * | | Sales Charge for Class A Shares is 5.25%. |

| ** | | Assumes a 1% CDSC (contingent deferred sales charge) for the one year period and 0% CDSC thereafter. |

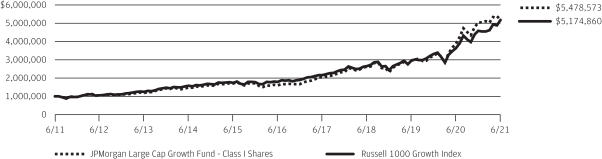

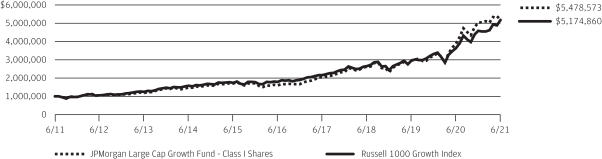

TEN YEAR PERFORMANCE (6/30/11 TO 6/30/21)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

Returns for Class R3 and Class R4 Shares prior to their inception dates are based on the performance of Class I Shares. With respect to Class R3 Shares, prior class performance has been adjusted to reflect the differences in expenses between classes. The actual returns of Class R4 Shares would have been similar to those shown because Class R4 Shares had similar expenses to Class I Shares.

The graph illustrates comparative performance for $1,000,000 invested in Class I Shares of the JPMorgan Large Cap Growth Fund and the Russell 1000 Growth Index from June 30, 2011 to June 30, 2021. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the Russell 1000 Growth Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and has been adjusted to reflect reinvestment of

all dividends and capital gain distributions of the securities included in the benchmark, if applicable. The Russell 1000 Growth Index is an unmanaged index which measures the performance of those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values. Investors cannot invest directly in an index.

Class I Shares have a $1,000,000 minimum initial investment.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on gains resulting from redemptions of Fund shares.

Because Class C Shares automatically convert to Class A Shares after 8 years, the 10 year average annual total return shown above for Class C reflects Class A Performance for the period after conversion.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | | | | | |

| | | | | |

| JUNE 30, 2021 | | J.P. MORGAN LARGE CAP FUNDS | | | | | | | | 17 |

JPMorgan Large Cap Value Fund

FUND COMMENTARY

TWELVE MONTHS ENDED JUNE 30, 2021 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | | | |

| Fund (Class I Shares)* | | | 62.22% | |

| Russell 1000 Value Index | | | 43.68% | |

| |

| Net Assets as of 6/30/2021 (In Thousands) | | | $4,341,470 | |

INVESTMENT OBJECTIVE**

The JPMorgan Large Cap Value Fund (the “Fund”) seeks capital appreciation with the incidental goal of achieving current income by investing primarily in equity securities.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund’s Class I Shares outperformed the Russell 1000 Value Index (the “Benchmark”) for the twelve months ended June 30, 2021. The Fund’s security selection and overweight position in the consumer discretionary sector and its security selection in the information technology sector were leading contributors to performance relative to the Benchmark, while the Fund’s security selection in the health care and financials sectors were the smallest contributors and no sectors detracted from relative performance.

Leading individual contributors to relative performance included the Fund’s overweight positions in U.S. Foods Holding Corp., General Motors Co. and ON Semiconductor Corp. Shares of U.S. Foods Holding, a foodservice distributor, rose after the company reported a narrower-than-expected loss for the first quarter of 2021 and amid investor demand for value stocks. Shares of ON Semiconductor, a semiconductor manufacturer, rose amid a surge in global demand for semiconductors in 2021. Shares of General Motors, an automobile manufacturer, rose amid increased demand for cars and trucks in the second half of 2020 and investor expectations for increased government spending on electric vehicle development.

Leading individual detractors from relative performance included the Fund’s overweight positions in FMC Corp. and Carter’s Inc. and its underweight position in Alphabet Inc. Shares of FMC, a diversified chemicals manufacturer, underperformed after the company issued a lower-than-expected earnings forecast for the first quarter and full year 2021. Shares of Carter’s, a maker of children’s apparel, underperformed late in the period following a run-up in the stock price driven by better-than-expected earnings for the first quarter of 2021. Shares of Alphabet, parent company of Google Inc., rose on continued growth in earnings and revenue throughout the period.

HOW WAS THE FUND POSITIONED?

The Fund’s portfolio manager combined a bottom-up fundamental approach to security selection with a systematic valuation process. Overall, the Fund’s portfolio manager looked to take advantage of mispriced stocks that he believed appeared attractive relative to their fair value.

| | | | | | | | |

TOP TEN EQUITY HOLDINGS OF THE

PORTFOLIO AS OF JUNE 30, 2021 | | PERCENT OF

TOTAL

INVESTMENTS | |

| | |

| | 1. | | | Wells Fargo & Co. | | | 3.8 | % |

| | 2. | | | US Foods Holding Corp. | | | 3.6 | |

| | 3. | | | Bank of America Corp. | | | 3.2 | |

| | 4. | | | Comcast Corp., Class A | | | 2.7 | |

| | 5. | | | Lamb Weston Holdings, Inc. | | | 2.7 | |

| | 6. | | | Cigna Corp. | | | 2.7 | |

| | 7. | | | Freeport-McMoRan, Inc. | | | 2.5 | |

| | 8. | | | State Street Corp. | | | 2.4 | |

| | 9. | | | FMC Corp. | | | 2.3 | |

| | 10. | | | Boeing Co. (The) | | | 2.3 | |

| | | | |

PORTFOLIO COMPOSITION BY SECTOR

AS OF JUNE 30, 2021 | | PERCENT OF

TOTAL

INVESTMENTS | |

| |

| Financials | | | 18.0 | % |

| Industrials | | | 15.7 | |

| Health Care | | | 15.0 | |

| Energy | | | 9.9 | |

| Materials | | | 9.5 | |

| Consumer Discretionary | | | 8.9 | |

| Consumer Staples | | | 8.0 | |

| Information Technology | | | 5.9 | |

| Communication Services | | | 3.3 | |

| Real Estate | | | 2.9 | |

| Utilities | | | 0.9 | |

| Short-Term Investments | | | 2.0 | |

| * | | The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| ** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| | | | | | | | | | |

| | | | | |

| 18 | | | | | | | | J.P. MORGAN LARGE CAP FUNDS | | JUNE 30, 2021 |

| | | | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS AS OF JUNE 30, 2021 | |

| | | | |

| | | INCEPTION DATE OF

CLASS | | 1 YEAR | | | 5 YEAR | | | 10 YEAR | |

CLASS A SHARES | | February 18, 1992 | | | | | | | | | | | | |

With Sales Charge* | | | | | 53.42 | % | | | 14.15 | % | | | 12.17 | % |

Without Sales Charge | | | | | 61.86 | | | | 15.38 | | | | 12.78 | |

CLASS C SHARES | | March 22, 1999 | | | | | | | | | | | | |

With CDSC** | | | | | 60.04 | | | | 14.79 | | | | 12.32 | |

Without CDSC | | | | | 61.04 | | | | 14.79 | | | | 12.32 | |

CLASS I SHARES | | March 1, 1991 | | | 62.22 | | | | 15.64 | | | | 13.00 | |

CLASS R2 SHARES | | November 3, 2008 | | | 61.40 | | | | 15.07 | | | | 12.48 | |

CLASS R3 SHARES | | October 1, 2018 | | | 61.83 | | | | 15.38 | | | | 12.78 | |

CLASS R4 SHARES | | October 1, 2018 | | | 62.16 | | | | 15.63 | | | | 12.99 | |

CLASS R5 SHARES | | May 15, 2006 | | | 62.47 | | | | 15.81 | | | | 13.20 | |

CLASS R6 SHARES | | November 30, 2010 | | | 62.68 | | | | 15.92 | | | | 13.28 | |

| * | | Sales Charge for Class A Shares is 5.25%. |

| ** | | Assumes a 1% CDSC (contingent deferred sales charge) for the one year period and 0% CDSC thereafter. |

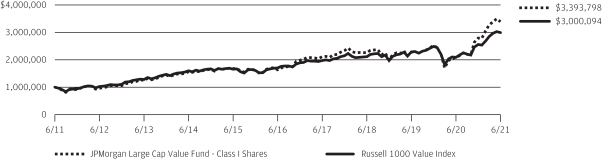

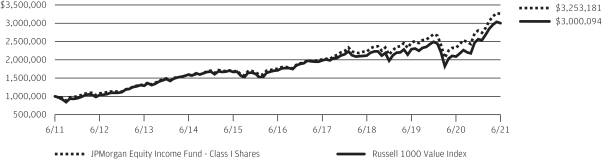

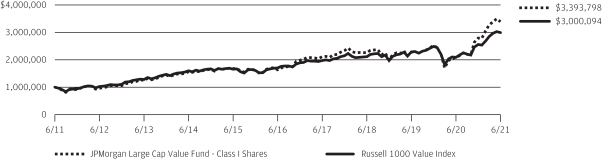

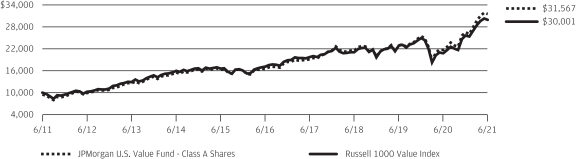

TEN YEAR PERFORMANCE (6/30/11 TO 6/30/21)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

Returns for Class R3 Shares prior to their inception date are based on the performance of Class A Shares. The actual returns of Class R3 Shares would have been different than those shown because Class R3 Shares have different expenses than Class A Shares.

Returns for Class R4 Shares prior to their inception date are based on the performance of Class I Shares. The actual returns for Class R4 Shares would have been similar to those shown because Class R4 Shares have similar expenses than Class I Shares.

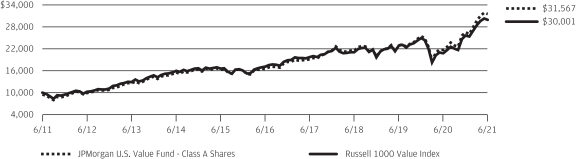

The graph illustrates comparative performance for $1,000,000 invested in Class I Shares of the JPMorgan Large Cap Value Fund and the Russell 1000 Value Index from June 30, 2011 to June 30, 2021. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the Russell 1000 Value Index does not reflect the deduction of expenses or a sales charge associated

with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the benchmark, if applicable. The Russell 1000 Value Index is an unmanaged index which measures the performance of those Russell 1000 companies with lower price-to-book ratios and lower forecasted growth values. Investors cannot invest directly in an index.

Class I Shares have a $1,000,000 minimum initial investment.

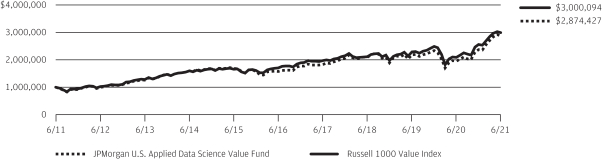

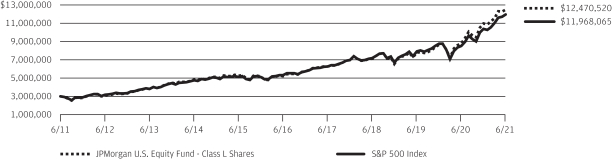

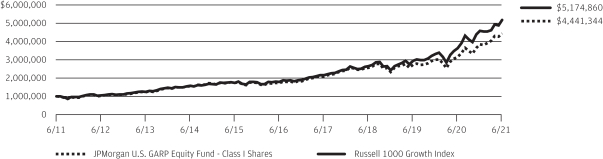

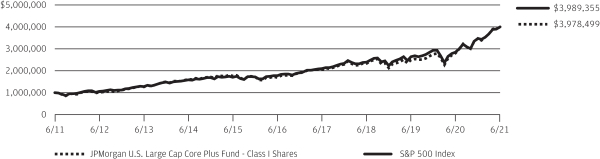

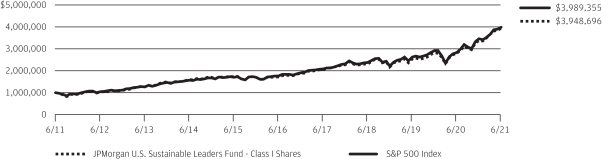

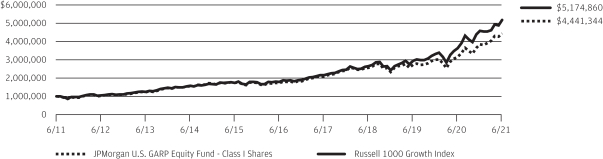

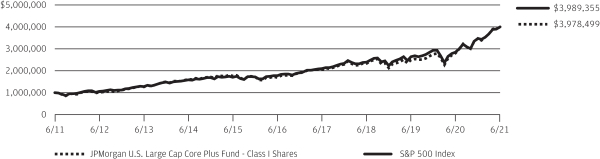

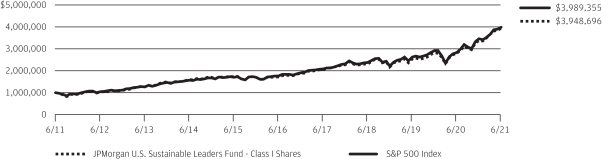

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on gains resulting from redemptions of Fund shares.