UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-23117

JPMorgan Trust IV

(Exact name of registrant as specified in charter)

277 Park Avenue

New York, NY 10172

(Address of principal executive offices) (Zip code)

Gregory S. Samuels

277 Park Avenue

New York, NY 10172

(Name and Address of Agent for Service)

Registrant’s telephone number, including area code: (800) 480-4111

Date of fiscal year end: October 31

Date of reporting period: November 1, 2019 through October 31, 2020

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. Section 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

Annual Report

J.P. Morgan International Equity Funds

October 31, 2020

JPMorgan Emerging Markets Equity Fund

JPMorgan Emerging Markets Research Enhanced Equity Fund

JPMorgan Europe Dynamic Fund

JPMorgan International Advantage Fund

JPMorgan International Equity Fund

JPMorgan International Focus Fund

(formerly known as JPMorgan International Unconstrained Equity Fund)

JPMorgan International Hedged Equity Fund

JPMorgan International Research Enhanced Equity Fund

JPMorgan International Value Fund

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Funds’ annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Funds’ website www.jpmorganfunds.com and you will be notified by mail each time a report is posted and provided with a website to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action.

You may elect to receive shareholder reports and other communications from the Funds electronically anytime by contacting your financial intermediary (such as a broker dealer, bank, or retirement plan) or, if you are a direct investor, by going to www.jpmorganfunds.com/edelivery.

You may elect to receive paper copies of all future reports free of charge. Contact your financial intermediary or, if you invest directly with the Funds, email us at funds.website.support@jpmorganfunds.com or call 1-800-480-4111. Your election to receive paper reports will apply to all funds held within your account(s).

CONTENTS

Investments in a Fund are not deposits or obligations of, or guaranteed or endorsed by, any bank and are not insured or guaranteed by the FDIC, the Federal Reserve Board or any other government agency. You could lose money if you sell when a Fund’s share price is lower than when you invested.

Past performance is no guarantee of future performance. The general market views expressed in this report are opinions based on market and other conditions through the end of the reporting period and are subject to change without notice. These views are not intended to predict the future performance of a Fund or the securities markets. References to specific securities and their issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Such views are not meant as investment advice and may not be relied on as an indication of trading intent on behalf of any Fund.

Prospective investors should refer to the Funds’ prospectuses for a discussion of the Funds’ investment objectives, strategies and risks. Call J.P. Morgan Funds Service Center at 1-800-480-4111 for a prospectus containing more complete information about a Fund, including management fees and other expenses. Please read it carefully before investing.

LETTER TO SHAREHOLDERS

DECEMBER 10, 2020 (Unaudited)

Dear Shareholders,

Even as the pandemic fueled deep uncertainty over the past year, global financial markets proved to be resilient with unprecedented support from central banks and broad investor optimism over advances in global efforts to end the pandemic. Over the twelve months ended October 31, 2020, equity prices in the U.S. and emerging markets generally led a broad but uneven recovery from lows reached in the first quarter of 2020. For the period, the S&P 500 Index returned 9.71%, the MSCI Emerging Markets Index returned 8.62% and the MSCI EAFE Index returned -6.46%.

| | |

| | “We maintain an unwavering commitment to seeking to provide investors with innovative and timely solutions required to meet the demands and opportunities of any market environment.”

— Andrea L. Lisher |

The period began with upward momentum in global equity markets but by the end of March 2020, investors responded to the emerging pandemic with a broad sell-off that fed a sharp spike in financial market volatility. The swift response of leading central banks to seek to ensure market liquidity brought

some calm to financial markets and in the following months equity prices began to recover. Though the full economic impact of the pandemic remains unknown, investors have appeared to focus on specific efforts to contain Covid-19 and the timeline for the potential availability of vaccines against the virus.

Throughout this period, J.P. Morgan Asset Management has quickly adapted to unique challenges and has continued to operate utilizing the same fundamental practices and principles that have driven our success. We maintain an unwavering commitment to seeking to provide investors with innovative and timely solutions required to meet the demands and opportunities of any market environment. On behalf of J.P. Morgan Asset Management, thank you for entrusting us to manage your investment. Should you have any questions, please visit www.jpmorganfunds.com or contact the J.P. Morgan Funds Service Center at 1-800-480-4111.

Sincerely yours,

Andrea L. Lisher

Head of Americas, Client

J.P. Morgan Asset Management

| | | | | | | | |

| | | |

| OCTOBER 31, 2020 | | J.P. MORGAN INTERNATIONAL EQUITY FUNDS | | | | | 1 | |

J.P. Morgan International Equity Funds

MARKET OVERVIEW

TWELVE MONTHS ENDED OCTOBER 31, 2020 (Unaudited)

While global financial markets largely entered the reporting period with support from an improving economic and trade outlook, the economic shock of the pandemic response sparked a drop in global asset prices and a spike in market volatility in the first quarter of 2020. Rapid interventions by the world’s central banks helped to calm investors and set the stage for general but uneven recovery in financial markets.

The final months of 2019 were marked by rising prices for global equity - led by U.S. markets - driven partly by gains in U.S. and European manufacturing and an initial U.S.-China agreement to lower trade barriers. Amid already low interest rates, the U.S. Federal Reserve declined to cut rates further at its December meeting.

In the first days of January 2020, financial markets largely shrugged off a brief flare-up in military tensions between the U.S. and Iran. However, the emergence and spread of Covid-19 fed increasing investor uncertainty and by early March, the novel coronavirus was declared a pandemic by the World Health Organization. The closure of large sectors of national economies on a global scale sparked a dramatic sell-off in financial markets across the globe. Yields on developed market sovereign bonds fell sharply and prices for commodity gold spiked. By the end of the first quarter of 2020, leading developed market equity indexes had lost 20% or more of their value from the start of the year. Corporate bond prices generally fell and the price of crude oil ended the first quarter down by 60%.

Leading central banks promptly responded with lower interest rates and/or asset purchasing programs, which helped to support asset price stability and head off a potential liquidity crunch in credit markets. Governments also responded with a range of fiscal stimulus or paycheck protection programs designed to cushion the economic impact of the pandemic. In the ensuing months, global equity markets staged a slow and uneven rebound, led by U.S. and emerging markets.

For the twelve months ended October 31, 2020, the S&P 500 Index returned a total of 9.71%, MSCI Emerging Markets Index returned 8.62% and the MSCI EAFE Index returned -6.46%. Among bond market indexes, the Bloomberg Barclays U.S. Aggregate Index returned 6.19% and the Bloomberg Barclays Emerging Markets Index returned 3.38%

| | | | | | |

| | | |

| 2 | | | | J.P. MORGAN INTERNATIONAL EQUITY FUNDS | | OCTOBER 31, 2020 |

JPMorgan Emerging Markets Equity Fund

FUND COMMENTARY

TWELVE MONTHS ENDED OCTOBER 31, 2020 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | | | |

| Fund (Class L Shares)* | | | 22.29% | |

| MSCI Emerging Markets Index (net of foreign withholding taxes) | | | 8.25% | |

| |

| Net Assets as of 10/31/2020 (In Thousands) | | $ | 11,220,225 | |

INVESTMENT OBJECTIVE**

The JPMorgan Emerging Markets Equity Fund (the “Fund”) seeks to provide high total return.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund’s Class L Shares outperformed the MSCI Emerging Markets Index (net of foreign withholding taxes) (the “Benchmark”) for the twelve months ended October 31, 2020.

By sector, the Fund’s security selection in the communications services sector and its underweight position and security selection in the energy sector were leading contributors to relative to the Benchmark. The Fund’s overweight positions in the consumer staples and financials sectors were leading detractors from relative performance.

By country, the Fund’s security selection and overweight position in China and its out-of-Benchmark allocation to Singapore were leading contributors to performance relative performance. The Fund’s security selection and overweight position in India and its out-of-Benchmark allocation to Panama were leading detractors from relative performance.

Leading individual contributors to relative performance included the Fund’s out-of-Benchmark positions in Sea Ltd. and MercadoLibre Inc. and its overweight position in Meituan Dianping . Shares of Sea, a Singapore online gaming and electronic commerce provider with a presence in Southeast Asia, Taiwan and Latin America, rose amid growth in consumer demand for online services and entertainment. Shares of MercadoLibre, an

electronic commerce platform operator based in Argentina, rose amid growth in consumer demand for online services. Shares of Meituan Dianping, a Chinese provider of an electronic commerce platform, rose amid growth in consumer demand for online services.

Leading individual detractors from relative performance included the Fund’s out-of-Benchmark positions in IndusInd Bank Ltd., HDFC Bank Ltd., and Copa Holdings SA. Shares of IndusInd Bank and HDFC Bank, both Indian banking and financial services providers, fell amid investor expectations for a sharp contraction in the India’s economy due to Covid-19. Shares of Copa Holdings, an airline based in Panama, fell amid a decline in demand for passenger air travel.

HOW WAS THE FUND POSITIONED?

The Fund’s portfolio managers employed an active strategy in which portfolio construction was focused on the highest-conviction ideas found at the security level. The Fund’s portfolio managers used bottom-up fundamental research to determine the Fund’s security weightings, researching companies in an attempt to determine their underlying value and potential for future earnings growth.

As a result of this process, the Fund’s largest sector overweight allocations relative to the Benchmark were in the financials and consumer staples sectors and its largest relative underweight allocations were in the energy and materials sectors. The Fund’s largest country overweight allocations relative to the Benchmark were in India and China and its largest relative underweight allocations were in South Korea and Taiwan.

| | | | | | | | |

| | | |

| OCTOBER 31, 2020 | | J.P. MORGAN INTERNATIONAL EQUITY FUNDS | | | | | 3 | |

JPMorgan Emerging Markets Equity Fund

FUND COMMENTARY

TWELVE MONTHS ENDED OCTOBER 31, 2020 (Unaudited) (continued)

| | | | | | | | |

| TOP TEN EQUITY HOLDINGS OF THE PORTFOLIO*** | |

| | 1. | | | Taiwan Semiconductor Manufacturing Co. Ltd., ADR (Taiwan) | | | 6.8 | % |

| | 2. | | | Tencent Holdings Ltd. (China) | | | 4.6 | |

| | 3. | | | Alibaba Group Holding Ltd., ADR (China) | | | 4.4 | |

| | 4. | | | Samsung Electronics Co. Ltd., GDR (South Korea) | | | 3.7 | |

| | 5. | | | Meituan Dianping, Class B (China) | | | 3.0 | |

| | 6. | | | Sea Ltd., ADR (Taiwan) | | | 3.0 | |

| | 7. | | | EPAM Systems, Inc. (United States) | | | 3.0 | |

| | 8. | | | Wuxi Biologics Cayman, Inc. (China) | | | 2.7 | |

| | 9. | | | Alibaba Group Holding Ltd. (China) | | | 2.7 | |

| | 10. | | | MercadoLibre, Inc. (Argentina) | | | 2.5 | |

| | | | |

PORTFOLIO COMPOSITION BY COUNTRY*** | |

| China | | | 37.1 | % |

| India | | | 15.9 | |

| Taiwan | | | 10.2 | |

| Brazil | | | 6.3 | |

| Hong Kong | | | 5.7 | |

| South Korea | | | 5.0 | |

| United States | | | 3.0 | |

| Argentina | | | 2.4 | |

| Mexico | | | 2.2 | |

| Indonesia | | | 1.7 | |

| South Africa | | | 1.4 | |

| Portugal | | | 1.0 | |

| Others (each less than 1.0%) | | | 4.2 | |

| Short-Term Investments | | | 3.9 | |

| * | | The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| ** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | | Percentages indicated are based on total investments as of October 31, 2020. The Fund’s portfolio composition is subject to change. |

| | | | | | |

| | | |

| 4 | | | | J.P. MORGAN INTERNATIONAL EQUITY FUNDS | | OCTOBER 31, 2020 |

| | | | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS AS OF OCTOBER 31, 2020 | |

| | | | |

| | | INCEPTION DATE OF

CLASS | | 1 YEAR | | | 5 YEAR | | | 10 YEAR | |

CLASS A SHARES | | September 28, 2001 | | | | | | | | | | | | |

With Sales Charge* | | | | | 15.43 | % | | | 12.59 | % | | | 4.37 | % |

Without Sales Charge | | | | | 21.84 | | | | 13.81 | | | | 4.94 | |

CLASS C SHARES | | February 28, 2006 | | | | | | | | | | | | |

With CDSC** | | | | | 20.24 | | | | 13.24 | | | | 4.52 | |

Without CDSC | | | | | 21.24 | | | | 13.24 | | | | 4.52 | |

CLASS I SHARES | | September 10, 2001 | | | 22.16 | | | | 14.08 | | | | 5.20 | |

CLASS L SHARES | | November 15, 1993 | | | 22.29 | | | | 14.22 | | | | 5.34 | |

CLASS R2 SHARES | | July 31, 2017 | | | 21.47 | | | | 13.52 | | | | 4.80 | |

CLASS R3 SHARES | | July 31, 2017 | | | 21.80 | | | | 13.78 | | | | 4.93 | |

CLASS R4 SHARES | | July 31, 2017 | | | 22.09 | | | | 14.04 | | | | 5.18 | |

CLASS R5 SHARES | | September 9, 2016 | | | 22.29 | | | | 14.23 | | | | 5.34 | |

CLASS R6 SHARES | | December 23, 2013 | | | 22.39 | | | | 14.35 | | | | 5.41 | |

| * | | Sales Charge for Class A Shares is 5.25%. |

| ** | | Assumes a 1% CDSC (contingent deferred sales charge) for the one year period and 0% CDSC thereafter. |

TEN YEAR PERFORMANCE (10/31/10 TO 10/31/20)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

Returns for Class R5 Shares and Class R6 Shares prior to their inception dates are based on the performance of Class L Shares. The actual returns of Class R5 Shares and Class R6 Shares would have been different than those shown because Class R5 Shares and Class R6 Shares have different expenses than Class L Shares.

Returns shown for Class R2 Shares and Class R3 Shares prior to their inception dates are based on the performance of Class A Shares. The actual returns of Class R2 Shares and Class R3 Shares would have been lower than those shown because Class R2 Shares and Class R3 Shares have higher expenses than Class A Shares.

Returns for Class R4 Shares prior to its inception date are based on the performance of Class I Shares. The actual returns of Class R4 Shares would have been lower than those shown because Class R4 Shares have higher expenses than Class I Shares.

The graph illustrates comparative performance for $3,000,000 invested in Class L Shares of the JPMorgan Emerging Markets Equity Fund and the MSCI Emerging Markets Index (net of foreign withholding taxes) from October 31, 2010 to October 31, 2020. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the MSCI Emerging Markets Index (net of foreign withholding taxes) does not reflect the deduction of expenses or a sales charge associated with a mutual fund and approximates the minimum possible dividend reinvestment of the securities included in the benchmark, if applicable. The dividend is reinvested after deduction of withholding tax, applying the maximum rate to non-resident institutional investors who do not benefit from double taxation treaties. The MSCI Emerging Markets Index (net of foreign withholding taxes) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of emerging markets. Investors cannot invest directly in an index.

Class L Shares have a $3,000,000 minimum initial investment.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the applicable inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on gains resulting from redemptions of Fund shares.

| | | | | | | | |

| | | |

| OCTOBER 31, 2020 | | J.P. MORGAN INTERNATIONAL EQUITY FUNDS | | | | | 5 | |

JPMorgan Emerging Markets Equity Fund

FUND COMMENTARY

TWELVE MONTHS ENDED OCTOBER 31, 2020 (Unaudited) (continued)

International investing involves a greater degree of risk and increased volatility. Changes in currency exchange rates and differences in accounting and taxation policies outside the U.S. can raise or lower returns. Also, some overseas markets may not be as politically and economically stable as the U.S. and other nations.

Because Class C Shares automatically convert to Class A Shares after 8 years, the 10 year average annual total return shown above for Class C reflects Class A performance for the period after conversion.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | |

| | | |

| 6 | | | | J.P. MORGAN INTERNATIONAL EQUITY FUNDS | | OCTOBER 31, 2020 |

JPMorgan Emerging Markets Research Enhanced Equity Fund

FUND COMMENTARY

TWELVE MONTHS ENDED OCTOBER 31, 2020 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | | | |

Fund (Class R6 Shares)* | | | 8.28% | |

| MSCI Emerging Markets Index (net of foreign withholding taxes) | | | 8.25% | |

| |

| Net Assets as of 10/31/2020 (In Thousands) | | $ | 2,840,342 | |

INVESTMENT OBJECTIVE**

The JPMorgan Emerging Markets Research Enhanced Equity Fund (the “Fund”) seeks to provide long-term capital appreciation.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund’s Class R6 Shares outperformed the MSCI Emerging Markets Index (net of foreign withholding taxes) (the “Benchmark”) for the twelve months ended October 31, 2020.

By sector, the Fund’s security selection in the financials and industrials sectors was a leading contributor to performance relative to the Benchmark, while the Fund’s security selection in the consumer discretionary and consumer staples sectors was a leading detractor from relative performance.

By country, the Fund’s underweight allocation to Brazil and its security selection in Saudi Arabia were leading contributors to relative performance, while the Fund’s security selection in China and its overweight allocation to Mexico were leading detractors from relative performance.

Leading individual contributors to relative performance included the Fund’s overweight positions in Taiwan Semiconductor Manufacturing Co., Wuxi Biologics (Cayman) Inc. and Alibaba Group Holding Ltd. Shares of Taiwan Semiconductor Manufacturing rose after the company reported consecutive quarters of better-than-expected earnings amid growth in demand for advanced semiconductors. Shares of Wuxi Biologics (Cayman), a Chinese developer of biological testing and drug research, rose amid investor expectations of increased demand for its products and services in response to the pandemic. Shares of Alibaba Group Holding, an electronic commerce platform provider, rose amid growth in demand for digital services.

Leading individual detractors from relative performance included the Fund’s underweight positions in Nio Inc., BYD Co. and Pinduoduo Inc. Shares of Nio, a Chinese maker of electric vehicles, rose after the company reported better-than-expected revenue for the second quarter of 2020 and raised its third quarter forecast amid continued growth in vehicle sales. Shares of BYD, a Chinese maker of electronic vehicles that was not held in the Fund, rose after the company won a contract to supply electric vehicle batteries to Ford Motor Corp. Shares of Pinduoduo, a Chinese electronic commerce platform provider, rose amid growth in consumer demand for online shopping.

HOW WAS THE FUND POSITIONED?

The Fund’s portfolio managers employed a combination of disciplined portfolio construction with in-depth fundamental research

conducted by a global network of research analysts to identify what they believed to be overvalued and undervalued stocks.

As a result of this process, by sector, the Fund’s sole overweight allocation relative to the Benchmark was in the information technology sector and its largest underweight allocations were in the financials and materials sectors. By country, the Fund’s largest overweight allocations relative to the Benchmark were in Mexico and Russia and its largest relative underweight allocations were in Taiwan and Malaysia.

| | | | | | | | |

| TOP TEN EQUITY HOLDINGS OF THE PORTFOLIO*** | |

| | 1. | | | Alibaba Group Holding Ltd. (China) | | | 8.2 | % |

| | 2. | | | Tencent Holdings Ltd. (China) | | | 7.0 | |

| | 3. | | | Taiwan Semiconductor Manufacturing Co. Ltd., ADR (Taiwan) | | | 5.7 | |

| | 4. | | | Samsung Electronics Co. Ltd. (South Korea) | | | 4.5 | |

| | 5. | | | Meituan Dianping, Class B (China) | | | 2.3 | |

| | 6. | | | Reliance Industries Ltd. (India) | | | 1.4 | |

| | 7. | | | Naspers Ltd., Class N (South Africa) | | | 1.3 | |

| | 8. | | | Ping An Insurance Group Co. of China Ltd., Class H (China) | | | 1.3 | |

| | 9. | | | China Construction Bank Corp., Class H (China) | | | 1.2 | |

| | 10. | | | Infosys Ltd., ADR (India) | | | 1.0 | |

| | | | |

PORTFOLIO COMPOSITION BY COUNTRY*** | |

| China | | | 43.7 | % |

| South Korea | | | 12.3 | |

| Taiwan | | | 11.9 | |

| India | | | 8.6 | |

| Brazil | | | 4.3 | |

| South Africa | | | 3.8 | |

| Russia | | | 3.0 | |

| Mexico | | | 2.3 | |

| Saudi Arabia | | | 2.0 | |

| Indonesia | | | 1.3 | |

| Thailand | | | 1.2 | |

| Others (each less than 1.0%) | | | 4.6 | |

| Short-Term Investments | | | 1.0 | |

| * | | The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| ** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | | Percentages indicated are based on total investments as of October 31, 2020. The Fund’s portfolio composition is subject to change. |

| | | | | | | | |

| | | |

| OCTOBER 31, 2020 | | J.P. MORGAN INTERNATIONAL EQUITY FUNDS | | | | | 7 | |

JPMorgan Emerging Markets Research Enhanced Equity Fund

FUND COMMENTARY

TWELVE MONTHS ENDED OCTOBER 31, 2020 (Unaudited) (continued)

| | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS AS OF OCTOBER 31, 2020 | |

| | | |

| | | INCEPTION DATE OF

CLASS | | 1 YEAR | | | SINCE

INCEPTION | |

CLASS I SHARES | | January 30, 2019 | | | 8.15 | % | | | 10.93 | % |

CLASS R6 SHARES | | December 11, 2018 | | | 8.28 | | | | 11.07 | |

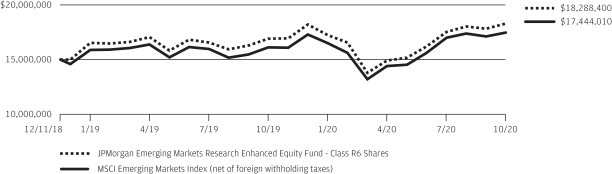

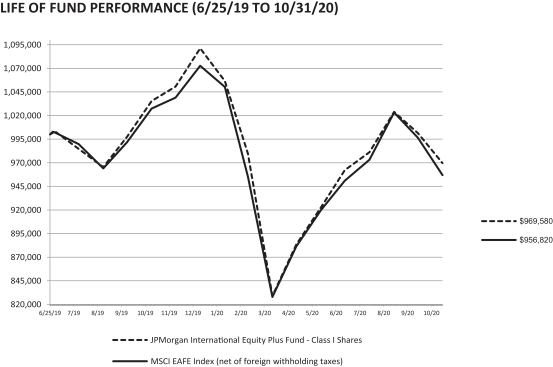

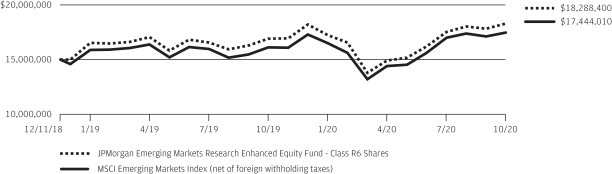

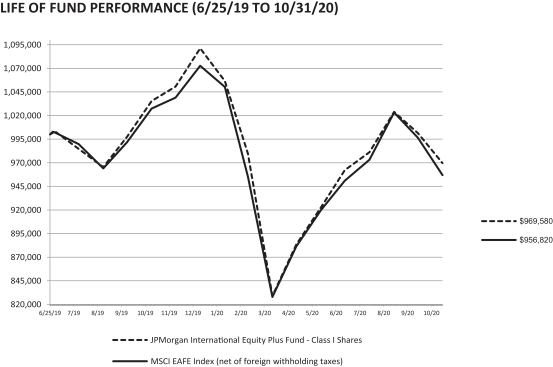

LIFE OF FUND PERFORMANCE (12/11/18 TO 10/31/2020)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

The Fund commenced operations on December 11, 2018.

Returns for Class I Shares prior to its inception date are based on the performance of Class R6 Shares. The actual returns of Class I Shares would have been lower than those shown because Class I Shares have higher expenses than Class R6 Shares.

The graph illustrates comparative performance for $15,000,000 invested in Class R6 Shares of the JPMorgan Emerging Markets Research Enhanced Equity Fund and the MSCI Emerging Markets Index (net of foreign withholding taxes) from December 11, 2018 to October 31, 2020. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the MSCI Emerging Markets Index (net of foreign withholding taxes) does not reflect the deduction of expenses or a sales charge associated with a mutual fund and approximates the minimum possible dividend reinvestment of the securities included in the benchmark, if applicable. The dividend is reinvested after deduction of withholding tax, applying the maximum rate to non-resident institutional investors who do not benefit from double taxation treaties. The MSCI Emerging Markets Index (net of foreign withholding taxes) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of emerging markets. Investors cannot invest directly in an index.

Class R6 Shares have a $15,000,000 minimum initial investment.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the applicable inception date.

Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on gains resulting from redemptions of Fund shares.

International investing involves a greater degree of risk and increased volatility. Changes in currency exchange rates and differences in accounting and taxation policies outside the U.S. can raise or lower returns. Also, some overseas markets may not be as politically and economically stable as the U.S. and other nations.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com)

| | | | | | |

| | | |

| 8 | | | | J.P. MORGAN INTERNATIONAL EQUITY FUNDS | | OCTOBER 31, 2020 |

JPMorgan Europe Dynamic Fund

FUND COMMENTARY

TWELVE MONTHS ENDED OCTOBER 31, 2020 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | |

| Fund (Class A Shares, without a sales charge)* | | | (8.21)% | |

| MSCI Europe Index (net of foreign withholding taxes) | | | (9.29)% | |

| |

| Net Assets as of 10/31/2020 (In Thousands) | | | $438,828 | |

INVESTMENT OBJECTIVE**

The JPMorgan Europe Dynamic Fund (the “Fund”) seeks total return from long-term capital growth. Total return consists of capital growth and current income.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund’s Class A Shares, without a sales charge, outperformed the MSCI Europe Index (net of foreign withholding taxes) (the “Benchmark”) for the twelve months ended October 31, 2020.

By sector, the Fund’s security selection and underweight position in the energy services sector and its security selection in the software & services sector were leading contributors to relative performance. The Fund’s underweight position and security selection in the food, beverages & tobacco sector and its security selection and overweight position in the automobiles & components sector were leading detractors from performance relative to the Benchmark.

Leading individual contributors to relative performance included the Fund’s overweight position in Evolution Gaming Group AB, its out-of-Benchmark position in HelloFresh SE and its underweight position in Royal Dutch Shell PLC. Shares of Evolution Gaming Group, a Swedish provider of online casino games, rose amid strong demand for at-home entertainment during 2020. Shares of HelloFresh, a German provider of delivery meal kits, rose amid continued growth in consumer demand

for at-home meals in 2020. Shares of Royal Dutch Shell, an Anglo/Dutch integrated oil and gas company not held by the Fund, fell amid a sharp decline in energy demand in 2020.

Leading individual detractors from relative performance included the Fund’s overweight positions in Nestle SA and OMV AG and its underweight position in ASML Holdings NV

Shares of Nestle, a Swiss maker of prepared foods and beverages, fell after the company lowered its 2020 earnings and sales forecast at the end of July 2020, citing the impact of at-home quarantines across Europe and North America. Shares of OMV, an Austrian integrated oil and gas company, fell amid a sharp decline in energy demand during 2020. Shares of ASML Holdings, a Dutch provider of semiconductor manufacturing equipment, rose after the company reported better-than-expected earnings and revenue for the third quarter of 2020 and confirmed its positive outlook for fourth quarter 2020 results.

HOW WAS THE FUND POSITIONED?

The Fund’s portfolio managers believe that attractively valued, high quality securities with positive momentum have the potential to outperform the market. During the reporting period, the Fund’s portfolio managers invested in securities that they believed had these style characteristics. Portfolio positions were based on bottom-up security selection rather than top-down asset allocation decisions.

| | | | | | | | |

| | | |

| OCTOBER 31, 2020 | | J.P. MORGAN INTERNATIONAL EQUITY FUNDS | | | | | 9 | |

JPMorgan Europe Dynamic Fund

FUND COMMENTARY

TWELVE MONTHS ENDED OCTOBER 31, 2020 (Unaudited) (continued)

| | | | | | | | |

| TOP TEN EQUITY HOLDINGS OF THE PORTFOLIO*** | |

| | 1. | | | Nestle SA (Registered) (Switzerland) | | | 3.9 | % |

| | 2. | | | Roche Holding AG (Switzerland) | | | 2.9 | |

| | 3. | | | Novartis AG (Registered) (Switzerland) | | | 2.8 | |

| | 4. | | | Deutsche Telekom AG (Registered) (Germany) | | | 2.0 | |

| | 5. | | | Deutsche Post AG (Registered) (Germany) | | | 2.0 | |

| | 6. | | | Sanofi (France) | | | 1.9 | |

| | 7. | | | Schneider Electric SE (France) | | | 1.8 | |

| | 8. | | | Enel SpA (Italy) | | | 1.8 | |

| | 9. | | | Orsted A/S (Denmark) | | | 1.7 | |

| | 10. | | | ASM International NV (Netherlands) | | | 1.6 | |

| | | | |

PORTFOLIO COMPOSITION BY COUNTRY*** | |

| Switzerland | | | 18.2 | % |

| United Kingdom | | | 17.1 | |

| Germany | | | 14.2 | |

| France | | | 11.1 | |

| Sweden | | | 7.7 | |

| Netherlands | | | 7.1 | |

| Denmark | | | 4.3 | |

| Italy | | | 3.7 | |

| Ireland | | | 3.1 | |

| Australia | | | 2.9 | |

| Austria | | | 2.4 | |

| Finland | | | 2.2 | |

| China | | | 1.3 | |

| Spain | | | 1.1 | |

| United States | | | 1.1 | |

| Jordan | | | 1.0 | |

| Others (each less than 1.0%) | | | 0.4 | |

| Short-Term Investments | | | 1.1 | |

| * | | The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| ** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | | Percentages indicated are based on total investments as of October 31, 2020. The Fund’s portfolio composition is subject to change. |

| | | | | | |

| | | |

| 10 | | | | J.P. MORGAN INTERNATIONAL EQUITY FUNDS | | OCTOBER 31, 2020 |

| | | | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS AS OF OCTOBER 31, 2020 | |

| | | | |

| | | INCEPTION DATE OF

CLASS | | 1 YEAR | | | 5 YEAR | | | 10 YEAR | |

CLASS A SHARES | | November 2, 1995 | | | | | | | | | | | | |

With Sales Charge* | | | | | (13.02 | )% | | | (1.48 | )% | | | 3.16 | % |

Without Sales Charge | | | | | (8.21 | ) | | | (0.42 | ) | | | 3.71 | |

CLASS C SHARES | | November 1, 1998 | | | | | | | | | | | | |

With CDSC** | | | | | (9.64 | ) | | | (0.91 | ) | | | 3.30 | |

Without CDSC | | | | | (8.64 | ) | | | (0.91 | ) | | | 3.30 | |

CLASS I SHARES | | September 10, 2001 | | | (7.98 | ) | | | (0.15 | ) | | | 3.99 | |

CLASS L SHARES | | September 10, 2001 | | | (7.86 | ) | | | (0.01 | ) | | | 4.18 | |

CLASS R6 SHARES | | October 1, 2018 | | | (7.75 | ) | | | 0.03 | | | | 4.20 | |

| * | | Sales Charge for Class A Shares is 5.25%. |

| ** | | Assumes a 1% CDSC (contingent deferred sales charge) for the one year period and 0% CDSC thereafter. |

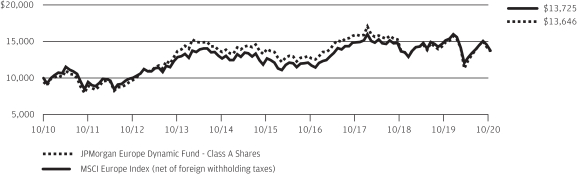

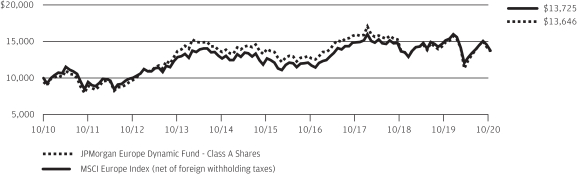

TEN YEAR PERFORMANCE (10/31/10 TO 10/31/20)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

Returns for Class R6 Shares prior to its inception date are based on the performance of Class L Shares. The actual returns of Class R6 Shares would have been different than those shown because Class R6 Shares have different expenses than Class L Shares.

The graph illustrates comparative performance for $10,000 invested in Class A Shares of the JPMorgan Europe Dynamic Fund and the MSCI Europe Index (net of foreign withholding taxes) from October 31, 2010 to October 31, 2020. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and includes a sales charge. The performance of the MSCI Europe Index (net of foreign withholding taxes) does not reflect the deduction of expenses or a sales charge associated with a mutual fund and approximates the minimum possible dividend reinvestment of the securities included in the benchmark, if applicable. The dividend is reinvested after deduction of withholding tax, applying the maximum rate to non-resident institutional investors who do not benefit from double taxation treaties. The MSCI Europe Index (net of foreign withholding taxes) is a free float-adjusted market capitalization weighted

index that is designed to measure the equity market performance of the developed markets in Europe. Investors cannot invest directly in an index.

Class A Shares have a $1,000 minimum initial investment and carry a 5.25% sales charge.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the applicable inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on gains resulting from redemptions of Fund shares.

International investing involves a greater degree of risk and increased volatility. Changes in currency exchange rates and differences in accounting and taxation policies outside the U.S. can raise or lower returns. Also, some overseas markets may not be as politically and economically stable as the U.S. and other nations.

Because Class C Shares automatically convert to Class A Shares after 8 years, the 10 year average annual total return shown above for Class C reflects Class A performance for the period after conversion.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | | | |

| | | |

| OCTOBER 31, 2020 | | J.P. MORGAN INTERNATIONAL EQUITY FUNDS | | | | | 11 | |

JPMorgan International Advantage Fund

FUND COMMENTARY

TWELVE MONTHS ENDED OCTOBER 31, 2020 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | |

| Fund (Class A Shares, without a sales charge)* | | | (9.11)% | |

| MSCI EAFE Index (net of foreign withholding taxes) | | | (6.86)% | |

| |

| Net Assets as of 10/31/2020 (In Thousands) | | $ | 1,509,015 | |

INVESTMENT OBJECTIVE**

The JPMorgan International Advantage Fund (the “Fund”) seeks to maximize long-term capital growth by investing primarily in equity securities in developed markets outside the U.S.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund’s Class A Shares, without a sales charge, underperformed the MSCI EAFE Index (net of foreign withholding taxes) (the “Benchmark”) for the twelve months ended October 31, 2020.

By sector, the Fund’s security selection in the industrials sector, and its security selection and underweight position in the health care sector were leading detractors from performance relative to the Benchmark, while the Fund’s underweight position in the energy sector and its security selection in the communication services sector were leading contributors to relative performance.

By country, the Fund’s security selection in Germany and Japan was a leading detractor from relative performance, while the Fund’s security selection in the U.K. and France was a leading contributor to relative performance.

The Fund targeted investments in companies that exhibited specific growth, value and quality characteristics during the period. Due to the relatively large number of securities held in the Fund during the reporting period, the impact of individual holdings on the Fund’s relative performance tended to be small.

HOW WAS THE FUND POSITIONED?

The Fund’s portfolio managers believe that attractively valued, high quality securities with positive momentum have the potential to outperform the market. During the reporting period, the Fund’s portfolio managers invested in securities that they believed were attractive based on proprietary multifactor screens that are used to rank securities in the Fund’s investment universe on the basis of value, quality and momentum characteristics.

| | | | | | | | |

| TOP TEN EQUITY HOLDINGS OF THE PORTFOLIO*** | |

| | 1. | | | Nestle SA (Registered) (Switzerland) | | | 3.1 | % |

| | 2. | | | Roche Holding AG (Switzerland) | | | 2.7 | |

| | 3. | | | BHP Group Ltd. (Australia) | | | 1.8 | |

| | 4. | | | Sanofi (France) | | | 1.7 | |

| | 5. | | | Novo Nordisk A/S, Class B (Denmark) | | | 1.7 | |

| | 6. | | | Toyota Motor Corp. (Japan) | | | 1.7 | |

| | 7. | | | Rio Tinto plc (Australia) | | | 1.6 | |

| | 8. | | | Schneider Electric SE (France) | | | 1.5 | |

| | 9. | | | Allianz SE (Registered) (Germany) | | | 1.4 | |

| | 10. | | | Sony Corp. (Japan) | | | 1.4 | |

| | | | |

PORTFOLIO COMPOSITION BY COUNTRY*** | |

| Japan | | | 26.0 | % |

| Switzerland | | | 10.6 | |

| United Kingdom | | | 10.5 | |

| Australia | | | 8.8 | |

| Germany | | | 8.7 | |

| France | | | 8.2 | |

| Netherlands | | | 6.4 | |

| Sweden | | | 3.1 | |

| Denmark | | | 2.6 | |

| Singapore | | | 1.7 | |

| Hong Kong | | | 1.7 | |

| Belgium | | | 1.6 | |

| Norway | | | 1.4 | |

| South Africa | | | 1.2 | |

| Italy | | | 1.1 | |

| Spain | | | 1.0 | |

| United States | | | 1.0 | |

| Others (each less than 1.0%) | | | 3.7 | |

| Short-Term Investments | | | 0.7 | |

| * | | The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| ** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | | Percentages indicated are based on total investments as of October 31, 2020. The Fund’s portfolio composition is subject to change. |

| | | | | | |

| | | |

| 12 | | | | J.P. MORGAN INTERNATIONAL EQUITY FUNDS | | OCTOBER 31, 2020 |

| | | | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS AS OF OCTOBER 31, 2020 | |

| | | | |

| | | INCEPTION DATE OF

CLASS | | 1 YEAR | | | 5 YEAR | | | 10 YEAR | |

CLASS A SHARES | | April 30, 2001 | | | | | | | | | | | | |

With Sales Charge* | | | | | (13.87 | )% | | | (0.85 | )% | | | 1.76 | % |

Without Sales Charge | | | | | (9.11 | ) | | | 0.22 | | | | 2.32 | |

CLASS C SHARES | | February 28, 2006 | | | | | | | | | | | | |

With CDSC** | | | | | (10.54 | ) | | | (0.28 | ) | | | 1.90 | |

Without CDSC | | | | | (9.54 | ) | | | (0.28 | ) | | | 1.90 | |

CLASS I SHARES | | February 28, 2006 | | | (8.84 | ) | | | 0.51 | | | | 2.59 | |

CLASS R2 SHARES | | November 3, 2008 | | | (9.37 | ) | | | (0.06 | ) | | | 2.04 | |

CLASS R6 SHARES | | May 29, 2015 | | | (8.71 | ) | | | 0.69 | | | | 2.81 | |

| * | | Sales Charge for Class A Shares is 5.25%. |

| ** | | Assumes a 1% CDSC (contingent deferred sales charge) for the one year period and 0% CDSC thereafter. |

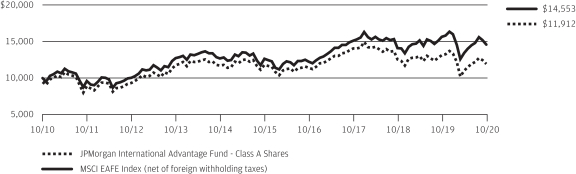

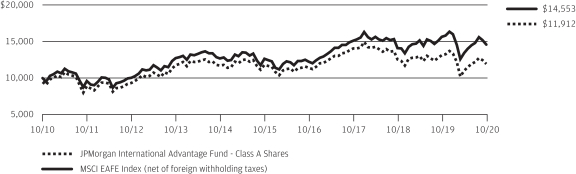

TEN YEAR PERFORMANCE (10/31/10 TO 10/31/20)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

Returns for Class R6 Shares prior to its inception date are based on the performance of Class L Shares (liquidated on December 8, 2016). The actual returns of Class R6 Shares would have been different than those shown because Class R6 Shares have different expenses than Class L Shares.

The graph illustrates comparative performance for $10,000 invested in Class A Shares of the JPMorgan International Advantage Fund and the MSCI EAFE Index (net of foreign withholding taxes) from October 31, 2010 to October 31, 2020. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the MSCI EAFE Index (net of foreign withholding taxes) does not reflect the deduction of expenses or a sales charge associated with a mutual fund and approximates the minimum possible dividend reinvestment of the securities included in the benchmark, if applicable. The dividend is reinvested after deduction of withholding tax, applying the maximum rate to non-resident institutional investors who do not benefit from double taxation treaties. The MSCI EAFE Index (net of foreign withholding taxes) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets, excluding the U.S. and Canada. Investors cannot invest directly in an index.

Class A Shares have a $1,000 minimum initial investment and carry a 5.25% sales charge.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the applicable inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on gains resulting from redemptions of Fund shares.

International investing involves a greater degree of risk and increased volatility. Changes in currency exchange rates and differences in accounting and taxation policies outside the U.S. can raise or lower returns. Also, some overseas markets may not be as politically and economically stable as the U.S. and other nations.

Because Class C Shares automatically convert to Class A Shares after 8 years, the 10 year average annual total return shown above for Class C reflects Class A performance for the period after conversion.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | | | |

| | | |

| OCTOBER 31, 2020 | | J.P. MORGAN INTERNATIONAL EQUITY FUNDS | | | | | 13 | |

JPMorgan International Equity Fund

FUND COMMENTARY

TWELVE MONTHS ENDED OCTOBER 31, 2020 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | |

| Fund (Class I Shares)* | | | (1.64)% | |

| MSCI EAFE Index (net of foreign withholding taxes) | | | (6.86)% | |

| |

| Net Assets as of 10/31/2020 (In Thousands) | | | $2,930,922 | |

INVESTMENT OBJECTIVE**

The JPMorgan International Equity Fund (the “Fund”) seeks total return from long-term capital growth and income. Total return consists of capital growth and current income.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund’s Class I Shares outperformed the MSCI EAFE Index (net of foreign withholding taxes) (the “Benchmark”) for the twelve months ended October 31, 2020.

By sector, the Fund’s security selection and overweight position in the industrials and information technology sectors were leading contributors to performance relative to the Benchmark, while the Fund’s security selection and underweight position in the health care sector and its security selection in the consumer staples sector were leading detractors from relative performance.

By region, the Fund’s out-of-Benchmark position in emerging markets and its security selection in Japan were leading contributors to performance relative to the Benchmark, while the Fund’s overweight positions in the U.K. and Continental Europe were the smallest contributors to relative performance.

Leading individual contributors to the Fund’s relative performance included the Fund’s out-of-Benchmark positions in Taiwan Semiconductor Manufacturing Co., Tencent Holdings Ltd. and Alibaba Group Holding Ltd. Shares of Taiwan Semiconductor Manufacturing, a maker of semiconductors, rose after the company reported consecutive quarters of better-than-

expected earnings amid growth in demand for advanced semiconductors during the period. Shares of Tencent Holdings, a Hong Kong online gaming, advertising and services company, rose amid growth in consumer demand for the company’s services. Shares of Alibaba Group Holding, an electronic commerce platform provider, rose amid increased demand for digital services for the period.

Leading individual detractors from the Fund’s relative performance included its out of Benchmark position in Itaú Unibanco Holding SA, its underweight position in Softbank Group Corp. and its overweight position in Royal Dutch Shell PLC. Shares of Itau Unibanco Holding, a Brazilian banking and financial services company, fell amid several consecutive quarters for lower-than-expected earnings in 2020. Shares of Softbank Group, a Japanese technology and investment company not held by the Fund, rose after it agreed to sell its Arm unit to Nvidia Corp. for $40 billion. Shares of Royal Dutch Shell, an Anglo/Dutch integrated oil and gas company, fell amid a sharp decline in energy demand in 2020. Shares of Royal Dutch Shell, a British/Dutch oil and natural gas producer and retailer, fell as global energy demand contracted and global oil prices fell sharply in 2020.

HOW WAS THE FUND POSITIONED?

The Fund’s portfolio managers continued to focus on security selection to build a portfolio of international equities. They used bottom-up fundamental research to identify what they believed were attractively priced securities of companies with solid financial positions that possessed the potential to increase their earnings faster than their industry peers.

| | | | | | |

| | | |

| 14 | | | | J.P. MORGAN INTERNATIONAL EQUITY FUNDS | | OCTOBER 31, 2020 |

| | | | | | | | |

| TOP TEN EQUITY HOLDINGS OF THE PORTFOLIO*** | |

| | 1. | | | Nestle SA (Registered) (Switzerland) | | | 3.6 | % |

| | 2. | | | Roche Holding AG (Switzerland) | | | 2.9 | |

| | 3. | | | ASML Holding NV (Netherlands) | | | 2.3 | |

| | 4. | | | Novartis AG (Registered) (Switzerland) | | | 2.1 | |

| | 5. | | | Sony Corp. (Japan) | | | 2.1 | |

| | 6. | | | Keyence Corp. (Japan) | | | 2.1 | |

| | 7. | | | AIA Group Ltd. (Hong Kong) | | | 2.1 | |

| | 8. | | | LVMH Moet Hennessy Louis Vuitton SE (France) | | | 2.0 | |

| | 9. | | | Unilever plc (United Kingdom) | | | 2.0 | |

| | 10. | | | Novo Nordisk A/S, Class B (Denmark) | | | 2.0 | |

| | | | |

PORTFOLIO COMPOSITION BY COUNTRY*** | |

| Japan | | | 19.8 | % |

| United Kingdom | | | 13.1 | |

| France | | | 12.1 | |

| Switzerland | | | 11.7 | |

| Germany | | | 8.0 | |

| Denmark | | | 4.1 | |

| China | | | 4.0 | |

| Australia | | | 3.9 | |

| Hong Kong | | | 3.3 | |

| Netherlands | | | 3.1 | |

| Spain | | | 3.0 | |

| Sweden | | | 2.2 | |

| Taiwan | | | 1.6 | |

| South Korea | | | 1.6 | |

| India | | | 1.4 | |

| Finland | �� | | 1.2 | |

| United States | | | 1.1 | |

| Others (each less than 1.0%) | | | 2.7 | |

| Short-Term Investments | | | 2.1 | |

| * | | The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| ** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | | Percentages indicated are based on total investments as of October 31, 2020. The Fund’s portfolio composition is subject to change. |

| | | | | | | | |

| | | |

| OCTOBER 31, 2020 | | J.P. MORGAN INTERNATIONAL EQUITY FUNDS | | | | | 15 | |

JPMorgan International Equity Fund

FUND COMMENTARY

TWELVE MONTHS ENDED OCTOBER 31, 2020 (Unaudited) (continued)

| | | | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS AS OF OCTOBER 31, 2020 | |

| | | | |

| | | INCEPTION DATE OF

CLASS | | 1 YEAR | | | 5 YEAR | | | 10 YEAR | |

CLASS A SHARES | | February 28, 2002 | | | | | | | | | | | | |

With Sales Charge* | | | | | (7.05 | )% | | | 3.11 | % | | | 3.36 | % |

Without Sales Charge | | | | | (1.88 | ) | | | 4.23 | | | | 3.92 | |

CLASS C SHARES | | January 31, 2003 | | | | | | | | | | | | |

With CDSC** | | | | | (3.38 | ) | | | 3.70 | | | | 3.51 | |

Without CDSC | | | | | (2.38 | ) | | | 3.70 | | | | 3.51 | |

CLASS I SHARES | | January 1, 1997 | | | (1.64 | ) | | | 4.49 | | | | 4.18 | |

CLASS R2 SHARES | | November 3, 2008 | | | (2.21 | ) | | | 3.93 | | | | 3.64 | |

CLASS R5 SHARES | | May 15, 2006 | | | (1.52 | ) | | | 4.63 | | | | 4.36 | |

CLASS R6 SHARES | | November 30, 2010 | | | (1.46 | ) | | | 4.72 | | | | 4.42 | |

| * | | Sales Charge for Class A Shares is 5.25%. |

| ** | | Assumes a 1% CDSC (contingent deferred sales charge) for the one year period and 0% CDSC thereafter. |

TEN YEAR PERFORMANCE (10/31/10 TO 10/31/20)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

Returns for Class R6 Shares prior to its inception date are based on the performance of Class R5 Shares. The actual returns of Class R6 Shares would have been different than those shown because Class R6 Shares have different expenses than Class R5 Shares.

The graph illustrates comparative performance for $1,000,000 invested in Class I Shares of the JPMorgan International Equity Fund and the MSCI EAFE Index (net of foreign withholding taxes) from October 31, 2010 to October 31, 2020. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the MSCI EAFE Index (net of foreign withholding taxes) does not reflect the deduction of expenses or a sales charge associated with a mutual fund and approximates the minimum possible dividend reinvestment of the securities included in the benchmark, if applicable. The dividend is reinvested after deduction of withholding tax, applying the maximum rate to non-resident institutional investors who do not benefit from double taxation treaties. The MSCI EAFE Index (net of foreign withholding taxes) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed

markets, excluding the U.S. and Canada. Investors cannot invest directly in an index.

Class I Shares have a $1,000,000 minimum initial investment.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the applicable inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on gains resulting from redemptions of Fund shares.

International investing involves a greater degree of risk and increased volatility. Changes in currency exchange rates and differences in accounting and taxation policies outside the U.S. can raise or lower returns. Also, some overseas markets may not be as politically and economically stable as the U.S. and other nations.

Because Class C Shares automatically convert to Class A Shares after 8 years, the 10 year average annual total return shown above for Class C reflects Class A performance for the period after conversion.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | |

| | | |

| 16 | | | | J.P. MORGAN INTERNATIONAL EQUITY FUNDS | | OCTOBER 31, 2020 |

JPMorgan International Focus Fund

(formerly known as JPMorgan International Unconstrained Equity Fund)

FUND COMMENTARY

TWELVE MONTHS ENDED OCTOBER 31, 2020 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | |

| Fund (Class I Shares)* | | | 4.71% | |

| MSCI All Country World Index, ex-U.S. (net of foreign withholding taxes) | | | (2.61)% | |

| |

| Net Assets as of 10/31/2020 (In Thousands) | | $ | 2,801,670 | |

INVESTMENT OBJECTIVE**

The JPMorgan International Focus Fund (the “Fund”) seeks to provide long-term capital appreciation.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund’s Class I Shares outperformed the MSCI All Country World Index, Ex-U.S. (net of foreign withholding taxes) (the “Benchmark”) for the twelve months ended October 31, 2020.

By sector, the Fund’s security selection in the financials and consumer discretionary sectors was a leading contributor to performance relative to the Benchmark. The Fund’s security selection in the health care and materials sectors was a leading detractor from relative performance.

By region, the Fund’s security selection in continental Europe and the U.K. was a leading contributor to relative performance, while the Fund’s underweight position in Japan was the sole regional detractor from relative performance.

Leading individual contributors to the Fund’s relative performance included its overweight positions in Delivery Hero AG, Tencent Holdings Ltd. and Alibaba Group Holding Ltd. Shares of Delivery Hero, a German online food delivery service, rose amid increased consumer demand during 2020. Shares of Tencent

Holdings, a Hong Kong online gaming, advertising and services company, rose amid growth in consumer demand for the company’s services. Shares of Alibaba Group Holding, an electronic commerce platform provider, rose amid increased demand for digital services during the period.

Leading individual detractors from the Fund’s relative performance included its overweight positions in Airbus SE, Continental AG and Erste Group Bank AG. Shares of Airbus, a French airplanes and aerospace company, fell after the company slashed production due to decreased demand throughout the global response to the pandemic. Shares of Continental, a German automotive parts manufacturer, fell amid a sharp decline in auto production in 2020. Shares of Erste Group Bank, an Austrian regional bank, fell amid a sharp drop in earnings due to the pandemic.

HOW WAS THE FUND POSITIONED?

By harnessing their team’s global sector specialists, the Fund’s portfolio managers sought to build a high-conviction, benchmark-agnostic portfolio of growth, value and unique companies, whose future prospects, the portfolio managers believed, were under-appreciated by the market and thus possessed the potential to deliver higher-than-expected earnings that could have a positive effect on their share prices.

| | | | | | | | |

| | | |

| OCTOBER 31, 2020 | | J.P. MORGAN INTERNATIONAL EQUITY FUNDS | | | | | 17 | |

JPMorgan International Focus Fund

(formerly known as JPMorgan International Unconstrained Equity Fund)

FUND COMMENTARY

TWELVE MONTHS ENDED OCTOBER 31, 2020 (Unaudited) (continued)

| | | | | | | | |

| TOP TEN EQUITY HOLDINGS OF THE PORTFOLIO*** | |

| | 1. | | | Tencent Holdings Ltd. (China) | | | 4.4 | % |

| | 2. | | | Alibaba Group Holding Ltd., (China) | | | 4.4 | |

| | 3. | | | HDFC Bank Ltd., ADR (India) | | | 3.6 | |

| | 4. | | | Nestle SA (Registered) (Switzerland) | | | 3.6 | |

| | 5. | | | Samsung Electronics Co. Ltd. (South Korea) | | | 3.2 | |

| | 6. | | | Taiwan Semiconductor Manufacturing Co. Ltd., ADR (Taiwan) | | | 3.2 | |

| | 7. | | | AIA Group Ltd. (Hong Kong) | | | 3.1 | |

| | 8. | | | Ping An Insurance Group Co. of China Ltd., Class H (China) | | | 2.8 | |

| | 9. | | | Unilever NV (United Kingdom) | | | 2.7 | |

| | 10. | | | ASML Holding NV (Netherlands) | | | 2.3 | |

| | | | |

PORTFOLIO COMPOSITION BY COUNTRY*** | |

| United Kingdom | | | 17.2 | % |

| China | | | 11.7 | |

| Switzerland | | | 10.5 | |

| Germany | | | 7.0 | |

| Canada | | | 6.2 | |

| Japan | | | 5.3 | |

| Taiwan | | | 4.5 | |

| Hong Kong | | | 4.5 | |

| France | | | 4.2 | |

| India | | | 3.6 | |

| South Korea | | | 3.2 | |

| Spain | | | 3.0 | |

| Sweden | | | 2.8 | |

| Netherlands | | | 2.3 | |

| Denmark | | | 2.1 | |

| Australia | | | 1.9 | |

| Finland | | | 1.6 | |

| United States | | | 1.6 | |

| Indonesia | | | 1.4 | |

| Belgium | | | 1.2 | |

| Short-Term Investments | | | 4.2 | |

| * | | The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| ** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | | Percentages indicated are based on total investments as of October 31, 2020. The Fund’s portfolio composition is subject to change. |

| | | | | | |

| | | |

| 18 | | | | J.P. MORGAN INTERNATIONAL EQUITY FUNDS | | OCTOBER 31, 2020 |

| | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS AS OF OCTOBER 31, 2020 |

| | | | | | | | | | | | | | |

| | | | |

| | | INCEPTION DATE OF

CLASS | | 1 YEAR | | | 5 YEAR | | | SINCE

INCEPTION | |

CLASS A SHARES | | November 30, 2011 | | | | | | | | | | | | |

With Sales Charge* | | | | | (1.04 | )% | | | 4.56 | % | | | 6.60 | % |

Without Sales Charge | | | | | 4.43 | | | | 5.70 | | | | 7.24 | |

CLASS C SHARES | | November 30, 2011 | | | | | | | | | | | | |

With CDSC** | | | | | 2.93 | | | | 5.16 | | | | 6.76 | |

Without CDSC | | | | | 3.93 | | | | 5.16 | | | | 6.76 | |

CLASS I SHARES | | November 30, 2011 | | | 4.71 | | | | 6.00 | | | | 7.54 | |

CLASS R2 SHARES | | November 30, 2011 | | | 4.14 | | | | 5.40 | | | | 6.95 | |

CLASS R5 SHARES | | November 30, 2011 | | | 4.79 | | | | 6.10 | | | | 7.68 | |

CLASS R6 SHARES | | November 30, 2011 | | | 4.89 | | | | 6.19 | | | | 7.75 | |

| * | | Sales Charge for Class A Shares is 5.25%. |

| ** | | Assumes a 1% CDSC (contingent deferred sales charge) for the one year period and 0% CDSC thereafter. |

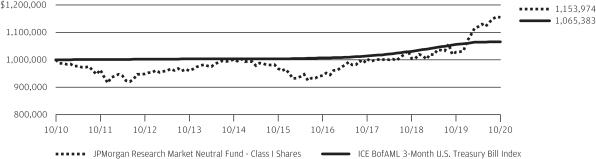

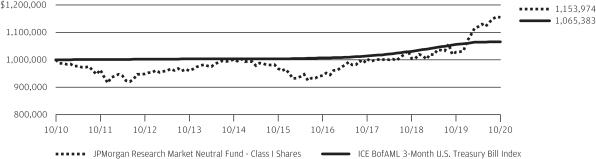

LIFE OF FUND PERFORMANCE (11/30/11 TO 10/31/20)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

The Fund commenced operations on November 30, 2011.

The graph illustrates comparative performance for $1,000,000 invested in Class I Shares of the JPMorgan International Focus Fund and the MSCI All Country World Index, ex-U.S. (net of foreign withholding taxes) from November 30, 2011 to October 31, 2020. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the MSCI All Country World Index, ex-U.S. (net of foreign withholding taxes) does not reflect the deduction of expenses or a sales charge associated with a mutual fund and approximates the minimum possible dividend reinvestment of the securities included in the benchmark, if applicable. The dividend is reinvested after deduction of withholding tax, applying the maximum rate to non-resident institutional investors who do not benefit from double taxation treaties. The MSCI All Country World Index, ex-U.S. (net of foreign withholding taxes) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets, excluding the United States. Investors cannot invest directly in an index.

Class I Shares have a $1,000,000 minimum initial investment.

Subsequent to the inception date of the Fund and through May 30, 2013, the Fund did not experience any shareholder activity. If such shareholder activity had occurred, the Fund’s performance may have been impacted.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the applicable inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on gains resulting from redemptions of Fund shares.

International investing involves a greater degree of risk and increased volatility. Changes in currency exchange rates and differences in accounting and taxation policies outside the U.S. can raise or lower returns. Also, some overseas markets may not be as politically and economically stable as the U.S. and other nations.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | | | |

| | | |

| OCTOBER 31, 2020 | | J.P. MORGAN INTERNATIONAL EQUITY FUNDS | | | | | 19 | |

JPMorgan International Hedged Equity Fund

FUND COMMENTARY

TWELVE MONTHS ENDED OCTOBER 31, 2020 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | |

| Fund (Class I Shares)* | | | (7.78)% | |

| MSCI EAFE Index (net of foreign withholding taxes) | | | (6.86)% | |

| ICE BofAML 3-Month U.S. Treasury Bill Index | | | 0.92% | |

| |

| Net Assets as of 10/31/2020 (In Thousands) | | $ | 137,268 | |

INVESTMENT OBJECTIVE**

The JPMorgan International Hedged Equity Fund (the “Fund”) seeks to provide capital appreciation.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund’s Class I Shares underperformed both the MSCI EAFE Index (net of foreign withholding taxes) (the “Benchmark”) and the ICE BofAML 3-Month U.S. Treasury Bill Index for the twelve months ended October 31, 2020. The Fund’s options hedge allowed the Fund to generally perform as designed during the reporting period with about 50% of the Benchmark’s volatility.

By sector, the Fund’s security selection in the consumer discretionary and industrials sectors was a leading detractor from performance relative to the Benchmark, while the Fund’s security selection in the information technology sector and the utilities sector was a leading contributor to relative performance.

By country, the Fund’s security selection in Japan and the U.K. was a leading detractor from performance relative to the Benchmark, while the Fund’s security in Italy and Germany was a leading contributor to relative performance.

Leading individual detractors from relative performance included the Fund’s overweight positions in BP PLC and Standard Chartered PLC and its underweight position in Softbank Group Corp. Shares of BP, a U.K. integrated oil and natural gas company, fell amid a sharp decline in energy demand in 2020 as a result of the global response to the pandemic. Shares of Standard Chartered, a U.K. banking and financial services company, fell amid declining earnings due to low interest rates and reduced business activity as a result of the pandemic. Shares of Softbank Group, a Japanese technology and investment company, rose after it agreed to sell its Arm unit to Nvidia Corp. for $40 billion.

Leading individual contributors to the Fund’s relative performance included the Fund’s overweight positions in Nintendo Ltd., ASML Holdings NV and Daikin Industries Ltd. Shares of Nintendo, a Japanese developer of home entertainment products, rose amid increased consumer demand during as a result of the pandemic. Shares of ASML Holdings, a Dutch provider of semiconductor manufacturing equipment, rose after the company reported better-than-expected earnings and revenue for the third quarter of 2020 and confirmed its positive outlook for fourth quarter 2020 results. Shares of Daikin Industries, a Japanese manufacturer of air conditioning equipment, rose amid increased demand for its products as a result of the pandemic.

HOW WAS THE FUND POSITIONED?

The Fund’s portfolio managers continued to focus on security selection to build a portfolio of international equities. They used bottom-up fundamental research to identify what they believed were attractively priced securities of companies with solid financial positions that possessed the potential to increase their earnings faster than their industry peers.

| | | | | | | | |

| TOP TEN EQUITY HOLDINGS OF THE PORTFOLIO*** | |

| | 1. | | | MSCI EAFE Index 12/18/2020 (United States) | | | 4.4 | % |

| | 2. | | | Nestle SA (Registered) (Switzerland) | | | 3.0 | |

| | 3. | | | Roche Holding AG (Switzerland) | | | 2.4 | |

| | 4. | | | Novartis AG (Registered) (Switzerland) | | | 1.9 | |

| | 5. | | | ASML Holding NV (Netherlands) | | | 1.7 | |

| | 6. | | | Novo Nordisk A/S, Class B (Denmark) | | | 1.5 | |

| | 7. | | | Toyota Motor Corp. (Japan) | | | 1.4 | |

| | 8. | | | LVMH Moet Hennessy Louis Vuitton SE (France) | | | 1.3 | |

| | 9. | | | Iberdrola SA (Spain) | | | 1.3 | |

| | 10. | | | Unilever NV (United Kingdom) | | | 1.2 | |

| | | | |

PORTFOLIO COMPOSITION BY COUNTRY*** | |

| Japan | | | 25.2 | % |

| United Kingdom | | | 11.1 | |

| Switzerland | | | 10.3 | |

| France | | | 9.9 | |

| Germany | | | 9.2 | |

| Australia | | | 5.2 | |

| Netherlands | | | 5.1 | |

| United States | | | 4.8 | |

| Denmark | | | 2.9 | |

| Spain | | | 2.2 | |

| Hong Kong | | | 2.2 | |

| Sweden | | | 2.1 | |

| Italy | | | 1.4 | |

| Others (each less than 1.0%) | | | 3.6 | |

| Short-Term Investments | | | 4.8 | |

| * | | The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| ** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | | Percentages indicated are based on total investments as of October 31, 2020. The Fund’s portfolio composition is subject to change. |

| | | | | | |

| | | |

| 20 | | | | J.P. MORGAN INTERNATIONAL EQUITY FUNDS | | OCTOBER 31, 2020 |

| | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS AS OF OCTOBER 31, 2020 | |

| | | |

| | | INCEPTION DATE OF

CLASS | | | 1 YEAR | | | SINCE

INCEPTION | |

CLASS A SHARES | | | March 15, 2019 | | | | | | | | | |

With Sales Charge* | | | | | | | (12.83 | )% | | | (5.92 | )% |

Without Sales Charge | | | | | | | (8.02 | ) | | | (2.76 | ) |

CLASS C SHARES | | | March 15, 2019 | | | | | | | | | |

With CDSC** | | | | | | | (9.47 | ) | | | (3.24 | ) |

Without CDSC | | | | | | | (8.47 | ) | | | (3.24 | ) |

CLASS I SHARES | | | March 15, 2019 | | | | (7.78 | ) | | | (2.49 | ) |

CLASS R5 SHARES | | | March 15, 2019 | | | | (7.68 | ) | | | (2.39 | ) |

CLASS R6 SHARES | | | March 15, 2019 | | | | (7.53 | ) | | | (2.25 | ) |

| * | | Sales Charge for Class A Shares is 5.25%. |

| ** | | Assumes a 1% CDSC (contingent deferred sales charge) for the one year period and 0% CDSC thereafter. |

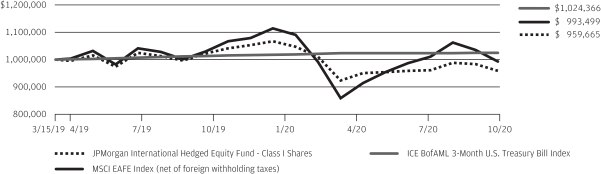

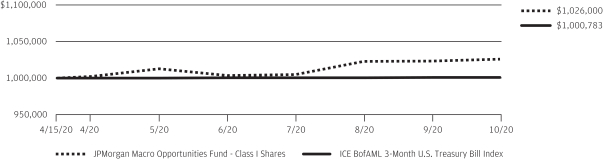

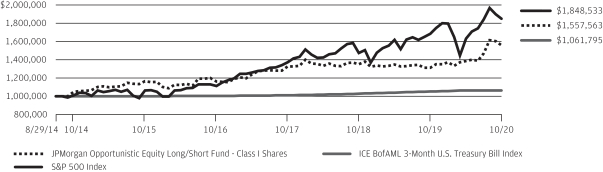

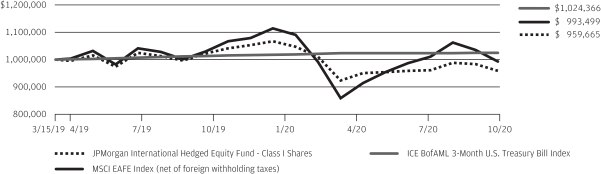

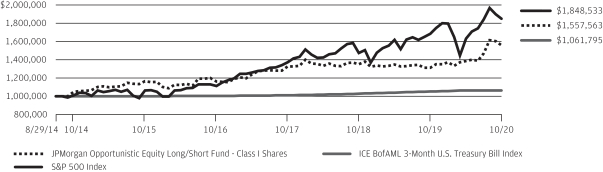

LIFE OF FUND PERFORMANCE (3/15/19 TO 10/31/20)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

The Fund commenced operations on March 15, 2019.

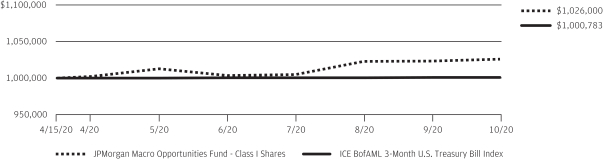

The graph illustrates comparative performance for $1,000,000 invested in Class I Shares of the JPMorgan International Hedged Equity Fund, the MSCI EAFE Index (net of foreign withholding taxes) and the ICE BofAML 3-Month U.S. Treasury Bill Index from March 15, 2019 to October 31, 2020. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the MSCI EAFE Index (net of foreign withholding taxes) does not reflect the deduction of expenses or a sales charge associated with a mutual fund and approximates the minimum possible dividend reinvestment of the securities included in the benchmark, if applicable. The dividend is reinvested after deduction of withholding tax, applying the maximum rate to non-resident institutional investors who do not benefit from double taxation treaties. The performance of the ICE BofAML 3-Month U.S. Treasury Bill Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of securities included in the benchmarks, if applicable. The MSCI EAFE Index (net of foreign withholding taxes) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets, excluding the U.S. and Canada. The ICE BofAML 3-Month U.S. Treasury Bill Index is comprised of a single issue

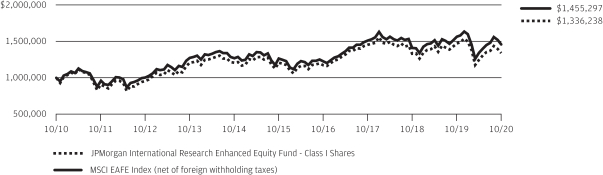

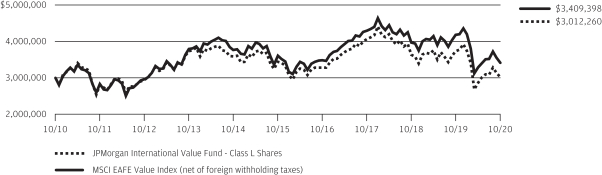

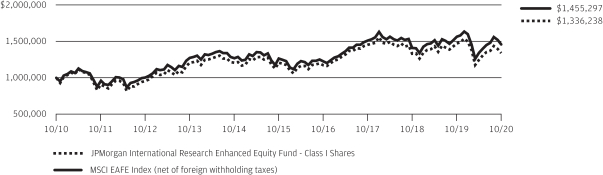

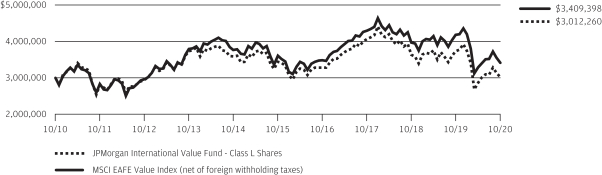

purchased at the beginning of the month and held for a full month. Each month the index is rebalanced and the issue selected is the outstanding Treasury Bill that matures closest to, but not beyond, 3 months from the rebalancing date. Investors cannot invest directly in an index.