The following table presents gross amounts of recognized assets and/or liabilities and the net amounts after deducting collateral that has been pledged by counterparties or has been pledged to counterparties (if applicable). For corresponding information grouped by type of instrument, see the Portfolio's Schedule of Investments.

The Portfolio and other funds advised by Janus Capital or its affiliates may transfer daily uninvested cash balances into one or more joint trading accounts. Assets in the joint trading accounts are invested in money market instruments and the proceeds are allocated to the participating funds on a pro rata basis.

Repurchase agreements held by the Portfolio are fully collateralized, and such collateral is in the possession of the Portfolio’s custodian or, for tri-party agreements, the custodian designated by the agreement. The collateral is evaluated daily to ensure its market value exceeds the current market value of the repurchase agreements, including accrued interest. In the event of default on the obligation to repurchase, the Portfolio has the right to liquidate the collateral and apply the proceeds in satisfaction of the obligation. In the event of default or bankruptcy by the other party to the agreement, realization and/or retention of the collateral or proceeds may be subject to legal proceedings.

Under procedures adopted by the Trustees, the Portfolio may seek to earn additional income by lending securities to certain qualified broker-dealers and institutions. Deutsche Bank AG acts as securities lending agent and a limited purpose custodian or subcustodian to receive and disburse cash balances and cash collateral, hold short-term investments, hold collateral, and perform other custodian functions in accordance with the Agency Securities Lending and Repurchase Agreement. The Portfolio may lend portfolio securities in an amount equal to up to 1/3 of its total assets as determined at the time of the loan origination. There is the risk of delay in recovering a loaned security or the risk of loss in collateral rights if the borrower fails financially. In addition, Janus Capital Management LLC (“Janus Capital”) makes efforts to balance the benefits and risks from granting such loans. All loans will be continuously secured by collateral which may consist of cash, U.S. Government securities, domestic and foreign short-term debt instruments, letters of credit, time deposits, repurchase agreements, money market mutual funds or other money market accounts, or such other collateral as permitted by the SEC. If the Portfolio is unable to recover a security on loan, the Portfolio may use the collateral to purchase replacement securities in the market. There is a risk that the value of the collateral could decrease below the cost of the replacement security by the time the replacement investment is made, resulting in a loss to the Portfolio.

Upon receipt of cash collateral, Janus Capital may invest it in affiliated or non-affiliated cash management vehicles, whether registered or unregistered entities, as permitted by the 1940 Act and rules promulgated thereunder. Janus Capital currently intends to invest the cash collateral in a cash management vehicle for which Janus Capital serves as investment adviser, Janus Henderson Cash Collateral Fund LLC. An investment in Janus Henderson Cash Collateral Fund LLC is generally subject to the same risks that shareholders experience when investing in similarly structured vehicles, such as the potential for significant fluctuations in assets as a result of the purchase and redemption activity of the securities lending program, a decline in the value of the collateral, and possible liquidity issues. Such risks may delay the return of the cash collateral and cause the Portfolio to violate its agreement to return the cash collateral to a borrower in a timely manner. As adviser to the Portfolio and Janus Henderson Cash Collateral Fund LLC, Janus Capital has an inherent conflict of interest as a result of its fiduciary duties to both the Portfolio and Janus Henderson Cash

Protective Life Dynamic Allocation Series - Moderate Portfolio

Notes to Financial Statements (unaudited)

Collateral Fund LLC. Additionally, Janus Capital receives an investment advisory fee of 0.05% for managing Janus Henderson Cash Collateral Fund LLC, but it may not receive a fee for managing certain other affiliated cash management vehicles in which the Portfolio may invest, and therefore may have an incentive to allocate preferred investment opportunities to investment vehicles for which it is receiving a fee.

The value of the collateral must be at least 102% of the market value of the loaned securities that are denominated in U.S. dollars and 105% of the market value of the loaned securities that are not denominated in U.S. dollars. Loaned securities and related collateral are marked-to-market each business day based upon the market value of the loaned securities at the close of business, employing the most recent available pricing information. Collateral levels are then adjusted based on this mark-to-market evaluation.

The cash collateral invested by Janus Capital is disclosed in the Schedule of Investments (if applicable). Income earned from the investment of the cash collateral, net of rebates paid to, or fees paid by, borrowers and less the fees paid to the lending agent are included as “Affiliated securities lending income, net” on the Statement of Operations. As of June 30, 2018, securities lending transactions accounted for as secured borrowings with an overnight and continuous contractual maturity are $4,970,549. Gross amounts of recognized liabilities for securities lending (collateral received) as of June 30, 2018 is $5,079,089, resulting in the net amount due to the counterparty of $108,540.

3. Investment Advisory Agreements and Other Transactions with Affiliates

The Portfolio pays Janus Capital an investment advisory fee which is calculated daily and paid monthly. The Portfolio’s contractual investment advisory fee rate (expressed as an annual rate) is 0.40% of its average daily net assets.

Janus Capital has contractually agreed to waive the advisory fee payable by the Portfolio or reimburse expenses in an amount equal to the amount, if any, that the Portfolio’s normal operating expenses including the investment advisory fee, but excluding the 12b-1 distribution and shareholder servicing fees, administrative services fees payable pursuant to the Transfer Agency Agreement, brokerage commissions, interest, dividends, taxes and extraordinary expenses, exceed the annual rate of 0.55% of the Portfolio’s average daily net assets. Janus Capital has agreed to continue the waiver until at least May 1, 2019. If applicable, amounts reimbursed to the Portfolio by Janus Capital are disclosed as “Excess Expense Reimbursement” on the Statement of Operations.

Janus Capital may recover from the Portfolio fees and expenses previously waived or reimbursed during the period beginning with the Portfolio’s commencement of operations and expiring on the third anniversary of the commencement of operations. Janus Capital may elect to recoup such amounts only if: (i) recoupment is obtained within three years from the date an amount is waived or reimbursed to the Portfolio, and (ii) the Portfolio’s expense ratio at the time of recoupment, inclusive of the recoupment amounts, does not exceed the expense limit at the time of waiver or at the time of recoupment. If applicable, this amount is disclosed as “Recoupment expense” on the Statement of Operations. During the period ended June 30, 2018, Janus Capital reimbursed the Portfolio $169,494 of fees and expenses that are eligible for recoupment. As of June 30, 2018, the aggregate amount of recoupment that may potentially be made to Janus Capital is $669,205. The recoupment of such reimbursements expires April 7, 2019.

Janus Services LLC (“Janus Services”), a wholly-owned subsidiary of Janus Capital, is the Portfolio’s transfer agent. In addition, Janus Services provides or arranges for the provision of certain other administrative services including, but not limited to, recordkeeping, accounting, order processing, and other shareholder services for the Portfolio. These amounts are disclosed as “Other transfer agent fees and expenses” on the Statement of Operations.

Janus Services receives an administrative services fee at an annual rate of 0.10% of the Portfolio’s average daily net assets for providing, or arranging for the provision by Protective Life of administrative services, including recordkeeping, subaccounting, order processing, or other shareholder services provided on behalf of shareholders of the Portfolio. Janus Services expects to use this entire fee to compensate Protective Life for providing these services to its customers who invest in the Portfolio. These amounts are disclosed as “Transfer agent administrative fees and expenses” on the Statement of Operations.

Services provided by Protective Life may include, but are not limited to, recordkeeping, subaccounting, order processing, providing order confirmations, periodic statements, forwarding prospectuses, shareholder reports, and other materials to existing contract holders, answering inquiries regarding accounts, and other administrative services. Order processing includes the submission of transactions through the National Securities Clearing Corporation (“NSCC”) or similar systems, or those processed on a manual basis with Janus Capital.

Protective Life Dynamic Allocation Series - Moderate Portfolio

Notes to Financial Statements (unaudited)

Since inception the Portfolio has paid the Trust’s distributor, Janus Distributors LLC dba Janus Henderson Distributors (“Janus Henderson Distributors”), a wholly-owned subsidiary of Janus Capital, a fee at an annual rate of up to 0.25% of the average daily net assets of the Portfolio. Such payments were initially made pursuant to a distribution and shareholder servicing plan (“the Plan”) adopted by the Board of Trustees in accordance with Rule 12b-1 under the 1940 Act at the time of the Portfolio’s formation. Under the terms of the Plan, the Trust was authorized to make payments to Janus Distributors for remittance to Protective Life or other intermediaries as compensation for distribution and/or shareholder services performed by Protective Life or its agents, or by such intermediary. The existence of the Plan and the fees paid pursuant to the terms of the Plan have been disclosed in certain of the Portfolio’s regulatory filings, including its prospectus, statement of additional information and prior shareholder reports. Due to a recently discovered administrative oversight, following its initial adoption at the organizational meeting, the Plan was not annually renewed by the Board as required by Rule 12b-1 and as intended by the parties. As a result, the Plan could be viewed to have expired on March 5, 2017, which was the date on which the annual renewal was required to have occurred.

At an in-person meeting held on July 18, 2018, the Board approved a new Rule 12b-1 Plan (“New Rule 12b-1 Plan”) with respect to the Portfolio, with fees and terms substantively identical to the Plan. Because the Funds have commenced operations, the New Rule 12b-1 Plan must also be approved by the Portfolio’s shareholders. As a result, the Portfolio intends to seek shareholder approval of (1) the New Rule 12b-1 Plan and (2) ratification of fees paid by the Portfolio since March 5, 2017 (the date upon which Board renewal of the Plan was required) until the date of final determination by shareholders with respect to the approval of the New Rule 12b-1 Plan. The Portfolio will continue to accrue the 0.25% fee pursuant to the terms of the New Rule 12b-1 Plan, with such amounts to be paid by the Portfolio into escrow and held pending final determination by shareholders.

Amounts that have been paid or otherwise accrued are disclosed as “12b-1 Distribution and shareholder servicing fees” on the Statement of Operations. Such payments or accruals are not tied exclusively to actual 12b-1 distribution and servicing fees, and the payments or accruals may exceed 12b-1 distribution and servicing fees actually incurred. If any of the Portfolio’s actual 12b-1 distribution and servicing fees incurred during a calendar year are less than the payments made during a calendar year, the Portfolio will be refunded the difference. Refunds, if any, are included in “12b-1 Distribution and shareholder servicing fees” in the Statement of Operations.

Janus Capital serves as administrator to the Portfolio pursuant to an administration agreement between Janus Capital and the Trust. Under the administration agreement, Janus Capital provides oversight and coordination of the Portfolio’s service providers, recordkeeping, and other administrative services, and is reimbursed by the Portfolio for certain of its costs in providing these services (to the extent Janus Capital seeks reimbursement and such costs are not otherwise waived). In addition, employees of Janus Capital and/or its affiliates may serve as officers of the Trust. The Portfolio pays for some or all of the salaries, fees, and expenses of Janus Capital employees and Portfolio officers, with respect to certain specified administration functions they perform on behalf of the Portfolio. The Portfolio pays these costs based on out-of-pocket expenses incurred by Janus Capital, and these costs are separate and apart from advisory fees and other expenses paid in connection with the investment advisory services Janus Capital provides to the Portfolio. These amounts are disclosed as “Affiliated Portfolio administration fees” on the Statement of Operations. In addition, some expenses related to compensation payable to the Portfolio’s Chief Compliance Officer and certain compliance staff, all of whom are employees of Janus Capital and/or its affiliates are shared with the Portfolio. Total compensation of $45,007 was paid to the Chief Compliance Officer and certain compliance staff by the Trust during the period ended June 30, 2018. The Portfolio's portion is reported as part of “Compliance Office fees” on the Statement of Operations.

Effective April 1, 2018, BNP Paribas Financial Services (“BPFS”) provides certain administrative services to the Portfolio, including services related to Portfolio accounting, calculation of the Portfolio daily NAV, and audit, tax, and reporting obligations, pursuant to a sub-administration agreement with Janus Capital on behalf of the Portfolio. As compensation for such services, Janus Capital pays BPFS a fee based on a percentage of the Portfolio’s assets, along with a flat fee, and is reimbursed by the Portfolio for amounts paid to BPFS (to the extent Janus Capital seeks reimbursement and such costs are not otherwise waived). These amounts are disclosed as “Non-affiliated portfolio administration fees” on the Statement of Operations.

The Portfolio is permitted to purchase or sell securities (“cross-trade”) between itself and other funds or accounts managed by Janus Capital in accordance with Rule 17a-7 under the Investment Company Act of 1940 (“Rule 17a-7”), when the transaction is consistent with the investment objectives and policies of the Portfolio and in accordance with

Protective Life Dynamic Allocation Series - Moderate Portfolio

Notes to Financial Statements (unaudited)

the Internal Cross Trade Procedures adopted by the Trust’s Board of Trustees. These procedures have been designed to ensure that any cross-trade of securities by the Portfolio from or to another fund or account that is or could be considered an affiliate of the Portfolio under certain limited circumstances by virtue of having a common investment adviser, common Officer, or common Trustee complies with Rule 17a-7. Under these procedures, each cross-trade is effected at the current market price to save costs where allowed. During the period ended June 30, 2018, the Portfolio engaged in cross trades amounting to $924,335 in purchases and $591,293 in sales, resulting in a net realized loss of $1,957. The net realized loss is included within the “Net Realized Gain/(Loss) on Investments” section of the Portfolio’s Statement of Operations.

4. Federal Income Tax

Income and capital gains distributions are determined in accordance with income tax regulations that may differ from accounting principles generally accepted in the United States of America. These differences are due to differing treatments for items such as net short-term gains, deferral of wash sale losses, foreign currency transactions, net investment losses, and capital loss carryovers.

The aggregate cost of investments and the composition of unrealized appreciation and depreciation of investment securities for federal income tax purposes as of June 30, 2018 are noted below. The primary difference between book and tax appreciation or depreciation of investments is wash sale loss deferrals.

| | | | |

Federal Tax Cost | Unrealized

Appreciation | Unrealized

(Depreciation) | Net Tax Appreciation/

(Depreciation) |

$ 139,034,619 | $ 9,476,939 | $ (1,225,460) | $ 8,251,479 |

| | | | |

5. Capital Share Transactions

| | | | | | | |

| | | | | | | |

| | | Period ended June 30, 2018 | | Year ended December 31, 2017 |

| | | Shares | Amount | | Shares | Amount |

| | | | | | | |

Shares sold | 2,845,409 | $34,211,752 | | 7,029,850 | $79,286,224 |

Reinvested dividends and distributions | 66,964 | 810,271 | | 55,714 | 642,835 |

Shares repurchased | (178,928) | (2,156,388) | | (42,382) | (461,851) |

Net Increase/(Decrease) | 2,733,445 | $32,865,635 | | 7,043,182 | $79,467,208 |

6. Purchases and Sales of Investment Securities

For the period ended June 30, 2018, the aggregate cost of purchases and proceeds from sales of investment securities (excluding any short-term securities, short-term options contracts, TBAs, and in-kind transactions, as applicable) was as follows:

| | | | |

Purchases of

Securities | Proceeds from Sales

of Securities | Purchases of Long-

Term U.S. Government

Obligations | Proceeds from Sales

of Long-Term U.S.

Government Obligations |

$40,937,810 | $ 15,928,036 | $ - | $ - |

7. Recent Accounting Pronouncements

The FASB issued Accounting Standards Update No. 2017-08, Receivables – Nonrefundable Fees and Other Costs (Subtopic 310-20), Premium Amortization on Purchased Callable Debt Securities ("ASU 2017-08") to amend the amortization period for certain purchased callable debt securities held at a premium. The guidance requires certain premiums on callable debt securities to be amortized to the earliest call date. The amortization period for callable debt securities purchased at a discount will not be impacted. The amendments are effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2018. Early adoption is permitted, including adoption in an interim period. Management is currently evaluating the impacts of ASU 2017-08 on the financial statements.

Protective Life Dynamic Allocation Series - Moderate Portfolio

Notes to Financial Statements (unaudited)

8. Subsequent Event

Management has evaluated whether any events or transactions occurred subsequent to June 30, 2018 and through the date of issuance of the Portfolio’s financial statements and determined that there were no material events or transactions that would require recognition or disclosure in the Portfolio’s financial statements.

Protective Life Dynamic Allocation Series - Moderate Portfolio

Additional Information (unaudited)

Proxy Voting Policies and Voting Record

A description of the policies and procedures that the Portfolio uses to determine how to vote proxies relating to its portfolio securities is available without charge: (i) upon request, by calling 1-800-525-0020 (toll free); (ii) on the Portfolio’s website at janushenderson.com/proxyvoting; and (iii) on the SEC’s website at http://www.sec.gov.

Quarterly Portfolio Holdings

The Portfolio files its complete portfolio holdings (schedule of investments) with the SEC for the first and third quarters of each fiscal year on Form N-Q within 60 days of the end of such fiscal quarter. The Portfolio’s Form N-Q: (i) is available on the SEC’s website at http://www.sec.gov; (ii) may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. (information on the Public Reference Room may be obtained by calling 1-800-SEC-0330); and (iii) is available without charge, upon request, by calling Janus Henderson at 1-800-525-0020 (toll free).

Protective Life Dynamic Allocation Series - Moderate Portfolio

Useful Information About Your Portfolio Report (unaudited)

Management Commentary

The Management Commentary in this report includes valuable insight as well as statistical information to help you understand how your Portfolio’s performance and characteristics stack up against those of comparable indices.

If the Portfolio invests in foreign securities, this report may include information about country exposure. Country exposure is based primarily on the country of risk. A company may be allocated to a country based on other factors such as location of the company’s principal office, the location of the principal trading market for the company’s securities, or the country where a majority of the company’s revenues are derived.

Please keep in mind that the opinions expressed in the Management Commentary are just that: opinions. They are a reflection based on best judgment at the time this report was compiled, which was June 30, 2018. As the investing environment changes, so could opinions. These views are unique and are not necessarily shared by fellow employees or by Janus Henderson in general.

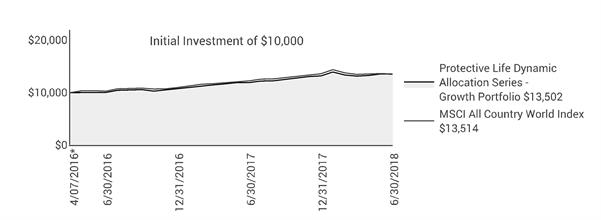

Performance Overviews

Performance overview graphs compare the performance of a hypothetical $10,000 investment in the Portfolio with one or more widely used market indices. When comparing the performance of the Portfolio with an index, keep in mind that market indices are not available for investment and do not reflect deduction of expenses.

Average annual total returns are quoted for a Portfolio with more than one year of performance history. Average annual total return is calculated by taking the growth or decline in value of an investment over a period of time, including reinvestment of dividends and distributions, then calculating the annual compounded percentage rate that would have produced the same result had the rate of growth been constant throughout the period. Average annual total return does not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or redemptions of Portfolio shares.

Cumulative total returns are quoted for a Portfolio with less than one year of performance history. Cumulative total return is the growth or decline in value of an investment over time, independent of the period of time involved. Cumulative total return does not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or redemptions of Portfolio shares.

Pursuant to federal securities rules, expense ratios shown in the performance chart reflect subsidized (if applicable) and unsubsidized ratios. The total annual fund operating expenses ratio is gross of any fee waivers, reflecting the Portfolio’s unsubsidized expense ratio. The net annual fund operating expenses ratio (if applicable) includes contractual waivers of Janus Capital and reflects the Portfolio’s subsidized expense ratio. Ratios may be higher or lower than those shown in the “Financial Highlights” in this report.

Schedule of Investments

Following the performance overview section is the Portfolio’s Schedule of Investments. This schedule reports the types of securities held in the Portfolio on the last day of the reporting period. Securities are usually listed by type (common stock, corporate bonds, U.S. Government obligations, etc.) and by industry classification (banking, communications, insurance, etc.). Holdings are subject to change without notice.

The value of each security is quoted as of the last day of the reporting period. The value of securities denominated in foreign currencies is converted into U.S. dollars.

If the Portfolio invests in foreign securities, it will also provide a summary of investments by country. This summary reports the Portfolio exposure to different countries by providing the percentage of securities invested in each country. The country of each security represents the country of risk. The Portfolio’s Schedule of Investments relies upon the industry group and country classifications published by Barclays and/or MSCI Inc.

Tables listing details of individual forward currency contracts, futures, written options, swaptions, and swaps follow the Portfolio’s Schedule of Investments (if applicable).

Statement of Assets and Liabilities

This statement is often referred to as the “balance sheet.” It lists the assets and liabilities of the Portfolio on the last day of the reporting period.

Protective Life Dynamic Allocation Series - Moderate Portfolio

Useful Information About Your Portfolio Report (unaudited)

The Portfolio’s assets are calculated by adding the value of the securities owned, the receivable for securities sold but not yet settled, the receivable for dividends declared but not yet received on securities owned, and the receivable for Portfolio shares sold to investors but not yet settled. The Portfolio’s liabilities include payables for securities purchased but not yet settled, Portfolio shares redeemed but not yet paid, and expenses owed but not yet paid. Additionally, there may be other assets and liabilities such as unrealized gain or loss on forward currency contracts.

The section entitled “Net Assets Consist of” breaks down the components of the Portfolio’s net assets. Because the Portfolio must distribute substantially all earnings, you will notice that a significant portion of net assets is shareholder capital.

The last section of this statement reports the net asset value (“NAV”) per share on the last day of the reporting period. The NAV is calculated by dividing the Portfolio’s net assets for each share class (assets minus liabilities) by the number of shares outstanding.

Statement of Operations

This statement details the Portfolio’s income, expenses, realized gains and losses on securities and currency transactions, and changes in unrealized appreciation or depreciation of Portfolio holdings.

The first section in this statement, entitled “Investment Income,” reports the dividends earned from securities and interest earned from interest-bearing securities in the Portfolio.

The next section reports the expenses incurred by the Portfolio, including the advisory fee paid to the investment adviser, transfer agent fees and expenses, and printing and postage for mailing statements, financial reports and prospectuses. Expense offsets and expense reimbursements, if any, are also shown.

The last section lists the amounts of realized gains or losses from investment and foreign currency transactions, and changes in unrealized appreciation or depreciation of investments and foreign currency-denominated assets and liabilities. The Portfolio will realize a gain (or loss) when it sells its position in a particular security. A change in unrealized gain (or loss) refers to the change in net appreciation or depreciation of the Portfolio during the reporting period. “Net Realized and Unrealized Gain/(Loss) on Investments” is affected both by changes in the market value of Portfolio holdings and by gains (or losses) realized during the reporting period.

Statements of Changes in Net Assets

These statements report the increase or decrease in the Portfolio’s net assets during the reporting period. Changes in the Portfolio’s net assets are attributable to investment operations, dividends and distributions to investors, and capital share transactions. This is important to investors because it shows exactly what caused the Portfolio’s net asset size to change during the period.

The first section summarizes the information from the Statement of Operations regarding changes in net assets due to the Portfolio’s investment operations. The Portfolio’s net assets may also change as a result of dividend and capital gains distributions to investors. If investors receive their dividends and/or distributions in cash, money is taken out of the Portfolio to pay the dividend and/or distribution. If investors reinvest their dividends and/or distributions, the Portfolio’s net assets will not be affected. If you compare the Portfolio’s “Net Decrease from Dividends and Distributions” to “Reinvested Dividends and Distributions,” you will notice that dividends and distributions have little effect on the Portfolio’s net assets. This is because the majority of the Portfolio’s investors reinvest their dividends and/or distributions.

The reinvestment of dividends and distributions is included under “Capital Share Transactions.” “Capital Shares” refers to the money investors contribute to the Portfolio through purchases or withdrawals via redemptions. The Portfolio’s net assets will increase and decrease in value as investors purchase and redeem shares from the Portfolio.

Financial Highlights

This schedule provides a per-share breakdown of the components that affect the Portfolio’s NAV for current and past reporting periods as well as total return, asset size, ratios, and portfolio turnover rate.

The first line in the table reflects the NAV per share at the beginning of the reporting period. The next line reports the net investment income/(loss) per share. Following is the per share total of net gains/(losses), realized and unrealized. Per share dividends and distributions to investors are then subtracted to arrive at the NAV per share at the end of the

Protective Life Dynamic Allocation Series - Moderate Portfolio

Useful Information About Your Portfolio Report (unaudited)

period. The next line reflects the total return for the period. Also included are ratios of expenses and net investment income to average net assets.

The Portfolio’s expenses may be reduced through expense offsets and expense reimbursements. The ratios shown reflect expenses before and after any such offsets and reimbursements.

The ratio of net investment income/(loss) summarizes the income earned less expenses, divided by the average net assets of the Portfolio during the reporting period. Do not confuse this ratio with the Portfolio’s yield. The net investment income ratio is not a true measure of the Portfolio’s yield because it does not take into account the dividends distributed to the Portfolio’s investors.

The next figure is the portfolio turnover rate, which measures the buying and selling activity in the Portfolio. Portfolio turnover is affected by market conditions, changes in the asset size of the Portfolio, fluctuating volume of shareholder purchase and redemption orders, the nature of the Portfolio’s investments, and the investment style and/or outlook of the portfolio manager(s) and/or investment personnel. A 100% rate implies that an amount equal to the value of the entire portfolio was replaced once during the fiscal year; a 50% rate means that an amount equal to the value of half the portfolio is traded in a year; and a 200% rate means that an amount equal to the value of the entire portfolio is traded every six months.

Protective Life Dynamic Allocation Series - Moderate Portfolio

Notes

NotesPage1

| | | | | | | | | |

| | | | | |

| | | | | |

| | | | | |

This report is submitted for the general information of shareholders of the Portfolio. It is not an offer or solicitation for the Portfolio and is not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus. |

Janus Henderson and Janus are trademarks or registered trademarks of Janus Henderson Investors. © Janus Henderson Investors. The name Janus Henderson Investors includes HGI Group Limited, Henderson Global Investors (Brand Management) Sarl and Janus International Holding LLC. Protective Life Dynamic Allocation Series Portfolios are distributed by Janus Henderson Distributors and exclusively offered in connection with variable annuity contracts issued by Protective Life Insurance Company and its affiliates. Janus Henderson is not affiliated with Protective Life. |

| | | | | 109-24-93064 08-18 |

Item 2 - Code of Ethics

Not applicable to semiannual reports.

Item 3 - Audit Committee Financial Expert

Not applicable to semiannual reports.

Item 4 - Principal Accountant Fees and Services

Not applicable to semiannual reports.

Item 5 - Audit Committee of Listed Registrants

Not applicable.

Item 6 - Investments

(a) Schedule of Investments is contained in the Reports to Shareholders included under Item 1 of this Form N-CSR.

(b) Not applicable.

Item 7 - Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies

Not applicable to this Registrant.

Item 8 - Portfolio Managers of Closed-End Management Investment Companies

Not applicable to this Registrant.

Item 9 - Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers

Not applicable to this Registrant.

Item 10 - Submission of Matters to a Vote of Security Holders

There have been no material changes to the procedures by which shareholders may recommend nominees to the Registrant's Board of Trustees.

Item 11 - Controls and Procedures

(a) The Registrant's Principal Executive Officer and Principal Financial Officer have evaluated the Registrant's disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940, as amended) within 90 days of this filing and have concluded that the Registrant's disclosure controls and procedures were effective, as of that date.

(b) There have been no changes in the Registrant's internal control over financial reporting (as defined in Rule 30a-3(d) under the Investment Company Act of 1940, as amended) that occurred during the Registrant's second fiscal quarter of the period covered by this report that have materially affected, or are reasonably likely to materially affect, the Registrant's internal control over financial reporting.

Item 12 - Disclosure of Securities Lending Activities for Closed-End Management Investment Companies

(a) Not applicable.

(b) Not applicable.

Item 13 - Exhibits

(a)(1) Not applicable because the Registrant has posted its Code of Ethics (as defined in Item 2(b) of Form N-CSR) on its website pursuant to paragraph (f)(2) of Item 2 of Form N-CSR.

(a)(2) Separate certifications for the Registrant's Principal Executive Officer and Principal Financial Officer, as required under Rule 30a-2(a) under the Investment Company Act of 1940, as amended, are attached as Ex99.CERT.

(a)(3) Not applicable to this Registrant.

(b) A certification for the Registrant's Principal Executive Officer and Principal Financial Officer, as required by Rule 30a-2(b) under the Investment Company Act of 1940, as amended, is attached as Ex99.906CERT.

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, and the Investment Company Act of 1940, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Clayton Street Trust

By: /s/ Bruce Koepfgen

Bruce Koepfgen, President and Chief Executive Officer of Clayton Street Trust

(Principal Executive Officer)

Date: August 29, 2018

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, and the Investment Company Act of 1940, as amended, this report has been signed below by the following persons on behalf of the Registrant and in the capacities and on the dates indicated.

By: /s/ Bruce Koepfgen

Bruce Koepfgen, President and Chief Executive Officer of Clayton Street Trust

(Principal Executive Officer)

Date: August 29, 2018

By: /s/ Jesper Nergaard

Jesper Nergaard, Vice President, Chief Financial Officer, Treasurer and Principal Accounting Officer of Clayton Street Trust (Principal Accounting Officer and Principal Financial Officer)

Date: August 29, 2018