Deutsche Bank AG acts as securities lending agent and a limited purpose custodian or subcustodian to receive and disburse cash balances and cash collateral, hold short-term investments, hold collateral, and perform other custodian functions in accordance with the Agency Securities Lending and Repurchase Agreement. For financial reporting purposes, the Portfolio does not offset financial instruments' payables and receivables and related collateral on the Statement of Assets and Liabilities. Securities on loan will be continuously secured by collateral which may consist of cash, U.S. Government securities, domestic and foreign short-term debt instruments, letters of credit, time deposits, repurchase agreements, money market mutual funds or other money market accounts, or such other collateral as permitted by the SEC. See “Securities Lending” in the notes to financial statements for additional information.

All repurchase agreements are transacted under legally enforceable master repurchase agreements that give the Portfolio, in the event of default by the counterparty, the right to liquidate securities held and to offset receivables and payables with the counterparty. For financial reporting purposes, the Portfolio does not offset financial instruments' payables and receivables and related collateral on the Statement of Assets and Liabilities. Repurchase agreements held by the Portfolio are fully collateralized, and such collateral is in the possession of the Portfolio’s custodian or, for tri-party agreements, the custodian designated by the agreement. The collateral is evaluated daily to ensure its market value exceeds the current market value of the repurchase agreements, including accrued interest.

The Portfolio and other funds advised by Janus Capital or its affiliates may transfer daily uninvested cash balances into one or more joint trading accounts. Assets in the joint trading accounts are invested in money market instruments and the proceeds are allocated to the participating funds on a pro rata basis.

Repurchase agreements held by the Portfolio are fully collateralized, and such collateral is in the possession of the Portfolio’s custodian or, for tri-party agreements, the custodian designated by the agreement. The collateral is evaluated daily to ensure its market value exceeds the current market value of the repurchase agreements, including accrued interest. In the event of default on the obligation to repurchase, the Portfolio has the right to liquidate the collateral and apply the proceeds in satisfaction of the obligation. In the event of default or bankruptcy by the other party to the agreement, realization and/or retention of the collateral or proceeds may be subject to legal proceedings.

Under procedures adopted by the Trustees, the Portfolio may seek to earn additional income by lending securities to certain qualified broker-dealers and institutions. Deutsche Bank AG acts as securities lending agent and a limited purpose custodian or subcustodian to receive and disburse cash balances and cash collateral, hold short-term investments, hold collateral, and perform other custodian functions in accordance with the Agency Securities Lending and Repurchase Agreement. The Portfolio may lend portfolio securities in an amount equal to up to 1/3 of its total assets as determined at the time of the loan origination. There is the risk of delay in recovering a loaned security or the risk of loss in collateral rights if the borrower fails financially. In addition, Janus Capital makes efforts to balance the benefits and risks from granting such loans. All loans will be continuously secured by collateral which may consist of cash, U.S. Government securities, domestic and foreign short-term debt instruments, letters of credit, time deposits, repurchase agreements, money market mutual funds or other money market accounts, or such other collateral as permitted by the SEC. If the Portfolio is unable to recover a security on loan, the Portfolio may use the collateral to purchase replacement securities in the market. There is a risk that the value of the collateral could decrease below the cost of the replacement security by the time the replacement investment is made, resulting in a loss to the Portfolio.

Upon receipt of cash collateral, Janus Capital may invest it in affiliated or non-affiliated cash management vehicles, whether registered or unregistered entities, as permitted by the 1940 Act and rules promulgated thereunder. Janus Capital currently intends to invest the cash collateral in a cash management vehicle for which Janus Capital serves as investment adviser, Janus Henderson Cash Collateral Fund LLC. An investment in Janus Henderson Cash Collateral Fund LLC is generally subject to the same risks that shareholders experience when investing in similarly structured vehicles, such as the potential for significant fluctuations in assets as a result of the purchase and redemption activity of the securities lending program, a decline in the value of the collateral, and possible liquidity issues. Such risks may delay the return of the cash collateral and cause the Portfolio to violate its agreement to return the cash collateral to a borrower in a timely manner. As adviser to the Portfolio and Janus Henderson Cash Collateral Fund LLC, Janus Capital has an inherent conflict of interest as a result of its fiduciary duties to both the Portfolio and Janus Henderson Cash Collateral Fund LLC. Additionally, Janus Capital receives an investment advisory fee of 0.05% for managing Janus Henderson Cash Collateral Fund LLC, but it may not receive a fee for managing certain other affiliated cash

Protective Life Dynamic Allocation Series - Growth Portfolio

Notes to Financial Statements (unaudited)

management vehicles in which the Portfolio may invest, and therefore may have an incentive to allocate preferred investment opportunities to investment vehicles for which it is receiving a fee.

The value of the collateral must be at least 102% of the market value of the loaned securities that are denominated in U.S. dollars and 105% of the market value of the loaned securities that are not denominated in U.S. dollars. Loaned securities and related collateral are marked-to-market each business day based upon the market value of the loaned securities at the close of business, employing the most recent available pricing information. Collateral levels are then adjusted based on this mark-to-market evaluation.

The cash collateral invested by Janus Capital is disclosed in the Schedule of Investments (if applicable).

Income earned from the investment of the cash collateral, net of rebates paid to, or fees paid by, borrowers and less the fees paid to the lending agent are included as “Affiliated securities lending income, net” on the Statement of Operations. As of June 30, 2019, securities lending transactions accounted for as secured borrowings with an overnight and continuous contractual maturity are $4,142,000. Gross amounts of recognized liabilities for securities lending (collateral received) as of June 30, 2019 is $4,251,000, resulting in the net amount due to the counterparty of $109,000.

3. Investment Advisory Agreements and Other Transactions with Affiliates

The Portfolio pays Janus Capital an investment advisory fee which is calculated daily and paid monthly. The Portfolio’s contractual investment advisory fee rate (expressed as an annual rate) is 0.40%.

Janus Capital has contractually agreed to waive the advisory fee payable by the Portfolio or reimburse expenses in an amount equal to the amount, if any, that the Portfolio’s normal operating expenses including the investment advisory fee, but excluding the 12b-1 distribution and shareholder servicing fees, administrative services fees payable pursuant to the Transfer Agency Agreement, brokerage commissions, interest, dividends, taxes and extraordinary expenses, exceed the annual rate of 0.55% of the Portfolio’s average daily net assets. Janus Capital has agreed to continue the waiver until at least May 1, 2020. If applicable, amounts reimbursed to the Portfolio by Janus Capital are disclosed as “Excess Expense Reimbursement and Waivers” on the Statement of Operations.

Janus Capital may recover from the Portfolio fees and expenses previously waived or reimbursed during the period beginning with the Portfolio’s commencement of operations and ending on the third anniversary of the commencement of operations (“Recoupment Period”). The Recoupment Period closed on April 7, 2019. Janus Capital may elect to recoup such amounts only if: (i) recoupment is obtained within three years from the date an amount is waived or reimbursed to the Portfolio, and (ii) the Portfolio’s expense ratio at the time of recoupment, inclusive of the recoupment amounts, does not exceed the expense limit at the time of waiver or at the time of recoupment. If applicable, this amount is disclosed as “Recoupment expense” on the Statement of Operations. During the period ended June 30, 2019, Janus Capital reimbursed the Portfolio $89,331 of fees and expenses, of which $36,068 are eligible for recoupment. As of June 30, 2019, the aggregate amount of recoupment that may potentially be made to Janus Capital is $604,537.

Janus Capital has also contractually agreed to waive and/or reimburse a portion of the Portfolio's management fee in an amount equal to the management fee it earns as an investment adviser to any of the affiliated funds in which the Portfolio invests. Janus Capital has agreed to continue the waiver until at least May 1, 2020. Janus Capital may not recover amounts previously waived or reimbursed under this agreement. During the period ended June 30, 2019, Janus Capital waived $30,938 of the Portfolio’s management fee, attributable to the Portfolio’s investment in the Janus Henderson Short Duration Income ETF.

Janus Services LLC (“Janus Services”), a wholly-owned subsidiary of Janus Capital, is the Portfolio’s transfer agent. In addition, Janus Services provides or arranges for the provision of certain other administrative services including, but not limited to, recordkeeping, accounting, order processing, and other shareholder services for the Portfolio. These amounts are disclosed as “Other transfer agent fees and expenses” on the Statement of Operations.

Janus Services receives an administrative services fee at an annual rate of 0.10% of the Portfolio’s average daily net assets for providing, or arranging for the provision by Protective Life of administrative services, including recordkeeping, subaccounting, order processing, or other shareholder services provided on behalf of shareholders of the Portfolio. Janus Services expects to use this entire fee to compensate Protective Life for providing these services to its customers who invest in the Portfolio. These amounts are disclosed as “Transfer agent administrative fees and expenses” on the Statement of Operations.

Protective Life Dynamic Allocation Series - Growth Portfolio

Notes to Financial Statements (unaudited)

Services provided by Protective Life may include, but are not limited to, recordkeeping, subaccounting, order processing, providing order confirmations, periodic statements, forwarding prospectuses, shareholder reports, and other materials to existing contract holders, answering inquiries regarding accounts, and other administrative services. Order processing includes the submission of transactions through the National Securities Clearing Corporation (“NSCC”) or similar systems, or those processed on a manual basis with Janus Capital.

Since inception the Portfolio has paid the Trust’s distributor, Janus Distributors LLC dba Janus Henderson Distributors (“Janus Henderson Distributors”), a wholly-owned subsidiary of Janus Capital, a fee at an annual rate of up to 0.25% of the average daily net assets of the Portfolio. Such payments were initially made pursuant to a distribution and shareholder servicing plan (“the Plan”) adopted by the Board of Trustees in accordance with Rule 12b-1 under the 1940 Act at the time of the Portfolio’s formation. Under the terms of the Plan, the Trust was authorized to make payments to Janus Distributors for remittance to Protective Life or other intermediaries as compensation for distribution and/or shareholder services performed by Protective Life or its agents, or by such intermediary. The existence of the Plan and the fees paid pursuant to the terms of the Plan have been disclosed in certain of the Portfolio’s regulatory filings, including its prospectus, statement of additional information and prior shareholder reports. Due to an administrative oversight, following its initial adoption at the organizational meeting, the Plan was not annually renewed by the Board as required by Rule 12b-1 and as intended by the parties. As a result, the Plan could be viewed to have expired on March 5, 2017, which was the date on which the annual renewal was required to have occurred.

At an in-person meeting held on July 18, 2018, the Board approved a new Rule 12b-1 Plan (“New Rule 12b-1 Plan”) with respect to the Portfolio, with fees and terms substantively identical to the Plan. Because the Portfolio has commenced operations, the New Rule 12b-1 Plan was also required to be approved by the Portfolio’s shareholders. As a result, on September 17, 2018, the Portfolio commenced proxy solicitation of shareholders seeking approval of (1) the New Rule 12b-1 Plan and (2) ratification of fees paid by the Portfolio since March 5, 2017 (the date upon which Board renewal of the Plan was required) until the date of final determination by shareholders with respect to the approval of the New Rule 12b-1 Plan. The Portfolio continued to accrue the 0.25% fee pursuant to the terms of the New Rule 12b-1 Plan, with such amounts paid by the Portfolio into escrow and held pending final determination by shareholders. At a special meeting of shareholders held on October 9, 2018, shareholders voted to approve the New Rule 12b-1 Plan and ratify fees paid by the Portfolio since March 5, 2017.

Amounts that have been paid or otherwise accrued are disclosed as “12b-1 Distribution and shareholder servicing fees” on the Statement of Operations. Such payments or accruals are not tied exclusively to actual 12b-1 distribution and servicing fees, and the payments or accruals may exceed 12b-1 distribution and servicing fees actually incurred. If any of the Portfolio’s actual 12b-1 distribution and servicing fees incurred during a calendar year are less than the payments made during a calendar year, the Portfolio will be refunded the difference. Refunds, if any, are included in “12b-1 Distribution and shareholder servicing fees” in the Statement of Operations.

Janus Capital serves as administrator to the Portfolio pursuant to an administration agreement between Janus Capital and the Trust. Under the administration agreement, Janus Capital provides oversight and coordination of the Portfolio’s service providers, recordkeeping, and other administrative services, and is reimbursed by the Portfolio for certain of its costs in providing these services (to the extent Janus Capital seeks reimbursement and such costs are not otherwise waived). In addition, employees of Janus Capital and/or its affiliates may serve as officers of the Trust. The Portfolio pays for some or all of the salaries, fees, and expenses of Janus Capital employees and Portfolio officers, with respect to certain specified administration functions they perform on behalf of the Portfolio. The Portfolio pays these costs based on out-of-pocket expenses incurred by Janus Capital, and these costs are separate and apart from advisory fees and other expenses paid in connection with the investment advisory services Janus Capital provides to the Portfolio. These amounts are disclosed as “Affiliated Portfolio administration fees” on the Statement of Operations. In addition, some expenses related to compensation payable to the Portfolio’s Chief Compliance Officer and certain compliance staff, all of whom are employees of Janus Capital and/or its affiliates are shared with the Portfolio. Total compensation of $72,810 was paid to the Chief Compliance Officer and certain compliance staff by the Trust during the period ended June 30, 2019. The Portfolio's portion is reported as part of “Other expenses” on the Statement of Operations.

Any purchases and sales, realized gains/losses and recorded dividends from affiliated investments during the period ended June 30, 2019 can be found in the “Schedules of Affiliated Investments” located in the Schedule of Investments.

The Portfolio is permitted to purchase or sell securities (“cross-trade”) between itself and other funds or accounts managed by Janus Capital in accordance with Rule 17a-7 under the Investment Company Act of 1940 (“Rule 17a-7”),

Protective Life Dynamic Allocation Series - Growth Portfolio

Notes to Financial Statements (unaudited)

when the transaction is consistent with the investment objectives and policies of the Portfolio and in accordance with the Internal Cross Trade Procedures adopted by the Trust’s Board of Trustees. These procedures have been designed to ensure that any cross-trade of securities by the Portfolio from or to another fund or account that is or could be considered an affiliate of the Portfolio under certain limited circumstances by virtue of having a common investment adviser, common Officer, or common Trustee complies with Rule 17a-7. Under these procedures, each cross-trade is effected at the current market price to save costs where allowed. During the period ended June 30, 2019, the Portfolio engaged in cross trades amounting to $591,340 in purchases and $1,157,937 in sales, resulting in a net realized loss of $11,818. The net realized loss is included within the “Net Realized Gain/(Loss) on Investments” section of the Portfolio’s Statement of Operations.

4. Federal Income Tax

Income and capital gains distributions are determined in accordance with income tax regulations that may differ from accounting principles generally accepted in the United States of America. These differences are due to differing treatments for items such as net short-term gains, deferral of wash sale losses, foreign currency transactions, net investment losses, and capital loss carryovers.

The aggregate cost of investments and the composition of unrealized appreciation and depreciation of investment securities for federal income tax purposes as of June 30, 2019 are noted below. The primary difference between book and tax appreciation or depreciation of investments is wash sale loss deferrals.

| | | | |

Federal Tax Cost | Unrealized

Appreciation | Unrealized

(Depreciation) | Net Tax Appreciation/

(Depreciation) |

$ 84,422,941 | $ 3,228,667 | $ (232,982) | $ 2,995,685 |

| | | | |

5. Capital Share Transactions

| | | | | | | |

| | | | | | | |

| | | Period ended June 30, 2019 | | Year ended December 31, 2018 |

| | | Shares | Amount | | Shares | Amount |

| | | | | | | |

Shares sold | 1,127,172 | $14,134,048 | | 1,866,803 | $24,817,542 |

Reinvested dividends and distributions | 201,476 | 2,494,271 | | 55,280 | 723,326 |

Shares repurchased | (362,483) | (4,569,314) | | (235,614) | (3,072,172) |

Net Increase/(Decrease) | 966,165 | $12,059,005 | | 1,686,469 | $22,468,696 |

6. Purchases and Sales of Investment Securities

For the period ended June 30, 2019, the aggregate cost of purchases and proceeds from sales of investment securities (excluding any short-term securities, short-term options contracts, TBAs, and in-kind transactions, as applicable) was as follows:

| | | | |

Purchases of

Securities | Proceeds from Sales

of Securities | Purchases of Long-

Term U.S. Government

Obligations | Proceeds from Sales

of Long-Term U.S.

Government Obligations |

$160,349,439 | $ 100,977,428 | $ - | $ - |

7. Recent Accounting Pronouncements

The FASB issued Accounting Standards Update No. 2017-08, Receivables – Nonrefundable Fees and Other Costs (Subtopic 310-20), Premium Amortization on Purchased Callable Debt Securities ("ASU 2017-08") to amend the amortization period for certain purchased callable debt securities held at a premium. The guidance requires certain premiums on callable debt securities to be amortized to the earliest call date. The amortization period for callable debt securities purchased at a discount will not be impacted. The amendments are effective for portfolios with fiscal years ending after December 15, 2018. Management is currently evaluating the impacts of ASU 2017-08 on the Portfolio’s financial statements.

Protective Life Dynamic Allocation Series - Growth Portfolio

Notes to Financial Statements (unaudited)

The FASB issued Accounting Standards Update 2018-13, Fair Value Measurement (Topic 820), in August 2018. The new guidance removes, modifies and enhances the disclosures to Topic 820. For public entities, the amendments are effective for financial statements issued for fiscal years beginning after December 15, 2019, and interim periods within those fiscal years. An entity is permitted, and Management has decided, to early adopt the removed and modified disclosures in these financial statements.

8. Subsequent Event

Management has evaluated whether any events or transactions occurred subsequent to June 30, 2019 and through the date of issuance of the Portfolio’s financial statements and determined that there were no material events or transactions that would require recognition or disclosure in the Portfolio’s financial statements.

Protective Life Dynamic Allocation Series - Growth Portfolio

Additional Information (unaudited)

Proxy Voting Policies and Voting Record

A description of the policies and procedures that the Portfolio uses to determine how to vote proxies relating to its portfolio securities is available without charge: (i) upon request, by calling 1-800-525-0020 (toll free); (ii) on the Portfolio’s website at janushenderson.com/proxyvoting; and (iii) on the SEC’s website at http://www.sec.gov.

Quarterly Portfolio Holdings

The Portfolio files its complete portfolio holdings (schedule of investments) with the SEC for the first and third quarters of each fiscal year on Form N-Q within 60 days of the end of such fiscal quarter. The Portfolio’s Form N-Q: (i) is available on the SEC’s website at http://www.sec.gov; (ii) may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. (information on the Public Reference Room may be obtained by calling 1-800-SEC-0330); and (iii) is available without charge, upon request, by calling Janus Henderson at 1-800-525-0020 (toll free).

Board Considerations Regarding Renewal of Investment Advisory Agreements

The Board of Trustees (the “Board”) of Clayton Street Trust (the “Trust”), including a majority of the Trustees who are not “interested persons” as that term is defined in the Investment Company Act of 1940, as amended (the “Independent Trustees”), met in-person on April 17, 2019 to consider the proposed renewal of the investment advisory agreement between Janus Capital Management LLC (the “Adviser”) and the Trust (the “Advisory Agreement”), on behalf of Protective Life Dynamic Allocation Series - Conservative Portfolio (the “Conservative Portfolio”), Protective Life Dynamic Allocation Series - Moderate Portfolio (the “Moderate Portfolio”), and Protective Life Dynamic Allocation Series - Growth Portfolio (the “Growth Portfolio,” and together with the Conservative Portfolio and the Moderate Portfolio, the “Portfolios”). In the course of their consideration of the renewal of the Advisory Agreement, the Independent Trustees met in executive session and were advised by their independent counsel. In this regard, the Independent Trustees evaluated the terms of the Advisory Agreement and reviewed the duties and responsibilities of trustees in evaluating and approving such agreements. In considering renewal of the Advisory Agreement, the Board reviewed the materials provided to it relating to its consideration of the renewal of the Advisory Agreement for the Portfolios and other information provided by counsel and the Adviser, including: (i) information regarding the nature, quality and extent of the services provided to the Portfolios by the Adviser, and the fees charged to each Portfolio therefor; (ii) information concerning the Adviser’s financial condition, business, operations, portfolio management personnel, compliance programs, and profitability with respect to the Trust and each Portfolio; (iii) comparative information describing each Portfolio’s advisory fee structures, operating expenses, and performance information as compared to peer fund groups selected and reported to the Board by an independent third party; (iv) a copy of the Adviser’s current Form ADV; and (v) a memorandum from counsel on the responsibilities of trustees in considering investment advisory arrangements under the 1940 Act. The Board also considered presentations made by, and discussions held with, representatives of the Adviser over the previous year and since inception of the Portfolios. The Trustees previously met via telephone on March 6, 2019 and April 5, 2019 to discuss certain information provided by the Adviser.

During its review of this information, the Board focused on and analyzed the factors that it deemed relevant, including: the nature, extent and quality of the services provided to the Portfolios by the Adviser; the Adviser’s personnel and operations; each Portfolio’s expense level; the profitability to the Adviser under the Advisory Agreement with respect to each Portfolio; any “fall-out” benefits to the Adviser and its affiliates (i.e., the ancillary benefits realized by the Adviser and its affiliates from the Adviser’s relationship with the Trust); the effect of asset growth on each Portfolio’s expenses; and potential conflicts of interest.

The Trustees also considered benefits that accrue to the Adviser and its affiliates from their relationships with the Trust and each Portfolio. The Trustees also concluded that, other than the services provided by the Adviser and its affiliates pursuant to agreements with the Portfolios and the fees paid by the Portfolios therefor, the Portfolios and the Adviser may potentially benefit from their relationship with each other in other ways. The Trustees concluded that the success of the Portfolios could attract other business to the Adviser or other Janus Henderson funds, and that the success of the Adviser could enhance the Adviser’s ability to serve the Portfolios.

The Board, including the Independent Trustees, considered the following in respect of the Portfolios:

(a) The nature, extent and quality of services provided by the Adviser; personnel and operations of the Adviser.

The Board reviewed the services that the Adviser provides to the Portfolios. In connection with the investment advisory services provided by the Adviser, the Board noted the responsibilities that the Adviser has as the Portfolios’ investment adviser, including: the overall supervisory responsibility for the general management and investment of each Portfolio’s

Protective Life Dynamic Allocation Series - Growth Portfolio

Additional Information (unaudited)

securities portfolio; providing oversight of the investment performance and processes and compliance with each Portfolio’s investment objectives, policies and limitations; the implementation of the investment management program of each Portfolio; the management of the day-to-day investment and reinvestment of the assets of each Portfolio; the review of brokerage matters; the oversight of general portfolio compliance with relevant law; and the implementation of Board directives as they relate to the Portfolios.

The Board reviewed the Adviser’s experience, resources and strengths in managing the Portfolios and other pooled investment vehicles, including an assessment of the Adviser’s personnel. Based on its consideration and review of the foregoing information, the Board determined that each Portfolio was likely to continue to benefit from the nature, quality and extent of these services, as well as the Adviser’s ability to render such services based on the Adviser’s experience, personnel, operations and resources.

(b) Comparison of services rendered and fees paid under other investment advisory contracts, and the cost of the services to be provided and profits to be realized by the Adviser from the relationship with the Portfolios; “fall-out” benefits.

The Board then compared both the services rendered and the fees paid under other contracts of the Adviser and under contracts of other investment advisers with respect to similar investment companies. In particular, the Board reviewed a report compiled by an independent third party to compare each Portfolio’s management fee, and expense ratio to other investment companies within each Portfolio’s respective peer grouping, as determined by the independent third party. The comparative reporting indicated that the contractual management fees for the Conservative Portfolio and the Moderate Portfolio were in the 5th quintile and the contractual management fee for the Growth Portfolio was in the 4th quintile, as compared to each Portfolio’s respective peer grouping. The comparative reporting also indicated that the actual management fees were in the 1st quintile for each Portfolio, as a result of the Portfolios’ expense limitation arrangements as discussed below. The comparative reporting further indicated that the total expense ratios for the Conservative Portfolio and the Moderate Portfolio were in the 2nd quintile and that the total expense ratio for the Growth Portfolio was in the 1st quintile as compared to each Portfolio’s respective peer grouping.

The Board also discussed the costs incurred by the Adviser in connection with its serving as investment adviser to the Portfolios, including operational costs. After comparing each Portfolio’s fees and expenses with those of other investment companies in the Portfolios’ respective peer groups, and in light of the nature, extent and quality of services provided by the Adviser and the costs incurred by the Adviser in rendering those services, as well as the profitability of the Adviser in providing these services, the Board concluded that the level of fees paid to the Adviser with respect to each Portfolio was fair and reasonable.

The Board also considered that the Adviser may experience reputational “fall-out” benefits based on the success of the Portfolios, but that such benefits are not easily quantifiable.

(c) The extent to which economies of scale would be realized as the Portfolios grow and whether fee levels would reflect such economies of scale.

The Board next discussed potential economies of scale. The Trustees considered that the Adviser had entered into an expense limitation agreement with the Trust on behalf of each Portfolio, which effectively maintains the total expense ratio for each Portfolio at approximately 90 basis points. The Board further considered that the application of the Portfolios’ expense caps pursuant to the expense limitation agreement results in an effective waiver by the Adviser of its entire advisory fee collected for the Conservative Portfolio at its current asset level and the majority of its fees for the Moderate Portfolio and the Growth Portfolio at their current asset levels. The Board determined that the fee structure for the Portfolios was appropriate at this time, taking into account the expense limitation arrangements in place.

(d) Investment performance of the Portfolios and the Adviser.

The Board next discussed the performance of the Portfolios on both an absolute basis and relative to the performance of funds comprising a peer group compiled by an independent third party for each Portfolio for the one year and two year periods. The Board noted that for both the one and two year periods ended October 31, respectively, the Conservative Portfolio and the Moderate Portfolio were each reported to be in the 1st quintile; and the Growth Portfolio was reported to be in the 2nd quintile for the one year period and 1st quintile for the two year period, of their respective peer groupings.

Conclusion.

Protective Life Dynamic Allocation Series - Growth Portfolio

Additional Information (unaudited)

No single factor was determinative to the decision of the Board. Based on the foregoing and such other matters as were deemed relevant, the Board concluded that the management fee rates and total expense ratios of each Portfolio are reasonable in relation to the services provided by the Adviser to such Portfolio, as well as the costs incurred and benefits gained by the Adviser in providing such services. The Board also found the management fees to be reasonable in comparison to the fees charged by advisers to other comparable investment companies. As a result, the Board concluded that the renewal of the Advisory Agreement for an additional one year period was in the best interests of the each Portfolio.

After full consideration of the above factors, as well as other factors, the Trustees, including all of the Independent Trustees voting separately, determined to approve the renewal of the Advisory Agreement for each Portfolio.

Protective Life Dynamic Allocation Series - Growth Portfolio

Useful Information About Your Portfolio Report (unaudited)

Management Commentary

The Management Commentary in this report includes valuable insight as well as statistical information to help you understand how your Portfolio’s performance and characteristics stack up against those of comparable indices.

If the Portfolio invests in foreign securities, this report may include information about country exposure. Country exposure is based primarily on the country of risk. A company may be allocated to a country based on other factors such as location of the company’s principal office, the location of the principal trading market for the company’s securities, or the country where a majority of the company’s revenues are derived.

Please keep in mind that the opinions expressed in the Management Commentary are just that: opinions. They are a reflection based on best judgment at the time this report was compiled, which was June 30, 2019. As the investing environment changes, so could opinions. These views are unique and are not necessarily shared by fellow employees or by Janus Henderson in general.

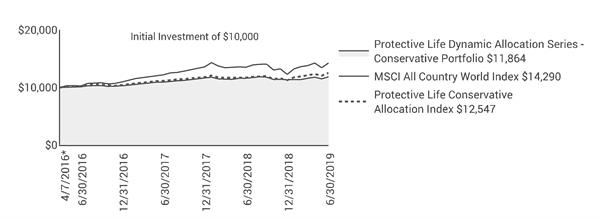

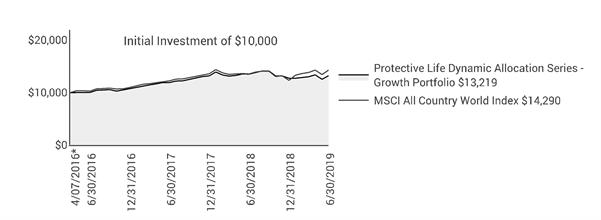

Performance Overviews

Performance overview graphs compare the performance of a hypothetical $10,000 investment in the Portfolio with one or more widely used market indices. When comparing the performance of the Portfolio with an index, keep in mind that market indices are not available for investment and do not reflect deduction of expenses.

Average annual total returns are quoted for a Portfolio with more than one year of performance history. Average annual total return is calculated by taking the growth or decline in value of an investment over a period of time, including reinvestment of dividends and distributions, then calculating the annual compounded percentage rate that would have produced the same result had the rate of growth been constant throughout the period. Average annual total return does not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or redemptions of Portfolio shares.

Cumulative total returns are quoted for a Portfolio with less than one year of performance history. Cumulative total return is the growth or decline in value of an investment over time, independent of the period of time involved. Cumulative total return does not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or redemptions of Portfolio shares.

Pursuant to federal securities rules, expense ratios shown in the performance chart reflect subsidized (if applicable) and unsubsidized ratios. The total annual fund operating expenses ratio is gross of any fee waivers, reflecting the Portfolio’s unsubsidized expense ratio. The net annual fund operating expenses ratio (if applicable) includes contractual waivers of Janus Capital and reflects the Portfolio’s subsidized expense ratio. Ratios may be higher or lower than those shown in the “Financial Highlights” in this report.

Schedule of Investments

Following the performance overview section is the Portfolio’s Schedule of Investments. This schedule reports the types of securities held in the Portfolio on the last day of the reporting period. Securities are usually listed by type (common stock, corporate bonds, U.S. Government obligations, etc.) and by industry classification (banking, communications, insurance, etc.). Holdings are subject to change without notice.

The value of each security is quoted as of the last day of the reporting period. The value of securities denominated in foreign currencies is converted into U.S. dollars.

If the Portfolio invests in foreign securities, it will also provide a summary of investments by country. This summary reports the Portfolio exposure to different countries by providing the percentage of securities invested in each country. The country of each security represents the country of risk. The Portfolio’s Schedule of Investments relies upon the industry group and country classifications published by Barclays and/or MSCI Inc.

Tables listing details of individual forward currency contracts, futures, written options, swaptions, and swaps follow the Portfolio’s Schedule of Investments (if applicable).

Statement of Assets and Liabilities

This statement is often referred to as the “balance sheet.” It lists the assets and liabilities of the Portfolio on the last day of the reporting period.

Protective Life Dynamic Allocation Series - Growth Portfolio

Useful Information About Your Portfolio Report (unaudited)

The Portfolio’s assets are calculated by adding the value of the securities owned, the receivable for securities sold but not yet settled, the receivable for dividends declared but not yet received on securities owned, and the receivable for Portfolio shares sold to investors but not yet settled. The Portfolio’s liabilities include payables for securities purchased but not yet settled, Portfolio shares redeemed but not yet paid, and expenses owed but not yet paid. Additionally, there may be other assets and liabilities such as unrealized gain or loss on forward currency contracts.

The section entitled “Net Assets Consist of” breaks down the components of the Portfolio’s net assets. Because the Portfolio must distribute substantially all earnings, you will notice that a significant portion of net assets is shareholder capital.

The last section of this statement reports the net asset value (“NAV”) per share on the last day of the reporting period. The NAV is calculated by dividing the Portfolio’s net assets for each share class (assets minus liabilities) by the number of shares outstanding.

Statement of Operations

This statement details the Portfolio’s income, expenses, realized gains and losses on securities and currency transactions, and changes in unrealized appreciation or depreciation of Portfolio holdings.

The first section in this statement, entitled “Investment Income,” reports the dividends earned from securities and interest earned from interest-bearing securities in the Portfolio.

The next section reports the expenses incurred by the Portfolio, including the advisory fee paid to the investment adviser, transfer agent fees and expenses, and printing and postage for mailing statements, financial reports and prospectuses. Expense offsets and expense reimbursements, if any, are also shown.

The last section lists the amounts of realized gains or losses from investment and foreign currency transactions, and changes in unrealized appreciation or depreciation of investments and foreign currency-denominated assets and liabilities. The Portfolio will realize a gain (or loss) when it sells its position in a particular security. A change in unrealized gain (or loss) refers to the change in net appreciation or depreciation of the Portfolio during the reporting period. “Net Realized and Unrealized Gain/(Loss) on Investments” is affected both by changes in the market value of Portfolio holdings and by gains (or losses) realized during the reporting period.

Statements of Changes in Net Assets

These statements report the increase or decrease in the Portfolio’s net assets during the reporting period. Changes in the Portfolio’s net assets are attributable to investment operations, dividends and distributions to investors, and capital share transactions. This is important to investors because it shows exactly what caused the Portfolio’s net asset size to change during the period.

The first section summarizes the information from the Statement of Operations regarding changes in net assets due to the Portfolio’s investment operations. The Portfolio’s net assets may also change as a result of dividend and capital gains distributions to investors. If investors receive their dividends and/or distributions in cash, money is taken out of the Portfolio to pay the dividend and/or distribution. If investors reinvest their dividends and/or distributions, the Portfolio’s net assets will not be affected. If you compare the Portfolio’s “Net Decrease from Dividends and Distributions” to “Reinvested Dividends and Distributions,” you will notice that dividends and distributions have little effect on the Portfolio’s net assets. This is because the majority of the Portfolio’s investors reinvest their dividends and/or distributions.

The reinvestment of dividends and distributions is included under “Capital Share Transactions.” “Capital Shares” refers to the money investors contribute to the Portfolio through purchases or withdrawals via redemptions. The Portfolio’s net assets will increase and decrease in value as investors purchase and redeem shares from the Portfolio.

Financial Highlights

This schedule provides a per-share breakdown of the components that affect the Portfolio’s NAV for current and past reporting periods as well as total return, asset size, ratios, and portfolio turnover rate.

The first line in the table reflects the NAV per share at the beginning of the reporting period. The next line reports the net investment income/(loss) per share. Following is the per share total of net gains/(losses), realized and unrealized. Per share dividends and distributions to investors are then subtracted to arrive at the NAV per share at the end of the

Protective Life Dynamic Allocation Series - Growth Portfolio

Useful Information About Your Portfolio Report (unaudited)

period. The next line reflects the total return for the period. Also included are ratios of expenses and net investment income to average net assets.

The Portfolio’s expenses may be reduced through expense offsets and expense reimbursements. The ratios shown reflect expenses before and after any such offsets and reimbursements.

The ratio of net investment income/(loss) summarizes the income earned less expenses, divided by the average net assets of the Portfolio during the reporting period. Do not confuse this ratio with the Portfolio’s yield. The net investment income ratio is not a true measure of the Portfolio’s yield because it does not take into account the dividends distributed to the Portfolio’s investors.

The next figure is the portfolio turnover rate, which measures the buying and selling activity in the Portfolio. Portfolio turnover is affected by market conditions, changes in the asset size of the Portfolio, fluctuating volume of shareholder purchase and redemption orders, the nature of the Portfolio’s investments, and the investment style and/or outlook of the portfolio manager(s) and/or investment personnel. A 100% rate implies that an amount equal to the value of the entire portfolio was replaced once during the fiscal year; a 50% rate means that an amount equal to the value of half the portfolio is traded in a year; and a 200% rate means that an amount equal to the value of the entire portfolio is traded every six months.

| | | | | | | | | |

| | | | | |

| | | | | |

| | | | | |

This report is submitted for the general information of shareholders of the Portfolio. It is not an offer or solicitation for the Portfolio and is not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus. |

Janus Henderson, Janus and Knowledge. Shared are trademarks of Janus Henderson Group plc or one of its subsidiaries. © Janus Henderson Group plc. Protective Life Dynamic Allocation Series Portfolios are distributed by Janus Henderson Distributors and exclusively offered in connection with variable annuity contracts issued by Protective Life Insurance Company and its affiliates. Janus Henderson is not affiliated with Protective Life. |

| | | | | 109-24-93065 08-19 |

| | | | |

| | | |

| | | SEMIANNUAL REPORT June 30, 2019 |

| | |

| | Protective Life Dynamic Allocation Series - Moderate Portfolio |

| | |

| | Clayton Street Trust |

| | | |

| | | |

| | | HIGHLIGHTS · Portfolio management perspective · Investment strategy behind your portfolio · Portfolio performance, characteristics

and holdings |

Table of Contents

Protective Life Dynamic Allocation Series - Moderate Portfolio

| | |

Management Commentary and Schedule of Investments | 1 |

Notes to Schedule of Investments and Other Information | 6 |

Statement of Assets and Liabilities | 7 |

Statement of Operations | 8 |

Statements of Changes in Net Assets | 9 |

Financial Highlights | 10 |

Notes to Financial Statements | 11 |

Additional Information | 20 |

Useful Information About Your Portfolio Report | 23 |

Protective Life Dynamic Allocation Series - Moderate Portfolio (unaudited)

| | | | | | |

PORTFOLIO SNAPSHOT This global asset allocation portfolio can help investors remove the emotion from investing by following a rules-based asset allocation process. The Portfolio looks to shift equity allocations to and from short-term investments weekly based on defined market signals while maintaining consistent exposure to intermediate-term fixed income assets, with a goal to grow assets over time while mitigating downside risk. | | | | Benjamin Wang co-portfolio manager | Scott M. Weiner co-portfolio manager |

| | | |

PERFORMANCE OVERVIEW

Protective Life Dynamic Allocation Series – Moderate Portfolio returned 4.60% during the six-month period ending June 30, 2019. This compares with a return of 16.23% for its benchmark, the MSCI All Country World IndexSM, and 12.77% for its secondary benchmark, the Protective Life Moderate Allocation Index, which is our internally calculated blended benchmark of 65% MSCI All Country World Index and 35% Bloomberg Barclays U.S. Aggregate Bond Index.

MARKET ENVIRONMENT

Holding sway over financial markets during the period was the growing consensus that the Federal Reserve (Fed) would step in to backstop riskier assets – namely equities – should economic growth soften further. This assumption was reinforced in May when an equities sell-off pushed Fed officials to drop even stronger hints that rate cuts would be coming this year.

Expectations of greater accommodation by the Fed were most evident in U.S. Treasuries markets where the yield on the 10-year note slid 68 basis points (bps) to close out the period at 2.0%. Riskier assets rallied, with some U.S. equity benchmarks achieving record closes in the period’s final days. After widening much of the period, the difference between the yields on investment-grade credits and their underlying benchmark tightened. Emerging market stocks rebounded from the mid-period sell-off – although not to the degree of developed market equities.

PERFORMANCE DISCUSSION

Gains for the period were led by the Portfolio’s allocation to U.S. investment-grade bonds, large-cap U.S. stocks and growth-oriented large-cap U.S. stocks. U.S. small-cap stocks and Asia ex Japan stocks weighed on results.

Thank you for investing in Protective Life Dynamic Allocation Series – Moderate Portfolio.

| | | | | | |

Asset Allocation - (% of Net Assets) |

Investment Companies | | 90.5% |

Repurchase Agreements | | 11.8% |

Other | | (2.3)% |

| | | 100.0% |

Protective Life Dynamic Allocation Series - Moderate Portfolio (unaudited)

Performance

| |

See important disclosures on the next page. |

| | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | Expense Ratios - |

Average Annual Total Return - for the periods ended June 30, 2019 | | | per the May 1, 2019 prospectus |

| | Fiscal

Year-to-Date | One

Year | Since

Inception* | | | Total Annual Fund

Operating Expenses | Net Annual Fund

Operating Expenses |

Protective Life Dynamic Allocation Series - Moderate Portfolio | | 4.60% | 1.12% | 6.60% | | | 1.12% | 0.90% |

MSCI All Country World Index | | 16.23% | 5.74% | 11.69% | | | | |

Protective Life Moderate Allocation Index | | 12.77% | 6.84% | 8.62% | | | | |

Morningstar Quartile - Class S Shares | | - | 4th | 4th | | | | |

Morningstar Ranking - based on total returns for Insurance Allocation--50% to 70% Equity Funds | | - | 374/374 | 323/350 | | | | |

Returns quoted are past performance and do not guarantee future results; current performance may be lower or higher. Investment returns and principal value will vary; there may be a gain or loss when shares are sold. For the most recent month-end performance call 800.456.6330.

Net expense ratios reflect expense waivers, if any, contractually agreed to through May 1, 2020.

Investing involves risk and it is possible to lose money by investing. Investment return and value will fluctuate in response to issuer, political, market and economic developments, which can affect a single issuer, issuers within an industry, economic sector or geographic region, or the market as a whole. Please see the prospectus for more information about risks, holdings and other details.

Performance of the Dynamic Allocation Series Portfolios depends on that of the underlying funds. They are subject to risk with respect to the aggregation of holdings of underlying funds which may result in increased volatility as a result of indirectly having concentrated assets in a particular industry, geographical sector, or single company.

No assurance can be given that the investment strategy will be successful under all or any market conditions. Janus Capital Management has limited prior experience using the proprietary methodology co-developed by Janus Capital Management and Protective Life Insurance Company. Although it is designed to achieve the Portfolios’ investment objectives, there is no guarantee that it will achieve the desired results. Because Janus Capital Management is the adviser to the Portfolios and to certain affiliated funds that may be held within the Portfolios, it is subject to certain potential conflicts of interest.

Returns do not reflect the deduction of fees, charges or expenses of any insurance product or qualified plan. If applied, returns would have been lower.

Returns include reinvestment of all dividends and distributions and do not reflect the deduction of taxes that a shareholder would pay on Portfolio

Protective Life Dynamic Allocation Series - Moderate Portfolio (unaudited)

Performance

distributions or redemptions of Portfolio shares. The returns do not include adjustments in accordance with generally accepted accounting principles required at the period end for financial reporting purposes.

See Financial Highlights for actual expense ratios during the reporting period.

Expenses waived or reimbursed during the first three years of operation may be recovered within three years of such waiver or reimbursement amount, if the expense ratio falls below certain limits.

When an expense waiver is in effect, it may have a material effect on the total return, and therefore the ranking for the period.

© 2019 Morningstar, Inc. All Rights Reserved.

There is no assurance that the investment process will consistently lead to successful investing.

See Notes to Schedule of Investments and Other Information for index definitions.

Index performance does not reflect the expenses of managing a portfolio as an index is unmanaged and not available for direct investment.

See “Useful Information About Your Portfolio Report.”

*The Portfolio’s inception date – April 7, 2016

Protective Life Dynamic Allocation Series - Moderate Portfolio (unaudited)

Expense Examples

As a shareholder of the Portfolio, you incur two types of costs: (1) transaction costs and (2) ongoing costs, including management fees; 12b-1 distribution and shareholder servicing fees; transfer agent fees and expenses payable pursuant to the Transfer Agency Agreement; and other Portfolio expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Portfolio and to compare these costs with the ongoing costs of investing in other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. The example is based upon an investment of $1,000 invested at the beginning of the period and held for the six-months indicated, unless noted otherwise in the table and footnotes below.

Actual Expenses

The information in the table under the heading “Actual” provides information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during the period.

Hypothetical Example for Comparison Purposes

The information in the table under the heading “Hypothetical (5% return before expenses)” provides information about hypothetical account values and hypothetical expenses based upon the Portfolio’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Portfolio and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Additionally, for an analysis of the fees associated with an investment in the Portfolio or other similar funds, please visit www.finra.org/fundanalyzer.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs, such as any charges at the separate account level or contract level. These fees are fully described in the Portfolio’s prospectus. Therefore, the hypothetical examples are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

| | | | | | | | | | | |

| | | | | | | | | |

| | | | Actual | | Hypothetical

(5% return before expenses) | |

| Beginning

Account

Value

(1/1/19) | Ending

Account

Value

(6/30/19) | Expenses

Paid During

Period

(1/1/19 - 6/30/19)† | | Beginning

Account

Value

(1/1/19) | Ending

Account

Value

(6/30/19) | Expenses

Paid During

Period

(1/1/19 - 6/30/19)† | Net Annualized

Expense Ratio

(1/1/19 - 6/30/19) |

| $1,000.00 | $1,046.00 | $3.91 | | $1,000.00 | $1,020.98 | $3.86 | 0.77% |

† | Expenses Paid During Period is equal to the Net Annualized Expense Ratio multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). Expenses in the examples include the effect of applicable fee waivers and/or expense reimbursements, if any. Had such waivers and/or reimbursements not been in effect, your expenses would have been higher. Please refer to the Notes to Financial Statements or the Portfolio’s prospectus for more information regarding waivers and/or reimbursements. |

Protective Life Dynamic Allocation Series - Moderate Portfolio

Schedule of Investments (unaudited)

June 30, 2019

| | | | | | | | |

Shares or

Principal Amounts | | | Value | |

Investment Companies – 90.5% | | | |

Exchange-Traded Funds (ETFs) – 88.4% | | | |

| | Franklin FTSE Asia Ex Japan# | | 106,111 | | | $2,302,948 | |

| | Franklin FTSE United Kingdom | | 150,757 | | | 3,607,102 | |

| | Invesco QQQ Trust Series 1 | | 99,719 | | | 18,621,526 | |

| | iShares Core S&P 500 | | 168,863 | | | 49,772,369 | |

| | iShares Core U.S. Aggregate Bond | | 603,927 | | | 67,247,272 | |

| | iShares MSCI All Country Asia ex Japan | | 28,421 | | | 1,983,502 | |

| | iShares MSCI United Kingdom | | 259,832 | | | 8,397,770 | |

| | Janus Henderson Short Duration Income£ | | 58,674 | | | 2,929,006 | |

| | SPDR EURO STOXX 50# | | 325,660 | | | 12,472,778 | |

| | | 167,334,273 | |

Investments Purchased with Cash Collateral from Securities Lending – 2.1% | | | |

| | Janus Henderson Cash Collateral Fund LLC, 2.3576%ºº,£ | | 3,933,725 | | | 3,933,725 | |

Total Investment Companies (cost $164,665,696) | | 171,267,998 | |

Repurchase Agreements(a) – 11.8% | | | |

| | Undivided interest of 11.2% in a joint repurchase agreement (principal amount $199,800,000 with a maturity value of $199,840,793) with Credit Agricole, 2.4500%, dated 6/28/19, maturing 7/1/19 to be repurchased at $22,304,553 collateralized by $202,044,900 in U.S. Treasuries 1.6250% - 1.8750%, 6/30/20 - 9/30/22 with a value of $203,796,063 (cost $22,300,000) | | $22,300,000 | | | 22,300,000 | |

Total Investments (total cost $186,965,696) – 102.3% | | 193,567,998 | |

Liabilities, net of Cash, Receivables and Other Assets – (2.3)% | | (4,305,940) | |

Net Assets – 100% | | $189,262,058 | |

Schedules of Affiliated Investments – (% of Net Assets)

| | | | | | | | | | | |

| | Dividend Income(1) | Realized Gain/(Loss)(1) | Change in Unrealized Appreciation/ Depreciation(1) | Value at 6/30/19 |

Investment Companies - 3.6% |

Exchange-Traded Funds (ETFs) - 1.5% |

| | Janus Henderson Short Duration Income | $ | 329,789 | $ | 536,635 | $ | 47,245 | $ | 2,929,006 |

Investments Purchased with Cash Collateral from Securities Lending - 2.1% |

| | Janus Henderson Cash Collateral Fund LLC, 2.3576%ºº | | 11,852∆ | | - | | - | | 3,933,725 |

Total Affiliated Investments - 3.6% | $ | 341,641 | $ | 536,635 | $ | 47,245 | $ | 6,862,731 |

(1) For securities that were affiliated for a portion of the period ended June 30, 2019, this column reflects amounts for the entire period ended June 30, 2019 and not just the period in which the security was affiliated.

| | | | | | | | | | | |

| | Share Balance at 12/31/18 | Purchases | Sales | Share Balance at 6/30/19 |

Investment Companies - 3.6% |

Exchange-Traded Funds (ETFs) - 1.5% |

| | Janus Henderson Short Duration Income | | - | | 2,150,321 | | (2,091,647) | | 58,674 |

Investments Purchased with Cash Collateral from Securities Lending - 2.1% |

| | Janus Henderson Cash Collateral Fund LLC, 2.3576%ºº | | 202,200 | | 149,752,727 | | (146,021,202) | | 3,933,725 |

| | |

See Notes to Schedule of Investments and Other Information and Notes to Financial Statements. |

| |

Clayton Street Trust | 5 |

Protective Life Dynamic Allocation Series - Moderate Portfolio

Notes to Schedule of Investments and Other Information (unaudited)

| | |

MSCI All Country World IndexSM | MSCI All Country World IndexSM reflects the equity market performance of global developed and emerging markets. |

Protective Life Moderate Allocation Index | Protective Life Moderate Allocation Index is an internally-calculated, hypothetical combination of total returns from the MSCI All Country World IndexSM (65%) and the Bloomberg Barclays U.S. Aggregate Bond Index (35%). |

| | |

LLC | Limited Liability Company |

SPDR | Standard & Poor's Depositary Receipt |

| | |

ºº | Rate shown is the 7-day yield as of June 30, 2019. |

| | |

# | Loaned security; a portion of the security is on loan at June 30, 2019. |

| | |

£ | The Portfolio may invest in certain securities that are considered affiliated companies. As defined by the Investment Company Act of 1940, as amended, an affiliated company is one in which the Portfolio owns 5% or more of the outstanding voting securities, or a company which is under common ownership or control. |

| | |

(a) | The Fund may have elements of risk due to concentration of investments. Such concentrations may subject the Fund to additional risks. |

| | |

∆ | Net of income paid to the securities lending agent and rebates paid to the borrowing counterparties. |

| | | | | | | | | | | | | |

The following is a summary of the inputs that were used to value the Portfolio’s investments in securities and other financial instruments as of June 30, 2019. See Notes to Financial Statements for more information. |

| |

Valuation Inputs Summary |

| | | | | | | |

| | | | | Level 2 - | | Level 3 - |

| | | Level 1 - | | Other Significant | | Significant |

| | | Quoted Prices | | Observable Inputs | | Unobservable Inputs |

| | | | | | | |

Assets | | | | | | |

Investments In Securities: | | | | | | |

Investment Companies | $ | 167,334,273 | $ | 3,933,725 | $ | - |

Repurchase Agreements | | - | | 22,300,000 | | - |

Total Assets | $ | 167,334,273 | $ | 26,233,725 | $ | - |

| | | | | | | |

Protective Life Dynamic Allocation Series - Moderate Portfolio

Statement of Assets and Liabilities (unaudited)

June 30, 2019

| | | | | | | |

| | | | | | |

Assets: | | | | |

| | Unaffiliated investments, at value(1)(2) | | $ | 164,405,267 | |

| | Affiliated investments, at value(3) | | | 6,862,731 | |

| | Repurchase agreements, at value(4) | | | 22,300,000 | |

| | Receivables: | | | | |

| | | Investments sold | | | 1,396,817 | |

| | | Dividends | | | 153,663 | |

| | | Portfolio shares sold | | | 36,876 | |

| | | Interest | | | 4,553 | |

| | Other assets | | | 6,424 | |

Total Assets | | | 195,166,331 | |

Liabilities: | | | | |

| | Due to custodian | | | 20,345 | |

| | Collateral for securities loaned (Note 2) | | | 3,933,725 | |

| | Payables: | | | — | |

| | | Investments purchased | | | 1,790,340 | |

| | | 12b-1 Distribution and shareholder servicing fees | | | 38,392 | |

| | | Professional fees | | | 34,924 | |

| | | Advisory fees | | | 30,245 | |

| | | Transfer agent fees and expenses | | | 15,537 | |

| | | Non-interested Trustees' fees and expenses | | | 14,080 | |

| | | Affiliated portfolio administration fees payable | | | 5,887 | |

| | | Portfolio shares repurchased | | | 500 | |

| | | Custodian fees | | | 374 | |

| | | Accrued expenses and other payables | | | 19,924 | |

Total Liabilities | | | 5,904,273 | |

Net Assets | | $ | 189,262,058 | |

Net Assets Consist of: | | | | |

| | Capital (par value and paid-in surplus) | | $ | 181,666,717 | |

| | Total distributable earnings (loss) | | | 7,595,341 | |

Total Net Assets | | $ | 189,262,058 | |

Net Assets | | $ | 189,262,058 | |

| | Shares Outstanding, $0.01 Par Value (unlimited shares authorized) | | | 15,940,954 | |

Net Asset Value Per Share | | $ | 11.87 | |

| |

(1) Includes cost of $157,850,210. (2) Includes $3,834,583 of securities on loan. See Note 2 in Notes to Financial Statements. (3) Includes cost of $6,815,486. (4) Includes cost of repurchase agreements of $22,300,000. |

| | |

See Notes to Financial Statements. |

| |

Clayton Street Trust | 7 |

Protective Life Dynamic Allocation Series - Moderate Portfolio

Statement of Operations (unaudited)

For the period ended June 30, 2019

| | | | | | |

| | | | | |

Investment Income: | | | |

| Dividends | $ | 1,881,474 | |

| | Dividends from affiliates | | 329,789 | |

| | Interest | | 227,536 | |

| | Affiliated securities lending income, net | | 11,852 | |

Total Investment Income | | 2,450,651 | |

Expenses: | | | |

| | Advisory fees | | 350,333 | |

| | 12b-1 Distribution and shareholder servicing fees | | 218,958 | |

| | Transfer agent administrative fees and expenses | | 87,583 | |

| | Other transfer agent fees and expenses | | 1,156 | |

| | Professional fees | | 85,504 | |

| | Affiliated portfolio administration fees | | 32,484 | |

| | Non-interested Trustees’ fees and expenses | | 26,350 | |

| | Non-affiliated portfolio administration fees | | 21,945 | |

| | Shareholder reports expense | | 9,888 | |

| | Custodian fees | | 1,311 | |

| | Other expenses | | 31,294 | |

Total Expenses | | 866,806 | |

Less: Excess Expense Reimbursement and Waivers | | (185,115) | |

Net Expenses | | 681,691 | |

Net Investment Income/(Loss) | | 1,768,960 | |

Net Realized Gain/(Loss) on Investments: | | | |

| | Investments | | (553,964) | |

| | Investments in affiliates | | 536,635 | |

Total Net Realized Gain/(Loss) on Investments | | (17,329) | |

Change in Unrealized Net Appreciation/Depreciation: | | | |

| | Investments | | 6,283,508 | |

| | Investments in affiliates | | 47,245 | |

Total Change in Unrealized Net Appreciation/Depreciation | | 6,330,753 | |

Net Increase/(Decrease) in Net Assets Resulting from Operations | $ | 8,082,384 | |

| | | | | | |

| | |

See Notes to Financial Statements. |

| |

8 | JUNE 30, 2019 |

Protective Life Dynamic Allocation Series - Moderate Portfolio

Statements of Changes in Net Assets

| | | | | | | | | |

| | | | | | | | | |

| | | Period ended

June 30, 2019 (unaudited) | | Year ended

December 31, 2018 | |

| | | | | | | | | |

Operations: | | | | | | |

| | Net investment income/(loss) | $ | 1,768,960 | | $ | 1,938,307 | |

| | Net realized gain/(loss) on investments | | (17,329) | | | 1,500,736 | |

| | Change in unrealized net appreciation/depreciation | | 6,330,753 | | | (7,874,097) | |

Net Increase/(Decrease) in Net Assets Resulting from Operations | | 8,082,384 | | | (4,435,054) | |

Dividends and Distributions to Shareholders | | | | | | |

| | Dividends and Distributions to Shareholders | | (2,797,275) | | | (1,809,461) | |

Net Decrease from Dividends and Distributions to Shareholders | | (2,797,275) | | | (1,809,461) | |

Capital Shares Transactions | | 20,551,880 | | | 57,221,625 | |

Net Increase/(Decrease) in Net Assets | | 25,836,989 | | | 50,977,110 | |

Net Assets: | | | | | | |

| | Beginning of period | | 163,425,069 | | | 112,447,959 | |

| End of period | $ | 189,262,058 | | $ | 163,425,069 | |

| | | | | | | | | |

| | |

See Notes to Financial Statements. |

| |

Clayton Street Trust | 9 |

Protective Life Dynamic Allocation Series - Moderate Portfolio

Financial Highlights

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

For a share outstanding during the period ended June 30, 2019 (unaudited) and the year or period ended December 31 | 2019 | | | 2018 | | | 2017 | | | 2016(1) | |

| | Net Asset Value, Beginning of Period | | $11.52 | | | $11.94 | | | $10.43 | | | $10.00 | |

| | Income/(Loss) from Investment Operations: | | | | | | | | | | | | |

| | | Net investment income/(loss)(2) | | 0.12 | | | 0.16 | | | 0.18 | | | 0.13 | |

| | | Net realized and unrealized gain/(loss) | | 0.41 | | | (0.44) | | | 1.42 | | | 0.30 | |

| | Total from Investment Operations | | 0.53 | | | (0.28) | | | 1.60 | | | 0.43 | |

| | Less Dividends and Distributions: | | | | | | | | | | | | |

| | | Dividends (from net investment income) | | (0.07) | | | (0.14) | | | (0.09) | | | — | |

| | | Distributions (from capital gains) | | (0.11) | | | —(3) | | | — | | | — | |

| | Total Dividends and Distributions | | (0.18) | | | (0.14) | | | (0.09) | | | — | |

| | Net Asset Value, End of Period | | $11.87 | | | $11.52 | | | $11.94 | | | $10.43 | |

| | Total Return* | | 4.60% | | | (2.37)% | | | 15.42% | | | 4.30% | |

| | Net Assets, End of Period (in thousands) | | $189,262 | | | $163,425 | | | $112,448 | | | $24,762 | |

| | Average Net Assets for the Period (in thousands) | | $177,520 | | | $143,135 | | | $65,001 | | | $11,145 | |

| | Ratios to Average Net Assets**: | | | | | | | | | | | | |

| | | Ratio of Gross Expenses(4) | | 0.98% | | | 0.99% | | | 1.26% | | | 2.71% | |

| | | Ratio of Net Expenses (After Waivers and Expense Offsets)(4) | | 0.77% | | | 0.77% | | | 0.73% | | | 0.77% | |

| | | Ratio of Net Investment Income/(Loss)(4) | | 2.01% | | | 1.35% | | | 1.60% | | | 1.73% | |

| | Portfolio Turnover Rate | | 104% | | | 76% | | | 4% | | | 55% | |

| | | | | | | | | | | | | | | | |

| |

* Total return includes adjustments in accordance with generally accepted accounting principles required at the year or period end and are not annualized for periods of less than one full year. Total return does not include fees, charges, or expenses imposed by the variable annuity contracts for which Clayton Street Trust serves as an underlying investment vehicle. ** Annualized for periods of less than one full year. (1) Period from April 7, 2016 (inception date) through December 31, 2016. (2) Per share amounts are calculated based on average shares outstanding during the year or period. (3) Less than $0.005 on a per share basis. (4) Ratios do not include indirect expenses of the underlying funds and/or investment companies in which the Portfolio invests. |

| | |

See Notes to Financial Statements. |

| |

10 | JUNE 30, 2019 |

Protective Life Dynamic Allocation Series - Moderate Portfolio

Notes to Financial Statements (unaudited)

1. Organization and Significant Accounting Policies

Protective Life Dynamic Allocation Series - Moderate Portfolio (the “Portfolio”) is a series of Clayton Street Trust (the “Trust”), which is organized as a Delaware statutory trust and is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company, and therefore has applied the specialized accounting and reporting guidance in Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946. The Portfolio operates as a “fund of funds,” meaning substantially all of the Portfolio’s assets may be invested in exchange-traded funds (the “underlying funds”). The Trust offers three portfolios with differing investment objectives and policies. The Portfolio seeks total return through growth of capital and income, balanced by capital preservation. The Portfolio is classified as diversified, as defined in the 1940 Act.

The Portfolio currently offers one class of shares. The shares are offered in connection with investment in and payments under variable annuity contracts issued exclusively by Protective Life Insurance Company and its affiliates ("Protective Life").

Underlying Funds

During the period, the Portfolio invested in a dynamic portfolio of exchange-traded funds across seven different equity asset classes, as well as fixed-income investments, and a short duration allocation that may be comprised of cash, money market instruments and short duration exchange-traded funds. The equity asset classes are adjusted weekly based on market conditions pursuant to a proprietary, quantitative-based allocation program. Over the long term, and when fully invested, the Portfolio seeks to maintain an asset allocation of approximately 65% global equity investments and 35% fixed income investments. Additional details and descriptions of the investment objectives and strategies of each of the potential underlying funds are available in the Portfolio's prospectus.

The following accounting policies have been followed by the Portfolio and are in conformity with accounting principles generally accepted in the United States of America.

Investment Valuation

Securities held by the Portfolio, including the underlying funds, are valued in accordance with policies and procedures established by and under the supervision of the Trustees (the “Valuation Procedures”). The values of the Portfolio's investments in the underlying funds are based upon the closing price of such underlying funds on the applicable exchange. Most debt securities are valued in accordance with the evaluated bid price supplied by the pricing service that is intended to reflect market value. The evaluated bid price supplied by the pricing service is an evaluation that may consider factors such as security prices, yields, maturities, and ratings. Certain short-term securities maturing within 60 days or less may be evaluated and valued on an amortized cost basis provided that the amortized cost determined approximates market value. Securities for which market quotations or evaluated prices are not readily available or are deemed by Janus Capital Management LLC (“Janus Capital”) to be unreliable are valued at fair value determined in good faith under the Valuation Procedures. Circumstances in which fair value pricing may be utilized include, but are not limited to: (i) a significant event that may affect the securities of a single issuer, such as a merger, bankruptcy, or significant issuer-specific development; (ii) an event that may affect an entire market, such as a natural disaster or significant governmental action; (iii) a nonsignificant event such as a market closing early or not opening, or a security trading halt; and (iv) pricing of a nonvalued security and a restricted or nonpublic security. Special valuation considerations may apply with respect to “odd-lot” fixed-income transactions which, due to their small size, may receive evaluated prices by pricing services which reflect a large block trade and not what actually could be obtained for the odd-lot position.

Valuation Inputs Summary

FASB ASC 820, Fair Value Measurements and Disclosures (“ASC 820”), defines fair value, establishes a framework for measuring fair value, and expands disclosure requirements regarding fair value measurements. This standard emphasizes that fair value is a market-based measurement that should be determined based on the assumptions that market participants would use in pricing an asset or liability and establishes a hierarchy that prioritizes inputs to valuation techniques used to measure fair value. These inputs are summarized into three broad levels:

Level 1 – Unadjusted quoted prices in active markets the Portfolio has the ability to access for identical assets or liabilities.

Level 2 – Observable inputs other than unadjusted quoted prices included in Level 1 that are observable for the asset or liability either directly or indirectly. These inputs may include quoted prices for the identical instrument on

Protective Life Dynamic Allocation Series - Moderate Portfolio

Notes to Financial Statements (unaudited)

an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

Assets or liabilities categorized as Level 2 in the hierarchy generally include: debt securities fair valued in accordance with the evaluated bid or ask prices supplied by a pricing service; securities traded on OTC markets and listed securities for which no sales are reported that are fair valued at the latest bid price (or yield equivalent thereof) obtained from one or more dealers transacting in a market for such securities or by a pricing service approved by the Portfolio’s Trustees; and certain short-term debt securities with maturities of 60 days or less that are fair valued at amortized cost. Other securities that may be categorized as Level 2 in the hierarchy include, but are not limited to, preferred stocks, bank loans, swaps, investments in unregistered investment companies, options, and forward contracts.

Level 3 – Unobservable inputs for the asset or liability to the extent that relevant observable inputs are not available, representing the Portfolio’s own assumptions about the assumptions that a market participant would use in valuing the asset or liability, and that would be based on the best information available.

The Portfolio classifies each of its investments in underlying funds as Level 1, without consideration as to the classification level of the specific investments held by the underlying funds. There have been no significant changes in valuation techniques used in valuing any such positions held by the Portfolio since the beginning of the fiscal year.

The inputs or methodology used for fair valuing securities are not necessarily an indication of the risk associated with investing in those securities. The summary of inputs used as of June 30, 2019 to fair value the Portfolio’s investments in securities and other financial instruments is included in the “Valuation Inputs Summary” in the Notes to Schedule of Investments and Other Information.

Investment Transactions and Investment Income