UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

| | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE QUARTERLY PERIOD ENDED MARCH 31, 2023

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM TO

Commission File Number: 000-55931

Blackstone Real Estate Income Trust, Inc.

(Exact name of Registrant as specified in its charter)

| | | | | | | | | | | | | | |

| | | |

| Maryland | | 81-0696966 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

| 345 Park Avenue | | |

| New York, | NY | | 10154 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (212) 583-5000

Securities registered pursuant to Section 12(b) of the Act: None

| | | | | | | | | | | | | | |

| Title of each class | | Trading

Symbol(s) | | Name of each exchange on which registered |

| | | | | |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | |

| Large accelerated filer | | ☐ | Accelerated filer | | ☐ |

| | | | |

| Non-accelerated filer | | ☒ | Smaller reporting company | | ☐ |

| | | | | | |

| Emerging growth company | | ☐ | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of May 12, 2023, the issuer had the following shares outstanding: 1,575,756,064 shares of Class S common stock, 2,776,774,467 shares of Class I common stock, 69,375,679 shares of Class T common stock, 167,298,938 shares of Class D common stock, and 1,798,206 shares of Class C common stock.

TABLE OF CONTENTS

| | | | | | | | |

| PART I. | | |

| | |

| ITEM 1. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| ITEM 2. | | |

| | |

| ITEM 3. | | |

| | |

| ITEM 4. | | |

| | |

| PART II. | | |

| | |

| ITEM 1. | | |

| | |

| ITEM 1A. | | |

| | |

| ITEM 2. | | |

| | |

| ITEM 3. | | |

| | |

| ITEM 4. | | |

| | |

| ITEM 5. | | |

| | |

| ITEM 6. | | |

| | |

| | |

PART I. FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

| | |

Blackstone Real Estate Income Trust, Inc. Condensed Consolidated Balance Sheets (Unaudited) (in thousands, except per share data) |

| | | | | | | | | | | |

| | March 31, 2023 | | December 31, 2022 |

| Assets | | | |

| Investments in real estate, net | $ | 97,177,003 | | | $ | 98,149,492 | |

Investments in unconsolidated entities (includes $5,032,399 and $4,947,251 at fair value as of March 31, 2023 and December 31, 2022, respectively) | 8,581,171 | | | 9,369,402 | |

| Investments in real estate debt | 7,820,403 | | | 8,001,703 | |

| Real estate loans held by consolidated securitization vehicles, at fair value | 16,948,146 | | | 17,030,387 | |

| Cash and cash equivalents | 2,368,212 | | | 1,281,292 | |

| Restricted cash | 820,302 | | | 973,200 | |

| Other assets | 6,984,579 | | | 7,881,948 | |

| Total assets | $ | 140,699,816 | | | $ | 142,687,424 | |

| | | |

| Liabilities and Equity | | | |

| Mortgage notes, secured term loans, and secured revolving credit facilities, net | $ | 62,105,875 | | | $ | 64,962,703 | |

| Secured financings of investments in real estate debt | 4,876,746 | | | 4,966,685 | |

| Senior obligations of consolidated securitization vehicles, at fair value | 15,214,633 | | | 15,288,598 | |

| Unsecured revolving credit facilities and term loans | 1,126,923 | | | 1,126,923 | |

| Due to affiliates | 1,281,375 | | | 1,676,308 | |

| Other liabilities | 4,250,000 | | | 3,912,033 | |

| Total liabilities | 88,855,552 | | | 91,933,250 | |

| | | |

| Commitments and contingencies | — | | | — | |

| Redeemable non-controlling interests | 236,874 | | | 553,423 | |

| | | |

| Equity | | | |

| | | |

| Common stock — Class S shares, $0.01 par value per share, 3,000,000 shares authorized; 1,582,436 and 1,597,414 shares issued and outstanding as of March 31, 2023 and December 31, 2022, respectively | 15,824 | | | 15,974 | |

| Common stock — Class I shares, $0.01 par value per share, 6,000,000 shares authorized; 2,827,354 and 2,394,737 shares issued and outstanding as of March 31, 2023 and December 31, 2022, respectively | 28,274 | | | 23,947 | |

| Common stock — Class T shares, $0.01 par value per share, 500,000 shares authorized; 70,538 and 72,599 shares issued and outstanding as of March 31, 2023 and December 31, 2022, respectively | 705 | | | 726 | |

| Common stock — Class D shares, $0.01 par value per share, 500,000 shares authorized; 166,792 and 421,428 shares issued and outstanding as of March 31, 2023 and December 31, 2022, respectively | 1,668 | | | 4,214 | |

| Common stock — Class C shares, $0.01 par value per share, 500,000 shares authorized; 1,085 and 0 shares issued and outstanding as of March 31, 2023 and December 31, 2022, respectively | 11 | | | — | |

| Additional paid-in capital | 55,971,090 | | | 53,212,494 | |

| Accumulated other comprehensive income | 231,651 | | | 393,928 | |

| Accumulated deficit and cumulative distributions | (10,516,519) | | | (9,196,019) | |

| Total stockholders’ equity | 45,732,704 | | | 44,455,264 | |

| Non-controlling interests attributable to third party joint ventures | 4,209,810 | | | 4,278,895 | |

| Non-controlling interests attributable to BREIT OP unitholders | 1,664,876 | | | 1,466,592 | |

| Total equity | 51,607,390 | | | 50,200,751 | |

| Total liabilities and equity | $ | 140,699,816 | | | $ | 142,687,424 | |

See accompanying notes to condensed consolidated financial statements.

| | |

Blackstone Real Estate Income Trust, Inc. Condensed Consolidated Statements of Operations (Unaudited) (in thousands, except per share data) |

| | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended March 31, | |

| | | | | 2023 | | 2022 | | | | | |

| Revenues | | | | | | | | | | | | |

| Rental revenue | | | | | $ | 1,988,065 | | | $ | 1,303,720 | | | | | | |

| Hospitality revenue | | | | | 201,221 | | | 147,245 | | | | | | |

| Other revenue | | | | | 98,654 | | | 68,100 | | | | | | |

| Total revenues | | | | | 2,287,940 | | | 1,519,065 | | | | | | |

| | | | | | | | | | | | |

| Expenses | | | | | | | | | | | | |

| Rental property operating | | | | | 892,189 | | | 566,987 | | | | | | |

| Hospitality operating | | | | | 133,823 | | | 103,463 | | | | | | |

| General and administrative | | | | | 17,176 | | | 13,106 | | | | | | |

| Management fee | | | | | 221,138 | | | 189,150 | | | | | | |

| Performance participation allocation | | | | | — | | | 411,569 | | | | | | |

| Impairment of investments in real estate | | | | | 12,499 | | | — | | | | | | |

| Depreciation and amortization | | | | | 999,385 | | | 915,051 | | | | | | |

| Total expenses | | | | | 2,276,210 | | | 2,199,326 | | | | | | |

| | | | | | | | | | | | |

| Other income (expense) | | | | | | | | | | | | |

| Income from unconsolidated entities | | | | | 444,658 | | | 184,225 | | | | | | |

| Income (loss) from investments in real estate debt | | | | | 153,471 | | | (18,370) | | | | | | |

| Change in net assets of consolidated securitization vehicles | | | | | 29,254 | | | (15,674) | | | | | | |

| (Loss) income from interest rate derivatives | | | | | (620,250) | | | 675,790 | | | | | | |

| Net gain on dispositions of real estate | | | | | 121,003 | | | 205,262 | | | | | | |

| | | | | | | | | | | | |

| Interest expense | | | | | (800,009) | | | (346,259) | | | | | | |

| (Loss) gain on extinguishment of debt | | | | | (5,258) | | | 1,395 | | | | | | |

| Other expense | | | | | (27,060) | | | (102,687) | | | | | | |

| Total other (expense) income | | | | | (704,191) | | | 583,682 | | | | | | |

| Net loss | | | | | $ | (692,461) | | | $ | (96,579) | | | | | | |

| Net loss attributable to non-controlling interests in third party joint ventures | | | | | $ | 74,358 | | | $ | 44,255 | | | | | | |

| Net loss attributable to non-controlling interests in BREIT OP unit holders | | | | | 17,048 | | | 656 | | | | | | |

| Net loss attributable to BREIT stockholders | | | | | $ | (601,055) | | | $ | (51,668) | | | | | | |

| Net loss per share of common stock — basic and diluted | | | | | $ | (0.13) | | | $ | (0.01) | | | | | | |

| Weighted-average shares of common stock outstanding, basic and diluted | | | | | 4,662,301 | | | 4,001,087 | | | | | | |

See accompanying notes to condensed consolidated financial statements.

| | |

Blackstone Real Estate Income Trust, Inc. Condensed Consolidated Statements of Comprehensive Income (Loss) (Unaudited) (in thousands) |

| | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended March 31, |

| | | | | 2023 | | | | 2022 | | |

| Net loss | | | | | $ | (692,461) | | | | | $ | (96,579) | | | |

| Other comprehensive loss: | | | | | | | | | | | |

| Foreign currency translation gains (losses), net | | | | | 10,465 | | | | | (6,592) | | | |

| Unrealized loss on derivatives | | | | | (151,255) | | | | | — | | | |

| Unrealized loss on derivatives from unconsolidated entities | | | | | (57,231) | | | | | (16,000) | | | |

| Other comprehensive loss | | | | | (198,021) | | | | | (22,592) | | | |

| Comprehensive loss | | | | | (890,482) | | | | | (119,171) | | | |

| Comprehensive loss attributable to non-controlling interests in third party joint ventures | | | | | 106,221 | | | | | 44,255 | | | |

| Comprehensive loss attributable to non-controlling interests in BREIT OP unit holders | | | | | 20,929 | | | | | 656 | | | |

| Comprehensive loss attributable to BREIT stockholders | | | | | $ | (763,332) | | | | | $ | (74,260) | | | |

| | | | | | | | | | | |

See accompanying notes to condensed consolidated financial statements.

| | |

Blackstone Real Estate Income Trust, Inc. Condensed Consolidated Statements of Changes in Equity (Unaudited) (in thousands, except per share data) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Par Value | | | | Accumulated

Other Comprehensive (Loss) Income | | Accumulated

Deficit and

Cumulative

Distributions | | | | Non-

controlling

Interests

Attributable

to Third Party

Joint Ventures | | Non-

controlling

Interests

Attributable

to BREIT OP

Unitholders | | |

| Common

Stock

Class S | | Common

Stock

Class I | | Common

Stock

Class T | | Common

Stock

Class D | | Common

Stock

Class C | | Additional

Paid-in

Capital | | | | Total

Stockholders'

Equity | | | | Total

Equity |

| Balance at December 31, 2022 | $ | 15,974 | | | $ | 23,947 | | | $ | 726 | | | $ | 4,214 | | | $ | — | | | $ | 53,212,494 | | | $ | 393,928 | | | $ | (9,196,019) | | | $ | 44,455,264 | | | $ | 4,278,895 | | | $ | 1,466,592 | | | $ | 50,200,751 | |

| Common stock issued (transferred) | 113 | | | 5,913 | | | (7) | | | (2,450) | | | 11 | | | 5,434,632 | | | — | | | — | | | 5,438,212 | | | — | | | — | | | 5,438,212 | |

| Reduction in accrual for offering costs, net | — | | | — | | | — | | | — | | | — | | | 336,413 | | | — | | | — | | | 336,413 | | | — | | | — | | | 336,413 | |

| Distribution reinvestment | 79 | | | 128 | | | 4 | | | 22 | | | — | | | 344,417 | | | — | | | — | | | 344,650 | | | — | | | — | | | 344,650 | |

| Common stock/units repurchased | (342) | | | (1,787) | | | (18) | | | (118) | | | — | | | (3,340,654) | | | — | | | — | | | (3,342,919) | | | — | | | (45,984) | | | (3,388,903) | |

| Amortization of compensation awards | — | | | 73 | | | — | | | — | | | — | | | 7,225 | | | — | | | — | | | 7,298 | | | — | | | 2,114 | | | 9,412 | |

| Net loss ($436 of net income allocated to redeemable non‑controlling interests) | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (601,055) | | | (601,055) | | | (73,096) | | | (18,746) | | | (692,897) | |

Other comprehensive loss ($235 of other comprehensive income allocated to redeemable non‑controlling interests) | — | | | — | | | — | | | — | | | — | | | — | | | (162,277) | | | — | | | (162,277) | | | (31,873) | | | (4,106) | | | (198,256) | |

| Distributions declared on common stock ($0.1663 gross per share) | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (719,445) | | | (719,445) | | | — | | | — | | | (719,445) | |

| Contributions from non-controlling interests | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 89,932 | | | 287,349 | | | 377,281 | |

| Distributions to and redemptions of non-controlling interests | — | | | — | | | — | | | — | | | — | | | 5,534 | | | — | | | — | | | 5,534 | | | (54,048) | | | (22,343) | | | (70,857) | |

| Allocation to redeemable non-controlling interests | — | | | — | | | — | | | — | | | — | | | (28,971) | | | — | | | — | | | (28,971) | | | — | | | — | | | (28,971) | |

| Balance at March 31, 2023 | $ | 15,824 | | | $ | 28,274 | | | $ | 705 | | | $ | 1,668 | | | $ | 11 | | | $ | 55,971,090 | | | $ | 231,651 | | | $ | (10,516,519) | | | $ | 45,732,704 | | | $ | 4,209,810 | | | $ | 1,664,876 | | | $ | 51,607,390 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Par Value | | | | Accumulated

Other Comprehensive Loss | | Accumulated Deficit and

Cumulative

Distributions | | | | Non-

controlling

Interests

Attributable

to Third Party

Joint Ventures | | Non-

controlling

Interests

Attributable

to BREIT OP

Unitholders | | |

| Common

Stock

Class S | | Common

Stock

Class I | | Common

Stock

Class T | | Common

Stock

Class D | | Additional

Paid-in

Capital | | | | Total

Stockholders'

Equity | | | | Total

Equity |

| Balance at December 31, 2021 | $ | 12,543 | | | $ | 20,865 | | | $ | 573 | | | $ | 2,911 | | | $ | 42,249,094 | | | (9,569) | | | $ | (5,631,014) | | | $ | 36,645,403 | | | $ | 1,744,256 | | | $ | 640,267 | | | $ | 39,029,926 | |

| Common stock issued | 1,699 | | | 3,279 | | | 78 | | | 479 | | | 8,000,740 | | | — | | | — | | | 8,006,275 | | | — | | | — | | | 8,006,275 | |

| Offering costs | — | | | — | | | — | | | — | | | (285,297) | | | — | | | — | | | (285,297) | | | — | | | — | | | (285,297) | |

| Distribution reinvestment | 74 | | | 116 | | | 4 | | | 18 | | | 307,088 | | | — | | | — | | | 307,300 | | | — | | | — | | | 307,300 | |

| Common stock/units repurchased | (52) | | | (807) | | | (4) | | | (9) | | | (1,254,562) | | | — | | | — | | | (1,255,434) | | | — | | | (8,172) | | | (1,263,606) | |

| Amortization of compensation awards | — | | | 40 | | | — | | | — | | | 3,977 | | | — | | | — | | | 4,017 | | | — | | | 5,768 | | | 9,785 | |

| Net loss ($1,195 allocated to redeemable non-controlling interests) | — | | | — | | | — | | | — | | | — | | | — | | | (51,668) | | | (51,668) | | | (39,947) | | | (3,769) | | | (95,384) | |

| Other comprehensive loss | — | | | — | | | — | | | — | | | — | | | (22,592) | | | — | | | (22,592) | | | — | | | — | | | (22,592) | |

| Distributions declared on common stock ($0.1662 gross per share) | — | | | — | | | — | | | — | | | — | | | — | | | (617,477) | | | (617,477) | | | — | | | — | | | (617,477) | |

| Contributions from non-controlling interests | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 836 | | | 520,160 | | | 520,996 | |

| Distributions to and redemptions of non-controlling interests | — | | | — | | | — | | | — | | | (4,029) | | | — | | | — | | | (4,029) | | | (24,638) | | | (15,479) | | | (44,146) | |

| Allocation to redeemable non-controlling interests | — | | | — | | | — | | | — | | | (35,702) | | | — | | | — | | | (35,702) | | | — | | | — | | | (35,702) | |

| Balance at March 31, 2022 | $ | 14,264 | | | $ | 23,493 | | | $ | 651 | | | $ | 3,399 | | | $ | 48,981,309 | | | $ | (32,161) | | | $ | (6,300,159) | | | $ | 42,690,796 | | | $ | 1,680,507 | | | $ | 1,138,775 | | | $ | 45,510,078 | |

See accompanying notes to condensed consolidated financial statements.

| | |

Blackstone Real Estate Income Trust, Inc. Condensed Consolidated Statements of Cash Flows (Unaudited) (in thousands) |

| | | | | | | | | | | | | |

| | Three Months Ended March 31, |

| | 2023 | | 2022 | | |

| Cash flows from operating activities: | | | | | |

| Net loss | $ | (692,461) | | | $ | (96,579) | | | |

| Adjustments to reconcile net loss to net cash provided by operating activities: | | | | | |

| Management fee | 221,138 | | | 189,150 | | | |

| Performance participation allocation | — | | | 411,569 | | | |

| Impairment of investments in real estate | 12,499 | | | — | | | |

| Depreciation and amortization | 999,385 | | | 915,051 | | | |

| Net gain on dispositions of real estate | (121,003) | | | (205,262) | | | |

| Loss (gain) on extinguishment of debt | 5,258 | | | (1,395) | | | |

| Unrealized loss (gain) on fair value of financial instruments | 635,715 | | | (175,457) | | | |

| Realized gain on sale of real estate-related equity securities | — | | | (240,694) | | | |

| Income from unconsolidated entities | (444,658) | | | (184,225) | | | |

| Distributions of earnings from unconsolidated entities | 28,385 | | | 69,570 | | | |

| Other items | 85,909 | | | 17,000 | | | |

| Change in assets and liabilities: | | | | | |

| (Increase) decrease in other assets | (89,240) | | | (79,263) | | | |

| Increase in due to affiliates | 1,943 | | | 3,281 | | | |

| Increase (decrease) in other liabilities | (77,023) | | | 77 | | | |

| Net cash provided by operating activities | 565,847 | | | 622,823 | | | |

| Cash flows from investing activities: | | | | | |

| Acquisitions of real estate | (34,795) | | | (2,221,780) | | | |

| Capital improvements to real estate | (350,472) | | | (196,224) | | | |

| Proceeds from disposition of real estate | 773,552 | | | 571,225 | | | |

| Refunds of pre-acquisition costs/deposits | 12,959 | | | 37,692 | | | |

| Investment in unconsolidated entities | (161,132) | | | (551,580) | | | |

| Dispositions of and return of capital from unconsolidated entities | 1,261,299 | | | 15,954 | | | |

| Purchase of investments in real estate debt | (81,141) | | | (1,414,261) | | | |

| Proceeds from consolidation of previously unconsolidated entities | 16,550 | | | — | | | |

| Proceeds from sale/repayment of investments in real estate debt | 295,944 | | | 412,323 | | | |

| Purchase of real estate-related equity securities | (376) | | | (1,045,329) | | | |

| Proceeds from sale of real estate-related equity securities | — | | | 967,347 | | | |

| Proceeds from repayments of real estate loans held by consolidated securitization vehicles | 53,233 | | | 444,831 | | | |

| | | | | |

| Payments on settlement of derivative contracts | (2,803) | | | — | | | |

| Collateral posted under derivative contracts | (3,848) | | | — | | | |

| Net cash provided by (used in) investing activities | 1,778,970 | | | (2,979,802) | | | |

| Cash flows from financing activities: | | | | | |

| Proceeds from issuance of common stock | 4,941,929 | | | 5,952,091 | | | |

| Offering costs paid | (61,255) | | | (72,157) | | | |

| Subscriptions received in advance | 137,687 | | | 1,843,583 | | | |

| Repurchase of common stock | (2,827,722) | | | (965,715) | | | |

| | | | | |

| Borrowings under mortgage notes, secured term loans, and secured revolving credit facilities | 822,020 | | | 2,442,063 | | | |

| Repayments of mortgage notes, secured term loans, and secured revolving credit facilities | (3,792,768) | | | (2,699,283) | | | |

| Borrowings under secured financings of investments in real estate debt | 58,801 | | | 541,821 | | | |

| Repayments of secured financings of investments in real estate debt | (154,623) | | | (674,264) | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Payment of deferred financing costs | (42,457) | | | (26,514) | | | |

| Contributions from redeemable non-controlling interest | 50 | | | — | | | |

| Distributions to and redemption of redeemable non-controlling interest | (1,877) | | | (26,639) | | | |

| Redemption of affiliate service provider incentive compensation awards | (38) | | | — | | | |

| Contributions from non-controlling interests | 7,564 | | | 30,644 | | | |

| Distributions to and redemptions of non-controlling interests | (82,141) | | | (47,060) | | | |

| Distributions | (365,054) | | | (280,278) | | | |

| | | | | |

| Repayments of senior obligations of consolidated securitization vehicles | (50,858) | | | (473,731) | | | |

| Net cash (used in) provided by financing activities | (1,410,742) | | | 5,544,561 | | | |

| Net change in cash and cash equivalents and restricted cash | 934,075 | | | 3,187,582 | | | |

| Cash, cash equivalents and restricted cash, beginning of year | 2,254,492 | | | 3,418,581 | | | |

| Effects of foreign currency translation on cash, cash equivalents and restricted cash | (53) | | | (1,944) | | | |

| Cash, cash equivalents and restricted cash, end of year | $ | 3,188,514 | | | $ | 6,604,219 | | | |

| | | | | |

| Reconciliation of cash, cash equivalents and restricted cash to the consolidated balance sheets: | | | | | |

| Cash and cash equivalents | $ | 2,368,212 | | | $ | 3,824,779 | | | |

| Restricted cash | 820,302 | | | 2,779,440 | | | |

| Total cash, cash equivalents and restricted cash | $ | 3,188,514 | | | $ | 6,604,219 | | | |

| | | | | | | | | | | | | |

| | | | | |

| | | | | |

| Non-cash investing and financing activities: | | | | | |

| Assumption of mortgage notes in conjunction with acquisitions of real estate | $ | — | | | $ | 235,772 | | | |

| Assumption of other assets and liabilities in conjunction with acquisitions of real estate | $ | 6,757 | | | $ | 32,676 | | | |

| Issuance of BREIT OP units as consideration for acquisitions of real estate and purchases of non-controlling interests | $ | — | | | $ | 79,577 | | | |

| | | | | |

| | | | | |

| | | | | |

| Accrued pre-acquisition costs | $ | — | | | $ | 15 | | | |

| Accrued capital expenditures and acquisition related costs | $ | — | | | $ | 6,326 | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Accrued distributions | $ | 10,529 | | | $ | 31,865 | | | |

| Decrease in accrued stockholder servicing fee due to affiliate | $ | 398,094 | | | $ | — | | | |

| Accrued stockholder servicing fee due to affiliate | $ | — | | | $ | 217,595 | | | |

| Redeemable non-controlling interest issued as settlement of performance participation allocation | $ | — | | | $ | 67,233 | | | |

| Issuance of class I shares for payment of management fee | $ | 219,860 | | | $ | 179,068 | | | |

| | | | | |

| Exchange of redeemable non-controlling interest for Class I or Class C shares | $ | 65,313 | | | $ | 128,205 | | | |

| Exchange of redeemable non-controlling interest for Class I or Class B units | $ | 278,990 | | | $ | 434,717 | | | |

| | | | | |

| Allocation to redeemable non-controlling interest | $ | 28,971 | | | $ | 35,702 | | | |

| Distribution reinvestment | $ | 344,650 | | | $ | 307,300 | | | |

| Accrued common stock repurchases | $ | 694,720 | | | $ | 393,509 | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Receivable for proceeds from disposition of real estate | $ | 1,373 | | | $ | — | | | |

| | | | | |

| Net increase in additional paid-in capital resulting from purchases of non-controlling interest | $ | 6,709 | | | $ | — | | | |

| Consolidation of securitization vehicles | $ | — | | | $ | 427,771 | | | |

| | | | | |

| | | | | |

| Increases (Decreases) in assets and liabilities resulting from consolidation of previously unconsolidated entities: | | | | | |

| Investments in real estate, net | $ | 252,808 | | | $ | — | | | |

| Other assets | $ | (9,132) | | | $ | — | | | |

| Mortgage notes, net | $ | 101,494 | | | $ | — | | | |

| Other liabilities | $ | 21,190 | | | $ | — | | | |

| Non-controlling interests attributable to third party joint ventures | $ | 84,387 | | | $ | — | | | |

| | | | | |

See accompanying notes to condensed consolidated financial statements.

Blackstone Real Estate Income Trust, Inc.

Notes to Condensed Consolidated Financial Statements (Unaudited)

1. Organization and Business Purpose

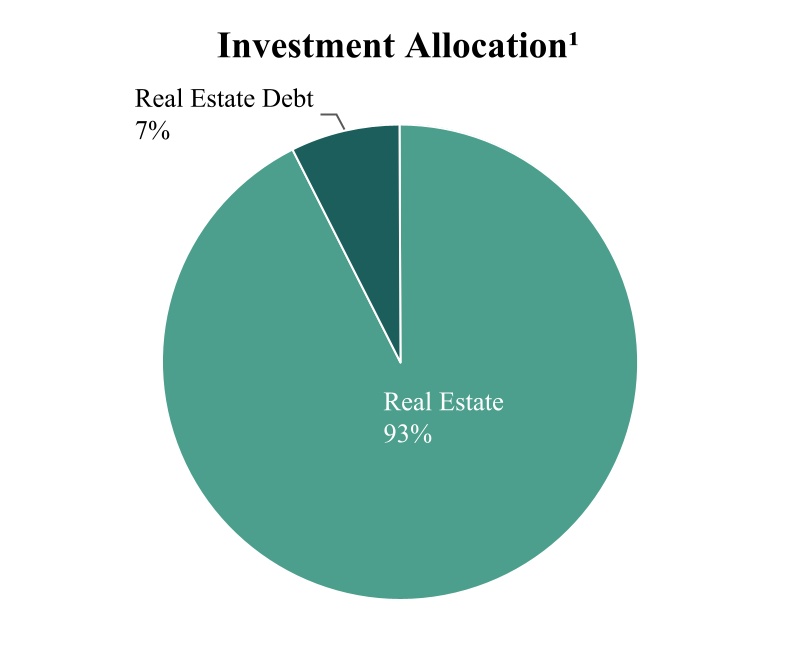

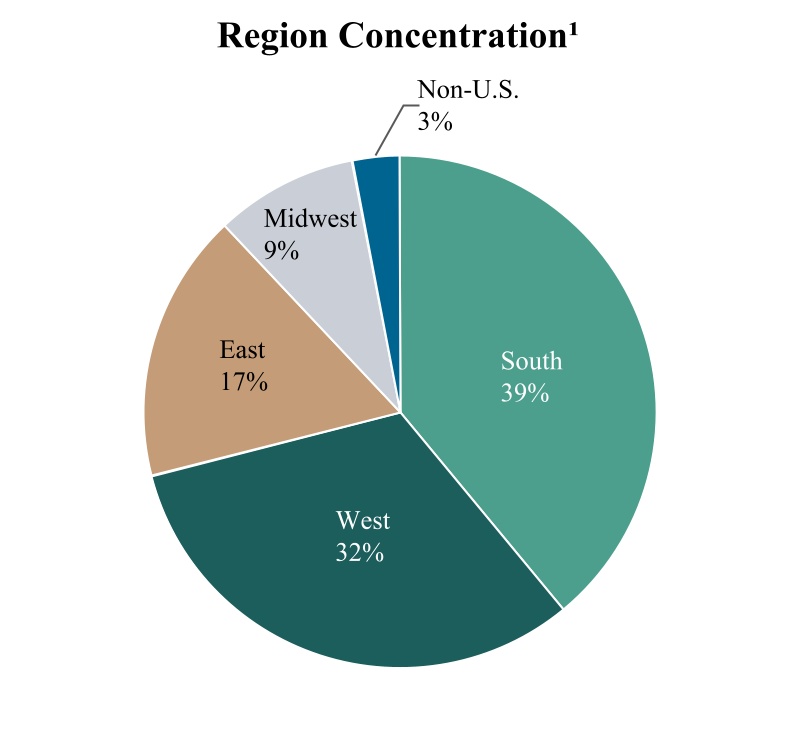

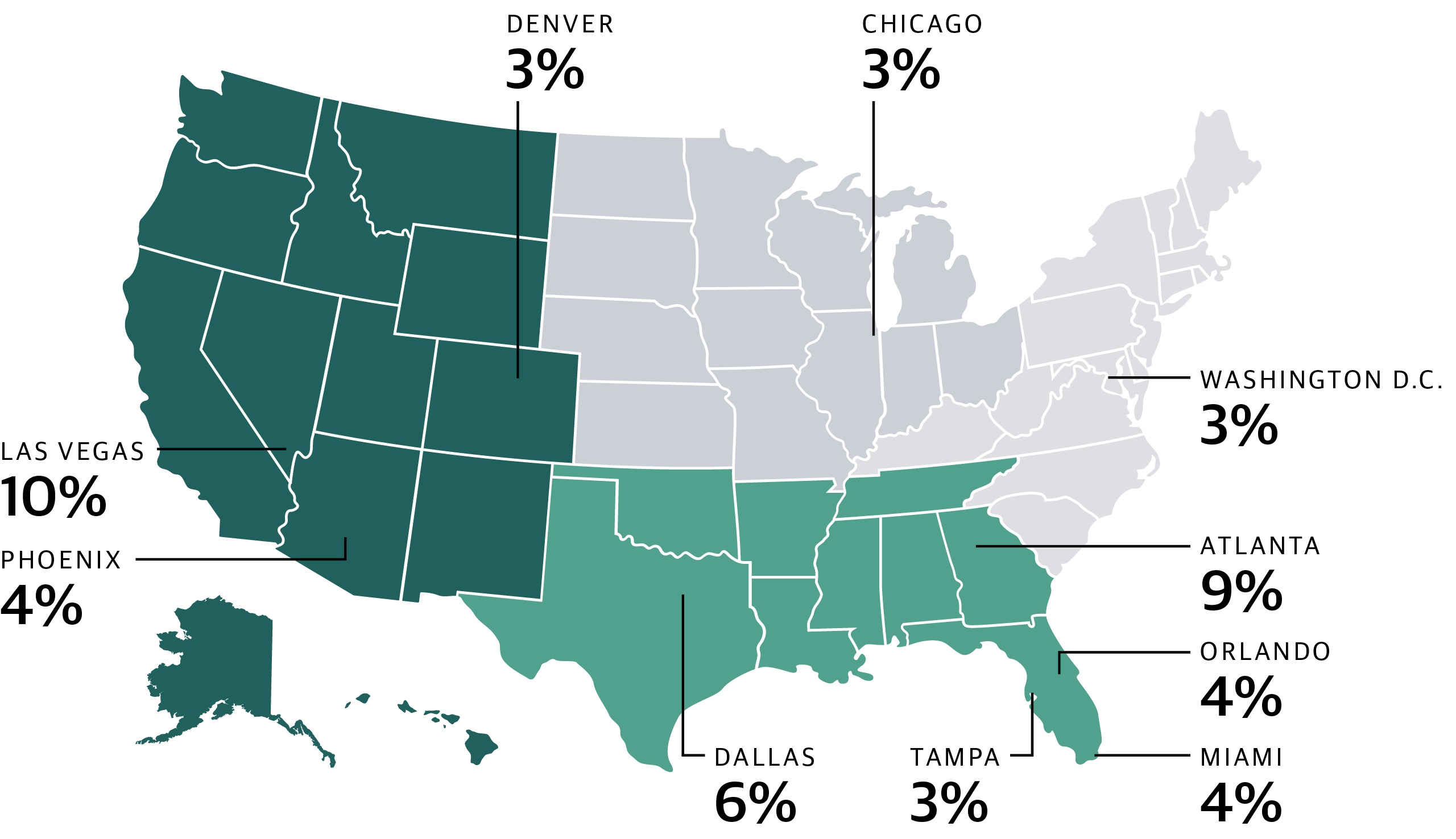

Blackstone Real Estate Income Trust, Inc. (“BREIT” or the “Company”) invests primarily in stabilized income-generating commercial real estate in the United States and, to a lesser extent, outside the United States. The Company to a lesser extent invests in real estate debt investments. The Company is the sole general partner and majority limited partner of BREIT Operating Partnership L.P., a Delaware limited partnership (“BREIT OP”). BREIT Special Limited Partner L.P. (the “Special Limited Partner”), a wholly-owned subsidiary of Blackstone Inc. (together with its affiliates, “Blackstone”), owns a special limited partner interest in BREIT OP. Substantially all of the Company’s business is conducted through BREIT OP. The Company and BREIT OP are externally managed by BX REIT Advisors L.L.C. (the “Adviser”). The Adviser is part of the real estate group of Blackstone, a leading global investment manager. The Company was formed on November 16, 2015 as a Maryland corporation and qualifies as a real estate investment trust (“REIT”) for U.S. federal income tax purposes.

The Company registered an offering with the Securities and Exchange Commission (the “SEC”) of up to $60.0 billion in shares of common stock, consisting of up to $48.0 billion in shares in its primary offering and up to $12.0 billion in shares pursuant to its distribution reinvestment plan, which the Company began using to offer shares of its common stock in March 2022 (the “Current Offering”). As of March 31, 2023, the Company had received aggregate net proceeds of $72.0 billion from selling shares of the Company’s common stock through the Current Offering, prior offerings registered with the SEC, and in unregistered private offerings. The Company intends to sell any combination of four classes of shares of its common stock, with a dollar value up to the maximum aggregate amount of the Current Offering. The share classes have different upfront selling commissions, dealer manager fees and ongoing stockholder servicing fees. The Company intends to continue selling shares on a monthly basis.

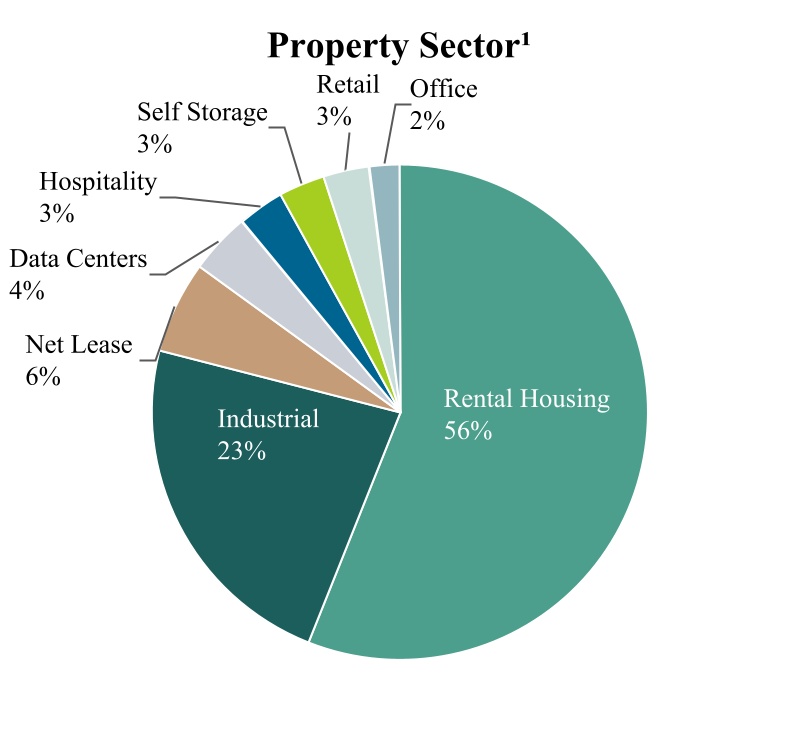

As of March 31, 2023, the Company owned 5,113 properties and 28,616 single family rental homes. The Company currently operates in nine reportable segments: Rental Housing, Industrial, Net Lease, Data Centers, Hospitality, Self Storage, Retail, and Office properties, and Investments in Real Estate Debt. Rental Housing includes multifamily and other types of rental housing such as manufactured, student, affordable and single family rental housing, as well as senior living. Net Lease includes the real estate assets of The Bellagio Las Vegas (the “Bellagio”) and The Cosmopolitan of Las Vegas (the “Cosmopolitan”). Financial results by segment are reported in Note 16 — Segment Reporting.

2. Summary of Significant Accounting Policies

Basis of Presentation

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) for interim financial information and the instructions to Form 10-Q and Rule 10-01 of Regulation S-X. The condensed consolidated financial statements, including the condensed notes thereto, are unaudited and exclude some of the disclosures required in audited financial statements. Management believes it has made all necessary adjustments, consisting of only normal recurring items, so that the condensed consolidated financial statements are presented fairly and that estimates made in preparing the Company’s condensed consolidated financial statements are reasonable and prudent. The accompanying unaudited condensed consolidated interim financial statements should be read in conjunction with the audited consolidated financial statements included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022 filed with the SEC.

The accompanying condensed consolidated financial statements include the accounts of the Company, the Company’s subsidiaries, and joint ventures in which the Company has a controlling financial interest. All intercompany balances and transactions have been eliminated in consolidation.

Certain amounts in the Company’s prior period Condensed Consolidated Statements of Operations included in interest expense of $39.8 million for the three months ended March 31, 2022 have been reclassified to income from interest rate derivatives to conform to the current period presentation. Additionally, certain amounts in the Company’s prior period Condensed Consolidated Statements of Operations included in other income (expense) of $636.0 million for the three months ended March 31, 2022 have been reclassified to income from interest rate derivatives to conform to the current period presentation.

Principles of Consolidation

The Company consolidates all entities in which it has a controlling financial interest through majority ownership or voting rights and variable interest entities whereby the Company is the primary beneficiary. In determining whether the Company has a controlling financial interest in a partially owned entity and the requirement to consolidate the accounts of that entity, the Company considers whether the entity is a variable interest entity (“VIE”) and whether it is the primary beneficiary. The Company is the primary beneficiary of a VIE when it has (i) the power to direct the most significant activities impacting the economic performance of the VIE and (ii) the obligation to absorb losses or receive benefits significant to the VIE. Entities that do not qualify as VIEs are generally considered voting interest entities (“VOEs”) and are evaluated for consolidation under the voting interest model. VOEs are consolidated when the Company controls the entity through a majority voting interest or other means.

When the requirements for consolidation are not met and the Company has significant influence over the operations of the entity, the investment is accounted for under the equity method of accounting. Investments in unconsolidated entities for which the Company has not elected a fair value option are initially recorded at cost and subsequently adjusted for the Company’s pro-rata share of net income, contributions and distributions. When the Company elects the fair value option (“FVO”), the Company records its share of net asset value of the entity and any related unrealized gains and losses.

BREIT OP and each of the Company’s joint ventures are considered to be a VIE or VOE. The Company consolidates these entities, excluding certain investments in unconsolidated entities, because it has the ability to direct the most significant activities of the entities such as purchases, dispositions, financings, budgets, and overall operating plans.

For consolidated joint ventures, the non-controlling partner’s share of the assets, liabilities, and operations of each joint venture is included in non-controlling interests as equity of the Company. The non-controlling partner’s interest is generally computed as the joint venture partner’s ownership percentage. Certain of the joint ventures formed by the Company provide the other partner a profits interest based on certain internal rate of return hurdles being achieved. Any profits interest due to the other partner is reported within non-controlling interests.

The Company owns certain subordinate securities in CMBS securitizations that give the Company certain rights with respect to the underlying loans that serve as collateral for the CMBS securitization. In particular, these subordinate securities typically give the holder the right to direct certain activities of the securitization on behalf of all securityholders, which could impact the securitization's overall economic performance. Such rights, along with the obligation to absorb losses and receive benefits from the ownership of the subordinate securities, require consolidation of these securitizations, which are considered VIEs under GAAP.

As of March 31, 2023, the total assets and liabilities of the Company’s consolidated VIEs, excluding BREIT OP, were $51.8 billion and $37.7 billion, respectively, compared to $52.1 billion and $37.8 billion as of December 31, 2022. Such amounts are included on the Company’s Condensed Consolidated Balance Sheets.

Adjustment to Prior Period Financial Statements

In connection with the preparation of the Company’s condensed consolidated financial statements for the period ended June 30, 2022, the Company determined that it should have consolidated certain securitization vehicles in previously issued financial statements. These consolidations result from certain subordinate securities that the Company owns in CMBS securitizations (such securities, “Controlling Class Securities”) as part of its portfolio of investments in real estate debt. These Controlling Class Securities typically give the Company the right to direct certain activities of the securitization on behalf of all securityholders, which could impact the securitization's overall economic performance. Under GAAP, the presence of such rights, along with the obligation to absorb losses and receive benefits from the ownership of the Controlling Class Securities, require the Company to consolidate these securitizations, which are considered VIEs.

See Principles of Consolidation section above for further discussion of VIEs. As discussed further below, consolidation of these securitizations results in (i) a gross presentation of the Company’s Condensed Consolidated Balance Sheets, (ii) the reclassification of the change in net assets of the securitization vehicles on the Company’s Condensed Consolidated Statements of Operations, and (iii) the gross presentation of securitization vehicles on the Company's Condensed Consolidated Statements of Cash Flows, but has no impact on the economic exposure or performance of the Company.

The consolidation of these securitizations results in the inclusion of the underlying collateral loans as assets on the Company’s Condensed Consolidated Balance Sheets and the inclusion of the senior CMBS positions owned by third-parties as liabilities on the Company’s Condensed Consolidated Balance Sheets. Additionally, the change in net assets of the consolidated securitization vehicles during a given period is presented separately on the Company’s Condensed Consolidated Statements of Operations, whereas it was previously included in income from investments in real estate debt. The Company’s Condensed Consolidated Statements of Cash Flows includes the consolidation of the securitization vehicles as a non-cash item, the subsequent repayments of consolidated loans and related CMBS positions are presented on a gross basis, and the Company's purchases and sales of non-controlling securities in consolidated securitization vehicles are reclassed from investing activities to financing activities. There is no impact from consolidation on the Company’s total equity, net income, cash flows from operating activities, or net cash flows.

Further, the assets of any particular consolidated securitization can only be used to satisfy the liabilities of that securitization and such assets are not available to the Company for any other purpose. Similarly, the senior CMBS obligations of these securitizations can only be satisfied through repayment of the underlying collateral loans, as they do not have any recourse to the Company or its assets, nor has the Company provided any guarantees with respect to the performance or repayment of the senior CMBS obligations. Accordingly, while consolidation of the securitizations increases the gross presentation of the Company’s Condensed Consolidated Balance Sheets, it does not change the economic exposure or performance of the Company, which remains limited to that of the actual CMBS securities that it holds directly and not the consolidated securitized loans.

The following tables detail the immaterial adjustments to the Company’s previously issued condensed consolidated financial statements to reflect the consolidation of these securitizations at such time, which presentation is comparable to the Company’s condensed consolidated financial statements as of March 31, 2023.

The following table details the adjustments to the Company's Condensed Consolidated Statements of Operations ($ in thousands):

| | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, 2022 |

| As Reported | | Adjustment | | As Adjusted |

| Other income (expense) | | | | | |

| Loss from investments in real estate debt | $ | (34,044) | | | $ | 15,674 | | | $ | (18,370) | |

| Change in net assets of consolidated securitization vehicles | — | | | (15,674) | | | (15,674) | |

| Total other income (expense) | 583,682 | | | — | | | 583,682 | |

| Net Loss | $ | (96,579) | | | $ | — | | | $ | (96,579) | |

The following table details the adjustments to the Company's Condensed Consolidated Statements of Cash Flows ($ in thousands):

| | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, 2022 |

| As Reported | | Adjustment | | As Adjusted |

| Cash flows from investing activities: | | | | | |

| Purchase of investments in real estate debt | $ | (1,483,788) | | | $ | 69,527 | | | $ | (1,414,261) | |

| Proceeds from sale/repayment of investments in real estate debt | 452,950 | | | (40,627) | | | 412,323 | |

| Proceeds from paydowns of real estate loans held by consolidated securitization vehicles | — | | | 444,831 | | | 444,831 | |

| Net cash used in investing activities | (3,453,533) | | | 473,731 | | | (2,979,802) | |

| Cash flows from financing activities: | | | | | |

| | | | | |

| Repayment of senior obligations of consolidated securitization vehicles | — | | | (473,731) | | | (473,731) | |

| Net cash provided by financing activities | $ | 6,018,292 | | | $ | (473,731) | | | $ | 5,544,561 | |

| Non-cash investing and financing activities: | | | | | |

| Consolidation of securitization vehicles | $ | — | | | $ | 427,771 | | | $ | 427,771 | |

| Deconsolidation of securitization vehicles | $ | — | | | $ | — | | | $ | — | |

Use of Estimates

The preparation of consolidated financial statements in conformity with GAAP requires the Company to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as of the date of the consolidated financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results may ultimately differ materially from those estimates.

Fair Value Measurements

Under normal market conditions, the fair value of an investment is the amount that would be received to sell an asset or transfer a liability in an orderly transaction between market participants at the measurement date (i.e., the exit price). The Company uses a hierarchical framework that prioritizes and ranks the level of market price observability used in measuring investments at fair value. Market price observability is impacted by a number of factors, including the type of investment and the characteristics specific to the investment, and the state of the marketplace, including the existence and transparency of transactions between market participants. Investments with readily available actively quoted prices or for which fair value can be measured from actively quoted prices generally will have a higher degree of market price observability and a lesser degree of judgment used in measuring fair value.

Investments measured and reported at fair value are classified and disclosed in one of the following levels within the fair value hierarchy:

Level 1 — quoted prices are available in active markets for identical investments as of the measurement date. The Company does not adjust the quoted price for these investments.

Level 2 — quoted prices are available in markets that are not active or model inputs are based on inputs that are either directly or indirectly observable as of the measurement date.

Level 3 — pricing inputs are unobservable and include instances where there is minimal, if any, market activity for the investment. These inputs require significant judgment or estimation by management or third parties when determining fair value and generally represent anything that does not meet the criteria of Levels 1 and 2. Due to the inherent uncertainty of these estimates, these values may differ materially from the values that would have been used had a ready market for these investments existed.

Valuation of assets and liabilities measured at fair value

The Company’s investments in real estate debt are reported at fair value. As of March 31, 2023 and December 31, 2022, the Company’s investments in real estate debt, directly or indirectly, consisted of commercial mortgage backed securities (“CMBS”) and residential mortgage-backed securities (“RMBS”), which are securities backed by one or more mortgage loans secured by real estate assets, as well as corporate bonds, term loans, mezzanine loans, and other investments in debt issued by real estate-related companies or secured by real estate assets. The Company generally determines the fair value of its investments in real estate debt by utilizing third-party pricing service providers whenever available.

In determining the fair value of a particular investment, pricing service providers may use broker-dealer quotations, reported trades or valuation estimates from their internal pricing models to determine the reported price. The pricing service providers’ internal models for securities such as real estate debt generally consider the attributes applicable to a particular class of the security (e.g., credit rating, seniority), current market data, and estimated cash flows for each security, and incorporate specific collateral performance, as applicable.

Certain of the Company’s investments in real estate debt, such as mezzanine loans and other investments, are unlikely to have readily available market quotations. In such cases, the Company will generally determine the initial value based on the acquisition price of such investment if acquired by the Company or the par value of such investment if originated by the Company. Following the initial measurement, the Company will determine fair value by utilizing or reviewing certain of the following (i) market yield data, (ii) discounted cash flow modeling, (iii) collateral asset performance, (iv) local or macro real estate performance, (v) capital market conditions, (vi) debt yield or loan-to-value ratios, and (vii) borrower financial condition and performance. Refer to Note 5 for additional details on the Company’s investments in real estate debt.

The Company has elected to apply the measurement alternative under GAAP and measures both the financial assets and financial liabilities of the CMBS securitizations it consolidates using the fair value of the financial liabilities, which it considers more observable than the fair value of the financial assets.

The Company’s investments in equity securities of public and private real estate-related companies are reported at fair value. In determining the fair value of public equity securities, the Company utilizes the closing price of such securities in the principal market in which the security trades (Level 1 inputs). The Company’s investment in a preferred equity security is reflected at its fair value as of March 31, 2023 (Level 2 inputs). In determining the fair value, the Company utilizes inputs such as stock volatility, discount rate, and risk-free interest rate. The Company’s investment in a private real estate company is reflected at its fair value as of March 31, 2023 (Level 3 inputs). To determine the fair value, the Company utilizes inputs such as the multiples of comparable companies and select financial statement metrics. As of both March 31, 2023 and December 31, 2022, the Company’s $0.5 billion of equity securities were recorded as a component of Other Assets on the Company’s Condensed Consolidated Balance Sheets.

The resulting unrealized and realized gains and losses from investments in equity securities of public and private real estate-related companies are recorded as a component of Other Expense on the Company’s Condensed Consolidated Statements of Operations. During the three months ended March 31, 2023 and March 31, 2022, the Company recognized $3.7 million of net unrealized loss and $125.4 million of net unrealized/realized loss, respectively, on its investments in equity securities.

The Company has elected the FVO for certain of its investments in unconsolidated entities and therefore, reports these investments at fair value. The Company separately values the assets and liabilities of the investments in unconsolidated entities. To determine the fair value of the real estate assets of the investments in unconsolidated entities, the Company utilizes a discounted cash flow methodology or market comparable methodology, taking into consideration various factors including discount rate, exit capitalization rate and multiples of comparable companies. The Company determines the fair value of the indebtedness of the investments in unconsolidated entities by modeling the cash flows required by the debt agreements and discounting them back to the present value using weighted average cost of capital. Additionally, the Company considers current market rates and conditions by evaluating similar borrowing agreements with comparable loan-to-value ratios and credit profiles. After the fair value of the assets and liabilities are determined, the Company applies its ownership interest to the net asset value and reflects this amount as its investments in unconsolidated entities at fair value. The inputs used in determining the Company’s investments in unconsolidated entities carried at fair value are considered Level 3.

The Company’s derivative financial instruments are reported at fair value. As of March 31, 2023 and December 31, 2022, the Company’s derivative financial instruments consisted of foreign currency and interest rate contracts. The fair values of the Company's foreign currency and interest rate contracts were estimated using advice from a third-party derivative specialist, based on contractual cash flows and observable inputs comprising yield curves, foreign currency rates and credit spreads (Level 2 inputs).

The following table details the Company’s assets and liabilities measured at fair value on a recurring basis ($ in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| March 31, 2023 | | December 31, 2022 |

| Level 1 | | Level 2 | | Level 3 | | Total | | Level 1 | | Level 2 | | Level 3 | | Total |

| Assets: | | | | | | | | | | | | | | | |

| Investments in real estate debt | $ | — | | | $ | 6,355,326 | | | $ | 1,465,077 | | | $ | 7,820,403 | | | $ | — | | | $ | 6,460,520 | | | $ | 1,541,183 | | | $ | 8,001,703 | |

| Real estate loans held by consolidated securitization vehicles, at fair value | — | | | 16,948,146 | | | — | | | 16,948,146 | | | — | | | 17,030,387 | | | — | | | 17,030,387 | |

| Equity securities | 53,152 | | | 249,199 | | | 224,408 | | | 526,759 | | | 52,512 | | | 253,199 | | | 224,408 | | | 530,119 | |

| Investments in unconsolidated entities | — | | | — | | | 5,032,399 | | | 5,032,399 | | | — | | | — | | | 4,947,251 | | | 4,947,251 | |

Interest rate and foreign currency hedging derivatives(1) | — | | | 2,249,220 | | | — | | | 2,249,220 | | | — | | | 3,033,595 | | | — | | | 3,033,595 | |

| Total | $ | 53,152 | | | $ | 25,801,891 | | | $ | 6,721,884 | | | $ | 32,576,927 | | | $ | 52,512 | | | $ | 26,777,701 | | | $ | 6,712,842 | | | $ | 33,543,055 | |

| | | | | | | | | | | | | | | |

| Liabilities: | | | | | | | | | | | | | | | |

| Senior obligations of consolidated securitization vehicles, at fair value | $ | — | | | $ | 15,214,633 | | | $ | — | | | $ | 15,214,633 | | | $ | — | | | $ | 15,288,598 | | | $ | — | | | $ | 15,288,598 | |

Interest rate and foreign currency hedging derivatives(2) | — | | | 50,162 | | | — | | | 50,162 | | | — | | | 50,557 | | | — | | | 50,557 | |

| Total | $ | — | | | $ | 15,264,795 | | | $ | — | | | $ | 15,264,795 | | | $ | — | | | $ | 15,339,155 | | | $ | — | | | $ | 15,339,155 | |

(1)Included in Other Assets in the Company’s Condensed Consolidated Balance Sheets.

(2)Included in Other Liabilities in the Company’s Condensed Consolidated Balance Sheets.

The following table details the Company’s assets and liabilities measured at fair value on a recurring basis using Level 3 inputs ($ in thousands): | | | | | | | | | | | | | | | | | | | | | | | |

| Investments in

Real Estate Debt | | Equity Securities | | Investments in

Unconsolidated Entities | | Total Assets |

| Balance as of December 31, 2022 | $ | 1,541,183 | | | $ | 224,408 | | | $ | 4,947,251 | | | $ | 6,712,842 | |

| Purchases and contributions | 17,775 | | | — | | | 17,975 | | | 35,750 | |

| Sales and repayments | (111,131) | | | — | | | — | | | (111,131) | |

| Distributions received | — | | | — | | | (8,747) | | | (8,747) | |

| Included in net income | | | | | | | |

| Income from unconsolidated entities measured at fair value | — | | | — | | | 75,920 | | | 75,920 | |

| | | | | | | |

| Realized income included in income (loss) from investments in real estate debt | 583 | | | — | | | — | | | 583 | |

| Unrealized gain included in income (loss) from investments in real estate debt | 16,667 | | | — | | | — | | | 16,667 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Balance as of March 31, 2023 | $ | 1,465,077 | | | $ | 224,408 | | | $ | 5,032,399 | | | $ | 6,721,884 | |

The following tables contain the quantitative inputs and assumptions used for items categorized in Level 3 of the fair value hierarchy ($ in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| March 31, 2023 | | |

| | Fair Value | | Valuation Technique | | Unobservable Inputs | | Weighted Average Rate | | Impact to Valuation from an Increase in Input | | |

| Assets | | | | | | | | | | | |

| Investments in real estate loans | $ | 1,465,077 | | | Yield Method | | Market Yield | | 10.1% | | Decrease | | |

| Equity securities | $ | 224,408 | | | Market comparable | | Enterprise Value/

Stabilized EBITDA Multiple | | 18.5x | | Increase | | |

| Investments in unconsolidated entities | $ | 4,493,715 | | | Discounted cash flow | | Discount Rate | | 6.8% | | Decrease | | |

| | | | | Exit Capitalization Rate | | 5.1% | | Decrease | | |

| | | | | | Weighted Average Cost of Capital | | 8.8% | | Decrease | | |

| $ | 538,684 | | | Market comparable | | LTM EBITDA Multiple | | 10.8x | | Increase | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | December 31, 2022 | | |

| | Fair Value | | Valuation Technique | | Unobservable Inputs | | Weighted Average Rate | | Impact to Valuation from an Increase in Input | | |

| Assets | | | | | | | | | | | |

| Investments in real estate loans | $ | 1,541,183 | | | Yield Method | | Market Yield | | 9.6% | | Decrease | | |

| Equity securities | $ | 224,408 | | | Market comparable | | Enterprise Value/

Stabilized EBITDA Multiple | | 18.5x | | Increase | | |

| Investments in unconsolidated entities | $ | 4,399,935 | | | Discounted cash flow | | Discount Rate | | 6.8% | | Decrease | | |

| | | | | Exit Capitalization Rate | | 4.9% | | Decrease | | |

| | | | | Weighted Average Cost of Capital | | 8.3% | | Decrease | | |

| $ | 547,316 | | | Market comparable | | LTM EBITDA Multiple | | 10.8x | | Increase | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Valuation of assets measured at fair value on a nonrecurring basis

Certain of the Company’s assets are not measured at fair value on an ongoing basis but are subject to fair value adjustments, such as when there is evidence of impairment, and therefore measured at fair value on a nonrecurring basis. The Company reviews its real estate properties for impairment each quarter or when there is an event or change in circumstances that could indicate the carrying amount of the real estate value may not be recoverable.

During the three months ended March 31, 2023, the Company recognized an impairment of $12.5 million related to its held-for-sale real estate investments. The fair value of such held-for-sale real estate investments as of March 31, 2023 was $36.9 million and was primarily based on the sale price per the binding executed contracts, which are considered a Level 2 input. Refer to Note 3 for additional details of the impairments.

Valuation of liabilities not measured at fair value

As of both March 31, 2023 and December 31, 2022, the fair value of the Company’s mortgage notes, secured term loans, secured revolving credit facilities, secured financings on investments in real estate debt, and unsecured revolving credit facilities was $1.4 billion below carrying value. Fair value of the Company’s indebtedness is estimated by modeling the cash flows required by the Company’s debt agreements and discounting them back to the present value using an estimated market yield. Additionally, the Company considers current market rates and conditions by evaluating similar borrowing agreements with comparable loan-to-value ratios and credit profiles. The inputs used in determining the fair value of the Company’s indebtedness are considered Level 3.

Stock-Based Compensation

The Company’s stock-based compensation consists of incentive compensation awards issued to certain employees of affiliate portfolio company service providers and certain employees of Simply Self Storage, Home Partners of America (“HPA”), and April Housing, all of which are indirect, wholly-owned subsidiaries of BREIT. Such awards vest over the life of the awards and stock-based compensation expense is recognized for these awards on a graded vesting attribution method over the applicable vesting period of each award, based on the value of the awards on their grant date, as adjusted for forfeitures. The awards are subject to service periods ranging from three to four years. The vesting conditions that are based on the Company achieving certain returns over a stated hurdle amount are considered market conditions. The achievement of returns over the stated hurdle amounts, which affect the quantity of awards that vest, is considered a performance condition. If the Company determines it is probable that the performance conditions will be met, the value of the award will be amortized over the service periods, as adjusted for forfeitures. The number of awards expected to vest is evaluated each reporting period and compensation expense is recognized for those awards for which achievement of the performance criteria is considered probable. Refer to Note 10 for additional information on the awards issued to certain employees of the affiliate portfolio companies.

The following table details the incentive compensation awards issued to certain employees of Simply Self Storage, HPA and April Housing ($ in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | December 31, 2022 | | For the Three Months Ended March 31, 2023 | | March 31, 2023 |

| Plan Year | | Unrecognized Compensation Cost | | Forfeiture of unvested awards | | Value of Awards Issued | | Amortization of Compensation Cost | | Unrecognized Compensation Cost | | Remaining Amortization Period |

| 2021 | | $ | 2,042 | | | $ | — | | | $ | — | | | $ | (259) | | | $ | 1,783 | | | 1.8 years |

| 2022 | | 20,811 | | | (456) | | | — | | | (2,245) | | | 18,110 | | | 2.5 years |

| 2023 | | — | | | — | | | 5,090 | | | (318) | | | 4,772 | | | 3.8 years |

| Total | | $ | 22,853 | | | $ | (456) | | | $ | 5,090 | | | $ | (2,822) | | | $ | 24,665 | | | |

Recent Accounting Pronouncements

In March 2020, the FASB issued Accounting Standards Update (“ASU”) 2020-04 “Reference Rate Reform (Topic 848): Facilitation of the Effects of Reference Rate Reform on Financial Reporting,” or ASU 2020-04. ASU 2020-04 provides optional expedients and exceptions to GAAP requirements for modifications on debt instruments, leases, derivatives, and other contracts, related to the market transition from LIBOR, and certain other floating rate benchmark indices, or collectively, “IBORs,” to alternative reference rates. ASU 2020-04 generally considers contract modifications related to reference rate reform to be an event that does not require contract remeasurement at the modification date nor a reassessment of a previous accounting determination. In January 2021, the FASB issued ASU 2021-01 “Reference Rate Reform (Topic 848): Scope,” or ASU 2021-01. ASU 2021-01 clarifies that the practical expedients in ASU 2020-04 apply to derivatives impacted by changes in the interest rate used for margining, discounting, or contract price alignment. In December 2022, the FASB issued ASU 2022-06 “Reference Rate Reform (Topic 848): Deferral of the Sunset Date of Topic 848,” or ASU 2022-06. ASU 2022-06 deferred the sunset date of ASU 2020-04 to December 31, 2024. The guidance in ASU 2020-04 is optional and may be elected over time, through December 31, 2024, as reference rate reform activities occur. Once ASU 2020-04 is elected, the guidance must be applied prospectively for all eligible contract modifications. The Company has not adopted any of the optional expedients or exceptions as of March 31, 2023, but will continue to evaluate the possible adoption of any such expedients or exceptions during the effective period as circumstances evolve.

3. Investments in Real Estate

Investments in real estate, net consisted of the following ($ in thousands):

| | | | | | | | | | | |

| March 31, 2023 | | December 31, 2022 |

| Building and building improvements | $ | 81,703,592 | | | $ | 81,914,789 | |

| Land and land improvements | 18,574,859 | | | 18,635,672 | |

| Furniture, fixtures and equipment | 2,344,943 | | | 2,301,683 | |

Right of use asset - operating leases(1) | 1,101,370 | | | 1,090,782 | |

Right of use asset - financing leases(1) | 72,861 | | | 72,872 | |

| Total | 103,797,625 | | | 104,015,798 | |

| Accumulated depreciation and amortization | (6,620,622) | | | (5,866,306) | |

| Investments in real estate, net | $ | 97,177,003 | | | $ | 98,149,492 | |

(1)Refer to Note 15 for additional details on the Company’s leases.

Acquisitions

During the three months ended March 31, 2023, the Company acquired 94 wholly-owned single family rental homes for a total purchase price of $34.8 million. The Company allocated $24.9 million to building and building improvements and $9.9 million to land and land improvements. During the three months ended March 31, 2023, there were no acquired intangibles.

Dispositions

The following table details the dispositions during the periods set forth below ($ in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended March 31, 2023 | | Three Months Ended March 31, 2022 | | |

| Segments | | Number of Properties | | Net Proceeds | | Net Gain(1) | | Number of Properties | | Net Proceeds | | Net Gain(1) | | | | | | |

Rental Housing properties(2) | | 42 | | $ | 653,770 | | | $ | 105,788 | | | 7 | | $ | 445,419 | | | $ | 184,031 | | | | | | | |

| Industrial properties | | 4 | | 9,217 | | | 1,605 | | | 9 | | 125,806 | | | 21,231 | | | | | | | |

| Retail properties | | 1 | | 14,384 | | | 2,650 | | | — | | — | | | — | | | | | | | |

| Hospitality properties | | 5 | | 97,554 | | | 10,960 | | | — | | — | | | — | | | | | | | |

| | 52 | | $ | 774,925 | | | $ | 121,003 | | | 16 | | $ | 571,225 | | | $ | 205,262 | | | | | | | |

(1)Net gain includes losses of $30.8 million on 19 rental housing properties, $3.3 million on one hospitality property, and $0.5 million on three industrial properties sold during the three months ended March 31, 2023. For the three months ended March 31, 2022, net gain included losses of $2.3 million on five industrial properties sold.

(2)Net proceeds and net gain include 185 single family rental homes sold that are not included in the number of properties during the three months ended March 31, 2023. Net proceeds and net gain include 123 single family rental homes sold that are not included in the number of properties during the three months ended March 31, 2022.

Properties Held-for-Sale

As of March 31, 2023, 17 properties in the Rental Housing segment and one property in the Retail segment were classified as held-for-sale. The held-for-sale assets and liabilities are included as components of Other Assets and Other Liabilities, respectively, on the Company’s Condensed Consolidated Balance Sheets.

The following table details the assets and liabilities of the Company’s properties classified as held-for-sale ($ in thousands):

| | | | | | | |

| Assets: | March 31, 2023 | | |

| Investments in real estate, net | $ | 383,767 | | | |

| Other assets | 8,496 | | | |

| Total assets | $ | 392,263 | | | |

| | | |

| Liabilities: | | | |

| Mortgage notes, net | $ | 208,752 | | | |

| Other liabilities | 9,613 | | | |

| Total liabilities | $ | 218,365 | | | |

Impairment

During the three months ended March 31, 2023, the Company recognized an aggregate of $12.5 million of impairment charges related to certain held-for-sale real estate investments where their carrying amount exceeded their fair value, less estimated closing costs. The Company did not recognize any impairment charges related to held-for-sale real estate investments during the three months ended March 31, 2022.

The Company did not recognize any impairment charges on properties held and used during the three months ended March 31, 2023 and 2022.

4. Investments in Unconsolidated Entities

The Company holds investments in joint ventures that it accounts for under the equity method of accounting, as the Company’s ownership interest in each joint venture does not meet the requirements for consolidation. Refer to Note 2 for additional details.

The following tables detail the Company’s investments in unconsolidated entities ($ in thousands): | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | March 31, 2023 |

| Investment in Joint Venture | | Segment | | Number of Joint Ventures | | | | Number of Properties | | Ownership

Interest | | Book Value | | |

| Unconsolidated entities carried at historical cost: | | | | | | | | | | | | | | |

QTS Data Centers(1) | | Data Centers | | 1 | | | | 67 | | 35.7% | | $ | 1,701,553 | | | |

Rental Housing investments(2) | | Rental Housing | | 63 | | | | 58 | | 12.2% - 52.0% | | 1,199,027 | | | |

Industrial investments(3) | | Industrial | | 3 | | | | 56 | | 10.1% - 22.4% | | 240,979 | | | |

| Retail investments | | Retail | | 2 | | | | 7 | | 50.0% | | 95,595 | | | |

| Hospitality investment | | Hospitality | | 1 | | | | 196 | | 30.0% | | 311,618 | | | |

| Total unconsolidated entities carried at historical cost | | | | 70 | | | | 384 | | | | 3,548,772 | | | |

| Unconsolidated entities carried at fair value: | | | | | | | | | | | | | | |

Industrial investments(4) | | Industrial | | 12 | | | | 2,128 | | 7.9% - 85.0% | | 3,835,981 | | | |

| Office investments | | Office | | 1 | | | | 1 | | 49.0% | | 501,054 | | | |

Data Center investments(5) | | Data Centers | | 1 | | | | N/A | | 12.4% | | 695,364 | | | |

Total unconsolidated entities carried at fair value | | | | 14 | | | | 2,129 | | | | 5,032,399 | | | |

| Total | | | | 84 | | | | 2,513 | | | | $ | 8,581,171 | | | |

(1)The Company along with certain Blackstone-managed investment vehicles formed a joint venture (“QTS Data Centers”) and acquired all outstanding shares of common stock of QTS Realty Trust (“QTS”).

(2)Includes 10,703 wholly-owned single family rental homes, that are not included in the number of properties.

(3)Includes $241.0 million from investments in three joint ventures formed by the Company and certain Blackstone-managed investment vehicles.

(4)Includes $2.9 billion from investments in four joint ventures formed by the Company and certain Blackstone-managed investment vehicles.

(5)Includes $695.4 million from investments in a digital towers joint venture formed by the Company and certain Blackstone-managed investment vehicles.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | December 31, 2022 |

| Investment in Joint Venture | | Segment | | Number of Joint Ventures | | Number of Properties | | Ownership

Interest | | Book Value |

| Unconsolidated entities carried at historical cost: | | | | | | | | | | |

QTS Data Centers(1) | | Data Centers | | 1 | | 62 | | 35.7% | | $ | 1,657,778 | |

| MGM Grand & Mandalay Bay | | Net Lease | | 1 | | 2 | | 49.9% | | 834,148 | |

Rental Housing investments(2) | | Rental Housing | | 92 | | 87 | | 12.2% - 52.0% | | 1,275,365 | |

Industrial investments(3) | | Industrial | | 3 | | 56 | | 10.0% - 55.0% | | 242,883 | |

| Retail investments | | Retail | | 2 | | 7 | | 50.0% | | 97,971 | |

| Hospitality investment | | Hospitality | | 1 | | 196 | | 30.0% | | 314,006 | |

| Total unconsolidated entities carried at historical cost | | | | 100 | | 410 | | | | 4,422,151 | |

| Unconsolidated entities at carried at fair value: | | | | | | | | | | |

Industrial investments(4) | | Industrial | | 12 | | 2,135 | | 7.9% - 85.0% | | 3,751,864 | |

| Office investments | | Office | | 1 | | 1 | | 49.0% | | 520,976 | |

Data Center investments(5) | | Data Centers | | 1 | | N/A | | 12.4% | | 674,411 | |

Total unconsolidated entities carried at fair value | | | | 14 | | 2,136 | | | | 4,947,251 | |

| Total | | | | 114 | | 2,546 | | | | $ | 9,369,402 | |

(1)The Company along with certain Blackstone-managed investment vehicles formed a joint venture (“QTS Data Centers”) and acquired all outstanding shares of common stock of QTS Realty Trust (“QTS”).

(2)Includes 10,767 wholly-owned single family rental homes, that are not included in the number of properties.

(3)Includes $242.9 million from investments in three joint ventures formed by the Company and certain Blackstone-managed investment vehicles.

(4)Includes $2.8 billion from investments in four joint ventures formed by the Company and certain Blackstone-managed investment vehicles.

(5)Includes $674.4 million from investments in a digital towers joint venture formed by the Company and certain Blackstone-managed investment vehicles.

The following table details the Company’s income from unconsolidated entities ($ in thousands): | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | For the Three Months Ended March 31, |

| BREIT Income (Loss) from Unconsolidated Entities | | Segment | | Ownership

Interest | | 2023 | | 2022 | | |

| Unconsolidated entities carried at historical cost: | | | | | | | | | | |

| QTS Data Centers | | Data Centers | | 35.7% | | $ | (43,570) | | | $ | (38,469) | | | |

MGM Grand & Mandalay Bay(1) | | Net Lease | | 49.9% | | 432,528 | | | 25,273 | | | |

| Rental Housing investments | | Rental Housing | | 12.2% - 52.0% | | (12,500) | | | (28,800) | | | |

| Industrial investments | | Industrial | | 10.1% - 22.4% | | (4,298) | | | 19,551 | | | |

| Retail investments | | Retail | | 50.0% | | (1,230) | | | (189) | | | |

| Hospitality investment | | Hospitality | | 30.0% | | (2,388) | | | — | | | |

| Total unconsolidated entities carried at historical cost | | | | | | 368,542 | | | (22,634) | | | |

| Unconsolidated entities carried at fair value: | | | | | | | | | | |

| Industrial investments | | Industrial | | 7.9% - 85.0% | | 92,593 | | | 205,169 | | | |

| Office investments | | Office | | 49.0% | | (19,930) | | | 1,690 | | | |

| Data Center investments | | Data Centers | | 12.4% | | 3,453 | | | — | | | |

| Total unconsolidated entities carried at fair value | | | | | | 76,116 | | | 206,859 | | | |

| Total | | | | | | $ | 444,658 | | | $ | 184,225 | | | |

(1)On January 9, 2023, the Company sold its 49.9% interest in MGM Grand Las Vegas and Mandalay Bay Resort for cash consideration of approximately $1.3 billion, resulting in a gain on sale of $430.4 million.

5. Investments in Real Estate Debt

The following tables detail the Company’s investments in real estate debt ($ in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | March 31, 2023 |

Type of Security/Loan(1) | | Weighted Average Coupon(2) | | Weighted Average Maturity Date(3) | | Face

Amount | | Cost

Basis | | Fair

Value |

CMBS(4) | | +3.9% | | 10/27/2032 | | $ | 6,386,687 | | | $ | 6,385,165 | | | $ | 5,831,097 | |

| RMBS | | +4.4% | | 3/30/2053 | | 404,802 | | | 393,439 | | | 302,994 | |

| Corporate bonds | | 5.0% | | 4/8/2031 | | 107,946 | | | 118,691 | | | 104,236 | |

| Total real estate securities | | 7.8% | | 10/15/2033 | | 6,899,435 | | | 6,897,295 | | | 6,238,327 | |

| Commercial real estate loans | | +5.6% | | 7/23/2026 | | 1,407,539 | | | 1,418,945 | | | 1,407,198 | |

Other investments(5) | | 5.7% | | 9/21/2029 | | 205,305 | | | 179,142 | | | 174,878 | |

| Total investments in real estate debt | | 8.1% | | 5/24/2032 | | $ | 8,512,279 | | | $ | 8,495,382 | | | $ | 7,820,403 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | December 31, 2022 |

Type of Security/Loan(1) | | Weighted Average Coupon(2) | | Weighted Average Maturity Date(3) | | Face

Amount | | Cost

Basis | | Fair

Value |

CMBS(4) | | +3.9% | | 12/10/2032 | | $ | 6,474,823 | | | $ | 6,473,296 | | | $ | 5,943,403 | |

| RMBS | | +4.4% | | 1/21/2053 | | 404,953 | | | 393,511 | | | 292,516 | |

| Corporate bonds | | 4.9% | | 3/17/2031 | | 115,980 | | | 126,052 | | | 105,558 | |

| Total real estate securities | | 7.0% | | 11/4/2033 | | 6,995,756 | | | 6,992,859 | | | 6,341,477 | |

| Commercial real estate loans | | +5.5% | | 7/17/2026 | | 1,489,296 | | | 1,499,691 | | | 1,483,358 | |

Other investments(5) | | 5.7% | | 9/21/2029 | | 209,746 | | | 183,017 | | | 176,868 | |

| Total investments in real estate debt | | 7.4% | | 5/25/2032 | | $ | 8,694,798 | | | $ | 8,675,567 | | | $ | 8,001,703 | |

(1)This table does not include the Company’s Controlling Class Securities in certain CMBS securitizations that have been consolidated on the Company’s financial statements. The underlying collateral loans and the senior CMBS positions owned by third-parties of such securitizations are presented separately on the Company’s Condensed Consolidated Balance Sheets. See Note 6 to the condensed consolidated financial statements.

(2)The symbol “+” refers to the relevant floating benchmark rates, which include USD LIBOR, EURIBOR, SOFR and SONIA, as applicable to each security and loan. Fixed rate CMBS and commercial real estate loans are reflected as a spread over the relevant floating benchmark rates for purposes of the weighted-averages. Weighted Average Coupon for CMBS does not include zero-coupon securities. As of March 31, 2023 and December 31, 2022, the Company had interest rate swaps outstanding with a notional value of $1.4 billion and $1.4 billion, respectively, that effectively converts a portion of its fixed rate investments in real estate debt to floating rates. Total weighted average coupon does not include the impact of such interest rate swaps or other derivatives.

(3)Weighted average maturity date is based on the fully extended maturity date of the instrument.

(4)Face amount excludes interest-only securities with a notional amount of $1.1 billion as of both March 31, 2023 and December 31, 2022.

(5)Includes an interest in an unconsolidated joint venture that holds investments in real estate debt.

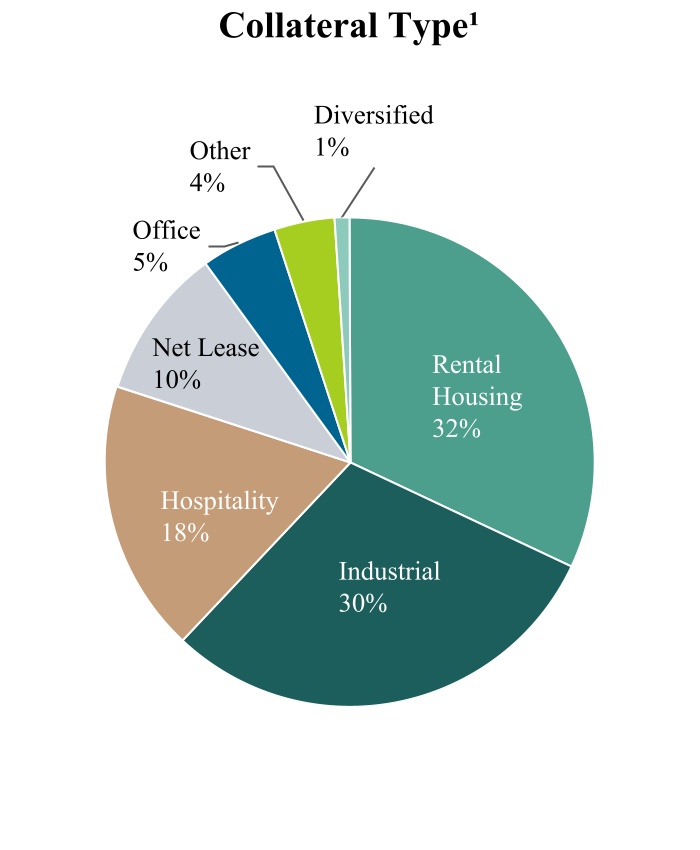

The following table details the collateral type of the properties securing the Company’s investments in real estate debt ($ in thousands): | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | March 31, 2023 | | | | December 31, 2022 |

Collateral(1) | | | | Cost

Basis | | Fair

Value | | Percentage Based on Fair Value | | | | Cost

Basis | | Fair

Value | | Percentage Based on Fair Value |

| Industrial | | | | $ | 2,727,882 | | | $ | 2,533,247 | | | 33% | | | | $ | 2,681,299 | | | $ | 2,483,592 | | | 32% |

Rental Housing(2) | | | | 2,035,063 | | | 1,869,787 | | | 24% | | | | 2,119,282 | | | 1,940,795 | | | 24% |

| Hospitality | | | | 1,738,205 | | | 1,639,085 | | | 21% | | | | 1,884,353 | | | 1,768,090 | | | 22% |

| Net Lease | | | | 983,523 | | | 943,152 | | | 12% | | | | 983,374 | | | 947,368 | | | 12% |

| Office | | | | 551,744 | | | 412,401 | | | 5% | | | | 552,016 | | | 439,938 | | | 5% |

| Other | | | | 365,061 | | | 340,608 | | | 4% | | | | 360,903 | | | 339,609 | | | 4% |

| Diversified | | | | 93,904 | | | 82,123 | | | 1% | | | | 94,340 | | | 82,311 | | | 1% |

| | | | | | | | | | | | | | | | |

| Total | | | | $ | 8,495,382 | | | $ | 7,820,403 | | | 100% | | | | $ | 8,675,567 | | | $ | 8,001,703 | | | 100% |

(1)This table does not include the Company’s Controlling Class Securities in certain CMBS securitizations that have been consolidated on the Company’s financial statements. The underlying collateral loans and the senior CMBS positions owned by third-parties of such securitizations are presented separately on the Company’s Condensed Consolidated Balance Sheets. See Note 6 to the condensed consolidated financial statements.

(2)Rental Housing investments in real estate debt are collateralized by various forms of rental housing including apartments and single family rental homes.

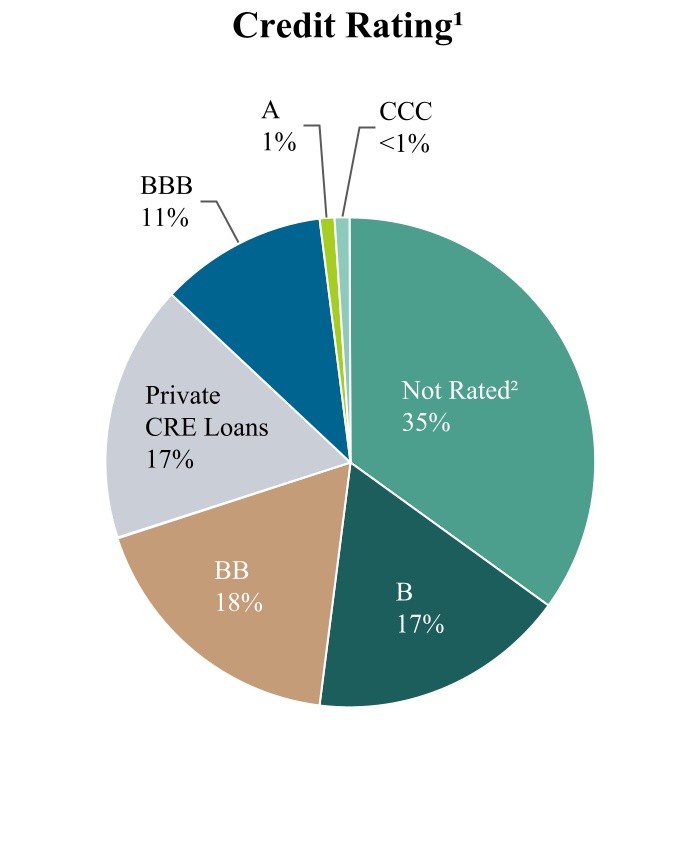

The following table details the credit rating of the Company’s investments in real estate debt ($ in thousands): | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | March 31, 2023 | | | | December 31, 2022 |

Credit Rating(1) | | Cost

Basis | | Fair

Value | | Percentage Based on Fair Value | | | | Cost

Basis | | Fair

Value | | Percentage Based on Fair Value |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| A | | $ | 91,795 | | | $ | 86,715 | | | 1% | | | | $ | 91,809 | | | $ | 86,055 | | | 1% |

| BBB | | 1,075,691 | | | 1,023,017 | | | 13% | | | | 1,077,419 | | | 1,024,908 | | | 13% |

| BB | | 1,826,016 | | | 1,626,826 | | | 21% | | | | 1,858,101 | | | 1,659,281 | | | 21% |

| B | | 1,518,574 | | | 1,343,155 | | | 17% | | | | 1,609,017 | | | 1,424,940 | | | 18% |

| CCC | | 67,905 | | | 55,157 | | | 1% | | | | 40,486 | | | 33,225 | | | —% |

| Private commercial real estate loans | | 1,598,087 | | | 1,582,076 | | | 20% | | | | 1,682,708 | | | 1,660,226 | | | 21% |

Not rated(2) | | 2,317,314 | | | 2,103,457 | | | 27% | | | | 2,316,027 | | | 2,113,068 | | | 26% |

| Total | | $ | 8,495,382 | | | $ | 7,820,403 | | | 100% | | | | $ | 8,675,567 | | | $ | 8,001,703 | | | 100% |