- ULCC Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Frontier (ULCC) 8-KRegulation FD Disclosure

Filed: 12 Feb 25, 6:05am

Exhibit 99.2 Presentation to Spirit Alternative Proposal February 4, 2025 | Strictly private and confidential

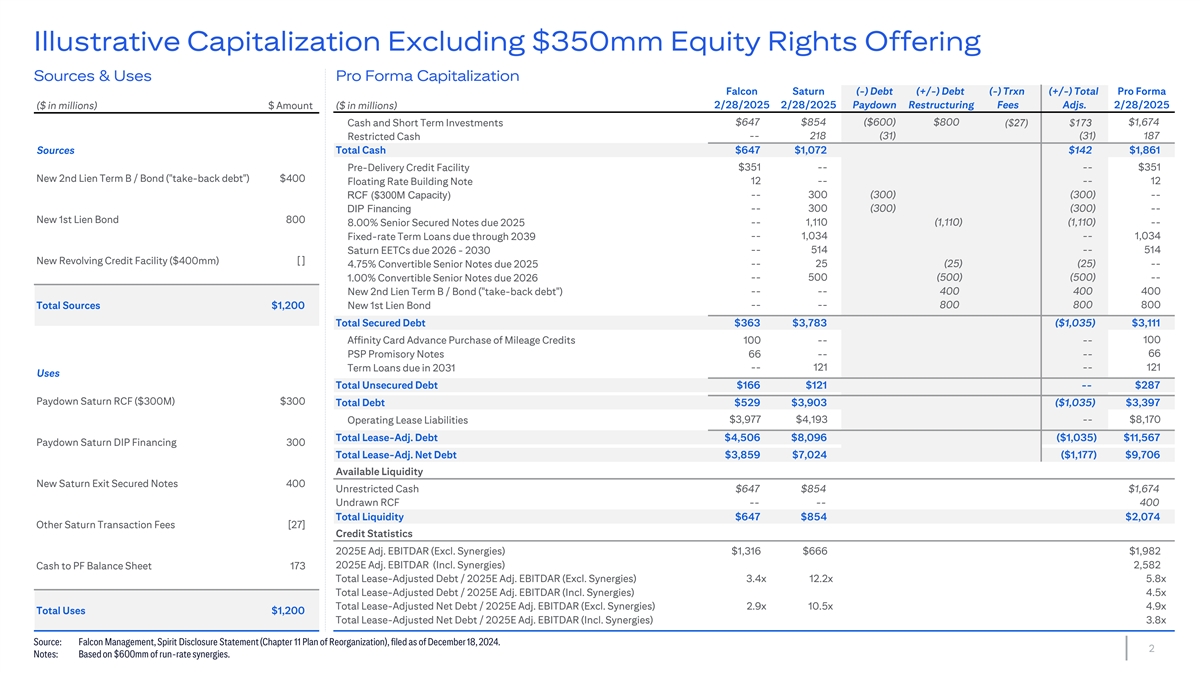

Illustrative Capitalization Excluding $350mm Equity Rights Offering Sources & Uses Pro Forma Capitalization Falcon Saturn (-) Debt (+/-) Debt (-) Trxn (+/-) Total Pro Forma ($ in millions) $ Amount ($ in millions) 2/28/2025 2/28/2025 Paydown Restructuring Fees Adjs. 2/28/2025 Cash and Short Term Investments $647 $854 ($600) $800 ($27) $173 $1,674 Restricted Cash -- 218 (31) (31) 187 Sources Total Cash $647 $1,072 $142 $1,861 Pre-Delivery Credit Facility $351 -- -- $351 New 2nd Lien Term B / Bond ( take-back debt ) $400 Floating Rate Building Note 12 -- -- 12 RCF ($300M Capacity) -- 300 (300) (300) -- DIP Financing -- 300 (300) (300) -- New 1st Lien Bond 800 8.00% Senior Secured Notes due 2025 -- 1,110 (1,110) (1,110) -- Fixed-rate Term Loans due through 2039 -- 1,034 -- 1,034 Saturn EETCs due 2026 - 2030 -- 514 -- 514 New Revolving Credit Facility ($400mm) [ ] 4.75% Convertible Senior Notes due 2025 -- 25 (25) (25) -- 1.00% Convertible Senior Notes due 2026 -- 500 (500) (500) -- New 2nd Lien Term B / Bond ( take-back debt ) -- -- 400 400 400 Total Sources $1,200 New 1st Lien Bond -- -- 800 800 800 Total Secured Debt $363 $3,783 ($1,035) $3,111 Affinity Card Advance Purchase of Mileage Credits 100 -- -- 100 PSP Promisory Notes 66 -- -- 66 Term Loans due in 2031 -- 121 -- 121 Uses Total Unsecured Debt $166 $121 -- $287 Paydown Saturn RCF ($300M) $300 Total Debt $529 $3,903 ($1,035) $3,397 Operating Lease Liabilities $3,977 $4,193 -- $8,170 Total Lease-Adj. Debt $4,506 $8,096 ($1,035) $11,567 Paydown Saturn DIP Financing 300 Total Lease-Adj. Net Debt $3,859 $7,024 ($1,177) $9,706 Available Liquidity New Saturn Exit Secured Notes 400 Unrestricted Cash $647 $854 $1,674 Undrawn RCF -- -- 400 Total Liquidity $647 $854 $2,074 Other Saturn Transaction Fees [27] Credit Statistics 2025E Adj. EBITDAR (Excl. Synergies) $1,316 $666 $1,982 2025E Adj. EBITDAR (Incl. Synergies) 2,582 Cash to PF Balance Sheet 173 Total Lease-Adjusted Debt / 2025E Adj. EBITDAR (Excl. Synergies) 3.4x 12.2x 5.8x Total Lease-Adjusted Debt / 2025E Adj. EBITDAR (Incl. Synergies) 4.5x Total Lease-Adjusted Net Debt / 2025E Adj. EBITDAR (Excl. Synergies) 2.9x 10.5x 4.9x Total Uses $1,200 Total Lease-Adjusted Net Debt / 2025E Adj. EBITDAR (Incl. Synergies) 3.8x Source: Falcon Management, Spirit Disclosure Statement (Chapter 11 Plan of Reorganization), filed as of December 18, 2024. 2 Notes: Based on $600mm of run-rate synergies.

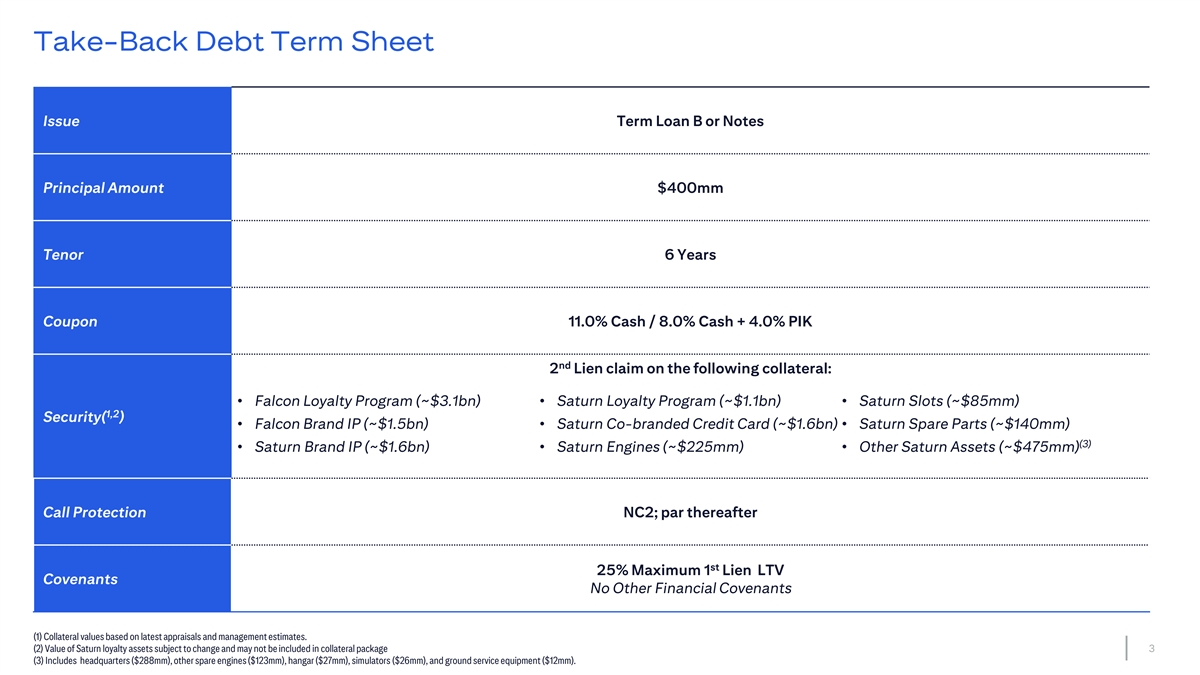

Take-Back Debt Term Sheet Issue Term Loan B or Notes Principal Amount $400mm Tenor 6 Years Coupon 11.0% Cash / 8.0% Cash + 4.0% PIK nd 2 Lien claim on the following collateral: • Falcon Loyalty Program (~$3.1bn) • Saturn Loyalty Program (~$1.1bn) • Saturn Slots (~$85mm) 1,2 Security( ) • Falcon Brand IP (~$1.5bn) • Saturn Co-branded Credit Card (~$1.6bn) • Saturn Spare Parts (~$140mm) (3) • Saturn Brand IP (~$1.6bn) • Saturn Engines (~$225mm) • Other Saturn Assets (~$475mm) Call Protection NC2; par thereafter st 25% Maximum 1 Lien LTV Covenants No Other Financial Covenants (1) Collateral values based on latest appraisals and management estimates. (2) Value of Saturn loyalty assets subject to change and may not be included in collateral package 3 (3) Includes headquarters ($288mm), other spare engines ($123mm), hangar ($27mm), simulators ($26mm), and ground service equipment ($12mm).