- ULCC Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Frontier (ULCC) 8-KRegulation FD Disclosure

Filed: 12 Feb 25, 6:05am

Exhibit 99.4 Pr Pri iv viil leg eged ed an and d Co Con nf fi ide dennti tia al l –– S Su ubj bjeec ct to t to ND NDA A Pr Prepar epareed d at at the D the Di ir reec cti tio on n of of Co Cou un ns sel el S Su ubj bjeec ct t to toR R FFE E 40 408 8 an and d S State tatequ q EEui iva vallen ents ts Project Galaxy Transaction Proposal February 7, 2025 1

Privileged and Confidential – Subject to NDA Prepared at the Direction of Counsel Subject to FRE 408 and State Equivalents Transaction Proposal Frontier (2/4) Spirit (2/7) ▪ Frontier and Spirit to combine as part of Spirit’s ongoing chapter ▪ Agreed 11 proceedings with securities of the combined enterprise provided to Spirit stakeholders as consideration for the combination transaction Structure ▪ Frontier to raise $800M New Money First Lien debt to facilitate ▪ Agreed paydown of existing DIP and RCF facilities, in addition to any transaction fees and accrued interest at closing ▪ New $400M RCF to be issued and [undrawn] at close▪ Agreed ▪ Spirit and its stakeholders to receive $400M Second Lien debt▪ Spirit and its stakeholders to receive $600M First Lien Takeback debt to trade at par , pari passu with New Money First Lien debt ▪ To discuss potential backstop of new debt issuance by Spirit Debt Consideration stakeholders, subject to further diligence ▪ Spirit and its stakeholders provided 19.0% of the pro forma ▪ Spirit and its stakeholders provided $1,185M of market- combined company on a fully-diluted basis determined equity value in the combined business (implies par – Illustratively assumes 52,865,110 shares based on current recovery on funded debt, plus $1.15 per-share recovery to existing Frontier shares outstanding, subject to refinement at closing equity holders per current Frontier proposal) Equity Consideration ▪ To discuss market mechanism and timing to determine valuation of equity in the combined enterprise to Spirit stakeholders (e.g., VWAP, mandatory convertible note, etc. with potential collar to be discussed) ▪ Required parties agree to waive existing $35M ERO break-up fee▪ Required parties to receive $35M ERO break-up fee at transaction ERO Break-Up Fee close 2

Privileged and Confidential – Subject to NDA Prepared at the Direction of Counsel Subject to FRE 408 and State Equivalents Transaction Proposal (Cont.) Frontier (2/4) Spirit (2/7) ▪ Frontier to complete confirmatory within 10 business days.▪ Agreed ▪ Scope of confirmatory diligence limited to: – A limited review of Spirit’s Q4 results – Update on recent sales trends – Updated 2-year cash forecast (incl. any impact of bankruptcy) – Disclosure of any material contracts or changes to the business since conclusion of prior engagement – Select tax diligence Diligence ▪ Spirit stakeholders provided opportunity to conduct reverse diligence on key operational and legal matters, in addition to evaluation of the proposed debt / collateral structure in a manner satisfactory to Spirit and its stakeholders ▪ N/A▪ Frontier required to take any steps required by regulators for closing unless they would cause a materially adverse effect on the combined enterprise ▪ To the extent transaction is terminated as a result of failure to Reverse Break-Up Fee / achieve regulatory approval or any reason other than a Spirit Regulatory Approval breach, Frontier to provide Spirit a reverse termination fee on transaction enterprise value in line with market precedents for similar situations 3

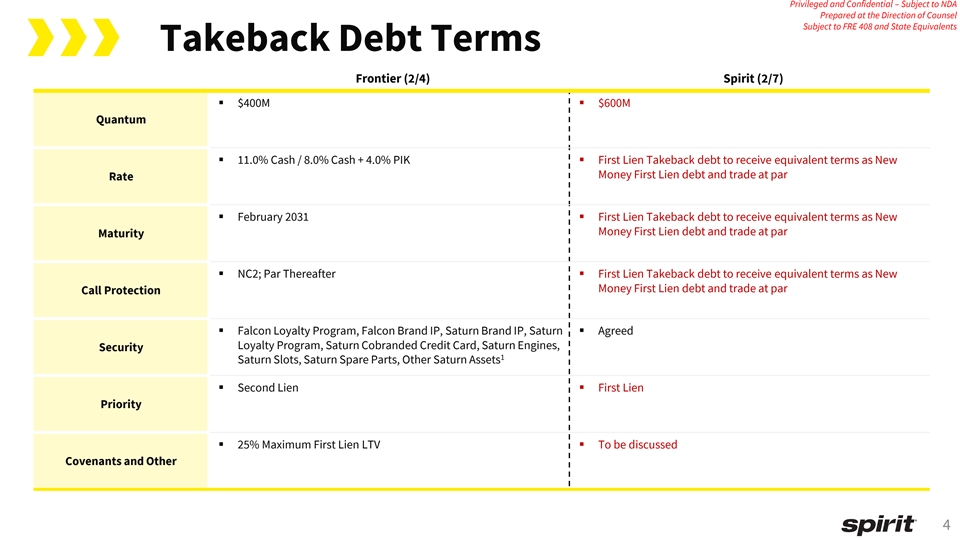

Privileged and Confidential – Subject to NDA Prepared at the Direction of Counsel Subject to FRE 408 and State Equivalents Takeback Debt Terms Frontier (2/4) Spirit (2/7) ▪ $400M▪ $600M Quantum ▪ 11.0% Cash / 8.0% Cash + 4.0% PIK▪ First Lien Takeback debt to receive equivalent terms as New Money First Lien debt and trade at par Rate ▪ February 2031▪ First Lien Takeback debt to receive equivalent terms as New Money First Lien debt and trade at par Maturity ▪ NC2; Par Thereafter▪ First Lien Takeback debt to receive equivalent terms as New Money First Lien debt and trade at par Call Protection ▪ Falcon Loyalty Program, Falcon Brand IP, Saturn Brand IP, Saturn ▪ Agreed Loyalty Program, Saturn Cobranded Credit Card, Saturn Engines, Security 1 Saturn Slots, Saturn Spare Parts, Other Saturn Assets ▪ Second Lien▪ First Lien Priority ▪ 25% Maximum First Lien LTV▪ To be discussed Covenants and Other 4

Pr Pri ivi vil leg eged ed an and d Co Con nf fi iden denti tial al –– S Su ubje bjec ct to t to ND NDA A Pr Prepare epared d at at the D the Di ire rec cti tion on of of Co Cou un ns sel el S Su ubje bjec ct t to to F FR RE E 40 408 8 an and d S State tate E Equ qui ival valen ents ts 5