- ULCC Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Frontier (ULCC) 8-KRegulation FD Disclosure

Filed: 12 Feb 25, 6:05am

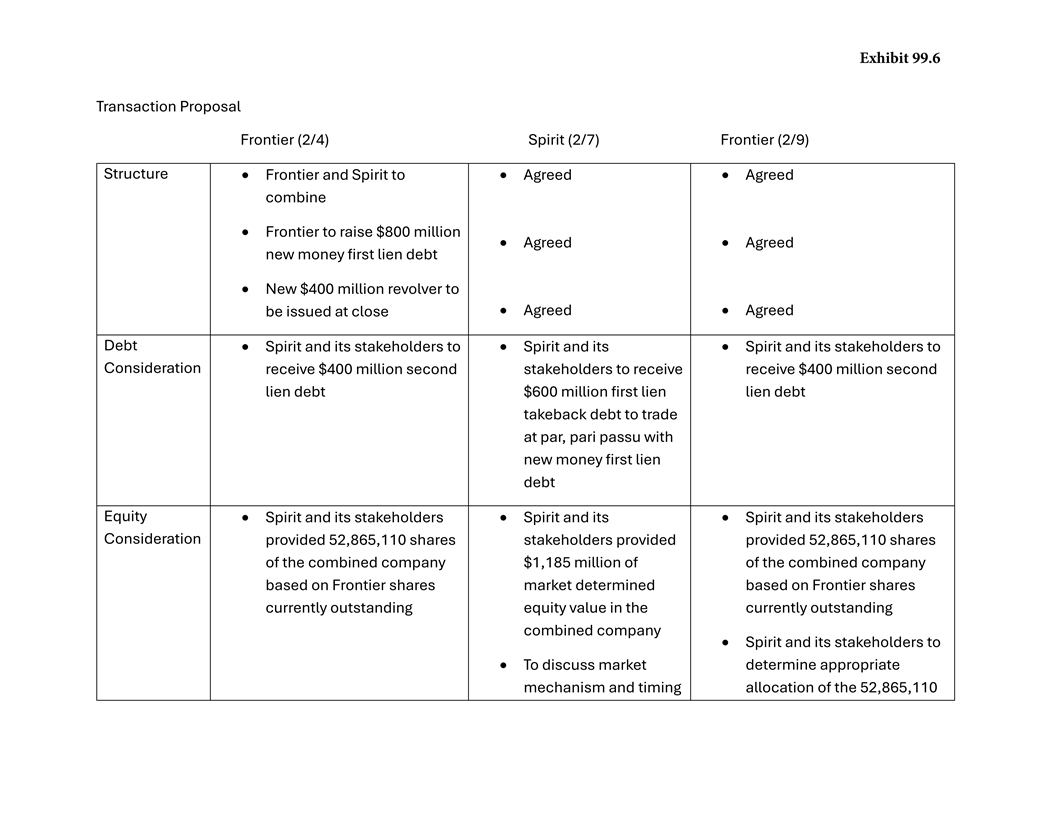

Exhibit 99.6 Transaction Proposal Frontier (2/4) Spirit (2/7) Frontier (2/9) Structure • Frontier and Spirit to• Agreed• Agreed combine • Frontier to raise $800 million • Agreed• Agreed new money first lien debt • New $400 million revolver to • Agreed• Agreed be issued at close Debt • Spirit and its stakeholders to• Spirit and its• Spirit and its stakeholders to Consideration receive $400 million second stakeholders to receive receive $400 million second lien debt $600 million first lien lien debt takeback debt to trade at par, pari passu with new money first lien debt Equity • Spirit and its stakeholders• Spirit and its• Spirit and its stakeholders Consideration provided 52,865,110 shares stakeholders provided provided 52,865,110 shares of the combined company $1,185 million of of the combined company based on Frontier shares market determined based on Frontier shares currently outstanding equity value in the currently outstanding combined company • Spirit and its stakeholders to determine appropriate • To discuss market mechanism and timing allocation of the 52,865,110

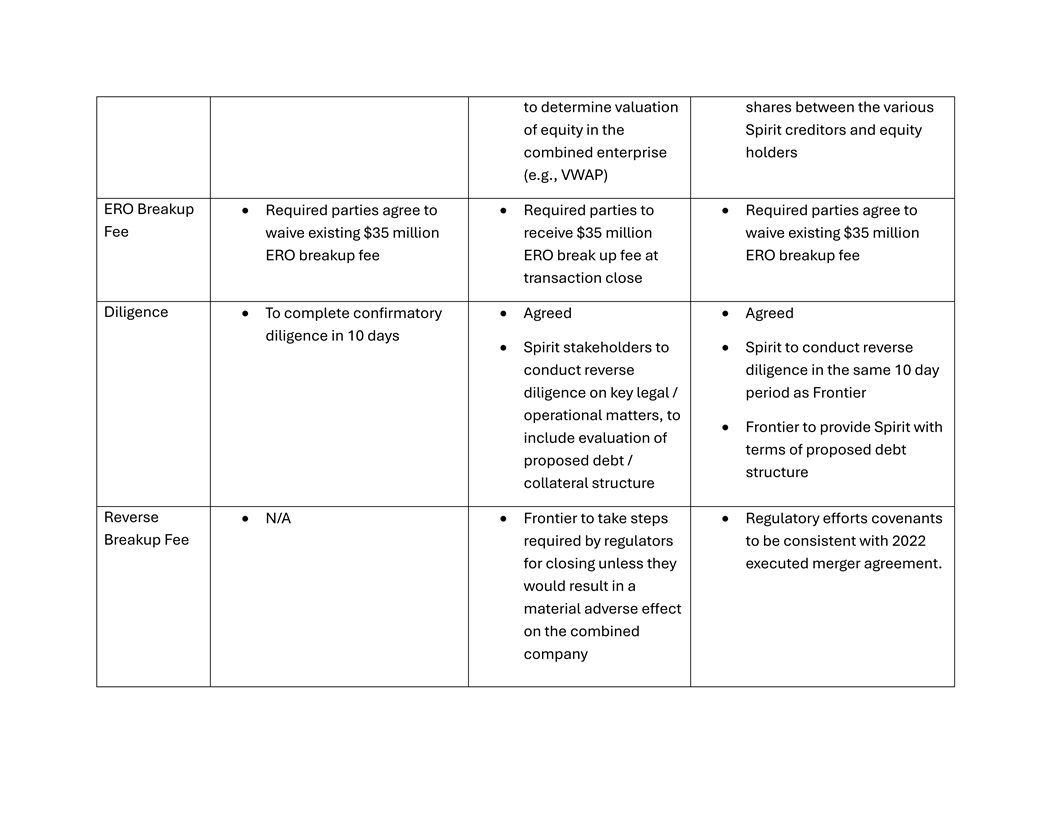

to determine valuation shares between the various of equity in the Spirit creditors and equity combined enterprise holders (e.g., VWAP) ERO Breakup • Required parties agree to • Required parties to • Required parties agree to Fee waive existing $35 million receive $35 million waive existing $35 million ERO breakup fee ERO break up fee at ERO breakup fee transaction close Diligence • To complete confirmatory • Agreed • Agreed diligence in 10 days • Spirit stakeholders to • Spirit to conduct reverse conduct reverse diligence in the same 10 day diligence on key legal / period as Frontier operational matters, to • Frontier to provide Spirit with include evaluation of terms of proposed debt proposed debt / structure collateral structure Reverse • N/A • Frontier to take steps • Regulatory efforts covenants Breakup Fee required by regulators to be consistent with 2022 for closing unless they executed merger agreement. would result in a material adverse effect on the combined company

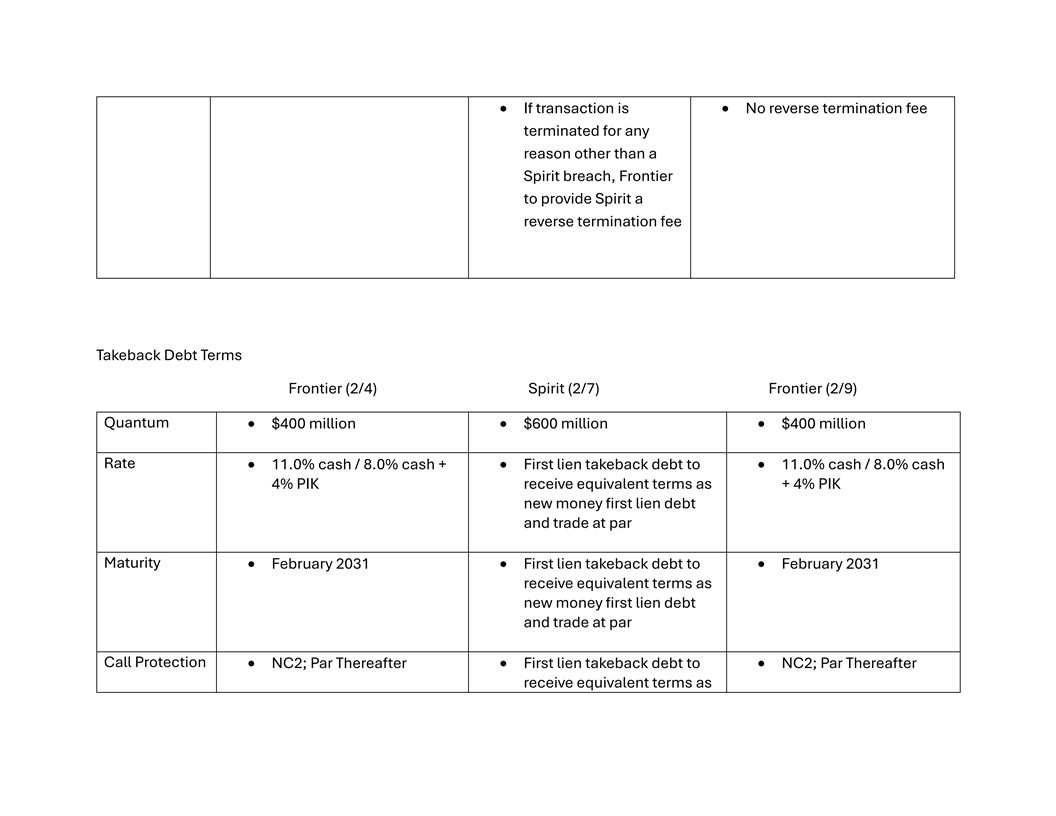

• If transaction is • No reverse termination fee terminated for any reason other than a Spirit breach, Frontier to provide Spirit a reverse termination fee Takeback Debt Terms Frontier (2/4) Spirit (2/7) Frontier (2/9) Quantum • $400 million • $600 million • $400 million Rate • 11.0% cash / 8.0% cash + • First lien takeback debt to • 11.0% cash / 8.0% cash 4% PIK receive equivalent terms as + 4% PIK new money first lien debt and trade at par Maturity • February 2031 • First lien takeback debt to • February 2031 receive equivalent terms as new money first lien debt and trade at par Call Protection • NC2; Par Thereafter • First lien takeback debt to • NC2; Par Thereafter receive equivalent terms as

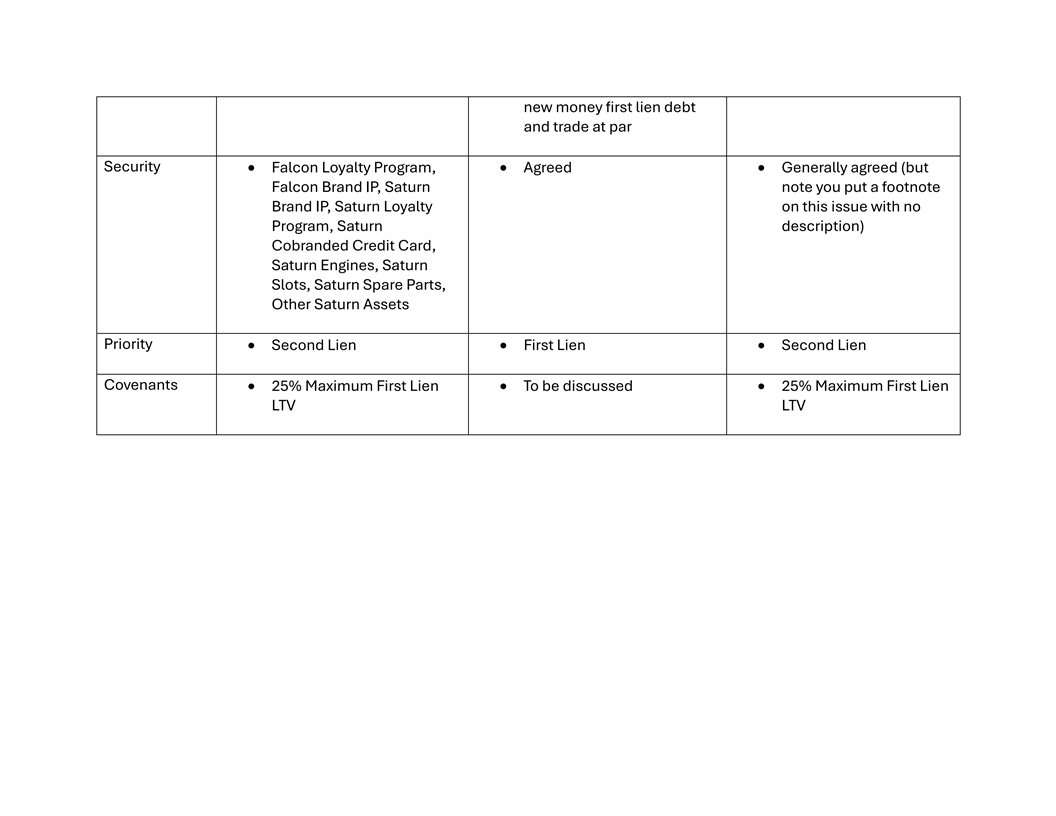

new money first lien debt and trade at par Security • Falcon Loyalty Program, • Agreed • Generally agreed (but Falcon Brand IP, Saturn note you put a footnote Brand IP, Saturn Loyalty on this issue with no Program, Saturn description) Cobranded Credit Card, Saturn Engines, Saturn Slots, Saturn Spare Parts, Other Saturn Assets Priority • Second Lien • First Lien • Second Lien Covenants • 25% Maximum First Lien • To be discussed • 25% Maximum First Lien LTV LTV