UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

811-23159

(Investment Company Act file number)

Griffin Institutional Access Credit Fund

(Exact name of registrant as specified in charter)

Griffin Capital Plaza

1520 E. Grand Avenue

El Segundo, CA 90245

(Address of principal executive offices) (Zip code)

ALPS Fund Services, Inc.

1290 Broadway, Suite 1100

Denver, CO 80203

(Name and address of agent for service)

Copy to:

Terrence O. Davis, Esq.

Holland & Knight

1180 West Peachtree Street, N.W.

Suite 1800

Atlanta, GA 30309

Registrant’s telephone number, including area code: (404) 817-8500

Date of fiscal year end: December 31

Date of reporting period: July 1, 2017 – December 31, 2017

Item 1. Reports to Stockholders.

Table of Contents

| Shareholder Letter | 1 |

| Portfolio Update | 6 |

| Schedule of Investments | 8 |

| Statement of Assets and Liabilities | 16 |

| Statement of Operations | 18 |

| Statements of Changes in Net Assets | 19 |

| Financial Highlights | 21 |

| Notes to Financial Statements | 26 |

| Report of Independent Registered Public Accounting Firm | 38 |

| Additional Information | 39 |

| Trustees and Officers | 40 |

| GRIFFIN INSTITUTIONAL ACCESS CREDIT FUND | ANNUAL REPORT 2017 |  |

Dear Fellow Shareholders,

We are pleased to present the annual report for Griffin Institutional Access™ Credit Fund (the “Fund”). Since the Fund launched on April 3, 2017, assets under management have grown to over $100 million. We appreciate the support of our shareholders as well as our broker-dealer partners and will remain true to our stated investment objective of generating a return comprised of both current income and capital appreciation with low volatility and low correlation1 to the broader markets.

During its first nine months of operations, the Fund’s sub-adviser—BCSF Advisors, LP, an affiliate of Bain Capital Credit, LP—continued to construct a well-diversified portfolio consisting primarily of floating rate, senior secured bank loans. The portfolio composition is ultimately determined through both fundamental quantitative and qualitative analysis to determine the optimal mix of securities across global markets with the potential to deliver the best risk-adjusted returns for investors.

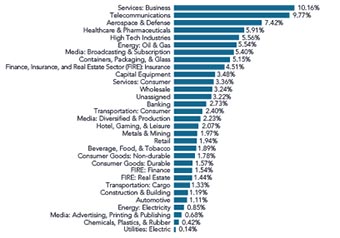

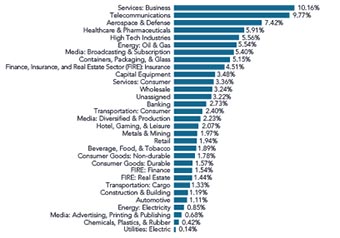

Since inception, our portfolio allocation strategy delivered a total return of 4.31%, outperforming the S&P/ LSTA Leveraged Loan Index2 by 142 basis points.3 As of December 31, 2017, the Fund was diversified across 236 individual securities and 31 industries.

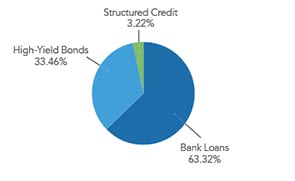

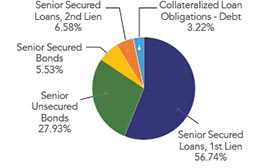

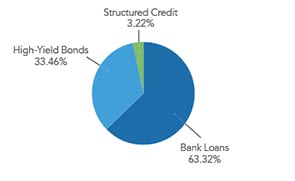

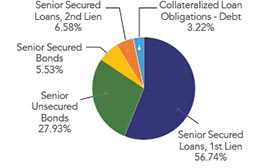

Griffin Institutional Access Credit Fund Holdings

(Based on market value of invested assets as of December 31, 2017)

| FLOATING RATE ASSETS4 66.54% | FIXED RATE ASSETS4 33.46% |

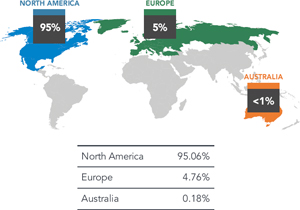

| SECTOR ANALYSIS4 | ASSET TYPE4 |

| | |

|  |

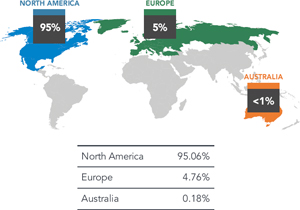

| INDUSTRY CONCENTRATION4,5 | GEOGRAPHY4 |

| | |

|  |

| GRIFFIN INSTITUTIONAL ACCESS CREDIT FUND | ANNUAL REPORT 2017 |  |

(Shareholder Letter continued)

Investment Performance

Performance during the year was driven by a combination of carry and price appreciation across high yield and bank loan positions. Bank loans were the largest contributors to Fund’s performance followed by bonds and structured products. The Fund is overweight loans relative to bonds given our preference for safety and current relative value, though we continue to monitor how loan repricing might alter this relationship. Lower-quality assets within loans and bonds outperformed higher quality mainly due to the carry advantage and recovery in spreads. While the Fund’s structured holdings (CLOs) had an attractive return on assets (ROA),6 the contribution to return was more muted given the limited allocation. We view our structured investments as a tactical alpha generation tool which we will dynamically adjust based on prevailing market conditions and relative value. Our CLO purchases to-date have been evenly split between BB debt, which has a low risk of impairment and an attractive yield profile, and equity classes. As part of our CLO equity selection process, we have focused on 2017 vintage deals with clean portfolios and long reinvestment periods. As spreads in the leveraged loan market have compressed, CLO liability funding costs have followed suit and now hover near multi-year tights, creating upside to equity classes if loan price volatility materializes over the next few years.

We continue to approach opportunities in private credit cautiously, choosing to pass on deals that do not meet our underwriting criteria or where the market has mispriced risk. Despite the competitive headwinds, the middle market still commands an attractive yield premium to broadly syndicated loans. We continue to believe that investors should approach opportunities in the middle market with discipline and that the risk/reward proposition remains attractive, although some caution is warranted.

Outside of the traditional credit asset classes, Bain Capital Credit as a firm continues to focus on European non-performing loans (NPLs) given the size of the opportunity, high barriers to entry and the attractive return profile. Within NPLs, assuming certain conditions are met, we intend to target portfolios of loans backed by hard collateral (real estate, small-to-medium sized enterprises) as a way to minimize our downside and drive value. Sourcing, underwriting and servicing NPL portfolios is a rigorous and time-consuming process that requires significant human and financial capital, limiting the competitive set to a few dedicated institutions with local market expertise and sufficient scale.7

Investment Environment

During 2017, the market environment oscillated between risk-on and risk-off, but the environment remained generally accommodative for high-yield credit. In the fourth quarter, spreads in high yield approached their post-crisis tights in response to a steady rise in oil prices, improving economic data –Q3 gross domestic product (GDP) rebounded to a 3.2% annualized pace–and solid corporate earnings, despite concerns surrounding the Gulf Coast hurricane impact. Although the fundamental backdrop for credit markets was supportive, the positive gains in high yield suffered a brief hiccup during the fourth quarter, driven by interest rate volatility, which caused the 10-year Treasury to hit a multi-month high amid uncertainty on who would succeed Janet Yellen as the next Fed Chair. Leveraged loans were the beneficiary of this move as inflows accelerated during October, causing the asset class to outperform bonds and post the second highest monthly return of 2017.8 Credit markets recovered towards the latter half amidst rallying stock and oil prices and renewed optimism related to U.S. tax reform, causing both high yield and leveraged loans to retrace most of their price declines. For companies seeking debt financing, the markets have been highly receptive, an indication that technicals remain strong and investors continue to invest cash balances in the face of limited real supply.

We are pleased with the continued build out of the portfolio and our performance to date. We believe that our ability to actively manage across credit sectors and markets will allow us to provide value to our shareholders in the form of strong risk-adjusted returns. Moving forward, the portfolio management team will continue to leverage the breadth of Bain Capital Credit, LP’s global platform to uncover investment opportunities in line with the stated investment objective of the Fund.

| GRIFFIN INSTITUTIONAL ACCESS CREDIT FUND | ANNUAL REPORT 2017 |  |

(Shareholder Letter continued)

Thank you for your investment in and support of Griffin Institutional Access Credit Fund.

Sincerely,

Randy I. Anderson, Ph.D., CRE

President

Griffin Capital Asset Management Company, LLC

Griffin Institutional Access Credit Fund (the “Fund”) is a closed-end interval fund. Limited liquidity is provided to shareholders only through the Fund’s quarterly repurchase offers for no less than 5% of the Fund’s shares outstanding at net asset value. The Fund is suitable only for investors who can bear the risks associated with the limited liquidity of the Fund and should be viewed as a long-term investment.

| GRIFFIN INSTITUTIONAL ACCESS CREDIT FUND | ANNUAL REPORT 2017 |  |

FUND SUB-ADVISER (unaudited)

| BCSF Advisors, LP |  |

Griffin Institutional Access Credit Fund is sub-advised by BCSF Advisors, LP, an SEC-registered investment adviser and affiliate of Bain Capital Credit, LP.

Bain Capital Credit, LP provides ongoing research, opinions and recommendations regarding the Fund’s investment portfolio. Bain Capital Credit, LP was formed in 1998 as the credit investing arm of Bain Capital, one of the world’s premier alternative investment firms, with approximately $85 billion in assets under management as of October 1, 2017. Bain Capital Credit, LP invests across the full spectrum of credit strategies, including leveraged loans, high-yield bonds, distressed debt, direct lending, structured products, non-performing loans and equities. With offices in Boston, Chicago, New York, London, Dublin, Hong Kong, Melbourne and Sydney, Bain Capital Credit, LP has a global footprint with approximately $36 billion9 in assets under management.

END NOTES

| 1 | Correlation is a statistical measure of how two securities move in relation to each other. A correlation ranges from -1 to 1. A positive correlation of 1 implies that as one security moves, either up or down, the other security will move in lockstep, in the same direction. A negative correlation of -1 indicates that the securities will move in the opposite direction. If the correlation is 0, the movements of the securities are said to have no correlation; they are completely random. |

| 2 | The S&P/LSTA Leveraged Loan Index is a daily total return index that uses mark-to-market pricing to calculate market value change. The LSTA tracks, on a real-time basis, the current outstanding balance and spread over the London Interbank Offered Rate (LIBOR) for fully funded term loans. The facilities included in the LSTA represent a broad cross section of leveraged loans syndicated in the United States, including dollar-denominated loans to overseas issuers. You cannot invest directly in an index. Index performance does not represent actual Fund or portfolio performance. A fund or portfolio may differ significantly from the securities included in the index. Index performance assumes reinvestment of dividends but does not reflect any management fees, transaction costs or other expenses that would be incurred by a fund or portfolio, or brokerage commissions on transactions in fund shares. Such fees, expenses, and commissions could reduce returns. |

| 3 | One basis point is equal to 1/100th of 1%, or 0.01%. |

| 4 | Based on market value of invested assets as of December 31, 2017. |

| 5 | Based on Moody’s 35 Industry Categories (“Moody’s 35”) . |

| 6 | Return on assets (ROA) is an indicator of how profitable a company is relative to its total assets. ROA gives a manager, investor, or analyst an idea as to how efficient a company’s management is at using its assets to generate earnings. Return on assets is expressed as a percentage that calculated by dividing the company’s net income by total assets. |

| 7 | Source: Deloitte (Deleveraging Europe 2016-2017). Data as of 12/31/16. |

| 8 | Source: JP Morgan Loan Market Monitor. Data as of 12/31/17. |

| 9 | As of October 1, 2017. Bain Capital Credit’s assets under management includes its subsidiaries and credit vehicles managed by its AIFM affiliate. |

| GRIFFIN INSTITUTIONAL ACCESS CREDIT FUND | ANNUAL REPORT 2017 |  |

DISCLOSURES (unaudited)

Investors in Griffin Institutional Access Credit Fund (the “Fund”) should understand that the net asset value (“NAV”) of the Fund will fluctuate, which may result in a loss of the principal amount invested. The Fund is a closed-end interval fund, the shares have no history of public trading, nor is it intended at this time that the shares will be listed on a public exchange. No secondary market is expected to develop for the Fund’s shares, liquidity for the Fund’s shares will be provided only through quarterly repurchase offers for no less than 5% and no more than 25% of the Fund’s shares at NAV, and there is no guarantee that an investor will be able to sell all the shares that the investor desires to sell in the repurchase offer. Due to these restrictions, an investor should consider an investment in the Fund to be of limited liquidity. The Fund is suitable only for investors who can bear the risks associated with the limited liquidity of the Fund and should be viewed as a long-term investment. Investing in the Fund is speculative and involves a high degree of risk, including the risks associated with leverage.

Diversification does not assure a profit or protect against loss in a declining market.

By investing in the Fund, a shareholder will not be deemed to be an investor in any underlying fund and will not have the ability to exercise any rights attributable to an investor in any such underlying fund related to their investment.

The views and information discussed in this commentary are as of the date of publication, are subject to change, and may not reflect the writer’s current views. The views expressed represent an assessment of market conditions at a specific point in time, are opinions only and should not be relied upon as investment advice regarding a particular investment or markets in general. Such information does not constitute a recommendation to buy or sell specific securities or investment vehicles. It should not be assumed that any investment will be profitable or will equal the performance of the fund(s) or any securities or any sectors mentioned herein. The subject matter contained herein has been derived from several sources believed to be reliable and accurate at the time of compilation. Griffin Capital Securities, LLC does not accept any liability for losses either direct or consequential caused by the use of this information.

DISTRIBUTION POLICY RISK

The Fund’s distribution policy is to make quarterly distributions to shareholders. All or a portion of a distribution may consist solely of a return of capital (i.e. from your original investment) and not a return of net profit. Shareholders should not assume that the source of a distribution from the Fund is net profit. Shareholders should note that return of capital will reduce the tax basis of their shares and potentially increase the taxable gain, if any, upon disposition of their shares. Sources of distributions to shareholders for tax reporting purposes will depend upon the Fund’s investment experience during the remainder of its fiscal year and may be subject to changes based on tax regulations. Pursuant to Section 852 of the Internal Revenue Code, the taxability of distributions will be reported on Form 1099-DIV.

The Fund distribution rate is the amount, expressed as a percentage, a Fund investor would receive in distributions if the most recent Fund distribution stayed consistent going forward. It is calculated by annualizing the most recent Fund distribution yield. The percentage represents a single distribution from the Fund and does not represent the total return of the Fund.

ALPS Distributors, Inc. is the distributor of Griffin Institutional Access Credit Fund. Griffin Capital and ALPS Distributors, Inc. are not affiliated.

| Griffin Institutional Access Credit Fund | Portfolio Update |

December 31, 2017 (Unaudited)

Performance (for the period ended December 31, 2017)

| | 3 Month | Since Inception | Inception | Total Expense Ratio**** |

| Griffin Institutional Access Credit Fund - A - Without Load | 1.20% | 4.38% | 4/3/17 | 2.64% |

| Griffin Institutional Access Credit Fund - A - With Load* | -4.61% | -1.64% | 4/3/17 | |

| Griffin Institutional Access Credit Fund - C - Without Load | 1.20% | 4.37% | 4/3/17 | 3.39% |

| Griffin Institutional Access Credit Fund - C - With Load** | 0.20% | 3.37% | 4/3/17 | |

| Griffin Institutional Access Credit Fund - I - NAV | 1.20% | 4.38% | 4/3/17 | 2.39% |

| Griffin Institutional Access Credit Fund - L - Without Load | 1.20% | 1.84% | 9/5/17 | 2.89% |

| Griffin Institutional Access Credit Fund - L - With Load*** | -3.09% | -2.50% | 9/5/17 | |

| Griffin Institutional Access Credit Fund - F - NAV | 1.24% | 1.41% | 9/25/17 | 1.85% |

| S&P/LSTA Leveraged Loan Index | 1.11% | 2.89% | 4/3/17 | |

| * | Adjusted for initial maximum sales charge of 5.75%. |

| ** | Adjusted for contingent deferred sales charge of 1.00%. |

| *** | Adjusted for initial maximum sales charge of 4.25% |

| **** | Per the Fund’s most recent prospectus. Includes borrowing costs of 0.04%. |

The S&P/LSTA Leveraged Loan Index is a capitalization-weighted syndicated loan index based upon market weightings, spreads and interest payments. The S&P/LSTA Leveraged Loan Index covers the U.S. market back to 1997 and currently calculates on a daily basis.

Indexes are not actively managed and do not reflect deduction for fees, expenses or taxes. An investor cannot invest directly into an index.

The returns shown above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or redemption of Fund shares.

The performance data quoted above represents past performance. Past performance is not a guarantee of future results. Investment return and value of the Fund shares will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Fund performance current to the most recent month-end is available by calling 1-888-926-2688 or by visiting www.griffincapital.com.

Class A shares are offered subject to a maximum sales charge of 5.75% of the offering price and Class L shares are offered subject to a maximum sales charge of 4.25% of the offering price. Class C, Class I and Class F shares are offered at net asset value per share. Class C shares may be subject to a 1.00% contingent deferred sales charge on shares redeemed during the first 365 days after their purchase. The Fund’s investment adviser has contractually agreed to waive its fees and to pay or absorb the ordinary annual operating expenses of the Fund (including offering expenses, but excluding taxes, interest, brokerage commissions, acquired fund fees and expenses and extraordinary expenses), to the extent that they exceed 2.60%, 3.35%, 2.35%, 2.85 and 1.85% per annum of the Fund’s average daily net assets attributable to Class A, Class C, Class I, Class L and Class F, respectively. The Expense Limitation Agreement will remain in effect at least until August 31, 2018, unless and until the Board approves its modification or termination. Without the waiver the expenses would be 3.06%, 3.81%, 2.81%, 3.31% and 2.81% for Class A, Class C, Class I, Class L and Class F, respectively per the Fund’s most recent prospectus. In addition to the Expense Limitation Agreement described above, the Adviser voluntarily has absorbed all of the operating expenses of the Fund since the commencement of the Fund’s operations. The Adviser will continue to bear such expenses on a going forward basis in its discretion and is under no obligation to continue to do so for any specified period of time. In the absence of the election by the Adviser to bear all of the Fund’s operating expenses, the performance of the Fund would have been reduced. Please review the Fund’s Prospectus for more details regarding the Fund’s fees and expenses. No assurances can be given that the Fund will pay a dividend in the future; or, if any such dividend is paid, the amount or rate of the dividend.

| 6 | 1.888.926.2688 | www.griffincapital.com |

| Griffin Institutional Access Credit Fund | Portfolio Update |

December 31, 2017 (Unaudited)

Performance of $10,000 Initial Investment (for the period ended December 31, 2017)

The graph shown above represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Past performance does not guarantee future results. All returns reflect reinvested dividends, but do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Industry Concentration (as a % of Net Assets)

| Services: Business | 9.61% |

| Telecommunications | 9.23% |

| Aerospace & Defense | 7.01% |

| Healthcare & Pharmaceuticals | 5.58% |

| High Tech Industries | 5.25% |

| Energy: Oil & Gas | 5.24% |

| Media: Broadcasting & Subscription | 5.10% |

| Containers, Packaging, & Glass | 4.86% |

| FIRE: Insurance | 4.26% |

| Capital Equipment | 3.28% |

| Services: Consumer | 3.18% |

| Wholesale | 3.06% |

| Unassigned | 3.04% |

| Banking | 2.58% |

| Transportation: Consumer | 2.27% |

| Media: Diversified & Production | 2.11% |

| Hotel, Gaming, & Leisure | 1.95% |

| Metals & Mining | 1.86% |

| Retail | 1.83% |

| Beverage, Food, & Tobacco | 1.78% |

| Consumer goods: non-durable | 1.69% |

| Consumer goods: durable | 1.48% |

| FIRE: Finance | 1.46% |

| FIRE: Real Estate | 1.36% |

| Transportation: Cargo | 1.26% |

| Construction & Building | 1.12% |

| Automotive | 1.05% |

| Energy: Electricity | 0.80% |

| Media: Advertising, Printing & Publishing | 0.64% |

| Chemicals, Plastics, & Rubber | 0.39% |

| Utilities: Electric | 0.14% |

| Other Assets in Excess of Liabilities | 5.53% |

| TOTAL | 100.00% |

Portfolio Composition (as a % of Net Assets)

| Bank Loans | 59.82% |

| Corporate Bonds | 31.61% |

| Collateralized Loan Obligations | 3.04% |

| Other Assets in Excess of Liabilities | 5.53% |

| TOTALS | 100.00% |

| Annual Report | December 31, 2017 | 7 |

| Griffin Institutional Access Credit Fund | Schedule of Investments |

December 31, 2017

| Description | | Currency | | | Rate | | Maturity

Date | | | Principal

Amount | | | Value

(Note 2) | |

| BANK LOANS (59.82%)(a) | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| 1011778 BC ULC (New Red Finance, Inc.), Term B-3 Loan, Tranche 1 | | | USD | | | 1M US L + 2.25% | | | 02/16/24 | | | | 58,842 | | | $ | 58,906 | |

| 1011778 BC ULC (New Red Finance, Inc.), Term B-3 Loan, Tranche 2 | | | USD | | | 3M US L + 2.25% | | | 02/16/24 | | | | 37,829 | | | | 37,870 | |

| Accudyne Industries Borrower SCA/Accudyne Industries LLC, Initial Term Loan | | | USD | | | 1M US L + 3.75% | | | 08/18/24 | | | | 243,621 | | | | 245,410 | |

| Acosta, Inc., Tranche B-1 Loan | | | USD | | | 1M US L + 3.25% | | | 09/26/21 | | | | 107,110 | | | | 94,904 | |

| Advantage Sales & Marketing, Inc., Initial Term Loan (First Lien) | | | USD | | | 3M US L + 3.25% | | | 07/23/21 | | | | 373,072 | | | | 364,755 | |

| Agro Merchants North America Holdings, Inc., Effective Date Loan (First Lien) | | | USD | | | 1M US L + 3.75% | | | 12/06/24 | | | | 89,993 | | | | 90,893 | |

| A-I Parent LLC, Initial Term Loan (First Lien)(b) | | | USD | | | L + 3.25% | | | 12/01/23 | | | | 401,197 | | | | 404,707 | |

| Alliant Holdings Intermediate LLC, Initial Term Loan | | | USD | | | 1M US L + 3.25% | | | 08/12/22 | | | | 1,492,360 | | | | 1,501,910 | |

| American Tire Distributors, Inc., Initial Term Loan | | | USD | | | 1M US L + 4.25% | | | 09/01/21 | | | | 1,491,058 | | | | 1,503,546 | |

| Anaren, Inc., Term Loan (First Lien) | | | USD | | | 3M US L + 4.50% | | | 02/18/21 | | | | 209,136 | | | | 210,182 | |

| Ancestry.com Operations Inc., Term Loan (First Lien) | | | USD | | | 1M US L + 3.25% | | | 10/19/23 | | | | 598,364 | | | | 602,478 | |

| Aqgen Ascensus, Inc., Delayed Draw Term Loan(c) | | | USD | | | L + 3.50% | | | 12/05/22 | | | | 241,874 | | | | 243,689 | |

| Aristrocrat Leisure, Ltd., New 2017 Term Loan | | | USD | | | 3M US L + 2.00% | | | 10/19/24 | | | | 170,639 | | | | 171,306 | |

| Ascena Retail Group, Inc., Tranche B Term Loan | | | USD | | | 1M US L + 4.50% | | | 08/21/22 | | | | 330,000 | | | | 275,138 | |

| Ascend Performance Materials Operations LLC, Term B Loan | | | USD | | | 3M US L + 5.25% | | | 08/12/22 | | | | 227,597 | | | | 229,304 | |

| ASP MCS Acquisition Corp., Initial Term Loan | | | USD | | | 1M US L + 4.75% | | | 05/20/24 | | | | 580,713 | | | | 586,520 | |

| Asurion LLC, Amendment No.14 Replacement B-4 Term Loan | | | USD | | | 1M US L + 2.75% | | | 08/04/22 | | | | 497,500 | | | | 500,654 | |

| Asurion LLC, Replacement B-2 Term Loan (Second Lien) | | | USD | | | 1M US L + 6.00% | | | 08/04/25 | | | | 2,085,308 | | | | 2,146,997 | |

| Asurion LLC, Replacement B-5 Term Loan | | | USD | | | 1M US L + 3.00% | | | 11/03/23 | | | | 80,762 | | | | 81,231 | |

| Autodata, Inc., Initial Term Loan (First Lien)(b) | | | USD | | | 3M US L + 3.25% | | | 12/12/24 | | | | 500,000 | | | | 501,250 | |

| Autodata, Inc., Initial Term Loan (Second Lien) | | | USD | | | 3M US L + 7.25% | | | 12/12/25 | | | | 190,967 | | | | 192,638 | |

| BCP Renaissance Parent LLC, Initial Term Loan | | | USD | | | 3M US L + 4.00% | | | 10/31/24 | | | | 87,088 | | | | 88,267 | |

| Belron Finance US LLC, Initial Euro Term Loan | | | EUR | | | 3M EUR L + 2.75%, 0.01% Floor | | | 11/07/24 | | | | 125,589 | | | | 152,038 | |

| Berlin Packaging LLC, 2017 Replacement Term Loan (First Lien), Tranche 1 | | | USD | | | 1M US L + 3.25% | | | 10/01/21 | | | | 236,546 | | | | 238,296 | |

| Berlin Packaging LLC, 2017 Replacement Term Loan (First Lien), Tranche 2 | | | USD | | | 3M US L + 3.25% | | | 10/01/21 | | | | 141,513 | | | | 142,556 | |

| BioClinica Holding I, LP, Initial Term Loan (First Lien) | | | USD | | | 3M US L + 4.25% | | | 10/20/23 | | | | 507,471 | | | | 497,322 | |

| BWAY Holding Co., Initial Term Loan | | | USD | | | 3M US L + 3.25% | | | 04/03/24 | | | | 995,000 | | | | 1,000,442 | |

| Cactus Wellhead LLC, Tranche B Term Loan | | | USD | | | 3M US L + 6.00% | | | 07/31/20 | | | | 424,358 | | | | 425,419 | |

| Caelus Energy Alaska 03 LLC, Second Lien Loan | | | USD | | | 3M US L + 7.50% | | | 04/15/20 | | | | 53,937 | | | | 48,454 | |

| CB Poly Investments, LLC, Closing Date Term Loan (First Lien) | | | USD | | | 1M US L + 4.75% | | | 08/16/23 | | | | 1,011,210 | | | | 1,020,715 | |

| CDS US Intermediate Holdings, Inc., Term B Loan (First Lien) | | | USD | | | 3M US L + 3.75% | | | 07/08/22 | | | | 118,769 | | | | 118,139 | |

| CenturyLink, Inc., Initial Term B Loan | | | USD | | | 1M US L + 2.75% | | | 01/31/25 | | | | 227,505 | | | | 219,908 | |

| Ch Hold Corp., Initial Term Loan (First Lien) | | | USD | | | 1M US L + 3.00% | | | 02/01/24 | | | | 103,857 | | | | 104,636 | |

| Checkout Holding Corp., Term B Loan (First Lien) | | | USD | | | 1M US L + 3.50% | | | 04/09/21 | | | | 500,000 | | | | 399,452 | |

| Circor International, Inc., Initial Term Loan | | | USD | | | 1M US L + 3.50% | | | 12/11/24 | | | | 422,246 | | | | 421,455 | |

| Comet Bidco Ltd., Facility B | | | GBP | | | 1M GBP L + 5.25% | | | 09/30/24 | | | | 469,565 | | | | 623,550 | |

| Commercial Vehicle Group, Inc. (CVG), Term B Loan | | | USD | | | 1M US L + 6.00% | | | 04/12/23 | | | | 246,875 | | | | 248,727 | |

| Communications Sales & Leasing, Inc. (CSL Capital LLC), Shortfall Term Loan(b) | | | USD | | | 1M US L + 3.00% | | | 10/24/22 | | | | 256,398 | | | | 247,712 | |

| Compass Power Generation, LLC, Term Loan | | | USD | | | 3M US L + 3.75% | | | 12/20/24 | | | | 147,323 | | | | 148,428 | |

See Notes to Financial Statements.

| 8 | 1.888.926.2688 | www.griffincapital.com |

| Griffin Institutional Access Credit Fund | Schedule of Investments |

December 31, 2017

| Description | | Currency | | | Rate | | Maturity

Date | | | Principal

Amount | | | Value

(Note 2) | |

| CPG International LLC, New Term Loan | | | USD | | | 3M US L + 3.75% | | | 05/05/24 | | | | 364,471 | | | $ | 366,863 | |

| CVS Holdings I LP, Delayed Draw Term Loan(c)(d) | | | USD | | | 1M US L + 6.25% | | | 08/14/21 | | | | 1,200,000 | | | | 1,188,000 | |

| CVS Holdings I LP, First Incremental Term Loan(d) | | | USD | | | 1M US L + 6.25% | | | 08/16/21 | | | | 790,000 | | | | 782,100 | |

| CVS Holdings I LP, Revolver Loan(c)(d) | | | USD | | | 1M US L + 6.25% | | | 08/14/21 | | | | 43,000 | | | | 42,570 | |

| CVS Holdings I LP, Term Loan(d) | | | USD | | | 1M US L + 6.25% | | | 08/16/21 | | | | 251,335 | | | | 248,821 | |

| DAE Aviation Holdings, Inc., Initial Term Loan | | | USD | | | 1M US L + 3.75% | | | 07/07/22 | | | | 1,073,894 | | | | 1,083,962 | |

| Deep Gulf Energy II LLC, 2018 Term Loan(d)(e) | | | USD | | | 3M US L + 14.50% | | | 09/30/18 | | | | 100,000 | | | | 96,500 | |

| Deluxe Entertainment Services Group, Inc., Initial Term Loan | | | USD | | | 3M US L + 5.50% | | | 02/28/20 | | | | 194,550 | | | | 191,145 | |

| Digicert Holdings, Inc., Term Loan (First Lien) | | | USD | | | 3M US L + 4.75% | | | 10/31/24 | | | | 158,764 | | | | 161,007 | |

| Digicert Holdings, Inc., Term Loan (Second Lien) | | | USD | | | 3M US L + 8.00% | | | 10/31/25 | | | | 51,768 | | | | 52,205 | |

| Direct Chassis Acquisition, Inc., Term Loan (Second Lien)(b) | | | USD | | | L + 6.00% | | | 06/15/23 | | | | 374,252 | | | | 381,737 | |

| DXP Enterprises, Inc., Initial Term Loan | | | USD | | | 1M US L + 5.50% | | | 08/29/23 | | | | 53,590 | | | | 54,126 | |

| Envision Healthcare Corp., Initial Term Loan | | | USD | | | 1M US L + 3.00% | | | 12/01/23 | | | | 116,454 | | | | 116,891 | |

| EXC Holdings III Corp., Initial Euro Term Loan (First Lien) | | | EUR | | | 3M EUR L + 3.50% 0.00% Floor | | | 12/02/24 | | | | 22,825 | | | | 27,660 | |

| EXC Holdings III Corp., Initial USD Term Loan (Second Lien) | | | USD | | | 6M US L + 3.50% | | | 12/02/24 | | | | 158,089 | | | | 159,571 | |

| EXC Holdings III Corp., Term Loan(b) | | | USD | | | 3M US L + 7.50% | | | 12/01/25 | | | | 143,183 | | | | 145,330 | |

| Exgen Renewables IV, LLC, Term Loan | | | USD | | | 3M US L + 3.00% | | | 11/28/24 | | | | 137,680 | | | | 139,401 | |

| EZE Software Group LLC, Term B-2 Loan (First Lien), Tranche 1 | | | USD | | | 3M US L + 3.00% | | | 04/06/20 | | | | 276,125 | | | | 277,736 | |

| EZE Software Group LLC, Term B-2 Loan (First Lien), Tranche 2 | | | USD | | | 1M US L + 3.00% | | | 04/06/20 | | | | 221,288 | | | | 222,579 | |

| First Data Corp., 2024A New Dollar Term Loan | | | USD | | | 1M US L + 2.25% | | | 04/26/24 | | | | 500,000 | | | | 500,893 | |

| Flex Acquisition Co., Inc., Initial Term Loan | | | USD | | | 3M US L + 3.00% | | | 12/29/23 | | | | 127,884 | | | | 128,736 | |

| Frontier Communications Corp., Term B-1 Loan(b) | | | USD | | | 1M US L + 3.75% | | | 06/15/24 | | | | 249,373 | | | | 241,175 | |

| Go Daddy Operating Co., LLC, Tranche B-1 Term loan | | | USD | | | 1M US L + 2.25% | | | 02/15/24 | | | | 249,373 | | | | 250,377 | |

| GTT Communications, Inc. Tranche B Term Loan | | | USD | | | 1M US L + 3.25% | | | 01/09/24 | | | | 398,992 | | | | 402,484 | |

| Hargray Communications Group, Inc., Initial Term Loan | | | USD | | | 1M US L + 3.00% | | | 05/16/24 | | | | 248,750 | | | | 249,709 | |

| Hayward Industries Inc., Initial Term Loan (First Lien) | | | USD | | | 1M US L + 3.50% | | | 08/05/24 | | | | 498,750 | | | | 500,944 | |

| HD Supply Waterworks, Ltd., Initial Term Loan | | | USD | | | 3M US L + 3.00% | | | 08/01/24 | | | | 337,594 | | | | 340,126 | |

| HGC Holdings LLC, Term Loan B | | | USD | | | 3M US L + 5.50% | | | 12/20/24 | | | | 337,768 | | | | 324,399 | |

| Hub International, LTD, Initial Term Loan | | | USD | | | 3M US L + 3.00% | | | 10/02/20 | | | | 471,817 | | | | 474,472 | |

| Inc Research Holdings, Inc., Term B Loan | | | USD | | | 1M US L + 2.25% | | | 08/01/24 | | | | 158,552 | | | | 159,007 | |

| Intelsat Jackson Holdings SA, Tranche B-2 Term Loan(b) | | | USD | | | 3M US L + 2.75% | | | 06/30/19 | | | | 711,957 | | | | 715,071 | |

| Intelsat Jackson Holdings SA, Tranche B-4 Term Loan(b) | | | USD | | | L + 4.50% | | | 01/02/24 | | | | 177,721 | | | | 180,387 | |

| Intelsat Jackson Holdings SA, Tranche B-5 Term Loan(b) | | | USD | | | L + 6.63% | | | 01/02/24 | | | | 289,875 | | | | 293,638 | |

| Intralinks, Inc., Initial Term Loan (First Lien)(b) | | | USD | | | 3M US L + 4.00% | | | 11/14/24 | | | | 234,852 | | | | 233,854 | |

| Jaguar Holding Co. I LLC, 2017 Term Loan, Tranche 1 | | | USD | | | 1M US L + 2.75% | | | 08/18/22 | | | | 826,124 | | | | 828,654 | |

| Jaguar Holding Co. I LLC, 2017 Term Loan, Tranche 2 | | | USD | | | 3M US L + 2.75% | | | 08/18/22 | | | | 914,947 | | | | 917,750 | |

| Jane Street Group LLC, Dollar Term Loan | | | USD | | | 3M US L + 4.50% | | | 08/25/22 | | | | 104,544 | | | | 105,851 | |

| Jazz Acquisition, Inc., Term Loan (First Lien) | | | USD | | | 3M US L + 3.50% | | | 06/19/21 | | | | 1,301,634 | | | | 1,273,974 | |

| Kronos Acquisition Intermediate, Inc., Initial Loan | | | USD | | | 3M US L + 4.50% | | | 08/26/22 | | | | 983,049 | | | | 992,060 | |

| Kronos, Inc., Incremental Term Loan (First Lien) | | | USD | | | 3M US L + 3.50% | | | 11/01/23 | | | | 77,950 | | | | 78,557 | |

| Lakeland Tours LLC, Delayed Draw Term Loan(c) | | | USD | | | L + 4.00% | | | 12/16/24 | | | | 9,330 | | | | 9,423 | |

| Lakeland Tours LLC, Initial Term Loan(b) | | | USD | | | L + 4.00% | | | 12/16/24 | | | | 113,290 | | | | 114,423 | |

| Logix Communications LP., Term Loan(b) | | | USD | | | L + 5.75% | | | 12/22/24 | | | | 360,000 | | | | 363,375 | |

| Masergy Holdings, Inc., 2017 Replacement Term Loan (First Lien) | | | USD | | | 3M US L + 3.75% | | | 12/15/23 | | | | 8,239 | | | | 8,290 | |

| Masergy Holdings, Inc., Initial Loan (Second Lien) | | | USD | | | 3M US L + 8.50% | | | 12/16/24 | | | | 230,000 | | | | 233,307 | |

| MB Aerospace ACP Holdings III Corp., Term Loan(b) | | | USD | | | L + 3.50% | | | 12/13/24 | | | | 115,794 | | | | 115,939 | |

See Notes to Financial Statements.

| Annual Report | December 31, 2017 | 9 |

| Griffin Institutional Access Credit Fund | Schedule of Investments |

December 31, 2017

| Description | | Currency | | | Rate | | Maturity

Date | | | Principal

Amount | | | Value

(Note 2) | |

| MH Sub I LLC (Micro Holding Corp.), Amendment No. 2 Initial Term Loan (First Lien) | | | USD | | | 3M US L + 3.75% | | | 09/13/24 | | | | 743,726 | | | $ | 746,552 | |

| MH Sub I LLC (Micro Holding Corp.), Amendment No. 2 Initial Term Loan (Second Lien) | | | USD | | | 3M US L + 7.50% | | | 09/15/25 | | | | 491,828 | | | | 495,209 | |

| MRO Holdings, Inc., Initial Term Loan | | | USD | | | 3M US L + 5.25% | | | 10/25/23 | | | | 728,226 | | | | 734,598 | |

| MTN Infrastructure TopCo, Inc., Delayed Draw Term Loan(c) | | | USD | | | L + 3.25% | | | 11/15/24 | | | | 88,073 | | | | 88,476 | |

| MTN Infrastructure TopCo, Inc., Initial Term Loan | | | USD | | | 1M US L + 3.25% | | | 11/15/24 | | | | 89,927 | | | | 90,339 | |

| Murray Energy Corp., Term B-2 Loan | | | USD | | | 3M US L + 7.25% | | | 04/16/20 | | | | 1,043,754 | | | | 926,114 | |

| National Vision, Inc., New Term Loan (First Lien) | | | USD | | | 1M US L + 2.75% | | | 11/20/24 | | | | 703,525 | | | | 705,722 | |

| Netsmart, Inc., Term C-1 Loan | | | USD | | | 3M US L + 4.50% | | | 04/19/23 | | | | 282,099 | | | | 285,742 | |

| Novetta Solutions LLC, Initial Term Loan (First Lien) | | | USD | | | 3M US L + 5.00% | | | 10/17/22 | | | | 440,816 | | | | 428,418 | |

| NPC International, Inc., Bridge Loan (Second Lien)(b) | | | USD | | | L + 7.50% | | | 04/18/25 | | | | 425,238 | | | | 424,175 | |

| NPC International, Inc., Initial Term Loan (Second Lien) | | | USD | | | 1M US L + 7.50% | | | 04/18/25 | | | | 250,000 | | | | 256,250 | |

| Oeconnection LLC, Term Loan (Second Lien) | | | USD | | | 3M US L + 8.00% | | | 11/22/25 | | | | 222,772 | | | | 222,772 | |

| Optiv, Inc., Initial Term Loan (First Lien) | | | USD | | | 3M US L + 3.25% | | | 02/01/24 | | | | 89,829 | | | | 84,514 | |

| Oxbow Carbon LLC, Term Loan (Second Lien)(b) | | | USD | | | L + 7.50% | | | 01/04/24 | | | | 246,275 | | | | 247,506 | |

| Oxbow Carbon LLC, Tranche B Term Loan (First Lien)(b) | | | USD | | | L + 3.75% | | | 01/04/23 | | | | 50,856 | | | | 51,269 | |

| Packaging Coordinators Midco, Inc., Initial Term Loan | | | USD | | | 1M US L + 4.00% | | | 06/30/23 | | | | 678,118 | | | | 679,813 | |

| Packaging Coordinators Midco, Inc., Term Loan (Second Lien) | | | USD | | | 1M US L + 8.75% | | | 06/29/24 | | | | 512,500 | | | | 512,500 | |

| Paladin Brands Holdings, Inc., Term B Loan | | | USD | | | 3M US L + 5.50% | | | 08/15/22 | | | | 803,935 | | | | 809,964 | |

| Parexel International Corp., Initial Term Loan | | | USD | | | 1M US L + 3.00% | | | 09/27/24 | | | | 736,493 | | | | 740,789 | |

| Petco Animal Supplies, Inc., Term Loan | | | USD | | | 3M US L + 3.00% | | | 01/26/23 | | | | 658,325 | | | | 501,150 | |

| Playa Resorts Holding B.V., Initial Term Loan | | | USD | | | 3M US L + 3.25% | | | 04/29/24 | | | | 73,340 | | | | 73,798 | |

| Pods, LLC, Tranche B-3 Term Loan | | | USD | | | 1M US L + 3.00% | | | 12/06/24 | | | | 99,003 | | | | 99,705 | |

| Polycom Inc., Initial Term Loan (First Lien) | | | USD | | | 1M US L + 5.25% | | | 09/27/23 | | | | 454,323 | | | | 459,047 | |

| Post Holdings, Inc., Series A Incremental Term Loan | | | USD | | | 1M US L + 2.25% | | | 05/24/24 | | | | 128,061 | | | | 128,648 | |

| Press Ganey Holdings, Inc., Replacement Term Loan (First Lien)(b) | | | USD | | | 1M US L + 3.00% | | | 10/23/23 | | | | 499,078 | | | | 501,886 | |

| Prime Security Services Borrower LLC, 2016-2 Refinancing Term B-1 Loan (First Lien) | | | USD | | | 1M US L + 2.75% | | | 05/02/22 | | | | 179,841 | | | | 181,334 | |

| Project Alpha Intermediate Holding, Inc., Term Loan | | | USD | | | 3M US L + 3.50% | | | 04/26/24 | | | | 220,592 | | | | 216,180 | |

| Quest Soffware US Holdings, Inc., 2017 Incremental Term Loan (First Lien) | | | USD | | | 3M US L + 5.50% | | | 10/31/22 | | | | 996,184 | | | | 1,013,492 | |

| Rackspace Hosting, Inc., Term B Loan (First Lien) | | | USD | | | 3M US L + 3.00% | | | 11/03/23 | | | | 593,861 | | | | 594,514 | |

| Radiate Holdco LLC, Closing Date Term Loan | | | USD | | | 1M US L + 3.00% | | | 02/01/24 | | | | 1,004,937 | | | | 998,656 | |

| RP Crown Parent LLC, Initial Term Loan | | | USD | | | 1M US L + 3.00% | | | 10/12/23 | | | | 335,400 | | | | 337,182 | |

| Sally Holdings LLC, Term B-1 Loan | | | USD | | | 1M US L + 2.50% | | | 07/05/24 | | | | 55,242 | | | | 55,311 | |

| Sedgwick Claims Management Services, Inc., Initial Term Loan (First Lien) | | | USD | | | 1M US L + 2.75% | | | 03/01/21 | | | | 994,832 | | | | 995,206 | |

| Sequa Mezzanine Holdings LLC, Initial Loan (Second Lien) | | | USD | | | 3M US L + 9.00% | | | 04/28/22 | | | | 635,787 | | | | 645,324 | |

| Sequa Mezzanine Holdings LLC, Initial Term Loan ( First Lien) | | | USD | | | 3M US L + 5.00% | | | 11/28/21 | | | | 1,513,398 | | | | 1,527,272 | |

| SolarWinds Holdings, Inc., 2017 Refinancing Term loan | | | USD | | | 1M US L + 3.50% | | | 02/03/23 | | | | 1,571,554 | | | | 1,579,214 | |

| Sophia LP, Term B Loan | | | USD | | | 3M US L + 3.25% | | | 09/30/22 | | | | 984,295 | | | | 986,669 | |

| SRS Distribution Inc., Term B-2 Loan (Second Lien) | | | USD | | | 1M US L + 8.75% | | | 02/24/23 | | | | 370,000 | | | | 379,558 | |

| Sterling Midco Holdings, Inc. , Initial Term Loan (First Lien) | | | USD | | | 1M US L + 3.50% | | | 06/19/24 | | | | 34,732 | | | | 34,992 | |

| STG-Fairway Acquisitions, Inc., Term Loan (First Lien)(b) | | | USD | | | 3M US L + 5.25% | | | 06/30/22 | | | | 636,363 | | | | 629,999 | |

| Tecostar Holding, Inc., 2017 Term Loan (First Lien) | | | USD | | | 3M US L + 3.50% | | | 05/01/24 | | | | 1,088,189 | | | | 1,100,431 | |

| Tempo Acquisition LLC, Initial Term Loan | | | USD | | | 1M US L + 3.00% | | | 05/01/24 | | | | 596,271 | | | | 595,154 | |

| TMF Group Holding B.V., Term B Loan(b) | | | EUR | | | EUR L + 3.25% | | | 12/06/24 | | | | 175,143 | | | | 210,802 | |

See Notes to Financial Statements.

| 10 | 1.888.926.2688 | www.griffincapital.com |

| Griffin Institutional Access Credit Fund | Schedule of Investments |

December 31, 2017

| Description | | Currency | | | Rate | | Maturity

Date | | | Principal

Amount | | | Value

(Note 2) | |

| TMK Hawk Parent Corp., Delayed Draw Term Loan (First Lien)(c) | | | USD | | | L + 3.50% | | | 08/28/24 | | | | 35,384 | | | $ | 35,694 | |

| TMK Hawk Parent Corp., Initial Term Loan (First Lien) | | | USD | | | 3M US L + 3.50% | | | 08/28/24 | | | | 790,630 | | | | 797,587 | |

| TNS, Inc. (Transaction Network Services, Inc.), Initial Term Loan (First Lien), Tranche 1(b) | | | USD | | | 2M US L + 4.00% | | | 08/14/22 | | | | 244,427 | | | | 245,313 | |

| TNS, Inc. (Transaction Network Services, Inc.), Initial Term Loan (First Lien), Tranche 2 | | | USD | | | 1M US L + 4.00% | | | 08/14/22 | | | | 2,785 | | | | 2,795 | |

| TransDigm, Inc., New Tranche F Term Loan, Tranche 1 | | | USD | | | 1M US L + 2.75% | | | 06/09/23 | | | | 83,171 | | | | 83,414 | |

| TransDigm, Inc., New Tranche F Term Loan, Tranche 2 | | | USD | | | 3M US L + 2.75% | | | 06/09/23 | | | | 43,389 | | | | 43,515 | |

| TransDigm, Inc., Tranche G Term Loan, Tranche 1 | | | USD | | | 1M US L + 3.00% | | | 08/22/24 | | | | 71,433 | | | | 71,858 | |

| TransDigm, Inc., Tranche G Term Loan, Tranche 2 | | | USD | | | 3M US L + 3.00% | | | 08/22/24 | | | | 243,976 | | | | 245,426 | |

| Travel Leaders Group LLC, New Incremental Term Loan | | | USD | | | 3M US L + 4.50% | | | 01/25/24 | | | | 270,557 | | | | 274,954 | |

| Traverse Midstream Partners LLC, Advance(b) | | | USD | | | L + 4.00% | | | 09/27/24 | | | | 46,471 | | | | 47,151 | |

| TRC Companies, Inc., Initial Term Loan | | | USD | | | 1M US L + 3.50% | | | 06/21/24 | | | | 325,374 | | | | 326,493 | |

| TurboCombustor Technology, Inc., Initial Term Loan | | | USD | | | 3M US L + 4.50% | | | 12/02/20 | | | | 685,212 | | | | 674,934 | |

| US Anesthesia Partners, Inc., Initial Term Loan (First Lien) | | | USD | | | 1M US L + 3.25% | | | 06/23/24 | | | | 985,260 | | | | 989,004 | |

| Vantiv LLC, New Term B-4 Loan(c) | | | USD | | | L + 2.00% | | | 09/19/24 | | | | 32,973 | | | | 33,148 | |

| Vantiv LLC, New Term B-4 Loan | | | USD | | | 1M US L + 2.00% | | | 08/09/24 | | | | 117,488 | | | | 118,288 | |

| VICI Properties 1 LLC, Term B Loan(b) | | | USD | | | L + 2.25% | | | 12/20/24 | | | | 505,354 | | | | 506,248 | |

| Virgin Media Bristol LLC, K Facility | | | USD | | | 1M US L + 2.50% | | | 01/15/26 | | | | 137,770 | | | | 137,942 | |

| West Corp., Term B Loan | | | USD | | | 1M US L + 4.00% | | | 10/10/24 | | | | 177,729 | | | | 178,606 | |

| Wheels Up Partners LLC, Class A Notes | | | USD | | | 3M US L + 6.50% | | | 03/01/24 | | | | 369,511 | | | | 367,664 | |

| William Morris Endeavor Entertainment LLC (IMG Worldwide Holdings LLC), Term Loan (First Lien) | | | USD | | | 3M US L + 3.25% | | | 05/06/21 | | | | 909,902 | | | | 915,873 | |

| Windstream Services, LLC, Tranche B-6 Term Loan | | | USD | | | 1M US L + 4.00% | | | 03/29/21 | | | | 124,684 | | | | 117,437 | |

| WireCo WorldGroup, Inc. (WireCo WorldGroup Finance LP), Initial Term Loan (First Lien) | | | USD | | | 3M US L + 5.50% | | | 09/29/23 | | | | 333,244 | | | | 335,119 | |

| WP CPP Holdings, LLC, Term B-3 Loan (First Lien) | | | USD | | | 3M US L + 3.50% | | | 12/28/19 | | | | 498,688 | | | | 498,843 | |

| | | | | | | | | | | | | | | | | | | |

| TOTAL BANK LOANS | | | | | | | | | | | | | | | | | | |

| (Cost $61,143,943) | | | | | | | | | | | | | | | | | 61,388,435 | |

| | | | | | | | | | | | | | | | | | | |

| CORPORATE BONDS (31.61%)(f) | | | | | | | | | | | | | | | | | | |

| 1011778 BC ULC (New Red Finance, Inc.)(g) | | | USD | | | 4.25% | | | 05/15/24 | | | | 150,000 | | | | 150,000 | |

| 1011778 BC ULC (New Red Finance, Inc.)(g) | | | USD | | | 5.00% | | | 10/15/25 | | | | 233,000 | | | | 235,913 | |

| AECOM | | | USD | | | 5.13% | | | 03/15/27 | | | | 650,000 | | | | 663,748 | |

| Alta Mesa Holdings LP / Alta Mesa Finance Services Corp. | | | USD | | | 7.88% | | | 12/15/24 | | | | 273,000 | | | | 300,641 | |

| APTIM Corp.(g) | | | USD | | | 7.75% | | | 06/15/25 | | | | 231,000 | | | | 221,760 | |

| Ashtead Capital, Inc.(g) | | | USD | | | 4.13% | | | 08/15/25 | | | | 269,000 | | | | 272,026 | |

| Berry Global, Inc. | | | USD | | | 5.13% | | | 07/15/23 | | | | 250,000 | | | | 260,938 | |

| Berry Global, Inc. | | | USD | | | 5.50% | | | 05/15/22 | | | | 38,000 | | | | 39,188 | |

| BWAY Holding Co.(g) | | | USD | | | 5.50% | | | 04/15/24 | | | | 250,000 | | | | 260,625 | |

| BWAY Holding Co.(g) | | | USD | | | 7.25% | | | 04/15/25 | | | | 1,000,000 | | | | 1,034,999 | |

| California Resources Corp.(g) | | | USD | | | 8.00% | | | 12/15/22 | | | | 125,000 | | | | 103,594 | |

| CB Escrow Corp.(g) | | | USD | | | 8.00% | | | 10/15/25 | | | | 280,000 | | | | 285,600 | |

| CCO Holdings LLC / CCO Holdings Capital Corp.(g) | | | USD | | | 5.00% | | | 02/01/28 | | | | 596,000 | | | | 582,590 | |

| CCO Holdings LLC / CCO Holdings Capital Corp.(g) | | | USD | | | 5.75% | | | 02/15/26 | | | | 910,000 | | | | 947,538 | |

| CDW LLC / CDW Finance Corp. | | | USD | | | 5.00% | | | 09/01/25 | | | | 125,000 | | | | 130,000 | |

| Churchill Downs, Inc.(g) | | | USD | | | 4.75% | | | 01/15/28 | | | | 88,000 | | | | 87,864 | |

| Compass Minerals International, Inc.(g) | | | USD | | | 4.88% | | | 07/15/24 | | | | 177,000 | | | | 175,230 | |

| Comstock Resources, Inc. | | | USD | | | 10.00% Cash or 12.25% PIK | | | 03/15/20 | | | | 250,000 | | | | 259,063 | |

| CPG Merger Sub LLC(g) | | | USD | | | 8.00% | | | 10/01/21 | | | | 504,000 | | | | 522,900 | |

See Notes to Financial Statements.

| Annual Report | December 31, 2017 | 11 |

| Griffin Institutional Access Credit Fund | Schedule of Investments |

December 31, 2017

| Description | | Currency | | | Rate | | | Maturity

Date | | Principal

Amount | | | Value

(Note 2) | |

| CSC Holdings LLC(g) | | | USD | | | | 10.88% | | | 10/15/25 | | | 842,000 | | | $ | 1,001,979 | |

| Dell International LLC / EMC Corp.(g) | | | USD | | | | 6.02% | | | 06/15/26 | | | 130,000 | | | | 143,540 | |

| Diamondback Energy, Inc. | | | USD | | | | 4.75% | | | 11/01/24 | | | 304,000 | | | | 306,660 | |

| Eldorado Resorts, Inc. | | | USD | | | | 6.00% | | | 04/01/25 | | | 80,000 | | | | 84,000 | |

| Gates Global LLC / Gates Global Co.(g) | | | USD | | | | 6.00% | | | 07/15/22 | | | 625,000 | | | | 642,188 | |

| Genworth Holdings, Inc. | | | USD | | | | 4.80% | | | 02/15/24 | | | 229,000 | | | | 195,795 | |

| Genworth Holdings, Inc. | | | USD | | | | 4.90% | | | 08/15/23 | | | 32,000 | | | | 27,440 | |

| GTT Communications, Inc.(g) | | | USD | | | | 7.88% | | | 12/31/24 | | | 750,000 | | | | 793,124 | |

| Gulfport Energy Corp. | | | USD | | | | 6.00% | | | 10/15/24 | | | 375,000 | | | | 376,875 | |

| Gulfport Energy Corp.(g) | | | USD | | | | 6.38% | | | 01/15/26 | | | 636,000 | | | | 642,360 | |

| Hanesbrands, Inc.(g) | | | USD | | | | 4.88% | | | 05/15/26 | | | 109,000 | | | | 112,270 | |

| HCA, Inc. | | | USD | | | | 5.38% | | | 02/01/25 | | | 900,000 | | | | 933,750 | |

| Intelsat Jackson Holdings SA(g) | | | USD | | | | 9.50% | | | 09/30/22 | | | 729,000 | | | | 843,817 | |

| Intrepid Aviation Group Holdings LLC / Intrepid Finance Co.(g) | | | USD | | | | 6.88% | | | 02/15/19 | | | 945,000 | | | | 942,637 | |

| Intrum Justitia AB(g) | | | EUR | | | | 3.13% | | | 07/15/24 | | | 195,000 | | | | 235,406 | |

| Iron Mountain, Inc.(g) | | | USD | | | | 5.25% | | | 03/15/28 | | | 274,000 | | | | 274,000 | |

| Jones Energy Holdings LLC / Jones Energy Finance Corp. | | | USD | | | | 6.75% | | | 04/01/22 | | | 125,000 | | | | 94,375 | |

| KAR Auction Services, Inc.(g) | | | USD | | | | 5.13% | | | 06/01/25 | | | 103,000 | | | | 105,833 | |

| Kronos Acquisition Holdings, Inc.(g) | | | USD | | | | 9.00% | | | 08/15/23 | | | 353,000 | | | | 330,938 | |

| Level 3 Financing, Inc. | | | USD | | | | 5.38% | | | 01/15/24 | | | 410,000 | | | | 410,513 | |

| Live Nation Entertainment, Inc.(g) | | | USD | | | | 4.88% | | | 11/01/24 | | | 250,000 | | | | 256,875 | |

| MEDNAX, Inc.(g) | | | USD | | | | 5.25% | | | 12/01/23 | | | 500,000 | | | | 510,000 | |

| Multi-Color Corp.(g) | | | USD | | | | 4.88% | | | 11/01/25 | | | 610,000 | | | | 613,812 | |

| Murray Energy Corp.(g) | | | USD | | | | 11.25% | | | 04/15/21 | | | 512,000 | | | | 263,680 | |

| National CineMedia LLC | | | USD | | | | 5.75% | | | 08/15/26 | | | 500,000 | | | | 471,250 | |

| Park Aerospace Holdings, Ltd.(g) | | | USD | | | | 5.50% | | | 02/15/24 | | | 1,000,000 | | | | 994,999 | |

| Parsley Energy LLC / Parsley Finance Corp.(g) | | | USD | | | | 5.25% | | | 08/15/25 | | | 250,000 | | | | 251,875 | |

| Parsley Energy LLC / Parsley Finance Corp.(g) | | | USD | | | | 5.38% | | | 01/15/25 | | | 760,000 | | | | 771,399 | |

| Pioneer Holdings LLC / Pioneer Finance Corp.(g) | | | USD | | | | 9.00% | | | 11/01/22 | | | 253,000 | | | | 262,171 | |

| Plastipak Holdings, Inc.(g) | | | USD | | | | 6.25% | | | 10/15/25 | | | 78,000 | | | | 80,535 | |

| Post Holdings, Inc.(g) | | | USD | | | | 5.00% | | | 08/15/26 | | | 250,000 | | | | 246,563 | |

| Post Holdings, Inc.(g) | | | USD | | | | 5.75% | | | 03/01/27 | | | 121,000 | | | | 123,420 | |

| Prime Security Services Borrower LLC / Prime Finance, Inc.(g) | | | USD | | | | 9.25% | | | 05/15/23 | | | 1,375,000 | | | | 1,529,687 | |

| PVH Corp.(g) | | | EUR | | | | 3.13% | | | 12/15/27 | | | 242,000 | | | | 294,986 | |

| QEP Resources, Inc. | | | USD | | | | 5.25% | | | 05/01/23 | | | 375,000 | | | | 381,323 | |

| Range Resources Corp. | | | USD | | | | 5.00% | | | 03/15/23 | | | 500,000 | | | | 500,000 | |

| Rbs Global Inc. / Rexnord LLC(g) | | | USD | | | | 4.88% | | | 12/15/25 | | | 220,000 | | | | 222,750 | |

| Regal Entertainment Group | | | USD | | | | 5.75% | | | 02/01/25 | | | 500,000 | | | | 515,000 | |

| Sabre GLBL, Inc.(g) | | | USD | | | | 5.25% | | | 11/15/23 | | | 250,000 | | | | 256,950 | |

| Sabre GLBL, Inc.(g) | | | USD | | | | 5.38% | | | 04/15/23 | | | 250,000 | | | | 258,750 | |

| Sally Holdings LLC / Sally Capital, Inc. | | | USD | | | | 5.63% | | | 12/01/25 | | | 250,000 | | | | 250,000 | |

| SBA Communications Corp. | | | USD | | | | 4.88% | | | 09/01/24 | | | 298,000 | | | | 306,940 | |

| Service Corp. International | | | USD | | | | 4.63% | | | 12/15/27 | | | 98,000 | | | | 99,678 | |

| Sirius XM Radio, Inc.(g) | | | USD | | | | 3.88% | | | 08/01/22 | | | 76,000 | | | | 76,570 | |

| Sirius XM Radio, Inc.(g) | | | USD | | | | 5.00% | | | 08/01/27 | | | 105,000 | | | | 105,788 | |

| Six Flags Entertainment Corp.(g) | | | USD | | | | 4.88% | | | 07/31/24 | | | 250,000 | | | | 254,375 | |

| Sophia LP / Sophia Finance, Inc.(g) | | | USD | | | | 9.00% | | | 09/30/23 | | | 250,000 | | | | 265,625 | |

| Sprint Corp. | | | USD | | | | 7.88% | | | 09/15/23 | | | 250,000 | | | | 266,875 | |

| SRC Energy, Inc.(g) | | | USD | | | | 6.25% | | | 12/01/25 | | | 246,000 | | | | 252,765 | |

| Summit Materials LLC / Summit Materials Finance Corp.(g) | | | USD | | | | 5.13% | | | 06/01/25 | | | 119,000 | | | | 121,678 | |

| Tesla, Inc.(g) | | | USD | | | | 5.30% | | | 08/15/25 | | | 250,000 | | | | 239,688 | |

See Notes to Financial Statements.

| 12 | 1.888.926.2688 | www.griffincapital.com |

| Griffin Institutional Access Credit Fund | Schedule of Investments |

December 31, 2017

| Description | | Currency | | | Rate | | | Maturity

Date | | Principal

Amount | | | Value

(Note 2) | |

| T-Mobile USA, Inc. | | | USD | | | | 6.38% | | | 03/01/25 | | | 1,125,000 | | | $ | 1,206,562 | |

| T-Mobile USA, Inc. | | | USD | | | | 6.50% | | | 01/15/26 | | | 250,000 | | | | 273,438 | |

| TreeHouse Foods, Inc.(g) | | | USD | | | | 6.00% | | | 02/15/24 | | | 375,000 | | | | 391,875 | |

| TriMas Corp.(g) | | | USD | | | | 4.88% | | | 10/15/25 | | | 184,000 | | | | 185,035 | |

| Ultra Resources, Inc.(g) | | | USD | | | | 7.13% | | | 04/15/25 | | | 125,000 | | | | 125,156 | |

| United Continental Holdings, Inc. | | | USD | | | | 5.00% | | | 02/01/24 | | | 850,000 | | | | 871,250 | |

| United Rentals North America, Inc. | | | USD | | | | 4.88% | | | 01/15/28 | | | 622,000 | | | | 626,664 | |

| United Rentals North America, Inc. | | | USD | | | | 5.88% | | | 09/15/26 | | | 375,000 | | | | 402,656 | |

| ViaSat, Inc.(g) | | | USD | | | | 5.63% | | | 09/15/25 | | | 220,000 | | | | 222,750 | |

| Wabash National Corp.(g) | | | USD | | | | 5.50% | | | 10/01/25 | | | 162,000 | | | | 163,620 | |

| West Corp.(g) | | | USD | | | | 8.50% | | | 10/15/25 | | | 181,000 | | | | 179,643 | |

| Whiting Petroleum Corp. | | | USD | | | | 1.25% | | | 04/01/20 | | | 125,000 | | | | 115,625 | |

| Wildhorse Resource Development Corp. | | | USD | | | | 6.88% | | | 02/01/25 | | | 43,000 | | | | 44,280 | |

| WildHorse Resource Development Corp.(g) | | | USD | | | | 6.88% | | | 02/01/25 | | | 82,000 | | | | 83,845 | |

| Zayo Group LLC / Zayo Capital, Inc.(g) | | | USD | | | | 5.75% | | | 01/15/27 | | | 500,000 | | | | 511,250 | |

| Zayo Group LLC / Zayo Capital, Inc. | | | USD | | | | 6.00% | | | 04/01/23 | | | 410,000 | | | | 429,086 | |

| Zayo Group LLC / Zayo Capital, Inc. | | | USD | | | | 6.38% | | | 05/15/25 | | | 500,000 | | | | 530,625 | |

| TOTAL CORPORATE BONDS | | | | | | | | | | | | | | | | | | |

| (Cost $32,289,905) | | | | | | | | | | | | | | | | | 32,441,084 | |

| | | | | | | | | | | | | | | | | | | |

| COLLATERALIZED LOAN OBLIGATIONS (3.04%) | | | | | | | | | | | | | | | | | | |

| DEBT (0.89%) | | | | | | | | | | | | | | | | | | |

| OZLM, Ltd., Series 2017-19D(a)(g) | | | USD | | | | 3M US L + 6.60% | | | 11/22/30 | | | 400,000 | | | | 401,594 | |

| Sound Point CLO, Ltd., Series 2017-3A(a)(g) | | | USD | | | | 3M US L + 6.50% | | | 10/20/30 | | | 500,000 | | | | 509,856 | |

| | | | | | | | | | | | | | | | | | 911,450 | |

| EQUITY (2.15%) | | | | | | | | | | | | | | | | | | |

| Carlyle Global Market Strategies, Ltd., Series 2017-5A(g)(h) | | | USD | | | | 16.74% | | | 01/20/30 | | | 700,000 | | | | 668,857 | |

| OZLM, Ltd., Series 2017-19A(g)(h) | | | USD | | | | 17.78% | | | 11/22/30 | | | 1,100,000 | | | | 990,001 | |

| Venture CDO, Ltd., Series 2017-30A(g)(h) | | | USD | | | | 17.44% | | | 01/15/31 | | | 600,000 | | | | 550,500 | |

| | | | | | | | | | | | | | | | | | 2,209,358 | |

| TOTAL COLLATERALIZED LOAN OBLIGATIONS | | | | | | | | | | | | | | | |

| (Cost $3,106,494) | | | | | | | | | | | | | | | | | 3,120,808 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | Expiration

Date | | | Shares | | | | Value

(Note 2) | |

| WARRANTS (0.00%) | | | | | | | | | | | | | | | | | | |

| Deep Gulf Energy II, LLC(d) | | | USD | | | | | | | 12/31/25 | | | 33 | | | | 4,000 | |

| | | | | | | | | | | | | | | | | | | |

| TOTAL WARRANTS | | | | | | | | | | | | | | | | | | |

| (Cost $–) | | | | | | | | | | | | | | | | | 4,000 | |

| | | | | | | | | | | | | | | | | | | |

| TOTAL INVESTMENTS (94.47%) | | | | | | | | | | | | | | | | | | |

| (Cost $96,540,342) | | | | | | | | | | | | | | | | $ | 96,954,327 | |

| | | | | | | | | | | | | | | | | | | |

| Other Assets In Excess Of Liabilities (5.53%) | | | | | | | | | | | | | | | | | 5,673,943 | |

| NET ASSETS (100.00%) | | | | | | | | | | | | | | | | $ | 102,628,270 | |

Libor Rates:

1M US L - 1 Month US LIBOR as of December 31, 2017 was 1.57%

2M US L - 2 Month US LIBOR as of December 31, 2017 was 1.62%

3M US L - 3 Month US LIBOR as of December 31, 2017 was 1.69%

6M US L - 6 Month US LIBOR as of December 31, 2017 was 1.84%

3M EUR L - 3 Month EURIBOR as of December 31, 2017 was -0.32%

1M GBP L - 1 Month GBP LIBOR as of December 31, 2017 was 0.50%

See Notes to Financial Statements.

| Annual Report | December 31, 2017 | 13 |

| Griffin Institutional Access Credit Fund | Schedule of Investments |

December 31, 2017

| (a) | Floating or variable rate security. The reference rate is described above. The rate in effect as of December 31, 2017 is based on the reference rate plus the displayed spread as of the security's last reset date. |

| (b) | All or a portion of this position has not settled as of December 31, 2017. The interest rate shown represents the stated spread over London Interbank Offered Rate ("LIBOR" or "L") or the applicable LIBOR floor; the Fund will not accrue interest until the settlement date, at which point LIBOR will be established. If the position is partially settled, the reference rate shown is applicable to the settled portion. |

| (c) | A portion of this position or the entire position was not funded as of December 31, 2017. The Fund had approximately $1,540,021 in unfunded commitments pursuant to a Delayed Draw Term Loan facility. The Schedule of Investments records each of these investments as fully funded and accordingly, a corresponding payable for investments purchased has also been recorded which represents the actual unfunded amount on the balance sheet date. |

| (d) | This investment is classified as a level 3 asset, and such classification was a result of unavailable quoted prices from an active market or the unavailability of other significant observable inputs. |

| (e) | 60.91% of the total coupon was PIK and 39.09% was cash. |

| (g) | Securities exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be sold in the ordinary course of business in transactions exempt from registration, normally to qualified institutional buyers. As of December 31, 2017, the aggregate market value of those securities was $24,187,654, representing 23.57% of net assets. |

| (h) | CLO subordinated notes, income notes, and M notes are considered CLO equity positions. CLO equity positions are entitled to recurring distributions which are generally equal to the remaining cash flow of payments made by underlying securities less contractual payments to debt holders and fund expenses. The effective yield is estimated based upon the current projection of the amount and timing of these recurring distributions in addition to the estimated amount of terminal principal payment. Effective yields for the Fund's CLO equity positions are updated at least once a year, either on the anniversary of the formation of a CLO investment that the Fund holds in its portfolio or on a transaction such as a partial sale, add-on purchase, refinancing or reset. The estimated yield and investment cost may ultimately not be realized. |

Industry Concentration (as a % of Net Assets)

| Services: Business | | | 9.61 | % |

| Telecommunications | | | 9.23 | % |

| Aerospace & Defense | | | 7.01 | % |

| Healthcare & Pharmaceuticals | | | 5.58 | % |

| High Tech Industries | | | 5.25 | % |

| Energy: Oil & Gas | | | 5.24 | % |

| Media: Broadcasting & Subscription | | | 5.10 | % |

| Containers, Packaging, & Glass | | | 4.86 | % |

| FIRE*: Insurance | | | 4.26 | % |

| Capital Equipment | | | 3.28 | % |

| Services: Consumer | | | 3.18 | % |

| Wholesale | | | 3.06 | % |

| Unassigned | | | 3.04 | % |

| Banking | | | 2.58 | % |

| Transportation: Consumer | | | 2.27 | % |

| Media: Diversified & Production | | | 2.11 | % |

| Hotel, Gaming, & Leisure | | | 1.95 | % |

| Metals & Mining | | | 1.86 | % |

| Retail | | | 1.83 | % |

| Beverage, Food, & Tobacco | | | 1.78 | % |

| Consumer goods: non-durable | | | 1.69 | % |

| Consumer goods: durable | | | 1.48 | % |

| FIRE*: Finance | | | 1.46 | % |

| FIRE*: Real Estate | | | 1.36 | % |

| Transportation: Cargo | | | 1.26 | % |

| Construction & Building | | | 1.12 | % |

| Automotive | | | 1.05 | % |

| Energy: Electricity | | | 0.80 | % |

| Media: Advertising, Printing & Publishing | | | 0.64 | % |

| Chemicals, Plastics, & Rubber | | | 0.39 | % |

| Utilities: Electric | | | 0.14 | % |

| Other Assets in Excess of Liabilities | | | 5.53 | % |

| TOTAL | | | 100.00 | % |

| * | Finance, Insurance, and Real Estate. |

See Notes to Financial Statements.

| 14 | 1.888.926.2688 | www.griffincapital.com |

| Griffin Institutional Access Credit Fund | Schedule of Investments |

December 31, 2017

Common Abbreviations:

EURIBOR - Euro InterBank Offered Rate

LIBOR - London Interbank Offered Rate

LLC - Limited Liability Company

LP - Limited Partnerships

PIK - Payment in Kind

OUTSTANDING FORWARD FOREIGN CURRENCY CONTRACTS

| Counterparty | | Buy/Sale Currency | | Contracted Amount* | | | Purchase/Sale Contract | | Settlement Date | | Current Value(USD) | | | Unrealized Appreciation/ (Depreciation) | |

| BNY Mellon | | USD/EUR | | | 600,000 | | | Sale | | 01/19/2018 | | $ | 720,641 | | | $ | (8,441 | ) |

| BNY Mellon | | USD/GBP | | | 470,000 | | | Sale | | 01/29/2018 | | | 635,160 | | | | (4,260 | ) |

| | | | | | | | | | | | | | | | | $ | (12,701 | ) |

| * | The contracted amount is stated in the foreign currency in which the security is denominated. |

See Notes to Financial Statements.

| Annual Report | December 31, 2017 | 15 |

| Griffin Institutional Access Credit Fund | Statement of Assets and Liabilities |

December 31, 2017

| ASSETS | | |

| Investments, at value (Cost $96,540,342) | $ | 96,954,327 | |

| Cash | | 10,450,066 | |

| Foreign currency, at value (Cost $17,745) | | 17,864 | |

| Receivable for investments sold | | 1,593,255 | |

| Receivable for shares sold | | 1,403,576 | |

| Dividends and interest receivable | | 756,325 | |

| Receivable due from Adviser (Note 4) | | 308,287 | |

| Prepaid offering costs (Note 2) | | 83,178 | |

| Prepaid expenses and other assets | | 10,926 | |

| Total Assets | | 111,577,804 | |

| LIABILITIES | | | |

| Payable for investments purchased | | 7,507,684 | |

| Shareholder servicing fees payable (Note 4) | | 7,381 | |

| Unrealized depreciation on forward foreign currency contracts | | 12,701 | |

| Administration fees payable (Note 4) | | 33,959 | |

| Transfer agency fees payable (Note 4) | | 26,807 | |

| Distribution fees payable (Note 4) | | 4,144 | |

| Payable due to Adviser | | 154,832 | |

| Payable for distributions | | 996,393 | |

| Chief compliance officer fees payable (Note 4) | | 8,982 | |

| Trustees' fees payable (Note 4) | | 15,404 | |

| Legal fees payable | | 41,363 | |

| Audit and tax fees payable | | 109,898 | |

| Custody fees payable | | 17,167 | |

| Insurance fees payable | | 7,653 | |

| Accrued expenses and other liabilities | | 5,166 | |

| Total Liabilities | | 8,949,534 | |

| NET ASSETS | $ | 102,628,270 | |

| NET ASSETS CONSIST OF | | | |

| Paid-in capital | $ | 102,157,786 | |

| Accumulated net investment income | | 73,667 | |

| Accumulated net realized loss | | (574 | ) |

| Net unrealized appreciation | | 397,391 | |

| NET ASSETS | $ | 102,628,270 | |

See Notes to Financial Statements.

| 16 | 1.888.926.2688 | www.griffincapital.com |

| Griffin Institutional Access Credit Fund | Statement of Assets and Liabilities |

December 31, 2017

| PRICING OF SHARES | | |

| Class A: | | | |

| Net asset value | $ | 25.30 | |

| Net assets | $ | 14,580,527 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | 576,344 | |

| Maximum offering price per share ((NAV/0.9425), based on maximum sales charge of 5.75% of the offering price) | $ | 26.84 | |

| Class C: | | | |

| Net asset value and offering | $ | 25.30 | |

| Net assets | $ | 6,680,564 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | 264,046 | |

| Class I: | | | |

| Net asset value and offering | $ | 25.30 | |

| Net assets | $ | 42,592,584 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | 1,683,407 | |

| Class L:(a) | | | |

| Net asset value | $ | 25.30 | |

| Net assets | $ | 520,211 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | 20,563 | |

| Maximum offering price per share ((NAV/0.9575), based on maximum sales charge of 4.25% of the offering price) | $ | 26.42 | |

| Class F:(b) | | | |

| Net asset value and offering | $ | 25.30 | |

| Net assets | $ | 38,254,384 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | 1,511,761 | |

| (a) | The Fund's Class L shares commenced operations on September 5, 2017. |

| (b) | The Fund's Class F shares commenced operations on September 25, 2017. |

See Notes to Financial Statements.

| Annual Report | December 31, 2017 | 17 |

| Griffin Institutional Access Credit Fund | Statement of Operations |

| | For the Period April 3, 2017 (Commencement of Operations) to December 31, 2017 | |

| INVESTMENT INCOME | | | |

| Interest | $ | 1,567,613 | |

| Total Investment Income | | 1,567,613 | |

| | | | |

| EXPENSES | | | |

| Investment advisory fees (Note 4) | | 598,942 | |

| Administrative fees (Note 4) | | 136,416 | |

| Transfer Agency fees (Note 4) | | 86,777 | |

| Shareholder servicing fees: | | | |

| Class A | | 10,199 | |

| Class C | | 5,672 | |

| Class L(a) | | 412 | |

| Distribution fees: | | | |

| Class C | | 17,017 | |

| Class L(a) | | 412 | |

| Legal fees | | 79,507 | |

| Audit and tax fees | | 95,000 | |

| Reports to shareholders and printing fees | | 24,638 | |

| State registration fees | | 4,728 | |

| Insurance fees | | 56,091 | |

| Custody fees | | 31,000 | |

| Chief compliance officer fees (Note 4) | | 75,929 | |

| Organizational cost | | 80,043 | |

| Offering cost (Note 2) | | 240,202 | |

| Trustees' fees (Note 4) | | 42,279 | |

| Other expenses | | 7,395 | |

| Total Expenses | | 1,592,659 | |

| Less: Fees waived/expenses reimbursed by Adviser (Note 4) | | (1,592,659 | ) |

| Net Expenses | | – | |

| Net Investment Income | | 1,567,613 | |

| Net realized gain on investments | | 57,574 | |

| Net realized loss on forward foreign currency transactions | | (25,533 | ) |

| Net realized gain on foreign currency translation | | 5,695 | |

| Net realized gain | | 37,736 | |

| Net change in unrealized appreciation on investments | | 413,985 | |

| Net change in unrealized appreciation/(depreciation) on forward foreign currency transactions | | (12,701 | ) |

| Net change in unrealized appreciation/(depreciation) on translation of assets and liabilities denominated in foreign currencies | | (3,893 | ) |

| Net change in unrealized appreciation | | 397,391 | |

| NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS | | 435,127 | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | $ | 2,002,740 | |

| (a) | The Fund's Class L shares commenced operations on September 5, 2017. |

See Notes to Financial Statements.

| 18 | 1.888.926.2688 | www.griffincapital.com |

| Griffin Institutional Access Credit Fund | Statement of Changes in Net Assets |

| | For the Period April 3, 2017 (Commencement of Operations) to December 31, 2017 | |

| OPERATIONS: | | |

| Net investment income | $ | 1,567,613 | |

| Net realized gain on investments | | 37,736 | |

| Net change in unrealized appreciation on investments | | 397,391 | |

| Net Increase in Net Assets Resulting from Operations | | 2,002,740 | |

| | | | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | |

| Class A | | | |

| From net investment income | | (195,865 | ) |

| Class C | | | |

| From net investment income | | (104,149 | ) |

| Class I | | | |

| From net investment income | | (729,549 | ) |

| Class L(a) | | | |

| From net investment income | | (7,568 | ) |

| Class F(b) | | | |

| From net investment income | | (436,978 | ) |

| Total Distributions to Shareholders | | (1,474,109 | ) |

| | | | |

| BENEFICIAL INTEREST TRANSACTIONS, IN DOLLARS: | | | |

| Class A | | | |

| Shares sold | | 14,979,001 | |

| Distributions reinvested | | 100,857 | |

| Shares redeemed | | (36,689 | ) |

| Transferred out | | (507,511 | ) |

| Class C | | | |

| Shares sold | | 7,102,320 | |

| Distributions reinvested | | 61,626 | |

| Transferred out | | (506,599 | ) |

| Class I | | | |

| Shares sold | | 42,883,835 | |

| Distributions reinvested | | 442,561 | |

| Shares redeemed | | (916,892 | ) |

| Class L(a) | | | |

| Shares sold | | 4,334 | |

| Distributions reinvested | | 7,416 | |

| Transferred in | | 506,599 | |

| Class F(b) | | | |

| Shares sold | | 38,863,613 | |

| Distributions reinvested | | 24,326 | |

| Shares redeemed | | (1,416,669 | ) |

| Transferred in | | 507,511 | |

| Net Increase in Net Assets Derived from Beneficial Interest Transactions | | 102,099,639 | |

| | | | |

| Net increase in net assets | | 102,628,270 | |

| | | | |

| NET ASSETS: | | | |

| Beginning of period | | – | |

| End of period * | $ | 102,628,270 | |

| *Including accumulated net investment income of: | $ | 73,667 | |

See Notes to Financial Statements.

| Annual Report | December 31, 2017 | 19 |

| Griffin Institutional Access Credit Fund | Statement of Changes in Net Assets |

| | For the Period April 3, 2017 (Commencement of Operations) to December 31, 2017 | |

| Other Information | | | |

| BENEFICIAL INTEREST TRANSACTIONS, IN SHARES: | | | |

| Class A | | | |

| Beginning shares | | – | |

| Shares sold | | 593,898 | |

| Distributions reinvested | | 3,994 | |

| Shares redeemed | | (1,449 | ) |

| Transferred out | | (20,099 | ) |

| Net increase in shares outstanding | | 576,344 | |

| Ending shares | | 576,344 | |

| Class C | | | |

| Beginning shares | | – | |

| Shares sold | | 281,702 | |

| Distributions reinvested | | 2,440 | |

| Transferred out | | (20,096 | ) |

| Net increase in shares outstanding | | 264,046 | |

| Ending shares | | 264,046 | |

| Class I | | | |

| Beginning shares | | – | |

| Shares sold | | 1,702,079 | |

| Distributions reinvested | | 17,528 | |

| Shares redeemed | | (36,200 | ) |

| Net increase in shares outstanding | | 1,683,407 | |

| Ending shares | | 1,683,407 | |

| Class L(a) | | | |

| Beginning shares | | – | |

| Shares sold | | 172 | |

| Distributions reinvested | | 293 | |

| Transferred in | | 20,098 | |

| Net increase in shares outstanding | | 20,563 | |

| Ending shares | | 20,563 | |

| Class F(b) | | | |

| Beginning shares | | – | |

| Shares sold | | 1,546,583 | |

| Distributions reinvested | | 963 | |

| Shares redeemed | | (55,884 | ) |

| Transferred in | | 20,099 | |

| Net increase in shares outstanding | | 1,511,761 | |

| Ending shares | | 1,511,761 | |

| (a) | The Fund's Class L shares commenced operations on September 5, 2017. |

| (b) | The Fund's Class F shares commenced operations on September 25, 2017. |

See Notes to Financial Statements.

| 20 | 1.888.926.2688 | www.griffincapital.com |

| Griffin Institutional Access Credit Fund – Class A | Financial Highlights |

For a Share Outstanding Throughout the Period Presented

| | For the Period April 3, 2017 (Commencement of Operations) to December 31, 2017 | |

| Net asset value, beginning of period | $ | 25.00 | |

| | | | |

| INCOME FROM INVESTMENT OPERATIONS: | | | |

| Net investment income(a) | | 0.92 | |

| Net realized and unrealized gain/(loss) | | 0.16 | |

| Total from investment operations | | 1.08 | |

| | | | |

| DISTRIBUTIONS: | | | |

| From net investment income(b) | | (0.78 | ) |

| Total distributions | | (0.78 | ) |

| | | | |

| Net increase in net asset value | | 0.30 | |

| Net asset value, end of period | $ | 25.30 | |

| TOTAL RETURN(c) | | 4.38 | % |

| | | | |

| RATIOS/SUPPLEMENTAL DATA: | | | |

| Net assets, end of period (000s) | $ | 14,581 | |

| Ratios to Average Net Assets | | | |

| Ratio of expenses to average net assets excluding fee waivers and reimbursements | | 5.15 | %(d)(e) |

| Ratio of expenses to average net assets including fee waivers and reimbursements | | 0 | %(f) |

| Ratio of net investment income to average net assets | | 4.86 | %(d) |

| | | | |

| Portfolio turnover rate(g) | | 48 | % |

| (a) | Calculated using the average shares method. |

| (b) | Distributions are based on a daily accrual of net investment income, which will vary based on investment yields and daily shares outstanding. |

| (c) | Total returns are for the period indicated and have not been annualized. Total returns would have been lower had certain expenses not been waived during the period. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| (e) | The gross expense ratio included non-recurring organizational costs. |

| (f) | The Adviser voluntarily has absorbed all of the operating expenses of the Fund since the commencement of the Fund's operations. The Adviser will continue to bear such expenses on a going forward basis in its discretion and is under no obligation to continue to do so for any specified period of time. In the absence of the election by the Fund's investment adviser to bear all of the Fund's operating expenses, the ratio of expenses to average net assets including fee waivers and reimbursements would have been higher. |

| (g) | Portfolio turnover rate for periods less than one full year has not been annualized and is calculated at the Fund level. |

See Notes to Financial Statements.

| Annual Report | December 31, 2017 | 21 |

| Griffin Institutional Access Credit Fund – Class C | Financial Highlights |

For a Share Outstanding Throughout the Period Presented

| | For the Period April 3, 2017 (Commencement of Operations) to December 31, 2017 | |

| Net asset value, beginning of period | $ | 25.00 | |

| | | | |

| INCOME FROM INVESTMENT OPERATIONS: | | | |

| Net investment income(a) | | 0.91 | |

| Net realized and unrealized gain/(loss) | | 0.17 | |

| Total from investment operations | | 1.08 | |

| | | | |

| DISTRIBUTIONS: | | | |

| From net investment income(b) | | (0.78 | ) |

| Total distributions | | (0.78 | ) |

| | | | |

| Net increase in net asset value | | 0.30 | |

| Net asset value, end of period | $ | 25.30 | |

| TOTAL RETURN(c) | | 4.37 | % |

| | | | |

| RATIOS/SUPPLEMENTAL DATA: | | | |

| Net assets, end of period (000s) | $ | 6,681 | |

| Ratios to Average Net Assets | | | |

| Ratio of expenses to average net assets excluding fee waivers and reimbursements | | 6.25 | %(d)(e) |

| Ratio of expenses to average net assets including fee waivers and reimbursements | | 0 | %(f) |

| Ratio of net investment income to average net assets | | 4.83 | %(d) |

| | | | |

| Portfolio turnover rate(g) | | 48 | % |

| (a) | Calculated using the average shares method. |

| (b) | Distributions are based on a daily accrual of net investment income, which will vary based on investment yields and daily shares outstanding. |

| (c) | Total returns are for the period indicated and have not been annualized. Total returns would have been lower had certain expenses not been waived during the period. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| (e) | The gross expense ratio included non-recurring organizational costs. |