UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

811-23159

(Investment Company Act file number)

Griffin Institutional Access Credit Fund

(Exact name of registrant as specified in charter)

Griffin Capital Plaza

1520 E. Grand Avenue

El Segundo, CA 90245

(Address of principal executive offices) (Zip code)

(310) 469.6100

(Registrant's telephone number, including area code)

ALPS Fund Services, Inc.

1290 Broadway, Suite 1000

Denver, CO 80203

(Name and address of agent for service)

Copy to:

Terrence O. Davis, Esq.

Greenberg Traurig, LLP

Terminus 200

3333 Piedmont Road, NE, Suite 2500

Atlanta, GA 30305

Date of fiscal year end: December 31

Date of reporting period: January 1, 2020 – December 31, 2020

Item 1. Reports to Stockholders.

ELECTRONIC REPORTS DISCLOSURE

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary (such as a broker-dealer or bank). Instead, the reports will be made available on the Fund’s website (www.griffincapital.com), and you will be notified electronically or by mail, depending on your elections, each time a report is posted and provided with a website link to access the report.

You may elect to receive all future reports in paper free of charge. If you invest directly with the Fund, you can call the Fund toll-free at 1-888-926-2688 or visit www.griffincapital.com/investor-login to inform the Fund that you wish to continue receiving paper copies of your shareholder reports. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. Please note that not all financial intermediaries may offer this service. Your election to receive reports in paper will apply to all funds held in your account if you invest through your financial intermediary or all funds held with the fund sponsor if you invest directly with a fund.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive electronic delivery of shareholder reports and other communications by: (i) calling the Fund toll-free at 1-888-926-2688 or visiting www.griffincapital.com/investorlogin, if you invest directly with the Fund, or (ii) contacting your financial intermediary, if you invest through a financial intermediary. Please note that not all financial intermediaries may offer this service.

Table of Contents

| Shareholder Letter | 2 |

| Portfolio Update | 10 |

| Consolidated Schedule of Investments | 12 |

| Consolidated Statement of Assets and Liabilities | 35 |

| Consolidated Statement of Operations | 37 |

| Consolidated Statements of Changes in Net Assets | 38 |

| Consolidated Statement of Cash Flows | 40 |

| Consolidated Financial Highlights | 41 |

| Notes to Consolidated Financial Statements | 46 |

| Report of Independent Registered Public Accounting Firm | 63 |

| Dividend Reinvestment Policy | 64 |

| Additional Information | 65 |

| Trustees and Officers | 66 |

| Service Providers | 68 |

| Privacy Notice | 69 |

| Actively managed by |  |

Dear Fellow Shareholders,

We are pleased to present the annual report for Griffin Institutional Access® Credit Fund (the “Fund”). We greatly appreciate the support of our shareholders and will remain true to our stated investment objective of generating a return comprised of both current income and capital appreciation with low volatility and low correlation to the broader markets. From the Fund’s inception on April 3, 2017 through December 31, 2020, the Fund’s Class I shares (NASDAQ: CRDIX) generated a:

| ● | Total cumulative return of 20.47% (5.09% annualized) since inception1 |

| ● | Beta of 0.39 since inception1 |

| ● | 3.07% total return in 20201 |

The Fund’s sub-adviser—BCSF Advisors, LP, an affiliate of Bain Capital Credit, LP—has continued to construct a well-diversified alternative credit portfolio. The portfolio composition is ultimately determined through both fundamental quantitative and qualitative analysis to determine the optimal mix of securities across global markets with the potential to deliver strong risk-adjusted returns for investors.

Randy I. Anderson,

Ph.D., CRE

Chief Executive Officer

Griffin Capital Asset Management Company, LLC

Founding Partner

Griffin Institutional Access Credit Fund

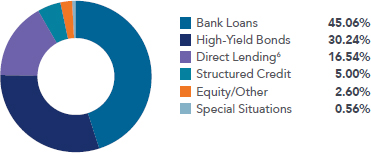

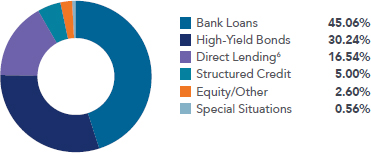

| Portfolio Highlights as of December 31, 2020 |

| 6.48% | $580.99M | 0.97 |

Q4 Annualized Distribution Rate

(Class I Share) | Total Investment Exposure2 | Average Duration (Years) |

Past performance is not a guarantee of future results. Due to financial statement adjustments, performance information presented herein for the Fund differs from the Fund’s financial highlights which are prepared in accordance with U.S. GAAP. Such differences generally are attributable to valuation adjustments to certain of the Fund’s investments which are reflected in the financial statements.

Distribution rates are not performance and reflect the applicable quarter’s cumulative distribution rate when annualized. The cumulative distribution rate for the quarter presented represents the sum of the daily dividend distribution rate as calculated by dividing the daily dividend per share by the daily net asset value (NAV) per share, for each respective class, for each day in the quarter for which a daily dividend is declared. Shareholders should not assume that the source of a distribution from the Fund is net profit or income. All or a portion of a distribution may consist of a return of capital (i.e. from your original investment) and should not be confused with yield or income. Fund distributions would have been lower had expenses, such as management fees, not been waived during the period and the Adviser is under no obligation to continue its voluntary expense support for any specified period of time.

2

Investment Performance and Positioning3

Credit markets finished the year strong, ending 2020 in positive territory, primarily driven by favorable vaccine news and increased optimism for continued economic recovery in 2021. The Fund concluded 2020 with similar strength, posting an 11.44% return in the second half of the year (7/1/20 – 12/31/20)1. Active management contributed to performance in recent months, specifically investments in lower-rated bond and loan positions, and investments in portfolio companies with proximity to COVID-sensitive areas of the economy. We attribute much of this to Bain’s industry research team, whose insights allowed the Fund to navigate a complex and unsettled credit market in 2020. The Fund’s asset allocation adjustments across alternative credit instruments were also accretive to performance, namely CLO debt purchases in March and April 2020, which were among the top performers in the second half of 2020. Additionally, the Fund’s direct lending portfolio performed well and delivered consistent income throughout 2020.

From a positioning perspective, we remain constructive on the Fund’s asset allocation. For much of 2020, we increased high-yield bond exposure, which contributed positively to Fund performance as the sector performed well. That said, the Fund continues to be overweight loans as we believe the medium-term outlook is favorable, particularly as interest rates rise. Within the Fund’s corporate credit allocation, we are trimming lower-yielding positions that are trading above par in favor of portfolio companies trading at discounted valuations. Within the Fund’s CLO allocation, mezzanine debt tranches, which account for much of the Fund’s CLO exposure, have recovered markedly but remain attractive. We anticipate the Fund’s CLO exposure will remain near current levels, though we have focused more recently on rotating into newer issue deals. Lastly, the Fund’s investment team continues to actively review a steadily increasing pipeline of new direct lending opportunities, many with improved terms and wider spreads compared to what we observed prior to the pandemic. Overall, we continue to take advantage of market strength to selectively trim positions that have rebounded with the market and redeploying capital to opportunities that have more compelling risk/return characteristics.

Market and Outlook3

Throughout 2020, significant dispersion existed across alternative credit instruments and the quality spectrum. During the fourth quarter of 2020, lower-rated assets led the way with CCC loans and bonds outperforming BBs and Bs, and after lagging the initial recovery, CCC bonds ended the year with strong performance. Bond fund flows were largely positive since the first quarter of 2020, which contributed to the rally in bonds through the end of the year. In the loan market, technicals have been largely supportive of valuation, especially as CLO formation ramped up in the second half of the year. While default rates for leveraged loans, 4.3% (S&P/LSTA Leveraged Loan Index), and high-yield bonds, 6.8% (ICE BAML U.S. High Yield Index), are higher relative to recent history, these rates remain well below the consensus estimates at the height of the pandemic in March 2020. Although default rates may creep higher in coming months due to the ongoing impact of the pandemic, we expect this increase to be concentrated in a few high-impact industries.

3

The economic recovery gained traction moving into 2021 as progress on vaccine distribution, along with favorable monetary and fiscal policy, has created a supportive macro environment for alternative credit. Notwithstanding the foregoing, we continue to exercise caution as the trajectory and timing of the recovery will be dictated by coronavirus containment strategies, and we could yet see further pockets of volatility as a result. For this reason, the Fund continues to maintain broad portfolio diversification to manage potential volatility moving forward.

Investors may find the Fund provides an attractive solution for enhanced income relative to traditional fixed income investments, which are currently exhibiting high levels of duration in today’s low-rate environment and introducing unintended price risk to investors as a result. Conversely, the Fund’s meaningful exposure to floating rate alternative credit investments may provide for durable income and a degree of insulation in a rising rate environment. Additionally, the Fund’s preference for senior secured credits provides a degree of stability as such investments are senior in repayment and secured by assets of the borrower. Further, despite the recovery following pandemic-related volatility, spreads remain elevated within both private and public alternative credit markets. The Fund’s ability to actively manage and allocate across markets, industry, geography, quality, and asset class to potentially capitalize on opportunities may provide a unique advantage to investors seeking enhanced income and total return opportunities, particularly within today’s environment.

We wish you a prosperous 2021 and hope that you and your families continue to stay safe and healthy during these difficult and uncertain times. We appreciate your continued confidence and support.

Sincerely,

Randy I. Anderson, Ph.D., CRE

Chief Executive Officer, Griffin Capital Asset Management Company, LLC

Founding Partner, Griffin Institutional Access Credit Fund

Griffin Institutional Access Credit Fund is a closed-end interval fund. Limited liquidity is provided to shareholders only through the Fund’s quarterly repurchase offers for no less than 5% and no more than 25% of the Fund’s shares outstanding at net asset value. The Fund is suitable only for investors who can bear the risks associated with the limited liquidity of the Fund and should be viewed as a long-term investment. There is no secondary market for the Fund’s shares and none is expected to develop.

4

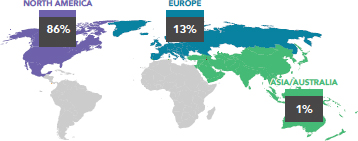

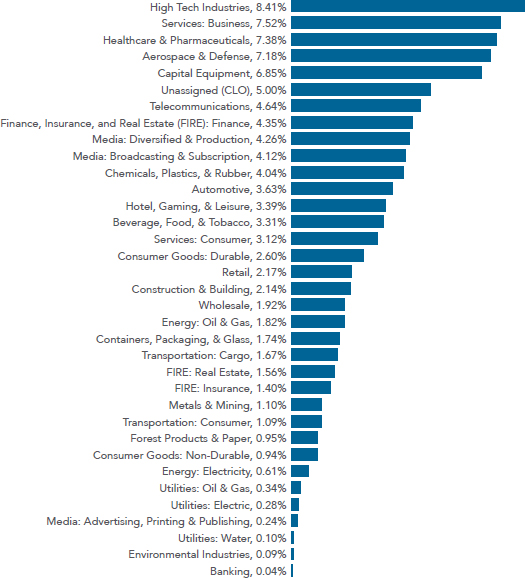

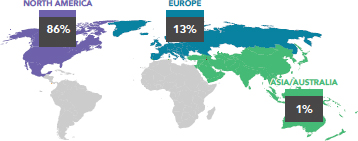

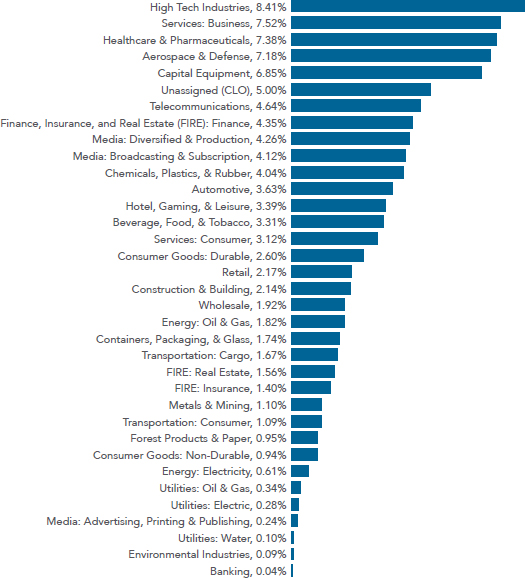

PORTFOLIO DIVERSIFICATION AS OF DECEMBER 31, 2020

Floating Rate Assets: 68.37%4 | Fixed Rate Assets: 31.63%4 | Senior Secured: 72.31%4

| Asset Allocation5 | Geography5 |

|  |

Industry 5, 7

Past performance is not a guarantee of future results. Holdings and allocations are subject to change without notice. Diversification does not eliminate the risk of experiencing investment losses.

5

SUB-ADVISER (UNAUDITED)

| BCSF Advisors, LP8 |  |

Griffin Institutional Access Credit Fund is sub-advised by BCSF Advisors, LP, an SEC-registered investment adviser and affiliate of Bain Capital Credit, LP.

Bain Capital Credit, LP provides ongoing research, opinions and recommendations regarding the Fund’s investment portfolio. Bain Capital Credit was formed in 1998 as the credit investing arm of Bain Capital, one of the world’s premier alternative investment firms, with approximately $120 billion in assets under management. Bain Capital Credit invests across the full spectrum of credit strategies, including leveraged loans, high-yield bonds, distressed debt, direct lending, structured products, non-performing loans and equities. With offices in Boston, Chicago, New York, London, Dublin, Madrid, Hong Kong, Guangzhou, Seoul, Mumbai, Melbourne, Singapore and Sydney, Bain Capital Credit has a global footprint with approximately $44 billion in assets under management.

ENDNOTES

| 1. | Past performance is not a guarantee of future results. Data source: Morningstar Direct for the period of 4/3/17 – 12/31/20. Performance reflects the Fund’s Class I share (NASDAQ: CRDIX) and the reinvestment of dividends or other distributions. Class I shareholders do not pay a front-end sales charge/load. The S&P 500 is generally representative of the broad market and as such is used as a calculation benchmark for beta. As of 12/31/20, the Fund’s Class I shares had an annualized three-year return of 4.93%. |

| 2. | Total investment exposure is the total of the Fund’s net assets plus exposure gained through the use of total return swaps at the notional value of the swaps. A total return swap is a derivatives contract in which one party makes payments to the counterparty in exchange for the total return of the swap reference asset. |

| 3. | Represents the views of Bain Capital Credit and Griffin Capital at the time of this letter and is subject to change. Data as of December 31, 2020. Source: JPM, unless otherwise noted. Leveraged loans represented by the S&P/LSTA Leveraged Loan Index and high-yield bonds represented by the ICE BAML U.S. High Yield Index. |

| 4. | Based on the Fund’s total market value exposure to debt securities including exposure to debt securities gained through the Fund’s use of total return swaps. |

| 5. | Based on the Fund’s total market value exposure including exposure gained through the Fund’s use of total return swaps. |

| 6. | The Fund executes its direct lending strategy by investing primarily in middle-market opportunities in which the Fund and Sub-Adviser generally seek to originate and negotiate loans directly to sponsor-backed companies. |

| 7. | Based on Moody’s 35 Industry Categories (“Moody’s 35”). |

| 8. | Firm-level assets under management (AUM) for Bain Capital is estimated and is presented as of October 1, 2020. Bain Capital Credit’s assets under management is estimated as of October 1, 2020 and includes its subsidiaries and credit vehicles managed by its Alternative Investment Fund Managers (AIFM) affiliate. Individuals in the Mumbai office are employed by IndiaRF, a joint venture between Bain Capital Credit, LP and Piramal Enterprises Ltd. |

6

GLOSSARY (UNAUDITED)

Annualized Return: Calculated by annualizing cumulative return (i.e., adjusting it for a period of one year). Annualized return includes capital appreciation and assumes a reinvestment of dividends and distributions.

Beta: A measure of systematic risk (volatility), or the sensitivity of a fund to movements in a benchmark. A beta of 1 implies that you can expect the movement of a fund’s return series to match that of the benchmark used to measure beta. A value of less than 1 implies that the fund is less volatile than the index.

Bond: A debt instrument, also considered a loan, that an investor makes to a corporation, government, federal agency or other organization (known as an issuer) in which the issuer typically agrees to pay the owner the amount of the face value of the bond on a future date, and to pay interest at a specified rate at regular intervals.

Bond Rating: A method of evaluating the quality and safety of a bond. This rating is based on an examination of the issuer’s financial strength and the likelihood that it will be able to meet scheduled repayments. Ratings range from AAA (best) to D (worst). Bonds receiving a rating of BB or below are not considered investment grade because of the relative potential for issuer default.

Collateralized Loan Obligation (CLO): A structured credit security backed by a pool of bank loans, structured so there are several classes of bondholders with varying maturities, called tranches. Debt and equity securities of CLOs are sold in tranches where each CLO tranche has a different priority on distributions, unique risk exposures, and yield expectations based on the tranche’s place in the capital structure. Distributions begin with the senior debt tranches (CLO debt) and flow down to the equity tranches (CLO equity).

Correlation: A statistical measure of how two securities move in relation to each other. A correlation ranges from -1 to 1. A positive correlation of 1 implies that as one security moves, either up or down, the other security will move in lockstep, in the same direction. A negative correlation of -1 indicates that the securities have moved in the opposite direction. If the correlation is 0, the movements of the securities are said to have no correlation; they are completely random.

Cumulative Return: The compound return of an investment. It includes capital appreciation and assumes a reinvestment of dividends and distributions.

Duration: A measure of how sensitive the price of a debt instrument (such as a bond) is to a change in interest rates and is measured in years.

High-Yield Bond: A bond issued by an issuer that is considered a credit risk by a Nationally Recognized Statistical Rating Organization, as indicated by a low bond rating (e.g., “Ba” or lower by Moody’s Investors Services, or “BB” or below by Standard & Poor’s Corporation). Because of this risk, a high-yield bond generally pays a higher return (yield) than a bond with an issuer that carries lower default risk. Also known as a “junk” bond.

ICE Bank of America Merrill Lynch U.S. High Yield Index: Tracks the performance of U.S. dollar denominated below investment grade corporate debt publicly issued in the U.S. domestic market.

London Interbank Offered Rate (LIBOR): Benchmark interest rate index used to make adjustments to variable-rate loans. LIBOR is used by world banks when charging each other for short-term loans.

S&P/LSTA Leveraged Loan Index (LSTA): A daily total return index that uses mark-to-market pricing to calculate market value change. It tracks, on a real-time basis, the current outstanding balance and spread over LIBOR for fully funded term loans. The facilities included in the LSTA represent a broad cross section of leveraged loans syndicated in the United States, including dollar-denominated loans to overseas issuers.

7

IMPORTANT DISCLOSURES (UNAUDITED)

This is neither an offer to sell nor a solicitation to purchase any security. Investors should carefully consider the investment objectives, risks, charges and expenses of Griffin Institutional Access Credit Fund (the “Fund”). This and other important information about the Fund is contained in the prospectus, which can be obtained by contacting your financial advisor or visiting www.griffincapital.com. Please read the prospectus carefully before investing.

All Morningstar calculations and metrics are based on monthly data. Performance reflects management fees and other expenses. Performance uses the Class I share (NASDAQ: CRDIX) of Griffin Institutional Access Credit Fund. Investors of the Class I share do not pay a front-end sales charge/load.

Past performance is not a guarantee of future results. Investing in the Fund involves risks, including the risk that you may receive little or no return on your investment or that you may lose part or all of your investment. The ability of the Fund to achieve its investment objective depends, in part, on the ability of the Adviser to allocate effectively the assets of the Fund among the various securities and investments in which the Fund invests. There can be no assurance that the actual allocations will be effective in achieving the Fund’s investment objective or delivering positive returns. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance quoted. The most recent performance is available at www.griffincapital.com or by calling 888.926.2688.

The Fund is a closed-end interval fund, the shares have no history of public trading, nor is it intended that the shares will be listed on a public exchange at this time. No secondary market is expected to develop for the Fund’s shares. Limited liquidity is provided to shareholders only through the Fund’s quarterly repurchase offers for no less than 5% and no more than 25% of the Fund’s shares outstanding at net asset value. There is no guarantee that an investor will be able to sell all the shares that the investor desires to sell in the repurchase offer. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Due to these restrictions, an investor should consider an investment in the Fund to be of limited liquidity. The Fund is suitable only for investors who can bear the risks associated with the limited liquidity of the Fund and should be viewed as a long-term investment. Investing in the Fund is speculative and involves a high degree of risk, including the risks associated with leverage and the risk of a substantial loss of investment. There is no guarantee that the investment strategies will work under all market conditions.

The Fund’s inception date was April 3, 2017. Per the Fund’s prospectus dated April 30, 2020, the total annual expense ratio (after fee waiver and reimbursement) is 2.36% for Class I shares. Performance data quoted represents past performance. Past performance is no guarantee of future results and investment returns and principal value of the Fund will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. The Adviser and Fund have entered into an expense limitation agreement until at least April 30, 2021 under which the Adviser has contractually agreed to waive its fees and to pay or absorb the ordinary annual operating expenses of the Fund (including offering expenses, but excluding taxes, interest, brokerage commissions, acquired fund fees and expenses and extraordinary expenses) to the extent that they exceed 2.35% for Class I shares, subject to possible recoupment from the Fund in future years. Separate of the expense limitation agreement, commencing on August 26, 2019, the Adviser voluntarily absorbs Fund expenses in excess of 1.25% and will continue to bear such expenses on a going forward basis in its discretion and is under no obligation to continue to do so for any specified period of time. Prior to August 26, 2019 and since the commencement of the operations of the Fund, the Adviser has borne all of the operating expenses of the Fund and waived its entire management fee. Without the waiver the expenses would have been higher. Fund returns would have been lower had expenses, such as management fees, not been waived during the period. The Fund return does not reflect the deduction of all fees, including third-party brokerage commissions or third-party investment advisory fees paid by investors to a financial intermediary for brokerage services. If the deduction of such fees was reflected, the performance would be lower. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Investors in the Fund should understand that the net asset value (“NAV”) of the Fund will fluctuate, which may result in a loss of the principal amount invested. An investment in shares is subject to investment risk, including the possible loss of the entire principal amount invested. An investment in shares represents an indirect investment in the securities owned by the Fund. The value of these securities, like other market investments, may move up or down, sometimes rapidly and unpredictably. The value of your shares at any point in time may be worth less than the value of your original investment, even after taking into account any reinvestment of dividends and distributions. The Fund’s investments may be negatively affected by the broad investment environment and capital markets in which the Fund invests, including the real estate market, the debt market and/or the equity securities market. The value of the Fund’s investments will increase or decrease based on changes in the prices of the investments it holds. This will cause the value of the Fund’s shares to increase or decrease. The Fund is “diversified” under the Investment Company Act of 1940. Diversification does not eliminate the risk of experiencing investment losses. Holdings are subject to change without notice. The Fund is not intended to be a complete investment program.

When the Fund invests in debt securities, the value of your investment in the Fund will fluctuate with changes in interest rates. Typically, a rise in interest rates causes a decline in the value of debt securities. In general, the market price of debt securities with longer maturities will increase or decrease more in response to changes in interest rates than shorter-term securities. The Fund’s investments are also subject to liquidity risk. Liquidity risk exists when particular investments of the Fund would be difficult to purchase or sell, possibly preventing the Fund from selling such illiquid securities at an advantageous time or price, or possibly requiring the Fund to dispose of other investments at unfavorable times or prices in order to satisfy its obligations. Funds with principal investment strategies that involve securities of companies with smaller market capitalizations, derivatives or securities with substantial market and/or credit risk tend to have the greatest exposure to liquidity risk. Other risk factors include credit risk (the debtor may default) and prepayment risk (the debtor may pay its obligation early, reducing the amount of interest payments). These risks could affect the value of a particular investment, possibly causing the Fund’s share price and total return to be reduced and fluctuate more than other types of investments. The Adviser’s judgments about the attractiveness, value and potential appreciation of a particular sector and securities in which the Fund invests may prove to be incorrect and may not produce the desired results. Foreign investing involves special risks such as currency fluctuations and political uncertainty. The Fund’s use of derivative instruments involves risks different from, or possibly greater than, the risks associated with investing directly in securities and other traditional investments. Derivatives may involve certain costs and risks such as liquidity, interest rate, market, credit, management and pricing risk (i.e., derivatives may be difficult to value). Derivatives may also be leveraged and subject to counterparty risk (e.g., the risk of a counterparty’s defaulting on the obligation or bankruptcy). Investing in derivatives could substantially increase the impact of adverse price movements on the Fund’s portfolio. Derivatives are also subject to non-correlation risk because they may not be perfect substitutes for the instruments they are intended to hedge or replace. It may not be possible for the Fund to liquidate a derivative position at an advantageous time or price, which may result in significant losses. These investments give the Fund investment exposure that is greater than the investment amount. There is no guarantee that the Fund’s leverage strategy will be successful.

8

The Fund’s distributions may be affected by numerous factors, including but not limited to changes in Fund expenses including the amount of voluntary expense support provided by the Fund’s Adviser, investment performance, realized and projected market returns, fluctuations in market interest rates, and other factors. Fund distributions would have been lower had expenses, such as management fees, not been waived during the period and the Adviser is under no obligation to continue its voluntary expense support for any specified period of time. There is no assurance that the Fund’s distribution rate will be sustainable in the future nor are distributions guaranteed. The Fund’s distribution policy is to make quarterly distributions to shareholders. The Fund intends to distribute as of the last business day of each quarter. The Fund intends to declare and pay distributions from its net investment income, however, the amount of distributions that the Fund may pay, if any, is uncertain. Shareholders should not assume that the source of a distribution from the Fund is net profit. All or a portion of a distribution may consist of a return of capital (i.e. from your original investment) and not a return of net profit. The sources of distributions may vary periodically. Please refer to the Fund’s most recent Section 19(a) notice, if applicable, at www.griffincapital.com or the Fund’s semi-annual or annual reports filed with the U.S. Securities and Exchange Commission (the “SEC”) for the sources of distributions.

The Fund is advised by Griffin Capital Credit Advisor, LLC (“GCCA”). GCCA is registered as an investment adviser with the SEC pursuant to the provisions of the Investment Advisers Act of 1940, as amended (the “Advisers Act”). GCCA is an indirect majority-owned subsidiary of Griffin Capital Company, LLC. The Fund is sub-advised by BCSF Advisors, LP (“BCSF”). BCSF is registered as an investment adviser with the SEC pursuant to the provisions of the Advisers Act. BCSF is an affiliate of Bain Capital Credit, LP. Registration with the SEC does not constitute an endorsement by the SEC nor does it imply a certain level of skill or training.

This annual report may contain certain forward-looking statements. Such forward-looking statements can generally be identified by our use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “anticipate,” “estimate,” “believe,” “continue,” or other similar words. Because such statements include risks, uncertainties and contingencies, actual results may differ materially from the expectations, intentions, beliefs, plans or predictions of the future expressed or implied by such forward-looking statements. These risks, uncertainties and contingencies include, but are not limited to: uncertainties relating to changes in general economic, credit and real estate conditions; uncertainties relating to the implementation of our investment strategy; uncertainties relating to capital proceeds; and other risk factors as outlined in our prospectus, annual report and semi-annual report filed with the SEC.

This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product or be relied upon for any other purpose. Information contained herein has been obtained from sources deemed to be reliable, but not guaranteed. This material represents views as of the date of this publication and is subject to change without notice of any kind. Griffin Capital does not accept any liability for losses either direct or consequential caused by the use of this information.

9

| Griffin Institutional Access Credit Fund | Portfolio Update |

December 31, 2020 (Unaudited)

Performance (for the period ended December 31, 2020)

| | 6 Month | 1 Year | 3 Year | Since

Inception**** | Inception |

| Griffin Institutional Access Credit Fund - A - With Load* | 5.19% | -2.78% | 2.91% | 3.49% | 4/3/17 |

| Griffin Institutional Access Credit Fund - A - Without Load | 11.63% | 3.16% | 4.96% | 5.15% | 4/3/17 |

| Griffin Institutional Access Credit Fund - C - With Load** | 10.62% | 2.16% | 4.96% | 5.15% | 4/3/17 |

| Griffin Institutional Access Credit Fund - C - Without Load | 11.62% | 3.16% | 4.96% | 5.15% | 4/3/17 |

| Griffin Institutional Access Credit Fund - I - NAV | 11.63% | 3.16% | 4.96% | 5.15% | 4/3/17 |

| Griffin Institutional Access Credit Fund - L - With Load*** | 6.87% | -1.24% | 3.45% | 3.67% | 9/5/17 |

| Griffin Institutional Access Credit Fund - L - Without Load | 11.63% | 3.13% | 4.95% | 5.04% | 9/5/17 |

| Griffin Institutional Access Credit Fund - F - NAV | 11.67% | 3.15% | 4.95% | 4.99% | 9/25/17 |

| S&P/LSTA Leveraged Loan Index | 8.11% | 3.12% | 4.01% | 3.99% | 4/3/17 |

| * | Adjusted for initial maximum sales charge of 5.75%. |

| ** | Adjusted for contingent deferred sales charge of 1.00%. |

| *** | Adjusted for initial maximum sales charge of 4.25% |

The S&P/LSTA Leveraged Loan Index is a capitalization-weighted syndicated loan index based upon market weightings, spreads and interest payments. The S&P/LSTA Leveraged Loan Index covers the U.S. market back to 1997 and currently calculates on a daily basis.

Indexes are not actively managed and do not reflect deduction of fees, expenses or taxes. An investor cannot invest directly into an index.

The returns shown above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or redemption of Fund shares.

The performance data quoted above represents past performance. Past performance is not a guarantee of future results. Investment return and value of the Fund shares will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Fund performance current to the most recent month-end is available by calling 1-888-926-2688 or by visiting www.griffincapital.com.

Class A shares are offered subject to a maximum sales charge of 5.75% of the offering price and Class L shares are offered subject to a maximum sales charge of 4.25% of the offering price. Class C and Class I shares are offered at net asset value per share. Class C shares may be subject to a 1.00% contingent deferred sales charge on shares redeemed during the first 365 days after their purchase. Class F Shares are no longer offered except for reinvestment of dividends at net asset value. The Adviser and the Fund have entered into an expense limitation and reimbursement agreement (the “Expense Limitation Agreement”) under which the Adviser has agreed contractually to waive its fees and to pay or absorb the ordinary annual operating expenses of the Fund (including offering expenses, but excluding taxes, interest, brokerage commissions, acquired fund fees and expenses and extraordinary expenses) (i) at least through April 30, 2021 for Class A, Class C, Class I, and Class L shares, so that the total annual operating expenses of the Fund do not exceed 2.60% per annum of Class A average daily net assets, 3.35% per annum of Class C average daily net assets, 2.35% per annum of Class I average daily net assets, 2.85% per annum of Class L average daily net assets and, (ii) for Class F shares, for so long as Class F shares are outstanding and the Adviser is the investment adviser to the Fund so that the total annual operating expenses of the Fund do not exceed 1.85% per annum of Class F average daily net assets (the “Expense Limitations”). The agreement can be extended at the discretion of the Adviser and the Trustees. Without the waiver, the expenses would be 2.98%, 3.74%, 2.73%, 3.20%, and 2.71% for Class A, Class C, Class I, Class L and Class F, respectively per the Fund’s most recent prospectus dated April 30, 2020. In consideration of the Adviser’s agreement to limit the Fund’s expenses, the Fund has agreed to repay the Adviser in the amount of any fees waived and Fund expenses paid or absorbed, subject to the limitations that: (1) the reimbursement for fees and expenses will be made only if payable not more than three years from the date such expenses were incurred; and (2) the reimbursement may not be made if it would cause the lesser of the Expense Limitations in place at the time of waiver or at the time of reimbursement to be exceeded. Fees waived and Fund expenses paid or absorbed with respect to Class F assets will not be repaid or reimbursed. Separate of the expense limitation agreement, commencing on August 26, 2019, the Adviser voluntarily absorbs Fund expenses in excess of 1.25% and will continue to bear such expenses on a going forward basis in its discretion and is under no obligation to continue to do so for any specified period of time. Prior to August 26, 2019 and since the commencement of the operations of the Fund, the Adviser has borne all of the operating expenses of the Fund and waived its entire management fee. Operating expenses absorbed by the Adviser during this voluntary period will be permanently waived. In the absence of the election by the Adviser to bear all of the Fund’s operating expenses, the performance of the Fund would have been reduced. Please review the Fund’s Prospectus for more details regarding the Fund’s fees and expenses. No assurances can be given that the Fund will pay a distribution in the future; or, if any such distribution is paid, the amount or rate of the distribution.

| 10 | 1.888.926.2688 | www.griffincapital.com |

| Griffin Institutional Access Credit Fund | Portfolio Update |

December 31, 2020 (Unaudited)

Performance of $10,000 Initial Investment (for the period ended December 31, 2020)

The graph shown above represents historical performance of a hypothetical investment of $10,000 in the Class A Shares of the Fund since inception. Past performance does not guarantee future results. All returns reflect reinvested dividends, but do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| Annual Report | December 31, 2020 | 11 |

| Griffin Institutional Access Credit Fund | Consolidated Schedule of Investments |

December 31, 2020

| Description | | Country | | Spread

Above Index | | Rate | | Maturity

Date | | Principal

Amount | | Value

(Note 2)(a) | |

| BANK LOANS (44.52%)(b) | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| AEROSPACE & DEFENSE (5.20%) | | | | | | | | | | | | | |

| Air Comm Corp. LLC Term Loan(c) | | United States | | | 3M US L + 6.50% | | | 7.50 | % | | 07/01/25 | | $ | 1,688,960 | | $ | 1,655,181 | |

| Bleriot US Bidco, Inc., Second Lien Initial Term Loan | | United States | | | 3M US L + 8.50% | | | 8.75 | % | | 10/29/27 | | | 198,113 | | | 194,276 | |

| Dynasty Acquisition Co., Inc., First Lien 2020 B-1 Term Loan | | United States | | | 3M US L + 3.50% | | | 3.75 | % | | 04/06/26 | | | 654,146 | | | 625,072 | |

| Dynasty Acquisition Co., Inc., First Lien 2020 B-2 Term Loan | | United States | | | 3M US L + 3.50% | | | 3.75 | % | | 04/06/26 | | | 351,691 | | | 336,060 | |

| Forming Machining Industries Holdings LLC, First Lien Initial Term Loan | | United States | | | 3M US L + 4.25% | | | 4.50 | % | | 10/09/25 | | | 687,085 | | | 550,242 | |

| Forming Machining Industries Holdings LLC, Second Lien Initial Term Loan(c) | | United States | | | 3M US L + 8.25% | | | 8.50 | % | | 10/09/26 | | | 310,000 | | | 238,700 | |

| Jazz Acquisition, Inc., First Lien Initial Term Loan | | United States | | | 1M US L + 4.25% | | | 4.40 | % | | 06/19/26 | | | 214,296 | | | 200,366 | |

| Jazz Acquisition, Inc., Second Lien Initial Term Loan(c) | | United States | | | 1M US L + 8.00% | | | 8.15 | % | | 06/18/27 | | | 1,058,702 | | | 870,782 | |

| Kellstrom Commercial Aerospace, Inc. - Initial Term Loan(c) | | United States | | | 3M US L + 5.50% | | | 6.50 | % | | 07/01/25 | | | 2,277,726 | | | 2,072,730 | |

| Kellstrom Commercial Aerospace, Inc. - Revolver(c)(d) | | United States | | | 3M US L + 5.50% | | | 6.50 | % | | 07/01/25 | | | 433,577 | | | 394,555 | |

| MB Aerospace Holdings II Corp., First Lien Initial Term Loan | | United States | | | 3M US L + 3.50% | | | 4.50 | % | | 01/22/25 | | | 994,872 | | | 849,999 | |

| MRO Holdings, Inc., First Lien Initial Term Loan | | United States | | | 3M US L + 5.00% | | | 5.25 | % | | 06/04/26 | | | 268,182 | | | 233,821 | |

| Nordam Group LLC, First Lien Initial Term Loan | | United States | | | 1M US L + 5.50% | | | 5.70 | % | | 04/09/26 | | | 1,114,305 | | | 919,302 | |

| Novaria Holdings LLC, First Lien Initial Term Loan | | United States | | | 3M US L + 5.50% | | | 6.50 | % | | 01/27/27 | | | 539,277 | | | 511,863 | |

| PICP Project Sprint Intermediate II LLC(c)(e)(f) | | United States | | | | | | 16.00 | % | | 06/30/21 | | | 714,115 | | | 723,041 | |

| Salient CRGT, Inc., First Lien Initial Term Loan | | United States | | | 3M US L + 6.50% | | | 7.50 | % | | 02/28/22 | | | 1,427,509 | | | 1,373,978 | |

| Sprint Intermediate Holding I Term Loan(c)(e)(f) | | United States | | | | | | 16.00 | % | | 06/30/26 | | | 2,186,744 | | | 2,241,413 | |

| Turbocombustor Technology, Inc., First Lien Term Loan(c)(e) | | United States | | | 1M US L + 10.25% | | | 11.25 | % | | 07/30/27 | | | 2,992,556 | | | 2,992,556 | |

| Wheels Up Partners LLC, First Lien Class A Notes Term Loan(c) | | United States | | | 3M US L + 6.50% | | | 7.50 | % | | 03/01/24 | | | 264,226 | | | 261,584 | |

| Whitcraft LLC, First Lien Initial Term Loan(c) | | United States | | | 3M US L + 6.00% | | | 7.00 | % | | 04/03/23 | | | 3,515,883 | | | 3,340,088 | |

| Whitcraft LLC, First Lien Revolving Term Loan(c)(d) | | United States | | | L + 0.50% | | | | | | 04/03/23 | | | 158,575 | | | 150,647 | |

| WP CPP Holdings LLC, First Lien Initial Term Loan(g) | | United States | | | 3M US L + 3.75% | | | 3.75 | % | | 04/30/25 | | | 2,358,472 | | | 2,216,539 | |

| WP CPP Holdings LLC, Second Lien Initial Term Loan | | United States | | | 3M US L + 7.75% | | | 8.75 | % | | 04/30/26 | | | 1,069,457 | | | 906,365 | |

| | | | | | | | | | | | | | | | | | 23,859,160 | |

| AUTOMOTIVE (1.92%) | | | | | | | | | | | | | | | | | | |

| CST Buyer Company, First Lien Tranche B Term Loan(c) | | United States | | | 1M US L + 6.00% | | | 7.00 | % | | 10/03/25 | | | 4,634,444 | | | 4,634,444 | |

| CST Buyer Company, Revolving Credit Facility Term Loan(c)(d) | | United States | | | L + 0.50% | | | | | | 10/03/25 | | | 233,472 | | | 233,472 | |

See Notes to Consolidated Financial Statements.

| 12 | 1.888.926.2688 | www.griffincapital.com |

| Griffin Institutional Access Credit Fund | Consolidated Schedule of Investments |

December 31, 2020

| Description | | Country | | Spread

Above Index | | Rate | | Maturity

Date | | Principal

Amount | | Value

(Note 2)(a) | |

| AUTOMOTIVE (continued) | | | | | | | | | | | | | | | | | | |

| Mavis Tire Express Services Corp., First Lien Closing Date Term Loan | | United States | | | 3M US L + 3.25% | | | 3.50 | % | | 03/20/25 | | $ | 774,972 | | $ | 763,153 | |

| Midas Intermediate Holdco II LLC, First Lien Closing Date Term Loan(g) | | United States | | | 3M US L + 6.75% | | | 7.50 | % | | 12/22/25 | | | 1,327,340 | | | 1,349,739 | |

| Project Boost Purchaser LLC, Second Lien Term Loan(c) | | United States | | | 1M US L + 8.00% | | | 8.15 | % | | 05/31/27 | | | 448,768 | | | 439,793 | |

| Wheel Pros, Inc., First Lien Term Loan | | United States | | | 1M US L + 5.25% | | | 6.25 | % | | 11/09/27 | | | 1,413,698 | | | 1,395,320 | |

| | | | | | | | | | | | | | | | | | 8,815,921 | |

| BANKING (0.05%) | | | | | | | | | | | | | | | | | | |

| TNS, Inc., First Lien Initial Term Loan | | United States | | | 1M US L + 4.00% | | | 4.15 | % | | 08/14/22 | | | 234,819 | | | 233,755 | |

| | | | | | | | | | | | | | | | | | | |

| BEVERAGE, FOOD, & TOBACCO (1.31%) | |

| Carrols Restaurant Group, Inc., First Lien Cov-Lite Incremental TLB Term Loan | | United States | | | 3M US L + 6.25% | | | 7.25 | % | | 04/30/26 | | | 1,990,000 | | | 1,982,537 | |

| Froneri International, Ltd., First Lien Facility B1 Term Loan | | United Kingdom | | | 1M EUR L + 2.63% | | | 2.63 | % | | 01/29/27 | | € | 650,024 | | | 785,255 | |

| H-Food Holdings LLC, First Lien Initial Term Loan | | United States | | | 1M US L + 3.69% | | | 3.83 | % | | 05/23/25 | | $ | 786,732 | | | 774,868 | |

| K-Mac Holdings Corp., Second Lien Initial Term Loan | | United States | | | 1M US L + 6.75% | | | 6.90 | % | | 03/16/26 | | | 1,002,890 | | | 987,847 | |

| Quidditch Acquisition, Inc., First Lien B Term Loan | | United States | | | 3M US L + 9.00% | | | 10.00 | % | | 03/21/25 | | | 1,561,466 | | | 1,474,282 | |

| | | | | | | | | | | | | | | | | | 6,004,789 | |

| CAPITAL EQUIPMENT (5.23%) | | | | | | | | | | | | | | | | | | |

| 10945048 Canada, Inc., Second Lien Term Loan(c) | | Canada | | | 3M CDOR + 8.00% | | | 9.38 | % | | 09/21/26 | | CAD | 1,585,500 | | | 1,245,581 | |

| ACProducts, Inc., First Lien Initial Term Loan | | United States | | | 3M US L + 6.50% | | | 7.50 | % | | 08/18/25 | | $ | 972,035 | | | 1,000,739 | |

| ASP Unifrax Holdings, Inc., First Lien EUR Term Loan | | United States | | | 3M EUR L + 3.75% | | | 3.75 | % | | 12/12/25 | | € | 615,277 | | | 687,368 | |

| ASP Unifrax Holdings, Inc., First Lien USD Term Loan | | United States | | | 3M US L + 3.75% | | | 4.00 | % | | 12/12/25 | | $ | 1,478,599 | | | 1,365,922 | |

| ASP Unifrax Holdings, Inc., Second Lien Term Loan | | United States | | | 3M US L + 8.50% | | | 8.72 | % | | 12/14/26 | | | 917,431 | | | 779,816 | |

| Avaya, Inc., First Lien Tranche B Term Loan | | United States | | | 1M US L + 4.25% | | | 4.41 | % | | 12/15/24 | | | 3,412 | | | 3,437 | |

| Blackbird Purchaser, Inc., Second Lien Incremental Term Loan(c) | | United States | | | 3M US L + 8.50% | | | 8.75 | % | | 04/08/27 | | | 1,418,860 | | | 1,362,106 | |

| C&D Technologies, Inc., First Lien B Term Loan | | United States | | | 1M US L + 5.75% | | | 5.90 | % | | 12/20/25 | | | 1,713,312 | | | 1,619,080 | |

| Cohu, Inc., First Lien Initial B Term Loan | | United States | | | 1M US L + 3.00% | | | 3.15 | % | | 10/01/25 | | | 373,929 | | | 369,647 | |

| CP Atlas Buyer, Inc., First Lien Initial Tranche B-1 Term Loan | | United States | | | 3M US L + 4.50% | | | 5.25 | % | | 11/23/27 | | | 299,005 | | | 300,014 | |

| CP Atlas Buyer, Inc., First Lien Initial Tranche B-2 Term Loan | | United States | | | 3M US L + 4.50% | | | 5.25 | % | | 11/23/27 | | | 99,668 | | | 100,005 | |

| Crosby Group LLC, First Lien Initial Term Loan | | United States | | | 1M US L + 4.75% | | | 4.89 | % | | 06/26/26 | | | 405,556 | | | 397,952 | |

| Cyxtera DC Holdings, Inc., First Lien Initial Term Loan | | United States | | | 3M US L + 3.00% | | | 4.00 | % | | 05/01/24 | | | 686,566 | | | 644,775 | |

| Electronics for Imaging, Inc., First Lien Initial Term Loan | | United States | | | 1M US L + 5.00% | | | 5.15 | % | | 07/23/26 | | | 1,233,184 | | | 1,060,150 | |

| Electronics for Imaging, Inc., Second Lien Initial Term Loan(c) | | United States | | | 1M US L + 9.00% | | | 9.15 | % | | 07/23/27 | | | 2,227,800 | | | 1,826,796 | |

See Notes to Consolidated Financial Statements.

| Annual Report | December 31, 2020 | | 13 |

| Griffin Institutional Access Credit Fund | Consolidated Schedule of Investments |

December 31, 2020

| Description | | Country | | | Spread

Above Index | | | Rate | | | Maturity

Date | | | Principal

Amount | | | Value

(Note 2)(a) | |

| CAPITAL EQUIPMENT (continued) | | | | | | | | | | | | | | | | | | |

| Engineered Controls Intl, LLC, Term Loan(c) | | United States | | | 3M US L + 7.00% | | | 8.50 | % | | 11/05/24 | | $ | 4,094,856 | | $ | 4,094,856 | |

| Erpe Bidco, Ltd., First Lien Facility B EUR Term Loan | | United Kingdom | | | 3M EUR L + 4.00% | | | 4.00 | % | | 10/04/24 | | € | 1,536,058 | | | 1,238,499 | |

| Excelitas Technologies Corp., First Lien Initial Euro Term Loan(c) | | United States | | | 3M EUR L + 3.50% | | | 3.50 | % | | 12/02/24 | | | 22,140 | | | 26,709 | |

| LEB Holdings , Inc., First Lien Initial Term Loan | | United States | | | 3M US L + 4.00% | | | 4.75 | % | | 11/02/27 | | $ | 263,505 | | | 264,657 | |

| Maravai Intermediate Holdings LLC, First Lien Initial Term Loan(c) | | United States | | | 3M US L + 4.25% | | | 5.25 | % | | 10/19/27 | | | 421,468 | | | 426,210 | |

| Ohio Transmission Corporation, Term Loan(c) | | United States | | | 3M US L + 8.50% | | | 8.75 | % | | 04/09/27 | | | 1,961,592 | | | 1,883,128 | |

| Shape Technologies Group, Inc., First Lien Initial Term Loan | | United States | | | 1M US L + 3.00% | | | 3.15 | % | | 04/21/25 | | | 919,195 | | | 815,785 | |

| WireCo WorldGroup, Inc., First Lien Initial Term Loan | | United States | | | 3M US L + 5.00% | | | 6.00 | % | | 09/29/23 | | | 1,930,390 | | | 1,850,356 | |

| WireCo WorldGroup, Inc., Second Lien Initial Term Loan | | United States | | | 3M US L + 9.00% | | | 10.00 | % | | 09/30/24 | | | 750,000 | | | 612,814 | |

| | | | | | | | | | | | | | | | | | 23,976,402 | |

| CHEMICALS, PLASTICS, & RUBBER (0.98%) | | | | | | | | | | | | | | | | | | |

| Ascend Performance Materials Operations LLC, First Lien Initial Term Loan | | United States | | | 3M US L + 5.25% | | | 6.25 | % | | 08/27/26 | | | 950,077 | | | 954,827 | |

| ASK Chemicals GmbH, First Lien Facility B Term Loan | | Germany | | | 6M EUR L + 5.50% | | | 5.50 | % | | 05/12/23 | | € | 1,000,000 | | | 926,922 | |

| V Global Holdings LLC, First Lien Facility Term Loan(c) | | United States | | | 3M US L + 6.00% | | | 7.00 | % | | 12/21/27 | | $ | 2,296,875 | | | 2,239,453 | |

| V Global Holdings LLC, Revolving Credit(c)(d) | | United States | | | L + 6.00% | | | | | | 12/22/25 | | | 371,009 | | | 361,734 | |

| | | | | | | | | | | | | | | | | | 4,482,936 | |

| CONSTRUCTION & BUILDING (0.45%) | | | | | | | | | | | | | | | | | | |

| Playpower, Inc., First Lien Initial Term Loan | | United States | | | 3M US L + 5.50% | | | 5.74 | % | | 05/08/26 | | | 967,908 | | | 929,192 | |

| Sequa Mezzanine Holdings LLC, First Lien Extended Term Loan(c) | | United States | | | 3M US L + 6.75% | | | 7.75 | % | | 11/28/23 | | | 1,118,041 | | | 1,126,426 | |

| | | | | | | | | | | | | | | | | | 2,055,618 | |

| CONSUMER GOODS: DURABLE (1.46%) | | | | | | | | | | | | | | | | | | |

| Auris Luxembourg III SARL, First Lien Facility B1A Term Loan | | Denmark | | | 6M EUR L + 4.00% | | | 4.00 | % | | 02/27/26 | | € | 795,720 | | | 948,118 | |

| New Milani Group LLC, First Lien Term Loan(c) | | United States | | | 3M US L + 2.50% | | | 6.00 | % | | 06/06/24 | | $ | 780,000 | | | 709,800 | |

| TLC Purchaser, Inc. Delayed Draw Term Loan(c)(d) | | United States | | | L + 0.50% | | | | | | 10/13/25 | | | 623,197 | | | 615,407 | |

| TLC Purchaser, Inc. Revolver Loan(c)(d) | | United States | | | L + 0.50% | | | | | | 10/13/25 | | | 778,763 | | | 769,028 | |

| TLC Purchaser, Inc. Term Loan B(c) | | United States | | | 3M US L + 5.75% | | | 6.75 | % | | 10/13/25 | | | 3,700,494 | | | 3,654,238 | |

| | | | | | | | | | | | | | | | | | 6,696,591 | |

| CONTAINERS, PACKAGING, & GLASS (0.16%) | | | | | | | | | | | | | | | | | | |

| Pro Mach Group, Inc., First Lien Initial Term Loan | | United States | | | 1M US L + 2.75% | | | 2.90 | % | | 03/07/25 | | | 454,750 | | | 447,929 | |

| Trident TPI Holdings, Inc., First Lien Tranche B-1 Term Loan | | United States | | | 3M US L + 3.25% | | | 4.00 | % | | 10/17/24 | | | 298,486 | | | 295,337 | |

| | | | | | | | | | | | | | | | | | 743,266 | |

| ENERGY: ELECTRICITY (0.39%)(c) | | | | | | | | | | | | | | | | | | |

| Infinite Electronics International, Inc., First Lien B-2 Term Loan | | United States | | | 1M US L + 4.00% | | | 4.15 | % | | 07/02/25 | | | 1,635,819 | | | 1,578,565 | |

See Notes to Consolidated Financial Statements.

| 14 | 1.888.926.2688 | www.griffincapital.com |

| Griffin Institutional Access Credit Fund | Consolidated Schedule of Investments |

December 31, 2020

| Description | | Country | | Spread

Above Index | | Rate | | | Maturity

Date | | Principal

Amount | | | Value

(Note 2)(a) | |

| ENERGY: ELECTRICITY (continued) | | | | | | | | | | | | | | | | | | |

| Infinite Electronics International, Inc., Second Lien B-2 Term Loan | | United States | | 1M US L + 8.00% | | | 8.15 | % | | 07/02/26 | | $ | 240,000 | | | $ | 230,400 | |

| | | | | | | | | | | | | | | | | | 1,808,965 | |

| ENERGY: OIL & GAS (0.37%) | | | | | | | | | | | | | | | | | | |

| AMH Litigation Trust Initial Loan(c)(h) | | United States | | | | | | | | 06/06/25 | | | 1,044 | | | | 1,044 | |

| BlackBrush Oil & Gas LP, First Lien Term Loan(c)(e) | | United States | | 3M US L + 5.00% | | | 8.00 | % | | 09/03/25 | | | 810,976 | | | | 810,976 | |

| Lower Cadence Holdings LLC, First Lien Initial Term Loan | | United States | | 1M US L + 4.00% | | | 4.15 | % | | 05/22/26 | | | 894,619 | | | | 875,889 | |

| | | | | | | | | | | | | | | | | | 1,687,909 | |

| FIRE: FINANCE (0.15%) | | | | | | | | | | | | | | | | | | |

| Advisor Group Holdings, Inc., First Lien Initial B Term Loan | | United States | | 1M US L + 5.00% | | | 5.15 | % | | 07/31/26 | | | 681,826 | | | | 677,565 | |

| | | | | | | | | | | | | | | | | | | |

| FIRE: INSURANCE (0.71%)(c) | | | | | | | | | | | | | | | | | | |

| Ivy Finco Limited, Facility B Term Loan | | Jersey | | 6M GBP L + 5.50% | | | 5.83 | % | | 05/19/25 | | £ | 451,074 | | | | 607,592 | |

| Ivy Finco Limited, Term Loan | | Jersey | | 6M GBP L + 5.25% | | | 6.17 | % | | 05/19/25 | | | 1,508,621 | | | | 2,063,043 | |

| Ivy Finco Limited, Term Loan, Acquisition Facility (Original) | | Jersey | | 6M GBP L + 5.25% | | | 5.83 | % | | 05/19/25 | | | 442,316 | | | | 595,796 | |

| | | | | | | | | | | | | | | | | | 3,266,431 | |

| FIRE: REAL ESTATE (0.15%)(c) | | | | | | | | | | | | | | | | | | |

| Strand Court Limited, Facility A Tranche 4 | | United Kingdom | | 6M EUR L + 6.75% | | | 7.25 | % | | 02/13/23 | | € | 340,216 | | | | 411,466 | |

| Strand Court Limited, Facility A Tranche 5 | | United Kingdom | | 6M EUR L + 6.75% | | | 7.25 | % | | 02/13/23 | | | 240,148 | | | | 290,441 | |

| | | | | | | | | | | | | | | | | | 701,907 | |

| FOREST PRODUCTS & PAPER (0.45%) | | | | | | | | | | | | | | | | |

| Solenis Holdings LLC, First Lien Initial Dollar Term Loan | | United States | | 3M US L + 4.00% | | | 4.23 | % | | 06/26/25 | | $ | 14,606 | | | | 14,609 | |

| Solenis Holdings LLC, Second Lien Initial Dollar Term Loan(g) | | United States | | 3M US L + 8.50% | | | 8.73 | % | | 06/26/26 | | | 2,036,269 | | | | 2,034,569 | |

| | | | | | | | | | | | | | | | | | 2,049,178 | |

| HEALTHCARE & PHARMACEUTICALS (3.53%) | | | | | | | | | | | | | | | | |

| AEA Holdings SARL(c)(e) | | Luxembourg | | 6M US L + 9.25% | | | 10.25 | % | | 11/17/24 | | | 2,525,512 | | | | 2,525,512 | |

| BioClinica Holding I LP, First Lien Initial Term Loan | | United States | | 1M US L + 4.25% | | | 5.25 | % | | 10/20/23 | | | 568,125 | | | | 567,773 | |

| Chip Holdco, Ltd., First Lien B Term Loan(c) | | United Kingdom | | 6M US L + 5.00% | | | 5.26 | % | | 07/11/25 | | | 961,318 | | | | 951,704 | |

| Curium BidCo S.a r.l., Second Lien 2nd lien TL Term Loan(c)(g) | | Luxembourg | | L + 7.75% | | | | | | 10/27/28 | | | 811,462 | | | | 813,491 | |

| Endo Luxembourg Finance Co. I SARL, First Lien Initial Term Loan | | United States | | 3M US L + 4.25% | | | 5.00 | % | | 04/29/24 | | | 916,938 | | | | 905,476 | |

| Envision Healthcare Corp., First Lien Initial Term Loan(g) | | United States | | L + 3.75% | | | | | | 10/10/25 | | | 108,501 | | | | 90,992 | |

| eResearchTechnology, Inc., First Lien Initial Term Loan | | United States | | 1M US L + 4.50% | | | 5.50 | % | | 02/04/27 | | | 1,251,631 | | | | 1,243,026 | |

| Genesis Care Finance Pty, Ltd., First Lien Facility B4 Term Loan(c) | | United States | | 3M EUR L + 4.75% | | | 4.75 | % | | 05/14/27 | | € | 561,618 | | | | 692,958 | |

| Golden State Buyer, Inc., First Lien Initial Term Loan | | United States | | 1M US L + 4.75% | | | 5.50 | % | | 06/21/26 | | $ | 1,142,192 | | | | 1,135,767 | |

| Mendel Bidco, Inc., Term Loan(c) | | United States | | 3M US L + 4.50%

| | | 4.73 | % | | 06/17/27 | | | 2,715,805 | | | | 2,675,068 | |

| Mertus 522. GmbH, Acquisition/Capex Facility(c) | | Germany | | 6M EUR L + 6.00% | | | 6.00 | % | | 05/28/26 | | € | 467,970 | | | | 565,975 | |

| Mertus 522. GmbH, Facility B(c) | | Germany | | 6M EUR L + 6.00% | | | 6.00 | % | | 05/28/26 | | | 800,751 | | | | 968,449 | |

| Parexel International Corp., First Lien Initial Term Loan | | United States | | 1M US L + 2.75% | | | 2.90 | % | | 09/27/24 | | $ | 765,511 | | | | 754,029 | |

See Notes to Consolidated Financial Statements.

| Annual Report | December 31, 2020 | 15 |

| Griffin Institutional Access Credit Fund | Consolidated Schedule of Investments |

December 31, 2020

| Description | | Country | | Spread

Above Index | | Rate | | | Maturity

Date | | Principal

Amount | | | Value

(Note 2)(a) | |

| HEALTHCARE & PHARMACEUTICALS (continued) | | | | | | | | | | | | | | | | |

| Soursop, Ltd., Acquisition/Capex Facility(c)(d) | | Ireland | | 3M EUR L + 5.50% | | | 5.75 | % | | 11/03/25 | | € | 1,119,435 | | | $ | 1,367,550 | |

| Soursop, Ltd., First Lien Term Loan(c) | | Ireland | | 3M EUR L + 5.50% | | | 5.75 | % | | 11/03/25 | | | 432,376 | | | | 528,209 | |

| U.S. Anesthesia Partners, Inc., First Lien Initial Term Loan | | United States | | 3M US L + 3.00% | | | 4.00 | % | | 06/23/24 | | $ | 401,611 | | | | 393,768 | |

| | | | | | | | | | | | | | | | | | 16,179,747 | |

| HIGH TECH INDUSTRIES (4.81%) | | | | | | | | | | | | | | | | |

| AMI US Holdings Inc. Revolver Loan(c)(d) | | United States | | 1M US L + 5.50% | | | 5.65 | % | | 04/01/24 | | | 145,361 | | | | 145,361 | |

| AMI US Holdings Inc. Term Loan(c) | | United States | | 3M US L + 5.50% | | | 6.50 | % | | 04/01/25 | | | 1,085,382 | | | | 1,085,383 | |

| Barracuda Networks, Inc., Second Lien 2nd Lien Term Loan | | United States | | 3M US L + 6.75% | | | 7.50 | % | | 10/30/28 | | | 532,670 | | | | 539,328 | |

| CB Nike Intermediateco Ltd. Closing Date Term Loan(c) | | Israel | | 3M US L + 4.75% | | | 5.75 | % | | 10/31/25 | | | 2,455,200 | | | | 2,455,200 | |

| CB Nike Intermediateco Ltd. Revolver Loan(c)(d) | | Israel | | L + 0.50% | | | | | | 10/31/25 | | | 310,000 | | | | 310,000 | |

| CMI Marketing, Inc., First Lien Initial Term Loan(c) | | United States | | 1M US L + 4.50% | | | 5.50 | % | | 05/24/24 | | | 858,000 | | | | 858,000 | |

| CMI Marketing, Inc., First Lien Revolving Term Loan(c)(d) | | United States | | L + 4.50% | | | | | | 05/24/23 | | | 120,000 | | | | 120,000 | |

| Drilling Info Holdings, Inc. Delayed Draw Term Loan(d) | | United States | | L + 2.00% | | | | | | 07/30/25 | | | 112,500 | | | | 109,219 | |

| Drilling Info Holdings, Inc., First Lien Initial Term Loan | | United States | | 1M US L + 4.25% | | | 4.40 | % | | 07/30/25 | | | 1,907,545 | | | | 1,851,911 | |

| Epicor Software Corp., First Lien B (2020) Term Loan | | United States | | 1M US L + 4.25% | | | 5.25 | % | | 07/30/27 | | | 1,046,486 | | | | 1,054,606 | |

| Epicor Software Corp., Second Lien Initial Term Loan | | United States | | 1M US L + 7.75% | | | 8.75 | % | | 07/31/28 | | | 352,503 | | | | 368,917 | |

| Everest Bidco SAS, First Lien Facility B Term Loan | | France | | 3M EUR L + 3.25% | | | 3.25 | % | | 07/04/25 | | € | 947,437 | | | | 1,126,758 | |

| Everest Bidco SAS, Second Lien Term Loan(c) | | France | | 3M GBP L + 7.50% | | | 8.50 | % | | 07/03/26 | | £ | 378,378 | | | | 517,433 | |

| Fiserv Investment Solutions, Inc., First Lien Initial Term Loan | | United States | | 3M US L + 4.75% | | | 4.97 | % | | 02/18/27 | | $ | 313,983 | | | | 317,177 | |

| Ivanti Software, Inc., First Lien Initial Term Loan | | United States | | 1M US L + 4.75% | | | 5.75 | % | | 12/01/27 | | | 969,847 | | | | 969,241 | |

| LTI Holdings, Inc., First Lien Initial Term Loan | | United States | | 1M US L + 3.50% | | | 3.65 | % | | 09/06/25 | | | 1,417,937 | | | | 1,381,099 | |

| LTI Holdings, Inc., Second Lien Initial Term Loan(c) | | United States | | 1M US L + 6.75% | | | 6.90 | % | | 09/06/26 | | | 275,478 | | | | 267,902 | |

| MRI Software LLC, Delayed Draw Term Loan(d)(e) | | United States | | L + 0.50% | | | | | | 02/10/26 | | | 63,933 | | | | 63,773 | |

| MRI Software LLC, First Lien Closing Date Term Loan(e) | | United States | | 3M US L + 5.50% | | | 6.50 | % | | 02/10/26 | | | 2,227,210 | | | | 2,221,642 | |

| MRI Software LLC, First Lien Revolving Term Loan(d)(e) | | United States | | L + 0.50% | | | | | | 02/10/26 | | | 155,944 | | | | 152,045 | |

| Oneshield, Inc., Revolver Loan(c)(d) | | United States | | L + 0.50% | | | | | | 09/09/26 | | | 115,942 | | | | 114,783 | |

| Oneshield, Inc., Term Note(c) | | United States | | 3M US L + 9.00% | | | 10.00 | % | | 09/09/26 | | | 1,304,348 | | | | 1,291,305 | |

| Sabre GLBL, Inc., First Lien 2020 Other B Term Loan(g) | | United States | | L + 4.00% | | | | | | 12/17/27 | | | 332,625 | | | | 333,873 | |

| Symplr Software, Inc., First Lien Initial Term Loan | | United States | | 6M US L + 4.50% | | | 5.25 | % | | 12/22/27 | | | 821,856 | | | | 814,151 | |

| Utimaco Management GMBH, Facility C1(c) | | Germany | | 6M EUR L + 4.25% | | | 4.25 | % | | 08/09/27 | | € | 2,786,275 | | | | 3,403,832 | |

See Notes to Consolidated Financial Statements.

| 16 | 1.888.926.2688 | www.griffincapital.com |

| Griffin Institutional Access Credit Fund | Consolidated Schedule of Investments |

December 31, 2020

| Description | | Country | | Spread

Above Index | | Rate | | | Maturity

Date | | Principal

Amount | | | Value

(Note 2)(a) | |

| HIGH TECH INDUSTRIES (continued) | | | | | | | | | | | | | | | | |

| Virtusa Corp., First Lien Term Loan(g) | | United States | | L + 4.25% | | | | | | 12/09/27 | | $ | 168,661 | | | $ | 168,028 | |

| | | | | | | | | | | | | | | | | | 22,040,967 | |

| HOTEL, GAMING, & LEISURE (0.99%) | | | | | | | | | | | | | | | | |

| Aimbridge Acquisition Co., Inc., First Lien Initial (2019) Term Loan(g) | | United States | | L + 3.75% | | | | | | 02/02/26 | | | 1,000,000 | | | | 949,380 | |

| Compass III, Ltd., First Lien Facility B2 Term Loan | | Netherlands | | 6M EUR L + 4.25% | | | 4.25 | % | | 05/09/25 | | € | 671,493 | | | | 800,698 | |

| HNVR Holdco, Ltd., First Lien Facility C Term Loan | | United Kingdom | | 6M EUR L + 4.50% | | | 4.50 | % | | 09/12/25 | | | 1,353,619 | | | | 1,483,554 | |

| Hurtigruten Group AS, First Lien Term Loan | | Norway | | 6M EUR L + 8.00% | | | 8.00 | % | | 06/11/23 | | | 953,443 | | | | 1,105,072 | |

| IRB Holding Corp., First Lien 2020 Replacement B Term Loan | | United States | | 3M US L + 2.75% | | | 3.75 | % | | 02/05/25 | | $ | 201,905 | | | | 200,586 | |

| | | | | | | | | | | | | | | | | | 4,539,290 | |

| MEDIA: BROADCASTING & SUBSCRIPTION (0.82%)(c) | | | | | | | | | | | | | |

| Vital Holdco Limited, Facility B1 | | United Kingdom | | 3M US L + 4.75% | | | 5.75 | % | | 05/29/26 | | | 2,946,432 | | | | 2,946,432 | |

| Vital Holdco Limited, Facility B2 | | United Kingdom | | 3M EUR L + 4.75% | | | 4.75 | % | | 05/29/26 | | € | 659,780 | | | | 806,015 | |

| | | | | | | | | | | | | | | | | | 3,752,447 | |

| MEDIA: DIVERSIFIED & PRODUCTION (2.65%) | | | | | | | | | | | | |

| 9 Story Media Group Inc. CAD, First Lien Term Loan(c) | | Canada | | 3M CDOR + 5.50% | | | 6.50 | % | | 04/30/26 | | CAD | 1,736,215 | | | | 1,363,983 | |

| 9 Story Media Group Inc. Euro, First Lien Term Loan(c) | | Canada | | 3M EUR L + 5.50% | | | 5.50 | % | | 04/30/26 | | € | 776,501 | | | | 948,607 | |

| 9 Story Media Group Inc. Revolver, First Lien Term Loan(c)(d) | | Canada | | 1M CDOR + 5.50% | | | 6.50 | % | | 04/30/26 | | CAD | 895,604 | | | | 703,593 | |

| Crown Finance US, Inc., First Lien Initial B-1 Term Loan(e)(f)(g) | | United Kingdom | | | | | 7.00 | % | | 05/23/24 | | $ | 240,969 | | | | 288,561 | |

| Crown Finance US, Inc., First Lien Initial Dollar Tranche Term Loan(g) | | United Kingdom | | 3M US L + 2.50%

| | | 2.50 | % | | 02/28/25 | | | 1,836,007 | | | | 1,255,939 | |

| Getty Images, Inc., First Lien Initial Euro Term Loan | | United States | | 1M EUR L + 5.00% | | | 5.00 | % | | 02/19/26 | | € | 294,729 | | | | 353,829 | |

| International Entertainment Investments, Ltd., First Lien C1 Term Loan(c) | | United Kingdom | | 6M GBP L + 4.75%

| | | 4.82 | % | | 05/31/23 | | £ | 619,048 | | | | 846,549 | |

| International Entertainment Investments, Ltd., First Lien C2 Term Loan(c) | | United Kingdom | | 6M GBP L + 4.75% | | | 4.82 | % | | 05/31/23 | | | 380,952 | | | | 520,953 | |

| MH Sub I LLC, First Lien Amendment No. 2 Initial Term Loan | | United States | | 1M US L + 3.50% | | | 3.65 | % | | 09/13/24 | | $ | 490,115 | | | | 484,878 | |

| MH Sub I LLC, Second Lien Amendment No. 2 Initial Term Loan | | United States | | 1M US L + 7.50% | | | 7.65 | % | | 09/15/25 | | | 393,373 | | | | 396,570 | |

| National CineMedia LLC, First Lien Initial Term Loan(g) | | United States | | 1M US L + 3.00% | | | 3.00 | % | | 06/20/25 | | | 1,211,896 | | | | 1,022,537 | |

| Tech 6, First Lien Tranche 1(e) | | France | | 6M EUR L + 6.00% | | | 6.00 | % | | 06/30/24 | | € | 282,512 | | | | 377,809 | |

| Tech 6, First Lien Tranche 2(e) | | France | | 6M EUR L + 6.00% | | | 6.00 | % | | 06/30/24 | | | 332,576 | | | | 445,057 | |

| Technicolor USA, Inc., US New Money Loan(e) | | France | | 6M US L + 12.00% | | | 12.34 | % | | 06/30/24 | | $ | 235,352 | | | | 257,785 | |

| Technicolor USA, Inc., First Lien Tranche 1 Term Loan(e) | | France | | 6M EUR L + 3.00% | | | 3.00 | % | | 12/31/24 | | € | 854,402 | | | | 895,036 | |

| William Morris Endeavor Entertainment LLC, First Lien B-1 Term Loan | | United States | | 1M US L + 2.75% | | | 2.90 | % | | 05/18/25 | | $ | 1,946,711 | | | | 1,804,757 | |

See Notes to Consolidated Financial Statements.

| Annual Report | December 31, 2020 | 17 |

| Griffin Institutional Access Credit Fund | Consolidated Schedule of Investments |

December 31, 2020

| Description | | Country | | Spread

Above Index | | Rate | | | Maturity

Date | | Principal

Amount | | | Value

(Note 2)(a) | |

| MEDIA: DIVERSIFIED & PRODUCTION (continued) | | | | | | | | | | | | | |

| William Morris Endeavor Entertainment LLC, First Lien B-2 Term Loan | | United States | | 1M US L + 8.50% | | | 9.50 | % | | 05/18/25 | | $ | 205,758 | | | $ | 211,802 | |

| | | | | | | | | | | | | | | | | | 12,178,245 | |

| METALS & MINING (0.40%) | | | | | | | | | | | | | | | | | | |

| American Consolidated Natural Resources, Inc., First Priority Term Loan(e) | | United States | | 3M US L + 3.00% | | | 17.00 | % | | 09/16/25 | | | 1,034,082 | | | | 996,596 | |

| Hyperion Materials & Technologies, Inc., First Lien Initial Term Loan | | United States | | 3M US L + 5.50% | | | 6.50 | % | | 08/28/26 | | | 908,791 | | | | 849,152 | |

| | | | | | | | | | | | | | | | | | 1,845,748 | |

| RETAIL (1.02%) | | | | | | | | | | | | | | | | | | |

| Ascena Retail Group, Inc., First Lien Tranche B Term Loan(e) | | United States | | 1M US L + 4.50% | | | 5.25 | % | | 08/21/22 | | | 1,435,369 | | | | 290,662 | |

| Casino, Guichard-Perrachon S.A., First Lien Facility Term Loan | | France | | 3M EUR L + 5.50% | | | 5.50 | % | | 01/31/24 | | € | 1,339,120 | | | | 1,633,456 | |

| Financiere Abra SAS, Second Lien Facility | | | | | | | | | | | | | | | | | | |

| Term Loan(g) | | France | | L + 8.00% | | | | | | 10/23/26 | | | 500,000 | | | | 605,476 | |

| Hunkemoller B.V., First Lien Term Loan(g) | | Netherlands | | L + 4.50% | | | | | | 02/10/23 | | | 1,714,286 | | | | 1,795,815 | |

| MED ParentCo LP, First Lien Delayed Draw Term Loan | | United States | | 1M US L + 4.25% | | | 4.40 | % | | 08/31/26 | | $ | 75,257 | | | | 74,330 | |

| MED ParentCo LP, First Lien Initial Term Loan | | United States | | 1M US L + 4.25% | | | 4.40 | % | | 08/31/26 | | | 300,106 | | | | 296,408 | |

| | | | | | | | | | | | | | | | | | 4,696,147 | |

| SERVICES: BUSINESS (6.22%) | | | | | | | | | | | | | | | | | | |

| Alliant Holdings Intermediate LLC, First Lien 2018 Initial Term Loan | | United States | | 1M US L + 3.25% | | | 3.40 | % | | 05/09/25 | | | 732,150 | | | | 721,775 | |

| AMCP Clean Acquisition Company LLC, First Lien Delayed Draw Term Loan | | United States | | 1M US L + 4.25% | | | 4.40 | % | | 07/10/25 | | | 160,488 | | | | 110,737 | |

| AMCP Clean Acquisition Company LLC, First Lien Term Loan | | United States | | 1M US L + 4.25% | | | 4.40 | % | | 07/10/25 | | | 663,241 | | | | 457,636 | |

| Automate Intermediate Holdings II SARL(c) | | Luxembourg | | 1M US L + 7.75% | | | 7.90 | % | | 07/22/27 | | | 1,090,250 | | | | 1,082,073 | |

| AVSC Holding Corp., First Lien 2020 B-1 Term Loan(g) | | United States | | 6M US L + 3.50% | | | 4.50 | % | | 03/03/25 | | | 2,396,368 | | | | 2,056,395 | |

| AVSC Holding Corp., First Lien 2020 B-3 Term Loan(e)(g) | | United States | | L + 15.00% | | | | | | 10/15/26 | | | 1,834,234 | | | | 2,136,883 | |

| BBD Bidco, Ltd., First Lien Facility B1 Term Loan | | United Kingdom | | 3M GBP L + 4.75% | | | 4.84 | % | | 11/13/26 | | £ | 819,435 | | | | 1,108,774 | |

| BBD Bidco, Ltd., Second Lien Facility B1 Term Loan | | United Kingdom | | 6M GBP L + 8.25% | | | 8.34 | % | | 11/22/27 | | | 1,445,511 | | | | 1,958,820 | |

| Comet Bidco, Ltd., First Lien Facility B Term Loan | | United Kingdom | | 6M GBP L + 5.25% | | | 5.34 | % | | 09/30/24 | | | 469,565 | | | | 569,359 | |

| Comet Bidco, Ltd., First Lien Facility B2 Term Loan | | United Kingdom | | 6M US L + 5.00% | | | 6.00 | % | | 09/30/24 | | $ | 1,154,440 | | | | 1,041,882 | |

| Marnix SAS, First Lien Facility B (EUR) Term Loan | | France | | 6M EUR L + 3.25% | | | 3.25 | % | | 11/19/26 | | € | 464,705 | | | | 567,467 | |

| Monotype Imaging Holdings, Inc., First Lien Term Loan | | United States | | 3M US L + 5.50% | | | 5.75 | % | | 10/09/26 | | $ | 1,802,449 | | | | 1,709,326 | |

| MZR Buyer, LLC(c) | | United States | | 3M US L + 6.75% | | | 7.75 | % | | 12/21/26 | | | 2,667,241 | | | | 2,613,897 | |

| MZR Buyer, LLC(c) | | United States | | 3M US L + 6.75% | | | 7.75 | % | | 12/21/26 | | | 341,954 | | | | 335,115 | |

See Notes to Consolidated Financial Statements.

| 18 | 1.888.926.2688 | www.griffincapital.com |

| Griffin Institutional Access Credit Fund | Consolidated Schedule of Investments |

December 31, 2020

| Description | | Country | | Spread

Above Index | | Rate | | | Maturity

Date | | Principal

Amount | | | Value

(Note 2)(a) | |

| SERVICES: BUSINESS (continued) | | | | | | | | | | | | | | | | |

| Orion Advisor Solutions, Inc., First Lien Initial Term Loan | | United States | | 3M US L + 4.00% | | | 5.00 | % | | 09/24/27 | | $ | 352,600 | | | $ | 354,495 | |

| Refine Intermediate, Inc., Facility B Term Loan(c) | | United States | | 1M US L + 4.75% | | | 5.75 | % | | 03/03/27 | | | 1,915,751 | | | | 1,915,751 | |

| Refine Intermediate, Inc., Revolving Facility Term Loan(c)(d) | | United States | | L + 0.50% | | | | | | 09/03/26 | | | 467,256 | | | | 467,257 | |

| Research Now Group, Inc., First Lien Initial Term Loan | | United States | | 3M US L + 5.50% | | | 6.50 | % | | 12/20/24 | | | 547,010 | | | | 540,446 | |

| Research Now Group, Inc., Second Lien Term Loan | | United States | | 3M US L + 9.50% | | | 10.50 | % | | 12/20/25 | | | 2,000,000 | | | | 1,863,331 | |

| SumUp Holdings Luxembourg SARL, Facility A Term Loan(c) | | Luxembourg | | 3M EUR L + 8.00% | | | 9.00 | % | | 08/01/24 | | € | 1,375,071 | | | | 1,679,846 | |

| SumUp Holdings Luxembourg SARL, Facility B Delayed Draw Term Loan(c) | | Luxembourg | | 3M EUR L + 8.00% | | | 9.00 | % | | 08/01/24 | | | 1,461,013 | | | | 1,784,836 | |

| Thrasio, LLC, Initial Delayed Draw Term Loan(c)(d) | | United States | | L + 5.75% | | | | | | 12/18/26 | | $ | 1,633,201 | | | | 1,592,371 | |

| Thrasio, LLC, Initial Term Loan(c) | | United States | | 3M US L + 5.75% | | | 6.75 | % | | 12/18/26 | | | 1,429,299 | | | | 1,393,566 | |

| Upstream Rehabilitation, Inc., Second Lien Term Loan(c) | | United States | | 1M US L + 8.50% | | | 8.65 | % | | 11/20/27 | | | 456,140 | | | | 444,737 | |

| | | | | | | | | | | | | | | | | | 28,506,775 | |

| SERVICES: CONSUMER (2.00%) | | | | | | | | | | | | | | | | |

| Casablanca US Holdings, Inc., First Lien Amendment No. 2 Initial Term Loan(g) | | United States | | L + 4.00% | | | | | | 03/29/24 | | | 2,497,845 | | | | 2,039,915 | |

| Pathway Vet Alliance LLC, First Lien Initial Term Loan | | United States | | 1M US L + 4.00% | | | 4.15 | % | | 03/31/27 | | | 453,756 | | | | 454,267 | |

| Pathway Vet Alliance LLC, Initial Delayed Draw Term Loan | | United States | | 1M US L + 4.00% | | | 4.15 | % | | 03/31/27 | | | 37,046 | | | | 37,088 | |

| Trafalgar Bidco, Ltd., First Lien Term Loan(c) | | United Kingdom | | 1M GBP L + 5.00% | | | 5.02 | % | | 09/11/24 | | £ | 1,502,760 | | | | 2,055,028 | |

| Travel Leaders Group LLC, First Lien 2018 Refinancing Term Loan(c) | | United States | | 1M US L + 4.00% | | | 4.15 | % | | 01/25/24 | | $ | 3,067,816 | | | | 2,722,687 | |

| WeddingWire, Inc., Second Lien Initial Dollar Term Loan | | United States | | 3M US L + 8.25% | | | 8.46 | % | | 12/21/26 | | | 533,333 | | | | 505,333 | |

| Zeppelin Bidco Pty Limited(c) | | Australia | | 6M BBSY + 6.00% | | | 6.23 | % | | 06/28/24 | | AUD | 1,804,348 | | | | 1,377,152 | |

| | | | | | | | | | | | | | | | | | 9,191,470 | |

| TELECOMMUNICATIONS (1.20%) | | | | | | | | | | | | | | | | |

| GTT Communications B.V., First Lien Delayed Draw Term Loan(c)(d)(e) | | United States | | L + 5.00% | | | | | | 12/28/21 | | $ | 138,241 | | | | 126,491 | |

| GTT Communications, Inc., First Lien Closing Date U.S. Term Loan | | United States | | 3M US L + 2.75% | | | 3.00 | % | | 05/31/25 | | | 903,441 | | | | 713,420 | |

| GTT Communications, Inc., First Lien Term Loan(c)(e) | | United States | | 1M US L + 5.00% | | | 8.50 | % | | 12/28/21 | | | 78,995 | | | | 72,280 | |

| Horizon Telcom, Inc., First Lien Delayed Draw Term Loan(c) | | United States | | 3M US L + 5.00% | | | 6.00 | % | | 06/15/23 | | | 45,970 | | | | 45,166 | |

| Horizon Telcom, Inc., First Lien Revolving Term Loan(c) | | United States | | 3M US L + 5.00% | | | 6.00 | % | | 06/15/23 | | | 5,793 | | | | 5,692 | |

| Horizon Telcom, Inc., First Lien Term Loan(c) | | United States | | 3M US L + 5.00% | | | 6.00 | % | | 06/15/23 | | | 676,924 | | | | 665,078 | |

| Intelsat Jackson Holdings S.A., First Lien DIP Facility Term Loan | | Luxembourg | | 3M US L + 5.50% | | | 6.50 | % | | 07/13/21 | | | 78,688 | | | | 80,498 | |

| LOGIX Holding Company LLC, First Lien Initial Term Loan | | United States | | 1M US L + 5.75% | | | 6.75 | % | | 12/22/24 | | | 334,800 | | | | 309,691 | |

See Notes to Consolidated Financial Statements.

| Annual Report | December 31, 2020 | 19 |

| Griffin Institutional Access Credit Fund | Consolidated Schedule of Investments |

December 31, 2020

| Description | | Country | | Spread

Above Index | | Rate | | | Maturity

Date | | Principal

Amount | | | Value

(Note 2)(a) | |

| TELECOMMUNICATIONS (continued) | | | | | | | | | | | | | | | | |

| Masergy Holdings, Inc., First Lien 2017 Replacement Term Loan | | United States | | 3M US L + 3.25% | | | 4.25 | % | | 12/15/23 | | $ | 935,902 | | | $ | 930,052 | |

| Masergy Holdings, Inc., Second Lien Initial Term Loan | | United States | | 3M US L + 7.50% | | | 8.50 | % | | 12/16/24 | | | 462,778 | | | | 459,307 | |

| Matterhorn Telecom S.A., First Lien Facility B1 Term Loan | | Luxembourg | | 3M EUR L + 2.63% | | | 2.63 | % | | 09/15/26 | | € | 369,547 | | | | 446,698 | |

| Northwest Fiber LLC, First Lien B Term Loan | | United States | | 1M US L + 5.50% | | | 5.65 | % | | 04/30/27 | | $ | 817,193 | | | | 821,279 | |

| Pulsant Acquisitions Ltd., First Lien Facility B Term Loan(c) | | United Kingdom | | 6M GBP L + 5.25% | | | 6.25 | % | | 05/31/23 | | £ | 605,008 | | | | 819,077 | |

| | | | | | | | | | | | | | | | | | 5,494,729 | |

| TRANSPORTATION: CARGO (0.87%) | | | | | | | | | | | | | | | | |

| Drive Chassis Holdco LLC, Second Lien B Term Loan | | United States | | 3M US L + 8.25% | | | 8.47 | % | | 04/10/26 | | $ | 2,120,128 | | | | 2,115,496 | |