UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-23165 |

|

CION ARES DIVERSIFIED CREDIT FUND |

(Exact name of registrant as specified in charter) |

|

3 PARK AVENUE 36TH FLOOR NEW YORK, NEW YORK | | 10016 |

(Address of principal executive offices) | | (Zip code) |

|

Eric A. Pinero 3 Park Avenue, 36th Floor New York, New York 10016 |

(Name and address of agent for service) |

| | | |

Copy to:

Michael A. Reisner | | Richard Horowitz, Esq. |

Mark Gatto | | Matthew K. Kerfoot, Esq. |

CION Ares Management, LLC | | Dechert LLP |

3 Park Avenue, 36th Floor | | 1095 Avenue of the Americas |

New York, New York 10016 | | New York, New York 10036 |

Registrant’s telephone number, including area code: | (646) 845-2577 | |

|

Date of fiscal year end: | October 31 | |

|

Date of reporting period: | October 31, 2017 | |

| | | | | |

Item 1. Report to Stockholders.

CION Ares Diversified Credit Fund

CION Ares Diversified Credit Fund

Letter to Shareholders | | | 2 | | |

Fund Profile & Financial Data | | | 4 | | |

Schedule of Investments | | | 6 | | |

Statement of Assets and Liabilities | | | 11 | | |

Statement of Operations | | | 12 | | |

Statement of Changes in Net Assets | | | 13 | | |

Statement of Cash Flows | | | 14 | | |

Financial Highlights | | | 15 | | |

Notes to Financial Statements | | | 18 | | |

Proxy & Portfolio Information | | | 35 | | |

Dividend Reinvestment Plan | | | 36 | | |

Corporate Information | | | 39 | | |

Privacy Notice | | | 40 | | |

Directors and Officers | | | 41 | | |

Annual Report 2017

CION Ares Diversified Credit Fund

Letter to Shareholders

October 31, 2017

Fellow Shareholders,

We are pleased to present the Annual Report for the CION Ares Diversified Credit Fund (the "Fund"), for the year ending October 31, 2017.

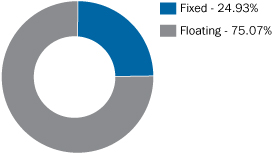

We are also proud to report on the Fund's early success in deploying capital. As of our year-end, the Fund had made 67 total investments, spread across 20 distinct industries. Floating rate instruments accounted for 75% of the Fund and 37% of the Fund was deployed in direct lending investments originated by Ares. The Fund has yet to deploy any leverage, though it expects to in the upcoming quarters.

Investment Philosophy and Process

The Fund remains focused on delivering attractive risk-adjusted returns for our shareholders across market cycles by investing in a diversified pool of liquid and illiquid credit instruments utilizing a flexible strategy. We believe the optimal investment strategy for non-investment grade credit is an actively managed portfolio that encompasses a broad spectrum of liquid and illiquid credit asset classes including high yield bonds, syndicated loans, structured credit, real estate debt, and direct lending in the U.S. and Europe. We believe unconstrained flexibility within a single portfolio affords investors an opportunity to capitalize on inefficiencies and dislocations across the credit spectrum in an effort to capture the best relative value.

The due diligence and investment process by which the Fund's investments are selected is rigorous. The Fund's advisor, leveraging resources of the broader Ares platform, conducts ongoing proprietary analysis at the asset-class level to compare current market conditions with historical precedents and industry-level data to examine the rate environment, correlation to public markets, and regional risks. Ares also monitors both spread and standard deviation movements against historical benchmarks to determine the relative value of specific asset classes. This information is brought before the twelve member allocation committee in biweekly meetings, where senior members in each of the underlying asset classes across the Ares platform share their observations and insights with portfolio managers Greg Margolies and Mitch Goldstein.

Investment Environment

Throughout 2017, the global economy has continued to recover, corporate fundamentals have largely improved, monetary policy has remained supportive, rates continue to be low and there is still a large amount of capital searching for yield. These factors have supported non-investment grade assets in 2017 and have kept market volatility for the most part at bay. Credit spreads have continued to grind tighter in the face of various headwinds as fiscal policy optimism, healthy corporate earnings reports, robust technicals, and positive macroeconomic indicators continue to lift investor sentiment. Despite elevated concerns around shifting monetary policy, ongoing geopolitical tensions (particularly with North Korea) and inclement weather due to Hurricanes Harvey and Irma, credit markets were resilient and spreads tightened throughout the year as investors reached further down the risk spectrum. Amid these favorable conditions, in early November the Federal Reserve ("Fed") indicated the pace of economic expansion was upgraded from "moderate" in previous statements to "solid" signifying the increased likelihood of a December interest rate hike. However, by investing in mostly floating rate securities, the Fund is somewhat insulated from the interest rate risk associated with a rising rate environment. Overall we remain highly constructive on credit given solid corporate earnings growth, a benign inflationary environment and a patient Fed, all of which continue to act as an overriding support mechanism for our markets.

European markets have shown notable stability during recent months as improving growth prospects and employment data in the region seemed to offset geopolitical and monetary policy concerns. Economic growth in Europe continued to show signs of strength with upwardly revised gross domestic product readings and low unemployment rates supporting sentiment. However, inflation levels remain well below the European Central Bank ("ECB") target and volatility in the euro-dollar exchange rates has been elevated recently, both of which are important indicators of potential changes to monetary policy in the Eurozone. These data points, in combination with renewed geopolitical concerns resulting from the suspension of activities in the Catalan parliament by the Spanish government, argue for a gradual and cautious approach to tapering the quantitative easing program, which is exactly what the ECB has reiterated. In late October the ECB announced it would begin to reduce the pace of its bond purchases by 50% beginning in October of 2018, but the market reaction was relatively muted as the ECB confirmed it would be patient in its approach given the geopolitical risks at play.

Annual Report 2017

2

CION Ares Diversified Credit Fund

Letter to Shareholders (continued)

October 31, 2017

Against the macroeconomic backdrop described above, we continue to favor high-quality, floating rate assets in defensive sectors. We have and continue to increase our exposure to directly originated loans in the U.S. and Europe as well as new-issue CLO instruments given the yield premium that exists in those markets today. Owing to its flexible investment strategy, we believe the Fund offers a compelling combination of yield, diversification, and downside protection. We maintain strong conviction in the current portfolio positioning and believe we will generate attractive risk-adjusted returns going forward.

Summary

Given the current investment environment, we believe that our ability to dynamically allocate across credit sectors and geographies will allow us to provide attractive risk-adjusted returns to our shareholders. We are pleased with the continued progress of constructing the Fund's diversified portfolio and our performance to date. Looking ahead, the portfolio management team will continue to leverage the power of the Ares platform and its position as a global market leader in the non-investment grade credit markets and direct lending to identify attractive investment opportunities in line with the stated objective of the Fund.

We thank you for your investment in and continued support of the CION Ares Diversified Credit Fund.

Sincerely,

Mark Gatto Michael Reisner

Co-CEO Co-CEO

CION Ares Management CION Ares Management

Views expressed are those of CION Ares Management as of the date of this communication, are subject to change at any time, and may differ from the views of other portfolio managers or of Ares as a whole. Although these views are not intended to be a forecast of future events, a guarantee of futures results, or investment advice, any forward looking statements are not reliable indicators of future events and no guarantee is given that such activities will occur as expected or at all. Information contained herein has been obtained from sources believed to be reliable, but the accuracy and completeness of the information cannot be guaranteed. CION Ares Management does not undertake any obligation to publicly update or review any forward-looking information, whether as a result of new information, future developments or otherwise, except as required by law. All investments involve risk, including possible loss of principal. Past performance is not indicative of future results.

CION Securities, LLC ("CSL") is the wholesale marketing agent for CION Ares Diversified Credit Fund ("CADC" or the "Fund"), advised by CION Ares Management, LLC ("CAM") and distributed by ALPS Distributors, Inc ("ADI"). CSL, member FINRA, and CAM are not affiliated with ADI, member FINRA. Certain Ares fund securities may be offered through its affiliate, Ares Investor Services LLC ("AIS"), a broker-dealer registered with the SEC, and a member of FINRA and SIPC.

Annual Report 2017

3

CION Ares Diversified Credit Fund

Fund Fact Sheet — As of October 31, 2017

A: CADEX C: CADCX I: CADUX

FUND OVERVIEW

CION Ares Diversified Credit Fund ("CADC") is an unlisted closed-end interval fund with quarterly repurchase offers at net asset value totaling no less than 5% of the Fund's outstanding shares. By leveraging the Ares global credit platform — one of the largest in the United States and Europe — the Fund seeks to provide superior risk-adjusted returns across various market cycles by investing in a diversified portfolio of liquid and illiquid asset classes comprised of various credit instruments which, under normal circumstances, will represent at least 80% of the Fund's assets. The Fund seeks to capitalize on market inefficiencies and relative value opportunities throughout the entire global credit spectrum.

PORTFOLIO CHARACTERISTICS

Management Team

? Mitch Goldstein

Co-Head of Ares Credit Group 23 years experience

? Greg Margolies

Head of Markets, Ares Management 29 years experience

? CADC's allocation committee consists of an additional 13 members, averaging nearly 25 years experience.

Fund Information

Class A Inception | | 01/26/2017 | |

Class C & I Inception | | 07/12/2017 | |

Assets | | $22.1 MM | |

Total Issues | | 67 | |

Distributions1 | | Monthly | |

Current Distribution Rate2 | | 5.54% | |

Sharpe Ratio | | N/A | |

Standard Deviation | | N/A | |

Fixed vs. Floating Rate†

† Excludes cash, other net assets and equity instruments.

Fund holdings and sector allocations are subject to change and are not a recommendation to buy or sell any security.

FUND PERFORMANCE

| | | MTD | | YTD | | Since Inception | |

Class A Share — CADEX | | | 1.27 | % | | | 5.32 | % | | | 5.32 | % | |

Class C Share — CADCX | | | 1.27 | % | | | 2.95 | % | | | 2.95 | % | |

Class I Share — CADUX | | | 1.27 | % | | | 2.95 | % | | | 2.95 | % | |

Total return is a measure of the change in NAV including reinvestment of all distributions and is presented on a net basis reflecting expense support provided by CAM. The Class A Share excludes all sales commissions and dealer manager fees. If these had been deducted, performance would have been lower. Returns for periods of less than one year are not annualized. Past performance is not indicative of future results.

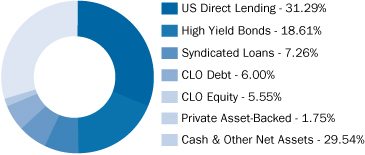

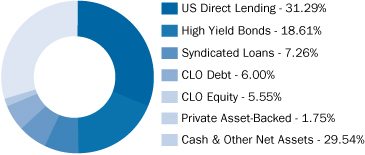

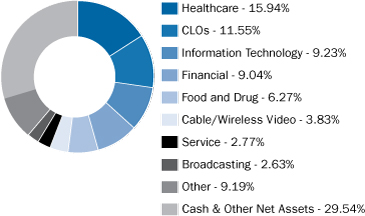

Portfolio Composition by Asset Type

Top 10 Holdings

Name of Holding | | % of Portfolio | |

SPDR Barclays High Yield Bond ETF | | | 4.08 | % | |

Centene Corp. | | | 2.36 | % | |

Charter Communications, Inc. | | | 2.25 | % | |

Sirius XM Radio, Inc. | | | 2.21 | % | |

Molina Healthcare, Inc. | | | 2.17 | % | |

DRB Holdings, LLC | | | 2.17 | % | |

Tenet Healthcare Corp. | | | 2.16 | % | |

Asurion, LLC | | | 2.16 | % | |

Penn Virginia Holding Corp. | | | 2.15 | % | |

DecoPac, Inc. | | | 2.14 | % | |

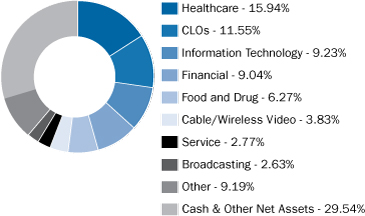

Allocation by Industry

Annual Report 2017

4

CION Ares Diversified Credit Fund

Fund Fact Sheet — As of October 31, 2017 (continued)

A: CADEX C: CADCX I: CADUX

RISK DISCLOSURES AND GLOSSARY

Risks and limitations include, but are not limited to, the following: most credit instruments will be rated below investment grade and should be considered speculative; illiquid investments may be susceptible to economic downturns causing extended losses; there is no guarantee that all shares can be repurchased; the Fund's business and operations may be negatively impacted by fluctuations in the capital markets; the Fund is a newly organized, diversified, closed-end investment company with no operating history; diversification does not eliminate the risk of experiencing investment losses.

Sharpe Ratio — a risk-adjusted measure that measures reward per unit of risk. The higher the Sharpe Ratio, the better. The numerator is the difference between a portfolio's annualized return and the return of a risk-free instrument. The denominator is the portfolio's standard deviation.

Standard Deviation — a widely used measure of an investment's performance volatility. Standard deviation shows how much variation from the mean exists with a larger number indicating the data points are more spread out over a larger range of values.

1. Monthly Distributions — There is no assurance monthly distributions paid by the fund will be maintained at the targeted level or paid at all.

2. Current Distribution Rate — Current distribution rate is expressed as a percentage equal to the projected annualized distribution amount (which is calculated by annualizing the current cash distribution per share without compounding), divided by the current net asset value. The current distribution rate shown may be rounded.

A portion of distributions may be a direct result of expense support payments provided by CION Ares Management, LLC ("CAM"), which are subject to repayment by CADC within three years. The purpose of this arrangement is to ensure that CADC bears an appropriate level of expenses. Any such distributions may not be entirely based on investment performance and can only be sustained if positive investment performance is achieved in future periods and/or CAM continues to make such expense support payments. Future repayments will reduce cash otherwise potentially available for distributions. There can be no assurance that such performance will be achieved in order to sustain these distributions. CAM has no obligation to provide expense support payments in future periods.

CADC may fund distributions from unlimited amounts of offering proceeds or borrowings, which may constitute a return of capital, as well as net income from operations, capital and non-capital gains from the sale of assets, dividends or distributions from equity investments and expense support payments from CAM, which are subject to repayment. For the year ending October 31, 2017, distributions were paid from taxable income and did not include a return of capital for tax purposes. If expense support payments from CAM were not provided, some or all of the distributions may have been a return of capital which would reduce the available capital for investment. The sources of distributions may vary periodically. Please refer to the semi-annual or annual reports filed with the SEC for the sources of distributions.

ABOUT CION INVESTMENTS

CION Investments is a leading manager of alternative investment solutions that focuses on alternative credit strategies for individual investors. The firm currently manages a leading non-traded BDC with approximately $1.7 billion in assets under management and sponsors, through CION Ares Management, CION Ares Diversified Credit Fund. CION Investments is headquartered in New York.

ABOUT ARES MANAGEMENT

Ares Management, L.P. ("Ares") is a publicly traded, leading global alternative asset manager with approximately $106 billion of assets under management* and approximately 1,000 employees. Ares seeks to deliver attractive performance to its investors across its investment groups and strategies, including credit (high yield bonds, syndicated loans, structured credit, and direct lending in the U.S. and Europe), private equity (corporate private equity, U.S. power and energy infrastructure, and special situations) and real estate (debt and equity). The firm is headquartered in Los Angeles with offices across the United States, Europe, Asia, and Australia. Its common units are traded on the New York Stock Exchange under the ticker symbol "ARES".

* As of September 30, 2017, AUM amounts include funds managed by Ivy Hill Asset Management, L.P., a wholly owned portfolio company of Ares Capital Corporation and a registered investment adviser.

This is neither an offer to sell nor a solicitation to purchase the securities described herein. An offering is made only by the prospectus which must precede or accompany this piece. Please read the prospectus prior to making any investment decision and consider the risks, charges, expenses and other important information described therein. Additional copies of the prospectus may be obtained by contacting CION Securities at 800.435.5697 or by visiting cioninvestments.com.

Please be aware that the Fund, the Advisers, the Distributor or the Wholesale Marketing Agent and their respective officers, directors, employees and affiliates do not undertake to provide impartial investment advice or to give advice in a Fiduciary capacity in connection with the Fund's public offering of shares.

CION Securities, LLC ("CSL") is the wholesale marketing agent for CION Ares Diversified Credit Fund, advised by CION Ares Management, LLC ("CAM") and distributed by ALPS Distributors, Inc ("ADI"). CSL, member FINRA, and CAM are not affiliated with ADI, member FINRA.

Annual Report 2017

5

CION Ares Diversified Credit Fund

Schedule of Investments

October 31, 2017

Senior Loans 38.4%(b)(g)

| | | Principal

Amount | | Value(a) | |

Aerospace and Defense 0.4% | |

Sequa Mezzanine Holdings LLC,

Initial 1st Lien Term Loan,

LIBOR + 5.50%, 6.87%, 11/26/2021 | | $ | 69,825 | | | $ | 70,327 | | |

Sequa Mezzanine Holdings LLC,

Initial 2nd Lien Term Loan,

LIBOR + 9.00%,

10.37%, 04/28/2022 | | | 29,830 | | | | 30,594 | | |

| | | | | | 100,921 | | |

Banking, Finance, Insurance & Real Estate 3.2% | |

A.U.L. Corp., 1st Lien Revolver,

LIBOR + 5.00%,

6.00%, 06/05/2023(c)(f)(i) | | | 1,000 | | | | (20 | ) | |

A.U.L. Corp., 1st Lien Term Loan,

LIBOR + 5.00%,

6.38%, 06/05/2023(f)(i) | | | 49,688 | | | | 48,694 | | |

Asurion, LLC, 1st Lien Term Loan B-5,

L+ 3.00%, 4.24%, 11/03/2023(d) | | | 488,520 | | | | 492,491 | | |

SCM Insurance Services, Inc.,

CAD 1st Lien Revolver,

0.50%, 08/29/2022(c)(f) | | CAD | 1,000 | | | | (32 | ) | |

SCM Insurance Services, Inc.,

CAD 1st Lien Term Loan,

CDOR + 5.00%,

6.31%, 08/29/2024(f) | | | 125,000 | | | | 95,968 | | |

SCM Insurance Services, Inc.,

CAD 2nd Lien Term Loan,

CDOR + 9.00%,

10.31%, 03/01/2025(f) | | | 125,000 | | | | 95,967 | | |

| | | | | | 733,068 | | |

Beverage, Food and Tobacco 3.5% | |

BakeMark Holdings, Inc.,

1st Lien Term Loan, LIBOR + 5.25%,

6.58%, 08/14/2023(f) | | $ | 250,000 | | | | 248,750 | | |

Jim N Nicks Management LLC,

1st Lien Revolver, LIBOR + 5.25%,

6.49%, 07/10/2023(c)(f) | | | 1,000 | | | | 328 | | |

Jim N Nicks Management LLC,

1st Lien Term Loan,

LIBOR + 5.25%,

6.60%, 07/10/2023(f) | | | 49,875 | | | | 48,753 | | |

Penn Virginia Holding Corporation,

2nd Lien Term Loan, LIBOR + 7.00%,

8.34%, 09/29/2022(f) | | | 500,000 | | | | 490,000 | | |

| | | | | | 787,831 | | |

Senior Loans(b)(g) (continued)

| | | Principal

Amount | | Value(a) | |

Consumer Goods: Durable 3.5% | |

DecoPac, Inc., 1st Lien Revolver,

LIBOR + 4.25%,

5.58%, 09/29/2023(c)(f) | | $ | 1,000 | | | $ | 180 | | |

DecoPac, Inc., 1st Lien Term Loan,

LIBOR + 4.25%,

5.58%, 09/30/2024(f) | | | 499,000 | | | | 489,020 | | |

Sigma Electric Manufacturing

Corporation, 1st Lien Revolver,

LIBOR + 4.75%,

5.75%, 10/31/2022(c)(f) | | | 1,000 | | | | (15 | ) | |

Sigma Electric Manufacturing

Corporation, Tranche A-2 1st Lien

Term Loan, LIBOR + 4.75%,

6.13%, 10/31/2023(f) | | | 318,113 | | | | 314,931 | | |

| | | | | | 804,116 | | |

Consumer Goods: Non-Durable 1.7% | |

MND Holdings III Corporation,

Initial 1st Lien Term Loan,

CIBOR + 4.50%, 5.83%, 06/19/2024(f) | | | 199,500 | | | | 201,993 | | |

Movati Athletic Group, Inc.,

CAD 1st Lien Term Loan A,

CIBOR + 4.50%, 5.82%, 10/05/2022(f) | | CAD | 246,699 | | | | 189,401 | | |

Movati Athletic Group, Inc.,

CAD Delayed Draw 1st Lien Term Loan,

1.50%, 10/05/2022(c)(f) | | | 253,301 | | | | (7,052 | ) | |

| | | | | | 384,342 | | |

Energy: Oil & Gas 1.2% | |

Associated Asphalt Partners, LLC,

Tranche B 1st Lien Term Loan,

LIBOR + 5.25%, 6.49%, 04/05/2024(f) | | $ | 20,948 | | | | 18,643 | | |

Traverse Midstream Partners LLC,

1st Lien Term Loan,

L+ 5.00%, 6.00%, 06/30/2018(d)(f) | | | 250,000 | | | | 250,000 | | |

| | | | | | 268,643 | | |

Environmental Industries 1.2% | |

VLS Recovery Services, LLC,

1st Lien Revolver, LIBOR + 6.00%,

7.24%, 10/17/2023(c)(f) | | | 1,000 | | | | 140 | | |

VLS Recovery Services, LLC,

Delayed Draw 1st Lien Term Loan,

LIBOR + 6.00%,

7.00%, 10/17/2023(c)(f) | | | 77,212 | | | | (772 | ) | |

Annual Report 2017

6

CION Ares Diversified Credit Fund

Schedule of Investments (continued)

October 31, 2017

Senior Loans(b)(g) (continued)

| | | Principal

Amount | | Value(a) | |

VLS Recovery Services, LLC,

1st Lien Term Loan, LIBOR + 6.00%,

7.53%, 10/17/2023(f) | | $ | 271,788 | | | $ | 269,070 | | |

| | | | | | 268,438 | | |

Healthcare & Pharmaceuticals 7.3% | |

DJO Finance, LLC,

Initial 1st Lien Term Loan,

LIBOR + 3.25%, 4.59%, 06/08/2020 | | | 198,982 | | | | 199,024 | | |

Emerus Holdings, Inc.,

1st Lien Term Loan,

LIBOR + 4.50%, 5.75%, 09/01/2021(f) | | | 10,825 | | | | 9,526 | | |

Heartland Dental Care, LLC,

2nd Lien Term Loan,

LIBOR + 8.50%, 9.75%, 07/31/2024(f) | | | 250,000 | | | | 250,000 | | |

JDC Healthcare Management, LLC,

1st Lien Term Loan,

LIBOR + 6.25%, 7.49%, 04/10/2023(f) | | | 108,966 | | | | 106,787 | | |

MB2 Dental Solutions, LLC,

1st Lien Revolver, PRIME + 2.75%,

7.00%, 09/29/2023(c)(f) | | | 1,000 | | | | 157 | | |

MB2 Dental Solutions, LLC,

Initial 1st Lien Term Loan,

LIBOR + 3.75%, 6.08%, 09/29/2023(f) | | | 349,000 | | | | 345,510 | | |

Pathway Partners Vet Management

Company, LLC, 1st Lien Term Loan,

LIBOR + 4.25%, 5.49%, 10/10/2024 | | | 348,321 | | | | 348,321 | | |

Pathway Partners Vet Management

Company, LLC, Delayed Draw 1st Lien

Term Loan, LIBOR + 4.50%,

5.50%, 10/10/2024(c) | | | 150,678 | | | | — | | |

SCSG EA Acquisition Company, Inc.,

1st Lien Revolver, LIBOR + 4.25%,

5.25%, 09/01/2022(c)(f) | | | 1,000 | | | | (5 | ) | |

SCSG EA Acquisition Company, Inc.,

1st Lien Term Loan, LIBOR + 4.25%,

5.57%, 09/01/2023(f) | | | 349,000 | | | | 347,255 | | |

TerSera Therapeutics LLC,

1st Lien Term Loan, LIBOR + 5.25%,

6.58%, 03/30/2023(f) | | | 49,750 | | | | 49,004 | | |

| | | | | | 1,655,579 | | |

High Tech Industries 9.1% | |

Almonde, Inc., USD 1st Lien

Term Loan, LIBOR + 3.50%,

4.82%, 06/13/2024 | | | 25,000 | | | | 24,899 | | |

Almonde, Inc., USD 2nd Lien

Term Loan, LIBOR + 7.25%,

8.57%, 06/13/2025 | | | 25,000 | | | | 24,757 | | |

Senior Loans(b)(g) (continued)

| | | Principal

Amount | | Value(a) | |

DRB Holdings, LLC, 1st Lien

Revolver, LIBOR + 5.75%,

6.75%, 10/06/2023(c)(f) | | $ | 1,000 | | | $ | (10 | ) | |

DRB Holdings, LLC, 1st Lien

Term Loan, LIBOR + 5.75%,

7.10%, 10/06/2023(f) | | | 499,000 | | | | 494,010 | | |

Frontline Technologies Group

Holding LLC, Delayed Draw 1st Lien

Term Loan, LIBOR + 6.50%,

7.50%, 09/18/2023(c)(f) | | | 57,213 | | | | (858 | ) | |

Frontline Technologies Group

Holding LLC, 1st Lien Term Loan,

LIBOR + 6.50%, 7.82%, 09/18/2023(f) | | | 291,787 | | | | 287,410 | | |

IQMS, Inc., 1st Lien Last Out

Term Loan, LIBOR + 8.25%,

9.49%, 03/28/2022(f) | | | 250,000 | | | | 250,000 | | |

PDI TA Holdings, Inc., 1st Lien

Revolver, LIBOR + 4.75%,

6.07%, 08/25/2023(c)(f) | | | 11,290 | | | | (113 | ) | |

PDI TA Holdings, Inc., Delayed Draw

1st Lien Term Loan, LIBOR + 4.75%,

5.75%, 08/25/2023(c)(f) | | | 43,468 | | | | (435 | ) | |

PDI TA Holdings, Inc., Delayed Draw

2nd Lien Term Loan, LIBOR + 8.75%,

9.75%, 08/25/2024(c)(f) | | | 18,629 | | | | (186 | ) | |

PDI TA Holdings, Inc., 2nd Lien

Term Loan, LIBOR + 8.75%,

10.07%, 08/25/2024(f) | | | 84,677 | | | | 83,830 | | |

PDI TA Holdings, Inc., Initial 1st Lien

Term Loan, LIBOR + 4.75%,

6.07%, 08/25/2023(f) | | | 191,935 | | | | 190,016 | | |

Practice Insight, LLC, 1st Lien

Revolver, PRIME + 4.00%,

8.25%, 08/23/2022(c)(f) | | | 1,000 | | | | 195 | | |

Practice Insight, LLC, 1st Lien

Term Loan, LIBOR + 5.00%,

6.24%, 08/23/2022(f) | | | 349,000 | | | | 347,255 | | |

Storm US Holdco, Inc., USD 1st Lien

Term Loan, LIBOR + 5.25%,

6.56%, 05/05/2023(f) | | | 49,875 | | | | 49,002 | | |

Visual Edge Technology, Inc.,

1st Lien Term Loan, LIBOR + 5.75%,

7.07%, 08/31/2022(f) | | | 162,500 | | | | 160,875 | | |

Visual Edge Technology, Inc.,

Delayed Draw 1st Lien Term Loan,

LIBOR + 5.75%,

7.08%, 08/31/2022(c)(f) | | | 62,500 | | | | 46,875 | | |

Visual Edge Technology, Inc.,

Mezzanine 1st Lien Term Loan,

12.50%, 09/02/2024(f) | | | 126,259 | | | | 118,065 | | |

| | | | | | 2,075,587 | | |

Annual Report 2017

7

CION Ares Diversified Credit Fund

Schedule of Investments (continued)

October 31, 2017

Senior Loans(b)(g) (continued)

| | | Principal

Amount | | Value(a) | |

Hotel, Gaming & Leisure 1.1% | |

SFE Acquisition LLC, 1st Lien

Revolver, LIBOR + 5.00%,

6.24%, 07/31/2022(c)(f) | | $ | 1,000 | | | $ | 424 | | |

SFE Acquisition LLC, 1st Lien

Term Loan, LIBOR + 5.00%,

6.38%, 07/31/2023(f) | | | 250,000 | | | | 248,750 | | |

| | | | | | 249,174 | | |

Media: Advertising, Printing & Publishing 0.3% | |

Harland Clarke Holdings Corporation,

1st Lien Term Loan B-7, L+ 5.00%,

6.00%, 10/31/2023(d) | | | 74,559 | | | | 74,807 | | |

Media: Broadcasting & Subscription 0.9% | |

WideOpenWest Finance, LLC,

1st Lien Term Loan B,

LIBOR + 3.25%, 4.49%, 08/18/2023 | | | 205,856 | | | | 206,114 | | |

Media: Diversified & Production 0.1% | |

Equinox Holdings, Inc., Initial 2nd Lien

Term Loan, LIBOR + 7.00%,

8.24%, 09/06/2024 | | | 26,852 | | | | 27,322 | | |

Metals & Mining 0.3% | |

Murray Energy Holdings Co., 1st Lien

Term Loan B-2, LIBOR + 7.25%,

8.58%, 04/16/2020 | | | 74,603 | | | | 66,316 | | |

Printing and Publishing 0.8% | |

Dex Media, Inc., 1st Lien Term Loan,

LIBOR + 10.00%,

11.24%, 07/29/2021 | | | 185,128 | | | | 189,062 | | |

Retail 3.0% | |

Bambino CI, Inc., 1st Lien Revolver,

LIBOR + 6.00%,

7.24%, 10/17/2022(c)(f) | | | 1,000 | | | | 123 | | |

Bambino CI, Inc., 1st Lien Term Loan,

LIBOR + 6.00%, 7.24%, 10/17/2023(f) | | | 349,000 | | | | 345,510 | | |

FWR Holding Corporation, 1st Lien

Revolver, LIBOR + 6.00%,

7.32%, 08/21/2023(c)(f) | | | 1,000 | | | | 265 | | |

FWR Holding Corporation, Delayed

Draw 1st Lien Term Loan,

LIBOR + 6.00%,

7.00%, 08/21/2023(c)(f) | | | 1,000 | | | | (10 | ) | |

FWR Holding Corporation, 1st Lien

Term Loan, LIBOR + 6.00%,

7.48%, 08/21/2023(f) | | | 350,000 | | | | 346,500 | | |

| | | | | | 692,388 | | |

Senior Loans(b)(g) (continued)

| | | Principal

Amount | | Value(a) | |

Utilities: Electric 0.8% | |

Sunk Rock Foundry Partners LP,

Tranche A-1 1st Lien Term Loan,

LIBOR + 4.75%, 6.13%, 10/31/2023(f) | | $ | 180,888 | | | $ | 179,079 | | |

Total Senior Loans

(Cost: $8,704,544) | | | | | 8,762,787 | | |

Corporate Bonds 14.5%

Healthcare & Pharmaceuticals 8.7% | |

Centene Corporation,

6.13%, 02/15/2024 | | | 500,000 | | | | 537,500 | | |

Molina Healthcare, Inc.,

144A, 4.88%, 06/15/2025 | | | 499,000 | | | | 494,010 | | |

Tenet Healthcare Corporation,

8.13%, 04/01/2022 | | | 400,000 | | | | 402,000 | | |

Tenet Healthcare Corporation,

144A, 7.00%, 08/01/2025 | | | 100,000 | | | | 91,625 | | |

Valeant Pharmaceuticals

International, Inc., 144A, (Canada),

5.63%, 12/01/2021 | | | 500,000 | | | | 455,625 | | |

| | | | | | 1,980,760 | | |

High Tech Industries 0.2% | |

Veritas US, Inc.,

144A, 10.50%, 02/01/2024 | | | 50,000 | | | | 53,250 | | |

Media: Broadcasting & Subscription 4.8% | |

Charter Communications, Inc.,

144A, 5.50%, 05/01/2026 | | | 500,000 | | | | 512,500 | | |

Sinclair Broadcast Group, Inc.,

144A, 5.13%, 02/15/2027 | | | 100,000 | | | | 95,125 | | |

Sirius XM Radio, Inc.,

144A, 5.00%, 08/01/2027 | | | 500,000 | | | | 504,375 | | |

| | | | | | 1,112,000 | | |

Metals & Mining 0.1% | |

Murray Energy Holdings Co.,

144A, 11.25%, 04/15/2021 | | | 25,000 | | | | 13,750 | | |

Telecommunications 0.7% | |

Ziggo Bond Finance B.V., 144A,

(Netherlands), 5.88%, 01/15/2025 | | | 150,000 | | | | 154,312 | | |

Total Corporate Bonds

(Cost: $3,333,876) | | | | | 3,314,072 | | |

Annual Report 2017

8

CION Ares Diversified Credit Fund

Schedule of Investments (continued)

October 31, 2017

Collateralized Loan Obligations 11.5%(g)(i)

| | | Principal

Amount | | Value(a) | |

Collateralized Loan Obligations — Debt 6.0%(e) | |

AMMC CLO XIV, Ltd., (Cayman Islands),

8.72%, LIBOR + 7.35%, 07/25/2029 | | $ | 250,000 | | | $ | 257,562 | | |

Carlyle US CLO 2016-4, Ltd.,

(Cayman Islands), 8.26%,

LIBOR + 6.90%, 10/20/2027 | | | 250,000 | | | | 255,710 | | |

Highbridge Loan Management

2013-2, Ltd., (Cayman Islands),

7.96%, LIBOR + 6.60%, 10/20/2029 | | | 250,000 | | | | 250,000 | | |

THL Credit Wind River 2016-2

CLO, Ltd., (Cayman Islands),

7.79%, LIBOR + 6.48%, 11/01/2028 | | | 250,000 | | | | 253,608 | | |

Venture XXIV CLO, Ltd.,

(Cayman Islands), LIBOR + 6.72%,

8.08%, 10/20/2028 | | | 100,000 | | | | 101,391 | | |

Voya CLO 2017-3, Ltd.,

(Cayman Islands), LIBOR + 6.20%,

7.52%, 07/20/2030 | | | 250,000 | | | | 250,307 | | |

| | | | | | 1,368,578 | | |

Collateralized Loan Obligations — Equity 5.5% | |

Carlyle US CLO 2017-3, Ltd.,

(Cayman Islands), 07/20/2029 | | | 250,000 | | | | 231,790 | | |

Cedar Funding VIII Clo 2017-8, Ltd.,

(Cayman Islands), 10/17/2030 | | | 250,000 | | | | 229,242 | | |

Dryden XXVIII Senior Loan Fund,

(Cayman Islands), 08/15/2030 | | | 250,000 | | | | 132,384 | | |

Eastland Investors Corporation,

(Cayman Islands), 01/05/2022 | | | 100 | | | | 48,220 | | |

Madison Park Funding X, Ltd.,

(Cayman Islands), 01/20/2025 | | | 200,000 | | | | 164,807 | | |

OZLM XIX, Ltd., (Cayman Islands),

11/22/2030(f)(h) | | | 350,000 | | | | 315,000 | | |

Race Point VIII CLO, Ltd.,

(Cayman Islands), 02/20/2030 | | | 250,000 | | | | 144,224 | | |

| | | | | | 1,265,667 | | |

Total Collateralized Loan Obligations

(Cost: $2,584,118) | | | | | 2,634,245 | | |

Exchange Traded Funds 4.1%

| | | Shares | | Value(a) | |

Banking, Finance, Insurance & Real Estate 4.1% | |

| SPDR Barclays High Yield Bond ETF | | | 25,000 | | | $ | 931,000 | | |

Total Exchange Traded Funds

(Cost: $931,000) | | | | | 931,000 | | |

Common Stocks 0.1%(g)(j)

High Tech Industries 0.1% | |

Frontline Technologies Group

Holding LLC — Class A(i) | | | 25 | | | | 25,594 | | |

Frontline Technologies Group

Holding LLC — Class B(i) | | | 2,728 | | | | 250 | | |

Total Common Stocks

(Cost: $25,750) | | | | | 25,844 | | |

Private Asset-Backed Debt 1.8%(g)

| | | Principal

Amount | | Value(a) | |

Banking, Finance, Insurance & Real Estate 1.8% | |

Avant Warehouse Trust II, Class B

Credit Facility, 10.99%,

LIBOR + 9.75%, 04/07/2021(c)(f)(i) | | $ | 150,000 | | | | 88,903 | | |

DFC Global Facility Borrower II LLC,

11.99%, LIBOR + 10.75%,

09/27/2022(c)(f)(i) | | | 500,000 | | | | 310,003 | | |

Total Private Asset-Backed Debt

(Cost: $391,339) | | | | | 398,906 | | |

Total Investments — 70.4%

(Cost: $15,970,627) | | | | $ | 16,066,854 | | |

Liabilities in Excess of Other Assets — 29.6% | | | | | 6,743,155 | | |

Net Assets — 100.0% | | | | $ | 22,810,009 | | |

Annual Report 2017

9

CION Ares Diversified Credit Fund

Schedule of Investments (continued)

October 31, 2017

Footnotes:

(a) Investment holdings in foreign currencies are converted to U.S. Dollars using period end spot rates. All investments are in United States enterprises unless otherwise noted.

(b) Interest rates on floating rate term loans adjust periodically based upon a predetermined schedule. Stated interest rates in this schedule represents the "all-in" rate as of October 31, 2017.

(c) Reported net of unfunded commitments, reduced by any upfront payments received if purchased at a discount, see Note 2.

(d) This position or a portion of this position represents an unsettled loan purchase. The interest rate will be determined at the time of settlement and will be based upon the London-Interbank Offered Rate ("LIBOR" or "L") or the applicable LIBOR floor plus a spread which was determined at the time of purchase.

(e) Variable rate coupon rate shown as of October 31, 2017.

(f) Security valued at fair value using methods determined in good faith by or under the direction of the board of directors.

(g) All of the company's Senior Loans, Collateralized Loan Obligations, Common Stocks, and Private Asset Backed Debt, which as of October 31, 2017 represented 51.9% of the company's net assets or 42.9% of the company's total assets, are subject to legal restrictions on sales.

(h) When-Issued or delayed delivery security based on typical market settlement convention for such security.

(i) Investments categorized as a significant unobservable input (Level 3) (See Note 3 of the Notes to Financial Statements).

(j) Non-income producing security as of October 31, 2017.

As of October 31, 2017, the aggregate cost of securities for Federal income tax purposes was $15,970,627.

Unrealized appreciation and depreciation on investments for Federal income tax purposes are as follows:

Gross unrealized appreciation | | $ | 142,945 | | |

Gross unrealized depreciation | | | (46,718 | ) | |

Net unrealized depreciation | | $ | 96,227 | | |

Foreign Forward Currency Contracts

On October 31, 2017, CION Ares Diversified Credit Fund had entered into forward foreign currency contracts that obligate the Fund to deliver currencies at specified future dates. Unrealized appreciation and depreciation on these contracts is included in the accompanying financial statements. The terms of the open contracts were as follows:

| | | Settlement

Date | | Currency to be

delivered — SELL | | Currency to be

received — BUY | | Unrealized

Gain (Loss) | | Counterparty | |

| | | | | 11/24/17 | | | 193,911 | | | CAD | | | | | 199,394 | | | USD | | | | $ | 5,483 | | | Goldman Sachs | |

| | | | | 1/04/18 | | | 191,444 | | | CAD | | | | | 197,454 | | | USD | | | | | 6,010 | | | Goldman Sachs | |

| | | | | | | | | | | | $ | 11,493 | | | | |

Abbreviations:

144A Certain conditions for public sale may exist. Unless otherwise noted, these securities are deemed to be liquid.

CLO Collateralized Loan Obligation

Currencies:

$ U.S. Dollars

CAD Canadian Dollars

Annual Report 2017

10

CION Ares Diversified Credit Fund

Statement of Assets and Liabilities

October 31, 2017

Assets: | |

Investments in unaffiliated issuers, at value (cost $15,970,627) | | $ | 16,066,854 | | |

Cash | | | 9,326,677 | | |

Cash denominated in foreign currency, at value (cost $5,679) | | | 5,531 | | |

Receivable for expense support from the Adviser | | | 113,825 | | |

Deferred offering costs | | | 119,849 | | |

Receivable for securities sold | | | 25,395 | | |

Forward foreign currency contracts | | | 408,341 | | |

Receivable for fund shares issued | | | 1,285,987 | | |

Interest and principal receivable | | | 103,245 | | |

Total assets | | | 27,455,704 | | |

Liabilities: | |

Payable for securities purchased | | | 3,913,354 | | |

Forward foreign currency contracts | | | 396,848 | | |

Payable for administration and transfer agent fees | | | 192,372 | | |

Payable for distributions to shareholders | | | 48,312 | | |

Payable for investment advisory fees | | | 22,235 | | |

Payable for distribution and shareholder servicing fees | | | 2,566 | | |

Accrued expenses and other payables | | | 70,008 | | |

Total liabilities | | | 4,645,695 | | |

Net assets | | $ | 22,810,009 | | |

Net assets consist of: | |

Paid-in capital | | $ | 22,620,796 | | |

Undistributed net investment income | | | 44,045 | | |

Accumulated net realized gains on investments and foreign currency | | | 37,596 | | |

Net unrealized appreciation on investments and foreign currency | | | 107,572 | | |

Net assets | | $ | 22,810,009 | | |

Common shares: | |

Class A: | |

Net Assets | | $ | 12,864,545 | | |

Shares Outstanding ($.001 par value; unlimited shares authorized) | | | 509,552 | | |

Net Asset Value Per Share | | $ | 25.25 | | |

Maximum Offering Price Per Share | | $ | 26.79 | | |

Class C: | |

Net Assets | | $ | 3,897,826 | | |

Shares Outstanding ($.001 par value; unlimited shares authorized) | | | 154,356 | | |

Net Asset Value Per Share | | $ | 25.25 | | |

Class I: | |

Net Assets | | $ | 6,047,638 | | |

Shares Outstanding ($.001 par value; unlimited shares authorized) | | | 239,494 | | |

Net Asset Value Per Share | | $ | 25.25 | | |

Annual Report 2017

11

CION Ares Diversified Credit Fund

Statement of Operations

For the period from January 26, 2017 (commencement of operations) to October 31, 2017

Investment income: | |

Interest | | $ | 243,651 | | |

Expenses: | |

Investment advisory fees (Note 5) | | | 77,609 | | |

Administrative services of the adviser (Note 5) | | | 595,000 | | |

Legal fees | | | 578,198 | | |

Offering costs | | | 388,817 | | |

Marketing expense | | | 175,000 | | |

Administration, custodian and transfer agent fees (Note 5) | | | 292,753 | | |

Insurance expense | | | 44,985 | | |

Audit fees | | | 74,500 | | |

Due diligence fees | | | 160,285 | | |

Directors fee expense | | | 181,242 | | |

Shareholder service expense Class A | | | 10,354 | | |

Shareholder service expense Class C | | | 855 | | |

Distribution fees Class C | | | 2,566 | | |

Other expenses | | | 107,355 | | |

Total expenses | | | 2,689,519 | | |

Expense support payments by the adviser (Note 5) | | | (2,689,519 | ) | |

Net expenses | | | — | | |

Net investment income | | | 243,651 | | |

Net realized and net change in unrealized gain/(loss) on investments and foreign currency | |

Net realized gain on investments | | | 37,596 | | |

Net realized loss on foreign currency | | | (207 | ) | |

Net change in unrealized appreciation on investments | | | 96,227 | | |

Net change in unrealized appreciation on foreign currency | | | 11,345 | | |

Net realized and change in unrealized gain on investments and foreign currency | | | 144,961 | | |

Total increase in net assets resulting from operations | | $ | 388,612 | | |

Annual Report 2017

12

CION Ares Diversified Credit Fund

Statement of Changes in Net Assets

For the period from January 26, 2017 (commencement of operations) to October 31, 2017

Increase (decrease) in net assets from operations: | |

Net investment income | | $ | 243,651 | | |

Net realized gain on investments and foreign currency | | | 37,389 | | |

Net change in unrealized appreciation on investments and foreign currency | | | 107,572 | | |

Net increase from operations | | | 388,612 | | |

Distributions to shareholders from: | |

Class A: | |

Net investment income | | | (200,208 | ) | |

Net realized gains | | | (26,506 | ) | |

Net change in unrealized appreciation on investments and foreign currency | | | (14,213 | ) | |

Total distributions — Class A | | | (240,927 | ) | |

Class C: | |

Net investment income | | | (14,785 | ) | |

Net realized gains | | | (3,822 | ) | |

Net change in unrealized appreciation on investments and foreign currency | | | (1,259 | ) | |

Total distributions — Class C | | | (19,866 | ) | |

Class I: | |

Net investment income | | | (28,658 | ) | |

Net realized gains | | | (7,061 | ) | |

Net change in unrealized appreciation on investments and foreign currency | | | (2,887 | ) | |

Total distributions — Class I | | | (38,606 | ) | |

Net increase (decrease) in net assets from operations and distributions | | | 89,213 | | |

Share transactions: | |

Class A: | |

Proceeds of shares issued | | | 12,629,074 | | |

Value of distributions reinvested | | | 119,269 | | |

Contribution from Adviser (Note 1) | | | 56,284 | | |

Cost of shares repurchased (Note 4) | | | (97,677 | ) | |

Net increase from share transactions | | | 12,706,950 | | |

Class C: | |

Proceeds of shares issued | | | 3,856,960 | | |

Value of distributions reinvested | | | 13,319 | | |

Contribution from Adviser (Note 1) | | | 17,618 | | |

Net increase from share transactions | | | 3,887,897 | | |

Class I: | |

Proceeds of shares issued | | | 5,993,339 | | |

Value of distributions reinvested | | | 6,512 | | |

Contribution from Adviser (Note 1) | | | 26,098 | | |

Net increase from share transactions | | | 6,025,949 | | |

Total increase in net assets | | | 22,710,009 | | |

Net assets, beginning of period | | | 100,000 | | |

Net assets, end of period | | $ | 22,810,009 | | |

Undistributed net investment income | | $ | — | | |

Annual Report 2017

13

CION Ares Diversified Credit Fund

Statement of Cash Flows

For the period from January 26, 2017 (commencement of operations) to October 31, 2017

Operating activities: | |

Net increase in net assets from operations | | $ | 388,612 | | |

Adjustments to reconcile net increase in net assets resulting from operations to net cash provided by

operating activities: | |

Purchases of investments | | | (19,069,208 | ) | |

Proceeds from the sale of investments | | | 3,142,898 | | |

Amortization and accretion of discounts and premiums, net | | | (6,721 | ) | |

Net realized gain on investments | | | (37,596 | ) | |

Net realized loss on foreign currency | | | 207 | | |

Net unrealized appreciation on investments | | | (96,227 | ) | |

Changes in operating assets and liabilities: | |

Receivable for expense support from the Adviser | | | (113,855 | ) | |

Deferred offering costs | | | (119,849 | ) | |

Receivable for securities sold | | | (25,395 | ) | |

Forward foreign currency contracts | | | (408,341 | ) | |

Interest and principal receivable | | | (103,245 | ) | |

Payable for securities purchased | | | 3,913,354 | | |

Forward foreign currency contracts | | | 396,848 | | |

Payable for administration and transfer agent fees | | | 192,372 | | |

Payable for investment advisory fees | | | 22,235 | | |

Payable for distribution and shareholder servicing fees | | | 2,566 | | |

Accrued expenses and payables | | | 70,038 | | |

Net cash used in operating activities | | | (11,851,307 | ) | |

Financing activities: | |

Proceeds of sale of shares | | | 21,293,386 | | |

Cost of shares redeemed | | | (97,677 | ) | |

Distributions paid to common shareholders | | | (111,987 | ) | |

Net cash used in financing activities | | | 21,083,722 | | |

Effect of exchange rate changes on cash | | | (207 | ) | |

Net increase in cash | | | 9,232,208 | | |

Cash: | |

Beginning of period | | | 100,000 | | |

End of period | | $ | 9,332,208 | | |

Annual Report 2017

14

CION Ares Diversified Credit Fund

Financial Highlights

For the Period from January 26, 2017 (commencement of operations) to October 31, 2017

Class A | |

Per share data: | |

Net asset value, beginning of period | | $ | 25.00 | | |

Income from investment operations: | |

Net investment income(a) | | | 0.86 | | |

Net realized and unrealized gains | | | 0.44 | | |

Total income from investment operations | | | 1.30 | | |

Less distributions declared to shareholders: | |

From net investment income | | | (0.86 | ) | |

From net realized gains on investments | | | (0.12 | ) | |

From net unrealized appreciation on investments and foreign currency | | | (0.07 | ) | |

Total distributions | | | (1.05 | ) | |

Net asset value end of period | | $ | 25.25 | | |

Total return, excluding expense support(b)(e) | | | (37.12 | )% | |

Total return, including expense support(c)(e) | | | 5.32 | % | |

Ratios to average net assets/supplemental data: | |

Net assets, end of period | | $ | 12,864,545 | | |

Expenses, excluding expense support(d)(f) | | | 58.85 | % | |

Expenses, including expense support(d)(f) | | | 0.00 | % | |

Net investment income(d)(f) | | | 4.48 | % | |

Portfolio turnover rate(e) | | | 164.09 | % | |

(a) Per share net investment income has been calculated using the average shares outstanding during the period.

(b) Based on net asset value per share. Distributions, if any, are assumed for purposes of this calculation to be reinvested at prices obtained under the Fund's Dividend Reinvestment Plan. Total Return is not annualized for periods less than one year. Total Return excludes expense support provided by the adviser.

(c) Based on net asset value per share. Distributions, if any, are assumed for purposes of this calculation to be reinvested at prices obtained under the Fund's Dividend Reinvestment Plan. Total Return is not annualized for periods less than one year. Total Return includes support provided by the adviser.

(d) Includes organizational and offering costs.

(e) Not annualized.

(f) Annualized.

Annual Report 2017

15

CION Ares Diversified Credit Fund

Financial Highlights (continued)

For the Period from July 12, 2017 (commencement of operations) to October 31, 2017

Class C | |

Per share data: | |

Net asset value, beginning of period | | $ | 24.95 | | |

Income from investment operations: | |

Net investment income(a) | | | 0.39 | | |

Net realized and unrealized gains | | | 0.33 | | |

Total income from investment operations | | | 0.72 | | |

Less distributions declared to shareholders: | |

From net investment income | | | (0.39 | ) | |

From net realized gains on investments | | | (0.02 | ) | |

From net unrealized appreciation on investments and foreign currency | | | (0.01 | ) | |

Total distributions | | | (0.42 | ) | |

Net asset value end of period | | $ | 25.25 | | |

Total return, excluding expense support(b)(e) | | | (3.56 | )% | |

Total return, including expense support(c)(e) | | | 2.95 | % | |

Ratios to average net assets/supplemental data: | |

Net assets, end of period | | $ | 3,897,826 | | |

Expenses, excluding expense support(d)(f) | | | 22.59 | % | |

Expenses, including expense support(d)(f) | | | 0.00 | % | |

Net investment income(d)(f) | | | 5.17 | % | |

Portfolio turnover rate(e) | | | 164.09 | % | |

(a) Per share net investment income has been calculated using the average shares outstanding during the period.

(b) Based on net asset value per share. Distributions, if any, are assumed for purposes of this calculation to be reinvested at prices obtained under the Fund's Dividend Reinvestment Plan. Total Return is not annualized for periods less than one year. Total Return excludes expense support provided by the adviser.

(c) Based on net asset value per share. Distributions, if any, are assumed for purposes of this calculation to be reinvested at prices obtained under the Fund's Dividend Reinvestment Plan. Total Return is not annualized for periods less than one year. Total Return includes support provided by the adviser.

(d) Includes organizational and offering costs.

(e) Not annualized.

(f) Annualized.

Annual Report 2017

16

CION Ares Diversified Credit Fund

Financial Highlights (continued)

For the Period from July 12, 2017 (commencement of operations) to October 31, 2017

Class I | |

Per share data: | |

Net asset value, beginning of period | | $ | 24.95 | | |

Income from investment operations: | |

Net investment income(a) | | | 0.40 | | |

Net realized and unrealized gains | | | 0.32 | | |

Total income from investment operations | | | 0.72 | | |

Less distributions declared to shareholders: | |

From net investment income | | | (0.40 | ) | |

From net realized gains on investments | | | (0.01 | ) | |

From net unrealized appreciation on investments and foreign currency | | | (0.01 | ) | |

Total distributions | | | (0.42 | ) | |

Net asset value end of period | | $ | 25.25 | | |

Total return, excluding expense support(b)(e) | | | (2.49 | )% | |

Total return, including expense support(c)(e) | | | 2.95 | % | |

Ratios to average net assets/supplemental data: | |

Net assets, end of period | | $ | 6,047,638 | | |

Expenses, excluding expense support(d)(f) | | | 18.62 | % | |

Expenses, including expense support(d)(f) | | | 0.00 | % | |

Net investment income(d)(f) | | | 5.19 | % | |

Portfolio turnover rate(e) | | | 164.09 | % | |

(a) Per share net investment income has been calculated using the average shares outstanding during the period.

(b) Based on net asset value per share. Distributions, if any, are assumed for purposes of this calculation to be reinvested at prices obtained under the Fund's Dividend Reinvestment Plan. Total Return is not annualized for periods less than one year. Total Return excludes expense support provided by the adviser.

(c) Based on net asset value per share. Distributions, if any, are assumed for purposes of this calculation to be reinvested at prices obtained under the Fund's Dividend Reinvestment Plan. Total Return is not annualized for periods less than one year. Total Return includes support provided by the adviser.

(d) Includes organizational and offering costs.

(e) Not annualized.

(f) Annualized.

Annual Report 2017

17

CION Ares Diversified Credit Fund

Notes to Financial Statements

October 31, 2017

(1) Organization

CION Ares Diversified Credit Fund (the "Fund'') is a diversified, closed-end investment company that is registered under the Investment Company Act of 1940. The Fund is structured as an interval fund and continuously offers its shares. The Fund was organized as a Delaware statutory trust on June 21, 2016. CION Ares Management, LLC (the "Adviser'') serves as the investment Adviser to the Fund and was registered as an investment adviser with the Securities and Exchange Commission ("SEC") under the Investment Advisers Act of 1940 (the "Advisers Act") on January 4, 2017. The Adviser is a joint venture between affiliates of Ares Management LLC ("Ares") and CION Investment Group, LLC ("CION") and is controlled by Ares. The Adviser oversees the management of the Fund's activities and is responsible for making investment decisions for the Fund's portfolio.

Investment Objective and Policies

The Fund's investment objective is to provide superior risk-adjusted returns across various market cycles by investing in a diversified portfolio of liquid and illiquid asset classes. The Fund seeks to capitalize on market inefficiencies and relative value opportunities throughout the entire global credit spectrum.

(2) Significant Accounting Policies

Basis of Presentation

In October 2016, the SEC adopted new rules and amended existing rules (together, "final rules") intended to modernize the reporting and disclosure of information by registered investment companies. In part, the final rules amend Regulation S-X and require standardized, enhanced disclosure about derivatives in investment company financial statements, as well as other amendments. The compliance date for the amendments to Regulation S-X is August 1, 2017, and the Adviser has implemented the applicable requirements into this report.

The accompanying financial statements have been prepared on an accrual basis of accounting in conformity with U.S. generally accepted accounting principles ("GAAP"), and includes the accounts of the Fund. The Fund is an investment company following accounting and reporting guidance in Financial Accounting Standards ("FASB") Accounting Standards Codification ("ASC") Topic 946, Financial Services — Investment Companies. The Adviser makes estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results may differ from those estimates and such differences may be material.

Investments Valuation

All investments in securities are recorded at their fair value, as described in Note 3.

Revolving loan, bridge loan and delayed draw term loan agreements

As a part of the Fund's investment objective, the Fund may enter into certain loan commitments which may include revolving loan, bridge loan, partially unfunded term loan and delayed draw term loan commitments ("unfunded loan commitments"). Unfunded loan commitments purchased at a discount/premium may include cash received/paid for the amounts representing such discounts/premiums. Unfunded loan commitments are agreements to participate in the lending of up to a specified maximum amount for a specified period. Unfunded loan commitments are valued in relation to par and may result in negative market values. As of October 31, 2017, the fair value of loans included in the Schedule of Investments does not include unfunded commitments, which totaled $838,003.

Interest Income

Interest income is recorded on the accrual basis to the extent that such amounts are expected to be collected, and adjusted for accretion of discounts and amortization of premiums.

The Fund may have investments that contain payment-in-kind ("PIK") provisions. The PIK interest, computed at the contractual rate specified, may be added to the principal balance and adjusted cost of the investments or paid out in cash and recorded as interest income. All interest for the period ended October 31, 2017 was received in cash.

Discounts and Premiums

Discounts and premiums on securities purchased are accreted/amortized over the life of the respective security using the effective interest method. The adjusted cost of investments represents the original cost adjusted for PIK interest and the accretion of discounts and amortization of premiums.

Cash and Cash Equivalents

The Fund considers all highly liquid investments with original maturities of 90 days or less to be cash equivalents. The Fund's cash and cash equivalents are maintained with a major United States financial institution, which is a member of the Federal Deposit Insurance Corporation. While the Fund's current cash balance exceeds Insurance limits, the risk of loss is remote.

Annual Report 2017

18

CION Ares Diversified Credit Fund

Notes to Financial Statements (continued)

October 31, 2017

Investment Transactions, Related Investment Income and Expenses

Investment transactions are accounted for on the trade date. Investments for which market quotations are readily available are typically valued at such market quotations. In order to validate market quotations, the Fund looks at a number of factors to determine if the quotations are representative of fair value, including the source and nature of the quotations. Debt and equity securities that are not publicly traded or whose market prices are not readily available are valued at fair value as determined in good faith by the Adviser in accordance with the Fund's valuation policy (the "Valuation Policy"). The Valuation Policy is reviewed and approved at least annually by the Fund's board of trustees (the "Board"). The Adviser has been authorized by the Board to utilize independent third-party pricing and valuation services to assist in the valuation of each portfolio investment without a readily available market quotation at least once during a trailing 12-month period (with certain de minimis exceptions) in accordance with the Valuation Policy and a consistently applied valuation process.

As part of the valuation process for investments that do not have readily available market prices, the Adviser may take into account the following types of factors, if relevant, in determining the fair value of the Fund's investments: the enterprise value of a portfolio company (the entire value of the portfolio company to a market participant, including the sum of the values of debt and equity securities used to capitalize the enterprise at a point in time), the nature and realizable value of any collateral, the portfolio company's ability to make payments and its earnings and discounted cash flow, the markets in which the portfolio company does business, a comparison of the portfolio company's securities to any similar publicly traded securities, changes in the interest rate environment and the credit markets, which may affect the price at which similar investments would trade in their principal markets and other relevant factors. When an external event such as a purchase transaction, public offering or subsequent equity sale occurs, the Adviser considers the pricing indicated by the external event to corroborate its valuation.

Due to the inherent uncertainty of determining the fair value of investments that do not have a readily available market value, the fair value of the Fund's investments may fluctuate from period to period. Additionally, the fair value of the Fund's investments may differ significantly from the values that would have been used had a ready market existed for such investments and may differ materially from the values that the Fund may ultimately realize. Further, such investments are generally subject to legal and other restrictions on resale or

otherwise are less liquid than publicly traded securities. If the Fund was required to liquidate a portfolio investment in a forced or liquidation sale, the Fund could realize significantly less than the value at which the Fund has recorded it.

In addition, changes in the market environment and other events that may occur over the life of the investments may cause the gains or losses ultimately realized on these investments to be different than the unrealized gains or losses reflected in the valuations currently assigned.

See Note 3 for more information on the Fund's valuation process.

Foreign Currency Transactions and Forward Foreign Currency Contracts

Amounts denominated in foreign currencies are translated into U.S. dollars on the following basis: (i) investments and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars based upon currency exchange rates effective on the date of valuation; and (ii) purchases and sales of investments and income and expense items denominated in foreign currencies are translated into U.S. dollars based upon currency exchange rates prevailing on transaction dates.

The Fund does not isolate that portion of the results of operations resulting from the changes in foreign exchange rates on investments from fluctuations arising from changes in market prices of securities held. Such fluctuations are included within the net realized and unrealized gain on investments in the Statements of Operations.

Reported net realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates of securities transactions, and the difference between the amounts of income and expense items recorded on the Fund's books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign currency gains and losses arise from the changes in fair values of assets and liabilities, other than investments in securities at period end, resulting from changes in exchange rates.

Investments in foreign companies and securities of foreign governments may involve special risks and considerations not typically associated with investing in U.S. companies and securities of the U.S. government. These risks include, among other things, revaluation of currencies, less reliable information about issuers, different transaction clearance and settlement practices, and potential future adverse political and economic developments. Moreover, investments in foreign companies and securities of foreign governments and their

Annual Report 2017

19

CION Ares Diversified Credit Fund

Notes to Financial Statements (continued)

October 31, 2017

markets may be less liquid and their prices more volatile than those of comparable U.S. companies and the U.S. government.

The Fund may enter into forward foreign currency exchange contracts for operational purposes and to protect against adverse exchange rate fluctuations. A forward foreign currency contract is an agreement between the Fund and a counterparty to buy or sell a foreign currency at a specific exchange rate on a future date. The Fund may also enter into these contracts for purposes of increasing exposure to a foreign currency or to shift exposure to foreign currency fluctuations from one country to another. The net U.S. dollar value of foreign currency underlying all contractual commitments held by the Fund and the resulting unrealized appreciation or depreciation are determined using foreign currency exchange rates from an independent pricing service. The Fund is subject to the credit risk that the other party will not complete the obligations of the contract. The fair values of the forward foreign currency exchange contracts are obtained from an independent pricing source.

Distributions to Shareholders

The Fund records distributions from net investment income daily. These distributions may be reinvested or paid monthly to shareholders. The Fund intends to pay common shareholders at least annually all or substantially all of its taxable income. The Fund intends to pay any capital gain distributions at least annually. Distributions to shareholders are recorded on the ex-dividend date.

The Fund may make distributions, without limitation, from offering proceeds or borrowings, which may constitute a return of capital, as well as net investment income from operations, capital and non-capital gains from the sale of assets, and dividends or distributions from equity investments. Furthermore, a portion of the Fund's distributions during the period January 26, 2017 (commencement of operations) through October 31, 2017 was derived from expense support payments made by the Adviser, which are subject to repayment by the Fund within three years. The purpose of such expense support payments is to ensure that the Fund bears an appropriate level of expenses. As such, the Fund's distributions may not be entirely based on investment performance and can only be sustained if positive investment performance is achieved in future periods and/or the Adviser continues to make such expense support payments. Any future repayments of expenses by the Fund will reduce cash otherwise potentially available for distributions. There can be no assurance that such performance will be achieved in order to sustain the current level of the Fund's distributions. After the expiration of the initial term of the Expense Support and Conditional Reimbursement Agreement on July 10, 2018, the

Adviser has no obligation to make expense support payments in future periods.

In addition to expense support payments made during the period January 26, 2017 (commencement of operations) through October 31, 2017, the Adviser made a $100,000 capital contribution to the Fund. The Adviser did not receive shares in exchange for its $100,000 capital contribution. This capital contribution is included as a component of Paid in Capital on the balance sheet of the Fund's financial statements and is not subject to reimbursement by the Fund in the future.

For the period from January 26, 2017 (commencement of operations) through October 31, 2017, distributions were paid from taxable income. If the Adviser did not make any expense support payments or related capital contribution during such period, all or a portion of the Fund's distributions would have been a return of capital which would reduce the available capital for investment. The sources of the Fund's distributions may vary periodically. Please refer to the Financial Highlights table for the sources of distributions.

Commitments and Contingencies

In the normal course of business, the Fund's investment activities involve executions, settlement and financing of various transactions resulting in receivables from, and payables to, brokers, dealers and the Fund's custodian. These activities may expose the Fund to risk in the event that such parties are unable to fulfill contractual obligations. Management does not anticipate any material losses from counterparties with whom it conducts business. Consistent with standard business practice, the Fund enters into contracts that contain a variety of indemnifications, and is engaged from time to time in various legal actions. The maximum exposure of the Fund under these arrangements and activities is unknown. However, the Fund expects the risk of material loss to be remote.

Income Taxes

The Fund intends to distribute all or substantially all of its taxable income and to comply with the other requirements of Subchapter M of the U.S. Internal Revenue Code of 1986 (the "Code"), as amended, applicable to RICs. Accordingly, no provision for U.S. federal income taxes is required.

The Fund may elect to defer the distribution of some portion of its taxable income to the year following the year such income is earned. In doing so, the Fund may incur an excise tax if it is deemed prudent by its board of trustees from a cash management perspective or in the best interest of shareholders due to other facts and circumstances.

As of October 31, 2017, the Fund had no uncertain tax positions that would require financial statement recognition,

Annual Report 2017

20

CION Ares Diversified Credit Fund

Notes to Financial Statements (continued)

October 31, 2017

derecognition, or disclosure. The Fund files a U.S. federal income tax return annually after its fiscal year-end, which is subject to examination by the Internal Revenue Service for a period of three years from the date of filing.

Net investment income and net realized capital gains and losses may differ for financial statement and tax purposes because of temporary or permanent book/tax difference and therefore may lead to differences between dividends paid from taxable income and book income reported on the financial statements. These differences are primarily due to the capital contribution from the Adviser.

Undistributed net investment income | | $ | 99,793 | | |

Accumulated net realized gain/(loss) | | | 207 | | |

Additional paid-in capital/(reduction) | | | (100,000 | ) | |

The characterization of distributions made during the fiscal period from net investment income or net realized gains may differ from its ultimate characterization for federal income tax purposes. In addition, due to the timing of dividend distributions, the fiscal period in which amounts are distributed may differ from the fiscal period that the income or realized gains or losses were recorded by the Fund.

The characterization of distributions paid during the period from January 26, 2017 (commencement of operations) to October 31, 2017 was as follows:

| | | 2017 | |

Ordinary income | | $ | 299,399 | | |

Capital gain | | | — | | |

Return of capital | | | — | | |

As of October 31, 2017, the components of accumulated earnings (deficit) on a tax basis were as follows:

Undistributed ordinary income | | $ | 93,134 | | |

Undistributed capital gains | | | — | | |

Accumulated capital and other losses | | | — | | |

Other undistributed ordinary losses | | | — | | |

Net unrealized appreciation | | | 96,079 | | |

Total accumulated earnings | | | 189,213 | | |

ASC 740, Income Taxes, provides guidance for how uncertain tax positions should be recognized, measured, presented, and disclosed in the financial statements. The Fund has evaluated the implications of ASC 740 for all open tax years, and have determined there is no impact to the Fund's financial statements as of the period from January 26, 2017 (commencement of operations) to October 31, 2017. The Fund's federal and state income returns for which the applicable statutes of limitations have not expired (2016)

remain subject to examination by the Internal Revenue Service and states department of revenue.

All penalties and interest associated with income taxes, if any, are included in other expenses in the Statement of Operations. There were no penalties and interest incurred by the Fund for the current fiscal year.

Recently Issued Accounting Pronouncements

In October 2016, the SEC amended existing rules intended to modernize reporting and disclosure of information. These amendments relate to Regulation S-X which sets forth the form and content of financial statements. The Fund has adopted the amendments related to Regulation S-X, which have had no material impact to the Fund's financial statements or disclosures.

In March 2017, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) No. 2017-08, Receivables — Nonrefundable Fees and Other Costs (Subtopic 310-20): Premium Amortization on Purchased Callable Debt Securities. The amendments in the ASU shorten the amortization period for certain callable debt securities, held at a premium, to be amortized to the earliest call date. The ASU does not require an accounting change for securities held at a discount, which continue to be amortized to maturity. The ASU is effective for fiscal years and for interim periods within those fiscal years beginning after December 15, 2018. Management is currently evaluating the impact, if any, of applying this provision.

In May 2014, the FASB issued ASU No. 2014-09, Revenue from Contracts with Customers (Topic 606). The guidance in this ASU supersedes the revenue recognition requirements in Revenue Recognition (Topic 605) . Under the new guidance, an entity should recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. The amendments in ASU No. 2014-09 are effective for annual reporting periods beginning after December 15, 2017, including interim periods within that reporting period. In March 2016, the FASB issued ASU No. 2016-08, Revenue from Contracts with Customers (Topic 606): Principal versus Agent Considerations, which clarifies the guidance in ASU No. 2014-09 and has the same effective date as the original standard. In April 2016, the FASB issued ASU No. 2016-10, Revenue from Contracts with Customers (Topic 606): Identifying Performance Obligations and Licensing, an update on identifying performance obligations and accounting for licenses of intellectual property. In May 2016, the FASB issued ASU No. 2016-12, Revenue from Contracts with Customers (Topic 606): Narrow-Scope Improvements and Practical Expedients, which includes

Annual Report 2017

21

CION Ares Diversified Credit Fund

Notes to Financial Statements (continued)

October 31, 2017

amendments for enhanced clarification of the guidance. In December 2016, the FASB issued ASU No. 2016-20, Technical Corrections and Improvements to Revenue from Contracts with Customers (Topic 606), the amendments in this update are of a similar nature to the items typically addressed in the technical corrections and improvements project. Additionally, in February 2017, the FASB issued ASU No. 2017-05, Other Income — Gains and Losses from the Derecognition of Nonfinancial Assets (subtopic 610-20): Clarifying the Scope of Asset Derecognition Guidance and Accounting for Partial Sales of Nonfinancial Assets, an update clarifying that a financial asset is within the scope of Subtopic 610-20 if it is deemed an "in-substance non-financial asset." The application of this guidance is not expected to have a material impact on our consolidated financial statements.

(3) Investments

Fair Value Measurements

The Fund follows the provisions of ASC 820, Fair Value Measurements and Disclosures under U.S. GAAP, which among other matters, requires enhanced disclosures about investments that are measured and reported at fair value. This standard defines fair value and establishes a hierarchal disclosure framework, which prioritizes and ranks the level of market price observability used in measuring investments at fair value and expands disclosures about assets and liabilities measured at fair value. ASC 820 defines "fair value" as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The hierarchal disclosure framework establishes a three-tier hierarchy to maximize the use of observable data and minimize the use of unobservable inputs. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk, for example, the risk inherent in a particular valuation technique used to measure fair value (such as a pricing model) and/or the risk inherent in the inputs to the valuation technique.

Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity's own assumptions about the assumptions market participants would use in pricing the asset or liability based on the best information available in the circumstances. The three tier hierarchy of inputs is summarized in the three broad levels listed below.

• Level 1 — Valuations based on quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access

• Level 2 — Valuations based on quoted prices in markets that are not active or for which all significant inputs are observable, either directly or indirectly.

• Level 3 — Valuations based on inputs that are unobservable and significant to the overall fair value measurement.

In addition to using the above inputs in investment valuations, the Fund continues to employ a valuation policy that is consistent with the provisions of ASC 820. Consistent with the Fund's valuation policy, it evaluates the source of inputs, including any markets in which the Fund's investments are trading (or any markets in which securities with similar attributes are trading), in determining fair value. The Fund's valuation policy considers the fact that because there may not be a readily available market value for the investments in the Fund's portfolio, therefore, the fair value of the investments may be determined using unobservable inputs.