UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-23165

CION ARES DIVERSIFIED CREDIT FUND

(Exact name of registrant as specified in charter)

3 PARK AVENUE

36TH FLOOR

NEW YORK, NEW YORK 10016

(Address of principal executive offices)(Zip code)

Eric A. Pinero

3 Park Avenue, 36th Floor

New York, New York 10016

(Name and Address of Agent for Service)

Copy to:

Michael A. Reisner

Mark Gatto

CION Ares Management, LLC

3 Park Avenue, 36th Floor

New York, New York 10016 | Richard Horowitz, Esq.

Matthew K. Kerfoot, Esq.

Dechert LLP

1095 Avenue of the Americas

New York, New York 10036 |

Registrant’s telephone number, including area code: (646) 845-2577

Date of fiscal year end: December 31

Date of reporting period: June 30, 2020

Item 1. Report to Stockholders.

CION Ares Diversified Credit Fund

SEMI-ANNUAL REPORT

JUNE 30, 2020

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund's shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund or your financial intermediary electronically by calling 888-729-4266 toll-free or by sending an e-mail request to CION Ares Diversified Credit Fund Investor Relations Department at ir@cioninvestments.com if you invest directly with the Fund, or by contacting your financial intermediary (such as a broker-dealer or bank) if you invest through your financial intermediary. Beginning on January 1, 2019, you may elect to receive all future reports in paper free of charge. You can inform the Fund or your financial intermediary that you wish to continue receiving paper copies of your shareholder reports by calling 888-729-4266 toll-free or by sending an e-mail request to CION Ares Diversified Credit Fund Investor Relations Department at ir@cioninvestments.com, or by contacting your financial intermediary. Your election to receive reports in paper will apply to all funds held in your account if you invest through your financial intermediary or all funds held with the fund complex if you invest directly with the Fund.

CION Ares Diversified Credit Fund

Letter to Shareholders | | | 2 | | |

Fund Profile & Financial Data | | | 5 | | |

Consolidated Schedule of Investments | | | 7 | | |

Consolidated Statement of Assets and Liabilities | | | 41 | | |

Consolidated Statement of Operations | | | 43 | | |

Consolidated Statements of Changes in Net Assets | | | 44 | | |

Consolidated Statement of Cash Flows | | | 46 | | |

Financial Highlights | | | 48 | | |

Notes to Consolidated Financial Statements | | | 55 | | |

Proxy & Portfolio Information | | | 80 | | |

Dividend Reinvestment Plan | | | 81 | | |

Corporate Information | | | 83 | | |

Privacy Notice | | | 84 | | |

Trustees and Executive Officers | | | 85 | | |

Voting Results | | | 89 | | |

Semi-Annual Report 2020

CION Ares Diversified Credit Fund

Letter to Shareholders

June 30, 2020

Fellow Shareholders,

We hope this semi-annual report for the CION Ares Diversified Credit Fund (the "Fund"), for the period ending June 30, 2020 finds you and your loved ones healthy and safe during these unprecedented times.

We are pleased to report that notwithstanding the extraordinary events of COVID-19 and its impact on the U.S. financial markets and economy, the Fund has reached $805 million in total managed assets and delivered a 3.23% annualized return since inception.1 As of period-end, the Fund had 394 total investments, spread across more than 27 unique industries. Secured debt instruments accounted for 95.1%2 of the Fund and approximately 55% of the Fund was deployed in investments directly originated by affiliates of the Fund's investment advisor. The Fund has continued to gain traction with investors, and we are pleased to announce that the Fund has now launched on multiple platforms nationwide, which has led to strong asset growth.

Investment Philosophy and Process

The Fund remains focused on seeking to deliver attractive risk-adjusted returns for our shareholders across market cycles by utilizing a flexible strategy to invest in a diversified pool of liquid and illiquid credit instruments. We believe the optimal investment strategy for non-investment grade credit is an actively managed portfolio that encompasses a broad spectrum of credit asset classes including high yield bonds, leveraged loans, structured credit (CLOs and Private ABS), real estate debt, and direct lending in the United States and Europe. We believe unconstrained flexibility within a single portfolio affords investors an opportunity to capitalize on inefficiencies and dislocations across the credit universe and capture the best relative value.

The process by which the Fund's investments are selected is rigorous. The Fund's Advisor, CION Ares Management ("CAM" or the "Advisor"), leverages the resources of the broader Ares platform to conduct ongoing proprietary analysis at the asset-class level that compares current market conditions with historical and industry-level precedents to examine the rate environment, correlation to public markets, and local/regional risks. This information is brought before the 15-member investment allocation committee in semimonthly meetings, where senior members in each of the underlying asset classes within the Ares Credit Group share their observations with the Advisor's portfolio managers.

Investment Environment

Throughout 2020, global capital markets experienced unprecedented volatility as a result of the COVID-19 pandemic and its impact on the global economy. Investor sentiment plunged in a dramatic manner in March as the impacts of the pandemic magnified and were further exacerbated by the onset of the Saudi-Russian oil price war. During this time, default expectations increased, and credit spreads rose to levels last seen during the Global Financial Crisis. Starting in late March, investor sentiment was boosted behind unprecedented levels of financial stimulus being pumped into the economy and the expansion of eligibility of the Federal Reserve's (the "Fed") credit facilities. Though credit markets rallied significantly in the second quarter, levels remain wide when compared to year-end 2019. Year-to-date, the high yield markets in the U.S. and Europe have returned -4.78% and -4.97%, respectively.3 The bank loan markets remain wide of year-end 2019 levels in the U.S. and Europe as well with returns of -4.76% and -3.80%, respectively.4

Specific to the U.S., high yield and bank loan spreads widened with unprecedented momentum. In March, the high yield market experienced its five largest single day declines in history while the bank loan market experienced four of the five largest single day declines.5 Investor sentiment was decidedly "risk off", pushing the 10-year U.S. Treasury yield to all time lows while high yield mutual funds experienced a $13 billion outflow in March, the second largest on record.6 The loan market experienced a significant increase in downgrades while the high yield market saw a material increase in default activity, largely driven by the energy and retail sectors. Markets started to rebound in late March following unprecedented stimulus from the Fed, which bolstered sentiment and improved liquidity in the liquid credit markets. The bank loan market experienced its two largest daily price increases in history in late March and proceeded to return 9.71% in the second quarter.4 The high yield market returned 9.61% in the second quarter3 as demand from institutional and retail investors offset a record $146 billion of new issuance which occurred during the period.7 The record new issuance provided much needed liquidity to COVID-impacted industries, resulting in dampened default expectations relative to earlier in the year. Though

Semi-Annual Report 2020

2

CION Ares Diversified Credit Fund

Letter to Shareholders (continued)

June 30, 2020

reduced, expectations remain elevated when compared to year-end 2019 and dispersion remains elevated in both markets, underscoring the importance of credit selection and mistake avoidance in the current environment.

The European markets have experienced similar trends year-to-date. In March, European loan and bond spreads reached levels not seen since the sovereign debt crisis in 2011. Unprecedented fiscal packages were unveiled by governments alongside highly accommodative packages from central banks. Markets reacted positively to the stimulus and in a swift manner, retracing ~50% of the spread widening year-to-date in April. European loans, which saw spreads exceed sovereign debt crisis levels in March, rebounded sharply in April and had their strongest monthly return since 2009. Spreads continued to move in a bullish manner behind measures such as the ECB's Pandemic Emergency Purchase Program (PEPP). New issuance started to resume, and the high yield market saw its largest monthly print on record in June.7 Notably, some of the issuers that came to the primary market in June were among those that had their original deals shelved due to the onset of the crisis.

Looking ahead, capital markets volatility is expected to persist, particularly as the COVID-19 pandemic evolves and the U.S. presidential election comes into focus. We believe this should cause further sector and single-name dispersion, creating opportunities for bottom-up, fundamental active managers to uncover value. In the private markets, we're seeing new issuance start to resume with enhanced structures and terms, benefitting active managers who are well-capitalized to take advantage of the emerging opportunity set. Specific to the Fund, we remain strategically focused on high-quality, floating rate assets in defensive sectors and will seek to continue to increase our exposure to directly originated loans in the U.S. and Europe given the attractive risk-adjusted return opportunities in those markets today. Owing to its flexible investment strategy, we believe the Fund offers a compelling combination of yield, diversification, and a level of downside protection. We maintain strong conviction in the current portfolio positioning and believe the Fund can generate attractive risk-adjusted returns going forward.

Summary

The first and second quarters of 2020 saw heightened volatility as headlines and COVID-19 drove the markets. However, the committed and active Fed has largely succeeded so far, and default expectations are decreasing. The U.S. economy officially entered recession in February, but employment rebounded in May and June as the first stimulus took effect, and a new round of stimulus will likely be enacted soon.

We continue to believe this is an attractive entry point for credit as markets remain attractive compared to pre-dislocation levels, dispersion remains elevated and central bank stimulus supports supply and demand in the loan and high yield markets. Though we're optimistic, much uncertainty remains, and we expect volatility to persist as market technicals eventually reconcile with corporate fundamentals. We believe credit selection is of the utmost importance given our expectations for increased volatility in addition to elevated default rates.

We believe flexible mandates are best suited to take advantage of the opportunities in leveraged credit markets; whether by asset class, geography or within individual capital structures. From a risk perspective, we continue to balance a high-quality posture with selective additions to risk, particularly as the market's level of empathy toward COVID-19 impacted issuers and industries continues to evolve. Overall, we believe the go-forward environment will continue to test the full depth and breadth of active managers, and those with scale, experience and a nimble approach to portfolio construction will benefit the most in this unique economic and market backdrop

Against this backdrop, we believe the Fund's strategy, driven by our ability to dynamically allocate capital across credit sectors and geographies, is well situated to seek attractive risk-adjusted returns for our shareholders. We are pleased with the ongoing construction of the Fund's diversified portfolio, and we believe the Fund is well positioned to find relative value-driven opportunities as we move into economic recovery. Our Advisor will continue to leverage its position as a global leader in the liquid and illiquid credit markets to identify attractive investment opportunities in line with the stated objective of the Fund.

Semi-Annual Report 2020

3

CION Ares Diversified Credit Fund

Letter to Shareholders (continued)

June 30, 2020

We thank you for your investment in and continued support of CION Ares Diversified Credit Fund.

Sincerely,

Mark Gatto Michael A. Reisner

Co-CEO Co-CEO

CION Ares Management CION Ares Management

Views expressed are those of CION Ares Management as of the date of this communication, are subject to change at any time, and may differ from the views of other portfolio managers or of Ares as a whole. Although these views are not intended to be a forecast of future events, a guarantee of futures results, or investment advice, any forward-looking statements are not reliable indicators of future events and no guarantee is given that such activities will occur as expected or at all. Information contained herein has been obtained from sources believed to be reliable, but the accuracy and completeness of the information cannot be guaranteed. CION Ares Management does not undertake any obligation to publicly update or review any forward-looking information, whether as a result of new information, future developments or otherwise, except as required by law. All investments involve risk, including possible loss of principal. Past performance is not indicative of future results.

The recent outbreak of a novel and highly contagious form of coronavirus ("COVID-19"), which the World Health Organization has declared to constitute a pandemic, has resulted in numerous deaths, adversely impacted global commercial activity and contributed to significant volatility in certain equity and debt markets. The global impact of the outbreak is rapidly evolving, and many countries have reacted by instituting quarantines, prohibitions on travel and the closure of offices, businesses, schools, retail stores and other public venues. Businesses are also implementing similar precautionary measures. Such measures, as well as the general uncertainty surrounding the dangers and impact of COVID-19, are creating significant disruption in supply chains and economic activity and are having a particularly adverse impact on energy, transportation, hospitality, tourism, entertainment and other industries. The impact of COVID-19 has led to significant volatility and declines in the global financial markets and oil prices and it is uncertain how long this volatility will continue. As COVID-19 continues to spread, the potential impacts, including a global, regional or other economic recession, are increasingly uncertain and difficult to assess. Any public health emergency, including any outbreak of COVID-19 or other existing or new epidemic diseases, or the threat thereof, and the resulting financial and economic market uncertainty could have a significant adverse impact on the Fund, the value of its investments and its portfolio companies. The performance information herein is as of June 30, 2020 and not all of the effects, directly and indirectly, resulting from COVID-19 and/or the current market environment, may be reflected herein. The full impact of COVID-19 and its ultimate potential effects on portfolio company performance and valuations is particularly uncertain and difficult to predict.

CION Securities, LLC ("CSL") is the wholesale marketing agent for CION Ares Diversified Credit Fund ("CADC" or the "Fund"), advised by CION Ares Management, LLC ("CAM") and distributed by ALPS Distributors, Inc ("ADI"). CSL, member FINRA, and CAM are not affiliated with ADI, member FINRA. Certain Ares fund securities may be offered through its affiliate, Ares Investor Services LLC ("AIS"), a broker-dealer registered with the SEC, and a member of FINRA and SIPC.

REF: CP?00531

1 Past performance is not indicative of future results. Portfolio characteristics of the Fund are as of June 30, 2020 and are subject to change. Performance shown here is the I-Share Class. The I-Share was incepted on July 12, 2017. Returns include reinvestment of distributions and reflect fund expenses inclusive of recoupment of previously provided expense support. The net expense ratio, which includes expense support recoupment, is 3.47% as of June 30, 2020. The gross expense ratio, which excludes expense support recoupment, is 2.99% as of June 30, 2020. Expense ratios are annualized (except for certain non-recurring costs) and calculated as a percentage of average net assets. The sales charge for Class A is up to 5.75%. Share values will fluctuate, therefore if repurchased, they may be worth more or less than their original cost. Current performance may differ and can be obtained at cioninvestments.com.

2 Secured Debt Includes First and Second Lien assets, Structured Credit Debt, Structured Credit Equity.

3 Source: ICE BofA HY Indices. European returns are hedged to Euro. As of June 30, 2020.

4 Source: Credit Suisse Leveraged Loan Index ("CSLLI"), Credit Suisse Western European Leveraged Loan Index (CS "WELLI"). WELLI returns hedged to Euro. As of June 30, 2020.

5 Sources: ICE BofA US High Yield Index ("HUCO"), CSLLI. As of June 30, 2020.

6 Source: JP Morgan High Yield Market Monitor. As of March 31, 2020.

7 Source: JP Morgan High Yield Market Monitor. As of June 30, 2020.

Semi-Annual Report 2020

4

CION Ares Diversified Credit Fund

Fund Fact Sheet — As of June 30, 2020

CLASS A CADEX | CLASS C CADCX | CLASS I CADUX | CLASS L CADWX

CLASS U CADZX | CLASS U2 CADSX | CLASS W CADFX

FUND OVERVIEW

CION Ares Diversified Credit Fund (CADC) is a diversified, unlisted closed-end management investment company registered under the 1940 Act as an interval fund. The Fund will seek to capitalize on market inefficiencies and relative value opportunities by dynamically allocating a portfolio of directly originated loans, secured floating and fixed rate syndicated loans, corporate bonds, asset-backed securities, commercial real estate loans and other types of credit instruments which, under normal circumstances, will represent at least 80% of the Fund's assets.

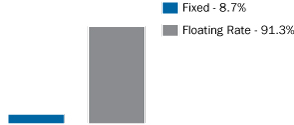

Fixed vs. Floating Rate

Excludes cash, other net assets and equity instruments.

KEY FACTS

CLASS A INCEPTION | | | 1/26/2017 | | |

CLASS C INCEPTION | | | 7/12/2017 | | |

CLASS I INCEPTION | | | 7/12/2017 | | |

CLASS L INCEPTION | | | 11/2/2017 | | |

CLASS U INCEPTION | | | 7/25/2019 | | |

CLASS U-2 INCEPTION | | | 4/13/2020 | | |

CLASS W INCEPTION | | | 12/4/2018 | | |

TOTAL MANAGED ASSETS* | | | ~$805M | | |

TOTAL ISSUES | | | 394 | | |

DISTRIBUTIONS1 | | | Monthly | | |

CURRENT DISTRIBUTION

RATE2 | | | 6.00 | % | |

CLASS A SHARPE RATIO3

(ANNUALIZED) | | | 0.20 | | |

CLASS A STANDARD DEVIATION4 | | | 4.35 | % | |

CLASS C SHARPE RATIO3

(ANNUALIZED) | | | 0.18 | | |

CLASS C STANDARD DEVIATION4 | | | 4.41 | % | |

CLASS I SHARPE RATIO3

(ANNUALIZED) | | | 0.21 | | |

CLASS I STANDARD DEVIATION4 | | | 4.42 | % | |

CLASS L SHARPE RATIO3

(ANNUALIZED) | | | 0.00 | | |

CLASS L STANDARD DEVIATION4 | | | 4.67 | % | |

CLASS U SHARPE RATIO3

(ANNUALIZED) | | | -0.95 | | |

CLASS U STANDARD DEVIATION4 | | | 7.67 | % | |

CLASS W SHARPE RATIO3

(ANNUALIZED) | | | -0.26 | | |

CLASS W STANDARD DEVIATION4 | | | 6.08 | % | |

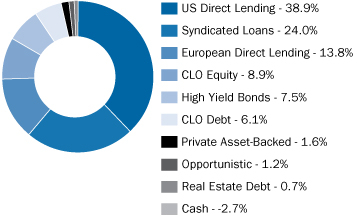

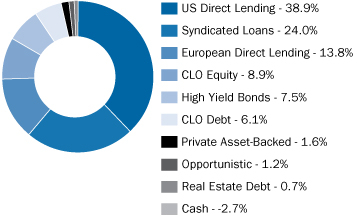

Portfolio Allocation*

Allocation by Asset Type

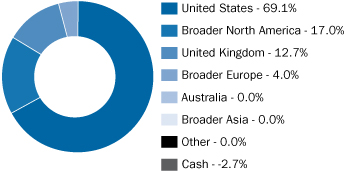

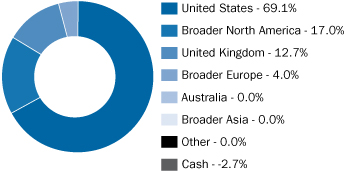

Allocation by Geography

Top 10 Holdings* % of Portfolio

CEP V I 5 Midco Limited (aka Mak System) | | | 3.3 | % | |

True Potential Group Limited | | | 1.5 | % | |

Nelipak Holding Company | | | 1.3 | % | |

AffiniPay Midco, LLC | | | 1.2 | % | |

Bearcat Buyer, Inc. | | | 1.1 | % | |

GPM Investments, LLC | | | 1.0 | % | |

Capnor Connery Holdco A/S | | | 1.0 | % | |

Drilling Info Holdings, Inc. | | | 1.0 | % | |

Reddy Ice LLC | | | 0.9 | % | |

Foundation Risk Partners, Corp. | | | 0.9 | % | |

Allocation by Industry* % of Portfolio

Structured Products (CLOs & Private ABS) | | | 17.1 | % | |

Information Technology | | | 15.3 | % | |

Healthcare | | | 14.0 | % | |

Financial | | | 13.3 | % | |

Service | | | 11.6 | % | |

Food/Tobacco | | | 4.8 | % | |

Gaming/Leisure | | | 3.5 | % | |

Manufacturing | | | 2.3 | % | |

Other | | | 20.8 | % | |

Cash | | | -2.7 | % | |

* Holdings and allocations, unless otherwise indicated, are based on the total managed assets and subject to change without notice. Total managed assets is defined as the total assets (including any assets attributable to financial leverage) minus accrued liabilities (other than debt representing financial leverage). Data shown is for informational purposes only and not a recommendation to buy or sell any security.

Semi-Annual Report 2020

5

CION Ares Diversified Credit Fund

Fund Fact Sheet — As of June 30, 2020 (continued)

CLASS A CADEX | CLASS C CADCX | CLASS I CADUX | CLASS L CADWX

CLASS U CADZX | CLASS U2 CADSX | CLASS W CADFX

MANAGEMENT TEAM

• Mitch Goldstein, Co-Head of Ares Credit Group | 25 Years of Experience

• Greg Margolies, Head of Markets, Ares Management | 31 Years of Experience

• CADC's allocation committee consists of an additional 13 members, averaging nearly 25 years of experience.

ABOUT CION INVESTMENTS

CION Investments is a leading manager of investment solutions designed to redefine the way individual investors can build their portfolios and help meet their long-term investment goals. With more than 30 years of experience in the alternative asset management industry, CION strives to level the playing field. CION currently manages CION Investment Corporation, a leading non-traded BDC, and sponsors, through CION Ares Management, CION Ares Diversified Credit Fund, a globally diversified interval fund.

ABOUT ARES MANAGEMENT

Ares Management Corporation (NYSE: ARES) is a leading global alternative investment manager operating three integrated businesses across Credit, Private Equity and Real Estate. Ares Management's investment groups collaborate to deliver innovative investment solutions and consistent and attractive investment returns for fund investors throughout market cycles. Ares Management's global platform had $165 billion of assets under management as of June 30, 2020 with over 1,200 employees in over 25 offices in more than 10 countries. Please visit www.aresmgmt.com for additional information.

RISK DISCLOSURES & GLOSSARY

Risks and limitations include, but are not limited to, the following: investment instruments may be susceptible to economic downturns; most of the underlying credit instruments are rated below investment grade and considered speculative; there is no guarantee all shares can be repurchased; the Fund's business and operations may be impacted by fluctuations in the capital markets; the Fund is a diversified, closed-end investment company with limited operating history; diversification does not eliminate the risk of investment losses.

1 Monthly Distributions — There is no assurance monthly distributions paid by the fund will be maintained at the targeted level or paid at all.

2 Current Distribution Rate — Current distribution rate is expressed as a percentage equal to the projected annualized distribution amount (which is calculated by annualizing the current cash distribution per share without compounding), divided by the current net asset value. The current distribution rate shown may be rounded.

3 Sharpe Ratio — a risk-adjusted measure that measures reward per unit of risk. The higher the Sharpe Ratio, the better. The numerator is the difference between a portfolio's return and the return of a risk-free instrument. The denominator is the portfolio's standard deviation. Figures shown here are based on non-loaded daily NAV total returns utilizing data since inception.

4 Standard Deviation — a widely used measure of an investment's performance volatility. Standard deviation shows how much variation from the mean exists with a larger number indicating the data points are more spread out over a larger range of values. Figures shown here are based on non-loaded daily NAV total returns utilizing data since inception.

A portion of distributions may be a direct result of expense support payments provided by CION Ares Management, LLC (CAM), which are subject to repayment by CADC within three years. The purpose of this arrangement is to ensure that CADC bears an appropriate level of expenses. Any such distributions may not be entirely based on investment performance and can only be sustained if positive investment performance is achieved in future periods and/or CAM continues to make such expense support payments. Future repayments will reduce cash otherwise potentially available for distributions. There can be no assurance that such performance will be achieved in order to sustain these distributions. CAM has no obligation to provide expense support payments in future periods.

CADC may fund distributions from unlimited amounts of offering proceeds or borrowings, which may constitute a return of capital, as well as net income from operations, capital and non-capital gains from the sale of assets, dividends or distributions from equity investments and expense support payments from CAM, which are subject to repayment. For the year ending December 31, 2019, distributions were paid from taxable income and did not include a return of capital for tax purposes. If expense support payments from CAM were not provided, some or all of the distributions may have been a return of capital which would reduce the available capital for investment. The sources of distributions may vary periodically. Please refer to the semi-annual or annu-al reports filed with the SEC for the sources of distributions.

Semi-Annual Report 2020

6

CION Ares Diversified Credit Fund

Schedule of Investments

June 30, 2020 (Unaudited)

Senior Loans 90.2%(b)(c)(d)

| | | Principal

Amount | | Value(a) | |

Aerospace & Defense 1.9% | |

Aero Operating, LLC, 1st Lien

Delayed Draw Term Loan, 1M

LIBOR + 6.50%, 8.00%,

02/09/2026(e) | | $ | 838,503 | | | $ | 796,578 | | |

Aero Operating, LLC, Initial 1st Lien

Term Loan, 1M LIBOR + 6.50%,

8.00%, 02/09/2026(e)(f) | | | 2,922,726 | | | | 2,776,590 | | |

Radius Aerospace Europe, Ltd.,

1st Lien Term Loan, (Great Britain),

3M LIBOR + 5.75%, 6.75%,

03/29/2025(e)(f) | | | 1,618,502 | | | | 1,553,761 | | |

Radius Aerospace Europe, Ltd.,

1st Lien Revolver, (Great Britain),

3M GBP LIBOR + 5.75%, 6.75%,

03/29/2025(e) | | £ | 185,714 | | | | 220,896 | | |

Radius Aerospace, Inc., Initial

1st Lien Term Loan, 3M LIBOR +

5.75%, 6.75%, 03/29/2025(e)(f) | | $ | 2,539,286 | | | | 2,437,714 | | |

Radius Aerospace, Inc., 1st Lien

Revolver, 3M LIBOR + 5.75%,

6.75%, 03/29/2025(e) | | | 428,571 | | | | 411,429 | | |

SecurAmerica, LLC, 1st Lien

6th Amendment Term Loan,

1M LIBOR + 9.00%, 10.25%,

07/16/2021(e)(g) | | | 191,759 | | | | 191,759 | | |

SecurAmerica, LLC, 1st Lien

Delayed Draw Term Loan A,

1M LIBOR + 9.00%, 10.25%,

12/21/2023(e)(g) | | | 615,750 | | | | 615,750 | | |

SecurAmerica, LLC, 1st Lien

Delayed Draw Term Loan B,

1M LIBOR + 9.00%, 10.25%,

12/21/2023(e)(g) | | | 111,611 | | | | 111,611 | | |

SecurAmerica, LLC, 1st Lien

Delayed Draw Term Loan C,

1M LIBOR + 9.00%, 10.25%,

12/21/2023(e)(g) | | | 69,992 | | | | 69,992 | | |

SecurAmerica, LLC, 1st Lien

Revolver, 06/21/2023(e)(h)(i) | | | 1,125 | | | | — | | |

SecurAmerica, LLC, 1st Lien Term

Loan, 1M LIBOR + 9.00%, 10.25%,

12/21/2023(e)(f)(g) | | | 1,644,085 | | | | 1,644,085 | | |

TransDigm Group, Inc., Tranche

Refinancing 1st Lien Term Loan F,

1M LIBOR + 2.25%, 2.43%,

12/09/2025(i) | | | 1,997,222 | | | | 1,791,788 | | |

| | | | | | 12,621,953 | | |

Senior Loans(b)(c)(d) (continued)

| | | Principal

Amount | | Value(a) | |

Automotive 1.4% | |

GB Auto Service, Inc., 1st Lien

1st Amendment Delayed Draw Term

Loan, 3M LIBOR + 6.50%, 7.50%,

10/19/2024(e)(h) | | $ | 6,002,624 | | | $ | 2,735,508 | | |

GB Auto Service, Inc., 1st Lien

Delayed Draw Term Loan,

3M LIBOR + 6.50%, 7.50%,

10/19/2024(e) | | | 1,649,034 | | | | 1,583,073 | | |

GB Auto Service, Inc., 1st Lien

Revolver, 3M LIBOR + 6.50%,

7.52%, 10/19/2024(e)(h) | | | 264,159 | | | | 44,206 | | |

GB Auto Service, Inc., 1st Lien

Term Loan, 3M LIBOR + 6.50%,

7.50%, 10/19/2024(e)(f) | | | 1,200,833 | | | | 1,152,800 | | |

Panther BF Aggregator 2, LP, Initial

1st Lien Term Loan, 1M LIBOR +

3.50%, 3.68%, 04/30/2026 | | | 1,120,211 | | | | 1,064,200 | | |

Truck Hero, Inc., Initial 1st Lien

Term Loan, 1M LIBOR + 3.75%,

3.93%, 04/22/2024 | | | 383,089 | | | | 347,033 | | |

Wand NewCo 3, Inc., Initial 2nd Lien

Term Loan, 1M LIBOR + 7.25%,

7.43%, 02/05/2027(e)(f) | | | 3,000,000 | | | | 2,880,000 | | |

| | | | | | 9,806,820 | | |

Banking, Finance, Insurance & Real Estate 13.4% | |

A.U.L. Corp., 1st Lien Revolver,

06/05/2023(e)(h) | | | 1,000 | | | | (10 | ) | |

A.U.L. Corp., Initial 1st Lien Term

Loan, 1M LIBOR + 4.50%, 5.50%,

06/05/2023(e)(f) | | | 37,344 | | | | 36,971 | | |

Acrisure, LLC, 1st Lien Additional

Term Loan, 1M LIBOR + 3.50%,

3.68%, 02/15/2027 | | | 3,614,279 | | | | 3,406,458 | | |

Affinipay Midco, LLC, 1st Lien

Revolver, 3M LIBOR + 5.50%,

6.75%, 03/02/2026(e)(h) | | | 766,307 | | | | 130,272 | | |

Affinipay Midco, LLC, Initial 1st Lien

Term Loan, 3M LIBOR + 5.50%,

6.75%, 03/02/2026(e)(f) | | | 7,250,308 | | | | 7,032,798 | | |

Affirm Operational Loans VI Trust,

1st Lien Revolver, 12/17/2026(e)(h) | | | 500,000 | | | | (5,426 | ) | |

Amynta Agency Borrower, Inc.,

1st Lien Incremental Term Loan B,

1M LIBOR + 4.50%, 4.68%,

02/28/2025(e)(f) | | | 2,954,896 | | | | 2,659,407 | | |

AQ Sunshine, Inc., 1st Lien Delayed

Draw Term Loan, 04/15/2025(e)(h) | | | 85,975 | | | | (2,579 | ) | |

Semi-Annual Report 2020

7

CION Ares Diversified Credit Fund

Schedule of Investments (continued)

June 30, 2020 (Unaudited)

Senior Loans(b)(c)(d) (continued)

| | | Principal

Amount | | Value(a) | |

AQ Sunshine, Inc., Initial 1st Lien

Revolver, 6M LIBOR + 5.75%,

6.75%, 04/15/2024(e)(h) | | $ | 136,423 | | | $ | 118,689 | | |

AQ Sunshine, Inc., Initial 1st Lien

Term Loan, 6M LIBOR + 5.75%,

6.75%, 04/15/2025(e)(f) | | | 1,143,613 | | | | 1,109,305 | | |

AQ Sunshine, Inc., Initial 1st Lien

Term Loan, 6M LIBOR + 5.75%,

6.75%, 04/15/2025(e) | | | 299,191 | | | | 290,215 | | |

Ardonagh Midco 3, PLC, EUR

Facility 1st Lien Term Loan B-1,

(Great Britain), 07/14/2026(e)(f)(h)(i)(j) | | € | 193,893 | | | | — | | |

Ardonagh Midco 3, PLC, GBP

Facility 1st Lien Term Loan B-1,

(Great Britain), 07/14/2026(e)(f)(h)(i)(j) | | £ | 1,521,885 | | | | — | | |

Ardonagh Midco 3, PLC, GBP

Facility 1st Lien Term Loan B-2,

(Great Britain), 07/14/2026(e)(h)(i)(j) | | | 323,155 | | | | — | | |

ARM Funding, LLC, 1st Lien

Revolver B, 1M LIBOR + 7.95%,

8.95%, 02/29/2024(e)(h) | | $ | 2,500,000 | | | | 1,412,267 | | |

AssuredPartners, Inc., 1st Lien

Incremental Term Loan, 1M LIBOR +

4.50%, 5.50%, 02/12/2027 | | | 1,074,776 | | | | 1,053,281 | | |

Asurion, LLC, 1st Lien Replacement

Term Loan B-6, 1M LIBOR + 3.00%,

3.18%, 11/03/2023(i) | | | 3,994,728 | | | | 3,858,228 | | |

Asurion, LLC, 2nd Lien Term

Loan B-2, 1M LIBOR + 6.50%,

6.68%, 08/04/2025(i) | | | 963,051 | | | | 955,828 | | |

Blackhawk Network Holdings, Inc.,

2nd Lien Term Loan, 1M LIBOR +

7.00%, 7.25%, 06/15/2026 | | | 150,000 | | | | 134,625 | | |

Blackwood Bidco, Ltd., Facility

1st Lien Term Loan B-1,

(Great Britain), 6M LIBOR + 7.30%,

9.25%, 10/08/2026(e)(f)(j) | | | 3,184,069 | | | | 3,184,069 | | |

Blackwood Bidco, Ltd., GBP

Facility 1st Lien Term Loan B-1,

(Great Britain), 6M GBP LIBOR +

7.30%, 8.11%, 10/08/2026(e)(f)(j) | | £ | 2,550,724 | | | | 3,160,346 | | |

Foundation Risk Partners Corp.,

1st Lien 1st Amendment Delayed

Draw Term Loan, 3M LIBOR +

4.75%, 5.75%, 11/10/2023(e) | | $ | 785,921 | | | | 778,061 | | |

Foundation Risk Partners Corp.,

1st Lien 1st Amendment Term

Loan, 3M LIBOR + 4.75%, 5.75%,

11/10/2023(e)(f) | | | 628,994 | | | | 622,704 | | |

Senior Loans(b)(c)(d) (continued)

| | | Principal

Amount | | Value(a) | |

Foundation Risk Partners Corp.,

1st Lien 2nd Amendment Delayed

Draw Term Loan, 3M LIBOR +

4.75%, 5.75%, 11/10/2023(e) | | $ | 3,225,347 | | | $ | 3,193,094 | | |

Foundation Risk Partners Corp.,

1st Lien 3rd Amendment Delayed

Draw Term Loan, 3M LIBOR +

4.75%, 5.75%, 11/10/2023(e)(h) | | | 1,258,791 | | | | 355,348 | | |

Foundation Risk Partners Corp.,

1st Lien Delayed Draw Term Loan,

3M LIBOR + 4.75%, 5.75%,

11/10/2023(e)(f) | | | 139,446 | | | | 138,051 | | |

Foundation Risk Partners Corp.,

1st Lien Revolver, 11/10/2023(e)(h) | | | 3,000 | | | | (30 | ) | |

Foundation Risk Partners Corp.,

1st Lien Term Loan, 3M LIBOR +

4.75%, 5.75%, 11/10/2023(e)(f) | | | 619,394 | | | | 613,200 | | |

Foundation Risk Partners Corp.,

2nd Lien 1st Amendment Delayed

Draw Term Loan, 3M LIBOR +

8.50%, 9.50%, 11/10/2024(e) | | | 292,900 | | | | 289,971 | | |

Foundation Risk Partners Corp.,

2nd Lien 1st Amendment Term

Loan, 3M LIBOR + 8.50%, 9.50%,

11/10/2024(e) | | | 264,795 | | | | 262,147 | | |

Foundation Risk Partners Corp.,

2nd Lien 2nd Amendment Delayed

Draw Term Loan, 3M LIBOR +

8.50%, 9.50%, 11/10/2024(e) | | | 1,007,133 | | | | 997,061 | | |

Foundation Risk Partners Corp.,

2nd Lien 3rd Amendment Delayed

Draw Term Loan, 3M LIBOR +

8.50%, 9.50%, 11/10/2024(e)(h) | | | 720,610 | | | | 55,592 | | |

Foundation Risk Partners Corp.,

2nd Lien Term Loan, 3M LIBOR +

8.50%, 9.50%, 11/10/2024(e) | | | 221,778 | | | | 219,560 | | |

Gulf Finance, LLC, Tranche 1st Lien

Term Loan B, 1M LIBOR + 5.25%,

6.25%, 08/25/2023 | | | 297,241 | | | | 190,235 | | |

Hammersmith Bidco, Ltd., Facility

1st Lien Term Loan B, (Great

Britain), 1M GBP LIBOR + 7.44%,

7.94%, 09/02/2026(e)(f)(j) | | £ | 4,112,437 | | | | 5,095,306 | | |

Hammersmith Bidco, Ltd.,

Acquisition Capex Facility 1st Lien

Term Loan, (Great Britain),

1M GBP LIBOR + 7.44%, 7.94%,

09/02/2026(e)(h)(j) | | | 1,678,545 | | | | 1,089,441 | | |

Leo Bidco, Ltd., GBP Facility

1st Lien Term Loan B, (Great

Britain), 6M GBP LIBOR + 6.25%,

7.00%, 03/30/2026(e)(f)(j) | | | 500,000 | | | | 619,500 | | |

Semi-Annual Report 2020

8

CION Ares Diversified Credit Fund

Schedule of Investments (continued)

June 30, 2020 (Unaudited)

Senior Loans(b)(c)(d) (continued)

| | | Principal

Amount | | Value(a) | |

London Acquisition Bidco B.V., EUR

Facility 1st Lien Term Loan B-1,

(Netherlands), 3M EURIBOR +

6.75%, 7.25%, 02/09/2026(e)(f)(j) | | € | 430,556 | | | $ | 474,034 | | |

NXTGenpay Intressenter Bidco AB,

Facility 1st Lien Term Loan B,

(Sweden), 3M STIBOR + 6.75%,

6.82%, 06/30/2025(e)(j) | | SEK | 5,500,000 | | | | 590,455 | | |

NXTGenpay Intressenter Bidco AB,

Facility 1st Lien Term Loan D,

(Sweden), 06/30/2025(e)(h)(i)(j) | | | 1,800,000 | | | | — | | |

NXTGenpay Intressenter Bidco AB,

Facility 1st Lien Term Loan D,

(Sweden), 3M STIBOR + 6.75%,

6.82%, 06/30/2025(e)(j) | | | 2,700,000 | | | | 289,860 | | |

PI UK Holdco II, Ltd., Facility

1st Lien Term Loan B-1, (Great

Britain), 3M LIBOR + 3.50%,

4.50%, 01/03/2025 | | $ | 775,056 | | | | 738,892 | | |

Refinitiv U.S. Holdings, Inc., Initial

1st Lien Term Loan, 1M LIBOR +

3.25%, 3.43%, 10/01/2025 | | | 1,994,937 | | | | 1,946,560 | | |

Right Choice Holdings, Ltd., GBP

Facility 1st Lien Term Loan B,

(Great Britain), 3M GBP LIBOR +

6.75%, 7.50%, 06/06/2024(e)(f)(j) | | £ | 1,000,000 | | | | 1,238,999 | | |

RSC Acquisition, Inc., Initial

1st Lien Delayed Draw Term Loan,

3M LIBOR + 5.50%, 6.50%,

10/30/2026(e)(h) | | $ | 554,024 | | | | 15,970 | | |

RSC Acquisition, Inc., Initial

1st Lien Revolver, 10/30/2026(e)(h) | | | 1,000 | | | | (30 | ) | |

RSC Acquisition, Inc., Initial

1st Lien Term Loan, 3M LIBOR +

5.50%, 6.50%, 10/30/2026(e)(f) | | | 2,671,762 | | | | 2,591,609 | | |

SaintMichelCo, Ltd., Acquisition

Facility 1st Lien Term Loan,

(Great Britain), 3M GBP LIBOR +

7.00%, 7.50%, 09/09/2025(e)(h)(j) | | £ | 300,000 | | | | 198,240 | | |

SaintMichelCo, Ltd., Facility

1st Lien Term Loan B, (Great

Britain), 3M GBP LIBOR + 7.00%,

7.50%, 09/09/2025(e)(j) | | | 2,400,000 | | | | 2,973,598 | | |

SCM Insurance Services, Inc.,

1st Lien Revolver, (Canada), CAD

PRIME + 4.00%, 6.45%,

08/29/2022(e)(h) | | CAD | 1,000 | | | | 309 | | |

SCM Insurance Services, Inc.,

1st Lien Term Loan, (Canada),

1M CDOR + 5.00%, 6.00%,

08/29/2024(e)(f) | | | 121,875 | | | | 82,527 | | |

Senior Loans(b)(c)(d) (continued)

| | | Principal

Amount | | Value(a) | |

SCM Insurance Services, Inc.,

2nd Lien Term Loan, (Canada),

1M CDOR + 9.00%, 10.00%,

03/01/2025(e) | | CAD | 125,000 | | | $ | 82,803 | | |

Sedgwick Claims Management

Services, Inc., Initial 1st Lien Term

Loan, 1M LIBOR + 3.25%, 3.43%,

12/31/2025 | | $ | 2,874,905 | | | | 2,707,556 | | |

Selectquote, Inc., Initial 1st Lien

Term Loan, 1M LIBOR + 6.00%,

7.00%, 11/05/2024(e) | | | 779,213 | | | | 779,213 | | |

SG Acquisition, Inc., Initial

1st Lien Term Loan, 1M LIBOR +

5.75%, 5.93%, 01/27/2027(e)(f) | | | 3,372,235 | | | | 3,271,068 | | |

Staysure Bidco, Ltd., Facility

1st Lien Term Loan B, (Great

Britain), 3M GBP LIBOR + 7.00%,

7.75%, 07/01/2025(e) | | £ | 1,000,000 | | | | 1,189,439 | | |

Symbol Bidco I, Ltd., Facility

1st Lien Term Loan B, (Great

Britain), 3M GBP LIBOR + 6.50%,

7.00%, 02/22/2027(e)(f)(j) | | | 571,429 | | | | 708,000 | | |

Symbol Bidco I, Ltd., Acquisition

Capex Facility 1st Lien Term Loan,

(Great Britain), 12/21/2026(e)(h)(j) | | | 428,571 | | | | — | | |

TA/WEG Holdings, LLC, Initial

1st Lien Term Loan, 12M LIBOR +

6.00%, 7.00%, 10/02/2025(e)(f) | | $ | 3,529,018 | | | | 3,458,438 | | |

TA/WEG Holdings, LLC, 1st Lien

Revolver, 12M LIBOR + 6.00%,

7.00%, 10/02/2025(e)(h) | | | 301,041 | | | | 160,822 | | |

TA/WEG Holdings, LLC, Initial

1st Lien Delayed Draw Term Loan,

12M LIBOR + 6.00%, 7.00%,

10/02/2025(e)(h)(i) | | | 2,186,891 | | | | 831,019 | | |

Tempo Acquisition, LLC, Initial

1st Lien Term Loan, 1M LIBOR +

2.75%, 2.93%, 05/01/2024 | | | 1,510,335 | | | | 1,431,042 | | |

Toscafund, Ltd., Facility 1st Lien

Term Loan, (Great Britain),

6M GBP LIBOR + 7.50%, 8.25%,

04/02/2025(e)(f)(j) | | £ | 4,680,000 | | | | 5,798,516 | | |

True Potential LLP, Facility 1st Lien

Term Loan B-2, (Great Britain),

6M GBP LIBOR + 7.17%, 7.90%,

10/16/2026(e)(f)(j) | | | 8,112,754 | | | | 10,051,696 | | |

True Potential LLP, Acquisition

Facility 1st Lien Term Loan,

(Great Britain), 3M GBP LIBOR +

7.17%, 7.84%, 10/16/2026(e)(h)(j) | | | 1,943,174 | | | | 1,963,908 | | |

Semi-Annual Report 2020

9

CION Ares Diversified Credit Fund

Schedule of Investments (continued)

June 30, 2020 (Unaudited)

Senior Loans(b)(c)(d) (continued)

| | | Principal

Amount | | Value(a) | |

Ultimus Group Midco, LLC (The),

1st Lien Revolver, 3M LIBOR +

3.50%, 6.75%, 02/01/2024(e)(h) | | $ | 396,226 | | | $ | 210,566 | | |

Ultimus Group Midco, LLC (The),

Initial 1st Lien Term Loan,

3M LIBOR + 4.50%, 5.50%,

02/01/2026(e)(f) | | | 3,181,215 | | | | 3,053,966 | | |

USI, Inc., 1st Lien Term Loan,

3M LIBOR + 4.00%, 4.31%,

12/02/2026 | | | 497,500 | | | | 482,162 | | |

| | | | | | 90,375,222 | | |

Beverage, Food & Tobacco 4.7% | |

CC Fly Holding II A/S, Unitranche

Facility 1st Lien Term Loan A,

(Denmark), 3M CIBOR + 7.50%,

8.00%, 05/09/2025(e)(f) | | DKK | 2,500,000 | | | | 358,039 | | |

CC Fly Holding II A/S, Unitranche

Facility 1st Lien Term Loan B,

(Denmark), 3M NIBOR + 7.50%,

8.00%, 05/09/2025(e)(f) | | | 2,500,000 | | | | 358,039 | | |

CC Fly Holding II A/S, Accordian

Facility 1st Lien Term Loan,

(Denmark), 3M CIBOR + 7.50%,

8.00%, 05/09/2025(e)(f) | | | 520,833 | | | | 74,592 | | |

CC Fly Holding II A/S, Accordian

Facility 2 1st Lien Term Loan,

(Denmark), 3M NIBOR + 7.50%,

8.00%, 05/09/2025(e)(f) | | | 520,833 | | | | 74,592 | | |

CC Fly Holding II A/S, Accordian

Facility 3 1st Lien Term Loan,

(Denmark), 3M CIBOR + 7.50%,

8.00%, 05/09/2025(e)(f) | | | 1,041,666 | | | | 149,183 | | |

CHG PPC Parent, LLC, 2nd Lien

Term Loan, 1M LIBOR + 7.50%,

7.68%, 03/30/2026(e)(f) | | $ | 1,000,000 | | | | 970,000 | | |

CHG PPC Parent, LLC, 2nd Lien

Additional Term Loan, 1M LIBOR +

7.75%, 7.93%, 03/30/2026(e)(f) | | | 2,000,000 | | | | 1,940,000 | | |

Ferraro Fine Foods Corp., 1st Lien

2nd Amendment Term Loan,

3M LIBOR + 4.25%, 5.32%,

05/09/2024(e)(f) | | | 295,825 | | | | 286,950 | | |

Ferraro Fine Foods Corp., 1st Lien

Incremental Term Loan, 3M LIBOR +

4.25%, 5.32%, 05/09/2024(e) | | | 53,791 | | | | 52,177 | | |

Ferraro Fine Foods Corp., 1st Lien

Revolver, 6M LIBOR + 4.25%,

5.32%, 05/09/2023(e)(h) | | | 1,000 | | | | 303 | | |

Senior Loans(b)(c)(d) (continued)

| | | Principal

Amount | | Value(a) | |

Ferraro Fine Foods Corp., 1st Lien

Term Loan, 6M LIBOR + 4.25%,

5.32%, 05/09/2024(e)(f) | | $ | 981,518 | | | $ | 952,072 | | |

Froneri International, Ltd., Facility

1st Lien Term Loan B-2,

(Great Britain), 1M LIBOR + 2.25%,

2.43%, 01/29/2027 | | | 2,501,824 | | | | 2,347,036 | | |

GPM Investments, LLC, 1st Lien

Delayed Draw Term Loan A,

03/01/2027(e)(h) | | | 3,312,452 | | | | (66,249 | ) | |

GPM Investments, LLC, Initial

1st Lien Term Loan, 3M LIBOR +

4.75%, 6.25%, 03/01/2027(e)(f) | | | 8,496,439 | | | | 8,326,510 | | |

Hometown Food Co., 1st Lien

Revolver, 08/31/2023(e)(h) | | | 1,000 | | | | — | | |

Hometown Food Co., 1st Lien Term

Loan, 1M LIBOR + 5.00%, 6.25%,

08/31/2023(e)(f) | | | 1,473,707 | | | | 1,473,707 | | |

IRB Holding Corp., 1st Lien

Replacement Term Loan B,

6M LIBOR + 2.75%, 3.75%,

02/05/2025 | | | 2,192,449 | | | | 2,019,399 | | |

Jim N Nicks Management, LLC,

1st Lien Revolver, 3M LIBOR +

5.25%, 6.25%, 07/10/2023(e) | | | 1,000 | | | | 880 | | |

Jim N Nicks Management, LLC,

Initial 1st Lien Term Loan, 3M

LIBOR + 5.25%, 6.25%,

07/10/2023(e)(f) | | | 48,500 | | | | 42,680 | | |

Portillo's Holdings, LLC, 1st Lien

Additional Term Loan B-3,

09/06/2024(i)(j) | | | 275,969 | | | | 252,856 | | |

Portillo's Holdings, LLC, 2nd Lien

Additional Term Loan B-3,

3M LIBOR + 9.50%, 10.75%,

12/06/2024(e) | | | 2,465,616 | | | | 2,342,335 | | |

Reddy Ice Holdings, Inc., 1st Lien

Delayed Draw Term Loan,

6M LIBOR + 5.50%, 6.70%,

07/01/2025(e)(h) | | | 952,667 | | | | 417,980 | | |

Reddy Ice Holdings, Inc., 1st Lien

Revolver, 1M LIBOR + 5.50%,

6.50%, 07/01/2024(e)(h) | | | 955,102 | | | | 305,633 | | |

Reddy Ice Holdings, Inc., 1st Lien

Term Loan, 6M LIBOR + 5.50%,

6.70%, 07/01/2025(e)(f) | | | 7,375,298 | | | | 6,859,027 | | |

SFE Intermediate HoldCo, LLC,

1st Lien Incremental Term Loan,

3M LIBOR + 5.25%, 6.25%,

07/31/2024(e)(f) | | | 1,904,098 | | | | 1,866,016 | | |

Semi-Annual Report 2020

10

CION Ares Diversified Credit Fund

Schedule of Investments (continued)

June 30, 2020 (Unaudited)

Senior Loans(b)(c)(d) (continued)

| | | Principal

Amount | | Value(a) | |

SFE Intermediate HoldCo, LLC,

1st Lien Revolver, PRIME + 4.25%,

7.50%, 07/31/2023(e) | | $ | 2,000 | | | $ | 1,960 | | |

SFE Intermediate HoldCo, LLC,

1st Lien Term Loan, 3M LIBOR +

5.25%, 6.25%, 07/31/2024(e)(f) | | | 235,708 | | | | 230,994 | | |

| | | | | | 31,636,711 | | |

Capital Equipment 1.9% | |

Avantor Funding, Inc., Initial 1st Lien

Term Loan, 1M LIBOR + 2.25%,

3.25%, 11/21/2024(i) | | | 2,500,000 | | | | 2,431,250 | | |

Blue Angel Buyer 1, LLC, 1st Lien

1st Amendment Term Loan,

3M LIBOR + 4.50%, 5.64%,

01/02/2026(e)(f) | | | 1,113,930 | | | | 1,102,790 | | |

Blue Angel Buyer 1, LLC, 1st Lien

Delayed Draw Term Loan,

3M LIBOR + 3.25%, 6.50%,

01/02/2026(e)(h) | | | 640,850 | | | | 268,290 | | |

Blue Angel Buyer 1, LLC, 1st Lien

Revolver, 01/02/2025(e)(h) | | | 321,199 | | | | (6,424 | ) | |

Blue Angel Buyer 1, LLC, Initial

1st Lien Term Loan, 6M LIBOR +

4.25%, 5.25%, 01/02/2026(e)(f) | | | 2,010,948 | | | | 1,970,729 | | |

Dynacast International, LLC,

1st Lien Term Loan B-2,

3M LIBOR + 3.25%, 4.25%,

01/28/2022(i) | | | 2,022,935 | | | | 1,638,578 | | |

Flow Control Solutions, Inc.,

1st Lien Delayed Draw Term Loan,

11/21/2024(e)(h) | | | 994,201 | | | | (1 | ) | |

Flow Control Solutions, Inc.,

1st Lien Revolver, 11/21/2024(e)(h) | | | 372,825 | | | | — | | |

Flow Control Solutions, Inc.,

1st Lien Term Loan, 3M LIBOR +

5.25%, 6.25%, 11/21/2024(e)(f) | | | 1,287,695 | | | | 1,287,695 | | |

IMIA Holdings, Inc., 1st Lien

Revolver, 10/26/2024(e)(h) | | | 408,163 | | | | — | | |

IMIA Holdings, Inc., 1st Lien Term

Loan, 3M LIBOR + 4.50%, 5.50%,

10/26/2024(e)(f) | | | 2,517,932 | | | | 2,517,932 | | |

Welbilt, Inc., 1st Lien Term Loan B,

1M LIBOR + 2.50%, 2.68%,

10/23/2025(e) | | | 1,902,256 | | | | 1,635,940 | | |

| | | | | | 12,846,779 | | |

Senior Loans(b)(c)(d) (continued)

| | | Principal

Amount | | Value(a) | |

Chemicals, Plastics & Rubber 1.6% | |

Atlas Intermediate III, LLC, Initial

1st Lien Term Loan, 3M LIBOR +

5.75%, 6.75%, 04/29/2025(e)(f) | | $ | 1,150,044 | | | $ | 1,115,543 | | |

Atlas Intermediate III, LLC,

1st Lien Revolver, 3M LIBOR +

5.50%, 6.50%, 04/29/2025(e)(h) | | | 226,621 | | | | 144,282 | | |

DCG Acquisition Corp., Initial

1st Lien Term Loan, 1M LIBOR +

4.50%, 4.69%, 09/30/2026(e) | | | 2,271,070 | | | | 2,021,253 | | |

Laboratories Bidco, LLC, 1st Lien

Term Loan, 1M CDOR + 6.00%,

7.00%, 06/25/2024(e)(f) | | CAD | 1,797,779 | | | | 1,296,746 | | |

Laboratories Bidco, LLC, 1st Lien

2nd Amendment Incremental

Term Loan, 1M LIBOR + 5.75%,

6.75%, 06/25/2024(e)(f) | | $ | 588,426 | | | | 576,658 | | |

Laboratories Bidco, LLC, 1st Lien

Revolver, 06/25/2024(e)(h) | | | 513,489 | | | | (10,270 | ) | |

Laboratories Bidco, LLC, 1st Lien

Term Loan, 1M LIBOR + 5.75%,

6.75%, 06/25/2024(e)(f) | | | 1,916,362 | | | | 1,878,034 | | |

Plaskolite PPC Intermediate II, LLC,

2nd Lien Term Loan, 1M LIBOR +

7.75%, 8.75%, 12/14/2026(e)(f) | | | 3,000,000 | | | | 2,850,000 | | |

Plaskolite PPC Intermediate II, LLC,

1st Lien Term Loan, 3M LIBOR +

4.25%, 5.25%, 12/15/2025(e) | | | 990 | | | | 940 | | |

Trident TPI Holdings, Inc., Tranche

1st Lien Term Loan B-1,

6M LIBOR + 3.25%, 4.07%,

10/17/2024 | | | 691,454 | | | | 658,610 | | |

| | | | | | 10,531,796 | | |

Construction & Building 1.4% | |

EISG Bidco AB, Facility 1st Lien

Term Loan A, (Sweden),

3M STIBOR + 7.50%, 7.57%,

06/30/2026(e)(f)(i)(j) | | SEK | 42,000,000 | | | | 4,508,929 | | |

EISG Bidco AB, Facility 1st Lien

Term Loan B, (Sweden),

06/30/2026(e)(h)(i)(j) | | | 4,000,000 | | | | — | | |

Kene Acquisition, Inc., 1st Lien

Delayed Draw Term Loan,

3M LIBOR + 4.25%, 5.25%,

08/10/2026(e)(h) | | $ | 632,240 | | | | 458,355 | | |

Kene Acquisition, Inc., 1st Lien

Revolver, 3M LIBOR + 4.25%,

5.25%, 08/08/2024(e)(h) | | | 675,812 | | | | 82,787 | | |

Semi-Annual Report 2020

11

CION Ares Diversified Credit Fund

Schedule of Investments (continued)

June 30, 2020 (Unaudited)

Senior Loans(b)(c)(d) (continued)

| | | Principal

Amount | | Value(a) | |

Kene Acquisition, Inc., 1st Lien

Term Loan, 3M LIBOR + 4.25%,

5.25%, 08/10/2026(e)(f) | | $ | 2,891,887 | | | $ | 2,776,212 | | |

Wilsonart, LLC, Tranche 1st Lien

Term Loan D, 3M LIBOR + 3.25%,

4.25%, 12/19/2023(i) | | | 1,883,674 | | | | 1,812,452 | | |

| | | | | | 9,638,735 | | |

Consumer Goods: Durable 1.6% | |

AI Aqua Merger Sub, Inc., 1st Lien

5th Amendment Incremental Term

Loan, 3M LIBOR + 4.25%, 5.34%,

12/13/2023(e) | | | 2,487,500 | | | | 2,425,312 | | |

AI Aqua Merger Sub, Inc., Tranche

1st Lien Term Loan B-1,

6M LIBOR + 3.25%, 4.32%,

12/13/2023 | | | 1,979,540 | | | | 1,897,884 | | |

DecoPac, Inc., Initial 1st Lien

Revolver, 1M LIBOR + 4.25%,

5.25%, 09/29/2023(e)(h) | | | 1,000 | | | | 190 | | |

DecoPac, Inc., Initial 1st Lien Term

Loan, 3M LIBOR + 4.25%, 5.25%,

09/30/2024(e)(f) | | | 478,791 | | | | 474,003 | | |

DRS Holdings III, Inc., 1st Lien

Term Loan, 3M LIBOR + 5.75%,

6.75%, 11/01/2025(e)(f) | | | 2,021,606 | | | | 1,940,741 | | |

DRS Holdings III, Inc., 1st Lien

Revolver, 1M LIBOR + 5.75%,

6.75%, 11/01/2025(e)(h) | | | 1,000 | | | | 360 | | |

Star US Bidco, LLC, Initial 1st Lien

Term Loan, 1M LIBOR + 4.25%,

5.25%, 03/17/2027 | | | 4,144,583 | | | | 3,750,847 | | |

| | | | | | 10,489,337 | | |

Consumer Goods: Non-Durable 0.0% | |

Movati Athletic Group, Inc., 1st Lien

Delayed Draw Term Loan, (Canada),

3M LIBOR + 6.50%, 8.00%,

10/05/2022(e)(h) | | CAD | 251,915 | | | | 121,008 | | |

Movati Athletic Group, Inc., 1st Lien

Term Loan A, (Canada), 3M LIBOR +

6.50%, 8.00%, 10/05/2022(e)(f) | | | 240,532 | | | | 169,956 | | |

| | | | | | 290,964 | | |

Containers, Packaging & Glass 2.6% | |

Anchor Packaging, LLC, 1st Lien

Delayed Draw Term Loan,

1M LIBOR + 3.75%, 3.93%,

07/18/2026 | | $ | 574,359 | | | | 551,385 | | |

Senior Loans(b)(c)(d) (continued)

| | | Principal

Amount | | Value(a) | |

Anchor Packaging, LLC, Initial

1st Lien Term Loan, 1M LIBOR +

3.75%, 3.93%, 07/18/2026 | | $ | 2,605,949 | | | $ | 2,501,711 | | |

BWAY Holding Co., Initial 1st Lien

Term Loan, 3M LIBOR + 3.25%,

4.56%, 04/03/2024(i) | | | 2,764,751 | | | | 2,475,614 | | |

Charter NEX U.S., Inc., Initial

1st Lien Term Loan, 1M LIBOR +

2.75%, 3.75%, 05/16/2024 | | | 314,478 | | | | 300,282 | | |

Charter NEX U.S., Inc., Initial

1st Lien Term Loan, 1M LIBOR +

2.75%, 3.75%, 05/16/2024 | | | 1,436 | | | | 1,371 | | |

IntraPac Canada Corp., 1st Lien

Term Loan, (Canada), 6M LIBOR +

5.50%, 6.57%, 01/11/2026(e)(f) | | | 806,588 | | | | 766,259 | | |

IntraPac International, LLC,

1st Lien Revolver, 6M LIBOR +

5.50%, 6.57%, 01/11/2025(e)(h) | | | 415,407 | | | | 146,431 | | |

IntraPac International, LLC,

1st Lien Term Loan, 6M LIBOR +

5.50%, 6.57%, 01/11/2026(e)(f) | | | 1,582,923 | | | | 1,503,777 | | |

Pregis TopCo LLC, Initial 1st Lien

Term Loan, 1M LIBOR + 4.00%,

4.18%, 07/31/2026 | | | 2,932,321 | | | | 2,821,127 | | |

Reynolds Group Holdings, Inc.,

1st Lien Incremental Term Loan,

1M LIBOR + 2.75%, 2.93%,

02/05/2023 | | | 1,230,194 | | | | 1,172,252 | | |

Ring Container Technologies Group,

LLC, Initial 1st Lien Term Loan,

1M LIBOR + 2.75%, 2.93%,

10/31/2024 | | | 1,470,832 | | | | 1,393,613 | | |

Tank Holding Corp., 1st Lien

Refinancing Term Loan, 1M LIBOR +

3.50%, 3.68%, 03/26/2026 | | | 4,440,599 | | | | 4,135,308 | | |

| | | | | | 17,769,130 | | |

Energy: Oil & Gas 3.0% | |

Birch Permian, LLC, Initial 1st Lien

Term Loan, 3M LIBOR + 8.00%,

9.50%, 04/12/2023(e) | | | 6,981,049 | | | | 5,445,218 | | |

Cheyenne Petroleum Co., LP, 2nd

Lien Term Loan, 3M LIBOR + 8.50%,

10.50%, 01/10/2024(e) | | | 7,244,000 | | | | 5,650,320 | | |

Drilling Info Holdings, Inc., 2nd Lien

Incremental Term Loan, 1M LIBOR +

8.25%, 8.43%, 07/30/2026(e)(f) | | | 8,077,000 | | | | 7,673,150 | | |

Penn Virginia Holding Corp.,

2nd Lien Term Loan, 1M LIBOR +

7.00%, 8.00%, 09/29/2022(e) | | | 500,000 | | | | 375,000 | | |

Semi-Annual Report 2020

12

CION Ares Diversified Credit Fund

Schedule of Investments (continued)

June 30, 2020 (Unaudited)

Senior Loans(b)(c)(d) (continued)

| | | Principal

Amount | | Value(a) | |

Sundance Energy, Inc., 2nd Lien

Term Loan, 3M LIBOR + 8.00%,

8.31%, 04/23/2023(e) | | $ | 1,000,000 | | | $ | 740,000 | | |

Traverse Midstream Partners, LLC,

1st Lien Term Loan, 1M LIBOR +

4.00%, 5.00%, 09/27/2024 | | | 249,365 | | | | 206,662 | | |

| | | | | | 20,090,350 | | |

Environmental Industries 1.3% | |

Core & Main, LP, Initial 1st Lien

Term Loan, 6M LIBOR + 2.75%,

3.75%, 08/01/2024 | | | 4,045,603 | | | | 3,844,577 | | |

GFL Environmental, Inc., 1st Lien

Term Loan B, (Canada),

05/30/2025(i) | | | 2,501,452 | | | | 2,426,934 | | |

Restaurant Technologies, Inc.,

1st Lien 1st Amendment

Incremental Term Loan,

1M LIBOR + 6.25%, 7.25%,

10/01/2025(e) | | | 250,000 | | | | 250,000 | | |

Restaurant Technologies, Inc.,

Initial 1st Lien Term Loan,

1M LIBOR + 3.25%, 3.43%,

10/01/2025 | | | 1,454,921 | | | | 1,333,071 | | |

VLS Recovery Services, LLC,

1st Lien 2nd Amendment Term

Loan, 1M LIBOR + 6.00%, 7.00%,

10/17/2023(e)(f) | | | 729,471 | | | | 729,471 | | |

VLS Recovery Services, LLC,

1st Lien Delayed Draw Term Loan,

1M LIBOR + 6.00%, 7.00%,

10/17/2023(e)(f) | | | 43,692 | | | | 43,692 | | |

VLS Recovery Services, LLC,

1st Lien Delayed Draw Term

Loan B, 1M LIBOR + 6.00%,

7.00%, 10/17/2023(e) | | | 89,557 | | | | 89,557 | | |

VLS Recovery Services, LLC,

1st Lien Delayed Draw Term

Loan C, 10/17/2023(e)(h) | | | 1,070,365 | | | | — | | |

VLS Recovery Services, LLC,

1st Lien Revolver, 10/17/2023(e)(h) | | | 1,000 | | | | — | | |

VLS Recovery Services, LLC,

1st Lien Term Loan, 1M LIBOR +

6.00%, 7.00%, 10/17/2023(e)(f) | | | 259,845 | | | | 259,845 | | |

| | | | | | 8,977,147 | | |

Healthcare & Pharmaceuticals 19.1% | |

Air Medical Group Holdings, Inc.,

1st Lien Term Loan, 6M LIBOR +

3.25%, 4.25%, 04/28/2022 | | | 3,491,049 | | | | 3,350,988 | | |

Senior Loans(b)(c)(d) (continued)

| | | Principal

Amount | | Value(a) | |

Athenahealth, Inc., 1st Lien

Revolver, 02/12/2024(e)(h) | | $ | 232,108 | | | $ | (6,963 | ) | |

Athenahealth, Inc., 1st Lien Term

Loan B, 3M LIBOR + 4.50%,

4.82%, 02/11/2026(e)(f) | | | 228,801 | | | | 221,937 | | |

Athenahealth, Inc., 2nd Lien Term

Loan, 3M LIBOR + 8.50%, 8.82%,

02/11/2027(e)(f) | | | 2,187,621 | | | | 2,143,868 | | |

Bausch Health Companies Inc.,

1st Lien Term Loan B, (Canada),

1M LIBOR + 3.00%, 3.19%,

06/02/2025 | | | 2,596,963 | | | | 2,520,041 | | |

Bearcat Buyer, Inc., 1st Lien

Incremental Term Loan,

3M LIBOR + 4.25%, 4.25%,

07/09/2026(e)(f) | | | 828,497 | | | | 820,212 | | |

Bearcat Buyer, Inc., 1st Lien

Delayed Draw Term Loan,

3M LIBOR + 4.25%, 4.56%,

07/09/2026(e)(h) | | | 1,013,387 | | | | 311,048 | | |

Bearcat Buyer, Inc., 1st Lien

Revolver, 07/09/2024(e)(h) | | | 580,465 | | | | (5,805 | ) | |

Bearcat Buyer, Inc., 1st Lien Term

Loan, 3M LIBOR + 4.25%, 4.56%,

07/09/2026(e)(f) | | | 4,896,949 | | | | 4,847,979 | | |

Bearcat Buyer, Inc., 2nd Lien

Delayed Draw Term Loan,

3M LIBOR + 8.25%, 8.56%,

07/09/2027(e)(h) | | | 580,465 | | | | 178,493 | | |

Bearcat Buyer, Inc., 2nd Lien

Incremental Term Loan,

3M LIBOR + 8.25%, 8.56%,

07/09/2027(e) | | | 617,308 | | | | 611,134 | | |

Bearcat Buyer, Inc., 2nd Lien

Term Loan, 3M LIBOR + 8.25%,

8.25%, 07/09/2027(e)(f) | | | 2,249,302 | | | | 2,226,809 | | |

Cambrex Corp., Initial 1st Lien

Term Loan, 1M LIBOR + 5.00%,

6.00%, 12/04/2026(e) | | | 3,482,500 | | | | 3,412,850 | | |

CEP V I 5 UK, Ltd., Acquisition

Facility 1st Lien Term Loan,

(Great Britain), 02/18/2027(e)(h)(j) | | | 6,346,154 | | | | — | | |

CEP V I 5 UK, Ltd., Facility 1st Lien

Term Loan B, (Great Britain),

6M LIBOR + 7.00%, 8.71%,

02/18/2027(e)(f)(j) | | | 26,653,846 | | | | 26,653,846 | | |

Change Healthcare Holdings, LLC,

1st Lien Term Loan, 1M LIBOR +

2.50%, 3.50%, 03/01/2024 | | | 4,000,000 | | | | 3,833,880 | | |

Semi-Annual Report 2020

13

CION Ares Diversified Credit Fund

Schedule of Investments (continued)

June 30, 2020 (Unaudited)

Senior Loans(b)(c)(d) (continued)

| | | Principal

Amount | | Value(a) | |

Comprehensive EyeCare Partners,

LLC, 1st Lien Delayed Draw Term

Loan, 3M LIBOR + 4.75%, 6.00%,

02/14/2024(e)(h) | | $ | 419,106 | | | $ | 315,165 | | |

Comprehensive EyeCare Partners,

LLC, 1st Lien Revolver, 3M LIBOR +

4.75%, 6.00%, 02/14/2024(e)(h) | | | 1,000 | | | | 855 | | |

Comprehensive EyeCare Partners,

LLC, 1st Lien Term Loan,

3M LIBOR + 4.75%, 6.00%,

02/14/2024(e)(f) | | | 563,907 | | | | 530,073 | | |

Convey Health Solutions, Inc.,

1st Lien Term Loan, 3M LIBOR +

5.25%, 6.25%, 09/04/2026(e)(f) | | | 3,127,797 | | | | 3,065,241 | | |

Convey Health Solutions, Inc.,

1st Lien Incremental Term Loan,

3M LIBOR + 9.00%, 10.35%,

09/04/2026(e)(f) | | | 367,428 | | | | 367,428 | | |

CPI Holdco, LLC, 1st Lien Revolver,

3M LIBOR + 4.00%, 5.18%,

11/04/2024(e)(h) | | | 3,435,381 | | | | 554,678 | | |

CVP Holdco, Inc., 1st Lien Delayed

Draw Term Loan, 3M LIBOR +

6.25%, 7.84%, 10/31/2025(e)(h) | | | 2,725,227 | | | | 643,126 | | |

CVP Holdco, Inc., 1st Lien Revolver,

3M LIBOR + 6.25%, 7.25%,

10/31/2024(e)(h) | | | 326,487 | | | | 302,001 | | |

CVP Holdco, Inc., 1st Lien Term

Loan, 6M LIBOR + 5.75%, 7.34%,

10/31/2025(e)(f) | | | 3,774,630 | | | | 3,548,152 | | |

Da Vinci Purchaser Corp., Initial

1st Lien Term Loan, 6M LIBOR +

4.00%, 5.24%, 01/08/2027 | | | 2,000,000 | | | | 1,942,500 | | |

Emerus Holdings, Inc., 1st Lien

Term Loan, 14.00%, 02/28/2022(e) | | | 18,696 | | | | 18,696 | | |

Evolent Health, LLC, 1st Lien

Delayed Draw Term Loan,

12/30/2024(e)(h) | | | 3,518,192 | | | | (246,273 | ) | |

Evolent Health, LLC, 1st Lien Term

Loan, 3M LIBOR + 8.00%, 9.00%,

12/30/2024(e) | | | 5,277,288 | | | | 4,907,878 | | |

Floss Bidco, Ltd., Acquisition

Facility 1st Lien Term Loan,

(Great Britain), 3M GBP LIBOR +

8.00%, 8.50%, 09/07/2026(e)(h)(i) | | £ | 1,195,339 | | | | 277,217 | | |

Floss Bidco, Ltd., Facility 1st Lien

Term Loan B, (Great Britain),

3M GBP LIBOR + 8.00%, 8.50%,

09/07/2026(e)(f) | | | 814,437 | | | | 978,815 | | |

Senior Loans(b)(c)(d) (continued)

| | | Principal

Amount | | Value(a) | |

Gentiva Health Services, Inc.,

1st Lien Term Loan B, 1M LIBOR +

3.25%, 3.44%, 07/02/2025 | | $ | 2,182,611 | | | $ | 2,108,947 | | |

Hanger, Inc., 1st Lien Term Loan,

03/06/2025 | | | 3,000,000 | | | | 2,855,010 | | |

Immucor, Inc., 1st Lien Term

Loan B-3, 3M LIBOR + 5.00%,

6.00%, 06/15/2021 | | | 837,268 | | | | 803,777 | | |

Jaguar Holding Co., 1st Lien Term

Loan, 1M LIBOR + 2.50%, 3.50%,

08/18/2022(i) | | | 2,998,691 | | | | 2,958,389 | | |

JDC Healthcare Management, LLC,

1st Lien Term Loan, 1M LIBOR +

8.00%, 9.00%, 04/10/2023(e)(f)(g)(k) | | | 107,742 | | | | 81,884 | | |

Just Childcare, Ltd., Unitranche

Facility 1st Lien Term Loan,

(Great Britain), 6M GBP LIBOR +

7.00%, 7.75%, 10/16/2026(e)(f)(j) | | £ | 861,006 | | | | 1,066,786 | | |

Just Childcare, Ltd., Acquisition

Facility 1st Lien Term Loan,

(Great Britain), 10/16/2026(e)(h)(j) | | | 426,945 | | | | — | | |

Kedleston Schools, Ltd., GBP

Facility 1st Lien Term Loan B-2,

(Great Britain), 3M GBP LIBOR +

8.00%, 9.00%, 05/30/2024(e)(f)(j) | | | 1,000,000 | | | | 1,238,999 | | |

LivaNova USA, Inc., Initial 1st Lien

Term Loan, 3M LIBOR + 6.50%,

7.50%, 06/30/2025(e) | | $ | 1,033,465 | | | | 1,002,461 | | |

MB2 Dental Solutions, LLC,

1st Lien Revolver, 6M LIBOR +

4.75%, 5.82%, 09/29/2023(e)(h) | | | 1,333 | | | | 1,239 | | |

MB2 Dental Solutions, LLC, Initial

1st Lien Term Loan, 6M LIBOR +

4.75%, 5.81%, 09/29/2023(e)(f) | | | 523,263 | | | | 486,634 | | |

MB2 Dental Solutions, LLC, Initial

1st Lien Term Loan, 6M LIBOR +

4.75%, 5.81%, 09/29/2023(e) | | | 57,387 | | | | 53,370 | | |

National Mentor Holdings, Inc.,

Initial 1st Lien Term Loan,

1M LIBOR + 4.25%, 4.43%,

03/09/2026 | | | 2,193,234 | | | | 2,110,067 | | |

National Mentor Holdings, Inc.,

Initial 1st Lien Term Loan C,

1M LIBOR + 4.25%, 4.43%,

03/09/2026 | | | 99,860 | | | | 96,074 | | |

Nelipak European Holdings

Cooperatief U.A., EUR 1st Lien

Revolver, (Netherlands),

6M EURIBOR + 4.50%, 4.50%,

07/02/2024(e)(h) | | € | 581,751 | | | | 245,362 | | |

Semi-Annual Report 2020

14

CION Ares Diversified Credit Fund

Schedule of Investments (continued)

June 30, 2020 (Unaudited)

Senior Loans(b)(c)(d) (continued)

| | | Principal

Amount | | Value(a) | |

Nelipak European Holdings

Cooperatief U.A., EUR 1st Lien

Term Loan, (Netherlands),

6M EURIBOR + 4.50%, 4.50%,

07/02/2026(e)(f) | | € | 818,283 | | | $ | 891,722 | | |

Nelipak Holding Co., 1st Lien

Incremental Term Loan,

6M LIBOR + 4.25%, 5.25%,

07/02/2026(e)(f) | | $ | 302,460 | | | | 290,362 | | |

Nelipak Holding Co., 1st Lien

Revolver, 3M LIBOR + 4.25%,

5.25%, 07/02/2024(e) | | | 604,780 | | | | 580,589 | | |

Nelipak Holding Co., 1st Lien Term

Loan, 6M LIBOR + 4.25%, 5.25%,

07/02/2026(e)(f) | | | 2,711,840 | | | | 2,603,367 | | |

Nuehealth Performance, LLC,

1st Lien Incremental Delayed Draw

Term Loan, 1M LIBOR + 7.25%,

8.25%, 09/27/2023(e)(f) | | | 289,821 | | | | 281,127 | | |

Nuehealth Performance, LLC,

1st Lien Revolver, 09/27/2023(e)(h) | | | 1,000 | | | | (30 | ) | |

Nuehealth Performance, LLC,

1st Lien Term Loan, 1M LIBOR +

7.25%, 8.25%, 09/27/2023(e)(f) | | | 2,177,348 | | | | 2,112,028 | | |

Olympia Acquisition, Inc., 1st Lien

Term Loan, 1M LIBOR + 5.50%,

6.50%, 09/24/2026(e)(f) | | | 2,527,321 | | | | 2,400,955 | | |

Olympia Acquisition, Inc., 1st Lien

Delayed Draw Term Loan,

09/24/2026(e)(h) | | | 2,425,161 | | | | (121,258 | ) | |

Olympia Acquisition, Inc., 1st Lien

Revolver, 3M LIBOR + 5.50%,

6.50%, 09/24/2024(e)(h) | | | 640,539 | | | | 565,809 | | |

OMH-HealthEdge Holdings, LLC,

1st Lien Revolver, 10/24/2024(e)(h) | | | 1,000 | | | | (10 | ) | |

OMH-HealthEdge Holdings, LLC,

1st Lien Term Loan, 6M LIBOR +

5.50%, 6.57%, 10/24/2025(e)(f) | | | 1,427,195 | | | | 1,412,923 | | |

Option Care Health, Inc., 1st Lien

Term Loan B, 1M LIBOR + 4.50%,

4.68%, 08/06/2026(i) | | | 723,480 | | | | 701,775 | | |

Ortho-Clinical Diagnostics, Inc.,

1st Lien Term Loan B, 1M LIBOR +

3.25%, 3.43%, 06/30/2025 | | | 3,592,401 | | | | 3,352,177 | | |

PAKNK Netherlands Treasury B.V.,

EUR 1st Lien Incremental Term

Loan, (Netherlands), 6M EURIBOR +

4.50%, 4.50%, 07/02/2026(e)(f) | | € | 5,334,513 | | | | 5,813,269 | | |

Senior Loans(b)(c)(d) (continued)

| | | Principal

Amount | | Value(a) | |

PetVet Care Centers, LLC, 1st Lien

Delayed Draw Term Loan,

1M LIBOR + 4.25%, 5.25%,

02/14/2025(e)(f) | | $ | 3,299,566 | | | $ | 3,233,575 | | |

Premise Health Holding Corp.,

1st Lien Delayed Draw Term Loan,

07/10/2025(e)(h) | | | 1,103 | | | | (44 | ) | |

Premise Health Holding Corp.,

1st Lien Revolver, 3M LIBOR +

3.25%, 3.64%, 07/10/2023(e)(h) | | | 1,000 | | | | 543 | | |

Premise Health Holding Corp.,

1st Lien Term Loan, 3M LIBOR +

3.50%, 3.81%, 07/10/2025(e)(f) | | | 13,654 | | | | 13,108 | | |

Premise Health Holding Corp.,

2nd Lien Term Loan, 3M LIBOR +

7.50%, 7.81%, 07/10/2026(e)(f) | | | 2,000,000 | | | | 1,940,000 | | |

ProVation Medical, Inc., 1st Lien

Last Out Term Loan, 1M LIBOR +

7.00%, 7.19%, 03/08/2024(e)(f) | | | 977,500 | | | | 967,725 | | |

RegionalCare Hospital Partners

Holdings, Inc., 1st Lien Term

Loan B, 1M LIBOR + 3.75%,

3.93%, 11/16/2025 | | | 2,865,657 | | | | 2,679,017 | | |

RTI Surgical, Inc., 2nd Lien 2nd

Amendment Incremental Delayed

Draw Term Loan, 1M LIBOR +

13.50%, 15.00%,

04/27/2021(e)(g)(h) | | | 915,319 | | | | 867,581 | | |

RTI Surgical, Inc., 2nd Lien Term

Loan, 1M LIBOR + 8.75%, 9.75%,

12/05/2023(e)(f)(g) | | | 3,216,067 | | | | 3,376,870 | | |

SCSG EA Acquisition Co., Inc.,

1st Lien Revolver, 1M LIBOR +

4.00%, 5.00%, 09/01/2022(e)(h) | | | 1,000 | | | | 162 | | |

SCSG EA Acquisition Co., Inc.,

Initial 1st Lien Term Loan,

3M LIBOR + 3.50%, 4.93%,

09/01/2023(e)(f) | | | 339,403 | | | | 319,038 | | |

SiroMed Physician Services, Inc.,

1st Lien Revolver, 3M LIBOR +

4.75%, 6.19%, 03/26/2024(e) | | | 1,000 | | | | 900 | | |

SiroMed Physician Services, Inc.,

Initial 1st Lien Term Loan,

3M LIBOR + 4.75%, 5.75%,

03/26/2024(e)(f) | | | 945,611 | | | | 851,050 | | |

Sotera Health Holdings, LLC, Initial

1st Lien Term Loan, 1M LIBOR +

4.50%, 5.50%, 12/11/2026 | | | 1,521,434 | | | | 1,483,078 | | |

Semi-Annual Report 2020

15

CION Ares Diversified Credit Fund

Schedule of Investments (continued)

June 30, 2020 (Unaudited)

Senior Loans(b)(c)(d) (continued)

| | | Principal

Amount | | Value(a) | |

Team Health Holdings, Inc., Initial

1st Lien Term Loan, 1M LIBOR +

2.75%, 3.75%, 02/06/2024 | | $ | 1,496,134 | | | $ | 1,145,291 | | |

Teligent, Inc., 1st Lien Revolver,

3M LIBOR + 5.50%, 7.00%,

06/13/2024(e)(h)(k) | | | 1,100 | | | | 758 | | |

Teligent, Inc., 2nd Lien Delayed

Draw Term Loan A, 3M LIBOR +

13.00%, 14.50%, 06/13/2024(e)(g)(k) | | | 719,982 | | | | 561,586 | | |

Teligent, Inc., 2nd Lien Term Loan,

3M LIBOR + 13.00%, 14.50%,

06/13/2024(e)(g)(k) | | | 1,275,369 | | | | 994,788 | | |

TerSera Therapeutics, LLC, 1st Lien

Term Loan, 3M LIBOR + 5.60%,

7.05%, 03/30/2023(e)(f) | | | 48,375 | | | | 47,891 | | |

United Digestive MSO Parent, LLC,

1st Lien Delayed Draw Term Loan,

3M LIBOR + 4.00%, 5.00%,

12/16/2024(e)(h) | | | 1,022,727 | | | | 282,954 | | |

United Digestive MSO Parent, LLC,

1st Lien Revolver, 3M LIBOR +

4.00%, 5.00%, 12/14/2023(e) | | | 511,364 | | | | 511,364 | | |

United Digestive MSO Parent, LLC,

1st Lien Term Loan, 3M LIBOR +

4.00%, 5.00%, 12/16/2024(e)(f) | | | 1,443,920 | | | | 1,443,920 | | |

WSHP FC Acquisition, LLC, 1st Lien

1st Amendment Delayed Draw Term

Loan, 3M LIBOR + 6.25%, 7.25%,

03/30/2024(e) | | | 1,102,778 | | | | 1,102,778 | | |

WSHP FC Acquisition, LLC, 1st Lien

1st Amendment Term Loan,

3M LIBOR + 6.25%, 7.25%,

03/30/2024(e)(f) | | | 875,556 | | | | 875,556 | | |

WSHP FC Acquisition, LLC, 1st Lien

2nd Amendment Delayed Draw

Term Loan, 03/30/2024(e)(h) | | | 350,877 | | | | — | | |

WSHP FC Acquisition, LLC, 1st Lien

2nd Amendment Term Loan,

3M LIBOR + 6.25%, 7.25%,

03/30/2024(e)(f) | | | 557,193 | | | | 557,193 | | |

WSHP FC Acquisition, LLC, 1st Lien

3rd Amendment Incremental Term

Loan, 3M LIBOR + 6.25%, 7.25%,

03/30/2024(e)(f) | | | 596,494 | | | | 596,494 | | |

WSHP FC Acquisition, LLC, 1st Lien

Delayed Draw Term Loan,

3M LIBOR + 6.25%, 7.25%,

03/30/2024(e)(f) | | | 169,244 | | | | 169,244 | | |

WSHP FC Acquisition, LLC, 1st Lien

Revolver, 3M LIBOR + 6.25%,

7.25%, 03/30/2024(e)(h) | | | 88,719 | | | | 28,390 | | |

Senior Loans(b)(c)(d) (continued)

| | | Principal

Amount | | Value(a) | |

WSHP FC Acquisition, LLC, 1st Lien

Term Loan, 3M LIBOR + 6.25%,

7.25%, 03/30/2024(e)(f) | | $ | 808,156 | | | $ | 808,156 | | |

| | | | | | 129,178,639 | | |

High Tech Industries 16.1% | |

Anaqua Parent Holdings, Inc.,

1st Lien EUR Facility Term Note B,

6M EURIBOR + 5.50%, 5.50%,

04/10/2026(e) | | € | 675,422 | | | | 743,627 | | |

Anaqua Parent Holdings, Inc.,

1st Lien Revolver, 6M LIBOR +

5.25%, 6.25%, 10/08/2025(e)(h) | | $ | 230,769 | | | | 70,000 | | |

Anaqua Parent Holdings, Inc.,

Facility 1st Lien Term Loan B,

6M LIBOR + 5.25%, 6.48%,

04/08/2026(e)(f) | | | 1,827,692 | | | | 1,772,862 | | |

Applied Systems, Inc., 2nd Lien

Term Loan, 3M LIBOR + 7.00%,

8.00%, 09/19/2025 | | | 1,000,000 | | | | 995,000 | | |

Applied Systems, Inc., Initial

1st Lien Term Loan, 3M LIBOR +

3.25%, 4.25%, 09/19/2024 | | | 1,940,954 | | | | 1,883,386 | | |

Atlanta Bidco, Ltd., EUR Facility

1st Lien Term Loan A, (Great

Britain), 6M EURIBOR + 7.00%,

7.75%, 08/23/2024(e)(f)(j) | | € | 1,000,000 | | | | 1,100,981 | | |

Cority Software Inc., 1st Lien

Revolver, (Canada), 07/02/2025(e)(h) | | $ | 230,579 | | | | (4,612 | ) | |

Cority Software Inc., 1st Lien Term

Loan, (Canada), 3M LIBOR +

5.75%, 7.21%, 07/02/2026(e)(f) | | | 1,759,074 | | | | 1,723,892 | | |

Creation Holdings, Inc., 1st Lien

Term Loan, 3M LIBOR + 5.75%,

6.75%, 08/15/2025(e)(f) | | | 2,378,432 | | | | 2,283,295 | | |

Creation Holdings, Inc., 1st Lien

Delayed Draw Term Loan,

3M LIBOR + 5.75%, 6.75%,

08/15/2025(e) | | | 448,203 | | | | 430,275 | | |

Creation Holdings, Inc., 1st Lien

Revolver, 1M LIBOR + 5.75%,

6.75%, 08/15/2024(e)(h) | | | 544,813 | | | | 341,416 | | |

Cvent, Inc., 1st Lien Term Loan,

1M LIBOR + 3.75%, 3.93%,

11/29/2024 | | | 2,754,131 | | | | 2,353,625 | | |

Datix Bidco, Ltd., 1st Lien Term

Loan B-3, (Great Britain),

6M LIBOR + 4.50%, 5.36%,

04/28/2025(e)(f) | | | 1,384,627 | | | | 1,343,088 | | |

Semi-Annual Report 2020

16

CION Ares Diversified Credit Fund

Schedule of Investments (continued)

June 30, 2020 (Unaudited)

Senior Loans(b)(c)(d) (continued)

| | | Principal

Amount | | Value(a) | |

Datix Bidco, Ltd., Additional Facility

1st Lien Term Loan, (Great Britain),

6M LIBOR + 4.50%, 5.36%,

04/28/2025(e)(f) | | $ | 466,003 | | | $ | 452,023 | | |

Datix Bidco, Ltd., Facility 1st Lien

Term Loan B-1, (Great Britain),

6M LIBOR + 4.50%, 5.36%,

04/28/2025(e)(f) | | | 1,000,000 | | | | 970,000 | | |

Doxim, Inc., 1st Lien Last Out

Delayed Draw Term Loan,

3M LIBOR + 6.00%, 7.00%,

02/28/2024(e) | | | 327,399 | | | | 320,851 | | |

Doxim, Inc., 1st Lien Last Out

Term Loan, 3M LIBOR + 6.00%,

7.00%, 02/28/2024(e)(f) | | | 714,286 | | | | 700,000 | | |

DRB Holdings, LLC, 1st Lien

Revolver, 10/06/2023(e)(h) | | | 1,000 | | | | — | | |

DRB Holdings, LLC, Initial 1st Lien

Term Loan, 3M LIBOR + 5.75%,

6.75%, 10/06/2023(e)(f) | | | 486,525 | | | | 486,525 | | |

Elemica Parent, Inc., 1st Lien

Delayed Draw Term Loan,

09/18/2025(e)(h) | | | 561,538 | | | | (39,308 | ) | |

Elemica Parent, Inc., 1st Lien

Revolver, 3M LIBOR + 5.50%,

5.78%, 09/18/2025(e)(h) | | | 478,712 | | | | 317,147 | | |

Elemica Parent, Inc., 1st Lien Term

Loan, 3M LIBOR + 5.50%, 5.81%,

09/18/2025(e) | | | 2,879,520 | | | | 2,677,953 | | |

eResearch Technology, Inc.,

2nd Lien Delayed Draw Term Loan,

02/04/2028(e)(h) | | | 1,343,232 | | | | (40,297 | ) | |

eResearch Technology, Inc., Initial

2nd Lien Term Loan, 1M LIBOR +

8.00%, 8.50%, 02/04/2028(e)(f) | | | 5,305,768 | | | | 5,146,595 | | |

Frontline Technologies Intermediate

Holdings, LLC (fka Project Dublin

Intermediate Target, LLC), 1st Lien

Delayed Draw Term Loan,

3M LIBOR + 5.75%, 6.75%,

09/18/2023(e) | | | 56,721 | | | | 56,154 | | |

Frontline Technologies Intermediate

Holdings, LLC (fka Project Dublin

Intermediate Target, LLC), 1st Lien

Term Loan, 3M LIBOR + 5.75%,

6.75%, 09/18/2023(e)(f) | | | 461,098 | | | | 456,487 | | |

GlobalFoundries, Inc., Initial 1st

Lien Term Loan, 3M LIBOR +

4.75%, 5.06%, 06/05/2026(e) | | | 1,989,950 | | | | 1,910,352 | | |

GraphPAD Software, LLC, 1st Lien

Revolver, 12/21/2023(e)(h) | | | 1,000 | | | | — | | |

Senior Loans(b)(c)(d) (continued)

| | | Principal

Amount | | Value(a) | |

GraphPAD Software, LLC, 1st Lien

Term Loan, 12M LIBOR + 6.00%,

7.00%, 12/21/2023(e)(f) | | $ | 1,590,867 | | | $ | 1,590,867 | | |

Greeneden U.S. Holdings I, LLC,

1st Lien Term Loan B, 1M LIBOR +

3.25%, 3.43%, 12/01/2023 | | | 780,339 | | | | 749,547 | | |

Huskies Parent, Inc., 1st Lien

Closing Date Term Loan,

1M LIBOR + 4.00%, 4.18%,

07/31/2026(e) | | | 2,728,888 | | | | 2,660,666 | | |

Idera, Inc., Initial 1st Lien Term

Loan, 6M LIBOR + 4.00%, 5.08%,

06/28/2024 | | | 2,578,483 | | | | 2,475,344 | | |

Infoblox, Inc., 1st Lien Term Loan,

1M LIBOR + 4.50%, 4.68%,

11/07/2023(i) | | | 2,354,269 | | | | 2,309,138 | | |

Informatica, LLC, 1st Lien Term

Loan, 1M LIBOR + 3.25%, 3.43%,

02/25/2027 | | | 969,480 | | | | 925,854 | | |

Informatica, LLC, Initial 2nd Lien

Term Loan, 7.13%, 02/25/2025 | | | 1,411,898 | | | | 1,410,133 | | |

Invoice Cloud, Inc., 1st Lien

Delayed Draw Term Loan,

3M LIBOR + 3.25%, 7.50%,

02/11/2024(e)(g)(h) | | | 1,197,849 | | | | 1,070,189 | | |

Invoice Cloud, Inc., 1st Lien

Revolver, 02/11/2024(e)(h) | | | 255,319 | | | | — | | |

Invoice Cloud, Inc., 1st Lien Term

Loan, 3M LIBOR + 3.25%, 7.50%,

02/11/2024(e)(g) | | | 2,660,281 | | | | 2,660,281 | | |

IQS, Inc., 1st Lien Incremental

Term Loan, 2019, 3M LIBOR +

5.75%, 7.21%, 07/02/2026(e)(f) | | | 547,267 | | | | 536,322 | | |

IQS, Inc., 1st Lien Incremental

Term Loan, 2020, 3M LIBOR +

5.75%, 7.21%, 07/02/2026(e)(f) | | | 1,107,565 | | | | 1,085,414 | | |

Ishtar Bidco Norway AS, Facility

1st Lien Term Loan B, (Great

Britain), 6M GBP LIBOR + 7.25%,

8.00%, 11/26/2025(e)(f)(j) | | £ | 1,000,000 | | | | 1,238,999 | | |

MA FinanceCo., LLC, Tranche

1st Lien Term Loan B-4,

3M LIBOR + 4.25%, 5.25%,