UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-23165

CION ARES DIVERSIFIED CREDIT FUND

(Exact name of registrant as specified in charter)

3 PARK AVENUE

36TH FLOOR

NEW YORK, NEW YORK 10016

(Address of principal executive offices)(Zip code)

Eric A. Pinero 3 Park Avenue, 36th Floor New York, New York 10016 (Name and Address of Agent for Service) |

| | Copy to: | |

Michael A. Reisner Mark Gatto CION Ares Diversified Credit Fund 3 Park Avenue, 36th Floor New York, New York 10016 | | Richard Horowitz, Esq. Jonathan Gaines, Esq. Dechert LLP 1095 Avenue of the Americas New York, New York 10036 |

| | | |

Registrant’s telephone number, including area code: (646) 845-2577

Date of fiscal year end: December 31

Date of reporting period: January 1, 2022 - June 30, 2022

Item 1. Report to Stockholders.

(a)

CION Ares Diversified Credit Fund

SEMI-ANNUAL REPORT

JUNE 30, 2022

CION Ares Diversified Credit Fund

Letter to Shareholders | | | 2 | | |

Fund Profile & Financial Data | | | 5 | | |

Consolidated Schedule of Investments | | | 7 | | |

Consolidated Statement of Assets and Liabilities | | | 99 | | |

Consolidated Statement of Operations | | | 101 | | |

Consolidated Statements of Changes in Net Assets | | | 102 | | |

Consolidated Statement of Cash Flows | | | 104 | | |

Financial Highlights | | | 106 | | |

Notes to Consolidated Financial Statements | | | 114 | | |

Proxy & Portfolio Information | | | 142 | | |

Dividend Reinvestment Plan | | | 143 | | |

Corporate Information | | | 145 | | |

Privacy Notice | | | 146 | | |

Trustees and Executive Officers | | | 147 | | |

Approval of Investment Advisory Agreement and Investment

Sub-Advisory Agreement | | | 151 | | |

Semi-Annual Report 2022

CION Ares Diversified Credit Fund

Letter to Shareholders

June 30, 2022

Fellow Shareholders,

We are pleased to present the semi-annual report for the CION Ares Diversified Credit Fund (the "Fund"), for the period ending June 30, 2022. The Fund has continued to experience steady asset growth over the last six months, bringing total assets to $3.4 billion as of June 30, 2022. The Fund returned -3.2% for the year-to-date period through June 30, outperforming leveraged credit, traditional fixed income, and equity markets owing to the Fund's defensive and diversified investment posture1. As of period-end, the Fund had 600 total investments, spread across 25 unique industries. Secured debt instruments accounted for 91.9%2 of the Fund and more than 60% of the Fund was deployed in investments directly originated by the Ares platform. The Fund's relative value strategy across liquid and illiquid credit allowed us to capitalize quickly on market opportunities, which has been beneficial as volatility continues to permeate global markets amid persistent inflation and growing recessionary concerns.

Investment Philosophy and Process

The Fund employs a dynamic asset allocation framework that seeks to offer enhanced yield and downside risk mitigation, while enabling the manager to respond to changing market conditions. We believe that the differentiated, diversified portfolio of directly originated and liquid investments can provide superior risk-adjusted returns for our shareholders. Active management across a broad spectrum of credit asset classes, including direct lending in the United States and Europe, high yield bonds, leveraged loans, structured credit, real estate debt, and other credit instruments provides the opportunity to generate attractive risk-adjusted returns by capturing the best relative value.

The Fund's investment process is rigorous and incorporates top-down and bottom-up factors. The Fund's adviser, CION Ares Management ("CAM" or the "Adviser"), leverages the resources of the broader Ares platform to conduct ongoing proprietary analysis at the asset-class level that compares current market conditions with historical and industry-level precedents to examine the rate environment, correlation to public markets, and local/regional risks. This information is brought before the investment allocation committee in semimonthly meetings, where senior members overseeing each of the underlying asset classes share their observations with the Adviser's portfolio managers.

Investment Environment

Following a rapid rise in interest rates at the start of the year, market sentiment was decidedly "risk-off" during the second quarter as inflationary pressures continued to challenge global economies, supply chain dynamics, and consumer sentiment. Inflation remained elevated and ended the first half of the year at 9.1%, the highest level since 19813, largely driven by elevated commodity prices. In an effort to combat inflation, central banks continued to be aggressive, with the Federal Reserve ("Fed") hiking interest rates by 75 basis points in June, their largest hike since 1994. Rising input costs began to impact companies and consumers as well. While corporate earnings largely beat expectations, 70% of the S&P 500 companies cited "supply chain" on their earnings calls, often in the context of forward guidance cuts4. Meanwhile, consumer sentiment ticked lower in response to higher prices and a lack of fiscal stimulus to rely on. Further, global economic growth forecasts were reduced and recessionary fears grew as investors speculated whether central banks could engineer a "soft landing" amid a decelerating macroeconomic backdrop.

From a performance perspective, dispersion across asset classes, industries, ratings cohorts and individual companies remained elevated as the uncertain environment weighed on sentiment and contributed to a "risk-off" tone in public equity and credit markets. The syndicated loan market was one of the better performing asset classes on a relative basis, returning -4.45% and -6.78% in the U.S. and Europe for the year-to-date period5, respectively, as floating rate assets were insulated from the rates driven sell-off at the start of the year. As the first half of 2022 progressed, focus shifted from rate risk to credit risk as the war in Ukraine escalated, growth slowed, and financial conditions tightened. High yield bonds endured their second largest spread widening since 2008 during June, contributing to year-to-date returns of -14.04% and -14.86% in the U.S. and Europe5, respectively. Higher beta, lower quality assets underperformed in both loans and bonds, and even more reflective of the broader aversion to risk, equities returned -19.97% over the period6. Specific to structured credit, CLO secondary spreads widened and primary market volumes were muted due to weakness in the underlying loan market. On the private side, while slower to reprice, issuance slowed in the middle market as macro uncertainty impacted origination trends and lending terms, but demand was steady as all-in yields drifted upward on the back of increased reference rates.

Semi-Annual Report 2022

2

CION Ares Diversified Credit Fund

Letter to Shareholders (continued)

June 30, 2022

Defaults have ticked up but remain below historical averages and while we believe a recession is likely, we do not expect default rates to spike. Central banks continue to signal that growth may be hindered until inflation comes under control, but issuers are well-positioned to service their debt, maturities have been pushed out and liquidity shored up. Therefore, even if a recession is deeper and more protracted than we expect, we take comfort in the healthier corporate and consumer balance sheets than leading up to prior recessions from a fundamental perspective.

Looking forward, the global economy presents a mixed picture as we enter the second half of 2022. Credit markets continue to be under pressure amid a risk-off environment and sustained macro uncertainty as record-high inflation, tighter financial conditions, and growing recession risk continue to weigh on investor sentiment. In the U.S., real consumer spending has started to contract, and the latest manufacturing data was weaker than expected. Despite slowing growth, global central banks remain focused on combating inflation and restoring price stability by raising interest rates. While commodity prices have recently declined, the risk of energy prices spiking higher in the coming months lingers as a result of the conflict between Russia and the West. Despite weakness in the economy, employment and labor income remain robust, investment spending continues to grow and balance sheets remain healthy.

As a result of the Fund's dynamic rotation and wider spread levels, the portfolio's yield has increased by approximately 300 basis points over the year-to-date period, which we believe has created an attractive entry point for yield-focused investors. We believe attractive risk-adjusted return opportunities lie ahead in the private markets, which have begun to reprice and tilt towards more defensive structures as companies and private equity sponsors seek to mitigate execution risk that is present in capital markets. It is in this type of environment that scaled providers of flexible capital, such as Ares, are able to directly originate attractive risk-adjusted return opportunities. While we don't anticipate increasing the Fund's public markets exposure in the near term, we continue to actively "high grade" our allocation in this cohort by adding shorter duration, higher convexity credits. We are closely monitoring macroeconomic headwinds and proactively managing exposures to identify relative value opportunities created by shifts in sentiment on rates, growth expectations, and idiosyncratic credit news. In today's rapidly evolving investment environment, we believe credit selection and active portfolio management will continue to be paramount.

Summary

Choppy market conditions are expected in the months ahead and we believe our scaled platform, tenured experience and cycle-tested investment process will allow us to successfully navigate these changing market environments as we seek to take advantage of bouts of volatility. We are pleased with the ongoing construction of the Fund's diversified portfolio, and we believe the Fund is well positioned to find relative opportunities in a volatile market environment given our emphasis on senior secured, floating rate, directly originated assets in defensive, non-cyclical, service-based sectors. Our Adviser will continue to seek to leverage Ares' position as a global leader in credit markets to identify attractive investment opportunities in line with the stated objective of the Fund.

We thank you for your investment in and continued support of CION Ares Diversified Credit Fund.

Sincerely,

| |

| |

Mitch Goldstein

Portfolio Manager

CION Ares Diversified Credit Fund | | Greg Margolies

Portfolio Manager

CION Ares Diversified Credit Fund | |

Views expressed are those of CION Ares Management as of the date of this communication, are subject to change at any time, and may differ from the views of other portfolio managers or of Ares as a whole. Although these views are not intended to be a forecast of future events, a guarantee of futures results, or investment advice, any forward-looking statements are not reliable indicators of future events and no guarantee is given that such activities will occur as expected or at all. Information contained herein has been obtained from sources believed to be reliable, but the accuracy and completeness of the information cannot be guaranteed. CION Ares Management does not undertake any obligation to publicly update or review any forward-looking information, whether as a result of new information, future developments or otherwise, except as required by law. All investments involve risk, including possible loss of principal. Past performance is not indicative of future results.

Semi-Annual Report 2022

3

CION Ares Diversified Credit Fund

Letter to Shareholders (continued)

June 30, 2022

The novel coronavirus ("COVID-19") pandemic has adversely impacted global commercial activity and contributed to significant volatility in the capital markets. Many states have issued orders requiring the closure of, or certain restrictions on the operation of certain businesses. Such actions and effects remain ongoing and the ultimate duration and severity of the COVID-19 pandemic, including COVID-19 variants, such as the recent Delta and Omicron variants, remain uncertain. The COVID-19 pandemic and restrictive measures taken to contain or mitigate its spread have caused, and are continuing to cause, business shutdowns, or the reintroduction of business shutdowns, cancellations of events and restrictions on travel, significant reductions in demand for certain good and services, reductions in business activity and financial transactions, supply chain interruptions, labor shortages, increased inflationary pressure and overall economic and financial market instability both globally and in the United States. While several countries, as well as certain states, counties and cities in the United States, relaxed the public health restrictions throughout 2021 partly as a result of the introduction of vaccines, recurring COVID-19 outbreaks caused by different virus variants continue to lead to the reintroduction of certain restrictions in certain states in the United States and globally. Any public health emergency, including any outbreak of COVID-19 or other existing or new epidemic diseases, or the threat thereof, and the resulting financial and economic market uncertainty could have a significant adverse impact on the Fund, the value of its investments and its portfolio companies. The performance information herein is as of June 30, 2022 and not all of the effects, directly and indirectly, resulting from COVID-19 and/or the current market environment, may be reflected herein. The full impact of COVID-19 and its ultimate potential effects on portfolio company performance and valuations is particularly uncertain and difficult to predict.

CION Securities, LLC ("CSL") is the wholesale marketing agent for CION Ares Diversified Credit Fund ("CADC" or the "Fund"), advised by CION Ares Management, LLC ("CAM") and distributed by ALPS Distributors, Inc ("ADI"). CSL, member FINRA, and CAM are not affiliated with ADI, member FINRA. Certain Ares funds' securities are offered through its affiliate, Ares Wealth Management Solutions ("AWMS"), a broker-dealer registered with the SEC, and a member of FINRA and SIPC.

1 Please refer to the "Investment Environment" portion for the list of referenced benchmarks and quantified year-to-date returns. Past performance is not indicative of future results. Performance shown here is the I-Share Class. The I-Share was incepted on July 12, 2017. Returns include reinvestment of distributions and reflect fund expenses inclusive of recoupment of previously provided expense support. The estimated expense ratio is 3.88%. Expense ratios are annualized and calculated as a percentage of estimated average net assets. Share values will fluctuate, therefore if repurchased, they may be worth more or less than their original cost.

2 Secured Debt Includes First and Second Lien assets, Structured Credit Debt, Structured Credit Equity (excluding cash).

3 Source: U.S. Bureau of Labor Statistics.

4 Source: Factset as of May 27, 2022.

5 Source: Credit Suisse, ICE BofA. As of June 30, 2022.

6 Source: S&P 500 as of June 30, 2022.

Semi-Annual Report 2022

4

CION Ares Diversified Credit Fund

Fund Fact Sheet — As of June 30, 2022

CLASS A CADEX | CLASS C CADCX | CLASS I CADUX | CLASS L CADWX

CLASS U CADZX | CLASS U2 CADSX | CLASS W CADFX

FUND OVERVIEW

CION Ares Diversified Credit Fund (CADC) is a diversified, unlisted closed-end management investment company registered under the 1940 Act as an interval fund. The Fund will seek to capitalize on market inefficiencies and relative value opportunities by dynamically allocating a portfolio of directly originated loans, secured floating and fixed rate syndicated loans, corporate bonds, asset-backed securities, commercial real estate loans and other types of credit instruments which, under normal circumstances, will represent at least 80% of the Fund's assets.

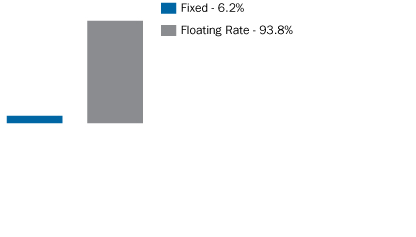

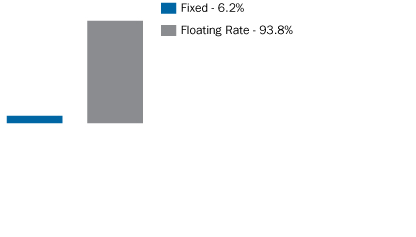

Fixed vs. Floating Rate

Excludes cash, other net assets and equity instruments.

KEY FACTS

TOTAL MANAGED ASSETS* | | ~$3.43B | |

DISTRIBUTIONS1 | | Monthly | |

TOTAL ISSUES | | | 600 | | |

SHARE CLASS | | CURRENT

INCEPTION | | DISTRIBUTION

RATE2 | | STANDARD

DEVIATION3 | | SHARPE RATIO4

(ANNUALIZED) | |

CLASS A | | 1/26/2017 | | | 5.75 | % | | | 4.05 | % | | | 0.90 | | |

CLASS C | | 7/12/2017 | | | 5.79 | % | | | 4.08 | % | | | 0.87 | | |

CLASS I | | 7/12/2017 | | | 5.94 | % | | | 4.06 | % | | | 0.96 | | |

CLASS L | | 11/2/2017 | | | 5.98 | % | | | 4.18 | % | | | 0.84 | | |

CLASS U | | 7/25/2019 | | | 5.72 | % | | | 5.04 | % | | | 0.59 | | |

CLASS U-2 | | 4/13/2020 | | | 5.73 | % | | | 3.19 | % | | | 3.17 | | |

CLASS W | | 12/4/2018 | | | 5.94 | % | | | 4.67 | % | | | 0.84 | | |

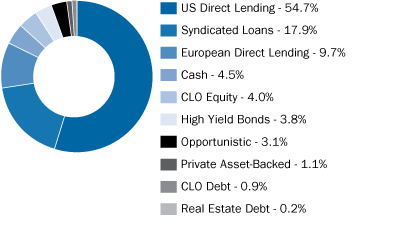

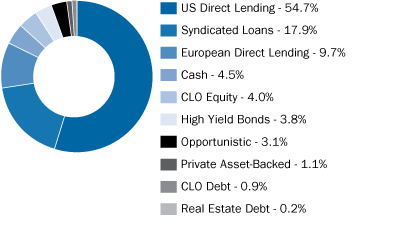

Portfolio Allocation*

Allocation by Asset Type

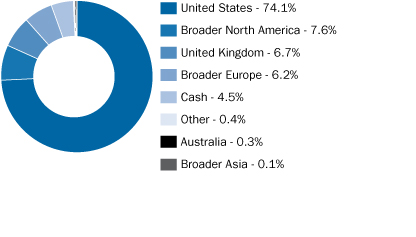

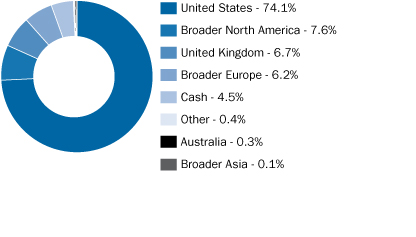

Allocation by Geography

Top 10 Holdings* % of Portfolio

Mimecast | | | 1.4 | % | |

Kaseya | | | 1.3 | % | |

Global Medical Response, Inc. | | | 1.2 | % | |

TurnPoint Services | | | 1.0 | % | |

eCapital | | | 1.0 | % | |

Conservice Midco, LLC | | | 1.0 | % | |

High Street Insurance Partners | | | 1.0 | % | |

Cornerstone OnDemand, Inc. | | | 0.9 | % | |

Shermco Intermediate Holdings, Inc. | | | 0.9 | % | |

Athenahealth | | | 0.9 | % | |

Allocation by Industry* % of Portfolio

Software & Services | | | 23.1 | % | |

Commercial & Professional Services | | | 9.2 | % | |

Health Care Equipment & Services | | | 9.1 | % | |

Capital Goods | | | 6.9 | % | |

Structured Products | | | 6.6 | % | |

Diversified Financials | | | 6.3 | % | |

Insurance | | | 5.4 | % | |

Consumer Services | | | 5.4 | % | |

Other | | | 23.4 | % | |

Cash | | | 4.5 | % | |

* Holdings and allocations, unless otherwise indicated, are based on the total managed assets and subject to change without notice. Total managed assets is defined as the total assets (including any assets attributable to financial leverage) minus accrued liabilities (other than debt representing financial leverage). Data shown is for informational purposes only and not a recommendation to buy or sell any security.

Semi-Annual Report 2022

5

CION Ares Diversified Credit Fund

Fund Fact Sheet — As of June 30, 2022 (continued)

CLASS A CADEX | CLASS C CADCX | CLASS I CADUX | CLASS L CADWX

CLASS U CADZX | CLASS U2 CADSX | CLASS W CADFX

MANAGEMENT TEAM

• Mitch Goldstein, Co-Head of Ares Credit Group | 27 Years of Experience

• Greg Margolies, Partner, Ares Management | 34 Years of Experience

• CADC's allocation committee consists of an additional 13 members, averaging nearly 25 years of experience.

ABOUT CION INVESTMENTS

CION Investments is a leading manager of investment solutions designed to redefine the way individual investors can build their portfolios and help meet their long-term investment goals. With more than 30 years of experience in the alternative asset management industry, CION strives to level the playing field. CION currently manages CION Investment Corporation, a leading BDC, and sponsors, through CION Ares Management, CION Ares Diversified Credit Fund, a globally diversified interval fund.

ABOUT ARES MANAGEMENT

Ares Management Corporation (NYSE: ARES) is a leading global alternative investment manager offering clients complementary primary and secondary investment solutions across the credit, private equity, real estate and infrastructure asset classes. Ares Management Corporation seeks to provide flexible capital to support businesses and create value for its stakeholders and within its communities. By collaborating across its investment groups, Ares Management Corporation aims to generate consistent and attractive investment returns throughout market cycles. As of June 30, 2022, Ares Management Corporation's global platform had approximately $334 billion of assets under management, with over 2,300 employees operating across North America, Europe, Asia Pacific and the Middle East. For more information, please visit www.aresmgmt.com.

RISK DISCLOSURES & GLOSSARY

Risks and limitations include, but are not limited to, the following: investment instruments may be susceptible to economic downturns; most of the underlying credit instruments are rated below investment grade and considered speculative; there is no guarantee all shares can be repurchased; the Fund's business and operations may be impacted by fluctuations in the capital markets; the Fund is a diversified, closed-end investment company with limited operating history; diversification does not eliminate the risk of investment losses.

1 Monthly Distributions — There is no assurance monthly distributions paid by the fund will be maintained at the targeted level or paid at all.

2 Current Distribution Rate — Current distribution rate is expressed as a percentage equal to the projected annualized distribution amount (which is calculated by annualizing the current cash distribution per share without compounding), divided by the net asset value. The current distribution rate shown may be rounded.

3 Standard Deviation — a risk-adjusted measure that measures reward per unit of risk. The higher the Sharpe Ratio, the better. The numerator is the difference between a portfolio's return and the return of a risk-free instrument. The denominator is the portfolio's standard deviation. Figures shown here are based on non-loaded daily NAV total returns utilizing data since inception.

4 Sharpe Ratio — a widely used measure of an investment's performance volatility. Standard deviation shows how much variation from the mean exists with a larger number indicating the data points are more spread out over a larger range of values. Figures shown here are based on non-loaded daily NAV total returns utilizing data since inception.

A portion of distributions may be a direct result of expense support payments provided by CION Ares Management, LLC (CAM), which are subject to repayment by CADC within three years. The purpose of this arrangement is to ensure that CADC bears an appropriate level of expenses. Any such distributions may not be entirely based on investment performance and can only be sustained if positive investment performance is achieved in future periods and/or CAM continues to make such expense support payments. Future repayments will reduce cash otherwise potentially available for distributions. There can be no assurance that such performance will be achieved in order to sustain these distributions. CAM has no obligation to provide expense support payments in future periods.

CADC may fund distributions from unlimited amounts of offering proceeds or borrowings, which may constitute a return of capital, as well as net income from operations, capital and non-capital gains from the sale of assets, dividends or distributions from equity investments and expense support payments from CAM, which are subject to repayment. For the year ending December 31, 2021, distributions were paid from taxable income and did not include a return of capital for tax purposes. If expense support payments from CAM were not provided, some or all of the distributions may have been a return of capital which would reduce the available capital for investment. The sources of distributions may vary periodically. Please refer to the semi-annual or annual reports filed with the SEC for the sources of distributions.

Semi-Annual Report 2022

6

CION Ares Diversified Credit Fund

Consolidated Schedule of Investments

June 30, 2022 (Unaudited)

(in thousands, except shares, percentages and as otherwise noted)

Senior Loans(b)(c)(d)

Company | | Country(a) | | Investment | | Interest | | Maturity

Date | | Acquisition

Date | | Shares | | Principal

Amount(a) | | Fair Value(a) | | Percentage

of Net

Assets | |

Automobiles & Components | |

Automotive Keys

Group, LLC | | | | 1st Lien Term

Loan | | 7.25% (3M

LIBOR +

5.00%) | | 11/6/2025 | | | | | | $ | 1,767 | | | $ | 1,732 | (e)(f) | | | |

Continental

Acquisition

Holdings, Inc. | | | | 1st Lien

Revolver | | 5.53

(SOFR +

3.50%)% | | 1/20/2026 | | | | | | | 1 | | | | 1 | (e)(h) | | | |

Continental

Acquisition

Holdings, Inc. | | | | 1st Lien Term

Loan | | 9.00% (3M

LIBOR +

6.75%) | | 1/20/2027 | | | | | | | 5,989 | | | | 5,989 | (e)(f) | | | |

Continental

Acquisition

Holdings, Inc. | | | | 1st Lien

Delayed Draw

Term Loan | | 9.00% (3M

LIBOR +

6.75%) | | 1/20/2027 | | | | | | | 1,454 | | | | 1,454 | (e)(f) | | | |

Highline

Aftermarket

Acquisition, LLC | | | | 1st Lien

Revolver | | 7.50

(PRIME +

3.75%)% | | 11/10/2025 | | | | | | | 1 | | | | — | (e)(h) | | | |

Highline

Aftermarket

Acquisition, LLC | | | | 1st Lien Term

Loan | | 6.17% (3M

LIBOR +

4.50%) | | 11/9/2027 | | | | | | | 4,436 | | | | 3,881 | (f)(i) | | | |

Highline

Aftermarket

Acquisition, LLC | | | | 2nd Lien Term

Loan | | 10.24% (3M

LIBOR +

8.00%) | | 11/9/2028 | | | | | | | 5,942 | | | | 5,407 | (e)(f) | | | |

Highline

Aftermarket

Acquisition, LLC | | | | 2nd Lien

Delayed Draw

Term Loan | | 10.24% (3M

LIBOR +

8.00%) | | 11/9/2028 | | | | | | | 4,209 | | | | 3,830 | (e) | | | |

Mavis Tire

Express Services

Topco Corp. | | | | 1st Lien

Revolver | | | | 5/4/2026 | | | | | | | 1 | | | | — | (e)(h) | | | |

Sun Acquirer

Corp. | | | | 1st Lien

Revolver | | 9.50

(PRIME +

4.75%)% | | 9/8/2027 | | | | | | | 1,059 | | | | 106 | (e)(h) | | | |

Sun Acquirer

Corp. | | | | 1st Lien Term

Loan | | 7.42% (3M

LIBOR +

5.75%) | | 9/8/2028 | | | | | | | 8,339 | | | | 8,339 | (e) | | | |

Sun Acquirer

Corp. | | | | 1st Lien

Delayed Draw

Term Loan | | | | 9/8/2028 | | | | | | | 1,370 | | | | — | (e)(h) | | | |

Sun Acquirer

Corp. | | | | 1st Lien

Delayed Draw

Term Loan | | 7.42% (3M

LIBOR +

5.75%) | | 9/8/2028 | | | | | | | 4,856 | | | | 2,736 | (e)(h) | | | |

Truck Hero, Inc. | | | | 1st Lien Term

Loan | | 5.17

LIBOR +

3.50%)% (1M | | 1/31/2028 | | | | | | | 9,010 | | | | 8,037 | | | | |

Wand Newco 3,

Inc. | | | | 1st Lien Term

Loan | | 4.67

LIBOR +

3.00%)% (1M | | 2/5/2026 | | | | | | | 10,154 | | | | 9,405 | | | | |

Wand Newco 3,

Inc. | | | | 2nd Lien Term

Loan | | 8.92

LIBOR +

7.25%)% (1M | | 2/5/2027 | | | | | | | 3,000 | | | | 2,940 | (e)(f) | | | |

| | | | | | | | | | | | | | | | | | 53,857 | | | | 2.29 | % | |

Semi-Annual Report 2022

7

CION Ares Diversified Credit Fund

Consolidated Schedule of Investments (continued)

June 30, 2022 (Unaudited)

(in thousands, except shares, percentages and as otherwise noted)

Senior Loans(b)(c)(d) (continued)

Company | | Country(a) | | Investment | | Interest | | Maturity

Date | | Acquisition

Date | | Shares | | Principal

Amount(a) | | Fair Value(a) | | Percentage

of Net

Assets | |

Capital Goods | |

AIM Acquisition,

LLC | | | | 1st Lien

Revolver | | | | 12/2/2025 | | | | | | $ | 457 | | | $ | (9 | )(e)(h) | | | �� |

AIM Acquisition,

LLC | | | | 1st Lien Term

Loan | | 7.33% (3M

LIBOR +

5.25%) | | 12/2/2025 | | | | | | | 212 | | | | 207 | (e)(f) | | | |

AllClear Military

Inc. | | | | 1st Lien Term

Loan | | | | 8/10/2025 | | | | | | | 2,142 | | | | 1,071 | (e)(i)(j) | | | |

Alliance Laundry

Systems LLC | | | | 1st Lien Term

Loan | | 4.52% (3M

LIBOR +

3.50%) | | 10/8/2027 | | | | | | | 7,930 | | | | 7,519 | | | | |

Artera Services,

LLC | | | | 1st Lien Term

Loan | | 5.75% (3M

LIBOR +

3.50%) | | 3/6/2025 | | | | | | | 874 | | | | 689 | | | | |

BlueHalo Global

Holdings, LLC | | | | 1st Lien

Revolver | | 7.67

LIBOR +

6.00%)% (1M | | 10/31/2025 | | | | | | | 759 | | | | 343 | (e)(h) | | | |

BlueHalo Global

Holdings, LLC | | | | 1st Lien Term

Loan | | 8.25% (3M

LIBOR +

6.00%) | | 10/31/2025 | | | | | | | 4,110 | | | | 4,069 | (e)(f) | | | |

Box Bidco

Limited | | United

Kingdom | | 1st Lien Term

Loan | | 8.17

LIBOR +

6.10%)% (6M | | 11/24/2028 | | | | | | | 1,691 | | | | 1,691 | (e)(f) | | | |

Box Bidco

Limited | | United

Kingdom | | 1st Lien Term

Loan | | 7.83

EURIBOR +

7.83%)% (1M | | 11/24/2028 | | | | | | € | 878 | | | | 921 | (e)(f) | | | |

Clarios

Global LP | | Canada | | 1st Lien Term

Loan | | 4.92

LIBOR +

3.25%)% (1M | | 4/30/2026 | | | | | | | 4,925 | | | | 4,586 | | | | |

CP Atlas

Buyer Inc | | | | 1st Lien Term

Loan | | 5.42

LIBOR +

3.75%)% (1M | | 11/23/2027 | | | | | | | 7,652 | | | | 6,699 | | | | |

Dynamic NC

Aerospace

Holdings, LLC | | | | 1st Lien

Revolver | | | | 12/30/2025 | | | | | | | 1,296 | | | | (13 | )(e)(h) | | | |

Dynamic NC

Aerospace

Holdings, LLC | | | | 1st Lien Term

Loan | | 7.50

LIBOR +

6.50%)% (6M | | 12/30/2026 | | | | | | | 3,293 | | | | 3,260 | (e)(f) | | | |

Dynasty

Acquisition

Co., Inc. | | | | 1st Lien Term

Loan | | 5.17% (3M

LIBOR +

3.50%) | | 4/6/2026 | | | | | | | 5,104 | | | | 4,693 | | | | |

Electro Rent

Corporation | | | | 2nd Lien Term

Loan | | 10.57% (3M

LIBOR +

9.00%) | | 1/31/2025 | | | | | | | 5,535 | | | | 5,480 | (e)(f) | | | |

Electro Rent

Corporation | | | | 2nd Lien Term

Loan | | 10.24% (3M

LIBOR +

9.00%) | | 1/31/2025 | | | | | | | 3,690 | | | | 3,653 | (e)(f) | | | |

Eleda BidCo AB

(fka EISG

BidCo AB) | | Sweden | | 1st Lien Term

Loan | | | | 9/30/2026 | | | | | | SEK | 12,758 | | | | — | (e)(h)(i) | | | |

Semi-Annual Report 2022

8

CION Ares Diversified Credit Fund

Consolidated Schedule of Investments (continued)

June 30, 2022 (Unaudited)

(in thousands, except shares, percentages and as otherwise noted)

Senior Loans(b)(c)(d) (continued)

Company | | Country(a) | | Investment | | Interest | | Maturity

Date | | Acquisition

Date | | Shares | | Principal

Amount(a) | | Fair Value(a) | | Percentage

of Net

Assets | |

Eleda BidCo AB

(fka EISG

BidCo AB) | | Sweden | | 1st Lien Term

Loan | | 6.59% (3M

STIBOR +

6.50%) | | 6/30/2026 | | | | | | SEK | 21,000 | | | $ | 2,053 | (e)(f) | | | |

Eleda BidCo AB

(fka EISG

BidCo AB) | | Sweden | | 1st Lien Term

Loan | | 7.80% (3M

STIBOR +

7.00%) | | 6/30/2026 | | | | | | SEK | 24,107 | | | | 2,357 | (e)(f) | | | |

Eleda BidCo AB

(fka EISG

BidCo AB) | | Sweden | | 1st Lien

Delayed Draw

Term Loan | | | | 6/30/2026 | | | | | | SEK | 8,000 | | | | — | (e)(h)(i) | | | |

Eleda BidCo AB

(fka EISG

BidCo AB) | | Sweden | | 1st Lien

Delayed Draw

Term Loan | | 6.59% (3M

STIBOR +

6.50%) | | 6/30/2026 | | | | | | SEK | 9,070 | | | | 887 | (e)(f) | | | |

EPS NASS

Parent, Inc. | | | | 1st Lien

Revolver | | 8.00

LIBOR +

5.75%)% (1M | | 4/17/2026 | | | | | | | 158 | | | | 17 | (e)(h) | | | |

EPS NASS

Parent, Inc. | | | | 1st Lien Term

Loan | | 8.00% (3M

LIBOR +

5.75%) | | 4/19/2028 | | | | | | | 5,803 | | | | 5,803 | (e)(f) | | | |

EPS NASS

Parent, Inc. | | | | 1st Lien

Delayed Draw

Term Loan | | 8.00% (3M

LIBOR +

5.75%) | | 4/19/2028 | | | | | | | 585 | | | | 327 | (e)(h) | | | |

Kene

Acquisition, Inc. | | | | 1st Lien

Revolver | | 6.50% (3M

LIBOR +

4.25%) | | 8/8/2024 | | | | | | | 676 | | | | 263 | (e)(h) | | | |

Kene

Acquisition, Inc. | | | | 1st Lien Term

Loan | | 6.50% (3M

LIBOR +

4.25%) | | 8/10/2026 | | | | | | | 2,833 | | | | 2,805 | (e)(f) | | | |

Kene

Acquisition, Inc. | | | | 1st Lien

Delayed Draw

Term Loan | | 5.26% (3M

LIBOR +

4.25%) | | 8/10/2026 | | | | | | | 474 | | | | 469 | (e)(f) | | | |

Kodiak BP, LLC | | | | 1st Lien Term

Loan | | 5.50

LIBOR +

3.25%)% (1M | | 3/12/2028 | | | | | | | 7,773 | | | | 6,768 | | | | |

LBM

Acquisition LLC | | | | 1st Lien Term

Loan | | 5.42% (3M

LIBOR +

3.75%) | | 12/17/2027 | | | | | | | 9,869 | | | | 8,065 | | | | |

Lower ACS, Inc. | | | | 1st Lien

Revolver | | | | 1/7/2028 | | | | | | | 2,356 | | | | (47 | )(e)(h) | | | |

Lower ACS, Inc. | | | | 1st Lien Term

Loan | | 8.00% (3M

LIBOR +

5.75%) | | 1/7/2028 | | | | | | | 9,759 | | | | 9,661 | (e)(f) | | | |

Lower ACS, Inc. | | | | 1st Lien

Delayed Draw

Term Loan | | | | 1/7/2028 | | | | | | | 8,173 | | | | (82 | )(e)(h) | | | |

Madison IAQ LLC | | | | 1st Lien Term

Loan | | 4.52

LIBOR +

3.25%)% (2M | | 6/21/2028 | | | | | | | 7,471 | | | | 6,786 | | | | |

Maverick

Acquisition, Inc. | | | | 1st Lien Term

Loan | | 8.25% (3M

LIBOR +

6.00%) | | 6/1/2027 | | | | | | | 5,321 | | | | 5,055 | (e)(f) | | | |

Semi-Annual Report 2022

9

CION Ares Diversified Credit Fund

Consolidated Schedule of Investments (continued)

June 30, 2022 (Unaudited)

(in thousands, except shares, percentages and as otherwise noted)

Senior Loans(b)(c)(d) (continued)

Company | | Country(a) | | Investment | | Interest | | Maturity

Date | | Acquisition

Date | | Shares | | Principal

Amount(a) | | Fair Value(a) | | Percentage

of Net

Assets | |

Maverick

Acquisition, Inc. | | | | 1st Lien

Delayed Draw

Term Loan | | | | 6/1/2027 | | | | | | $ | 1,255 | | | $ | (63 | )(e)(h) | | | |

Maverick

Acquisition, Inc. | | | | 1st Lien

Delayed Draw

Term Loan | | 8.25% (3M

LIBOR +

6.00%) | | 6/1/2027 | | | | | | | 1,912 | | | | 1,117 | (e)(h) | | | |

Noble

Aerospace, LLC | | | | 1st Lien

Revolver | | | | 9/14/2022 | | | | | | | 1,400 | | | | (14 | )(e)(h) | | | |

Noble

Aerospace, LLC | | | | 1st Lien Term

Loan | | 6.17

LIBOR +

4.50%)% (1M | | 9/14/2023 | | | | | | | 2,587 | | | | 2,561 | (e)(f) | | | |

Osmose Utilities

Services, Inc. | | | | 2nd Lien Term

Loan | | 8.42

LIBOR +

6.75%)% (1M | | 6/25/2029 | | | | | | | 8,237 | | | | 7,578 | (e) | | | |

Osmosis Buyer

Limited | | | | 1st Lien Term

Loan | | | | 7/31/2028 | | | | | | | 6,474 | | | | 5,869 | (i) | | | |

Osmosis Buyer

Limited | | | | 1st Lien Term

Loan | | 4.83

(SOFR +

3.75%)% | | 7/31/2028 | | | | | | | 7,566 | | | | 6,876 | | | | |

Osmosis Buyer

Limited | | | | 1st Lien

Delayed Draw

Term Loan | | | | 7/31/2028 | | | | | | | 1,471 | | | | 1,334 | (i) | | | |

Patagonia BidCo

Limited | | United

Kingdom | | 1st Lien Term

Loan | | 5.69

(SONIA +

5.00%)% | | 11/1/2028 | | | | | | £ | 3,482 | | | | 3,860 | | | | |

Patagonia BidCo

Limited | | United

Kingdom | | 1st Lien Term

Loan | | 5.94

(SONIA +

5.25%)% | | 11/1/2028 | | | | | | £ | 633 | | | | 702 | | | | |

Prime

Buyer, L.L.C. | | | | 1st Lien

Revolver | | 7.30

(SOFR +

5.25%)% | | 12/22/2026 | | | | | | | 3,985 | | | | 624 | (e)(h) | | | |

Prime

Buyer, L.L.C. | | | | 1st Lien Term

Loan | | 7.30

(SOFR +

5.25%)% | | 12/22/2026 | | | | | | | 15,289 | | | | 15,136 | (e)(f) | | | |

Radius

Aerospace

Europe Limited | | United

Kingdom | | 1st Lien

Revolver | | | | 3/29/2025 | | | | | | £ | 186 | | | | — | (e)(h) | | | |

Radius

Aerospace

Europe Limited | | United

Kingdom | | 1st Lien Term

Loan | | 7.95

(SOFR +

5.75%)% | | 3/29/2025 | | | | | | | 1,586 | | | | 1,586 | (e)(f) | | | |

Radius

Aerospace, Inc. | | | | 1st Lien

Revolver | | 7.60

(SOFR +

5.75%)% | | 3/29/2025 | | | | | | | 429 | | | | 114 | (e)(h) | | | |

Radius

Aerospace, Inc. | | | | 1st Lien Term

Loan | | 7.95

(SOFR +

5.75%)% | | 3/29/2025 | | | | | | | 2,259 | | | | 2,259 | (e)(f) | | | |

Sigma Electric

Manufacturing

Corporation | | | | 1st Lien

Revolver | | | | 10/31/2022 | | | | | | | 1 | | | | — | (e)(h) | | | |

Semi-Annual Report 2022

10

CION Ares Diversified Credit Fund

Consolidated Schedule of Investments (continued)

June 30, 2022 (Unaudited)

(in thousands, except shares, percentages and as otherwise noted)

Senior Loans(b)(c)(d) (continued)

Company | | Country(a) | | Investment | | Interest | | Maturity

Date | | Acquisition

Date | | Shares | | Principal

Amount(a) | | Fair Value(a) | | Percentage

of Net

Assets | |

Sigma Electric

Manufacturing

Corporation | | | | 1st Lien Term

Loan | | 5.75% (3M

LIBOR +

4.75%) | | 10/31/2023 | | | | | | $ | 286 | | | $ | 286 | (e)(f) | | | |

Sigma Electric

Manufacturing

Corporation | | | | 1st Lien Term

Loan | | 7.01% (3M

LIBOR +

4.75%) | | 10/31/2023 | | | | | | | 119 | | | | 119 | (e)(f) | | | |

Specialty

Building

Products

Holdings, LLC | | | | 1st Lien Term

Loan | | 5.35

LIBOR +

3.75%)% (1M | | 10/15/2028 | | | | | | | 6,484 | | | | 5,689 | | | | |

SPX Flow, Inc. | | | | 1st Lien Term

Loan | | 6.13

(SOFR +

4.50%)% | | 4/5/2029 | | | | | | | 77 | | | | 72 | | | | |

SRS

Distribution Inc. | | | | 1st Lien Term

Loan | | 4.02

LIBOR +

3.50%)% (6M | | 6/2/2028 | | | | | | | 4,077 | | | | 3,753 | | | | |

SRS

Distribution Inc. | | | | 1st Lien Term

Loan | | 4.00

(SOFR +

3.50%)% | | 6/2/2028 | | | | | | | 3,362 | | | | 3,088 | | | | |

Star US

Bidco LLC | | | | 1st Lien Term

Loan | | 5.92

LIBOR +

4.25%)% (1M | | 3/17/2027 | | | | | | | 1,552 | | | | 1,478 | | | | |

Sunk Rock

Foundry

Partners LP | | | | 1st Lien Term

Loan | | 7.01% (3M

LIBOR +

4.75%) | | 10/31/2023 | | | | | | | 200 | | | | 200 | (e)(f) | | | |

TransDigm

Group

Incorporated | | | | 1st Lien Term

Loan | | 3.92

LIBOR +

2.25%)% (1M | | 12/9/2025 | | | | | | | 5,199 | | | | 4,919 | | | | |

Turbo

Acquisitions 10

Bidco Limited | | United

Kingdom | | 1st Lien Term

Loan | | 8.06

(SONIA +

7.25%)% | | 2/26/2027 | | | | | | £ | 2,516 | | | | 3,064 | (e)(f) | | | |

Turbo

Acquisitions 10

Bidco Limited | | United

Kingdom | | 1st Lien

Delayed Draw

Term Loan | | 7.97

(SONIA +

7.25%)% | | 2/26/2027 | | | | | | £ | 2,692 | | | | 2,302 | (e)(h) | | | |

Turbo

Acquisitions 10

Bidco Limited | | United

Kingdom | | 1st Lien

Delayed Draw

Term Loan | | 8.06

(SONIA +

7.25%)% | | 2/26/2027 | | | | | | £ | 2,827 | | | | 3,444 | (e)(f) | | | |

Two Six

Labs, LLC | | | | 1st Lien

Revolver | | | | 8/20/2027 | | | | | | | 2,561 | | | | — | (e)(h) | | | |

Two Six

Labs, LLC | | | | 1st Lien Term

Loan | | 7.55

(SOFR +

5.50%)% | | 8/20/2027 | | | | | | | 7,411 | | | | 7,411 | (e)(f) | | | |

Two Six

Labs, LLC | | | | 1st Lien

Delayed Draw

Term Loan | | 6.51% (3M

LIBOR +

5.50%) | | 8/20/2027 | | | | | | | 1,425 | | | | 1,425 | (e) | | | |

VC GB

Holdings I Corp | | | | 2nd Lien Term

Loan | | 9.63% (3M

LIBOR +

6.75%) | | 7/23/2029 | | | | | | | 3,200 | | | | 2,860 | | | | |

Victory

Buyer LLC | | | | 1st Lien Term

Loan | | 5.81% (3M

LIBOR +

3.75%) | | 11/19/2028 | | | | | | | 6,386 | | | | 5,891 | (e) | | | |

Semi-Annual Report 2022

11

CION Ares Diversified Credit Fund

Consolidated Schedule of Investments (continued)

June 30, 2022 (Unaudited)

(in thousands, except shares, percentages and as otherwise noted)

Senior Loans(b)(c)(d) (continued)

Company | | Country(a) | | Investment | | Interest | | Maturity

Date | | Acquisition

Date | | Shares | | Principal

Amount(a) | | Fair Value(a) | | Percentage

of Net

Assets | |

Wilsonart LLC | | | | 1st Lien Term

Loan | | 5.51% (3M

LIBOR +

3.25%) | | 12/31/2026 | | | | | | $ | 9,374 | | | $ | 8,279 | | | | |

WP CPP

Holdings, LLC | | | | 1st Lien Term

Loan | | 4.99% (3M

LIBOR +

3.75%) | | 4/30/2025 | | | | | | | 6,022 | | | | 4,964 | (e)(f) | | | |

WP CPP

Holdings, LLC | | | | 2nd Lien Term

Loan | | 8.99% (3M

LIBOR +

7.75%) | | 4/30/2026 | | | | | | | 398 | | | | 330 | (e)(f) | | | |

| | | | | | | | | | | | | | | | | | 205,159 | | | | 8.74 | % | |

Commercial & Professional Services | |

Aero

Operating LLC | | | | 1st Lien Term

Loan | | 8.50

LIBOR +

7.00%)% (1M | | 2/9/2026 | | | | | | | 2,951 | | | | 2,892 | (e)(f) | | | |

Aero

Operating LLC | | | | 1st Lien

Delayed Draw

Term Loan | | 8.50

LIBOR +

7.00%)% (1M | | 2/9/2026 | | | | | | | 821 | | | | 804 | (e)(f) | | | |

Applied

Technical

Services, LLC | | | | 1st Lien

Revolver | | 9.50

(PRIME +

4.75%)% | | 12/29/2026 | | | | | | | 909 | | | | 309 | (e)(h) | | | |

Applied

Technical

Services, LLC | | | | 1st Lien Term

Loan | | 8.00% (3M

LIBOR +

5.75%) | | 12/29/2026 | | | | | | | 4,280 | | | | 4,237 | (e)(f) | | | |

Applied

Technical

Services, LLC | | | | 1st Lien

Delayed Draw

Term Loan | | | | 12/29/2026 | | | | | | | 2,521 | | | | (25 | )(e)(h) | | | |

Applied

Technical

Services, LLC | | | | 1st Lien

Delayed Draw

Term Loan | | 8.00% (3M

LIBOR +

5.75%) | | 12/29/2026 | | | | | | | 1,439 | | | | 1,424 | (e)(f) | | | |

Applied

Technical

Services, LLC | | | | 1st Lien

Delayed Draw

Term Loan | | 7.27% (3M

LIBOR +

5.75%) | | 12/29/2026 | | | | | | | 2,521 | | | | 2,378 | (e)(h) | | | |

Argenbright

Holdings V, LLC | | | | 1st Lien Term

Loan | | 7.67

LIBOR +

6.00%)% (1M | | 11/30/2026 | | | | | | | 2,834 | | | | 2,834 | (e)(f) | | | |

Argenbright

Holdings V, LLC | | | | 1st Lien

Delayed Draw

Term Loan | | | | 11/30/2026 | | | | | | | 178 | | | | — | (e)(h) | | | |

Armorica Lux

S.a.r.l. | | Luxembourg | | 1st Lien Term

Loan | | 5.00% (3M

EURIBOR +

5.00%) | | 7/28/2028 | | | | | | € | 4,000 | | | | 3,563 | | | | |

Auxadi Midco

S.L.U. | | Spain | | 1st Lien Term

Loan | | 4.75% (3M

EURIBOR +

4.75%) | | 7/17/2028 | | | | | | € | 836 | | | | 877 | (e) | | | |

Auxadi Midco

S.L.U. | | Spain | | 1st Lien

Delayed Draw

Term Loan | | | | 7/17/2028 | | | | | | € | 909 | | | | — | (e)(h) | | | |

Capstone

Acquisition

Holdings, Inc. | | | | 1st Lien

Revolver | | | | 11/12/2025 | | | | | | | 1,150 | | | | — | (e)(h) | | | |

Semi-Annual Report 2022

12

CION Ares Diversified Credit Fund

Consolidated Schedule of Investments (continued)

June 30, 2022 (Unaudited)

(in thousands, except shares, percentages and as otherwise noted)

Senior Loans(b)(c)(d) (continued)

Company | | Country(a) | | Investment | | Interest | | Maturity

Date | | Acquisition

Date | | Shares | | Principal

Amount(a) | | Fair Value(a) | | Percentage

of Net

Assets | |

Capstone

Acquisition

Holdings, Inc. | | | | 1st Lien Term

Loan | | 6.42

LIBOR +

4.75%)% (1M | | 11/12/2027 | | | | | | $ | 10,898 | | | $ | 10,898 | (e)(f) | | | |

Capstone

Acquisition

Holdings, Inc. | | | | 1st Lien

Delayed Draw

Term Loan | | 6.42

LIBOR +

4.75%)% (1M | | 11/12/2027 | | | | | | | 639 | | | | 639 | (e) | | | |

Capstone

Acquisition

Holdings, Inc. | | | | 2nd Lien Term

Loan | | 10.42

LIBOR +

8.75%)% (1M | | 11/13/2028 | | | | | | | 3,008 | | | | 3,008 | (e)(f) | | | |

Compex Legal

Services, Inc. | | | | 1st Lien

Revolver | | 7.50% (3M

LIBOR +

5.25%) | | 2/7/2025 | | | | | | | 900 | | | | 540 | (e)(h) | | | |

Compex Legal

Services, Inc. | | | | 1st Lien Term

Loan | | 6.31% (3M

LIBOR +

5.25%) | | 2/7/2026 | | | | | | | 1,291 | | | | 1,291 | (e)(f) | | | |

Dispatch

Acquisition

Holdings, LLC | | | | 1st Lien Term

Loan | | 6.50% (3M

LIBOR +

4.25%) | | 3/27/2028 | | | | | | | 15,020 | | | | 13,594 | (e)(f) | | | |

Dun &

Bradstreet

Corporation, The | | | | 1st Lien Term

Loan | | 4.87

LIBOR +

3.25%)% (1M | | 2/6/2026 | | | | | | | 6,755 | | | | 6,360 | | | | |

Dun &

Bradstreet

Corporation, The | | | | 1st Lien Term

Loan | | 4.75

(SOFR +

3.25%)% | | 1/18/2029 | | | | | | | 1,995 | | | | 1,858 | | | | |

Elevation

Services Parent

Holdings, LLC | | | | 1st Lien

Revolver | | 8.75% (3M

LIBOR +

6.00%) | | 12/18/2026 | | | | | | | 631 | | | | 126 | (e)(h) | | | |

Elevation

Services Parent

Holdings, LLC | | | | 1st Lien Term

Loan | | 8.75% (3M

LIBOR +

6.00%) | | 12/18/2026 | | | | | | | 1,330 | | | | 1,330 | (e)(f) | | | |

Elevation

Services Parent

Holdings, LLC | | | | 1st Lien Term

Loan | | 7.37% (3M

LIBOR +

6.00%) | | 12/18/2026 | | | | | | | 634 | | | | 634 | (e)(f) | | | |

Elevation

Services Parent

Holdings, LLC | | | | 1st Lien

Delayed Draw

Term Loan | | 7.00% (3M

LIBOR +

6.00%) | | 12/18/2026 | | | | | | | 1,778 | | | | 1,778 | (e)(f) | | | |

Elevation

Services Parent

Holdings, LLC | | | | 1st Lien

Delayed Draw

Term Loan | | | | 12/18/2026 | | | | | | | 986 | | | | — | (e)(h) | | | |

Eucalyptus

BidCo Pty Ltd | | Australia | | 1st Lien Term

Loan | | | | 12/23/2027 | | | | | | AUD | 1,337 | | | | — | (e)(h) | | | |

Eucalyptus

BidCo Pty Ltd | | Australia | | 1st Lien Term

Loan | | 7.64

(BBSY +

6.50%)% | | 12/23/2027 | | | | | | AUD | 11,142 | | | | 7,695 | (e)(f) | | | |

HH-Stella, Inc. | | | | 1st Lien

Revolver | | 7.19

LIBOR +

5.50%)% (1M | | 4/22/2027 | | | | | | | 444 | | | | 224 | (e)(h) | | | |

HH-Stella, Inc. | | | | 1st Lien Term

Loan | | 7.81

LIBOR +

5.50%)% (1M | | 4/24/2028 | | | | | | | 6,123 | | | | 6,062 | (e)(f) | | | |

Semi-Annual Report 2022

13

CION Ares Diversified Credit Fund

Consolidated Schedule of Investments (continued)

June 30, 2022 (Unaudited)

(in thousands, except shares, percentages and as otherwise noted)

Senior Loans(b)(c)(d) (continued)

Company | | Country(a) | | Investment | | Interest | | Maturity

Date | | Acquisition

Date | | Shares | | Principal

Amount(a) | | Fair Value(a) | | Percentage

of Net

Assets | |

HH-Stella, Inc. | | | | 1st Lien

Delayed Draw

Term Loan | | 7.73

LIBOR +

5.50%)% (1M | | 4/24/2028 | | | | | | $ | 1,977 | | | $ | 426 | (e)(h) | | | |

Integrated Power

Services

Holdings, Inc. | | | | 2nd Lien Term

Loan | | 9.42% (3M

LIBOR +

7.75%) | | 11/22/2029 | | | | | | | 4,983 | | | | 4,983 | (e) | | | |

IRI Holdings, Inc. | | | | 1st Lien Term

Loan | | 5.92

LIBOR +

4.25%)% (1M | | 12/1/2025 | | | | | | | 1,626 | | | | 1,626 | (e)(f) | | | |

IRI Holdings, Inc. | | | | 2nd Lien Term

Loan | | 9.67

LIBOR +

8.00%)% (1M | | 11/30/2026 | | | | | | | 1,472 | | | | 1,472 | (e)(f) | | | |

Kellermeyer

Bergensons

Services, LLC | | | | 1st Lien Term

Loan | | 7.67% (3M

LIBOR +

6.00%) | | 11/7/2026 | | | | | | | 1,755 | | | | 1,755 | (e)(f) | | | |

Kellermeyer

Bergensons

Services, LLC | | | | 1st Lien Term

Loan | | 7.67

LIBOR +

6.00%)% (6M | | 11/7/2026 | | | | | | | 6,068 | | | | 6,068 | (e)(f) | | | |

Kellermeyer

Bergensons

Services, LLC | | | | 1st Lien

Delayed Draw

Term Loan | | 7.67% (3M

LIBOR +

6.00%) | | 11/7/2026 | | | | | | | 4,923 | | | | 4,923 | (e)(f) | | | |

Laboratories

Bidco LLC | | | | 1st Lien

Revolver | | 9.50

(PRIME +

4.75%)% | | 7/23/2027 | | | | | | | 1,562 | | | | 208 | (e)(h) | | | |

Laboratories

Bidco LLC | | | | 1st Lien Term

Loan | | 6.81% (3M

LIBOR +

5.75%) | | 7/23/2027 | | | | | | | 3,986 | | | | 3,986 | (e) | | | |

Laboratories

Bidco LLC | | | | 1st Lien Term

Loan | | 7.04% (3M

CDOR +

5.75%) | | 7/23/2027 | | | | | | CAD | 1,771 | | | | 1,376 | (e)(f) | | | |

Laboratories

Bidco LLC | | | | 1st Lien Term

Loan | | 6.78% (3M

LIBOR +

5.75%) | | 7/23/2027 | | | | | | | 5,232 | | | | 5,232 | (e)(f) | | | |

Laboratories

Bidco LLC | | | | 1st Lien Term

Loan | | 8.69% (3M

LIBOR +

5.75%) | | 7/23/2027 | | | | | | | 580 | | | | 580 | (e)(f) | | | |

Laboratories

Bidco LLC | | | | 1st Lien

Delayed Draw

Term Loan | | 7.83% (3M

LIBOR +

5.75%) | | 7/23/2027 | | | | | | | 2,201 | | | | 37 | (e)(h) | | | |

Lavatio Midco

Sarl | | Luxembourg | | 1st Lien

Delayed Draw

Term Loan | | 7.50

EURIBOR +

7.25%)% (6M | | 11/30/2026 | | | | | | € | 802 | | | | 799 | (e)(f)(g) | | | |

Lavatio Midco

Sarl | | Luxembourg | | 1st Lien

Delayed Draw

Term Loan | | 7.50

EURIBOR +

7.25%)% (6M | | 11/30/2026 | | | | | | € | 989 | | | | 598 | (e)(g)(h) | | | |

Lowe P27

Bidco Limited | | United

Kingdom | | 1st Lien

Delayed Draw

Term Loan | | | | 6/25/2029 | | | | | | £ | 325 | | | | — | (e)(h)(i) | | | |

Lowe P27

Bidco Limited | | United

Kingdom | | 1st Lien

Delayed Draw

Term Loan | | 7.75

LIBOR +

7.00%)% (6M | | 7/31/2026 | | | | | | | 610 | | | | 573 | (e) | | | |

Semi-Annual Report 2022

14

CION Ares Diversified Credit Fund

Consolidated Schedule of Investments (continued)

June 30, 2022 (Unaudited)

(in thousands, except shares, percentages and as otherwise noted)

Senior Loans(b)(c)(d) (continued)

Company | | Country(a) | | Investment | | Interest | | Maturity

Date | | Acquisition

Date | | Shares | | Principal

Amount(a) | | Fair Value(a) | | Percentage

of Net

Assets | |

Lowe P27

Bidco Limited | | United

Kingdom | | 1st Lien

Delayed Draw

Term Loan | | 7.97

(SONIA +

7.00%)% | | 7/31/2026 | | | | | | £ | 2,031 | | | $ | 2,008 | (e)(h) | | | |

Management

Consulting &

Research LLC | | | | 1st Lien

Revolver | | | | 8/16/2027 | | | | | | | 1,004 | | | | — | (e)(h) | | | |

Management

Consulting &

Research LLC | | | | 1st Lien Term

Loan | | 8.83

(SOFR +

6.00%)% | | 8/16/2027 | | | | | | | 4,512 | | | | 4,512 | (e)(f) | | | |

Marmic

Purchaser, LLC | | | | 1st Lien

Revolver | | 7.00

(SOFR +

6.00%)% | | 3/5/2027 | | | | | | | 287 | | | | 55 | (e)(h) | | | |

Marmic

Purchaser, LLC | | | | 1st Lien Term

Loan | | 8.20

(SOFR +

6.00%)% | | 3/5/2027 | | | | | | | 2,037 | | | | 2,017 | (e)(f) | | | |

Marmic

Purchaser, LLC | | | | 1st Lien

Delayed Draw

Term Loan | | 8.05

(SOFR +

6.00%)% | | 3/5/2027 | | | | | | | 1,192 | | | | 1,180 | (e) | | | |

Marmic

Purchaser, LLC | | | | 1st Lien

Delayed Draw

Term Loan | | 7.80

(SOFR +

5.75%)% | | 3/5/2027 | | | | | | | 2,543 | | | | 97 | (e)(h) | | | |

MPLC Debtco

Limited | | Jersey | | 1st Lien

Delayed Draw

Term Loan | | 8.75

LIBOR +

7.25%)% (6M | | 1/7/2027 | | | | | | | 2,100 | | | | 2,100 | (e)(f) | | | |

MPLC Debtco

Limited | | Jersey | | 1st Lien

Delayed Draw

Term Loan | | 8.06

(SONIA +

7.25%)% | | 1/7/2027 | | | | | | £ | 1,052 | | | | 1,281 | (e)(f) | | | |

National

Intergovernmental

Purchasing

Alliance Company | | | | 1st Lien Term

Loan | | 5.75% (3M

LIBOR +

3.50%) | | 5/23/2025 | | | | | | | 2,313 | | | | 2,198 | (f) | | | |

National

Intergovernmental

Purchasing

Alliance Company | | | | 2nd Lien Term

Loan | | 9.75% (3M

LIBOR +

7.50%) | | 5/23/2026 | | | | | | | 19,151 | | | | 19,151 | (e)(f) | | | |

Nest Topco

Borrower Inc. | | | | 1st Lien Term

Loan | | 10.10% (3M

LIBOR +

8.50%) | | 8/31/2029 | | | | | | | 13,162 | | | | 13,162 | (e) | | | |

Nest Topco

Borrower Inc. | | | | 1st Lien

Delayed Draw

Term Loan | | | | 8/31/2029 | | | | | | | 13,162 | | | | — | (e)(h) | | | |

North American

Fire Holdings,

LLC | | | | 1st Lien

Revolver | | | | 5/19/2027 | | | | | | | 411 | | | | — | (e)(h) | | | |

North American

Fire Holdings,

LLC | | | | 1st Lien Term

Loan | | 7.80

(SOFR +

5.75%)% | | 5/19/2027 | | | | | | | 2,315 | | | | 2,315 | (e)(f) | | | |

North American

Fire Holdings,

LLC | | | | 1st Lien

Delayed Draw

Term Loan | | 7.42

(SOFR +

5.75%)% | | 5/19/2027 | | | | | | | 2,451 | | | | 2,189 | (e)(f)(h) | | | |

Semi-Annual Report 2022

15

CION Ares Diversified Credit Fund

Consolidated Schedule of Investments (continued)

June 30, 2022 (Unaudited)

(in thousands, except shares, percentages and as otherwise noted)

Senior Loans(b)(c)(d) (continued)

Company | | Country(a) | | Investment | | Interest | | Maturity

Date | | Acquisition

Date | | Shares | | Principal

Amount(a) | | Fair Value(a) | | Percentage

of Net

Assets | |

North American

Fire Holdings,

LLC | | | | 1st Lien

Delayed Draw

Term Loan | | 7.11

(SOFR +

5.75%)% | | 5/19/2027 | | | | | | $ | 3,468 | | | $ | 1,200 | (e)(h) | | | |

North Haven

Stack Buyer, LLC | | | | 1st Lien

Revolver | | 7.17% (3M

LIBOR +

5.50%) | | 7/16/2027 | | | | | | | 259 | | | | 73 | (e)(h) | | | |

North Haven

Stack Buyer, LLC | | | | 1st Lien Term

Loan | | 7.17

LIBOR +

5.50%)% (1M | | 7/16/2027 | | | | | | | 1,326 | | | | 1,300 | (e)(f) | | | |

North Haven

Stack Buyer, LLC | | | | 1st Lien

Delayed Draw

Term Loan | | 6.80% (3M

LIBOR +

5.50%) | | 7/16/2027 | | | | | | | 1,015 | | | | 341 | (e)(h) | | | |

Orbit Private

Holdings I Ltd | | United

Kingdom | | 1st Lien Term

Loan | | 6.50

(SONIA +

5.75%)% | | 12/11/2028 | | | | | | £ | 4,915 | | | | 5,628 | (e) | | | |

Packers

Holdings, LLC | | | | 1st Lien Term

Loan | | 5.12% (3M

LIBOR +

3.25%) | | 3/9/2028 | | | | | | | 4,295 | | | | 3,922 | | | | |

Petroleum

Service Group

LLC | | | | 1st Lien

Revolver | | 7.25% (3M

LIBOR +

6.00%) | | 7/23/2025 | | | | | | | 2,106 | | | | 562 | (e)(h) | | | |

Petroleum

Service Group

LLC | | | | 1st Lien Term

Loan | | 7.24% (3M

LIBOR +

6.00%) | | 7/23/2025 | | | | | | | 5,312 | | | | 5,312 | (e)(f) | | | |

Petroleum

Service Group

LLC | | | | 1st Lien Term

Loan | | 7.63% (3M

LIBOR +

6.00%) | | 7/23/2025 | | | | | | | 3,574 | | | | 3,574 | (e)(f) | | | |

Petroleum

Service Group

LLC | | | | 1st Lien

Delayed Draw

Term Loan | | | | 7/23/2025 | | | | | | | 1,589 | | | | — | (e)(h) | | | |

Petroleum

Service Group

LLC | | | | 1st Lien

Delayed Draw

Term Loan | | 8.15% (3M

LIBOR +

6.00%) | | 7/23/2025 | | | | | | | 1,603 | | | | 1,432 | (e)(f)(h) | | | |

Petroleum

Service Group

LLC | | | | 1st Lien

Delayed Draw

Term Loan | | 8.18% (3M

LIBOR +

6.00%) | | 7/23/2025 | | | | | | | 106 | | | | 106 | (e)(f) | | | |

Registrar

Intermediate,

LLC | | | | 1st Lien

Revolver | | | | 8/26/2027 | | | | | | | 764 | | | | — | (e)(h) | | | |

Registrar

Intermediate,

LLC | | | | 1st Lien Term

Loan | | 6.67% (3M

LIBOR +

5.00%) | | 8/26/2027 | | | | | | | 4,167 | | | | 4,167 | (e)(f) | | | |

Registrar

Intermediate,

LLC | | | | 1st Lien

Delayed Draw

Term Loan | | | | 8/26/2027 | | | | | | | 2,327 | | | | — | (e)(h) | | | |

Research Now

Group, Inc. | | | | 2nd Lien Term

Loan | | 10.50% (3M

LIBOR +

9.50%) | | 12/20/2025 | | | | | | | 893 | | | | 893 | (e)(f) | | | |

Research Now

Group, LLC | | | | 1st Lien Term

Loan | | 6.50% (3M

LIBOR +

5.50%) | | 12/20/2024 | | | | | | | 3,529 | | | | 3,242 | (f) | | | |

Semi-Annual Report 2022

16

CION Ares Diversified Credit Fund

Consolidated Schedule of Investments (continued)

June 30, 2022 (Unaudited)

(in thousands, except shares, percentages and as otherwise noted)

Senior Loans(b)(c)(d) (continued)

Company | | Country(a) | | Investment | | Interest | | Maturity

Date | | Acquisition

Date | | Shares | | Principal

Amount(a) | | Fair Value(a) | | Percentage

of Net

Assets | |

Rodeo

AcquisitionCo

LLC | | | | 1st Lien

Revolver | | 7.39% (3M

LIBOR +

6.00%) | | 7/26/2027 | | | | | | $ | 311 | | | $ | 105 | (e)(h) | | | |

Rodeo

AcquisitionCo

LLC | | | | 1st Lien Term

Loan | | 7.67% (3M

LIBOR +

6.00%) | | 7/26/2027 | | | | | | | 2,108 | | | | 2,065 | (e) | | | |

Rodeo

AcquisitionCo

LLC | | | | 1st Lien

Delayed Draw

Term Loan | | | | 7/26/2027 | | | | | | | 460 | | | | (9 | )(e)(h) | | | |

RSK Group

Limited | | United

Kingdom | | 1st Lien Term

Loan | | 5.25

(EURIBOR +

5.00%)% | | 8/7/2028 | | | | | | € | 986 | | | | 1,034 | (e)(f) | | | |

RSK Group

Limited | | United

Kingdom | | 1st Lien Term

Loan | | 6.06

(SONIA +

5.00%)% | | 8/7/2028 | | | | | | £ | 3,276 | | | | 4,001 | (e) | | | |

RSK Group

Limited | | United

Kingdom | | 1st Lien Term

Loan | | 6.31

(SONIA +

5.00%)% | | 8/7/2028 | | | | | | £ | 13,064 | | | | 2,329 | (e)(h) | | | |

RSK Group

Limited | | United

Kingdom | | 1st Lien Term

Loan | | 5.81

(SONIA +

5.00%)% | | 8/7/2028 | | | | | | £ | 7,881 | | | | 9,601 | (e)(f) | | | |

Schill

Landscaping and

Lawn Care

Services, LLC | | | | 1st Lien

Revolver | | 7.38

LIBOR +

5.75%)% (1M | | 12/16/2027 | | | | | | | 720 | | | | 216 | (e)(h) | | | |

Schill

Landscaping and

Lawn Care

Services, LLC | | | | 1st Lien Term

Loan | | 7.35

LIBOR +

5.75%)% (1M | | 12/16/2027 | | | | | | | 2,584 | | | | 2,584 | (e)(f) | | | |

Schill

Landscaping and

Lawn Care

Services, LLC | | | | 1st Lien

Delayed Draw

Term Loan | | 7.38

LIBOR +

5.75%)% (1M | | 12/16/2027 | | | | | | | 1,542 | | | | 216 | (e)(h) | | | |

Shermco

Intermediate

Holdings, Inc. | | | | 1st Lien

Revolver | | 8.25

(PRIME +

3.50%)% | | 6/5/2023 | | | | | | | 1,000 | | | | 925 | (e)(h) | | | |

Shermco

Intermediate

Holdings, Inc. | | | | 1st Lien Term

Loan | | 6.17

LIBOR +

4.50%)% (1M | | 6/5/2024 | | | | | | | 30,191 | | | | 30,191 | (e)(f) | | | |

SLR BD Limited | | United

Kingdom | | 1st Lien Term

Loan | | 8.29

LIBOR +

7.00%)% (6M | | 9/22/2028 | | | | | | | 753 | | | | 753 | (e)(f) | | | |

SLR BD Limited | | United

Kingdom | | 1st Lien Term

Loan | | 7.72

(SONIA +

7.00%)% | | 9/22/2028 | | | | | | £ | 1,226 | | | | 1,494 | (e)(f) | | | |

SLR BD Limited | | United

Kingdom | | 1st Lien

Delayed Draw

Term Loan | | 7.97

(SONIA +

7.00%)% | | 9/22/2028 | | | | | | £ | 1,232 | | | | 599 | (e)(h) | | | |

SSE Buyer, Inc. | | | | 1st Lien

Revolver | | 3.00

LIBOR +

2.00%)% (1M | | 6/30/2025 | | | | | | | 3 | | | | 1 | (e)(h) | | | |

Semi-Annual Report 2022

17

CION Ares Diversified Credit Fund

Consolidated Schedule of Investments (continued)

June 30, 2022 (Unaudited)

(in thousands, except shares, percentages and as otherwise noted)

Senior Loans(b)(c)(d) (continued)

Company | | Country(a) | | Investment | | Interest | | Maturity

Date | | Acquisition

Date | | Shares | | Principal

Amount(a) | | Fair Value(a) | | Percentage

of Net

Assets | |

SSE Buyer, Inc. | | | | 1st Lien Term

Loan | | 10.22% (3M

LIBOR +

9.22%) | | 6/30/2026 | | | | | | $ | 615 | | | $ | 524 | (e)(f)(h) | | | |

Stealth

Holding LLC | | | | 1st Lien Term

Loan | | 7.75

(SOFR +

6.75%)% | | 3/2/2026 | | | | | | | 2,467 | | | | 2,467 | (e)(f) | | | |

Stealth

Holding LLC | | | | 1st Lien

Delayed Draw

Term Loan | | 8.04% (3M

LIBOR +

6.75%) | | 3/2/2026 | | | | | | | 984 | | | | 984 | (e) | | | |

Stealth

Holding LLC | | | | 1st Lien

Delayed Draw

Term Loan | | 8.25

(SOFR +

6.75%)% | | 3/2/2026 | | | | | | | 1,786 | | | | 774 | (e)(h) | | | |

Steer

Automotive

Group Ltd | | United

Kingdom | | 1st Lien

Revolver | | | | 10/19/2028 | | | | | | £ | 597 | | | | — | (e)(h)(i) | | | |

Steer

Automotive

Group Ltd | | United

Kingdom | | 1st Lien Term

Loan | | 7.22

(SONIA +

6.25%)% | | 4/19/2029 | | | | | | £ | 2,449 | | | | 2,983 | (e)(f) | | | |

Steer

Automotive

Group Ltd | | United

Kingdom | | 1st Lien

Delayed Draw

Term Loan | | 7.56

(SONIA +

6.25%)% | | 4/19/2029 | | | | | | £ | 1,633 | | | | 875 | (e)(h) | | | |

Survitec

Group Holdco

Limited | | United

Kingdom | | 1st Lien Term

Loan | | 8.81

(SONIA +

8.00%)% | | 4/6/2027 | | | | | | £ | 9,056 | | | | 11,032 | (e)(f)(g) | | | |

Thermostat

Purchaser III,

Inc. | | | | 1st Lien

Revolver | | 7.75

(PRIME +

3.00%)% | | 8/31/2026 | | | | | | | 100 | | | | (1 | )(e)(h) | | | |

Thermostat

Purchaser III,

Inc. | | | | 2nd Lien Term

Loan | | 8.82% (3M

LIBOR +

7.25%) | | 8/31/2029 | | | | | | | 3,575 | | | | 3,432 | (e) | | | |

Thermostat

Purchaser III,

Inc. | | | | 2nd Lien

Delayed Draw

Term Loan | | | | 8/31/2029 | | | | | | | 612 | | | | (24 | )(e)(h) | | | |

Trans Union LLC | | | | 1st Lien Term

Loan | | 3.92

LIBOR +

2.25%)% (1M | | 12/1/2028 | | | | | | | 8,543 | | | | 8,128 | | | | |

UCIT Online

Security Inc. | | Canada | | 1st Lien Term

Loan | | 7.75% (3M

LIBOR +

6.75%) | | 3/2/2026 | | | | | | | 1,645 | | | | 1,645 | (e)(f) | | | |

Visual Edge

Technology, Inc. | | | | 1st Lien Term

Loan | | 8.58% (3M

LIBOR +

7.00%) | | 8/31/2022 | | | | | | | 161 | | | | 153 | (e)(f)(g) | | | |

Visual Edge

Technology, Inc. | | | | 1st Lien

Delayed Draw

Term Loan | | 8.58% (3M

LIBOR +

7.00%) | | 8/31/2022 | | | | | | | 1,978 | | | | 1,879 | (e)(f)(g) | | | |

VLS

Environmental

Solutions, LLC | | | | 1st Lien

Revolver | | | | 10/17/2024 | | | | | | | 622 | | | | — | (e)(h) | | | |

VLS

Environmental

Solutions, LLC | | | | 1st Lien Term

Loan | | 6.50% (3M

LIBOR +

5.50%) | | 10/17/2024 | | | | | | | 3,892 | | | | 3,892 | (e)(f) | | | |

Semi-Annual Report 2022

18

CION Ares Diversified Credit Fund

Consolidated Schedule of Investments (continued)

June 30, 2022 (Unaudited)

(in thousands, except shares, percentages and as otherwise noted)

Senior Loans(b)(c)(d) (continued)

Company | | Country(a) | | Investment | | Interest | | Maturity

Date | | Acquisition

Date | | Shares | | Principal

Amount(a) | | Fair Value(a) | | Percentage

of Net

Assets | |

VLS

Environmental

Solutions, LLC | | | | 1st Lien Term

Loan | | 7.21% (3M

LIBOR +

5.50%) | | 10/17/2024 | | | | | | $ | 969 | | | $ | 969 | (e)(f) | | | |

VLS

Environmental

Solutions, LLC | | | | 1st Lien

Delayed Draw

Term Loan | | 6.50% (3M

LIBOR +

5.50%) | | 10/17/2024 | | | | | | | 1,063 | | | | 1,063 | (e) | | | |

VLS

Environmental

Solutions, LLC | | | | 1st Lien

Delayed Draw

Term Loan | | 7.21% (3M

LIBOR +

5.50%) | | 10/17/2024 | | | | | | | 88 | | | | 88 | (e) | | | |

VLS

Environmental

Solutions, LLC | | | | 1st Lien

Delayed Draw

Term Loan | | 7.21% (3M

LIBOR +

5.50%) | | 10/17/2024 | | | | | | | 43 | | | | 43 | (e)(f) | | | |

VLS

Environmental

Solutions, LLC | | | | 1st Lien

Delayed Draw

Term Loan | | 6.56

LIBOR +

5.50%)% (1M | | 10/17/2024 | | | | | | | 1,385 | | | | 104 | (e)(h) | | | |

VRC

Companies, LLC | | | | 1st Lien

Revolver | | 9.25

(PRIME +

4.50%)% | | 6/29/2027 | | | | | | | 1,342 | | | | 322 | (e)(h) | | | |

VRC

Companies, LLC | | | | 1st Lien Term

Loan | | 8.38% (3M

LIBOR +

5.50%) | | 6/29/2027 | | | | | | | 14,451 | | | | 14,306 | (e)(f) | | | |

VRC

Companies, LLC | | | | 1st Lien

Delayed Draw

Term Loan | | 7.35% (3M

LIBOR +

5.50%) | | 6/29/2027 | | | | | | | 2,332 | | | | 1,183 | (e)(h) | | | |

| | | | | | | | | | | | | | | | | | 306,915 | | | | 13.07 | % | |

Consumer Durables & Apparel | |

Centric Brands

LLC | | | | 1st Lien

Revolver | | 6.67% (3M

LIBOR +

5.50%) | | 10/9/2024 | | | | | | | 269 | | | | 230 | (e)(h) | | | |

Centric Brands

LLC | | | | 1st Lien Term

Loan | | 10.01% (3M

LIBOR +

9.00%) | | 10/9/2025 | | | | | | | 2,427 | | | | 2,427 | (e)(g) | | | |

Crocs, Inc. | | | | 1st Lien Term

Loan | | 4.00

(SOFR +

3.50%)% | | 2/20/2029 | | | | | | | 3,096 | | | | 2,811 | | | | |

DRS

Holdings III, Inc. | | | | 1st Lien

Revolver | | | | 11/1/2025 | | | | | | | 173 | | | | (2 | )(e)(h) | | | |

DRS

Holdings III, Inc. | | | | 1st Lien Term

Loan | | 7.42% (3M

LIBOR +

5.75%) | | 11/1/2025 | | | | | | | 1,938 | | | | 1,918 | (e)(f) | | | |

DRS

Holdings III, Inc. | | | | 1st Lien Term

Loan | | 7.42

LIBOR +

5.75%)% (1M | | 11/1/2025 | | | | | | | 13,337 | | | | 13,204 | (e)(f) | | | |

LHS

Borrower, LLC | | | | 1st Lien Term

Loan | | 6.38

(SOFR +

4.75%)% | | 2/16/2029 | | | | | | | 7,805 | | | | 6,712 | | | | |

New Era

Cap, LLC | | | | 1st Lien Term

Loan | | 6.75

LIBOR +

6.00%)% (6M | | 7/13/2027 | | | | | | | 12,651 | | | | 12,525 | (e)(f) | | | |

Semi-Annual Report 2022

19

CION Ares Diversified Credit Fund

Consolidated Schedule of Investments (continued)

June 30, 2022 (Unaudited)

(in thousands, except shares, percentages and as otherwise noted)

Senior Loans(b)(c)(d) (continued)

Company | | Country(a) | | Investment | | Interest | | Maturity

Date | | Acquisition

Date | | Shares | | Principal

Amount(a) | | Fair Value(a) | | Percentage

of Net

Assets | |

Rawlings

Sporting Goods

Company, Inc. | | | | 1st Lien

Revolver | | 4.94

LIBOR +

3.75%)% (1M | | 12/31/2025 | | | | | | $ | 1 | | | $ | 1 | (e)(h) | | | |

Rawlings

Sporting Goods

Company, Inc. | | | | 1st Lien Term

Loan | | 9.00% (3M

LIBOR +

6.75%) | | 12/31/2026 | | | | | | | 6,695 | | | | 6,695 | (e)(f) | | | |

TGP

Holdings III LLC | | | | 1st Lien Term

Loan | | 4.92

LIBOR +

3.50%)% (1M | | 6/29/2028 | | | | | | | 7,308 | | | | 6,164 | | | | |

TGP

Holdings III LLC | | | | 1st Lien

Delayed Draw

Term Loan | | 4.92% (3M

LIBOR +

3.25%) | | 6/29/2028 | | | | | | | 964 | | | | 90 | (h) | | | |

| | | | | | | | | | | | | | | | | | 52,775 | | | | 2.25 | % | |

Consumer Services | |

Aimbridge

Acquisition

Co., Inc. | | | | 2nd Lien Term

Loan | | 8.56

LIBOR +

7.50%)% (1M | | 2/1/2027 | | | | | | | 4,788 | | | | 4,501 | (e)(f) | | | |

American

Residential

Services L.L.C. | | | | 1st Lien

Revolver | | 7.00

(PRIME +

2.25%)% | | 10/15/2025 | | | | | | | 1 | | | | — | (e)(h) | | | |

American

Residential

Services L.L.C. | | | | 2nd Lien Term

Loan | | 10.75% (3M

LIBOR +

8.50%) | | 10/16/2028 | | | | | | | 8,314 | | | | 8,314 | (e) | | | |

Apollo Finco BV | | Belgium | | 1st Lien Term

Loan | | 5.08

EURIBOR +

4.85%)% (6M | | 10/2/2028 | | | | | | € | 5,000 | | | | 4,795 | | | | |

ASP Dream

Acquisition

Co LLC | | | | 1st Lien Term

Loan | | 5.43

(SOFR +

4.25%)% | | 12/15/2028 | | | | | | | 6,133 | | | | 6,072 | (e)(f) | | | |

Aspris Bidco

Limited | | United

Kingdom | | 1st Lien Term

Loan | | 7.47

(SONIA +

6.25%)% | | 8/23/2028 | | | | | | £ | 3,234 | | | | 3,940 | (e)(f) | | | |

Aspris Bidco

Limited | | United

Kingdom | | 1st Lien

Delayed Draw

Term Loan | | 7.31

(SONIA +

6.25%)% | | 8/23/2028 | | | | | | £ | 1,406 | | | | 1,713 | (e) | | | |

CC Fly

Holding II A/S | | Denmark | | 1st Lien Term

Loan | | 9.41% (3M

NIBOR +

7.75%) | | 5/9/2025 | | | | | | NOK | 868 | | | | 85 | (e)(f)(g) | | | |

CC Fly

Holding II A/S | | Denmark | | 1st Lien

Delayed Draw

Term Loan | | 8.48% (3M

CIBOR +

7.75%) | | 5/9/2025 | | | | | | DKK | 4,860 | | | | 488 | (e)(f)(g) | | | |

CC Fly

Holding II A/S | | Denmark | | 1st Lien

Delayed Draw

Term Loan | | 9.41% (3M

NIBOR +

7.75%) | | 5/9/2025 | | | | | | NOK | 3,876 | | | | 531 | (e)(f)(g)(h) | | | |

CMG

HoldCo, LLC | | | | 1st Lien

Revolver | | | | 5/19/2028 | | | | | | | 318 | | | | (6 | )(e)(h) | | | |

CMG

HoldCo, LLC | | | | 1st Lien Term

Loan | | 6.52

(SOFR +

5.25%)% | | 5/19/2028 | | | | | | | 726 | | | | 711 | (e)(f) | | | |

Semi-Annual Report 2022

20

CION Ares Diversified Credit Fund

Consolidated Schedule of Investments (continued)

June 30, 2022 (Unaudited)

(in thousands, except shares, percentages and as otherwise noted)

Senior Loans(b)(c)(d) (continued)

Company | | Country(a) | | Investment | | Interest | | Maturity

Date | | Acquisition

Date | | Shares | | Principal

Amount(a) | | Fair Value(a) | | Percentage

of Net

Assets | |

CMG

HoldCo, LLC | | | | 1st Lien

Delayed Draw

Term Loan | | | | 5/19/2028 | | | | | | $ | 1,069 | | | $ | (21 | )(e)(h) | | | |

CMG

HoldCo, LLC | | | | 1st Lien

Delayed Draw

Term Loan | | 6.62

(SOFR +

5.25%)% | | 5/19/2028 | | | | | | | 428 | | | | 217 | (e)(h) | | | |

Equinox

Holdings Inc. | | | | 1st Lien Term

Loan | | 5.25% (3M

LIBOR +

3.00%) | | 3/8/2024 | | | | | | | 2,559 | | | | 1,894 | | | | |

Equinox

Holdings Inc. | | | | 2nd Lien Term

Loan | | 9.25% (3M

LIBOR +

7.00%) | | 9/6/2024 | | | | | | | 5,736 | | | | 4,251 | | | | |

Essential

Services Holding

Corporation | | | | 1st Lien

Revolver | | | | 11/17/2025 | | | | | | | 1,560 | | | | — | (e)(h) | | | |

Essential

Services Holding

Corporation | | | | 1st Lien Term

Loan | | 6.75% (3M

LIBOR +

5.75%) | | 11/16/2026 | | | | | | | 9,668 | | | | 9,668 | (e)(f) | | | |

Essential

Services Holding

Corporation | | | | 1st Lien

Delayed Draw

Term Loan | | 6.75% (3M

LIBOR +

5.75%) | | 11/16/2026 | | | | | | | 11,565 | | | | 11,565 | (e)(f) | | | |

Essential

Services Holding

Corporation | | | | 1st Lien

Delayed Draw

Term Loan | | 7.12% (3M

LIBOR +

5.75%) | | 11/16/2026 | | | | | | | 8,146 | | | | 3,892 | (e)(h) | | | |

Essential

Services Holding

Corporation | | | | 1st Lien

Delayed Draw

Term Loan | | 8.03% (3M

LIBOR +

5.75%) | | 11/16/2026 | | | | | | | 10,428 | | | | 10,428 | (e)(f) | | | |

EuroParcs

Topholding B.V. | | Netherlands | | 1st Lien Term

Loan | | 6.25% (3M

EURIBOR +

6.25%) | | 7/3/2026 | | | | | | € | 2,652 | | | | 2,780 | (e) | | | |

EuroParcs

Topholding B.V. | | Netherlands | | 1st Lien

Delayed Draw

Term Loan | | 6.25% (3M

EURIBOR +

6.25%) | | 7/3/2026 | | | | | | € | 1,861 | | | | 1,951 | (e) | | | |

EuroParcs

Topholding B.V. | | Netherlands | | 1st Lien

Delayed Draw

Term Loan | | 6.75% (3M

EURIBOR +

6.75%) | | 7/3/2026 | | | | | | € | 2,830 | | | | 2,965 | (e)(h) | | | |

Goldcup

16786 AB | | Sweden | | 1st Lien

Delayed Draw

Term Loan | | 7.34

STIBOR +

6.50%)% (6M | | 8/18/2025 | | | | | | SEK | 10,000 | | | | 978 | (e)(f) | | | |

Horizon

Bidco S.A.S | | France | | 1st Lien Term

Loan | | 6.75% (3M

EURIBOR +

6.75%) | | 10/2/2028 | | | | | | € | 6,010 | | | | 6,299 | (e)(f) | | | |

Horizon

Bidco S.A.S | | France | | 1st Lien Term

Loan | | | | 10/2/2028 | | | | | | € | 3,082 | | | | — | (e)(f)(h) | | | |

Horizon

Bidco S.A.S | | France | | 1st Lien Term

Loan | | 8.06

(SONIA +

6.75%)% | | 10/2/2028 | | | | | | £ | 9,567 | | | | 11,655 | (e)(f) | | | |

IRB Holding

Corp. | | | | 1st Lien Term

Loan | | 4.42% (3M

LIBOR +

2.75%) | | 2/5/2025 | | | | | | | 7,962 | | | | 7,534 | | | | |

Semi-Annual Report 2022

21

CION Ares Diversified Credit Fund

Consolidated Schedule of Investments (continued)

June 30, 2022 (Unaudited)

(in thousands, except shares, percentages and as otherwise noted)

Senior Loans(b)(c)(d) (continued)

Company | | Country(a) | | Investment | | Interest | | Maturity

Date | | Acquisition

Date | | Shares | | Principal

Amount(a) | | Fair Value(a) | | Percentage

of Net

Assets | |

IRB Holding

Corp. | | | | 1st Lien Term

Loan | | 4.84

(SOFR +

3.00%)% | | 12/15/2027 | | | | | | $ | 8,236 | | | $ | 7,715 | | | | |

Jim N Nicks

Management

LLC | | | | 1st Lien

Revolver | | 7.50% (3M

LIBOR +

5.25%) | | 7/10/2023 | | | | | | | 1 | | | | — | (e)(h) | | | |

Jim N Nicks

Management

LLC | | | | 1st Lien Term

Loan | | 7.50% (3M

LIBOR +

5.25%) | | 7/10/2023 | | | | | | | 48 | | | | 48 | (e)(f) | | | |

Learning Care

Group (US)

No. 2 Inc. | | | | 1st Lien Term

Loan | | 4.47% (3M

LIBOR +

3.25%) | | 3/13/2025 | | | | | | | 5,737 | | | | 5,300 | | | | |

Learning Care

Group (US)

No. 2 Inc. | | | | 1st Lien Term

Loan | | 10.07% (3M

LIBOR +

8.50%) | | 3/13/2025 | | | | | | | 980 | | | | 960 | (e) | | | |

LGDN Bidco

Limited | | United

Kingdom | | 1st Lien

Revolver | | | | 7/9/2027 | | | | | | £ | 100 | | | | — | (e)(h) | | | |

LGDN Bidco

Limited | | United

Kingdom | | 1st Lien Term

Loan | | 9.06

(SONIA +

7.75%)% | | 7/9/2027 | | | | | | £ | 1,923 | | | | 1,468 | (e)(h) | | | |

LGDN Bidco

Limited | | United

Kingdom | | 1st Lien

Delayed Draw

Term Loan | | 8.56

(SONIA +

7.75%)% | | 7/9/2027 | | | | | | £ | 359 | | | | 437 | (e)(f) | | | |

LSP HoldCo, LLC | | | | 1st Lien

Revolver | | | | 10/7/2026 | | | | | | | 127 | | | | (3 | )(e)(h) | | | |

LSP HoldCo, LLC | | | | 1st Lien Term

Loan | | 7.00% (3M

LIBOR +

6.00%) | | 10/7/2026 | | | | | | | 852 | | | | 844 | (e)(f) | | | |

LSP HoldCo, LLC | | | | 1st Lien

Delayed Draw