UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-23165

CION ARES DIVERSIFIED CREDIT FUND

(Exact name of registrant as specified in charter)

100 PARK AVENUE

25TH FLOOR

NEW YORK, NEW YORK 10017

(Address of principal executive offices)(Zip code)

Eric A. Pinero 100 Park Avenue, 25th Floor New York, New York 10017 (Name and Address of Agent for Service) |

| | Copy to: | |

Michael A. Reisner Mark Gatto CION Ares Diversified Credit Fund 100 Park Avenue, 25th Floor New York, New York 10017 | | P. Jay Spinola Willkie Farr & Gallagher LLP 787 Seventh Avenue New York, New York 10019 |

| | | |

Registrant’s telephone number, including area code: (646) 845-2577

Date of fiscal year end: December 31

Date of reporting period: January 1, 2023 – December 31, 2023

Item 1. Report to Stockholders.

(a)

CION Ares Diversified Credit Fund

ANNUAL REPORT

DECEMBER 31, 2023

CION Ares Diversified Credit Fund

Letter to Shareholders | | | 2 | | |

Fund Profile & Financial Data | | | 5 | | |

Performance Summary | | | 7 | | |

Consolidated Schedule of Investments | | | 8 | | |

Consolidated Statement of Assets and Liabilities | | | 118 | | |

Consolidated Statement of Operations | | | 120 | | |

Consolidated Statements of Changes in Net Assets | | | 121 | | |

Consolidated Statement of Cash Flows | | | 123 | | |

Financial Highlights | | | 124 | | |

Notes to Consolidated Financial Statements | | | 145 | | |

Report of Independent Registered Public Accounting Firm | | | 172 | | |

Proxy & Portfolio Information | | | 173 | | |

Dividend Reinvestment Plan | | | 174 | | |

Corporate Information | | | 176 | | |

Privacy Notice | | | 177 | | |

Trustees and Executive Officers | | | 178 | | |

Annual Report 2023

CION Ares Diversified Credit Fund

Letter to Shareholders

December 31, 2023

Fellow Shareholders,

We are pleased to present the annual report for the CION Ares Diversified Credit Fund (the "Fund" or "CADC"), for the period ending December 31, 2023. The Fund has continued to experience steady asset growth, with total managed assets reaching approximately $4.5 billion as of December 31, 2023. The Fund returned +13.79%1 over the period, benefitting from elevated base rates, stable credit fundamentals within the portfolio and tactical asset allocation. The Fund continues to maintain a defensive and diversified investment posture. As of period-end, the Fund had over 600 investments, spread across 24 unique industries. Secured debt instruments accounted for 86%2 of the Fund and 72%3 of the Fund was deployed in investments directly originated by investment groups within the Ares Management Corporation ("Ares") platform. Further, the Fund's distribution rate was increased three times in 2023 as elevated interest rates served as a tailwind for the portfolio, concluding the year at a distribution rate of 9.23%4. The Fund's relative value strategy across liquid and illiquid credit enabled the portfolio to capitalize on market opportunities across global credit markets over the period, while maintaining steady distributions of income and preserving shareholder capital.

Investment Philosophy and Process

The Fund employs a dynamic asset allocation framework that seeks to offer enhanced yield and downside risk mitigation, while enabling the Fund's investment advisor, CION Ares Management, LLC ("CION Ares Management," "CAM" or the "Advisor") and the Fund's investment sub-advisor, Ares Capital Management II LLC (the "Sub-Advisor"), an affiliate of Ares, to respond to changing market conditions. We believe that the Fund's differentiated, diversified portfolio of directly originated and liquid investments can provide superior risk-adjusted returns for our shareholders. Active management across a broad spectrum of credit asset classes, including direct lending in the United States and Europe, high yield bonds, leveraged loans, structured credit, real estate debt, and other credit instruments provides the opportunity to generate attractive risk-adjusted returns by capturing the best relative value.

The Fund's investment process is rigorous and incorporates both top-down and bottom-up factors. The Advisor leverages the resources of the Sub-Advisor to conduct ongoing proprietary analysis at the asset-class level that compares current market conditions with historical and industry-level precedents to examine the rate environment, correlation to public markets, and local/regional risks. This information is brought before the Advisor's allocation committee, where senior members overseeing each of the underlying asset classes share their observations with the Fund's portfolio managers.

Investment Environment

Despite a mixed outlook entering the year, markets generated positive returns in 2023 due to resilient economic data, stable corporate fundamentals, and a pause in the Federal Reserve's (the "Fed") interest rate hiking cycle. Economic growth in the U.S. was positive throughout the year as tight labor conditions supported consumer health, offsetting concerns that the runoff of pandemic era stimulus would weigh on sentiment. Inflation decelerated from 6.5% to 3.4%5 as the impacts of the Fed's aggressive hiking cycle began to filter through to the economy. Against this backdrop, the Fed shifted to a less aggressive stance in 2023, though rates remained elevated and ended the year at over 5%6. The migration to a slightly more dovish stance was a tailwind for asset prices, particularly during the fourth quarter, as investors reacted positively to the idea of peak rates and the possibility of rate cuts in 2024. Due to these factors, as well as stable corporate earnings, optimism that the Fed has engineered a "soft landing" of the economy took hold.

From a performance perspective, tighter monetary conditions and resilient economic data drove strong returns across equity and credit markets. Public equities returned +26.26%7 for the year due to better-than-expected corporate earnings, artificial intelligence fervor and expectations of a soft landing of the global economy. Within credit, the rate environment and sound corporate fundamentals lead to a solid backdrop for investors. Specific to leveraged credit, high yield bonds and syndicated loans returned +13.46%8 and +13.04%9, respectively due to elevated yields and a strong bid for risk assets towards year-end. Reflective of investor sentiment, lower credit quality outperformed in both markets, and both credit sectors materially outperformed traditional fixed income, which returned +5.53%10.

The shifting interest rate environment impacted market dynamics throughout the period. Despite new issuance in the syndicated loan and high yield bond markets being down 14% and 29%, respectively through the first seven months of the

Annual Report 2023

2

CION Ares Diversified Credit Fund

Letter to Shareholders (continued)

December 31, 2023

year, supply finished the year higher relative to 2022 as a less aggressive Fed encouraged companies and private equity sponsors to tap the capital markets for refinancings and new deal activity closer to year-end11. Similar dynamics unfolded in private credit markets, though were less dramatic as companies and sponsors turned to non-bank lenders to decrease execution risk throughout the first half 2023, particularly following the regional bank volatility that took place during April and May. In terms of credit fundamentals, while companies grappled with elevated interest expense, earnings grew at a moderate pace, and leverage levels continued to migrate lower. Despite headlines suggesting otherwise, default rates remained in line with historical averages as companies entered 2023 on sound financial footing.

Looking ahead, uncertainty abounds, and various risks continue to persist. While growth was consistently positive throughout 2023, leading indicators continue to suggest a global economic slow-down is on the horizon. Further, while the consumer has been resilient, much of the recent strength has been fueled with debt and as such, consumer health overall is at risk of declining. Additionally, various geopolitical tensions continue to be a potential source of market volatility and drag on the soft-landing narrative. These potential headwinds are offset by the prospects of a dovish Fed, corporate fundamentals that remain stable and tight labor conditions.

Specific to CADC, the Fund concluded 2023 with an attractive 10.9% current yield12 and 9.23% distribution rate4. We are excited about the opportunities that lie ahead in the global credit markets and continue to actively participate in corporate and asset-backed direct lending opportunities, while seeking to take advantage of pockets of volatility within the liquid credit markets. While the Fund maintains an emphasis towards directly originated assets, we continue to utilize the depth and breadth of Ares' investment capabilities to identify pockets of relative value across the more liquid segments of the market, such as high yield bonds and CLO securities. We continue to closely monitor macroeconomic conditions, proactively manage exposures, and identify relative value opportunities created by shifts in sentiment on rates, growth expectations, geopolitical events, and idiosyncratic credit news.

Summary

We expect market volatility to be episodic as central banks attempt to navigate a soft landing, and we believe Ares' scaled platform, tenured experience and cycle-tested investment process will allow the Fund to successfully navigate the evolving market environment. We are pleased with the ongoing construction of the Fund's diversified portfolio, and we believe the Fund is well positioned to find relative value opportunities in an unpredictable market environment given our emphasis on senior secured, floating rate, directly originated assets in defensive, non-cyclical, service-based sectors. The Advisor will continue to seek to leverage Ares' position as a global leader in credit markets to identify attractive investment opportunities in line with the stated objective of the Fund.

We thank you for your investment in and continued support of the CION Ares Diversified Credit Fund.

Sincerely,

| |

| |

| |

Mitch Goldstein

Portfolio Manager

CION Ares Diversified Credit Fund | | Greg Margolies

Portfolio Manager

CION Ares Diversified Credit Fund | | Michael Smith

Portfolio Manager

CION Ares Diversified Credit Fund | |

Views expressed are those of CION Ares Management as of the date of this communication, are subject to change at any time, and may differ from the views of other portfolio managers or of Ares as a whole. Although these views are not intended to be a forecast of future events, a guarantee of future results, or investment advice, any forward-looking statements are not reliable indicators of future events and no guarantee is given that such activities will occur as expected or at all. Information contained herein has been obtained from sources believed to be reliable, but the accuracy and completeness of the information cannot be guaranteed. CION Ares Management does not undertake any obligation to publicly update or review any forward-looking information, whether as a result of new information, future developments or otherwise, except as required by law. All investments involve risk, including possible loss of principal. Past performance is not indicative of future results.

Annual Report 2023

3

CION Ares Diversified Credit Fund

Letter to Shareholders (continued)

December 31, 2023

CION Securities, LLC ("CSL") is the wholesale marketing agent for the Fund, advised by CION Ares Management and distributed by ALPS Distributors, Inc ("ADI"). CSL, member FINRA, and CAM are not affiliated with ADI, member FINRA. Certain Ares fund securities may be offered through its affiliate, Ares Management Capital Markets LLC, a broker-dealer registered with the SEC, and a member of FINRA and SIPC.

1 Past performance is not indicative of future results. Performance shown here is the I-Share Class. The I-Share was incepted on July 12, 2017. Returns include reinvestment of distributions and reflect fund expenses inclusive of recoupment of previously provided expense support. The expense ratio is 4.18% as of December 31, 2023 excluding interest expense. Expense ratios are annualized and calculated as a percentage of estimated average net assets. Share values will fluctuate, therefore if repurchased, they may be worth more or less than their original cost.

2 Secured Debt includes First and Second Lien assets, Structured Credit Debt, Structured Credit Equity. Excludes Cash.

3 Includes U.S. Direct Lending, European Direct Lending, Alternative Credit, Real Estate Debt and Opportunistic investments. Excludes cash.

4 The current distribution rate is expressed as a percentage equal to the projected annualized distribution amount (which is calculated by annualizing the current daily cash distribution per share without compounding), divided by the relevant net asset value per share. A portion of distributions may be a direct result of expense support payments provided by CION Ares Management, which are subject to repayment by CADC within three years. The purpose of this arrangement is to ensure that CADC bears an appropriate level of expenses. Any such distributions may not be entirely based on investment performance and can only be sustained if positive investment performance is achieved in future periods and/or CAM continues to make such expense support payments. Future repayments will reduce cash otherwise potentially available for distributions. There can be no assurance that such performance will be achieved in order to sustain these distributions. CAM has no obligation to provide expense support payments in future periods.

5 Source: Bureau of Labor Statistics. As of January 11, 2024.

6 Source: Federal Reserve. As of December 13, 2023.

7 Proxy: S&P 500 Index. Please refer to Index Definitions for index definitions.

8 Proxy: ICE BofA US High Yield Index. Please refer to Index Definitions for index definitions.

9 Proxy: Credit Suisse Leveraged Loan Index. Please refer to Index Definitions for index definitions.

10 Proxy: Bloomberg Aggregate Bond Index. Please refer to Index Definitions for index definitions.

11 Source: JP Morgan. As of December 31, 2023.

12 CADC's current yield does not represent a return to investors.

Index Definitions

The Bloomberg Aggregate Bond Index measures the performance of the U.S. investment grade bond market. The index invests in a wide spectrum of public, investment-grade, taxable, fixed income securities in the United States — including government, corporate, and international dollar-denominated bonds, as well as mortgage-backed and asset-backed securities, all with maturities of more than 1 year. To be included in the index, bonds must be rated investment grade (at least Baa3/BBB) by Moody's and S&P. Inception date: January 1, 1976.

The Standard & Poor's 500 Index, often abbreviated as the S&P 500, or just "the S&P", is an American stock market index based on the market capitalizations of 500 large companies having common stock listed on the NYSE or NASDAQ. The index components and their weightings are determined by S&P Dow Jones Indices.

The Credit Suisse Leveraged Loan Index is designed to mirror the investable universe of the US dollar-denominated leveraged loan market. The index inception is January 1992. The index frequency is daily, weekly and monthly. New loans are added to the index on their effective date if they qualify according to the following criteria: 1) Loan facilities must be rated "5B" or lower. That is, the highest Moody's/S&P ratings are Baa1/BB+ or Ba1/BBB+. For unrated loans, the initial spread must be 125 basis points or higher above the benchmark reference reset rate. 2) Only fully-funded term loan facilities are included. 3) The tenor must be at least one year. 4) Issuers must be domiciled in developed countries; issuers from developing countries are excluded.

The ICE BofA US High Yield Index tracks the performance of US dollar denominated below investment grade corporate debt publicly issued in the US domestic market. Qualifying securities must have a below investment grade rating (based on an average of Moody's, S&P and Fitch), at least 18 months to final maturity at the time of issuance, at least one year remaining term to final maturity as of the rebalancing date, a fixed coupon schedule and a minimum amount outstanding of $100 million. Index constituents are capitalization-weighted based on their current amount outstanding times the market price plus accrued interest. Accrued interest is calculated assuming next-day settlement. Cash flows from bond payments that are received during the month are retained in the index until the end of the month and then are removed as part of the rebalancing. Cash does not earn any reinvestment income while it is held in the index. The index is rebalanced on the last calendar day of the month, based on information available up to and including the third business day before the last business day of the month. No changes are made to constituent holdings other than on month end rebalancing dates. Inception date: August 31, 1986.

Annual Report 2023

4

CION Ares Diversified Credit Fund

Fund Fact Sheet — As of December 31, 2023

CLASS A CADEX | CLASS C CADCX | CLASS I CADUX | CLASS L CADWX

CLASS U CADZX | CLASS U2 CADSX | CLASS W CADFX

FUND OVERVIEW

CION Ares Diversified Credit Fund (CADC) is a diversified, unlisted closed-end management investment company registered under the 1940 Act as an interval fund. The Fund will seek to capitalize on market inefficiencies and relative value opportunities by dynamically allocating a portfolio of directly originated loans, secured floating and fixed rate syndicated loans, corporate bonds, asset-backed securities, commercial real estate loans and other types of credit instruments which, under normal circumstances, will represent at least 80% of the Fund's assets.

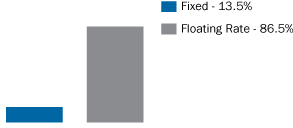

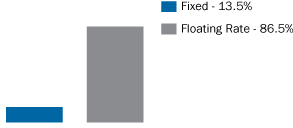

Fixed vs. Floating Rate

Excludes cash, other net assets and equity instruments.

KEY FACTS

TOTAL MANAGED ASSETS* | | $ | 4.4 | B | |

TOTAL ISSUES | | | 690 | | |

DISTRIBUTIONS1 | | Monthly | |

SHARE CLASS | | INCEPTION | | CURRENT

DISTRIBUTION

RATE2 | | STANDARD

DEVIATION3 | | SHARPE RATIO4

(ANNUALIZED) | |

CLASS A | | 1/26/2017 | | | 8.98 | % | | | 3.80 | % | | | 1.02 | | |

CLASS C | | 7/12/2017 | | | 8.24 | % | | | 3.80 | % | | | 0.97 | | |

CLASS I | | 7/12/2017 | | | 9.23 | % | | | 3.81 | % | | | 1.08 | | |

CLASS L | | 11/2/2017 | | | 8.73 | % | | | 3.88 | % | | | 0.97 | | |

CLASS U | | 7/25/2019 | | | 8.49 | % | | | 4.39 | % | | | 0.79 | | |

CLASS U-2 | | 4/13/2020 | | | 8.49 | % | | | 2.99 | % | | | 2.63 | | |

CLASS W | | 12/4/2018 | | | 8.73 | % | | | 4.19 | % | | | 0.99 | | |

Portfolio Allocation*

Allocation by Asset Type

Allocation by Geography

Top 10 Holdings* % of Portfolio

Kaseya | | | 1.1 | % | |

Mimecast | | | 1.1 | % | |

Nielsen | | | 1.0 | % | |

High Street Insurance Partners | | | 1.0 | % | |

DigiCert | | | 1.0 | % | |

TurnPoint Services | | | 0.9 | % | |

European Camping Group | | | 0.9 | % | |

eCapital | | | 0.9 | % | |

RSK Group Limited | | | 0.9 | % | |

Platinum Credit | | | 0.8 | % | |

Allocation by Industry* % of Portfolio

Software & Services | | | 21.3 | % | |

Commercial & Professional Services | | | 9.8 | % | |

Financial Services | | | 9.2 | % | |

Health Care Equipment & Services | | | 8.1 | % | |

Structured Products | | | 8.0 | % | |

Consumer Services | | | 6.7 | % | |

Capital Goods | | | 6.7 | % | |

Insurance | | | 6.0 | % | |

Other | | | 25.6 | % | |

Cash | | | -1.3 | % | |

* Holdings and allocations, unless otherwise indicated, are based on the total managed assets and subject to change without notice. Total managed assets is defined as the total assets (including any assets attributable to financial leverage) minus accrued liabilities (other than debt representing financial leverage). Data shown is for informational purposes only and not a recommendation to buy or sell any security.

Annual Report 2023

5

CION Ares Diversified Credit Fund

Fund Fact Sheet — As of December 31, 2023 (continued)

CLASS A CADEX | CLASS C CADCX | CLASS I CADUX | CLASS L CADWX

CLASS U CADZX | CLASS U2 CADSX | CLASS W CADFX

MANAGEMENT TEAM

• Mitch Goldstein, Co-Head of Ares Credit Group | 28 Years of Experience

• Greg Margolies, Partner, Ares Management | 35 Years of Experience

• Michael Smith, Co-Head of Ares Credit Group | 28 Years of Experience

• CADC's allocation committee consists of an additional 13 members, averaging nearly 25 years of experience.

ABOUT CION INVESTMENTS

CION Investments is a leading manager of investment solutions designed to redefine the way individual investors can build their portfolios and help meet their long-term investment goals. With more than 30 years of experience in the alternative asset management industry, CION strives to level the playing field. CION currently manages CION Investment Corporation, a leading BDC, and sponsors, through CION Ares Management, CION Ares Diversified Credit Fund, a globally diversified interval fund.

ABOUT ARES MANAGEMENT

Ares Management Corporation (NYSE: ARES) is a leading global alternative investment manager offering clients complementary primary and secondary investment solutions across the credit, private equity, real estate and infrastructure asset classes. Ares Management Corporation seeks to provide flexible capital to support businesses and create value for its stakeholders and within its communities. By collaborating across its investment groups, Ares Management Corporation aims to generate consistent and attractive investment returns throughout market cycles. As of September 30, 2023, Ares Management Corporation's global platform had approximately $395 billion of assets under management, with over 2,300 employees operating across North America, Europe, Asia Pacific and the Middle East. For more information, please visit www.aresmgmt.com.

RISK DISCLOSURES & GLOSSARY

Risks and limitations include, but are not limited to, the following: investment instruments may be susceptible to economic downturns; most of the underlying credit instruments are rated below investment grade and considered speculative; there is no guarantee all shares can be repurchased; the Fund's business and operations may be impacted by fluctuations in the capital markets; the Fund is a diversified, closed-end investment company with limited operating history; diversification does not eliminate the risk of investment losses.

1 Monthly Distributions — There is no assurance monthly distributions paid by the fund will be maintained at the targeted level or paid at all.

2 Current Distribution Rate — Current distribution rate is expressed as a percentage equal to the projected annualized distribution amount (which is calculated by annualizing the current cash distribution per share without compounding), divided by the net asset value. The current distribution rate shown may be rounded.

3 Standard Deviation — a widely used measure of an investment's performance volatility. Standard deviation shows how much variation from the mean exists with a larger number indicating the data points are more spread out over a larger range of values. Figures shown here are based on non-loaded daily NAV total returns utilizing data since inception.

4 Sharpe Ratio — a risk-adjusted measure that measures reward per unit of risk. The higher the Sharpe Ratio, the better. The numerator is the difference between a portfolio's return and the return of a risk-free instrument. The denominator is the portfolio's standard deviation. Figures shown here are based on non-loaded daily NAV total returns utilizing data since inception.

A portion of distributions may be a direct result of expense support payments provided by CION Ares Management, LLC (CAM), which are subject to repayment by CADC within three years. The purpose of this arrangement is to ensure that CADC bears an appropriate level of expenses. Any such distributions may not be entirely based on investment performance and can only be sustained if positive investment performance is achieved in future periods and/or CAM continues to make such expense support payments. Future repayments will reduce cash otherwise potentially available for distributions. There can be no assurance that such performance will be achieved in order to sustain these distributions. CAM has no obligation to provide expense support payments in future periods.

CADC may fund distributions from unlimited amounts of offering proceeds or borrowings, which may constitute a return of capital, as well as net income from operations, capital and non-capital gains from the sale of assets, dividends or distributions from equity investments and expense support payments from CAM, which are subject to repayment. For the year ending December 31, 2022, distributions were paid from taxable income and did not include a return of capital for tax purposes. If expense support payments from CAM were not provided, some or all of the distributions may have been a return of capital which would reduce the available capital for investment. The sources of distributions may vary periodically. Please refer to the semi-annual or annual reports filed with the SEC for the sources of distributions.

Annual Report 2023

6

CION Ares Diversified Credit Fund

Performance Summary

December 31, 2023

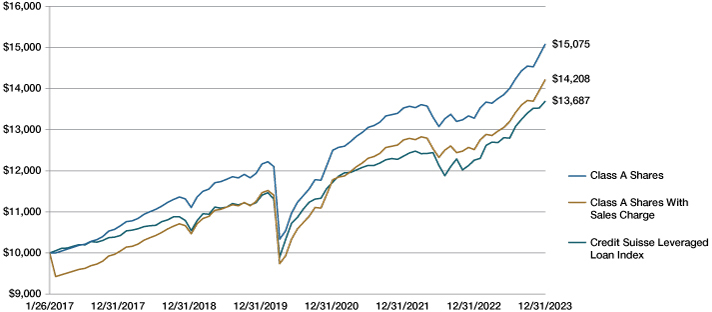

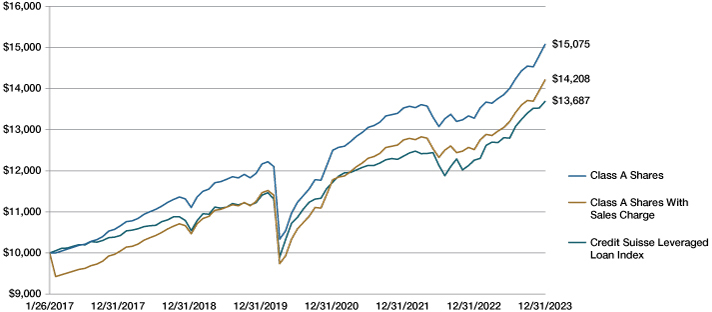

The following graph shows the value, as of December 31, 2023, of a hypothetical $10,000 investment made on January 26, 2017 in Class A Shares at net asset value (with a sales charge of 5.75%). For comparative purposes, the performance of the Credit Suisse Leveraged Loan Index ("CSLLI") is shown. CSLLI is designed to mirror the investable universe of the U.S. Dollar-denominated leveraged loan market, and is deemed to be an appropriate broad-based securities market index for the Fund. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and in their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the repurchase of Fund shares. The returns in the graph and table set forth below represent past performance.

Past performance does not guarantee future results. The Fund's investment return and principal value will fluctuate so that an investor's shares, when repurchased, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted below. Please visit our website at https://www.cioninvestments.com/products/cion-ares-diversified-credit-fund/ to obtain the most recent month-end returns.

CION Ares Diversified Credit Fund's Lifetime Performance Data

CADC Performance Since Inception

Annual Report 2023

7

CION Ares Diversified Credit Fund

Consolidated Schedule of Investments

December 31, 2023

(in thousands, except shares, percentages and as otherwise noted)

Senior Loans(b)(c)(d)

Company | | Country(a) | | Investment | | Interest | | Maturity

Date | | Acquisition

Date | | Shares | | Principal

Amount(a) | | Fair Value(a) | | % of

Net

Assets | |

Automobiles and Components | |

Automotive

Keys Group,

LLC | | | | | | 1st Lien Term

Loan | | 11.75% (3M

SOFR +

6.25%) | | 11/06/2025 | | | | | | | | $ | 1,670 | | | $ | 1,603 | (e)(f) | | | | | |

Automotive

Keys Group,

LLC | | | | | | 1st Lien Term

Loan | | 11.75% (3M

SOFR +

6.25%) | | 11/06/2025 | | | | | | | | | 238 | | | | 228 | (e) | | | | | |

Clarios Global

LP | | | | | | 1st Lien Term

Loan | | 9.11% (1M

SOFR +

3.75%) | | 05/06/2030 | | | | | | | | | 5,611 | | | | 5,618 | | | | | | |

Continental

Acquisition

Holdings, Inc. | | | | | | 1st Lien

Revolving

Loan | | 9.19% (3M

SOFR +

3.75%) | | 01/20/2026 | | | | | | | | | 1 | | | | 1 | (e)(h) | | | | | |

Continental

Acquisition

Holdings, Inc. | | | | | | 1st Lien Term

Loan | | 12.50% (3M

SOFR +

7.00%) | | 01/20/2027 | | | | | | | | | 5,974 | | | | 5,138 | (e)(f) | | | | | |

Continental

Acquisition

Holdings, Inc. | | | | | | 1st Lien Delay

Draw Loan | | 12.50% (3M

SOFR +

7.00%) | | 01/20/2027 | | | | | | | | | 1,451 | | | | 1,248 | (e)(f) | | | | | |

Highline

Aftermarket

Acquisition, LLC | | | | | | 1st Lien

Revolving

Loan | | | | 11/10/2025 | | | | | | | | | — | | | | — | (e)(h) | | | | | |

Highline

Aftermarket

Acquisition, LLC | | | | | | 2nd Lien Term

Loan | | 13.52% (3M

SOFR +

8.00%) | | 11/09/2028 | | | | | | | | | 5,942 | | | | 5,942 | (e)(f) | | | | | |

Highline

Aftermarket

Acquisition, LLC | | | | | | 2nd Lien

Delay Draw

Loan | | 13.52% (3M

SOFR +

8.00%) | | 11/09/2028 | | | | | | | | | 4,209 | | | | 4,209 | (e) | | | | | |

New Churchill

Holdco LLC | | | | | | 1st Lien

Revolving

Loan | | 10.87% (3M

SOFR +

5.50%) | | 11/09/2029 | | | | | | | | | 19 | | | | 19 | (e)(h) | | | | | |

New Churchill

Holdco LLC | | | | | | 1st Lien Term

Loan | | 10.87% (3M

SOFR +

5.50%) | | 11/09/2029 | | | | | | | | | 1,213 | | | | 1,188 | (e) | | | | | |

New Churchill

Holdco LLC | | | | | | 1st Lien Delay

Draw Loan | | 10.88% (3M

SOFR +

5.50%) | | 11/09/2029 | | | | | | | | | 173 | | | | 170 | (e)(h) | | | | | |

Sun Acquirer

Corp. | | | | | | 1st Lien

Revolving

Loan | | 11.22% (1M

SOFR +

5.75%) | | 09/08/2027 | | | | | | | | | 212 | | | | 210 | (e)(h) | | | | | |

Sun Acquirer

Corp. | | | | | | 1st Lien Term

Loan | | 11.22% (1M

SOFR +

5.75%) | | 09/08/2028 | | | | | | | | | 6,482 | | | | 6,418 | (e) | | | | | |

Sun Acquirer

Corp. | | | | | | 1st Lien Term

Loan | | 11.22% (1M

SOFR +

5.75%) | | 09/08/2028 | | | | | | | | | 1,731 | | | | 1,713 | (e)(f) | | | | | |

Sun Acquirer

Corp. | | | | | | 1st Lien Delay

Draw Loan | | 11.22% (1M

SOFR +

5.75%) | | 09/08/2028 | | | | | | | | | 4,581 | | | | 4,535 | (e) | | | | | |

Sun Acquirer

Corp. | | | | | | 1st Lien Delay

Draw Loan | | | | 09/08/2028 | | | | | | | | | — | | | | — | (e)(h) | | | | | |

Annual Report 2023

8

CION Ares Diversified Credit Fund

Consolidated Schedule of Investments (continued)

December 31, 2023

(in thousands, except shares, percentages and as otherwise noted)

Senior Loans(b)(c)(d) (continued)

Company | | Country(a) | | Investment | | Interest | | Maturity

Date | | Acquisition

Date | | Shares | | Principal

Amount(a) | | Fair Value(a) | | % of

Net

Assets | |

Wand Newco 3,

Inc. | | | | 1st Lien Term

Loan | | 8.22% (1M

SOFR +

2.75%) | | 02/05/2026 | | | | | | | | $ | 15,959 | | | $ | 15,993 | | | | | | |

Wand Newco 3,

Inc. | | | | 2nd Lien Term

Loan | | 12.71% (1M

SOFR +

7.25%) | | 02/05/2027 | | | | | | | | | 2,026 | | | | 2,026 | (e)(f) | | | | | |

| | | | | | | | | | | | | | | | | | | | 56,259 | | | | 1.75 | % | |

Capital Goods | |

AI Aqua Merger

Sub, Inc. | | | | 1st Lien Delay

Draw Loan | | | | 07/31/2028 | | | | | | | | | 1,652 | | | | 1,658 | (h)(i) | | | | | |

AIM Acquisition,

LLC | | | | 1st Lien

Revolving

Loan | | | | 12/02/2025 | | | | | | | | | — | | | | — | (e)(h) | | | | | |

AIM Acquisition,

LLC | | | | 1st Lien Term

Loan | | 10.49% (6M

SOFR +

5.00%) | | 12/02/2025 | | | | | | | | | 212 | | | | 212 | (e)(f) | | | | | |

Airx Climate

Solutions, Inc. | | | | 1st Lien

Revolving

Loan | | | | 11/07/2029 | | | | | | | | | — | | | | — | (e)(h) | | | | | |

Airx Climate

Solutions, Inc. | | | | 1st Lien Term

Loan | | 11.68% (3M

SOFR +

6.25%) | | 11/07/2029 | | | | | | | | | 1,513 | | | | 1,475 | (e) | | | | | |

Airx Climate

Solutions, Inc. | | | | 1st Lien Delay

Draw Loan | | | | 11/07/2029 | | | | | | | | | — | | | | — | (e)(h) | | | | | |

AllClear Military

Inc. | | | | 1st Lien Term

Loan | | | | 08/10/2025 | | | | | | | | | 1,947 | | | | 1,110 | (e)(j) | | | | | |

Artera Services,

LLC | | | | 1st Lien Term

Loan | | 8.70% (3M

SOFR +

3.25%) | | 03/06/2025 | | | | | | | | | 3,484 | | | | 3,270 | | | | | | |

Artera Services,

LLC | | | | 1st Lien Term

Loan | | 8.95% (3M

SOFR +

3.50%) | | 03/06/2025 | | | | | | | | | 3,393 | | | | 3,184 | | | | | | |

BlueHalo Global

Holdings, LLC | | | | 1st Lien

Revolving

Loan | | 12.02% (3M

SOFR +

6.50%) | | 10/31/2025 | | | | | | | | | 444 | | | | 436 | (e)(h) | | | | | |

BlueHalo Global

Holdings, LLC | | | | 1st Lien Term

Loan | | 12.02% (3M

SOFR +

6.50%) | | 10/31/2025 | | | | | | | | | 4,048 | | | | 3,967 | (e)(f) | | | | | |

Box Bidco

Limited | | United

Kingdom | | 1st Lien Term

Loan | | 11.48% (6M

EURIBOR +

7.42%) | | 11/24/2028 | | | | | | | | € | 878 | | | | 969 | (e)(f) | | | | | |

Box Bidco

Limited | | United

Kingdom | | 1st Lien Term

Loan | | 11.50% (6M

SOFR +

5.75%) | | 11/24/2028 | | | | | | | | | 1,691 | | | | 1,691 | (e)(f) | | | | | |

Brookfield WEC

Holdings Inc. | | | | 1st Lien Term

Loan | | 8.22% (1M

SOFR +

2.75%) | | 08/01/2025 | | | | | | | | | 13,108 | | | | 13,133 | | | | | | |

Brown Group

Holding, LLC | | | | 1st Lien Term

Loan | | 8.21% (1M

SOFR +

2.75%) | | 06/07/2028 | | | | | | | | | 4,959 | | | | 4,961 | | | | | | |

Annual Report 2023

9

CION Ares Diversified Credit Fund

Consolidated Schedule of Investments (continued)

December 31, 2023

(in thousands, except shares, percentages and as otherwise noted)

Senior Loans(b)(c)(d) (continued)

Company | | Country(a) | | Investment | | Interest | | Maturity

Date | | Acquisition

Date | | Shares | | Principal

Amount(a) | | Fair Value(a) | | % of

Net

Assets | |

Brown Group

Holding, LLC | | | | 1st Lien Term

Loan | | 9.14% (3M

SOFR +

3.75%) | | 07/02/2029 | | | | | | | | $ | 496 | | | $ | 498 | | | | | | |

Burgess Point

Purchaser

Corporation | | | | 1st Lien Term

Loan | | 10.71% (1M

SOFR +

5.25%) | | 07/25/2029 | | | | | | | | | 4,146 | | | | 3,902 | | | | | | |

Chart Industries,

Inc. | | | | 1st Lien Term

Loan | | 8.69% (1M

SOFR +

3.25%) | | 03/15/2030 | | | | | | | | | 6,361 | | | | 6,366 | | | | | | |

CP Atlas Buyer

Inc | | | | 1st Lien Term

Loan | | 9.21% (1M

SOFR +

3.75%) | | 11/23/2027 | | | | | | | | | 4,455 | | | | 4,374 | | | | | | |

CPIG Holdco Inc. | | | | 1st Lien

Revolving

Loan | | 10.24% (3M

SOFR +

4.75%) | | 04/28/2028 | | | | | | | | | 1 | | | | 1 | (e)(h) | | | | | |

CPIG Holdco Inc.

Loan | | | | 1st Lien Term | | 12.49% (3M

SOFR +

7.00%) | | 04/28/2028 | | | | | | | | | 3,863 | | | | 3,863 | (e) | | | | | |

Cube Industrials

Buyer, Inc. &

Cube A&D

Buyer Inc. | | | | 1st Lien

Revolving

Loan | | | | 10/18/2029 | | | | | | | | | — | | | | — | (e)(h) | | | | | |

Cube Industrials

Buyer, Inc. &

Cube A&D

Buyer Inc. | | | | 1st Lien Term

Loan | | 11.40% (3M

SOFR +

6.00%) | | 10/18/2030 | | | | | | | | | 4,308 | | | | 4,201 | (e) | | | | | |

Dynamic NC

Aerospace

Holdings, LLC | | | | 1st Lien

Revolving

Loan | | 12.54% (3M

SOFR +

7.00%) | | 12/30/2025 | | | | | | | | | 670 | | | | 670 | (e)(h) | | | | | |

Dynamic NC

Aerospace

Holdings, LLC | | | | 1st Lien Term

Loan | | 12.54% (3M

SOFR +

7.00%) | | 12/30/2026 | | | | | | | | | 2,750 | | | | 2,750 | (e)(f) | | | | | |

Eleda BidCo AB

(fka EISG BidCo

AB) | | Sweden | | 1st Lien Term

Loan | | 10.15% (3M

STIBOR +

6.25%) | | 06/30/2026 | | | | | | | | SEK | 21,000 | | | | 2,082 | (e)(f) | | | | | |

Eleda BidCo AB

(fka EISG BidCo

AB) | | Sweden | | 1st Lien Term

Loan | | 10.29% (3M

STIBOR +

6.25%) | | 06/30/2026 | | | | | | | | SEK | 24,107 | | | | 2,390 | (e)(f) | | | | | |

Eleda BidCo AB

(fka EISG BidCo

AB) | | Sweden | | 1st Lien Delay

Draw Loan | | 10.95% (3M

NIBOR +

6.25%) | | 06/30/2026 | | | | | | | | SEK | 2,106 | | | | 209 | (e) | | | | | |

Eleda BidCo AB

(fka EISG BidCo

AB) | | Sweden | | 1st Lien Delay

Draw Loan | | 10.29% (3M

STIBOR +

6.25%) | | 06/30/2026 | | | | | | | | SEK | 9,070 | | | | 899 | (e)(f) | | | | | |

EPS NASS

Parent, Inc. | | | | 1st Lien

Revolving

Loan | | 11.25% (3M

SOFR +

5.75%) | | 04/17/2026 | | | | | | | | | 135 | | | | 131 | (e)(h) | | | | | |

EPS NASS

Parent, Inc. | | | | 1st Lien Term

Loan | | 11.25% (3M

SOFR +

5.75%) | | 04/19/2028 | | | | | | | | | 5,715 | | | | 5,544 | (e)(f) | | | | | |

Annual Report 2023

10

CION Ares Diversified Credit Fund

Consolidated Schedule of Investments (continued)

December 31, 2023

(in thousands, except shares, percentages and as otherwise noted)

Senior Loans(b)(c)(d) (continued)

Company | | Country(a) | | Investment | | Interest | | Maturity

Date | | Acquisition

Date | | Shares | | Principal

Amount(a) | | Fair Value(a) | | % of

Net

Assets | |

EPS NASS

Parent, Inc. | | | | 1st Lien Delay

Draw Loan | | 11.25% (3M

SOFR +

5.75%) | | 04/19/2028 | | | | | | | | $ | 322 | | | $ | 312 | (e) | | | | | |

Helix Acquisition

Holdings, Inc. | | | | 1st Lien Term

Loan | | 12.45% (3M

SOFR +

7.00%) | | 03/29/2030 | | | | | | | | | 473 | | | | 473 | (e) | | | | | |

Husky Injection

Molding

Systems Ltd. | | Canada | | 1st Lien Term

Loan | | 8.47% (1M

SOFR +

3.00%) | | 03/28/2025 | | | | | | | | | 15,087 | | | | 15,055 | | | | | | |

INNIO Group

Holding GmbH | | Germany | | 1st Lien Term

Loan | | | | 10/31/2028 | | | | | | | | € | 6,900 | | | | 7,611 | (i) | | | | | |

Kene

Acquisition,

Inc. | | | | 1st Lien

Revolving

Loan | | | | 08/08/2024 | | | | | | | | | — | | | | — | (e)(h) | | | | | |

Kene

Acquisition,

Inc. | | | | 1st Lien Term

Loan | | 9.75% (3M

SOFR +

4.25%) | | 08/10/2026 | | | | | | | | | 2,790 | | | | 2,790 | (e)(f) | | | | | |

Kene

Acquisition,

Inc. | | | | 1st Lien

Delay Draw

Loan | | 9.75% (3M

SOFR +

4.25%) | | 08/10/2026 | | | | | | | | | 467 | | | | 466 | (e)(f) | | | | | |

Kodiak BP, LLC | | | | 1st Lien Term

Loan | | 8.86% (3M

SOFR +

3.25%) | | 03/12/2028 | | | | | | | | | 6,497 | | | | 6,477 | | | | | | |

LBM Acquisition

LLC | | | | 1st Lien Term

Loan | | 9.21% (1M

SOFR +

3.75%) | | 12/17/2027 | | | | | | | | | 8,264 | | | | 8,155 | | | | | | |

Maverick

Acquisition, Inc. | | | | 1st Lien Term

Loan | | 11.60% (3M

SOFR +

6.25%) | | 06/01/2027 | | | | | | | | | 5,240 | | | | 4,245 | (e)(f) | | | | | |

Maverick

Acquisition, Inc. | | | | 1st Lien Delay

Draw Loan | | 11.60% (3M

SOFR +

6.25%) | | 06/01/2027 | | | | | | | | | 1,195 | | | | 967 | (e) | | | | | |

Osmose Utilities

Services, Inc. | | | | 2nd Lien Term

Loan | | 12.11% (1M

SOFR +

6.75%) | | 06/25/2029 | | | | | | | | | 8,237 | | | | 8,155 | (e) | | | | | |

Osmosis Buyer

Limited | | | | 1st Lien Term

Loan | | 9.09% (1M

SOFR +

3.75%) | | 07/31/2028 | | | | | | | | | 7,358 | | | | 7,354 | | | | | | |

Prime Buyer,

L.L.C. | | | | 1st Lien

Revolving

Loan | | | | 12/22/2026 | | | | | | | | | — | | | | — | (e)(h) | | | | | |

Prime Buyer,

L.L.C. | | | | 1st Lien Term

Loan | | 10.71% (1M

SOFR +

5.25%) | | 12/22/2026 | | | | | | | | | 13,572 | | | | 12,486 | (e)(f) | | | | | |

Radius

Aerospace

Europe Limited | | United

Kingdom | | 1st Lien

Revolving

Loan | | 10.94% (1M

SONIA +

5.75%) | | 03/29/2025 | | | | | | | | £ | 157 | | | | 200 | (e)(h) | | | | | |

Radius

Aerospace

Europe Limited | | United

Kingdom | | 1st Lien Term

Loan | | 11.25% (3M

SOFR +

5.75%) | | 03/29/2025 | | | | | | | | | 1,561 | | | | 1,562 | (e)(f) | | | | | |

Annual Report 2023

11

CION Ares Diversified Credit Fund

Consolidated Schedule of Investments (continued)

December 31, 2023

(in thousands, except shares, percentages and as otherwise noted)

Senior Loans(b)(c)(d) (continued)

Company | | Country(a) | | Investment | | Interest | | Maturity

Date | | Acquisition

Date | | Shares | | Principal

Amount(a) | | Fair Value(a) | | % of

Net

Assets | |

Radius

Aerospace, Inc. | | | | 1st Lien

Revolving

Loan | | 11.23% (1M

SOFR +

5.75%) | | 03/29/2025 | | | | | | | | $ | 114 | | | $ | 114 | (e)(h) | | | | | |

Radius

Aerospace, Inc. | | | | 1st Lien Term

Loan | | 11.25% (3M

SOFR +

5.75%) | | 03/29/2025 | | | | | | | | | 2,252 | | | | 2,252 | (e)(f) | | | | | |

Sigma Electric

Manufacturing

Corporation | | | | 1st Lien

Revolving

Loan | | | | 10/31/2024 | | | | | | | | | — | | | | — | (e)(h) | | | | | |

Sigma Electric

Manufacturing

Corporation | | | | 1st Lien Term

Loan | | 11.25% (3M

SOFR +

5.75%) | | 10/31/2024 | | | | | | | | | 387 | | | | 387 | (e)(f) | | | | | |

Specialty

Building

Products

Holdings, LLC | | | | 1st Lien Term

Loan | | 9.21% (1M

SOFR +

3.75%) | | 10/15/2028 | | | | | | | | | 1,396 | | | | 1,393 | | | | | | |

SRS Distribution

Inc. | | | | 1st Lien Term

Loan | | 8.97% (1M

SOFR +

3.50%) | | 06/02/2028 | | | | | | | | | 4,016 | | | | 4,017 | | | | | | |

SRS Distribution

Inc. | | | | 1st Lien Term

Loan | | 8.96% (1M

SOFR +

3.50%) | | 06/02/2028 | | | | | | | | | 3,311 | | | | 3,307 | | | | | | |

Sunk Rock

Foundry

Partners LP | | | | 1st Lien Term

Loan | | 11.25% (3M

SOFR +

5.75%) | | 10/31/2024 | | | | | | | | | 193 | | | | 193 | (e)(f) | | | | | |

TransDigm Inc. | | | | 1st Lien Term

Loan | | 8.60% (3M

SOFR +

3.25%) | | 08/24/2028 | | | | | | | | | 9,696 | | | | 9,732 | | | | | | |

Two Six Labs,

LLC | | | | 1st Lien

Revolving

Loan | | | | 08/20/2027 | | | | | | | | | — | | | | — | (e)(h) | | | | | |

Two Six Labs,

LLC | | | | 1st Lien Term

Loan | | 10.85% (3M

SOFR +

5.50%) | | 08/20/2027 | | | | | | | | | 7,299 | | | | 7,299 | (e)(f) | | | | | |

Two Six Labs,

LLC | | | | 1st Lien Term

Loan | | 11.35% (3M

SOFR +

6.00%) | | 08/20/2027 | | | | | | | | | 1,338 | | | | 1,338 | (e) | | | | | |

Two Six Labs,

LLC | | | | 1st Lien Delay

Draw Loan | | 10.85% (3M

SOFR +

5.50%) | | 08/20/2027 | | | | | | | | | 2,831 | | | | 2,831 | (e) | | | | | |

Victory Buyer

LLC | | | | 1st Lien Term

Loan | | 9.39% (3M

SOFR +

3.75%) | | 11/19/2028 | | | | | | | | | 5,293 | | | | 5,009 | | | | | | |

Wilsonart LLC | | | | 1st Lien Term

Loan | | 8.70% (3M

SOFR +

3.25%) | | 12/31/2026 | | | | | | | | | 10,793 | | | | 10,806 | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | 198,932 | | | | 6.20 | % | |

Annual Report 2023

12

CION Ares Diversified Credit Fund

Consolidated Schedule of Investments (continued)

December 31, 2023

(in thousands, except shares, percentages and as otherwise noted)

Senior Loans(b)(c)(d) (continued)

Company | | Country(a) | | Investment | | Interest | | Maturity

Date | | Acquisition

Date | | Shares | | Principal

Amount(a) | | Fair Value(a) | | % of

Net

Assets | |

Commercial and Professional Services | |

Aero Operating

LLC | | | | 1st Lien Term

Loan | | 14.54% (3M

SOFR +

9.00%) | | 02/09/2026 | | | | | | | | $ | 2,898 | | | $ | 2,463 | (e)(f) | | | | | |

Aero Operating

LLC | | | | 1st Lien

Delay Draw

Loan | | 14.54% (3M

SOFR +

9.00%) | | 02/09/2026 | | | | | | | | | 806 | | | | 685 | (e)(f) | | | | | |

Applied

Technical

Services, LLC | | | | 1st Lien

Revolving

Loan | | 13.25

(PRIME +

4.75%)% | | 12/29/2026 | | | | | | | | | 523 | | | | 523 | (e)(h) | | | | | |

Applied

Technical

Services, LLC | | | | 1st Lien Term

Loan | | 11.25% (3M

SOFR +

5.75%) | | 12/29/2026 | | | | | | | | | 4,215 | | | | 4,214 | (e)(f) | | | | | |

Applied

Technical

Services, LLC | | | | 1st Lien Term

Loan | | 11.52% (3M

SOFR +

6.00%) | | 12/29/2026 | | | | | | | | | 571 | | | | 571 | (e) | | | | | |

Applied

Technical

Services, LLC | | | | 1st Lien Delay

Draw Loan | | 11.25% (3M

SOFR +

5.75%) | | 12/29/2026 | | | | | | | | | 1,417 | | | | 1,417 | (e)(f) | | | | | |

Applied

Technical

Services, LLC | | | | 1st Lien Delay

Draw Loan | | 11.25% (3M

SOFR +

5.75%) | | 12/29/2026 | | | | | | | | | 4,942 | | | | 4,942 | (e) | | | | | |

Applied

Technical

Services, LLC | | | | 1st Lien Delay

Draw Loan | | 11.52% (3M

SOFR +

6.00%) | | 12/29/2026 | | | | | | | | | 573 | | | | 573 | (e) | | | | | |

Argenbright

Holdings V, LLC | | | | 1st Lien Term

Loan | | 12.78% (3M

SOFR +

7.25%) | | 11/30/2026 | | | | | | | | | 2,791 | | | | 2,791 | (e)(f) | | | | | |

Argenbright

Holdings V, LLC | | | | 1st Lien Delay

Draw Loan | | | | 11/30/2026 | | | | | | | | | — | | | | — | (e)(h) | | | | | |

Armorica

Lux S.a.r.l. | | Luxembourg | | 1st Lien Term

Loan | | 8.87% (3M

EURIBOR +

4.93%) | | 07/28/2028 | | | | | | | | € | 4,000 | | | | 4,195 | | | | | | |

Auxadi Midco

S.L.U. | | Spain | | 1st Lien Term

Loan | | 8.72% (3M

EURIBOR +

4.75%) | | 07/17/2028 | | | | | | | | € | 473 | | | | 522 | (e)(g) | | | | | |

Capstone

Acquisition

Holdings, Inc. | | | | 1st Lien

Revolving

Loan | | | | 11/12/2025 | | | | | | | | | — | | | | — | (e)(h) | | | | | |

Capstone

Acquisition

Holdings, Inc. | | | | 1st Lien Term

Loan | | 10.21% (1M

SOFR +

4.75%) | | 11/12/2027 | | | | | | | | | 10,759 | | | | 10,760 | (e)(f) | | | | | |

Capstone

Acquisition

Holdings, Inc. | | | | 2nd Lien Term

Loan | | 14.21% (1M

SOFR +

8.75%) | | 11/13/2028 | | | | | | | | | 3,008 | | | | 3,008 | (e)(f) | | | | | |

Capstone

Acquisition

Holdings, Inc. | | | | 1st Lien Delay

Draw Loan | | 10.21% (1M

SOFR +

4.75%) | | 11/12/2027 | | | | | | | | | 631 | | | | 631 | (e) | | | | | |

Compex Legal

Services, Inc. | | | | 1st Lien

Revolving

Loan | | 10.94% (3M

SOFR +

5.45%) | | 02/07/2025 | | | | | | | | | 270 | | | | 270 | (e)(h) | | | | | |

Annual Report 2023

13

CION Ares Diversified Credit Fund

Consolidated Schedule of Investments (continued)

December 31, 2023

(in thousands, except shares, percentages and as otherwise noted)

Senior Loans(b)(c)(d) (continued)

Company | | Country(a) | | Investment | | Interest | | Maturity

Date | | Acquisition

Date | | Shares | | Principal

Amount(a) | | Fair Value(a) | | % of

Net

Assets | |

Compex Legal

Services, Inc. | | | | 1st Lien Term

Loan | | 10.90% (3M

SOFR +

5.45%) | | 02/09/2026 | | | | | | | | $ | 1,271 | | | $ | 1,271 | (e)(f) | | | | | |

Dispatch

Acquisition

Holdings, LLC | | | | 1st Lien Term

Loan | | 9.75% (3M

SOFR +

4.25%) | | 03/27/2028 | | | | | | | | | 14,793 | | | | 13,868 | (f) | | | | | |

Dun &

Bradstreet

Corporation, The | | | | 1st Lien Term

Loan | | 8.21% (1M

SOFR +

2.75%) | | 02/06/2026 | | | | | | | | | 15,118 | | | | 15,139 | | | | | | |

Dun &

Bradstreet

Corporation, The | | | | 1st Lien Term

Loan | | 8.36% (1M

SOFR +

3.00%) | | 01/18/2029 | | | | | | | | | 1,845 | | | | 1,848 | | | | | | |

Elevation

Services Parent

Holdings, LLC | | | | 1st Lien

Revolving

Loan | | 11.54% (3M

SOFR +

6.00%) | | 12/18/2026 | | | | | | | | | 467 | | | | 457 | (e)(h) | | | | | |

Elevation

Services Parent

Holdings, LLC | | | | 1st Lien Term

Loan | | 11.54% (3M

SOFR +

6.00%) | | 12/18/2026 | | | | | | | | | 1,310 | | | | 1,283 | (e)(f) | | | | | |

Elevation

Services Parent

Holdings, LLC | | | | 1st Lien Term

Loan | | 11.53% (3M

SOFR +

6.00%) | | 12/18/2026 | | | | | | | | | 625 | | | | 612 | (e)(f) | | | | | |

Elevation

Services Parent

Holdings, LLC | | | | 1st Lien Delay

Draw Loan | | 11.54% (3M

SOFR +

6.00%) | | 12/18/2026 | | | | | | | | | 1,751 | | | | 1,716 | (e)(f) | | | | | |

Elevation

Services Parent

Holdings, LLC | | | | 1st Lien Delay

Draw Loan | | 11.53% (3M

SOFR +

6.00%) | | 12/18/2026 | | | | | | | | | 21 | | | | 21 | (e)(h) | | | | | |

Erasmus

Acquisition

Holding B.V. | | Netherlands | | 1st Lien Term

Loan | | 11.95% (6M

EURIBOR +

8.06%) | | 03/13/2030 | | | | | | | | € | 3,323 | | | | 3,669 | (e)(g) | | | | | |

Erasmus

Acquisition

Holding B.V. | | Netherlands | | 1st Lien Delay

Draw Loan | | 11.95% (6M

EURIBOR +

8.06%) | | 03/13/2030 | | | | | | | | € | 222 | | | | 245 | (e)(g)(h) | | | | | |

Flywheel

Acquireco, Inc. | | | | 1st Lien

Revolving

Loan | | 11.86% (1M

SOFR +

6.50%) | | 05/12/2028 | | | | | | | | | 1,110 | | | | 1,099 | (e)(h) | | | | | |

Flywheel

Acquireco, Inc. | | | | 1st Lien Term

Loan | | 11.86% (1M

SOFR +

6.50%) | | 05/13/2030 | | | | | | | | | 13,783 | | | | 13,645 | (e) | | | | | |

HH-Stella, Inc. | | | | 1st Lien

Revolving

Loan | | | | 04/22/2027 | | | | | | | | | — | | | | — | (e)(h) | | | | | |

HH-Stella, Inc. | | | | 1st Lien Term

Loan | | 11.50% (3M

SOFR +

6.00%) | | 04/24/2028 | | | | | | | | | 6,030 | | | | 6,030 | (e)(f) | | | | | |

HH-Stella, Inc. | | | | 1st Lien Delay

Draw Loan | | 11.50% (3M

SOFR +

6.00%) | | 04/24/2028 | | | | | | | | | 1,079 | | | | 1,079 | (e) | | | | | |

HH-Stella, Inc. | | | | 1st Lien Delay

Draw Loan | | 11.50% (3M

SOFR +

6.00%) | | 04/24/2028 | | | | | | | | | 1,135 | | | | 1,135 | (e)(h) | | | | | |

Annual Report 2023

14

CION Ares Diversified Credit Fund

Consolidated Schedule of Investments (continued)

December 31, 2023

(in thousands, except shares, percentages and as otherwise noted)

Senior Loans(b)(c)(d) (continued)

Company | | Country(a) | | Investment | | Interest | | Maturity

Date | | Acquisition

Date | | Shares | | Principal

Amount(a) | | Fair Value(a) | | % of

Net

Assets | |

HP RSS Buyer,

Inc. | | | | 1st Lien Term

Loan | | 10.37% (3M

SOFR +

5.00%) | | 12/11/2029 | | | | | | | | $ | 1,265 | | | $ | 1,240 | (e) | | | | | |

HP RSS Buyer,

Inc. | | | | 1st Lien Delay

Draw Loan | | 10.37% (1M

SOFR +

5.00%) | | 12/11/2029 | | | | | | | | | 271 | | | | 266 | (e) | | | | | |

HP RSS Buyer,

Inc. | | | | 1st Lien Delay

Draw Loan | | 10.37% (1M

SOFR +

5.00%) | | 12/11/2029 | | | | | | | | | 112 | | | | 110 | (e)(h) | | | | | |

Integrated

Power Services

Holdings, Inc. | | | | 2nd Lien Term

Loan | | 12.96% (1M

SOFR +

7.50%) | | 11/22/2029 | | | | | | | | | 4,983 | | | | 4,983 | (e) | | | | | |

IRI Group

Holdings, Inc. | | | | 1st Lien

Revolving

Loan | | 11.11% (1M

SOFR +

5.75%) | | 12/01/2027 | | | | | | | | | 235 | | | | 235 | (e)(h) | | | | | |

IRI Group

Holdings, Inc. | | | | 1st Lien Term

Loan | | 11.61% (1M

SOFR +

6.25%) | | 12/01/2028 | | | | | | | | | 24,933 | | | | 24,933 | (e)(f)(g) | | | | | |

Ishtar Bidco

Norway AS | | United

Kingdom | | 1st Lien Delay

Draw Loan | | 16.28% (6M

SONIA +

10.75%) | | 11/26/2025 | | | | | | | | £ | 735 | | | | 656 | (e)(f) | | | | | |

Kellermeyer

Bergensons

Services, LLC | | | | 1st Lien Term

Loan | | 11.59% (3M

SOFR +

6.00%) | | 11/07/2026 | | | | | | | | | 3,475 | | | | 3,476 | (e)(f) | | | | | |

Kellermeyer

Bergensons

Services, LLC | | | | 1st Lien Term

Loan | | | | 11/07/2026 | | | | | | | | | 6,890 | | | | 4,678 | (e)(j) | | | | | |

Kellermeyer

Bergensons

Services, LLC | | | | 1st Lien Delay

Draw Loan | | 11.59% (3M

SOFR +

6.00%) | | 11/07/2026 | | | | | | | | | 2,187 | | | | 2,187 | (e)(f) | | | | | |

Kings Buyer,

LLC | | | | 1st Lien

Revolving

Loan | | | | 10/29/2027 | | | | | | | | | — | | | | — | (e)(h) | | | | | |

Kings Buyer,

LLC | | | | 1st Lien Term

Loan | | 11.99% (6M

SOFR +

6.50%) | | 10/29/2027 | | | | | | | | | 3,436 | | | | 3,385 | (e) | | | | | |

Laboratories

Bidco LLC | | | | 1st Lien

Revolving

Loan | | 12.29% (3M

SOFR +

6.75%) | | 07/23/2027 | | | | | | | | | 654 | | | | 569 | (e)(h) | | | | | |

Laboratories

Bidco LLC | | | | 1st Lien Term

Loan | | 12.31% (3M

SOFR +

6.75%) | | 07/23/2027 | | | | | | | | | 5,170 | | | | 4,498 | (e)(f) | | | | | |

Laboratories

Bidco LLC | | | | 1st Lien Term

Loan | | 12.28% (3M

CDOR +

6.75%) | | 07/23/2027 | | | | | | | | CAD | 1,750 | | | | 1,149 | (e)(f) | | | | | |

Laboratories

Bidco LLC | | | | 1st Lien Term

Loan | | 12.31% (3M

SOFR +

6.75%) | | 07/23/2027 | | | | | | | | | 573 | | | | 498 | (e)(f) | | | | | |

Laboratories

Bidco LLC | | | | 1st Lien Term

Loan | | 12.28% (3M

SOFR +

6.75%) | | 07/23/2027 | | | | | | | | | 3,964 | | | | 3,449 | (e) | | | | | |

Annual Report 2023

15

CION Ares Diversified Credit Fund

Consolidated Schedule of Investments (continued)

December 31, 2023

(in thousands, except shares, percentages and as otherwise noted)

Senior Loans(b)(c)(d) (continued)

Company | | Country(a) | | Investment | | Interest | | Maturity

Date | | Acquisition

Date | | Shares | | Principal

Amount(a) | | Fair Value(a) | | % of

Net

Assets | |

Laboratories

Bidco LLC | | | | 1st Lien Delay

Draw Loan | | 12.28% (3M

SOFR +

6.75%) | | 07/23/2027 | | | | | | | | $ | 288 | | | $ | 250 | (e) | | | | | |

Lavatio Midco

Sarl | | Luxembourg | | 1st Lien Delay

Draw Loan | | 10.64% (6M

EURIBOR +

6.75%) | | 11/30/2026 | | | | | | | | € | 569 | | | | 628 | (e)(h) | | | | | |

Lavatio Midco

Sarl | | Luxembourg | | 1st Lien Delay

Draw Loan | | 10.64% (6M

EURIBOR +

6.75%) | | 11/30/2026 | | | | | | | | € | 746 | | | | 824 | (e)(f) | | | | | |

Lightbeam

Bidco, Inc. | | | | 1st Lien

Revolving

Loan | | | | 05/04/2029 | | | | | | | | | — | | | | — | (e)(h) | | | | | |

Lightbeam

Bidco, Inc. | | | | 1st Lien Term

Loan | | 11.70% (3M

SOFR +

6.25%) | | 05/06/2030 | | | | | | | | | 1,132 | | | | 1,132 | (e) | | | | | |

Lightbeam

Bidco, Inc. | | | | 1st Lien Term

Loan | | 10.85% (3M

SOFR +

5.50%) | | 05/06/2030 | | | | | | | | | 131 | | | | 130 | (e) | | | | | |

Lightbeam

Bidco, Inc. | | | | 1st Lien Delay

Draw Loan | | 11.70% (3M

SOFR +

6.25%) | | 05/06/2030 | | | | | | | | | 171 | | | | 171 | (e) | | | | | |

Lightbeam

Bidco, Inc. | | | | 1st Lien Delay

Draw Loan | | 10.86% (6M

SOFR +

5.50%) | | 05/06/2030 | | | | | | | | | 81 | | | | 80 | (e)(h) | | | | | |

Lowe P27 Bidco

Limited | | United

Kingdom | | 1st Lien Delay

Draw Loan | | 11.98% (6M

SOFR +

6.50%) | | 07/31/2026 | | | | | | | | | 610 | | | | 609 | (e) | | | | | |

Lowe P27 Bidco

Limited | | United

Kingdom | | 1st Lien Delay

Draw Loan | | 12.33% (6M

SONIA +

6.75%) | | 07/31/2026 | | | | | | | | £ | 1,706 | | | | 2,174 | (e) | | | | | |

Lowe P27 Bidco

Limited | | United

Kingdom | | 1st Lien Delay

Draw Loan | | 11.83% (6M

SONIA +

6.50%) | | 07/31/2026 | | | | | | | | £ | 325 | | | | 415 | (e) | | | | | |

Lowe P27 Bidco

Limited | | United

Kingdom | | 1st Lien Delay

Draw Loan | | 11.46% (6M

SONIA +

6.50%) | | 07/31/2026 | | | | | | | | £ | 137 | | | | 174 | (e)(h) | | | | | |

Lowe P27 Bidco

Limited | | United

Kingdom | | 1st Lien Delay

Draw Loan | | | | 07/31/2026 | | | | | | | | £ | — | | | | — | (e)(h)(i) | | | | | |

Marmic

Purchaser, LLC | | | | 1st Lien

Revolving

Loan | | 11.25% (3M

SOFR +

5.75%) | | 03/05/2027 | | | | | | | | | 230 | | | | 230 | (e)(h) | | | | | |

Marmic

Purchaser, LLC | | | | 1st Lien Term

Loan | | 11.25% (3M

SOFR +

5.75%) | | 03/05/2027 | | | | | | | | | 2,011 | | | | 2,011 | (e)(f) | | | | | |

Marmic

Purchaser, LLC | | | | 1st Lien Delay

Draw Loan | | 11.25% (3M

SOFR +

5.75%) | | 03/05/2027 | | | | | | | | | 2,016 | | | | 2,016 | (e) | | | | | |

Marmic

Purchaser, LLC | | | | 1st Lien Delay

Draw Loan | | 11.75% (3M

SOFR +

6.25%) | | 03/05/2027 | | | | | | | | | 783 | | | | 783 | (e)(h) | | | | | |

Annual Report 2023

16

CION Ares Diversified Credit Fund

Consolidated Schedule of Investments (continued)

December 31, 2023

(in thousands, except shares, percentages and as otherwise noted)

Senior Loans(b)(c)(d) (continued)

Company | | Country(a) | | Investment | | Interest | | Maturity

Date | | Acquisition

Date | | Shares | | Principal

Amount(a) | | Fair Value(a) | | % of

Net

Assets | |

MPLC Debtco

Limited | | Jersey | | 1st Lien Term

Loan | | 11.44% (3M

SONIA +

6.25%) | | 01/07/2027 | | | | | | £ | 148 | | | $ | 189 | (e)(f) | | | |

MPLC Debtco

Limited | | Jersey | | 1st Lien Delay

Draw Loan | | 12.05% (6M

SOFR +

6.25%) | | 01/07/2027 | | | | | | | 2,100 | | | | 2,100 | (e)(f) | | | |

MPLC Debtco

Limited | | Jersey | | 1st Lien Delay

Draw Loan | | 11.76% (6M

SONIA +

6.25%) | | 01/07/2027 | | | | | | £ | 1,052 | | | | 1,341 | (e)(f) | | | | | |

Neptune BidCo

US Inc. | | | | 1st Lien

Revolving

Loan | | | | 10/11/2027 | | | | | | | — | | | | — | (e)(h) | | | |

Neptune BidCo

US Inc. | | | | 1st Lien Term

Loan | | 10.26% (3M

SOFR +

4.75%) | | 10/11/2028 | | | | | | | 13,244 | | | | 12,048 | | | | |

Neptune BidCo

US Inc. | | | | 1st Lien Term

Loan | | 10.51% (3M

SOFR +

5.00%) | | 04/11/2029 | | | | | | | 15,321 | | | | 13,961 | | | | |

Neptune BidCo

US Inc. | | | | 2nd Lien Term

Loan | | 15.26% (3M

SOFR +

9.75%) | | 10/11/2029 | | | | | | | 9,882 | | | | 9,388 | (e) | | | |

Nest Topco

Borrower Inc. | | | | 1st Lien Term

Loan | | 16.00

(PRIME +

7.50%)% | | 08/31/2029 | | | | | | | 13,162 | | | | 13,162 | (e)(g) | | | |

North American

Fire Holdings,

LLC | | | | 1st Lien

Revolving

Loan | | 11.27% (3M

SOFR +

5.75%) | | 05/19/2027 | | | | | | | 185 | | | | 185 | (e)(h) | | | |

North American

Fire Holdings,

LLC | | | | 1st Lien Term

Loan | | 11.25% (3M

SOFR +

5.75%) | | 05/19/2027 | | | | | | | 2,280 | | | | 2,280 | (e)(f) | | | |

North American

Fire Holdings,

LLC | | | | 1st Lien Delay

Draw Loan | | 11.25% (3M

SOFR +

5.75%) | | 05/19/2027 | | | | | | | 2,156 | | | | 2,156 | (e)(f) | | | |

North American

Fire Holdings,

LLC | | | | 1st Lien Delay

Draw Loan | | 11.27% (3M

SOFR +

5.75%) | | 05/19/2027 | | | | | | | 2,853 | | | | 2,853 | (e) | | | |

North Haven

Fairway Buyer,

LLC | | | | 1st Lien

Revolving

Loan | | | | 05/17/2028 | | | | | | | — | | | | — | (e)(h) | | | |

North Haven

Fairway Buyer,

LLC | | | | 1st Lien Term

Loan | | 11.86% (3M

SOFR +

6.50%) | | 05/17/2028 | | | | | | | 45 | | | | 45 | (e) | | | |

North Haven

Fairway Buyer,

LLC | | | | 1st Lien Delay

Draw Loan | | 11.86% (3M

SOFR +

6.50%) | | 05/17/2028 | | | | | | | 155 | | | | 154 | (e)(h) | | | |

North Haven

Stack Buyer,

LLC | | | | 1st Lien

Revolving

Loan | | 11.03% (3M

SOFR +

5.50%) | | 07/16/2027 | | | | | | | 162 | | | | 162 | (e)(h) | | | |

North Haven

Stack Buyer,

LLC | | | | 1st Lien Term

Loan | | 11.03% (3M

SOFR +

5.50%) | | 07/16/2027 | | | | | | | 1,306 | | | | 1,306 | (e)(f) | | | |

Annual Report 2023

17

CION Ares Diversified Credit Fund

Consolidated Schedule of Investments (continued)

December 31, 2023

(in thousands, except shares, percentages and as otherwise noted)

Senior Loans(b)(c)(d) (continued)

Company | | Country(a) | | Investment | | Interest | | Maturity

Date | | Acquisition

Date | | Shares | | Principal

Amount(a) | | Fair Value(a) | | % of

Net

Assets | |

North Haven

Stack Buyer,

LLC | | | | 1st Lien Delay

Draw Loan | | 11.02% (3M

SOFR +

5.50%) | | 07/16/2027 | | | | | | | | $ | 839 | | | $ | 840 | (e) | | | | | |

North Haven

Stack Buyer,

LLC | | | | 1st Lien Delay

Draw Loan | | 11.02% (1M

SOFR +

5.50%) | | 07/16/2027 | | | | | | | | | 145 | | | | 145 | (e) | | | | | |

North Haven

Stack Buyer,

LLC | | | | 1st Lien Delay

Draw Loan | | 11.01% (3M

SOFR +

5.50%) | | 07/16/2027 | | | | | | | | | 177 | | | | 177 | (e)(h) | | | | | |

North Haven

Stack Buyer,

LLC | | | | 1st Lien Delay

Draw Loan | | 11.03% (3M

SOFR +

5.50%) | | 07/16/2027 | | | | | | | | | 21 | | | | 21 | (e) | | | | | |

Orbit Private

Holdings I Ltd | | United

Kingdom | | 1st Lien Term

Loan | | 10.94% (3M

SONIA +

5.75%) | | 12/11/2028 | | | | | | | | £ | 4,915 | | | | 6,076 | (e) | | | | | |

Priority Waste

Holdings LLC | | | | 1st Lien

Revolving

Loan | | 10.89% (3M

SOFR +

5.50%) | | 08/20/2029 | | | | | | | | | 1 | | | | 1 | (e)(h) | | | | | |

Priority Waste

Holdings LLC | | | | 1st Lien Term

Loan | | 13.40% (3M

SOFR +

8.00%) | | 08/20/2029 | | | | | | | | | 1,797 | | | | 1,764 | (e)(g) | | | | | |

Priority Waste

Holdings LLC | | | | 1st Lien Delay

Draw Loan | | 13.40% (3M

SOFR +

8.00%) | | 08/20/2029 | | | | | | | | | 1,043 | | | | 1,024 | (e)(g)(h) | | | | | |

Priority Waste

Holdings LLC | | | | 1st Lien Delay

Draw Loan | | | | 08/20/2029 | | | | | | | | | — | | | | — | (e)(g)(h) | | | | | |

PSC Group LLC | | | | 1st Lien

Revolving

Loan | | | | 07/23/2025 | | | | | | | | | — | | | | — | (e)(h) | | | | | |

PSC Group LLC | | | | 1st Lien Term

Loan | | 11.53% (3M

SOFR +

6.00%) | | 07/23/2025 | | | | | | | | | 5,218 | | | | 5,218 | (e)(f) | | | | | |

PSC Group LLC | | | | 1st Lien Term

Loan | | 11.41% (3M

SOFR +

6.00%) | | 07/23/2025 | | | | | | | | | 3,520 | | | | 3,520 | (e)(f) | | | | | |

PSC Group LLC | | | | 1st Lien Delay

Draw Loan | | 11.53% (3M

SOFR +

6.00%) | | 07/23/2025 | | | | | | | | | 104 | | | | 104 | (e)(f) | | | | | |

PSC Group LLC | | | | 1st Lien Delay

Draw Loan | | 11.29% (3M

SOFR +

5.75%) | | 07/23/2025 | | | | | | | | | 1,576 | | | | 1,576 | (e)(f) | | | | | |

PSC Group LLC | | | | 1st Lien Delay

Draw Loan | | 11.53% (3M

SOFR +

6.00%) | | 07/23/2025 | | | | | | | | | 959 | | | | 959 | (e) | | | | | |

PSC Group LLC | | | | 1st Lien Delay

Draw Loan | | 11.54% (3M

SOFR +

6.00%) | | 07/23/2025 | | | | | | | | | 703 | | | | 704 | (e)(h) | | | | | |

Pye-Barker

Fire & Safety,

LLC | | | | 1st Lien Delay

Draw Loan | | | | 11/26/2027 | | | | | | | | | — | | | | — | (e)(h) | | | | | |

Annual Report 2023

18

CION Ares Diversified Credit Fund

Consolidated Schedule of Investments (continued)

December 31, 2023

(in thousands, except shares, percentages and as otherwise noted)

Senior Loans(b)(c)(d) (continued)

Company | | Country(a) | | Investment | | Interest | | Maturity

Date | | Acquisition

Date | | Shares | | Principal

Amount(a) | | Fair Value(a) | | % of

Net

Assets | |

Registrar

Intermediate,

LLC | | | | 1st Lien

Revolving

Loan | | | | 08/26/2027 | | | | | | | | $ | — | | | $ | — | (e)(h) | | | | | |

Registrar

Intermediate,

LLC | | | | 1st Lien Term

Loan | | 10.64% (6M

SOFR +

5.00%) | | 08/26/2027 | | | | | | | | | 4,104 | | | | 4,022 | (e)(f) | | | | | |

Research Now

Group, LLC | | | | 1st Lien Term

Loan | | 11.14% (3M

SOFR +

5.50%) | | 12/20/2024 | | | | | | | | | 3,474 | | | | 2,572 | (f) | | | | | |

Research Now

Group, LLC | | | | 2nd Lien Term

Loan | | 15.14% (3M

SOFR +

9.50%) | | 12/20/2025 | | | | | | | | | 893 | | | | 661 | (e)(f) | | | | | |

Rodeo

AcquisitionCo

LLC | | | | 1st Lien

Revolving

Loan | | 11.54% (3M

SOFR +

6.00%) | | 07/26/2027 | | | | | | | | | 215 | | | | 211 | (e)(h) | | | | | |

Rodeo

AcquisitionCo

LLC | | | | 1st Lien Term

Loan | | 11.54% (3M

SOFR +

6.00%) | | 07/26/2027 | | | | | | | | | 2,076 | | | | 2,034 | (e) | | | | | |

RSK Group

Limited | | United

Kingdom | | 1st Lien Term

Loan | | 10.22% (3M

SONIA +

4.88%) | | 08/07/2028 | | | | | | | | £ | 3,405 | | | | 4,340 | (e)(f)(g) | | | | | |

RSK Group

Limited | | United

Kingdom | | 1st Lien Delay

Draw Loan | | 10.18% (3M

SONIA +

4.88%) | | 08/07/2028 | | | | | | | | £ | 8,248 | | | | 10,514 | (e)(f)(g) | | | | | |

RSK Group

Limited | | United

Kingdom | | 1st Lien Delay

Draw Loan | | 8.80% (3M

EURIBOR +

4.88%) | | 08/07/2028 | | | | | | | | € | 1,033 | | | | 1,140 | (e)(f)(g) | | | | | |

RSK Group

Limited | | United

Kingdom | | 1st Lien Delay

Draw Loan | | 10.25% (3M

SONIA +

4.88%) | | 08/07/2028 | | | | | | | | £ | 13,314 | | | | 16,970 | (e)(g) | | | | | |

RSK Group

Limited | | United

Kingdom | | 1st Lien Delay

Draw Loan | | 10.33% (3M

SONIA +

4.88%) | | 08/07/2028 | | | | | | | | £ | 3,978 | | | | 5,071 | (e)(g)(h) | | | | | |

Saturn

Purchaser Corp. | | | | 1st Lien Term

Loan | | 10.71% (1M

SOFR +

5.25%) | | 07/23/2029 | | | | | | | | | 244 | | | | 243 | (e) | | | | | |

Schill

Landscaping

and Lawn Care

Services, LLC | | | | 1st Lien

Revolving

Loan | | 11.21% (1M

SOFR +

5.75%) | | 12/16/2027 | | | | | | | | | 288 | | | | 285 | (e)(h) | | | | | |

Schill

Landscaping

and Lawn Care

Services, LLC | | | | 1st Lien Term

Loan | | 11.21% (1M

SOFR +

5.75%) | | 12/16/2027 | | | | | | | | | 2,538 | | | | 2,513 | (e)(f) | | | | | |

Schill

Landscaping

and Lawn Care

Services, LLC | | | | 1st Lien Delay

Draw Loan | | 11.21% (1M

SOFR +

5.75%) | | 12/16/2027 | | | | | | | | | 1,500 | | | | 1,485 | (e) | | | | | |

Shermco

Intermediate

Holdings, Inc. | | | | 1st Lien

Revolving

Loan | | 10.86% (1M

SOFR +

5.50%) | | 06/05/2026 | | | | | | | | | 25 | | | | 25 | (e)(h) | | | | | |

Annual Report 2023

19

CION Ares Diversified Credit Fund

Consolidated Schedule of Investments (continued)

December 31, 2023

(in thousands, except shares, percentages and as otherwise noted)

Senior Loans(b)(c)(d) (continued)

Company | | Country(a) | | Investment | | Interest | | Maturity

Date | | Acquisition

Date | | Shares | | Principal

Amount(a) | | Fair Value(a) | | % of

Net

Assets | |

Shermco

Intermediate

Holdings, Inc. | | | | 1st Lien Term

Loan | | 10.86% (1M

SOFR +

5.50%) | | 06/05/2026 | | | | | | | | $ | 30,928 | | | $ | 30,928 | (e)(f) | | | | | |

Shermco

Intermediate

Holdings, Inc. | | | | 1st Lien Delay

Draw Loan | | 10.95% (3M

SOFR +

5.50%) | | 06/05/2026 | | | | | | | | | 38 | | | | 38 | (e)(h) | | | | | |

SSE Buyer, Inc. | | | | 1st Lien

Revolving

Loan | | 7.42% (1M

SOFR +

2.00%) | | 06/30/2025 | | | | | | | | | 1 | | | | 1 | (e)(h) | | | | | |

SSE Buyer, Inc. | | | | 2nd Lien Term

Loan | | | | 06/30/2026 | | | | | | | | | 706 | | | | 21 | (e)(f)(j) | | | | | |

Stealth Holding

LLC | | | | 1st Lien Term

Loan | | 12.29% (3M

SOFR +

6.75%) | | 03/02/2026 | | | | | | | | | 2,430 | | | | 2,430 | (e)(f) | | | | | |

Stealth Holding

LLC | | | | 1st Lien Delay

Draw Loan | | 12.29% (3M

SOFR +

6.75%) | | 03/02/2026 | | | | | | | | | 967 | | | | 967 | (e) | | | | | |

Stealth Holding

LLC | | | | 1st Lien Delay

Draw Loan | | 12.29% (3M

SOFR +

6.75%) | | 03/02/2026 | | | | | | | | | 1,762 | | | | 1,762 | (e) | | | | | |

Stealth Holding

LLC | | | | 1st Lien Delay

Draw Loan | | 12.28% (3M

SOFR +

6.75%) | | 03/02/2026 | | | | | | | | | 1,433 | | | | 1,433 | (e) | | | | | |

Steer

Automotive

Group Ltd | | United

Kingdom | | 1st Lien Term

Loan | | 12.06% (3M

SONIA +

6.75%) | | 04/19/2029 | | | | | | | | £ | 2,449 | | | | 3,121 | (e)(f) | | | | | |

Steer

Automotive

Group Ltd | | United

Kingdom | | 1st Lien Term

Loan | | 12.06% (3M

SONIA +

6.75%) | | 04/19/2029 | | | | | | | | £ | 4,509 | | | | 5,747 | (e) | | | | | |

Steer

Automotive

Group Ltd | | United

Kingdom | | 1st Lien Term

Loan | | 12.06% (3M

SONIA +

6.75%) | | 06/30/2030 | | | | | | | | £ | 6,265 | | | | 7,986 | (e) | | | | | |

Steer

Automotive

Group Ltd | | United

Kingdom | | 1st Lien Delay

Draw Loan | | 12.06% (3M

SONIA +

6.75%) | | 04/19/2029 | | | | | | | | £ | 1,633 | | | | 2,081 | (e) | | | | | |

Steer

Automotive

Group Ltd | | United

Kingdom | | 1st Lien Delay

Draw Loan | | 12.07% (3M

SONIA +

6.75%) | | 06/30/2030 | | | | | | | | £ | 1,558 | | | | 1,986 | (e) | | | | | |

Survitec Group

Holdco Limited | | United

Kingdom | | 1st Lien Term

Loan | | 13.82% (6M

SONIA +

8.25%) | | 04/06/2027 | | | | | | | | £ | 8,152 | | | | 10,079 | (e)(f)(g) | | | | | |

Survitec Group

Holdco Limited | | United

Kingdom | | 1st Lien Term

Loan | | 13.55% (6M

SONIA +

8.00%) | | 04/06/2027 | | | | | | | | £ | 495 | | | | 612 | (e) | | | | | |

Survitec Group

Holdco Limited | | United

Kingdom | | 1st Lien Term

Loan | | 13.76% (6M

SONIA +

8.25%) | | 04/06/2027 | | | | | | | | £ | 1,667 | | | | 2,061 | (e)(f)(g) | | | | | |

Systems

Planning and

Analysis, Inc. | | | | 1st Lien

Revolving

Loan | | | | 08/16/2027 | | | | | | | | | — | | | | — | (e)(h) | | | | | |

Annual Report 2023

20

CION Ares Diversified Credit Fund

Consolidated Schedule of Investments (continued)

December 31, 2023

(in thousands, except shares, percentages and as otherwise noted)

Senior Loans(b)(c)(d) (continued)

Company | | Country(a) | | Investment | | Interest | | Maturity

Date | | Acquisition

Date | | Shares | | Principal

Amount(a) | | Fair Value(a) | | % of

Net

Assets | |

Systems

Planning and

Analysis, Inc. | | | | 1st Lien Term

Loan | | 11.33% (3M

SOFR +

6.00%) | | 08/16/2027 | | | | | | | | $ | 4,444 | | | $ | 4,444 | (e)(f) | | | | | |

Thermostat

Purchaser III,

Inc. | | | | 1st Lien

Revolving

Loan | | | | 08/31/2026 | | | | | | | | | — | | | | — | (e)(h) | | | | | |

Thermostat

Purchaser III,

Inc. | | | | 2nd Lien Term

Loan | | 12.79% (3M

SOFR +

7.25%) | | 08/31/2029 | | | | | | | | | 3,575 | | | | 3,468 | (e) | | | | | |

Trans Union LLC | | | | 1st Lien Term

Loan | | 7.72% (1M

SOFR +

2.25%) | | 12/01/2028 | | | | | | | | | 4,231 | | | | 4,242 | | | | | | |

TSS Buyer, LLC | | | | 1st Lien Term

Loan | | 11.00% (6M

SOFR +

5.50%) | | 06/22/2029 | | | | | | | | | 260 | | | | 254 | (e) | | | | | |

TSS Buyer, LLC | | | | 1st Lien Delay

Draw Loan | | 11.00% (3M

SOFR +

5.50%) | | 06/22/2029 | | | | | | | | | 124 | | | | 121 | (e)(h) | | | | | |

UCIT Online

Security Inc. | | Canada | | 1st Lien Term

Loan | | 12.29% (3M

SOFR +

6.75%) | | 03/02/2026 | | | | | | | | | 1,620 | | | | 1,620 | (e)(f) | | | | | |

Villa Dutch

Bidco B.V. | | Netherlands | | 1st Lien Term

Loan | | | | 11/03/2029 | | | | | | | | € | 6,000 | | | | 6,579 | (i) | | | | | |

Visual Edge

Technology, Inc. | | | | 1st Lien Term

Loan | | 12.50% (3M

SOFR +

7.00%) | | 12/31/2025 | | | | | | | | | 2,202 | | | | 2,202 | (e)(f)(g) | | | | | |

Visual Edge

Technology, Inc. | | | | 1st Lien Delay

Draw Loan | | | | 12/31/2025 | | | | | | | | | — | | | | — | (e)(g)(h) | | | | | |

VRC Companies,

LLC | | | | 1st Lien

Revolving

Loan | | | | 06/29/2027 | | | | | | | | | — | | | | — | (e)(h) | | | | | |

VRC Companies,

LLC | | | | 1st Lien Term

Loan | | 11.14% (3M

SOFR +

5.50%) | | 06/29/2027 | | | | | | | | | 16,532 | | | | 16,036 | (e)(f) | | | | | |

Waste Services

Finco Pty Ltd | | Australia | | 1st Lien Term

Loan | | 9.99% (1M

BBSY +

5.63%) | | 12/23/2027 | | | | | | | | AUD | 11,142 | | | | 7,592 | (e)(f) | | | | | |

Waste Services

Finco Pty Ltd | | Australia | | 1st Lien Delay

Draw Loan | | 10.33% (6M

BBSY +

5.63%) | | 12/23/2027 | | | | | | | | AUD | 802 | | | | 547 | (e)(h) | | | | | |

| | | | | | | | | | | | | | | | | | | | | | 422,524 | | | | 13.16 | % | |

Consumer Discretionary Distribution and Retail | |

Bamboo

Purchaser, Inc. | | | | 1st Lien

Revolving

Loan | | 10.25% (3M

SOFR +

1.75%) | | 11/05/2026 | | | | | | | | | 1 | | | | — | (e)(h) | | | | | |

Bamboo

Purchaser, Inc. | | | | 1st Lien Term

Loan | | 12.00% (3M

SOFR +

6.50%) | | 11/05/2027 | | | | | | | | | 3,483 | | | | 3,309 | (e)(f) | | | | | |

Annual Report 2023

21

CION Ares Diversified Credit Fund

Consolidated Schedule of Investments (continued)

December 31, 2023

(in thousands, except shares, percentages and as otherwise noted)

Senior Loans(b)(c)(d) (continued)

Company | | Country(a) | | Investment | | Interest | | Maturity

Date | | Acquisition

Date | | Shares | | Principal

Amount(a) | | Fair Value(a) | | % of

Net

Assets | |

Bamboo

Purchaser, Inc. | | | | 1st Lien Delay

Draw Loan | | 12.00% (3M

SOFR +

6.50%) | | 11/05/2027 | | | | | | | | $ | 822 | | | $ | 781 | (e) | | | | | |

BradyIFS

Holdings, LLC | | | | 1st Lien

Revolving

Loan | | | | 10/31/2029 | | | | | | | | | — | | | | — | (e)(h) | | | | | |

BradyIFS

Holdings, LLC | | | | 1st Lien Term

Loan | | 11.38% (3M

SOFR +

6.00%) | | 10/31/2029 | | | | | | | | | 18,246 | | | | 17,881 | (e) | | | | | |

BradyIFS