Exhibit 99.45

Execution Copy

ORLA MINING LTD.

as Borrower

and

TRINITY CAPITAL PARTNERS CORPORATION

as Arranging Lender

and

GLAS USA LLC

as Administrative Agent

and

GLAS AMERICAS LLC

as Collateral Agent

and

THE PARTIES LISTED ON SCHEDULE A HERETO

as Lenders

LOAN AGREEMENT

Dated as of December 18, 2019

TABLE OF CONTENTS

| Article 1 INTERPRETATION | 1 |

| | 1.1 | Defined Terms | 1 |

| | 1.2 | Other Usages | 20 |

| | 1.3 | Plural and Singular | 21 |

| | 1.4 | Headings | 21 |

| | 1.5 | Currency | 21 |

| | 1.6 | Applicable Law | 21 |

| | 1.7 | Time of the Essence | 21 |

| | 1.8 | Non Banking Days | 21 |

| | 1.9 | Consents and Approvals | 21 |

| | 1.10 | Schedules | 21 |

| | 1.11 | Rule of Construction | 22 |

| | 1.12 | Accounting Terms – GAAP | 22 |

| | 1.13 | Permitted Encumbrances | 22 |

| | | | |

| Article 2 CREDIT FACILITY | 22 |

| | 2.1 | Establishment of Credit Facility | 22 |

| | 2.2 | Lenders’ Commitments | 23 |

| | 2.3 | Permanent Reduction of Credit Facility | 23 |

| | 2.4 | Termination of Credit Facility | 23 |

| | | | |

| Article 3 GENERAL PROVISIONS RELATING TO CREDITS | 23 |

| | 3.1 | Funding of Loans | 23 |

| | 3.2 | Defaulting Lender | 24 |

| | 3.3 | Time and Place of Payments | 25 |

| | 3.4 | Remittance of Payments | 25 |

| | 3.5 | Evidence of Indebtedness | 25 |

| | 3.6 | Notice Periods | 25 |

| | | | |

| Article 4 DRAWDOWNS | 25 |

| | 4.1 | Drawdown Notice | 25 |

| | | | |

| Article 5 INTEREST AND FEES | 26 |

| | 5.1 | Interest Rates | 26 |

| | 5.2 | Calculation and Payment of Interest | 26 |

| | 5.3 | General Interest Rules | 26 |

| | 5.4 | Commitment Fee | 27 |

| | | | |

| Article 6 replacement of Lenders, Indemnity and Tax Provisions | 27 |

| | 6.1 | Conditions of Credit | 27 |

| | 6.2 | Replacement of Lenders | 28 |

| | 6.3 | Indemnity for Transactional Liability | 28 |

| | 6.4 | Gross-Up for Taxes | 29 |

| | 6.5 | Environmental Indemnity | 32 |

| | 6.6 | Benefit of Indemnities | 33 |

| Article 7 REPAYMENTS AND PREPAYMENTS | 33 |

| | 7.1 | Repayment of Credit Facility | 33 |

| | 7.2 | Voluntary Prepayments under Credit Facility | 33 |

| | 7.3 | Prepayment Notice | 33 |

| | | | |

| Article 8 REPRESENTATIONS AND WARRANTIES | 34 |

| | 8.1 | Representations and Warranties | 34 |

| | 8.2 | Accredited Investor Status | 40 |

| | 8.3 | Survival of Representations and Warranties | 40 |

| | | | |

| Article 9 COVENANTS | 40 |

| | 9.1 | Affirmative Covenants | 40 |

| | 9.2 | Restrictive Covenants | 47 |

| | 9.3 | Performance of Covenants by Administrative Agent | 50 |

| | | | |

| Article 10 CONDITIONS PRECEDENT | 51 |

| | 10.1 | Conditions Precedent to Effectiveness of this Agreement | 51 |

| | 10.2 | Conditions Precedent to All Loans | 53 |

| | 10.3 | Conditions Precedent to Tranche Two Loan and Tranche Three Loan | 54 |

| | 10.4 | Waiver | 56 |

| | | | |

| Article 11 DEFAULT AND REMEDIES | 56 |

| | 11.1 | Events of Default | 56 |

| | 11.2 | Remedies Cumulative | 59 |

| | 11.3 | Set-Off | 59 |

| | 11.4 | Default Interest | 60 |

| | | | |

| Article 12 THE AGENTs | 60 |

| | 12.1 | Appointment and Authorization of Agents | 60 |

| | 12.2 | Interest Holders | 60 |

| | 12.3 | Consultation with Counsel | 61 |

| | 12.4 | Documents | 61 |

| | 12.5 | Responsibility of the Agents | 61 |

| | 12.6 | Action by the Agents | 61 |

| | 12.7 | Notice of Events of Default | 62 |

| | 12.8 | Responsibility Disclaimed | 62 |

| | 12.9 | Indemnification | 64 |

| | 12.10 | Credit Decision | 64 |

| | 12.11 | Successor Agent | 64 |

| | 12.12 | Delegation by an Agent | 65 |

| | 12.13 | Waivers and Amendments | 65 |

| | 12.14 | Determination by an Agent Conclusive and Binding | 66 |

| | 12.15 | Adjustments among Lenders after Acceleration | 66 |

| | 12.16 | Redistribution of Payment | 67 |

| | 12.17 | Distribution of Notices | 67 |

| | 12.18 | Decision to Enforce Security | 67 |

| | 12.19 | Enforcement | 68 |

| | 12.20 | Determination of Exposures | 68 |

| | 12.21 | Application of Cash Proceeds | 68 |

| | 12.22 | Entering into Contracts | 69 |

| | 12.23 | Other Security Not Permitted | 69 |

| | 12.24 | Discharge of Security | 69 |

| | 12.25 | Survival | 69 |

| | | | |

| Article 13 MISCELLANEOUS | 70 |

| | 13.1 | Notices | 70 |

| | 13.2 | Severability | 70 |

| | 13.3 | Counterparts | 70 |

| | 13.4 | Successors and Assigns | 70 |

| | 13.5 | Assignment | 70 |

| | 13.6 | Entire Agreement | 72 |

| | 13.7 | Further Assurances | 72 |

| | 13.8 | Judgment Currency | 72 |

| | 13.9 | Anti-Money Laundering Legislation | 73 |

| | 13.10 | No Fiduciary Duty | 74 |

| | 13.11 | Treatment of Certain Information: Confidentiality | 75 |

SCHEDULES

| Schedule A | - | Lenders and Individual Commitments |

| Schedule B | - | Compliance Certificate |

| Schedule C | - | Form of Assignment |

| Schedule D | - | Form of Drawdown Notice |

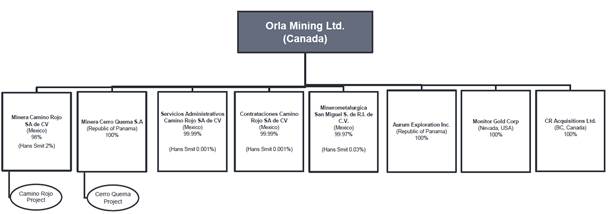

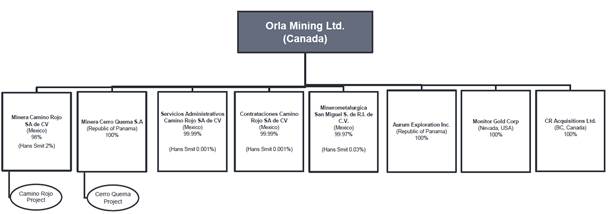

| Schedule E | - | Corporate Structure |

| Schedule F | - | Relevant Jurisdictions |

| Schedule G | - | Security Documents |

| Schedule H | - | Material Agreements and Permits |

| Schedule I | - | Litigation |

| Schedule J | - | Non-Arm’s Length Transactions |

| Schedule K | - | Accredited Investor Status Certificate |

| Schedule L | - | U.S. Accredited Investor Status Certification Letter |

| Schedule M | - | Encumbrances Consisting of Royalties |

| Schedule N | - | Permitted Investments |

| Schedule O | - | Permit Exceptions |

| Schedule P | - | Permitted Debt |

LOAN AGREEMENT dated as of December 18, 2019 among Orla Mining Ltd., a corporation amalgamated under the Canadian Business Corporations Act (the “Borrower”), Trinity Capital Partners Corporation (the “Arranging Lender”), GLAS AMERICAS LLC, a limited liability company organized and existing under the laws of the State of New York, as collateral agent for the Lenders (in such capacity, together with its successors and assigns in such capacity, the “Collateral Agent”), and GLAS USA LLC, a limited liability company organized and existing under the laws of the State of New Jersey, as administrative agent for the Lenders (in such capacity, together with its successors and assigns in such capacity, the “Administrative Agent” and together with the Collateral Agent, each an “Agent” and collectively, the “Agents”), and the parties listed on Schedule A from time to time as lenders (each, a “Lender” and, collectively, the “Lenders”).

WHEREAS the Borrower has requested the Lenders provide to it a certain loans for the purposes set forth in Section 9.1(e);

AND WHEREAS the Lenders are each willing, on a several basis, to provide such loans to the Borrower for the aforementioned purposes upon the terms and conditions contained herein;

NOW THEREFORE THIS AGREEMENT WITNESSES that, in consideration of the mutual covenants and agreements herein contained and for other good and valuable consideration (the receipt and sufficiency of which are hereby acknowledged), the parties hereto covenant and agree as follows:

Article 1

INTERPRETATION

The following defined terms shall for all purposes of this agreement, or any amendment, substitution, supplement, replacement or addition hereto, have the following respective meanings unless the context otherwise specifies or requires or unless otherwise defined herein:

“Additional Equity” means net cash proceeds of $45,000,000 of additional capital (after deducting therefrom fees, commissions, costs and expenses and other amounts attributable to the raising of such capital) raised by the Borrower, which may not be redeemed, retracted or repaid in any manner whatsoever, and on which no fixed payments are required to be made while any Secured Obligations remain outstanding.

“Additional Capital” means the Additional Equity and the Loans.

“Administrative Agent” means GLAS USA LLC, in its capacity as administrative agent for the Lenders, and any successor thereto pursuant to Section 12.11.

“Affiliate” means, with respect to a specified Person, another Person that directly, or indirectly through one or more intermediaries, Controls or is Controlled by, or is under common Control with, the Person specified.

“Agent Account” means the following United States Dollar account of the Administrative Agent:

[commercially sensitive information redacted]

or such other account as may be notified by the Administrative Agent to the other parties hereto.

“AML Legislation” has the meaning set out in Section 13.9.

“Anti-Corruption Laws” means all laws, rules, and regulations having the force of law of any jurisdiction applicable to any of the Obligors from time to time concerning or relating to bribery or corruption, including without limitation the Corruption of Foreign Public Officials Acts (Canada).

“Applicable Laws” means in respect of any Person, property, transaction or event, all applicable laws, standards, requirements, policies, approvals, statutes, ordinances, guidelines, treaties and regulations, and all applicable directives, orders, permits, judgments, injunctions, awards and decrees of any Governing Authority, in each case, having the force of law and binding on or affecting such Person or any of its property.

“Applicable Securities Laws” means, collectively, all applicable securities laws of each of the Provinces and Territories of Canada and the respective rules and regulations under such laws together with applicable published instruments, notices and orders of the securities regulatory authorities in such jurisdictions, and the rules and policies of the Toronto Stock Exchange and any other exchange or marketplace on which the Borrower has applied and been accepted for listing or quotation of its securities.

“Arranging Lender” means Trinity Capital Partners Corporation, in its capacity as arranging lender of the Credit Facility, and its successors and assigns.

“Arm’s Length” shall have the meaning ascribed thereto for the purposes of the Tax Act, as in effect as of the date hereof.

“Asset Disposition” has the meaning set out in Section 9.2(h).

“Assets” means, with respect to any Person, any and all property, assets and undertakings of such Person of every kind, real and personal, and wheresoever situate, whether now owned or hereafter acquired (and, for greater certainty, includes any equity or like interest of such Person in any other Person).

“Banking Day” means any day, other than Saturday and Sunday, on which banks generally are open for business in Vancouver, British Columbia, Toronto, Ontario and New York, New York.

“Bankruptcy Law” means the Bankruptcy and Insolvency Act (Canada), the Companies’ Creditors Arrangement Act (Canada), the Winding-up and Restructuring Act (Canada), Title 11, U.S. Code and any similar federal, provincial, state or foreign law for or in respect of the relief of debtors, conservatorship, bankruptcy, general assignment for the benefit of creditors, moratorium, arrangement, receivership, insolvency, reorganization or similar laws of Canada, the United States or other applicable jurisdictions from time to time in effect and any similar federal, provincial, state or foreign law for the relief of debtors affecting the rights of creditors generally.

“Blocked Person” means a Person which is a department, agency or instrumentality of, or is otherwise controlled by or acting on behalf of, directly or indirectly, (x) any OFAC Listed Person or (y) any Person, entity, organization, foreign country or regime that is subject to any OFAC Sanctions Program.

“Bonding Obligations” means any reimbursement or indemnity obligations incurred in the ordinary course of business in respect of performance bonds, reclamation bonds and indemnities, surety bonds, appeal bonds, completion guarantees or like instruments (excluding letters of credit or guarantee) issued to secure performance obligations relating to the Camino Rojo Project or the Cerro Quema Project.

“Borrower Account” means the following United States Dollar account of the Borrower, the wire transfer instructions with respect to which are as set forth below:

[commercially sensitive information redacted]

or such other account as may be notified by the Borrower to the Administrative Agent.

“Camino Rojo” means Minera Camino Rojo, S.A. de C.V.

“Camino Rojo Project” means the Camino Rojo Oxide, heap-leach gold project located in the municipality of Mazapil, state of Zacatecas, Mexico as defined in the June 25, 2019 feasibility study NI 43-101 technical report filed on SEDAR.

“Canada Blocked Person” means (i) a “terrorist group” as defined for the purposes of Part II.1 of the Criminal Code (Canada), as amended, or (ii) a Person identified in or pursuant to (x) Part II.1 of the Criminal Code (Canada), as amended, or (y) regulations or orders promulgated pursuant to the Special Economic Measures Act (Canada), as amended, the United Nations Act (Canada), as amended, or the Freezing Assets of Corrupt Foreign Officials Act (Canada), as amended, as a Person in respect of whose property or benefit a Lender would be prohibited from entering into or facilitating a related financial transaction.

“Canadian Sanctions Law” means the Special Economic Measures Act (Canada), the United Nations Act (Canada), the Freezing Assets of Corrupt Foreign Officials Act (Canada), the Criminal Code (Canada) and other similar Canadian laws imposing sanctions.

“Capitalized Lease Obligations” means, with respect to any Person, at any time, all liabilities of such Person as lessee in respect of any lease of real or personal property, which, in accordance with GAAP (as in effect on January 1, 2019), have been or are required to be capitalized.

“Cash Proceeds” means, at any time, the aggregate of (i) all Proceeds of Realization in the form of cash and (ii) all cash proceeds of the sale or disposition of non-cash Proceeds of Realization, in each case expressed in Dollars at such time.

“Cerro Quema” means Minera Cerro Quema, S.A.

“Cerro Quema Project” means the oxide, heap-leach gold project located in the Los Santos province, Republic of Panama.

“Change of Control” means with respect to any Obligor: (y) the consummation of any transaction, including any consolidation, arrangement, amalgamation or merger or any issue, transfer or acquisition of voting shares, the result of which is that any other Person or group of other Persons acting jointly or in concert for purposes of such transaction becomes the beneficial owner, directly or indirectly, of more than 50% of the voting shares of such Obligor; or (z) if, after the Closing Date, in any twelve (12) month consecutive period, the Continuing Directors cease to constitute a majority of the board of directors of the Borrower; provided that it shall not be a Change of Control where the Arranging Lender or any Affiliate thereof, acting jointly or in concert, acquires control of the applicable Obligor.

“Closing Date” means the date of execution and delivery of this agreement and upon which all conditions precedent in Section 10.1 have been satisfied.

“Code” means the Internal Revenue Code of 1986, as amended.

“Collateral Agent” means GLAS Americas LLC, in its capacity as collateral agent for the Lenders, and any successor thereto pursuant to Section 12.11.

“Commitment Fee” has the meaning ascribed thereto in Section 5.4.

“Continuing Directors” means (a) any member of the board of directors who was a director of the Borrower on the Closing Date, and (b) any individual who becomes a member of the board of directors of the Borrower after the Closing Date if such individual was approved, appointed or nominated for the election to the board of directors of the Borrower by a majority of the Continuing Directors.

“Control” means the possession, directly or indirectly of the power to direct or cause the direction of the management or policies of a Person, whether through the ability to exercise voting power, by contract or otherwise. “Controlling” and “Controlled” have corresponding meanings.

“Credit Documents” means this agreement, the Guarantees and the Security Documents and “Credit Document” means any of the Credit Documents.

“Credit Facility” has the meaning ascribed thereto in Section 2.1.

“Debt” means, with respect to a Person, without duplication, the following amounts, each calculated in accordance with GAAP, unless the context otherwise requires:

| (a) | all obligations of such Person that would be considered to be indebtedness for borrowed money (including, without limitation, by way of overdraft and drafts or orders accepted representing extensions of credit), and all obligations of such Person (whether or not with respect to the borrowing of money) that are evidenced by bonds, debentures, notes or other similar instruments; |

| (b) | reimbursement obligations under bankers’ acceptances and contingent obligations of such Person in respect of any letter of credit, letters of guarantee or similar instruments; |

| (c) | Bonding Obligations of such Person; |

| (d) | any Equity Interests of that Person which Equity Interests, by their terms (or by the terms of any security into which it is convertible or for which it is exchangeable at the option of the holder), or upon the happening of any event, matures or is mandatorily redeemable, pursuant to a sinking fund obligation or otherwise, or is redeemable at the option of the holder thereof, in whole or in part, prior to the Maturity Date, for cash or securities constituting Debt (read without reference to this subsection (d)) unless the issuer of such Equity Interests has by the terms of such Equity Interests the option of repaying such amounts or retiring or exchanging such Equity Interests with Equity Interests not convertible or exchangeable or redeemable for Debt (read without reference to this subsection (d)); |

| (e) | all obligations of such Person for the deferred purchase price of Assets or services which constitute indebtedness (other than trade accounts payable and accrued expenses arising in the ordinary course of business); |

| (f) | all Capitalized Lease Obligations of such Person, obligations under synthetic leases, obligations under sale and leaseback transactions (unless the lease component of the sale and leaseback transaction is an operating lease) and indebtedness under arrangements relating to purchase money liens and other obligations in respect of the deferred purchase price of property and services; |

| (g) | all Hedge Exposure of such Person; and |

| (h) | the amount of the contingent obligations of such Person under any guarantee (other than by endorsement of negotiable instruments for collection or deposit in the ordinary course), indemnity or other financial assistance or other agreement assuring payment or performance of, any obligation in any manner of any part or all of an obligation of another Person of the type included in subsections (a) through (g) above; |

but excluding, for greater certainty, trade payables and accrued liabilities that are current liabilities incurred in the ordinary course of business for which payment is due within 60 days of the date of any invoice or payment request related thereto; unearned revenue; current and deferred taxes shall not constitute Debt, and, for greater certainty, the stated amount of a letter of credit or any other letter of credit or guarantee shall not be included to the extent that the obligation in respect of which it has been issued is included in one of items (a) to (h) above.

“Default” means any event, fact or circumstance which is or which, with the passage of time, the giving of notice or both, would be an Event of Default.

“Defaulting Lender” means any Lender that (a) has failed to fund any portion of the Loans required to be funded by it hereunder within three Banking Days of the date required to be funded by it hereunder unless such failure has been cured, (b) has otherwise failed to pay over to the Administrative Agent or any other Lender any other amount required to be paid by it hereunder within three Banking Days of the date when due, unless the subject of a good faith dispute or unless such failure has been cured, (c) has been determined by a court of competent jurisdiction or regulator to be insolvent or is unable to meet its obligations or admits in writing it is unable to pay its debts as they generally become due, (d) is the subject of a bankruptcy or insolvency proceeding, (e) is subject to or is seeking the appointment of an administrator, regulator, conservator, liquidator, receiver, trustee, custodian or other similar official over any portion of its assets or business, or (f) fails to confirm in writing that it will comply with its obligations hereunder after written request from the Administrative Agent or the Borrower, or a Lender who provides notice in writing, or makes a public statement to the effect that (i) it does not intend to comply with its funding obligations hereunder or (ii) it does not intend to generally comply with any of its funding obligations under other agreements (unless such writing or public statement indicates that such position is based on such Lender’s good faith determination that a condition precedent to extending credit hereunder (specifically identified in such writing including, if applicable, by reference to a specific Default) cannot be satisfied).

“Disclosure Documents” means, collectively, all of the documents which have been filed by or on behalf of the Borrower since January 1, 2017 and prior to the date hereof with the relevant securities commissions pursuant to the Applicable Securities Laws, including all documents filed by the Borrower on www.sedar.com.

“Distribution” means, with respect to any Person, (i) any dividend or other distribution, direct or indirect, declared or paid on issued Equity Interests of such Person, (ii) any payment (in any form whatsoever) made on account of any redemption, exchange, retirement, purchase or other acquisition for value, and any payment by such Person on account of a sinking fund or similar payment for the redemption, exchange, retirement, purchase or other acquisition for value, direct or indirect, made or paid in respect of the issued Equity Interests of such Person now or hereafter outstanding, (iii) any payment made to retire, or to obtain the surrender of, any outstanding or other rights to acquire issued, Equity Interests of any Obligor now or hereafter outstanding, and (iv) the payment by any Obligor of any royalty, consulting fee, management fee, bonus or similar fee to the shareholders or any Affiliate of such Person, except as otherwise not restricted in accordance with the terms of Section 9.2(r).

“Dollars” or “$” means the lawful currency of the United States of America.

“Drawdown Notice” shall have the meaning ascribed thereto in Section 4.1.

“Encumbrance” means, with respect to any property or Asset, any mortgage, encumbrance, deed of trust, defeasance arrangement, trust arrangement, statutory or deemed trust, assignment, royalty, adverse claim, netting arrangement or right of set-off, pledge, charge, security interest, hypothec, usufruct or encumbrance of any kind or other arrangement, in each case, having the effect of security for the payment or performance of any debt, liability or obligation in respect of such property or Asset, whether or not filed, recorded or otherwise perfected under Applicable Law, including any conditional sale or other title retention agreement, any lease in the nature thereof, including title reservations, limitations, provisos or conditions.

“Enforcement Date” means the date on which the Administrative Agent notifies the Borrower, pursuant to and as then authorized by Section 11.1, that all Secured Obligations owing to the Lenders have become immediately due and payable or on which such Secured Obligations automatically become due and payable pursuant to Section 11.1, whichever occurs first.

“Environmental Claims” means any and all administrative, regulatory or judicial actions, suits, demands, claims, liens, notices of non compliance or violation, investigations, inspections, inquiries or proceedings relating in any way to any Environmental Laws or to any permit issued under any such Environmental Laws including, without limitation:

| (a) | any claim by a Governing Authority for enforcement, clean up, removal, response, remedial or other actions or damages pursuant to any Environmental Laws; and |

| (b) | any claim by a person seeking damages, contribution, indemnification, cost recovery, compensation or injunctive or other relief resulting from or relating to Hazardous Materials, including any Release thereof, or arising from alleged injury or threat of injury to human health or safety (arising from environmental matters) or the environment. |

“Environmental Laws” means all Applicable Laws relating to the environment or environmental or occupational health and safety matters.

“Equity Interests” means, means, with respect to any Person, all shares, interests, units, trust units, partnership, membership or other interests, participations or other equivalent rights in the Person’s equity or capital, however designated, whether voting or non voting, whether now outstanding or issued after the Closing Date, together with warrants, options or other rights to acquire any such equity interests of such Person and securities convertible into or exchangeable for any such equity interests of such Person.

“Event of Default” means any one of the events set forth in Section 11.1.

“Excluded Taxes” means any of the following Taxes imposed on or with respect to an Agent or any other Finance Party (each, a “Recipient”) or required to be withheld or deducted from a payment to a Recipient: (a) Taxes imposed on or measured by net income (however denominated), franchise Taxes, Canadian federal or provincial capital Taxes and branch profits Taxes, in each case, (i) imposed as a result of such Recipient being organized under the laws of, or having its principal office or, in the case of any Lender, its applicable lending office located in, the jurisdiction imposing such Tax (or any political subdivision thereof) or (ii) that are Other Connection Taxes, (b) U.S. federal withholding Taxes imposed under FATCA, (c) any Canadian withholding Taxes imposed on a payment by or on account of any obligation of the Borrower hereunder by reason of the Recipient (i) not dealing at arm’s length (for purposes of the Income Tax Act (Canada)) with the payer of such amount or (ii) being, or not dealing at arm’s length (for purposes of the Income Tax Act (Canada)) with, a specified shareholder (as defined in subsection 18(5) of the Income Tax Act (Canada) of the payer of such amount except, in each case, where the non-arm’s length relationship arises, or where the Recipient is a “specified shareholder” or does not deal at arm’s length with a “specified shareholder”, as a result of the Recipient having executed, delivered, become a party to, performed its obligations under, received payments under, received or perfected a security interest under, or engaged in any other transaction pursuant to or enforced any rights under, a Credit Document, and (d) Taxes attributable to such Recipient’s failure to comply with Sections 6.4(f).

“Exposure” means, with respect to a particular Finance Party at a particular time and without duplication, the aggregate amount of the Secured Obligations owing to such Finance Party at such time determined by such Finance Party.

“FATCA” means Sections 1471 through 1474 of the Code, as of the date of this agreement (or any amended or successor version that is substantively comparable and not materially more onerous to comply with), any current or future regulations or official interpretations thereof, any agreement entered into pursuant to Section 1471(b)(1) of the Code, and any applicable intergovernmental agreements and local implementing laws (including, for greater certainty, Part XVIII of the Tax Act), regulations and official guidance with respect to the foregoing.

“Finance Parties” means, collectively, the Agents and the Lenders.

“Financial Statements” means, at any time, the audited consolidated financial statements of the Borrower for the most recent Fiscal Year.

“Fiscal Quarter” means each three-month period of the Borrower ending on the last day of March, June, September and December during each Fiscal Year.

“Fiscal Year” means the fiscal year of the Borrower which ends on December 31 of each calendar year.

[commercially sensitive information redacted]

[commercially sensitive information redacted]

[commercially sensitive information redacted]

“GAAP” or “generally accepted accounting principles” means generally accepted accounting principles accepted in Canada from time to time as recommended in the Handbook of the Chartered Professional Accountants of Canada and its successors and including, where applicable, IFRS.

“Governing Authority” means any government, parliament, legislature, commission or agency or board of any government, parliament or legislature, or any political subdivision thereof, or any court or (without limitation to the foregoing) any other law-, regulation- or rule-making entity (including, without limitation, any central bank, fiscal or monetary authority or authority regulating banks) having jurisdiction in the relevant circumstances, or any Person acting under the authority of any of the foregoing (including, without limitation, any arbitrator) or any other authority charged with the administration or enforcement of Applicable Laws.

“Guarantees” means the guarantees entered into by each of the Guarantors in favour of the Collateral Agent, pursuant to which each Guarantor agreed to guarantee the Secured Obligations of the Borrower, as the same may be amended, modified, supplemented or replaced from time to time.

“Guarantors” means Camino Rojo and Cerro Quema, and each other Restricted Subsidiary that has entered into a Guarantee on or after the date of this agreement, and “Guarantor” means any one of them.

“Hazardous Materials” means any substance, product, liquid, waste, pollutant, chemical, contaminant, insecticide, pesticide, gaseous or solid matter, organic or inorganic matter, fuel, micro-organism, ray, odour, radiation, energy, vector, plasma, constituent, material or any combination thereof which (a) is listed, regulated or prohibited under any Environmental Law, or (b) is hazardous waste, toxic, a pollutant, a deleterious substance or a contaminant under any Environmental Law, including petroleum or petroleum distillates, asbestos or asbestos containing materials, polychlorinated biphenyls, radon gas and all other substances or wastes of any nature regulated pursuant to any Environmental Law.

“Hedging Agreements” means any arrangement or transaction which is a rate swap transaction, basis swap, forward rate transaction, commodity swap, interest rate option, spot or forward foreign exchange transaction, cap transaction, floor transaction, collar transaction, currency swap transaction, cross-currency rate swap transaction, currency option, equity hedging or any other similar transaction (including any option with respect to any of such transactions or arrangements) designed to protect or mitigate against risks in interest, currency exchange, metals or commodity price fluctuations.

“Hedge Exposure” of a Person means all obligations of such Person arising under or in connection with Hedging Agreements; provided that:

| (a) | when calculating the value of a Hedging Agreement only the mark-to-market value (or, if any actual amount is due as a result of the termination or close-out of such Hedging Agreement, that amount) shall be taken into account; and |

| (b) | where any such Hedging Agreement allows for cross-transaction netting, the Hedge Exposure with respect to any counterparty shall be calculated on an aggregate net basis after taking into account all amounts owing by such counterparty to such Person under Hedging Agreements. |

“IFRS” means International Financial Reporting Standards adopted by the International Accounting Standards Board from time to time.

“Indemnified Parties” has the meaning set out in Section 6.3.

“Indemnified Taxes” means Taxes, other than Excluded Taxes.

“Individual Commitment” means, with respect to a particular Lender, the amount set forth in Schedule A for the Tranche One Loan, Tranche Two Loan and Tranche Three Loan, as applicable, as the individual commitment of such Lender to provide such Loan; as reduced or amended from time to time pursuant to Sections 2.3, 6.2 and 13.5.

“Insolvent Person” has the meaning set out in the Bankruptcy and Insolvency Act (Canada), as of the date of this agreement.

“Intellectual Property” means the intellectual property in patents, patent applications, trade-marks, trade-mark applications, trade names, service marks, copyrights, copyright registrations and trade secrets including, without limitation, customer lists and information and business opportunities, industrial designs, proprietary software, technology, recipes and formulae and other similar intellectual property rights.

“Interest Rate” means a rate per annum equal to 8.80%.

“Investment” means, with respect to any Person, all direct or indirect investments by such Person in other Persons or in Assets in the form of:

| (a) | loans, advances or capital contributions (excluding (i) loans or advances to officers and employees made in the ordinary course of business or in connection with the relocation of such officers and employees and (ii) accounts receivable arising from sales or services rendered in the ordinary course of such Person’s business); |

| (b) | acquisition of any Equity Interests of another Person or any bond, debenture or other indebtedness or debt securities of another Person; |

| (c) | acquisition, by purchase or otherwise, of all or substantially all of the business, Assets or stock or other evidence of beneficial ownership of a Person; and |

| (d) | acquisition by purchase or otherwise of any real property and related personal property of a Person. |

Any binding commitment to make an Investment in any Person or property and assets, as well as any option of another Person to require an Investment in such Person or property and assets, shall constitute an Investment.

“Loans” means the Tranche One Loan, Tranche Two Loan and Tranche Three Loan, made subject to and in accordance with the terms of this agreement, and “Loan” means any one of them.

“Majority Lenders” means, at any particular time prior to the repayment in full of all Secured Obligations and the termination of all commitments of the Lenders hereunder but subject to the next sentence, such group of Lenders whose Individual Commitments (expressed in Dollars) aggregate at least 75% of the aggregate amount of the Individual Commitments of all of the Lenders at such time. Notwithstanding the preceding sentence and except for the purposes of Section 12.13 of this Agreement, at all times prior to the advance of the Tranche Two Loan, Majority Lenders means the group of Tranche One Lenders whose Individual Commitments (expressed in Dollars) aggregate at least 75% of the aggregate amount of the Individual Commitments of all of the Tranche One Lenders at such time. Notwithstanding the foregoing, the unfunded Individual Commitment of, and the outstanding extensions of credit held or deemed to be held by, any Defaulting Lender shall be excluded for purposes of making a determination of Majority Lenders.

“Material Adverse Change” means any change of circumstances or event reasonably likely to have a Material Adverse Effect.

“Material Adverse Effect” means a material adverse effect on:

| (a) | the business, operations, property, assets, liabilities (actual or contingent) or condition (financial or otherwise) of the Obligors taken as a whole; |

| (b) | metals prices, commodity prices, the economy or financial markets that disproportionately affect the Obligors; |

| (c) | the ability of the Obligors to perform their obligations under the Credit Documents or the validity or enforceability of the Credit Documents; or |

| (d) | the ability of any Finance Party to enforce its rights under any Credit Documents. |

“Material Agreement” means (i) [commercially sensitive information redacted], (ii) the Material Agreements referred to in Schedule H hereto, and (iii) any agreement to which an Obligor is party, the termination of which could reasonably be expected to have a Material Adverse Effect, including the investor rights agreement between the Borrower and Agnico Eagle Mines Limited dated October 18, 2019.

“Maturity Date” means December 18, 2024.

“Minera Peñasquito Indebtedness” mean the indebtedness owing by the Obligors to Minera Peñasquito, S.A. de C.V. in a principal amount which does not exceed MXN $220,000,000.

“MXN $” means Mexican pesos.

“Net Cash Proceeds” means, with respect to any Permitted Asset Disposition pursuant to Section 9.2(h), the gross cash proceeds (including payments from time to time in respect of instalment obligations, if any) received in respect of such Permitted Asset Disposition, less the sum of:

| (a) | the amount, if any, of all Taxes paid or estimated to be payable by or in connection with such Permitted Asset Disposition; |

| (b) | amounts received in cash required to be reserved for indemnification, adjustment of purchase price or similar obligations pursuant to the agreements governing such Permitted Asset Disposition; |

| (c) | amounts required to be applied to, and applied to, the repayment of Debt secured by an Encumbrance expressly permitted hereunder on any asset that is the subject of such Permitted Asset Disposition (other than any Encumbrance created pursuant to a Credit Document); and |

| (d) | reasonable fees, commissions, expenses and costs paid by or on behalf of the selling Obligor relating to such Permitted Asset Disposition. |

“Non-Consenting Lender” means a Lender that has not provided its consent to a waiver of, or amendment to, any provision of the Credit Documents where requested to do so by the Borrower or the Administrative Agent if such waiver or amendment requires the consent of all the Lenders and Lenders whose Individual Commitment at the relevant time aggregate at least 75% of the Total Commitment Amount at such time have consented to such waiver or amendment.

“Obligors” means the Borrower and the Guarantors, and “Obligor” means any one of them.

“OFAC” means the United States Office of Foreign Assets Control.

“OFAC Listed Person” means a Person whose name appears on the list of “Specially Designated Nationals” and “Blocked Persons” published by OFAC.

“OFAC Sanctions Program” means sanctions programmes administered from time to time by OFAC.

“Other Connection Taxes” means, with respect to any Recipient, Taxes imposed as a result of a present or former connection between such Recipient and the jurisdiction imposing such Tax (other than any connection arising from such Recipient having executed, delivered, become a party to, performed its obligations under, received payments under, received or perfected a security interest under, engaged in any other transaction pursuant to or enforced any Credit Document, or sold or assigned an interest in any Credit Document or advance thereunder).

“Other Taxes” means all present or future stamp or documentary taxes or any other excise or property taxes, charges or similar levies arising from any payment made hereunder or under any other Credit Document or from the execution, delivery or enforcement of, or otherwise with respect to, this agreement or any other Credit Document.

“Permits” means all material permits, consents, orders, authorizations, licences, concessions, approvals, rights and privileges or the like issued or granted by any Governing Authority required for the construction, development or operation of the Camino Rojo Project or Cerro Quema Project.

“Permitted Asset Disposition” has the meaning set out in Section 9.2(h).

“Permitted Debt” means any of the following:

| (a) | unsecured cash management obligations of the Borrower in the ordinary course of business; |

| (b) | the Secured Obligations; |

| (c) | any Debt secured by a Permitted Encumbrance; |

| (d) | the Minera Peñasquito Indebtedness; |

| (e) | Permitted Foreign Exchange Hedging Indebtedness; |

| (f) | a working capital credit facility in a principal amount [commercially sensitive information redacted], and ranking first only on accounts receivable and inventory of the Obligors, provided that such working capital facility is (i) subordinate in all other respects to the Secured Obligations and the Security, and (ii) is in form and substance satisfactory to the Majority Lenders, acting reasonably, and subject to an intercreditor agreement on terms satisfactory to the Majority Lenders, acting reasonably (the “Working Capital Facility”); |

| (g) | any Guarantee by an Obligor of Debt of any other Obligor if such Debt is permitted under this agreement, excluding any Guarantee by the Borrower or Camino Rojo of any Debt of Cerro Quema or any Debt of any other Restricted Subsidiary; |

| (h) | any (i) indebtedness of an Obligor to any other Obligor that is set out in Schedule P, as such amount may be reduced by payment thereof from time to time, or (ii) indebtedness of an Obligor to any other Obligor; provided that such indebtedness is funded by (x) amounts of Permitted Distributions permitted to be used for such purpose, and from such sources, qualifying as Permitted Distributions in compliance with Section 9.2(g), or (y) the proceeds of additional capital raised by the Borrower (in excess of, and excluding, the proceeds of the Additional Equity); |

| (i) | unsecured Debt of an Obligor to any Affiliate thereof (other than any other Obligor) that is subject to a subordination and postponement agreement in favour of the Administrative Agent in form acceptable to the Administrative Agent, acting reasonably; |

| (j) | obligations of Camino Rojo consisting of Bonding Obligations, |

| (k) | obligations of Cerro Quema consisting of Bonding Obligations; provided that such obligations are (i) set out in Schedule P, as such obligations may be reduced by payment thereof from time to time, or (ii) funded by (x) amounts of Permitted Distributions permitted to be used, and from such sources, qualifying as Permitted Distributions in compliance with Section 9.2(g), or (y) the proceeds of additional capital raised by the Borrower (in excess of, and excluding, the proceeds of the Additional Equity); and |

| (l) | any extension, renewal or replacement of any of the foregoing, |

provided that, the aggregate outstanding amount of Debt referred to in subparagraphs (c) (which, for certainty, shall not include the Secured Obligations) and (i) shall not at any time exceed [commercially sensitive information redacted].

“Permitted Distribution” means any of the following, provided that no Default or Event of Default has occurred and is continuing at the time thereof:

| (a) | capital contributions and loans by the Borrower to Camino Rojo and other Subsidiaries of the Borrower; provided that such capital contributions and loans made to Subsidiaries other than Camino Rojo are not funded from (i) Additional Capital, or (ii) save and except as permitted by paragraph (b) below, proceeds of the business or operations of any Restricted Subsidiary, or the proceeds of the sale of any shares or Assets of any Restricted Subsidiary; |

| (b) | subject to compliance with paragraph (d) below, capital contributions and loans in a minimum amount of $1,000,000 and integral multiples of $100,000 thereafter made after such time as the Additional Equity is raised and using (i) proceeds of the business or operations of any Restricted Subsidiary or (ii) proceeds of the sale of any Assets of any Restricted Subsidiary permitted by Section 9.2(h) of this agreement (and not from Additional Capital), in each case to fund the Cerro Quema Project; |

| (c) | dividends, loans, repayments or other Distributions by Camino Rojo to the Borrower in a minimum amount of $1,000,000 and integral multiples of $100,000 where all of the proceeds of such dividends, loans, repayments or other Distributions are immediately used to repay the Loans, together with all accrued and unpaid interest thereon and all other Secured Obligations owing by the Obligors to and including the date of such Distribution; and |

| (d) | dividends, loans, repayments or other Distributions by Camino Rojo to the Borrower or any Restricted Subsidiary in a minimum amount of $1,000,000 and integral multiples of $100,000 thereafter for use by the Borrower or such Restricted Subsidiary for general corporate purposes; provided that, 50% of the proceeds of such dividend, loan, repayment or other Distribution are used by the Borrower or such Restricted Subsidiary for general corporate purposes (which general corporate purpose (i) shall include funding the Cerro Quema Project (including, without limitation, the construction, development and operation thereof), provided that the same is not funded with Additional Capital and (ii) shall not include (x) dividends, loans, share buy-backs, repayments and other Distributions, or (y) the construction, development or operation of, or investment in, or funding of debt service related to, any mine, property or business that is not subject to the Security) and the remaining 50% of such proceeds are immediately distributed to the Borrower to be used to repay the Loans, together with all accrued and unpaid interest thereon and all other Secured Obligations owing by the Obligors to and including the date of such Distribution. |

Absent a Default or an Event of Default, and except for the requirement to repay the Loans under (c) above, in no circumstances will the Obligors be required to use more than 50% of the proceeds of any Distributions or Investments to repay the Loans, accrued and unpaid interest thereon and other Secured Obligations.

“Permitted Encumbrances” means, as of any particular time, any of the following with respect to the property and assets of any Obligor:

| (a) | the rights reserved to or vested in any municipality or governmental or other public authority by any statutory provision or by the terms of leases, licenses, franchises, grants or permits, which do not materially interfere with the use of or materially detract from the value of the assets subject thereto; |

| (b) | servitudes, easements, rights-of-way, restrictions and other similar encumbrances imposed by Applicable Law or incurred in the ordinary course of business and encumbrances consisting of zoning or building restrictions, easements, licenses, restrictions on the use of property or minor imperfections in title thereto which, in the aggregate, are not material, and which do not in any case materially detract from the value of the property subject thereto or interfere with the ordinary conduct of the business of any Obligor; |

| (c) | Encumbrances imposed by law for Taxes, assessments or governmental charges or levies not yet due or which are being contested in good faith and by appropriate proceedings diligently conducted if adequate reserves with respect thereto are maintained in accordance with GAAP on the books of the applicable Obligor; |

| (d) | carrier’s, warehousemen’s, mechanics’, materialmen’s, repairmen’s, construction and other like Encumbrances arising by operation of Applicable Law, arising in the ordinary course of business and securing amounts (i) which are not overdue for a period of more than 30 days, or (ii) which are being contested in good faith and by appropriate proceedings and, during such period during which amounts are being so contested, such Encumbrances shall not be executed on or enforced against any Secured Assets, provided that the applicable Obligor shall have set aside on its books adequate reserves therefor and not resulting in qualification by auditors; |

| (e) | undetermined or inchoate Encumbrances and charges arising or potentially arising under statutory provisions which have not at the time been filed or registered in accordance with Applicable Law or of which written notice has not been given in accordance with Applicable Law or which although filed or registered, relate to obligations not due or delinquent, including without limitation statutory Encumbrances incurred, or pledges or deposits made, under worker’s compensation, employment insurance, pension and employment and other social security legislation; |

| (f) | deposits or Encumbrances over cash collateral and securing Bonding Obligations which qualify as Permitted Debt, together with any Encumbrance over the contract for which the underlying instrument was issued as security; |

| (g) | Encumbrances or covenants restricting or prohibiting access to or from lands abutting on controlled access highways or covenants affecting the use to which lands may be put; provided that such Encumbrances or covenants do not materially and adversely affect the use of the lands by any Obligor; |

| (h) | customary securities granted to public utilities or to any municipalities or Governing Authorities or other public authority when required by the utility, municipality or Governing Authorities or other public authority in connection with the supply of services or utilities to the Obligors; |

| (i) | unsecured adverse claims resulting from any judgment or award which does not constitute an Event of Default, the time for the appeal or petition for rehearing of which shall not have expired, or in respect of which the applicable Obligor shall be prosecuting an appeal or proceeding for review in good faith and by appropriate proceedings and in respect of which a stay of execution pending such appeal or proceeding for review shall have been granted and remains in effect; |

| (j) | customary statutory Encumbrances incurred or pledges or deposits made in favour of a Governmental Authority to secure the performance of obligations of any Obligor under Environmental Laws to which any assets of such Obligor are subject; |

| (k) | any and all other statutory liens, charges, adverse claims, prior claims, security interests or encumbrances of any nature whatsoever which are not registered on the title to the property and of which such Obligor does not have notice, claimed or held by any Governing Authority under or pursuant to any Applicable Law, which do not materially interfere with the use of or materially detract from the value of the assets subject thereto; |

| (l) | Encumbrances consisting of royalties payable with respect to any Assets of the Obligors existing as of the Closing Date described in Schedule M or otherwise permitted by Section 9.2(c). |

| (m) | customary rights of set-off or combination of accounts with respect to deposits and/or accounts permitted to be maintained under the terms of this agreement; |

| (n) | the interest of a vendor or a lessor under any conditional sale agreement, title retention agreement or consignment agreement (or any financing lease having substantially the same economic effect as any of the foregoing) permitted under the terms of this agreement; |

| (o) | Encumbrances on concentrates, minerals or the proceeds of sale of such concentrates or minerals arising or granted pursuant to a processing arrangement entered into in the ordinary course and upon usual market terms, securing the payment of the Borrower’s or any of its Subsidiaries’ portion of the fees, costs and expenses attributable to the processing of such concentrates or minerals under any such processing arrangement, but only insofar as such Encumbrances relate to obligations which are at such time not past due or the validity of which are being contested in good faith by appropriate proceedings and as to which reserves are being maintained in accordance with GAAP; |

| (p) | Encumbrances granted pursuant to the Security Documents; |

| (q) | Encumbrances on equipment in favour of a Person providing financing for such equipment or securing Capitalized Lease Obligations (and proceeds thereof, including any insurance proceeds related thereto); provided that, such Encumbrance is expressly and strictly limited to the equipment being financed by such Person and its proceeds and the aggregate amount of Debt secured by all such financings [commercially sensitive information redacted]; |

| (r) | Encumbrances in respect of the Working Capital Facility ranking first only on accounts receivable and inventory but subordinate to the Lenders in all other respects, which are subject to an intercreditor agreement on terms satisfactory to the Majority Lenders, acting reasonably; |

| (s) | Encumbrances in respect of Permitted Foreign Exchange Hedging Indebtedness which are subject to an intercreditor agreement on terms satisfactory to the Majority Lenders, acting reasonably; and |

| (t) | any extension, renewal or replacement of any of the foregoing. |

“Permitted Foreign Exchange Hedging Indebtedness” means foreign exchange related hedging indebtedness of up to 100% of the peso denominated capital expenditures during the Camino Rojo construction period, and which is subject to an intercreditor agreement on terms satisfactory to the Majority Lenders, acting reasonably. Following completion of the Camino Rojo construction period, Permitted Foreign Exchange Hedging Indebtedness shall be limited to contract term not to exceed 12-month and an amount not to exceed up to 25% of the peso-denominated operating costs at the Camino Rojo Project.

“Permitted Investment” means any of the following Investments:

| (a) | [commercially sensitive information redacted]; |

| (b) | Investments made by an Obligor using proceeds of a Permitted Distribution that are not required to be used to prepay the Loans, accrued and unpaid interest thereon and other Secured Obligations; |

| (c) | Investments made by the Borrower in Camino Rojo using proceeds of the Additional Capital; and |

| (d) | Investments existing as at the Closing Date described in Schedule N. |

“Person” means any individual, partnership, limited partnership, limited liability partnership, limited or unlimited liability company, joint venture, syndicate, sole proprietorship, company or corporation with or without share capital, unincorporated association, unincorporated syndicate, unincorporated organization, foundation, business entity, trust, trustee, executor, administrator or other legal personal representative or Governing Authority.

“PPSA” means the Personal Property Security Act (Ontario), as amended.

“Proceeds of Realization” means all cash and non-cash proceeds derived from any sale, disposition or other realization of the Secured Assets (i) on or after the Enforcement Date, (ii) upon any dissolution, liquidation, winding-up, reorganization, bankruptcy, insolvency or receivership of any Obligor (or any other arrangement or marshalling of the Secured Assets that is similar thereto) or (iii) upon the enforcement of, or any action taken with respect to, any Security Document.

“Pro Rata Share” means at any particular time with respect to a particular Lender, the ratio of the Individual Commitments of such Lender at such time to the Total Commitment Amount of all of the Lenders at such time.

“Receiver” means a receiver, receiver and manager or the person having similar powers or authority appointed by the Collateral Agent at the direction of the Majority Lenders, or by a court at the instance of the Collateral Agent, in each case respect of the Secured Assets or any part thereof.

“Recipient” shall have the meaning ascribed thereto in the definition of “Excluded Taxes”.

“Release” means any release, spill, emission, leak, pumping, injection, deposit, disposal, discharge, dispersal, leaching or migration into the environment including, without limitation, the movement of Hazardous Materials through ambient air, soil, surface water, ground water, wetlands, land or sub surface strata.

“Relevant Jurisdiction” means, from time to time, with respect to a Person that is granting Security hereunder, any province or territory of Canada or any other country, political subdivision thereof, in which such Person has its jurisdiction of formation, chief executive office or chief place of business or has tangible real and personal Assets (other than Assets in transit) and, for greater certainty, at the Closing Date includes the locations set forth in Schedule F.

“Responsible Officer” means, with respect to any Person, the chief executive officer, president, or chief financial officer of such Person (and, in the case of the execution and delivery of the Transaction Documents, any other Person properly authorized by resolutions of the board of directors (or equivalent) of such Person, or a valid power of attorney under Applicable Law) and, with respect to an Agent, includes any senior officer of such Agent with responsibility for the administration of the duties of such Agent under this Agreement and the other Credit Documents. Any document delivered hereunder that is signed by a Responsible Officer of an Obligor shall be conclusively presumed to have been authorized by all necessary corporate and/or other action on the part of such Obligor and such Responsible Officer shall be conclusively presumed to have acted on behalf of such Obligor.

“Restricted Subsidiary” means each direct or indirect Subsidiary of the Borrower with a direct or indirect interest in: (i) the Camino Rojo Project or (ii) the Cerro Quema Project.

[commercially sensitive information redacted]

“Sanctioned Entity” means (a) a country or a government of a country, (b) an agency of the government of a country, (c) an organization directly or indirectly controlled by a country or its government, (d) a Person resident in or determined to be resident in a country, in each case, that is subject to a country sanctions program administered and enforced by OFAC or similar program administered under Canadian Sanctions Law.

“Secured Assets” means all of the present and future (a) Assets constituting personal property of the Obligors, (b) Assets constituting real property of the Obligors related to the Camino Rojo Project and (c) any and all proceeds of any of the foregoing.

“Secured Obligations” means all indebtedness, obligations and liabilities, present or future, absolute or contingent, matured or not, at any time owing by any Obligor to the Finance Parties or any of them or remaining unpaid to the Finance Parties or any of them under or in connection with the Credit Documents. For certainty, “Secured Obligations” shall include interest accruing subsequent to the filing of, or which would have accrued but for the filing of, a petition for bankruptcy, in accordance with and at the rate (including any rate applicable pursuant to this agreement upon the occurrence of any Event of Default that is continuing to the extent lawful) specified herein, whether or not such interest is an allowable claim in such bankruptcy proceeding.

“Secured Obligations Termination Date” means the date on which all Secured Obligations (other than those provisions which by their terms survive the termination of the Credit Documents) have been indefeasibly paid in full and the Finance Parties have no Individual Commitments.

“Security” means the Encumbrances created by the Security Documents.

“Security Documents” means the security documents (as the same may be amended, modified, supplemented, restated or replaced from time to time) which, in the reasonable opinion of the Collateral Agent, are required to be entered into from time to time by the Obligors in favour of the Collateral Agent on behalf of the Finance Parties in order to grant to the Collateral Agent an Encumbrance on the Secured Assets as continuing collateral security for the payment and performance of the Secured Obligations of the Obligors, such security documents to be in form and substance satisfactory to the Collateral Agent and to include the security documents described in Schedule G.

“share” means, at any particular time with respect to a particular Lender and a particular Loan, the ratio of the Individual Commitment of such Lender with respect to such Loan at such time to the aggregate of the Individual Commitments of all Lenders with respect to such Loan at such time.

“Subsidiary” means, as to any Person, any other Person in which such first Person or one or more of its Subsidiaries or such first Person and one or more of its Subsidiaries owns sufficient voting interests to enable it or them (as a group) ordinarily, in the absence of contingencies, to elect a majority of the directors (or Persons performing similar functions) of such second Person, and any partnership or joint venture if more than a 50% interest in the profits or capital thereof is owned by such first Person or one or more of its Subsidiaries or such first Person and one or more of its Subsidiaries (unless such partnership or joint venture can and does ordinarily take major business actions without the prior approval of such Person or one or more of its Subsidiaries). Unless the context otherwise clearly requires, any reference to a “Subsidiary” is a reference to a Subsidiary of the Borrower.

“Tax Act” means the Income Tax Act (Canada), as the same may be amended, supplemented or replaced.

“Taxes” means all taxes, charges, fees, levies, imposts, rates, dues, premiums and assessments, including all income, sales, use, goods and services, harmonized sales, value added, capital, capital gains, alternative, net worth, transfer, profits, branch, gross receipts, windfall profits, withholding, payroll, employer health, excise, environmental, real property and personal property taxes, and any other taxes, customs duties, fees, assessments, or similar charges in the nature of a tax including federal, state and provincial pension plan contributions, employment/unemployment insurance payments, employer health and workers’ compensation premiums, together with any instalments with respect thereto, and any interest, fines and penalties with respect thereto, imposed, levied, collected, withheld or assessed by any Governing Authority (including federal, state, local, territorial, provincial, municipal, supranational and foreign Governing Authority), and whether disputed or not.

“Total Commitment Amount” means, at any particular time, the aggregate of the Individual Commitments of all of the Lenders at such time.

“Tranche One Lenders” means the Lenders set forth in Schedule A as Lenders under the heading “Tranche One Loan”, and “Tranche One Lender” means any of them.

“Tranche One Loan” shall have the meaning ascribed in Section 2.1(a).

“Tranche Two Loan” shall have the meaning ascribed in Section 2.1(b).

“Tranche Three Loan” shall have the meaning ascribed in Section 2.1(c).

“Transaction Documents” means the Credit Documents and the Warrants and “Transaction Document” means any of the Transaction Documents.

“U.S.” and “United States” means the United States of America, its territories and possessions, and any State of the United States and the District of Columbia.

“U.S. Person” means a (a) U.S. Person as that term is defined in Rule 902 of Regulation S (“Regulation S”) promulgated under the U.S. Securities Act, (b) any person purchasing securities on behalf or the account or benefit of any “U.S. Person” or any person in the United States, (c) any person that receives or received an offer of the securities while in the United States, (d) any person that is in the United States at the time the purchaser’s buy order was made or this subscription was executed or delivered. “U.S. person” includes but is not limited to (i) any natural person resident in the United States; (ii) any partnership or corporation organized or incorporated under the laws of the United States; (iii) any partnership or corporation organized outside the United States by a U.S. person principally for the purpose of investing in securities not registered under the U.S. Securities Act, unless it is organized or incorporated, and owned, by accredited investors who are not natural persons, estates or trusts; (iv) any estate or trust of which any executor or administrator or trustee is a U.S. person.

“U.S. Securities Act” means the United States Securities Act of 1933, as amended, and all rules, regulations and orders promulgated thereunder, as amended from time to time.

“Warrants” means, collectively, the 32,500,000 common share purchase warrants in the capital of the Borrower, with an exercise price of Cdn$3.00 per common share and a seven (7) year exercise period from the date of issue, to be issued to each of the Lenders on or before the Closing Date in consideration, inter alia, for such Lender’s commitment to fund the Loans in accordance with the terms of this agreement.

“Working Capital Facility” has the meaning set out in subparagraph (f) of the definition of “Permitted Debt”.

References to “this agreement”, “the agreement”, “hereof”, “herein”, “hereto” and like references refer to this Loan Agreement and not to any particular Article, Section or other subdivision of this agreement. References to an “Article”, “Section” or “Schedule” followed by a number or letter refer to the specified Article or Section of or Schedule to this agreement. Except as otherwise specifically provided, references in this agreement or any other Credit Document to any contract, agreement, license, franchise or any other instrument (including the Credit Documents) shall be deemed to include references to the same as varied, supplemented, waived, amended, restated or replaced from time to time in accordance with the terms hereof and thereof. References to “include” and “including” shall be read and construed as being followed by the phrase “without limitation”.

Where the context so requires, words importing the singular number shall include the plural and vice versa.

The division of this agreement into Articles and Sections and the insertion of headings in this agreement are for convenience of reference only and shall not affect the construction or interpretation of this agreement.

Unless otherwise specified herein, all statements of or references to dollar amounts in this agreement shall mean lawful money of the United States.

This agreement shall be governed by and construed in accordance with the laws of the Province of Ontario and the federal laws of Canada applicable therein. Any legal action or proceeding with respect to this agreement may be brought in the courts of the Province of Ontario and, by execution and delivery of this agreement, the parties hereby accept for themselves and in respect of their property, generally and unconditionally, the non-exclusive jurisdiction of the aforesaid courts. Nothing herein shall limit the right of any party to serve process in any manner permitted by law or to commence legal proceedings or otherwise proceed against any other party in any other jurisdiction.

Time shall in all respects be of the essence of this agreement.

Whenever any payment to be made hereunder shall be stated to be due or any action to be taken hereunder shall be stated to be required to be taken on a day other than a Banking Day, such payment shall be made or such action shall be taken on the next succeeding Banking Day and, in the case of the payment of any amount, the extension of time shall be included for the purposes of computation of interest, if any, thereon.

| 1.9 | Consents and Approvals |

Whenever the consent or approval of a party hereto is required in a particular circumstance, unless otherwise expressly provided for therein, such consent or approval shall not be unreasonably withheld or delayed by such party.

Each and every one of the schedules which is referred to in this agreement and attached to this agreement shall form a part of this agreement.

The Credit Documents have been negotiated by each party with the benefit of legal representation, and any rule of construction to the effect that any ambiguities are to be resolved against the drafting party shall not apply to the construction or interpretation of the Credit Documents.

| 1.12 | Accounting Terms – GAAP |

All accounting terms not otherwise defined in this agreement shall have those meanings assigned to them by, and all calculations are to be made and all financial data to be submitted are to be prepared in accordance with, GAAP, except as otherwise expressly provided.

To the extent that the definitions of accounting terms in this agreement or in any certificate or other document made or delivered pursuant to this agreement are inconsistent with the meanings of such terms under GAAP, the definitions in this agreement or in any such certificate or other document shall prevail.

| 1.13 | Permitted Encumbrances |

For the avoidance of doubt, any reference to a Permitted Encumbrance in any Credit Document shall not subordinate or postpone, and shall not be interpreted as subordinating or postponing, any Encumbrance created by any Security Document to such Permitted Encumbrance.

Article 2

CREDIT FACILITY

| 2.1 | Establishment of Credit Facility |

Subject to the terms and conditions of this agreement, the Lenders hereby establish in favour of the Borrower a non-revolving term credit facility (the “Credit Facility”) in the amount of $125,000,000 (as such amount may be reduced pursuant to Section 2.3). The Credit Facility shall be advanced to the Borrower in three tranches as follows, subject to and in accordance with the terms of this agreement:

| (a) | the first tranche in the amount of $25,000,000 (the “Tranche One Loan”) shall be advanced to the Borrower upon satisfaction of the conditions set forth in Sections 10.1 and 10.2; |

| (b) | the second tranche in the amount of $50,000,000 (the “Tranche Two Loan”) shall be advanced to the Borrower upon satisfaction of the conditions set forth in Section 10.3; and |

| (c) | the third tranche in the amount of $50,000,000 (the “Tranche Three Loan”) shall be advanced to the Borrower upon satisfaction of the conditions set forth in Section 10.3. |

Subject to the terms and conditions of this agreement, each Lender severally agrees to advance its share of the Loans to the Borrower based on their respective Individual Commitments provided that the aggregate amount of Loans advanced by each Lender shall not at any time exceed the aggregate Individual Commitments of such Lender. The Tranche One Loan shall be made available to the Borrower contemporaneously by all of the Tranche One Lenders. The Tranche Two Loan and Tranche Three Loan shall be made available to the Borrower contemporaneously by all of the Lenders. No Lender shall be responsible for any default by any other Lender in its obligation to provide its required share of any Loan nor shall the Individual Commitment of any Lender be increased as a result of any such default of another Lender in advancing its required share of such Loan. The failure of any Lender to make available to the Borrower its required share of any Loan shall not relieve any other Lender of its obligation hereunder to make available to the Borrower its required share of such Loans.

| 2.3 | Permanent Reduction of Credit Facility |

The amount of the Credit Facility will be permanently reduced with respect to each repayment or prepayment made in accordance with Sections 7.1 and 7.2, such reduction to be in an amount equal to the amount of the repayment or prepayment and to be at the time of the repayment or prepayment. Upon any repayment or prepayment, Schedule A shall be deemed to be amended to reduce the aggregate amount of the Individual Commitments by the amount of such repayment or prepayment, with the Individual Commitment of each Lender reduced on a pro rata basis.

| 2.4 | Termination of Credit Facility |

The Credit Facility shall terminate upon the earliest to occur of:

| (a) | the termination of the Credit Facility in accordance with Section 11.1; |

| (b) | the date, if any, on which the Secured Obligations have been indefeasibly repaid in full pursuant to Sections 7.1(b), 7.1(c) or 7.2; and |

Upon the termination of the Credit Facility, the right of the Borrower to obtain any Loan under the Credit Facility and all of the obligations of the Lenders to advance any Loan under the Credit Facility shall automatically terminate.

Article 3

GENERAL PROVISIONS RELATING TO CREDITS

Each Tranche One Lender agrees, severally and not jointly and severally, to make available to the Administrative Agent its share of the Tranche One Loan prior to 12:00 p.m. (Toronto time) on the date which is at least one Banking Day prior to the date for the extension of such loan. For the Tranche Two Loan and Tranche Three Loan, each Lender agrees, severally and not jointly and severally, to make available to the Administrative Agent its Individual Commitment of the principal amount of the Tranche Two Loan and Tranche Three Loan, as applicable, prior to 12:00 p.m. (Toronto time) on the date which is at least five (5) Banking Days prior to the date for the extension of the applicable Loan. The Administrative Agent shall, upon fulfilment by the Borrower of the applicable terms and conditions set forth in Article 10 and as irrevocably authorized and directed in the Drawdown Notice, make the applicable Loan available to the Borrower on the date of the extension of such Loan by crediting the Borrower Account (or causing such account to be credited) provided that the Administrative Agent has received from each applicable Lender, its respective share of the applicable advance.

If any Defaulting Lender fails to make available to the Administrative Agent any portion of its share of any Loan, the Administrative Agent shall forthwith give notice of such failure by the Defaulting Lender to the Borrower and the other Lenders and such notice shall state that any Lender may make available to the Administrative Agent all or any portion of the Defaulting Lender’s share of such Loan, as applicable (but in no way shall any other Lender or the Administrative Agent be obliged to do so), in the place and stead of the Defaulting Lender. If more than one Lender gives notice that it is prepared to make funds available in the place and stead of a Defaulting Lender in such circumstances and the aggregate of the funds which such Lenders (herein collectively called the “Contributing Lenders” and individually called the “Contributing Lender”) are prepared to make available exceeds the amount of the advance which the Defaulting Lender failed to make, then each Contributing Lender shall be deemed to have given notice that it is prepared to make available its Pro Rata Share of such advance based on the Contributing Lenders’ relative commitments to advance in such circumstance. If any Contributing Lender makes funds available in the place and stead of a Defaulting Lender in such circumstances, then the Defaulting Lender shall (i) pay to such Contributing Lender, forthwith on demand, (x) any amount advanced to the Borrower on the Defaulting Lender’s behalf together with interest thereon at the same rate payable by the Borrower on the funds advanced for each day from the date of advance to the date of payment, against payment by such Contributing Lender making the funds available of all interest received in respect of the Loan from the Borrower, and (y) such Defaulting Lender’s Pro Rata Share of the Commitment Fee previously received by it in an amount equal to the amount of the Defaulting Lender’s failed commitment for such Loan divided by the Total Commitment Amount (the “Defaulting Percentage”), and (ii) transfer to the Contributing Lender, in consideration for payment to the Defaulting Lender of ten dollars ($10) and no other fee or compensation (and at such Defaulting Lender’s sole cost and expense), its Defaulting Percentage of all Warrants previously issued to such Defaulting Lender. In furtherance of the foregoing, each Lender acknowledges and agrees that, until such time as such Lender has funded its respective commitment for the Tranche Two Loan or Tranche Three Loan, as the case may be, such Lender shall not be entitled to sell, assign, transfer or otherwise dispose of (a “Disposition”) that portion of the Warrants issued to it corresponding to the portion of the Loans not yet funded by such Lender at such time divided by the Total Commitment Amount at such time, and that any such Disposition of such Warrants shall be restricted accordingly. In addition to interest as aforesaid, the Borrower shall pay all amounts which would otherwise have been owing and payable by the Borrower to the Defaulting Lender hereunder (with respect to the amounts advanced by the Contributing Lenders to the Borrower on behalf of the Defaulting Lender) to the Contributing Lenders until such time as the Defaulting Lender pays to the Administrative Agent for the Contributing Lenders all amounts advanced by the Contributing Lenders on behalf of the Defaulting Lender.

| 3.3 | Time and Place of Payments |

Unless otherwise expressly provided herein, the Borrower shall make all payments pursuant to this agreement or pursuant to any document, instrument or agreement delivered pursuant hereto by deposit to the Agent Account before 12:00 p.m. (Toronto time) on the day specified for payment and the Administrative Agent shall be entitled to withdraw the amount of any payment due to the Administrative Agent or the Lenders hereunder from such account on the day specified for payment.

| 3.4 | Remittance of Payments |